Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Summary

In 2023, the Korean stock market witnessed positive changes, marked by substantial increases in both the KOSPI and KOSDAQ and a shift from foreign investors’ fund outflows to inflows. Amid expectations of entering the recovery phase in 2024 beyond the low point in 2023 and corporate performance improvements, the Korean stock market is poised for favorable performance in 2024. Notably, it is essential to exercise caution in the bond market due to uncertainties about the timing of rate cuts in 2024 and concerns about construction project financing (PF) failures within the credit bond market.

Despite the net outflow of funds from retail investors in 2023, the surge in retail investors following the Covid-19 pandemic is expected to significantly influence the market in 2024. This increased participation in the stock market has heightened interest in shareholder rights protection. Positive changes are likely to follow, including the facilitation of virtual shareholder meetings and the improvement in protective mechanisms for minority shareholders during mergers or acquisitions. However, given the trading features and investment behaviors of retail investors, characterized by excessive turnover ratios and a preference for lottery-type stocks, direct investment may lead to returns below the market average, underscoring the need for careful investment strategies.

On the market landscape front, the emergence of the ATS and improvement in the security token issuance and distribution system will pose new challenges for the transformation and growth of the securities market. To prepare for these changes, market participants can identify potential business opportunities, while investors can benefit from a wider range of choices. In addition, regulatory improvements in market stability and investor protection, such as the introduction of stricter sanctions against unfair trading, will continue well into 2024, aiming for enhancing market integrity and protecting investor interests amid the evolving financial environment.

Despite the net outflow of funds from retail investors in 2023, the surge in retail investors following the Covid-19 pandemic is expected to significantly influence the market in 2024. This increased participation in the stock market has heightened interest in shareholder rights protection. Positive changes are likely to follow, including the facilitation of virtual shareholder meetings and the improvement in protective mechanisms for minority shareholders during mergers or acquisitions. However, given the trading features and investment behaviors of retail investors, characterized by excessive turnover ratios and a preference for lottery-type stocks, direct investment may lead to returns below the market average, underscoring the need for careful investment strategies.

On the market landscape front, the emergence of the ATS and improvement in the security token issuance and distribution system will pose new challenges for the transformation and growth of the securities market. To prepare for these changes, market participants can identify potential business opportunities, while investors can benefit from a wider range of choices. In addition, regulatory improvements in market stability and investor protection, such as the introduction of stricter sanctions against unfair trading, will continue well into 2024, aiming for enhancing market integrity and protecting investor interests amid the evolving financial environment.

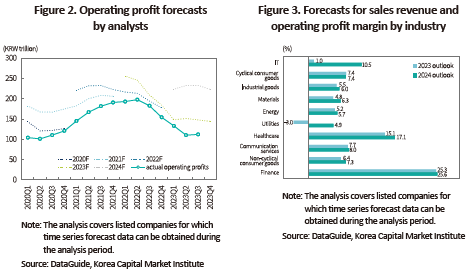

In 2023, the Korean stock market showed solid performance, with the KOSPI and KOSDAQ rising by 18.7% and 27.6%, respectively. Of particular significance is the reversal of the trend observed since 2020, as foreign investors and financial institutions who had exited the market made a comeback, marking a positive shift. In the bond market, bond yields, which had been on an upward trajectory until the third quarter of 2023, began to decline towered the end of the year. Credit spreads, which had plunged following the Legoland crisis, stabilized at relatively lower levels. Credit bond issuance increased by 15% year-on-year, driven by a recovery in demand. The Korean economy is anticipated to enter a recovery phase in 2024 after reaching a trough, with corporate performance expected to improve compared to 2023. Exploring prospects for capital markets in 2024, this article delves into key issues affecting the financial landscape, including the enhancement of shareholder rights protection, the emergence of multiple trading markets, and advancements in the tokenized securities system.

Prospects for Korea’s economic recovery and corporate performance improvement

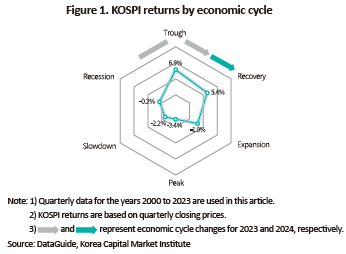

As the Korean economy is considered to have reached a trough in 2023, it is poised to transition into a recovery phase in 2024. As the stock market often exhibits patterns preceding economic cycles, the highest returns are typically recorded during economic downturns and the return growth tends to decelerate during economic recovery and expansion periods. This article finds that Korea witnessed an upward trend in stock returns after passing through a low point in 2023, and the expected economic recovery is likely to further boost stock prices in 2024.

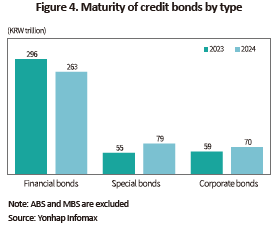

Credit bonds that reach maturity in 2024 are worth KRW 412 trillion, similar to the previous year’s figures. By bond type, special bonds and corporate bonds are forecasted to rise by 43% and 19%, respectively, while financial bonds, the largest category, are anticipated to decline by 11% compared to the previous year. This suggests that the supply-demand balance in the credit bond market is projected to remain stable relative to 2023. Notably, KEPCO bonds that mature this year are expected to increase nearly threefold, reaching KRW 18.6 trillion, which may pose potential challenges.

Furthermore, concerns about failures in construction project financing (PF) and fluctuations in interest rates are expected to influence the credit bond market. The commencement of a workout plan for Taeyoung Engineering and Construction (E&C) has recently intensified the risk of the PF crisis. Should additional issues arise from PF or the construction industry experience a prolonged downturn, it could exert a substantial impact on the credit bond market. On top of that, expectations of a potential decline in interest rates in 2024 have contributed to a reduction in credit spreads. However, if a high-interest rate environment persists for an extended period without a prompt decline in interest rates as anticipated by the market, it would boost corporate financing costs, leading to a deterioration in corporate financial performance and an expansion of credit spreads.

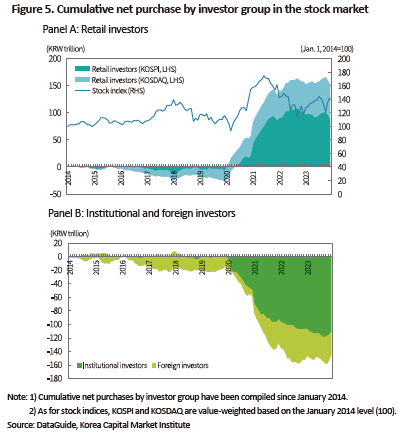

Over the past decade, retail investors have entered or exited the stock market, depending on prevailing market conditions. In 2023 alone, they net sold stocks worth KRW 14 trillion in the KOSPI market and net bought stocks worth KRW 8 trillion in the KOSDAQ market, resulting in a total net outflow of KRW 6 trillion from retail investors’ funds in the stock market. Despite this net outflow, the Korean stock market witnessed a notable influx of funds during market fluctuations prompted by the Covid-19 pandemic. As a result, the cumulative net purchase by retail investors since 2020 has amounted to KRW 160 trillion. As we move into 2024, retail investors are expected to have an enduring impact on market dynamics.

Amid increasing market participation and growing investor interest, the push for enhancing shareholder rights protection continues to gain momentum, with ongoing regulatory improvements slated for 2024. A primary focus is on facilitating retail investors’ exercise of voting rights. In August 2023, the Ministry of Justice announced plans to legislate a bill for an electronic system enabling shareholder meeting notifications, exercise of voting rights, and meeting processes, which is currently under review in the National Assembly. According to the proposed amendment to the Commercial Act, parallel virtual shareholder meetings, allowing shareholders to choose between physical attendance and electronic participation, will be permitted, in addition to fully virtual shareholder meetings. This aims to address issues associated with shareholder meetings coinciding on a specific date, commonly known as “Super Shareholders Meeting Day”, and to enhance opportunities for ordinary investors to exercise their voting rights, especially those facing difficulties in physical attendance. Additionally, regulations concerning mergers will be enhanced to safeguard the rights of minority shareholders during mergers or acquisitions that may alter corporate organization or ownership structures. These enhancements include mandatory disclosure of the board of directors’ statement on merger decisions and merger progress updates, ensuring merger decisions are beneficial for both the company and its shareholders. Moreover, companies will gain autonomy in determining merger valuation methods, while the external evaluation system will be improved to enhance objectivity and reliability. These measures are anticipated to promote responsible board decision-making and foster a more equitable calculation of merger valuations. There will also be discussions regarding the protection of minority shareholders who may suffer losses stemming from companies' use of treasury shares during corporate structural changes such as spin-offs or mergers.

Transition to the multi-market trading system

Nextrade is poised to launch Korea’s first Alternative Trading System (ATS) in the first quarter of 2025, marking a departure from the current market structure where all orders are centralized in the Korea Exchange (KRX). With the establishment of the ATS, orders will be executed in a more favorable market by prioritizing factors such as optimal quotes, affordable commissions, swift execution, and various execution methods. Consequently, the advent of the ATS is expected to fuel competition among trading markets, resulting in diversified order-related services, delivering more value for market participants, and fostering market advancement. Leading up to the introduction of the multi-market trading system in 2024, key market participants including regulatory authorities, broker-dealers, securities information providers, and order execution automation solution providers are gearing up to actively prepare for order execution implementation and the overhaul of the secondary market. If guidelines are established to determine what is the best order by comparing various orders, broker-dealers will devise best execution policies and develop an order execution system to ensure policy adherence. Securities information providers will come up with measures to efficiently integrate dispersed trading data in each market, while solution providers are expected to create new business opportunities by differentiating order execution strategies. Given that the foundation of the ATS represents a structural market shift affecting all investors, a range of measures aimed at enhancing investor interest and understanding are likely to ensue.

Following regulatory improvements and bill proposals for security tokens in 2023, concrete regulations are set to be implemented in 2024. In July 2023, legislators proposed an amendment to the Financial Investment Services and Capital Markets Act (FSCMA) to permit the distribution of investment contract securities, a key component of security tokens, which is currently pending in the National Assembly. Although the passage of the security token bill in 2024 remains uncertain, discussions will focus on establishing provisions for issuing and distributing non-monetary trust beneficiary certificates, along with improving sub-regulations concerning investment contract securities and over-the-counter brokerage business. In addition, the amendment to the Act on Electronic Registration of Stocks and Bonds (AERSB), proposed in July 2023, will entail specifying sub-regulations to ensure investors establish legal rights from distributed ledgers. Under the existing AERSB, security token investors can establish legal rights only after trading data of distributed ledgers are mirrored on electronic registration accounts, which causes inefficiencies. To address this inconvenience, distributed ledgers should be recognized as electronic registration accounts under the AERSB. Moreover, specific regulations will be prepared regarding distributed ledger requirements, distributed ledger entry, trading data retention and destruction, and registration requirements and procedures for issuer account management organizations. These measures are expected to enable the issuance and distribution of security tokens, thereby enhancing the stability and convenience of security token trading through distributed ledgers.

Policies for market integrity improvement and investor protection

In 2023, measures were swiftly adopted to impose stricter sanctions against unfair trading practices, and the amendment including introducing fines, legislating the calculation of unfair gains, and reducing penalties for voluntary reporters is set to take effect in January 2024. This year, further discussions are expected to strengthen non-monetary sanctions against unfair trading to bolster market integrity and protect investors. Once specific measures are devised to disclose sanctions for unfair trading practices, restrict executives of listed companies, and enable the freezing of assets and market trading restrictions, they may prove effective in safeguarding investors against unfair trading practices and deterring recurrent offenses.

On top of that, specific plans to relieve retail investors’ damages done by unfair trading will be implemented. Regulatory improvements will be conducted to ensure that securities-related class action suits contribute to damage relief for retail investors. In addition, other measures will be discussed to reinforce compensation for financial fraud victims by recognizing the recovery from damages as a sentencing factor.

Conclusion and implications

In conclusion, the outlook for 2024 maintains an optimistic stance, building upon the positive performance observed in the stock market in 2023. This optimism is well supported by the shift toward a net influx among foreign investors and some institutional investors in 2023, the prediction for an economic recovery following a trough, and analysts’ expectations for corporate performance improvement, particularly in the IT sector. Notably, it is necessary to exercise caution in the bond market where concerns persist regarding the uncertain timing of expected rate cuts in 2024 and the potential risks associated with construction PF failures.

Despite the net outflow of funds from retail investors in 2023, their increased presence following the Covid-19 pandemic is likely to have a substantial impact on the market in 2024. This heightened participation in the stock market has drawn greater attention to shareholder rights protection. Positive changes that prompt the board of directors to make responsible decisions are awaited in 2024, including the facilitation of virtual shareholders meetings and the improvement in protective mechanisms for minority shareholders during mergers or acquisitions. However, given the trading features and investment behaviors of retail investors, marked by excessive turnover ratios and a preference for lottery-type stocks, direct investment may lead to returns below the market average, underscoring the need for careful investment decisions.

On the market landscape front, the emergence of the ATS and improvement in the security token issuance and distribution system will pose new challenges for the transformation and growth of the securities market. To prepare for these changes, market participants can identify potential business opportunities, while investors can benefit from a wider range of choices. Lastly, regulatory improvements in market stability and investor protection, such as the introduction of stricter sanctions against unfair trading, will continue well into 2024, aiming for enhancing market integrity and protecting investor interests amid the evolving financial environment.