Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Establishment of IFRS 18 Presentation and Disclosure in Financial Statements: its Impact and Implications

Publication date Mar. 19, 2024

Summary

The International Accounting Standards Board (IASB) is poised to introduce a new standard, IFRS 18 Presentation and Disclosure in Financial Statements, scheduled to come into effect on January 1, 2027. IFRS 18 intends to define operating profit as residual income after deducting the investing and financing categories from the total. This definition deviates from the current K-IFRS operating profit in terms of amount and characteristics, which is determined by deducting the cost of goods sold and selling and administrative expenses from sales revenue, potentially causing confusion among information users. In an analysis of 31 countries, including the US and European countries, conducted from 1997 to 2019, the comprehensive presentation of operating profit through the residual category approach encourages a conservative representation of operating performance and significantly limits management’s discretion in classifying operating or non-operating profit. However, this shift is expected to curtail the persistence and value relevance of the represented operating profit, thereby reducing its usefulness for investors. To enhance the usefulness of operating performance information, it is crucial to consider introducing a subtotal for ordinary operating profit items based on extraordinary income information disclosed in financial statement footnotes. Additionally, careful examination and preparation are required to respond to the impact of the revised definition of operating profit on the regulatory framework in Korea.

Introduction of IFRS 18 Presentation and Disclosure in Financial Statement and its impact

In the second quarter of 2024, the International Accounting Standards Board (IASB) is scheduled to release a new accounting standard, IFRS 18 Presentation and Disclosure in Financial Statements. This standard is the outcome of the ‘Primary Financial Statements’ project aimed at enhancing how companies communicate performance-related information, particularly signaling significant changes in the preparation of the statement of profit or loss.

Previously, the IASB refrained from separately defining operating profit to allow corporate management to autonomously calculate operating profit and report operating performance based on economic substance. However, inconsistencies in operating profit calculations, even among companies employing the same International Financial Reporting Standards (IFRS), have compromised inter-company and international comparability regarding operating performance. Furthermore, adjusted EBIT (earnings before interest and taxes) or adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) and other non-GAAP measures not recognized under accounting standards have been increasingly used by corporate management, leading to investor confusion (IASB, April 2019).

Against this backdrop, the IASB has opted to adopt IFRS 18, aiming to provide a clear definition of operating profit for inclusion in the statement of profit or loss. Specifically, operating profit is aggregated as income items that are not classified under either investing or financing categories (see Figure 1). In addition, if management chooses to utilize performance measures not recognized under accounting standards, this should be disclosed in the footnotes as Management Performance Measures (MPMs). Any adjustments made from the most directly comparable measure, among recognized performance measures, and their calculation basis must be specified and subject to external audit scrutiny.

However, Korea faces challenges in aligning with the objectives behind the establishment of IFRS 18 by the IASB. Since 2012, Korea has defined a separate operating profit, known as “K-IFRS operating profit”, calculated as sales revenue minus the cost of goods sold and selling and administrative expenses under the K-IFRS framework, and consistently has applied it in financial reporting. In practice, Korea has been proactive in addressing the issue of lower comparability of operating performance among companies following the introduction of IFRS (Yu et al., 2013). Notably, Korean companies rarely use alternative performance measures beyond those recognized under accounting standards, thereby mitigating the necessity for disclosing MPMs in footnotes and requiring external audit scrutiny.

Moreover, the operating profit newly categorized by IFRS 18 (referred to as “IFRS 18 operating profit”) differs in both value and nature from K-IFRS operating profit, which has long been utilized in the Korean capital market. Various other income items, previously categorized as non-operating income under K-IFRS—such as tangible and intangible asset disposal gains or losses, impairment losses, donations and foreign exchange gains or losses—will now be included in operating income under IFRS 18. This change has the potential to cause confusion among financial information users. Given that IFRS 18 is set to replace IAS 1, which currently governs financial statement presentation, starting from January 1, 2027 and its early adoption is permitted, it is crucial to proactively review considerations for the proper implementation of IFRS 18 in Korea.

Comparing the usefulness of K-IFRS operating profit and IFRS 18 operating profit

The primary objective of IFRS 18, as established by the IASB, is to enhance transparency and comparability in corporate performance reporting, ultimately providing investors with more useful information (IASB, April 2019). While some countries, such as Korea and Germany, have defined operating profit to maintain consistency with legal frameworks, the majority of those adopting IFRS have not provided a separate definition for operating profit in the statement of profit or loss (Park & Kim, 2019). With the upcoming implementation of IFRS 18, the reporting of operating performance will become standardized, thereby improving the technical comparability of operating performance information across most IFRS-compliant countries.

According to research findings, improved comparability of performance information can reduce financing costs and potentially enhance corporate value (Kim et al., 2013; Imhof et al., 2017). However, the effectiveness of improved comparability relies on the relevance of information being compared. Even when presented in a comparable form, information that lacks relevance to corporate value hardly meets investors’ needs and fails to influence decision-making processes.

IFRS 18 operating profit, calculated using the residual category approach, is composed of a heterogeneous set of items excluding those related to investing and financing. Operating activities-related items are aggregated into a subtotal, regardless of their materiality, frequency, and persistence, resulting in the inclusion of various special items, both temporary and non-recurring. While these special items may offer insights into a firm’s operating environment or prospects (Francis et al., 1996), unpredictable temporary profits show lower relevance and consequently, decreased information usefulness compared to permanent profits (Ohlson, 1999).

On the other hand, K-IFRS recognizes profits derived from regular operating activities as operating profit, calculated by deducting the cost of goods sold and selling and administrative expenses from sales revenue. While this functional calculation approach may lack faithful representation in that it cannot fully encompass operating performance, it offers a comparative advantage by providing investors with highly relevant operating profit information, particularly focusing on consistent and recurring items.

Empirical studies focusing on listed companies in Korea suggest that K-IFRS operating profit is more persistent and better predicts future stock returns than the operating profit calculated indirectly through the residual category approach (Park & Kim, 2019). In a comparative analysis of the amount of other income and expenses added to or subtracted from K-IFRS operating profit as a proxy for IFRS 18 operating profit, K-IFRS operating profit demonstrates higher information value in the Korean market (Kim & Choi, 2022). However, given its long-standing use in Korea, K-IFRS operating profit may inherently hold high relevance to investors in the domestic capital market due to its familiarity as a performance measure.

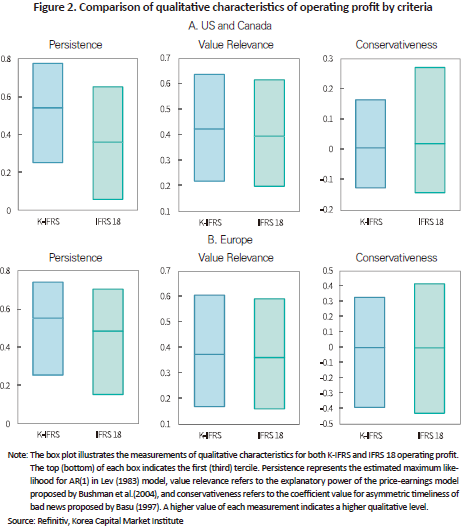

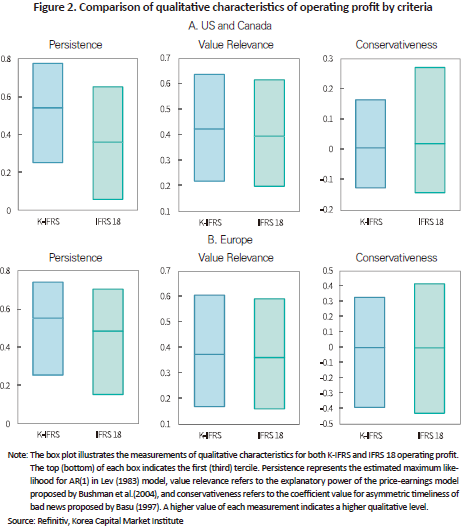

Under this context, this article conducts a comparative analysis of K-IFRS operating profit and IFRS 18 operating profit in terms of information usefulness across the US, Canada, and some European countries eligible for empirical analysis, including the UK, Germany, and France. The presentation of operating profit in these countries is entirely independent of any institutional framework in Korea, thereby allowing for a relatively unbiased assessment of how accounting attributes affect information relevance in the market. Additionally, using cross-national empirical evidence enables the evaluation of the intended purpose of IFRS 18, which aims to enhance the international comparability of operating performance and provide valuable information to investors.

Firstly, the methodology involves deducting the cost of goods sold, selling and general administrative expenses, and depreciation charges from sales revenue to calculate K-IFRS operating profit for each country. Subsequently, the calculated amount is adjusted by adding or subtracting extraordinary and special profit or loss to derive a proxy for IFRS 18 operating profit.1) In addition, a rolling regression model spanning 10 years (with a minimum of seven years) is employed for each firm to assess persistence, value relevance, and conservativeness, with the aim of capturing the long-term time-series characteristics of corporate earnings (Francis et al., 2004).

The analysis covers 31 countries including the US, Canada, and 29 European countries over the period from 1997 to 2019 (data available from 1991 to 2019). The long-term time-series model reveals that K-IFRS operating profit exhibits greater persistence and higher value relevance, compared to IFRS 18 operating profit (see Figure 2). Investors prioritize earnings persistence and value relevance when assessing the materiality of various performance measures (Bradshaw & Sloan, 2002; Barton et al., 2010). This implies that the K-IFRS operating profit methodology generally offers more useful information across most countries, compared to IFRS 18’s residual category approach. However, IFRS 18 operating profit does not consistently underperform in all aspects. It seems to prudently estimate extraordinary and special profit or loss items, albeit with variations across companies and countries, and adopts a conservative approach by proactively reflecting adverse events ahead of K-IFRS operating profit.

Conclusion and implications

In summary, the IFRS 18 methodology for presenting performance information has some definite advantages and disadvantages. Income statement that is categorized into operating, investing, and financing activities would be able to provide relevant information for evaluating a firm’s core activities. Unlike the investing category where income is generated independently from other corporate resources and the financing category where profit or loss arises from assets and liabilities related to the firm’s financing activities, it is challenging to set a clear definition on the operating category. For this reason, IFRS 18 seems to include all residual items, not falling under the investing and financing categories, in operating profit.

Presenting comprehensive operating profit in residual categories inherently limits management’s discretion in classifying items for inclusion in operating or non-operating income. This approach is beneficial in conservatively presenting operating activities-related performance, in line with accounting principles requiring prudent estimation of losses from extraordinary items. However, it may lead to lower earnings predictability and value relevance for investors as aggregated operating income includes a significant portion of other income items apart from its core operating activities. This inference is supported by empirical evidence observed not only in Korea but also in many European countries that have adopted the IFRS.

If IFRS 18 is finalized similarly to its released Exposure Draft, it is worth examining the following considerations. First, when introducing IFRS 18 in Korea, it is necessary to consider including a subtotal for ordinary items to distinguish them from extraordinary items. The Exposure Draft ‘General Presentation and Disclosures’ proposes reporting all extraordinary items in footnotes, including their amounts, reasons for occurrence, and justification for classification, enabling investors to identify persistent profit elements. However, there is a clear discrepancy in the ability to convey information between footnotes and the main financial statements (Barth et al., 2003). Furthermore, it is inconsistent to require the presentation of extraordinary income information in footnotes, without any indication in the income statement. While this may aim to reduce the possibility of discretionary classification into the operating category and enhance transparency in operating profit information, it seems to deviate from the underlying principles of IFRS.

Second, institutional implications stemming from the changing definition of operating profit require thorough examination. For example, interim performance and changes in the profit or loss composition of sales revenue are disclosed, typically focusing on key summary items like sales revenue, operating profit, and net profit or loss. If K-IFRS operating profit is replaced by IFRS 18 operating profit, the usefulness of information will inevitably diminish in pre-annual performance disclosures, as detailed information regarding extraordinary profit or loss is disclosed only on the footnotes in the annual financial statement. This underscores the need to establish disclosure guidelines for extraordinary items, and standardized formats tailored to machine readability should be adopted in preparation for the increasing volume of disclosure documents.

Lastly, management should develop an MPM suitable for each firm and actively present performance measures with high information usefulness. While authorities may consider uniformly designating K-IFRS operating profit as an MPM, such a designation may not be the optimal solution for the Korean capital market, which necessitates improved communication with shareholders and the establishment of a robust governance framework. The relatively limited adoption of MPMs by Korean companies, in contrast to their counterparts in the US and Europe, may partly stem from the influence of K-IFRS operating profit as a useful and comparable performance measure. Moreover, cultural factors, such as a shareholder-unfriendly environment characterized by a reluctance to provide earnings forecasts and lackluster investor relation activities, may also contribute to this trend. By introducing the well-established system developed based on advanced markets’ experience to ensure reliable MPM disclosures, it is expected that the negative effects of discretionary use by management can be minimized. It should be noted that the inherent limitations of external audits necessitate thorough monitoring of MPM utilization by the board of directors. More importantly, the introduction of IFRS 18 presents an opportunity to increase management’s sensitivity to performance and compensation, in tandem with the Say-on-Pay system.

1) Extraordinary and special profit or loss items may include those categorized as investing or financing activities. However, the precedent analysis on KOSPI200 companies reveals that only a limited number of items are expected to clearly fall outside the operating category (Kim & Choi, 2022).

References

Barth, M.E., Clinch, G., Shibano, T., 2003, Market effects of recognition and disclosure, Journal of Accounting research 41(4), 581-609.

Barton, J., Hansen, T.B., Pownall, G., 2010, Which performance measures do investors around the world value the most—And why?, The Accounting Review 85(3), 753-789.

Basu, S., 1997, The conservatism principle and the asymmetric timeliness of earnings, Journal of Accounting and economics 24(1), 3-37.

Bradshaw, M.T., Sloan, R.G., 2002, GAAP versus the street: An empirical assessment of two alternative definitions of earnings, Journal of Accounting Research 40(1), 41-66.

Bushman, R., Chen, Q., Engel, E., Smith, A., 2004, Financial accounting information, organizational complexity and corporate governance systems, Journal of Accounting and economics 37(2), 167-201.

Francis, J., Hanna, J.D., Vincent, L., 1996, Causes and effects of discretionary asset write-offs, Journal of Accounting Research 34, 117-134.

Francis, J., LaFond, R., Olsson, P.M., Schipper, K., 2004, Costs of equity and earnings attributes, The Accounting Review 79(4), 967-1010.

IASB, 2019. 4, Exposure Draft ‘General Presentation and Disclosures’.

IFRS Advisory Council, 2023. 11, Steps after publication of IFRS 18 Presentation and Disclosure in Financial Statements.

Imhof, M.J., Seavey, S.E., Smith, D.B., 2017, Comparability and cost of equity capital, Accounting Horizons 31(2), 125-138.

Kim, S., Kraft, P., Ryan, S.G., 2013, Financial statement comparability and credit risk, Review of Accounting Studies 18, 783-823.

Lev, B., 1983, Some economic determinants of time-series properties of earnings, Journal of Accounting and Economics 5, 31-48.

Ohlson, J.A., 1999, On transitory earnings, Review of Accounting Studies 4, 145-162.

[Korean]

Kim, H.T. & Choi, Y.S., 2022, IASB Exposure Draft on ‘General Presentation and Disclosures’ and Operating Profit, Korean Accounting Journal 31(4), 287-329.

Park, I.H. & Kim, K.S., 2019, Utility Comparison of Operating Profit and EBIT as Performance Measures, Journal of Taxation and Accounting 20(5), 165-211.

Yu, Y.G., Mun, B.Y. & Choi, E.S., 2013, Comparative Analysis of Value Relevance of Operating Profit by Calculation Method, Korean Accounting Journal 22(2), 1-21.

In the second quarter of 2024, the International Accounting Standards Board (IASB) is scheduled to release a new accounting standard, IFRS 18 Presentation and Disclosure in Financial Statements. This standard is the outcome of the ‘Primary Financial Statements’ project aimed at enhancing how companies communicate performance-related information, particularly signaling significant changes in the preparation of the statement of profit or loss.

Previously, the IASB refrained from separately defining operating profit to allow corporate management to autonomously calculate operating profit and report operating performance based on economic substance. However, inconsistencies in operating profit calculations, even among companies employing the same International Financial Reporting Standards (IFRS), have compromised inter-company and international comparability regarding operating performance. Furthermore, adjusted EBIT (earnings before interest and taxes) or adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) and other non-GAAP measures not recognized under accounting standards have been increasingly used by corporate management, leading to investor confusion (IASB, April 2019).

Against this backdrop, the IASB has opted to adopt IFRS 18, aiming to provide a clear definition of operating profit for inclusion in the statement of profit or loss. Specifically, operating profit is aggregated as income items that are not classified under either investing or financing categories (see Figure 1). In addition, if management chooses to utilize performance measures not recognized under accounting standards, this should be disclosed in the footnotes as Management Performance Measures (MPMs). Any adjustments made from the most directly comparable measure, among recognized performance measures, and their calculation basis must be specified and subject to external audit scrutiny.

However, Korea faces challenges in aligning with the objectives behind the establishment of IFRS 18 by the IASB. Since 2012, Korea has defined a separate operating profit, known as “K-IFRS operating profit”, calculated as sales revenue minus the cost of goods sold and selling and administrative expenses under the K-IFRS framework, and consistently has applied it in financial reporting. In practice, Korea has been proactive in addressing the issue of lower comparability of operating performance among companies following the introduction of IFRS (Yu et al., 2013). Notably, Korean companies rarely use alternative performance measures beyond those recognized under accounting standards, thereby mitigating the necessity for disclosing MPMs in footnotes and requiring external audit scrutiny.

Moreover, the operating profit newly categorized by IFRS 18 (referred to as “IFRS 18 operating profit”) differs in both value and nature from K-IFRS operating profit, which has long been utilized in the Korean capital market. Various other income items, previously categorized as non-operating income under K-IFRS—such as tangible and intangible asset disposal gains or losses, impairment losses, donations and foreign exchange gains or losses—will now be included in operating income under IFRS 18. This change has the potential to cause confusion among financial information users. Given that IFRS 18 is set to replace IAS 1, which currently governs financial statement presentation, starting from January 1, 2027 and its early adoption is permitted, it is crucial to proactively review considerations for the proper implementation of IFRS 18 in Korea.

Comparing the usefulness of K-IFRS operating profit and IFRS 18 operating profit

The primary objective of IFRS 18, as established by the IASB, is to enhance transparency and comparability in corporate performance reporting, ultimately providing investors with more useful information (IASB, April 2019). While some countries, such as Korea and Germany, have defined operating profit to maintain consistency with legal frameworks, the majority of those adopting IFRS have not provided a separate definition for operating profit in the statement of profit or loss (Park & Kim, 2019). With the upcoming implementation of IFRS 18, the reporting of operating performance will become standardized, thereby improving the technical comparability of operating performance information across most IFRS-compliant countries.

According to research findings, improved comparability of performance information can reduce financing costs and potentially enhance corporate value (Kim et al., 2013; Imhof et al., 2017). However, the effectiveness of improved comparability relies on the relevance of information being compared. Even when presented in a comparable form, information that lacks relevance to corporate value hardly meets investors’ needs and fails to influence decision-making processes.

IFRS 18 operating profit, calculated using the residual category approach, is composed of a heterogeneous set of items excluding those related to investing and financing. Operating activities-related items are aggregated into a subtotal, regardless of their materiality, frequency, and persistence, resulting in the inclusion of various special items, both temporary and non-recurring. While these special items may offer insights into a firm’s operating environment or prospects (Francis et al., 1996), unpredictable temporary profits show lower relevance and consequently, decreased information usefulness compared to permanent profits (Ohlson, 1999).

On the other hand, K-IFRS recognizes profits derived from regular operating activities as operating profit, calculated by deducting the cost of goods sold and selling and administrative expenses from sales revenue. While this functional calculation approach may lack faithful representation in that it cannot fully encompass operating performance, it offers a comparative advantage by providing investors with highly relevant operating profit information, particularly focusing on consistent and recurring items.

Empirical studies focusing on listed companies in Korea suggest that K-IFRS operating profit is more persistent and better predicts future stock returns than the operating profit calculated indirectly through the residual category approach (Park & Kim, 2019). In a comparative analysis of the amount of other income and expenses added to or subtracted from K-IFRS operating profit as a proxy for IFRS 18 operating profit, K-IFRS operating profit demonstrates higher information value in the Korean market (Kim & Choi, 2022). However, given its long-standing use in Korea, K-IFRS operating profit may inherently hold high relevance to investors in the domestic capital market due to its familiarity as a performance measure.

Under this context, this article conducts a comparative analysis of K-IFRS operating profit and IFRS 18 operating profit in terms of information usefulness across the US, Canada, and some European countries eligible for empirical analysis, including the UK, Germany, and France. The presentation of operating profit in these countries is entirely independent of any institutional framework in Korea, thereby allowing for a relatively unbiased assessment of how accounting attributes affect information relevance in the market. Additionally, using cross-national empirical evidence enables the evaluation of the intended purpose of IFRS 18, which aims to enhance the international comparability of operating performance and provide valuable information to investors.

Firstly, the methodology involves deducting the cost of goods sold, selling and general administrative expenses, and depreciation charges from sales revenue to calculate K-IFRS operating profit for each country. Subsequently, the calculated amount is adjusted by adding or subtracting extraordinary and special profit or loss to derive a proxy for IFRS 18 operating profit.1) In addition, a rolling regression model spanning 10 years (with a minimum of seven years) is employed for each firm to assess persistence, value relevance, and conservativeness, with the aim of capturing the long-term time-series characteristics of corporate earnings (Francis et al., 2004).

The analysis covers 31 countries including the US, Canada, and 29 European countries over the period from 1997 to 2019 (data available from 1991 to 2019). The long-term time-series model reveals that K-IFRS operating profit exhibits greater persistence and higher value relevance, compared to IFRS 18 operating profit (see Figure 2). Investors prioritize earnings persistence and value relevance when assessing the materiality of various performance measures (Bradshaw & Sloan, 2002; Barton et al., 2010). This implies that the K-IFRS operating profit methodology generally offers more useful information across most countries, compared to IFRS 18’s residual category approach. However, IFRS 18 operating profit does not consistently underperform in all aspects. It seems to prudently estimate extraordinary and special profit or loss items, albeit with variations across companies and countries, and adopts a conservative approach by proactively reflecting adverse events ahead of K-IFRS operating profit.

Conclusion and implications

In summary, the IFRS 18 methodology for presenting performance information has some definite advantages and disadvantages. Income statement that is categorized into operating, investing, and financing activities would be able to provide relevant information for evaluating a firm’s core activities. Unlike the investing category where income is generated independently from other corporate resources and the financing category where profit or loss arises from assets and liabilities related to the firm’s financing activities, it is challenging to set a clear definition on the operating category. For this reason, IFRS 18 seems to include all residual items, not falling under the investing and financing categories, in operating profit.

Presenting comprehensive operating profit in residual categories inherently limits management’s discretion in classifying items for inclusion in operating or non-operating income. This approach is beneficial in conservatively presenting operating activities-related performance, in line with accounting principles requiring prudent estimation of losses from extraordinary items. However, it may lead to lower earnings predictability and value relevance for investors as aggregated operating income includes a significant portion of other income items apart from its core operating activities. This inference is supported by empirical evidence observed not only in Korea but also in many European countries that have adopted the IFRS.

If IFRS 18 is finalized similarly to its released Exposure Draft, it is worth examining the following considerations. First, when introducing IFRS 18 in Korea, it is necessary to consider including a subtotal for ordinary items to distinguish them from extraordinary items. The Exposure Draft ‘General Presentation and Disclosures’ proposes reporting all extraordinary items in footnotes, including their amounts, reasons for occurrence, and justification for classification, enabling investors to identify persistent profit elements. However, there is a clear discrepancy in the ability to convey information between footnotes and the main financial statements (Barth et al., 2003). Furthermore, it is inconsistent to require the presentation of extraordinary income information in footnotes, without any indication in the income statement. While this may aim to reduce the possibility of discretionary classification into the operating category and enhance transparency in operating profit information, it seems to deviate from the underlying principles of IFRS.

Second, institutional implications stemming from the changing definition of operating profit require thorough examination. For example, interim performance and changes in the profit or loss composition of sales revenue are disclosed, typically focusing on key summary items like sales revenue, operating profit, and net profit or loss. If K-IFRS operating profit is replaced by IFRS 18 operating profit, the usefulness of information will inevitably diminish in pre-annual performance disclosures, as detailed information regarding extraordinary profit or loss is disclosed only on the footnotes in the annual financial statement. This underscores the need to establish disclosure guidelines for extraordinary items, and standardized formats tailored to machine readability should be adopted in preparation for the increasing volume of disclosure documents.

Lastly, management should develop an MPM suitable for each firm and actively present performance measures with high information usefulness. While authorities may consider uniformly designating K-IFRS operating profit as an MPM, such a designation may not be the optimal solution for the Korean capital market, which necessitates improved communication with shareholders and the establishment of a robust governance framework. The relatively limited adoption of MPMs by Korean companies, in contrast to their counterparts in the US and Europe, may partly stem from the influence of K-IFRS operating profit as a useful and comparable performance measure. Moreover, cultural factors, such as a shareholder-unfriendly environment characterized by a reluctance to provide earnings forecasts and lackluster investor relation activities, may also contribute to this trend. By introducing the well-established system developed based on advanced markets’ experience to ensure reliable MPM disclosures, it is expected that the negative effects of discretionary use by management can be minimized. It should be noted that the inherent limitations of external audits necessitate thorough monitoring of MPM utilization by the board of directors. More importantly, the introduction of IFRS 18 presents an opportunity to increase management’s sensitivity to performance and compensation, in tandem with the Say-on-Pay system.

1) Extraordinary and special profit or loss items may include those categorized as investing or financing activities. However, the precedent analysis on KOSPI200 companies reveals that only a limited number of items are expected to clearly fall outside the operating category (Kim & Choi, 2022).

References

Barth, M.E., Clinch, G., Shibano, T., 2003, Market effects of recognition and disclosure, Journal of Accounting research 41(4), 581-609.

Barton, J., Hansen, T.B., Pownall, G., 2010, Which performance measures do investors around the world value the most—And why?, The Accounting Review 85(3), 753-789.

Basu, S., 1997, The conservatism principle and the asymmetric timeliness of earnings, Journal of Accounting and economics 24(1), 3-37.

Bradshaw, M.T., Sloan, R.G., 2002, GAAP versus the street: An empirical assessment of two alternative definitions of earnings, Journal of Accounting Research 40(1), 41-66.

Bushman, R., Chen, Q., Engel, E., Smith, A., 2004, Financial accounting information, organizational complexity and corporate governance systems, Journal of Accounting and economics 37(2), 167-201.

Francis, J., Hanna, J.D., Vincent, L., 1996, Causes and effects of discretionary asset write-offs, Journal of Accounting Research 34, 117-134.

Francis, J., LaFond, R., Olsson, P.M., Schipper, K., 2004, Costs of equity and earnings attributes, The Accounting Review 79(4), 967-1010.

IASB, 2019. 4, Exposure Draft ‘General Presentation and Disclosures’.

IFRS Advisory Council, 2023. 11, Steps after publication of IFRS 18 Presentation and Disclosure in Financial Statements.

Imhof, M.J., Seavey, S.E., Smith, D.B., 2017, Comparability and cost of equity capital, Accounting Horizons 31(2), 125-138.

Kim, S., Kraft, P., Ryan, S.G., 2013, Financial statement comparability and credit risk, Review of Accounting Studies 18, 783-823.

Lev, B., 1983, Some economic determinants of time-series properties of earnings, Journal of Accounting and Economics 5, 31-48.

Ohlson, J.A., 1999, On transitory earnings, Review of Accounting Studies 4, 145-162.

[Korean]

Kim, H.T. & Choi, Y.S., 2022, IASB Exposure Draft on ‘General Presentation and Disclosures’ and Operating Profit, Korean Accounting Journal 31(4), 287-329.

Park, I.H. & Kim, K.S., 2019, Utility Comparison of Operating Profit and EBIT as Performance Measures, Journal of Taxation and Accounting 20(5), 165-211.

Yu, Y.G., Mun, B.Y. & Choi, E.S., 2013, Comparative Analysis of Value Relevance of Operating Profit by Calculation Method, Korean Accounting Journal 22(2), 1-21.