OPINION

2022 Dec/06

The Paradox of Stablecoins: Risks and Policy Challenges

Dec. 06, 2022

PDF

- Summary

- Despite the literal meaning, stablecoins entail risks that cannot be ignored. Fiat-collateralized stablecoins, the mainstream type, could invite massive requests for redemption or a speculative attack due to inadequate management of reserve assets. A sharp price drop in non-stablecoins such as Bitcoin could put downward price pressure on the entire stablecoin market. Furthermore, distress in the stablecoin market could be passed on to the traditional financial market as well as the crypto market. There is also a possibility that the supply of stablecoins would come into conflict with monetary policy.

In Korea, policy discussions about crypto assets primarily center around non-stablecoins, which raises concerns over a regulatory gap in stablecoins. In preparation for the rapid growth of Korea’s stablecoin market, the government needs to promptly establish the related institutional framework. First of all, the policy direction should be geared toward inducing the issuance of fiat-collateralized stablecoins than other types. In addition, regulations on stablecoins should be differentiated depending on the scope of use to keep a balance between technical neutrality and financial stability. It is also necessary to support the redemption of stablecoins, which are not covered by deposit insurance, by applying the supervisory guideline for prepaid electronic money. To prevent conflicts with monetary policy, it is worth considering measures for large stablecoin issuers that impose a stricter regulation on prudence or a limit on the total issuance volume.

The collapse of Terra has called into question the stability of stablecoins. This crisis might be treated as an exception limited to the algorithmic type1), an uncommon one. However, as serious problems have erupted from the mainstream type, fiat-collateralized stablecoins, concerns have been growing over direct and indirect side effects of stablecoins. In response, major economies have pushed ahead with policy measures to address the risk posed by stablecoins. The US has worked on market disciplines through policy research by the presidential working group and legislative proposals, while member states of the EU have already agreed on the related bill slated to take effect soon. Korea has set a specific policy direction for non-stablecoins but has made little progress regarding the regulation on stablecoins. Against this backdrop, this article explores the risk of stablecoins and relevant policy challenges for Korea, with a focus on fiat-collateralized stablecoins.

Risks of stablecoins

The primary concern about stablecoins is the risk arising from price stability and redeemability for a fiat currency. This may be regarded as an internal risk as it stems from issues inherent in stablecoins,2) which could be easily affected by management of reserve assets and conditions of the crypto market. Additionally, the internal risk is likely to be transmitted to the conventional financial system beyond the territory of stablecoins. This is the risk triggered by externalities, which could bring about an adverse impact on financial stability, financial intermediation and monetary policy.

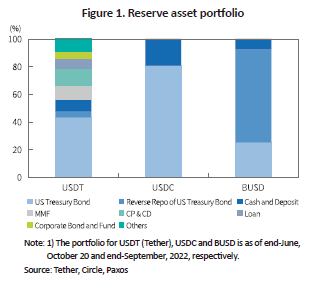

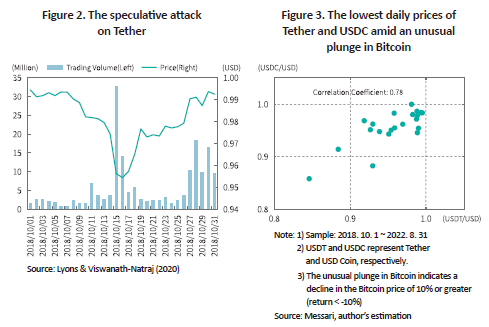

With Tether’s lack of reserves, the internal risk of fiat-collateralized stablecoins has come to the fore. Tether is the world’s largest stablecoin3) issued by Tether Limited. The issuer advertised Tether’s stability, claiming that it held the amount of reserve assets equivalent to the total value of Tether issued. However, Tether Limited was fined $18.5 million and $41 million by the New York State Court and the Commodity Futures Trading Commission (CFTC), respectively, for its mismanagement of reserves. Furthermore, the CFTC’s investigation found that the adequate level of reserve assets was secured only for a quarter of the 26-month period between 2016 and 2018.4) On top of that, Tether’s reserves have a problem with their composition. More than 40% are comprised of risky assets including CP, corporate bonds and loans (Figure 1), which could spark market jitters like the money market fund (MMF) crisis in the past.

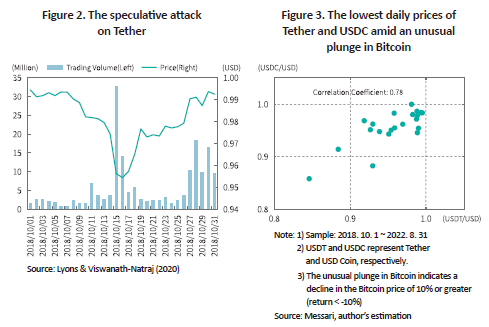

Stablecoins’ vulnerability in terms of the volume and portfolio of reserve assets could invite a speculative attack, which is well demonstrated by the 2018 speculative attack on Tether. Figure 2 illustrates that the trading volume of Tether soared to an unusual level around mid-October, 2018, resulting in a sharp drop in its price. Back then, low-priced sales of Tether spiked in a few trading platforms (exchanges), thereby dragging the price down to $0.95. The attack seems to stem from market participants’ distrust in Tether Limited’s reserves and solvency (Lyons & Viswanath-Natraj, 2020; Eichengreen & Viswanath-Natraj, 2022). This suggests other stablecoins with insufficient reserves could also be subject to such a speculative attack.

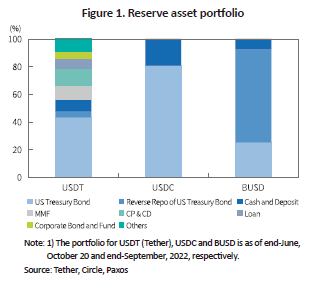

The stability of stablecoins could be influenced by conditions of the overall crypto market. If a large number of investors exit the crypto market, this may lead to massive sell-off and downward pressure on prices.5) In particular, there is a possibility that a plunge in the Bitcoin price would cause distress in the entire stablecoin market. Figure 3 shows the lowest daily prices of Tether and USDC amid a sharp price decline in Bitcoin. As illustrated, when the price of Bitcoin plummeted over 10% (absolute value), prices of both Tether and USDC fell during a given trading day, exhibiting a considerably high correlation of 0.78.6) This suggests that turbulence in the non-stablecoin market could be widely transmitted to the stablecoin market.

On multiple fronts, stablecoins could be linked to other crypto assets and the existing financial system, thereby giving rise to adverse externalities. A prime example of such negative effects is that instability of the stablecoin market may be spread to the entire crypto market. Stablecoins are used as a principal medium of exchange in the global crypto market.7) If major stablecoin issuers become insolvent, crypto investors would lose their source of funds, thereby triggering a liquidity crisis in the entire crypto market.

In addition, crises in stablecoins could be passed on to the financial market, which also requires caution. Notably, the fiat-collateralized type is closely related to the traditional financial market via reserve assets, which could contribute to systemic risk. The previous run on MMFs set off a liquidity crunch in the money market through ABCP, CD and RP products invested by MMFs (Li et al., 2021). Fiat-collateralized stablecoins hold reserve assets in the form of deposit savings, short-term securities, loans, etc. If demand for withdrawal in a fiat currency soars, the issuer should dispose of a massive amount of reserve assets. The resultant run on stablecoins could transmit the turmoil to the banking sector or the money market.

Furthermore, stablecoins could have adverse effects on domestic financial intermediation. This is a major side effect potentially arising from the widespread use of stablecoins. A stablecoin pegged to a foreign currency (FCS, hereafter) is expected to accumulate assets denominated in the corresponding currency for its reserves. Accordingly, growing demand for FCSs would intensify capital outflows, thereby undermining the function of domestic financial intermediaries. On the other hand, stablecoins pegged to a domestic currency (the fiat-collateralized type) are unlikely to have a profound impact on financial intermediation. Issuers of such stablecoins accumulate reserves with domestic financial assets and the funds would stay within the domestic financial system. Hence, financial institutions’ capability of credit provision is likely to remain intact as a whole.

On top of that, stablecoins could also weaken the efficacy of monetary policy. The quantity of stablecoins in circulation can be determined by issuers’ policies such as airdrop.8) If a large amount of stablecoins are distributed for free through airdrop while the central bank tightens, it could dampen the effects of the monetary policy. Additionally, if a domestic currency is replaced with FCSs, it would undermine financial intermediation and thus, impair the monetary policy transmission channel, curtailing the effectiveness of monetary policy.

Policy challenges

Korea’s stablecoin market currently remains modest in size9) but could rapidly grow going forward, which necessitates thorough preparation. If the initial coin offering (ICO) is permitted and blockchain-based payment and settlement become commonplace, Korea could see the issuance and use of stablecoins burgeoning in the domestic market.10) Traditional financial institutions also show great interest in entry into the market, as evidenced by banks’ efforts to issue stablecoins to support new services such as the blockchain-based foreign currency remittance.11)

As diverse economic players with various purposes are expected to participate, rapid growth is likely to follow in the Korean stablecoin market. This means Korea’s authorities should work on relevant policy measures. At this juncture, it is necessary to decide a clear policy direction for stablecoin types to be issued. Considering the redemption guarantee mechanism and stability, it seems desirable for the government to induce the issuance of fiat-collateralized stablecoins among the three types. The issuance of algorithmic stablecoins would be restricted in major countries as they entail vulnerabilities in terms of stability and user protection as evidenced by the Terra collapse. Even with safeguards such as over-collateralization in place, the cryptocurrency-collateralized type would be susceptible to price instability and mass withdrawals due to the higher price volatility of crypto assets.

The scope of use (functional scope) is an important consideration for the policy design. This should serve as a key to balancing between technical neutrality and financial stability in regulation. If stablecoins become more widely used, it could improve users’ convenience and spur innovation. But as they are more interconnected to financial and economic sectors, the systemic risk would potentially intensify further. Based on these considerations, regulatory safeguards need to be differentiated depending on the scope of use. As for stablecoins confined to trading of domestic crypto assets, what can be referred to as a policy benchmark would be regulations on e-money and prepaid e-money. Safeguards for general purpose stablecoins could be established based on laws and regulations regarding banking and foreign exchange transactions. As is the case with the EU’s Markets in Crypto-Assets (MiCA) regulation,12) exemptions and additional measures could be implemented by taking into account a stablecoin’s market capitalization or trading volume.

According to the approach above, some stablecoins not covered by deposit insurance could reveal a blind spot in terms of user protection. Such coins should be backed by a separate protection to strengthen a redemption guarantee function. Among various alternatives, the most suitable one under the existing regulatory framework would be the supervisory guideline for prepaid e-money. 「The Guideline for User Funds Protection of Electronic Financial Business」 released by the Financial Supervisory Service requires that e-payment companies should designate individual users as beneficiaries of trust funds or the insured of payment bonds, covering 100% of user funds. This guideline has been implemented to specify how to manage deposit balance because the prepaid amount is not protected by deposit insurance, which may apply to stablecoins, not covered by the insurance. Hence, it is necessary to enforce issuers of such stablecoins to manifest the duty of redemption and apply the aforementioned regulatory framework in the e-payment business to how to manage reserves of stablecoins.

It is also notable that the huge growth of the stablecoin market could undercut the effectiveness of monetary policy, which also requires caution. Primarily, regarding large issuers’ airdrop, an additional prudential regulation could prevent its abuses and conflicts with monetary policy. The airdrop of a stablecoin reduces the issuer’s equity capital. Accordingly, if stricter prudential regulation is put in place, the abuse of free-of-charge offerings would be constrained to some extent. If the regulation hardly proves effective, it would be worth considering controlling the total issuance volume under risk sharing between issuers and policy authorities.13)

As such, this article has proposed key policy measures with a focus on the inherent features of stablecoins. General rules for crypto assets, which are applicable to stablecoins as well, are not covered here as there has been considerable progress in the policy discussions. However, it should be noted that the omission is not because such rules are of secondary importance. Regulations regarding cybersecurity, internal control, information disclosure and market abuse are a requisite for the normal function of markets for all crypto assets, including stablecoins. Therefore, the government should accelerate setting up policies to fill a regulatory gap in the stablecoin market by reflecting all these factors in the process.

1) Stablecoins can be classified into fiat-collateralized, cryptocurrency-collateralized and algorithmic types. Fiat-collateralized stablecoins maintain a reserve of a fiat currency or fiat-denominated deposits and securities, being pegged to the fiat currency. Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) are the examples. As the name suggests, cryptocurrency-collateralized stablecoins are issued using cryptocurrencies as collateral, which include DAI. Algorithmic stablecoins such as Terra peg their price by programmed supply rules.

2) While payment and cybersecurity risks also fall into the internal risk category, this article mainly covers risks related to price stability and redeemability for a fiat currency with a focus on stablecoins-specific features.

3) In terms of market capitalization in the stablecoin market (as of September 2022), Tether represents the largest proportion of 45%, followed by USD Coin (31%), Binance USD (14%) and DAI (5%).

4) This is attributable to illegal loans that Tether Limited extended to its affiliate, Bitfinex and the unbacked issuance of Tether without reserve assets for manipulation of Bitcoin prices (Griffin & Shams, 2020).

5) In this context, Eichengreen & Viswanath-Natraj (2022) demonstrate that higher price volatility of Bitcoin increases stablecoin issuers’ risk of default.

6) Without a plunge in Bitcoin prices, the correlation coefficient between the lowest daily prices of Tether and USDC stands at 0.10, which hardly suggests any noticeable correlation.

7) In terms of the total crypto trades (as of end-August, 2022), Tether takes up 50.2%, followed by USDC at 25.7% and BUSD at 11.3%. Crypto trading using stablecoins far exceeds that with fiat currencies (USD: 7.9%, Euro: 1.3%).

8) Stablecoin issuers can use free offerings to gain greater market power. An issuer could make up for the airdrop of its stablecoin (liabilities) through retained earnings (equity) and convert assets accumulated from retained earnings into reserve assets equivalent to the value of free offerings. In this case, the issuer could conduct additional issuance without affecting stablecoin prices. Stablecoins offered through airdrop could be used for consumption.

9) As for KRW-based stablecoins, Binance Korea issued BKRW but terminated issuance in end-2020, and KRW-based Terra (KRT) was delisted from major trading platforms in May 2022. A small volume of foreign currency-based stablecoins (USDT and USDC) are traded in some small- or medium-sized platforms.

10) Stablecoins could be used to implement smart contracts in trading of crypto assets and security tokens.

11) https://news.einfomax.co.kr/news/articleView.html?idxno=4186159

12) The MiCA regulation bill requires stablecoin issuers to hold an equity capital equivalent to more than 2% of reserve assets. Significant issuers are obliged to hold an equity capital 1.5 times larger than the basic requirement and conduct liquidity stress testing.

13) According to this approach, issuers are obliged to participate in controlling of the total issuance volume, and in crisis times, the authorities could provide liquidity to issuers (Schwarcz, 2022).

References

Eichengreen, B., Viswanath-Natraj, G., 2022, Stablecoins and central bank digital currencies: Policy and regulatory challenges, Asian Economic Papers 21(1), 29–46.

Griffin, J.M., Shams, A., 2020, Is bitcoin really untethered? Journal of Finance 75(4), 1913-1964.

Li, L., Li, Y., Macchiavelli, M., Zhou, X., 2021, Liquidity restrictions, runs, and central bank interventions: Evidence from money market funds, Review of Financial Studies 34(11), 5402-5437.

Lyons, R. K., Viswanath-Natraj, G., 2020, What keeps stablecoins stable?, NBER Working Papers 27136.

Schwarcz, S. L., 2022, Regulating digital currencies: Towards an analytical framework. Boston University Law Review 102, 1037-1081.

[Korean]

Financial Supervisory Service, September 28, 2022, Prior notice on the revision and extension of the Guideline for User Funds Protection of Electronic Financial Business, reference materials.

Risks of stablecoins

The primary concern about stablecoins is the risk arising from price stability and redeemability for a fiat currency. This may be regarded as an internal risk as it stems from issues inherent in stablecoins,2) which could be easily affected by management of reserve assets and conditions of the crypto market. Additionally, the internal risk is likely to be transmitted to the conventional financial system beyond the territory of stablecoins. This is the risk triggered by externalities, which could bring about an adverse impact on financial stability, financial intermediation and monetary policy.

With Tether’s lack of reserves, the internal risk of fiat-collateralized stablecoins has come to the fore. Tether is the world’s largest stablecoin3) issued by Tether Limited. The issuer advertised Tether’s stability, claiming that it held the amount of reserve assets equivalent to the total value of Tether issued. However, Tether Limited was fined $18.5 million and $41 million by the New York State Court and the Commodity Futures Trading Commission (CFTC), respectively, for its mismanagement of reserves. Furthermore, the CFTC’s investigation found that the adequate level of reserve assets was secured only for a quarter of the 26-month period between 2016 and 2018.4) On top of that, Tether’s reserves have a problem with their composition. More than 40% are comprised of risky assets including CP, corporate bonds and loans (Figure 1), which could spark market jitters like the money market fund (MMF) crisis in the past.

The stability of stablecoins could be influenced by conditions of the overall crypto market. If a large number of investors exit the crypto market, this may lead to massive sell-off and downward pressure on prices.5) In particular, there is a possibility that a plunge in the Bitcoin price would cause distress in the entire stablecoin market. Figure 3 shows the lowest daily prices of Tether and USDC amid a sharp price decline in Bitcoin. As illustrated, when the price of Bitcoin plummeted over 10% (absolute value), prices of both Tether and USDC fell during a given trading day, exhibiting a considerably high correlation of 0.78.6) This suggests that turbulence in the non-stablecoin market could be widely transmitted to the stablecoin market.

On multiple fronts, stablecoins could be linked to other crypto assets and the existing financial system, thereby giving rise to adverse externalities. A prime example of such negative effects is that instability of the stablecoin market may be spread to the entire crypto market. Stablecoins are used as a principal medium of exchange in the global crypto market.7) If major stablecoin issuers become insolvent, crypto investors would lose their source of funds, thereby triggering a liquidity crisis in the entire crypto market.

In addition, crises in stablecoins could be passed on to the financial market, which also requires caution. Notably, the fiat-collateralized type is closely related to the traditional financial market via reserve assets, which could contribute to systemic risk. The previous run on MMFs set off a liquidity crunch in the money market through ABCP, CD and RP products invested by MMFs (Li et al., 2021). Fiat-collateralized stablecoins hold reserve assets in the form of deposit savings, short-term securities, loans, etc. If demand for withdrawal in a fiat currency soars, the issuer should dispose of a massive amount of reserve assets. The resultant run on stablecoins could transmit the turmoil to the banking sector or the money market.

Furthermore, stablecoins could have adverse effects on domestic financial intermediation. This is a major side effect potentially arising from the widespread use of stablecoins. A stablecoin pegged to a foreign currency (FCS, hereafter) is expected to accumulate assets denominated in the corresponding currency for its reserves. Accordingly, growing demand for FCSs would intensify capital outflows, thereby undermining the function of domestic financial intermediaries. On the other hand, stablecoins pegged to a domestic currency (the fiat-collateralized type) are unlikely to have a profound impact on financial intermediation. Issuers of such stablecoins accumulate reserves with domestic financial assets and the funds would stay within the domestic financial system. Hence, financial institutions’ capability of credit provision is likely to remain intact as a whole.

On top of that, stablecoins could also weaken the efficacy of monetary policy. The quantity of stablecoins in circulation can be determined by issuers’ policies such as airdrop.8) If a large amount of stablecoins are distributed for free through airdrop while the central bank tightens, it could dampen the effects of the monetary policy. Additionally, if a domestic currency is replaced with FCSs, it would undermine financial intermediation and thus, impair the monetary policy transmission channel, curtailing the effectiveness of monetary policy.

Policy challenges

Korea’s stablecoin market currently remains modest in size9) but could rapidly grow going forward, which necessitates thorough preparation. If the initial coin offering (ICO) is permitted and blockchain-based payment and settlement become commonplace, Korea could see the issuance and use of stablecoins burgeoning in the domestic market.10) Traditional financial institutions also show great interest in entry into the market, as evidenced by banks’ efforts to issue stablecoins to support new services such as the blockchain-based foreign currency remittance.11)

As diverse economic players with various purposes are expected to participate, rapid growth is likely to follow in the Korean stablecoin market. This means Korea’s authorities should work on relevant policy measures. At this juncture, it is necessary to decide a clear policy direction for stablecoin types to be issued. Considering the redemption guarantee mechanism and stability, it seems desirable for the government to induce the issuance of fiat-collateralized stablecoins among the three types. The issuance of algorithmic stablecoins would be restricted in major countries as they entail vulnerabilities in terms of stability and user protection as evidenced by the Terra collapse. Even with safeguards such as over-collateralization in place, the cryptocurrency-collateralized type would be susceptible to price instability and mass withdrawals due to the higher price volatility of crypto assets.

The scope of use (functional scope) is an important consideration for the policy design. This should serve as a key to balancing between technical neutrality and financial stability in regulation. If stablecoins become more widely used, it could improve users’ convenience and spur innovation. But as they are more interconnected to financial and economic sectors, the systemic risk would potentially intensify further. Based on these considerations, regulatory safeguards need to be differentiated depending on the scope of use. As for stablecoins confined to trading of domestic crypto assets, what can be referred to as a policy benchmark would be regulations on e-money and prepaid e-money. Safeguards for general purpose stablecoins could be established based on laws and regulations regarding banking and foreign exchange transactions. As is the case with the EU’s Markets in Crypto-Assets (MiCA) regulation,12) exemptions and additional measures could be implemented by taking into account a stablecoin’s market capitalization or trading volume.

According to the approach above, some stablecoins not covered by deposit insurance could reveal a blind spot in terms of user protection. Such coins should be backed by a separate protection to strengthen a redemption guarantee function. Among various alternatives, the most suitable one under the existing regulatory framework would be the supervisory guideline for prepaid e-money. 「The Guideline for User Funds Protection of Electronic Financial Business」 released by the Financial Supervisory Service requires that e-payment companies should designate individual users as beneficiaries of trust funds or the insured of payment bonds, covering 100% of user funds. This guideline has been implemented to specify how to manage deposit balance because the prepaid amount is not protected by deposit insurance, which may apply to stablecoins, not covered by the insurance. Hence, it is necessary to enforce issuers of such stablecoins to manifest the duty of redemption and apply the aforementioned regulatory framework in the e-payment business to how to manage reserves of stablecoins.

It is also notable that the huge growth of the stablecoin market could undercut the effectiveness of monetary policy, which also requires caution. Primarily, regarding large issuers’ airdrop, an additional prudential regulation could prevent its abuses and conflicts with monetary policy. The airdrop of a stablecoin reduces the issuer’s equity capital. Accordingly, if stricter prudential regulation is put in place, the abuse of free-of-charge offerings would be constrained to some extent. If the regulation hardly proves effective, it would be worth considering controlling the total issuance volume under risk sharing between issuers and policy authorities.13)

As such, this article has proposed key policy measures with a focus on the inherent features of stablecoins. General rules for crypto assets, which are applicable to stablecoins as well, are not covered here as there has been considerable progress in the policy discussions. However, it should be noted that the omission is not because such rules are of secondary importance. Regulations regarding cybersecurity, internal control, information disclosure and market abuse are a requisite for the normal function of markets for all crypto assets, including stablecoins. Therefore, the government should accelerate setting up policies to fill a regulatory gap in the stablecoin market by reflecting all these factors in the process.

1) Stablecoins can be classified into fiat-collateralized, cryptocurrency-collateralized and algorithmic types. Fiat-collateralized stablecoins maintain a reserve of a fiat currency or fiat-denominated deposits and securities, being pegged to the fiat currency. Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) are the examples. As the name suggests, cryptocurrency-collateralized stablecoins are issued using cryptocurrencies as collateral, which include DAI. Algorithmic stablecoins such as Terra peg their price by programmed supply rules.

2) While payment and cybersecurity risks also fall into the internal risk category, this article mainly covers risks related to price stability and redeemability for a fiat currency with a focus on stablecoins-specific features.

3) In terms of market capitalization in the stablecoin market (as of September 2022), Tether represents the largest proportion of 45%, followed by USD Coin (31%), Binance USD (14%) and DAI (5%).

4) This is attributable to illegal loans that Tether Limited extended to its affiliate, Bitfinex and the unbacked issuance of Tether without reserve assets for manipulation of Bitcoin prices (Griffin & Shams, 2020).

5) In this context, Eichengreen & Viswanath-Natraj (2022) demonstrate that higher price volatility of Bitcoin increases stablecoin issuers’ risk of default.

6) Without a plunge in Bitcoin prices, the correlation coefficient between the lowest daily prices of Tether and USDC stands at 0.10, which hardly suggests any noticeable correlation.

7) In terms of the total crypto trades (as of end-August, 2022), Tether takes up 50.2%, followed by USDC at 25.7% and BUSD at 11.3%. Crypto trading using stablecoins far exceeds that with fiat currencies (USD: 7.9%, Euro: 1.3%).

8) Stablecoin issuers can use free offerings to gain greater market power. An issuer could make up for the airdrop of its stablecoin (liabilities) through retained earnings (equity) and convert assets accumulated from retained earnings into reserve assets equivalent to the value of free offerings. In this case, the issuer could conduct additional issuance without affecting stablecoin prices. Stablecoins offered through airdrop could be used for consumption.

9) As for KRW-based stablecoins, Binance Korea issued BKRW but terminated issuance in end-2020, and KRW-based Terra (KRT) was delisted from major trading platforms in May 2022. A small volume of foreign currency-based stablecoins (USDT and USDC) are traded in some small- or medium-sized platforms.

10) Stablecoins could be used to implement smart contracts in trading of crypto assets and security tokens.

11) https://news.einfomax.co.kr/news/articleView.html?idxno=4186159

12) The MiCA regulation bill requires stablecoin issuers to hold an equity capital equivalent to more than 2% of reserve assets. Significant issuers are obliged to hold an equity capital 1.5 times larger than the basic requirement and conduct liquidity stress testing.

13) According to this approach, issuers are obliged to participate in controlling of the total issuance volume, and in crisis times, the authorities could provide liquidity to issuers (Schwarcz, 2022).

References

Eichengreen, B., Viswanath-Natraj, G., 2022, Stablecoins and central bank digital currencies: Policy and regulatory challenges, Asian Economic Papers 21(1), 29–46.

Griffin, J.M., Shams, A., 2020, Is bitcoin really untethered? Journal of Finance 75(4), 1913-1964.

Li, L., Li, Y., Macchiavelli, M., Zhou, X., 2021, Liquidity restrictions, runs, and central bank interventions: Evidence from money market funds, Review of Financial Studies 34(11), 5402-5437.

Lyons, R. K., Viswanath-Natraj, G., 2020, What keeps stablecoins stable?, NBER Working Papers 27136.

Schwarcz, S. L., 2022, Regulating digital currencies: Towards an analytical framework. Boston University Law Review 102, 1037-1081.

[Korean]

Financial Supervisory Service, September 28, 2022, Prior notice on the revision and extension of the Guideline for User Funds Protection of Electronic Financial Business, reference materials.