Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Significance and Utilization of Total Portfolio Approach

Publication date Jan. 30, 2024

Summary

The asset management of pension funds and public funds should focus on goal-oriented asset management. Whether it is a pension fund or a project fund, the purpose of the public fund is specified in relevant laws, and the fund management system should be aligned toward satisfying the specific purpose. In this respect, the multilevel asset allocation system based on asset classes, which has been commonly adopted by all public funds in Korea, entails structural limitations. In particular, if a fund aims to increase the proportion of risky assets, especially focusing on alternative investments, the current system with target weights assigned to predefined asset classes proves highly inefficient. This fundamental challenge explains why many public funds face difficulties in defining sub-asset classes and establishing benchmarks for alternative investments. To address these issues, this article proposes the adoption of the Total Portfolio Approach (TPA) of Canada Pension Plan Investment (CPPI), which Korea’s National Pension Fund (NPF) is considering introducing.

The TPA is designed around risk-based management. The fund’s asset management goal is presented in the form of reference portfolios that represent the fund’s risk appetite. Newly invested assets are evaluated and managed based solely on value addition to the reference portfolio, without being limited to a specific asset class. This approach aims to facilitate a more flexible and aggressive exploration of market returns (β) through the expansion of the active asset management scope by the execution team. If an actual portfolio is constructed with a focus on alternative investments for goal-oriented asset management, the TPA will emerge as a rational alternative to overcome structural limitations in the asset allocation system based on asset classes.

The TPA is designed around risk-based management. The fund’s asset management goal is presented in the form of reference portfolios that represent the fund’s risk appetite. Newly invested assets are evaluated and managed based solely on value addition to the reference portfolio, without being limited to a specific asset class. This approach aims to facilitate a more flexible and aggressive exploration of market returns (β) through the expansion of the active asset management scope by the execution team. If an actual portfolio is constructed with a focus on alternative investments for goal-oriented asset management, the TPA will emerge as a rational alternative to overcome structural limitations in the asset allocation system based on asset classes.

Introduction

The pension reform aimed to ensure the sustainability of the public pension system places an emphasis on fund management, alongside parametric changes such as adjusting contribution rate. This stems from the recognition that enhancing the long-term return on huge reserves exceeding KRW 1,000 trillion of the National Pension Fund could directly alleviate the financial burden on future generations. To actively improve investment returns with controlled risks, the National Pension Fund (NPF) of Korea has been benchmarking the Total Portfolio Approach (TPA) of the Canada Pension Plan (CPP). Notably, the CPP has built an aggressive investment portfolio with risky assets taking up 85% of its fund, resulting in an average annual return exceeding 10% over the past decade. Even amidst the simultaneous downturn in traditional asset markets in 2022, the CPP exhibited a relatively solid performance, which can be attributed to its stable and resilient investment portfolio centered around alternative investments through the unique management system of the TPA.

The expansion of alternative investment-focused risky assets is a medium to long-term investment strategy commonly employed not only by the NPF but also by various public funds in Korea. The simultaneous decline in traditional assets such as stocks and bonds in 2022 has highlighted the need to increase alternative investments. However, many public funds have repeatedly failed to raise the proportion of alternative investments in strategic asset classes as planned, due to practical difficulties in turning this strategy into portfolios. One major factor behind this failure is the inflexibility of the multilevel asset allocation system based on asset classes. Given the heterogeneous nature of alternative investment assets, categorizing them within a traditional asset class and establishing a benchmark pose significant challenges. Even upon successful categorization and benchmark establishment, it seems almost impossible to integrate these sub-asset classes of alternative investments into the traditional asset allocation model based on mean variance. Against this backdrop, this article delves into the structure and limitations of the multilevel asset allocation system based on asset classes, and examines how to introduce and utilize the CPP’s TPA, which the NPF has considered adopting alongside the reference portfolio system.

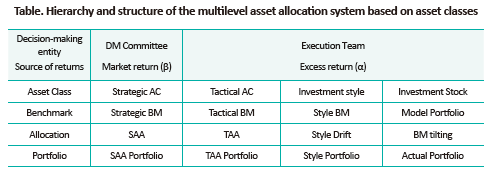

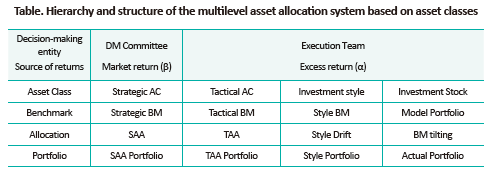

The asset class-based multilevel asset allocation system

Most public funds, including pension funds, operate on a multilevel asset allocation system ranging from Strategic Asset Allocation (SAA) to style investment. The foundation of this asset allocation system lies in explicitly predefined asset classes. In each level of asset allocation, corresponding asset classes are defined, as shown in Table below. Strategic asset classes are specified for SAA recognized for having the most significant impact on overall returns, while Tactical Asset Allocation (TAA), one of the sources of excess returns (alpha source), involves defining tactical asset classes. When implemented, investment style can be standardized and grouped as an asset class. Once the target weight for individual asset classes is determined through a mean variance-based asset allocation model, a virtual portfolio with specific weights can be created. For instance, a virtual portfolio comprised of SAA target weights and benchmarks is referred to as the SAA portfolio. The return of the SAA portfolio represents the market return (β) pursued by the fund. All portfolios in asset allocation, excluding the actual portfolio, are virtual and decomposition analysis, which is part of performance evaluation, is conducted using a combination of virtual and actual portfolios.

An asset class refers to an independent investment market, which materializes through benchmarks. For instance, the NPF defines domestic stocks as an asset class and sets the market index “Dividend-paying KOSPI” as the benchmark. In this context, the NPF’s asset class for domestic stocks pertains to the domestic securities market that excludes unlisted stocks from KOSDAQ or K-OTC. In contrast, the CPP Investment (CPPI) categorizes investments in corporate equity into the public market and private market, without distinguishing between domestic and global investment markets. The categorization of asset classes lacks standardized criteria and represents an essential part of the investment decision-making process that determines the level of performance. Strategic asset classes predefined by the CPPI committee serve as the fundamental unit of SAA activities. How the asset allocation system based on asset classes is structured can be explained by estimating the risk-return profile of benchmarks set for each asset class and the correlation with other asset classes and deriving the strategic target weights and risk tolerance for each class using the mean-variance model.

The year 2022 is notable for the simultaneous decline in prices of traditional assets, including stocks and bonds, leading to double-digit losses for many public funds. Despite efforts to construct diversified portfolios using sophisticated asset allocation models, traditional assets sustained such huge losses since the increased correlation between asset classes eliminated the diversification effect as intended by traditional asset allocation models. The NPF with 55% of its portfolio allocated to risky assets posted a loss of -8.2%, while the CPPI managed to record a relatively lower loss of -5.0%, despite allocating up to 85% to risky assets. The CPPI’s comparatively better performance can be attributed to the high proportion of alternative investments, reaching up to 60%. Notably, the increased exposure to risky assets does not necessarily result in heightened volatility in returns. This implies that to enhance the long-term return, the type of risk is more crucial than the quantity of risk in the process of raising the proportion of risky assets.

As for the asset class-based asset allocation model, the risk-return profile of each asset class and the correlation between asset classes can be accurately measured and remain stable for a considerable period. However, it should be noted that the correlation between traditional asset classes not only varies over time but also becomes synchronized during crises, resulting in repeated failures in meeting fundamental preconditions. In the case of alternative investment assets categorized as individual asset classes akin to those of traditional assets, measuring the risk-return profile in a single figure is not an easy task. This difficulty arises from the integration of various alternative instruments with heterogeneous features into a single asset class, which defies the basic concept of asset classes.1) Proposed solutions, such as grouping alternative investment assets into multiple sub-asset classes for potential homogeneity, fall short of providing a fundamental solution. The challenge in establishing benchmarks for alternative investments, faced by all public funds, lies in the underlying structure of asset classes. In the year 2022, the structural limitations in a top-down, static strategic asset allocation system, which stem from the inflexible categorization of asset classes, were well manifested.

The TPA of the CPPI

The CPP, established in 1997 through the pension reform, founded the CPPI recognized as one of the world’s most efficient pension fund management institutions. The CPPI designed the TPA based on the reference portfolio (RP), which was initially deemed a radical experiment. Today, the TPA of the CPPI has been acknowledged as a highly efficient fund management scheme adopted by pension funds of major economies, such as the Government of Singapore Investment Corporation (GIC) and Australia’s Future Fund.2) The long-term investment goal of the CPPI is presented in the form of RPs. The CPP’s conservative risk level targets less than 65% of exposure to risky assets for steady-state partial funding.3) However, it has established an aggressive RP with an 85% exposure to risky assets by taking into account its ability and willingness. It should be noted that although the same exposure to risky assets is proposed by RPs, the characteristics of the actual portfolio used to achieve such an exposure can vary greatly. As mentioned earlier, the CPPI is evaluated as a relatively stable investment portfolio, despite its high proportion of risky assets. This suggests that, as an approach to enhance returns, it is worth considering how to integrate specific types of risk, rather than merely expanding the allocation of risky assets. The CPPI’s TPA can be seen as the institutional framework for optimizing risk exposure designed to achieve the fund’s investment goal.

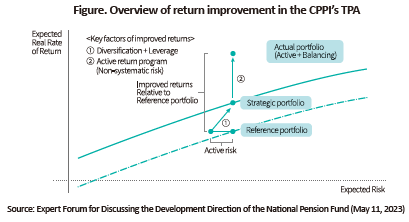

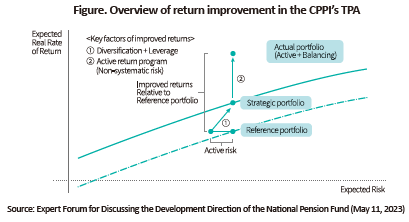

The Figure below illustrates how the CPPI can improve the fund’s long-term returns by utilizing the TPA. The CPPI’s RP is not a typical virtual portfolio; instead, it is an actual portfolio comprised of low-cost passive assets. In new active programs, the proceeds generated from the sale of RP assets are accurately decomposed as excess returns relative to the return of the RP’s return. As individual investment strategies are not constrained by specific asset classes, such proceeds represent the overall value addition, encompassing the exploration of market returns (β) and active returns. Diversification, as shown in Figure ①, involves the expansion of strategic portfolios through the flexible exploration of market returns. To further expand these portfolios, the CPPI employs leverage of around 20%. In addition, it seeks to achieve high active returns through aggressive non-systematic risk-taking activities. To this end, the CPPI has secured the expertise and adequacy of relevant personnel, required for direct investment in all assets, including alternative investments.4) This investment portfolio has not only achieved high returns but has also proved highly resilient to short-term market fluctuations.

Conclusion and implications

Fund management should place its focus on goal-oriented asset management. The purpose of all public funds is specified in relevant laws, whether it is a pension fund or a project fund, and the fund’s management scheme should be aligned toward fulfilling the specified purpose. To set a clear goal, Asset and Liability Management (ALM) should be underscored for a pension fund, while securing stable liquidity should be a priority for a project fund. As such, a fund’s management goals can vary depending on the nature of the fund. After the medium to long-term asset management goals are determined, the goal-oriented asset management scheme aims to create a management framework that is most likely to achieve these goals over the investment horizon.

In this respect, this article tries to highlight that the asset class-based multilevel asset allocation system adopted by most public funds in Korea, including the NPF, is hardly an efficient approach from the perspective of goal-oriented asset management. One of the major reasons for questioning the asset allocation system based on asset classes, recognized as the textbook approach for fund management, is the increase in alternative investments. Despite differences between funds, the current market landscape makes it challenging to achieve a fund’s asset management goal through an increase in risk exposure, with a focus on traditional assets. Accordingly, various public funds pursue the growth of alternative investments as part of their medium to long-term strategy. However, a range of alternative investment instruments, collectively referred to as alternative investments, often hardly align with the existing asset class categorization. If alternative investment assets are partially incorporated into a portfolio focusing on traditional assets, this issue could be treated as a simple error in the asset allocation model. But it would represent a structural limitation in the model once the proportion of alternative investment assets exceeds a certain level. If a fund seeks to achieve its asset management goal by raising the proportion of alternative investments, it should actively pursue a transition to the TPA scheme. In addition, it may be worth contemplating applying the TPA primarily to alternative investments excluding traditional assets.

The enhancement in the asset allocation system, investment diversification, and alternative investment management are popular topics of research projects commissioned by Korean public funds as they have been repeatedly pointed out as key issues in the Ministry of Economy and Finance’s fund evaluation. The recurrence of these issues calls for a more fundamental change rather than mere parametric or formal improvements. At this juncture, a more critical and genuine approach is needed to overhaul the current fund management framework from the perspective of goal-oriented fund management.

1) An asset class is defined as a collection of securities with similar characteristics, and the securities within an asset class should exhibit high homogeneity, while different asset classes should remain mutually exclusive.

2) Public pension funds such as the NZSF of New Zealand, the USS of the UK, and the ATP of Denmark operate on the Total Portfolio Approach (TPA), while the GPIF of Japan is reportedly considering the adoption of the TPA to expand alternative investments.

3) The steady state partial funding refers to a funding scheme where funded reserve funds maintain a certain level of funding ratio and make consistent contributions, despite not being a fully funded pension system.

4) Despite having an asset size half that of the NPF, the CPPI boasts more than double the number of investment personnel.

The pension reform aimed to ensure the sustainability of the public pension system places an emphasis on fund management, alongside parametric changes such as adjusting contribution rate. This stems from the recognition that enhancing the long-term return on huge reserves exceeding KRW 1,000 trillion of the National Pension Fund could directly alleviate the financial burden on future generations. To actively improve investment returns with controlled risks, the National Pension Fund (NPF) of Korea has been benchmarking the Total Portfolio Approach (TPA) of the Canada Pension Plan (CPP). Notably, the CPP has built an aggressive investment portfolio with risky assets taking up 85% of its fund, resulting in an average annual return exceeding 10% over the past decade. Even amidst the simultaneous downturn in traditional asset markets in 2022, the CPP exhibited a relatively solid performance, which can be attributed to its stable and resilient investment portfolio centered around alternative investments through the unique management system of the TPA.

The expansion of alternative investment-focused risky assets is a medium to long-term investment strategy commonly employed not only by the NPF but also by various public funds in Korea. The simultaneous decline in traditional assets such as stocks and bonds in 2022 has highlighted the need to increase alternative investments. However, many public funds have repeatedly failed to raise the proportion of alternative investments in strategic asset classes as planned, due to practical difficulties in turning this strategy into portfolios. One major factor behind this failure is the inflexibility of the multilevel asset allocation system based on asset classes. Given the heterogeneous nature of alternative investment assets, categorizing them within a traditional asset class and establishing a benchmark pose significant challenges. Even upon successful categorization and benchmark establishment, it seems almost impossible to integrate these sub-asset classes of alternative investments into the traditional asset allocation model based on mean variance. Against this backdrop, this article delves into the structure and limitations of the multilevel asset allocation system based on asset classes, and examines how to introduce and utilize the CPP’s TPA, which the NPF has considered adopting alongside the reference portfolio system.

The asset class-based multilevel asset allocation system

Most public funds, including pension funds, operate on a multilevel asset allocation system ranging from Strategic Asset Allocation (SAA) to style investment. The foundation of this asset allocation system lies in explicitly predefined asset classes. In each level of asset allocation, corresponding asset classes are defined, as shown in Table below. Strategic asset classes are specified for SAA recognized for having the most significant impact on overall returns, while Tactical Asset Allocation (TAA), one of the sources of excess returns (alpha source), involves defining tactical asset classes. When implemented, investment style can be standardized and grouped as an asset class. Once the target weight for individual asset classes is determined through a mean variance-based asset allocation model, a virtual portfolio with specific weights can be created. For instance, a virtual portfolio comprised of SAA target weights and benchmarks is referred to as the SAA portfolio. The return of the SAA portfolio represents the market return (β) pursued by the fund. All portfolios in asset allocation, excluding the actual portfolio, are virtual and decomposition analysis, which is part of performance evaluation, is conducted using a combination of virtual and actual portfolios.

The year 2022 is notable for the simultaneous decline in prices of traditional assets, including stocks and bonds, leading to double-digit losses for many public funds. Despite efforts to construct diversified portfolios using sophisticated asset allocation models, traditional assets sustained such huge losses since the increased correlation between asset classes eliminated the diversification effect as intended by traditional asset allocation models. The NPF with 55% of its portfolio allocated to risky assets posted a loss of -8.2%, while the CPPI managed to record a relatively lower loss of -5.0%, despite allocating up to 85% to risky assets. The CPPI’s comparatively better performance can be attributed to the high proportion of alternative investments, reaching up to 60%. Notably, the increased exposure to risky assets does not necessarily result in heightened volatility in returns. This implies that to enhance the long-term return, the type of risk is more crucial than the quantity of risk in the process of raising the proportion of risky assets.

As for the asset class-based asset allocation model, the risk-return profile of each asset class and the correlation between asset classes can be accurately measured and remain stable for a considerable period. However, it should be noted that the correlation between traditional asset classes not only varies over time but also becomes synchronized during crises, resulting in repeated failures in meeting fundamental preconditions. In the case of alternative investment assets categorized as individual asset classes akin to those of traditional assets, measuring the risk-return profile in a single figure is not an easy task. This difficulty arises from the integration of various alternative instruments with heterogeneous features into a single asset class, which defies the basic concept of asset classes.1) Proposed solutions, such as grouping alternative investment assets into multiple sub-asset classes for potential homogeneity, fall short of providing a fundamental solution. The challenge in establishing benchmarks for alternative investments, faced by all public funds, lies in the underlying structure of asset classes. In the year 2022, the structural limitations in a top-down, static strategic asset allocation system, which stem from the inflexible categorization of asset classes, were well manifested.

The TPA of the CPPI

The CPP, established in 1997 through the pension reform, founded the CPPI recognized as one of the world’s most efficient pension fund management institutions. The CPPI designed the TPA based on the reference portfolio (RP), which was initially deemed a radical experiment. Today, the TPA of the CPPI has been acknowledged as a highly efficient fund management scheme adopted by pension funds of major economies, such as the Government of Singapore Investment Corporation (GIC) and Australia’s Future Fund.2) The long-term investment goal of the CPPI is presented in the form of RPs. The CPP’s conservative risk level targets less than 65% of exposure to risky assets for steady-state partial funding.3) However, it has established an aggressive RP with an 85% exposure to risky assets by taking into account its ability and willingness. It should be noted that although the same exposure to risky assets is proposed by RPs, the characteristics of the actual portfolio used to achieve such an exposure can vary greatly. As mentioned earlier, the CPPI is evaluated as a relatively stable investment portfolio, despite its high proportion of risky assets. This suggests that, as an approach to enhance returns, it is worth considering how to integrate specific types of risk, rather than merely expanding the allocation of risky assets. The CPPI’s TPA can be seen as the institutional framework for optimizing risk exposure designed to achieve the fund’s investment goal.

The Figure below illustrates how the CPPI can improve the fund’s long-term returns by utilizing the TPA. The CPPI’s RP is not a typical virtual portfolio; instead, it is an actual portfolio comprised of low-cost passive assets. In new active programs, the proceeds generated from the sale of RP assets are accurately decomposed as excess returns relative to the return of the RP’s return. As individual investment strategies are not constrained by specific asset classes, such proceeds represent the overall value addition, encompassing the exploration of market returns (β) and active returns. Diversification, as shown in Figure ①, involves the expansion of strategic portfolios through the flexible exploration of market returns. To further expand these portfolios, the CPPI employs leverage of around 20%. In addition, it seeks to achieve high active returns through aggressive non-systematic risk-taking activities. To this end, the CPPI has secured the expertise and adequacy of relevant personnel, required for direct investment in all assets, including alternative investments.4) This investment portfolio has not only achieved high returns but has also proved highly resilient to short-term market fluctuations.

Fund management should place its focus on goal-oriented asset management. The purpose of all public funds is specified in relevant laws, whether it is a pension fund or a project fund, and the fund’s management scheme should be aligned toward fulfilling the specified purpose. To set a clear goal, Asset and Liability Management (ALM) should be underscored for a pension fund, while securing stable liquidity should be a priority for a project fund. As such, a fund’s management goals can vary depending on the nature of the fund. After the medium to long-term asset management goals are determined, the goal-oriented asset management scheme aims to create a management framework that is most likely to achieve these goals over the investment horizon.

In this respect, this article tries to highlight that the asset class-based multilevel asset allocation system adopted by most public funds in Korea, including the NPF, is hardly an efficient approach from the perspective of goal-oriented asset management. One of the major reasons for questioning the asset allocation system based on asset classes, recognized as the textbook approach for fund management, is the increase in alternative investments. Despite differences between funds, the current market landscape makes it challenging to achieve a fund’s asset management goal through an increase in risk exposure, with a focus on traditional assets. Accordingly, various public funds pursue the growth of alternative investments as part of their medium to long-term strategy. However, a range of alternative investment instruments, collectively referred to as alternative investments, often hardly align with the existing asset class categorization. If alternative investment assets are partially incorporated into a portfolio focusing on traditional assets, this issue could be treated as a simple error in the asset allocation model. But it would represent a structural limitation in the model once the proportion of alternative investment assets exceeds a certain level. If a fund seeks to achieve its asset management goal by raising the proportion of alternative investments, it should actively pursue a transition to the TPA scheme. In addition, it may be worth contemplating applying the TPA primarily to alternative investments excluding traditional assets.

The enhancement in the asset allocation system, investment diversification, and alternative investment management are popular topics of research projects commissioned by Korean public funds as they have been repeatedly pointed out as key issues in the Ministry of Economy and Finance’s fund evaluation. The recurrence of these issues calls for a more fundamental change rather than mere parametric or formal improvements. At this juncture, a more critical and genuine approach is needed to overhaul the current fund management framework from the perspective of goal-oriented fund management.

1) An asset class is defined as a collection of securities with similar characteristics, and the securities within an asset class should exhibit high homogeneity, while different asset classes should remain mutually exclusive.

2) Public pension funds such as the NZSF of New Zealand, the USS of the UK, and the ATP of Denmark operate on the Total Portfolio Approach (TPA), while the GPIF of Japan is reportedly considering the adoption of the TPA to expand alternative investments.

3) The steady state partial funding refers to a funding scheme where funded reserve funds maintain a certain level of funding ratio and make consistent contributions, despite not being a fully funded pension system.

4) Despite having an asset size half that of the NPF, the CPPI boasts more than double the number of investment personnel.