Find out more about our latest publications

Overhauling the DC-type pension scheme for strengthening the old-age income safety net

Research Papers 22-03 Feb. 14, 2022

- Research Topic Asset Management/Pension

- Page 92

The single-tier pension scheme has historically evolved to the multi-pillar system, which can be summarized as a transition from DB (defined benefit) plans towards DC (defined contribution) plans. The US and the UK have focused on pure DC-type plans, while European nations have developed hybrid pension plans combining the characteristics of both DB and DC plans. Regardless of the types, the growth of the DC plan would undermine the old-age income safety net because it requires employees, not the government or employers, to take greater responsibility for the post-retirement income security to support those without the ability to work. Employees should take investment and inflation risks that may be posed in the course of pension assets accumulation. Furthermore, the burden of determining the transition to an annuity and managing longevity risks should be borne by employees. This implies that the DC plan has become mainstream not because it serves as an old-age income safety net but because there are limitations on the growth of the DB plan.

For these reasons, markets, industries, governments, and international organizations have already made efforts for regulatory reform on the DC plan. Mandatory or automatic enrollment into the retirement pension has been widely adopted to overcome the limitations of private pension plans. In addition, a default option or a hybrid pension scheme has been introduced to manage investment risks, and institutional incentives are increasingly provided in an effort to curb the outflow of retirement funds and to encourage the transition to an annuity. These measures have been implemented through monetary incentives or institutional enforcement, albeit to varying levels.

In Korea where DC plans including IRPs account for 40% of pension assets, there are discussions about how to strengthen the function of DC plans as the post-retirement income security, which, however, have not yielded fruitful results. Korea’s retirement pension scheme has an underdeveloped contract-based pension fund governance, complicating discussions for enhancing pension scheme-related institutions.

To remove marginalized groups in the pension scheme, Korea needs to mandate enrollment into pension plans by shifting from the current severance pay scheme towards the retirement pension system, rather than adopting mandatory or automatic subscription selected by advanced countries. Furthermore, the requirements to join pension plans, which are tougher compared to other countries, should be eased to facilitate a more inclusive retirement pension system for the whole nation including the self-employed and non-regular workers in the long run. Recognition of losses and expenses in excess of contributions and direct support for pension contributions should be applied to small business entities with a greater burden of introducing the pension scheme, aiming for creating the long-term virtuous cycle in terms of business management and welfare.

Concerning the pension management reform to improve low returns, the introduction of the fund-type pension scheme may not be efficient for DC plans where plan members have the right to entrust pension asset management. In response to this problem, advanced countries have introduced a default option under which the right to manage plan assets is given to plan providers (experts) if certain conditions are met, or have adopted a hybrid pension scheme that entrusts experts with plan asset management in the pension plan designing stage, as is the case with the DB plan. It is desirable for Korea to embrace both of the two institutional tools to offer options to plan members. Under the circumstances, Korea should consider mandating a default option as Australia, the UK, and the US do, or needs to have an exemption system to show a strong commitment to facilitating default options. It can also benchmark Japan’s pension system for introducing a default option system comprised of investment products to overhaul the principal-protected retirement pension scheme. Furthermore, it should allow competition with the SME retirement pension fund that has adopted a hybrid pension scheme to reorganize the plan providers-driven retirement pension market into the plan members-driven market where plan providers compete for higher returns.

With regard to the annuitization, it is the global standard among advanced countries not to mandate the annuitization for a pure DC plan. Thus, there seems to be no alternative other than to minimize the lump-sum pension withdrawal by offering a wide range of options for plan assets in excess of a certain amount such as programmed withdrawal and a life annuity. However, it is notable that Korea’s low annuitization rate is attributable to the fact that IRPs can be freely canceled, not to excessive interim payments from DC plans. Thus, the IRP cancellation should be limited to the level of advanced countries over the course of pension asset accumulation through policy measures such as a relevant tax regime or withdrawal limits. Moreover, institutional tools should be reformed for promoting annuitization through innovation of products and services including the combination of an annuity and a default option product, innovation of programmed withdrawal, and rationalization of high annuitization costs. As for the SME retirement pension fund that can be collectively operated by hybrid pension plans, it is necessary to examine the introduction of a default annuity to significantly cut down annuitization costs.

For these reasons, markets, industries, governments, and international organizations have already made efforts for regulatory reform on the DC plan. Mandatory or automatic enrollment into the retirement pension has been widely adopted to overcome the limitations of private pension plans. In addition, a default option or a hybrid pension scheme has been introduced to manage investment risks, and institutional incentives are increasingly provided in an effort to curb the outflow of retirement funds and to encourage the transition to an annuity. These measures have been implemented through monetary incentives or institutional enforcement, albeit to varying levels.

In Korea where DC plans including IRPs account for 40% of pension assets, there are discussions about how to strengthen the function of DC plans as the post-retirement income security, which, however, have not yielded fruitful results. Korea’s retirement pension scheme has an underdeveloped contract-based pension fund governance, complicating discussions for enhancing pension scheme-related institutions.

To remove marginalized groups in the pension scheme, Korea needs to mandate enrollment into pension plans by shifting from the current severance pay scheme towards the retirement pension system, rather than adopting mandatory or automatic subscription selected by advanced countries. Furthermore, the requirements to join pension plans, which are tougher compared to other countries, should be eased to facilitate a more inclusive retirement pension system for the whole nation including the self-employed and non-regular workers in the long run. Recognition of losses and expenses in excess of contributions and direct support for pension contributions should be applied to small business entities with a greater burden of introducing the pension scheme, aiming for creating the long-term virtuous cycle in terms of business management and welfare.

Concerning the pension management reform to improve low returns, the introduction of the fund-type pension scheme may not be efficient for DC plans where plan members have the right to entrust pension asset management. In response to this problem, advanced countries have introduced a default option under which the right to manage plan assets is given to plan providers (experts) if certain conditions are met, or have adopted a hybrid pension scheme that entrusts experts with plan asset management in the pension plan designing stage, as is the case with the DB plan. It is desirable for Korea to embrace both of the two institutional tools to offer options to plan members. Under the circumstances, Korea should consider mandating a default option as Australia, the UK, and the US do, or needs to have an exemption system to show a strong commitment to facilitating default options. It can also benchmark Japan’s pension system for introducing a default option system comprised of investment products to overhaul the principal-protected retirement pension scheme. Furthermore, it should allow competition with the SME retirement pension fund that has adopted a hybrid pension scheme to reorganize the plan providers-driven retirement pension market into the plan members-driven market where plan providers compete for higher returns.

With regard to the annuitization, it is the global standard among advanced countries not to mandate the annuitization for a pure DC plan. Thus, there seems to be no alternative other than to minimize the lump-sum pension withdrawal by offering a wide range of options for plan assets in excess of a certain amount such as programmed withdrawal and a life annuity. However, it is notable that Korea’s low annuitization rate is attributable to the fact that IRPs can be freely canceled, not to excessive interim payments from DC plans. Thus, the IRP cancellation should be limited to the level of advanced countries over the course of pension asset accumulation through policy measures such as a relevant tax regime or withdrawal limits. Moreover, institutional tools should be reformed for promoting annuitization through innovation of products and services including the combination of an annuity and a default option product, innovation of programmed withdrawal, and rationalization of high annuitization costs. As for the SME retirement pension fund that can be collectively operated by hybrid pension plans, it is necessary to examine the introduction of a default annuity to significantly cut down annuitization costs.

Ⅰ. 연구 배경과 목적

현행법상 퇴직연금은 연금수요자와 연금 사업자가 사적계약에 의해 연금서비스를 생산하는 사적연금으로서 퇴직연금제도에 대한 정부의 개입은 최소화 되어 있다. 연금제도로서 법적 정의와 가입자에 대한 불건전경영 감독을 위한 연금 사업자 규제가 현행 근로자퇴직급여보장법의 주된 내용이다. 퇴직연금이 대법원 판례에서도 인정한 노후소득안전망의 한 축이라는 사실이나, 공적연금의 약화되는 노후소득안전망기능을 퇴직연금이 보완해야 한다는 사회적 요구는 제도 속에 반영되어 있지 않다.

그런데 공적연금의 재정위기를 일찍 겪으며 퇴직연금의 보완적 역할을 강조한 선진국의 사례를 살펴보면 퇴직연금은 사적연금으로서 자율성보다 공적연금을 보완하는 준공적연금으로서 역할에 충실하도록 제도가 설계되어 있는 것이 일반적 흐름으로 확인된다. 가입을 강제화하거나 자동가입제도, 그리고 비정규 근로자로의 자격범위 확대를 통해 퇴직연금의 사각지대를 보완하고, 디폴트옵션제도나 혼합형 연금의 도입을 통해 확정기여형(Defined Contribution: DC) 퇴직연금 운용제도의 연금자산 축적 능력을 높이고 있다. 아울러 노후안전망 관점에서 가장 취약한 DC형의 인출정책에도 연금화를 유도하고 꼬리위험(tail risk)을 관리하기 위한 수단을 제도화하고 있다. 노후안전망기능의 강화로 요약되는 이 같은 퇴직연금의 준공적연금화 흐름은 고령화와 저성장, 저금리 등 뉴노멀시대로의 흐름과 함께 강화되는 양상이다.

그 간의 DC형 연금에 대한 선행 연구는 다양하게 확인할 수 있으나, 대부분 특정 나라의 제도 동향이나 자산배분, 수익률 비교, 연금화 등을 간략히 정리하는 경우가 대부분이다(배종원 외, 2020; 이상우, 2017; 김세중, 2015; 홍원구, 2015; 이경희, 2011). 노후안전망 관점에서 DC형의 가입, 운용, 연금화를 체계적으로 분석한 사례를 찾기는 어렵다. 이에 본 보고서에는 퇴직연금, 특히 글로벌 퇴직연금시장의 주류가 되고 있는 DC형 연금제도의 노후안전망 역할을 평가하고, 이를 개혁하기 위한 연금 선진국의 제도적 흐름을 사각지대 해소, 운용체제 개선, 연금화 등을 주제로 정리한다. 이를 통해 공적연금의 노후보장 역할 약화 속에서 우리나라 DC형 퇴직연금이 노후안전망 역할을 강화하기 위해서는 어떤 방향으로 준공적연금화를 위한 제도 개선이 이루어져야 하는지 검토하기로 한다.

Ⅱ. 노후소득안전망과 DC형 연금의 성장

1. 연금제도 진화와 DC형 연금의 성장

오늘날 연금제도를 비스마르크형 중심 다층연금제도라고 한다. 노령, 장애 등으로 근로 기회와 능력을 상실한 국민에게 빈곤 방지와 소득 보장을 목적으로 도입된 제도가 연금인데, 비스마르크형은 수혜자부담원칙에 충실한 보험방식을, 베버리지형은 최저생계에 대한 국가 책임성에 기반한 재정지원을 운영원리로 한다는 점에서 차이가 있다. 비스마르크형 연금이 주류가 된 데에는 자본주의의 자기책임원칙이 연금복지라고 예외가 아니기 때문일 것이다. 재정지원 방식의 베버리지형은 보조적 기능을 수행하고 있다.

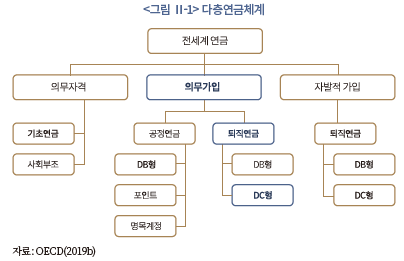

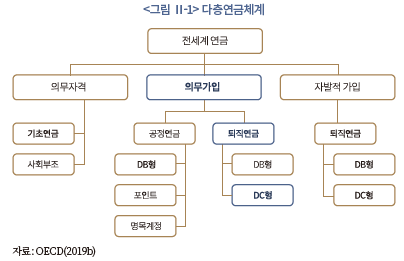

<그림 Ⅱ-1>의 OECD 분류에 보듯 현대의 다층연금제도는 대단히 복잡다단하다. 연금 분류조차 단일 방식으로 분류하기 어려울 만큼 가입방식, 기여/급여방식, 적립방식, 위험부담방식 등 다원화되며 기초연금, 공적연금, 사적연금 등 대분류 내에서 존재양식도 다양해졌다. 베버리지형도 전통적인 사회부조에 기초연금이 더해지는 흐름이다. 사회부조가 빈곤선 아래 근로능력 상실자를 위한 선별 연금제도라면 기초연금은 근로기간에 노동력을 제공한 모든 국민들에게 노후생계 일부를 지원하는 보편복지적 연금으로 운영되는 것이 추세이다. 공적연금도 순수 확정급여(Defined Benefit: DB)형 외에 포인트제도, 명목확정기여(Notional Defined Contribution: NDC) 같은 제도적 변이가 만들어졌는데, 기본 모티브는 순수 DB형의 재정위기에 대한 대응이었다. 퇴직연금도 가입방식에 따라 의무화와 자발적 가입으로 이원화되는 추세이다. 퇴직연금의 제도 의무화는 퇴직연금의 사적연금으로서 정체성의 약화를 의미하는 것으로 퇴직연금이 준공적연금화 되는 중요한 징표가 되고 있다.

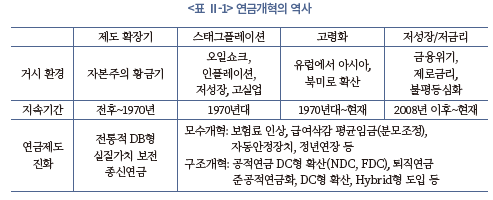

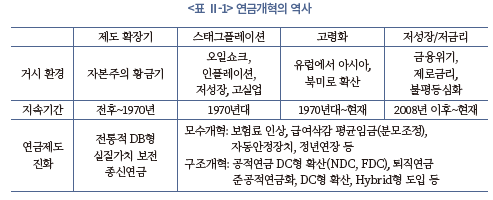

그런데 단층연금제도의 다층연금체계로의 진화는 전통 비스마르크형 연금, 즉, 부과방식(Pay As You GO: PAYG)의 확정급여(DB)형 연금제도가 발전하는 과정이 아닌 지속가능성에 한계를 드러내는 과정이라는 점은 분명히 인식할 필요가 있다. 뿐만 아니라 전통 DB형 연금의 위기는 <표 Ⅱ-1>에서 설명하듯이 자본주의 경제의 다양한 사회경제적 충격요인에 의해 야기되고 있다. 실제 전통 DB형 연금의 안정적 운영기간은 전후 약 20년간의 자본주의 황금기와 일치한다. 전통 DB형은 부과방식(PAYG)이고 종신연금으로 급여가 기여년수와 급여율(accrual rates), 임금수준에 따라 결정되는데, 자본주의 황금기 동안의 높은 인구성장률과 경제성장률은 전통 DB형 재정안정에 무리가 없을 정도로 높은 내부수익률을 가능케 하였다. 이렇듯 전후의 고생산성-고성장-저실업-저물가의 거시경제 선순환이 요람에서 무덤까지라는 연금복지체제의 버팀목으로 작용하는 가운데, 선진국들은 비스마르크형과 베버리지형 연금을 상호보완적으로 도입하며 국가간 복지체제의 수렴현상이 나타난다. 그런데 1970년대부터 생산성위기를 야기하는 오일쇼크, 고령화, 저성장, 저금리 등 거시경제의 구조적 불균형들이 전통 DB형 연금의 지속가능성을 위협하기 시작한다. 1970년대 두 번의 오일쇼크는 지속가능성에 첫 번째 균열요인이다. 오일쇼크로 인한 디플레이션의 현실화는 연금재정에 저성장/고실업에 의한 연금수입 악화, 고물가에 의한 물가연동 급여지출 급증, 적립금 운용의 어려움 등 삼중의 부담을 안기며 전통 공적연금의 재정안정을 위협했다.

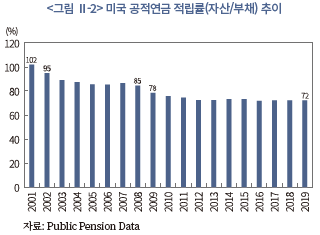

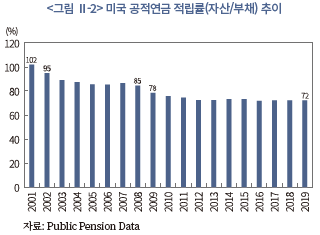

두 번째 균열요인은 인구고령화라는 경제사회적 내생변수이다. 복지국가에서 사민주의모델을 대표하는 스웨덴이 1972년 세계 최초로 고령사회(노인인구 14%)에 진입한 이후 영국(자유주의모델), 독일(보수주의모델), 노르웨이(사민주의모델) 등 유럽 복지국가모델(Esping-Anderson, 1990)의 대표국가들이 1970년대 동안 모두 고령사회에 진입함에 따라 인구구조 변화가 부과방식(PAYG) 연금제도의 지속가능성에 구조적 위협요인으로 부각되기 시작했다. 이후 스웨덴은 약 25년간 세계 최고령 사회의 자리를 유지하다 1990년대 후반에는 남유럽 이탈리아, 그리고 2003년부터는 아시아국가인 일본에 불명예의 자리를 내주면서 2000년대 초에는 고령화는 전세계 연금제도의 지속가능성을 위협하는 최대 상수가 되었다. 전통 연금제도를 위협하는 마지막 균열요인은 글로벌 금융위기 이후의 저금리‧저성장 환경이다. 금융위기과 코로나 팬데믹을 겪으며 뉴노멀 환경은 다시 회귀할 수 없는 거시경제 환경이 되고 있다. 제로금리와 양적완화의 뉴노멀 경제환경은 장기부채인 연금부채의 급증과 연금자산의 운용수익률을 둔화시킴으로써 연금재정을 크게 악화시키고 있다. <그림 Ⅱ-2>는 미국의 6,000여개 공적연금(DB형 부과방식 종신연금)의 적립률(funded ratio)이 2001년 102%에서 코로나 팬데믹 직전인 2019년 72%까지 악화된 것을 확인할 수 있다. 연금개혁 없이는 장기적으로 지속되기 어려운 수준으로 재정이 악화되고 있는 것이다.

결국, 다층연금제도는 오일쇼크라는 외생충격과 인구고령화와 저성장 저금리라는 사회경제적 내생적 구조변화에 대응한 연금제도의 진화 결과라고 할 수 있다. 노후안전망의 관점에서 이러한 진화 과정은 한마디로 노후안전망기능의 약화이다. 경제구조는 고령화와 기대수명 연장으로 근로기간보다 은퇴기간이 길어지며 저축갭(savings gap) 확대 압력이 높아지는데, 노후소득안전망은 거꾸로 약화되고 있는 것이다.1) 노후안전망 약화는 다음 세 가지 양상으로 나타난다. 첫째, 공적연금의 약화이다. 공적연금의 약화는 전통 DB형 연금의 부담과 급여수준을 장기적인 연금수지균형 관점에서 조정(실질가치 연계 약화, 급여 축소, 보험료 인상 등)하는 모수적 개혁이 이루어지고, 스웨덴 등 일부 국가는 전통 DB형을 포기하고 NDC로 전환하거나 개인형 확정기여연금(Financial Defined Contribution: FDC)으로 전환하였으며 칠레 등 일부 국가는 공적연금을 민영화하기에 이른다. 둘째, 사적연금의 준공적연금화가 진행된다. 사적연금은 사적 합의와 계약에 따라 노후소득을 마련하는 사적 노후안전망이지만, DB형 연금의 재정 불안과 세계은행(1994)의 사적연금 강화를 통한 다층연금체계 권고에 따라 사적연금의 가입을 강제하는 준공적연금화가 이루어진다.2) 강제 가입은 스위스(1985년), 네덜란드(2000년) 등 초기에는 주로 사민주의모델 연금제도에서 시작되었으며, 2008년 글로벌 금융위기 전후에는 영국(2012), 호주(2014) 등 영미형 연금제도로 확산되고 있다. 마지막으로 DC형 연금제도의 급격한 확산이다. 전통 연금의 재정위기와 함께 DC형의 확산은 나라를 구분하지 않고, 그리고 공적연금과 사적연금을 가리지 않는 전세계 연금제도에서 광범위하게 확인되는 현상이다. 그리고 DC형 연금은 그 형태에 있어서도 미국에서 주로 확인되는 순수 DC형 연금은 물론이고 다양한 하이브리드형 연금들이 대부분 DC형 성격을 강하게 포함하고 있다. 그런데 그 형태가 어떠하든 DC형 연금의 확산은 기본적으로 연금 적립금 운용과 연금수령에 있어 자기책임성의 강화를 의미하기 때문에 고령사회의 노후안전망 관점에서 보면 중대한 도전이라고 할 수 있다.

2. DC형 연금제도의 현주소

연금재정 위기 이후 DC형 연금이 글로벌 차원의 큰 흐름이 되고 있는데, 그 흐름은 두 가지 관점에서 확인이 가능하다. 하나는 제도 면에서 우리에게 익숙한 순수 영미형 DC형 연금은 물론이고 전통 DB형 연금에 DC형 요소를 강화하는 다양한 형태의 혼합형 연금의 출현이다. 다른 하나는 적립금 통계로 DC형의 성장세를 확인하는 것인데, 이때 주의할 점은 혼합형 연금의 경우 대게 DB형에 근거를 두고 있기 때문에 DC형 연금 적립금으로 분류되지는 않고 있다는 점이다. 이하에서는 두 가지 관점에서 DC형 연금의 성장 현황을 살펴본다.

가. 연금제도의 DC형 도입 흐름

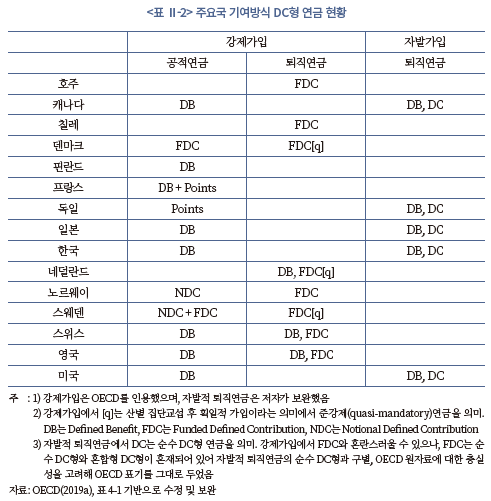

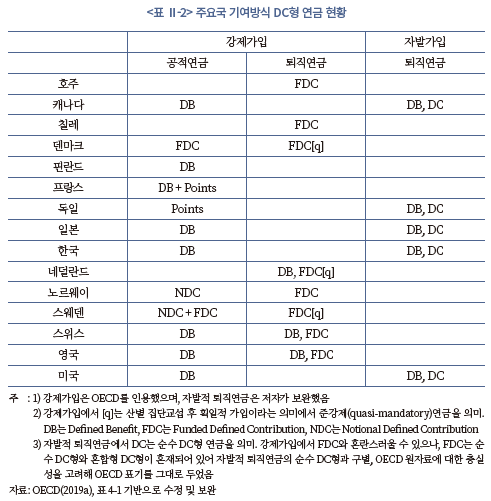

<표 Ⅱ-2>는 2019년 현재 주요 국가의 보험료방식(contribution-based)의 공적연금과 퇴직연금의 연금 유형을 국가별로 정리한 것이다. 우선 공적연금을 보면 미국, 영국, 한국, 일본, 캐나다, 핀란드, 스위스 등이 <표 Ⅱ-1>에서 열거한 다소의 모수 조정과 함께 전통 DB형을 지금까지 유지하고 있는 것이 확인된다. 공교롭게도 핀란드, 스위스를 제외하면 대부분 영미형 다층연금체계에 가까운 나라들이다. 반면 스웨덴, 덴마크, 독일, 프랑스, 스위스 등 주요 유럽 국가들은 기존 부과방식 연금제도를 폐지하거나 상대화하고 DC형 연금 성격을 크게 강화했다. 스웨덴은 1998년 공적연금을 NDC로 전환하고 보험료의 일부를 순수 DC형 연금에 해당하는 프리미엄연금을 도입하였으며, 덴마크는 1964년에 도입한 확정기여형 소득비례연금(Allman Tillaggs Pesion: ATP)의 역할을 1985년에 크게 강화하였다. 프랑스와 독일은 전통 DB형 대신 포인트제도를 도입한 것이 특징이다.

퇴직연금의 경우 제도의 개혁은 주로 퇴직연금을 강제가입 방식으로 준공적연금화한 나라들에서 DC형 연금제도로의 전환이 확인된다. 호주는 슈퍼에뉴에이션 이후 DB형보다 DC형 연금이 지배적인 제도가 되었으며, 칠레는 1980년대초 기존의 공적연금제도를 폐지하고 민영화하면서 DC형 연금으로 전환했다. 스위스는 연금 스폰서들이 집합운용을 하며 최소수익률을 보장하고 연금전환율을 정부가 정하는 DC형 제도를 의무화하였으며, 스웨덴과 노르웨이, 덴마크 모두 DC형 기업연금을 산업별 협약에 의해 준강제적인 형태로 운영하고 있다. 네덜란드 역시 마찬가지인데, 특징은 순수 DB형을 변형한 CDC(Collective DC)제도를 운영하고 있다는 점이다. 글로벌 4대 연기금에 해당하는 네덜란드 공무원연금(ABP)이 대표적인 CDC 방식으로 운영되고 있다.3) 영국은 비교적 최근에 자동가입제도로 전환한 나라로서 영미형의 순수 DC형 연금을 운영하는 나라에 해당한다. 자발적 퇴직연금제도를 가진 나라에 해당하는 캐나다, 독일, 일본, 한국, 미국 등은 DB형과 DC형을 자유롭게 선택가능하며, 순수 DC형을 주로 운영하고 있다.

나. 적립금 규모로 본 DC형 연금

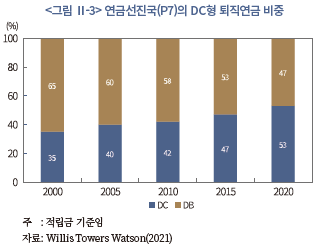

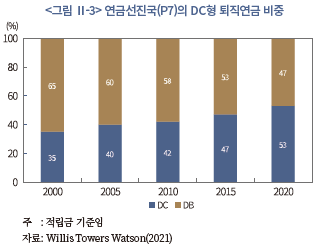

전세계적으로 공적연금이든 사적연금이든 DC형 연금으로 전환이 계속되고 있으나, 적립금 통계를 통해 DC형 연금시장의 규모를 파악할 수 있는 범위는 아직까지는 주로 퇴직연금시장이다. 퇴직연금에 대한 글로벌 컨설팅회사인 Willis Towers Watson이 퇴직연금 선진 7개 국가(이하 P7)4)에 대해 발표하는 통계에 따르면 2020년 P7 국가 퇴직연금 중 DC 형 적립금 규모 비중은 53%로 처음으로 적립금의 과반이 된 것으로 추정되고 있다. 참고로, 여기서 DC형에는 개인형 퇴직연금(가령, 미국의 IRA( Individual Retirement Account))을 포함한다.5) DC형 비중은 통계 작성이 가능한 2000년대 이후 지속적으로 증가하는 추세를 보이고 있으며, 전환 속도는 글로벌 금융위기 이후 가속화되는 양상이다.

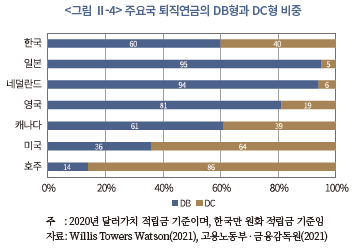

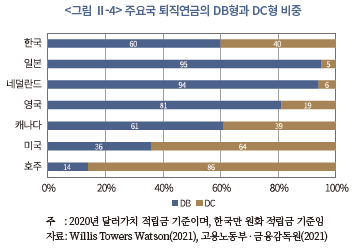

나라별로는 호주가 DC형 비중이 2020년 86%로 가장 높다. 호주의 슈퍼에뉴에이션은 디폴트옵션인 마이슈퍼를 도입하는 등 DC형 중심으로 제도 개선이 지속되면서 2010년 80% 수준이던 DC형 비중이 2020년 86%로 지속적으로 상승하고 있다. 호주와 함께 대표적인 순수 DC형 퇴직연금이 크게 발전하고 있는 미국도 2020년 64%가 DC형(IRA 포함)인 것으로 나타났다. 미국 역시 2010년 56%에서 비중이 추세적으로 상승하고 있다. 그 외 캐나다, 영국 등 영미형 다층연금제도를 가진 나라에서 DC형 퇴직연금 비중이 높은 것을 확인할 수 있다. 흥미로운 것은 한국의 DC형(IRP 포함) 퇴직연금 비중이 전체 적립금의 40% 수준으로 영국보다 높고 캐나다와 비교할 만한 수준이란 점이다. 우리나라 퇴직연금제도가 DC형 비중으로 보면 영미형에 가깝다고 해석할 수 있다. 이와 달리 사민주의모델을 대표하며 글로벌 연금 리그테이블에서 2018년부터 글로벌 1위를 지키고 있는 네덜란드 퇴직연금의 경우 순수 DC형 비중은 6% 수준인 것으로 나타났다. 앞서 언급했듯이 네덜란드는 DB형이 중심이고, DB형 제도를 근간으로 DC형을 가미하는 CDC형 퇴직연금을 운영하는 것이 특징인 나라이다. 일본의 DC형 비중은 5% 수준에 머물고 있어, 일본과 한국이 퇴직연금제도에 관한 한 상당히 이질적임을 확인할 수 있다.

3. DC형 연금의 노후안전망기능: 평가와 과제

주요 선진국 현황으로 볼 때 현재의 퇴직연금시장은 DC형 중심의 시장으로 규정할 수 있으며, 전통 DB형 연금의 지속가능성을 위협하는 고령화, 저금리, 저성장 경제 아래서는 DC형 중심의 연금제도로의 전환은 지속될 것으로 예상된다. 진화 경로로 보면 DC형 연금은 글로벌 연금개혁의 종착지가 되고 있다는 판단이다. 그렇다면, 연금자산 축적의 궁극적 목적인 노후안전망의 관점에서 DC형 퇴직연금이 신뢰할만한 종착지가 될 수 있는가 하는 근본적인 질문이 가능하다. 이는 연금개혁 역사를 보면 DC형 연금은 DB형 연금이 재정위기를 타개하는 과정에서 불가피 하게 선택된 제도 형태처럼 이해될 수 있기 때문이다.

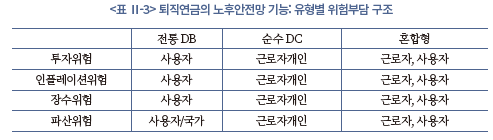

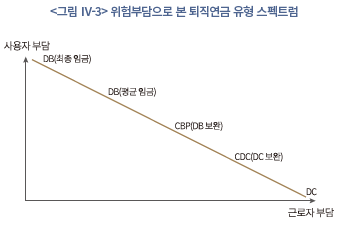

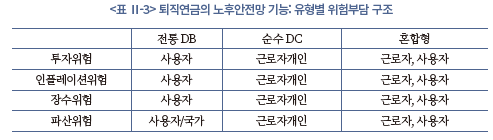

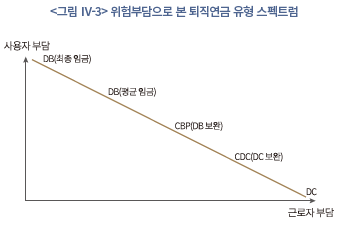

<표 Ⅱ-3>은 노후안전망 관점에서 DB형과 DC형을 평가한 것이다. 여기서 노후안전망 관점이란 근로자의 노후자산 형성 및 위험관리가 근로자 자기책임에만 의존하지 않고 가입/운용/인출 각 단계에서 공적으로 보충되고 지원되는 시스템을 의미한다. 이런 관점에서 노후자산 축적과정에서의 투자위험과 은퇴기간의 장수위험은 회사가 부담하고, 회사가 파산하여 퇴직연금기금이 파산했을 때는 국가가 부담하는 DB형 연금은 매우 잘 설계된 노후안전망으로 평가된다. 이에 비해 DC형 연금은 연금자산 축적과정에서 투자위험과 인플레이션위험은 물론 파산위험과 은퇴 후의 장수위험 등 그 어떠한 위험에 대해서도 근로자가 스스로 책임을 지는 특징을 갖고 있기 때문에 노후안전망으로서 안정성과 신뢰도는 낮게 평가되고 있다. 위험부담 관점에서 DB형과 DC형은 사용자와 근로자가 노후 위험을 일방적으로 부담하는 극단적인 위험부담모델이라고 할 수 있다. 혼합형은 근로자와 사용자 일방이 노후안전망 위험을 부담하지 않고 제도 혹은 합의에 의하여 위험을 분담하는 제도이다. 전통적인 CBP(Cash Balance Plan)부터 최근의 CDC까지 다양한 형태의 혼합형이 존재하며, 대체로 DB형을 기본으로 급여수준을 전통 DB형과 달리하며 장수위험 부담을 줄이는 형태뿐만 아니라, 스위스처럼 DC형을 기반으로 집합운용 등을 통해 규모의 경제를 추구하고, 최소수익률, 연금전환율 등의 안전장치를 통해 노후안전망으로서 안정성을 높이는 형태 등으로 다양하게 존재한다. 우리나라가 2021년부터 도입하는 중소기업퇴직연금기금은 혼합형 퇴직연금 중에서 DC형에 기반한 스위스 퇴직연금과 유사한 측면이 있다.

그런데 현실에 존재하는 대부분의 DC형 퇴직연금은 앞서 <그림 Ⅱ-3>에서 보았듯이 순수 DC형 연금으로 노후안전망기능으로 보면 안정성이 높은 연금제도라고 할 수 없다. 그리고 이 순수 DC형 연금이 다층연금체제로 전환 이후 2층 퇴직연금제도에서 주류가 됨에 따라 다층연금제도로의 진화가 결과적으로는 노후안전망기능의 약화로 나타나고 있는 것이 현재 연금제도의 현주소가 되고 있다.

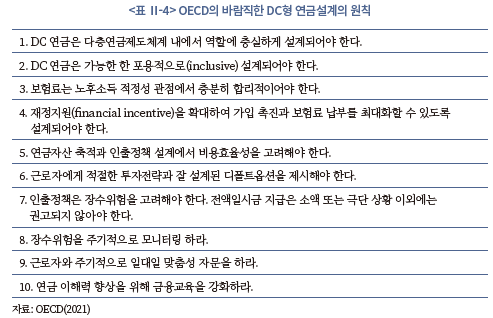

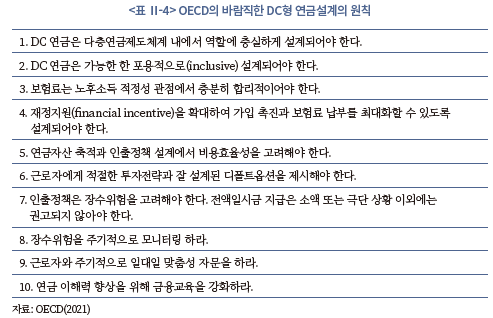

이로 인해 OECD 등 국제기구는 다층연금제도의 주류가 되고 있는 DC형 연금의 노후안전망기능 강화를 위한 제도 연구와 모범규준을 연구하기 시작했다. OECD 사적연금실무협의회(Working Party on Private Pensions: WPPP)는 2012년 바람직한 DC형 연금제도 설계 로드맵을 처음으로 발표하여 DC형 연금이 노후안전망으로 기능하기 위한 가입, 운용, 연금화에 관한 원칙들을 제시하였다. 그리고 2021년 3월 WPPP는 이후 10년간의 연금시장 변화를 반영하여 현재 상황에 적합한 DC형 제도 설계로드맵을 업데이트하여 발표하였다.

로드맵은 크게 목적, 가입, 운용, 인출, 교육 다섯 가지 영역의 10개 원칙으로 구성되어 있다. 첫 번째 원칙에서 DC형 연금이 노후안전망(retirement security system)임을 명확히 하고 있다. 다층연금체계 내에서 공적연금 등 다른 연금과 기능과 역할 면에서 상호 보완적으로 노후소득안정이라는 목적을 달성할 수 있도록 설계되어야 한다는 원칙을 제시하고 있다. 우리나라 역시 근로자퇴직급여보장법의 도입 취지나 대법원의 판례로 볼 때 퇴직연금을 공적연금을 보완하는 다층적 노후안전망의 성격을 확인할 수 있으나, 퇴직연금제도의 가입, 운용, 연금화 등 실제 운영 측면에서는 구조적인 결함이 있다는데 대해서는 이론의 여지가 없다. 두 번째 원칙은 포용성이다. 비록 보험료 방식의 당사자간 사적연금이지만 가입의 사각지대를 최소화 하여 공적연금의 노후소득보장기능 약화를 보완할 수 있도록 가입자 범위를 최대한 확대하라는 것이다. 이는 우리나라 퇴직연금제도의 사각지대 해소를 위해서는 가입제도를 의무화는 것을 넘어 주당 15시간 미만 노동하고 1년 미만 근속기간을 가진 근로자를 배제하는 정책에서 포용하는 정책으로 나아가는 것이 중요함을 시사한다.

세 번째 원칙은 보험료의 적정성이다. 한국처럼 퇴직연금이 후불임금의 법적 성격을 갖는 나라는 보험료가 확정되어 있으나, 영미형 국가처럼 퇴직연금이 보너스 혹은 시혜적 사내복지로 이해되는 경우 DC형 연금의 보험료는 사용자의 매칭 정도에 따라 보험료 수준이 상당히 달라지는 문제를 염두에 둔 원칙으로 이해할 수 있다. 이는 우리나라 퇴직연금제도가 한 단계 더 발전하기 위해서는 후불임성의 기초 위에 기여금제도의 다양성이 확보될 필요성을 시사한다. 네 번째 원칙은 재정지원을 최대화 하라는 것이다. 사적연금에 재정지원은 다른 금융상품과 구별되는 과세체계와 함께 앞서 영미형 국가에서의 사용자 매칭으로 한정하여 이해하는 경우도 있으나, 여기서는 국가의 재정지원을 포함한다. 특히, 글로벌 금융위기 이후 사적연금에도 국가가 직접 저소득 근로자나 비정규 근로자의 가입을 지원하는 보조금제도가 도입되는 등 국가의 역할이 강화되고 있다. 보조금정책은 공적연금에 대한 정책이라는 관념은 낡은 것이 되고 있으며, 다층연금제도 내에서의 기능적 보완성을 목적으로 하는 사적연금에 대한 국가 보조금정책은 필요하다는 것을 원칙화 한 것으로 볼 수 있다. 이는 우리나라 퇴직연금제도에도 저소득 근로자 혹은 비정규 근로자, 나아가 영세기업 사용자에 대한 보조금제도의 도입 필요성을 제기한다. 다섯 번째 원칙은 연금자산 축적과 인출제도는 비용효율적으로 설계되어야 하며, 이런 관점에서 여섯 번째 원칙으로 운용효율을 위한 디폴트옵션 도입을 별도의 원칙으로 구별하여 강조하고 있다. 일곱 번째와 여덟 번째 원칙은 인출정책에 관한 것으로 DC형 연금도 장수위험을 고려할 때 비용효율적인 연금화가 중요하며, 일시금인출은 최소화해야 한다는 원칙을 제시하고 있다. DC형 연금이 장수위험을 관리하는데 큰 약점이 있는 점을 염두에 둔 원칙으로 판단된다. 아홉 번째와 열 번째 원칙은 맞춤성 자문과 금융교육에 관한 것인데, 이는 DC형 연금이 근로자가 자기책임으로 연금자산을 운용하고 또 자기책임으로 연금화를 해야 하는 제도의 특성을 감안하여, 연금 사업자가 신인의무에 따라 근로자의 연금선택을 자문하고 교육할 필요성을 강조한 원칙이라고 할 수 있다.

Ⅲ. 가입 사각지대 해소 위한 준공적연금화

OECD(2021)의 두 번째 원칙인 퇴직연금의 포용성 강화를 위한 가입 활성화정책은 크게 가입제도 개편과 재정지원 강화 두 방향의 흐름이 강하게 나타나고 있다. 이하에서는 가입제도를 의무화 혹은 자동가입으로 전환하거나 가입자의 자격요건 완화를 통해 비정규 근로자를 적극 포섭하는 가입제도 측면의 개혁 흐름과, 세제혜택을 강화한 연금과세체계를 도입하거나, 정부 혹은 사용자가 근로자에게 보조금 지급을 확대하여 가입을 유도하는 재정지원을 확대하는 흐름에 대해 각각 살펴보자.

1. 해외 퇴직연금 가입제도의 개선 흐름

사각지대 해소를 위한 가입제도에 관한 글로벌 개혁은 크게 의무화 혹은 자동가입 등 가입제도 자체에 공적 성격을 강화하여, 공적연금 이외 사적연금에서 가입 사각지대를 해소하는 정책과, 가입자의 범위를 상용근로자에서 임시/일용직 근로자와 자영업자로 확대하는 정책 흐름이 동시에 나타나고 있다.

가. 의무가입 또는 자동가입제도로 전환

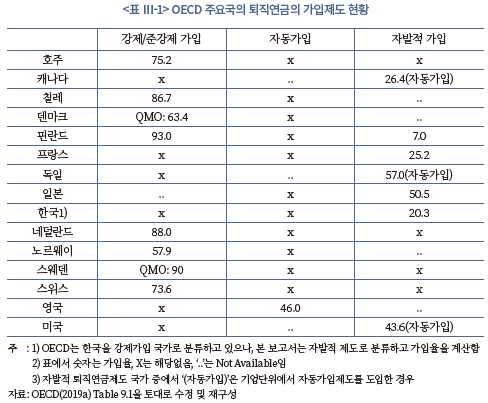

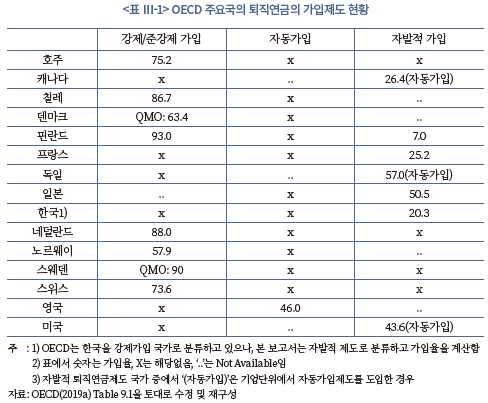

2018년 기준으로 OECD 국가 36개 중에서 17개 국가가 강제가입 혹은 준강제가입제도를 운영하고 있다. 이런 나라들은 기여방식의 공적연금 내지 퇴직연금은 경제활동인구 기준으로 높은 커버리지를 보이고 있다. 특히, 핀란드와 스위스의 경우 퇴직연금 강제가입제도를 일찍 도입하면서 2층의 퇴직연금 가입율이 핀란드 93%, 호주 75%, 스위스 73% 등 70% 이상의 경제활동인구를 커버하고 있다. 강제가입의 경우 사용자가 제도를 자율적으로 운영하며 보험료는 정부가 결정한다. 그리고 단체교섭 등을 통해 산업별로 퇴직연금을 운영하는 나라들은 준강제가입 연금제도를 가진 나라에서는 사용자가 퇴직연금을 도입하면 근로자들은 강제는 아니지만 거의 대부분 가입을 하기 때문에 준강제퇴직연금으로 분류된다. 덴마크, 네덜란드, 스웨덴 등 사민주의모델이 준강제퇴직연금 운영국가에 해당하는데, 가입율은 강제가입 국가들 수준에 근접한다. 경제활동인구 대비 퇴직연금 가입율이 네덜란드 88%, 덴마크 63%, 스웨덴 90%에 이르고 있다.

강제가입과 유사한 자동가입제도를 택한 나라들도 늘고 있다. 대표적인 나라가 영국으로 2012년에 도입했으며 이탈리아(2007), 뉴질랜드(2007) 등의 OECD 국가도 동참했는데, 특히 뉴질랜드는 ‘KiwiSaver’이라는 퇴직연금의 가입률이 80%에 이를 만큼 상당한 성과를 거두었다. 뉴질랜드보다 늦게 자동가입제도를 도입한 영국의 경우 가입율이 경제활동인구의 46%를 기록하고 있다. 국가 단위에서 자동가입제도는 사실상 강제가입과 동일한 효과를 기대할 수 있으나 영국의 경우 다른 연금제도를 선택할 수 있는 opt-out을 다층연금제도 내에서 허용하고 있다는 점이 특징이다. 또한 자동가입제도이지만 전국 단위에서 도입하는 대신 기업단위에서 자동가입제도를 도입한 나라들도 있다. 대표적으로 캐나다와 미국(2006), 그리고 독일(2018)이다. 세 나라는 퇴직연금제도가 강제 혹은 준강제가입제도가 아니라 사용자가 자발적으로 선택하는 제도를 운영하고 있으나, 일단 퇴직연금제도를 자발적으로 도입하게 되면, 해당 기업의 모든 근로자는 본인 의지와 관계없이 자동가입하는 제도이다. 기업단위의 자동가입제도 역시 가입율을 제고하는데 일정한 효과가 있는 것으로 확인되고 있다. 미국과 캐나다의 퇴직연금 가입율은 각각 43.6%, 26.4%로 나타났으며, 2018년에 자동가입제도를 도입한 독일은 자동가입제도 이전에 가입률이 이미 57%에 이르는 등 자발적 퇴직연금 국가 중에서는 높은 가입율을 보이고 있다.

강제가입, 준강제가입, 자동가입제도 등 가입제도에서 준공적연금화 개혁을 추진한 나라들의 퇴직연금 가입율은 자발적인 퇴직여금제도를 운영하는 나라들보다 높은 가입율을 나타나는 것은 분명히 확인된다. 자발적인 임의가입 퇴직연금제도를 운영하는 나라의 가입율은 핀란드 7%, 프랑스 25%, 한국 20% 등으로 매우 낮아 2층 퇴직연금부터 사각지대가 광범위한 것을 확인할 수 있다.

나. 비정규 근로자로 가입 범위 확대

공적연금 약화와 퇴직연금의 준공적연금화 흐름으로 퇴직연금의 적용 대상이 되는 근로자의 자격 범위를 확대하는 커버리지정책이 글로벌 노후안전망의 사각지대 정책과 관련하여 중요한 과제로 떠오르고 있다. 이는 비정규 근로(non-standard work)를 어떻게 노후안전망체계로 포섭하는가의 문제로서 4차 산업혁명과 플랫폼 중심의 긱 경제(gig economy) 확산으로 새로운 유형의 비정규 근로형태가 빠르게 성장하면서 비정형 근로의 규모와 노동시장 내에서 중요성이 커진 흐름과 맞닿아 있다. 이에 OECD는 2016년 사적연금 규제원칙을 발표하면서 가입자 요건과 관련하여 연금의 가입과 급여는 고용형태와 관계없이 차별 없는 접근성이 보장되어야 한다는 원칙(원칙 8)으로 제시하기에 이르렀다(OECD, 2016).6)

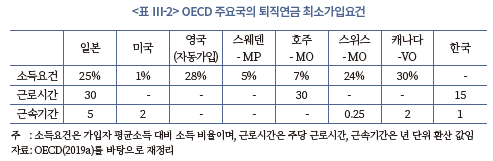

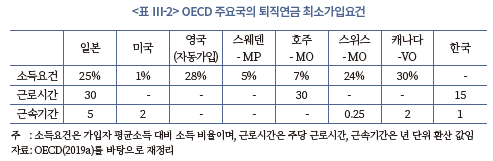

한편 비정규 근로의 범위에 대해 OECD(2019a)는 매우 포괄적으로 정의하고 있다. 비정규 근로란 풀타임으로 기간을 정함이 없는 근로계약(full- time open-ended contract)을 맺는 정규근로(standard employment) 이외의 모든 근로형태와 자영업을 포함하며7), 비정규 근로자 내에도 근로조건, 안정성, 근로자보호 등에서 나라별 이질성은 매우 큰 것으로 나타났다. 그럼에도 대부분의 비정규 근로자들은 퇴직연금 노후안전망에서 배제되고 있다는 공통점이 퇴직연금제도를 운영하는 세계 많은 나라에서 확인되고 있다. 우리나라가 주당 15시간 이상의 근속 1년 이상인 근로자가 퇴직연금의 적용 대상이듯이, OECD 여러 국가들은 정도의 차이는 있지만 근로기간, 근로시간, 소득요건 등의 형태로 퇴직연금 가입자의 접근성을 제한하고 있는 것이다. 첫째, 근로기간 요건은 비정규 근로자 중에서 근속기간이 짧은 임시직(temporary job)의 가입을 제한하는 제도로서 일본 DB형 연금이 5년으로 주요국 중에서 가장 길며 미국과 캐나다가 각각 2년과 1년을 두고 있다. 스위스는 0.25년으로 제한을 두고있어 주요국 중에서는 가장 짧았다. 영국, 스웨덴, 호주 등은 근속기간의 제한을 두지 않고 있다. 둘째, 근로시간 요건이다. 주당 근로시간에 최저한을 두는 제도로 파트타임(part-time) 근로자의 퇴직연금 가입을 제한하는 요인이 되고 있다. 우리나라도 주당 15시간 이상 근로를 제공하는 근로자가 가입 대상이다. 일본과 호주가 주당 30시간 이상 근로를 해야 퇴직연금을 가입할 수 있게 되어 있어 비교적 엄격한 편이다. 그 외 미국, 영국, 스웨덴, 스위스, 캐나다 등 주요국은 근로시간 요건을 두고 있지 않다. 셋째, 최소소득요건(minimum income thresholds)이다. 이 요건은 저소득층, 근로형태로는 파트타임 근로자들에게 연금의 접근성과 혜택을 제약한다. 캐나다는 가입자 평균임금의 30% 이상 소득자만 가입이 가능하며 일본도 25%, 스위스는 24%, 영국도 28%의 최소요건을 두고 있다. 최소소득요건을 두지 않은 나라는 주요국 중에서는 우리나라가 있다. 미국이나 캐나다는 자발적인 퇴직연금임에도 이같은 소득요건이 존재하고 있다.

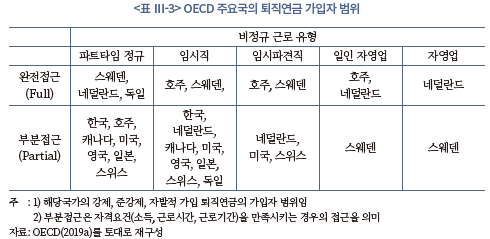

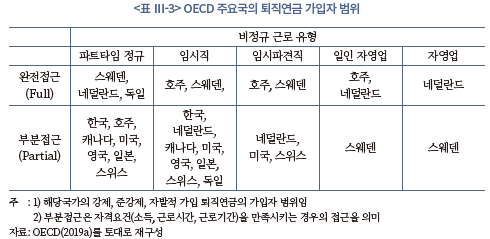

풀타임 정규직 근로자의 연금에 대한 완전접근성을 100(full)으로 볼 때 비정규 근로자들을 완전접근과 부분접근으로 나누어 정리한 것이 <표 Ⅲ-3>이다. 파트타임정규(part-time permanent)의 경우 스웨덴, 네덜란드 등 사민주의모델의 경우 정규직(full-time permanent)과 동일하게 연금 가능했으며, 부분적인 접근을 허용하는 나라들로는 영미형 모델(호주, 캐나다, 미국, 영국)과 일본, 스위스, 한국 등이 있었다. 임시직(temporary employee)과 임시파견직(temporary agency worker)의 경우 호주와 스웨덴은 정규직과 동일한 접근성을 가진다. 호주와 스웨덴은 소득요건이 있어 파트타임 근로자는 부분접근이지만 근속기간 요건이 없어 임시직과 임시파견직의 연금접근성은 완전하다. 자영업자의 경우 네덜란드가 완전한 접근성을 허용하고 있다. 세부적으로 일인 자영업(contractor)은 호주도 전문직 퇴직연금(Self Managed Superannuation Fund: SMSF)을 통해 허용을 하고 있고, 네덜란드는 고용원이 있는 자영업자도 완전접근을 허용하고 있다. 참고로, 네덜란드는 임시직이나 임시파견직의 경우 가령 농업 등 계절노동자(seasonal employee)에 대해 부분접근만 허용하는 대신 자영업에 대해서는 전문직에 해당하는 직역연금을 도입하여 완전접근을 허용하고 있다.

한편 소득요건이나 근로기간, 근로시간을 만족하지 못하는 비정규 근로자의 규모는 OECD(2019)에 따르면 OECD 국가들 고용의 1/3이 넘는 것으로 추정되고 있다. 이같은 비정규 근로는 전통적인 연금제도의 사각지대에 놓이게 된다. 그렇다 보니 자영업자, 비정규 근로자들은 보장성이 약화되는 공적연금 이외에는 스스로 노후대책을 마련해야 함에 따라 정규 근로자와의 노후준비 격차가 커지고 있다. 15개 OECD 국가에서 퇴직한 자영업자의 연금수령액은 정규 근로자의 연금수령액에 비해 중간값(median) 기준으로 22% 적은 것으로 나타났다. 그리고 호주, 덴마크, 독일, 일본, 네덜란드, 한국 등 연금 선진국들조차 자영업자들이 의무적으로 가입해야 하는 기여금 방식의 연금제도는 존재하지 않았다. 한편 파트타임 근로자 역시 근로형태가 불안정한 것은 물론 노후안전망의 사각지대에 있다. 참고로, OECD 국가 파트타임 근로자의 1/3은 더 오래 일을 하고 싶지만 일할 기회를 얻지 못하는 근로자들이고 2/3만 자기의지로 선택에 의해 파트타임을 하는 것으로 나타났다. 그리고 노인 일자리의 1/3이 파트타임인 것으로 나타났다. 결국, 비정규 근로가 늘어나는 변화된 노동시장 환경을 고려할 때 직업 안정성이 높은 정규 근로자를 염두에 두고 설계된 기존의 노후안전망은 좀 더 포용적으로 변화를 해야 하는 과제를 안고 있다.

2. 해외의 가입자 재정지원정책 흐름

세제혜택과 보조금 등을 통해 연금 가입을 유도하거나 연금 자산 축적을 지원하는 재정지원정책은 공적연금에 익숙한 제도들이다. 그런데 공적연금의 재정 위기와 사적연금의 준공적연금화로 이같은 재정지원정책이 사적연금인 퇴직연금에도 도입을 강제하거나 강화하는 흐름이 나타나고 있다.

가. 퇴직연금의 과세체계

저축 세제에 대한 전통적인 접근은 일반 조세원칙에 따라 소득이 있는 곳에 예외 없이 소득세를 부과하는 것이다. 만일 이 원칙을 연금저축에 적용하면 기여(contribution) 단계에서 원천징수 등의 형태로 세금을 부과하고, 저축 혹은 투자에 따라 발생한 금융소득에 다시 과세를 한 후 인출(withdrawals)할 때에는 세금을 부과하지 않는 것이다. 이것이 바로 저축에 대한 소위 TTE(Taxed-Taxed-Exempted) 과세체계이다. 그런데 연금저축의 경우 대부분 나라에서 이같은 과세원칙을 적용하지 않는다. 연금저축의 장기 저축과 장기 인출이라는 상품 속성과 노후안전망 강화라는 사회정책 요소를 고려하기 때문이다.

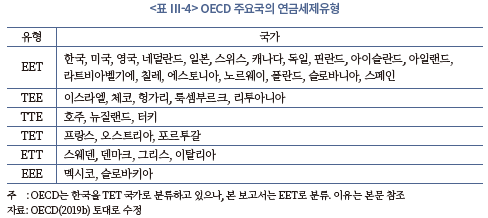

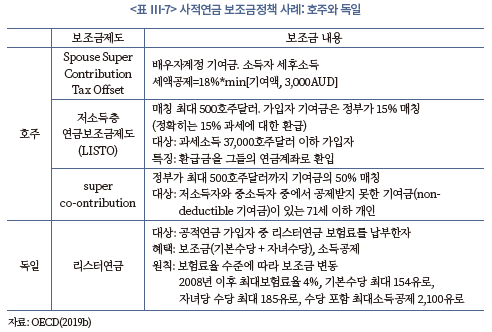

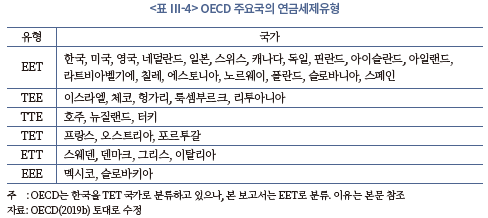

OECD 국가의 연금저축에 대한 과세는 크게 세 가지 유형이다. 크게 삼 단계(기여, 운용, 인출) 중에서 한 단계에만 과세하는 유형(EET, TEE), 저축에 관한 일반과세원리를 연금에도 그대로 유지하여 삼 단계 중 두 단계에서 과세하는 유형(TTE, ETT, TET), 그리고 삼 단계 모두에서 과세를 하지 않는 유형(EEE)이다. 현실 세계에서는 한 단계에서만 과세하는 EET와 TEE 과세체계가 가장 많이 발견된다. 가장 일반적인 형태의 연금세제는 EET 이다. 연금 납입과 운용 단계에서의 소득세를 각각 면제(exemption)하고 마지막 연금 인출 단계에서 연금소득세를 부과(taxation)하는 것을 의미한다. EET는 연금 기여금 납입 단계에서 근로자에게 소득공제 혹은 세액공제 형태로 면제를 해주기 때문에 연금을 통한 저축 유인(incentive)에 직접적인 영향을 미치는 장점이 있다. 준강제퇴직연금제도로서 가장 경쟁력 있는 연금 선진국으로 평가받는 네덜란드를 비롯하여 미국, 영국, 한국, 스위스, 일본, 캐나다, 핀란드 등 가장 많은 OECD 국가들이 EET 체계를 채택하고 있다. EET는 기여와 운용 단계에서 과세를 인출단계로 이연시켜주는 제도인데, 이는 재무적으로 근로자에게 세율만큼의 투자효과와 복리효과를 제공하기 때문에 더 많은 기여와 더 적극적인 운용 유인을 제공하는 유인부합성이 있다. TEE는 동유럽 국가들에서 주로 발견되는 과세체계인데 이스라엘을 제외하면 주목할 만한 연금 선진국은 찾기 어렵다.

연금제도 삼 단계 중 두 단계에서 과세를 하는 연금과세 유형 중에서는 TTE와 ETT 국가들이 주목할 만한다. 영미형 퇴직연금제도로 연금 선진국에 해당하는 호주가 TTE 제도에 해당한다. 호주는 일반소득세율이 매우 높기 때문에 기여단계에서 평균 15%의 세율로 부과하는 퇴직연금 기여금에 대한 과세는 그 자체가 인센티브 효과가 있는 것으로 알려져 있다. 인출단계는 물론 운용 단계에서도 과세를 하는 ETT 국가 중에는 스웨덴과 덴마크가 주목할 만한다. 스웨덴은 공적연금인 프리미엄연금의 경우 EET이나 퇴직연금은 모두 운용 단계에서 발생한 금융소득에 대해 15%의 과세를 하게 된다. 덴마크도 스웨덴과 마찬가지로 퇴직연금 운용 단계에서 발생한 금융소득에 대해 15.3%를 과세한다. 마지막으로 연금저축에 대해서는 삼 단계 중 어느 단계에서도 과세를 하지 않는 EEE 국가로는 멕시코가 있다. 멕시코의 퇴직연금은 강제연금으로 세금을 한 푼도 내지 않는특이한 경우에 해당한다.

그런데 가장 많은 나라들이 채택하고 있는 EET 과세체계와 관련하여서는 한 가지 유의할 점이 있다. <표 Ⅲ-5>에 미국과 한국의 사례이다. OECD 과세체계 분류에서 기여단계의 면세는 통상적으로 소득공제(tax deduction)를 의미한다. 소득공제란 근로자의 과세대상소득(taxable income; 우리나라는 과세표준으로 명명)의 크기를 줄여주는 세제혜택으로 누진소득세율 구간 결정에 영향을 미치거나 세율 구간에는 영향을 주지 못하더라도 결정세액을 낮추는 역할을 한다. 소득공제의 실질은 공제액만큼을 부가가치가 아닌 비용으로 인정해주는 제도이다. 가령, 한국의 DC형 기여금 중 사용자가 부담하는 총급여의 8.3%는 사용자의 비용으로 인식하도록 하여 과세대상소득에서 제외하는 것이며, 근로자가 받은 가처분소득 중에서 일부를 추가 납입한다면 그것을 비용으로 인정하여 과세대상 소득에서 제외하는 것이다. 대부분의 OECD 국가들은 이같은 소득공제 방식으로 기여단계에서 면세를 해주는 방식을 택하고 있다. 그런데, 미국의 경우 기여단계에서 이같은 소득공제에 더하여 자격이 되는 가입자에게는 세액공제(tax credit) 혜택까지 주고 있다. 세액공제란 과세대상소득에 개인소득세를 곱해 산출한 산출세액을 직접 줄여주는 공제제도로서 최종적인 세금납부액(결정세액)의 크기를 줄여준다. 미국은 모든 퇴직연금에 대해 요건을 만족하는 근로자의 경우 기여금의 0%에서 최대 50%까지 비환급형(non-refundable) 방식8)으로 세액공제 혜택을 주고 있다.9) 미국도 처음에는 소득공제 제도만 있었으나, 2002년 경제성장과 조세감면법 개정으로 세액공제제도를 2006년까지 한시적으로 도입하였다가 2006년 연금보호법 제정에 반영하여 상시 제도화 하였다. 한국은 OECD 국가 중에서 기여단계 세제혜택을 소득공제에서 세액공제로 2014년에 전환한 특이한 과세체계를 갖고 있다. 이런 이유로 OECD(2019b)는 한국을 EET 국가로 분류하지 않고 TET 국가로 분류하고 있다. 사용자 부담분은 손비인정(소득공제)제도를 유지함에 따라 EET로 분류하면서도 가입자의 추가 기여에 대해서는 TET로 분류하고 있다. 그러나 필자는 형평성을 강화할 목적으로 세액공제제도로 전환을 한 것일 뿐, 선택적으로 세액공제 혜택을 주는 미국과 달리 모든 근로자에게 세액공제방식으로 기여단계에서 세제혜택을 주고 있다는 점을 고려하여 EET로 수정 분류하였다.

나. 해외 퇴직연금의 가입자 보조금정책

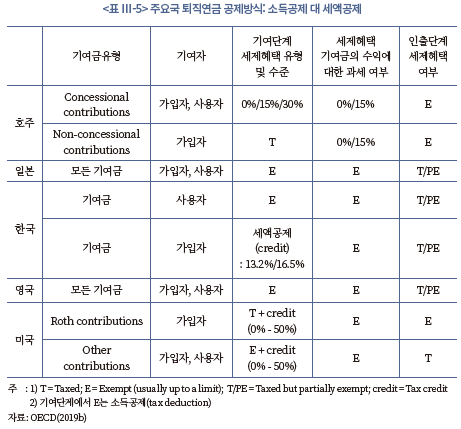

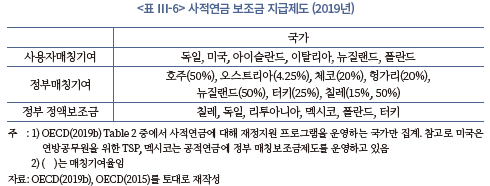

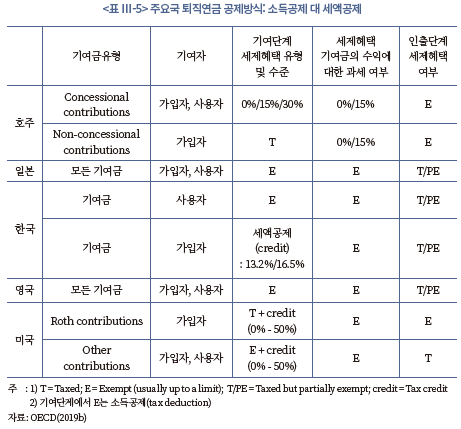

재정지원(financial incentives) 방식으로 조세지원 이외에 주목받는 것이 보조금정책이다. 퇴직연금 보조금은 퇴직연금 기여단계에서 지원정책으로 크게 정부나 사용자로부터 지원받는 매칭보조금(matching contributions)과 정부의 정액보조금(subsidies)으로 구분된다. 자격요건을 갖춘 가입자에게 지원되며 강제가입보다 자발적 가입제도를 택한 퇴직연금제도에 주로 찾을 수 있다. <표 Ⅲ-6>에 따르면 2019년 기준으로 OECD 국가에서 확인되는 일반적 사적연금 재정지원 방식은 매칭보조금제도로 12개 국가에서 운영하고 있으며, 정부의 정액보조금은 6개 국가에서 운영하고 있다. 2015년 설문조사와 비교하면 국가 보조금은 3개 나라(칠레, 독일, 멕시코)에서 6개 나라로 늘어났고, 매칭보조금은 독일이 새로 도입하면서 12개 나라로 확대되었다. 매칭보조금 중에서는 사용자매칭보다 정부에 의한 매칭보조금이 일반적이다. 매칭보조금은 가입자의 기여분의 일정 비율만큼을 정부 혹은 사용자가 병행 납입해주는 제도이다. 매칭비율은 호주 50%, 미국 50~100%, 멕시코는 325%(공무원퇴직연금)로 나라별 편차가 매우 크다(OECD, 2019b). 요약하면, 당사자 간의 사적계약인 퇴직연금제도의 노후안전망으로 보완성이 강조되면서 퇴직연금의 준공적연금화 흐름이 기여단계에서 재정지원을 확대하는 방식으로 강화되고 있다고 할 수 있다.

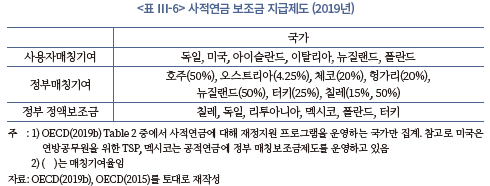

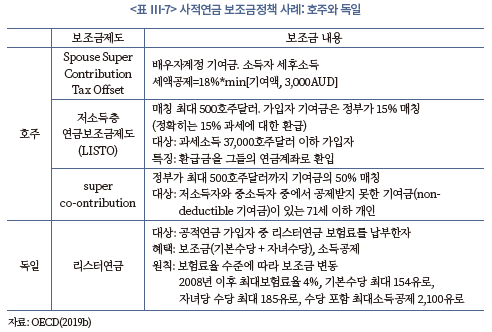

호주는 사용자 매칭보조금제도가 없는 대신 정부가 50%를 매칭하는 보조금제도를 운영하고 있다. 칠레는 정부매칭보조금을 청년과 저소득층 근로자의 연금에 대해 50% 매칭해 주는 제도와 근로자의 추가 기여금에 대해 15%를 매칭해주는 두 제도를 운영하고 있으며, 미국은 정부 매칭은 없고 고용주 매칭보조금을 운영하고 있다. 독일은 고용주 매칭과 정부의 정액보조금제도를 운영하고 있는 것이 특징이다. 이하에서는 대표 사례로 호주의 정부 매칭보조금제도와 독일의 정부 정액보조금제도에 대해 좀 더 살펴보기로 한다. 호주는 독특한 TTE의 연금세제를 운영하는 동시에 특정 계층 지원 목적의 매칭보조금제도를 운영하고 있는데, 크게 저소득층세액공제제도(Low Income Super Tax Offset: LISTO)라는 저소득층 보조금제도와 중저소득층을 위한 퇴직연금 매칭기여제도(Super co-contribution), 그리고 배우자세액공제제도(Spouse Super Contribution Tax Offset)가 있다. LISTO는 한마디로 TEE 체계에서 기여단계에 납입한 세금(T)을 그대로 연금계좌로 돌려주는 환급제도 형태로 운영되고 있다. 환급세액이 곧 매칭 기여금이 되며, 최대 500호주달러까지 환급된다. 이때 매칭보조금의 매칭율은 기여단계에서 소득세율인 15%가 된다. 호주의 저소득층 기준인 과세소득 37,000호주달러 이하의 슈퍼에뉴에이션 가입자가 LISTO의 대상이다. 특징은 연금 기여단계에서 발생하는 정부의 소득세 수입을 저소득층에게 그대로 돌려주되, 연금계좌로만 특정해서 환급되도록 설계하였다는 점이며, 결국은 환급세액 만큼 저소득 가입자의 연금 불입액이 늘어나는 효과가 있다. 가령, 사용자가 근로자를 위해 슈퍼에뉴에이션 기여금으로 100호주달러를 납입하면, 해당 근로자 계정에는 우선 세금을 제한 기여금(85호주달러)이 입금되며, 해당 근로자가 저소득층에 해당하면 15% 세율로 징수한 정부세수 15호주달러를 해당 근로자의 계정으로 환급(매칭기여)하게 된다. 호주는 일인 일연금계좌를 추구하면서 가입자의 배우자계정에 대해서 LISTO와 동일한 방식의 매칭보조금을 지급하고 있다. 즉, 가입자가 배우자 연금계정에 세후소득의 일부로 기여한 기여금에 대해 징수한 소득세를 환급하고 있다. 기여금과 300호주달러 중 작은 금액에 대해 18%의 환급율로 배우자 연금계좌에 매칭해주고 있다. 다음으로 중저소득층 퇴직연금 매칭기여(Super co-contribution)제도는 앞선 환급방식과는 다른 원리로 운영된다. 정부가 퇴직연금 기여금의 50%를 매칭해 주는 제도로서 매칭한도는 500호주달러이다. 다만 이때 매칭 대상은 공제를 받지 못한 기여금으로 한정되며, 대상은 저소득층은 물론 중소득층도 포괄하며, 연령이 71세 이하 가입자가 해당한다.

호주가 기여금에 대한 정부의 매칭보조금제도를 운영하고 있다면, 독일은 기여금과 상관없이 정액의 보조금을 지급하는 리스터(Riester)연금제도를 운영하고 있다. 2001년 공적연금의 보험료율 상한제(2020년 20%) 도입과 소득대체율 인하정책(70%에서 58%)에 대한 대응으로 사적연금 개혁을 추진한 소위 리스터연금개혁으로 도입되었다. 리스터연금의 핵심은 공적연금 가입자 중에서 리스터연금에 보험료를 납입한 납입자에 한해 정액의 보조금(수당)을 지급하여 사적연금 적립을 유도한다는 것이다. 수당은 소득수준이 아닌 보험료율에 따라 변동하며, 2008년 이후 최대 수당을 받기 위한 최대보험료율은 전년 소득의 4%이고, 이때 최대 수당은 기본수당 154유로, 자녀당 수당 185유로로 이때 수당 포함 최대 소득공제한도는 2,100유로이다. 독일의 리스터연금의 장점은 소득수준이 아닌 보험료율에 따라 정액의 보조금을 지급하기 때문에 저소득층일수록 소득 대비 보험료를 적게 내는 대신 혜택은 많이 받는 구조라는 것이다. 참고로, 독일의 리스터연금 도입은 사적연금의 가입은 자발적이고 임의적인 방식으로 운영하되, 보조금제도를 통해 사적연금을 강화하려는 연금개혁 전략으로 사적연금을 강제 가입으로 전환한 스웨덴 등 사민주의모델과는 구별되는 길을 걷고 있다.

3. 국내 퇴직연금 가입 사각지대 해소 방안

가. 가입제도 개선 방안

국내 가입제도를 이해하기 위해서는 퇴직금, 퇴직급여, 퇴직연금 세 개념에 대한 우리나라 법제도를 이해할 필요가 있다. 퇴직금제도는 5인 이상 사업장 근로자가 1년 이상 근속하고 퇴직할 때 사용자가 의무적으로 지급해야 하는 급여로서 1953년 근로기준법을 제정하며 처음 도입된 기업복지제도이다. 우리나라는 오랜기간 퇴직금제도를 중심으로 발전해 왔으며 큰 변화의 계기는 2005년 근로자퇴직급여보장법이 제정되면서이다. 퇴직급여와 퇴직연금이란 용어가 정의된 것도 이 때이다. 퇴직급여는 근로기준법상의 퇴직금제도를 이 법으로 이전하고, 새롭게 도입한 퇴직연금제도를 합쳐서 일컫는 용어이다. 이때 퇴직연금제도는 근로기준법에서 이전한 퇴직금제도와 함께 사용자가 임의로 선택할 수 있는 제도로 도입되었다. 가입제도 관점에서 보면 퇴직금제도는 강제가입제도라고 할 수 있고, 퇴직연금제도는 임의가입제도라고 할 수 있다. 그런데 OECD는 퇴직연금제도를 퇴직금제도의 한 형태라는 점을 강조하여, 우리나라를 의무가입 국가로 분류하고 있다.

그렇지만 이 같은 OECD의 해석은 실질보다 형식을 강조한 것으로 과도하고 무리가 있어 보인다. 퇴직연금제도 의무가입 여부의 판단은 퇴직연금제도 자체의 의무가입제도 여부로 판단하는 것이 합당해 보이며, 퇴직금제도가 의무화되었다고 해서, 퇴직금제도의 하위 제도이지만 임의가입제를 택하고 있는 퇴직연금제도까지 의무화되었다고 할 수는 없다. 더구나, 두 제도는 수급권 보호 측면에서 커다란 차이가 엄존하고 있다는 점에서 퇴직연금제도를 의무가입으로 분류할 경우, 우리나라 근로자의 수급권 보호와 관련하여 상당한 오해를 불러 올 수 있다고 판단된다.

우리나라 퇴직연금의 고질적 문제로 가입 사각지대를 해소해야 한다는 주장도 이런 맥락과 맞닿아 있다고 할 수 있다. 우리나라의 퇴직연금제도를 OECD처럼 의무가입제도로 분류하는 것은 내용적 실상을 왜곡할 여지가 있는 바, 우리나라는 임의가입제도로 분류하는 것이 타당하다고 생각된다.

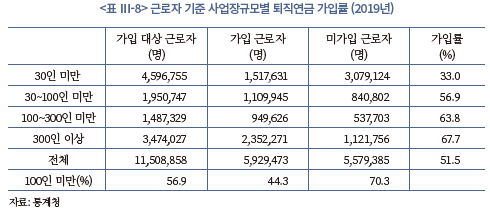

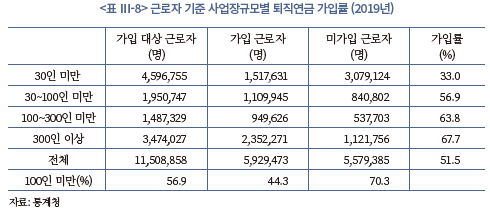

이런 맥락과 맞닿아 국내 퇴직연금 가입제도 개선 논의는 크게 두 방향에서 사회적 합의가 진행되고 있다. 첫째, 임의가입제도의 퇴직연금제도를 의무화는 것이다. 2019년 퇴직연금 가입자는 IRP 포함 682만명(593+89)으로 전체 경제활동인구의 24%가 가입하고 있다. 이는 전체 경제활동인구의 80%(2,220만명)가 가입한 국민연금과 비교하면 우리나라 국민의 상당수가 2층 노후안전망인 퇴직연금제도의 혜택을 받고 있지 못한 상태이다. 사업장 기준으로는 <표 Ⅲ-8>에서 보듯 전체 1,150만명의 상용근로자 중 593만명이 가입하여 가입률은 51% 수준이다. 문제는 미가입 근로자의 사업장 특성이다. 미가입 근로자 558만명 중 70%가 넘는 390만명의 근로자가 100인 미만 사업장에 소속된 근로자이며, 55%가 넘는 308만명의 근로자가 30인 미만 영세사업장에서 일하는 근로자라는 점이다. 영세사업장일수록 퇴직금 수급권이 경영리스크에 크게 노출되어 있다는 점을 감안할 때 퇴직연금 49%의 가입 사각지대는 수급권 불안과 노후안전망 취약성에 그대로 노출되어 있다고 판단할 수 있다.

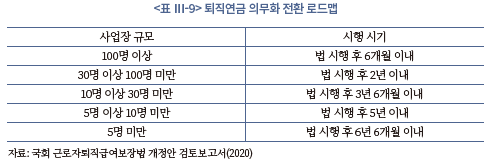

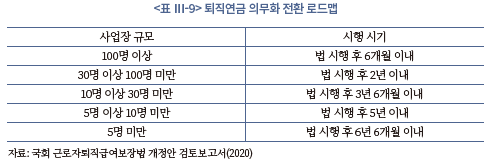

다층연금체계 중 적어도 2층의 퇴직연금까지는 전국민에게 적용할 때 노후소득 적정성에 어느 정도 근접하는 상황을 고려하여 정부도 2014년부터 사적연금 활성화정책의 일환으로 퇴직연금제도의 의무가입의 제도화를 추진해 왔다(강동수 외, 2014). 기본 방안은 대형 사업장뿐만 아니라 사용자에게 경영부담이 될 수 있는 영세사업장에도 예외 없이 퇴직연금 의무화를 도입하는 것이다. 현재 모든 사업장에 대해 강제 규정인 퇴직금제도를 폐지하고 퇴직연금을 강행규정으로 만들어 영세 근로자의 수급권을 보장하도록 하는 것이다. 다만, 영세사업장에게는 경영부담을 해소할 수 있도록 점진적인 의무화 로드맵을 제시하는 동시에, 과도기적으로 가중될 재정부담을 완화하기 위한 재정지원정책이 패키지로 제시될 필요는 있을 것이다. <표 Ⅲ-9>는 현재 제시된 의무화 전환 로드맵으로 영세사업장의 부담 경감을 위해 대규모 사업장부터 단계적 의무화 방안을 제시하고 있다.

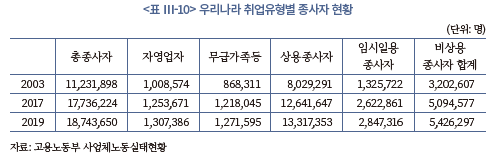

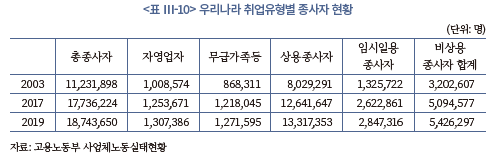

둘째, 퇴직연금 가입자 범위를 확대할 필요가 있다. 현재 퇴직연금 가입 자격은 주당 근로시간이 15시간 이상이면서 근속기간 1년 이상인 사용근로자로 한정하고 있다. 그렇다 보니 퇴직연금제도에서 당연 배제되는 임시직, 일용직, 나아가 자영업자 등의 비정규 근로계층의 규모가 점점 커지면서 2층의 노후안전망으로서 보편성이 점차 약화되고 있다. 일시직, 일용직, 자영업자를 포함하는 비정규 종사자는 2003년 320만명에서 2019년 540만명으로 증가하였다. 그런데, 우리나라 퇴직연금의 가입 대상은 퇴직금의 경제적 실질을 ‘후불적 임금’으로 본 판례(2007년 대법원 판례)에 비추어 볼 때 1년 미만의 근로자에게로 확대하는 것에는 아무런 법적 장애는 없다. 15시간 미만 근로하는 1년 미만 근속자에게도 임금은 일할로 발생하며, 발생한 일할 단위의 임금을 회사가 적립했다가 후불임금으로 지급하는 것이 퇴직금의 경제적 실질이기 때문이다. 따라서 정부는 퇴직연금 가입제도 의무화 로드맵과 함께 가입자 자격 확대를 위한 로드맵을 함께 제시할 필요가 있으며, 장기적으로는 모든 국민을 2층의 노후안전망으로 포섭하는 ‘전국민 퇴직연금제도’로의 비전을 마련할 필요가 있다고 본다. 물론 이때도 가입 범위 확대에 따른 취약계층 가입자에 대한 재정지원을 로드맵에 담아 점진적으로 회사와 가입자의 수용성을 제고할 필요가 있어 보인다.

나. 재정지원 확대 방안

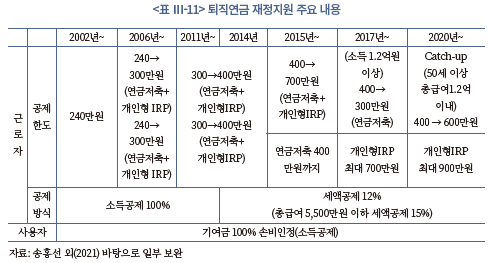

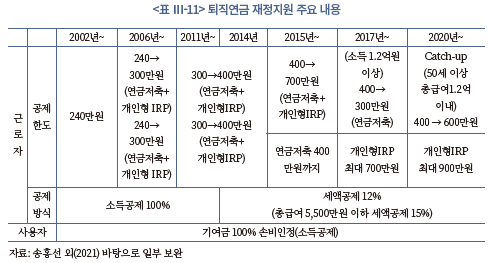

우리나라의 퇴직연금 재정지원제도는 세제혜택 방식으로 변천해 왔다. 후불성 임금이지만 퇴직연금제도를 도입하고 기여금을 납부하는 사용자의 경우 기여금에 대해 100% 손비인정을 해왔으며, 근로자가 개인형 IRP 제도를 통해 세후 소득으로 추가 납입하는 기여금에 대해서는 지속적으로 공제한도를 확대하였으며, 2014년부터는 혜택의 역진성 완화를 위해 소득공제(income deduction)방식에서 세액공제(tax credit)방식으로 전환하였다. 아울러, 중저소득층과 고소득층에 대한 세제혜택 차등정책을 지속적으로 강화하여 왔으며, 2020년부터는 50세 이상 중저소득 장년층의 노후소득 안정을 위하여 추가납입세제혜택(catch-up)을 도입하는 등 계층별 맞춤형 정책을 추진해왔다(<표 Ⅲ-11>).

그런데 그간의 재정지원정책은 EET 방식의 세제혜택 중심의 재정지원이 유일한 정책수단이었다는 점에서, 가입 사각지대의 해소라는 재정지원의 궁극적 정책 목표를 감안할 때 기본적으로 한계가 있는 정책이다. 사각지대의 영세사업장의 경우 가입에 따른 기여금 자체가 부담요인이어서 퇴직연금제도 전환을 주저하고 있고, 사각지대의 저소득 근로자는 노후를 위해 추가 납입할 소득능력에서 부족을 느끼는 경우가 많기 때문이다. 따라서 퇴직연금제도 의무화를 준비하는 앞으로의 재정지원정책의 기본 방향은 세제 중심의 재정지원과 더불어 사각지대의 사용자와 근로자에 대한 보조금 지원 등 보다 직접적인 재정지원정책을 선별적으로 도입해야 할 것으로 판단된다.

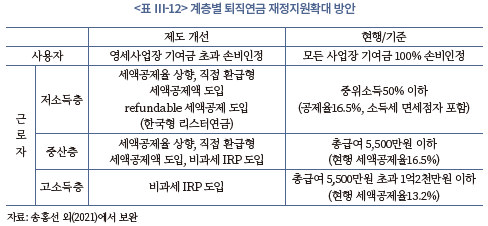

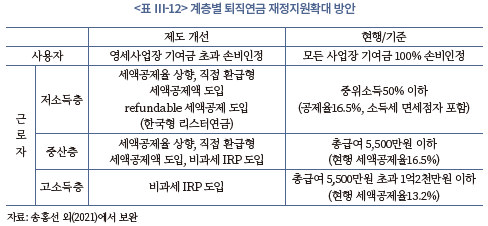

<표 Ⅲ-12>는 퇴직연금 의무화 시대의 재정지원정책방안을 계층별로 정리한 것이다. 크게 세제혜택제도를 개선하는 방안과 보조금정책을 적용하는 방안을 계층별 맞춤형으로 정리했다. 우선, 사용자에 대해서는 퇴직연금 의무화정책에 대응하여, 내수침체와 양극화로 기여금 부담능력이 약화된 영세사업장 사용자에 대한 세제혜택의 대폭적인 확대가 필요하다. 사용자는 기업규모나 재무능력에 관계없이 퇴직연금으로의 기여금에 대해 100% 손비인정하는 제도를 운영 중이나, 앞으로는 영세사업장 사용자에 대해서는 추가적인 손비인정 확대가 필요하다고 본다. 가령, 기여금을 초과하는 손비인정 확대(가령, 120%)를 통해 사실상 이들의 퇴직연금 기여금의 일부를 보조해주는 부담 완화 인센티브가 필요하다고 판단된다.

근로자에 대해서는 소득계층별로 맞춤형 재정지원정책을 제안한다. 중산층과 저소득층(여기서는 급여 5,500만원 이하)에 대해서는 세액공제율을 현행 15%보다 높게 상향하는 동시에 해당 세액공제금액을 근로자의 IRP계정으로 직접 환급하여 사실상 연금 추가납입액이 퇴직연금 세액공제액 만큼 늘어나도록 하는 환급형 세액공제를 도입할 것을 제안한다. 연금 세제혜택 확대 정책수단으로 활용되어 왔던 공제한도 확대 방식은 중저소득층의 소득 둔화와 소득능력 약화로 정책의 실효성이 높지 않은 것으로 확인되고 있는 바(송홍선 외, 2021), 정책방향을 공제한도 확대에서 공제율 상향정책으로 전환할 것을 제안한다. 공제율 상향은 수년간 일인당 추가납입액이 250만원 내외로 안정되어 있는 상황에서 중저소득층이 세액공제혜택을 늘리는 직접 수단이 될 수 있을 것으로 보이며, 이렇게 확대된 세액공제액이 직접 IRP 계좌로 환급될 경우, 퇴직연금자산 형성과 노후소득 안정화에 직접적인 효과를 거둘 수 있을 것으로 판단된다. 참고로, 앞서 호주의 환급형 세제혜택 사례에 더하여 미국도 공적연금인 사회보장제도(Old-Age Survivors, and Disability Insurance: OASDI)에도 1980년 법제도 개정을 통하여 연금급여 수령 시 납부하는 연금소득세수를 정부가 일반회계로 환입하지 않고 사회보장제도 계정으로 직접 환입하고 있다. 호주와 미국의 사례는 환급이 개인계정과 부과계정(PAYGO)으로 각각 이루어진다는 점에서 차이점은 있으나, 연금 세수가 국고(일반계정)로 귀속되지 않고 특정 목적 아래 기능적으로 사용되기도 한다는 사례를 제시한다는 점에서 국내 재정지원정책에 공통적인 시사점을 제공하고 있다.

저소득층에게는 낮은 소득 등으로 이들이 소득세를 납부하지 않는 소득세 면세점자들인 점을 감안하여, 결정세액이 없는 경우도 이들이 납부한 퇴직연금 추가납입액에 대한 세액공제액에 해당하는 만큼을 이들에게 환급해 주는 refundable 세액공제제도를 도입할 것을 제안한다. 이 제도가 도입되면 사실상 저소득층 근로자의 추가 납입에 대하여 보조금을 지급하는 효과가 발생하는 것은 물론, 소득세 면세점자라는 이유로 퇴직연금 세액공제제도의 혜택을 받지 못하는 실질적인 형평의 문제를 해소할 수 있을 것이다. 아울러, 소득 부족으로 연금 추가 납입을 하지 못하는 저소득층에 대해서는 독일의 리스터연금처럼 일정 규모의 정액보조금으로 연금 납입을 지원하는 방안을 제안한다.

고소득층과 중산층 대상으로는 비과세 IRP 도입을 제안한다. 비과세 IRP는 미국의 로스(Roth) IRA를 한국에 적용하는 것으로, 은퇴하여 연금소득세를 납부할 때 사용자 기여금과 근로자 추가납입액을 운용하여 거둔 연금자산 운용수익에 대해 연금소득세를 납부하지 않는 제도를 의미한다. 추가납입 IRP에 대한 기존의 EET 연금과세체계에 더하여 일정 요건 아래 비과세(TEE) IRP를 고소득층과 중산층에 도입할 경우 소득능력이 있는 근로자가 세제자산관리(tax planning) 인센티브 아래 자기책임의 장기투자를 할 수 있는 기반을 마련하며 국가 전체의 노후안전망 확충 부담을 완화하는데 도움이 될 것으로 보인다. 실무적으로는 현재 최대 납입한도(1,800만원)중에서 세액공제한도(납입액 700만원)를 초과하는 1,100만원에 대하여 그 운용수익을 연금으로 수령할 때 연금소득세 적용대상에서 제외(비과세 혜택)하는 비과세 IRP제도를 도입하는 방안을 고려할 수 있다. 지금은 1,100만원으로 운용하여 얻은 운용수익에 대해 연금소득으로 수령할 때 연금소득세를 부과하고 있다.10)

Ⅳ. DC형 연금자산의 운용체제 개혁

1. 기금형 DC 연금의 의미와 한계

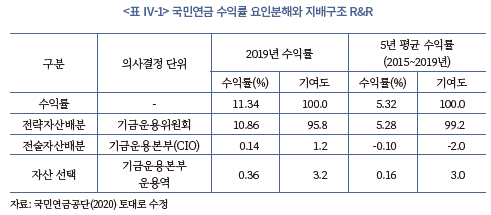

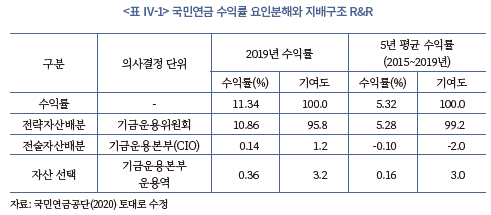

연금의 자산부채 특성을 고려한 운용 철학과 운용 목표를 설정하고, 운용수익률의 90% 이상을 결정하는 전략적 자산배분을 체계화하기 위해서는 연금 운용지배구조를 기금형으로 전환해야 한다는 주장은 우리사회에서는 더 이상 새롭지 않다. 특히, 2014년 정부의 사적연금 활성화정책이 발표되고, 2015년 이후 초저금리가 새로운 경제금융시장의 뉴노멀이 되면서 기금형 퇴직연금제도 도입의 필요성과 당위성은 노사 당사자는 물론 정부, 학계, 시장 등으로 전방위 확산되고 있다. <표 Ⅳ-1>은 비록 퇴직연금은 아니지만, 기금형 지배구조를 가진 국민연기금의 수익률이 기금형 지배구조와 어떤 대응 관계에 있는지, 그리고 지배구조의 구체적 형태가 어떤 모습인지를 간명하게 보여준다. 국민연금의 2019년 기준 5년 평균 수익률은 5.32% 인데, 이 중기 수익률이 어떤 요인에 의해 창출되었는가를 요인분해하면, 전략적 자산배분을 하는 기금운용위원회의 기여율이 99.2%로 압도적으로 높고, 나머지 투자의사결정 단위들의 기여율은 모두 합쳐 0.8%라는 것을 보여준다. 퇴직연금제도에 기금형 지배구조란 바로 전략적 자산배분을 하는 의사결정단위, 즉, 기금운용위원회를 퇴직연금제도에 도입하자는 주장과 일맥상통한다고 할 수 있다. 가령, 현행 계약형 DB형 퇴직연금의 경우 회사의 재무팀(CFO)이 전술적 자산배분과 증권선택을 담당하며 적립금을 운용하고 있다고 할 수 있다. 연금 수익률의 90% 이상을 결정하는 전략적 자산배분의 권한과 책임을 가진 기금운용위원회가 현행 계약형 제도에는 존재하지 않다 보니 적립금 대부분이 원리금보장자산으로 배분되며 수익률이 임금상승률보다 낮은 역마진 상태가 지속되고 있는 것이다. 바로 이런 이유로 인해 퇴직연금제도 역시 국민연금 같은 기금형 지배구조로 전환해야 한다는 주장에 힘이 실리고 있는 것이다.

그런데, DC형 퇴직연금의 경우 기금형 지배구조가 도입된다고 해서 낮은 수익률 문제가 완전히 해소되지 않는다는 것이 논리적으로나 해외의 퇴직연금 운영 사례가 말해준다. 주된 이유는 두 가지 이다. 첫째, 국민연금이나 DB형 퇴직연금의 경우 연금 적립금 운용에 대한 권한과 책임이 전적으로 사용자와 암묵적으로 정부 등에 집중되어 있다. 때문에 기금운용위원회 등 수탁자이사회에 신인의무에 기반하여 명확한 권한과 책임을 부과할 경우 수익자 최선의 전략적 자산배분이 가능할 수 있다. 그런데 DC형의 경우 연금 적립금은 기본적으로 개인계정으로 소유권이 명확히 정의되어 있고 적립금에 대한 전략적 자산배분을 포함한 투자결정권은 가입자 개인에게 귀속되어 있다. 때문에 DC형 연금에 대해 기금형 지배구조를 도입하더라도 기금운용위원회의 권한은 지극히 제한되며 투자결정의 결과에 대한 책임성도 모호해진다. 둘째, 규모의 경제이다. 국민연금이나 DB형 연금의 적립금은 근로자의 퇴직급여를 집합(pooling)한 것은 맞으나 적립금에 대한 소유권은 근로자 개인이 퇴직할 때 비로소 정의되기 때문에 자산배분과 분산투자의 전제가 되는 규모의 경제가 가능하다. 그러나 DC형의 경우 개인계정이기 때문에 또다른 형태의 사적 계약이나 공적 개입이 없는 한 집합운용이 불가능하며 투자운용의 규모의 경제 달성이 어렵다. 그 결과는 DC형 연금 운용의 비효율이다. Yermo(2008)는 연금 사고와 수익률 하락을 야기하는 연금 지배구조에서의 비효율은 기금형 지배구조이라고 예외는 아니며, 연금자산의 규모의 불경제가 DC형의 비효율과 밀접한 관련이 있다고 주장하고 있다.11)

결국, 수익률 제고를 위한 DC형 퇴직연금의 운용체계 개선은 기금형 운용지배구조를 도입하는 것만으로는 부족하다. 오히려 기금형 운용지배구조가 DC형에서도 잘 작동할 수 있는 기초적인 전제조건들을 함께 검토해야 한다. 전제조건은 앞서 언급한 대로 규모의 경제를 가능하도록 DC형 제도를 개선하고 DC형 제도 아래서도 기금형 지배구조가 작동할 수 있는 투자의사결정을 합리적으로 개편하는 것이다. 관련하여 본 보고서는 두 가지 방향의 DC형 연금제도 개혁 흐름을 정리한다. 하나는 잘 알려진 디폴트옵션제도의 도입이다. 디폴트옵션제도는 가입 당사자에 의한 연금 적립금 운용을 전문가에 의한 적립금 운용으로 전환하는 또 다른 차원의 지배구조의 전환으로서 글로벌 금융위기 전후의 DC형 연금제도 개혁의 핵심 어젠다가 되고 있다. 다른 하나는 하이브리드연금 실험이다. 하이브리드연금은 집합운용과 전문가에 의한 투자결정이 중요한 특징으로 전통적인 연금제도의 대안으로 확산되고 있다. 각각에 대해 살펴보기로 하자.

2. DC형 운용지시권의 전환: 디폴트옵션

디폴트옵션은 가입자에게 투자선택의 기회과 정보를 충분히 제공하였음에도 가입자가 적립금 운용을 지시하지 않을 경우, 연금 사업자가 주어진 절차에 따라 미리 정하여 가입자에게 고지한 디폴트옵션상품으로 가입자의 적립금에 대해 대신 운용 지시를 하는 제도를 의미한다. 한마디로 일정 조건 아래 DC형 연금 적립금의 운용지시권한을 가입자(근로자)에서 전문가(연금 사업자)로 전환하는 제도가 디폴트옵션제도인 것이다. 그래서 디폴트옵션제도를 지배구조의 관점에서 DC형 연금의 지배구조(운용지시권)의 변동으로 이해하기도 한다. DC형 연금은 본질적으로 운용지시권(잔여통제권)이 가입자 본인에게 있음에도 그것을 일정한 조건 아래 연금 사업자로 이전하는 제도이기 때문이다.

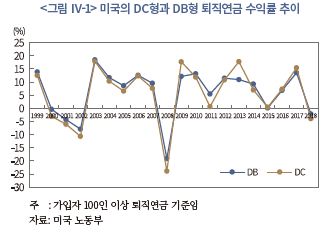

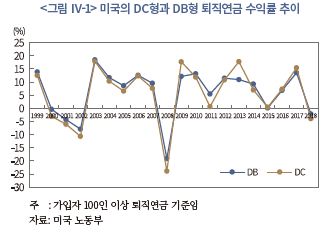

디폴트옵션제도는 1990년대부터 일부 나라 혹은 연금제도12)에 도입되기는 하였으나 본격적인 도입은 DC형 연금의 전통 DB형 대비 낮은 수익률이 가입자의 행태적 편의(behavioral bias)와 금융이해력(financial literacy) 등 제한된 합리성과 전문성 부족에 기인한다는 인식이 확산되면서 부터이다.13) <그림 Ⅳ-1>은 미국의 DB형 퇴직연금과 DC형 퇴직연금의 연평균 수익률의 장기 추이를 나타내는데, 미국 노동부가 제공하는 전체 시계열(1999~2018년) 기하평균수익률로 보면 실제 DB형이 5.8%로 DC형 4.9%보다 높다. 다만, 2006년 연금투자자보호법으로 디폴트옵션이 도입되고 글로벌 금융위기 이후부터 비전통적 통화정책에 따른 제로금리와 자산시장의 장기 성장 추세가 이어지면서 DC형 연금의 수익률이 DB형을 따라잡기 시작했다. 2009년부터 2018년까지 평균수익률은 DB형이 8.0%, DC형이 8.3%를 기록했고, 2016년부터 2018년 최근 3년 동안도 DB형이 5.9%, DC형이 6.0%를 기록하고 있다.

디폴트옵션은 연금 가입자의 투자결정 과정에서 행태적 편의를 크게 두 가지 방식으로 통제하도록 설계된다. 첫째, 개인은 제한된 합리성으로 인해 투자결정 과정에서 체계적인 행태적 편의에 노출되므로, 개인의 자기책임에 기반한 선택권을 부분적으로 제한하도록 설계한다. 즉, DC형 제도이지만 개인의 투자선택을 개인단위가 아닌 집단차원에서 이루어지도록 하는 디폴트상품을 라인업(line-up)하도록 하는 것이다. 그리고 개인 단위의 투자선택이 이루어지지 않은 경우에 한하여 집단 차원의 투자선택이 이루어지도록 하고 연금 사업자에게 그것을 위임하도록 하는 것이다. 이것의 장점은 개인 단위의 상품 적합성을 집단 단위의 상품 적합성을 어떻게 담보할 것인가의 문제를 일정한 적합성 대리변수(proxy)를 통해 해결하고 있다는 것이다. 연령이 대표적이다. 뿐만 아니라 디폴트옵션의 도입으로 과다선택지(choice overload) 문제도 자연스럽게 완화됨에 따라 제한된 합리성이 야기하는 선택장애 문제가 크게 줄어들며, 연금 투자결정에서 행태적 편의로 인한 포트폴리오 비효율을 낮출 수 있다. 이러한 장점에도 불구하고 디폴트옵션제도는 투자결정권을 연금 사업자에게 위임하는 과정에서 법적 불확실성 문제가 존재한다. 즉, DC형 연금은 가입자가 자기책임으로 자기계정의 적립금을 운용하는 제도인데, 투자결정권의 위임에 대한 가입자와 연금 사업자간의 동의가 명확하지 않을 경우 디폴트옵션의 운용성과에 따라 책임 분쟁이 생길 수 있는 것이다. 때문에 주요 퇴직연금국가들은 이같은 법적 불확실성 문제를 완화하는 다양한 정책 옵션들이 존재하며, 어떤 정책 옵션을 제도화하느냐에 따라서 주요 국가의 디폴트옵션제도의 운영 방식에서 차이가 존재한다.

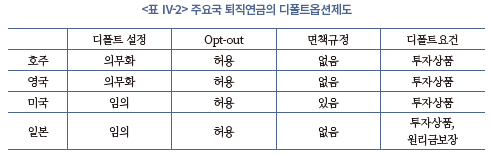

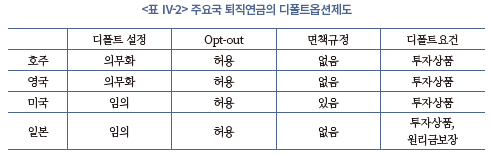

디폴트옵션이 DC형 내부의 지배구조 개선을 통한 수익률 개선 수단으로 주목받으면서 주요국들이 자율적으로 운영하던 디폴트옵션을 법적 근거를 가진 제도로 도입한 것은 2000년대 들어서이다. 미국이 2006년에 먼저 도입하였고 영국, 호주, 일본 순으로 디폴트옵션을 도입했다.14) <표 Ⅳ-2>는 주요 선진국의 퇴직연금 디폴트옵션제도의 기본구조를 요약한 것이다. 나라별 디폴트옵션제도의 핵심적인 구별은 의무화 여부, 탈퇴여부, 법적 불확실성 현실화 시 면책규정 존재 여부, 디폴트옵션상품의 형태 등으로 살펴볼 수 있다. 퇴직연금 도입 시 디폴트옵션의 도입이 의무화된 나라는 호주와 영국이다. 호주는 퇴직연금제도가 의무화이고 디폴트옵션 도입도 일부 유형(SMSF) 등을 제외하면 모두 의무화가 되었으며, 영국은 자동가입제도 대상 사업자에 대해서는 해당 사업장 근로자의 디폴트옵션 가입을 의무화했다.

미국과 일본은 퇴직연금제도를 도입하는 사용자가 임의로 도입여부를 선택한다. 호주와 영국처럼 디폴트옵션을 법적으로 의무화할 경우 장점은 앞서 운용지시권 위임에 따른 법적 불확실성 문제가 해소된다. 때문에 투자판단과 관련한 책임 분쟁은 해소되며, 법적 분쟁 대상은 연금 사업자의 불건전영업행위로 제한된다. 자발적 도입 국가인 미국과 일본의 경우 디폴트옵션이 법적 근거 없이 당사자간 계약에 의해 도입되다 보니 투자판단에 대한 법적 책임 문제로 인해 디폴트옵션의 활용성을 제약한다. 그래서 미국은 2006년 제도 도입 시 디폴트옵션 운용에 따른 손실책임에 대해 수탁자(사용자, 연금 사업자)의 책임을 면제하는 규정을 도입했다. 미국이 비록 임의도입 방식을 택했지만 디폴트옵션제도가 활성화된 배경으로 면책조항의 도입이 꼽힌다. 일본은 반대로 임의도입이면서 면책조항을 도입하지 않았다. 그러다 보니 디폴트옵션 활용이 활발하지 않을 뿐만 아니라 위험자산 비중이 높은 금융상품이 디폴트옵션으로 선택하기를 꺼리는 경향이 존재한다.

마지막으로 디폴트옵션은 일본을 제외한 미국, 호주, 영국에서는 투자상품만으로 정의된다. 그 이유는 간단하다. 퇴직연금은 장기상품이고 노후소득목표를 기반으로 연금자산을 운용하기 때문에 포트폴리오 개념의 투자상품이 디폴트옵션상품으로 정의되는 것이다. 예금 등 원리금보장상품을 디폴트옵션으로 정의한다면 굳이 디폴트옵션제도를 의무화하거나 임의도입을 하면서 면책제도를 도입할 이유가 없을 것이다. 운용지시권을 근로자가 행사하나 연금 사업자가 행사하나 운용성과에는 차이가 미미하기 때문이다. 운용지시권의 전환 혹은 지배구조의 전환이라고 의미를 부여할 만한 제도의 전환이라고 할 수 없을 것이다. 앞서 언급한 영국과 스웨덴의 공적개인연금에서 도입한 디폴트옵션도 기본적으로 투자상품이다. 이런 점에서 일본이 원리금보장상품을 디폴트옵션 정의에 포함한 것은 제도 설계 관점에서 이례적인 것이다.

일본의 사례를 투자자 선택권 관점에서 정당화하기도 어렵다. 디폴트옵션이란 일정한 조건 아래서 운용지시권을 연금 사업자로 이전하는 제도이므로 가입자는 사전적으로 디폴트옵션을 선택하지 않을 권리와 기회가 주어져야 하고(opt-out), 사후적으로는 언제든지 디폴트옵션상품의 운용을 환매비용 없이 해지할 수 있다. 즉, 원리금보장상품을 디폴트옵션상품으로 정의를 해야 투자자 선택권이 비로소 충족되는 것이 아니며, 그보다는 오히려 행태편의와 전문성 부족에 따른 적립금 운용 어려움과 저성과 문제를 해결하기 위한 제도 도입의 취지와의 충돌, 그로 인한 노후자산의 과소축적 가능성을 높일 수 있는 것이다.

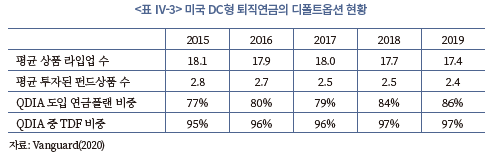

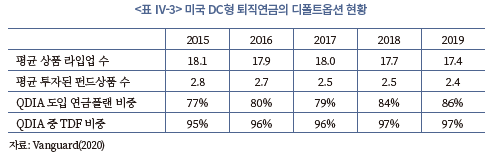

디폴트옵션의 제도 설계가 얼마나 중요한지 확인할 수 있도록 디폴트옵션의 성공사례인 미국과 그렇지 못한 일본의 사례를 살펴보자. 미국은 1997년에 DC형 연금자산(1.8조달러)이 DB형 연금자산(1.7조달러)을 추월한 후 글로벌 금융위기를 거치며 DC형 연금자산의 성장이 더욱 가속화되는 가운데, 2006년 도입된 디폴트옵션(Qualified Default Investment Arrangement: QDIA) 도입율과 도입 속도가 매우 빠르다. QDIA를 도입한 연금이 2015년 77%에서 2019년 86%로 높아졌다. 그리고 디폴트옵션으로 도입한 상품은 2019년 기준으로 97%가 타겟데이트펀드(Target Date Fund: TDF)인 것으로 나타났다.

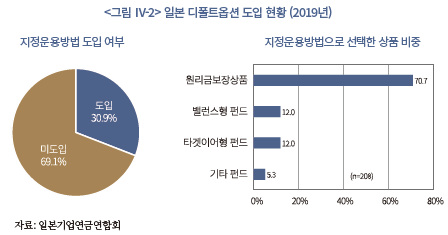

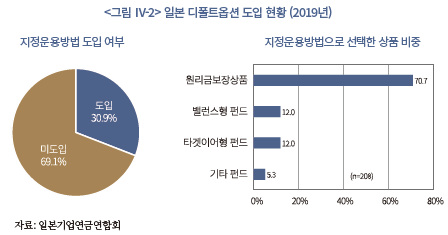

일본은 시장 규모 면에서 디폴트옵션제도 도입효과가 명시적이지는 않다. 2019년 일본연금연합회가 조사한 바에 따르면 디폴트옵션을 도입한 퇴직연금은 673개 퇴직연금 사용자 기준으로 30% 정도에 머물렀다. 더구나 디폴트옵션으로 선택한 상품도 혼합형(밸런스형)이나 TDF는 각각 12% 수준에 불과하고, 70% 이상이 원리금보장펀드로 나타났다. 일본은 디폴트옵션제도를 도입하기 이전이나 이후나 원리금보장펀드 중심으로 퇴직연금 운용지시가 나타나고 있는 것이다.

3. DC형에서 혼합형(hybrid) 연금으로 전환

디폴트옵션제도를 DC형 연금의 틀(scheme)은 유지한 채 편입상품의 운영방식 변경을 통해 적립금 운용 효율을 높이는 제도 개선이라고 한다면, 혼합형 연금제도는 DC형 연금제도의 틀에 변화를 주는 보다 근본적이고 거시적인 제도 개선의 성격이 있다. 왜냐하면 디폴트옵션은 가입자가 투자자 선택권을 행사하지 않은 경우에 한해 연금 사업자가 디폴트옵션을 통해 운용지시권을 행사하지만, 혼합형은 다양한 변종이 있지만 기본적으로 가입자에게 사전적으로도 투자선택권을 주지 않고 전문가가 운용지시권을 행사하도록 설계되기 때문이다.

혼합형 연금은 넓게 보면 연금개혁의 역사, 다시 말해, 전통 DB형 연금(공적이든 사적이든)이 재정개혁을 하는 과정에서 가입자가 노후에 받는 연금급여가 미리 정해지는 확정급여라는 DB형의 속성이 약화되며 사용자로부터 근로자로 적립금 운용과 급여 변동 위험이 이전되는 것을 일반적인 특징으로 하는 순수 DC형을 제외한 모든 연금을 포함하는 개념이다. 현실에서는 <그림 Ⅳ-3>에서 보듯 매우 넓은 스펙트럼으로 분포되어 있으며, 사용자부담이 상대적으로 큰 DB형에 가까운지 근로자 혹은 근로자집단의 위험부담이 사용자보다 더 크게 되는 DC형에 가까운지를 기준으로 혼합형 연금의 성격을 가늠할 수 있다.

Turner(2014)에 따르면 영미형 국가에서 혼합형 연금 중 대표적인 것은 CBP이다.15) 기본적으로 DB형 성격을 가지나 적립금은 집합운용관리 되나 개별 신탁계좌를 갖는 DC형과 달리 가상계좌 형태의 개별계정으로 가입자별로 크레딧을 배분하기 때문에 운용성과와 사용자의 기여금간 상관성이 없으며 급여의 확정성(연금화) 의무도 사라지며 수익배분과 급여정책이 사실상 DC형 연금과 유사하다. 미국에서 가장 널리 활용되는 혼합형 연금이라고 할 수 있으며, 1985년에 뱅크오브아메리카에서 처음 고안된 제도이다. 최근 규모는 확인이 어려우나 2003년 기준 가입자 1,000명 이상 퇴직연금플랜의 19%가 CBP인 것으로 조사되었다(IRS, 2014).

사민주의모델 중에서는 스위스 퇴직연금이 미국과 유사한 CBP를 운영하고 있다. 스위스 퇴직연금은 1985년에 강제가입 퇴직연금으로 전환하면서 CBP제도에 해당하는 명목퇴직연금제도(Notional Individual Retirement Account: NIRA)를 도입하였다. 특이점은 크레딧으로 적립된 연금자산에 연금전환승수를 고려하여 강제적으로 연금화 한다는 점이 미국과는 차이가 있으며, 연금 사업자가 최소수익률을 보장하도록 하고 있어 퇴직연금자산이 대체로 보수적으로 운용되는 것이 특징이다.

마지막으로 네덜란드의 혼합형 연금으로 CDC가 있다. 네덜란드는 연금 선진국(P7)에 해당하는 사민주의 다층연금모델 국가로 분류되지만, 2층이 소득비례 공적연금이 아닌 강제가입 퇴직연금이란 점에서 호주와 유사하며 전체적으로는 영미형 다층연금모델의 성격도 동시에 가진 독특한 나라이다. 강제가입 퇴직연금은 주로 산업퇴직연금으로서 오랫 동안 전통 DB형 제도를 유지하였으나, 2005년 연금개혁과 함께 CDC 연금제도를 도입했다. 네덜란드 CDC는 금리하락, 고령화, IFRS 등으로 인한 DB형 연금 재정 불안을 해소하기 위해 적립금 비율이 일정 허들(105%)을 하향 이탈할 경우 급여조정, 기여금 인상 등의 안정화 장치를 도입하여 전통 DB형의 급여 확정성을 완화하는 것을 골자로 한다. 앞서 미국과 스위스의 CBP와 달리 DB형 성격을 강하게 유지하고 있는 것이 특징이다. 2018년 기준으로 전체 퇴직연금의 89%를 차지하는 DB형 연금 중에서 11%가 CDC 연금이다(송홍선, 2019b). 참고로 네덜란드의 최대 퇴직연금이자 전세계 4대 연금기금에 해당하는 ABP(APG 투자회사가 운용)가 바로 CDC 연금제도를 택하고 있다.

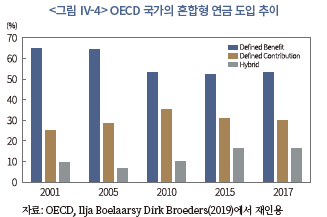

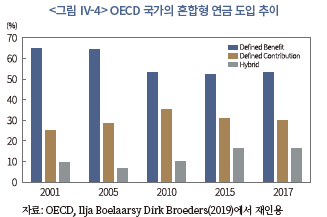

이상에서 혼합형 퇴직연금으로 미국, 스위스, 네덜란드 등의 대표 사례를 살펴보았는데, 글로벌 흐름으로 보면 혼합형 연금은 DB형 연금과 달리 성장하고 있는 연금제도로 분류된다. 영국도 2015년에 네덜란드의 CDC를 도입하였으며, 일본도 위험분담형 퇴직연금을 2014년 도입하였고, 일본의 중소퇴직연금공제회는 앞서 세 가지 사례와 달리 DC형 연금이면서도 적립금을 집합운용을 하는 혼합형 연금제도로 운영되고 있다. <그림 Ⅳ-4>에서 확인할 수 있듯이 전세계 연금제도는 DB형이 성장 둔화하는 가운데 DC형과 DC형 성격을 강화하는 혼합형 연금의 성장세가 지속되고 있다. 2005년 혼합형 연금은 19개 OECD 국가 연금자산의 7%를 차지했으나, 2017년에는 전체의 16%로 성장했다.

4. 국내 DC형 연금의 운용제도 개선 방안

가. 디폴트옵션제도의 도입

디폴트옵션제도를 도입한 나라들의 공통적인 도입 배경은 두 가지 인데, 하나는 DC형 연금의 낮은 수익률을 제고할 목적이고, 다른 하나는 퇴직연금을 의무가입제도로 전환하는 과정에서 제도에 대한 이해와 무관심 등으로 적립금을 운용하지 않을 가능성에 대비하여 도입되었다. 일본이 전자에 가깝다면 자동가입제도나 의무가입제도를 운영하는 영국, 미국은 후자에 가깝다. 임의가입제도를 유지하고 있고 낮은 수익률이 퇴직연금제도의 신뢰의 위기를 야기하고 있는 우리나라의 경우 일본과 같이 낮은 수익률 극복이 디폴트옵션제도 도입의 근본적인 취지라고 할 수 있다. 때문에 수익률 제고 원칙과 상충하는 방향으로 디폴트옵션제도가 도입되는 것은 바람직하지 않다. 이하에서는 이 원칙을 기본으로 두고 2021년 말에 도입한 국내 디폴트옵션제도를 평가하고 바람직한 운영 방향에 대해 살펴보기로 한다.

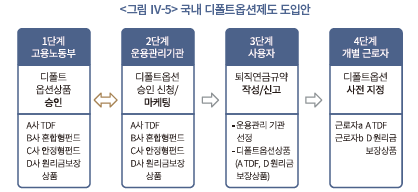

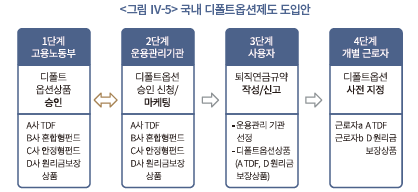

우리나라 디폴트옵션제도는 한마디로 해외의 호주모델과 일본모델에 한국적 상황을 추가로 고려한 절충모델이라고 할 수 있다. <그림 Ⅳ-5>는 국내에 도입된 디폴트옵션제도의 운영원리를 도식화 한 것이다. 첫 번째 단계는 정부의 상품 승인이다. 우리나라의 경우 일정한 요건을 갖춘 디폴트옵션에 대해 정부가 상품심사를 하여 최종적으로 승인해 주는 호주 방식의 인가디폴트옵션상품으로 설계되고 있다. 미국이나 영국, 일본이 원칙(principle)중심으로 요건을 정부가 제시하고 시장에서 자율적으로 요건을 충족한 상품을 공급하는 제도와는 차이가 있으며, 그만큼 디폴트옵션상품 상품설계단계부터 신뢰를 높이는 방식을 택하고 있다. 두 번째 단계는 연금 사업자(운용관리기관)가 정부에 심사를 신청할 디폴트옵션상품을 설계, 제조한 후, 승인된 디폴트옵션상품을 가지고 DC형 연금을 도입할 의사가 있는 사용자와 근로자를 상대로 권유를 하게 된다. 세 번째 단계는 사용자가 근로자 대표의 동의 아래 어떤 연금 사업자의 어떤 디폴트옵션상품을 회사의 디폴트옵션상품으로 도입할 것인지 선정하는 단계이다. 네 번째 단계는 사용자가 근로자 대표와 협의하여 선정한 퇴직연금 사업자가 제시하는 승인받은 디폴트옵션상품 중에서 개별 가입자 본인이 어떤 디폴트옵션상품을 택할지 결정하는 단계이다. 그런데 다른 선진국 디폴트옵션제도의 경우 앞서 세 번째 단계가 마지막이다. 사용자가 근로자 대표와 협의하여 특정 연금 사업자의 특정 디폴트옵션을 선택하면, 그것으로 제도적 절차는 종결된다. 개별 근로자는 스스로 운용지시를 하지 않을 경우 근로자의 적립금은 자동으로 디폴트옵션상품으로 운용되게 된다. 네 번째 단계는 사용자가 정한 복수의 디폴트옵션상품 중에서 근로자가 다시 한번 선택하는 단계를 둔 것인데, 우리나라 디폴트옵션제도에만 있는 독특한 제도이다. 한편 국내 디폴트옵션제도는 원리금보장상품을 디폴트옵션상품에 포함시키고 있다. 미국, 영국, 호주 등 디폴트옵션제도 선진국에서 전례가 없는 방식으로 일본모델을 절충한 것으로 볼 수 있다.

이렇게 볼때 우리나라의 디폴트옵션제도는 한국적 상황을 진진하게 고려하려는 제도적 노력은 평가할만 하나, 수익률제고와 노후소득 확충을 위한 게임체인저가 될 정도로 제도가 잘 설계되었다고 평가하기는 힘들다. 특히, 원리금보장상품의 지정 허용은 수익률제고 목적으로 도입된 디폴트옵션제도의 근본 취지를 훼손할 수 있음을 경계할 필요가 있으며, 이로 인해 노후소득 확충의 주체인 가입자들의 역할은 디폴트옵션 도입에도 불구하고 여전히 중요한 상황이다. 이하에서는 크게 두 가지 이슈에 대해 평가하기 한다.

첫째, 디폴트옵션은 가입자의 운용지시권이 연금 사업자로 일정한 조건 아래 이전하는 제도이기 때문에 디폴트옵션 운용에 따른 손실책임을 두고 가입자와 연금 사업자간에 분쟁이 있을 수 있다. 이 같은 분쟁 소지는 디폴트옵션제도의 활성화에 큰 제약으로 작용할 수 있는데, 실제 디폴트옵션상품을 당사자간 자율로 도입해 운영하던 2006년 이전의 미국이나 2014년 이전의 호주에서 디폴트옵션은 크게 활성화되지 못하였다. 여기에 대한 제도적 대응은 선진국에서 크게 두 가지로 나타났다. 한 가지 대응은 면책조항을 법적으로 명문화한 미국의 사례이며, 다른 하나는 디폴트옵션제도 도입을 의무화 한 호주와 영국의 사례이다. 우리나라는 호주와 영국 사례를 따라 근로자퇴직급여보장법 제 19조와 제 21조의 2를 개정하여 디폴트옵션 도입을 의무화하는 방식을 택하였다. 그리고 여기에 더하여 우리나라만의 독특한 방식이라고 언급했던 4단계(가입자가 디폴트옵션상품을 사전 선택)를 추가로 제도화 하여 손실책임 논란을 사실상 해소하는 방식을 택하고 있다. 다른 나라와 달리 가입자가 디폴트옵션상품 중에서 어떤 상품을 선택할지 결정권을 행사하도록 함으로써, 근로자가 디폴트옵션에 대해서도 운용지시권을 행사하는 독특한 방식의 디폴트옵션제도를 도입한 것이다. 그래서 우리 제도를 디폴트옵션제도라고 볼 수 있는가에 대한 논란이 있으며, 디폴트옵션제도라기 보다 수익률 제고를 위한 대표상품제도로 이해하는 것이 합리적일 수 있다. 그렇지만, 국내 디폴트옵션제도의 근본 도입 취지가 수익률 제고인 점을 감안하면, 손실책임 논란을 회피하면서 수익률 제고를 위한 장기투자와 자산배분을 제도적으로 유도하고 있다는 점에서 한국적 디폴트옵션제도는 적극적으로 평가할만 하다.

둘째, 디폴트옵션상품에 원리금보장상품의 지정(편입)을 허용한 것이 바람직한가 이다. 연금자산의 장기 투자 속성에 맞게 디폴트옵션상품은 자산배분과 분산투자을 충족하도록 설계되어야 하기 때문에 미국, 영국, 호주 등 선진국은 원리금보장상품을 디폴트옵션 상품으로 지정하는 것을 허용하지 않는다. 우리나라는 이들과 달리 원리금보장상품에 대한 가입자 선택권을 강조하며 편입을 허용하고 있다. 가입자가 선택권을 행사하지 않을 때 자동투자하는 개념이 디폴트옵션제도인데, 거꾸로 선택권을 강조하며 원리금보장상품을 허용하는 논리적 모순이 발견된다. 가입자 선택권은 디폴트옵션제도가 아닌 퇴직연금 가입단계에서 가입자 성향에 맞게 실적배당상품과 원리금보장상품을 권유 자문하는 판매단계에서 강조되어야 할 규제 원칙이기 때문이다. 원리금보장상품의 도입으로 자산배분과 분산투자라는 연금자산 운용의 기본 원리는 약화되었다. 이로 인한 가장 비관적인 시나리오는 대표상품 성격(4단계)과 원리금보장상품 허용, 그리고 원리금보장상품 중심으로 라인업되는 연금사업자시장구조가 상호작용하며 자산배분과 분산투자, 수익률제고라는 디폴트옵션제도의 취지를 무력화하는 것이다. 이같은 비관적 시나리오를 염두해 둔 제도의 보완과 제도운영의 묘가 중요해졌다. 한가지 방안은 가입자 교육 요건을 강화하는 것이다. 디폴트옵션의 도입 취지와 자산배분, 분산투자 등 연금자산 운용의 기본 개념과 중요성을 가입자 금융교육 과정의 필수 사항으로 포함할 필요가 있다. 또 하나의 방안은 TDF 등 디폴트옵션펀드에서도 분산투자의 일환으로 고금리예금, GIC 보험상품 등을 필요에 따라 편입할 수 있도록 하여 퇴직이 임박한 안정추구 고객의 원리금보장 니즈를 흡수하는 것이다. 이를 위해서는 자본시장법 또는 근로자퇴직급여보장법의 개정을 통하여 GIC 같은 보험상품의 디폴트옵션펀드 편입을 허용할 필요가 있다.16)

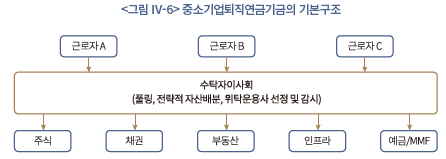

나. 혼합형 연금 도입: 중소기업퇴직연금기금

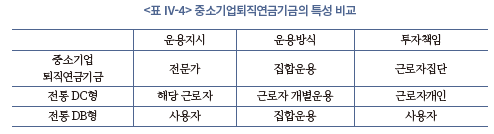

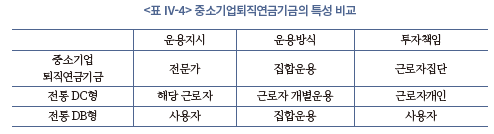

2021년초 우리나라 최초로 기금형 퇴직연금이 영세사업장 근로자를 대상으로 도입되었다. 바로 중소기업퇴직연금기금(이하 중소퇴직기금)이다. 그런데 중소퇴직기금은 기금형이란 상징성만 있는 것이 아니라, 우리나라 최초의 혼합형 퇴직연금이란 또 하나의 특징을 갖고 있다. 도입 취지는 2절에서 언급한 것처럼 DC형 연금지배구조의 한계를 DB형의 특성을 가미하여 극복하는데 일차적인 목적이 있다. 그래서 30인 미만 영세사업장 근로자를 대상으로 하는 중소퇴직기금은 첫째, 기금형 지배구조, 둘째, DB형의 집합운용, 셋째, DC형의 개인계정, 넷째, 급여안정화를 위한 가입자간 위험분담(최소수익률) 등 4가지를 특징으로 하는 집합적 DC(collective DC scheme)로 규정할 수 있다.

첫째, 지배구조는 기금형 지배구조이다. 중소퇴직기금의 운용철학과 목표수익률, 허용위험, 그리고 전략적 자산배분은 기금운용위원회라는 수탁자이사회를 통해 결정된다. 이는 기존의 근로자퇴직급여보장법에 근거한 계약형 퇴직연금과는 구별되는 의사결정구조이며, 국민연금 등 우리나라 공적연기금과 동일한 성격의 연금운용 지배구조로 운영된다고 할 수 있다.

둘째, 그렇지만 사용자의 기여금 방식은 DC형에 해당한다. 사용자는 매년 임금의 1/12 이상을 기여하면 퇴직연금기금의 운용위험과 절연(book off)하는 DC형 제도이다. 때문에 중소퇴직기금의 운용위험은 사용자가 아닌 근로자가 기본적으로 부담하게 되며, 급여 안정화 장치를 도입할 경우 중소퇴직기금에 가입한 근로자들과 집단적으로 위험의 일부를 분담하게 된다.

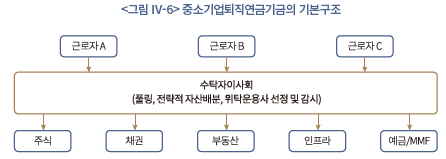

셋째, 중소퇴직기금은 가입자들의 기여금을 집합하여 운용한다. 사용자가 납부한 기여금을 일반 DC형처럼 가입자가 직접 운용지시를 하지 않고, DB형처럼 기여금을 공동으로 조성하여 자산운용에 전문성이 있는 전문 매니저가 가입자를 대신하여 집합 운용(pooled investment)하는 방식을 택하고 있다. 집합운용의 목적은 우선, 기금 풀링에 따른 규모의 경제 효과를 누리기 위함이며, 규모의 경제 → 분산투자 → 자산배분 기대수익률 제고이며, 또한 개인의 제한된 합리성(bounded rationality)으로 복잡 다양한 운용상품으로 최적 포트폴리오 구성이 어려운 현실 등을 감안한 것이다. 이상을 요약하면 <그림 Ⅳ-6>처럼 사용자가 집합운용하는 기금계정으로 근로자별 기여금을 납입하면, 수탁자이사회, 중소퇴직기금 운용조직, 외부 자산운용회사 등이 투자정책서가 정한 권한과 의무 범위 내에서 중소퇴직기금을 운용하게 된다. 전략적 자산배분은 기금운용위원회, 전술적 자산배분과 펀드 선택은 근로복지공단과 외부위탁운영관리(Outsourced Chief Investment Officer: OCIO)가 기금 운용 관련 책임과 의무를 수탁자책무에 따라 수행하게 된다. 한편 가입자들은 자신의 기여금과 그로부터 운용수익을 매년 확정하여 배당받게 되나, 인출하지 않고 재투자를 통해 중소퇴직기금에 적립되어 퇴직시점까지 집합운용 된다. 가입자는 일종의 가상계좌 형태의 개인계정을 갖게 된다.

넷째, 중소퇴직기금은 급여안정화를 위한 최소수익률 장치를 둔다. 급여안정화 장치는 혼합형 연금에서 흔히 발견되는 제도로서 집합운용에 따른 이익을 공유하듯이 집합운용에 따른 손실 역시 최소한으로 공유함으로써 운용위험이 특정가입계층에 집중되는 것을 방지하는 장치이다. 역사적으로 DC형 연금이 가장 큰 손실을 본 것은 2008년 미국 금융위기 때이다. 이미 DB형 규모를 훨씬 능가할 정도로 성장한 미국 DC형은 2008년 단기적으로 평균 24% 손실이 발생한 것으로 나타났는데, 이 손실의 충격은 2008년에 퇴직하는 근로자에 집중되었다. 그 이후에 은퇴하는 근로자의 경우 위험자산가치가 2009년부터 본격적으로 장기 상승하면서 손실을 대부분 회복하고도 남았다. 2008년 은퇴 당사자에 집중된 꼬리위험은 당시 401(k)제도의 신뢰에도 영향을 줄만큼 충격적이었기 때문에 이를 해결하기 위한 국제적 논의가 이어졌으며, 그런 논의의 성과 중에 하나가 혼합형 연금에서 급여안정화 장치에 대한 고려였다. 급여안정화 장치의 필요성이 사회적으로 합의된다며, 중소퇴직기금은 기본적으로 투자성과를 매년 가입자에게 배당을 하되, 투자성과 중의 일부를 유보한 후 꼬리위험으로 부담이 집중된 근로자계층에게 일정 수익률을 보장하는 방안을 검토할 수 있을 것이다. 다만, 급여안정화 장치 도입과 관련하여 고려할 점은 급여안정화는 가입자에게 귀속될 투자성과 중에서 아주 일부분만의 유보를 통해 실현가능한 수준이 되어야 지속가능한 급여 안정 장치로 역할을 할 수 있을 것이란 점이며, 또한 급여안정을 위한 최소수익률의 보장이 기금의 자산배분과 효율적인 포트폴리오 구성을 왜곡하지 않는 방식으로 구조화 되어야 한다는 점이다.

Ⅴ. 노후소득 안정을 위한 인출제도 개선

노후안전망 관점에서 DC형 연금의 가장 취약한 부분이 인출정책이다. 연금자산을 언제 어떻게 인출하도록 제도를 설계하느냐에 따라 은퇴기간 노후소득의 적정성과 안정성은 크게 달라지는데, DB형 연금과 달리 DC형 연금은 연금화를 통해 장수위험을 관리하는 문제는 물론이고 중도인출을 관리하는데 어려움이 있다. 또한 은퇴시점의 연금자산이 금융위기 등 꼬리위험에 노출될 때 안전장치가 미흡하여 노후소득 안정성 면에서 우려가 있는 것도 사실이다. 이하에서는 각각에 대한 글로벌 흐름을 살펴보자.

1. 노후소득 안정을 위한 연금화정책

가. DC형의 연금화정책

DC형 연금의 노후소득 자금화와 관련하여 글로벌 이슈는 첫째, DC형 연금의 특성상 연금화가 DB형 연금처럼 제대로 설계되기 어렵다는 점, 둘째, 연금자산의 유출 가능성이 상존하여 연금자산의 체계적 축적에 어려움이 있다는 점이다. 노후소득 자금화와 관련한 DC형의 이 같은 문제점은 순수 DC형 연금에 나타나는 전형적인 현상으로 근본 원인은 DC형 연금의 성격이 개인계정(individual account)이라는 속성과 관련이 있다. 즉, DC형 연금은 사용자가 근로자 개인계정으로 기여금을 이전하면 그때부터 연금계정의 소유권은 근로자 본인에게 귀속되기 때문에 중도인출 가능성과 퇴직시 일시금을 인출하려는 연금퍼즐(pension puzzle) 문제에 취약하게 된다. 그럼 이 문제를 연금 선진국은 어떻게 관리하고 있는지 연금화 이슈와 중도인출 등 유동성관리 이슈를 차례로 살펴보자.

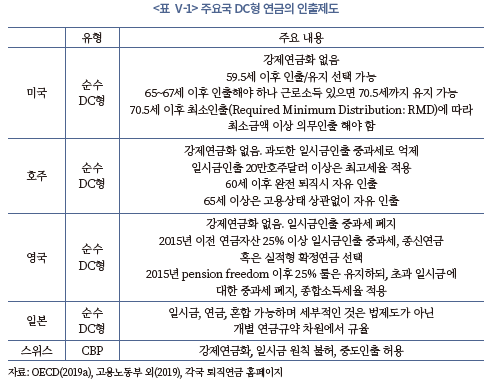

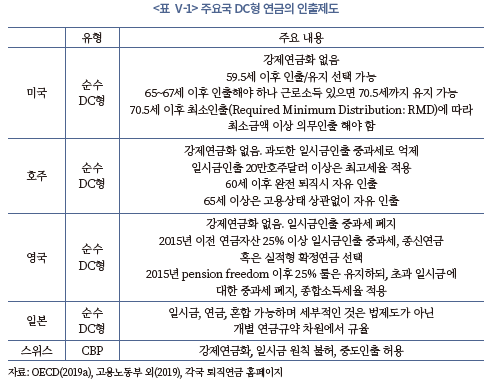

<표 Ⅴ-1>은 주요국 DC형 연금의 연금화정책을 정리한 것이다. 주요국의 공통점은 순수 DC형 연금의 경우 비교를 위해 제시한 스위스의 CBP 혼합형 연금과 달리, 연금화를 강제하지는 않는다는 점이다. 미국, 호주, 일본, 영국 등은 모두 강제적인 연금화제도를 도입하지 않고 있다. 근로자가 연금화를 원한다면 은퇴시점의 은퇴자산으로 금융회사의 연금상품을 구매하게 된다. 적어도 제도적으로 국가가 연금화를 체계적으로 지원하지는 않고 있다. 이는 일시금을 원칙적으로 금지하고 은퇴시점의 연금자산에 연금전환계수를 고려하여 연금수령으로 강제 연금화를 도입하고 있다는 스위스와는 비교된다.

대신 순수 DC형 연금 국가들은 일시금과 연금화를 근로자 개인의 자유로운 선택에 맡기되, 재정지원정책을 활용하여 연금화를 유도하고 있다. 가장 강력한 세제유인책을 두고 있는 나라는 호주이다. 호주는 20만호주달러 이상을 일시금으로 인출할 경우 최고세율로 중과세하는 정책을 펴고 있다. 인출 시점도 65세가 되어야 자유롭게 인출 가능하며 그 전에는 직장 유무에 따라 인출을 제한하고 있다. 영국은 전통적으로 세제유인을 통해 강력한 연금화를 유도하는 나라였다. 연금자산의 25% 이상 일시금인출시 중과세를 통해 강력하게 억제하고 종신연금이나 프로그램인출정책을 유도하였다. 그러나 2015년 연금개혁으로 연금화정책은 크게 약화되었다. 25% 이상 일시금에 대해서도 정상과세로 전환한 것이다. 일시금과 연금화 선택을 정부가 특정 방향으로 유인하지는 않겠다고 선언한 것이다. 미국은 전통적인 자유방임 국가이다. 그러나 영국이나 미국처럼 중과세를 하지 않더라도 일시금인출일 경우 그 금액 크기에 따라 정상적인 소득세를 부과하더라도 상당한 소득세를 부담해야 한다는 점과, 더 이상 연금제도가 제공하는 EET 등 연금자산 운용과정의 세제혜택을 보지 못한다는 점 때문에, 긴급자금이 아닌 한 일정규모 이상 금액을 일시금으로 인출할 경제적 유인은 크지 않다.

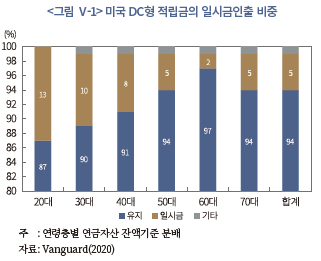

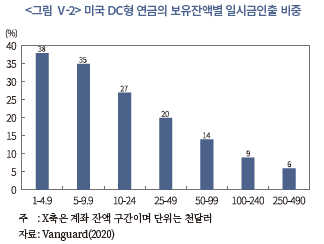

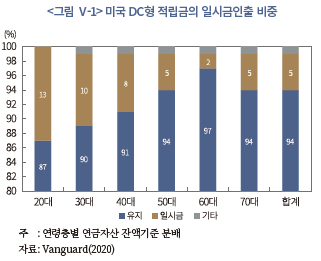

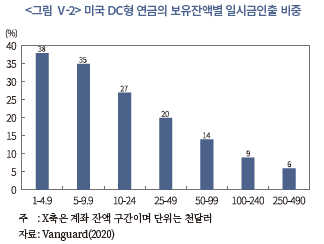

실제 일시금인출을 원칙적으로 허용하는 미국에서 실제 인출 실태를 살펴보자. 미국의 인출 분포를 봐도 대부분 연금화를 선택하고 있다(<그림 Ⅴ-1>, <그림 Ⅴ-2>). 금액으로 1만달러에서 2만 5천달러 사이 연금자산의 경우 73% 정도가 연금수령을 위해 계좌에 유지되었으며17), 연령으로는 은퇴가 시작되는 60대의 경우 연금자산의 2%만 일시금으로 인출하는 것으로 확인되고 있다. 즉, 강제적인 연금화제도는 없지만 연금에 대해 부과하는 기본적인 세제혜택 속에서도 가입자는 자기계산에 따라 연금화를 선택하고 있다고 할 수 있다.

요약하면, 지금까지 살펴본 대로 순수 DC형 연금에서 연금화를 법으로 강제하는 나라는 없으며, 또한 일시금인출에 대해 패널티 성격의 중과세를 하는 경우도 일반적이지 않다는 것을 확인했다. 통상적인 세율과 연금세제에 주어지는 과세특례(EET 등)로도 미국의 경우 연금화가 상당히 유도되는 것을 확인했다. 그리고 혼합형 연금인 경우 순수 DC형과 달리 개인계정 성격이 약하기 때문에 연금화를 강제하는 인출정책을 채택하여도 제도적으로 큰 무리가 없다는 것도 확인했다.

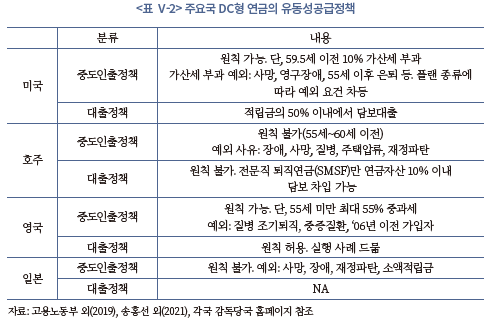

나. DC형의 중도인출정책

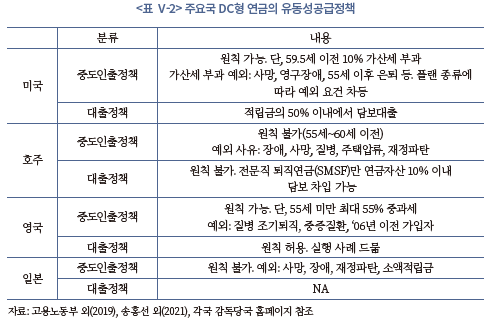

다음으로 주요국 DC형 연금의 중도인출정책에 대해 살펴보자. <표 Ⅴ-2>에서 볼 수 있듯이 대부분 나라들은 연금자산의 중도인출을 엄격하게 운용하고 있다. 근로소득이 있는 기간에 노후자산의 유출을 최소화하겠다는 것이다. 다만, 중도인출최소화를 위한 정책수단은 차이가 있다. 호주와 일본은 중도인출을 원칙적으로 금지하고 있다. 한국과 마찬가지이다. 엄격한 예외 요건을 운영하고 있는데, 질병, 사망, 장애, 재정파탄 등 우니나라와 요건의 엄격성이 유사하다. 다만 주택구입 관련 요건은 우리와 달리 없다. 호주는 주택압류의 경우에 허용하고 있다.

반면 미국과 영국은 중도인출을 원칙적으로 허용하고 있다. 영미형 모델이지만 임의가입의 미국과 자동가입제도의 영국, 강제가입의 호주가 중도인출정책에서 차이가 확인되는 점은 흥미롭다. 미국과 영국의 중도인출최소화정책은 조세라는 간접수단을 이용하고 있다. 미국은 일정 요건을 충족하지 못하는 중도인출에 대해 10% 가산세를 부과한다. 연방과 주정부에서 부과하는 소득세에 더하여 가산세를 부담하도록 하고 있다. 영국은 55세 이전 인출에 대해서는 55%의 소득세율로 중과한다.

DC형 연금의 중도인출정책은 넓게는 가입자에 대한 유동성공급정책 관점에서 살펴볼 필요가 있다. 여기에는 자신의 연금자산을 중도인출하는 것과 연금자산을 담보로 대출을 받는 방법이 포함된다. 중도인출을 원칙적으로 금지하는 호주는 대부분 유형의 퇴직연금에 대해 대출을 원칙 금지하고 있다. 5인 미만의 전문직이 설정하는 퇴직연금(Self Managed Super Funds: SMSF)은 예외적으로 연금자산의 10% 이내에서 담보대출을 허용하고 있다. 일본은 확인이 어렵다. 중도인출을 원칙적으로 허용하는 미국과 영국은 연금자산 담보대출을 허용하고 있다. DC형 연금자산이 기본적으로 노후준비자산이지만 근로기간 중 긴급한 유동성수요에 활용을 허용하고 있는 셈이다. 영국도 연금기금법 제19조5항에서 대출을 허용하고 있는데, 특이한 점은 대출의 목적이 주택 관련 대출로 용도를 한정한 점이다. 그런데 이와 관련된 연금대출이 활발하게 이루어지지는 않고 있다.18)

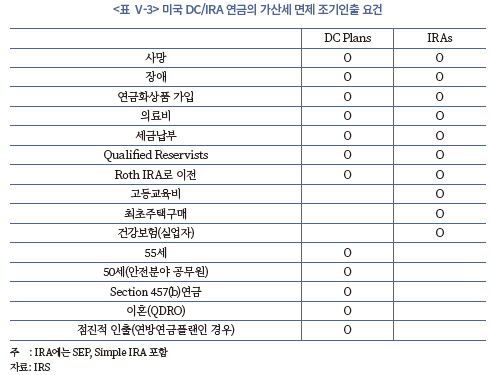

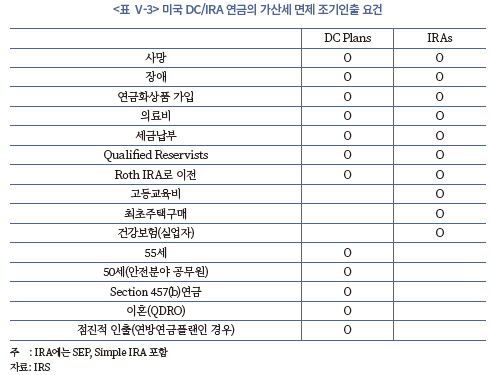

결국 요약하면 DC형 연금에서 유동성공급기능이 가장 발달한 나라는 미국이다. 세금만 부담하면 원칙적으로 중도인출도 자유롭고 연금자산 담보대출도 자유롭게 가능하기 때문이다. <표 Ⅴ-3>에 따르면 IRA의 경우 가산세 없이 중도인출을 자유롭게 할 수 있는 요건으로 고등교육비, 최초 집구매, 요양비 등을 포함하고 있다. 앞서 다른 나라에 비해 요건이 완화되어있을 뿐만 아니라, 401(k)에 비해서도 요건이 완화적임을 확인할 수 있다.

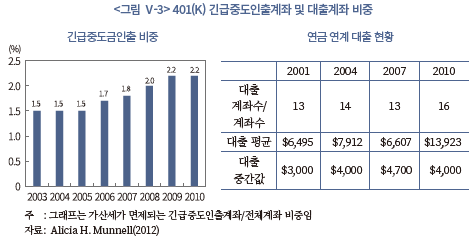

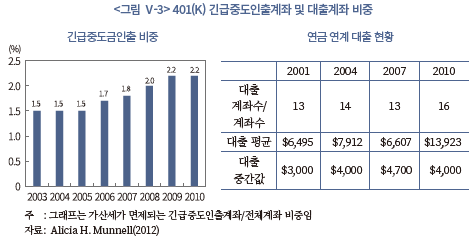

그렇다면 미국 401(k)의 중도인출규모와 대출규모를 좀 더 구체적으로 살펴보자. 유동성공급제도가 가장 발달한 미국에서 중도인출과 담보대출이 어느 정도 활발한지 살펴봄으로써 유동성공급과 노후자산축적 간 상충의 정도를 판단할 수 있을 것으로 본다. <그림 Ⅴ-3>에 따르면 긴급요건이 충족(<표 Ⅴ-3>)되어 가산세가 면제되는 401(k) 중도인출 규모는 계좌기준으로 전체의 2% 내외로 나타났으며, 연금자산을 담보로 한 대출은 계좌기준으로 2010년에 16%를 차지했다. 계좌당 대출규모는 글로벌 금융위기 직후인 2010년로 평균 13,923달러, 중간값 4,000달러로 나타났다. 401(k) 계좌당 중간값이 약 5만달러라고 할 때 중간값 기준으로 담보대출은 잔액의 10% 이내인 것으로 추정된다. 금액 기준 비교는 어렵지만, 미국의 경우 긴급유동성수요를 긴급중도인출을 통해 조달하기 보다는 연금자산 담보대출로 조달하는 비중이 더 높다는 것을 분명히 확인할 수 있다.

2. 은퇴시점의 꼬리위험 관리

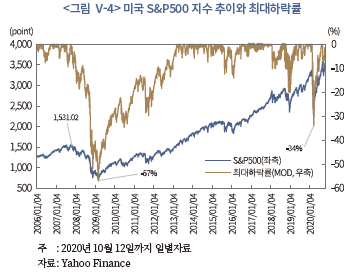

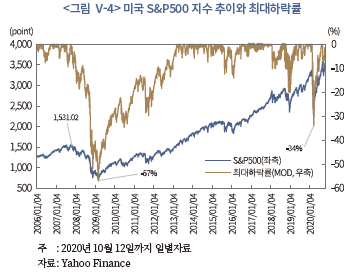

2008년 글로벌 금융위기를 겪으면서 적립금 운용책임이 가입자 본인에게 있는 순수 DC형 연금제도와 관련하여 중요한 이슈가 하나 제기되었는데, 다름 아닌 금융시장의 꼬리위험으로부터 은퇴시점의 연금자산을 어떻게 지킬 것인가에 관한 것이다. 주지하듯이, 대부분의 나라는 연금 급여의 수령시점을 대개 주된 직장으로부터 퇴직시점으로 하거나, 이외 별개로 법으로 정한 퇴직연령 부근에서 연급 급여의 수급을 시작하도록 원칙을 정하고 있다. 이처럼 연금 수급시점이 정해진 상황에서는 개별 가입자는 연금 급여시점에서 한꺼번에 일시금을 받거나 민간보험회사로부터 연금상품을 구매하게 된다. 그런데 역사적으로 보면 경제위기는 반복되어 왔기 때문에 은퇴시점에서 금융위기 등 금융시장의 꼬리위험이 현재화 될 가능성은 존재한다. 2008년 금융위기가 대표적인 사례이다. 특히, 미국의 경우 1990년대 이후 신경제와 2000년대 버블 붕괴 회복 이후 경제호황으로 자산시장이 장기상승 하며 DC/IRA 연금자산이 크게 상승한 상황이었다. 이런 상황에서 2007년 최고점 대비 S&P500 지수가 57%의 최대하락을 보인 글로벌 금융위기는 2008년에 은퇴하여 DC형 연금자산을 수령한 가입자에게는 재앙적이었다.

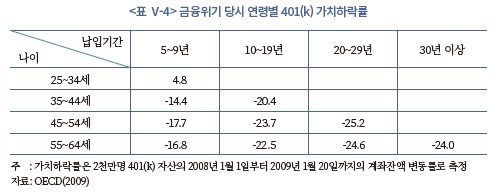

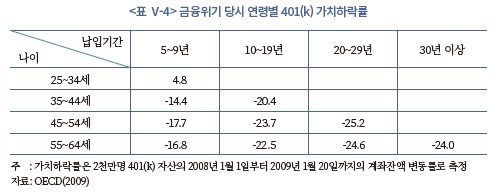

<표 Ⅴ-4>는 미국 401(k)의 2008년부터 2009년 1월 20일까지 연금자산 손실을 보여준다. 30대 이상 연령 가입자는 그간 축적한 연금자산에서 상당한 손실이 발생했음을 확인할 수 있다. 특히, 은퇴로 연금 수급 가능 연령에 해당하는 55세에서 64세 가입자는 가입기간이 길수록 연금자산 손실율이 컸으며 대부분 20% 이상 손실이 발생했음을 알 수 있다. 그런데 55세에서 64세 가입자는 은퇴시점에 해당하므로 연금을 불가피하게 수령해야 하기 때문에 이런 갑작스런 재앙으로부터 손실을 회복할 기회가 주어지지 않는다. 30대와 40대 가입자는 금융위기를 극복하면서 자산가치가 상승하며 연금자산의 가치가 회복되겠지만, 은퇴시점이 임박한 가입자는 그렇지 못한 것이다. 이것이 DC형 연금의 특징이다. DC형 연금의 가입과 적립금 운용과정에서 운용지시는 자유롭게 할 수 있지만, 퇴직 혹은 연금 수급 연령이 법적으로 정해져 있기 때문에 엑시트(exit) 할 수 있는 가입자의 선택권은 제도적으로 제약되어 있다. 미국이 금융위기로 대규모 연금자산의 손실이 발생하면서 노후안전망 관점에서 순수 DC형 연금제도의 구조적 결함으로 제기된 것이 바로 엑시트 제약에 따른 갑작스런 연금자산의 대규모 손실이다.

글로벌 금융위기를 경험하면서 은퇴시점 꼬리위험 관리 문제는 노후안전망으로서 퇴직연금제도의 신뢰성을 확보하는데 DC형 연금의 중요한 과제로 대두되었다. 여기에 대한 제도 개혁의 논의는 두 방향의 정책 대안을 검토하면서 은퇴시점 꼬리위험을 은퇴 전후로 분산시키는 방향으로 이루어지고 있다. 하나는 디폴트옵션제도를 보완하는 방안이고 다른 하나는 혼합형 DC연금제도를 도입하여 집합운용과 최소수익률 등 수익률 안정화 장치를 도입하는 방안이다. 각각의 논의와 사례에 대해 살펴보자.

먼저, 디폴트옵션 등 DC형 연금자산 운용과정에서 꼬리위험을 관리하는 노력이다. 디폴트옵션제도 자체가 꼬리위험을 관리하는 기능을 수행하지는 않지만, 글로벌 금융위기 이후 디폴트옵션상품으로 성장하고 있는 자산배분펀드나 TDF 등 자동적으로 동태적인 생애자산배분전략을 구사하는 투자상품의 경우 꼬리위험을 완화는 기능을 일부 수행하고 있다. 특히, 연령을 기준으로 자동자산배분을 하는 TDF의 경우 은퇴가 가까워질수록 위험자산 비중을 낮추도록(de-risking) 투자전략을 설계19)하고 있어, 은퇴시점 꼬리위험을 완화하는 기능이 내재되어 있다. 그런데, 미국의 디폴트옵션을 통한 꼬리위험 관리 논의에는 좀 더 적극적인 꼬리위험 관리 방안이 담겨 있다. 바로 연금상품(annuity)을 TDF 자동자산배분 과정에서 편입하는 것이다. 미국 국세청은 이미 2014년에 연금상품으로 자동자산배분하는 TDF가 신인의무를 만족한다는 유권해석을 내리면서 TDF와 연금화가 상품 단위에서 결합서비스 되기 시작했다. 연금상품(deferred annuity)은 사실상 장기채권과 경제적 실질이 유사하기 때문에 위험자산비중을 낮추고 안전자산비중을 높이는 TDF에 연금상품을 채권 대용으로 포함되는 것이 신인의무와 차별금지원칙에 부합한다는 해석을 내린 것이다(IRS, 2014). 그리고 법적 위원회인 미국 노동부 퇴직연금자문위원회(ERISA Advisory Council, 2018)는 2018년 적격디폴트옵션(QDIA)에 연금상품 등의 생애소득프로그램(life income solution)을 자동자산배분에 포함하는 것이 가능하다는 의견을 제시했으며, 이를 반영하여 2019년 미국은 SECURE법을 제정하여 401(k)가입자들이 연금화상품을 플랜 내에서 편입하는 것을 허용하였다. 이처럼 디폴트옵션과 연금화가 상품단위에서 결합서비스 될 경우, 자산배분과 통산성 문제 등 규제적으로 해결해야 할 문제도 있지만, 은퇴시점의 꼬리위험은 연금상품을 편입하지 않은 디폴트옵션상품에 비해 관리가 가능해지며 꼬리위험으로 인한 갑작스런 은퇴자산의 손실을 완화할 수 있다.

둘째, 혼합형 연금을 도입하여 꼬리위험을 관리하는 방안이다. 혼합형연금은 그것이 미국, 스위스의 CBP나 네덜란드의 CDC처럼 DB형에 기반을 하든 일본 중소기업퇴직공제회처럼 DC형에 기반을 하든 연금 적립금을 집합운용(pooled investment)하는 공통점이 있다. 집합운용은 개별 가입자들이 개인계정을 독립적으로 운용하는 개별운용에 비해 비용 면에서 규모의 경제를 누릴 수 있고, 운용 면에서는 다양한 자산군들로 자산배분이 가능하기 때문에 평상시의 위험관리는 물론 꼬리위험 상태에서도 위험관리효과가 있다.

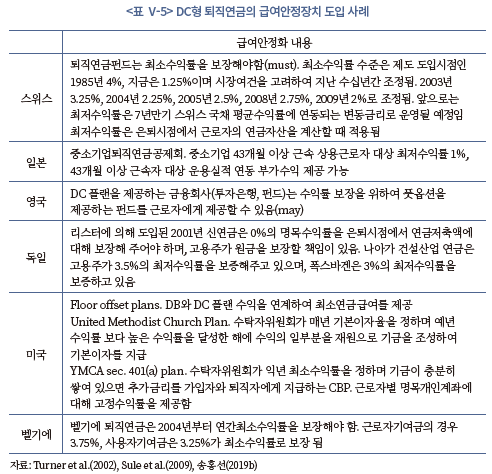

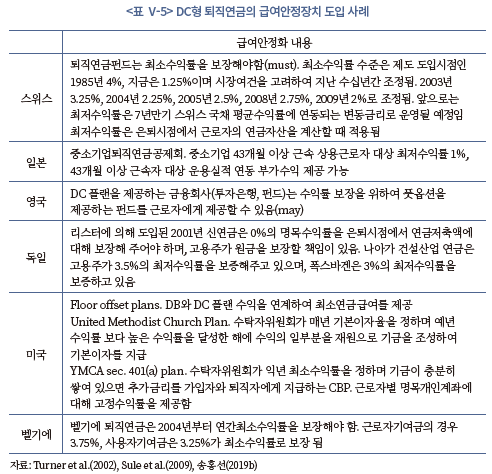

뿐만 아니라, 혼합형 연금은 대개 급여안정화 프로그램을 도입하는 방식으로 꼬리위험을 직접 관리를 한다. 스위스 CBP는 1.25% 정도의 최소수익률을 보장하는 장치를 도입하고 있으며, 네덜란드의 CDC는 적립률이 일정 기준(130%)이상을 유지할 경우 실질가치 연동 확정급여를 보장받고, 이하인 경우에는 여러 단계 임계치를 두고 급여를 조금씩 조정 혹은 삭감하고 있다. 그리고 일본의 중소기업퇴직공제회는 최소수익률을 1%로 보장하고 운용수익이 일정 수준 축적되면 부가 수익을 돌려준다. 미국의 경우에도 ERISA 법의 적용을 받지 않는 민간 비영리법인들은 DC형을 운영하면서 최소수익률 등 급여 안정화 장치를 도입하는 경우가 적지 않다. 그 외 영국, 독일, 벨기에도 최소수익률을 보장하는 사적연금이 운영되고 있다.

3. 국내 인출제도 개선 방안

2020년말 현재 국내 퇴직연금 적립금이 255조원을 넘어서며 지난 15년간 빠르게 성장하고 있지만, 우리나라 퇴직연금 인출제도가 조금만 더 엄격하게 운영되었다면 이보다 훨씬 더 많은 적립금이 쌓였을 것이라는 데 대해 대부분의 연금 전문가들은 동의할 것이다. 2020년 55세 이상 퇴직자 중에서 연금 수령 비중은 계좌기준 3.3%에 불과하지만 이들의 가입자당 적립액은 2억원 수준인데 비해, 일시금을 인출하는 96.7%의 가입자 당 평균 적립금은 1,600만원에 불과하였다. 일시금 1,600만원은 상용근로자 평균 임금 400만원(2020년말)을 가정하면 4년 근속할 때 받는 일시금 규모에 해당하는 것으로, 근로기간 25년, 평균 근속기간 5년을 가정하면 퇴직 전까지 약 4회 정도 중도인출이나 이직 전후 IRP 해지 등을 통해 일시금으로 수령한다는 단순 추측이 가능하다. 그런데 앞서 해외사례를 살펴 보았듯이 우리나라처럼 일시금인출 수요가 많은 경우는 찾기 어렵다. 물론 일시금인출은 그만큼 긴급한 자금수요를 반영할 수도 있지만, 인출과 관련된 제도적이고 구조적인 요인도 있을 것이다. 이에 아래에서는 국내 퇴직연금의 노후자산화 강화를 염두에 두고, 연금화정책, 중도인출정책, 그리고 꼬리위험 관리정책으로 나누어 제도‧개선방안을 검토하기로 한다.

가. 연금화정책

먼저, 연금화의 경우 순수 DC형 연금과 중소기업퇴직연금기금을 구분해서 제도 개선 방안을 마련할 수 있다. 순수 DC형의 경우 해외사례에서 보듯 플랜 내에 연금화 강제는 현실적인 대안이 아닌 것으로 보인다. 개별 계정이기 때문에 미국, 영국, 호주 사례에서 보듯이 일시금과 연금화의 선택, 그리고 연금화 방식의 선택은 모두 개인의 선택사항이다. 제도적으로 크게 프로그램인출과 연금화상품에 개별적으로 가입하는 방법이 있다. 프로그램인출의 경우 최근 디폴트옵션상품과 결합하는 방안을 생각할 수 있다. 가령, 퇴직시점에 디폴트옵션상품을 해지하지 않고 계속 기존 포트폴리오를 유지하는 대신 노후생활비 충당을 위해 월지급액 만큼만 최소로 수령하는 방식이다. 이처럼 은퇴 후에도 TDF 자산배분을 기본적으로 유지하며 월지급액을 인출 받는 상품을 쓰루(Through) TDF라고 하는데, 개념적으로 연금자산운용을 위한 디폴트옵션과 연금자산 인출을 위한 연금화서비스를 결합한 것이라고 할 수 있다. 그리고 앞서 해외사례에서 보았듯이 디폴트옵션 자산배분에 연금화상품(deferred annuity) 편입을 허용하는 방안도 함께 고려할 수 있다. 다만 국내에서 연금화상품을 디폴트옵션에 편입하기 위해서는 법적 불확실성을 해소할 필요는 있다. 현재 자본시장법은 집합투자의 투자대상을 포괄주의원칙에 따라 재산적 가치가 있는 모든 자산으로 포괄하고 있지만 즉시연금 등 연금화상품이 지금까지 펀드 운용자산으로 편입된 적은 없다. 자본시장법의 투자신탁 관련 법적 불확실성을 해소하거나, 퇴직연금신탁에 대해 미국 SECURE법처럼 플랜 내에서 연금화상품을 합리적으로 취득할 수 있도록 근로자퇴직급여보장법의 개정을 검토할 필요가 있다.

한편 혼합형 연금인 중소기업퇴직연금기금의 경우 연금화 도입이 보다 용이할 것으로 판단된다. 한 가지 방식은 프로그램인출이다. 이 기금은 적립금을 집합운용하기 때문에 정년으로 퇴직하는 근로자들이 본인 적립금을 한꺼번에 인출하지 않고 프로그램인출(drawdown) 방식으로 포트폴리오 변경 없이 적립금을 운용하면서 생활비만큼 월지급으로 연금을 수령하는 연금화가 어렵지 않게 가능하다. 다른 방식은 정년 퇴직하는 가입자 전체를 대상으로 수탁자이사회가 디폴트연금(default annuity)의 가입을 유도하는 것이다. 디폴트연금은 민간 연금보험회사가 제조를 하더라도 중소기업퇴직연금기금의 수탁자이사회가 민간 연금보험사업자로부터 적격디폴트연금을 지정하여 퇴직자에게 연금화상품을 서비스 할 경우 근로자들은 더 유리한 조건에서 연금화가 가능하게 될 것이다.

나. 중도인출정책

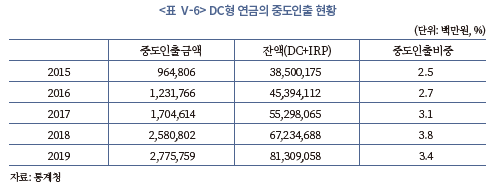

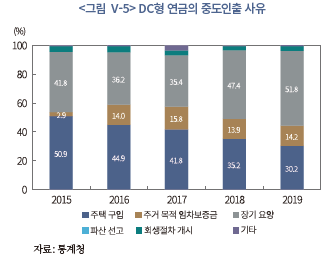

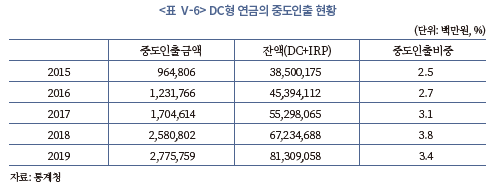

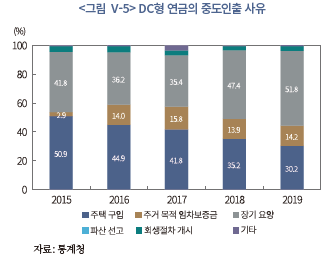

다음으로 DC형 연금 적립금의 중도인출정책의 개선 방안이다. 우리나라 DC형 연금의 중도인출제도는 호주, 일본처럼 원칙 불가이다. 예외적으로 중도인출사유에 해당할 경우 중도인출이 허용된다. 그래서 많은 전문가들이 예상하는 것과 달리 DC형(IRP 포함)의 중도인출 규모는 크다고 단정할 수 없다. 금액으로 2019년 2조 7천억원으로 DC형 잔액 대비 3.4%에 해당한다. 가산세만 부담하면 중도인출이 자유로운 미국과 직접 비교는 어렵지만, 계좌기준으로 발표하는 미국의 중도인출 규모(전체계좌의 2.2%)와 비교할 때 특별히 크다고 단정할 수 없다(<표 Ⅴ-6>). 그리고 중도인출 사유도 주택 관련보다 장기요양 사유에 의한 비중이 최근에는 더 커지는 등 투자성 긴급유동성 사유보다 고령화에 따른 생계상 긴급유동성 성격이 강화되고 있다(<그림 Ⅴ-5>).

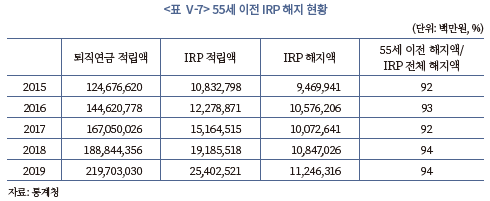

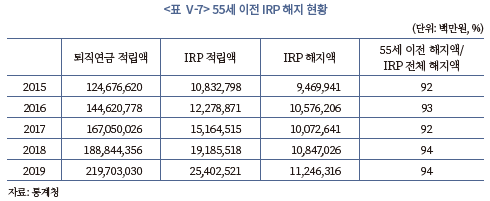

그런데 이처럼 중도인출 규모가 용인 가능한 수준에 있음에도 대부분의 연금자산이 중도에 소진되는 이유는 따로 있다. 바로 IRP의 자유로운 해지이다. 이직 전후 또는 중도인출 사유를 포함한 여러 생활상의 사유로 인해 긴급 유동성이 필요할 때 근로자들은 통산계좌인 IRP로부터 중도인출 옵션을 사용하는 것이 아니라 아예 계좌 자체를 해지하는 방법으로 연금자산을 인출하고 있다. <표 Ⅴ-7>을 보면 2019년 IRP 적립금 잔액은 25조원인데, 그 해에 해지된 IRP 잔고가 11조원에 이른다. 2015년 이후 매년 10조원 내외의 IRP 잔고가 해지되고 있는 것이다. 그리고 이 같은 해지는 주로 55세 퇴직 이전에 이루어지고 있다. 2019년 해지액의 94%가 55세 퇴직 이전에 발생했다. 앞서 <그림 Ⅴ-1>에서 미국의 30대 401K 가입자도 10%만 일시금으로 인출하는 것과 비교하면 우리나라 근로자들은 IRP를 이용해 마치 현금인출기처럼 연금자산을 유출하고 있다는 것을 짐작할 수 있다. 따라서 우리나라의 연금자산에 대한 인출제한정책은 중도인출보다는 IRP 해지 제한에 집중될 필요가 있다.

그런데 IRP 해지를 제도적으로 직접 금지하는 것은 쉽지 않다. DC형이나 DB형 퇴직연금은 사용자와 연금 사업자간 퇴직연금계약으로 이루어지지만, IRP의 경우 근로자 개인과 연금 사업자간 사적 계약으로 계좌가 설정되기 때문에 직접 규제의 법리를 적용하는데 애로가 있다. 더구나, IRP는 퇴직급여의 통산계좌이자 근로자가 추가 납입한 기여금도 함께 적립된다. 이런 제약 아래서 IRP 해지를 억제하는 정책의 선택폭은 넓지 않지만 다음과 같은 방안을 고려해 볼 수 있다. 첫째, 호주처럼 퇴직연금의 가입 의무화를 전제로 IRP 해지를 제도적으로 제한하는 방법이다. 제한은 퇴직급여 통산분과 추가납입 통산분을 구분하고, 퇴직급여 통산분에 대해서는 해지를 DC형 연금처럼 원칙적으로 금지한다. 비록 IRP가 사적계약이지만 가입 의무화로 퇴직연금이 준공적연금으로 전환한 이상 퇴직급여에 대한 인출은 제한할 수 있다. 다만, 예외적으로 중도인출요건에 해당하는 경우에만 부분 인출을 허용한다. 그리고 추가 납입분에 대해서는 현행 중도인출 요건보다 좀 더 완화된 인출요건을 두되, 세액공제액 환급 면제를 위한 보유기간 요건 등을 두어 인출을 세제인센티브로 조절하는 방법이다. 둘째, IRP 해지 억제를 위해 금전적 부담 대신 금전적 인센티브를 제공하는 방법이다. 미국은 가산세, 영국은 중과세 등 금전적 부담으로 해지를 억제하고 있으나, 가계의 가처분소득 대비 순자산 비중20)이나 노후안전망의 소득대체율이 주요 선진국 대비 높지 않고, 노후빈곤율이 높은 나라에서 근로자의 장기저축자산에 대해 세제 부담을 가중하는 방식의 유도정책은 바람직하지 않다. 재정인센티브를 주는 한 가지 방법으로 퇴사 후 실업기간 동안 IRP를 유지하는 경우 55세 최종 퇴직시점에서 퇴직소득세의 할인율(현재 70%)을 높여 주는 방안을 생각할 수 있다. 그리고 청년계층 등 특정 계층을 한정하여 퇴직기간 동안 IRP 유지시 퇴직소득세 할인율 상향에 더하여 퇴직기간 동안 납입하지 못한 추가납입액 등에 대해 보험료를 지원하는 방안도 생각해 볼 수 있다. 어떤 재정인센티브가 되었든 우리나라의 낮은 노후소득환경을 볼 때 영미형의 가산세 방식보다는 한국만의 인센티브제도가 실효적일 수 있다고 판단된다.

다. 꼬리위험(tail risk) 관리

꼬리위험이란 금융시장의 붕괴로 분산불가능한 대규모 손실위험에 노출되는 경우를 의미하는 것으로, 은퇴시점의 꼬리위험은 그러한 대규모 손실위험이 가입자가 모든 은퇴자산을 인출해야 하는 은퇴시점에서 발생하는 것을 의미한다. 은퇴시점의 꼬리위험 관리는 순수 DC형과 혼합형 연금에 대해 다른 제도화 방안이 제시될 수 있다. 순수 DC형의 경우 연금화 방안으로 제시한 디폴트옵션제도가 위험자산을 연령에 따라 줄이는 자동자산배분기능과 연금화상품의 편입, 그리고 쓰루(Through) TDF의 활용 등을 통해 꼬리위험을 관리할 수 있다. 한편 꼬리위험은 연금수령 관련 제도를 보다 탄력적으로 운영하는 방법으로도 관리가 가능하다. 가령, 미국의 경우 은퇴를 하더라도 59.5세에서 65세 사이는 DC형 연금을 인출할 수도 있고 추가납입을 할 수 있는 일종의 완충기간에 해당한다. 70.5세 이상이 되어야 최소인출요건에 의해 의무적으로 최소금액을 인출(Retirement Minimum Distribution: RMD)하도록 하고 있다. 이처럼 완충기간 개념을 우리나라에도 도입하면 근로자들은 맞춤형으로 인출시기를 조절할 수 있어 꼬리위험을 관리하는데 도움이 될 것이다.

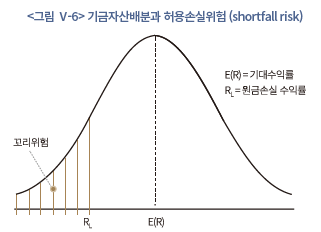

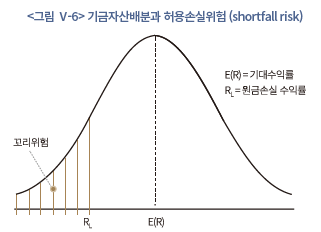

혼합형 연금제도인 중소기업퇴직연금기금의 경우 꼬리위험을 급여안정화 프로그램을 통해 직접 관리하는 방안을 생각할 수 있다. 앞 절에서 해외 일부 국가 혹은 일부 DC형 퇴직연금 플랜에서 최소수익률을 보장하는 급여안정화 프로그램을 운영하는 것을 확인했다. 그런데 해당 제도들의 치명적인 문제점은 최소수익률을 보장하기 위해서 연금자산을 안전자산 중심으로 운용하는 등 적립금 운용의 자유도를 크게 제약한다는 점이다. 더구나 글로벌 금융위기 이후 저금리와 저성장 환경 아래서도 안전자산 중심으로 적립금을 운용함에 따라 보장해야 할 최소수익률의 수준도 스위스 사례에서 보듯이 점점 낮아져 수익률 보장의 의미가 크게 퇴색하고 있다는 점이다. 결국 저금리 저성장 환경 아래서는 적립금의 자산배분과 분산투자를 제약하지 않는 방식으로 급여안정화 프로그램을 도입하는 것이 중요해진다. 자산배분을 왜곡하지 않으면서 급여안정화 방안을 도입하는 한 가지 방안으로는 적립금 자산배분 과정에서 정책적으로 결정하는 허용손실위험(shortfall risk)과 급여안정화제도를 결합하는 것이다. 여기서 허용손실위험은 주어진 자산배분을 통한 적립금의 운용수익률이 특정한 허들(가령, 원금손실) 아래로 내려갈 확률을 일정한 통계적 신뢰구간(가령 10%) 내로 통제하는 기금의 총위험 한도라고 할 수 있다. 허용손실위험(원금손실, RL) 아래로 운용수익률이 하락할 때 꼬리위험은 현실화한다. <그림 Ⅴ-6>에서 빗금친 구간을 의미하며 최소수익률 보장은 꼬리위험이 발생한 시기에 퇴직하는 근로자(전체 근로자의 일부)를 대상으로 이루어진다.

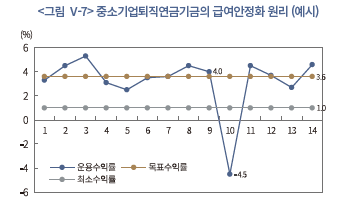

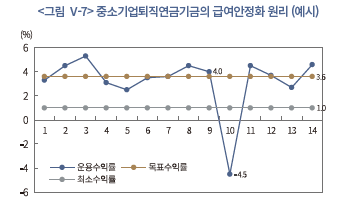

이상의 논리를 중소기업퇴직연금기금에 적용하면 다음과 같다. 중소기업퇴직연금기금의 수탁자이사회가 기금의 목표수익률과 허용손실위험을 정책적으로 결정하고, 그에 맞게 주식, 채권, 대체자산 등으로의 전략적 자산배분을 결정하게 되는데, 이때 정책제약인 허용손실위험은 기금이 자산배분안 대로 운용할 때 꼬리위험에 노출될 확률을 의미한다. 때문에 허용손실위험을 계산하면 그 노출 확률과 예상손실금액(expected shortfall) 등이 계량화된다. 이 정보를 이용하여 꼬리위험에 실현되는 기간(가령, 2008년 금융위기)에 은퇴시점이 일치하는 근로자(은퇴자)에 대해 최소수익률을 보장하는 방안이다. <그림 Ⅴ-7>은 최소수익률 보장 예시인데, 적립금 운용의 목표수익률(3.6%)이고 이를 위한 안전자산과 위험자산 배분을 통해 정상적인 금융시장 환경 아래서 목표수익률 내외의 실제운용수익률이 실현되는 것을 예시한 것이다. 그런데 기금이 정책적으로 정한 허용손실위험이 원금손실을 10% 이내로 통제하는 것이라면(shortfall risk(원금손실) < 10%), 해당 기금은 통계적으로 10년에 한 번씩 원금손실을 보는 꼬리위험에 노출될 수 있으며 아래 그림은 그것이 10년차에 운용수익률이 –4.5%임을 예시한 것이다. 최소수익률은 바로 꼬리위험이 현실화한 10년차에 퇴직하는 근로자에게 최소수익률을 1% 보장하는 것을 예시하고 있다. 비퇴직 근로자의 경우 계속 기금을 운용하게 되므로 역사적 경험상 몇 년 내에 가치를 회복하므로 이들을 위한 유보기금을 적립할 필요는 없다. 이렇게 되면 기금의 목표수익률에 따라 위험자산을 최적으로 편입하는 등 자산배분을 자유롭게 하면서도, 꼬리위험에 노출된 근로자에게 최소수익률을 비교적 적은 비용부담으로 보장할 수 있게 된다. 이처럼 최소 유보금으로 모든 근로자들의 연금자산을 꼬리위험으로부터 보호할 수 있다면, DC형 연금이 개별계정이고 은퇴시점이 고정되어 있기 때문에 야기되는 DC형 연금의 노후안전망으로서 약점을 보완하는 안정화 장치의 역할을 할 수 있을 것이다.

현행법상 퇴직연금은 연금수요자와 연금 사업자가 사적계약에 의해 연금서비스를 생산하는 사적연금으로서 퇴직연금제도에 대한 정부의 개입은 최소화 되어 있다. 연금제도로서 법적 정의와 가입자에 대한 불건전경영 감독을 위한 연금 사업자 규제가 현행 근로자퇴직급여보장법의 주된 내용이다. 퇴직연금이 대법원 판례에서도 인정한 노후소득안전망의 한 축이라는 사실이나, 공적연금의 약화되는 노후소득안전망기능을 퇴직연금이 보완해야 한다는 사회적 요구는 제도 속에 반영되어 있지 않다.

그런데 공적연금의 재정위기를 일찍 겪으며 퇴직연금의 보완적 역할을 강조한 선진국의 사례를 살펴보면 퇴직연금은 사적연금으로서 자율성보다 공적연금을 보완하는 준공적연금으로서 역할에 충실하도록 제도가 설계되어 있는 것이 일반적 흐름으로 확인된다. 가입을 강제화하거나 자동가입제도, 그리고 비정규 근로자로의 자격범위 확대를 통해 퇴직연금의 사각지대를 보완하고, 디폴트옵션제도나 혼합형 연금의 도입을 통해 확정기여형(Defined Contribution: DC) 퇴직연금 운용제도의 연금자산 축적 능력을 높이고 있다. 아울러 노후안전망 관점에서 가장 취약한 DC형의 인출정책에도 연금화를 유도하고 꼬리위험(tail risk)을 관리하기 위한 수단을 제도화하고 있다. 노후안전망기능의 강화로 요약되는 이 같은 퇴직연금의 준공적연금화 흐름은 고령화와 저성장, 저금리 등 뉴노멀시대로의 흐름과 함께 강화되는 양상이다.

그 간의 DC형 연금에 대한 선행 연구는 다양하게 확인할 수 있으나, 대부분 특정 나라의 제도 동향이나 자산배분, 수익률 비교, 연금화 등을 간략히 정리하는 경우가 대부분이다(배종원 외, 2020; 이상우, 2017; 김세중, 2015; 홍원구, 2015; 이경희, 2011). 노후안전망 관점에서 DC형의 가입, 운용, 연금화를 체계적으로 분석한 사례를 찾기는 어렵다. 이에 본 보고서에는 퇴직연금, 특히 글로벌 퇴직연금시장의 주류가 되고 있는 DC형 연금제도의 노후안전망 역할을 평가하고, 이를 개혁하기 위한 연금 선진국의 제도적 흐름을 사각지대 해소, 운용체제 개선, 연금화 등을 주제로 정리한다. 이를 통해 공적연금의 노후보장 역할 약화 속에서 우리나라 DC형 퇴직연금이 노후안전망 역할을 강화하기 위해서는 어떤 방향으로 준공적연금화를 위한 제도 개선이 이루어져야 하는지 검토하기로 한다.

Ⅱ. 노후소득안전망과 DC형 연금의 성장

1. 연금제도 진화와 DC형 연금의 성장

오늘날 연금제도를 비스마르크형 중심 다층연금제도라고 한다. 노령, 장애 등으로 근로 기회와 능력을 상실한 국민에게 빈곤 방지와 소득 보장을 목적으로 도입된 제도가 연금인데, 비스마르크형은 수혜자부담원칙에 충실한 보험방식을, 베버리지형은 최저생계에 대한 국가 책임성에 기반한 재정지원을 운영원리로 한다는 점에서 차이가 있다. 비스마르크형 연금이 주류가 된 데에는 자본주의의 자기책임원칙이 연금복지라고 예외가 아니기 때문일 것이다. 재정지원 방식의 베버리지형은 보조적 기능을 수행하고 있다.

<그림 Ⅱ-1>의 OECD 분류에 보듯 현대의 다층연금제도는 대단히 복잡다단하다. 연금 분류조차 단일 방식으로 분류하기 어려울 만큼 가입방식, 기여/급여방식, 적립방식, 위험부담방식 등 다원화되며 기초연금, 공적연금, 사적연금 등 대분류 내에서 존재양식도 다양해졌다. 베버리지형도 전통적인 사회부조에 기초연금이 더해지는 흐름이다. 사회부조가 빈곤선 아래 근로능력 상실자를 위한 선별 연금제도라면 기초연금은 근로기간에 노동력을 제공한 모든 국민들에게 노후생계 일부를 지원하는 보편복지적 연금으로 운영되는 것이 추세이다. 공적연금도 순수 확정급여(Defined Benefit: DB)형 외에 포인트제도, 명목확정기여(Notional Defined Contribution: NDC) 같은 제도적 변이가 만들어졌는데, 기본 모티브는 순수 DB형의 재정위기에 대한 대응이었다. 퇴직연금도 가입방식에 따라 의무화와 자발적 가입으로 이원화되는 추세이다. 퇴직연금의 제도 의무화는 퇴직연금의 사적연금으로서 정체성의 약화를 의미하는 것으로 퇴직연금이 준공적연금화 되는 중요한 징표가 되고 있다.

2. DC형 연금제도의 현주소

연금재정 위기 이후 DC형 연금이 글로벌 차원의 큰 흐름이 되고 있는데, 그 흐름은 두 가지 관점에서 확인이 가능하다. 하나는 제도 면에서 우리에게 익숙한 순수 영미형 DC형 연금은 물론이고 전통 DB형 연금에 DC형 요소를 강화하는 다양한 형태의 혼합형 연금의 출현이다. 다른 하나는 적립금 통계로 DC형의 성장세를 확인하는 것인데, 이때 주의할 점은 혼합형 연금의 경우 대게 DB형에 근거를 두고 있기 때문에 DC형 연금 적립금으로 분류되지는 않고 있다는 점이다. 이하에서는 두 가지 관점에서 DC형 연금의 성장 현황을 살펴본다.

가. 연금제도의 DC형 도입 흐름

<표 Ⅱ-2>는 2019년 현재 주요 국가의 보험료방식(contribution-based)의 공적연금과 퇴직연금의 연금 유형을 국가별로 정리한 것이다. 우선 공적연금을 보면 미국, 영국, 한국, 일본, 캐나다, 핀란드, 스위스 등이 <표 Ⅱ-1>에서 열거한 다소의 모수 조정과 함께 전통 DB형을 지금까지 유지하고 있는 것이 확인된다. 공교롭게도 핀란드, 스위스를 제외하면 대부분 영미형 다층연금체계에 가까운 나라들이다. 반면 스웨덴, 덴마크, 독일, 프랑스, 스위스 등 주요 유럽 국가들은 기존 부과방식 연금제도를 폐지하거나 상대화하고 DC형 연금 성격을 크게 강화했다. 스웨덴은 1998년 공적연금을 NDC로 전환하고 보험료의 일부를 순수 DC형 연금에 해당하는 프리미엄연금을 도입하였으며, 덴마크는 1964년에 도입한 확정기여형 소득비례연금(Allman Tillaggs Pesion: ATP)의 역할을 1985년에 크게 강화하였다. 프랑스와 독일은 전통 DB형 대신 포인트제도를 도입한 것이 특징이다.

퇴직연금의 경우 제도의 개혁은 주로 퇴직연금을 강제가입 방식으로 준공적연금화한 나라들에서 DC형 연금제도로의 전환이 확인된다. 호주는 슈퍼에뉴에이션 이후 DB형보다 DC형 연금이 지배적인 제도가 되었으며, 칠레는 1980년대초 기존의 공적연금제도를 폐지하고 민영화하면서 DC형 연금으로 전환했다. 스위스는 연금 스폰서들이 집합운용을 하며 최소수익률을 보장하고 연금전환율을 정부가 정하는 DC형 제도를 의무화하였으며, 스웨덴과 노르웨이, 덴마크 모두 DC형 기업연금을 산업별 협약에 의해 준강제적인 형태로 운영하고 있다. 네덜란드 역시 마찬가지인데, 특징은 순수 DB형을 변형한 CDC(Collective DC)제도를 운영하고 있다는 점이다. 글로벌 4대 연기금에 해당하는 네덜란드 공무원연금(ABP)이 대표적인 CDC 방식으로 운영되고 있다.3) 영국은 비교적 최근에 자동가입제도로 전환한 나라로서 영미형의 순수 DC형 연금을 운영하는 나라에 해당한다. 자발적 퇴직연금제도를 가진 나라에 해당하는 캐나다, 독일, 일본, 한국, 미국 등은 DB형과 DC형을 자유롭게 선택가능하며, 순수 DC형을 주로 운영하고 있다.

전세계적으로 공적연금이든 사적연금이든 DC형 연금으로 전환이 계속되고 있으나, 적립금 통계를 통해 DC형 연금시장의 규모를 파악할 수 있는 범위는 아직까지는 주로 퇴직연금시장이다. 퇴직연금에 대한 글로벌 컨설팅회사인 Willis Towers Watson이 퇴직연금 선진 7개 국가(이하 P7)4)에 대해 발표하는 통계에 따르면 2020년 P7 국가 퇴직연금 중 DC 형 적립금 규모 비중은 53%로 처음으로 적립금의 과반이 된 것으로 추정되고 있다. 참고로, 여기서 DC형에는 개인형 퇴직연금(가령, 미국의 IRA( Individual Retirement Account))을 포함한다.5) DC형 비중은 통계 작성이 가능한 2000년대 이후 지속적으로 증가하는 추세를 보이고 있으며, 전환 속도는 글로벌 금융위기 이후 가속화되는 양상이다.

주요 선진국 현황으로 볼 때 현재의 퇴직연금시장은 DC형 중심의 시장으로 규정할 수 있으며, 전통 DB형 연금의 지속가능성을 위협하는 고령화, 저금리, 저성장 경제 아래서는 DC형 중심의 연금제도로의 전환은 지속될 것으로 예상된다. 진화 경로로 보면 DC형 연금은 글로벌 연금개혁의 종착지가 되고 있다는 판단이다. 그렇다면, 연금자산 축적의 궁극적 목적인 노후안전망의 관점에서 DC형 퇴직연금이 신뢰할만한 종착지가 될 수 있는가 하는 근본적인 질문이 가능하다. 이는 연금개혁 역사를 보면 DC형 연금은 DB형 연금이 재정위기를 타개하는 과정에서 불가피 하게 선택된 제도 형태처럼 이해될 수 있기 때문이다.

<표 Ⅱ-3>은 노후안전망 관점에서 DB형과 DC형을 평가한 것이다. 여기서 노후안전망 관점이란 근로자의 노후자산 형성 및 위험관리가 근로자 자기책임에만 의존하지 않고 가입/운용/인출 각 단계에서 공적으로 보충되고 지원되는 시스템을 의미한다. 이런 관점에서 노후자산 축적과정에서의 투자위험과 은퇴기간의 장수위험은 회사가 부담하고, 회사가 파산하여 퇴직연금기금이 파산했을 때는 국가가 부담하는 DB형 연금은 매우 잘 설계된 노후안전망으로 평가된다. 이에 비해 DC형 연금은 연금자산 축적과정에서 투자위험과 인플레이션위험은 물론 파산위험과 은퇴 후의 장수위험 등 그 어떠한 위험에 대해서도 근로자가 스스로 책임을 지는 특징을 갖고 있기 때문에 노후안전망으로서 안정성과 신뢰도는 낮게 평가되고 있다. 위험부담 관점에서 DB형과 DC형은 사용자와 근로자가 노후 위험을 일방적으로 부담하는 극단적인 위험부담모델이라고 할 수 있다. 혼합형은 근로자와 사용자 일방이 노후안전망 위험을 부담하지 않고 제도 혹은 합의에 의하여 위험을 분담하는 제도이다. 전통적인 CBP(Cash Balance Plan)부터 최근의 CDC까지 다양한 형태의 혼합형이 존재하며, 대체로 DB형을 기본으로 급여수준을 전통 DB형과 달리하며 장수위험 부담을 줄이는 형태뿐만 아니라, 스위스처럼 DC형을 기반으로 집합운용 등을 통해 규모의 경제를 추구하고, 최소수익률, 연금전환율 등의 안전장치를 통해 노후안전망으로서 안정성을 높이는 형태 등으로 다양하게 존재한다. 우리나라가 2021년부터 도입하는 중소기업퇴직연금기금은 혼합형 퇴직연금 중에서 DC형에 기반한 스위스 퇴직연금과 유사한 측면이 있다.

이로 인해 OECD 등 국제기구는 다층연금제도의 주류가 되고 있는 DC형 연금의 노후안전망기능 강화를 위한 제도 연구와 모범규준을 연구하기 시작했다. OECD 사적연금실무협의회(Working Party on Private Pensions: WPPP)는 2012년 바람직한 DC형 연금제도 설계 로드맵을 처음으로 발표하여 DC형 연금이 노후안전망으로 기능하기 위한 가입, 운용, 연금화에 관한 원칙들을 제시하였다. 그리고 2021년 3월 WPPP는 이후 10년간의 연금시장 변화를 반영하여 현재 상황에 적합한 DC형 제도 설계로드맵을 업데이트하여 발표하였다.

로드맵은 크게 목적, 가입, 운용, 인출, 교육 다섯 가지 영역의 10개 원칙으로 구성되어 있다. 첫 번째 원칙에서 DC형 연금이 노후안전망(retirement security system)임을 명확히 하고 있다. 다층연금체계 내에서 공적연금 등 다른 연금과 기능과 역할 면에서 상호 보완적으로 노후소득안정이라는 목적을 달성할 수 있도록 설계되어야 한다는 원칙을 제시하고 있다. 우리나라 역시 근로자퇴직급여보장법의 도입 취지나 대법원의 판례로 볼 때 퇴직연금을 공적연금을 보완하는 다층적 노후안전망의 성격을 확인할 수 있으나, 퇴직연금제도의 가입, 운용, 연금화 등 실제 운영 측면에서는 구조적인 결함이 있다는데 대해서는 이론의 여지가 없다. 두 번째 원칙은 포용성이다. 비록 보험료 방식의 당사자간 사적연금이지만 가입의 사각지대를 최소화 하여 공적연금의 노후소득보장기능 약화를 보완할 수 있도록 가입자 범위를 최대한 확대하라는 것이다. 이는 우리나라 퇴직연금제도의 사각지대 해소를 위해서는 가입제도를 의무화는 것을 넘어 주당 15시간 미만 노동하고 1년 미만 근속기간을 가진 근로자를 배제하는 정책에서 포용하는 정책으로 나아가는 것이 중요함을 시사한다.

세 번째 원칙은 보험료의 적정성이다. 한국처럼 퇴직연금이 후불임금의 법적 성격을 갖는 나라는 보험료가 확정되어 있으나, 영미형 국가처럼 퇴직연금이 보너스 혹은 시혜적 사내복지로 이해되는 경우 DC형 연금의 보험료는 사용자의 매칭 정도에 따라 보험료 수준이 상당히 달라지는 문제를 염두에 둔 원칙으로 이해할 수 있다. 이는 우리나라 퇴직연금제도가 한 단계 더 발전하기 위해서는 후불임성의 기초 위에 기여금제도의 다양성이 확보될 필요성을 시사한다. 네 번째 원칙은 재정지원을 최대화 하라는 것이다. 사적연금에 재정지원은 다른 금융상품과 구별되는 과세체계와 함께 앞서 영미형 국가에서의 사용자 매칭으로 한정하여 이해하는 경우도 있으나, 여기서는 국가의 재정지원을 포함한다. 특히, 글로벌 금융위기 이후 사적연금에도 국가가 직접 저소득 근로자나 비정규 근로자의 가입을 지원하는 보조금제도가 도입되는 등 국가의 역할이 강화되고 있다. 보조금정책은 공적연금에 대한 정책이라는 관념은 낡은 것이 되고 있으며, 다층연금제도 내에서의 기능적 보완성을 목적으로 하는 사적연금에 대한 국가 보조금정책은 필요하다는 것을 원칙화 한 것으로 볼 수 있다. 이는 우리나라 퇴직연금제도에도 저소득 근로자 혹은 비정규 근로자, 나아가 영세기업 사용자에 대한 보조금제도의 도입 필요성을 제기한다. 다섯 번째 원칙은 연금자산 축적과 인출제도는 비용효율적으로 설계되어야 하며, 이런 관점에서 여섯 번째 원칙으로 운용효율을 위한 디폴트옵션 도입을 별도의 원칙으로 구별하여 강조하고 있다. 일곱 번째와 여덟 번째 원칙은 인출정책에 관한 것으로 DC형 연금도 장수위험을 고려할 때 비용효율적인 연금화가 중요하며, 일시금인출은 최소화해야 한다는 원칙을 제시하고 있다. DC형 연금이 장수위험을 관리하는데 큰 약점이 있는 점을 염두에 둔 원칙으로 판단된다. 아홉 번째와 열 번째 원칙은 맞춤성 자문과 금융교육에 관한 것인데, 이는 DC형 연금이 근로자가 자기책임으로 연금자산을 운용하고 또 자기책임으로 연금화를 해야 하는 제도의 특성을 감안하여, 연금 사업자가 신인의무에 따라 근로자의 연금선택을 자문하고 교육할 필요성을 강조한 원칙이라고 할 수 있다.

OECD(2021)의 두 번째 원칙인 퇴직연금의 포용성 강화를 위한 가입 활성화정책은 크게 가입제도 개편과 재정지원 강화 두 방향의 흐름이 강하게 나타나고 있다. 이하에서는 가입제도를 의무화 혹은 자동가입으로 전환하거나 가입자의 자격요건 완화를 통해 비정규 근로자를 적극 포섭하는 가입제도 측면의 개혁 흐름과, 세제혜택을 강화한 연금과세체계를 도입하거나, 정부 혹은 사용자가 근로자에게 보조금 지급을 확대하여 가입을 유도하는 재정지원을 확대하는 흐름에 대해 각각 살펴보자.

1. 해외 퇴직연금 가입제도의 개선 흐름

사각지대 해소를 위한 가입제도에 관한 글로벌 개혁은 크게 의무화 혹은 자동가입 등 가입제도 자체에 공적 성격을 강화하여, 공적연금 이외 사적연금에서 가입 사각지대를 해소하는 정책과, 가입자의 범위를 상용근로자에서 임시/일용직 근로자와 자영업자로 확대하는 정책 흐름이 동시에 나타나고 있다.

가. 의무가입 또는 자동가입제도로 전환

2018년 기준으로 OECD 국가 36개 중에서 17개 국가가 강제가입 혹은 준강제가입제도를 운영하고 있다. 이런 나라들은 기여방식의 공적연금 내지 퇴직연금은 경제활동인구 기준으로 높은 커버리지를 보이고 있다. 특히, 핀란드와 스위스의 경우 퇴직연금 강제가입제도를 일찍 도입하면서 2층의 퇴직연금 가입율이 핀란드 93%, 호주 75%, 스위스 73% 등 70% 이상의 경제활동인구를 커버하고 있다. 강제가입의 경우 사용자가 제도를 자율적으로 운영하며 보험료는 정부가 결정한다. 그리고 단체교섭 등을 통해 산업별로 퇴직연금을 운영하는 나라들은 준강제가입 연금제도를 가진 나라에서는 사용자가 퇴직연금을 도입하면 근로자들은 강제는 아니지만 거의 대부분 가입을 하기 때문에 준강제퇴직연금으로 분류된다. 덴마크, 네덜란드, 스웨덴 등 사민주의모델이 준강제퇴직연금 운영국가에 해당하는데, 가입율은 강제가입 국가들 수준에 근접한다. 경제활동인구 대비 퇴직연금 가입율이 네덜란드 88%, 덴마크 63%, 스웨덴 90%에 이르고 있다.

강제가입과 유사한 자동가입제도를 택한 나라들도 늘고 있다. 대표적인 나라가 영국으로 2012년에 도입했으며 이탈리아(2007), 뉴질랜드(2007) 등의 OECD 국가도 동참했는데, 특히 뉴질랜드는 ‘KiwiSaver’이라는 퇴직연금의 가입률이 80%에 이를 만큼 상당한 성과를 거두었다. 뉴질랜드보다 늦게 자동가입제도를 도입한 영국의 경우 가입율이 경제활동인구의 46%를 기록하고 있다. 국가 단위에서 자동가입제도는 사실상 강제가입과 동일한 효과를 기대할 수 있으나 영국의 경우 다른 연금제도를 선택할 수 있는 opt-out을 다층연금제도 내에서 허용하고 있다는 점이 특징이다. 또한 자동가입제도이지만 전국 단위에서 도입하는 대신 기업단위에서 자동가입제도를 도입한 나라들도 있다. 대표적으로 캐나다와 미국(2006), 그리고 독일(2018)이다. 세 나라는 퇴직연금제도가 강제 혹은 준강제가입제도가 아니라 사용자가 자발적으로 선택하는 제도를 운영하고 있으나, 일단 퇴직연금제도를 자발적으로 도입하게 되면, 해당 기업의 모든 근로자는 본인 의지와 관계없이 자동가입하는 제도이다. 기업단위의 자동가입제도 역시 가입율을 제고하는데 일정한 효과가 있는 것으로 확인되고 있다. 미국과 캐나다의 퇴직연금 가입율은 각각 43.6%, 26.4%로 나타났으며, 2018년에 자동가입제도를 도입한 독일은 자동가입제도 이전에 가입률이 이미 57%에 이르는 등 자발적 퇴직연금 국가 중에서는 높은 가입율을 보이고 있다.

강제가입, 준강제가입, 자동가입제도 등 가입제도에서 준공적연금화 개혁을 추진한 나라들의 퇴직연금 가입율은 자발적인 퇴직여금제도를 운영하는 나라들보다 높은 가입율을 나타나는 것은 분명히 확인된다. 자발적인 임의가입 퇴직연금제도를 운영하는 나라의 가입율은 핀란드 7%, 프랑스 25%, 한국 20% 등으로 매우 낮아 2층 퇴직연금부터 사각지대가 광범위한 것을 확인할 수 있다.

공적연금 약화와 퇴직연금의 준공적연금화 흐름으로 퇴직연금의 적용 대상이 되는 근로자의 자격 범위를 확대하는 커버리지정책이 글로벌 노후안전망의 사각지대 정책과 관련하여 중요한 과제로 떠오르고 있다. 이는 비정규 근로(non-standard work)를 어떻게 노후안전망체계로 포섭하는가의 문제로서 4차 산업혁명과 플랫폼 중심의 긱 경제(gig economy) 확산으로 새로운 유형의 비정규 근로형태가 빠르게 성장하면서 비정형 근로의 규모와 노동시장 내에서 중요성이 커진 흐름과 맞닿아 있다. 이에 OECD는 2016년 사적연금 규제원칙을 발표하면서 가입자 요건과 관련하여 연금의 가입과 급여는 고용형태와 관계없이 차별 없는 접근성이 보장되어야 한다는 원칙(원칙 8)으로 제시하기에 이르렀다(OECD, 2016).6)

한편 비정규 근로의 범위에 대해 OECD(2019a)는 매우 포괄적으로 정의하고 있다. 비정규 근로란 풀타임으로 기간을 정함이 없는 근로계약(full- time open-ended contract)을 맺는 정규근로(standard employment) 이외의 모든 근로형태와 자영업을 포함하며7), 비정규 근로자 내에도 근로조건, 안정성, 근로자보호 등에서 나라별 이질성은 매우 큰 것으로 나타났다. 그럼에도 대부분의 비정규 근로자들은 퇴직연금 노후안전망에서 배제되고 있다는 공통점이 퇴직연금제도를 운영하는 세계 많은 나라에서 확인되고 있다. 우리나라가 주당 15시간 이상의 근속 1년 이상인 근로자가 퇴직연금의 적용 대상이듯이, OECD 여러 국가들은 정도의 차이는 있지만 근로기간, 근로시간, 소득요건 등의 형태로 퇴직연금 가입자의 접근성을 제한하고 있는 것이다. 첫째, 근로기간 요건은 비정규 근로자 중에서 근속기간이 짧은 임시직(temporary job)의 가입을 제한하는 제도로서 일본 DB형 연금이 5년으로 주요국 중에서 가장 길며 미국과 캐나다가 각각 2년과 1년을 두고 있다. 스위스는 0.25년으로 제한을 두고있어 주요국 중에서는 가장 짧았다. 영국, 스웨덴, 호주 등은 근속기간의 제한을 두지 않고 있다. 둘째, 근로시간 요건이다. 주당 근로시간에 최저한을 두는 제도로 파트타임(part-time) 근로자의 퇴직연금 가입을 제한하는 요인이 되고 있다. 우리나라도 주당 15시간 이상 근로를 제공하는 근로자가 가입 대상이다. 일본과 호주가 주당 30시간 이상 근로를 해야 퇴직연금을 가입할 수 있게 되어 있어 비교적 엄격한 편이다. 그 외 미국, 영국, 스웨덴, 스위스, 캐나다 등 주요국은 근로시간 요건을 두고 있지 않다. 셋째, 최소소득요건(minimum income thresholds)이다. 이 요건은 저소득층, 근로형태로는 파트타임 근로자들에게 연금의 접근성과 혜택을 제약한다. 캐나다는 가입자 평균임금의 30% 이상 소득자만 가입이 가능하며 일본도 25%, 스위스는 24%, 영국도 28%의 최소요건을 두고 있다. 최소소득요건을 두지 않은 나라는 주요국 중에서는 우리나라가 있다. 미국이나 캐나다는 자발적인 퇴직연금임에도 이같은 소득요건이 존재하고 있다.

2. 해외의 가입자 재정지원정책 흐름

세제혜택과 보조금 등을 통해 연금 가입을 유도하거나 연금 자산 축적을 지원하는 재정지원정책은 공적연금에 익숙한 제도들이다. 그런데 공적연금의 재정 위기와 사적연금의 준공적연금화로 이같은 재정지원정책이 사적연금인 퇴직연금에도 도입을 강제하거나 강화하는 흐름이 나타나고 있다.

가. 퇴직연금의 과세체계

저축 세제에 대한 전통적인 접근은 일반 조세원칙에 따라 소득이 있는 곳에 예외 없이 소득세를 부과하는 것이다. 만일 이 원칙을 연금저축에 적용하면 기여(contribution) 단계에서 원천징수 등의 형태로 세금을 부과하고, 저축 혹은 투자에 따라 발생한 금융소득에 다시 과세를 한 후 인출(withdrawals)할 때에는 세금을 부과하지 않는 것이다. 이것이 바로 저축에 대한 소위 TTE(Taxed-Taxed-Exempted) 과세체계이다. 그런데 연금저축의 경우 대부분 나라에서 이같은 과세원칙을 적용하지 않는다. 연금저축의 장기 저축과 장기 인출이라는 상품 속성과 노후안전망 강화라는 사회정책 요소를 고려하기 때문이다.

OECD 국가의 연금저축에 대한 과세는 크게 세 가지 유형이다. 크게 삼 단계(기여, 운용, 인출) 중에서 한 단계에만 과세하는 유형(EET, TEE), 저축에 관한 일반과세원리를 연금에도 그대로 유지하여 삼 단계 중 두 단계에서 과세하는 유형(TTE, ETT, TET), 그리고 삼 단계 모두에서 과세를 하지 않는 유형(EEE)이다. 현실 세계에서는 한 단계에서만 과세하는 EET와 TEE 과세체계가 가장 많이 발견된다. 가장 일반적인 형태의 연금세제는 EET 이다. 연금 납입과 운용 단계에서의 소득세를 각각 면제(exemption)하고 마지막 연금 인출 단계에서 연금소득세를 부과(taxation)하는 것을 의미한다. EET는 연금 기여금 납입 단계에서 근로자에게 소득공제 혹은 세액공제 형태로 면제를 해주기 때문에 연금을 통한 저축 유인(incentive)에 직접적인 영향을 미치는 장점이 있다. 준강제퇴직연금제도로서 가장 경쟁력 있는 연금 선진국으로 평가받는 네덜란드를 비롯하여 미국, 영국, 한국, 스위스, 일본, 캐나다, 핀란드 등 가장 많은 OECD 국가들이 EET 체계를 채택하고 있다. EET는 기여와 운용 단계에서 과세를 인출단계로 이연시켜주는 제도인데, 이는 재무적으로 근로자에게 세율만큼의 투자효과와 복리효과를 제공하기 때문에 더 많은 기여와 더 적극적인 운용 유인을 제공하는 유인부합성이 있다. TEE는 동유럽 국가들에서 주로 발견되는 과세체계인데 이스라엘을 제외하면 주목할 만한 연금 선진국은 찾기 어렵다.

연금제도 삼 단계 중 두 단계에서 과세를 하는 연금과세 유형 중에서는 TTE와 ETT 국가들이 주목할 만한다. 영미형 퇴직연금제도로 연금 선진국에 해당하는 호주가 TTE 제도에 해당한다. 호주는 일반소득세율이 매우 높기 때문에 기여단계에서 평균 15%의 세율로 부과하는 퇴직연금 기여금에 대한 과세는 그 자체가 인센티브 효과가 있는 것으로 알려져 있다. 인출단계는 물론 운용 단계에서도 과세를 하는 ETT 국가 중에는 스웨덴과 덴마크가 주목할 만한다. 스웨덴은 공적연금인 프리미엄연금의 경우 EET이나 퇴직연금은 모두 운용 단계에서 발생한 금융소득에 대해 15%의 과세를 하게 된다. 덴마크도 스웨덴과 마찬가지로 퇴직연금 운용 단계에서 발생한 금융소득에 대해 15.3%를 과세한다. 마지막으로 연금저축에 대해서는 삼 단계 중 어느 단계에서도 과세를 하지 않는 EEE 국가로는 멕시코가 있다. 멕시코의 퇴직연금은 강제연금으로 세금을 한 푼도 내지 않는특이한 경우에 해당한다.

재정지원(financial incentives) 방식으로 조세지원 이외에 주목받는 것이 보조금정책이다. 퇴직연금 보조금은 퇴직연금 기여단계에서 지원정책으로 크게 정부나 사용자로부터 지원받는 매칭보조금(matching contributions)과 정부의 정액보조금(subsidies)으로 구분된다. 자격요건을 갖춘 가입자에게 지원되며 강제가입보다 자발적 가입제도를 택한 퇴직연금제도에 주로 찾을 수 있다. <표 Ⅲ-6>에 따르면 2019년 기준으로 OECD 국가에서 확인되는 일반적 사적연금 재정지원 방식은 매칭보조금제도로 12개 국가에서 운영하고 있으며, 정부의 정액보조금은 6개 국가에서 운영하고 있다. 2015년 설문조사와 비교하면 국가 보조금은 3개 나라(칠레, 독일, 멕시코)에서 6개 나라로 늘어났고, 매칭보조금은 독일이 새로 도입하면서 12개 나라로 확대되었다. 매칭보조금 중에서는 사용자매칭보다 정부에 의한 매칭보조금이 일반적이다. 매칭보조금은 가입자의 기여분의 일정 비율만큼을 정부 혹은 사용자가 병행 납입해주는 제도이다. 매칭비율은 호주 50%, 미국 50~100%, 멕시코는 325%(공무원퇴직연금)로 나라별 편차가 매우 크다(OECD, 2019b). 요약하면, 당사자 간의 사적계약인 퇴직연금제도의 노후안전망으로 보완성이 강조되면서 퇴직연금의 준공적연금화 흐름이 기여단계에서 재정지원을 확대하는 방식으로 강화되고 있다고 할 수 있다.

호주가 기여금에 대한 정부의 매칭보조금제도를 운영하고 있다면, 독일은 기여금과 상관없이 정액의 보조금을 지급하는 리스터(Riester)연금제도를 운영하고 있다. 2001년 공적연금의 보험료율 상한제(2020년 20%) 도입과 소득대체율 인하정책(70%에서 58%)에 대한 대응으로 사적연금 개혁을 추진한 소위 리스터연금개혁으로 도입되었다. 리스터연금의 핵심은 공적연금 가입자 중에서 리스터연금에 보험료를 납입한 납입자에 한해 정액의 보조금(수당)을 지급하여 사적연금 적립을 유도한다는 것이다. 수당은 소득수준이 아닌 보험료율에 따라 변동하며, 2008년 이후 최대 수당을 받기 위한 최대보험료율은 전년 소득의 4%이고, 이때 최대 수당은 기본수당 154유로, 자녀당 수당 185유로로 이때 수당 포함 최대 소득공제한도는 2,100유로이다. 독일의 리스터연금의 장점은 소득수준이 아닌 보험료율에 따라 정액의 보조금을 지급하기 때문에 저소득층일수록 소득 대비 보험료를 적게 내는 대신 혜택은 많이 받는 구조라는 것이다. 참고로, 독일의 리스터연금 도입은 사적연금의 가입은 자발적이고 임의적인 방식으로 운영하되, 보조금제도를 통해 사적연금을 강화하려는 연금개혁 전략으로 사적연금을 강제 가입으로 전환한 스웨덴 등 사민주의모델과는 구별되는 길을 걷고 있다.

가. 가입제도 개선 방안