Find out more about our latest publications

Financial innovation by fintech and its implications

Research Papers 21-03 Feb. 02, 2021

- Research Topic Financial Services Industry

- Page 77

This report analyzes the aspects of FinTech leading the digitalization of finance by focusing on financial innovation and draw implications for the domestic financial industries and authorities by comparing the overseas and domestic aspects, in order to objectively evaluate financial innovation driven by FinTech. The results of the analysis confirms that FinTech innovation shows a very different aspects from the past financial innovation by technological progress as the literature of FinTech innovation asserts. For example, financial innovation by FinTech is appearing and spreading all over the world, showing an aspect of combination or convergence of heterogeneous industries, and appearing all-round and simultaneously in almost all financial sectors. In addition, an aspect of combination and convergence between financial services is also observed, along with the emergence of a new type of financial service that has not been present.

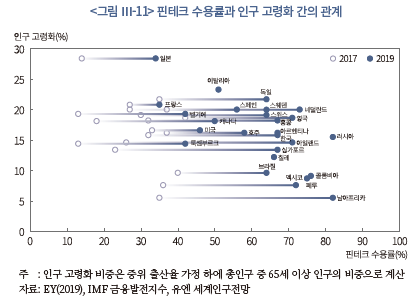

However, it can also be found that the effects of financial innovation by FinTech are somewhat overestimated. For example, the unbundling of existing financial services provided by incumbent financial companies has less impact than originally expected, disintermediation by P2P financial services is very limited, and the effect of increasing financial inclusion by FinTech also shows a gap depending on the financial service sectors. In addition, although the adoption rate of FinTech continues to increase, it is evaluated that the higher the proportion of the population aging in countries, the higher the possibility that the elderly would be excluded from financial services through FinTech.

The aspect of financial innovation by FinTech on reshaping the financial industries is also expected to unfold differently than originally expected. This is because even FinTech companies that choose to compete with incumbent financial companies show a aspect of enhancing collaboration with the incumbents financial companies and other FinTech companies to expand their customer base and generate more profits. On the contrary, the entry of big tech companies with a strong customer base and significant capital into the financial industries is expected to intensify competition between incumbent financial companies and BigTech companies, and significantly weaken the influence of incumbent financial companies as well. Meanwhile, active overseas expansion of FinTech companies is promoting competition for financial services across borders.

Looking at the aspects of financial innovation by FinTech in Korea, it can be found that there are many similarities with foreign countries but also there are significant differences. For example, though there are FinTech companies that discover new types of financial services, more FinTech companies seem to imitate financial services that have already been introduced. As a result, it is observed an aspect that FinTech companies are excessively focused on specific fields. Also, the unbundling of existing financial services, the new introduction of bank-like financial services, and the rebundling of financial service using open banking are not also observed in detail. The effect of increasing financial inclusion through simple transfer and P2P lending services is also very limited.

It is also characteristic that Korean FinTech companies expand their customer base through competition for price or benefits and generate revenue by recommending or advertising financial products of incumbent financial companies. This may be due to the fact that the domestic market size of each financial sector is not large enough for FinTech companies to generate revenue independently. This may be the reason that domestic FinTech companies are more active in overseas expansion than is known. Meanwhile, the impact of BigTech companies' entry into the financial industry on the competitive landscape in financial industries is likely to be greater than in the US or China. For example, the customer contact points of incumbent financial companies can be drastically reduced, and the survival of FinTech companies can be greatly threatened.

Financial innovation by FinTech is leading to changes in the landscape of the financial industries and financial markets in a different way than before, but like the previous financial innovation, it can cause negative effects as well as positive effects. With this in mind, it is necessary to create an environment for fair competition between incumbent financial companies, FinTech companies, and BigTech companies, and to minimize regulatory arbitrage and regulatory gray zone under the principle of the same activity, the same regulation. In addition, if Korea's FinTech has succeeded in quantitative growth over the past five years, it is now necessary to focus on promoting qualitative growth so that financial innovation by FinTech can substantially improve the efficiency of the financial industry and improve international competitiveness.

However, it can also be found that the effects of financial innovation by FinTech are somewhat overestimated. For example, the unbundling of existing financial services provided by incumbent financial companies has less impact than originally expected, disintermediation by P2P financial services is very limited, and the effect of increasing financial inclusion by FinTech also shows a gap depending on the financial service sectors. In addition, although the adoption rate of FinTech continues to increase, it is evaluated that the higher the proportion of the population aging in countries, the higher the possibility that the elderly would be excluded from financial services through FinTech.

The aspect of financial innovation by FinTech on reshaping the financial industries is also expected to unfold differently than originally expected. This is because even FinTech companies that choose to compete with incumbent financial companies show a aspect of enhancing collaboration with the incumbents financial companies and other FinTech companies to expand their customer base and generate more profits. On the contrary, the entry of big tech companies with a strong customer base and significant capital into the financial industries is expected to intensify competition between incumbent financial companies and BigTech companies, and significantly weaken the influence of incumbent financial companies as well. Meanwhile, active overseas expansion of FinTech companies is promoting competition for financial services across borders.

Looking at the aspects of financial innovation by FinTech in Korea, it can be found that there are many similarities with foreign countries but also there are significant differences. For example, though there are FinTech companies that discover new types of financial services, more FinTech companies seem to imitate financial services that have already been introduced. As a result, it is observed an aspect that FinTech companies are excessively focused on specific fields. Also, the unbundling of existing financial services, the new introduction of bank-like financial services, and the rebundling of financial service using open banking are not also observed in detail. The effect of increasing financial inclusion through simple transfer and P2P lending services is also very limited.

It is also characteristic that Korean FinTech companies expand their customer base through competition for price or benefits and generate revenue by recommending or advertising financial products of incumbent financial companies. This may be due to the fact that the domestic market size of each financial sector is not large enough for FinTech companies to generate revenue independently. This may be the reason that domestic FinTech companies are more active in overseas expansion than is known. Meanwhile, the impact of BigTech companies' entry into the financial industry on the competitive landscape in financial industries is likely to be greater than in the US or China. For example, the customer contact points of incumbent financial companies can be drastically reduced, and the survival of FinTech companies can be greatly threatened.

Financial innovation by FinTech is leading to changes in the landscape of the financial industries and financial markets in a different way than before, but like the previous financial innovation, it can cause negative effects as well as positive effects. With this in mind, it is necessary to create an environment for fair competition between incumbent financial companies, FinTech companies, and BigTech companies, and to minimize regulatory arbitrage and regulatory gray zone under the principle of the same activity, the same regulation. In addition, if Korea's FinTech has succeeded in quantitative growth over the past five years, it is now necessary to focus on promoting qualitative growth so that financial innovation by FinTech can substantially improve the efficiency of the financial industry and improve international competitiveness.

Ⅰ. 연구 배경과 목적

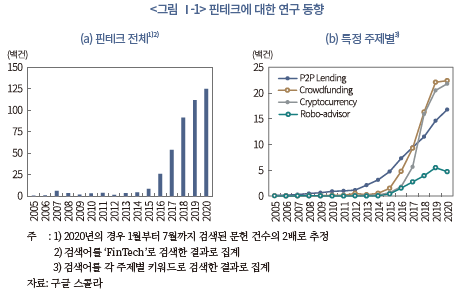

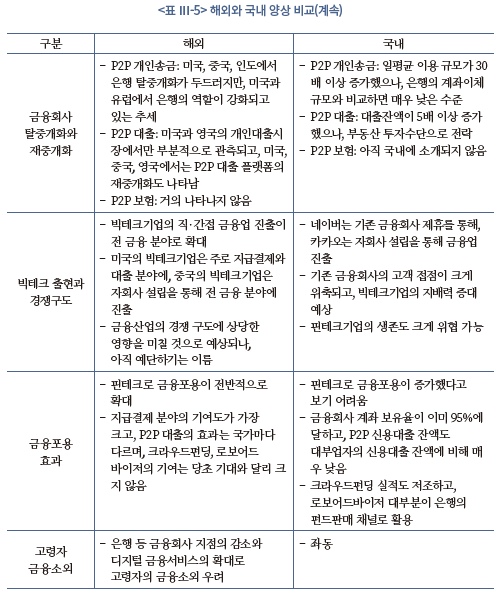

전 세계적으로 핀테크(FinTech)가 상당한 주목을 받고 있는 것은 분명해 보인다. <그림 Ⅰ-1>에서 나타난 바와 같이 2016년을 기점으로 핀테크에 대한 연구가 폭발적으로 증가한 것만 봐도 쉽게 짐작할 수 있다. 핀테크 관련 문헌 수는 2016년에 약 2,580건이 조회되며 전년 대비 3배 이상 증가하였고, 이후 빠르게 증가하여 2020년에는 12,500건을 상회할 것으로 예상된다. 이전에도 금융혁신은 끊임없이 일어났지만, 하나의 주제로 이렇게 많은 연구가 이루어진 적은 드문 것으로 판단된다.

한편 그간의 핀테크에 대한 연구는 대개 P2P(peer-to-peer) 대출, 크라우드펀딩(crowdfunding), 암호통화, 로보어드바이저 등 특정 주제와 분야에 초점을 맞춰 이루어졌다. 그 주된 이유는 개별 금융 분야에서조차 핀테크에 의한 금융혁신이 다양한 양상으로 계속 진화하면서 일어나고 있기 때문인 것으로 판단된다. 물론 최근 들어 핀테크에 의한 금융혁신의 양상을 종합적으로 이해하려는 시도가 있지만, 이마저도 기존의 특정 주제 또는 분야별 연구 결과를 취합하거나 핀테크에 의한 금융서비스의 출현 여부를 기존 금융 분야와 부분적으로 맵핑하여 파악하는 데 그치고 있다(Allen et al., 2020; EBA, 2017; EC, 2018; Kavuri & Milne, 2019).

한편 핀테크에 의한 금융혁신은 이전의 기술진보에 따른 금융혁신과는 다른 양상을 보인다는 평가가 지배적이다. 기존 금융회사가 아닌 주로 창업기업이 주도하고 있고, 모든 금융 분야에서 전방위적이고 동시적으로 일어나고 있다. 또한 금융서비스를 제공하는 방식이나 절차를 재정의하고, 금융서비스의 결합과 융합을 통해 금융서비스 간의 경계를 모호하게 하며, 금융산업의 경쟁 구도에도 상당한 영향을 미치고 있다. 최근에는 구글(Google)과 같이 거대한 플랫폼(platform)을 보유한 빅테크(BigTech) 기업들이 금융업에 직‧간접적으로 진출하고 있다.

이처럼 핀테크에 의한 금융혁신이 금융산업과 금융시장에 큰 영향을 미치고 있는 바, 그 양상을 제대로 이해하는 것은 여러 측면에서 매우 중요하다. 먼저 핀테크에 의한 금융혁신을 객관적으로 평가할 수 있는 시각을 가질 수 있다. 또한 핀테크에 의한 금융혁신으로 인해 제기되는 여러 쟁점을 논의하고 해소하는 데 유용할 수 있다. 더 나아가 금융당국이 핀테크에 의한 금융혁신에 따른 긍정적 효과를 최대화하고 부정적 효과를 최소화할 수 있도록 금융정책을 설정하는 데도 활용될 수 있다.

이러한 배경과 목적을 바탕으로 본 보고서에서는 핀테크에 의한 금융혁신의 양상을 종합적으로 분석하고자 하였다. 이를 위해 Crunchbase.com에서 제공하는 12,256개 핀테크기업 자료를 활용하였으며 다양한 출처의 문헌도 참고하였다. 또한 국내의 양상을 분석하고 해외의 양상과 비교하기 위해 2019년 11월에 핀테크지원센터가 「2019년도 핀테크기업편람」 제작과 관련하여 실시한 설문조사 결과와 국내 문헌도 참고하였다. 이를 토대로 국내에 주는 시사점을 도출하였다.

본 보고서에서는 기존문헌과 차별성을 두기 위해 핀테크 자체보다는 금융혁신에 초점을 맞춰 그 양상을 객관적으로 이해하고 평가하고자 하였다. 물론 본 보고서가 핀테크에 의한 금융혁신의 모든 양상을 설명하는 것은 아니다. 본 보고서에서 논의하지 못한 다양한 양상이 존재할 수 있고, 핀테크를 바라보는 시각에 따라 그 양상도 달리 평가될 수 있다는 점을 주지할 필요가 있다.

본 보고서의 나머지는 다음과 같이 구성되어 있다. 제Ⅱ장에서는 기존 문헌을 토대로 전통적인 금융혁신의 동인과 역할을 살펴보고, 핀테크에 의한 금융혁신의 역할과 금융산업에 미치는 영향을 논의하였다. 핀테크의 출현에 따른 금융규제와 금융혁신의 관계 변화도 살펴보았다. 이를 토대로 제Ⅲ장에서는 핀테크에 의한 금융혁신의 양상을 12가지로 정리하고 해외와 국내의 양상을 비교하였다. 이를 위한 분석방법과 데이터에 대해서도 논의하였다. 제Ⅳ장에서는 국내에 주는 시사점을 제시하였다.

Ⅱ. 금융혁신과 핀테크의 역할

1. 금융혁신의 동인과 역할

혁신(innovation)은 새로운 상품, 서비스 또는 아이디어를 발명(invention)하고 확산(diffusion)하는 행위이며, 그 혁신의 목적이나 대상에 따라 상품혁신(product innovation)과 공정혁신(process innovation)으로 구분될 수 있다(Tufano, 2003). 상품혁신은 새로운 상품이나 서비스를 소개하여 소비자나 시장의 수요를 창출하는 것이고, 공정혁신은 새로운 방식이나 절차로 상품이나 서비스를 공급하거나 제공하는 것을 뜻한다. 물론 상품혁신과 공정혁신이 명확하게 구분되는 것은 아니다. 상품혁신이 공정혁신을 가져오기도 하고, 공정혁신이 결과적으로 상품혁신을 낳기도 한다(OECD, 2019).1)

이와 같이 금융혁신도 새로운 금융상품 또는 금융서비스를 발명하고 확산하는 행위로 정의될 수 있다. 그 결과, 새로운 유형의 금융회사가 출현하고 이전에 없던 금융시장이 새롭게 형성될 수 있다(Tufano, 2003; Lerner & Tufano, 2011). 금융상품과 금융서비스는 금융회사 또는 금융시장이 경제주체 간의 금융거래를 중개하거나 촉진하기 위해 경제주체에게 공급하거나 제공하는 매개이다. 그러므로 어떤 금융상품과 금융서비스가 또는 그 금융상품과 금융서비스가 어떤 방식이나 절차로 공급되거나 제공되느냐에 따라 금융거래의 효율성이 좌우될 수 있고, 금융산업과 금융시장의 발전에도 영향을 미칠 수 있다.

한편 모든 시장이 완전하고 완결한 애로우-드브루 경제(Arrow-Debreu economy)에서는 금융혁신이 필요하지 않다. 새로운 금융상품이나 금융서비스를 소개할 이유가 없고, 그 금융상품과 금융서비스를 공급하거나 제공하는 방식을 바꿀 이유도 없기 때문이다. 그러나 현실 세계의 금융산업과 금융시장은 불완전(imperfect)하고 불완결(incomplete)하다(Tufano, 2003). 다른 말로 표현하면 금융산업과 금융시장에는 정보 비대칭성, 거래 비용, 도덕적 해이, 규제, 과세, 외부성 등과 같은 금융마찰(financial frictions)이 존재한다. 이로 인해 경제주체 간의 금융거래 또는 금융회사의 중개가 비효율적으로 일어난다.

그렇다면 금융혁신이 일어나는 근본적인 이유는 금융산업과 금융시장의 불완전성과 불완결성 또는 금융마찰의 존재에서 찾을 수 있다. 새로운 금융상품 또는 금융서비스의 발명이나 확산으로 금융산업과 금융시장의 불완전성과 불완결성 또는 금융마찰이 완화되면 경제주체 간의 금융거래 또는 금융회사의 중개가 증가할 수 있고, 금융회사 등은 새로운 수익을 창출할 수 있기 때문이다(Calomiris, 2002). Tufano(2003)는 기존문헌 조사를 토대로 앞서 살펴본 금융마찰의 존재뿐만 아니라 글로벌화, 변동성 확대 및 기술진보와 같은 외부요인 변화도 금융혁신의 동인으로 보았다.

따라서 금융혁신은 금융산업과 금융시장의 불완전성과 불완결성 또는 금융마찰을 완화함으로써 금융산업과 금융시장의 효율성을 제고할 수 있어야 한다(Lerner & Tufano, 2011). Merton(1992)은 <표 Ⅱ-1>에서 살펴볼 수 있듯이 금융혁신의 역할을 자금의 시‧공간 이동, 자금의 모집, 위험관리, 의사결정을 지원하는 정보 추출, 도덕적 해이와 정보 비대칭성 문제 해소, 지급결제 시스템을 통한 상품과 서비스의 거래 촉진으로 구분하여 제시하였다.2) 한편 금융혁신의 역할이 항상 명확하게 구분되는 것은 아니다. 복수의 역할을 동시에 수행하기도 한다. 예를 들면, 자산유동화의 경우 자금의 시‧공간 이동, 자금의 모집, 위험관리의 역할을 수행한다(Tufano, 2003).

2008년 글로벌 금융위기 이전의 금융혁신은 금융회사에 의한 상품혁신이 대부분이었다(Tufano, 2003). Goetzmann & Rouwenhorst(2005)가 제시한 역사적으로 주요한 18개의 금융혁신 사례 중 14개의 금융혁신 사례가 상품혁신에 해당할 정도다.3) Miller(1986)는 대부분 상품혁신에 해당되는 금융혁신 사례를 제시하면서 지난 20년의 금융혁신이 1966년에는 존재하지 않았거나 기본적인 형태로만 존재하였다고 설명하고 있다.4) Tufano(2003)는 1980년대 중반부터 새롭게 소개된 증권의 20%가 혁신적 구조를 사용했다고 평가하며 그간의 금융혁신이 주로 상품혁신이었다는 점을 강조하였다. 더구나 최근까지도 부채담보부증권(CDO), 조건부 자본증권(CoCos), 바이너리 옵션(binary option), 차액결제거래(CFD) 등과 같은 상품혁신이 계속해서 일어나고 있다.

물론 금융 분야에서 기술진보에 따른 공정혁신도 적지 않게 일어났다. 예를 들면, 1951년에 최초로 다목적용 신용카드가 발급되었고, 1958년에는 미국에서 리볼빙 신용카드가 처음 소개되었으며, 1967년에는 자동입출금기계(ATM)가 처음으로 런던 지역에 설치되었다. 1971년에는 세계 최초로 미국에서 전자증권거래시스템인 NASDAQ이 개설되었고, 1972년에는 ATM에서 사용할 수 있는 직불카드가 처음 발급되었으며, 1973년에는 해외송금 전신을 처리하는 SWIFT가 설립되었다. 1982년에는 세계 최초로 온라인 증권사인 E-Trade가 설립되었고, 1983년에는 영국에서 온라인 뱅킹 서비스가 최초로 소개되었으며, 1987년에는 알리안츠 보험회사가 생명보험 인수업무를 자동화하였다. 1995년에는 세계 최초로 미국에서 인터넷전문은행이 설립되었고, 인터넷 자산관리 서비스도 처음 출시되었다. 1990년대 중반부터 은행의 인터넷뱅킹도 빠르게 도입되었다.

그럼에도 불구하고 금융 분야에서의 공정혁신은 상품혁신에 비해 크게 주목받지 못한 것이 사실이다. 이는 그간의 공정혁신이 개별적이고 산발적으로 일어났기 때문이다. 한편 2008년 글로벌 금융위기가 부채담보부증권(CDO)과 신용부도스왑(CDS)과 같은 상품혁신에서 비롯되었다는 비판이 제기되면서 공정혁신을 재평가하는 움직임도 있다(Litan, 2010; Lerner & Tufano, 2011). 예를 들면, Volcker(2009. 12. 14)는 지난 20년의 금융혁신 사례 중 ATM과 같은 사례를 찾아볼 수 없다고 평가하며 그간의 상품혁신에 대한 평가가 과도했다고 에둘러 비판하였다. 또한 Frame et al.(2018)은 미국 내 은행 간 계좌이체를 처리하고 지원하는 ACH(Automated Clearing House) 네트워크와 소기업 신용평가 사례를 들며 지난 30년 동안 금융 분야에서 일어난 공정혁신의 의의를 재평가하였다.

2. 핀테크의 역할과 영향

가. 핀테크 출현 배경

금융기술(financial technology)의 줄임말로 사용되는 핀테크는 예전에도 기술진보에 따른 금융혁신이 존재하였다는 점에서 전혀 새로운 것이 아닐 수 있다. 실제 핀테크라는 용어는 1990년대에 처음 고안된 것으로 조사된다(Buckley et al., 2016; Hochstein, 2015). 그럼에도 불구하고 2008년 글로벌 금융위기 이후부터 핀테크에 의한 금융혁신은 이전의 기술진보에 따른 금융혁신과 여러 측면에서 다르다는 평가를 받고 있다(OECD, 2018; Schindler, 2018).

예를 들면, Schindler(2018)는 핀테크에 의한 금융혁신이 모든 금융 분야에서 전방위적이고 연속적으로 일어나고 있다고 평가한다. 또한 이전의 금융혁신이 기술을 표면적으로 활용했다면 핀테크에 의한 금융혁신은 기술을 금융상품과 금융서비스를 공급하고 제공하는 방식이나 절차를 근본적으로 바꾸는 데 활용하고 있다고 보았다. 더 특징적인 것은 핀테크에 의한 금융혁신은 기존의 금융회사가 아닌 창업기업이 주도하고 있다는 점이다. 이에 대해 Philippon(2017)은 핀테크에 의한 금융혁신이 왜 일찌감치 기존 금융회사에 의해 일어나지 않았는가라는 의문을 제기하였다.

Schindler(2018)는 핀테크에 의한 금융혁신이 일어날 수 있었던 것은 2008년 글로벌 금융위기로 기존 금융회사에 대한 신뢰가 추락하고 금융규제가 강화되었기 때문이라고 설명한다. 그러나 이보다는 2007년부터 모바일 스마트기기가 대중적으로 보급되기 시작하면서 경제 전반의 패러다임이 디지털 경제(digital economy)로 전환되고 있는 시대적 흐름이 더 크게 작용한 것으로 판단된다. 왜냐하면 2008년에 글로벌 금융위기가 일어나지 않았더라도 금융의 디지털화는 지금과 같이 핀테크가 주도하는 양상으로 일어났을 것이 분명하기 때문이다(Philippon, 2017).

IMF(2018)는 거래 활동의 관점에서 디지털 경제를 ‘전자적으로 주문되거나, 플랫폼에서 이용할 수 있거나, 전자적으로 배송되는(digitally ordered, platform-enabled, or digitally delivered)’ 상품과 서비스의 경제로 정의한다. 이 정의를 따르자면 개인컴퓨터(PC)를 통해 접속할 수 있는 온라인 환경에서도 디지털 경제가 구현될 수 있다. 그러나 모바일 스마트기기는 개인컴퓨터를 통한 온라인 환경과 달리 시간과 공간의 제약을 거의 받지 않고 언제 어디서나 접근하고 이용할 수 있는 플랫폼(platform) 기반의 환경을 제공한다. 이로써 경제 전반의 디지털화뿐만 아니라 핀테크에 의한 금융혁신을 촉진하고 있다고 볼 수 있다.

나. 긍정적 역할과 영향

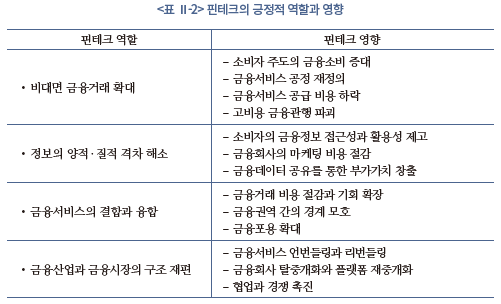

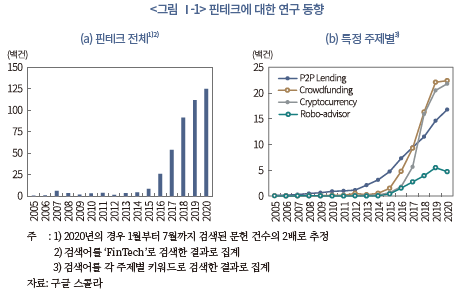

기존문헌을 종합해보면 핀테크에 의한 금융혁신의 긍정적 역할은 <표 Ⅱ-2>에서 살펴볼 수 있듯이 비대면 금융거래 확대, 정보의 양적‧질적 격차 해소, 금융서비스의 결합과 융합, 금융산업과 금융시장의 구조 재편 등 네 가지로 구분하여 살펴볼 수 있다. 또한 각 역할에 따라 이전의 기술진보에 따른 금융혁신과 다른 양상으로 금융산업과 금융시장에 미치는 영향도 다양하게 나타날 수 있는 것으로 파악된다.

핀테크에 의한 금융혁신의 긍정적 역할과 그 영향을 자세히 살펴보면 다음과 같다. 첫째, 핀테크에 의한 금융혁신은 대면 중심의 금융상품과 금융서비스의 공급을 비대면 중심으로 전환할 수 있다. 물론 이전에도 비대면 금융상품과 금융서비스가 존재하였다. 그러나 그 공급은 매우 제한적이었다. 예를 들면, 우리나라의 경우 기존 은행의 인터넷뱅킹 서비스는 2017년에 첫 인터넷전문은행이 출범하기 이전까지 계좌조회와 계좌이체 서비스 위주로 제공되었다(이성복, 2016b).

금융상품과 금융서비스의 공급이나 제공이 비대면 중심으로 전환된다는 것은 비대면 채널에서의 소비자의 편리성과 경험이 금융상품과 금융서비스를 선택하고 소비하는 데 있어 중요한 요인으로 작용한다는 것을 뜻한다. 이는 금융상품과 금융서비스가 이전과 달리 소비자 주도에 의해 선택될 가능성이 크다는 것을 뜻하기도 한다. 예를 들면, 비대면 채널에서 소비자는 빠른 반응(quick response), 적절한 제시(relevant service providing), 막힘없는 전달(seamless delivery)이 가능한 서비스를 더 선호할 것이다. 그렇지 못하면 소비자는 그 서비스를 외면할 가능성이 크다.

또한 금융상품과 금융서비스의 공급이나 제공이 비대면 중심으로 전환된다는 것은 그 공정이나 절차가 자동화(automation)되어야 하고 소비자가 언제 어디서나 쉽게 접근할 수 있도록 플랫폼화(platformication)되어야 한다는 것을 뜻한다. 이는 금융상품과 금융서비스의 탐색, 마케팅, 거래 비용이 대폭 절감될 수 있다는 것을 뜻하기도 한다. 그러나 핀테크에 의한 금융혁신은 단순하게 비용을 절감하는 데 그치지 않고, 그 과정을 새롭게 재정의(redefining)함으로써 비효율적인 기존의 금융상품과 금융서비스의 공급이나 제공 방식을 완전히 대체할 수도 있다(WEF, 2015; Philippon, 2017; Philippon, 2019).5)

둘째, 핀테크에 의한 금융혁신은 이전과 다른 양상으로 정보의 양적‧질적 격차를 해소하여 금융거래의 효율성을 제고할 수 있다. 핀테크에 의한 금융혁신이 출현하기 이전에도 정보기술의 발전과 인터넷의 보급은 금융상품과 금융서비스의 거래비용을 낮추고 금융시장의 가격발견 기능을 향상시켰다(Bai et al., 2013; Greenwood et al., 2007; U.S. Congress, 1984). 그러나 정보기술의 발달에 따른 비용절감 효과는 소비자와 공유되지 않고 금융회사가 거의 독점한 것으로 보고된다(Philippon, 2015; Greenwood & Scharfstein, 2013).

예를 들면, Philippon(2015)은 1886년부터 2015년까지 금융중개 단위비용은 거의 감소하지 않았을 뿐만 아니라 1960년대 후반부터 2008년까지는 오히려 증가했다고 보고한다. 여기서 금융중개 단위비용이란 금융회사가 자금중개를 위해 제공하는 금융서비스의 단위비용을 뜻한다.6) 또한 Greenwood & Scharfstein(2013)은 자산운용시장이 그동안 크게 성장했음에도 불구하고 소비자가 부담하는 보수(fee)가 거의 변하지 않은 이유 중 하나로 정보기술의 발달로 인한 비용절감 효과가 소비자와 공유되지 않았기 때문이라고 지적한다.

이와 달리 핀테크에 의한 금융혁신은 소비자의 금융정보 접근성뿐만 아니라 활용성을 제공함으로써 정보기술의 발달에 따른 비용절감 효과를 소비자도 누리게 할 수 있다.7) 예를 들면, API(Application Programming Interface) 기술 등을 활용하여 여기저기 흩어져 있는 고객의 금융정보를 하나의 플랫폼으로 집중하고 데이터 분석 또는 인공지능 기술을 활용하여 소비자에게 필요한 금융조언 또는 금융자문 서비스를 제공할 수 있다. Philippon(2019)은 지난 5년 동안 핀테크에 의한 금융혁신으로 금융중개 단위비용이 실제 감소했다고 보고한다.

한편 소비자의 금융정보 접근성과 활용성이 제고되려면 데이터 공유가 전제되어야 한다. 이 점에서도 핀테크에 의한 금융혁신은 자신들이 보유한 데이터를 공유하는 데 소극적이었던 기존 금융회사와 다른 양상을 보인다. 더구나 빅데이터(big data) 기술을 활용할 경우 금융 데이터뿐만 아니라 대체 데이터(alternative data)까지 수집할 수 있고, 플랫폼과 API 기술을 활용해 그 데이터를 효율적으로 유통시킬 수 있다. 이 과정에서 데이터를 매개로 새로운 가치사슬이 형성될 수도 있다(이성복, 2016a).8)

셋째, 핀테크에 의한 금융혁신은 기존 금융서비스를 결합(combination)하거나 융합(convergence)함으로써 기존 금융회사가 포용하지 않는 개인이나 기업에게까지 금융서비스를 공급할 수 있다.9) 또한 새로운 유형의 금융서비스 발명을 통해 금융거래의 효율성도 제고할 수 있다. 이를 통해 고객의 금융거래 비용을 절감하고 금융거래 기회를 확장할 수 있다. 결과적으로 금융권역 간의 경계가 모호해지고 금융포용(financial inclusion)이 확대될 수 있다(PwC, 2016b; IMF, 2020).

넷째, 핀테크에 의한 금융혁신은 단순히 금융 분야의 디지털화에 그치지 않고 금융산업과 금융시장의 구조를 재편(reshaping)할 수 있다. 특히 플랫폼이 주축이 되어 은행의 금융서비스를 언번들링(unbundling)하고 리번들링(rebundling)하는 방식으로, 은행으로부터 탈중개화(disintermediation)하고 플랫폼으로 재중개화(reintermediation)하는 과정을 통해 은행산업에 상당한 영향을 미칠 수 있다(PwC, 2016c; BIS, 2018; FSB, 2019a; OECD, 2020).10) 더구나 기존 금융회사보다 더 탄탄한 고객기반과 자본금을 보유한 빅테크기업의 금융업 진출은 은행산업뿐만 아니라 금융산업 전반의 구조적 변화를 가져올 수 있다(Vives, 2017; FSB, 2019b).

다. 부정적 역할과 영향

핀테크에 의한 금융혁신이 빠르게 진전하면서 부작용에 대한 우려도 제기되고 있다. 우선 핀테크에 의한 금융혁신은 금융서비스의 접근성, 편리성, 신속성을 높여 소비자의 편익을 제고할 수 있으나, 그만큼 소비자의 권익이 더 쉽게 침해될 수 있고 소비자가 불건전한 영업행위에 더 쉽게 노출될 수 있다(OECD, 2018a; BIS, 2019). 예를 들면, 소비자는 부주의하게 금융서비스를 이용하거나 잘못된 의사결정을 내릴 수 있다. 고의적 또는 악의적 금융상품 불완전판매(mis-selling)나 금융사기(financial fraud)에 노출될 위험도 크다. 명의도용이나 금융착취(financial exploitation)를 더 쉽게 당할 가능성도 크다(이성복, 2020).11)

핀테크에 의한 금융혁신의 빠른 진전은 핀테크 수용률을 높이며 금융포용을 증대하는 효과를 가져올 수 있지만, 고령자의 금융소외(financial exclusion)를 확대하는 효과도 가져올 수 있다. 고령자는 신체적‧정신적 특성으로 인해 디지털 환경에 적응하는 데 여러 한계에 직면할 수 있기 때문이다. 예를 들면, 시력 약화는 작은 화면의 스마트기기의 이용을 어렵게 할 수 있다. 또한 인지‧판단 능력의 저하는 신속한 의사결정 요구에 제때 반응하지 못하게 할 수 있다. 더구나 고령자가 이용할 수 있는 대면 서비스가 빠르게 감소할수록 고령자의 금융소외도 그만큼 빠르게 확대될 수 있다.

2008년 글로벌 금융위기가 그간 과대평가된 금융혁신에서 비롯되었다는 비판이 있는 만큼 핀테크에 의한 금융혁신도 금융안정(financial stabilities)을 저해할 수 있다(Litan, 2010; Lerner & Tufano, 2011; Simon & Kwak, 2012). FSB(2017)는 아직까지는 핀테크의 긍정적 역할과 영향이 더 크고, Philippon(2017)은 금융규제가 잘 작동한다면 핀테크가 금융안정을 향상시킬 수 있다고 본다. 그러나 FSB(2017, 2019a, 2019b)는 핀테크기업이나 빅테크기업에 대한 규제공백이 지속될 경우 이전과 다른 양상으로 금융산업과 금융시장의 미시적 위험뿐만 아니라 금융시스템 전반의 거시적 위험까지 증대할 수 있다는 점을 유의해야 한다고 권고하고 있다.

3. 금융혁신과 금융규제의 관계

금융규제는 금융혁신을 방해하는 요소로 작용할 때가 많지만, 금융혁신을 자극하고 촉진하는 동인으로도 작용한다(Miller, 1986; Schindler, 2017; White, 1997). 이 때문에 규제완화(deregulation)가 새로운 금융혁신을 가져오기도 하고 금융혁신으로 규제차익을 추구하는 행위가 일어나고 이로 인해 규제공백이 발견되면 새로운 금융규제가 도입되기도 한다. 예를 들면, 자산유동화는 자본규제를 회피하기 위해 고안된 또는 규제완화의 결과로 나타난 금융혁신 사례로 자주 인용된다(Calomiris, 2009).

이렇듯 금융혁신과 금융규제는 그간의 금융혁신이 주로 금융회사에 의한 상품혁신에 집중되면서 순차적이고 순환적 관계를 보였다. 그러나 핀테크에 의한 금융혁신이 대개 금융규제의 적용을 받지 않는 핀테크기업에 의해 주도되면서 금융혁신과 금융규제가 동시적 관계로 발전하는 양상을 보인다. 예를 들면, Ehrentraud et al.(2020)은 핀테크에 의한 금융혁신으로 금융산업과 금융시장의 효율성이 제고될 수 있지만, 이 과정에서 규제차익이 남용되고 규제공백이 확대되면 소비자 피해와 금융안정 저해가 우려된다고 보고 각 국가에서는 핀테크에 대한 규제를 동시에 강화하고 있다고 설명한다.

핀테크에 의한 금융혁신과 관련된 규제 논의는 세 분야로 나눠 살펴볼 수 있다(Ehrentraud et al., 2020; Restory, 2019). 먼저 페이테크(PayTech), P2P 대출, 크라우드펀딩, 로보어드바이저, 인슈어테크(InsurTech) 등 새롭게 출현한 핀테크기업에 대한 규제 논의다. 최근까지도 많은 국가에서는 기존의 금융규제를 완화하거나 새로운 금융규제를 신설해 핀테크기업의 금융혁신 활동을 장려해왔다.12) 그러나 최근 들어 각 국가에서 기존 금융회사와 핀테크기업 간의 규제 형평성의 문제가 대두되고 있다(BIS, 2020). 일부 핀테크기업들이 핀테크에 의한 금융혁신을 내세워 금융규제를 회피하기 위해 규제차익(regulatory arbitrage)을 추구하면서 핀테크기업에 대한 규제공백이 커지고 있기 때문이다. 이에 따라 동일행위-동일규제(same activity, same regulation) 원칙에 따라 기존 금융회사와 같이 핀테크기업을 규제해야 한다고 지적되고 있다.

다음으로 스크린 스크래핑(screen scraping), API, 클라우드 컴퓨팅, 빅데이터, 생체인식(biometrics), 분산원장, 인공지능(AI) 등과 같이 핀테크에 활용되는 기술에 대한 규제 논의다. 핀테크에 활용되는 기술이 이전과 다른 양상으로 활용되면서 기술로 인해 새롭게 제기되는 이슈와 위험을 사전에 통제할 필요성이 커지고 있기 때문이다. 예를 들면, 금융회사가 고객의 금융정보를 독점하고 있을 때 스크린 스크래핑은 여러 금융회사에 흩어져 있는 고객의 금융정보를 수집하는 데 활용되었다. 그러나 과도한 트래픽 유발, 사이버보안 위험 등을 이유로 EU에서는 2019년 9월부터 스크린 스크래핑을 금지하였다.

마지막으로 핀테크에 의한 금융혁신을 저해하는 공통적인 장애요소를 제거하기 위한 규제 논의다. 예를 들면, 디지털 ID, 마이데이터, 사이버보안, 오픈뱅킹(open banking), 금융규제 샌드박스 등이 대표적인 논의 사례다. 이를 통해 각 국가에서는 핀테크기업의 금융산업 진입을 촉진하고 핀테크기업과 기존 금융회사 간의 공정경쟁 환경을 조성하고자 한다. 한편 이러한 규제 논의는 핀테크기업뿐만 아니라 기존 금융회사에도 상당한 영향을 미칠 수 있다. 예를 들어, 마이데이터와 오픈뱅킹과 같은 규제는 금융소비자의 은행에 대한 의존도를 낮추고 금융서비스의 질적 경쟁을 심화할 것으로 평가받는다.

Ⅲ. 핀테크에 의한 금융혁신 양상

1. 분석 방법과 데이터

최근 들어 핀테크에 대한 연구가 축적되고 금융규제 강화의 필요성이 논의되면서 핀테크에 의한 금융혁신의 양상을 종합하고 진단하려는 시도가 나타나고 있다(Allen et al., 2020; EBA, 2017; EC, 2018; Kavuri & Milne, 2019). 예를 들면, Allen et al.(2020)과 Kavuri & Milne(2019)는 핀테크에 의한 금융서비스 분야별로 연구 성과를 종합하고 향후 연구 또는 정책 과제를 제시하고 있다. EBA(2017)는 핀테크에 의한 금융혁신의 양상을 핀테크기업과 금융서비스를 맵핑(mapping)하는 방식으로, EC(2018)는 핀테크가 각 금융서비스 분야에 미치는 영향을 평가하는 방식으로 이해하고자 하였다.

그러나 이러한 시도에는 두 가지 측면에서 핀테크에 의한 금융혁신의 양상을 제대로 이해하는 데 한계가 있을 수 있다. 먼저 분석대상이 모집단을 대표하지 못할 경우 그 양상에 대한 평가가 편향될 수 있다. 예를 들면, EBA(2017)는 EU 역내에 약 1,600개 이상의 핀테크기업이 실질적으로 금융서비스를 제공하고 있다고 인식하면서도 282개 핀테크기업만을 대상으로 핀테크에 의한 금융혁신의 양상을 분석하였다. 그 결과, 보험 분야 등의 핀테크기업이 EBA(2017)의 분석대상에 포함되지 않았다.

또한 그 분석대상이 특정 지역 또는 국가에 편중될 경우에 동일한 문제가 발생할 수 있다. 각 국가의 금융산업과 금융시장의 발전 정도와 구조적 특징, 금융규제의 범위와 정도에 따라 핀테크에 의한 금융혁신의 양상도 다를 수 있기 때문이다. 예를 들면, P2P 대출 서비스가 개인신용대출시장에서 은행의 대출 서비스를 대체하고 있다는 평가가 있다(이성복, 2018; Tang, 2019). 그러나 개인신용대출시장의 구조적 특징으로 은행 탈중개화 양상이 나타나지 않을 수 있다.

따라서 핀테크에 의한 금융혁신의 양상을 종합적으로 분석하고 이해하려면 최대한 많은 핀테크기업이 분석대상에 포함되어야 하고, 그 분석대상이 특정 지역이나 국가에 편중되지 않아야 한다. 그러나 이러한 한계를 극복하고 핀테크에 의한 금융혁신의 양상을 분석한다는 것은 현실적으로 불가능에 가깝다. 2020년 7월말 기준으로 핀테크기업 수가 1만개를 크게 상회할 것으로 추정되고, 각 국가에서 일어나고 있는 핀테크에 의한 금융혁신의 양상을 자세히 파악할 수 있는 자료를 확보하는 것도 쉽지 않기 때문이다.

한편 핀테크에 의한 금융혁신은 두 가지 추세적 특징을 보이는 것으로 파악된다. 먼저 성공적인 핀테크기업의 사업모델을 모방하는 사례가 많다. 예를 들면, 지급결제와 연계한 소액저축과 소액투자 서비스는 여러 국가의 핀테크기업들이 모방하는 대표적인 사례 중 하나이다. 또한 각 국가의 금융마찰 양상에 따라 핀테크에 의한 금융혁신의 양상도 다르게 나타난다(BIS, 2020). 예를 들면, 간편송금 서비스는 우리나라의 경우 은행의 번잡한 계좌이체 서비스에 대응하여 출현한 반면, 미국의 경우 은행의 느린 계좌이체 서비스에 대응하여 출현하였다.

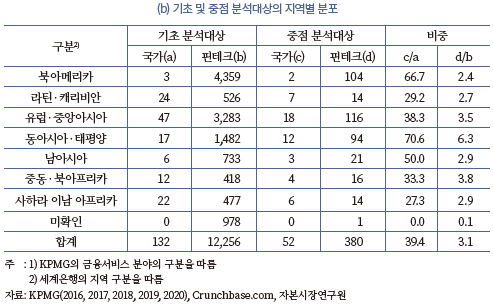

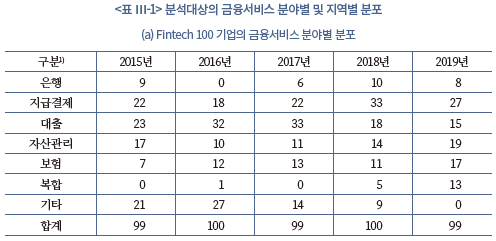

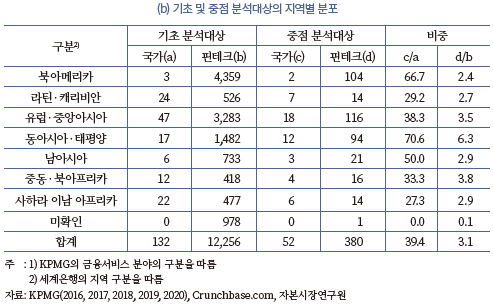

본 보고서에서는 기존문헌의 한계와 추세적 특징을 고려하여 두 가지 분석방법을 병행하였다. 먼저 2020년 7월말 기준으로 Crunchbase.com에서 조회되는 핀테크기업 중 2000년부터 설립된 핀테크기업 12,256개를 기초 분석대상으로 추출하였다. 그러나 기초 분석대상에 포함된 핀테크기업을 모두 조사한다는 것은 현실적으로 불가능하다. 이를 감안해 기초 분석대상 중에서 KPMG가 2015년부터 2019년까지 발표한 Fintech 100에 속하거나 2020년 3월말 기준으로 유니콘으로 평가된 핀테크기업 380개를 중점 분석대상으로 선정하였다.

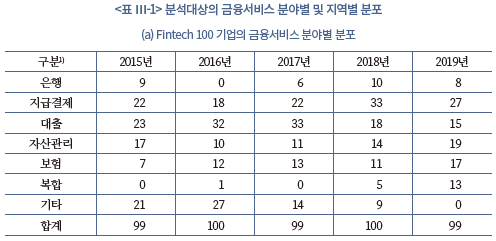

<표 Ⅲ-1>에서 살펴볼 수 있듯이 Fintech 100에 속한 핀테크기업은 모든 금융서비스 분야에 골고루 분포되어 있는 것으로 확인된다. 따라서 기초 분석대상도 거의 모든 금융서비스 분야를 포괄할 것으로 판단된다. 또한 핀테크기업의 지역별 분포를 비교하면 북아메리카와 유럽‧중앙아시아 지역에 다소 편중되어 있는 것은 사실이나, 이들 지역에서 핀테크기업의 창업이 상대적으로 활발하였던 점을 고려하면 기초와 중점 분석대상이 특정 지역이나 국가에 심각하게 편중된 것은 아닌 것으로 판단된다.

Crunchbase.com가 제공하는 기업 데이터에는 핀테크기업의 설립연도, 설립지역, 서비스 설명, 산업 분류, 자금조달, 투자자, 합병‧인수, 기업공개, 웹 트레픽, 기업가치 등 다양한 정보가 포함되어 있다. 그러나 이들 정보만으로는 설명되지 않는 핀테크에 의한 금융혁신의 양상이 존재한다. 또한 2020년 7월말 기준으로 추출한 기초 분석대상 정보로는 핀테크에 의한 금융혁신 양상의 추세적 특징과 그 변화를 추적하기도 어렵다. 이러한 한계를 극복하기 위해 다양한 출처의 문헌을 참고해 기초 분석대상 데이터로 설명되지 않는 양상을 정리하고, 이를 뒷받침할 수 있는 사례를 기초 또는 중점 분석대상 데이터를 활용해 보충하였다.

한편 국내의 핀테크에 의한 금융혁신 양상도 해외의 양상을 분석한 방법과 동일하게 분석하였다. 우선 2019년 11월에 핀테크지원센터가 「2019년도 핀테크기업편람」 제작을 위해 실시한 설문조사 결과를 토대로 국내의 핀테크에 의한 금융혁신 양상을 파악하였다. 상기 설문조사 결과에는 핀테크기업 579개 중 345개(응답률 59.5%)의 현황이 포함되어 있다.13) 그럼에도 불구하고 상기 설문조사만으로는 국내의 모든 양상을 파악하는 데 한계가 있으므로 해외의 양상을 분석한 방법과 동일하게 다양한 출처의 문헌을 참고하여 보충하였다.

2. 핀테크에 의한 금융혁신 양상

가. 핀테크기업의 출현 양상

(1) 전 세계적 출현과 확산

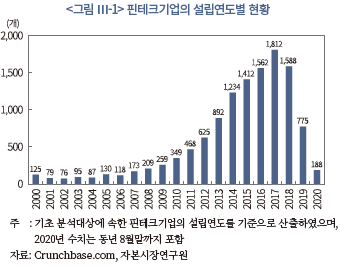

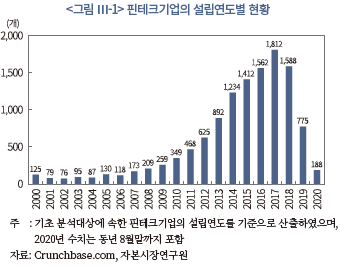

핀테크에 의한 금융혁신은 전 세계적으로 빠르게 출현하고 확산한 것으로 파악된다. 먼저 핀테크기업의 설립은 <그림 Ⅲ-1>에서 살펴볼 수 있듯이 2017년까지 빠르게 증가하였고, 이후 다시 빠르게 감소하였다. 이를 지역별로 살펴봐도 크게 차이나지 않는다. 핀테크기업이 2017년 이후부터 감소하는 추세로 전환한 것은 두 가지 요인이 핀테크기업의 창업 유인을 복합적으로 낮추고 있기 때문으로 판단된다. 첫 번째 요인으로는 핀테크에 의한 금융혁신이 빠르게 진전되면서 이미 많은 핀테크기업이 거의 모든 금융서비스 분야에 진출하였다. 두 번째 요인으로는 핀테크기업 중 사업활동을 중단하거나 폐업하는 사례가 증가하고 있다.

실제 기초 분석대상에 속한 핀테크기업 중에는 사업활동을 중단하거나 폐업한 핀테크기업들이 다수 포함되어 있는 것으로 파악된다. 2020년 7월말 기준으로 기초 분석대상에 속한 핀테크기업 중 315개(2.6%) 핀테크기업이 명확하게 폐업한 것으로 확인되고, 각 핀테크기업의 웹사이트가 정상적으로 운영되고 있는지를 확인하는 방법으로 2020년 8월말 기준으로 각 핀테크기업의 사업활동 여부를 살펴보면 1,415개(11.5%) 핀테크기업이 사실상 사업활동을 중단하거나 폐업한 것으로 추정된다.

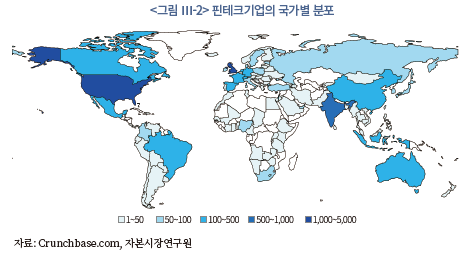

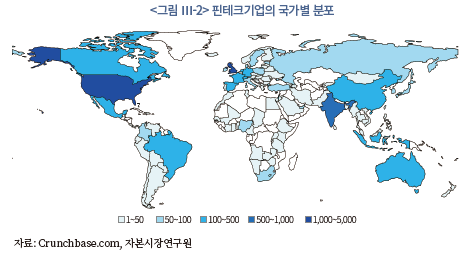

기초 분석대상에 속한 핀테크기업의 국가별 분포를 살펴보면 핀테크에 의한 금융혁신이 국지적인 현상이 아님을 확인할 수 있다. <그림 Ⅲ-2>에서 볼 수 있듯이 미국과 영국에서 핀테크기업의 출현이 상대적으로 활발하지만, 인도, 캐나다, 싱가포르, 중국, 브라질, 독일, 이스라엘, 호주, 스페인, 프랑스, 홍콩, 스위스, 네덜란드, 멕시코, 인도네시아, 스웨덴, 에스토니아, 남아공, 나이지리아 등 그 외 지역의 국가에서도 핀테크기업의 출현이 상당한 것으로 파악된다. 이는 Findexable(2019)이 65개 국가, 230개 도시를 대상으로 국가‧도시별 핀테크 인덱스를 산출한 것으로도 확인할 수 있다.

(2) 거의 모든 금융서비스 분야에서 출현

핀테크에 의한 금융혁신은 거의 모든 금융서비스 분야에서 일어나고 있다. 핀테크 초창기에는 상대적으로 진입 장벽이 낮고 대중적 수요가 높은 지급결제 서비스 분야에서 핀테크에 의한 금융혁신이 집중적으로 일어났다. 그러나 P2P 대출, 크라우드펀딩, 로보어드바이저 서비스가 동시다발적으로 출현하면서 핀테크 영역이 대출과 금융투자 서비스 분야로까지 확장되었다. 또한 보험 서비스 분야에서는 인슈어테크라는 독자적 이름으로 핀테크가 발전하고 있고, 은행 서비스 분야에서는 새로운 방식의 디지털뱅킹과 오픈뱅킹이 은행업을 새롭게 정의하고 있다.

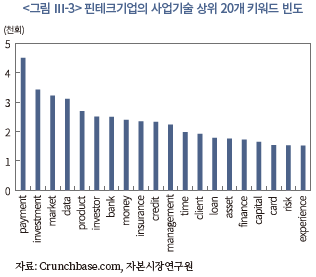

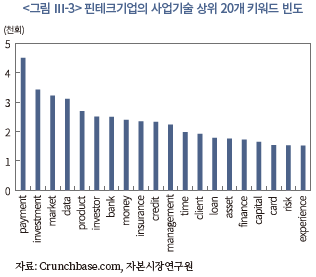

<그림 Ⅲ-3>에서 볼 수 있듯이 기초 분석대상에 속한 핀테크기업의 사업기술(business description)을 텍스트마이닝(text mining) 기술을 활용해 키워드 빈도를 분석해보면, 핀테크에 의한 금융서비스 분야 중 지급결제(payment) 분야의 비중이 가장 크다는 것을 간접적으로 확인할 수 있다. 그 다음으로 투자(investment), 은행(bank), 보험(insurance), 대출(loan) 등 순으로 비중이 높게 분석된다. 이외에도 시장(market), 투자자(investor), 상품(product), 데이터(data), 자금(money), 신용(credit), 관리(management) 등이 높은 비중을 보인다.

한편 핀테크에 의한 금융혁신이 기존 금융권역 간의 경계를 모호하게 하고 금융의 영역을 확대하는 양상으로 진행되면서 전통적인 금융권역 구분에 따라 핀테크에 의한 금융서비스 분야를 구분하는 것이 무의미할 수 있다. 예를 들면, P2P 대출 서비스는 전통적인 구분에 따라 대출로 구분되고 있으나 투자 서비스로도 볼 수 있다. 지급결제 서비스로 분류되고 있는 소액저축(micro-savings) 또는 소액투자(micro-investing) 서비스도 각각 저축과 투자 서비스로 볼 수 있다. 또한 급여 관리와 가불 서비스는 기존 금융회사가 공급하지 않았던 서비스다.

각 문헌마다 핀테크에 의한 금융서비스 분야를 달리 구분하고 있는 것도 핀테크에 의한 금융혁신이 기존 금융권역 간의 경계를 모호하게 하는 양상을 간접적으로 시사한다. 예를 들면, <그림 Ⅲ-4>에서 살펴볼 수 있듯이 핀테크에 의한 금융서비스는 매우 세부적으로 구분될 수 있으며, 은행, 증권, 보험, 기타 등 전통적인 금융권역 구분에 따라 분류하기 어려운 경우도 있다는 것을 확인할 수 있다(CB Insights, 2018b).

(3) 핀테크 수용률 증가

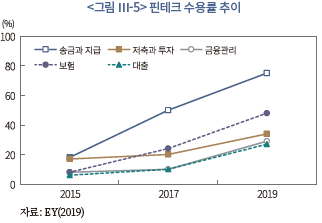

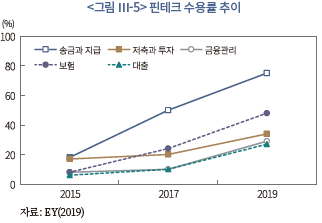

핀테크에 의한 금융서비스가 거의 모든 금융 분야에서 출현하고 기존 금융회사도 핀테크에 대응하여 금융의 디지털화를 적극적으로 추진하면서 비대면 금융거래가 빠르게 증가하고 있는 것으로 확인된다. 예를 들어, EY(2019)가 27개 국가를 대상으로 조사한 결과에 따르면 <그림 Ⅲ-5>에 나타난 바와 같이 금융서비스별 핀테크 수용률이 지속적으로 증가하는 추세를 보인다.

2019년 개인의 핀테크 수용률은 평균 64.0%로 집계된다. 특히 응답자의 96%는 핀테크에 의한 지급결제 서비스를 적어도 1개 이상 알고 있고, 75%는 실제 이용한 경험이 있는 것으로 조사된다. 이는 지급결제 분야의 핀테크 수용률이 가장 빠르게 증가하였고, 2019년 기준으로 80%에 달하고 있는 것으로도 설명된다. 한편 일반적인 기대와 달리 보험 분야의 핀테크 수용률이 빠르게 증가하였고, 대출 분야의 핀테크 수용률은 가장 느리게 증가한 점이 특징적이다.

(4) 성장단계 핀테크기업의 해외진출 활발

핀테크에 의한 금융혁신은 금융 분야의 해외진출 양상에도 상당한 변화를 가져오고 있다. 일반적으로 기존 금융회사는 오프라인 영업을 전제로 해외진출을 계획하고 추진해왔기 때문에 금융서비스 공급이 영업점을 설치한 도시에 국한될 수밖에 없었다. 그러나 핀테크기업은 플랫폼에 기반하여 금융서비스를 제공하기 때문에 기존 금융회사와 같은 공간적 제약을 받지 않는다. 어떤 국가에 진출할 경우 그 국가 전체를 대상으로 금융서비스를 제공할 수 있다. 다만 현지 국가의 금융규제와 현지 핀테크기업과의 경쟁이 핀테크기업의 해외진출에 장애요소로 작용할 수 있다. 이 때문에 주로 성장단계에 있는 핀테크기업의 해외진출이 상대적으로 활발한 것으로 파악된다(Mastercard, 2020; BIS, 2020).

핀테크기업의 해외진출은 영국을 포함한 유럽 지역의 국가들에서 활발한 것으로 파악된다. 예를 들면, 유럽 지역의 유니콘 핀테크기업 12개 중 11개가 해외로 진출하였다.14) 각 핀테크기업별로 살펴보면, 영국의 Transferwise는 10개, Revolut는 17개, Monzo는 1개, Greensill은 5개, Checkout.com은 8개, ivalua는 8개, Rapyd는 2개, 독일의 N26은 5개, WeFox는 1개, Deposit Solutions는 3개, 스페인의 Klarna는 9개 국가에 진출한 것으로 조사된다. 특히 이들 핀테크기업은 핀테크에 의한 금융혁신이 가장 활발하다고 평가받고 있는 미국에 대부분 진출하였고, EU 국가뿐만 아니라 일본, 인도, 말레이시아, 브라질, UAE 등 아시아, 남미, 중동 지역에도 진출하였다.

미국의 경우 지급결제와 대출 분야의 핀테크기업이 상대적으로 더 많이 해외로 진출한 것으로 보인다. 예를 들면, 미국의 유니콘 핀테크기업 38개 중 14개만이 해외로 진출하였는데, 이들 중에서 Robinhood와 Carta를 제외한 나머지 핀테크기업은 지급결제와 대출 분야로 분류된다. 대표적으로 Stripe가 12개, Payoneer가 8개, C2FO가 4개, Tradeshift가 14개, Flywire는 7개, Plaid는 2개, Zenefits는 2개, HighRadius는 3개 국가에 진출하였다. 미국 핀테크기업의 해외진출이 유럽에 비해 상대적으로 활발하지 않은 이유는 불분명하다. 다만 미국 자체의 시장 규모가 크고 핀테크 수용률이 낮기 때문에 해외진출의 유인이 상대적으로 높지 않은 것으로 추정된다.

중국의 경우 지급결제 분야의 핀테크기업 중심으로 동남아 지역뿐만 아니라 아프리카 지역과 호주 등 오세아니아 지역으로도 진출하고 있는 것으로 파악된다. 다만 유럽이나 미국처럼 핀테크기업이 해외로 직접 진출하기보다는 주로 현지 핀테크기업과의 서비스 제휴나 현지 핀테크기업에 대한 전략적 투자를 통해 간접적으로 진출하는 양상을 보이는 것이 특징적이다(Han, 2020. 6. 15). 예를 들면, Alipay는 태국의 TrueMoney, 캄보디아의 DaraPay, 인도의 Paytm 등과 서비스 제휴를 체결하였고, Alibaba, JD, Tencent, Ping An Capital, Ping An Insurance 등은 인도의 Paytm과 Ola, 싱가포르의 Grab, 인도네시아의 Gojek 등에 전략적 투자를 실행하였다.

그 외 지역의 핀테크기업도 해외로 진출하는 사례가 있으나 그 특징적 양상을 파악할 수 있는 자료가 충분하지 않아 논의하지 않기로 한다.

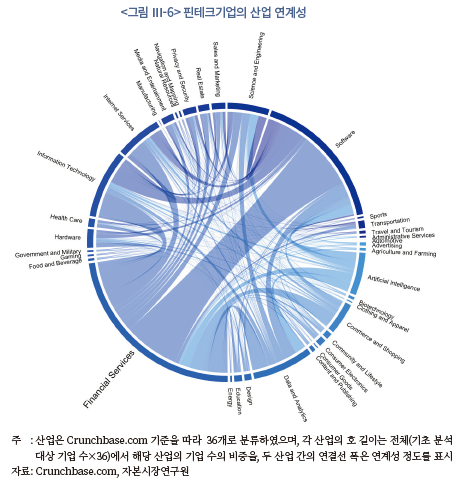

나. 기존 금융회사와의 차이

(1) 이종 산업의 결합 또는 융합

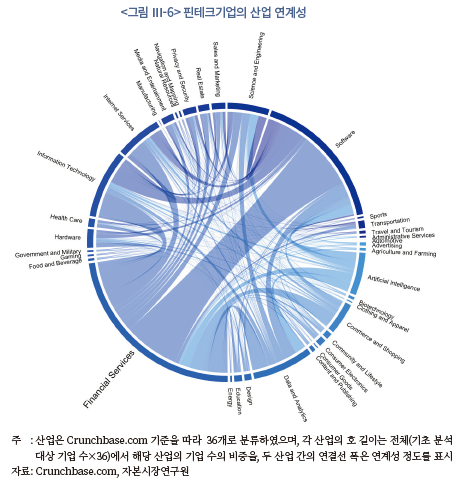

핀테크에 의한 금융혁신은 이종 산업이 서로 결합하거나 융합하는 양상으로 일어나고 있다. 일반적으로 금융회사라 함은 금융업 또는 보험업을 전업으로 영위하는 회사를 일컫는다. 그러나 <그림 Ⅲ-6>에서 살펴볼 수 있듯이 기초 분석대상에 속한 핀테크기업은 모두 금융서비스를 제공함과 동시에 다른 산업에서도 사업을 영위하는 것으로 파악된다. 특히 소프트웨어, 데이터분석, IT, 인공지능, 상업 및 쇼핑 등 분야에서 사업을 영위하는 핀테크기업들이 많다.

예를 들면, 동남아 지역에 영업 중인 Grab은 이동과 배달에 특화된 혁신 기업으로 알려져 있지만, KPMG의 2019년 Fintech 100에서는 송금‧결제 분야의 핀테크기업으로 분류되어 있다. 이는 Grab이 2016년 11월에 GrabPay 자회사를 설립하고 2017년 4월에 지급결제 서비스에 특화된 핀테크기업인 Kudo를 인수하여 간편송금과 간편결제 서비스를 Grab을 이용하는 고객을 대상으로 제공하기 시작했기 때문으로 이해된다. 이와 더불어 최근 빅테크기업의 금융업 진출도 이종 산업의 결합 또는 융합이라는 핀테크에 의한 금융혁신의 양상을 설명하는 사례로 볼 수 있다.

핀테크기업이 다양한 산업에서 사업을 영위하는 이유는 두 가지로 설명될 수 있다. 첫째, 금융산업은 상대적으로 진입이 어렵기 때문에 많은 핀테크기업들이 기존 금융회사와 경쟁하는 도전자(challenger)보다는 전략적으로 기존 금융회사와 협업하는 가능자(enabler)를 선택하기 때문이다. 물론 기존 금융회사와 경쟁하면서 다른 금융회사와 협업하는 핀테크기업도 존재한다. 둘째, 핀테크에 의한 금융혁신이 빠르게 진행되면서 금융규제가 핀테크에 친화적으로 개선되고 있기 때문이다. 이 때문에 다른 산업에 속한 기술 기업이나 빅테크기업이 금융업에 직‧간접적으로 진입하는 경우가 늘어나고 있다.

(2) 새로운 유형의 금융서비스 소개

핀테크에 의한 금융혁신은 그간 다양한 금융서비스 분야에서 기존 금융서비스의 제공 방식이나 절차를 재정의하고 비용 효율성을 개선함으로써 기존 금융회사의 서비스 경쟁력을 약화시켰다. 이 과정에서 동일한 분야에서 각각의 사업모델을 모방한 다수의 핀테크기업들이 출현하였다. 간편송금, 간편결제, P2P 대출, 로보어드바이저가 대표적인 분야다. 그런데 이와 동시에 새로운 유형의 금융서비스를 발굴하고 금융서비스의 영역을 확장하는 핀테크기업도 출현하는 양상이 관측된다. 물론 새로운 유형의 금융서비스의 시장성이 입증되면 이를 모방한 핀테크기업들이 다수 출현하는 양상도 보인다.

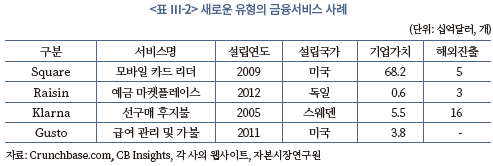

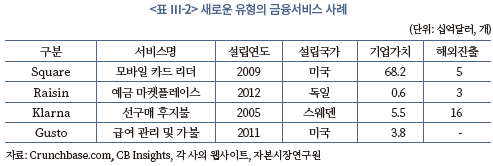

핀테크기업에 의해 소개된 새로운 유형의 금융서비스는 매우 다양하고 많다. 이 중에서 <표 Ⅲ-2>에 나타난 바와 같이 잘 알려진 사례를 중심으로 살펴보면 다음과 같다. 먼저 2009년에 미국 샌프란시스코에서 설립된 Square는 세계 최초로 모바일 카드 리더(card reader)를 출시하여 자영업자나 소상공인이 유선 통신과 카드 단말기를 별도로 설치하지 않아도 손쉽게 지급카드를 수납할 수 있도록 도왔다. 이를 통해 Square는 지급카드 가맹점을 모바일화하고 지급카드 결제의 사각지대를 최소화하는 데 기여했다고 평가받는다. 2015년 11월에 Square는 뉴욕거래소(NYSE)에 상장하는 데 성공하였고, 2020년 8월말 현재까지 캐나다, 일본, 호주, 영국, 아일랜드 등에 진출하였으며, 2020년 8월말 기준으로 682억 달러의 시가총액을 기록하고 있다.

2012년에 독일 베를린에서 설립된 Raisin은 예금 마켓플레이스(deposit marketplace) 서비스를 제공하며 금융상품 중개 서비스의 영역을 은행 예금상품으로까지 확장하였다. 특히 저금리가 지속되고 있는 상황에서 고객에게 상대적으로 금리가 높은 유럽 지역의 은행 정기예금 상품에 가입할 수 있는 기회를 제공한다는 점에서 상당한 주목을 받고 있다(Finch Capital & dealroom.co, 2019). 2020년 7월말 기준으로 미국, 영국, 네덜란드에 진출하였고, 유럽 지역의 97개 은행과 제휴하고 있으며, 고객 1인당 평균 9.3만유로의 예금을 중개한 것으로 조사된다.

2005년에 스웨덴 스톡홀름에서 설립된 Klarna는 선구매 후지불(buy now, pay later) 서비스를 통해 신용카드가 없어도 외상으로 상품을 구매할 수 있는 판매신용 서비스를 제공하고 있다. 선구매 후지불 서비스는 POS 대출(point-of-sale lending)로도 불리며 사실상 신용카드 서비스와 동일한 원리로 작용한다. 예를 들면, 일시불 또는 할부 서비스를 선택할 수 있으며, 일시불 서비스를 선택한 경우 Klarna는 판매자에게 외상 판매대금을 즉시 지급하고 구매자는 일정 기간 내에 외상 구매대금을 Klarna에 상환해야 한다. 2020년 8월말 기준으로 Klarna는 스웨덴을 포함해 미국, 영국 등 17개 국가에서 20만개 이상의 가맹점과 약 8,500만명의 고객을 대상으로 선구매 후지불 서비스를 제공하고 있다.15)

2011년에 미국 샌프란시스코에서 설립된 Gusto는 소상공인과 소기업을 대상으로 인사, 급여, 일정 등을 체계적으로 관리할 수 있는 플랫폼을 제공하고, 이를 기반으로 근로자에게는 급여를 가불받을 수 있는 소액대출 서비스를, 사업주에게는 근로자 복지의 일환으로 제공되는 건강보험과 퇴직연금 상품을 사업 규모와 예산에 맞게 중개하는 서비스를 제공하고 있다. 2020년 8월말 기준으로 10만개 이상의 소상공인과 소기업을 대상으로 서비스를 제공하고 있으며, 코로나19가 발발한 이후 Gusto가 정부의 긴급자금 대출서비스 등을 지원하면서 소상공인과 소기업의 서비스 가입이 빠르게 증가하고 있다.

(3) 고객 회원제와 제3자 제휴에 기반한 수익창출

핀테크기업의 수익창출 방식은 기존 금융회사와 다른 것으로 파악된다. 기존 금융회사는 대개 고객의 금융자산 또는 금융거래에 기반하여 수익을 창출한다. 은행은 예대금리 마진과 서비스 수수료를, 증권사는 고객의 금융자산에 대한 자문 보수 또는 증권거래에 따른 수수료를, 보험사는 보험료 수입과 보험금 지출의 차액을, 신용카드사와 할부금융사는 조달금리와 대출금리 차이를 주요 수익원으로 한다. 이와 달리 핀테크기업은 주로 고객 회원제와 제3자 제휴에 기반하여 수익을 창출한다. 이는 핀테크기업이 언제 어디서나 접근할 수 있고 여러 금융서비스를 손쉽게 결합 또는 융합할 수 있으나 경쟁자에 의해 쉽게 대체될 수 있는 플랫폼에 기반하여 금융서비스를 제공하기 때문인 것으로 판단된다.

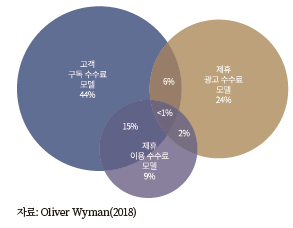

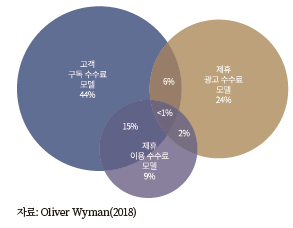

핀테크기업의 수익모델은 수익원천의 대상에 따라 세 가지 유형으로 나뉠 수 있다(Olivier Wyman, 2018). 첫 번째 유형은 고객으로부터 구독 수수료(subscription fee)를 수취하는 모델이다. 이 경우 고객에게 구독 서비스 유형을 선택하게 하고, 각 서비스 유형에 따라 금융서비스 이용과 구독 수수료를 차등한다. 예를 들면, 영국의 전자지급서비스업자로서 사실상 은행과 같은 금융서비스를 제공하는 Revolut, 독일의 디지털뱅크인 N26, 미국의 로보어드바이저인 Acorns와 Betterment가 고객의 구독 수수료를 주요 수익원으로 한다. 또한 이들 핀테크기업은 고객의 금융서비스 이용으로 비용이 발생하더라도 일정 수준 이내에서 무료로 금융서비스를 제공하거나 최소한의 비용만을 부과한다.

두 번째 유형은 제휴 금융회사 등으로부터 금융상품이나 금융서비스에 대한 광고 또는 추천 수수료(referral fee)를 수취하는 모델이다. 이 모델은 여기저기 흩어져 있는 고객의 금융정보를 한 곳에 모아 고객의 예산, 지출, 금융자산과 부채 정보와 신용점수를 관리하고, 금융상품을 비교해주며, 금융조언 또는 금융자문을 제공하는 핀테크기업이 주로 채택하고 있다. 대표적인 사례로는 미국의 Mint와 Credit Karma를 들 수 있다. 특히 고객의 신용점수 관리를 기반 서비스로 제공하는 Credit Karma는 금융회사의 제휴 유인과 고객의 선택 기회를 동시에 높이기 위해 고객이 제휴 금융회사의 금융상품이나 금융서비스에 가입하는 경우에만 제휴 금융회사로부터 수수료를 수취하는 방식을 채택하고 있다.

세 번째 유형은 제휴 핀테크기업에게 고객기반 또는 고객정보를 제공하고 그 대가로 이용 수수료(usage fee)를 수취하는 모델이다. 이 수익모델은 주로 API 또는 오픈뱅킹을 통해 자신의 고객에게 다른 핀테크기업의 금융서비스를 이용할 수 있도록 연결해주는 핀테크기업이 채택한다. 한편 세 번째 유형의 수익모델을 채택한 핀테크기업의 상당수가 첫 번째 유형의 수익모델을 동시에 채택한 것으로 파악된다. 영국의 Revolut와 독일의 N26가 대표적 사례다.

Oliver Wyman(2018)이 350개 핀테크기업을 대상으로 조사한 결과에 따르면, <그림 Ⅲ-7>에서 볼 수 있듯이 여러 유형의 수익모델을 동시에 채택하는 핀테크기업도 상당수 존재하는 것으로 파악된다. 특히 조사대상의 약 15%가 첫 번째 유형과 세 번째 유형의 수익모델을 동시에 채택한 것으로 나타난다.

다. 금융산업 구조에 미치는 영향

(1) 금융서비스 언번들링과 리번들링

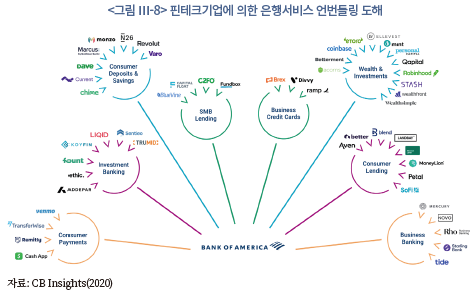

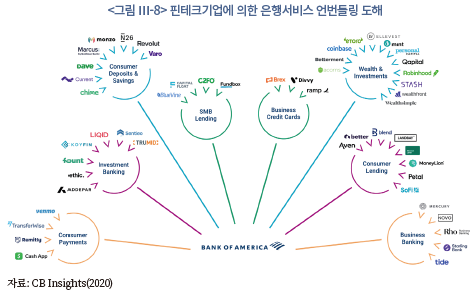

핀테크에 의한 금융혁신은 초창기에 <그림 Ⅲ-8>에서 살펴볼 수 있듯이 은행의 금융서비스를 언번들링하는 양상으로 출현하였고, 많은 은행들은 핀테크기업이 자신의 금융서비스 영역을 위협할 것이라고 예상하였다(PwC, 2016a). 그러나 핀테크기업에 의한 은행의 금융서비스 언번들링은 고객기반이 얇고 자본금도 취약한 창업 단계에 있는 핀테크기업이 특정 금융서비스에 집중하면서 나타난 표면적 양상에 불과할 수 있다. 그간 수많은 핀테크기업의 출현에도 불구하고 핀테크기업이 은행의 금융서비스를 대체하는 정도가 일부 국가를 제외하고 여전히 낮은 수준에 머물러 있기 때문이다(BIS, 2018).

그럼에도 불구하고 핀테크기업에 의한 은행의 금융서비스 언번들링은 세 가지 측면에서 중요한 의의를 갖는다. 첫째, 기존의 금융서비스가 비효율적으로 제공되었고 고객에게 높은 비용을 요구하였다는 점을 실체적으로 입증하였을 뿐만 아니라 핀테크에 의한 금융혁신의 가능성과 중요성을 부각하였다. 둘째, 기존의 금융서비스를 새롭게 정의하며 금융서비스 간의 결합과 융합을 촉진하였다. 이는 핀테크기업이 플랫폼에 기반하여 자동화된 방식으로 금융서비스를 제공하기 때문이기도 한다. 셋째, 언번들링된 금융서비스를 리번들링하는 플랫폼의 출현을 가져왔다.

핀테크에 의한 금융서비스 간의 결합과 융합은 크게 세 가지 양상으로 요약될 수 있다. 가장 눈에 띄는 양상으로는 기존의 금융서비스가 새롭게 정의되고 있다는 것이다. 대출과 투자를 연계한 P2P 대출 서비스가 대표적 사례다. 이 경우 금융회사가 차주의 신용위험을 인수하는 대출 서비스를 P2P 대출 플랫폼이 차주의 채권 발행을 중개하는 서비스로 재정의하였다고 볼 수 있다(이성복, 2018; 이성복, 2019b). 또 다른 예로는 라운드업(round-up) 소액저축 또는 소액투자 서비스와 직불카드 연계 판매신용 서비스를 들 수 있다.16)

두 번째 양상으로는 고객기반을 어느 정도 확보하는 데 성공한 핀테크기업이 은행과 같은 금융서비스를 제공한다는 것이다. 미국의 Betterment와 Wealthfront가 대표적인 사례다. 원래 Betterment와 Wealthfront는 로보어드바이저로 출범하여 투자자산과 퇴직연금 관리에 집중하였다. 그러나 이들 로보어드바이저는 상당한 고객기반을 확보하는 데 성공하면서 전통적인 은행처럼 다양한 금융서비스를 제공하기 시작하였다.17) Betterment는 특정 은행과 제휴하여 당좌계좌 개설과 직불카드 발급 서비스를 제공하고 현금자산의 유동성과 수익성을 동시에 관리해주는 저축 서비스 또는 현금자산관리 서비스도 제공하고 있다. 이에 더해 Wealthfront는 대출 서비스까지 제공하고 있다. 다만 이러한 양상은 은행과의 업무 제휴에 있어 법적 제약이 거의 없는 미국에서 주로 관찰된다.

또 다른 양상으로는 디지털뱅크 또는 비은행 핀테크기업이 오픈뱅킹을 활용해 단일의 플랫폼에서 여러 핀테크기업의 금융서비스를 리번들링하여 제공한다는 것이다. 이러한 양상은 오픈뱅킹이 상대적으로 잘 발달된 유럽과 영국에서 두드러지게 관찰된다(CB Insights, 2018a). 대표적인 사례로는 독일의 N26, 영국의 Revolut와 Starling Bank를 들 수 있다. 독일의 N26과 영국의 Starling Bank는 은행 인가를 받은 디지털뱅크이나 코어 뱅킹(core banking) 서비스만을 제공하고 <그림 Ⅲ-9>에서 살펴볼 수 있듯이 다른 핀테크기업과 제휴하여 다양한 금융서비스를 제공하고 있다. 영국의 Revolut는 전자화폐사업자이지만 N26과 Starling Bank와 동일한 방식으로 다양한 금융서비스를 제공하고 있다. 특히 Revolut는 디지털뱅크가 아니지만 사실상 N26과 거의 유사하게 은행과 같은 금융서비스를 제공하면서 N26의 경쟁상대로 평가받고 있다.18)

한편 금융서비스 간의 결합 또는 융합의 양상이 각각 다르더라도 두 가지 공통된 경향성이 발견된다. 먼저 지급결제 서비스를 기반 서비스로 제공하고 있다는 점이다. 이는 지급결제 서비스가 누구나 이용해야 하는 필수적인 금융서비스이고, 핀테크기업 입장에서 지급결제 서비스는 고객기반을 용이하게 확보할 수 있는 수단이기 때문이다. 이와 함께 금융자문 서비스를 매개로 저축, 대출, 투자, 보험 서비스 등을 제공한다는 점이다. 이는 비대면 환경에서는 금융회사나 핀테크기업이 아닌 고객이 금융상품 또는 금융서비스 소비를 주도할 수밖에 없다는 점을 전략적으로 고려했기 때문이다.

(2) 금융회사 탈중개화와 재중개화

핀테크 초창기에는 P2P 금융서비스가 기존 금융회사의 역할을 축소하거나 대체할 것이라는 예상이 많았다. 그러나 P2P 금융서비스에 의한 탈중개화는 세 가지 측면에서 아직까지는 제한적인 것으로 보인다. 첫째, P2P 금융서비스의 공급 규모가 지속적으로 증가하고 있는 것은 사실이지만, 기존 금융회사의 역할을 상당 수준 축소할 만큼 시장점유율이 높지 않거나 해당 금융서비스 시장의 일부에서만 시장점유율이 높게 나타나기 때문이다. 둘째, P2P 금융서비스가 기존 금융회사의 역할을 대체하기보다는 보완하는 양상이 더 강하게 나타나기 때문이다. 셋째, 기존 금융회사가 금융서비스의 디지털화를 적극적으로 추진하기 시작하면서 P2P 금융서비스의 시장점유율이 낮아지고 있기 때문이다.

P2P 금융서비스에 의한 기존 금융회사의 탈중개화는 개인송금시장에서 두드러진다. 예를 들면, 미국의 경우 2018년중 PayPal을 통한 개인송금액은 은행과 신용조합의 계좌이체에 의한 개인송금액의 82.2%를 차지한다. PayPal의 자회사인 Venmo를 통한 개인송금액까지 포함하면 119.5%에 달하는 것으로 조사된다(Cornerstone Advisors, 2020). 중국과 인도도 예외는 아니다. 중국의 경우 Alipay와 TenPay(WeChat Pay)가 개인송금시장에서 90% 이상의 시장점유율을 차지하고 있으며, 인도의 경우 Paytm이 2010년부터 개인송금시장을 주도하다가 2019년에 WhatsApp Pay와 Amazon Pay의 진출로 경쟁이 격화되고 있는 상황이다(BIS, 2019; The Payers, 2019).

그러나 이러한 P2P 개인송금 서비스에 의한 은행의 탈중개화가 대부분의 국가에서 나타나는 것은 아니다. 예를 들면, 케냐의 경우 인구 절반 이상이 M-Pesa를 사용할 정도이지만, 은행 계좌 미보유 인구 비중이 44%를 차지할 정도로 은행의 개인송금 서비스가 낙후되어 있다는 점에서 은행을 대체하기보다는 보완한다고 볼 수 있다(The Payers, 2019; World Bank Group, 2018). 영국과 유럽의 경우 2019년에 페이스북이 P2P 개인송금 서비스를 중단할 정도로 완전히 다른 양상으로 전개되고 있다(The Payers, 2019). 이는 2016년 1월부터 지급서비스지침2(PSD2)가 발효되고 지급지시서비스업이 신설되면서 P2P보다는 은행 계좌이체를 통한 개인송금 서비스가 더 강화되었기 때문이다.

한편 미국에서는 Bank of America, Capital One, JPMorgan Chase, Wells Fargo 등 기존 은행들이 공동으로 2017년에 Zelle라는 P2P 개인송금 서비스를 출시함에 따라 개인송금시장에서 새로운 양상의 경쟁이 전개되고 있다. Zelle는 선불 충전이 필요한 PayPal이나 Venmo와 달리 은행과 신용조합과의 제휴를 통해 실시간 계좌이체를 지원한다. 2020년 7월 기준으로 Zelle는 924개 은행과 신용조합과 제휴한 상태이며, 제휴 은행과 신용조합은 계속 증가할 것으로 보인다. Zelle의 시장점유율도 빠르게 증가하고 있다. 2018년중 Zelle를 통한 개인송금액이 PayPal의 86.0%를 차지하였으며 Zelle가 개인송금시장에서 PayPal를 앞지를 것이라는 전망도 있다(Cornerstone Advisors, 2020).

P2P 대출 서비스에 의한 은행의 탈중개화도 각 국가마다 다른 양상을 보인다. 미국의 경우 P2P 대출 서비스가 개인신용대출시장에서 소형 은행을 대체하고 있다고 보고된다(Maggio & Yao, 2018; Tang, 2019). 영국의 경우에도 개인신용대출시장에서 은행의 탈중개화 양상을 보이나, 기업신용대출시장에서는 은행의 금융중개 역할을 보완하는 것으로 파악된다.19) 전 세계 P2P 대출시장의 82.5%를 설명하는 중국의 경우 은행의 부족한 신용 공급을 보완하고 있다(이성복, 2018; Liao et al., 2017). 아프리카와 동남아시아 지역의 국가에서도 중국과 동일한 양상을 보이는 것으로 파악된다(Cambridge Centre for Alternative Finance, 2020).

미국, 중국, 영국 등에서는 P2P 대출 서비스의 재중개화 양상도 나타나고 있다(Balyuk & Davydenko, 2018; Braggion et al., 2019; Havrylchyk & Verdier, 2018). 일반적으로 P2P 대출은 차입자와 투자자 간의 자금융통의 거래를 중개하는 방식으로 이루어진다. 그러나 P2P 대출시장의 규모가 빠르게 확대되고 다양한 니즈를 갖고 있는 투자자의 참여가 증가하면서 자동분산투자 서비스를 제공하는 P2P 대출 플랫폼이 늘기 시작하였다. 예를 들면, 미국의 LendingClub의 경우 2020년 6월말 기준으로 개인 투자자의 투자금액 중 약 37.0%가 자동분산투자 서비스를 이용하고 있다. 중국에서 다섯 번째로 큰 P2P 대출 서비스업체인 Renrendai(人人贷)도 신규 대출의 80%가 자동분산투자 서비스에 의해 조달되고 있다.

P2P 금융서비스 중에는 상호 부조의 성격을 지닌 P2P 보험 서비스도 있다(NAIC, 2020a). 대표적으로 영국의 So-sure, Teambrella, 독일의 Friendsurance, 프랑스의 insPeer, 일본의 justInCase, 미국의 Lemonade, 캐나다의 Besure가 P2P 보험 서비스를 제공하고 있는 핀테크기업이다(김규동, 2018). 그러나 P2P 보험 서비스에 의한 보험회사 탈중개화는 매우 미약한 것으로 확인된다. 그나마 미국의 26개 주와 워싱턴 DC에서 주택보험상품을 판매하는 Lemonade가 일반손해보험회사로서 2020년 7월에 뉴욕거래소에 성공적으로 상장하면서 상당한 이목을 끌고 있지만, 미국 전체 주택소유자 및 임대인 보험시장에서 2019년말 기준으로 0.1%의 시장점유율을 차지하는 정도에 그치는 것으로 파악된다(NAIC, 2020b).

(3) 빅테크기업의 출현과 경쟁 구도 변화

지난 10여년 동안 핀테크기업들이 이전과 다른 양상으로 금융혁신이 가능함을 입증하는 데 성공하면서 IT사업을 토대로 거대한 플랫폼을 보유한 빅테크기업들도 직‧간접적으로 금융산업에 진입하고 있다. 특히 빅테크기업은 핀테크기업과 달리 두터운 고객기반과 상당한 자본금을 보유하고 있어 기존 금융회사와 핀테크기업이 경쟁하는 양상과 다르게 기존 금융회사를 위협하고 금융산업의 구조를 재편할 것이라는 평가까지 받고 있다(BIS, 2019; FSB, 2019a; FSB, 2019b; OECD, 2019; Stulz, 2019). 최근 2~3년간 빅테크가 금융 분야에서 가장 뜨거운 화두로 떠오르고 있는 것도 이러한 양상의 변화가 반영된 것으로 판단된다.

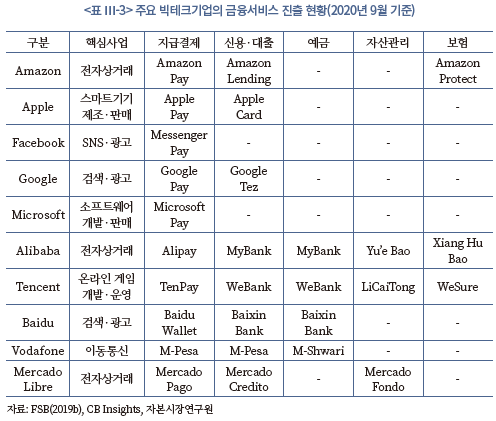

빅테크기업으로는 대표적으로 미국의 Amazon, Apple, Facebook, Microsoft, Google과 중국의 Alibaba, Baidu, Tencent 등이 거론되고 있다. 이들 빅테크기업의 공통적인 특징 중 하나는 특정 지역이나 국가에 국한하지 않고 활발한 해외진출을 통해 다수의 국가에서 금융서비스를 제공한다는 점이다(Frost et al., 2019; FSB, 2019b). 예를 들어, 미국의 빅테크기업들은 유럽, 남미, 인도 등에, 중국의 빅테크기업들은 동남아시아, 아프리카 등에 진출하고 있다. 한편 각 지역 또는 국가에 한정하여 금융서비스를 제공하는 빅테크기업들도 있다. 예를 들면, 동아프리카, 이집트 및 인도에서는 Vodafone이, 브라질, 아르헨티나, 멕시코에서는 Mercado Libre가, 한국에서는 카카오 등이, 동남아시아에서는 Grab 등이 빅테크기업으로 인용된다(BIS, 2019; Frost et al., 2019).

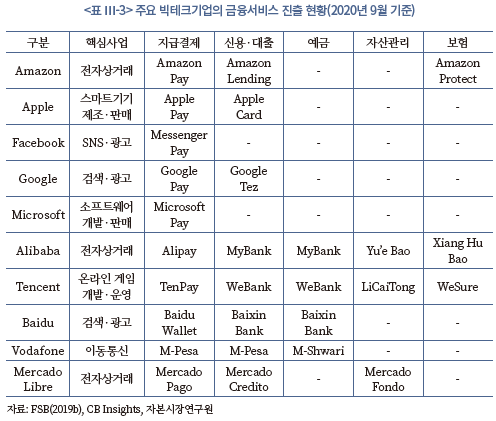

빅테크기업들은 핵심사업을 보완하고 강화하기 위해 먼저 지급결제 분야에 진출하고, 점차적으로 다른 금융 분야로 사업의 영역을 확장하는 추세를 보인다(Frost et al., 2019; FSB, 2019b; Stulz, 2019). 다만 <표 Ⅲ-3>에서 살펴볼 수 있듯이 미국에 기반을 두고 있는 빅테크기업들의 경우 Amazon과 Apple이 대출 분야에 진출한 것을 제외하고는 지급결제 외 다른 금융 분야로는 아직 진출하지 않았다. 이와 달리 중국, 아프리카, 남미에 기반을 두고 있는 빅테크기업들은 지급결제뿐만 아니라 다른 금융 분야로도 진출한 상태이다. 특히 중국의 Alibaba와 Tencent는 자국의 신용평가 인프라가 미흡한 점을 보완하기 위해 각각 Zhima Credit과 Tencent CB를 설립해 신용평가 서비스까지도 제공하고 있다.

빅테크기업들이 금융 분야에 새롭게 진출하는 동기는 크게 세 가지로 제시되고 있다(BIS, 2019; FSB, 2019b). 첫째, 범위의 경제를 실현하여 비용을 절감하고 다양한 수익원을 확보할 수 있기 때문이다. 둘째, 금융서비스를 통해 핵심사업 활동을 보완하고 강화하여 고객기반과 충성도를 제고할 수 있기 때문이다. 셋째, 고객의 소비, 지출, 금융정보 등 새로운 원천의 데이터에 접근할 수 있기 때문이다. 그러나 이러한 동기들은 빅테크기업들이 금융 분야에 진출하는 동기라기보다는 목적에 가깝다. 이보다 더 근본적인 동기는 빅테크기업이 핀테크기업 또는 기존 금융회사보다 더 효율적으로 금융의 디지털화를 구현할 수 있고, 더 편리한 절차와 저렴한 비용으로 고객이 원하는 금융서비스를 더 알맞게 제공할 수 있다고 전략적으로 판단하기 때문이다.

핀테크기업은 기존 금융회사의 금융서비스 언번들링을 통해 고객기반을 확보하고, 점차적으로 다양한 금융서비스를 리번들링하며 서비스 영역과 고객기반을 확대해왔다. 그러나 여전히 낮은 자본력으로 인해 일부 핀테크기업을 제외하고는 기존 금융회사와 경쟁하는 데 상당한 한계를 느끼고 있다. 한편 기존 금융회사는 오프라인 지점망, 인력 구조, 레거시 시스템, 금융규제 등으로 인해 금융의 디지털화에 상대적으로 기민하게 대처하지 못하고 있다(Stulz, 2019). 이와 달리 빅데크 기업은 두터운 고객기반과 상당한 자본력뿐만 아니라 핀테크기업보다 더 우수한 기술력을 보유하고 있다. 또한 기존 금융회사보다 플랫폼에 기반한 서비스 경험이 풍부하고 다양한 비금융 서비스도 제공하고 있다. 더구나 핵심사업 활동으로 수집한 비금융 정보와 금융 정보를 병합할 경우 기존 금융회사보다 더 경쟁력 있는 금융서비스를 제공할 수도 있다.

결과적으로 빅테크기업의 금융업 진출은 금융산업의 경쟁 구도에 상당한 변화를 가져올 수 있다. 다만 빅테크기업의 금융업 진출 방식에 따라 그 영향도 다르게 나타날 것으로 보인다(FSB, 2019b; Moody’s, 2018). 먼저 중국과 같이 빅테크기업이 직접 금융업에 진출하는 경우 기존 금융회사와 빅테크기업의 경쟁뿐만 아니라 빅테크기업 간의 경쟁도 심화될 것으로 예상된다. 이에 더해 빅테크기업에 의한 시장 독과점도 발생할 수 있다. 다음으로 미국처럼 빅테크기업이 기존 금융회사와 제휴하는 경우 빅테크기업이 기존 금융회사에게 과도한 지배력을 행사하거나 금융서비스 경쟁을 제한할 수 있다.

빅테크기업의 금융업 진출은 현재 진행형이다. 이 점에서 그 영향을 예단하기에는 아직 이르다. 그럼에도 불구하고 빅테크기업이 다른 산업에 미친 영향을 고려할 때 빅테크기업이 금융산업에 미칠 영향이 반드시 긍정적이지만은 않을 것으로 보인다.

라. 금융포용 효과

(1) 전반적인 금융포용 증대

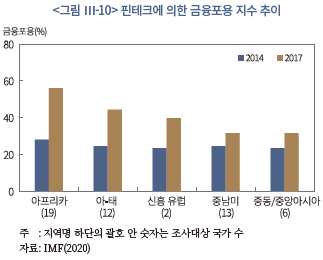

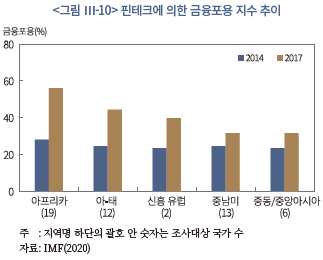

핀테크에 의한 금융혁신으로 금융서비스의 공급비용이 낮아지고 접근성과 편리성이 향상되면 핀테크에 의한 금융포용이 여러 채널을 통해 증대될 수 있다(IMF, 2020; Philippon, 2019). IMF(2020)가 52개 국가를 대상으로 조사한 결과에 따르면 2014년과 2017년 사이 기존 금융회사의 전통적인 금융서비스에 의한 금융포용이 정체되어 있거나 감소한 것과 달리 <그림 Ⅲ-10>에서 살펴볼 수 있듯이 핀테크에 의한 금융혁신에 따른 금융포용은 증가한 것으로 나타난다. 이는 각 국가에서 적극적으로 오프라인 중심의 금융규제를 개선하고 새로운 금융제도를 도입하여 핀테크에 의한 금융혁신을 정책적으로 지원하는 주된 이유이기도 하다.

핀테크에 의해 금융포용이 가장 크게 증대된 분야는 지급결제 분야로 알려져 있다(BIS, 2020; IMF, 2020). 이는 은행 계좌를 개설할 수 없는 은행서비스 소외자(unbanked)가 은행 계좌가 없더라도 P2P 개인송금 서비스나 모바일 지급결제 서비스를 이용할 수 있게 되었기 때문이다. 더구나 핀테크에 의한 금융혁신이 지급결제 서비스와 다른 금융서비스를 결합 또는 융합하는 양상으로 발전하면서 핀테크에 의한 금융포용이 지급결제 분야에서 다른 분야로 점차 확대되는 양상도 관측되고 있다.

그 다음으로 핀테크에 의해 금융포용이 크게 증대된 분야는 대출 분야를 들 수 있다. 이는 P2P 대출이나 온라인 대출 서비스가 은행 등 기존 금융회사로부터 대출받지 못했던 개인이나 중소기업에게 새로운 차입 기회를 제공하기 때문이다. 다만 앞서 살펴본 바와 같이 대출 분야에서 금융포용이 증대되는 효과는 국가마다 다소 다르다. 중국, 동남아, 아프리카 지역의 국가에서는 P2P 대출 서비스에 의한 금융포용 증대 효과가 뚜렷하게 관찰되나, 미국이나 영국 등에서는 고신용 차입자가 선호되면서 그 효과가 점차 감소하고 있는 것으로 보인다.

그 외 분야에서의 금융포용 증대 효과는 제한적인 것으로 파악된다. 예를 들면, 크라우드펀딩을 통한 중소기업의 자금조달 규모는 P2P 대출 서비스와 비교할 때 당초 기대보다 크지 않다(Cambridge Centre for Alternative Finance, 2020). 이 점을 고려할 때 크라우드펀딩이 중소기업의 자금조달 기회를 확장하는 효과는 아직 크지 않다고 판단된다. 또한 로보어드바이저에 의한 자산관리 서비스의 대중화도 미국 외 다른 국가에서는 크게 나타나지 않는다. 더구나 미국에서조차도 자산관리시장에서 로보어드바이저의 관리자산 비중이 당초 예상과 다르게 매우 낮은 수준이다(The Economist, 2017; Carey, 2019).

한편 핀테크에 의한 금융혁신으로 새로운 금융서비스가 출현하고 금융서비스 영역이 확장되면서 이에 따른 금융포용도 증대되고 있는 것으로 판단된다. 예를 들면, 앞서 논의한 바와 같이 미국의 Stripe와 Gusto의 경우 각각 지급결제와 대출 서비스의 영역을 확장하면서 금융포용을 증대했다고 볼 수 있다. 다만 핀테크에 의한 금융포용 효과가 전통적인 금융서비스 분야 중심으로 논의되다 보니 새로운 금융서비스의 금융포용 효과에 대한 논의는 상대적으로 부족해 보인다.

(2) 고령자의 금융소외 우려

핀테크에 의한 금융혁신의 빠른 진전은 고령자의 금융소외 가능성을 확대시킬 우려가 있는 것으로 파악된다. 우선 평균적으로 은행 지점 수가 높은 국가일수록 은행 등 금융회사의 지점이 빠르게 감소하는 추세를 보인다. 예를 들면, OECD 회원국가의 성인 10만 명당 은행 지점 수는 2011년에 24.2개에서 2019년에 19.6개로 감소한 것으로 나타난다.20) 또한 은행 지점 수가 낮은 국가의 경우 은행 지점 수가 정체하거나 소폭 증가하는 데 그치고 있다. 이는 고령자의 금융 접근성이 낮아지고 금융소외가 확대된다는 것을 시사한다.

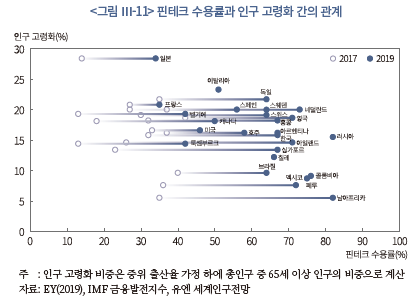

더구나 <그림 Ⅲ-11>에서 살펴볼 수 있듯이 핀테크 수용률과 인구 고령화의 관계를 살펴보면 인구 고령화 비중이 높은 국가일수록 핀테크 수용률이 상대적으로 낮은 것을 확인할 수 있다. 또한 각 국가별 2019년 핀테크 수용률을 종속변수로 하고 인구 고령화 비중을 설명변수로 하여 최소자승법(OLS) 회귀분석을 실시해보면 인구 고령화 비중이 1% 포인트 높으면 5% 유의수준에서 핀테크 수용률이 통계적으로 유의하게 1.06% 포인트 낮은 것으로 추정된다.21) 이는 인구 고령화 비중이 높은 국가일수록 고령자가 핀테크에 의한 금융서비스를 이용하지 못하거나 이로부터 소외받을 가능성이 크다는 것을 간접적으로 시사한다.

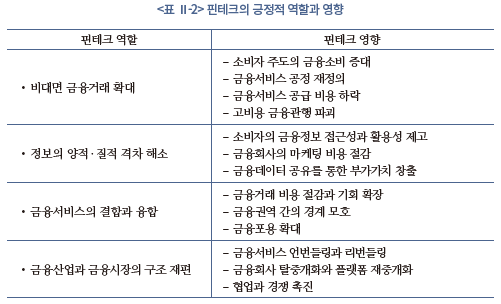

3. 해외와 국내 양상 비교

각 국가의 금융산업과 금융시장의 발전 정도와 구조적 특징, 금융규제의 범위와 정도가 다르기 때문에 핀테크에 의한 금융혁신도 국가마다 다른 양상을 보일 수 있다. 이 점에서 국내의 핀테크에 의한 금융혁신 양상도 해외 양상과 다를 수 있다. 이를 확인하고 국내에 주는 시사점을 도출하기 위해 해외 양상에 맞추어 국내 양상을 살펴보고 해외와 국내 양상을 비교하였다.

가. 국내의 핀테크에 의한 금융혁신 양상

(1) 핀테크기업의 출현 양상

우리나라에서의 핀테크에 의한 금융혁신은 해외와 비교할 때 상당히 늦은 2015년부터 본격적으로 일어나기 시작하였다. 이는 인터넷 보급률이 전 세계적으로 가장 높음에도 불구하고 대면 중심의 금융규제로 인해 기존 금융회사조차도 비대면에서 금융서비스를 원활하게 제공하기 어려웠기 때문이다. 예를 들면, 2016년 12월 이전까지는 금융실명 및 본인 확인 규제로 인해 은행 지점을 방문해야 은행 계좌를 개설할 수 있었다(금융위원회, 2015. 5. 18; 금융위원회, 2016. 5. 26). 그럼에도 불구하고 지난 5년 동안 핀테크에 의한 금융혁신은 압축적으로 일어났다고 평가할 수 있다.

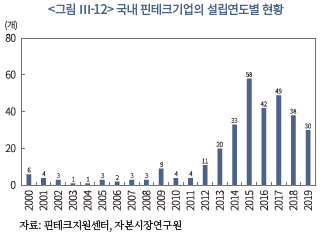

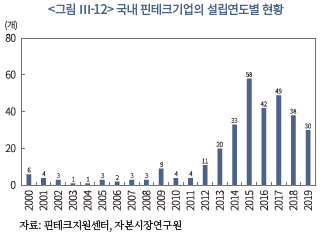

2020년 6월말 핀테크지원센터가 확인한 핀테크기업만 해도 800여개에 이른다. 물론 이들 핀테크기업 모두가 정상적으로 활동하는 것은 아닌 것으로 보인다.22) 그럼에도 불구하고 영국의 핀테크기업이 2019년 기준으로 약 1,600여개인 점을 감안하면 상당한 수준이라고 볼 수 있다(UK DIP & HM Treasury, 2020). 한편 「2019년도 핀테크기업편람」에 등재된 345개 핀테크기업 중 2000년부터 설립된 핀테크기업을 대상으로 설립연도별 현황을 살펴보면, <그림 Ⅲ-12>에서 볼 수 있듯이 핀테크기업의 설립이 2015년까지 빠르게 증가하다가 이후 완만하게 감소하였다.

국내 핀테크기업의 주력 분야를 살펴보면 지급결제 분야에 집중되어 있던 초창기보다 다양한 분야에서 핀테크기업이 출현한 것으로 보인다. 예를 들면, 지급결제 분야의 핀테크기업은 전체의 24.1%를 차지하고, 그 다음으로 P2P 대출과 크라우드펀딩 분야가 13.0%, 자산관리 분야가 9.6%, 보험 분야가 6.4%, 금융투자 분야가 5.2% 등으로 집계된다. 또한 기존 금융회사 등과의 협업을 선택한 핀테크기업이 많은 만큼 보안‧인증 분야가 12.5%로 높은 비중을 차지하고 있고, 핀테크 솔루션인프라를 제공하는 핀테크 SI 분야도 5.2%를 차지한다. 그럼에도 불구하고 간편송금, 간편결제, P2P 대출, 로보어드바이저 등 특정 분야의 쏠림이 존재하는 것으로 보인다.23)

국내의 핀테크 수용률은 2019년 조사에 따르면 67.0%로 2017년 대비 35% 포인트 증가하였다(EY, 2019). 이는 싱가포르, 홍콩과 동일하고, 영국보다 4% 포인트 낮은 수준이다. 국내의 핀테크 수용률은 핀테크기업의 가입자 규모로도 쉽게 가늠할 수 있다. 예를 들면, 2019년말 기준으로 토스(Toss) 가입자는 약 1,600만명, 카카오페이(KakaoPay) 가입자는 3,000만명에 달한다. 고객의 금융정보를 한곳에 모아 관리할 수 있고, 가계부, 금융비서, 금융상품 추천 서비스 등을 이용할 수 있는 뱅크샐러드(BankSalad) 가입자도 2019년말 기준으로 약 800만명에 이르는 것으로 알려져 있다.

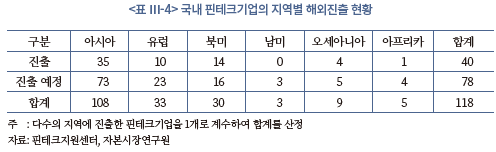

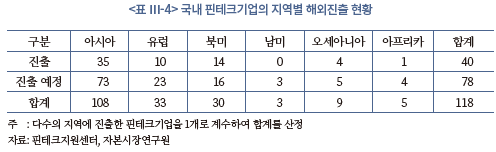

국내 핀테크기업의 해외진출은 알려진 것보다 매우 활발하다. 예를 들어, 「2019년도 핀테크기업편람」에 등재된 345개 핀테크기업의 34.2%인 118개가 해외로 이미 진출해 있거나 준비하고 있다. <표 Ⅲ-4>에서 볼 수 있듯이 지역별 해외진출 현황을 살펴보면, 아시아 지역으로의 진출이 가장 많고, 그 다음으로 유럽, 미국, 오세아니아, 아프리카, 남미 순으로 집계된다. 더구나 나머지 핀테크기업 중 132개가 향후 해외로 진출할 의향을 갖고 있는 것으로 파악된다. 이렇듯 국내 핀테크기업의 해외진출이 활발한 것은 현지 금융회사 또는 핀테크기업과의 기술공급 계약을 통해 진출할 수 있고 자신의 플랫폼을 현지화하여 현지 고객을 대상으로 상대적으로 용이하게 금융서비스를 제공할 수 있기 때문이다.

(2) 기존 금융회사와의 차이

국내 핀테크기업의 산업 분류를 살펴보면 해외와 유사하게 이종 산업의 결합 또는 융합의 양상도 발견된다. 「2019년도 핀테크기업편람」에 등재된 345개 핀테크기업 중 소프트웨어 분야에서 사업을 영위하는 핀테크기업이 180개로 52.2%를 차지한다.24) 이외에도 정보서비스, 하드웨어, 전자상거래, 경영컨설팅, 광고, 무역, 부동산, 임대, 출판 등 분야에서 사업을 영위하는 경우도 있다. 물론 다른 산업과 연관 없이 핀테크에 의한 금융서비스를 제공하는 핀테크기업도 전체에서 20.6%를 차지하는 것으로 파악된다. 한편 분석대상 345개 핀테크기업 중 기존 금융회사와의 경쟁을 선택한 핀테크기업은 40.0%인 반면, 기존 금융회사 등과의 협업을 선택한 핀테크기업은 50.7%로 집계된다.25)

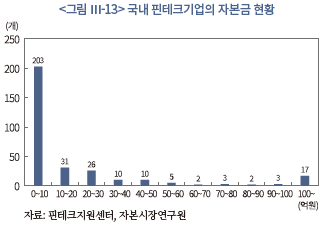

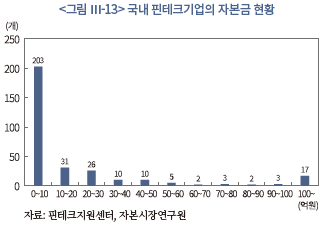

지난 5년 동안 핀테크에 의한 금융혁신이 빠르게 진전되면서 해외와 같은 새로운 금융서비스의 출현도 관측된다. 그럼에도 불구하고 이미 소개된 핀테크에 의한 금융서비스를 모방하는 데 치중하는 양상이 더 크게 보인다. 이는 자본금이 취약하고 투자 유치가 어려운 핀테크기업일수록 위험한 모험보다 안전한 모방을 선택하기 때문으로 판단된다. <그림 Ⅲ-13>에서 볼 수 있듯이 「2019년도 핀테크기업편람」에 등재된 핀테크기업의 자본금 현황을 살펴보면, 2019년 10월말 기준으로 자본금을 보고한 312개 핀테크기업 중 65.0%가 10억원 미만의 자본금을 보유하고 있다. 더구나 자본금이 50억원 이상인 32개 핀테크기업 중 25개가 간편송금 또는 간편결제를 주력 서비스로 제공하고 있다.

또 다른 이유 중에 하나는 그간 금융당국의 많은 노력에도 불구하고 여전히 새로운 금융서비스 출현을 저해하는 금융규제가 존재하기 때문이다. 예를 들면, 「금융회사의 업무위탁 등에 관한 규정」에서 은행, 보험회사 등 금융회사의 본질적 업무를 위탁하지 못하도록 금지함에 따라 새로운 유형의 금융서비스 출현을 어렵게 하고 있다. 또한 2019년 4월부터 시행된 금융규제 샌드박스에 2020년 8월까지 330건 이상의 혁신 금융서비스가 신청되고, 이중 110건이 금융규제 특례를 지정받은 사실이 이를 간접적으로 뒷받침한다(금융위원회, 2020. 8. 21).

국내 핀테크기업은 주로 금융회사 또는 핀테크기업과의 제3자 제휴를 통해 수익을 창출하고 있다. 특히 기존 금융회사의 금융상품을 추천 또는 중개하는 방식으로 수익을 창출하고자 하는 핀테크기업이 늘고 있다. 이와 달리 고객 회원제에 기반하여 수익을 창출하는 핀테크기업은 찾아보기 힘들다. 2020년 5월에 국내에서는 처음으로 네이버 파이낸셜이 고객 회원제에 기반한 수익모델을 제시했으나 그 반응이 아직까지는 엇갈리고 있다. 한편 고객의 이용 빈도에 따라 핀테크기업의 가치가 결정되는 지급결제 분야의 핀테크기업들을 중심으로 고객기반을 유지하기 위해 캐쉬백(cashback)과 같은 혜택을 무리하게 제공하는 양상도 관측된다.

(3) 금융산업 구조에 미치는 영향

핀테크에 의한 금융서비스 간의 결합과 융합 양상은 탄탄한 고객기반을 확보하는 데 성공한 일부 핀테크기업이 소위 금융플랫폼을 지향하며 기존 금융회사와 제휴하여 여러 금융서비스를 제공하는 표면적 결합이 주를 이루고 있다. 여기서 표면적 결합이란 기존 금융회사와 같이 메뉴 방식으로 여러 금융서비스를 일방적으로 제공하는 것을 뜻한다. 예를 들면, 간편송금이 주력 서비스인 토스(Toss)의 경우 제휴 은행과 증권사의 계좌 개설, 대출상품 조회, 미니보험 가입, 제휴 P2P 대출업체의 P2P 대출 투자 등의 서비스를 이용할 수 있는 기회를 고객에게 제공하고 있다. 물론 카카오페이, 뱅크샐러드 등 일부 핀테크기업에 의해 해외와 유사하게 지급결제와 연계한 소액저축 또는 소액투자 서비스와 금융자문 서비스를 토대로 기존 금융회사의 금융상품을 추천하거나 중개하는 서비스가 소개되기도 하였다.

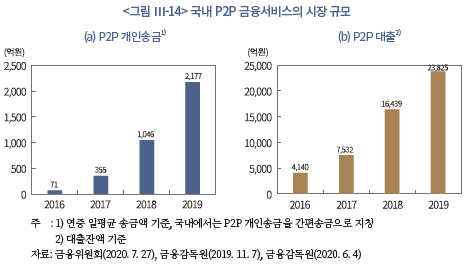

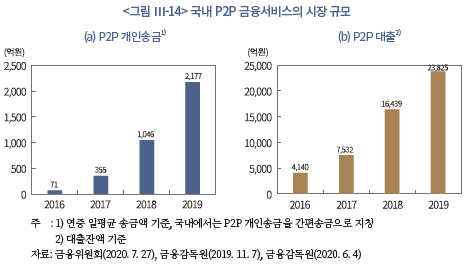

국내의 경우 P2P 금융서비스 중 P2P 개인송금 서비스와 P2P 대출 서비스가 지난 5년 동안 압축적으로 성장하면서 상당한 주목을 받고 있다. <그림 Ⅲ-14>에서 살펴볼 수 있듯이 P2P 개인송금 규모는 2016년중 일평균 71억원에서 2019년중 일평균 2,177억원으로 무려 30배 이상, P2P 대출 규모(잔액 기준)는 2016년말 4,140억원에서 2019년말 2조 3,825억원으로 5배 이상 증가하였다(금융위원회, 2020. 7. 27; 금융감독원, 2019. 11. 7; 금융감독원, 2020. 6. 4). 한편 P2P 보험 서비스는 아직 국내에 소개되지 않았다.26)

그러나 이들 P2P 금융서비스에 의한 금융회사 탈중개화는 거의 일어나지 않은 것으로 보인다. 우선 은행의 인터넷뱅킹을 통한 일평균 송금액은 2016년 이후에도 계속 증가하고 있고, 2019년중 일평균 송금액도 25.1조원에 달한다(한국은행, 2020. 3. 5). 또한 P2P 대출의 80% 이상이 부동산 대출에 해당될 정도로 P2P 대출 서비스가 개인의 부동산 투자수단으로 전락한 측면이 강하다.

국내에서 빅테크는 2020년 초부터 뜨거운 화두로 제기되기 시작하였다. 2020년 9월에는 은행지주회사와 빅테크기업 등이 참여하는「디지털금융 협의회」가 금융당국의 주도 하에 출범하기까지 하였다(금융위원회‧금융감독원, 2020. 9. 10). 국내에서 대표적인 빅테크기업으로는 네이버와 카카오를 들 수 있다. 이동통신회사인 SKT와 KT도 각각 핀크(Finnq)와 케이뱅크(KBank)를 통해 금융 분야에서 입지를 다지고 있으나 아직까지 그 영향력은 크지 않다.

네이버와 카카오는 상당한 고객기반과 자본금을 보유하고 있는 인터넷 포털이라는 공통점이 있다. 그러나 네이버와 카카오가 금융업에 진출하는 방식은 다른 것으로 파악된다. 네이버는 기존 금융회사와 제휴하는 방식으로, 카카오는 금융업에 직접 진출하는 방식을 채택하고 있다. 이는 네이버가 검색 플랫폼을 기반으로, 카카오는 메신저 플랫폼을 기반으로 사업 영역을 확장해 온 점과 관련 있어 보인다.

예를 들면, 네이버는 미래에셋과 공동으로 네이버 파이낸셜(Naver Financial)을 설립해 네이버 쇼핑몰 이용자를 대상으로 간편결제 서비스를 제공하고 있다. 최근에는 증권사의 CMA계좌를 개설할 수 있는 네이버통장 서비스도 출시하였다. 또한 네이버 쇼핑몰 판매자를 대상으로 대출 서비스를, 기존 보험회사의 보험상품을 중개‧대리하는 보험 서비스를 출시할 예정이다. 이와 달리 카카오는 카카오페이(KakaoPay)를 설립해 간편송금과 간편결제 서비스를, 카카오뱅크와 카카오페이증권을 설립해 은행 서비스와 금융투자 서비스를 직접 제공하고 있다. 게다가 보험 서비스를 제공하기 위해 보험대리점을 인수했으며 손해보험사도 설립할 계획을 갖고 있다.

네이버와 카카오의 직‧간접적인 금융업 진출은 우선적으로 기존 금융회사의 고객 접점을 크게 위축시킬 것으로 보인다. 특히 네이버가 검색 플랫폼의 경쟁우위를 적극적으로 활용해 인터넷 쇼핑몰을 네이버 쇼핑몰로 흡수한 것처럼 기존 금융회사의 금융상품 판매 채널도 상당 부분 네이버에 종속될 수 있을 것으로 예상된다. 이 경우 현재 핀테크기업의 수익모델에도 부정적인 영향을 미칠 것으로 예상된다.

더구나 네이버와 카카오가 그간 각종 인터넷 서비스를 흡수하며 양대 인터넷 포털로 성장한 것과 같이 핀테크기업의 금융서비스를 복제하여 자신의 플랫폼에 탑재할 경우 핀테크기업의 대고객 서비스 기회가 크게 위축될 수 있고, 생존까지도 위협받을 수 있다. 이는 비대면으로 제공되는 금융서비스가 플랫폼에 기반하고 있기 때문에 필연적으로 나타날 수밖에 없는 결과일 수 있으나, 이 과정에서 금융산업 구조와 경쟁 양상뿐만 아니라 핀테크 생태계에도 상당한 영향을 미칠 것으로 예상된다.

(4) 금융포용 효과

핀테크에 의한 금융혁신으로 금융서비스의 접근성과 편리성이 크게 향상된 것은 사실이나, 금융포용이 증대되었다고 보기는 어렵다. 먼저 우리나라의 15세 이상 인구의 금융회사 계좌 보유율은 2017년 기준으로 94.9%에 달한다. 또한 신용카드 발급 비율도 전 세계적으로 매우 높은 수준이다. 더구나 간편송금이나 간편결제 서비스는 기존의 은행 계좌나 신용카드에 기반하여 제공된다. 그만큼 지급결제 분야에서 핀테크에 의한 금융포용 증대 효과는 거의 없다고 볼 수 있다.

P2P 대출의 경우에도 2019년말 대출잔액의 약 18.0%(약 0.4조원)가 개인이나 기업에게 신용대출로 제공되고 있으나, 2019년 6월말 대부업자의 대출잔액 16.7조원과 비교할 때 매우 낮은 수준이다(금융감독원, 2018. 11. 20; 금융위원회‧금융감독원, 2019. 12. 26). 크라우드펀딩의 경우 2016년 1월부터 2020년 8월까지 총 656개 창업기업이 1,284억원의 자금을 조달하는 데 그쳤다(크라우드넷 웹사이트). 로보어드바이저도 자산관리 서비스의 대중화라는 당초 기대와 달리 은행의 펀드상품 판매채널로 활용되고 있다(이성복, 2019a).27)

한편 핀테크에 의한 금융혁신으로 금융의 디지털화가 빠르게 진전될수록 고령자의 금융소외가 확대될 수 있다는 우려가 제기되고 있다(금융위원회‧금융감독원, 2020. 8. 31). 먼저 은행 등 금융회사의 지점이 빠르게 감소하면서 고령자의 금융접근성이 저하되고 있는 것으로 파악된다. 예를 들면, 국내은행의 지점 수는 2013년 6월말에 7,689개였으나 2019년말에 12.7% 감소한 6,711개로 집계된다.28) 또한 고령자의 모바일뱅킹과 모바일결제(간편송금, 간편결제, 앱카드, 소액결제 등) 서비스의 이용경험도 매우 낮다. 2018년 기준 전 연령대의 이용경험 비중이 각각 57.9%와 44.9%이나 60대 이상의 경우 각각 13.1%와 6.7%에 불과하고, 70대 이상 고령자 대부분이 모바일뱅킹이나 모바일결제 서비스를 들어본 적도 없는 것으로 조사된다(한국은행, 2019).

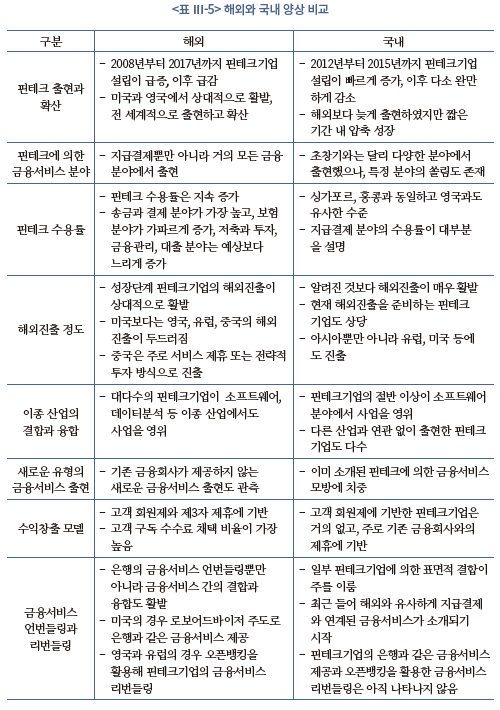

나. 해외와 국내 양상 비교

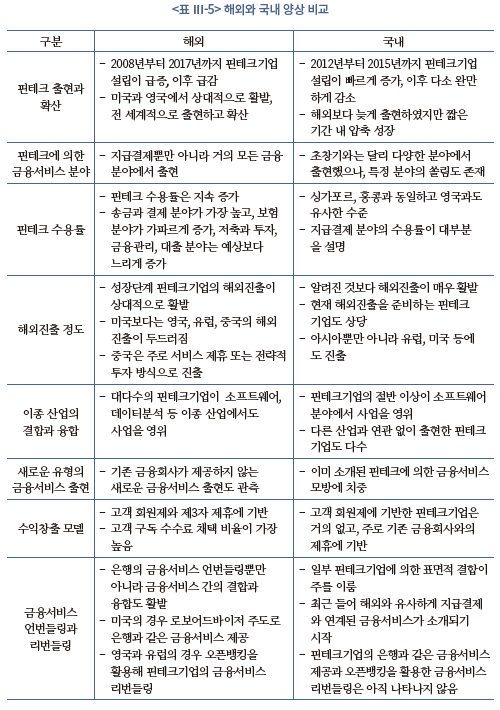

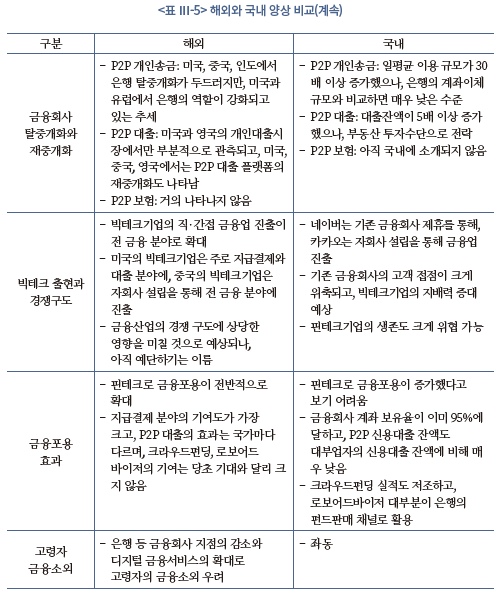

해외와 국내의 핀테크에 의한 금융혁신의 양상을 비교해보면 <표 Ⅲ-5>에서 살펴볼 수 있듯이 유사점도 많지만 차이점도 상당하다는 것을 확인할 수 있다. 이 중에서 차이점을 중심으로 살펴보면 다음과 같다. 우선 해외에서도 핀테크에 의한 금융서비스 분야 중 특정 분야의 쏠림이 어느 정도 있을 것으로 판단되지만, 국내의 특정 분야 쏠림은 그 정도가 과도한 것으로 판단된다. 이는 국내 핀테크기업이 새로운 유형의 금융서비스를 발굴하기보다는 모방하는 데 치중하는 양상과 맞물려 있다.

국내에서는 핀테크기업이 기존 은행의 금융서비스를 언번들링하고, 은행과 같은 금융서비스를 제공하며, 오픈뱅킹을 활용해 다른 핀테크기업의 금융서비스를 리번들링하는 양상도 구체적으로 관측되지 않는다. 이는 기존 은행도 금융의 디지털화를 공세적으로 추진하고 있고, 금융규제가 은행과 핀테크기업 간의 업무 제휴를 제한하고 있으며, 핀테크기업들이 상호협업보다는 독자생존을 우선하기 때문으로 이해된다. 특히 디지털뱅크인 케이뱅크와 카카오뱅크의 경우 예금과 대출에 대한 의존도가 기존 은행보다 더 크고 기존 은행과 유사하게 풀뱅킹(full banking) 사업모델을 지향하고 있다는 점이 특징적이다.

국내 핀테크기업은 해외와는 다소 다르게 고객에게는 무료 서비스를 제공하고 기존 금융회사의 금융상품의 추천이나 광고를 통해 수익을 창출하고 있다. 이 때문에 새로운 유형의 금융서비스가 발굴되거나 서비스 차별화가 이루어지기보다는 핀테크기업 간의 가격 또는 혜택 경쟁이 심화되고 있는 것으로 보인다. 이렇듯 해외와 다른 양상이 나타나는 이유는 핀테크기업이 독자적으로 수익을 창출할 만큼 각 금융 분야의 국내 시장규모가 충분히 크지 않기 때문일 수 있다. 국내 핀테크기업들의 해외진출이 활발한 것도 이 때문인 것으로 판단된다.

국내에서도 P2P 개인송금과 P2P 대출 서비스가 해외와 유사하게 핀테크에 대한 사회적 관심과 금융규제의 변화를 주도하고 있으나, 그 경제적 역할은 매우 제한적인 것으로 판단된다. 예를 들면, P2P 개인송금 서비스로 개인송금의 절차적 간편성이 크게 향상되었으나 개인송금 서비스의 비용 효율성은 더 낙후되었고 금융포용 증대에도 기여한 바가 거의 없어 보인다. P2P 대출 서비스의 경우에도 개인이나 기업의 대출 기회를 신장하기 보다는 개인의 부동산 투자수단으로 더 많이 활용되고 있는 것으로 보인다.

국내의 경우에도 해외와 유사하게 빅테크기업의 금융업 진출이 금융산업의 경쟁 구도에 상당한 영향을 미칠 것으로 보인다. 특히 국내의 경우 핀테크에 의한 금융혁신이 충분히 성숙하기도 전에 빅테크기업이 금융업에 진출하고 있는 상황이기 때문에 기존 금융회사뿐만 아니라 핀테크기업에게도 상당한 영향을 미칠 것으로 예상된다. 더구나 국내의 금융발전 정도가 미국과 유사하고 중국보다 앞서지만, 국내의 금융산업 규모가 미국과 중국에 비해 협소한 점을 고려할 경우 빅테크기업의 금융업 진출이 미치는 영향은 미국이나 중국에 비해 더 위협적일 것으로 예상된다.

Ⅳ. 시사점

지금의 핀테크에 의한 금융혁신이 이전과 다른 양상으로 금융산업과 금융시장의 변화를 이끌어내고 있지만, 이전의 금융혁신처럼 긍정적 효과뿐만 아니라 부정적 효과도 유발할 수도 있다. 예를 들면, 핀테크에 의한 금융서비스가 금융산업과 금융시장의 효율성을 오히려 악화할 수 있고 금융소비자의 권익과 금융시스템의 안정까지 크게 저해할 수 있다. 따라서 핀테크에 의한 금융혁신이 항상 유익할 것이라고 생각하기보다는 사회후생의 관점에서 핀테크에 의한 금융혁신을 객관적으로 이해하고 평가할 수 있어야 한다.

해외와 국내의 핀테크에 의한 금융혁신 양상을 비교해보면 그간 금융당국의 적극적인 지원에도 불구하고 핀테크에 의한 금융혁신의 긍정적 효과는 크게 발견되지 않는다. 물론 지급결제 분야에서 간편송금이나 간편결제 서비스가 고객의 지급결제 서비스의 이용 편리성을 크게 향상시켰고, P2P 대출 서비스가 개인이나 기업의 대출 기회를 신장하였으며, 로보어드바이저 서비스가 개인의 자산관리 서비스 접근성을 향상시켰다고 주장할 수 있다. 그러나 지금까지 살펴본 바에 따르면 각 서비스가 각 금융 분야의 비효율성을 상당 수준 개선할 만큼 그 효과가 크다고 보기는 어렵다. 이보다는 기존 금융회사로 하여금 금융혁신에 적극적으로 뛰어들도록 자극한 효과가 더 크다고 판단된다.

경제 전반의 디지털화는 앞으로도 빠른 속도로 진행될 것으로 예상된다. 그만큼 금융의 디지털화도 빠르게 진행될 것이다. 이 점에서 핀테크에 의한 금융혁신을 지금과 같이 계속해서 촉진하고 지원할 필요가 있다. 그러나 금융의 디지털화가 반드시 핀테크기업에 의해 주도될 이유는 없다. 기존 금융회사에 의해서도 금융의 디지털화가 더 효율적이고 효과적으로 실현될 수 있다. 이를 고려했을 때 금융정책이나 금융규제가 핀테크기업과 기존 금융회사를 차별할 이유가 없다. 기존 금융회사에게도 금융의 디지털화에 적극적으로 참여할 수 있는 공정한 기회를 부여할 필요가 있다. 그렇지 않으면 오히려 금융의 디지털화가 늦어질 수 있고, 핀테크에 의한 금융혁신의 긍정적 효과가 지금과 같이 크게 나타나지 않을 수 있다.

특히 최근 법 제‧개정으로 예금상품을 포함한 모든 금융상품에 대한 판매 중개‧대리가 가능해졌고, 금융상품자문업, 오픈뱅킹제도, 마이데이터업, 마이페이먼트업, 종합지급결제업 등이 신설되거나 신설될 예정이다. 은행이 독점하던 금융결제원의 소액지급결제망의 전면 개방도 논의되고 있다. 이에 따라 이전보다 더 용이하게 혁신적 금융서비스가 발명되고 공급될 수 있을 것으로 기대된다. 그럼에도 불구하고 상기와 같은 제도 변화로 금융혁신의 긍정적 효과가 최대한 발현되려면 은행뿐만 아니라 비은행 금융회사에게도 공정한 기회가 부여될 필요가 있다. 이 점에서 2020년 10월에 은행과 핀테크기업만 참여할 수 있었던 오픈뱅킹공동망시스템을 비은행 금융회사에게도 개방하기로 결정한 점은 이전보다 진일보하였다고 판단된다(금융위원회‧금융감독원, 2020. 10. 21).

새로운 금융서비스의 출현을 촉진하기 위해서는 핀테크기업이나 빅테크기업이 기존 금융회사와 자유롭게 협업할 수 있는 환경을 마련해야 한다. 예를 들면, 인허가 금융업의 본질적 업무의 위탁을 제한한 금융회사 업무위탁 규제를 합리화하고, 금융실명 확인의 제3자 위탁대상도 확대할 필요가 있다. 다만 핀테크기업이나 빅테크기업이 규제공백을 남용해 규제차익을 과도하게 추구하지 않도록 동일행위-동일규제 원칙에 따라 기존 금융회사와 동일한 수준의 규제를 적용하고 감독할 수 있어야 한다. 특히 기존 금융회사와 빅테크기업 간의 갈등으로 금융소비자가 피해보지 않도록 각별한 주의를 기울여야 한다. 더 나아가서는 시장이 협소한 국내에서 서로가 과도하게 경쟁하지 않도록 핀테크기업의 해외진출도 체계적으로 지원하는 방안도 강구해야 한다.

지난 5년 동안 우리나라의 핀테크는 금융당국의 적극적인 지원으로 양적으로 성장하는 데 성공하였다. 그러나 이제는 핀테크에 의한 금융혁신이 금융산업의 효율성을 실질적으로 개선할 수 있도록 질적인 성장을 도모해야 한다. 그럴 때 우리나라 금융산업의 국제적 경쟁력이 향상될 것으로 기대된다.

1) 예를 들면, 산업로봇(industrial robot)의 발명은 그 자체가 상품혁신에 해당되나, 자동차 조립 공정을 새롭게 바꾸는 공정혁신을 가져왔다. 또한 반도체 나노 공정은 반도체를 생산하는 공정을 효율화하는 데 그치지 않고, 고용량‧고성능 반도체의 생산을 가능하게 하였다.

2) Finnerty(1992)와 BIS(1986)는 금융혁신의 역할을 Merton(1992)과 조금 다르게 위험의 재배분 또는 이전, 대리인 비용의 감소, 유동성 증대 또는 강화, 자금의 형성 등으로 제시한다.

3) Goetzmann & Rouwenhorst(2005)에서는 메소포타미아의 이자 발명, 로마의 지분증권, 중국의 지폐, 상거래 어음, 이탈리아의 채권과 국채, 네덜란드 동인도회사의 벤처 지분증권, 암스테르담의 선물거래, 현대유럽 초창기의 연금, 미국 초창기의 인플레이션 연계 채권, 뮤추얼 펀드, 유로본드 등에 대해 자세히 소개하고 있다.

4) Miller(1986)에서는 양도성예금증서(CD), 유로달러 계좌, 유로본드(Eurobond), 스시본드(sushi bonds), 변동금리 채권, 풋옵션부 채권, 제로쿠폰 채권(zero-coupon bond), 쿠폰분리 채권(stripped bond), 현금관리계좌(CMA), collateralized mortgage, home equity loan, 통화스왑, 상하단 금리스왑(floor-ceiling swap), 교환사채(exchangeable bonds) 등이 대표적인 금융혁신 사례로 제시되어 있다.

5) Philippon(2017)은 기존 금융회사보다 핀테크기업이 금융중개 단위비용을 낮출 수 있다고 설명한다.

6) Pillippon(2015)은 금융회사의 수입과 금융회사에 의해 자금중개된 금융자산의 비율로 금융중개 단위비용을 측정하였다.

7) 소비자의 금융정보 접근성은 핀테크가 출현하기 이전부터 크게 향상되었다고 볼 수 있다. 그러나 소비자의 금융정보가 금융회사별로 흩어져 있고 가공되지 않은 채로 제공되다 보니 소비자 입장에서 그 활용성이 높지 않았다.

8) 이성복(2016a)은 금융 데이터는 전 산업 데이터의 약 50%를 차지할 정도로 상당하기 때문에 데이터 공유를 통해 새로운 부가가치가 창출될 수 있다고 보고한다.

9) 결합은 둘 이상의 것을 합쳐 새로운 가치를 창출하는 것이고, 융합은 둘 이상의 것을 모아 각각의 경계가 모호한 새로운 것을 창출하는 것이다. 테이프와 DVD 매체를 비디오를 재생할 수 있는 콤보 플레이어가 결합의 대표적인 사례이고, 스마트폰(smart phone)이 융합의 대표적인 사례로 제시된다.

10) 언번들링은 기존 금융회사가 종합적으로 제공하고 있는 금융서비스를 세분화하여 제공하는 것을, 리번들링은 세분화된 금융서비스를 재결합하는 것을 뜻한다.

11) 이성복(2020)에서 금융상품 불완전판매, 금융사기, 금융착취에 대해 자세히 설명하고 있다.

12) Ehrentraud et al.(2020)은 31개 조사대상 국가(한국 미포함) 중 24개 국가에서 대출형 또는 증권형 크라우드펀딩 제도를 신설하였다고 보고한다.

13) 국내의 핀테크기업 현황을 조사하기 위해 설문조사가 설계된 만큼 Crunchbase.com이 제공하는 정보보다 더 다양한 정보를 포함하고 있다.

14) 각 핀테크기업의 해외진출 여부는 Craft.co에서 조회된 해외 사무실을 기준으로 조사하였다. Craft.co로 해외진출 여부가 확인되지 않을 경우 해당 핀테크기업의 웹사이트 등을 통해 확인하였다.

15) Klarna는 스웨덴 금융당국으로부터 사업모델의 혁신성과 성장성을 인정받아 2017년 6월에 풀뱅킹 은행업을 인가받았다.

16) 라운드업 서비스는 소비지출 성향이 높고 여유자금이 없는 젊은 세대에게 손쉽게 지급결제 서비스와 함께 저축 또는 투자 서비스를 경험할 수 있는 기회를 제공하고, 직불카드 연계 판매신용 서비스는 까다로운 발급심사로 신용카드를 발급받지 못하는 고객에게 신용카드와 같은 판매신용을 제공하는 서비스다.

17) Betterment와 Wealthfront의 고객 수는 2020년 7월말 기준으로 각각 약 50만명과 40만명 내외로 조사된다.

18) Revolut는 2018년 12월에 EU에서 은행 인가를 받았고, 2020년 3월에는 은행 인가 없이 미국에 진출하였다. 독일의 N26도 2019년 7월에 은행업 인가 없이 미국에 진출하였다.

19) 영국의 경우 중소기업의 자금조달을 확대하기 위해 정책적으로 P2P 대출 플랫폼을 지원하기 때문에 P2P 대출 서비스에 의한 기업신용대출 규모가 개인신용대출보다 크다.

20) 세계은행 그룹(The World Bank Group)이 제공하는 세계발전지수(World Development Indicators)를 참고하였다.

21) 통제변수로는 IMF에서 발표한 최근년도 금융회사에 의한 금융서비스의 접근성(access), 깊이(depth), 효율성(efficiency) 지표를 사용하였다.

22) 2019년 핀테크기업편람 조사대상은 당초 682개였으나 폐업 또는 전화번호 결번 등으로 확인되지 않는 103개가 최종 조사대상에서 제외되었고, 나머지 579개 핀테크기업 중 345개만 설문조사에 응답한 점을 고려하였다.

23) 2018년 6월말 기준으로 간편송금 서비스업자는 14개, 간편결제 서비스업자는 39개, 2020년 6월 3일 기준으로 P2P 대출업자가 241개, 2020년 6월말 기준으로 테스트베드를 통과한 로보어드바이저가 45개로 집계된다(금융위원회, 2018; 금융위원회‧금융감독원, 2020. 6. 4; 코스콤, 2020. 7. 20).

24) 핀테크기업의 사업자등록증에 기재된 ‘사업의 종류’ 항목의 내용을 기준으로 하였다.

25) 핀테크기업의 일차 서비스 대상을 기준으로 분류하였다.

26) 2020년 7월 7일에 미래에셋생명이 국내 최초로 ‘사후정산형 P2P 보험’에 대한 금융규제 특례를 금융규제 샌드박스를 통해 지정받았다.

27) 2020년 6월말 로보어드바이저를 활용한 투자일임과 투자자문 서비스 이용금액은 390.9억원(전체의 3.26%)이고, 은행의 펀드추천 서비스 이용금액은 1조 1,572.6억원(9678%)로 조사된다(코스콤, 2020. 7. 20).

28) 성인 10만 명당 은행 지점 수는 2011년에 18.2개에서 2019년에 15.1개로 감소하였다.

참고문헌

금융감독원, 2018. 11. 20, P2P 대출 취급실태 점검결과 및 향후 계획, 보도자료.

금융감독원, 2019. 11. 7, 안전한 P2P투자를 위한 투자자 유의사항 - 소비자경보(주의) 발령, 보도자료.

금융위원회, 2015. 1. 27, IT‧금융 융합 지원방안, 보도자료.

금융위원회, 2015. 5. 18, 금융거래시 실명확인방식 합리화방안, 보도자료.

금융위원회, 2016. 5. 26, 비대면 실명확인 운영 현황 및 향후 계획, 보도자료.

금융위원회, 2018, 금융혁신국 주요통계 자료, 내부자료.

금융위원회, 2020. 7. 27,『디지털금융 종합혁신방안』발표, 보도자료.

금융위원회, 2020. 8. 21, 금융규제 샌드박스를 통해 ‘정비 필요성’이 입증된 27건의 금융규제를 개선해 나가겠습니다, 보도자료.

금융위원회, 2020. 12. 10, 「디지털금융 규제‧제도 개선방안」, 보도자료 첨부.

금융위원회‧금융감독원, 2019. 12. 26, 19년 상반기 대부업 실태조사 결과, 보도자료.

금융위원회‧금융감독원, 2020. 6. 4, 온투법 시행에 따라 강화되는 P2P 투자자 보호 제도, 지금부터 투자하기 전에 확인하세요! 보도자료.

금융위원회‧금융감독원, 2020. 8. 31, 고령친화 금융환경 조성방안, 보도자료 첨부.

금융위원회‧금융감독원, 2020. 9. 10, 디지털 금융혁신 및 빅테크-금융사간 “상호윈윈” 논의의 장인 「디지털금융 협의회」를 출범하였습니다, 보도자료.

금융위원회‧금융감독원, 2020. 10. 21, 제3차 「디지털금융 협의회」개최, 보도자료.

김규동, 2018, P2P 보험의 특징 및 활용 사례, 보험연구원 KIRI 포커스.

이성복, 2016a, 미국 인터넷전문은행의 사업성과 분석 및 시사점, 자본시장연구원 연구보고서 16-01.

이성복, 2016b, 해외 자본시장의 빅데이터 도입 현황 및 시사점, 자본시장연구원 조사보고서 16-08.

이성복, 2018, P2P 대출중개시장 분석과 시사점-금융중개 역할을 중심으로, 자본시장연구원 조사보고서 18-02.

이성복, 2019a, 국내 로보어드바이저 도입 현황과 시사점, 자본시장연구원 자본시장포커스 2019-16호.

이성복, 2019b, P2P 대출중개 플랫폼의 금융중개 역할에 관한 연구, 금융연구 32(2), 21-62.

이성복, 2020, 해외의 고령 금융소비자 보호 강화 추세와 시사점, 자본시장연구원 이슈보고서 20-12.

코스콤, 2020. 7. 20, 2020년 2분기 로보어드바이저 테스트베드 운영현황, RA 테스트베드 사무국.

핀테크지원센터, 2020, 「2019년도 핀테크기업편람」.

한국은행, 2019, 「2018 지급결제보고서」.

한국은행, 2020. 3. 5, 2019년중 지급결제동향, 보도자료.

Allen, F., Gu, X., Jagtiani, J., 2020, A survey of FinTech research and policy discussion, FRB of Philadelphia Working Papers 20-21.

Bai, J., Philippon, T., Savov, A., 2013, Have financial markets become more informative? NBER Working Paper No.19728.

Balyuk, T., Davydenko, S., 2018, Reintermediation in Fintech: Evidence From Online Lending, University of Toronto Rotman School of Management Research Paper Series.

BIS, 1986, Recent innovations in international banking, Prepared by a Study Group established by the Central Banks of the Group of Ten Countries.

BIS, 2018, Implications of Fintech Developments for Banks and Bank Supervisors, Basel Committee on Banking Supervision.

BIS, 2019, Big tech in finance: opportunities and risks, Annual Economic Report 2019.

BIS, 2020, The economic forces driving FinTech adoption across countries, BIS working papers No.838.

Braggion, F., Manconi, A., Pavanini, N., 2019, Fintech and the value of financial disintermediation, SSRN Electronic Journal.

Buchak, G., Matvos, G., Piskorski, T., Seru, A., 2018, Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics 130(3), 453-483.

Buckley, R., Arner, D.W., Barberis, J.N., 2016, 150 years of FinTech: An evolutionary analysis, The Finsia Journal of Applied Finance 3.

Calomiris, C.W., 2002, Banking and Financial Intermediation, A Council on Foreign Relation Book Chapter 11.

Calomiris, C.W., 2009, Financial innovation, regulation, and reform, The Cato Journal 29(1), 65-91.

Cambridge Centre for Alternative Finance, 2020, The Global Alternative Finance Market Benchmarking Report.

Capgemini, Efma, 2020, World Fintech Report 2020.

Carey, T.W., 2019, Robo-Advisors 2019: Still Waiting for the Revolution, Investopedia.

CB Insights, 2018a, The Challenger Bank Playbook: How 6 Digital Banking Startups Are Taking On Retail Banking.

CB Insights, 2018b, The 2018 Fintech 250.

CB Insights, 2020, Unbundling Bank Of America: How The Traditional Bank Is Being Disrupted.

Cornerstone Advisors, 2020, Fintech Adoption in the United States: The Opportunity for Banks and Credit Unions.

EBA, 2017, EBA Publishes a Discussion Paper on its Approach to Fintech, Discussion Paper.

EC, 2018, Overview of the Fintech sector: challenges for the European players and Possible Policy.

Ehrentraud, J., Ocampo, D.G., Garzoni, L., Piccolo, M., 2020, Policy Responses to Fintech: A Cross-Country Overview, BIS FSI Insights 23.

EY, 2017, Fintech Adoption Index 2017.

EY, 2019, Global Fintech Adoption Index 2019.

Finch capital & Dealroom.co, 2019, The State of European Fintech.

Findexable, 2019, The Global Fintech Index 2020.

Finnerty, J.D., 1992, An overview of corporate securities innovation, Journal of Applied Corporate Finance 4(4), 23-39.

Frame, W.S., White, L.J., 2012, Technological Change, Financial Innovation, and Diffusion in Banking, Oxford Handbook of Banking.

Frost, J., Gambacorta, L., Huang, Yi., Shin, H.S., Zbinden, P., 2019, BigTech and the changing structure of financial intermediation, BIS working papers No.779.

FSB, 2017, Financial Stability Implications from Fintech.

FSB, 2019a, Fintech and Market Structure in Financial Services: Market Devolopments and Potential Financial Stability Implications.

FSB, 2019b, BigTech in Finance: Market Developments and Potential Financial Stability Implications.

Goetzmann W., Rouwenhorst G., 2005. The Origins of Value: The Financial Innovations that Created Modern Capital Markets, Oxford University Press.

Greenwood, J., Sanchez, J.M., Wang, C., 2007, Financing Development: The Role of Information Costs.

Greenwood, R., Scharfstein, D., 2013, The growth of finance, Journal of Economics Perspectives 27(2), 3-28.

Han, 2020. 6. 15, Nation's FinTech companies expand their reach, China Daily.

Havrylchyk, O., Verdier, M., 2018, The Financial intermediation role of the P2P lending platforms, Comparative Economic Studies 60, 115-130.

IMF, 2018, Measuring the Digital Economy, IMF Staff Report.

IMF, 2020, The Promise of Fintech: Financial Inclusion in the Post COVID-19 Era, Monetary and Capital Market Department 20/09.

Johnson, S., Kwak, J., 2012, Is Financial Innovation Good for the Economy? Innovation Policy and the Economy 12(1), 1-16.

Kavuri, A.S., Milne, A., 2019, Fintech and the future of financial services: What are the research gaps? CAMA working paper.

KPMG, 2016, 2015 Fintech 100: Leading Global Fintech Innovators.

KPMG, 2017, 2016 Fintech 100: Leading Global Fintech Innovators.

KPMG, 2018, 2017 Fintech 100: Leading Global Fintech Innovators.

KPMG, 2019, 2018 Fintech 100: Leading Global Fintech Innovators.

KPMG, 2020, 2019 Fintech 100: Leading Global Fintech Innovators.

Lerner, J., Tufano, P., 2011, The consequences of financial innovation: a counterfactual research agenda, NBER working paper No.16780.

Liao, L., Wang, Z., Xiang, H., Zhang, X., 2017, P2P Lending in China: An Overview.

Litan, R.E., 2010, In Defense of Much, But Not All, Financial Innovation, Brookings Report.

Maggio, M.D., Yao, V.W., 2018, Fintech borrowers: Lax-screening or cream-skimming? SSRN Electronic Journal.

Mastercard, 2020, Fintech in 2020: Five Global Trends to Watch.

Miller, M., 1986, Financial innovation: the last twenty years and the next, Journal of Financial and Quantitative Analysis 21(4).

Moody’s, 2018, Threat of Big Tech Disruption is Real.

NAIC, 2020a, Peer-To-Peer (P2P) Insurance, The Center for Insurance Policy and Research.

NAIC, 2020b, NAIC Releases 2019 Market Share Data.

OECD, 2018a, Financial Consumer Protection Approaches in the Digital Age, G20/OECD Policy Guidance.

OECD, 2018b, Financial Market, Insurance and Pension: Digitalization and Finance.

OCED, 2019, Directorate for Financial and Enterprise Affairs Competition Committee.

OECD, 2020, Digital Disruption in Banking and Its Impact on Competition.

Oliver Wyman, 2018, Breaking New Ground in Fintech.

Philippon, T., 2015, Has the US finance industry become less efficient? On the theory and measurement of financial intermediation, American Economic Review 105(4), 1408-1438.

Philippon, T., 2017, The FinTech Opportunity, BIS Working Papers No. 655.

Philippon, T., 2019, On Fintech and Financial Inclusion, NBER Working Paper No. 26330.

PwC, 2016a, Financial Services Technology 2020 and Beyond: Embracing Disruption.

PwC, 2016b, Blurred Lines: How Fintech is Shaping Financial Services, Global Fintech Report.

PwC, 2016c, Customers in the Spotlight: How Fintech is Reshaping Banking, Global Fintech Survey 2016.

Restory, F., 2019, Regulating Fintech: What Is Going On and Where Are the Challenges? BIS.

Schindler, J., 2017, Fintech and Financial Innovation: Divers and Depth, FRB Finance and Economics Discussion Series.

Simon, J., Kwak, J., 2012, Is Financial Innovation Good for the Economy? Innovation Policy and the Economy 12, 1-15.

Stulz, R.M., 2019, Fintech, bigTech, and the future of banks, NBER working paper No.26312.

Tang, H., 2019, Peer-to-Peer lenders Versus Banks: Substitutes or Complements? Oxford University Press.

The Economist, 2017, Silicon Speculators.

The Paypers, 2019, Payment Methods Report 2019.

Tufano, P., 2002, Financial innovation, Handbook of the Economics of Finance 1(1), 307-335.

U.S. Congress, 1984, Effects of Information Technology on Financial Services Systems, Office of Technology Assessment, OTA-CIT-202.

UK DIP and HM Treasury, 2020, UK FinTech State of the Nation.

Vives, X., 2017, The Impact of Fintech on Banking, European Economy.

Volcker, P., 2009. 12. 14, Think More Boldly, The Wall Street Journal.

WEF, 2015, The Future of Financial Services.

WEF, 2017, Beyond Fintech: A Pragmatic Assesment of Disruptive Potential in Financial Services.

White, L.J., 1997, Technological Change, Financial Innovation, and Financial Regulation in the U.S.: The Challenges for Public Policy, New York University.

World Bank Group, 2018, The Global Findex Database 2017.

World Bank Group, 2020, Payment Aspects of Financial Inclusion in the Fintech Era, Committee on Payments and Market Infrastructures.

전 세계적으로 핀테크(FinTech)가 상당한 주목을 받고 있는 것은 분명해 보인다. <그림 Ⅰ-1>에서 나타난 바와 같이 2016년을 기점으로 핀테크에 대한 연구가 폭발적으로 증가한 것만 봐도 쉽게 짐작할 수 있다. 핀테크 관련 문헌 수는 2016년에 약 2,580건이 조회되며 전년 대비 3배 이상 증가하였고, 이후 빠르게 증가하여 2020년에는 12,500건을 상회할 것으로 예상된다. 이전에도 금융혁신은 끊임없이 일어났지만, 하나의 주제로 이렇게 많은 연구가 이루어진 적은 드문 것으로 판단된다.

한편 핀테크에 의한 금융혁신은 이전의 기술진보에 따른 금융혁신과는 다른 양상을 보인다는 평가가 지배적이다. 기존 금융회사가 아닌 주로 창업기업이 주도하고 있고, 모든 금융 분야에서 전방위적이고 동시적으로 일어나고 있다. 또한 금융서비스를 제공하는 방식이나 절차를 재정의하고, 금융서비스의 결합과 융합을 통해 금융서비스 간의 경계를 모호하게 하며, 금융산업의 경쟁 구도에도 상당한 영향을 미치고 있다. 최근에는 구글(Google)과 같이 거대한 플랫폼(platform)을 보유한 빅테크(BigTech) 기업들이 금융업에 직‧간접적으로 진출하고 있다.

이처럼 핀테크에 의한 금융혁신이 금융산업과 금융시장에 큰 영향을 미치고 있는 바, 그 양상을 제대로 이해하는 것은 여러 측면에서 매우 중요하다. 먼저 핀테크에 의한 금융혁신을 객관적으로 평가할 수 있는 시각을 가질 수 있다. 또한 핀테크에 의한 금융혁신으로 인해 제기되는 여러 쟁점을 논의하고 해소하는 데 유용할 수 있다. 더 나아가 금융당국이 핀테크에 의한 금융혁신에 따른 긍정적 효과를 최대화하고 부정적 효과를 최소화할 수 있도록 금융정책을 설정하는 데도 활용될 수 있다.

이러한 배경과 목적을 바탕으로 본 보고서에서는 핀테크에 의한 금융혁신의 양상을 종합적으로 분석하고자 하였다. 이를 위해 Crunchbase.com에서 제공하는 12,256개 핀테크기업 자료를 활용하였으며 다양한 출처의 문헌도 참고하였다. 또한 국내의 양상을 분석하고 해외의 양상과 비교하기 위해 2019년 11월에 핀테크지원센터가 「2019년도 핀테크기업편람」 제작과 관련하여 실시한 설문조사 결과와 국내 문헌도 참고하였다. 이를 토대로 국내에 주는 시사점을 도출하였다.

본 보고서에서는 기존문헌과 차별성을 두기 위해 핀테크 자체보다는 금융혁신에 초점을 맞춰 그 양상을 객관적으로 이해하고 평가하고자 하였다. 물론 본 보고서가 핀테크에 의한 금융혁신의 모든 양상을 설명하는 것은 아니다. 본 보고서에서 논의하지 못한 다양한 양상이 존재할 수 있고, 핀테크를 바라보는 시각에 따라 그 양상도 달리 평가될 수 있다는 점을 주지할 필요가 있다.

본 보고서의 나머지는 다음과 같이 구성되어 있다. 제Ⅱ장에서는 기존 문헌을 토대로 전통적인 금융혁신의 동인과 역할을 살펴보고, 핀테크에 의한 금융혁신의 역할과 금융산업에 미치는 영향을 논의하였다. 핀테크의 출현에 따른 금융규제와 금융혁신의 관계 변화도 살펴보았다. 이를 토대로 제Ⅲ장에서는 핀테크에 의한 금융혁신의 양상을 12가지로 정리하고 해외와 국내의 양상을 비교하였다. 이를 위한 분석방법과 데이터에 대해서도 논의하였다. 제Ⅳ장에서는 국내에 주는 시사점을 제시하였다.

Ⅱ. 금융혁신과 핀테크의 역할

1. 금융혁신의 동인과 역할

혁신(innovation)은 새로운 상품, 서비스 또는 아이디어를 발명(invention)하고 확산(diffusion)하는 행위이며, 그 혁신의 목적이나 대상에 따라 상품혁신(product innovation)과 공정혁신(process innovation)으로 구분될 수 있다(Tufano, 2003). 상품혁신은 새로운 상품이나 서비스를 소개하여 소비자나 시장의 수요를 창출하는 것이고, 공정혁신은 새로운 방식이나 절차로 상품이나 서비스를 공급하거나 제공하는 것을 뜻한다. 물론 상품혁신과 공정혁신이 명확하게 구분되는 것은 아니다. 상품혁신이 공정혁신을 가져오기도 하고, 공정혁신이 결과적으로 상품혁신을 낳기도 한다(OECD, 2019).1)

이와 같이 금융혁신도 새로운 금융상품 또는 금융서비스를 발명하고 확산하는 행위로 정의될 수 있다. 그 결과, 새로운 유형의 금융회사가 출현하고 이전에 없던 금융시장이 새롭게 형성될 수 있다(Tufano, 2003; Lerner & Tufano, 2011). 금융상품과 금융서비스는 금융회사 또는 금융시장이 경제주체 간의 금융거래를 중개하거나 촉진하기 위해 경제주체에게 공급하거나 제공하는 매개이다. 그러므로 어떤 금융상품과 금융서비스가 또는 그 금융상품과 금융서비스가 어떤 방식이나 절차로 공급되거나 제공되느냐에 따라 금융거래의 효율성이 좌우될 수 있고, 금융산업과 금융시장의 발전에도 영향을 미칠 수 있다.

한편 모든 시장이 완전하고 완결한 애로우-드브루 경제(Arrow-Debreu economy)에서는 금융혁신이 필요하지 않다. 새로운 금융상품이나 금융서비스를 소개할 이유가 없고, 그 금융상품과 금융서비스를 공급하거나 제공하는 방식을 바꿀 이유도 없기 때문이다. 그러나 현실 세계의 금융산업과 금융시장은 불완전(imperfect)하고 불완결(incomplete)하다(Tufano, 2003). 다른 말로 표현하면 금융산업과 금융시장에는 정보 비대칭성, 거래 비용, 도덕적 해이, 규제, 과세, 외부성 등과 같은 금융마찰(financial frictions)이 존재한다. 이로 인해 경제주체 간의 금융거래 또는 금융회사의 중개가 비효율적으로 일어난다.

그렇다면 금융혁신이 일어나는 근본적인 이유는 금융산업과 금융시장의 불완전성과 불완결성 또는 금융마찰의 존재에서 찾을 수 있다. 새로운 금융상품 또는 금융서비스의 발명이나 확산으로 금융산업과 금융시장의 불완전성과 불완결성 또는 금융마찰이 완화되면 경제주체 간의 금융거래 또는 금융회사의 중개가 증가할 수 있고, 금융회사 등은 새로운 수익을 창출할 수 있기 때문이다(Calomiris, 2002). Tufano(2003)는 기존문헌 조사를 토대로 앞서 살펴본 금융마찰의 존재뿐만 아니라 글로벌화, 변동성 확대 및 기술진보와 같은 외부요인 변화도 금융혁신의 동인으로 보았다.

따라서 금융혁신은 금융산업과 금융시장의 불완전성과 불완결성 또는 금융마찰을 완화함으로써 금융산업과 금융시장의 효율성을 제고할 수 있어야 한다(Lerner & Tufano, 2011). Merton(1992)은 <표 Ⅱ-1>에서 살펴볼 수 있듯이 금융혁신의 역할을 자금의 시‧공간 이동, 자금의 모집, 위험관리, 의사결정을 지원하는 정보 추출, 도덕적 해이와 정보 비대칭성 문제 해소, 지급결제 시스템을 통한 상품과 서비스의 거래 촉진으로 구분하여 제시하였다.2) 한편 금융혁신의 역할이 항상 명확하게 구분되는 것은 아니다. 복수의 역할을 동시에 수행하기도 한다. 예를 들면, 자산유동화의 경우 자금의 시‧공간 이동, 자금의 모집, 위험관리의 역할을 수행한다(Tufano, 2003).

물론 금융 분야에서 기술진보에 따른 공정혁신도 적지 않게 일어났다. 예를 들면, 1951년에 최초로 다목적용 신용카드가 발급되었고, 1958년에는 미국에서 리볼빙 신용카드가 처음 소개되었으며, 1967년에는 자동입출금기계(ATM)가 처음으로 런던 지역에 설치되었다. 1971년에는 세계 최초로 미국에서 전자증권거래시스템인 NASDAQ이 개설되었고, 1972년에는 ATM에서 사용할 수 있는 직불카드가 처음 발급되었으며, 1973년에는 해외송금 전신을 처리하는 SWIFT가 설립되었다. 1982년에는 세계 최초로 온라인 증권사인 E-Trade가 설립되었고, 1983년에는 영국에서 온라인 뱅킹 서비스가 최초로 소개되었으며, 1987년에는 알리안츠 보험회사가 생명보험 인수업무를 자동화하였다. 1995년에는 세계 최초로 미국에서 인터넷전문은행이 설립되었고, 인터넷 자산관리 서비스도 처음 출시되었다. 1990년대 중반부터 은행의 인터넷뱅킹도 빠르게 도입되었다.

그럼에도 불구하고 금융 분야에서의 공정혁신은 상품혁신에 비해 크게 주목받지 못한 것이 사실이다. 이는 그간의 공정혁신이 개별적이고 산발적으로 일어났기 때문이다. 한편 2008년 글로벌 금융위기가 부채담보부증권(CDO)과 신용부도스왑(CDS)과 같은 상품혁신에서 비롯되었다는 비판이 제기되면서 공정혁신을 재평가하는 움직임도 있다(Litan, 2010; Lerner & Tufano, 2011). 예를 들면, Volcker(2009. 12. 14)는 지난 20년의 금융혁신 사례 중 ATM과 같은 사례를 찾아볼 수 없다고 평가하며 그간의 상품혁신에 대한 평가가 과도했다고 에둘러 비판하였다. 또한 Frame et al.(2018)은 미국 내 은행 간 계좌이체를 처리하고 지원하는 ACH(Automated Clearing House) 네트워크와 소기업 신용평가 사례를 들며 지난 30년 동안 금융 분야에서 일어난 공정혁신의 의의를 재평가하였다.

2. 핀테크의 역할과 영향

가. 핀테크 출현 배경

금융기술(financial technology)의 줄임말로 사용되는 핀테크는 예전에도 기술진보에 따른 금융혁신이 존재하였다는 점에서 전혀 새로운 것이 아닐 수 있다. 실제 핀테크라는 용어는 1990년대에 처음 고안된 것으로 조사된다(Buckley et al., 2016; Hochstein, 2015). 그럼에도 불구하고 2008년 글로벌 금융위기 이후부터 핀테크에 의한 금융혁신은 이전의 기술진보에 따른 금융혁신과 여러 측면에서 다르다는 평가를 받고 있다(OECD, 2018; Schindler, 2018).

예를 들면, Schindler(2018)는 핀테크에 의한 금융혁신이 모든 금융 분야에서 전방위적이고 연속적으로 일어나고 있다고 평가한다. 또한 이전의 금융혁신이 기술을 표면적으로 활용했다면 핀테크에 의한 금융혁신은 기술을 금융상품과 금융서비스를 공급하고 제공하는 방식이나 절차를 근본적으로 바꾸는 데 활용하고 있다고 보았다. 더 특징적인 것은 핀테크에 의한 금융혁신은 기존의 금융회사가 아닌 창업기업이 주도하고 있다는 점이다. 이에 대해 Philippon(2017)은 핀테크에 의한 금융혁신이 왜 일찌감치 기존 금융회사에 의해 일어나지 않았는가라는 의문을 제기하였다.

Schindler(2018)는 핀테크에 의한 금융혁신이 일어날 수 있었던 것은 2008년 글로벌 금융위기로 기존 금융회사에 대한 신뢰가 추락하고 금융규제가 강화되었기 때문이라고 설명한다. 그러나 이보다는 2007년부터 모바일 스마트기기가 대중적으로 보급되기 시작하면서 경제 전반의 패러다임이 디지털 경제(digital economy)로 전환되고 있는 시대적 흐름이 더 크게 작용한 것으로 판단된다. 왜냐하면 2008년에 글로벌 금융위기가 일어나지 않았더라도 금융의 디지털화는 지금과 같이 핀테크가 주도하는 양상으로 일어났을 것이 분명하기 때문이다(Philippon, 2017).

IMF(2018)는 거래 활동의 관점에서 디지털 경제를 ‘전자적으로 주문되거나, 플랫폼에서 이용할 수 있거나, 전자적으로 배송되는(digitally ordered, platform-enabled, or digitally delivered)’ 상품과 서비스의 경제로 정의한다. 이 정의를 따르자면 개인컴퓨터(PC)를 통해 접속할 수 있는 온라인 환경에서도 디지털 경제가 구현될 수 있다. 그러나 모바일 스마트기기는 개인컴퓨터를 통한 온라인 환경과 달리 시간과 공간의 제약을 거의 받지 않고 언제 어디서나 접근하고 이용할 수 있는 플랫폼(platform) 기반의 환경을 제공한다. 이로써 경제 전반의 디지털화뿐만 아니라 핀테크에 의한 금융혁신을 촉진하고 있다고 볼 수 있다.

나. 긍정적 역할과 영향

기존문헌을 종합해보면 핀테크에 의한 금융혁신의 긍정적 역할은 <표 Ⅱ-2>에서 살펴볼 수 있듯이 비대면 금융거래 확대, 정보의 양적‧질적 격차 해소, 금융서비스의 결합과 융합, 금융산업과 금융시장의 구조 재편 등 네 가지로 구분하여 살펴볼 수 있다. 또한 각 역할에 따라 이전의 기술진보에 따른 금융혁신과 다른 양상으로 금융산업과 금융시장에 미치는 영향도 다양하게 나타날 수 있는 것으로 파악된다.

핀테크에 의한 금융혁신의 긍정적 역할과 그 영향을 자세히 살펴보면 다음과 같다. 첫째, 핀테크에 의한 금융혁신은 대면 중심의 금융상품과 금융서비스의 공급을 비대면 중심으로 전환할 수 있다. 물론 이전에도 비대면 금융상품과 금융서비스가 존재하였다. 그러나 그 공급은 매우 제한적이었다. 예를 들면, 우리나라의 경우 기존 은행의 인터넷뱅킹 서비스는 2017년에 첫 인터넷전문은행이 출범하기 이전까지 계좌조회와 계좌이체 서비스 위주로 제공되었다(이성복, 2016b).

금융상품과 금융서비스의 공급이나 제공이 비대면 중심으로 전환된다는 것은 비대면 채널에서의 소비자의 편리성과 경험이 금융상품과 금융서비스를 선택하고 소비하는 데 있어 중요한 요인으로 작용한다는 것을 뜻한다. 이는 금융상품과 금융서비스가 이전과 달리 소비자 주도에 의해 선택될 가능성이 크다는 것을 뜻하기도 한다. 예를 들면, 비대면 채널에서 소비자는 빠른 반응(quick response), 적절한 제시(relevant service providing), 막힘없는 전달(seamless delivery)이 가능한 서비스를 더 선호할 것이다. 그렇지 못하면 소비자는 그 서비스를 외면할 가능성이 크다.

둘째, 핀테크에 의한 금융혁신은 이전과 다른 양상으로 정보의 양적‧질적 격차를 해소하여 금융거래의 효율성을 제고할 수 있다. 핀테크에 의한 금융혁신이 출현하기 이전에도 정보기술의 발전과 인터넷의 보급은 금융상품과 금융서비스의 거래비용을 낮추고 금융시장의 가격발견 기능을 향상시켰다(Bai et al., 2013; Greenwood et al., 2007; U.S. Congress, 1984). 그러나 정보기술의 발달에 따른 비용절감 효과는 소비자와 공유되지 않고 금융회사가 거의 독점한 것으로 보고된다(Philippon, 2015; Greenwood & Scharfstein, 2013).

예를 들면, Philippon(2015)은 1886년부터 2015년까지 금융중개 단위비용은 거의 감소하지 않았을 뿐만 아니라 1960년대 후반부터 2008년까지는 오히려 증가했다고 보고한다. 여기서 금융중개 단위비용이란 금융회사가 자금중개를 위해 제공하는 금융서비스의 단위비용을 뜻한다.6) 또한 Greenwood & Scharfstein(2013)은 자산운용시장이 그동안 크게 성장했음에도 불구하고 소비자가 부담하는 보수(fee)가 거의 변하지 않은 이유 중 하나로 정보기술의 발달로 인한 비용절감 효과가 소비자와 공유되지 않았기 때문이라고 지적한다.

이와 달리 핀테크에 의한 금융혁신은 소비자의 금융정보 접근성뿐만 아니라 활용성을 제공함으로써 정보기술의 발달에 따른 비용절감 효과를 소비자도 누리게 할 수 있다.7) 예를 들면, API(Application Programming Interface) 기술 등을 활용하여 여기저기 흩어져 있는 고객의 금융정보를 하나의 플랫폼으로 집중하고 데이터 분석 또는 인공지능 기술을 활용하여 소비자에게 필요한 금융조언 또는 금융자문 서비스를 제공할 수 있다. Philippon(2019)은 지난 5년 동안 핀테크에 의한 금융혁신으로 금융중개 단위비용이 실제 감소했다고 보고한다.

한편 소비자의 금융정보 접근성과 활용성이 제고되려면 데이터 공유가 전제되어야 한다. 이 점에서도 핀테크에 의한 금융혁신은 자신들이 보유한 데이터를 공유하는 데 소극적이었던 기존 금융회사와 다른 양상을 보인다. 더구나 빅데이터(big data) 기술을 활용할 경우 금융 데이터뿐만 아니라 대체 데이터(alternative data)까지 수집할 수 있고, 플랫폼과 API 기술을 활용해 그 데이터를 효율적으로 유통시킬 수 있다. 이 과정에서 데이터를 매개로 새로운 가치사슬이 형성될 수도 있다(이성복, 2016a).8)

셋째, 핀테크에 의한 금융혁신은 기존 금융서비스를 결합(combination)하거나 융합(convergence)함으로써 기존 금융회사가 포용하지 않는 개인이나 기업에게까지 금융서비스를 공급할 수 있다.9) 또한 새로운 유형의 금융서비스 발명을 통해 금융거래의 효율성도 제고할 수 있다. 이를 통해 고객의 금융거래 비용을 절감하고 금융거래 기회를 확장할 수 있다. 결과적으로 금융권역 간의 경계가 모호해지고 금융포용(financial inclusion)이 확대될 수 있다(PwC, 2016b; IMF, 2020).

넷째, 핀테크에 의한 금융혁신은 단순히 금융 분야의 디지털화에 그치지 않고 금융산업과 금융시장의 구조를 재편(reshaping)할 수 있다. 특히 플랫폼이 주축이 되어 은행의 금융서비스를 언번들링(unbundling)하고 리번들링(rebundling)하는 방식으로, 은행으로부터 탈중개화(disintermediation)하고 플랫폼으로 재중개화(reintermediation)하는 과정을 통해 은행산업에 상당한 영향을 미칠 수 있다(PwC, 2016c; BIS, 2018; FSB, 2019a; OECD, 2020).10) 더구나 기존 금융회사보다 더 탄탄한 고객기반과 자본금을 보유한 빅테크기업의 금융업 진출은 은행산업뿐만 아니라 금융산업 전반의 구조적 변화를 가져올 수 있다(Vives, 2017; FSB, 2019b).

다. 부정적 역할과 영향

핀테크에 의한 금융혁신이 빠르게 진전하면서 부작용에 대한 우려도 제기되고 있다. 우선 핀테크에 의한 금융혁신은 금융서비스의 접근성, 편리성, 신속성을 높여 소비자의 편익을 제고할 수 있으나, 그만큼 소비자의 권익이 더 쉽게 침해될 수 있고 소비자가 불건전한 영업행위에 더 쉽게 노출될 수 있다(OECD, 2018a; BIS, 2019). 예를 들면, 소비자는 부주의하게 금융서비스를 이용하거나 잘못된 의사결정을 내릴 수 있다. 고의적 또는 악의적 금융상품 불완전판매(mis-selling)나 금융사기(financial fraud)에 노출될 위험도 크다. 명의도용이나 금융착취(financial exploitation)를 더 쉽게 당할 가능성도 크다(이성복, 2020).11)

핀테크에 의한 금융혁신의 빠른 진전은 핀테크 수용률을 높이며 금융포용을 증대하는 효과를 가져올 수 있지만, 고령자의 금융소외(financial exclusion)를 확대하는 효과도 가져올 수 있다. 고령자는 신체적‧정신적 특성으로 인해 디지털 환경에 적응하는 데 여러 한계에 직면할 수 있기 때문이다. 예를 들면, 시력 약화는 작은 화면의 스마트기기의 이용을 어렵게 할 수 있다. 또한 인지‧판단 능력의 저하는 신속한 의사결정 요구에 제때 반응하지 못하게 할 수 있다. 더구나 고령자가 이용할 수 있는 대면 서비스가 빠르게 감소할수록 고령자의 금융소외도 그만큼 빠르게 확대될 수 있다.

2008년 글로벌 금융위기가 그간 과대평가된 금융혁신에서 비롯되었다는 비판이 있는 만큼 핀테크에 의한 금융혁신도 금융안정(financial stabilities)을 저해할 수 있다(Litan, 2010; Lerner & Tufano, 2011; Simon & Kwak, 2012). FSB(2017)는 아직까지는 핀테크의 긍정적 역할과 영향이 더 크고, Philippon(2017)은 금융규제가 잘 작동한다면 핀테크가 금융안정을 향상시킬 수 있다고 본다. 그러나 FSB(2017, 2019a, 2019b)는 핀테크기업이나 빅테크기업에 대한 규제공백이 지속될 경우 이전과 다른 양상으로 금융산업과 금융시장의 미시적 위험뿐만 아니라 금융시스템 전반의 거시적 위험까지 증대할 수 있다는 점을 유의해야 한다고 권고하고 있다.

3. 금융혁신과 금융규제의 관계

금융규제는 금융혁신을 방해하는 요소로 작용할 때가 많지만, 금융혁신을 자극하고 촉진하는 동인으로도 작용한다(Miller, 1986; Schindler, 2017; White, 1997). 이 때문에 규제완화(deregulation)가 새로운 금융혁신을 가져오기도 하고 금융혁신으로 규제차익을 추구하는 행위가 일어나고 이로 인해 규제공백이 발견되면 새로운 금융규제가 도입되기도 한다. 예를 들면, 자산유동화는 자본규제를 회피하기 위해 고안된 또는 규제완화의 결과로 나타난 금융혁신 사례로 자주 인용된다(Calomiris, 2009).

이렇듯 금융혁신과 금융규제는 그간의 금융혁신이 주로 금융회사에 의한 상품혁신에 집중되면서 순차적이고 순환적 관계를 보였다. 그러나 핀테크에 의한 금융혁신이 대개 금융규제의 적용을 받지 않는 핀테크기업에 의해 주도되면서 금융혁신과 금융규제가 동시적 관계로 발전하는 양상을 보인다. 예를 들면, Ehrentraud et al.(2020)은 핀테크에 의한 금융혁신으로 금융산업과 금융시장의 효율성이 제고될 수 있지만, 이 과정에서 규제차익이 남용되고 규제공백이 확대되면 소비자 피해와 금융안정 저해가 우려된다고 보고 각 국가에서는 핀테크에 대한 규제를 동시에 강화하고 있다고 설명한다.

핀테크에 의한 금융혁신과 관련된 규제 논의는 세 분야로 나눠 살펴볼 수 있다(Ehrentraud et al., 2020; Restory, 2019). 먼저 페이테크(PayTech), P2P 대출, 크라우드펀딩, 로보어드바이저, 인슈어테크(InsurTech) 등 새롭게 출현한 핀테크기업에 대한 규제 논의다. 최근까지도 많은 국가에서는 기존의 금융규제를 완화하거나 새로운 금융규제를 신설해 핀테크기업의 금융혁신 활동을 장려해왔다.12) 그러나 최근 들어 각 국가에서 기존 금융회사와 핀테크기업 간의 규제 형평성의 문제가 대두되고 있다(BIS, 2020). 일부 핀테크기업들이 핀테크에 의한 금융혁신을 내세워 금융규제를 회피하기 위해 규제차익(regulatory arbitrage)을 추구하면서 핀테크기업에 대한 규제공백이 커지고 있기 때문이다. 이에 따라 동일행위-동일규제(same activity, same regulation) 원칙에 따라 기존 금융회사와 같이 핀테크기업을 규제해야 한다고 지적되고 있다.

다음으로 스크린 스크래핑(screen scraping), API, 클라우드 컴퓨팅, 빅데이터, 생체인식(biometrics), 분산원장, 인공지능(AI) 등과 같이 핀테크에 활용되는 기술에 대한 규제 논의다. 핀테크에 활용되는 기술이 이전과 다른 양상으로 활용되면서 기술로 인해 새롭게 제기되는 이슈와 위험을 사전에 통제할 필요성이 커지고 있기 때문이다. 예를 들면, 금융회사가 고객의 금융정보를 독점하고 있을 때 스크린 스크래핑은 여러 금융회사에 흩어져 있는 고객의 금융정보를 수집하는 데 활용되었다. 그러나 과도한 트래픽 유발, 사이버보안 위험 등을 이유로 EU에서는 2019년 9월부터 스크린 스크래핑을 금지하였다.

마지막으로 핀테크에 의한 금융혁신을 저해하는 공통적인 장애요소를 제거하기 위한 규제 논의다. 예를 들면, 디지털 ID, 마이데이터, 사이버보안, 오픈뱅킹(open banking), 금융규제 샌드박스 등이 대표적인 논의 사례다. 이를 통해 각 국가에서는 핀테크기업의 금융산업 진입을 촉진하고 핀테크기업과 기존 금융회사 간의 공정경쟁 환경을 조성하고자 한다. 한편 이러한 규제 논의는 핀테크기업뿐만 아니라 기존 금융회사에도 상당한 영향을 미칠 수 있다. 예를 들어, 마이데이터와 오픈뱅킹과 같은 규제는 금융소비자의 은행에 대한 의존도를 낮추고 금융서비스의 질적 경쟁을 심화할 것으로 평가받는다.

Ⅲ. 핀테크에 의한 금융혁신 양상

1. 분석 방법과 데이터