Find out more about our latest publications

Analysis on Robo-advisor Performance in Korea

Research Papers 21-05 Dec. 06, 2021

- Research Topic Financial Services Industry

- Page 90

It has been 5 years since robo-advisors were first introduced in Korea in 2016. As of the end of June 2021, the number of subscribers recorded a rapid increase over the past year and recorded 380,000, and the amount of managed assets continued to increase, but as of the end of June 2021, it was below 2 trillion won. However, since the COVID-19 pandemic was declared in early 2020, the number of investment advisory and discretionary robo-advisors increased significantly in line with the increase in individual participation in stock markets.

In Korea, unlike overseas, various types of robo-advisors have emerged and developed. Among them, product recommendation robo-advisors provided by banks record a high market share, while the investment advisory and discretionary robo-advisors of investment advisory companies have been making strides since the mid-2020. There are also many information-providing robo-advisors from securities companies that recommend listed stocks and provide trading timing information, while the size of the market is unknown.

As of the end of March 2021, there are 14 robo-advisory service providers that have passed the examination of the Robo-advisor Test Bed (RATB) and are currently providing services, whereas there are 31. This is because anyone can freely use the name of the robo-advisor, and if there is any human intervention, it does not fall under the ‘electronic investment advice device’ according to the Financial Investment Services and Capital Market Act, so it is implicitly accepted that it does not need to be reviewed by RATB.

In addition, although the product recommendation robo-advisor is almost identical to the investment advisory robo-advisor in terms of service content, it does not need to be reviewed by RATB and is not subject to investment advisory regulations. In addition, information-providing robo-advisors are not legally providing guidance, not advice, so that they are not subject to regulation on the sale of financial products or investment advice.

However, as the number of robo-advisor subscribers increases and the demand for robo-advisors continues to increase, financial consumers may misunderstand robo-advisors, which may lead to large-scale mis-selling and large-scale damage to financial consumers. In this regard, it is necessary to reorganize the robo-advisor regulation and supervision system based on the same conduct-same regulation principle.

Moreover, digital finance is now becoming a necessity, not an option. As such, the issue of selecting the most suitable robo-advisor for financial consumers is becoming more important than before. In particular, if there is a difference in asset management performance among robo-advisors, the financial consumer’s asset management performance may vary depending on the choice of robo-advisors.

As a result of empirically analyzing the asset management performance of robo-advisors based on the data provided by RATB as of the end of March 2021, the paper found that there is a clear gap in asset management performance across robo-advisors. In particular, among robo-advisors to be analyzed, robo-advisors that realize abnormal excess returns, follow market returns well, and show good rebalancing performance are not observed. Of course, among robo-advisors, even if the rebalancing performance is low or insignificant, there are some robo-advisors that can realize an abnormal excess return while tracking the market return at a very low level. Some robo-advisors with relatively good rebalancing performance are also observed.

Considering that there is a clear gap in asset management performance across robo-advisors, it is necessary to improve the robo-advisor disclosure system so that financial consumers can easily inquire and compare them to make the right choice for them. Furthermore, it seems necessary to strengthen the regulation on the obligation to explain the robo-advisor algorithm as in other countries and to thoroughly check the problem of conflicts of interest by robo-advisors.

A policy is also needed to improve the asset management performance of robo-advisors. For example, there is a need for regulatory support so that robo-advisors can easily implement efficient diversification for financial consumers who invest in small amounts. For reference, in September 2021, the financial authorities announced a plan to introduce a fractional stock trading for overseas stocks in 2021 and for domestic stocks during the second half of 2021.

Finally, as a result of empirical analysis of the client acquiring performance of robo-advisors, it appears that the asset management performance does not necessarily lead to the client acquiring performance. In particular, in cases of the robo-advisory service provider being a brokerage company, it shows poor client acquiring performance compared to banks or investment advisory companies, despite its asset management performance not lagging behind. Considering this, securities companies are required to make efforts to significantly improve the service accessibility of their robo-advisors.

In Korea, unlike overseas, various types of robo-advisors have emerged and developed. Among them, product recommendation robo-advisors provided by banks record a high market share, while the investment advisory and discretionary robo-advisors of investment advisory companies have been making strides since the mid-2020. There are also many information-providing robo-advisors from securities companies that recommend listed stocks and provide trading timing information, while the size of the market is unknown.

As of the end of March 2021, there are 14 robo-advisory service providers that have passed the examination of the Robo-advisor Test Bed (RATB) and are currently providing services, whereas there are 31. This is because anyone can freely use the name of the robo-advisor, and if there is any human intervention, it does not fall under the ‘electronic investment advice device’ according to the Financial Investment Services and Capital Market Act, so it is implicitly accepted that it does not need to be reviewed by RATB.

In addition, although the product recommendation robo-advisor is almost identical to the investment advisory robo-advisor in terms of service content, it does not need to be reviewed by RATB and is not subject to investment advisory regulations. In addition, information-providing robo-advisors are not legally providing guidance, not advice, so that they are not subject to regulation on the sale of financial products or investment advice.

However, as the number of robo-advisor subscribers increases and the demand for robo-advisors continues to increase, financial consumers may misunderstand robo-advisors, which may lead to large-scale mis-selling and large-scale damage to financial consumers. In this regard, it is necessary to reorganize the robo-advisor regulation and supervision system based on the same conduct-same regulation principle.

Moreover, digital finance is now becoming a necessity, not an option. As such, the issue of selecting the most suitable robo-advisor for financial consumers is becoming more important than before. In particular, if there is a difference in asset management performance among robo-advisors, the financial consumer’s asset management performance may vary depending on the choice of robo-advisors.

As a result of empirically analyzing the asset management performance of robo-advisors based on the data provided by RATB as of the end of March 2021, the paper found that there is a clear gap in asset management performance across robo-advisors. In particular, among robo-advisors to be analyzed, robo-advisors that realize abnormal excess returns, follow market returns well, and show good rebalancing performance are not observed. Of course, among robo-advisors, even if the rebalancing performance is low or insignificant, there are some robo-advisors that can realize an abnormal excess return while tracking the market return at a very low level. Some robo-advisors with relatively good rebalancing performance are also observed.

Considering that there is a clear gap in asset management performance across robo-advisors, it is necessary to improve the robo-advisor disclosure system so that financial consumers can easily inquire and compare them to make the right choice for them. Furthermore, it seems necessary to strengthen the regulation on the obligation to explain the robo-advisor algorithm as in other countries and to thoroughly check the problem of conflicts of interest by robo-advisors.

A policy is also needed to improve the asset management performance of robo-advisors. For example, there is a need for regulatory support so that robo-advisors can easily implement efficient diversification for financial consumers who invest in small amounts. For reference, in September 2021, the financial authorities announced a plan to introduce a fractional stock trading for overseas stocks in 2021 and for domestic stocks during the second half of 2021.

Finally, as a result of empirical analysis of the client acquiring performance of robo-advisors, it appears that the asset management performance does not necessarily lead to the client acquiring performance. In particular, in cases of the robo-advisory service provider being a brokerage company, it shows poor client acquiring performance compared to banks or investment advisory companies, despite its asset management performance not lagging behind. Considering this, securities companies are required to make efforts to significantly improve the service accessibility of their robo-advisors.

Ⅰ. 연구 배경과 목적

2016년에 로보어드바이저(robo-advisor)가 국내에 처음으로 소개된 지 벌써 5년이 지났다. 2021년 6월말 코스콤의 로보어드바이저 테스트베드센터 집계 기준으로 가입자 수는 지난 1년 간 17만명 이상이 증가하면서 38만명을 기록하였다. 가입자 수로만 보면 로보어드바이저에 의한 자산관리 시장은 이전에 비해 크게 성장한 것처럼 보인다. 하지만 로보어드바이저의 관리자산 금액은 지난 5년 동안 지속적으로 증가하였음에도 불구하고 2조원을 밑돈다.

로보어드바이저의 가입자 수가 빠르게 증가한 것에 비해 관리자산 금액이 그만큼 증가하지 않은 것은 지난 1년 동안 20~30대 연령층의 가입이 크게 증가했기 때문일 수 있다. 그러나 다른 요인도 존재하는 것으로 보인다. 예를 들면, 로보어드바이저의 수익률이 사람보다 못하거나 시장수익률을 따라가지 못한다는 비판이 2020년 초반까지 지속적으로 제기된 것과 무관해보이지 않는다.

국내는 투자일임형이 주를 이루는 해외와 달리 은행의 상품추천형 로보어드바이저가 높은 시장점유율을 기록하고 있다. 이들은 대개 펀드상품을 포트폴리오로 구성하여추천하지만, 서비스 내용 측면에서는 투자자문 서비스를 제공하는 투자자문형이나 고객의 투자금액을 일임받아 운용하는 투자일임형과 크게 다르지 않다. 이외에도 주식시장의상장종목을 추천하고 매매 타이밍 정보를 제공하는 정보제공형 로보어드바이저가 있다.

그런데 코로나19 팬데믹이 선언된 3월 이후 주식시장이 급락하고 곧이어 견조한 상승세를 보였던 2020년 중반부터 로보어드바이저에 의한 자산관리 시장에도 구조적 변화가 일기 시작하였다. 우선 2021년 6월말 기준 가입자 수가 전년 동월 대비 81.7%, 관리자산 금액은 46.9% 증가하였다. 특히 이전과 다르게 투자자문형과 투자일임형 로보어드바이저의 약진이 두드러졌다.

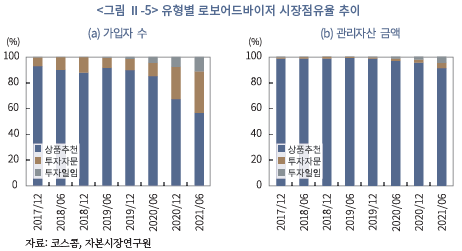

2019년 6월말 이후 투자자문형과 투자일임형 로보어드바이저의 가입자 수 기준 시장점유율은 지속적으로 증가하여 2021년 6월말 43.4%를 기록하였다. 이와 달리 상품추천형 로보어드바이저의 시장점유율은 2019년 6월말 91.3%를 기록한 이후 계속 감소하였다. 물론 2021년 6월말 상품추천형 로보어드바이저의 관리자산 금액 기준 시장점유율은 90.9%로 여전히 높다.

금융의 디지털화가 빠르게 진전되면서 이제 디지털금융은 선택이 아닌 필수가 되어가고 있다. 그만큼 앞으로 자동화된 자산관리 서비스를 제공하는 로보어드바이저에 대한 수요도 계속 증가할 것으로 보인다. 또한 지난 1년 6개월여 동안 개인의 주식투자가 대폭 증가하였지만 이러한 추세가 지속될지 의문스럽다. 이보다는 개인의 지속가능한 금융투자활동을 지원할 수 있는 전문적인 자산관리 서비스가 더 요구될 수 있다. 이 점에서 개인의 로보어드바이저 선택은 효율적 자산관리에 있어 가장 중요한 문제로 부각될 것으로 예상된다.

이 보고서에서는 이와 같은 배경을 바탕으로 국내 로보어드바이저의 성과를 분석하고 시사점을 제시하였다. 이를 위해 먼저 국내 로보어드바이저의 현황을 코스콤의 로보어드바이저 테스트베드센터가 제공한 데이터와 자체 조사한 자료를 토대로 종합하였다. 또한 로보어드바이저의 본질적인 역할에 초점을 맞춰 로보어드바이저의 성과를 분석하고 자산관리 성과가 고객유치 성과에 미치는 영향을 분석하였다.

이 보고서의 나머지는 다음과 같이 구성되어 있다. 제Ⅱ장에서는 로보어드바이저의법적, 기술적 정의를 바탕으로 국내 로보어드바이저의 서비스 유형을 구분하고, 서비스 유형별 현황과 시장규모를 살펴보았다. 제Ⅲ장에서는 국내 로보어드바이저의 성과를 자산관리 성과와 고객유치 성과로 구분하여 실증적으로 분석하고 서비스 유형과 제공업체 유형별로 비교하였다. 마지막으로 제Ⅳ장에서는 지금까지 분석한 결과를 토대로 시사점을 제시하였다.

Ⅱ. 국내 로보어드바이저 현황

국내에서 로보어드바이저는 다소 복잡한 양상으로 출현하고 발전하였다. 특히 로보어드바이저라는 용어가 광범위하게 사용되다보니 그 현황을 자세히 파악하기도 쉽지 않고 체계적으로 집계한 자료도 찾아보기 어렵다. 따라서 이 장에서는 국내 로보어드바이저 현황을 코스콤의 로보어드바이저 테스트베드센터가 제공한 데이터와 자체 조사한 자료를 토대로 정리하고 종합하였다.1)

1. 정의와 유형

가. 로보어드바이저 정의

1) 법적 정의

로보어드바이저는 2002년 미국에서 처음 사용된 명칭으로 지금은 대개 자동화된 디지털 투자자문 또는 자산관리 서비스의 뜻으로 사용된다(Karz, 2015; 이성복, 2016a; 이성복, 2016b).2) 그러나 로보어드바이저에 대한 합의된 정의는 없다. 이 때문에 국내에서도 로보어드바이저라는 명칭이 다소 다른 의미로 사용되는 경우가 종종 있다. 예를 들어, 2021년 초부터 보험업계에서는 자동화된 보험설계사의 뜻으로 보험 로보어드바이저라는 명칭을 사용하고 있다.

로보어드바이저의 사전적 의미는 분명하다. 로보(robo)는 자동화(automation)를, 어드바이저(advisor)는 법적으로 금융자문(financial advice)을 제공하는 자를 뜻한다. 따라서 로보어드바이저는 자동화된 금융자문 도구로 이해될 수 있다. 해외에서도 로보어드바이저를 이와 유사하게 정의하고 사용한다.

예를 들어, 미국의 증권거래위원회(Securities and Exchange Commission: SEC)는 로보어드바이저를 ‘자동화된 디지털 투자자문 프로그램(automated digital investment advisory program)’의 뜻으로 한정하여 사용한다(SEC, 2017. 2. 23). 영국의 금융영업행위감독청(Financial Conduct Authority: FCA)은 로보어드바이저 대신에 ‘자동화된 디지털 또는 온라인 자문(automated digital or online advice)’의 뜻으로 로보어드바이스(robo-advice) 명칭을 사용한다(FCA, 2017. 2. 11, 2020).

국내에서는 법적으로 로보어드바이저를 ‘전자적 투자조언장치’로 명명하고, 집합투자업자가 집합투자재산을 운용하거나 투자자문업자 또는 투자일임업자가 해당 업무를 수행하는 데 활용하는 자동화된 전산정보처리장치로 정의하고 있다. 그런데 금융당국에서는 ‘로보어드바이저’ 명칭을 로보어드바이저 테스트베드의 심사통과 여부와 상관없이 누구나 사용할 수 있도록 허용하였다(금융위원회, 2016. 8. 29).3) 이 점에서 사실상 로보어드바이저의 법적 정의는 없다고도 볼 수 있다.

2) 기술적 정의

로보어드바이저는 기술적 특성을 고려하여 정의되기도 한다. 로보어드바이저는 기본적으로 자동화된 자산관리 서비스를 체계적으로 제공하는 것을 목적으로 하기 때문에 미리 짜여진 알고리듬(algorithm)을 사용한다. 따라서 로보어드바이저는 기술적으로는 자동화된 자산관리 서비스를 제공하기 위한 미리 짜여진 알리리듬 체계로 정의될 수 있다.

한편 로보어드바이저라고 해서 사람의 보조나 개입이 반드시 없어야 한다는 것을 뜻하지 않는다(SEC, 2017. 2. 23). 예를 들어, 사람의 개입 없이 서비스 가입부터 모든 서비스 절차를 완전하게 자동화하여 자산관리 서비스를 제공하는 로보어드바이저가 있는 반면, 자문사(human advisor)의 자문이나 상담사의 보조 서비스를 결합하여 제공하는 하이브리드(hybrid) 또는 바이오닉(bionic) 로보어드바이저도 있다. 대표적으로 미국의 뱅가드(Vanguard)의 Vanguard Personal Adivsor Services와 찰스슈왑(Charles Schwab)의 Schwab Intelligent Portfolio Products가 후자에 해당된다.

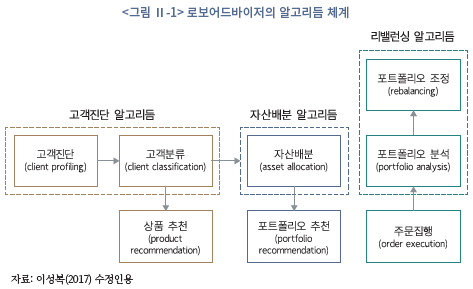

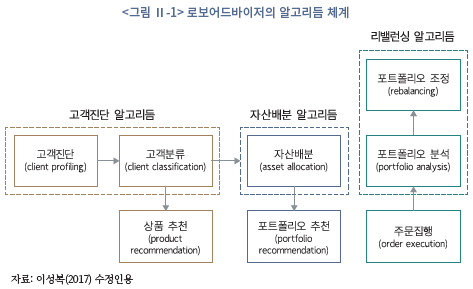

로보어드바이저의 알고리듬 체계는 <그림 Ⅱ-1>에서 살펴볼 수 있듯이 크게 고객진단(client profiling), 자산배분(asset allocation), 리밸런싱(rebalancing) 알고리듬으로 나뉠 수 있다(이성복, 2017). 고객진단 알고리듬은 온라인 질문을 통해 고객의 정보를 파악하고 고객의 투자성향을 평가하는 알고리듬이다. 자산배분 알고리듬은 고객의 투자성향에 가장 적합한 자산배분 또는 자산구성을 도출하는 알고리듬이다. 리밸런싱 알고리듬은 고객자산의 수익과 위험을 효율적으로 관리하기 위해 시장 상황이나 고객 요구에 맞게 자산구성을 조정하는 알고리듬이다.4)

로보어드바이저의 알고리듬은 서비스 유형이나 내용에 따라 그 구성이 다를 수 있다. 고객에게 적합한 금융상품을 일회적 또는 불연속적으로 추천할 경우 자산배분이나 리밸런싱 알고리듬이 필요하지 않을 수 있다. 그러나 고객에게 계속적이고 반복적으로 금융상품 포트폴리오를 추천하거나 투자자문이나 투자일임 서비스를 제공할 경우 자산배분과 리밸런싱 알고리듬이 요구된다.

로보어드바이저의 알고리듬은 서비스 절차를 자동화하기 위한 것으로 그 자체만으로는 특별하지 않다. 이보다는 각 알고리듬에 설계된 가정이나 전제, 고객 응답을 처리하는 방식, 이론적 모형이나 IT 기술 등이 로보어드바이저의 서비스 역량을 결정한다. 예를 들어, 고객진단 알고리듬의 경우 온라인 질문에 대한 고객 응답을 처리하는 방식에 따라 또는 고객이 온라인 질문에 대해 비일관적이거나 모순적으로 응답하는 경우를 고려하는지 여부에 따라 고객의 투자성향에 대한 평가가 달라질 수 있다.

자산배분 알고리듬의 경우 어떤 이론적 모형 또는 자산구성 전략에 기초하느냐에 따라 고객에게 최초로 제시되는 자산구성이 다를 수 있고, 궁극적으로는 자산관리 성과에도 영향을 미칠 수 있다. Beketov et al.(2018)이 미국, 독일, 영국, 스위스 등의 217개 로보어드바이저를 대상으로 조사한 결과에 따르면, 조사대상의 39.7%가 자산배분 알고리듬의 이론모형으로 해리 마코비츠(Harry Markowitz)의 현대 포트폴리오 이론(Modern Portfolio Theory: MPT)을 사용하고 있는 것으로 파악된다.

이 밖에 블랙-리터만 모형(Black-Litterman model), 파마-프렌츠 요인 모형(Fama-French Factor model), 몬테-카를로 시뮬레이션(Monte-Carlo simulation) 등을 사용하는 로보어드바이저도 있다. 한편 고객의 투자성향에 따라 미리 자산을 구성한 샘플 포트폴리오(sample portfolio)나 사전에 자산구성의 비중을 정한 상수 포트폴리오(constant portfolio)를 제시하는 로보어드바이저도 조사대상의 41.1%에 달한다.

리밸런싱 알고리듬의 경우 시장 상황을 어떻게 파악하고 분석하느냐 또는 어떤 기준으로 리밸런싱을 실시하느냐에 따라 로보어드바이저의 자산관리 성과가 달라질 수 있다. 시장 상황을 파악하고 분석하기 위해 빅데이터(big data)와 인공지능(AI) 기술이 활용되기도 한다. 또한 자산가격에 상당한 영향을 미칠 수 있는 이벤트 발생 여부, 리밸런싱을 실행하도록 사전에 설정된 자산가격의 임계치(threshold) 기준 등에 따라 리밸런싱 실행 여부가 결정될 수 있다. 그러나 일정 기간마다 주기적으로 리밸런싱을 실시하는 로보어드바이저도 있다.

나. 로보어드바이저 유형

국내에 출시된 로보어드바이저는 서비스 관점에서 크게 상품추천형, 투자자문형 또는 투자일임형, 정보제공형으로 구분될 수 있다.5) 상품추천형은 말 그대로 금융회사 등이 금융상품을 판매할 목적으로 단일 금융상품이나 금융상품 포트폴리오를 추천하는 로보어드바이저다. 대표적으로 은행의 펀드 로보어드바이저가 이에 해당된다. 투자자문형 또는 투자일임형은 자본시장법에 따라 금융위원회에 등록한 투자자문업자 또는 투자일임업자가 제공하는 로보어드바이저다. 정보제공형은 금융상품이나 상장종목 등에 대한 정보를제공하는 로보어드바이저를 말한다.

그런데 로보어드바이저의 유형은 그 구분 기준에 따라 달라질 수 있다. 예를 들어, 로보어드바이저 유형을 서비스 주체에 따라 구분할 경우 서비스 주체가 금융소비자보호법에 따른 금융상품판매업자이면 상품추천형, 자본시장법에 따른 투자자문업자 또는 투자일임업자이면 투자자문형 또는 투자일임형으로 분류될 수 있다. 그러나 금융상품판매업자가 투자자문업이나 투자일임업을 겸영할 경우 서비스 주체에 따른 유형 구분은 적합하지 않다. 또한 정보제공형은 누구나 제공할 수 있는 일종의 조언을 제공하는 것이므로 서비스 주체로 그 유형을 구분하기 어렵다.

로보어드바이저 유형을 서비스 내용으로 구분한다고 해도 서비스 내용의 유사성이 존재할 경우 그 유형을 명확하게 구분하기 어렵다. 예를 들어, 은행의 펀드 로보어드바이저는 별도의 투자자문이나 투자일임 계약을 체결하지 않고 펀드 포트폴리오를 고객에게 추천한다는 점에서 상품추천형으로 분류된다. 그러나 이들 로보어바이저는 계속적으로 고객에게 리밸렁싱 정보를 제공하고, 고객의 동의가 있으면 보유 펀드를 환매하고 신규 펀드를 구매하는 방식 등으로 리밸런싱을 실시한다. 이 점에서 은행의 펀드 로보어드바이저는 서비스 내용 측면에서 투자자문형이나 투자일임형과 다를 게 없다.

로보어드바이저 유형은 수익 원천에 의해서도 구분될 수 있다. 예를 들어, 로보어드바이저가 금융상품 제조사 또는 판매사로부터 상품판매와 관련된 수수료 또는 보수를 수취하면 상품추천형으로, 고객으로부터 자문 또는 일임 보수를 수취하면 투자자문형 또는 투자일임형으로, 두 경우에 해당되지 않으면 정보제공형으로 분류할 수 있다. 그러나 무료로 서비스를 제공하는 로보어드바이저도 있기 때문에 이마저도 적절하지 않다.

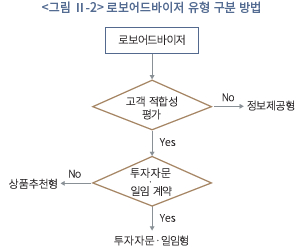

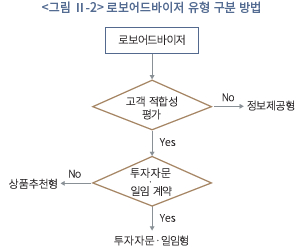

지금까지 논의를 종합해보면 서비스 주체, 서비스 내용 또는 수익 원천을 기준으로 로보어드바이저 유형을 명확하게 구분하는 것은 쉽지 않다. 그러나 국내 로보어드바이저의 성과를 분석하고 유형별로 비교하려면 그 유형을 명확하게 구분할 필요가 있다. 따라서 이 보고서에서는 <그림 Ⅱ-2>에 나타난 바와 같이 고객 적합성 평가 여부와 투자자문 또는 투자일임 계약 여부로 로보어드바이저 유형을 구분하기로 한다.

우선 로보어드바이저가 온라인 질문을 통해 고객의 적합성을 평가하지 않으면 정보제공형으로 분류한다. 상품추천형이나 투자자문ㆍ일임형은 금융소비자보호법에 따라 고객 적합성 평가를 실시해야 한다. 이와 달리 정보제공형은 고객에게 일방적으로 조언을 하는 것이므로 고객 적합성 평가가 요구되지 않는다. 다음으로 로보어드바이저가 고객에게 자본시장법에 따라 투자자문 또는 투자일임 계약을 체결할 것을 요구하면 투자자문형 또는 투자일임형으로 분류한다. 그렇지 않으면 상품추천형으로 분류한다.

마지막으로 로보어드바이저의 유형은 자산구성에 따라 구분될 수 있다. 우선 국내 자산으로만 구성되어 있는 국내형, 해외 자산으로만 구성되어 있는 해외형, 국내외 자산이 혼합되어 있으면 글로벌형으로 분류된다. 또한 주식, ETF 등 상장종목으로 구성된 상장종목형, 펀드로만 구성된 펀드형, 퇴직연금 또는 개인연금 상품으로 운용되면 연금형, 연금이나 랩(wrap) 계좌처럼 다양한 자산 유형으로 구성된 혼합형으로 분류된다.

2. 유형별 현황

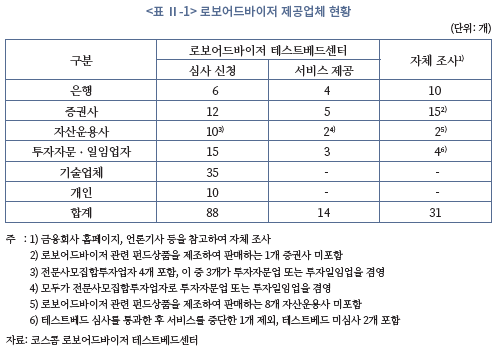

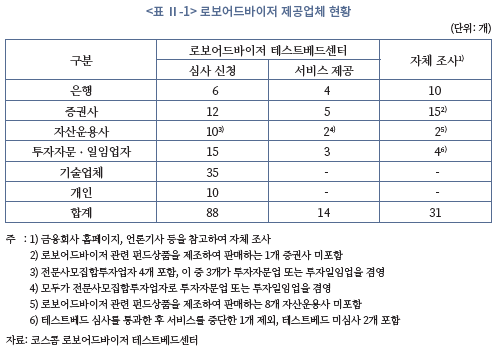

2021년 3월말 기준으로 코스콤의 로보어드바이저 테스트베드센터(이하 테스트베드센터)의 심사를 통과하거나 받고 있는 로보어드바이저는 제공업체 기준으로 88개로 집계된다. 이 중 <표 Ⅱ-1>에서 살펴볼 수 있듯이 은행 6개, 증권사 12개, 자산운용사 10개, 투자자문ㆍ일임업자 15개, 기술업체 35개, 개인 10명이 로보어드바이저 테스트베드에 참여하였다. 또한 이 중 2021년 3월말 기준으로 로보어드바이저 상품 또는 서비스를 제공하는 업체는 14개(은행 4개, 증권사 5개, 자산운용사 2개, 투자자문ㆍ일임업자 3개)로 조사된다.

그러나 2021년 3월말 기준으로 자체 조사한 자료에 따르면, <표 Ⅱ-1>에서 살펴볼 수 있듯이 은행 10개, 증권사 15개, 자산운용사 2개, 투자자문ㆍ일임업자 4개가 실제 로보어드바이저 서비스 또는 상품을 제공하는 것으로 파악된다. 이는 제휴 기술업체를 포함하지 않은 수치로, 테스트베드센터의 집계보다 더 많다는 것을 보여준다.

이처럼 테스트베드센터가 제공한 자료와 자체 조사한 자료 간에 로보어드바이저 현황이 다른 것은 금융당국에서 로보어드바이저 명칭의 사용을 테스트베드센터의 심사 여부와 상관 없이 허용하고 있기 때문이다. 또한 로보어드바이저를 법적으로 ‘전자적 투자조언장치’로 정의함에 따라 사람의 개입이 조금이라도 있으면 법상 로보어드바이저가 아니고 테스트베드센터의 심사를 받지 않아도 된다는 견해가 암묵적으로 용인되기 때문이다.

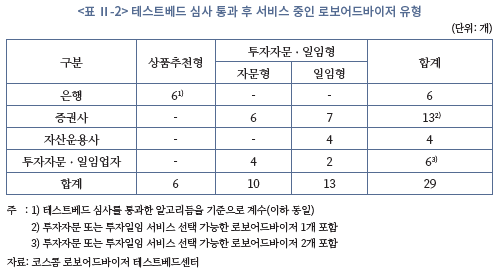

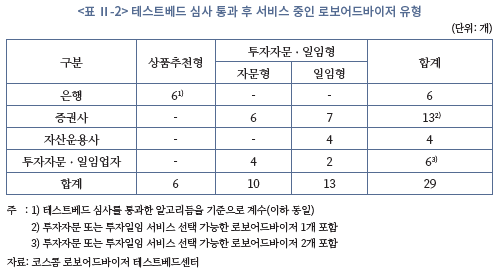

2021년 3월말 기준으로 테스트베드센터의 심사를 통과하고 서비스를 제공 중인 14개 제공업체의 로보어드바이저 상품 또는 서비스는 총 29개로 집계된다. 그리고 이들 로보어드바이저의 유형을 구분해보면 <표 Ⅱ-2>에서 살펴볼 수 있듯이 상품추천형이 6개, 투자자문형이 10개, 투자일임형이 13개이며, 이 중 투자자문과 투자일임 서비스를 선택할 수 있는 투자자문ㆍ일임형이 3개로 파악된다.

<표 Ⅱ-1>에서 살펴본 바와 같이 테스트베드센터의 심사를 통과하지 않고도 로보어드바이저 상품 또는 서비스를 제공하는 업체가 다소 존재하는 만큼 실제 로보어드바이저 상품 또는 서비스는 <표 Ⅱ-2>에 나타난 로보어드바이저 유형 수보다 훨씬 더 많고 다양하다. 특히 증권사가 제공하는 주식투자 정보제공형 로보어드바이저까지 고려하면 더욱 그렇다. 참고로 2021년 6월말 기준으로 정보제공형 로보어드바이저를 제공하고 있는 업체 중 테스트베드센터의 심사를 신청한 곳은 한군데도 없다.

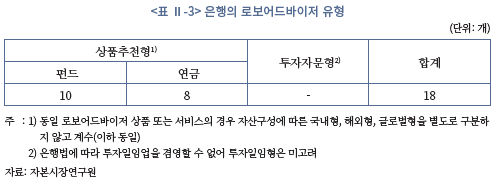

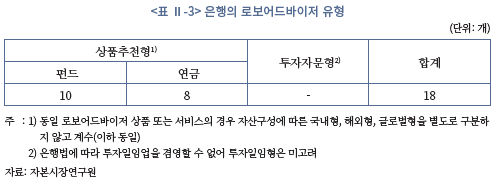

2021년 3월말 기준으로 자체 조사한 자료에 따르면 <표 Ⅱ-3>에서 살펴볼 수 있듯이 10개 은행이 펀드 포트폴리오를 추천하는 상품추천형 로보어드바이저를 제공하고 있는 것으로 파악된다.6) 또한 광주은행과 대구은행을 제외한 8개 은행은 연금 포트폴리오를 추천하거나 제안하고 관리해주는 연금 로보어드바이저도 제공하고 있다. 참고로 연금 로보어드바이저의 경우 그 유형을 명확하게 구분하기 쉽지 않으나, 대개 펀드 로보어드바이저와 같이 제공된다는 점에서 상품추천형으로 판단된다.

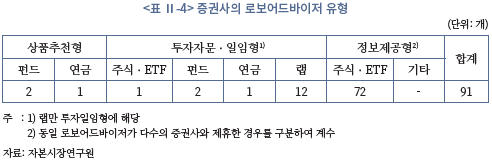

증권사의 로보어드바이저 상품 또는 서비스는 은행보다 더 다양하고 복잡하게 구성되어 있다. 예를 들어, 증권사는 은행과 유사하게 주식ㆍETF, 펀드, 연금 포트폴리오를 추천하는 상품추천형, 펀드 또는 연금 자산관리를 지원하는 투자자문형, 국내외 주식ㆍETF 등으로 자산배분을 지원하는 투자자문형, 랩 투자일임형, 주식ㆍETF 상장종목 추천과 매매 타이밍 정보를 제공하는 정보제공형 등 다양한 유형의 로보어드바이저 상품 또는 서비스를 제공하고 있다.

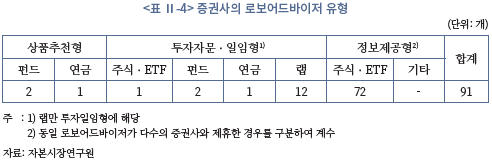

2021년 3월말 기준으로 자체 조사한 자료를 토대로 15개 증권사의 로보어드바이저 유형을 구분해보면 <표 Ⅱ-4>에서 살펴볼 수 있듯이 매우 다양하다는 것을 확인할 수 있다. 또한 은행의 로보어드바이저가 펀드나 연금 포트폴리오 추천에 집중되어 있는 반면, 증권사의 로보어드바이저는 랩 투자일임형과 주식투자 정보제공형에 집중되어 있다. 한편 2019년 6월말 기준으로 자체 조사한 자료와 비교해보면 새로운 로보어드바이저 상품 또는 서비스를 출시한 증권사도 있지만, 기존의 로보어드바이저 상품 또는 서비스를 중단한 증권사가 더 많은 것으로 확인된다.

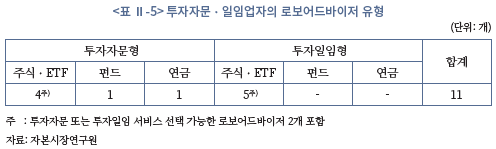

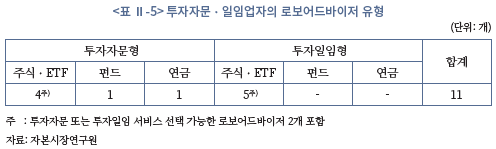

투자자문ㆍ일임업자(전문사모집합투자업자 포함)가 제공하는 로보어드바이저 유형은 그 업의 특성상 투자자문형 또는 투자일임형으로 분류된다. 특히 이들 로보어드바이저는 은행이나 증권사와 다르게 전용 플랫폼을 제공한다는 점이 차별된다.7) 2021년 3월말 기준으로 자체 조사한 자료에 따라 로보어드바이저 유형을 구분해보면 <표 Ⅱ-5>와 같으며, 주로 주식 또는 ETF로 자산배분과 자산관리에 대해 투자자문이나 투자일임 서비스를 제공하고 있다는 것이 특징적이다.

3. 시장규모

국내에서는 로보어드바이저 테스트베드센터가 유일하게 매월 로보어드바이저 시장규모를 발표하고 있다.8) 따라서 이 보고서에서도 테스트베드센터의 자료를 토대로 로보어드바이저의 시장규모를 살펴보았다.

가. 전체 시장규모

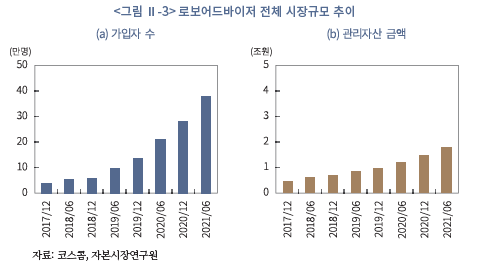

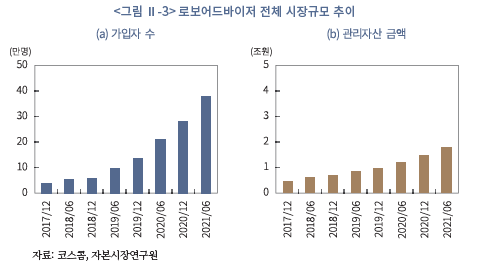

로보어드바이저 시장규모는 테스트베드센터의 집계에 따르면 2021년 6월말 가입자 수 기준 37만 9,477명, 관리자산 금액 기준 1조 7,584억원으로 절대적 규모 측면에서 크지 않다. 그러나 <그림 Ⅱ-3>에서 살펴볼 수 있듯이 그 동안 시장규모는 가파르게 증가하였다. 2017년 12월 대비 가입자 수가 약 10배, 관리자산 금액이 약 4배 증가하였고, 전년 동월 대비 가입자 수는 81.7%, 관리자산 금액은 46.9% 증가하였다.

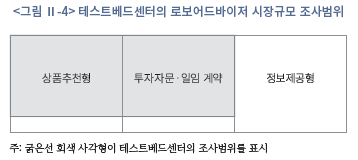

한편 로보어드바이저를 앞서 논의한 것처럼 폭넓게 정의할 경우 로보어드바이저 시장규모는 상품추천형, 투자자문ㆍ일임형, 정보제공형 로보어드바이저를 모두 포괄해야 정확하게 측정될 수 있다. 그런데 테스트베드센터가 발표하는 시장규모 자료에는 우선 정보제공형 로보어드바이저가 포함되어 있지 않다. 뿐만 아니라 상품추천형과 투자자문ㆍ일임형 로보어드바이저의 경우에도 일부만 집계되고 있다. 따라서 <그림 Ⅱ-4>에서 살펴볼 수 있듯이 로보어드바이저 시장규모를 테스트베드센터의 자료로 설명하기에는 한계가 있다.

이를 감안해 KEB하나은행(2018)은 2018년에 로보어드바이저 시장규모를 1조원으로 추산했으며, 2020년에 5조원, 2025년에 30조원까지 성장할 것으로 전망하였다. 유진투자증권(2016. 6. 8)도 이와 유사하게 2021년에 6조원, 2025년에 46조원까지 시장규모가 커질 것으로 전망한 바 있다. 물론 이러한 전망치가 정확한 것은 아니다. 특히 유진투자증권의 시장규모 전망치는 국내에 로보어드바이저가 출시되기 이전에 추정된 것으로 그 근거도 빈약하다. 그럼에도 불구하고 두 전망치는 실제 로보어드바이저 시장규모가 테스트베드센터의 발표 수치보다 더 클 수 있다는 것을 확인해 준다.

나. 유형별 시장규모

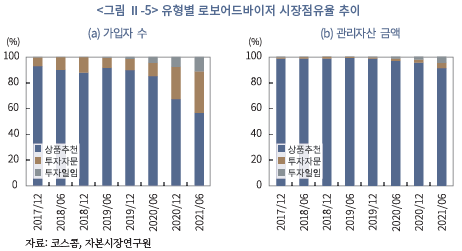

로보어드바이저 유형별 시장규모를 테스트베드센터가 발표한 자료를 토대로 살펴보면, 상품추천형 로보어드바이저의 비중이 여전히 높은 것으로 파악된다. 2021년 6월말 상품추천형 로보어드바이저의 시장점유율이 누적 가입자 수 기준으로 56.6%, 관리자산 금액 기준으로 90.9%에 달한다. 투자자문형과 투자일임형의 경우 가입자 수 기준으로 각각 32.2%와 11.2%, 관리자산 금액 기준으로 각각 4.1%와 5.0%로 계산된다.

그러나 <그림 Ⅱ-5>에서 살펴볼 수 있듯이 코로나19 팬데믹이 진행된 2020년 이후부터 투자자문형과 투자일임형 로보어드바이저가 약진하였다. 그 결과, 2021년 6월말 상품추천형의 시장점유율이 전년 동월 대비 가입자 수 기준으로 28.4%p, 관리자산 금액 기준으로 5.8%p 감소하였다. 반면에 투자자문형과 투자일임형의 경우 가입자 수 기준으로 각각 21.9%p와 6.5%p, 관리자산 금액 기준으로 각각 2.3%p와 3.5%p 증가하였다.

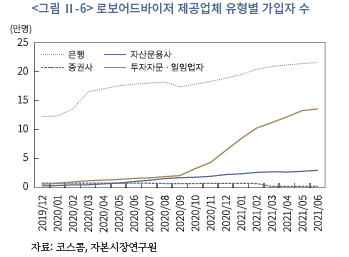

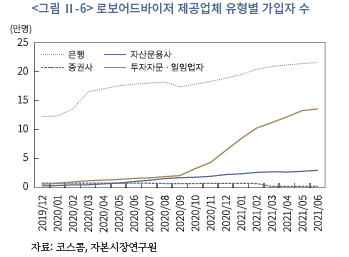

2020년 중반부터 투자자문형과 투자일임형 로보어드바이저의 가입자 수가 눈에 띄게 증가한 이유는 두 가지로 설명될 수 있다. 먼저 코로나19 팬데믹에 대한 각국의 대응조치로 시중 유동성이 급증하면서 국내외 주가가 견조한 상승세를 보였고 개인의 투자 참여가 이전보다 크게 증가했기 때문이다. 또한 이들 로보어드바이저가 상대적으로 서비스 접근성이 좋은 전용 플랫폼을 제공하였기 때문이라는 평가도 있다. <그림 Ⅱ-6>에서 살펴볼 수 있듯이 실제 전용 플랫폼을 제공하는 자산운용사(전문사모집합투자업자)를 포함해 투자자문ㆍ일임업자의 가입자 수가 2020년 하반기부터 눈에 띄게 빠른 속도로 증가한것을 확인할 수 있다.

한편 2020년 중반부터 투자자문형과 투자일임형 로보어드바이저의 가입자 수가 크게 증가하였음에도 불구하고 상품추천형 로보어드바이저의 시장점유율은 관리자산 금액 기준으로 90.9%로 여전히 높은 수준을 유지하고 있다. 이는 연령이 낮은 금융소비자가 상대적으로 전용 플랫폼을 제공하는 로보어드바이저를 선호했기 때문일 수 있다. 지난해 이들 로보어드바이저에 20~30대 연령층의 가입자가 큰 폭으로 증가한 점이 이를 뒷받침한다.

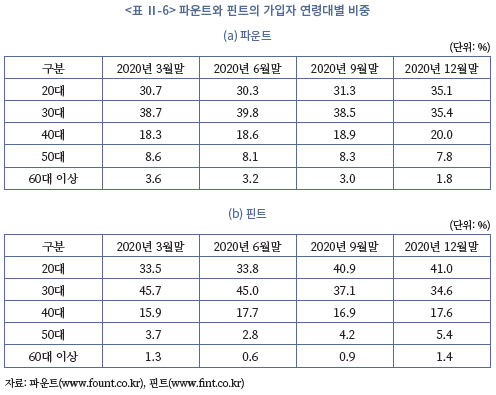

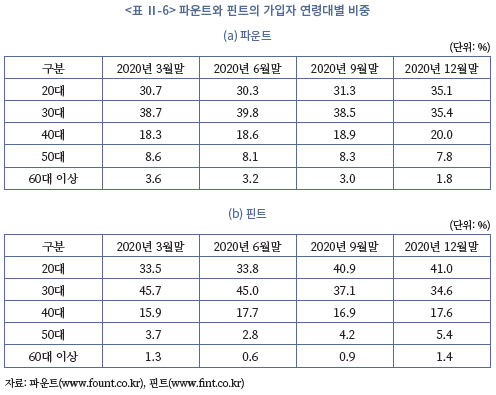

예를 들어, <표 Ⅱ-6>에서 살펴볼 수 있듯이 각각 투자자문형과 투자일임형 로보어드바이저를 대표하는 파운트(Fount)와 핀트(Fint)의 가입자 연령대를 살펴보면, 2020년 12월말 20~30대 가입자가 각각 70.5%와 75.6%를 차지하고 있고, 이 중 20대 가입자 비중이 2020년 3월말 대비 각각 4.4%p와 7.5%p 증가하였다.

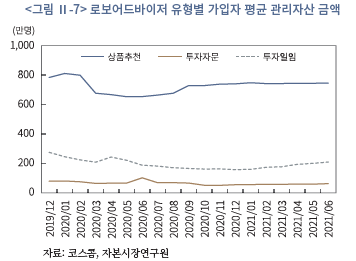

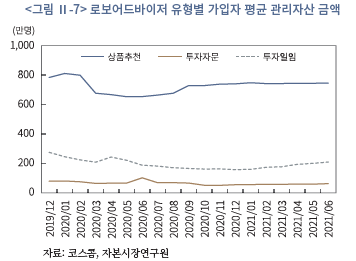

이에 따라 <그림 Ⅱ-7>에서 살펴볼 수 있듯이 투자자문형과 투자일임형 로보어드바이저의 가입자 평균 관리자산 금액도 2020년 12월말까지는 감소한 것으로 나타난다. 이를 자세히 살펴보면, 2020년 12월말 투자자문형 로보어드바이저의 가입자 평균 관리자산 금액은 51만 3천원으로 전년 동월 대비 23만 6천원, 투자일임형의 경우 154만 6천원으로 전년 동월 대비 117만 3천원 감소한 것을 확인할 수 있다.

한편 2021년 1월부터 이들 로보어드바이저의 가입자 평균 관리자산 금액이 소폭 상승하는 양상을 보이고 있다. 특히 투자일임형의 경우 그 상승세가 더 두드러져 보인다. 이를 자세히 살펴보면, 2021년 6월말 투자자문형의 가입자 평균 관리자산 금액은 2020년 12월말 대비 7만 6천원 증가한 것에 비해 투자일임형의 경우 51만 3천원 증가하였다. 상품추천형의 경우에는 4만 9천원 증가하였다.

Ⅲ. 국내 로보어드바이저 성과

1. 연구 동기와 데이터

가. 연구 동기

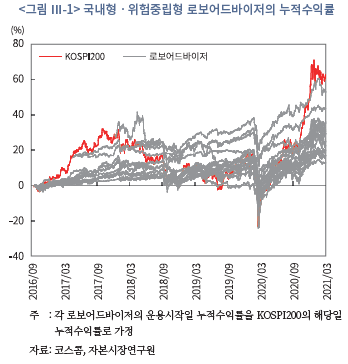

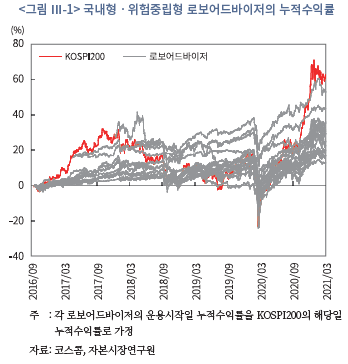

2016년 9월 전후로 로보어드바이저가 국내에 처음 소개된 후 언론 등에서는 수익률에 초점을 맞춰 로보어드바이저를 평가하는 경향을 보여왔다. 이 때문에 로보어드바이저는 수익률이 사람보다 못하거나 시장수익률을 따라가지 못한다는 비판을 줄곧 받아왔다. 실제 로보어드바이저 테스트베드의 심사를 통과하고 상용화된 국내형ㆍ위험중립형 로보어드바이저의 누적수익률을 살펴보면 <그림 Ⅲ-1>에 나타난 바와 같이 2018년 하반기까지만 해도 일부를 제외한 대부분의 로보어드바이저의 누적수익률이 KOSPI200의 누적수익률을 하회하고 있다는 것을 확인할 수 있다.

물론 이후 일부 로보어드바이저의 누적수익률이 KOSPI200의 누적수익률을 상회하는 모습을 보이자 로보어드바이저에 대한 우호적인 평가가 나오기 시작하였고, 2020년 코로나19 팬데믹 직후 주식시장이 빠른 하락에 이어 빠른 상승세를 보이면서 로보어드바이저의 절대 수익률도 상승하였다. 이에 따라 이전보다 로보어드바이저를 긍정적으로 평가하는 사례도 늘었다. 그럼에도 불구하고 대부분의 로보어드바이저가 KOSPI200의 누적수익률을 충분하게 따라잡지 못하는 양상은 크게 달라지지 않았다.

이처럼 로보어드바이저의 성과를 수익률로만 평가한다면 그간의 로보어드바이저에 대한 평가가 크게 틀리지 않을 수 있다. 그러나 로보어드바이저의 성과를 수익률로 평가하는 것은 로보어드바이저의 본질적 역할을 고려하지 않는 것과 같다. 로보어드바이저의 수익률이 단기적으로 높다고 해서 로보어드바이저의 자산관리 역량이 우수하고, 그렇지 않다고 해서 저조하다고 평가할 수 없기 때문이다.

또한 로보어드바이저의 성과가 수익률로만 평가될 경우 개인의 로보어드바이저 선택에 부정적 영향을 미칠 수 있다. 수익률이 높은 로보어드바이저가 좋게 평가된다면 주식시장이 상승장일 경우 고위험-고수익 원칙에 따라 원금손실의 위험이 큰 로보어드바이저가 좋게 평가될 수밖에 없다. 또한 개인의 투자성향에 따라 자신에게 적합한 포트폴리오를 추천하는 로보어드바이저를 선택하는 것이 바람직한데, 상대적으로 수익률이 높은 로보어드바이저만을 선택하도록 잘못 유도할 수도 있다.

따라서 로보어드바이저의 성과는 로보어드바이저가 자신의 본질적 역할을 얼마나 잘 수행하는가로 평가되는 것이 바람직하다. 로보어드바이저의 본질적 역할은 장기적 관점에서 금융자산을 효율적으로 관리하는 데 있다. 이를 위해 로보어드바이저는 고객의 투자성향과 투자목적에 적합하게 금융자산을 적절하게 분산투자되도록 구성하여 추천하고, 시장 상황에 맞게 금융자산을 재구성 또는 리밸런싱하며, 궁극적으로 고객의 자산관리 수익을 높이고 위험을 낮춤으로써 고객의 금융자산을 효율적으로 관리할 수 있어야 한다.

한편 로보어드바이저의 성과를 본질적 역할에 맞게 평가하려면 자산관리 성과와 고객유치 성과를 구분하는 것이 필요하다. 전자는 개별 로보어드바이저의 자산관리 역량을 가늠할 수 있는 성과이고, 후자는 로보어드바이저 중 개별 로보어드바이저에 대한 수요를 측정할 수 있는 성과라는 점에서 다르다. 또한 자산관리 성과와 고객유치 성과는 높은 상관관계를 가질 수 있으나, 로보어드바이저가 비대면 채널을 통해 제공되는 자동화된 자산관리 서비스라는 점에서 자산관리 성과가 양호하다고 해서 반드시 고객유치 성과가 양호한 것은 아닐 수 있다.

상기의 논의를 바탕으로 이 보고서에서는 먼저 로보어드바이저의 자산관리 성과를 객관적으로 평가하기 위해 수식 (1)과 같이 Fama and French(1993)의 3요인 회귀분석 모형을 따라 로보어드바이저가 자산구성 또는 포트폴리오 선택(portfolio selection) 역량을 보유하고 있는지와 로보어드바이저가 적절하게 분산투자를 실시하는지 또는 시장수익률을 잘 추종하는지를 실증적으로 분석하였다.

여기서 종속변수  은 로보어드바이저

은 로보어드바이저  의 무위험수익률(

의 무위험수익률( ) 대비 초과수익률(

) 대비 초과수익률( )을, 설명변수

)을, 설명변수  은 시장지수의 무위험수익률 대비 초과수익률(

은 시장지수의 무위험수익률 대비 초과수익률( )을 나타낸다.

)을 나타낸다.  와

와  은 Fama and French(1993)를 따라 상장기업의 규모효과 (size effect)와 가치효과(value effect)를 통제하기 위해 사용하였다.

은 Fama and French(1993)를 따라 상장기업의 규모효과 (size effect)와 가치효과(value effect)를 통제하기 위해 사용하였다.

로보어드바이저가 자산구성 또는 포트폴리오 선택 역량을 보유하고 있다면 >0일 것이다.

>0일 것이다.  >0은 로보어드바이저가 시장요인으로 설명하지 못하는 비정상적(abnormal) 초과수익률을 실현할 수 있다는 것을 뜻한다. 로보어드바이저가 적절한 분산투자를 통해 시장수익률을 잘 따라간다면

>0은 로보어드바이저가 시장요인으로 설명하지 못하는 비정상적(abnormal) 초과수익률을 실현할 수 있다는 것을 뜻한다. 로보어드바이저가 적절한 분산투자를 통해 시장수익률을 잘 따라간다면  =1이게 된다. 이와 달리

=1이게 된다. 이와 달리  >1이면 시장보다 적극적 또는 공격적으로,

>1이면 시장보다 적극적 또는 공격적으로,  <1이면 시장보다 보수적 또는 안정적으로 고객의 자산을 운용한다고 해석할 수 있다.

<1이면 시장보다 보수적 또는 안정적으로 고객의 자산을 운용한다고 해석할 수 있다.

Puhle(2019)는 2015년 5월부터 2018년 12월까지 독일의 5개 로보어드바이저를 대상으로 개별 로보어드바이저의 자산관리 성과를 평가하기 위해 Sharpe(1964)의 자본자산 가격결정 모형(CAPM)으로 회귀분석을 실시하였다. 그 결과, 의 추정치가 모두 10% 유의수준에서조차 통계적으로 유의하지 않은 음(-)의 값을 보이고,

의 추정치가 모두 10% 유의수준에서조차 통계적으로 유의하지 않은 음(-)의 값을 보이고,  의 추정치는 거의 유사하게 0.5 내외의 유의한 값을 보인다는 것을 발견하였다. 그럼에도 불구하고 로보어드바이저 간에 자산관리 성과의 차이가 존재할 수 있다고 판단하고, 그 차이는 상장기업의 규모효과와 가치효과와 같은 시장요인이나 리밸런싱으로 설명될 수 있다고 제시하였다.

의 추정치는 거의 유사하게 0.5 내외의 유의한 값을 보인다는 것을 발견하였다. 그럼에도 불구하고 로보어드바이저 간에 자산관리 성과의 차이가 존재할 수 있다고 판단하고, 그 차이는 상장기업의 규모효과와 가치효과와 같은 시장요인이나 리밸런싱으로 설명될 수 있다고 제시하였다.

Tao et al.(2020)은 미국의 100개 로보어드바이저를 대상으로 로보어드바이저의 평균 적인 자산관리 성과를 평가하기 위해 Fama and French(1993)의 3요인 모형과 Cahart (1997)의 4요인 모형으로 회귀분석을 실시하였다. 그 결과, 로보어드바이저가 시장지수 일부와 뮤추얼 펀드(mutual fund)보다 평균적으로 높은 초과수익률을 보인다는 것을 발견하였다. 그러나 Tao et al.(2020)도 Puhle(2019)와 마찬가지로 로보어드바이저의 리밸런싱을 통제하지 않은 한계를 갖고 있다.

이를 고려해 이 보고서에서는 수식 (2)에서와 같이 Goetzmann et al.(2000)의 시장 타이밍(market timing) 모형에 기초하여 로보어드바이저의 리밸런싱 성과를 추가적으로 분석하였다(Bollen and Busse, 2001; 김상배ㆍ박종구, 2009).

여기서  는 리밸런싱 실시 여부를 표시하는 더미(dummy)이고,

는 리밸런싱 실시 여부를 표시하는 더미(dummy)이고,  은 Treynor and Mazuy(1966)를 따라 로보어드바이저의 시장 타이밍 능력을 대변하는 변수다. Goetzmann et al.(2000)과 다르게

은 Treynor and Mazuy(1966)를 따라 로보어드바이저의 시장 타이밍 능력을 대변하는 변수다. Goetzmann et al.(2000)과 다르게  를 사용한 이유는 로보어드바이저가 매 시점마다 리밸런싱을 실시하지 않는다는 점을 고려하기 위해서다.

를 사용한 이유는 로보어드바이저가 매 시점마다 리밸런싱을 실시하지 않는다는 점을 고려하기 위해서다.

시장 타이밍 전략은 시장이 상승장일 때 시장수익률에 민감한 종목의 편입 비중을 높이고, 반대로 시장이 하락장일 때 편입 비중을 낮추는 리밸런싱 전략이다. 따라서 >0이면 로보어드바이저의 리밸런싱 성과가 양호하고,

>0이면 로보어드바이저의 리밸런싱 성과가 양호하고,  ≤0이면 그렇지 않다고 해석할 수 있다. 한편 로보어드바이저의 실제 리밸런싱 전략이 시장 타이밍 전략과 다를 수 있다. 이 점을 고려하여 리밸런싱 통제변수로

≤0이면 그렇지 않다고 해석할 수 있다. 한편 로보어드바이저의 실제 리밸런싱 전략이 시장 타이밍 전략과 다를 수 있다. 이 점을 고려하여 리밸런싱 통제변수로  대신에 최근 10영업일 간의 리밸런싱 평균회수를 사용해 추가적으로 분석하였다.

대신에 최근 10영업일 간의 리밸런싱 평균회수를 사용해 추가적으로 분석하였다.

로보어드바이저의 자산관리 성과를 평가하는 데 있어 리밸런싱 성과를 고려하는 것은 두 가지 측면에서 매우 중요하다. 첫째, 로보어드바이저는 빅데이터 또는 인공지능 기술을 접목한 자동화된 알고리듬으로 더 체계적이고 시의적절하게 시장 상황에 대응한다고 평가되고 있다. 그렇다면 리밸런싱 성과에 따라 로보어드바이저의 자산관리 성과도 달라질 수 있다.

둘째, 리밸런싱 성과를 고려하지 않을 경우 로보어드바이저의 자산관리 성과 평가의 결과가 왜곡될 수 있다(Lee and Rahman, 1991). 예를 들어, Jensen(1968)은 시장 타이밍 능력이 존재함에도 이를 고려하지 않을 경우 의 추정치는 위로 편향되고,

의 추정치는 위로 편향되고,  의 추정치는 아래로 편향될 수 있다고 지적하였다. Grant(1977)는

의 추정치는 아래로 편향될 수 있다고 지적하였다. Grant(1977)는  의 추정치가 아래로 편향될 수 있다는 것을 보였다.

의 추정치가 아래로 편향될 수 있다는 것을 보였다.

이 보고서에서는 로보어드바이저의 자산관리 성과가 고객유치 성과로 이어지는지를 살펴보기 위해 로보어드바이저 중 어떤 로보어드바이저가 더 선호되는가를 분석하였다. 예를 들어, 자산관리 성과가 양호한 로보어드바이저일수록 더 선호될 수 있다. 또는 서비스 제공업체, 서비스 접근성이나 편리성, 최소 가입금액, 서비스 비용 등과 같은 개별 로보어드바이저의 특성에 따라 로보어드바이저가 선호될 수 있다.

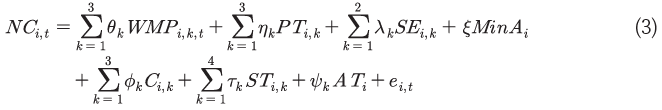

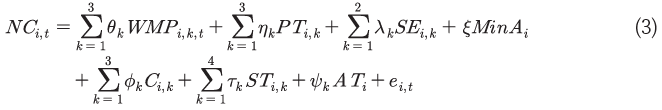

이를 따라 로보어드바이저의 고객유치 성과를 평가하기 위해 수식 (3)과 같이 회귀분석 모형을 설정하였다.

여기서 종속변수  는 로보어드바이저

는 로보어드바이저  의 가입자 수, 설명변수

의 가입자 수, 설명변수  는 자산관리 성과 지표로 연환산 수익률(annualized returns), 샤프지수(Sharpe ratio), 표준편차를 사용하였다.9)

는 자산관리 성과 지표로 연환산 수익률(annualized returns), 샤프지수(Sharpe ratio), 표준편차를 사용하였다.9)  는 은행, 증권사, 투자자문ㆍ일임업자로 구분되는 서비스 제공업제 유형,

는 은행, 증권사, 투자자문ㆍ일임업자로 구분되는 서비스 제공업제 유형,  는 각각 PC 환경과 모바일 환경에서의 서비스 접근성,

는 각각 PC 환경과 모바일 환경에서의 서비스 접근성,  는 최소 가입금액,

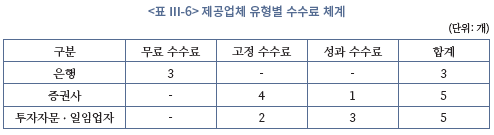

는 최소 가입금액,  는 무료, 고정, 성과로 구분되는 수수료 부과체계 유형,

는 무료, 고정, 성과로 구분되는 수수료 부과체계 유형,  는 상품추천형, 투자자문형, 투자일임형, 투자자문과 투자일임 서비스를 동시에 제공하는 투자자문ㆍ일임형으로 구분되는 서비스 유형,

는 상품추천형, 투자자문형, 투자일임형, 투자자문과 투자일임 서비스를 동시에 제공하는 투자자문ㆍ일임형으로 구분되는 서비스 유형,  은 관리자산 유형을 국내형과 해외형으로 구분하는 더미변수로 로보어드바이저

은 관리자산 유형을 국내형과 해외형으로 구분하는 더미변수로 로보어드바이저  의 개별 특성을 통제하기 위해 사용하였다.

의 개별 특성을 통제하기 위해 사용하였다.

나. 데이터

이 보고서에서는 기본적으로 코스콤의 로보어드바이저 테스트베드센터로부터 직접제공받은 로보어드바이저의 운용 및 실적 데이터를 사용하였다. 이 데이터에는 2016년 10월 18일부터 2021년 3월 31일까지 로보어드바이저의 일별 수익률, 자산위험도, 구성종목 수, 종목 편중률, 매매 회전율, 투자자 유형 등에 대한 정보가 포함되어 있다. 또한 주별 젠센알파, 베타, 표준편차, 샤프지수, 정보비율, 추적오차, 보상비율 등과 같은 성과 또는 위험지표도 포함되어 있다. 그리고 로보어드바이저의 월별 가입자 수, 관리자산 금액이 포함되어 있다.

로보어드바이저의 자산관리 성과를 분석하기 위한 수식 (1)과 (2)에 따른 회귀분석 모형에서 무위험수익률( )은 한국은행의 경제통계시스템에서 제공하는 국고채 3년물의 일별 수익률을, 로보어드바이저의 수익률(

)은 한국은행의 경제통계시스템에서 제공하는 국고채 3년물의 일별 수익률을, 로보어드바이저의 수익률( )은 테스트베드센터에서 공시하는 일별 기준가로 계산한 값을, 시장수익률(

)은 테스트베드센터에서 공시하는 일별 기준가로 계산한 값을, 시장수익률( )은 KOSPI지수와 KOSDAQ지수의 일별 수익률을 각각의 시가총액으로 가중평균한 값을, 시장요인을 통제하기 위한 상장기업의 규모효과(

)은 KOSPI지수와 KOSDAQ지수의 일별 수익률을 각각의 시가총액으로 가중평균한 값을, 시장요인을 통제하기 위한 상장기업의 규모효과( )와 가치효과(

)와 가치효과( )는 FnGuide가 제공하는 값을 사용하였다.10)

)는 FnGuide가 제공하는 값을 사용하였다.10)

로보어드바이저의 고객유치 성과를 분석하기 위한 수식 (3)에 따른 회귀분석 모형에서 로보어드바이저의 누적 가입자 수( ), 자산관리 성과 지표(

), 자산관리 성과 지표( )는 테스트베드센터가 제공한 데이터를 사용하였다. 참고로 가입자 수(

)는 테스트베드센터가 제공한 데이터를 사용하였다. 참고로 가입자 수( )가 매월 말 기준으로 집계되는 점을 고려하여 자산관리 성과 지표는 주별 지표의 월중 평균 값을 사용하였다. 또한 가입자 수(

)가 매월 말 기준으로 집계되는 점을 고려하여 자산관리 성과 지표는 주별 지표의 월중 평균 값을 사용하였다. 또한 가입자 수( )는 천명 단위로 환산하여 사용하였다.

)는 천명 단위로 환산하여 사용하였다.

또한 로보어드바이저의 최소 가입금액( ), 서비스 비용(

), 서비스 비용( ), 제공업체 유형(

), 제공업체 유형( ), 서비스 유형(

), 서비스 유형( ) 등 개별 특성 변수는 로보어드바이저 제공업체가 테스트베드센터에 제출한 알고리듬 설명서와 자체 조사한 자료에서 추출하였다.11) 마지막으로 로보어드바이저의 서비스 접근성(

) 등 개별 특성 변수는 로보어드바이저 제공업체가 테스트베드센터에 제출한 알고리듬 설명서와 자체 조사한 자료에서 추출하였다.11) 마지막으로 로보어드바이저의 서비스 접근성( )은 서비스 접근 채널을 PC 웹사이트와 모바일 앱으로 구분하고 일정 기준에 따라 각각의 서비스 접근성을 측정한 값을 사용하였다.12)

)은 서비스 접근 채널을 PC 웹사이트와 모바일 앱으로 구분하고 일정 기준에 따라 각각의 서비스 접근성을 측정한 값을 사용하였다.12)

한편 제Ⅱ장에서 살펴본 바와 같이 2021년 3월말 기준으로 서비스 중인 모든 로보어드바이저 제공업체가 테스트베드센터에 자신의 로보어드바이저 운용 및 실적 데이터를 제출하는 것은 아니다. 예를 들어, 2021년 3월말 기준으로 펀드 로보어드바이저를 제공하고 있는 10개 은행 중 6개 은행만이 테스트베드센터의 심사에 참가하였고, 이 중 4개 은행만이 로보어드바이저 데이터를 제출하고 있다.13)14) 또한 투자자문형 로보어드바이저 중 에임(AIM) 등 일부 로보어드바이저는 테스트베드센터에 데이터를 제출하지 않고 있다.15) 따라서 테스트베드센터가 제공한 데이터에는 2021년 3월말 기준으로 서비스 중인 모든 로보어드바이저의 데이터가 포함되어 있는 것은 아니다.

이 때문에 테스트베드센터가 제공한 데이터에 기초하여 로보어드바이저의 성과를 분석할 경우 일부 로보어드바이저가 분석대상에 포함되지 않으므로써 발생할 수 있는 샘플 편향(sample bias)의 문제가 존재할 수 있다. 그러나 자산관리 성과의 경우 개별 로보어드바이저를 대상으로 분석하기 때문에 일부 로보어드바이저가 분석대상에 포함되지 않았다고 해서 분석 결과에 영향을 미치지 않는다. 또한 고객유치 성과의 경우 분석대상에서 제외된 로보어드바이저의 가입자 수가 전체 가입자 수에서 차지하는 비중이 높지 않고 분석대상에 포함된 로보어드바이저의 유형도 충분히 다양하기 때문에 분석 결과가 편향되지 않을 것으로 판단된다.

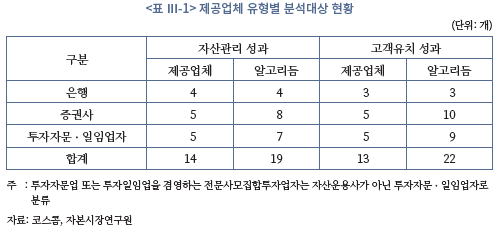

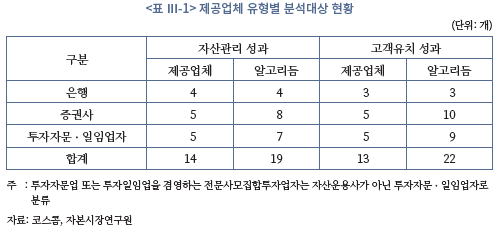

따라서 로보어드바이저의 성과 분석대상은 2021년 3월말 현재 서비스를 제공하면서 2020년 이전부터 테스트베드센터에 로보어드바이저 데이터를 제출하는 경우로 한정하였다. 또한 자산관리 성과 분석대상에서 해외 자산으로 운용되는 해외형 로보어드바이저도 제외하였다.16) 이에 따라 <표 Ⅲ-1>에 나타난 바와 같이 자산관리 성과의 분석대상은 제공업체 기준으로 14개, 알고리듬 기준으로 19개로, 고객유치 성과의 분석대상은 제공업체 기준으로 13개, 알고리듬 기준으로 22개로 추려진다.

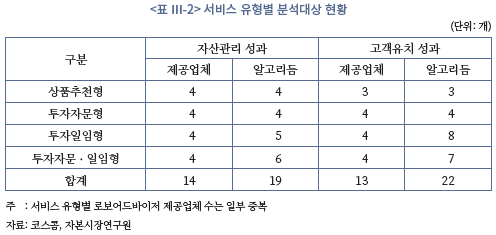

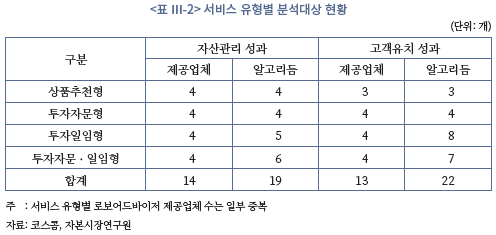

로보어드바이저의 성과 분석대상을 서비스 유형별로 구분하여 살펴보면, <표 Ⅲ-2>에 나타난 바와 같이 자산관리 성과의 분석대상의 경우 알고리듬 기준으로 상품추천형이 4개, 투자자문 서비스만을 제공하는 투자자문형이 4개, 투자일임 서비스만을 제공하는 투자일임형이 5개, 투자자문과 투자일임 서비스를 모두 제공하는 투자자문ㆍ일임형이 9개로, 고객유치 성과의 분석대상은 각각 3개, 4개, 8개, 7개로 추려진다.

로보어드바이저의 성과 분석대상을 앞서 살펴본 바와 같이 확정함에 따라 자산관리 성과 분석의 경우 2016년 10월 18일부터 2021년 3월 31일까지의 일별 데이터를 사용하였다. 결과적으로 분석대상에 포함된 로보어드바이저 알고리듬에 따라 최소 530일, 최대 1,097일의 일별 데이터가 자산관리 성과 분석에 사용되었다.

고객유치 성과 분석의 경우 2019년 5월에 제공업체 유형 간에 제도적 차별이 대폭 완화된 점을 고려하여 2019년 6월부터 2021년 3월까지의 월별 데이터를 사용하였다(금융위원회, 2019. 5. 15). 결과적으로 분석대상에 포함된 로보어드바이저 알고리듬에 따라 최소 16개월, 최대 22개월의 월별 데이터가 고객유치 성과 분석에 사용되었다.

2. 자산관리 성과

가. 성과ㆍ위험지표 비교

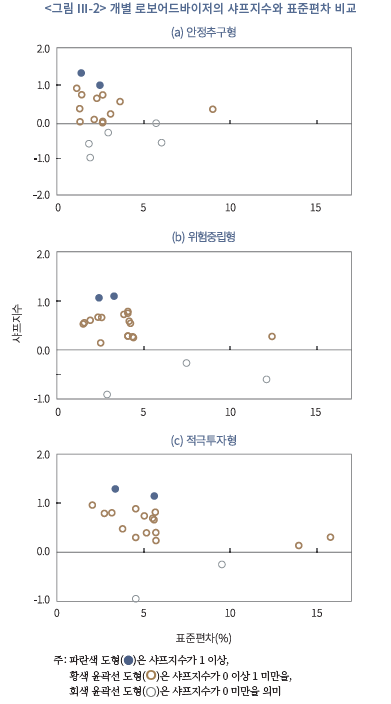

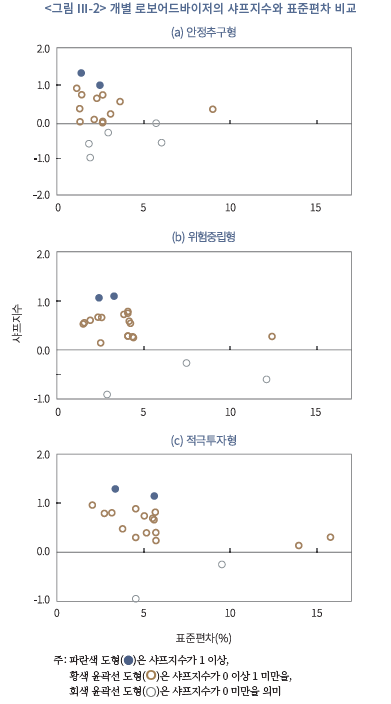

개별 로보어드바이저를 대상으로 자산관리 성과를 실증 분석하고 비교하기에 앞서 개별 로보어드바이저의 샤프지수(Sharpe ratio)와 수익률 표준편차를 투자자 유형으로 구분하여 비교해보았다.17) 그 결과, 로보어드바이저의 위험 대비 자산관리 성과의 차이가 뚜렷하고 안전자산과 위험자산을 구성하는 포트폴리오 선택 역량에도 차이가 있어 보인다.18)19)

예를 들어, 안정추구형 로보어드바이저의 경우를 살펴보면 수익률 표준편차가 동일한 로보어드바이저 간에도 샤프지수 차이가 뚜렷하게 관찰된다. 이러한 양상은 위험중립형과 적극투자형 로보어드바이저에서도 비슷하게 관찰된다. 더구나 대부분의 로보어드바이저는 투자자 유형과 관계없이 샤프지수가 1보다 작고, 샤프지수가 음(-)의 값을 보이는 로보어드바이저도 보인다.

수익률 표준편차도 동일 투자자 유형 내에서조차 큰 차이를 보인다. 특히 일부 로보어드바이저의 수익률 표준편차는 다른 로보어드바이저와 큰 격차를 보인다. 더구나 수익률 표준편차가 위험중립형보다 작은 적극투자형과 안정추구형보다 작은 위험중립형 로보어드바이저가 상당 수 관찰된다. 또한 수익률 표준편차의 절대적 값이 크지 않은 점도 눈에 띈다. 이는 안전자산의 비중이 크기 때문일 수 있고, 분산투자가 잘 이루어지지 않았기 때문일 것으로 판단된다.

나. 회귀분석 결과 비교

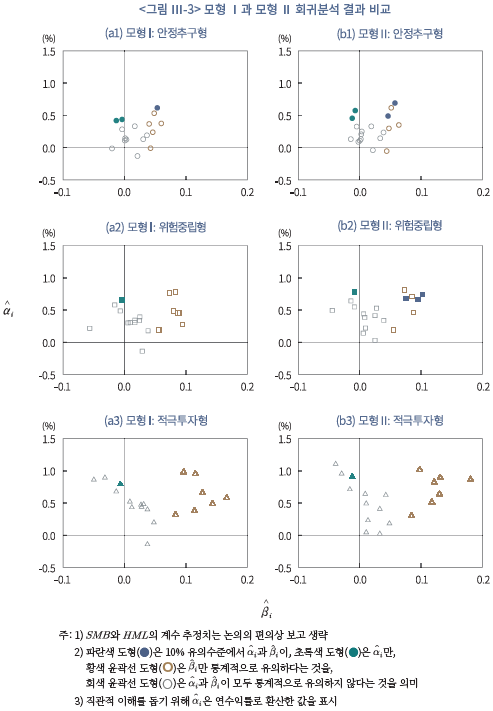

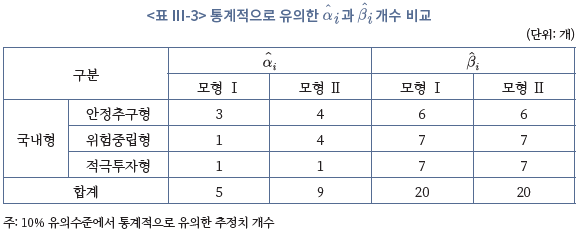

개별 로보어드바이저를 대상으로 리밸런싱 성과를 고려하지 않은 수식 (1)(이하 모형 Ⅰ)과 리밸런싱 성과를 고려한 수식 (2)(이하 모형 Ⅱ)에 대해 각각 최소자승법(OLS)으로 회귀분석을 실시하였다.20) 그 결과, <그림 Ⅲ-3>에서 살펴볼 수 있듯이 포트폴리오 선택 역량을 나타내는 와 시장수익률 추종 정도를 나타내는

와 시장수익률 추종 정도를 나타내는  의 추정치가 두 모형 간에 약간의 차이를 보이고, 통계적 유의성도 다소 다르게 추정되었다는 것이 확인된다.21)

의 추정치가 두 모형 간에 약간의 차이를 보이고, 통계적 유의성도 다소 다르게 추정되었다는 것이 확인된다.21)

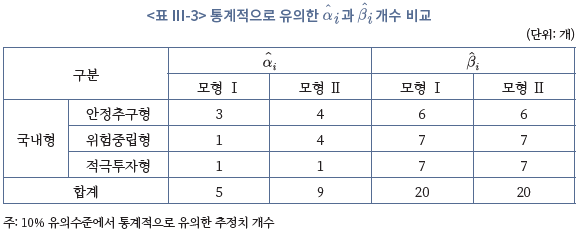

이를 자세히 살펴보면, <표 Ⅲ-3>에 나타난 바와 같이 10% 유의수준에서 통계적으로 유의한 은 57개 중 5개에서 9개로 증가하였고,

은 57개 중 5개에서 9개로 증가하였고,  은 20개로 동일하다. 특히 모형 Ⅱ에서 안정추구형 1개, 위험중립형 3개와 적극투자형 1개에서 새롭게

은 20개로 동일하다. 특히 모형 Ⅱ에서 안정추구형 1개, 위험중립형 3개와 적극투자형 1개에서 새롭게  이 통계적으로 유의하게 추정되었다. 한편 로보어드바이저 제공업체 기준으로 통계적으로 유의한

이 통계적으로 유의하게 추정되었다. 한편 로보어드바이저 제공업체 기준으로 통계적으로 유의한  을 보유한 제공업체는 14개 중 3개에서 5개로 증가했고, 통계적으로 유의한

을 보유한 제공업체는 14개 중 3개에서 5개로 증가했고, 통계적으로 유의한  을 보유한 제공업체는 6개로 동일하다.

을 보유한 제공업체는 6개로 동일하다.

로보어드바이저의 리밸런싱 성과를 나타내는  의 추정치를 살펴보면, 10% 유의수준에서 통계적으로 유의한

의 추정치를 살펴보면, 10% 유의수준에서 통계적으로 유의한  은 57개 중 23개이며, 이 중 5개만 양(+)의 값을 보이고 나머지 18개는 음(-)의 값을 보이는 것으로 나타난다. 이는 당초 기대와 달리 리밸런싱 성과가 양호한 로보어드바이저가 많지 않다는 점을 시사한다.

은 57개 중 23개이며, 이 중 5개만 양(+)의 값을 보이고 나머지 18개는 음(-)의 값을 보이는 것으로 나타난다. 이는 당초 기대와 달리 리밸런싱 성과가 양호한 로보어드바이저가 많지 않다는 점을 시사한다.

로보어드바이저의 실제 리밸런싱 전략이 Treynor and Mazuy(1966)가 제시한 시장 타이밍 전략과 다를 수 있다. 이러한 가능성을 고려하여 시장 타이밍 능력을 통제하는 설명변수 대신에 영업일 기준 최근 10일을 구간으로 이동평균한 리밸런싱 회수를 사용하여 회귀분석을 실시해보았다. 그 결과, 10% 유의수준에서 통계적으로 유의한 이 4개에 불과하고, 그 값도 거의 영(0)의 값에 가깝게 추정된다. 이는 로보어드바이저의 실제 리밸런싱 전략이 시장 타이밍 전략과 다르더라도 리밸런싱 성과가 유의미하지 않다는 것을 보여준다.

이 4개에 불과하고, 그 값도 거의 영(0)의 값에 가깝게 추정된다. 이는 로보어드바이저의 실제 리밸런싱 전략이 시장 타이밍 전략과 다르더라도 리밸런싱 성과가 유의미하지 않다는 것을 보여준다.

상기 회귀분석 결과에 따르면 Jensen(1968)과 Grant(1977)가 지적한 것처럼 리밸런싱 성과를 고려하지 않고 로보어드바이저의 자산관리 성과를 분석할 경우 와

와  의 추정치가 편향될 수 있다는 것을 확인할 수 있다. 이 점을 고려하여 이후의 논의에서는 리밸런싱 성과를 고려한 모형 Ⅱ의 회귀분석 결과를 토대로 로보어드바이저의 자산관리 성과를 평가하고 비교하였다.

의 추정치가 편향될 수 있다는 것을 확인할 수 있다. 이 점을 고려하여 이후의 논의에서는 리밸런싱 성과를 고려한 모형 Ⅱ의 회귀분석 결과를 토대로 로보어드바이저의 자산관리 성과를 평가하고 비교하였다.

다. 서비스 유형별 비교

상기의 회귀분석 결과를 서비스 유형으로 구분하여 비교해보면 다음과 같다. 우선 <그림 Ⅲ-4>에서 살펴볼 수 있듯이 국내형 로보어드바이저 중 상품추천형, 투자자문형, 투자자문ㆍ일임형의 경우 일부가 포트폴리오 선택 역량을 보유한 것으로 보이나, 투자일임형의 경우 모두가 그렇지 않은 것으로 나타난다. 이는 서비스 유형 간뿐만 아니라 동일 서비스 유형 내에서도 포트폴리오 선택 역량의 차이가 존재한다는 점을 확인시켜준다.

한편 통계적으로 유의한  을 보유한 국내형 로보어드바이저의 포트폴리오 선택 역량은 서비스 유형 간에 그 차이가 크지 않는 것으로 보인다. 이를 자세히 살펴보면,

을 보유한 국내형 로보어드바이저의 포트폴리오 선택 역량은 서비스 유형 간에 그 차이가 크지 않는 것으로 보인다. 이를 자세히 살펴보면,  이 통계적으로 유의해 포트폴리오 선택 역량을 보유한 것으로 보이는 안정추구형의 경우 4.48~5.91%, 위험중립형의 경우 6.46~7.62%, 적극투자형의 경우 9.21%의 비정상적 초과수익률을 실현할 수 있는 것으로 나타난다.

이 통계적으로 유의해 포트폴리오 선택 역량을 보유한 것으로 보이는 안정추구형의 경우 4.48~5.91%, 위험중립형의 경우 6.46~7.62%, 적극투자형의 경우 9.21%의 비정상적 초과수익률을 실현할 수 있는 것으로 나타난다.

그러나 투자일임형 1개를 제외하고 모든 투자자 유형에서 비정상적 초과수익률을 실현할 수 있는 로보어드바이저는 없는 것으로 나타난다. 이에 대한 명확한 이유는 알 수 없으나, 로보어드바이저 간에 위험자산 선택 역량에 차이가 존재하고 포트폴리오 선택 역량도 위험자산 선택 역량에 의해 영향을 받기 때문으로 판단된다.

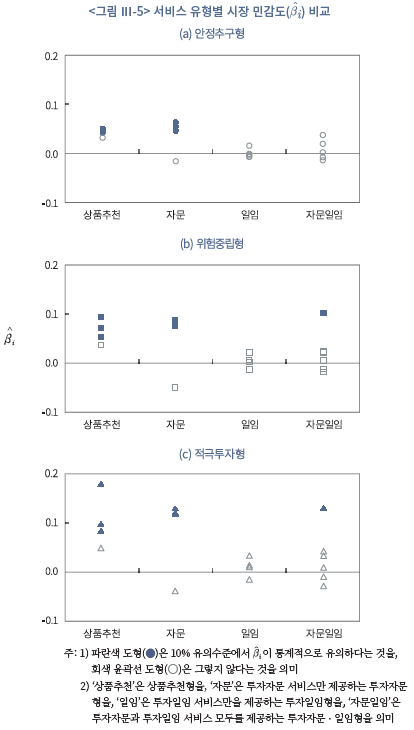

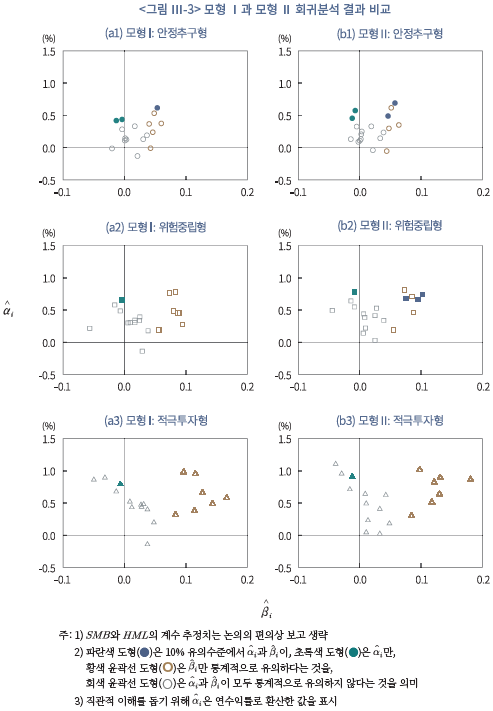

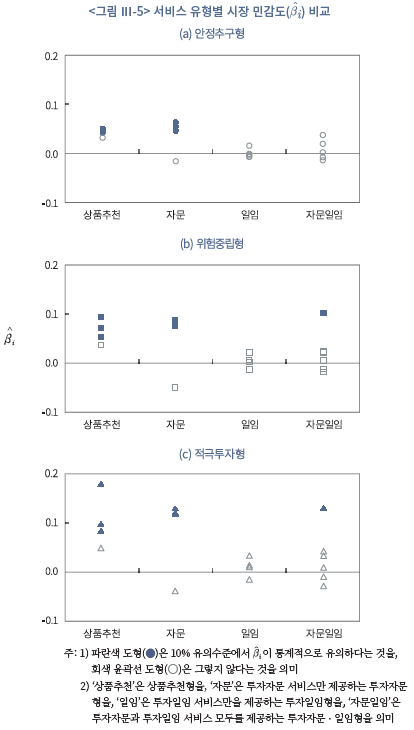

개별 로보어드바이저가 시장수익률을 추종하는 정도를 파악할 수 있는 시장 민감도를 서비스 유형별로 살펴보면, <그림 Ⅲ-5>에 나타난 바와 같이 상품추천형과 투자자문형의 경우 시장 민감도가 대체적으로 통계적으로 유의하게 추정되고, 투자일임형과 투자자문ㆍ일임형의 경우 그렇지 못한 것으로 보인다.

그러나 로보어드바이저의 시장 민감도는 서비스 유형과 상관 없이 매우 낮게 추정되었다. 이 통계적으로 유의한 로보어드바이저만을 놓고 살펴보면

이 통계적으로 유의한 로보어드바이저만을 놓고 살펴보면  이 0.2를 초과하는 로보어드바이저는 발견되지 않는다. 다만 동일 서비스 유형 내에서는 안정추구형, 위험중립형, 적극투자형 순으로 시장수익률 추종 정도의 차이가 상대적으로 커지는 것으로 파악된다.

이 0.2를 초과하는 로보어드바이저는 발견되지 않는다. 다만 동일 서비스 유형 내에서는 안정추구형, 위험중립형, 적극투자형 순으로 시장수익률 추종 정도의 차이가 상대적으로 커지는 것으로 파악된다.

로보어드바이저의 시장 민감도가 낮게 추정된 것은 포트폴리오를 구성하는 데 있어 효율적으로 분산투자를 하지 못하거나 분산투자에 제약이 있기 때문일 수 있다. 또한 로보어드바이저 간에 안전자산을 과도한 비중으로 보유하거나 위험자산을 선택하는 역량이 부족할 경우 시장 민감도가 낮을 수 있다. 한편 로보어드바이저마다 자산배분이나 자산관리 전략이 다를 수 있기 때문에 로보어드바이저가 시장수익률을 잘 추종한다고 해서자산관리 성과가 양호하다고 평가할 수는 없다.

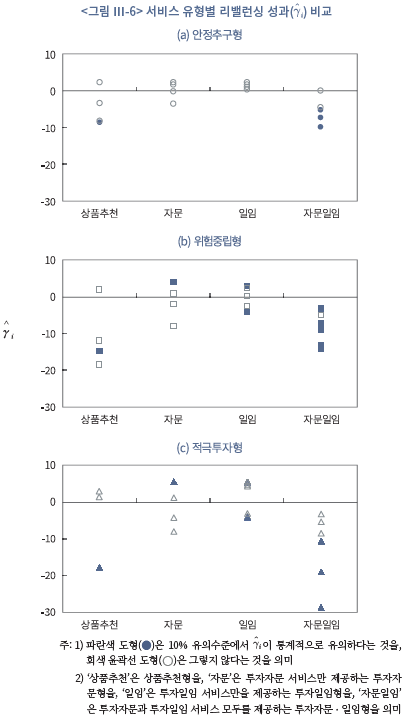

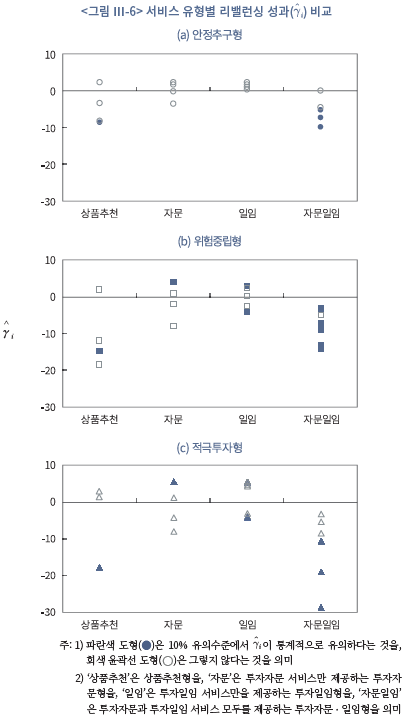

개별 로보어드바이저의 리밸런싱 성과를 서비스 유형별로 살펴보면, <그림 Ⅲ-6>에 나타난 바와 같이 투자자문형과 투자일임형 로보어드바이저 일부를 제외한 나머지는  이 10% 유의수준에서 통계적으로 유의하지 않거나 통계적으로 유의하더라도 음(-)의 값을 보인다. 상품추천형과 투자자문ㆍ일임형의 경우 예외 없이

이 10% 유의수준에서 통계적으로 유의하지 않거나 통계적으로 유의하더라도 음(-)의 값을 보인다. 상품추천형과 투자자문ㆍ일임형의 경우 예외 없이  이 10% 유의수준에서 통계적으로 유의하지 않거나 통계적으로 유의하더라도 음(-)의 값을 보인다.

이 10% 유의수준에서 통계적으로 유의하지 않거나 통계적으로 유의하더라도 음(-)의 값을 보인다.

동일 서비스 유형 내에서 로보어드바이저 간의 리밸런싱 성과를 비교해보면, 안정추구형, 위험중립형, 적극투자형 순으로 리밸런싱 성과의 차이가 상대적으로 더 크다. 또한 그 차이의 정도는 투자자문ㆍ일임형이 가장 크고, 투자일임형, 투자자문형, 상품추천형 순으로 커진다. 이는 동일 서비스 유형 내에서 로보어드바이저 간에 시장 민감도의 차이 양상과 크게 다르지 않다.

한편 10% 유의수준에서 통계적으로 유의하게 양(+)의 값을 보이는 로보어드바이저의 은 작게는 1.26, 크게는 5.64로 추정되었다. 이는 시장수익률이 1%p 변동할 때 로보어드바이저가 리밸런싱을 통해 작게는 1.26bp, 크게는 5.64bp만큼 수익률을 개선할 수 있다는 것을 뜻한다. 다만 이러한 분석 결과는 로보어드바이저가 리밸런싱 전략으로 시장 타이밍을 채택했다는 가정 하에서 도출되었다는 점에서 제한적으로 해석되어야 한다.

은 작게는 1.26, 크게는 5.64로 추정되었다. 이는 시장수익률이 1%p 변동할 때 로보어드바이저가 리밸런싱을 통해 작게는 1.26bp, 크게는 5.64bp만큼 수익률을 개선할 수 있다는 것을 뜻한다. 다만 이러한 분석 결과는 로보어드바이저가 리밸런싱 전략으로 시장 타이밍을 채택했다는 가정 하에서 도출되었다는 점에서 제한적으로 해석되어야 한다.

지금까지 서비스 유형 간에 로보어드바이저의 자산관리 성과를 비교해본 결과, 서비스 유형 간뿐만 아니라 동일 서비스 유형 내에서도 로보어드바이저의 자산관리 성과의 차이가 존재하는 것을 확인할 수 있다. 특히 비정상적 초과수익률을 실현할 수 있는 포트폴리오 선택 역량을 갖추고, 효율적인 분산투자를 통해 시장수익률을 잘 추종하며, 이와 동시에 양호한 리밸런싱 성과를 보이는 로보어드바이저는 관찰되지 않는다. 다만 상품추천형이나 투자자문형 로보어드바이저 중에서 리밸런싱 성과는 저조하거나 통계적으로 유의하지 않더라도 시장수익률을 매우 낮은 수준으로 추종하면서 비정상적 초과수익률을 실현할 수 있는 로보어드바이저가 일부 관찰된다.

라. 제공업체 유형별 비교

상기의 회귀분석 결과를 제공업체 유형별로 구분하여 비교해보면, 제공업체 유형 간에도 로보어드바이저의 자산관리 성과의 차이가 발견된다. 특히 증권사의 경우 포트폴리오 선택 역량 측면에서, 은행은 시장 민감도 측면에서 상대적으로 우위를 보이는 것으로나타난다. 리밸런싱 성과 측면에서는 거의 모든 로보어드바이저가 제공업체 유형과 상관없이 저조하거나 통계적으로 유의하지 않기 때문에 우위를 가리기 어렵지만, 증권사가 상대적으로 우위를 보이는 것으로 판단된다.

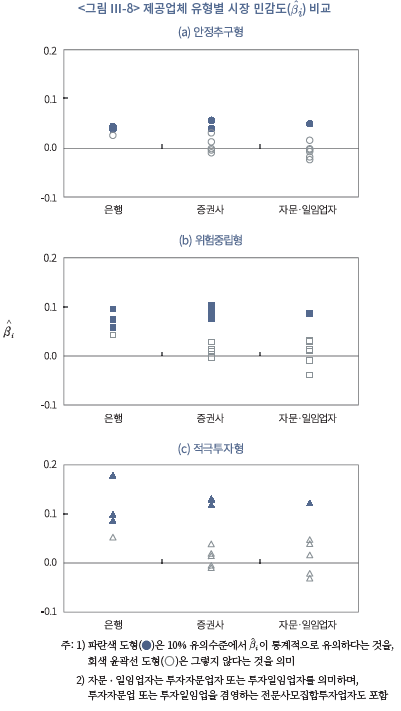

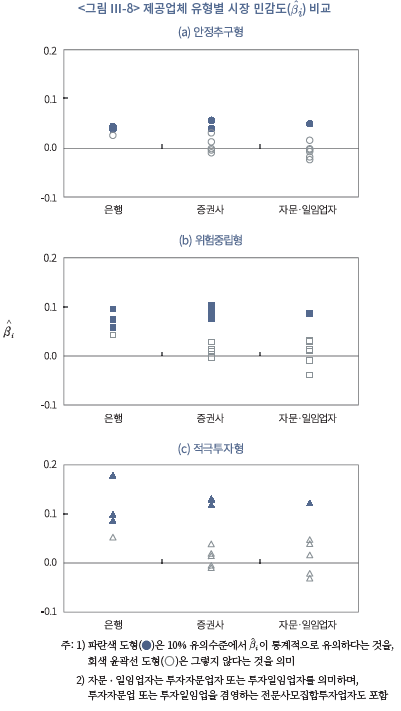

우선 포트폴리오 선택 역량 측면에서는 <그림 Ⅲ-7>에서 살펴볼 수 있듯이 비정상적 초과수익률을 실현할 수 있는 로보어드바이저 제공업체는 은행이 1개, 증권사가 2개, 투자자문ㆍ일임업자가 2개로 집계된다. 그런데 투자자 유형까지 고려하면 증권사가 가장 우위에 있는 것으로 보인다.22) 시장 민감도 측면에서는 <그림 Ⅲ-8>에서 살펴볼 수 있듯이 은행, 증권사, 투자자문ㆍ일임업자 순으로 우위를 보이는 것으로 나타난다.

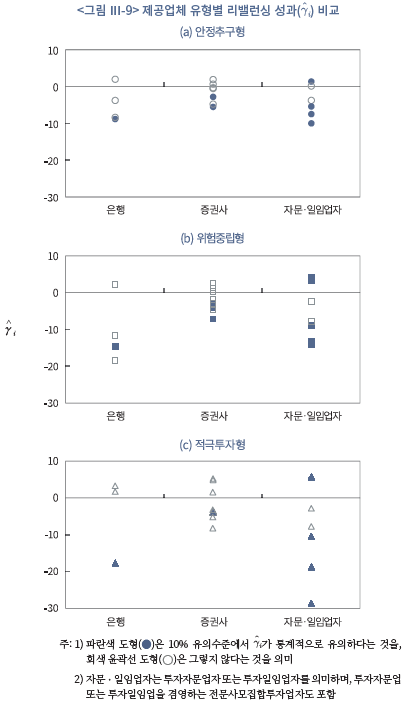

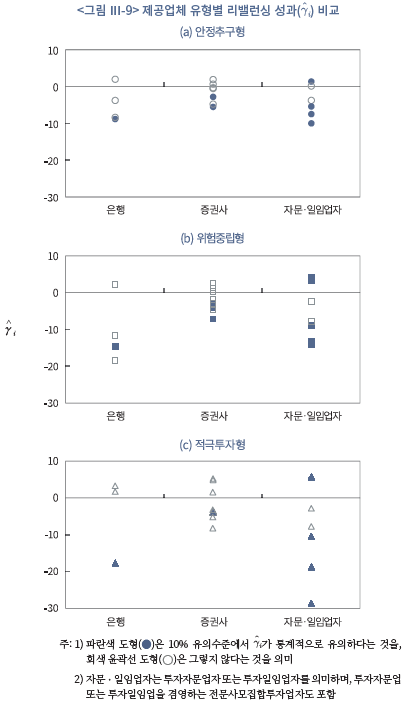

리밸런싱 성과 측면에서는 <그림 Ⅲ-9>에서 살펴볼 수 있듯이 증권사가 은행보다 두드러지게, 투자자문ㆍ일임업자보다 대체적으로 우위에 있는 것으로 보인다. 증권사의 경우 리밸런싱 성과의 격차가 가장 작고, 투자자문ㆍ일임업자의 경우 그 격차가 클 뿐 아니라 리밸런싱 성과가 매우 저조한 로보어드바이저도 증권사보다 상대적으로 더 많기 때문이다. 물론 투자자문ㆍ일임업자 일부만 유일하게 양호한 리밸런싱 성과를 보인다.

이러한 제공업체 유형별 자산관리 성과의 차이는 은행의 경우 펀드로, 증권사의 경우 주로 랩으로, 투자자문ㆍ일임업자의 경우 주식ㆍETF로 자산을 관리하는 것과 관련이 있어 보인다. 예를 들어, 은행처럼 펀드로 자산을 관리할 경우 상대적으로 시장수익률을 잘 추종할 수 있는 반면, 리밸런싱하는 데 시간이 소요되어 리밸런싱 성과가 좋지 못할 수 있다.

마. 소결

지금까지 살펴본 바와 같이 개별 로보어드바이저의 자산관리 성과를 분석한 결과에 따르면, 로보어드바이저 간에 자산관리 성과의 차이가 존재한다는 것을 확인할 수 있다. 특히 동일 서비스 유형 또는 동일 제공업체 유형 간에도 자산관리 성과의 차이가 존재한다는 것을 확인할 수 있다. 이는 개인이 효율적인 자산관리를 위해 로보어드바이저를 이용할 경우 로보어드바이저 선택에 따라 자산관리 성과가 달라질 수 있고, 그만큼 효율적 자산관리가 로보어드바이저 선택에 의해 좌우될 수 있다는 것을 시사한다.

로보어드바이저가 미리 짜여진 알고리듬을 활용하여 자동화된 자산관리 서비스를 제공하는 것이라면 로보어드바이저 간에 자산관리 성과의 차이가 없을 것이라는 기대가 있다. 그러나 로보어드바이저 간 자산관리 성과의 차이는 알고리듬에 사용된 자산배분 모형의 적정성 또는 객관성, 리밸런싱 실시 기준의 타당성 또는 일관성 등 기술적 역량의 차이나 포트폴리오에 편입되는 자산 유형과 수의 차이로 나타날 수 있다.

국내의 경우 로보어드바이저가 출현하고 서비스가 제공된지 5년이 지나지 않았기 때문에 로보어드바이저 간에 기술적 역량의 차이가 존재할 수 있고, 해외와 달리 다양한 서비스 유형이 출현하다보니 포트폴리오에 편입되는 자산의 유형도 다르고 그 수도 다르다. 따라서 로보어드바이저 간에 자산관리 성과의 차이가 존재하는 것은 상기와 같은 국내 로보어드바이저의 특성이 복합적으로 작용한 결과로 판단된다.

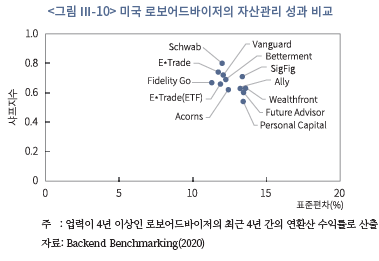

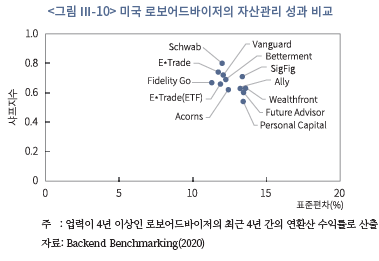

이와 달리 미국의 로보어드바이저의 경우 <그림 Ⅲ-10>에서 살펴볼 수 있듯이 로보어드바이저 간에 자산관리 성과의 차이가 크지 않은 것으로 판단된다(Backend Bench-marking, 2020). 이는 미국의 경우 거의 모든 로보어드바이저가 투자일임형으로 제공되고 포트폴리오를 ETF로 구성하여 운용함에 따라 기술적 요소 외의 다른 차이가 없기 때문일 수 있다. 이 때문에 미국의 경우 일반적으로 로보어드바이저를 평가할 때 수익률이나 자산관리 성과가 아닌 주로 최소 가입금액, 서비스 비용, 서비스 편리성 등을 고려하는것으로 파악된다(NerdWallet, 2021. 9. 2).

3. 고객유치 성과

가. 회귀분석 결과

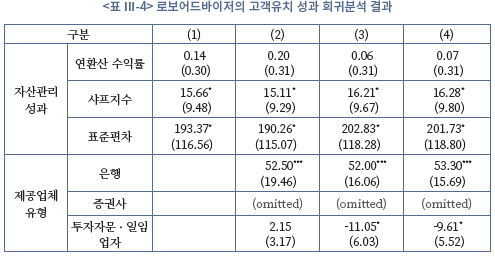

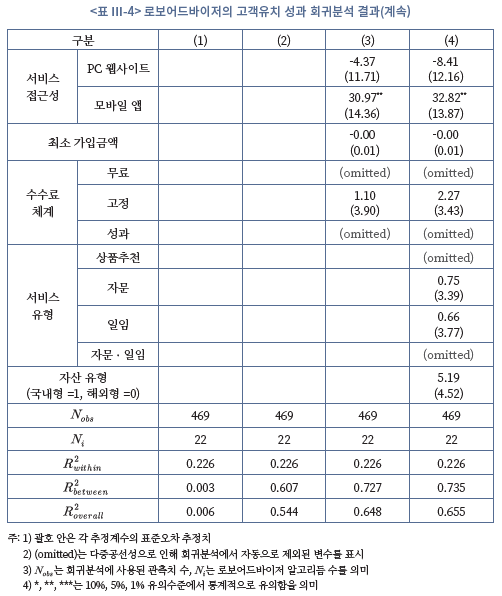

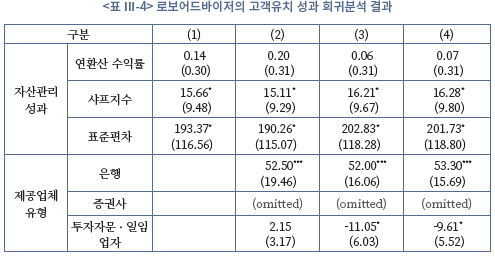

로보어드바이저의 고객유치 성과를 분석하기 위해 수식 (3)에 대해 확률효과(random effects) 모형으로 회귀분석을 실시하였다.23)24) 그 결과, <표 Ⅲ-4>에서 살펴볼 수 있듯이 로보어드바이저의 개별 특성을 나타내는 설명변수를 추가할수록 값이 커지는 것을 확인할 수 있다. 특히 개별 특성을 나타내는 설명변수를 추가하더라도

값이 커지는 것을 확인할 수 있다. 특히 개별 특성을 나타내는 설명변수를 추가하더라도  값이 0.226으로 동일한 반면,

값이 0.226으로 동일한 반면,  값은 0.003에서 0.735로 커진다. 이는 로보어드바이저의 개별 특성을 나타내는 설명변수를 추가할수록 회귀분석 모형의 설명력이 높아진다는 점에서 로보어드바이저 간에 고객유치 성과의 차이가 개별 특성에 의해 주로 설명된다고 풀이될 수 있다.

값은 0.003에서 0.735로 커진다. 이는 로보어드바이저의 개별 특성을 나타내는 설명변수를 추가할수록 회귀분석 모형의 설명력이 높아진다는 점에서 로보어드바이저 간에 고객유치 성과의 차이가 개별 특성에 의해 주로 설명된다고 풀이될 수 있다.

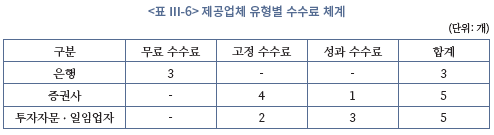

각 설명변수가 로보어드바이저의 고객유치에 미치는 효과를 살펴보면, 우선 연환산 수익률은 로보어드바이저의 고객유치에 통계적으로 유의한 효과를 미치지 못하는 것으로 추정된다. 이와 달리 위험 대비 초과수익률을 나타내는 샤프지수와 수익률의 변동성을 나타내는 표준편차가 10% 유의수준에서 통계적으로 유의하게 양(+)의 효과를 보이는 것으로 추정된다. 이는 가입자들이 로보어드바이저를 선택할 때 수익률만을 보지 않고 원금손실 위험도 같이 고려하기 때문인 것으로 판단된다.

로보어드바이저의 제공업체 유형을 은행, 증권사, 투자자문ㆍ일임업자(전문사모집합투자업자 포함)로 구분하여 고객유치에 미치는 효과를 살펴보면, 제공업체가 은행이면 고객유치 효과가 증권사에 비해 1% 유의수준에서 통계적으로 유의하게 매우 큰 것으로 추정된다. 이와 달리 투자자문ㆍ일임업자이면 증권사에 비해 고객유치 효과가 10% 유의수준에서 통계적으로 유의하게 음(-)의 값을 보이는 것으로 나타난다.

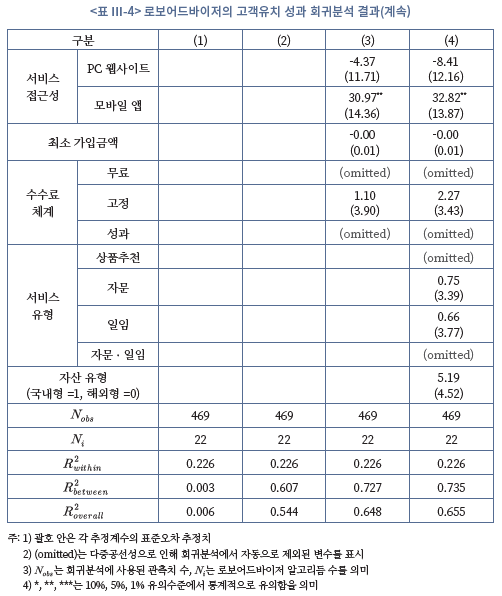

PC 웹사이트의 서비스 접근성은 로보어드바이저의 고객유치에 통계적으로 유의한 효과를 미치지 못하지만, 모바일 앱의 서비스 접근성이 높은 로보어드바이저일수록 5% 유의수준에서 통계적으로 유의하게 더 많은 고객을 유치하는 것으로 추정된다. 이는 로보어드바이저의 고객 연령대가 주로 20~30대에 집중되어 있기 때문일 수 있다. 그러나 제공업체가 은행인 경우 전체 고객의 50% 이상을 차지하는 점을 고려하면 반드시 그렇지 않을 수도 있다.25)

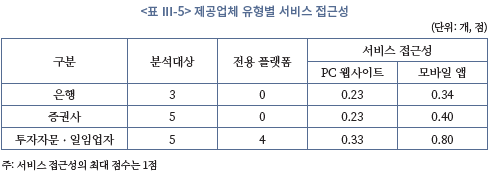

제공업체 유형별 서비스 접근성을 조사한 결과에 따르면, <표 Ⅲ-5>에 나타난 바와 같이 모바일 앱의 서비스 접근성이 가장 높게 측정된 제공업체 유형은 투자자문ㆍ일임업자로 조사된다. 특히 이들 대부분은 전용 플랫폼을 제공하고 있다는 특징을 가지고 있다. 이와 달리 제공업체 유형이 은행이거나 증권사인 경우 서비스 접근성이 상대적으로 매우 낮게 측정되었다. 특히 제공업체 유형이 은행인 경우 서비스 접근성은 증권사인 경우보다같거나 낮게 측정되었다.

이렇게 제공업체 유형 간에 로보어드바이저의 서비스 접근성이 차이가 나는 가장 큰 이유는 은행 또는 증권사와 투자자문ㆍ일임업자 간의 서비스 공급대상이 다르기 때문이다. 은행이나 증권사는 신규 고객을 유치하기보다는 기존 고객을 대상으로 서비스를 공급할 목적이 큰 것으로 보인다. 예를 들어, 은행이나 증권사의 경우 웹사이트 또는 앱에서 로그인해야 서비스 조회나 가입이 가능한 경우가 많다. 이와 달리 로보어드바이저 알고리듬을 자체 개발하고 직접 공급하는 투자자문ㆍ일임업자는 대개 기존 고객기반이 없기 때문에 신규 고객을 유치해야 하고, 이를 위해 서비스 소개, 가입, 이용 등 모든 단계에서 고객 경험과 편의를 고려해 전용 플랫폼을 설계하고 제공하고 있는 것으로 파악된다.

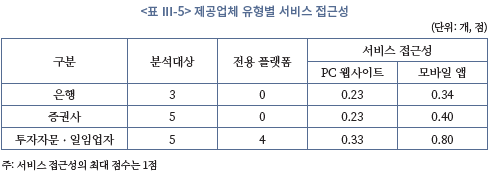

로보어드바이저 간 최소 가입금액, 수수료 체계, 서비스 유형, 자산 유형의 차이는 로보어드바이저의 고객유치에 통계적으로 유의한 효과를 미치지 못하는 것으로 추정된다. 이러한 회귀분석 결과는 국내 로보어드바이저 시장이 해외와 조금 다른 양상으로 발전했기 때문일 수 있다. 예를 들어, 해외에서는 전통적인 자산관리 서비스와 달리 로보어드바이저가 낮은 최소 가입금액과 수수료를 제시함으로써 자산관리의 대중화를 이끌어 왔다. 특히 미국의 경우 로보어드바이저 간에 고객유치를 위한 최소 가입금액과 수수료 인하 경쟁이 꾸준하게 일어났다. 그러나 국내에서는 이러한 경쟁 양상이 뚜렷하게 관찰되지 않는다. 또한 투자일임형이 주를 이루는 해외와 달리 국내의 경우 다양한 서비스 유형의 로보어드바이저가 출현했음에도 불구하고 서비스 내용 측면에서 큰 차이가 없다. 이 때문에 서비스 유형의 차이가 로보어드바이저의 고객유치에 유의미한 효과를 미치지 못한 것으로 보인다.

한편 로보어드바이저에 대한 수요는 다른 요인이 동일하다면 서비스 비용이 낮을수록 높아야 한다. 그런데 <표 Ⅲ-4>에 나타난 회귀분석 결과로는 수수료의 무료 여부가 로보어바이저의 고객유치에 미치는 효과를 파악할 수 없다. 더구나 통계적 유의성을 고려하지 않을 경우 고정 수수료를 수취하는 로보어드바이저의 고객유치 효과가 그렇지 않은 경우보다 크다고 볼 여지도 있다. 이를 근거로 수수료 체계를 나타내는 각 설명변수의 계수 추정치가 편향되었거나 그 통계적 유의성이 과소 평가되었다고 주장될 수 있다.

하지만 이러한 회귀분석 결과는 다음과 같이 설명될 수 있다. 먼저 무료 수수료의 고객유치 효과는 제공업체 유형이 은행인 경우의 고객유치 효과에 내재되어 추정되었을 수 있다. <표 Ⅲ-6>에서 살펴볼 수 있듯이 무료 수수료를 채택한 로보어드바이저는 은행에 의해서만 제공되고 있기 때문이다. 이는 은행이 제공하는 로보어드바이저를 선택하면 수수료가 무료이고, 그렇지 않으면 유료라는 것을 뜻하기도 한다. 따라서 무료 수수료의 고객유치 효과는 양(+)의 값을 보일 수 있다.

다음으로 고정 수수료를 수취하는 로보어드바이저의 고객유치 효과가 그렇지 않은 경우보다 클 수 있는 이유는 성과 수수료는 손실이 발생하면 면제되지만, 수익이 발생하면 고정 수수료보다 더 높은 경우가 적지 않기 때문인 것으로 판단된다.26) 이 때문에 고객이 로보어드바이저는 항상 수익을 실현한다고 믿을 경우 고정 수수료를 채택한 로보어드바이저를 더 선호할 수 있다. 물론 고정 수수료의 고객유치 효과는 무료 수수료보다는 크지 않을 것으로 판단된다.

나. 제공업체 유형별 실제와 추정 가입자 수 비교

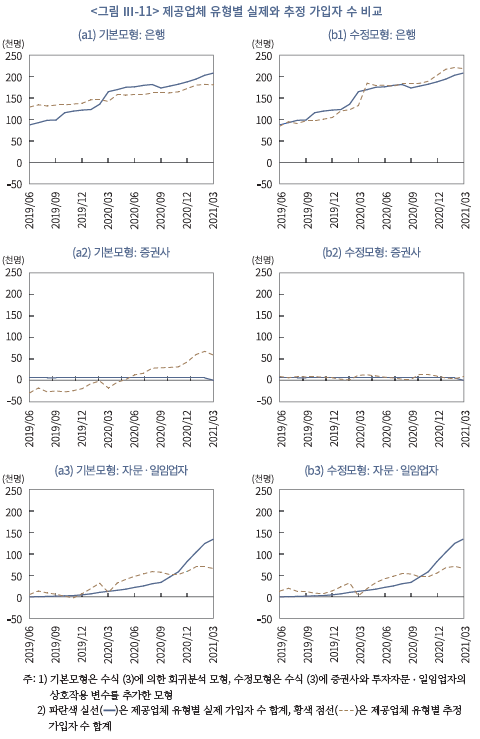

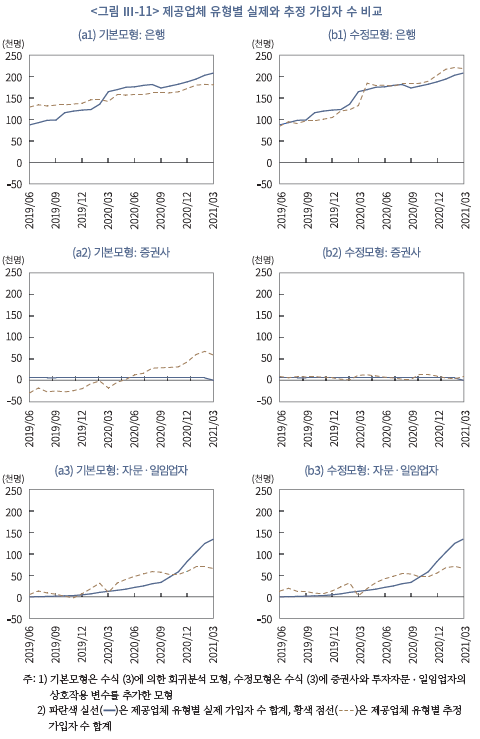

제공업체 유형에 따른 로보어드바이저의 개별 특성이 고객유치 성과에 미치는 영향을 자세히 살펴보기 위해 <표 Ⅲ-4>의 (4)에 나타난 기본모형의 회귀분석 결과를 토대로 제공업체 유형별 실제와 추정 가입자 수를 비교하였다. 그 결과, <그림 Ⅲ-11>의 좌측 열 그림에서 살펴볼 수 있듯이 은행과 투자자문ㆍ일임업자의 경우 실제 가입자 추세와 비슷하게 추정되나 증권사의 경우 과소 또는 과다하게 추정된 것이 확인된다. 이는 증권사의 가입자 수가 분석기간 중 7천명 이하의 매우 낮은 수준을 유지하며 거의 변하지 않는 반면, 설명변수 중 자산관리 성과를 나타내는 설명변수는 시간에 따라 변하기 때문인 것으로 이해된다.

이 점을 고려해 자산관리 성과를 나타내는 설명변수에 증권사와 투자자문ㆍ일임업자를 나타내는 더미변수를 곱한 상호작용 설명변수를 수식 (3)에 추가한 수정모형에 대해 회귀분석을 실시하여 동일한 방법으로 제공업체 유형별 실제와 추정 가입자 수를 비교하였다. 그 결과, <그림 Ⅲ-11>의 우측 열 그림에서 살펴볼 수 있듯이 제공업체 유형이 증권사인 경우 실제와 추정 가입자 수의 차이가 크게 감소한 것을 확인할 수 있다. 이를 통해 로보어드바이저의 자산관리 성과보다는 제공업체 유형에 따른 로보어드바이저의 개별 특성이 로보어드바이저의 고객유치 성과의 차이를 더 잘 설명한다는 것을 확인할 수 있다.

한편 제공업체 유형이 투자자문ㆍ일임업자인 로보어드바이저의 경우 2020년 하반기부터 기본모형이나 수정모형에서의 회귀분석 결과로 설명되지 않는 가입자 수의 증가세가 존재하는 것으로 확인된다. 이는 코로나19가 공식 선언된 이후 개인의 주식 직접투자참여가 대폭 증가한 것과 관련이 있어 보인다. 예를 들면, 주식에 직접투자하는 것보다 간접투자하는 것을 선호하는 개인의 경우 간접투자의 방법으로 로보어드바이저를 선택할수 있고, 이 중 상대적으로 서비스 접근성이 좋은 전용 플랫폼을 제공하는 투자자문ㆍ일임업자의 로보어드바이저가 선택될 가능성이 크다.

다. 소결

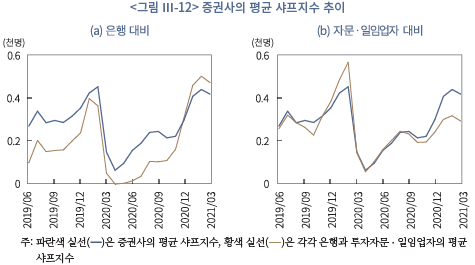

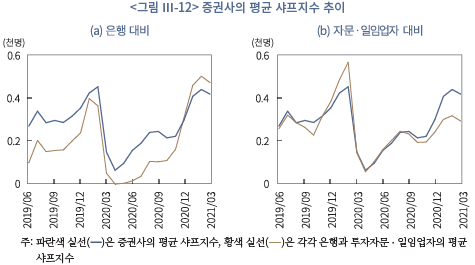

지금까지 살펴본 로보어드바이저의 고객유치 성과를 분석한 결과를 종합하면 다음과 같다. 우선 로보어드바이저의 자산관리 성과가 좋다고 해서 반드시 고객유치 성과가 좋은 것은 아니다. 예를 들어, 테스트베드센터가 공시하는 제공업체 유형별 평균 샤프지수를 비교해보면 <그림 Ⅲ-12>에서 살펴볼 수 있듯이 증권사인 경우 2020년 12월 이전까지만해도 샤프지수가 평균적으로 은행보다 높고 2020년 6월 이후부터는 투자자문ㆍ일임업자보다 높다. 그런데도 증권사의 총 가입자 수는 7천명 이하 수준으로 계속 정체되어 있다. 만약 로보어드바이저의 자산관리 성과가 고객유치 성과를 잘 설명한다면 증권사의 총 가입자 수는 최소한 투자자문ㆍ일임업자보다 더 많아야 한다.

이보다는 로보어드바이저의 개별 특성이 고객유치 성과를 더 잘 설명하는 것으로 확인된다. 예를 들어, 제휴업체 유형이 은행이거나 상대적으로 서비스 접근성이 좋은 투자자문ㆍ일임형 로보어드바이저일수록 고객유치 성과가 더 높게 나타난다. 물론 최소 가입금액, 수수료 체계, 서비스 유형 등과 개별 특성 변수의 설명력은 통계적으로 유의하지 않은 것으로 추정된다. 그러나 제공업체 유형이 증권사인 경우를 제외하거나 이들만 놓고보면 이들 개별 특성 변수도 어느 정도 고객유치 성과에 영향을 미친 것으로 판단된다.27)

Ⅳ. 시사점

지금까지 살펴본 바와 같이 국내 로보어드바이저의 현황을 서비스 유형별로 구분하여 종합하고 자산관리 성과와 고객유치 성과를 서비스 유형과 제공업체 유형별로 구분하여 비교ㆍ분석한 결과를 토대로 시사점을 도출하면 다음과 같다.

우선 로보어드바이저에 대한 규제와 감독 체계를 정비할 필요가 있다. 로보어드바이저라는 명칭이 법적 용어가 아니라는 점에서 그 명칭이 광범위하게 사용되는 것을 제한하지 않더라도 금융소비자 보호 차원에서 로보어드바이저 규제와 감독 체계를 동일행위-동일규제 원칙에 입각하여 정비할 필요가 있다.

예를 들어, 은행의 상품추천형 로보어드바이저의 경우 서비스 내용 측면에서 투자자문형과 거의 유사하다는 점에서 투자자문 계약을 반드시 체결하도록 지도하는 것이 필요할 수 있다.28) 또한 로보어드바이저 테스트베드센터의 심사를 받지 않거나 회피하는 정보제공형 또는 투자자문ㆍ일임형 로보어드바이저의 경우 설명의무나 광고규제를 통해 이 사실을 설명하거나 적시하도록 지도할 필요가 있다.

더 나아가 금융소비자가 로보어드바이저를 잘 구별할 수 있도록 로보어드바이저 명칭의 사용을 제한할 필요도 있다.29) 이를 위해 로보어드바이저의 법적 용어를 ‘전자적 투자자문장치’로 수정하고 자본시장법에 따른 투자자문업자나 투자일임업자 또는 금융소비자보호법에 따른 금융상품자문업자만이 로보어드바이저 명칭을 사용할 수 있도록 제한해야 한다.30)

2020년 중반부터 투자자문ㆍ일임형 로보어드바이저에 대한 수요가 빠르게 증가하고 있는 점은 로보어드바이저를 통한 자산관리 서비스의 대중화라는 정책적 목표 측면에서 매우 고무적이다. 하지만 로보어드바이저 간에 자산관리 성과의 격차가 존재하는 만큼 금융소비자가 자신에게 가장 적합한 로보어드바이저를 선택하는 것은 이전보다 더 중요해졌다. 따라서 금융소비자가 로보어드바이저의 자산관리 성과를 손쉽게 조회하고 비교할 수 있도록 현행 로보어드바이저 공시체계를 체계적이고 통일되게 개선할 필요가 있다.

예를 들어, 현재는 로보어드바이저 제공업체의 자율 의사에 따라 테스트베드센터의 공시 참여 여부를 결정한다. 이보다는 테스트베드 심사를 받고 통과한 로보어드바이저 제공업체는 반드시 공시에도 참여하도록 의무화할 필요가 있다. 이를 통해 테스트베드센터가 로보어드바이저의 자산관리 성과와 위험 지표를 정확하게 산출하고 공시하는 체계를갖추도록 지원할 필요가 있다. 또한 테스트베드센터 홈페이지뿐만 아니라 로보어드바이저 제공업체의 PC 웹사이트나 모바일 앱에서도 로보어드바이저의 자산관리 성과를 공시토록 하여 금융소비자가 로보어드바이저의 자산관리 성과를 손쉽게 조회하고 비교할 수있도록 해야 한다.

로보어드바이저의 자산관리 성과를 분석한 결과에 따르면 로보어드바이저의 포트폴리오 선택 역량이나 리밸런싱을 통한 수익과 위험 관리 역량이 대부분의 경우 저조하거나 유의미하지 않은 것으로 나타난다. 이 점을 고려할 때 금융소비자가 수익률이 아닌 자산관리 역량을 판단기준으로 로보어드바이저를 선택할 수 있도록 로보어드바이저 알고리듬에 대한 설명의무 규제를 강화하는 방안을 검토할 필요가 있다. 더 나아가 중장기적으로는 불필요한 리밸런싱으로 금융소비자에게 과도한 비용을 유발하지 않는지를 살펴보고 로보어드바이저의 이해상충 문제가 발견되면 개선할 필요도 있다.

참고로 미국의 SEC는 금융소비자가 로보어드바이저의 작동원리를 이해하고 로보어드바이저를 이용하는 것이 중요하다고 판단하여 2017년 2월에 로보어드바이저의 알고리듬 설명의무뿐만 아니라 사업모델 전반에 대한 설명의무를 가이드라인을 통해 지도하였다(SEC, 2017; 이성복, 2017, 2018). 최근에 유럽 의회는 로보어드바이저에 대한 이용이 증가하자 금융소비자 보호를 강화하기 위해 로보어드바이저의 알고리듬 설명의무뿐아니라 이해상충 문제 등 다양한 측면에서 로보어드바이저 규제 방안을 논의하고 있다(European Parliament, 2021).

로보어드바이저의 포트폴리오 선택 역량이나 시장수익률 추종 정도를 향상하려면 로보어드바이저가 효율적 분산투자를 용이하게 구현할 수 있도록 정책적으로 지원하는 것도 필요하다. 예를 들어, 소수점 매매제도의 도입이 필요할 수 있다. 참고로 국내의 경우 2021년 6월말 기준으로 2개 증권사에 한하여 해외 상장증권의 소수점 매매가 금융규제 샌드박스를 통해 허용되었고, 금융당국에서도 2021년 9월에 해외주식은 2021년 중, 국내 주식은 2022년 9월부터 시행하겠다는 계획을 발표한 상태다(김민기, 2021; 금융위원회, 2020. 12. 20, 2021. 9. 13).

마지막으로 로보어드바이저의 고객유치 성과를 분석한 결과에 따르면 자산관리 성과가 반드시 고객유치 성과로 이어지지는 않는 것으로 나타난다. 특히 로보어드바이저 제공업체가 증권사인 경우 은행이나 투자자문ㆍ일임업자에 비해 자산관리 성과가 뒤지지 않음에도 불구하고 저조한 고객유치 성과를 보인다. 이 점을 고려할 때 증권사는 로보어드바이저의 서비스 접근성을 대폭 개선할 필요가 있어 보인다.

예를 들어, 증권사는 주로 랩 투자일임형이나 정보제공형 로보어드바이저를 집중적으로 제공하고 있는데, 이보다는 미국의 뱅가드나 찰스슈왑처럼 별도의 전용 플랫폼을 통해 주식과 ETF로 자산관리하는 투자자문ㆍ일임형 로보어드바이저를 제공하고, 상대적으로 높은 최소 가입금액과 수수료도 인하할 필요가 있다. 더 나아가 서비스 차별화 차원에서 자문사의 자문이나 상담사의 보조 서비스를 결합하는 방안도 고민해볼 수 있다.

1) 코스콤은 2016년 9월 금융위원회의 지정으로 로보어드바이저 테스트베드센터(이하 테스트베드센터)를 운영하고 있다. 2021년 3월말 기준으로 187개 로보어드바이저 알고리듬이 테스트베드센터에 심사를 신청하였고, 이 중 88개에 대한 기본 현황이 웹사이트(ratestbed.kr)를 통해 공시되고 있다.

2) 국내에서는「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」에 따라 투자자문업과 투자일임업을 구분하고 있으나, 해외에서는 대개 투자자문 또는 자산관리 서비스로 통칭한다.

3) 자본시장법 시행령 제2조제6호와 금융투자업규정 제1-2조의2제3호에 따라 전자적 투자조언장치를 활용하려면 (주)코스콤의 지원을 받아 외부전문가로 구성된 심의위원회(로보어드바이저 테스트베드)의 요건 심사를 받아야 한다.

4) 로보어드바이저 제공업체가 투자자문ㆍ일임업자일 경우 최초 자산구성과 리밸런싱 시에 자산 편출입의 주문집행이 제휴 증권사를 통해 처리된다.

5) 테스트베드센터에서는 로보어드바이저 유형을 무료추천형, 투자자문형, 투자일임형으로 분류하고 있다. 여기서 무료추천형은 이 보고서에서 구분한 상품추천형과 동일하다. 또한 정보제공형 로보어드바이저는 법적으로 심사대상이 아니기 때문에 테스트베드센터에서는 별도로 구분하지 않는다. 한편 무료추천형은 로보어드바이저 서비스가 무료라는 관점에서 붙여진 용어이나 엄밀하게 따지자면 잘못된 용어다. 사실상 펀드 등 금융상품을 추천하거나 환매하면서 고객으로부터 수수료를 수취하기 때문이다.

6) 기업은행은 i-ONE 로보, 광주은행은 KJ마이봇, 대구은행은 Ro.D, 신한은행은 쏠리치, 우리은행은 우리로보-알파, 하나은행은 하이로보, BNK경남은행과 BNK부산은행은 웰스타로보, KB국민은행은 케이봇쌤, NH농협은행은 NH로보-PRO 브랜드로 펀드 또는 연금 로보어드바이저 서비스를 제공 중이다.

7) 디셈버앤컴퍼니는 핀트, 쿼터백자산운용은 쿼터백, 두물머리투자자문은 불릴레오, 에임은 에임, 이루다투자일임은 이루다투자, 파운트투자자문은 파운트 모바일 앱을 제공하고 있다.

8) 2017년 7월부터 2021년 3월까지 3개 은행, 4개 증권사, 2개 자산운용사, 4개 투자자문ㆍ일임업자가 테스트베드센터에 로보어드바이저 가입자 수와 관리자산 금액을 보고하였다. 또한 서비스 중단 등을 이유로 동 기간 중 보고를 중단한 제공업체도 있다. 여기서 가입자 수는 누적이고, 관리자산 금액은 가치 변동이 반영되지 않은 고객의 계약 금액이다.

9) 개인이 로보어드바이저의 누적수익률이나 자산관리 성과를 직접 계산하거나 추정하는 것은 쉽지 않다는 점을 고려하여 개인이 접근할 수 있는 코스콤의 로보어드바이저 테스트베드센터의 공시자료를 사용하였다.

10) 주별 또는 월별 수익률이 아닌 일별 수익률을 사용한 것은 로보어드바이저가 자동화된 자산관리 서비스라면 실시간으로 시장 상황에 대응할 수 있어야 한다는 점을 고려하였다.

11) 해외의 경우 로보어드바이저가 활성화될수록 고객유치 경쟁이 심화되고 최소 가입금액과 서비스 비용이 낮아지는 추세가 관찰된다. 그러나 국내의 경우 이러한 추세가 뚜렷하게 관찰되지 않는다. 이 점을 고려해 이 보고서에서는 최소 가입금액과 서비스 비용 설명변수를 시간 불변 변수로 설정하였다.

12) 먼저 서비스 단계를 소개(탐색), 가입, 이용으로 구분하였다. 그리고 웹이나 앱에서 단계별 서비스를 제공할 경우 1점을 부여하였다. 또한 서비스 편리성을 고려하기 위해 각 서비스 단계에 최종적으로 도달하는 데 소요되는 절차 수에 따라 점수를 할인하였다. 예를 들면, 로보어드바이저의 소개 정보를 찾아 들어가는 데 7번의 마우스 클릭(mouse click)이나 스크린 터치(screen touch)가 요구될 경우 1/7점으로 할인하였다. 마지막으로 각 채널의 서비스 접근성 점수 합계를 최대 1점을 기준으로 환산하였다.

13) 은행의 펀드 로보어드바이저는 상품추천형이고 자본시장법에 따른 ‘전자적 투자조언장치’에 해당되지 않기 때문에 광주은행, 대구은행, BNK경남은행, BNK부산은행은 테스트베드센터의 심사에 참가하지 않은 것으로 보인다.

14) 테스트베드센터의 심사에 참가한 기업은행과 농협은행은 심사 중에만 로보어드바이저 운용 데이터를 제출하였고, 우리은행은 실적 데이터를 제출하지 않는 것으로 파악된다.

15) 에임(AIM)은 자신을 로보어드바이저로 광고하면서도 자본시장법에 따른 ‘전자적 투자조언장치’에 해당되지 않는다고 판단하여 테스트베드센터 심사에 참가하지 않은 것으로 파악된다.

16) 해외형 로보어드바이저는 대개 미국 주식ㆍETF로 운용되는 것으로 알려져 있으나, 그 구성을 정확히 알 수 없어 제외하기로 하였다. 자산관리 성과 분석대상에서 해외형 로보어드바이저를 제외할 경우 제공업체 유형별 수는 변동이 없고, 제공업체 유형이 은행인 경우 2개, 증권사인 경우 2개, 투자자문ㆍ일임업자의 경우 4개 알고리듬이 분석대상에서 제외된다.

17) 샤프지수와 표준편차는 개별 로보어드바이저의 주별 연환산 수익률로 계산하였다. 무위험수익률은 국고채 3년물의 수익률을 사용하였다. 참고로 샤프지수는 포트폴리오의 자산관리 성과를 평가하는 데 사용되는 지표로 평균 수익률에서 무위험수익률을 차감한 초과수익률을 수익률의 표준편차로 나눠 계산한다. 또한 포트폴리오 수익률의 표준편차는 포트폴리오의 위험을 나타내는 지표이다.

18) 만약 로보어드바이저 간에 자산관리 성과의 차이가 크지 않다면 동일 투자자 유형 내에서 개별 로보어드바이저의 샤프지수가 비슷해야 한다. 또한 안전자산과 위험자산의 구성의 차이가 크지 않다면 수익률 표준편차도 비슷해야 하고, 수익률 표준편차가 투자자 유형에 따라 안정추구형, 위험중립형, 적극투자형 순으로 일정하게 커야 한다.

19) 테스트베드센터는 각 로보어드바이저에게 안정추구형, 위험중립형, 적극투자형 등 투자자 유형별 운용 실적을 보고하도록 요구하고 있다.

20) 수식 (1)과 (2) 오차항의 이분산성(heteroskedasticity)을 고려해 Newey-West 표준오차를 이용하여 통계적 유의성을 판단하였다.

21) 모든 추정계수의 통계적 유의성은 10% 유의수준에서 양측검정으로 판단하였다.

22) 증권사의 경우 모든 투자자 유형에 대해 비정상적 초과수익률을 실현하는 반면, 은행의 경우 안정추구형과 위험중립형에 대해서만, 투자자문ㆍ일임업자의 경우 안정추구형에 대해서만 비정상적 초과수익률을 실현하는 것으로 나타난다.

23) 수식 (3)에는 로보어드바이저의 개별 특성을 나타내는 시간불변(time-invariant) 설명변수를 다수 포함하고 있기 때문에 고정효과 모형으로 회귀분석을 실시할 경우 시간불변 설명변수가 제외되어 회귀분석 결과의 설명력이 낮아진다. 또한 로보어드바이저의 개별 특성이 고객유치 성과에 영향을 미친다면 통합 최소자승법보다 확률효과 모형이 더 적합할 수 있다.

24) 자산관리 성과 지표인 연환산 수익률, 샤프지수, 표준편차 간에는 높은 상관관계를 보이기 때문에 다중공선성 문제가 존재할 수 있다. 이를 고려해 세 변수에 대해 분산팽창지수(Variation Infl ation Index: VIX)로 다중공선성을 검증한 결과, 세 변수의 VIX 값은 5 미만으로 다중공선성 문제가 회귀분석의 결과에 영향을 미칠 만큼 크지 않은 것으로 판단된다. 참고로 고객이 로보어드바이저를 선택할 때 세 변수를 독립적으로 고려한다고 가정하였다.

25) 은행이 지점 창구에 방문한 고객에게 모바일 앱으로 로보어드바이저 가입을 유인했을 가능성도 존재한다. 또한 이들 고객은 연령대가 상대적으로 높을 수 있다.

26) 고정 수수료를 수취하는 로보어드바이저 중 제공업체가 증권사일 경우 매년 관리자산 금액의 0.8~1.2%, 투자자문ㆍ일임업자일 경우 0.25~0.8%를 수수료로 받고, 성과 수수료를 수취하는 로보어드바이저의 경우 매년 수익금액의 9.5~15%를 받는다.

27) 제공업체 유형이 증권사인 경우 상대적으로 최소 가입금액과 수수료 수준이 높고, 주로 랩상품으로 제공된다는 특징이 있다.

28) 은행은 이미 투자자문업을 겸영하고 있기 때문에 투자자문 계약을 통해 로보어드바이저 서비스를 제공하는 것이 가능하다.

29) 해외의 경우 로보어드바이저라고 하면 일반적으로 투자자문ㆍ일임업자가 제공하는 자동화된 자산관리 서비스를 지칭하기 때문에 로보어드바이저를 오인하는 문제가 발생하지 않는다. 특히 로보어드바이저 테스트베드센터를 운영하는 국가는 한국이 유일하게 때문에 해외와 다르게 그 명칭의 사용도 엄격하게 제한할 필요가 있다.

30) 법적으로 로보어드바이저를 ‘전자적 투자조언장치’로 명명하는 것은 적절하지 않다. 자본시장법과 금융소비자보호법에서 자문과 조언을 명확하게 구분하여 정의하고 있다.

2016년에 로보어드바이저(robo-advisor)가 국내에 처음으로 소개된 지 벌써 5년이 지났다. 2021년 6월말 코스콤의 로보어드바이저 테스트베드센터 집계 기준으로 가입자 수는 지난 1년 간 17만명 이상이 증가하면서 38만명을 기록하였다. 가입자 수로만 보면 로보어드바이저에 의한 자산관리 시장은 이전에 비해 크게 성장한 것처럼 보인다. 하지만 로보어드바이저의 관리자산 금액은 지난 5년 동안 지속적으로 증가하였음에도 불구하고 2조원을 밑돈다.

로보어드바이저의 가입자 수가 빠르게 증가한 것에 비해 관리자산 금액이 그만큼 증가하지 않은 것은 지난 1년 동안 20~30대 연령층의 가입이 크게 증가했기 때문일 수 있다. 그러나 다른 요인도 존재하는 것으로 보인다. 예를 들면, 로보어드바이저의 수익률이 사람보다 못하거나 시장수익률을 따라가지 못한다는 비판이 2020년 초반까지 지속적으로 제기된 것과 무관해보이지 않는다.

국내는 투자일임형이 주를 이루는 해외와 달리 은행의 상품추천형 로보어드바이저가 높은 시장점유율을 기록하고 있다. 이들은 대개 펀드상품을 포트폴리오로 구성하여추천하지만, 서비스 내용 측면에서는 투자자문 서비스를 제공하는 투자자문형이나 고객의 투자금액을 일임받아 운용하는 투자일임형과 크게 다르지 않다. 이외에도 주식시장의상장종목을 추천하고 매매 타이밍 정보를 제공하는 정보제공형 로보어드바이저가 있다.

그런데 코로나19 팬데믹이 선언된 3월 이후 주식시장이 급락하고 곧이어 견조한 상승세를 보였던 2020년 중반부터 로보어드바이저에 의한 자산관리 시장에도 구조적 변화가 일기 시작하였다. 우선 2021년 6월말 기준 가입자 수가 전년 동월 대비 81.7%, 관리자산 금액은 46.9% 증가하였다. 특히 이전과 다르게 투자자문형과 투자일임형 로보어드바이저의 약진이 두드러졌다.

2019년 6월말 이후 투자자문형과 투자일임형 로보어드바이저의 가입자 수 기준 시장점유율은 지속적으로 증가하여 2021년 6월말 43.4%를 기록하였다. 이와 달리 상품추천형 로보어드바이저의 시장점유율은 2019년 6월말 91.3%를 기록한 이후 계속 감소하였다. 물론 2021년 6월말 상품추천형 로보어드바이저의 관리자산 금액 기준 시장점유율은 90.9%로 여전히 높다.

금융의 디지털화가 빠르게 진전되면서 이제 디지털금융은 선택이 아닌 필수가 되어가고 있다. 그만큼 앞으로 자동화된 자산관리 서비스를 제공하는 로보어드바이저에 대한 수요도 계속 증가할 것으로 보인다. 또한 지난 1년 6개월여 동안 개인의 주식투자가 대폭 증가하였지만 이러한 추세가 지속될지 의문스럽다. 이보다는 개인의 지속가능한 금융투자활동을 지원할 수 있는 전문적인 자산관리 서비스가 더 요구될 수 있다. 이 점에서 개인의 로보어드바이저 선택은 효율적 자산관리에 있어 가장 중요한 문제로 부각될 것으로 예상된다.

이 보고서에서는 이와 같은 배경을 바탕으로 국내 로보어드바이저의 성과를 분석하고 시사점을 제시하였다. 이를 위해 먼저 국내 로보어드바이저의 현황을 코스콤의 로보어드바이저 테스트베드센터가 제공한 데이터와 자체 조사한 자료를 토대로 종합하였다. 또한 로보어드바이저의 본질적인 역할에 초점을 맞춰 로보어드바이저의 성과를 분석하고 자산관리 성과가 고객유치 성과에 미치는 영향을 분석하였다.

이 보고서의 나머지는 다음과 같이 구성되어 있다. 제Ⅱ장에서는 로보어드바이저의법적, 기술적 정의를 바탕으로 국내 로보어드바이저의 서비스 유형을 구분하고, 서비스 유형별 현황과 시장규모를 살펴보았다. 제Ⅲ장에서는 국내 로보어드바이저의 성과를 자산관리 성과와 고객유치 성과로 구분하여 실증적으로 분석하고 서비스 유형과 제공업체 유형별로 비교하였다. 마지막으로 제Ⅳ장에서는 지금까지 분석한 결과를 토대로 시사점을 제시하였다.

Ⅱ. 국내 로보어드바이저 현황

국내에서 로보어드바이저는 다소 복잡한 양상으로 출현하고 발전하였다. 특히 로보어드바이저라는 용어가 광범위하게 사용되다보니 그 현황을 자세히 파악하기도 쉽지 않고 체계적으로 집계한 자료도 찾아보기 어렵다. 따라서 이 장에서는 국내 로보어드바이저 현황을 코스콤의 로보어드바이저 테스트베드센터가 제공한 데이터와 자체 조사한 자료를 토대로 정리하고 종합하였다.1)

1. 정의와 유형

가. 로보어드바이저 정의

1) 법적 정의

로보어드바이저는 2002년 미국에서 처음 사용된 명칭으로 지금은 대개 자동화된 디지털 투자자문 또는 자산관리 서비스의 뜻으로 사용된다(Karz, 2015; 이성복, 2016a; 이성복, 2016b).2) 그러나 로보어드바이저에 대한 합의된 정의는 없다. 이 때문에 국내에서도 로보어드바이저라는 명칭이 다소 다른 의미로 사용되는 경우가 종종 있다. 예를 들어, 2021년 초부터 보험업계에서는 자동화된 보험설계사의 뜻으로 보험 로보어드바이저라는 명칭을 사용하고 있다.

로보어드바이저의 사전적 의미는 분명하다. 로보(robo)는 자동화(automation)를, 어드바이저(advisor)는 법적으로 금융자문(financial advice)을 제공하는 자를 뜻한다. 따라서 로보어드바이저는 자동화된 금융자문 도구로 이해될 수 있다. 해외에서도 로보어드바이저를 이와 유사하게 정의하고 사용한다.

예를 들어, 미국의 증권거래위원회(Securities and Exchange Commission: SEC)는 로보어드바이저를 ‘자동화된 디지털 투자자문 프로그램(automated digital investment advisory program)’의 뜻으로 한정하여 사용한다(SEC, 2017. 2. 23). 영국의 금융영업행위감독청(Financial Conduct Authority: FCA)은 로보어드바이저 대신에 ‘자동화된 디지털 또는 온라인 자문(automated digital or online advice)’의 뜻으로 로보어드바이스(robo-advice) 명칭을 사용한다(FCA, 2017. 2. 11, 2020).

국내에서는 법적으로 로보어드바이저를 ‘전자적 투자조언장치’로 명명하고, 집합투자업자가 집합투자재산을 운용하거나 투자자문업자 또는 투자일임업자가 해당 업무를 수행하는 데 활용하는 자동화된 전산정보처리장치로 정의하고 있다. 그런데 금융당국에서는 ‘로보어드바이저’ 명칭을 로보어드바이저 테스트베드의 심사통과 여부와 상관없이 누구나 사용할 수 있도록 허용하였다(금융위원회, 2016. 8. 29).3) 이 점에서 사실상 로보어드바이저의 법적 정의는 없다고도 볼 수 있다.

2) 기술적 정의

로보어드바이저는 기술적 특성을 고려하여 정의되기도 한다. 로보어드바이저는 기본적으로 자동화된 자산관리 서비스를 체계적으로 제공하는 것을 목적으로 하기 때문에 미리 짜여진 알고리듬(algorithm)을 사용한다. 따라서 로보어드바이저는 기술적으로는 자동화된 자산관리 서비스를 제공하기 위한 미리 짜여진 알리리듬 체계로 정의될 수 있다.

한편 로보어드바이저라고 해서 사람의 보조나 개입이 반드시 없어야 한다는 것을 뜻하지 않는다(SEC, 2017. 2. 23). 예를 들어, 사람의 개입 없이 서비스 가입부터 모든 서비스 절차를 완전하게 자동화하여 자산관리 서비스를 제공하는 로보어드바이저가 있는 반면, 자문사(human advisor)의 자문이나 상담사의 보조 서비스를 결합하여 제공하는 하이브리드(hybrid) 또는 바이오닉(bionic) 로보어드바이저도 있다. 대표적으로 미국의 뱅가드(Vanguard)의 Vanguard Personal Adivsor Services와 찰스슈왑(Charles Schwab)의 Schwab Intelligent Portfolio Products가 후자에 해당된다.

로보어드바이저의 알고리듬 체계는 <그림 Ⅱ-1>에서 살펴볼 수 있듯이 크게 고객진단(client profiling), 자산배분(asset allocation), 리밸런싱(rebalancing) 알고리듬으로 나뉠 수 있다(이성복, 2017). 고객진단 알고리듬은 온라인 질문을 통해 고객의 정보를 파악하고 고객의 투자성향을 평가하는 알고리듬이다. 자산배분 알고리듬은 고객의 투자성향에 가장 적합한 자산배분 또는 자산구성을 도출하는 알고리듬이다. 리밸런싱 알고리듬은 고객자산의 수익과 위험을 효율적으로 관리하기 위해 시장 상황이나 고객 요구에 맞게 자산구성을 조정하는 알고리듬이다.4)

로보어드바이저의 알고리듬은 서비스 절차를 자동화하기 위한 것으로 그 자체만으로는 특별하지 않다. 이보다는 각 알고리듬에 설계된 가정이나 전제, 고객 응답을 처리하는 방식, 이론적 모형이나 IT 기술 등이 로보어드바이저의 서비스 역량을 결정한다. 예를 들어, 고객진단 알고리듬의 경우 온라인 질문에 대한 고객 응답을 처리하는 방식에 따라 또는 고객이 온라인 질문에 대해 비일관적이거나 모순적으로 응답하는 경우를 고려하는지 여부에 따라 고객의 투자성향에 대한 평가가 달라질 수 있다.

자산배분 알고리듬의 경우 어떤 이론적 모형 또는 자산구성 전략에 기초하느냐에 따라 고객에게 최초로 제시되는 자산구성이 다를 수 있고, 궁극적으로는 자산관리 성과에도 영향을 미칠 수 있다. Beketov et al.(2018)이 미국, 독일, 영국, 스위스 등의 217개 로보어드바이저를 대상으로 조사한 결과에 따르면, 조사대상의 39.7%가 자산배분 알고리듬의 이론모형으로 해리 마코비츠(Harry Markowitz)의 현대 포트폴리오 이론(Modern Portfolio Theory: MPT)을 사용하고 있는 것으로 파악된다.

이 밖에 블랙-리터만 모형(Black-Litterman model), 파마-프렌츠 요인 모형(Fama-French Factor model), 몬테-카를로 시뮬레이션(Monte-Carlo simulation) 등을 사용하는 로보어드바이저도 있다. 한편 고객의 투자성향에 따라 미리 자산을 구성한 샘플 포트폴리오(sample portfolio)나 사전에 자산구성의 비중을 정한 상수 포트폴리오(constant portfolio)를 제시하는 로보어드바이저도 조사대상의 41.1%에 달한다.

리밸런싱 알고리듬의 경우 시장 상황을 어떻게 파악하고 분석하느냐 또는 어떤 기준으로 리밸런싱을 실시하느냐에 따라 로보어드바이저의 자산관리 성과가 달라질 수 있다. 시장 상황을 파악하고 분석하기 위해 빅데이터(big data)와 인공지능(AI) 기술이 활용되기도 한다. 또한 자산가격에 상당한 영향을 미칠 수 있는 이벤트 발생 여부, 리밸런싱을 실행하도록 사전에 설정된 자산가격의 임계치(threshold) 기준 등에 따라 리밸런싱 실행 여부가 결정될 수 있다. 그러나 일정 기간마다 주기적으로 리밸런싱을 실시하는 로보어드바이저도 있다.

나. 로보어드바이저 유형

국내에 출시된 로보어드바이저는 서비스 관점에서 크게 상품추천형, 투자자문형 또는 투자일임형, 정보제공형으로 구분될 수 있다.5) 상품추천형은 말 그대로 금융회사 등이 금융상품을 판매할 목적으로 단일 금융상품이나 금융상품 포트폴리오를 추천하는 로보어드바이저다. 대표적으로 은행의 펀드 로보어드바이저가 이에 해당된다. 투자자문형 또는 투자일임형은 자본시장법에 따라 금융위원회에 등록한 투자자문업자 또는 투자일임업자가 제공하는 로보어드바이저다. 정보제공형은 금융상품이나 상장종목 등에 대한 정보를제공하는 로보어드바이저를 말한다.

그런데 로보어드바이저의 유형은 그 구분 기준에 따라 달라질 수 있다. 예를 들어, 로보어드바이저 유형을 서비스 주체에 따라 구분할 경우 서비스 주체가 금융소비자보호법에 따른 금융상품판매업자이면 상품추천형, 자본시장법에 따른 투자자문업자 또는 투자일임업자이면 투자자문형 또는 투자일임형으로 분류될 수 있다. 그러나 금융상품판매업자가 투자자문업이나 투자일임업을 겸영할 경우 서비스 주체에 따른 유형 구분은 적합하지 않다. 또한 정보제공형은 누구나 제공할 수 있는 일종의 조언을 제공하는 것이므로 서비스 주체로 그 유형을 구분하기 어렵다.

로보어드바이저 유형을 서비스 내용으로 구분한다고 해도 서비스 내용의 유사성이 존재할 경우 그 유형을 명확하게 구분하기 어렵다. 예를 들어, 은행의 펀드 로보어드바이저는 별도의 투자자문이나 투자일임 계약을 체결하지 않고 펀드 포트폴리오를 고객에게 추천한다는 점에서 상품추천형으로 분류된다. 그러나 이들 로보어바이저는 계속적으로 고객에게 리밸렁싱 정보를 제공하고, 고객의 동의가 있으면 보유 펀드를 환매하고 신규 펀드를 구매하는 방식 등으로 리밸런싱을 실시한다. 이 점에서 은행의 펀드 로보어드바이저는 서비스 내용 측면에서 투자자문형이나 투자일임형과 다를 게 없다.

로보어드바이저 유형은 수익 원천에 의해서도 구분될 수 있다. 예를 들어, 로보어드바이저가 금융상품 제조사 또는 판매사로부터 상품판매와 관련된 수수료 또는 보수를 수취하면 상품추천형으로, 고객으로부터 자문 또는 일임 보수를 수취하면 투자자문형 또는 투자일임형으로, 두 경우에 해당되지 않으면 정보제공형으로 분류할 수 있다. 그러나 무료로 서비스를 제공하는 로보어드바이저도 있기 때문에 이마저도 적절하지 않다.

지금까지 논의를 종합해보면 서비스 주체, 서비스 내용 또는 수익 원천을 기준으로 로보어드바이저 유형을 명확하게 구분하는 것은 쉽지 않다. 그러나 국내 로보어드바이저의 성과를 분석하고 유형별로 비교하려면 그 유형을 명확하게 구분할 필요가 있다. 따라서 이 보고서에서는 <그림 Ⅱ-2>에 나타난 바와 같이 고객 적합성 평가 여부와 투자자문 또는 투자일임 계약 여부로 로보어드바이저 유형을 구분하기로 한다.

우선 로보어드바이저가 온라인 질문을 통해 고객의 적합성을 평가하지 않으면 정보제공형으로 분류한다. 상품추천형이나 투자자문ㆍ일임형은 금융소비자보호법에 따라 고객 적합성 평가를 실시해야 한다. 이와 달리 정보제공형은 고객에게 일방적으로 조언을 하는 것이므로 고객 적합성 평가가 요구되지 않는다. 다음으로 로보어드바이저가 고객에게 자본시장법에 따라 투자자문 또는 투자일임 계약을 체결할 것을 요구하면 투자자문형 또는 투자일임형으로 분류한다. 그렇지 않으면 상품추천형으로 분류한다.

2. 유형별 현황

2021년 3월말 기준으로 코스콤의 로보어드바이저 테스트베드센터(이하 테스트베드센터)의 심사를 통과하거나 받고 있는 로보어드바이저는 제공업체 기준으로 88개로 집계된다. 이 중 <표 Ⅱ-1>에서 살펴볼 수 있듯이 은행 6개, 증권사 12개, 자산운용사 10개, 투자자문ㆍ일임업자 15개, 기술업체 35개, 개인 10명이 로보어드바이저 테스트베드에 참여하였다. 또한 이 중 2021년 3월말 기준으로 로보어드바이저 상품 또는 서비스를 제공하는 업체는 14개(은행 4개, 증권사 5개, 자산운용사 2개, 투자자문ㆍ일임업자 3개)로 조사된다.

그러나 2021년 3월말 기준으로 자체 조사한 자료에 따르면, <표 Ⅱ-1>에서 살펴볼 수 있듯이 은행 10개, 증권사 15개, 자산운용사 2개, 투자자문ㆍ일임업자 4개가 실제 로보어드바이저 서비스 또는 상품을 제공하는 것으로 파악된다. 이는 제휴 기술업체를 포함하지 않은 수치로, 테스트베드센터의 집계보다 더 많다는 것을 보여준다.

2021년 3월말 기준으로 테스트베드센터의 심사를 통과하고 서비스를 제공 중인 14개 제공업체의 로보어드바이저 상품 또는 서비스는 총 29개로 집계된다. 그리고 이들 로보어드바이저의 유형을 구분해보면 <표 Ⅱ-2>에서 살펴볼 수 있듯이 상품추천형이 6개, 투자자문형이 10개, 투자일임형이 13개이며, 이 중 투자자문과 투자일임 서비스를 선택할 수 있는 투자자문ㆍ일임형이 3개로 파악된다.

2021년 3월말 기준으로 자체 조사한 자료에 따르면 <표 Ⅱ-3>에서 살펴볼 수 있듯이 10개 은행이 펀드 포트폴리오를 추천하는 상품추천형 로보어드바이저를 제공하고 있는 것으로 파악된다.6) 또한 광주은행과 대구은행을 제외한 8개 은행은 연금 포트폴리오를 추천하거나 제안하고 관리해주는 연금 로보어드바이저도 제공하고 있다. 참고로 연금 로보어드바이저의 경우 그 유형을 명확하게 구분하기 쉽지 않으나, 대개 펀드 로보어드바이저와 같이 제공된다는 점에서 상품추천형으로 판단된다.

2021년 3월말 기준으로 자체 조사한 자료를 토대로 15개 증권사의 로보어드바이저 유형을 구분해보면 <표 Ⅱ-4>에서 살펴볼 수 있듯이 매우 다양하다는 것을 확인할 수 있다. 또한 은행의 로보어드바이저가 펀드나 연금 포트폴리오 추천에 집중되어 있는 반면, 증권사의 로보어드바이저는 랩 투자일임형과 주식투자 정보제공형에 집중되어 있다. 한편 2019년 6월말 기준으로 자체 조사한 자료와 비교해보면 새로운 로보어드바이저 상품 또는 서비스를 출시한 증권사도 있지만, 기존의 로보어드바이저 상품 또는 서비스를 중단한 증권사가 더 많은 것으로 확인된다.

국내에서는 로보어드바이저 테스트베드센터가 유일하게 매월 로보어드바이저 시장규모를 발표하고 있다.8) 따라서 이 보고서에서도 테스트베드센터의 자료를 토대로 로보어드바이저의 시장규모를 살펴보았다.

가. 전체 시장규모

로보어드바이저 시장규모는 테스트베드센터의 집계에 따르면 2021년 6월말 가입자 수 기준 37만 9,477명, 관리자산 금액 기준 1조 7,584억원으로 절대적 규모 측면에서 크지 않다. 그러나 <그림 Ⅱ-3>에서 살펴볼 수 있듯이 그 동안 시장규모는 가파르게 증가하였다. 2017년 12월 대비 가입자 수가 약 10배, 관리자산 금액이 약 4배 증가하였고, 전년 동월 대비 가입자 수는 81.7%, 관리자산 금액은 46.9% 증가하였다.

나. 유형별 시장규모

로보어드바이저 유형별 시장규모를 테스트베드센터가 발표한 자료를 토대로 살펴보면, 상품추천형 로보어드바이저의 비중이 여전히 높은 것으로 파악된다. 2021년 6월말 상품추천형 로보어드바이저의 시장점유율이 누적 가입자 수 기준으로 56.6%, 관리자산 금액 기준으로 90.9%에 달한다. 투자자문형과 투자일임형의 경우 가입자 수 기준으로 각각 32.2%와 11.2%, 관리자산 금액 기준으로 각각 4.1%와 5.0%로 계산된다.

그러나 <그림 Ⅱ-5>에서 살펴볼 수 있듯이 코로나19 팬데믹이 진행된 2020년 이후부터 투자자문형과 투자일임형 로보어드바이저가 약진하였다. 그 결과, 2021년 6월말 상품추천형의 시장점유율이 전년 동월 대비 가입자 수 기준으로 28.4%p, 관리자산 금액 기준으로 5.8%p 감소하였다. 반면에 투자자문형과 투자일임형의 경우 가입자 수 기준으로 각각 21.9%p와 6.5%p, 관리자산 금액 기준으로 각각 2.3%p와 3.5%p 증가하였다.

예를 들어, <표 Ⅱ-6>에서 살펴볼 수 있듯이 각각 투자자문형과 투자일임형 로보어드바이저를 대표하는 파운트(Fount)와 핀트(Fint)의 가입자 연령대를 살펴보면, 2020년 12월말 20~30대 가입자가 각각 70.5%와 75.6%를 차지하고 있고, 이 중 20대 가입자 비중이 2020년 3월말 대비 각각 4.4%p와 7.5%p 증가하였다.

한편 2021년 1월부터 이들 로보어드바이저의 가입자 평균 관리자산 금액이 소폭 상승하는 양상을 보이고 있다. 특히 투자일임형의 경우 그 상승세가 더 두드러져 보인다. 이를 자세히 살펴보면, 2021년 6월말 투자자문형의 가입자 평균 관리자산 금액은 2020년 12월말 대비 7만 6천원 증가한 것에 비해 투자일임형의 경우 51만 3천원 증가하였다. 상품추천형의 경우에는 4만 9천원 증가하였다.

1. 연구 동기와 데이터

가. 연구 동기

2016년 9월 전후로 로보어드바이저가 국내에 처음 소개된 후 언론 등에서는 수익률에 초점을 맞춰 로보어드바이저를 평가하는 경향을 보여왔다. 이 때문에 로보어드바이저는 수익률이 사람보다 못하거나 시장수익률을 따라가지 못한다는 비판을 줄곧 받아왔다. 실제 로보어드바이저 테스트베드의 심사를 통과하고 상용화된 국내형ㆍ위험중립형 로보어드바이저의 누적수익률을 살펴보면 <그림 Ⅲ-1>에 나타난 바와 같이 2018년 하반기까지만 해도 일부를 제외한 대부분의 로보어드바이저의 누적수익률이 KOSPI200의 누적수익률을 하회하고 있다는 것을 확인할 수 있다.

이처럼 로보어드바이저의 성과를 수익률로만 평가한다면 그간의 로보어드바이저에 대한 평가가 크게 틀리지 않을 수 있다. 그러나 로보어드바이저의 성과를 수익률로 평가하는 것은 로보어드바이저의 본질적 역할을 고려하지 않는 것과 같다. 로보어드바이저의 수익률이 단기적으로 높다고 해서 로보어드바이저의 자산관리 역량이 우수하고, 그렇지 않다고 해서 저조하다고 평가할 수 없기 때문이다.

또한 로보어드바이저의 성과가 수익률로만 평가될 경우 개인의 로보어드바이저 선택에 부정적 영향을 미칠 수 있다. 수익률이 높은 로보어드바이저가 좋게 평가된다면 주식시장이 상승장일 경우 고위험-고수익 원칙에 따라 원금손실의 위험이 큰 로보어드바이저가 좋게 평가될 수밖에 없다. 또한 개인의 투자성향에 따라 자신에게 적합한 포트폴리오를 추천하는 로보어드바이저를 선택하는 것이 바람직한데, 상대적으로 수익률이 높은 로보어드바이저만을 선택하도록 잘못 유도할 수도 있다.

따라서 로보어드바이저의 성과는 로보어드바이저가 자신의 본질적 역할을 얼마나 잘 수행하는가로 평가되는 것이 바람직하다. 로보어드바이저의 본질적 역할은 장기적 관점에서 금융자산을 효율적으로 관리하는 데 있다. 이를 위해 로보어드바이저는 고객의 투자성향과 투자목적에 적합하게 금융자산을 적절하게 분산투자되도록 구성하여 추천하고, 시장 상황에 맞게 금융자산을 재구성 또는 리밸런싱하며, 궁극적으로 고객의 자산관리 수익을 높이고 위험을 낮춤으로써 고객의 금융자산을 효율적으로 관리할 수 있어야 한다.

한편 로보어드바이저의 성과를 본질적 역할에 맞게 평가하려면 자산관리 성과와 고객유치 성과를 구분하는 것이 필요하다. 전자는 개별 로보어드바이저의 자산관리 역량을 가늠할 수 있는 성과이고, 후자는 로보어드바이저 중 개별 로보어드바이저에 대한 수요를 측정할 수 있는 성과라는 점에서 다르다. 또한 자산관리 성과와 고객유치 성과는 높은 상관관계를 가질 수 있으나, 로보어드바이저가 비대면 채널을 통해 제공되는 자동화된 자산관리 서비스라는 점에서 자산관리 성과가 양호하다고 해서 반드시 고객유치 성과가 양호한 것은 아닐 수 있다.

상기의 논의를 바탕으로 이 보고서에서는 먼저 로보어드바이저의 자산관리 성과를 객관적으로 평가하기 위해 수식 (1)과 같이 Fama and French(1993)의 3요인 회귀분석 모형을 따라 로보어드바이저가 자산구성 또는 포트폴리오 선택(portfolio selection) 역량을 보유하고 있는지와 로보어드바이저가 적절하게 분산투자를 실시하는지 또는 시장수익률을 잘 추종하는지를 실증적으로 분석하였다.

로보어드바이저가 자산구성 또는 포트폴리오 선택 역량을 보유하고 있다면

Puhle(2019)는 2015년 5월부터 2018년 12월까지 독일의 5개 로보어드바이저를 대상으로 개별 로보어드바이저의 자산관리 성과를 평가하기 위해 Sharpe(1964)의 자본자산 가격결정 모형(CAPM)으로 회귀분석을 실시하였다. 그 결과,

Tao et al.(2020)은 미국의 100개 로보어드바이저를 대상으로 로보어드바이저의 평균 적인 자산관리 성과를 평가하기 위해 Fama and French(1993)의 3요인 모형과 Cahart (1997)의 4요인 모형으로 회귀분석을 실시하였다. 그 결과, 로보어드바이저가 시장지수 일부와 뮤추얼 펀드(mutual fund)보다 평균적으로 높은 초과수익률을 보인다는 것을 발견하였다. 그러나 Tao et al.(2020)도 Puhle(2019)와 마찬가지로 로보어드바이저의 리밸런싱을 통제하지 않은 한계를 갖고 있다.

이를 고려해 이 보고서에서는 수식 (2)에서와 같이 Goetzmann et al.(2000)의 시장 타이밍(market timing) 모형에 기초하여 로보어드바이저의 리밸런싱 성과를 추가적으로 분석하였다(Bollen and Busse, 2001; 김상배ㆍ박종구, 2009).

시장 타이밍 전략은 시장이 상승장일 때 시장수익률에 민감한 종목의 편입 비중을 높이고, 반대로 시장이 하락장일 때 편입 비중을 낮추는 리밸런싱 전략이다. 따라서

로보어드바이저의 자산관리 성과를 평가하는 데 있어 리밸런싱 성과를 고려하는 것은 두 가지 측면에서 매우 중요하다. 첫째, 로보어드바이저는 빅데이터 또는 인공지능 기술을 접목한 자동화된 알고리듬으로 더 체계적이고 시의적절하게 시장 상황에 대응한다고 평가되고 있다. 그렇다면 리밸런싱 성과에 따라 로보어드바이저의 자산관리 성과도 달라질 수 있다.

둘째, 리밸런싱 성과를 고려하지 않을 경우 로보어드바이저의 자산관리 성과 평가의 결과가 왜곡될 수 있다(Lee and Rahman, 1991). 예를 들어, Jensen(1968)은 시장 타이밍 능력이 존재함에도 이를 고려하지 않을 경우

이 보고서에서는 로보어드바이저의 자산관리 성과가 고객유치 성과로 이어지는지를 살펴보기 위해 로보어드바이저 중 어떤 로보어드바이저가 더 선호되는가를 분석하였다. 예를 들어, 자산관리 성과가 양호한 로보어드바이저일수록 더 선호될 수 있다. 또는 서비스 제공업체, 서비스 접근성이나 편리성, 최소 가입금액, 서비스 비용 등과 같은 개별 로보어드바이저의 특성에 따라 로보어드바이저가 선호될 수 있다.

이를 따라 로보어드바이저의 고객유치 성과를 평가하기 위해 수식 (3)과 같이 회귀분석 모형을 설정하였다.

나. 데이터

이 보고서에서는 기본적으로 코스콤의 로보어드바이저 테스트베드센터로부터 직접제공받은 로보어드바이저의 운용 및 실적 데이터를 사용하였다. 이 데이터에는 2016년 10월 18일부터 2021년 3월 31일까지 로보어드바이저의 일별 수익률, 자산위험도, 구성종목 수, 종목 편중률, 매매 회전율, 투자자 유형 등에 대한 정보가 포함되어 있다. 또한 주별 젠센알파, 베타, 표준편차, 샤프지수, 정보비율, 추적오차, 보상비율 등과 같은 성과 또는 위험지표도 포함되어 있다. 그리고 로보어드바이저의 월별 가입자 수, 관리자산 금액이 포함되어 있다.

로보어드바이저의 자산관리 성과를 분석하기 위한 수식 (1)과 (2)에 따른 회귀분석 모형에서 무위험수익률(

로보어드바이저의 고객유치 성과를 분석하기 위한 수식 (3)에 따른 회귀분석 모형에서 로보어드바이저의 누적 가입자 수(

또한 로보어드바이저의 최소 가입금액(

한편 제Ⅱ장에서 살펴본 바와 같이 2021년 3월말 기준으로 서비스 중인 모든 로보어드바이저 제공업체가 테스트베드센터에 자신의 로보어드바이저 운용 및 실적 데이터를 제출하는 것은 아니다. 예를 들어, 2021년 3월말 기준으로 펀드 로보어드바이저를 제공하고 있는 10개 은행 중 6개 은행만이 테스트베드센터의 심사에 참가하였고, 이 중 4개 은행만이 로보어드바이저 데이터를 제출하고 있다.13)14) 또한 투자자문형 로보어드바이저 중 에임(AIM) 등 일부 로보어드바이저는 테스트베드센터에 데이터를 제출하지 않고 있다.15) 따라서 테스트베드센터가 제공한 데이터에는 2021년 3월말 기준으로 서비스 중인 모든 로보어드바이저의 데이터가 포함되어 있는 것은 아니다.

이 때문에 테스트베드센터가 제공한 데이터에 기초하여 로보어드바이저의 성과를 분석할 경우 일부 로보어드바이저가 분석대상에 포함되지 않으므로써 발생할 수 있는 샘플 편향(sample bias)의 문제가 존재할 수 있다. 그러나 자산관리 성과의 경우 개별 로보어드바이저를 대상으로 분석하기 때문에 일부 로보어드바이저가 분석대상에 포함되지 않았다고 해서 분석 결과에 영향을 미치지 않는다. 또한 고객유치 성과의 경우 분석대상에서 제외된 로보어드바이저의 가입자 수가 전체 가입자 수에서 차지하는 비중이 높지 않고 분석대상에 포함된 로보어드바이저의 유형도 충분히 다양하기 때문에 분석 결과가 편향되지 않을 것으로 판단된다.

따라서 로보어드바이저의 성과 분석대상은 2021년 3월말 현재 서비스를 제공하면서 2020년 이전부터 테스트베드센터에 로보어드바이저 데이터를 제출하는 경우로 한정하였다. 또한 자산관리 성과 분석대상에서 해외 자산으로 운용되는 해외형 로보어드바이저도 제외하였다.16) 이에 따라 <표 Ⅲ-1>에 나타난 바와 같이 자산관리 성과의 분석대상은 제공업체 기준으로 14개, 알고리듬 기준으로 19개로, 고객유치 성과의 분석대상은 제공업체 기준으로 13개, 알고리듬 기준으로 22개로 추려진다.

고객유치 성과 분석의 경우 2019년 5월에 제공업체 유형 간에 제도적 차별이 대폭 완화된 점을 고려하여 2019년 6월부터 2021년 3월까지의 월별 데이터를 사용하였다(금융위원회, 2019. 5. 15). 결과적으로 분석대상에 포함된 로보어드바이저 알고리듬에 따라 최소 16개월, 최대 22개월의 월별 데이터가 고객유치 성과 분석에 사용되었다.

2. 자산관리 성과

가. 성과ㆍ위험지표 비교

개별 로보어드바이저를 대상으로 자산관리 성과를 실증 분석하고 비교하기에 앞서 개별 로보어드바이저의 샤프지수(Sharpe ratio)와 수익률 표준편차를 투자자 유형으로 구분하여 비교해보았다.17) 그 결과, 로보어드바이저의 위험 대비 자산관리 성과의 차이가 뚜렷하고 안전자산과 위험자산을 구성하는 포트폴리오 선택 역량에도 차이가 있어 보인다.18)19)

예를 들어, 안정추구형 로보어드바이저의 경우를 살펴보면 수익률 표준편차가 동일한 로보어드바이저 간에도 샤프지수 차이가 뚜렷하게 관찰된다. 이러한 양상은 위험중립형과 적극투자형 로보어드바이저에서도 비슷하게 관찰된다. 더구나 대부분의 로보어드바이저는 투자자 유형과 관계없이 샤프지수가 1보다 작고, 샤프지수가 음(-)의 값을 보이는 로보어드바이저도 보인다.

수익률 표준편차도 동일 투자자 유형 내에서조차 큰 차이를 보인다. 특히 일부 로보어드바이저의 수익률 표준편차는 다른 로보어드바이저와 큰 격차를 보인다. 더구나 수익률 표준편차가 위험중립형보다 작은 적극투자형과 안정추구형보다 작은 위험중립형 로보어드바이저가 상당 수 관찰된다. 또한 수익률 표준편차의 절대적 값이 크지 않은 점도 눈에 띈다. 이는 안전자산의 비중이 크기 때문일 수 있고, 분산투자가 잘 이루어지지 않았기 때문일 것으로 판단된다.

개별 로보어드바이저를 대상으로 리밸런싱 성과를 고려하지 않은 수식 (1)(이하 모형 Ⅰ)과 리밸런싱 성과를 고려한 수식 (2)(이하 모형 Ⅱ)에 대해 각각 최소자승법(OLS)으로 회귀분석을 실시하였다.20) 그 결과, <그림 Ⅲ-3>에서 살펴볼 수 있듯이 포트폴리오 선택 역량을 나타내는

이를 자세히 살펴보면, <표 Ⅲ-3>에 나타난 바와 같이 10% 유의수준에서 통계적으로 유의한

로보어드바이저의 실제 리밸런싱 전략이 Treynor and Mazuy(1966)가 제시한 시장 타이밍 전략과 다를 수 있다. 이러한 가능성을 고려하여 시장 타이밍 능력을 통제하는 설명변수 대신에 영업일 기준 최근 10일을 구간으로 이동평균한 리밸런싱 회수를 사용하여 회귀분석을 실시해보았다. 그 결과, 10% 유의수준에서 통계적으로 유의한

상기 회귀분석 결과에 따르면 Jensen(1968)과 Grant(1977)가 지적한 것처럼 리밸런싱 성과를 고려하지 않고 로보어드바이저의 자산관리 성과를 분석할 경우

와

와  의 추정치가 편향될 수 있다는 것을 확인할 수 있다. 이 점을 고려하여 이후의 논의에서는 리밸런싱 성과를 고려한 모형 Ⅱ의 회귀분석 결과를 토대로 로보어드바이저의 자산관리 성과를 평가하고 비교하였다.

의 추정치가 편향될 수 있다는 것을 확인할 수 있다. 이 점을 고려하여 이후의 논의에서는 리밸런싱 성과를 고려한 모형 Ⅱ의 회귀분석 결과를 토대로 로보어드바이저의 자산관리 성과를 평가하고 비교하였다.다. 서비스 유형별 비교

상기의 회귀분석 결과를 서비스 유형으로 구분하여 비교해보면 다음과 같다. 우선 <그림 Ⅲ-4>에서 살펴볼 수 있듯이 국내형 로보어드바이저 중 상품추천형, 투자자문형, 투자자문ㆍ일임형의 경우 일부가 포트폴리오 선택 역량을 보유한 것으로 보이나, 투자일임형의 경우 모두가 그렇지 않은 것으로 나타난다. 이는 서비스 유형 간뿐만 아니라 동일 서비스 유형 내에서도 포트폴리오 선택 역량의 차이가 존재한다는 점을 확인시켜준다.

그러나 투자일임형 1개를 제외하고 모든 투자자 유형에서 비정상적 초과수익률을 실현할 수 있는 로보어드바이저는 없는 것으로 나타난다. 이에 대한 명확한 이유는 알 수 없으나, 로보어드바이저 간에 위험자산 선택 역량에 차이가 존재하고 포트폴리오 선택 역량도 위험자산 선택 역량에 의해 영향을 받기 때문으로 판단된다.

개별 로보어드바이저가 시장수익률을 추종하는 정도를 파악할 수 있는 시장 민감도를 서비스 유형별로 살펴보면, <그림 Ⅲ-5>에 나타난 바와 같이 상품추천형과 투자자문형의 경우 시장 민감도가 대체적으로 통계적으로 유의하게 추정되고, 투자일임형과 투자자문ㆍ일임형의 경우 그렇지 못한 것으로 보인다.

그러나 로보어드바이저의 시장 민감도는 서비스 유형과 상관 없이 매우 낮게 추정되었다.

로보어드바이저의 시장 민감도가 낮게 추정된 것은 포트폴리오를 구성하는 데 있어 효율적으로 분산투자를 하지 못하거나 분산투자에 제약이 있기 때문일 수 있다. 또한 로보어드바이저 간에 안전자산을 과도한 비중으로 보유하거나 위험자산을 선택하는 역량이 부족할 경우 시장 민감도가 낮을 수 있다. 한편 로보어드바이저마다 자산배분이나 자산관리 전략이 다를 수 있기 때문에 로보어드바이저가 시장수익률을 잘 추종한다고 해서자산관리 성과가 양호하다고 평가할 수는 없다.

동일 서비스 유형 내에서 로보어드바이저 간의 리밸런싱 성과를 비교해보면, 안정추구형, 위험중립형, 적극투자형 순으로 리밸런싱 성과의 차이가 상대적으로 더 크다. 또한 그 차이의 정도는 투자자문ㆍ일임형이 가장 크고, 투자일임형, 투자자문형, 상품추천형 순으로 커진다. 이는 동일 서비스 유형 내에서 로보어드바이저 간에 시장 민감도의 차이 양상과 크게 다르지 않다.

한편 10% 유의수준에서 통계적으로 유의하게 양(+)의 값을 보이는 로보어드바이저의

지금까지 서비스 유형 간에 로보어드바이저의 자산관리 성과를 비교해본 결과, 서비스 유형 간뿐만 아니라 동일 서비스 유형 내에서도 로보어드바이저의 자산관리 성과의 차이가 존재하는 것을 확인할 수 있다. 특히 비정상적 초과수익률을 실현할 수 있는 포트폴리오 선택 역량을 갖추고, 효율적인 분산투자를 통해 시장수익률을 잘 추종하며, 이와 동시에 양호한 리밸런싱 성과를 보이는 로보어드바이저는 관찰되지 않는다. 다만 상품추천형이나 투자자문형 로보어드바이저 중에서 리밸런싱 성과는 저조하거나 통계적으로 유의하지 않더라도 시장수익률을 매우 낮은 수준으로 추종하면서 비정상적 초과수익률을 실현할 수 있는 로보어드바이저가 일부 관찰된다.

상기의 회귀분석 결과를 제공업체 유형별로 구분하여 비교해보면, 제공업체 유형 간에도 로보어드바이저의 자산관리 성과의 차이가 발견된다. 특히 증권사의 경우 포트폴리오 선택 역량 측면에서, 은행은 시장 민감도 측면에서 상대적으로 우위를 보이는 것으로나타난다. 리밸런싱 성과 측면에서는 거의 모든 로보어드바이저가 제공업체 유형과 상관없이 저조하거나 통계적으로 유의하지 않기 때문에 우위를 가리기 어렵지만, 증권사가 상대적으로 우위를 보이는 것으로 판단된다.

우선 포트폴리오 선택 역량 측면에서는 <그림 Ⅲ-7>에서 살펴볼 수 있듯이 비정상적 초과수익률을 실현할 수 있는 로보어드바이저 제공업체는 은행이 1개, 증권사가 2개, 투자자문ㆍ일임업자가 2개로 집계된다. 그런데 투자자 유형까지 고려하면 증권사가 가장 우위에 있는 것으로 보인다.22) 시장 민감도 측면에서는 <그림 Ⅲ-8>에서 살펴볼 수 있듯이 은행, 증권사, 투자자문ㆍ일임업자 순으로 우위를 보이는 것으로 나타난다.

리밸런싱 성과 측면에서는 <그림 Ⅲ-9>에서 살펴볼 수 있듯이 증권사가 은행보다 두드러지게, 투자자문ㆍ일임업자보다 대체적으로 우위에 있는 것으로 보인다. 증권사의 경우 리밸런싱 성과의 격차가 가장 작고, 투자자문ㆍ일임업자의 경우 그 격차가 클 뿐 아니라 리밸런싱 성과가 매우 저조한 로보어드바이저도 증권사보다 상대적으로 더 많기 때문이다. 물론 투자자문ㆍ일임업자 일부만 유일하게 양호한 리밸런싱 성과를 보인다.

이러한 제공업체 유형별 자산관리 성과의 차이는 은행의 경우 펀드로, 증권사의 경우 주로 랩으로, 투자자문ㆍ일임업자의 경우 주식ㆍETF로 자산을 관리하는 것과 관련이 있어 보인다. 예를 들어, 은행처럼 펀드로 자산을 관리할 경우 상대적으로 시장수익률을 잘 추종할 수 있는 반면, 리밸런싱하는 데 시간이 소요되어 리밸런싱 성과가 좋지 못할 수 있다.

지금까지 살펴본 바와 같이 개별 로보어드바이저의 자산관리 성과를 분석한 결과에 따르면, 로보어드바이저 간에 자산관리 성과의 차이가 존재한다는 것을 확인할 수 있다. 특히 동일 서비스 유형 또는 동일 제공업체 유형 간에도 자산관리 성과의 차이가 존재한다는 것을 확인할 수 있다. 이는 개인이 효율적인 자산관리를 위해 로보어드바이저를 이용할 경우 로보어드바이저 선택에 따라 자산관리 성과가 달라질 수 있고, 그만큼 효율적 자산관리가 로보어드바이저 선택에 의해 좌우될 수 있다는 것을 시사한다.

로보어드바이저가 미리 짜여진 알고리듬을 활용하여 자동화된 자산관리 서비스를 제공하는 것이라면 로보어드바이저 간에 자산관리 성과의 차이가 없을 것이라는 기대가 있다. 그러나 로보어드바이저 간 자산관리 성과의 차이는 알고리듬에 사용된 자산배분 모형의 적정성 또는 객관성, 리밸런싱 실시 기준의 타당성 또는 일관성 등 기술적 역량의 차이나 포트폴리오에 편입되는 자산 유형과 수의 차이로 나타날 수 있다.

국내의 경우 로보어드바이저가 출현하고 서비스가 제공된지 5년이 지나지 않았기 때문에 로보어드바이저 간에 기술적 역량의 차이가 존재할 수 있고, 해외와 달리 다양한 서비스 유형이 출현하다보니 포트폴리오에 편입되는 자산의 유형도 다르고 그 수도 다르다. 따라서 로보어드바이저 간에 자산관리 성과의 차이가 존재하는 것은 상기와 같은 국내 로보어드바이저의 특성이 복합적으로 작용한 결과로 판단된다.

이와 달리 미국의 로보어드바이저의 경우 <그림 Ⅲ-10>에서 살펴볼 수 있듯이 로보어드바이저 간에 자산관리 성과의 차이가 크지 않은 것으로 판단된다(Backend Bench-marking, 2020). 이는 미국의 경우 거의 모든 로보어드바이저가 투자일임형으로 제공되고 포트폴리오를 ETF로 구성하여 운용함에 따라 기술적 요소 외의 다른 차이가 없기 때문일 수 있다. 이 때문에 미국의 경우 일반적으로 로보어드바이저를 평가할 때 수익률이나 자산관리 성과가 아닌 주로 최소 가입금액, 서비스 비용, 서비스 편리성 등을 고려하는것으로 파악된다(NerdWallet, 2021. 9. 2).

가. 회귀분석 결과

로보어드바이저의 고객유치 성과를 분석하기 위해 수식 (3)에 대해 확률효과(random effects) 모형으로 회귀분석을 실시하였다.23)24) 그 결과, <표 Ⅲ-4>에서 살펴볼 수 있듯이 로보어드바이저의 개별 특성을 나타내는 설명변수를 추가할수록

각 설명변수가 로보어드바이저의 고객유치에 미치는 효과를 살펴보면, 우선 연환산 수익률은 로보어드바이저의 고객유치에 통계적으로 유의한 효과를 미치지 못하는 것으로 추정된다. 이와 달리 위험 대비 초과수익률을 나타내는 샤프지수와 수익률의 변동성을 나타내는 표준편차가 10% 유의수준에서 통계적으로 유의하게 양(+)의 효과를 보이는 것으로 추정된다. 이는 가입자들이 로보어드바이저를 선택할 때 수익률만을 보지 않고 원금손실 위험도 같이 고려하기 때문인 것으로 판단된다.

로보어드바이저의 제공업체 유형을 은행, 증권사, 투자자문ㆍ일임업자(전문사모집합투자업자 포함)로 구분하여 고객유치에 미치는 효과를 살펴보면, 제공업체가 은행이면 고객유치 효과가 증권사에 비해 1% 유의수준에서 통계적으로 유의하게 매우 큰 것으로 추정된다. 이와 달리 투자자문ㆍ일임업자이면 증권사에 비해 고객유치 효과가 10% 유의수준에서 통계적으로 유의하게 음(-)의 값을 보이는 것으로 나타난다.

PC 웹사이트의 서비스 접근성은 로보어드바이저의 고객유치에 통계적으로 유의한 효과를 미치지 못하지만, 모바일 앱의 서비스 접근성이 높은 로보어드바이저일수록 5% 유의수준에서 통계적으로 유의하게 더 많은 고객을 유치하는 것으로 추정된다. 이는 로보어드바이저의 고객 연령대가 주로 20~30대에 집중되어 있기 때문일 수 있다. 그러나 제공업체가 은행인 경우 전체 고객의 50% 이상을 차지하는 점을 고려하면 반드시 그렇지 않을 수도 있다.25)

이렇게 제공업체 유형 간에 로보어드바이저의 서비스 접근성이 차이가 나는 가장 큰 이유는 은행 또는 증권사와 투자자문ㆍ일임업자 간의 서비스 공급대상이 다르기 때문이다. 은행이나 증권사는 신규 고객을 유치하기보다는 기존 고객을 대상으로 서비스를 공급할 목적이 큰 것으로 보인다. 예를 들어, 은행이나 증권사의 경우 웹사이트 또는 앱에서 로그인해야 서비스 조회나 가입이 가능한 경우가 많다. 이와 달리 로보어드바이저 알고리듬을 자체 개발하고 직접 공급하는 투자자문ㆍ일임업자는 대개 기존 고객기반이 없기 때문에 신규 고객을 유치해야 하고, 이를 위해 서비스 소개, 가입, 이용 등 모든 단계에서 고객 경험과 편의를 고려해 전용 플랫폼을 설계하고 제공하고 있는 것으로 파악된다.

한편 로보어드바이저에 대한 수요는 다른 요인이 동일하다면 서비스 비용이 낮을수록 높아야 한다. 그런데 <표 Ⅲ-4>에 나타난 회귀분석 결과로는 수수료의 무료 여부가 로보어바이저의 고객유치에 미치는 효과를 파악할 수 없다. 더구나 통계적 유의성을 고려하지 않을 경우 고정 수수료를 수취하는 로보어드바이저의 고객유치 효과가 그렇지 않은 경우보다 크다고 볼 여지도 있다. 이를 근거로 수수료 체계를 나타내는 각 설명변수의 계수 추정치가 편향되었거나 그 통계적 유의성이 과소 평가되었다고 주장될 수 있다.

하지만 이러한 회귀분석 결과는 다음과 같이 설명될 수 있다. 먼저 무료 수수료의 고객유치 효과는 제공업체 유형이 은행인 경우의 고객유치 효과에 내재되어 추정되었을 수 있다. <표 Ⅲ-6>에서 살펴볼 수 있듯이 무료 수수료를 채택한 로보어드바이저는 은행에 의해서만 제공되고 있기 때문이다. 이는 은행이 제공하는 로보어드바이저를 선택하면 수수료가 무료이고, 그렇지 않으면 유료라는 것을 뜻하기도 한다. 따라서 무료 수수료의 고객유치 효과는 양(+)의 값을 보일 수 있다.

나. 제공업체 유형별 실제와 추정 가입자 수 비교

제공업체 유형에 따른 로보어드바이저의 개별 특성이 고객유치 성과에 미치는 영향을 자세히 살펴보기 위해 <표 Ⅲ-4>의 (4)에 나타난 기본모형의 회귀분석 결과를 토대로 제공업체 유형별 실제와 추정 가입자 수를 비교하였다. 그 결과, <그림 Ⅲ-11>의 좌측 열 그림에서 살펴볼 수 있듯이 은행과 투자자문ㆍ일임업자의 경우 실제 가입자 추세와 비슷하게 추정되나 증권사의 경우 과소 또는 과다하게 추정된 것이 확인된다. 이는 증권사의 가입자 수가 분석기간 중 7천명 이하의 매우 낮은 수준을 유지하며 거의 변하지 않는 반면, 설명변수 중 자산관리 성과를 나타내는 설명변수는 시간에 따라 변하기 때문인 것으로 이해된다.

이 점을 고려해 자산관리 성과를 나타내는 설명변수에 증권사와 투자자문ㆍ일임업자를 나타내는 더미변수를 곱한 상호작용 설명변수를 수식 (3)에 추가한 수정모형에 대해 회귀분석을 실시하여 동일한 방법으로 제공업체 유형별 실제와 추정 가입자 수를 비교하였다. 그 결과, <그림 Ⅲ-11>의 우측 열 그림에서 살펴볼 수 있듯이 제공업체 유형이 증권사인 경우 실제와 추정 가입자 수의 차이가 크게 감소한 것을 확인할 수 있다. 이를 통해 로보어드바이저의 자산관리 성과보다는 제공업체 유형에 따른 로보어드바이저의 개별 특성이 로보어드바이저의 고객유치 성과의 차이를 더 잘 설명한다는 것을 확인할 수 있다.

한편 제공업체 유형이 투자자문ㆍ일임업자인 로보어드바이저의 경우 2020년 하반기부터 기본모형이나 수정모형에서의 회귀분석 결과로 설명되지 않는 가입자 수의 증가세가 존재하는 것으로 확인된다. 이는 코로나19가 공식 선언된 이후 개인의 주식 직접투자참여가 대폭 증가한 것과 관련이 있어 보인다. 예를 들면, 주식에 직접투자하는 것보다 간접투자하는 것을 선호하는 개인의 경우 간접투자의 방법으로 로보어드바이저를 선택할수 있고, 이 중 상대적으로 서비스 접근성이 좋은 전용 플랫폼을 제공하는 투자자문ㆍ일임업자의 로보어드바이저가 선택될 가능성이 크다.

지금까지 살펴본 로보어드바이저의 고객유치 성과를 분석한 결과를 종합하면 다음과 같다. 우선 로보어드바이저의 자산관리 성과가 좋다고 해서 반드시 고객유치 성과가 좋은 것은 아니다. 예를 들어, 테스트베드센터가 공시하는 제공업체 유형별 평균 샤프지수를 비교해보면 <그림 Ⅲ-12>에서 살펴볼 수 있듯이 증권사인 경우 2020년 12월 이전까지만해도 샤프지수가 평균적으로 은행보다 높고 2020년 6월 이후부터는 투자자문ㆍ일임업자보다 높다. 그런데도 증권사의 총 가입자 수는 7천명 이하 수준으로 계속 정체되어 있다. 만약 로보어드바이저의 자산관리 성과가 고객유치 성과를 잘 설명한다면 증권사의 총 가입자 수는 최소한 투자자문ㆍ일임업자보다 더 많아야 한다.

Ⅳ. 시사점

지금까지 살펴본 바와 같이 국내 로보어드바이저의 현황을 서비스 유형별로 구분하여 종합하고 자산관리 성과와 고객유치 성과를 서비스 유형과 제공업체 유형별로 구분하여 비교ㆍ분석한 결과를 토대로 시사점을 도출하면 다음과 같다.

우선 로보어드바이저에 대한 규제와 감독 체계를 정비할 필요가 있다. 로보어드바이저라는 명칭이 법적 용어가 아니라는 점에서 그 명칭이 광범위하게 사용되는 것을 제한하지 않더라도 금융소비자 보호 차원에서 로보어드바이저 규제와 감독 체계를 동일행위-동일규제 원칙에 입각하여 정비할 필요가 있다.

예를 들어, 은행의 상품추천형 로보어드바이저의 경우 서비스 내용 측면에서 투자자문형과 거의 유사하다는 점에서 투자자문 계약을 반드시 체결하도록 지도하는 것이 필요할 수 있다.28) 또한 로보어드바이저 테스트베드센터의 심사를 받지 않거나 회피하는 정보제공형 또는 투자자문ㆍ일임형 로보어드바이저의 경우 설명의무나 광고규제를 통해 이 사실을 설명하거나 적시하도록 지도할 필요가 있다.

더 나아가 금융소비자가 로보어드바이저를 잘 구별할 수 있도록 로보어드바이저 명칭의 사용을 제한할 필요도 있다.29) 이를 위해 로보어드바이저의 법적 용어를 ‘전자적 투자자문장치’로 수정하고 자본시장법에 따른 투자자문업자나 투자일임업자 또는 금융소비자보호법에 따른 금융상품자문업자만이 로보어드바이저 명칭을 사용할 수 있도록 제한해야 한다.30)

2020년 중반부터 투자자문ㆍ일임형 로보어드바이저에 대한 수요가 빠르게 증가하고 있는 점은 로보어드바이저를 통한 자산관리 서비스의 대중화라는 정책적 목표 측면에서 매우 고무적이다. 하지만 로보어드바이저 간에 자산관리 성과의 격차가 존재하는 만큼 금융소비자가 자신에게 가장 적합한 로보어드바이저를 선택하는 것은 이전보다 더 중요해졌다. 따라서 금융소비자가 로보어드바이저의 자산관리 성과를 손쉽게 조회하고 비교할 수 있도록 현행 로보어드바이저 공시체계를 체계적이고 통일되게 개선할 필요가 있다.

예를 들어, 현재는 로보어드바이저 제공업체의 자율 의사에 따라 테스트베드센터의 공시 참여 여부를 결정한다. 이보다는 테스트베드 심사를 받고 통과한 로보어드바이저 제공업체는 반드시 공시에도 참여하도록 의무화할 필요가 있다. 이를 통해 테스트베드센터가 로보어드바이저의 자산관리 성과와 위험 지표를 정확하게 산출하고 공시하는 체계를갖추도록 지원할 필요가 있다. 또한 테스트베드센터 홈페이지뿐만 아니라 로보어드바이저 제공업체의 PC 웹사이트나 모바일 앱에서도 로보어드바이저의 자산관리 성과를 공시토록 하여 금융소비자가 로보어드바이저의 자산관리 성과를 손쉽게 조회하고 비교할 수있도록 해야 한다.

로보어드바이저의 자산관리 성과를 분석한 결과에 따르면 로보어드바이저의 포트폴리오 선택 역량이나 리밸런싱을 통한 수익과 위험 관리 역량이 대부분의 경우 저조하거나 유의미하지 않은 것으로 나타난다. 이 점을 고려할 때 금융소비자가 수익률이 아닌 자산관리 역량을 판단기준으로 로보어드바이저를 선택할 수 있도록 로보어드바이저 알고리듬에 대한 설명의무 규제를 강화하는 방안을 검토할 필요가 있다. 더 나아가 중장기적으로는 불필요한 리밸런싱으로 금융소비자에게 과도한 비용을 유발하지 않는지를 살펴보고 로보어드바이저의 이해상충 문제가 발견되면 개선할 필요도 있다.

참고로 미국의 SEC는 금융소비자가 로보어드바이저의 작동원리를 이해하고 로보어드바이저를 이용하는 것이 중요하다고 판단하여 2017년 2월에 로보어드바이저의 알고리듬 설명의무뿐만 아니라 사업모델 전반에 대한 설명의무를 가이드라인을 통해 지도하였다(SEC, 2017; 이성복, 2017, 2018). 최근에 유럽 의회는 로보어드바이저에 대한 이용이 증가하자 금융소비자 보호를 강화하기 위해 로보어드바이저의 알고리듬 설명의무뿐아니라 이해상충 문제 등 다양한 측면에서 로보어드바이저 규제 방안을 논의하고 있다(European Parliament, 2021).

로보어드바이저의 포트폴리오 선택 역량이나 시장수익률 추종 정도를 향상하려면 로보어드바이저가 효율적 분산투자를 용이하게 구현할 수 있도록 정책적으로 지원하는 것도 필요하다. 예를 들어, 소수점 매매제도의 도입이 필요할 수 있다. 참고로 국내의 경우 2021년 6월말 기준으로 2개 증권사에 한하여 해외 상장증권의 소수점 매매가 금융규제 샌드박스를 통해 허용되었고, 금융당국에서도 2021년 9월에 해외주식은 2021년 중, 국내 주식은 2022년 9월부터 시행하겠다는 계획을 발표한 상태다(김민기, 2021; 금융위원회, 2020. 12. 20, 2021. 9. 13).

마지막으로 로보어드바이저의 고객유치 성과를 분석한 결과에 따르면 자산관리 성과가 반드시 고객유치 성과로 이어지지는 않는 것으로 나타난다. 특히 로보어드바이저 제공업체가 증권사인 경우 은행이나 투자자문ㆍ일임업자에 비해 자산관리 성과가 뒤지지 않음에도 불구하고 저조한 고객유치 성과를 보인다. 이 점을 고려할 때 증권사는 로보어드바이저의 서비스 접근성을 대폭 개선할 필요가 있어 보인다.

예를 들어, 증권사는 주로 랩 투자일임형이나 정보제공형 로보어드바이저를 집중적으로 제공하고 있는데, 이보다는 미국의 뱅가드나 찰스슈왑처럼 별도의 전용 플랫폼을 통해 주식과 ETF로 자산관리하는 투자자문ㆍ일임형 로보어드바이저를 제공하고, 상대적으로 높은 최소 가입금액과 수수료도 인하할 필요가 있다. 더 나아가 서비스 차별화 차원에서 자문사의 자문이나 상담사의 보조 서비스를 결합하는 방안도 고민해볼 수 있다.

1) 코스콤은 2016년 9월 금융위원회의 지정으로 로보어드바이저 테스트베드센터(이하 테스트베드센터)를 운영하고 있다. 2021년 3월말 기준으로 187개 로보어드바이저 알고리듬이 테스트베드센터에 심사를 신청하였고, 이 중 88개에 대한 기본 현황이 웹사이트(ratestbed.kr)를 통해 공시되고 있다.

2) 국내에서는「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」에 따라 투자자문업과 투자일임업을 구분하고 있으나, 해외에서는 대개 투자자문 또는 자산관리 서비스로 통칭한다.

3) 자본시장법 시행령 제2조제6호와 금융투자업규정 제1-2조의2제3호에 따라 전자적 투자조언장치를 활용하려면 (주)코스콤의 지원을 받아 외부전문가로 구성된 심의위원회(로보어드바이저 테스트베드)의 요건 심사를 받아야 한다.

4) 로보어드바이저 제공업체가 투자자문ㆍ일임업자일 경우 최초 자산구성과 리밸런싱 시에 자산 편출입의 주문집행이 제휴 증권사를 통해 처리된다.

5) 테스트베드센터에서는 로보어드바이저 유형을 무료추천형, 투자자문형, 투자일임형으로 분류하고 있다. 여기서 무료추천형은 이 보고서에서 구분한 상품추천형과 동일하다. 또한 정보제공형 로보어드바이저는 법적으로 심사대상이 아니기 때문에 테스트베드센터에서는 별도로 구분하지 않는다. 한편 무료추천형은 로보어드바이저 서비스가 무료라는 관점에서 붙여진 용어이나 엄밀하게 따지자면 잘못된 용어다. 사실상 펀드 등 금융상품을 추천하거나 환매하면서 고객으로부터 수수료를 수취하기 때문이다.

6) 기업은행은 i-ONE 로보, 광주은행은 KJ마이봇, 대구은행은 Ro.D, 신한은행은 쏠리치, 우리은행은 우리로보-알파, 하나은행은 하이로보, BNK경남은행과 BNK부산은행은 웰스타로보, KB국민은행은 케이봇쌤, NH농협은행은 NH로보-PRO 브랜드로 펀드 또는 연금 로보어드바이저 서비스를 제공 중이다.

7) 디셈버앤컴퍼니는 핀트, 쿼터백자산운용은 쿼터백, 두물머리투자자문은 불릴레오, 에임은 에임, 이루다투자일임은 이루다투자, 파운트투자자문은 파운트 모바일 앱을 제공하고 있다.

8) 2017년 7월부터 2021년 3월까지 3개 은행, 4개 증권사, 2개 자산운용사, 4개 투자자문ㆍ일임업자가 테스트베드센터에 로보어드바이저 가입자 수와 관리자산 금액을 보고하였다. 또한 서비스 중단 등을 이유로 동 기간 중 보고를 중단한 제공업체도 있다. 여기서 가입자 수는 누적이고, 관리자산 금액은 가치 변동이 반영되지 않은 고객의 계약 금액이다.

9) 개인이 로보어드바이저의 누적수익률이나 자산관리 성과를 직접 계산하거나 추정하는 것은 쉽지 않다는 점을 고려하여 개인이 접근할 수 있는 코스콤의 로보어드바이저 테스트베드센터의 공시자료를 사용하였다.

10) 주별 또는 월별 수익률이 아닌 일별 수익률을 사용한 것은 로보어드바이저가 자동화된 자산관리 서비스라면 실시간으로 시장 상황에 대응할 수 있어야 한다는 점을 고려하였다.

11) 해외의 경우 로보어드바이저가 활성화될수록 고객유치 경쟁이 심화되고 최소 가입금액과 서비스 비용이 낮아지는 추세가 관찰된다. 그러나 국내의 경우 이러한 추세가 뚜렷하게 관찰되지 않는다. 이 점을 고려해 이 보고서에서는 최소 가입금액과 서비스 비용 설명변수를 시간 불변 변수로 설정하였다.

12) 먼저 서비스 단계를 소개(탐색), 가입, 이용으로 구분하였다. 그리고 웹이나 앱에서 단계별 서비스를 제공할 경우 1점을 부여하였다. 또한 서비스 편리성을 고려하기 위해 각 서비스 단계에 최종적으로 도달하는 데 소요되는 절차 수에 따라 점수를 할인하였다. 예를 들면, 로보어드바이저의 소개 정보를 찾아 들어가는 데 7번의 마우스 클릭(mouse click)이나 스크린 터치(screen touch)가 요구될 경우 1/7점으로 할인하였다. 마지막으로 각 채널의 서비스 접근성 점수 합계를 최대 1점을 기준으로 환산하였다.

13) 은행의 펀드 로보어드바이저는 상품추천형이고 자본시장법에 따른 ‘전자적 투자조언장치’에 해당되지 않기 때문에 광주은행, 대구은행, BNK경남은행, BNK부산은행은 테스트베드센터의 심사에 참가하지 않은 것으로 보인다.

14) 테스트베드센터의 심사에 참가한 기업은행과 농협은행은 심사 중에만 로보어드바이저 운용 데이터를 제출하였고, 우리은행은 실적 데이터를 제출하지 않는 것으로 파악된다.

15) 에임(AIM)은 자신을 로보어드바이저로 광고하면서도 자본시장법에 따른 ‘전자적 투자조언장치’에 해당되지 않는다고 판단하여 테스트베드센터 심사에 참가하지 않은 것으로 파악된다.

16) 해외형 로보어드바이저는 대개 미국 주식ㆍETF로 운용되는 것으로 알려져 있으나, 그 구성을 정확히 알 수 없어 제외하기로 하였다. 자산관리 성과 분석대상에서 해외형 로보어드바이저를 제외할 경우 제공업체 유형별 수는 변동이 없고, 제공업체 유형이 은행인 경우 2개, 증권사인 경우 2개, 투자자문ㆍ일임업자의 경우 4개 알고리듬이 분석대상에서 제외된다.