Find out more about our latest publications

Retirement Income Tax Reform and Annuitization in Korea

Issue Papers 22-02 Jan. 13, 2022

- Research Topic Asset Management/Pension

- Page 20

In the 2010s, the Korean government revised the Income Tax Act to increase the tax burden for retirement income paid in a lump sum. The reform gradually increased the tax from 2015 to 2020. In addition, if a plan member transfers retirement income to the individual retirement pension account to select annuity payment, the applicable tax would be reduced to 70% of that imposed on lump-sum withdrawals.

The reform primarily aimed to promote annuitization of retirement income, by driving up the tax burden for lump-sum withdrawals of retirement benefits (retirement annuity and severance pay). The tax policy for lump-sum payments was considerably generous, thanks to the previous severance pay scheme. The effective tax rate of around 3% was applied to most retirees who withdrew their retirement income in a lump sum. But the reform abandoned fixed-rate deductions that were applied regardless of the amount of retirement benefits and imposed a relatively higher tax rate on the annualized wages.

This article analyzed how the tax amount imposed on retirement income changed by referring to the statistical yearbook published by the National Tax Service. It was found that nearly 50% of the retirement income was transferred to the individual retirement pension account after the revised retirement income tax policy was fully implemented in 2016. The group of retirees being subject to higher effective tax rates held a larger proportion of deferred retirement income. As the years rolled by after the end of 2016, retirees tended to hold a larger proportion of deferred retirement income. Given the above, the first phase of annuitization has achieved some measure of success. However, the contributions accumulated in the retirement pension account, being similar in amount to the retirement income transferred annually to the retirement pension account, were withdrawn in any form other than annuity payments. This implies that once transferred to the retirement pension account, retirement income rarely stays long in the account.

More incentives should be offered to ensure that retirement benefits would be placed in the retirement pension account for a longer period and then be annuitized. One solution is to allow retirees to withdraw part of their retirement assets tax-free for emergency funds.

The reform primarily aimed to promote annuitization of retirement income, by driving up the tax burden for lump-sum withdrawals of retirement benefits (retirement annuity and severance pay). The tax policy for lump-sum payments was considerably generous, thanks to the previous severance pay scheme. The effective tax rate of around 3% was applied to most retirees who withdrew their retirement income in a lump sum. But the reform abandoned fixed-rate deductions that were applied regardless of the amount of retirement benefits and imposed a relatively higher tax rate on the annualized wages.

This article analyzed how the tax amount imposed on retirement income changed by referring to the statistical yearbook published by the National Tax Service. It was found that nearly 50% of the retirement income was transferred to the individual retirement pension account after the revised retirement income tax policy was fully implemented in 2016. The group of retirees being subject to higher effective tax rates held a larger proportion of deferred retirement income. As the years rolled by after the end of 2016, retirees tended to hold a larger proportion of deferred retirement income. Given the above, the first phase of annuitization has achieved some measure of success. However, the contributions accumulated in the retirement pension account, being similar in amount to the retirement income transferred annually to the retirement pension account, were withdrawn in any form other than annuity payments. This implies that once transferred to the retirement pension account, retirement income rarely stays long in the account.

More incentives should be offered to ensure that retirement benefits would be placed in the retirement pension account for a longer period and then be annuitized. One solution is to allow retirees to withdraw part of their retirement assets tax-free for emergency funds.

Ⅰ. 서장

국내 퇴직연금(퇴직금 포함) 세제는 퇴직연금 납입액과 투자수익은 과세하지 않고 인출 시에 퇴직소득에 대해서 과세하는 방식이다. 즉 납입액 면세(exempted), 투자수익 면세(exempted), 퇴직소득 과세(taxed) 방식(EET)이다. 이러한 방식은 많은 나라에서 퇴직연금에 적용하는 과세 방식이며, 국민연금과 같은 공적연금에도 EET 방식이 적용된다. 2014년 정부는 퇴직일시금 수급자의 세금 부담을 높이는 방향으로 퇴직소득 세제를 개정하였다. 2014년 개정으로 그 이전부터 추진해 오던 퇴직연금 일시금에 대한 증세 작업이 완료되었다. 한편 급격한 세금 부담의 증가를 완화하기 위해 새로운 세금 계산 방식을 2016년부터 일부 적용하고, 2020년까지 매년 적용 비율을 높여가기로 하였다.

2014년 퇴직소득 세제 개정은 연금화의 확대를 주요 목표로 하였다. 퇴직연금 도입 이후에도 여전히 퇴직연금의 일시금 수급 비율이 높았다. 그 이유의 하나로 퇴직금 시대부터 퇴직일시금에 대한 세율이 매우 낮아 연금화의 유인 효과가 적었다. 따라서 정부는 퇴직일시금에 대한 세금 부담을 높이고, 연금의 세금 부담을 상대적으로 낮추어 연금 수급 비율을 높이려 한 것이다.1) 제도 개정의 핵심 내용은 근로자가 퇴직할 때 받은 퇴직소득 중 일부 또는 전부를 연금계좌에 이체하면 이연되는 퇴직소득에 해당하는 퇴직소득세도 이연해 주는 것이다. 그리고 이연된 퇴직소득을 연금으로 수령하면 이연된 퇴직소득세의 30%를 감면해 준다.

그런데 퇴직연금 일시금에 대한 과세 강화에도 불구하고 퇴직연금을 연금으로 받는 사람의 비율이 매우 낮다. 즉 대부분의 퇴직자들이 퇴직급여를 일시금으로 받는다. 가장 큰 원인은 퇴직연금 적립금이 다양한 사유로 퇴직 전에 인출되어 퇴직급여가 연금으로 받기에는 너무 작아졌기 때문이다. 따라서 퇴직소득 세제의 변화는 큰 효과가 없어 보인다. 그러나 퇴직급여를 연금으로 받는 퇴직자의 비율은 낮지만 그 퇴직소득의 금액 비중은 2020년의 경우 20%를 넘고 있다(고용노동부ㆍ금융감독원, 2021). 퇴직급여액이 상대적으로 큰 퇴직자에게는 퇴직소득 세제 변화의 효과가 상당히 클 수 있다.

연금화를 촉진하는 것은 퇴직소득의 안정을 위해 필수적이다. 따라서 연금 수급을 확대하기 위한 퇴직소득 세제 변화가 어느 정도 목적을 달성하였는지 평가해보는 작업도 퇴직연금 제도의 발전을 위해 중요한 의미를 갖는다. 연금 납입에 대한 세액공제로의 전환과 공제한도액에 대한 논쟁과 연구는 상당히 많았던 것에 비해 소득세제 개정 이후 제도의 영향과 효과에 대한 검토, 연구는 매우 적었다. 본 연구는 국세청의 국세통계연감 자료를 분석하여 2010년대 초반에 이루어진 퇴직연금소득세 변화의 영향을 검토하고, 향후 정책적 시사점을 찾아본다. 본 연구의 구성은 다음과 같다. Ⅱ장에서는 세금과 연금화의 관계, 국내 연금 세제의 변화, 그리고 영국을 중심으로 외국의 퇴직소득세 변화 사례를 살펴본다. Ⅲ장에서는 퇴직소득세 변화의 내용과 그 영향을 살펴본다. 그리고 마지막으로 Ⅳ장에서는 퇴직소득 안정성 측면에서 퇴직연금 세제의 개선 방향을 찾아본다.

Ⅱ. 퇴직소득세 개정의 배경

세금은 연금의 가격을 변화시켜 퇴직자의 연금화 결정에 영향을 미친다. 국내 퇴직소득 세제의 변화는 퇴직일시금의 세금 부담을 높이고, 상대적으로 연금의 세금 부담을 낮추는 방향으로 변화하였다. 본장에서는 퇴직소득세가 연금화에 미치는 영향에 대해 살펴본다. 또한 국내 퇴직소득세의 개정과 비슷한 시기에 영국은 퇴직일시금의 비용을 대폭 낮추는 세제 개정을 하였다. 국내 퇴직소득세의 변화와 영국과의 비교를 통해 세제 변화의 효과를 엿볼 수 있다.

1. 세금과 연금화

퇴직연금을 일찍 도입한 나라들은 퇴직연금의 연금 수급을 유도하기 위해 일시금이든 연금이든 일반적인 소득세율로 과세한다.2) 대부분의 국가에서 소득세율이 소득에 따라 누진적으로 높아지므로 일시금을 받을 경우 높은 세율을 연금을 받을 경우 낮은 세율을 적용받게 되어 퇴직자들은 연금을 선택하게 된다.

일반적으로 연금과 일시금의 선택은 퇴직자에게 매우 어려운 선택 중의 하나이다. 매우 큰 금액이 관련되어 있고, 때로는 선택 후 되돌리기 어려운 경우도 있다. 연금은 장수위험에 대비하는 좋은 대안임에도 불구하고, 연금을 구입하는 사람은 매우 적다. 흔히 연금 퍼즐(annuity puzzle)로 불리는 이러한 현상을 설명하기 위해 많은 연구들이 있었다. 그 연구들은 크게 두 방향에서 연금 퍼즐을 설명한다. 하나는 연금 가격이 구입자들에게 불리하기 때문에 연금 구입을 꺼린다는 입장이고, 또 다른 방향은 행태적 편의(behavioral anomalies) 때문에 연금 구입이 적다는 입장이다.

연금에 대한 세금은 연금 선택의 또 다른 영향 요인이 될 수 있는데, 연금과 일시금의 상대적 가격에 영향을 미칠 수 있기 때문이다. 2004년 스위스 대형 생보사들이 연금 가격을 인상하였을 때 퇴직자들이 일시금을 선택하는 비율이 높아졌다(Butler et al., 2013).3) Butler & Rams-den(2017)은 스위스의 주별 세제 차이 때문에 동일한 퇴직연금 기금에 속한 퇴직자들의 연금 선택 비율이 달라진다는 사실을 확인하였다. 즉 연금 세율이 높을수록 연금 선택 비율이 낮아졌다.

국내의 경우 퇴직금에 대한 세제가 매우 관대하여, 퇴직연금 도입 이후에 퇴직연금을 연금으로 받을 유인이 낮았다(김재칠·홍원구, 2013). 이러한 인식을 바탕으로 정부는 2010년대에 들어서면서 지속적으로 일시금에 대한 세부담을 늘리는 방향으로 세제를 개편하였다. 따라서 퇴직자의 퇴직소득세 부담이 꾸준히 증가하였다.4) 이에 따라 퇴직자들이 일시금이 아닌 연금을 선택할 유인이 높아졌다. 그러나 현재까지 퇴직소득 세제에 대한 연구가 거의 없어 퇴직소득 세제 변화의 효과에 대해 정확한 평가가 힘든 상황이다(박한순, 2018). 일반적으로 연금가격과 세금이 연금에 미칠 수 있는 잠재력에 대해서는 공감할 수 있으나, 연금 가격의 변화, 세금 변화에 대한 자료를 얻기 힘들기 때문에 이에 대한 실증 연구 결과는 많지 않았다. 이에 더하여 연금 납입액에 대한 세제는 매년 연말정산 과정을 통하여 모든 근로자에게 영향을 미치고, 연금 시장에 참여한 금융회사들의 경쟁 구도에도 영향을 미치기 때문에 연금 납입액에 대한 세제 변경은 많은 관심을 끌게 된다. 이에 비해 연금-일시금의 선택 문제는 매년 발생하는 문제가 아니고, 개인의 문제로 인식되어 상대적으로 사회적 관심이 덜하다. 또한 연금 도입 초기 단계에 있는 우리나라에서는 퇴직연금(퇴직금) 인출의 문제를 미래의 문제로 인식하고 있다. 그러나 퇴직연금 적립금 규모도 증가하고 있고, 퇴직연금에 가입하지 않더라도 퇴직금을 받고 퇴직하는 근로자들도 많기 때문에 퇴직소득의 수령 형태(연금 또는 일시금)는 매우 중요한 문제이다. 또한 2015~2020년 사이에 매년 퇴직소득 세율이 변하는 상황이 전개되어 퇴직소득 세금이 퇴직소득의 수급 형태에 미치는 영향을 연구하기 적합한 환경이 조성되었다.

2. 외국의 사례

미국, 영국 등 사적연금을 도입 운용하고 있는 나라들은 대부분 EET 방식의 과세 방식을 채용하고 있다(이소라, 2018). 따라서 퇴직연금이 인출될 때 과세를 한다. 이때 퇴직연금 인출액을 일반 소득액과 구분하지 않고 과세함으로써 일시 거액의 인출 가능성을 줄이고 있다.

우리나라의 과세 방식과 비교하여 특이한 점은 DC형 퇴직연금 계좌에서 가입자가 일정 연령 (예를 들어 미국 70.5세, 캐나다 72세)에 이를 때까지 인출하지 않으면, 일정 비율의 금액을 인출한 것으로 보고 그에 대해 과세하는 방식이다(홍원구, 2016).5) 의무인출(Required Minimum Distribution) 비율은 연령이 높아지면서 증가한다. 이처럼 연령에 따라 일정 비율 이상을 의무적으로 인출하도록 하는 것은 세제 혜택을 받으며 형성된 퇴직자산이 퇴직자의 생활자금으로 사용되지 않고, 상속되는 경우를 막기 위한 조치들이다.

그리고 퇴직연금 납입액에 한도가 있는 경우가 많다(Rejda & McNamara, 2017, pp.378~379). 예를 들어 미국의 경우 DB형 퇴직연금의 연간 급여한도(연속 3년 최고 평균)는 소득 100%와 $230,000(2021년) 중 적은 금액이다. 401(k)형 연금의 경우 이연 가능한 소득한도는 $19,500 (2021년)이며 물가와 연동되어 금액이 조정된다. 이때 근로자가 50세 이상인 경우 $6,500까지 추가 납입이 가능하다. 이에 비해 국내 퇴직연금은 납입액에 대한 한도가 없다.6)

국내 퇴직소득 세제의 변화와 관련하여 가장 인상적인 변화는 영국의 연금 강제화 정책의 변화였다. 영국은 DC형 퇴직연금 자산으로 75세까지 의무적으로 연금을 구입하도록 하는 정책을 유지하였으나, 2015년 4월부터 퇴직자들이 55세 이후 자신의 한계 소득세율7)에 따라 세금을 납부하면 원하는 만큼의 금액을 원하는 시기에 인출할 수 있도록 허용하였다.8) 2015년 4월 이전에는 일시금이나 분할 인출에 대해 55%의 세율을 적용하여 종신연금을 구입하도록 유도하였다.9) 1956년 이후 거의 60년간 지속되어 온 영국의 DC형 퇴직연금 의무 연금화 정책은 퇴직소득 안정화 정책을 대표하는 모범적 사례로 인식되어 왔다. 따라서 영국의 정책 변화는 매우 충격적이라 할 수 있다. 자유로운 인출이 허용된 2015년 4월 이후 2020년말까지 약 160만명이 1,190만개의 계좌에서 424억파운드를 인출하였다.10) 인출액이 급격히 늘어남에 따라 세금 또한 늘어났는데, 2018년 말까지 20억파운드 가량 세수가 늘었으며 그 이후에도 매년 4억파운드 가량 세수가 늘 것으로 전망되었다.11) 영국 정부가 세제를 바꾼 이유는 명확하지 않지만 퇴직소득 세제의 변화가 연금의 인출 방식에 영향을 줄 수 있다는 사례를 제시하고 있다.12) 즉 영국의 경우 일시금에 대한 세율을 낮추어 일시금 인출이 확대되었는데, 반대로 일시금에 대한 세금을 높이면 인출이 축소되고 퇴직 소득의 연금화가 촉진될 수도 있음을 보여준다.

한편 우리나라의 경우 연금 자산의 축적 단계가 다르기 때문에 영국의 정책 전환을 곧 받아들이기는 어렵다. 무엇보다도 국내 퇴직연금의 경우 아직 연금화가 안정적으로 정착되지 않았기 때문에 영국에 비해 훨씬 적극적으로 연금화를 후원해야 한다. 영국은 오랜 동안 연금화 정책을 추진하였기 때문에 어느 정도 연금화가 정착되어 있었지만, 그럼에도 불구하고 일시금의 인출이 증가하였다. 두 번째, 세수 측면에서 볼 때 국내의 경우 기존의 퇴직급여가 상당 부분 일시금으로 인출되고 있었기 때문에 일시금이 늘어나서 세수가 증가할 여지가 적다. 국내의 경우 세수를 줄여서라도, 즉 세제 혜택을 늘려서라도 연금화를 촉진해야 할 단계에 있다. 마지막으로 영국처럼 인출 과정의 유연성을 높이겠다는 측면에서 볼 때도 국내의 연금 인출 방식에 대한 강제성이 매우 약해 영국과는 상황이 다르다. 인출 과정 뿐 아니라 국내 퇴직급여(퇴직금, 퇴직연금) 제도는 퇴직연금의 도입, 유형의 선택, 투자 결정 등에 있어 매우 유연한 측면이 있다.13)

Ⅲ. 연금화에 대한 퇴직소득세의 영향

2010년대 들어오면서 개정되기 시작한 퇴직소득 세제 개정작업은 2014년 개정을 통해 일단락된다. 여러 번의 개정 작업을 통해 퇴직소득 세액이 증가하였는데14), 늘어난 퇴직소득 세액이 퇴직연금(퇴직급)의 연금화를 촉진하는 효과가 있었는지를 살펴본다.

퇴직소득세의 증세가 급격하게 진행된 것은 퇴직연금의 일시금 수급에 대해 세금 부담이 낮아 연금수령에 대한 유인이 낮다는 데 근거하고 있다. 과거 퇴직금 제도의 영향으로 퇴직시 일시금을 받을 때 실효세율이 낮았는데 그 이유는 퇴직금에 대한 세액을 계산할 때 관대하게 설정된 공제방식과 세율을 계산할 때 사용하던 연분연승 방식에 있었다. 따라서 정부의 퇴직소득 세제 변경의 핵심은 공제 방식의 조정과 연분연승 방식의 조정에 집중되었다.

1. 퇴직소득 세액의 산출 과정

퇴직소득은 상당한 기간 동안 서서히 발생하여 집적된 소득이 일시에 실현되는 특징을 가지고 있다. 이를 종합소득에 합산하여 누진세율로 과세하게 되면 특정연도에 소득이 결집되어 누진세율 구조하에서 부당하게 높은 세율을 적용받게 되는 문제점이 있다. 이것을 결집효과 또는 묶음효과라고 한다. 이러한 점을 고려하여 현행 소득세법은 퇴직소득을 종합소득에서 제외하여 별도로 분류과세하고 있다(임상엽·정정운, 2021, p.606).15) 국내에서 거주자에게 퇴직소득을 지급하는 자는 그 거주자에 대한 소득세를 원천징수하여 정부에 납부해야 한다. 또한 퇴직소득은 종합과세에 합산하지 않고 별도로 과세한다.

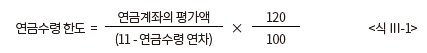

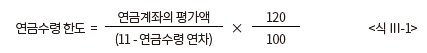

현행 세법은 퇴직연금과 연금저축을 세법상 ‘연금계좌’에 통합하여 연금으로 인출할 경우 연금소득으로 과세하고, 연금외 인출 시에는 퇴직금은 퇴직소득으로 과세하고, 퇴직외소득(자기불입금, 운용수익)은 기타소득으로 과세한다(임상엽ㆍ정정운, 2021, p.444). 이때 연금소득은 3~5%의 낮은 세율로 과세하나, 기타소득은 20%의 높은 세율로 과세한다. 한편 이연된 퇴직연금은 일시금 등 연금외 인출 시에는 이연된 퇴직소득세가 과세되며, 연금으로 인출될 경우 실제 연금수령 연차가 10년 이하일 때는 이연된 퇴직소득세의 70%(10년 초과일 때 60%)가 과세된다. 이때 연금 인출의 조건을 살펴보면 다음과 같다. 연금은 ① 가입자가 55세 이상일 것, ② 연금계좌의 가입 일부터 5년이 경과된 후에 인출할 것. ③ 연금계좌 평가액의 일정 범위 이내일 것의 세 가지의 조건을 갖추어야 한다. 이때 연금수령 한도는 연금계좌 평가액을 10년간 인출하는 금액을 기준으로 하여, 120% 범위에 들어야 한다. 다음 식으로 계산할 수 있다(이 경우 의료비 인출은 인출한 금액에 포함하지 않는다)(<식 Ⅱ-1> 참조).

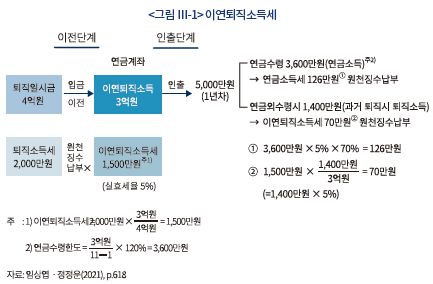

다음으로 이연퇴직소득세의 결정과정을 살펴보자. 퇴직연금(퇴직금)의 퇴직일시금이 퇴직 후 생활을 유지하는 자금으로 활용되는 것을 세제상 지원하기 위하여 근로자가 퇴직소득을 연금계좌로 이전(입금, 이체)하는 경우에는 퇴직소득세액을 납부하지 않고, 연금계좌에서 그 퇴직소득(이연퇴직소득)이 인출될 때 소득세를 납부한다(<그림 Ⅲ-1> 참조). 예를 들어 어느 근로자가 퇴직금으로 4억원을 받았고, 그에 따른 퇴직소득세가 2,000만원이라고 가정하자. 이때 근로자가 1억원은 그대로 일시금으로 수령하고, 나머지 3억원을 연금계좌로 이체하였다. 이 경우 퇴직소득세 2,000만원 중 500만원은 바로 퇴직소득세로 원천징수된다. 한편 퇴직소득세 중 나머지 1500만원은 3억원에 포함되어 연금계좌로 이체된다. 이후 모든 금액이 10년에 걸쳐 매년 3,000만원씩 연금으로 인출된다면 이 근로자가 납부해야 할 연금소득세는 이연된 1500만원의 70%인 퇴직소득세 중 1,050만원이다. 그런데 이체 후 1년차에 5,000만원이 인출되었다고 가정하면, 이 근로자의 연금수령 한도는 360만원이기 때문에 연금소득세 126만원을 납부하고, 나머지 1,400만원에 해당하는 금액은 퇴직소득세로 납부한다. 이때 퇴직금이 이체될 때 이 근로자의 퇴직소득세율은 5%이었으므로 세액은 70만원이다.

다음으로 이연퇴직소득세의 결정과정을 살펴보자. 퇴직연금(퇴직금)의 퇴직일시금이 퇴직 후 생활을 유지하는 자금으로 활용되는 것을 세제상 지원하기 위하여 근로자가 퇴직소득을 연금계좌로 이전(입금, 이체)하는 경우에는 퇴직소득세액을 납부하지 않고, 연금계좌에서 그 퇴직소득(이연퇴직소득)이 인출될 때 소득세를 납부한다(<그림 Ⅲ-1> 참조). 예를 들어 어느 근로자가 퇴직금으로 4억원을 받았고, 그에 따른 퇴직소득세가 2,000만원이라고 가정하자. 이때 근로자가 1억원은 그대로 일시금으로 수령하고, 나머지 3억원을 연금계좌로 이체하였다. 이 경우 퇴직소득세 2,000만원 중 500만원은 바로 퇴직소득세로 원천징수된다. 한편 퇴직소득세 중 나머지 1500만원은 3억원에 포함되어 연금계좌로 이체된다. 이후 모든 금액이 10년에 걸쳐 매년 3,000만원씩 연금으로 인출된다면 이 근로자가 납부해야 할 연금소득세는 이연된 1500만원의 70%인 퇴직소득세 중 1,050만원이다. 그런데 이체 후 1년차에 5,000만원이 인출되었다고 가정하면, 이 근로자의 연금수령 한도는 360만원이기 때문에 연금소득세 126만원을 납부하고, 나머지 1,400만원에 해당하는 금액은 퇴직소득세로 납부한다. 이때 퇴직금이 이체될 때 이 근로자의 퇴직소득세율은 5%이었으므로 세액은 70만원이다.

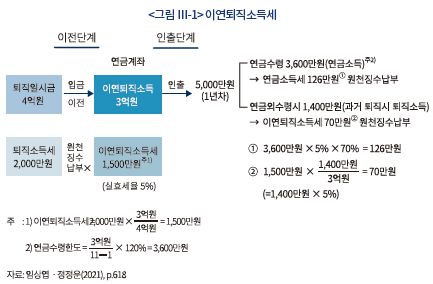

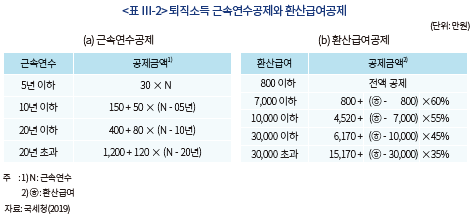

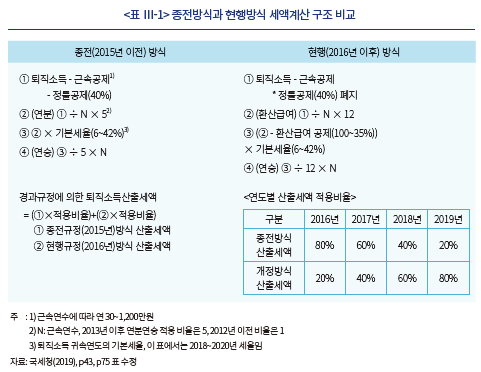

마지막으로 퇴직소득에 따른 퇴직소득 세액 결정 과정을 살펴보자. 퇴직소득에 대한 과세는 최종 수령 형태에 관계없이 퇴직급여로 지급되는 일시금을 기준으로 계산된다. 퇴직연금의 계산 방식은 2014년 세법 개정에 따라 2015년 이전과 2016년 이후로 크게 달라진다. 2014년 세법 개정의 결과 새롭게 계산되는 퇴직소득 세액이 크게 증가하게 되어 정부는 경과 기간을 두어 새로운 규정을 적용하였다(<표 Ⅲ-1> 참조).

2016년 이전 퇴직소득 세액 계산 과정에서 중요한 특징은 정률공제(40%)와 연분연승의 적용비율이다. 그런데 2014년 세법 개정 이전에도 퇴직소득 일시금에 대한 과세가 증가하였음을 알 수 있다. 우선 2011년부터 퇴직소득 기본 공제율이 45%에서 40%로 줄어들었다.16) 또한 2013년부터 연분연승 과정에 5배수가 적용되어 누진적 소득세율 체계에서 전보다 높은 세율이 적용되어 세액이 높아졌다.17)

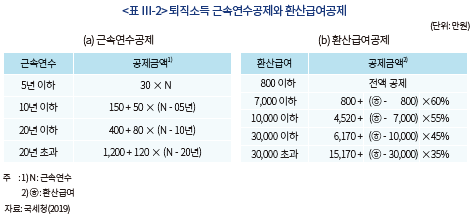

2016년 이후 퇴직소득 세액 계산 과정을 보면 다음과 같다(국세청, 2019). 2014년 세법 개정을 통해 퇴직소득 세액이 더욱 늘었다. 2014년 개정 내용은 2016년부터 적용되었다. 2016년부터 퇴직소득 세액을 계산할 때 금액에 관계없이 일률적으로 적용되던 40%의 정률공제 방식이 폐지되고, 퇴직소득액에 따른 차등공제(환산급여 공제) 방식으로 변경되었다. 그리고 연분연승 적용 비율이 5에서 12로 변경되었다.18) 퇴직소득 세액의 산출 과정을 보면 먼저 퇴직소득에서 근속연수공제(<표 Ⅲ-2 (a)> 참조)를 차감한 금액을 근속연수로 나누어 12를 곱한 금액을 환산급여로 한다. 이 환산급여에서 환산급여 공제를 차감한 금액을 과세 표준으로 한다. 이때 환산급여 공제 비율은 소득에 따라 100~35%까지 점차로 감소한다(<표 Ⅲ-2 (b)> 참조). 환산급여에서 환산급여 공제를 차감한 금액을 퇴직소득 과세표준으로 하고 세율을 적용한다. 이 금액을 12로 나누고, 근속연수를 곱하여 최종 퇴직소득 세액을 계산한다.

개정된 퇴직소득세법은 정률기본공제(40%)를 폐지하고, 환산급여 금액에 따른 환산급여공제를 적용하였다. 또한 연분연승 과정에서 근로기간 1년당 1개월 분의 급여에 해당하는 퇴직소득에 12를 곱하여 환산급여를 기준으로 세율을 적용하여 높은 한계 세율이 적용된다. 따라서 2014년 퇴직소득 세제 개정으로 고소득 퇴직소득자들의 세액이 급격히 높아진다.19) 정부도 이러한 상황을 감안하여 새로운 제도를 2016년부터 적용하며, 적용 비중도 2016년에서 2020년까지 서서히 높여 가기로 하였다. 즉 종전 방식의 산출세액과 개정 방식의 산출세액을 모두 계산한 후 2016년은 기존 세액 80%, 개정 세액 20%를 적용한다. 개정 세액의 적용 비율을 점차로 높여 2017년 40%, 2018년 60%, 2019년 80%, 2020년 100%로 하였다(<표 Ⅲ-1> 참조). 제도 개정으로 퇴직소득 계산 과정이 매우 복잡해졌다.

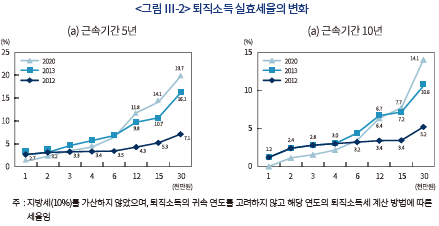

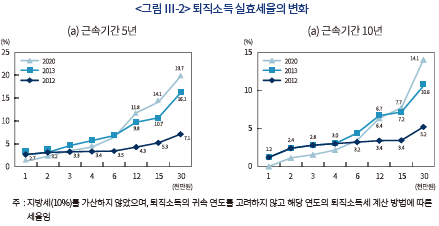

세제 개정에 따라 고소득층의 실효세율이 높아진다(<그림 Ⅲ-2 (a)> 참조). 예를 들어 5년 근속한 퇴직자의 경우 퇴직소득이 6,000만원을 넘어서면 퇴직소득 세율이 높아지기 시작하여 1억 2,000만원인 경우 세율이 종전 9.8%에서 현행 11.8%로, 1억 5,000만원인 경우 10.2%에서 14.1%로 높아지고 있다. 한편 저소득층의 세율이 낮아진다. 예를 들어 10년 근속한 퇴직자의 경우 퇴직 소득 4,000만원까지 세율이 종전 방식의 세율보다 낮아진다(<그림 Ⅲ-2 (b)> 참조). 또한 근속 기간이 길어질수록 세율이 낮아지고 있다(<그림 Ⅲ-2 (b)> 참조). 현행 기준에 의하면 근속 기간이 10년인 퇴직자의 경우 퇴직소득이 1억 5,000만원일 때 세율이 7.1%인데, 이는 근속 기간 5년이고 퇴직소득 1억 5,000만원인 경우와 비교할 때 근무 기간의 소득이 50%이므로 세율이 그에 상응하여 낮아진다. 그리고 2012년 세율과 2013년 세율의 증가 폭을 비교해 볼 때 연분연승의 적용비율을 5배수로 높인 것이 세율 증가의 주요 요인이라는 것을 알 수 있다.

2. 연금화에 미치는 영향

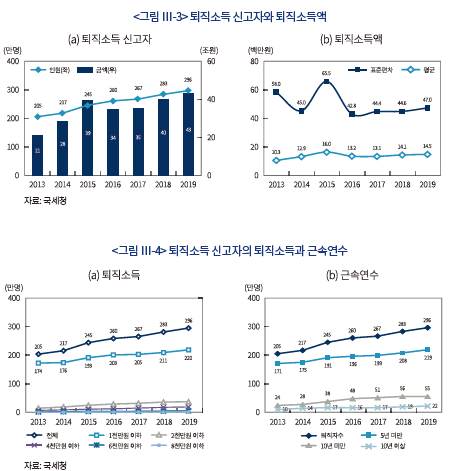

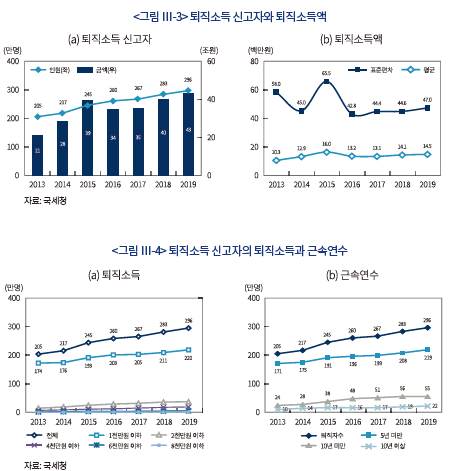

2013년 이후 퇴직소득 신고자 수와 퇴직소득이 꾸준히 증가하였다. 퇴직소득 신고자 수는 2013년 205.3만 명이었는데 2019년 296.5만 명으로 꾸준히 증가하고 있다. 이때 모든 퇴직소득 신고자가 정년 퇴직자는 아니므로 근로자의 직장 이동이 보다 활발해지고 있는 고용 상황을 반영하는 것으로 해석할 수 있다. 퇴직소득 신고자 수의 증가와 함께 신고 퇴직소득액도 증가하였다. 퇴직소득액은 2013년 21.1조원에서 2019년 43.0조원으로 증가하였다(<그림 Ⅲ-3 (a)> 참조). 1인당 평균 퇴직소득액도 2013년 1,026만원에서 2019년 1,449만원으로 증가하였다. 2015년 평균 퇴직소득이 1,604만원으로 다른 해에 비해 높은데, 2016년부터 본격적으로 퇴직소득세가 높아지기 전에 고액 퇴직소득자들의 퇴직소득 신고가 많았던 것으로 볼 수 있다.20) 따라서 다른 해에 비해 퇴직소득의 변동 폭도 크다(<그림 Ⅲ-3 (b)> 참조).

연도별 퇴직소득의 평균과 표준편차에서 볼 수 있듯이 퇴직소득 분포는 매우 불균등하다(<그림 Ⅲ-3 (b)> 참조). 예를 들어 2019년 퇴직소득 신고자 중 1천만원 이하자의 비율이 74%를 넘고 있다(<그림 Ⅲ-4 (a)> 참조).21) 이처럼 퇴직소득이 낮은 퇴직자의 비율이 높은 이유의 하나는 퇴직소득 신고자의 근속연수가 낮기 때문인데, 2019년 신고자 중에서 5년 미만 근속자가 74%에 달하고 있다(<그림 Ⅲ-4 (b)> 참조).

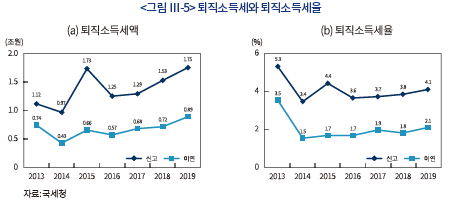

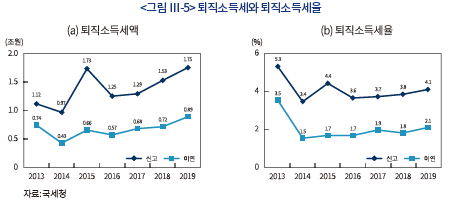

2013년 이후 퇴직소득세액의 변화를 보면 퇴직소득 신고액의 증감에 따라 퇴직소득세액도 변화하고 있다. 퇴직소득 신고 대상세액은 2013년 1.12조원에서 2019년 1.75조원으로 증가하였다. 평균 퇴직소득 신고액이 높았던 2015년은 퇴직소득 세액도 많았다(<그림 Ⅲ-5 (a)> 참조). 한편 매년 퇴직소득의 상당 부분(37.8~66.6%)이 연금계좌로 이체되기 때문에 신고 대상세액 중의 해당 부분도 당해 부과되지 않고 이연된다. 이연퇴직소득세도 2016년 이후 매년 증가 추세를 보이고 있다. 신고 대상세액이 많았던 2015년의 이연퇴직소득세의 비중(37.8%)이 가장 낮았다.

연도별 실효세율을 보면 평균적으로는 큰 변화가 없다. 즉 2016년 이후 실효 퇴직소득세율이 완만하게 증가하고 있다(<그림 Ⅲ-5 (b)> 참조). 그리고 이연퇴직소득세를 차감하면 매년 부담하는 퇴직소득세율은 1.76~2.74%(= 신고소득세율-이연퇴직소득세율)의 범위에서 움직이고 있다.

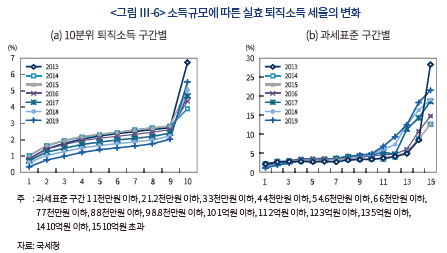

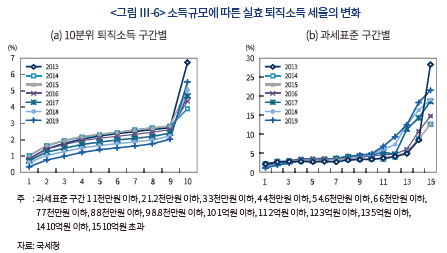

평균적으로 보면 실효 퇴직소득세율이 크게 변하지 않았다. 그러나 퇴직소득 규모별로 살펴보면 세율이 증가하고 있으며, 고소득층의 실효세율이 급격히 높아지는 추세를 볼 수 있다. 10분위 퇴직급여의 구간별 퇴직소득 세율은 1분위 소득자의 경우 0.3~1.0%에서 9분위 소득자의 경우 2.0~2.8%까지 일관되게 증가하고 있다.22) 10분위 소득자의 경우 세율이 크게 증가하여 3.8~6.7%에 이르고 있다(<그림 Ⅲ-6 (a)> 참조). 퇴직소득 금액이 클 때 세율이 급격히 증가하는 추세는 과세표준 구간별 세율을 보면 더욱 분명하게 나타난다. 퇴직소득별 실효세율을 보면 과세표준 기준 1억원 이상(구간 10: 8.8천만원 이상 1억원 이하)부터 크게 증가하고 있다. 5% 이내에 머물던 세율이 10% 이상으로 높아지고 있으며, 최고 소득 등급의 경우 20%를 넘기도 하였다(<그림 Ⅲ-6 (b)> 참조). 따라서 퇴직소득이 높아질수록 연금계좌 이체 유인이 높아진다고 볼 수 있다.

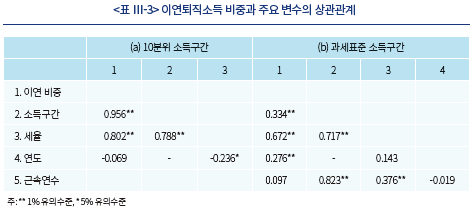

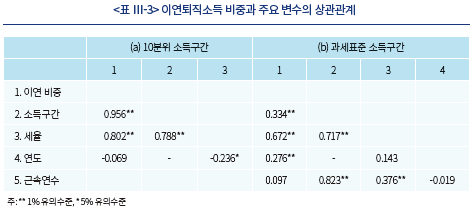

2015년부터 2019년까지 퇴직소득 세율 계산방식의 변화에 따른 효과는 1~9분위 퇴직소득 구간에서는 연차에 따라 낮아지고 있다. 이는 앞서 보았듯이((<그림 Ⅲ-1 (b)> 참조) 퇴직소득이 낮을 때 세율이 낮아지는 효과 때문이다(연차와 세율은 상관관계는 -0.236(5% 수준 유의적)이다(<표 III-3 (a)> 참조).). 10분위 구간에서는 연차에 따른 세율 증가 경향을 볼 수 있다. 한편 퇴직소득 구간을 과세표준에 의해 구분할 경우에도 연차에 따른 소득세율의 증가 경향을 볼 수 있다. 과세표준 방식으로 구분할 경우 고소득 계층의 세율 변화폭을 보다 상세히 파악할 수 있기 때문이다.

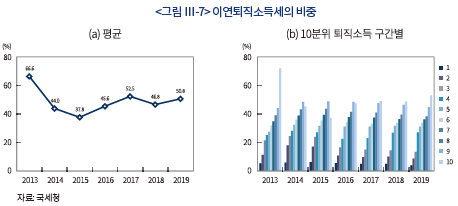

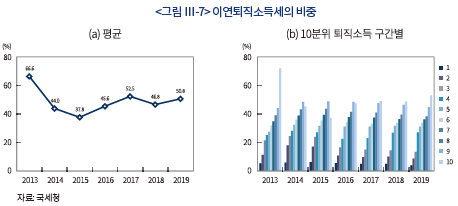

퇴직소득이 높을수록 실효세율이 급격히 높아짐에 따라 고소득 구간에서 연금화의 유인이 높아진다. 이연퇴직소득세는 퇴직소득세 중에서 과세가 이연되는 부분이며, 퇴직소득 중 연금계좌로 이체된 금액의 비중에 해당한다. 퇴직소득 중 이연퇴직소득세의 비중은 평균적으로 보면 일정 수준을 유지하는 것처럼 보인다(<그림 Ⅲ-7 (a)> 참조). 그러나 10분위 퇴직소득 규모별로 보면 우상향하는 경향이 발견된다(<그림 Ⅲ-7 (b)> 참조). 또한 과세표준 구간별로 비교해 보아도 퇴직소득 이연 비중이 높아진다.23)

퇴직소득 세율은 소득 규모 뿐 아니라 근속연수의 영향도 받는다. 앞서 보았듯이(<표 Ⅲ-2 (a)> 참조) 퇴직소득세는 근속연수에 비례하여 근속공제를 받기 때문에 근속연수가 길어질수록 세율이 낮아진다. 따라서 근속연수는 이연퇴직소득 비중과 음(-)의 상관관계를 가져야 한다.24) 그러나 근속연수와 소득세율의 상관관계를 살펴보면 양의 상관관계(1% 유의수준)를 보이고 있다(<표 III-3 (b)> 참조). 근속연수와 함께 증가하는 퇴직소득 규모의 효과가 혼재되어 있기 때문으로 보인다. 이와 함께 근속연수는 연령과 관계가 있다. 직장을 자주 옮긴 사람은 연령과 관계없이 근속연수가 낮겠지만, 일반적으로 근속기간이 길수록 연령이 높아진다. 그런데 연령이 낮을수록 일단 퇴직소득을 정년퇴직 또는 최종퇴직 시기(예를 들어 55세)까지 미룰 가능성이 높으므로 근속연수가 길수록 이연퇴직소득 비중이 낮아질 가능성이 높다.25)

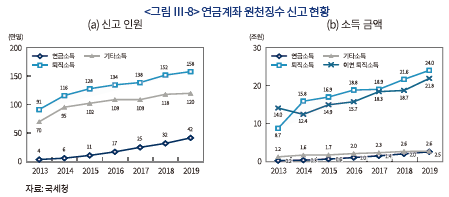

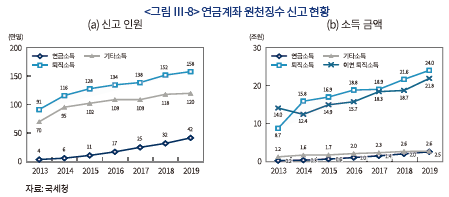

연금계좌로 이체된 퇴직소득(퇴직금과 퇴직연금)은 55세 이후 연금(달돈)으로 인출될 것으로 기대되지만, 실제 인출 상황을 보면 여전히 연금 이외의 인출이 많다. 연금 계좌로 이체된 퇴직소득의 인출 상황을 살펴보기 위해 연금계좌 원천징수 신고 현황(국세통계연감 4-4-7 거주자의 연금계좌 원천징수 신고 현황)을 살펴보면 연금(달돈)이 아닌 일시금 또는 연금 한도 초과액 형태로 인출되는 금액이 상당히 많다는 것을 알 수 있다. 매년 연금소득 신고자가 늘고 있다. 2013년 4만명이던 연금소득 신고자가 2019년 42만명으로 증가하였다(<그림 Ⅲ-8 (a)> 참조). 연금소득액도 2015년 0.2조원에서 2019년 2.5조원으로 증가하였다(<그림 Ⅲ-8 (b)> 참조). 연금계좌로 이체된 퇴직소득이 연금 형태로 인출되었다면 연금소득에 포함된다. 그러나 연금 인출한도를 넘어선 금액은 퇴직소득으로 처리되기 때문에 연금계좌 원천징수 신고 현황에 나타난 퇴직소득액은 일시금 또는 연금 인출액의 한도를 넘는 인출액을 의미한다. 퇴직소득 신고자는 2013년 91만명에서 2015년 2019년 158만명으로 연금소득 신고자에 비해 4배 정도 많다. 또한 이들의 퇴직소득액도 2019년 24.0조원에 달해 연금소득에 비해 10배 정도 많다. 일시금 형태로 인출되는 퇴직소득 비중이 상당함을 알 수 있다. 해당 연도에 이연되는 퇴직소득을 초과하는 금액이 연금 이외의 형태로 인출되고 있다(<그림 Ⅲ-8 (b)> 참조).26) 2019년의 경우 21.8조원의 퇴직소득이 이연되었는데 24.0조원의 퇴직소득이 연금 이외의 형태로 인출되었다.

근로자가 개인연금 또는 IRP 추가 납입 형태로 형성한 연금 자산 중에서도 연금 이외의 형태로 인출되는 금액이 상당하다. 기타소득 신고자 수가 2013년 70만명에서 2019년 120만명으로 증가하였으며, 기타소득 신고액도 2013년 1.2조원에서 2019년 2.6조원으로 증가하였다.

연금계좌에서 신고되는 퇴직소득이 많다는 사실은 퇴직소득세 개정이 퇴직소득을 연금계좌로 이체시키는 데는 비교적 성공적이었지만, 이체된 퇴직소득을 연금계좌에 유지시키면서 연금화하는 데는 성공하지 못했음을 의미한다.27)

Ⅳ. 시사점

정부는 2010년대 초에 이루어진 대대적인 사적연금 관련 세법 개정 작업을 통해 개인연금의 납입금에 대한 세액 계산 방식을 소득공제 방식에서 세액공제 방식으로 변경하였고, 연금계좌 개념을 이용하여 연금계좌에서 인출되는 연금과 그 외의 금액에 대한 세율을 정비하였다. 이와 함께 퇴직소득 세제도 동시에 정비하였는데 일시금 인출을 억제하고, 연금수령을 확대하려는 목표를 가지고, 퇴직일시금에 대한 세부담을 증가시켰다. 또한 퇴직소득이 낮은 계층의 실효세율이 낮아졌기 때문에 퇴직소득세의 변경은 조세 형평성 차원에서도 어느 정도 성과가 있었다고 볼 수 있다.

퇴직연금 일시금에 대한 과세 강화는 연금화의 1단계에서는 어느 정도 성공적이라고 할 수 있다. 퇴직소득의 상당 부분이 연금계좌로 이체되고 있다. 퇴직연금 소득에 대한 과세는 퇴직급여를 연금계좌로 이체시키는 실질적인 수단이 되고 있다.28) 특히 퇴직소득이 높은 층에서 이체 비율이 높아지는 경향을 보이고 있어, 이연퇴직소득세가 어느 정도 성공을 거두고 있다고 볼 수 있다. 그러나 이체된 퇴직소득이 연금계좌에 오래 머물지 못해 이연퇴직소득 세제의 효과는 한계가 있는 것으로 보인다.

연금계좌로 이체된 퇴직소득이 최종적으로 연금으로 수령될 수 있는 방안이 고려되어야 한다. 우선 고려해 볼 수 있는 방법은 정년 퇴직자의 경우(또는 55세 이후 등 특정 연령 이후) 퇴직소득의 40% 정도를 세금 없이 인출할 수 있도록 허용하는 방안이다.29) 연금계좌에 이체된 이후에 연금외수령되는 경우 중 상당 부분이 퇴직 후 긴급 자금이 필요하여 인출되고 있기 때문이다. 이때 40%의 면세 인출 한도를 허용한다면 이 부분만으로 우선 필요 자금을 인출할 수 있다. 적어도 긴급한 자금 인출로 인해 추가적인 세금을 부담하는 상황을 피할 수 있다. 또한 40%의 면세 인출을 허용하면 이 부분만을 인출하고, 세금을 부담해야 할 부분은 이연시킬 수도 있다. 예를 들어 영국의 경우 인출 방식에 대한 대대적인 세제 변화에도 불구하고 25%의 면세 인출 한도를 유지하였다.

퇴직연금 도입과 함께 일시금의 연금화가 중요한 과제로 등장하였다. 그러나 연금화 촉진 방안이 증세를 통해서만 이루어져야 했는지에 대한 의문이 남는다. 연금화를 촉진하기 위해 연금을 후원한 것이 아니라 일시금의 부담을 늘리고, 연금을 선택하면 그 부담을 줄여 준 것이다. 게다가 연금계좌로 이체된 일시금의 상당 부분이 연금외 방식으로 인출되어 연금소득의 세제혜택도 받지 못한다. 따라서 전반적으로 퇴직소득에 대한 세금 부담이 커졌다고 할 수 있다.30) 또한 연금화의 확대라는 목표가 있더라도 환산급여 방식을 통해 ‘1년’에 형성된 ‘1개월’ 급여에 대해 1년 소득에 상응하는 세율을 적용하는 방식은 세액을 지나치게 높이는 것으로 보인다. 그리고 많은 퇴직소득자가 중도인출 등으로 인해 퇴직소득 금액이 낮아 세율의 고저에 큰 영향을 크게 받지 않는다. 따라서 세율 조정을 통한 연금화 확대는 상대적으로 퇴직소득 금액이 큰 퇴직자들에게만 부담이 되는 경향이 있다.31)

마지막으로 근로자 입장에서 볼 때 퇴직소득 세액 증가에 따른 보상이 명확해져야 한다. 퇴직연금 도입과 함께 퇴직소득세가 증가되었다고 볼 수 있다. 근로자 입장에서 볼 때 퇴직금 제도와 동일한 수준의 퇴직급여를 받으면서 그에 대한 세금을 더 내는 상황이 되었다. 그래도 퇴직연금 가입자들은 퇴직연금 적립금이 금융회사에 적립되기 때문에 퇴직급여에 대한 안전성이 높아졌다. 이에 비해 퇴직금 제도에 머물고 있는 기업의 근로자들은 퇴직연금 도입 전에 비해 아무런 변화도 없이 퇴직할 때 세금만 늘어난 셈이다. 따라서 정부는 퇴직연금 도입과 함께 당연히 이루어질 것으로 기대했던 퇴직연금의 혜택이 실현되도록 더욱 정책적 노력을 해야 한다. 퇴직연금 가입 확대, DB형 퇴직연금의 적립비율 확충, DC형 퇴직연금의 투자 수익률 제고 장치의 확보 등을 그러한 예로 들 수 있다.

1) 퇴직연금의 도입 목적은 퇴직소득의 안정적 확보이며, 퇴직소득의 연금화가 필수적이다. 따라서 세금을 늘려서라도 연금화를 촉진하려는 취지는 이해할 수 있다. 그러나 과거에 비해 세금 부담이 늘어나는 정책이 바람직한 것인가 하는 논쟁의 여지는 남는다.

2) 퇴직급여를 일시금으로 인출할 수 있는 확정기여형(Defined Contribution: DC) 퇴직연금에 해당한다. 확정급여형(Defined Benefit: DB) 퇴직연금은 연금, 즉 달돈으로 퇴직급여를 받는다.

3) 스위스의 퇴직연금 가입자들은 종신연금을 받기 위해서는 퇴직연금 적립금으로 생보사의 연금을 구입하여야 한다. 이러한 시장의 특수성을 고려하여 스위스 정부는 종신연금의 가격을 강력하게 통제하고 있다. 그러나 2004년 평균 수명 연장, 이자율 하락 등 가격 상승 요인을 견디지 못하는 대형 생보사들이 연금 가격을 인상하였다.

4) 미국의 경우 퇴직자 가구들이 평균적으로 6%의 퇴직자산을 세금으로 부담해야 하는 것으로 추정되며, 상위 5%는 16.4%, 상위 1%는 22.7%를 세금으로 납부해야 한다(Chen & Munnnell, 2020).

5) 미국의 경우 의무인출 비율만큼 인출되지 않고 남아 있는 부분에 대해서는 50% 과세를 한다(US IRS, 2021). DB형 퇴직연금은 근로자가 일정 연령에 도달하면 연금(달돈)을 지급하므로 이러한 문제가 발생하지 않는다.

6) 퇴직급여의 최저한도는 존재한다. 또한 2013년 세법 개정을 통하여 임원 특례 조항이 도입되었다. 2012년 이후 퇴직소득 금액에 임원 퇴직소득 한도를 설정하여 이 한도를 넘는 금액에 대해서는 근로소득으로 과세한다. 이때 한도는 1년 급여(3년 평균) 10%의 3배수로 정하였다. 이 한도는 2020년 이후 적립분에 대해서는 1년 급여 10%의 2배수로 하향 조정되었다(임상엽·정정운, 2021).

7) 2014년 영국의 소득세율은 과세소득 £31,865까지 20%, £31,866에서 £150,000까지 40%, £150,000 이상에 대해서는 45%이다. 개인별 £10,000 기본 공제가 있는데, 소득이 £100,000를 넘으면 소득 £2에 £1씩 기본 공제액이 줄어들어, 소득이 £120,000를 넘으면 기본 공제액이 없다. 한편 2021년 현재 소득세율은 £12,570까지 0%, £12,571에서 £50,270까지 20%, £50,271에서 £150,000까지 40%, £150,000 이상에 대해서는 45%이다(https://www.gov.uk/income-tax-rates).

8) 연금자산의 강제 연금화 정책은 1921년 재정법(Finance Act)에서 시작되었으며, 1956년 재정법은 60세에서 70세 사이에 연금화를 강제하였고, 1976년 재정법은 연금화 상한연령을 75세로 조정하였다.

9) 퇴직자산의 25%까지는 세금을 내지 않고 인출할 수 있었으며, 제도 변화 이후에도 면세 인출 한도는 동일하게 유지되었다.

10) HM Revenue & Customs, 2021, Number and value of flexible payments made from pensions since April 2015. 한편 2020년말 9월말 DC형 퇴직연금의 적립액은 1,610억 파운드이다.

11) Office for Budget Responsibility, 2020, Economic and fiscal outlook https://www.moneymarketing.co.uk/news/budget-2020-pension-freedoms-tax-revenues-continue-to-surprise/

12) 영국 정부는 연금화 정책 변경의 주요 목적을 가입자의 선택권을 늘리는 것이라고 발표하였다. 변화된 연금 정책을 연금선택의 자유(Pension Freedom)라 명명한 데서도 그 의지를 찾아 볼 수 있다. 그러나 한편으로 세수 확대도 중요한 목표의 하나라는 의견도 있었다. 가입자들이 일시금을 선택할 경우 연금으로 받을 때에 비해 세금을 앞당겨내는 효과가 있기 때문이다. 또한 선택권의 확대 측면에서도 가입, 투자 단계에서 자동가입, 디폴트 옵션을 추진하면서 인출 단계에서는 선택권을 확대한다는 정책도 서로 모순된다는 지적도 있었다.

13) 모든 기업이 퇴직급여를 지급해야 한다는 측면에서는 의무적이지만, 퇴직금과 퇴직연금의 선택, DB형 퇴직연금 또는 DC형 퇴직연금의 선택 등에서 기업과 근로자의 선택의 여지가 있다. 이러한 유연성은 국내 퇴직연금 제도의 장점이기도 하지만 원리금에 집중된 자산 운용 등 문제점을 내포하고 있다.

14) 퇴직소득 세제의 개정과 별개로 고소득자 증세를 위한 고소득 과세표준 구간이 추가되면서 고소득자에 대한 세금이 증가하였다.

15) 퇴직소득, 양도소득은 다른 소득과 합산하지 않고 별도로 과세한다(분류과세). 일부 소득(분리과세 이자소득, 분리과세 배당소득, 근로소득 중 일용근로자의 급여, 분리과세 연금소득, 분리과세 기타소득)은 기간별로 합산하지 않고 그 소득이 지급될 때 소득세를 원천징수함으로써 과세를 종결하는데, 이것을 ‘분리과세’라고 한다(임상엽·정정운, 2021).

16) 퇴직소득 정률공제는 과세기간 2002~2005년 50%이며, 2006~2010년 45%, 2011~2015년 40%로 점차 축소되어 왔다.

17) 김수성·성종훈(2014)은 5배수 방식이 5년 미만 단기 근속 근로자를 차별하는 효과가 있음을 지적하고, 근로자 전직이 증가하는 추세에서 관련 규정의 개정을 제안하였다.

18) 임성종(2017)은 근속연수에 따른 차등적인 배수 규정의 적용을 제안하였다.

19) 정률공제(40%)가 폐지되었지만, 환산급여공제의 최소 비율이 35%(3억원 초과 구간)이기 때문에 대부분의 퇴직소득자는 퇴직소득의 일정 비율에 대해 소득공제를 받고 있다. 따라서 세액 증가 주요 요인은 12배수 연승비율을 통해 한계소득세율이 높아지는데 있다고 볼 수 있다. 한편, 2014년 환산급여공제가 처음 발표되었을 때 공제비율은 100~15%이었으며, 최고 공제구간도 2억원 초과로 현행 기준보다 더 낮았다(기획재정부, 2014).

20) 2015년 과세표준 2억원 이상자의 수가 15,400명으로 가장 많았고(다른 해 3,378~7,750명), 전체 퇴직소득 신고자 대비 비중도 0.6%로 가장 높았다(다른 해 0.2~03%).

21) 이들의 퇴직소득의 금액 비중을 보면 평균 20%대에 머물고 있다. 한편 인원 비중으로는 2.4%(2019년)인 1억원 이상자의 금액 비중이 38.8%에 이르고 있다(국세청 통계연감).

22) 2013~2019년 10분위별 퇴직소득의 평균 금액(단위 백만원)을 보면 다음과 같다. 1분위 0.9, 2분위 1.7, 3분위 2.3, 4분위 2.9, 5분위 3.7, 6분위 4.7, 7분위 6.3, 8분위 8.9, 9분위 14.9, 10분위 88.3.

23) 퇴직소득 규모에 따라 연금계좌 이체 비율이 높아지는 경향을 확인하기 위해 연도와 과세표준구간을 독립변수로 하고, 이연 퇴직소득세의 비중을 종속변수로 하는 회귀분석을 하였다. 그 결과 연도와 과세표준 구간 두 변수 모두 1% 수준에서 유의적인 양(+)의 계수를 갖는다. 한편 근속연수를 독립변수로 추가하였을 때 근속연수는 1% 수준에서 유의적인 음(-)의 계수를 가지며, 연도, 과세표준 구간은 유의적인 양의 계수를 유지하였다.

24) 연도와 퇴직소득 규모의 효과를 통제하기 위해 근속연수, 연도, 소득구간을 독립변수로 하고, 퇴직소득 세율을 종속변수로 하는 회귀분석을 진행하면 근속연수는 퇴직소득 세율과 유의적인 음(-)의 계수를 보인다.

25) 연령이 높아짐에 따라 이연퇴직소득 비중이 낮아지는 경향이 있다. 2013~2019년 사이 연령대별 이연퇴직소득 비중은 30대 60.0%, 40대 52.0%, 50대 45.9%, 60대 36.3% 순이다(국세청 통계연감, 4-4-3 퇴직소득 원천징수 신고 현황 III(10분위, 성, 연령)).

26) 해당 연도에 이연된 퇴직소득이 바로 그 해에 인출된다는 의미는 아니다. 그럴 경우 연금계좌 원천징수 신고 현황의 퇴직소득으로 기록되지 않고 퇴직소득 원천징수 신고 현황의 퇴직소득으로 기록된다.

27) 이처럼 이연된 퇴직소득이 퇴직계좌에 오래 머물지 못하는 이유는 다양하겠지만 현재 연금계좌로서 사용되는 개인형 퇴직연금(IRP)의 한계도 있다. 예를 들어 IRP의 성격이 적립 과정에 초점을 둔 상품이기 때문에 인출 과정에 들어간 퇴직자에게 적합하지 않을 수 있다. 또한 개인이 투자결정을 하기 때문에 자산운용에 있어 많은 한계(예; 원리금보장형에 집중된 자산운용)를 보이고 있다.

28)「 근로자퇴직급여보장법」 개정(2012년 7월 26일)으로 퇴직연금 급여를 개인형퇴직연금(Individual Retirement Pension: IRP) 계정으로 이체하도록 하고 있다. 그러나 퇴직자가 IRP를 해약할 수 있다. 이연퇴직소득세의 효과가 없다면 해약률이 더욱 높아질 것이다.

29) 세액 계산 과정에서 40% 정률공제를 허용하는 데서 더 나아가 적립금의 40%를 세금 없이 인출할 수 있도록 허용하는 방안이다. 이와 함께 환산급여에 대한 소득공제를 적절히 조절할 수 있다. 즉 나머지 60%에 대해 현행 세제를 유지하는 방식(결과적으로 세수 감소)과 60% 부분에 현재의 퇴직소득 100%에 부과되는 세액을 부과하는 방식(결과적으로 세수 동일) 등을 선택할 수 있다.

30) 퇴직자 1인당 퇴직소득세액이 2016년 48.1만원에서 2019년 59.1만원으로 증가하였다. 그러나 상위 10%의 고소득자 위주로 세액이 증가하여 세제 형평성은 높아졌다 할 수 있다.

31) 퇴직소득은 근속연수는 비례하므로 장기 근속자들의 부담이 커지는 효과가 있다. 장기소득공제를 받기 때문에 근속연수 증가 자체에서 오는 효과는 세율을 낮춘다. 그러나 그 효과가 소득증가에 따른 효과를 전부 상쇄하지는 못한다.

참고문헌

고용노동부·금융감독원, 2021. 4. 5, 2020년도 퇴직연금 적립금 운용현황 통계, 보도자료.국세청, 2019,『퇴직 · 연금소득원천징수 안내』.

국세청, 2021,『국세통계연보』, TASIS 국세통계포털.

기획재정부, 2014. 8. 6, 2014년 세법개정안 - 경쟁력을 갖춘 공평하고 원칙이 있는 세제.김수성·성종훈, 2014, 퇴직소득 세제의 합리적 개선방안에 관한 연구, 『조세연구』 14(2), 73-108.

김재칠·홍원구, 2013,『인구고령화와 우리나라의 자본시장 Ⅱ: 퇴직연금과 자본시장 성장의 선순환』, 자본시장연구원.

박한순, 2018, 퇴직소득세 개정의 경제적 효과 분석과 세제 개선방안,『세무와회계저널』19(2), 41-61.

이소라, 2018, 퇴직연금 발전을 위한 세제분석과 개편방안 연구, 근로복지연구원.

임상엽·정정훈, 2021,『세법개론』, 상경사.

임성종, 2017, 연금소득 및 퇴직소득 세제의 합리적 개선방안에 관한 연구, 『경영과 정보연구』36(1), 215-232.

홍원구, 2016, 퇴직소득 안정화를 위한 퇴직연금 세제의 개선 방향,『퇴직급여제도 근로자 수급권 보장방안』, 근로복지연구원.

Bütler, M., Ramsden, A., 2017, How taxes impact the choice between an annuity and the lump sum at retirement, Discussion Paper 2017-01, University of St.Gallen.

Bütler, M., Staubli, S., Zito, M., 2013, How Much Does Annuity Demand React to a Large Price Change? Scandinavian Journal of Economics 115(3), 808–824.

Chen, A., Munnell, A., 2020, How much taxes will retirees owe on theire retirement

income., Center for Research at Boston College working paper 2020-16.

Rejda, G.E.. McNamara, M.J., 2017, Principles of Risk Management and Insurance, 13th ed., Pearson.

국내 퇴직연금(퇴직금 포함) 세제는 퇴직연금 납입액과 투자수익은 과세하지 않고 인출 시에 퇴직소득에 대해서 과세하는 방식이다. 즉 납입액 면세(exempted), 투자수익 면세(exempted), 퇴직소득 과세(taxed) 방식(EET)이다. 이러한 방식은 많은 나라에서 퇴직연금에 적용하는 과세 방식이며, 국민연금과 같은 공적연금에도 EET 방식이 적용된다. 2014년 정부는 퇴직일시금 수급자의 세금 부담을 높이는 방향으로 퇴직소득 세제를 개정하였다. 2014년 개정으로 그 이전부터 추진해 오던 퇴직연금 일시금에 대한 증세 작업이 완료되었다. 한편 급격한 세금 부담의 증가를 완화하기 위해 새로운 세금 계산 방식을 2016년부터 일부 적용하고, 2020년까지 매년 적용 비율을 높여가기로 하였다.

2014년 퇴직소득 세제 개정은 연금화의 확대를 주요 목표로 하였다. 퇴직연금 도입 이후에도 여전히 퇴직연금의 일시금 수급 비율이 높았다. 그 이유의 하나로 퇴직금 시대부터 퇴직일시금에 대한 세율이 매우 낮아 연금화의 유인 효과가 적었다. 따라서 정부는 퇴직일시금에 대한 세금 부담을 높이고, 연금의 세금 부담을 상대적으로 낮추어 연금 수급 비율을 높이려 한 것이다.1) 제도 개정의 핵심 내용은 근로자가 퇴직할 때 받은 퇴직소득 중 일부 또는 전부를 연금계좌에 이체하면 이연되는 퇴직소득에 해당하는 퇴직소득세도 이연해 주는 것이다. 그리고 이연된 퇴직소득을 연금으로 수령하면 이연된 퇴직소득세의 30%를 감면해 준다.

그런데 퇴직연금 일시금에 대한 과세 강화에도 불구하고 퇴직연금을 연금으로 받는 사람의 비율이 매우 낮다. 즉 대부분의 퇴직자들이 퇴직급여를 일시금으로 받는다. 가장 큰 원인은 퇴직연금 적립금이 다양한 사유로 퇴직 전에 인출되어 퇴직급여가 연금으로 받기에는 너무 작아졌기 때문이다. 따라서 퇴직소득 세제의 변화는 큰 효과가 없어 보인다. 그러나 퇴직급여를 연금으로 받는 퇴직자의 비율은 낮지만 그 퇴직소득의 금액 비중은 2020년의 경우 20%를 넘고 있다(고용노동부ㆍ금융감독원, 2021). 퇴직급여액이 상대적으로 큰 퇴직자에게는 퇴직소득 세제 변화의 효과가 상당히 클 수 있다.

연금화를 촉진하는 것은 퇴직소득의 안정을 위해 필수적이다. 따라서 연금 수급을 확대하기 위한 퇴직소득 세제 변화가 어느 정도 목적을 달성하였는지 평가해보는 작업도 퇴직연금 제도의 발전을 위해 중요한 의미를 갖는다. 연금 납입에 대한 세액공제로의 전환과 공제한도액에 대한 논쟁과 연구는 상당히 많았던 것에 비해 소득세제 개정 이후 제도의 영향과 효과에 대한 검토, 연구는 매우 적었다. 본 연구는 국세청의 국세통계연감 자료를 분석하여 2010년대 초반에 이루어진 퇴직연금소득세 변화의 영향을 검토하고, 향후 정책적 시사점을 찾아본다. 본 연구의 구성은 다음과 같다. Ⅱ장에서는 세금과 연금화의 관계, 국내 연금 세제의 변화, 그리고 영국을 중심으로 외국의 퇴직소득세 변화 사례를 살펴본다. Ⅲ장에서는 퇴직소득세 변화의 내용과 그 영향을 살펴본다. 그리고 마지막으로 Ⅳ장에서는 퇴직소득 안정성 측면에서 퇴직연금 세제의 개선 방향을 찾아본다.

Ⅱ. 퇴직소득세 개정의 배경

세금은 연금의 가격을 변화시켜 퇴직자의 연금화 결정에 영향을 미친다. 국내 퇴직소득 세제의 변화는 퇴직일시금의 세금 부담을 높이고, 상대적으로 연금의 세금 부담을 낮추는 방향으로 변화하였다. 본장에서는 퇴직소득세가 연금화에 미치는 영향에 대해 살펴본다. 또한 국내 퇴직소득세의 개정과 비슷한 시기에 영국은 퇴직일시금의 비용을 대폭 낮추는 세제 개정을 하였다. 국내 퇴직소득세의 변화와 영국과의 비교를 통해 세제 변화의 효과를 엿볼 수 있다.

1. 세금과 연금화

퇴직연금을 일찍 도입한 나라들은 퇴직연금의 연금 수급을 유도하기 위해 일시금이든 연금이든 일반적인 소득세율로 과세한다.2) 대부분의 국가에서 소득세율이 소득에 따라 누진적으로 높아지므로 일시금을 받을 경우 높은 세율을 연금을 받을 경우 낮은 세율을 적용받게 되어 퇴직자들은 연금을 선택하게 된다.

일반적으로 연금과 일시금의 선택은 퇴직자에게 매우 어려운 선택 중의 하나이다. 매우 큰 금액이 관련되어 있고, 때로는 선택 후 되돌리기 어려운 경우도 있다. 연금은 장수위험에 대비하는 좋은 대안임에도 불구하고, 연금을 구입하는 사람은 매우 적다. 흔히 연금 퍼즐(annuity puzzle)로 불리는 이러한 현상을 설명하기 위해 많은 연구들이 있었다. 그 연구들은 크게 두 방향에서 연금 퍼즐을 설명한다. 하나는 연금 가격이 구입자들에게 불리하기 때문에 연금 구입을 꺼린다는 입장이고, 또 다른 방향은 행태적 편의(behavioral anomalies) 때문에 연금 구입이 적다는 입장이다.

연금에 대한 세금은 연금 선택의 또 다른 영향 요인이 될 수 있는데, 연금과 일시금의 상대적 가격에 영향을 미칠 수 있기 때문이다. 2004년 스위스 대형 생보사들이 연금 가격을 인상하였을 때 퇴직자들이 일시금을 선택하는 비율이 높아졌다(Butler et al., 2013).3) Butler & Rams-den(2017)은 스위스의 주별 세제 차이 때문에 동일한 퇴직연금 기금에 속한 퇴직자들의 연금 선택 비율이 달라진다는 사실을 확인하였다. 즉 연금 세율이 높을수록 연금 선택 비율이 낮아졌다.

국내의 경우 퇴직금에 대한 세제가 매우 관대하여, 퇴직연금 도입 이후에 퇴직연금을 연금으로 받을 유인이 낮았다(김재칠·홍원구, 2013). 이러한 인식을 바탕으로 정부는 2010년대에 들어서면서 지속적으로 일시금에 대한 세부담을 늘리는 방향으로 세제를 개편하였다. 따라서 퇴직자의 퇴직소득세 부담이 꾸준히 증가하였다.4) 이에 따라 퇴직자들이 일시금이 아닌 연금을 선택할 유인이 높아졌다. 그러나 현재까지 퇴직소득 세제에 대한 연구가 거의 없어 퇴직소득 세제 변화의 효과에 대해 정확한 평가가 힘든 상황이다(박한순, 2018). 일반적으로 연금가격과 세금이 연금에 미칠 수 있는 잠재력에 대해서는 공감할 수 있으나, 연금 가격의 변화, 세금 변화에 대한 자료를 얻기 힘들기 때문에 이에 대한 실증 연구 결과는 많지 않았다. 이에 더하여 연금 납입액에 대한 세제는 매년 연말정산 과정을 통하여 모든 근로자에게 영향을 미치고, 연금 시장에 참여한 금융회사들의 경쟁 구도에도 영향을 미치기 때문에 연금 납입액에 대한 세제 변경은 많은 관심을 끌게 된다. 이에 비해 연금-일시금의 선택 문제는 매년 발생하는 문제가 아니고, 개인의 문제로 인식되어 상대적으로 사회적 관심이 덜하다. 또한 연금 도입 초기 단계에 있는 우리나라에서는 퇴직연금(퇴직금) 인출의 문제를 미래의 문제로 인식하고 있다. 그러나 퇴직연금 적립금 규모도 증가하고 있고, 퇴직연금에 가입하지 않더라도 퇴직금을 받고 퇴직하는 근로자들도 많기 때문에 퇴직소득의 수령 형태(연금 또는 일시금)는 매우 중요한 문제이다. 또한 2015~2020년 사이에 매년 퇴직소득 세율이 변하는 상황이 전개되어 퇴직소득 세금이 퇴직소득의 수급 형태에 미치는 영향을 연구하기 적합한 환경이 조성되었다.

2. 외국의 사례

미국, 영국 등 사적연금을 도입 운용하고 있는 나라들은 대부분 EET 방식의 과세 방식을 채용하고 있다(이소라, 2018). 따라서 퇴직연금이 인출될 때 과세를 한다. 이때 퇴직연금 인출액을 일반 소득액과 구분하지 않고 과세함으로써 일시 거액의 인출 가능성을 줄이고 있다.

우리나라의 과세 방식과 비교하여 특이한 점은 DC형 퇴직연금 계좌에서 가입자가 일정 연령 (예를 들어 미국 70.5세, 캐나다 72세)에 이를 때까지 인출하지 않으면, 일정 비율의 금액을 인출한 것으로 보고 그에 대해 과세하는 방식이다(홍원구, 2016).5) 의무인출(Required Minimum Distribution) 비율은 연령이 높아지면서 증가한다. 이처럼 연령에 따라 일정 비율 이상을 의무적으로 인출하도록 하는 것은 세제 혜택을 받으며 형성된 퇴직자산이 퇴직자의 생활자금으로 사용되지 않고, 상속되는 경우를 막기 위한 조치들이다.

그리고 퇴직연금 납입액에 한도가 있는 경우가 많다(Rejda & McNamara, 2017, pp.378~379). 예를 들어 미국의 경우 DB형 퇴직연금의 연간 급여한도(연속 3년 최고 평균)는 소득 100%와 $230,000(2021년) 중 적은 금액이다. 401(k)형 연금의 경우 이연 가능한 소득한도는 $19,500 (2021년)이며 물가와 연동되어 금액이 조정된다. 이때 근로자가 50세 이상인 경우 $6,500까지 추가 납입이 가능하다. 이에 비해 국내 퇴직연금은 납입액에 대한 한도가 없다.6)

국내 퇴직소득 세제의 변화와 관련하여 가장 인상적인 변화는 영국의 연금 강제화 정책의 변화였다. 영국은 DC형 퇴직연금 자산으로 75세까지 의무적으로 연금을 구입하도록 하는 정책을 유지하였으나, 2015년 4월부터 퇴직자들이 55세 이후 자신의 한계 소득세율7)에 따라 세금을 납부하면 원하는 만큼의 금액을 원하는 시기에 인출할 수 있도록 허용하였다.8) 2015년 4월 이전에는 일시금이나 분할 인출에 대해 55%의 세율을 적용하여 종신연금을 구입하도록 유도하였다.9) 1956년 이후 거의 60년간 지속되어 온 영국의 DC형 퇴직연금 의무 연금화 정책은 퇴직소득 안정화 정책을 대표하는 모범적 사례로 인식되어 왔다. 따라서 영국의 정책 변화는 매우 충격적이라 할 수 있다. 자유로운 인출이 허용된 2015년 4월 이후 2020년말까지 약 160만명이 1,190만개의 계좌에서 424억파운드를 인출하였다.10) 인출액이 급격히 늘어남에 따라 세금 또한 늘어났는데, 2018년 말까지 20억파운드 가량 세수가 늘었으며 그 이후에도 매년 4억파운드 가량 세수가 늘 것으로 전망되었다.11) 영국 정부가 세제를 바꾼 이유는 명확하지 않지만 퇴직소득 세제의 변화가 연금의 인출 방식에 영향을 줄 수 있다는 사례를 제시하고 있다.12) 즉 영국의 경우 일시금에 대한 세율을 낮추어 일시금 인출이 확대되었는데, 반대로 일시금에 대한 세금을 높이면 인출이 축소되고 퇴직 소득의 연금화가 촉진될 수도 있음을 보여준다.

한편 우리나라의 경우 연금 자산의 축적 단계가 다르기 때문에 영국의 정책 전환을 곧 받아들이기는 어렵다. 무엇보다도 국내 퇴직연금의 경우 아직 연금화가 안정적으로 정착되지 않았기 때문에 영국에 비해 훨씬 적극적으로 연금화를 후원해야 한다. 영국은 오랜 동안 연금화 정책을 추진하였기 때문에 어느 정도 연금화가 정착되어 있었지만, 그럼에도 불구하고 일시금의 인출이 증가하였다. 두 번째, 세수 측면에서 볼 때 국내의 경우 기존의 퇴직급여가 상당 부분 일시금으로 인출되고 있었기 때문에 일시금이 늘어나서 세수가 증가할 여지가 적다. 국내의 경우 세수를 줄여서라도, 즉 세제 혜택을 늘려서라도 연금화를 촉진해야 할 단계에 있다. 마지막으로 영국처럼 인출 과정의 유연성을 높이겠다는 측면에서 볼 때도 국내의 연금 인출 방식에 대한 강제성이 매우 약해 영국과는 상황이 다르다. 인출 과정 뿐 아니라 국내 퇴직급여(퇴직금, 퇴직연금) 제도는 퇴직연금의 도입, 유형의 선택, 투자 결정 등에 있어 매우 유연한 측면이 있다.13)

Ⅲ. 연금화에 대한 퇴직소득세의 영향

2010년대 들어오면서 개정되기 시작한 퇴직소득 세제 개정작업은 2014년 개정을 통해 일단락된다. 여러 번의 개정 작업을 통해 퇴직소득 세액이 증가하였는데14), 늘어난 퇴직소득 세액이 퇴직연금(퇴직급)의 연금화를 촉진하는 효과가 있었는지를 살펴본다.

퇴직소득세의 증세가 급격하게 진행된 것은 퇴직연금의 일시금 수급에 대해 세금 부담이 낮아 연금수령에 대한 유인이 낮다는 데 근거하고 있다. 과거 퇴직금 제도의 영향으로 퇴직시 일시금을 받을 때 실효세율이 낮았는데 그 이유는 퇴직금에 대한 세액을 계산할 때 관대하게 설정된 공제방식과 세율을 계산할 때 사용하던 연분연승 방식에 있었다. 따라서 정부의 퇴직소득 세제 변경의 핵심은 공제 방식의 조정과 연분연승 방식의 조정에 집중되었다.

1. 퇴직소득 세액의 산출 과정

퇴직소득은 상당한 기간 동안 서서히 발생하여 집적된 소득이 일시에 실현되는 특징을 가지고 있다. 이를 종합소득에 합산하여 누진세율로 과세하게 되면 특정연도에 소득이 결집되어 누진세율 구조하에서 부당하게 높은 세율을 적용받게 되는 문제점이 있다. 이것을 결집효과 또는 묶음효과라고 한다. 이러한 점을 고려하여 현행 소득세법은 퇴직소득을 종합소득에서 제외하여 별도로 분류과세하고 있다(임상엽·정정운, 2021, p.606).15) 국내에서 거주자에게 퇴직소득을 지급하는 자는 그 거주자에 대한 소득세를 원천징수하여 정부에 납부해야 한다. 또한 퇴직소득은 종합과세에 합산하지 않고 별도로 과세한다.

현행 세법은 퇴직연금과 연금저축을 세법상 ‘연금계좌’에 통합하여 연금으로 인출할 경우 연금소득으로 과세하고, 연금외 인출 시에는 퇴직금은 퇴직소득으로 과세하고, 퇴직외소득(자기불입금, 운용수익)은 기타소득으로 과세한다(임상엽ㆍ정정운, 2021, p.444). 이때 연금소득은 3~5%의 낮은 세율로 과세하나, 기타소득은 20%의 높은 세율로 과세한다. 한편 이연된 퇴직연금은 일시금 등 연금외 인출 시에는 이연된 퇴직소득세가 과세되며, 연금으로 인출될 경우 실제 연금수령 연차가 10년 이하일 때는 이연된 퇴직소득세의 70%(10년 초과일 때 60%)가 과세된다. 이때 연금 인출의 조건을 살펴보면 다음과 같다. 연금은 ① 가입자가 55세 이상일 것, ② 연금계좌의 가입 일부터 5년이 경과된 후에 인출할 것. ③ 연금계좌 평가액의 일정 범위 이내일 것의 세 가지의 조건을 갖추어야 한다. 이때 연금수령 한도는 연금계좌 평가액을 10년간 인출하는 금액을 기준으로 하여, 120% 범위에 들어야 한다. 다음 식으로 계산할 수 있다(이 경우 의료비 인출은 인출한 금액에 포함하지 않는다)(<식 Ⅱ-1> 참조).

다음으로 이연퇴직소득세의 결정과정을 살펴보자. 퇴직연금(퇴직금)의 퇴직일시금이 퇴직 후 생활을 유지하는 자금으로 활용되는 것을 세제상 지원하기 위하여 근로자가 퇴직소득을 연금계좌로 이전(입금, 이체)하는 경우에는 퇴직소득세액을 납부하지 않고, 연금계좌에서 그 퇴직소득(이연퇴직소득)이 인출될 때 소득세를 납부한다(<그림 Ⅲ-1> 참조). 예를 들어 어느 근로자가 퇴직금으로 4억원을 받았고, 그에 따른 퇴직소득세가 2,000만원이라고 가정하자. 이때 근로자가 1억원은 그대로 일시금으로 수령하고, 나머지 3억원을 연금계좌로 이체하였다. 이 경우 퇴직소득세 2,000만원 중 500만원은 바로 퇴직소득세로 원천징수된다. 한편 퇴직소득세 중 나머지 1500만원은 3억원에 포함되어 연금계좌로 이체된다. 이후 모든 금액이 10년에 걸쳐 매년 3,000만원씩 연금으로 인출된다면 이 근로자가 납부해야 할 연금소득세는 이연된 1500만원의 70%인 퇴직소득세 중 1,050만원이다. 그런데 이체 후 1년차에 5,000만원이 인출되었다고 가정하면, 이 근로자의 연금수령 한도는 360만원이기 때문에 연금소득세 126만원을 납부하고, 나머지 1,400만원에 해당하는 금액은 퇴직소득세로 납부한다. 이때 퇴직금이 이체될 때 이 근로자의 퇴직소득세율은 5%이었으므로 세액은 70만원이다.

2016년 이전 퇴직소득 세액 계산 과정에서 중요한 특징은 정률공제(40%)와 연분연승의 적용비율이다. 그런데 2014년 세법 개정 이전에도 퇴직소득 일시금에 대한 과세가 증가하였음을 알 수 있다. 우선 2011년부터 퇴직소득 기본 공제율이 45%에서 40%로 줄어들었다.16) 또한 2013년부터 연분연승 과정에 5배수가 적용되어 누진적 소득세율 체계에서 전보다 높은 세율이 적용되어 세액이 높아졌다.17)

세제 개정에 따라 고소득층의 실효세율이 높아진다(<그림 Ⅲ-2 (a)> 참조). 예를 들어 5년 근속한 퇴직자의 경우 퇴직소득이 6,000만원을 넘어서면 퇴직소득 세율이 높아지기 시작하여 1억 2,000만원인 경우 세율이 종전 9.8%에서 현행 11.8%로, 1억 5,000만원인 경우 10.2%에서 14.1%로 높아지고 있다. 한편 저소득층의 세율이 낮아진다. 예를 들어 10년 근속한 퇴직자의 경우 퇴직 소득 4,000만원까지 세율이 종전 방식의 세율보다 낮아진다(<그림 Ⅲ-2 (b)> 참조). 또한 근속 기간이 길어질수록 세율이 낮아지고 있다(<그림 Ⅲ-2 (b)> 참조). 현행 기준에 의하면 근속 기간이 10년인 퇴직자의 경우 퇴직소득이 1억 5,000만원일 때 세율이 7.1%인데, 이는 근속 기간 5년이고 퇴직소득 1억 5,000만원인 경우와 비교할 때 근무 기간의 소득이 50%이므로 세율이 그에 상응하여 낮아진다. 그리고 2012년 세율과 2013년 세율의 증가 폭을 비교해 볼 때 연분연승의 적용비율을 5배수로 높인 것이 세율 증가의 주요 요인이라는 것을 알 수 있다.

2013년 이후 퇴직소득 신고자 수와 퇴직소득이 꾸준히 증가하였다. 퇴직소득 신고자 수는 2013년 205.3만 명이었는데 2019년 296.5만 명으로 꾸준히 증가하고 있다. 이때 모든 퇴직소득 신고자가 정년 퇴직자는 아니므로 근로자의 직장 이동이 보다 활발해지고 있는 고용 상황을 반영하는 것으로 해석할 수 있다. 퇴직소득 신고자 수의 증가와 함께 신고 퇴직소득액도 증가하였다. 퇴직소득액은 2013년 21.1조원에서 2019년 43.0조원으로 증가하였다(<그림 Ⅲ-3 (a)> 참조). 1인당 평균 퇴직소득액도 2013년 1,026만원에서 2019년 1,449만원으로 증가하였다. 2015년 평균 퇴직소득이 1,604만원으로 다른 해에 비해 높은데, 2016년부터 본격적으로 퇴직소득세가 높아지기 전에 고액 퇴직소득자들의 퇴직소득 신고가 많았던 것으로 볼 수 있다.20) 따라서 다른 해에 비해 퇴직소득의 변동 폭도 크다(<그림 Ⅲ-3 (b)> 참조).

2013년 이후 퇴직소득세액의 변화를 보면 퇴직소득 신고액의 증감에 따라 퇴직소득세액도 변화하고 있다. 퇴직소득 신고 대상세액은 2013년 1.12조원에서 2019년 1.75조원으로 증가하였다. 평균 퇴직소득 신고액이 높았던 2015년은 퇴직소득 세액도 많았다(<그림 Ⅲ-5 (a)> 참조). 한편 매년 퇴직소득의 상당 부분(37.8~66.6%)이 연금계좌로 이체되기 때문에 신고 대상세액 중의 해당 부분도 당해 부과되지 않고 이연된다. 이연퇴직소득세도 2016년 이후 매년 증가 추세를 보이고 있다. 신고 대상세액이 많았던 2015년의 이연퇴직소득세의 비중(37.8%)이 가장 낮았다.

연도별 실효세율을 보면 평균적으로는 큰 변화가 없다. 즉 2016년 이후 실효 퇴직소득세율이 완만하게 증가하고 있다(<그림 Ⅲ-5 (b)> 참조). 그리고 이연퇴직소득세를 차감하면 매년 부담하는 퇴직소득세율은 1.76~2.74%(= 신고소득세율-이연퇴직소득세율)의 범위에서 움직이고 있다.

2015년부터 2019년까지 퇴직소득 세율 계산방식의 변화에 따른 효과는 1~9분위 퇴직소득 구간에서는 연차에 따라 낮아지고 있다. 이는 앞서 보았듯이((<그림 Ⅲ-1 (b)> 참조) 퇴직소득이 낮을 때 세율이 낮아지는 효과 때문이다(연차와 세율은 상관관계는 -0.236(5% 수준 유의적)이다(<표 III-3 (a)> 참조).). 10분위 구간에서는 연차에 따른 세율 증가 경향을 볼 수 있다. 한편 퇴직소득 구간을 과세표준에 의해 구분할 경우에도 연차에 따른 소득세율의 증가 경향을 볼 수 있다. 과세표준 방식으로 구분할 경우 고소득 계층의 세율 변화폭을 보다 상세히 파악할 수 있기 때문이다.

퇴직소득이 높을수록 실효세율이 급격히 높아짐에 따라 고소득 구간에서 연금화의 유인이 높아진다. 이연퇴직소득세는 퇴직소득세 중에서 과세가 이연되는 부분이며, 퇴직소득 중 연금계좌로 이체된 금액의 비중에 해당한다. 퇴직소득 중 이연퇴직소득세의 비중은 평균적으로 보면 일정 수준을 유지하는 것처럼 보인다(<그림 Ⅲ-7 (a)> 참조). 그러나 10분위 퇴직소득 규모별로 보면 우상향하는 경향이 발견된다(<그림 Ⅲ-7 (b)> 참조). 또한 과세표준 구간별로 비교해 보아도 퇴직소득 이연 비중이 높아진다.23)

연금계좌에서 신고되는 퇴직소득이 많다는 사실은 퇴직소득세 개정이 퇴직소득을 연금계좌로 이체시키는 데는 비교적 성공적이었지만, 이체된 퇴직소득을 연금계좌에 유지시키면서 연금화하는 데는 성공하지 못했음을 의미한다.27)

Ⅳ. 시사점

정부는 2010년대 초에 이루어진 대대적인 사적연금 관련 세법 개정 작업을 통해 개인연금의 납입금에 대한 세액 계산 방식을 소득공제 방식에서 세액공제 방식으로 변경하였고, 연금계좌 개념을 이용하여 연금계좌에서 인출되는 연금과 그 외의 금액에 대한 세율을 정비하였다. 이와 함께 퇴직소득 세제도 동시에 정비하였는데 일시금 인출을 억제하고, 연금수령을 확대하려는 목표를 가지고, 퇴직일시금에 대한 세부담을 증가시켰다. 또한 퇴직소득이 낮은 계층의 실효세율이 낮아졌기 때문에 퇴직소득세의 변경은 조세 형평성 차원에서도 어느 정도 성과가 있었다고 볼 수 있다.

퇴직연금 일시금에 대한 과세 강화는 연금화의 1단계에서는 어느 정도 성공적이라고 할 수 있다. 퇴직소득의 상당 부분이 연금계좌로 이체되고 있다. 퇴직연금 소득에 대한 과세는 퇴직급여를 연금계좌로 이체시키는 실질적인 수단이 되고 있다.28) 특히 퇴직소득이 높은 층에서 이체 비율이 높아지는 경향을 보이고 있어, 이연퇴직소득세가 어느 정도 성공을 거두고 있다고 볼 수 있다. 그러나 이체된 퇴직소득이 연금계좌에 오래 머물지 못해 이연퇴직소득 세제의 효과는 한계가 있는 것으로 보인다.

연금계좌로 이체된 퇴직소득이 최종적으로 연금으로 수령될 수 있는 방안이 고려되어야 한다. 우선 고려해 볼 수 있는 방법은 정년 퇴직자의 경우(또는 55세 이후 등 특정 연령 이후) 퇴직소득의 40% 정도를 세금 없이 인출할 수 있도록 허용하는 방안이다.29) 연금계좌에 이체된 이후에 연금외수령되는 경우 중 상당 부분이 퇴직 후 긴급 자금이 필요하여 인출되고 있기 때문이다. 이때 40%의 면세 인출 한도를 허용한다면 이 부분만으로 우선 필요 자금을 인출할 수 있다. 적어도 긴급한 자금 인출로 인해 추가적인 세금을 부담하는 상황을 피할 수 있다. 또한 40%의 면세 인출을 허용하면 이 부분만을 인출하고, 세금을 부담해야 할 부분은 이연시킬 수도 있다. 예를 들어 영국의 경우 인출 방식에 대한 대대적인 세제 변화에도 불구하고 25%의 면세 인출 한도를 유지하였다.

퇴직연금 도입과 함께 일시금의 연금화가 중요한 과제로 등장하였다. 그러나 연금화 촉진 방안이 증세를 통해서만 이루어져야 했는지에 대한 의문이 남는다. 연금화를 촉진하기 위해 연금을 후원한 것이 아니라 일시금의 부담을 늘리고, 연금을 선택하면 그 부담을 줄여 준 것이다. 게다가 연금계좌로 이체된 일시금의 상당 부분이 연금외 방식으로 인출되어 연금소득의 세제혜택도 받지 못한다. 따라서 전반적으로 퇴직소득에 대한 세금 부담이 커졌다고 할 수 있다.30) 또한 연금화의 확대라는 목표가 있더라도 환산급여 방식을 통해 ‘1년’에 형성된 ‘1개월’ 급여에 대해 1년 소득에 상응하는 세율을 적용하는 방식은 세액을 지나치게 높이는 것으로 보인다. 그리고 많은 퇴직소득자가 중도인출 등으로 인해 퇴직소득 금액이 낮아 세율의 고저에 큰 영향을 크게 받지 않는다. 따라서 세율 조정을 통한 연금화 확대는 상대적으로 퇴직소득 금액이 큰 퇴직자들에게만 부담이 되는 경향이 있다.31)

마지막으로 근로자 입장에서 볼 때 퇴직소득 세액 증가에 따른 보상이 명확해져야 한다. 퇴직연금 도입과 함께 퇴직소득세가 증가되었다고 볼 수 있다. 근로자 입장에서 볼 때 퇴직금 제도와 동일한 수준의 퇴직급여를 받으면서 그에 대한 세금을 더 내는 상황이 되었다. 그래도 퇴직연금 가입자들은 퇴직연금 적립금이 금융회사에 적립되기 때문에 퇴직급여에 대한 안전성이 높아졌다. 이에 비해 퇴직금 제도에 머물고 있는 기업의 근로자들은 퇴직연금 도입 전에 비해 아무런 변화도 없이 퇴직할 때 세금만 늘어난 셈이다. 따라서 정부는 퇴직연금 도입과 함께 당연히 이루어질 것으로 기대했던 퇴직연금의 혜택이 실현되도록 더욱 정책적 노력을 해야 한다. 퇴직연금 가입 확대, DB형 퇴직연금의 적립비율 확충, DC형 퇴직연금의 투자 수익률 제고 장치의 확보 등을 그러한 예로 들 수 있다.

1) 퇴직연금의 도입 목적은 퇴직소득의 안정적 확보이며, 퇴직소득의 연금화가 필수적이다. 따라서 세금을 늘려서라도 연금화를 촉진하려는 취지는 이해할 수 있다. 그러나 과거에 비해 세금 부담이 늘어나는 정책이 바람직한 것인가 하는 논쟁의 여지는 남는다.

2) 퇴직급여를 일시금으로 인출할 수 있는 확정기여형(Defined Contribution: DC) 퇴직연금에 해당한다. 확정급여형(Defined Benefit: DB) 퇴직연금은 연금, 즉 달돈으로 퇴직급여를 받는다.

3) 스위스의 퇴직연금 가입자들은 종신연금을 받기 위해서는 퇴직연금 적립금으로 생보사의 연금을 구입하여야 한다. 이러한 시장의 특수성을 고려하여 스위스 정부는 종신연금의 가격을 강력하게 통제하고 있다. 그러나 2004년 평균 수명 연장, 이자율 하락 등 가격 상승 요인을 견디지 못하는 대형 생보사들이 연금 가격을 인상하였다.

4) 미국의 경우 퇴직자 가구들이 평균적으로 6%의 퇴직자산을 세금으로 부담해야 하는 것으로 추정되며, 상위 5%는 16.4%, 상위 1%는 22.7%를 세금으로 납부해야 한다(Chen & Munnnell, 2020).

5) 미국의 경우 의무인출 비율만큼 인출되지 않고 남아 있는 부분에 대해서는 50% 과세를 한다(US IRS, 2021). DB형 퇴직연금은 근로자가 일정 연령에 도달하면 연금(달돈)을 지급하므로 이러한 문제가 발생하지 않는다.

6) 퇴직급여의 최저한도는 존재한다. 또한 2013년 세법 개정을 통하여 임원 특례 조항이 도입되었다. 2012년 이후 퇴직소득 금액에 임원 퇴직소득 한도를 설정하여 이 한도를 넘는 금액에 대해서는 근로소득으로 과세한다. 이때 한도는 1년 급여(3년 평균) 10%의 3배수로 정하였다. 이 한도는 2020년 이후 적립분에 대해서는 1년 급여 10%의 2배수로 하향 조정되었다(임상엽·정정운, 2021).

7) 2014년 영국의 소득세율은 과세소득 £31,865까지 20%, £31,866에서 £150,000까지 40%, £150,000 이상에 대해서는 45%이다. 개인별 £10,000 기본 공제가 있는데, 소득이 £100,000를 넘으면 소득 £2에 £1씩 기본 공제액이 줄어들어, 소득이 £120,000를 넘으면 기본 공제액이 없다. 한편 2021년 현재 소득세율은 £12,570까지 0%, £12,571에서 £50,270까지 20%, £50,271에서 £150,000까지 40%, £150,000 이상에 대해서는 45%이다(https://www.gov.uk/income-tax-rates).

8) 연금자산의 강제 연금화 정책은 1921년 재정법(Finance Act)에서 시작되었으며, 1956년 재정법은 60세에서 70세 사이에 연금화를 강제하였고, 1976년 재정법은 연금화 상한연령을 75세로 조정하였다.

9) 퇴직자산의 25%까지는 세금을 내지 않고 인출할 수 있었으며, 제도 변화 이후에도 면세 인출 한도는 동일하게 유지되었다.

10) HM Revenue & Customs, 2021, Number and value of flexible payments made from pensions since April 2015. 한편 2020년말 9월말 DC형 퇴직연금의 적립액은 1,610억 파운드이다.

11) Office for Budget Responsibility, 2020, Economic and fiscal outlook https://www.moneymarketing.co.uk/news/budget-2020-pension-freedoms-tax-revenues-continue-to-surprise/

12) 영국 정부는 연금화 정책 변경의 주요 목적을 가입자의 선택권을 늘리는 것이라고 발표하였다. 변화된 연금 정책을 연금선택의 자유(Pension Freedom)라 명명한 데서도 그 의지를 찾아 볼 수 있다. 그러나 한편으로 세수 확대도 중요한 목표의 하나라는 의견도 있었다. 가입자들이 일시금을 선택할 경우 연금으로 받을 때에 비해 세금을 앞당겨내는 효과가 있기 때문이다. 또한 선택권의 확대 측면에서도 가입, 투자 단계에서 자동가입, 디폴트 옵션을 추진하면서 인출 단계에서는 선택권을 확대한다는 정책도 서로 모순된다는 지적도 있었다.

13) 모든 기업이 퇴직급여를 지급해야 한다는 측면에서는 의무적이지만, 퇴직금과 퇴직연금의 선택, DB형 퇴직연금 또는 DC형 퇴직연금의 선택 등에서 기업과 근로자의 선택의 여지가 있다. 이러한 유연성은 국내 퇴직연금 제도의 장점이기도 하지만 원리금에 집중된 자산 운용 등 문제점을 내포하고 있다.

14) 퇴직소득 세제의 개정과 별개로 고소득자 증세를 위한 고소득 과세표준 구간이 추가되면서 고소득자에 대한 세금이 증가하였다.

15) 퇴직소득, 양도소득은 다른 소득과 합산하지 않고 별도로 과세한다(분류과세). 일부 소득(분리과세 이자소득, 분리과세 배당소득, 근로소득 중 일용근로자의 급여, 분리과세 연금소득, 분리과세 기타소득)은 기간별로 합산하지 않고 그 소득이 지급될 때 소득세를 원천징수함으로써 과세를 종결하는데, 이것을 ‘분리과세’라고 한다(임상엽·정정운, 2021).

16) 퇴직소득 정률공제는 과세기간 2002~2005년 50%이며, 2006~2010년 45%, 2011~2015년 40%로 점차 축소되어 왔다.

17) 김수성·성종훈(2014)은 5배수 방식이 5년 미만 단기 근속 근로자를 차별하는 효과가 있음을 지적하고, 근로자 전직이 증가하는 추세에서 관련 규정의 개정을 제안하였다.

18) 임성종(2017)은 근속연수에 따른 차등적인 배수 규정의 적용을 제안하였다.

19) 정률공제(40%)가 폐지되었지만, 환산급여공제의 최소 비율이 35%(3억원 초과 구간)이기 때문에 대부분의 퇴직소득자는 퇴직소득의 일정 비율에 대해 소득공제를 받고 있다. 따라서 세액 증가 주요 요인은 12배수 연승비율을 통해 한계소득세율이 높아지는데 있다고 볼 수 있다. 한편, 2014년 환산급여공제가 처음 발표되었을 때 공제비율은 100~15%이었으며, 최고 공제구간도 2억원 초과로 현행 기준보다 더 낮았다(기획재정부, 2014).

20) 2015년 과세표준 2억원 이상자의 수가 15,400명으로 가장 많았고(다른 해 3,378~7,750명), 전체 퇴직소득 신고자 대비 비중도 0.6%로 가장 높았다(다른 해 0.2~03%).

21) 이들의 퇴직소득의 금액 비중을 보면 평균 20%대에 머물고 있다. 한편 인원 비중으로는 2.4%(2019년)인 1억원 이상자의 금액 비중이 38.8%에 이르고 있다(국세청 통계연감).

22) 2013~2019년 10분위별 퇴직소득의 평균 금액(단위 백만원)을 보면 다음과 같다. 1분위 0.9, 2분위 1.7, 3분위 2.3, 4분위 2.9, 5분위 3.7, 6분위 4.7, 7분위 6.3, 8분위 8.9, 9분위 14.9, 10분위 88.3.

23) 퇴직소득 규모에 따라 연금계좌 이체 비율이 높아지는 경향을 확인하기 위해 연도와 과세표준구간을 독립변수로 하고, 이연 퇴직소득세의 비중을 종속변수로 하는 회귀분석을 하였다. 그 결과 연도와 과세표준 구간 두 변수 모두 1% 수준에서 유의적인 양(+)의 계수를 갖는다. 한편 근속연수를 독립변수로 추가하였을 때 근속연수는 1% 수준에서 유의적인 음(-)의 계수를 가지며, 연도, 과세표준 구간은 유의적인 양의 계수를 유지하였다.

24) 연도와 퇴직소득 규모의 효과를 통제하기 위해 근속연수, 연도, 소득구간을 독립변수로 하고, 퇴직소득 세율을 종속변수로 하는 회귀분석을 진행하면 근속연수는 퇴직소득 세율과 유의적인 음(-)의 계수를 보인다.

25) 연령이 높아짐에 따라 이연퇴직소득 비중이 낮아지는 경향이 있다. 2013~2019년 사이 연령대별 이연퇴직소득 비중은 30대 60.0%, 40대 52.0%, 50대 45.9%, 60대 36.3% 순이다(국세청 통계연감, 4-4-3 퇴직소득 원천징수 신고 현황 III(10분위, 성, 연령)).

26) 해당 연도에 이연된 퇴직소득이 바로 그 해에 인출된다는 의미는 아니다. 그럴 경우 연금계좌 원천징수 신고 현황의 퇴직소득으로 기록되지 않고 퇴직소득 원천징수 신고 현황의 퇴직소득으로 기록된다.

27) 이처럼 이연된 퇴직소득이 퇴직계좌에 오래 머물지 못하는 이유는 다양하겠지만 현재 연금계좌로서 사용되는 개인형 퇴직연금(IRP)의 한계도 있다. 예를 들어 IRP의 성격이 적립 과정에 초점을 둔 상품이기 때문에 인출 과정에 들어간 퇴직자에게 적합하지 않을 수 있다. 또한 개인이 투자결정을 하기 때문에 자산운용에 있어 많은 한계(예; 원리금보장형에 집중된 자산운용)를 보이고 있다.

28)「 근로자퇴직급여보장법」 개정(2012년 7월 26일)으로 퇴직연금 급여를 개인형퇴직연금(Individual Retirement Pension: IRP) 계정으로 이체하도록 하고 있다. 그러나 퇴직자가 IRP를 해약할 수 있다. 이연퇴직소득세의 효과가 없다면 해약률이 더욱 높아질 것이다.

29) 세액 계산 과정에서 40% 정률공제를 허용하는 데서 더 나아가 적립금의 40%를 세금 없이 인출할 수 있도록 허용하는 방안이다. 이와 함께 환산급여에 대한 소득공제를 적절히 조절할 수 있다. 즉 나머지 60%에 대해 현행 세제를 유지하는 방식(결과적으로 세수 감소)과 60% 부분에 현재의 퇴직소득 100%에 부과되는 세액을 부과하는 방식(결과적으로 세수 동일) 등을 선택할 수 있다.

30) 퇴직자 1인당 퇴직소득세액이 2016년 48.1만원에서 2019년 59.1만원으로 증가하였다. 그러나 상위 10%의 고소득자 위주로 세액이 증가하여 세제 형평성은 높아졌다 할 수 있다.

31) 퇴직소득은 근속연수는 비례하므로 장기 근속자들의 부담이 커지는 효과가 있다. 장기소득공제를 받기 때문에 근속연수 증가 자체에서 오는 효과는 세율을 낮춘다. 그러나 그 효과가 소득증가에 따른 효과를 전부 상쇄하지는 못한다.

참고문헌

고용노동부·금융감독원, 2021. 4. 5, 2020년도 퇴직연금 적립금 운용현황 통계, 보도자료.국세청, 2019,『퇴직 · 연금소득원천징수 안내』.

국세청, 2021,『국세통계연보』, TASIS 국세통계포털.

기획재정부, 2014. 8. 6, 2014년 세법개정안 - 경쟁력을 갖춘 공평하고 원칙이 있는 세제.김수성·성종훈, 2014, 퇴직소득 세제의 합리적 개선방안에 관한 연구, 『조세연구』 14(2), 73-108.

김재칠·홍원구, 2013,『인구고령화와 우리나라의 자본시장 Ⅱ: 퇴직연금과 자본시장 성장의 선순환』, 자본시장연구원.

박한순, 2018, 퇴직소득세 개정의 경제적 효과 분석과 세제 개선방안,『세무와회계저널』19(2), 41-61.

이소라, 2018, 퇴직연금 발전을 위한 세제분석과 개편방안 연구, 근로복지연구원.

임상엽·정정훈, 2021,『세법개론』, 상경사.

임성종, 2017, 연금소득 및 퇴직소득 세제의 합리적 개선방안에 관한 연구, 『경영과 정보연구』36(1), 215-232.

홍원구, 2016, 퇴직소득 안정화를 위한 퇴직연금 세제의 개선 방향,『퇴직급여제도 근로자 수급권 보장방안』, 근로복지연구원.

Bütler, M., Ramsden, A., 2017, How taxes impact the choice between an annuity and the lump sum at retirement, Discussion Paper 2017-01, University of St.Gallen.

Bütler, M., Staubli, S., Zito, M., 2013, How Much Does Annuity Demand React to a Large Price Change? Scandinavian Journal of Economics 115(3), 808–824.

Chen, A., Munnell, A., 2020, How much taxes will retirees owe on theire retirement

income., Center for Research at Boston College working paper 2020-16.

Rejda, G.E.. McNamara, M.J., 2017, Principles of Risk Management and Insurance, 13th ed., Pearson.