Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Technology Neutrality in Financial Investment Regulations: Implications of Reg PDA

Publication date Oct. 08, 2024

Summary

This article examines the impact of Reg PDA, proposed by the U.S. Securities and Exchange Commission (SEC) in August 2023, on the financial investment industry with an emphasis on the concept of technology neutrality and discusses its implications in an era of digital transformation. The SEC has been facing opposition from the financial industry stakeholders as Reg PDA broadly defines data-driven predictive analytics technologies, which are widespread within financial investment firms, and requires these firms to neutralize or eliminate potential conflicts of interest due to the technology. Technology neutrality is the key concept guiding Reg PDA which refers to the principle that regulations should remain neutral and unbiased toward specific technologies. This principle has been introduced to proactively address the rapid evolution of data-driven predictive technologies, such as AI, which support decision-making processes. However, it also raised concerns that a broad and ambiguous scope may increase the cost of adopting new technologies and hinder innovation. In this regard, this article argues that financial regulations concerning digital transformation should focus on supporting sustainable growth of the financial investment industry by achieving a balance between promoting innovation and ensuring market stability.

In August 2023, the U.S. Securities and Exchange Commission (SEC) announced a regulatory proposal concerning the effects of data-driven prediction and analysis technologies, commonly referred to as Predictive Data Analytics (PDA) (“Reg PDA”).1) Since its announcement, the proposal has faced strong opposition from the financial investment industry. A key requirement of Reg PDA mandates that financial services firms neutralize or eliminate the effects of any conflicts of interest that may arise from the use of technologies covered by the proposal.

Industry stakeholders have expressed concerns that the proposed regulation may significantly impede the use of AI-driven predictive models and financial services, including robo-advisors, which are already in use or under development in the financial investment industry. A key issue raised by them is that Reg PDA’s definition of analytical tools is overly broad and ambiguous, potentially affecting technologies with little or no relevance to the regulation. Furthermore, the requirement to disclose analytical and predictive algorithms used by the firms could lead to extensive exposure of specific operational methods.2)

The industry’s opposition hinges on the principle of technology neutrality, a key concept of Reg PDA’s direction. In this context, this article analyzes the concept and background of technology neutrality and explores the implications of Reg PDA for market stability and innovation within the financial sector.

The concept of technology neutrality

Technology neutrality refers to the principle that regulations should remain neutral, not favoring or being biased toward specific technologies. This concept is closely associated with the regulation of information and communication technologies. In 1976, technology neutrality came to the fore during the enactment of the U.S. Copyright Act. At that time, new technologies were reshaping the concept of reproduction and copyright, raising concerns about a constant call for regulatory amendments. In response, some argued that technology-related regulations should remain neutral.3)

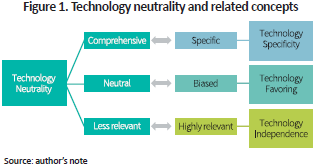

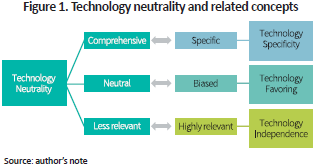

A technology-neutral regulation takes a comprehensive and impartial approach, with minimal links to the distinctive features of covered technologies. Technology neutrality can be understood by comparing it with contrasting ideas (see Figure 1). First, regulations that explicitly state specific types or forms of technology are considered to exhibit technology specificity, which stands in contrast to the goal of technology neutrality. On the other hand, when a regulation shows a preference for or disapproval of a particular technology, it is described as technology favoring. Technology favoring is akin to technology specificity in that it reflects distinctive features of the covered technology; however, it is positioned in direct opposition to technology neutrality. Regulations underpinned by technology specificity or technology favoring could easily become obsolete, when applied to rapidly evolving technologies, such as AI.

Technology independence holds that regulations should be detached from the form or effects of technology, which is related to but distinct from technology neutrality. This concept centers on the principle that regulatory effects should be independent of existing technologies. Such an approach requires first defining the scope and characteristics of the covered technology and then establishing regulatory frameworks and procedures that are not influenced by those characteristics. For this reason, technology independence imposes stricter restrictions than technology neutrality, as the latter allows for a certain level of association or avoids defining the characteristics of the covered technology as long as the regulation remains unbiased.4)

Technology neutrality of Reg PDA

In the proposal, the SEC explicitly states that Reg PDA is based on the principle of technology neutrality,5) providing two primary rationales. First, it allows flexibility by which firms can use their discretion in selecting appropriate technologies, such as data analytics models, to enhance operational efficiency and reduce management risk.6) If a regulation were to specify particular features of the technology to be covered—i.e., written based on the principle of technology specificity or technology favoring—regulatory requirements would drive the selection of technologies rather than market demand. This could result in an excess demand for necessary technologies or an excess supply of unnecessary ones. Second, the SEC seeks to create a technology-neutral regulatory framework that can consistently adapt to both current and future technologies for financial investment analytics and prediction in their general and specialized forms.7) This approach aligns with the purpose of the technology neutrality principle, as mentioned in the case of the U.S. Copyright Act, and is expected to prevent Reg PDA from becoming outdated as technologies evolve.

However, this regulatory intent may not necessarily yield positive effects for the market. The financial investment industry, in particular, has raised concerns about the overly broad definition of technologies covered under the proposal. The primary criticism is that this extensive regulatory scope may stifle innovation by creating disincentives. Reg PDA requires financial investment firms to eliminate potential conflicts of interest arising from the use of PDA and to disclose detailed aspects of covered technologies to investors. Coupled with the broad definition of PDA, this could significantly increase the disclosure burden.

Furthermore, concerns have arisen regarding potential regulatory overlap with existing rules. The SEC has already established Regulation Best Interest (“Reg BI”) in 2019, aimed at obligating financial services firms to prioritize investors’ interests.8) Additionally, it can impose penalties for data-based investment advisory services, if necessary, under the current set of enforcement tools.9) Such a regulatory overlap is commonly observed in principle-based regulations on transparency of decision-making algorithms, which are recently proliferating, thereby leading to concerns about overregulation.10)

Impact on the financial investment industry

In both domestic and global financial investment markets, AI and big data-driven predictive models and relevant services, such as robo-advisors, are already widely available, with their use expected to grow further. In this context, technology-neutral regulations could have a significant impact. U.S.-based global financial services firms are actively utilizing generative AI to enhance their ability to offer innovative financial services.11) However, comprehensive regulations such as Reg PDA could raise the costs associated with the adoption of innovative technologies, potentially slowing the pace of digital transformation in the financial investment industry over the long term.

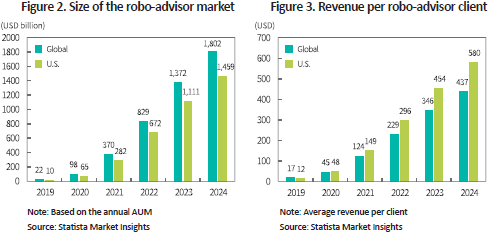

Robo-advisors, specifically mentioned in the proposed regulation as a prime example of PDA, have experienced a significant rise in their influence in the U.S.-led global financial investment advisory market. The total assets under management (AUM) for robo-advisors are projected to exceed $1.8 trillion by 2024, with the U.S. accounting for roughly $1.5 trillion, or 81%, of the global market (Figure 2). A decline in robo-advisor services in the U.S., which dominates the global robo-advisor market, would have substantial effects.

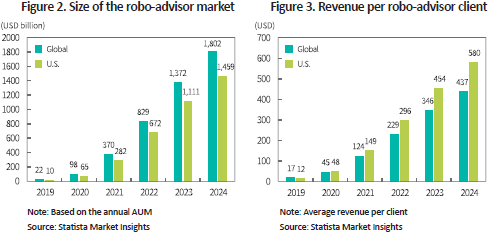

From a profitability perspective, however, the impact of Reg PDA may be less significant than expected. In 2024, revenue per robo-advisor client in the U.S. is estimated at $580, higher than the global average of $437 (Figure 3), but still relatively modest compared to other advisory sectors.12) Therefore, if the implementation of Reg PDA pushes up the cost of operating robo-advisors, firms are likely to respond by shifting to alternative advisory services.

Implications for digital transformation and financial regulation

As digital transformation accelerates in the financial investment industry, there have been active discussions about potential risks associated with innovative technologies and appropriate regulatory guidelines to address relevant challenges. According to Acemoglu & Lensman (2024), if market participants fail to internalize the social costs of adopting innovative technologies, these technologies may proliferate too rapidly, expanding risks across the market. Notably, AI-driven services have provided benefits such as greater accessibility and reduced operational costs for investors, while they have sparked controversy about diminished transparency in decision-making processes and heightened market instability due to synchronization.13) In this sense, recent developments align with the theoretical prediction of Acemoglu & Lensman (2024), suggesting a growing need for regulatory oversight of innovative financial technologies, including AI.

On the other hand, a cautious approach should be taken to the introduction of overly abstract and broad regulations designed for proactively addressing digital transformation in the financial investment sector. Technology-neutral regulations offer the advantage of adapting flexibly to rapidly evolving technologies, without being biased toward specific technologies. As is the case with Reg PDA, these regulations may impose unnecessarily broad constraints, thereby driving up the costs of adopting new technologies and stifling innovation in the financial services industry. Moreover, such a broad regulatory framework can result in vague definitions of regulatory scope and impact, creating uncertainty among market participants subject to the regulation.

Financial regulations concerning digital transformation should be limited to the necessary level to ensure market stability, based on an understanding of the specific features of covered technologies. This requires continuous monitoring and adjustments. Their ultimate goal should be to develop a regulatory framework that can foster long-term growth and flexibly respond to diverse technologies. In this context, regulations should maintain a balance between stability and innovation.

1) U.S. Securities and Exchange Commission (SEC), 2023, Conflict of Interest Associated with the Use of Predictive Data Analytics by Broker-Dealers and Investment Advisers, Release Nos. 34-97990; IA-6353; File No. S7-12-23, (https://www.sec.gov/files/rules/proposed/2023/34-97990.pdf)

2) ICI (Oct. 10, 2023), SIFMA (Oct. 10, 2023)

3) Greenberg (2016)

4) Koops (2006)

5) “The proposal is intended to be technology neutral. We are not seeking to identify which technologies a firm should or should not use.” (p.39)

6) “The proposal also is designed to permit firms the ability to employ tools that they believe would address these risks that are specific to the particular technology they use consistent with the proposal” (pp. 39-40)

7) “[…] the proposed definition of covered technology is also designed to capture the variety of technologies and methods that firms currently use as well as those technologies and methods that may develop over time.” (p.43)

8) Sim, S.Y. (2019)

9) For example, the SEC fined an investment advisor $35 million for recommending investment strategies based on incorrect data (https://www.sec.gov/newsroom/press-releases/2014-289).

10) New & Castro (2018)

11) Lee, H.S. (2024)

12) In Korea, robo-advisors represent a limited market share in the financial investment industry. According to Lee (2021), there is a significant divergence in investment returns across robo-advisor service providers, and even the more successful ones are struggling to attract clients. For this reason, if regulations similar to Reg PDA generate higher costs in Korea, less profitable services such as robo-advisors may be forced to exit the market.

13) World Economic Forum (2019), Gensler & Bailey (2020)

References

Acemoglu, D., Lensman, T., 2024, Regulating transformative technologies, American Economic Review: Insights 6(3), 359-376.

Gensler, G., Bailey, L., 2020, Deep learning and financial stability, SSRN working paper No.3723132.

Greenberg, B.A., 2016, Rethinking technology neutrality, Minnesota Law Review 100(4),1495-1562.

Koops, B.-J., 2006, Should ICT Regulation be Technology-Neutral?, in Koops, B.-J., Lips, M., Prins, C., Schellekens, M. (eds.), Starting Points for ICT Regulation. Deconstructing Prevalent Policy One-Liners, IT & Law Series 9, 77-108.

Investment Company Institute (ICI), 2023. 10. 10, Re: Conflicts of interest associated with the use of predictive data analytics by broker-dealers and investment advisors; File No S7-12-23.

New, J., Castro, D., 2018, How policymakers can foster algorithmic accountability, Center for Data Innovation.

Securities Industry and Financial Markets Association (SIFMA), 2023. 10. 10, Re: Conflicts of interest associated with the use of predictive data analytics by broker-dealers and investment advisors.

World Economic Forum, 2019, Navigating Uncharted Waters: A Roadmap to Responsible Innovation with AI in Financial Services.

Statista Market Insights https://www.statista.com/outlook/

[Korean]

Sim, S.Y. (2019), The Securities and Exchange Commission’s adoption of Regulation Best Interest, Korea Capital Market Institute, Capital Market Focus 2019-15.

Lee, S.B. (2021), Analyzing the status and performance of robo-advisors in Korea, Korea Capital Market Institute, Research Paper 21-05.

Lee, H.S. (2024), How the proliferation of generative AI is reshaping the financial services industry and future challenges, Korea Capital Market Institute, Capital Market Focus 2024-13.

Industry stakeholders have expressed concerns that the proposed regulation may significantly impede the use of AI-driven predictive models and financial services, including robo-advisors, which are already in use or under development in the financial investment industry. A key issue raised by them is that Reg PDA’s definition of analytical tools is overly broad and ambiguous, potentially affecting technologies with little or no relevance to the regulation. Furthermore, the requirement to disclose analytical and predictive algorithms used by the firms could lead to extensive exposure of specific operational methods.2)

The industry’s opposition hinges on the principle of technology neutrality, a key concept of Reg PDA’s direction. In this context, this article analyzes the concept and background of technology neutrality and explores the implications of Reg PDA for market stability and innovation within the financial sector.

The concept of technology neutrality

Technology neutrality refers to the principle that regulations should remain neutral, not favoring or being biased toward specific technologies. This concept is closely associated with the regulation of information and communication technologies. In 1976, technology neutrality came to the fore during the enactment of the U.S. Copyright Act. At that time, new technologies were reshaping the concept of reproduction and copyright, raising concerns about a constant call for regulatory amendments. In response, some argued that technology-related regulations should remain neutral.3)

A technology-neutral regulation takes a comprehensive and impartial approach, with minimal links to the distinctive features of covered technologies. Technology neutrality can be understood by comparing it with contrasting ideas (see Figure 1). First, regulations that explicitly state specific types or forms of technology are considered to exhibit technology specificity, which stands in contrast to the goal of technology neutrality. On the other hand, when a regulation shows a preference for or disapproval of a particular technology, it is described as technology favoring. Technology favoring is akin to technology specificity in that it reflects distinctive features of the covered technology; however, it is positioned in direct opposition to technology neutrality. Regulations underpinned by technology specificity or technology favoring could easily become obsolete, when applied to rapidly evolving technologies, such as AI.

Technology independence holds that regulations should be detached from the form or effects of technology, which is related to but distinct from technology neutrality. This concept centers on the principle that regulatory effects should be independent of existing technologies. Such an approach requires first defining the scope and characteristics of the covered technology and then establishing regulatory frameworks and procedures that are not influenced by those characteristics. For this reason, technology independence imposes stricter restrictions than technology neutrality, as the latter allows for a certain level of association or avoids defining the characteristics of the covered technology as long as the regulation remains unbiased.4)

Technology neutrality of Reg PDA

In the proposal, the SEC explicitly states that Reg PDA is based on the principle of technology neutrality,5) providing two primary rationales. First, it allows flexibility by which firms can use their discretion in selecting appropriate technologies, such as data analytics models, to enhance operational efficiency and reduce management risk.6) If a regulation were to specify particular features of the technology to be covered—i.e., written based on the principle of technology specificity or technology favoring—regulatory requirements would drive the selection of technologies rather than market demand. This could result in an excess demand for necessary technologies or an excess supply of unnecessary ones. Second, the SEC seeks to create a technology-neutral regulatory framework that can consistently adapt to both current and future technologies for financial investment analytics and prediction in their general and specialized forms.7) This approach aligns with the purpose of the technology neutrality principle, as mentioned in the case of the U.S. Copyright Act, and is expected to prevent Reg PDA from becoming outdated as technologies evolve.

However, this regulatory intent may not necessarily yield positive effects for the market. The financial investment industry, in particular, has raised concerns about the overly broad definition of technologies covered under the proposal. The primary criticism is that this extensive regulatory scope may stifle innovation by creating disincentives. Reg PDA requires financial investment firms to eliminate potential conflicts of interest arising from the use of PDA and to disclose detailed aspects of covered technologies to investors. Coupled with the broad definition of PDA, this could significantly increase the disclosure burden.

Furthermore, concerns have arisen regarding potential regulatory overlap with existing rules. The SEC has already established Regulation Best Interest (“Reg BI”) in 2019, aimed at obligating financial services firms to prioritize investors’ interests.8) Additionally, it can impose penalties for data-based investment advisory services, if necessary, under the current set of enforcement tools.9) Such a regulatory overlap is commonly observed in principle-based regulations on transparency of decision-making algorithms, which are recently proliferating, thereby leading to concerns about overregulation.10)

Impact on the financial investment industry

In both domestic and global financial investment markets, AI and big data-driven predictive models and relevant services, such as robo-advisors, are already widely available, with their use expected to grow further. In this context, technology-neutral regulations could have a significant impact. U.S.-based global financial services firms are actively utilizing generative AI to enhance their ability to offer innovative financial services.11) However, comprehensive regulations such as Reg PDA could raise the costs associated with the adoption of innovative technologies, potentially slowing the pace of digital transformation in the financial investment industry over the long term.

Robo-advisors, specifically mentioned in the proposed regulation as a prime example of PDA, have experienced a significant rise in their influence in the U.S.-led global financial investment advisory market. The total assets under management (AUM) for robo-advisors are projected to exceed $1.8 trillion by 2024, with the U.S. accounting for roughly $1.5 trillion, or 81%, of the global market (Figure 2). A decline in robo-advisor services in the U.S., which dominates the global robo-advisor market, would have substantial effects.

From a profitability perspective, however, the impact of Reg PDA may be less significant than expected. In 2024, revenue per robo-advisor client in the U.S. is estimated at $580, higher than the global average of $437 (Figure 3), but still relatively modest compared to other advisory sectors.12) Therefore, if the implementation of Reg PDA pushes up the cost of operating robo-advisors, firms are likely to respond by shifting to alternative advisory services.

Implications for digital transformation and financial regulation

As digital transformation accelerates in the financial investment industry, there have been active discussions about potential risks associated with innovative technologies and appropriate regulatory guidelines to address relevant challenges. According to Acemoglu & Lensman (2024), if market participants fail to internalize the social costs of adopting innovative technologies, these technologies may proliferate too rapidly, expanding risks across the market. Notably, AI-driven services have provided benefits such as greater accessibility and reduced operational costs for investors, while they have sparked controversy about diminished transparency in decision-making processes and heightened market instability due to synchronization.13) In this sense, recent developments align with the theoretical prediction of Acemoglu & Lensman (2024), suggesting a growing need for regulatory oversight of innovative financial technologies, including AI.

On the other hand, a cautious approach should be taken to the introduction of overly abstract and broad regulations designed for proactively addressing digital transformation in the financial investment sector. Technology-neutral regulations offer the advantage of adapting flexibly to rapidly evolving technologies, without being biased toward specific technologies. As is the case with Reg PDA, these regulations may impose unnecessarily broad constraints, thereby driving up the costs of adopting new technologies and stifling innovation in the financial services industry. Moreover, such a broad regulatory framework can result in vague definitions of regulatory scope and impact, creating uncertainty among market participants subject to the regulation.

Financial regulations concerning digital transformation should be limited to the necessary level to ensure market stability, based on an understanding of the specific features of covered technologies. This requires continuous monitoring and adjustments. Their ultimate goal should be to develop a regulatory framework that can foster long-term growth and flexibly respond to diverse technologies. In this context, regulations should maintain a balance between stability and innovation.

1) U.S. Securities and Exchange Commission (SEC), 2023, Conflict of Interest Associated with the Use of Predictive Data Analytics by Broker-Dealers and Investment Advisers, Release Nos. 34-97990; IA-6353; File No. S7-12-23, (https://www.sec.gov/files/rules/proposed/2023/34-97990.pdf)

2) ICI (Oct. 10, 2023), SIFMA (Oct. 10, 2023)

3) Greenberg (2016)

4) Koops (2006)

5) “The proposal is intended to be technology neutral. We are not seeking to identify which technologies a firm should or should not use.” (p.39)

6) “The proposal also is designed to permit firms the ability to employ tools that they believe would address these risks that are specific to the particular technology they use consistent with the proposal” (pp. 39-40)

7) “[…] the proposed definition of covered technology is also designed to capture the variety of technologies and methods that firms currently use as well as those technologies and methods that may develop over time.” (p.43)

8) Sim, S.Y. (2019)

9) For example, the SEC fined an investment advisor $35 million for recommending investment strategies based on incorrect data (https://www.sec.gov/newsroom/press-releases/2014-289).

10) New & Castro (2018)

11) Lee, H.S. (2024)

12) In Korea, robo-advisors represent a limited market share in the financial investment industry. According to Lee (2021), there is a significant divergence in investment returns across robo-advisor service providers, and even the more successful ones are struggling to attract clients. For this reason, if regulations similar to Reg PDA generate higher costs in Korea, less profitable services such as robo-advisors may be forced to exit the market.

13) World Economic Forum (2019), Gensler & Bailey (2020)

References

Acemoglu, D., Lensman, T., 2024, Regulating transformative technologies, American Economic Review: Insights 6(3), 359-376.

Gensler, G., Bailey, L., 2020, Deep learning and financial stability, SSRN working paper No.3723132.

Greenberg, B.A., 2016, Rethinking technology neutrality, Minnesota Law Review 100(4),1495-1562.

Koops, B.-J., 2006, Should ICT Regulation be Technology-Neutral?, in Koops, B.-J., Lips, M., Prins, C., Schellekens, M. (eds.), Starting Points for ICT Regulation. Deconstructing Prevalent Policy One-Liners, IT & Law Series 9, 77-108.

Investment Company Institute (ICI), 2023. 10. 10, Re: Conflicts of interest associated with the use of predictive data analytics by broker-dealers and investment advisors; File No S7-12-23.

New, J., Castro, D., 2018, How policymakers can foster algorithmic accountability, Center for Data Innovation.

Securities Industry and Financial Markets Association (SIFMA), 2023. 10. 10, Re: Conflicts of interest associated with the use of predictive data analytics by broker-dealers and investment advisors.

World Economic Forum, 2019, Navigating Uncharted Waters: A Roadmap to Responsible Innovation with AI in Financial Services.

Statista Market Insights https://www.statista.com/outlook/

[Korean]

Sim, S.Y. (2019), The Securities and Exchange Commission’s adoption of Regulation Best Interest, Korea Capital Market Institute, Capital Market Focus 2019-15.

Lee, S.B. (2021), Analyzing the status and performance of robo-advisors in Korea, Korea Capital Market Institute, Research Paper 21-05.

Lee, H.S. (2024), How the proliferation of generative AI is reshaping the financial services industry and future challenges, Korea Capital Market Institute, Capital Market Focus 2024-13.