Find out more about our latest publications

Retail Investors’ Margin Trading in Korea: Current State, Characteristics and Implications

Issue Papers 22-01 Jan. 05, 2022

- Research Topic Capital Markets

Amid a massive inflow of retail investors to Korea’s stock market, margin loans have reported a steep rise in value since the Covid-19 outbreak. Margin trading could act as a double-edged sword both for the entire stock market and retail investors, which requires caution. Against this backdrop, this article intends to quantitatively examine the soundness of margin loans in Korea’s stock market, and to conduct a multi-pronged analysis of the characteristics of those engaging in margin trading based on retail investors’ margin transaction data.

The results of the empirical analysis conducted by this article can be summed up as follows. First, although Korea’s amount of margin loans is lower than that of major economies, it has shot up quite rapidly since the spread of the Covid-19. Second, increases in outstanding margin loans are relatively concentrated in the small-cap, high-risk stocks that show high volatility. It is worth noting that the stocks that took up a high proportion of outstanding margin loans experienced a larger decline in prices amid the Covid-19 pandemic. Given this, when downward pressure on the stock market mounts, high-risk stocks are likely to face rising volatility. Third, although Korea’s retail investors who buy stocks on margin account for a small proportion at 5.5%, a number of small investors with low risk tolerance levels show a tendency towards margin trading. The analysis result reveals that if trading costs are taken into account, investors who buy stocks on margin underperform other retail investors. In particular, small investors tend to obtain a far lower rate of return, implying that their loss may rise even further presumably due to margin trading. Fourth, it has been analyzed that despite their good financial standing, those who use margin loans bear greater investment risk, which can be attributable to a large proportion of high-risk stocks and less diversified portfolios. Notably, investors who buy stocks using borrowed capital exhibit an extremely speculative, short-term investment behavior, as evidenced by their trading frequency three times higher than that of ordinary retail investors. As speculative behavior is especially evident in new entrants, younger investors and small investors, it can be assumed that the poor performance of investors engaging in margin trading stems from behavioral biases such as overconfidence.

Margin trading can be seen as speculative demand and thus, investors should remain cautious about using margin loans excessively since it could threaten the stock market stability and incur heavy losses. Considering that some of the margin loan users are not capable of properly using leverage, retail investors should understand exactly the risk posed by margin trading and respond to potential investment risks.

The results of the empirical analysis conducted by this article can be summed up as follows. First, although Korea’s amount of margin loans is lower than that of major economies, it has shot up quite rapidly since the spread of the Covid-19. Second, increases in outstanding margin loans are relatively concentrated in the small-cap, high-risk stocks that show high volatility. It is worth noting that the stocks that took up a high proportion of outstanding margin loans experienced a larger decline in prices amid the Covid-19 pandemic. Given this, when downward pressure on the stock market mounts, high-risk stocks are likely to face rising volatility. Third, although Korea’s retail investors who buy stocks on margin account for a small proportion at 5.5%, a number of small investors with low risk tolerance levels show a tendency towards margin trading. The analysis result reveals that if trading costs are taken into account, investors who buy stocks on margin underperform other retail investors. In particular, small investors tend to obtain a far lower rate of return, implying that their loss may rise even further presumably due to margin trading. Fourth, it has been analyzed that despite their good financial standing, those who use margin loans bear greater investment risk, which can be attributable to a large proportion of high-risk stocks and less diversified portfolios. Notably, investors who buy stocks using borrowed capital exhibit an extremely speculative, short-term investment behavior, as evidenced by their trading frequency three times higher than that of ordinary retail investors. As speculative behavior is especially evident in new entrants, younger investors and small investors, it can be assumed that the poor performance of investors engaging in margin trading stems from behavioral biases such as overconfidence.

Margin trading can be seen as speculative demand and thus, investors should remain cautious about using margin loans excessively since it could threaten the stock market stability and incur heavy losses. Considering that some of the margin loan users are not capable of properly using leverage, retail investors should understand exactly the risk posed by margin trading and respond to potential investment risks.

Ⅰ. 분석 배경

코로나19 이후 개인투자자의 활발한 주식거래와 함께 국내 주식시장 신용융자잔고가 가파르게 증가했다. 최근 소폭 감소하긴 했으나 주식시장 신용융자잔고 금액은 2021년 10월 말 기준 24조원으로 코로나19 팬데믹이 본격화되던 2020년 3월 말 6.6조원에 비해 265% 늘어났다. 증가 규모로는 유례가 없던 기록적인 수치이며 같은 기간(2020년 4월~2021년 10월) 개인투자자 주식시장 순매수금액인 127조원과 비교했을 때 결코 적지 않은 금액으로 판단된다. 신용융자는 주식시장 수급 측면에서 일종의 가수요로 투기적인 요소가 짙을 경우, 향후 잠재적 상환 수요로 인해 주식시장의 하방 위험이 확대될 수 있어 면밀한 모니터링이 요구된다.

한편 투자자 입장에서 레버리지(leverage) 수단인 신용융자는 투자자의 기대수익을 극대화하기 위한 용도로 충분히 활용될 수 있는 옵션이지만 반대로 투자자의 손실을 키울 수 있는 양날의 검이기도 하다. 이처럼 신중하게 접근해야하는 수단인 만큼 투자자의 각별한 주의가 요구되나, 신용융자에 대한 접근성이 높아 개인투자자의 위험 감내 수준에 적합하지 않게 활용될 소지가 있다. 특히 국내 개인투자자의 과도한 거래, 낮은 분산투자 수준 등을 고려하면(김민기ㆍ김준석, 2021), 신용융자의 활용으로 인해 개인투자자가 과도한 위험에 노출되어 있을 가능성도 배제할 수 없다.

이에 본고는 국내 개인투자자의 주식시장 신용융자거래 현황과 특징을 종합적으로 검토하고자 한다. 먼저 신용융자거래에 대한 그간의 연구 결과를 종합해보고(Ⅱ장), 시장 데이터를 기반으로 국내 주식시장 신용융자의 건전성을 융자 규모와 종목별 비중을 통해 검토한다(Ⅲ장). 국내 주식시장의 상승세가 둔화되고 신용융자잔고가 정점에 도달한 시점에서 신용융자의 현황과 특징을 분석하는 것은 의미가 있을 것으로 판단된다. 또한 개인투자자별 신용융자거래 자료를 바탕으로 신용거래자의 구성, 투자성과와 투자행태를 투자자 유형별로 분석하여 개인투자자가 신용융자를 적절하게 활용하고 있는 지 살펴본다(Ⅳ장). 그간의 국내 연구는 개인투자자의 신용융자거래가 주식시장에 미치는 영향에 집중한 측면이 있어, 본 연구는 신용거래자의 현황과 건전성을 다양한 각도로 분석하는 점에서 의의가 있다. 본고의 분석 결과를 바탕으로 국내 개인투자자의 신용융자거래에 대한 시사점을 제공할 수 있을 것으로 기대한다.

Ⅱ. 선행 연구

신용융자거래(margin trading)1)는 증권사에서 제공하는 신용공여를 통해 주식을 매수하는 거래로, 정책 당국의 지속적인 관심의 대상인 공매도와 달리 신용융자거래에 대한 연구는 자료의 제약, 학술적 관심 부재로 활발히 진행되지 못한 측면이 있다. 가령 신용거래의 역사가 깊은 미국의 경우 1929년 대공황 당시 증시 폭락으로 1934년 증권거래법(Securities and Exchange Act) 제정과 함께 증거금율 규제가 시행되었는데, 관련하여 초기의 연구는 신용규제의 효과를 검증하는 방향으로 진행되었다. 초창기 연구결과(Cohen, 1966; Moore, 1966; Grube et al., 1979)에 따르면 신용규제는 시장 변동성에 별다른 영향을 주지 못하는 것으로 실증되었으며, 이에 따라 미국은 신용거래제도가 어느 정도 안정화되었다고 판단된 이후 개시증거금율을 1974년부터 지금까지 그대로 유지해오고 있다.2)

이후 1987년 10월 미국 증시가 블랙 먼데이(Black Monday)를 겪으면서 신용거래에 대한 연구가 다시 활발히 재개되었고, 이후의 연구는 신용규제의 유용성과 신용거래의 효과에 대해 긍정적 또는 부정적 견해로 나뉘게 된다. 먼저 신용규제가 주식시장 안정화를 위해 유용하다는 주장(Hardouvelis, 1988)이 있는 반면, 고정된 증거금율 규제는 자산 가격 변동에 따라 시장에 부담이될 수 있음을 보인 연구도 있으며(Chowdhry & Nanda, 1998), Seguin & Jerrel(1993)은 1987년블랙 먼데이와 관련하여 신용거래가 가능한 주식에서 오히려 주가 하락이 덜 해 신용거래와 당시주가 폭락은 아무런 관련이 없음을 주장했다. 우리나라의 경우 고광수 외(2007)는 과거 신용규제가 주식시장 변동성에 전혀 영향을 주지 못했음을 실증한 바 있다.

신용거래의 효과에 대한 미시적인 분석을 살펴보면, 선진국의 경우 전반적으로 신용거래가 주식시장에 미치는 영향은 미미하고 시장의 질적 수준을 개선하는 것으로 알려져 있다.3) 미국의 OTC시장을 분석한 Seguin(1990)에 따르면, 신용거래가 가능한 종목군에 편입될 경우 거래량이 유의미하게 증가하고 변동성이 줄어드는 것으로 나타났다. 다만 미국 주식시장의 경우 시장 내 주된 거래주체가 기관투자자임을 인지할 필요가 있다. 기관투자자는 대개 정보거래자(informed investor)로 간주되어 자본 제약이 발생할 시 레버리지를 활용하여 정보거래를 통한 가격발견 기능을 수행할 수 있다. 반면 개인투자자와 같은 비정보거래자(uninformed investor)가 많은 신흥국 주식시장의 경우 신용거래의 영향이 다른 양상으로 나타날 수 있다.

이와 관련하여 인도, 중국과 같이 개인투자자 비중이 높은 신흥국을 대상으로 한 연구에 따르면 신용거래가 정상적인 상황에서는 시장 유동성 제고에 기여하지만, 위기 기간에서는 오히려 반대 현상이 나타나며 개별주식 수익률간의 동조화(comovement) 현상이 현저해짐을 실증했다 (Kahraman & Tookes, 2017, 2019). 특히 2015년 중국 주식시장 폭등ㆍ폭락의 주범으로 신용거래가 지목되면서 Bian et al.(2021)은 불안정한 시장 상황(stressed market condition)에서 신용거래자(margin investor)의 신용축소(deleveraging)는 주식시장 내 부정적인 파급효과(spillover)를 야기한다고 주장한다. 요약하면 시장의 상황이나 성숙도에 따라 신용거래가 주식시장에 미치는 영향은 상이하게 나타는 것으로 평가할 수 있다. 국내 주식시장에 대한 분석에서는 신용거래가 주식가격을 크게 교란하지 않으며 호가 스프레드(bid-ask spread)를 감소시키는 등 시장의 질적 측면에서 긍정적 효과가 나타난다고 확인되었으나(김지현ㆍ윤선흠, 2017; 박수철 외, 2019), 시장 상황에 따른 조건부 분석(conditional analysis)은 실시하지 않았다.

이 외에도 최근에는 개인투자자 거래자료 및 설문자료를 바탕으로 한 연구가 진행되었는데, Kim et al.(2021)은 미국 개인투자자 1,215명을 대상으로 설문을 진행하여 신용거래를 하는 개인투자자는 투자 능력(literacy)이 부족하고 과잉확신(overconfidence) 성향이 강함을 보였다. 또한 중국 신용거래자의 체결자료를 분석한 Bian et al.(2021)의 연구에서도 신용융자를 많이 활용하는투자자일수록 오히려 투자경험이 부족하고, 거래가 잦으며, 포트폴리오의 위험 수준이 높게 나타났다. 이처럼 상기 전술한 학술적 논의를 종합하면 신용거래는 경우에 따라 시장 전반에 부정적인영향을 미칠 수 있으며, 이를 주로 활용하는 투자주체가 개인투자자일 경우 신용거래가 적절하게활용되지 못할 가능성이 존재함을 암시한다.

Ⅲ. 개인투자자 신용융자 현황 및 특징 분석

본 장에서는 국내 개인투자자의 신용융자거래 및 잔고 현황과 특징을 분석하여 전반적인 주식시장 신용융자의 건전성을 정량적으로 검토한다. 또한 주식시장의 변동성이 높았던 코로나19 팬데믹 국면에 신용융자잔고 비중이 높은 종목의 주가 변동 특징을 살펴본다. 본 장에서 활용하는 자료는 전체 시장 및 개별종목 단위의 신용융자거래 및 잔고 자료로 DataGuide, 금융투자협회 포탈을 통해 확보하였다. 자료의 특성상 신용거래의 주체를 정확히 식별할 수 없으나, 신용융자가 주로 개인투자자에게 제공되는 매수대금의 융자라는 점에서 시장에서 관측되는 신용거래 및 신용융자잔고를 개인투자자의 신용거래와 신용융자잔고로 가정하고 분석을 진행한다.

1. 개인투자자 신용융자거래 비중

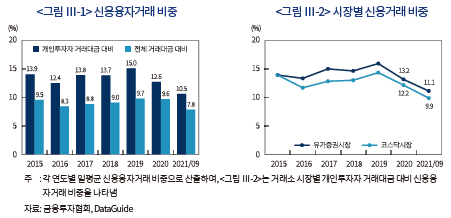

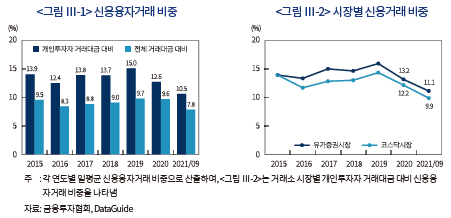

<그림 Ⅲ-1>에서와 같이 국내 주식시장 거래금액 중 신용거래 비중은 2020년 일평균 9.6%, 2021년의 경우 9월까지의 거래실적을 기준으로 일평균 약 7.8%로 추정된다. 2015년 이후 10% 남짓한 비중을 차지했던 신용거래가 2021년에는 다소 감소했다. 개인투자자 거래대금 대비 신용거래 비중은 2020년 이전 12~15% 수준이었으나 2021년에는 10.5%로 마찬가지 감소했다. 이는 주식시장 내 개인투자자가 늘어난 것과 연관되는데, 신규로 진입한 투자자 중에서 신용거래자보다 비(非)신용거래자가 차지하는 비중이 더 높기 때문인 것으로 판단된다.

<그림 Ⅲ-2>는 거래소 시장별 개인투자자 거래대금 대비 신용거래 비중을 나타낸다. 시장별 신용거래 비중 추이도 합산 결과(<그림 Ⅲ-1>)와 유사한 추이를 보이나, 유가증권시장 개인투자자 거래대금 대비 신용거래 비중이 코스닥시장보다 소폭 높게 나타난다. 가령 2021년 유가증권시장 개인투자자 거래대금 대비 신용거래 비중은 11.1%로 코스닥시장(9.9%)을 1.2%p 상회한다. 이는 코스닥시장 구성종목 내 투자위험이 높은 종목이 많아 신용거래가 상대적으로 제한되기 때문인 것으로 추정된다.

2. 합산 신용융자잔고 추이

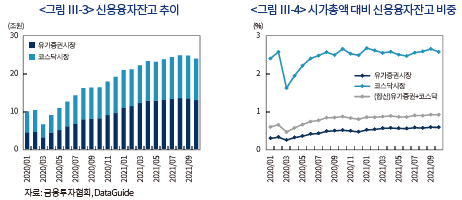

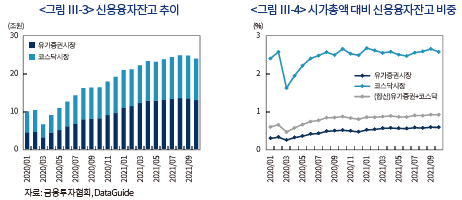

다음으로 국내 신용융자잔고 현황에 대해 살펴보자. <그림 Ⅲ-3>에서 알 수 있듯이 주식시장 신용융자잔고4)는 최근 소폭 감소했으나 코로나19 팬데믹 이후 급격히 증가했다. 2021년 10월 말 기준, 신용융자잔고는 약 24조원으로 2020년 3월 코로나19 충격 당시 6.6조원에서 265% 증가했다. 시장별로 살펴보면 유가증권시장은 13조원(+310%), 코스닥 시장은 11조원(+223%)으로 융자규모와 증가율 측면에서는 유가증권시장이 더 높지만, 주식시장 규모 대비 상대적 비중은 코스닥시장이 훨씬 높다(<그림 Ⅲ-4>). 2021년 10월 말 기준 주식시장 시가총액 대비 비율은 유가증권시장이 0.6%, 코스닥시장은 2.6%이며, 이는 2020년 3월 당시 비중(유가증권시장 0.27%, 코스닥시장 1.63%)과 비교했을 때 1.6~2배가량 증가한 수치이다. 코로나19 발생 이후 국내 증시가 상승했지만 그보다 신용융자잔고의 증가세가 더 가파른 것으로 해석할 수 있다.

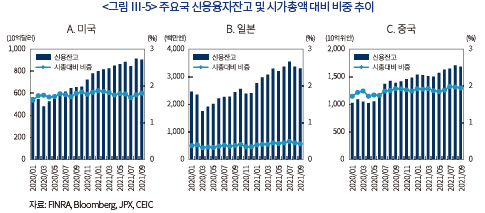

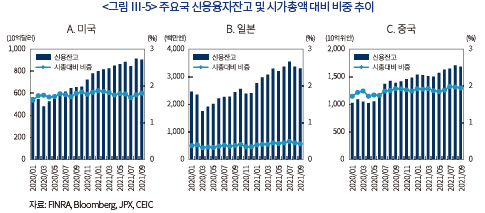

신용융자잔고의 증가세는 상승장에서 두드러지는데, 이는 주요국 주식시장에서도 유사하게 관찰되는 현상이다. 코로나19 이후 국내 증시뿐만 아니라 주요국 증시도 동반 상승하면서 각국의 신용융자잔고도 증가했다(<그림 Ⅲ-5>). 2021년 9월 말 주요국 신용융자잔고는 미국 0.9조달러(1,069조원), 일본 3.3조엔(35조원), 중국 1.68조위안(309조원)5)으로 신용융자잔고의 절대적 규모는 우리나라보다 크다. 동일 시점 각국의 주식시장 시가총액 대비 신용융자잔고의 비중은 미국 1.8%, 일본 0.43%, 중국 1.94%로, 일본을 제외하면 우리나라 주식시장 신용융자잔고의 상대적 비중(0.93%, 2021년 9월 기준)도 낮은 편이라고 할 수 있다.

다만 코로나19 이후 신용융자잔고의 증가율은 우리나라가 월등히 높게 나타난다. 2020년 3월부터 2021년 9월까지 주요국 신용융자잔고 증가율은 미국 88.4%, 일본 88.1%, 중국 60.9%로 같은 기간 우리나라 277.6%에 비해 낮다. 시가총액 대비 상대적 비중의 경우 3개국 모두 분석기간 내 비슷한 수준을 유지하고 있으나 (2020년 3월 이후 미국: +0.05%p, 일본: +0.11%p, 중국: +0.08%p), 우리나라의 경우 주식시장 규모 대비 신용잔고가 차지하는 비중이 지속적으로 늘어났다. 요약하면 국내 주식시장 신용융자잔고의 규모는 주요국 대비 작은 편이지만, 융자의 증가속도는 주요국과 달리 시장규모의 성장보다 빨랐다고 할 수 있다.

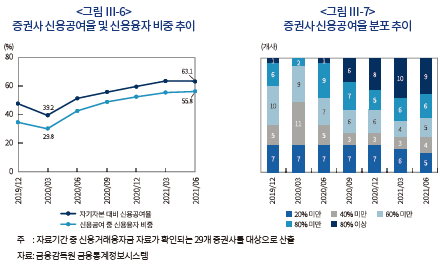

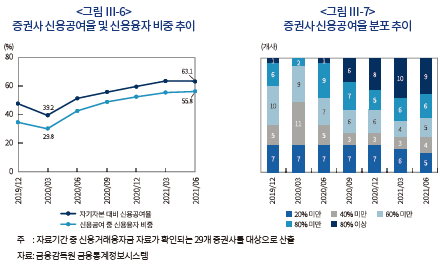

한편 신용융자잔고의 가파른 증가로 국내 증권사 신용공여율도 큰 폭으로 상승했다. 2021년 상반기 말 기준 가용한 자료가 있는 증권사의 합산 신용공여율6)은 63.1%로 2020년 3월말 39.2% 대비 23.9%p 증가했으며, 신용공여 증가의 대부분은 신용거래융자금이 기여한 것으로 나타난다(<그림 Ⅲ-6>). 증권사 신용공여금 중 신용거래융자금이 차지하는 비중은 29.8%(2020년 3월 기준)에서 55.8%(2021년 6월 기준)로 증가한 반면, 같은 기간 증권담보대출의 비중은 69.2%에서 42.5%로 감소했다.

<그림 Ⅲ-7>은 분기별 증권사 신용공여율 분포 변화를 나타낸다. 코로나19 이전 및 2020년 상반기 당시에는 신용공여율이 80% 이상인 증권사가 거의 없었지만, 1년 후 표본 내 31%(9개사)의 증권사가 신용공여율이 80%를 넘긴 것으로 확인된다. 금융당국은 신용공여가 금융투자업자의 건전성에 미치는 영향을 고려하여 신용공여의 규모를 자기자본 100% 이내로 제한하고7), 위험관리 차원에서 각 증권사별로 법적 한도 내 자체 신용공여 한도를 설정하기 때문에 향후 신용융자잔고가 이전처럼 빠른 속도로 증가하기는 어려울 것으로 예상된다.

3. 종목별 신용융자잔고의 횡단면적 특징

이상의 분석에서 국내 신용융자의 현황을 검토했다면, 본 절에서는 신용융자잔고의 횡단면적인 차이를 투자위험도와 연관된 개별종목의 특징을 기반으로 살펴본다. 종목별 비교가능성을 높이기 위해 상대지표인 신용융자잔고 비율(=신용융자잔고/시가총액)을 활용한다. 신용융자잔고 비율이 높을수록 주가의 하방위험이 가중될 시 담보가치의 감소에 따른 융자상환 수요와 투자자 급매(fire sales)로 인해 해당 주식의 주가가 더 큰 하락 압력을 받을 수 있다(Bian et al., 2021). 개별종목의 투자위험도 대용치로 기업의 규모(size), 시장 베타(beta), 고유 변동성(idiosyncratic vola-tility)을 활용한다.8) 이를 기반으로 상장주식을 월간 시가총액 상위 10%, 중위 30%, 하위 60%를 각각 대형주, 중형주, 소형주로 구분하고, 월별로 산출한 시장 베타 및 고유 변동성의 상위 30%, 중위 40%, 하위 30%를 각각 고위험, 중위험, 저위험 그룹으로 분류하여 각 그룹별 평균 신용잔고 비율을 살펴본다. 분석 표본 내 신용거래가 불가능해 신용잔고가 없는 종목이 존재하므로 이러한 종목은 제거한 뒤 분석을 진행한다.9)

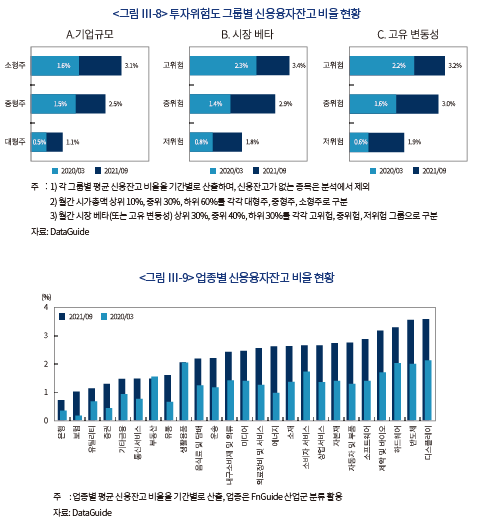

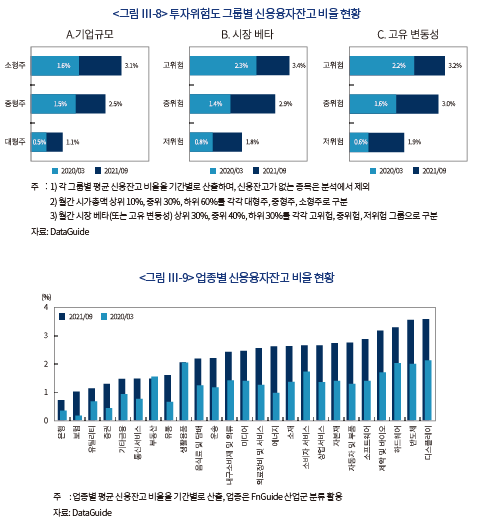

<그림 Ⅲ-8>은 코로나19 이후(2020년 3월 vs. 2021년 9월) 각 그룹별 평균 신용융자잔고 비율과 변화를 나타낸다. 분석 결과 전반적으로 투자위험도가 높은 주식에서 신용융자잔고 비율이 높게 나타난다. 가령 2021년 9월 말 기준 신용융자잔고 비율은 소형주의 경우 평균 3.1%인 반면 대형주는 1.1%로 나타나며, 고변동성 그룹은 평균 3.2%인 반면 저변동성 그룹은 평균 1.9%이다. 시장 베타 및 고유 변동성 그룹 간 신용잔고 비율 변화는 뚜렷한 패턴이 나타나지 않으나, 기업 규모의 경우 소형주는 신용잔고 비율 증가분이 1.5%p인 반면 대형주는 0.6%p로 상대적으로 낮다.

한편 업종별 평균 신용융자잔고 비율은 디스플레이 3.6%, 반도체 3.5%, 하드웨어 3.3%, 제약 및 바이오 3.2% 순으로 주로 ITㆍ전자 또는 제약ㆍ바이오 섹터에서 신용융자잔고 비율이 높게 나타나고(<그림 Ⅲ-9>), 이 외 자동차 제조업, 자본재 등 상대적으로 경기변동에 민감하거나 투자위험이 높은 업종에서 신용잔고 비율 및 변화가 높게 관찰된다. 반면 은행, 보험, 유틸리티, 통신서비스등 경기변동에 덜 민감한 필수소비와 관련된 업종은 신용융자잔고 비율이 상대적으로 낮은 경향이 있다. 이러한 분석 결과는 신용융자를 활용하는 개인투자자는 높은 투자위험을 감수하며 투자하고 있을 가능성을 시사한다. 또한 투자위험도가 높은 종목이나 업종에서 신용잔고 비중이 높게관찰되는 점은, 향후 증시의 하방위험이 가중될 경우 이러한 특징을 갖는 종목에서 신용융자가 주가에 하락 압력으로 작용할 것으로 판단된다.

그렇다면 높은 신용잔고 비율은 증시 하락 시 변동성과 수익률에 부정적인 영향을 줄까? 과거 국내 연구에서는 신용거래가 주식가격을 교란하지 않으며 시장의 질적 수준을 제고하는 긍정적인 효과를 확인했으나(김지현ㆍ윤선흠, 2017; 박수철 외, 2019), 해당 연구는 신용거래 비중과 순매수 강도를 기반으로 무조건부 분석(unconditional analysis)을 수행했으며 분석기간인 2013~2017년 당시는 국내 증시의 변동성이 낮은 편에 속한다. 이에 본 절에서는 최근 증시 변동성이 가장 높았던 시기인 코로나19 팬데믹 국면을 중심으로10), 신용융자잔고 비율이 높은 종목과 낮은 종목 간의 주가 변화를 살펴봄으로써 위기 기간 내 신용거래가 개별주식의 수익률에 미치는 영향을 확인한다. 분석기간을 2020년 1월 셋째 주(국내 첫 코로나19 확진자 발생일 포함)부터 이후 증시가 다시 회복했던 2020년 5월 말까지의 기간으로 설정하고, 기간의 길이를 고려하여 모든 자료를 주별(weekly)로 전환하여 분석을 진행한다.

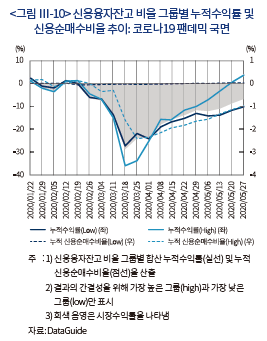

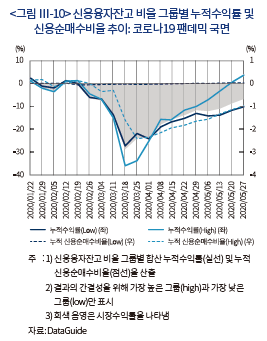

<그림 Ⅲ-10>은 분석기간 초 종목별 신용융자잔고 비율을 기준으로 분석대상 주식을 다섯 그룹으로 분류한 뒤, 잔고 비율이 가장 높은 그룹(high)과 가장 낮은 그룹(low)의 합산 누적수익률(실선)과 합산 신용순매수비율(점선) 추이를 나타낸다. 신용순매수비율은 종목별로 신용매수대금과 신용매도대금의 차이를 주별 시가총액으로 나눠 산출11)하며, 초소형주(micro-cap)의 영향을 최소화하기 위해 합산하는 과정에서 시가총액가중평균(value-weighted average)을 활용한다. 분석 결과 신용융자잔고 비율이 높은 종목은 코로나19 충격 당시 주가가 더 크게 하락하였으며, 하락하는 과정에서 신용순매수비율이 크게 감소했다. 신용거래자들은 코로나19 팬데믹 국면에서 해당 종목군을 신용매도(상환)하였으며, 증시 하방위험 확대에 따른 레버리지 축소 수요가 변동성 확대에 영향을 준 것으로 해석된다. 한편 신용융자잔고 비율이 높은 종목은 주가가 크게 하락한 만큼 이후 더 빠르게 회복하였으며 무엇보다 증시 회복기간의 수익률은 더 높게 나타난다. 신용거래로 인한 유동성 및 가격효율성 제고 효과가 주가 회복력(resilience)과도 연관된 것으로 보인다. 이러한 분석결과는 신용거래가 특정 시기에는 일부 종목의 주가 변동성을 오히려 확대시키고 결과적으로 투자자의 효익(welfare)에 부정적인 영향을 미칠 수 있음을 시사하며, 이는 과거 선행연구의 견해와 일치한다(Kahraman & Tookes, 2017, 2019; Bian et al., 2021).

Ⅳ. 개인 신용거래자의 투자성과와 투자행태 분석

앞선 장에서 시장자료를 기반으로 국내 주식시장 신용융자의 전반적인 현황과 특징을 살펴보았다면, 본 장에서는 투자자별 자료를 바탕으로 신용융자를 활용하여 거래하는 신용거래자의 투자성과와 투자행태를 검토한다. 분석에서 활용한 자료는 4개 대형 증권사가 제공한 약 20만 명의 개인 투자자의 국내 상장주식 거래 및 포트폴리오 내역으로, 이 중 신용융자를 활용한 투자자를 구별하여 실증분석을 진행한다. 본 장에서 활용하는 3개 증권사의 자료는 2020년 3월부터 10월까지의 자료로 구성되며, 나머지 1개 증권사의 자료는 2020년 3월부터 6월까지의 자료만을 포함한다. 거래체결 자료의 경우 신용융자 활용 여부를 식별할 수 있어, 이를 기반으로 각 개인투자자별12) 신용거래와 일반(현금)거래를 구분하여 분석 자료를 구축하였다. 자료의 특성상 신용거래에 포함되는 보증금(개시증거금) 및 담보 내역을 상세히 알 수 없어 신용융자를 활용한 거래 자체를 신용거래로 간주하여 분석을 진행한다.

1. 신용거래자 구성

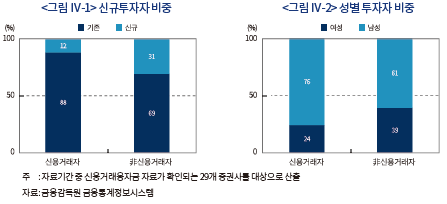

최소한의 필터링을 거친 투자자 표본 내 분석기간 중 신용융자거래가 최소 1건이라도 존재하는 투자자를 신용거래자로 정의하면, 분석에 포함된 신용거래자는 11,178명으로 약 20.4만명에 달하는 개인투자자 표본 내 5.5% 정도를 차지하는 것으로 확인된다. 실제 개인투자자 내 신용거래자 비율과는 다소 차이가 있을 수 있으나, 개인투자자 거래대금 중 신용거래 비중이 일평균 12.6%(2020년 기준)임을 감안했을 때 신용거래자는 비(非)신용거래자13)보다 많은 거래를 일으키는 것으로 예상할 수 있다.

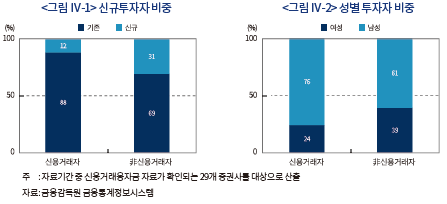

신용거래자의 구성상 특징을 살펴보면 다음과 같다. 먼저 신용거래자 표본 내 새로 진입한 신규투자자14) 비중은 12%로 非신용거래자에 비해 신규투자자 비중은 약 1/3 정도 낮은 것으로 나타난다(<그림 Ⅳ-1>). 상대적으로 투자경험이 부족한 신규투자자의 신용융자 활용도는 낮은 것으로 볼 수 있다. <그림 Ⅳ-2>의 성별 투자자 비중에 따르면, 신용거래자는 주로 남성 투자자임을 알 수 있다. 신용거래자 내 남성 비중은 76%로 여성의 3배 이상이며, 기존 개인투자자 중 남성의 비중이 65%임을 고려해도(김민기ㆍ김준석, 2021) 신용거래자 내에 남성의 비중이 여성에 비해 압도적으로 높다. 일반적으로 남성이 위험추구 및 과잉확신 성향이 강한 점과 연관된 것으로 보이며(Jianakopolos & Bernasek, 1998; Barber & Odean, 2001), 여성 투자자의 경우 레버지지 활용에 다소 보수적인 것으로 해석할 수 있다.

이 외 연령대별 신용거래자 비중은 40대(31%), 50대(30%), 30대(17%), 60대 이상(17%), 20대 이하(5%) 순으로, 전체 주식투자자 구성 대비 저연령대 투자자가 적은 것으로 확인된다. 특히 20대 이하 신용거래자의 비중(5%)은 非신용거래자 비중(15%)의 1/3 수준으로 나타나는데, 대개 투자경험이 적고 평균 보유자산 규모가 작은 젊은 투자자의 특성상 신용융자 활용에 보수적일 것으로 예상할 수 있다. 한편 투자자산15) 규모별 투자자 비중의 경우, 신용거래자 내 평균 1천만원 이하인 투자자 비중이 37%로 가장 크고, 1천만원 초과 3천만원 이하 26%, 3천만원 초과 1억원 이하 24%, 1억원 초과 13% 순이다. 평균 순자산 3천만원 이하인 소액투자자가 63%로 높은 비중을 차지하고 있으나 非신용거래자(77%)와 비교했을 때 14%p 낮아 상대적으로 신용거래는 투자자산 규모가 큰 투자자가 많이 이용하는 것으로 확인된다. 다만 평균 1천만원 이하인 소액투자자의 비중도 꽤 높게 나타나 위험 감내 여력이 낮은 투자자도 신용융자를 다수 이용하는 것으로 나타난다.

2. 신용거래자의 투자성과

신용거래자는 레버리지를 활용하여 만족할만한 투자성과를 달성했을까? 분석기간 동안 신용거래자의 투자성과는 유형별 합산 포트폴리오의 누적시간가중 수익률(cumulative time-weight-ed return)로 산출한다. 누적시간가중 수익률은 포트폴리오의 일간 수익률을 누적하여 산출하는 방식으로 투자자금의 유출입 영향을 제거한 포트폴리오의 성과를 평가하는 데 적합한 수익률 척도다. 일간 수익률16)의 경우 투자자 유형별 일간 합산 포트폴리오 평가금액과 거래대금을 이용하여 계산하며, 거래비용을 고려할 경우 일간 수익에서 거래비용(거래세, 거래수수료, 신용이자17)을 차감한다. 거래비용 중 신용이자는 신용포지션에만 적용되며, 당일 매수ㆍ매도한 신용포지션(일중거래)의 이자비용은 각 증권사별 신용이자 적용방식을 참고한다.18)

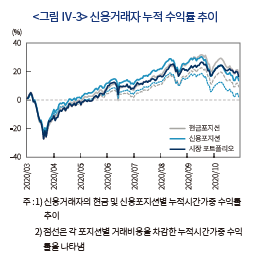

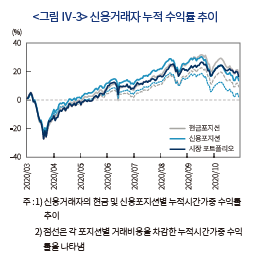

<그림 Ⅳ-3>은 신용거래자의 현금 및 신용포지션의 누적시간가중 수익률을 나타낸다. 대체로 시장 포트폴리오의 누적수익률19)과 유사한 추이를 보이며, 신용거래자의 현금포지션은 시장 수익률을 소폭 상회, 신용포지션은 시장 수익률을 소폭 하회하는 것으로 나타난다. 하지만 거래비용을 고려하면 현금포지션은 9.2%, 신용포지션은 2.1%로 동기간 시장 수익률(16.4%)을 크게 하회하며, 포지션간 수익률 격차는 크게 확대된다. 분석기간 누증된 거래비용과 신용거래에 포함되는 신용이자의 영향이 컸던 것으로 해석된다.

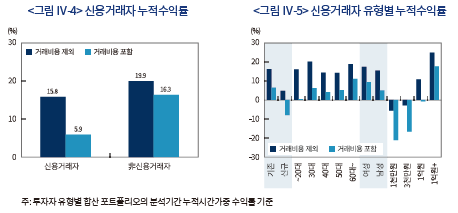

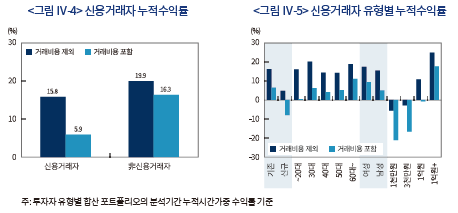

투자자 유형별로 수익률을 비교해보자. <그림 Ⅳ-4>는 신용거래자와 非신용거래자의 포트폴리오 누적수익률을 나타낸다. 거래비용을 제외할 경우 신용거래자가의 투자성과는 非신용거래자보다 4.1%p 낮은 15.8%이며, 거래비용을 포함하면 신용거래자의 누적수익률은 5.9%로 非신용거래자보다 10.4%p 낮다. 신용거래자는 전반적으로 일반적인 개인투자자와 비교했을 때 성과가 저조한 것을 알 수 있다. 신용거래자 세부유형별 누적수익률을 살펴보면(<그림 Ⅳ-5>), 거래비용을 포함할 경우 신규투자자, 20대 이하 젊은 투자자, 남성 투자자, 평균 투자자산 3천만원 이하인 투자자에서 상대적으로 수익률이 낮게 확인되며, 수익률 격차는 성별 격차가 가장 낮고 투자자산 규모별 격차가 가장 크게 나타난다. 특히 신규투자자, 평균 투자자산 3천만원 이하의 투자자와 20대 이하의 투자자는 신용거래를 통해 레버리지 효과를 크게 누리지 못한 것으로 파악되며, 신용포지션만을 고려한 추가적인 분석 결과 평균 자산 1천만원 이하의 소액투자자의 수익률이 가장 저조하게 나타났다. 분석기간 소액투자자는 레버리지 활용으로 인해 오히려 손실 규모가 확대되었을 것으로 추정된다.

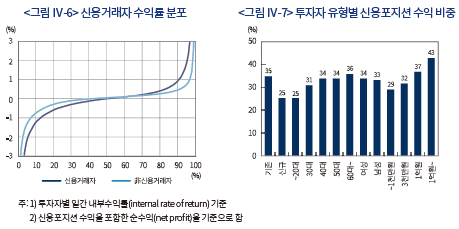

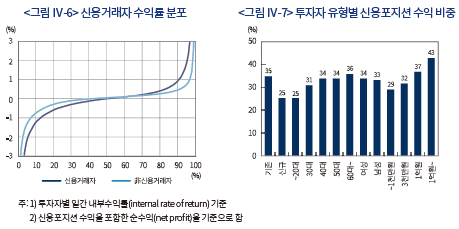

위 분석에서는 신용거래자의 투자성과를 합산하여 살펴봤다면, 다음으로는 신용거래자 개인 단위에서 투자성과를 살펴보자. 개인별 수익률은 김민기ㆍ김준석(2021)에서 활용한 내부수익률(internal rate of return)을 기반으로 한다.20) <그림 Ⅳ-6>은 신용거래자와 非신용거래자의 수익률 분포를 보여준다. 신용거래자 수익률 분포의 중앙값이 0%로, 신용거래자 중 약 절반은 거래비용을 포함해도 순이익을 달성한 것으로 나타난다. 또한 두 그룹 모두 투자자간 수익률 격차가 매우 크지만, 무엇보다 신용거래자간 수익률 격차가 더 크게 나타난다. 가령 신용거래자의 하위 10%는 –1.25%(연 –95.6%21)), 상위 10%는 0.92%(연 864%)이며, 非신용거래자의 경우 하위 10% -0.77%(연 –85.2%), 상위 10% 0.46%(연 212%)이다. 신용거래자 중에는 매우 높은 수익률을 달성한 투자자도 있는 반면, 매우 열악한 성과를 보인 투자자도 존재하는 것으로 보인다. 이러한 수익률 분포의 특징은 상대적으로 공격적으로 투자하는 신용거래자의 특성에 기인하는 것으로 판단되며, 수익률에 레버리지 효과를 고려하면 격차는 더욱 확대된다. 투자자간 투자시점의 차이를 고려하기 위해 시장 수익률 대비 초과수익률로 분석해도 결과의 질적인 차이는 없는 것으로 나타났다.

마지막으로 신용거래자 중 레버리지 효과를 누린 투자자 비중을 살펴보자. 신용융자를 활용한 레버리지 효과는 신용포지션의 순이익이 0보다 큰 것을 의미한다. 분석 결과 전체 신용거래자 중 33.5%는 신용포지션을 통해 이익을 달성한 것으로 파악된다. 절반에 크게 못 미치는 수치로 신용거래자 중 레버리지 효과를 달성한 투자자는 많지 않은 것으로 예상된다. 투자자 유형별로 살펴보면 성별에 따른 차이는 관찰되지 않으나, 기존 투자자, 고령 투자자, 고액 투자자 내에 신용포지션이 양(+)인 투자자 비중이 상대적으로 높게 나타난다(<그림 Ⅳ-7>). 반면 신규 투자자 및 20대 이하 투자자의 75%가 신용융자 활용을 통해 손실을 본 것으로 나타나, 투자경험이 다소 부족한 투자자 그룹 내 4명 중 3명이 신용거래를 통해 손실이 가중되었을 것으로 추정된다. 전반적인 분석결과, 개인투자자는 신용거래를 통해 만족할만한 성과를 달성했다고 보기 어렵다. 거리비용을 고려할 경우 신용포지션의 수익률은 같은 기간 시장수익률을 크게 하회하며, 레버리지 효과를 누린투자자의 비중이 낮게 확인된다. 또한 분석기간이 대체로 상승장이었음을 감안하면 개인투자자중 다수는 신용거래를 제대로 활용하지 못함을 시사한다.

3. 신용거래자 투자행태

본 절에서는 앞선 신용거래자 투자성과의 요인을 분석하기 위해, 신용거래자의 투자행태를 투자자 유형별로 포트폴리오 구성과 거래빈도를 중심으로 검토한다. 분석에 앞서 신용거래자가 신용융자로 매수한 포지션 비중을 투자자 유형별로 확인해보자. 신용거래자의 합산 주식 평가금액 대비 신용융자로 매수한 주식의 합산 평가금액의 비율(신용포지션 비중)은 전체 36.6%이다. 포지션 구축 시 보증금(증거금) 비중에 대한 자료가 부재해 분자에 해당하는 신용포지션은 보증금을 포함한 합산 평가금액이다. 이를 고려하면 실제 순수한 신용포지션은 더 작을 것으로 예상된다. 신용거래자 전체 담보자산(현금 자산ㆍ주식평가금액) 대비 융자금(증거금 포함)의 비중은 34.1%로 추정되는데, 이를 담보유지 비율로 환산할 경우 293%(=1/0.341)로 법정 최저 담보유지 비율22)인140%를 크게 상회해 전반적으로 신용거래자들이 융자금 대비 담보 수준을 높게 유지하고 있는것으로 파악된다. 만약 최저 개시증거금인 40%를 현금(또는 대용자산)이라고 가정하면 융자금의 비중은 전체 20.5%(=34.1%× 0.6)으로 담보유지 비율은 488%(=1/0.205)로 늘어난다. 전반적으로 신용거래자의 재무상태는 크게 우려할 수준은 아닌 것으로 판단되며, 주가 하락 시 신용포지션의 평가금액이 크게 감소해도 예상치 못한 대규모 임의상환(반대매매)이 발생할 가능성은 높지 않을 것으로 판단된다.23)

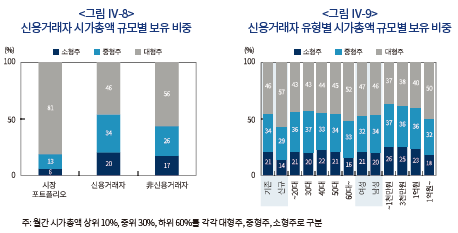

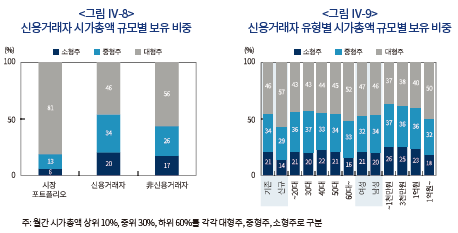

다음으로 분석기간 신용거래자의 포트폴리오 구성의 특징을 확인해 보자. Ⅲ장 3절에서 실시한 시장자료 분석과 마찬가지로 개별종목의 투자위험도와 관련된 지표 중 기업 규모(size)를 활용한다. 아래 <그림 Ⅳ-8>과 <그림 Ⅳ-9>는 상장주식을 시가총액 규모별로 세 그룹으로 분류하고 투자자 그룹별 일평균 보유비중을 산출한 것이다. 신용거래자의 포트폴리오 내에는 대형주 46%, 중형주 34%, 소형주 20%로 주식시장 내 대형주(81%), 중형주(13%), 소형주(6%)에 비해 중소형주가 월등히 과대배분되어 있는 것으로 나타난다. 非신용거래자의 평균 보유비중과 비교할 시 소형주와 중형주 투자비중이 각각 10%p, 8%p 높다. 신용거래자를 세부 유형으로 분류하면 기존투자자, 20~30대 이하 젊은 투자자, 남성, 소액투자자에서 중소형주 투자비중이 상대적으로 높게 나타난다(<그림 Ⅳ-9>). 특히 전체 개인투자자를 분석한 김민기ㆍ김준석(2021)의 분석 결과와 비교했을 때, 모든 투자자 유형에서 신용거래자의 중소형주 투자비중이 높게 나타나 신용거래자는 평균적으로 위험추구 성향이 높고 더욱 공격적으로 투자하는 것으로 평가된다. 한편 신용거래자의 신용포지션은 현금포지션에 비해 중소형주 비중이 소폭 낮은 것으로 나타나, 중소형주의 경우 신용거래에 차입 제약(margin constraints)이 다소 존재하는 것으로 추정된다. 이 외에도 투자위험도의 대용치를 시장 베타와 고유 변동성으로 변경하여 분석해도 결과는 대체로 유사하다. 한편 신용거래자는 의료섹터 종목을 非신용거래자 대비 2%p 높게 과다보유하는데, 추가적인 분석 결과 평균 투자자산 1천만원 이하의 소액투자자의 의료섹터 신용포지션 비중이 높게 나타난다. 신용거래자는 단기적으로 높은 수익률을 기대할 수 있는 종목을 선호하는 것으로 해석된다.

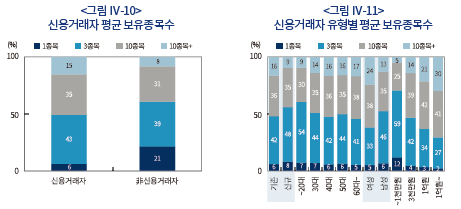

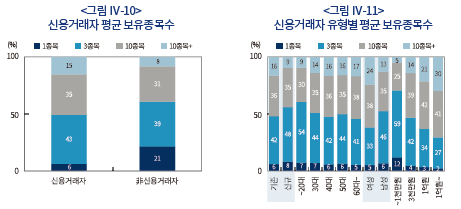

다음으로 신용거래자의 분산투자 수준을 확인하기 위해 평균 보유종목수를 산출한 결과, 평균적으로 1종목을 보유한 신용거래자 비중이 6%, 1종목 초과 3종목 이하 43%, 3종목 초과 10종목 이하 35%, 10종목 초과가 15%로 나타난다(<그림 Ⅳ-10>). 非신용거래자 대비 신용거래자의 분산투자 수준은 상대적으로 양호하다고 할 수 있으나, 신용거래자의 49%가 평균 3종목 이하를 보유하고 있어 분산투자 수준이 낮은 신용거래자도 다수 확인된다. 특히 신용거래자의 분산투자 수준은 신규 투자자, 젊은 투자자, 남성, 소액투자자에서 더 낮게 나타난다(<그림 Ⅳ-11>). 앞선 포트폴리오 구성의 특징과 레버리지를 고려하면 신용거래자의 주식 포트폴리오는 일반 개인투자자의 포트폴리오보다 더 높은 위험에 노출되어 있는 것으로 평가되며, 높은 고유위험(idiosyncratic risk)에 노출된 탓에 신용거래자간 수익률 편차가 크게 나타는 것으로 추정된다.

마지막으로 신용거래자의 거래행태를 거래빈도를 중심으로 검토해보자. 분석에 앞서 신용거래자의 거래대금 중 신용융자를 활용한 거래는 전체 약 38.6%로 추정된다. 앞서 신용포지션 비중이 36.6%임을 고려하면, 신용거래자는 현금포지션보다 신용포지션을 자주 변경하는 것으로 예상할 수 있다. 신용거래자의 거래빈도는 거래회전율을 기준으로 살펴본다. 거래회전율은 일별 매수과 매도대금의 평균을 전일과 당일 포트폴리오 평가금액의 평균으로 나누어 계산한다. 통상 국내 개인투자자는 주식을 과잉거래하는 것으로 확인되며(김민기ㆍ김준석, 2021), 과거 연구 결과에 따르면 신용거래자는 더 높은 과신(overconfi dence) 성향을 보이는 것으로 알려져 있다(Kim et al., 2021). 또한 포트폴리오 리벨런싱 외 유동성 충격에 대한 예방적 매도(preemptive sales)와 같은 추가적인 거래유인이 있어, 신용거래자는 일반 개인투자자보다 거래가 빈번할 것으로 예상된다(Bian et al., 2021).

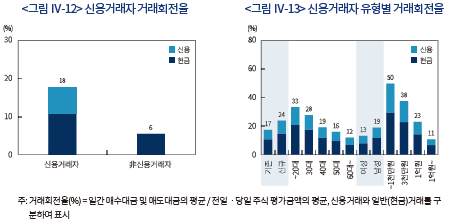

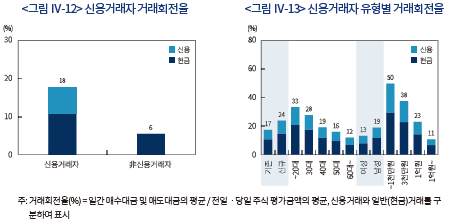

신용거래자와 非신용거래자의 일간 거래회전율을 비교한 결과 신용거래자의 거래회전율은 17.7%로 非신용거래자의 거래회전율보다 약 3배 이상 높게 나타난다(<그림 Ⅳ-12>). 연간으로 환산할 시 약 4,400%로 거래빈도가 굉장히 높아 앞선 성과 분석에서 확인된 바와 같이 잦은 거래가 수익률에 미치는 부정적 효과가 현저하다. 신용거래자 내 투자자 유형별 거래회전율을 살펴보면, 신규투자자, 젊은 투자자, 남성, 소액투자자의 거래빈도가 높게 확인되는데(<그림 Ⅳ-13>), 이는 전체 개인투자자를 대상으로 한 김민기ㆍ김준석(2021)의 분석 결과와 동일한 패턴이나, 전반적인 거래회전율 수준이 높게 나타난다. 특히 20대 이하의 거래회전율은 33.2%, 평균 투자자산 1천만원 이하 소액투자자의 거래회전율은 49.8%로 이를 평균 보유기간으로 환산하면 각각 3일(=1/0.332)과 2일(=1/0.498)에 불과한 수준이다. 또한 신용거래자의 일중거래(day trading) 비중24)은 56.6%로 非신용거래자의 52.3%에 비해 높게 나타나 신용거래자는 극단적인 단기투자성향을 보이는 것으로 평가할 수 있다. 앞선 Ⅳ장 2절의 투자성과 분석과 비교할 경우 거래가 잦은 투자자 유형의 투자성과가 저조하며 거래빈도 수준 또한 매우 높아 신용거래자의 낮은 수익률은 과잉확신과 같은 투자자의 행태적 편의가 영향을 미쳤을 것으로 생각된다.

Ⅴ. 요약 및 시사점

본 보고서의 실증분석 결과를 요약하면 다음과 같다. 첫째, 국내 주식시장 신용융자 규모는 주요국과 우리나라 주식시장 규모를 고려했을 때 상대적으로 낮은 수준이나, 코로나19 이후 매우 빠른 속도로 증가한 것으로 확인된다. 둘째, 상대적으로 신용융자잔고가 높은 종목은 시가총액이 작고, 변동성, 베타가 높은 고위험 주식인 것으로 나타난다. 또한 코로나19 팬데믹 국면을 살펴본 결과 신용융자잔고가 높은 종목의 주가 하락폭이 더 크게 나타나, 향후 주식시장 하방위험이 가중될 시 이러한 고위험 종목에서 변동성이 확대될 가능성이 존재함을 암시한다. 셋째, 국내 신용거래자는 전체 개인투자자의 약 5.5%로 높은 비중을 차지하고 있지는 않으나, 위험 감내 수준이 낮을 것으로 예상되는 자산규모가 작은 투자자가 다수 신용융자거래를 활용하는 것으로 나타나 소액 개인투자자의 건전성이 다소 우려된다. 넷째, 거래비용을 고려할 경우 신용거래자의 투자성과는 기존 개인투자자를 하회하는 것으로 분석되며, 세부 유형별로는 소액투자자의 수익률이 현저히 낮아 이들은 신용거래로 인해 오히려 손실이 확대되었을 것으로 추정된다. 마지막으로, 신용거래자의 전반적인 재무상태는 양호하나, 투자위험도가 높은 주식에 대한 투자 비중이 높고 거래빈도가매우 높게 확인된다. 또한 분산투자 수준도 낮아 신용거래자는 매우 단기적이고 투기적인 투자행태를 보이는 것으로 확인된다. 특히 이러한 행태는 투자 수익률이 낮은 신규 투자자, 20대 이하 젊은 투자자, 남성, 소액투자자에서 현저하게 나타나 신용거래자의 투자행태에는 과잉확신과 같은행태적 편의가 작용했을 것으로 추정된다.

본 보고서의 시사점은 다음과 같다. 먼저 국내 주식시장 신용거래자 중에는 신용융자를 적절하게 활용하지 못하는 개인투자자가 존재하는 것으로 나타난다. 개인투자자는 신용융자 활용에 세심한 주의가 요구되며 신용거래에 대한 투자위험을 정확히 인식하고 위험 감내 수준에 맞는 투자를 집행할 필요가 있다. 또한 신용융자 규모는 이전처럼 큰 폭으로 증가하기 어려울 것으로 예상되나 코로나19 이후 매우 빠르게 증가한 만큼, 향후 발생할 수 있는 투자위험에 적절히 대응할 필요가 있다. 주지하듯 신용거래는 일종의 가수요이며 레버리지 수단으로써 투자자 효용과 주식시장 안정성에 양날의 검이 될 수 있어 과도한 사용은 경계할 필요가 있다.

1) 본 보고서에서는 신용융자거래와 신용거래, 신용융자잔고와 신용잔고를 혼용해서 사용한다.

2) 개시증거금율(보증금율)을 고정한 점은 우리나라의 경우와도 유사하다. 과거 우리나라는 1970년 이후 1990년까지 약 20년 간 20차례 신용거래 보증금율을 변경했지만, 1990년 이후 40%로 고정된 뒤 1999년 자유화되었으며 2007년 다시 40%로 재설정되었다.

3) 가령 Alexander et al.(2004)과 Hirose et al.(2009)은 각각 미국, 일본 주식시장을 대상으로 신용거래의 영향에 대해 분석했다.

4) 신용융자잔고는 주식을 매수할 때 증권사로부터 융자한 현금(신용융자) 중 아직 상환되지 않은 잔액으로 정의된다.

5) 2021년 9월 말 통화별 환율로 환산

6) 증권사의 신용공여율은 자기자본 대비 신용공여금으로 산출한다. 증권사 신용공여는 신용융자, 신용대주, 청약자금대출, 증권담보대출, 기타로 구성되며, 신용융자와 증권담보대출이 신용공여금의 대부분을 차지한다.

7) 금융투자업자 규정 제4-23조, 제3-24조의 2

8) 기업 규모가 작을수록 투자위험도가 높은 종목이라 할 수 있으며, 시장 베타와 고유 변동성은 각각 개별종목의 체계적 위험(systematic risk)과 비체계적 위험(unsystematic risk)의 대용치로 자주 활용되는 측정치이다. 시장 베타와 고유 변동성은 일별 자료를 토대로 각각 시장모형(market model) 및 Fama-French(1993) 3요인 모형으로 산출한다.

9) 신용잔고가 없는 종목의 잔고 비율을 0으로 처리해도 분석 결과의 질적인 차이는 없다. 또한 신용잔고가 없는(또는 0인) 종목이 전체 표본의 약 5%로 나타나 전반적인 결과에 영향을 줄 수 있는 선택 편향(selection bias)은 미미할 것으로 생각된다.

10) 코로나19 국면에 국한하지 않더라도 주식시장이 크게 하락하는 시기에서 유사한 특징이 확인되며, 기업의 규모(size)를 고려해도 유의미하게 관찰되는 특징이다.

11) 예를 들어 신용순매수비율이 1%라면, 해당 종목의 약 1%의 지분을 신용융자거래로 순매수했음을 의미한다.

12) 자료의 특성상 개인투자자는 해당 증권사 내에서만 식별되므로 한 개인투자자가 복수의 증권사에 계좌를 보유한 경우 복수의 개인투자자로 구분된다.

13) 非신용거래자는 분석기간 중 신용융자거래가 1건도 없는 투자자를 의미한다.

14) 분석 시작 시점인 2020년 3월 이후 주식계좌를 개설한 투자자로 정의한다.

15) 분석기간 내 일간 투자자산의 평균값 기준. 투자자산 = 주식 및 ETP 평가금액 + 예수금 및 CMA잔고 – 담보대출, 미수금, 및 추정 신용융자금(순자산 기준)

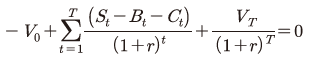

16) 일별 합산 포트폴리오의 평가금액을 , 매수대금 및 매도대금을 각각

, 매수대금 및 매도대금을 각각  ,

,  라 하면,

라 하면,  일의 수익률은

일의 수익률은  로 정의된다. 거래비용을 고려할 경우 분자에서 증권거래세와 위탁매매수수료율, 신용융자이자율을 차감한다.

로 정의된다. 거래비용을 고려할 경우 분자에서 증권거래세와 위탁매매수수료율, 신용융자이자율을 차감한다.

17) 거래세는 2020년 증권거래세인 25bp를 일괄 적용하고, 위탁매매수수료율의 경우 분석에 포함된 증권사의 2020년 사업보고서에 공개된 코스닥시장 위탁매매대금과 위탁매매수수료 정보를 이용하여 평균 수수료율을 추정한다. 또한 개인별 신용융자 잔액을 추정하여 융자기간에 따라 신용이자를 일률화하여 일별로 적용하는데, 각 증권사별 신용이자율은 금융투자협회 공시사이트에서 제공하는 신용융자 이자율 공시자료를 기반으로 한다.

18) 통 상 신용융자 이자 적용기간에 융자 당일(이자가산일)은 경과일수에서 제외되나, 일중거래에 1일차 이자를 부여하는 증권사의 경우 1일치 이자비용만큼 차감한다. 또한 경과기간 1일 이상에 대한 신용이자를 산출할 때, 융자금 추정을 위해 일괄적으로 증거금율을 50%로 설정한다. 증거금율을 변경해도 결과의 질적인 차이는 없음을 밝혀둔다.

19) 유가증권시장 및 코스닥시장의 시가총액 가중평균 수익률

20) 내 부수익률은 투자자금 유출입에 대한 의사결정을 반영한 금액가중 수익률 개념으로, 투자자별로 아래 수식을 만족하는 수익률 을 산출한다. 내부수익률은 일간(daily) 기준이다.

투자기간이 이며,

이며,  ,

,  ,

,  ,

,  는 각각 시점의 종가기준 포트폴리오 평가금액, 매수대금, 매도대금, 거래비용을 나타낸다.

는 각각 시점의 종가기준 포트폴리오 평가금액, 매수대금, 매도대금, 거래비용을 나타낸다.  와

와  는 시작시점과 종료시점의 평가금액이다.

는 시작시점과 종료시점의 평가금액이다.

21) 연환산 수익률 =

22) 금융투자업규정 제4-25조에서 정한 최소 담보비율(=담보평가금액/신용융자액)

23) 이 와 관련하여 금융감독원에서 발간한 위험 분석보고서(2021)에 따르면, 신용계좌 중 반대매매가 발생할 가능성이 높은 계좌의 비중은 27% 미만이며 연체율도 하락하고 있어 전반적인 신용계좌의 건전성은 우려할 만한 수준이 아닌 것으로 평가되었다.

24) 일중거래 비중은 투자자별로 개별종목을 당일 매수ㆍ매도한 체결내역을 일중거래로 정의하여 전체 투자자 합산 거래대금 대비 일중거래금액 비율로 산출한다.

참고문헌

고광수ㆍ김영갑ㆍ하연정, 2007, 신용규제의 경제적 의미와 증권시장, 한국금융공학회『금융공학연구』6(2), 197-222.

금융감독원, 2021,『자본시장 위험 분석보고서』.

김민기ㆍ김준석, 2021,『코로나19 국면의 개인투자자; 투자행태와 투자성과』, 자본시장연구원 이슈보고서 21-11.

김지현ㆍ윤선흠, 2017, 신용매수거래가 개별주식의 변동성, 유동성, 수익률예측력에 미치는 영향, 충남대학교 경영경제연구소『경영경제연구』39(2), 67-92.

박수철ㆍ우민철ㆍ이윤종, 2019, 개인투자자의 레버리지 거래가 주식시장에 미치는 영향, 한국재무관리학회『재무관리연구』36(3), 205-228.

Alexander, G.J., Ors, E., Peterson, M.A., Seguin, P.J., 2004, Margin regulation and market quality: A microstructure analysis, Journal of Corporate Finance 10(4), 549-574.

Barber, B.M., Odean, T., 2001, Boys will be boys: Gender, overconfidence, and common stock investment, Quarterly Journal of Economics 116(1), 261-292.

Bian J., Da, Z., He, Z., Lou, D., Shue, K., Zhou, H., 2021, Margin trading and leverage management, working paper.

Cohen, J., 1966, Federal Reserve margin requirements and the stock market, Journal of Financial and Quantitative Analysis 1(3), 30-54.

Chowdhry, B., Nanda, V., 1998, Leverage and market stability: The role of margin rules and price limits, Journal of Business 71(2), 179-210.

Grube, R.C., Joy, O.M., Panton, D.B., 1979, Market responses to federal reserve changes in the initial margin requirement, Journal of Finance 34(3), 659-674.

Hardouvelis, G.A., 1988, Margin requirements and stock market volatility, Quarterly Review 13(Sum), 80-89.

Hirose, T., Kato, H.K., Bremer, M., 2009, Can margin traders predict future stock market returns in Japan? Pacific-Basin Finance Journal 17(1), 41-57.

Jianakopolos, N.A., Bernasek, A., 1998, Are women are more risk averse? Economic inquiry 36(4), 620-630.

Kahraman, B., Tookes, H.E., 2017, Trader leverage and liquidity, Journal of Finance 72(4), 1567-1610.

Kahraman, B., Tookes, H.E., 2019, Margin trading and comovement during crises, Review of Finance 24(4), 813-846.

Kim, H., Kim, K.T., Hanna, S.D., 2021, The effect of investment literacy on the likelihood of retail investor margin trading and having a margin call, Finance Research Letters, 102146.

Moore, T.G., 1966, Stock market margin requirements, Journal of Political Economy 74(2), 158-167.

Seguin, P.J., 1990, Stock volatility and margin trading, Journal of Monetary Economics 26(1), 101-121.

Seguin, P.J., Jarrell, G.A., 1993, The irrelevance of margin: evidence from the Crash of ‘87, Journal of Finance 48(4), 1457-1473.

코로나19 이후 개인투자자의 활발한 주식거래와 함께 국내 주식시장 신용융자잔고가 가파르게 증가했다. 최근 소폭 감소하긴 했으나 주식시장 신용융자잔고 금액은 2021년 10월 말 기준 24조원으로 코로나19 팬데믹이 본격화되던 2020년 3월 말 6.6조원에 비해 265% 늘어났다. 증가 규모로는 유례가 없던 기록적인 수치이며 같은 기간(2020년 4월~2021년 10월) 개인투자자 주식시장 순매수금액인 127조원과 비교했을 때 결코 적지 않은 금액으로 판단된다. 신용융자는 주식시장 수급 측면에서 일종의 가수요로 투기적인 요소가 짙을 경우, 향후 잠재적 상환 수요로 인해 주식시장의 하방 위험이 확대될 수 있어 면밀한 모니터링이 요구된다.

한편 투자자 입장에서 레버리지(leverage) 수단인 신용융자는 투자자의 기대수익을 극대화하기 위한 용도로 충분히 활용될 수 있는 옵션이지만 반대로 투자자의 손실을 키울 수 있는 양날의 검이기도 하다. 이처럼 신중하게 접근해야하는 수단인 만큼 투자자의 각별한 주의가 요구되나, 신용융자에 대한 접근성이 높아 개인투자자의 위험 감내 수준에 적합하지 않게 활용될 소지가 있다. 특히 국내 개인투자자의 과도한 거래, 낮은 분산투자 수준 등을 고려하면(김민기ㆍ김준석, 2021), 신용융자의 활용으로 인해 개인투자자가 과도한 위험에 노출되어 있을 가능성도 배제할 수 없다.

이에 본고는 국내 개인투자자의 주식시장 신용융자거래 현황과 특징을 종합적으로 검토하고자 한다. 먼저 신용융자거래에 대한 그간의 연구 결과를 종합해보고(Ⅱ장), 시장 데이터를 기반으로 국내 주식시장 신용융자의 건전성을 융자 규모와 종목별 비중을 통해 검토한다(Ⅲ장). 국내 주식시장의 상승세가 둔화되고 신용융자잔고가 정점에 도달한 시점에서 신용융자의 현황과 특징을 분석하는 것은 의미가 있을 것으로 판단된다. 또한 개인투자자별 신용융자거래 자료를 바탕으로 신용거래자의 구성, 투자성과와 투자행태를 투자자 유형별로 분석하여 개인투자자가 신용융자를 적절하게 활용하고 있는 지 살펴본다(Ⅳ장). 그간의 국내 연구는 개인투자자의 신용융자거래가 주식시장에 미치는 영향에 집중한 측면이 있어, 본 연구는 신용거래자의 현황과 건전성을 다양한 각도로 분석하는 점에서 의의가 있다. 본고의 분석 결과를 바탕으로 국내 개인투자자의 신용융자거래에 대한 시사점을 제공할 수 있을 것으로 기대한다.

Ⅱ. 선행 연구

신용융자거래(margin trading)1)는 증권사에서 제공하는 신용공여를 통해 주식을 매수하는 거래로, 정책 당국의 지속적인 관심의 대상인 공매도와 달리 신용융자거래에 대한 연구는 자료의 제약, 학술적 관심 부재로 활발히 진행되지 못한 측면이 있다. 가령 신용거래의 역사가 깊은 미국의 경우 1929년 대공황 당시 증시 폭락으로 1934년 증권거래법(Securities and Exchange Act) 제정과 함께 증거금율 규제가 시행되었는데, 관련하여 초기의 연구는 신용규제의 효과를 검증하는 방향으로 진행되었다. 초창기 연구결과(Cohen, 1966; Moore, 1966; Grube et al., 1979)에 따르면 신용규제는 시장 변동성에 별다른 영향을 주지 못하는 것으로 실증되었으며, 이에 따라 미국은 신용거래제도가 어느 정도 안정화되었다고 판단된 이후 개시증거금율을 1974년부터 지금까지 그대로 유지해오고 있다.2)

이후 1987년 10월 미국 증시가 블랙 먼데이(Black Monday)를 겪으면서 신용거래에 대한 연구가 다시 활발히 재개되었고, 이후의 연구는 신용규제의 유용성과 신용거래의 효과에 대해 긍정적 또는 부정적 견해로 나뉘게 된다. 먼저 신용규제가 주식시장 안정화를 위해 유용하다는 주장(Hardouvelis, 1988)이 있는 반면, 고정된 증거금율 규제는 자산 가격 변동에 따라 시장에 부담이될 수 있음을 보인 연구도 있으며(Chowdhry & Nanda, 1998), Seguin & Jerrel(1993)은 1987년블랙 먼데이와 관련하여 신용거래가 가능한 주식에서 오히려 주가 하락이 덜 해 신용거래와 당시주가 폭락은 아무런 관련이 없음을 주장했다. 우리나라의 경우 고광수 외(2007)는 과거 신용규제가 주식시장 변동성에 전혀 영향을 주지 못했음을 실증한 바 있다.

신용거래의 효과에 대한 미시적인 분석을 살펴보면, 선진국의 경우 전반적으로 신용거래가 주식시장에 미치는 영향은 미미하고 시장의 질적 수준을 개선하는 것으로 알려져 있다.3) 미국의 OTC시장을 분석한 Seguin(1990)에 따르면, 신용거래가 가능한 종목군에 편입될 경우 거래량이 유의미하게 증가하고 변동성이 줄어드는 것으로 나타났다. 다만 미국 주식시장의 경우 시장 내 주된 거래주체가 기관투자자임을 인지할 필요가 있다. 기관투자자는 대개 정보거래자(informed investor)로 간주되어 자본 제약이 발생할 시 레버리지를 활용하여 정보거래를 통한 가격발견 기능을 수행할 수 있다. 반면 개인투자자와 같은 비정보거래자(uninformed investor)가 많은 신흥국 주식시장의 경우 신용거래의 영향이 다른 양상으로 나타날 수 있다.

이와 관련하여 인도, 중국과 같이 개인투자자 비중이 높은 신흥국을 대상으로 한 연구에 따르면 신용거래가 정상적인 상황에서는 시장 유동성 제고에 기여하지만, 위기 기간에서는 오히려 반대 현상이 나타나며 개별주식 수익률간의 동조화(comovement) 현상이 현저해짐을 실증했다 (Kahraman & Tookes, 2017, 2019). 특히 2015년 중국 주식시장 폭등ㆍ폭락의 주범으로 신용거래가 지목되면서 Bian et al.(2021)은 불안정한 시장 상황(stressed market condition)에서 신용거래자(margin investor)의 신용축소(deleveraging)는 주식시장 내 부정적인 파급효과(spillover)를 야기한다고 주장한다. 요약하면 시장의 상황이나 성숙도에 따라 신용거래가 주식시장에 미치는 영향은 상이하게 나타는 것으로 평가할 수 있다. 국내 주식시장에 대한 분석에서는 신용거래가 주식가격을 크게 교란하지 않으며 호가 스프레드(bid-ask spread)를 감소시키는 등 시장의 질적 측면에서 긍정적 효과가 나타난다고 확인되었으나(김지현ㆍ윤선흠, 2017; 박수철 외, 2019), 시장 상황에 따른 조건부 분석(conditional analysis)은 실시하지 않았다.

이 외에도 최근에는 개인투자자 거래자료 및 설문자료를 바탕으로 한 연구가 진행되었는데, Kim et al.(2021)은 미국 개인투자자 1,215명을 대상으로 설문을 진행하여 신용거래를 하는 개인투자자는 투자 능력(literacy)이 부족하고 과잉확신(overconfidence) 성향이 강함을 보였다. 또한 중국 신용거래자의 체결자료를 분석한 Bian et al.(2021)의 연구에서도 신용융자를 많이 활용하는투자자일수록 오히려 투자경험이 부족하고, 거래가 잦으며, 포트폴리오의 위험 수준이 높게 나타났다. 이처럼 상기 전술한 학술적 논의를 종합하면 신용거래는 경우에 따라 시장 전반에 부정적인영향을 미칠 수 있으며, 이를 주로 활용하는 투자주체가 개인투자자일 경우 신용거래가 적절하게활용되지 못할 가능성이 존재함을 암시한다.

Ⅲ. 개인투자자 신용융자 현황 및 특징 분석

본 장에서는 국내 개인투자자의 신용융자거래 및 잔고 현황과 특징을 분석하여 전반적인 주식시장 신용융자의 건전성을 정량적으로 검토한다. 또한 주식시장의 변동성이 높았던 코로나19 팬데믹 국면에 신용융자잔고 비중이 높은 종목의 주가 변동 특징을 살펴본다. 본 장에서 활용하는 자료는 전체 시장 및 개별종목 단위의 신용융자거래 및 잔고 자료로 DataGuide, 금융투자협회 포탈을 통해 확보하였다. 자료의 특성상 신용거래의 주체를 정확히 식별할 수 없으나, 신용융자가 주로 개인투자자에게 제공되는 매수대금의 융자라는 점에서 시장에서 관측되는 신용거래 및 신용융자잔고를 개인투자자의 신용거래와 신용융자잔고로 가정하고 분석을 진행한다.

1. 개인투자자 신용융자거래 비중

<그림 Ⅲ-1>에서와 같이 국내 주식시장 거래금액 중 신용거래 비중은 2020년 일평균 9.6%, 2021년의 경우 9월까지의 거래실적을 기준으로 일평균 약 7.8%로 추정된다. 2015년 이후 10% 남짓한 비중을 차지했던 신용거래가 2021년에는 다소 감소했다. 개인투자자 거래대금 대비 신용거래 비중은 2020년 이전 12~15% 수준이었으나 2021년에는 10.5%로 마찬가지 감소했다. 이는 주식시장 내 개인투자자가 늘어난 것과 연관되는데, 신규로 진입한 투자자 중에서 신용거래자보다 비(非)신용거래자가 차지하는 비중이 더 높기 때문인 것으로 판단된다.

<그림 Ⅲ-2>는 거래소 시장별 개인투자자 거래대금 대비 신용거래 비중을 나타낸다. 시장별 신용거래 비중 추이도 합산 결과(<그림 Ⅲ-1>)와 유사한 추이를 보이나, 유가증권시장 개인투자자 거래대금 대비 신용거래 비중이 코스닥시장보다 소폭 높게 나타난다. 가령 2021년 유가증권시장 개인투자자 거래대금 대비 신용거래 비중은 11.1%로 코스닥시장(9.9%)을 1.2%p 상회한다. 이는 코스닥시장 구성종목 내 투자위험이 높은 종목이 많아 신용거래가 상대적으로 제한되기 때문인 것으로 추정된다.

다음으로 국내 신용융자잔고 현황에 대해 살펴보자. <그림 Ⅲ-3>에서 알 수 있듯이 주식시장 신용융자잔고4)는 최근 소폭 감소했으나 코로나19 팬데믹 이후 급격히 증가했다. 2021년 10월 말 기준, 신용융자잔고는 약 24조원으로 2020년 3월 코로나19 충격 당시 6.6조원에서 265% 증가했다. 시장별로 살펴보면 유가증권시장은 13조원(+310%), 코스닥 시장은 11조원(+223%)으로 융자규모와 증가율 측면에서는 유가증권시장이 더 높지만, 주식시장 규모 대비 상대적 비중은 코스닥시장이 훨씬 높다(<그림 Ⅲ-4>). 2021년 10월 말 기준 주식시장 시가총액 대비 비율은 유가증권시장이 0.6%, 코스닥시장은 2.6%이며, 이는 2020년 3월 당시 비중(유가증권시장 0.27%, 코스닥시장 1.63%)과 비교했을 때 1.6~2배가량 증가한 수치이다. 코로나19 발생 이후 국내 증시가 상승했지만 그보다 신용융자잔고의 증가세가 더 가파른 것으로 해석할 수 있다.

다만 코로나19 이후 신용융자잔고의 증가율은 우리나라가 월등히 높게 나타난다. 2020년 3월부터 2021년 9월까지 주요국 신용융자잔고 증가율은 미국 88.4%, 일본 88.1%, 중국 60.9%로 같은 기간 우리나라 277.6%에 비해 낮다. 시가총액 대비 상대적 비중의 경우 3개국 모두 분석기간 내 비슷한 수준을 유지하고 있으나 (2020년 3월 이후 미국: +0.05%p, 일본: +0.11%p, 중국: +0.08%p), 우리나라의 경우 주식시장 규모 대비 신용잔고가 차지하는 비중이 지속적으로 늘어났다. 요약하면 국내 주식시장 신용융자잔고의 규모는 주요국 대비 작은 편이지만, 융자의 증가속도는 주요국과 달리 시장규모의 성장보다 빨랐다고 할 수 있다.

<그림 Ⅲ-7>은 분기별 증권사 신용공여율 분포 변화를 나타낸다. 코로나19 이전 및 2020년 상반기 당시에는 신용공여율이 80% 이상인 증권사가 거의 없었지만, 1년 후 표본 내 31%(9개사)의 증권사가 신용공여율이 80%를 넘긴 것으로 확인된다. 금융당국은 신용공여가 금융투자업자의 건전성에 미치는 영향을 고려하여 신용공여의 규모를 자기자본 100% 이내로 제한하고7), 위험관리 차원에서 각 증권사별로 법적 한도 내 자체 신용공여 한도를 설정하기 때문에 향후 신용융자잔고가 이전처럼 빠른 속도로 증가하기는 어려울 것으로 예상된다.

이상의 분석에서 국내 신용융자의 현황을 검토했다면, 본 절에서는 신용융자잔고의 횡단면적인 차이를 투자위험도와 연관된 개별종목의 특징을 기반으로 살펴본다. 종목별 비교가능성을 높이기 위해 상대지표인 신용융자잔고 비율(=신용융자잔고/시가총액)을 활용한다. 신용융자잔고 비율이 높을수록 주가의 하방위험이 가중될 시 담보가치의 감소에 따른 융자상환 수요와 투자자 급매(fire sales)로 인해 해당 주식의 주가가 더 큰 하락 압력을 받을 수 있다(Bian et al., 2021). 개별종목의 투자위험도 대용치로 기업의 규모(size), 시장 베타(beta), 고유 변동성(idiosyncratic vola-tility)을 활용한다.8) 이를 기반으로 상장주식을 월간 시가총액 상위 10%, 중위 30%, 하위 60%를 각각 대형주, 중형주, 소형주로 구분하고, 월별로 산출한 시장 베타 및 고유 변동성의 상위 30%, 중위 40%, 하위 30%를 각각 고위험, 중위험, 저위험 그룹으로 분류하여 각 그룹별 평균 신용잔고 비율을 살펴본다. 분석 표본 내 신용거래가 불가능해 신용잔고가 없는 종목이 존재하므로 이러한 종목은 제거한 뒤 분석을 진행한다.9)

<그림 Ⅲ-8>은 코로나19 이후(2020년 3월 vs. 2021년 9월) 각 그룹별 평균 신용융자잔고 비율과 변화를 나타낸다. 분석 결과 전반적으로 투자위험도가 높은 주식에서 신용융자잔고 비율이 높게 나타난다. 가령 2021년 9월 말 기준 신용융자잔고 비율은 소형주의 경우 평균 3.1%인 반면 대형주는 1.1%로 나타나며, 고변동성 그룹은 평균 3.2%인 반면 저변동성 그룹은 평균 1.9%이다. 시장 베타 및 고유 변동성 그룹 간 신용잔고 비율 변화는 뚜렷한 패턴이 나타나지 않으나, 기업 규모의 경우 소형주는 신용잔고 비율 증가분이 1.5%p인 반면 대형주는 0.6%p로 상대적으로 낮다.

한편 업종별 평균 신용융자잔고 비율은 디스플레이 3.6%, 반도체 3.5%, 하드웨어 3.3%, 제약 및 바이오 3.2% 순으로 주로 ITㆍ전자 또는 제약ㆍ바이오 섹터에서 신용융자잔고 비율이 높게 나타나고(<그림 Ⅲ-9>), 이 외 자동차 제조업, 자본재 등 상대적으로 경기변동에 민감하거나 투자위험이 높은 업종에서 신용잔고 비율 및 변화가 높게 관찰된다. 반면 은행, 보험, 유틸리티, 통신서비스등 경기변동에 덜 민감한 필수소비와 관련된 업종은 신용융자잔고 비율이 상대적으로 낮은 경향이 있다. 이러한 분석 결과는 신용융자를 활용하는 개인투자자는 높은 투자위험을 감수하며 투자하고 있을 가능성을 시사한다. 또한 투자위험도가 높은 종목이나 업종에서 신용잔고 비중이 높게관찰되는 점은, 향후 증시의 하방위험이 가중될 경우 이러한 특징을 갖는 종목에서 신용융자가 주가에 하락 압력으로 작용할 것으로 판단된다.

<그림 Ⅲ-10>은 분석기간 초 종목별 신용융자잔고 비율을 기준으로 분석대상 주식을 다섯 그룹으로 분류한 뒤, 잔고 비율이 가장 높은 그룹(high)과 가장 낮은 그룹(low)의 합산 누적수익률(실선)과 합산 신용순매수비율(점선) 추이를 나타낸다. 신용순매수비율은 종목별로 신용매수대금과 신용매도대금의 차이를 주별 시가총액으로 나눠 산출11)하며, 초소형주(micro-cap)의 영향을 최소화하기 위해 합산하는 과정에서 시가총액가중평균(value-weighted average)을 활용한다. 분석 결과 신용융자잔고 비율이 높은 종목은 코로나19 충격 당시 주가가 더 크게 하락하였으며, 하락하는 과정에서 신용순매수비율이 크게 감소했다. 신용거래자들은 코로나19 팬데믹 국면에서 해당 종목군을 신용매도(상환)하였으며, 증시 하방위험 확대에 따른 레버리지 축소 수요가 변동성 확대에 영향을 준 것으로 해석된다. 한편 신용융자잔고 비율이 높은 종목은 주가가 크게 하락한 만큼 이후 더 빠르게 회복하였으며 무엇보다 증시 회복기간의 수익률은 더 높게 나타난다. 신용거래로 인한 유동성 및 가격효율성 제고 효과가 주가 회복력(resilience)과도 연관된 것으로 보인다. 이러한 분석결과는 신용거래가 특정 시기에는 일부 종목의 주가 변동성을 오히려 확대시키고 결과적으로 투자자의 효익(welfare)에 부정적인 영향을 미칠 수 있음을 시사하며, 이는 과거 선행연구의 견해와 일치한다(Kahraman & Tookes, 2017, 2019; Bian et al., 2021).

앞선 장에서 시장자료를 기반으로 국내 주식시장 신용융자의 전반적인 현황과 특징을 살펴보았다면, 본 장에서는 투자자별 자료를 바탕으로 신용융자를 활용하여 거래하는 신용거래자의 투자성과와 투자행태를 검토한다. 분석에서 활용한 자료는 4개 대형 증권사가 제공한 약 20만 명의 개인 투자자의 국내 상장주식 거래 및 포트폴리오 내역으로, 이 중 신용융자를 활용한 투자자를 구별하여 실증분석을 진행한다. 본 장에서 활용하는 3개 증권사의 자료는 2020년 3월부터 10월까지의 자료로 구성되며, 나머지 1개 증권사의 자료는 2020년 3월부터 6월까지의 자료만을 포함한다. 거래체결 자료의 경우 신용융자 활용 여부를 식별할 수 있어, 이를 기반으로 각 개인투자자별12) 신용거래와 일반(현금)거래를 구분하여 분석 자료를 구축하였다. 자료의 특성상 신용거래에 포함되는 보증금(개시증거금) 및 담보 내역을 상세히 알 수 없어 신용융자를 활용한 거래 자체를 신용거래로 간주하여 분석을 진행한다.

1. 신용거래자 구성

최소한의 필터링을 거친 투자자 표본 내 분석기간 중 신용융자거래가 최소 1건이라도 존재하는 투자자를 신용거래자로 정의하면, 분석에 포함된 신용거래자는 11,178명으로 약 20.4만명에 달하는 개인투자자 표본 내 5.5% 정도를 차지하는 것으로 확인된다. 실제 개인투자자 내 신용거래자 비율과는 다소 차이가 있을 수 있으나, 개인투자자 거래대금 중 신용거래 비중이 일평균 12.6%(2020년 기준)임을 감안했을 때 신용거래자는 비(非)신용거래자13)보다 많은 거래를 일으키는 것으로 예상할 수 있다.

신용거래자의 구성상 특징을 살펴보면 다음과 같다. 먼저 신용거래자 표본 내 새로 진입한 신규투자자14) 비중은 12%로 非신용거래자에 비해 신규투자자 비중은 약 1/3 정도 낮은 것으로 나타난다(<그림 Ⅳ-1>). 상대적으로 투자경험이 부족한 신규투자자의 신용융자 활용도는 낮은 것으로 볼 수 있다. <그림 Ⅳ-2>의 성별 투자자 비중에 따르면, 신용거래자는 주로 남성 투자자임을 알 수 있다. 신용거래자 내 남성 비중은 76%로 여성의 3배 이상이며, 기존 개인투자자 중 남성의 비중이 65%임을 고려해도(김민기ㆍ김준석, 2021) 신용거래자 내에 남성의 비중이 여성에 비해 압도적으로 높다. 일반적으로 남성이 위험추구 및 과잉확신 성향이 강한 점과 연관된 것으로 보이며(Jianakopolos & Bernasek, 1998; Barber & Odean, 2001), 여성 투자자의 경우 레버지지 활용에 다소 보수적인 것으로 해석할 수 있다.

이 외 연령대별 신용거래자 비중은 40대(31%), 50대(30%), 30대(17%), 60대 이상(17%), 20대 이하(5%) 순으로, 전체 주식투자자 구성 대비 저연령대 투자자가 적은 것으로 확인된다. 특히 20대 이하 신용거래자의 비중(5%)은 非신용거래자 비중(15%)의 1/3 수준으로 나타나는데, 대개 투자경험이 적고 평균 보유자산 규모가 작은 젊은 투자자의 특성상 신용융자 활용에 보수적일 것으로 예상할 수 있다. 한편 투자자산15) 규모별 투자자 비중의 경우, 신용거래자 내 평균 1천만원 이하인 투자자 비중이 37%로 가장 크고, 1천만원 초과 3천만원 이하 26%, 3천만원 초과 1억원 이하 24%, 1억원 초과 13% 순이다. 평균 순자산 3천만원 이하인 소액투자자가 63%로 높은 비중을 차지하고 있으나 非신용거래자(77%)와 비교했을 때 14%p 낮아 상대적으로 신용거래는 투자자산 규모가 큰 투자자가 많이 이용하는 것으로 확인된다. 다만 평균 1천만원 이하인 소액투자자의 비중도 꽤 높게 나타나 위험 감내 여력이 낮은 투자자도 신용융자를 다수 이용하는 것으로 나타난다.

신용거래자는 레버리지를 활용하여 만족할만한 투자성과를 달성했을까? 분석기간 동안 신용거래자의 투자성과는 유형별 합산 포트폴리오의 누적시간가중 수익률(cumulative time-weight-ed return)로 산출한다. 누적시간가중 수익률은 포트폴리오의 일간 수익률을 누적하여 산출하는 방식으로 투자자금의 유출입 영향을 제거한 포트폴리오의 성과를 평가하는 데 적합한 수익률 척도다. 일간 수익률16)의 경우 투자자 유형별 일간 합산 포트폴리오 평가금액과 거래대금을 이용하여 계산하며, 거래비용을 고려할 경우 일간 수익에서 거래비용(거래세, 거래수수료, 신용이자17)을 차감한다. 거래비용 중 신용이자는 신용포지션에만 적용되며, 당일 매수ㆍ매도한 신용포지션(일중거래)의 이자비용은 각 증권사별 신용이자 적용방식을 참고한다.18)

위 분석에서는 신용거래자의 투자성과를 합산하여 살펴봤다면, 다음으로는 신용거래자 개인 단위에서 투자성과를 살펴보자. 개인별 수익률은 김민기ㆍ김준석(2021)에서 활용한 내부수익률(internal rate of return)을 기반으로 한다.20) <그림 Ⅳ-6>은 신용거래자와 非신용거래자의 수익률 분포를 보여준다. 신용거래자 수익률 분포의 중앙값이 0%로, 신용거래자 중 약 절반은 거래비용을 포함해도 순이익을 달성한 것으로 나타난다. 또한 두 그룹 모두 투자자간 수익률 격차가 매우 크지만, 무엇보다 신용거래자간 수익률 격차가 더 크게 나타난다. 가령 신용거래자의 하위 10%는 –1.25%(연 –95.6%21)), 상위 10%는 0.92%(연 864%)이며, 非신용거래자의 경우 하위 10% -0.77%(연 –85.2%), 상위 10% 0.46%(연 212%)이다. 신용거래자 중에는 매우 높은 수익률을 달성한 투자자도 있는 반면, 매우 열악한 성과를 보인 투자자도 존재하는 것으로 보인다. 이러한 수익률 분포의 특징은 상대적으로 공격적으로 투자하는 신용거래자의 특성에 기인하는 것으로 판단되며, 수익률에 레버리지 효과를 고려하면 격차는 더욱 확대된다. 투자자간 투자시점의 차이를 고려하기 위해 시장 수익률 대비 초과수익률로 분석해도 결과의 질적인 차이는 없는 것으로 나타났다.

마지막으로 신용거래자 중 레버리지 효과를 누린 투자자 비중을 살펴보자. 신용융자를 활용한 레버리지 효과는 신용포지션의 순이익이 0보다 큰 것을 의미한다. 분석 결과 전체 신용거래자 중 33.5%는 신용포지션을 통해 이익을 달성한 것으로 파악된다. 절반에 크게 못 미치는 수치로 신용거래자 중 레버리지 효과를 달성한 투자자는 많지 않은 것으로 예상된다. 투자자 유형별로 살펴보면 성별에 따른 차이는 관찰되지 않으나, 기존 투자자, 고령 투자자, 고액 투자자 내에 신용포지션이 양(+)인 투자자 비중이 상대적으로 높게 나타난다(<그림 Ⅳ-7>). 반면 신규 투자자 및 20대 이하 투자자의 75%가 신용융자 활용을 통해 손실을 본 것으로 나타나, 투자경험이 다소 부족한 투자자 그룹 내 4명 중 3명이 신용거래를 통해 손실이 가중되었을 것으로 추정된다. 전반적인 분석결과, 개인투자자는 신용거래를 통해 만족할만한 성과를 달성했다고 보기 어렵다. 거리비용을 고려할 경우 신용포지션의 수익률은 같은 기간 시장수익률을 크게 하회하며, 레버리지 효과를 누린투자자의 비중이 낮게 확인된다. 또한 분석기간이 대체로 상승장이었음을 감안하면 개인투자자중 다수는 신용거래를 제대로 활용하지 못함을 시사한다.

본 절에서는 앞선 신용거래자 투자성과의 요인을 분석하기 위해, 신용거래자의 투자행태를 투자자 유형별로 포트폴리오 구성과 거래빈도를 중심으로 검토한다. 분석에 앞서 신용거래자가 신용융자로 매수한 포지션 비중을 투자자 유형별로 확인해보자. 신용거래자의 합산 주식 평가금액 대비 신용융자로 매수한 주식의 합산 평가금액의 비율(신용포지션 비중)은 전체 36.6%이다. 포지션 구축 시 보증금(증거금) 비중에 대한 자료가 부재해 분자에 해당하는 신용포지션은 보증금을 포함한 합산 평가금액이다. 이를 고려하면 실제 순수한 신용포지션은 더 작을 것으로 예상된다. 신용거래자 전체 담보자산(현금 자산ㆍ주식평가금액) 대비 융자금(증거금 포함)의 비중은 34.1%로 추정되는데, 이를 담보유지 비율로 환산할 경우 293%(=1/0.341)로 법정 최저 담보유지 비율22)인140%를 크게 상회해 전반적으로 신용거래자들이 융자금 대비 담보 수준을 높게 유지하고 있는것으로 파악된다. 만약 최저 개시증거금인 40%를 현금(또는 대용자산)이라고 가정하면 융자금의 비중은 전체 20.5%(=34.1%× 0.6)으로 담보유지 비율은 488%(=1/0.205)로 늘어난다. 전반적으로 신용거래자의 재무상태는 크게 우려할 수준은 아닌 것으로 판단되며, 주가 하락 시 신용포지션의 평가금액이 크게 감소해도 예상치 못한 대규모 임의상환(반대매매)이 발생할 가능성은 높지 않을 것으로 판단된다.23)

다음으로 분석기간 신용거래자의 포트폴리오 구성의 특징을 확인해 보자. Ⅲ장 3절에서 실시한 시장자료 분석과 마찬가지로 개별종목의 투자위험도와 관련된 지표 중 기업 규모(size)를 활용한다. 아래 <그림 Ⅳ-8>과 <그림 Ⅳ-9>는 상장주식을 시가총액 규모별로 세 그룹으로 분류하고 투자자 그룹별 일평균 보유비중을 산출한 것이다. 신용거래자의 포트폴리오 내에는 대형주 46%, 중형주 34%, 소형주 20%로 주식시장 내 대형주(81%), 중형주(13%), 소형주(6%)에 비해 중소형주가 월등히 과대배분되어 있는 것으로 나타난다. 非신용거래자의 평균 보유비중과 비교할 시 소형주와 중형주 투자비중이 각각 10%p, 8%p 높다. 신용거래자를 세부 유형으로 분류하면 기존투자자, 20~30대 이하 젊은 투자자, 남성, 소액투자자에서 중소형주 투자비중이 상대적으로 높게 나타난다(<그림 Ⅳ-9>). 특히 전체 개인투자자를 분석한 김민기ㆍ김준석(2021)의 분석 결과와 비교했을 때, 모든 투자자 유형에서 신용거래자의 중소형주 투자비중이 높게 나타나 신용거래자는 평균적으로 위험추구 성향이 높고 더욱 공격적으로 투자하는 것으로 평가된다. 한편 신용거래자의 신용포지션은 현금포지션에 비해 중소형주 비중이 소폭 낮은 것으로 나타나, 중소형주의 경우 신용거래에 차입 제약(margin constraints)이 다소 존재하는 것으로 추정된다. 이 외에도 투자위험도의 대용치를 시장 베타와 고유 변동성으로 변경하여 분석해도 결과는 대체로 유사하다. 한편 신용거래자는 의료섹터 종목을 非신용거래자 대비 2%p 높게 과다보유하는데, 추가적인 분석 결과 평균 투자자산 1천만원 이하의 소액투자자의 의료섹터 신용포지션 비중이 높게 나타난다. 신용거래자는 단기적으로 높은 수익률을 기대할 수 있는 종목을 선호하는 것으로 해석된다.

신용거래자와 非신용거래자의 일간 거래회전율을 비교한 결과 신용거래자의 거래회전율은 17.7%로 非신용거래자의 거래회전율보다 약 3배 이상 높게 나타난다(<그림 Ⅳ-12>). 연간으로 환산할 시 약 4,400%로 거래빈도가 굉장히 높아 앞선 성과 분석에서 확인된 바와 같이 잦은 거래가 수익률에 미치는 부정적 효과가 현저하다. 신용거래자 내 투자자 유형별 거래회전율을 살펴보면, 신규투자자, 젊은 투자자, 남성, 소액투자자의 거래빈도가 높게 확인되는데(<그림 Ⅳ-13>), 이는 전체 개인투자자를 대상으로 한 김민기ㆍ김준석(2021)의 분석 결과와 동일한 패턴이나, 전반적인 거래회전율 수준이 높게 나타난다. 특히 20대 이하의 거래회전율은 33.2%, 평균 투자자산 1천만원 이하 소액투자자의 거래회전율은 49.8%로 이를 평균 보유기간으로 환산하면 각각 3일(=1/0.332)과 2일(=1/0.498)에 불과한 수준이다. 또한 신용거래자의 일중거래(day trading) 비중24)은 56.6%로 非신용거래자의 52.3%에 비해 높게 나타나 신용거래자는 극단적인 단기투자성향을 보이는 것으로 평가할 수 있다. 앞선 Ⅳ장 2절의 투자성과 분석과 비교할 경우 거래가 잦은 투자자 유형의 투자성과가 저조하며 거래빈도 수준 또한 매우 높아 신용거래자의 낮은 수익률은 과잉확신과 같은 투자자의 행태적 편의가 영향을 미쳤을 것으로 생각된다.

본 보고서의 실증분석 결과를 요약하면 다음과 같다. 첫째, 국내 주식시장 신용융자 규모는 주요국과 우리나라 주식시장 규모를 고려했을 때 상대적으로 낮은 수준이나, 코로나19 이후 매우 빠른 속도로 증가한 것으로 확인된다. 둘째, 상대적으로 신용융자잔고가 높은 종목은 시가총액이 작고, 변동성, 베타가 높은 고위험 주식인 것으로 나타난다. 또한 코로나19 팬데믹 국면을 살펴본 결과 신용융자잔고가 높은 종목의 주가 하락폭이 더 크게 나타나, 향후 주식시장 하방위험이 가중될 시 이러한 고위험 종목에서 변동성이 확대될 가능성이 존재함을 암시한다. 셋째, 국내 신용거래자는 전체 개인투자자의 약 5.5%로 높은 비중을 차지하고 있지는 않으나, 위험 감내 수준이 낮을 것으로 예상되는 자산규모가 작은 투자자가 다수 신용융자거래를 활용하는 것으로 나타나 소액 개인투자자의 건전성이 다소 우려된다. 넷째, 거래비용을 고려할 경우 신용거래자의 투자성과는 기존 개인투자자를 하회하는 것으로 분석되며, 세부 유형별로는 소액투자자의 수익률이 현저히 낮아 이들은 신용거래로 인해 오히려 손실이 확대되었을 것으로 추정된다. 마지막으로, 신용거래자의 전반적인 재무상태는 양호하나, 투자위험도가 높은 주식에 대한 투자 비중이 높고 거래빈도가매우 높게 확인된다. 또한 분산투자 수준도 낮아 신용거래자는 매우 단기적이고 투기적인 투자행태를 보이는 것으로 확인된다. 특히 이러한 행태는 투자 수익률이 낮은 신규 투자자, 20대 이하 젊은 투자자, 남성, 소액투자자에서 현저하게 나타나 신용거래자의 투자행태에는 과잉확신과 같은행태적 편의가 작용했을 것으로 추정된다.

본 보고서의 시사점은 다음과 같다. 먼저 국내 주식시장 신용거래자 중에는 신용융자를 적절하게 활용하지 못하는 개인투자자가 존재하는 것으로 나타난다. 개인투자자는 신용융자 활용에 세심한 주의가 요구되며 신용거래에 대한 투자위험을 정확히 인식하고 위험 감내 수준에 맞는 투자를 집행할 필요가 있다. 또한 신용융자 규모는 이전처럼 큰 폭으로 증가하기 어려울 것으로 예상되나 코로나19 이후 매우 빠르게 증가한 만큼, 향후 발생할 수 있는 투자위험에 적절히 대응할 필요가 있다. 주지하듯 신용거래는 일종의 가수요이며 레버리지 수단으로써 투자자 효용과 주식시장 안정성에 양날의 검이 될 수 있어 과도한 사용은 경계할 필요가 있다.

1) 본 보고서에서는 신용융자거래와 신용거래, 신용융자잔고와 신용잔고를 혼용해서 사용한다.

2) 개시증거금율(보증금율)을 고정한 점은 우리나라의 경우와도 유사하다. 과거 우리나라는 1970년 이후 1990년까지 약 20년 간 20차례 신용거래 보증금율을 변경했지만, 1990년 이후 40%로 고정된 뒤 1999년 자유화되었으며 2007년 다시 40%로 재설정되었다.

3) 가령 Alexander et al.(2004)과 Hirose et al.(2009)은 각각 미국, 일본 주식시장을 대상으로 신용거래의 영향에 대해 분석했다.

4) 신용융자잔고는 주식을 매수할 때 증권사로부터 융자한 현금(신용융자) 중 아직 상환되지 않은 잔액으로 정의된다.

5) 2021년 9월 말 통화별 환율로 환산

6) 증권사의 신용공여율은 자기자본 대비 신용공여금으로 산출한다. 증권사 신용공여는 신용융자, 신용대주, 청약자금대출, 증권담보대출, 기타로 구성되며, 신용융자와 증권담보대출이 신용공여금의 대부분을 차지한다.

7) 금융투자업자 규정 제4-23조, 제3-24조의 2

8) 기업 규모가 작을수록 투자위험도가 높은 종목이라 할 수 있으며, 시장 베타와 고유 변동성은 각각 개별종목의 체계적 위험(systematic risk)과 비체계적 위험(unsystematic risk)의 대용치로 자주 활용되는 측정치이다. 시장 베타와 고유 변동성은 일별 자료를 토대로 각각 시장모형(market model) 및 Fama-French(1993) 3요인 모형으로 산출한다.

9) 신용잔고가 없는 종목의 잔고 비율을 0으로 처리해도 분석 결과의 질적인 차이는 없다. 또한 신용잔고가 없는(또는 0인) 종목이 전체 표본의 약 5%로 나타나 전반적인 결과에 영향을 줄 수 있는 선택 편향(selection bias)은 미미할 것으로 생각된다.

10) 코로나19 국면에 국한하지 않더라도 주식시장이 크게 하락하는 시기에서 유사한 특징이 확인되며, 기업의 규모(size)를 고려해도 유의미하게 관찰되는 특징이다.

11) 예를 들어 신용순매수비율이 1%라면, 해당 종목의 약 1%의 지분을 신용융자거래로 순매수했음을 의미한다.

12) 자료의 특성상 개인투자자는 해당 증권사 내에서만 식별되므로 한 개인투자자가 복수의 증권사에 계좌를 보유한 경우 복수의 개인투자자로 구분된다.

13) 非신용거래자는 분석기간 중 신용융자거래가 1건도 없는 투자자를 의미한다.

14) 분석 시작 시점인 2020년 3월 이후 주식계좌를 개설한 투자자로 정의한다.

15) 분석기간 내 일간 투자자산의 평균값 기준. 투자자산 = 주식 및 ETP 평가금액 + 예수금 및 CMA잔고 – 담보대출, 미수금, 및 추정 신용융자금(순자산 기준)

16) 일별 합산 포트폴리오의 평가금액을

17) 거래세는 2020년 증권거래세인 25bp를 일괄 적용하고, 위탁매매수수료율의 경우 분석에 포함된 증권사의 2020년 사업보고서에 공개된 코스닥시장 위탁매매대금과 위탁매매수수료 정보를 이용하여 평균 수수료율을 추정한다. 또한 개인별 신용융자 잔액을 추정하여 융자기간에 따라 신용이자를 일률화하여 일별로 적용하는데, 각 증권사별 신용이자율은 금융투자협회 공시사이트에서 제공하는 신용융자 이자율 공시자료를 기반으로 한다.

18) 통 상 신용융자 이자 적용기간에 융자 당일(이자가산일)은 경과일수에서 제외되나, 일중거래에 1일차 이자를 부여하는 증권사의 경우 1일치 이자비용만큼 차감한다. 또한 경과기간 1일 이상에 대한 신용이자를 산출할 때, 융자금 추정을 위해 일괄적으로 증거금율을 50%로 설정한다. 증거금율을 변경해도 결과의 질적인 차이는 없음을 밝혀둔다.

19) 유가증권시장 및 코스닥시장의 시가총액 가중평균 수익률

20) 내 부수익률은 투자자금 유출입에 대한 의사결정을 반영한 금액가중 수익률 개념으로, 투자자별로 아래 수식을 만족하는 수익률 을 산출한다. 내부수익률은 일간(daily) 기준이다.

투자기간이

21) 연환산 수익률 =

22) 금융투자업규정 제4-25조에서 정한 최소 담보비율(=담보평가금액/신용융자액)

23) 이 와 관련하여 금융감독원에서 발간한 위험 분석보고서(2021)에 따르면, 신용계좌 중 반대매매가 발생할 가능성이 높은 계좌의 비중은 27% 미만이며 연체율도 하락하고 있어 전반적인 신용계좌의 건전성은 우려할 만한 수준이 아닌 것으로 평가되었다.

24) 일중거래 비중은 투자자별로 개별종목을 당일 매수ㆍ매도한 체결내역을 일중거래로 정의하여 전체 투자자 합산 거래대금 대비 일중거래금액 비율로 산출한다.

참고문헌

고광수ㆍ김영갑ㆍ하연정, 2007, 신용규제의 경제적 의미와 증권시장, 한국금융공학회『금융공학연구』6(2), 197-222.

금융감독원, 2021,『자본시장 위험 분석보고서』.

김민기ㆍ김준석, 2021,『코로나19 국면의 개인투자자; 투자행태와 투자성과』, 자본시장연구원 이슈보고서 21-11.

김지현ㆍ윤선흠, 2017, 신용매수거래가 개별주식의 변동성, 유동성, 수익률예측력에 미치는 영향, 충남대학교 경영경제연구소『경영경제연구』39(2), 67-92.

박수철ㆍ우민철ㆍ이윤종, 2019, 개인투자자의 레버리지 거래가 주식시장에 미치는 영향, 한국재무관리학회『재무관리연구』36(3), 205-228.

Alexander, G.J., Ors, E., Peterson, M.A., Seguin, P.J., 2004, Margin regulation and market quality: A microstructure analysis, Journal of Corporate Finance 10(4), 549-574.

Barber, B.M., Odean, T., 2001, Boys will be boys: Gender, overconfidence, and common stock investment, Quarterly Journal of Economics 116(1), 261-292.

Bian J., Da, Z., He, Z., Lou, D., Shue, K., Zhou, H., 2021, Margin trading and leverage management, working paper.

Cohen, J., 1966, Federal Reserve margin requirements and the stock market, Journal of Financial and Quantitative Analysis 1(3), 30-54.

Chowdhry, B., Nanda, V., 1998, Leverage and market stability: The role of margin rules and price limits, Journal of Business 71(2), 179-210.

Grube, R.C., Joy, O.M., Panton, D.B., 1979, Market responses to federal reserve changes in the initial margin requirement, Journal of Finance 34(3), 659-674.

Hardouvelis, G.A., 1988, Margin requirements and stock market volatility, Quarterly Review 13(Sum), 80-89.

Hirose, T., Kato, H.K., Bremer, M., 2009, Can margin traders predict future stock market returns in Japan? Pacific-Basin Finance Journal 17(1), 41-57.

Jianakopolos, N.A., Bernasek, A., 1998, Are women are more risk averse? Economic inquiry 36(4), 620-630.

Kahraman, B., Tookes, H.E., 2017, Trader leverage and liquidity, Journal of Finance 72(4), 1567-1610.

Kahraman, B., Tookes, H.E., 2019, Margin trading and comovement during crises, Review of Finance 24(4), 813-846.

Kim, H., Kim, K.T., Hanna, S.D., 2021, The effect of investment literacy on the likelihood of retail investor margin trading and having a margin call, Finance Research Letters, 102146.

Moore, T.G., 1966, Stock market margin requirements, Journal of Political Economy 74(2), 158-167.

Seguin, P.J., 1990, Stock volatility and margin trading, Journal of Monetary Economics 26(1), 101-121.

Seguin, P.J., Jarrell, G.A., 1993, The irrelevance of margin: evidence from the Crash of ‘87, Journal of Finance 48(4), 1457-1473.