Find out more about our latest publications

A Feasibility Study of Introducing the Silicon Valley Bank Model to Korea

Issue Papers 22-11 Jul. 12, 2022

- Research Topic Financial Services Industry

- Page 21

Amid the rapid growth of the venture debt market in advanced economies including the US and Europe, venture debt plays an important role in funding the scale-up of mid- and late-stage companies. The global venture debt market has been led by Silicon Valley Bank (SVB) Financial Group founded in 1983 in the US. Against this backdrop, this article intends to conduct an in-depth analysis of the business model of SVB Financial Group and study the feasibility of introducing the business model to Korea, aiming for enhancing the qualitative competencies of Korea’s startup ecosystem.

SVB Financial Group has adopted a growth strategy under which it has forged strategic alliances with angel investors, venture capitalists and private funds in the form of equity investment and loans and offered loans only to companies eligible for equity investment by such investors. With this strategy, SVB’s venture debt business has prospered by forming a partnership with the startup ecosystem. As part of its strategy, SVB Financial Group has provided financing support tailored for the life cycle of startups. First, it classifies startups by the size of sales and arranges a nurturing service and seed funding for early-stage companies and follow-up equity investment and venture debt for those in the mid- and late-stages. Also notable is its differentiated risk control plan under which SVB offers a higher interest rate loan in smaller volume to earlier-stage companies with a smaller size of sales by setting up a credit limit of $50 million. Despite its short history, SVB Financial Group has been on a par with global financial services firms, on the back of its distinct business model and the rapid growth of the US startup ecosystem.

With the launch of the new government, some have argued that Korea should actively embrace the business model of SVB Financial Group to create a higher-quality startup supporting ecosystem. Building upon SVB’s model, private financial services firms need to form a financial partnership with the startup ecosystem through a nurturing service for non-listed startups, equity investment, venture debt, and company analysis. However, their efforts may not be enough for the SVB model to take hold in Korea, probably due to the discrepancy in the startup ecosystem between Korea and the US. In Korea, innovative firms are highly dependent on government-sponsored financing, such as credit guarantee, and IP finance and the secondary market have not been facilitated. For the successful introduction of SVB’s model, financial authorities should gradually reduce startups’ reliance on government-sponsored financing and cultivate various venture investment schemes to encourage the private sector to supply more risk capital. Furthermore, it is necessary to facilitate IP finance, permit the issuance of independent warrants that meet certain requirements, and reform sales-related regulations to ensure that the secondary market and the high-yield corporate bond market perform well in Korea.

SVB Financial Group has adopted a growth strategy under which it has forged strategic alliances with angel investors, venture capitalists and private funds in the form of equity investment and loans and offered loans only to companies eligible for equity investment by such investors. With this strategy, SVB’s venture debt business has prospered by forming a partnership with the startup ecosystem. As part of its strategy, SVB Financial Group has provided financing support tailored for the life cycle of startups. First, it classifies startups by the size of sales and arranges a nurturing service and seed funding for early-stage companies and follow-up equity investment and venture debt for those in the mid- and late-stages. Also notable is its differentiated risk control plan under which SVB offers a higher interest rate loan in smaller volume to earlier-stage companies with a smaller size of sales by setting up a credit limit of $50 million. Despite its short history, SVB Financial Group has been on a par with global financial services firms, on the back of its distinct business model and the rapid growth of the US startup ecosystem.

With the launch of the new government, some have argued that Korea should actively embrace the business model of SVB Financial Group to create a higher-quality startup supporting ecosystem. Building upon SVB’s model, private financial services firms need to form a financial partnership with the startup ecosystem through a nurturing service for non-listed startups, equity investment, venture debt, and company analysis. However, their efforts may not be enough for the SVB model to take hold in Korea, probably due to the discrepancy in the startup ecosystem between Korea and the US. In Korea, innovative firms are highly dependent on government-sponsored financing, such as credit guarantee, and IP finance and the secondary market have not been facilitated. For the successful introduction of SVB’s model, financial authorities should gradually reduce startups’ reliance on government-sponsored financing and cultivate various venture investment schemes to encourage the private sector to supply more risk capital. Furthermore, it is necessary to facilitate IP finance, permit the issuance of independent warrants that meet certain requirements, and reform sales-related regulations to ensure that the secondary market and the high-yield corporate bond market perform well in Korea.

Ⅰ. 서론

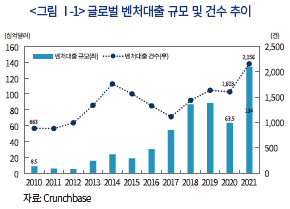

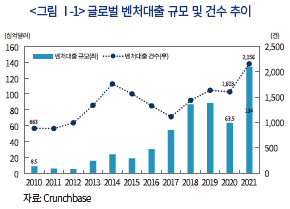

한국 벤처기업들은 우수한 기술을 보유하더라도 중기ㆍ후기에 자금 부족 등의 이유로 사업화 단계까지 어려움을 겪는 이른바 죽음의 계곡(death valley)에 직면한 사례가 많다. 반면 미국, 유럽 등 주요 국가에서는 글로벌 금융위기 이후 벤처대출(venture debt) 시장이 빠르게 성장하면서 벤처기업 중기·후기에 필요한 스케일업(scale-up) 자금을 원활히 공급하고 있다. 2021년말 기준 글로벌 벤처대출 규모는 1,340억달러(약 150조원) 규모로 글로벌 벤처투자 규모1)의 약 20~30% 내외를 차지하고 있으며, 2010년말 이후 연평균 30% 이상의 성장세를 기록하고 있다(<그림 Ⅰ-1>). 벤처대출 시장의 발전으로 벤처기업 창업가는 지분 희석에 따른 경영권 위협 없이 대규모 스케일업 자금을 빌릴 수 있으며, 벤처대출을 공급하는 금융회사는 일반적인 은행대출보다 높은 순이자마진(Net Interest Margin: NIM) 수익률을 기대할 수 있는 장점이 있다.

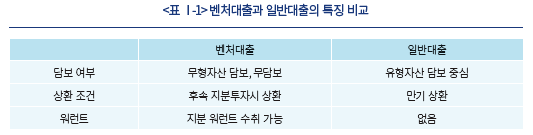

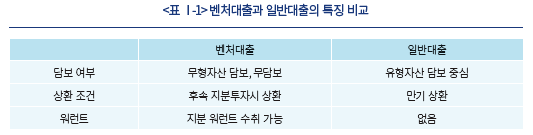

벤처대출은 일반 은행대출과는 세 가지 측면에서 구별되는 특징을 가진다.2) 첫째, 일반 은행대출은 기업이 보유한 유형자산을 담보로 대출을 수행하지만 벤처대출은 벤처기업이 보유한 특허, 영업권, 미래 현금흐름 등을 담보로 대출을 제공하거나 담보 없이 대출을 제공하기도 한다. 즉, 벤처대출은 일반 은행대출보다 부실 위험이 크며 대출 이자율도 높게 측정되는 것이 일반적이다. 둘째, 벤처대출은 은행대출과 상환 조건에서 차이가 난다. 벤처대출은 통상 후속 지분투자를 받을 때 신규 투자금액의 일부를 벤처대출의 상환금액으로 사용하도록 명시된 경우가 많아, 은행대출과 달리 대출 만기일을 하나의 날짜로 고정하기 어렵고 후속 지분투자를 받는 즉시 대출을 상환하는 경우가 많다. 셋째, 벤처대출은 은행대출보다 부실 위험이 크기 때문에 벤처대출을 공급하는 투자은행(Investment Bank: IB), 사모펀드에게 인센티브의 일환으로 벤처기업 지분 워런트(warrant)를 제공하는 경우가 많다. 벤처기업 워런트를 보유한 금융회사는 해당 벤처기업이 M&A나 IPO를 수행할 때 지분가치 매각을 통해 상당한 수익을 실현할 수 있는 장점이 있으며 벤처기업 창업가는 신주 발행과 달리 지분희석이 크지 않아 안정적으로 경영권을 유지할 수 있는 장점이 있다.

글로벌 벤처대출 시장의 발전은 1983년 설립된 미국 실리콘밸리은행그룹(Silicon Valley Bank Group: SVB)이 선도한 것으로 알려져 있다. 실리콘밸리은행그룹(이하 SVB 그룹)은 설립 초기부터 실리콘밸리 지역 내 벤처회사 및 벤처회사 임직원들이 맡긴 예금을 기초로 초기 혁신벤처기업에게 대출 형태의 자금공급을 수행해왔다. SVB 그룹은 젊고 성장성이 높은 벤처기업에게는 자회사인 SVB 캐피탈 또는 전략적 제휴 관계에 있는 벤처캐피탈, 사모펀드 등과 공동으로 지분투자를 수행하며, 성숙기에 접어든 중ㆍ후기 벤처기업에게는 지분투자를 줄이고 벤처대출을 늘리는 등 생애주기 맞춤형 포트폴리오 자금공급을 통해 미국 벤처기업 생태계에서 모험자금 공급을 선도해왔다. SVB 그룹은 1983년 설립 이래 최근까지 3만개 이상의 벤처기업에게 직ㆍ간접적으로 자금공급을 수행하였으며, 2021년말 기준 미국 전체 ICT 및 바이오 섹터 벤처기업 중 55%가 SVB 그룹의 고객으로 알려져 있다.3) SVB 그룹 사업모델을 벤치마크하여 골드만삭스, 웰스파고, 코메리카은행, 스퀘어1 은행 등 대형 금융회사들도 벤처대출 사업에 참여하고 있으며 라이터 캐피탈(Lighter Capital), 트리니티 캐피탈(Trinity Capital) 등 대형 사모펀드회사들도 벤처대출펀드를 운영하는 것으로 알려져 있다.4)

최근 신정부 출범을 계기로 벤처기업 생태계의 질적 개선을 위해 벤처대출 활성화 등 SVB 그룹의 사업모델을 적극적으로 검토해야 한다는 의견이 제기되고 있다. 실제로 2022년 들어 일부 금융회사는 SVB식 벤처대출 서비스 출시 계획을 밝히는 등 SVB 사업모델에 대한 관심이 크게 늘었다. 다만 SVB 그룹 사업모델은 미국 실리콘밸리 지역 내 벤처기업 생태계에서 자생적으로 발전해온 이유로 신용보증 등 정책금융 의존도가 높은 한국 벤처기업 생태계에서 SVB 그룹 사업모델이 성공하는 것은 한계가 있을 수 있다. 이에 본 연구에서는 미국 SVB 그룹의 사업모델을 심도 있게 분석하고 SVB 그룹 사업모델의 국내 도입 가능성을 진단하고자 한다. Ⅱ장에서는 SVB 그룹의 발전 역사와 주요 사업모델을 살펴본다. Ⅲ장에서는 한국 벤처기업 생태계의 부채성 자금공급 현황을 진단하고 SVB 그룹 사업모델의 국내 도입 가능성을 진단한다. Ⅳ장에서는 한국에서 SVB 그룹 사업모델이 정착할 수 있는 정책 방향을 제시한다.

Ⅱ. SVB 그룹의 사업모델

SVB 그룹은 1983년 설립 초기부터 벤처기업 금융중개 및 벤처지분 직접투자 등을 핵심 사업모델로 두고 있다는 점에서 미국 은행지주회사들과는 차별화된 사업전략을 구사한다고 볼 수 있다. SVB 그룹은 미국 금융지주그룹에 비해 짧은 역사에도 불구하고 자산규모, 수익성 등 다양한 측면에서 미국 금융회사를 대표하는 금융지주그룹으로 발돋움했다. 무엇보다 실리콘밸리 지역 벤처기업을 대상으로 차별화된 모험자본을 공급하고 미국 벤처기업 생태계의 성장과 함께 발전해왔다는 점에서 상업은행 중심의 금융지주그룹이나 골드만삭스, 모건스탠리 등 주요 투자은행 기반 금융지주그룹과도 구별된다. 본 절에서는 혁신적인 사업모델을 발전시켜온 SVB 그룹의 발전 역사와 주요 사업모델, 그리고 SVB 그룹 사업모델의 성공 요인을 분석하고자 한다.

1. SVB 그룹 개요

SVB 그룹의 전신은 실리콘밸리은행으로, 1983년 웰스파고 은행원이었던 Roger Smith와 Bill Biggerstaff, 그리고 미국 스탠포드 교수로 재직했던 Robert Medearirs가 실리콘밸리 지역 내 혁신 벤처기업들을 발굴하고 육성하는 것을 목표로 캘리포니아 주 은행으로 인가를 받아 설립되었다.5) 당시 SVB 그룹은 벤처기업 및 벤처기업 임직원의 예ㆍ적금을 받아 유망 벤처기업에게 대출해주는 업무를 주로 수행해왔다. SVB 그룹은 1985년 실리콘밸리 팔로알토 지역에 첫 번째 지점을 개설한 이후 1980년대 M&A와 나스닥 IPO를 통해 미국 서부로 지점을 확장했으며 2000년대 중반 이후 인도(2004년), 영국(2004년), 중국(2005년), 이스라엘(2005년) 등 글로벌 시장으로 진출했다. 2008년 글로벌 금융위기 당시 보유자산의 일시적 부실로 미국 재무부로부터 2.35억달러의 구제금융 지원을 받았으나, 2009년말 즉시 채무 상환을 완료했으며 2010년 이후에는 미국 전역의 벤처기업들을 대상으로 벤처대출과 지분투자 등을 성공적으로 수행하며 괄목할만한 성장을 이루었다. 2012년에는 중국 상해포동발전은행과 조인트 벤처 형태로 중국내 SVB 은행을 설립했으며, 아일랜드(2016년), 독일(2018년), 덴마크(2019년), 토론토(2019년), 벤쿠버(2020년) 등으로 글로벌 지점을 넓혀가고 있다.

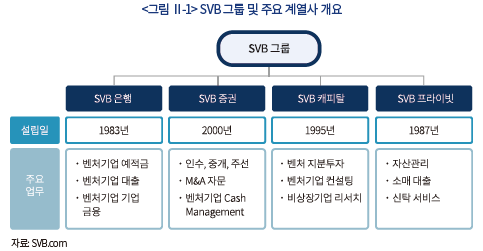

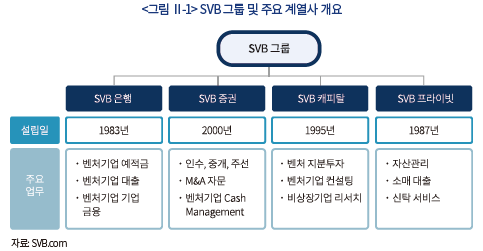

SVB 그룹은 미국 은행지주회사법에 근거한 금융지주회사로 연방준비제도이사회(Federal Reserve Board: FRB)에 의해 감독을 받으며 SVB 은행, SVB 증권, SVB 캐피탈, SVB 프라이빗(Private) 등을 주요 자회사로 두고 있다(<그림 Ⅱ-1> 참조). SVB 은행은 캘리포니아주 상업은행 라이센스를 보유하고 있으며 실리콘밸리 지역 내 기업과 임직원으로부터 예ㆍ적금을 수취 받아 유망 벤처기업에게 대출해주는 업무를 주로 수행하고 있다. SVB 은행은 벤처기업을 대상으로 여신과 수신 업무를 수행하는 것 외에 법인결제, 외환 업무, 종합자금관리 업무 등을 제공하고 있다. SVB 증권은 2022년 2월 SVB Leerink에서 SVB 증권으로 사명을 변경했는데 SEC(Securities and Exchange Commission)로부터 브로커-딜러 라이센스를 취득하여 벤처기업 주식, 채권의 인수 및 중개, IPOㆍM&A 주선, M&A 자문 등 다양한 투자은행 업무를 수행하고 있다. 그 외에 SVB 캐피탈은 미국 투자회사법 라이센스 등을 취득하여 벤처캐피탈 지분투자 및 소매금융 서비스를 제공하고 있으며, 비상장기업에 대한 리서치 업무를 수행하고 있다. SVB 프라이빗의 전신은 1987년 설립된 보스톤 프라이빗으로, 현재 미국 투자자문사 및 소매금융 라이센스 보유를 통해 고액 자산가를 대상으로 자산관리 서비스뿐 아니라 소매 대출 서비스를 제공하고 있다.

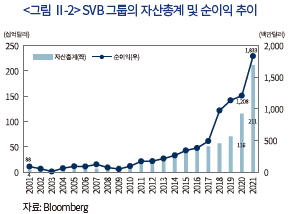

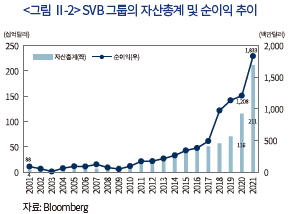

2021년말 SVB 그룹의 자산총계는 2,115억달러(약 262조원)로 FRB로부터 규율을 받는 미국 은행 소유 금융그룹 중에서 13번째로 큰 규모를 기록하고 있다.6) 2021년 6월말 기준 실리콘밸리 지역 내 예ㆍ적금 규모 기준으로 SVB 그룹이 622억달러를 기록하며 1위를 차지하고 있으며, 웰스파고(315억달러), 뱅크오브아메리카(240억달러), JP모건(159억달러)이 2~4위를 기록하고 있다. SVB 그룹의 자산총계는 2001년말 42억달러에 불과했으나, 2000년대 이후 미국 벤처기업 생태계의 성장과 더불어 연평균(CAGR) 22%의 높은 성장률을 기록했다(<그림 Ⅱ-2> 참조). 동기간 SVB 그룹의 순이익은 8,800만달러(약 1,100억원)에서 18억 3천만달러(약 2조 3천억원)로 21배나 증가했다. 2021년 기준 도이치뱅크, 노무라 등의 연간 순이익이 각각 28.4억달러, 14.4억달러인 것과 비교하면 SVB 그룹의 순이익(18.3억달러)은 글로벌 IB들의 순이익과 견줄만하다. 과거 SVB 그룹의 자본 효율성과 건전성 지표 또한 우수하다. SVB 그룹의 최근 3년 평균 ROE는 18.2%로 미국 전체 은행들 평균 ROE인 11.9%를 크게 상회한다. 2022년 3월말 SVB 그룹의 Tier1 보통주 비율과 자기자본 비율은 각각 14.9%와 15.4%로 규제 임계수준인 7%와 10.5%를 크게 상회하며 최근 3년간 SVB 그룹의 NPL(Non Performing Loan) 비율은 0.23%로 미국 상업은행 평균(1.0%)을 크게 하회한다. 다만 유럽, 중국 등 미국 외 지역에서의 SVB 그룹 수익성은 높지 않은 것으로 추정된다. SVB 그룹의 연차보고서에 의하면 미국 외 지역에서의 SVB 그룹 고객 자산규모는 전체 SVB 그룹 고객 자산규모의 11.4%에 불과한 것으로 알려져 있다.

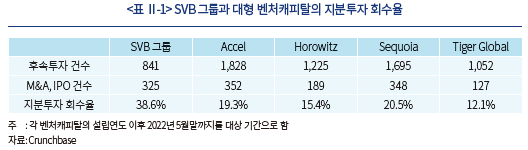

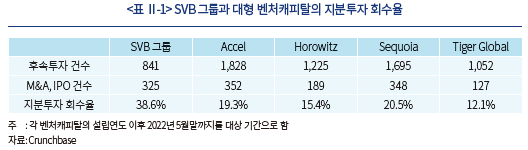

SVB 그룹의 벤처투자 성과도 우수하다. SVB 그룹은 1983년 설립 이후 2021년 말까지 3만개 이상의 벤처기업들에게 직접 또는 간접적으로 자금을 공급했으며 미국 전체 테크 및 바이오ㆍ헬스케어 섹터 벤처기업의 50%를 SVB 그룹의 고객으로 두고 있다.7) SVB 그룹의 자회사인 SVB 은행, SVB 캐피탈 등은 설립 이래 벤처기업 후속 지분투자를 841건 수행했는데8), 이중 38.6%인 325개 벤처기업이 M&A나 IPO를 통해 성공적으로 회수(exit)를 실현했다. 글로벌 벤처캐피탈을 대표하는 Accel, Andreessen Horowitz, Sequoia, Tiger Global 등은 설립 이후 1,000~2,000건의 벤처기업 후속 지분투자를 수행했는데 이들 대형 벤처캐피탈의 회수(exit) 확률은 SVB 그룹의 절반 수준인 10~20%를 기록하고 있다(<표 Ⅱ-1> 참조). SVB 그룹은 벤처기업 여수신 업무를 기반으로 사업을 확장했음에도 불구하고 미국 대형 벤처캐피탈들과 견줄만한 벤처투자 성과를 기록한 것은 주목할 만한 부분이다.

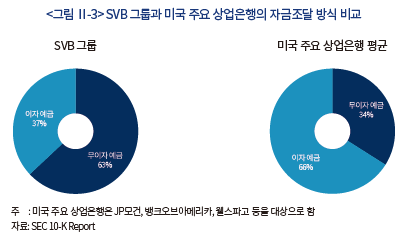

2. SVB 그룹의 주요 사업모델

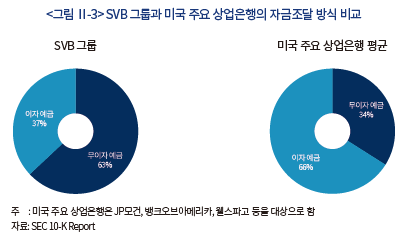

SVB 그룹의 사업모델은 수익 원천별로 순이자마진 수익, 벤처기업 워런트 및 지분투자 수익, 자산관리 수수료 수익, 증권 부문 투자은행 수익 등으로 구분할 수 있다.9) SVB 그룹 내 핵심 자회사인 SVB 은행은 실리콘밸리 지역 벤처기업 및 임직원을 대상으로 예ㆍ적금을 수취 받고 혁신 벤처기업들과 중견 기업에게 무담보 형태로 대출을 제공하며 나파밸리 와이너리 등에게는 부동산 담보대출 등을 제공하고 있다. SVB 그룹이 일반 상업은행과 달리 고위험 여신을 제공하고 있음에도 불구하고 높은 순이자마진을 실현하는 배경에는 전체 자금조달 중에서 이자지급 부담이 낮은 무이자 기반 예금(non-interest bearing deposits) 수취 비중이 63%로 높은데서 그 이유를 찾을 수 있다. JP모건, 웰스파고, 뱅크오브아메리카 등 미국 주요 상업은행들의 이자 기반 예금(interests bearing deposits) 수취 비중이 60~70% 내외이고10), 무이자 기반 예금 수취 비중이 30~40% 내외인 것과 비교하면 SVB 그룹의 무이자 기반 예ㆍ적금 수취 비중은 미국 주요 상업은행보다 약 2배 높다. 이는 SVB 그룹의 경우 예금 고객 중에서 벤처기업 고객 비중이 높고 개인 고객 비중이 낮으며, 개인 고객 중에서는 체크계좌(checking account) 고객 비중이 높은 것과 관련되어 있다.

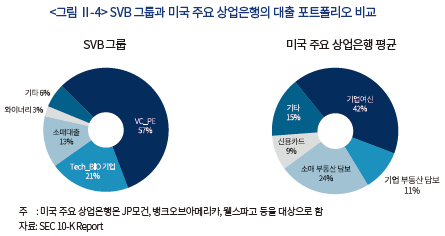

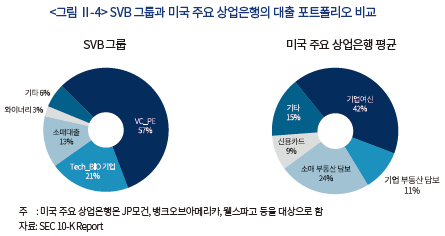

다음으로 2021년말 SVB 그룹의 자산 구성을 살펴보면, 만기보유증권 규모가 982억달러로 전체 자산의 46%를 기록하며 가장 큰 비중을 차지하고 있다. 다음으로 순대출 규모가 658억달러로 자산 총계의 31%를 차지하며 두 번째로 높은 비중을 차지하고 있으며 단기투자상품과 현금성 자산규모가 각각 272억달러와 146억달러로 13%, 7%의 비중을 차지하고 있다. 만기보유증권의 대부분은 MBS 등으로 구성되어 있으며, 순대출은 VC/PE 대출(순대출의 57%), ICT 및 바이오 섹터 벤처기업 대출(21%), 소매 신용 대출(13%), 와이너리 대출(3%) 등으로 구성되어 있다. SVB 그룹 대출의 78%는 벤처기업에게 공급되는 여신으로 미국 주요 상업은행이 대기업 대출, 기업 부동산 담보대출, 개인 부동산 담보대출을 주로 수행하는 것과 구별된다. <그림 Ⅱ-4>에서 볼 수 있듯이, SVB 그룹의 주요 대출은 VC와 PE에게 공급하는 대출과 테크 및 바이오 섹터 벤처기업에게 제공하는 대출로 구성되어 있는 등 벤처기업 생태계에 집중되어 있으나 JP모건, 웰스파고, 뱅크오브아메리카 등 주요 상업은행들은 대기업 여신, 기업 부동산 담보대출, 소매 부동산 담보대출 비중이 전체의 76%를 차지한다.

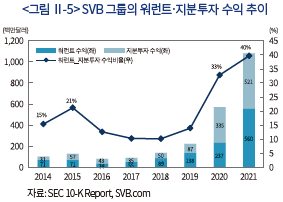

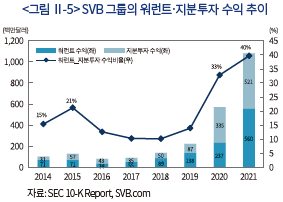

SVB 그룹은 벤처기업 기반 여수신 업무 외에도 핵심 계열사 중 하나인 SVB 캐피탈을 통해 벤처기업 지분투자를 수행하고 있다. 2022년 3월말 기준 SVB 캐피탈이 운용하는 벤처투자펀드 규모는 75억 달러로 SVB 전략적 펀드 등을 운용하고 있으며 재간접펀드 형태로 Accel, Sequoia, Index Ventures 등 대형 벤처캐피탈이 운용하는 벤처펀드에도 지분투자를 수행하고 있다. SVB 캐피탈이 1995년 설립 이후 투자한 벤처펀드들 중에서 600개 이상이 유니콘 기업으로 성장한 것으로 알려져 있다. SVB 캐피탈 외에도 SVB 은행과 SVB 증권도 벤처기업 워런트, 벤처기업 지분투자 등을 수행하며 높은 수익을 실현하고 있다. 2021년말 SVB 그룹이 벤처기업 워런트와 지분투자를 통해 얻은 수익은 각각 5.6억달러, 5.2억달러로 이는 전체 순이익의 40%를 차지한다(<그림 Ⅱ-5>). 2014년말 SVB 그룹의 워런트ㆍ지분투자 수익이 1.02억 달러에 불과했으나 2021년말 워런트ㆍ지분투자 수익은 10.81억 달러로 약 10배 증가하며 SVB 그룹의 전체 수익을 견인하고 있다.11)

SVB 그룹 영업수익에서 세 번째로 큰 비중을 차지하는 것은 고객 자산관리 수수료 수익(core fee income)이다. SVB 그룹의 10-K 보고서에 따르면 SVB의 고객 자산관리 수수료는 부외계정 고객 펀드의 운용 관련 수익, FX 서비스 수익, 고액 자산가들을 대상으로 한 자문 서비스 수익, 신용카드 제반 수수료 수익 등으로 구성된다. 이때 SVB의 부외계정 고객 펀드는 CD, CP 등 다양한 단기금융상품에 투자하는 펀드로 SVB 그룹 전체의 레버리지비율을 높이지 않으면서 수신 기반을 확대하는 역할을 수행한다. 2021년말 부외계정 고객 펀드의 순자산총액은 SVB 그룹 예ㆍ적금 수신 금액(1,480억달러)을 상회한 1,810억달러로 2013년말 이후 연평균 29%의 높은 성장세를 기록하고 있다. 미국 실리콘밸리 벤처기업 생태계의 성장과 더불어 SVB 고객 펀드들이 우수한 투자성과를 실현함에 따라 SVB 그룹의 고객 자산관리 수수료 역시 2013년말 1.8억달러에서 2021년말 7.5억달러로 연평균 20%의 증가세를 기록하고 있다.

SVB 그룹에서 네 번째로 큰 수익을 차지하는 부문은 핵심 계열사 중 하나인 SVB 증권의 투자은행 관련 수익이다. SVB 증권은 실리콘밸리 벤처기업 생태계에서 벤처기업 지분, 채권의 인수(underwriting), M&A와 IPO 등의 주선, M&A 자문 등의 업무를 주로 수행하는데 벤처기업 M&A나 IPO 활동이 활발할수록 투자은행 관련 수익이 증가한다. 2021년 SVB 증권의 투자은행 관련 수익은 5.4억달러로, 2019년 수익(2.5억달러) 대비 2배 이상 증가했는데 이는 코로나19 위기에도 불구하고 미국 벤처기업들의 M&A와 IPO 등이 활발했기 때문으로 판단한다. SVB 증권은 2021년 테크기업 리서치 분석 및 투자은행 업무에 특화된 MoffettNathanson LLC 회사를 인수하여 업무 커버리지를 바이오, 헬스케어, ICT 등으로 확장했으며 미국 대형 IB들과 차별화하여 비상장 벤처기업에 대한 리서치 분석, 인수금융, 스팩, M&A 자문 등에 역량을 집중하고 있다.

3. SVB 그룹 사업모델의 성공 요인

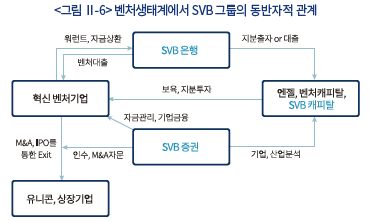

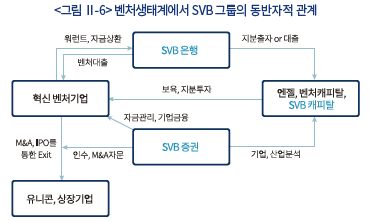

SVB 그룹 사업모델의 주요 성공 요인으로 벤처생태계와의 동반 성장전략을 꼽을 수 있다. 우선 벤처기업 생태계의 초기 단계에서 SVB 그룹은 실리콘밸리 지역 내 엔젤투자자, 벤처캐피탈에게 지분출자 및 대출 등의 형태로 전략적 제휴 관계를 맺고 있다. <그림 Ⅱ-6>에서 볼 수 있듯이, 주요 엔젤투자자, 벤처캐피탈들이 유망 벤처기업들에게 시딩(seeding), 시리즈 A~B 등 지분투자를 수행할 때 이들 엔젤투자자와 벤처캐피탈이 필요한 자금을 사전 지분출자 또는 사후 대출 등의 형태로 공급한다. 즉, 엔젤투자자와 벤처캐피탈이 벤처투자에 성공할수록 SVB 그룹의 수익도 증가한다. 반대로 이들 엔젤투자자와 벤처캐피탈의 투자 성과가 부진할수록 SVB 그룹의 위험도 증가하는 등 SVB 그룹의 수익과 위험 모두 벤처기업 생태계 구성원들과 공유하는 전략을 취하고 있다. SVB 그룹은 100% 자회사인 SVB 캐피탈을 통해 벤처기업에 대한 보육, 자금공급, 마케팅 지원 등의 역할도 수행하고 있다. SVB 캐피탈은 액셀러레이터 역할을 수행하며 재무 및 법률 상담, 쇼케이스 행사 지원, 보고서 작성 등 초기 벤처기업을 대상으로 다양한 사업촉진 서비스를 제공한다.

벤처기업 생태계의 중기 이후 단계에서도 SVB 그룹은 벤처기업 생태계와 긴밀한 동반자적 관계를 형성하고 있다. 벤처기업이 SVB 그룹과 엔젤투자자, 벤처투자자를 통해 직접 또는 간접적으로 지분투자를 받은 후에도 스케일업을 위해 대규모 자금이 필요한 경우가 많다. 이때 SVB 은행은 이미 성공한 벤처기업과 해당 벤처기업의 임직원을 통해 예금, 부외펀드 등을 통해 모은 자금을 기초로 스케일업에 필요한 벤처대출을 제공한다. 벤처대출을 필요로 하는 벤처기업들은 담보로 제공할 수 있는 유형자산이 부족하기 때문에 후속 지분투자를 받는 즉시 벤처대출을 상환하는 조건으로 자금을 빌리거나 SVB 은행에게 벤처기업 지분 워런트를 제공함으로써 자금을 빌릴 수 있다. 벤처기업 생태계의 후기 단계에서도 SVB 그룹은 벤처기업, 사모펀드, 전문투자자들과 긴밀한 동반자적 관계를 형성하고 있다. SVB 증권은 현금성 자산관리, 외환 업무, 단기 자금 대출, 구조화금융 등 벤처기업이 필요로 하는 다양한 금융서비스를 제공하고 있다. 벤처기업 임직원들에게는 예ㆍ적금 수신, MMF, 맞춤형 사모펀드 등 종합자산관리 서비스를 제공하고 있다. 더불어 벤처기업이 M&A나 IPO 등을 수행할 때 인수, M&A 자문 등을 적극적으로 수행함으로써 벤처기업의 회수를 원활히 돕는 역할을 수행한다.

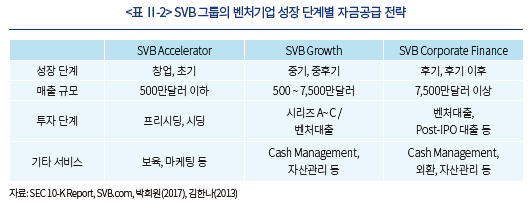

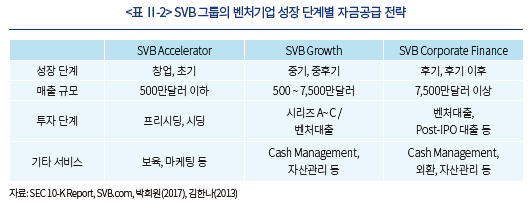

SVB 그룹 사업모델의 두 번째 성공 요인은 벤처기업 생애주기별 맞춤형 자금공급 전략에서 찾을 수 있다.12) SVB 그룹은 고객 대상 벤처기업을 업력, 매출규모 등에 따라 SVB Accelerator, SVB Growth, SVB Corporate Finance로 구분하여 차별화된 금융서비스를 제공해왔다. 우선 SVB Accelerator는 연매출 규모가 5백만달러(약 60억원) 이하인 창업 초기 벤처기업으로 구분하여 이들이 우수한 기술력과 아이디어를 상업화할 수 있도록 엑셀러레이터 업무를 제공하며 엔젤투자자 및 벤처캐피탈 등과 협업하여 지분(equity) 형태의 자금공급 서비스를 제공하고 있다(이하 <표 Ⅱ-2> 참조). 구체적으로 SVB 그룹의 자회사인 SVB 캐피탈이 SVB Accelerator를 대상으로 보육, 초기자금 지원, 마케팅 서비스 등을 제공하고 있다. 더불어 SVB 은행이 지분출자 또는 대출 형태로 협력 관계를 맺은 실리콘밸리 지역 내 엔젤투자자를 통해 프리시딩(pre-seeding), 시딩(seeding) 투자 등을 제공하고 있다.

다음으로 SVB 그룹은 벤처기업 성장 단계 중 중기 또는 후기에 놓인 SVB Growth 기업을 대상으로 후속 지분투자 또는 벤처대출 서비스를 제공하고 있다. SVB Growth 기업은 매출규모가 5백만달러(약 60억원) 이상이고 7천 5백만달러(약 900억원) 이하인 벤처기업이 대상으로, 이들이 죽음의 계곡(death valley)을 수월하게 넘을 수 있도록 자회사인 SVB 캐피탈이나 SVB 그룹과 협력 관계에 있는 벤처캐피탈을 통해 시리즈 A~C 등 후속 지분투자를 제공한다. 특히 중ㆍ후기 단계에 놓인 벤처기업들이 스케일업을 위해 대규모 자금이 필요한 경우 SVB 은행을 통해 벤처대출을 제공한다. 즉 SVB 그룹은 벤처기업이 성장기, 성숙기 등에 진입할수록 주식 형태의 직ㆍ간접 지분투자는 줄이고 벤처대출 형태로 자금을 공급하는 전략을 수행하고 있다. 마지막으로 매출규모가 7천 5백만달러 이상이고, 성숙기에 접어든 SVB Corporate Finance 기업을 대상으로 맞춤형 종합금융서비스를 제공하고 있다. SVB Corporate Finance 기업들이 M&A나 IPO를 수행할 때 인수금융, M&A 자문 서비스 등을 제공하며, 상장기업에 대해서는 주식 담보대출, 무형자산 담보대출 등도 제공하고 있다. 이들 SVB Corporate Finance 기업들 및 해당 기업 임직원을 대상으로 현금성 자산관리 서비스, 외환 서비스, 종합자산관리, 소매 자산관리 등 종합 투자은행 서비스를 제공하고 있다.

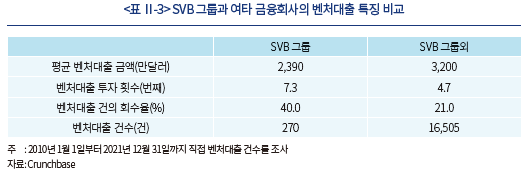

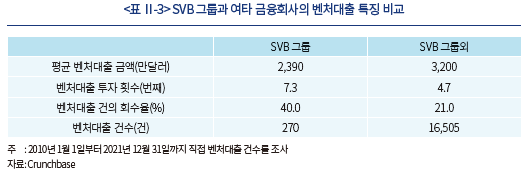

SVB 그룹이 부도 위험이 큰 벤처기업 생태계를 대상으로 여신업무와 지분투자 업무를 수행하고 있음에도 불구하고 미국 내 상업은행과 투자은행 대비 우수한 건전성 지표를 기록한 데에는 차별화된 리스크관리 전략을 수행해왔기 때문이다. 우선 SVB 그룹은 대형 벤처캐피탈이나 자회사인 SVB 캐피탈로부터 지분투자를 받은 기업에 대해 벤처기업 대출 등 기업여신을 제공한다.13) SVB 그룹은 실리콘밸리 지역 내 다수의 벤처캐피탈들과 지분출자, 대출 등을 제공하며 협력적 관계를 형성해왔기 때문에 벤처기업에 대한 간접적 지분투자자로서 벤처기업에 대한 모니터링을 통해 정보비대칭을 최소화할 수 있다. 이와 같은 직접금융과 간접금융의 장점을 기초로, SVB 그룹은 벤처기업의 업력, 기술력, 매출 성장성, 담보가치 등에 따라 대출 한도와 대출 이자율을 차등화하고 있다. 구체적으로 벤처기업의 업력이 짧고 매출규모가 작을수록 대출 규모를 줄이거나 대출 이자율을 높이는 전략을 구사한다. 실제 SVB 그룹이 수행한 벤처대출의 평균 투자 횟수는 7.3번째로 일반 벤처대출의 평균 투자 횟수(4.7번째)보다 높은데(이하 <표 Ⅱ-3> 참조), 이는 SVB 그룹이 타 금융회사에 비해 업력이 오래되고 다수의 지분투자를 받은 벤처기업을 대상으로 벤처대출을 수행한 것으로 추론할 수 있다.

SVB 그룹이 벤처대출에 대한 집중위험을 최소화하는 전략을 구사해온 점도 우수한 건전성 지표를 실현하는데 기여를 했다. SVB 그룹은 특정 벤처기업에 대한 대출 한도를 5천만달러(약 600억원)로 제한하고 있으며, 우수한 담보를 보유한 경우 등에 한해서만 5천만달러 이상으로 대출을 허용하고 있다. 2010년초부터 2021년말까지 수행된 16,775건의 벤처대출 평균금액은 3천2백만달러이나 SVB 그룹이 수행한 벤처대출의 평균금액은 2천 4백만달러로 SVB 그룹의 대출 금액이 30% 이상 작다. 더불어 SVB 그룹은 산업 섹터를 분산하여 벤처기업 대출을 수행함으로써 집중위험을 줄이고 있다. SVB 그룹은 VC와 PE가 운용하는 글로벌 뱅킹펀드에 대출해주는 비중이 57%로 대출 포트폴리오에서 가장 큰 비중을 차지하고 있는데, 해당 글로벌 뱅킹펀드는 테크(37%), 생명과학(12%), 소비재(7%), 부동산(7%), 제조업(5%), 핀테크(4%) 등 섹터가 잘 분산되어 있다. SVB 그룹이 우수한 신용리스크 심사 인력을 보유한 점도 SVB 그룹의 차별화된 리스크관리 능력에 크게 기여한 요인이다. SVB 그룹은 1983년 설립 초기부터 벤처기업 여신평가 경험을 보유한 인력을 대거 채용하여 고위험 벤처기업 여신평가 역량을 갖추어 나갔다. 벤처기업의 채무불이행시 벤처기업이 보유한 무형자산을 회수할 수 있는 능력을 갖춘 것도 차별화된 장점으로 꼽을 수 있다.

Ⅲ. SVB 그룹 모델의 한국 도입 가능성 진단

SVB 그룹은 대형 금융회사와 달리 벤처기업에 특화된 차별적인 금융서비스를 제공하며 단기간 빠른 성장세를 실현하였기에 한국에서도 혁신벤처기업 육성을 위해 SVB 사업모델을 신속히 도입해야 한다는 의견이 있다. 그러나 한국 벤처기업 생태계는 정책금융 의존도가 높고 IP(Intellectual Property)금융이나 세컨더리 시장이 활성화되어 있지 않은 점 등 미국 실리콘밸리 지역 내 벤처기업 생태계와 많은 부분에서 차이가 나기 때문에 SVB 그룹 사업모델이 성공하는데 다소 어려움이 따를 것으로 예상한다. 이에 본 절에서는 한국 벤처기업의 자금공급 현황을 살펴보고 SVB 그룹 사업모델의 국내 도입 가능성을 진단하고자 한다.

1. 한국 벤처기업의 자금공급 현황

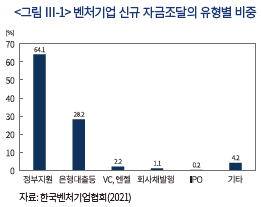

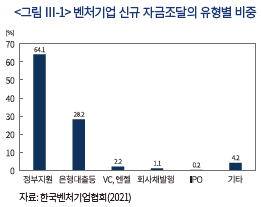

한국 벤처투자 시장은 양적 측면에서 견조한 성장세를 기록하고 있으나14), 질적 측면에서는 다소 부족한 점이 많다. 우선 벤처기업 창업 초기에는 정책자금 의존도가 높고 민간의 모험자본 공급이 상대적으로 부족하다.15) 한국벤처기업협회가 3만 여개 중소벤처기업에 대해 설문ㆍ조사를 수행한 바에 따르면, 2020년 신규로 자금을 조달한 3만 5천개 벤처기업으로부터 자금조달 유형을 조사한 결과, 정부의 융자ㆍ보증 등 정책지원금 형태가 전체의 64.1%로 가장 많은 비중을 차지하고 있으며 담보에 기반한 은행대출 비중이 28.2%로 두 번째로 높은 비중을 차지하고 있다. 반면 모험자본으로 분류할 수 있는 벤처캐피탈, 엔젤투자자로부터 조달받는 비중은 2.2%이며 회사채 발행 비중은 1.1%에 불과하다(<그림 Ⅲ-1> 참조). 미국, 유럽 등에서 빠르게 증가하고 있는 벤처대출은 독립형 워런트의 발행 제약 등의 이유로 한국에서는 거의 활용되지 않는 것으로 알려져 있다.16) 한편 벤처기업들이 금융기관을 통해 자금조달을 수행하기 어려운 이유로, 은행의 대출한도가 부족하거나(35.9%) 과도한 담보를 요구하거나(20.3%) 신용대출이 부족한 점(13.2%) 그리고 대출관련 구비서류 및 절차가 복잡한 점(11.9%) 등으로 나타나, 상당수 벤처기업들이 은행 담보대출 중심의 자금조달에도 비교적 큰 어려움을 느끼는 것으로 보인다.

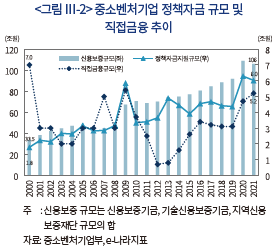

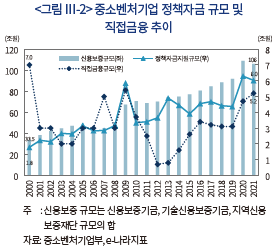

중소벤처기업에 대한 정책자금 규모는 꾸준히 증가하는 반면, 회사채 발행 등 직접금융 규모는 정체 또는 감소하는 모습을 보이고 있다. 정부가 중소벤처기업에게 정책자금으로 공급하는 규모는 2000년 2.2조원에서 2021년 6조원으로 2.7배 증가했으며 신용보증기금, 기술신용보증기금 등 신용보증 잔액17)도 동기간 33.5조원에서 106조원으로 3.2배 증가했다. 반면 중소기업이 회사채 등 직접금융을 통해 자금을 조달하는 규모는 최근 소폭 증가하고 있으나 2000년과 2021년을 비교하면 7조원에서 5.2조원으로 다소 둔화되고 있다. 동기간 중소기업이 은행을 통해 대출을 받는 간접금융 규모는 146조원(’00년)에서 886조원(’21년)으로 6.1배 증가한 것을 고려하면 중소벤처기업은 정책보증 프로그램 등에 힘입어 은행 담보대출의 의존도가 절대적으로 높은 것으로 이해할 수 있다. 중소벤처기업에 대한 정책금융이 확대되면 다수의 벤처기업들에게 낮은 이자로 자금을 공급할 수 있는 장점이 있으나 오랜 기간 수익성이 악화되어 회생 가능성이 낮은 일부 벤처기업에게 대규모 자금이 공급되어 자원배분의 효율성을 저해하는 문제를 야기할 수 있다.

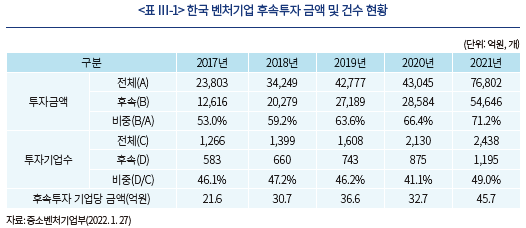

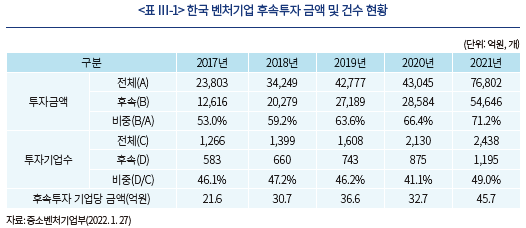

벤처기업 중기ㆍ후기에는 미국, 유럽 등과 달리 후속투자 비중이 낮아 한국 벤처기업들 중 상당수는 죽음의 계곡(death valley)을 넘는데 어려움을 겪고 있다. 2020년 중소벤처기업부 발표에 따르면 한국 창업기업의 5년 생존율은 29%로 OECD 국가 창업기업의 5년 생존율인 43%에 비해 크게 저조하다. 벤처기업이 기술 개발에 성공하여 고객을 확보하고 본격적인 매출 성장을 실현하려면 중기ㆍ후기 단계에서 대규모 스케일업 투자가 필요한데 한국의 경우 벤처대출, 스케일업 전용펀드, 공모형 비상장기업 투자기구 등 민간 영역의 스케일업 자금공급 수단이 매우 부족하다.18) 한국 벤처기업이 초기투자를 받은 이후 후속투자를 받는 비중은 최근 5년간 46~49%대를 기록하고 있는 반면, 미국ㆍ유럽 등은 벤처기업 후속투자 비중이 90%대로 알려져 있다(<표 Ⅲ-1> 참조). 다행히 최근 대형 벤처캐피탈의 후속투자가 늘면서 한국 벤처기업 후속투자 규모는 2017년 1.26조원에서 2021년 5.46조원으로 증가하고 있으나 글로벌 시장의 후속투자 규모와 비교하면 한국의 스케일업 규모는 여전히 부족하다. 한편 벤처기업 후기에는 벤처지분 세컨더리 시장(secondary market)과 고수익 회사채 시장이 활성화되지 않아 창업가와 벤처캐피탈이 투자지분을 회수하는데 어려움이 따르는 문제를 가진다.

2. SVB 그룹 모델의 한국 도입 가능성 진단

SVB 그룹은 짧은 역사에도 불구하고 실리콘밸리 지역 내 벤처기업 생태계와의 동반자적 금융관계 형성 전략, 벤처기업 생애주기 맞춤형 자금공급 전략, 혁신 벤처산업에 대한 차별화된 리스크관리 전략 등에 힘입어 글로벌 대형 금융지주회사들과 견줄만한 성과를 실현하고 있다. 코로나19 이후 ICT와 바이오 분야의 벤처기업이 괄목할만한 매출 성장과 수익성을 실현한 점도 SVB 그룹 사업모델의 성공 요인으로 꼽을 수 있다. 이에, 한국 금융회사들은 벤처기업 생태계의 활성화를 목표로 SVB 그룹 사업모델의 도입 계획을 밝힌 바가 있다. 기술보증기금, 신용보증기금 등 정책금융기관들도 보증연계투자19), 투자옵션부보증20) 등 SVB 그룹의 사업모델을 벤치마크한 투자ㆍ융자 결합 금융서비스를 제공해왔다. 2021년초 중소벤처기업부는 SVB식 투자ㆍ융자 결합 금융 도입을 추진하기 위해 투자조건부융자 제도21)를 도입하고 투자옵션부보증 제도를 확대하기로 발표하기도 했다.22)

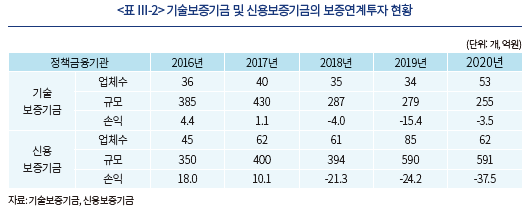

아쉽게도 SVB식 사업모델과 유사한 보증연계투자, 투자옵션부보증 등은 활성화가 미진하며 해당 투자ㆍ융자 복합 프로그램을 제공한 정책금융기관들도 일부 손실을 기록한 것으로 알려져 있다. 실제 2016~2020년 동안 기술보증기금과 신용보증기금이 수행한 보증연계투자규모는 두 기관을 합쳐서 연간 약 100여개 기업에 대해 700~900억원에 불과하며 최근 일부 정책금융기관의 경우 보증연계투자의 규모는 감소하고 있다(<표 Ⅲ-2> 참조). 한국의 보증연계투자규모는 1개 업체당 약 5~10억원 내외로, 글로벌 벤처대출의 평균금액(약 300~500억원 내외)23)과 비교하면 규모가 작다. 그뿐 아니라 기술보증기금과 신용보증기금 모두 보증연계투자 부문에서 손실을 기록하고 있으며 일부 정책금융기관의 경우 보증연계투자 부문의 손실이 확대되고 있다. 민간 금융회사들 역시 최근 SVB식 사업모델의 도입 계획을 밝힌 바가 있으나 SVB식 벤처대출, 투자ㆍ융자 결합 금융 프로그램 등은 한국 벤처기업 생태계에서 성공하는데 많은 제약이 따를 것으로 판단한다.

한국에서 SVB식 사업모델을 도입하는데 법적 장애 요인은 크지 않으나, 해당 SVB식 사업모델이 한국에서 당장 성공하기에는 어려울 것으로 예상한다. 여기에는 무엇보다 한국 벤처기업 생태계에서는 미국과 다르게 낮은 이자로 대출해주는 정책금융 비중이 매우 큰 점을 주된 이유로 꼽을 수 있다. 앞 절에서 살펴보았듯이 국내 벤처기업들은 정책금융기관의 보증기반 대출을 통해 자금을 조달하고 있어, 높은 이자 비용을 내고 벤처대출을 활용할 유인이 크지 않다. 민간 금융회사들 역시 SVB식 사업모델을 활용하는데 제약이 많다. 우선 한국에서는 IP금융이 활성화되어 있지 않아 벤처기업이 보유한 무형자산을 담보로 활용하기 어렵다. 또한 독립형 워런트를 발행하는 것이 금지되어 있어 민간 금융회사가 벤처기업으로부터 지분 워런트를 수취하는 것이 쉽지 않다. 즉 민간 금융회사가 SVB식 사업모델을 도입하는데 금전적 유인체계가 부족하다. 그뿐 아니라 한국에서는 세컨더리 시장이나 고수익 회사채 시장이 활성화되어 있지 않아 벤처대출에서 부실이 발생하면 회수가 어려운 점도 민간 금융회사가 SVB식 벤처대출을 수행하는데 장애 요인으로 작용한다.

Ⅳ. 맺음말

한국 벤처기업 생태계의 질적 역량 제고를 위해 벤처대출 활성화 등 SVB식 사업모델을 적극적으로 도입해야 한다는 의견이 있다. SVB 그룹은 대형 금융회사와 달리 벤처기업에 특화된 투자ㆍ융자 결합 금융서비스 등 차별적인 전략을 구사하며 미국 벤처기업 생태계의 혁신과 성장을 견인하는데 큰 기여를 한 것으로 보인다. SVB 그룹 사업모델이 실리콘밸리 지역 내에서 성공적으로 자리매김한 것은 SVB 그룹이 민간 주도로 발전해온 실리콘밸리 벤처생태계에게 맞춤형 금융서비스를 제공하고, 인적 교류를 통해 금융리스크를 효율적으로 관리할 수 있는 능력을 갖추었기 때문이다. 그뿐 아니라 실리콘밸리 지역 내 벤처기업 생태계는 우수한 무형자산 평가 및 중개 인프라를 갖추었고, 비상장 벤처기업 주식·채권을 손쉽게 사고팔 수 있는 세컨더리 시장을 가진 점도 SVB 그룹의 성공 요인으로 꼽을 수 있다.

SVB 그룹의 사업모델을 참고하여, 한국 금융회사들도 비상장 혁신벤처기업에 대한 보육 서비스, 지분투자, 벤처대출, 기업 분석 등 벤처기업 생태계와 동반자적 금융관계 형성에 노력을 기울여야 할 것이다. 다만 민간 금융회사들의 노력만으로는 한국에서 SVB식 사업모델이 당장 성공하기에는 어려움이 따를 것으로 예상한다. 무엇보다 한국에서는 신용보증 프로그램 등 낮은 이자에 기초한 정책금융 의존도가 높아 상대적으로 조달 비용이 높은 SVB식 벤처대출이 활성화되기 어렵다. 또한 IP금융이 활성화되어 있지 않아 무형자산을 담보로 자금을 빌리기 어려우며 독립형 워런트가 금지되어 있어 벤처대출을 제공하는 금융기관의 참여 유인이 부족한 측면이 있다. 그 외에 세컨더리 시장, 고수익 회사채 시장 등이 활성화되어 있지 않은 점도 SVB식 사업모델을 도입하는데 장애 요인이 된다.

따라서 민간 금융회사가 벤처기업 생태계와 동반자적 금융관계 형성에 앞장설 수 있도록 금융당국의 뒷받침이 필요할 것이다. SVB식 사업모델의 성공적 도입을 위한 선결 조건으로, 첫째 장기적으로 벤처기업의 정책금융 의존도를 낮추고 다양한 벤처투자기구 육성을 통한 민간의 모험자본 공급 확대를 유도할 필요가 있다. 다음으로 벤처기업이 보유한 우수한 무형자산을 담보로 활용할 수 있도록 IP금융 인프라를 활성화하고, 일정 요건을 갖춘 경우 독립형 워런트를 발행할 수 있도록 제도 개선을 검토할 필요가 있다. 더불어 국내 금융회사들이 고위험 벤처기업 지분과 벤처대출을 적극적으로 인수할 수 있도록 매출 규제의 합리적 개선 등을 통해 세컨더리 시장과 고수익 회사채 시장의 활성화를 모색할 필요가 있다.

1) CB Insights에 따르면 2021년 글로벌 벤처투자 규모는 6,210억달러를 기록했다.

2) 홍종수ㆍ나수미(2020), 박용린(2019) 참조

3) www.svb.com 참조

4) Davis et al.(2020)

5) 1970년대 말부터 1980년대 중반까지 실리콘밸리 지역에서는 애플, 마이크로소프트, 오라클 등이 설립되어 IPO를 성공적으로 마치는 등 컴퓨터 소프트웨어 산업이 빠르게 발전했다.

6) FRB Statistical Release(2022. 3. 31)에 따르면 2022년 3월말 기준 은행 그룹 자산총계 기준으로 JP모건(3.5조달러), 뱅크오브아메리카(2.5조달러), 웰스파고(1.8조달러)가 1~3위를 기록하고 있으며 골드만삭스는 4,746억달러로 8위를 기록하고 있다.

7) SVB.com 참조

8) SVB 그룹이 벤처기업 지분투자, 벤처대출 등의 형태로 직접 자금공급을 수행한 건에 해당하며, 상당수 벤처기업 지분투자, 벤처대출은 벤처캐피탈, 사모펀드 등에 지분출자, 대출 등 재간접투자 형태로 참여했다.

9) 2021년 동안 SVB 그룹의 순이자마진 수익은 32억달러로 가장 큰 비중을 차지하고 있으며, 워런트·지분투자 수익이 11억달러, 자산관리 수수료 수익이 7.5억달러, 증권 부문 투자은행 수익이 5.4억달러를 기록하고 있다.

10) 2021년말 JP모건, 웰스파고, 뱅크오브아메리카의 이자 기반 예금 수취 비중은 각각 73%, 63%, 61%를 기록했다.

11) 2020~2021년 워런트ㆍ지분투자 부문 수익이 큰 폭으로 증가한 배경에는 코로나19 이후 미국 ICT 및 바이오 섹터 벤처기업의 수익성과 성장성이 개선된 것과 관련이 높다.

12) 이하 Zhou et al.(2013) 참조

13) SVB 그룹이 직접 지분투자를 수행한 벤처기업에게 직접 벤처대출을 수행한 건수는 26건으로 직접 벤처투자 건수의 9.6%에 해당한다.

14) 중소벤처기업부(2022. 1. 27)에 따르면, 2021년 한국 벤처투자 규모는 7.7조원으로 2020년 4.3조원 대비 79% 증가했다.

15) 박용린 외(2017) 참조

16) 홍종수ㆍ나수미(2020) 참조

17) 2021년 중소벤처기업에 대한 신용보증 지원현황은 잔액 기준으로 신용보증기금 56조원, 기술신용보증기금 25.4조원, 지역신용보증재단 24.6조원을 기록하고 있다.

18) 박용린 외(2017), 박용린(2019) 참조

19) 보증연계투자란 기술과 사업성이 우수한 벤처기업에게 보증과 연계하여 투자하는 금융상품이다.

20) 투자옵션부보증은 성장성이 높은 초기 창업기업에 대해 자본증자에 참여할 수 있는 권리가 부여된 보증을 지원한 후, 기업의 경영성과에 따라 투자전환을 결정하는 금융상품이다.

21) 투자조건부융자 제도는 초기 지분투자를 받은 벤처기업이 후속투자를 받을 가능성이 높은 경우 낮은 이자로 대출을 해주는 대신 소액의 지분인수권을 받는 제도이다.

22) 중소벤처기업부(2021. 1. 13) 참조

23) <그림 Ⅰ-1>, <표 Ⅱ-3> 참조

참고문헌

김한나, 2013, 미국 벤처기업의 파트너: 실리콘밸리은행, 「IBK경제소식지」110, 19-20.

박용린ㆍ김종민ㆍ남재우ㆍ장정모ㆍ천창민, 2017, 「국내 모험자본시장의 현황 분석과 발전 방향」, 자본시장연구원 연구총서 17-01.

박용린, 2019, 스케일업(Scale-Up)을 위한 벤처대출의 역할, 자본시장연구원 「자본시장포커스」 2019-05.

박희원, 2017, 해외 벤처금융 전문은행의 성공사례 분석 및 시사점 – 실리콘밸리은행그룹(SVB Financial Group), 「산은조사월보」 747, 50-69.

중소벤처기업부, 2021. 1. 13, 기술기반 벤처스타트업 복합금융 지원방안, 보도자료.

중소벤처기업부, 2022. 1. 27, 2021년 신규 벤처투자 실적 발표, 보도자료.

홍종수ㆍ나수미, 2020, 「스케일업 촉진을 위한 벤처대출(Venture Debt) 도입 방안」, 중소 기업연구원 중소기업포커스 20-05.

Davis, J., Morse, A., Wang, X., 2020, The leveraging of silicon valley, NBER working paper No.27591.

FRB, 2022. 3. 31, Large commercial banks, Federal Reserve Statistical Release.

Zhou, Li., Mei, J., Sun, X., 2013, Risk Management in Commercial Banks’ Participating in Private Equity – Case Study based on Silicon Valley Bank, 2nd International Conference on Science and Social Research.

한국 벤처기업들은 우수한 기술을 보유하더라도 중기ㆍ후기에 자금 부족 등의 이유로 사업화 단계까지 어려움을 겪는 이른바 죽음의 계곡(death valley)에 직면한 사례가 많다. 반면 미국, 유럽 등 주요 국가에서는 글로벌 금융위기 이후 벤처대출(venture debt) 시장이 빠르게 성장하면서 벤처기업 중기·후기에 필요한 스케일업(scale-up) 자금을 원활히 공급하고 있다. 2021년말 기준 글로벌 벤처대출 규모는 1,340억달러(약 150조원) 규모로 글로벌 벤처투자 규모1)의 약 20~30% 내외를 차지하고 있으며, 2010년말 이후 연평균 30% 이상의 성장세를 기록하고 있다(<그림 Ⅰ-1>). 벤처대출 시장의 발전으로 벤처기업 창업가는 지분 희석에 따른 경영권 위협 없이 대규모 스케일업 자금을 빌릴 수 있으며, 벤처대출을 공급하는 금융회사는 일반적인 은행대출보다 높은 순이자마진(Net Interest Margin: NIM) 수익률을 기대할 수 있는 장점이 있다.

최근 신정부 출범을 계기로 벤처기업 생태계의 질적 개선을 위해 벤처대출 활성화 등 SVB 그룹의 사업모델을 적극적으로 검토해야 한다는 의견이 제기되고 있다. 실제로 2022년 들어 일부 금융회사는 SVB식 벤처대출 서비스 출시 계획을 밝히는 등 SVB 사업모델에 대한 관심이 크게 늘었다. 다만 SVB 그룹 사업모델은 미국 실리콘밸리 지역 내 벤처기업 생태계에서 자생적으로 발전해온 이유로 신용보증 등 정책금융 의존도가 높은 한국 벤처기업 생태계에서 SVB 그룹 사업모델이 성공하는 것은 한계가 있을 수 있다. 이에 본 연구에서는 미국 SVB 그룹의 사업모델을 심도 있게 분석하고 SVB 그룹 사업모델의 국내 도입 가능성을 진단하고자 한다. Ⅱ장에서는 SVB 그룹의 발전 역사와 주요 사업모델을 살펴본다. Ⅲ장에서는 한국 벤처기업 생태계의 부채성 자금공급 현황을 진단하고 SVB 그룹 사업모델의 국내 도입 가능성을 진단한다. Ⅳ장에서는 한국에서 SVB 그룹 사업모델이 정착할 수 있는 정책 방향을 제시한다.

Ⅱ. SVB 그룹의 사업모델

SVB 그룹은 1983년 설립 초기부터 벤처기업 금융중개 및 벤처지분 직접투자 등을 핵심 사업모델로 두고 있다는 점에서 미국 은행지주회사들과는 차별화된 사업전략을 구사한다고 볼 수 있다. SVB 그룹은 미국 금융지주그룹에 비해 짧은 역사에도 불구하고 자산규모, 수익성 등 다양한 측면에서 미국 금융회사를 대표하는 금융지주그룹으로 발돋움했다. 무엇보다 실리콘밸리 지역 벤처기업을 대상으로 차별화된 모험자본을 공급하고 미국 벤처기업 생태계의 성장과 함께 발전해왔다는 점에서 상업은행 중심의 금융지주그룹이나 골드만삭스, 모건스탠리 등 주요 투자은행 기반 금융지주그룹과도 구별된다. 본 절에서는 혁신적인 사업모델을 발전시켜온 SVB 그룹의 발전 역사와 주요 사업모델, 그리고 SVB 그룹 사업모델의 성공 요인을 분석하고자 한다.

1. SVB 그룹 개요

SVB 그룹의 전신은 실리콘밸리은행으로, 1983년 웰스파고 은행원이었던 Roger Smith와 Bill Biggerstaff, 그리고 미국 스탠포드 교수로 재직했던 Robert Medearirs가 실리콘밸리 지역 내 혁신 벤처기업들을 발굴하고 육성하는 것을 목표로 캘리포니아 주 은행으로 인가를 받아 설립되었다.5) 당시 SVB 그룹은 벤처기업 및 벤처기업 임직원의 예ㆍ적금을 받아 유망 벤처기업에게 대출해주는 업무를 주로 수행해왔다. SVB 그룹은 1985년 실리콘밸리 팔로알토 지역에 첫 번째 지점을 개설한 이후 1980년대 M&A와 나스닥 IPO를 통해 미국 서부로 지점을 확장했으며 2000년대 중반 이후 인도(2004년), 영국(2004년), 중국(2005년), 이스라엘(2005년) 등 글로벌 시장으로 진출했다. 2008년 글로벌 금융위기 당시 보유자산의 일시적 부실로 미국 재무부로부터 2.35억달러의 구제금융 지원을 받았으나, 2009년말 즉시 채무 상환을 완료했으며 2010년 이후에는 미국 전역의 벤처기업들을 대상으로 벤처대출과 지분투자 등을 성공적으로 수행하며 괄목할만한 성장을 이루었다. 2012년에는 중국 상해포동발전은행과 조인트 벤처 형태로 중국내 SVB 은행을 설립했으며, 아일랜드(2016년), 독일(2018년), 덴마크(2019년), 토론토(2019년), 벤쿠버(2020년) 등으로 글로벌 지점을 넓혀가고 있다.

SVB 그룹은 미국 은행지주회사법에 근거한 금융지주회사로 연방준비제도이사회(Federal Reserve Board: FRB)에 의해 감독을 받으며 SVB 은행, SVB 증권, SVB 캐피탈, SVB 프라이빗(Private) 등을 주요 자회사로 두고 있다(<그림 Ⅱ-1> 참조). SVB 은행은 캘리포니아주 상업은행 라이센스를 보유하고 있으며 실리콘밸리 지역 내 기업과 임직원으로부터 예ㆍ적금을 수취 받아 유망 벤처기업에게 대출해주는 업무를 주로 수행하고 있다. SVB 은행은 벤처기업을 대상으로 여신과 수신 업무를 수행하는 것 외에 법인결제, 외환 업무, 종합자금관리 업무 등을 제공하고 있다. SVB 증권은 2022년 2월 SVB Leerink에서 SVB 증권으로 사명을 변경했는데 SEC(Securities and Exchange Commission)로부터 브로커-딜러 라이센스를 취득하여 벤처기업 주식, 채권의 인수 및 중개, IPOㆍM&A 주선, M&A 자문 등 다양한 투자은행 업무를 수행하고 있다. 그 외에 SVB 캐피탈은 미국 투자회사법 라이센스 등을 취득하여 벤처캐피탈 지분투자 및 소매금융 서비스를 제공하고 있으며, 비상장기업에 대한 리서치 업무를 수행하고 있다. SVB 프라이빗의 전신은 1987년 설립된 보스톤 프라이빗으로, 현재 미국 투자자문사 및 소매금융 라이센스 보유를 통해 고액 자산가를 대상으로 자산관리 서비스뿐 아니라 소매 대출 서비스를 제공하고 있다.

SVB 그룹의 벤처투자 성과도 우수하다. SVB 그룹은 1983년 설립 이후 2021년 말까지 3만개 이상의 벤처기업들에게 직접 또는 간접적으로 자금을 공급했으며 미국 전체 테크 및 바이오ㆍ헬스케어 섹터 벤처기업의 50%를 SVB 그룹의 고객으로 두고 있다.7) SVB 그룹의 자회사인 SVB 은행, SVB 캐피탈 등은 설립 이래 벤처기업 후속 지분투자를 841건 수행했는데8), 이중 38.6%인 325개 벤처기업이 M&A나 IPO를 통해 성공적으로 회수(exit)를 실현했다. 글로벌 벤처캐피탈을 대표하는 Accel, Andreessen Horowitz, Sequoia, Tiger Global 등은 설립 이후 1,000~2,000건의 벤처기업 후속 지분투자를 수행했는데 이들 대형 벤처캐피탈의 회수(exit) 확률은 SVB 그룹의 절반 수준인 10~20%를 기록하고 있다(<표 Ⅱ-1> 참조). SVB 그룹은 벤처기업 여수신 업무를 기반으로 사업을 확장했음에도 불구하고 미국 대형 벤처캐피탈들과 견줄만한 벤처투자 성과를 기록한 것은 주목할 만한 부분이다.

SVB 그룹의 사업모델은 수익 원천별로 순이자마진 수익, 벤처기업 워런트 및 지분투자 수익, 자산관리 수수료 수익, 증권 부문 투자은행 수익 등으로 구분할 수 있다.9) SVB 그룹 내 핵심 자회사인 SVB 은행은 실리콘밸리 지역 벤처기업 및 임직원을 대상으로 예ㆍ적금을 수취 받고 혁신 벤처기업들과 중견 기업에게 무담보 형태로 대출을 제공하며 나파밸리 와이너리 등에게는 부동산 담보대출 등을 제공하고 있다. SVB 그룹이 일반 상업은행과 달리 고위험 여신을 제공하고 있음에도 불구하고 높은 순이자마진을 실현하는 배경에는 전체 자금조달 중에서 이자지급 부담이 낮은 무이자 기반 예금(non-interest bearing deposits) 수취 비중이 63%로 높은데서 그 이유를 찾을 수 있다. JP모건, 웰스파고, 뱅크오브아메리카 등 미국 주요 상업은행들의 이자 기반 예금(interests bearing deposits) 수취 비중이 60~70% 내외이고10), 무이자 기반 예금 수취 비중이 30~40% 내외인 것과 비교하면 SVB 그룹의 무이자 기반 예ㆍ적금 수취 비중은 미국 주요 상업은행보다 약 2배 높다. 이는 SVB 그룹의 경우 예금 고객 중에서 벤처기업 고객 비중이 높고 개인 고객 비중이 낮으며, 개인 고객 중에서는 체크계좌(checking account) 고객 비중이 높은 것과 관련되어 있다.

SVB 그룹에서 네 번째로 큰 수익을 차지하는 부문은 핵심 계열사 중 하나인 SVB 증권의 투자은행 관련 수익이다. SVB 증권은 실리콘밸리 벤처기업 생태계에서 벤처기업 지분, 채권의 인수(underwriting), M&A와 IPO 등의 주선, M&A 자문 등의 업무를 주로 수행하는데 벤처기업 M&A나 IPO 활동이 활발할수록 투자은행 관련 수익이 증가한다. 2021년 SVB 증권의 투자은행 관련 수익은 5.4억달러로, 2019년 수익(2.5억달러) 대비 2배 이상 증가했는데 이는 코로나19 위기에도 불구하고 미국 벤처기업들의 M&A와 IPO 등이 활발했기 때문으로 판단한다. SVB 증권은 2021년 테크기업 리서치 분석 및 투자은행 업무에 특화된 MoffettNathanson LLC 회사를 인수하여 업무 커버리지를 바이오, 헬스케어, ICT 등으로 확장했으며 미국 대형 IB들과 차별화하여 비상장 벤처기업에 대한 리서치 분석, 인수금융, 스팩, M&A 자문 등에 역량을 집중하고 있다.

3. SVB 그룹 사업모델의 성공 요인

SVB 그룹 사업모델의 주요 성공 요인으로 벤처생태계와의 동반 성장전략을 꼽을 수 있다. 우선 벤처기업 생태계의 초기 단계에서 SVB 그룹은 실리콘밸리 지역 내 엔젤투자자, 벤처캐피탈에게 지분출자 및 대출 등의 형태로 전략적 제휴 관계를 맺고 있다. <그림 Ⅱ-6>에서 볼 수 있듯이, 주요 엔젤투자자, 벤처캐피탈들이 유망 벤처기업들에게 시딩(seeding), 시리즈 A~B 등 지분투자를 수행할 때 이들 엔젤투자자와 벤처캐피탈이 필요한 자금을 사전 지분출자 또는 사후 대출 등의 형태로 공급한다. 즉, 엔젤투자자와 벤처캐피탈이 벤처투자에 성공할수록 SVB 그룹의 수익도 증가한다. 반대로 이들 엔젤투자자와 벤처캐피탈의 투자 성과가 부진할수록 SVB 그룹의 위험도 증가하는 등 SVB 그룹의 수익과 위험 모두 벤처기업 생태계 구성원들과 공유하는 전략을 취하고 있다. SVB 그룹은 100% 자회사인 SVB 캐피탈을 통해 벤처기업에 대한 보육, 자금공급, 마케팅 지원 등의 역할도 수행하고 있다. SVB 캐피탈은 액셀러레이터 역할을 수행하며 재무 및 법률 상담, 쇼케이스 행사 지원, 보고서 작성 등 초기 벤처기업을 대상으로 다양한 사업촉진 서비스를 제공한다.

SVB 그룹 사업모델의 두 번째 성공 요인은 벤처기업 생애주기별 맞춤형 자금공급 전략에서 찾을 수 있다.12) SVB 그룹은 고객 대상 벤처기업을 업력, 매출규모 등에 따라 SVB Accelerator, SVB Growth, SVB Corporate Finance로 구분하여 차별화된 금융서비스를 제공해왔다. 우선 SVB Accelerator는 연매출 규모가 5백만달러(약 60억원) 이하인 창업 초기 벤처기업으로 구분하여 이들이 우수한 기술력과 아이디어를 상업화할 수 있도록 엑셀러레이터 업무를 제공하며 엔젤투자자 및 벤처캐피탈 등과 협업하여 지분(equity) 형태의 자금공급 서비스를 제공하고 있다(이하 <표 Ⅱ-2> 참조). 구체적으로 SVB 그룹의 자회사인 SVB 캐피탈이 SVB Accelerator를 대상으로 보육, 초기자금 지원, 마케팅 서비스 등을 제공하고 있다. 더불어 SVB 은행이 지분출자 또는 대출 형태로 협력 관계를 맺은 실리콘밸리 지역 내 엔젤투자자를 통해 프리시딩(pre-seeding), 시딩(seeding) 투자 등을 제공하고 있다.

다음으로 SVB 그룹은 벤처기업 성장 단계 중 중기 또는 후기에 놓인 SVB Growth 기업을 대상으로 후속 지분투자 또는 벤처대출 서비스를 제공하고 있다. SVB Growth 기업은 매출규모가 5백만달러(약 60억원) 이상이고 7천 5백만달러(약 900억원) 이하인 벤처기업이 대상으로, 이들이 죽음의 계곡(death valley)을 수월하게 넘을 수 있도록 자회사인 SVB 캐피탈이나 SVB 그룹과 협력 관계에 있는 벤처캐피탈을 통해 시리즈 A~C 등 후속 지분투자를 제공한다. 특히 중ㆍ후기 단계에 놓인 벤처기업들이 스케일업을 위해 대규모 자금이 필요한 경우 SVB 은행을 통해 벤처대출을 제공한다. 즉 SVB 그룹은 벤처기업이 성장기, 성숙기 등에 진입할수록 주식 형태의 직ㆍ간접 지분투자는 줄이고 벤처대출 형태로 자금을 공급하는 전략을 수행하고 있다. 마지막으로 매출규모가 7천 5백만달러 이상이고, 성숙기에 접어든 SVB Corporate Finance 기업을 대상으로 맞춤형 종합금융서비스를 제공하고 있다. SVB Corporate Finance 기업들이 M&A나 IPO를 수행할 때 인수금융, M&A 자문 서비스 등을 제공하며, 상장기업에 대해서는 주식 담보대출, 무형자산 담보대출 등도 제공하고 있다. 이들 SVB Corporate Finance 기업들 및 해당 기업 임직원을 대상으로 현금성 자산관리 서비스, 외환 서비스, 종합자산관리, 소매 자산관리 등 종합 투자은행 서비스를 제공하고 있다.

SVB 그룹이 벤처대출에 대한 집중위험을 최소화하는 전략을 구사해온 점도 우수한 건전성 지표를 실현하는데 기여를 했다. SVB 그룹은 특정 벤처기업에 대한 대출 한도를 5천만달러(약 600억원)로 제한하고 있으며, 우수한 담보를 보유한 경우 등에 한해서만 5천만달러 이상으로 대출을 허용하고 있다. 2010년초부터 2021년말까지 수행된 16,775건의 벤처대출 평균금액은 3천2백만달러이나 SVB 그룹이 수행한 벤처대출의 평균금액은 2천 4백만달러로 SVB 그룹의 대출 금액이 30% 이상 작다. 더불어 SVB 그룹은 산업 섹터를 분산하여 벤처기업 대출을 수행함으로써 집중위험을 줄이고 있다. SVB 그룹은 VC와 PE가 운용하는 글로벌 뱅킹펀드에 대출해주는 비중이 57%로 대출 포트폴리오에서 가장 큰 비중을 차지하고 있는데, 해당 글로벌 뱅킹펀드는 테크(37%), 생명과학(12%), 소비재(7%), 부동산(7%), 제조업(5%), 핀테크(4%) 등 섹터가 잘 분산되어 있다. SVB 그룹이 우수한 신용리스크 심사 인력을 보유한 점도 SVB 그룹의 차별화된 리스크관리 능력에 크게 기여한 요인이다. SVB 그룹은 1983년 설립 초기부터 벤처기업 여신평가 경험을 보유한 인력을 대거 채용하여 고위험 벤처기업 여신평가 역량을 갖추어 나갔다. 벤처기업의 채무불이행시 벤처기업이 보유한 무형자산을 회수할 수 있는 능력을 갖춘 것도 차별화된 장점으로 꼽을 수 있다.

SVB 그룹은 대형 금융회사와 달리 벤처기업에 특화된 차별적인 금융서비스를 제공하며 단기간 빠른 성장세를 실현하였기에 한국에서도 혁신벤처기업 육성을 위해 SVB 사업모델을 신속히 도입해야 한다는 의견이 있다. 그러나 한국 벤처기업 생태계는 정책금융 의존도가 높고 IP(Intellectual Property)금융이나 세컨더리 시장이 활성화되어 있지 않은 점 등 미국 실리콘밸리 지역 내 벤처기업 생태계와 많은 부분에서 차이가 나기 때문에 SVB 그룹 사업모델이 성공하는데 다소 어려움이 따를 것으로 예상한다. 이에 본 절에서는 한국 벤처기업의 자금공급 현황을 살펴보고 SVB 그룹 사업모델의 국내 도입 가능성을 진단하고자 한다.

1. 한국 벤처기업의 자금공급 현황

한국 벤처투자 시장은 양적 측면에서 견조한 성장세를 기록하고 있으나14), 질적 측면에서는 다소 부족한 점이 많다. 우선 벤처기업 창업 초기에는 정책자금 의존도가 높고 민간의 모험자본 공급이 상대적으로 부족하다.15) 한국벤처기업협회가 3만 여개 중소벤처기업에 대해 설문ㆍ조사를 수행한 바에 따르면, 2020년 신규로 자금을 조달한 3만 5천개 벤처기업으로부터 자금조달 유형을 조사한 결과, 정부의 융자ㆍ보증 등 정책지원금 형태가 전체의 64.1%로 가장 많은 비중을 차지하고 있으며 담보에 기반한 은행대출 비중이 28.2%로 두 번째로 높은 비중을 차지하고 있다. 반면 모험자본으로 분류할 수 있는 벤처캐피탈, 엔젤투자자로부터 조달받는 비중은 2.2%이며 회사채 발행 비중은 1.1%에 불과하다(<그림 Ⅲ-1> 참조). 미국, 유럽 등에서 빠르게 증가하고 있는 벤처대출은 독립형 워런트의 발행 제약 등의 이유로 한국에서는 거의 활용되지 않는 것으로 알려져 있다.16) 한편 벤처기업들이 금융기관을 통해 자금조달을 수행하기 어려운 이유로, 은행의 대출한도가 부족하거나(35.9%) 과도한 담보를 요구하거나(20.3%) 신용대출이 부족한 점(13.2%) 그리고 대출관련 구비서류 및 절차가 복잡한 점(11.9%) 등으로 나타나, 상당수 벤처기업들이 은행 담보대출 중심의 자금조달에도 비교적 큰 어려움을 느끼는 것으로 보인다.

SVB 그룹은 짧은 역사에도 불구하고 실리콘밸리 지역 내 벤처기업 생태계와의 동반자적 금융관계 형성 전략, 벤처기업 생애주기 맞춤형 자금공급 전략, 혁신 벤처산업에 대한 차별화된 리스크관리 전략 등에 힘입어 글로벌 대형 금융지주회사들과 견줄만한 성과를 실현하고 있다. 코로나19 이후 ICT와 바이오 분야의 벤처기업이 괄목할만한 매출 성장과 수익성을 실현한 점도 SVB 그룹 사업모델의 성공 요인으로 꼽을 수 있다. 이에, 한국 금융회사들은 벤처기업 생태계의 활성화를 목표로 SVB 그룹 사업모델의 도입 계획을 밝힌 바가 있다. 기술보증기금, 신용보증기금 등 정책금융기관들도 보증연계투자19), 투자옵션부보증20) 등 SVB 그룹의 사업모델을 벤치마크한 투자ㆍ융자 결합 금융서비스를 제공해왔다. 2021년초 중소벤처기업부는 SVB식 투자ㆍ융자 결합 금융 도입을 추진하기 위해 투자조건부융자 제도21)를 도입하고 투자옵션부보증 제도를 확대하기로 발표하기도 했다.22)

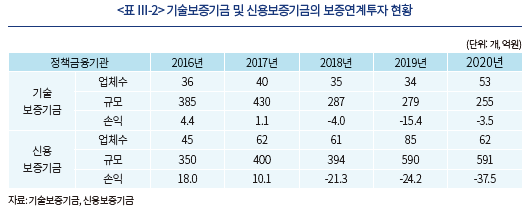

아쉽게도 SVB식 사업모델과 유사한 보증연계투자, 투자옵션부보증 등은 활성화가 미진하며 해당 투자ㆍ융자 복합 프로그램을 제공한 정책금융기관들도 일부 손실을 기록한 것으로 알려져 있다. 실제 2016~2020년 동안 기술보증기금과 신용보증기금이 수행한 보증연계투자규모는 두 기관을 합쳐서 연간 약 100여개 기업에 대해 700~900억원에 불과하며 최근 일부 정책금융기관의 경우 보증연계투자의 규모는 감소하고 있다(<표 Ⅲ-2> 참조). 한국의 보증연계투자규모는 1개 업체당 약 5~10억원 내외로, 글로벌 벤처대출의 평균금액(약 300~500억원 내외)23)과 비교하면 규모가 작다. 그뿐 아니라 기술보증기금과 신용보증기금 모두 보증연계투자 부문에서 손실을 기록하고 있으며 일부 정책금융기관의 경우 보증연계투자 부문의 손실이 확대되고 있다. 민간 금융회사들 역시 최근 SVB식 사업모델의 도입 계획을 밝힌 바가 있으나 SVB식 벤처대출, 투자ㆍ융자 결합 금융 프로그램 등은 한국 벤처기업 생태계에서 성공하는데 많은 제약이 따를 것으로 판단한다.

Ⅳ. 맺음말

한국 벤처기업 생태계의 질적 역량 제고를 위해 벤처대출 활성화 등 SVB식 사업모델을 적극적으로 도입해야 한다는 의견이 있다. SVB 그룹은 대형 금융회사와 달리 벤처기업에 특화된 투자ㆍ융자 결합 금융서비스 등 차별적인 전략을 구사하며 미국 벤처기업 생태계의 혁신과 성장을 견인하는데 큰 기여를 한 것으로 보인다. SVB 그룹 사업모델이 실리콘밸리 지역 내에서 성공적으로 자리매김한 것은 SVB 그룹이 민간 주도로 발전해온 실리콘밸리 벤처생태계에게 맞춤형 금융서비스를 제공하고, 인적 교류를 통해 금융리스크를 효율적으로 관리할 수 있는 능력을 갖추었기 때문이다. 그뿐 아니라 실리콘밸리 지역 내 벤처기업 생태계는 우수한 무형자산 평가 및 중개 인프라를 갖추었고, 비상장 벤처기업 주식·채권을 손쉽게 사고팔 수 있는 세컨더리 시장을 가진 점도 SVB 그룹의 성공 요인으로 꼽을 수 있다.

SVB 그룹의 사업모델을 참고하여, 한국 금융회사들도 비상장 혁신벤처기업에 대한 보육 서비스, 지분투자, 벤처대출, 기업 분석 등 벤처기업 생태계와 동반자적 금융관계 형성에 노력을 기울여야 할 것이다. 다만 민간 금융회사들의 노력만으로는 한국에서 SVB식 사업모델이 당장 성공하기에는 어려움이 따를 것으로 예상한다. 무엇보다 한국에서는 신용보증 프로그램 등 낮은 이자에 기초한 정책금융 의존도가 높아 상대적으로 조달 비용이 높은 SVB식 벤처대출이 활성화되기 어렵다. 또한 IP금융이 활성화되어 있지 않아 무형자산을 담보로 자금을 빌리기 어려우며 독립형 워런트가 금지되어 있어 벤처대출을 제공하는 금융기관의 참여 유인이 부족한 측면이 있다. 그 외에 세컨더리 시장, 고수익 회사채 시장 등이 활성화되어 있지 않은 점도 SVB식 사업모델을 도입하는데 장애 요인이 된다.

따라서 민간 금융회사가 벤처기업 생태계와 동반자적 금융관계 형성에 앞장설 수 있도록 금융당국의 뒷받침이 필요할 것이다. SVB식 사업모델의 성공적 도입을 위한 선결 조건으로, 첫째 장기적으로 벤처기업의 정책금융 의존도를 낮추고 다양한 벤처투자기구 육성을 통한 민간의 모험자본 공급 확대를 유도할 필요가 있다. 다음으로 벤처기업이 보유한 우수한 무형자산을 담보로 활용할 수 있도록 IP금융 인프라를 활성화하고, 일정 요건을 갖춘 경우 독립형 워런트를 발행할 수 있도록 제도 개선을 검토할 필요가 있다. 더불어 국내 금융회사들이 고위험 벤처기업 지분과 벤처대출을 적극적으로 인수할 수 있도록 매출 규제의 합리적 개선 등을 통해 세컨더리 시장과 고수익 회사채 시장의 활성화를 모색할 필요가 있다.

1) CB Insights에 따르면 2021년 글로벌 벤처투자 규모는 6,210억달러를 기록했다.

2) 홍종수ㆍ나수미(2020), 박용린(2019) 참조

3) www.svb.com 참조

4) Davis et al.(2020)

5) 1970년대 말부터 1980년대 중반까지 실리콘밸리 지역에서는 애플, 마이크로소프트, 오라클 등이 설립되어 IPO를 성공적으로 마치는 등 컴퓨터 소프트웨어 산업이 빠르게 발전했다.

6) FRB Statistical Release(2022. 3. 31)에 따르면 2022년 3월말 기준 은행 그룹 자산총계 기준으로 JP모건(3.5조달러), 뱅크오브아메리카(2.5조달러), 웰스파고(1.8조달러)가 1~3위를 기록하고 있으며 골드만삭스는 4,746억달러로 8위를 기록하고 있다.

7) SVB.com 참조

8) SVB 그룹이 벤처기업 지분투자, 벤처대출 등의 형태로 직접 자금공급을 수행한 건에 해당하며, 상당수 벤처기업 지분투자, 벤처대출은 벤처캐피탈, 사모펀드 등에 지분출자, 대출 등 재간접투자 형태로 참여했다.

9) 2021년 동안 SVB 그룹의 순이자마진 수익은 32억달러로 가장 큰 비중을 차지하고 있으며, 워런트·지분투자 수익이 11억달러, 자산관리 수수료 수익이 7.5억달러, 증권 부문 투자은행 수익이 5.4억달러를 기록하고 있다.

10) 2021년말 JP모건, 웰스파고, 뱅크오브아메리카의 이자 기반 예금 수취 비중은 각각 73%, 63%, 61%를 기록했다.

11) 2020~2021년 워런트ㆍ지분투자 부문 수익이 큰 폭으로 증가한 배경에는 코로나19 이후 미국 ICT 및 바이오 섹터 벤처기업의 수익성과 성장성이 개선된 것과 관련이 높다.

12) 이하 Zhou et al.(2013) 참조

13) SVB 그룹이 직접 지분투자를 수행한 벤처기업에게 직접 벤처대출을 수행한 건수는 26건으로 직접 벤처투자 건수의 9.6%에 해당한다.

14) 중소벤처기업부(2022. 1. 27)에 따르면, 2021년 한국 벤처투자 규모는 7.7조원으로 2020년 4.3조원 대비 79% 증가했다.

15) 박용린 외(2017) 참조

16) 홍종수ㆍ나수미(2020) 참조

17) 2021년 중소벤처기업에 대한 신용보증 지원현황은 잔액 기준으로 신용보증기금 56조원, 기술신용보증기금 25.4조원, 지역신용보증재단 24.6조원을 기록하고 있다.

18) 박용린 외(2017), 박용린(2019) 참조

19) 보증연계투자란 기술과 사업성이 우수한 벤처기업에게 보증과 연계하여 투자하는 금융상품이다.

20) 투자옵션부보증은 성장성이 높은 초기 창업기업에 대해 자본증자에 참여할 수 있는 권리가 부여된 보증을 지원한 후, 기업의 경영성과에 따라 투자전환을 결정하는 금융상품이다.

21) 투자조건부융자 제도는 초기 지분투자를 받은 벤처기업이 후속투자를 받을 가능성이 높은 경우 낮은 이자로 대출을 해주는 대신 소액의 지분인수권을 받는 제도이다.

22) 중소벤처기업부(2021. 1. 13) 참조

23) <그림 Ⅰ-1>, <표 Ⅱ-3> 참조

참고문헌

김한나, 2013, 미국 벤처기업의 파트너: 실리콘밸리은행, 「IBK경제소식지」110, 19-20.

박용린ㆍ김종민ㆍ남재우ㆍ장정모ㆍ천창민, 2017, 「국내 모험자본시장의 현황 분석과 발전 방향」, 자본시장연구원 연구총서 17-01.

박용린, 2019, 스케일업(Scale-Up)을 위한 벤처대출의 역할, 자본시장연구원 「자본시장포커스」 2019-05.

박희원, 2017, 해외 벤처금융 전문은행의 성공사례 분석 및 시사점 – 실리콘밸리은행그룹(SVB Financial Group), 「산은조사월보」 747, 50-69.

중소벤처기업부, 2021. 1. 13, 기술기반 벤처스타트업 복합금융 지원방안, 보도자료.

중소벤처기업부, 2022. 1. 27, 2021년 신규 벤처투자 실적 발표, 보도자료.

홍종수ㆍ나수미, 2020, 「스케일업 촉진을 위한 벤처대출(Venture Debt) 도입 방안」, 중소 기업연구원 중소기업포커스 20-05.

Davis, J., Morse, A., Wang, X., 2020, The leveraging of silicon valley, NBER working paper No.27591.

FRB, 2022. 3. 31, Large commercial banks, Federal Reserve Statistical Release.

Zhou, Li., Mei, J., Sun, X., 2013, Risk Management in Commercial Banks’ Participating in Private Equity – Case Study based on Silicon Valley Bank, 2nd International Conference on Science and Social Research.