Find out more about our latest publications

Determinants and Implications of Korea’s Inflation

Issue Papers 22-19 Oct. 17, 2022

- Research Topic Macrofinance

- Page 30

Soaring inflation in major economies as well as in Korea has hit economic players hard. Global economic conditions such as supply chain disruptions and rising commodity prices are recognized as the main driver of the current inflation cycle, and demand recovery observed in each country is aggravating inflationary pressure. This article explores the determinants and characteristics of Korea’s inflation by comparing inflation factors between the US and Korea.

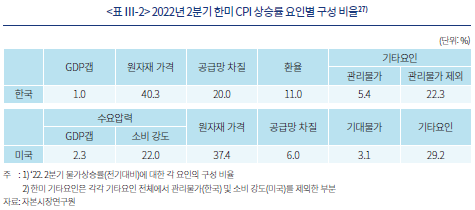

It has been found that commodity prices affect Korea’s inflation most and that the global supply chain crunch has the same critical influence as the won-dollar exchange rate. Notably, the pressure on the demand side has worsened inflation in the US, whereas it hardly has had any significant impact on prices in Korea. This can be attributable to Korea’s structurally sluggish domestic consumption. As of the second quarter of 2022, about 60% of price increases in Korea (consumer price index, on a QoQ basis) came from global factors such as the rise in commodity prices (40%) and the supply chain crisis (20%), while the proportion of demand pressure remained at a meager 1%. In addition, the won-dollar exchange rate made a considerable contribution, representing 11% of entire inflation factors.

As the main drivers of domestic inflation are global factors, Korea’s authorities face difficulties in implementing policies. The upward trend of expected inflation starting this year and the recent instability in the won-dollar exchange rate require monetary tightening. However, it is necessary to consider that demand-side pressure makes a marginal contribution to price hikes. Other policies need to be aligned with monetary policy. On top of that, recent history has shown that comprehensive energy policies including oil tax reduction are less effective in the medium to long term. Accordingly, policy responses to rising energy prices should focus on supporting low-income households.

The current uptrend in inflation could be eased on the back of tightening policies around the globe. But there is a possibility that higher commodity prices and supply chain disruptions would be entrenched as structural factors that can escalate global inflation uncertainties, due to the prolonged pandemic crisis, intensifying geopolitical conflicts and accelerated responses to climate change. Considering recent higher inflation, central banks’ effort to adjust the aggregate demand is of importance in inflation stabilization, which should be coupled with policy measures to tackle the intensifying and prolonged inflation uncertainty arising from structural factors.

It has been found that commodity prices affect Korea’s inflation most and that the global supply chain crunch has the same critical influence as the won-dollar exchange rate. Notably, the pressure on the demand side has worsened inflation in the US, whereas it hardly has had any significant impact on prices in Korea. This can be attributable to Korea’s structurally sluggish domestic consumption. As of the second quarter of 2022, about 60% of price increases in Korea (consumer price index, on a QoQ basis) came from global factors such as the rise in commodity prices (40%) and the supply chain crisis (20%), while the proportion of demand pressure remained at a meager 1%. In addition, the won-dollar exchange rate made a considerable contribution, representing 11% of entire inflation factors.

As the main drivers of domestic inflation are global factors, Korea’s authorities face difficulties in implementing policies. The upward trend of expected inflation starting this year and the recent instability in the won-dollar exchange rate require monetary tightening. However, it is necessary to consider that demand-side pressure makes a marginal contribution to price hikes. Other policies need to be aligned with monetary policy. On top of that, recent history has shown that comprehensive energy policies including oil tax reduction are less effective in the medium to long term. Accordingly, policy responses to rising energy prices should focus on supporting low-income households.

The current uptrend in inflation could be eased on the back of tightening policies around the globe. But there is a possibility that higher commodity prices and supply chain disruptions would be entrenched as structural factors that can escalate global inflation uncertainties, due to the prolonged pandemic crisis, intensifying geopolitical conflicts and accelerated responses to climate change. Considering recent higher inflation, central banks’ effort to adjust the aggregate demand is of importance in inflation stabilization, which should be coupled with policy measures to tackle the intensifying and prolonged inflation uncertainty arising from structural factors.

Ⅰ. 논의 배경

최근 우리나라를 포함해 주요국에서 물가상승세가 확대되며 경제주체의 어려움이 가중되고 있다. 금년 2분기에 국내 소비자물가는 전년보다 5.4% 상승하며, 글로벌 금융위기 이후 최고치를 기록하였다. 같은 기간 미국 물가는 1982년 이래 최고 수준인 8.6%까지 상승했다. 금번 인플레이션은 예상을 상회한 수요회복, 글로벌 공급망 및 고용시장의 병목현상, 러시아-우크라이나 전쟁으로 심화된 글로벌 에너지 수급 차질 등의 충격이 복합적으로 작용하며, 수요-공급간 불균형이 심화되어 발생하였다(BIS, 2022). 국내 물가 급등도 공급망 차질 및 원자재 가격 상승 등이 주요 원인으로 지목되고 있다(한국은행, 2022. 6. 21).

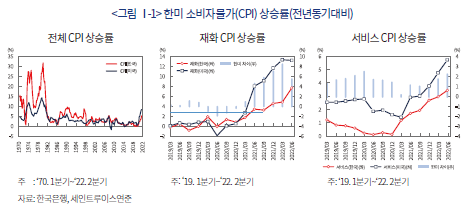

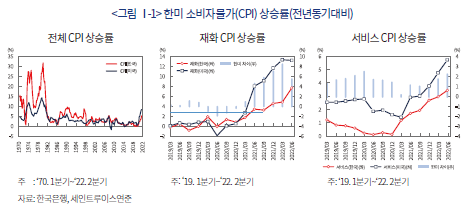

이처럼 물가상승의 주요 동인은 대외요인에 있으나, 국가별로 글로벌 요인과 수요압력이 물가에 미치는 영향에는 차이가 있다(Powell, 2022. 6. 22; Lagarde, 2022. 6. 28). 이로 인해 <그림 Ⅰ-1>에 나타난 바와 같이, 한미간에 전체 물가상승 폭에 차이가 있으며, 하위 품목(재화 및 서비스) 물가의 상승 시기 및 강도 또한 차별화되고 있다. 따라서 국내 인플레이션에 대한 이해와 대응을 위해서는 요인별 특성과 물가 기여도를 살펴볼 필요가 있다.

이에 본 고에서는 국내 인플레이션의 결정요인을 분석한다. 우선, 금번 인플레이션의 주요 원인을 알아본다. 다음으로, 우리나라와 미국 인플레이션의 결정요인을 비교분석하고, 이를 통해 국내 인플레이션의 특징을 살펴본다.

Ⅱ. 인플레이션의 주요 원인 및 지속가능성

아래에서는 본 연구의 실증분석에서 사용된 변수를 중심으로 금번 인플레이션의 주요 원인에 대해 살펴본다. 우선 재화(goods)에 대한 급격한 소비 증가가 글로벌 공급망 차질과 맞물려 인플레이션이 촉발된 점을 살펴본다. 다음으로 금년들어 글로벌 인플레이션을 주도하고 있는 원자재 가격 상승을 논의한다.

1. 수요회복

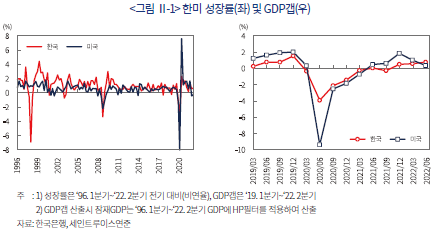

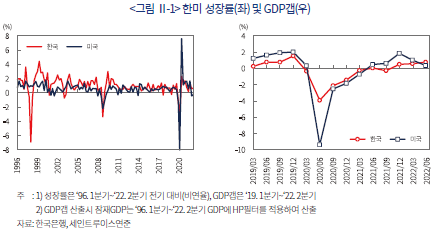

팬데믹 발생 이후의 세계 경기변동은 침체의 폭과 회복 속도 모두 이례적인 수준으로 평가된다. <그림 Ⅱ-1>에 나타난 것처럼, 특히 미국 경기는 강한 침체에 진입한 후 매우 빠르게 회복하였다. 이로 인해 한미 모두 전반적인 수요측면의 물가상승 압력1)을 나타내는 GDP갭2)이 지난해 하반기에 양(+)으로 전환하였다.

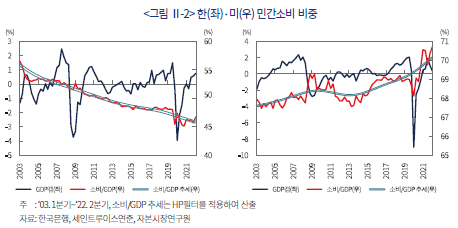

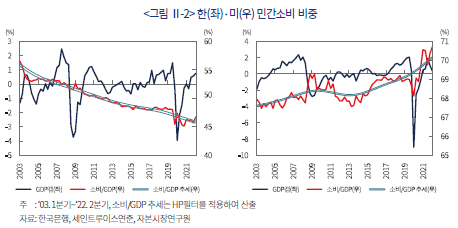

그런데, 한미 모두 최근 GDP갭이 저물가였던 팬데믹 이전과 유사한 수준이라는 점에 주목할 필요가 있다. 이는 GDP갭을 통해 최근의 높은 물가를 이해하는 데 한계가 있으며, 금번 경기회복이 과거와 차별화된 특징이 있음을 시사한다. <그림 Ⅱ-2>는 GDP에서 민간소비(가계 및 비영리단체)가 차지하는 비중을 나타낸다. 본 고에서는 동 비중을 통해 소비 강도를 파악하고자 한다. 미국의 소비 비중은 팬데믹 이전에는 대략 67~69%에서 변동하였으나, 지난해부터 70% 이상까지 급등하였다. 따라서 미국의 경우, GDP갭은 팬데믹 이전과 유사하지만, 소비 강도는 이례적인 수준으로 볼 수 있다. 민간소비가 물가상승을 유발하는 중요 수요 요인이라는 점을 감안하면, 미국은 수요측면의 물가상승 압력이 매우 높은 것으로 평가할 수 있다. 국내는 소비 비중이 55% 수준에서 추세적으로 낮아지고 있다. 지난해 말에 반등하여 추세를 상회하고 있으나, 국내 민간수요 압력은 아직 구조적 부진에서 완전히 벗어나지 못하고 있는 것으로 판단된다.3) 이로부터 한미간에 GDP갭이 유사하더라도 국내 소비 강도가 미국보다 낮은 것으로 평가할 수 있다. 국가별로 차이는 있으나, 팬데믹 이후 소비 증가는 재정지원의 영향이 큰 것으로 평가된다. 특히 미국은 재정지원에 힘입어 팬데믹에도 가계의 가처분소득이 증가하며 소비 여력이 축적되었다(Tauber & Zandweghe, 2021).

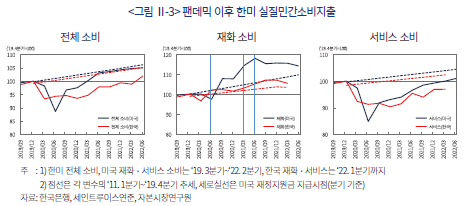

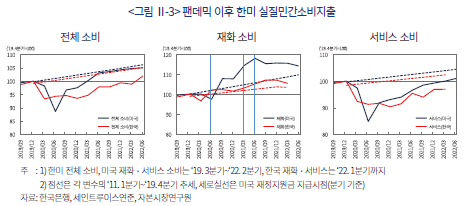

최근의 소비와 관련한 또 다른 특징으로 재화-서비스간 소비 선호에 변화가 발생했다는 점을 들 수 있다. <그림 Ⅱ-3>이 보여주듯이, 팬데믹 이후 소비가 대면이 필요한 서비스에서 내구재를

중심으로 한 재화에 집중되는 현상이 발생하였다. 이와 같은 변화는 주요국에서 공통된 현상이며, 재화에 대한 수요 강도는 재정지원 규모에 따라 상이한 것으로 알려져 있다(Jorda et al., 2022; Schnabel, 2022. 5. 11).4) 미국의 경우, 우리나라를 포함한 여타 국가보다 재정지원 규모가 컸으며, 그 결과 재화에 대한 소비가 이례적인 수준까지 급증하였다. 이와 같이 재화 수요가 크게 증가한 데 반해, 팬데믹으로 글로벌 공급망이 차질을 빚어 재화 가격이 큰 폭으로 상승하였다(<그림 Ⅰ-1> 참고). 서비스 소비는 경제활동이 재개되면서 점진적인 회복세를 나타내고 있다. 미국 서비스 소비는 금년 1분기에 팬데믹 이전 수준으로 회복되었으며, 국내는 사회적 거리두기가 해제된 4월부터 빠르게 정상화되고 있다(이용대ㆍ이웅, 2021; 한국은행, 2022a). 이로 인해 한미 서비스 물가는 금년들어 상승세가 확대되고 있다.

향후 각국의 통화긴축 등으로 국내외 경기가 둔화하면서(BIS, 2022; IMF, 2022), 총수요 측면의 물가상승 압력은 점차 완화될 것으로 예상된다. 소비 행태의 경우, 재화에 대한 소비 집중이 팬데믹에 기인한 일시적 현상인 만큼, 점차 정상화될 것이라는 견해가 우세하다(Tauber & Zandweghe, 2021). 하지만 팬데믹 이후에도 보건위험이 지속될 수 있고(Celasun et al., 2022), 재택근무가 새로운 근무형태로 정착함에 따라(Barrero et al., 2021), 재화와 서비스에 대한 소비 선호가 팬데믹 이전으로 복귀하지 않을 가능성도 제기되고 있다.

2. 글로벌 공급망(Global Supply Chain: GSC) 차질

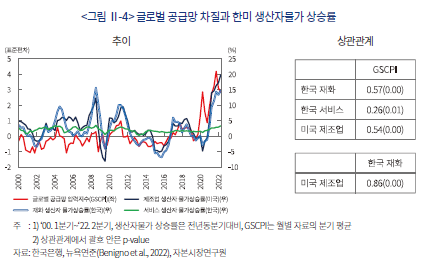

글로벌 공급망 차질은 재화 중심의 소비 변화와 결합하여 금번 인플레이션을 촉발하였다. 재화의 경우, 글로벌 분업체계(Global Value Chain: GVC)의 영향을 많이 받는 품목으로, 기업은 다양한 생산 단계에 걸쳐 전 세계에서 제공되는 중간재를 사용한다. 이러한 환경에서 각국의 봉쇄조치로 글로벌 공급망에 차질이 발생하며 생산 및 물류에 병목이 발생하였다. Santacreu et al.(2022) 및 Akinci et al.(2022. 1. 28)에 따르면 공급망 차질로 미국의 제조업 생산자물가가 크게 상승한 것으로 나타났다.

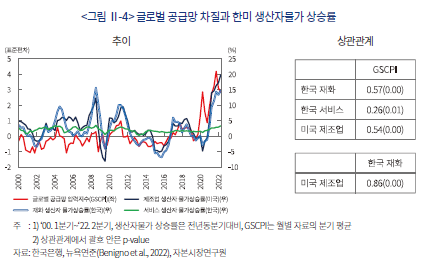

<그림 Ⅱ-4>는 Benigno et al.(2022)이 고안한 글로벌 공급망 압력지수(Global Supply Chain Pressure Index: GSCPI)5)와 한미 생산자물가 상승률을 보여준다. 공급망 차질은 팬데믹으로 크게 악화된 후 금년 5월부터 개선 중이지만, 최근의 개선에도 2000년 이후 평균치를 크게 상회하고 있다. 그림에서 한미 재화(및 제조업) 생산자물가가 공급망 차질과 높은 상관관계를 가지는 것을 알 수 있다.6) 따라서 최근의 공급망 차질은 제조업을 중심으로 기업의 생산비용 상승을 유발한 것으로 평가된다.7) 생산자물가 상승은 시차를 두고 해당 품목에 대한 수요 강도에 따라 소비자물가 상승을 유발한다(Datta et al., 2022. 6. 24; Summers, 2022. 7. 14).

당초 팬데믹이 완화됨에 따라 공급망 차질이 점진적으로 해소되고 소비 행태가 정상화되면서, 재화 인플레이션 압력이 완화될 것으로 예상하는 견해가 지배적이었다(Furman, 2022. 1. 13). 하지만 공급망에서 핵심적인 역할을 담당하는 중국이 제로코로나 정책을 유지할 가능성이 있으며, 개도국을 중심으로 보건위험이 지속될 가능성이 있다. 이와 같은 불확실성을 고려하면, 공급망이 팬데믹 이전으로 복원되는데 예상보다 긴 시간이 소요될 가능성이 있는 것으로 판단된다.8)

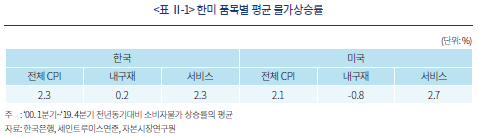

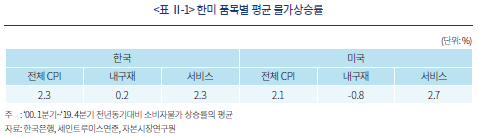

글로벌 공급망이 물가에 미치는 영향은 단기적 변동보다 중장기적 관점에서 파악할 필요가 있는 것으로 판단된다. 팬데믹으로 아웃소싱ㆍ오프쇼어링을 통해 효율성(비용)을 우선시하는 글로벌 공급망의 취약성이 확인되었다. 여기에 지정학적 갈등이 심화됨에 따라, 리쇼어링ㆍ프렌드쇼어링 등과 같이 안정성(복원력)을 중시하는 방향으로 공급망 재편이 가속화될 가능성이 있다(Javorcik, 2020; White House, 2021). <표 Ⅱ-1>이 확인해 주듯이, 글로벌 분업체계가 본격화된 2000년 이후 내구재를 중심으로 한 재화 가격은 저물가 요인으로 작용하며 글로벌 저물가 기조를 이끌었다(Auer et al., 2017a, Lane, 2020. 5. 22). 라가르드(Lagarde) 유럽중앙은행 총재가 지적한 바와 같이(Lagarde, 2022. 4. 22), 글로벌 공급망의 재편 속도에는 불확실성이 있으나, 구조적인 인플레이션 확대 요인으로 자리잡을 가능성이 있는 것으로 판단된다.

3. 원자재 가격 상승

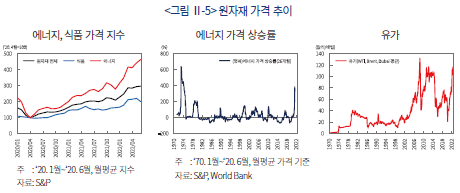

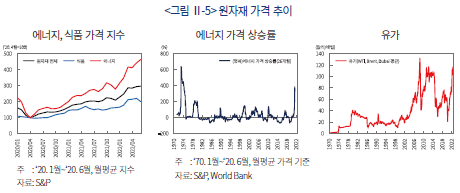

원자재 가격은 팬데믹 초기에 봉쇄조치와 수요 감소로 크게 하락하였으나, 2020년 2분기부터 수요가 급증하며 상승세로 전환하였다. 여기에 우크라이나 전쟁으로 상승 폭이 확대되며 주요국 인플레이션 심화의 주요 원인으로 작용하였다. <그림 Ⅱ-5>에 나타난 것처럼, 금년 6월 전체 원자재 가격은 2020년 4월보다 두 배 넘게 상승하였다. 특히 에너지 가격은 400% 급등해 1973년 오일쇼크 이후 가장 높은 상승세를 나타냈다. 다만, 금년 7월 들어서는 중국을 포함하여 글로벌 경기둔화로 인한 수요 감소 및 러시아 원유 생산 규모의 안정을 반영하여, 유가(WTI 기준)가 100달러를 하회하는 등 전반적인 에너지 가격이 안정세로 전환하였다(IEA, 2022a).

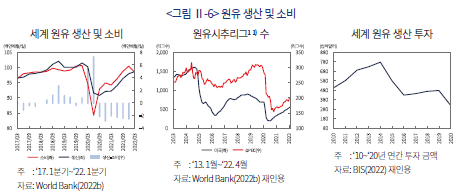

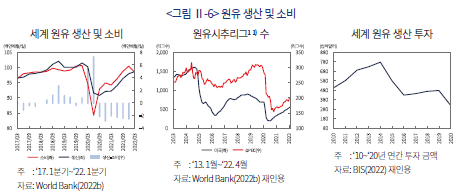

최근의 안정세에도 불구하고 에너지 가격은 팬데믹 이전부터 누적되어온 수요-공급간 불균형이 지속되며, 글로벌 인플레이션의 불확실성을 높이는 요인이 될 가능성이 있다. <그림 Ⅱ-6>은 원유 생산ㆍ소비와 함께 원유 생산을 위한 투자 추이를 보여준다. 원유 소비는 2020년 2분기부터 빠르게 증가했지만, 생산은 수요만큼 탄력적으로 증가하지 못했음을 알 수 있다. 원유 생산이 저조한 주요 원인은 신규 설비 투자 부진에 있는 것으로 지적되는데, 세계 원유 생산 투자는 2015년부터 큰 폭의 감소세를 보여 왔다.

이와 같은 투자 축소는 주요국의 탄소중립 정책(화석연료 사용 제한 및 재생에너지 사용 확대)과 소비자의 에너지 선호 변화 등과 같은 구조적 요인이 작용한 결과로 파악된다(Baffes et al., 2022; World Bank, 2022a).9) 여기에 2020년에는 팬데믹으로 인한 수요 감소 및 노동력ㆍ부품 조달 차질이 발생하여, 투자가 추가로 감소하였다(World Bank, 2020). 이처럼 원유 생산능력은 구조적으로 감소 중인 반면, 재생에너지의 화석연료 대체는 아직 낮은 수준에 머물고 있다.10)

러시아-우크라이나 전쟁이 에너지 전환에 미치는 단기적 영향에 대해서는 논란이 있으나, 세계은행 및 국제에너지기구(IEA) 등의 의견(World Bank, 2022b; IEA, 2022b)과 미국ㆍEU 등의 정책방향12) 등을 토대로 평가해보면, 향후 그린(재생) 에너지로의 전환이 가팔라질 것으로 예상된다. 이런 가운데 에너지 전환 가속화가 중장기적 인플레이션 확대 요인으로 작용할 가능성이 제기되고 있다(Matthews & Blunt, 2022; Schnabel, 2022. 3. 17). 우선 주요국의 탈탄소 정책 강화는 탄소배출권 가격 상승, 자금조달 비용 상승 및 규제 비용 등을 통해 화석연료 생산비용 상승압력으로 작용할 전망이다. 또한 에너지 전환 가속화로 재생에너지 생산에 사용되는 원자재 수요가 확대되어 재생에너지 생산비용의 증가가 예상된다.13) 결과적으로 에너지 가격은 단기시계에서는 러시아에 대한 제재조치 및 러시아의 원유ㆍ천연가스 공급 규모에 따라 변동할 가능성이 크나, 전쟁이 종료되더라도 팬데믹 이전의 안정적 수준으로 복귀할 것인 지에는 상당한 불확실성이 있는 것으로 평가된다.

Ⅲ. 국내 인플레이션 결정요인 및 특징 분석

본 장에서는 앞에서 살펴본 요인을 중심으로 국내 인플레이션 결정요인을 분석한다. 특히, 한미 비교를 통해 국내 인플레이션의 특징을 알아본다. 다음으로 최근 국내에서 주목받고 있는 서비스 품목별 인플레이션의 결정요인을 살펴본다.

1. 분석방법

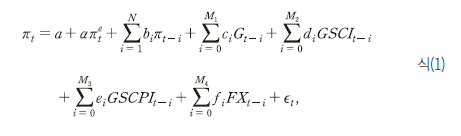

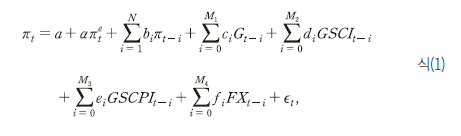

본 고에서는 <부록 1>에 정리된 바에 기초하여, 식(1)을 통해 인플레이션 결정요인을 분석한다. 간략히 살펴보면, 우선 표준 축약형(reduced form) 필립스 곡선을 참고하여, 초과수요를 나타내는 GDP갭(변수명 ), 기대물가 상승률(

), 기대물가 상승률( ) 및 물가의 지속성(관성)을 나타내는 과거 물가상승률(

) 및 물가의 지속성(관성)을 나타내는 과거 물가상승률( )을 인플레이션 결정요인에 포함하였다. 여기에 원자재 가격(

)을 인플레이션 결정요인에 포함하였다. 여기에 원자재 가격( )과 글로벌 공급망 압력지수(

)과 글로벌 공급망 압력지수( )를 글로벌 물가요인으로 선정하였다. 다음으로 우리나라의 경우, 개방경제의 특성을 반영하여 원달러 환율(

)를 글로벌 물가요인으로 선정하였다. 다음으로 우리나라의 경우, 개방경제의 특성을 반영하여 원달러 환율( )을 추가하였다.

)을 추가하였다.

분석기간은 2001년 1분기부터 2022년 2분기이며,14) 변수별 상세한 정의는 <부록 2>에 정리하였다. 여기서는 변수별 핵심 내용만 살펴본다. 물가상승률( )은 전분기대비 CPI 상승률(비연율)을 사용하였으며, GSCI, GSCPI 및 FX는 분기별 관측치의 전분기대비 변화(율)를 이용하였다. 기대물가상승률의 경우, <부록 1>의 기존 연구들은 공통으로 중기 이상의 기대치를 사용하였다. 본 고에서는 이를 참고하여, 미국 기대물가상승률로 미시간대의 향후 5년간 기대물가상승률 서베이 결과를 이용하였다. 국내에는 분석기간 중 가용한 중기 이상의 기대물가 데이터가 존재하지 않으므로 기대물가상승률은 제외하고 과거 물가상승률만 사용하였다.15) 다음으로 변수별 래그(lag)항의 차수(

)은 전분기대비 CPI 상승률(비연율)을 사용하였으며, GSCI, GSCPI 및 FX는 분기별 관측치의 전분기대비 변화(율)를 이용하였다. 기대물가상승률의 경우, <부록 1>의 기존 연구들은 공통으로 중기 이상의 기대치를 사용하였다. 본 고에서는 이를 참고하여, 미국 기대물가상승률로 미시간대의 향후 5년간 기대물가상승률 서베이 결과를 이용하였다. 국내에는 분석기간 중 가용한 중기 이상의 기대물가 데이터가 존재하지 않으므로 기대물가상승률은 제외하고 과거 물가상승률만 사용하였다.15) 다음으로 변수별 래그(lag)항의 차수( )는 추정계수의 유의성 및 BIC(Bayesian Information Criteria) 통계량을 기준으로 선정하였다.

)는 추정계수의 유의성 및 BIC(Bayesian Information Criteria) 통계량을 기준으로 선정하였다.

2. 분석결과

가. 추정결과

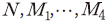

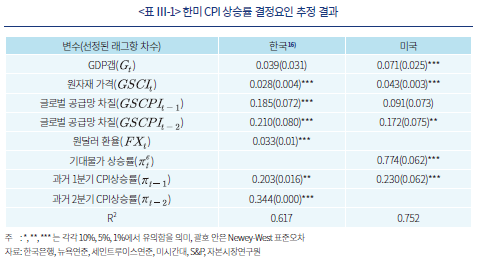

<표 Ⅲ-1>에는 식(1)의 추정결과가 정리되어 있다. 주요 결과를 살펴보면 다음과 같다. 첫째, 물가의 지속성 측면에서, 한국은 과거 2분기까지의 물가상승률이 현재 물가에 영향을 주는 반면, 미국은 과거 1분기 물가상승률만 유의한 것으로 확인되었다. 이는 국내 인플레이션이 미국보다 지속성이 다소 높음을 의미한다.

둘째, 한미간에 수요압력(GDP갭)이 물가에 미치는 영향이 다른 것으로 나타났다. 미국은 GDP갭이 확대될수록 물가가 유의하게 상승한다. 반면 국내는 GDP갭의 유의성이 낮은 것으로 분석되었다.17) 이는 국내 물가가 수요압력보다 원자재 등 여타 요인의 영향을 많이 받아 결정됨을 의미한다. 동시에, 앞 장(<그림 Ⅱ-2>)에서 언급된 국내 경제의 구조적 수요압력 둔화가 반영된 결과로 판단된다.

셋째, 한미 모두 원자재 가격 및 글로벌 공급망 차질이 물가에 유의한 영향을 미친다. 원자재 가격은 시차를 두지 않고 당분기에 물가상승을 유발하는 반면, 공급망은 1~2분기의 시차를 두고 물가에 영향을 미친다. 이는 공급망 차질이 일차적으로 생산자물가에 영향을 주기 때문으로 해석할 수 있다.18)

넷째, 환율은 다양한 경로를 통해 국내 물가상승을 증폭하거나 완화하는 역할을 할 수 있는데, <표 Ⅲ-1>에서는 원달러 환율이 상승할수록 물가상승률이 높아지는 경향이 확인되었다. 이는 분석기간 동안 환율이 원자재 등 수입물가 경로를 통해 국내 물가상승 압력을 가중하였음을 의미한다.

나. 한미 인플레이션 역사적 분해

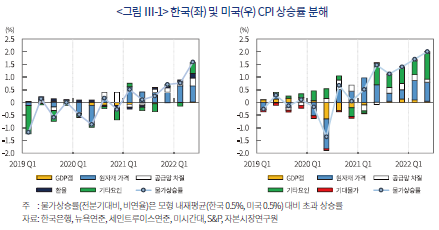

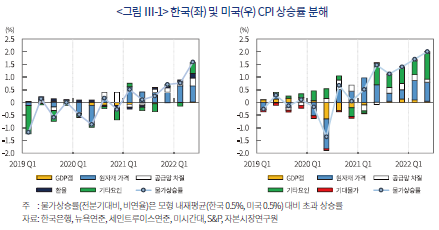

여기서는 식(1)의 추정결과를 이용하여, 물가를 요인별로 분해하여 살펴본다.19) <그림 Ⅲ-1>은 각 요인의 물가상승률에 대한 기여도를 나타낸다. 그림에서 물가상승률은 식(1)에서 산출된 물가상승률의 내재(장기)평균 대비 초과 상승률이다. 따라서 이하 논의에서 물가상승 또는 하락은 내재평균 대비 초과 변동을 의미한다. 각 요인의 기여도가 양(음)의 값을 가지면 물가를 상승(하락)시키는 효과가 있음을 나타낸다. 기타요인은 물가상승률 중에서 식(1)에 포함된 요인에 의해 설명되지 않는 부분이다.

우선 한미 모두 팬데믹 초기에 GDP갭이 음으로 전환(수요압력 감소)하며, 물가하락 요인으로 작용하였음을 알 수 있다. 미국은 한국보다 빠른 경기회복으로 2021년 하반기부터 GDP갭이 물가상승 요인으로 전환하였다. 반면 국내는 금년 2분기까지 수요측면의 물가상승 압력이 미미한 것으로 나타났다. 금번 인플레이션의 특징적인 측면은 한미 모두 GDP갭에 의해 측정된 수요압력의 물가상승 기여도가 낮다는 점에 있다. 미국의 경우 수요압력이 일부 물가상승을 유발하였으나, 다른 요인에 비해 기여도가 낮음을 알 수 있다.

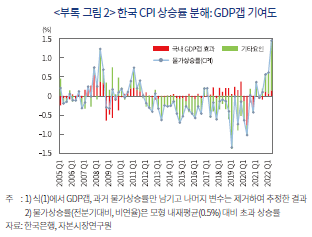

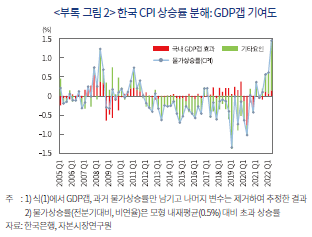

국내 GDP갭과 물가간 관계에서 주목할 점이 있다. <부록 그림 2>는 식(1)에서 GDP갭만 사용한 표준 필립스 곡선에서 도출된 물가분해 결과를 보여준다. 대략 2012년까지 GDP갭이 물가상승률의 상당 부분을 설명하였으나, 2013년을 전후한 시점부터 GDP갭의 기여도가 현저히 낮아졌다.20) GDP갭과 물가가 반대 방향으로 변동하는 시기도 관찰된다. <부록 그림 1>과 앞 장의 <그림 Ⅱ-2>를 종합해보면, 국내에서 표준 필립스 곡선의 설명력이 낮아진 것은, 주요국과 유사하게 원자재 및 공급망 등 글로벌 요인의 영향이 증가한 점과 함께, 국내 고유의 구조적 수요압력 둔화가 반영된 결과로 평가해 볼 수 있다.

다음으로 <그림 Ⅲ-1>에서 한미 모두 공급망 차질이 2020년 2분기부터 물가상승 요인으로 작용한 것으로 나타났다. 공급망 차질이 물가에 미치는 영향은 다음과 같은 이유에서 주목할 필요가 있다. 첫째, 공급망 차질은 팬데믹 초기에 경기침체로 GDP갭 및 원자재 가격이 급락하며 물가상승률이 낮게 형성되었던 시기에도 물가상승 요인으로 작용하였다.21) 둘째, 한미간에 공급망 차질이 물가에 영향을 미치는 시기가 매우 유사한 것으로 나타났다. 셋째, 한미 모두 공급망 차질이 물가상승률에 대한 기여도가 작지 않다. 이러한 점들을 종합하면, 향후 공급망 문제가 경기둔화기(마이너스 GDP갭 시기)에도 글로벌 인플레이션을 확대하는 중요 요인으로 자리잡을 가능성이 있는 것으로 판단해볼 수 있다.22)

분석기간 동안 한미 모두 원자재 가격이 물가 변동의 핵심 요인으로 나타났다. 특히, 경기가 침체에 진입한 2020년 2분기에 GDP갭보다 원자재 가격의 물가하락 기여도가 큰 것으로 확인되었다. 원자재 가격은 2020년 3분기부터 상승세로 전환하며 물가상승에 크게 기여하고 있다.

원달러 환율의 경우, 대체로 원화가 약세를 보이는 시기에 물가 오름세가 확대되었다. 환율은 2021년 2분기까지는 물가하락 요인이었으나, 동년 3분기부터 지속적인 물가상승 요인으로 작용하고 있다. 환율 변화는 원자재 가격이 국내 물가에 미치는 영향을 확대하거나 완화할 수 있다. 2021년 3분기 이후에는 원자재 가격과 환율이 동일한 방향으로 변동하는 경향이 강해지고 있어, 환율의 물가에 대한 영향을 주시할 필요가 있다.

한편, <그림 Ⅲ-1>에서 금번 물가상승 국면에서 기타요인의 비중이 작지 않음을 알 수 있다. 2021년 3분기까지 국내 기타요인은 주요 물가하락 요인이었으나, 금년 2분기에 물가상승 요인으로 전환하였다. 미국은 기타요인이 대체로 물가상승을 유발해온 가운데, 특히 최근에는 전체 물가상승률에서 차지하는 비중이 원자재와 유사하다. 기타요인은 식(1)에서 고려하지 못한 여러 요인의 영향이 합산된 결과이다. 아래에서는 본 고에서 파악한 요인에 초점을 두고 살펴본다.

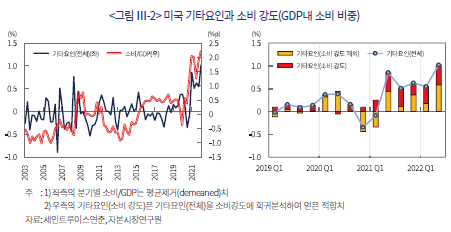

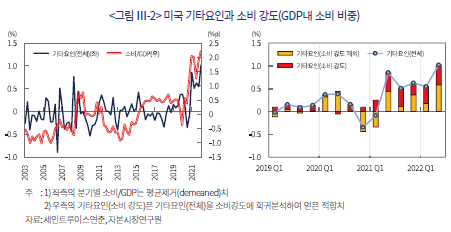

<그림 Ⅲ-2>의 좌측은 미국 소비 강도(GDP내 소비 비중)와 미국 기타요인(<그림 Ⅲ-1>과 동일)을 보여준다. 두 변수간에 유의한 상관관계(0.45)가 존재하므로 기타요인 중 소비 강도에 의해 설명되는 부분을 분리해볼 수 있다.23) <그림 Ⅲ-2>의 우측은 기타요인을 소비 강도에 의해 설명되는 부분과 나머지로 구분하여 나타낸다. 그림에서 확인할 수 있듯이, 2021년 2분기부터 소비 강도가 기타요인 중 상당 부분을 차지하고 있다.

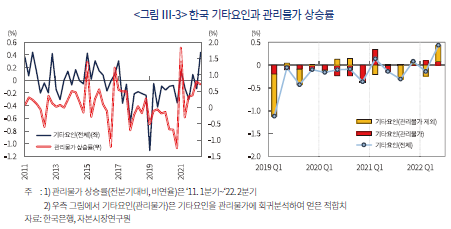

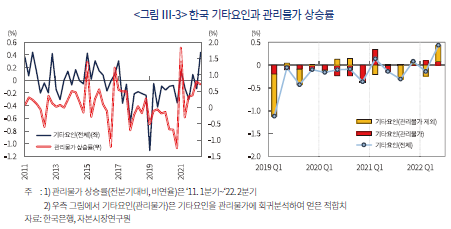

다음으로 <그림 Ⅲ-3>의 좌측은 국내 관리물가24) 상승률과 기타요인을 나타낸다. 국내 기타요인은 관리물가와 밀접히 연관된 것으로 파악된다(상관관계 0.5). <그림 Ⅲ-3>의 우측에는 국내 기타요인을 관리물가에 의해 설명되는 부분과 나머지로 구분한 결과가 나타나 있다.25) 관리물가는 2020년까지 기타요인의 대부분을 차지하며 물가하락 요인으로 작용하였다. 하지만 2021년부터는 물가하락 기여도가 낮아지며 상승요인으로 전환 중이다. 주요 원인으로는 전기ㆍ가스 등 공공요금 인상 등을 들 수 있다(한국은행, 2022. 6. 21, 2022b).

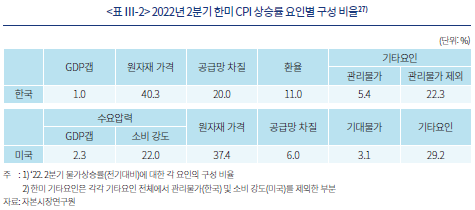

이상을 종합하여 <표 Ⅲ-2>에 금년 2분기 물가상승률의 요인별 구성 비율을 정리하였다. 우선 한미 모두 글로벌 요인(원자재 가격, 공급망 차질)의 비중이 60%(한국)와 43%(미국)로 나타났다. 하지만 한미간에 수요측면의 물가상승 압력에는 상당한 차이가 있는 것으로 확인되었다. 국내는 GDP갭으로 측정된 초과수요가 물가상승분의 1%를 차지하는 데 그쳤으나, 미국은 GDP갭과 소비 강도의 합이 24%에 달한다.26)

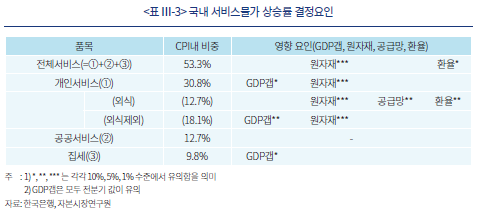

다. 국내 서비스물가 결정요인

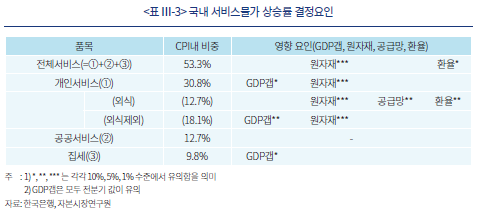

2장에서 살펴본 소비 행태 복원(재화→서비스)과 관련하여, 최근 국내에서도 pent-up 소비28)로 인한 개인서비스물가 상승세가 주목받고 있다(이용대ㆍ이웅, 2021; 한국은행, 2022b). 서비스 인플레이션의 경우 재화물가보다 지속성이 높다는 점에서 주의를 기울일 필요가 있다(Carstens, 2022). 개인서비스물가는 외식 및 외식제외(숙박ㆍ레저 등 77개 품목)로 구분되는데, 금년 2분기에 각각 전기대비(전년동기비) 2.1%(7.3%) 및 1.2%(3.6%) 상승하였다. <표 Ⅲ-3>에는 식(1)에 품목별 서비스물가를 적용한 결과가 나타나 있다.29) 30)

개인서비스의 하위 품목인 외식 및 외식제외 서비스물가는 근원품목(식료품 및 에너지 제외)임에도 원자재 가격에 유의한 영향을 받는다. 공급망 차질은 외식서비스에서만 유의한 것으로 나타났다.31) GDP갭의 경우, 외식제외서비스물가에는 유의한 영향을 미치지만, 외식서비스물가에서는 유의하지 않은 것을 알 수 있다. 이는 최근 외식물가의 높은 상승률이 예상과 달리 수요 증가보다 원자재 가격 및 환율 상승으로 인한 재료비 급등이 주요 원인일 가능성을 시사한다. 다만, 외식제외서비스물가는 수요에 민감하게 반응하므로, 향후 pent-up 소비 효과가 강화될 가능성에 유의할 필요가 있는 것으로 판단된다.

Ⅳ. 결론 및 시사점

본 고에서는 한미 비교를 통해 국내 인플레이션의 결정요인과 특징을 알아보았다. 주요 결과를 정리하면 다음과 같다. 최근 국내 물가상승에는 원자재 가격이 가장 큰 영향을 미치는 가운데, 글로벌 공급망 차질이 원달러 환율과 유사한 수준으로 중요한 역할을 하는 것으로 분석되었다. 다음으로, 우리나라는 미국에 비해 수요압력이 높지 않은 것으로 확인되었다. 여기에는 다양한 원인이 있겠으나, 국내 소비가 구조적 부진에서 완전히 벗어나지 못한 점을 중요 원인으로 들 수 있다. GDP갭을 통해 측정한 수요압력의 영향은 개인서비스를 중심으로 한 일부 품목에 제한되었다. 결과적으로 금년 2분기 국내 물가상승률(전기대비)의 60%가 원자재 가격 상승과 공급망 차질로부터 유발되었으며, 수요압력 비중은 1% 수준으로 미미하였다.32)

이처럼 국내 물가상승의 주요 동인이 글로벌 요인에 있는 만큼, 통화정책을 포함한 국내 정책대응에 어려움이 많은 상황이다. 국내 인플레이션의 특성을 고려한 정책적 시사점을 간략하게 언급하고자 한다. 우선 통화정책과 관련하여, 우리나라는 주요국보다 선제적으로 통화긴축을 실시한 덕분에 점진적인 기준금리 인상경로를 유지하고 있다. 대외요인의 영향에도 불구하고, 금년들어 상승세를 보이는 기대인플레이션,33) 개인서비스 품목을 중심으로 한 일부 pent-up 소비 확산 가능성 및 최근 불안정성을 보이는 원달러 환율을 고려할 때, 통화긴축의 중요성이 높은 것으로 평가된다. 다만, 향후 기준금리 인상경로 결정시, 미국과 달리 국내에서는 수요압력이 물가상승에 기여하는 바가 크지 않다는 점을 고려할 필요가 있는 것으로 판단된다.

여타 정책대응의 경우, 통화정책과의 일관성 유지를 중요하게 고려할 필요가 있다.34) 특히, 우리나라를 포함한 여러 국가에서 포괄적 감세 및 보조금 지급을 통해 유가 상승에 대응하고 있는데, 포괄적 지원을 통해 단기충격을 완화하고, 인플레이션을 일시적으로 낮추는 효과를 기대할 수 있을 것이다. 하지만 역사적으로 포괄적 에너지 지원정책은 중장기적 유효성이 낮은 것으로 판명되었다(World Bank, 2022a). 수요를 유지시킴으로써 공급충격이 지속되는 부작용이 있고, 기업의 비용 전가가 용이해질 가능성이 있다. 또한 총수요압력 완화를 위한 통화긴축과도 일관되지 않는 측면이 있다. 이런 점들을 고려할 때, 향후 에너지 가격 상승에 대한 대응은 포괄적 지원보다는 저소득층 지원에 초점을 둘 필요가 있다.

향후 중앙은행의 긴축 등에 힘입어 물가상승세가 완화될 수 있을 것이다. 하지만 팬데믹 영향의 지속, 지정학적 갈등 심화, 기후변화 대응 가속화 등의 영향으로, 원자재 가격 및 공급망 문제35)가 장기적 관점에서 물가 불확실성을 확대하는 구조적 요인으로 자리잡을 가능성이 있다. 미국ㆍ유로지역ㆍ영국 중앙은행 총재들 또한 과거와 같은 저물가로 회귀하지 못할 가능성을 제기한 바 있다.36) 최근의 높은 물가 수준을 고려할 때, 중앙은행의 경기변동 조절을 통한 물가안정 노력이 무엇보다 중요할 것이나, 구조적 요인에 의한 물가 불확실성 확대ㆍ지속에 대비하기 위한 노력이 병행되어야 할 것이다.

<부록 1> 글로벌 요인을 고려한 필립스 곡선

본 연구의 실증분석 모형 식(1)은 국가별 인플레이션 결정요인으로 대내 수요 요인과 함께 글로벌 요인을 고려하는 Borio & Filardo(2007), Mikolajun & Lodge(2016), Auer et al.(2017b), Forbes(2019a, 2019b), Forbes et al.(2021) 등에 기초한다. 세부적으로는 차이가 있으나, 동 연구들은 축약형(reduced form) 표준 필립스 곡선에 세계화 관련 변수, 원자재 가격 등과 같은 글로벌 요인을 물가 결정요인으로 추가 고려한다.

우선 표준 필립스 곡선에서는 경제내 초과수요압력을 나타내는 유휴생산능력(economic slack), 과거 물가상승률 및 기대물가상승률을 물가결정 요인으로 고려한다. 잘 알려진 대로, 연구에 따라 차이는 있으나, 대략 1990년대 후반부터 인플레이션의 대내 유휴생산능력에 대한 민감도가 감소하였다(Powell, 2018. 10. 2). 이와 같이 표준 필립스 곡선의 물가 설명력이 저하된 한편, 선진국을 중심으로 국가별 인플레이션의 동조화가 심화되었다(Ciccarelli & Mojon, 2010 등).37) Borio & Filardo(2007) 등 위에 언급된 연구들에서는 세계화로 글로벌 경제구조에 변화가 발생하여, 국가별 인플레이션의 자국내 유휴생산능력에 대한 민감도가 감소한 반면, 글로벌 요인의 중요성이 커졌을 가능성을 제기하였다.38)

동 연구들에서는 표준 필립스 곡선에 세계화 관련 변수 및 원자재 가격 등의 글로벌 요인을 추가로 고려한다. 기존 연구에서 고려한 대표적인 세계화 변수에는 글로벌 유휴생산능력(global 또는 foreign slack), 글로벌 분업체계(GVC), 글로벌 공급망(GSC) 등이 포함된다. 글로벌 유휴생산능력을 중심으로 글로벌 요인의 중요성에 대해서는 많은 논란이 있어왔으나(ECB, 2017; Attinasi & Balatti, 2021), 금번의 전 세계적 인플레이션은 개별 국가의 인플레이션 결정에 있어 글로벌 요인의 중요성을 보여주는 대표적 사례로 볼 수 있을 것이다(Schnabel, 2022. 5. 11). 이에 본 연구에서는 기존 연구를 참고하여, 표준 필립스 곡선에 글로벌 공급망 및 원자재 가격을 글로벌 요인으로 추가 고려하였다.39)

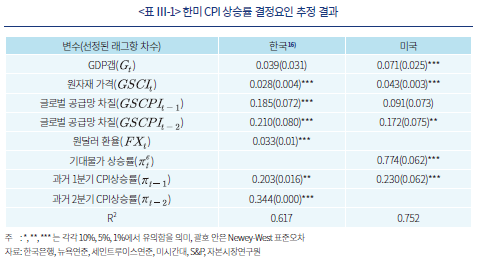

다음으로 국내 물가상승률의 글로벌 공급망 압력지수(GSCPI) 계수 추정치에 대해 설명한다. 본 고에서는 BIC 및 추정계수의 유의성을 기준으로 변수별 래그항 차수( )를 선별하였는데, <표 Ⅲ-1>과 같이 변수별로 상이한 래그항 차수가 선정되었다. 이에 팬데믹을 전후하여 각 변수의 래그항 차수에 변화가 발생하였는지를 점검하였다. 분석 결과, 국내 물가상승률에 영향을 미치는 GSCPI의 래그항 차수(

)를 선별하였는데, <표 Ⅲ-1>과 같이 변수별로 상이한 래그항 차수가 선정되었다. 이에 팬데믹을 전후하여 각 변수의 래그항 차수에 변화가 발생하였는지를 점검하였다. 분석 결과, 국내 물가상승률에 영향을 미치는 GSCPI의 래그항 차수( )에 변화가 발생한 것으로 확인되었다. 미국은 이러한 변화가 발생하지 않았으며, GSCPI를 제외한 여타 변수들은 한미 모두 팬데믹을 전후하여 유의한 래그항 차수에 변화가 없는 것으로 분석되었다.

)에 변화가 발생한 것으로 확인되었다. 미국은 이러한 변화가 발생하지 않았으며, GSCPI를 제외한 여타 변수들은 한미 모두 팬데믹을 전후하여 유의한 래그항 차수에 변화가 없는 것으로 분석되었다.

구체적으로 식(1)에 더미변수를 과 같이 적용하였다. 여기서 더미변수인

과 같이 적용하였다. 여기서 더미변수인  는 2019년 4분기까지는 0이며, 2020년 1분기부터는 1의 값을 가진다. 결과적으로 식(1)에서 공급망 항은

는 2019년 4분기까지는 0이며, 2020년 1분기부터는 1의 값을 가진다. 결과적으로 식(1)에서 공급망 항은  과 같이 구성된다. 국내 물가상승률에 대해

과 같이 구성된다. 국내 물가상승률에 대해  과

과  추정치가 유의수준 1%에서 통계적으로 유의한 것으로 나타났으며,

추정치가 유의수준 1%에서 통계적으로 유의한 것으로 나타났으며,  는 유의하지 않았다. <표 Ⅲ-1>에 제시된 국내 인플레이션의 GSCPI 계수는

는 유의하지 않았다. <표 Ⅲ-1>에 제시된 국내 인플레이션의 GSCPI 계수는  과

과  의 추정치(0.185, 0.210)이다. 미국의 경우에는

의 추정치(0.185, 0.210)이다. 미국의 경우에는  가 유의하지 않았으며,

가 유의하지 않았으며,  의 추정치가 <표 Ⅲ-1>에 나타나 있다.40)

의 추정치가 <표 Ⅲ-1>에 나타나 있다.40)

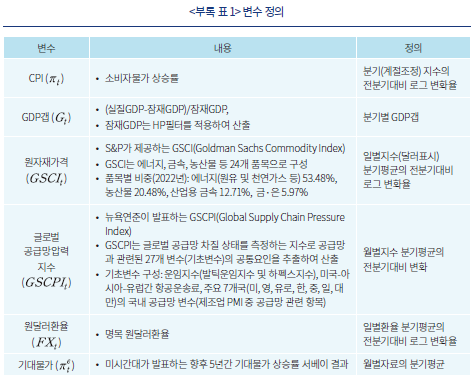

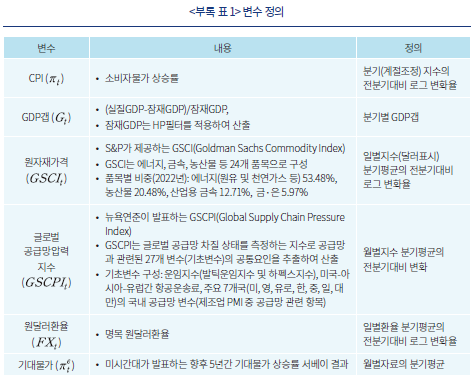

<부록 2> 변수 선정 및 정의

본 연구에서 사용한 변수는 <부록 1>에 제시된 글로벌 필립스 곡선에 관한 기존 연구에서 보편적으로 사용한 방법에 따라 선정 및 측정하였다. 다만, 본 고에서 사용한 글로벌 공급망 압력지수는 Benigno et al.(2022)이 2022년에 개발한 변수이므로, 기존 연구들에서는 사용되지 않았다.

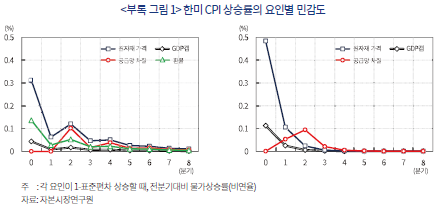

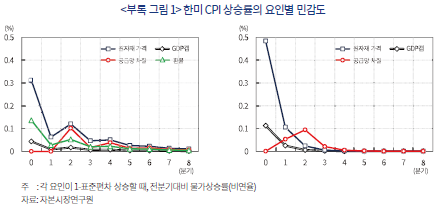

<부록 3> 한미 CPI 상승률의 요인별 민감도 분석

본문에서 살펴본 물가분해는 물가상승률의 각 요인에 대한 민감도와 시기별 요인의 변화가 합산된 결과이다. 아래에서는 물가상승률의 각 요인에 대한 민감도를 살펴본다.41) <부록 그림 1>은 각 요인이 현재 시점(t=0)에서 1-표준편차42) 만큼 증가할 때, 향후 8분기까지 전분기대비 물가상승률을 나타낸다.43)

<부록 그림 1>을 통해 원자재 가격 변동이 한미 물가에 미치는 영향을 살펴본다. 그림에 나타난 한국과 미국 물가의 원자재 가격 변화에 대한 당분기 민감도는 각각 0.32%와 0.49%이다. 이는 원자재 가격이 1-표준편차(원자재 가격의 11.4%)만큼 증가하면, 같은 분기에 물가가 전분기대비 0.32%(연율 1.28%, 한국) 및 0.49%(연율 1.96%, 미국) 상승함을 의미한다. 같은 방식으로 국내 물가결정의 핵심 요인인 원자재와 환율이 국내 인플레이션에 미치는 영향을 합산해보자. 원자재 가격과 원달러 환율이 각각 11.4% 및 4.2% 상승하면, 국내 물가는 전분기보다 0.46%(연율 1.84%) 상승한다.

요인별 민감도의 주요 특징을 살펴보면 다음과 같다. 국내 물가의 경우 당분기에는 원자재 및 환율의 영향이 가장 크다. 하지만 요인별 최대 영향을 기준으로 보면, 공급망의 영향이 환율과 유사한 것으로 볼 수 있다. 미국의 경우 당분기에는 원자재 가격이 여타 요인에 비해 월등하게 높은 영향을 미치나, 2분기가 지나면 공급망 차질이 원자재 가격 효과를 넘어선다.

다음으로 한미 요인별 민감도를 지속성과 크기 측면에서 비교해보면 아래와 같다. 첫째, 한미간에 GDP갭을 제외한 원자재 및 공급망 효과의 지속 기간에 차이가 관찰된다. 미국은 대체로 3분기부터 두 요인의 물가에 대한 영향이 급속히 감소한다. 반면, 국내 물가의 경우 원자재 가격 및 공급망 효과가 미국보다 1~2분기 오래 지속된다. 둘째, 양국의 요인별 민감도 크기를 각국의 물가 변동성으로 표준화하여 비교해 보았다.44) 분석 결과, 원자재 가격에 대해서는 미국 물가가 더 민감하게 반응하며, 공급망 차질에 대해서는 한국 물가가 미국보다 영향을 많이 받는다.45)

1) 인플레이션은 총수요가 경제의 적정 공급능력을 초과할 때 발생한다. 초과수요는 경제의 유휴생산능력(economic slack)을 의미하며, 유휴생산능력은 통상 GDP갭 또는 실업률갭으로 측정한다.

2) GDP갭(실제GDP-잠재GDP)은 잠재GDP 추정방법에 따라 상이하게 산출된다. 본 고에서는 한미간 비교를 위해 HP필터를 적용하였다. 관련 기존연구는 <부록 1>을 참고하기 바란다.

3) 국내 실질소비는 2021년부터 점진적인 회복세에 진입하였으며, 사회적 거리두기가 해제된 금년 2분기에 큰 폭으로 증가하였다. 다만, <그림 Ⅱ-3>에 나타난 바와 같이, 소비 규모는 금년 2분기에서야 팬데믹 이전(2019년 4분기) 수준을 회복하는데 그쳤다. <그림 Ⅱ-2>를 소비 및 GDP의 장기성장률 측면에서 살펴보면, 잠재성장률이 하락추세를 나타내는 가운데, 실질소비의 추세성장률은 잠재성장률보다 낮은 수준에서 하락세를 유지하고 있다.

4) Jorda et al.(2022)에 따르면, 소비 구조의 변화와 함께 미국의 높은 재정지원이 금번 글로벌 인플레이션 발생 초기에 미국이 다른 나라보다 높은 물가상승을 보인 원인으로 분석되었다.

5) 글로벌 공급망 압력지수(GSCPI)에 대해서는 <부록 2>를 참고하기 바란다.

6) 공급망은 서비스 생산자물가에도 영향을 미치나, 강도는 재화보다 현저히 낮다.

7) 박창현 외(2022)의 분석에서도 2021년 이후의 공급망 차질이 우리나라를 포함한 주요국의 제조업 생산비용 상승을 유발한 것으로 나타났다.

8) 한국은행도 감염병 확산세, 주요국간 갈등 지속 및 우크라이나 사태 등의 영향으로 글로벌 공급 차질이 장기화될 가능성이 있음을 지적하였다(한국은행, 2022a).

9) Baffes et al.(2022)에 따르면 탄소중립 정책에 따른 에너지 전환은 2000년경부터 본격화되었으며, 이로 인해 미국을 중심으로 원유 생산 기업의 신규 투자가 감소하였다.

10) 2020년 세계 에너지 소비 중 재생에너지 비중은 10% 수준이다(Baffes & Nagle, 2022).

11) 리그(rig)는 통합원유굴착장비이며, 통상 신규 굴착활동을 측정하는 지표로 사용된다(World Bank, 2020).

12) EU의 REPowerEU Plan 및 미국의 인플레이션 감축법(Inflation reduction act) 등을 대표적 사례로 들 수 있다.

13) ECB 슈나벨(Schnabel) 이사는 전자를 ‘fossilflation’, 후자를 ‘greenflation’으로 지칭하였다.

14) 뉴욕연준에서 제공하는 글로벌 공급망 압력지수(GSCPI)는 1998년부터 제공된다. 또한 1998년 국내 외환위기 당시의 거시경제 여건이 이례적이었던 만큼, 분석기간을 2001년 이후로 선정하였다.

15) 분석기간 중 사용 가능한 국내 기대물가에는 한국은행이 제공하는 일반인 대상 향후 1년 기대물가상승률 서베이 결과가 있다. 그런데 동 기대물가상승률은 과거 물가상승률과 매우 밀접하게 연관되어 있다(과거 4분기까지의 물가상승률이 83%를 설명). 이로 인해, 식(1)에 과거 물가와 기대물가를 동시에 고려하면, 기대물가상승률이 통계적으로 유의하지 않은 것으로 나타났다. 본 고에서는 이런 점들을 고려하여, O’Reilly & Whelan(2005), Stock & Watson(2009) 및 ECB(2017) 등과 같이 적응적 기대(adaptive expectations)이론 관점에서 과거 물가상승률을 사용하여 분석하였다.

16) 한국 글로벌 공급망 차질 계수 추정치에 대해서는 <부록 1>을 참고하기 바란다.

17) 국내 GDP갭의 p-value는 0.22이다. 참고로, 초과수요 측정치로 GDP갭 대신 실업률갭을 사용하면 한미 모두 전반적인 계수의 유의성이 낮아진다.

18) 공급망 차질로 상승한 생산자물가는 시차를 두고 수요 강도에 따라 소비자물가로 전가된다. 이 점을 살펴보기 위해, 식(1)에 공급망 차질과 수요압력(GDP갭)간 상호작용항( )을 추가해 분석한 결과, 한미 모두 상호작용항이 유의(p-value<10%)한 것으로 확인되었다. 이는 공급망 차질 정도가 동일해도 수요압력이 높을수록 소비자물가로 전가되는 정도가 높음을 의미한다.

)을 추가해 분석한 결과, 한미 모두 상호작용항이 유의(p-value<10%)한 것으로 확인되었다. 이는 공급망 차질 정도가 동일해도 수요압력이 높을수록 소비자물가로 전가되는 정도가 높음을 의미한다.

19) 상세한 분해 방법은 기술적인 내용이므로 생략하기로 한다.

20) 국내 경제는 2013년경부터 저성장 국면에 진입하며 역동성이 크게 저하된 것으로 평가된다.

21) 글로벌 공급망 차질은 팬데믹 초기인 2020년 1분기부터 악화하기 시작하였다.

22) <그림 Ⅲ-1>은 공급망 차질과 수요압력간 관계가 비대칭적일 수 있음을 의미한다. 이는 경기상황이 악화되어도 생산자물가 상승이 소비자물가로 전가되기 때문으로 보인다.

23) 기타요인을 소비강도에 대해 회귀분석한 결과, 회귀계수는 양의 값으로 1%에서 유의하였으며, 설명력은 18%이다.

24) 관리물가는 공공서비스, 전기ㆍ가스ㆍ수도 등 정부가 직간접적으로 가격결정에 영향을 미치는 품목의 가격 변동을 측정하는 지표이다(이병록ㆍ노현주, 2020). 관리물가 상승률은 별도로 공표되지 않는다. 본 고는 이병록ㆍ노현주(2020)가 제공한 2020년 기준 관리물가 항목 및 비중을 사용하여 과거 관리물가 상승률을 생성하였다. 구체적으로 통계청이 발표하는 과거 세부 품목별 물가 자료 중 2020년 기준의 관리물가 항목을 선별하고 가중치를 적용하였다. 그런데, 2010년 이전의 경우 2020년 기준 관리물가 항목에 대한 물가 자료가 존재하지 않는 경우가 있다. 이에 본 고에서는 2020년 기준의 모든 관리물가 항목 자료가 존재하는 2011년부터 관리물가를 생성하였다.

25) ‘11. 1분기~‘22. 2분기 기타요인을 관리물가에 대해 회귀분석한 결과, 회귀계수는 양의 값으로 1%에서 유의하였으며, 설명력은 20%이다.

26) 본 고에서는 다루지 않았으나, 미국은 고용여건이 물가상승을 유발 중인 것으로 파악되고 있다. 미국 실업률은 3.5%(금년 7월)로 1970년 이후 최저치이다. 아울러, 구직자당 채용공고 건수가 1.7개 수준으로 1960년 이후 최고치를 기록 중이다(Domash & Summers, 2022). 미국은 팬데믹으로 인한 노동공급 병목이 경기회복과 맞물리며, 명목임금 증가율이 노동 생산성을 지속해서 초과하고 있다. 이로 인해 임금 인플레이션 압력이 작용 중인 것으로 추정되고 있다(Blanchard, 2002. 3. 14; Furman, 2022. 3. 10; Holzer, 2022. 4. 13).

27) 미국 소비 강도는 여타 변수와 상관관계가 높지 않기 때문에 기타요인으로 구분하지 않고, 독립적인 수요요인으로 분류하였다. 참고로 미국의 여타 변수 중 공급망 차질(래그1)이 소비 강도와 가장 높은 상관관계(0.1)를 가진다. 한편, 국내 관리물가 통계는 2011년 이후에만 사용가능하므로 별도 요인으로 고려하지 않고, 기타요인의 하위 요인으로 분류하였다.

28) Pent-up 소비는 경기침체 등으로 소비가 억눌렸다 경기회복기에 재개되는 현상을 의미한다(이용대ㆍ이웅, 2021, 원문 수정인용).

29) 공공서비스물가는 정부가 관리하는 품목으로, 어떤 요인도 유의하지 않았다.

30) 재화물가 상승률은 대체로 전체 CPI 상승률과 유사한 결과가 확인되었다. GDP갭은 유의하지 않았으며, 원자재 가격, 공급망 차질 및 환율은 유의하였다.

31) 이는 해외에서 조달하는 식자재 공급 차질 때문으로 생각된다.

32) 다만, 본 고에서 분석된 한미간 요인별 물가상승 기여도에는 양국의 소비자물가지수(CPI) 구성 차이가 영향을 미쳤을 가능성이 있다. 예를 들어, 금년 6월 기준, 주거비 비중은 한국은 9.8%이나, 미국은 32% 수준이다. 또한 본 고에서 언급된 바와 같이, 국내에서는 정부가 공공서비스, 전기ㆍ가스ㆍ수도요금을 직간접적으로 관리한다는 점이 여타 변수와 물가상승률간 관계에 영향을 미쳤을 것으로 판단된다.

33) 국내 기대물가상승률(향후 1년, 일반인 기대)은 금년 7월에 4.7%까지 상승하였다. 기대물가는 여러 경로를 통해 실제 물가에 영향을 미칠 가능성이 있다(Yellen, 2015. 9. 24). 예를 들어, (장기) 기대물가는 가계와 기업의 가격책정(price-setting)정책에 영향을 미치는데, 1970년대와 같이 임금-물가 상승 연쇄작용 등을 통해 물가 자체의 상승 동학메커니즘이 작동할 위험이 있다. 또한 기대물가가 통제되지 않을 경우, 일시적 물가상승이 추세화될 수 있다. 기대물가는 다양한 요인에 의해 결정되나, 중앙은행의 물가안정 능력에 대한 신뢰가 핵심 요인이다.

34) 아울러, 브레이너드(Brainard) 미 연준 부의장이 지적한 바와 같이, 물가안정을 추구하는 가장 중요한 이유가 저소득층 보호에 있다는 점(Brainard, 2022. 4. 5)에도 유의할 필요가 있다. 미국 미네아폴리스 연준은 인플레이션이 소득별 가계에 미치는 영향을 파악하기 위해 금년 4월에 관할지역내 거주자와의 간담회를 개최하였다. 간담회 결과는 Horowitz & Tchourumoff(2022. 8. 9)에 정리되어 있다. 국내에서도 이러한 노력이 필요한 것으로 판단된다.

35) 최근 미국은 글로벌 공급망에서 중국의 역할을 제한하기 위한 정책을 시행하고 있다. Lovely & Dahlman(2022)의 분석에 따르면, 미국의 인도-태평양 경제프레임워크(Indo-Pacific Economic Framework)로 국내 기업의 생산비용이 유의하게 상승할 가능성이 있는 것으로 나타났다.

36) www.ecb.europa.eu/pub/conferences/html/20220627_ecb_forum_on_central_banking.en.html

37) 국가간 인플레이션 변동이 소수 글로벌 공통요인에 의해 많은 부분이 설명됨을 의미한다.

38) 이를 인플레이션 세계화 가설(globalization of inflation hypothesis: GH)이라 한다.

39) 통상 글로벌 GDP갭으로 측정되는 글로벌 유휴생산능력은 글로벌 필립스 곡선에서 중요하게 다뤄지는 변수이다. 다만, 글로벌갭의 유의성에 대해서는 연구자간에 아직 합의가 이루어지지 않은 상태이다. 당초 본 고에서도 글로벌갭을 모형에 포함하는 방안을 고려하였다. 기존 연구에서 제시된 다양한 글로벌갭 측정방법을 다각도로 고려한 결과, 동 변수가 미국 인플레이션에는 유의한 영향을 미치나, 우리나라에서는 유의하지 않은 것으로 분석되었다. 글로벌갭은 측정방법 및 추정기간에 따라 국내갭과의 상관관계가 상이한데, 본 고의 분석기간 중에는 미국 국내갭과 글로벌갭간 상관관계가 0.8~0.9로 매우 높게 나타났다. Jasova et al.(2018)이 제시한 바와 같이, 이런 경우에는 국내갭과 글로벌갭을 직교화해서 고려해야 한다. 하지만 직교화된 글로벌갭과 국내갭은 추정방법론상 국내갭과 글로벌갭간 상대적 역할을 해석하는데 한계가 있다. 본 고에서는 이와 같은 이유와 금번 인플레이션에서 글로벌갭의 역할이 크게 부각되지 않는 점을 고려하여 모형에서 제외하기로 결정하였다.

40) 참고로 해석상 편의를 위해, 제약식에 대해 F-검정을 실시해 보았다. 검정 결과, 유의수준 10%에서 제약식이 기각되지 않았다(F-검정통계량 p-value = 0.74). 따라서 동 제약식을 반영하여 국내 공급망 관련항을 해석해보면, 2020년을 기점으로 국내 물가상승률에 영향을 미치는 GSCPI 래그항의 차수가 1에서 2로 변화된 것으로 이해할 수 있다.

제약식에 대해 F-검정을 실시해 보았다. 검정 결과, 유의수준 10%에서 제약식이 기각되지 않았다(F-검정통계량 p-value = 0.74). 따라서 동 제약식을 반영하여 국내 공급망 관련항을 해석해보면, 2020년을 기점으로 국내 물가상승률에 영향을 미치는 GSCPI 래그항의 차수가 1에서 2로 변화된 것으로 이해할 수 있다.

41) <표 Ⅲ-1>에서 변수별로 스케일이 다르므로 회귀계수 크기로 민감도를 비교할 수 없다.

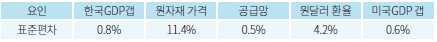

42) 요인별 1-표준편차는 아래 표와 같다.

43) 다만, 본 분석에서 민감도는 여타 요인이 동일하다는 가정 하에 산출되었다.

44) 민감도 비교를 위해서는 양국 물가 변동성 수준을 고려해야 한다.

45) 국내 물가가 미국보다 공급망 차질에 민감하게 반응하는 이유는 양국의 CPI에서 공급망의 영향을 많이 받는 재화품목의 비중이 다르기 때문일 가능성이 있다. 금년 6월 기준 한국과 미국 CPI에서 재화품목의 비중은 각각 47% 및 40%이다.

참고문헌

박창현ㆍ김선진ㆍ이규환ㆍ주연희, 2022, 최근 글로벌 공급망 차질의 특징 및 국내 산업에 미치는 영향, 한국은행 『BOK 이슈노트』 제2022-24호.

이병록ㆍ노현주, 2020, 최근 관리물가 동향 및 향후 전망, 한국은행 『BOK 이슈노트』 제2020-16호.

이용대ㆍ이웅, 2021, 향후 pent-up 소비 가능성 점검, 한국은행 『BOK 이슈노트』 제2021-6호.

한국은행, 2022a, 『통화신용정책보고서』 (2022년 3월).

한국은행, 2022b, 『통화신용정책보고서』 (2022년 6월).

한국은행, 2022. 6. 21., 물가안정목표 운영상황 점검, 보도자료.

Akinci, O., Benigno, G., Heymann, R.C., di Giovanni, J., Groen, J.J.J., Lin, L, Noble, A., 2022. 1. 28, The global supply side of inflationary pressures, FRB New York, Liberty Street Economics.

Attinasi, M.G., Balatti, M., 2021, Globalisation and its implications for inflation in advanced economies, ECB Economic Bulletin, Issue 4/2021.

Auer, R.A., Levchenko, A.A., Saure, P., 2017a, International inflation spillovers through input linkages, Working Papers No.623, BIS.

Auer, R., Borio, C., Filardo, A., 2017b, The globalisation of inflation: The growing importance of global value chains, Working Papers No. 602, BIS.

Baffes, J., Koh, W.C., Nagle, P., 2022, The evolutions of commodity markets over the past centry, Commodity Markets: Evolution, Challenges and Policies, World Bank.

Baffes, J., Nagle, P., 2022, Commodity demands: Drivers, outlook and implications, Commodity Markets: Evolution, Challenges and Policies, World Bank.

Barrero, J.M., Bloom., Davis, S.J., 2021, Why working from home will stick, NBER Working Paper.

Benigno, G., Giovanni, J., Groen, J.J.J., Noble, I., 2022. 1. 4, A new barometer of global supply chain pressures, FRB New York Liberty Street Economics.

BIS, 2022, Old challenges, new shock(Chapter 1), Annual Economic Report, June.

Blanchard, O., 2022. 3. 14, Why I worry about inflation, interest rates, and employment, Peterson Institute for International Economics.

Borio, C., Filardo, A., 2007. Globalisation and Inflation: New Cross-Country evidence on the global determinants of domestic inflation. Working Paper No.227, BIS.

Brainard, L., 2022 4. 5, Variation in the inflation experiences of households, FRB Minneapolis.

Carstens, A., 2022, The Return of Inflation, BIS.

Celasun, O., Hansen, N.-J., Mineshima, A., Spector, M., Zhou, J., 2022, Supply bottlenecks: Where, why, how much, and what next? WP/22/31 IMF.

Ciccarelli, M., Mojon, B., 2010, Global inflation, Review of Economics and Statistics 92(3), 524-535.

Datta, D.D., Feiveson, L., Peneva, E., Rua, G., 2022. 6. 24, Bottlenecks, shortages, and soaring prices in the U.S. economy, FEDS Notes.

Di Giovanni, J., Kalemli-Ozacan, S., Silva, A., Yildirim, M.A., 2022, Global Supply Chain Pressures, International Trade, and Inflation, FRB New York.

Domash, A., Summers, L.H., 2022, How tight are U.S. labor markets? NBER Working Paper 29739.

European Central Bank(ECB), 2017, Domestic and global drivers of inflation in the Euro area, ECB Economic Bulletin, Issue 4/2017.

Forbes, K.J., 2019a, Has globalization changed the inflation process?, Working Papers No.791, BIS.

Forbes, K.J., 2019b, Inflation dynamics: Dead, dormant or determined abroad?, Brookings Papers on Economic Activity, Fall 2019, 257-319.

Forbes, K.J., Gagnon, J.E., Collins, C.G., 2021, Low inflation bends the Phillips curve around the world: Extended results, NBER Working Paper 29323.

Furman, J., 2022. 1. 13, Four reasons to keep worrying about inflation, Wall Street Journal.

Furman, J., 2022. 3. 10, Will anchored inflation expectations actually anchor inflation? Peterson Institute for International Economics.

Holzer, H.J., 2022. 4. 13, Tight labor markets and wage growth in the current economy, Brookings Institution.

Horowitz, B., Tchourumoff, A., 2022, 8. 9, As inflation rises, low-income households grapple with particular challenges, FRB Minneapolis.

International Energy Association(IEA), 2022a, Oil Market Report, July.

International Energy Association(IEA), 2022b, A 10-point Plan to Reduce the European Union’s Reliance on Russian Natural Gas, March.

International Monetary Fund(IMF), 2022, World Economic Outlook Update.

Jasova, M., Moessner, R., Takats, E., 2018, Domestic and global output gaps as inflation drivers: what does the Phillips curve tell?, BIS Working Papers No. 748.

Javorcik, B.S., 2020, Global supply chains will not be the same in the post-COVID-19 world, COVID-19 and Trade Policy: Why Turning Inward Won’t Work, 111-116.

Jorda, O., Liu, C., Nechio, F., Rivera-Reyes, F., 2022, Why is U.S. inflation higher than in other countries, FRB San Francisco Economic Letter 2022-07.

Lagarde, C., 2022. 4. 22, A new global map: European resilience in a changing world, ECB.

Lagarde, C., 2022. 6. 28, Price stability and policy transmission in the euro area, ECB.

Lane, P.R., 2020. 5. 22, International inflation co-movements, ECB.

Lovely, M.E., Dahlman, A., 2022, South Korea should prepare for its exposure to US-China technology tensions, Policy Brief 22-8, PIIE.

Matthews, C.M., Blunt, K., 2022. 8. 1, America’s new energy crisis, Wall Street Journal.

Mikolajun, I., Lodge, D., 2016, Advanced economy inflation: The role of global factors, ECB Working Paper Series No. 1948.

O’Reilly, G., Whelan, K., 2005, Has Euro-area inflation persistence changed over time?, Review of Economics and Statistics 87(4), 709–720.

Powell, J.H., 2018. 10. 2, Monetary policy and risk management at a time of low inflation and low unemployment, FRB.

Powell, J.H, 2022. 6. 22, Semiannual monetary policy report to the Congress, FRB.

Santacreu, A., M., LaBelle, J., 2022, Global supply chain disruptions and inflation during the COVID-19 pandemic, FRB St. Louis Review 104(2), 78-91.

Schnabel, I., 2022. 3. 17, A new age of energy inflation: Climateflation, fossilflation and greenflation, ECB.

Schnabel, I., 2022. 5. 11, The globalisation of inflation, ECB.

Stock, J.H., Watson, M.W., 2009, Phillips curve inflation forecasts, Understanding Inflation and the Implications for Monetary Policy, 101–186.

Summers, L., 2022. 7. 14, A dangerous level of groupthink, Interview with NY Magazine.

Tauber, K., Zandweghe, W.V., 2021, Why has durable goods spending been so strong during the COVID-19 pandemic?, FRB Cleveland Economic Commentary 2021-16.

White House, 2021, Building resilient supply chains, Revitalizing American manufacturing, and fostering broad-based growth.

World Bank, 2020, Commodity Markets Outlook: Persistence of Commodity Shocks, October.

World Bank, 2022a, Russia’s invasion of Ukraine: Implications for energy markets and activity, Global Economic Prospects, 101-103.

World Bank, 2022b, Commodity Markets Outlook, April.

Yellen, J.L., 2015. 9. 24, Inflation dynamics and monetary policy, FRB.

최근 우리나라를 포함해 주요국에서 물가상승세가 확대되며 경제주체의 어려움이 가중되고 있다. 금년 2분기에 국내 소비자물가는 전년보다 5.4% 상승하며, 글로벌 금융위기 이후 최고치를 기록하였다. 같은 기간 미국 물가는 1982년 이래 최고 수준인 8.6%까지 상승했다. 금번 인플레이션은 예상을 상회한 수요회복, 글로벌 공급망 및 고용시장의 병목현상, 러시아-우크라이나 전쟁으로 심화된 글로벌 에너지 수급 차질 등의 충격이 복합적으로 작용하며, 수요-공급간 불균형이 심화되어 발생하였다(BIS, 2022). 국내 물가 급등도 공급망 차질 및 원자재 가격 상승 등이 주요 원인으로 지목되고 있다(한국은행, 2022. 6. 21).

이처럼 물가상승의 주요 동인은 대외요인에 있으나, 국가별로 글로벌 요인과 수요압력이 물가에 미치는 영향에는 차이가 있다(Powell, 2022. 6. 22; Lagarde, 2022. 6. 28). 이로 인해 <그림 Ⅰ-1>에 나타난 바와 같이, 한미간에 전체 물가상승 폭에 차이가 있으며, 하위 품목(재화 및 서비스) 물가의 상승 시기 및 강도 또한 차별화되고 있다. 따라서 국내 인플레이션에 대한 이해와 대응을 위해서는 요인별 특성과 물가 기여도를 살펴볼 필요가 있다.

이에 본 고에서는 국내 인플레이션의 결정요인을 분석한다. 우선, 금번 인플레이션의 주요 원인을 알아본다. 다음으로, 우리나라와 미국 인플레이션의 결정요인을 비교분석하고, 이를 통해 국내 인플레이션의 특징을 살펴본다.

Ⅱ. 인플레이션의 주요 원인 및 지속가능성

아래에서는 본 연구의 실증분석에서 사용된 변수를 중심으로 금번 인플레이션의 주요 원인에 대해 살펴본다. 우선 재화(goods)에 대한 급격한 소비 증가가 글로벌 공급망 차질과 맞물려 인플레이션이 촉발된 점을 살펴본다. 다음으로 금년들어 글로벌 인플레이션을 주도하고 있는 원자재 가격 상승을 논의한다.

1. 수요회복

팬데믹 발생 이후의 세계 경기변동은 침체의 폭과 회복 속도 모두 이례적인 수준으로 평가된다. <그림 Ⅱ-1>에 나타난 것처럼, 특히 미국 경기는 강한 침체에 진입한 후 매우 빠르게 회복하였다. 이로 인해 한미 모두 전반적인 수요측면의 물가상승 압력1)을 나타내는 GDP갭2)이 지난해 하반기에 양(+)으로 전환하였다.

중심으로 한 재화에 집중되는 현상이 발생하였다. 이와 같은 변화는 주요국에서 공통된 현상이며, 재화에 대한 수요 강도는 재정지원 규모에 따라 상이한 것으로 알려져 있다(Jorda et al., 2022; Schnabel, 2022. 5. 11).4) 미국의 경우, 우리나라를 포함한 여타 국가보다 재정지원 규모가 컸으며, 그 결과 재화에 대한 소비가 이례적인 수준까지 급증하였다. 이와 같이 재화 수요가 크게 증가한 데 반해, 팬데믹으로 글로벌 공급망이 차질을 빚어 재화 가격이 큰 폭으로 상승하였다(<그림 Ⅰ-1> 참고). 서비스 소비는 경제활동이 재개되면서 점진적인 회복세를 나타내고 있다. 미국 서비스 소비는 금년 1분기에 팬데믹 이전 수준으로 회복되었으며, 국내는 사회적 거리두기가 해제된 4월부터 빠르게 정상화되고 있다(이용대ㆍ이웅, 2021; 한국은행, 2022a). 이로 인해 한미 서비스 물가는 금년들어 상승세가 확대되고 있다.

2. 글로벌 공급망(Global Supply Chain: GSC) 차질

글로벌 공급망 차질은 재화 중심의 소비 변화와 결합하여 금번 인플레이션을 촉발하였다. 재화의 경우, 글로벌 분업체계(Global Value Chain: GVC)의 영향을 많이 받는 품목으로, 기업은 다양한 생산 단계에 걸쳐 전 세계에서 제공되는 중간재를 사용한다. 이러한 환경에서 각국의 봉쇄조치로 글로벌 공급망에 차질이 발생하며 생산 및 물류에 병목이 발생하였다. Santacreu et al.(2022) 및 Akinci et al.(2022. 1. 28)에 따르면 공급망 차질로 미국의 제조업 생산자물가가 크게 상승한 것으로 나타났다.

<그림 Ⅱ-4>는 Benigno et al.(2022)이 고안한 글로벌 공급망 압력지수(Global Supply Chain Pressure Index: GSCPI)5)와 한미 생산자물가 상승률을 보여준다. 공급망 차질은 팬데믹으로 크게 악화된 후 금년 5월부터 개선 중이지만, 최근의 개선에도 2000년 이후 평균치를 크게 상회하고 있다. 그림에서 한미 재화(및 제조업) 생산자물가가 공급망 차질과 높은 상관관계를 가지는 것을 알 수 있다.6) 따라서 최근의 공급망 차질은 제조업을 중심으로 기업의 생산비용 상승을 유발한 것으로 평가된다.7) 생산자물가 상승은 시차를 두고 해당 품목에 대한 수요 강도에 따라 소비자물가 상승을 유발한다(Datta et al., 2022. 6. 24; Summers, 2022. 7. 14).

글로벌 공급망이 물가에 미치는 영향은 단기적 변동보다 중장기적 관점에서 파악할 필요가 있는 것으로 판단된다. 팬데믹으로 아웃소싱ㆍ오프쇼어링을 통해 효율성(비용)을 우선시하는 글로벌 공급망의 취약성이 확인되었다. 여기에 지정학적 갈등이 심화됨에 따라, 리쇼어링ㆍ프렌드쇼어링 등과 같이 안정성(복원력)을 중시하는 방향으로 공급망 재편이 가속화될 가능성이 있다(Javorcik, 2020; White House, 2021). <표 Ⅱ-1>이 확인해 주듯이, 글로벌 분업체계가 본격화된 2000년 이후 내구재를 중심으로 한 재화 가격은 저물가 요인으로 작용하며 글로벌 저물가 기조를 이끌었다(Auer et al., 2017a, Lane, 2020. 5. 22). 라가르드(Lagarde) 유럽중앙은행 총재가 지적한 바와 같이(Lagarde, 2022. 4. 22), 글로벌 공급망의 재편 속도에는 불확실성이 있으나, 구조적인 인플레이션 확대 요인으로 자리잡을 가능성이 있는 것으로 판단된다.

원자재 가격은 팬데믹 초기에 봉쇄조치와 수요 감소로 크게 하락하였으나, 2020년 2분기부터 수요가 급증하며 상승세로 전환하였다. 여기에 우크라이나 전쟁으로 상승 폭이 확대되며 주요국 인플레이션 심화의 주요 원인으로 작용하였다. <그림 Ⅱ-5>에 나타난 것처럼, 금년 6월 전체 원자재 가격은 2020년 4월보다 두 배 넘게 상승하였다. 특히 에너지 가격은 400% 급등해 1973년 오일쇼크 이후 가장 높은 상승세를 나타냈다. 다만, 금년 7월 들어서는 중국을 포함하여 글로벌 경기둔화로 인한 수요 감소 및 러시아 원유 생산 규모의 안정을 반영하여, 유가(WTI 기준)가 100달러를 하회하는 등 전반적인 에너지 가격이 안정세로 전환하였다(IEA, 2022a).

이와 같은 투자 축소는 주요국의 탄소중립 정책(화석연료 사용 제한 및 재생에너지 사용 확대)과 소비자의 에너지 선호 변화 등과 같은 구조적 요인이 작용한 결과로 파악된다(Baffes et al., 2022; World Bank, 2022a).9) 여기에 2020년에는 팬데믹으로 인한 수요 감소 및 노동력ㆍ부품 조달 차질이 발생하여, 투자가 추가로 감소하였다(World Bank, 2020). 이처럼 원유 생산능력은 구조적으로 감소 중인 반면, 재생에너지의 화석연료 대체는 아직 낮은 수준에 머물고 있다.10)

러시아-우크라이나 전쟁이 에너지 전환에 미치는 단기적 영향에 대해서는 논란이 있으나, 세계은행 및 국제에너지기구(IEA) 등의 의견(World Bank, 2022b; IEA, 2022b)과 미국ㆍEU 등의 정책방향12) 등을 토대로 평가해보면, 향후 그린(재생) 에너지로의 전환이 가팔라질 것으로 예상된다. 이런 가운데 에너지 전환 가속화가 중장기적 인플레이션 확대 요인으로 작용할 가능성이 제기되고 있다(Matthews & Blunt, 2022; Schnabel, 2022. 3. 17). 우선 주요국의 탈탄소 정책 강화는 탄소배출권 가격 상승, 자금조달 비용 상승 및 규제 비용 등을 통해 화석연료 생산비용 상승압력으로 작용할 전망이다. 또한 에너지 전환 가속화로 재생에너지 생산에 사용되는 원자재 수요가 확대되어 재생에너지 생산비용의 증가가 예상된다.13) 결과적으로 에너지 가격은 단기시계에서는 러시아에 대한 제재조치 및 러시아의 원유ㆍ천연가스 공급 규모에 따라 변동할 가능성이 크나, 전쟁이 종료되더라도 팬데믹 이전의 안정적 수준으로 복귀할 것인 지에는 상당한 불확실성이 있는 것으로 평가된다.

Ⅲ. 국내 인플레이션 결정요인 및 특징 분석

본 장에서는 앞에서 살펴본 요인을 중심으로 국내 인플레이션 결정요인을 분석한다. 특히, 한미 비교를 통해 국내 인플레이션의 특징을 알아본다. 다음으로 최근 국내에서 주목받고 있는 서비스 품목별 인플레이션의 결정요인을 살펴본다.

1. 분석방법

본 고에서는 <부록 1>에 정리된 바에 기초하여, 식(1)을 통해 인플레이션 결정요인을 분석한다. 간략히 살펴보면, 우선 표준 축약형(reduced form) 필립스 곡선을 참고하여, 초과수요를 나타내는 GDP갭(변수명

분석기간은 2001년 1분기부터 2022년 2분기이며,14) 변수별 상세한 정의는 <부록 2>에 정리하였다. 여기서는 변수별 핵심 내용만 살펴본다. 물가상승률(

2. 분석결과

가. 추정결과

<표 Ⅲ-1>에는 식(1)의 추정결과가 정리되어 있다. 주요 결과를 살펴보면 다음과 같다. 첫째, 물가의 지속성 측면에서, 한국은 과거 2분기까지의 물가상승률이 현재 물가에 영향을 주는 반면, 미국은 과거 1분기 물가상승률만 유의한 것으로 확인되었다. 이는 국내 인플레이션이 미국보다 지속성이 다소 높음을 의미한다.

셋째, 한미 모두 원자재 가격 및 글로벌 공급망 차질이 물가에 유의한 영향을 미친다. 원자재 가격은 시차를 두지 않고 당분기에 물가상승을 유발하는 반면, 공급망은 1~2분기의 시차를 두고 물가에 영향을 미친다. 이는 공급망 차질이 일차적으로 생산자물가에 영향을 주기 때문으로 해석할 수 있다.18)

넷째, 환율은 다양한 경로를 통해 국내 물가상승을 증폭하거나 완화하는 역할을 할 수 있는데, <표 Ⅲ-1>에서는 원달러 환율이 상승할수록 물가상승률이 높아지는 경향이 확인되었다. 이는 분석기간 동안 환율이 원자재 등 수입물가 경로를 통해 국내 물가상승 압력을 가중하였음을 의미한다.

나. 한미 인플레이션 역사적 분해

여기서는 식(1)의 추정결과를 이용하여, 물가를 요인별로 분해하여 살펴본다.19) <그림 Ⅲ-1>은 각 요인의 물가상승률에 대한 기여도를 나타낸다. 그림에서 물가상승률은 식(1)에서 산출된 물가상승률의 내재(장기)평균 대비 초과 상승률이다. 따라서 이하 논의에서 물가상승 또는 하락은 내재평균 대비 초과 변동을 의미한다. 각 요인의 기여도가 양(음)의 값을 가지면 물가를 상승(하락)시키는 효과가 있음을 나타낸다. 기타요인은 물가상승률 중에서 식(1)에 포함된 요인에 의해 설명되지 않는 부분이다.

국내 GDP갭과 물가간 관계에서 주목할 점이 있다. <부록 그림 2>는 식(1)에서 GDP갭만 사용한 표준 필립스 곡선에서 도출된 물가분해 결과를 보여준다. 대략 2012년까지 GDP갭이 물가상승률의 상당 부분을 설명하였으나, 2013년을 전후한 시점부터 GDP갭의 기여도가 현저히 낮아졌다.20) GDP갭과 물가가 반대 방향으로 변동하는 시기도 관찰된다. <부록 그림 1>과 앞 장의 <그림 Ⅱ-2>를 종합해보면, 국내에서 표준 필립스 곡선의 설명력이 낮아진 것은, 주요국과 유사하게 원자재 및 공급망 등 글로벌 요인의 영향이 증가한 점과 함께, 국내 고유의 구조적 수요압력 둔화가 반영된 결과로 평가해 볼 수 있다.

다음으로 <그림 Ⅲ-1>에서 한미 모두 공급망 차질이 2020년 2분기부터 물가상승 요인으로 작용한 것으로 나타났다. 공급망 차질이 물가에 미치는 영향은 다음과 같은 이유에서 주목할 필요가 있다. 첫째, 공급망 차질은 팬데믹 초기에 경기침체로 GDP갭 및 원자재 가격이 급락하며 물가상승률이 낮게 형성되었던 시기에도 물가상승 요인으로 작용하였다.21) 둘째, 한미간에 공급망 차질이 물가에 영향을 미치는 시기가 매우 유사한 것으로 나타났다. 셋째, 한미 모두 공급망 차질이 물가상승률에 대한 기여도가 작지 않다. 이러한 점들을 종합하면, 향후 공급망 문제가 경기둔화기(마이너스 GDP갭 시기)에도 글로벌 인플레이션을 확대하는 중요 요인으로 자리잡을 가능성이 있는 것으로 판단해볼 수 있다.22)

분석기간 동안 한미 모두 원자재 가격이 물가 변동의 핵심 요인으로 나타났다. 특히, 경기가 침체에 진입한 2020년 2분기에 GDP갭보다 원자재 가격의 물가하락 기여도가 큰 것으로 확인되었다. 원자재 가격은 2020년 3분기부터 상승세로 전환하며 물가상승에 크게 기여하고 있다.

원달러 환율의 경우, 대체로 원화가 약세를 보이는 시기에 물가 오름세가 확대되었다. 환율은 2021년 2분기까지는 물가하락 요인이었으나, 동년 3분기부터 지속적인 물가상승 요인으로 작용하고 있다. 환율 변화는 원자재 가격이 국내 물가에 미치는 영향을 확대하거나 완화할 수 있다. 2021년 3분기 이후에는 원자재 가격과 환율이 동일한 방향으로 변동하는 경향이 강해지고 있어, 환율의 물가에 대한 영향을 주시할 필요가 있다.

한편, <그림 Ⅲ-1>에서 금번 물가상승 국면에서 기타요인의 비중이 작지 않음을 알 수 있다. 2021년 3분기까지 국내 기타요인은 주요 물가하락 요인이었으나, 금년 2분기에 물가상승 요인으로 전환하였다. 미국은 기타요인이 대체로 물가상승을 유발해온 가운데, 특히 최근에는 전체 물가상승률에서 차지하는 비중이 원자재와 유사하다. 기타요인은 식(1)에서 고려하지 못한 여러 요인의 영향이 합산된 결과이다. 아래에서는 본 고에서 파악한 요인에 초점을 두고 살펴본다.

<그림 Ⅲ-2>의 좌측은 미국 소비 강도(GDP내 소비 비중)와 미국 기타요인(<그림 Ⅲ-1>과 동일)을 보여준다. 두 변수간에 유의한 상관관계(0.45)가 존재하므로 기타요인 중 소비 강도에 의해 설명되는 부분을 분리해볼 수 있다.23) <그림 Ⅲ-2>의 우측은 기타요인을 소비 강도에 의해 설명되는 부분과 나머지로 구분하여 나타낸다. 그림에서 확인할 수 있듯이, 2021년 2분기부터 소비 강도가 기타요인 중 상당 부분을 차지하고 있다.

2장에서 살펴본 소비 행태 복원(재화→서비스)과 관련하여, 최근 국내에서도 pent-up 소비28)로 인한 개인서비스물가 상승세가 주목받고 있다(이용대ㆍ이웅, 2021; 한국은행, 2022b). 서비스 인플레이션의 경우 재화물가보다 지속성이 높다는 점에서 주의를 기울일 필요가 있다(Carstens, 2022). 개인서비스물가는 외식 및 외식제외(숙박ㆍ레저 등 77개 품목)로 구분되는데, 금년 2분기에 각각 전기대비(전년동기비) 2.1%(7.3%) 및 1.2%(3.6%) 상승하였다. <표 Ⅲ-3>에는 식(1)에 품목별 서비스물가를 적용한 결과가 나타나 있다.29) 30)

개인서비스의 하위 품목인 외식 및 외식제외 서비스물가는 근원품목(식료품 및 에너지 제외)임에도 원자재 가격에 유의한 영향을 받는다. 공급망 차질은 외식서비스에서만 유의한 것으로 나타났다.31) GDP갭의 경우, 외식제외서비스물가에는 유의한 영향을 미치지만, 외식서비스물가에서는 유의하지 않은 것을 알 수 있다. 이는 최근 외식물가의 높은 상승률이 예상과 달리 수요 증가보다 원자재 가격 및 환율 상승으로 인한 재료비 급등이 주요 원인일 가능성을 시사한다. 다만, 외식제외서비스물가는 수요에 민감하게 반응하므로, 향후 pent-up 소비 효과가 강화될 가능성에 유의할 필요가 있는 것으로 판단된다.

Ⅳ. 결론 및 시사점

본 고에서는 한미 비교를 통해 국내 인플레이션의 결정요인과 특징을 알아보았다. 주요 결과를 정리하면 다음과 같다. 최근 국내 물가상승에는 원자재 가격이 가장 큰 영향을 미치는 가운데, 글로벌 공급망 차질이 원달러 환율과 유사한 수준으로 중요한 역할을 하는 것으로 분석되었다. 다음으로, 우리나라는 미국에 비해 수요압력이 높지 않은 것으로 확인되었다. 여기에는 다양한 원인이 있겠으나, 국내 소비가 구조적 부진에서 완전히 벗어나지 못한 점을 중요 원인으로 들 수 있다. GDP갭을 통해 측정한 수요압력의 영향은 개인서비스를 중심으로 한 일부 품목에 제한되었다. 결과적으로 금년 2분기 국내 물가상승률(전기대비)의 60%가 원자재 가격 상승과 공급망 차질로부터 유발되었으며, 수요압력 비중은 1% 수준으로 미미하였다.32)

이처럼 국내 물가상승의 주요 동인이 글로벌 요인에 있는 만큼, 통화정책을 포함한 국내 정책대응에 어려움이 많은 상황이다. 국내 인플레이션의 특성을 고려한 정책적 시사점을 간략하게 언급하고자 한다. 우선 통화정책과 관련하여, 우리나라는 주요국보다 선제적으로 통화긴축을 실시한 덕분에 점진적인 기준금리 인상경로를 유지하고 있다. 대외요인의 영향에도 불구하고, 금년들어 상승세를 보이는 기대인플레이션,33) 개인서비스 품목을 중심으로 한 일부 pent-up 소비 확산 가능성 및 최근 불안정성을 보이는 원달러 환율을 고려할 때, 통화긴축의 중요성이 높은 것으로 평가된다. 다만, 향후 기준금리 인상경로 결정시, 미국과 달리 국내에서는 수요압력이 물가상승에 기여하는 바가 크지 않다는 점을 고려할 필요가 있는 것으로 판단된다.

여타 정책대응의 경우, 통화정책과의 일관성 유지를 중요하게 고려할 필요가 있다.34) 특히, 우리나라를 포함한 여러 국가에서 포괄적 감세 및 보조금 지급을 통해 유가 상승에 대응하고 있는데, 포괄적 지원을 통해 단기충격을 완화하고, 인플레이션을 일시적으로 낮추는 효과를 기대할 수 있을 것이다. 하지만 역사적으로 포괄적 에너지 지원정책은 중장기적 유효성이 낮은 것으로 판명되었다(World Bank, 2022a). 수요를 유지시킴으로써 공급충격이 지속되는 부작용이 있고, 기업의 비용 전가가 용이해질 가능성이 있다. 또한 총수요압력 완화를 위한 통화긴축과도 일관되지 않는 측면이 있다. 이런 점들을 고려할 때, 향후 에너지 가격 상승에 대한 대응은 포괄적 지원보다는 저소득층 지원에 초점을 둘 필요가 있다.

향후 중앙은행의 긴축 등에 힘입어 물가상승세가 완화될 수 있을 것이다. 하지만 팬데믹 영향의 지속, 지정학적 갈등 심화, 기후변화 대응 가속화 등의 영향으로, 원자재 가격 및 공급망 문제35)가 장기적 관점에서 물가 불확실성을 확대하는 구조적 요인으로 자리잡을 가능성이 있다. 미국ㆍ유로지역ㆍ영국 중앙은행 총재들 또한 과거와 같은 저물가로 회귀하지 못할 가능성을 제기한 바 있다.36) 최근의 높은 물가 수준을 고려할 때, 중앙은행의 경기변동 조절을 통한 물가안정 노력이 무엇보다 중요할 것이나, 구조적 요인에 의한 물가 불확실성 확대ㆍ지속에 대비하기 위한 노력이 병행되어야 할 것이다.

<부록 1> 글로벌 요인을 고려한 필립스 곡선

본 연구의 실증분석 모형 식(1)은 국가별 인플레이션 결정요인으로 대내 수요 요인과 함께 글로벌 요인을 고려하는 Borio & Filardo(2007), Mikolajun & Lodge(2016), Auer et al.(2017b), Forbes(2019a, 2019b), Forbes et al.(2021) 등에 기초한다. 세부적으로는 차이가 있으나, 동 연구들은 축약형(reduced form) 표준 필립스 곡선에 세계화 관련 변수, 원자재 가격 등과 같은 글로벌 요인을 물가 결정요인으로 추가 고려한다.

우선 표준 필립스 곡선에서는 경제내 초과수요압력을 나타내는 유휴생산능력(economic slack), 과거 물가상승률 및 기대물가상승률을 물가결정 요인으로 고려한다. 잘 알려진 대로, 연구에 따라 차이는 있으나, 대략 1990년대 후반부터 인플레이션의 대내 유휴생산능력에 대한 민감도가 감소하였다(Powell, 2018. 10. 2). 이와 같이 표준 필립스 곡선의 물가 설명력이 저하된 한편, 선진국을 중심으로 국가별 인플레이션의 동조화가 심화되었다(Ciccarelli & Mojon, 2010 등).37) Borio & Filardo(2007) 등 위에 언급된 연구들에서는 세계화로 글로벌 경제구조에 변화가 발생하여, 국가별 인플레이션의 자국내 유휴생산능력에 대한 민감도가 감소한 반면, 글로벌 요인의 중요성이 커졌을 가능성을 제기하였다.38)

동 연구들에서는 표준 필립스 곡선에 세계화 관련 변수 및 원자재 가격 등의 글로벌 요인을 추가로 고려한다. 기존 연구에서 고려한 대표적인 세계화 변수에는 글로벌 유휴생산능력(global 또는 foreign slack), 글로벌 분업체계(GVC), 글로벌 공급망(GSC) 등이 포함된다. 글로벌 유휴생산능력을 중심으로 글로벌 요인의 중요성에 대해서는 많은 논란이 있어왔으나(ECB, 2017; Attinasi & Balatti, 2021), 금번의 전 세계적 인플레이션은 개별 국가의 인플레이션 결정에 있어 글로벌 요인의 중요성을 보여주는 대표적 사례로 볼 수 있을 것이다(Schnabel, 2022. 5. 11). 이에 본 연구에서는 기존 연구를 참고하여, 표준 필립스 곡선에 글로벌 공급망 및 원자재 가격을 글로벌 요인으로 추가 고려하였다.39)

다음으로 국내 물가상승률의 글로벌 공급망 압력지수(GSCPI) 계수 추정치에 대해 설명한다. 본 고에서는 BIC 및 추정계수의 유의성을 기준으로 변수별 래그항 차수(

구체적으로 식(1)에 더미변수를

<부록 2> 변수 선정 및 정의

본 연구에서 사용한 변수는 <부록 1>에 제시된 글로벌 필립스 곡선에 관한 기존 연구에서 보편적으로 사용한 방법에 따라 선정 및 측정하였다. 다만, 본 고에서 사용한 글로벌 공급망 압력지수는 Benigno et al.(2022)이 2022년에 개발한 변수이므로, 기존 연구들에서는 사용되지 않았다.

본문에서 살펴본 물가분해는 물가상승률의 각 요인에 대한 민감도와 시기별 요인의 변화가 합산된 결과이다. 아래에서는 물가상승률의 각 요인에 대한 민감도를 살펴본다.41) <부록 그림 1>은 각 요인이 현재 시점(t=0)에서 1-표준편차42) 만큼 증가할 때, 향후 8분기까지 전분기대비 물가상승률을 나타낸다.43)

<부록 그림 1>을 통해 원자재 가격 변동이 한미 물가에 미치는 영향을 살펴본다. 그림에 나타난 한국과 미국 물가의 원자재 가격 변화에 대한 당분기 민감도는 각각 0.32%와 0.49%이다. 이는 원자재 가격이 1-표준편차(원자재 가격의 11.4%)만큼 증가하면, 같은 분기에 물가가 전분기대비 0.32%(연율 1.28%, 한국) 및 0.49%(연율 1.96%, 미국) 상승함을 의미한다. 같은 방식으로 국내 물가결정의 핵심 요인인 원자재와 환율이 국내 인플레이션에 미치는 영향을 합산해보자. 원자재 가격과 원달러 환율이 각각 11.4% 및 4.2% 상승하면, 국내 물가는 전분기보다 0.46%(연율 1.84%) 상승한다.

다음으로 한미 요인별 민감도를 지속성과 크기 측면에서 비교해보면 아래와 같다. 첫째, 한미간에 GDP갭을 제외한 원자재 및 공급망 효과의 지속 기간에 차이가 관찰된다. 미국은 대체로 3분기부터 두 요인의 물가에 대한 영향이 급속히 감소한다. 반면, 국내 물가의 경우 원자재 가격 및 공급망 효과가 미국보다 1~2분기 오래 지속된다. 둘째, 양국의 요인별 민감도 크기를 각국의 물가 변동성으로 표준화하여 비교해 보았다.44) 분석 결과, 원자재 가격에 대해서는 미국 물가가 더 민감하게 반응하며, 공급망 차질에 대해서는 한국 물가가 미국보다 영향을 많이 받는다.45)

1) 인플레이션은 총수요가 경제의 적정 공급능력을 초과할 때 발생한다. 초과수요는 경제의 유휴생산능력(economic slack)을 의미하며, 유휴생산능력은 통상 GDP갭 또는 실업률갭으로 측정한다.

2) GDP갭(실제GDP-잠재GDP)은 잠재GDP 추정방법에 따라 상이하게 산출된다. 본 고에서는 한미간 비교를 위해 HP필터를 적용하였다. 관련 기존연구는 <부록 1>을 참고하기 바란다.

3) 국내 실질소비는 2021년부터 점진적인 회복세에 진입하였으며, 사회적 거리두기가 해제된 금년 2분기에 큰 폭으로 증가하였다. 다만, <그림 Ⅱ-3>에 나타난 바와 같이, 소비 규모는 금년 2분기에서야 팬데믹 이전(2019년 4분기) 수준을 회복하는데 그쳤다. <그림 Ⅱ-2>를 소비 및 GDP의 장기성장률 측면에서 살펴보면, 잠재성장률이 하락추세를 나타내는 가운데, 실질소비의 추세성장률은 잠재성장률보다 낮은 수준에서 하락세를 유지하고 있다.

4) Jorda et al.(2022)에 따르면, 소비 구조의 변화와 함께 미국의 높은 재정지원이 금번 글로벌 인플레이션 발생 초기에 미국이 다른 나라보다 높은 물가상승을 보인 원인으로 분석되었다.

5) 글로벌 공급망 압력지수(GSCPI)에 대해서는 <부록 2>를 참고하기 바란다.

6) 공급망은 서비스 생산자물가에도 영향을 미치나, 강도는 재화보다 현저히 낮다.

7) 박창현 외(2022)의 분석에서도 2021년 이후의 공급망 차질이 우리나라를 포함한 주요국의 제조업 생산비용 상승을 유발한 것으로 나타났다.

8) 한국은행도 감염병 확산세, 주요국간 갈등 지속 및 우크라이나 사태 등의 영향으로 글로벌 공급 차질이 장기화될 가능성이 있음을 지적하였다(한국은행, 2022a).

9) Baffes et al.(2022)에 따르면 탄소중립 정책에 따른 에너지 전환은 2000년경부터 본격화되었으며, 이로 인해 미국을 중심으로 원유 생산 기업의 신규 투자가 감소하였다.

10) 2020년 세계 에너지 소비 중 재생에너지 비중은 10% 수준이다(Baffes & Nagle, 2022).

11) 리그(rig)는 통합원유굴착장비이며, 통상 신규 굴착활동을 측정하는 지표로 사용된다(World Bank, 2020).

12) EU의 REPowerEU Plan 및 미국의 인플레이션 감축법(Inflation reduction act) 등을 대표적 사례로 들 수 있다.

13) ECB 슈나벨(Schnabel) 이사는 전자를 ‘fossilflation’, 후자를 ‘greenflation’으로 지칭하였다.

14) 뉴욕연준에서 제공하는 글로벌 공급망 압력지수(GSCPI)는 1998년부터 제공된다. 또한 1998년 국내 외환위기 당시의 거시경제 여건이 이례적이었던 만큼, 분석기간을 2001년 이후로 선정하였다.

15) 분석기간 중 사용 가능한 국내 기대물가에는 한국은행이 제공하는 일반인 대상 향후 1년 기대물가상승률 서베이 결과가 있다. 그런데 동 기대물가상승률은 과거 물가상승률과 매우 밀접하게 연관되어 있다(과거 4분기까지의 물가상승률이 83%를 설명). 이로 인해, 식(1)에 과거 물가와 기대물가를 동시에 고려하면, 기대물가상승률이 통계적으로 유의하지 않은 것으로 나타났다. 본 고에서는 이런 점들을 고려하여, O’Reilly & Whelan(2005), Stock & Watson(2009) 및 ECB(2017) 등과 같이 적응적 기대(adaptive expectations)이론 관점에서 과거 물가상승률을 사용하여 분석하였다.

16) 한국 글로벌 공급망 차질 계수 추정치에 대해서는 <부록 1>을 참고하기 바란다.

17) 국내 GDP갭의 p-value는 0.22이다. 참고로, 초과수요 측정치로 GDP갭 대신 실업률갭을 사용하면 한미 모두 전반적인 계수의 유의성이 낮아진다.

18) 공급망 차질로 상승한 생산자물가는 시차를 두고 수요 강도에 따라 소비자물가로 전가된다. 이 점을 살펴보기 위해, 식(1)에 공급망 차질과 수요압력(GDP갭)간 상호작용항(

19) 상세한 분해 방법은 기술적인 내용이므로 생략하기로 한다.

20) 국내 경제는 2013년경부터 저성장 국면에 진입하며 역동성이 크게 저하된 것으로 평가된다.

21) 글로벌 공급망 차질은 팬데믹 초기인 2020년 1분기부터 악화하기 시작하였다.

22) <그림 Ⅲ-1>은 공급망 차질과 수요압력간 관계가 비대칭적일 수 있음을 의미한다. 이는 경기상황이 악화되어도 생산자물가 상승이 소비자물가로 전가되기 때문으로 보인다.

23) 기타요인을 소비강도에 대해 회귀분석한 결과, 회귀계수는 양의 값으로 1%에서 유의하였으며, 설명력은 18%이다.

24) 관리물가는 공공서비스, 전기ㆍ가스ㆍ수도 등 정부가 직간접적으로 가격결정에 영향을 미치는 품목의 가격 변동을 측정하는 지표이다(이병록ㆍ노현주, 2020). 관리물가 상승률은 별도로 공표되지 않는다. 본 고는 이병록ㆍ노현주(2020)가 제공한 2020년 기준 관리물가 항목 및 비중을 사용하여 과거 관리물가 상승률을 생성하였다. 구체적으로 통계청이 발표하는 과거 세부 품목별 물가 자료 중 2020년 기준의 관리물가 항목을 선별하고 가중치를 적용하였다. 그런데, 2010년 이전의 경우 2020년 기준 관리물가 항목에 대한 물가 자료가 존재하지 않는 경우가 있다. 이에 본 고에서는 2020년 기준의 모든 관리물가 항목 자료가 존재하는 2011년부터 관리물가를 생성하였다.

25) ‘11. 1분기~‘22. 2분기 기타요인을 관리물가에 대해 회귀분석한 결과, 회귀계수는 양의 값으로 1%에서 유의하였으며, 설명력은 20%이다.

26) 본 고에서는 다루지 않았으나, 미국은 고용여건이 물가상승을 유발 중인 것으로 파악되고 있다. 미국 실업률은 3.5%(금년 7월)로 1970년 이후 최저치이다. 아울러, 구직자당 채용공고 건수가 1.7개 수준으로 1960년 이후 최고치를 기록 중이다(Domash & Summers, 2022). 미국은 팬데믹으로 인한 노동공급 병목이 경기회복과 맞물리며, 명목임금 증가율이 노동 생산성을 지속해서 초과하고 있다. 이로 인해 임금 인플레이션 압력이 작용 중인 것으로 추정되고 있다(Blanchard, 2002. 3. 14; Furman, 2022. 3. 10; Holzer, 2022. 4. 13).

27) 미국 소비 강도는 여타 변수와 상관관계가 높지 않기 때문에 기타요인으로 구분하지 않고, 독립적인 수요요인으로 분류하였다. 참고로 미국의 여타 변수 중 공급망 차질(래그1)이 소비 강도와 가장 높은 상관관계(0.1)를 가진다. 한편, 국내 관리물가 통계는 2011년 이후에만 사용가능하므로 별도 요인으로 고려하지 않고, 기타요인의 하위 요인으로 분류하였다.

28) Pent-up 소비는 경기침체 등으로 소비가 억눌렸다 경기회복기에 재개되는 현상을 의미한다(이용대ㆍ이웅, 2021, 원문 수정인용).

29) 공공서비스물가는 정부가 관리하는 품목으로, 어떤 요인도 유의하지 않았다.

30) 재화물가 상승률은 대체로 전체 CPI 상승률과 유사한 결과가 확인되었다. GDP갭은 유의하지 않았으며, 원자재 가격, 공급망 차질 및 환율은 유의하였다.

31) 이는 해외에서 조달하는 식자재 공급 차질 때문으로 생각된다.

32) 다만, 본 고에서 분석된 한미간 요인별 물가상승 기여도에는 양국의 소비자물가지수(CPI) 구성 차이가 영향을 미쳤을 가능성이 있다. 예를 들어, 금년 6월 기준, 주거비 비중은 한국은 9.8%이나, 미국은 32% 수준이다. 또한 본 고에서 언급된 바와 같이, 국내에서는 정부가 공공서비스, 전기ㆍ가스ㆍ수도요금을 직간접적으로 관리한다는 점이 여타 변수와 물가상승률간 관계에 영향을 미쳤을 것으로 판단된다.

33) 국내 기대물가상승률(향후 1년, 일반인 기대)은 금년 7월에 4.7%까지 상승하였다. 기대물가는 여러 경로를 통해 실제 물가에 영향을 미칠 가능성이 있다(Yellen, 2015. 9. 24). 예를 들어, (장기) 기대물가는 가계와 기업의 가격책정(price-setting)정책에 영향을 미치는데, 1970년대와 같이 임금-물가 상승 연쇄작용 등을 통해 물가 자체의 상승 동학메커니즘이 작동할 위험이 있다. 또한 기대물가가 통제되지 않을 경우, 일시적 물가상승이 추세화될 수 있다. 기대물가는 다양한 요인에 의해 결정되나, 중앙은행의 물가안정 능력에 대한 신뢰가 핵심 요인이다.

34) 아울러, 브레이너드(Brainard) 미 연준 부의장이 지적한 바와 같이, 물가안정을 추구하는 가장 중요한 이유가 저소득층 보호에 있다는 점(Brainard, 2022. 4. 5)에도 유의할 필요가 있다. 미국 미네아폴리스 연준은 인플레이션이 소득별 가계에 미치는 영향을 파악하기 위해 금년 4월에 관할지역내 거주자와의 간담회를 개최하였다. 간담회 결과는 Horowitz & Tchourumoff(2022. 8. 9)에 정리되어 있다. 국내에서도 이러한 노력이 필요한 것으로 판단된다.

35) 최근 미국은 글로벌 공급망에서 중국의 역할을 제한하기 위한 정책을 시행하고 있다. Lovely & Dahlman(2022)의 분석에 따르면, 미국의 인도-태평양 경제프레임워크(Indo-Pacific Economic Framework)로 국내 기업의 생산비용이 유의하게 상승할 가능성이 있는 것으로 나타났다.

36) www.ecb.europa.eu/pub/conferences/html/20220627_ecb_forum_on_central_banking.en.html

37) 국가간 인플레이션 변동이 소수 글로벌 공통요인에 의해 많은 부분이 설명됨을 의미한다.

38) 이를 인플레이션 세계화 가설(globalization of inflation hypothesis: GH)이라 한다.

39) 통상 글로벌 GDP갭으로 측정되는 글로벌 유휴생산능력은 글로벌 필립스 곡선에서 중요하게 다뤄지는 변수이다. 다만, 글로벌갭의 유의성에 대해서는 연구자간에 아직 합의가 이루어지지 않은 상태이다. 당초 본 고에서도 글로벌갭을 모형에 포함하는 방안을 고려하였다. 기존 연구에서 제시된 다양한 글로벌갭 측정방법을 다각도로 고려한 결과, 동 변수가 미국 인플레이션에는 유의한 영향을 미치나, 우리나라에서는 유의하지 않은 것으로 분석되었다. 글로벌갭은 측정방법 및 추정기간에 따라 국내갭과의 상관관계가 상이한데, 본 고의 분석기간 중에는 미국 국내갭과 글로벌갭간 상관관계가 0.8~0.9로 매우 높게 나타났다. Jasova et al.(2018)이 제시한 바와 같이, 이런 경우에는 국내갭과 글로벌갭을 직교화해서 고려해야 한다. 하지만 직교화된 글로벌갭과 국내갭은 추정방법론상 국내갭과 글로벌갭간 상대적 역할을 해석하는데 한계가 있다. 본 고에서는 이와 같은 이유와 금번 인플레이션에서 글로벌갭의 역할이 크게 부각되지 않는 점을 고려하여 모형에서 제외하기로 결정하였다.

40) 참고로 해석상 편의를 위해,

41) <표 Ⅲ-1>에서 변수별로 스케일이 다르므로 회귀계수 크기로 민감도를 비교할 수 없다.

42) 요인별 1-표준편차는 아래 표와 같다.

43) 다만, 본 분석에서 민감도는 여타 요인이 동일하다는 가정 하에 산출되었다.

44) 민감도 비교를 위해서는 양국 물가 변동성 수준을 고려해야 한다.

45) 국내 물가가 미국보다 공급망 차질에 민감하게 반응하는 이유는 양국의 CPI에서 공급망의 영향을 많이 받는 재화품목의 비중이 다르기 때문일 가능성이 있다. 금년 6월 기준 한국과 미국 CPI에서 재화품목의 비중은 각각 47% 및 40%이다.

참고문헌

박창현ㆍ김선진ㆍ이규환ㆍ주연희, 2022, 최근 글로벌 공급망 차질의 특징 및 국내 산업에 미치는 영향, 한국은행 『BOK 이슈노트』 제2022-24호.

이병록ㆍ노현주, 2020, 최근 관리물가 동향 및 향후 전망, 한국은행 『BOK 이슈노트』 제2020-16호.

이용대ㆍ이웅, 2021, 향후 pent-up 소비 가능성 점검, 한국은행 『BOK 이슈노트』 제2021-6호.

한국은행, 2022a, 『통화신용정책보고서』 (2022년 3월).

한국은행, 2022b, 『통화신용정책보고서』 (2022년 6월).

한국은행, 2022. 6. 21., 물가안정목표 운영상황 점검, 보도자료.

Akinci, O., Benigno, G., Heymann, R.C., di Giovanni, J., Groen, J.J.J., Lin, L, Noble, A., 2022. 1. 28, The global supply side of inflationary pressures, FRB New York, Liberty Street Economics.

Attinasi, M.G., Balatti, M., 2021, Globalisation and its implications for inflation in advanced economies, ECB Economic Bulletin, Issue 4/2021.

Auer, R.A., Levchenko, A.A., Saure, P., 2017a, International inflation spillovers through input linkages, Working Papers No.623, BIS.

Auer, R., Borio, C., Filardo, A., 2017b, The globalisation of inflation: The growing importance of global value chains, Working Papers No. 602, BIS.

Baffes, J., Koh, W.C., Nagle, P., 2022, The evolutions of commodity markets over the past centry, Commodity Markets: Evolution, Challenges and Policies, World Bank.

Baffes, J., Nagle, P., 2022, Commodity demands: Drivers, outlook and implications, Commodity Markets: Evolution, Challenges and Policies, World Bank.

Barrero, J.M., Bloom., Davis, S.J., 2021, Why working from home will stick, NBER Working Paper.

Benigno, G., Giovanni, J., Groen, J.J.J., Noble, I., 2022. 1. 4, A new barometer of global supply chain pressures, FRB New York Liberty Street Economics.

BIS, 2022, Old challenges, new shock(Chapter 1), Annual Economic Report, June.

Blanchard, O., 2022. 3. 14, Why I worry about inflation, interest rates, and employment, Peterson Institute for International Economics.

Borio, C., Filardo, A., 2007. Globalisation and Inflation: New Cross-Country evidence on the global determinants of domestic inflation. Working Paper No.227, BIS.

Brainard, L., 2022 4. 5, Variation in the inflation experiences of households, FRB Minneapolis.

Carstens, A., 2022, The Return of Inflation, BIS.

Celasun, O., Hansen, N.-J., Mineshima, A., Spector, M., Zhou, J., 2022, Supply bottlenecks: Where, why, how much, and what next? WP/22/31 IMF.

Ciccarelli, M., Mojon, B., 2010, Global inflation, Review of Economics and Statistics 92(3), 524-535.

Datta, D.D., Feiveson, L., Peneva, E., Rua, G., 2022. 6. 24, Bottlenecks, shortages, and soaring prices in the U.S. economy, FEDS Notes.

Di Giovanni, J., Kalemli-Ozacan, S., Silva, A., Yildirim, M.A., 2022, Global Supply Chain Pressures, International Trade, and Inflation, FRB New York.

Domash, A., Summers, L.H., 2022, How tight are U.S. labor markets? NBER Working Paper 29739.

European Central Bank(ECB), 2017, Domestic and global drivers of inflation in the Euro area, ECB Economic Bulletin, Issue 4/2017.

Forbes, K.J., 2019a, Has globalization changed the inflation process?, Working Papers No.791, BIS.

Forbes, K.J., 2019b, Inflation dynamics: Dead, dormant or determined abroad?, Brookings Papers on Economic Activity, Fall 2019, 257-319.

Forbes, K.J., Gagnon, J.E., Collins, C.G., 2021, Low inflation bends the Phillips curve around the world: Extended results, NBER Working Paper 29323.

Furman, J., 2022. 1. 13, Four reasons to keep worrying about inflation, Wall Street Journal.

Furman, J., 2022. 3. 10, Will anchored inflation expectations actually anchor inflation? Peterson Institute for International Economics.

Holzer, H.J., 2022. 4. 13, Tight labor markets and wage growth in the current economy, Brookings Institution.

Horowitz, B., Tchourumoff, A., 2022, 8. 9, As inflation rises, low-income households grapple with particular challenges, FRB Minneapolis.

International Energy Association(IEA), 2022a, Oil Market Report, July.

International Energy Association(IEA), 2022b, A 10-point Plan to Reduce the European Union’s Reliance on Russian Natural Gas, March.

International Monetary Fund(IMF), 2022, World Economic Outlook Update.

Jasova, M., Moessner, R., Takats, E., 2018, Domestic and global output gaps as inflation drivers: what does the Phillips curve tell?, BIS Working Papers No. 748.

Javorcik, B.S., 2020, Global supply chains will not be the same in the post-COVID-19 world, COVID-19 and Trade Policy: Why Turning Inward Won’t Work, 111-116.

Jorda, O., Liu, C., Nechio, F., Rivera-Reyes, F., 2022, Why is U.S. inflation higher than in other countries, FRB San Francisco Economic Letter 2022-07.

Lagarde, C., 2022. 4. 22, A new global map: European resilience in a changing world, ECB.

Lagarde, C., 2022. 6. 28, Price stability and policy transmission in the euro area, ECB.

Lane, P.R., 2020. 5. 22, International inflation co-movements, ECB.

Lovely, M.E., Dahlman, A., 2022, South Korea should prepare for its exposure to US-China technology tensions, Policy Brief 22-8, PIIE.

Matthews, C.M., Blunt, K., 2022. 8. 1, America’s new energy crisis, Wall Street Journal.

Mikolajun, I., Lodge, D., 2016, Advanced economy inflation: The role of global factors, ECB Working Paper Series No. 1948.

O’Reilly, G., Whelan, K., 2005, Has Euro-area inflation persistence changed over time?, Review of Economics and Statistics 87(4), 709–720.

Powell, J.H., 2018. 10. 2, Monetary policy and risk management at a time of low inflation and low unemployment, FRB.

Powell, J.H, 2022. 6. 22, Semiannual monetary policy report to the Congress, FRB.

Santacreu, A., M., LaBelle, J., 2022, Global supply chain disruptions and inflation during the COVID-19 pandemic, FRB St. Louis Review 104(2), 78-91.

Schnabel, I., 2022. 3. 17, A new age of energy inflation: Climateflation, fossilflation and greenflation, ECB.

Schnabel, I., 2022. 5. 11, The globalisation of inflation, ECB.

Stock, J.H., Watson, M.W., 2009, Phillips curve inflation forecasts, Understanding Inflation and the Implications for Monetary Policy, 101–186.

Summers, L., 2022. 7. 14, A dangerous level of groupthink, Interview with NY Magazine.

Tauber, K., Zandweghe, W.V., 2021, Why has durable goods spending been so strong during the COVID-19 pandemic?, FRB Cleveland Economic Commentary 2021-16.

White House, 2021, Building resilient supply chains, Revitalizing American manufacturing, and fostering broad-based growth.

World Bank, 2020, Commodity Markets Outlook: Persistence of Commodity Shocks, October.

World Bank, 2022a, Russia’s invasion of Ukraine: Implications for energy markets and activity, Global Economic Prospects, 101-103.

World Bank, 2022b, Commodity Markets Outlook, April.

Yellen, J.L., 2015. 9. 24, Inflation dynamics and monetary policy, FRB.