Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Target Date Funds and Retirement Pension Asset Management

Publication date Apr. 16, 2024

Summary

The Target Date Funds (TDFs) market remained stagnant by the end of 2023, having reached its peak at the end of 2021. This stagnation primarily resulted from a deterioration in returns in 2022. Other contributing factors include the lower-than-expected effects of the default option scheme and the proliferation of ETFs. TDFs autonomously adjust asset compositions without explicit investment instructions from individual investors. This suggests that TDFs hold significant potential in managing defined contribution (DC) retirement plan assets. In this respect, they can play a crucial role in retirement plan asset management until collective investments, such as fund-type retirement plans, are fully established in Korea. Continuous improvements are required for retirement products in the asset management industry, such as cost reduction.

The rapid growth of Target Date Funds (TDFs) has slowed down.1) The net asset value (NAV) of TDFs has been on the decline after reaching its peak at the end of 2021, only recovering to the previous levels by the end of 2023. Deteriorating returns in 2022 may play a major role in the sluggish growth of TDFs. In addition, various factors, such as the emergence of alternative investment products like ETFs and the lower-then-expected impact of the default option scheme, have contributed to the slowdown in TDF growth. Funds invested in TDFs primarily come from defined contribution (DC) plan assets, and TDFs hold significance in the asset management of DC plan assets. TDFs, for which asset management companies (AMCs) adjust asset allocation depending on market conditions, are suitable for many plan members who are not familiar with asset management. In this regard, the growth of TDFs is crucial for the stable advancement of DC plans.

To facilitate the development of the retirement pension scheme, it is a meaningful endeavor to explore the current state and performance of TDFs amid the slower growth trend of TDFs.2)

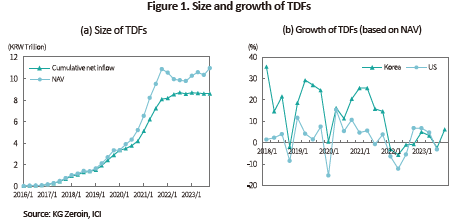

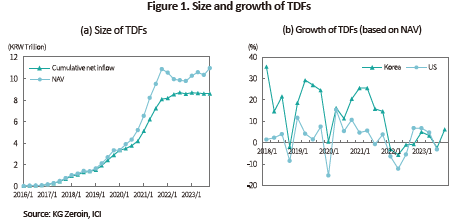

Size of TDFs

The growth of TDFs has been losing its momentum after reaching its peak at the end of 2021. As of the end of 2023, the cumulative net inflow of TDFs stood at KRW 8.6 trillion, with their NAV amounting to KRW 11 trillion (see Figure 1(a)). The NAV barely increased by KRW 100 billion from KRW 10.9 trillion at the end of 2021, while the cumulative net inflow rose by approximately KRW 500 billion from KRW 8.1 trillion at the end of 2021 to KRW 8.6 trillion at the end of 2023. This underscores the sluggish growth of TDFs, compared to the nearly two-fold increase in the cumulative net inflow of TDFs from KRW 4.2 trillion at the end of 2020 to KRW 8.1 trillion at the end of 2021. The slowdown in TDF growth, driven by the bear stock market, is also evident in the US TDF market (see Figure 1(b)).3)

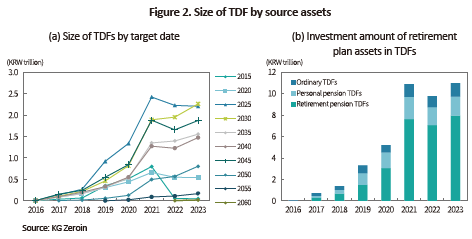

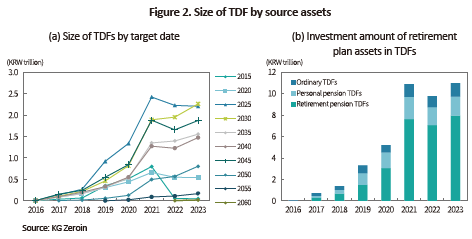

By target date, TDF2030 is the largest TDF in size as of the end of 2023 (see Figure 2(a)). As TDF2025 approaches its target date, its size has been reduced after peaking in 2021. TDF2015 and TDF2020 exhibit an even steeper declining trend. In contrast, TDFs with target dates set beyond 2030 are growing in size. Considering changes in the size of TDFs by target date, the stagnant growth of TDFs may stem from the retirement of baby boomers and subsequent plan asset withdrawals. In response, it is necessary to develop products that allow plan members to make partial withdrawals and continue managing the remaining assets after reaching target dates.

As of the end of 2023, retirement plan assets invested in TDFs amounted to KRW 8 trillion, representing 72.5% of the NAV of TDFs (see Figure 2(b)).4) Except for retirement plan assets, personal pension TDFs and ordinary TDFs accounted for KRW 1.8 trillion (17.2%) and KRW 1.2 trillion (11.2%), respectively. The fact that the proportion of ordinary TDFs, which comprised over 50% in 2016, has plunged demonstrates that TDFs have been established as a primary investment product for pension funds.

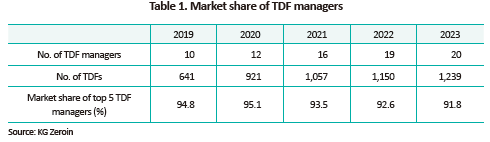

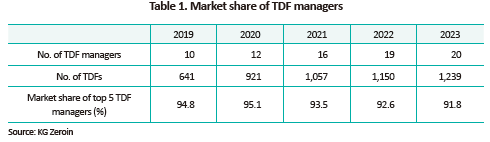

The success or failure of the TDF market is expected to have a critical impact on competition among AMCs. As of the end of 2023, 20 AMCs have launched TDFs, and in terms of cumulative net inflow, the top three AMCs hold a market share of 72.4%, with the top five capturing as much as 91.8% of the market share. The leading TDF managers tend to launch TDFs earlier and offer a large number of funds (see Table 1).

Returns and expenses of TDFs

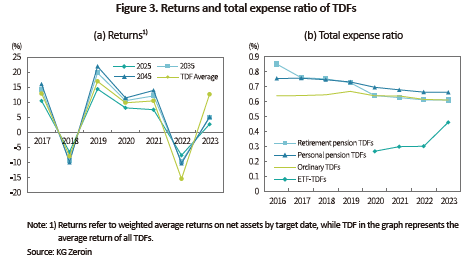

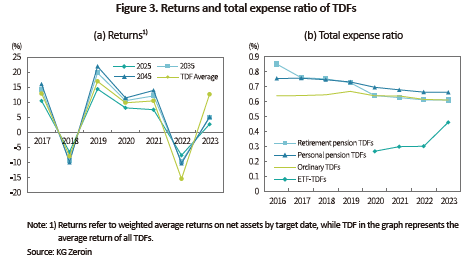

TDF returns, which remained stable from 2018 to 2021, tumbled due to factors such as a decline in the stock market. The return on TDFs, which stayed within the 11.2% range in 2021, plummeted to -15.4% in 2022 (see Figure 3(a)). A comparison of returns by target date reveals that during the period characterized by high returns, the further the target date, the higher the return. During market downturns like in 2022, the opposite trend emerged because TDFs with more distant target dates tend to increase the share of stocks in their portfolios.

The total expense ratio of retirement pension TDFs has experienced a steady decline from 0.85% in 2016 to 0.61% in 2023 (see Figure 3(b)). Initially, retirement pension TDFs charged higher fees than ordinary TDFs. Given that retirement plan funds typically have lower fees compared to ordinary funds on average, the initial total expense ratio of retirement pension TDFs can be considered relatively high.5) TDF products investing in ETFs, which were first introduced in March 2020, amounted to KRW 140 billion (1.3%) in NAV as of the end of 2023. Their fees are around two-thirds of those for ordinary TDFs. With the sustained growth in the ETF market, TDFs are expected to face pressure to reduce costs.

Asset management strategies of TDFs and retirement pension

Similar to the structure of the US 401(k), asset management for DC plans in Korea is driven by plan members. The US 401(k) is structured as an individually driven retirement plan as the funds primarily come from employees’ paychecks. Pre-401(k) retirement plans in the US were typically funded by employer contributions, whether they were of the defined benefit (DB) or DC type, leading to asset management being overseen by companies and funds. Notably, 401(k) assets are primarily composed of employee contributions to pension accounts, set aside from their wages, alongside employers’ matching contributions. Since these funds originate from individual sources, a plan member-driven asset management approach was adopted. In comparison, Korea’s retirement pension scheme is rooted in the severance pay system. As severance pay is considered part of an employee’s wage, an individually driven asset management approach has been established. Whether in the case of 401(k) or the Korean DC pension plan, the asset management led by plan members is a valid strategy. However, it should be noted that plan members often struggle with investment decisions due to limited expertise in asset management.6) Furthermore, the limited size of individual retirement assets poses challenges for portfolio diversification. TDFs can address these limitations by offering a solution for individual investors. Given that fund-type retirement plans are not yet prevalent in the market, TDFs emerge as the sole product type capable of adjusting asset composition without investment instructions from plan members.

To tackle challenges such as the difficulty of investment decision-making and delays in investment decisions, the default option scheme was implemented in July 2022, with TDFs incorporated as basic products. However, the constraints of the default option scheme, coupled with the stock market downturn in 2022, have impeded the growth of TDFs.7)

Various strategies such as fund-type retirement plans and collective defined contribution (Collective DC) plans could be explored to improve the asset management of DC retirement plans. Prior to the implementation of such strategies, TDFs can continue to play a crucial role, and continuous improvements are essential, including the development of products tailored to post-target date investment, adapting to the proliferation of ETFs, and cost reduction.

1) TDFs are the funds that allocate assets conservatively as the target date approaches. The target date is typically set based on the investor’s asset needs, often the retirement date, and asset allocation is determined by a glide path.

2) The analysis utilizes data from Zeroin, FnGuide, and Korea Financial Investment Association.

3) In 2022, the MSCI ACWI, the benchmark for Korean TDFs, fell by 19.8%.

4) The proportion of retirement pension funds in TDFs increased annually, reaching 24.7% at the end of 2016, 39.5% at the end of 2017, 49.6% at the end of 2018, 45.6% at the end of 2019, 58.9% at the end of 2020, 70.2% at the end of 2021, 72.4% at the end of 2022, and 72.5% at the end of 2023.

5) As of the end of 2022, the annual average of the total expense ratio of retirement pension funds stood at 0.82%, while that of ordinary funds reached 1.04% (Source: Zeroin).

6) Following the same logic, Korean DB plans should be driven by plan members. It is notable that under DB plans, employers guarantee returns on contributions, equivalent to the wage growth rate. Thus, employer-driven investment also serves as a valid approach.

7) The term “Default Investment Alternatives”, introduced as the default option scheme in Korea, refers to the fundamental investment product where retirement plan contributions are automatically invested in the absence of explicit investment instructions from plan members. However, the Korean version of this scheme allows plan members to pre-designate default investment alternatives, which, thus, turn into investment products with explicitly stated investment preferences. In particular, as principal guarantee products are incorporated into the Korean default option scheme, the existing investment approach tilting heavily towards principal protection is highly likely to continue. Furthermore, products must be subject to assessment to qualify for the default option scheme, potentially posing an entry barrier for small firms with limited experience in TDF design.

To facilitate the development of the retirement pension scheme, it is a meaningful endeavor to explore the current state and performance of TDFs amid the slower growth trend of TDFs.2)

Size of TDFs

The growth of TDFs has been losing its momentum after reaching its peak at the end of 2021. As of the end of 2023, the cumulative net inflow of TDFs stood at KRW 8.6 trillion, with their NAV amounting to KRW 11 trillion (see Figure 1(a)). The NAV barely increased by KRW 100 billion from KRW 10.9 trillion at the end of 2021, while the cumulative net inflow rose by approximately KRW 500 billion from KRW 8.1 trillion at the end of 2021 to KRW 8.6 trillion at the end of 2023. This underscores the sluggish growth of TDFs, compared to the nearly two-fold increase in the cumulative net inflow of TDFs from KRW 4.2 trillion at the end of 2020 to KRW 8.1 trillion at the end of 2021. The slowdown in TDF growth, driven by the bear stock market, is also evident in the US TDF market (see Figure 1(b)).3)

By target date, TDF2030 is the largest TDF in size as of the end of 2023 (see Figure 2(a)). As TDF2025 approaches its target date, its size has been reduced after peaking in 2021. TDF2015 and TDF2020 exhibit an even steeper declining trend. In contrast, TDFs with target dates set beyond 2030 are growing in size. Considering changes in the size of TDFs by target date, the stagnant growth of TDFs may stem from the retirement of baby boomers and subsequent plan asset withdrawals. In response, it is necessary to develop products that allow plan members to make partial withdrawals and continue managing the remaining assets after reaching target dates.

As of the end of 2023, retirement plan assets invested in TDFs amounted to KRW 8 trillion, representing 72.5% of the NAV of TDFs (see Figure 2(b)).4) Except for retirement plan assets, personal pension TDFs and ordinary TDFs accounted for KRW 1.8 trillion (17.2%) and KRW 1.2 trillion (11.2%), respectively. The fact that the proportion of ordinary TDFs, which comprised over 50% in 2016, has plunged demonstrates that TDFs have been established as a primary investment product for pension funds.

The success or failure of the TDF market is expected to have a critical impact on competition among AMCs. As of the end of 2023, 20 AMCs have launched TDFs, and in terms of cumulative net inflow, the top three AMCs hold a market share of 72.4%, with the top five capturing as much as 91.8% of the market share. The leading TDF managers tend to launch TDFs earlier and offer a large number of funds (see Table 1).

TDF returns, which remained stable from 2018 to 2021, tumbled due to factors such as a decline in the stock market. The return on TDFs, which stayed within the 11.2% range in 2021, plummeted to -15.4% in 2022 (see Figure 3(a)). A comparison of returns by target date reveals that during the period characterized by high returns, the further the target date, the higher the return. During market downturns like in 2022, the opposite trend emerged because TDFs with more distant target dates tend to increase the share of stocks in their portfolios.

Asset management strategies of TDFs and retirement pension

Similar to the structure of the US 401(k), asset management for DC plans in Korea is driven by plan members. The US 401(k) is structured as an individually driven retirement plan as the funds primarily come from employees’ paychecks. Pre-401(k) retirement plans in the US were typically funded by employer contributions, whether they were of the defined benefit (DB) or DC type, leading to asset management being overseen by companies and funds. Notably, 401(k) assets are primarily composed of employee contributions to pension accounts, set aside from their wages, alongside employers’ matching contributions. Since these funds originate from individual sources, a plan member-driven asset management approach was adopted. In comparison, Korea’s retirement pension scheme is rooted in the severance pay system. As severance pay is considered part of an employee’s wage, an individually driven asset management approach has been established. Whether in the case of 401(k) or the Korean DC pension plan, the asset management led by plan members is a valid strategy. However, it should be noted that plan members often struggle with investment decisions due to limited expertise in asset management.6) Furthermore, the limited size of individual retirement assets poses challenges for portfolio diversification. TDFs can address these limitations by offering a solution for individual investors. Given that fund-type retirement plans are not yet prevalent in the market, TDFs emerge as the sole product type capable of adjusting asset composition without investment instructions from plan members.

To tackle challenges such as the difficulty of investment decision-making and delays in investment decisions, the default option scheme was implemented in July 2022, with TDFs incorporated as basic products. However, the constraints of the default option scheme, coupled with the stock market downturn in 2022, have impeded the growth of TDFs.7)

Various strategies such as fund-type retirement plans and collective defined contribution (Collective DC) plans could be explored to improve the asset management of DC retirement plans. Prior to the implementation of such strategies, TDFs can continue to play a crucial role, and continuous improvements are essential, including the development of products tailored to post-target date investment, adapting to the proliferation of ETFs, and cost reduction.

1) TDFs are the funds that allocate assets conservatively as the target date approaches. The target date is typically set based on the investor’s asset needs, often the retirement date, and asset allocation is determined by a glide path.

2) The analysis utilizes data from Zeroin, FnGuide, and Korea Financial Investment Association.

3) In 2022, the MSCI ACWI, the benchmark for Korean TDFs, fell by 19.8%.

4) The proportion of retirement pension funds in TDFs increased annually, reaching 24.7% at the end of 2016, 39.5% at the end of 2017, 49.6% at the end of 2018, 45.6% at the end of 2019, 58.9% at the end of 2020, 70.2% at the end of 2021, 72.4% at the end of 2022, and 72.5% at the end of 2023.

5) As of the end of 2022, the annual average of the total expense ratio of retirement pension funds stood at 0.82%, while that of ordinary funds reached 1.04% (Source: Zeroin).

6) Following the same logic, Korean DB plans should be driven by plan members. It is notable that under DB plans, employers guarantee returns on contributions, equivalent to the wage growth rate. Thus, employer-driven investment also serves as a valid approach.

7) The term “Default Investment Alternatives”, introduced as the default option scheme in Korea, refers to the fundamental investment product where retirement plan contributions are automatically invested in the absence of explicit investment instructions from plan members. However, the Korean version of this scheme allows plan members to pre-designate default investment alternatives, which, thus, turn into investment products with explicitly stated investment preferences. In particular, as principal guarantee products are incorporated into the Korean default option scheme, the existing investment approach tilting heavily towards principal protection is highly likely to continue. Furthermore, products must be subject to assessment to qualify for the default option scheme, potentially posing an entry barrier for small firms with limited experience in TDF design.