Find out more about our latest publications

The Transformation of Investment Banks after the 2008 Global Financial Crisis

Research Papers 21-04 Apr. 15, 2021

- Research Topic Financial Services Industry

- Page 71

The competitive landscape and business structure of global investment banks has changed fundamentally following the 2008 global financial crisis(GFC). With the bankruptcy, acquisition or shift to bank holding companies of the leading pure investment banks, such as Lehman Brothers, Merrill Lynch, Bear Stearns, Goldman Sachs and Morgan Stanley, there are now fewer investment banks than ever before. In addition, the business model of the surviving investment banks has changed significantly in the post GFC era. While the focus prior to the GFC was on the trading business for high income and ROEs, there is now a strategic emphasis on stabilization of income through diversification of business lines. A particularly notable change post GFC is the entry of major investment banks into the retail finance market. This is taking place especially in wealth and asset management, as well as in new business entry areas such as internet banking. This report looks at the historical development of investment banks, from its inception in the 1930s with the passage of the Glass Steagall Act up to the GFC, and following the GFC to the present. The report aims to look at the major changes in the business model of the major investment banks along with the underlying drivers.

Ⅰ. 서론

2008년 글로벌 금융위기가 발생한지 10년이 넘었다. 당시 Goldman Sachs, Morgan Stanley와 같은 주요 글로벌 투자은행1)은 금융위기로 인해 큰 손실을 보기도 했지만, 금융위기를 촉발한 주범으로도 지목되었다. 이들 투자은행은 복잡한 구조화상품의 제조와 판매로 서브프라임 모기지(sub-prime mortgage) 시장의 위험을 실물경제 전반으로 전이 및 증폭시키는 매개체였기 때문이다.

금융위기 이후 세계 투자은행 산업은 크게 변화했다. 우선 100년 넘는 역사를 지닌Lehman Brothers, Bear Stearns, Merrill Lynch가 파산하거나 인수합병되고, Gold-man Sachs 및 Morgan Stanley가 은행지주회사로 전환함에 따라 대형 전업계 투자은행의 시대가 막을 내렸다. 또한, 금융위기의 재발을 방지하기 위해 도입된 새로운 규제들은 투자은행이 과거와 같은 사업모델을 영위하기 어렵게 만들고 있다. 나아가 금융위기가 야기한 세계적 경기침체로 전반적인 수요가 감소하고 수익성이 악화됨에 따라 주요 투자은행은 새로운 사업구조와 수익원을 마련할 필요가 생겼다.

글로벌 투자은행의 최근 행보는 국내 금융투자업의 시각에서도 관심을 가질 부분이다. 자기자본과 레버리지를 적극적으로 활용하여 고성장과 고수익을 창출하던 글로벌 투자은행은 위탁매매 의존도를 줄이고 새로운 사업모델을 찾고 있는 국내 증권사가 나아가야 할 방향으로 여겨져 왔다. 2013년 종합금융투자사업자 제도 또한 ‘한국판 Goldman Sachs’의 출현을 기대하며 도입되기도 했다. 그러나 금융위기 이후 Goldman Sachs를 비롯한 주요 투자은행은 사업의 구조, 방식, 대상 등 다방면에서 변화하였다. 따라서 최근 글로벌 투자은행의 사업모델이 국내 금융투자회사에 여전히 벤치마크로 유효한지에 대해서 고민해볼 필요가 있다.

본 보고서는 ‘글로벌 투자은행’으로 불리는 금융회사가 어떻게 발전하고 사업모델은 어떻게 변모했으며, 이와 같은 변화를 이끌어낸 근본적인 요인들이 무엇이었는지를 살펴보고자 한다. 우선 1930년대 현대적 개념의 투자은행 출현부터 2008년 글로벌 금융위기의 발생까지 투자은행 산업의 발전을 정리하고, 어떠한 이유로 무수히 많던 투자은행이 현재 10개 남짓의 대형사로 압축되었는지를 정리해본다. 그 다음으로는 2008년 글로벌 금융위기 이후 ‘글로벌 투자은행’의 개념을 재정리하고, 8개 대표적 투자은행을 중심으로 금융위기 전후로 사업구조, 재무구조 및 사업전략의 변화를 분석해 본다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 1930년대 현대적 개념의 투자은행 출현부터 시작하여 2008년 글로벌 금융위기까지 투자은행의 발전사를 정리한다. Ⅲ장에서는 금융위기 이후 ‘글로벌 투자은행’의 개념을 정리하고, 8개 대표적 투자은행을 중심으로 사업구조와 재무구조의 변화를 분석한다. Ⅳ장에서는 금융위기 이후 글로벌 투자은행의 사업모델을 3개 유형으로 구분하여 각 유형의 대표적인 투자은행의 사례를 살펴본다. 마지막으로 V장은 결론과 시사점을 제시한다.

Ⅱ. 글로벌 투자은행의 발전과정

1. 전업계 투자은행의 시대

가. 현대적 투자은행의 출현

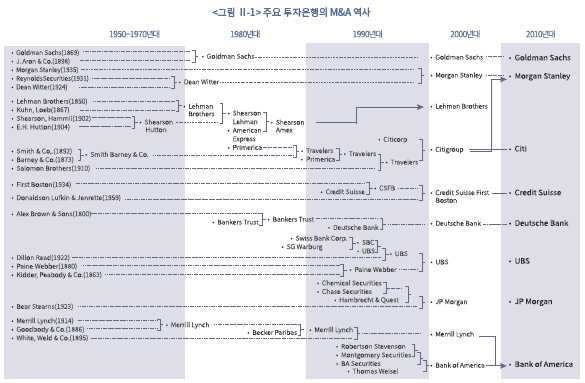

최근 글로벌 투자은행의 변화를 논의하기에 앞서 투자은행의 개념과 발전 과정에 대해 살펴볼 필요가 있다. 현대적 개념의 투자은행은 100년 넘는 역사를 지니고 있으나, 그 모습과 주요 회사들은 시대별로 크게 바뀌어 왔다.2) 투자은행의 발전 배경에는 규제, 기술 등 시장 환경의 변화와 더불어 틈틈이 발생하는 크고 작은 금융위기도 중요한 요인으로 작용해왔다. 이러한 과정 속에 일부 투자은행은 그 모습은 변화했지만 여전히 생존하고 있는 반면, 대다수의 투자은행은 인수합병되거나 파산하여 지금은 그 존재를 찾아볼 수 없게 되었다.

현대적 개념의 투자은행은 미국에서 탄생했다고 볼 수 있으며, 1933년 제정된 글래스-스티걸법(Glass-Steagall Act)이 계기를 마련해 주었다.3) 글래스-스티걸법은 대공황(Great Depression)에 배경을 두고 있으며, 해당 법의 제정은 당시 다수 은행의 연쇄도산에 대한 일부 원인이 은행의 증권업 겸영으로 인한 과도한 위험추구와 이해상충으로부터 비롯되었다는 인식을 반영하고 있다.4) 해당 법은 은행을 여수신 업무를 취급하는 ‘상업은행(commercial bank)’과 유가증권의 인수(underwriting) 및 위탁매매(brokerage)를 하는 ‘투자은행(investment bank)’으로 이원화했다. 이처럼 글래스-스티걸법은 상업은행과 투자은행의 고유 업무를 규정하고, 두 유형의 은행 간의 겸영은 물론 계열사를 통한 겸업도 금지함에 따라 결과적으로 투자은행에게 상업은행으로부터 분리되고 보호된 시장을 마련해 주었다.

글래스-스티걸법의 제정으로 전업계 투자은행의 시대가 막을 올렸다. 당시 주요 은행은 글래스-스티걸법 준수를 위해 사업을 분리해야 했고, 1932년 First Boston이 Boston Bank에서, 1935년 Morgan Stanley가 JP Morgan에서 분리되어 투자은행으로 출현하게되었다. 새롭게 형성된 투자은행 산업은 막강한 고객기반을 둔 Morgan Stanley를 필두로 First Boston, Dillon Read 및 Kuhn Loeb가 1군, 일명 ‘벌지브래킷(bulge bracket)’ 을 형성하고, Goldman Sachs, Merrill Lynch 등의 투자은행이 2군을 구성했다.5)

초기 투자은행의 사업모델은 유가증권의 인수와 발행된 증권의 유통을 중개하는 브로커리지 업무 중심으로 이루어졌다. 또한 당시 주요 투자은행은 Morgan Stanley와 같은 인수 업무 중심과 Merrill Lynch와 같은 브로커리지 업무 중심으로 구분되었다. 1930~1940년대에는 투자은행 산업의 경쟁구도나 사업모델에 큰 변화가 없었으며, 이는 당시 암묵적인 담합과 계급 시스템이 존재했기 때문이다. 당시 증권 인수는 단체로 하는 신디케이트(syndicate) 방식으로 이루어졌고, 투자은행 간에는 고객 약탈이 금지되었으며 이를 어기는 투자은행은 신디케이트에서 일정 기간 배제되었다.6)

이와 같은 경직된 경쟁구도는 1950년대 들어서 무너지기 시작했다. 세계 2차 대전 이후 미국 경제는 고성장의 시대, 일명 자본주의의 황금기(golden age of capitalism)를 맞이하였고, 1950~1973년 사이의 자본주의 황금기는 대대적인 산업 구조조정을 수반하면서 이에 따라 투자은행의 희비도 엇갈렸다. 철도, 철강 등 전통적 산업에 주요 고객을 둔 투자은행은 상위권에서 밀려나고, 자동차, 유통 등 신산업에 고객을 둔 투자은행이 부상하기 시작했다. 1975년 투자은행 벌지브래킷에는 Morgan Stanley와 더불어 Goldman Sachs, Merrill Lynch 및 Salomon Brothers가 새롭게 진입하고, Dillon Read 및 Kuhn Loeb는 2군으로 밀려났다.7)

나. 투자은행의 분업화 및 대형화

1970년대에 들어서는 브로커리지 사업 중심의 투자은행, 일명 ‘리테일 투자은행’의 대형화가 시작되었다. 미국 개인 투자자의 주식거래량은 빠르게 증가하여 1968년에는 일평균 1,200만 건을 상회하면서 역대 최고치를 기록했다. 그러나 당시 수기 체결 방식으로는 급증하는 거래량을 소화하기에 역부족이었으며, 급기야 대량의 거래가 미체결되는 ‘서류 위기(paperwork crisis)’가 발생했다. 뉴욕증권거래소(New York Stock Exchange: NYSE)도 넘쳐나는 주식거래량을 소화하지 못하여 일 주식거래 시간을 단축하고 주 거래일을 4일로 제한하는 등의 조치까지 취해야 했다. 서류 위기로 인해 1968~1970년 사이 NYSE 회원사 1/6을 포함한 수백 개의 투자은행이 파산하거나 경쟁사에 인수합병되었다.8) 반면, 생존한 리테일 투자은행은 거래체결 업무의 자동화에 나섰고, IT 시스템구축을 위한 자본 확충이 필요해졌다. 이러한 상황 속에 NYSE는 1971년 회원사의 공개를 허용하였고, Merrill Lynch, Donaldson Lufkin & Jenrette, EF Hutton, Bache, Paine Webber, Dean Witter 등 16개의 리테일 브로커리지 중심 투자은행이 파트너쉽(partnership)에서 상장회사로 전환하고 대형화되었다.9)

1980년대에는 유가증권 인수 업무 중심의 투자은행도 대형화하기 시작했으며, 미국 기업의 늘어나는 주식발행 규모와 1983년 도입된 일괄등록제(shelf registration)가 주요 요인으로 작용했다. 1981~1999년 사이 연평균 신규 주식발행은 19%, 채권발행은 25% 증가하면서 증권 인수 호황의 시대가 열렸다. 또한, 이 기간에는 뮤추얼펀드, 보험사, 연기금 등 기관투자자의 시장 참여도가 높아지고 보다 신속한 증권발행에 대한 요구가 늘어났다. 미국 금융당국도 급증하는 증권발행의 인수가 보다 원활하게 이루어질 수 있도록 규제 완화에 나섰다. 이를 위해 미국 증권거래위원회(Securities and Exchange Commission: SEC)는 1983년 일괄등록제를 도입했다. 일괄등록제는 유가증권 발행 시 매번 증권신고서를 제출 및 승인하는 기존의 방식에서 2년 내 기간 중 기업이 발행할 유가증권을 미리 일괄신고하고 수시로 발행할 수 있게 해주었다.10)

일괄등록제의 도입으로 가장 유리한 조건을 제시하는 하나의 투자은행이 발행 증권 전액을 인수하는 방식이 정착되면서 신디케이트 구조가 퇴조하고 투자은행 간의 경쟁이 심화되었다. 또한 일괄등록을 위해서 투자은행은 대량의 증권을 인수하고 배분할 수 있는 자본력, 판매력 및 트레이딩 역량을 동시에 갖추어야 하는 부담이 생겼다. 여기에 기술적 발전이 결합되어 투자은행의 대형화를 촉진시켰으며, 1970년대에는 미들 오피스(middle office), 1980년대에는 프런트 오피스(front office) 업무의 자동화가 진행되었다. 이에 따라 유가증권 인수 업무 중심의 투자은행도 급증한 증권발행량을 소화하고, IT 시스템을 구축하기 위해 자본 확충의 필요성이 높아지면서 인수합병하거나 상장화사로 전환하여 대형화되었다. 1984년 Lehman Brothers가 American Express에 인수되고, 1985년 Bear Stearns, 1986년 Morgan Stanley, 1999년 Goldman Sachs가 상장회사로 전환했다.11)

다. 투자은행의 사업범위 확대

1980년대에 들어서 투자은행 업무도 보다 다양화되었다. 첫째, 금융공학의 발전과 규제완화에 따라 구조화상품의 설계 및 유동화가 투자은행의 새로운 수익원으로 마련되었다. 특히, 1980년대 저축대부조합(savings and loans association) 사태 이후의 규제완화로 주택담보대출의 유동화가 허용되면서 주택저당증권(Mortgage Backed Securities: MBS) 시장이 활성화되었고 당시 Salomon Brothers는 MBS 시장을 선점하면서 투자은행 순위가 급등했다. 또한, 1980년대에는 Drexel Burnham Lambert가 정크본드 시장을 개척하여 한때 미국 5대 투자은행으로 부상하기도 했다.

둘째, 1980년대 4차 M&A 대 물결(Merger Wave)이 형성되면서 M&A자문이 투자은행의 새로운 업무로 자리 잡기 시작했다.12) 이전만 하더라도 M&A는 우호적으로 이루어지고, M&A자문은 법률사무소 및 회계법인이 주도하는 시장으로 투자은행의 참여는 제한적이었다. 주요 투자은행 중에서는 Morgan Stanley가 1972년 최초로 M&A자문 부서를 설립하였고, 4차 Merger Wave에서는 차입매수(leveraged buyout: LBO)와 적대적 유형의 M&A가 늘어나면서 투자은행이 M&A자문 시장을 주도하기 시작했다.13) 나아가, 1990년대 5차 Merger Wave는 1~4차를 합한 규모의 5배가 넘는 금액, 국경간(cross-border) M&A 확대 등으로 복잡성도 증가함에 따라 M&A자문 시장에서 투자은행의 주도권이 더욱 굳건해졌다. 나아가, 투자은행 간의 경쟁으로 유가증권 인수 수수료율이 지속적으로 하락하는 상황에서 M&A자문은 높은 수수료를 제공하는 새로운 수익원을 마련해주었다.

2. 겸업화 시대의 도래

가. 유럽 유니버설뱅크의 투자은행화

1990년대에 들어서는 ‘글로벌’한 투자은행이 본격적으로 출현하기 시작했으며, 그 배경은 1980년대 유럽의 금융산업 규제완화가 마련해주었다. 우선 1984년 영국은 런던을 세계 금융중심지로 부상시키기 위해 ‘빅뱅(big bang)’으로 불리는 대대적인 금융시장 개방 및 규제완화 정책을 펼쳤다. 동 시기 유럽 대륙에서도 유럽연합(European Union: EU)의 형성을 위한 시장 개방 및 통합이 준비되고 있었으며, 1992년 마스트리히트 조약(Maastricht Treaty)의 체결로 EU 형성의 기본적 사항들이 합의되었으며, 1993년에 EU가 공식 출범했다.

당시 유럽에서는 미국과 달리 상업은행과 투자은행의 겸영이 가능한 유니버설뱅크(universal bank)가 주류를 이루고 있었으나, 이들 유니버설뱅크는 사실상 상업은행으로 투자은행 사업이나 역량은 미미한 수준이었다. 대표적인 유니버설뱅크로는 스위스의 Union Bank of Switzerland 및 Swiss Bank Corporation, 독일의 Deutsche Bank, 영국의 Barclays, 프랑스의 Bank National de Paris(BNP) 및 Credit Agricole 등이 있었다. 유럽의 유니버설뱅크는 EU의 형성이 초래할 금융산업의 경쟁심화에 대응하기 위해 우선적으로 모국에서 인수합병으로 대형화를 추진하고, 이후 해외진출을 도모했다. 그러나 이들 유니버설뱅크는 상업은행 중심 사업구조로는 해외진출이 어렵다고 판단하여 투자은행 사업을 키우는 전략을 채택하고, 이를 위해 영국의 유수 투자은행의 인수합병에나섰다.

Swiss Bank Corporation은 1992~1995년 사이 영국 투자은행 O’Connor & Associ-ates, Brinson Partners 및 SG Warburg를 잇따라 인수하고, 1997년에는 오랜 역사를 지닌 미국의 Dillon Read를 인수하면서 투자은행 역량을 구축했다. 1998년 Swiss Bank Corporation은 스위스 1위 상업은행 Union Bank of Switzerland와 합병하여 UBS로 재출범하고, 합병사의 투자은행 사업부문 Warburd Dillon Read는 당시 유럽 최강의 투자은행으로 자리 잡았다. 2000년 UBS는 추가적으로 미국의 종합서비스 투자은행 Paine Webber를 인수하면서 미국 시장 입지를 강화하고, 세계 10대 투자은행 반열에 진입했다. Deutsche Bank는 1990년 미국 투자은행 Bankers Trust 인수를 통해 미국 시장 진출 및 글로벌 투자은행 지위를 얻었다. 반면, BNP Paribas와 Societe Generale은 자체적으로 투자은행 사업을 키워서 글로벌 투자은행 반열에 진입하기도 했다.14) 유럽 유니버설뱅크의 투자은행화 및 해외진출은 단기간에 이루어졌으며, 당시에는 이와 같은 변모가 성공적으로 평가되었으나, 2008년 글로벌 금융위기는 이와 같은 압축적 성장의 부작용을 보여주는 계기로 작용하기도 했다.

영국의 빅뱅은 미국의 주요 투자은행에도 해외사업 확대의 길을 열어주었다. Goldman Sachs, Merrill Lynch 등 미국의 대형 투자은행은 영국을 필두로 유럽 시장을 공략하기 위해 런던 사무소를 공격적으로 키워나갔고, 인수합병보다는 현지 우수 인력을 경쟁사로부터 유입하면서 영국의 토종 투자은행을 시장에서 몰아내기도 했다. 금융 빅뱅으로 영국은 모국 금융회사를 외국계에 내주었지만, 런던을 뉴욕에 버금가는 금융중심지로 부상시키는 데에는 성공한 것으로 평가된다.

나. 미국 상업은행의 투자은행화

1980년대 투자은행은 호황을 맞이하고 있었지만 미국 상업은행의 상황은 달랐다. 라틴아메리카 채무위기, 기업 탈중개화 등으로 미국 상업은행의 수익성은 악화되고, 유럽 시장에서는 규제 차익으로 인해 유니버설뱅크에 비해 경쟁력이 뒤떨어지고 있었다. 이로 인해 미국 상업은행의 투자은행 업무 허용에 대한 목소리가 높아지고, 미국 금융당국도 이러한 요구를 받아들여 상업은행의 투자은행 업무 수행을 점진적으로 허용하기 시작했다. 1986년 미국 연방준비제도이사회(Federal Reserve Board: FRB)는 글라스-스티컬법 제20조의 우호적인 해석을 통해 상업은행이 자회사를 통해 유가증권 인수 업무를 자회사 총 수익의 5% 내에서 할 수 있도록 허용하고, 이후 그 비중을 10%(1989년), 25%(1997년)로 점진적으로 확대해 주었다.15) 이러한 추세가 이어지면서 상업은행과 투자은행 간의 장벽은 점차 허물어져갔고, 궁극적으로 1999년 그램-리치-블라일리(Gramm-Leach-Bliley: GLB)법이16) 제정되면서 상업은행의 투자은행 겸업이 전면적으로 허용되었다.

GLB법 제정을 전후로 상업은행의 투자은행 인수합병이 활발하게 진행되었다. 그 첫 단추로 1997년 Banker Trust가 투자은행 Alex Brown을 인수하고, 1998년에는 Citi-corp이 보험사ㆍ투자은행 Travelers와 합병하면서 세계 최대 규모의 종합금융서비스회사 Citigroup이 탄생했다. 1999년에는 JP Morgan의 Hambricht & Quest 인수, Bank of America의 Montgomery Securities, Robertson Stephens 및 Thomas Wiesel 인수, Deutsche Bank의 Bankers Trust 인수, UBS의 Paine Webber 인수가 성사되었다.

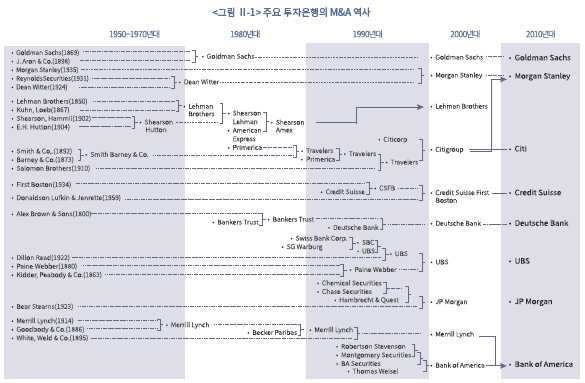

이러한 겸업화 추세는 상업은행에만 국한되지 않고, 타 금융업 및 비금융업으로도 확산되었다. 보험 판매사 Primerica는 1987년 Smith Barney, 1993년 Shearson Lehman Brothers를 인수하고, 같은 해 보험사 Travelers와 합병한 이후 1997년에는 Salomon Brothers를 인수했다. Discover Card를 보유한 유통업체 Sears는 1981년 투자은행 Dean Witter를 인수하고, 이후 1987년에는 Dean Witter Discover가 Morgan Stanley와 합병했다. 카드사 American Express는 1981년 Shearson, 1984년 Lehman Broth-ers Kuhn Loeb, 1988년 E. F. Hutton을 인수했다. 종합상사 Phibro는 1981년 Salomon Brothers를 인수하고, 제조업체 General Electric은 M&A자문 비용을 절약하기 위해 1986년 투자은행 Kidder, Peabody & Co.를 인수했다.17)

1990년대가 마감되면서 100년 넘는 역사를 지닌 무수한 투자은행이 그 이름마저 찾아볼 수 없게 되었다. 투자은행의 수는 줄어들고 남아 있는 투자은행은 더욱 대형화 및 글로벌화되었다. 또한, 과거 전업계 투자은행이 독식하던 시장을 유럽의 유니버설뱅크와 미국의 상업은행이 잠식하면서 경쟁은 더욱 심화되었다.

3. 전업계 투자은행 시대의 종결

가. 트레이딩 중심의 사업구조

2000년대 들어 글로벌 투자은행의 경쟁구도와 사업구조는 20년 전에 비해 크게 변화했다. 우선 경쟁구도 측면에서 과거 50개가 넘는 전업계 투자은행이 경쟁하던 시장은 1980년대 업계 내에서의 구조조정과 1990년대 미국 상업은행 및 유럽 유니버설뱅크에 따른 인수합병 과정을 거치면서 2000년대에 들어서는 10~15개의 대형 투자은행이 경쟁하는 구조가 되었다.

글로벌 투자은행의 사업구조도 2000년대 들어 크게 변화했다. 전통적으로 투자은행은 주요 수익을 고객의 자금조달을 중개하는 유가증권 인수 및 브로커리지 업무에서 창출했으며, 이는 고객 네트워크 및 신뢰 기반의 관계형 사업이었다. 1980년대 주요 수익원으로 새롭게 추가된 M&A자문 역시 고객과의 관계가 핵심 역량이었다. 그러나 2000년대에 들어서는 트레이딩(trading) 사업이 투자은행의 주요 수익원으로 자리 잡기 시작했으며, 특히, 트레이딩 사업 내에서도 시장조성(market making)보다 자기자본을 활용해 투자수익을 얻는 자기매매(proprietary trading)와 자기자본투자(principal investments)에서 고수익을 창출했다. 주요 투자은행은 사내 사모펀드(private equity, hedge fund) 사업을 담당하는 부서를 설립하고 더욱더 많은 자본을 해당 부서에 할당했다.

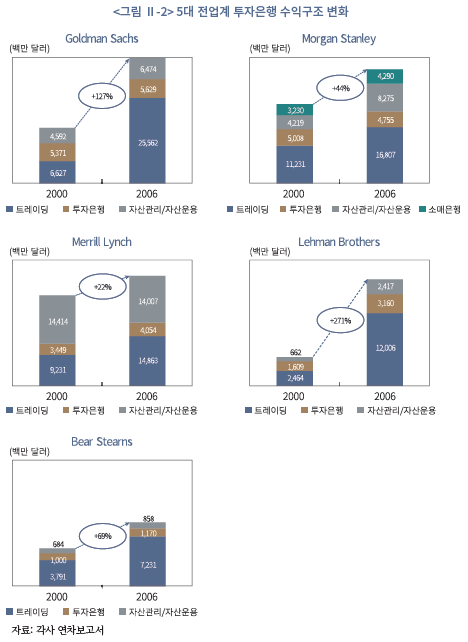

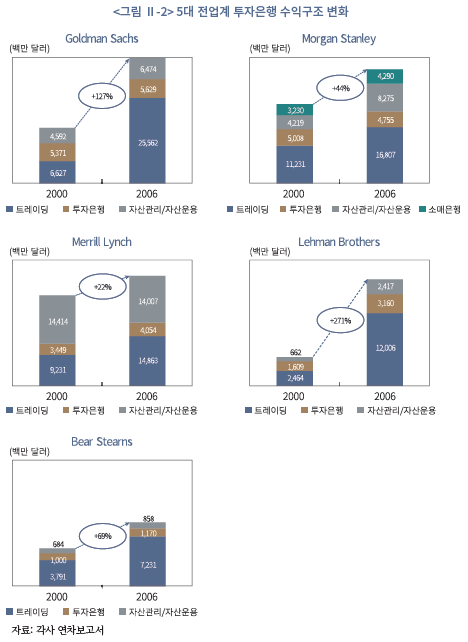

<그림 Ⅱ-2>는 2000년 및 2006년 Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers 및 Bear Stearns로 구성된 5대 전업계 투자은행의 사업부문별 수익 증감을 보여준다. 5개 전업계 투자은행의 수익은 2000~2006년 사이 평균 106.6% 증가했으며, 이는 대부분 트레이딩 사업 수익 증가에 기인한다. 2000~2006년 사이 5개 전업계 투자은행의 트레이딩 사업 수익은 평균 174.8% 증가한 반면 자산관리ㆍ운용 사업 수익은 70.6%, 투자은행 사업 수익은 29.9%만 증가하는데 그쳤다.

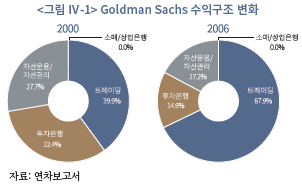

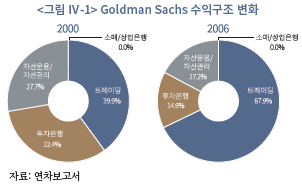

2000년대 초반 주요 전업계 투자은행은 트레이딩, 투자은행 및 자산관리ㆍ운용 사업 간 일정 수준의 균형적인 수익구조를 갖추고 있었으나, 점차 트레이딩 사업 중심으로 수익구조가 편중되어 갔다. Goldman Sachs의 경우 2000년에는 트레이딩 39.9%, 투자은행 32.4%, 자산관리ㆍ운용 27.7%로 사업부문별 수익 비중이 균형적이었으나, 2006년에는 67.9%로 트레이딩 사업 비중이 압도적으로 높아졌다. 이와 같은 상황은 나머지 4개 전업계 투자은행에서도 공통적으로 나타나는 특징이다. 2006년 전체 수익 중 트레이딩 사업 비중은 Morgan Stanley 49.2%, Merrill Lynch 45.1%, Lehman Brothers 68.3%, Bear Stearns 78.1%로 모두 2000년에 비해 크게 증가했다.

나. 글로벌 금융위기의 여파

2008년 글로벌 금융위기의 발생은 전업계 투자은행 시대의 종결을 야기했다. 5대 전업계 투자은행을 구성했던 Goldman Sachs, Morgan Stanley, Lehman Brothers, Mer-rill Lynch 및 Bear Stearns는 파산, 인수합병 또는 은행지주회사로 전환했다. 5대 전업계 투자은행의 몰락은 미국 서브프라임 모기지(sub-prime mortgage) 시장이 붕괴하면서 트레이딩 사업부문에서 MBS 및 주택담보부증권(collateralized debt obligation: CDO) 관련 대거 손실이 발생한 데에 기인한다.

Lehman Brothers는 2003~2004년 사이 5개 모기지회사(mortgage lender)를 인수하는 등 미국 MBS 및 CDO 시장에 공격적으로 뛰어들었고 Lehman Brothers의 수익은 2005~2007년 사이 매년 최고치를 경신했다. 그러나 2007년에는 31.9배의 레버리지 비율과 금융사 중 최대 규모인 850억 달러에 달하는 규모의 MBS 포트폴리오를 떠안고 있는 상황에서 2008년 보유하던 MBS 및 CDO 포트폴리오에서 대거 손실이 발생하고, 유동성위기에 처한 Lehman Brothers는 당해 11월 파산신청에 들어갔다.

Bear Stearns는 1980년대 CDO 시장 형성의 초기부터 진출해 상당한 입지를 구축했다. 그러나 2007년 서브프라임 MBS와 CDO에 집중 투자한 Bears Stearns 산하 헤지펀드 2개에서 대거 손실이 발생하고, 160억 달러의 긴급 자금지원에도 불구하고 결과적으로 해당 헤지펀드가 파산하면서 Bear Stearns 자체가 유동성위기에 처해졌다. 결국 Bear Stearns는 2008년 JP Morgan에 주당 2달러에 인수되었다.

Merrill Lynch는 전통적으로 자산관리 사업을 중심으로 성장해왔으나, 2001년 CEO Stanley O’Neal이 취임하면서 상대적으로 뒤늦게 트레이딩 사업 확대에 공격적으로 나섰다. 2006~2007년 사이 Merrill Lynch의 서브프라임 관련 CDO 포트폴리오는 50억 달러에서 1,170억 달러로 늘어났으며, 2007년 미국 서브프라임 시장이 붕괴하면서 대거 손실이 발생했다. Merrill Lynch는 재무상황이 극도로 악화된 상황에서 2008년 Bank of America와의 인수합병을 결정하게 되었다.18)

Goldman Sachs 및 Morgan Stanley의 경우 서브프라임 모기지 관련 직접적인 손실은 상대적으로 크지 않았으나, 금융위기가 발생하면서 단기자금시장의 경색으로 유동성이 악화되고 이를 해소하기 위해 2008년 은행지주회사로의 전환을 결정하게 되었다. 은행지주회사 전환으로 두 투자은행은 연방준비은행(Federal Reserve Bank)의 재할인 창구를 통한 자금조달이 마련되었지만, SEC와 더불어 FRB의 감독 대상이 되고 상업은행에적용되는 각종 규제를 받게 되었다.19)

Ⅲ. 금융위기 이후 글로벌 투자은행의 변모

1. 경쟁구도의 변화

2008년 글로벌 금융위기가 발생하면서 투자은행 산업은 대대적인 변화를 맞이하게 되었다. 그간 우리가 익숙했던 ‘전업계 투자은행’은 더 이상 찾아볼 수 없게 되었고, 그 자리는 금융지주회사의 형태로 보다 다양한 사업을 영위하는 여러 유형의 은행(bank)이 차지하고 있다. 그럼에도 불구하고 ‘글로벌 투자은행’은 여전히 특정 그룹의 은행을 지칭하여 일반적으로 사용되고 있다. 따라서 금융위기 이후 ‘글로벌 투자은행’으로 구분되는 금융회사는 무엇이며, 어떠한 사업구조와 사업전략을 취하고 있는지 살펴볼 필요가 있다.

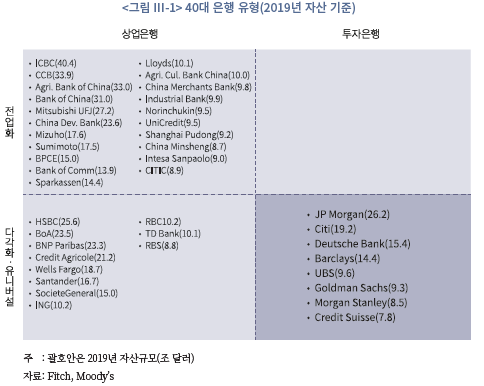

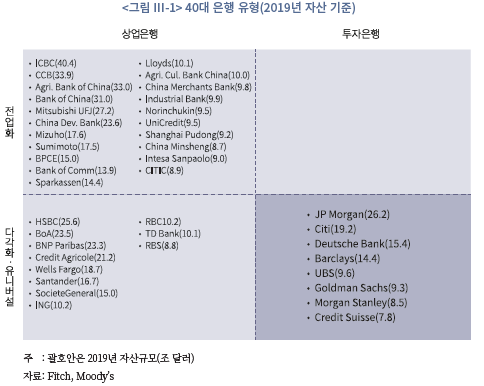

은행을 구분하는 데는 여러 유형과 기준이 있다. Martel et al.(2012)은 자금조달 및 자산구조에 따라 은행을 상업은행 또는 투자은행, 전업화(specialized) 또는 다각화ㆍ유니버설(diversifiedㆍuniversal)로 구분하여 총 4개의 유형으로 분류한다.20) <그림 Ⅲ-1>은 Martel et al.(2012)의 기준을 2019년 현재 자산규모 순위 세계 40대 은행에 적용한 경우를 보여준다.21) 세계 40대 은행의 대부분은 상업은행으로 분류되며 ‘전문화 상업은행’이 가장 많다. 투자은행으로 분류되는 금융회사는 8개가 있으며 ‘전업화 투자은행’ 유형은 없고 모두 ‘다각화ㆍ유니버설 투자은행’으로 분류된다. 나아가 8개 투자은행을 지역별 나누어보면 미국계 4개와 유럽계 4개가 있다.

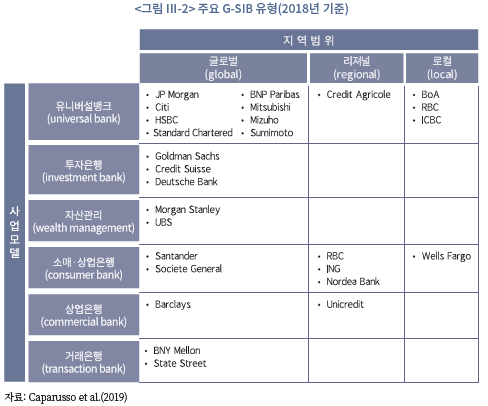

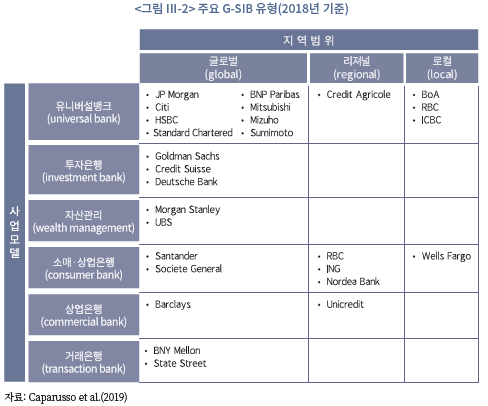

Caparusso et al.(2019)은 수익구조를 기준으로 은행을 6개의 사업모델과 지역별로 로컬(local), 리져널(regional) 및 글로벌(global)로 나누어 총 18개의 유형으로 구분한다. <그림 Ⅲ-2>는 Caparusso et al.(2019)이 분류한 30개 글로벌 시스템적 중요은행(Global Systematically Important Bank: G-SIB)의 유형을 보여준다. Caparusso et al.(2019)의 분류상 다수의 G-SIB은 ‘유니버설뱅크’로 분류되며, JP Morgan, Citi 등이 여기에 포함된다. 반면, ‘글로벌’한 ‘투자은행’에는 Goldman Sachs, Credit Suisse, Deutsche Bank 3개사만 있다. 그리고 ‘자산관리’ 유형에는 Morgan Stanley와 UBS가, ‘소매ㆍ상업은행’ 유형에는 Barclays, Royal Bank of Canada(RBC) 등이 포함된다. 반면, Caparusso et al.(2019)에 따르면, Bank of America, Royal Bank of Scotland(RBS), RBC 및 Wells Fargo는 대부분의 수익을 모국 또는 인근지역에서 창출하기 때문에 ‘글로벌’한 은행에 속하지 않는다.

글로벌 투자은행으로 구분할 수 있는 또 하나의 기준은 투자은행 업무의 4개 주요 시장인 주식 인수(equity capital markets: ECM), 채권 인수(debt capital markets: DCM), M&A자문 및 신디케이트론(syndicate loan)에서 차지하는 중요도다. <표 Ⅲ-1>은 2019년 기준 4개 투자은행 업무 시장에서 점유율 기준으로 은행 순위를 보여준다. 4개 시장 모두에서 20위권에 속해있는 은행은 총 10개가 있으며, 여기에는 Goldman Sachs, Morgan Stanley와 같은 과거 전업계 투자은행, Credit Suisse, Deutsche Bank와 같은 유럽계 유니버설뱅크 및 JP Morgan, Bank of America, Citi와 같은 소매ㆍ상업은행 중심의 은행이 포함된다.22)

앞선 여러 기준으로 볼 경우 2019년 현재 글로벌 투자은행으로 구분할 수 있는 금융회사는 10~12개 정도에 불과하다. 더불어 이는 글로벌 투자은행을 광의의 개념으로 볼 경우이고, 투자은행 및 트레이딩 사업이 주요 수익원인 협의의 개념으로는 그 수가 2~5개로 제한되며, 나아가 50% 이상의 수익을 투자은행 및 트레이딩 사업에서 창출하는 투자은행은 현재 Goldman Sachs가 유일하다.

2. 사업구조의 변화

가. 규제환경의 변화

2008년 글로벌 금융위기 이후 은행에 대한 규제가 큰 폭으로 강화되었다. 새 규제체계는 금융위기의 원인분석에 기반하여 은행의 건전성을 강화하고 고위험 업무를 제한하는 방향으로 설계되었다. Goldman Sachs와 Morgan Stanley도 은행지주회사로 전환함에 따라 새로운 규제체계를 준수해야 한다.

은행 규제의 표준을 마련하는 바젤(Basel) Ⅲ에서는 한층 강화된 건전성 및 유동성 기준이 마련되었다. 미국의 경우 바젤Ⅲ의 규제내용을 대부분 도입하였고, EU 또한 바젤 Ⅲ를 바탕으로 필요자본지침(Capital Requirement Directives: CRD) Ⅳ를 제정하였다.23) 은행의 업무범위도 제한된다. 미국 도드-프랭크(Dodd-Frank)법에 포함된 볼커룰(Volcker Rule)은 은행 및 은행그룹(banking entity)의 자기매매를 금지하고 자기자본투자를 제한하고 있다. 볼커룰은 은행그룹의 사모펀드에 대한 투자를 개별 펀드 투자자본의 3% 미만 및 총 펀드 투자자본을 은행 기본자본의 3% 이내로 제한하고 있다.

주요 투자은행은 볼커룰의 시행에 앞서 자기매매 사업부서를 해산하고, 자기자본투자 자산도 축소했다. Goldman Sachs의 경우 사내 자기매매 부서 Principal Strategies Group(PSG)의 인력 대부분이 퇴사하고, PSG 투자담당자였던 Morgan Sze가 설립한Azentus Capital Management로 이직했다. Morgan Stanley는 Peter Muller가 이끌던사내 자기매매 부서를 헤지펀드 PDT Advisers로 재구성하고 분사(spin-off)했다. 이와더불어 Morgan Stanley는 2006년 인수했던 헤지펀드 Front Point Partners도 2011년에 매각했다. Citi는 Sutesh Sharma가 이끌던 자기매매 부서 Citi Principal Strategies Desk를 2012년에 폐쇄했다.24)

나. 수익구조의 변화

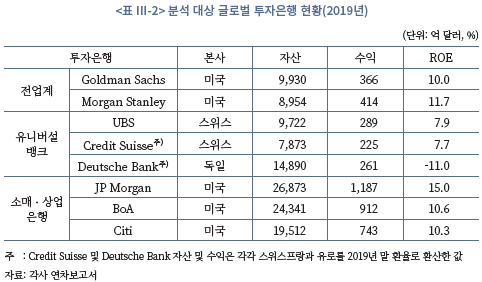

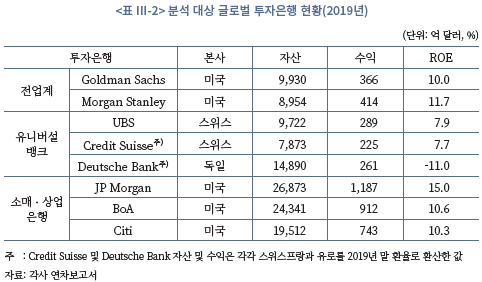

본 장에서는 8개의 대표적 글로벌 투자은행을 중심으로 글로벌 금융위기 이후 사업 및 재무 구조의 변화를 살펴본다.25) 편의상 분석 대상 투자은행을 3개 유형으로 구분한다. 첫 번째 유형은 ‘전업계’ 투자은행으로 Goldman Sachs와 Morgan Stanley가 포함된다. 두 번째 유형은 ‘유니버설뱅크’로 UBS, Credit Suisse 및 Deutsche Bank가 포함된다. 세 번째 유형은 소매ㆍ상업은행으로 JP Morgan, Bank of America 및 Citi가 있다. <표 Ⅲ-2>는 2019년 현재 분석 대상 8개 투자은행의 주요 재무 상황을 보여준다. 자산규모의 경우 소매ㆍ상업은행 중심 3개 투자은행 평균이 2.3조 달러로 전업계 및 유니버설뱅크 5개사의 평균인 1.0조 달러의 2배 이상이다. 이는 사업구조의 차이에서 비롯된다. 반면, ROE의 경우 투자은행의 유형보다 지역별 편차가 보다 의미 있게 나타나며, 미국계 투자은행의 평균은 11.5%인 반면, UBS와 Credit Suisse의 평균은 7.8%, Deutsche Bank는 –11.0%를 기록하고 있다.

글로벌 금융위기 이후 주요 투자은행에서는 두 가지 변화가 주목된다. 첫째, 사업의 다각화다. 금융위기 이전 트레이딩 사업에 편중되었던 수익구조는 금융위기 이후 보다 균형적인 구조로 바뀌었다. 둘째, 리테일 금융시장으로의 진출이다. 전통적으로 투자은행, 특히 전업계의 경우 대상 고객이 대기업 및 기관투자자 중심이었으나, 금융위기 이후에는 리테일 및 중소기업(middle market) 고객 시장으로 사업을 확대하고 있다. 이러한 변화는 금융위기 이후 강화된 규제와 더불어 과거에 비해 고수익보다는 안정적인 현금흐름을 확보하고, 사업의 다변화를 통해 수익의 변동성을 줄이려는 취지로 풀이된다.

<그림 Ⅲ-3>은 8개 주요 투자은행의 2006년 및 2019년 수익구조를 보여준다. 우선, 금융위기 이후 주요 투자은행의 수익구조가 다각화된 모습을 확인할 수 있으며, 이는 트레이딩 사업 수익 비중의 감소와 자산관리ㆍ운용 사업 수익 비중의 증가가 결합된 결과다. 특히, Goldman Sachs, Morgan Stanley, Credit Suisse 및 Deutsche Bank의 경우 금융위기 이전에는 트레이딩 사업이 가장 많은 수익을 제공했던 반면, 금융위기 이후에는 Goldman Sachs의 경우에만 트레이딩 사업이 최대 수익원으로 남아 있다. 소매ㆍ상업은행 중심 투자은행의 경우 JP Morgan은 2006년 대비 2019년의 트레이딩 수익 비중이 감소했다. 반면 Bank of America 및 Citi의 경우 2006년 대비 2019년의 트레이딩 수익 비중이 오히려 증가했으나 이는 금융위기 이후 저금리의 장기화로 예대마진이 축소되어 소매ㆍ상업은행 수익이 트레이딩 사업 수익보다 빠르게 감소했기 때문이다.

금융위기 이후 주요 투자은행의 자산관리ㆍ운용 수익 비중의 증가도 주목할 만한 변화다. 자산관리ㆍ운용 수익 비중은 투자은행의 유형을 불문하고 모든 경우 증가했으며, Morgan Stanley, UBS, Credit Suisse 및 Deutsche Bank는 자산관리ㆍ운용 수익이 트레이딩 수익을 대체하고 가장 큰 수익원으로 부상했다. 특히, 이와 같은 변화는 트레이딩 수익이 감소했기 때문만이 아니라 금융위기 이후 주요 투자은행이 자산관리ㆍ운용 사업을 전략적으로 확대하여 수익이 빠르게 증가하고 있기 때문이다. 소매ㆍ상업은행 중심 투자은행의 경우에도 JP Morgan 및 Bank of America의 경우 2019년 자산관리ㆍ운용 사업 수익이 트레이딩 사업 수익을 상회하고 있다. 반면, Citi의 경우 자산관리ㆍ운용 사업 수익이 트레이딩 사업 수익을 상당 수준 하회하고 있으며, 이는 금융위기 이후 자산관리 사업 Smith Barney를 Morgan Stanley에 매각한 데에 기인한다.

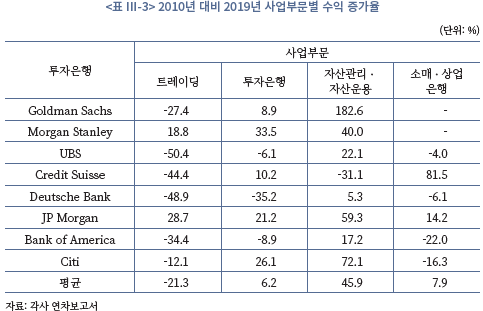

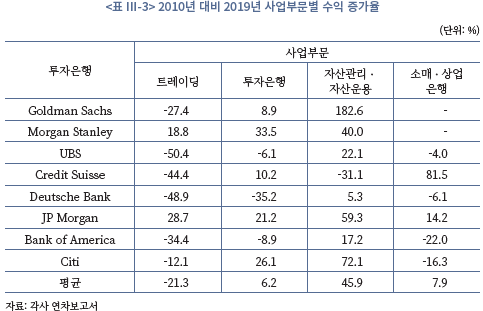

<표 Ⅲ-3>은 2010년 및 2019년 8개 투자은행의 사업부문별 수익 증가율을 보여준다.26) 우선 2010년 대비 2019년 8개 투자은행의 트레이딩 수익은 평균 21.3% 감소했다. 즉, 주요 투자은행의 트레이딩 수익 감소는 금융위기 직후에만 국한되지 않고, 이후 10년 넘게 지속되고 있는 추세다. 반면, 8개 투자은행의 자산관리ㆍ운용 수익은 높은 성장세를 보이고 있으며, 2010년 대비 2019년 8개 투자은행의 자산관리ㆍ운용 수익은 45.9% 증가했다. 앞서 본바와 같이 금융위기 이후 주요 투자은행의 수익구조 변화가 단순히 트레이딩 수익 감소에 따른 기저 효과만이 아니고, 자산관리ㆍ운용 사업 수익의 절대적 수준이 높아지고 있는 것이다. 주요 투자은행의 자산관리ㆍ운용 수익이 빠르게 증가하고 있는 이유는 사업의 범위를 기존 고액자산가 및 기관투자자에서 리테일 고객 시장으로 확대하고 있기 때문이다. 이는 리테일 시장의 빠른 성장세로 매력도가 높아지고, 로보어드바이저(robo-advisor) 등 핀테크 기술의 발전으로 리테일 자산관리ㆍ운용 시장의 진입장벽이 낮아지고 있기 때문이다.

3. 재무구조의 변화

가. 수익 및 수익성

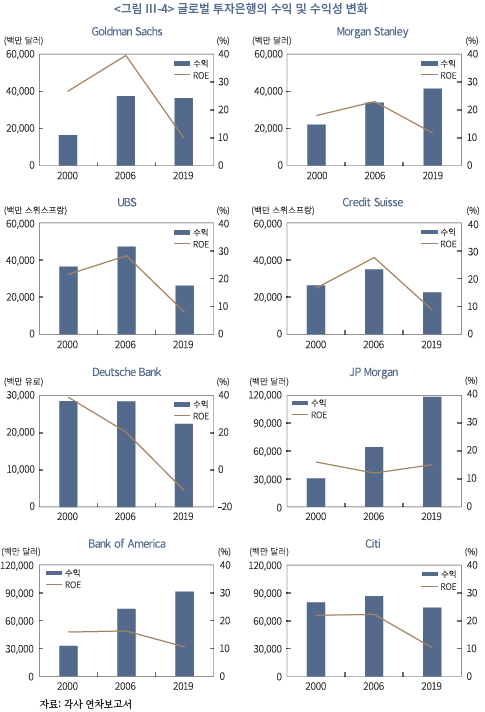

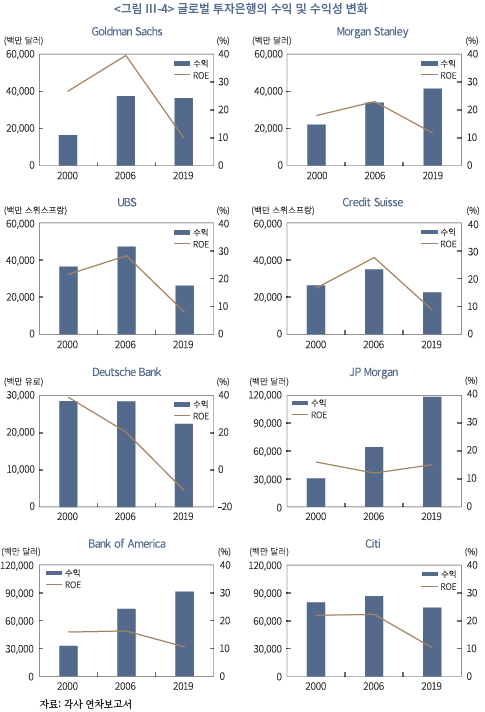

2008년 글로벌 금융위기 이후 주요 투자은행의 수익 추이는 개별 투자은행과 더불어 지역별로 차이를 보인다. <그림 Ⅲ-4>는 8개 주요 투자은행의 2000년, 2006년 및 2019년 수익 및 ROE 수준을 보여준다. 우선, 북미계 투자은행 중 Morgan Stanley, JP Morgan 및 Bank of America의 수익은 금융위기 이전 수준을 빠르게 회복했다. 2006년 대비 2019년 Morgan Stanley, JP Morgan 및 Bank of America의 수익은 각각 22.3%, 83.9%, 25.4% 증가했다. 다만, Goldman Sachs 및 Citi의 경우 2006년 대비 2019년 수익이 각각 3.0%, 14.9% 감소했다. Goldman Sachs는 트레이딩 수익 감소가 전체 수익 감소의 주요 원인이며, Citi는 저금리 기조에 따른 예대마진 축소로 이자수익이 줄어들고, 자산관리 사업인 Smith Barney를 매각했기 때문에 전체 수익이 금융위기 이전 수준을 하회한다.

반면, 유럽의 주요 유니버설뱅크의 경우 금융위기 이전 수준의 수익을 회복하지 못하고 있다. 2006년 대비 2019년 UBS, Credit Suisse 및 Deutsche Bank의 수익은 각각 44.3%, 35.6%, 21.2% 감소했다. 유럽계 유니버설뱅크의 수익 감소는 유로존 위기 이후 유럽 시장의 더딘 경제회복과 더불어 트레이딩 및 투자은행 사업의 축소, 해외사업 철수 등 구조조정의 결과물이다.

<그림 Ⅲ-4>에서 볼 수 있듯이 금융위기 이후 주요 투자은행의 수익성은 일관되게 하락했다. 2006년 8개 투자은행의 평균 ROE는 23.7%를 기록한 반면, 2019년에 들어서는 7.9%로 낮아졌다. 특히 ROE의 감소세는 전업계 및 유니버설뱅크에 속하는 5개 투자은행에서 더욱 두드러지게 나타나며, 이들의 ROE 평균은 2006년 29.6%에서 2019년 9.6%로 하락했다. 소매ㆍ상업은행 중심인 3개 투자은행의 경우에도 상대적으로 덜하지만 ROE 평균이 2006년 16.9%에서 2019년 12.0%로 낮아졌다.

개별 투자은행 중에서는 Goldman Sachs의 ROE 낙폭이 가장 크다. 2006년 Gold-man Sachs의 ROE는 39.8%로 경쟁사의 2~3배 수준이었으나, 2019년에는 10.0%로 감소하여 업계 평균과 큰 차이를 보이지 않는다. 이와 같은 ROE의 하락은 과거 자기자본과 레버리지를 결합하여 고수익을 제공했던 트레이딩 사업이 금융위기 이후 감소했기 때문이다. Morgan Stanley, UBS, Credit Suisse 및 Deutsche Bank의 경우에도 트레이딩 수익의 감소로 ROE가 2006년 20%대에서 2019년 10%대로 낮아졌다. 특히, Deutsche Bank의 경우 금융위기 이후 9차례의 구조조정을 단행하면서 2019년 ROE가 –11.0%를 기록하고 있다. 반면, 금융위기 이후 가장 우수한 수익성을 보이고 있는 투자은행은 JP Morgan이며, ROE가 2006년 12.0%에서 2019년 15.0%로 8개 투자은행 중 ROE가 유일하게 높아졌다.

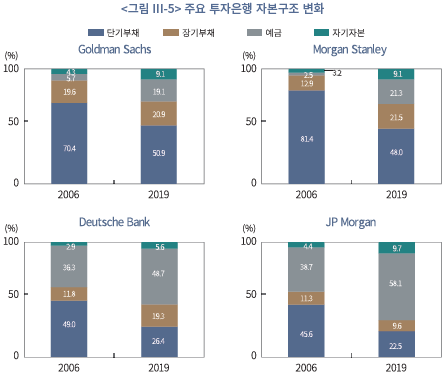

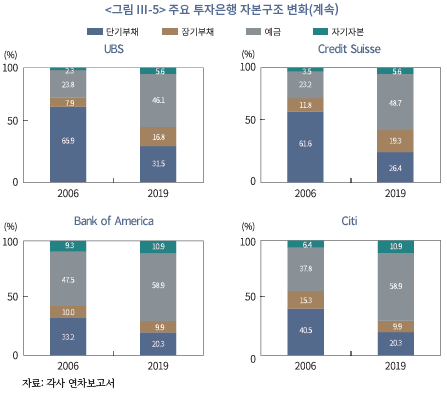

나. 자본구조

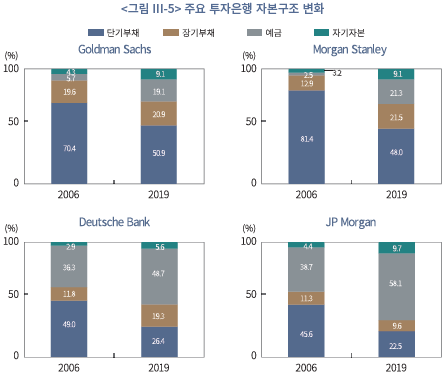

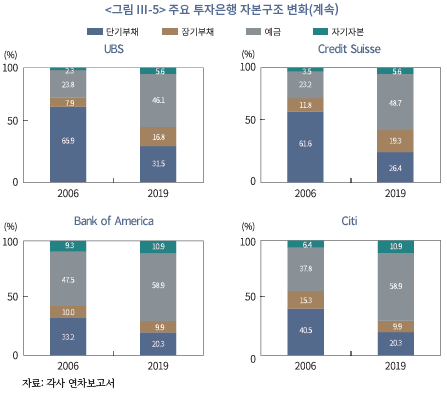

전업계 투자은행 및 유니버설뱅크의 과도한 단기자금시장 의존도와 레버리지는 금융위기를 심화시킨 원인 중 하나로 지적되었다. 따라서 금융위기 이후 도입된 각종 건전성 및 영업행위 규제들은 투자은행의 자본구조를 개선하고 위험추구를 완화하기 위해 설계되었다. 금융위기 이후 글로벌 투자은행의 자본구조는 이와 같은 규제 강화의 영향을 반영하고 있다. <그림 Ⅲ-5>는 2006년 및 2019년 8개 투자은행의 자본구조 변화를 보여주며 3가지 특징이 있다. 첫째, 2006년 대비 2019년 8개 투자은행의 총부채 중 단기부채 비중은 평균 56.0%에서 32.4%로 감소했다. 특히, 전업계 투자은행과 유니버설뱅크의 단기부채 비중 평균은 2006년 65.7%에서 2019년 36.6%로 크게 낮아졌다. 소매ㆍ상업은행 중심 투자은행의 단기부채 비중 평균도 2006년 39.8%에서 2019년 25.3%로 감소했다.

둘째, 투자은행 자금구조 상 예금 비중이 높아졌다. 2006년 대비 2019년 8개 투자은행의 자금조달에서 예금 비중은 평균 26.9%에서 43.6%로 증가했다. 자본구조 상 전업계 투자은행 및 유니버설뱅크의 예금 비중 평균은 2006년 18.3%에서 2019년 36.8%, 소매ㆍ상업은행 중심 투자은행의 예금 비중은 평균 2006년 41.3%에서 2019년 54.9%로 높아졌다. 특히, 금융위기 이전에는 소매은행 사업이 미미했던 Goldman Sachs 및 Morgan Stanley의 경우에도 자금조달에서 예금 비중이 의미 있게 늘어났으며, Goldman Sachs는 인터넷뱅킹, Morgan Stanley는 자산관리 사업을 중심으로 리테일고객의 예금을 유치하고 있다.

셋째, 투자은행의 자기자본도 금융위기 이후 확충되었다. 8개 투자은행의 총자산 대비 자기자본 비중은 2006년 4.5%에서 2019년 8.1%로 높아졌다. 자기자본 비중에 있어서는 투자은행의 유형보다는 지역별로 차이를 보이며 2006년 대비 2019년 총자산 중 자기자본 비중 평균은 미국계 투자은행은 5.5%에서 9.6%, 유럽계 투자은행은 2.9%에서 5.6%로 증가했다.

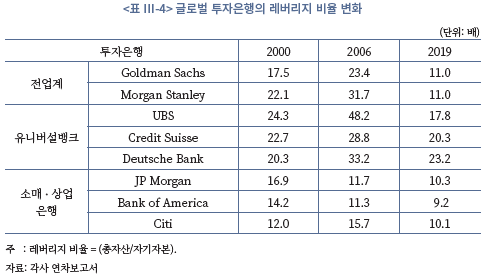

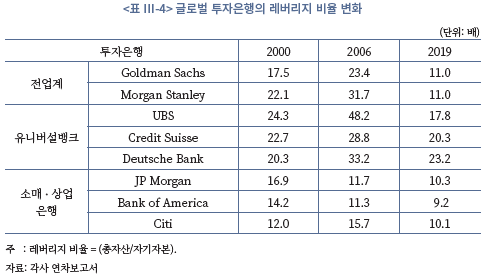

글로벌 금융위기 이후 투자은행의 과도한 레버리지도 완화되었다. <표 Ⅲ-4>는 2000년, 2007년 및 2019년 8개 주요 투자은행의 레버리지 비율을 보여준다. 8개 투자은행의 평균 레버리지 비율은 2006년 25.5배에서 2019년 14.1배로 낮아졌다. 특히, 5개 전업계 투자은행 및 유니버설뱅크의 경우 평균 레버리지 비율은 2006년 33.1배에 달했으나, 2019년에 들어서는 16.7배로 줄어들었다. 3개 소매ㆍ상업은행 중심의 투자은행의 경우 금융위기 이전에도 레버리지 비율이 높지 않았으며, 평균 레버리지 비율은 2006년 12.9배에서 2019년 9.9배로 감소했다.

Ⅳ. 주요 투자은행의 사업전략

본 절에서는 2008년 글로벌 금융위기 이후 주요 투자은행의 수익구조 및 사업전략을 반영하여 3개의 사업모델로 구분하고 각 유형에 해당되는 대표적 투자은행의 사례를 살펴본다. 첫 번째 유형은 투자은행 및 트레이딩 사업모델이며 여기에는 Goldman Sachs가 유일하다. 두 번째 유형은 자산관리ㆍ운용 사업모델로 Morgan Stanley, UBS 및 Cred-it Suisse가 해당되며, Morgan Stanley 사례를 소개한다. 세 번째 유형은 다각화 사업모델이며, 소개하는 사례인 JP Morgan과 더불어 Bank of America 및 Citi가 포함된다.

1. 투자은행ㆍ트레이딩 사업모델: Goldman Sachs

가. 개요

Goldman Sachs는 1869년 기업어음(Commercial Paper: CP) 딜러로 출발하여 1906년 유가증권 인수로 업무를 확대해나갔다. 1930년대 Sidney Weinberg 대표 체제하에서 투자은행 부문에 두각이 나타나기 시작했고, 1950년대 Ford Motors의 IPO를 주관하는 등 10대 투자은행 반열에 진입했다. 1970년대에는 John Whitehaed와 John Weinberg의 공동대표체제하에 Goldman Sachs는 글로벌 선두 투자은행으로 자리 잡았다. 1981년에는 상품 현물 거래기업인 J. Aron & Co.를 인수하면서 자기매매를 포함한 트레이딩 사업의 기반이 마련되었다. 1989년에는 Goldman Sachs Asset Management(GSAM) 부문을 신설하여 초부유층 중심의 자산관리 업무를 시작했고, 2003년에는 금융자문사 Ayco 인수를 통해 자산관리 사업을 강화하였다.27)

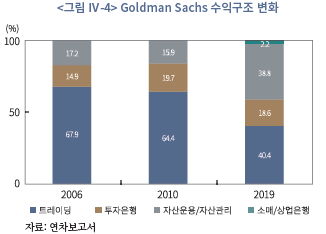

2000년대 들어 Goldman Sachs의 수익구조는 균형적인 모습에서 트레이딩 사업 중심으로 변화했다. <그림 Ⅳ-1>은 2000년 및 2006년 Goldman Sachs의 수익구조를 보여준다. 2000년 Goldman Sachs의 수익은 트레이딩 부문 39.9%, 투자은행 부문 32.4%, 자산관리ㆍ운용 부문 27.7%로 균등한 구조를 이루었다. 그러나 2006년에 들어서는 트레이딩 부문 수익이 67.9%로 증가하고, 투자은행 부문은 14.9%, 자산관리ㆍ운용 부문은 17.2%로 감소했다.

나. 글로벌 금융위기 이후 사업전략

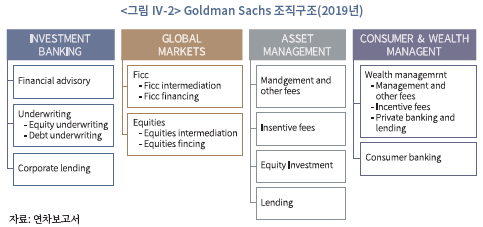

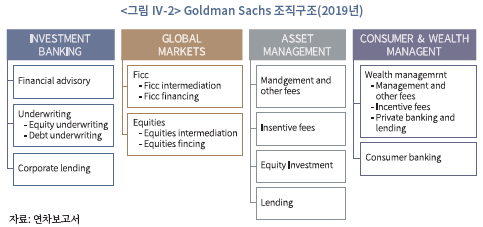

글로벌 금융위기 이후 Goldman Sachs는 경쟁우위를 지닌 트레이딩 및 투자은행 사업을 중심으로 하면서 리테일 사업(자산관리ㆍ운용 및 소매금융)을 확대하는 전략을 추진하고 있다. <그림 Ⅳ-2>는 2019년 현재 Goldman Sachs의 조직구조를 보여준다. 2008년 Goldman Sachs는 전업계 투자은행에서 은행지주회사로 전환하고 경영 투명성 강화를 위해 기존의 3개 사업부문으로 나누어졌던 조직을 4개 사업부문으로 세분화하는 조직구조 개편을 단행했다. Investment Banking 부문은 투자은행 업무를 취급하고, Institu-tional Client Service 부문은 트레이딩 사업을 포함하며, Asset Management 부문은 자산운용 사업을 영위한다. 신설된 Consumer & Wealth Management 부문은 기존 자산관리 사업과 더불어 Marcus를 포함한 소매은행 사업을 영위한다.

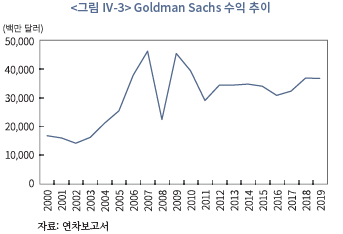

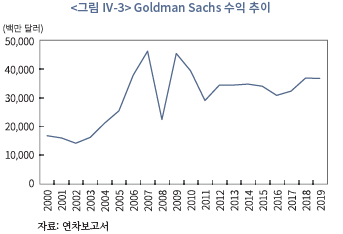

글로벌 금융위기 이후 Goldman Sachs의 수익은 더딘 회복세를 보이고 있다. <그림 Ⅳ-3>은 2000~2019년 사이 Goldman Sachs의 수익 추이를 보여준다. 금융위기 이전 5년(2000~2007년) Goldman Sachs의 수익은 연평균 26.9%의 높은 성장률을 기록하면서 2007년 459.9억 달러로 역대 최고치를 기록했다. 2008년에는 금융위기로 인해 수익이 222.2억 달러로 감소한 후 2009년에는 451.2억 달러로 반등했으나, 2010~2013년 사이에는 다시 감소세로 전환했다. 최근 5년(2014~2019년) Goldman Sachs의 연평균 수익 성장률은 1.1%에 불과하며, 2019년 수익은 365.5억 달러로 금융위기 직전인 2007년의 수준을 여전히 하회하고 있다.

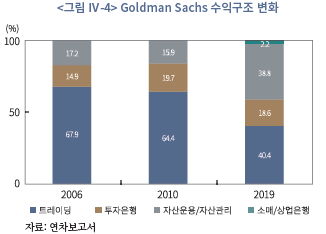

<그림 Ⅳ-4>는 2006년, 2010년 및 2019년 Goldman Sachs의 수익구조를 보여준다. 2019년 Goldman Sachs의 수익구조는 금융위기 직전보다 2000년대 초반의 균형적인 모습에 보다 근접해 보인다. 2006년 Goldman Sachs는 수익의 87.8%를 트레이딩(67.9%) 및 투자은행(14.9%) 사업에서 창출했다. 반면, 2019년에 들어서는 트레이딩(40.4%) 및 투자은행(18.6%) 사업의 수익 비중이 59.0%로 감소하면서 주요 투자은행 중에서는 가장 높은 수준이지만, 금융위기 이전에 비해서는 상당히 줄어들었다. 반면, 자산관리ㆍ운용 사업 수익 비중은 2006년 17.2%에서 2019년 38.8%로 크게 증가했으며, 과거 전무한 수준이었던 소매ㆍ상업은행 사업 수익 비중도 2019년 2.2%를 기록하고 있다.

글로벌 금융위기 이후 Goldman Sachs 사업전략의 가장 두드러진 변화는 리테일 시장으로의 진출이다. <그림 Ⅳ-4>에서 볼 수 있듯이 2019년 Goldman Sachs 수익 중 자산관리ㆍ운용 사업이 38.8%를 차지하면서 투자은행 부문 수익을 상회하고, 소매ㆍ상업은행 수익 비중도 2.2%로 아직 그 수준은 크지 않지만 전략적으로 확대하고 있는 사업이다. 자산관리ㆍ운용 사업의 경우 과거에는 초부유층 및 기관투자자 고객 중심으로 이루어졌던 반면, 글로벌 금융위기 이후에는 사업을 리테일 고객층으로 확대했다. 2012년 퇴직연금에 강점을 지닌 Dwight Asset Management의 인수도 이러한 리테일 고객층 확대 전략의 일환이다.

Goldman Sachs는 2016년 미국에서 인터넷뱅크 Marcus를 출시하면서 소매은행 사업에 본격적으로 진출했다. Marcus는 우선적으로 온라인 전용 예금 및 대출을 제공하고, 주택담보대출, 중소기업 대출 및 신용카드 사업으로 서비스를 확대하고 있다. 2018년에는 영국 Marcus를 출시하면서 소매은행 사업을 해외시장으로 확대했다. 영국 Marcus는 리테일 고객 대상 대출 사업으로 시작하여 신용카드 및 주택담보대출을 추가하고 있다. 2019년에는 Apple과의 제휴를 통해 신용카드 사업에 진출하면서 Apple Card를 출시하였고, 2020년에는 자동차회사 GM의 신용카드 포트폴리오를 인수했다. 2018년에는 개인자산관리 전문 핀테크사 Clarity Money를 인수하고, 2021년에는 디지털 자산관리 서비스 Marcus Invest를 출시하는 등 온라인 자산관리 사업을 확대하고 있다. 또한, Goldman Sachs는 중소ㆍ중견기업(middle market) 대출 시장에도 적극적으로 나서고 있으며, 자체적 사업 확대와 더불어 Walmart, Amazon 등 유통업체와의 제휴를 통해 유통업체 상품공급 기업에게 신용대출을 제공하고 있다. Goldman Sachs는 Marcus를 단순한 인터넷뱅크가 아닌 개방형구조(open-architecture)로 자사 및 제3자 주택담보대출, 자동차 할부 등 다양한 금융상품의 중개 플랫폼(platform)으로 키워나갈 계획이다.28)

2. 자산관리ㆍ운용 사업모델: Morgan Stanley

가. 개요

Morgan Stanley는 1935년 JP Morgan에서 분리되어 독립 투자은행으로 출범했다. JP Morgan의 우수 고객을 승계받아 Morgan Stanley는 출범과 함께 투자은행업계의 선두자리를 차지했다. 1972년 Morgan Stanley는 업계 최초로 M&A 및 LBO 전담부서를 설립하고 M&A자문이 투자은행의 새로운 수익원으로 자리 잡는데 선도적인 역할을 했다.29)

종합금융회사로 거듭나기 위해 1997년 Morgan Stanley는 Dean Witter Discover와 합병하고, 사명을 Morgan Stanley Dean Witter Discover로 변경했다. 투자은행 및 트레이딩 사업에 강점을 지닌 Morgan Stanley와 리테일 사업(브로커리지, 자산운용 및 신용카드)에 강점을 지닌 Dean Witter Discover와의 합병은 두 회사 간의 문화적 충돌, 내부 분쟁 등으로 인해 기대했던 만큼의 시너지를 제공하지 못했다. Morgan Stanley Dean Witter Discover는 합병 후 리테일 사업에 초점을 두면서 트레이딩 및 브로커리지 사업은 상대적으로 후퇴했다. 2000년대 들어 주요 경쟁사 Goldman Sachs가 트레이딩 사업을 중심으로 고수익을 달성하고, 실적 개선에 대한 주주의 압박이 높아지면서 2001년에는 사명을 다시 Morgan Stanley로 변경하고, 2005년에는 John Mack이 CEO로 복귀하면서 트레이딩 사업 확대에 뒤늦게 박차를 가했다. 2007년에는 신용카드 사업 Discover를 매각하면서 소매금융 사업이 크게 감소했다.

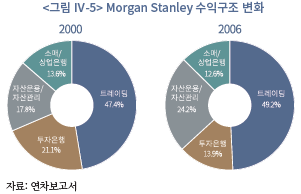

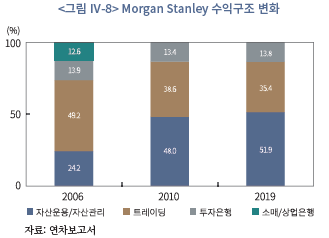

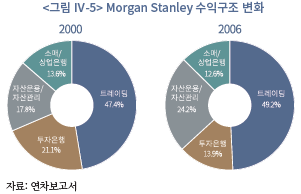

<그림 Ⅳ-5>는 2000년 및 2006년 Morgan Stanley의 수익구조를 보여준다. 2000년 Morgan Stanley의 수익은 트레이딩(47.4%), 투자은행(21.1%), 자산관리운용(17.8%) 및 소매ㆍ상업은행(13.6%) 사업부문 간의 균형적인 구조를 갖추고 있다.30) 2006년에도 수익구조의 균형이 일정 수준 유지되고 있으며, 2000년에 비해 트레이딩 부문 수익 비중이 1.8%p로 소폭 증가하고, 자산관리ㆍ운용 부문 수익 비중도 6.4%p 증가했다. 반면, 2000년 대비 2006년 투자은행 부문 수익 비중은 7.2%p, 소매ㆍ상업은행 부문 수익 비중은 1.0%p 감소했다.

나. 글로벌 금융위기 이후 사업전략

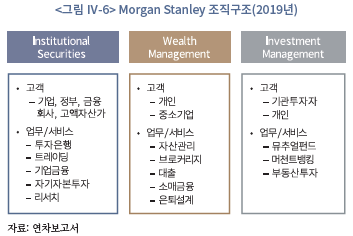

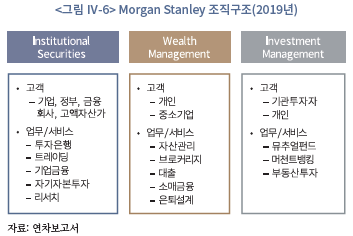

Morgan Stanley는 2008년 은행지주회사로 전환하고, 2010년 취임한 CEO James Gorman의 주도 하에 자산관리ㆍ운용 중심으로 사업을 전환하는 전략을 추진하고 있다. <그림 Ⅳ-6>은 2019년 현재 Morgan Stanley의 조직구조를 보여준다. Institutional Securities 부문은 기업, 정부, 금융회사 및 고액자산가 고객을 대상으로 투자은행 및 트레이딩 업무를 제공하고, 기업금융 및 자기자본투자도 해당 사업부문에서 담당한다. Wealth Management 부문은 개인 및 중소기업 고객 대상으로 자산관리 서비스를 제공하며, 이와 연계하여 대출 등 소매금융 서비스도 제공한다. Investment Management 부문은 기관투자자 및 개인 고객을 대상으로 펀드 설계 및 운용 서비스를 제공하며, 머천트뱅킹 및 부동산투자 사업도 해당 부문에 포함된다.

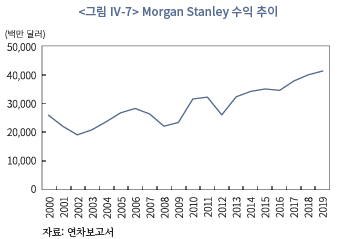

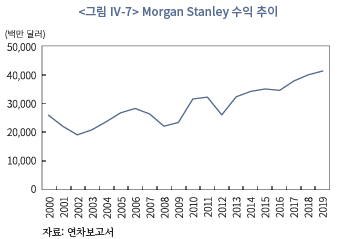

<그림 Ⅳ-7>은 2000~2019년 사이 Morgan Stanley의 수익 추이를 보여준다. Morgan Stanley의 수익은 글로벌 금융위기로 인한 충격으로부터 빠르게 회복하고 안정적인 증가세를 보이고 있다. 글로벌 금융위기의 여파로 2008년 Morgan Stanley의 수익은 전년 대비 16.3% 감소한 221.4억 달러를 기록했으나, 2010년에 들어서 316.2억 달러로 금융위기 이전 수준을 회복했다. 최근 5년 간(2014~2019년) Morgan Stanley의 연평균 수익 증가율은 3.9%를 기록하고 있으며, 2019년 수익 규모는 414.2억 달러에 달한다.

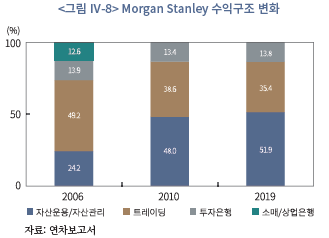

글로벌 금융위기 이후 Morgan Stanley의 수익구조는 자산관리ㆍ운용 중심으로 재편되고 있다. <그림 Ⅳ-8>은 2006, 2010, 2019년 Morgan Stanley의 수익구조를 보여준다. 2006년 Morgan Stanley는 49.2%로 트레이딩 사업에서 가장 많은 수익을 창출했으며, 여기에 투자은행 부문 수익 비중 13.9%를 더하면 63.1%의 수익이 트레이딩 및 투자은행 부문에서 발생했다. 2006년 자산관리ㆍ운용 수익 비중도 24.2%를 차지했으며, 해당 사업의 기반은 1997년 Dean Witter Discover와의 합병에서 마련되었고, 이와 더불어 Discover 신용카드 사업에서 12.6%의 소매금융 수익이 발생했다. 반면, 2019년에 들어서는 자산관리ㆍ운용 사업 수익이 51.9%로 가장 큰 수익원으로 부상했다. 투자은행 부문 수익 비중은 13.8%로 2006년 수준과 유사한 반면, 트레이딩 부문 수익 비중은 35.4%로 감소했다. 또한, 2007년 Discover 신용카드 사업을 매각함에 따라 2019년에는 의미 있는 소매금융 수익은 발생하지 않고 있다.

금융위기 이후 Morgan Stanley의 새로운 사업방향은 2010년 취임한 CEO James Gorman이 주도하고 있다. Morgan Stanley는 Citi의 Smith Barney 사업부문을 인수하면서 단기간에 자산관리 사업 규모를 2배 이상 키웠다. Smith Barney의 인수는 2단계로 이루어졌다. 2008년 Morgan Stanley와 Citi는 각사의 자산관리 사업을 분리 후 결합하여 Morgan Stanley Smith Barney 합작회사(Morgan Stanley 51%, Smith Barney 49%)를 설립했고, Morgan Stanley는 단계적으로 지분을 확대하여, 2013년에 합작사 인수를 완결하였다. 추가적으로 Morgan Stanley는 2020년에 운용자산 규모 5,186억 달러로 세계 52위 자산운용사에 속하는 Eaton Vance를 70억 달러에 인수했다.31) 이와 더불어 Morgan Stanley는 2020년 미국 3위 디스카운트 브로커리지(discount broker) E*Trade를 인수했다. Smith Barney의 인수가 자산관리 사업의 규모의 경제(economies of scale) 달성을 위한 것이었다면, E*Trade 인수는 리테일 브로커리지로 사업을 확대하는 범위의 경제(economies of scope) 목적을 가지는 것으로 볼 수 있다. Morgan Stanley는 E*Trade 브로커리지 고객에게 자산관리 서비스를 제공하고, E*Trade 브로커리지 고객의 예탁금을 활용하여 기존 자산관리 사업 고객에게 대출을 제공하는 시너지를 기대하고 있다. 이와 더불어 E*Trade의 퇴직연금 사업도 Morgan Stanley가 새롭게 키워나가고 있는 분야다.

3. 다각화 사업모델: JP Morgan

가. 개요

JP Morgan은 2019년 자산규모 기준으로 미국 최대, 세계 6위 은행으로 자리 잡고 있다. JP Morgan은 1990~2000년대 Chemical Bank, Chase Manhattan, Bank One 등 다수 상업은행 간의 M&A를 통해 대형 금융지주회사로 성장했다. Chase Manhattan은 JP Morgan과의 합병 이전 1999년 투자은행 Hambrecht & Quist, 2000년 투자은행 및 자산운용사 Robert Fleming & Co.를 인수했다. 이와 더불어 2008년 글로벌 금융위기가 발생하면서 JP Morgan은 투자은행 Bear Stearns와 상호저축은행 Washington Mutual을 인수하기도 했다. 이처럼 JP Morgan은 여러 M&A를 통해 상업은행, 투자은행 및 자산관리ㆍ운용 사업의 다각화된 사업구조를 구축했다.

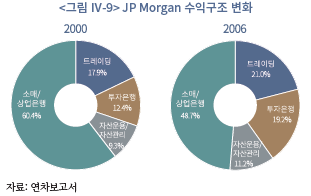

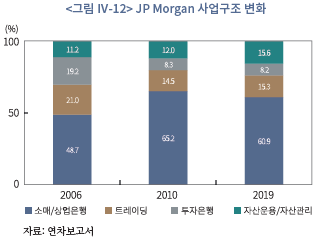

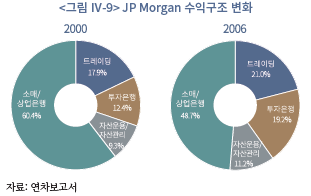

<그림 Ⅳ-9>는 2000년 및 2006년 JP Morgan의 수익구조를 보여준다. 2000년 JP Mor-gan은 소매ㆍ상업은행 사업에서 60.4%로 가장 많은 수익을 창출했으며, 다음으로 트레이딩 부문 17.9%, 투자은행 부문 12.4%, 자산관리ㆍ운용 부문 9.3%로 수익구조가 구성되었다. 반면, 2006년에 들어서 JP Morgan의 소매ㆍ상업은행 수익 비중은 48.7%로 감소하고, 트레이딩 부문 21.0%, 투자은행 부문 19.2%, 자산관리ㆍ운용 부문 11.2%로 수익 구조가 바뀌었다. 2000년 대비 2006년 수익구조의 변화는 소매ㆍ상업은행 수익보다 트레이딩 및 투자은행 수익이 상대적으로 빠르게 증가한데 기인한다.32)

나. 글로벌 금융위기 이후 사업전략

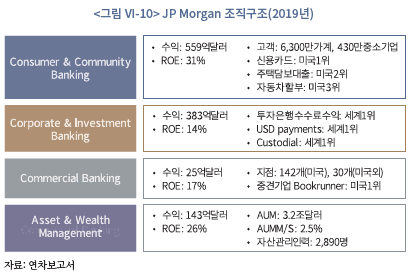

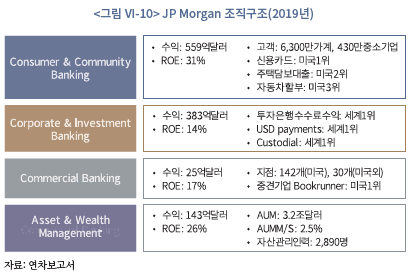

JP Morgan은 2008년 글로벌 금융위기를 원만하게 극복하고, 금융위기 이후 실적이 가장 우수한 금융회사로 주목받고 있다. 이는 다각화된 사업구조에 따른 수익성과 안정성 간의 적절한 균형으로부터 비롯되는 것으로 평가된다. JP Morgan의 사업전략은 이자수익과 비이자수익을 적절하게 배분하고 다양한 사업 간 시너지를 극대화하는 것이다. <그림 Ⅳ-10>은 2019년 JP Morgan의 조직구조를 보여준다. Consumer & Community Banking 부문은 개인 및 중소기업(연매출 2,000만 달러 미만)을 대상으로 대출, 신용카드 등 소매금융 서비스를 제공한다. Commercial Banking 부문은 중견기업(연매출 2,000만 달러 이상) 대상으로 대출 등 자금조달을 제공한다. Corporate & Investment Banking 부문은 투자은행 및 트레이딩 사업을 포함하여, 주요 고객층은 대기업 및 기관투자자다. Asset & Wealth Management 부문은 개인 및 기관투자자 대상 자산관리 및 자산운용 서비스를 제공하고 있다.

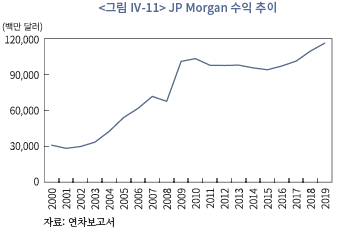

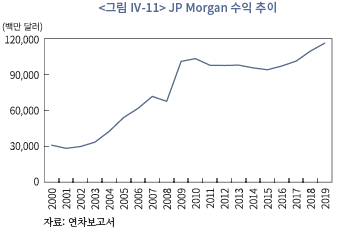

<그림 Ⅳ-11>은 2000~2019년 사이 JP Morgan의 수익 추이를 보여준다. 글로벌 금융위기 이전 5년(2002~2007) JP Morgan 수익은 연평균 19.2%로 매우 높은 성장률을 기록했다. 2004년 Bank One과의 합병이 빠른 수익 증가세에 일부 기여한 요인이다. 글로벌 금융위기로 인한 JP Morgan의 수익 감소도 크지 않았으며, 2008년 JP Morgan의 수익은 672.5억 달러로 전년대비 5.8% 감소했으나, 2009년에는 1,004.3억 달러로 빠르게 회복했다. 2019년 JP Morgan의 수익 규모는 1,115.6억 달러에 달하며, 최근 5년(2014~2019년) JP Morgan의 수익 증가율은 연평균 4.0%로 주요 투자은행 중에서는 가장 높은 수준을 기록하고 있다.

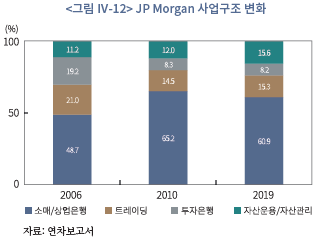

<그림 Ⅳ-12>는 2006년, 2010년, 2019년 JP Morgan의 수익구조를 보여준다. 전반적으로 JP Morgan의 수익구조는 글로벌 금융위기 이전과 이후 크게 변화하지 않은 것으로 나타난다. 2019년 소매ㆍ상업은행 수익 비중은 60.9%로 2006년 금융위기 이전보다는 증가했으나, 2010년 65.2%를 기록한 이후 최근에 들어서는 감소하는 추세다. 2010년 대비 2019년 소매ㆍ상업은행 수익의 감소세는 특히 금융위기 이후 저금리가 장기화됨에 따라 은행 예대마진의 축소로 이자수익이 줄어들고 있기 때문이다. 주요 비이자수익 사업을 살펴볼 경우 2006년 대비 2019년 트레이딩 사업 비중은 21.0%에서 2019년 15.3%로, 투자은행 사업 수익 비중도 19.2%에서 8.2%로 감소했다. 반면, 자산관리ㆍ운용 사업 수익 비중은 2006년 11.2%에서 2019년 15.6%로 꾸준한 증가세를 유지하고 있다.33)

JP Morgan의 사업전략은 다각화된 사업구조를 통해 사업부문 간의 시너지를 극대화하는 것이다. 예를 들어 소매은행 사업 고객에게 예금 및 대출 상품과 더불어 투자은행 및 자산관리 사업부문의 상품을 교차판매(cross-selling)하고, 중소기업이 중견기업으로 발전하면 Consumer & Community Banking 부문에서 Commercial Banking 부문으로, 중견기업이 대기업이 되면 Corporate & Investment Banking 부문으로 고객을 이전하면서 관계를 유지하는 것이다. 또한, JP Morgan은 주요 은행 중에서도 사업의 디지털화(digitalization)에 가장 많은 투자를 하고 있으며, 다각화된 사업구조는 IT 시스템 개발 등 관련 비용을 사업부문 간 분담할 수 있는 것도 중요한 시너지다.34)

반면, JP Morgan의 거대 규모와 다각화된 사업은 금융위기 이후 도입된 각종 규제로 인해 단일 사업모델에 비해 추가적인 비용을 발생시킨다. 예를 들어 G-SIB에 적용되는 건전성 규제 등으로 트레이딩 부문의 위험자산이 일정 수준 넘어가면 JP Morgan의 G-SIB 수치가 높아져서 추가 자본세가 부과되고 이로 인해 모든 사업부문의 자본비용이 증가한다. 따라서 JP Morgan은 다각화된 사업구조의 시너지와 규모 및 복잡성 증가 등에 따른 위험과 비용 간의 적절한 균형을 관리해야 한다.

V. 결론 및 시사점

1930년대 막을 올린 전업계 투자은행의 시대는 2008년 글로벌 금융위기의 발생과 함께 종결되었다. 그간 국내 증권사를 비롯한 주요 금융회사의 벤치마크로 여겨졌던 글로벌 투자은행은 금융위기 이전과는 다른 모습으로 발전하고 있다. 최근 글로벌 투자은행의 변모를 이끄는 주요 테마는 ‘균형’, ‘관계’ 및 ‘기술’이다.

첫째, 주요 투자은행은 수익구조의 ‘균형’을 지향하고 있다. 글로벌 금융위기 전과 후 주요 투자은행의 사업전략을 비교해볼 경우 금융위기 이전에는 트레이딩 사업을 편중되게 키워나갔다면, 금융위기 이후에는 사업의 다각화를 적극적으로 추진하고 있다는 것이다. 특히 이와 같은 사업 다각화는 공통적으로 자산관리 및 자산운용 사업의 확대를 통해 이루어지고 있다. 트레이딩 사업의 고수익과 고변동성을 지양하고, 자산관리 및 자산운용 사업의 안정적인 현금흐름에 중점을 두고 있는 모습이다.

둘째, 투자은행이 영위하는 주요 사업에 있어서 ‘관계’의 중요성이 다시 부각되고 있다. 금융위기 이전 트레이딩 중심의 사업구조 하에서는 자본력이 투자은행의 주요 경쟁력이었다. 반면, 금융위기 이후 주요 투자은행은 과거의 관계형 사업으로 회귀하는 측면이 있다. 특히, 자산관리ㆍ운용이나 일부 투자은행이 새롭게 진출하는 인터넷뱅크 등 리테일 시장 사업은 만족스러운 고객 경험(customer experience)과 신뢰(trust) 구축이 성공의 핵심이다. 기업 고객에 있어서도 금융위기 이전에는 주로 Forutne 500대에 속하는 글로벌 대기업을 대상으로 했지만, 이제는 중소기업 시장도 집중적으로 공략하고 있는 만큼 적합한 관계 관리 역량도 필요하다.

셋째, ‘기술’의 발전이 주요 투자은행의 새로운 시장 진출을 가능하게 하고 있다. 금융위기 이전 글로벌 투자은행, 특히 전업계 투자은행의 리테일 사업이 제한되었던 일부 이유는 리테일 고객이 제공하는 수익에 비해 점포 설립, 고객 당 투입 인력 등 비용이 과도했기 때문이다. 그러나 최근 빠르게 발전하고 있는 인터넷뱅크, 로보어드바이저 등 핀테크를 포함한 전반적인 IT 기술의 발전은 리테일 고객 대상 사업의 비용을 과거에 비해 현저하게 낮춰주고 있다. Goldman Sachs의 Marcus를 비롯해서, 현재 주요 투자은행이 영위하는 다양한 사업은 무점포로 온라인ㆍ모바일 플랫폼에서 이루어지고 있으며, 서비스의 제공도 점차 자동화되어 고객 당 비용도 줄어들고 있다.

글로벌 금융위기 이후 주요 투자은행은 새로운 사업환경에 대응하기 위해 대대적인 사업구조 재편을 단행하고 있다. 투자은행별로 사업전략의 차이는 있으나, 전반적으로 사업 다각화를 통해 안정적인 수익구조를 마련하려고 노력하고 있다. 또한, 자산관리ㆍ운용, 소매금융 등 리테일 사업의 확대는 금융위기 이후 주요 투자은행의 가장 특징적인 변화다. 국내 금융투자회사도 시장 환경 변화에 맞추어 사업전략을 재검토해볼 필요가 있다. 특히, 핀테크 등 기술의 발전으로 과거에는 접근성이나 시장성이 부족하게 여겨진 사업 분야에 대한 재검토 등 새로운 수익원 발굴을 위한 노력이 요구된다.

1) 일반적으로 ‘투자은행(investment bank)’은 금융회사를 지칭하며, ‘투자은행 업무(investment banking)’는 유가증권 인수(underwriting), 인수합병 자문(M&A자문) 등의 금융투자 서비스를 말한다. 본 보고서에서는 ‘투자은행 업무’와 ‘투자은행 사업’을 병행하여 사용한다.

2) 현대적 투자은행의 전신은 19세기 유럽의 머천트뱅크(merchant bank)로 볼 수 있으며, 머천트뱅크는 주로 무역금융에 집중한 반면, 20세기 미국의 투자은행은 보다 포괄적인 범위에서 기업의 자금조달을 중개하는 금융회사로 차이를 둘 수 있다(Fleuriet, 2018).

3) 공화당 상원위원 카터 글라스(Carter Glass)와 민주당 하원위원 헨리 스티컬(Henry Steagall)이 법안을 공동발의 했으며, 공식 명칭은 1933년 은행법(Banking Act of 1933)이다.

4) Kroszner & Rajan(1994)

5) Smith(2001)

6) Chernow(1990)

7) Chernow(1990)

8) NYSE(1971)

9) Morrison et al.(2007)

10) Karmel(1986)

11) Morrison et al.(2007)

12) 주요 Merger Wave는 1차(1897~1904년), 2차(1916~1929년), 3차(1965~1973년), 4차(1981~1989년), 5차(1993~2000년), 6차(2003~2007년)로 구분된다(박용린, 2011).

13) Cole(2008)

14) BNP Paribas는 2000년 BNP와 Paribas의 합병을 통해 출현했다.

15) 글래스-스티걸법 제20조항은 상업은행 자회사의 ‘주된 업무(engaged principally)’가 투자은행 업무일 경우 불허한다. FRB는 자회사의 투자은행업무 관련 수익이 일정 수준 이하일 경우 주된 업무로 간주하지 않는다는 해석으로 상업은행의 투자은행업무를 허용하였다.

16) 공식 명칭은 1999년 금융서비스현대화법(Financial Services Modernization Act of 1999)이며, Phil Gramm 상원은행원장, Jim Leach 하원은행원장 및 Thomas Bliley 하원상업위원장이 법안을 발의했다.

17) Fleuriet(2018)

18) Farrell(2010), Stalter(2017. 10. 24)

19) Sorkin(2010)

20) Martel et al.(2012)은 은행 분류에 대한 정량적 기준은 제시하지 않으며, 자금조달에서 예금 비중이 높고, 자산구성이 대출로 이루어질수록 전문화 상업은행, 자금조달이 도매, 특히 단기자금으로 조달되고, 투자은행 및 트레이딩 관련 자산이 높을수록 전문화 투자은행으로 구분한다.

21) 해당 분류는 자금조달의 50% 이상이 도매자금(wholesale funding)인 경우, 그리고 수익에서 투자은행 및 트레이딩 부문의 비중이 50% 이상인 경우를 전문화 투자은행으로 분류한다. 반면, 단기자금조달 비중이 30% 미만이고, 투자은행 및 트레이딩 부문 수익이 25% 이상인 경우는 다각화ㆍ유니버설 투자은행으로 분류한다.

22) <표 Ⅲ-1>에서는 Bank of China, CITIC, China Securities, Guotai, Huatai와 같은 중국계, Mitsubishi UFJ, Sumimoto, Nomura와 같은 일본계 상업은행과 투자은행도 세계 순위에서 높은 자리를 차지하고 있으나, 이들은 특정 투자은행 업무 또는 지역에서 대부분 수익을 창출한다. 또한, Jeff eries, Lazard, Houlian Lokey, Rothchild 등 일부 부티크 IB는 M&A 자문 시장에 국한해서 상위권에 포함되어 있다.

23) 신보성 외(2015)

24) Carney(2010. 9. 3), Rauch(2011. 1. 11), Rexrode(2016. 8. 18)

25) BNP Paribas, HSBC 등 일부 은행의 경우 연차보고서 등의 자료에서 세부 항목들이 포함되지 않아 금융위기 전후 및 타 은행과의 비교가 어려워 분석 대상에서 제외된다.

26) JP Morgan, Bank of America 및 Morgan Stanley의 경우 2008~2013년 사이 주요 인수합병을 단행하였기 때문에 그 영향을 배제하고 사업부문별 수익 변화를 보기 위해 2010년과 2019년을 비교한다.

27) Endlich(2000)

28) McDonald et al.(2019), Son(2020. 6. 10), Irrera & Hussain(2021. 2. 16)

29) Farrell(2010)

30) 소매ㆍ상업은행 수익은 대부분 신용카드 사업 Discover에서 발생했다.

31) Bisnoff(2020. 10. 8), Thinking Ahead Institute(2020)

32) 2000~2006년 사이 JP Morgan의 사업부문별 연평균 수익 증가율은 투자은행 부문 17.8%, 트레이딩 부문 12.5%, 자산관리운용 부문 12.8%, 소매ㆍ상업은행 부문 5.6%를 기록했다.

33) JP Morgan은 자산운용 사업 확대를 위해 2020년 Eaton Vance 인수전에 참여했으나, 최종적으로 Morgan Stanley가 Eaton Vance를 인수하는데 성공했다(Morris & Massoudi, 2020. 12. 17).

34) 2018년 기준 JP Morgan은 세계 금융회사 중 가장 많은 10.8조 달러의 예산을 디지털화 투자를 위해 편성하고, 이 중 5조 달러를 핀테크 투자에 할당하였다. JP Morgan은 블록체인(block chain), 빅데이터, 클라우드, 인공지능(AI), 로보틱스 등 다방면의 기술 투자를 단행하고 있다.

참고문헌

박용린, 2011,『세계 M&A 시장 전망과 시사점』, 자본시장연구원 이슈&정책 11-07.

신보성ㆍ권재현ㆍ김종민ㆍ이효섭ㆍ천창민, 2015,『 글로벌 금융규제 흐름과 우리나라 금융규제개혁의 바람직한 방향』, 자본시장연구원 연구총서 15-02.

Bisnoff, J., 2020. 10. 8., Morgan Stanley’s Eaton Vance acquisition could mean more asset management mergers are coming, Forbes.

Caparusso, J., Chen, Y., Dattels, P., Goel, R., Hieber, P., 2019, Post-crisis changes in global bank business models: a new taxonomy, IMF Working Paper.

Carney, J., 2010. 9. 3., Goldman Sachs shuttering principal strategies group, CNBC.

Chernow, R., 1990, The house of Morgan: An American banking dynasty and the rise of modern finance, Atlantic Monthly Press.

Cole, B., 2008, M&A titans: the pioneers who shapes Wall Street’s mergers and acquisitions industry, Wiley.

Endlich, L., 2000, Goldman Sachs: the culture of success, Touchstone.

Farrell, G., 2010, Crash of the titans: Greed, hubris, the fall of Merrill Lynch, and the near-collapse of Bank of America, Crown Publishing.

Fleuriet, M., 2018, Investment banking explained: an insider’s guide to the industry, McGraw-Hill Education.

Irrera, A., Hussain, N., 2021. 2. 16., Goldman Sachs to launch digital investment platform in Marcus push, Reuters.

Kalemli-Ozcan, S., Sorensen, B., Yesiltas, S., 2011, Leverage across firms, banks, and countries, NBER Working Paper Series.

Karmel, R.S., 1986, Assessment of shelf registration: How much diligence is due investors? Yale Journal on Regulation 3, 401-405.

Kroszner, R.S., Rajan, R.G., 1994, Is the Glass-Steagall Act justified? A study of the U.S. experience with universal banking before 1933, American Economic Review 84(4), 810-832.

Martel, M. M., van Rixtel, A., Mota, E. G., 2012, Business models of international banks in the wake of the 2007-2009 global financial crisis, Establidad Financiera 22, 97-121.

McDonald, R., Junnarkar, S., Lane, D., 2019, Marcus by Goldman Sachs, Harvard Business Review.

Morris, S., Massoudi, A., 2020. 12. 17, JPMorgan was losing bidder in $7bn battle for asset manager Eaton Vance, Financial Times.

Morrison, A.D., Wilhelm Jr., W.J., 2007, Investment banking: Past, present and future, Journal of Applied Corporate Finance 19(1), 8-20.

NYSE, 1971, Crisis in the securities industry, a chronology: 1967-1970, Booklet prepared for the subcommittee on commerce and finance, committee on interstate and foreign commerce, house of representatives.

Rauch, J., 2011. 1. 11., Morgan Stanley to spin off prop trading unit, Reuters.

Rexrode, C., 2016. 8. 18., Citigroup’s last proprietary trader walks out the door, The Wall Street Journal.

Smith, R.C., 2001, Strategic directions in investment banking – a retrospective analysis, Journal of Applied Corporate Finance 14(1), 111-124.

Son, H., 2020. 6. 10., Amazon unveils small business credit line with Goldman Sachs in latest tie-up between tech and Wall Street, CNBC.

Sorkin, A.R., 2010, Too big to fail: The inside story of how Wall Street and Washington fought to save the financial system-and themselves, Penguin Publishing.

Stalter, K., 2017. 10. 24, The demise of Merrill Lynch: revisiting its monumental write-down 10 year ago, Forbes.com.

Thinking Ahead Institute, 2020, The world’s largest 500 asset managers, joint study with Pension & Investments.

CNBC cnbc.com

Forbes forbes.com

Reuters reuters.com

The Wall Street Journal wsj.com

2008년 글로벌 금융위기가 발생한지 10년이 넘었다. 당시 Goldman Sachs, Morgan Stanley와 같은 주요 글로벌 투자은행1)은 금융위기로 인해 큰 손실을 보기도 했지만, 금융위기를 촉발한 주범으로도 지목되었다. 이들 투자은행은 복잡한 구조화상품의 제조와 판매로 서브프라임 모기지(sub-prime mortgage) 시장의 위험을 실물경제 전반으로 전이 및 증폭시키는 매개체였기 때문이다.

금융위기 이후 세계 투자은행 산업은 크게 변화했다. 우선 100년 넘는 역사를 지닌Lehman Brothers, Bear Stearns, Merrill Lynch가 파산하거나 인수합병되고, Gold-man Sachs 및 Morgan Stanley가 은행지주회사로 전환함에 따라 대형 전업계 투자은행의 시대가 막을 내렸다. 또한, 금융위기의 재발을 방지하기 위해 도입된 새로운 규제들은 투자은행이 과거와 같은 사업모델을 영위하기 어렵게 만들고 있다. 나아가 금융위기가 야기한 세계적 경기침체로 전반적인 수요가 감소하고 수익성이 악화됨에 따라 주요 투자은행은 새로운 사업구조와 수익원을 마련할 필요가 생겼다.

글로벌 투자은행의 최근 행보는 국내 금융투자업의 시각에서도 관심을 가질 부분이다. 자기자본과 레버리지를 적극적으로 활용하여 고성장과 고수익을 창출하던 글로벌 투자은행은 위탁매매 의존도를 줄이고 새로운 사업모델을 찾고 있는 국내 증권사가 나아가야 할 방향으로 여겨져 왔다. 2013년 종합금융투자사업자 제도 또한 ‘한국판 Goldman Sachs’의 출현을 기대하며 도입되기도 했다. 그러나 금융위기 이후 Goldman Sachs를 비롯한 주요 투자은행은 사업의 구조, 방식, 대상 등 다방면에서 변화하였다. 따라서 최근 글로벌 투자은행의 사업모델이 국내 금융투자회사에 여전히 벤치마크로 유효한지에 대해서 고민해볼 필요가 있다.

본 보고서는 ‘글로벌 투자은행’으로 불리는 금융회사가 어떻게 발전하고 사업모델은 어떻게 변모했으며, 이와 같은 변화를 이끌어낸 근본적인 요인들이 무엇이었는지를 살펴보고자 한다. 우선 1930년대 현대적 개념의 투자은행 출현부터 2008년 글로벌 금융위기의 발생까지 투자은행 산업의 발전을 정리하고, 어떠한 이유로 무수히 많던 투자은행이 현재 10개 남짓의 대형사로 압축되었는지를 정리해본다. 그 다음으로는 2008년 글로벌 금융위기 이후 ‘글로벌 투자은행’의 개념을 재정리하고, 8개 대표적 투자은행을 중심으로 금융위기 전후로 사업구조, 재무구조 및 사업전략의 변화를 분석해 본다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 1930년대 현대적 개념의 투자은행 출현부터 시작하여 2008년 글로벌 금융위기까지 투자은행의 발전사를 정리한다. Ⅲ장에서는 금융위기 이후 ‘글로벌 투자은행’의 개념을 정리하고, 8개 대표적 투자은행을 중심으로 사업구조와 재무구조의 변화를 분석한다. Ⅳ장에서는 금융위기 이후 글로벌 투자은행의 사업모델을 3개 유형으로 구분하여 각 유형의 대표적인 투자은행의 사례를 살펴본다. 마지막으로 V장은 결론과 시사점을 제시한다.

Ⅱ. 글로벌 투자은행의 발전과정

1. 전업계 투자은행의 시대

가. 현대적 투자은행의 출현

최근 글로벌 투자은행의 변화를 논의하기에 앞서 투자은행의 개념과 발전 과정에 대해 살펴볼 필요가 있다. 현대적 개념의 투자은행은 100년 넘는 역사를 지니고 있으나, 그 모습과 주요 회사들은 시대별로 크게 바뀌어 왔다.2) 투자은행의 발전 배경에는 규제, 기술 등 시장 환경의 변화와 더불어 틈틈이 발생하는 크고 작은 금융위기도 중요한 요인으로 작용해왔다. 이러한 과정 속에 일부 투자은행은 그 모습은 변화했지만 여전히 생존하고 있는 반면, 대다수의 투자은행은 인수합병되거나 파산하여 지금은 그 존재를 찾아볼 수 없게 되었다.

현대적 개념의 투자은행은 미국에서 탄생했다고 볼 수 있으며, 1933년 제정된 글래스-스티걸법(Glass-Steagall Act)이 계기를 마련해 주었다.3) 글래스-스티걸법은 대공황(Great Depression)에 배경을 두고 있으며, 해당 법의 제정은 당시 다수 은행의 연쇄도산에 대한 일부 원인이 은행의 증권업 겸영으로 인한 과도한 위험추구와 이해상충으로부터 비롯되었다는 인식을 반영하고 있다.4) 해당 법은 은행을 여수신 업무를 취급하는 ‘상업은행(commercial bank)’과 유가증권의 인수(underwriting) 및 위탁매매(brokerage)를 하는 ‘투자은행(investment bank)’으로 이원화했다. 이처럼 글래스-스티걸법은 상업은행과 투자은행의 고유 업무를 규정하고, 두 유형의 은행 간의 겸영은 물론 계열사를 통한 겸업도 금지함에 따라 결과적으로 투자은행에게 상업은행으로부터 분리되고 보호된 시장을 마련해 주었다.

글래스-스티걸법의 제정으로 전업계 투자은행의 시대가 막을 올렸다. 당시 주요 은행은 글래스-스티걸법 준수를 위해 사업을 분리해야 했고, 1932년 First Boston이 Boston Bank에서, 1935년 Morgan Stanley가 JP Morgan에서 분리되어 투자은행으로 출현하게되었다. 새롭게 형성된 투자은행 산업은 막강한 고객기반을 둔 Morgan Stanley를 필두로 First Boston, Dillon Read 및 Kuhn Loeb가 1군, 일명 ‘벌지브래킷(bulge bracket)’ 을 형성하고, Goldman Sachs, Merrill Lynch 등의 투자은행이 2군을 구성했다.5)

초기 투자은행의 사업모델은 유가증권의 인수와 발행된 증권의 유통을 중개하는 브로커리지 업무 중심으로 이루어졌다. 또한 당시 주요 투자은행은 Morgan Stanley와 같은 인수 업무 중심과 Merrill Lynch와 같은 브로커리지 업무 중심으로 구분되었다. 1930~1940년대에는 투자은행 산업의 경쟁구도나 사업모델에 큰 변화가 없었으며, 이는 당시 암묵적인 담합과 계급 시스템이 존재했기 때문이다. 당시 증권 인수는 단체로 하는 신디케이트(syndicate) 방식으로 이루어졌고, 투자은행 간에는 고객 약탈이 금지되었으며 이를 어기는 투자은행은 신디케이트에서 일정 기간 배제되었다.6)

이와 같은 경직된 경쟁구도는 1950년대 들어서 무너지기 시작했다. 세계 2차 대전 이후 미국 경제는 고성장의 시대, 일명 자본주의의 황금기(golden age of capitalism)를 맞이하였고, 1950~1973년 사이의 자본주의 황금기는 대대적인 산업 구조조정을 수반하면서 이에 따라 투자은행의 희비도 엇갈렸다. 철도, 철강 등 전통적 산업에 주요 고객을 둔 투자은행은 상위권에서 밀려나고, 자동차, 유통 등 신산업에 고객을 둔 투자은행이 부상하기 시작했다. 1975년 투자은행 벌지브래킷에는 Morgan Stanley와 더불어 Goldman Sachs, Merrill Lynch 및 Salomon Brothers가 새롭게 진입하고, Dillon Read 및 Kuhn Loeb는 2군으로 밀려났다.7)

나. 투자은행의 분업화 및 대형화

1970년대에 들어서는 브로커리지 사업 중심의 투자은행, 일명 ‘리테일 투자은행’의 대형화가 시작되었다. 미국 개인 투자자의 주식거래량은 빠르게 증가하여 1968년에는 일평균 1,200만 건을 상회하면서 역대 최고치를 기록했다. 그러나 당시 수기 체결 방식으로는 급증하는 거래량을 소화하기에 역부족이었으며, 급기야 대량의 거래가 미체결되는 ‘서류 위기(paperwork crisis)’가 발생했다. 뉴욕증권거래소(New York Stock Exchange: NYSE)도 넘쳐나는 주식거래량을 소화하지 못하여 일 주식거래 시간을 단축하고 주 거래일을 4일로 제한하는 등의 조치까지 취해야 했다. 서류 위기로 인해 1968~1970년 사이 NYSE 회원사 1/6을 포함한 수백 개의 투자은행이 파산하거나 경쟁사에 인수합병되었다.8) 반면, 생존한 리테일 투자은행은 거래체결 업무의 자동화에 나섰고, IT 시스템구축을 위한 자본 확충이 필요해졌다. 이러한 상황 속에 NYSE는 1971년 회원사의 공개를 허용하였고, Merrill Lynch, Donaldson Lufkin & Jenrette, EF Hutton, Bache, Paine Webber, Dean Witter 등 16개의 리테일 브로커리지 중심 투자은행이 파트너쉽(partnership)에서 상장회사로 전환하고 대형화되었다.9)

1980년대에는 유가증권 인수 업무 중심의 투자은행도 대형화하기 시작했으며, 미국 기업의 늘어나는 주식발행 규모와 1983년 도입된 일괄등록제(shelf registration)가 주요 요인으로 작용했다. 1981~1999년 사이 연평균 신규 주식발행은 19%, 채권발행은 25% 증가하면서 증권 인수 호황의 시대가 열렸다. 또한, 이 기간에는 뮤추얼펀드, 보험사, 연기금 등 기관투자자의 시장 참여도가 높아지고 보다 신속한 증권발행에 대한 요구가 늘어났다. 미국 금융당국도 급증하는 증권발행의 인수가 보다 원활하게 이루어질 수 있도록 규제 완화에 나섰다. 이를 위해 미국 증권거래위원회(Securities and Exchange Commission: SEC)는 1983년 일괄등록제를 도입했다. 일괄등록제는 유가증권 발행 시 매번 증권신고서를 제출 및 승인하는 기존의 방식에서 2년 내 기간 중 기업이 발행할 유가증권을 미리 일괄신고하고 수시로 발행할 수 있게 해주었다.10)

일괄등록제의 도입으로 가장 유리한 조건을 제시하는 하나의 투자은행이 발행 증권 전액을 인수하는 방식이 정착되면서 신디케이트 구조가 퇴조하고 투자은행 간의 경쟁이 심화되었다. 또한 일괄등록을 위해서 투자은행은 대량의 증권을 인수하고 배분할 수 있는 자본력, 판매력 및 트레이딩 역량을 동시에 갖추어야 하는 부담이 생겼다. 여기에 기술적 발전이 결합되어 투자은행의 대형화를 촉진시켰으며, 1970년대에는 미들 오피스(middle office), 1980년대에는 프런트 오피스(front office) 업무의 자동화가 진행되었다. 이에 따라 유가증권 인수 업무 중심의 투자은행도 급증한 증권발행량을 소화하고, IT 시스템을 구축하기 위해 자본 확충의 필요성이 높아지면서 인수합병하거나 상장화사로 전환하여 대형화되었다. 1984년 Lehman Brothers가 American Express에 인수되고, 1985년 Bear Stearns, 1986년 Morgan Stanley, 1999년 Goldman Sachs가 상장회사로 전환했다.11)

다. 투자은행의 사업범위 확대

1980년대에 들어서 투자은행 업무도 보다 다양화되었다. 첫째, 금융공학의 발전과 규제완화에 따라 구조화상품의 설계 및 유동화가 투자은행의 새로운 수익원으로 마련되었다. 특히, 1980년대 저축대부조합(savings and loans association) 사태 이후의 규제완화로 주택담보대출의 유동화가 허용되면서 주택저당증권(Mortgage Backed Securities: MBS) 시장이 활성화되었고 당시 Salomon Brothers는 MBS 시장을 선점하면서 투자은행 순위가 급등했다. 또한, 1980년대에는 Drexel Burnham Lambert가 정크본드 시장을 개척하여 한때 미국 5대 투자은행으로 부상하기도 했다.

둘째, 1980년대 4차 M&A 대 물결(Merger Wave)이 형성되면서 M&A자문이 투자은행의 새로운 업무로 자리 잡기 시작했다.12) 이전만 하더라도 M&A는 우호적으로 이루어지고, M&A자문은 법률사무소 및 회계법인이 주도하는 시장으로 투자은행의 참여는 제한적이었다. 주요 투자은행 중에서는 Morgan Stanley가 1972년 최초로 M&A자문 부서를 설립하였고, 4차 Merger Wave에서는 차입매수(leveraged buyout: LBO)와 적대적 유형의 M&A가 늘어나면서 투자은행이 M&A자문 시장을 주도하기 시작했다.13) 나아가, 1990년대 5차 Merger Wave는 1~4차를 합한 규모의 5배가 넘는 금액, 국경간(cross-border) M&A 확대 등으로 복잡성도 증가함에 따라 M&A자문 시장에서 투자은행의 주도권이 더욱 굳건해졌다. 나아가, 투자은행 간의 경쟁으로 유가증권 인수 수수료율이 지속적으로 하락하는 상황에서 M&A자문은 높은 수수료를 제공하는 새로운 수익원을 마련해주었다.

2. 겸업화 시대의 도래

가. 유럽 유니버설뱅크의 투자은행화

1990년대에 들어서는 ‘글로벌’한 투자은행이 본격적으로 출현하기 시작했으며, 그 배경은 1980년대 유럽의 금융산업 규제완화가 마련해주었다. 우선 1984년 영국은 런던을 세계 금융중심지로 부상시키기 위해 ‘빅뱅(big bang)’으로 불리는 대대적인 금융시장 개방 및 규제완화 정책을 펼쳤다. 동 시기 유럽 대륙에서도 유럽연합(European Union: EU)의 형성을 위한 시장 개방 및 통합이 준비되고 있었으며, 1992년 마스트리히트 조약(Maastricht Treaty)의 체결로 EU 형성의 기본적 사항들이 합의되었으며, 1993년에 EU가 공식 출범했다.

당시 유럽에서는 미국과 달리 상업은행과 투자은행의 겸영이 가능한 유니버설뱅크(universal bank)가 주류를 이루고 있었으나, 이들 유니버설뱅크는 사실상 상업은행으로 투자은행 사업이나 역량은 미미한 수준이었다. 대표적인 유니버설뱅크로는 스위스의 Union Bank of Switzerland 및 Swiss Bank Corporation, 독일의 Deutsche Bank, 영국의 Barclays, 프랑스의 Bank National de Paris(BNP) 및 Credit Agricole 등이 있었다. 유럽의 유니버설뱅크는 EU의 형성이 초래할 금융산업의 경쟁심화에 대응하기 위해 우선적으로 모국에서 인수합병으로 대형화를 추진하고, 이후 해외진출을 도모했다. 그러나 이들 유니버설뱅크는 상업은행 중심 사업구조로는 해외진출이 어렵다고 판단하여 투자은행 사업을 키우는 전략을 채택하고, 이를 위해 영국의 유수 투자은행의 인수합병에나섰다.

Swiss Bank Corporation은 1992~1995년 사이 영국 투자은행 O’Connor & Associ-ates, Brinson Partners 및 SG Warburg를 잇따라 인수하고, 1997년에는 오랜 역사를 지닌 미국의 Dillon Read를 인수하면서 투자은행 역량을 구축했다. 1998년 Swiss Bank Corporation은 스위스 1위 상업은행 Union Bank of Switzerland와 합병하여 UBS로 재출범하고, 합병사의 투자은행 사업부문 Warburd Dillon Read는 당시 유럽 최강의 투자은행으로 자리 잡았다. 2000년 UBS는 추가적으로 미국의 종합서비스 투자은행 Paine Webber를 인수하면서 미국 시장 입지를 강화하고, 세계 10대 투자은행 반열에 진입했다. Deutsche Bank는 1990년 미국 투자은행 Bankers Trust 인수를 통해 미국 시장 진출 및 글로벌 투자은행 지위를 얻었다. 반면, BNP Paribas와 Societe Generale은 자체적으로 투자은행 사업을 키워서 글로벌 투자은행 반열에 진입하기도 했다.14) 유럽 유니버설뱅크의 투자은행화 및 해외진출은 단기간에 이루어졌으며, 당시에는 이와 같은 변모가 성공적으로 평가되었으나, 2008년 글로벌 금융위기는 이와 같은 압축적 성장의 부작용을 보여주는 계기로 작용하기도 했다.

영국의 빅뱅은 미국의 주요 투자은행에도 해외사업 확대의 길을 열어주었다. Goldman Sachs, Merrill Lynch 등 미국의 대형 투자은행은 영국을 필두로 유럽 시장을 공략하기 위해 런던 사무소를 공격적으로 키워나갔고, 인수합병보다는 현지 우수 인력을 경쟁사로부터 유입하면서 영국의 토종 투자은행을 시장에서 몰아내기도 했다. 금융 빅뱅으로 영국은 모국 금융회사를 외국계에 내주었지만, 런던을 뉴욕에 버금가는 금융중심지로 부상시키는 데에는 성공한 것으로 평가된다.

나. 미국 상업은행의 투자은행화

1980년대 투자은행은 호황을 맞이하고 있었지만 미국 상업은행의 상황은 달랐다. 라틴아메리카 채무위기, 기업 탈중개화 등으로 미국 상업은행의 수익성은 악화되고, 유럽 시장에서는 규제 차익으로 인해 유니버설뱅크에 비해 경쟁력이 뒤떨어지고 있었다. 이로 인해 미국 상업은행의 투자은행 업무 허용에 대한 목소리가 높아지고, 미국 금융당국도 이러한 요구를 받아들여 상업은행의 투자은행 업무 수행을 점진적으로 허용하기 시작했다. 1986년 미국 연방준비제도이사회(Federal Reserve Board: FRB)는 글라스-스티컬법 제20조의 우호적인 해석을 통해 상업은행이 자회사를 통해 유가증권 인수 업무를 자회사 총 수익의 5% 내에서 할 수 있도록 허용하고, 이후 그 비중을 10%(1989년), 25%(1997년)로 점진적으로 확대해 주었다.15) 이러한 추세가 이어지면서 상업은행과 투자은행 간의 장벽은 점차 허물어져갔고, 궁극적으로 1999년 그램-리치-블라일리(Gramm-Leach-Bliley: GLB)법이16) 제정되면서 상업은행의 투자은행 겸업이 전면적으로 허용되었다.

GLB법 제정을 전후로 상업은행의 투자은행 인수합병이 활발하게 진행되었다. 그 첫 단추로 1997년 Banker Trust가 투자은행 Alex Brown을 인수하고, 1998년에는 Citi-corp이 보험사ㆍ투자은행 Travelers와 합병하면서 세계 최대 규모의 종합금융서비스회사 Citigroup이 탄생했다. 1999년에는 JP Morgan의 Hambricht & Quest 인수, Bank of America의 Montgomery Securities, Robertson Stephens 및 Thomas Wiesel 인수, Deutsche Bank의 Bankers Trust 인수, UBS의 Paine Webber 인수가 성사되었다.

이러한 겸업화 추세는 상업은행에만 국한되지 않고, 타 금융업 및 비금융업으로도 확산되었다. 보험 판매사 Primerica는 1987년 Smith Barney, 1993년 Shearson Lehman Brothers를 인수하고, 같은 해 보험사 Travelers와 합병한 이후 1997년에는 Salomon Brothers를 인수했다. Discover Card를 보유한 유통업체 Sears는 1981년 투자은행 Dean Witter를 인수하고, 이후 1987년에는 Dean Witter Discover가 Morgan Stanley와 합병했다. 카드사 American Express는 1981년 Shearson, 1984년 Lehman Broth-ers Kuhn Loeb, 1988년 E. F. Hutton을 인수했다. 종합상사 Phibro는 1981년 Salomon Brothers를 인수하고, 제조업체 General Electric은 M&A자문 비용을 절약하기 위해 1986년 투자은행 Kidder, Peabody & Co.를 인수했다.17)

1990년대가 마감되면서 100년 넘는 역사를 지닌 무수한 투자은행이 그 이름마저 찾아볼 수 없게 되었다. 투자은행의 수는 줄어들고 남아 있는 투자은행은 더욱 대형화 및 글로벌화되었다. 또한, 과거 전업계 투자은행이 독식하던 시장을 유럽의 유니버설뱅크와 미국의 상업은행이 잠식하면서 경쟁은 더욱 심화되었다.

가. 트레이딩 중심의 사업구조

2000년대 들어 글로벌 투자은행의 경쟁구도와 사업구조는 20년 전에 비해 크게 변화했다. 우선 경쟁구도 측면에서 과거 50개가 넘는 전업계 투자은행이 경쟁하던 시장은 1980년대 업계 내에서의 구조조정과 1990년대 미국 상업은행 및 유럽 유니버설뱅크에 따른 인수합병 과정을 거치면서 2000년대에 들어서는 10~15개의 대형 투자은행이 경쟁하는 구조가 되었다.

글로벌 투자은행의 사업구조도 2000년대 들어 크게 변화했다. 전통적으로 투자은행은 주요 수익을 고객의 자금조달을 중개하는 유가증권 인수 및 브로커리지 업무에서 창출했으며, 이는 고객 네트워크 및 신뢰 기반의 관계형 사업이었다. 1980년대 주요 수익원으로 새롭게 추가된 M&A자문 역시 고객과의 관계가 핵심 역량이었다. 그러나 2000년대에 들어서는 트레이딩(trading) 사업이 투자은행의 주요 수익원으로 자리 잡기 시작했으며, 특히, 트레이딩 사업 내에서도 시장조성(market making)보다 자기자본을 활용해 투자수익을 얻는 자기매매(proprietary trading)와 자기자본투자(principal investments)에서 고수익을 창출했다. 주요 투자은행은 사내 사모펀드(private equity, hedge fund) 사업을 담당하는 부서를 설립하고 더욱더 많은 자본을 해당 부서에 할당했다.

<그림 Ⅱ-2>는 2000년 및 2006년 Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers 및 Bear Stearns로 구성된 5대 전업계 투자은행의 사업부문별 수익 증감을 보여준다. 5개 전업계 투자은행의 수익은 2000~2006년 사이 평균 106.6% 증가했으며, 이는 대부분 트레이딩 사업 수익 증가에 기인한다. 2000~2006년 사이 5개 전업계 투자은행의 트레이딩 사업 수익은 평균 174.8% 증가한 반면 자산관리ㆍ운용 사업 수익은 70.6%, 투자은행 사업 수익은 29.9%만 증가하는데 그쳤다.

나. 글로벌 금융위기의 여파

2008년 글로벌 금융위기의 발생은 전업계 투자은행 시대의 종결을 야기했다. 5대 전업계 투자은행을 구성했던 Goldman Sachs, Morgan Stanley, Lehman Brothers, Mer-rill Lynch 및 Bear Stearns는 파산, 인수합병 또는 은행지주회사로 전환했다. 5대 전업계 투자은행의 몰락은 미국 서브프라임 모기지(sub-prime mortgage) 시장이 붕괴하면서 트레이딩 사업부문에서 MBS 및 주택담보부증권(collateralized debt obligation: CDO) 관련 대거 손실이 발생한 데에 기인한다.

Lehman Brothers는 2003~2004년 사이 5개 모기지회사(mortgage lender)를 인수하는 등 미국 MBS 및 CDO 시장에 공격적으로 뛰어들었고 Lehman Brothers의 수익은 2005~2007년 사이 매년 최고치를 경신했다. 그러나 2007년에는 31.9배의 레버리지 비율과 금융사 중 최대 규모인 850억 달러에 달하는 규모의 MBS 포트폴리오를 떠안고 있는 상황에서 2008년 보유하던 MBS 및 CDO 포트폴리오에서 대거 손실이 발생하고, 유동성위기에 처한 Lehman Brothers는 당해 11월 파산신청에 들어갔다.

Bear Stearns는 1980년대 CDO 시장 형성의 초기부터 진출해 상당한 입지를 구축했다. 그러나 2007년 서브프라임 MBS와 CDO에 집중 투자한 Bears Stearns 산하 헤지펀드 2개에서 대거 손실이 발생하고, 160억 달러의 긴급 자금지원에도 불구하고 결과적으로 해당 헤지펀드가 파산하면서 Bear Stearns 자체가 유동성위기에 처해졌다. 결국 Bear Stearns는 2008년 JP Morgan에 주당 2달러에 인수되었다.

Merrill Lynch는 전통적으로 자산관리 사업을 중심으로 성장해왔으나, 2001년 CEO Stanley O’Neal이 취임하면서 상대적으로 뒤늦게 트레이딩 사업 확대에 공격적으로 나섰다. 2006~2007년 사이 Merrill Lynch의 서브프라임 관련 CDO 포트폴리오는 50억 달러에서 1,170억 달러로 늘어났으며, 2007년 미국 서브프라임 시장이 붕괴하면서 대거 손실이 발생했다. Merrill Lynch는 재무상황이 극도로 악화된 상황에서 2008년 Bank of America와의 인수합병을 결정하게 되었다.18)

Goldman Sachs 및 Morgan Stanley의 경우 서브프라임 모기지 관련 직접적인 손실은 상대적으로 크지 않았으나, 금융위기가 발생하면서 단기자금시장의 경색으로 유동성이 악화되고 이를 해소하기 위해 2008년 은행지주회사로의 전환을 결정하게 되었다. 은행지주회사 전환으로 두 투자은행은 연방준비은행(Federal Reserve Bank)의 재할인 창구를 통한 자금조달이 마련되었지만, SEC와 더불어 FRB의 감독 대상이 되고 상업은행에적용되는 각종 규제를 받게 되었다.19)

Ⅲ. 금융위기 이후 글로벌 투자은행의 변모

1. 경쟁구도의 변화

2008년 글로벌 금융위기가 발생하면서 투자은행 산업은 대대적인 변화를 맞이하게 되었다. 그간 우리가 익숙했던 ‘전업계 투자은행’은 더 이상 찾아볼 수 없게 되었고, 그 자리는 금융지주회사의 형태로 보다 다양한 사업을 영위하는 여러 유형의 은행(bank)이 차지하고 있다. 그럼에도 불구하고 ‘글로벌 투자은행’은 여전히 특정 그룹의 은행을 지칭하여 일반적으로 사용되고 있다. 따라서 금융위기 이후 ‘글로벌 투자은행’으로 구분되는 금융회사는 무엇이며, 어떠한 사업구조와 사업전략을 취하고 있는지 살펴볼 필요가 있다.

은행을 구분하는 데는 여러 유형과 기준이 있다. Martel et al.(2012)은 자금조달 및 자산구조에 따라 은행을 상업은행 또는 투자은행, 전업화(specialized) 또는 다각화ㆍ유니버설(diversifiedㆍuniversal)로 구분하여 총 4개의 유형으로 분류한다.20) <그림 Ⅲ-1>은 Martel et al.(2012)의 기준을 2019년 현재 자산규모 순위 세계 40대 은행에 적용한 경우를 보여준다.21) 세계 40대 은행의 대부분은 상업은행으로 분류되며 ‘전문화 상업은행’이 가장 많다. 투자은행으로 분류되는 금융회사는 8개가 있으며 ‘전업화 투자은행’ 유형은 없고 모두 ‘다각화ㆍ유니버설 투자은행’으로 분류된다. 나아가 8개 투자은행을 지역별 나누어보면 미국계 4개와 유럽계 4개가 있다.

2. 사업구조의 변화

가. 규제환경의 변화

2008년 글로벌 금융위기 이후 은행에 대한 규제가 큰 폭으로 강화되었다. 새 규제체계는 금융위기의 원인분석에 기반하여 은행의 건전성을 강화하고 고위험 업무를 제한하는 방향으로 설계되었다. Goldman Sachs와 Morgan Stanley도 은행지주회사로 전환함에 따라 새로운 규제체계를 준수해야 한다.

은행 규제의 표준을 마련하는 바젤(Basel) Ⅲ에서는 한층 강화된 건전성 및 유동성 기준이 마련되었다. 미국의 경우 바젤Ⅲ의 규제내용을 대부분 도입하였고, EU 또한 바젤 Ⅲ를 바탕으로 필요자본지침(Capital Requirement Directives: CRD) Ⅳ를 제정하였다.23) 은행의 업무범위도 제한된다. 미국 도드-프랭크(Dodd-Frank)법에 포함된 볼커룰(Volcker Rule)은 은행 및 은행그룹(banking entity)의 자기매매를 금지하고 자기자본투자를 제한하고 있다. 볼커룰은 은행그룹의 사모펀드에 대한 투자를 개별 펀드 투자자본의 3% 미만 및 총 펀드 투자자본을 은행 기본자본의 3% 이내로 제한하고 있다.

주요 투자은행은 볼커룰의 시행에 앞서 자기매매 사업부서를 해산하고, 자기자본투자 자산도 축소했다. Goldman Sachs의 경우 사내 자기매매 부서 Principal Strategies Group(PSG)의 인력 대부분이 퇴사하고, PSG 투자담당자였던 Morgan Sze가 설립한Azentus Capital Management로 이직했다. Morgan Stanley는 Peter Muller가 이끌던사내 자기매매 부서를 헤지펀드 PDT Advisers로 재구성하고 분사(spin-off)했다. 이와더불어 Morgan Stanley는 2006년 인수했던 헤지펀드 Front Point Partners도 2011년에 매각했다. Citi는 Sutesh Sharma가 이끌던 자기매매 부서 Citi Principal Strategies Desk를 2012년에 폐쇄했다.24)

나. 수익구조의 변화

본 장에서는 8개의 대표적 글로벌 투자은행을 중심으로 글로벌 금융위기 이후 사업 및 재무 구조의 변화를 살펴본다.25) 편의상 분석 대상 투자은행을 3개 유형으로 구분한다. 첫 번째 유형은 ‘전업계’ 투자은행으로 Goldman Sachs와 Morgan Stanley가 포함된다. 두 번째 유형은 ‘유니버설뱅크’로 UBS, Credit Suisse 및 Deutsche Bank가 포함된다. 세 번째 유형은 소매ㆍ상업은행으로 JP Morgan, Bank of America 및 Citi가 있다. <표 Ⅲ-2>는 2019년 현재 분석 대상 8개 투자은행의 주요 재무 상황을 보여준다. 자산규모의 경우 소매ㆍ상업은행 중심 3개 투자은행 평균이 2.3조 달러로 전업계 및 유니버설뱅크 5개사의 평균인 1.0조 달러의 2배 이상이다. 이는 사업구조의 차이에서 비롯된다. 반면, ROE의 경우 투자은행의 유형보다 지역별 편차가 보다 의미 있게 나타나며, 미국계 투자은행의 평균은 11.5%인 반면, UBS와 Credit Suisse의 평균은 7.8%, Deutsche Bank는 –11.0%를 기록하고 있다.

<그림 Ⅲ-3>은 8개 주요 투자은행의 2006년 및 2019년 수익구조를 보여준다. 우선, 금융위기 이후 주요 투자은행의 수익구조가 다각화된 모습을 확인할 수 있으며, 이는 트레이딩 사업 수익 비중의 감소와 자산관리ㆍ운용 사업 수익 비중의 증가가 결합된 결과다. 특히, Goldman Sachs, Morgan Stanley, Credit Suisse 및 Deutsche Bank의 경우 금융위기 이전에는 트레이딩 사업이 가장 많은 수익을 제공했던 반면, 금융위기 이후에는 Goldman Sachs의 경우에만 트레이딩 사업이 최대 수익원으로 남아 있다. 소매ㆍ상업은행 중심 투자은행의 경우 JP Morgan은 2006년 대비 2019년의 트레이딩 수익 비중이 감소했다. 반면 Bank of America 및 Citi의 경우 2006년 대비 2019년의 트레이딩 수익 비중이 오히려 증가했으나 이는 금융위기 이후 저금리의 장기화로 예대마진이 축소되어 소매ㆍ상업은행 수익이 트레이딩 사업 수익보다 빠르게 감소했기 때문이다.

금융위기 이후 주요 투자은행의 자산관리ㆍ운용 수익 비중의 증가도 주목할 만한 변화다. 자산관리ㆍ운용 수익 비중은 투자은행의 유형을 불문하고 모든 경우 증가했으며, Morgan Stanley, UBS, Credit Suisse 및 Deutsche Bank는 자산관리ㆍ운용 수익이 트레이딩 수익을 대체하고 가장 큰 수익원으로 부상했다. 특히, 이와 같은 변화는 트레이딩 수익이 감소했기 때문만이 아니라 금융위기 이후 주요 투자은행이 자산관리ㆍ운용 사업을 전략적으로 확대하여 수익이 빠르게 증가하고 있기 때문이다. 소매ㆍ상업은행 중심 투자은행의 경우에도 JP Morgan 및 Bank of America의 경우 2019년 자산관리ㆍ운용 사업 수익이 트레이딩 사업 수익을 상회하고 있다. 반면, Citi의 경우 자산관리ㆍ운용 사업 수익이 트레이딩 사업 수익을 상당 수준 하회하고 있으며, 이는 금융위기 이후 자산관리 사업 Smith Barney를 Morgan Stanley에 매각한 데에 기인한다.

가. 수익 및 수익성

2008년 글로벌 금융위기 이후 주요 투자은행의 수익 추이는 개별 투자은행과 더불어 지역별로 차이를 보인다. <그림 Ⅲ-4>는 8개 주요 투자은행의 2000년, 2006년 및 2019년 수익 및 ROE 수준을 보여준다. 우선, 북미계 투자은행 중 Morgan Stanley, JP Morgan 및 Bank of America의 수익은 금융위기 이전 수준을 빠르게 회복했다. 2006년 대비 2019년 Morgan Stanley, JP Morgan 및 Bank of America의 수익은 각각 22.3%, 83.9%, 25.4% 증가했다. 다만, Goldman Sachs 및 Citi의 경우 2006년 대비 2019년 수익이 각각 3.0%, 14.9% 감소했다. Goldman Sachs는 트레이딩 수익 감소가 전체 수익 감소의 주요 원인이며, Citi는 저금리 기조에 따른 예대마진 축소로 이자수익이 줄어들고, 자산관리 사업인 Smith Barney를 매각했기 때문에 전체 수익이 금융위기 이전 수준을 하회한다.

반면, 유럽의 주요 유니버설뱅크의 경우 금융위기 이전 수준의 수익을 회복하지 못하고 있다. 2006년 대비 2019년 UBS, Credit Suisse 및 Deutsche Bank의 수익은 각각 44.3%, 35.6%, 21.2% 감소했다. 유럽계 유니버설뱅크의 수익 감소는 유로존 위기 이후 유럽 시장의 더딘 경제회복과 더불어 트레이딩 및 투자은행 사업의 축소, 해외사업 철수 등 구조조정의 결과물이다.

개별 투자은행 중에서는 Goldman Sachs의 ROE 낙폭이 가장 크다. 2006년 Gold-man Sachs의 ROE는 39.8%로 경쟁사의 2~3배 수준이었으나, 2019년에는 10.0%로 감소하여 업계 평균과 큰 차이를 보이지 않는다. 이와 같은 ROE의 하락은 과거 자기자본과 레버리지를 결합하여 고수익을 제공했던 트레이딩 사업이 금융위기 이후 감소했기 때문이다. Morgan Stanley, UBS, Credit Suisse 및 Deutsche Bank의 경우에도 트레이딩 수익의 감소로 ROE가 2006년 20%대에서 2019년 10%대로 낮아졌다. 특히, Deutsche Bank의 경우 금융위기 이후 9차례의 구조조정을 단행하면서 2019년 ROE가 –11.0%를 기록하고 있다. 반면, 금융위기 이후 가장 우수한 수익성을 보이고 있는 투자은행은 JP Morgan이며, ROE가 2006년 12.0%에서 2019년 15.0%로 8개 투자은행 중 ROE가 유일하게 높아졌다.

나. 자본구조

전업계 투자은행 및 유니버설뱅크의 과도한 단기자금시장 의존도와 레버리지는 금융위기를 심화시킨 원인 중 하나로 지적되었다. 따라서 금융위기 이후 도입된 각종 건전성 및 영업행위 규제들은 투자은행의 자본구조를 개선하고 위험추구를 완화하기 위해 설계되었다. 금융위기 이후 글로벌 투자은행의 자본구조는 이와 같은 규제 강화의 영향을 반영하고 있다. <그림 Ⅲ-5>는 2006년 및 2019년 8개 투자은행의 자본구조 변화를 보여주며 3가지 특징이 있다. 첫째, 2006년 대비 2019년 8개 투자은행의 총부채 중 단기부채 비중은 평균 56.0%에서 32.4%로 감소했다. 특히, 전업계 투자은행과 유니버설뱅크의 단기부채 비중 평균은 2006년 65.7%에서 2019년 36.6%로 크게 낮아졌다. 소매ㆍ상업은행 중심 투자은행의 단기부채 비중 평균도 2006년 39.8%에서 2019년 25.3%로 감소했다.

둘째, 투자은행 자금구조 상 예금 비중이 높아졌다. 2006년 대비 2019년 8개 투자은행의 자금조달에서 예금 비중은 평균 26.9%에서 43.6%로 증가했다. 자본구조 상 전업계 투자은행 및 유니버설뱅크의 예금 비중 평균은 2006년 18.3%에서 2019년 36.8%, 소매ㆍ상업은행 중심 투자은행의 예금 비중은 평균 2006년 41.3%에서 2019년 54.9%로 높아졌다. 특히, 금융위기 이전에는 소매은행 사업이 미미했던 Goldman Sachs 및 Morgan Stanley의 경우에도 자금조달에서 예금 비중이 의미 있게 늘어났으며, Goldman Sachs는 인터넷뱅킹, Morgan Stanley는 자산관리 사업을 중심으로 리테일고객의 예금을 유치하고 있다.

셋째, 투자은행의 자기자본도 금융위기 이후 확충되었다. 8개 투자은행의 총자산 대비 자기자본 비중은 2006년 4.5%에서 2019년 8.1%로 높아졌다. 자기자본 비중에 있어서는 투자은행의 유형보다는 지역별로 차이를 보이며 2006년 대비 2019년 총자산 중 자기자본 비중 평균은 미국계 투자은행은 5.5%에서 9.6%, 유럽계 투자은행은 2.9%에서 5.6%로 증가했다.

본 절에서는 2008년 글로벌 금융위기 이후 주요 투자은행의 수익구조 및 사업전략을 반영하여 3개의 사업모델로 구분하고 각 유형에 해당되는 대표적 투자은행의 사례를 살펴본다. 첫 번째 유형은 투자은행 및 트레이딩 사업모델이며 여기에는 Goldman Sachs가 유일하다. 두 번째 유형은 자산관리ㆍ운용 사업모델로 Morgan Stanley, UBS 및 Cred-it Suisse가 해당되며, Morgan Stanley 사례를 소개한다. 세 번째 유형은 다각화 사업모델이며, 소개하는 사례인 JP Morgan과 더불어 Bank of America 및 Citi가 포함된다.

1. 투자은행ㆍ트레이딩 사업모델: Goldman Sachs

가. 개요

Goldman Sachs는 1869년 기업어음(Commercial Paper: CP) 딜러로 출발하여 1906년 유가증권 인수로 업무를 확대해나갔다. 1930년대 Sidney Weinberg 대표 체제하에서 투자은행 부문에 두각이 나타나기 시작했고, 1950년대 Ford Motors의 IPO를 주관하는 등 10대 투자은행 반열에 진입했다. 1970년대에는 John Whitehaed와 John Weinberg의 공동대표체제하에 Goldman Sachs는 글로벌 선두 투자은행으로 자리 잡았다. 1981년에는 상품 현물 거래기업인 J. Aron & Co.를 인수하면서 자기매매를 포함한 트레이딩 사업의 기반이 마련되었다. 1989년에는 Goldman Sachs Asset Management(GSAM) 부문을 신설하여 초부유층 중심의 자산관리 업무를 시작했고, 2003년에는 금융자문사 Ayco 인수를 통해 자산관리 사업을 강화하였다.27)

2000년대 들어 Goldman Sachs의 수익구조는 균형적인 모습에서 트레이딩 사업 중심으로 변화했다. <그림 Ⅳ-1>은 2000년 및 2006년 Goldman Sachs의 수익구조를 보여준다. 2000년 Goldman Sachs의 수익은 트레이딩 부문 39.9%, 투자은행 부문 32.4%, 자산관리ㆍ운용 부문 27.7%로 균등한 구조를 이루었다. 그러나 2006년에 들어서는 트레이딩 부문 수익이 67.9%로 증가하고, 투자은행 부문은 14.9%, 자산관리ㆍ운용 부문은 17.2%로 감소했다.

글로벌 금융위기 이후 Goldman Sachs는 경쟁우위를 지닌 트레이딩 및 투자은행 사업을 중심으로 하면서 리테일 사업(자산관리ㆍ운용 및 소매금융)을 확대하는 전략을 추진하고 있다. <그림 Ⅳ-2>는 2019년 현재 Goldman Sachs의 조직구조를 보여준다. 2008년 Goldman Sachs는 전업계 투자은행에서 은행지주회사로 전환하고 경영 투명성 강화를 위해 기존의 3개 사업부문으로 나누어졌던 조직을 4개 사업부문으로 세분화하는 조직구조 개편을 단행했다. Investment Banking 부문은 투자은행 업무를 취급하고, Institu-tional Client Service 부문은 트레이딩 사업을 포함하며, Asset Management 부문은 자산운용 사업을 영위한다. 신설된 Consumer & Wealth Management 부문은 기존 자산관리 사업과 더불어 Marcus를 포함한 소매은행 사업을 영위한다.

Goldman Sachs는 2016년 미국에서 인터넷뱅크 Marcus를 출시하면서 소매은행 사업에 본격적으로 진출했다. Marcus는 우선적으로 온라인 전용 예금 및 대출을 제공하고, 주택담보대출, 중소기업 대출 및 신용카드 사업으로 서비스를 확대하고 있다. 2018년에는 영국 Marcus를 출시하면서 소매은행 사업을 해외시장으로 확대했다. 영국 Marcus는 리테일 고객 대상 대출 사업으로 시작하여 신용카드 및 주택담보대출을 추가하고 있다. 2019년에는 Apple과의 제휴를 통해 신용카드 사업에 진출하면서 Apple Card를 출시하였고, 2020년에는 자동차회사 GM의 신용카드 포트폴리오를 인수했다. 2018년에는 개인자산관리 전문 핀테크사 Clarity Money를 인수하고, 2021년에는 디지털 자산관리 서비스 Marcus Invest를 출시하는 등 온라인 자산관리 사업을 확대하고 있다. 또한, Goldman Sachs는 중소ㆍ중견기업(middle market) 대출 시장에도 적극적으로 나서고 있으며, 자체적 사업 확대와 더불어 Walmart, Amazon 등 유통업체와의 제휴를 통해 유통업체 상품공급 기업에게 신용대출을 제공하고 있다. Goldman Sachs는 Marcus를 단순한 인터넷뱅크가 아닌 개방형구조(open-architecture)로 자사 및 제3자 주택담보대출, 자동차 할부 등 다양한 금융상품의 중개 플랫폼(platform)으로 키워나갈 계획이다.28)

2. 자산관리ㆍ운용 사업모델: Morgan Stanley

가. 개요

Morgan Stanley는 1935년 JP Morgan에서 분리되어 독립 투자은행으로 출범했다. JP Morgan의 우수 고객을 승계받아 Morgan Stanley는 출범과 함께 투자은행업계의 선두자리를 차지했다. 1972년 Morgan Stanley는 업계 최초로 M&A 및 LBO 전담부서를 설립하고 M&A자문이 투자은행의 새로운 수익원으로 자리 잡는데 선도적인 역할을 했다.29)

종합금융회사로 거듭나기 위해 1997년 Morgan Stanley는 Dean Witter Discover와 합병하고, 사명을 Morgan Stanley Dean Witter Discover로 변경했다. 투자은행 및 트레이딩 사업에 강점을 지닌 Morgan Stanley와 리테일 사업(브로커리지, 자산운용 및 신용카드)에 강점을 지닌 Dean Witter Discover와의 합병은 두 회사 간의 문화적 충돌, 내부 분쟁 등으로 인해 기대했던 만큼의 시너지를 제공하지 못했다. Morgan Stanley Dean Witter Discover는 합병 후 리테일 사업에 초점을 두면서 트레이딩 및 브로커리지 사업은 상대적으로 후퇴했다. 2000년대 들어 주요 경쟁사 Goldman Sachs가 트레이딩 사업을 중심으로 고수익을 달성하고, 실적 개선에 대한 주주의 압박이 높아지면서 2001년에는 사명을 다시 Morgan Stanley로 변경하고, 2005년에는 John Mack이 CEO로 복귀하면서 트레이딩 사업 확대에 뒤늦게 박차를 가했다. 2007년에는 신용카드 사업 Discover를 매각하면서 소매금융 사업이 크게 감소했다.

<그림 Ⅳ-5>는 2000년 및 2006년 Morgan Stanley의 수익구조를 보여준다. 2000년 Morgan Stanley의 수익은 트레이딩(47.4%), 투자은행(21.1%), 자산관리운용(17.8%) 및 소매ㆍ상업은행(13.6%) 사업부문 간의 균형적인 구조를 갖추고 있다.30) 2006년에도 수익구조의 균형이 일정 수준 유지되고 있으며, 2000년에 비해 트레이딩 부문 수익 비중이 1.8%p로 소폭 증가하고, 자산관리ㆍ운용 부문 수익 비중도 6.4%p 증가했다. 반면, 2000년 대비 2006년 투자은행 부문 수익 비중은 7.2%p, 소매ㆍ상업은행 부문 수익 비중은 1.0%p 감소했다.

Morgan Stanley는 2008년 은행지주회사로 전환하고, 2010년 취임한 CEO James Gorman의 주도 하에 자산관리ㆍ운용 중심으로 사업을 전환하는 전략을 추진하고 있다. <그림 Ⅳ-6>은 2019년 현재 Morgan Stanley의 조직구조를 보여준다. Institutional Securities 부문은 기업, 정부, 금융회사 및 고액자산가 고객을 대상으로 투자은행 및 트레이딩 업무를 제공하고, 기업금융 및 자기자본투자도 해당 사업부문에서 담당한다. Wealth Management 부문은 개인 및 중소기업 고객 대상으로 자산관리 서비스를 제공하며, 이와 연계하여 대출 등 소매금융 서비스도 제공한다. Investment Management 부문은 기관투자자 및 개인 고객을 대상으로 펀드 설계 및 운용 서비스를 제공하며, 머천트뱅킹 및 부동산투자 사업도 해당 부문에 포함된다.

3. 다각화 사업모델: JP Morgan

가. 개요

JP Morgan은 2019년 자산규모 기준으로 미국 최대, 세계 6위 은행으로 자리 잡고 있다. JP Morgan은 1990~2000년대 Chemical Bank, Chase Manhattan, Bank One 등 다수 상업은행 간의 M&A를 통해 대형 금융지주회사로 성장했다. Chase Manhattan은 JP Morgan과의 합병 이전 1999년 투자은행 Hambrecht & Quist, 2000년 투자은행 및 자산운용사 Robert Fleming & Co.를 인수했다. 이와 더불어 2008년 글로벌 금융위기가 발생하면서 JP Morgan은 투자은행 Bear Stearns와 상호저축은행 Washington Mutual을 인수하기도 했다. 이처럼 JP Morgan은 여러 M&A를 통해 상업은행, 투자은행 및 자산관리ㆍ운용 사업의 다각화된 사업구조를 구축했다.

<그림 Ⅳ-9>는 2000년 및 2006년 JP Morgan의 수익구조를 보여준다. 2000년 JP Mor-gan은 소매ㆍ상업은행 사업에서 60.4%로 가장 많은 수익을 창출했으며, 다음으로 트레이딩 부문 17.9%, 투자은행 부문 12.4%, 자산관리ㆍ운용 부문 9.3%로 수익구조가 구성되었다. 반면, 2006년에 들어서 JP Morgan의 소매ㆍ상업은행 수익 비중은 48.7%로 감소하고, 트레이딩 부문 21.0%, 투자은행 부문 19.2%, 자산관리ㆍ운용 부문 11.2%로 수익 구조가 바뀌었다. 2000년 대비 2006년 수익구조의 변화는 소매ㆍ상업은행 수익보다 트레이딩 및 투자은행 수익이 상대적으로 빠르게 증가한데 기인한다.32)

JP Morgan은 2008년 글로벌 금융위기를 원만하게 극복하고, 금융위기 이후 실적이 가장 우수한 금융회사로 주목받고 있다. 이는 다각화된 사업구조에 따른 수익성과 안정성 간의 적절한 균형으로부터 비롯되는 것으로 평가된다. JP Morgan의 사업전략은 이자수익과 비이자수익을 적절하게 배분하고 다양한 사업 간 시너지를 극대화하는 것이다. <그림 Ⅳ-10>은 2019년 JP Morgan의 조직구조를 보여준다. Consumer & Community Banking 부문은 개인 및 중소기업(연매출 2,000만 달러 미만)을 대상으로 대출, 신용카드 등 소매금융 서비스를 제공한다. Commercial Banking 부문은 중견기업(연매출 2,000만 달러 이상) 대상으로 대출 등 자금조달을 제공한다. Corporate & Investment Banking 부문은 투자은행 및 트레이딩 사업을 포함하여, 주요 고객층은 대기업 및 기관투자자다. Asset & Wealth Management 부문은 개인 및 기관투자자 대상 자산관리 및 자산운용 서비스를 제공하고 있다.

반면, JP Morgan의 거대 규모와 다각화된 사업은 금융위기 이후 도입된 각종 규제로 인해 단일 사업모델에 비해 추가적인 비용을 발생시킨다. 예를 들어 G-SIB에 적용되는 건전성 규제 등으로 트레이딩 부문의 위험자산이 일정 수준 넘어가면 JP Morgan의 G-SIB 수치가 높아져서 추가 자본세가 부과되고 이로 인해 모든 사업부문의 자본비용이 증가한다. 따라서 JP Morgan은 다각화된 사업구조의 시너지와 규모 및 복잡성 증가 등에 따른 위험과 비용 간의 적절한 균형을 관리해야 한다.

V. 결론 및 시사점

1930년대 막을 올린 전업계 투자은행의 시대는 2008년 글로벌 금융위기의 발생과 함께 종결되었다. 그간 국내 증권사를 비롯한 주요 금융회사의 벤치마크로 여겨졌던 글로벌 투자은행은 금융위기 이전과는 다른 모습으로 발전하고 있다. 최근 글로벌 투자은행의 변모를 이끄는 주요 테마는 ‘균형’, ‘관계’ 및 ‘기술’이다.

첫째, 주요 투자은행은 수익구조의 ‘균형’을 지향하고 있다. 글로벌 금융위기 전과 후 주요 투자은행의 사업전략을 비교해볼 경우 금융위기 이전에는 트레이딩 사업을 편중되게 키워나갔다면, 금융위기 이후에는 사업의 다각화를 적극적으로 추진하고 있다는 것이다. 특히 이와 같은 사업 다각화는 공통적으로 자산관리 및 자산운용 사업의 확대를 통해 이루어지고 있다. 트레이딩 사업의 고수익과 고변동성을 지양하고, 자산관리 및 자산운용 사업의 안정적인 현금흐름에 중점을 두고 있는 모습이다.

둘째, 투자은행이 영위하는 주요 사업에 있어서 ‘관계’의 중요성이 다시 부각되고 있다. 금융위기 이전 트레이딩 중심의 사업구조 하에서는 자본력이 투자은행의 주요 경쟁력이었다. 반면, 금융위기 이후 주요 투자은행은 과거의 관계형 사업으로 회귀하는 측면이 있다. 특히, 자산관리ㆍ운용이나 일부 투자은행이 새롭게 진출하는 인터넷뱅크 등 리테일 시장 사업은 만족스러운 고객 경험(customer experience)과 신뢰(trust) 구축이 성공의 핵심이다. 기업 고객에 있어서도 금융위기 이전에는 주로 Forutne 500대에 속하는 글로벌 대기업을 대상으로 했지만, 이제는 중소기업 시장도 집중적으로 공략하고 있는 만큼 적합한 관계 관리 역량도 필요하다.

셋째, ‘기술’의 발전이 주요 투자은행의 새로운 시장 진출을 가능하게 하고 있다. 금융위기 이전 글로벌 투자은행, 특히 전업계 투자은행의 리테일 사업이 제한되었던 일부 이유는 리테일 고객이 제공하는 수익에 비해 점포 설립, 고객 당 투입 인력 등 비용이 과도했기 때문이다. 그러나 최근 빠르게 발전하고 있는 인터넷뱅크, 로보어드바이저 등 핀테크를 포함한 전반적인 IT 기술의 발전은 리테일 고객 대상 사업의 비용을 과거에 비해 현저하게 낮춰주고 있다. Goldman Sachs의 Marcus를 비롯해서, 현재 주요 투자은행이 영위하는 다양한 사업은 무점포로 온라인ㆍ모바일 플랫폼에서 이루어지고 있으며, 서비스의 제공도 점차 자동화되어 고객 당 비용도 줄어들고 있다.

글로벌 금융위기 이후 주요 투자은행은 새로운 사업환경에 대응하기 위해 대대적인 사업구조 재편을 단행하고 있다. 투자은행별로 사업전략의 차이는 있으나, 전반적으로 사업 다각화를 통해 안정적인 수익구조를 마련하려고 노력하고 있다. 또한, 자산관리ㆍ운용, 소매금융 등 리테일 사업의 확대는 금융위기 이후 주요 투자은행의 가장 특징적인 변화다. 국내 금융투자회사도 시장 환경 변화에 맞추어 사업전략을 재검토해볼 필요가 있다. 특히, 핀테크 등 기술의 발전으로 과거에는 접근성이나 시장성이 부족하게 여겨진 사업 분야에 대한 재검토 등 새로운 수익원 발굴을 위한 노력이 요구된다.

1) 일반적으로 ‘투자은행(investment bank)’은 금융회사를 지칭하며, ‘투자은행 업무(investment banking)’는 유가증권 인수(underwriting), 인수합병 자문(M&A자문) 등의 금융투자 서비스를 말한다. 본 보고서에서는 ‘투자은행 업무’와 ‘투자은행 사업’을 병행하여 사용한다.

2) 현대적 투자은행의 전신은 19세기 유럽의 머천트뱅크(merchant bank)로 볼 수 있으며, 머천트뱅크는 주로 무역금융에 집중한 반면, 20세기 미국의 투자은행은 보다 포괄적인 범위에서 기업의 자금조달을 중개하는 금융회사로 차이를 둘 수 있다(Fleuriet, 2018).

3) 공화당 상원위원 카터 글라스(Carter Glass)와 민주당 하원위원 헨리 스티컬(Henry Steagall)이 법안을 공동발의 했으며, 공식 명칭은 1933년 은행법(Banking Act of 1933)이다.

4) Kroszner & Rajan(1994)

5) Smith(2001)

6) Chernow(1990)

7) Chernow(1990)

8) NYSE(1971)

9) Morrison et al.(2007)

10) Karmel(1986)

11) Morrison et al.(2007)

12) 주요 Merger Wave는 1차(1897~1904년), 2차(1916~1929년), 3차(1965~1973년), 4차(1981~1989년), 5차(1993~2000년), 6차(2003~2007년)로 구분된다(박용린, 2011).

13) Cole(2008)

14) BNP Paribas는 2000년 BNP와 Paribas의 합병을 통해 출현했다.

15) 글래스-스티걸법 제20조항은 상업은행 자회사의 ‘주된 업무(engaged principally)’가 투자은행 업무일 경우 불허한다. FRB는 자회사의 투자은행업무 관련 수익이 일정 수준 이하일 경우 주된 업무로 간주하지 않는다는 해석으로 상업은행의 투자은행업무를 허용하였다.

16) 공식 명칭은 1999년 금융서비스현대화법(Financial Services Modernization Act of 1999)이며, Phil Gramm 상원은행원장, Jim Leach 하원은행원장 및 Thomas Bliley 하원상업위원장이 법안을 발의했다.

17) Fleuriet(2018)

18) Farrell(2010), Stalter(2017. 10. 24)

19) Sorkin(2010)

20) Martel et al.(2012)은 은행 분류에 대한 정량적 기준은 제시하지 않으며, 자금조달에서 예금 비중이 높고, 자산구성이 대출로 이루어질수록 전문화 상업은행, 자금조달이 도매, 특히 단기자금으로 조달되고, 투자은행 및 트레이딩 관련 자산이 높을수록 전문화 투자은행으로 구분한다.

21) 해당 분류는 자금조달의 50% 이상이 도매자금(wholesale funding)인 경우, 그리고 수익에서 투자은행 및 트레이딩 부문의 비중이 50% 이상인 경우를 전문화 투자은행으로 분류한다. 반면, 단기자금조달 비중이 30% 미만이고, 투자은행 및 트레이딩 부문 수익이 25% 이상인 경우는 다각화ㆍ유니버설 투자은행으로 분류한다.

22) <표 Ⅲ-1>에서는 Bank of China, CITIC, China Securities, Guotai, Huatai와 같은 중국계, Mitsubishi UFJ, Sumimoto, Nomura와 같은 일본계 상업은행과 투자은행도 세계 순위에서 높은 자리를 차지하고 있으나, 이들은 특정 투자은행 업무 또는 지역에서 대부분 수익을 창출한다. 또한, Jeff eries, Lazard, Houlian Lokey, Rothchild 등 일부 부티크 IB는 M&A 자문 시장에 국한해서 상위권에 포함되어 있다.

23) 신보성 외(2015)

24) Carney(2010. 9. 3), Rauch(2011. 1. 11), Rexrode(2016. 8. 18)

25) BNP Paribas, HSBC 등 일부 은행의 경우 연차보고서 등의 자료에서 세부 항목들이 포함되지 않아 금융위기 전후 및 타 은행과의 비교가 어려워 분석 대상에서 제외된다.

26) JP Morgan, Bank of America 및 Morgan Stanley의 경우 2008~2013년 사이 주요 인수합병을 단행하였기 때문에 그 영향을 배제하고 사업부문별 수익 변화를 보기 위해 2010년과 2019년을 비교한다.

27) Endlich(2000)

28) McDonald et al.(2019), Son(2020. 6. 10), Irrera & Hussain(2021. 2. 16)

29) Farrell(2010)

30) 소매ㆍ상업은행 수익은 대부분 신용카드 사업 Discover에서 발생했다.

31) Bisnoff(2020. 10. 8), Thinking Ahead Institute(2020)

32) 2000~2006년 사이 JP Morgan의 사업부문별 연평균 수익 증가율은 투자은행 부문 17.8%, 트레이딩 부문 12.5%, 자산관리운용 부문 12.8%, 소매ㆍ상업은행 부문 5.6%를 기록했다.

33) JP Morgan은 자산운용 사업 확대를 위해 2020년 Eaton Vance 인수전에 참여했으나, 최종적으로 Morgan Stanley가 Eaton Vance를 인수하는데 성공했다(Morris & Massoudi, 2020. 12. 17).

34) 2018년 기준 JP Morgan은 세계 금융회사 중 가장 많은 10.8조 달러의 예산을 디지털화 투자를 위해 편성하고, 이 중 5조 달러를 핀테크 투자에 할당하였다. JP Morgan은 블록체인(block chain), 빅데이터, 클라우드, 인공지능(AI), 로보틱스 등 다방면의 기술 투자를 단행하고 있다.

참고문헌

박용린, 2011,『세계 M&A 시장 전망과 시사점』, 자본시장연구원 이슈&정책 11-07.

신보성ㆍ권재현ㆍ김종민ㆍ이효섭ㆍ천창민, 2015,『 글로벌 금융규제 흐름과 우리나라 금융규제개혁의 바람직한 방향』, 자본시장연구원 연구총서 15-02.

Bisnoff, J., 2020. 10. 8., Morgan Stanley’s Eaton Vance acquisition could mean more asset management mergers are coming, Forbes.

Caparusso, J., Chen, Y., Dattels, P., Goel, R., Hieber, P., 2019, Post-crisis changes in global bank business models: a new taxonomy, IMF Working Paper.

Carney, J., 2010. 9. 3., Goldman Sachs shuttering principal strategies group, CNBC.

Chernow, R., 1990, The house of Morgan: An American banking dynasty and the rise of modern finance, Atlantic Monthly Press.

Cole, B., 2008, M&A titans: the pioneers who shapes Wall Street’s mergers and acquisitions industry, Wiley.

Endlich, L., 2000, Goldman Sachs: the culture of success, Touchstone.

Farrell, G., 2010, Crash of the titans: Greed, hubris, the fall of Merrill Lynch, and the near-collapse of Bank of America, Crown Publishing.

Fleuriet, M., 2018, Investment banking explained: an insider’s guide to the industry, McGraw-Hill Education.

Irrera, A., Hussain, N., 2021. 2. 16., Goldman Sachs to launch digital investment platform in Marcus push, Reuters.

Kalemli-Ozcan, S., Sorensen, B., Yesiltas, S., 2011, Leverage across firms, banks, and countries, NBER Working Paper Series.

Karmel, R.S., 1986, Assessment of shelf registration: How much diligence is due investors? Yale Journal on Regulation 3, 401-405.

Kroszner, R.S., Rajan, R.G., 1994, Is the Glass-Steagall Act justified? A study of the U.S. experience with universal banking before 1933, American Economic Review 84(4), 810-832.

Martel, M. M., van Rixtel, A., Mota, E. G., 2012, Business models of international banks in the wake of the 2007-2009 global financial crisis, Establidad Financiera 22, 97-121.

McDonald, R., Junnarkar, S., Lane, D., 2019, Marcus by Goldman Sachs, Harvard Business Review.

Morris, S., Massoudi, A., 2020. 12. 17, JPMorgan was losing bidder in $7bn battle for asset manager Eaton Vance, Financial Times.

Morrison, A.D., Wilhelm Jr., W.J., 2007, Investment banking: Past, present and future, Journal of Applied Corporate Finance 19(1), 8-20.

NYSE, 1971, Crisis in the securities industry, a chronology: 1967-1970, Booklet prepared for the subcommittee on commerce and finance, committee on interstate and foreign commerce, house of representatives.

Rauch, J., 2011. 1. 11., Morgan Stanley to spin off prop trading unit, Reuters.

Rexrode, C., 2016. 8. 18., Citigroup’s last proprietary trader walks out the door, The Wall Street Journal.

Smith, R.C., 2001, Strategic directions in investment banking – a retrospective analysis, Journal of Applied Corporate Finance 14(1), 111-124.

Son, H., 2020. 6. 10., Amazon unveils small business credit line with Goldman Sachs in latest tie-up between tech and Wall Street, CNBC.

Sorkin, A.R., 2010, Too big to fail: The inside story of how Wall Street and Washington fought to save the financial system-and themselves, Penguin Publishing.

Stalter, K., 2017. 10. 24, The demise of Merrill Lynch: revisiting its monumental write-down 10 year ago, Forbes.com.

Thinking Ahead Institute, 2020, The world’s largest 500 asset managers, joint study with Pension & Investments.

CNBC cnbc.com

Forbes forbes.com

Reuters reuters.com

The Wall Street Journal wsj.com