Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Summary

This article analyzes key macroeconomic issues for the South Korean and global economy in 2024 by assessing the possible return to low rates due to the monetary policy shift of the US and Korea. It also explores two Korea-specific risk factors: the risk of a delayed recovery in private consumption; and the risk of real estate PFs due to the deteriorating profitability of the construction sector. Among others, rate cuts in both the US and Korea have raised the possibility of a return to the low-rate era in the 2010s. However, despite the monetary policy shift, we believe that the decline in long-term government bond yields will be limited due to the rise in equilibrium interest rates. In addition, despite the expected improvement in the high-inflation, high-rate conditions that constrained private consumption during 2023, there exists the risk of a prolonged consumption slump due to a delay in income increases in low-income households which show a high propensity to consume. Finally, it is worth noting that as rising construction costs could deteriorate the profitability of real estate PFs, the risk in the sector could transfer to financial institutions and the money market and escalate into a crisis.

Key macroeconomic issue 1: Assessing the possibility of a return to low rates after a monetary policy shift

The current period of high inflation and high interest rates has been quite a shock to economic and financial markets, as the shock came when the global economy was accustomed to low inflation and low interest rates that had begun around 2010. Against this backdrop, strong expectations mounting over the US Fed's rate cut have raised the possibility of a sharp return to the low-rate stance of the past. In fact, Korean and US medium- and long-term government bond yields have fallen significantly since November 2023 amid expectations for a shift in monetary policy. In this paper, we evaluate whether a cut in the key interest rate will bring down government bond yields as low as that in the 2010s. As the government bond yield can be composed of the bond market's expectation of monetary policy and the term premium, we looked at each of the two particular factors to examine the possibility of a return to low interest rates.

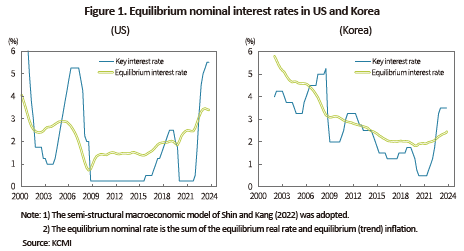

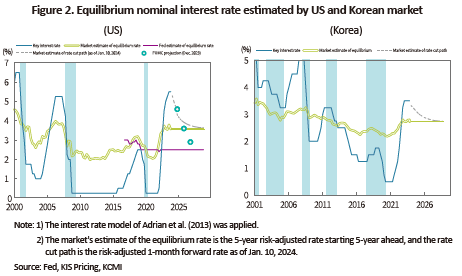

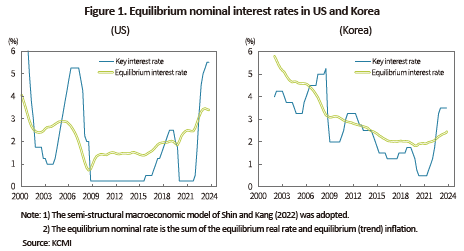

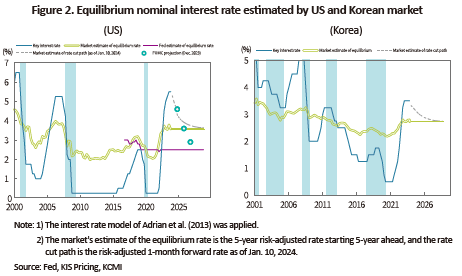

As noted in 2024 Macroeconomic Outlook, the terminal point of this rate cut is expected to be at the equilibrium nominal rate unless there is a recession in either the US or Korea in 2024. Figure 1 shows the equilibrium nominal rates in Korea and the US estimated from macroeconomic conditions. Both countries have seen their equilibrium nominal rate shifting upward during the Covid-19 and remaining at a higher level than in the 2010s. Next, Figure 2 shows the equilibrium nominal rate estimated from the government bond market. This rate reflects the changes in the economic structure from a medium- to long-term perspective, which is evaluated by government bond market participants. Since the Covid-19 outbreak, the market's estimate of the equilibrium interest rate has also turned upward. In January 2024, it reached the mid-3% range for the US and the mid-2% range for Korea. Meanwhile, as shown in Figure 2, bond market participants in both countries expect the benchmark interest rate to decrease gradually to reach the equilibrium level in 2026.1)

Through the above analysis, we expect that the terminal point of the current round of rate cuts may be determined at a higher level than that of the 2010s. We cannot completely rule out the possibility that the equilibrium rate will fall back to the 2010s level in the future. However, as the upward shift in equilibrium rates may reflect structural economic changes, such as demographic shifts and deglobalization, we see a limited possibility of a return to low rates from a monetary policy perspective (Kang, Baek and Jang, 2023).

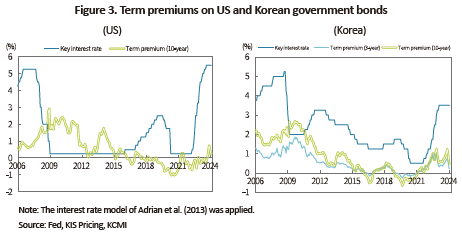

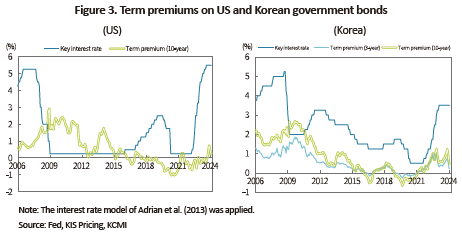

Figure 3 demonstrates the term premiums in both countries. As the term premium of government bonds changes depending on the supply and demand factors for the bonds along with uncertainty about rate cuts and inflation, there is a possibility that the term premium will decrease as the uncertainty is resolved about the timing of rate cuts this year. Moreover, US quantitative tightening is expected to be scaled back despite the uncertainty lingering over when the Fed will end it. Therefore, there is potential for a decline in term premiums from the perspective of government bond supply and demand. On the other hand, there is also a risk that the term premium will increase given the inevitable expansion of US Treasury issuance. As such, the US term premium can be seen as influenced by both upward and downward factors, but it is unclear whether it will decline enough to trigger a return to low interest rates. Given that QE was a major contributor to the low term premium in the 2010s,2) it is possible that the size of declines could be limited this year. As the Korean term premium tends to strongly synchronize with that of the US, the future trajectory of the US term premium is forecast to be a key determinant.

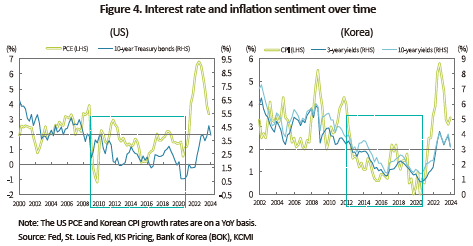

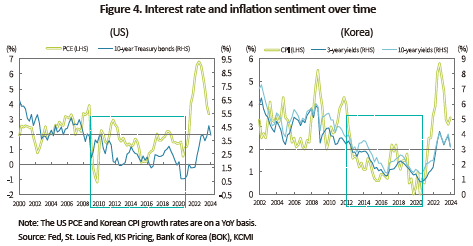

Based on the above discussion, we believe that government bond yields will likely fall in 2024 as the key interest rate is expected to start declining. However, the size of the fall may not be significant. In particular, as shown in Figure 4, it will be difficult to return to the low-rate era of the 2010s, when quantitative easing contributed to a sustained decline in US and Korean government bond yields with inflation remaining below 2%. However, for the future trajectories of government bond yields, it is important to closely watch the stable range of inflation when major economies shift their monetary policy in tandem with the change in equilibrium rate. If inflation anchors at the 2% level in the medium term, the equilibrium rate will decline again, lowering the terminal rate of the current rate cut round. In this case, government bond yields are highly likely to be adjusted further.

Key Macroeconomic Issue 2: Assessing the causes of weak consumption and the risk of a delayed recovery

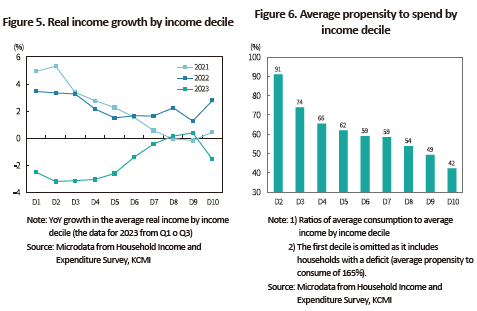

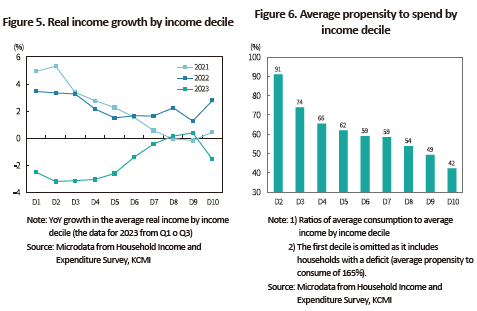

The persistent high-inflation and high-rate conditions have led to a continuing slump in private consumption. High inflation erodes real purchasing power, leading to a slowdown in consumption. In 2023, households' real income declined as nominal income growth fell below the rate of inflation across all income deciles (see Figure 5).3) As shown in Figure 6, the negative effect on their consumption will likely be more severe given their higher propensity to spend.

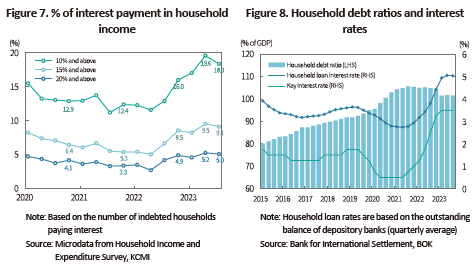

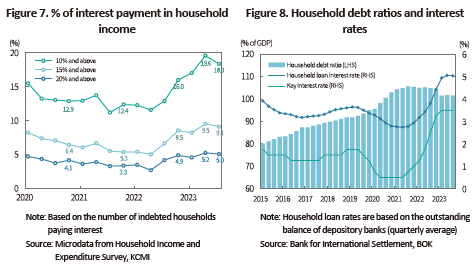

In addition to high inflation, high interest rates are increasing the burden of principal and interest repayment, thus acting as a constraint on consumption. Figure 7 demonstrates the share of indebted households whose interest payment accounts for more than 10%, 15%, and 20% of their income.4) We confirmed that the share of the households in each category increased amid the rapid rate hikes. Increased interest burden diminished disposable income and further weakened Korean households' spending power. Considering these negative effects of high inflation and high interest rates on private consumption, we believe a gradual recovery in this area no sooner than the second half of the year when the high-inflation, high-rate conditions ease little by little, and when households' income conditions improve thanks to export recovery.

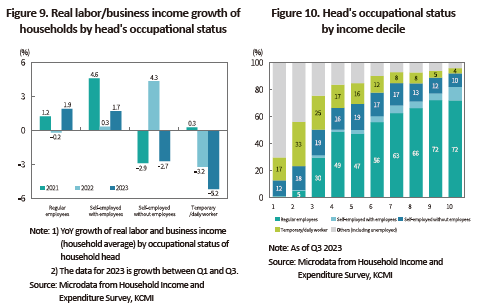

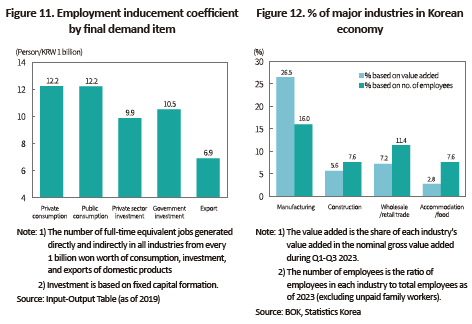

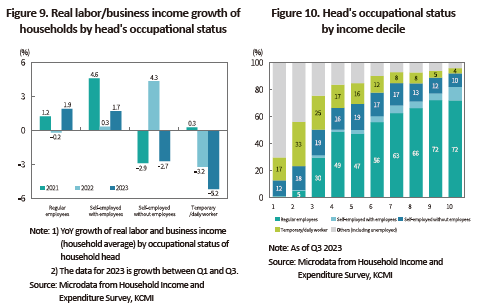

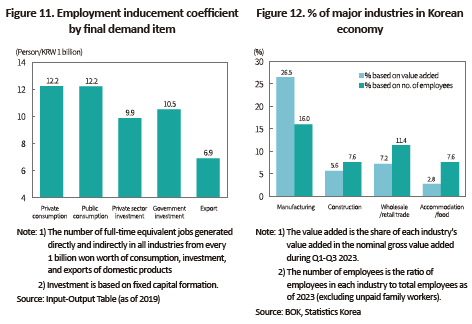

However, it is worth noting that despite the prospect of a pickup in private consumption, weak consumption may remain longer than expected due to a delay in income improvement mostly among lower-income households, quite a few of whose heads are small self-employed and temporary/daily workers. Figure 9 compares the growth rate of real labor and business income by household heads’ occupational status.5) It shows that when consumption was weak in 2023, labor and business income declined significantly among the households whose head is a small self-employed (self-employed without an employer) or a temporary/daily worker. This decline in income was likely driven by a significant deterioration in business conditions in the wholesale/retail trade, and accommodation/food sectors, where the share of small self-employed and temporary/daily workers is relatively high.6) Taken together, the above analysis suggests that the recent slump in consumption could have slowed down wholesale/retail trade and accommodation/food sectors and delayed income increase among low-income households that include a high proportion of small self-employed and temporary/daily workers. Also, it could have led to a vicious circle in which households with a high propensity to consume reduce their consumption to the extent it delays recovery in private consumption. In particular, Figure 11 and Figure 12 suggest that improvement in economic conditions could be delayed further despite the rebound in GDP growth, if the current slump continues to linger in private consumption and the industries such as wholesale/retail trade and accommodation/food which provide a high employment inducement effect and employ a large number of workers compared to exports.

Key Macroeconomic Issue 3: Reviewing real estate PF risks amid deteriorating profitability in construction sector

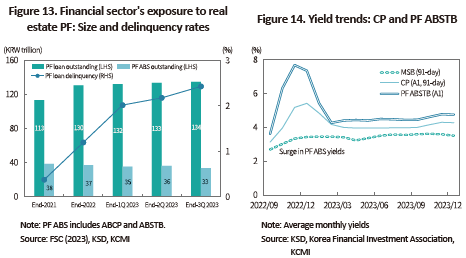

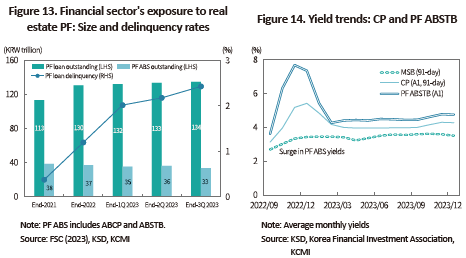

In 2023, the risk associated with real estate PF, which was highlighted after the Legoland incident, was somewhat contained due to the stabilization of market interest rates and government action. The government provided liquidity support to the money market and induced maturity extensions and restructuring through the intercreditor agreement, while financial firms steadily accumulated provisions. Since 2023, such action has helped the financial sector to maintain its PF volume (loans and asset-backed securities), to curb the delinquency rate of PF loans, and to stabilize the yields of PF ABS,7) which had surged in the fourth quarter of 2022 as shown in Figure 13 and Figure 14. However, the existing risks associated with real estate PF will be resolved after properties are not only built, but also sold and occupied. Given real estate PF's deteriorating profitability and delayed construction process, this will likely be a risk factor for the financial market and real economy in 2024.

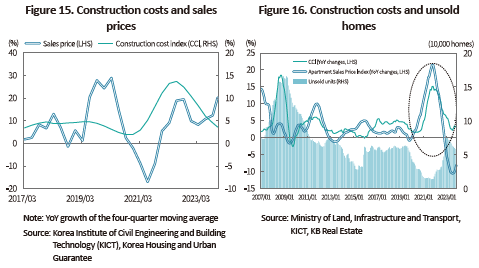

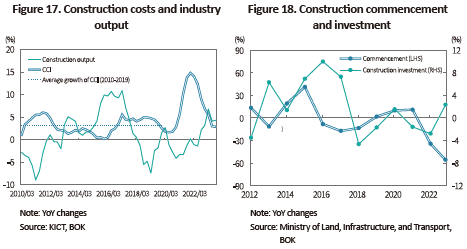

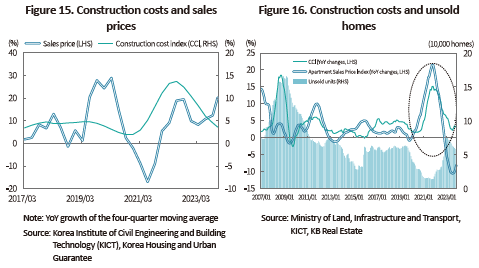

We believe rising development costs and falling housing prices are the main reasons that have recently deteriorated the profitability of real estate PF. Interest expenses have increased due to high interest rates and widening credit spreads, and construction costs surged 27% from 2020 to 2023. However, house prices have declined due to downturn in the real estate market. Figure 15 and Figure 16 demonstrate that, as rising construction costs generally lead to higher sales prices, the number of unsold apartments tends to decrease despite the cost increase when apartment prices rise sharply. However, during periods of low price increases such as the recent one, the number of unsold units tends to increase.

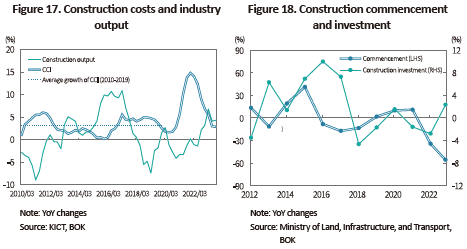

As the profitability of real estate PFs deteriorates, there are concerns about the contraction of the real economy such as sluggish investment in construction. Moreover, it is advisable to be aware of the possibility that the increased risk of contractors (construction companies) who provide a completion guarantee will escalate into a crisis of financial institutions and the money market. First of all, the construction sector may contract for a considerable period of time because deteriorating PF profitability gives rise to difficulties in the conversion of bridge loans to PF or in the construction of existing PF deals. Another reason is the abrupt decline in construction permits and commencements due to the cumulative surge in construction costs and the burden of existing PF positions since 2021. Notably, the high proportion of the construction industry in overall employment shown in Figure 12 makes it impossible for us to rule out that the slump in construction investment induced by real estate PF may exacerbate the aforementioned employment and income conditions of lower-income households, possibly leading to a concurrent slowdown in private consumption. There is also another possibility to be wary of: If the contractor responsible for carrying out and completing the project is in distress and unable to complete the project, the distress could spread to other financial institutions that provided loans or guarantees to the project and potentially escalate into a money market crisis (Jang et al., 2023).

Overall, when the Legoland crisis occurred at the end of 2022, the risk of real estate PF arose from the liquidity crisis in the money market and securities firms that guaranteed the PF ABS. On the other hand, in 2024, the cause of increased PF risk could stem from the projects themselves as well as the construction companies. Against the backdrop, policy authorities should manage real estate PF risks by taking into account the characteristics of real estate PF when formulating their policies that would enable them to restructure and support construction companies, select profitable projects, and induce projects to operate seamlessly.

1) The rising volatility in Treasury yields since the December 2023 FOMC led to a pattern of unstable market expectations for the timing and pace of further cuts in the key interest rate. According to our analysis of risk-adjusted one-month forward rates, the US Treasury market as of January 2024 expects four to five rate cuts in 2024, two in 2025, and one in 2026. On the other hand, the Korean government bond market reflects two rate cuts in the second half of 2024 and one to two rate cuts from 2025 to 2026, showing higher stability in expectations compared to the US.

2) According to Kang and Baek (2023), the average US term premium was lowered by about 100bp due to QE in the 2010s. Along with QE, low inflation and the rising demand for long-term Treasuries due to aging population are also believed to have contributed to the decline in term premiums.

3) The lower real income growth for lower-income households in 2023 is also due to the phase-out of government support, such as small business relief funds.

4) Households' loan payments compiled in the Household Income and Expenditure Survey includes interest payments only, not principal repayments. Therefore, households' actual principal repayment burden including interest payments is greater than shown in Figure 7.

5) For the purpose of exploring income changes resulting from economic conditions, the data included labor and business income only, not transfer income such as government subsidies.

6) Shares of small self-employed and temporary/daily workers (excluding unpaid family workers) in all employees as of 2023: 40.6% in wholesale and retail trade, 57.0% in accommodation and food.

7) Securities backed by PF loans include PF asset-backed commercial paper (ABCP), and PF asset-backed short-term bonds (ABSTB). They are mainly guaranteed by securities firms and construction companies.

References

Kang, H.J., Baek, I.S., 2023, Declining interest rate sensitivity of the US real economy and its implications, KCMI Issue Paper 23-22.

Kang, H.J., Baek, I.S., Jang, K.H., 2023, Assessing the possibility of a structural shift in interest rate stance, KCMI 26th Anniversary International Conference.

Financial Services Commission, Dec. 11, 2023, FSC and FSS hold meeting to check financial market situation, Press Release.

Shin, I.S., Kang H.J., 2022, 25-55. Evaluation of recent policy stance and issues in Korea's monetary policy, Korean Economic Forum 14(4): 25-55.

Jang, K.H., Lee, S.H., Lee, H.S., 2023, Korean securities firms' real estate PF: Risk factors and future responses, KCMI Issue Paper 23-10.

Adrian, T., Crump, R., Moench, E., 2013, Pricing term structure with linear regression, Journal of Financial Economics 110(1), 110-138.

The current period of high inflation and high interest rates has been quite a shock to economic and financial markets, as the shock came when the global economy was accustomed to low inflation and low interest rates that had begun around 2010. Against this backdrop, strong expectations mounting over the US Fed's rate cut have raised the possibility of a sharp return to the low-rate stance of the past. In fact, Korean and US medium- and long-term government bond yields have fallen significantly since November 2023 amid expectations for a shift in monetary policy. In this paper, we evaluate whether a cut in the key interest rate will bring down government bond yields as low as that in the 2010s. As the government bond yield can be composed of the bond market's expectation of monetary policy and the term premium, we looked at each of the two particular factors to examine the possibility of a return to low interest rates.

As noted in 2024 Macroeconomic Outlook, the terminal point of this rate cut is expected to be at the equilibrium nominal rate unless there is a recession in either the US or Korea in 2024. Figure 1 shows the equilibrium nominal rates in Korea and the US estimated from macroeconomic conditions. Both countries have seen their equilibrium nominal rate shifting upward during the Covid-19 and remaining at a higher level than in the 2010s. Next, Figure 2 shows the equilibrium nominal rate estimated from the government bond market. This rate reflects the changes in the economic structure from a medium- to long-term perspective, which is evaluated by government bond market participants. Since the Covid-19 outbreak, the market's estimate of the equilibrium interest rate has also turned upward. In January 2024, it reached the mid-3% range for the US and the mid-2% range for Korea. Meanwhile, as shown in Figure 2, bond market participants in both countries expect the benchmark interest rate to decrease gradually to reach the equilibrium level in 2026.1)

Through the above analysis, we expect that the terminal point of the current round of rate cuts may be determined at a higher level than that of the 2010s. We cannot completely rule out the possibility that the equilibrium rate will fall back to the 2010s level in the future. However, as the upward shift in equilibrium rates may reflect structural economic changes, such as demographic shifts and deglobalization, we see a limited possibility of a return to low rates from a monetary policy perspective (Kang, Baek and Jang, 2023).

Based on the above discussion, we believe that government bond yields will likely fall in 2024 as the key interest rate is expected to start declining. However, the size of the fall may not be significant. In particular, as shown in Figure 4, it will be difficult to return to the low-rate era of the 2010s, when quantitative easing contributed to a sustained decline in US and Korean government bond yields with inflation remaining below 2%. However, for the future trajectories of government bond yields, it is important to closely watch the stable range of inflation when major economies shift their monetary policy in tandem with the change in equilibrium rate. If inflation anchors at the 2% level in the medium term, the equilibrium rate will decline again, lowering the terminal rate of the current rate cut round. In this case, government bond yields are highly likely to be adjusted further.

The persistent high-inflation and high-rate conditions have led to a continuing slump in private consumption. High inflation erodes real purchasing power, leading to a slowdown in consumption. In 2023, households' real income declined as nominal income growth fell below the rate of inflation across all income deciles (see Figure 5).3) As shown in Figure 6, the negative effect on their consumption will likely be more severe given their higher propensity to spend.

In 2023, the risk associated with real estate PF, which was highlighted after the Legoland incident, was somewhat contained due to the stabilization of market interest rates and government action. The government provided liquidity support to the money market and induced maturity extensions and restructuring through the intercreditor agreement, while financial firms steadily accumulated provisions. Since 2023, such action has helped the financial sector to maintain its PF volume (loans and asset-backed securities), to curb the delinquency rate of PF loans, and to stabilize the yields of PF ABS,7) which had surged in the fourth quarter of 2022 as shown in Figure 13 and Figure 14. However, the existing risks associated with real estate PF will be resolved after properties are not only built, but also sold and occupied. Given real estate PF's deteriorating profitability and delayed construction process, this will likely be a risk factor for the financial market and real economy in 2024.

Overall, when the Legoland crisis occurred at the end of 2022, the risk of real estate PF arose from the liquidity crisis in the money market and securities firms that guaranteed the PF ABS. On the other hand, in 2024, the cause of increased PF risk could stem from the projects themselves as well as the construction companies. Against the backdrop, policy authorities should manage real estate PF risks by taking into account the characteristics of real estate PF when formulating their policies that would enable them to restructure and support construction companies, select profitable projects, and induce projects to operate seamlessly.

1) The rising volatility in Treasury yields since the December 2023 FOMC led to a pattern of unstable market expectations for the timing and pace of further cuts in the key interest rate. According to our analysis of risk-adjusted one-month forward rates, the US Treasury market as of January 2024 expects four to five rate cuts in 2024, two in 2025, and one in 2026. On the other hand, the Korean government bond market reflects two rate cuts in the second half of 2024 and one to two rate cuts from 2025 to 2026, showing higher stability in expectations compared to the US.

2) According to Kang and Baek (2023), the average US term premium was lowered by about 100bp due to QE in the 2010s. Along with QE, low inflation and the rising demand for long-term Treasuries due to aging population are also believed to have contributed to the decline in term premiums.

3) The lower real income growth for lower-income households in 2023 is also due to the phase-out of government support, such as small business relief funds.

4) Households' loan payments compiled in the Household Income and Expenditure Survey includes interest payments only, not principal repayments. Therefore, households' actual principal repayment burden including interest payments is greater than shown in Figure 7.

5) For the purpose of exploring income changes resulting from economic conditions, the data included labor and business income only, not transfer income such as government subsidies.

6) Shares of small self-employed and temporary/daily workers (excluding unpaid family workers) in all employees as of 2023: 40.6% in wholesale and retail trade, 57.0% in accommodation and food.

7) Securities backed by PF loans include PF asset-backed commercial paper (ABCP), and PF asset-backed short-term bonds (ABSTB). They are mainly guaranteed by securities firms and construction companies.

References

Kang, H.J., Baek, I.S., 2023, Declining interest rate sensitivity of the US real economy and its implications, KCMI Issue Paper 23-22.

Kang, H.J., Baek, I.S., Jang, K.H., 2023, Assessing the possibility of a structural shift in interest rate stance, KCMI 26th Anniversary International Conference.

Financial Services Commission, Dec. 11, 2023, FSC and FSS hold meeting to check financial market situation, Press Release.

Shin, I.S., Kang H.J., 2022, 25-55. Evaluation of recent policy stance and issues in Korea's monetary policy, Korean Economic Forum 14(4): 25-55.

Jang, K.H., Lee, S.H., Lee, H.S., 2023, Korean securities firms' real estate PF: Risk factors and future responses, KCMI Issue Paper 23-10.

Adrian, T., Crump, R., Moench, E., 2013, Pricing term structure with linear regression, Journal of Financial Economics 110(1), 110-138.