Find out more about our latest publications

Entry into the Crypto Assets Business by Global Financial Services Firms

Issue Papers 22-17 Sep. 13, 2022

- Research Topic Financial Services Industry

- Page 24

Global financial services firms are entering into the crypto assets business on multiple fronts. This stands in contrast to the previously negative stance held by these same firms regarding crypto assets. Part of this shift in attitude comes from regulatory changes enabling entry into the business of crypto assets, but more importantly, it is due to the growing demand for crypto assets investing by the core clients of global financial firms, that is high net worth and institutional investors.

Interest in crypto assets investing especially heightened in 2021 as prices of major crypto assets sky-rocketed. The market capitalization of crypto assets reached 3 trillion dollars in 2021, on par with the global alternative investments market, such as private equity and hedge funds. With growing demand by high net worth and institutional investors, entry into the crypto assets space became a necessity for global financial services firms in order to retain and expand their core client base. Many financial services firms are adding crypto assets as part of their main business, such as wealth management, asset management, trading and custody services. In addition, blockchain technology, which underpins crypto assets, is being adopted more and more by financial services firms to improve the efficiency of their financial infrastructure, such as payment and settlement systems.

Despite the broad entry into the crypto assets related business by financial services firms, the approach is still quite cautious as uncertainties surrounding the crypto assets market and related regulations are still high. In addition, the ‘crypto winter’, brought on by the Terra-Luna crisis in 2022, is likely to further slow the speed of crypto assets business of global financial firms, but not enough to reverse the momentum that has already been established. In the case of Korea, though a clear regulatory framework for crypto assets is still pending, local financial services firms are showing great interest and already entering into some related areas of business, particularly crypto assets custody services. In addition, Korean financial services firms are actively entering into partnerships and joint ventures with fintechs specializing in crypto assets and blockchain technology. Although the crypto assets market is in the early stages of development, the environment is changing rapidly. Korea’s financial services firms need to closely monitor the market development and develop appropriate business strategies for crypto assets.

Interest in crypto assets investing especially heightened in 2021 as prices of major crypto assets sky-rocketed. The market capitalization of crypto assets reached 3 trillion dollars in 2021, on par with the global alternative investments market, such as private equity and hedge funds. With growing demand by high net worth and institutional investors, entry into the crypto assets space became a necessity for global financial services firms in order to retain and expand their core client base. Many financial services firms are adding crypto assets as part of their main business, such as wealth management, asset management, trading and custody services. In addition, blockchain technology, which underpins crypto assets, is being adopted more and more by financial services firms to improve the efficiency of their financial infrastructure, such as payment and settlement systems.

Despite the broad entry into the crypto assets related business by financial services firms, the approach is still quite cautious as uncertainties surrounding the crypto assets market and related regulations are still high. In addition, the ‘crypto winter’, brought on by the Terra-Luna crisis in 2022, is likely to further slow the speed of crypto assets business of global financial firms, but not enough to reverse the momentum that has already been established. In the case of Korea, though a clear regulatory framework for crypto assets is still pending, local financial services firms are showing great interest and already entering into some related areas of business, particularly crypto assets custody services. In addition, Korean financial services firms are actively entering into partnerships and joint ventures with fintechs specializing in crypto assets and blockchain technology. Although the crypto assets market is in the early stages of development, the environment is changing rapidly. Korea’s financial services firms need to closely monitor the market development and develop appropriate business strategies for crypto assets.

Ⅰ. 서론

최근 글로벌 금융회사가 가상자산 사업을 바라보는 시각이 변화하고 있다. 그간 다수 글로벌 금융회사는 가상자산에 대해 다소 부정적인 견해를 밝혀 왔으며 특히 이와 같은 입장은 다름 아닌 일부 글로벌 금융회사의 최고경영자로부터 표명되어 왔다. 2014년 JP Morgan 회장 Jamie Dimon은 World Economic Forum에서 가상자산은 “매우 쓸모없는 가치보관 수단이며 불법적 용도로 사용된다”고 비판했다. 2017년 BlackRock 회장 Larry Fink는 비트코인(Bitcoin)을 “돈세탁의 지수”라고 폄훼하기도 했다. 2018년 Bank of America의 CEO Briam Moynihan은 자사 자산관리 고객에 대한 가상자산 투자 중개 금지령을 내렸다. 또한, 2020년 Goldman Sachs는 고객 투자자 설명회에서 가상자산은 자산군으로 보기 어려우며, 전략적으로나 전술적으로 가상자산에 투자하는 것을 권유하지 않는다고 했다(Business Insider, 2021. 9. 21; The New York Times, 2021. 11. 1; Forbes, 2022. 4. 13; Goldman Sachs, 2020. 5. 29).

글로벌 금융회사가 가상자산에 대해 취해 온 비판적 입장은 글로벌 금융회사의 이해관계와도 일치하는 측면이 있다. 이는 이더리움(Ethereum)과 같은 가상자산에 스마트 계약(smart contract)을 탑재해 투자, 대출, 보험 등의 금융서비스를 제공하는 디파이(Decentralized Finance: DeFi) 생태계의 형성이 기존 글로벌 금융회사의 고객과 자금을 잠식하고 있기 때문이다. 보다 장기적인 관점에서 DeFi가 제시하는 탈중개화(disintermediation)는 글로벌 금융회사의 기존 사업방식 자체를 위협하는 요인이다.

이러한 관점에서 최근 글로벌 금융회사가 추진하고 있는 각종 가상자산 관련 사업은 과거의 태도와는 다소 상충되는 모습이다. 다수의 글로벌 금융회사는 가상자산을 자산관리, 자산운용, 트레이딩, 수탁 서비스 등 여러 사업분야에 접목하고 있다. 여기에는 가상자산 시장의 성장, 일부 제도적 기반 마련 등 복합적인 요인이 작용하고 있지만, 무엇보다 고객 수요 증가가 배경에 있는 것으로 파악된다. 특히, 글로벌 금융회사의 주력 고객층인 고액자산가 및 기관투자자의 가상자산 투자 요구가 늘어남에 따라 고객 유지 및 유치 차원에서 가상자산 관련 금융상품 및 서비스의 제공이 불가피해진 것이다.

본 연구에서는 최근 가상자산에 대한 글로벌 금융회사의 방향 전환의 배경을 살펴보고, 글로벌 금융회사가 추진하고 있는 가상자산 관련 사업 현황을 정리해 본다. 현재 가상자산 관련 금융시장은 형성 초기 단계에 있으며 가상자산의 법적 지위 등 제도적 불확실성도 높은 상황으로 글로벌 금융회사 간뿐만 아니라 글로벌 금융회사 내에서도 가상자산에 대한 상이한 시각이 존재한다. 그럼에도 불구하고 최근 글로벌 금융회사의 가상자산 사업 진출은 의미 있는 변화로 볼 수 있다. 국내 금융회사도 가상자산 시장에 높은 관심을 보이고 있으며, 가상자산 관련 사업을 위한 다양한 준비를 하고 있다. 글로벌 금융회사의 가상자산 사업 현황 파악이 국내 금융회사의 가상자산 사업전략 수립에 도움이 되기를 기대한다.

Ⅱ. 가상자산 시장의 성장과 기관투자자의 참여 확대

1. 가상자산 시장의 성장

가상자산에 대한 세계적인 관심은 2017년부터 본격화되기 시작했다. 대표적 가상자산인 비트코인의 가격은 2011년 3월 처음으로 1달러를 상회하였고 2017년 1월에 들어 1천달러 수준을 달성했다. 2017년 비트코인 가격은 개인 투자자 중심의 시장참여로 가파른 상승세를 타면서 동년 12월에 들어서는 2만달러에 육박했다. 이후 등락을 거듭하면서 2020년 3월중 4,971달러까지 하락했던 비트코인 가격은 2021년 11월중 6만 7,567달러로 최고치를 경신하며 1년 7개월 사이 13배 이상 증가했다. 비트코인의 시가총액은 동기간 908억달러에서 1조달러를 상회하며 14배 급증하였다. 2021년 비트코인을 포함한 가상자산 가격의 급상승에는 개인과 더불어 기관투자자의 시장참여가 주요 역할을 했다.

2021년 현재 전체 가상자산 시가총액에서 비트코인의 점유율은 약 40% 수준으로 비트코인이 계속해서 시장을 주도하고 있으나, 2020년 60%대를 유지하던 점유율에 비해 축소되었다. 이는 비트코인 외에도 이더리움, 솔라나(Solana) 등 알트코인을 중심으로 투자 수요가 크게 증가했기 때문이다. 2021년 11월 전체 가상자산 시가총액은 3조달러에 근접했다.

Retirement Fund: HFRRF)으로 2021년 10월 55억달러의 운용기금 중 0.5%를 비트코인과 이더리움에 투자했다. 최근에는 Harvard, Yale, Brown 및 Michigan 대학 기금이 가상자산 거래소 Coinbase에 계좌를 두고 가상자산에 직접 투자하고 있는 것으로 알려졌다(CoinDesk, 2021. 1. 25).

Ⅲ. 글로벌 금융회사의 가상자산 사업전략

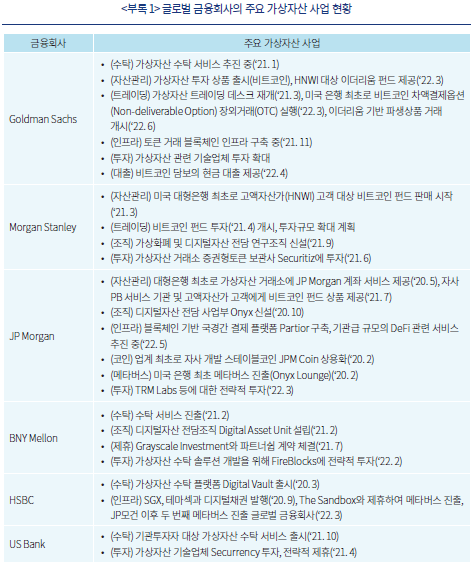

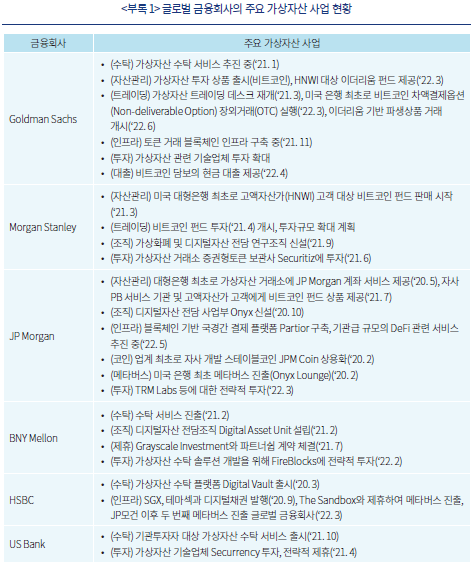

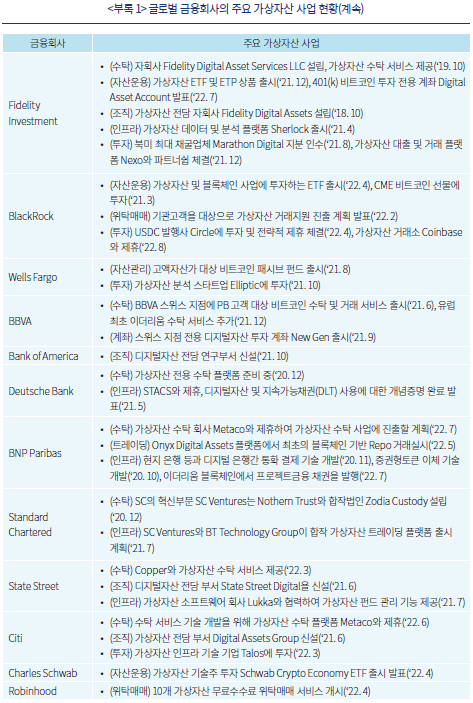

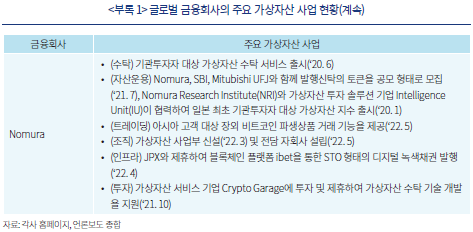

가상자산에 대한 투자 수요가 개인과 더불어 기관투자자로 확대되면서 글로벌 금융회사도 가상자산 관련 사업에 나서기 시작했다. 글로벌 금융회사의 가상자산 관련 사업 추진을 살펴보면 대부분 2021년을 기점으로 이루어지고 있으며, 이는 가상자산 가격의 급증과 고액자산가 및 기관투자자의 본격적인 시장참여와 일치하는 시기이다.4) <표 III-1>은 주요 사업 분야별로 가상자산 상품 및 서비스를 제공하고 있는 주요 글로벌 금융회사의 현황을 보여준다. 글로벌 금융회사는 가상자산을 자산관리, 자산운용, 수탁 서비스, 트레이딩 등 다양한 사업분야에 접목시키고 있다. 글로벌 금융회사 유형별로 살펴보면 상업ㆍ투자은행의 경우 주로 자산관리, 자산운용사는 가상자산 펀드ㆍETF, 수탁 전문 은행은 가상자산 수탁 서비스를 필두로 가상자산 사업을 추진하고 있는 것으로 파악된다. 이와 더불어 다수 글로벌 금융회사는 가상자산 전담 조직 설립, 가상자산 전문 핀테크 기업의 투자ㆍ제휴에 나섰으며, 일부 글로벌 금융회사는 금융 인프라 효율화를 위해 블록체인 기술을 활용하고 있다.

현재 글로벌 자산운용사가 미국 시장에서 제공하고 있는 가상자산 펀드 및 ETF의 경우 가상자산 현물ㆍ선물보다는 관련 기술 기업에 투자하는 유형이다.7) 그러나 최근에는 글로벌 자산운용사의 가상자산 현물 투자 상품 출시도 눈에 띈다. 2022년 8월 BlackRock은 대형 자산운용사 최초로 비트코인 현물 신탁 상품을 출시했다. 여기에 Fidelity는 2022년 7월 미국의 개인퇴직연금 제도인 401(k)에 최대 20%의 자금을 비트코인에 투자를 할 수 있는 전용계좌(Digital Assets Account)를 제공할 것이라고 발표했다(Barrons, 2022. 7. 25; Barrons, 2022. 8. 11).

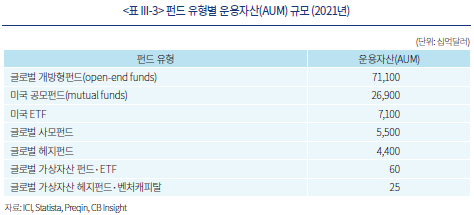

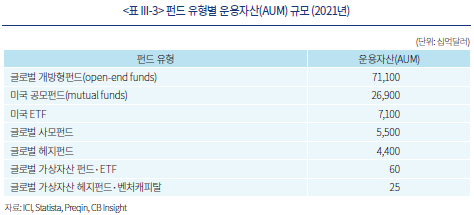

이처럼 글로벌 자산운용사도 가상자산 펀드 및 ETF 시장에 점진적으로 진출하고 있으나, 아직 해당 시장의 규모는 전통적 공모ㆍ사모펀드 시장에 비하면 미미한 수준이다. <표 III-3>은 2021년 AUM 기준 주요 공모ㆍ사모펀드 시장 규모를 보여준다. 2021년 AUM 기준 글로벌 개방형펀드(regulated open-end fund)는 71.1조달러, 미국 공모펀드(mutual fund)는 26.9조달러, 미국 ETF는 7.1조달러, 글로벌 사모펀드는 5.5조달러, 글로벌 헤지펀드는 4.4조달러 수준이다. 이에 비해 2021년 AUM 기준 글로벌 가상자산 펀드 및 ETF는 596억달러, 글로벌 가상자산 헤지펀드ㆍ벤처캐피탈은 252억달러 수준에 불과하다.

4. 가상자산 트레이딩

가상자산 전문 헤지펀드 등 기관투자자의 가상자산 투자 및 헤지(hedge) 수요가 증가함에 따라 일부 글로벌 금융회사는 트레이딩 사업의 일환으로 가상자산 선물 등에 대한 청산 서비스 제공하고 있다.12) 나아가 일부 글로벌 금융회사는 보다 적극적으로 가상자산 트레이딩에도 직접 나서고 있다. 대표적으로 Goldman Sachs는 2021년 3월 가상자산 트레이딩 데스크를 출범하였으며, 동년 5월에는 미국 은행 중 최초로 비트코인 파생상품 트레이딩을 개시하였다. 2022년 3월에는 가상자산 전문은행 Galaxy Digital과 비트코인 가격에 연동한 차액결제선물환(Non-deliverable Forward: NDF) 거래를 장외거래로 체결했다. Nomura는 2022년 5월 최초로 비트코인 트레이딩 거래를 체결한 것으로 알려졌다(Forbes, 2021. 4. 5).

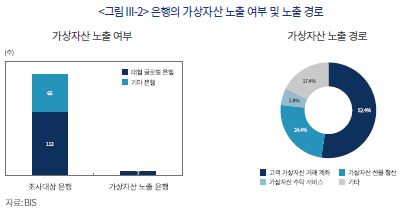

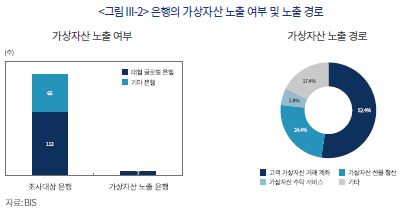

그러나 아직 글로벌 금융회사의 가상자산 트레이딩은 예외적이고, 관련 규모도 매우 미미한 수준으로 파악된다. 바젤위원회(Basel Committee on Banking Supervision: BCBS)는 2018년부터 은행 감독의 목적으로 대형은행의 가상자산 현황 자료를 수집하고 있으며, <그림 III-2>는 BCBS 조사 대상 은행 중 가상자산에 위험노출(risk exposure)이 있는 은행 수와 가상자산 노출 경로별 비중을 보여준다.13)

2020년 4분기 조사 대상 178개 은행 중 가상자산에 대한 위험노출이 있는 은행은 7개로 모두 자산규모 3조유로 이상의 대형은행에 속한다. 또한 조사 대상 은행의 총 가상자산 위험노출 규모는 1,880억달러에 불과하며, 가상자산 위험노출이 있는 은행의 경우에도 그 규모가 위험가중자산(Risk Weighted Assets: RWA)의 0.02% 수준으로 미미하다. 대형은행의 가상자산 위험노출은 52.4%가 고객 가상자산 거래 계좌 제공과 연계되었으며, 24.4%가 가상자산 선물 청산으로부터 비롯되는 것으로 나타난다.

6. 가상자산 조직ㆍ투자ㆍ인프라

가상자산에 대한 관심이 높아지면서 Goldman Sachs, Morgan Stanley, JP Morgan, BNY Mellon, Fidelity Investment, Bank of America, State Street, Citi, Nomura 등 다수의 글로벌 금융회사는 가상자산 전담 리서치 및 연구개발 부서를 신설하고 일부 글로벌 금융회사는 가상자산 관련 자회사ㆍ합작사 설립에도 나서고 있다. Fidelity Investment의 경우 2018년 가상자산 전문 자회사 Fidelity Digital Assets를 출범하였으며, 2020년 12월 Standard Chartered의 혁신부문 SC Ventures는 Nothern Trust와 함께 가상자산 수탁사 Zodia Custody를 설립했다. Nomura의 경우 2022년 3월 기관투자자 고객의 가상자산 투자를 전담하는 자회사를 설립하고, 2024년까지 100명 가량의 조직으로 확장할 것이라고 발표했다(Financial Times, 2022. 5. 16). 이와 더불어 가상자산 분야에 대한 역량 확보를 위해 글로벌 금융회사의 가상자산 전문 기업 투자ㆍ제휴도 활발하게 이루어지고 있다(<표 III-4> 참조).

셋째, 국내 금융회사의 금융 인프라 효율화 및 새로운 DeFi 사업 개발을 위한 블록체인 기술의 활용방안을 모색해 볼 수 있다. 이미 오래전부터 금융산업은 인적자원 중심에서 기술 중심으로 변모하고 있으며, 블록체인 기술의 도입은 이러한 추세의 일환이다. 기술적 우위는 금융회사의 경쟁력을 좌우하는 중요한 요인으로 작용하고 있으며, 글로벌 금융회사도 개방형 블록체인 개발 등 기술 경쟁력 확보를 위한 다양한 시도를 하고 있다. 현재 블록체인 기술의 발전은 핀테크 기업들이 주도하고 있는 만큼, 국내 금융회사도 가상자산 분야의 유망한 핀테크 기업과의 전략적 투자 및 제휴를 통해 기술력을 확보하고 국내 가상자산 생태계 발전에 기여하는 노력을 이어갈 필요가 있다.

가상자산 기술과 시장의 형성은 아직 초기 단계에 있으며, 향후 어떠한 방향으로 발전해 나갈지는 예측하기 어려운 측면이 있다. 그럼에도 불구하고 가상자산 생태계는 매우 빠른 속도로 변화하고 있으므로 가상자산에 대한 지속적인 관심과 참여에 노력에 노력을 기울이지 않는다면 기술 경쟁력에서 뒤처지고 사업 기회를 놓칠 위험이 있다. 따라서 국내 금융회사도 시장의 상황을 면밀하게 파악하고 가상자산 사업전략을 수립해 나가야 할 것이다.

1) Fidelity Digital Assets는 2019년부터 미국, 유럽, 아시아 지역의 기관투자자를 대상으로 가상자산 투자 현황에 대한 설문조사(Institutional Investor Digital Asset Study)를 실시하고 있다. 2021년 설문조사에는 미국(408개), 유럽(393개), 아시아(299개) 기관투자자 대상 1,100건의 조사결과를 포함한다.

2) Fidelity의 조사는 고액자산가 및 기관투자자의 가상자산 관련 투자 규모를 감안하지 않고 전체 투자자 수를 사용하는 통계인 점을 유념할 필요가 있다.

3) 해당 연기금은 가상자산 기술주에 운용자산의 85%를 투자하는 Morgan Creek Blockchain Opportunities Fund를 통해 가상자산에 투자하기 시작했다.

4) 글로벌 금융회사의 가상자산 사업 추진ㆍ진출에 대한 세부 내용 및 시기는 부록을 참고

5) 2021년 JP Morgan 회장 Jamie Dimon은 “개인적으로는 비트코인이 쓸모없다고 생각하지만 고객들은 달리 생각한다. 고객이 비트코인을 거래하고자 한다면 우리는 최소한 투명하고 안정적으로 거래할 수 있게 해줄 수 있다”고 설명했다(Financial Times, 2021. 11. 9).

6) Charles Schwab의 자사 고객 조사에 따르면 20%가 가상자산에 투자하고 있는 것으로 나타나며, 이는 전년 동기 대비 2배 늘어난 수준이다(Charles Schwab, 2022).

7) 반면, 해외에서는 가상자산 현물 ETF/ETP도 출시되고 있다. Fidelity Investment는 2019년 캐나다에서 가상자산 현물 Fidelity Advantage Bitcoin ETF를 출시하고 2022년 2월 가상자산 현물 상장지수상품(Exchange Traded Product: ETP)인 Fidelity Physical Bitcoin ETP를 독일 Borse Xetra에 상장했다.

8) SEC는 가상자산 거래소의 해킹(hacking) 위험 및 규제체계 부족, 협소한 시장 규모로 인한 가격 조작 위험, 국가 간 가상자산 규제차익 등을 주요 문제로 제기해 왔다.

9) OCC는 수탁 서비스가 전통적으로 은행이 제공하는 업무에 속하며, 그동안 다양한 물리적 및 디지털 형태의 자산에 대한 수탁 업무를 수행해 왔으므로, 가상자산의 수탁 업무는 전통적 은행 업무의 현대적 유형(modern form of traditional banking activities)에 속한다고 설명한다(OCC, 2020. 7. 22).

10) 8개 주요 가상자산 수탁사는 Coinbase, Bitgo, Fireblocks, Gemini, Ledger, Matrixport, NYDIG, Bitcoin Suisse이다.

11) Chainalysis 분석에 따르면 2021년 월렛(wallet)에 있는 20%의 가상자산이 분실되는 것으로 파악되며, 그 규모는 2,058억달러에 달한다.

12) 2022년 현재 Macquarie, Bank of America, Citi, Goldman Sachs, JP Morgan, Morgan Stanley, ABN Amro, Barclays, Societe Generale 및 UBS가 가상자산 청산 서비스를 제공 중이다(Risk.net, 2022. 2. 8).

13) BCBS는 은행의 자산규모에 따라 3조유로 이상의 대형은행(Group 1)과 3조유로 미만의 은행(Group 2)으로 분류하며, 조사 대상 178개 은행 중 112개가 Group 1에 속하고, 이 중 27개 은행이 시스템적으로 중요한 금융기관(Systematically Important Financial Institutions: SIFI)에 속한다.

참고문헌

Auer, R., Farag, M., Lewrick, U., Orazem, L., Zoss, M., 2022, Banking in the shadow of bitcoin? The institutional adoption of cyrptocurrencies, BIS working papers, No.1013.

Barrons, 2022. 7. 25, Fidelity made a splash with Bitcoin 401(k)s. Fintechs are wading in too.

Barrons, 2022. 8. 11, BlackRock launches a Bitcoin trust. What it means for crypto and the stock.

Bloomberg, 2022. 8. 4, BlackRock teams up with Coinbase in crypto market expansion.

Business Insider, 2021. 9. 21, From trading to wealth management, big banks are dabbling in crypto. Here’s a rundown of who’s doing what.

Charles Schwab, 2022, Q1 2022 Retail Client Sentiment Report.

CNBC, 2021. 8. 5, JPMorgan, led by bitcoin skeptic Jamie Dimon, quietly unveils access to a half-dozen crypto funds.

CNBC, 2022. 5. 17, Robinhood to let users hold their own crypto and NFTs as it reaches for growth beyond stock trading.

CoinDesk, 2021. 1. 25, Harvard, Yale, Brown endowments have been buying bitcoin for at least a year: Sources.

CoinDesk, 2021. 11. 2, Pension funds wade gingerly into crypto investments.

Fidelity Digital Assets, 2021, The Institutional Investor Digital Assets Study.

Financial Times, 2021. 11. 19, Crypto fever: The pressure grows on wealth managers.

Financial Times, 2022. 5. 16, Nomura prepares to launch crypto subsidiary.

Forbes, 2021. 4. 5, Goldman Sachs cryptocurrency endorsement boosts wealth management.

Forbes, 2022. 4. 13, BlackRock’s newest investment paves the way for digital assets on Wall Street.

Fortune, 2021. 8. 20, Wells Fargo, JPMorgan launch Bitcoin funds.

Goldman Sachs, 2020. 5. 29, US economic outlook & implications of current policies for inflation, gold and bitcoin.

OCC, 2020. 7. 22, Federally chartered banks and thrifts may provide custody services for crypto assets, New Release 2020-98.

Pension & Investments, 2019. 3. 4, More funds testing water on crypto-related assets.

Reuters, 2021. 7. 23, JPMorgan to give all wealth clients access to crypto funds.

Risk.net, 2022. 2. 8, Banks offer crypto clearing but, shhh, don’t tell.

SIFMA, 2022, Capital Markets Fact Book.

The New York Times, 2021. 11. 1, Banks tried to kill crypto and failed. Now they're embracing it (slowly).

최근 글로벌 금융회사가 가상자산 사업을 바라보는 시각이 변화하고 있다. 그간 다수 글로벌 금융회사는 가상자산에 대해 다소 부정적인 견해를 밝혀 왔으며 특히 이와 같은 입장은 다름 아닌 일부 글로벌 금융회사의 최고경영자로부터 표명되어 왔다. 2014년 JP Morgan 회장 Jamie Dimon은 World Economic Forum에서 가상자산은 “매우 쓸모없는 가치보관 수단이며 불법적 용도로 사용된다”고 비판했다. 2017년 BlackRock 회장 Larry Fink는 비트코인(Bitcoin)을 “돈세탁의 지수”라고 폄훼하기도 했다. 2018년 Bank of America의 CEO Briam Moynihan은 자사 자산관리 고객에 대한 가상자산 투자 중개 금지령을 내렸다. 또한, 2020년 Goldman Sachs는 고객 투자자 설명회에서 가상자산은 자산군으로 보기 어려우며, 전략적으로나 전술적으로 가상자산에 투자하는 것을 권유하지 않는다고 했다(Business Insider, 2021. 9. 21; The New York Times, 2021. 11. 1; Forbes, 2022. 4. 13; Goldman Sachs, 2020. 5. 29).

글로벌 금융회사가 가상자산에 대해 취해 온 비판적 입장은 글로벌 금융회사의 이해관계와도 일치하는 측면이 있다. 이는 이더리움(Ethereum)과 같은 가상자산에 스마트 계약(smart contract)을 탑재해 투자, 대출, 보험 등의 금융서비스를 제공하는 디파이(Decentralized Finance: DeFi) 생태계의 형성이 기존 글로벌 금융회사의 고객과 자금을 잠식하고 있기 때문이다. 보다 장기적인 관점에서 DeFi가 제시하는 탈중개화(disintermediation)는 글로벌 금융회사의 기존 사업방식 자체를 위협하는 요인이다.

이러한 관점에서 최근 글로벌 금융회사가 추진하고 있는 각종 가상자산 관련 사업은 과거의 태도와는 다소 상충되는 모습이다. 다수의 글로벌 금융회사는 가상자산을 자산관리, 자산운용, 트레이딩, 수탁 서비스 등 여러 사업분야에 접목하고 있다. 여기에는 가상자산 시장의 성장, 일부 제도적 기반 마련 등 복합적인 요인이 작용하고 있지만, 무엇보다 고객 수요 증가가 배경에 있는 것으로 파악된다. 특히, 글로벌 금융회사의 주력 고객층인 고액자산가 및 기관투자자의 가상자산 투자 요구가 늘어남에 따라 고객 유지 및 유치 차원에서 가상자산 관련 금융상품 및 서비스의 제공이 불가피해진 것이다.

본 연구에서는 최근 가상자산에 대한 글로벌 금융회사의 방향 전환의 배경을 살펴보고, 글로벌 금융회사가 추진하고 있는 가상자산 관련 사업 현황을 정리해 본다. 현재 가상자산 관련 금융시장은 형성 초기 단계에 있으며 가상자산의 법적 지위 등 제도적 불확실성도 높은 상황으로 글로벌 금융회사 간뿐만 아니라 글로벌 금융회사 내에서도 가상자산에 대한 상이한 시각이 존재한다. 그럼에도 불구하고 최근 글로벌 금융회사의 가상자산 사업 진출은 의미 있는 변화로 볼 수 있다. 국내 금융회사도 가상자산 시장에 높은 관심을 보이고 있으며, 가상자산 관련 사업을 위한 다양한 준비를 하고 있다. 글로벌 금융회사의 가상자산 사업 현황 파악이 국내 금융회사의 가상자산 사업전략 수립에 도움이 되기를 기대한다.

Ⅱ. 가상자산 시장의 성장과 기관투자자의 참여 확대

1. 가상자산 시장의 성장

가상자산에 대한 세계적인 관심은 2017년부터 본격화되기 시작했다. 대표적 가상자산인 비트코인의 가격은 2011년 3월 처음으로 1달러를 상회하였고 2017년 1월에 들어 1천달러 수준을 달성했다. 2017년 비트코인 가격은 개인 투자자 중심의 시장참여로 가파른 상승세를 타면서 동년 12월에 들어서는 2만달러에 육박했다. 이후 등락을 거듭하면서 2020년 3월중 4,971달러까지 하락했던 비트코인 가격은 2021년 11월중 6만 7,567달러로 최고치를 경신하며 1년 7개월 사이 13배 이상 증가했다. 비트코인의 시가총액은 동기간 908억달러에서 1조달러를 상회하며 14배 급증하였다. 2021년 비트코인을 포함한 가상자산 가격의 급상승에는 개인과 더불어 기관투자자의 시장참여가 주요 역할을 했다.

2021년 현재 전체 가상자산 시가총액에서 비트코인의 점유율은 약 40% 수준으로 비트코인이 계속해서 시장을 주도하고 있으나, 2020년 60%대를 유지하던 점유율에 비해 축소되었다. 이는 비트코인 외에도 이더리움, 솔라나(Solana) 등 알트코인을 중심으로 투자 수요가 크게 증가했기 때문이다. 2021년 11월 전체 가상자산 시가총액은 3조달러에 근접했다.

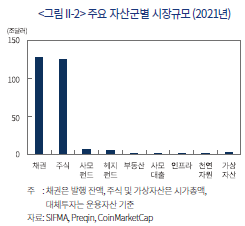

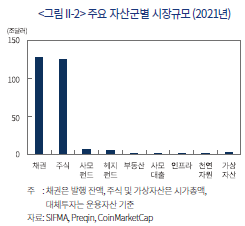

가상자산 시장의 규모를 가늠하기 위해 다른 자산군과 비교해 볼 수 있다. <그림 II-2>는 2021년 기준 주요 자산군별 시장규모를 보여준다. 2021년 12월 기준 세계 가상자산의 시가총액은 2.2조달러에 달한다. 이는 2021년 기준 100조달러를 상회하는 전통적 투자자산인 채권이나 주식 시장규모에 비해서는 매우 작지만, 대체투자 시장에는 버금가는 수준이다. 2021년 운용자산(Asset Under Management: AUM) 기준 세계 대체투자 시장규모는 사모펀드 5.5조달러, 헤지펀드 4.4조달러, 부동산펀드 1.2조달러, 사모대출 1.0조달러, 인프라 1.0조달러, 천연자원 0.2조달러 수준을 기록하고 있다.

2. 기관투자자의 가상자산 투자 증가

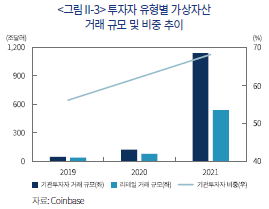

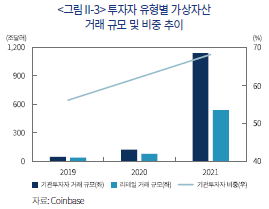

최근 가상자산 시장의 급성장에는 고액자산가 및 기관투자자의 참여가 중요한 요인으로 작용하고 있다. 이는 2008년 글로벌 금융위기 이후 형성된 장기 저금리 환경 하에서 보다 높은 수익률을 찾는 투자자가 늘어나고 있기 때문이다(Auer et al., 2022). <그림 II-3>은 미국 최대 가상자산 거래소 Coinbase의 투자자 유형별 가상자산 거래 규모 및 비중 추이를 보여준다. Coinbase의 가상자산 거래 규모는 2019년 80조달러에서 2021년 1,671조달러로 급증했으며, 이 기간 기관투자자의 비중은 56%에서 68%로 늘어나 리테일과 기관투자자 점유율 격차도 확대되는 추세다.

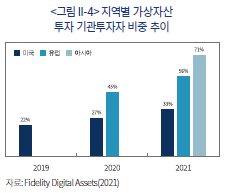

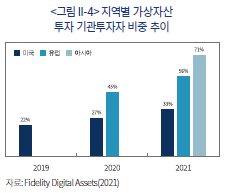

가상자산 투자에 새롭게 나서는 기관투자자 수도 늘어나고 있다. <그림 II-4>는 Fidelity Digital Assets(2021)의 설문조사 대상 지역별 가상자산 투자 기관투자자의 비중 추이를 보여준다.1) 여기서 가상자산 투자는 가상자산 현물과 더불어 가상자산 관련 기술주를 모두 포함한다. 2021년 현재 전체 조사 대상 기관투자자 중 52%가 가상자산에 투자하고 있으며, 지역별로는 아시아가 71%로 가장 높은 가운데, 유럽은 56%, 미국은 33%의 기관투자자가 가상자산에 직간접적으로 투자하고 있는 것으로 조사된다. 미국의 경우 가상자산에 투자하는 것으로 응답한 기관투자자 비중은 2019년 22%에서 2021년 33%로, 유럽의 경우 2020년 45%에서 2021년 56%로 증가했다.2)

Fidelity Digital Assets(2021) 조사에 따르면 기관투자자는 가상자산을 대체투자의 일환으로 접근하고 있다. 가상자산에 투자하는 이유를 물어보는 질문에 대해 높은 수익률 가능성, 다른 자산과의 낮은 상관성, 인플레이션 방어 수단이 가장 많은 응답에 속하며, 이는 주로 대체자산에 투자하는 이유와 동일하다. 반면, 가상자산 투자를 하지 않는 이유로는 시장조작 위험, 보관 위험, 법적 지위 불확실성 및 검증된 가치평가 방법론 부재를 꼽았다.

기관투자자 유형별로는 가상자산 투자 참여율에 의미 있는 차이가 있다. <그림 II-5>는 2021년 현재 지역별 기관투자자 유형별 가상자산의 투자 여부를 보여준다. 전반적으로 가상자산 투자에 가장 적극적인 투자자는 가상자산 전문 헤지펀드 및 벤처캐피탈, 고액자산가 및 고액자산가의 투자를 중개ㆍ관리하는 투자자문사 및 패밀리오피스다. 미국의 경우 15%의 고액자산가, 43%의 투자자문사, 47%의 패밀리오피스가 가상자산에 투자하고 있는 것으로 나타난다. 일반 사모펀드 및 기금(endowment, foundations)의 경우 각각 13%가 가상자산에 투자하고 있다. 반면 퇴직연금 등 대형 연기금(pension funds, defined benefit plans)의 경우 모든 지역에서 3% 정도만 가상자산 투자에 나서고 있는 것으로 조사된다.

대형 연기금은 가상자산 투자에 조심스럽게 접근하고 있다. 주요 연기금은 직접적인 가상자산 현물ㆍ선물 투자보다는 블록체인 등 관련 기술주에 투자하는 방식으로 가상자산 투자에 입문하는 것으로 파악된다. 미국의 경우 2018년 미국 버지니아주 페어팩스카운티 공무원 및 경찰 퇴직연금(Fairfax County Police Officers Retirement System)이 연기금 중에 최초로 가상자산 관련 투자에 나섰으며3), 미국 최대 공적 연기금인 캘리포니아 공무원 연금(California Public Employee Retirement System: CalPERS)은 2020년부터 비트코인 채굴기업 Riot Blockchain에 투자하기 시작했다. 대학 기금도 가상자산에 투자하기 시작했으며, 2018년 30조달러의 기금을 운용하는 Yale 대학이 가상자산 벤처펀드에 투자를 발표하고, 이후 Harvard, Stanford, Dartmouth, MIT, University of North Carolina, Michigan 대학 기금도 가상자산 벤처펀드 투자에 나섰다(Pension & Investments, 2019. 3. 4; CoinDesk, 2021. 11. 2).

가상자산 기술주 투자로 시작해 가상자산 현물에 직접 투자하는 연기금도 늘어나고 있다. 최초 가상자산 직접 투자 연기금은 휴스턴 소방관 퇴직연기금(Houston Firefighters’ Relief and Retirement Fund: HFRRF)으로 2021년 10월 55억달러의 운용기금 중 0.5%를 비트코인과 이더리움에 투자했다. 최근에는 Harvard, Yale, Brown 및 Michigan 대학 기금이 가상자산 거래소 Coinbase에 계좌를 두고 가상자산에 직접 투자하고 있는 것으로 알려졌다(CoinDesk, 2021. 1. 25).

Ⅲ. 글로벌 금융회사의 가상자산 사업전략

가상자산에 대한 투자 수요가 개인과 더불어 기관투자자로 확대되면서 글로벌 금융회사도 가상자산 관련 사업에 나서기 시작했다. 글로벌 금융회사의 가상자산 관련 사업 추진을 살펴보면 대부분 2021년을 기점으로 이루어지고 있으며, 이는 가상자산 가격의 급증과 고액자산가 및 기관투자자의 본격적인 시장참여와 일치하는 시기이다.4) <표 III-1>은 주요 사업 분야별로 가상자산 상품 및 서비스를 제공하고 있는 주요 글로벌 금융회사의 현황을 보여준다. 글로벌 금융회사는 가상자산을 자산관리, 자산운용, 수탁 서비스, 트레이딩 등 다양한 사업분야에 접목시키고 있다. 글로벌 금융회사 유형별로 살펴보면 상업ㆍ투자은행의 경우 주로 자산관리, 자산운용사는 가상자산 펀드ㆍETF, 수탁 전문 은행은 가상자산 수탁 서비스를 필두로 가상자산 사업을 추진하고 있는 것으로 파악된다. 이와 더불어 다수 글로벌 금융회사는 가상자산 전담 조직 설립, 가상자산 전문 핀테크 기업의 투자ㆍ제휴에 나섰으며, 일부 글로벌 금융회사는 금융 인프라 효율화를 위해 블록체인 기술을 활용하고 있다.

현재 글로벌 금융회사의 가상자산 관련 사업은 제도적 틀이 마련된 범위 내로 국한되어 있는 반면 그동안 ‘그림자 가상자산 금융시스템(shadow crypto financial system)’으로도 불리는 가상자산 시장의 발전은 주로 제도권 외에서 이루어져 왔다(Auer et al., 2022). 현재 가상자산을 둘러싼 규제가 국가ㆍ지역별로 상이하며, 글로벌 금융회사 간의 가상자산 관련 사업도 이에 따라 차이를 보인다.

1. 가상자산 자산관리

고액자산가 및 기관투자자 고객의 가상자산 투자 수요가 늘어남에 따라 일부 글로벌 금융회사는 고객 유치ㆍ유지의 차원에서 자산관리 사업을 통해 가상자산 투자 상품을 제공하기 시작했다.5) Morgan Stanley가 2021년 3월 미국 대형은행 중 최초로 고액자산가 및 기관투자자에게 가상자산 펀드를 제공하기 시작했고 이어 Goldman Sachs도 2021년 3월 자산관리 고객을 위한 이더리움 펀드를 소개할 것이라고 밝혔다. JP Morgan은 2021년 6월부터 자산관리 고객에 대한 가상자산 투자를 개시하였으며, Wells Fargo도 2021년 8월 고액자산가 대상 가상자산 펀드를 제공한다고 발표했다(CNBC, 2021. 8. 5; Fortune, 2021. 8. 20).

다만, 투자자보호 등을 인식하여 초기 글로벌 금융회사의 가상자산 자산관리 사업은 제한적으로 이루어지고 있다. <표 III-2>는 주요 글로벌 금융회사가 자산관리 사업을 통해 제공하는 가상자산 펀드ㆍ상품 및 투자 요건을 보여준다. 대부분의 경우 가상자산 투자는 고액자산가 및 기관투자자로 한정되어 있다. Morgan Stanley의 경우 가상자산 펀드 제공은 ‘높은 위험 감내도(aggressive risk tolerance)’를 가지면서 개인의 경우 2백만달러, 기관투자자의 경우 5백만달러 이상의 자산을 6개월 이상 예치하고 있는 고객에게만 허용되며 가상자산 펀드 투자도 총자산의 2.5% 미만으로 제한한다. Goldman Sachs 또한 가상자산 펀드 제공을 초부유층 및 기관투자자 고객으로 국한하고 있으며 통상 250만달러 이상의 자산을 가지고 있는 고객층을 대상으로 한다. Well Fargo 또한 가상자산 펀드는 고액자산가에 한해서 제공하고 있다. JP Morgan의 경우 고객의 요청이 있을 경우에만 가상자산 투자를 제공하고, 자산관리사가 먼저 가상자산 투자를 권유하지 못하는 내부 방침을 두고 있다. JP Morgan은 초기에는 가상자산 투자를 고액자산가 및 기관투자자로 한정했으나, 이후 미국 대형은행 최초로 리테일 고객에게도 가상자산 펀드 투자를 제공하기 시작했다(Reuters, 2021. 7. 23)

1. 가상자산 자산관리

고액자산가 및 기관투자자 고객의 가상자산 투자 수요가 늘어남에 따라 일부 글로벌 금융회사는 고객 유치ㆍ유지의 차원에서 자산관리 사업을 통해 가상자산 투자 상품을 제공하기 시작했다.5) Morgan Stanley가 2021년 3월 미국 대형은행 중 최초로 고액자산가 및 기관투자자에게 가상자산 펀드를 제공하기 시작했고 이어 Goldman Sachs도 2021년 3월 자산관리 고객을 위한 이더리움 펀드를 소개할 것이라고 밝혔다. JP Morgan은 2021년 6월부터 자산관리 고객에 대한 가상자산 투자를 개시하였으며, Wells Fargo도 2021년 8월 고액자산가 대상 가상자산 펀드를 제공한다고 발표했다(CNBC, 2021. 8. 5; Fortune, 2021. 8. 20).

대부분 글로벌 금융회사가 현재 가상자산 투자 상품을 리테일 고객으로 확대하지 않고 있는 이유는 가상자산 투자의 높은 위험성에 따른 불완전판매 및 평판 리스크가 크게 작용하는 것으로 판단된다. 가상자산의 투자 위험성을 평가하는 방법론 및 축적 데이터가 아직은 부족한 상황에서 일반 리테일 투자자에게 가상자산 투자가 적합한지를 판단하기에는 어려움이 있기 때문이다.

2. 가상자산 자산운용

자산운용 업계에서도 가상자산이 큰 관심사로 떠오르고 있다. 그간 글로벌 금융회사가 자산관리 사업의 일환 등으로 제공해 온 가상자산 펀드 및 ETF는 Grayscale Investments, Galaxy Digital, NYDIG 등 가상자산 전문 투자회사가 개발한 상품이다. 그러나 최근 자산운용사를 포함한 일부 글로벌 금융회사는 자체 가상자산 펀드 및 ETF를 출시하거나 준비하고 있다. 가장 먼저 세계 3위 자산운용사 Fidelity Investment가 자사 테마 ETF의 일환으로 2022년 4월 Fidelity Crypto Industry and Digital Payments ETF 및 Fidelity Metaverse ETF를 출시했다. 세계 최대 자산운용사 BlackRock은 2022년 4월 자사 최초 가상자산 ETF인 iShares Blockchain and Tech ETF를 출시하였으며 미국 최대 리테일 브로커리지 Charles Schwab도 늘어나는 고객 수요에 대응하기 위해 2022년 4월 가상자산 관련 기업에 투자하는 Schwab Crypto Economy ETF의 승인서를 미국 증권거래위원회(Securities and Exchange Commission: SEC)에 제출했다.6) 2. 가상자산 자산운용

현재 글로벌 자산운용사가 미국 시장에서 제공하고 있는 가상자산 펀드 및 ETF의 경우 가상자산 현물ㆍ선물보다는 관련 기술 기업에 투자하는 유형이다.7) 그러나 최근에는 글로벌 자산운용사의 가상자산 현물 투자 상품 출시도 눈에 띈다. 2022년 8월 BlackRock은 대형 자산운용사 최초로 비트코인 현물 신탁 상품을 출시했다. 여기에 Fidelity는 2022년 7월 미국의 개인퇴직연금 제도인 401(k)에 최대 20%의 자금을 비트코인에 투자를 할 수 있는 전용계좌(Digital Assets Account)를 제공할 것이라고 발표했다(Barrons, 2022. 7. 25; Barrons, 2022. 8. 11).

이처럼 글로벌 자산운용사도 가상자산 펀드 및 ETF 시장에 점진적으로 진출하고 있으나, 아직 해당 시장의 규모는 전통적 공모ㆍ사모펀드 시장에 비하면 미미한 수준이다. <표 III-3>은 2021년 AUM 기준 주요 공모ㆍ사모펀드 시장 규모를 보여준다. 2021년 AUM 기준 글로벌 개방형펀드(regulated open-end fund)는 71.1조달러, 미국 공모펀드(mutual fund)는 26.9조달러, 미국 ETF는 7.1조달러, 글로벌 사모펀드는 5.5조달러, 글로벌 헤지펀드는 4.4조달러 수준이다. 이에 비해 2021년 AUM 기준 글로벌 가상자산 펀드 및 ETF는 596억달러, 글로벌 가상자산 헤지펀드ㆍ벤처캐피탈은 252억달러 수준에 불과하다.

자산운용 사업의 관점에서 가상자산 펀드 시장이 의미 있는 수준으로 형성되기 위해서는 고객 기반이 리테일로 확대될 필요가 있으며, 이를 위해서는 가상자산 현물 ETF의 승인이 주요 관건 중 하나다. 가상자산 현물 ETF는 선물 ETF에 비해 가상자산 가격과의 괴리율이 낮고, 운용보수도 상대적으로 저렴하여 잠재적 투자 수요가 높다. 미국의 경우 가상자산 현물 및 선물 ETF에 대한 승인권을 지닌 SEC는 2021년 10월 첫 가상자산 선물 ETF를 승인했으나, 꾸준한 업계의 요구에도 불구하고 시장조작(market manipulation)의 우려로 가상자산 현물 ETF에 대해서는 불허 입장을 유지하고 있다.8) SEC가 제기하는 시장조작 위험이 해소되기 위해서는 가상자산 투자자 기반의 다양화, 가상자산 거래소 규제ㆍ감독 기관의 명확화, 가상자산 규제의 표준화 등 여러 과제가 선결되어야 하므로 가상자산 현물 ETF의 첫 승인까지는 상당 기간이 걸릴 수 있다.

3. 가상자산 수탁 서비스

가상자산 시장이 급격하게 성장하면서 가상자산 수탁 서비스도 금융회사의 새로운 사업 기회로 부상하고 있으며, 실제로 글로벌 금융회사가 가장 많이 취급하고 있는 가상자산 관련 사업이 수탁 서비스다. 2022년 현재 BNY Mellon, State Street, Citi, Fidelity Investment, US Bank, Goldman Sachs, HSBC, BBVA, Deutsche Bank, BNP Paribas, Standard Chartered, Nomura 등 다수의 글로벌 금융회사가 가상자산 수탁 서비스를 제공 또는 준비하고 있다. 대부분의 글로벌 금융회사는 규제적 틀이 마련되면서 2021년부터 가상자산 수탁 서비스를 제공하기 시작했다. 2020년 7월 미국 통화감독청(Office of Comptroller of the Currency: OCC)은 국법은행(national banks) 및 저축대부조합(savings and loan association)의 가상자산 수탁 서비스가 허용된다는 유권해석을 발표함에 따라 글로벌 은행의 가상자산 수탁 서비스 제공 가능성이 열렸다.9) 그러나 정확한 관련 지침이 마련되지 않아 대형은행의 가상자산 수탁 업무 진출이 이루어지지 않았으며, 이후 OCC는 2021년 1월까지 3차례의 지침을 통해 은행의 가상자산 수탁 업무 허용을 재확인함에 따라 글로벌 금융회사의 가상자산 수탁 서비스가 본격화되기 시작했다.

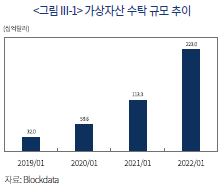

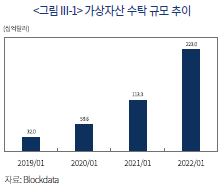

2022년 1월 기준 Blockdata에 따르면 세계 가상자산 수탁 규모는 2,230억달러로 추정되며, 2019년 320억달러에 비해 7배 가량 증가했다(<그림 III-1> 참조). 현재 가상자산 수탁 시장은 8개의 가상자산 전문 수탁업체가 주도하고 있다.10) 그러나 이들 8개 가상자산 수탁업체가 보관ㆍ관리해주는 가상자산 규모는 전체 가상자산의 10%에 불과하며, 이는 향후 가상자산 수탁 시장의 확대 가능성이 매우 높음을 시사한다.

3. 가상자산 수탁 서비스

가상자산 시장이 급격하게 성장하면서 가상자산 수탁 서비스도 금융회사의 새로운 사업 기회로 부상하고 있으며, 실제로 글로벌 금융회사가 가장 많이 취급하고 있는 가상자산 관련 사업이 수탁 서비스다. 2022년 현재 BNY Mellon, State Street, Citi, Fidelity Investment, US Bank, Goldman Sachs, HSBC, BBVA, Deutsche Bank, BNP Paribas, Standard Chartered, Nomura 등 다수의 글로벌 금융회사가 가상자산 수탁 서비스를 제공 또는 준비하고 있다. 대부분의 글로벌 금융회사는 규제적 틀이 마련되면서 2021년부터 가상자산 수탁 서비스를 제공하기 시작했다. 2020년 7월 미국 통화감독청(Office of Comptroller of the Currency: OCC)은 국법은행(national banks) 및 저축대부조합(savings and loan association)의 가상자산 수탁 서비스가 허용된다는 유권해석을 발표함에 따라 글로벌 은행의 가상자산 수탁 서비스 제공 가능성이 열렸다.9) 그러나 정확한 관련 지침이 마련되지 않아 대형은행의 가상자산 수탁 업무 진출이 이루어지지 않았으며, 이후 OCC는 2021년 1월까지 3차례의 지침을 통해 은행의 가상자산 수탁 업무 허용을 재확인함에 따라 글로벌 금융회사의 가상자산 수탁 서비스가 본격화되기 시작했다.

2022년 1월 기준 Blockdata에 따르면 세계 가상자산 수탁 규모는 2,230억달러로 추정되며, 2019년 320억달러에 비해 7배 가량 증가했다(<그림 III-1> 참조). 현재 가상자산 수탁 시장은 8개의 가상자산 전문 수탁업체가 주도하고 있다.10) 그러나 이들 8개 가상자산 수탁업체가 보관ㆍ관리해주는 가상자산 규모는 전체 가상자산의 10%에 불과하며, 이는 향후 가상자산 수탁 시장의 확대 가능성이 매우 높음을 시사한다.

기관투자자의 가상자산 투자와 글로벌 금융회사의 가상자산 수탁 서비스 제공은 상호작용하는 측면이 있다. 기관투자자의 가상자산 투자가 증가함에 따라 수탁 서비스의 제공도 늘어나고 있으며, 동시에 글로벌 금융회사의 가상자산 수탁 서비스 제공은 더 많은 기관투자자가 가상자산 투자에 나설 수 있는 발판을 마련해 준다. 특히, 연기금 등 대형 기관투자자의 경우 자산을 신뢰하는 업체에 수탁해야 하는 규정을 두고 있기 때문에 대형 금융회사의 가상자산 수탁 서비스 제공이 필요하다. 이와 더불어 글로벌 금융회사는 수탁 서비스의 일환으로 가상자산 보험을 제공하기 때문에 기관투자자의 가상자산 투자가 보다 수월해진다.11) 글로벌 금융회사는 가상자산의 보관으로 시작해 스테이킹(staking), 프라임 브로커리지(prime brokerage), 신용공여, 회계 관리 등 다양한 수익 사업으로 가상자산 수탁 사업을 키워나갈 것으로 예상된다.

글로벌 금융회사의 가상자산 수탁 사업 진출은 업계의 경쟁구도에도 중대한 영향을 미칠 것으로 예상된다. 그간 가상자산 수탁 시장은 가상자산 전문 업체들이 주도해 왔으나, 후발주자이지만 규모와 고객 기반 등의 측면에서 경쟁우위를 가지고 있는 글로벌 금융회사가 가상자산 수탁 시장에 진출함에 따라 빠른 시장 잠식이 이루어질 것으로 전망된다.4. 가상자산 트레이딩

가상자산 전문 헤지펀드 등 기관투자자의 가상자산 투자 및 헤지(hedge) 수요가 증가함에 따라 일부 글로벌 금융회사는 트레이딩 사업의 일환으로 가상자산 선물 등에 대한 청산 서비스 제공하고 있다.12) 나아가 일부 글로벌 금융회사는 보다 적극적으로 가상자산 트레이딩에도 직접 나서고 있다. 대표적으로 Goldman Sachs는 2021년 3월 가상자산 트레이딩 데스크를 출범하였으며, 동년 5월에는 미국 은행 중 최초로 비트코인 파생상품 트레이딩을 개시하였다. 2022년 3월에는 가상자산 전문은행 Galaxy Digital과 비트코인 가격에 연동한 차액결제선물환(Non-deliverable Forward: NDF) 거래를 장외거래로 체결했다. Nomura는 2022년 5월 최초로 비트코인 트레이딩 거래를 체결한 것으로 알려졌다(Forbes, 2021. 4. 5).

그러나 아직 글로벌 금융회사의 가상자산 트레이딩은 예외적이고, 관련 규모도 매우 미미한 수준으로 파악된다. 바젤위원회(Basel Committee on Banking Supervision: BCBS)는 2018년부터 은행 감독의 목적으로 대형은행의 가상자산 현황 자료를 수집하고 있으며, <그림 III-2>는 BCBS 조사 대상 은행 중 가상자산에 위험노출(risk exposure)이 있는 은행 수와 가상자산 노출 경로별 비중을 보여준다.13)

2020년 4분기 조사 대상 178개 은행 중 가상자산에 대한 위험노출이 있는 은행은 7개로 모두 자산규모 3조유로 이상의 대형은행에 속한다. 또한 조사 대상 은행의 총 가상자산 위험노출 규모는 1,880억달러에 불과하며, 가상자산 위험노출이 있는 은행의 경우에도 그 규모가 위험가중자산(Risk Weighted Assets: RWA)의 0.02% 수준으로 미미하다. 대형은행의 가상자산 위험노출은 52.4%가 고객 가상자산 거래 계좌 제공과 연계되었으며, 24.4%가 가상자산 선물 청산으로부터 비롯되는 것으로 나타난다.

5. 가상자산 위탁매매

일부 글로벌 금융회사는 가상자산 위탁매매 사업에도 관심을 보이고 있다. 2022년 8월 BlackRock은 가상자산 거래소 Coinbase와의 제휴를 통해 자사 고객에게 가상자산 매매, 수탁, 프라임 브로커리지 및 기록 서비스를 제공할 것으로 발표했다(Bloomberg, 2022. 8. 4). 현재 BlackRock의 가상자산 위탁매매 서비스는 기관투자자 고객으로 한정되어 있으며, 기관투자자에게 제공하는 투자관리 시스템 Aladdin을 통해 이루어진다. BlackRock의 가상자산 위탁매매 서비스는 비트코인에 국한되지만 향후 거래 가능한 가상자산이 확대될 것으로 예상된다.

리테일 고객을 대상으로 하는 가상자산 위탁매매 사업의 경우 온라인ㆍ모바일 전문 디스카운트 브로커리지 Robinhood가 2022년 5월부터 가상자산 및 NFT(Non-fungible Token) 거래 서비스를 출시했다. Robinhood는 주식 및 가상자산의 위탁매매를 동시에 제공하는 최초 브로커리지에 속하며, 가상자산 거래 무료수수료를 앞세워 Coinbase 등 가상자산 거래소와 직접적인 경쟁에 나서고 있다. Robinhood에 따르면 100달러의 가상자산 위탁매매 시 Coinbase는 2.99달러, Gemini는 2.99달러, Venmo는 2.30달러의 거래수수료를 부과한다. 현재 Robinhood를 통해 거래 가능한 가상자산은 12개만 있으며, Coinbase는 150개 이상의 가상자산 거래를 제공하고 있다. 반면, Charles Schwab, E-Trade 등 대형 리테일 브로커리지는 아직 가상자산 위탁매매 사업에 나서고 있지 않다(CNBC, 2022. 5. 17).일부 글로벌 금융회사는 가상자산 위탁매매 사업에도 관심을 보이고 있다. 2022년 8월 BlackRock은 가상자산 거래소 Coinbase와의 제휴를 통해 자사 고객에게 가상자산 매매, 수탁, 프라임 브로커리지 및 기록 서비스를 제공할 것으로 발표했다(Bloomberg, 2022. 8. 4). 현재 BlackRock의 가상자산 위탁매매 서비스는 기관투자자 고객으로 한정되어 있으며, 기관투자자에게 제공하는 투자관리 시스템 Aladdin을 통해 이루어진다. BlackRock의 가상자산 위탁매매 서비스는 비트코인에 국한되지만 향후 거래 가능한 가상자산이 확대될 것으로 예상된다.

6. 가상자산 조직ㆍ투자ㆍ인프라

가상자산에 대한 관심이 높아지면서 Goldman Sachs, Morgan Stanley, JP Morgan, BNY Mellon, Fidelity Investment, Bank of America, State Street, Citi, Nomura 등 다수의 글로벌 금융회사는 가상자산 전담 리서치 및 연구개발 부서를 신설하고 일부 글로벌 금융회사는 가상자산 관련 자회사ㆍ합작사 설립에도 나서고 있다. Fidelity Investment의 경우 2018년 가상자산 전문 자회사 Fidelity Digital Assets를 출범하였으며, 2020년 12월 Standard Chartered의 혁신부문 SC Ventures는 Nothern Trust와 함께 가상자산 수탁사 Zodia Custody를 설립했다. Nomura의 경우 2022년 3월 기관투자자 고객의 가상자산 투자를 전담하는 자회사를 설립하고, 2024년까지 100명 가량의 조직으로 확장할 것이라고 발표했다(Financial Times, 2022. 5. 16). 이와 더불어 가상자산 분야에 대한 역량 확보를 위해 글로벌 금융회사의 가상자산 전문 기업 투자ㆍ제휴도 활발하게 이루어지고 있다(<표 III-4> 참조).

일부 글로벌 금융회사는 블록체인 기술을 금융 인프라 효율화에 활용하는 방안을 추진하고 있다. 대표적으로 JP Morgan은 2020년 자사 블록체인 기반 기술 개발을 위한 전담 사업부인 Onxy를 신설하고, Onyx는 허가형 블록체인(permissioned blockchain) 네트워크 기반의 국경간 송금 및 메시징 시스템 Liink를 구축했다. 2021년 현재 78개국의 400개 이상 글로벌 은행들이 Liink 네트워크에 가입했으며, 이중 27개는 글로벌 50대 은행에 속한다. BNP Paribas는 2022년 5월 Liink를 통해 최초의 블록체인 기반 Repo 거래를 실시하였다. 또한, Onyx는 기업들의 국경간 자금 이동을 목적으로 설계된 자체적 스테이블코인(stable coin) JPM Coin을 상용화하기도 했다.

Ⅳ. 결론 및 시사점

최근 글로벌 금융회사는 과거 취해 왔던 부정적 입장과는 달리 가상자산과 관련된 사업을 여러 방면에서 추진하고 있다. 이와 같은 방향 전환에는 가상자산에 대한 일부 제도적 틀의 마련과 함께 주요 고객층의 수요 증가가 주요 요인으로 작용하고 있다. 2022년 테라-루나(Terra-Luna) 사태로 촉발된 가상자산 가격의 폭락, 일명 ‘가상자산 겨울(crypto winter)’로 인해 글로벌 금융회사의 가상자산 사업 추진은 일정 수준 속도조절이 예상되지만, 가상자산 사업을 위해 많은 준비와 자본을 투입하여 첫 발을 들인 만큼 그 모멘텀은 유지될 것으로 보인다. 2022년 8월 BlackRock은 가상자산 현물 신탁을 출시하면서, 최근 가상자산 가격 폭락에도 불구하고 기관투자자의 수요는 여전히 견고하다고 설명한 점도 이를 뒷받침해준다.

국내 금융회사도 가상자산 시장에 높은 관심을 보이고 있으며, 여러 사업을 추진하고 있다. 국내 4대 시중은행은 가상자산 전문 핀테크 기업과 합작법인 또는 지분투자 형태로 가상자산 수탁 서비스에 진출하고 있으며, 국내 증권사들도 가상자산 전문 핀테크 기업 등과의 제휴를 통해 가상자산 수탁 서비스를 준비하고 있다. 이와 더불어 다수 국내 금융사들은 가상자산 전담 부서를 신설하고 전문 인력을 충원하고 있으며, 블록체인, NFT, 메타버스(metaverse) 분야의 핀테크 기업에 대한 투자 및 제휴에도 적극적으로 나서고 있다. 또한 가상자산 관련 제도적 기반 마련을 위한 논의가 진행 중이다. 현재 금융당국과 관계 부처가 TF(Task Force)를 구성해 제정 방향을 검토하고 있으며 정부는 가상자산의 제도화를 위해 디지털자산기본법 제정을 추진하고 있다. 디지털자산기본법 제정은 국내 금융회사의 가상자산 사업이 본격화될 수 있는 발판을 마련해 줄 것으로 기대된다.

가상자산 관련 사업을 준비하고 있는 국내 금융회사의 관점에서 글로벌 금융회사의 가상자산 사업전략은 의미 있는 시사점을 제공한다. 첫째, 금융회사의 가상자산 사업이 활성화되기 위해서는 우선적으로 투자자 기반이 형성되어야 한다. 기관투자자의 경우 가상자산 투자에 나서기 위한 기반여건 중 하나로 신뢰할 수 있는 금융회사의 수탁, 청산결제, 프라임 브로커리지 등 가상자산 투자에 수반되는 각종 서비스의 제공이 필요하다. 그러므로 국내 금융회사가 가상자산 수탁 서비스에 진출하고 있는 점은 기관투자자의 가상자산 투자 참여를 위한 환경 조성에 큰 도움이 될 것으로 기대된다. 한편 리테일 고객의 경우 건전한 가상자산 투자 문화의 성립이 필요하다. 이를 위해 국내 금융회사는 투자자를 위한 가상자산 관련 리서치, 교육 프로그램 등 필요한 정보를 생산하고 제공해 줄 수 있다.

둘째, 가상자산 관련 다양한 투자 상품의 개발을 고민해 볼 수 있다. 현재 국내에서는 관련 제도의 미비로 가상자산 현물ㆍ선물 투자 제공에는 제약이 있으나 가상자산 관련 기술주에 대한 투자에는 제한이 없다. 해외 사례를 볼 경우 가상자산 기술주로 구성된 펀드 및 ETF에 대한 수요도 상당한 것으로 나타나며 특히, 연기금 등 대형 기관투자자의 경우 먼저 가상자산 기술주에 간접적으로 투자하고, 이후 가상자산 현물ㆍ선물 투자로 확대하는 성향을 보인다. 국내에서는 2021년 출시된 4개의 메타버스 ETF 등 일부 가상자산 테마 펀드가 제공되고 있으나 아직 그 종류와 규모는 제한적이다. 국내 증권사 및 자산운용사는 유망한 가상자산 관련 기업을 발굴하고 이에 기반한 가상자산 테마 펀드 및 ETF를 제공함으로써 국내 가상자산 투자 선택의 폭을 넓혀줄 수 있다.Ⅳ. 결론 및 시사점

최근 글로벌 금융회사는 과거 취해 왔던 부정적 입장과는 달리 가상자산과 관련된 사업을 여러 방면에서 추진하고 있다. 이와 같은 방향 전환에는 가상자산에 대한 일부 제도적 틀의 마련과 함께 주요 고객층의 수요 증가가 주요 요인으로 작용하고 있다. 2022년 테라-루나(Terra-Luna) 사태로 촉발된 가상자산 가격의 폭락, 일명 ‘가상자산 겨울(crypto winter)’로 인해 글로벌 금융회사의 가상자산 사업 추진은 일정 수준 속도조절이 예상되지만, 가상자산 사업을 위해 많은 준비와 자본을 투입하여 첫 발을 들인 만큼 그 모멘텀은 유지될 것으로 보인다. 2022년 8월 BlackRock은 가상자산 현물 신탁을 출시하면서, 최근 가상자산 가격 폭락에도 불구하고 기관투자자의 수요는 여전히 견고하다고 설명한 점도 이를 뒷받침해준다.

국내 금융회사도 가상자산 시장에 높은 관심을 보이고 있으며, 여러 사업을 추진하고 있다. 국내 4대 시중은행은 가상자산 전문 핀테크 기업과 합작법인 또는 지분투자 형태로 가상자산 수탁 서비스에 진출하고 있으며, 국내 증권사들도 가상자산 전문 핀테크 기업 등과의 제휴를 통해 가상자산 수탁 서비스를 준비하고 있다. 이와 더불어 다수 국내 금융사들은 가상자산 전담 부서를 신설하고 전문 인력을 충원하고 있으며, 블록체인, NFT, 메타버스(metaverse) 분야의 핀테크 기업에 대한 투자 및 제휴에도 적극적으로 나서고 있다. 또한 가상자산 관련 제도적 기반 마련을 위한 논의가 진행 중이다. 현재 금융당국과 관계 부처가 TF(Task Force)를 구성해 제정 방향을 검토하고 있으며 정부는 가상자산의 제도화를 위해 디지털자산기본법 제정을 추진하고 있다. 디지털자산기본법 제정은 국내 금융회사의 가상자산 사업이 본격화될 수 있는 발판을 마련해 줄 것으로 기대된다.

가상자산 관련 사업을 준비하고 있는 국내 금융회사의 관점에서 글로벌 금융회사의 가상자산 사업전략은 의미 있는 시사점을 제공한다. 첫째, 금융회사의 가상자산 사업이 활성화되기 위해서는 우선적으로 투자자 기반이 형성되어야 한다. 기관투자자의 경우 가상자산 투자에 나서기 위한 기반여건 중 하나로 신뢰할 수 있는 금융회사의 수탁, 청산결제, 프라임 브로커리지 등 가상자산 투자에 수반되는 각종 서비스의 제공이 필요하다. 그러므로 국내 금융회사가 가상자산 수탁 서비스에 진출하고 있는 점은 기관투자자의 가상자산 투자 참여를 위한 환경 조성에 큰 도움이 될 것으로 기대된다. 한편 리테일 고객의 경우 건전한 가상자산 투자 문화의 성립이 필요하다. 이를 위해 국내 금융회사는 투자자를 위한 가상자산 관련 리서치, 교육 프로그램 등 필요한 정보를 생산하고 제공해 줄 수 있다.

셋째, 국내 금융회사의 금융 인프라 효율화 및 새로운 DeFi 사업 개발을 위한 블록체인 기술의 활용방안을 모색해 볼 수 있다. 이미 오래전부터 금융산업은 인적자원 중심에서 기술 중심으로 변모하고 있으며, 블록체인 기술의 도입은 이러한 추세의 일환이다. 기술적 우위는 금융회사의 경쟁력을 좌우하는 중요한 요인으로 작용하고 있으며, 글로벌 금융회사도 개방형 블록체인 개발 등 기술 경쟁력 확보를 위한 다양한 시도를 하고 있다. 현재 블록체인 기술의 발전은 핀테크 기업들이 주도하고 있는 만큼, 국내 금융회사도 가상자산 분야의 유망한 핀테크 기업과의 전략적 투자 및 제휴를 통해 기술력을 확보하고 국내 가상자산 생태계 발전에 기여하는 노력을 이어갈 필요가 있다.

가상자산 기술과 시장의 형성은 아직 초기 단계에 있으며, 향후 어떠한 방향으로 발전해 나갈지는 예측하기 어려운 측면이 있다. 그럼에도 불구하고 가상자산 생태계는 매우 빠른 속도로 변화하고 있으므로 가상자산에 대한 지속적인 관심과 참여에 노력에 노력을 기울이지 않는다면 기술 경쟁력에서 뒤처지고 사업 기회를 놓칠 위험이 있다. 따라서 국내 금융회사도 시장의 상황을 면밀하게 파악하고 가상자산 사업전략을 수립해 나가야 할 것이다.

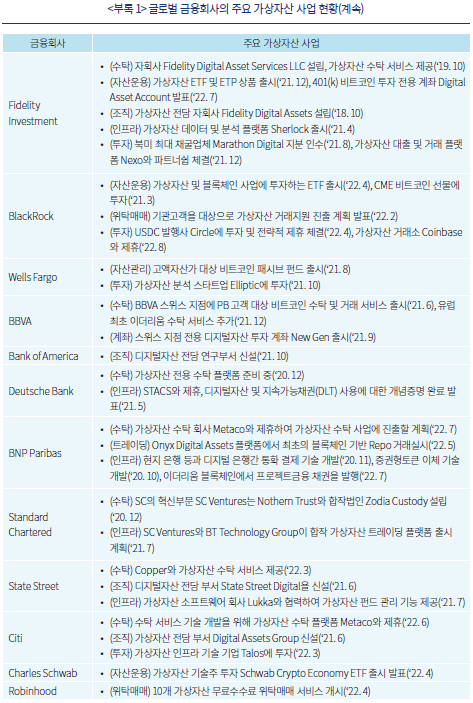

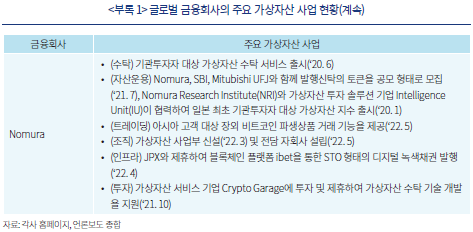

<부록> 글로벌 금융회사의 가상자산 사업 현황

1) Fidelity Digital Assets는 2019년부터 미국, 유럽, 아시아 지역의 기관투자자를 대상으로 가상자산 투자 현황에 대한 설문조사(Institutional Investor Digital Asset Study)를 실시하고 있다. 2021년 설문조사에는 미국(408개), 유럽(393개), 아시아(299개) 기관투자자 대상 1,100건의 조사결과를 포함한다.

2) Fidelity의 조사는 고액자산가 및 기관투자자의 가상자산 관련 투자 규모를 감안하지 않고 전체 투자자 수를 사용하는 통계인 점을 유념할 필요가 있다.

3) 해당 연기금은 가상자산 기술주에 운용자산의 85%를 투자하는 Morgan Creek Blockchain Opportunities Fund를 통해 가상자산에 투자하기 시작했다.

4) 글로벌 금융회사의 가상자산 사업 추진ㆍ진출에 대한 세부 내용 및 시기는 부록을 참고

5) 2021년 JP Morgan 회장 Jamie Dimon은 “개인적으로는 비트코인이 쓸모없다고 생각하지만 고객들은 달리 생각한다. 고객이 비트코인을 거래하고자 한다면 우리는 최소한 투명하고 안정적으로 거래할 수 있게 해줄 수 있다”고 설명했다(Financial Times, 2021. 11. 9).

6) Charles Schwab의 자사 고객 조사에 따르면 20%가 가상자산에 투자하고 있는 것으로 나타나며, 이는 전년 동기 대비 2배 늘어난 수준이다(Charles Schwab, 2022).

7) 반면, 해외에서는 가상자산 현물 ETF/ETP도 출시되고 있다. Fidelity Investment는 2019년 캐나다에서 가상자산 현물 Fidelity Advantage Bitcoin ETF를 출시하고 2022년 2월 가상자산 현물 상장지수상품(Exchange Traded Product: ETP)인 Fidelity Physical Bitcoin ETP를 독일 Borse Xetra에 상장했다.

8) SEC는 가상자산 거래소의 해킹(hacking) 위험 및 규제체계 부족, 협소한 시장 규모로 인한 가격 조작 위험, 국가 간 가상자산 규제차익 등을 주요 문제로 제기해 왔다.

9) OCC는 수탁 서비스가 전통적으로 은행이 제공하는 업무에 속하며, 그동안 다양한 물리적 및 디지털 형태의 자산에 대한 수탁 업무를 수행해 왔으므로, 가상자산의 수탁 업무는 전통적 은행 업무의 현대적 유형(modern form of traditional banking activities)에 속한다고 설명한다(OCC, 2020. 7. 22).

10) 8개 주요 가상자산 수탁사는 Coinbase, Bitgo, Fireblocks, Gemini, Ledger, Matrixport, NYDIG, Bitcoin Suisse이다.

11) Chainalysis 분석에 따르면 2021년 월렛(wallet)에 있는 20%의 가상자산이 분실되는 것으로 파악되며, 그 규모는 2,058억달러에 달한다.

12) 2022년 현재 Macquarie, Bank of America, Citi, Goldman Sachs, JP Morgan, Morgan Stanley, ABN Amro, Barclays, Societe Generale 및 UBS가 가상자산 청산 서비스를 제공 중이다(Risk.net, 2022. 2. 8).

13) BCBS는 은행의 자산규모에 따라 3조유로 이상의 대형은행(Group 1)과 3조유로 미만의 은행(Group 2)으로 분류하며, 조사 대상 178개 은행 중 112개가 Group 1에 속하고, 이 중 27개 은행이 시스템적으로 중요한 금융기관(Systematically Important Financial Institutions: SIFI)에 속한다.

참고문헌

Auer, R., Farag, M., Lewrick, U., Orazem, L., Zoss, M., 2022, Banking in the shadow of bitcoin? The institutional adoption of cyrptocurrencies, BIS working papers, No.1013.

Barrons, 2022. 7. 25, Fidelity made a splash with Bitcoin 401(k)s. Fintechs are wading in too.

Barrons, 2022. 8. 11, BlackRock launches a Bitcoin trust. What it means for crypto and the stock.

Bloomberg, 2022. 8. 4, BlackRock teams up with Coinbase in crypto market expansion.

Business Insider, 2021. 9. 21, From trading to wealth management, big banks are dabbling in crypto. Here’s a rundown of who’s doing what.

Charles Schwab, 2022, Q1 2022 Retail Client Sentiment Report.

CNBC, 2021. 8. 5, JPMorgan, led by bitcoin skeptic Jamie Dimon, quietly unveils access to a half-dozen crypto funds.

CNBC, 2022. 5. 17, Robinhood to let users hold their own crypto and NFTs as it reaches for growth beyond stock trading.

CoinDesk, 2021. 1. 25, Harvard, Yale, Brown endowments have been buying bitcoin for at least a year: Sources.

CoinDesk, 2021. 11. 2, Pension funds wade gingerly into crypto investments.

Fidelity Digital Assets, 2021, The Institutional Investor Digital Assets Study.

Financial Times, 2021. 11. 19, Crypto fever: The pressure grows on wealth managers.

Financial Times, 2022. 5. 16, Nomura prepares to launch crypto subsidiary.

Forbes, 2021. 4. 5, Goldman Sachs cryptocurrency endorsement boosts wealth management.

Forbes, 2022. 4. 13, BlackRock’s newest investment paves the way for digital assets on Wall Street.

Fortune, 2021. 8. 20, Wells Fargo, JPMorgan launch Bitcoin funds.

Goldman Sachs, 2020. 5. 29, US economic outlook & implications of current policies for inflation, gold and bitcoin.

OCC, 2020. 7. 22, Federally chartered banks and thrifts may provide custody services for crypto assets, New Release 2020-98.

Pension & Investments, 2019. 3. 4, More funds testing water on crypto-related assets.

Reuters, 2021. 7. 23, JPMorgan to give all wealth clients access to crypto funds.

Risk.net, 2022. 2. 8, Banks offer crypto clearing but, shhh, don’t tell.

SIFMA, 2022, Capital Markets Fact Book.

The New York Times, 2021. 11. 1, Banks tried to kill crypto and failed. Now they're embracing it (slowly).