Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Potential Structural Shift in the Interest Rate Trend and Corporate Debt

Publication date Sep. 05, 2023

Summary

As credit risk has spiked in the private sector due to the recent rise in interest rates, destabilizing factors in the stock market, such as worsening profitability and bankruptcy risk, are accumulating. Even with the possibility of a structural shift in interest rates, it is unlikely to resolve market uncertainties quickly. But a comprehensive examination suggests that short- and long-term default risks in the corporate sector are hardly grave. Despite concerns about growing dependence on loans, chances are slim that the insolvency risk of corporate debt spreads across the financial system. This can be attributed to a conservative debt management strategy that requires companies to focus on financial solvency even in the face of swelling liquidity resulting from the Covid-19 crisis. However, it is noteworthy that low-cost debt was not fully utilized to realize growth potential under the low interest rate environment that continued after the 2008 global financial crisis, which requires a future-oriented discussion. In this respect, it is time to figure out how to effectively utilize corporate debt to break away from sluggish growth trends.

Rising interest rates and growing anxiety over market conditions

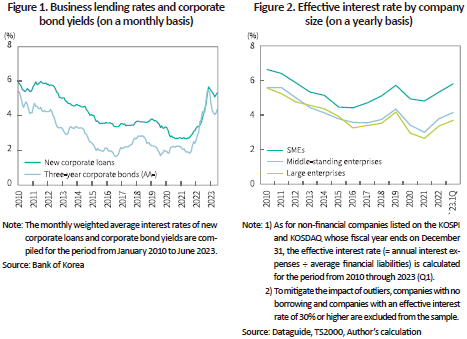

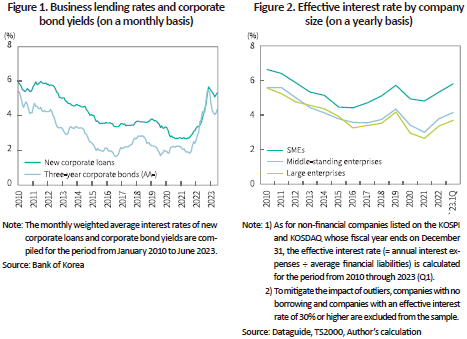

Currently, Korea is faced with the steepest interest rate hike cycle in history.1) The interest rate on new corporate loans, which stood at 2.72% in June 2021, rose to 5.32% by 2.6%p as of June 2023 (Figure 1). The cost of debt for companies, which had gradually declined over the past decade since the global financial crisis, returned to the 2010 level only in two years. As the interest burden of corporate financial debts has climbed, the effective interest rate for SMEs (large enterprises) engaging in non-financial sectors reached 5.79% (3.68%) at the end of the first quarter of 2023 (Figure 2). Considering that the effective interest rate compiled in financial statements lags behind market interest rates depending on a maturity structure, companies are highly likely to pay higher interest expenses for some time.

Although the upward trend in price indices has recently slowed down internally and externally, it should be noted that this rate hike cycle, being more abrupt than ever, is an inevitable response to prices by central banks, driven by structural factors behind global inflation increases such as deglobalization, decarbonization and demographic changes (Nagel, 2022). Given the prevailing view that it is difficult to expect a reversal of the current situation in the short term, a conservative scenario may be needed, assuming the possibility that the nominal equilibrium interest rate remains slightly higher than in the previous low interest rate environment (Kang, 2023).

In particular, various destabilizing factors stemming from rate hikes exacerbated market uncertainty in the first half of this year (Kim, 202; Park, 2023). First, the rapidly growing burden of interest payment deteriorated the short-term operating cash flow and raised concerns about the potential bankruptcy of insolvent and marginal companies. Second, anxieties such as the Legoland crisis put greater strains on the funding market in the midst of amplifying corporate financial difficulties, which compelled even financially sound companies to pay high refinancing costs. Third, the increase in the discount rate led to a conservative assessment of corporate growth value, worsening financing conditions for innovative companies. This sparked concerns that the sluggish growth trend would solidify over the long run. Furthermore, as efficient capital allocation becomes important, especially for low-growth, maturity-stage companies, high interest rates have partly contributed to promoting shareholder activism regarding the efficient use of capital.

Cash flow risk and default risk remain low

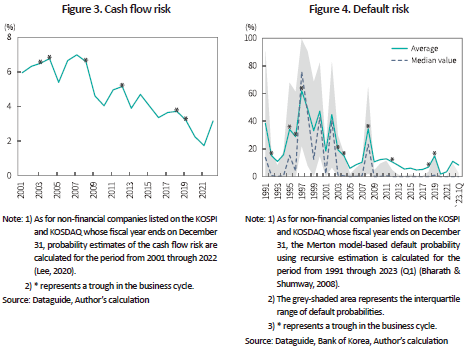

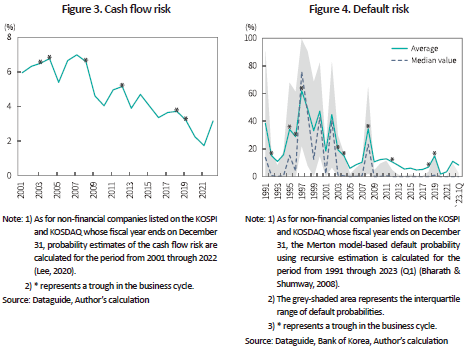

Despite various concerns, the cash crunch risk, a measurement of listed companies’ short-term default risk, is estimated to have rebounded only slightly within a relatively stable range (Figure 3). As of the end of 2022 (the latest fiscal year), around 3.17% of companies may suffer short-term funding pressure. This figure is similar to 3.22% in 2019 when corporate profitability declined in the wake of strengthened protectionism and a domestic market slowdown and can be considered considerably more stable than 6.6% in the face of the 2008 global financial crisis. A look at actual financial standing shows that the ratio of cash holdings to total short-term financial debt held by listed companies stands at 106% on an individual basis and 129% on a consolidated basis as of the end of 2022, suggesting that they can afford to flexibly respond to the demand for operating funds.

The default risk, which is estimated based on both short- and long-term default risk, also remains within a stable range (Figure 4). As of the end of the first quarter of 2023, the average default probability of listed companies is 8.33%. This is not excessively high, even compared to several economic crises including a previous trough in the business cycle.

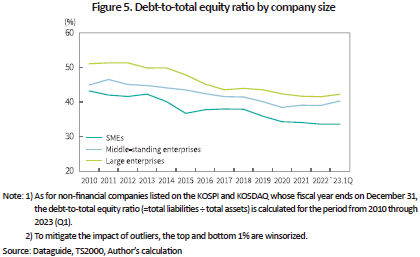

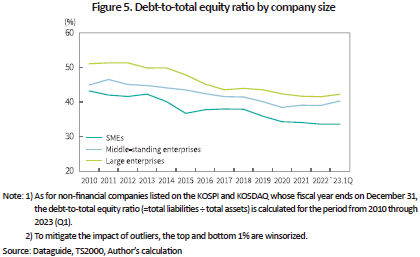

In the meantime, a surge in corporate loans from the second half of 2022 requires caution (Bank of Korea, 2022; 2023). Notably, such growth of loans can be attributable to the fact that companies have transformed their debt composition to expand borrowings rather than issuing more loans as the corporate bond market has become temporarily tight. The ratio of total debt to pledged assets keeps stabilizing downward to a healthy level (Figure 5), which hardly threatens the corporate sector’s financial solvency in macroeconomic terms.

These findings imply that despite the recent rise in market interest rates and companies’ growing dependence on loans, the default risk of short- and long-term debt is less likely to spread across the entire financial system. It is imperative to identify and respond to microeconomic issues with a focus on vulnerable sectors.2)

Need for debt management to facilitate corporate growth

When it comes to debt management, Korea’s corporate sector has placed priority on maintaining financial soundness in the aftermath of the 1997 foreign exchange crisis and the 2008 global financial crisis. This policy direction has served as the source of resilience in extreme crises such as liquidity crunch (Lee, 2020), which will also hold true for the current rate hike cycle. However, it should be noted that in spite of the downward trend of debt financing costs starting from 2010 (Figure 1 & 2), a corporate policy for financial structure has rarely moved away from pursuing deleveraging-based financial solvency (Figure 5), which seems to call for in-depth evaluation.

S&P 500 companies in the US have steadily increased their debt ratio over the past two decades, driven by the long-term downturn in interest rates (Smolyansky, 2023). Active utilization of low-cost borrowings has not only facilitated corporate profit growth through expanded financial leverage but also contributed to the increase in stock returns by lowering the weighted average cost of capital. As a result of the Trump administration’s drastic corporate tax cuts,3) 41% of real net profit growth and 28% of the increase in stock returns can be explained by a decrease in interest and tax expenses during the same period.4)

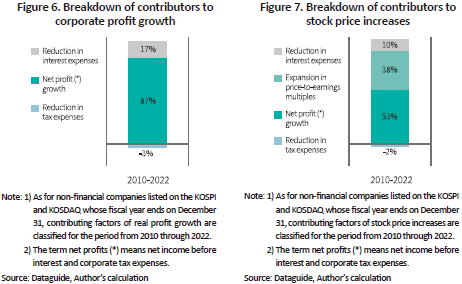

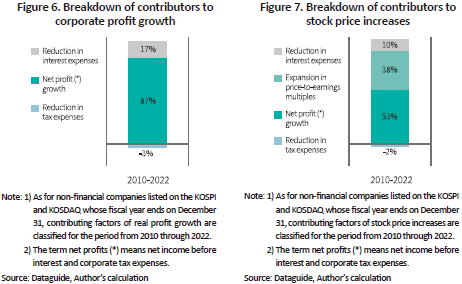

On the other hand, Korean companies focused more on stable debt management rather than flexibly raising the debt ratio even when the interest burden kept falling in the wake of the 2008 global financial crisis. Amid the low interest rate environment continuing from 2010 to 2022, however, the decline in interest expenses accounted for 7% of the real net profit growth of listed companies and only 10% of the rise in stock prices (Figures 6 & 7).

The finding that the low interest rate environment of the past decade contributed to the profit growth of the Korean corporate sector to a limited extent provides two-sided implications. First of all, even if interest rates are adjusted slightly upward compared to the past level, it is likely to have only a limited impact on the decline in corporate profitability. Considering financial fundamentals, Korea’s corporate sector is expected to weather a potential crisis in an orderly manner.

On another front, progressive discussions are needed for the corporate sector to figure out how to effectively manage debt. Financial solvency is still an important consideration under the assumption that the nominal equilibrium interest rate remains higher compared to the low interest rate environment. However, the utilization of corporate debt hardly aims at maintaining financial health. Although there are several theories of the adequate debt-to-equity ratio, one of the positive roles played by debt financing is to facilitate the achievement of growth potential, ultimately maximizing enterprise value.

Suggestions for effective debt utilization

Under the low interest rate environment that was prolonged after the global financial crisis, Korea has internalized corporate management based on a conservative borrowing strategy, considering that its economic structure is heavily dependent on foreign trade. During that period, it took a measure of designating an external auditor by authority for companies with a weak financial structure, such as the one in which the debt-to-equity ratio exceeds 200%, which may hinder active utilization of corporate debt.5) Notably, companies that proactively cut back on debt during that period had relatively strong fundamentals and already entered the growth stage. For proper utilization of debt, a range of internal and external factors should be considered comprehensively to boost growth potential.

In this respect, the first suggestion is to select a financial structure aligned with the corporate life cycle and review a shareholder return policy. Companies in the startup or growth stage need to seek growth opportunities by actively securing borrowings, whereas those in the maturity or decline stage should examine the need for efficiently reallocating resources for shareholder returns.

Second, it is necessary to maximize operational efficiency, for example by curtailing debt through the sale of non-core business units. With potential GDP growth expected to slow down, there may be limited room for corporate profit growth through the expansion in sales. For this reason, improving profit margin is highly likely to be the main path of profit growth for the time being. In this process, it is indispensable to overhaul the financial structure in vulnerable sectors including marginal companies.

Lastly, it is noteworthy that contributors to the structural increase in global inflation such as deglobalization, decarbonization and demographic changes, which have set off the recent rate hike cycle, have a close relationship with off-balance sheet debt. Dual investment aimed at dealing with economic blocs, investment for greenhouse gas reduction and replacement of stranded assets, and growing employee pension burden caused by population aging and the resultant decline in labor productivity are challenges to be tackled over the long run to boost corporate sustainability. With regard to these issues, stakeholders are increasingly calling for objective identification, measurement and management for sustainability disclosure.

1) Bank of Korea raised the benchmark rate ten times by a total of 3%p from August 2021 to January 2023, and currently keeps the rate at the 3.5% level as of August 2023.

2) Companies with poor financial health or loss of business competency, such as companies with capital impairment or marginal companies, are likely to face a serious cash flow risk if demand plunges as a result of economic slump. By sector, the utility sector that has failed to transfer the cost burden to sales prices for a long time is considered the most risky.

3) The Tax Cuts and Jobs Act of 2017, which came into force on January 1, 2018, has lowered the statutory maximum corporate tax rate by 14%p from 35% to 21%.

4) Smolyansky (2023) uses accounting identities to divide contributors to corporate net profit growth into 1) an increase in earnings before interest and corporate tax; 2) a decrease in the interest burden; and 3) a decline in the effective tax rate, and also breaks down factors of the increase in stock returns into 4) expansion in price-to-earnings multiples, in addition to 1); 2); and 3).

5) Under the Enforcement Decree of the Act on External Audit of Stock Companies, which took effect on November 19, 2014, if the debt-to-equity (D/E) ratio is more than 1.5 times, or 200% in absolute terms, compared to other companies in the same business sector and the operating profit falls short of interest expenses, the relevant stock-listed corporation shall be subject to the designation of an auditor. However, this provision was eliminated from the revision to the said Enforcement Decree that took effect on October 13, 2020.

References

Bharath, S.T., Shumway, T., 2008, Forecasting default with the Merton distance to default model, The Review of Financial Studies, 21(3): 1339-1369.

Nagel, J., 2022, The impact of the Russian aggression on inflation prospects and monetary policy’s response, keynote address at the International Economic Symposium co-hosted by the Deutsche Bundesbank and NABE, 10 May 2022.

Smolyansky, M., 2023, End of an era: The coming long-run slowdown in corporate profit growth and stock returns, Finance and Economics Discussion Series.

[Korean]

Kang, H.J., 2023, Declining Interest Rate Sensitivity of the US Real Economy and its Implications, KCMI Opinion 2023-12.

Kim, P.K., 2023, Changes in Corporate Debt Structure in Response to Rising Interest Rates, KCMI Opinion 2023-11.

Park, Y.R., 2023, Causes of the Recent Decline in Venture Capital Investment and Future Challenges for Venture Capital Market Development, KCMI Opinion 2023-13.

Lee, S.H., 2020, Stress Test for Cash Burn Risk of Listed Companies in Preparation for Demand Shock from the Spread of Covid-19, KCMI Issue Paper 20-11.

Bank of Korea, Financial Stability Report, 2022.12; 2023. 6.

Currently, Korea is faced with the steepest interest rate hike cycle in history.1) The interest rate on new corporate loans, which stood at 2.72% in June 2021, rose to 5.32% by 2.6%p as of June 2023 (Figure 1). The cost of debt for companies, which had gradually declined over the past decade since the global financial crisis, returned to the 2010 level only in two years. As the interest burden of corporate financial debts has climbed, the effective interest rate for SMEs (large enterprises) engaging in non-financial sectors reached 5.79% (3.68%) at the end of the first quarter of 2023 (Figure 2). Considering that the effective interest rate compiled in financial statements lags behind market interest rates depending on a maturity structure, companies are highly likely to pay higher interest expenses for some time.

Although the upward trend in price indices has recently slowed down internally and externally, it should be noted that this rate hike cycle, being more abrupt than ever, is an inevitable response to prices by central banks, driven by structural factors behind global inflation increases such as deglobalization, decarbonization and demographic changes (Nagel, 2022). Given the prevailing view that it is difficult to expect a reversal of the current situation in the short term, a conservative scenario may be needed, assuming the possibility that the nominal equilibrium interest rate remains slightly higher than in the previous low interest rate environment (Kang, 2023).

In particular, various destabilizing factors stemming from rate hikes exacerbated market uncertainty in the first half of this year (Kim, 202; Park, 2023). First, the rapidly growing burden of interest payment deteriorated the short-term operating cash flow and raised concerns about the potential bankruptcy of insolvent and marginal companies. Second, anxieties such as the Legoland crisis put greater strains on the funding market in the midst of amplifying corporate financial difficulties, which compelled even financially sound companies to pay high refinancing costs. Third, the increase in the discount rate led to a conservative assessment of corporate growth value, worsening financing conditions for innovative companies. This sparked concerns that the sluggish growth trend would solidify over the long run. Furthermore, as efficient capital allocation becomes important, especially for low-growth, maturity-stage companies, high interest rates have partly contributed to promoting shareholder activism regarding the efficient use of capital.

Cash flow risk and default risk remain low

Despite various concerns, the cash crunch risk, a measurement of listed companies’ short-term default risk, is estimated to have rebounded only slightly within a relatively stable range (Figure 3). As of the end of 2022 (the latest fiscal year), around 3.17% of companies may suffer short-term funding pressure. This figure is similar to 3.22% in 2019 when corporate profitability declined in the wake of strengthened protectionism and a domestic market slowdown and can be considered considerably more stable than 6.6% in the face of the 2008 global financial crisis. A look at actual financial standing shows that the ratio of cash holdings to total short-term financial debt held by listed companies stands at 106% on an individual basis and 129% on a consolidated basis as of the end of 2022, suggesting that they can afford to flexibly respond to the demand for operating funds.

The default risk, which is estimated based on both short- and long-term default risk, also remains within a stable range (Figure 4). As of the end of the first quarter of 2023, the average default probability of listed companies is 8.33%. This is not excessively high, even compared to several economic crises including a previous trough in the business cycle.

In the meantime, a surge in corporate loans from the second half of 2022 requires caution (Bank of Korea, 2022; 2023). Notably, such growth of loans can be attributable to the fact that companies have transformed their debt composition to expand borrowings rather than issuing more loans as the corporate bond market has become temporarily tight. The ratio of total debt to pledged assets keeps stabilizing downward to a healthy level (Figure 5), which hardly threatens the corporate sector’s financial solvency in macroeconomic terms.

These findings imply that despite the recent rise in market interest rates and companies’ growing dependence on loans, the default risk of short- and long-term debt is less likely to spread across the entire financial system. It is imperative to identify and respond to microeconomic issues with a focus on vulnerable sectors.2)

Need for debt management to facilitate corporate growth

When it comes to debt management, Korea’s corporate sector has placed priority on maintaining financial soundness in the aftermath of the 1997 foreign exchange crisis and the 2008 global financial crisis. This policy direction has served as the source of resilience in extreme crises such as liquidity crunch (Lee, 2020), which will also hold true for the current rate hike cycle. However, it should be noted that in spite of the downward trend of debt financing costs starting from 2010 (Figure 1 & 2), a corporate policy for financial structure has rarely moved away from pursuing deleveraging-based financial solvency (Figure 5), which seems to call for in-depth evaluation.

S&P 500 companies in the US have steadily increased their debt ratio over the past two decades, driven by the long-term downturn in interest rates (Smolyansky, 2023). Active utilization of low-cost borrowings has not only facilitated corporate profit growth through expanded financial leverage but also contributed to the increase in stock returns by lowering the weighted average cost of capital. As a result of the Trump administration’s drastic corporate tax cuts,3) 41% of real net profit growth and 28% of the increase in stock returns can be explained by a decrease in interest and tax expenses during the same period.4)

On the other hand, Korean companies focused more on stable debt management rather than flexibly raising the debt ratio even when the interest burden kept falling in the wake of the 2008 global financial crisis. Amid the low interest rate environment continuing from 2010 to 2022, however, the decline in interest expenses accounted for 7% of the real net profit growth of listed companies and only 10% of the rise in stock prices (Figures 6 & 7).

The finding that the low interest rate environment of the past decade contributed to the profit growth of the Korean corporate sector to a limited extent provides two-sided implications. First of all, even if interest rates are adjusted slightly upward compared to the past level, it is likely to have only a limited impact on the decline in corporate profitability. Considering financial fundamentals, Korea’s corporate sector is expected to weather a potential crisis in an orderly manner.

On another front, progressive discussions are needed for the corporate sector to figure out how to effectively manage debt. Financial solvency is still an important consideration under the assumption that the nominal equilibrium interest rate remains higher compared to the low interest rate environment. However, the utilization of corporate debt hardly aims at maintaining financial health. Although there are several theories of the adequate debt-to-equity ratio, one of the positive roles played by debt financing is to facilitate the achievement of growth potential, ultimately maximizing enterprise value.

Suggestions for effective debt utilization

Under the low interest rate environment that was prolonged after the global financial crisis, Korea has internalized corporate management based on a conservative borrowing strategy, considering that its economic structure is heavily dependent on foreign trade. During that period, it took a measure of designating an external auditor by authority for companies with a weak financial structure, such as the one in which the debt-to-equity ratio exceeds 200%, which may hinder active utilization of corporate debt.5) Notably, companies that proactively cut back on debt during that period had relatively strong fundamentals and already entered the growth stage. For proper utilization of debt, a range of internal and external factors should be considered comprehensively to boost growth potential.

In this respect, the first suggestion is to select a financial structure aligned with the corporate life cycle and review a shareholder return policy. Companies in the startup or growth stage need to seek growth opportunities by actively securing borrowings, whereas those in the maturity or decline stage should examine the need for efficiently reallocating resources for shareholder returns.

Second, it is necessary to maximize operational efficiency, for example by curtailing debt through the sale of non-core business units. With potential GDP growth expected to slow down, there may be limited room for corporate profit growth through the expansion in sales. For this reason, improving profit margin is highly likely to be the main path of profit growth for the time being. In this process, it is indispensable to overhaul the financial structure in vulnerable sectors including marginal companies.

Lastly, it is noteworthy that contributors to the structural increase in global inflation such as deglobalization, decarbonization and demographic changes, which have set off the recent rate hike cycle, have a close relationship with off-balance sheet debt. Dual investment aimed at dealing with economic blocs, investment for greenhouse gas reduction and replacement of stranded assets, and growing employee pension burden caused by population aging and the resultant decline in labor productivity are challenges to be tackled over the long run to boost corporate sustainability. With regard to these issues, stakeholders are increasingly calling for objective identification, measurement and management for sustainability disclosure.

1) Bank of Korea raised the benchmark rate ten times by a total of 3%p from August 2021 to January 2023, and currently keeps the rate at the 3.5% level as of August 2023.

2) Companies with poor financial health or loss of business competency, such as companies with capital impairment or marginal companies, are likely to face a serious cash flow risk if demand plunges as a result of economic slump. By sector, the utility sector that has failed to transfer the cost burden to sales prices for a long time is considered the most risky.

3) The Tax Cuts and Jobs Act of 2017, which came into force on January 1, 2018, has lowered the statutory maximum corporate tax rate by 14%p from 35% to 21%.

4) Smolyansky (2023) uses accounting identities to divide contributors to corporate net profit growth into 1) an increase in earnings before interest and corporate tax; 2) a decrease in the interest burden; and 3) a decline in the effective tax rate, and also breaks down factors of the increase in stock returns into 4) expansion in price-to-earnings multiples, in addition to 1); 2); and 3).

5) Under the Enforcement Decree of the Act on External Audit of Stock Companies, which took effect on November 19, 2014, if the debt-to-equity (D/E) ratio is more than 1.5 times, or 200% in absolute terms, compared to other companies in the same business sector and the operating profit falls short of interest expenses, the relevant stock-listed corporation shall be subject to the designation of an auditor. However, this provision was eliminated from the revision to the said Enforcement Decree that took effect on October 13, 2020.

References

Bharath, S.T., Shumway, T., 2008, Forecasting default with the Merton distance to default model, The Review of Financial Studies, 21(3): 1339-1369.

Nagel, J., 2022, The impact of the Russian aggression on inflation prospects and monetary policy’s response, keynote address at the International Economic Symposium co-hosted by the Deutsche Bundesbank and NABE, 10 May 2022.

Smolyansky, M., 2023, End of an era: The coming long-run slowdown in corporate profit growth and stock returns, Finance and Economics Discussion Series.

[Korean]

Kang, H.J., 2023, Declining Interest Rate Sensitivity of the US Real Economy and its Implications, KCMI Opinion 2023-12.

Kim, P.K., 2023, Changes in Corporate Debt Structure in Response to Rising Interest Rates, KCMI Opinion 2023-11.

Park, Y.R., 2023, Causes of the Recent Decline in Venture Capital Investment and Future Challenges for Venture Capital Market Development, KCMI Opinion 2023-13.

Lee, S.H., 2020, Stress Test for Cash Burn Risk of Listed Companies in Preparation for Demand Shock from the Spread of Covid-19, KCMI Issue Paper 20-11.

Bank of Korea, Financial Stability Report, 2022.12; 2023. 6.