Find out more about our latest publications

Korea’s Inclusion in MSCI Developed Market Index: Impacts, Challenges and Implications

Issue Papers 22-06 May. 11, 2022

- Research Topic Capital Markets

- Page 24

Amid growing expectations for Korea’s inclusion in the Morgan Stanley Capital International (MSCI) developed market index, this article explores the impact and future challenges that are accompanied by promotion in the MSCI index. If a developed market status is secured from the MSCI, Korea’s stock market is expected to attract a net foreign capital inflow ranging from $5 billion to $36 billion. However, it should be noted that the analysis result may vary depending on the amount of funds tracking the MSCI index and Korea’s weight in global market capitalization. As shown in the cases of Israel and Greece, inclusion in the MSCI development market index has contributed to reducing volatility of foreign capital flows and stock prices.

In its Global Market Accessibility Review, MSCI has presented six issues that Korea needs to improve. These include information flow, clearing and settlement and transferability, in addition to chronic problems such as the absence of an offshore currency market for the won, the mandatory foreign investor registration and restrictions on the use of stock indices. To address these matters, the Korean government’s latest plan to improve the foreign exchange market should be implemented properly to establish a solid foothold of the won as an international currency. The mandatory foreign investment registration also needs to be overhauled to raise the effectiveness and international compatibility of omnibus accounts. On top of that, additional efforts should be made to enhance market infrastructure, another obstacle previously mentioned by MSCI.

Securing a developed market status from MSCI has been one of Korea’s long-standing challenges, which can serve as a turning point for its financial market to take a leap forward. However, it is notable that the benefits of reclassification to the index cannot be realized within a short period and quite a few challenges to be resolved regardless of the MSCI index inclusion lie ahead. Accordingly, it is desirable to take the MSCI index inclusion as an opportunity to reinforce fundamentals of the financial market, rather than focusing only on the inclusion itself. If Korea strives to supply abundant liquidity to the stock market and strengthen market infrastructure to deal with the issues specified by MSCI, the promotion in the MSCI development market index would be achieved as a natural consequence.

In its Global Market Accessibility Review, MSCI has presented six issues that Korea needs to improve. These include information flow, clearing and settlement and transferability, in addition to chronic problems such as the absence of an offshore currency market for the won, the mandatory foreign investor registration and restrictions on the use of stock indices. To address these matters, the Korean government’s latest plan to improve the foreign exchange market should be implemented properly to establish a solid foothold of the won as an international currency. The mandatory foreign investment registration also needs to be overhauled to raise the effectiveness and international compatibility of omnibus accounts. On top of that, additional efforts should be made to enhance market infrastructure, another obstacle previously mentioned by MSCI.

Securing a developed market status from MSCI has been one of Korea’s long-standing challenges, which can serve as a turning point for its financial market to take a leap forward. However, it is notable that the benefits of reclassification to the index cannot be realized within a short period and quite a few challenges to be resolved regardless of the MSCI index inclusion lie ahead. Accordingly, it is desirable to take the MSCI index inclusion as an opportunity to reinforce fundamentals of the financial market, rather than focusing only on the inclusion itself. If Korea strives to supply abundant liquidity to the stock market and strengthen market infrastructure to deal with the issues specified by MSCI, the promotion in the MSCI development market index would be achieved as a natural consequence.

Ⅰ. 머리말

우리나라의 주식시장은 1992년 외국인투자자에게 처음 개방된 이래 꾸준한 양적 성장과 질적 발전을 거듭해왔다. 글로벌 주식시장 규모대비 2%를 상회하는 시가총액과 풍부한 일일 거래량 등 유동성이 크게 확충된 가운데 760조원에 달하는 외국인의 국내 주식투자자금 순유입이 이루어져 FTSE 등으로부터 이미 선진시장의 지위를 부여받고 있다. 그러나 글로벌 펀드자금이 벤치마크로 추종하는 규모가 가장 큰 것으로 알려져 있는 모건스탠리의 MSCI(Morgan Stanley Capital International)1)에서는 여전히 신흥국지수에 머물러 있다.

우리나라가 MSCI 선진국지수로 변경될 경우 안정적인 외국인투자자금의 순유입으로 주가상승과 변동성 완화 등 긍정적 효과가 기대된다는 점에서 그간 우리 정부는 수차례 선진국지수 편입을 시도한 바 있으나 아직까지 진전을 보지 못하고 있다. MSCI는 2008년 6월 한국을 선진국지수 편입 관찰대상(watch list) 국가로 지정하였으나 다음해인 2009년에는 선진국지수 편입을 위한 세 가지 선결조건으로 역외외환시장 부재, 외국인투자자의 등록의무, 지수사용권 등을 지적하며 편입유보 결정을 내린 바 있으며 2014년 6월에는 선결요건에 대한 진전이 없다는 이유로 관찰대상에서도 제외하였다.

최근 우리 정부는 물론 정치권을 중심으로 MSCI 선진국지수 편입과 관련하여 적극적인 추진의사를 표명하며 금년 6월 평가에서 관찰대상국 지정 후 내년 중 선진국지수 편입을 목표로 하고 있다. 우리나라의 선진국지수 편입시 효과와 관련한 분석에서는 대체로 외국인 주식투자자금의 순유입과 주가상승 등 긍정적 영향이 있을 것으로 예상하고 있으나 체계적이고 심도 있는 분석은 그리 많지 않은 것으로 보인다. 아울러 지금까지 선진국지수 편입의 걸림돌로 지적되어온 세부 사항들의 현황과 선결과제의 해결을 위한 논의가 필요한 상황으로 판단된다.

이러한 점에서 본 보고서에서는 MSCI 선진국지수 편입의 효과와 선결과제를 분석한 후 시사점을 제시하였다. 본고의 구성은 다음과 같다. 제Ⅱ장에서는 선진국지수 편입시 효과 분석을 위해 자본순유입 예상 규모를 추정해 보고 과거 선진국지수로 변경된 바 있는 이스라엘과 그리스의 사례를 통해 변동성에 미치는 영향을 간접적으로 분석하였다. 제Ⅲ장에서는 MSCI의 선진국지수 편입 기준을 소개하고 우리나라에 대한 세부 항목별 평가와 선결과제를 기술하였다. 제Ⅳ장에서는 시사점을 언급하였다.

Ⅱ. 선진국지수 편입시의 효과 분석

우리나라가 MSCI 국가분류상 신흥국지수에서 선진국지수로 편입될 경우 이를 벤치마크로 추종하는 장기 글로벌 펀드자금의 국내증시 유입이 확대되면서 국내 주가의 상승과 변동성 감소를 가져올 것이라는 기대감이 크다. 낙관적인 견해에 따르면 선진국지수 추종자금 규모가 신흥국지수 추종자금의 대략 5~6배에 달하므로 전체적으로 우리나라로 주식투자자금의 순유입이 발생하고 주가에도 긍정적인 영향을 줄 수 있을 것으로 본다. 또한 선진국지수 추종자금은 주로 장기자금으로 구성되므로 외부충격이 발생하더라도 외국인투자자금의 해외유출 가능성이 상대적으로 낮아 변동성을 감소시킬 수 있을 것으로 예상하고 있다.

이와 관련한 기존의 분석 자료들을 보면 선진국지수 편입시 대체로 우리나라로 주식투자자금의 순유입을 가져올 것으로 보는 분석이 우세하다. 한국경제연구원(2021. 5. 4)은 선진국지수 편입시 우리나라로 17.8조~61.1조원(159억~547억달러) 규모의 자금이 유입되면서 주가상승을 가져올 것으로 분석하였으며, KB증권(2022. 2)은 글로벌 패시브자금을 중심으로 20조~65조원이 순유입될 것으로 예상하였다. 글로벌투자은행인 Goldman Sachs(2022. 2)도 선진국지수 편입시 440억달러의 자금순유입으로 코리아 디스카운트가 완화되며 주가에 긍정적인 영향을 미칠 것으로 분석하였다. 다만, NH투자증권(2022. 2)은 선진국지수 편입에 따라 기존의 신흥국지수에서 이탈되는 패시브자금 규모가 오히려 더 커 약 18조원(150억달러)의 자금순유출이 발생할 것으로 분석하였다.

그러나 상기 분석들 대부분이 정교한 분석방법의 결여와 추정을 위한 다양한 가정에 의존하고 있어 선진국지수 편입시 실제 국내로의 자금순유입 규모와 유입 기간 및 형태 등에 대해 단정적으로 말하기 어렵다고 생각된다. 이는 지수변경시 실제 자금유입은 글로벌 경제상황이나 국내 주식시장에 대한 외국인투자자의 신인도 등 많은 요인에 영향을 받을 뿐만 아니라 추정을 위한 다양한 가정이 불가피하기 때문이다. 본고에서는 이러한 추정상의 한계에도 불구하고 자금유출입 추정을 위한 시도의 일환으로 글로벌 주식시장에서 차지하는 우리나라의 상대적 비중을 이용하여 주식투자자금의 순유입 규모를 추정해 보았다. 아울러 선진국지수 변경시 자금유출입 및 주가 변동성에 미치는 영향을 과거 이스라엘과 그리스 등 주요국의 사례를 통해 간접적으로 분석하였다.

1. 자금순유출입 규모 추정

가. MSCI 추종 자금규모

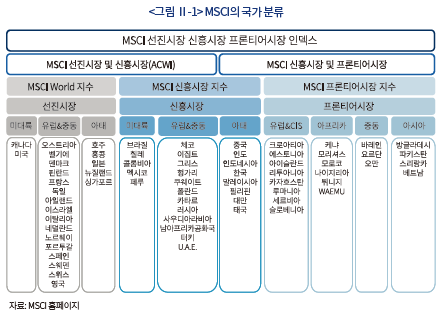

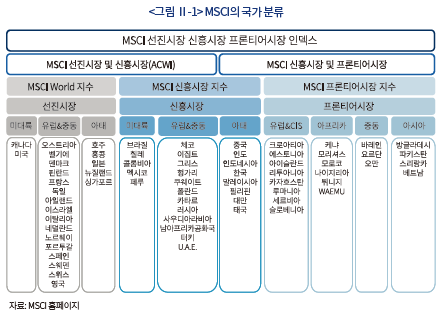

MSCI 선진국지수 편입시 우리나라에 대한 자금유출입 규모를 추정하기 위해서는 MSCI 지수를 추종하는 자금의 형태별 규모와 우리나라의 비중을 파악하여야 한다. MSCI 지수는 크게 선진시장(Developed Market: DM), 신흥시장(Emerging Market: EM) 및 프론티어시장(frontier market)으로 구분되는데 <그림 II-1>에서 보는 바와 같이 선진시장은 지역별로 북미, 유럽ㆍ중동 및 아시아ㆍ태평양으로 나누어지며 현재 23개국이 포함되어 있다. 신흥시장은 우리나라를 포함하여 25개국으로 구성되어 있으며 지역별로 중남미, 유럽ㆍ중동ㆍ아프리카 및 아시아로 구분된다.

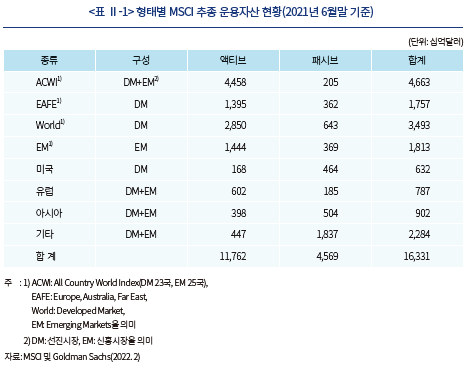

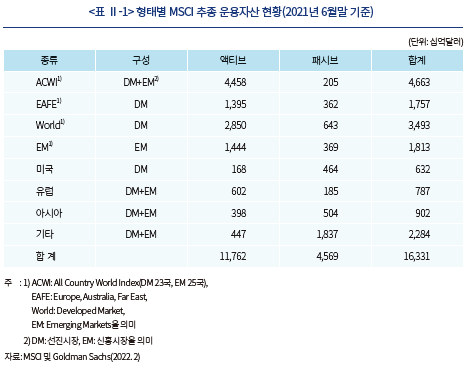

<표 Ⅱ-1>는 모건스탠리가 발표한 글로벌 추종자금의 규모를 나타낸다. 이에 따르면 MSCI 지수를 추종하는 글로벌 자금규모는 2021년 6월말 기준 16.3조달러에 달하는데 이는 2019년 6월말(12.3조달러) 대비 33% 증가한 수치이다. 전체 글로벌 펀드자산 규모 대비로는 약 30%에 달하는 자금이 MSCI 지수를 추종하는 것으로 파악되고 있다. 이를 운용형태로 보면 전체 추종자금 16.3조달러중 액티브자금이 11.8조달러, 패시브자금이 4.6조달러로 나타났다. 최근 글로벌 자산운용시장에서 ETF로의 자금유입이 크게 증가하면서 패시브펀드가 급성장하고 있는 특징을 반영하고 있다.2) 한편 추종자금을 지수의 형태별로 나누어 보면 선진국지수(EAFE, World, 미국)와 신흥국지수(EM) 및 혼합형(ACWI, 유럽, 아시아)으로 분류할 수 있다. 이중 우리나라에 대한 투자자금은 추종자금중 ACWI, EM 및 아시아지수 형태로 분산되어 유입되고 있다고 할 수 있다.

나. 자금유출입 규모 추정

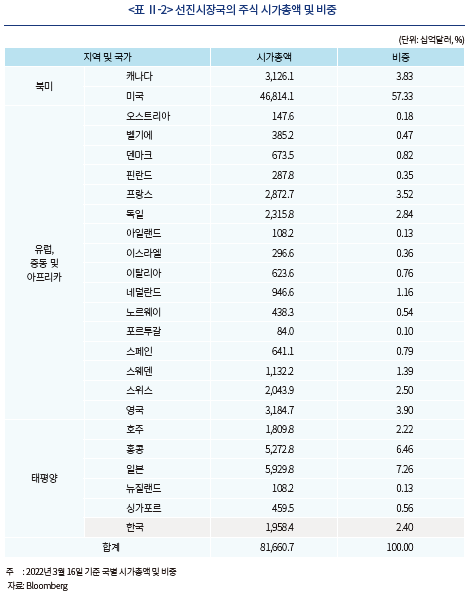

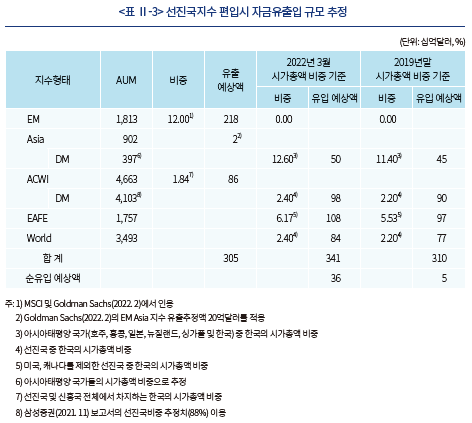

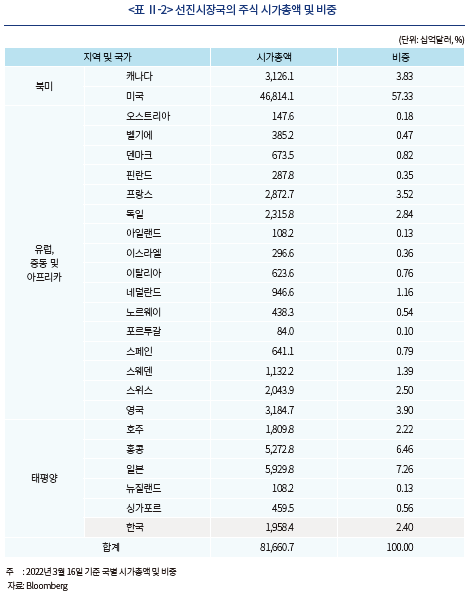

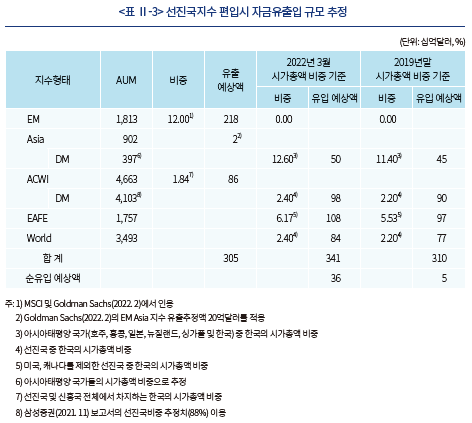

우리나라에 대한 주식투자자금 순유출입 규모를 추정하기 위해 현재 유입되어 있는 신흥국지수 추종자금의 이탈규모와 선진국지수 추종자금의 신규 유입규모를 각각 추정하여 비교하였다. 이를 위해 MSCI가 발표한 형태별 추종자금 규모와 글로벌 주식시장 시가총액에서 차지하는 우리나라의 비중을 이용하였다. 장기적으로 글로벌 펀드자금의 국별 투자비중은 각국의 주식시장 크기 및 유동성을 추수하는 것으로 볼 수 있기 때문이다. <표 II-2>는 금년 3월 기준 MSCI 선진국지수에 포함된 국가별 주식시장의 시가총액과 비중을 나타낸 것으로 우리나라가 선진시장에 새로이 진입할 경우 비중은 2.4%로 나타나 코로나19가 발생하기 직전인 2019년말(2.2%)에 비해 소폭 증가하였다.

한편 우리나라가 선진국지수에 편입될 경우 MSCI 지수중 ACWI, EAFE 및 World 지수의 형태로 분산투자될 것으로 예상된다. 이중 ACWI의 경우는 자금이 기존의 신흥국 부분에서 선진국 부분으로 지수내에서 이동하므로 유출 및 유입 규모를 각각 추정하였다. 신흥국지수에 기유입된 자금은 유출되는 것으로, 그리고 아시아지수의 경우에는 신흥아시아에서 선진아시아로 자금이동이 예상된다.

<표 Ⅱ-3>은 선진국지수의 신규유입 규모의 추정 결과를 나타낸다. 금년 3월 현재 우리나라 주식시장의 글로벌 시가총액 비중을 적용할 경우 우리나라로 유입되는 자금이 3,410억달러로 유출 예상액 3,050억달러보다 커 자금순유입 규모는 360억달러로 추정되었다. 그러나 코로나19 발생 이후 우리나라 주가의 상대적인 상승폭이 다른 선진국에 비해 컸던 점에 비추어 2019년말 기준 글로벌 시가총액 비중을 적용하면 자금순유입 규모는 50억달러에 그치는 것으로 나타났다.3)

결론적으로 선진국지수 편입시 우리나라로 50억~360억달러 범위의 자금순유입이 예상되나 추정결과가 MSCI 추종자금의 규모와 한국의 글로벌 시가총액 비중에 따라 상이할 수 있다는 점에 유의할 필요가 있다. 즉, 우리나라가 선진국지수에 진입하더라도 국내 주식시장의 시가총액 비중이 변화하거나 외국인투자자의 국내 주식시장에 대한 신뢰도와 긍정적 전망 여부에 따라 자금순유입 효과가 달라질 수 있음을 감안하여 자금유출입의 전체적인 방향을 참고하는 정도로 활용하는 것이 바람직할 것으로 보인다.

만약 선진국지수 편입으로 자금순유입이 일어날 경우 국내 주가에는 긍정적인 영향을 줄 것으로 보인다. 그러나 자금유입이 일시적 조정에 의해 이루어질지 아니면 수년에 걸쳐 진행될 것인지 등이 불분명하다. 만약 우리나라가 관찰대상국으로 지정되더라도 최종편입 결정은 1년 후에 결정되며 최종편입이 결정되더라도 실제 글로벌 펀드자금의 포트폴리오 재조정은 다시 1년 후부터 진행되어 단기간 내에 대규모 자금유입이 발생하기는 어려울 것으로 보인다.

또한 국내 주가는 글로벌 금융상황이나 국가별 요인 등 다양한 요인에 영향을 받는다는 점에 유의할 필요가 있다. 한 예로 우리나라에 앞서 2010년 중 선진국지수로 편입된 이스라엘의 경우 대표 주가지수인 TA-100가 글로벌 금융위기 직후 전세계적인 주가 상승기와 맞물리면서 2009년 6~12월중 32.9% 상승하였으나, 당시 글로벌 금융위기 직후 전세계적인 주가 상승기로 같은 기간중 선진국지수가 17.4%, 신흥국지수가 30% 상승했던 상황임을 감안할 때 선진국지수 변경만의 효과로 보기는 어렵다고 생각된다. 최근에는 이스라엘이 선진국지수 내에서 중동지역으로 분류되어 있어 과거 10여년간 오히려 자금유출이 발생하고 주식거래 규모가 감소하였다는 주장4)도 제기되고 있어 선진국지수 편입이 무조건 대규모 자금유입으로 이어진다고 보기에는 무리가 있는 것으로 판단된다.

2. 변동성에 대한 영향

여기서는 선진국지수 편입시 장기성 자금의 유입으로 변동성이 감소될 수 있는지를 주요국의 사례를 통해 간접적으로 분석해 보았다. 해외 사례로는 신흥국에서 선진국으로 편입된 이스라엘(2010년)과 선진국 편입 후 다시 신흥국으로 재분류된 그리스(2001년 및 2013년)를 각각 살펴보았다.

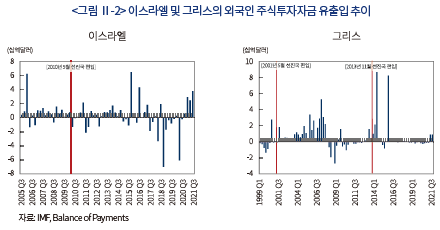

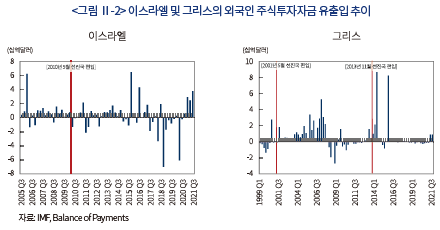

변동성은 자본유출입 및 주가의 변동성을 구분하여 살펴보았다. 전자의 경우 IMF가 제공하는 국별 국제수지 자료를 이용하였으며 이와 별도로 이스라엘에 대해서는 EPFR(Emerging Portfolio Fund Research)에서 제공하는 글로벌 펀드자금 유출입 자료를 이용한 분석을 병행하였다. 주가변동성은 블룸버그에서 제공하는 역사적 주가변동성(historical volatility)을 편입 전후 5년의 기간을 분석하였으며 국별 비교를 위해 같은 기간중 미국 및 우리나라의 주가변동성을 함께 제시하였다.

가. 자금유출입 변동성

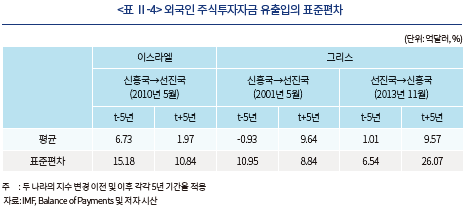

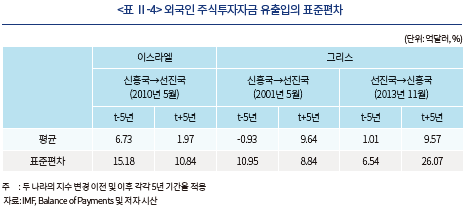

<표 II-4>에 나타난 바와 같이 이스라엘의 경우 선진국지수 편입 이후 5년 동안 변동성의 대용지표라 할 수 있는 자금유출입의 표준편차가 이전기간에 비해 크게 감소하였다. 그리스의 경우에도 선진국지수 편입시 이스라엘과 유사하게 변동성이 감소하였으며 반대로 2013년 신흥국지수로 재편입시에는 변동성이 이전보다 크게 확대되는 모습을 보였다.5) 이는 선진국지수 편입시 투자자금의 장기화와 국가 디스카운트의 완화 등으로 외부충격에 대해 상대적으로 자금유출입의 변동성이 감소하는 반면, 신흥국지수의 경우에는 글로벌 불확실성 증가시 위험회피 성향이 증가하면서 신흥국의 자금유출입 변동성이 증가하는 국제자본흐름의 통상적인 현상을 반영한 것으로 풀이할 수 있다.

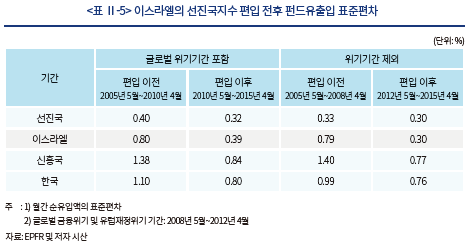

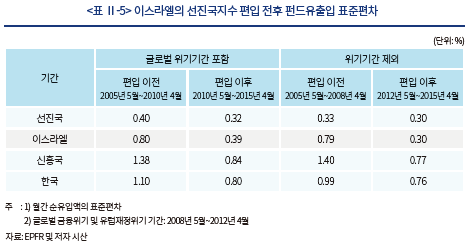

또한 <표 II-5>에 제시된 바와 같이 글로벌 주식펀드자금의 유출입 통계를 이용한 분석에서도 유사한 결과가 도출되었다. 즉 이스라엘의 경우 글로벌 위기기간의 포함여부와 상관없이 선진국지수 편입 이후 5년 동안 편입 이전 기간에 비해 펀드자금 유출입의 변동성이 감소하였을 뿐만 아니라 같은 기간중 선진국과 한국을 비롯한 여타 신흥국에 비해 감소폭이 더 컸던 것으로 나타났다.

나. 주가변동성

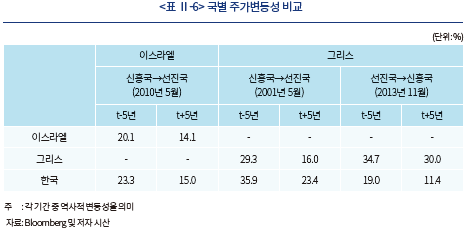

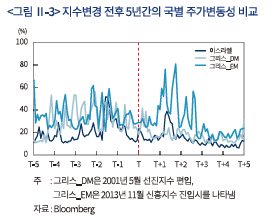

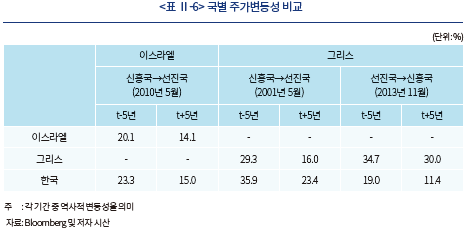

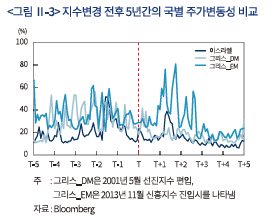

주가변동성의 경우에도 아래의 <표 II-6> 및 <그림 II-3>에서 보는 바와 같이 두 나라 모두 선진국지수 편입 이후 변동성이 감소하였다. 다만, 같은 기간 중 우리나라의 주가변동성도 완화된 것으로 나타나6) 두 나라의 MSCI 선진국지수 변경만으로 주가변동성이 유의미하게 감소한 것으로 판단하기는 어려우며 글로벌 금융환경이나 국내 사정 등 다른 요인들의 영향을 받은 것으로 보인다.

한편 2013년 선진국지수에서 다시 신흥국지수로 변경된 그리스의 경우를 보면 우리나라의 주가변동성이 같은 기간 중 큰 폭으로 감소한 것과 달리 소폭 감소에 그친 것으로 나타났다. 이는 당시 미국의 테이퍼텐트럼(taper tantrum) 등으로 통화정책 기조가 양적완화에서 긴축으로 선회하면서 글로벌 자금흐름의 변화가 나타났고, 선진국지수보다 신흥국지수에서 그 영향을 더 크게 받으면서 주가변동성을 확대시키는 요인으로 작용한 데 따른 것으로 판단된다.

Ⅲ. 선진국지수 편입의 선결과제

이 장에서는 MSCI 선진국지수 편입을 위해 요구되는 모건스탠리의 분류기준(MSCI Market Clas-sifi cation Framework)에 대해 소개하고 각 부문별로 우리나라의 현황 및 선결과제에 대해 살펴보았다.

1. MSCI 선진국지수 편입 기준

모건스탠리는 MSCI 선진시장 편입을 위한 요건으로 각국의 경제발전 정도 및 안정성(economic development), 주식시장 규모 및 유동성(size and liquidity), 그리고 시장접근성 기준(market access criteria) 등 세 가지 기준을 제시하고 있다. 우리나라는 이 중 경제발전 정도와 주식시장 유동성 측면에서는 선진국지수 편입 기준을 충족하고 있다. 그 예로 우리나라의 일인당 GDP는 선진국 수준이며 무역 및 경제규모, 대외건전성 등에서도 상대적으로 충분한 조건을 만족하고 있다. 국내 주식시장의 규모나 유동성도 중국, 인도 등을 제외하면 여타 신흥국 중에서 가장 큰 편이다. 그러나 글로벌 투자자의 입장에서 다양한 질적 요구 사항을 반영하고 있는 시장접근성 기준에서는 여전히 선진시장 기준에 미흡한 것으로 지적받고 있다.

시장접근성 기준은 세부적으로 5개 중분류(외국인투자 개방도, 자금유출입 편의성, 운영체계의 효율성, 투자수단의 활용가능성, 제도의 안정성) 및 18개 소분류로 구분된다. 아래에서는 이에 관한 모건스탠리의 기준에 관해 간략히 소개하였다.7)

가. 외국인투자 개방도(openness to foreign ownership)

외국인투자에 대한 개방도(openness)는 거주자와 외국인투자자간, 또는 외국인투자자간에 투자와 관련한 차별이 없어야 함을 의미한다. 따라서 외국인투자자에 대한 자격허가제(Qualified Foreign Institutional Investor: QFII)를 운영하거나 특정산업이나 섹터 등에 대한 투자한도의 과도한 설정이 없어야 한다. 특히 특정섹터에 대한 투자한도가 3년 연속 10%를 초과하는 경우 기준달성에 부정적으로, 3~10%는 주의를 요하는 범위로 판단하고 있다. 또한 투자한도 제한 등으로 추가적인 투자여력이 크게 떨어지는 경우에도 부정적으로 평가한다. 아울러 주주권행사와 관련하여 거주자와 외국인투자자간에 차별이 없어야 함을 제시하고 있다.

나. 자금유출입의 편의성(ease of capital inflows/outflows)

외국인의 투자자금 유출입이 아무런 제약 없이 자유로이 이동할 수 있어야 하며 선진국 수준의 외환시장의 개방 및 발전 정도를 요구한다. 특히 해당국 통화가 국제통화로서 시간과 장소의 제약 없이 교환가능(fully convertible)해야 한다. 이는 투자대상국 통화가 거래되는 외환시장이 해당국 역내는 물론 역외에 개설되어 있으면서 자유로이 교환가능한 국제통화로 기능할 경우 투자 및 환헤지에 따른 거래비용을 줄이고 자금유출입의 편의성은 커질 수 있기 때문이라 할 수 있다.

다. 운영체계의 효율성(efficiency of the operational framework)

운영체계는 외국인투자자의 최초 투자에서 자금회수에 이르는 과정까지의 제반 운영효율성과 편의성을 포함한다. 여기에는 투자자등록과 같은 시장진입(market entry), 거래관련 금융시장의 법적 규제, 정보흐름과 관련한 회계 및 시장조직(market organization), 청산 및 결제, 수탁업무, 거래 및 이체, 대주와 공매도 등 시장하부구조(market infrastructure)와 관련된 제반 사항들이 포함된다. 이러한 다양한 부문에 대한 기준을 제시하는 것은 운영리스크가 클 경우 외국인투자자의 비용상승을 초래하기 때문으로 볼 수 있다.

투자자등록과 관련하여서는 의무등록 여부는 물론 등록시 필요한 문서의 종류나 수, 또는 처리기간 등을 고려하여 효율성을 평가한다. 주식시장 등 금융시장에 존재하는 제반 규제는 일관성과 예측가능성을 중요시하며 투자자의 투자의사결정에 중요한 요소인 정보흐름에 있어서는 정보의 질, 적시성, 영문공시 여부, 국제회계기준(IFRS)에 부합하는 회계기준 적용 등이 중요하게 고려된다. 청산과 결제는 국제결제은행의 DVP(Delivery versus Payment)의 적용 여부가 중요하며, 수탁은행은 다수의 서비스 제공은행들의 경쟁여건이 주된 고려사항이다. 장외거래나 원활한 내부자금이체, 대주 및 공매도 관련 제도의 명확한 규칙과 효율적 운영체계 등도 요구된다.

라. 투자수단의 활용가능성(availability of investment instruments)

글로벌 투자자금은 각국 거래소(exchanges) 등에서 산출, 제공되는 거래가격이나 세부정보 등 각종 데이터를 이용하여 투자의사결정을 하므로 이러한 데이터가 충분히 제공되고 활용가능하여야 한다. 여기에는 거래소가 자체적으로 산출하는 개별지수나 이를 기반으로 한 투자수단 등에 대한 정보를 포함한다. 그렇지 않을 경우 경쟁적 구도를 약화시키므로 부정적 평가 요인이 된다.

마. 제도의 안정성(stability of the institutional framework)

글로벌 장기투자자들은 장기투자에 따른 제도의 안정성 여부를 중요시한다. 따라서 각국 정부의 개입이나 외국인투자자에 대한 규제 조치 등에 대한 과거 기록을 제공받음으로써 향후 시장 체제의 안정성이나 위기발생시 외국인투자자에 대한 조치 가능성을 판단하고 이를 장기투자에 따른 잠재적 위험요인으로 고려한다.

2. 우리나라에 대한 평가 및 선결과제

가. 시장접근성 항목별 평가

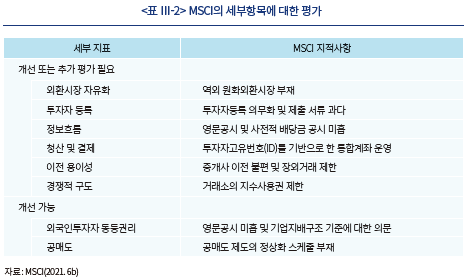

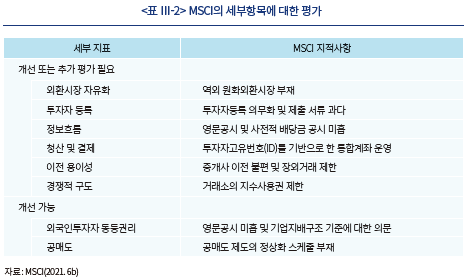

지난해 모건스탠리의 시장접근성 평가보고서에 따르면 우리나라는 총 18개 세부 항목 중 6개 항목에 대해 개선이나 추가적 평가가 필요한 것으로 나타났다. 여기에는 역외 원화외환시장 부재에 따른 외환시장 자유화 미흡, 외국인투자자 의무 등록제도의 유지, 거래소의 주가지수 사용권과 관련된 투자수단 활용도 미흡 등 과거부터 지적되어 온 주된 항목들 외에도 정보흐름, 청산 및 결제, 이전 용이성 등도 언급되었다. 그 밖에도 개선의 여지가 있는 항목으로는 외국인투자자에 대한 동등한 권리, 주식공매도, 제도의 안정성 관련 사항이 지적되고 있다.

<표 III-1>은 신흥시장국의 시장접근성 기준에 대한 세부항목 평가 결과를 나타낸다. 우리나라는 여타 신흥국과 대체로 비슷한 수준인 것으로 나타났으나 중국, 말레이시아, 인도네시아 등에 비해 개선필요 항목수가 더 많은 것으로 보인다. 반면 선진시장으로 분류된 23개국의 경우 아일랜드와 스페인을 제외하면8) 개선 사항이 전혀 없는 것으로 나타나 현재 우리나라 상황과는 차이가 있는 것으로 나타났다.

<표 III-2>는 MSCI가 시장접근성 평가보고서에서 우리나라에 대해 개선이 필요하거나 추가적 평가가 필요하다고 지적한 각 세부항목에 대한 언급내용을 요약한 것이다.

나. 세부과제 현황 및 선결과제

아래에서는 모건스탠리가 우리나라의 선진국지수 편입에 대해 과거부터 주된 문제점으로 지적하고 있는 개선필요 항목을 중심으로 그 현황과 선결과제에 대해 간략히 살펴보았다.

1) 역외 원화외환시장 부재

우리나라 외환시장은 원화와 미달러화 간에 거래가 이루어지는 원/달러 은행간시장이 서울외환시장에서만 이루어지고 이에 참가하기 위해서는 외환당국으로부터 외국환은행 허가를 받아야 한다. 현재 외국인 비거주자의 은행간시장에 대한 직접 참여는 허용되지 않는다. 외국인투자자의 입장에서 뉴욕, 런던, 동경 등 글로벌 역외 외환시장에서 원/달러 매매거래가 가능할 경우 시차에 구애받지 않고 거래할 수 있으며 국내 주식투자에 따른 외환관련 제반 비용이 축소되고 환헤지 전략을 구사하기도 보다 용이해진다. 이런 점에서 원화의 역외 외환시장의 부재는 MSCI 선진국지수 편입의 주된 걸림돌로 지적되어 왔다.

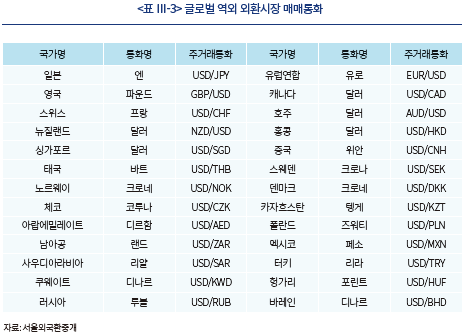

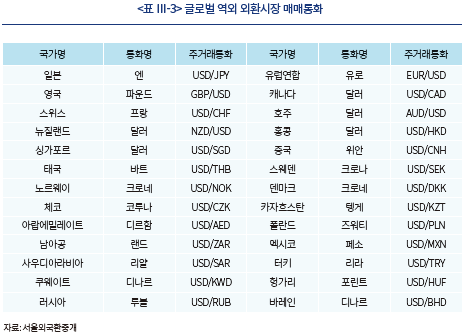

<표 III-3>은 주요 글로벌 외환시장에서 자국통화가 자유로이 거래되고 있는 국가와 통화들을 나타낸다. 여기에는 MSCI 선진국지수로 분류된 모든 선진시장국 통화는 물론 우리나라보다 외환시장의 거래규모9)가 훨씬 작거나 경제 및 금융시장의 발전정도가 낮은 신흥국 통화들을 상당수 포함한다. 아시아 국가 통화중 태국 바트화, 중국 위안화, 카자흐스탄 텡게화는 물론 멕시코 페소화, 러시아 루블화, 터키 리라화, 헝가리 포린트화 등 다수의 신흥국 통화들이 그 예이다.

최근 우리 정부는 MSCI 선진국지수 편입 노력의 일환으로「외환시장 선진화 계획」을 발표하며 외환시장 하부구조 개선을 계획중이다. 이에는 은행간 외환시장의 거래 마감시간을 현재의 오후 3시 30분에서 다음날 새벽 1시까지로 확대 운영하고, 비거주자의 국내 은행간시장에 대한 직접 참여를 허용하는 것을 골자로 하고 있다. 그간 우리나라 원화의 역외 외환시장의 개설이 진전을 이루지 못한 것은 무엇보다 정책 우선순위를 환율변동성 완화 및 외환시장 안정에 두고 운영해 왔기 때문이다. 즉 역외 원화시장 개설시 원화환율의 역외가격 형성 등으로 외환시장 변동성 확대 및 급격한 외화유출 가능성을 고려한 데 따른 것이라 할 수 있다. 최근 정부의 외환시장 선진화 노력은 외국인투자자의 외환관련 편의성 증진에 도움이 될 수 있을 것으로 보이나 보다 궁극적으로는 역외에 원화외환시장을 개설하여 선진국 수준의 외환시장 체계를 갖추고 중장기적으로 원화가 국제통화로 자리매김하도록 노력하는 것이 바람직한 방향이라 생각된다.

2) 외국인투자자 등록제도

외국인투자자 등록제도는 우리나라가 주식시장을 외국에 개방하면서부터 지금까지 외국인 주식투자 동향에 대한 모니터링과 일부 공기업의 외국인 투자한도를 점검하기 위해 운영되고 있다. 이에 따라 외국인투자자가 국내 상장증권에 투자하기 위해서는 사전에 계산주체 명의로 인적사항을 금융감독원에 등록하여 ID를 부여받아야 한다. 2021년말 전체 등록투자자는 51,185명이며 이 중 글로벌 자산운용사가 절반 가량을 차지한다. 국별로는 미국이 가장 많으나 룩셈브르크, 케이맨제도 등 조세회피처(약 30%)와 기타 국가의 비중이 절반을 넘고 있어 개별 투자자의 인적사항을 파악하는 실익이 크지 않은 것으로 보인다.

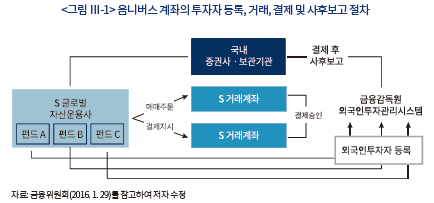

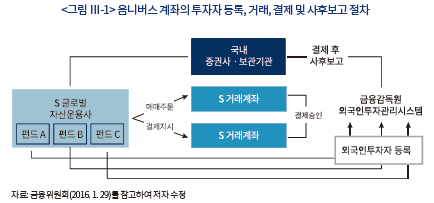

우리 정부는 글로벌 패시브펀드 투자비중이 확대되는 점을 고려하여 2016년에 국내에 투자하고 있는 글로벌 자산운용사들이 종전 개별 펀드별로 매매와 결제를 집행해야 하는 불편을 해소하고자 단일 외국인 통합계좌(omnibus account)를 도입하였다. 아래의 <그림 III-1>은 외국인 투자자의 투자관련 흐름도를 나타낸다. 글로벌 자산운용사는 각 펀드를 통합계좌 하나로 묶어 투자 매매주문과 결제를 수행하고 사후보고도 통합적으로 실시하면 되도록 하였으나 이 경우에도 외국인 투자자는 계산주체별(펀드별)로 사전적인 투자자등록을 하여야 하며 만약 펀드 최종투자자가 추가되는 경우 매매주문 이전에 외국인 ID를 발급받아야 한다.

이러한 통합계좌 운영은 다수 펀드에 대한 단일계좌 도입을 통해 주문 및 결제의 효율성을 높이고자 하는 당초 취지와 달리 실제 최종투자자의 파악에 어려움이 있고 개별 펀드에 대한 투자자 등록의무와 혼재되어 운영됨으로써 MSCI로부터 시장접근성 면에서 여전히 부정적 평가를 받고 있다.외국인 투자자들은 투자자 등록에 따른 번거로움과 금융당국의 외국인 투자관리시스템(FIMS)을통해 매매 및 자금이동 내역이 실시간 노출되는 데 대한 우려를 갖고 있다. 또한 외국인 투자자간내부거래나 자금의 상계거래가 발생하는 경우에는 청산 및 결제의 편의성을 저해하는 것으로 알려지고 있다.

따라서 옴니버스 제도 도입의 취지를 살리고 실효성을 높이기 위해서는 외국인투자자에 대한 의무적인 등록제도를 유지하더라도 결제 및 청산과정에서의 통합처리를 국제관행에 부합하도록 보완할 필요가 있을 것으로 생각된다. 아울러 외국인투자자 등록제도의 완화시 국내 증권 및 파생상품 시장에서 외국계 헤지펀드 등의 대량 포지션 구축을 통한 시장왜곡이나 불법자금의 유출입 등과 같은 부작용의 발생 가능성을 최소화할 수 있는 방안을 강구할 필요가 있을 것으로 보인다.

3) 지수사용권에 대한 제한

MSCI는 과거부터 한국거래소의 지수사용권과 관련하여 부정적 견해를 보여 왔다. MSCI의 입장에서 한국거래소가 산출하는 코스피200 지수 등 지수사용권에 대한 접근이 용이해질 경우 새로운 금융투자상품의 개발 및 수익창출이 가능하기 때문이다. 특히 MSCI는 주가지수를 산출할 때 시가총액보다는 정부 보유주식이나 자사주 등을 제외한 유동주식을 주로 이용하므로 거래소로부터 보다 세부적인 정보를 요구할 것으로 보인다.

현재 한국거래소는 모건스탠리에 세부적인 정보를 담은 지수사용권을 제공할 경우 새로운 금융상품이 뉴욕 등 해외 주식시장에 상장됨으로써 국내 주식시장을 위축시키고 한국거래소의 수익기반을 침해할 가능성에 대해 우려하는 것으로 보인다. 따라서 한국거래소는 MSCI에 지수사용권을 제공하는 경우에 대비하여 KOSPI200 선물, 옵션, ETF 등 한국내 KOSPI200 관련 상품의 유동성이 저하되지 않도록 방안을 강구해 나갈 필요가 있을 것으로 보인다. 또한 한국거래소가 국내 타 금융회사에 지수사용권을 제공하는 경우보다 합리적인 지수사용권에 대한 대가를 MSCI에 요구하는 것이 타당할 것으로 보이나 구체적인 세부사항은 한국거래소와 MSCI의 협의에 의해 결정하는 것이 바람직할 것으로 생각된다.

4) 기타 주식시장 하부구조 개선

MSCI는 우리나라 기업의 영문자료나 사전적 배당정보의 공시가 미흡하여 외국인 투자자의 투자의사결정에 어려움이 있다고 주장하고 있다. 기업정보의 영문자료 공시는 기업의 입장에서 비용증가를 수반할 것으로 예상되나 외국인의 정보접근성과 기업의 국제적 가시성(visibility)을 높이는 장점이 있으므로 기업의 자발적인 영문공시 유인이 존재할 것으로 생각된다. 또한 배당락일(ex-date of dividends) 이후 배당금액이 일정기간 확정되지 않는다는 지적은 각국마다 배당제도에 차이가 있고 최근 기업의 중간배당 성향이 높아지고 있다는 점에서 선진국지수 편입에 큰 장애가 되지는 않을 것으로 보인다.

그 밖에 외국인투자자가 이용하는 중개회사의 단순 이전(in-kind transfer)에 불편이 있다는 지적이 있는 만큼 이에 관한 사항에 대해서도 살펴볼 필요가 있다. 장외(off-exchange)거래에 있어서는 현재 우리나라의 장외거래 비중이 매우 작고 외국인투자자가 상장증권을 매매하는 경우 외국인투자관리시스템 또는 금융감독원장에게 신고 후 장외거래를 허용하고 있으므로 큰 문제가 되지 않을 것으로 보인다. 공매도제도와 관련하여 현재 우리 금융당국이 코로나19 발생 이전으로 회귀하는 데 대한 원칙을 밝히고 있으나 구체적인 시점을 명시하지 않고 있다는 점을 언급하고 있음에 유의할 필요가 있다.

Ⅳ. 요약 및 시사점

본 보고서의 추정 결과 우리나라가 MSCI 선진국지수로 편입될 경우 대체로 자금순유입 효과와 변동성 감소라는 긍정적 효과가 있을 것으로 분석되었다. 즉 선진국지수 편입으로 우리나라로 50억~360억달러 범위의 자금순유입이 예상되나 MSCI 추종자금의 규모와 한국의 글로벌 시가총액 비중 등에 따라 상이한 결과가 나타날 수 있는 추정상의 한계에도 유의할 필요가 있다. 또한 변동성과 관련한 이스라엘 및 그리스의 사례를 분석한 결과에서는 선진국지수 편입으로 외국인 주식투자자금의 유출입 및 주가의 변동성이 감소하는 긍정적 효과가 나타났다.

MSCI는 최근 시장접근성 평가보고서를 통해 우리나라의 6개 세부항목에 대해 개선이 필요하다고 지적한 바 있어 선진국지수 편입을 위해서는 이에 대한 개선 노력이 불가피할 것으로 보인다. 구체적으로 역외 외환시장 부재와 관련하여 최근 정부가 외환시장 선진화 계획을 차질 없이 이행하여 원화의 국제통화 위상 확립과 외환시장의 선진화를 추구해 나갈 필요가 있다. 또한 외국인투자자의 등록 의무와 관련하여서는 외국인투자자에 대한 옴니버스 제도의 도입 실효성과 국제적 정합성을 높이는 방향으로 개선할 필요가 있으며 거래소의 지수사용권 문제는 한국거래소와 모건스탠리 간 협의를 통해 해결해 나갈 수 있을 것으로 보인다.

우리나라의 MSCI 선진국지수 편입은 오랜 숙원과제로 우리 금융시장이 한 단계 도약하는 전환점이 될 수 있을 것으로 보인다. 그러나 선진국지수 편입시 자본유입이나 주가상승 등 긍정적 효과가 단기간에 획기적으로 일어나기 어렵고 편입과 무관하게 해결해 나가야 할 선결과제도 적지 않다. 따라서 MSCI 선진국지수 편입 그 자체보다는 이를 우리 주식 및 금융시장의 체질을 강화하는 기회로 삼아 우리 주식시장의 유동성 확충과 시장하부구조 개선 등 세부과제를 차분히 개선해 나가면서 선진국지수 편입이 자연스러운 결과로 나타나도록 하는 것이 바람직하다.

1) 모건스탠리의 자회사인 모건스탠리 캐피탈 인터내셔널(MSCI)에서 1969년 세계 최초로 만든 주가지수로 미국계 펀드의 95%가 이 지수를 추종하는 것으로 알려져 있다.

2) 2010년 이후 액티브펀드에서 패시브펀드로, 특히 뮤추얼펀드에서 ETF로의 자금이동이 크게 증가하였다.

3) 현재 FTSE 선진국지수에서 한국이 차지하는 비중(1.58%)을 적용할 경우에는 자금순유출이 더 커지게 됨을 의미한다.

4) Financial Times(2022. 2. 22)기사를 참조하기 바란다.

5) 다만, 이스라엘과 그리스의 경우에서 모두 자금유입의 평균치는 각각 감소 및 증가하였는데 이는 글로벌 자금유출입이 선진국지수 또는 신흥국지수의 변경 외에도 글로벌 경제상황 등 다양한 요인에 큰 영향을 받고 있는 데 따른 결과로 보인다.

6) 우리나라의 주가변동성이 최근 10년 동안 크게 하락하여 미국의 주가변동성보다 낮아진 상황이므로 대외충격시 시장의 안정성이 높아진 긍정적 측면과 더불어 주식시장의 활력이 감소하는 부정적 측면도 함께 감안할 필요가 있다.

7) 이에 관한 내용은 MSCI(2021. 6b)를 참고하기 바란다.

8) 두 나라의 경우 외국인의 추가투자 여력에서 개선이 필요하다고 지적되었다.

9) 국제결제은행(BIS)의 Triennial Survey 결과 우리나라 원화는 미달러화, 유로화, 엔화, 파운드화, 호주 달러화, 캐나다 달러화, 스위스 프랑화, 위안화, 홍콩 달러화, 뉴질랜드 달러화, 스웨덴 크로나화에 이어 글로벌 통화중 12번째 큰 일평균 거래량을 보이는 것으로 조사되었다(BIS, 2019).

참고문헌

금융감독원, 2021. 12,『외국인 투자제도에 대한 안내서』.

금융위원회, 2016. 1. 29, 외국인 투자자가 우리 주식시장에서 손쉽게 거래할 수 있도록 “외국인 통합계좌(omnibus account)”를 도입하겠습니다, 보도자료.

김보영, 2022, MSCI 지수 추종 운용자산 규모 현황과 영향, 자본시장연구원『 자본시장포커스』2022-05호.

삼성증권, 2021. 11,『MSCI 지수 설명서 ver2.0』, 삼성증권 Quantitative Issue.

한국은행, 2016. 1,『한국의 외환제도와 외환시장』.

한국경제연구원, 2021. 5. 4, 한국증시 MSCI 선진시장 편입 시 최대 27.5% 상승 가능!, 보도자료.

KB증권, 2022. 2,『MSCI 선진지수 편입: 거쳐야 할 관문은 ‘공매도 전면 재개’』, KB Research.

NH투자증권, 2022. 2,『MSCI 선진시장지수 편입가능성과 편입 시 영향』, NH투자전략 리서치리포트.

BIS, 2019, Triennial Central Bank Survey of Foreign Exchange and Over-thecounter(OTC) Derivatives Markets in 2019.

Financial Times, 2022. 2. 22, MSCI needs to add Israel to its Europe index.

FTSE Russell, 2022. 2, FTSE Developed ex US Index factsheet.

Goldman Sachs, 2022. 2, Korea: What if? Strong upside from potential MSCI DM reclassification and narrowing of valuation discount, Portfolio Strategy Research.

MSCI, 2000. 7. 31, Status of MSCI Greece, Egypt and Morocco Indices to change, MSCI Press Releases.

MSCI, 2009. 6. 15, MSCI Announces Market Classification Decisions, MSCI Press Releases.

MSCI, 2021. 6a, MSCI 2021 Market Classification Review, MSCI Press Releases.

MSCI, 2021. 6b, MSCI Global Market Accessibility Review.

MSCI, 2021. 6c, MSCI Market Classification Framework.

MSCI, 2021. 12a, MSCI ACWI Index(USD) factsheet.

MSCI, 2021. 12b, MSCI Emerging Market Index (USD) factsheet.

MSCI, 2021. 12c, MSCI AC Asia Index (USD) factsheet.

FTSE Russell www.ftserussell.com

MSCI www.msci.com

우리나라의 주식시장은 1992년 외국인투자자에게 처음 개방된 이래 꾸준한 양적 성장과 질적 발전을 거듭해왔다. 글로벌 주식시장 규모대비 2%를 상회하는 시가총액과 풍부한 일일 거래량 등 유동성이 크게 확충된 가운데 760조원에 달하는 외국인의 국내 주식투자자금 순유입이 이루어져 FTSE 등으로부터 이미 선진시장의 지위를 부여받고 있다. 그러나 글로벌 펀드자금이 벤치마크로 추종하는 규모가 가장 큰 것으로 알려져 있는 모건스탠리의 MSCI(Morgan Stanley Capital International)1)에서는 여전히 신흥국지수에 머물러 있다.

우리나라가 MSCI 선진국지수로 변경될 경우 안정적인 외국인투자자금의 순유입으로 주가상승과 변동성 완화 등 긍정적 효과가 기대된다는 점에서 그간 우리 정부는 수차례 선진국지수 편입을 시도한 바 있으나 아직까지 진전을 보지 못하고 있다. MSCI는 2008년 6월 한국을 선진국지수 편입 관찰대상(watch list) 국가로 지정하였으나 다음해인 2009년에는 선진국지수 편입을 위한 세 가지 선결조건으로 역외외환시장 부재, 외국인투자자의 등록의무, 지수사용권 등을 지적하며 편입유보 결정을 내린 바 있으며 2014년 6월에는 선결요건에 대한 진전이 없다는 이유로 관찰대상에서도 제외하였다.

최근 우리 정부는 물론 정치권을 중심으로 MSCI 선진국지수 편입과 관련하여 적극적인 추진의사를 표명하며 금년 6월 평가에서 관찰대상국 지정 후 내년 중 선진국지수 편입을 목표로 하고 있다. 우리나라의 선진국지수 편입시 효과와 관련한 분석에서는 대체로 외국인 주식투자자금의 순유입과 주가상승 등 긍정적 영향이 있을 것으로 예상하고 있으나 체계적이고 심도 있는 분석은 그리 많지 않은 것으로 보인다. 아울러 지금까지 선진국지수 편입의 걸림돌로 지적되어온 세부 사항들의 현황과 선결과제의 해결을 위한 논의가 필요한 상황으로 판단된다.

이러한 점에서 본 보고서에서는 MSCI 선진국지수 편입의 효과와 선결과제를 분석한 후 시사점을 제시하였다. 본고의 구성은 다음과 같다. 제Ⅱ장에서는 선진국지수 편입시 효과 분석을 위해 자본순유입 예상 규모를 추정해 보고 과거 선진국지수로 변경된 바 있는 이스라엘과 그리스의 사례를 통해 변동성에 미치는 영향을 간접적으로 분석하였다. 제Ⅲ장에서는 MSCI의 선진국지수 편입 기준을 소개하고 우리나라에 대한 세부 항목별 평가와 선결과제를 기술하였다. 제Ⅳ장에서는 시사점을 언급하였다.

Ⅱ. 선진국지수 편입시의 효과 분석

우리나라가 MSCI 국가분류상 신흥국지수에서 선진국지수로 편입될 경우 이를 벤치마크로 추종하는 장기 글로벌 펀드자금의 국내증시 유입이 확대되면서 국내 주가의 상승과 변동성 감소를 가져올 것이라는 기대감이 크다. 낙관적인 견해에 따르면 선진국지수 추종자금 규모가 신흥국지수 추종자금의 대략 5~6배에 달하므로 전체적으로 우리나라로 주식투자자금의 순유입이 발생하고 주가에도 긍정적인 영향을 줄 수 있을 것으로 본다. 또한 선진국지수 추종자금은 주로 장기자금으로 구성되므로 외부충격이 발생하더라도 외국인투자자금의 해외유출 가능성이 상대적으로 낮아 변동성을 감소시킬 수 있을 것으로 예상하고 있다.

이와 관련한 기존의 분석 자료들을 보면 선진국지수 편입시 대체로 우리나라로 주식투자자금의 순유입을 가져올 것으로 보는 분석이 우세하다. 한국경제연구원(2021. 5. 4)은 선진국지수 편입시 우리나라로 17.8조~61.1조원(159억~547억달러) 규모의 자금이 유입되면서 주가상승을 가져올 것으로 분석하였으며, KB증권(2022. 2)은 글로벌 패시브자금을 중심으로 20조~65조원이 순유입될 것으로 예상하였다. 글로벌투자은행인 Goldman Sachs(2022. 2)도 선진국지수 편입시 440억달러의 자금순유입으로 코리아 디스카운트가 완화되며 주가에 긍정적인 영향을 미칠 것으로 분석하였다. 다만, NH투자증권(2022. 2)은 선진국지수 편입에 따라 기존의 신흥국지수에서 이탈되는 패시브자금 규모가 오히려 더 커 약 18조원(150억달러)의 자금순유출이 발생할 것으로 분석하였다.

그러나 상기 분석들 대부분이 정교한 분석방법의 결여와 추정을 위한 다양한 가정에 의존하고 있어 선진국지수 편입시 실제 국내로의 자금순유입 규모와 유입 기간 및 형태 등에 대해 단정적으로 말하기 어렵다고 생각된다. 이는 지수변경시 실제 자금유입은 글로벌 경제상황이나 국내 주식시장에 대한 외국인투자자의 신인도 등 많은 요인에 영향을 받을 뿐만 아니라 추정을 위한 다양한 가정이 불가피하기 때문이다. 본고에서는 이러한 추정상의 한계에도 불구하고 자금유출입 추정을 위한 시도의 일환으로 글로벌 주식시장에서 차지하는 우리나라의 상대적 비중을 이용하여 주식투자자금의 순유입 규모를 추정해 보았다. 아울러 선진국지수 변경시 자금유출입 및 주가 변동성에 미치는 영향을 과거 이스라엘과 그리스 등 주요국의 사례를 통해 간접적으로 분석하였다.

1. 자금순유출입 규모 추정

가. MSCI 추종 자금규모

MSCI 선진국지수 편입시 우리나라에 대한 자금유출입 규모를 추정하기 위해서는 MSCI 지수를 추종하는 자금의 형태별 규모와 우리나라의 비중을 파악하여야 한다. MSCI 지수는 크게 선진시장(Developed Market: DM), 신흥시장(Emerging Market: EM) 및 프론티어시장(frontier market)으로 구분되는데 <그림 II-1>에서 보는 바와 같이 선진시장은 지역별로 북미, 유럽ㆍ중동 및 아시아ㆍ태평양으로 나누어지며 현재 23개국이 포함되어 있다. 신흥시장은 우리나라를 포함하여 25개국으로 구성되어 있으며 지역별로 중남미, 유럽ㆍ중동ㆍ아프리카 및 아시아로 구분된다.

우리나라에 대한 주식투자자금 순유출입 규모를 추정하기 위해 현재 유입되어 있는 신흥국지수 추종자금의 이탈규모와 선진국지수 추종자금의 신규 유입규모를 각각 추정하여 비교하였다. 이를 위해 MSCI가 발표한 형태별 추종자금 규모와 글로벌 주식시장 시가총액에서 차지하는 우리나라의 비중을 이용하였다. 장기적으로 글로벌 펀드자금의 국별 투자비중은 각국의 주식시장 크기 및 유동성을 추수하는 것으로 볼 수 있기 때문이다. <표 II-2>는 금년 3월 기준 MSCI 선진국지수에 포함된 국가별 주식시장의 시가총액과 비중을 나타낸 것으로 우리나라가 선진시장에 새로이 진입할 경우 비중은 2.4%로 나타나 코로나19가 발생하기 직전인 2019년말(2.2%)에 비해 소폭 증가하였다.

<표 Ⅱ-3>은 선진국지수의 신규유입 규모의 추정 결과를 나타낸다. 금년 3월 현재 우리나라 주식시장의 글로벌 시가총액 비중을 적용할 경우 우리나라로 유입되는 자금이 3,410억달러로 유출 예상액 3,050억달러보다 커 자금순유입 규모는 360억달러로 추정되었다. 그러나 코로나19 발생 이후 우리나라 주가의 상대적인 상승폭이 다른 선진국에 비해 컸던 점에 비추어 2019년말 기준 글로벌 시가총액 비중을 적용하면 자금순유입 규모는 50억달러에 그치는 것으로 나타났다.3)

만약 선진국지수 편입으로 자금순유입이 일어날 경우 국내 주가에는 긍정적인 영향을 줄 것으로 보인다. 그러나 자금유입이 일시적 조정에 의해 이루어질지 아니면 수년에 걸쳐 진행될 것인지 등이 불분명하다. 만약 우리나라가 관찰대상국으로 지정되더라도 최종편입 결정은 1년 후에 결정되며 최종편입이 결정되더라도 실제 글로벌 펀드자금의 포트폴리오 재조정은 다시 1년 후부터 진행되어 단기간 내에 대규모 자금유입이 발생하기는 어려울 것으로 보인다.

또한 국내 주가는 글로벌 금융상황이나 국가별 요인 등 다양한 요인에 영향을 받는다는 점에 유의할 필요가 있다. 한 예로 우리나라에 앞서 2010년 중 선진국지수로 편입된 이스라엘의 경우 대표 주가지수인 TA-100가 글로벌 금융위기 직후 전세계적인 주가 상승기와 맞물리면서 2009년 6~12월중 32.9% 상승하였으나, 당시 글로벌 금융위기 직후 전세계적인 주가 상승기로 같은 기간중 선진국지수가 17.4%, 신흥국지수가 30% 상승했던 상황임을 감안할 때 선진국지수 변경만의 효과로 보기는 어렵다고 생각된다. 최근에는 이스라엘이 선진국지수 내에서 중동지역으로 분류되어 있어 과거 10여년간 오히려 자금유출이 발생하고 주식거래 규모가 감소하였다는 주장4)도 제기되고 있어 선진국지수 편입이 무조건 대규모 자금유입으로 이어진다고 보기에는 무리가 있는 것으로 판단된다.

2. 변동성에 대한 영향

여기서는 선진국지수 편입시 장기성 자금의 유입으로 변동성이 감소될 수 있는지를 주요국의 사례를 통해 간접적으로 분석해 보았다. 해외 사례로는 신흥국에서 선진국으로 편입된 이스라엘(2010년)과 선진국 편입 후 다시 신흥국으로 재분류된 그리스(2001년 및 2013년)를 각각 살펴보았다.

변동성은 자본유출입 및 주가의 변동성을 구분하여 살펴보았다. 전자의 경우 IMF가 제공하는 국별 국제수지 자료를 이용하였으며 이와 별도로 이스라엘에 대해서는 EPFR(Emerging Portfolio Fund Research)에서 제공하는 글로벌 펀드자금 유출입 자료를 이용한 분석을 병행하였다. 주가변동성은 블룸버그에서 제공하는 역사적 주가변동성(historical volatility)을 편입 전후 5년의 기간을 분석하였으며 국별 비교를 위해 같은 기간중 미국 및 우리나라의 주가변동성을 함께 제시하였다.

가. 자금유출입 변동성

<표 II-4>에 나타난 바와 같이 이스라엘의 경우 선진국지수 편입 이후 5년 동안 변동성의 대용지표라 할 수 있는 자금유출입의 표준편차가 이전기간에 비해 크게 감소하였다. 그리스의 경우에도 선진국지수 편입시 이스라엘과 유사하게 변동성이 감소하였으며 반대로 2013년 신흥국지수로 재편입시에는 변동성이 이전보다 크게 확대되는 모습을 보였다.5) 이는 선진국지수 편입시 투자자금의 장기화와 국가 디스카운트의 완화 등으로 외부충격에 대해 상대적으로 자금유출입의 변동성이 감소하는 반면, 신흥국지수의 경우에는 글로벌 불확실성 증가시 위험회피 성향이 증가하면서 신흥국의 자금유출입 변동성이 증가하는 국제자본흐름의 통상적인 현상을 반영한 것으로 풀이할 수 있다.

주가변동성의 경우에도 아래의 <표 II-6> 및 <그림 II-3>에서 보는 바와 같이 두 나라 모두 선진국지수 편입 이후 변동성이 감소하였다. 다만, 같은 기간 중 우리나라의 주가변동성도 완화된 것으로 나타나6) 두 나라의 MSCI 선진국지수 변경만으로 주가변동성이 유의미하게 감소한 것으로 판단하기는 어려우며 글로벌 금융환경이나 국내 사정 등 다른 요인들의 영향을 받은 것으로 보인다.

한편 2013년 선진국지수에서 다시 신흥국지수로 변경된 그리스의 경우를 보면 우리나라의 주가변동성이 같은 기간 중 큰 폭으로 감소한 것과 달리 소폭 감소에 그친 것으로 나타났다. 이는 당시 미국의 테이퍼텐트럼(taper tantrum) 등으로 통화정책 기조가 양적완화에서 긴축으로 선회하면서 글로벌 자금흐름의 변화가 나타났고, 선진국지수보다 신흥국지수에서 그 영향을 더 크게 받으면서 주가변동성을 확대시키는 요인으로 작용한 데 따른 것으로 판단된다.

이 장에서는 MSCI 선진국지수 편입을 위해 요구되는 모건스탠리의 분류기준(MSCI Market Clas-sifi cation Framework)에 대해 소개하고 각 부문별로 우리나라의 현황 및 선결과제에 대해 살펴보았다.

1. MSCI 선진국지수 편입 기준

모건스탠리는 MSCI 선진시장 편입을 위한 요건으로 각국의 경제발전 정도 및 안정성(economic development), 주식시장 규모 및 유동성(size and liquidity), 그리고 시장접근성 기준(market access criteria) 등 세 가지 기준을 제시하고 있다. 우리나라는 이 중 경제발전 정도와 주식시장 유동성 측면에서는 선진국지수 편입 기준을 충족하고 있다. 그 예로 우리나라의 일인당 GDP는 선진국 수준이며 무역 및 경제규모, 대외건전성 등에서도 상대적으로 충분한 조건을 만족하고 있다. 국내 주식시장의 규모나 유동성도 중국, 인도 등을 제외하면 여타 신흥국 중에서 가장 큰 편이다. 그러나 글로벌 투자자의 입장에서 다양한 질적 요구 사항을 반영하고 있는 시장접근성 기준에서는 여전히 선진시장 기준에 미흡한 것으로 지적받고 있다.

시장접근성 기준은 세부적으로 5개 중분류(외국인투자 개방도, 자금유출입 편의성, 운영체계의 효율성, 투자수단의 활용가능성, 제도의 안정성) 및 18개 소분류로 구분된다. 아래에서는 이에 관한 모건스탠리의 기준에 관해 간략히 소개하였다.7)

가. 외국인투자 개방도(openness to foreign ownership)

외국인투자에 대한 개방도(openness)는 거주자와 외국인투자자간, 또는 외국인투자자간에 투자와 관련한 차별이 없어야 함을 의미한다. 따라서 외국인투자자에 대한 자격허가제(Qualified Foreign Institutional Investor: QFII)를 운영하거나 특정산업이나 섹터 등에 대한 투자한도의 과도한 설정이 없어야 한다. 특히 특정섹터에 대한 투자한도가 3년 연속 10%를 초과하는 경우 기준달성에 부정적으로, 3~10%는 주의를 요하는 범위로 판단하고 있다. 또한 투자한도 제한 등으로 추가적인 투자여력이 크게 떨어지는 경우에도 부정적으로 평가한다. 아울러 주주권행사와 관련하여 거주자와 외국인투자자간에 차별이 없어야 함을 제시하고 있다.

나. 자금유출입의 편의성(ease of capital inflows/outflows)

외국인의 투자자금 유출입이 아무런 제약 없이 자유로이 이동할 수 있어야 하며 선진국 수준의 외환시장의 개방 및 발전 정도를 요구한다. 특히 해당국 통화가 국제통화로서 시간과 장소의 제약 없이 교환가능(fully convertible)해야 한다. 이는 투자대상국 통화가 거래되는 외환시장이 해당국 역내는 물론 역외에 개설되어 있으면서 자유로이 교환가능한 국제통화로 기능할 경우 투자 및 환헤지에 따른 거래비용을 줄이고 자금유출입의 편의성은 커질 수 있기 때문이라 할 수 있다.

다. 운영체계의 효율성(efficiency of the operational framework)

운영체계는 외국인투자자의 최초 투자에서 자금회수에 이르는 과정까지의 제반 운영효율성과 편의성을 포함한다. 여기에는 투자자등록과 같은 시장진입(market entry), 거래관련 금융시장의 법적 규제, 정보흐름과 관련한 회계 및 시장조직(market organization), 청산 및 결제, 수탁업무, 거래 및 이체, 대주와 공매도 등 시장하부구조(market infrastructure)와 관련된 제반 사항들이 포함된다. 이러한 다양한 부문에 대한 기준을 제시하는 것은 운영리스크가 클 경우 외국인투자자의 비용상승을 초래하기 때문으로 볼 수 있다.

투자자등록과 관련하여서는 의무등록 여부는 물론 등록시 필요한 문서의 종류나 수, 또는 처리기간 등을 고려하여 효율성을 평가한다. 주식시장 등 금융시장에 존재하는 제반 규제는 일관성과 예측가능성을 중요시하며 투자자의 투자의사결정에 중요한 요소인 정보흐름에 있어서는 정보의 질, 적시성, 영문공시 여부, 국제회계기준(IFRS)에 부합하는 회계기준 적용 등이 중요하게 고려된다. 청산과 결제는 국제결제은행의 DVP(Delivery versus Payment)의 적용 여부가 중요하며, 수탁은행은 다수의 서비스 제공은행들의 경쟁여건이 주된 고려사항이다. 장외거래나 원활한 내부자금이체, 대주 및 공매도 관련 제도의 명확한 규칙과 효율적 운영체계 등도 요구된다.

라. 투자수단의 활용가능성(availability of investment instruments)

글로벌 투자자금은 각국 거래소(exchanges) 등에서 산출, 제공되는 거래가격이나 세부정보 등 각종 데이터를 이용하여 투자의사결정을 하므로 이러한 데이터가 충분히 제공되고 활용가능하여야 한다. 여기에는 거래소가 자체적으로 산출하는 개별지수나 이를 기반으로 한 투자수단 등에 대한 정보를 포함한다. 그렇지 않을 경우 경쟁적 구도를 약화시키므로 부정적 평가 요인이 된다.

마. 제도의 안정성(stability of the institutional framework)

글로벌 장기투자자들은 장기투자에 따른 제도의 안정성 여부를 중요시한다. 따라서 각국 정부의 개입이나 외국인투자자에 대한 규제 조치 등에 대한 과거 기록을 제공받음으로써 향후 시장 체제의 안정성이나 위기발생시 외국인투자자에 대한 조치 가능성을 판단하고 이를 장기투자에 따른 잠재적 위험요인으로 고려한다.

2. 우리나라에 대한 평가 및 선결과제

가. 시장접근성 항목별 평가

지난해 모건스탠리의 시장접근성 평가보고서에 따르면 우리나라는 총 18개 세부 항목 중 6개 항목에 대해 개선이나 추가적 평가가 필요한 것으로 나타났다. 여기에는 역외 원화외환시장 부재에 따른 외환시장 자유화 미흡, 외국인투자자 의무 등록제도의 유지, 거래소의 주가지수 사용권과 관련된 투자수단 활용도 미흡 등 과거부터 지적되어 온 주된 항목들 외에도 정보흐름, 청산 및 결제, 이전 용이성 등도 언급되었다. 그 밖에도 개선의 여지가 있는 항목으로는 외국인투자자에 대한 동등한 권리, 주식공매도, 제도의 안정성 관련 사항이 지적되고 있다.

<표 III-1>은 신흥시장국의 시장접근성 기준에 대한 세부항목 평가 결과를 나타낸다. 우리나라는 여타 신흥국과 대체로 비슷한 수준인 것으로 나타났으나 중국, 말레이시아, 인도네시아 등에 비해 개선필요 항목수가 더 많은 것으로 보인다. 반면 선진시장으로 분류된 23개국의 경우 아일랜드와 스페인을 제외하면8) 개선 사항이 전혀 없는 것으로 나타나 현재 우리나라 상황과는 차이가 있는 것으로 나타났다.

아래에서는 모건스탠리가 우리나라의 선진국지수 편입에 대해 과거부터 주된 문제점으로 지적하고 있는 개선필요 항목을 중심으로 그 현황과 선결과제에 대해 간략히 살펴보았다.

1) 역외 원화외환시장 부재

우리나라 외환시장은 원화와 미달러화 간에 거래가 이루어지는 원/달러 은행간시장이 서울외환시장에서만 이루어지고 이에 참가하기 위해서는 외환당국으로부터 외국환은행 허가를 받아야 한다. 현재 외국인 비거주자의 은행간시장에 대한 직접 참여는 허용되지 않는다. 외국인투자자의 입장에서 뉴욕, 런던, 동경 등 글로벌 역외 외환시장에서 원/달러 매매거래가 가능할 경우 시차에 구애받지 않고 거래할 수 있으며 국내 주식투자에 따른 외환관련 제반 비용이 축소되고 환헤지 전략을 구사하기도 보다 용이해진다. 이런 점에서 원화의 역외 외환시장의 부재는 MSCI 선진국지수 편입의 주된 걸림돌로 지적되어 왔다.

<표 III-3>은 주요 글로벌 외환시장에서 자국통화가 자유로이 거래되고 있는 국가와 통화들을 나타낸다. 여기에는 MSCI 선진국지수로 분류된 모든 선진시장국 통화는 물론 우리나라보다 외환시장의 거래규모9)가 훨씬 작거나 경제 및 금융시장의 발전정도가 낮은 신흥국 통화들을 상당수 포함한다. 아시아 국가 통화중 태국 바트화, 중국 위안화, 카자흐스탄 텡게화는 물론 멕시코 페소화, 러시아 루블화, 터키 리라화, 헝가리 포린트화 등 다수의 신흥국 통화들이 그 예이다.

2) 외국인투자자 등록제도

외국인투자자 등록제도는 우리나라가 주식시장을 외국에 개방하면서부터 지금까지 외국인 주식투자 동향에 대한 모니터링과 일부 공기업의 외국인 투자한도를 점검하기 위해 운영되고 있다. 이에 따라 외국인투자자가 국내 상장증권에 투자하기 위해서는 사전에 계산주체 명의로 인적사항을 금융감독원에 등록하여 ID를 부여받아야 한다. 2021년말 전체 등록투자자는 51,185명이며 이 중 글로벌 자산운용사가 절반 가량을 차지한다. 국별로는 미국이 가장 많으나 룩셈브르크, 케이맨제도 등 조세회피처(약 30%)와 기타 국가의 비중이 절반을 넘고 있어 개별 투자자의 인적사항을 파악하는 실익이 크지 않은 것으로 보인다.

우리 정부는 글로벌 패시브펀드 투자비중이 확대되는 점을 고려하여 2016년에 국내에 투자하고 있는 글로벌 자산운용사들이 종전 개별 펀드별로 매매와 결제를 집행해야 하는 불편을 해소하고자 단일 외국인 통합계좌(omnibus account)를 도입하였다. 아래의 <그림 III-1>은 외국인 투자자의 투자관련 흐름도를 나타낸다. 글로벌 자산운용사는 각 펀드를 통합계좌 하나로 묶어 투자 매매주문과 결제를 수행하고 사후보고도 통합적으로 실시하면 되도록 하였으나 이 경우에도 외국인 투자자는 계산주체별(펀드별)로 사전적인 투자자등록을 하여야 하며 만약 펀드 최종투자자가 추가되는 경우 매매주문 이전에 외국인 ID를 발급받아야 한다.

따라서 옴니버스 제도 도입의 취지를 살리고 실효성을 높이기 위해서는 외국인투자자에 대한 의무적인 등록제도를 유지하더라도 결제 및 청산과정에서의 통합처리를 국제관행에 부합하도록 보완할 필요가 있을 것으로 생각된다. 아울러 외국인투자자 등록제도의 완화시 국내 증권 및 파생상품 시장에서 외국계 헤지펀드 등의 대량 포지션 구축을 통한 시장왜곡이나 불법자금의 유출입 등과 같은 부작용의 발생 가능성을 최소화할 수 있는 방안을 강구할 필요가 있을 것으로 보인다.

3) 지수사용권에 대한 제한

MSCI는 과거부터 한국거래소의 지수사용권과 관련하여 부정적 견해를 보여 왔다. MSCI의 입장에서 한국거래소가 산출하는 코스피200 지수 등 지수사용권에 대한 접근이 용이해질 경우 새로운 금융투자상품의 개발 및 수익창출이 가능하기 때문이다. 특히 MSCI는 주가지수를 산출할 때 시가총액보다는 정부 보유주식이나 자사주 등을 제외한 유동주식을 주로 이용하므로 거래소로부터 보다 세부적인 정보를 요구할 것으로 보인다.

현재 한국거래소는 모건스탠리에 세부적인 정보를 담은 지수사용권을 제공할 경우 새로운 금융상품이 뉴욕 등 해외 주식시장에 상장됨으로써 국내 주식시장을 위축시키고 한국거래소의 수익기반을 침해할 가능성에 대해 우려하는 것으로 보인다. 따라서 한국거래소는 MSCI에 지수사용권을 제공하는 경우에 대비하여 KOSPI200 선물, 옵션, ETF 등 한국내 KOSPI200 관련 상품의 유동성이 저하되지 않도록 방안을 강구해 나갈 필요가 있을 것으로 보인다. 또한 한국거래소가 국내 타 금융회사에 지수사용권을 제공하는 경우보다 합리적인 지수사용권에 대한 대가를 MSCI에 요구하는 것이 타당할 것으로 보이나 구체적인 세부사항은 한국거래소와 MSCI의 협의에 의해 결정하는 것이 바람직할 것으로 생각된다.

4) 기타 주식시장 하부구조 개선

MSCI는 우리나라 기업의 영문자료나 사전적 배당정보의 공시가 미흡하여 외국인 투자자의 투자의사결정에 어려움이 있다고 주장하고 있다. 기업정보의 영문자료 공시는 기업의 입장에서 비용증가를 수반할 것으로 예상되나 외국인의 정보접근성과 기업의 국제적 가시성(visibility)을 높이는 장점이 있으므로 기업의 자발적인 영문공시 유인이 존재할 것으로 생각된다. 또한 배당락일(ex-date of dividends) 이후 배당금액이 일정기간 확정되지 않는다는 지적은 각국마다 배당제도에 차이가 있고 최근 기업의 중간배당 성향이 높아지고 있다는 점에서 선진국지수 편입에 큰 장애가 되지는 않을 것으로 보인다.

그 밖에 외국인투자자가 이용하는 중개회사의 단순 이전(in-kind transfer)에 불편이 있다는 지적이 있는 만큼 이에 관한 사항에 대해서도 살펴볼 필요가 있다. 장외(off-exchange)거래에 있어서는 현재 우리나라의 장외거래 비중이 매우 작고 외국인투자자가 상장증권을 매매하는 경우 외국인투자관리시스템 또는 금융감독원장에게 신고 후 장외거래를 허용하고 있으므로 큰 문제가 되지 않을 것으로 보인다. 공매도제도와 관련하여 현재 우리 금융당국이 코로나19 발생 이전으로 회귀하는 데 대한 원칙을 밝히고 있으나 구체적인 시점을 명시하지 않고 있다는 점을 언급하고 있음에 유의할 필요가 있다.

Ⅳ. 요약 및 시사점

본 보고서의 추정 결과 우리나라가 MSCI 선진국지수로 편입될 경우 대체로 자금순유입 효과와 변동성 감소라는 긍정적 효과가 있을 것으로 분석되었다. 즉 선진국지수 편입으로 우리나라로 50억~360억달러 범위의 자금순유입이 예상되나 MSCI 추종자금의 규모와 한국의 글로벌 시가총액 비중 등에 따라 상이한 결과가 나타날 수 있는 추정상의 한계에도 유의할 필요가 있다. 또한 변동성과 관련한 이스라엘 및 그리스의 사례를 분석한 결과에서는 선진국지수 편입으로 외국인 주식투자자금의 유출입 및 주가의 변동성이 감소하는 긍정적 효과가 나타났다.

MSCI는 최근 시장접근성 평가보고서를 통해 우리나라의 6개 세부항목에 대해 개선이 필요하다고 지적한 바 있어 선진국지수 편입을 위해서는 이에 대한 개선 노력이 불가피할 것으로 보인다. 구체적으로 역외 외환시장 부재와 관련하여 최근 정부가 외환시장 선진화 계획을 차질 없이 이행하여 원화의 국제통화 위상 확립과 외환시장의 선진화를 추구해 나갈 필요가 있다. 또한 외국인투자자의 등록 의무와 관련하여서는 외국인투자자에 대한 옴니버스 제도의 도입 실효성과 국제적 정합성을 높이는 방향으로 개선할 필요가 있으며 거래소의 지수사용권 문제는 한국거래소와 모건스탠리 간 협의를 통해 해결해 나갈 수 있을 것으로 보인다.

우리나라의 MSCI 선진국지수 편입은 오랜 숙원과제로 우리 금융시장이 한 단계 도약하는 전환점이 될 수 있을 것으로 보인다. 그러나 선진국지수 편입시 자본유입이나 주가상승 등 긍정적 효과가 단기간에 획기적으로 일어나기 어렵고 편입과 무관하게 해결해 나가야 할 선결과제도 적지 않다. 따라서 MSCI 선진국지수 편입 그 자체보다는 이를 우리 주식 및 금융시장의 체질을 강화하는 기회로 삼아 우리 주식시장의 유동성 확충과 시장하부구조 개선 등 세부과제를 차분히 개선해 나가면서 선진국지수 편입이 자연스러운 결과로 나타나도록 하는 것이 바람직하다.

1) 모건스탠리의 자회사인 모건스탠리 캐피탈 인터내셔널(MSCI)에서 1969년 세계 최초로 만든 주가지수로 미국계 펀드의 95%가 이 지수를 추종하는 것으로 알려져 있다.

2) 2010년 이후 액티브펀드에서 패시브펀드로, 특히 뮤추얼펀드에서 ETF로의 자금이동이 크게 증가하였다.

3) 현재 FTSE 선진국지수에서 한국이 차지하는 비중(1.58%)을 적용할 경우에는 자금순유출이 더 커지게 됨을 의미한다.

4) Financial Times(2022. 2. 22)기사를 참조하기 바란다.

5) 다만, 이스라엘과 그리스의 경우에서 모두 자금유입의 평균치는 각각 감소 및 증가하였는데 이는 글로벌 자금유출입이 선진국지수 또는 신흥국지수의 변경 외에도 글로벌 경제상황 등 다양한 요인에 큰 영향을 받고 있는 데 따른 결과로 보인다.

6) 우리나라의 주가변동성이 최근 10년 동안 크게 하락하여 미국의 주가변동성보다 낮아진 상황이므로 대외충격시 시장의 안정성이 높아진 긍정적 측면과 더불어 주식시장의 활력이 감소하는 부정적 측면도 함께 감안할 필요가 있다.

7) 이에 관한 내용은 MSCI(2021. 6b)를 참고하기 바란다.

8) 두 나라의 경우 외국인의 추가투자 여력에서 개선이 필요하다고 지적되었다.

9) 국제결제은행(BIS)의 Triennial Survey 결과 우리나라 원화는 미달러화, 유로화, 엔화, 파운드화, 호주 달러화, 캐나다 달러화, 스위스 프랑화, 위안화, 홍콩 달러화, 뉴질랜드 달러화, 스웨덴 크로나화에 이어 글로벌 통화중 12번째 큰 일평균 거래량을 보이는 것으로 조사되었다(BIS, 2019).

참고문헌

금융감독원, 2021. 12,『외국인 투자제도에 대한 안내서』.

금융위원회, 2016. 1. 29, 외국인 투자자가 우리 주식시장에서 손쉽게 거래할 수 있도록 “외국인 통합계좌(omnibus account)”를 도입하겠습니다, 보도자료.

김보영, 2022, MSCI 지수 추종 운용자산 규모 현황과 영향, 자본시장연구원『 자본시장포커스』2022-05호.

삼성증권, 2021. 11,『MSCI 지수 설명서 ver2.0』, 삼성증권 Quantitative Issue.

한국은행, 2016. 1,『한국의 외환제도와 외환시장』.

한국경제연구원, 2021. 5. 4, 한국증시 MSCI 선진시장 편입 시 최대 27.5% 상승 가능!, 보도자료.

KB증권, 2022. 2,『MSCI 선진지수 편입: 거쳐야 할 관문은 ‘공매도 전면 재개’』, KB Research.

NH투자증권, 2022. 2,『MSCI 선진시장지수 편입가능성과 편입 시 영향』, NH투자전략 리서치리포트.

BIS, 2019, Triennial Central Bank Survey of Foreign Exchange and Over-thecounter(OTC) Derivatives Markets in 2019.

Financial Times, 2022. 2. 22, MSCI needs to add Israel to its Europe index.

FTSE Russell, 2022. 2, FTSE Developed ex US Index factsheet.

Goldman Sachs, 2022. 2, Korea: What if? Strong upside from potential MSCI DM reclassification and narrowing of valuation discount, Portfolio Strategy Research.

MSCI, 2000. 7. 31, Status of MSCI Greece, Egypt and Morocco Indices to change, MSCI Press Releases.

MSCI, 2009. 6. 15, MSCI Announces Market Classification Decisions, MSCI Press Releases.

MSCI, 2021. 6a, MSCI 2021 Market Classification Review, MSCI Press Releases.

MSCI, 2021. 6b, MSCI Global Market Accessibility Review.

MSCI, 2021. 6c, MSCI Market Classification Framework.

MSCI, 2021. 12a, MSCI ACWI Index(USD) factsheet.

MSCI, 2021. 12b, MSCI Emerging Market Index (USD) factsheet.

MSCI, 2021. 12c, MSCI AC Asia Index (USD) factsheet.

FTSE Russell www.ftserussell.com

MSCI www.msci.com