OPINION

2024 Feb/20

2024 Macroeconomic Outlook

Feb. 20, 2024

PDF

- Summary

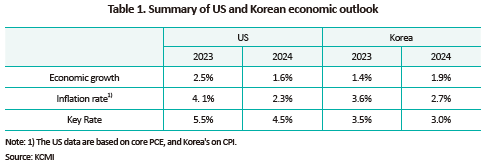

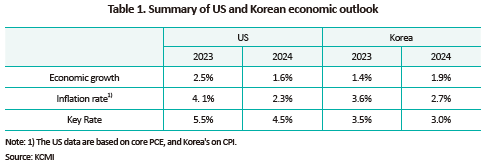

- In 2024, the Fed is likely to cut its key interest rate by 100bp as the US economy is expected to land softly (2.5% in 2023 to 1.6% in 2024) and inflation is projected to move closer to the Fed's target level (4.1% to 2.3%) despite fears of a recession due to monetary tightening. The Bank of Korea is also expected to decrease its key rate by 50bp amid expectations that the South Korean economy would pick up growth (1.4% to 1.9%) on the back of improved exports and capex and slowed inflation (3.6% to 2.7%). Overall, both Korea and the US are expected to see their respective key interest rates returning to equilibrium levels with gradual stabilization in their growth and inflation that have deviated significantly from equilibrium since the Covid-19 pandemic.

Global economic trends in 2023

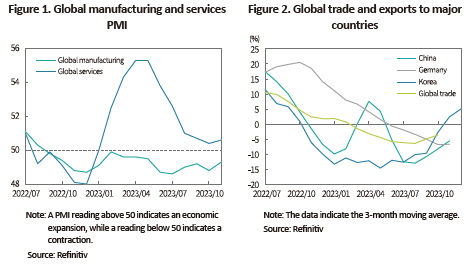

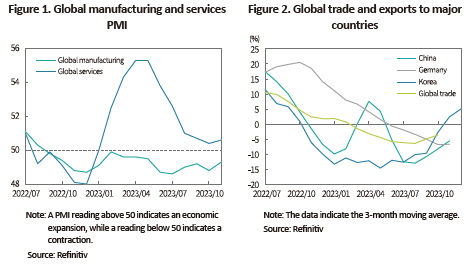

In 2023, the global economy contracted as international trade slowed down due to the slump in the IT and other manufacturing sectors excluding automobiles. As shown in Figure 1, the Purchasing Managers' Index (PMI) fell below the threshold of 50 during 2023, indicating a slowdown in economic activity. As a result, exports from major manufacturing countries such as South Korea, China, and Germany declined significantly from the previous year, resulting in slower economic growth than initially expected (see Figure 2). By contrast, despite high interest rates due to monetary tightening, the US showed robust growth driven by strong service consumption and employment. It means that growth trends varied across countries.

US economic growth outlook for 2024

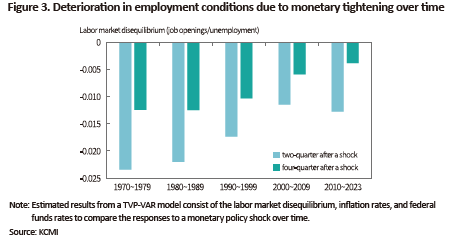

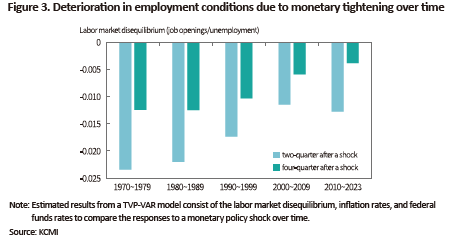

Despite concerns of an economic downturn due to the Fed's monetary tightening, the US economy is forecast to land softly in 2024, buoyed by solid employment conditions and robust private consumption following the trends from 2023. The rationale behind such forecast is the structural decline in the interest rate sensitivity of the US real economy, as well as the rise in the equilibrium nominal rate, both of which have diminished the effects of tightening. First, Figure 3 shows the extent to which employment conditions have deteriorated in response to monetary tightening over time. The vertical axis shows the changes in the number or job openings relative to the number of unemployed, an indicator of disequilibrium in the supply and demand of labor. A rise in the key rate increases unemployment (the denominator) and decreases the number of job advertisements (the numerator), thereby diminishing the labor market disequilibrium. By estimating the effects of monetary tightening based on a time-varying parameter vector autoregression (TVP-VAR) model, we find that from the 2010s onwards the deteriorating impact of monetary tightening on employment conditions fell to a half (two quarters after a monetary tightening shock) or one-third (four quarters after a shock) of its level from the 1970s and 1980s. This implies that the impact of a monetary policy shock on the labor market was reduced by half from the 2010s onwards compared to that in the 1970s and 1980s. It appears that the decline in the interest rate sensitivity of the US economy was more pronounced in the recent round of rate hikes, which could mainly have stemmed from weakening of the conventional monetary policy transmission mechanism amid the downward stabilization of long-term government bond yields and the increased proportion of fixed-rate loans (Kang and Baik, 2023).

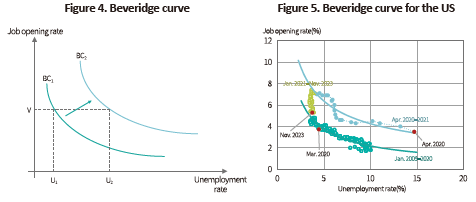

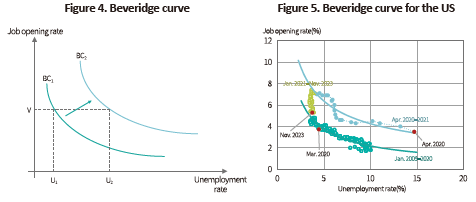

On top of that, we believe that the US labor market could maintain low unemployment rates even with high interest rates due to its regained efficiency. Figure 4 shows the Beveridge curve, where the vertical axis is the job openings rate and the horizontal axis is the unemployment rate. Theoretically, the Beveridge curve should slope downward because firms hire less when unemployment rises during an economic downturn. In addition, if the exogenous shock causes the Beveridge Curve to shift to the right from BC1 to BC2 as shown in Figure 4, the unemployment rate would increase from U1 to U2 for the same job openings rate V. This means a worsening level of job matching efficiency of the labor market. Figure 5 shows that the US Beveridge curve shifted significantly to the right in April 2020 due to the Covid-19 shock, followed by a gradual improvement in employment conditions along the new Beveridge curve, and then a gradual return to pre-Covid-19 levels (improved job matching efficiency) until recently after the Fed's rate hike. This is precisely in line with Fed Governor Christopher Waller’s estimation that monetary tightening could induce a slowdown by reducing the job openings rate only without worsening the unemployment rate (Waller, 2022).

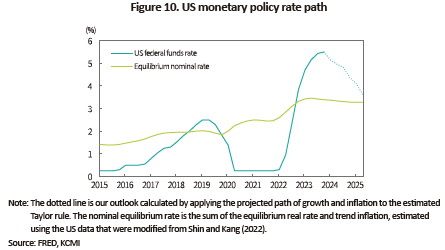

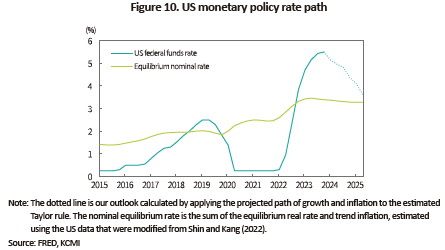

On the other hand, the fact that the equilibrium interest rate in the US economy has risen during the Covid-19 pandemic compared to the low-rate period following the global financial crisis also suggests that the current level of interest rates may be less tighter than previously expected. The equilibrium nominal rate is composed of the sum of the equilibrium real rate and trend inflation and can be defined as the level of short-term interest rates that neither stimulates nor contracts the economy. As discussed later in the Monetary Policy Outlook, estimates from economic models suggest that the level of the equilibrium nominal rate is likely to rise through the 2020s to the mid-3% range, which is higher than the medium-term rate projection of 2.5% in the Fed's dot plot. Thus, while the current rate appears to be the highest since February 2001, the actual level of monetary tightening as expressed as the interest rate gap–the difference between the key rate and the equilibrium rate–may not be as large as expected due to the rise in the equilibrium rate.

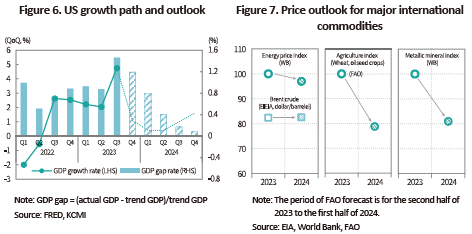

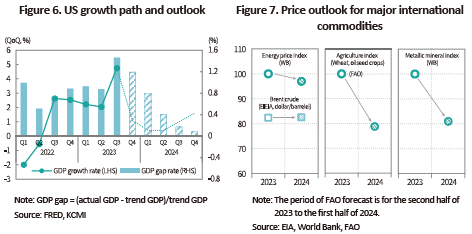

Taking into account all the potential factors such as the declining sensitivity of interest rates and the rising equilibrium rate, it is safe to conclude that the negative impact of higher rates is unlikely to escalate significantly. However, it is natural to expect growth to slow down, albeit moderately, in 2024 due to the base effect of the high growth in 2023 and the monetary policy lag. Accordingly, the US economy is expected to grow 1.6% in 2024, and the GDP gap, which represents the difference between actual GDP and trend GDP, is forecast to narrow modestly and gradually approach to the equilibrium level with the peak reached in the third quarter of 2023 (see Figure 6).

US inflation outlook for 2024

During 2024, US inflation is expected to gradually move closer to the Fed's target. First, global inflation is expected to stabilize as the prices of key international commodities such international oil prices get subdued, which would contribute to price stability in each country. Despite production cut efforts to support oil prices by OPEC, mainly in Saudi Arabia, supply is expected to grow primarily due to US shale oil. Furthermore, a moderate recovery in global manufacturing could boost the demand. Such a balance in the supply and demand for crude oil is projected to help international oil prices to remain at the 2023 level (EIA, 2024). In addition, the Food and Agriculture Organization (FAO, 2023) forecasts a decline in the prices of agricultural products such as grains and oilseed crops, which had a significant impact on the price rise in processed food, as shown in Figure 7. Also, the prices for major metals and minerals, which are materials for other industrial products, are also expected to be lower than in 2023 (World Bank, 2023).

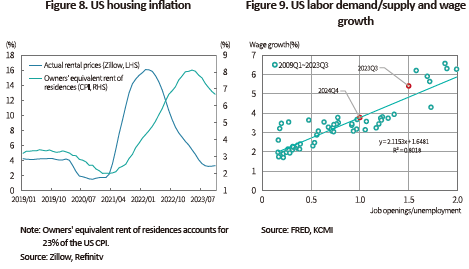

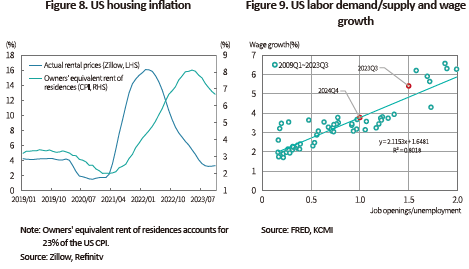

With regards to domestic factors in the US, the US GDP gap approaches zero, as shown in Figure 6. Accordingly, demand-side inflationary pressures are estimated to gradually narrow. In addition, as the actual housing prices are returning to pre-pandemic levels as shown in Figure 8, they are expected to be reflected in the CPI with a lag. It is also notable that the demand and supply of labor are stabilizing to possibly reach the equilibrium level during the fourth quarter of 2024 as illustrated in Figure 5. This implies that wage growth is expected to converge to the mid-to-high 3% range in line with the Fed's target (Figure 9). Overall, we expect US inflation (Core PCE) to stand at 2.3% in 2024.

US monetary policy outlook for 2024

When applying the growth and inflation paths to the Taylor rule, we believe there is room for a 100bp rate cut in the US during the year 2024. As inflation gradually converges to the Fed's target in the midst of a soft landing, a rate cut can be interpreted as less of a response to the slowdown. Rather, it can be more of an attempt to stabilize the currently elevated real rates resulting from the slowed inflation and to bring the policy rate back to equilibrium. In other words, if inflation declines to the low 2 percent range as expected and the policy rate is maintained at its current level, the real policy rate will be above 3 percent. This is quite high compared to the estimated 1 percent real equilibrium rate.

The specific timing of the rate cut is highly uncertain. As annualized core PCE already fell to 2% in the second half of 2023, there is enough room for a cut in the first quarter of 2024 according to the Taylor rule. However, the actual cut is likely to be somewhat delayed given the nature of data-dependent monetary policy operation in the US. All in all, the terminal rate of this rate cut cycle is expected to be in the mid-3% range, which is the level of the nominal equilibrium rate. The rate cut is expected to end in the second half of 2025 if the US economy remains on a soft landing without recession as expected.

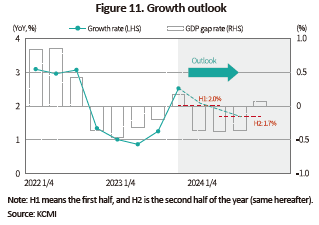

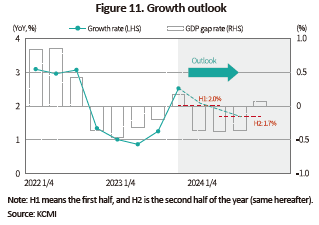

Growth outlook for South Korea

In 2023, growth in the Korean economy weakened as private consumption lost momentum amid weak manufacturing and exports. The economy is expected to recover with GDP growth of 1.9% in 2024. As shown in Figure 11, YoY growth is expected to be 2.0% in the first half of the year and 1.7% in the second half. Although YoY growth in the second half of the year appears to be somewhat lower, it should be interpreted as a result of a base effect rather than a weakening of growth. In other words, the growth from the previous period is expected to be higher in the second half, with the GDP gap turning positive in the fourth quarter.

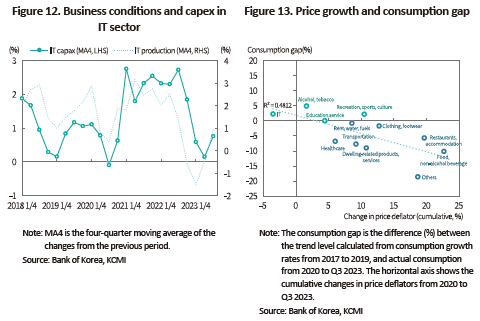

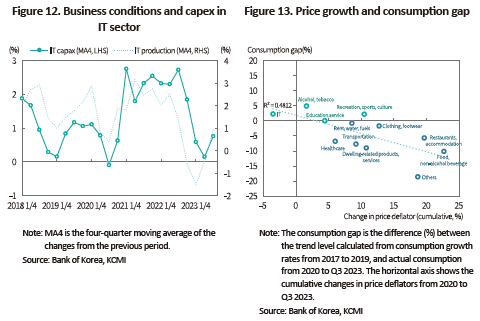

The IT sector will likely drive the growth recovery this year. According to major market research firms such as World Semiconductor Trade Statistics (WSTS), the IT industry is expected to enter an upward cycle this year. This will be driven by semiconductors with the acceleration of AI technology commercialization and related infrastructure adoption. In its December 2023 forecast, WSTS predicts that the semiconductor market will grow 13.1% from 2023 in 2024. Also, TrendForce forecasts that the average selling price of D-RAM and NAND will rise 13-18% and 15-20% YoY in the first quarter of 2024, respectively. These forecasts have a significant positive impact on South Korea's export expansion. In addition, as investment in the IT industry tends to be in sync with the business conditions in reference to Figure 12, capax is expected to expand mainly in the IT sector. However, unlike capax, construction investment could continue to remain sluggish. This could possibly be affected by the decreased volume of planned (existing) permits and delayed construction due to rising costs.

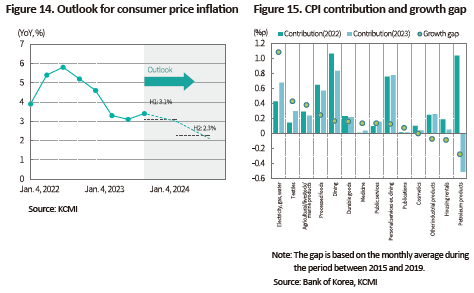

In the meantime, private consumption is expected to recover in the second half of the year. Price increases and demand contraction have persisted for a considerable period of time for items that have been significantly affected by supply shocks caused by the Covid-19 pandemic, the Russia-Ukraine war, and adverse weather conditions. This is evident in the consumption gap in Figure 13, which is the difference between the trend level calculated from consumption growth in the three years prior to the pandemic (2017-2019) and the actual consumption from the first quarter of 2020 to the third quarter of 2023 (on a cumulative basis). During the analyzed period, a significant negative gap and large price increase were found in consumption of food, non-alcoholic beverages, dwelling-related products and services (durable goods such as electronics and furniture), and others. In the second half of this year, private consumption will likely improve, mainly in the aforementioned items, as pressures from inflation and interest rates ease to some extent.

Inflation outlook for South Korea

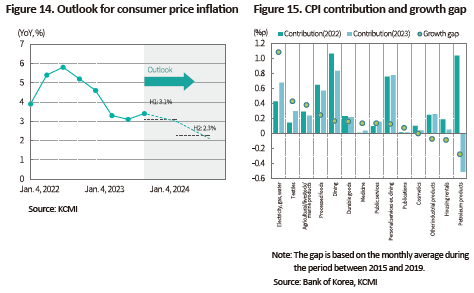

In 2024, consumer prices are expected to rise 2.7%, slowing down from 2023. As shown in Figure 14, prices will increase over 3% YoY in the first half of the year, but the growth will slow down to the 2% range in the second half of the year, approaching the BOK's 2% inflation target. This is expected to be driven by a slowed price increase in major industrial products. Consumer price inflation declined by 1.5 percentage points from 5.1% in 2022 to 3.6% in 2023, which equals to the change in the contribution of petroleum products to consumer price inflation (1.0 pp in 2022 to -0.5 pp in 2023). This implies that despite the large decline in petroleum prices in 2023 (-11%), prices of other items are still on the rise. In particular, Figure 15 shows that price stability was undermined by higher price increases than usual in electricity, gas, water, textiles, processed food, dining, durable goods, and other products that gradually reflected the impact of supply shocks. In 2024, we believe that consumer price inflation this year will slow down as it will gradually reflect the downward stabilization of international commodity prices.

Monetary policy outlook for South Korea

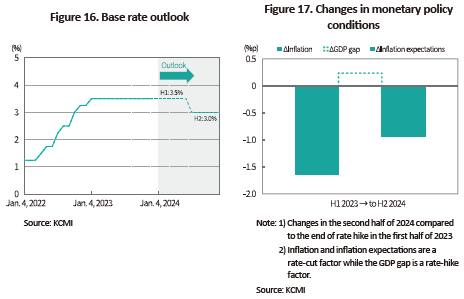

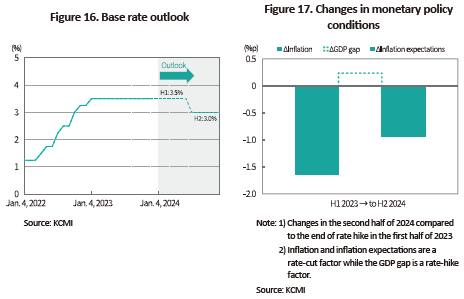

Since the BOK raised the key rate to 3.5% in January 2023, the rate has been maintained at the same level. In 2024, the key rate is expected to be cut twice, each by 25bp, in the second half of the year to 3.0% (see Figure 16). This is in line with the key rate path estimated by Reuters and Bloomberg from their recent survey on major forecasting institutions. Recently, liquidity issues in real estate PF loans and some construction companies have come to the fore, but the BOK recognize that their financial and economic spillover effects are not significant.1) Therefore, we believe that the future monetary policy outlook should focus on the real economy and inflationary conditions rather than those financial market conditions. Given the expected changes in conditions at the end of the rate hike, consumer price inflation is expected to decline to the low 2 percent range in the second half of this year. This could make the environment ripe for a shift in policy stance. Based on the key factors illustrated in Figure 17, it is likely that consumer price inflation will decelerate considerably and inflation expectations2) will also fall in the second half of 2024. There is still possibility of a slight rise in the GDP gap compared to the first half of 2023 to limit rate cuts. However, the decline in inflation and inflation expectations is expected to play a greater role in shaping the environment in favor of a rate cut.

Overall assessment

Over the course of 2024, Korea and the US are expected to see their growth and inflation paths converging towards equilibrium, and their monetary policy gradually adjusting to the equilibrium rate. In the US, its high growth–far exceeding the growth potential in 2023–is forecast to adjust downward to the level consistent with its potential GDP and fundamentals. Moreover, its sharply elevated inflation in the pandemic era will come down to near the Fed's target. As a result, the Fed's monetary policy expected this year is a rate cut to stabilize the real interest rates raised because of slowed inflation, and to adjust the key interest rate towards equilibrium. In South Korea, the shift in monetary policy is estimated to begin in full swing in the second half of 2024 if the sluggish exports rebound, growth reaches the potential growth level, and inflation finally slows down.

However, despite our baseline outlook, we see a mix of upside and downside risks to the domestic and international growth paths, with the downside risks being greater. First of all, one of the upside factors to the future growth path is that Korea's recovery in exports and investment could be stronger thanks to rising global investment in AI and a steeper-than-expected rebound in the IT industry. Moreover, economic recovery may be supported by an early rate cut if a larger-than-expected decline in international commodity prices quickly slows down inflation in major economies. On the other hand, downward factors to the future growth path include a possible delay in the recovery of the IT industry amid China's drive to modernize its manufacturing industry and the intensified US-China trade dispute during the US presidential election. Also possible is that the ongoing geo-economic disputes since 2022 could escalate further, which might lead to an unexpected rise in global commodity prices, and another supply disruption due to maritime transport issues. Domestically, it is worth noting that real estate PFs' deteriorating profitability might possibly result in a dual slump in construction investment and private consumption, as well as a prolonged contraction in domestic demand.

1) Refer to the BOK press conference on the monetary policy decision in January 2024.

2) A decline in inflation expectations will rise the real key interest rate (key rate minus inflation expectations). Hence, this naturally increases the strength of monetary tightening. The key rate should be lowered to offset such effect. The inflation expectations in 2H 2024 (ordinary consumers) used in this analysis were estimated based on the relationship between consumer price inflation and inflation expectations.

References

Kang, H.J., Baik, I.S., 2023, Declining interest rate sensitivity of the US real economy and its implications, KCMI Issue Paper 23-22.

Shin, I.S., Kang H.J., 2022, 25-55. Evaluation of recent policy stance and issues in Korea's monetary policy, Korean Economic Forum 14(4): 25-55.

Energy Information Administration, 2024, Short-term Energy Outlook, January 9.

Food and Agriculture Organization of the United Nations, 2023, Food Outlook.

Waller, C.J., 2022, Responding to high inflation with Some thoughts on a soft landing, Speech at the Institute for Monetary and Financial Stability (IMFS) Distinguished Lecture, May 30.

World Bank, 2023, Commodity Markets Outlook.

In 2023, the global economy contracted as international trade slowed down due to the slump in the IT and other manufacturing sectors excluding automobiles. As shown in Figure 1, the Purchasing Managers' Index (PMI) fell below the threshold of 50 during 2023, indicating a slowdown in economic activity. As a result, exports from major manufacturing countries such as South Korea, China, and Germany declined significantly from the previous year, resulting in slower economic growth than initially expected (see Figure 2). By contrast, despite high interest rates due to monetary tightening, the US showed robust growth driven by strong service consumption and employment. It means that growth trends varied across countries.

US economic growth outlook for 2024

Despite concerns of an economic downturn due to the Fed's monetary tightening, the US economy is forecast to land softly in 2024, buoyed by solid employment conditions and robust private consumption following the trends from 2023. The rationale behind such forecast is the structural decline in the interest rate sensitivity of the US real economy, as well as the rise in the equilibrium nominal rate, both of which have diminished the effects of tightening. First, Figure 3 shows the extent to which employment conditions have deteriorated in response to monetary tightening over time. The vertical axis shows the changes in the number or job openings relative to the number of unemployed, an indicator of disequilibrium in the supply and demand of labor. A rise in the key rate increases unemployment (the denominator) and decreases the number of job advertisements (the numerator), thereby diminishing the labor market disequilibrium. By estimating the effects of monetary tightening based on a time-varying parameter vector autoregression (TVP-VAR) model, we find that from the 2010s onwards the deteriorating impact of monetary tightening on employment conditions fell to a half (two quarters after a monetary tightening shock) or one-third (four quarters after a shock) of its level from the 1970s and 1980s. This implies that the impact of a monetary policy shock on the labor market was reduced by half from the 2010s onwards compared to that in the 1970s and 1980s. It appears that the decline in the interest rate sensitivity of the US economy was more pronounced in the recent round of rate hikes, which could mainly have stemmed from weakening of the conventional monetary policy transmission mechanism amid the downward stabilization of long-term government bond yields and the increased proportion of fixed-rate loans (Kang and Baik, 2023).

On top of that, we believe that the US labor market could maintain low unemployment rates even with high interest rates due to its regained efficiency. Figure 4 shows the Beveridge curve, where the vertical axis is the job openings rate and the horizontal axis is the unemployment rate. Theoretically, the Beveridge curve should slope downward because firms hire less when unemployment rises during an economic downturn. In addition, if the exogenous shock causes the Beveridge Curve to shift to the right from BC1 to BC2 as shown in Figure 4, the unemployment rate would increase from U1 to U2 for the same job openings rate V. This means a worsening level of job matching efficiency of the labor market. Figure 5 shows that the US Beveridge curve shifted significantly to the right in April 2020 due to the Covid-19 shock, followed by a gradual improvement in employment conditions along the new Beveridge curve, and then a gradual return to pre-Covid-19 levels (improved job matching efficiency) until recently after the Fed's rate hike. This is precisely in line with Fed Governor Christopher Waller’s estimation that monetary tightening could induce a slowdown by reducing the job openings rate only without worsening the unemployment rate (Waller, 2022).

Taking into account all the potential factors such as the declining sensitivity of interest rates and the rising equilibrium rate, it is safe to conclude that the negative impact of higher rates is unlikely to escalate significantly. However, it is natural to expect growth to slow down, albeit moderately, in 2024 due to the base effect of the high growth in 2023 and the monetary policy lag. Accordingly, the US economy is expected to grow 1.6% in 2024, and the GDP gap, which represents the difference between actual GDP and trend GDP, is forecast to narrow modestly and gradually approach to the equilibrium level with the peak reached in the third quarter of 2023 (see Figure 6).

During 2024, US inflation is expected to gradually move closer to the Fed's target. First, global inflation is expected to stabilize as the prices of key international commodities such international oil prices get subdued, which would contribute to price stability in each country. Despite production cut efforts to support oil prices by OPEC, mainly in Saudi Arabia, supply is expected to grow primarily due to US shale oil. Furthermore, a moderate recovery in global manufacturing could boost the demand. Such a balance in the supply and demand for crude oil is projected to help international oil prices to remain at the 2023 level (EIA, 2024). In addition, the Food and Agriculture Organization (FAO, 2023) forecasts a decline in the prices of agricultural products such as grains and oilseed crops, which had a significant impact on the price rise in processed food, as shown in Figure 7. Also, the prices for major metals and minerals, which are materials for other industrial products, are also expected to be lower than in 2023 (World Bank, 2023).

With regards to domestic factors in the US, the US GDP gap approaches zero, as shown in Figure 6. Accordingly, demand-side inflationary pressures are estimated to gradually narrow. In addition, as the actual housing prices are returning to pre-pandemic levels as shown in Figure 8, they are expected to be reflected in the CPI with a lag. It is also notable that the demand and supply of labor are stabilizing to possibly reach the equilibrium level during the fourth quarter of 2024 as illustrated in Figure 5. This implies that wage growth is expected to converge to the mid-to-high 3% range in line with the Fed's target (Figure 9). Overall, we expect US inflation (Core PCE) to stand at 2.3% in 2024.

When applying the growth and inflation paths to the Taylor rule, we believe there is room for a 100bp rate cut in the US during the year 2024. As inflation gradually converges to the Fed's target in the midst of a soft landing, a rate cut can be interpreted as less of a response to the slowdown. Rather, it can be more of an attempt to stabilize the currently elevated real rates resulting from the slowed inflation and to bring the policy rate back to equilibrium. In other words, if inflation declines to the low 2 percent range as expected and the policy rate is maintained at its current level, the real policy rate will be above 3 percent. This is quite high compared to the estimated 1 percent real equilibrium rate.

Growth outlook for South Korea

In 2023, growth in the Korean economy weakened as private consumption lost momentum amid weak manufacturing and exports. The economy is expected to recover with GDP growth of 1.9% in 2024. As shown in Figure 11, YoY growth is expected to be 2.0% in the first half of the year and 1.7% in the second half. Although YoY growth in the second half of the year appears to be somewhat lower, it should be interpreted as a result of a base effect rather than a weakening of growth. In other words, the growth from the previous period is expected to be higher in the second half, with the GDP gap turning positive in the fourth quarter.

The IT sector will likely drive the growth recovery this year. According to major market research firms such as World Semiconductor Trade Statistics (WSTS), the IT industry is expected to enter an upward cycle this year. This will be driven by semiconductors with the acceleration of AI technology commercialization and related infrastructure adoption. In its December 2023 forecast, WSTS predicts that the semiconductor market will grow 13.1% from 2023 in 2024. Also, TrendForce forecasts that the average selling price of D-RAM and NAND will rise 13-18% and 15-20% YoY in the first quarter of 2024, respectively. These forecasts have a significant positive impact on South Korea's export expansion. In addition, as investment in the IT industry tends to be in sync with the business conditions in reference to Figure 12, capax is expected to expand mainly in the IT sector. However, unlike capax, construction investment could continue to remain sluggish. This could possibly be affected by the decreased volume of planned (existing) permits and delayed construction due to rising costs.

In the meantime, private consumption is expected to recover in the second half of the year. Price increases and demand contraction have persisted for a considerable period of time for items that have been significantly affected by supply shocks caused by the Covid-19 pandemic, the Russia-Ukraine war, and adverse weather conditions. This is evident in the consumption gap in Figure 13, which is the difference between the trend level calculated from consumption growth in the three years prior to the pandemic (2017-2019) and the actual consumption from the first quarter of 2020 to the third quarter of 2023 (on a cumulative basis). During the analyzed period, a significant negative gap and large price increase were found in consumption of food, non-alcoholic beverages, dwelling-related products and services (durable goods such as electronics and furniture), and others. In the second half of this year, private consumption will likely improve, mainly in the aforementioned items, as pressures from inflation and interest rates ease to some extent.

Inflation outlook for South Korea

In 2024, consumer prices are expected to rise 2.7%, slowing down from 2023. As shown in Figure 14, prices will increase over 3% YoY in the first half of the year, but the growth will slow down to the 2% range in the second half of the year, approaching the BOK's 2% inflation target. This is expected to be driven by a slowed price increase in major industrial products. Consumer price inflation declined by 1.5 percentage points from 5.1% in 2022 to 3.6% in 2023, which equals to the change in the contribution of petroleum products to consumer price inflation (1.0 pp in 2022 to -0.5 pp in 2023). This implies that despite the large decline in petroleum prices in 2023 (-11%), prices of other items are still on the rise. In particular, Figure 15 shows that price stability was undermined by higher price increases than usual in electricity, gas, water, textiles, processed food, dining, durable goods, and other products that gradually reflected the impact of supply shocks. In 2024, we believe that consumer price inflation this year will slow down as it will gradually reflect the downward stabilization of international commodity prices.

Monetary policy outlook for South Korea

Since the BOK raised the key rate to 3.5% in January 2023, the rate has been maintained at the same level. In 2024, the key rate is expected to be cut twice, each by 25bp, in the second half of the year to 3.0% (see Figure 16). This is in line with the key rate path estimated by Reuters and Bloomberg from their recent survey on major forecasting institutions. Recently, liquidity issues in real estate PF loans and some construction companies have come to the fore, but the BOK recognize that their financial and economic spillover effects are not significant.1) Therefore, we believe that the future monetary policy outlook should focus on the real economy and inflationary conditions rather than those financial market conditions. Given the expected changes in conditions at the end of the rate hike, consumer price inflation is expected to decline to the low 2 percent range in the second half of this year. This could make the environment ripe for a shift in policy stance. Based on the key factors illustrated in Figure 17, it is likely that consumer price inflation will decelerate considerably and inflation expectations2) will also fall in the second half of 2024. There is still possibility of a slight rise in the GDP gap compared to the first half of 2023 to limit rate cuts. However, the decline in inflation and inflation expectations is expected to play a greater role in shaping the environment in favor of a rate cut.

Overall assessment

Over the course of 2024, Korea and the US are expected to see their growth and inflation paths converging towards equilibrium, and their monetary policy gradually adjusting to the equilibrium rate. In the US, its high growth–far exceeding the growth potential in 2023–is forecast to adjust downward to the level consistent with its potential GDP and fundamentals. Moreover, its sharply elevated inflation in the pandemic era will come down to near the Fed's target. As a result, the Fed's monetary policy expected this year is a rate cut to stabilize the real interest rates raised because of slowed inflation, and to adjust the key interest rate towards equilibrium. In South Korea, the shift in monetary policy is estimated to begin in full swing in the second half of 2024 if the sluggish exports rebound, growth reaches the potential growth level, and inflation finally slows down.

However, despite our baseline outlook, we see a mix of upside and downside risks to the domestic and international growth paths, with the downside risks being greater. First of all, one of the upside factors to the future growth path is that Korea's recovery in exports and investment could be stronger thanks to rising global investment in AI and a steeper-than-expected rebound in the IT industry. Moreover, economic recovery may be supported by an early rate cut if a larger-than-expected decline in international commodity prices quickly slows down inflation in major economies. On the other hand, downward factors to the future growth path include a possible delay in the recovery of the IT industry amid China's drive to modernize its manufacturing industry and the intensified US-China trade dispute during the US presidential election. Also possible is that the ongoing geo-economic disputes since 2022 could escalate further, which might lead to an unexpected rise in global commodity prices, and another supply disruption due to maritime transport issues. Domestically, it is worth noting that real estate PFs' deteriorating profitability might possibly result in a dual slump in construction investment and private consumption, as well as a prolonged contraction in domestic demand.

1) Refer to the BOK press conference on the monetary policy decision in January 2024.

2) A decline in inflation expectations will rise the real key interest rate (key rate minus inflation expectations). Hence, this naturally increases the strength of monetary tightening. The key rate should be lowered to offset such effect. The inflation expectations in 2H 2024 (ordinary consumers) used in this analysis were estimated based on the relationship between consumer price inflation and inflation expectations.

References

Kang, H.J., Baik, I.S., 2023, Declining interest rate sensitivity of the US real economy and its implications, KCMI Issue Paper 23-22.

Shin, I.S., Kang H.J., 2022, 25-55. Evaluation of recent policy stance and issues in Korea's monetary policy, Korean Economic Forum 14(4): 25-55.

Energy Information Administration, 2024, Short-term Energy Outlook, January 9.

Food and Agriculture Organization of the United Nations, 2023, Food Outlook.

Waller, C.J., 2022, Responding to high inflation with Some thoughts on a soft landing, Speech at the Institute for Monetary and Financial Stability (IMFS) Distinguished Lecture, May 30.

World Bank, 2023, Commodity Markets Outlook.