Find out more about our latest publications

Current State and Proposed Improvement for Stock Options of Listed Firms

Issue Papers 22-14 Aug. 02, 2022

- Research Topic Corporate Finance

- Page 24

As stock-based compensation plans for executives of listed companies have come to the fore, this has sparked social controversy over stock options, one of the stock compensation schemes widely used by Korea’s companies. A stock option plan is a compensation mechanism designed to alleviate agency problems between shareholders and corporate managers and improve long-term management performance and shareholder value. In this respect, this article conducts a comprehensive analysis of the current state and characteristics of stock options utilized by Korea’s listed companies, explores whether the stock option scheme serves its intended purpose, and presents improvement plans.

An analysis of stock options granted by listed companies between 2015 and 2021 has produced the following findings. First, listed companies are increasingly granting stock options, most of which have a cliff vesting provision except for a small portion of performance-linked or partially-exercised stock options. Notably, a majority of stock options can be freely sold after exercise as long as they satisfy the minimum exercise period requirements specified in the Commercial Act, which is unlikely to motivate management to hold treasury shares. Second, stock options are primarily used by listed companies that are cash-strapped and have high growth potential. But granting stock options to corporate managers does not necessarily lead to shareholders’ value improvement. Third, it has been confirmed that stock option holders are likely to exercise stock options during the initial period of exercise and dispose of such stocks in a short period after exercise. In particular, stock returns reported before and after the exercise of stock options or disposal of stocks have been favorable to stock option holders, implying that they may strategically choose the time of exercise or disposal. The overall results suggest that how stock options are practically used by companies is inconsistent with the original objective.

In this respect, it is essential to create an environment where the stock-based compensation scheme including stock options function well to achieve its intended purpose. To this end, a policy is needed to encourage listed companies to voluntarily design stock option plans based on specific principles and require key executives to mandatorily hold a certain amount of equity even after stock options are exercised. Also necessary is to forestall misuse of stock options by providing wider access to stock option-related information and adopting a prior disclosure for disposal of stocks by executives.

An analysis of stock options granted by listed companies between 2015 and 2021 has produced the following findings. First, listed companies are increasingly granting stock options, most of which have a cliff vesting provision except for a small portion of performance-linked or partially-exercised stock options. Notably, a majority of stock options can be freely sold after exercise as long as they satisfy the minimum exercise period requirements specified in the Commercial Act, which is unlikely to motivate management to hold treasury shares. Second, stock options are primarily used by listed companies that are cash-strapped and have high growth potential. But granting stock options to corporate managers does not necessarily lead to shareholders’ value improvement. Third, it has been confirmed that stock option holders are likely to exercise stock options during the initial period of exercise and dispose of such stocks in a short period after exercise. In particular, stock returns reported before and after the exercise of stock options or disposal of stocks have been favorable to stock option holders, implying that they may strategically choose the time of exercise or disposal. The overall results suggest that how stock options are practically used by companies is inconsistent with the original objective.

In this respect, it is essential to create an environment where the stock-based compensation scheme including stock options function well to achieve its intended purpose. To this end, a policy is needed to encourage listed companies to voluntarily design stock option plans based on specific principles and require key executives to mandatorily hold a certain amount of equity even after stock options are exercised. Also necessary is to forestall misuse of stock options by providing wider access to stock option-related information and adopting a prior disclosure for disposal of stocks by executives.

Ⅰ. 분석 배경

주식매수선택권(이하 스톡옵션) 제도는 기업의 장기성과와 주주가치 제고, 경영 활력 고취를 위해 1997년에 도입된 보상 수단이다. 상장기업에 처음으로 도입(1997년)된 이후 벤처기업(1998년), 일반기업(1999년)으로 확대되었으며, 이후 표준모델 구축, 공시제도 도입, 벤처 특례 시행 등 다양한 제도 변화와 함께 스톡옵션의 장점을 극대화하고 주주의 이익을 보호하는 방향으로 발전해왔다. 스톡옵션은 미리 정해진 조건에서 주식을 매수할 수 있는 권리를 부여받는 것으로 거래되지 않는 점(non-tradable)을 제외하면 흡사 만기가 긴 콜옵션(call option)과 유사한 형태이며, 보상체계 관점에서 경영진 보상과 주주 이익을 직접 연계할 수 있어 대리인 비용을 줄일 수 있는 보상 수단으로 잘 알려져 있다(Murphy, 1999). 또한 임금과 같은 고정비용을 줄일 수 있어 자본력이 부족한 기업(벤처기업)도 적절한 보상을 통해 우수 인재 확보를 가능케 하는 장점도 있다.

반면 스톡옵션은 일반적인 주식 소유(ownership)에 따른 보상체계와는 정확히 일치하는 것은 아니다. 부여 이후 행사 가능 시점이 짧을 시 경영진은 단기 실적주의(short-termism)에 매몰될 우려가 있으며, 통상 변동성에 비례하는 옵션의 가치로 인해 경영진이 더욱 위험한 투자를 집행할 유인도 발생할 수 있다(DeFusco et al., 1990; Hirshleifer & Huh, 1992). 또한 단순히 주가 상승에 바탕을 둔 보상이라는 측면에서 배당과 같은 주주환원이 감소할 가능성도 있고(Lambert et al., 1989), 스톡옵션 부여와 행사 시점을 전략적으로 선택함으로써 경영진의 사익 추구 행태가 발생할 수 있다(Yermark, 1997; Dhaliwal et al., 2009). 가령 작년 말 카카오페이 경영진의 스톡옵션 행사 및 주식 대량 매도 사태에는 위법적 요소는 없었으나, 주주의 이익을 도모하기 위해 도입된 스톡옵션의 근본적인 취지에 어긋나는 사례였고 스톡옵션에 대한 적잖은 사회적 논란이 제기되었다. 스톡옵션의 오남용을 최소화하고 궁극적인 도입 취지를 달성하기 위한 스톡옵션 설계 및 관련 제도 전반에 대한 세밀한 검토가 요구되는 시점이다.

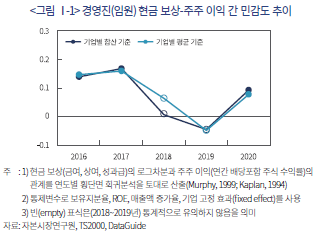

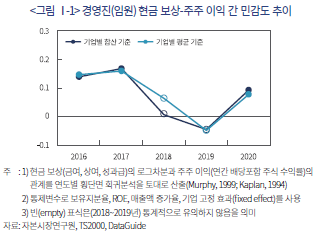

한편 그간 현금 보상 중심이었던 국내 경영진 보상체계도 조금씩 변화를 맞이하고 있다. 상장기업 경영진 보상 중 스톡옵션 행사이익의 비중이 지속해서 늘어나고 있고1), 스톡옵션을 보상 수단으로 많이 활용하는 벤처기업의 IPO와 특례상장기업도 증가하고 있다. 또한 아래 <그림 Ⅰ-1>에서 알 수 있듯이 국내 상장기업 경영진의 현금 보상과 주주 이익(자본이익+배당) 간의 민감도 수준(pay-performance sensitivity)이 작게 나타나고 있어2), 스톡옵션과 같은 주식 기반 보상체계의 중요성은 점차 부각되고 있다.

나. 경영진 스톡옵션 부여 기업의 특징과 스톡옵션 부여 효과

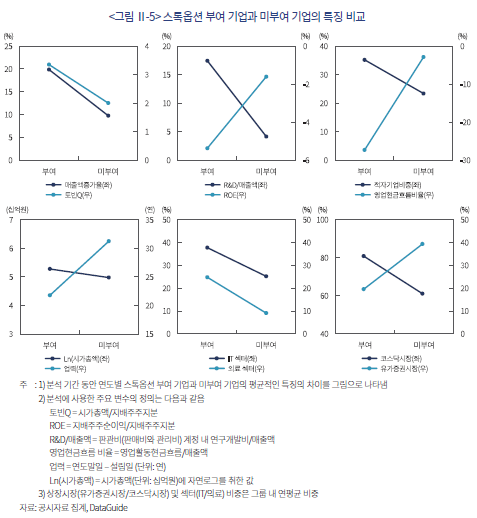

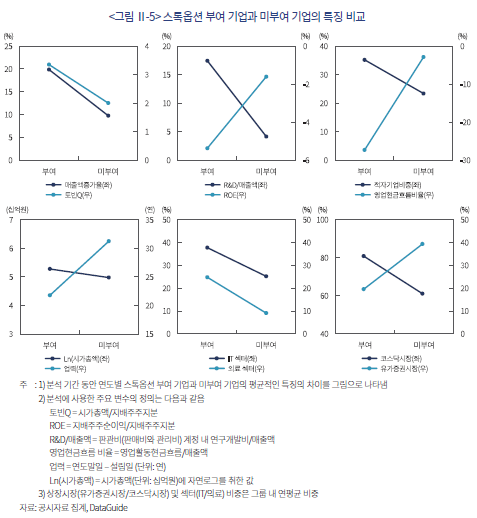

분석 기간 동안 경영진(임원)에 스톡옵션을 부여한 기업과 그렇지 않은 미부여 기업의 특징 차이를 요약하면 <그림 Ⅱ-5>와 같다. 먼저 스톡옵션을 부여한 기업은 평균적으로 매출액 증가율(20% > 9.8%: 스톡옵션 부여기업, 미부여기업 순, 이하 생략)과 토빈Q(3.4 > 2.0)가 높게 나타난다. 이는 기업의 높은 성장성을 의미하며, 이들 기업은 매출액 대비 연구개발(R&D) 투자 비중(17.5% > 4.2%)도 높아 향후 성장 잠재력이 있는 기업으로 볼 수 있다. 반면 스톡옵션 부여 기업은 자기자본이익률(ROE)이 낮고(-5.4% < -1.6%) 적자 기업의 비중(36% > 24%)도 높으며 영업현금흐름 비율도 낮아(-27.1% < -2.5%) 임금과 같은 고정비용 지급 여력이 부족한 기업으로 확인된다. 또한 스톡옵션 부여 기업은 상대적으로 업력이 짧고(평균 9년 차이) 기업의 시가총액 규모가 크다. 다만 시가총액의 차이는 평균 약 515억원으로 경제적으로 그 차이는 크지 않다.

이 외에도 스톡옵션을 부여한 기업은 IT, 의료 섹터와 같이 국내에서 성장 잠재력이 높다고 평가되는 업종의 비중이 높다. 스톡옵션 부여 기업 중 연평균 37.6%는 IT 섹터에 포함되며, 24.7%는 의료 섹터에 속해 있는데, 이는 미부여 기업 내 해당 섹터 비중(IT: 25%, 의료: 9.1%)과 큰 차이를 보인다. 또한 스톡옵션 부여 기업 내에는 코스닥 상장기업이 81%, 유가증권시장 상장기업이 19%로 미부여기업군 대비 코스닥 상장기업의 비중이 높다.10) 전반적으로 스톡옵션은 현재 재무적 제약(financial constraints)에 직면한 기업, 성장 잠재력이 높은 기업에서 주로 활용하는 보상체계임을 알 수 있으며, 이는 기존 국내외 문헌의 결과와도 일치한다(Core & Guay, 2001; Kedia & Mozumdar, 2002; 배길수, 2002).

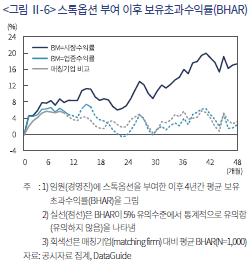

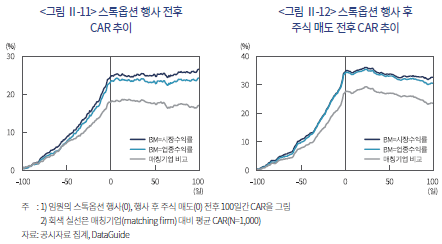

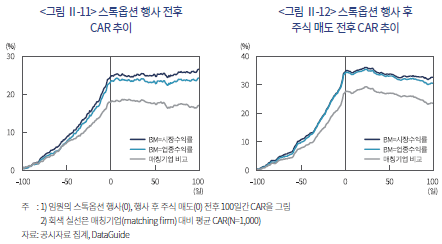

스톡옵션 행사±100일의 평균 CAR 패턴을 살펴본 결과(<그림 Ⅱ-11>), 분석 방법과 기간에 상관없이 스톡옵션 행사 전 뚜렷한 양(+) 초과수익률이 관찰된다. 스톡옵션 행사 전 100일부터 행사일까지의 CAR은 약 +17~23%로 통계적으로 유의한 주가 상승 패턴이 나타난다. 반면 행사 후 평균 CAR은 통계적으로 0에 가까운 결과가 도출된다. 스톡옵션 행사자로서는 이익 극대화를 위해 주식가격이 상승한 뒤 행사할 유인도 있고, 반면에 행사이익에 따른 세금을 최소화하기 위해 주가가 크게 상승하기 이전에 행사할 유인도 존재하나, 분석 결과는 전자에 가까운 것으로 볼 수 있다. 이는 주식을 행사 후에도 보유함으로써 위험을 지속해서 감수할 유인이 낮은 점과 행사 직후 주식처분이 자유롭기 때문인 것으로 판단된다. 앞서 살펴보았듯 스톡옵션 행사와 주식처분 사이의 간격이 짧은 점을 고려하면 경영진은 이익 극대화를 위해 행사 시점을 전략적으로 선택할 가능성이 존재한다.

<그림 Ⅱ-12>를 살펴보면 스톡옵션 행사 후 주식처분 시점 전후 수익률 패턴은 단순 행사 전후 패턴보다 CAR의 크기가 더 크게 확인된다. 예를 들어, 매칭기업 비교 결과 스톡옵션 행사 전 100일부터 행사일까지의 평균 CAR은 +17.1%지만 이벤트를 주식 매도로 변경하면 CAR의 크기가 +27.5%로 약 10%p 이상 차이가 난다. 벤치마크 수익률을 변경해도 이러한 차이는 유사하며, 무엇보다 주식처분 이후 평균 CAR이 음(-)의 값으로 통계적으로 유의하게 나타났다.23) 가령 매칭기업 비교 결과 주식처분 이후 100일 동안 평균 –3.9%의 비정상적인 주가 하락이 관찰된다. 전반적인 분석 결과는 경영진이 스톡옵션 행사 및 이후 주식처분을 전략적으로 수행하는 것을 시사하고, 이러한 결과는 과거 국내외 문헌과도 유사하다(Carpenter & Remmers, 2001; Huddart & Lang, 2003; 김현아, 2014; 김선호, 2015). 이들 연구에서는 스톡옵션이 내부자의 우월한 정보 및 규제차익을 통해 사적 이익 추구의 수단으로 활용될 수 있고, 이에 따른 대리인 비용의 발생과 주주 이익 감소 가능성을 지적한다.

Ⅲ. 상장기업 스톡옵션 개선방안

Ⅱ장의 실증분석 결과는 전반적으로 국내 스톡옵션이 궁극적 도입 취지에 걸맞지 않게 활용되고 있음을 보여준다. 이러한 추세가 지속된다면 국내 경영진 보상체계는 주요 선진국에 비해 뒤떨어질 수밖에 없고 이는 기업의 경쟁력과 주식시장의 신뢰성과도 직결되는 문제이다. 따라서 스톡옵션 제도의 도입 목적을 달성하고 장기적인 주주가치 증대로 이어지기 위해서는 스톡옵션과 같은 주식 기반 보상이 체계적으로 잘 작동할 수 있는 환경을 조성할 필요가 있다.

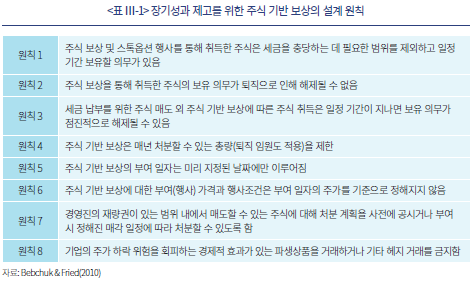

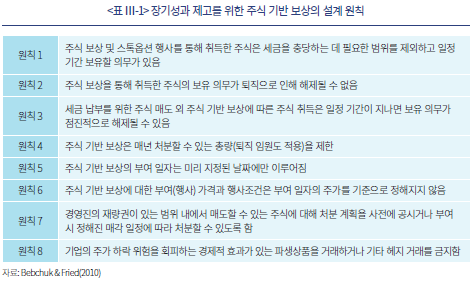

보상체계 설계에는 정답은 없으나 Bebchuk & Fried(2010)가 제시한 주식 기반 보상의 원칙을 소개하면 아래 <표 Ⅲ-1>과 같다.24) 본 고에서 조사한 국내 상장기업의 스톡옵션 현주소에 대입해보면, 스톡옵션 행사 후 보유 의무가 없는 점(원칙 1~3), 보상으로 부여받은 주식처분에 대한 총량 제한과 처분 계획에 대한 정보 공시규제가 없는 점(원칙 4, 7), 임의의 날짜에 스톡옵션을 부여할 수 있는 등(원칙 5) 제시된 원칙 대부분이 잘 지켜지지 않는 것으로 판단된다. 본 장에서는 이러한 원칙에 근거하여 스톡옵션의 유인부합적 설계 및 경영진 주식 보상 관련 정보제공 확대 방안에 대해 다루고자 한다.

다음으로 스톡옵션이 장기성과에 대한 주식 기반 보상으로서 기능하려면 실질적인 주식 보유(ownership)가 전제되어야 한다. 해외에서는 일반적으로 행사기한에 대한 법적 규제가 없음에도 불구하고 주식 보상은 ‘장기성과’ 보상체계의 수단으로 활용되는 것이 일반적이다. 미국 주요 상장기업의 경우 스톡옵션의 권리 행사 기간 설정은 법적 규제가 없어도 최소 3년 이상으로 설계되고 있고27), 유럽 상위 100대 기업의 장기성과 인센티브 중 99%의 권리 행사도 최소 3년 이상이다.28) 특히 S&P500 지수에 포함된 기업 중 경영진의 주식 소유를 의무화하는 주식소유요건(stock ownership requirements)을 설계하는 비중은 2019년 기준 97%에 달하고, 주식에 대한 권리 행사를 실행하더라도 처분을 제한하는 보유요건(retention requirements)을 채택하는 기업도 약 64%로 10년 전에 비해 30%p 가까이 증가했다.29) 이러한 해외 주요국 보상체계의 변화는 과거 경영진의 미미한 수준의 자사 주식 보유와 잦은 권리 행사 및 주식처분에 따른 단기 실적주의의 부작용을 반영한 결과였고(Holmstrom & Kaplan, 2003), 몇몇 연구에 따르면 이러한 요건을 채택한 이후 경영진의 유의미한 주식 보유 증가가 보고되고 있다(Korzcak & Liu, 2014).30)

이렇듯 국내 상장기업의 CEO 등 주요 임원의 경우 일정 지분을 의무적으로 소유하는 요건과 스톡옵션을 행사하더라도 처분을 다소 제한하는 요건을 채택하도록 유도할 필요가 있다. 이러한 경영진의 자사 주식 소유를 유도하는 원칙은 과거 Greenbury 보고서(1995), Walker 보고서(2009), 영국 기업지배구조 코드(2018) 등에도 기술되어 있는 보편적인 내용이며31), 미국 SEC는 2006년 이후 기업의 주주총회안건설명서(proxy statement) 내 보상 논의 및 분석(compensation discussion & analysis) 항목에 경영진의 주식소유요건과 보유요건에 관한 사항을 기재하도록 의무화하고 있다.32) 물론 이러한 요건의 채택은 관련 법이나 규제를 통해 의무적으로 강제되지 않으며 이사회 또는 보상위원회의 선택 요소 중 하나이다. 다만 이러한 요건을 채택할 시 <표 Ⅲ-1>의 원칙 1에 명시되어 있듯이 세금 납부를 위해 필요한 주식 매도는 보유요건에서 제외할 필요가 있으며, 기업의 자발적 채택을 유도하기 위해 스톡옵션 행사자에게 세제 혜택을 제공하는 방식도 고려해볼 수 있다.

2. 스톡옵션 관련 정보 제공 확대

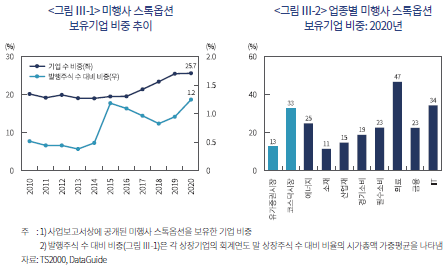

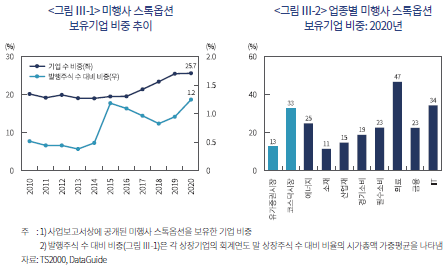

앞서 <표 Ⅲ-1>에 제시된 원칙 5(사전에 정해진 날에 부여) 및 원칙 7(처분 계획 공시 또는 사전에 정한 방식으로 매도)에 따라 스톡옵션 부여ㆍ행사ㆍ주식처분의 전략적 시점 선택이 어렵도록 규제를 재정비할 필요가 있다. 상장기업 스톡옵션 부여의 경우 자본시장법상 공시규제(자본시장법 제165조의17)로 인해 백데이팅(backdating)33) 이슈는 덜할 것으로 판단된다. 그러나 스톡옵션 행사에 대한 공시규제가 다소 미비한 편34)이고, 주식처분과 관련하여 내부자거래에 대한 사전적 방지 장치도 없어 개인의 사적 이익을 추구할 수 있는 통로가 열려 있다. 아래 <그림 Ⅲ-1>에 따르면 상장기업 스톡옵션 활용 증가로 인해 미행사된 스톡옵션을 보유한 상장기업의 비중은 전체 상장기업의 약 25.7%로 계속해서 증가하는 추세이다. 발행주식 수 대비 평균 약 1.2%이며, 특히 코스닥 상장기업 및 의료ㆍIT 섹터 기업과 같이 정보 비대칭성에 취약한 기업의 비중이 높다(<그림 Ⅲ-2>). 과거 스톡옵션의 오남용 이슈가 불거진 미국은 2002년 사베인-옥슬리법(SOX법) 제정 이후 스톡옵션 부여ㆍ행사에 대한 공시의무가 강화되었고 결과적으로 전략적 시점 선택에 대한 문제가 감소한 바 있어(Dhaliwal et al., 2009)35), 이를 참고삼아 스톡옵션과 연관된 중요한 정보 제공을 확대하는 방안을 고려할 필요가 있다.

1) 사업보고서상에 기재된 5억원 이상의 보수를 수령하는 임원의 평균 보수 중 스톡옵션 행사이익의 비중은 2.2%(2015년)에서 8.6%(2020년)로 조금씩 늘어나는 추세이며, 스톡옵션 행사이익의 규모는 평균 약 1억원(2020년 기준)에 달한다.

2) Murphy(1999)의 분석에 따르면 1990년대 중반 S&P500 기업(규제산업 제외)의 민감도는 약 0.26으로 산출되었으며, 규제산업의 경우 0.4~0.5 사이로 높게 나타난다.

3) 유가증권시장 상장기업은 스톡옵션 행사 관련 공시의무가 없는 점과 임원의 퇴임, 임기 만료 등으로 지분변동공시가 부재한 경우 스톡옵션 행사 추적이 불가해 경영진의 스톡옵션 행사 관련 분석은 자료 수집이 가능한 범위 내에서만 살펴본다.

4) 자세한 통계는 김민기(2022) 참고

5) 스톡옵션표준모델제정위원회(2000)

6) 변동부 스톡옵션도 일종의 성과연동 스톡옵션으로 간주할 수 있다. 실제 취합한 자료에 따르면, 분석 기간(2015~2021년) 동안 상장기업이 부여한 변동부 스톡옵션은 모두 성과연동 스톡옵션으로 확인된다.

7) 상법상 부여 당시 실질가액보다 행사가격을 높게 설정하나(상법 제340조의2) 대개 거래량가중평균가격(VWAP)을 기반으로 실질가액을 결정하는 경우가 많아서 부여 시점의 종가보다 종종 할인되어 부여되는 것으로 판단된다. 할인율의 중앙값은 1.3%로 부여 당시의 종가와 대체로 유사한 편이나 10% 이상 할인되는 경우도 표본의 약 10% 정도를 차지하는 것으로 나타난다.

10) 본 고에서는 단변량 분석 결과만 제시했으나, 스톡옵션 부여 여부에 대한 더미(dummy)변수를 종속변수로 하는 다변량 로짓(logit) 회귀분석에서도 수익성 지표를 제외한 모든 변수가 통계적으로 유의하게 나타난다.

11) 보유초과수익률(BHAR)을 조사하는 이유는 장기 사건연구(long-term event study)이기 때문이며 누적수익률 산출 시 복리 효과(compounding effect)를 고려하기 위함이다.

12) 자본시장법상 스톡옵션 부여를 의결한 당일 공시의무가 존재하기 때문에(자본시장법 제165조의17) 공시일과 부여일은 일반적으로 같다.

13) 표본 수의 확보와 장기 시계열 분석을 위해 사건 구간(event window)을 4년으로 설정했으나 구간을 3년 또는 5년으로 변경해도 결과의 질적인 차이는 없다.

14) 전체 상장기업 중 시가총액 규모를 기준으로 세 그룹(big, medium, small)으로 분류한다.

15) 의료ㆍIT 섹터의 시가총액가중평균(value-weighted) 수익률은 각각 +172%, +119%이며, 그 외 섹터의 경우 에너지(+65%), 소재(+55%), 통신서비스(+11%), 경기소비재(-4.4%), 산업재(-3.7%), 금융(-12.2%), 필수소비재(-34%), 유틸리티(-34.3%) 순이다.

16) 자세한 통계는 김민기(2022) 참고

17) 본 고의 실증분석 결과 유의미한 성과 제고가 관찰되지 않았으나 경영진 보상체계 방식은 기업의 문화나 경쟁기업 등에 영향을 받을 수 있고, 스톡옵션 부여의 실질적 목적이 기업마다 상이할 수 있어 본 고의 실증분석이 스톡옵션의 부여 효과를 면밀하게 검증하기에는 한계가 있다.

18) 상법상 본인의 귀책 사유가 아닌 경우 본인이 퇴임(또는 퇴직)하더라도 스톡옵션을 행사할 수 있다(단, 정년에 따른 퇴임이나 퇴직은 제외, 상법 제542조의3).

19) 이외 자기주식교부(자사주 교부)가 7.1%, 차액보상이 12.5%를 차지한다. 다만 행사 방법의 경우 행사공시 내용에만 기재되고 지분변동공시 상에서는 알 수 없으므로 실제 비중과 다를 수 있다.

20) 김민기(2022)의 분석에 따르면 2020~2021년 중 IPO 기업의 경영진이 상장 전 부여받은 스톡옵션을 주로 상장 후 6개월 이내 행사(약 51~53%)하는 것으로 나타난다.

21) 매도가 확인된 표본 외 53%는 지속하여 보유하고 있거나 증여 또는 임원 퇴임으로 인해 추적이 불가능한 경우이다.

22) 사건 기간을 이벤트 전후 50일로 변경해도 결과의 질적인 차이는 없다.

23) 이벤트 이후 CAR은 주식처분의 경우에만 통계적 유의성이 나타난다. 자세한 통계량은 보고서의 간결성을 위해 생략한다.

24) 원칙에 대한 자세한 국문 설명은 이승희(2022)를 참고하길 바란다.

25) FW Cook Book(2019)의 미국 S&P500 지수 내 주요 250개 기업 서베이 결과에 따르면, 스톡옵션 유형별 비중은 각각 일시효력발생(11%), 비율효력발생(74%), 성과연동 포함 기타(15%)로 나타난다.

26) Fidelity(2016) 조사에 따르면 북미지역 장기성과 인센티브 계획의 행사요건 중 성과평가(ratable) 행사의 비중은 70%에 달한다.

27) FW Cook Book(2020) 참고

28) Willis Towers Watson(2018) 참고

29) Brisley et al.(2021), Willis Towers Watson(2020) 참고. 이 외 영국의 경우 FTSE350 지수에 속한 기업 중 약 50%는 주식소유요건을 채택하고 있다(Korczak & Liu, 2014).

30) 다만 경영진의 주식 보유에 따른 대리인 비용의 감소, 주주가치 증대 효과를 기대하는 것 외에도, 경영진의 자사 주식에 대한 과도한 위험 노출로 인해 R&D, 레버리지 감소 등 기업의 가치 증대 활동을 저해할 수도 있다는 연구 결과도 존재한다

(Brisely et al., 2021).

31) Greenbury 보고서의 point 6.34, Walker 보고서 내 Recommendation 34, 영국 기업지배구조 코드 내 Provisions 36 참고

32) SEC, 2006, Final rule ‘Executive Compensation and Related Person Disclosure’

33) 백데이팅은 공시일과 실제 결의일 간의 시차를 악용, 서류상 부여(또는 행사) 날짜를 전략적으로 소급적용하여 부당이득을 챙기는 것을 뜻한다.

34) 코스닥 상장기업은 스톡옵션 행사주식수 누계(기신고된 행사주식수 제외)가 발행주식총수의 1% 이상일 때 주요경영사항(주식매수선택권 행사) 공시의무가 있고, 유가증권시장 상장기업은 이러한 공시의무가 없다. 다만 코스닥 상장기업 행사공시는 행사주식수 누계 규정으로 인해 실제 행사일과 공시일 간의 시차가 발생한다.

35) SOX법 제정 전 스톡옵션 행사는 행사가 발생한 달의 다음 달 10일에 일괄 공시했으나, 이후 2거래일 이내에 공시하는 것으로 변경되었다.

참고문헌

김갑래, 2019, 미국 주요주주 등의 내부자거래 사전신고 제도의 시사점, 자본시장연구원『자본시장포커스』 2019-11호.

김민기, 2022, 상장기업 스톡옵션 활용과 개선방안, 자본시장연구원 정책 세미나.

김선호, 2015, 스톡옵션 행사시 내부자는 내부정보를 이용하는가? KIF working paper.

김창수, 2004, 스톡옵션과 기업지배구조, 『재무연구』 17(1), 1-40.

김현아ㆍ정성창, 2009, 임직원 스톡옵션의 행사패턴 및 조기행사에 영향을 미치는 요인에 관한 연구, 『재무관리연구』 26(2), 1-32.

김현아, 2014, 경영자 스톡옵션의 전략적 행사시점선택에 관한 연구, 『재무관리연구』 31(1), 55-82.

배길수, 2002, 스톡옵션의 도입에 대한 주가반응 및 스톡옵션을 도입한 기업의 특성: 대리인 비용을 중심으로, 『회계학연구』 27(2), 1-26.

스톡옵션표준모델제정위원회, 2000, 스톡옵션 표준모델.

안승철ㆍ이소현, 2009, 스톡옵션 부여 기업의 주가반응과 특성 분석, 『산업경제연구』 21(1), 411-440.

윤태화ㆍ김선구ㆍ홍정화, 2005, 스톡옵션 부여가 기업의 경영성과에 미친 영향, 『세무와 회계저널』 6(4), 213-236.

이승희, 2022, 『스톡옵션 행사 후 주식보유의무 필요성과 사례』, 경제개혁연구소 이슈&분석 2022-01.

임자영, 2019, 『국내 주식매수선택권(스톡옵션) 부여 현황』, 기업지배구조원 KCGS Report 9권 11호.

Bebchuk, L.A., Fried, J.M., 2010, Paying for long-term performance, University of Pennsylvania Law Review, 1915-1959.

Brisley, N., Cai, J., Nguyen, T., 2021, Required CEO stock ownership: Consequences for risk-taking and compensation, Journal of Corporate Finance 66, 101850.

Carpenter, J.N., Remmers, B., 2001, Executive stock option exercises and inside information, Journal of Business 74(4), 513-534.

Core, J.E., Guay, W.R., 2001, Stock option plans for non-executive employees, Journal of Financial Economics 61(2), 253-287.

DeFusco R.A., Johnson R.R., Zorn, T.S., 1990, The effect of executive stock option plans on stockholders and bondholders, Journal of Finance 45(2), 617-627.

Dhaliwal, D., Erickson, M., Heitzman, S., 2009, Taxes and the backdating of stock option exercise dates, Journal of Accounting and Economics 47(1-2), 27-49.

Fidelity, 2016, Global Equity Insights 2016.

FRC, 2018, The UK Corporate Governance Code.

FW Cook Book, 2019, 2019 Top 250 Report.

FW Cook Book, 2020, 2020 Top 250 Report.

Greenbury, R., 1995, Directors’ Remuneration, Gee Publishing, London.

Griner, E.H., 1999, The effect of CEO stock option grants on shareholder return, Journal of Managerial issues, 427-439.

Hirshleifer, D., Suh, Y., 1992, Risk, managerial effort, and project choice, Journal of Financial Intermediation 2(3), 308-345.

Holmstrom, B., Kaplan, S.N., 2003, The state of US corporate governance: What’s right and what’s wrong? Journal of Applied Corporate Finance 15, 8-20.

Huddart, S., Lang, M., 2003, Information distribution within firms: evidence from stock option exercises, Journal of Accounting and Economics 34(1-3), 3-31.

Jensen, M.C., Meckling, W.H., 1976, Theory of the firm: managerial behavior, agency costs, and ownership structure, Journal of Financial Economics 3(4), 305-360.

Kaplan, S.N., 1994, Top executive rewards and firm performance: A comparison of Japan and United States, Journal of Political Economy 102(3), 510-546.

Kedia, S., Mozumdar, A., 2002, Performance Impact of Employee Stock Options, working paper.

Korczak, P., Liu, Xicheng, 2014, Managerial shareholding policies and retention of vested equity incentives, Journal of Empirical Finance 27, 116-129.

Lambert, R.A., Lanen, W.N., Larcker, D.F., 1989, Executive stock option plans and corporate dividend policy, Journal of Financial and Quantitative Analysis 24(4), 409-425.

Murphy, K.J., 1999, Executive compensation, Handbook of labor economics 3, 2485-2563.

Walker, D., 2009, A review of corporate governance in UK banks and other financial industry entities–final recommendation, HM Treasury.

Willis Towers Watson, 2018, CEO pay landscape in Europe’s Top 100 companies.

Willis Towers Watson, 2020, Executive stock ownership guidelines and retention requirements.

Yeo, G.H., Chen, S.S., Ho, K.W., Lee, C.F., 1999, Effects of executive share option plans on shareholder wealth and firm performance: The Singapore evidence, Financial Review 34(2), 1-20.

Yermark, D., 1997, Good timing: CEO stock option awards and company news announcements, Journal of Finance 52(2), 449-476.

주식매수선택권(이하 스톡옵션) 제도는 기업의 장기성과와 주주가치 제고, 경영 활력 고취를 위해 1997년에 도입된 보상 수단이다. 상장기업에 처음으로 도입(1997년)된 이후 벤처기업(1998년), 일반기업(1999년)으로 확대되었으며, 이후 표준모델 구축, 공시제도 도입, 벤처 특례 시행 등 다양한 제도 변화와 함께 스톡옵션의 장점을 극대화하고 주주의 이익을 보호하는 방향으로 발전해왔다. 스톡옵션은 미리 정해진 조건에서 주식을 매수할 수 있는 권리를 부여받는 것으로 거래되지 않는 점(non-tradable)을 제외하면 흡사 만기가 긴 콜옵션(call option)과 유사한 형태이며, 보상체계 관점에서 경영진 보상과 주주 이익을 직접 연계할 수 있어 대리인 비용을 줄일 수 있는 보상 수단으로 잘 알려져 있다(Murphy, 1999). 또한 임금과 같은 고정비용을 줄일 수 있어 자본력이 부족한 기업(벤처기업)도 적절한 보상을 통해 우수 인재 확보를 가능케 하는 장점도 있다.

반면 스톡옵션은 일반적인 주식 소유(ownership)에 따른 보상체계와는 정확히 일치하는 것은 아니다. 부여 이후 행사 가능 시점이 짧을 시 경영진은 단기 실적주의(short-termism)에 매몰될 우려가 있으며, 통상 변동성에 비례하는 옵션의 가치로 인해 경영진이 더욱 위험한 투자를 집행할 유인도 발생할 수 있다(DeFusco et al., 1990; Hirshleifer & Huh, 1992). 또한 단순히 주가 상승에 바탕을 둔 보상이라는 측면에서 배당과 같은 주주환원이 감소할 가능성도 있고(Lambert et al., 1989), 스톡옵션 부여와 행사 시점을 전략적으로 선택함으로써 경영진의 사익 추구 행태가 발생할 수 있다(Yermark, 1997; Dhaliwal et al., 2009). 가령 작년 말 카카오페이 경영진의 스톡옵션 행사 및 주식 대량 매도 사태에는 위법적 요소는 없었으나, 주주의 이익을 도모하기 위해 도입된 스톡옵션의 근본적인 취지에 어긋나는 사례였고 스톡옵션에 대한 적잖은 사회적 논란이 제기되었다. 스톡옵션의 오남용을 최소화하고 궁극적인 도입 취지를 달성하기 위한 스톡옵션 설계 및 관련 제도 전반에 대한 세밀한 검토가 요구되는 시점이다.

한편 그간 현금 보상 중심이었던 국내 경영진 보상체계도 조금씩 변화를 맞이하고 있다. 상장기업 경영진 보상 중 스톡옵션 행사이익의 비중이 지속해서 늘어나고 있고1), 스톡옵션을 보상 수단으로 많이 활용하는 벤처기업의 IPO와 특례상장기업도 증가하고 있다. 또한 아래 <그림 Ⅰ-1>에서 알 수 있듯이 국내 상장기업 경영진의 현금 보상과 주주 이익(자본이익+배당) 간의 민감도 수준(pay-performance sensitivity)이 작게 나타나고 있어2), 스톡옵션과 같은 주식 기반 보상체계의 중요성은 점차 부각되고 있다.

이에 본 고는 국내 상장기업의 스톡옵션 활용의 현주소를 파악하고 도입된 지 20년이 넘은 스톡옵션 제도가 궁극적 도입 취지에 걸맞게 잘 활용되는지 가늠하고자 한다. 이를 수행하기 위해 수집한 공시자료를 토대로 스톡옵션 부여 현황과 효과에 대해 살펴보고(Ⅱ장 1절), 경영진의 스톡옵션 행사의 특징을 분석한다(Ⅱ장 2절). 또한 분석 결과와 해외 현황을 비교하여 상장기업 스톡옵션 개선방안을 제시한다(Ⅲ장). 최근 스톡옵션 관련 연구는 자료 수집의 어려움으로 특정 요소에만 집중하는 경향이 있고 그간의 연구도 다소 오래된 측면이 있어, 본 보고서는 최근 자료를 바탕으로 다양한 측면에 대해 국내 상장기업 스톡옵션의 현황과 특징을 포괄적으로 조사한다는 점에서 의의가 있다. 본 고의 분석 결과를 바탕으로 국내 스톡옵션 개선방안에 대한 시사점을 제공할 수 있을 것으로 기대한다.

Ⅱ. 상장기업의 스톡옵션 활용 현황

상장기업 스톡옵션 활용 현황을 조사하기 위해 금융감독원 전자공시시스템(DART)을 통해 자료를 추출하며, 분석 대상은 유가증권시장ㆍ코스닥시장 상장 국내기업의 2015~2021년 중 임직원에 부여된 스톡옵션이다. 자료 구축을 위해 분석 기간 임직원에 스톡옵션을 부여한 685개 상장기업의 정정 공시 포함 약 3,600여 건의 공시자료를 취합했으며, 최종적으로 1,715건의 스톡옵션 부여 공시 내용을 토대로 분석을 진행한다. 이 중 임원(경영진)에 스톡옵션을 부여한 경우, 이후 해당 임원의 스톡옵션 행사, 행사 후 매도 내역을 스톡옵션 행사공시 및 지분변동공시를 바탕으로 추가로 구성했다.3) 이 외 상장기업 내 미행사 스톡옵션 및 경영진 보상 현황은 TS2000, 상장기업의 주가와 재무제표 등의 자료는 DataGuide를 통해 확보했다.

1. 상장기업의 스톡옵션 부여 현황 및 효과 분석

가. 상장기업 스톡옵션 부여 현황

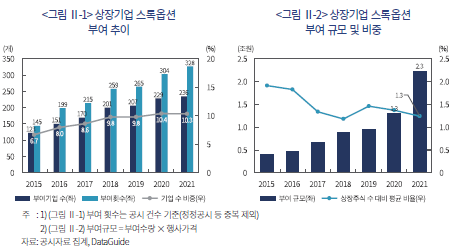

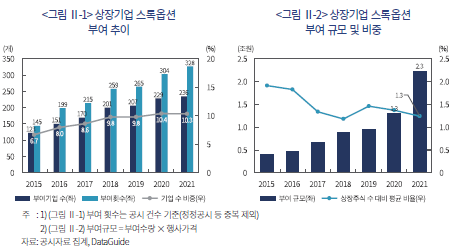

상장기업의 스톡옵션 활용 빈도는 점차 증가하는 추세로 확인된다. <그림 Ⅱ-1>에 따르면 상장기업의 스톡옵션 부여 횟수는 2015년 145건에서 2021년 328건으로 약 2.3배 증가했으며, 주식시장 상장기업 중 스톡옵션을 부여한 기업은 2015년 6.7%에서 2021년 10.3%로 3.6%p 상승한 것으로 나타난다. 또한 2021년 부여된 스톡옵션의 규모(부여 수량×행사가격)는 약 2.3조원으로 전년 대비 71% 증가해 스톡옵션의 경제적 규모도 상당한 수준으로 성장했다(<그림 Ⅱ-2>). 상장기업의 발행주식 수 대비 부여 수량 비중은 평균 1.3%로 2015년 이후 지속해서 감소하는 추세로 보이는데, 이는 상대적으로 대형 기업의 스톡옵션 부여가 늘어났기 때문으로 판단된다. 임원(경영진)과 직원으로 부여 대상을 나누어 보면 분석 기간 상장기업은 임원에게 더 자주 스톡옵션을 부여한 것으로 확인된다. 부여 공시 건수를 기준으로 임원이 58.1%(1,635건)로 직원의 35.1%(985건)보다 많다. 다만 직원의 경우 다수의 사람에게 동시에 부여하는 경우가 많아, 부여 규모를 기준으로 보면 임원의 비중은 44%로 직원(약 53%)보다 다소 작게 나타난다. CEO와 같은 주요 임원인 등기임원과 그 외 미등기임원으로 분류하면 임원 내에서는 등기임원의 부여 횟수와 규모의 비중이 소폭 큰 것으로 확인된다.4)

Ⅱ. 상장기업의 스톡옵션 활용 현황

상장기업 스톡옵션 활용 현황을 조사하기 위해 금융감독원 전자공시시스템(DART)을 통해 자료를 추출하며, 분석 대상은 유가증권시장ㆍ코스닥시장 상장 국내기업의 2015~2021년 중 임직원에 부여된 스톡옵션이다. 자료 구축을 위해 분석 기간 임직원에 스톡옵션을 부여한 685개 상장기업의 정정 공시 포함 약 3,600여 건의 공시자료를 취합했으며, 최종적으로 1,715건의 스톡옵션 부여 공시 내용을 토대로 분석을 진행한다. 이 중 임원(경영진)에 스톡옵션을 부여한 경우, 이후 해당 임원의 스톡옵션 행사, 행사 후 매도 내역을 스톡옵션 행사공시 및 지분변동공시를 바탕으로 추가로 구성했다.3) 이 외 상장기업 내 미행사 스톡옵션 및 경영진 보상 현황은 TS2000, 상장기업의 주가와 재무제표 등의 자료는 DataGuide를 통해 확보했다.

1. 상장기업의 스톡옵션 부여 현황 및 효과 분석

가. 상장기업 스톡옵션 부여 현황

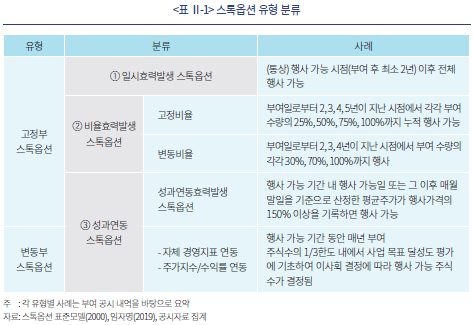

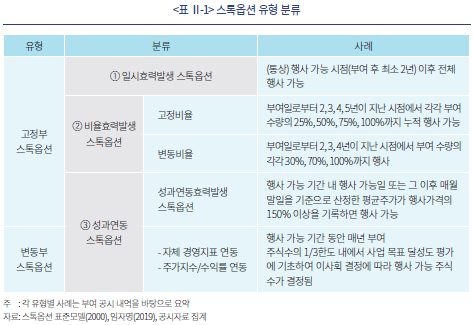

다음으로 스톡옵션의 유형별 부여 현황을 살펴보기에 앞서 본 고에서는 스톡옵션을 <표 Ⅱ-1>과 같이 크게 세 가지 종류로 분류한다. 스톡옵션 표준모델5)에 따르면 부여 시점에 수량, 행사가격, 행사 시점, 행사조건이 고정되어 있는지에 따라 ‘고정부 스톡옵션’과 ‘변동부 스톡옵션’으로 나눌 수 있는데, 고정부 스톡옵션은 행사 시점이 도래하면 전량 행사가 가능한 ‘일시효력발생 스톡옵션’, 시점별로 분할 행사가 가능한 ‘비율효력발생 스톡옵션’, 성과가 연동된 ‘성과연동효력발생 스톡옵션’으로 분류된다. 고정부 스톡옵션은 부여 당시 명시된 조건을 충족하면 권리 행사가 가능하고, 변동부 스톡옵션은 대개 경영지표 또는 주가지수와 연동되어 성과가 우수할수록 스톡옵션 행사 시 많은 이익을 거둘 수 있도록 설계된다. 본 고에서는 고정부 스톡옵션 중 성과연동효력발생 스톡옵션과 변동부 스톡옵션을 모두 성과연동 스톡옵션으로 분류하고6), 그 외 일시효력발생, 비율효력발생 스톡옵션 총 세 가지 유형으로 나눠서 살펴본다.

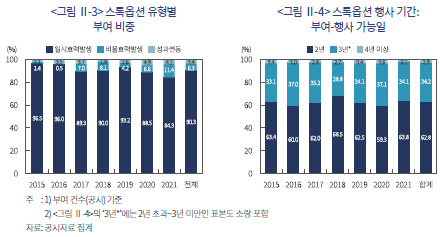

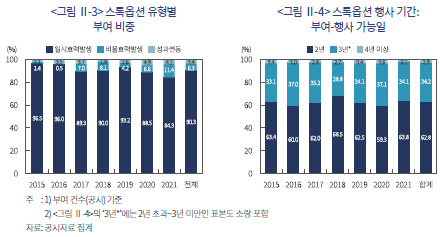

<그림 Ⅱ-3>은 임직원 전체에 부여된 스톡옵션의 유형별 부여 횟수에 대한 비중 추이를 보여준다. 그림에서 알 수 있듯이 상장기업이 주로 부여하는 스톡옵션은 일시효력발생 스톡옵션으로 전체 분석 대상 중 90.3%를 차지한다. 이러한 특징은 임원에 부여된 스톡옵션만 고려해도 큰 차이가 없고, 부여 규모를 기준으로 비중을 산출하면 임원에 부여된 일시효력발생 스톡옵션의 비중은 약 80%에 달한다. 최근 들어 성과연동 및 비율효력발생 스톡옵션의 부여량이 소폭 늘어났지만, 여전히 경영진에 부여된 대다수의 스톡옵션은 행사 가능 시점이 도래하면 언제든 권리 행사가 가능한 일시효력발생 스톡옵션이다. 행사조건이 아닌 행사가격을 기준으로 살펴보면 부여 건수의 42.5%는 할인(discount) 스톡옵션으로 확인된다. 할인 스톡옵션은 부여 시점의 시가(주식가격의 종가)보다 행사가격이 낮게 설정된 스톡옵션으로, 통상적으로 할증(premium) 스톡옵션이 도입 취지에 적합한 유형이라 할 수 있는데 행사가격이 할인되어 부여되는 스톡옵션의 비중도 유의미한 편이다.7) 주지하듯 성과연동 스톡옵션의 비중이 낮은 점과 함께 고려할 때, 국내 상장기업이 주로 활용하는 스톡옵션은 경영진의 자사 주주가치 제고 유인을 크게 제공하지 못할 것으로 예상할 수 있다.

마지막으로 스톡옵션의 행사 기간을 살펴보면, <그림 Ⅱ-4>는 부여 시점과 권리 행사가 가능한 시작 시점의 차이에 대한 분포를 정리한 것이다. 상법상 스톡옵션은 부여 결의 이후 최소 2년의 재직(또는 재임)기간이 지난 후에 행사할 수 있는데(상법 제340조의4), 2015~2021년간 부여된 상장기업의 스톡옵션 중 62.8%(부여 건수 기준)가 행사 가능 시점이 부여 이후 정확히 2년으로 설정되어 있다. 부여 금액을 기준으로 해도 전체 54.7%로 과반이 넘는 규모로 파악된다. 전체 약 97~99%의 스톡옵션이 부여 이후 2~3년 내 행사가 가능한 것으로 나타나고8), 이러한 분포의 특징은 연도와 무관하게 꾸준히 관찰된다. 장기성과 보상체계로서 스톡옵션이 잘 작동하려면 행사 기간의 적절한 설정이 중요함에도 불구하고 국내 상장기업의 스톡옵션 대부분은 행사 가능 기간이 다소 짧게 설정되어 있다고 볼 수 있다.9) 앞서 일시효력발생 스톡옵션의 비중이 높았기 때문에 결과적으로 스톡옵션을 활용한 주식 기반 보상이 경영진으로 하여금 자사 주식을 장기적으로 소유할 인센티브를 제공하기 어려울 것으로 판단된다.

나. 경영진 스톡옵션 부여 기업의 특징과 스톡옵션 부여 효과

분석 기간 동안 경영진(임원)에 스톡옵션을 부여한 기업과 그렇지 않은 미부여 기업의 특징 차이를 요약하면 <그림 Ⅱ-5>와 같다. 먼저 스톡옵션을 부여한 기업은 평균적으로 매출액 증가율(20% > 9.8%: 스톡옵션 부여기업, 미부여기업 순, 이하 생략)과 토빈Q(3.4 > 2.0)가 높게 나타난다. 이는 기업의 높은 성장성을 의미하며, 이들 기업은 매출액 대비 연구개발(R&D) 투자 비중(17.5% > 4.2%)도 높아 향후 성장 잠재력이 있는 기업으로 볼 수 있다. 반면 스톡옵션 부여 기업은 자기자본이익률(ROE)이 낮고(-5.4% < -1.6%) 적자 기업의 비중(36% > 24%)도 높으며 영업현금흐름 비율도 낮아(-27.1% < -2.5%) 임금과 같은 고정비용 지급 여력이 부족한 기업으로 확인된다. 또한 스톡옵션 부여 기업은 상대적으로 업력이 짧고(평균 9년 차이) 기업의 시가총액 규모가 크다. 다만 시가총액의 차이는 평균 약 515억원으로 경제적으로 그 차이는 크지 않다.

이 외에도 스톡옵션을 부여한 기업은 IT, 의료 섹터와 같이 국내에서 성장 잠재력이 높다고 평가되는 업종의 비중이 높다. 스톡옵션 부여 기업 중 연평균 37.6%는 IT 섹터에 포함되며, 24.7%는 의료 섹터에 속해 있는데, 이는 미부여 기업 내 해당 섹터 비중(IT: 25%, 의료: 9.1%)과 큰 차이를 보인다. 또한 스톡옵션 부여 기업 내에는 코스닥 상장기업이 81%, 유가증권시장 상장기업이 19%로 미부여기업군 대비 코스닥 상장기업의 비중이 높다.10) 전반적으로 스톡옵션은 현재 재무적 제약(financial constraints)에 직면한 기업, 성장 잠재력이 높은 기업에서 주로 활용하는 보상체계임을 알 수 있으며, 이는 기존 국내외 문헌의 결과와도 일치한다(Core & Guay, 2001; Kedia & Mozumdar, 2002; 배길수, 2002).

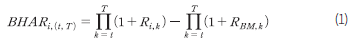

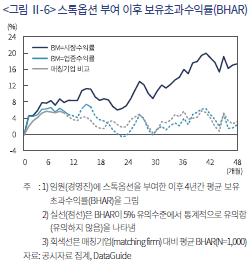

경영진에 스톡옵션을 부여한 이후 주주 이익에는 어떠한 영향이 있었을까? 주주 이익 관점에서 스톡옵션 부여 효과를 살펴보기 위해 경영진에 스톡옵션을 부여한 기업의 부여 이후 보유초과수익률(Buy-and-Hold Abnormal Return: BHAR)을 산출한다.11) BHAR 계산은 아래 식(1)과 같이 부여 공시일12) 이후 4년13)간 개별주식의 매수 후 보유(buy and hold) 수익률( )을 계산하여 동기간의 벤치마크 수익률(

)을 계산하여 동기간의 벤치마크 수익률( )을 차감하는 방식이다. 벤치마크 수익률로 유가증권시장ㆍ코스닥시장 합산 주식시장 수익률과 동종업종 수익률을 이용하며, 미부여 기업과의 비교를 위해 표본별 매칭기업(matching firm)을 선정하여 해당 기업의 주식 수익률을 벤치마크로 사용한다. 매칭기업 선정은 스톡옵션을 부여하지 않은 기업 내 연속적인 수익률 자료가 존재하는 기업 중 동일 섹터ㆍ유사 규모 그룹14) 내 임의추출(random sampling) 방식으로 선택하며, 유의성 검증(empirical p-value 산출)을 위해 1,000번의 추출을 반복한다.

)을 차감하는 방식이다. 벤치마크 수익률로 유가증권시장ㆍ코스닥시장 합산 주식시장 수익률과 동종업종 수익률을 이용하며, 미부여 기업과의 비교를 위해 표본별 매칭기업(matching firm)을 선정하여 해당 기업의 주식 수익률을 벤치마크로 사용한다. 매칭기업 선정은 스톡옵션을 부여하지 않은 기업 내 연속적인 수익률 자료가 존재하는 기업 중 동일 섹터ㆍ유사 규모 그룹14) 내 임의추출(random sampling) 방식으로 선택하며, 유의성 검증(empirical p-value 산출)을 위해 1,000번의 추출을 반복한다.

분석 결과 BHAR은 스톡옵션 부여 공시 이후 약 10개월간 통계적으로 유의한 양(+)의 값으로 산출되나, 벤치마크 설정에 따라 장기 BHAR의 크기와 통계적 유의성이 상이하게 나타난다(<그림 Ⅱ-6>). 벤치마크를 주식시장 합산 수익률로 사용할 경우 4년 보유초과수익률 평균은 17.1%로 통계적으로 유의하지만, 동일 업종 수익률 및 매칭기업을 벤치마크로 사용하면 각각 평균 2.4%, 3.2%이며 통계적 유의성이 사라진다. 이는 분석 기간(2015~2021년) 동안 의료ㆍIT 섹터의 주식 수익률이 타 섹터에 비해 훨씬 높고15) 스톡옵션을 부여한 기업 내에 의료ㆍIT 기업이 많기 때문으로 판단된다. 경영진에 스톡옵션을 부여한 이후 동종업종 또는 대조군 대비 유의미한 주주가치 증대를 시현했다고 평가하기에는 어렵다고 볼 수 있다.

이 외에도 수익성ㆍ성장성 지표를 토대로 경영진 스톡옵션 부여 이후 경영성과의 변화를 살펴보았지만 유의미한 성과 제고는 발견되지 않았다. 가령 자기자본이익률은 부여 이후 4년 동안 유의미한 변화가 없었고 동종업종 대비 낮은 수익성이 지속되었다. 이 외에도 스톡옵션 부여 이후 4년 동안 매출액의 증가가 관찰되나 성장세는 다소 둔화하는 경향을 보였다.16) 본 고의 분석 결과는 스톡옵션 부여 이후 주식 수익률 및 경영성과 측면에서 유의미한 변화를 발견하지 못한 선행연구의 결과와도 부합된다(Griner, 1999; Yeo et al., 1999; 김창수, 2004; 윤태화 외, 2005; 안승철ㆍ이소현, 2009). 이는 주주 이익과의 유인부합적 보상체계로 설계된 스톡옵션을 통해 궁극적으로 대리인 문제를 완화하는 긍정적 효과를 기대할 수 있지만(Jensen & Meckling, 1976), 스톡옵션의 오남용 및 단기 실적주의 등에 의해 본래 의도했던 긍정적인 효과가 상쇄될 수 있음을 시사한다. 앞서 국내 상장기업의 스톡옵션 활용 현황에서도 보여주듯, 상장기업이 주로 부여하는 스톡옵션의 구조가 장기적인 주주가치 제고를 기대하기 어려운 방식으로 설계되어 있어 스톡옵션의 부여 이후 효과 또한 불분명한 것으로 판단된다.17)

2. 경영진 스톡옵션 행사의 특징 분석

가. 상장기업 경영진의 스톡옵션 행사 특징

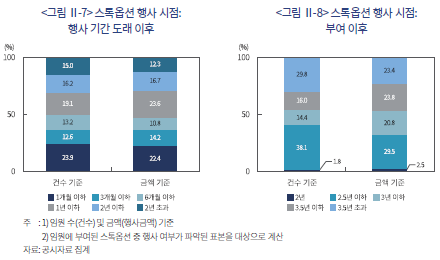

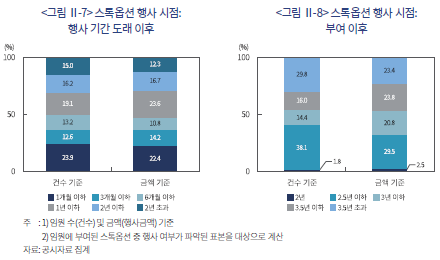

앞서 스톡옵션 부여와 관련된 여러 측면을 살펴보았다면, 본 절에서는 경영진의 스톡옵션 행사의 특징을 행사 시점, 방법 및 행사 전후 수익률 측면에서 분석한다. 다만 스톡옵션 부여와 달리 행사와 관련된 공시자료가 부족하여 자료 수집이 가능한 표본을 바탕으로 분석을 진행한다. 먼저 분석 기간 동안 경영진에 부여된 스톡옵션 중 행사가 확인된 경우(총 507명)를 살펴본 결과 부여 건을 기준으로 행사 가능 기간 도래 이후 1개월 이내에 행사하는 경우가 23.9%, 1개월 초과~3개월 이하의 비중이 12.6%, 3개월 초과~6개월 이하인 경우가 13.2%로, 약 절반에 달하는 임원이 6개월 이내에 스톡옵션을 행사하는 것으로 파악되며 약 70%는 1년 내에 행사되는 것으로 나타난다.(<그림 Ⅱ-7>). 부여 시점을 기준으로 보면 주로 부여 후 정확이 2년 뒤에 행사하는 예도 존재하고(부여 건수 기준 약 1.8%), 2년 초과~2.5년 이내인 경우가 33.1%, 2.5년 초과~3년 이하의 비중이 14.4%로, 경영진에 부여된 스톡옵션 중 절반에 달하는 경우는 부여 이후 2~3년 내 행사된다(<그림 Ⅱ-8>). 통상적인 행사 가능 기간을 고려했을 때(주로 부여 이후 2~5년 내 행사 가능), 해당 기간 내 초기에 주로 행사되는 것이다. 이는 행사 기간 중 정년퇴임 등에 영향도 있을 수 있으나, 일반적으로 퇴임하더라도 이후 스톡옵션을 행사할 수 있기 때문에 퇴임에 따른 영향은 적을 것으로 생각된다.18) 무엇보다 대다수의 스톡옵션이 일시효력발생 스톡옵션으로 설계되어 있으므로, 수익을 확정할 수 있다면 굳이 주가 변동 위험을 감수하지 않고 조기에 행사이익을 실현할 유인이 강할 수 있다.

2. 경영진 스톡옵션 행사의 특징 분석

가. 상장기업 경영진의 스톡옵션 행사 특징

앞서 스톡옵션 부여와 관련된 여러 측면을 살펴보았다면, 본 절에서는 경영진의 스톡옵션 행사의 특징을 행사 시점, 방법 및 행사 전후 수익률 측면에서 분석한다. 다만 스톡옵션 부여와 달리 행사와 관련된 공시자료가 부족하여 자료 수집이 가능한 표본을 바탕으로 분석을 진행한다. 먼저 분석 기간 동안 경영진에 부여된 스톡옵션 중 행사가 확인된 경우(총 507명)를 살펴본 결과 부여 건을 기준으로 행사 가능 기간 도래 이후 1개월 이내에 행사하는 경우가 23.9%, 1개월 초과~3개월 이하의 비중이 12.6%, 3개월 초과~6개월 이하인 경우가 13.2%로, 약 절반에 달하는 임원이 6개월 이내에 스톡옵션을 행사하는 것으로 파악되며 약 70%는 1년 내에 행사되는 것으로 나타난다.(<그림 Ⅱ-7>). 부여 시점을 기준으로 보면 주로 부여 후 정확이 2년 뒤에 행사하는 예도 존재하고(부여 건수 기준 약 1.8%), 2년 초과~2.5년 이내인 경우가 33.1%, 2.5년 초과~3년 이하의 비중이 14.4%로, 경영진에 부여된 스톡옵션 중 절반에 달하는 경우는 부여 이후 2~3년 내 행사된다(<그림 Ⅱ-8>). 통상적인 행사 가능 기간을 고려했을 때(주로 부여 이후 2~5년 내 행사 가능), 해당 기간 내 초기에 주로 행사되는 것이다. 이는 행사 기간 중 정년퇴임 등에 영향도 있을 수 있으나, 일반적으로 퇴임하더라도 이후 스톡옵션을 행사할 수 있기 때문에 퇴임에 따른 영향은 적을 것으로 생각된다.18) 무엇보다 대다수의 스톡옵션이 일시효력발생 스톡옵션으로 설계되어 있으므로, 수익을 확정할 수 있다면 굳이 주가 변동 위험을 감수하지 않고 조기에 행사이익을 실현할 유인이 강할 수 있다.

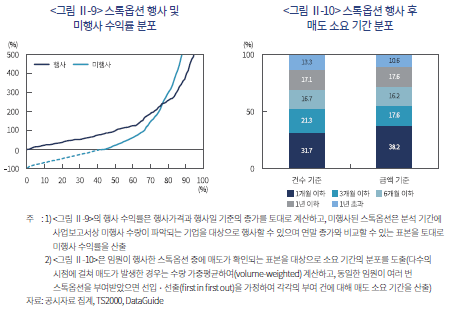

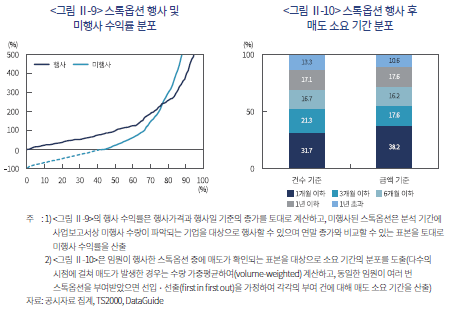

스톡옵션은 주로 주식을 교부하는 방식으로 행사되는데, 신주를 발행하여 교부하는 방식이 80.4%로 제일 높은 비중을 차지한다.19) 또한 행사 시점 수익률을 살펴보기 위해 행사가격과 행사일 기준 주식의 종가를 비교하여 가상의 수익률을 계산해보면 그 분포는 <그림 Ⅱ-9>와 같다. 통상 스톡옵션 행사 당시 양(+)의 행사이익을 실현한 것으로 확인되며, 행사 수익률의 중앙값은 +98.2%로 높은 수준이다. 이러한 수익률 분포의 특징은 미행사된 스톡옵션의 미실현 수익률 분포와는 차이가 있는데, 행사가 가능하나 아직 미행사된 스톡옵션 중 약 41%는 손실 구간에 있는 것으로 나타난다. 행사 시점과 종합해보면 경영진의 스톡옵션 행사는 주로 행사 가능 기간 조기에 수익 구간에서 신주 발행형으로 이루어지는 것으로 요약할 수 있다. 이러한 특징은 신규상장기업 내 경영진이 IPO 후 초기에 스톡옵션을 행사하여 높은 이익을 얻는 경우와 유사한 측면이 있는데20), 경영진의 도덕적 해이에 따른 스톡옵션의 오남용이 우려되는 부분이다.

앞서 분석한 스톡옵션 행사 표본 중 해당 주식의 처분(매도)까지 이어진 경우를 추적하면 약 47%의 표본은 매도가 이루어진 것으로 확인된다.21) 특히 <그림 Ⅱ-10>에서 알 수 있듯이, 스톡옵션의 행사와 매도 사이의 간격 또한 짧은 편으로 나타난다. 행사금액을 기준으로 했을 때 분석 표본 중 38.2%는 행사 후 1개월 이내, 17.6%는 행사 후 1개월 초과~3개월 이내에 매도되어, 50% 이상의 표본에서 스톡옵션 행사 후 부여받은 주식은 3개월 이내에 처분된다. 즉, 권리 행사 기간 조기에 스톡옵션이 행사되는 것과 유사하게 행사 후 부여받은 주식의 보유기간 또한 짧은 편에 속한다.

나. 경영진 스톡옵션 행사 및 주식처분 전후 수익률 분석

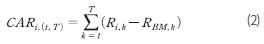

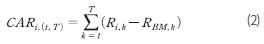

앞서 상장기업 경영진의 스톡옵션 조기 행사 및 주식처분 행태를 살펴보았다면, 본 절에서는 스톡옵션 행사 또는 주식처분 전후 수익률 패턴을 분석하고자 한다. 분석을 위해 단기 사건연구에서 주로 활용하는 누적초과수익률(Cumulative Abnormal Return: CAR)을 아래 식(2)와 같이 산출한다. 벤치마크 수익률 차감을 위해 같은 시점 유가증권시장ㆍ코스닥시장 합산 주식시장 수익률, 동종업종 수익률을 사용하며, 앞선 BHAR 분석과 마찬가지로 표본별 매칭기업(matching firm) 비교 분석을 진행한다. 분석 대상 기업은 경영진의 스톡옵션 행사(또는 행사 후 주식 매도)가 확인되고 분석이 가능한 연속적인 수익률 자료가 존재하는 기업이며, 분석 기간은 사건 전후 100일이다.22)

나. 경영진 스톡옵션 행사 및 주식처분 전후 수익률 분석

스톡옵션 행사±100일의 평균 CAR 패턴을 살펴본 결과(<그림 Ⅱ-11>), 분석 방법과 기간에 상관없이 스톡옵션 행사 전 뚜렷한 양(+) 초과수익률이 관찰된다. 스톡옵션 행사 전 100일부터 행사일까지의 CAR은 약 +17~23%로 통계적으로 유의한 주가 상승 패턴이 나타난다. 반면 행사 후 평균 CAR은 통계적으로 0에 가까운 결과가 도출된다. 스톡옵션 행사자로서는 이익 극대화를 위해 주식가격이 상승한 뒤 행사할 유인도 있고, 반면에 행사이익에 따른 세금을 최소화하기 위해 주가가 크게 상승하기 이전에 행사할 유인도 존재하나, 분석 결과는 전자에 가까운 것으로 볼 수 있다. 이는 주식을 행사 후에도 보유함으로써 위험을 지속해서 감수할 유인이 낮은 점과 행사 직후 주식처분이 자유롭기 때문인 것으로 판단된다. 앞서 살펴보았듯 스톡옵션 행사와 주식처분 사이의 간격이 짧은 점을 고려하면 경영진은 이익 극대화를 위해 행사 시점을 전략적으로 선택할 가능성이 존재한다.

<그림 Ⅱ-12>를 살펴보면 스톡옵션 행사 후 주식처분 시점 전후 수익률 패턴은 단순 행사 전후 패턴보다 CAR의 크기가 더 크게 확인된다. 예를 들어, 매칭기업 비교 결과 스톡옵션 행사 전 100일부터 행사일까지의 평균 CAR은 +17.1%지만 이벤트를 주식 매도로 변경하면 CAR의 크기가 +27.5%로 약 10%p 이상 차이가 난다. 벤치마크 수익률을 변경해도 이러한 차이는 유사하며, 무엇보다 주식처분 이후 평균 CAR이 음(-)의 값으로 통계적으로 유의하게 나타났다.23) 가령 매칭기업 비교 결과 주식처분 이후 100일 동안 평균 –3.9%의 비정상적인 주가 하락이 관찰된다. 전반적인 분석 결과는 경영진이 스톡옵션 행사 및 이후 주식처분을 전략적으로 수행하는 것을 시사하고, 이러한 결과는 과거 국내외 문헌과도 유사하다(Carpenter & Remmers, 2001; Huddart & Lang, 2003; 김현아, 2014; 김선호, 2015). 이들 연구에서는 스톡옵션이 내부자의 우월한 정보 및 규제차익을 통해 사적 이익 추구의 수단으로 활용될 수 있고, 이에 따른 대리인 비용의 발생과 주주 이익 감소 가능성을 지적한다.

Ⅲ. 상장기업 스톡옵션 개선방안

Ⅱ장의 실증분석 결과는 전반적으로 국내 스톡옵션이 궁극적 도입 취지에 걸맞지 않게 활용되고 있음을 보여준다. 이러한 추세가 지속된다면 국내 경영진 보상체계는 주요 선진국에 비해 뒤떨어질 수밖에 없고 이는 기업의 경쟁력과 주식시장의 신뢰성과도 직결되는 문제이다. 따라서 스톡옵션 제도의 도입 목적을 달성하고 장기적인 주주가치 증대로 이어지기 위해서는 스톡옵션과 같은 주식 기반 보상이 체계적으로 잘 작동할 수 있는 환경을 조성할 필요가 있다.

보상체계 설계에는 정답은 없으나 Bebchuk & Fried(2010)가 제시한 주식 기반 보상의 원칙을 소개하면 아래 <표 Ⅲ-1>과 같다.24) 본 고에서 조사한 국내 상장기업의 스톡옵션 현주소에 대입해보면, 스톡옵션 행사 후 보유 의무가 없는 점(원칙 1~3), 보상으로 부여받은 주식처분에 대한 총량 제한과 처분 계획에 대한 정보 공시규제가 없는 점(원칙 4, 7), 임의의 날짜에 스톡옵션을 부여할 수 있는 등(원칙 5) 제시된 원칙 대부분이 잘 지켜지지 않는 것으로 판단된다. 본 장에서는 이러한 원칙에 근거하여 스톡옵션의 유인부합적 설계 및 경영진 주식 보상 관련 정보제공 확대 방안에 대해 다루고자 한다.

1. 유인부합적 스톡옵션 설계 확대

스톡옵션이 기업의 장기성과를 제고하고 및 경영진-주주 간 대리인 문제를 해소하는 유인과 부합하도록 작동하려면 분할 행사를 통해 장기보유를 유도하고 성과와 연동된 스톡옵션을 확대할 필요가 있다. 미국 주요 기업의 스톡옵션 서베이 자료25)에 따르면 일시효력발생 스톡옵션보다 일정 시간에 걸쳐 권리 행사가 가능한 비율효력발생 스톡옵션의 비중이 높고, 주요 기업의 장기성과 보상 인센티브 계획 내에는 성과평가에 따른 행사요건의 비중이 높다.26) 국내법상 스톡옵션 행사 자격으로 최소 2년의 재직 또는 재임 요건을 규정하고 있지만, 실증분석에서 드러났듯이 다수의 스톡옵션이 법정 최소기한을 준수하는 것에 그치고 요건을 채운 뒤 행사 가능 기간 내 조기에 행사되는 특징이 보인다. 법적으로 스톡옵션 설계를 특정한 방향으로 강요할 수 없으나 상장기업의 정관이나 사업보고서상에 스톡옵션 설계 원칙에 대한 기준을 자발적으로 마련하고 이를 투자자에게 공시하도록 할 필요가 있다. 다음으로 스톡옵션이 장기성과에 대한 주식 기반 보상으로서 기능하려면 실질적인 주식 보유(ownership)가 전제되어야 한다. 해외에서는 일반적으로 행사기한에 대한 법적 규제가 없음에도 불구하고 주식 보상은 ‘장기성과’ 보상체계의 수단으로 활용되는 것이 일반적이다. 미국 주요 상장기업의 경우 스톡옵션의 권리 행사 기간 설정은 법적 규제가 없어도 최소 3년 이상으로 설계되고 있고27), 유럽 상위 100대 기업의 장기성과 인센티브 중 99%의 권리 행사도 최소 3년 이상이다.28) 특히 S&P500 지수에 포함된 기업 중 경영진의 주식 소유를 의무화하는 주식소유요건(stock ownership requirements)을 설계하는 비중은 2019년 기준 97%에 달하고, 주식에 대한 권리 행사를 실행하더라도 처분을 제한하는 보유요건(retention requirements)을 채택하는 기업도 약 64%로 10년 전에 비해 30%p 가까이 증가했다.29) 이러한 해외 주요국 보상체계의 변화는 과거 경영진의 미미한 수준의 자사 주식 보유와 잦은 권리 행사 및 주식처분에 따른 단기 실적주의의 부작용을 반영한 결과였고(Holmstrom & Kaplan, 2003), 몇몇 연구에 따르면 이러한 요건을 채택한 이후 경영진의 유의미한 주식 보유 증가가 보고되고 있다(Korzcak & Liu, 2014).30)

이렇듯 국내 상장기업의 CEO 등 주요 임원의 경우 일정 지분을 의무적으로 소유하는 요건과 스톡옵션을 행사하더라도 처분을 다소 제한하는 요건을 채택하도록 유도할 필요가 있다. 이러한 경영진의 자사 주식 소유를 유도하는 원칙은 과거 Greenbury 보고서(1995), Walker 보고서(2009), 영국 기업지배구조 코드(2018) 등에도 기술되어 있는 보편적인 내용이며31), 미국 SEC는 2006년 이후 기업의 주주총회안건설명서(proxy statement) 내 보상 논의 및 분석(compensation discussion & analysis) 항목에 경영진의 주식소유요건과 보유요건에 관한 사항을 기재하도록 의무화하고 있다.32) 물론 이러한 요건의 채택은 관련 법이나 규제를 통해 의무적으로 강제되지 않으며 이사회 또는 보상위원회의 선택 요소 중 하나이다. 다만 이러한 요건을 채택할 시 <표 Ⅲ-1>의 원칙 1에 명시되어 있듯이 세금 납부를 위해 필요한 주식 매도는 보유요건에서 제외할 필요가 있으며, 기업의 자발적 채택을 유도하기 위해 스톡옵션 행사자에게 세제 혜택을 제공하는 방식도 고려해볼 수 있다.

2. 스톡옵션 관련 정보 제공 확대

앞서 <표 Ⅲ-1>에 제시된 원칙 5(사전에 정해진 날에 부여) 및 원칙 7(처분 계획 공시 또는 사전에 정한 방식으로 매도)에 따라 스톡옵션 부여ㆍ행사ㆍ주식처분의 전략적 시점 선택이 어렵도록 규제를 재정비할 필요가 있다. 상장기업 스톡옵션 부여의 경우 자본시장법상 공시규제(자본시장법 제165조의17)로 인해 백데이팅(backdating)33) 이슈는 덜할 것으로 판단된다. 그러나 스톡옵션 행사에 대한 공시규제가 다소 미비한 편34)이고, 주식처분과 관련하여 내부자거래에 대한 사전적 방지 장치도 없어 개인의 사적 이익을 추구할 수 있는 통로가 열려 있다. 아래 <그림 Ⅲ-1>에 따르면 상장기업 스톡옵션 활용 증가로 인해 미행사된 스톡옵션을 보유한 상장기업의 비중은 전체 상장기업의 약 25.7%로 계속해서 증가하는 추세이다. 발행주식 수 대비 평균 약 1.2%이며, 특히 코스닥 상장기업 및 의료ㆍIT 섹터 기업과 같이 정보 비대칭성에 취약한 기업의 비중이 높다(<그림 Ⅲ-2>). 과거 스톡옵션의 오남용 이슈가 불거진 미국은 2002년 사베인-옥슬리법(SOX법) 제정 이후 스톡옵션 부여ㆍ행사에 대한 공시의무가 강화되었고 결과적으로 전략적 시점 선택에 대한 문제가 감소한 바 있어(Dhaliwal et al., 2009)35), 이를 참고삼아 스톡옵션과 연관된 중요한 정보 제공을 확대하는 방안을 고려할 필요가 있다.

현행 코스닥 기업에만 적용되는 스톡옵션 행사공시 규정을 유가증권시장 상장기업에도 확대하고 주요 경영진의 스톡옵션 행사는 발행주식 수 대비 비율과 무관하게 공시할 필요가 있다. 임원의 경우 지분변동공시가 의무화되어 있으나 어느 정도 시차가 존재하고 내용 파악에 시간적 비용이 소요되기 때문에 스톡옵션 행사와 같은 중요한 정보는 적시에 공시하는 것이 바람직하다. 다만 앞서 언급한 일정 기간 주식 보유요건이 사전에 설계되어 있다면 행사공시 자체는 선택적으로 하는 방안도 고려할 수 있다. 또한 스톡옵션으로 행사한 주식의 처분에 있어서는 미국의 SEC Rule 10b5-1을 벤치마크하여 주요 주주 거래에 대한 사전신고제를 도입하는 방법도 고려해볼 수 있다(김갑래, 2019). 이는 <표 Ⅲ-1>의 원칙 7과 부합하는 방향으로 처분 계획과 방식에 대한 사전 공시가 있다면 전략적 매도 시점 선택에 따른 사익 편취 유인을 원천적으로 봉쇄할 수 있기 때문이다. 주식시장에서 가장 중요한 사전적 투자자보호장치는 충분한 정보를 적시에 제공하는 것임을 명심해야 한다.

Ⅳ. 결론 및 시사점

본 고의 상장기업 스톡옵션에 대한 실증분석 결과를 요약하면 다음과 같다. 첫째, 상장기업의 스톡옵션의 활용도는 증가하는 추세이나 성과연동 또는 분할 행사가 이루어지는 스톡옵션의 활용 비중이 작고, 대부분 행사 가능 시점이 도래하면 전량 행사가 가능한 일시효력발생 스톡옵션이다. 특히 다수의 스톡옵션이 상법상 최소 권리 행사 기한을 준수하는 것에 그치고 행사 후 주식처분이 자유로워 경영진의 주식 보유에 대한 유인이 낮다. 둘째, 국내 상장기업에서는 경영진에 대한 스톡옵션의 부여 효과가 뚜렷하게 나타나지 않는다. 현금 지불 여력이 부족하고 성장성이 높은 기업 또는 섹터에서 주로 활용되는 보상 방식이긴 하나, 부여 이후 유의미한 경영성과 및 주주가치 제고가 관찰되지 않는다. 셋째, 부여 이후 스톡옵션 행사 시점이 대체로 짧은 편이고 이후 단기간 내 주식 매도가 관찰되며, 행사(또는 주식처분) 전후 주식 수익률의 패턴이 스톡옵션 행사자에 유리하게 나타난다. 즉, 상장기업의 경영진은 전략적으로 스톡옵션 행사 또는 주식처분 시점을 선택하는 경향이 존재할 것으로 예상된다. 이러한 결과는 국내 기업군을 대표하는 상장기업에서 스톡옵션 제도가 본래 도입 취지에 맞지 않게 활용되고 있음을 시사한다.

스톡옵션 제도는 본래 경영진과 주주의 이해를 일치시키는 방향으로 의사결정을 유도하여 대리인 비용을 줄이고 기업의 장기성과 및 주주가치 제고에 대한 경영진의 인센티브를 강화하기 위해 도입된 수단이다. 따라서 스톡옵션은 경영진의 인센티브를 왜곡시키지 않고 본래의 기능이 잘 작동할 수 있도록 설계되어야 하며, 스톡옵션이 개인의 이익을 극대화하는 수단으로 악용되는 것을 지양해야 한다. 이에 본 고에서는 주식 보상 설계 원칙에 입각한 유인부합적 스톡옵션 확대 방안으로 성과연동 및 비율효력발생 스톡옵션 활용 증대, 상장기업의 스톡옵션 설계원칙 마련, 경영진의 주식소유요건 채택 유도를 제시한다. 또한 스톡옵션 행사공시 강화, 내부자거래 관련 사전신고제 도입과 같은 관련 정보 제공 확대를 통해 정보 비대칭성을 근본적으로 완화할 필요가 있다.Ⅳ. 결론 및 시사점

본 고의 상장기업 스톡옵션에 대한 실증분석 결과를 요약하면 다음과 같다. 첫째, 상장기업의 스톡옵션의 활용도는 증가하는 추세이나 성과연동 또는 분할 행사가 이루어지는 스톡옵션의 활용 비중이 작고, 대부분 행사 가능 시점이 도래하면 전량 행사가 가능한 일시효력발생 스톡옵션이다. 특히 다수의 스톡옵션이 상법상 최소 권리 행사 기한을 준수하는 것에 그치고 행사 후 주식처분이 자유로워 경영진의 주식 보유에 대한 유인이 낮다. 둘째, 국내 상장기업에서는 경영진에 대한 스톡옵션의 부여 효과가 뚜렷하게 나타나지 않는다. 현금 지불 여력이 부족하고 성장성이 높은 기업 또는 섹터에서 주로 활용되는 보상 방식이긴 하나, 부여 이후 유의미한 경영성과 및 주주가치 제고가 관찰되지 않는다. 셋째, 부여 이후 스톡옵션 행사 시점이 대체로 짧은 편이고 이후 단기간 내 주식 매도가 관찰되며, 행사(또는 주식처분) 전후 주식 수익률의 패턴이 스톡옵션 행사자에 유리하게 나타난다. 즉, 상장기업의 경영진은 전략적으로 스톡옵션 행사 또는 주식처분 시점을 선택하는 경향이 존재할 것으로 예상된다. 이러한 결과는 국내 기업군을 대표하는 상장기업에서 스톡옵션 제도가 본래 도입 취지에 맞지 않게 활용되고 있음을 시사한다.

1) 사업보고서상에 기재된 5억원 이상의 보수를 수령하는 임원의 평균 보수 중 스톡옵션 행사이익의 비중은 2.2%(2015년)에서 8.6%(2020년)로 조금씩 늘어나는 추세이며, 스톡옵션 행사이익의 규모는 평균 약 1억원(2020년 기준)에 달한다.

2) Murphy(1999)의 분석에 따르면 1990년대 중반 S&P500 기업(규제산업 제외)의 민감도는 약 0.26으로 산출되었으며, 규제산업의 경우 0.4~0.5 사이로 높게 나타난다.

3) 유가증권시장 상장기업은 스톡옵션 행사 관련 공시의무가 없는 점과 임원의 퇴임, 임기 만료 등으로 지분변동공시가 부재한 경우 스톡옵션 행사 추적이 불가해 경영진의 스톡옵션 행사 관련 분석은 자료 수집이 가능한 범위 내에서만 살펴본다.

4) 자세한 통계는 김민기(2022) 참고

5) 스톡옵션표준모델제정위원회(2000)

6) 변동부 스톡옵션도 일종의 성과연동 스톡옵션으로 간주할 수 있다. 실제 취합한 자료에 따르면, 분석 기간(2015~2021년) 동안 상장기업이 부여한 변동부 스톡옵션은 모두 성과연동 스톡옵션으로 확인된다.

7) 상법상 부여 당시 실질가액보다 행사가격을 높게 설정하나(상법 제340조의2) 대개 거래량가중평균가격(VWAP)을 기반으로 실질가액을 결정하는 경우가 많아서 부여 시점의 종가보다 종종 할인되어 부여되는 것으로 판단된다. 할인율의 중앙값은 1.3%로 부여 당시의 종가와 대체로 유사한 편이나 10% 이상 할인되는 경우도 표본의 약 10% 정도를 차지하는 것으로 나타난다.

8) 임원에 부여된 스톡옵션만을 고려해도 전체 67.1%(금액 기준 61.4%)는 부여 이후 정확히 2년이 지난 시점에 행사할 수 있는 스톡옵션이며, 4년 이상 지나야 행사가 가능한 스톡옵션은 전체의 2.1%(금액 기준 1.6%)에 불과하다.

9) 미국 주요 기업을 대상으로 한 서베이 자료에 따르면, 법적인 규제가 없고 일시효력발생 스톡옵션의 비중이 작음에도 불구하고 행사 가능 기간이 3년 미만으로 설정된 경우는 거의 없다(자세한 해외 스톡옵션 부여 현황은 Ⅲ절 참고).10) 본 고에서는 단변량 분석 결과만 제시했으나, 스톡옵션 부여 여부에 대한 더미(dummy)변수를 종속변수로 하는 다변량 로짓(logit) 회귀분석에서도 수익성 지표를 제외한 모든 변수가 통계적으로 유의하게 나타난다.

11) 보유초과수익률(BHAR)을 조사하는 이유는 장기 사건연구(long-term event study)이기 때문이며 누적수익률 산출 시 복리 효과(compounding effect)를 고려하기 위함이다.

12) 자본시장법상 스톡옵션 부여를 의결한 당일 공시의무가 존재하기 때문에(자본시장법 제165조의17) 공시일과 부여일은 일반적으로 같다.

13) 표본 수의 확보와 장기 시계열 분석을 위해 사건 구간(event window)을 4년으로 설정했으나 구간을 3년 또는 5년으로 변경해도 결과의 질적인 차이는 없다.

14) 전체 상장기업 중 시가총액 규모를 기준으로 세 그룹(big, medium, small)으로 분류한다.

15) 의료ㆍIT 섹터의 시가총액가중평균(value-weighted) 수익률은 각각 +172%, +119%이며, 그 외 섹터의 경우 에너지(+65%), 소재(+55%), 통신서비스(+11%), 경기소비재(-4.4%), 산업재(-3.7%), 금융(-12.2%), 필수소비재(-34%), 유틸리티(-34.3%) 순이다.

16) 자세한 통계는 김민기(2022) 참고

17) 본 고의 실증분석 결과 유의미한 성과 제고가 관찰되지 않았으나 경영진 보상체계 방식은 기업의 문화나 경쟁기업 등에 영향을 받을 수 있고, 스톡옵션 부여의 실질적 목적이 기업마다 상이할 수 있어 본 고의 실증분석이 스톡옵션의 부여 효과를 면밀하게 검증하기에는 한계가 있다.

18) 상법상 본인의 귀책 사유가 아닌 경우 본인이 퇴임(또는 퇴직)하더라도 스톡옵션을 행사할 수 있다(단, 정년에 따른 퇴임이나 퇴직은 제외, 상법 제542조의3).

19) 이외 자기주식교부(자사주 교부)가 7.1%, 차액보상이 12.5%를 차지한다. 다만 행사 방법의 경우 행사공시 내용에만 기재되고 지분변동공시 상에서는 알 수 없으므로 실제 비중과 다를 수 있다.

20) 김민기(2022)의 분석에 따르면 2020~2021년 중 IPO 기업의 경영진이 상장 전 부여받은 스톡옵션을 주로 상장 후 6개월 이내 행사(약 51~53%)하는 것으로 나타난다.

21) 매도가 확인된 표본 외 53%는 지속하여 보유하고 있거나 증여 또는 임원 퇴임으로 인해 추적이 불가능한 경우이다.

22) 사건 기간을 이벤트 전후 50일로 변경해도 결과의 질적인 차이는 없다.

23) 이벤트 이후 CAR은 주식처분의 경우에만 통계적 유의성이 나타난다. 자세한 통계량은 보고서의 간결성을 위해 생략한다.

24) 원칙에 대한 자세한 국문 설명은 이승희(2022)를 참고하길 바란다.

25) FW Cook Book(2019)의 미국 S&P500 지수 내 주요 250개 기업 서베이 결과에 따르면, 스톡옵션 유형별 비중은 각각 일시효력발생(11%), 비율효력발생(74%), 성과연동 포함 기타(15%)로 나타난다.

26) Fidelity(2016) 조사에 따르면 북미지역 장기성과 인센티브 계획의 행사요건 중 성과평가(ratable) 행사의 비중은 70%에 달한다.

27) FW Cook Book(2020) 참고

28) Willis Towers Watson(2018) 참고

29) Brisley et al.(2021), Willis Towers Watson(2020) 참고. 이 외 영국의 경우 FTSE350 지수에 속한 기업 중 약 50%는 주식소유요건을 채택하고 있다(Korczak & Liu, 2014).

30) 다만 경영진의 주식 보유에 따른 대리인 비용의 감소, 주주가치 증대 효과를 기대하는 것 외에도, 경영진의 자사 주식에 대한 과도한 위험 노출로 인해 R&D, 레버리지 감소 등 기업의 가치 증대 활동을 저해할 수도 있다는 연구 결과도 존재한다

(Brisely et al., 2021).

31) Greenbury 보고서의 point 6.34, Walker 보고서 내 Recommendation 34, 영국 기업지배구조 코드 내 Provisions 36 참고

32) SEC, 2006, Final rule ‘Executive Compensation and Related Person Disclosure’

33) 백데이팅은 공시일과 실제 결의일 간의 시차를 악용, 서류상 부여(또는 행사) 날짜를 전략적으로 소급적용하여 부당이득을 챙기는 것을 뜻한다.

34) 코스닥 상장기업은 스톡옵션 행사주식수 누계(기신고된 행사주식수 제외)가 발행주식총수의 1% 이상일 때 주요경영사항(주식매수선택권 행사) 공시의무가 있고, 유가증권시장 상장기업은 이러한 공시의무가 없다. 다만 코스닥 상장기업 행사공시는 행사주식수 누계 규정으로 인해 실제 행사일과 공시일 간의 시차가 발생한다.

35) SOX법 제정 전 스톡옵션 행사는 행사가 발생한 달의 다음 달 10일에 일괄 공시했으나, 이후 2거래일 이내에 공시하는 것으로 변경되었다.

참고문헌

김갑래, 2019, 미국 주요주주 등의 내부자거래 사전신고 제도의 시사점, 자본시장연구원『자본시장포커스』 2019-11호.

김민기, 2022, 상장기업 스톡옵션 활용과 개선방안, 자본시장연구원 정책 세미나.

김선호, 2015, 스톡옵션 행사시 내부자는 내부정보를 이용하는가? KIF working paper.

김창수, 2004, 스톡옵션과 기업지배구조, 『재무연구』 17(1), 1-40.

김현아ㆍ정성창, 2009, 임직원 스톡옵션의 행사패턴 및 조기행사에 영향을 미치는 요인에 관한 연구, 『재무관리연구』 26(2), 1-32.

김현아, 2014, 경영자 스톡옵션의 전략적 행사시점선택에 관한 연구, 『재무관리연구』 31(1), 55-82.

배길수, 2002, 스톡옵션의 도입에 대한 주가반응 및 스톡옵션을 도입한 기업의 특성: 대리인 비용을 중심으로, 『회계학연구』 27(2), 1-26.

스톡옵션표준모델제정위원회, 2000, 스톡옵션 표준모델.

안승철ㆍ이소현, 2009, 스톡옵션 부여 기업의 주가반응과 특성 분석, 『산업경제연구』 21(1), 411-440.

윤태화ㆍ김선구ㆍ홍정화, 2005, 스톡옵션 부여가 기업의 경영성과에 미친 영향, 『세무와 회계저널』 6(4), 213-236.

이승희, 2022, 『스톡옵션 행사 후 주식보유의무 필요성과 사례』, 경제개혁연구소 이슈&분석 2022-01.

임자영, 2019, 『국내 주식매수선택권(스톡옵션) 부여 현황』, 기업지배구조원 KCGS Report 9권 11호.

Bebchuk, L.A., Fried, J.M., 2010, Paying for long-term performance, University of Pennsylvania Law Review, 1915-1959.

Brisley, N., Cai, J., Nguyen, T., 2021, Required CEO stock ownership: Consequences for risk-taking and compensation, Journal of Corporate Finance 66, 101850.

Carpenter, J.N., Remmers, B., 2001, Executive stock option exercises and inside information, Journal of Business 74(4), 513-534.

Core, J.E., Guay, W.R., 2001, Stock option plans for non-executive employees, Journal of Financial Economics 61(2), 253-287.

DeFusco R.A., Johnson R.R., Zorn, T.S., 1990, The effect of executive stock option plans on stockholders and bondholders, Journal of Finance 45(2), 617-627.

Dhaliwal, D., Erickson, M., Heitzman, S., 2009, Taxes and the backdating of stock option exercise dates, Journal of Accounting and Economics 47(1-2), 27-49.

Fidelity, 2016, Global Equity Insights 2016.

FRC, 2018, The UK Corporate Governance Code.

FW Cook Book, 2019, 2019 Top 250 Report.

FW Cook Book, 2020, 2020 Top 250 Report.

Greenbury, R., 1995, Directors’ Remuneration, Gee Publishing, London.

Griner, E.H., 1999, The effect of CEO stock option grants on shareholder return, Journal of Managerial issues, 427-439.

Hirshleifer, D., Suh, Y., 1992, Risk, managerial effort, and project choice, Journal of Financial Intermediation 2(3), 308-345.

Holmstrom, B., Kaplan, S.N., 2003, The state of US corporate governance: What’s right and what’s wrong? Journal of Applied Corporate Finance 15, 8-20.

Huddart, S., Lang, M., 2003, Information distribution within firms: evidence from stock option exercises, Journal of Accounting and Economics 34(1-3), 3-31.

Jensen, M.C., Meckling, W.H., 1976, Theory of the firm: managerial behavior, agency costs, and ownership structure, Journal of Financial Economics 3(4), 305-360.

Kaplan, S.N., 1994, Top executive rewards and firm performance: A comparison of Japan and United States, Journal of Political Economy 102(3), 510-546.

Kedia, S., Mozumdar, A., 2002, Performance Impact of Employee Stock Options, working paper.

Korczak, P., Liu, Xicheng, 2014, Managerial shareholding policies and retention of vested equity incentives, Journal of Empirical Finance 27, 116-129.

Lambert, R.A., Lanen, W.N., Larcker, D.F., 1989, Executive stock option plans and corporate dividend policy, Journal of Financial and Quantitative Analysis 24(4), 409-425.

Murphy, K.J., 1999, Executive compensation, Handbook of labor economics 3, 2485-2563.

Walker, D., 2009, A review of corporate governance in UK banks and other financial industry entities–final recommendation, HM Treasury.

Willis Towers Watson, 2018, CEO pay landscape in Europe’s Top 100 companies.

Willis Towers Watson, 2020, Executive stock ownership guidelines and retention requirements.

Yeo, G.H., Chen, S.S., Ho, K.W., Lee, C.F., 1999, Effects of executive share option plans on shareholder wealth and firm performance: The Singapore evidence, Financial Review 34(2), 1-20.

Yermark, D., 1997, Good timing: CEO stock option awards and company news announcements, Journal of Finance 52(2), 449-476.