Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

The ASEAN Sustainable Finance Market: Current State of Development and Opportunities

Publication date Nov. 05, 2024

Summary

ASEAN is one of the world’s fastest-growing regions and projected to become the fourth-largest economic bloc by 2030. Economic ties between ASEAN and Korea have deepened significantly, with ASEAN ranking as Korea’s second-largest trading partner after China as of 2024. Currently, Korean financial services firms operate 172 overseas branches across ASEAN countries.

Developing a sustainable finance market is crucial for sustaining ASEAN’s economic growth. ASEAN remains highly vulnerable to climate change, and its large-scale infrastructure projects driven by industrialization and urbanization require foreign capital that prioritizes sustainability. In response, ASEAN has introduced key frameworks to support an integrated sustainable finance market, notably the ASEAN Green Bond Standards (AGBS) and the ASEAN Taxonomy. Despite these initiatives, sustainable finance in ASEAN is still in its early stage, as indicated by the relatively small size of the ESG bond and ESG fund markets in the region. The development of ASEAN’s sustainable finance market represents a strategic opportunity for mutually beneficial cooperation with Korea, where both the government and financial services firms can play a significant role.

Developing a sustainable finance market is crucial for sustaining ASEAN’s economic growth. ASEAN remains highly vulnerable to climate change, and its large-scale infrastructure projects driven by industrialization and urbanization require foreign capital that prioritizes sustainability. In response, ASEAN has introduced key frameworks to support an integrated sustainable finance market, notably the ASEAN Green Bond Standards (AGBS) and the ASEAN Taxonomy. Despite these initiatives, sustainable finance in ASEAN is still in its early stage, as indicated by the relatively small size of the ESG bond and ESG fund markets in the region. The development of ASEAN’s sustainable finance market represents a strategic opportunity for mutually beneficial cooperation with Korea, where both the government and financial services firms can play a significant role.

The Association of Southeast Asian Nations (ASEAN), comprising ten member states, ranks among the fastest-growing regions in the world. Between 2010 and 2020, ASEAN achieved an average annual economic growth rate of 5% and is projected to become the world’s fourth-largest economic region by 2030.1) For the Korean economy, it has emerged as a vital economic partner. ASEAN has established itself as a significant consumer market, with the world’s third-largest population, and is becoming a major production base in the global value chain. As of 2024, ASEAN stands as Korea’s second-largest trading partner after China and is a primary destination for the overseas expansion of Korean financial services firms, with 172 overseas branches operating across the region.2)

Building a sustainable finance market is essential to supporting ASEAN’s continued economic growth. The region is highly vulnerable to the impacts of climate change and faces various environmental and social challenges, including resource depletion and social inequality, amid ongoing economic development. Additionally, large-scale infrastructure investments in sectors such as energy, transportation, and telecommunications are crucial for sustaining ASEAN’s economic growth. The Asian Development Bank (ADB) estimates that these investments will require $ 3.1 trillion between 2023 and 2030, or $210 billion per year.3) Given the scale of investments required, public finances in ASEAN member states are not sufficient, underscoring the need to mobilize private sector capital, particularly from foreign investors. As sustainability becomes a priority investment criterion for major foreign investors, developing a sustainable finance market is imperative for ASEAN’s economic future.

ASEAN’s sustainable finance framework

ASEAN and its individual member states are actively working to establish a sustainable finance market. At the regional level, key organizations, including the ASEAN Secretariat, are leading efforts to develop a core sustainable finance framework. Under the direction of the ASEAN Capital Markets Forum (ACMF), the ASEAN Green Bond Standards (AGBS) were introduced in 2017, followed by standards for social and sustainable bonds in 2018. The establishment of the ASEAN Taxonomy Board (ATB) in 2021 marked another milestone, with the introduction of ASEAN Taxonomy version 1, which was subsequently updated to version 2 in 2023 and version 3 in 2024. Individual member states’ stock exchanges are developing sustainability disclosure standards, though unified ASEAN-wide disclosure standards have yet to be implemented.4)

The development of an integrated sustainable finance framework within the ASEAN region presents complex challenges. ASEAN comprises countries at varying stages of economic development, ranging from advanced to developing and least-developed economies. This diversity complicates efforts to align international sustainability standards with economic maturity levels of member states, when establishing sustainable finance standards.

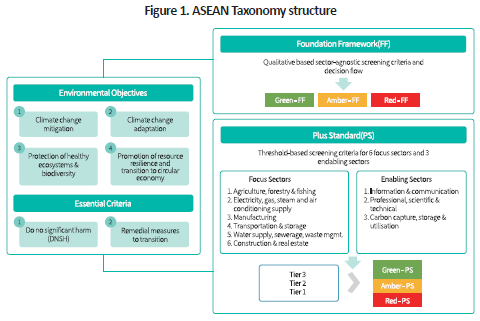

The multi-tier structure of the ASEAN Taxonomy exemplifies the challenge of harmonizing sustainability standards across the region (Figure 1). Taxonomy refers to a classification system that assesses whether specific economic activities or investments meet sustainability criteria. The ASEAN Taxonomy plays a critical role in the development and evaluation of various financial instruments such as ESG bonds and loans, serving as the foundation for sustainable finance. The ASEAN Taxonomy consists of two components: the Foundational Framework (FF) and the Plus Standard (PS). The FF establishes the baseline criteria for eligible green activities and investments that contribute to climate change mitigation and adaptation, while adhering to the Do No Significant Harm (DNSH) principle. Although the FF adopts an inclusive approach to accommodate all ASEAN member states, it lacks specific categorization for eligible economic activities. On the other hand, the PS introduces more stringent and specific criteria for eligible economic activities, aligning more closely with international benchmarks, such as the EU Taxonomy. However, the PS is optional and currently applicable only in some ASEAN member states.

The multi-tier structure of the ASEAN Taxonomy embodies the economic realities of its member states. Many of them are in transitional stages of economic development and may lack the capacity to meet the strict sustainability standards adopted by the EU and other advanced economies. While the ASEAN Taxonomy’s inclusive approach accommodates the varying levels of economic development across member states, it is less effective in attracting foreign investors who typically seek alignment with more rigorous sustainability standards.

Current state of the sustainable finance market in ASEAN

While ASEAN has done an admirable job in developing the key frameworks for sustainable finance for the region, the actual market itself remains in an early stage of development. Capital supply for sustainable finance is limited, falling far short of the levels required to facilitate economic development in the region.

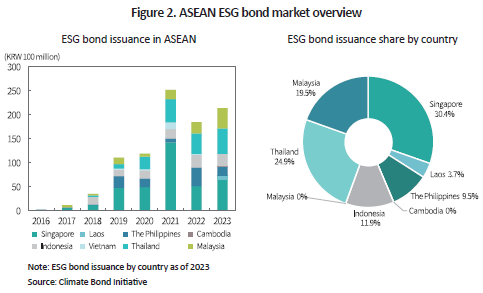

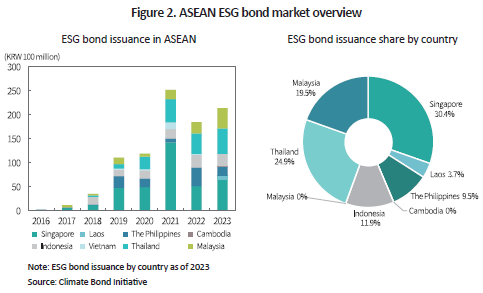

As illustrated in Figure 2, the ESG bond markets in ASEAN have recorded a high growth rate, with issuance surging from $250 million in 2016 to $21.4 billion in 2023. However, in terms of absolute amounts, ASEAN’s share of global ESG bond issuance remains significantly low at 2.5%. Furthermore, there is notable divergence in ESG bond issuance across ASEAN member states. As of 2023, Singapore, Thailand, and Malaysia accounted for 75% of ASEAN’s ESG bond issuance, while countries like Brunei and Laos have not yet issued any ESG bonds.

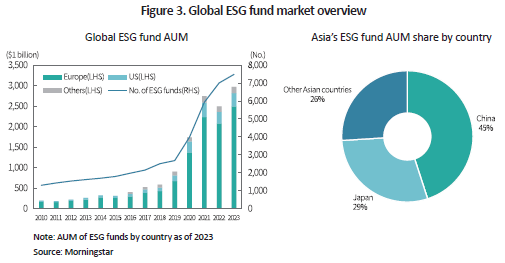

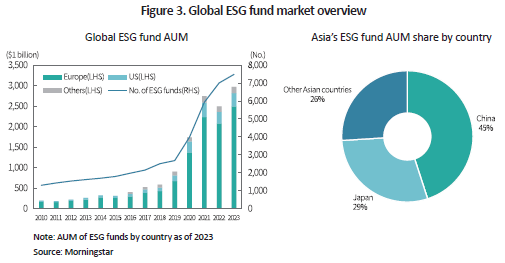

ESG fund markets in ASEAN face a similar challenge. Figure 3 depicts the distribution of assets under management (AUM) in the global ESG fund market as of 2023. Total AUM in ESG funds amounted to $3.0 trillion globally, with Europe and the US comprising the majority shares at 84.0% and 10.9% of the total AUM, respectively. In contrast, Asia represents only 2.9% of the global ESG fund market, with China (45%) and Japan (29%) making up the largest shares within the region, while ASEAN’s contribution remains minimal.

The underdevelopment of ASEAN’s sustainable finance market can be attributed to several factors, among which underdeveloped financial markets—especially capital markets—play a key role. Advanced financial markets are characterized by essential attributes, such as transparent disclosure, reliable credit ratings, and a robust institutional investor base, all of which are crucial for sustainable finance to function effectively. This underscores the importance of advanced capital markets in ASEAN member states for the growth of sustainable finance in the region.

Cooperation opportunities for Korea and ASEAN in sustainable finance

The relationship between Korea and ASEAN is deepening, not only in economic terms but across various dimensions. In this respect, Korea should pay attention to the development of ASEAN’s sustainable finance market, as it presents significant opportunities for mutually beneficial cooperation. Both the Korean government and financial services firms have crucial roles to play in fostering such cooperation.

First, it is worth considering how to enhance the connection between sustainable finance markets in the ASEAN+3 region, including ASEAN member states and Korea, or across the broader Asian region. Currently, Asia faces a supply-demand imbalance in sustainable finance. For instance, ASEAN’s geographical characteristics offer opportunities for various green projects, including forest restoration, eco-friendly agriculture, and renewable energy. These projects have potential for carbon reduction, capture, and storage; however, ASEAN lacks the necessary capital to fund such projects. By contrast, advanced Asian economies, including Korea, have ample capital but struggle to identify eligible green projects. A pan-Asian sustainable finance market could facilitate efficient capital allocation to meet environmental goals. Hong Kong and Singapore have already implemented strategies to position themselves as sustainable finance leaders within Asia. To advance the sustainable finance market in Asia, it is necessary to standardize sustainable finance frameworks across countries. This may involve government-led cooperation efforts on various fronts to establish regional standards, including the Asian green bond standards, the Asian Taxonomy, and the Asian carbon emissions trading market.

Korean financial services firms operating in ASEAN should focus on the development of local sustainable finance markets. Their subsidiaries in the ASEAN region could identify high-potential investment opportunities, such as green projects, both for local clients and Korean investors, while also developing tailored financial instruments and services. Notably, such firms, with expertise in areas such as underwriting green bonds, project evaluation, and offering guarantees for green technologies, are well positioned to make significant contributions in ASEAN member states with underdeveloped financial markets. Given that sustainable finance is a priority for ASEAN financial authorities, Korean financial services firms’ involvement in these markets could also strengthen their market presence within ASEAN’s local markets.

1) World Economic Forum, 2020, Future of Consumption in Fast-Growth Consumer Markets: ASEAN.

2) The ASEAN region hosts overseas branches of Korean financial services firms, including 65 banks, 41 specialized credit finance companies, 26 securities firms, 22 insurance companies, 15 asset management companies, and 3 holding companies.

3) ADB, 2023, Reinvigorating Financing Approaches for Sustainable and Resilient Infrastructure in ASEAN+3.

4) Singapore, Thailand, Vietnam, Indonesia, Brunei, Malaysia, and the Philippines have established sustainability disclosure standards, while Myanmar, Cambodia, and Laos have yet to develop these standards.

Building a sustainable finance market is essential to supporting ASEAN’s continued economic growth. The region is highly vulnerable to the impacts of climate change and faces various environmental and social challenges, including resource depletion and social inequality, amid ongoing economic development. Additionally, large-scale infrastructure investments in sectors such as energy, transportation, and telecommunications are crucial for sustaining ASEAN’s economic growth. The Asian Development Bank (ADB) estimates that these investments will require $ 3.1 trillion between 2023 and 2030, or $210 billion per year.3) Given the scale of investments required, public finances in ASEAN member states are not sufficient, underscoring the need to mobilize private sector capital, particularly from foreign investors. As sustainability becomes a priority investment criterion for major foreign investors, developing a sustainable finance market is imperative for ASEAN’s economic future.

ASEAN’s sustainable finance framework

ASEAN and its individual member states are actively working to establish a sustainable finance market. At the regional level, key organizations, including the ASEAN Secretariat, are leading efforts to develop a core sustainable finance framework. Under the direction of the ASEAN Capital Markets Forum (ACMF), the ASEAN Green Bond Standards (AGBS) were introduced in 2017, followed by standards for social and sustainable bonds in 2018. The establishment of the ASEAN Taxonomy Board (ATB) in 2021 marked another milestone, with the introduction of ASEAN Taxonomy version 1, which was subsequently updated to version 2 in 2023 and version 3 in 2024. Individual member states’ stock exchanges are developing sustainability disclosure standards, though unified ASEAN-wide disclosure standards have yet to be implemented.4)

The development of an integrated sustainable finance framework within the ASEAN region presents complex challenges. ASEAN comprises countries at varying stages of economic development, ranging from advanced to developing and least-developed economies. This diversity complicates efforts to align international sustainability standards with economic maturity levels of member states, when establishing sustainable finance standards.

The multi-tier structure of the ASEAN Taxonomy exemplifies the challenge of harmonizing sustainability standards across the region (Figure 1). Taxonomy refers to a classification system that assesses whether specific economic activities or investments meet sustainability criteria. The ASEAN Taxonomy plays a critical role in the development and evaluation of various financial instruments such as ESG bonds and loans, serving as the foundation for sustainable finance. The ASEAN Taxonomy consists of two components: the Foundational Framework (FF) and the Plus Standard (PS). The FF establishes the baseline criteria for eligible green activities and investments that contribute to climate change mitigation and adaptation, while adhering to the Do No Significant Harm (DNSH) principle. Although the FF adopts an inclusive approach to accommodate all ASEAN member states, it lacks specific categorization for eligible economic activities. On the other hand, the PS introduces more stringent and specific criteria for eligible economic activities, aligning more closely with international benchmarks, such as the EU Taxonomy. However, the PS is optional and currently applicable only in some ASEAN member states.

The multi-tier structure of the ASEAN Taxonomy embodies the economic realities of its member states. Many of them are in transitional stages of economic development and may lack the capacity to meet the strict sustainability standards adopted by the EU and other advanced economies. While the ASEAN Taxonomy’s inclusive approach accommodates the varying levels of economic development across member states, it is less effective in attracting foreign investors who typically seek alignment with more rigorous sustainability standards.

While ASEAN has done an admirable job in developing the key frameworks for sustainable finance for the region, the actual market itself remains in an early stage of development. Capital supply for sustainable finance is limited, falling far short of the levels required to facilitate economic development in the region.

As illustrated in Figure 2, the ESG bond markets in ASEAN have recorded a high growth rate, with issuance surging from $250 million in 2016 to $21.4 billion in 2023. However, in terms of absolute amounts, ASEAN’s share of global ESG bond issuance remains significantly low at 2.5%. Furthermore, there is notable divergence in ESG bond issuance across ASEAN member states. As of 2023, Singapore, Thailand, and Malaysia accounted for 75% of ASEAN’s ESG bond issuance, while countries like Brunei and Laos have not yet issued any ESG bonds.

Cooperation opportunities for Korea and ASEAN in sustainable finance

The relationship between Korea and ASEAN is deepening, not only in economic terms but across various dimensions. In this respect, Korea should pay attention to the development of ASEAN’s sustainable finance market, as it presents significant opportunities for mutually beneficial cooperation. Both the Korean government and financial services firms have crucial roles to play in fostering such cooperation.

First, it is worth considering how to enhance the connection between sustainable finance markets in the ASEAN+3 region, including ASEAN member states and Korea, or across the broader Asian region. Currently, Asia faces a supply-demand imbalance in sustainable finance. For instance, ASEAN’s geographical characteristics offer opportunities for various green projects, including forest restoration, eco-friendly agriculture, and renewable energy. These projects have potential for carbon reduction, capture, and storage; however, ASEAN lacks the necessary capital to fund such projects. By contrast, advanced Asian economies, including Korea, have ample capital but struggle to identify eligible green projects. A pan-Asian sustainable finance market could facilitate efficient capital allocation to meet environmental goals. Hong Kong and Singapore have already implemented strategies to position themselves as sustainable finance leaders within Asia. To advance the sustainable finance market in Asia, it is necessary to standardize sustainable finance frameworks across countries. This may involve government-led cooperation efforts on various fronts to establish regional standards, including the Asian green bond standards, the Asian Taxonomy, and the Asian carbon emissions trading market.

Korean financial services firms operating in ASEAN should focus on the development of local sustainable finance markets. Their subsidiaries in the ASEAN region could identify high-potential investment opportunities, such as green projects, both for local clients and Korean investors, while also developing tailored financial instruments and services. Notably, such firms, with expertise in areas such as underwriting green bonds, project evaluation, and offering guarantees for green technologies, are well positioned to make significant contributions in ASEAN member states with underdeveloped financial markets. Given that sustainable finance is a priority for ASEAN financial authorities, Korean financial services firms’ involvement in these markets could also strengthen their market presence within ASEAN’s local markets.

1) World Economic Forum, 2020, Future of Consumption in Fast-Growth Consumer Markets: ASEAN.

2) The ASEAN region hosts overseas branches of Korean financial services firms, including 65 banks, 41 specialized credit finance companies, 26 securities firms, 22 insurance companies, 15 asset management companies, and 3 holding companies.

3) ADB, 2023, Reinvigorating Financing Approaches for Sustainable and Resilient Infrastructure in ASEAN+3.

4) Singapore, Thailand, Vietnam, Indonesia, Brunei, Malaysia, and the Philippines have established sustainability disclosure standards, while Myanmar, Cambodia, and Laos have yet to develop these standards.