Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Challenges in Shareholder Protection during the M&A Process of Publicly Traded Companies: A Case Study on the M&A Deal among Doosan Affiliates

Publication date Aug. 20, 2024

Summary

The recent spin-off merger and all-inclusive share swap involving Doosan affiliates have raised significant concerns about shareholder protection in the M&A process. Doosan Group has claimed that the merger ratio was determined based on market prices in accordance with the Financial Investment Services and Capital Markets Act (FSCMA). But it did not apply the 10% adjustment range, which is legally permissible for mergers between affiliated companies, and its board of directors failed to fully explain how the merger ratios were determined. To protect the rights and interests of shareholders, the Korean government has prepared an amendment to the Enforcement Decree of the FSCMA, which was publicly announced in March this year. This amendment aims to mandate that the board of directors submit a formal opinion on the fairness of merger ratios. However, the M&A transaction involving Doosan affiliates has been executed before the amendment comes into force. Once the amended decree is implemented, it will require boards of directors to submit a formal opinion including specific information about the merger. Additionally, the amendment will grant greater flexibility in calculating the value of mergers involving non-affiliated companies, thereby imposing stronger accountability on directors.

Notably, since the majority of mergers among listed companies, like the Doosan case, involve affiliated companies, it is also necessary to introduce greater flexibility in determining the merger value and appraisal rights for such mergers. Although the market stock price serves as a critical benchmark, it is equally important to consider other aspects of corporate value in the merger valuation and to allow stakeholders to assess whether the merger value is fair and appropriate based on the information provided by the company. However, it should be noted that safeguards are necessary to ensure fairness in mergers between affiliates. To this end, this article proposes introducing a merger examiner and implementing measures to place stronger accountability on directors. Specifically, for mergers between affiliates, a court-appointed merger examiner would evaluate the fairness of the merger value and procedures upon the request of minority shareholders. Moreover, directors involved in negotiating and deciding on specific merger terms would be subject to increased accountability, thereby contributing to shareholder protection.

Notably, since the majority of mergers among listed companies, like the Doosan case, involve affiliated companies, it is also necessary to introduce greater flexibility in determining the merger value and appraisal rights for such mergers. Although the market stock price serves as a critical benchmark, it is equally important to consider other aspects of corporate value in the merger valuation and to allow stakeholders to assess whether the merger value is fair and appropriate based on the information provided by the company. However, it should be noted that safeguards are necessary to ensure fairness in mergers between affiliates. To this end, this article proposes introducing a merger examiner and implementing measures to place stronger accountability on directors. Specifically, for mergers between affiliates, a court-appointed merger examiner would evaluate the fairness of the merger value and procedures upon the request of minority shareholders. Moreover, directors involved in negotiating and deciding on specific merger terms would be subject to increased accountability, thereby contributing to shareholder protection.

The erosion of shareholder value during the M&A process of publicly traded companies has recently emerged as a significant concern in the capital markets. On July 11, Doosan Bobcat, Doosan Enerbility, and Doosan Robotics announced plans for a spin-off merger and an all-inclusive share swap aimed at enhancing corporate value and shareholder returns through a restructuring of their corporate governance. However, concerns were raised that the proposed merger ratio might be unfavorable to minority shareholders. In response, the Doosan Bobcat Case Prevention Act was introduced in the National Assembly, and on July 24, the Financial Supervisory Service (FSS) required the companies involved to submit revised statements. Although these companies asserted that the merger ratio was determined based on market prices in accordance with the Financial Investment Services and Capital Markets Acts (FSCMA), they did not invoke the provision that allows for a 10% adjustment in the merger ratio for mergers among affiliated companies. Furthermore, the boards of directors failed to provide a justification for the merger ratio. In this context, this article examines the key issues of the M&A deal among Doosan affiliates, identifies gaps in existing laws regarding shareholder protection such as the merger valuation method and the right to demand a share buyback, and proposes regulatory reforms to better safeguard shareholders’ interests.

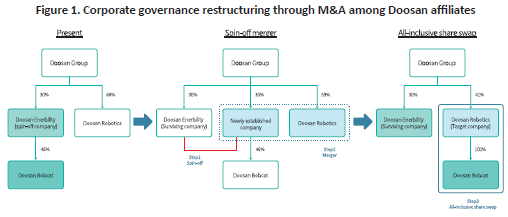

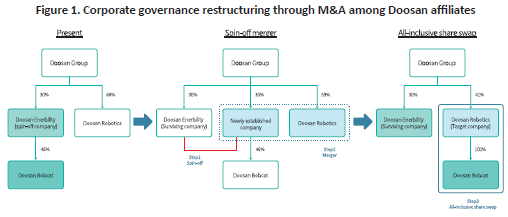

Overview of the M&A transaction among Doosan affiliates

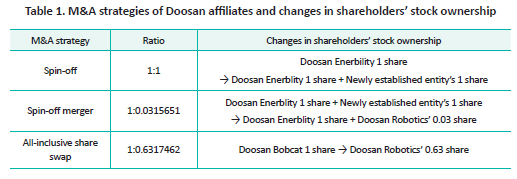

The proposed M&A deal among Doosan affiliates involves a multi-step process. Initially, Doosan Enerbility will spin off a new entity, which will receive the Doosan Bobcat shares currently held by Doosan Enerbility. In the subsequent step, Doosan Robotics will merge with this newly separated spin-off entity. Following this merger, an all-inclusive share swap will be conducted, transferring 100% of Doosan Bobcat shares to Doosan Robotics and allotting Doosan Robotics shares to the shareholders of Doosan Bobcat. Doosan Enerbility, Doosan Robotics, and Doosan Bobcat have announced that they would approve these transactions simultaneously and seek to restructure their corporate governance at the general shareholders’ meeting scheduled for September 25. The structure of these transactions can be illustrated as follows:

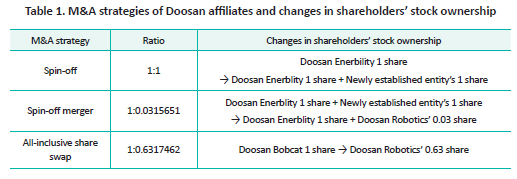

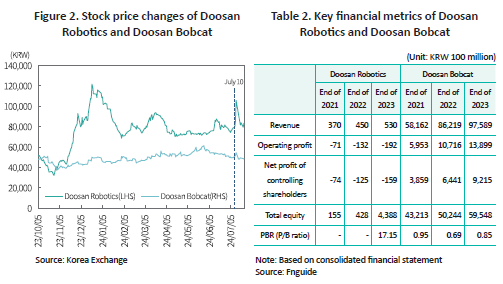

For shareholders, the most critical factor is the merger ratio, as it determines the number of shares that they will receive following a merger. In the case of Doosan Enerbiltiy, the merger is set to proceed without listing the new spin-off entity. The merger ratio was calculated based on a weighted arithmetic average, combining the asset value and earnings value of Doosan Enerbiltiy (KRW 10,221) with the market price-based valuation of Doosan Robotics (KRW 80,114), in accordance with the FSCMA. The division ratio between Doosan Enerbility and the new spin-off entity (1: 02474030) was multiplied by the merger ratio between the spin-off entity and Doosan Robotics (1:0.1275856), resulting in the spin-off merger ratio (1:03015651). Consequently, each existing Doosan Enerbility shareholder will receive an additional 0.03 share of Doosan Robotics for each share of Doosan Enerbiltiy they currently hold. For Doosan Bobcat, an arithmetic mean was calculated for the weighted arithmetic average closing price over the most recent month and the most recent week and the closing price on the most recent day (on July 10), in accordance with the FSCMA. This calculated value was lower than that of Doosan Bobcat (KRW 50,625). Based on these market prices, the merger ratio was set at 1:0.6317462, meaning that Doosan Bobcat shareholders will receive 0.63 shares of Doosan Robotics for each Doosan Bobcat share they hold. For Doosan Group, which holds stakes in both Doosan Enerbiltiy and Doosan Robotics, its ownership share in Doosan Enerbility will remain unchanged, while its stake in Doosan Robotics will decrease to 42%, though it will still retain its status as the largest shareholder. Meanwhile, Doosan Group’s indirect ownership in Doosan Bobcat, which currently stands at 14%, will increase to 42% following the spin-off merger and all-inclusive share swap.

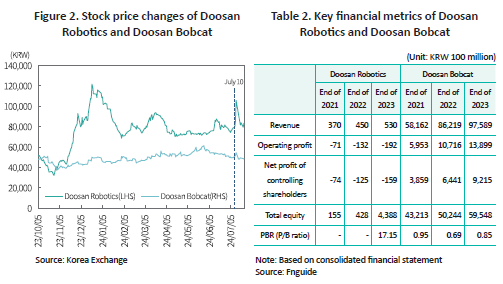

In an analysis of post-IPO stock price movement, Doosan Robotics, which was listed on October 5, 2023, has shown higher stock prices compared to Doosan Bobcat. However, key financial indicators that reflect the company’s financial standing—such as revenue, operating profit, net profit of controlling shareholders, and total equity (net assets)—paint a different picture. Contrary to market valuation, Doosan Bobcat outperforms Doosan Robotics.

To ensure fair value for the shareholders of the non-surviving company during a merger, it is crucial to conduct a fair valuation of the company. In the case of Doosan Bobcat, its market value as of July 10 is below its NAV with a PBR of 0.86, making it difficult to ensure a liquidation value even when assessed according to the FSCMA. This raises a question as to whether compliance with the FSCMA is sufficient to guarantee a fair merger valuation. Furthermore, although the valuation of unlisted shares was conducted as prescribed by the FSCMA as the spin-off merger proceeded with the spin-off entity remaining unlisted, Doosan Enerbility shareholders would receive only 0.03 shares of Doosan Robotics in exchange for the reduction in their indirect control over Doosan Bobcat, which may raise further concerns. Despite these issues, the boards of directors of Doosan affiliates determined the merger ratio based solely on market prices, without providing sufficient explanation of the fairness of the ratio. Additionally, they neither conduct the 10% adjustment permitted under the FSCMA nor consider any further adjustments beyond the 10% range based on an external valuation.

Issues with the merger valuation method

The merger ratio is typically determined by the boards of directors of the companies entering into the merger agreement. Shareholders can only vote to approve or reject the predetermined ratio at the shareholders’ meeting, with no direct involvement in the decision-making process. For this reason, if there is a conflict of interest between the board and the shareholders, or among different groups of shareholders, the merger could be conducted with a ratio that is disadvantageous to certain shareholders. To address these issues and safeguard shareholder interests, the FSCMA specifies regulations on the merger valuation to ensure that the merger ratio is fair and equitable.

This valuation method can contribute to investor protection by reducing uncertainty over valuation and enhancing predictability through the use of reliable prices on the exchange. However, relying solely on stock prices to determine the merger value carries the risk that the true intrinsic value of the shared may not be fully captured. For this reason, major countries like the US, Japan, and the UK allow companies involved in merger deals to exercise discretion in determining the merger value and ratio. As noted by Hwang & Jung (2023), mergers in the US and Japan tend to be valued significantly higher than those permitted under the FSCMA.1) In an analysis of 333 mergers between publicly traded companies in the US from January 2019 to April 2023, 86.2% (287 cases) of the mergers were valued at or above the reference value range defined by the FSCMA. Additionally, 77.2% (257 cases) of the mergers in the US were valued at least 10% above the reference value range, and 56.8% (189 cases) were executed at values 30% or more above this range. Similarly, an analysis of 88 mergers in Japan during the same period revealed that 90.9% (80 cases) were valued at or above the reference value calculated by the FSCMA. In Japan, 81.8% (72 cases) were conducted at values at least 10% above the reference value range, while 55.7% (49 cases) were valued at least 30% higher. In other words, if the merger involving Doosan affiliates had been carried out in the US or Japan, shareholders of the non-surviving companies like Doosan Bobcat could have been entitled to a higher merger ratio and received more shares than those based on the reference value specified by the FSCMA.

Even if stock prices in the market are considered reliable indicators of a company’s objective value, there remain concerns that the timing of mergers may be influenced more by the interests of controlling shareholders than by those of minority shareholders. According to Hwang & Jung (2023), an analysis of mergers between publicly traded companies announced from 2018 to December 2022 (16 cases) reveals that the cumulative market-adjusted returns stood at -6.0% in the year prior to the merger announcement. This suggests that the timing of these mergers may have been disadvantageous to minority shareholders. In a notable case, the Supreme Court of Korea ruled that Samsung C&T Corporation’s share price immediately prior to the board’s approval of its merger with Cheil Industries failed to represent the company’s fair value. The court decided that the reference date for calculating the share price should be set at the day before Cheil Industries’ listing, rather than the merger date (Supreme Court Decision 2016Ma5394, April 14, 2022). This ruling highlights the challenges investors face in trusting the stock price at a certain point in time, thereby raising concerns about the fairness of the merger valuation.

Although the market price is the most important factor in determining the merger value, it is the responsibility of each company’s board of directors to ensure a fair merger value by considering various other aspects of corporate value. The FSCMA also allows for adjustments to the market price by taking into account asset value and other relevant factors. However, issues arise when the board of directors sets the merger ratio based solely on the market price calculated under the FSCMA, with no practical measures in place to protect shareholders.

Can shareholders be protected by the appraisal right?

Some argue that shareholders dissatisfied with the merger ratio can be adequately protected by exercising their appraisal rights. However, the appraisal right primarily allows shareholders to sell their shares back to the company if they choose not to participate in the merger. It does not provide protection for shareholders who wish to remain with the company and seek a fair valuation of their shares. In practice, companies typically offer a buyback price calculated based on the formula specified by the FSCMA, and shareholders choose to accept the price. Thus, the buyback price for the appraisal right is determined based solely on the market price, as is the case with the merger value. If shareholders find this price unsatisfactory and seek a fairer price, they may request the court to determine a fair purchase price. However, this legal procedure can be lengthy and uncertain. Although there are only a few cases where shareholders petitioned the court for a share price determination and even fewer have reached the Supreme Court, an analysis shows that the time required for a final ruling ranges from a minimum of 537 days to a maximum of 3,925 days. In the most recent case involving Samsung C&T Corporation,2) shareholders waited 2,463 days, or approximately six years, from the shareholders’ meeting before receiving payment for their shares. During this extended period, shareholders were unable to recoup their investment, which not only limited their cash liquidity but also caused them to miss out on new investment opportunities.

Remedies for shareholders who suffer losses as a consequence of a merger

In the ongoing M&A deal involving Doosan affiliates, the FSS has required the companies to submit a revised securities registration statement. Despite this regulatory intervention, if the companies adhere strictly to the legally prescribed calculation method, it is difficult for Doosan Bobcat shareholders to find effective means to claim damages and seek relief. Even if shareholders believe that the merger ratio is unfair, they face difficulties in pursuing a lawsuit to invalidate the merger and obtain compensation as long as the ratio complies with the legal requirements. In practice, there are very few legal precedents for challenging the validity of a merger, with only three Supreme Court rulings on merger invalidation.3) Furthermore, none of them have recognized the annulment of a merger due to a significantly unfair merger ratio, provided that the merger value calculation method defined by law has been followed. Since the calculation method of the merger value is prescribed by law, courts generally do not scrutinize the fairness of the merger ratio, placing the burden of proof for demonstrating unfairness entirely on the shareholders.4)

If a merger, which clearly disadvantages minority shareholders due to its unfair merger ratio, were to take place in the US or Japan, shareholders could have exercised a merger injunction to challenge and potentially suspend the merger before it is finalized. In Germany, the management of a non-surviving company ought to exercise due care to avoid harming shareholders when determining the merger ratio, and if shareholders of the non-surviving company suffer losses due to the company’s negligence of this duty of care, they can directly claim damages against the directors, in accordance with Article 25 of the German Transformation Act (Umwandlungsgesetz, “UmwG”). In contrast, in Korea, there are limited practical remedies for shareholders affected by an unfair merger ratio.

Challenges in shareholder protection

While M&A deals can foster a company’s growth and development, they represent an important decision for shareholders, as these transactions can alter the stocks and the number of shares that they hold. In the Doosan M&A deal, Doosan Bobcat shareholders will transition from being shareholders of Doosan Bobcat to becoming shareholders of Doosan Robotics, with their shareholding ratio changing from 1 to 0.63. In this situation, the board of directors should fully explain the necessity of the merger to shareholders and ensure that the merger ratio fairly reflects the value of the shareholders’ holdings. Otherwise, a substantial number of shareholders may choose to exercise their appraisal right. This could compel the company to disburse a huge amount of cash to these shareholders, which may frustrate the merger deal itself.

To protect the rights and interests of shareholders in the merger process, the government has prepared an amendment to the Enforcement Decree of the FSCMA, which was publicly announced in March this year. Once the amended decree comes into force, it will require companies to disclose the purpose of the merger, the fairness of the merger value, and the names of dissenting directors and their reasons for objection. This places significant responsibilities on the board of directors. Moreover, for mergers between non-affiliated companies, the amendment will introduce greater flexibility in determining the merger value, thereby requiring the board of directors to ensure that corporate value, as well as the market price, is accurately reflected. However, as the majority of mergers among listed companies, including the Doosan case, involve affiliated companies, it is also necessary to introduce more flexibility in determining the merger value and appraisal rights for mergers among affiliates. Although the stock price in the market remains a crucial benchmark, it is equally important to consider other aspects of corporate value in merger valuation and allow stakeholders to assess whether the merger value is fair and appropriate based on the information provided by the company. Notably, in the case of mergers between affiliates, additional safeguards are needed to ensure fairness. To this end, this article proposes introducing a merger examiner and placing greater responsibilities on directors.

In Germany, except for mergers between wholly-owning parent companies and wholly-owned subsidiaries, it is mandatory to appoint a merger examiner under Articles 9 and 10 of the German Transformation Act. The court selects and appoints the merger examiner, who is responsible for evaluating the calculation method of the merger ratio and assessing its fairness. If multiple valuation methods are employed, the examiner ought to analyze how the merger ratios are derived by each method and the relative weight assigned to each ratio. The examiner’s findings should be compiled into a report and be submitted before the shareholders’ meeting commences (Article 12 of the German Transformation Act). Korea has a similar mechanism under the Korean Commercial Act, which specifies the appointment of an examiner for the general shareholders’ meeting or an examiner for in-kind investment by the court. This article proposes that the court appoint a merger examiner upon the request of minority shareholders with a certain shareholding ratio to ensure fairness in mergers among affiliates.5) As for mergers among non-affiliated companies, independent valuation agencies appointed by the parties involved would assess the fairness of the merger value and procedures, while, for mergers among affiliates, a court-appointed merger examiner would be responsible for evaluating the fairness of the merger. This approach would ensure that even if greater flexibility is allowed in determining the calculation method of the merger value, it is possible to protect shareholder interests.

Moreover, it is crucial to impose greater accountability on directors who negotiate the specific terms of a merger and make relevant decisions, ensuring adequate protection for shareholders. In M&A deals, directors must diligently examine the merger terms and make decisions that prioritize the best interests of shareholders. To this end, the board of directors is required to actively demonstrate the fairness of the merger value and the validity of the valuation methods. In addition, companies should offer a fair share value, allowing shareholders to exercise their appraisal rights based on a fair valuation of shares, rather than on market prices. While the duty of loyalty obliges directors to protect the interests of shareholders during a merger, even in the absence of explicit statutory provisions, adopting a declarative provision could further clarify and reinforce this duty.6) However, even if the duty of loyalty is specified, it is difficult for shareholders to hold directors liable for the breach of this duty. This is because directors are only liable for compensating damages, caused by their actions, to the company under Article 399 of the Korean Commercial Act. Although Article 401 of the said Act provides that directors could be held liable for direct damages to shareholders, courts generally recognize such claims only in limited circumstances. This limitation underscores the need for legal remedies to protect shareholders against unfair mergers. To address this issue, it is worth considering introducing the merger injunction provision adopted by the US and Japan, which allows shareholders to seek the suspension of unfair mergers. Another option is to adopt Germany’s merger-related liability provisions, which hold directors liable for damages caused to shareholders.

1) Hwang, H.Y. & Jung, S.M., 2023, Issues and improvements of valuation standards for mergers among listed companies, Korea Capital Market Institute Issue Papers 23-15.

2) Shareholders who owned common shares in the former Samsung C&T refused to accept the buyout price proposed by the company (KRW 57, 234 per share) and filed a claim with the court for the determination of the appropriate buyout price. The Supreme Court of Korea decided on a price of KRW 6,602 per share.

3) Supreme Court Decision 2008Da37193, July 22, 2010 (the spin-off of E-Land and E-Land World), Supreme Court Decision 2005Da22701, 22718, April 23, 2009 (the merger case involving KB Kookmin Bank and Housing & Commercial Bank of Korea), Supreme Court Decision 2007Da64136, January 10, 2008 (the merger case involving Namhan Paper and Poongman Paper).

4) Kim, J.H., 2017, Re-examination of appraisal rights, Korean Commercial Law Association 36(2), 335; Choi, M.Y., 2017, Mergers between affiliated companies and corporate law regulations, Commercial Cases Review 30(3), 146.

5) Noh, H.J., 2016, Unfairness of merger ratios and protection of minority shareholders: Toward an integrated regulation framework, Journal of Business Administration & Law 26(2), 107.

6) There are various opinions on how to stipulate directors’ duty of loyalty to shareholders. Initially, it was discussed that the subject to whom directors exercise their duty of loyalty should be the company and shareholders. However, considering the existing legal framework, which is based on the contractual relationship between the company and its directors and recognizes the person handling another person’s affairs as being subject to misappropriation, alternative proposals suggest that directors should perform their duties faithfully while protecting shareholders during the performance of their duties.

Overview of the M&A transaction among Doosan affiliates

The proposed M&A deal among Doosan affiliates involves a multi-step process. Initially, Doosan Enerbility will spin off a new entity, which will receive the Doosan Bobcat shares currently held by Doosan Enerbility. In the subsequent step, Doosan Robotics will merge with this newly separated spin-off entity. Following this merger, an all-inclusive share swap will be conducted, transferring 100% of Doosan Bobcat shares to Doosan Robotics and allotting Doosan Robotics shares to the shareholders of Doosan Bobcat. Doosan Enerbility, Doosan Robotics, and Doosan Bobcat have announced that they would approve these transactions simultaneously and seek to restructure their corporate governance at the general shareholders’ meeting scheduled for September 25. The structure of these transactions can be illustrated as follows:

Issues with the merger valuation method

The merger ratio is typically determined by the boards of directors of the companies entering into the merger agreement. Shareholders can only vote to approve or reject the predetermined ratio at the shareholders’ meeting, with no direct involvement in the decision-making process. For this reason, if there is a conflict of interest between the board and the shareholders, or among different groups of shareholders, the merger could be conducted with a ratio that is disadvantageous to certain shareholders. To address these issues and safeguard shareholder interests, the FSCMA specifies regulations on the merger valuation to ensure that the merger ratio is fair and equitable.

This valuation method can contribute to investor protection by reducing uncertainty over valuation and enhancing predictability through the use of reliable prices on the exchange. However, relying solely on stock prices to determine the merger value carries the risk that the true intrinsic value of the shared may not be fully captured. For this reason, major countries like the US, Japan, and the UK allow companies involved in merger deals to exercise discretion in determining the merger value and ratio. As noted by Hwang & Jung (2023), mergers in the US and Japan tend to be valued significantly higher than those permitted under the FSCMA.1) In an analysis of 333 mergers between publicly traded companies in the US from January 2019 to April 2023, 86.2% (287 cases) of the mergers were valued at or above the reference value range defined by the FSCMA. Additionally, 77.2% (257 cases) of the mergers in the US were valued at least 10% above the reference value range, and 56.8% (189 cases) were executed at values 30% or more above this range. Similarly, an analysis of 88 mergers in Japan during the same period revealed that 90.9% (80 cases) were valued at or above the reference value calculated by the FSCMA. In Japan, 81.8% (72 cases) were conducted at values at least 10% above the reference value range, while 55.7% (49 cases) were valued at least 30% higher. In other words, if the merger involving Doosan affiliates had been carried out in the US or Japan, shareholders of the non-surviving companies like Doosan Bobcat could have been entitled to a higher merger ratio and received more shares than those based on the reference value specified by the FSCMA.

Even if stock prices in the market are considered reliable indicators of a company’s objective value, there remain concerns that the timing of mergers may be influenced more by the interests of controlling shareholders than by those of minority shareholders. According to Hwang & Jung (2023), an analysis of mergers between publicly traded companies announced from 2018 to December 2022 (16 cases) reveals that the cumulative market-adjusted returns stood at -6.0% in the year prior to the merger announcement. This suggests that the timing of these mergers may have been disadvantageous to minority shareholders. In a notable case, the Supreme Court of Korea ruled that Samsung C&T Corporation’s share price immediately prior to the board’s approval of its merger with Cheil Industries failed to represent the company’s fair value. The court decided that the reference date for calculating the share price should be set at the day before Cheil Industries’ listing, rather than the merger date (Supreme Court Decision 2016Ma5394, April 14, 2022). This ruling highlights the challenges investors face in trusting the stock price at a certain point in time, thereby raising concerns about the fairness of the merger valuation.

Although the market price is the most important factor in determining the merger value, it is the responsibility of each company’s board of directors to ensure a fair merger value by considering various other aspects of corporate value. The FSCMA also allows for adjustments to the market price by taking into account asset value and other relevant factors. However, issues arise when the board of directors sets the merger ratio based solely on the market price calculated under the FSCMA, with no practical measures in place to protect shareholders.

Can shareholders be protected by the appraisal right?

Some argue that shareholders dissatisfied with the merger ratio can be adequately protected by exercising their appraisal rights. However, the appraisal right primarily allows shareholders to sell their shares back to the company if they choose not to participate in the merger. It does not provide protection for shareholders who wish to remain with the company and seek a fair valuation of their shares. In practice, companies typically offer a buyback price calculated based on the formula specified by the FSCMA, and shareholders choose to accept the price. Thus, the buyback price for the appraisal right is determined based solely on the market price, as is the case with the merger value. If shareholders find this price unsatisfactory and seek a fairer price, they may request the court to determine a fair purchase price. However, this legal procedure can be lengthy and uncertain. Although there are only a few cases where shareholders petitioned the court for a share price determination and even fewer have reached the Supreme Court, an analysis shows that the time required for a final ruling ranges from a minimum of 537 days to a maximum of 3,925 days. In the most recent case involving Samsung C&T Corporation,2) shareholders waited 2,463 days, or approximately six years, from the shareholders’ meeting before receiving payment for their shares. During this extended period, shareholders were unable to recoup their investment, which not only limited their cash liquidity but also caused them to miss out on new investment opportunities.

Remedies for shareholders who suffer losses as a consequence of a merger

In the ongoing M&A deal involving Doosan affiliates, the FSS has required the companies to submit a revised securities registration statement. Despite this regulatory intervention, if the companies adhere strictly to the legally prescribed calculation method, it is difficult for Doosan Bobcat shareholders to find effective means to claim damages and seek relief. Even if shareholders believe that the merger ratio is unfair, they face difficulties in pursuing a lawsuit to invalidate the merger and obtain compensation as long as the ratio complies with the legal requirements. In practice, there are very few legal precedents for challenging the validity of a merger, with only three Supreme Court rulings on merger invalidation.3) Furthermore, none of them have recognized the annulment of a merger due to a significantly unfair merger ratio, provided that the merger value calculation method defined by law has been followed. Since the calculation method of the merger value is prescribed by law, courts generally do not scrutinize the fairness of the merger ratio, placing the burden of proof for demonstrating unfairness entirely on the shareholders.4)

If a merger, which clearly disadvantages minority shareholders due to its unfair merger ratio, were to take place in the US or Japan, shareholders could have exercised a merger injunction to challenge and potentially suspend the merger before it is finalized. In Germany, the management of a non-surviving company ought to exercise due care to avoid harming shareholders when determining the merger ratio, and if shareholders of the non-surviving company suffer losses due to the company’s negligence of this duty of care, they can directly claim damages against the directors, in accordance with Article 25 of the German Transformation Act (Umwandlungsgesetz, “UmwG”). In contrast, in Korea, there are limited practical remedies for shareholders affected by an unfair merger ratio.

Challenges in shareholder protection

While M&A deals can foster a company’s growth and development, they represent an important decision for shareholders, as these transactions can alter the stocks and the number of shares that they hold. In the Doosan M&A deal, Doosan Bobcat shareholders will transition from being shareholders of Doosan Bobcat to becoming shareholders of Doosan Robotics, with their shareholding ratio changing from 1 to 0.63. In this situation, the board of directors should fully explain the necessity of the merger to shareholders and ensure that the merger ratio fairly reflects the value of the shareholders’ holdings. Otherwise, a substantial number of shareholders may choose to exercise their appraisal right. This could compel the company to disburse a huge amount of cash to these shareholders, which may frustrate the merger deal itself.

To protect the rights and interests of shareholders in the merger process, the government has prepared an amendment to the Enforcement Decree of the FSCMA, which was publicly announced in March this year. Once the amended decree comes into force, it will require companies to disclose the purpose of the merger, the fairness of the merger value, and the names of dissenting directors and their reasons for objection. This places significant responsibilities on the board of directors. Moreover, for mergers between non-affiliated companies, the amendment will introduce greater flexibility in determining the merger value, thereby requiring the board of directors to ensure that corporate value, as well as the market price, is accurately reflected. However, as the majority of mergers among listed companies, including the Doosan case, involve affiliated companies, it is also necessary to introduce more flexibility in determining the merger value and appraisal rights for mergers among affiliates. Although the stock price in the market remains a crucial benchmark, it is equally important to consider other aspects of corporate value in merger valuation and allow stakeholders to assess whether the merger value is fair and appropriate based on the information provided by the company. Notably, in the case of mergers between affiliates, additional safeguards are needed to ensure fairness. To this end, this article proposes introducing a merger examiner and placing greater responsibilities on directors.

In Germany, except for mergers between wholly-owning parent companies and wholly-owned subsidiaries, it is mandatory to appoint a merger examiner under Articles 9 and 10 of the German Transformation Act. The court selects and appoints the merger examiner, who is responsible for evaluating the calculation method of the merger ratio and assessing its fairness. If multiple valuation methods are employed, the examiner ought to analyze how the merger ratios are derived by each method and the relative weight assigned to each ratio. The examiner’s findings should be compiled into a report and be submitted before the shareholders’ meeting commences (Article 12 of the German Transformation Act). Korea has a similar mechanism under the Korean Commercial Act, which specifies the appointment of an examiner for the general shareholders’ meeting or an examiner for in-kind investment by the court. This article proposes that the court appoint a merger examiner upon the request of minority shareholders with a certain shareholding ratio to ensure fairness in mergers among affiliates.5) As for mergers among non-affiliated companies, independent valuation agencies appointed by the parties involved would assess the fairness of the merger value and procedures, while, for mergers among affiliates, a court-appointed merger examiner would be responsible for evaluating the fairness of the merger. This approach would ensure that even if greater flexibility is allowed in determining the calculation method of the merger value, it is possible to protect shareholder interests.

Moreover, it is crucial to impose greater accountability on directors who negotiate the specific terms of a merger and make relevant decisions, ensuring adequate protection for shareholders. In M&A deals, directors must diligently examine the merger terms and make decisions that prioritize the best interests of shareholders. To this end, the board of directors is required to actively demonstrate the fairness of the merger value and the validity of the valuation methods. In addition, companies should offer a fair share value, allowing shareholders to exercise their appraisal rights based on a fair valuation of shares, rather than on market prices. While the duty of loyalty obliges directors to protect the interests of shareholders during a merger, even in the absence of explicit statutory provisions, adopting a declarative provision could further clarify and reinforce this duty.6) However, even if the duty of loyalty is specified, it is difficult for shareholders to hold directors liable for the breach of this duty. This is because directors are only liable for compensating damages, caused by their actions, to the company under Article 399 of the Korean Commercial Act. Although Article 401 of the said Act provides that directors could be held liable for direct damages to shareholders, courts generally recognize such claims only in limited circumstances. This limitation underscores the need for legal remedies to protect shareholders against unfair mergers. To address this issue, it is worth considering introducing the merger injunction provision adopted by the US and Japan, which allows shareholders to seek the suspension of unfair mergers. Another option is to adopt Germany’s merger-related liability provisions, which hold directors liable for damages caused to shareholders.

1) Hwang, H.Y. & Jung, S.M., 2023, Issues and improvements of valuation standards for mergers among listed companies, Korea Capital Market Institute Issue Papers 23-15.

2) Shareholders who owned common shares in the former Samsung C&T refused to accept the buyout price proposed by the company (KRW 57, 234 per share) and filed a claim with the court for the determination of the appropriate buyout price. The Supreme Court of Korea decided on a price of KRW 6,602 per share.

3) Supreme Court Decision 2008Da37193, July 22, 2010 (the spin-off of E-Land and E-Land World), Supreme Court Decision 2005Da22701, 22718, April 23, 2009 (the merger case involving KB Kookmin Bank and Housing & Commercial Bank of Korea), Supreme Court Decision 2007Da64136, January 10, 2008 (the merger case involving Namhan Paper and Poongman Paper).

4) Kim, J.H., 2017, Re-examination of appraisal rights, Korean Commercial Law Association 36(2), 335; Choi, M.Y., 2017, Mergers between affiliated companies and corporate law regulations, Commercial Cases Review 30(3), 146.

5) Noh, H.J., 2016, Unfairness of merger ratios and protection of minority shareholders: Toward an integrated regulation framework, Journal of Business Administration & Law 26(2), 107.

6) There are various opinions on how to stipulate directors’ duty of loyalty to shareholders. Initially, it was discussed that the subject to whom directors exercise their duty of loyalty should be the company and shareholders. However, considering the existing legal framework, which is based on the contractual relationship between the company and its directors and recognizes the person handling another person’s affairs as being subject to misappropriation, alternative proposals suggest that directors should perform their duties faithfully while protecting shareholders during the performance of their duties.