Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

The Impact and Implications of a Shift in US Monetary Policy on the Won-Dollar Exchange Rate

Publication date Sep. 24, 2024

Summary

The strength of the US dollar, which has been the primary driver of the won-dollar exchange rate increase over the past two years, is approaching a turning point due to potential changes in US monetary policy. With the Fed poised for an imminent rate cut, the US dollar is expected to gradually weaken, leading to an influx of global investment funds into Korea and exerting upward pressure on the Korean won. It is also notable that the appreciation of the Japanese yen could accelerate the decline in the won-dollar exchange rate. This decline is likely to be gradual, which can be attributed to various factors, such as persistent geopolitical risks, ongoing price instability, uncertainties over the US presidential election, and exchange rate trends in neighboring countries. However, the short-term volatility of the exchange rate could increase further, which requires cautious monitoring. Economic agents in Korea need to prepare for a potential shift in the recent upward trend of the won-dollar exchange rate toward a gradual decline.

Over the past two years, the won-dollar exchange rate has followed a consistent upward trend, recently fluctuating in the mid-1,300 won range. The elevated exchange rate primarily stems from US monetary tightening and the resulting super-strong US dollar, rather than domestic factors such as foreign exchange supply and demand. Since July of this year, however, concerns about a potential economic downturn in the US have emerged, driven by worsening employment indicators. This has raised expectations for a shift toward monetary easing, heightening the interest in the timing and scale of the potential policy rate cut by the Fed. It should be noted that such a shift in US monetary policy is likely to exert a significant impact on the won-dollar exchange rate. Against this backdrop, this article analyses recent movements of the won-dollar exchange rate, with a particular emphasis on its correlation with the US dollar, and explores the implications of US monetary policy changes for the won-dollar exchange rate.

1. Recent trends in the won-dollar exchange rate

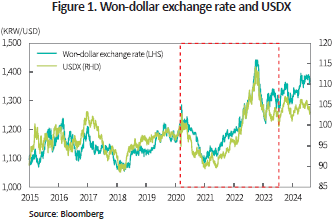

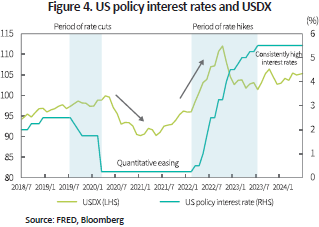

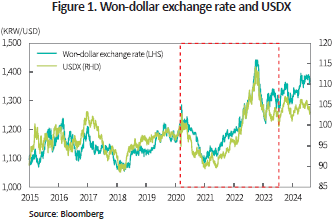

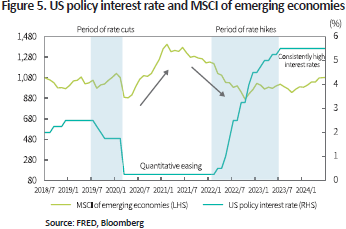

The factors affecting the won-dollar exchange rate can be broadly divided into domestic FX supply and demand dynamics and various global financial market conditions. The recent upward trend in the won-dollar exchange rate has been predominantly prompted by the latter.1) Since the Fed initiated rate hikes in March 2022, after a period of near-zero interest rates under its quantitative easing in response to the Covid-19 pandemic, the won-dollar exchange rate has been on the steady rise. Notably, the exchange rate peaked at KRW 1,439.9 based on the closing price on September 28, 2022, marking its highest level since the global financial crisis. This surge was largely driven by the US Dollar Index (USDX)2) hitting an all-time high of 114.2 on September 27, 2022, following the Fed’s aggressive rate hikes. Although the won-dollar exchange rate temporarily dropped to the 1,200-won range after this spike, it has fluctuated above the 1,300-won level since March 2023. This upward pressure stems from market expectations that the Fed’s monetary tightening will persist, following its policy increase to the current upper limit of 5.5%, amid ongoing global price instability.

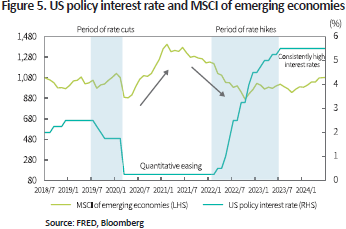

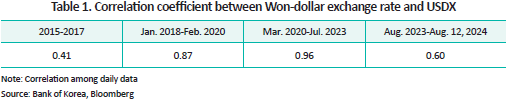

As shown in Figure 1, the daily won-dollar exchange rate is closely tied to fluctuations in the US dollar. In an analysis of the correlation coefficient between the daily won-dollar exchange rate and the USDX, the correlation coefficient reached 0.96 during the period of sharp rate hikes by the Fed following the quantitative easing phase (February 2020 to July 2023), representing a remarkably higher correlation compared to earlier periods. Despite its high interest rates, the US economy has shown a relatively strong performance compared to other economies, thereby strengthening the US dollar and, consequently, contributing to the rise in the won-dollar exchange rate. However, as the won-dollar exchange rate kept its upward trend even after the US dollar generally stabilized starting from August 2023, the correlation coefficient between these two variables decreased to 0.60.

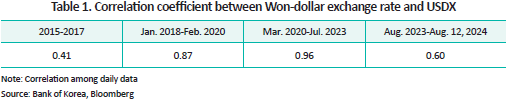

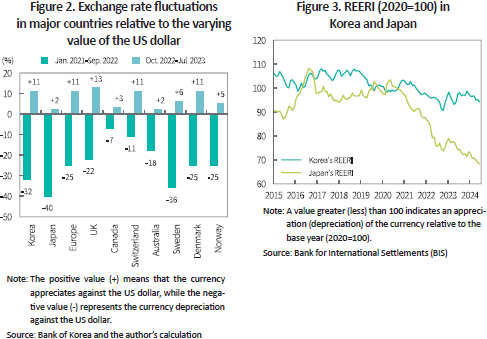

The strength of the US dollar has similarly influenced the value of most global currencies, including the Korean won. Specifically, during periods of US dollar appreciation (as indicated by the rise in the USDX), other currencies have tended to weaken, while periods of US dollar depreciation have been met with appreciation of other currencies. In an analysis of the US dollar’s appreciation phase (January 2021 to September 2022, +25%) and its depreciation phase (October 2022 to July 2023, -9%), it is observed that most currencies moved in the opposite direction to the US dollar. For instance, the won-dollar exchange rate increased by 32% during the dollar’s appreciation phase, while it fell by 11% during the dollar’s depreciation phase. Similarly, the yen-dollar exchange rate rose by 40% during the dollar’s strength and slipped by 2% when the dollar weakened.

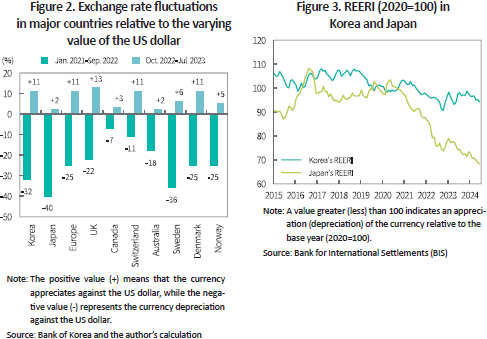

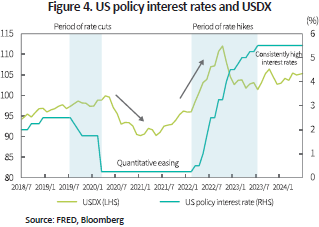

As global currencies tend to be consistently influenced by fluctuations in the US dollar, Korea’s Real Effective Exchange Rate Index (REERI) exhibited only a 2.4% depreciation in June 2024 compared to the period immediately before the Fed’s rate hikes. This suggests that, despite the rise in the nominal exchange rate, Korea faces difficulties in enhancing its relative competitiveness in current transactions. In contrast, Japan’s yen experienced the most significant increase in its exchange rate among major currencies, with its REERI falling by 20.4% during the same period. As a result, the won-yen exchange rate dropped to the 850-won range, reaching its lowest level since the global financial crisis.

2. How a shift in US monetary policy influences the won-dollar exchange rate

Recently, the Fed has shifted its monetary policy from tightening toward a more expansionary stance through interest rate cuts. This change is expected to affect the won-dollar exchange rate through various channels.

The first channel is fluctuations in the value of the dollar. A rise in US policy rates typically enhances the appeal of dollar-denominated financial assets, driving capital inflows into the US and strengthening the dollar. However, with the imminent rate cuts, the dollar, which has remained strong, is likely to gradually weaken going forward. This potential depreciation of the dollar could strengthen other global currencies relative to the US dollar. Historically, during periods of rate hikes, the dollar’s strength tended to reflect market expectations even before rate hikes were implemented, while during periods of rate cuts, however, the dollar’s depreciation often occurred with a time lag. This suggests that future rate cuts may give rise to a gradual weakening of the US dollar.

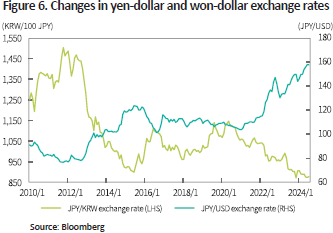

Second, changes in the Fed’s monetary policy are anticipated to influence global capital flows. If US interest rates decline, or if expectations for a rate cut rise, global investment funds are likely to flow out of the US and into other advanced and emerging economies, thereby contributing to the strengthening of currencies other than the US dollar. As shown in Figure 5, emerging market stock indices go up following US rate cuts, but they fall again as expectations of a potential US rate hike emerge. This trend indicates that fluctuations in US policy rates play a role in changing equity investment funds’ flow to and from emerging markets, potentially affecting global currency exchange rates.

In particular, if US rate cuts enhance global liquidity and boost investors’ risk appetite, the subsequent capital flows could pick up speed, further strengthening global currencies. If Korea delays its interest rate cut due to domestic factors, while US rates decrease, Korea’s interest rates would remain higher than global rates as observed in the past, which could attract foreign capital inflows to Korea and put additional downward pressure on the won-dollar exchange rate.

Third, if the Fed’s rate cuts minimize the risk of a US economic downturn and facilitate a soft landing for the economy, it could boost overseas demand, especially from the US, and potentially sustain Korea’s export growth. This scenario would support Korea’s current account surplus, thereby exerting downward pressure on the won-dollar exchange rate. Moreover, with the recent rate hikes by the Bank of Japan, the yen, which has experienced significant depreciation, may begin to strengthen. As a result, the won-yen exchange rate could shift from its current downward trend to an upward trajectory.3) This shift could enable Korean export goods to gain price competitiveness relative to Japanese goods in global markets like the US. In addition to global capital flows, this would lead to an increase in Korea’s current account surplus in real economic sectors such as exports, serving as an appreciation factor for the Korean won.

3. Implications for the won-dollar exchange rate

Over the past two years, the strong US dollar, which has primarily driven the increase in the won-dollar exchange rate, has reached a turning point due to a potential shift in US monetary policy. As the US moves toward a phase of rate cuts, the dollar, which has appreciated significantly, is expected to gradually weaken. Additionally, global investment capital flows out of the US and into other regions, including Korea, potentially strengthen other currencies such as the Korean won. Notably, if the Japanese yen, which has been sharply weakening, becomes strong, the won-dollar exchange rate could decline rapidly due to exchange rate synchronization among competing currencies.

Given these factors, the won-dollar exchange rate is expected to gradually stabilize downward from its previous upward trajectory. It should be noted that the pace of this decline is likely to be gradual, as various factors—the ongoing geopolitical risks, such as global wars, persistent global price instability, uncertainties related to the US presidential election, and exchange rate fluctuations in neighboring countries—are expected to influence the Korean won. These factors will likely contribute to significant short-term volatility in the exchange rate, particularly as exchange rates of global currencies have reached a potential inflection point.

Economic agents in Korea should recognize that the won-dollar exchange rate is approaching a turning point, driven by a shift in US monetary policy. In response, they should prepare for a potential decline in the exchange rate. Foreign exchange authorities should put continuous efforts into stabilizing the market, considering that a potential reversal in the exchange rate may heighten short-term volatility. In particular, they should pay particular attention to ensure that a sharp decline in the exchange rate or greater volatility does not adversely influence the recent growth in exports. Moreover, amid the rapid growth of overseas securities investments, investors should strive to manage risks, considering that a fall in the won-dollar exchange rate may lead to FX losses from overseas investments, potentially reducing investment returns.

1) Korea’s current account has remained in surplus, albeit with a modest decrease in the surplus size, and the inflation differential between Korea and the US hardly explains the current high exchange rate levels.

2) The USDX refers to an index (1973=100) that represents the average value of the US dollar against six major currencies (the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc). It is calculated by averaging the exchange rate between the US dollar and its trading partner’s currency, weighted by trading volume. An increase (decrease) in the USDX indicates an appreciation (depreciation) of the US dollar.

3) The yen exchange rate against the US dollar has shown a sharp upward trend during recent periods of the strong dollar, spurred by Japan’s departure from US monetary policy such as the Bank of Japan (BOJ)’s expansionary monetary policy, a weakening preference for the yen as a safe asset, and increased overseas investments by Japanese investors. Notably, contrary to market expectations, the BOJ decided to postpone its reduction in government bond purchases this July, pushing up the yen-dollar exchange rate to 460 yen per dollar. After this surge, the yen-dollar exchange rate dropped to 153 yen following the BOJ’s rate hike on July 31. It further plummeted to 142 yen during the stock market crash on August 5, and has currently fluctuated around the 145-yen range.

1. Recent trends in the won-dollar exchange rate

The factors affecting the won-dollar exchange rate can be broadly divided into domestic FX supply and demand dynamics and various global financial market conditions. The recent upward trend in the won-dollar exchange rate has been predominantly prompted by the latter.1) Since the Fed initiated rate hikes in March 2022, after a period of near-zero interest rates under its quantitative easing in response to the Covid-19 pandemic, the won-dollar exchange rate has been on the steady rise. Notably, the exchange rate peaked at KRW 1,439.9 based on the closing price on September 28, 2022, marking its highest level since the global financial crisis. This surge was largely driven by the US Dollar Index (USDX)2) hitting an all-time high of 114.2 on September 27, 2022, following the Fed’s aggressive rate hikes. Although the won-dollar exchange rate temporarily dropped to the 1,200-won range after this spike, it has fluctuated above the 1,300-won level since March 2023. This upward pressure stems from market expectations that the Fed’s monetary tightening will persist, following its policy increase to the current upper limit of 5.5%, amid ongoing global price instability.

As shown in Figure 1, the daily won-dollar exchange rate is closely tied to fluctuations in the US dollar. In an analysis of the correlation coefficient between the daily won-dollar exchange rate and the USDX, the correlation coefficient reached 0.96 during the period of sharp rate hikes by the Fed following the quantitative easing phase (February 2020 to July 2023), representing a remarkably higher correlation compared to earlier periods. Despite its high interest rates, the US economy has shown a relatively strong performance compared to other economies, thereby strengthening the US dollar and, consequently, contributing to the rise in the won-dollar exchange rate. However, as the won-dollar exchange rate kept its upward trend even after the US dollar generally stabilized starting from August 2023, the correlation coefficient between these two variables decreased to 0.60.

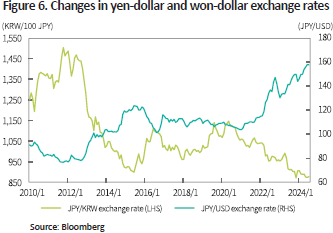

The strength of the US dollar has similarly influenced the value of most global currencies, including the Korean won. Specifically, during periods of US dollar appreciation (as indicated by the rise in the USDX), other currencies have tended to weaken, while periods of US dollar depreciation have been met with appreciation of other currencies. In an analysis of the US dollar’s appreciation phase (January 2021 to September 2022, +25%) and its depreciation phase (October 2022 to July 2023, -9%), it is observed that most currencies moved in the opposite direction to the US dollar. For instance, the won-dollar exchange rate increased by 32% during the dollar’s appreciation phase, while it fell by 11% during the dollar’s depreciation phase. Similarly, the yen-dollar exchange rate rose by 40% during the dollar’s strength and slipped by 2% when the dollar weakened.

As global currencies tend to be consistently influenced by fluctuations in the US dollar, Korea’s Real Effective Exchange Rate Index (REERI) exhibited only a 2.4% depreciation in June 2024 compared to the period immediately before the Fed’s rate hikes. This suggests that, despite the rise in the nominal exchange rate, Korea faces difficulties in enhancing its relative competitiveness in current transactions. In contrast, Japan’s yen experienced the most significant increase in its exchange rate among major currencies, with its REERI falling by 20.4% during the same period. As a result, the won-yen exchange rate dropped to the 850-won range, reaching its lowest level since the global financial crisis.

2. How a shift in US monetary policy influences the won-dollar exchange rate

Recently, the Fed has shifted its monetary policy from tightening toward a more expansionary stance through interest rate cuts. This change is expected to affect the won-dollar exchange rate through various channels.

The first channel is fluctuations in the value of the dollar. A rise in US policy rates typically enhances the appeal of dollar-denominated financial assets, driving capital inflows into the US and strengthening the dollar. However, with the imminent rate cuts, the dollar, which has remained strong, is likely to gradually weaken going forward. This potential depreciation of the dollar could strengthen other global currencies relative to the US dollar. Historically, during periods of rate hikes, the dollar’s strength tended to reflect market expectations even before rate hikes were implemented, while during periods of rate cuts, however, the dollar’s depreciation often occurred with a time lag. This suggests that future rate cuts may give rise to a gradual weakening of the US dollar.

Second, changes in the Fed’s monetary policy are anticipated to influence global capital flows. If US interest rates decline, or if expectations for a rate cut rise, global investment funds are likely to flow out of the US and into other advanced and emerging economies, thereby contributing to the strengthening of currencies other than the US dollar. As shown in Figure 5, emerging market stock indices go up following US rate cuts, but they fall again as expectations of a potential US rate hike emerge. This trend indicates that fluctuations in US policy rates play a role in changing equity investment funds’ flow to and from emerging markets, potentially affecting global currency exchange rates.

In particular, if US rate cuts enhance global liquidity and boost investors’ risk appetite, the subsequent capital flows could pick up speed, further strengthening global currencies. If Korea delays its interest rate cut due to domestic factors, while US rates decrease, Korea’s interest rates would remain higher than global rates as observed in the past, which could attract foreign capital inflows to Korea and put additional downward pressure on the won-dollar exchange rate.

Third, if the Fed’s rate cuts minimize the risk of a US economic downturn and facilitate a soft landing for the economy, it could boost overseas demand, especially from the US, and potentially sustain Korea’s export growth. This scenario would support Korea’s current account surplus, thereby exerting downward pressure on the won-dollar exchange rate. Moreover, with the recent rate hikes by the Bank of Japan, the yen, which has experienced significant depreciation, may begin to strengthen. As a result, the won-yen exchange rate could shift from its current downward trend to an upward trajectory.3) This shift could enable Korean export goods to gain price competitiveness relative to Japanese goods in global markets like the US. In addition to global capital flows, this would lead to an increase in Korea’s current account surplus in real economic sectors such as exports, serving as an appreciation factor for the Korean won.

3. Implications for the won-dollar exchange rate

Over the past two years, the strong US dollar, which has primarily driven the increase in the won-dollar exchange rate, has reached a turning point due to a potential shift in US monetary policy. As the US moves toward a phase of rate cuts, the dollar, which has appreciated significantly, is expected to gradually weaken. Additionally, global investment capital flows out of the US and into other regions, including Korea, potentially strengthen other currencies such as the Korean won. Notably, if the Japanese yen, which has been sharply weakening, becomes strong, the won-dollar exchange rate could decline rapidly due to exchange rate synchronization among competing currencies.

Given these factors, the won-dollar exchange rate is expected to gradually stabilize downward from its previous upward trajectory. It should be noted that the pace of this decline is likely to be gradual, as various factors—the ongoing geopolitical risks, such as global wars, persistent global price instability, uncertainties related to the US presidential election, and exchange rate fluctuations in neighboring countries—are expected to influence the Korean won. These factors will likely contribute to significant short-term volatility in the exchange rate, particularly as exchange rates of global currencies have reached a potential inflection point.

Economic agents in Korea should recognize that the won-dollar exchange rate is approaching a turning point, driven by a shift in US monetary policy. In response, they should prepare for a potential decline in the exchange rate. Foreign exchange authorities should put continuous efforts into stabilizing the market, considering that a potential reversal in the exchange rate may heighten short-term volatility. In particular, they should pay particular attention to ensure that a sharp decline in the exchange rate or greater volatility does not adversely influence the recent growth in exports. Moreover, amid the rapid growth of overseas securities investments, investors should strive to manage risks, considering that a fall in the won-dollar exchange rate may lead to FX losses from overseas investments, potentially reducing investment returns.

1) Korea’s current account has remained in surplus, albeit with a modest decrease in the surplus size, and the inflation differential between Korea and the US hardly explains the current high exchange rate levels.

2) The USDX refers to an index (1973=100) that represents the average value of the US dollar against six major currencies (the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc). It is calculated by averaging the exchange rate between the US dollar and its trading partner’s currency, weighted by trading volume. An increase (decrease) in the USDX indicates an appreciation (depreciation) of the US dollar.

3) The yen exchange rate against the US dollar has shown a sharp upward trend during recent periods of the strong dollar, spurred by Japan’s departure from US monetary policy such as the Bank of Japan (BOJ)’s expansionary monetary policy, a weakening preference for the yen as a safe asset, and increased overseas investments by Japanese investors. Notably, contrary to market expectations, the BOJ decided to postpone its reduction in government bond purchases this July, pushing up the yen-dollar exchange rate to 460 yen per dollar. After this surge, the yen-dollar exchange rate dropped to 153 yen following the BOJ’s rate hike on July 31. It further plummeted to 142 yen during the stock market crash on August 5, and has currently fluctuated around the 145-yen range.