Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Current State and Improvement Policy of Retirement Pensions in the Pension Reform Era

Publication date Oct. 24, 2023

Summary

The current retirement pension scheme provides considerable flexibility to companies and individual participants in the stages of enrollment, accumulation, and withdrawal. However, this flexibility can hinder the advancement of the retirement pension scheme.

Although it has been over 17 years since the introduction of retirement pensions, nearly 50% of employees are still covered by the severance pay system. Some have cast doubt on how defined contribution (DC) plans, which are similar to private investment, manage pension assets. The low annuitization rate highlights that the retirement pension scheme has a long way to go before it serves as a tool for stabilizing retirement income.

Low returns and low annuity selection rates have been pointed out since the initial stage of retirement pension introduction, but finding solutions has proven challenging. These issues are closely related to employees’ existing rights, making it legally difficult to mandate a shift toward retirement pensions. Accordingly, it is necessary to find a solution for each stage. In this regard, it is worth considering an alternative system to supplement the existing retirement pension scheme. Under the proposed system, companies will switch to retirement pensions with higher contribution rates than the current 1/12 and adopt a collective asset management approach while an annuity is selected as a default withdrawal option.

Although it has been over 17 years since the introduction of retirement pensions, nearly 50% of employees are still covered by the severance pay system. Some have cast doubt on how defined contribution (DC) plans, which are similar to private investment, manage pension assets. The low annuitization rate highlights that the retirement pension scheme has a long way to go before it serves as a tool for stabilizing retirement income.

Low returns and low annuity selection rates have been pointed out since the initial stage of retirement pension introduction, but finding solutions has proven challenging. These issues are closely related to employees’ existing rights, making it legally difficult to mandate a shift toward retirement pensions. Accordingly, it is necessary to find a solution for each stage. In this regard, it is worth considering an alternative system to supplement the existing retirement pension scheme. Under the proposed system, companies will switch to retirement pensions with higher contribution rates than the current 1/12 and adopt a collective asset management approach while an annuity is selected as a default withdrawal option.

In Korea, retirement pension assets amount to KRW 335.9 trillion as of the end of 2022, representing a 13.6% increase (KRW 40.3 trillion) compared to KRW 295.6 trillion at the end of 2021.1) The retirement pension assets worth around KRW 336 trillion are a critical achievement of the retirement pension scheme. Notably, Korea’s retirement plans take a flexible approach to withdrawal options and the possibility of early withdrawals. However, these advantages also run counter to the retirement pensions’ primary goal of stabilizing retirement income.

Korea’s retirement pension scheme has many advantages, including external accrual of pension liabilities, while struggling with serious challenges, such as the low annuity selection rate, low investment returns and the still relatively low enrollment rate.

The reform of the National Pension scheme is being actively discussed. In this process, some are making suggestions that might have a direct or indirect impact on retirement pension plans, including channeling a portion of retirement contributions into the National Pension. At this juncture, it is necessary to analyze major issues of the retirement pension scheme to seek directions for improvement. Before delving into such issues, this article intends to understand the role of retirement pensions within the entire pension framework.

Target retirement benefits

Retirement pension benefits are determined as a lump sum. In other words, severance pay or the benefits of defined benefit (DB)-type plans are designed to provide an amount equal to or greater than an employee’s final one-month salary multiplied by the years of service. Hence, retirement pensions have no target income replacement rate, and the Asset-Salary Ratio increases in proportion to years of service.

For example, if an employee works for 30 years and receives pension benefits for another 30 years after retirement, and the investment returns are assumed to be 5% during the pension eligibility period, the income replacement rate (=pension amount/final monthly salary) is calculated as 16.1%.2) In this case, the income replacement rate increases by 0.54% per year of service. As for a defined contribution (DC) retirement pension, the amount of final retirement benefits is not predetermined. Under DC plans, one month’s worth of salary is contributed every year. Therefore, if the rate of returns matches wage growth rates during the contribution accrual period, the amount equivalent to DB plans’ benefits—30 months’ worth of the final monthly salary—is received as the retirement benefit. If an employee is able to accumulate funds of a similar size to his or her retirement plan assets by additionally paying the monthly salary into personal pension or individual retirement pension (IRP) accounts eligible for tax incentives, it is possible to secure around a 30% income replacement rate through private pensions.3) If the National Pension is added to the equation, the income replacement rate would rise to 60% to 70%.4)

The National Pension scheme contributes 9% of the annual salary, which is slightly higher than the contribution rate of retirement pensions. If an individual joins the National Pension for 30 years, the income replacement rate of 30% is guaranteed, suggesting that the rate increases by 1% for each year. The National Pension provides much higher benefits compared to retirement plans, which demonstrates the need for the reform of the National Pension scheme. The income replacement rate guaranteed by the National Pension is achievable only if investment returns stay consistently much higher or the contribution rate is significantly higher than the current level. Meanwhile, even if the income replacement rate is reduced by taking into account realistic investment returns and contribution rates, it is possible to balance the budget.5)

How the National Pension is overhauled has yet to be confirmed, but the contribution rate is likely to go up. Hence, a major change is expected in the existing three-pillar pension scheme that has sought to achieve retirement income security by accumulating three months’ worth of salary in three different pensions.

Low enrollment rate

The number of retirement pension participants stood at 6.838 million as of the end of 2021, accounting for 53.3% of the eligible workers, which totaled 11.957 million. The remaining 47.7% or 5.589 million workers are covered by the severance pay system.

Even if employees are subject to the severance pay system, they receive the same amount of retirement benefits. Under the severance pay system, however, external accumulation of retirement benefits is not mandatory. This increases the likelihood of not receiving retirement benefits upon the bankruptcy of the employer.6) Small companies with a relatively high possibility of bankruptcy have a greater need for external accumulation of retirement benefits, but they are highly unlikely to adopt retirement pensions.7) It seems difficult to make it mandatory for companies under the severance pay system to adopt retirement pensions due to their smaller size and lack of external accumulation capacity. But a deadline should be set to encourage these companies to switch to the retirement pension scheme.

As the severance pay system operates in parallel with the retirement pension scheme, it seems challenging to mandate external accumulation of severance pay. However, it is necessary to require companies under the severance pay system to submit basic information, including the size of pension liabilities, to systematically manage severance pay-related information.

Low returns

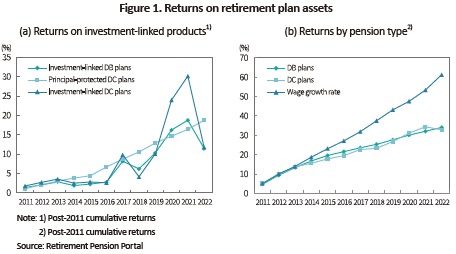

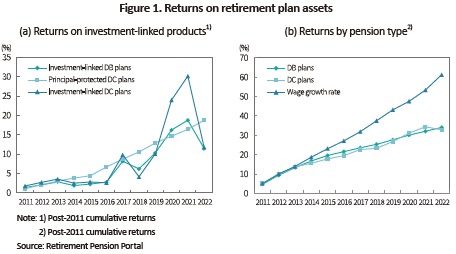

The annual return on retirement plan assets hit a significantly low level of 0.02% in 2022, a 1.98%p decrease from the previous year’s 2.00%. Overall, the retirement pension scheme barely avoided posting a negative return. Such a decline was attributable to the returns on investment-linked products plunging to -14.20% (Figure 1-(a)). Furthermore, the returns on retirement plan assets remain lower than wage growth rates (Figure 1-(b)).

In DC plans, participants are required to bear all investment risks and thus, low returns have a direct impact on participants’ plan assets. As for DB plans, participants are not directly affected by returns even if investment-linked products post negative (-) returns, which, however, places an additional burden on employers. If the return on DB plans is low, companies must cover additional costs equal to the difference between wage growth rates and the actual return on investment.8)

The introduction of the fund-type retirement pension has been actively discussed, considering that employees are directly affected by investment results and lack investment expertise. However, the interest in fund-type retirement pensions seems to have waned since the fund-type pension for SMEs was introduced. In the UK, the Collective Defined Contribution (CDC) scheme has recently garnered a lot of attention in the process of discussing pension reform.9) The CDC scheme is designed to compensate for an individual investor’s lack of risk diversification and expertise through collective management. When it comes to managing retirement plan assets, an alternative approach should be taken to diversify risks among participants and secure expertise, in addition to the existing strategy focusing only on individual needs.

Low annuity selection rate

Out of the 457,486 accounts held by recipients (aged 55 and over) who started receiving benefits in 2022, 92.9% (424,902) chose a lump sum payment, while only 7.1% (32,566 accounts) opted for an annuity. Among the total accounts, the proportion of annuity receipts has increased each year, with 3.3% in 2020 and 4.3% in 2021. In terms of the amount of benefits, 32.6% (KRW 5.1 trillion) out of the total KRW 15.5 trillion was received as an annuity.

The average lump sum payment is KRW 24.59 million per account, representing approximately 15.8% (KRW 155.5 million) of the average annuity amount received per account. The high percentage of recipients opting for the lump sum payment may be attributable to the relatively small amount of plan assets at the time of retirement, which is not large enough to yield significant benefits in selecting an annuity.10) One of the primary factors behind the reduced retirement benefits seems to be frequent early withdrawals to meet various financial needs such as house purchases.

It poses more challenges for Korea to annuitize retirement plans. This is because the annuitization must be done in a more restrictive manner, compared to foreign systems that have departed from the initial structure based on ‘monthly money’ or life annuities to allow for lump-sum payments and partial withdrawals. As the flexibility of withdrawal options is restricted, it places constraints on the rights of workers. To facilitate the annuitization of retirement pensions, it is necessary to develop alternative measures to meet the demand for funds for buying and renting a house.11) What is also needed are additional support measures, as well as the existing tax incentives.

The default option system (pre-designation system) has been introduced and implemented to improve how retirement plan assets are managed. In terms of withdrawals, it is worth considering adopting a default withdrawal option where once a participant reaches a certain age, a portion of pension assets is transferred to a pre-designated account without specific instruction from the participant.

Improvement policy

Discussions are underway for the improvement of the National Pension scheme. As part of the improvement plan, contributions to the National Pension are likely to increase. The rise in contribution rates may reduce the capacity to join private pension plans, initially affecting private pensions with voluntary payment options, such as personal pensions. In addition, if low returns and limited annuitization persist in the case of retirement pensions, the fundamental goal of retirement income stability could weaken. In this regard, it is essential to annuitize more retirement pensions, while maintaining investment returns that at least correspond to wage growth rates. To this end, it is necessary to introduce collective asset management methods like fund-type retirement pensions and establish a default withdrawal option primarily underpinned by annuities or partial withdrawals.

The traditional retirement pension scheme places the investment risk entirely on either companies or plan participants. The year 2022 was especially challenging for the participants of DC plans. Even companies that introduced DB plans have been bearing additional costs each year. If companies adopt the DC-type retirement plan, they would make additional contributions in excess of the existing contribution rate (1/12) and collectively manage plan assets to ensure risk sharing among employees, which could be beneficial for both employees and employers.12) Employees could enjoy the advantage of additional contributions and higher returns from collective investment management, while employers can reduce the burden of additional costs. Under this system, employees may select an annuity (not necessarily a life annuity) as their default withdrawal option.

1) Ministry of Employment and Labor·Financial Supervisory Service, 2023, Analysis of Retirement Pension Assets Accumulation and Management Status for 2022.

2) This can be calculated by dividing the lump sum of 30 months’ worth of severance pay by the present value of annuities (=30/186.3). Assuming that benefits are paid for a 30-year investment period with an annual return of 5% at the end of each month, the annuity present value is 186.3, which can be calculated by the formula: Annuity present value=[1-1/(1+i)N]/i, where i is the investment return and N is the payment period.

3) To achieve the balance between contributions of pension plans, it is worth considering replacing the current tax deduction for IRPs and private pensions with the pre-2013 income deduction method. In addition, it is necessary to change the limit on additional contributions to one month’s income to ensure that appropriate contributions are paid based on income levels. As for the self-employed, there is no distinction between retirement and private pensions and thus, contributions of two months’ worth of salary should be eligible for income deduction. This approach, similar to Canada’s retirement system, is expected to be implemented without significant difficulties.

4) Employees receive 12 months’ worth of salary and make separate contributions equivalent to one month’s salary to their retirement pension accounts. When contributions for retirement plans, private pensions and the National Pension (9%) are combined, around three months’ worth of income from 13 months’ worth of salary is contributed to retirement plans. This reduces employees’ income during the employment period to 76.9% of their total income (=10/13). If the income replacement rate reaches 60% after all pension plans are taken into account, the post-retirement income replacement rate would be 78.0% (=60/76.9). If the income replacement rate of the National Pension decreases to a level of retirement pensions (for example, 15%), the total income replacement rate is estimated at 58.5% (=45/76.9).

5) The National Pension’s income replacement rate is calculated based on the average income earned during the employment period, while the income replacement rate of retirement pensions is based on the final income. In addition, participants of the National Pension become eligible for benefit payments at the age of 65 and the benefits are paid for a lifetime, which poses difficulties in making a direct comparison with retirement pensions. Even considering these differences, there is an imbalance between contribution levels and benefit levels of the National Pension. This imbalance serves as a factor of financial instability for the National Pension and distorts how the private pension market operates. For example, if an employee has outstanding unpaid National Pension contributions and these unpaid contributions are paid with their retirement pension assets, he or she is expected to receive more money than what is typically available through retirement pensions.

6) As of the end of 2021, the size of retirement pension liabilities is estimated at KRW 142 trillion (Hong, W.K., 2023, Need for Disclosing Retirement Benefit Liabilities and Funding Ratios, KCMI Capital Market Focus 2023-07).

7) As for businesses with 300 or more employees, the enrollment rate of retirement pensions is 91.4% as of the end of 2021, while the enrollment rate for businesses with fewer than five employees stands at 10.6% (Statistics Korea, 2022, Retirement Pension Statistics for 2021).

8) KRW 1.0 trillion in 2015 → KRW 1.4 trillion in 2016 → KRW 2.1 trillion in 2017 → KRW 3.1 trillion in 2018 → KRW 2.7 trillion in 2019 → KRW 1.6 trillion in 2020 → KRW 3.7 trillion in 2021 → KRW 6.3 trillion in 2022. Additional costs are calculated from initial contributions of DB pension plans multiplied by (wage growth rate - returns on DB plans), and the wage growth rate is derived from the agreed wage growth rate in the private sector (Hong, W.K., Kwon, M.K. and Park, H.J., 2020, Obligation of external accumulation of retirement pension assets and Corporate Finance, KCMI Research Series 20-1).

9) Both companies and employees can make contributions to the CDC. Unlike traditional DB plans, the CDC scheme hardly requires companies to bear additional costs in excess of their contributions. The CDC is designed to pay a target pension amount, and upon the lack of pension assets, the pension amount is reduced (Mirza-Davies, J., 2022, Pensions: Collective Defined Contribution (CDC) schemes, Research Briefing, House of Commons; Sim, S.Y., 2023, Implementation and Implications of the Collective Defined Contribution (CDC) Retirement Pension Scheme in the UK, KCMI Capital Market Focus 2023-15).

10) If an annuity is selected, the recipient can pay in installments 70% of the tax that would be imposed on a lump-sum payment over the pension period. The 30% tax reduction and tax payments by installments can act as an incentive for annuitization. However, the tax reduction has a minimal effect on retirement benefits of a small size.

11) It is worth considering raising the loan limit on house purchases and residential rentals to match the amount of retirement pension assets in an effort to reduce the demand for withdrawals.

12) In terms of pension asset management, it can be done through a single institution, as is the case with the National Pension, and company-specific or pension provider-specific management options are also available.

Korea’s retirement pension scheme has many advantages, including external accrual of pension liabilities, while struggling with serious challenges, such as the low annuity selection rate, low investment returns and the still relatively low enrollment rate.

The reform of the National Pension scheme is being actively discussed. In this process, some are making suggestions that might have a direct or indirect impact on retirement pension plans, including channeling a portion of retirement contributions into the National Pension. At this juncture, it is necessary to analyze major issues of the retirement pension scheme to seek directions for improvement. Before delving into such issues, this article intends to understand the role of retirement pensions within the entire pension framework.

Target retirement benefits

Retirement pension benefits are determined as a lump sum. In other words, severance pay or the benefits of defined benefit (DB)-type plans are designed to provide an amount equal to or greater than an employee’s final one-month salary multiplied by the years of service. Hence, retirement pensions have no target income replacement rate, and the Asset-Salary Ratio increases in proportion to years of service.

For example, if an employee works for 30 years and receives pension benefits for another 30 years after retirement, and the investment returns are assumed to be 5% during the pension eligibility period, the income replacement rate (=pension amount/final monthly salary) is calculated as 16.1%.2) In this case, the income replacement rate increases by 0.54% per year of service. As for a defined contribution (DC) retirement pension, the amount of final retirement benefits is not predetermined. Under DC plans, one month’s worth of salary is contributed every year. Therefore, if the rate of returns matches wage growth rates during the contribution accrual period, the amount equivalent to DB plans’ benefits—30 months’ worth of the final monthly salary—is received as the retirement benefit. If an employee is able to accumulate funds of a similar size to his or her retirement plan assets by additionally paying the monthly salary into personal pension or individual retirement pension (IRP) accounts eligible for tax incentives, it is possible to secure around a 30% income replacement rate through private pensions.3) If the National Pension is added to the equation, the income replacement rate would rise to 60% to 70%.4)

The National Pension scheme contributes 9% of the annual salary, which is slightly higher than the contribution rate of retirement pensions. If an individual joins the National Pension for 30 years, the income replacement rate of 30% is guaranteed, suggesting that the rate increases by 1% for each year. The National Pension provides much higher benefits compared to retirement plans, which demonstrates the need for the reform of the National Pension scheme. The income replacement rate guaranteed by the National Pension is achievable only if investment returns stay consistently much higher or the contribution rate is significantly higher than the current level. Meanwhile, even if the income replacement rate is reduced by taking into account realistic investment returns and contribution rates, it is possible to balance the budget.5)

How the National Pension is overhauled has yet to be confirmed, but the contribution rate is likely to go up. Hence, a major change is expected in the existing three-pillar pension scheme that has sought to achieve retirement income security by accumulating three months’ worth of salary in three different pensions.

Low enrollment rate

The number of retirement pension participants stood at 6.838 million as of the end of 2021, accounting for 53.3% of the eligible workers, which totaled 11.957 million. The remaining 47.7% or 5.589 million workers are covered by the severance pay system.

Even if employees are subject to the severance pay system, they receive the same amount of retirement benefits. Under the severance pay system, however, external accumulation of retirement benefits is not mandatory. This increases the likelihood of not receiving retirement benefits upon the bankruptcy of the employer.6) Small companies with a relatively high possibility of bankruptcy have a greater need for external accumulation of retirement benefits, but they are highly unlikely to adopt retirement pensions.7) It seems difficult to make it mandatory for companies under the severance pay system to adopt retirement pensions due to their smaller size and lack of external accumulation capacity. But a deadline should be set to encourage these companies to switch to the retirement pension scheme.

As the severance pay system operates in parallel with the retirement pension scheme, it seems challenging to mandate external accumulation of severance pay. However, it is necessary to require companies under the severance pay system to submit basic information, including the size of pension liabilities, to systematically manage severance pay-related information.

Low returns

The annual return on retirement plan assets hit a significantly low level of 0.02% in 2022, a 1.98%p decrease from the previous year’s 2.00%. Overall, the retirement pension scheme barely avoided posting a negative return. Such a decline was attributable to the returns on investment-linked products plunging to -14.20% (Figure 1-(a)). Furthermore, the returns on retirement plan assets remain lower than wage growth rates (Figure 1-(b)).

The introduction of the fund-type retirement pension has been actively discussed, considering that employees are directly affected by investment results and lack investment expertise. However, the interest in fund-type retirement pensions seems to have waned since the fund-type pension for SMEs was introduced. In the UK, the Collective Defined Contribution (CDC) scheme has recently garnered a lot of attention in the process of discussing pension reform.9) The CDC scheme is designed to compensate for an individual investor’s lack of risk diversification and expertise through collective management. When it comes to managing retirement plan assets, an alternative approach should be taken to diversify risks among participants and secure expertise, in addition to the existing strategy focusing only on individual needs.

Low annuity selection rate

Out of the 457,486 accounts held by recipients (aged 55 and over) who started receiving benefits in 2022, 92.9% (424,902) chose a lump sum payment, while only 7.1% (32,566 accounts) opted for an annuity. Among the total accounts, the proportion of annuity receipts has increased each year, with 3.3% in 2020 and 4.3% in 2021. In terms of the amount of benefits, 32.6% (KRW 5.1 trillion) out of the total KRW 15.5 trillion was received as an annuity.

The average lump sum payment is KRW 24.59 million per account, representing approximately 15.8% (KRW 155.5 million) of the average annuity amount received per account. The high percentage of recipients opting for the lump sum payment may be attributable to the relatively small amount of plan assets at the time of retirement, which is not large enough to yield significant benefits in selecting an annuity.10) One of the primary factors behind the reduced retirement benefits seems to be frequent early withdrawals to meet various financial needs such as house purchases.

It poses more challenges for Korea to annuitize retirement plans. This is because the annuitization must be done in a more restrictive manner, compared to foreign systems that have departed from the initial structure based on ‘monthly money’ or life annuities to allow for lump-sum payments and partial withdrawals. As the flexibility of withdrawal options is restricted, it places constraints on the rights of workers. To facilitate the annuitization of retirement pensions, it is necessary to develop alternative measures to meet the demand for funds for buying and renting a house.11) What is also needed are additional support measures, as well as the existing tax incentives.

The default option system (pre-designation system) has been introduced and implemented to improve how retirement plan assets are managed. In terms of withdrawals, it is worth considering adopting a default withdrawal option where once a participant reaches a certain age, a portion of pension assets is transferred to a pre-designated account without specific instruction from the participant.

Improvement policy

Discussions are underway for the improvement of the National Pension scheme. As part of the improvement plan, contributions to the National Pension are likely to increase. The rise in contribution rates may reduce the capacity to join private pension plans, initially affecting private pensions with voluntary payment options, such as personal pensions. In addition, if low returns and limited annuitization persist in the case of retirement pensions, the fundamental goal of retirement income stability could weaken. In this regard, it is essential to annuitize more retirement pensions, while maintaining investment returns that at least correspond to wage growth rates. To this end, it is necessary to introduce collective asset management methods like fund-type retirement pensions and establish a default withdrawal option primarily underpinned by annuities or partial withdrawals.

The traditional retirement pension scheme places the investment risk entirely on either companies or plan participants. The year 2022 was especially challenging for the participants of DC plans. Even companies that introduced DB plans have been bearing additional costs each year. If companies adopt the DC-type retirement plan, they would make additional contributions in excess of the existing contribution rate (1/12) and collectively manage plan assets to ensure risk sharing among employees, which could be beneficial for both employees and employers.12) Employees could enjoy the advantage of additional contributions and higher returns from collective investment management, while employers can reduce the burden of additional costs. Under this system, employees may select an annuity (not necessarily a life annuity) as their default withdrawal option.

1) Ministry of Employment and Labor·Financial Supervisory Service, 2023, Analysis of Retirement Pension Assets Accumulation and Management Status for 2022.

2) This can be calculated by dividing the lump sum of 30 months’ worth of severance pay by the present value of annuities (=30/186.3). Assuming that benefits are paid for a 30-year investment period with an annual return of 5% at the end of each month, the annuity present value is 186.3, which can be calculated by the formula: Annuity present value=[1-1/(1+i)N]/i, where i is the investment return and N is the payment period.

3) To achieve the balance between contributions of pension plans, it is worth considering replacing the current tax deduction for IRPs and private pensions with the pre-2013 income deduction method. In addition, it is necessary to change the limit on additional contributions to one month’s income to ensure that appropriate contributions are paid based on income levels. As for the self-employed, there is no distinction between retirement and private pensions and thus, contributions of two months’ worth of salary should be eligible for income deduction. This approach, similar to Canada’s retirement system, is expected to be implemented without significant difficulties.

4) Employees receive 12 months’ worth of salary and make separate contributions equivalent to one month’s salary to their retirement pension accounts. When contributions for retirement plans, private pensions and the National Pension (9%) are combined, around three months’ worth of income from 13 months’ worth of salary is contributed to retirement plans. This reduces employees’ income during the employment period to 76.9% of their total income (=10/13). If the income replacement rate reaches 60% after all pension plans are taken into account, the post-retirement income replacement rate would be 78.0% (=60/76.9). If the income replacement rate of the National Pension decreases to a level of retirement pensions (for example, 15%), the total income replacement rate is estimated at 58.5% (=45/76.9).

5) The National Pension’s income replacement rate is calculated based on the average income earned during the employment period, while the income replacement rate of retirement pensions is based on the final income. In addition, participants of the National Pension become eligible for benefit payments at the age of 65 and the benefits are paid for a lifetime, which poses difficulties in making a direct comparison with retirement pensions. Even considering these differences, there is an imbalance between contribution levels and benefit levels of the National Pension. This imbalance serves as a factor of financial instability for the National Pension and distorts how the private pension market operates. For example, if an employee has outstanding unpaid National Pension contributions and these unpaid contributions are paid with their retirement pension assets, he or she is expected to receive more money than what is typically available through retirement pensions.

6) As of the end of 2021, the size of retirement pension liabilities is estimated at KRW 142 trillion (Hong, W.K., 2023, Need for Disclosing Retirement Benefit Liabilities and Funding Ratios, KCMI Capital Market Focus 2023-07).

7) As for businesses with 300 or more employees, the enrollment rate of retirement pensions is 91.4% as of the end of 2021, while the enrollment rate for businesses with fewer than five employees stands at 10.6% (Statistics Korea, 2022, Retirement Pension Statistics for 2021).

8) KRW 1.0 trillion in 2015 → KRW 1.4 trillion in 2016 → KRW 2.1 trillion in 2017 → KRW 3.1 trillion in 2018 → KRW 2.7 trillion in 2019 → KRW 1.6 trillion in 2020 → KRW 3.7 trillion in 2021 → KRW 6.3 trillion in 2022. Additional costs are calculated from initial contributions of DB pension plans multiplied by (wage growth rate - returns on DB plans), and the wage growth rate is derived from the agreed wage growth rate in the private sector (Hong, W.K., Kwon, M.K. and Park, H.J., 2020, Obligation of external accumulation of retirement pension assets and Corporate Finance, KCMI Research Series 20-1).

9) Both companies and employees can make contributions to the CDC. Unlike traditional DB plans, the CDC scheme hardly requires companies to bear additional costs in excess of their contributions. The CDC is designed to pay a target pension amount, and upon the lack of pension assets, the pension amount is reduced (Mirza-Davies, J., 2022, Pensions: Collective Defined Contribution (CDC) schemes, Research Briefing, House of Commons; Sim, S.Y., 2023, Implementation and Implications of the Collective Defined Contribution (CDC) Retirement Pension Scheme in the UK, KCMI Capital Market Focus 2023-15).

10) If an annuity is selected, the recipient can pay in installments 70% of the tax that would be imposed on a lump-sum payment over the pension period. The 30% tax reduction and tax payments by installments can act as an incentive for annuitization. However, the tax reduction has a minimal effect on retirement benefits of a small size.

11) It is worth considering raising the loan limit on house purchases and residential rentals to match the amount of retirement pension assets in an effort to reduce the demand for withdrawals.

12) In terms of pension asset management, it can be done through a single institution, as is the case with the National Pension, and company-specific or pension provider-specific management options are also available.