Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Japan’s IPO Bookbuilding Process: Recent Improvements and Implications for Korea’s IPO Market

Publication date Aug. 06, 2024

Summary

In recent years, the IPO market has been dominated by technology and biotech stocks and new large-cap growth stocks, rather than traditional manufacturing stocks. This shift has elevated the importance of future growth potential and the value of intangible assets in IPO valuation, thereby complicating the task for underwriters to set appropriate offer prices. In Korea’s IPO market, the average five-day, post-IPO return relative to the offer price has been 56.0% over the past four years, highlighting a significant level of IPO underpricing. In response to a similar underpricing issue, Japan overhauled its bookbuilding process in 2022. The improvements focused on enhancing the IPO pricing process and facilitating more effective dialogue with institutional investors and companies going public. These measures provide underwriters with greater flexibility in setting the offer price and adjusting the share issuance volume. Underwriters are now able to gather demand information from institutional investors in advance to better determine the initial offer price. Additionally, they are required to provide a comprehensive explanation of the IPO pricing rationale to the issuing companies, and may allocate shares to institutional investors who are expected to contribute to enhancing corporate value. These reforms in Japan offer valuable insights for improving the bookbuilding process in Korea.

Recently, the IPO market has been increasingly dominated by technology and biotech stocks, as well as new large-cap growth stocks like KakaoBank and LG Energy Solution, rather than traditional manufacturing stocks. This trend is driven by digital transformation, advancements in biotechnology, and innovation in the financial and energy sectors. Consequently, future growth potential and the value of intangible assets have become critical factors in IPO valuation. However, the current bookbuilding process often fails to fully reflect market valuations, complicating the task for underwriters to set appropriate offer prices. This challenge is particularly pronounced for new technology companies, where accurate market valuation is crucial. In Korea’s IPO market, the five-day, post-IPO return relative to the offer price has been 56.0% over the past four years, indicating that IPO offer prices have been frequently set too low.

In 2022, Japan undertook a reform of its bookbuilding process to mitigate issues of IPO underpricing. Specifically, the reform enhanced the IPO pricing mechanism and facilitated communication with institutional investors and companies going public, thereby increasing the flexibility of IPO pricing. This Japanese experience offers valuable insights for improving the IPO market in Korea. Against this backdrop, this article examines the improvements in Japan’s bookbuilding procedures and explores potential strategies to enhance Korea’s IPO market system.

1. Improvements in Japan’s IPO bookbuilding

A. Background and progress

In June 2021, the Japanese government set forth a “review of the IPO Pricing Process” as part of its Growth Strategy Action Plan. At that time, the first day market price often significantly exceeded the offer price, resulting in substantial gains for investors but imposing high costs on companies seeking to raise funds. According to the Growth Strategy Action Plan, IPOs in Japan where the first day market price surpassed the offer price had an average initial return of 48.8%, which is notably higher compared to the US (17.2%) and the UK (15.8%). To address this issue, the Japan Securities Dealers Association (JSDA) established a working group on the IPO pricing process (“WG”) in September 2021, in consultation with relevant authorities. The WG held six rounds of discussions with various stakeholders and published the WG Report1) in February 2022. Following the WG Report’s recommendations, the Regulations on Securities Underwriting were revised in June 2022 and January 2023.

B. IPO procedures in Japan

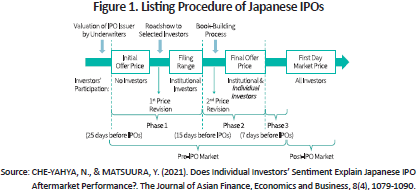

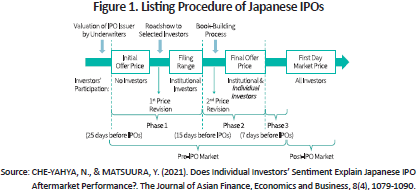

As illustrated in Figure 1, the IPO procedures in Japan differ from those in Korea. Therefore, before discussing the recent bookbuilding improvements, it is necessary to provide an overview of the relevant procedures. In Japan, the initial offer price, instead of the offer price band for the IPO, is disclosed in the securities registration statement. Feedback from major institutional investors, collected during roadshows, is then used to establish a preliminary offer price range, referred to as the filing range, before the bookbuilding process commences. During this phase, the underwriter can only set the offer price within the filing range, which defines the boundaries for the final offer price. For example, if the filing range specifies a lower limit of 1,000 yen and an upper limit of 1,200 yen, the offer price will be determined within the 1,000 to 1,200 yen range.

A comparative analysis of IPO procedures reveals the following differences. In Korea, the underwriter establishes the initial offer price band and determines the final offer price based on bookbuilding data. In contrast, in Japan, the underwriter sets a specific initial offer price and then incorporates feedback from major institutional investors gathered during roadshows and bookbuilding data to determine the final offer price. Additionally, Japan’s bookbuilding procedures allow broader participation from both institutional and individual investors, whereas Korea’s procedures are limited to institutional investors. However, since underwriters in Japan can only set the offer price within the filing range, bookbuilding data may be limited in terms of quality. The WG Report notes that investors often participate in bookbuilding, either not suggesting their specific bids or suggesting bids at the upper or lower end of the filing range.

C. Highlights of improvements in Japan’s IPO bookbuilding

The improvements in Japan’s bookbuilding can be broadly divided into three categories. The first category focuses on enhancing the IPO pricing process. The recent regulatory amendment allows underwriters to set the offer price or adjust the number of shares to be issued beyond the filing range, while staying within a “certain price range”.2) This new flexibility enables more responsive adjustments to market demand. The “certain price range” is defined as 80% or more of the lower end and 120% or less of the upper end of the filing range.3) For example, underwriters previously could set the offer price only within the filing range of 1,000 to 1,200 yen based on bookbuilding results, while they now can set the offer price anywhere from 800 to 1,440 yen. This change allows investors engaging in bookbuilding to propose bids outside the initial filing range, thereby enabling underwriters to capture a broader spectrum of demand and incorporate this data into the final offer price. Consequently, this approach enhances the quality of information available for bookbuilding and grants underwriters greater flexibility in IPO pricing.

The second improvement aims to increase the accuracy of IPO valuation by facilitating better communication with institutional investors. The WG believes that the initial offer price set by underwriters can exert an anchoring effect on institutional investors’ valuation. Specifically, if the initial offer price is set too low, it may prompt institutional investors to adjust downward their valuation of the IPO. To address this issue, underwriters are encouraged to engage in “testing-the-waters” communication with institutional investors to gauge their demand before determining the initial offer price. The JSDA decided to adopt this practice, inspired by approaches in the US and Europe. As a result, underwriters can now set the initial offer price with greater accuracy by incorporating market information obtained through these discussions with institutional investors.

The third improvement focuses on enhancing transparency and reliability in IPO pricing by fostering better dialogue with companies going public. Under this approach, underwriters are required to provide a comprehensive explanation of how the initial offer price, the filing range, and the final offer price are determined. In addition, underwriters should share information about the results of roadshows and bookbuilding, as well as investor forecasts for stock prices and their intention to participate. This ensures that IPO companies have a clear understanding of the pricing process. Moreover, the guidelines for preferential allotment of newly issued shares have been updated to allow the allocation of shares to institutional investors who are expected to contribute positively to corporate governance or enterprise value, upon the request of IPO companies. These measures are designed to enable underwriters to faithfully act as agents for companies going public, thereby alleviating the issue of IPO underpricing and enhancing the fairness and reliability of the IPO process.

2. Implications for Korea’s IPO market

As is the case in Japan, Korea’s IPO market suffers from significant underpricing, which can be attributed to its IPO procedures. Over the past four years, three-quarters of IPOs had offer prices set above the upper end of the initial offer price band, resulting in an average five-day, post-IPO return of 66.2% relative to the offer price. This suggests that in many cases, underwriters have priced IPOs below their market value. There are two possible reasons for this: first, underwriters may deliberately set lower offer prices to attract investors; second, underwriters may fail to accurately gauge market demand beforehand. In the former case, it is necessary to underscore the role of underwriters as agents for the issuing companies. In the latter case, it is worth considering adopting a system that allows underwriters to assess institutional investors’ demand before setting the offer price band.

In Korea’s bookbuliding process, underwriters receive subscriptions from retail investors only after the offer price has been determined. This procedural difference from Japan means that underwriters cannot use retail investors’ subscription rates in IPO pricing. However, subscription rate information is closely related to post-IPO stock performance. Ignoring this information can lead to less accurate IPO pricing. According to Lee (2021),4) the average post-IPO return on the 20th trading day is 61.5% for IPOs that are oversubscribed by more than 800 times, compared to just 8.8% for IPOs with a subscription rate of less than 200 times. This suggests that incorporating subscription rate information from retail investors could contribute to discovering an appropriate offer price. Therefore, it is worth considering improving the quality of information used in IPO pricing by integrating both retail investors’ subscription rates and institutional investors’ bookbuilding data.

1) Japan Securities Dealers Association’s working group for IPO pricing process, February 28, 2022, Report of the working group on IPO pricing process.

2) The provision regarding changes in the number of issued shares is based on Rule 430A.

3) The certain price range within which both the offer price and the number of issued shares can be adjusted is set to 80% to 120% of the offer price under the filing range.

4) Lee, S.H., Recent increase of retail investors in the IPO market and evaluation of the bookbuilding process, Korea Capital Market Institute Issue Paper 21-14.

In 2022, Japan undertook a reform of its bookbuilding process to mitigate issues of IPO underpricing. Specifically, the reform enhanced the IPO pricing mechanism and facilitated communication with institutional investors and companies going public, thereby increasing the flexibility of IPO pricing. This Japanese experience offers valuable insights for improving the IPO market in Korea. Against this backdrop, this article examines the improvements in Japan’s bookbuilding procedures and explores potential strategies to enhance Korea’s IPO market system.

1. Improvements in Japan’s IPO bookbuilding

A. Background and progress

In June 2021, the Japanese government set forth a “review of the IPO Pricing Process” as part of its Growth Strategy Action Plan. At that time, the first day market price often significantly exceeded the offer price, resulting in substantial gains for investors but imposing high costs on companies seeking to raise funds. According to the Growth Strategy Action Plan, IPOs in Japan where the first day market price surpassed the offer price had an average initial return of 48.8%, which is notably higher compared to the US (17.2%) and the UK (15.8%). To address this issue, the Japan Securities Dealers Association (JSDA) established a working group on the IPO pricing process (“WG”) in September 2021, in consultation with relevant authorities. The WG held six rounds of discussions with various stakeholders and published the WG Report1) in February 2022. Following the WG Report’s recommendations, the Regulations on Securities Underwriting were revised in June 2022 and January 2023.

B. IPO procedures in Japan

As illustrated in Figure 1, the IPO procedures in Japan differ from those in Korea. Therefore, before discussing the recent bookbuilding improvements, it is necessary to provide an overview of the relevant procedures. In Japan, the initial offer price, instead of the offer price band for the IPO, is disclosed in the securities registration statement. Feedback from major institutional investors, collected during roadshows, is then used to establish a preliminary offer price range, referred to as the filing range, before the bookbuilding process commences. During this phase, the underwriter can only set the offer price within the filing range, which defines the boundaries for the final offer price. For example, if the filing range specifies a lower limit of 1,000 yen and an upper limit of 1,200 yen, the offer price will be determined within the 1,000 to 1,200 yen range.

A comparative analysis of IPO procedures reveals the following differences. In Korea, the underwriter establishes the initial offer price band and determines the final offer price based on bookbuilding data. In contrast, in Japan, the underwriter sets a specific initial offer price and then incorporates feedback from major institutional investors gathered during roadshows and bookbuilding data to determine the final offer price. Additionally, Japan’s bookbuilding procedures allow broader participation from both institutional and individual investors, whereas Korea’s procedures are limited to institutional investors. However, since underwriters in Japan can only set the offer price within the filing range, bookbuilding data may be limited in terms of quality. The WG Report notes that investors often participate in bookbuilding, either not suggesting their specific bids or suggesting bids at the upper or lower end of the filing range.

C. Highlights of improvements in Japan’s IPO bookbuilding

The improvements in Japan’s bookbuilding can be broadly divided into three categories. The first category focuses on enhancing the IPO pricing process. The recent regulatory amendment allows underwriters to set the offer price or adjust the number of shares to be issued beyond the filing range, while staying within a “certain price range”.2) This new flexibility enables more responsive adjustments to market demand. The “certain price range” is defined as 80% or more of the lower end and 120% or less of the upper end of the filing range.3) For example, underwriters previously could set the offer price only within the filing range of 1,000 to 1,200 yen based on bookbuilding results, while they now can set the offer price anywhere from 800 to 1,440 yen. This change allows investors engaging in bookbuilding to propose bids outside the initial filing range, thereby enabling underwriters to capture a broader spectrum of demand and incorporate this data into the final offer price. Consequently, this approach enhances the quality of information available for bookbuilding and grants underwriters greater flexibility in IPO pricing.

The second improvement aims to increase the accuracy of IPO valuation by facilitating better communication with institutional investors. The WG believes that the initial offer price set by underwriters can exert an anchoring effect on institutional investors’ valuation. Specifically, if the initial offer price is set too low, it may prompt institutional investors to adjust downward their valuation of the IPO. To address this issue, underwriters are encouraged to engage in “testing-the-waters” communication with institutional investors to gauge their demand before determining the initial offer price. The JSDA decided to adopt this practice, inspired by approaches in the US and Europe. As a result, underwriters can now set the initial offer price with greater accuracy by incorporating market information obtained through these discussions with institutional investors.

The third improvement focuses on enhancing transparency and reliability in IPO pricing by fostering better dialogue with companies going public. Under this approach, underwriters are required to provide a comprehensive explanation of how the initial offer price, the filing range, and the final offer price are determined. In addition, underwriters should share information about the results of roadshows and bookbuilding, as well as investor forecasts for stock prices and their intention to participate. This ensures that IPO companies have a clear understanding of the pricing process. Moreover, the guidelines for preferential allotment of newly issued shares have been updated to allow the allocation of shares to institutional investors who are expected to contribute positively to corporate governance or enterprise value, upon the request of IPO companies. These measures are designed to enable underwriters to faithfully act as agents for companies going public, thereby alleviating the issue of IPO underpricing and enhancing the fairness and reliability of the IPO process.

2. Implications for Korea’s IPO market

As is the case in Japan, Korea’s IPO market suffers from significant underpricing, which can be attributed to its IPO procedures. Over the past four years, three-quarters of IPOs had offer prices set above the upper end of the initial offer price band, resulting in an average five-day, post-IPO return of 66.2% relative to the offer price. This suggests that in many cases, underwriters have priced IPOs below their market value. There are two possible reasons for this: first, underwriters may deliberately set lower offer prices to attract investors; second, underwriters may fail to accurately gauge market demand beforehand. In the former case, it is necessary to underscore the role of underwriters as agents for the issuing companies. In the latter case, it is worth considering adopting a system that allows underwriters to assess institutional investors’ demand before setting the offer price band.

In Korea’s bookbuliding process, underwriters receive subscriptions from retail investors only after the offer price has been determined. This procedural difference from Japan means that underwriters cannot use retail investors’ subscription rates in IPO pricing. However, subscription rate information is closely related to post-IPO stock performance. Ignoring this information can lead to less accurate IPO pricing. According to Lee (2021),4) the average post-IPO return on the 20th trading day is 61.5% for IPOs that are oversubscribed by more than 800 times, compared to just 8.8% for IPOs with a subscription rate of less than 200 times. This suggests that incorporating subscription rate information from retail investors could contribute to discovering an appropriate offer price. Therefore, it is worth considering improving the quality of information used in IPO pricing by integrating both retail investors’ subscription rates and institutional investors’ bookbuilding data.

1) Japan Securities Dealers Association’s working group for IPO pricing process, February 28, 2022, Report of the working group on IPO pricing process.

2) The provision regarding changes in the number of issued shares is based on Rule 430A.

3) The certain price range within which both the offer price and the number of issued shares can be adjusted is set to 80% to 120% of the offer price under the filing range.

4) Lee, S.H., Recent increase of retail investors in the IPO market and evaluation of the bookbuilding process, Korea Capital Market Institute Issue Paper 21-14.