Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Tick Size Reduction for Exchange-Traded Products: Effects and Implications

Publication date Aug. 20, 2024

Summary

In December of last year, the Korea Exchange implemented a reduction in the tick size for ETPs priced below KRW 2,000, lowering it from KRW 5 to KRW 1. Amid the growth of low-priced ETPs in the secondary market, this measure was introduced to address issues of low-priced products such as widening bid-ask spreads and increasing tracking errors. As of the date of the tick size reduction, the tick size for 13 low-priced ETPs was adjusted to KRW 1, resulting in a five-fold decrease in the average minimum bid-ask spread from 1.4% to 0.28%. Given the average daily trading value of these ETPs, this reduction has led to an estimated daily savings of about KRW 190 million in minimum spread costs for investors.

A comparative analysis of the period before and after the tick size reduction reveals that the decreased tick size for low-priced ETPs has enhanced liquidity quality without diminishing liquidity quantity, while improving the price efficiency of these products. This adjustment has significantly lowered the implicit trading costs for retail investors. However, it should be noted that many of these low-priced ETPs are inversely leveraged (-2X) products or products with highly volatile underlying assets. Such ETPs may still be prone to long-term price declines. In this case, the smallest tick size may not be sufficient to effectively narrow spreads and lower tracking errors. Therefore, it is worth considering additional measures, such as a reverse split, to further enhance the sustainability of ETPs.

A comparative analysis of the period before and after the tick size reduction reveals that the decreased tick size for low-priced ETPs has enhanced liquidity quality without diminishing liquidity quantity, while improving the price efficiency of these products. This adjustment has significantly lowered the implicit trading costs for retail investors. However, it should be noted that many of these low-priced ETPs are inversely leveraged (-2X) products or products with highly volatile underlying assets. Such ETPs may still be prone to long-term price declines. In this case, the smallest tick size may not be sufficient to effectively narrow spreads and lower tracking errors. Therefore, it is worth considering additional measures, such as a reverse split, to further enhance the sustainability of ETPs.

Reduction of tick size for low-priced ETPs

In December of last year, the Korea Exchange implemented a reduction in the tick size for Exchange Traded Products (ETPs), including Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs), priced below KRW 2,000.1) The tick size was reduced from KRW 5 to KRW 1 to mitigate pricing inefficiencies.2) Since the introduction of ETPs in Korea in October 2022, their tick size has been fixed at KRW 5, regardless of their trading price. However, the growth of low-priced ETPs has led to issues such as widened bid-ask spreads, increased intraday price volatility, and higher tracking errors. Given that ETPs are financial investment instruments that are listed and traded on the secondary market, it is crucial to establish an appropriate tick size. Therefore, the recent reduction in tick size can be seen as a strategic measure to enhance market efficiency for investors.

When considering investment costs in ETPs, investors need to account for both explicit and implicit costs. Explicit costs include trading fees, management expenses,3) and taxes, while bid-ask spreads and tracking errors fall under the implicit cost category. For instance, consider an ETF with a net asset value (NAV) of KRW 1,000 per share, for which the tick size is KRW 5. In this case, the NAV represents the equilibrium price of the ETF. However, if the best offer price and the best bid price are set at KRW 1,005 and KRW 998, respectively, an investor would have to pay KRW 1,005 to purchase the ETF, rather than the equilibrium price of KRW 1,000. Conversely, an investor would have to sell the ETF at KRW 995, incurring implicit costs due to the KRW 5 difference between the equilibrium price and the actual trading price. If the best bid price were to increase to KRW 1,000 or the best offer price were to decrease to KRW 1,000, the ETF could be traded at the equilibrium price. However, given the minimum bid-ask spread of KRW 5, either transaction party would still have to pay the cost of KRW 5 per share to demand market liquidity. In this case, the minimum bid-ask spread constitutes 0.5% of the equilibrium price, representing a non-trivial cost. When compounded across numerous trades, these costs can accumulate significantly.

In the scenarios described above, if the ETF’s NAV falls to KRW 1,004 or KRW 998 in increments of other than KRW 5, rather than remaining at KRW 1,000, due to fluctuations in the underlying index, the ETF may never trade at its equilibrium price, regardless of the fund’s liquidity. This discrepancy results in implicit costs ranging from 0.1% to 0.4% with every transaction. It should be noted that tracking errors are inherent to ETPs, and not all ETPs can consistently trade at their equilibrium prices. However, since this issue is particularly pronounced for ETPs with lower price levels, the recent reduction in tick size for these products has likely contributed to significantly lowering the implicit costs for investors who trade them.

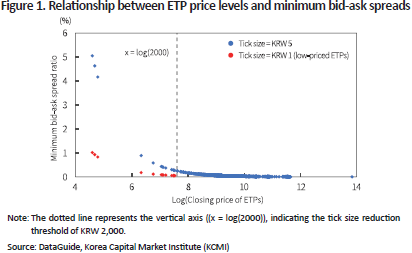

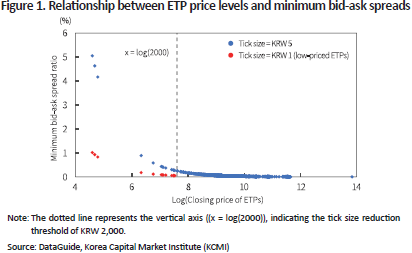

Figure 1 illustrates the relationship between price levels and minimum bid-ask spread ratios for 1,139 ETPs listed and trading as of the date of the tick size reduction for low-priced ETPs (December 11, 2023). To normalize the scale of ETP closing prices, the natural logarithm was used, and the minimum bid-ask spread ratio was calculated by dividing the tick size of each ETP by its closing price. In this case, the tick size represents the minimum bid-ask spread applied to these products. As indicated by the blue dots in Figure 1, the minimum bid-ask spread ratio increases non-linearly as the price level decreases. On the date of the tick size change, three products with price levels around KRW 100 exhibited spread costs of approximately 4% to 5%, even at the minimum bid-ask spread.

The red dots in Figure 1 represent minimum bid-ask spreads observed following the reduction of the tick size for ETPs priced below KRW 2,000 to KRW 1. On the date of the tick size change, the tick size for 13 ETPs—comprising one ETF and 12 ETNs—decreased from KRW 5 to KRW 1, resulting in an average decline in the minimum bid-ask spread by one-fifth from 1.4% to 0.28%. Although only 13 ETPs were priced below KRW 2,000 at the time, the 12 ETNs accounted for roughly 12% of the total listed ETNs by indicative value and 5.4% by trading volume. This underscores the regulatory significance of the tick size reduction from an investor’s perspective. Moreover, considering that the average daily trading value of these 13 products amounted to about KRW 16.7 billion,4) the decrease in the minimum spread cost from 1.4% to 0.28% translates to a reduction of at least KRW 190 million in daily implicit costs for investors. As such, the tick size reduction for low-priced ETPs appears to have positively affected investors of these products.

Analyzing the effects of tick size reduction for ETPs

What are the anticipated effects of the tick size reduction? Tick size represents the smallest increment by which an asset’s price can change. A reduction in tick size allows for segmented price increments in the trading market, which can lead to narrower bid-ask spreads and a higher probability that market prices will align more closely with equilibrium prices. Specifically, reduced tick sizes are expected to narrow bid-ask spreads, enhance precision in trading, and improve price discovery in the market. For ETFs (ETNs), their market prices are designed to track per-share NAV or indicative value. A smaller tick size for low-priced products can help market prices converge effectively with equilibrium prices, potentially lowering tracking errors. On top of that, narrower bid-ask spreads can attenuate the price shocks from noise trades, thereby diminishing intraday price volatility (Kaul & Nimalendran, 1990).

Meanwhile, the tick size reduction may also decrease the incentive for liquidity providers to supply liquidity. As bid-ask spreads serve as a form of compensation for providing liquidity, reduced tick sizes narrow bid-ask spreads, thereby lowering the incentives for liquidity providers to actively quote prices. As a result, the depth of liquidity may decline, potentially weakening the quantity of liquidity. Therefore, the impact of tick size reduction on market liquidity should be examined from multiple perspectives, and it should be noted that the economic benefits of tick size reduction may be less significant for traders placing large orders (Goldstein & Kavajecz, 2000).

In this article, five proxies for ETP market quality are used to analyze the effects of tick size reduction for ETPs. The first proxy is the daily turnover ratio, a quantitative measure of liquidity, defined as the daily trading volume of ETPs divided by the number of ETP shares. The second and third proxies are the bid-ask spread and intraday volatility, which serve as qualitative measures of liquidity. The bid-ask spread is calculated using the formula proposed by Corwin & Schultz (2000), while the intraday volatility indicator is derived from the high and low prices during trading hours.5) Additionally, the absolute tracking error is employed as an indicator of ETP price efficiency, and the implicit trading cost proxy for retail investors is calculated using the methodology outlined by Kim (2020).6) All these indicators can be computed on a daily basis. To assess the effects of tick size reduction, the group with reduced tick sizes is compared against a control group through the difference-in-differences (DID) method.7)

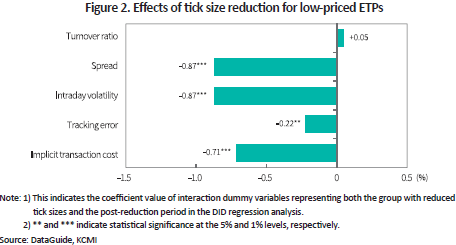

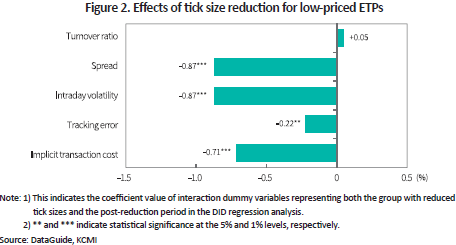

Figure 2 summarizes the key findings of the DID analysis conducted over 100 trading days before and after the tick size reduction.8) The analysis finds that the daily turnover ratio for low-priced ETPs with reduced tick sizes increased by five basis points (bp) post-reduction, although this change was not statistically significant. In the meantime, both the average bid-ask spread and intraday volatility declined by 87 bp, indicating an improvement in liquidity quality. The absolute value of ETP tracking errors showed a significant average decrease of 22bp per day. Additionally, the implicit trading costs for retail investors dropped by approximately 71bp per day, contributing to a significant reduction in both ETP price efficiency and implicit trading costs. In summary, the tick size reduction for low-priced ETPs has improved market quality without compromising the quantity of liquidity.

Implications and challenges

As the analysis results demonstrate, tick size affects various aspects of market quality and thus, setting an appropriate tick size is a critical element in the microstructure of the ETP market. The tick size reduction for low-priced ETPs implemented by the Korea Exchange in December of last year was aimed at enhancing the quality of the ETP market. This initiative appears to have effectively contributed to reducing the implicit trading costs for ETP investors.

However, it is also necessary to understand the context behind this tick size reduction. The low-priced ETPs analyzed in this article primarily consist of leveraged (2X) and inversely leveraged (-2X) products, with the majority being -2X products that often track highly volatile underlying assets.9) Recently, five ETPs have been priced below KRW 2,000, all of which are based on highly volatile assets or track underlying indices at -2X.10) Given the structure of inversely leveraged products, these ETPs are prone to price declines, and if they track highly volatile underlying indices, the rebalancing trades inherent in the management of leveraged and inverse ETPs can contribute to a downward price trajectory over the long term (Kwon, 2020). Consequently, even with the minimum tick size of KRW 1, significant bid-ask spreads and tracking errors may persist if the prices of these low-priced products or similar ETPs continue to decline. Therefore, in addition to reducing tick size, it is worth considering adopting measures, such as allowing a reverse split for ETPs, to enhance the sustainability of these products.

1) Generally, Exchange-Traded Products (ETPs) refer to financial products that are listed and traded on an exchange, and are linked to the returns of underlying assets. In Korea, ETPs are categorized into Exchange-Traded Funds (ETFs) issued by asset management companies and Exchange-Traded Notes (ETNs) issued by securities firms. In this article, the term “ETP” is used to collectively refer to both ETFs and ETNs.

2) Korea Exchange press release (October 5, 2023).

3) ETFs incur fund fees, while ETNs incur various expenses.

4) The daily trading value was calculated over the 100 trading days prior to the tick size change date. Similarly, the indicative value and the proportion of trading value for the 12 low-priced ETNs were derived over the 100 trading days prior to the date.

5) It is defined as the difference between the intraday high and low prices divided by the average of the high and low prices.

6) The implicit trading costs are estimated by calculating the difference between the buying and selling prices of retail investors for each product and comparing the difference to a reference price. In this article, the reference price was calculated using the open price of the day, but the qualitative results remain consistent even if the reference price is replaced by the previous day’s closing price or the volume-weighted average price (VWAP) of the trading day.

7) The difference-in-differences (DID) method compares an experimental group, which experiences an exogenous change before and after a certain event, and a control group that does not undergo such a change. In this context, the experimental group consists of 13 ETPs priced below KRW 2,000 whose tick sizes were reduced. The control group was chosen using the nearest neighbor matching method to identify ETPs that were similar to the experimental group in terms of average size, trading volume, and price levels over the 100 trading days prior to the tick size change.

8) To conservatively assess the exogenous effects of the tick size change, the 10 trading days immediately before and after the tick size reduction date were excluded from the analysis.

9) The 13 low-priced ETPs analyzed consist of nine -2X products and four 2X products, with the majority of these products using commodity futures such as crude oil, natural gas, and silver as their underlying assets.

10) Two ETNs tracking natural gas futures prices and three ETFs tracking the KOSPI futures index at -2X are priced below KRW 2,000 as of July 29, 2024.

References

Corwin, S.A., Schultz, P., 2012, A simple way to estimate bid-ask spreads from daily high and low prices, Journal of Finance 67(2), 719-760.

Goldstein, M.A., Kavajecz, K.A., 2000, Eighths, sixteenths, and market depth: changes in tick size and liquidity provision on the NYSE, Journal of Financial Economics 56(1), 125-149.

Kaul, G., Nimalendran, M., 1990, Price reversals: Bid-ask errors or market overreaction? Journal of Financial Economics 28(1-2), 67-93.

[Korean]

Kim, J.S., 2020, Analysis of trading costs for domestic institutional investors, Korea Capital Market Institute Issue Papers 20-04.

Kwon, M.K., 2020, Current state and risk factors of leveraged and inverse ETPs, Korea Capital Market Institute Issue Papers 20-04.

Korea Exchange, October 5, 2023, Notice of amendment to operational rules and listing regulations for improving the tick size for ETFs and ETNs and granting flexibility in selecting decimal multiples, press release.

In December of last year, the Korea Exchange implemented a reduction in the tick size for Exchange Traded Products (ETPs), including Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs), priced below KRW 2,000.1) The tick size was reduced from KRW 5 to KRW 1 to mitigate pricing inefficiencies.2) Since the introduction of ETPs in Korea in October 2022, their tick size has been fixed at KRW 5, regardless of their trading price. However, the growth of low-priced ETPs has led to issues such as widened bid-ask spreads, increased intraday price volatility, and higher tracking errors. Given that ETPs are financial investment instruments that are listed and traded on the secondary market, it is crucial to establish an appropriate tick size. Therefore, the recent reduction in tick size can be seen as a strategic measure to enhance market efficiency for investors.

When considering investment costs in ETPs, investors need to account for both explicit and implicit costs. Explicit costs include trading fees, management expenses,3) and taxes, while bid-ask spreads and tracking errors fall under the implicit cost category. For instance, consider an ETF with a net asset value (NAV) of KRW 1,000 per share, for which the tick size is KRW 5. In this case, the NAV represents the equilibrium price of the ETF. However, if the best offer price and the best bid price are set at KRW 1,005 and KRW 998, respectively, an investor would have to pay KRW 1,005 to purchase the ETF, rather than the equilibrium price of KRW 1,000. Conversely, an investor would have to sell the ETF at KRW 995, incurring implicit costs due to the KRW 5 difference between the equilibrium price and the actual trading price. If the best bid price were to increase to KRW 1,000 or the best offer price were to decrease to KRW 1,000, the ETF could be traded at the equilibrium price. However, given the minimum bid-ask spread of KRW 5, either transaction party would still have to pay the cost of KRW 5 per share to demand market liquidity. In this case, the minimum bid-ask spread constitutes 0.5% of the equilibrium price, representing a non-trivial cost. When compounded across numerous trades, these costs can accumulate significantly.

In the scenarios described above, if the ETF’s NAV falls to KRW 1,004 or KRW 998 in increments of other than KRW 5, rather than remaining at KRW 1,000, due to fluctuations in the underlying index, the ETF may never trade at its equilibrium price, regardless of the fund’s liquidity. This discrepancy results in implicit costs ranging from 0.1% to 0.4% with every transaction. It should be noted that tracking errors are inherent to ETPs, and not all ETPs can consistently trade at their equilibrium prices. However, since this issue is particularly pronounced for ETPs with lower price levels, the recent reduction in tick size for these products has likely contributed to significantly lowering the implicit costs for investors who trade them.

Figure 1 illustrates the relationship between price levels and minimum bid-ask spread ratios for 1,139 ETPs listed and trading as of the date of the tick size reduction for low-priced ETPs (December 11, 2023). To normalize the scale of ETP closing prices, the natural logarithm was used, and the minimum bid-ask spread ratio was calculated by dividing the tick size of each ETP by its closing price. In this case, the tick size represents the minimum bid-ask spread applied to these products. As indicated by the blue dots in Figure 1, the minimum bid-ask spread ratio increases non-linearly as the price level decreases. On the date of the tick size change, three products with price levels around KRW 100 exhibited spread costs of approximately 4% to 5%, even at the minimum bid-ask spread.

The red dots in Figure 1 represent minimum bid-ask spreads observed following the reduction of the tick size for ETPs priced below KRW 2,000 to KRW 1. On the date of the tick size change, the tick size for 13 ETPs—comprising one ETF and 12 ETNs—decreased from KRW 5 to KRW 1, resulting in an average decline in the minimum bid-ask spread by one-fifth from 1.4% to 0.28%. Although only 13 ETPs were priced below KRW 2,000 at the time, the 12 ETNs accounted for roughly 12% of the total listed ETNs by indicative value and 5.4% by trading volume. This underscores the regulatory significance of the tick size reduction from an investor’s perspective. Moreover, considering that the average daily trading value of these 13 products amounted to about KRW 16.7 billion,4) the decrease in the minimum spread cost from 1.4% to 0.28% translates to a reduction of at least KRW 190 million in daily implicit costs for investors. As such, the tick size reduction for low-priced ETPs appears to have positively affected investors of these products.

Analyzing the effects of tick size reduction for ETPs

What are the anticipated effects of the tick size reduction? Tick size represents the smallest increment by which an asset’s price can change. A reduction in tick size allows for segmented price increments in the trading market, which can lead to narrower bid-ask spreads and a higher probability that market prices will align more closely with equilibrium prices. Specifically, reduced tick sizes are expected to narrow bid-ask spreads, enhance precision in trading, and improve price discovery in the market. For ETFs (ETNs), their market prices are designed to track per-share NAV or indicative value. A smaller tick size for low-priced products can help market prices converge effectively with equilibrium prices, potentially lowering tracking errors. On top of that, narrower bid-ask spreads can attenuate the price shocks from noise trades, thereby diminishing intraday price volatility (Kaul & Nimalendran, 1990).

Meanwhile, the tick size reduction may also decrease the incentive for liquidity providers to supply liquidity. As bid-ask spreads serve as a form of compensation for providing liquidity, reduced tick sizes narrow bid-ask spreads, thereby lowering the incentives for liquidity providers to actively quote prices. As a result, the depth of liquidity may decline, potentially weakening the quantity of liquidity. Therefore, the impact of tick size reduction on market liquidity should be examined from multiple perspectives, and it should be noted that the economic benefits of tick size reduction may be less significant for traders placing large orders (Goldstein & Kavajecz, 2000).

In this article, five proxies for ETP market quality are used to analyze the effects of tick size reduction for ETPs. The first proxy is the daily turnover ratio, a quantitative measure of liquidity, defined as the daily trading volume of ETPs divided by the number of ETP shares. The second and third proxies are the bid-ask spread and intraday volatility, which serve as qualitative measures of liquidity. The bid-ask spread is calculated using the formula proposed by Corwin & Schultz (2000), while the intraday volatility indicator is derived from the high and low prices during trading hours.5) Additionally, the absolute tracking error is employed as an indicator of ETP price efficiency, and the implicit trading cost proxy for retail investors is calculated using the methodology outlined by Kim (2020).6) All these indicators can be computed on a daily basis. To assess the effects of tick size reduction, the group with reduced tick sizes is compared against a control group through the difference-in-differences (DID) method.7)

Figure 2 summarizes the key findings of the DID analysis conducted over 100 trading days before and after the tick size reduction.8) The analysis finds that the daily turnover ratio for low-priced ETPs with reduced tick sizes increased by five basis points (bp) post-reduction, although this change was not statistically significant. In the meantime, both the average bid-ask spread and intraday volatility declined by 87 bp, indicating an improvement in liquidity quality. The absolute value of ETP tracking errors showed a significant average decrease of 22bp per day. Additionally, the implicit trading costs for retail investors dropped by approximately 71bp per day, contributing to a significant reduction in both ETP price efficiency and implicit trading costs. In summary, the tick size reduction for low-priced ETPs has improved market quality without compromising the quantity of liquidity.

Implications and challenges

As the analysis results demonstrate, tick size affects various aspects of market quality and thus, setting an appropriate tick size is a critical element in the microstructure of the ETP market. The tick size reduction for low-priced ETPs implemented by the Korea Exchange in December of last year was aimed at enhancing the quality of the ETP market. This initiative appears to have effectively contributed to reducing the implicit trading costs for ETP investors.

However, it is also necessary to understand the context behind this tick size reduction. The low-priced ETPs analyzed in this article primarily consist of leveraged (2X) and inversely leveraged (-2X) products, with the majority being -2X products that often track highly volatile underlying assets.9) Recently, five ETPs have been priced below KRW 2,000, all of which are based on highly volatile assets or track underlying indices at -2X.10) Given the structure of inversely leveraged products, these ETPs are prone to price declines, and if they track highly volatile underlying indices, the rebalancing trades inherent in the management of leveraged and inverse ETPs can contribute to a downward price trajectory over the long term (Kwon, 2020). Consequently, even with the minimum tick size of KRW 1, significant bid-ask spreads and tracking errors may persist if the prices of these low-priced products or similar ETPs continue to decline. Therefore, in addition to reducing tick size, it is worth considering adopting measures, such as allowing a reverse split for ETPs, to enhance the sustainability of these products.

1) Generally, Exchange-Traded Products (ETPs) refer to financial products that are listed and traded on an exchange, and are linked to the returns of underlying assets. In Korea, ETPs are categorized into Exchange-Traded Funds (ETFs) issued by asset management companies and Exchange-Traded Notes (ETNs) issued by securities firms. In this article, the term “ETP” is used to collectively refer to both ETFs and ETNs.

2) Korea Exchange press release (October 5, 2023).

3) ETFs incur fund fees, while ETNs incur various expenses.

4) The daily trading value was calculated over the 100 trading days prior to the tick size change date. Similarly, the indicative value and the proportion of trading value for the 12 low-priced ETNs were derived over the 100 trading days prior to the date.

5) It is defined as the difference between the intraday high and low prices divided by the average of the high and low prices.

6) The implicit trading costs are estimated by calculating the difference between the buying and selling prices of retail investors for each product and comparing the difference to a reference price. In this article, the reference price was calculated using the open price of the day, but the qualitative results remain consistent even if the reference price is replaced by the previous day’s closing price or the volume-weighted average price (VWAP) of the trading day.

7) The difference-in-differences (DID) method compares an experimental group, which experiences an exogenous change before and after a certain event, and a control group that does not undergo such a change. In this context, the experimental group consists of 13 ETPs priced below KRW 2,000 whose tick sizes were reduced. The control group was chosen using the nearest neighbor matching method to identify ETPs that were similar to the experimental group in terms of average size, trading volume, and price levels over the 100 trading days prior to the tick size change.

8) To conservatively assess the exogenous effects of the tick size change, the 10 trading days immediately before and after the tick size reduction date were excluded from the analysis.

9) The 13 low-priced ETPs analyzed consist of nine -2X products and four 2X products, with the majority of these products using commodity futures such as crude oil, natural gas, and silver as their underlying assets.

10) Two ETNs tracking natural gas futures prices and three ETFs tracking the KOSPI futures index at -2X are priced below KRW 2,000 as of July 29, 2024.

References

Corwin, S.A., Schultz, P., 2012, A simple way to estimate bid-ask spreads from daily high and low prices, Journal of Finance 67(2), 719-760.

Goldstein, M.A., Kavajecz, K.A., 2000, Eighths, sixteenths, and market depth: changes in tick size and liquidity provision on the NYSE, Journal of Financial Economics 56(1), 125-149.

Kaul, G., Nimalendran, M., 1990, Price reversals: Bid-ask errors or market overreaction? Journal of Financial Economics 28(1-2), 67-93.

[Korean]

Kim, J.S., 2020, Analysis of trading costs for domestic institutional investors, Korea Capital Market Institute Issue Papers 20-04.

Kwon, M.K., 2020, Current state and risk factors of leveraged and inverse ETPs, Korea Capital Market Institute Issue Papers 20-04.

Korea Exchange, October 5, 2023, Notice of amendment to operational rules and listing regulations for improving the tick size for ETFs and ETNs and granting flexibility in selecting decimal multiples, press release.