Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

The US Bank Crisis in March and a Look Ahead

Publication date May. 30, 2023

Summary

In March 2023, some small and medium-sized US banks came to fail, which has put strains on global financial markets. An empirical analysis finds that when a negative US financial shock hits, stock prices fall in Korea while the spreads between corporate and government bond yields and between CP and call rates are on the rise. In particular, the interest rate spreads tend to widen for nearly six months, thereby having prolonged negative effects on the market. Fortunately, the March 2023 bank crisis was not severe, and its aftershocks are expected to subside gradually as the market regains stability. However, it is noteworthy that the Fed is anticipated to keep higher interest rates for the time being and a number of risk factors are lurking in the US banking sector. Accordingly, there is a possibility that other small and large shocks will hit the financial market in the near future. In this respect, it is time to take extra precautions to prevent the US financial instability from setting off turbulence in Korea. Considering the current inflation in Korea, it seems too early to discuss a pivot in monetary policy. But if financial stability risk continues to escalate, the financial authorities should take a targeted approach to supply liquidity immediately to areas in need to head off turmoil promptly.

As the US Fed has aggressively hiked interest rates, financial institutions with vulnerabilities in risk management have come to the fore. In March 2023, Silicon Valley Bank (SVB) (asset value of $212 billion)1) filed for bankruptcy, which was followed by a series of crises in small and medium-sized banks, such as the collapse of Signature Bank (asset value of $110 billion) and the liquidity crisis of First Republic Bank (asset value of $213 billion). These banks suffered massive deposit withdrawals, which can be attributable to a combination of multiple factors including a maturity mismatch between assets and liabilities, mark-to-market losses of asset holdings, and an excessive uninsured deposit share.

Policy response and developments

Policy authorities including the Fed took prompt measures such as liquidity provision and depositor protection to curtail the spread of the financial turmoil.2) The Fed enabled financial institutions to shore up liquidity by implementing the Bank Term Funding Program (BTFP) and lowering haircuts for discount window loans.3) On top of that, the Federal Deposit Insurance Corporation (FDIC) founded a bridge bank financed by the Fed to allow depositors of failed banks to withdraw their deposits regardless of a limit.

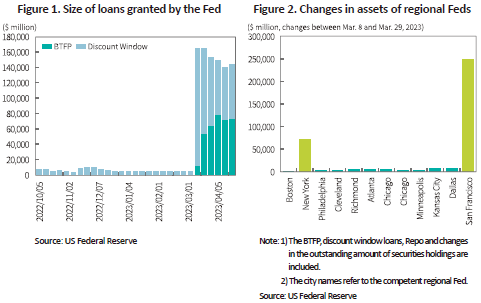

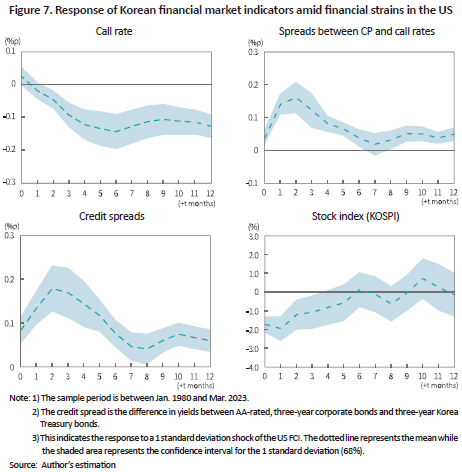

Commercial banks tend to avoid loans granted by the central bank, such as discount window loans, due to concerns about the stigma effect.4) But the use of the BTFP and discount window loans surged in the wake of the collapse of the aforementioned banks, suggesting that there was urgent need of liquidity (Figure 1) among other banks. As demonstrated by changes in asset holdings of each regional Fed shown in Figure 2, such loans were financed partially by the Federal Reserve Bank of New York, primarily by the Federal Reserve Bank of San Francisco. This implies that the need for liquidity came predominantly from areas where failed banks were located.

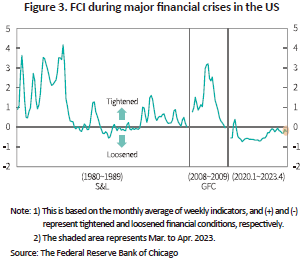

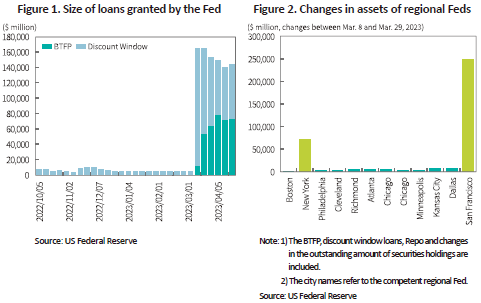

As measures taken by policy authorities have quickly stabilized the financial market, a series of bank failures in March seem not to have dealt a blow to the US financial market. Figure 3 shows changes in the Adjusted National Financial Conditions Index (FCI)5) by each period of financial instability including the savings and loan (S&L) crisis, the global financial crisis (GFC) and the recent period from January 2020 to April 2023. It is obvious that exacerbated financial conditions persisted during the S&L crisis and the GFC. In the case of the March 2023 financial unrest, however, the change in the FCI seems relatively small6) and temporary, although it shows a tightened condition (upward movement).

Risks

As the US financial market shows a sign of recovery, the aftershocks of the March bank failures are expected to subside gradually. But financial instability may rear its head again as several risk factors remain in the US financial market, especially in the banking sector. Prominent factors include the sizable mark-to-market loss of around $2 trillion on asset holdings of the entire banking sector, the large share7) of uninsured deposits and the high exposure of small and medium-sized banks to commercial real estate. In particular, US banks with a high uninsured deposit share may face a bank run that can be triggered by even a small shock, as is the case with SVB. Jiang et al. (2023) estimate that a total of 66 banks would become insolvent if only 10% of their uninsured deposits are withdrawn.8) The combined asset value of the 66 banks is estimated at $210 billion. If this scenario is realized, one SVB-scale bank would fall into insolvency. Given that this analysis takes only a direct financial impact into account, liquidity risk is likely to be amplified if ripple effects arising from social media or online banking come into play. If the vulnerability of a specific bank is unveiled when depositors are paying close attention to recent developments, the digital bank run may not only affect the bank at issue but also spread to other banks having similarities in part.

Impact of US financial uncertainty

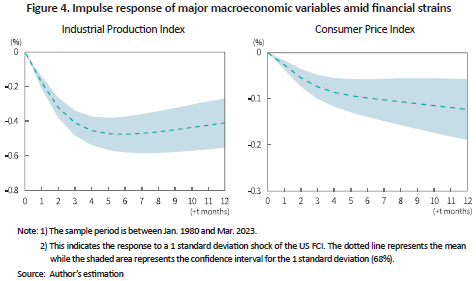

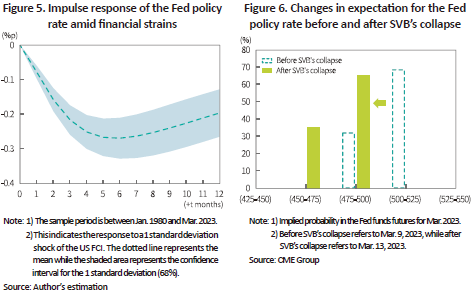

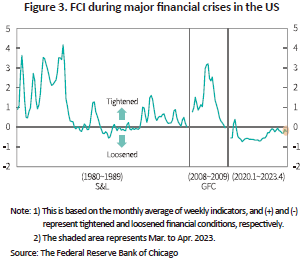

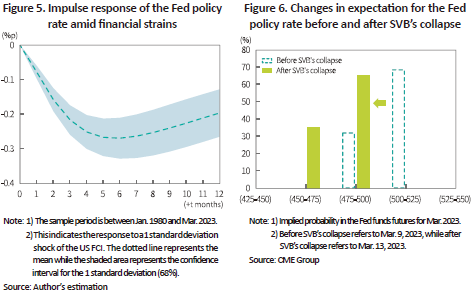

If financial turbulence arises in the US due to a bank run or an asset price crash, it will impact not only the entire US economy but also Korea’s financial and economic sectors. Figure 4 indicates that if a negative FCI shock hits, the US Industrial Production Index and Consumer Price Index would show a significant fall.9) In addition, if financial unrest brings about a slowdown in production activities and inflation, policy response from the Fed is likely to ensue, which is empirically demonstrated in Figure 5.

The estimation suggests that the FCI shock in March would lead to a 20bp cut in the policy rate.10) Prior to SVB’s collapse, it was generally expected that the March FOMC would agree on a 50bp hike of the policy rate. However, as the collapse of small and medium-sized banks put strains on the financial market, the market expectation was revised down to the 25bp increase (Figure 6). Fed Chairman Jerome Powell also hinted at a press conference held after the FOMC meeting that the rate hike would be smaller than planned before the bank collapse.11) Considering that the financial unrest in March hardly had severe repercussions and the market restored stability swiftly, it is unlikely for the Fed to bring forward the interest rate cut to this year due to financial conditions.

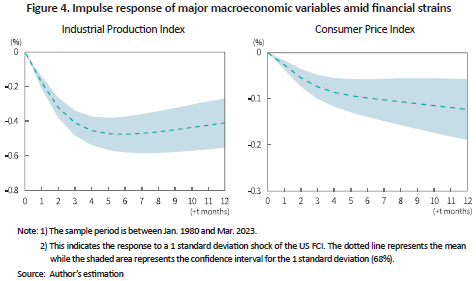

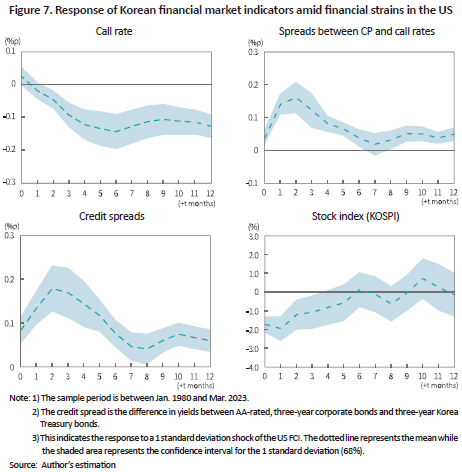

It is estimated that financial shocks in the US will have an adverse impact on Korea’s financial market via expectation and risk premium channels. Notably, it is found that the impact on the corporate bond and CP markets are likely to persist, despite the monetary policy response of changing the base rate. As illustrated in the upper left of Figure 7, Bank of Korea has counteracted impacts from US financial shocks by cutting the base rate or reducing the size of the rate hike. Such policy responses serve as an effective tool to curb the rise in market interest rates to some extent, especially for short-term bonds. As market participants became more vigilant against credit conditions, however, the spread between the 91-day, A1-rated CP and the call rates widened during the six-month period (upper right of Figure 7). A similar response is also observed in corporate bond credit spreads (lower left of Figure 7). It is estimated that the March shock in the US widens credit spreads by up to 15bp and has a prolonged impact for nearly six months. Lastly, the lower right of Figure 7 shows the reaction of the stock price index, KOSPI, which is estimated to fall by up to about 1.5% (measured based on the March shock). Still, its impact seems to be significant only for about two months, suggesting that the persistence is relatively lower.

Implications

A series of failures of small and medium-sized US banks in March has raised concerns about a potential financial crisis originating from the US. Fortunately, the market stabilized faster than expected thanks to policy measures, indicating that such failures seem not to have substantial effects on the market. Although the US saw net outflows of deposits, such as a massive migration of corporate deposits, to money market funds (MMFs), a serious credit crunch did not emerge, differently from the 2008 global financial crisis where the run on MMFs occurred. Additionally, as financial conditions have improved since end-March, the negative impact of the bank collapse is expected to be offset to some extent. It is noteworthy that the Fed is anticipated to keep higher interest rates for the time being and several risk factors are lurking in the banking sector. Accordingly, there is a possibility that large and small-scale shocks will hit the market in the near future. In particular, First Republic Bank eventually failed to revive despite the liquidity injection of 11 large commercial banks, implying that financial unrest could be rekindled among banks with unresolved risks.

In Korea, the entire CP and corporate bond markets were frozen last year, due to a local funding crunch. In this respect, it is necessary to take extra precautions to prevent financial instability in the US from setting off another crisis in Korea. In light of the current inflation, Bank of Korea still needs to maintain a tightening stance. But if financial stability risk spreads further, what is needed is a prompt response through a targeted liquidity supply. As discussed above, the US financial unrest will exacerbate the financing conditions of Korean companies for nearly six months. An excessively tightened financial condition is not what the financial authorities pursue. Furthermore, when the market is nearly dysfunctional, a delayed response will mean greater liquidity for normalization, putting constraints on the effectiveness of the deployed monetary policy and future policy implementation. In other words, the magnified emergency liquidity supply is likely to come into conflict with recently implemented monetary policy and a stronger tightening would be necessary to drain liquidity later. For this reason, it is imperative for the authorities to prepare and swiftly use micro tools for market stabilization while adhering to the separation principle.

1) The asset value is as of end-2022.

2) On March 12, 2023, shortly after SVB filed for bankruptcy (March 10), the financial authorities announced measures for liquidity provision and a full deposit guarantee. For details related to SVB’s collapse and BTFP, see Hwang (2023).

3) The Fed lowered the haircut from 1~6 percent to zero on collateral securities (US treasury and government sponsored enterprises bonds and agency backed mortgages) pledged to secure discount window loans.

4) This means that the borrower (commercial bank) is deemed to be under financial distress as it cannot secure liquidity from the market and has to rely on central bank lending facilities.

5) The Federal Reserve Bank of Chicago produces the FCI by extracting common factors from 105 financial market variables covering money markets, debt and equity markets, and the traditional and shadow banking systems.

6) Investigating shocks to FCI (identified by the model delivering the results shown in Figures 4 and 5) produces the same assessment. The maximum shocks generated from the GFC and S&L crisis were nine and six times of those from the March bank crisis, respectively, and during the two previous crises, the shocks of considerable size hit the market repeatedly.

7) Some argued that the US Department of Treasury was considering full deposit insurance to dispel such concerns (“US Studies Ways to Insure All Bank Deposits If Crisis Grows”, March 21, 2023, Bloomberg). But Treasury Secretary Janet Yellen said she was not considering guaranteeing all bank deposits (“Yellen Says Treasury Isn’t Considering Guaranteeing All Bank Deposits”, March 22, 2023, Wall Street Journal).

8) Jiang et al. (2023) consider a bank insolvent if the remaining mark-to-market value of assets after uninsured deposits are withdrawn is insufficient to repay all insured deposits.

9) For this analysis, a vector autoregressive model (VAR) has been set with variables including the US industrial production index, consumer price index, effective Fed funds rates, FCI, and oil prices (WTI). This result has derived from the analysis of the impulse response by applying a recursive identification condition according to the sequence above.

10) The impulse response function shown in the figure is an estimate based on the 1 standard deviation shock to the FCI. The intensity of the March 2023 shock represents around 0.8 standard deviation. The estimate (20bp) mentioned in this article is converted to a figure corresponding to the March shock.

11) “We also assess, as I mentioned, that the events of the last two weeks are likely to result in some tightening of credit conditions for households and businesses, and thereby weigh on demand, on the labor market, and on inflation. ……… you can think of it as being the equivalent of a rate hike or perhaps more than that.” (Remark at the press conference held immediately after the March FOMC)

References

Jiang, E. X., Matvos, G., Piskorski, T., Seru, A., 2023, Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?, NBER Working Papers 31048.

[Korean]

Hwang, S.W., 2023, Silicon Valley Bank’s Collapse: Its Ripple Effects on Korea’s Financial Market and Relevant Implications, Korea Capital Market Institute Capital Market Focus, 2023-06.

Policy response and developments

Policy authorities including the Fed took prompt measures such as liquidity provision and depositor protection to curtail the spread of the financial turmoil.2) The Fed enabled financial institutions to shore up liquidity by implementing the Bank Term Funding Program (BTFP) and lowering haircuts for discount window loans.3) On top of that, the Federal Deposit Insurance Corporation (FDIC) founded a bridge bank financed by the Fed to allow depositors of failed banks to withdraw their deposits regardless of a limit.

Commercial banks tend to avoid loans granted by the central bank, such as discount window loans, due to concerns about the stigma effect.4) But the use of the BTFP and discount window loans surged in the wake of the collapse of the aforementioned banks, suggesting that there was urgent need of liquidity (Figure 1) among other banks. As demonstrated by changes in asset holdings of each regional Fed shown in Figure 2, such loans were financed partially by the Federal Reserve Bank of New York, primarily by the Federal Reserve Bank of San Francisco. This implies that the need for liquidity came predominantly from areas where failed banks were located.

As measures taken by policy authorities have quickly stabilized the financial market, a series of bank failures in March seem not to have dealt a blow to the US financial market. Figure 3 shows changes in the Adjusted National Financial Conditions Index (FCI)5) by each period of financial instability including the savings and loan (S&L) crisis, the global financial crisis (GFC) and the recent period from January 2020 to April 2023. It is obvious that exacerbated financial conditions persisted during the S&L crisis and the GFC. In the case of the March 2023 financial unrest, however, the change in the FCI seems relatively small6) and temporary, although it shows a tightened condition (upward movement).

Risks

As the US financial market shows a sign of recovery, the aftershocks of the March bank failures are expected to subside gradually. But financial instability may rear its head again as several risk factors remain in the US financial market, especially in the banking sector. Prominent factors include the sizable mark-to-market loss of around $2 trillion on asset holdings of the entire banking sector, the large share7) of uninsured deposits and the high exposure of small and medium-sized banks to commercial real estate. In particular, US banks with a high uninsured deposit share may face a bank run that can be triggered by even a small shock, as is the case with SVB. Jiang et al. (2023) estimate that a total of 66 banks would become insolvent if only 10% of their uninsured deposits are withdrawn.8) The combined asset value of the 66 banks is estimated at $210 billion. If this scenario is realized, one SVB-scale bank would fall into insolvency. Given that this analysis takes only a direct financial impact into account, liquidity risk is likely to be amplified if ripple effects arising from social media or online banking come into play. If the vulnerability of a specific bank is unveiled when depositors are paying close attention to recent developments, the digital bank run may not only affect the bank at issue but also spread to other banks having similarities in part.

Impact of US financial uncertainty

If financial turbulence arises in the US due to a bank run or an asset price crash, it will impact not only the entire US economy but also Korea’s financial and economic sectors. Figure 4 indicates that if a negative FCI shock hits, the US Industrial Production Index and Consumer Price Index would show a significant fall.9) In addition, if financial unrest brings about a slowdown in production activities and inflation, policy response from the Fed is likely to ensue, which is empirically demonstrated in Figure 5.

The estimation suggests that the FCI shock in March would lead to a 20bp cut in the policy rate.10) Prior to SVB’s collapse, it was generally expected that the March FOMC would agree on a 50bp hike of the policy rate. However, as the collapse of small and medium-sized banks put strains on the financial market, the market expectation was revised down to the 25bp increase (Figure 6). Fed Chairman Jerome Powell also hinted at a press conference held after the FOMC meeting that the rate hike would be smaller than planned before the bank collapse.11) Considering that the financial unrest in March hardly had severe repercussions and the market restored stability swiftly, it is unlikely for the Fed to bring forward the interest rate cut to this year due to financial conditions.

It is estimated that financial shocks in the US will have an adverse impact on Korea’s financial market via expectation and risk premium channels. Notably, it is found that the impact on the corporate bond and CP markets are likely to persist, despite the monetary policy response of changing the base rate. As illustrated in the upper left of Figure 7, Bank of Korea has counteracted impacts from US financial shocks by cutting the base rate or reducing the size of the rate hike. Such policy responses serve as an effective tool to curb the rise in market interest rates to some extent, especially for short-term bonds. As market participants became more vigilant against credit conditions, however, the spread between the 91-day, A1-rated CP and the call rates widened during the six-month period (upper right of Figure 7). A similar response is also observed in corporate bond credit spreads (lower left of Figure 7). It is estimated that the March shock in the US widens credit spreads by up to 15bp and has a prolonged impact for nearly six months. Lastly, the lower right of Figure 7 shows the reaction of the stock price index, KOSPI, which is estimated to fall by up to about 1.5% (measured based on the March shock). Still, its impact seems to be significant only for about two months, suggesting that the persistence is relatively lower.

Implications

A series of failures of small and medium-sized US banks in March has raised concerns about a potential financial crisis originating from the US. Fortunately, the market stabilized faster than expected thanks to policy measures, indicating that such failures seem not to have substantial effects on the market. Although the US saw net outflows of deposits, such as a massive migration of corporate deposits, to money market funds (MMFs), a serious credit crunch did not emerge, differently from the 2008 global financial crisis where the run on MMFs occurred. Additionally, as financial conditions have improved since end-March, the negative impact of the bank collapse is expected to be offset to some extent. It is noteworthy that the Fed is anticipated to keep higher interest rates for the time being and several risk factors are lurking in the banking sector. Accordingly, there is a possibility that large and small-scale shocks will hit the market in the near future. In particular, First Republic Bank eventually failed to revive despite the liquidity injection of 11 large commercial banks, implying that financial unrest could be rekindled among banks with unresolved risks.

In Korea, the entire CP and corporate bond markets were frozen last year, due to a local funding crunch. In this respect, it is necessary to take extra precautions to prevent financial instability in the US from setting off another crisis in Korea. In light of the current inflation, Bank of Korea still needs to maintain a tightening stance. But if financial stability risk spreads further, what is needed is a prompt response through a targeted liquidity supply. As discussed above, the US financial unrest will exacerbate the financing conditions of Korean companies for nearly six months. An excessively tightened financial condition is not what the financial authorities pursue. Furthermore, when the market is nearly dysfunctional, a delayed response will mean greater liquidity for normalization, putting constraints on the effectiveness of the deployed monetary policy and future policy implementation. In other words, the magnified emergency liquidity supply is likely to come into conflict with recently implemented monetary policy and a stronger tightening would be necessary to drain liquidity later. For this reason, it is imperative for the authorities to prepare and swiftly use micro tools for market stabilization while adhering to the separation principle.

1) The asset value is as of end-2022.

2) On March 12, 2023, shortly after SVB filed for bankruptcy (March 10), the financial authorities announced measures for liquidity provision and a full deposit guarantee. For details related to SVB’s collapse and BTFP, see Hwang (2023).

3) The Fed lowered the haircut from 1~6 percent to zero on collateral securities (US treasury and government sponsored enterprises bonds and agency backed mortgages) pledged to secure discount window loans.

4) This means that the borrower (commercial bank) is deemed to be under financial distress as it cannot secure liquidity from the market and has to rely on central bank lending facilities.

5) The Federal Reserve Bank of Chicago produces the FCI by extracting common factors from 105 financial market variables covering money markets, debt and equity markets, and the traditional and shadow banking systems.

6) Investigating shocks to FCI (identified by the model delivering the results shown in Figures 4 and 5) produces the same assessment. The maximum shocks generated from the GFC and S&L crisis were nine and six times of those from the March bank crisis, respectively, and during the two previous crises, the shocks of considerable size hit the market repeatedly.

7) Some argued that the US Department of Treasury was considering full deposit insurance to dispel such concerns (“US Studies Ways to Insure All Bank Deposits If Crisis Grows”, March 21, 2023, Bloomberg). But Treasury Secretary Janet Yellen said she was not considering guaranteeing all bank deposits (“Yellen Says Treasury Isn’t Considering Guaranteeing All Bank Deposits”, March 22, 2023, Wall Street Journal).

8) Jiang et al. (2023) consider a bank insolvent if the remaining mark-to-market value of assets after uninsured deposits are withdrawn is insufficient to repay all insured deposits.

9) For this analysis, a vector autoregressive model (VAR) has been set with variables including the US industrial production index, consumer price index, effective Fed funds rates, FCI, and oil prices (WTI). This result has derived from the analysis of the impulse response by applying a recursive identification condition according to the sequence above.

10) The impulse response function shown in the figure is an estimate based on the 1 standard deviation shock to the FCI. The intensity of the March 2023 shock represents around 0.8 standard deviation. The estimate (20bp) mentioned in this article is converted to a figure corresponding to the March shock.

11) “We also assess, as I mentioned, that the events of the last two weeks are likely to result in some tightening of credit conditions for households and businesses, and thereby weigh on demand, on the labor market, and on inflation. ……… you can think of it as being the equivalent of a rate hike or perhaps more than that.” (Remark at the press conference held immediately after the March FOMC)

References

Jiang, E. X., Matvos, G., Piskorski, T., Seru, A., 2023, Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?, NBER Working Papers 31048.

[Korean]

Hwang, S.W., 2023, Silicon Valley Bank’s Collapse: Its Ripple Effects on Korea’s Financial Market and Relevant Implications, Korea Capital Market Institute Capital Market Focus, 2023-06.