Find out more about our latest publications

Behavioral biases and the trading of individual investors in the Korean stock markets

Research Papers 22-02 Feb. 03, 2022

- Research Topic Capital Markets

- Page 122

Behavioral biases and the trading of individual investors in the Korean stock markets

Previous literature has shown that individual investors in the stock markets trade excessively and underperform the market index. Since the COVID-19 outbreak in 2020, the annual trading turnover of individual investors in the Korean stock markets is estimated as above 1,600% and their investment performance is below the market returns (Kim & Kim, 2021). Their excessive trading and poor performance are not fully explained by rational trading motives (i.e., liquidity needs and portfolio rebalancing) or information asymmetry, but it might be the results of irrational investment decisions originated by behavioral biases.

This report empirically investigates the effect of four well-known behavioral biases; overconfidence, disposition effect, lottery preference, and herding, on the trading behavior and performance of individual investors by utilizing the transaction data of about 200,000 investors in the Korean stock markets from March to October in 2020.

The main results from the empirical analyses are summarized as follows. First, trading turnover of individual investors is positively related to lagged market returns, and the positive relations are more pronounced for the groups of investors who trade more frequently. Also in those groups, post-trade returns of stocks purchased are far less than those of stocks sold. Overall results indicate that investors’ overconfidence induces excessive trading and hinders their investment performance.

Secondly, the disposition effect is clearly confirmed in trading of individual investors, by showing that the probability to sell a stock that has increased in value since bought is higher than that has decreased in value since purchased. In addition, the disposition effect is stronger for investors who lack investment experience and in hard-to-value stocks. Furthermore, the disposition effect is negatively associated with investment performance.

Third, individual investors prefer trading and holding lottery-type stocks more than the institutional investors or foreign investors do. Especially, male and young investors seem to have such strong lottery preference. Lottery preference is significantly related to under-diversification and excessive trading, and the investment performance of whom prefer lottery-type stocks is worse than others.

Lastly, the stock-level proportions of net buying individual investors show a positive serial dependency on both daily and weekly basis, implying the short-term herding behaviors. New or young investors tend to herd more than others and the herding behavior is significantly observed in attention-grabbing stocks, which suggests that individual investors’ herding is closely related to the limited attention bias. In addition, the return reversals after herding imply that the herding behavior is a result of irrational investment decisions.

Overall empirical results show that individual investors in the Korean stock markets are exposed to a variety of behavioral biases and those biases have negative impacts on investment performance. The improvement of trading accessibility and the increase of investment targets and information may exacerbate the negative impacts of behavioral biases for individual investors. In order to mitigate the behavioral biases and their negative effects, the following means need to be considered. First, the utilization of indirect investment vehicles and professional advising services need to be encouraged. If an individual investor realizes a lack of investment expertise, it is desirable to invest in a mutual fund managed by experts or to seek professional advice to reduce the effect of behavioral biases. This presupposed that there is no conflict of interests between the individual investors and the investment firms that provide investment vehicles or advising services. Second, it is necessary to create an trading environment that could reduce the impact of behavioral biases. Individual investors depends too much on the salient information, recent price trends, or buying price. So we can consider improvement for a type or format of information provided to investors, order types, or trading procedure to mitigate behavioral decision making. Third, education programs on financial investment and behavioral biases should be improved. Financial education will not only contribute to the development of investing competency but also help find suitable alternative investment instruments. It is important to develop a education program that can make an actual change in a investment behavior rather than focus on the improvement of financial knowledge.

Previous literature has shown that individual investors in the stock markets trade excessively and underperform the market index. Since the COVID-19 outbreak in 2020, the annual trading turnover of individual investors in the Korean stock markets is estimated as above 1,600% and their investment performance is below the market returns (Kim & Kim, 2021). Their excessive trading and poor performance are not fully explained by rational trading motives (i.e., liquidity needs and portfolio rebalancing) or information asymmetry, but it might be the results of irrational investment decisions originated by behavioral biases.

This report empirically investigates the effect of four well-known behavioral biases; overconfidence, disposition effect, lottery preference, and herding, on the trading behavior and performance of individual investors by utilizing the transaction data of about 200,000 investors in the Korean stock markets from March to October in 2020.

The main results from the empirical analyses are summarized as follows. First, trading turnover of individual investors is positively related to lagged market returns, and the positive relations are more pronounced for the groups of investors who trade more frequently. Also in those groups, post-trade returns of stocks purchased are far less than those of stocks sold. Overall results indicate that investors’ overconfidence induces excessive trading and hinders their investment performance.

Secondly, the disposition effect is clearly confirmed in trading of individual investors, by showing that the probability to sell a stock that has increased in value since bought is higher than that has decreased in value since purchased. In addition, the disposition effect is stronger for investors who lack investment experience and in hard-to-value stocks. Furthermore, the disposition effect is negatively associated with investment performance.

Third, individual investors prefer trading and holding lottery-type stocks more than the institutional investors or foreign investors do. Especially, male and young investors seem to have such strong lottery preference. Lottery preference is significantly related to under-diversification and excessive trading, and the investment performance of whom prefer lottery-type stocks is worse than others.

Lastly, the stock-level proportions of net buying individual investors show a positive serial dependency on both daily and weekly basis, implying the short-term herding behaviors. New or young investors tend to herd more than others and the herding behavior is significantly observed in attention-grabbing stocks, which suggests that individual investors’ herding is closely related to the limited attention bias. In addition, the return reversals after herding imply that the herding behavior is a result of irrational investment decisions.

Overall empirical results show that individual investors in the Korean stock markets are exposed to a variety of behavioral biases and those biases have negative impacts on investment performance. The improvement of trading accessibility and the increase of investment targets and information may exacerbate the negative impacts of behavioral biases for individual investors. In order to mitigate the behavioral biases and their negative effects, the following means need to be considered. First, the utilization of indirect investment vehicles and professional advising services need to be encouraged. If an individual investor realizes a lack of investment expertise, it is desirable to invest in a mutual fund managed by experts or to seek professional advice to reduce the effect of behavioral biases. This presupposed that there is no conflict of interests between the individual investors and the investment firms that provide investment vehicles or advising services. Second, it is necessary to create an trading environment that could reduce the impact of behavioral biases. Individual investors depends too much on the salient information, recent price trends, or buying price. So we can consider improvement for a type or format of information provided to investors, order types, or trading procedure to mitigate behavioral decision making. Third, education programs on financial investment and behavioral biases should be improved. Financial education will not only contribute to the development of investing competency but also help find suitable alternative investment instruments. It is important to develop a education program that can make an actual change in a investment behavior rather than focus on the improvement of financial knowledge.

Ⅰ. 서론

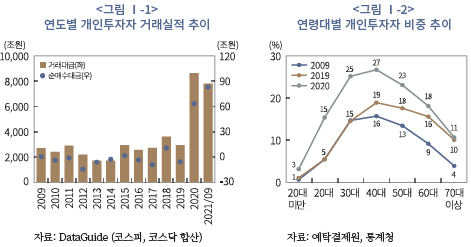

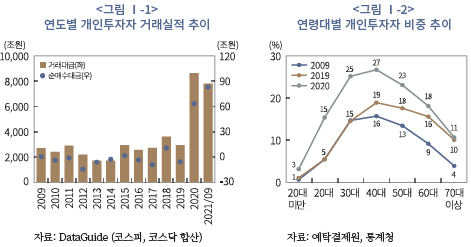

코로나19 발생 이후 한국 주식시장에서 개인투자자의 참여가 크게 늘었다. 2020년 말 기준으로 국내 상장기업 주식을 1주라도 보유한 투자자는 914만 명으로 전년 대비 약 300만 명 증가하였다. 2020년 개인투자자 거래대금(매수, 매도 합산) 및 순매수대금은 각각 8,710조원, 64조원으로 기록적인 한 해를 보냈으며, 2021년 거래실적은 이를 상회할 것으로 전망된다(<그림 I-1>). 무엇보다 20~30대 젊은 투자자들이 주식시장에 대거 유입되었다는 점이 특징적이다. 2019년 우리나라 20, 30대 전체 인구 중에서 주식투자자는 5%, 15%에 불과했으나, 1년 만에 15%, 25%로 증가한 것으로 나타난다(<그림 I-2>).

한국 주식시장의 투자자 저변이 확대되는 것, 위험자산에 대한 투자가 증가하는 것은 주식시장의 경제적 기능과 역할의 관점에서 볼 때 긍정적인 측면이 있으나, 개인투자자가 주식 직접투자를 통해 수익을 거두는 것은 결코 쉬운 일이 아니라는 사실은 우려되는 부분이다. 기업 성과와 주가 변동에 영향을 미치는 다양한 요인을 고려하여 투자의사결정을 내릴 수 있는, 충분한 경험과 역량을 갖춘 개인투자자는 드물기 때문이다. 김민기ㆍ김준석(2021)의 분석에 따르면 코로나19 국면에서 개인투자자들은 시장수익률을 하회하는 투자성과를 기록한 것으로 나타나며, 특히 2020년 3월 이후 주식시장에 진입한 신규투자자 중 60%는 손실을 시현하여 주식투자가 어려운 의사결정이라는 점을 여실히 보여주고 있다.

코로나19 국면에서 나타난 개인투자자의 저조한 투자성과는 일시적인 현상이 아닐 것으로 판단된다. 행동경제학 관점의 연구에 따르면 개인투자자의 투자의사결정은 충분한 정보와 정교한 전략을 바탕으로 하기보다 심리적인 요인과 여러 주변 상황에 쉽게 영향을 받는다. 본인의 투자능력이나 본인이 보유한 정보를 과도하게 신뢰하는 경향이 있고, 수익이 났을 때는 본인의 능력에 따른 결과로 생각하는 반면 손실이 난 경우에는 단순히 불운으로 치부한다. 본인의 위험성향을 망각한 채 과도한 위험을 감수하기도 하며, 가격이 더 오르기 전에 사야 한다는 불안감으로 다른 투자자를 추종하여 주식을 매수하기도 한다. 이러한 개인투자자의 행태적 편의(behavioral biases)는 체계적으로 나타나는 것으로 보고되고 있으며, 개인투자자의 비합리적인 투자의사결정, 결과적으로 저조한 투자성과를 유발하는 주요 원인으로 평가된다.

개인투자자가 행태적 편의에 의해 저조한 투자성과를 거두는 상황은 결코 바람직하지 않다. 개인투자자의 재산상의 손해와 함께 투자자 저변의 위축을 불러올 수 있고, 행태적 편의가 가격의 비효율성을 일으킬 경우 위험의 분산, 자원의 배분이라는 주식시장 본연의 기능을 저하시킬 수 있기 때문이다(Daniel et al., 2002). 기업의 경영진이나 금융투자회사가 개인투자자의 행태적 편의를 이용하여 이익을 취하고자 한다면 자본시장의 신뢰성을 무너뜨리는 결과도 초래할 수 있다. 한국 주식시장은 개인투자자의 비중이 크고, 특히 최근 행태적 편의에 보다 취약한 신규투자자가 급증한 상황이므로 이러한 가능성에 대한 우려는 더 클 수밖에 없다. 따라서 한국 주식시장에서 개인투자자의 행태적 편의의 양상과 영향을 파악하고 이해하는 것은 학술적, 정책적 관점에서 매우 중요한 과제라 할 수 있다.

본고는 코로나19와 함께 개인투자자의 주식시장 참여가 급증했던 2020년 계좌별 거래내역을 바탕으로, 개인투자자의 거래행태를 행태적 편의(behavioral biases)의 관점에서 분석한다. 본인의 투자능력과 보유정보를 과대평가하는 과잉확신(overconfidence), 손실의 실현은 미루고 이익의 실현은 서두르는 처분효과(disposition effect), 개인투자자의 투기적 성향을 반영하는 복권형(lottery-type) 주식 선호경향, 다른 투자자를 추종하여 동일한 투자의사결정을 내리는 군집거래(herding) 등 네 가지 대표적 행태적 편의를 대상으로, 주식시장 개인투자자의 거래행태에서 이상의 행태적 편의가 관찰되는지, 행태적 편의와 연관된 요인이 무엇인지, 행태적 편의가 투자성과에 어떠한 영향을 미치는지를 밝히고자 한다.

그간 국내 개인투자자의 거래행태에 대한 연구는 자료의 한계로 인해 개인투자자 전체 합산자료를 기반으로 한 분석이 대부분이다. 개별 개인투자자의 거래자료를 이용한 연구가 일부 확인되나 분석대상이 협소하고 분석기간이 다소 오래된 것으로 파악된다. 본 보고서는 약 20만명에 이르는 개인투자자의 2020년 주식거래 내역을 토대로 다각적인 분석을 시도함으로써 개인투자자의 거래행태를 이해하는 데 기여할 수 있을 것으로 기대한다. 무엇보다 개인투자자의 행태적 편의에 초점을 맞춰 분석함으로써 행태적 편의의 경제적 함의를 조명한다는 점에서 의의가 있다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 개인투자자의 행태적 편의와 거래행태와 관련된 국내외 문헌을 정리하고, Ⅲ장에서는 본 보고서의 분석 방향을 설정하고 분석자료에 대해 소개한다. Ⅳ장에서는 앞서 제시한 네 가지 행태적 편의가 개인투자자의 투자행태와 투자성과에 미치는 영향에 대해, 기존 연구결과, 분석 방법론, 실증분석 결과를 차례로 기술한다. 마지막으로 Ⅴ장에서 결론과 시사점을 제시한다.

Ⅱ. 선행연구

전통적 경제이론에서 상정하는 ‘합리적 투자자(rational investor)’는 투자안의 위험과 기대수익에 대한 평가를 바탕으로, 위험 대비 기대수익을 극대화하면서 본인의 위험성향에 부합하는 투자안을 집행한다. 가령 마코위츠(Markowitz) 포트폴리오 이론에 등장하는 투자자는 최적 포트폴리오와 무위험자산으로 구성된 잘 분산된(well-diversified) 포트폴리오를 보유한다. 또한 정보비대칭(information asymmetry) 기반의 균형모형에서는 주된 거래주체가 정보거래자(informed trader)이며 무정보거래자(uninformed trader)인 개인투자자는 수동적으로 거래하는 것으로 묘사된다(Grossman & Stiglitz, 1980; Kyle, 1985).

그러나 현실에서 관찰되는 개인투자자의 주식투자 행태는 합리적인 투자자와는 괴리가 있는 것으로 평가된다. 다수의 실증연구에서 밝혀진 개인투자자의 투자행태는 이론적기대와 달리 분산투자 수준이 낮고, 과도하게 거래하며, 때로는 매우 투기적인 행태를 보인다(Barber & Odean, 1999; Guetzmann & Kumar, 2008; Kumar, 2009a; Barber & Odean, 2013; Anderson, 2013). 과거 수익률을 추종하여 거래하는 현상(Statman et al., 2006), 군집적으로 거래하는 현상(Kumar & Lee, 2006), 매수가격에 비해 주가가 상승한주식보다 주가가 하락한 주식을 오래 보유하는 현상(Odean, 1998) 등의 비합리적 행태도 관찰된다. 특히 주목되는 점은, 개인투자자의 거래가 지나치게 많다는 것이다. 주식시장에서 관찰되는 개인투자자의 거래는 유동성 수요, 포트폴리오 조정, 헤지(hedge), 절세(tax avoidance) 등의 합리적 동기로 설명하기 어려운 수준으로 평가된다. 미국 월평균거래량 상위 25%에 해당되는 개인투자자의 거래회전율은 연간 250%에 이르며(Barber & Odean, 2000)1), 대만, 중국의 개인투자자 거래회전율은 각각 300%, 500%가 넘는다(Gao, 2002; Barber et al., 2009). 2020년 코로나19 국면에서 국내 개인투자자의 연간 거래회전율은 무려 1,600%를 상회한다(김민기ㆍ김준석, 2021).

개인투자자의 이러한 비합리적인 투자행태는 높은 거래비용, 높은 투자위험, 과잉반응 및 과소반응을 유발하여 저조한 직접투자성과로 이어진다는 것이 이론적, 실증적으로 일치되는 견해다. 예를 들어, 1990년대 중반 미국 개인투자자 자료를 분석한 연구에 따르면 개인투자자의 평균적인 투자성과는 시장수익률을 하회하고 거래가 빈번할수록 수익률은 더욱 낮아진다. 또한 개인투자자가 매수한 주식의 수익률은 매도한 주식의 수익률국내 개인투자자의 행태적 편의와 거래행태

보다 낮은 것으로 나타난다(Odean, 1999; Barber & Odean, 2000). 비슷한 시기의 핀란드 개인투자자 자료를 분석한 연구에서도 개인투자자의 주식투자 수익률이 다른 투자자유형에 비해 낮은 것이 확인되며(Grinblatt & Keloharju, 2000), 대만 개인투자자의 투자성과를 분석한 연구에서는 개인투자자의 연간 합산 투자손실이 전체 GDP의 2.2% 규모에 이르는 것으로 추산된 바 있다(Barber et al., 2009).

학술적으로 개인투자자의 비합리적인 투자행태의 근본 원인을 주로 ‘행태적 편의’와 같은 심리적인 요소에서 찾는다(Barberis & Thaler, 2003; Barber & Odean, 2013). 행태적 편의란 인간의 의사결정 과정에서 감정, 경험, 신념, 선호 등의 영향이 작용하여 결과적으로 비합리적인 의사결정이 유발되는 심리적 기제를 의미한다. 이러한 행태적 편의는 체계적으로 관찰되며, 전통적 경제학의 관점에서 비합리적이라고 간주되는 개인투자자의 여러 투자행태를 효과적으로 설명할 수 있다.

행태적 편의는 크게 인지적(cognitive) 한계 또는 편향된 신념(belief)에 의한 것과 감정(emotion) 또는 선호(preference)에 의한 것으로 구분할 수 있다. 전자의 대표적인 예로 과잉확신을 들 수 있다. 과잉확신은 자신이 보유한 정보의 신뢰성, 자신의 평가와 예측의 정확성을 과대평가하는 경향을 의미하며, 성과가 좋을 때 이를 본인의 능력으로 생각하는 자기귀인 편의(self-attribution bias)에 의해 더욱 강화된다. 이러한 과잉확신 성향은 실증적으로 과도한 거래를 유발하는 주요 원인으로 지적되고 있다(Odean, 1998; Odean, 1999). 일부 표본에서 관측되는 결과로 전체를 판단하는 대표성(representative) 편의, 새로운 정보에 대해 느리게 반응하는 보수주의(conservatism) 편의는 자산시장 내 과잉반응과 과소반응을 설명하는 행태적 편의이다(Tversky & Kahneman, 1974; Bar-beris et al., 1998; Daniel et al., 1998). 이밖에, 특정 준거점(reference)에 얽매여 합리적인 의사결정을 내리지 못하는 기준점 편향(anchoring bias), 관심을 끌거나 눈에 띄는 대상 또는 정보를 선택하는 제한된 주의(limited attention) 등도 투자자의 비합리적인 의사결정을 유발한다(Tversky & Kahneman, 1974; George & Hwang, 2004; Barber & Odean, 2008). 과거 수익률 추세를 추종하는 거래행태는 대표성 편의와 밀접한 관련이 있으며(Dhar & Kumar, 2001; Chen et al., 2007), 군집거래(herding) 행태는 대표성 편의 및 주의효과와 연관된 것으로 평가된다(Barber et al., 2009).

후자에 해당하는 대표적인 행태적 편의로는 손실회피(loss aversion)를 들 수 있다. 손실회피는 기대효용이론(expected utility theory)의 대안으로 제시된 전망이론(pros-pect theory)의 핵심을 구성하는 개념이다. 전망이론에 따르면, 손실에서 오는 고통이 같은 금액의 이익에서 오는 만족보다 크고, 이익에 대해서는 위험회피 경향을, 손실에 대해서는 위험선호 경향을 보인다(Kahneman & Tversky, 1979). 전망이론 관점은 이익이 발생한 주식은 서둘러 매도하고 손실이 발생한 주식은 매도하지 않고 보유하는 처분효과를 효과적으로 설명한다. 한편 처분효과는 자기합리화(self-justification) 경향과도 연관된 것으로 평가된다. 손실의 실현을 미룸으로써 본인의 의사결정 실수를 인정하는 데 따르는 불편함을 회피하고 이익을 실현함으로써 투자능력에 대한 만족감을 얻고자 한다는 해석이다. 또 다른 편의로 극단적인 수익률을 선호하는 경향을 들 수 있다. 투자자의 왜도(skewness) 선호는 이론적으로 투자자로 하여금 덜 분산된 포트폴리오를 보유하는 기제로 작용하고(Conine & Tamarkin, 1981; Goetzman & Kumar, 2008), 자극을 추구(sensation seeking)하는 경향은 고위험 포트폴리오의 보유와 빈번한 거래를 유발한다(Kumar & Lee, 2006; Dorn & Segmueller, 2009). 이밖에, 위험분포의 불확실성을 회피하는 모호성 회피(ambiguity aversion), 익숙한 대상을 선호하는 친숙성 편의(familiari-ty bias)는 개인투자자의 낮은 분산투자 수준에 영향을 주는 요인으로 제시되고 있다(Cao et al., 2011; Dimmock et al., 2016).

국내 개인투자자의 투자행태와 관련된 연구는 많지 않았던 것으로 보인다. 본고와 같이 개인투자자의 거래내역을 분석한 연구는 최운열 외(2004), 김동철 외(2005), 변영훈(2006)이 확인되는데, 공통적으로 국내 개인투자자에서 처분효과가 관찰됨을 보고하고있다.2) 특히 변영훈(2006)은 투자규모가 큰 투자자와 여성투자자에서 처분효과가 강하고, 처분효과가 주가의 평균회귀(mean reversion)에 대한 믿음에서 비롯된 것으로 평가하고 있다. 변진호 외(2007)는 개인투자자 240명에 대한 설문조사를 통해 과잉확신 성향을 직접 측정하여, 과잉확신이 과도한 거래를 유발하고 거래가 증가할수록 수익률이 하락한다는 결과를 제시하고 있다.

이외의 관련 연구는 시장자료를 이용하여 전체 개인투자자를 하나의 투자주체로 분석한 연구다. 분석결과를 요약하면, 개인투자자는 역추세추종 거래행태를 보이고(이가연ㆍ이윤구, 2004; 오승현ㆍ한상범, 2008), 고변동성, 소규모, 또는 복권형 주식을 선호하며(고광수ㆍ김근수, 2004; 강장구ㆍ심명화, 2014), 극단적인 거래량 또는 극단적인 수익률을 보이는 주식을 매수하는 경향을 보인다(공옥례ㆍ박대근, 2013). 또한 주가변동에 대해 과잉반응(박진우ㆍ황동혁, 2012)하고, 이익 공시에 대해 과소반응(김동순ㆍ전영순, 2004)하는 행태가 관찰된다.

개인투자자의 투자성과에 대한 연구에서는 투자자 유형 중 개인투자자의 수익률이 가장 낮고 시장수익률을 하회하는 것으로 나타난다(고광수ㆍ김근수, 2004; 변영훈, 2005b; 박경인 외, 2006). 변영훈(2005a)은 개인투자자의 거래회전율이 높을수록 성과가 하락하는 결과를 바탕으로 개인투자자의 저조한 투자성과가 과잉확신과 연관된 것으로 평가하고 있다.

Ⅲ. 실증분석 개요

1. 실증분석 구성

본고는 이상에서 논의한 선행연구를 바탕으로 국내 개인투자자의 행태적 편의와 거래행태에 대한 실증분석을 진행한다. 앞서 제시한 다양한 행태적 편의 중에서, 주식시장 개인투자자의 대표적 행태적 편의인 과잉확신, 처분효과, 복권형 주식 선호, 단기군집거래에 초점을 맞춰 분석한다.

Ⅳ장의 1절에서는 개인투자자의 과잉확신과 관련된 실증분석을 진행한다. Statman et al.(2006)의 방법론을 기반으로 개인투자자의 거래회전율과 시장수익률의 관계를 분석하며, 투자자의 매매의사결정 오류를 개인투자자 유형 및 개별주식의 횡단면적 특징과 연결하여 살펴본다. 개인투자자 전체를 하나의 투자주체로 분석한 기존 연구(이호ㆍ김은정, 2012; 강소현ㆍ김준석ㆍ양진영, 2015)와 비교할 때, 본고는 개인투자자 세부 유형별 분석을 진행함으로써 과잉확신의 영향요인을 보다 구체적으로 밝히고 있다.

Ⅳ장의 2절에서는 개인투자자의 처분효과에 대해 살펴본다. 개별 개인투자자의 거래자료를 바탕으로 Cox 비례위험모형을 적용하여 처분효과의 수준을 측정하고, 처분효과의 영향요인과 처분효과가 투자성과에 미치는 영향을 차례로 분석한다. 기존 국내 연구에 비해 정교한 방법론을 채택하여 다각적인 분석을 수행함으로써 국내 개인투자자의 처분효과에 대한 기존 연구를 확장하고 있다.

Ⅳ장의 3절에서는 개인투자자의 복권형(lottery-type) 주식 선호 현상을 다룬다. 복권형 주식의 수익률 특성을 포트폴리오 관점에서 접근한 기존연구(심명화ㆍ강장구, 2014; 고봉찬ㆍ김진우, 2017)와 달리, 본고는 개인투자자 개별 거래자료를 바탕으로 개인투자자 유형별 복권형 주식 선호 정도, 복권형 주식 선호가 투자행태 및 투자성과에 미치는 영향 등을 직접적이고 포괄적으로 분석하고자 한다.

마지막으로 Ⅳ장의 4절에서는 Sias(2004)의 연구 방법론을 바탕으로 개인투자자의 단기군집거래에 대해 살펴본다. 개인투자자의 단기군집거래의 존재 여부와 영향 요인, 단기군집거래가 투자성과에 미치는 영향을 살펴보고, 투자자의 행태적 편의와 연계하여 결과를 해석하고자 한다. 기존 국내외 연구는 대부분 기관투자자의 군집거래를 대상으로 진행되었으며, 영향요인의 불명확성, 자료의 한계 등으로 개인투자자의 군집거래에 대한 연구는 이루어지지 않았다. 본고의 연구는 개인투자자의 군집거래를 조명하는 드문 시도라는 점에서 학술적 의의가 있다.

2. 분석자료

본 보고서의 분석은 4개 대형 증권사가 제공한 개인투자자 204,004명3)의 일별 상장주식 거래체결 및 포트폴리오 구성 자료를 바탕으로 한다. 각 증권사의 전체 증권계좌 보유고객을 연령대별 8개 그룹, 성별 2개 그룹, 합산 자산규모 3개 그룹 등 총 48개 그룹으로 분류한 뒤, 각 그룹에서 5%를 임의추출(random sampling)하여 표본을 구성하였다.4) 4개 증권사 중 3개 증권사의 자료는 2020년 3월부터 10월까지, 나머지 1개 증권사의 자료는 2020년 3월부터 6월까지의 자료로 구성된다. 분석대상 자산은 SPAC 및 코넥스시장 상장종목을 제외한 유가증권시장 및 코스닥시장의 보통주 및 우선주다. 개별주식의 가격, 수익률, 기업 재무제표 자료는 DataGuide를 통해 추출하였다.

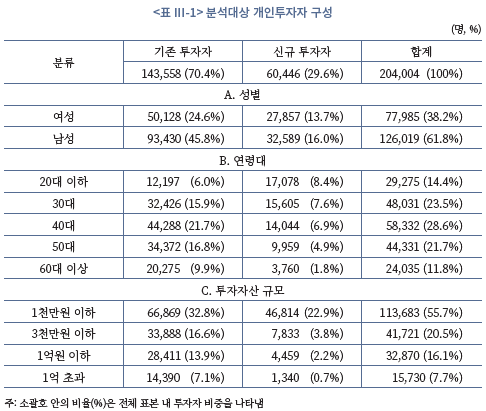

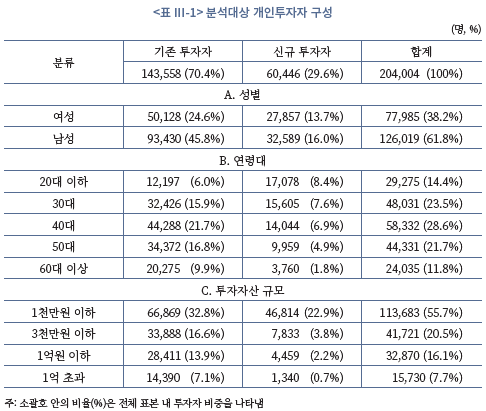

표본에 포함된 개인투자자의 유형별 구성 비중은 <표 Ⅲ-1>에 제시되어 있다. 2020년 3월 이후 계좌를 개설한 신규투자자는 60,446명으로 29.6%를 차지한다. 표본 내 전체 개인투자자 중 61.3%는 남성투자자이며, 연령대별 비중은 40대 28.6%, 30대 23.5%, 50대 21.7%, 20대 이하 14.4%, 60대 이상 11.8% 순으로 나타난다. 투자자의 평균 투자자산5) 규모는 1천만원 이하가 55.7%, 1천만원 초과 3천만원 이하가 20.5%로 소액투자자의 비중이 높다. 기존투자자와 신규투자자를 비교해 보면, 신규투자자는 여성투자자, 저연령대 투자자, 소액투자자의 비중이 상대적으로 높은 것을 확인할 수 있다.

Ⅳ. 개인투자자의 행태적 편의와 거래행태 분석

1. 과잉확신

과잉확신은 투자자의 신념과 관련된 행태적 편의 중 하나로, 결과에 대한 과대평가(overestimation), 본인의 능력이 남들보다 우월하다는 믿음(overplacement 또는 bet-ter-than-average effect), 본인의 평가와 정보에 대한 과한 믿음(overprecision 또는 miscalibration)이 이에 해당한다(Odean, 1999; Moore & Healy, 2008). 이러한 스스로에 대한 과도한 믿음은 누구나 가질 수 있는 심리적 상태로, 많은 사람들이 ‘투자’라는 어려운 의사결정을 ‘직접’ 실행하는 배경으로 작용한다.

과잉확신 성향을 가진 투자자는 투자를 통해 높은 수익률을 얻을 수 있을 것으로 기대한다. 만약 만족할만한 투자성과를 얻으면 본인의 능력에 따른 결과로 여기는 반면, 성과가 저조하면 본인의 잘못된 판단에 의한 결과가 아닌 불운으로 치부한다. 성공은 개인의능력 덕분으로, 실패는 외부요인의 탓으로 돌리는 경향을 자기귀인 편향(self-attribution bias)이라고 하는데, 자기귀인 편향과 결부된 투자자의 과잉확신은 주식시장 내 여러 현상을 설명하는 대표적인 행태경제학 이론으로 인정되고 있다(예: Daniel et al., 1998; Statman et al., 2006).

투자자의 과잉확신을 다룬 이론적 연구에서는 주로 모형 내 주체(agent)의 사적 정보(private signal)에 대한 해석오류를 가정하고 논의를 진행한다. 여기서 해석오류는 본인이 가진 정보에 대한 과도한 믿음(overprecision)이다. 이론적으로 도출되는 결론은, 투자자의 과잉확신이 거래량의 증가, 정보에 대한 과소(또는 과대) 반응, 기대효용의 감소,변동성 증가로 귀결된다는 것이다(Benos, 1998; Odean, 1998; Daniel et al., 1998).6) 또한 투자성과가 좋을 때 이를 본인의 능력과 정보의 우월성 때문이라고 여겨 더 많은 거래를 일으키고 과잉확신 성향이 강화되며, 결국 시장 내에는 과잉확신 성향이 강한 투자자들이 주로 남게 된다(Gervias & Odean, 2001; Wang, 2001).

과잉확신에 대한 실험연구에서는 과잉확신 수준을 설문 또는 실험을 통해 정량적으로 측정하고, 이 측정치와 투자행태 사이의 연관성을 찾는다. 독일 개인투자자를 대상으로 한 Dorn & Huberman(2005)의 연구에 따르면 본인의 지식수준이 다른 사람보다 우월하다고 생각하는 사람들의 포트폴리오 교체주기가 짧게 나타난다. 미국 개인투자자를 대상으로 한 Graham et al.(2009)에서도 스스로 우월하다고 여기는 투자자의 거래빈도가 높은 것으로 분석되었다.7) Glaser & Weber(2007) 또한 유사한 결과를 얻었는데, 다만 본인의 평가능력에 대한 과한 믿음(miscalibration)보다는 본인이 남들보다 우월하다는 믿음(better-than-average effect)이 거래활동에 영향을 주는 요인이라는 결과를 제시하고 있다.

개인투자자의 거래자료를 이용하여 실증분석을 진행한 Odean(1999), Barber & Odean(2000)은 주식시장 거래회전율이 높게 관측되는 요인 중 하나로 투자자의 과잉확신 성향을 지목한다. 아울러 과잉확신에 따른 과도한 거래는 투자성과를 저해한다고 보고하고 있다. Barber & Odean(2001)은 일반적으로 과잉확신 성향이 강한 남성이 여성보다 주식 거래가 잦으며, 잦은 거래는 투자성과를 악화시킨다는 결과를 제시하고 있다. 우리나라 개인투자자에 대한 연구에서도 개인투자자는 과도하게 거래하며, 과도한 거래는투자성과에 부정적인 영향을 주는 것으로 나타난다(변진호ㆍ김민수ㆍ최인철, 2007; 정성훈ㆍ이규만, 2007; 김민기ㆍ김준석, 2021).

가. 실증분석 방법론

본 장에서는 개인투자자의 과잉확신과 관련된 두 가지 실증분석을 진행한다. 먼저 Statman et al.(2006)의 방법론에 따라 시장수익률과 개인투자자 거래회전율 사이의 관계를 벡터자기회귀(Vector Autoregression: VAR) 모형을 이용하여 분석한다. 이는 시장수익률이 상승할 때 과잉확신 성향이 강화되고 과잉확신 성향의 강화는 거래의 증가로 이어진다는 논리를 바탕으로 한다. 이어서, 본질가치를 측정하기 어려운 종목일수록 투자자의 의사결정 오류가 확대된다는 Kumar(2009b)의 연구결과에 주목하여, 투자자의 과잉확신에 따른 의사결정 오류를 개별 주식의 횡단면적 특징과 연결하여 살펴본다.

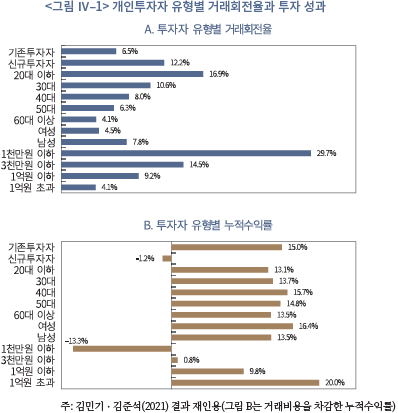

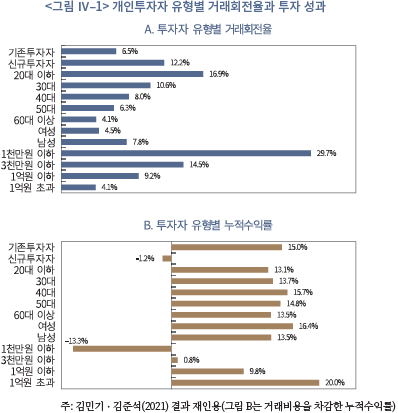

실증분석은 개인투자자를 유형별로 분류하여 상호 비교하는 방식을 적용한다. 거래빈도가 과잉확신과 연관되어 있다는 기존 연구결과를 고려할 때, 투자자의 성별, 자산규모, 연령대에 따라 거래빈도가 다르고 따라서 과잉확신의 수준도 다르다고 추정할 수 있기 때문이다. 아래 <그림 Ⅳ–1>은 본고와 동일한 자료를 이용한 김민기ㆍ김준석(2021)의 분석결과인데, 신규투자자, 젊은 투자자, 남성투자자, 소액투자자의 거래빈도가 상대적으로 높고, 거래빈도가 높은 투자자 유형일수록 투자성과가 저조한 특징을 확인할 수 있다.

나. 주식시장 수익률과 개인투자자 거래량

Statman et al.(2006)의 방법론은 과거의 시장수익률이 현재의 거래회전율에 영향을 미치는지를 VAR 모형으로 확인하는 방법으로, 시장수익률이 상승할 때 투자자의 과잉확신이 강화되어 거래량이 증가한다는 이론적 설명을 기반으로 한다(Daniel et al., 1998; Odean, 1998; Gervais & Odean, 2001). 일반적으로 주식시장이 상승할 때 개별주식의 주가도 함께 상승할 가능성이 높다. 이 때 과잉확신 성향을 가진 투자자는 보유종목 주가의 상승이 시장의 전체적인 상승에 의한 것임에도 불구하고 자신의 역량 또는 보유정보가 우월하기 때문이라고 생각한다. 따라서 시장수익률의 상승은 투자자의 과잉확신 성향을 증폭시키고, 거래의 증가를 유발한다는 것이다. 본 보고서의 분석기간인 코로나19 국면은 대체로 상승장이었기 때문에, 분석기간 내 개인투자자의 높은 거래빈도는 투자자의과잉확신에 영향을 받았을 가능성이 높다.

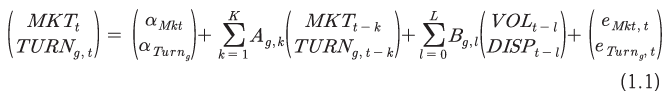

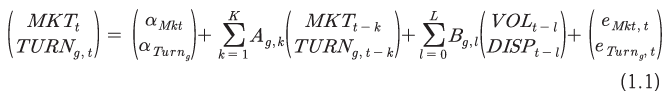

과잉확신 분석을 위한 VAR 모형은 식(1.1)과 같다. 각 투자자 유형( )별로 거래회전율 시계열을 산출하고, VAR 모형을 투자자 유형별로 추정한다.

)별로 거래회전율 시계열을 산출하고, VAR 모형을 투자자 유형별로 추정한다.  는 투자자 유형

는 투자자 유형  의

의  시점 거래회전율로,

시점 거래회전율로,  일의 투자자 유형

일의 투자자 유형  의 합산 매수대금과 합산 매도대금의 평균을

의 합산 매수대금과 합산 매도대금의 평균을  일과

일과  일 합산 포트폴리오 평가금액의 평균으로 나눠서 계산한다.

일 합산 포트폴리오 평가금액의 평균으로 나눠서 계산한다.  ,

,  ,

,  는 각각

는 각각  시점의 시장수익률(KOSPI지수와 KOSDAQ지수의 가중평균 수익률), 변동성(VIX 지수), 횡단면 변동성(개별주식 수익률의 횡단면 표준편차)을 나타낸다.

시점의 시장수익률(KOSPI지수와 KOSDAQ지수의 가중평균 수익률), 변동성(VIX 지수), 횡단면 변동성(개별주식 수익률의 횡단면 표준편차)을 나타낸다.

식(1.1)에서 VAR 모형 내 주요 독립변수 및 통제변수의 시차(lag), K와 L은 Schwarz’s Bayesian Criterion(SBC)기준에 따라 최적 모형(K=2, L=1)을 설정한다.8) 자료의 길이를 고려하여 모든 추정은 일간 거래회전율과 수익률을 기초로 한다.

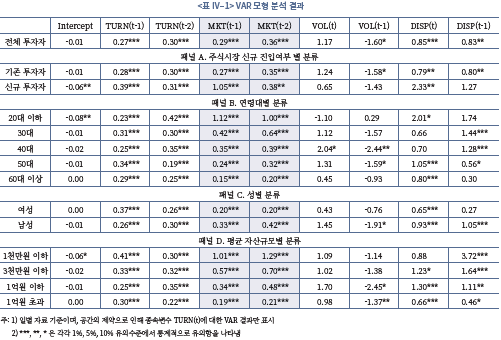

VAR 모형의 추정계수와 시장수익률 한 단위 (+)충격(상승)에 대한 개인투자자 거래회전율의 충격반응함수(impulse response function)를 차례로 검토해 보자. VAR 모형 회귀계수(식(1.1)의 )의 추정 결과는 <표 Ⅳ–1>에 제시되어 있다. 먼저 첫 번째 행의 전체 개인투자자 거래회전율을 이용한 결과를 보면,

)의 추정 결과는 <표 Ⅳ–1>에 제시되어 있다. 먼저 첫 번째 행의 전체 개인투자자 거래회전율을 이용한 결과를 보면,  및

및  시점 시장수익률의 VAR 회귀계수는 각각 0.29, 0.36으로 양(+)의 값이며 1% 수준에서 통계적으로 유의하다. 이러한 결과는 개인투자자의 거래회전율이 최근 시장수익률에 영향을 받는다는 것으로 개인투자자의 과잉확신 및 자기귀인 편향을 뒷받침하는 결과이며, 강소현ㆍ김준석ㆍ양진영(2015), 이호ㆍ김은정(2012) 등의 기존 연구결과와 일치한다.

시점 시장수익률의 VAR 회귀계수는 각각 0.29, 0.36으로 양(+)의 값이며 1% 수준에서 통계적으로 유의하다. 이러한 결과는 개인투자자의 거래회전율이 최근 시장수익률에 영향을 받는다는 것으로 개인투자자의 과잉확신 및 자기귀인 편향을 뒷받침하는 결과이며, 강소현ㆍ김준석ㆍ양진영(2015), 이호ㆍ김은정(2012) 등의 기존 연구결과와 일치한다.

개인투자자 유형별 결과는 <표 Ⅳ–1>의 패널 A, B, C, D에 제시되어 있다. 투자자 유형과 상관없이 시점 및

시점 및  시점 시장수익률의 회귀계수는 모두 양(+)의 값이며 통계적으로 유의하다. 패널 A에 따르면, 추정된 계수값은 기존투자자보다 신규투자자에서 크게 나타난다. 가령

시점 시장수익률의 회귀계수는 모두 양(+)의 값이며 통계적으로 유의하다. 패널 A에 따르면, 추정된 계수값은 기존투자자보다 신규투자자에서 크게 나타난다. 가령  시점 시장수익률의 회귀계수는 신규투자자에서 1.05, 기존투자자에서 0.27이다. 패널 B, C, D에 따르면, 연령대가 낮을수록, 남성투자자인 경우, 평균 자산규모가 작을수록 시장수익률의 회귀계수값이 크게 나타난다. 회귀계수값이 큰 투자자 유형, 즉 신규투자자, 젊은 투자자, 남성투자자, 소액투자자가 과잉확신이 강하다고 평가할 수 있으며, 이러한 평가는 이들 유형이 상대적으로 거래빈도가 높다는 김민기ㆍ김준석(2021)의 분석결과와도 일관된다.

시점 시장수익률의 회귀계수는 신규투자자에서 1.05, 기존투자자에서 0.27이다. 패널 B, C, D에 따르면, 연령대가 낮을수록, 남성투자자인 경우, 평균 자산규모가 작을수록 시장수익률의 회귀계수값이 크게 나타난다. 회귀계수값이 큰 투자자 유형, 즉 신규투자자, 젊은 투자자, 남성투자자, 소액투자자가 과잉확신이 강하다고 평가할 수 있으며, 이러한 평가는 이들 유형이 상대적으로 거래빈도가 높다는 김민기ㆍ김준석(2021)의 분석결과와도 일관된다.

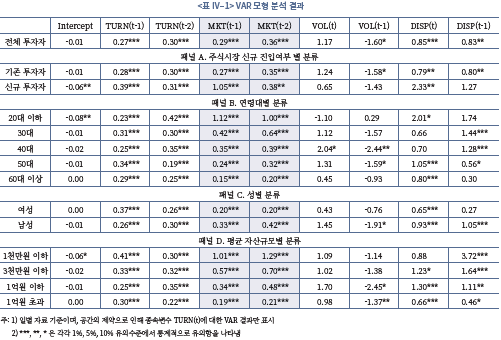

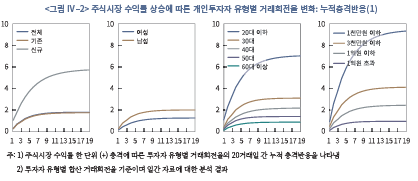

<그림 Ⅳ–2>는 시장수익률 (+)충격에 대한 거래회전율의 누적 충격반응함수를 투자자 유형별로 보여준다. 외생변수의 영향을 고려한 이후에도 앞선 VAR 분석과 마찬가지로과거의 시장수익률은 현재의 거래회전율에 정(+)의 영향을 미친다. 또한 <표 Ⅳ–1>에 제시된 회귀계수의 패턴과 유사하게, 신규투자자, 젊은 투자자, 남성투자자, 소액투자자의누적 충격반응의 크기가 크게 나타난다. 2020년 국내 주식시장이 급락 이후 견조한 상승세를 보인 기간 동안, 국내 개인투자자의 과도한 거래는 개인투자자의 과잉확신 및 자기귀인 편향이 영향을 미쳤을 가능성을 보여주는 결과이다.

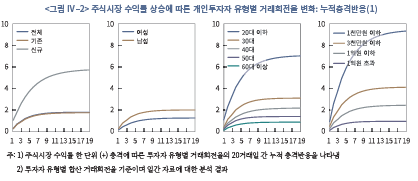

<그림 Ⅳ–3>은 각 투자자 유형별로 신규투자자 및 기존투자자의 누적 충격반응을 비교하여 나타낸 것이다. 분석기간 동안 새로운 투자자가 주식시장에 다수 유입되었다는 점을 고려하여, 신규투자자의 특징을 보다 정밀하게 평가하기 위한 분석이다. 대부분의 투자자 유형에서 신규투자자(실선)가 기존투자자(점선)보다 누적 충격반응이 더 크게 관찰된다. 다만 20대 이하의 젊은 투자자, 평균자산 1천만원 이하의 소액투자자의 경우는 주식 투자경험과 무관하게 누적 충격반응이 크게 나타난다. 이는 젊은 투자자, 소액투자자는 투자경험의 유무와 상관없이 다른 투자자 유형에 비해 과잉확신 성향이 더 크다는 것을 시사한다.

다. 투자자의 의사결정 오류

본 절에서는 투자자의 과잉확신과 의사결정 오류(error)의 관계에 대해 분석하고자 한다. Kumar(2009b)에 따르면 투자자는 적정가치를 산정하기 어려운 종목에서 투자의사결정 오류를 범할 가능성이 높다. 적정가치를 산정하기 어려운 종목은 정보가 부족한 종목이나 가격 변동이 큰 종목으로 볼 수 있는데, 기존 연구에서는 고유변동성(idiosyncrat-ic volatility)을 이용하여 이를 평가한다(예: Stambaugh et al., 2015).

Kumar(2009b)는 고유변동성을 기준으로 주식을 분류하고, 투자자의 의사결정 오류를 측정한다. 의사결정 오류는 매도의사결정 이후 수익률과 매수의사결정 이후 수익률의 차이로 계산한다. 만약 투자자가 향후 주가변화에 부합하는 의사결정을 했다면, 매수 이후의 수익률이 매도 이후의 수익률보다 높을 것이다. 즉 의사결정 오류는 작아진다. 투자자가 과잉확신 성향을 갖는다면, 이들의 과잉확신 성향에 따른 의사결정 오류는 가치를 측정하기 어려운 종목에서 더욱 확대될 것으로 예상할 수 있다.

먼저 분석대상 주식을 고유변동성9)을 기준으로 표본 수가 동일한 다섯 개의 그룹으로 나눈다. 그리고 각 그룹별로 개인투자자의 매수 및 매도 의사결정 이후 수익률을 각각 산출하여 아래 식(1.2)에 따라 매도-매수 평균수익률 차이(Post-trade Sell-Buy Return Differential: PTSBD)를 계산한다. 여기서 수익률은 시장수익률을 차감한 초과수익률을 이용한다. 매도-매수 평균수익률 차이가 양(+)의 값이면, 매도한 종목이 매수한 종목보다 수익률이 높다는 것으로 투자자의 의사결정 오류가 발생한 것으로 평가할 수 있다.

위 식(1.2)의  과

과  은 주식(

은 주식( )의 매도 또는 매수 후

)의 매도 또는 매수 후  거래일 동안의 주식시장 대비 초과수익률을 의미하고,

거래일 동안의 주식시장 대비 초과수익률을 의미하고,  및

및  는 각각 매도 및 매수 거래 표본수이다.

는 각각 매도 및 매수 거래 표본수이다.  는 고유변동성 그룹(

는 고유변동성 그룹( )별 매도 후 평균 초과수익률과 매수 후 평균 초과수익률의 차이, 즉 투자의사결정 오류를 의미한다. 소액투자로 인한 잡음(noise)을 최소화하기 위해 거래금액 50만원 이상으로 표본을 제한한다.10)

)별 매도 후 평균 초과수익률과 매수 후 평균 초과수익률의 차이, 즉 투자의사결정 오류를 의미한다. 소액투자로 인한 잡음(noise)을 최소화하기 위해 거래금액 50만원 이상으로 표본을 제한한다.10)

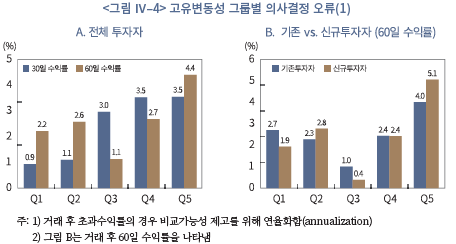

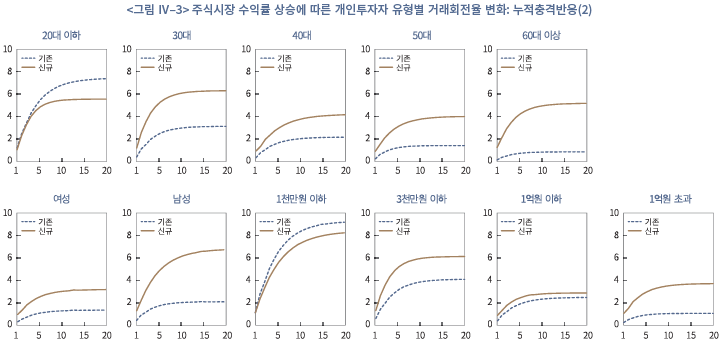

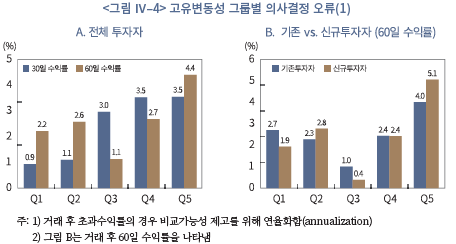

<그림 Ⅳ–4>는 고유변동성 그룹별 를 제시하고 있다. 패널 A는 전체 투자자의

를 제시하고 있다. 패널 A는 전체 투자자의  를 수익률 평가기간(30일, 60일)별로 비교하고 있으며, 패널 B는 기존투자자와 신규투자자의

를 수익률 평가기간(30일, 60일)별로 비교하고 있으며, 패널 B는 기존투자자와 신규투자자의  를 60일 초과수익률 기준으로 비교하고 있다. 전반적으로

를 60일 초과수익률 기준으로 비교하고 있다. 전반적으로  가 양(+)의 값을 보여, 평균적으로 매도 후 수익률이 매수 후 수익률보다 높은 것을 알 수 있다. 미국 개인투자자를 대상으로 분석한 Kumar(2009b)의 결과와 유사하며, 투자자가 시점선택(timing) 및 종목선택에서 오류를 범하는 것으로 해석할 수 있다. 특히 이러한 오류는 고유변동성이 높은 그룹에서 더 크게 나타난다. 가령 거래 후 60일 초과수익률 기준

가 양(+)의 값을 보여, 평균적으로 매도 후 수익률이 매수 후 수익률보다 높은 것을 알 수 있다. 미국 개인투자자를 대상으로 분석한 Kumar(2009b)의 결과와 유사하며, 투자자가 시점선택(timing) 및 종목선택에서 오류를 범하는 것으로 해석할 수 있다. 특히 이러한 오류는 고유변동성이 높은 그룹에서 더 크게 나타난다. 가령 거래 후 60일 초과수익률 기준  의 경우, 고유변동성이 가장 높은 그룹(Q5)에서 4.4%인 반면 고유변동성이 가장 낮은 그룹(Q1)에서는 2.2%로 절반 수준이다. 투자자의 과잉확신이 잘못된 의사결정을 유발한다고 할 때, 가치를 산정하기 어려운 종목에서 의사결정의 오류가 확대되는 것으로 해석할 수 있다. 또한 패널 B에 나타나듯이, 주식의 고유변동성이 가장 큰 그룹(Q5)에서 과잉확신 경향이 상대적으로 강한 신규투자자의 의사결정 오류가 5.1%로 기존투자자의 4.0%를 상회한다. 가령 거래 후 60일 초과수익률 기준 의 경우, 고유변동성이 가장 높은 그룹(Q5)에서 4.4%인반면 고유변동성이 가장 낮은 그룹(Q1)에서는 2.2%로 절반 수준이다. 투자자의 과잉확신이 잘못된 의사결정을 유발한다고 할 때, 가치를 산정하기 어려운 종목에서 의사결정의 오류가 확대되는 것으로 해석할 수 있다. 또한 패널 B에 나타나듯이, 주식의 고유변동성이 가장 큰 그룹(Q5)에서 과잉확신 경향이 상대적으로 강한 신규투자자의 의사결정 오류가 5.1%로 기존투자자의 4.0%를 상회한다.

의 경우, 고유변동성이 가장 높은 그룹(Q5)에서 4.4%인 반면 고유변동성이 가장 낮은 그룹(Q1)에서는 2.2%로 절반 수준이다. 투자자의 과잉확신이 잘못된 의사결정을 유발한다고 할 때, 가치를 산정하기 어려운 종목에서 의사결정의 오류가 확대되는 것으로 해석할 수 있다. 또한 패널 B에 나타나듯이, 주식의 고유변동성이 가장 큰 그룹(Q5)에서 과잉확신 경향이 상대적으로 강한 신규투자자의 의사결정 오류가 5.1%로 기존투자자의 4.0%를 상회한다. 가령 거래 후 60일 초과수익률 기준 의 경우, 고유변동성이 가장 높은 그룹(Q5)에서 4.4%인반면 고유변동성이 가장 낮은 그룹(Q1)에서는 2.2%로 절반 수준이다. 투자자의 과잉확신이 잘못된 의사결정을 유발한다고 할 때, 가치를 산정하기 어려운 종목에서 의사결정의 오류가 확대되는 것으로 해석할 수 있다. 또한 패널 B에 나타나듯이, 주식의 고유변동성이 가장 큰 그룹(Q5)에서 과잉확신 경향이 상대적으로 강한 신규투자자의 의사결정 오류가 5.1%로 기존투자자의 4.0%를 상회한다.

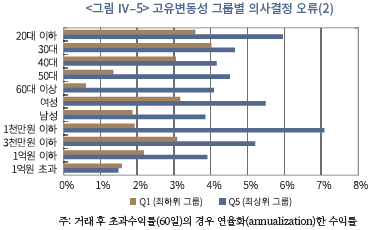

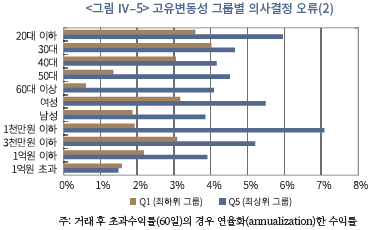

<그림 Ⅳ–5>는 개인투자자 유형별  를 보여준다. 비교의 편의를 위해 고유변동성 최하위(Q1) 및 최상위(Q5) 그룹의 결과만 제시한다. 모든 개인투자자 유형에서 투자자의 의사결정 오류가 관찰되는 가운데, 의사결정 오류는 고유변동성이 낮은 그룹보다 고유변동성이 높은 그룹에서 항상 크다. 또한 젊은 투자자, 소액투자자의 의사결정 오류가 상대적으로 크게 나타나고 있어, 과잉확신 성향이 의사결정 오류에 영향을 주는 요인 임을 시사한다. 투자경험과 역량이 상대적으로 부족할수록 행태적 편의의 영향에 보다 취약하다고 평가할 수 있다. 다만, 과잉확신 성향이 강한 남성투자자보다는 여성투자자가 의사결정 오류가 큰 것으로 나타나, 과잉확신 성향 이외의 요인이 의사결정 오류에 영향을 주고 있는 것으로 보인다.

를 보여준다. 비교의 편의를 위해 고유변동성 최하위(Q1) 및 최상위(Q5) 그룹의 결과만 제시한다. 모든 개인투자자 유형에서 투자자의 의사결정 오류가 관찰되는 가운데, 의사결정 오류는 고유변동성이 낮은 그룹보다 고유변동성이 높은 그룹에서 항상 크다. 또한 젊은 투자자, 소액투자자의 의사결정 오류가 상대적으로 크게 나타나고 있어, 과잉확신 성향이 의사결정 오류에 영향을 주는 요인 임을 시사한다. 투자경험과 역량이 상대적으로 부족할수록 행태적 편의의 영향에 보다 취약하다고 평가할 수 있다. 다만, 과잉확신 성향이 강한 남성투자자보다는 여성투자자가 의사결정 오류가 큰 것으로 나타나, 과잉확신 성향 이외의 요인이 의사결정 오류에 영향을 주고 있는 것으로 보인다.

2. 처분효과

처분효과(disposition eff ect)는 매수가격에 비해 가격이 상승한 주식은 매도하여 이익을 실현하고 매수가격에 비해 가격이 하락한 주식은 매도를 미루고 보유하는 현상을 말한다. Shefrin & Statman(1985)이 최초로 처분효과의 개념을 제시한 이후 처분효과의 특성, 배경, 영향에 대한 많은 연구가 이루어져 왔으며 주식시장 투자자에서 나타나는 대표적인 행태적 편의로 평가되고 있다.

실증적으로 처분효과는 매우 광범위하게 관찰된다. 가장 대표적인 연구로 Ode-an(1998)을 들 수 있는데, 미국 주식시장 개인투자자 1만명의 1987~1993년 거래내역을 분석하여 매수가격보다 주가가 상승한 경우 매도한 비율은 14.8%인데 비해 매수가격보다 주가가 하락한 경우 매도한 비율은 9.8%에 불과한 것을 확인하였다. Dhar & Zhu(2006), Kumar(2009b) 등 미국시장에 대한 후속 연구에서도 처분효과를 보고하고 있으며, 핀란드(Grinblatt & Keloharju, 2001; Seru et al., 2010), 이스라엘(Shapira & Venezia, 2001), 중국(Feng & Seaholes, 2005; Chen et al., 2007), 대만(Barber et al., 2007), 스웨덴(Calvet et al., 2009) 주식시장에 대한 분석에서도 처분효과가 뚜렷하게 관찰되고 있다. 한국도 예외는 아니어서 최운열 외(2004), 김동철 외(2005), 오승현ㆍ한상범(2012) 등이 처분효과를 보고하고 있다. 처분효과는 비단 주식시장에서만 관찰되는 현상이 아니라 부동산 시장(Case & Shiller, 1988; Genesove & Mayer, 2001), 파생상품시장(Heisler, 1994; Locke & Mann, 2005; Coval & Shumway, 2005; Choe & Eom, 2009),펀드시장(Frazzini, 2006)에서도 관찰되며, 실험연구(Weber & Camerer, 1998; Haigh & List, 2005; Da Costa Jr. et al., 2013)를 통해서도 입증되고 있다.

처분효과의 영향요인에 대한 분석에 따르면 처분효과는 투자전문성(sophistication)과 밀접한 연관이 있는 것으로 나타난다. 기관투자자에서도 처분효과가 관찰되나 개인투자자에서 보다 현저하며, 개인투자자 중에서도 투자역량11)과 투자경험이 부족할수록 처분효과가 강한 것으로 보고되고 있다(Grinblatt & Keloharju, 2001; Shapira & Vene-zia, 2001; Feng & Seaholes, 2005; Dhar & Zhu, 2006; Choe & Eom, 2009; Seru et al., 2010; Vaarmets et al., 2019). 아울러 처분효과는 정보비대칭성이 크거나 고유위험(idiosyncratic risk)이 높은 주식, 즉 가치평가가 어려운 주식에서 두드러지는 것으로 분석되고 있다(Kumar, 2009b).

처분효과가 나타나는 원인에 대한 가장 전통적인 가설은 투자자의 선호체계가 전망이론(prospect theory)을 따르기 때문이라는 것이다. 전망이론은 투자자가 이익에 대해서는 위험회피 경향을 보이고 손실에 대해서는 위험선호 경향을 보인다고 설명한다(Kahneman & Tversky, 1979). 따라서 매수가격을 기준으로 이익이 날 경우 추가적인 위험을 감수하지 않고 매도하여 이익을 실현하는 선택을 하고, 손실이 날 경우 추가적인 위험을 감수하기 위해 매도하지 않고 보유하는 선택을 하게 된다. 전망이론에 입각한 설명은 직관적 타당성으로 널리 인정되었으나, 이후의 연구에서 전망이론만으로는 처분효과를 충분히 설명하기 어렵다는 견해가 제시되었다. Kaustia(2010)는 실증적으로 관찰되는 처분효과의 패턴이 전망이론의 예측과는 다른 패턴임을 지적하고 있으며, Barberis & Xiong(2009)은 전망이론을 따를 경우 이론적으로 처분효과의 반대 현상도 나타날 수 있고, 전망이론적 관점이 처분효과를 설명하기 위해서는 투자자가 평가손익이 아니라 실현손익에서 효용을 얻는다는 가정이 필요하다고 주장하였다.

최근에는 투자자 심리에 입각한 견해가 부각되고 있다. 인간은 본인의 능력에 대해 긍정적인 태도를 유지하고자 하며, 여기에 부합하지 않는 행동을 할 경우 인지부조화(cognitive dissonance)에 따른 불편이 발생한다. 따라서 처분효과는, 손실을 실현하지 않음으로써 의사결정 실수를 인정하는데 따르는 심리적 불편함을 회피하고, 이익을 실현함으로써 만족감을 얻고자 하는데서 나타나는 현상으로 설명한다. 펀드투자, 전문가의 조언을 받은 투자, 상속ㆍ증여받은 주식에 대한 투자 등 투자 의사결정에 대한 개입 정도가 낮을수록 처분효과가 낮게 나타난다는 실증분석 결과가 이러한 설명을 뒷받침한다(Shapira & Venezia, 2001; Calvet et al., 2009; Lehenkari, 2012; Chang et al., 2016). 의사결정에 대한 책임을 미룰 수 있으므로 손실실현에 따르는 심리적 불편함을 겪지 않아도 되기 때문이다.

한편, 평균회귀(mean reversion)에 대한 기대, 포트폴리오 조정수요, 사적정보(pri-vate information)의 보유 등도 처분효과의 원인으로 검토된 바 있다. 평균회귀에 대한 기대나 포트폴리오 조정수요는 주가상승 후 매도, 주가하락 후 매수를 유발하는 요인이 될 수 있으나, 실제 매매패턴과는 차이가 있고 그 효과를 통제하더라도 처분효과는 여전히 관찰되는 것으로 나타난다. 또한 처분효과가 투자전문성이 가장 낮은 개인투자자에서 현저하다는 점에서 사적정보에 근거한 거래시점 선택의 결과도 아닌 것으로 평가되고 있다(Odean, 1998; Kaustia, 2010).

처분효과가 갖는 중요한 함의 중 하나는 투자성과에 부정적인 영향을 미친다는 것이다(Odean, 1998; Shumway & Wu, 2005; Chen et al., 2007; Choe & Eom, 2009; Seru et al., 2010). 이익을 조기에 실현함으로써 추가적인 이익기회를 포기하고 손실의 실현을 미룸으로써 손실을 누적시키는 결과를 초래하기 때문이다. 특히 주가에 모멘텀(momentum) 효과가 존재하는 경우, 혹은 자본이득세가 존재하는 경우 부정적인 영향은 더욱 명백하다.

본 절에서는 한국 주식시장 개인투자자의 처분효과를 실증적으로 분석한다. 실증분석은 크게 세 부분으로 구성된다. 먼저 처분효과가 존재하는지 여부를 확인하고, 처분효과에 영향을 주는 투자자 특성과 주식 특성을 검토한다. 이어서 처분효과의 수준에 따라 개인투자자를 구분하고 투자성과를 비교함으로써 처분효과가 투자성과에 미치는 영향을 분석한다.

가. 분석자료 구성

개인투자자의 처분효과는 포지션 단위의 거래 의사결정을 기준으로 분석한다. 종목별 포지션과 포지션의 수익률은 다음과 같이 정의한다. 각 개인투자자의 특정 종목에 대한 일별 매수수량, 매도수량을 선입선출 방법(First-In-First-Out: FIFO)에 따라 매칭시키고, 매칭된 매수-매도 조합 중에서 매도일이 동일한 조합을 묶어 하나의 포지션으로 간주한다. 각 포지션의 보유기간 수익률(holding period return)은, 평균매수가격과 평가기준일 해당종목 전체거래의 가중평균 체결가격을 이용하여 계산한다. 단, 포지션 매도일에는 평균매수가격과 평균매도가격을 이용하여 계산한다.

분석기간 최초 보유수량은 매수가격을 확인할 수 없으므로 매수-매도 매칭에는 반영하되 이 수량이 매칭된 조합은 분석에서 제외한다. 신규공모, 유상증자, 무상증자, 주식배당 등 장중거래 이외의 방식으로 취득한 수량 역시 매칭에는 반영하되 이 수량이 매칭된 조합은 분석에서 제외한다. 또한 본 분석에서 거래 의사결정은 일간 기준으로 이루어진다고 가정하기 때문에, 보유기간이 1거래일 미만인 조합, 즉 당일 매수, 당일 매도인 조합도 분석에서 제외한다.

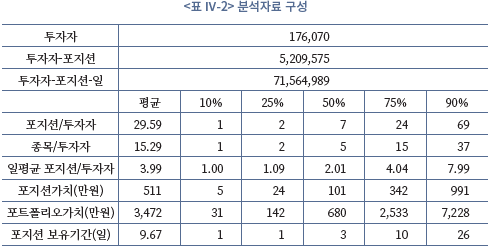

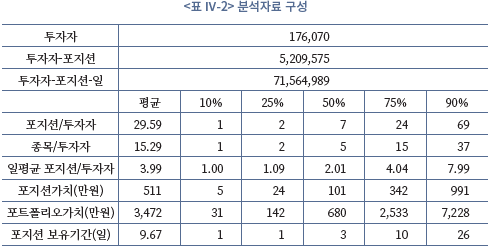

<표 Ⅳ-2>는 이상의 방법으로 구축한 분석자료의 구성과 기본적 특징을 제시하고 있다. 분석자료는 개인투자자 17만 6천명의 521만개 포지션으로 구성되며, 투자자-포지션의 일별 관측치는 약 7,156만개이다. 국내 개인투자자의 처분효과를 분석하기에 충분한 규모로 판단된다.

개인투자자는 분석기간 동안 평균 15개 종목에 대해 30개의 포지션을 구축하였으며, 평균 4개의 포지션을 동시에 보유하고 있는 것으로 나타난다. 각 포지션의 가치는 평균 511만원, 개인투자자별 포트폴리오의 가치는 평균 3,472만원 수준이다. 다만, 중간값을 기준으로 보면 종목과 포지션의 수, 포지션과 포트폴리오의 가치 모두 평균값에 비해 현저히 작다. 따라서 대부분의 개인투자자는 소수의 주식에 소액을 투자하고 있다고 보는 편이 적절하다. 한편 각 포지션의 보유기간은 평균 9.67일, 중간값 3일로, 개인투자자들의 보유기간이 매우 짧다는 사실을 확인할 수 있다.

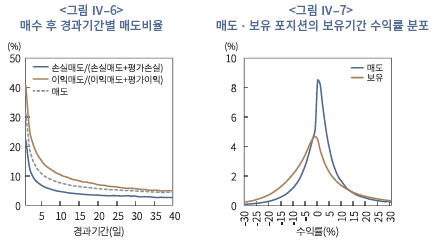

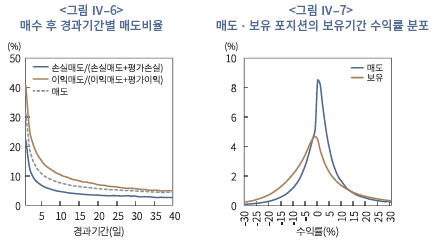

<그림 Ⅳ-6>은 손실포지션 중에서 포지션을 매도한 비율과 이익포지션 중에서 포지션을 매도한 비율을 포지션 구축 이후 보유기간에 따라 표시한 것이다. 이익포지션과 손실포지션은 앞서 정의한 보유기간 수익률이 양(+)인 경우와 음(-)인 경우로 구분한다.

<그림 Ⅳ-6>에 따르면, 보유기간에 상관없이 이익포지션의 매도비율(붉은선)이 손실포지션의 매도비율(파란선)보다 약 두 배 가량 높은 것을 확인할 수 있다. 보유기간 1일의 경우, 이익포지션 중에서는 41%를 매도하고 59%를 보유하는 반면, 손실포지션 중에서는 22%만을 매도하고 78%를 보유하는 것으로 나타난다. 보유기간 10일인 경우에도, 이익포지션 중에서는 11%를 매도하는 반면, 손실포지션 중에서는 5%만을 매도하는 것으로 나타난다. 포지션에서 이익이 발생한 경우 매도할 가능성이 높고, 포지션에서 손실이 발생한 경우 매도하지 않고 좀 더 지켜보기로 결정할 가능성이 높다는 결과로, 처분효과의 영향을 정확히 보여준다.

<그림 Ⅳ-7>은 개인투자자 포지션의 일별 관측치를 토대로, 매도포지션과 매도하지 않고 보유하고 있는 포지션의 보유기간 수익률 분포를 제시하고 있다. 매도포지션의 수익률 분포가 보유포지션의 수익률 분포보다 오른쪽에 위치한 것, 즉 매도포지션의 수익률이 전반적으로 높은 것을 볼 수 있다. 보유기간 수익률이 높을수록 매도할 가능성이 높고, 낮을수록 보유할 가능성이 높다는 것으로, 처분효과의 영향을 반영한다. 특히 매도포지션의 수익률 분포에서, 수익률 0% 지점에서 포지션 비중이 급격하게 증가하는 것은 흥미로운 특징이다. 평균매수가격에 비해 주가가 조금만 상승하여도 매도하는 경우가 많다는 것으로, 매도 의사결정이 수익률의 크기보다는 손실과 이익 여부에 따라 영향을 받는다는 사실을 보여준다.

나. 처분효과 분석: Cox 비례위험모형

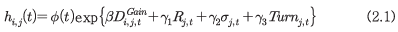

이상에서 간단한 분석을 통해 처분효과의 영향을 확인하였다. 이어서, Cox 비례위험모형(proportional hazard model)을 이용하여 개인투자자 주식거래에서 나타나는 처분효과를 보다 구체적으로 분석한다. Cox 비례위험모형은 생존분석(survival analysis) 기법의 하나로, 다수의 연구에서 처분효과 분석에 적용한 바 있다(Ivković & Weisben-ner, 2009; Seru et al., 2010; Barber & Odean, 2013; Li et al., 2021). 매수시점부터 매도시점까지 가격변동과 가격변동에 대응한 투자자의 의사결정을 모두 고려할 수 있기 때문에 매도비율분석(Odean, 1998)이나 로짓회귀분석(Grinblatt & Keloharju, 2001)에 비해 보다 정교한 분석이 가능하다. 추정모형은 다음 식(2.1)과 같다.

여기서 는 투자자

는 투자자  가 포지션

가 포지션  를 매수시점으로부터

를 매수시점으로부터  일 후 매도할 확률을 나타내는 위험함수(hazard function)이며,

일 후 매도할 확률을 나타내는 위험함수(hazard function)이며,  는 설명변수의 영향이 없을 때

는 설명변수의 영향이 없을 때  일 후 매도할 확률을 나타내는 기저위험함수(baseline hazard function)이다.

일 후 매도할 확률을 나타내는 기저위험함수(baseline hazard function)이다.  은 처분효과를 측정하는 설명변수로, 투자자

은 처분효과를 측정하는 설명변수로, 투자자  가 보유한 포지션

가 보유한 포지션  의 매수 이후

의 매수 이후  일까지 보유기간 수익률이 0보다 클 때 1의 값을, 그렇지 않을 경우 0의 값을 갖는 더미변수이다. 처분효과가 존재한다면, 보유기간 수익률이 0보다 클 때 매도할 가능성이 높을 것이므로

일까지 보유기간 수익률이 0보다 클 때 1의 값을, 그렇지 않을 경우 0의 값을 갖는 더미변수이다. 처분효과가 존재한다면, 보유기간 수익률이 0보다 클 때 매도할 가능성이 높을 것이므로  는 양(+)의 값을 갖게 된다.

는 양(+)의 값을 갖게 된다.  ,

,  ,

,  는 통제변수로서, 포지션의 관측일 직전 5일간의 수익률, 수익률 변동성, 평균 거래회전율이다.

는 통제변수로서, 포지션의 관측일 직전 5일간의 수익률, 수익률 변동성, 평균 거래회전율이다.

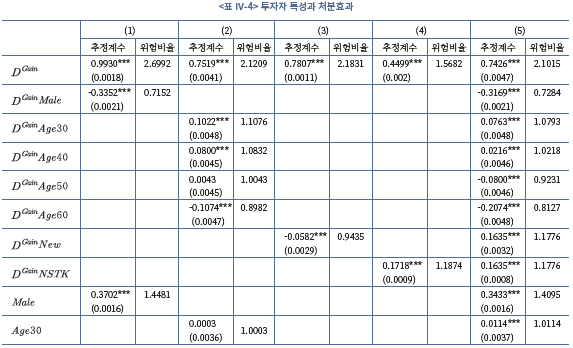

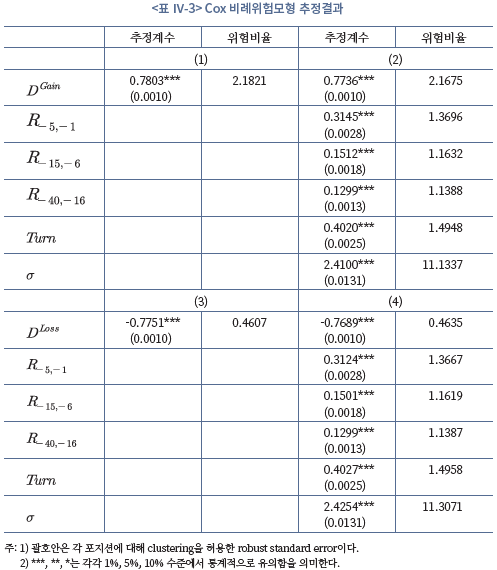

<표 Ⅳ-3>은 식(2.1)의 Cox 비례위험모형을 추정한 결과이다. 분석(1)은 보유기간 수익률이 양(+)일 때를 나타내는 더미변수, 만을 설명변수로 이용하여 분석한 결과이다.

만을 설명변수로 이용하여 분석한 결과이다.  의 계수

의 계수  는 0.7803으로 1% 수준에서 통계적으로 유의하다. 위험비율(hazard ratio)은 2.1821로, 포지션의 보유기간 수익률이 양(+)일 때 매도확률이 수익률이 0 또는 음(-)일 때 매도확률의 2.1821배임을 의미한다. 이러한 결과는 개인투자자의 매도 의사결정에 있어 처분효과가 존재함을 보여준다.

는 0.7803으로 1% 수준에서 통계적으로 유의하다. 위험비율(hazard ratio)은 2.1821로, 포지션의 보유기간 수익률이 양(+)일 때 매도확률이 수익률이 0 또는 음(-)일 때 매도확률의 2.1821배임을 의미한다. 이러한 결과는 개인투자자의 매도 의사결정에 있어 처분효과가 존재함을 보여준다.

분석(2)는 수익률 더미변수 이외에, 관측일 직전 5일간의 수익률( ), 6일전부터 15일전까지의 수익률(

), 6일전부터 15일전까지의 수익률( ), 16일전부터 40일전까지의 수익률(

), 16일전부터 40일전까지의 수익률( ), 직전 5일간의 수익률 변동성, 그리고 직전 5일간의 평균 거래회전율을 통제변수로 추가하여 분석한 결과이다. 통제변수를 추가하더라도

), 직전 5일간의 수익률 변동성, 그리고 직전 5일간의 평균 거래회전율을 통제변수로 추가하여 분석한 결과이다. 통제변수를 추가하더라도  의 추정치와 유의성에는 큰 변화가 없다. 과거 수익률 변수의 경우, 계수 모두 유의한 양(+)의 값이고 최근의 수익률 변수에서 값이 크다. 최근 수익률이 높을수록 매도확률이 높아진다는 것으로, 개인투자자가 역추세추종(contrarian) 방식으로 거래함을 보여준다.

의 추정치와 유의성에는 큰 변화가 없다. 과거 수익률 변수의 경우, 계수 모두 유의한 양(+)의 값이고 최근의 수익률 변수에서 값이 크다. 최근 수익률이 높을수록 매도확률이 높아진다는 것으로, 개인투자자가 역추세추종(contrarian) 방식으로 거래함을 보여준다.

분석(3)과 (4)는 분석(1)과 (2)에서 보유기간 수익률이 양(+)일 때를 나타내는 더미변수 대신 음(-)일 때를 나타내는 더미변수, 를 이용하여 분석한 결과다. 분석(3)과 (4)에서,

를 이용하여 분석한 결과다. 분석(3)과 (4)에서,  의 계수는 각각 –0.7751, -0.7689로 모두 1% 수준에서 통계적으로 유의하며, 위험비율은 0.4607, 0.4635로 모두 1보다 작다. 보유기간 수익률이 음(-)일 때 매도확률이 감소한다는 결과로 처분효과의 영향을 동일하게 확인할 수 있다.

의 계수는 각각 –0.7751, -0.7689로 모두 1% 수준에서 통계적으로 유의하며, 위험비율은 0.4607, 0.4635로 모두 1보다 작다. 보유기간 수익률이 음(-)일 때 매도확률이 감소한다는 결과로 처분효과의 영향을 동일하게 확인할 수 있다.

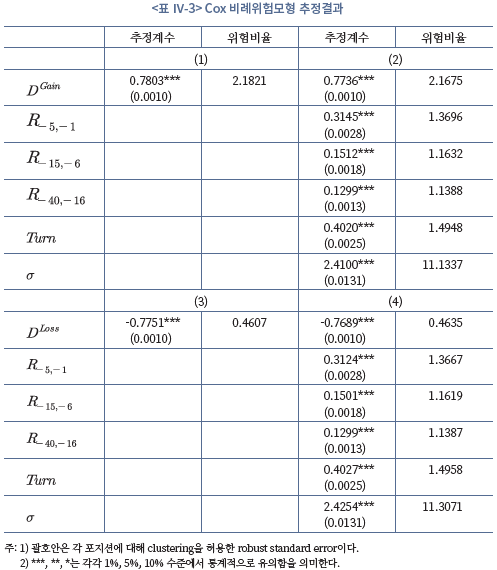

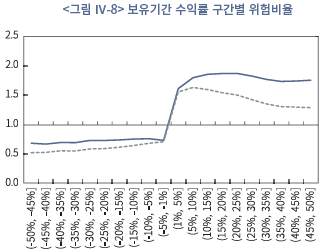

개인투자자의 매도 의사결정이 보유기간 동안의 손익여부 뿐만 아니라 보유기간 수익률의 크기에 영향을 받는지 분석해보자. 식(2.1)에서, 이익 더미변수 대신 보유기간 수익률 크기별 더미변수를 포함하여 추정한다. 보유기간 수익률을 –50% 이하 구간, -50%부터 50%까지 5% 간격으로 20개 구간, 50% 초과 구간 등 총 22개 구간으로 구분하고, 보유기간 수익률이 각 구간에 포함될 경우 1, 그렇지 않을 경우 0의 값을 갖는 22개 더미변수를 구성하였다. 단, -1%이상 1%미만 구간은 더미변수 구성에서 제외하여, 이 구간의 매도확률이 기저매도확률이 되도록 설정하였다(위험비율=1).

<그림 Ⅳ-8>은 보유기간 수익률 구간별 위험비율을 보여준다. 개인투자자의 처분효과가 명확히 관찰되는 가운데, 매도 의사결정은 수익률의 크기보다는 손익여부에 영향을 받는 것으로 판단된다. 수익률 구간별 더미변수만을 이용하여 추정한 결과(실선)를 보면, 수익률이 음(-)인 구간의 위험비율은 0.70~0.75 수준, 수익률이 양(+)인 구간의 위험비율은 1.75~1.85 수준에서 대체로 일정하게 나타난다. 외국시장에서 관찰되는 보유기간 수익률과 위험비율의 관계와 비교할 때, 수익률 0% 부근의 위험비율 변화가 더 극단적인 모습을 보인다는 점에서 차이가 있다. 국내 개인투자자의 처분효과는 인지부조화 이론 혹은 실현선호(realization preference) 이론12)의 관점에 부합하는 것으로 보인다. 한편, 수익률 구간별 더미변수 외에 최근의 수익률, 수익률 변동성, 거래회전율 등 통제변수를 추가하여 추정할 경우(점선), 보유기간 수익률이 양(+)인 구간에서 수익률이 높을수록 매도확률이 낮아지는 것으로 나타난다. 이는 <표 Ⅳ-3>에서 확인된 바와 같이 최근 수익률이 높을수록 매도확률이 증가함에 따라, 보유기간 수익률의 효과를 상쇄하기 때문인 것으로 추정된다.

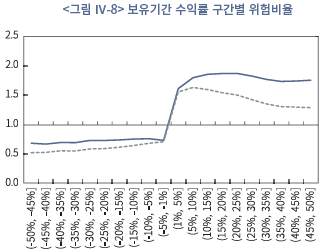

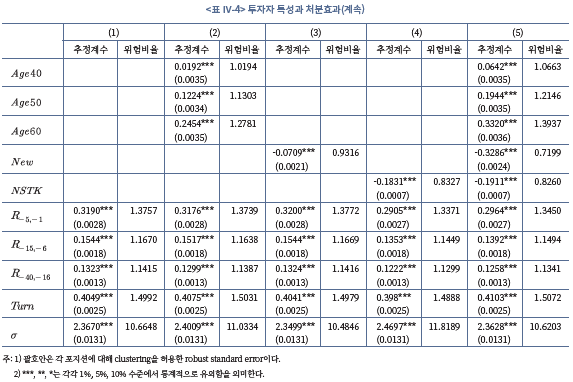

다음으로 개인투자자의 처분효과가 투자자 특성에 따라, 거래대상 종목특성에 따라 다르게 나타나는지 분석한다. 먼저 투자자특성은 투자행태, 투자경험, 투자역량과 연관된 것으로, 성별, 연령, 신규투자자 여부, 분산투자 수준을 변수로 이용하였다. 남성투자자는 과잉확신 경향이 강한데 비해 여성투자자는 손실회피 경향이 강하므로(Barber & Odean, 2001; Schmidt & Traub, 2002) 여성투자자에서 처분효과가 보다 강하게 관찰될 것으로 예상할 수 있다. 연령대가 낮을수록, 신규투자자일수록, 분산투자 수준이 낮을수록 투자경험 또는 역량이 부족하고 따라서 처분효과와 같은 행태적 편의에 노출될 가능성이 높다고 예상할 수 있다. 다만 연령대의 경우, 연령대가 낮을수록 주식투자 관련 교육과정보에 대한 접근성이 높다고 볼 수도 있으므로 반대의 결과도 가능하다.

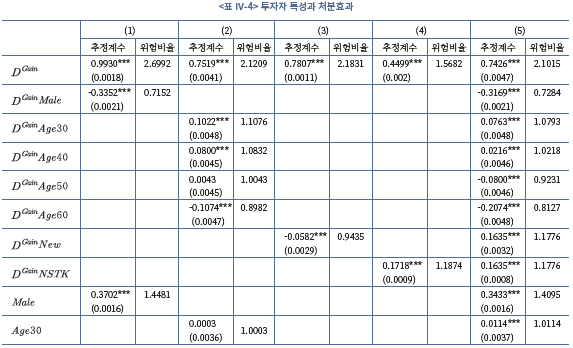

<표 Ⅳ-4>는 식(2.1)에 투자자특성 변수, 투자자특성 변수와 이익 더미변수의 교차(interaction) 변수를 추가하여 추정한 결과를 제시하고 있다. 성별은 남성인 경우 1의 값을 갖는 더미변수( ), 연령은 30대, 40대, 50대, 60대 이상인 경우 각각에 대한 더미변수(

), 연령은 30대, 40대, 50대, 60대 이상인 경우 각각에 대한 더미변수( ), 신규투자자는 분석기간 동안 증권계좌를 신규 개설한 경우 1의 값을 갖는 더미변수(

), 신규투자자는 분석기간 동안 증권계좌를 신규 개설한 경우 1의 값을 갖는 더미변수( )를 이용하였다. 분산투자 수준은 보유종목수의 로그값(

)를 이용하였다. 분산투자 수준은 보유종목수의 로그값( )을 이용하는데, 보유종목수는 거래 의사결정에 영향을 받으므로 분석기간의 최초 관측치를 이용한다.

)을 이용하는데, 보유종목수는 거래 의사결정에 영향을 받으므로 분석기간의 최초 관측치를 이용한다.

분석(1)에 따르면, 남성투자자가 여성투자자에 비해 처분효과가 작은 것으로 나타난다. 이익 더미변수와 남성 더미변수의 교차변수의 계수는 –0.3352로 1% 수준에서 통계적으로 유의하다. 매수가격에 비해 주가가 오른 경우 여성투자자의 매도확률은 주가가 떨어진 경우의 2.7배인데 반해 남성투자자의 매도확률은 1.9배로 상대적으로 낮게 나타난다. 예상한 바와 같이, 여성투자자의 손실회피 경향이 처분효과로 이어지는 것으로 해석할 수 있다.

분석(2)는 연령대별 차이를 분석하고 있다. 교차변수의 계수를 보면, 30대, 40대, 50대, 60대 이상 각각 0.1022, 0.0800, 0.0043, -0.1074로 연령대가 높을수록 감소하며, 50대를 제외한 연령대에서 통계적으로 유의하다. 처분효과는 30대에서 가장 강하고, 60대 이상에서 가장 약하다는 것으로, 투자경험과 연관이 있는 것으로 추정된다. 한편 20대의 처분효과는 30대, 40대보다 작은 것으로 나타나는데, 이는 20대 투자자의 경우 거래빈도가 매우 높아, 시장가격 변화를 의사결정에 반영할 가능성이 높고 따라서 매수가격(준거점)의 영향에서 비교적 자유롭기 때문으로 보인다(Dhar & Zhu, 2006).

분석(3)과 분석(4)는 각각 신규투자자 더미변수와 보유종목수(분산투자 수준) 변수를 이용한 분석결과이다. 분석(3)에서, 신규투자자 교차변수의 계수는 유의한 음(-)의 값으로 예상과 다른 결과를 보여준다. 반면 모든 투자자특성 변수를 동시에 포함하여 분석한 분석(5)에서는 유의한 양(+)의 값으로 나타난다. 분석(3)의 결과는 신규투자자의 구성에 영향을 받은 결과로 보이며, 성별, 연령, 보유종목수의 영향을 통제할 경우 신규투자자일수록 처분효과가 큰 것으로 판단된다. 분석(4)에서도, 보유종목수 교차변수의 계수는 유의한 양(+)의 값으로 예상과 상반된다. 다른 투자자특성을 통제한 분석(5)에서도 결과가 동일하게 유지되고 있어, 분산투자수준이 높을수록 처분효과가 강한 것으로 나타난다. 이는 보유종목수가 개인투자자의 투자역량을 측정하기보다는, 처분효과로 인해 매도하지 못한 포지션이 누적된 결과를 의미하기 때문일 가능성이 있다. 한편, 투자역량의 측정치로 포트폴리오 규모 또는 누적 포지션수를 이용해 보았으나 유의한 결과를 확인할 수 없었다.

마지막 분석(5)는 모든 개인투자자 특성 변수를 포함하여 분석한 결과이다. 앞서 별도로 논의한 신규투자자 변수를 제외하고, 성별, 연령, 보유종목수 변수에 대한 결과는 모두 일관되게 유지된다.

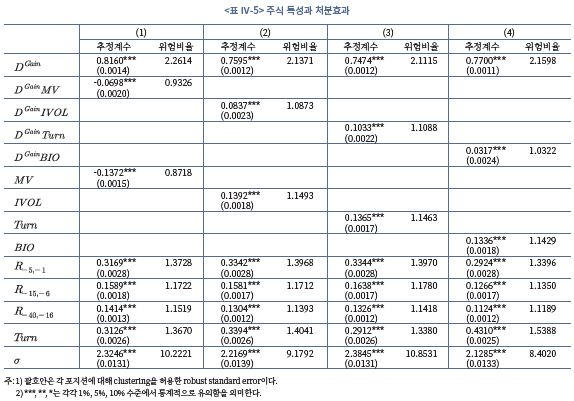

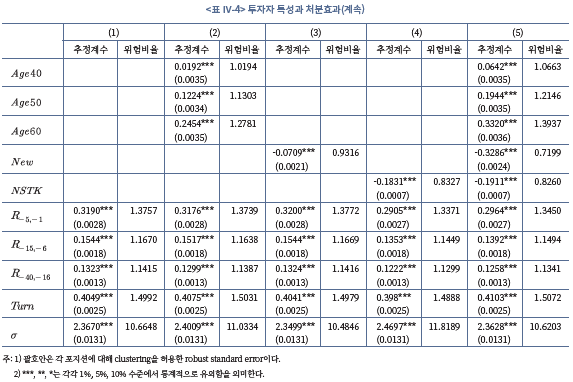

<표 Ⅳ-5>는 개인투자자의 처분효과를 거래대상 주식의 특성에 따라 분석한 결과이다. 투자정보가 부족하거나 변동성이 높아 가치평가가 어려운 주식일수록 투자자가 행태적 편의에 노출되기 쉽다는 논의를 고려하여(Hirshleifer, 2001; Kumar, 2009b), 시가총액 상위 20%, 거래회전율 상위 20%, 고유변동성 상위 20%에 대응하는 더미변수와 제약· 바이오 섹터 더비변수를 구성하여 분석하였다. 여기서 고유변동성은 시장모형(market model)의 잔차(residual)를 이용하여 추정하였다.

시가총액이 낮을수록, 고유변동성이 높을수록, 거래회전율이 높을수록, 제약·바이오 섹터 종목일수록 가치평가의 불확실성이 크고, 따라서 처분효과가 강하게 나타날 것으로 예상되는데, 분석결과는 이러한 예상과 일치한다. <표 Ⅳ-5>에 제시된 교차변수 계수 추정치에 따르면, 시가총액 –0.0698, 고유변동성 0.0837, 거래회전율 0.1033, 제약·바이오 0.0317로 모두 1% 수준에서 통계적으로 유의하다.

라. 처분효과가 투자성과에 미치는 영향 분석

처분효과가 행태적 편의에 따른 비합리적인 투자행태를 의미한다면 투자성과에 부정적인 영향을 미칠 것으로 예상할 수 있다. 본 절에서는 표본 내 개인투자자를 처분효과의 크기에 따라 6개 그룹으로 구분하고 그룹간 투자성과의 차이를 비교함으로써 처분효과와 투자성과의 관계를 분석해 보도록 한다.

우선, 전체 분석대상 투자자 중 포지션을 10회 이상 구축하고 일간 관측치가 30개 이상인 투자자를 대상으로 식(2.1)의 를 개별적으로 추정한다.

를 개별적으로 추정한다.  가 10% 수준에서 통계적으로 유의한 음(-)인 투자자를 그룹N으로, 양(+)인 투자자를

가 10% 수준에서 통계적으로 유의한 음(-)인 투자자를 그룹N으로, 양(+)인 투자자를  값에 따라 그룹P1-그룹P4 로,

값에 따라 그룹P1-그룹P4 로,  가 통계적으로 유의하지 않은 투자자를 그룹Z로 구분한다. 그룹N은 이익의 실현은 미루고 손실의 실현은 서두르는 행태를 보이는 그룹, 즉 역(逆)처분효과가 관찰되는 그룹이며, 그룹P1-그룹P4는 처분효과가 관찰되는 그룹이다. 이 중 처분효과가 가장 강한 그룹은 그룹P4이다. 추정에 포함된 개인투자자 63,551명 중 그룹N에 속하는 투자자는 2,006 명(3.2%)에 불과하며, 그룹P1-그룹P4에 속하는 투자자가 33,195명(52.2%)으로 다수를 차지한다.

가 통계적으로 유의하지 않은 투자자를 그룹Z로 구분한다. 그룹N은 이익의 실현은 미루고 손실의 실현은 서두르는 행태를 보이는 그룹, 즉 역(逆)처분효과가 관찰되는 그룹이며, 그룹P1-그룹P4는 처분효과가 관찰되는 그룹이다. 이 중 처분효과가 가장 강한 그룹은 그룹P4이다. 추정에 포함된 개인투자자 63,551명 중 그룹N에 속하는 투자자는 2,006 명(3.2%)에 불과하며, 그룹P1-그룹P4에 속하는 투자자가 33,195명(52.2%)으로 다수를 차지한다.

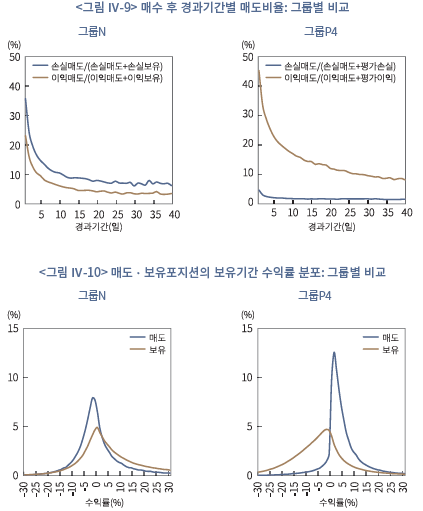

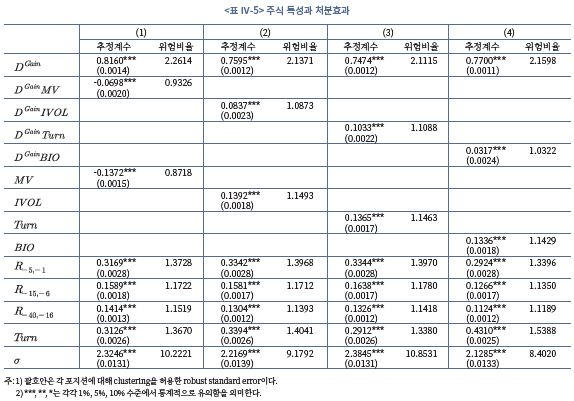

양 극단의 그룹N과 그룹P4의 매도의사결정 특성을 간단히 비교해보자. <그림 Ⅳ-9>는 그룹N과 그룹P4의 포지션 매수 이후 보유기간에 따라 이익매도비율과 손실매도비율을 비교하고 있다. 그룹N의 경우(왼쪽), 격차는 크지 않으나 손실매도비율이 이익매도비율을 상회하는 특징이 나타난다. 반면 그룹P4의 경우(오른쪽), 이익매도비율이 손실매도비율을 크게 상회하는 것을 볼 수 있다. 매수일 다음날 기준으로(경과기간 1일), 이익포지션의 경우 45%를 매도하는 반면 손실포지션의 경우 단 5%를 매도하는, 극단적인 처분효과를 확인할 수 있다.

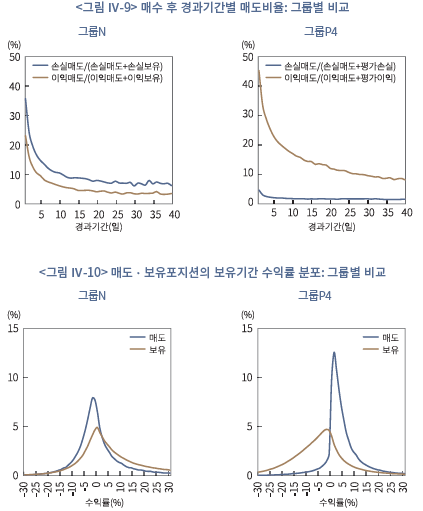

<그림 Ⅳ-10>는 그룹N과 그룹P4의 매도포지션과 보유포지션의 보유기간 수익률 분포를 비교하고 있다. 그룹N의 경우 보유포지션의 수익률이 매도포지션에 비해 높은 반면 그룹P4의 경우 매도포지션의 수익률이 보유포지션에 비해 높다. 특히 그룹P4에서 매도포지션과 보유포지션의 수익률 분포는 현저한 차이를 보여주는데, 수익률이 0보다 큰 포지션의 비중이 매도포지션에서는 87%에 이르는 반면, 보유포지션에서는 32%에 불과하다. 이익포지션의 매도는 서두르고 손실포지션의 매도는 미루는 의사결정이 누적된 결과이다.

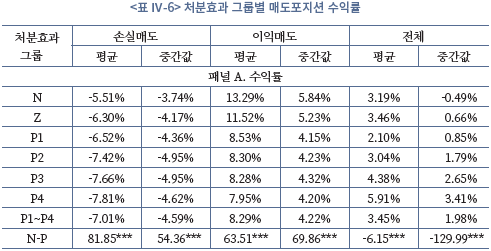

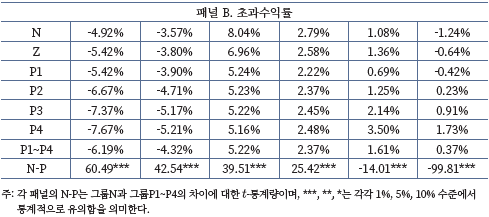

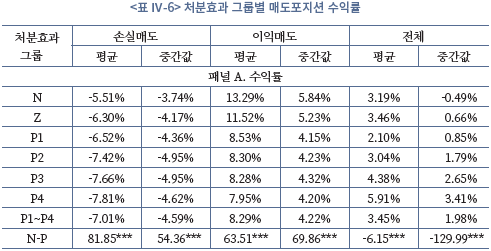

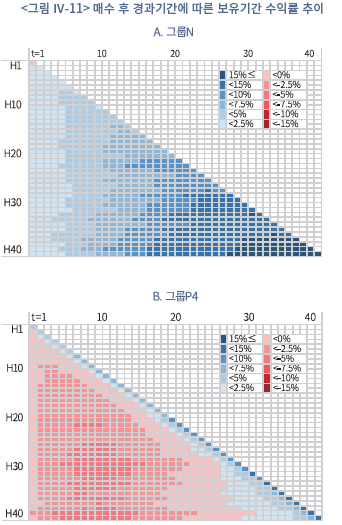

처분효과 그룹별 수익률 성과의 특징을 상세하게 비교해보자. <표 Ⅳ-6>은 분석기간 내에 매도한 포지션의 보유기간 수익률과 초과수익률을 손실매도와 이익매도로 구분하여 제시하고 있다. 초과수익률은 보유기간 수익률에서 같은 기간의 시장수익률(KOSPI지수와 KOSDAQ지수의 가중평균 수익률)을 차감하여 계산한다.

먼저 손실매도의 평균 수익률을 보면, 그룹N –5.51%, 그룹Z –6.30%, 그룹P1~P4 –6.52~–7.81%로, 그룹N의 수익률이 가장 높고 처분효과가 강할수록 수익률이 낮다. 그룹N과 그룹P1~P4의 수익률 차이는 통계적으로 유의하다. 그룹N은 손실을 조기에 실현하는 반면, 그룹P1~P4는 손실이 누적된 이후 매도하기 때문에 나타난 결과로 추정할 수 있다. 이익매도의 경우에서도, 그룹N의 수익률이 13.29%로 가장 높고 처분효과가 강할수록 수익률이 낮다. 그룹P1~P4는 이익을 조기에 실현한 반면, 그룹N은 이익이 누적된 이후 매도한 결과로 볼 수 있다.

반면, 손실매도와 이익매도를 합산한 전체 매도포지션의 보유기간 수익률은 그룹N보다 그룹P3과 그룹P4가 높게 나타난다. 그룹N의 평균 수익률은 3.19%인데 비해, 그룹P3 은 4.38%, 그룹P4는 5.91%이다. 이는 처분효과가 투자성과에 긍정적 영향을 미친다는의미가 아니라, 이익포지션만을 매도하는 처분효과의 특성에 의해 나타난 결과임에 유의할 필요가 있다. 처분효과가 강한 투자자는 매수 후 주가가 하락할 경우 매도를 미루고 주가가 반등하여 이익포지션으로 전환된 이후에야 매도를 실행한다. 따라서 투자성과에 대한 처분효과의 영향을 정확히 파악하기 위해서는 투자기간을 통제할 필요가 있으며, <표 Ⅳ-8>과 <표 Ⅳ-9>에서 별도로 분석하고 있다. 한편, 수익률의 중간값을 이용하여 비교하거나, 초과수익률을 기준으로 비교하여도 분석결과에 질적인 차이는 없다.

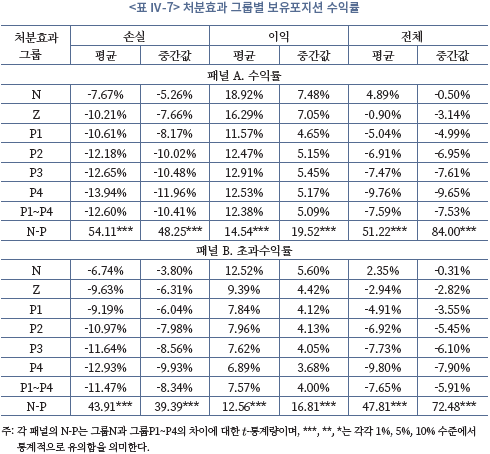

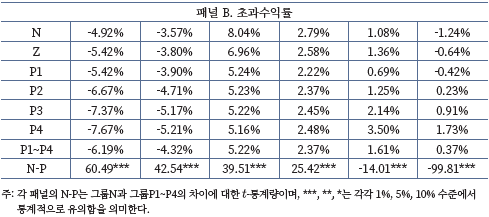

<표 Ⅳ-7>은 분석기간 내에 매도하지 않고 분석기간 종료시점까지 보유하고 있는 포지션의 보유기간 수익률을 처분효과 그룹별로 비교하고 있다. 손실포지션과 이익포지션 모두에서 그룹N의 평균 수익률이 가장 높으며, 전체 포지션의 수익률 역시 그룹N이 가장 높다. 처분효과가 강한 투자자는 손실포지션의 매도를 미루기 때문에 보유포지션에서 손실포지션의 비중이 높을 수밖에 없으며 따라서 수익률 역시 낮게 관찰되는 것으로 볼 수 있다.

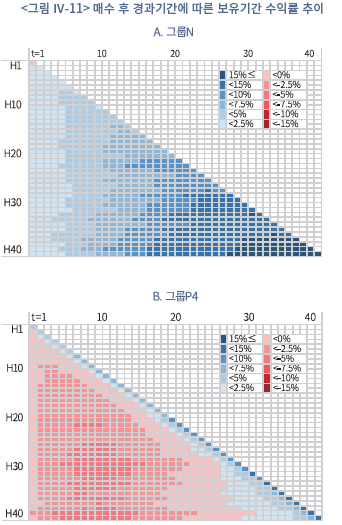

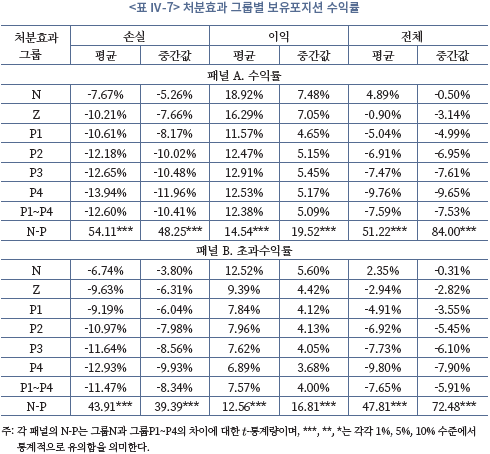

개인투자자의 의사결정 행태에 대한 이해를 돕기 위해, <그림 Ⅳ-11>은 그룹N과 그룹P4가 매도한 포지션의 수익률 변화를 매수 후 보유기간에 따라 제시하고 있다. 세로축은 포지션 매도일을, 가로축은 매수 후 보유기간을 의미한다. 예를 들어 세로축이 H40인 경우, 매수 40일 후 매도한 포지션의 보유기간 수익률 추이를 나타낸다. 푸른색은 수익률이 양(+)인 경우, 붉은색은 수익률이 음(-)인 경우를 나타내며, 수익률이 높아지거나 낮아질수록 짙은 색상으로 표시하였다.

그룹N(그림 Ⅳ-11.A)의 보유기간 1일(t=1)을 기준으로 보면, 매수 1일 후 매도한 포지션(H1)의 수익률만 음(-)의 값이고, 매수 2일 이후 매도한 포지션(H2-H40)의 수익률은 모두 양(+)의 값으로 관찰된다. 즉, 매수 다음날 주가가 하락하면 매도하고 상승하면 보유하기로 결정하는 것이다. 이후 수익률이 높아질수록 보유기간이 길어지는 패턴이다. 반면 그룹P4(그림 Ⅳ-11.B)의 보유기간 1일(t=1)을 기준으로 보면, 매수 1일 후 매도한 포지션 (H1)의 수익률만 양(+)이고, 매수 2일 이후 매도한 포지션(H2-H40)의 수익률은 모두 음 (-)의 값이다. 매수 다음날 주가가 상승하면 매도하고 하락하면 보유하기로 결정하는 것이다. 이후 수익률은 하락하는데 다시 반등하여 수익률이 양(+)으로 전환될 때까지 보유기간이 늘어나는 패턴이다. 매도까지 보유한 기간이 동일하다고 할 때, 그룹P4가 그룹N에 비해 더 높은 변동성을 감수하고 있음을 확인할 수 있다.

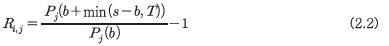

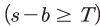

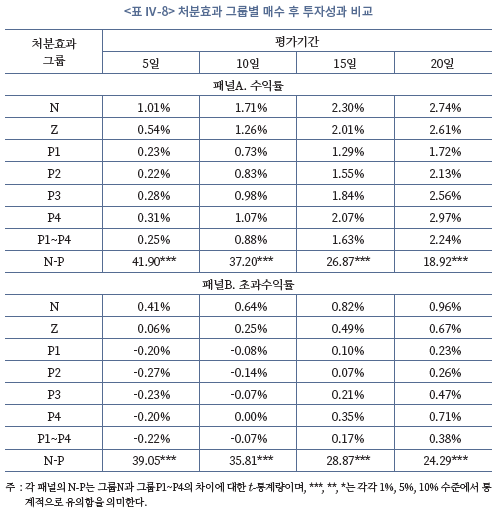

<표 Ⅳ-8>은 처분효과 그룹별 개인투자자의 투자성과를 평가기간에 따라 비교하고 있다. 평가기간을 고정시키는 것은, 앞서 언급했듯이 처분효과 그룹별로 보유기간에 차이가 존재하므로 투자성과를 공정하게 비교하기 위한 것이다. 평가기간은 포지션의 평균보유기간이 약 10일임을 감안하여 5일, 10일, 15일, 20일로 설정하였다. 투자성과는 Seru et al.(2010)의 방법론에 따라, 다음의 식(2.2)를 이용해 계산한 수익률,  로 측정한다.

로 측정한다.

여기서  는 투자자

는 투자자  가 보유한 종목

가 보유한 종목  의 가격을 의미하며

의 가격을 의미하며  는 매수시점,

는 매수시점,  는 매도시점,

는 매도시점,  는 평가기간을 나타낸다. 투자자

는 평가기간을 나타낸다. 투자자  가 종목

가 종목  를 평가기간 이후에 매도한 경우

를 평가기간 이후에 매도한 경우 , 수익률은 매수일 종가(

, 수익률은 매수일 종가( )와 평가기간말 종가(

)와 평가기간말 종가( )를 기준으로 계산되며, 평가기간 이전에 매도한 경우

)를 기준으로 계산되며, 평가기간 이전에 매도한 경우 , 수익률은 매수일 종가(

, 수익률은 매수일 종가( )와 매도일 종가(

)와 매도일 종가( )를 기준으로 계산된다.13) 이렇게 함으로써 평가기간 동안의 매도 의사결정의 효과를 고려할 수 있다. 예를 들어 평가기간 동안 주가가 상승하는 경우 매도를 서두를수록 수익률이 하락하며, 평가기간 동안 주가가 하락하는 경우 매도를 늦출수록 수익률이 하락한다.

)를 기준으로 계산된다.13) 이렇게 함으로써 평가기간 동안의 매도 의사결정의 효과를 고려할 수 있다. 예를 들어 평가기간 동안 주가가 상승하는 경우 매도를 서두를수록 수익률이 하락하며, 평가기간 동안 주가가 하락하는 경우 매도를 늦출수록 수익률이 하락한다.

<표 Ⅳ-8>에서 평가기간 10일을 기준으로 보면, 그룹N의 수익률은 1.71%, 그룹Z의 수익률은 1.26%, 그룹P1~P4의 수익률은 0.73~1.07%로, 그룹N의 수익률이 높은 것으로 나타난다. 그룹N과 그룹P1~P4의 수익률 차이는 1% 수준에서 통계적으로 유의하다. 평가기간을 5일, 15일, 20일로 설정하더라도 결과는 동일하다. 이러한 결과는 매도 의사결정에서 나타나는 처분효과가 투자성과에 부정적인 영향을 미친다는 것을 의미한다. 다만, 평가기간이 늘어날수록 처분효과가 강한 그룹의 수익률이 높아지는 패턴이 관찰된다. 이는 매수 이후 수익률 하락으로 매도를 미룬 포지션에서 수익률 반등이 발생하여 나타난 현상으로 파악되며 표본의 시기적 특성의 영향이 있는 것으로 보인다. 한편, 초과수익률을 기준으로 평가하는 경우에도 결과에는 큰 차이가 없다. 약 0.33% 수준14)의 거래세와 위탁매매수수료를 고려할 때, 그룹N은 초과수익률을 얻고 있는 반면 처분효과가 존재하는 그룹P1~P4는 초과수익률을 얻지 못하는 것으로 추정된다.

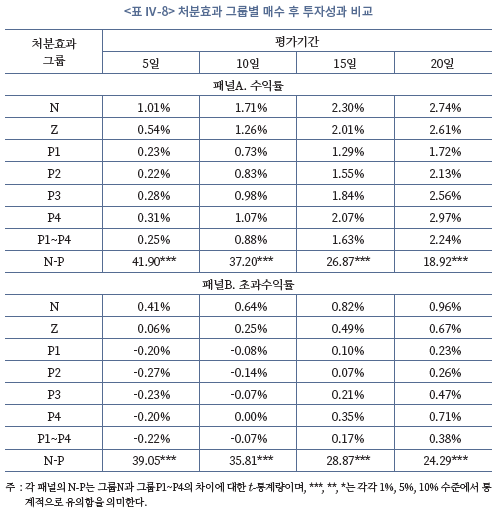

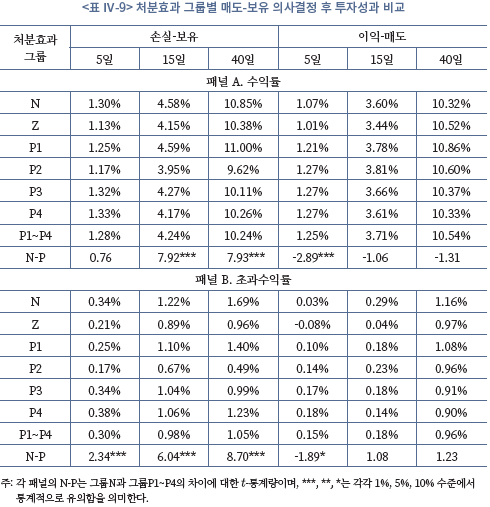

처분효과에 따른 매도·보유 의사결정이 비효율적이라면, 이익포지션의 매도 이후 수익률은 처분효과가 강할수록 높고, 손실포지션을 매도하지 않기로 결정한 이후 수익률은 처분효과가 강할수록 낮을 것으로 예상할 수 있다. <표 Ⅳ-9>는 매도하지 않은 손실포지션(손실-보유)과 매도한 이익포지션(이익-매도)의 의사결정 이후 수익률을 처분효과 그룹별로 비교하고 있다.

손실포지션의 보유 의사결정 이후 수익률은 그룹N이 그룹P1~P4에 비해 높고 이익포지션의 매도 이후 수익률은 그룹N이 그룹P1~P4에 비해 낮은 것으로 나타난다. 수익률 격차가 경제적으로 크지 않고 평가기간에 따라 통계적 유의성이 부족한 경우가 있으나, 전체적으로 예상에 부합하는 결과이다. 아울러 초과수익률로 분석하더라도 분석결과에 질적인 차이는 크지 않다. 처분효과가 투자성과에 부정적 영향을 미친다는 이상의 분석결과는 Odean(1998), Chen et al.(2007), Seru et al.(2010)의 분석과 일관된다.

3. 복권형 주식 선호

본 절에서는 개인투자자의 거래행태와 투자성과에 영향을 주는 요인으로, 주식투자를 소위 대박(jackpot)의 기회로 인식하는 경향, 또는 높은 수익률이 가져다주는 자극 (sensation)을 추구하는 성향에 대해 분석한다.

대박의 기회 또는 자극을 추구하는 것은 인간의 본성이며 많은 사람들이 복권(lottery) 을 구매하고 도박을 즐기는 이유다. 과거 여러 연구에서 주식거래를 개인투자자의 자극 추구(sensation seeking) 관점에서 분석을 시도한 바 있다. 빠르게 변동하는 주식가격을 통해 일종의 재미를 느낄 수 있고, 높은 수익을 거둘 때 느껴지는 쾌감은 주식거래를 지속하게 만드는 유인이 될 수 있다는 것이다. 개인투자자는 수익률의 변동성과 왜도 (skewness)가 크고 가격대가 낮은 주식, 즉 복권과 유사한 특성을 갖는 주식(lottery-type stock)을 선호하고(Kumar & Lee, 2006; Kumar, 2009a), 투자, 도박, 또는 속도를 즐기는 사람일수록 주식을 빈번하게 거래하는 것으로 나타난다(Dorn & Segmueller, 2009; Grinblatt & Keloharju, 2009). Gao & Lin(2015)의 분석에 따르면, 복권 당첨금이 이연되어 총 당첨금이 증가하는 시기에 개인투자자의 주식 거래량이 감소하고, 복권과 유사한 특징을 갖는 주식에서 거래량 감소가 더 크게 나타나는 현상을 보고하고 있다. 요컨대, 개인투자자는 주식거래를 복권의 대체재로 인식하는 것이다(Barber et al., 2009; Dorn et al., 2015).15)

코로나19 국면에서 나타난 개인투자자의 빈번한 거래는 주식거래를 통한 자극 추구 성향과 연관된 현상일 수 있다. 암호화폐 열풍이나 신용융자나 레버리지 상품을 이용한 투자의 급증 등을 생각해보면, 매우 높은 수익률과 자극을 추구하는 개인투자자가 존재한다는 사실을 부인하기 어렵다.

극단적인 수익률을 추구하는 성향은 개인투자자가 덜 분산된(under-diversified) 포트폴리오를 구축하는 배경으로 작용하기도 한다(Conine & Tamarkin, 1981; Mitton & Vorkink, 2007). 평균-분산(mean-variance) 포트폴리오 이론에 따르면 잘 분산된 (well-diversified) 포트폴리오를 보유하는 것이 합리적인 선택이다. 그러나 포트폴리오가 분산화될수록, 변동성(volatility)이 줄어드는 동시에 왜도 또한 줄어드는 결과가 나타날 수 있다. 따라서 수익률의 왜도가 높은, 즉 극단적인 수익률을 제공하는 자산을 선호하는 투자자에게 잘 분산된 포트폴리오는 그들의 선호체계와 효용 관점에서 효과적인 포트폴리오가 아닐 수 있는 것이다. 미국 투자자를 대상으로 한 Goetzman & Kumar(2008) 의 연구에 따르면, 분산투자 수준이 낮은 투자자들이 변동성 또는 왜도가 높은 주식을 초과 보유하는 것으로 나타난다.

극단적인 수익률에 대한 선호는 자산 가격에도 영향을 미칠 수 있다. 투자자들이 수익률의 왜도가 높은 자산을 선호한다면, 이러한 자산의 가격은 고평가 되고, 기대수익률은 낮아진다(Brunnermeier et al., 2007; Mitton & Vorkink, 2007; Barberis & Hwang, 2008). 기대수익이 구매비용보다 낮음에도 불구하고 많은 사람들이 복권을 구매하는 것과 유사한 맥락이다. 실증적으로, 복권과 유사한 특성을 가진 주식일수록 기대수익률이 낮다는 분석결과가 한국을 포함한 많은 국가에서 보고되고 있다(예: Boyer et al., 2010; Bali et al., 2011; Walkshӓusl, 2014; Cheon & Lee, 2018).

본 절에서는 투자자의 극단적 수익률 선호(또는 고왜도 선호)가 투자행태에 어떠한 영향을 미치는지 검토한다. 기존 문헌의 방법론을 활용하여 복권형 주식을 정의하고, 개인투자자들이 복권형 주식을 선호하는지, 개인투자자의 과도한 거래와 낮은 분산투자 수준이 복권형 주식 선호와 어떻게 관련되어 있는지 분석한다. 마지막으로 개인투자자의 저조한 투자성과와 복권형 주식 선호의 연관성에 대해 검토한다.

가. 복권형 주식 및 투자행태 변수 정의

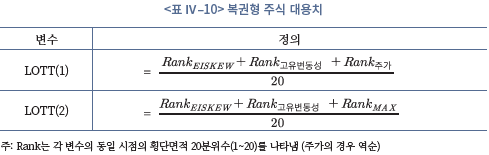

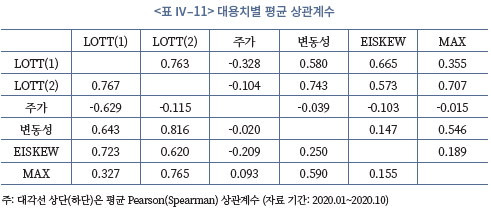

복권형 주식의 대용치(Lottery-likeness: LOTT) 정의는 기존문헌(Kumar, 2009a; Boyer et al., 2010; Bali et al., 2011)의 방법론을 준용한다. 복권은 저렴한 단위당 투자비용과 극단적으로 높은 수익의 발생가능성을 특징으로 한다. Kumar(2009a)는 이러한 특징을 주가가 낮고, 수익률의 변동성과 왜도가 높은 주식으로 해석하여 복권형 주식을 분류하였다. Bali et al.(2011)은 과거 한달간 일별 수익률의 최대값(maximum daily returns: MAX)을 복권형 주식의 직관적인 대용치로 활용하였고, Boyer et al.(2010)은 개별 주식 수익률의 사전적 고유왜도(ex-ante idiosyncratic skewness: EISKEW)를 추정하여 활용한 바 있다.

본고에서는 복권과 유사한 정도를 개별 주식의 고유변동성(idiosyncratic volatility), 고유왜도(idiosyncratic skewness), 그리고 주가를 활용하여 정의한다. 고유변동성은 Fama-French(1993) 3요인 모형으로 추출한 잔차(residual)의 표준편차로 계산하며, 과거 3개월 자료를 토대로 매월 계산한다.16) 고유왜도는 Fama-French(1993) 3요인 모형으로 추출한 잔차의 왜도를 이용하는데, 사후적(ex-post) 고유왜도가 아닌 사전적(ex-ante) 고유왜도를 추정하여 이용한다. 이는 과거 자료를 기반으로 측정한 수익률 왜도가 미래 수익률 왜도의 대용치로 적절하지 않기 때문이다(Boyer et al., 2010).17) 따라서 개별 주식의 과거 3개월 일별 자료를 이용해 매월 고유왜도를 산출하고, 고유왜도와 연관된 변수(왜도, 변동성, 과거 수익률, 중소형주 및 코스닥 상장종목 여부, 섹터)를 활용해 횡단면 예측 회귀분석을 실시한 뒤, 종목별 고유왜도의 기댓값을 구하여 사전적 고유왜도(EISKEW) 로 이용한다.18) 마지막으로 주가수준은 개별 주식의 월별 종가를 이용한다.

여기에 추가적인 지표를 활용한다. 일반적으로 주식 가격은 기업의 규모와 밀접하게 연관되어 있어 이후의 분석에서 규모 효과를 적절히 통제하지 못할 가능성이 있고, 국내 종목별 주가 수준이 대부분 낮은 편에 속해 복권형 주식의 경계가 모호해질 가능성이 있기 때문이다.19) 따라서 Bali et al.(2011)가 정의한 최근 1달 내 일별 수익률의 최대값 (MAX)을 추가적인 지표로 활용한다. 극단적인 수익률을 쫓는 개인투자자들이 최근 단기수익률이 높았던 종목에서 극단적인 수익률이 발생할 가능성을 주관적으로 높게 평가할수 있다는 점을 고려한 것이다(Barberis & Hwang, 2008).

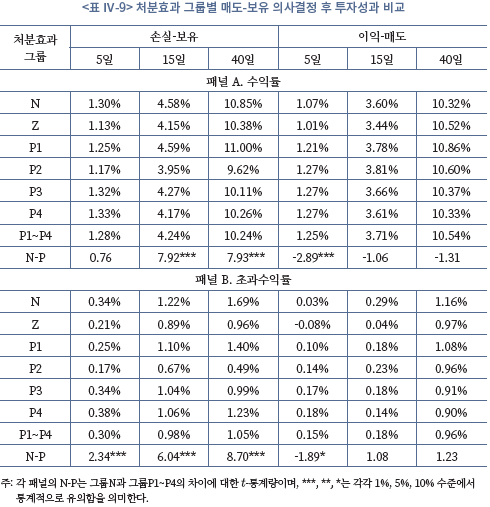

정리하면 매월 종목별로 산출한 고유변동성, EISKEW, 주가(또는 MAX) 등 세 가지 변수를 20분위로(주가의 경우 역순) 구분한 뒤, 각각의 분위수를 아래 <표 Ⅳ–10>의 정의에 따라 계산하여 익월의 분석에 적용한다. LOTT(1)은 Kumar(2009a)가 제시한 복권형 주식의 정의와 유사하며, LOTT(2)는 주식가격을 MAX로 대체한 추가적인 지표이다.

실증분석에서 활용되는 개별 투자자의 특성 변수를 알아보자. 개별 투자자의 특성 변수는 김민기ㆍ김준석(2021)의 분석결과를 참조하여 거래빈도와 분산투자 수준을 채택하였다. 거래빈도의 대용치는 김민기ㆍ김준석(2021)에서 활용된 일중거래비중, 거래회전율, 종목교체율이다. 일중거래비중은 각 개인별 거래대금 중 당일 매수 후 당일 매도한 거래대금의 비중이며, 거래회전율은 일간 매수ㆍ매도대금의 평균값을 전일 및 당일 보유주식 평가금액의 평균값으로 나눈 값이다. 종목교체율은 일평균 종목 편입율과 제외율의 합산 값으로, 편입률은 전일 보유ㆍ거래 종목수 대비 당일 신규 보유ㆍ거래 종목수, 제외율은 전일 보유ㆍ거래 종목 중 당일 비보유·비거래 종목수 비율로 정의한다.

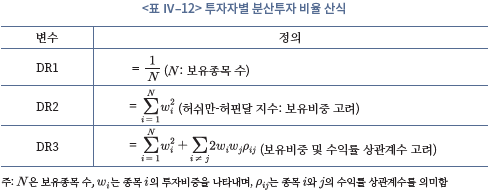

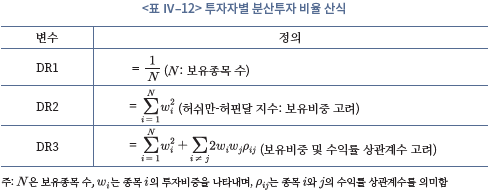

본 절에서 활용하는 투자자별 분산투자 비율(Diversification Ratio: DR)은 <표 Ⅳ–12>에 제시한 바와 같이 세 가지 방식으로 정의한다. 첫 번째는 평균 보유종목수로, 1/ 평균 보유종목수(=DR1)로 정의한다. 보유종목수가 많을수록 개별주식의 고유위험이 분산될 수 있다는 가정을 전제로 한다. 다만 이 지표는 종목별 투자 비중 및 포트폴리오 내 종목 간 연관성을 고려하지 못한다는 한계가 있어, 두 번째 지표로 종목별 투자 비중을 고려한 허쉬만-허핀달 지수(Hirschman-Herfindhal Index)를 이용한다. 허쉬만-허핀달 지수는 각 종목별 보유비중 제곱의 합으로 표현된다(DR2). DR2도 DR1과 마찬가지로 값이 클수록 분산투자 수준이 낮음을 의미하는데, 일부 종목에 투자가 집중될수록 값이 커지는 특성이 있다. 가령 두 종목을 50:50으로 보유할 경우 DR2는 0.5로 계산되고, 90:10 으로 한 종목을 집중적으로 보유할 경우 0.82로 증가한다. 모든 종목을 동일한 비율로 보유할 경우 DR2는 DR1과 동일하다. 마지막 세 번째는 보유비중뿐만 아니라 보유종목간수익률의 상관관계를 고려한 것이다(DR3). 만약 여러 종목을 보유하고 있어도 모두 동일한 업종의 종목이라면 잘 분산된 포트폴리오라고 말할 수 없을 것이다. DR3는 DR2에 종목 간 상관계수를 더하여 산출하는데, 포트폴리오 내 종목들의 상관관계가 높을수록 값이 증가하고 분산 수준이 낮아짐을 의미한다. 분산투자 수준은 투자자별로 평균 비율을산출하여 분석에 적용한다.

나. 복권형 주식의 특징

실증분석 결과에 앞서 가절에서 정의한 복권형 주식의 특성에 대해 살펴보자. 사후적 수익률 분포가 높은 변동성과 왜도를 가질수록 복권과 유사하다고 볼 수 있으며, Ku- mar(2009a)의 분석결과처럼 이러한 주식을 선호하는 투자자는 주로 개인투자자일 것이다. 또한 과거 이론ㆍ실증 연구에서 제시된 바와 같이, 개인투자자들이 선호하는 복권형 주식의 기대수익률은 낮게 나타날 것으로 예상된다(Mitton & Vorkink, 2007; Brunner- meier et al., 2007; Boyer et al., 2010; Bali et al., 2011).

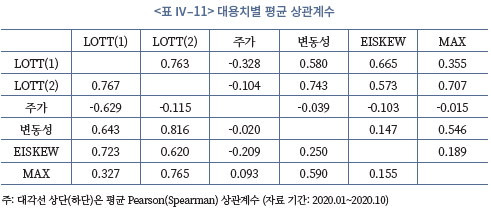

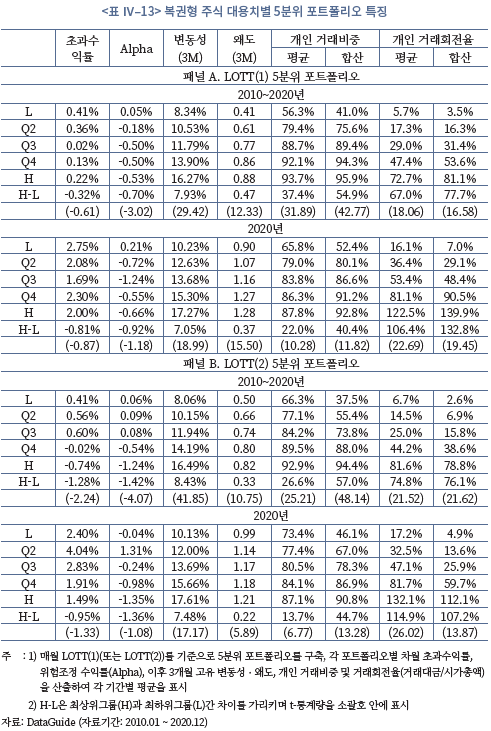

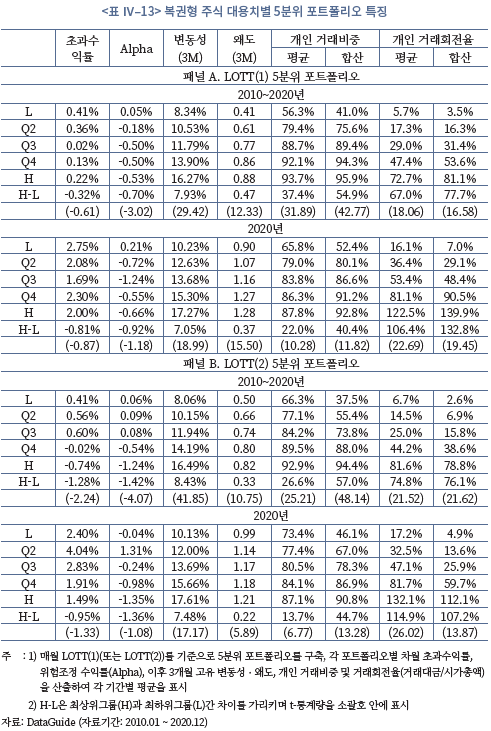

<표 Ⅳ–13>은 복권형 주식의 대용치인 LOTT(1)(또는 LOTT(2))로 구성한 5분위 그룹의 초과수익률, 사후적 수익률 분포, 개인투자자 거래비중을 요약한 결과이다. 패널 A, B는 각각 LOTT(1) 및 LOTT(2)에 대한 결과이며, 장기 분석 결과(2010~2020년)와 최근 1 개년(2020년) 분석 결과를 별도로 제시하고 있다.

패널 A와 패널 B가 대체로 유사한 결과를 보여주는데, 먼저 그룹별 초과수익률 및 위험조정수익률(Alpha)을 살펴보면 과거 실증연구와 마찬가지로 복권과 유사한 주식일수록 기대수익률이 낮다. 복권형 주식 최상위 그룹(H)과 최하위 그룹(L)의 위험조정수익률 차이는 2010~2020년의 경우 1% 수준에서 통계적으로 유의한 음(-)의 값이며, 2020년의 경우 통계적 유의성은 부족하나 음(-)의 값으로 나타난다. 이는 복권형 주식에 투자할 경우 시장 대비 저조한 성과를 시현할 가능성이 높음을 시사한다.

각 5분위 그룹 내 종목의 평균적인 수익률 분포를 살펴보면, 분석기간과 대용치와 상관없이 복권형 주식에 가까운 그룹일수록 사후적 변동성과 왜도가 증가한다. 이는 본 분석에서 활용한 복권형 주식의 대용치가 사후적 수익률 분포를 잘 설명한다는 것을 의미한다.20) 또한 개인투자자의 거래비중 및 거래회전율을 그룹별로 살펴보면, Kumar(2009a) 의 결과와 유사하게 국내 주식시장에서도 개인투자자들이 복권형 주식을 상대적으로 선호하는 것으로 확인된다. 패널 A의 2020년 개인투자자의 합산 거래비중은, 복권형 주식 최상위 그룹(H)의 경우 92.8%인 반면, 최하위 그룹(L)은 52.4%로 큰 차이가 관찰된다. 또한 개인투자자의 거래회전율도 비복권형 주식보다 복권형 주식에서 현저히 높아 개인투자자들이 복권형 주식을 과도하게 거래하는 것으로 평가할 수 있다.

다. 개인투자자의 복권형 주식 선호

복권형 주식에 대한 선호를 개인투자자 유형별로 비교해보자. 선호도의 상대적 비교를 위해 벤치마크 대비 초과 비중을 산출하는데, 보유비중의 벤치마크는 시가총액 비중으로 설정하고, 거래비중의 벤치마크는 개인투자자를 제외한 국내 기관투자자 및 외국인투자자의 거래비중으로 설정한다. 산출된 초과보유 또는 초과거래 비중이 양(+)이면 과도배분 또는 과도거래로, 반대로 음(-)이면 과소배분 또는 과소거래로 해석할 수 있다.

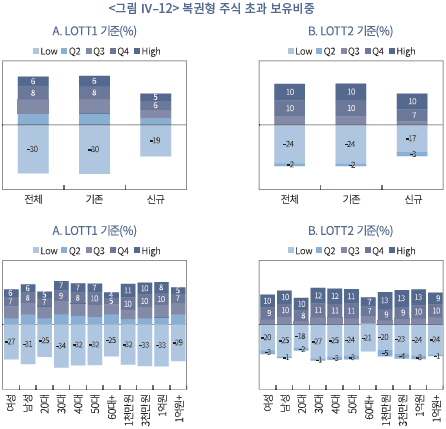

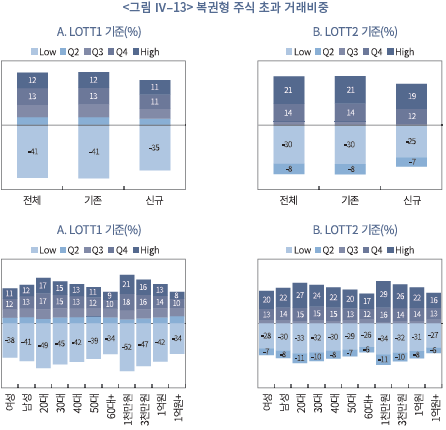

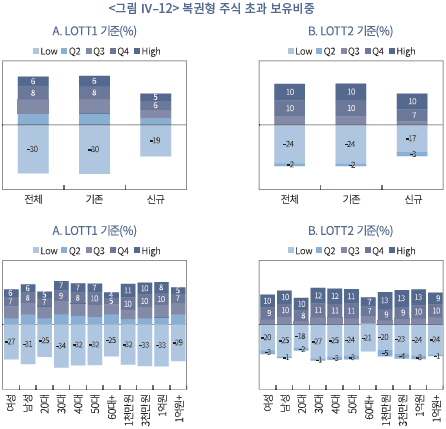

상장주식을 복권형 주식 대용치 LOTT(1)를 기준으로 5분위로 구분하고, 각 개인투자자 유형별 일평균 보유비중을 계산하여 시가총액 비중과의 차이를 산출한다. <그림 Ⅳ–12>를 보면, 복권형 주식 최상위 그룹(High)은 +6%, 차상위 그룹(Q4)은 +8%로 시가총액 비중 대비 과도배분되어 있고, 최하위 그룹(Low)은 –30%로 과소배분되어 있음을 확인할 수 있다. 신규투자자의 경우 그룹간 격차는 소폭 작으나, 복권형 주식을 선호하는 경향은 명확히 확인된다. 복권형 주식 대용치를 LOTT(2)로 변경해도 결과의 질적인 차이는 없으나 최하위 그룹(Low)의 과소배분 정도가 감소한다. 이는 LOTT(1)의 정의상 기업규모와 상관관계가 있는 주가가 반영되기 때문으로 추정된다. 개인투자자 세부 유형별로 보면 남성투자자, 30~50대, 1억원 이하의 중소규모 투자자에게서 복권형 주식의 초과보유가 강하게 관찰된다.

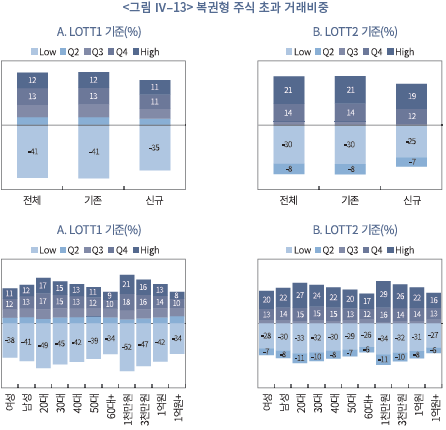

개인투자자의 복권형 주식 선호는 초과 거래비중에서도 잘 드러난다. 개인투자자의 초과 거래비중은 LOTT(2) 기준으로, 복권형 주식 최상위 그룹(High) +21%, 차상위 그룹(Q4) +14%인 반면, 최하위 그룹(Low) –30%, 차하위 그룹(Q2) –8%로 나타난다(<그림 Ⅳ–13>). 보유비중 분석 결과와 마찬가지로 개인투자자는 복권형 주식을 다른 투자자유형보다 더 많이 거래하는 것을 확인할 수 있다. 초과 거래비중은 남성일수록, 젊을수록, 소액투자자일수록 더 높게 나타난다. 김민기ㆍ김준석(2021)에 따르면 남성, 젊은 투자자, 소액투자자의 거래빈도가 다른 투자자 그룹에 비해 높게 나타나는데, 결국 이들의 거래대상은 주로 복권형 주식이었던 것으로 평가할 수 있다.

라. 복권형 주식 선호와 투자행태와의 관계

기존 연구결과에 따르면 개인투자자들이 극단적인 수익률을 추구하는 경향은 상대적으로 덜 분산된(under-diversifi ed) 포트폴리오를 구축하는 배경 중 하나다(Mitton & Vorkink, 2007). 또한 주식거래를 즐기는 투자자들은 더 높은 흥분(excitement)을 가져다 줄 수 있는 복권형 주식을 선호한다(Gao & Lin, 2015). 이러한 논의에 근거하여, 본 절에서는 복권형 주식에 대한 선호가 분산투자 수준과 거래빈도에 미치는 영향을 살펴본다.

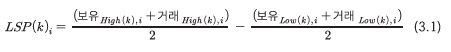

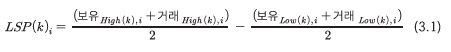

개인투자자별 복권형 주식 선호 정도는 다음과 같이 측정한다. 먼저 분석대상 주식을 복권형 주식 대용치, LOTT(1) 또는 LOTT(2)로 각각 4분위 그룹21)으로 분류한 뒤, 상위(High) 및 하위(Low) 그룹에 대한 투자자별 일평균 보유비중과 합산 거래비중을 산출한다. 거래비중을 합산하여 산출하는 이유는 모든 투자자의 거래가 매일 지속적으로 발생하지 않기 때문이다. 그 뒤 복권형 대용치 상위 그룹의 보유ㆍ거래 비중의 산술평균과 하위 그룹의 보유ㆍ거래 비중의 산술평균의 차이를 개인별 복권형 주식 선호 정도(Lot- tery-type Stock Preference: LSP)로 정의한다.

LSP(k)는 LOTT(k)에 대응하는 지표이며(k=1, 2), LSP(k)가 클수록 해당 투자자( )의 복권형 주식 선호도가 높다고 할 수 있다. LSP(k)의 신뢰성을 확보하기 위해 평균 보유종목수가 1개 이하인 개인투자자는 제외하고, 산출된 LSP(k)에 따라 개인투자자를 10개 그룹으로 분류하여 비교한다.

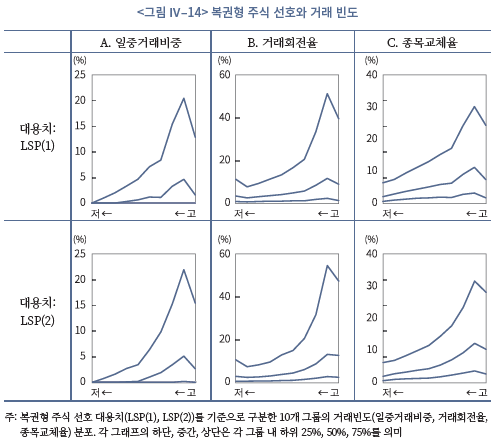

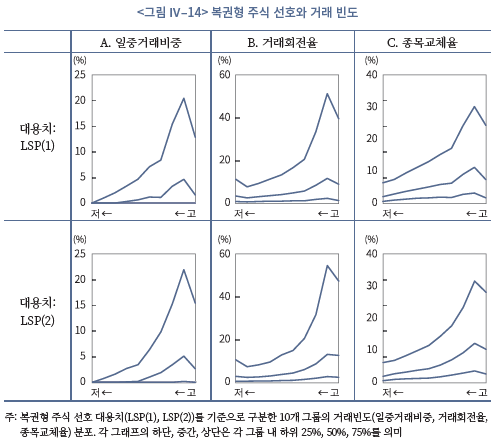

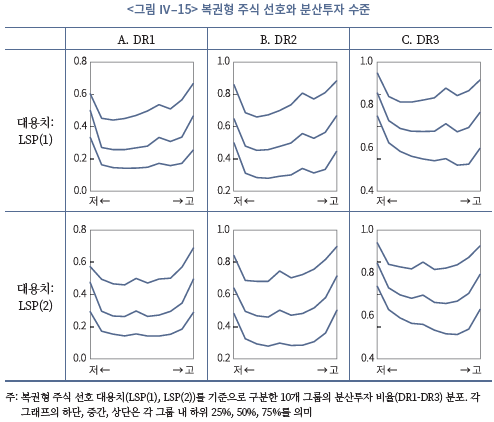

각 그룹별 개인투자자의 거래빈도 분포는 <그림 Ⅳ-14>와 같다. <그림 Ⅳ-14>의 A, B, C는 각각 10개 그룹 내 일중거래비중, 거래회전율, 종목교체율의 분포를 제시하고 있다. 그림에서 하단, 중간, 상단의 선은 각 그룹 내 하위 25%값, 중위값, 상위 25%값을 의미한다. 복권형 주식 선호도 최상위 그룹에서 소폭 감소하는 경향이 있지만, 전반적으로 복권형 주식 선호도가 높은 투자자일수록 거래빈도가 높은 것을 확인할 수 있다.

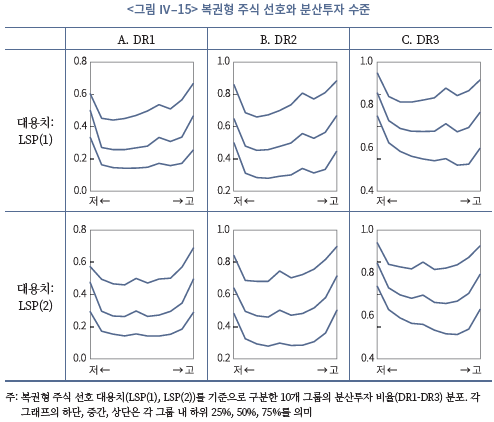

다음으로 복권형 주식 선호도 10개 그룹의 분산투자 비율(DR1-DR3)의 분포를 알아보자. <그림 Ⅳ-15>의 A, B, C는 각각 10개 그룹의 DR1, DR2, DR3의 분포를 제시하고 있다. 세 가지 분산투자 비율 모두 값이 클수록 분산투자 수준이 낮다는 점에 유의하자. 전반적으로 분산투자 비율은 복권형 주식 선호도와 U자형 관계를 나타낸다. 복권형 주식을 선호하는 투자자일수록 분산투자 수준이 낮다는 결과는 예상과 일치한다. 한편 복권형 주식 선호도가 낮은 그룹에서 분산투자 수준이 낮게 나타나는 것은, 복권형 주식과 거리가 먼 대형주 혹은 업종 대표주식을 집중적으로 보유 또는 거래하는 투자자들이 존재하기 때문인 것으로 파악된다.

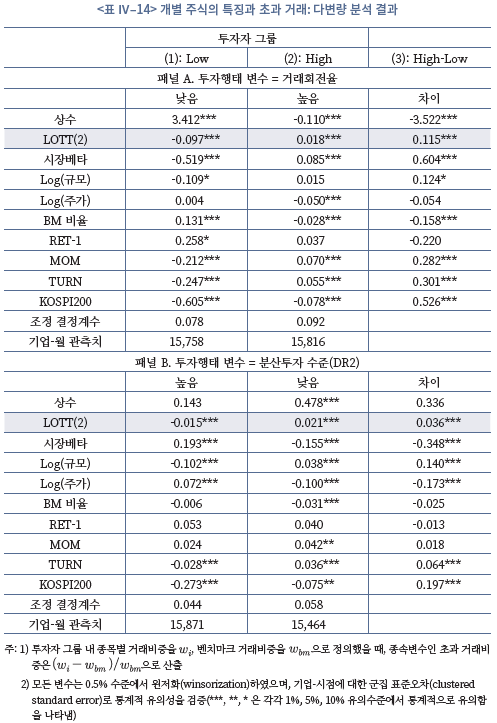

다음으로 다중회귀분석을 통해, 이상의 분석에서 확인된 결과의 강건성(robustness)을 검토해 보자. 개인투자자별 변수의 노이즈(noise)와 극단치(outlier) 문제를 최소화하기 위해 Goetzmann & Kumar(2008)의 분석방법을 적용한다. 개인투자자를 거래빈도 또는 분산투자 수준을 기준으로 세 그룹으로 나누고, 중간그룹을 제외한 상ㆍ하위 투자자 그룹에 대해 종목별로 초과거래 비중을 산출한다. 초과거래 비중을 산출하는 방식은 앞서 다절과 유사하다. 두 개인투자자 그룹 각각에서, 종목별 초과거래 비중을 종속변수로, 전월의 복권형 주식 대용치, 시장베타, 기업규모, 주가 수준, 장부가-시장가(BM) 비율, 과거 1개월(RET-1) 및 12개월(MOM) 수익률, 거래회전율(TURN), KOSPI200 포함여부 등을 독립변수로 이용한 패널 회귀분석을 수행한다. 이러한 분석방법은 투자행태가 다른 두 개인투자자 그룹에서 복권형 주식에 대한 선호도 차이가 있는지 비교하기 위한 것이다.

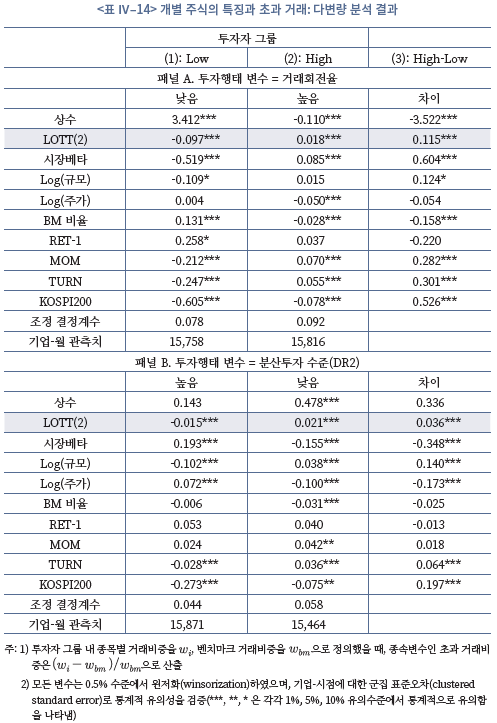

<표 Ⅳ–14>는 거래회전율(패널 A) 기준 개인투자자 그룹과 분산투자비율(DR2, 패널 B) 기준 개인투자자 그룹에 대한 추정결과를 요약한 것이다.22) 각 패널의 (3)은 (1)과 (2)의회귀분석 계수의 차이 및 그 차이의 통계적 유의성을 보여준다. 패널 A와 B의 결과에 따르면, 복권형 주식 대용치에 대한 계수의 부호가 상반되며 계수의 그룹 간 차이가 통계적으로 유의하다. 거래회전율이 높은 투자자 그룹 또는 분산투자 수준이 낮은 투자자 그룹에서 복권형 주식을 초과거래하는 것으로 확인된다. 이 외에도 시장베타, 장부가-시장가비율, 거래회전율, 코스피200 포함여부 등의 변수에서도 두 그룹간의 회귀계수의 차이가확인된다. 예를 들어, 거래회전율이 높은 투자자 그룹은 시장베타가 큰 주식, 장부가-시장가 비율이 낮은 주식, 거래회전율이 높은 주식을 초과거래하는 것으로 나타난다.

마. 복권형 주식 선호와 투자성과

마지막으로 복권형 주식의 투자성과, 복권형 주식 선호와 투자성과의 관계를 분석한다. <표 Ⅳ–13>에서 확인된 바와 같이, 복권형 주식은 음(-)의 초과수익률을 나타낸다. 이는 소위 대박을 추구하는 개인투자자들로 인해 복권형 주식의 가격이 과대평가되었기 때문이다(Barberis & Hwang, 2008; Bali et al., 2011; 강장구ㆍ심명화, 2014). 따라서 개인투자자의 복권형 주식에 대한 선호는 투자성과에 부정적인 영향을 미쳤을 가능성이 높다.

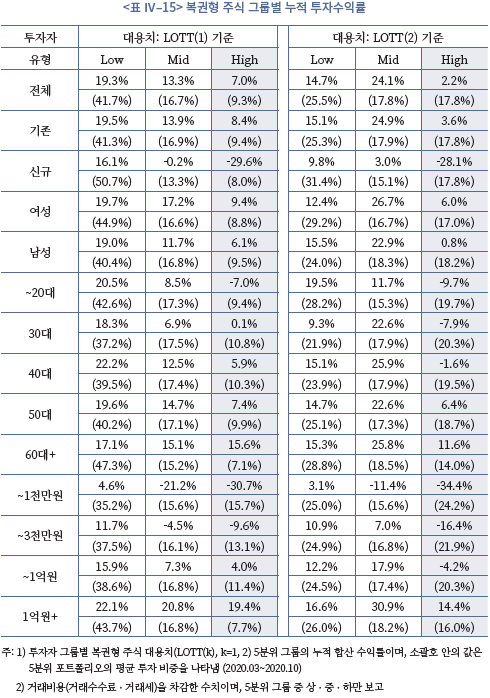

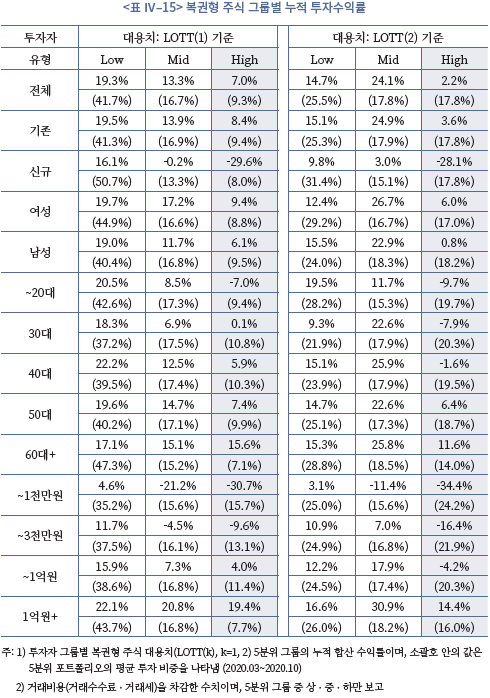

개인투자자 포트폴리오 내 복권형 주식이 투자성과에 미치는 영향을 파악하기 위해, 개인투자자 유형별 합산 주식 포트폴리오 내 복권형 주식 대용치 그룹별 투자성과를 분석한다. 앞선 실증분석과 유사하게, 포트폴리오에 포함된 상장주식을 복권형 주식 대용치에 따라 5개 그룹으로 나누고 각 그룹의 분석기간 누적수익률23)을 산출한다. <표 Ⅳ-15>는 복권형 주식 대용치별 5개 그룹 중 상위(Q5, High)ㆍ중위(Q3)ㆍ하위(Q1, Low) 그룹에 대한 결과를 제시하고 있으며, 소괄호 안의 수치는 해당 그룹에 대한 평균 투자비중이다.

먼저 전체 개인투자자에 대한 결과를 보면, LOTT(1) 기준으로 복권형 주식 그룹 (High)의 누적 투자성과는 7.0%이며, 평균 투자 비중은 9.3%이다. 양(+)의 성과를 시현했으나 다른 5분위 그룹에 비해 수익률이 낮다. 신규투자자의 경우 복권형 주식 그룹 (High)의 누적 수익률은 –29.6%로 기존투자자의 8.4%과 비교하여 매우 저조한 성과를 보인다. 거래비용을 고려하지 않을 경우 신규투자자의 수익률은 –19.8%로, 복권형 주식에 대한 잦은 거래 이외에도 종목 선택이나 투자시점 선택 또한 효율적이지 못했음을 시사한다. 20~30대 젊은 투자자, 자산 1천만원 이하의 소액투자자에서도 복권형 주식 그룹 (High)의 누적 수익률이 상대적으로 낮은 것으로 확인된다. 신규투자자, 젊은 투자자, 소액투자자의 저조한 투자성과(김민기ㆍ김준석(2021))는 복권형 주식의 부진한 성과와 밀접한 연관이 있는 것으로 평가할 수 있다. 한편, 복권형 주식 대용치를 LOTT(2)로 변경하여도 분석결과에 질적인 차이는 없다.

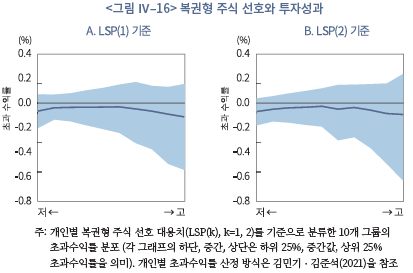

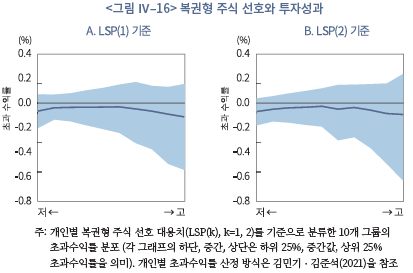

마지막으로 개인투자자별 복권형 주식 선호도와 투자성과의 관계를 살펴보자. <그림 Ⅳ-16>은 복권형 주식 선호도 10분위 그룹별 투자성과 분포를 제시하고 있다. 10분위 그룹은 개인투자자별 복권형 주식 선호 지표, LSP(1) 또는 LSP(2)를 기준으로 구분한다. 복권형 주식 선호도가 높을수록 초과수익률이 낮고, 복권형 주식 선호도 그룹 내 투자자간 성과 편차가 큰 것을 볼 수 있다. 복권형 주식의 특성상 수익률의 변동성이 크기 때문에 복권형 주식을 선호하는 그룹에서 투자성과의 편차가 큰 것으로 나타난다. 한편, 추가적인 다중회귀분석 결과, 복권형 주식 선호도와 투자성과의 음(-)의 관계는 거래빈도와 낮은 분산투자수준의 영향을 통제하더라도 유효한 것으로 나타난다. 이상의 분석결과는 복권형 주식 선호 경향이 개인투자자의 투자성과에 부정적인 영향을 미치는 것을 시사한다.

4. 단기군집거래

본 절에서는 개인투자자의 집단적인 매매행태, 군집거래에 대해 다루고자 한다. 군집거래는 다수의 투자자가 일정 기간 동안 같은 방향(매수 또는 매도)으로 매매하는 행태를 의미한다.

지금까지 군집거래에 대한 연구는 대부분 뮤추얼 펀드 등 기관투자자의 군집거래에 초점이 맞춰져 왔다(예: Lakonishok et al., 1992; Wermers, 1999; Sias, 2004; 박창균, 2004; 전용호ㆍ최혁, 2013). 기관투자자의 군집거래는, 타인의 거래를 통한 정보의 획득 (information cascade)(Banerjee, 1992), 평판 유지를 위한 모방(Scharfstein & Stein, 1999), 투자정보의 동조화(Froot et al., 1992; Hirshleifer et al., 1994) 등의 요인에 의해 발생하는 것으로 분석되고 있다.

개인투자자의 경우, 기관투자자의 군집거래를 유발하는 요인이 동일하게 개인투자자의 군집거래를 유발한다고 보기는 어렵다. 개인투자자의 열악한 정보량과 개개인의 의견 차이를 고려하면 군집거래 행태가 나타날 가능성이 낮다고 보는 편이 적절하다. 다만 정보 인프라의 발달, 정보채널의 확대 등의 변화와 함께 다수의 개인투자자가 유사한 정보를 취득하거나 혹은 제한된 주의(limited attention)와 같은 행태적 편의가 작동하여 세간의 관심을 받는 종목에 집단적으로 반응하는 경우 군집거래 현상이 나타나는 것으로 분석되고 있다(Hsieh et al., 2020; Baber et al., 2021).

본 절에서는 국내 개인투자자 군집거래의 존재 여부를 확인하고, 개인투자자 군집거래의 특징과 영향요인에 대해 분석한다. 특히 개인투자자의 거래특성 및 행태적 편의와의 관련성에 주목하여 살펴본다. 또한 개인투자자 군집거래와 미래 주식수익률 간의 관계를 통해 군집거래가 투자성과에 미치는 영향을 파악해 보도록 한다. 한편, 국내 개인투자자의 짧은 보유기간과 높은 거래회전율을 고려하여 모든 분석은 단기(short-term) 군집거래에 초점을 맞춘다.

가. 군집거래 분석 방법론

개인투자자의 단기군집거래 검증은 Sias(2004)의 방법론을 기초로 한다. 개인투자자들이 특정 종목에 대해 같은 방향으로 매매하는지 측정하고, 이러한 매매 방향이 양(+)의 시차 종속성(temporal dependency)을 보이는지 검토한다. 다시 말해 특정 종목을 지속적으로 매수 또는 매도하는지를 분석하는 것이다. 이는 기관투자자의 군집거래를 분석한 대부분의 연구에서 활용한 Lakonishok et al.(1992)의 방법론보다 직접적인 분석방법이다.24) 분기별 자료를 활용한 Sias(2004)와 달리, 본 보고서에서는 일간(daily) 또는 주간 (weekly) 단위의 단기군집거래를 살펴본다.

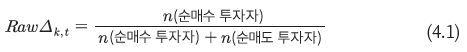

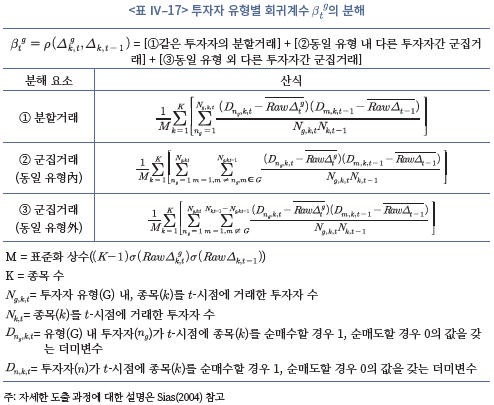

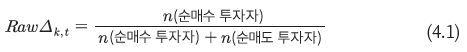

시점에 주식

시점에 주식  를 거래한 전체 개인투자자 중 10,000원 이상 순매수(net buy) 개인투자자 비중을 아래 식(4.1)의

를 거래한 전체 개인투자자 중 10,000원 이상 순매수(net buy) 개인투자자 비중을 아래 식(4.1)의  로 정의한다.25) 분석결과의 이상치(extreme value)를 최소화하기 위해 분석기간 내 평균 거래자수가 일간 10명, 주간 25명 이상인 종목, 일간 또는 주간 수익률이 빠짐없이 존재하는 종목을 대상으로 분석한다.

로 정의한다.25) 분석결과의 이상치(extreme value)를 최소화하기 위해 분석기간 내 평균 거래자수가 일간 10명, 주간 25명 이상인 종목, 일간 또는 주간 수익률이 빠짐없이 존재하는 종목을 대상으로 분석한다.

군집거래의 지표가 되는  는 투자자의 수를 기준으로 산출되는 것으로 투자자간 거래규모의 차이는 고려하지 않는다.

는 투자자의 수를 기준으로 산출되는 것으로 투자자간 거래규모의 차이는 고려하지 않는다.  가 1에 가까울수록 개인투자자의 집단 매수세가 강하고, 0에 가까울수록 집단 매도세가 강함을 의미한다.

가 1에 가까울수록 개인투자자의 집단 매수세가 강하고, 0에 가까울수록 집단 매도세가 강함을 의미한다.

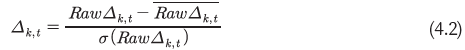

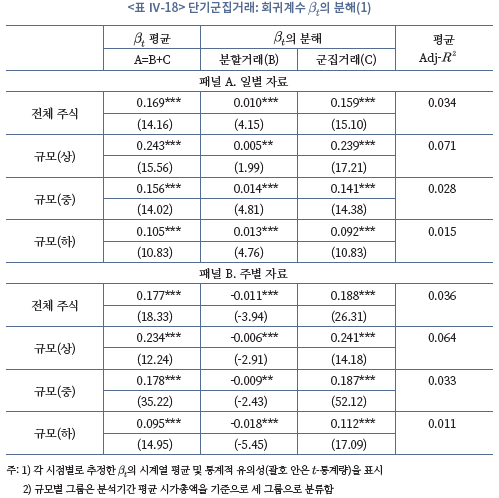

다음으로 식(4.2)와 같이 를 횡단면 평균 및 표준편차를 이용하여 표준화한

를 횡단면 평균 및 표준편차를 이용하여 표준화한  를 ‘군집매수성향’으로 정의한다.

를 ‘군집매수성향’으로 정의한다.  를 표준화하는 것은 회귀분석의 결과 해석을 용이하게 하고 분석결과의 비교가능성을 제고하는 한편, 특정 주식에 대한 선호도의 상대적인 크기를 측정하기 위한 것이다.

를 표준화하는 것은 회귀분석의 결과 해석을 용이하게 하고 분석결과의 비교가능성을 제고하는 한편, 특정 주식에 대한 선호도의 상대적인 크기를 측정하기 위한 것이다.  가 클수록 개인투자자들의 매수 선호도가 높으며, 반대로 값이 작을수록 개인투자자들의 매도 선호도가 높다.

가 클수록 개인투자자들의 매수 선호도가 높으며, 반대로 값이 작을수록 개인투자자들의 매도 선호도가 높다.

군집거래는 개인투자자의 매수 선호도 또는 매도 선호도가 일정 기간에 걸쳐 지속되는 것으로 정의할 수 있다. Sias(2004)의 방법론에 따라, 식(4.3)의 횡단면 회귀분석을 매 시점마다 시행하여 를 추정한다.26) 만약 추정된 회귀계수

를 추정한다.26) 만약 추정된 회귀계수  가 양(+)의 값으로 통계적으로 유의하다면 개인투자자 군집거래가 존재한다고 판단할 수 있다. (4.3)

가 양(+)의 값으로 통계적으로 유의하다면 개인투자자 군집거래가 존재한다고 판단할 수 있다. (4.3)

군집거래 회귀계수  는 두 개의 요소로 분해할 수 있다. 먼저 동일한 개인투자자가 같은 종목을

는 두 개의 요소로 분해할 수 있다. 먼저 동일한 개인투자자가 같은 종목을  시점 및

시점 및  시점에 분할 매수(또는 매도)함으로써

시점에 분할 매수(또는 매도)함으로써  에 기여할 수 있다. 이는 투자자 스스로 같은 방향의 거래를 일정기간 지속함으로써 발생하는 요소이다. 한편

에 기여할 수 있다. 이는 투자자 스스로 같은 방향의 거래를 일정기간 지속함으로써 발생하는 요소이다. 한편  시점에 거래한 투자자와 다른 개인투자자가

시점에 거래한 투자자와 다른 개인투자자가  시점에 거래함으로써

시점에 거래함으로써  에 기여할 수 있다. 개인투자자가 다른 개인투자자의 거래를 추종함으로써 발생하는 요소로, 실질적인 군집거래 요소로 볼 수 있다. <표 Ⅳ–16>은 의 각 요소를 식으로 정리하고 있다. ①은 ‘분할거래’로 동일한 개인투자자

에 기여할 수 있다. 개인투자자가 다른 개인투자자의 거래를 추종함으로써 발생하는 요소로, 실질적인 군집거래 요소로 볼 수 있다. <표 Ⅳ–16>은 의 각 요소를 식으로 정리하고 있다. ①은 ‘분할거래’로 동일한 개인투자자 의 분할매매 기여분이며, ②는 ‘군집거래’로 서로 다른 개인투자자

의 분할매매 기여분이며, ②는 ‘군집거래’로 서로 다른 개인투자자 의 추종거래 기여분이다.

의 추종거래 기여분이다.

본 분석에서는 개인투자자 세부 유형 내에서 군집거래가 더 강하게 나타나는지 살펴봄으로써 특성적 군집거래(characteristic herding)가 존재하는지 살펴본다. 국내 개인투자자 유형에 따라 포트폴리오 구성, 거래행태, 투자성과에 차이가 존재한다는 사실을 고려하면(김민기ㆍ김준석, 2021), 개인투자자 유형에 따라 선호하는 주식의 성격이 다를 수 있고, 투자정보의 원천이 다를 수 있다. 따라서 개인투자자 내 특성적 군집거래가 나타날 가능성이 예상된다.

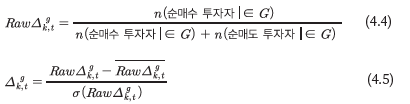

개인투자자 유형별 군집거래 분석에서도 Sias(2004)가 고안한 방법27)을 활용한다. 특정 개인투자자 유형 의 투자자 중, 주식

의 투자자 중, 주식  를 순매수한 개인투자자의 비율을

를 순매수한 개인투자자의 비율을  로 정의하고, 이를 표준화하여

로 정의하고, 이를 표준화하여  를 계산한다(식(4.4) 및 식(4.5)). 표준화된 변수

를 계산한다(식(4.4) 및 식(4.5)). 표준화된 변수  는 개인투자자 유형

는 개인투자자 유형  의

의  시점 주식

시점 주식  에 대한 군집매수성향이다.

에 대한 군집매수성향이다.

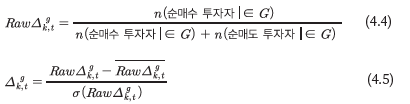

개인투자자 유형별 군집거래를 추정하는 회귀식은 아래 식(4.6)과 같다. 추정계수  는 분할거래 요소와 군집거래 요소로 분해할 수 있고, 군집거래 요소는 동일 유형의 투자자를 추종하는 요소와, 다른 유형의 투자자를 추종하는 요소로 다시 분해할 수 있다(<표 Ⅳ-17>). 여기서 개인투자자 유형은 신규 진입여부, 연령대, 성별, 자산규모 네 가지 기준으로 분류한다.

는 분할거래 요소와 군집거래 요소로 분해할 수 있고, 군집거래 요소는 동일 유형의 투자자를 추종하는 요소와, 다른 유형의 투자자를 추종하는 요소로 다시 분해할 수 있다(<표 Ⅳ-17>). 여기서 개인투자자 유형은 신규 진입여부, 연령대, 성별, 자산규모 네 가지 기준으로 분류한다.

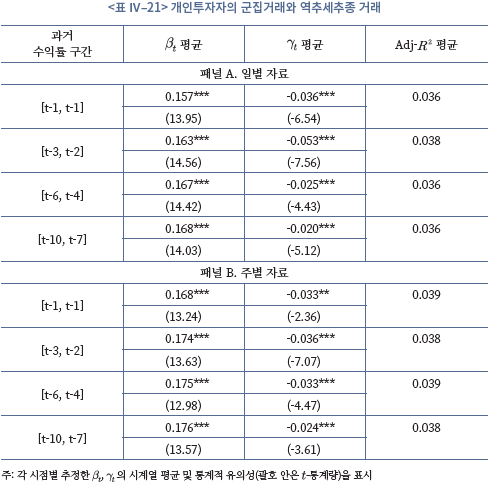

선행연구에 따르면 외국인투자자와 국내 기관투자자는 추세추종거래(positive feed-back trading) 경향을 보이며, 개인투자자는 반대로 역추세추종거래(negative feedback trading) 경향을 보인다(오승현ㆍ한상범, 2008; 전용호ㆍ최혁, 2013; 박수철ㆍ우민철, 2019; 김민기, 2020). 기관투자자의 경우 주로 활용하는 투자전략의 특성 또는 정보의 유사성으로 인해 추세추종 형태의 군집거래가 나타날 수 있다(Grinblatt et al., 1995; Wer-mers, 1999). 반면 개인투자자는 기업의 기초여건(fundamental)을 기반으로 한 중장기투자가 아닌 단기투자 경향을 보인다는 점에서, 최근 가격이 하락한 주식을 선호할 수 있다. 이에 개인투자자의 군집거래가 개인투자자의 역추세추종(또는 추세추종) 거래에 의해 유발되는지 검증하고자 하며, 개인투자자의 군집매수 성향  과 과거 주식 수익률 간의 상관관계를 통해 분석한다.

과 과거 주식 수익률 간의 상관관계를 통해 분석한다.

다음으로 개인투자자의 군집거래가 투자자의 제한된 주의(limited attention)에서 유발되는지 검토한다. 주식을 매도할 때는 포트폴리오에 속해 있는 종목 중에서 의사결정을 내리면 되는 반면, 주식을 매수할 때는 수많은 종목 중에서 선택해야 하는 문제에 직면하게 된다. 인지적 비용과 정보처리 능력의 불가피한 한계로 인해, 개인투자자들은 자주 노출되는 주식, 다수의 관심을 받거나 유행을 타는 주식에 유인될 가능성이 높다. 즉, 개인투자자의 단기군집거래는 개별 종목에 대한 시장의 관심 및 유행과 밀접하게 연관될 것으로 예상된다(Li et al., 2017; Hsieh et al., 2020).

개별 종목에 대한 투자자의 관심도는 네이버 데이터랩28)의 검색어 트렌드에서 추출한 검색빈도 시계열을 이용하여 측정한다. 기존연구에서 활용되는 투자자 관심도의 대용치는 거래량과 기업분석가 수(analysts’ coverage)가 대표적인데, 거래량은 본 분석의 핵심 변수인 군집매수 성향과 내생적으로 연관되어 있고, 기업분석은 주로 대형주 위주로 이루어지기 때문에 전체 상장종목에 대한 분석에서 활용하기에는 한계가 있다. 따라서 외생성을 갖추고 있으면서 동시에 모든 상장주식을 포괄할 수 있는 네이버 검색량이 보다 효과적인 대용치로 판단된다. 검색량을 계량적으로 활용한 대표적 연구인 Da et al.(2011)은 구글 검색량(Google search volume)29)이 기존 분석에서 사용된 투자자 관심도 대용치와 연관되어 있음을 보였으며, 이후 투자자 행태에 대한 다수의 실증연구에서 구글 검색량을 투자자 관심도의 대용치로 활용한 바 있다. 대만 개인투자자의 군집거래를 분석한 Hsieh et al.(2020)은 구글 검색량을 활용하여 개인투자자의 군집거래가 투자자의 관심도와 연관되어 있음을 보고하고 있다.

네이버 데이터랩 사이트를 통해 추출한 종목별 검색량을 바탕으로 종목별 검색량 지수(search volume index, SVI)를 산출30)하고, 개인투자자의 군집매수성향 와의 연관성을 다중회귀분석을 통해 분석한다.

와의 연관성을 다중회귀분석을 통해 분석한다.

나. 개인투자자의 단기군집거래

먼저 개인투자자들의 단기군집거래 경향을 검증해보자. 표본 내 전체 개인투자자의 거래자료를 이용하여 각 시점별 종목별 군집매수성향 를 계산하고, 횡단면 회귀분석을 통해

를 계산하고, 횡단면 회귀분석을 통해  의 시차 상관계수인

의 시차 상관계수인  를 매 시점마다 산출하여 검토한다.

를 매 시점마다 산출하여 검토한다.

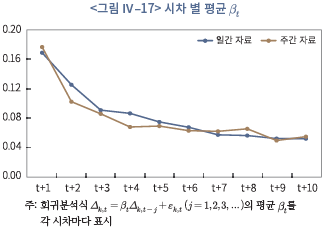

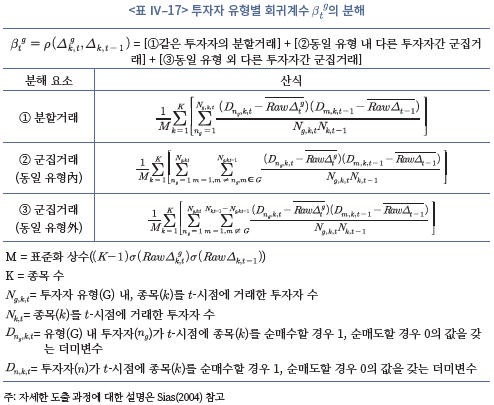

분석결과, 일별(주별) 시계열 의 평균은 0.169(0.177)로 나타나며 1% 수준에서 통계적으로 유의하다. 시차를 한 단위씩 늘려가며 동일한 분석을 진행한 결과, 아래 <그림 Ⅳ–17>처럼 평균 상관계수는 시차가 늘어날수록 감소하는 것으로 나타나지만 통계적으로 유의한 양(+)의 값으로 확인된다. 이는 개인투자자의 군집매수(매도)가 일정기간 내에서 지속된다는 것으로, 국내 개인투자자의 군집거래가 존재함을 의미한다.

의 평균은 0.169(0.177)로 나타나며 1% 수준에서 통계적으로 유의하다. 시차를 한 단위씩 늘려가며 동일한 분석을 진행한 결과, 아래 <그림 Ⅳ–17>처럼 평균 상관계수는 시차가 늘어날수록 감소하는 것으로 나타나지만 통계적으로 유의한 양(+)의 값으로 확인된다. 이는 개인투자자의 군집매수(매도)가 일정기간 내에서 지속된다는 것으로, 국내 개인투자자의 군집거래가 존재함을 의미한다.

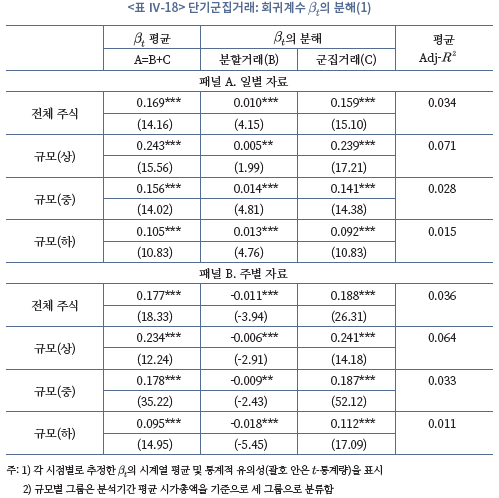

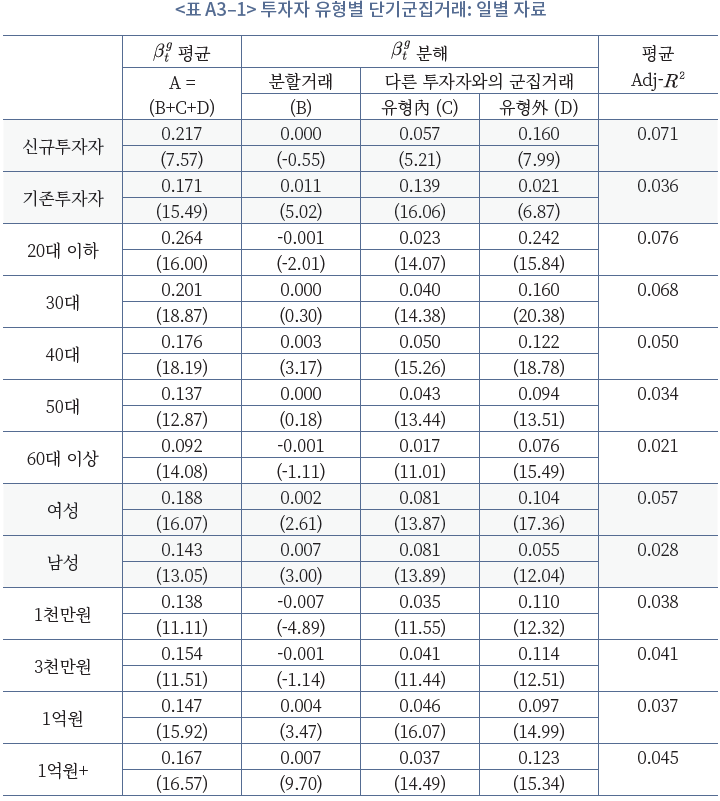

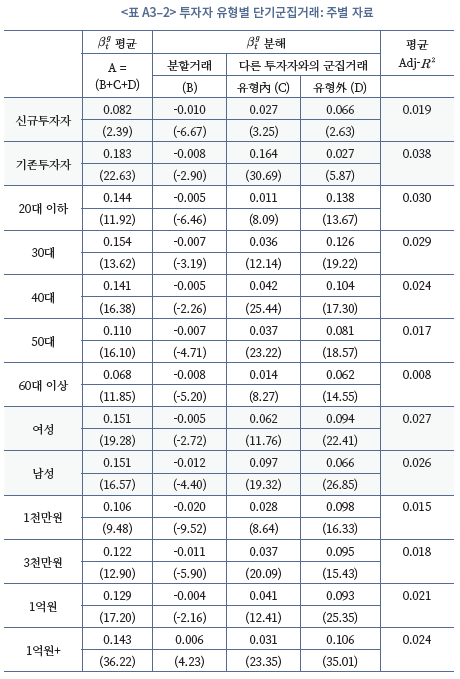

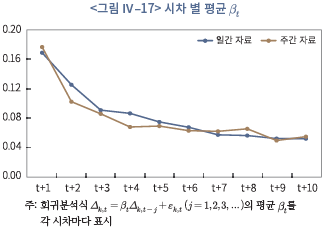

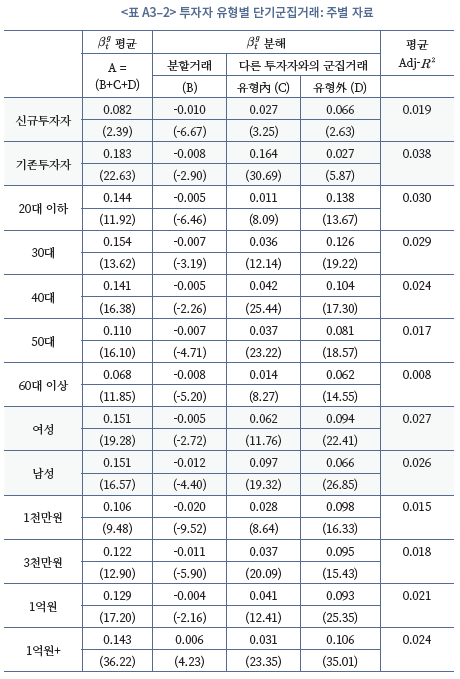

추정된 회귀계수  를 분할거래 요소와 군집거래 요소로 분해한 결과는 <표 Ⅳ–18>에 제시되어 있다. 가장 특징적인 점은

를 분할거래 요소와 군집거래 요소로 분해한 결과는 <표 Ⅳ–18>에 제시되어 있다. 가장 특징적인 점은  의 대부분은 다른 투자자간의 추종거래인 ‘군집거래’에 기인한다는 점이다. 동일 투자자의 분할거래는 통계적으로 유의하나, 일별 자료 분석에서는 비중이 작고, 주별 자료 분석에서는 부호가 오히려 음(-)의 값이다. 개인투자자는 일간 단위에서는 같은 방향의 분할거래를 일으키기도 하나, 주별 단위에서는 분할거래가 아니라 반대 방향의 매매를 하는 것으로 보인다. 상대적으로 소액의 자금을 운용하고 단기투자 성향이 강한 개인투자자의 특성을 고려할 때 같은 방향의 분할거래가 빈번하다고 보기는 어렵다.

의 대부분은 다른 투자자간의 추종거래인 ‘군집거래’에 기인한다는 점이다. 동일 투자자의 분할거래는 통계적으로 유의하나, 일별 자료 분석에서는 비중이 작고, 주별 자료 분석에서는 부호가 오히려 음(-)의 값이다. 개인투자자는 일간 단위에서는 같은 방향의 분할거래를 일으키기도 하나, 주별 단위에서는 분할거래가 아니라 반대 방향의 매매를 하는 것으로 보인다. 상대적으로 소액의 자금을 운용하고 단기투자 성향이 강한 개인투자자의 특성을 고려할 때 같은 방향의 분할거래가 빈번하다고 보기는 어렵다.

분석기간 평균 시가총액을 기준으로 주식을 세 그룹으로 나눈 뒤, 시가총액 그룹별로  를 추정하고 요인을 분해해보자. 전반적으로 대형주 그룹 내에서 개인투자자의 군집거래(C) 요인이 더 크게 산출되며, 분할거래(B) 요인은 크기는 작으나 소형주식일수록 절대값이 증가하는 경향이 있다. 개인투자자의 군집거래 요인이 대형주일수록 증가하는 경향은 기관투자자 및 외국인투자자와는 상반된 결과(예: Wermers, 1999; Sias, 2004; 전용호ㆍ최혁, 2013)로, 개인투자자의 군집거래가 타인의 거래를 통해 정보를 추론하는 정보의 폭포효과와 무관함을 시사한다.31) 한편, 해당 주식과 관련된 특정 정보가 개인투자자에게 비슷한 시점에 공통적으로 전달됨으로써 투자자들이 동일한 의사결정을 내리는 조사적 군집거래(investigative herding)로 해석될 수 있으나, 개인투자자가 일반적으로 정보거래자가 아님을 감안하면 투자자들이 공통적으로 접하는 미디어의 영향, 즉 주의효과에 의한 결과일 가능성이 더 크다.

를 추정하고 요인을 분해해보자. 전반적으로 대형주 그룹 내에서 개인투자자의 군집거래(C) 요인이 더 크게 산출되며, 분할거래(B) 요인은 크기는 작으나 소형주식일수록 절대값이 증가하는 경향이 있다. 개인투자자의 군집거래 요인이 대형주일수록 증가하는 경향은 기관투자자 및 외국인투자자와는 상반된 결과(예: Wermers, 1999; Sias, 2004; 전용호ㆍ최혁, 2013)로, 개인투자자의 군집거래가 타인의 거래를 통해 정보를 추론하는 정보의 폭포효과와 무관함을 시사한다.31) 한편, 해당 주식과 관련된 특정 정보가 개인투자자에게 비슷한 시점에 공통적으로 전달됨으로써 투자자들이 동일한 의사결정을 내리는 조사적 군집거래(investigative herding)로 해석될 수 있으나, 개인투자자가 일반적으로 정보거래자가 아님을 감안하면 투자자들이 공통적으로 접하는 미디어의 영향, 즉 주의효과에 의한 결과일 가능성이 더 크다.

한편 이 결과에서, 개인투자자가 주식을 순매수하는 것은 개인투자자의 의사결정 외에 거래 상대방의 의사결정도 영향을 미친다는 사실을 고려할 필요가 있다. 즉, 대형주일수록 가 크게 산출되는 것은 외국인과 국내 기관투자자의 거래가 대형주에 집중되기 때문일 수 있다는 것이다. 이러한 가능성을 통제하기 위해, 각 시가총액 그룹을 다시 기관투자자 거래비중에 따라 분류한 뒤, 그룹 내 개인투자자의 군집거래 여부를 확인하였다.

가 크게 산출되는 것은 외국인과 국내 기관투자자의 거래가 대형주에 집중되기 때문일 수 있다는 것이다. 이러한 가능성을 통제하기 위해, 각 시가총액 그룹을 다시 기관투자자 거래비중에 따라 분류한 뒤, 그룹 내 개인투자자의 군집거래 여부를 확인하였다.

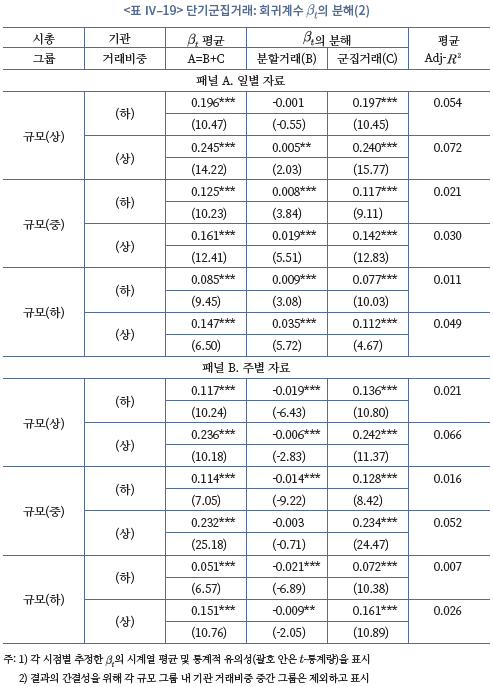

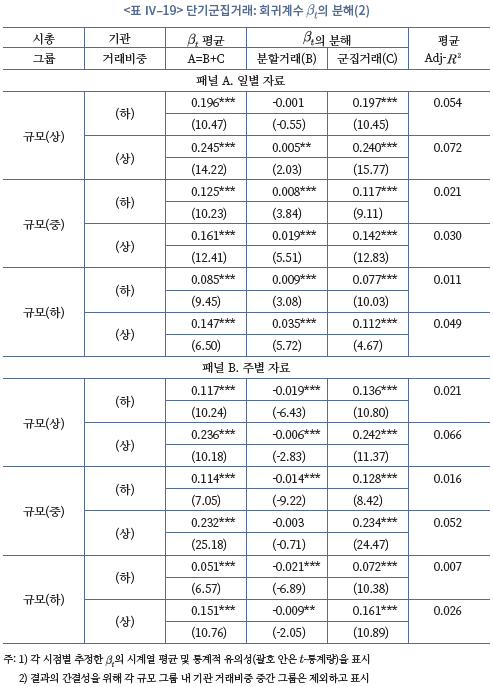

총 9개(3×3) 그룹 중 기관투자자 거래비중 중간 그룹을 제외한 6개 그룹에 대한 개인투자자 군집거래 분석결과가 <표 Ⅳ–19>에 요약되어 있다. 평균 회귀계수 는 모두 양(+) 의 값으로 산출되고, 분할거래 요인보다 군집거래 요인이 높은 비중을 차지한다. 아울러 기업의 규모와 상관없이 기관투자자의 거래비중이 높을수록

는 모두 양(+) 의 값으로 산출되고, 분할거래 요인보다 군집거래 요인이 높은 비중을 차지한다. 아울러 기업의 규모와 상관없이 기관투자자의 거래비중이 높을수록  와 군집거래 요인이 크게 추정되어, 개인투자자의 군집거래 행태는 투자자 유형별 구성과 연관이 있는 것으로 보인다. 다만 기관투자자의 거래비중이 낮은 소형주 그룹(규모(하) & 기관거래비중(하))에서도 개인투자자의 군집거래가 통계적으로 유의하게 나타나고 있어, 국내 주식시장에서 개인투자자의 군집거래가 존재함을 보여준다.

와 군집거래 요인이 크게 추정되어, 개인투자자의 군집거래 행태는 투자자 유형별 구성과 연관이 있는 것으로 보인다. 다만 기관투자자의 거래비중이 낮은 소형주 그룹(규모(하) & 기관거래비중(하))에서도 개인투자자의 군집거래가 통계적으로 유의하게 나타나고 있어, 국내 주식시장에서 개인투자자의 군집거래가 존재함을 보여준다.

다. 개인투자자 단기군집거래의 영향요인

다음으로, 개인투자자의 단기군집거래의 영향요인을 1)특성적 군집거래(characteristic herding), 2)(역)추세추종 성향, 3)투자자 관심(attention)의 관점으로 구분하여 분석한다.

먼저 표본 내 개인투자자를 신규구분 그룹, 연령대별 5개 그룹, 성별 그룹, 자산규모별 4개 그룹으로 분류한다. 투자자 유형별 평균 회귀계수 를 산출하고 분해하여, 유형 내 군집거래 요인과 유형 외 군집거래 요인을 비교한다. 다만 Sias(2004)가 지적한 바와 같이, 각 그룹별 투자자 수가 상이하여

를 산출하고 분해하여, 유형 내 군집거래 요인과 유형 외 군집거래 요인을 비교한다. 다만 Sias(2004)가 지적한 바와 같이, 각 그룹별 투자자 수가 상이하여  의 분해로 얻어진 값을 단순 비교하는 것은 적절하지 않으므로 각 분해요소별 평균 기여분을 산출하여 비교한다.32)

의 분해로 얻어진 값을 단순 비교하는 것은 적절하지 않으므로 각 분해요소별 평균 기여분을 산출하여 비교한다.32)

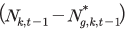

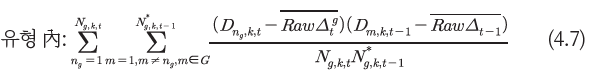

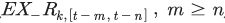

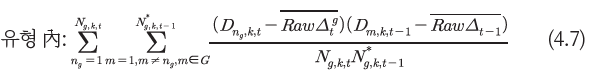

식(4.7) 및 (4.8)은 각각 유형 내, 유형 외 군집거래에 대한 평균 기여분을 나타내는데, 분모에 분자를 구성하는 투자자 조합의 수를 대입하여 투자자 한 쌍당 평균 기여도를 계산하는 방식이다. 식(4.7)의 분모는 같은 유형 내 서로 다른 투자자 조합의 수로, 그룹 의 투자자 수

의 투자자 수 와 투자자

와 투자자 를 제외한

를 제외한  시점에 거래한 그룹

시점에 거래한 그룹  내의 투자자 수

내의 투자자 수 의 곱이다. 식(4.8)의 분모는 그룹

의 곱이다. 식(4.8)의 분모는 그룹  의 투자자 수

의 투자자 수  와

와  시점에 거래한 다른 그룹 내 투자자 수

시점에 거래한 다른 그룹 내 투자자 수 의 곱이다.

의 곱이다.

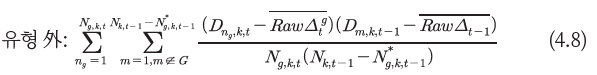

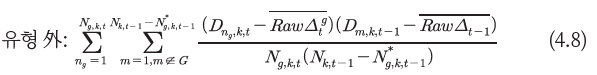

<표 Ⅳ–20>은 개인투자자 유형별 군집거래 회귀계수  의 분해요소 별 평균 기여도를 제시하고 있다. 군집거래 요인은 모든 개인투자자 유형에서 통계적으로 유의하다. 또한 각 유형별로 평균 기여도의 차이가 나타난다. <표 Ⅳ-20> 결과 내 군집거래요소를 합산하여 보면(A+B), 일별 자료를 기준으로 신규투자자(0.016)는 기존투자자(0.011)보다 크고, 20대 이하(0.019) 투자자는 60대 이상 고령투자자(0.007)보다 크다. 무엇보다 유형 내 군집거래의 평균 기여도가 유형 외 군집거래의 평균 기여도보다 항상 크고 통계적으로 유의한 차이를 보여, 같은 유형의 개인투자자가 선호하는 주식을 거래하는 특성적 군집거래를 확인할 수 있다.

의 분해요소 별 평균 기여도를 제시하고 있다. 군집거래 요인은 모든 개인투자자 유형에서 통계적으로 유의하다. 또한 각 유형별로 평균 기여도의 차이가 나타난다. <표 Ⅳ-20> 결과 내 군집거래요소를 합산하여 보면(A+B), 일별 자료를 기준으로 신규투자자(0.016)는 기존투자자(0.011)보다 크고, 20대 이하(0.019) 투자자는 60대 이상 고령투자자(0.007)보다 크다. 무엇보다 유형 내 군집거래의 평균 기여도가 유형 외 군집거래의 평균 기여도보다 항상 크고 통계적으로 유의한 차이를 보여, 같은 유형의 개인투자자가 선호하는 주식을 거래하는 특성적 군집거래를 확인할 수 있다.

이어서, 개인투자자의 군집거래가 역추세추종(또는 추세추종) 거래로 인해 발생하는지 검증한다. 이를 분석하기 위한 회귀모형은 기본적으로 식(4.3)과 동일하나, 독립변수로 시장수익률을 조정한 개별주식의 과거 초과수익률( )을 추가한다. 과거 초과수익률의 계수

)을 추가한다. 과거 초과수익률의 계수  의 부호를 통해 개인투자자의 추세추종 또는 역추세추종 거래행태를 확인할 수 있다.

의 부호를 통해 개인투자자의 추세추종 또는 역추세추종 거래행태를 확인할 수 있다.

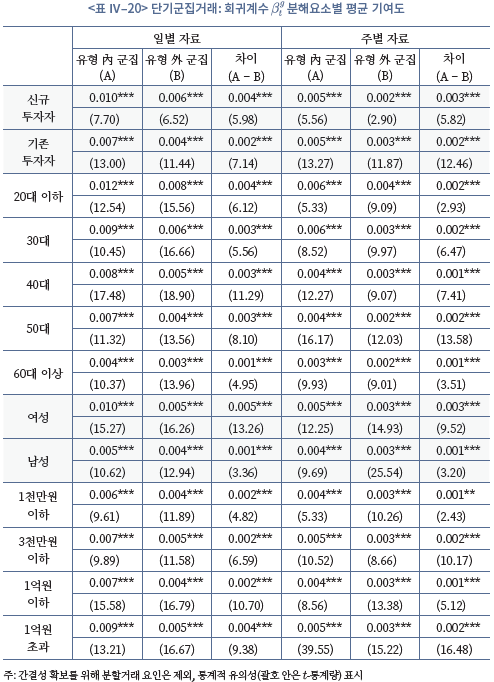

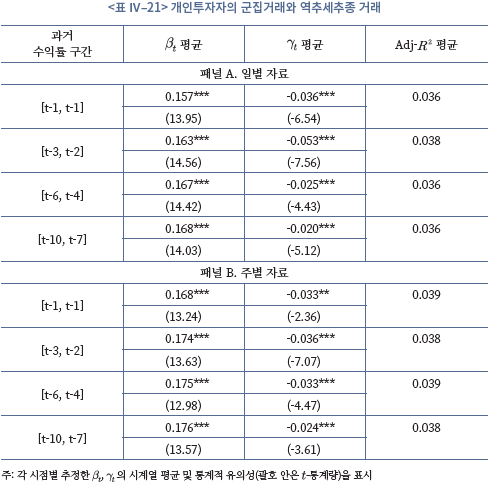

<표 Ⅳ–21>은 평균 회귀계수  및

및  를 과거 수익률 구간 및 자료 주기별로 요약한 것이다. 개인투자자의 과거 군집매수성향을 통제해도

를 과거 수익률 구간 및 자료 주기별로 요약한 것이다. 개인투자자의 과거 군집매수성향을 통제해도  의 부호는 모두 일관되게 음(-)의 값이며 통계적으로 유의하다. 이는 개인투자자가 일간(또는 주간) 단위의 역추세추종 거래행태를 보이며, 이러한 행태가 개인투자자의 군집매수 경향을 일부 설명하고 있음을 의미한다. 개인투자자의 역추세추종 거래행태는 과거 연구결과(오승현ㆍ한상범, 2008; 김민기, 2020)와 일관되며, 외국인투자자의 추세추종 거래와는 상반되는 특징이다(박창균, 2004; 전용호ㆍ최혁, 2013).

의 부호는 모두 일관되게 음(-)의 값이며 통계적으로 유의하다. 이는 개인투자자가 일간(또는 주간) 단위의 역추세추종 거래행태를 보이며, 이러한 행태가 개인투자자의 군집매수 경향을 일부 설명하고 있음을 의미한다. 개인투자자의 역추세추종 거래행태는 과거 연구결과(오승현ㆍ한상범, 2008; 김민기, 2020)와 일관되며, 외국인투자자의 추세추종 거래와는 상반되는 특징이다(박창균, 2004; 전용호ㆍ최혁, 2013).

개인투자자가 역추세추종 거래행태를 보이는 원인이 명확하게 밝혀진 바는 없다. 행태적으로, 주가가 상승할 때 매도하여 평가이익을 조기에 실현하고 하락한 종목을 지속적으로 보유하는 처분효과, 또는 과거 주가를 기준으로 주가의 향방을 판단하는 기준점 편향33)(anchoring bais)(Tversky & Kahneman, 1974)이 역추세추종 거래행태를 유발할 수 있는 것으로 평가되나, 본고에서는 역추세추종 거래의 요인에 대한 자세한 분석은 생략한다.

마지막으로 투자자의 제한된 주의가 개인투자자의 군집거래에 미치는 영향을 분석한다. 매수할 종목을 탐색할 때, 수많은 선택지와 정보에 직면한 개인투자자는 제한된 주의의 영향에 따라 다수의 투자자의 관심을 끄는 종목을 선호할 가능성이 존재한다. 앞서 설명한 바와 같이 네이버 검색량 지수(SVI)로 종목별 투자자 관심도를 계량화하여, 투자자 관심도가 개인투자자의 군집매수 경향을 설명하는지 분석한다.

네이버 검색량 지수의 시계열적 특징을 고려하여 패널 회귀분석을 진행하는데, 주요 독립변수는 전 시점의 군집매수 성향( )과 로그 검색량 지수(Logarithm of Search Volume Index: LSVI)이다. 여기에, 비선형성(non-linearity) 요소를 고려하기 위한 교차변수를 추가하여, 군집매수 경향의 지속성이 투자자 관심도와 어떠한 관련이 있는지 확인한다. 기타 통제변수로는 선행연구(Hsieh et al., 2020)를 참고하여 과거 주식수익률(

)과 로그 검색량 지수(Logarithm of Search Volume Index: LSVI)이다. 여기에, 비선형성(non-linearity) 요소를 고려하기 위한 교차변수를 추가하여, 군집매수 경향의 지속성이 투자자 관심도와 어떠한 관련이 있는지 확인한다. 기타 통제변수로는 선행연구(Hsieh et al., 2020)를 참고하여 과거 주식수익률( ), 규모(

), 규모( ), 해당 주식의 변동성(

), 해당 주식의 변동성( ), 시장수익률(

), 시장수익률( ), 시장 변동성(

), 시장 변동성( )을 포함한다.

)을 포함한다.

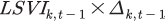

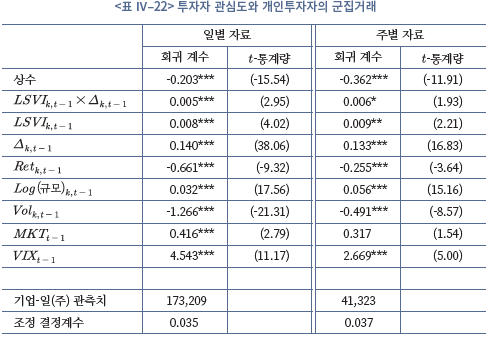

패널 회귀분석 결과는 <표 Ⅳ–22>에 요약되어 있다. 분석결과, 주요 변수인 와 교차항(

와 교차항( )의 계수는 자료의 주기와 상관없이 양(+)의 값으로 통계적으로 유의하다. 해당 종목에 대한 관심이 증가할 때 개인투자자의 군집매수 성향이 증가하고, 전 시점 군집매수 경향의 시차 종속성은 투자자의 관심이 증가한 종목에서 더 강하게 나타난다. 이는 개인투자자 군집거래가 투자자의 제한된 주의 및 관심 효과(atten-tion effect)와 연관되어 있음을 시사하며, Li et al.(2017), Hsieh et al.(2020)의 연구결과와 일관된다.

)의 계수는 자료의 주기와 상관없이 양(+)의 값으로 통계적으로 유의하다. 해당 종목에 대한 관심이 증가할 때 개인투자자의 군집매수 성향이 증가하고, 전 시점 군집매수 경향의 시차 종속성은 투자자의 관심이 증가한 종목에서 더 강하게 나타난다. 이는 개인투자자 군집거래가 투자자의 제한된 주의 및 관심 효과(atten-tion effect)와 연관되어 있음을 시사하며, Li et al.(2017), Hsieh et al.(2020)의 연구결과와 일관된다.

라. 개인투자자 단기군집거래와 투자성과

이상의 분석에서 확인된 국내 개인투자자의 단기군집거래 특징은 다음과 같다. 첫째, 젊은 투자자와 신규투자자의 군집거래 경향이 강하다. 둘째, 동일 유형 내 군집거래, 즉 특성적 군집거래가 확인된다. 셋째, 개인투자자의 군집거래는 부분적으로 역추세추종 거래행태와 연관되어 있는 것으로 추정된다. 넷째, 해당종목에 대한 시장의 관심도가 증가할수록 개인투자자의 군집거래 경향이 강화된다.

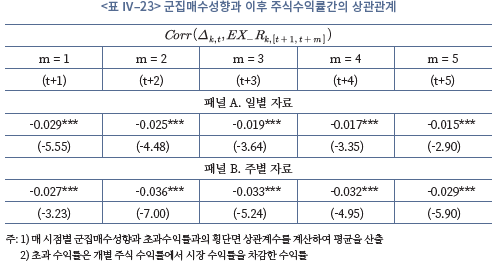

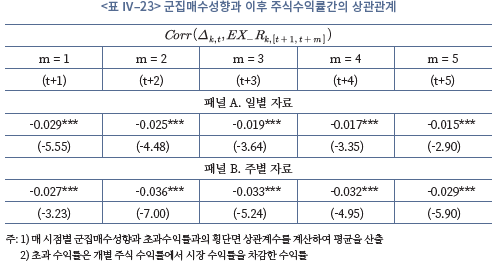

개인투자자 단기군집거래가 합리적 거래행태가 아니라면, 개인투자자의 단기군집거래는 사후 수익률과 무관하거나, 혹은 단기군집거래 이후 가격 반전(reversal)을 예상할 수 있다. <표 Ⅳ–23>은 주식 의

의  시점 군집매수 경향(

시점 군집매수 경향( )과 이후 초과수익률(

)과 이후 초과수익률( )간의 평균 상관관계를 제시하고 있다. 자료의 주기와 상관없이 개인투자자의 군집매수 이후 가격반전이 발생하는 것을 확인할 수 있다. 이는 개인투자자의 군집거래가 정보에 기반한 투자의사결정이 아닌 비합리적인 투자행태임을 시사하며, 기관투자자 군집거래에서 정보성이 확인된다는 기존 연구결과와 대비된다 (Nofsinger & Sias, 1999; Wermers, 1999).

)간의 평균 상관관계를 제시하고 있다. 자료의 주기와 상관없이 개인투자자의 군집매수 이후 가격반전이 발생하는 것을 확인할 수 있다. 이는 개인투자자의 군집거래가 정보에 기반한 투자의사결정이 아닌 비합리적인 투자행태임을 시사하며, 기관투자자 군집거래에서 정보성이 확인된다는 기존 연구결과와 대비된다 (Nofsinger & Sias, 1999; Wermers, 1999).

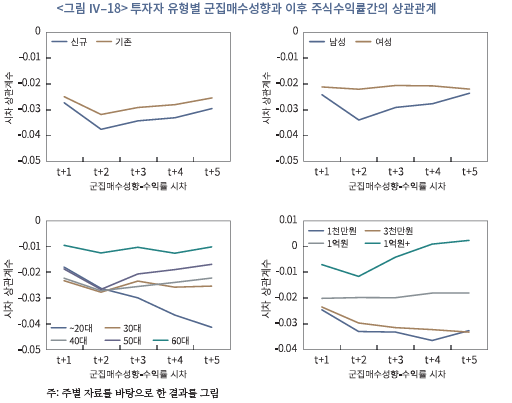

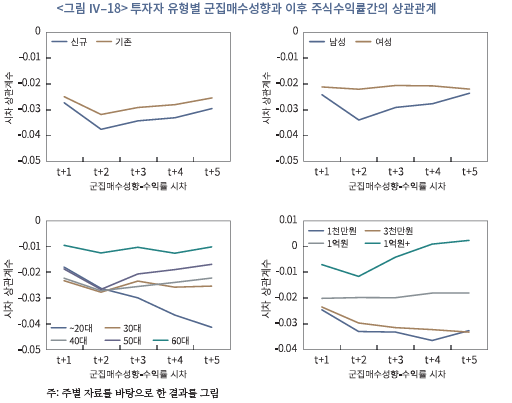

아래 <그림 Ⅳ–18>은 <표 Ⅳ–23>의 분석을 투자자 유형별 군집매수경향( )으로 확장한 결과이다. 대체로 음(-)의 상관관계를 보이며, 특히 신규투자자, 젊은 투자자, 남성투자자, 소액투자자에서 상관관계가 크다. 이들 투자자유형에서 군집거래 이후 가격반전이 보다 명확하게 나타난다는 것으로 이들이 다른 투자자유형에 비해 비합리적 투자행태를 보인다고 평가할 수 있다.

)으로 확장한 결과이다. 대체로 음(-)의 상관관계를 보이며, 특히 신규투자자, 젊은 투자자, 남성투자자, 소액투자자에서 상관관계가 크다. 이들 투자자유형에서 군집거래 이후 가격반전이 보다 명확하게 나타난다는 것으로 이들이 다른 투자자유형에 비해 비합리적 투자행태를 보인다고 평가할 수 있다.

V. 요약 및 시사점

본고는 국내 개인투자자 약 20만명의 2020년 3월부터 10월까지 거래내역을 토대로, 국내 개인투자자의 행태적 편의가 주식거래 행태와 투자성과에 미치는 영향을 실증적으로 분석하였다. 과잉확신, 처분효과, 복권형주식 선호, 단기군집거래 등 네 가지 대표적인 행태적 편의에 초점을 맞춰 분석한 결과는 다음과 같다.

먼저, 과잉확신은 개인투자자의 과도한 거래 및 저조한 투자성과에 영향을 주는 요인이며, 투자경험이 부족한 투자자들에서 그 영향은 더 큰 것으로 파악된다. 개인투자자의 거래량과 시장수익률과의 관계를 VAR 모형 및 충격반응함수를 통해 분석한 결과, 개인투자자의 거래량은 전 시점의 시장수익률과 통계적으로 유의한 양(+)의 관계를 갖는 것으로 나타난다. 특히 이러한 관계는 연령대가 낮은 투자자, 소액투자자 등 거래빈도가 높은 투자자유형에서 더 강하게 관찰된다. 또한 매수거래 후 수익률과 매도거래 후 수익률을 비교하여 투자자의 매매의사결정 오류를 분석한 결과, 매매의사결정 오류는 적정가치를 추정하기 어려운 주식에서, 연령대가 낮은 투자자, 소액투자자 등 과잉확신 경향이 강한 투자자 유형에서 현저한 것으로 관찰된다.

둘째, 개인투자자의 거래행태에 처분효과가 명확히 관찰되며 처분효과가 강한 투자자의 투자성과는 상대적으로 저조한 것으로 나타난다. Cox 비례위험모형을 이용해 보유기간 수익률에 따른 매도확률을 분석한 결과, 보유기간 수익률이 양(+)인 주식을 매도할 확률은 보유기간 수익률이 음(-)인 주식을 매도할 확률의 2배 이상인 것으로 분석된다. 즉, 이익이 난 주식은 서둘러 매도하고 손실이 난 주식은 매도를 미루는 경향이 뚜렷하다. 이러한 경향은 적정가치를 추정하기 어려운 주식, 연령대가 낮은 투자자, 신규투자자, 여성투자자에서 강하게 나타난다. 또한 동일한 평가기간을 설정하여 보유기간 수익률을 비교한 결과, 처분효과가 강한 투자자일수록 수익률이 낮은 것으로 분석된다. 이익이 난 주식을 서둘러 매도함으로써 추가적인 이익기회를 상실하고, 손실이 난 주식의 매도를 미룸으로써 추가적인 손실을 누적하는 결과를 초래한 것으로 추정된다.

셋째, 개인투자자는 복권형 주식을 선호하고, 복권형 주식을 선호하는 투자자일수록 투자성과가 저조한 것으로 나타난다. 수익률 변동성, 수익률 왜도, 주가수준 등을 바탕으로 복권형 주식을 정의하고, 해당 주식에 대한 보유비중과 거래비중을 분석한 결과, 개인투자자는 외국인투자자와 국내 기관투자자에 비해 복권형 주식을 초과보유, 초과거래하는 것으로 분석된다. 연령대가 낮은 투자자, 남성투자자에서 이러한 경향은 더 강하다. 또한 복권형 주식에 대한 선호가 높은 투자자일수록 분산투자 수준이 낮고, 거래빈도가 높으며, 투자성과가 저조한 것으로 파악된다.

마지막으로, 개인투자자는 군집적으로 거래하는 행태를 보이며 이는 행태적 편의에 따른 비합리적 투자의사결정으로 판단된다. 종목별 순매수 개인투자자 비중의 일간 및 주간 시계열 상관관계를 분석한 결과, 통계적으로 유의한 양(+)의 값이 일정기간 유지되어 단기군집거래 경향이 확인된다. 투자자 유형별로는 연령대가 낮은 투자자, 신규투자자에서 이러한 경향이 강하다. 또한 단기군집거래 경향은 관심도(검색량)가 높은 주식에서 뚜렷하게 관찰되어, 군집거래 경향이 접근하기 쉬운 정보, 눈에 띄는 정보에 의존하여 의사결정을 내리는 행태적 편의, 즉 제한된 주의와 밀접하게 연관된 것으로 추정된다. 한편, 단기군집거래 이후 가격반전현상이 관찰되어 단기군집거래가 정보에 기반한 거래가 아닌 비합리적인 거래행태임을 시사한다.

이상의 분석결과는 국내 개인투자자가 다양한 행태적 편의에 노출되어 있으며 행태적 편의는 비합리적인 투자의사결정을 유발하고 결과적으로 투자성과에 부정적인 영향을 미친다는 사실을 보여준다. 특히, 연령대가 낮은 투자자와 신규투자자가 행태적 편의의 영향에 보다 취약한 것을 확인할 수 있다. 이러한 결과는 개인투자자의 행태적 편의에 대한 기존 국내외 실증연구와도 일관된 결과로, 분석대상과 분석시기의 특성에 따른 결과는 아닌 것으로 판단된다.

주식거래의 편의성이 높아질수록 행태적 편의에 취약한 투자자가 유입될 가능성이 높으며, 거래대상 확대 및 정보채널 다양화로 투자의사결정 환경이 복잡해질수록 행태적 편의가 투자의사결정에 영향을 미칠 가능성이 높다(Agnew & Szykman, 2005; Barber et al., 2021). 개인투자자의 주식시장 참여가 확대된다 하더라도 행태적 편의의 영향으로 저조한 투자성과가 누적된다면 주식시장 개인투자자 기반이 장기적으로 유지되기는 어려울 것이다. 또한 개인투자자의 행태적 편의가 집단적으로 혹은 체계적으로 나타날 경우 주식시장의 가격효율성에도 부정적인 영향을 미칠 수 있다. 한국 주식시장과 같이 개인투자자의 비중이 높을 경우 부정적인 영향에 대한 우려는 더 클 수밖에 없다.

따라서 개인투자자의 투자성과를 제고하고 자본시장의 효율성을 유지하기 위해서는 개인투자자의 행태적 편의와 행태적 편의가 투자의사결정에 미치는 영향을 완화하기 위한 방안을 강구할 필요가 있다. 첫째, 개인투자자의 간접투자수단 및 전문적 자문에 대한 활용도를 높여야 한다. 실증적으로 주식투자 전문성이 낮을수록 행태적 편의에 취약하며, 본고의 분석에서도 연령대가 낮은 투자자, 소액투자자, 신규투자자 등 투자경험과 역량이 부족한 투자자에서 행태적 편의가 강하게 관찰된다. 잘 분산된 포트폴리오를 장기보유하는 것이 과거 수익률에 의존하여 소수의 주식을 빈번하게 거래하는 것보다 우수한 투자성과를 보인다는 사실은 분명하다. 개인투자자 본인의 투자역량에 대한 냉정한 평가가 필요하며, 투자역량을 갖추지 못하고 있다고 판단한다면 직접투자 보다는 주식투자 전문가가 운용하는 펀드에 투자하거나 전문가의 자문을 활용함으로써 행태적 편의의 영향을 줄여야 한다. 물론 이는, 간접투자수단 운용자 및 자문서비스 제공자가 충분한 전문성을 갖추고 있다는 것, 이들과 개인투자자 사이에 이해상충이 없다는 것을 전제로 한다.

둘째, 개인투자자의 행태적 편의를 유발하지 않고 나아가 감소시킬 수 있는 직접투자환경을 조성해야 한다. Barber et al.(2021)은 급등주와 급락주 정보가 동시에 제공될 경우 급등주와 급락주 모두에서 거래가 증가하고, 급등주와 급락주 정보가 별도로 제공될 경우 급등주에서 거래가 더 증가하는 현상을 보고하고 있다. 이와 같이 개인투자자의 거래행태는 어떤 정보를 접하느냐, 어떤 정보에 집중하느냐에 영향을 받기 때문에, 개인투자자에게 제공되는 정보의 유형과 형식 등을 개선함으로써 행태적 편의가 투자의사결정에 미치는 영향을 줄일 수 있을 것이다. Frydman & Rangel(2014)은 주식거래 프로그램에서 매수가격에 대한 정보를 제거할 때 처분효과가 감소한다는 실험결과를 제시하였으며, Russo & Schoemaker(1992)와 Kaustia & Perttula(2012)는 각각 과거성과에 대한 정보와 행태적 편의에 대한 경고 문구가 제공될 때 과잉확신 경향이 줄어든다는 결과를 제시하고 있다. 금융투자회사가 개인투자자의 행태적 편의에 따른 취약성을 파악하고 경고하는 것, 행태적 편의의 영향을 최소화하는 직접투자 환경을 조성하는 것은 투자자보호의무의 범주에 포함된다고 볼 수 있다. 또한 개인투자자의 행태적 편의를 유도하거나 방치하는 것보다 개인투자자가 행태적 편의의 영향에서 벗어나 투자수익률을 제고할 수 있도록 돕는 것이 신뢰성의 제고, 사업의 지속가능성에 부합한다.

셋째, 주식투자에 대한 지속적이고 체계적인 교육이 필요하다. 코로나19 국면에서 새롭게 유입된 투자자는 저연령대 투자자와 소액투자자의 비중이 높은데, 투자경험과 역량이 부족한 이들은 행태적 편의가 강하게 관찰되고, 과도하게 거래하며, 투자성과가 저조하다. 투자경험을 통한 학습효과가 존재한다고 하더라도, 재무적 여건이 취약한 이들에게 투자실패의 경험을 통한 학습효과를 기대하는 것은 적절하지 않다. 주식투자의 특성과 투자자의 행태적 편의에 대한 교육을 통해 직접투자 역량을 키우는 한편, 본인의 투자능력을 정확히 평가하고 대안적 투자수단을 선택할 수 있도록 해야 할 것이다. 다만, 지식(literacy)을 강조하는 전통적인 금융교육은 효과에 대한 논란이 존재하므로(Willis, 2009; Fernandes et al., 2014), 개인투자자의 행동을 실질적으로 변화시킬 수 있는 교육내용과 교육방식을 고안하는 것이 중요한 과제다.

부록1. 사전적 고유왜도 추정 모형

사전적 고유왜도(ex-ante idiosyncratic skewness)를 추정하기 위해 Boyer et al.(2010)의 방법론을 활용하여 아래와 같은 예측 횡단면 회귀분석을 실시한다. 각 종목별로 과거 3개월 일별 수익률을 활용해 매월 고유왜도 및 고유변동성을 산출하고, 시점의 고유왜도(

시점의 고유왜도( )를 종속변수로 하고,

)를 종속변수로 하고,  (T=3개월) 시점의 고유왜도 및 고유변동성(

(T=3개월) 시점의 고유왜도 및 고유변동성( ) 및 그 왜 개별기업의 특징(

) 및 그 왜 개별기업의 특징( )들을 독립변수로 설정한다. 예측 기간을 3개월로 설정한 이유는 국내 개인투자자의 단기투자 성향을 고려한 것이며, 6개월 또는 1년으로 설정해도 전반적인 결과의 질적인 차이는 없다.

)들을 독립변수로 설정한다. 예측 기간을 3개월로 설정한 이유는 국내 개인투자자의 단기투자 성향을 고려한 것이며, 6개월 또는 1년으로 설정해도 전반적인 결과의 질적인 차이는 없다.

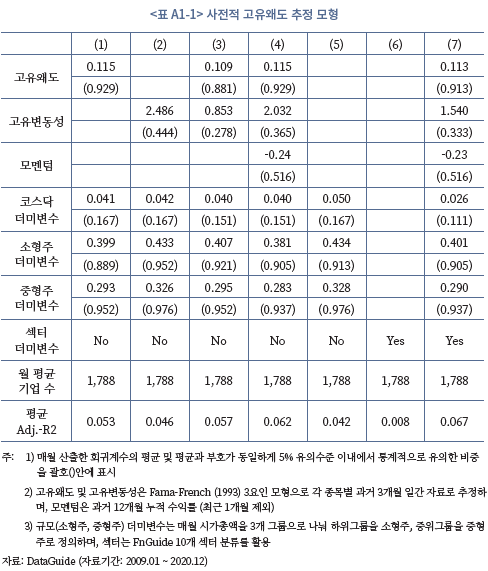

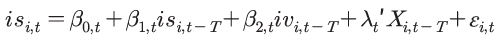

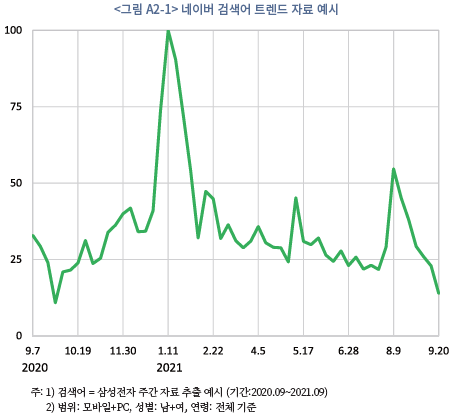

매월 횡단면 회귀분석을 실시한 뒤, 매월 산출된 회귀계수와 유의한 계수의 비중을 아래 <표 A1-1>에 나타낸 것이다. 최종 모형은 조정 결정계수가 가장 높은 모형(7)로 설정34)하였으며, 각 시점별 개별 종목의 사전적 고유왜도는 -시점까지의 자료를 활용한 회귀계수에 시점의 독립변수를 대입하여 산출한다.

시점의 독립변수를 대입하여 산출한다.

부록2. 네이버 검색어 트렌드 자료 추출 방법

네이버는 국내 검색엔진 중 가장 높은 점유율을 차지하고 있다.35) 또한 네이버 금융(finance.naver.com)에서 웹, 모바일 버전으로 개인투자자에게 종목 관련 각종 정보를 연동하여 제공하고 있어 일반 투자자의 활용도가 높다. 이러한 네이버 검색엔진의 특징과 점유율을 바탕으로 인터넷 사용자의 네이버 검색량을 투자자 관심 척도의 대용치로 사용한다.

자료 추출을 실시하기 전에 어떤 검색어를 입력할지 정해야한다. Da et al.(2011)은 미국 상장주식의 알파벳 티커(ticker)를 중심으로 검색어 지수를 개발했지만, 국내 상장주식의 경우 6자리 종목코드 외에도 해당 기업의 이름으로 검색하는 일이 빈번할 것이다. 예를 들어 SK하이닉스에 대해 검색할 때, SK하이닉스 또는 하이닉스와 같은 기업명으로 주로 검색하는 경우가 많을 것이며 종목코드인 ‘000660’을 입력하는 경우는 드물 것으로 예상된다. 따라서 자료를 추출할 때 종목명을 중심으로 수집하되, 종목명의 줄임말 표현36), 영문표현의 경우 국문표현을 합산하여 검색량을 추출한다. 또한 6자리 종목코드도 검색어 리스트에 포함한다. 이 외에도 상장기업의 상호가 변경될 경우, 변경 전 상호도 포함한다.37) 네이버 검색어트렌드는 20개 이내의 검색어의 합산 검색량을 추출할 수 있고, 자료의 주기(일간, 주간, 월간), 기간, 검색 대상자의 유형을 선택할 수 있다. 본 연구에서는 분석기간 내 모든 유형의 일간 검색량 자료를 중심으로 추출하며, 주간 자료 분석에서는 일간 자료의 주별 합산 자료를 활용한다.

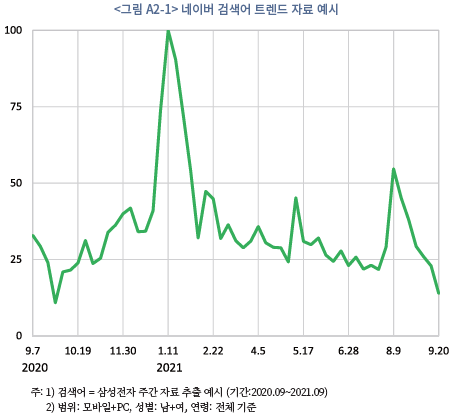

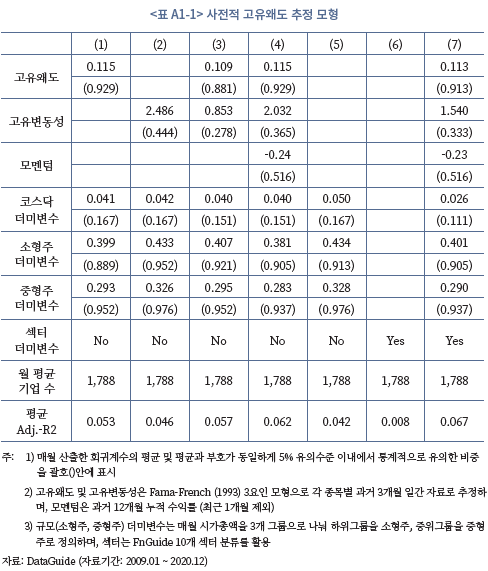

아래 <그림 A2-1>은 ‘삼성전자’로 검색한 결과의 예시를 보여준다. 검색어 트렌드의 특징은 가장 많이 검색된 시점을 100을 기준으로 나머지 기간의 검색량을 표준화한다는 점이다.38) 이는 절대적인 자료가 아닌 상대적인 트렌드이며, 시계열 혹은 패널(panel) 분석에 용이한 자료이다. 본 보고서에서는 모든 상장기업을 대상으로 추출한 검색어 트렌드를 검색량 지수(search volume index)로 정의하여 분석을 진행한다.

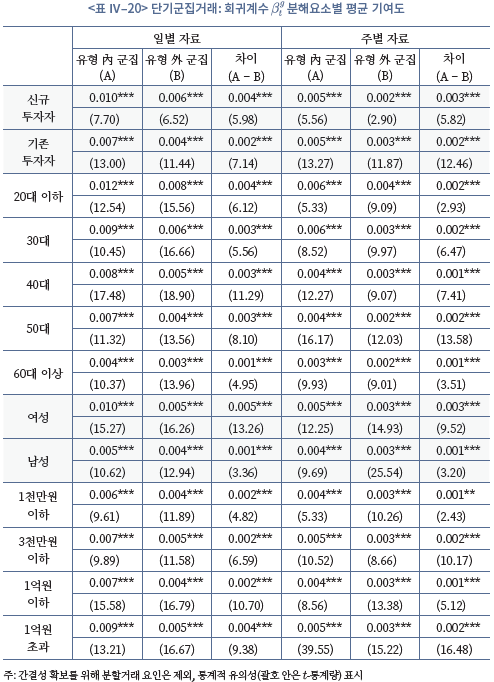

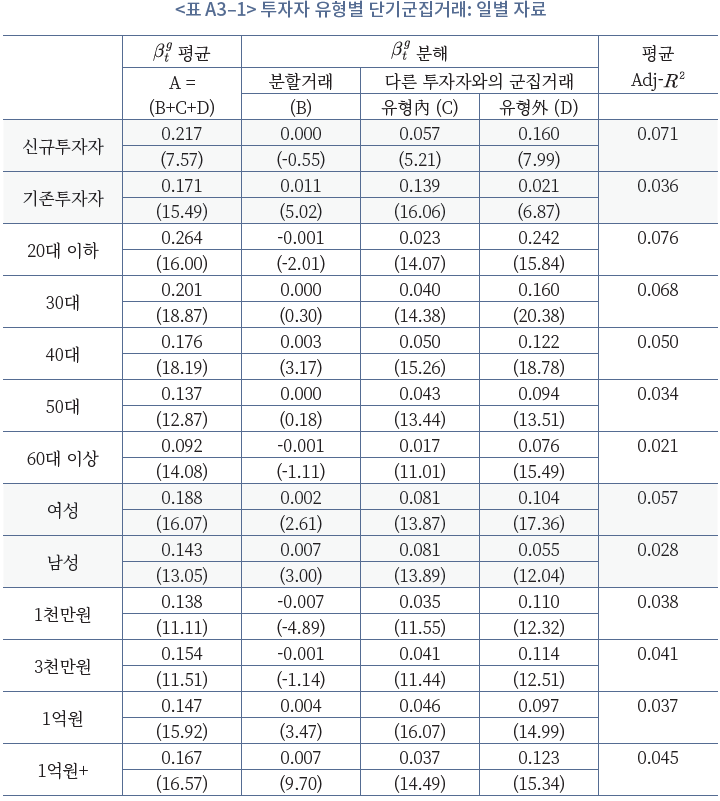

부록3. 투자자 유형 그룹별 단기군집거래 회귀분석 결과

보고서의 간결성을 위해 투자자 유형별 단기군집거래 회귀분석 결과는 부록에 첨부한다. 아래 표는 본문의 <표 Ⅳ–17>에 제시된 투자자 유형별 군집매수성향 의 회귀분석(본문의 식(4.6)) 결과 산출된

의 회귀분석(본문의 식(4.6)) 결과 산출된  의 시계열 평균과 각각의 세 가지 분해요소(분할거래, 동일 유형 내 군집거래, 유형 외 군집거래) 값을 나타낸다.

의 시계열 평균과 각각의 세 가지 분해요소(분할거래, 동일 유형 내 군집거래, 유형 외 군집거래) 값을 나타낸다.

1) Barber & Odean(2000)의 전체 조사대상 66,465가구의 연간 거래회전율은 75%로 나타났다.

2) 최운열 외(2004)는 1999년 3월~2003년 2월 기간의 1,400명, 김동철 외(2005)는 2001년~2003년 기간의 약 1만 명, 변영훈(2006)은 1998년~2003년 기간의 7,000명의 개인투자자 자료를 분석하였다.

3) 자료의 특성상 복수의 증권사를 활용하는 경우 식별이 불가능하므로 자료를 제공한 증권사 중 복수의 증권계좌를 보유한 개인투자자는 서로 다른 투자자로 인식된다.

4) 연령대별 그룹은 20대 미만, 20대, 30대, 40대, 50대, 60대, 70대, 80대 이상으로 구분하며, 합산 자산규모는 3천만원 미만, 3천만원 이상, 1억원 미만, 1억원 이상으로 구분한다.

5) 분석 기간 내 일별 투자자산의 평균값을 기준으로 분류하며, 투자자산은 주식 및 ETP(Exchange Traded Product) 평가금액과 예수금, CMA잔고의 합에서 예탁증권담보대출 및 미수금을 차감하여 산출한다.

6) 예를 들어 Daniel et al.(1998)에 따르면, 과잉확신과 자기귀인 편향을 가진 투자자들은 사적 정보에 대해 과대반응(overreaction), 공적 정보에 대해 과소반응(underaction)하며, 이러한 경향은 주식 수익률의 장기적인 부(-)의 자기상관(autocorrelation)과 단기적인 양(+)의 자기상관을 설명할 수 있다.

7) 남성, 지식수준이 높은 사람, 자산규모가 큰 사람이 스스로를 남들보다 우월하다고 여기는 것으로 나타난다.

8) 대부분의 투자자 유형에서 최적 시차가 동일한 것으로 확인된다. 신규투자자, 30대, 40대의 경우 최적 시차가 K=1, L=1로 산출되나, K=2, L=1 모형이 차상위(second-best) 모형으로 나타난다. 따라서 분석의 통일성을 확보하기 위해 최적 시차를 전체 투자자 거래회전율에 대한 최적 시차인 K=2, L=1로 설정한다.

9) 개별주식의 고유변동성은 Fama & French(1993) 3요인 모형을 통해 추정한다.

10) 최소금액 기준을 변경해도 결과의 질적인 차이는 없다.

11) 실증연구에서 투자역량은 소득규모, 교육수준, 전문직 종사 여부, 투자대상의 다양성, 파생상품 투자여부, 분산투자 수준 등으로 측정한다.

12) Barberis & Xiong(2012) 참조