Find out more about our latest publications

Need and Directions for Reform of the Foreign Exchange Transactions Act

Issue Papers 22-20 Oct. 24, 2022

- Research Topic Macrofinance

- Page 22

The Foreign Exchange Transactions Act (the “Act”) was enacted in 1999 immediately after the Asian financial crisis, aiming for freeing up foreign exchange transactions and invigorating market functions. Contrary to its purpose, the Act has been used to adjust and manage the foreign exchange sector to implicitly curb the outflow of foreign capital and ease excessive foreign exchange rate volatility over the past two decades. This has been inevitable to some extent because the prolonged external uncertainty has made external stability a top priority in the aftermath of the 2008 global financial crisis.

As a result, policy measures implemented in the era of the lack of foreign exchange still underpin the fundamentals of the Act, including prior reporting of capital transactions, procedural restrictions on international payment and receipts, and foreign exchange agencies. These measures cause the inconvenience that outweighs the benefits of contributing to external soundness, run counter to the liberalization of foreign exchange transactions and invigoration of market functions, and undermine crisis response capabilities and balanced development of the entire financial industry. Notably, Korea has experienced macroeconomic changes, transforming from a foreign exchange-deficit nation to a capital exporter. In addition, its competence in dealing with a crisis has improved immensely and it has seen non-banking financial institutions gaining importance due to the rise in overseas financial investments. Against this backdrop, the Korean government should gear the reform of the Act towards the following directions.

First, the new Foreign Exchange Transactions Act should focus on mitigating public inconvenience and facilitating freer foreign exchange transactions. To this end, the government should overhaul the relevant legal system and free up transactions by abolishing the prior reporting of capital transactions. Second, it is necessary to address the bank-centered foreign exchange agency system and the procedural regulation that requires international payment to go through a bank. With these measures, the government needs to allow other financial institutions including financial investment firms to freely engage in foreign exchange-related business, which can contribute to balanced development in foreign exchange business competence of the entire financial industry and help maintain external soundness. Third, the new Act should be designed to stimulate the economy under the open economic system. In preparation for population aging, investment conditions should be improved further to ensure that overseas financial investments by residents lead to a stable stream of national disposable income.

The reform of the Act could structurally reinforce Korea’s external soundness under the new macroeconomic environment and hence, enhance Korea’s capability to cope with external shocks. In this respect, a prudent approach is needed for the reform, regardless of destabilizing factors in the domestic and global financial markets.

As a result, policy measures implemented in the era of the lack of foreign exchange still underpin the fundamentals of the Act, including prior reporting of capital transactions, procedural restrictions on international payment and receipts, and foreign exchange agencies. These measures cause the inconvenience that outweighs the benefits of contributing to external soundness, run counter to the liberalization of foreign exchange transactions and invigoration of market functions, and undermine crisis response capabilities and balanced development of the entire financial industry. Notably, Korea has experienced macroeconomic changes, transforming from a foreign exchange-deficit nation to a capital exporter. In addition, its competence in dealing with a crisis has improved immensely and it has seen non-banking financial institutions gaining importance due to the rise in overseas financial investments. Against this backdrop, the Korean government should gear the reform of the Act towards the following directions.

First, the new Foreign Exchange Transactions Act should focus on mitigating public inconvenience and facilitating freer foreign exchange transactions. To this end, the government should overhaul the relevant legal system and free up transactions by abolishing the prior reporting of capital transactions. Second, it is necessary to address the bank-centered foreign exchange agency system and the procedural regulation that requires international payment to go through a bank. With these measures, the government needs to allow other financial institutions including financial investment firms to freely engage in foreign exchange-related business, which can contribute to balanced development in foreign exchange business competence of the entire financial industry and help maintain external soundness. Third, the new Act should be designed to stimulate the economy under the open economic system. In preparation for population aging, investment conditions should be improved further to ensure that overseas financial investments by residents lead to a stable stream of national disposable income.

The reform of the Act could structurally reinforce Korea’s external soundness under the new macroeconomic environment and hence, enhance Korea’s capability to cope with external shocks. In this respect, a prudent approach is needed for the reform, regardless of destabilizing factors in the domestic and global financial markets.

Ⅰ. 머리말

외국환거래법(Foreign Exchange Transaction Act)은 우리나라의 모든 대외거래 및 외환거래를 총괄하는 법으로서 외환위기 직후인 1990년대말 제정된 이후 지금까지 법체계를 유지해 오고 있다. 제정 당시 우리나라는 외화유동성의 절대적 부족으로 인한 원화환율의 급등과 대외건전성의 약화로 경제가 큰 어려움에 처해 있었던 상황을 반영하여 외국환거래법은 대외거래의 자유화와 시장기능의 활성화를 추진하는 동시에 한편으로는 대외안정을 유지하기 위한 조치들을 법에 반영하여 제정되었다. 또한 2008년 발생한 글로벌 금융위기를 비롯하여 이후에도 유럽재정위기, 미국 등 선진국의 통화정책 급변 등 지속적으로 발생하는 대외불확실성으로 말미암아 외국환거래법은 암묵적으로 외자의 유출을 억제하고 환율의 급변동을 완화하는 방향으로 운영되어 왔다.

그 결과 법의 도입취지인 대외거래의 자유화나 시장기능의 활성화보다는 상대적으로 거시건전성정책 등을 통한 대외건전성의 유지에 치중해 온 측면이 있다. 특히 법 제정 당시의 주요 특징이라 할 수 있는 자본거래 사전신고제, 대외지급 및 수령시 절차적 규제, 외국환업무취급기관에 대한 차별적 업무범위 등이 법의 근간을 이루고 있어 대외안정에 기여하는 실익에 비해 많은 정책비용과 국민 불편, 금융산업의 균형적인 발전 저해 등 부정적 측면도 상존하고 있는 것으로 판단된다.

최근 우리나라의 대외여건 및 거시금융환경의 변화로 외국환거래법의 전면적인 개편 필요성이 커지고 있다. 우리나라는 과거의 외환부족 국가에서 벗어나 이미 자본수출국으로 이행하였으며 대외부문의 위기대응력도 과거에 비해 훨씬 높아졌다. 특히 대규모 경상수지 흑자로 풍부해진 외화유동성은 경제주체들의 해외금융저축의 형태로 변모하고 있으며 이 과정에서 비은행금융기관의 중요성이 크게 높아지고 있다. 이러한 거시경제환경 변화는 현재의 외국환거래법에 상존하고 있는 외자유출 억제의 철학과 외국환은행 중심의 법 운영체계에도 한계가 커지고 있음을 의미한다.

지난해 이후 우리 정부도 이런 거시경제환경 변화를 반영하여 외국환거래법에 대한 개편논의와 준비를 적극적으로 진행중이다. 이번 개편은 과거 어느 때보다 전면 개편에 대한 필요성이 큰 것으로 인식되는 가운데 지금까지의 부분적인 수정을 넘어서 ‘신외환법’의 탄생을 목표로 내년중 법의 제정과 하위규정의 개정을 계획중이다. 이런 점에서 본 보고서는 거시경제환경 변화를 감안한 외국환거래법의 개편 필요성에 대해 분석하고 바람직한 개편방향을 모색해 보고자 한다. 보고서의 구성은 제II장에서 외국환거래법의 의의 및 변천과정과 주요 특징을 설명하였다. 제III장에서는 그간 우리나라의 거시경제환경 변화와 현재 법 운영의 현주소를 진단해 보았다. 제IV장에서는 외국환거래법의 개편 필요성과 바람직한 개편 방향을 제시하였다.

Ⅱ. 외국환거래법의 의의 및 특징

1. 의의 및 변천과정

외국환거래법(Foreign Exchange Transaction Act)은 우리나라의 모든 대외거래 및 외환거래를 총괄하는 법으로서 법의 목적은 “외국환거래와 그 밖의 대외거래의 자유를 보장하고 시장기능을 활성화하여 대외거래의 원활화 및 국제수지의 균형과 통화가치의 안정을 도모함으로써 국민경제의 건전한 발전에 이바지함을 목적으로 한다”로 명시(법 제1조)되어 있다. 이를 크게 나누어 보면 거래의 자유와 시장기능 활성화라는 측면과 국제수지의 균형 및 안정이라는 측면을 동시에 도모하여 외환위기를 벗어나 명실상부한 개방경제 체제로의 전환을 모색한 것으로 볼 수 있다.

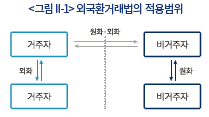

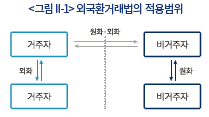

외국환거래법의 적용범위는 거주자와 비거주자간에 발생하는 모든 대외거래는 물론 거주자간에 발생하는 외환거래, 그리고 비거주자간에 발생하는 원화거래도 모두 포함하고 있다. 국제수지 통계에 포착되는 모든 대외거래의 경우에는 원화와 외화에 대해 모두 적용된다. 국가간 자본유출입이 발생하는 대외거래는 금융 및 외환시장에 직접적인 영향을 주는 데 반해 국내에서 거주자간에 발생하는 외환거래의 경우에는 대외건전성에 미치는 직접적인 영향이 크지 않다는 점에서 법의 적용범위에 관한 조정 필요성이 제기되고 있다. 또한 아직까지 원화가 국제화되지 않아 비거주자간의 원화거래가 실제 미미한 수준임에도 현행 외국환거래법은 이를 법의 적용범위에 포함하고 있다.

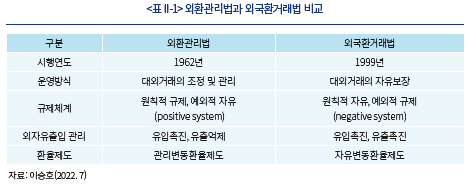

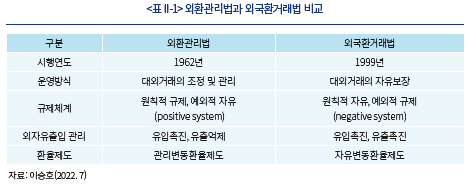

한편 외국환거래법은 종전의 외환관리법(Foreign Exchange Management Law)을 폐지하고 외환위기 직후인 1999년 4월 제정·시행되었다. 외국환거래법은 과거 외환관리법 체계하에서의 대외거래의 조정 및 관리 방식에서 벗어나 대외 및 외환거래시 원칙적 자유, 예외적 규제(negative system)를 표방하고 외자의 유입은 물론 유출의 촉진을 지향하였다. 또한 이를 뒷받침하기 위해 우리나라의 환율제도를 종전의 관리변동환율제도 형태인 시장평균환율제도에서 자유변동환율제도로 변경하였다.

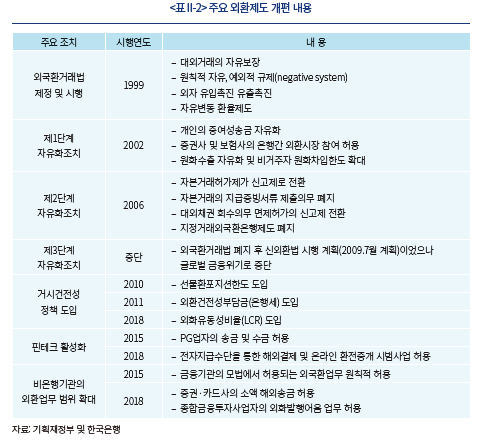

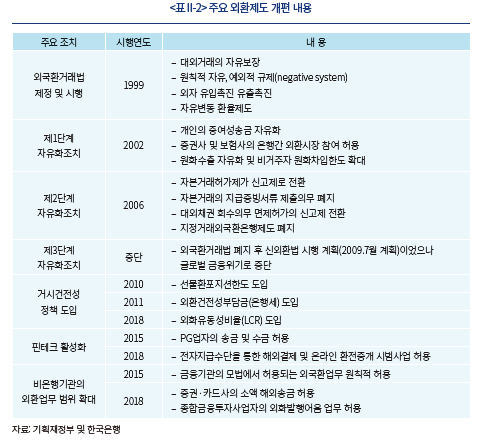

외국환거래법은 제정 이후부터 최근에 이르기까지 법의 전체적인 골격과 근간을 유지한 채 부분적인 보완을 거듭하여 왔다. 그간의 주요 변천과정을 살펴보면 대체로 글로벌 금융위기 이전과 이후로 구분되는 특징을 보이고 있다.

우선 글로벌 금융위기 이전까지는 외국환거래법의 목표를 달성하기 위해 부분적인 자유화가 꾸준히 진행되었다. 2002년 7월부터 시행된 제1차 외환자유화 조치에서는 개인의 증여성송금 자유화, 증권사 및 보험사의 은행간외환시장 참여 허용, 원화수출 자유화 및 비거주자 원화차입한도 확대 등의 조치가 이루어졌다. 2006년 1월부터 시행된 제2차 외환자유화 조치에서는 자본거래 허가제가 신고제로 전환되었으며 자본거래의 지급증빙서류 제출의무 폐지, 대외채권 회수의무 면제허가의 신고제 전환, 지정거래외국환은행제도 폐지 등도 시행되었다. 2009년 7월부터 시행 예정이었던 제3단계 자유화 조치 계획에는 외환자유화의 마지막 단계라 할 수 있는 원화의 국제화 추진과 외국환거래법을 폐지한 후 신외환법의 시행 계획까지 포함하였으나 2008년 발생한 글로벌 금융위기로 계획이 전면 중단된 채 현재에 이르고 있다.

한편 글로벌 금융위기 이후에는 대외불확실성의 지속에 따라 외환부문의 자유화를 위한 조치들이 큰 진전을 보이지 못하였다. 즉, 제1차 및 제2차 유럽재정위기, 미국의 테이퍼텐트럼(taper tantrum) 등 대외불확실성의 지속으로 법의 도입당시 표방하였던 거래자유화를 위한 조치들은 보류된 채 주로 대외부문의 안정달성을 위한 각종 거시건전성정책(macro-prudential policy)들이 도입되었다. 선물환포지션한도, 은행세, 외화LCR 도입 등이 대표적인데 이러한 조치들은 우리나라 대외부문의 취약성 극복과 안정에 기여한 것으로 평가받고 있다. 2015년에는 비은행금융기관의 외국환업무와 관련하여 외국환거래규정에서 허용가능업무를 일일이 열거하던 방식에서 자본시장법 등 해당기관의 모법에서 허용된 업무와 직접 관련이 있는 경우 원칙적으로 외국환업무를 영위할 수 있도록 변경하였으나 거래유형에 따라 사전신고제를 유지하고 있다.

한편 최근에는 금융산업의 새로운 환경변화를 반영하여 PG업자의 송·수금 허용(2015년), 소액 해외송금업 및 온라인환전업(2018년) 신설 등 핀테크를 외환법령의 영역에 포함하였다. 그러나 핀테크(FinTech) 산업 육성을 위한 이러한 조치들은 오히려 비은행금융기관과의 업무허용 범위에 대한 형평성 문제가 제기되는 결과를 초래하기도 하였다. 그 결과 2018년 이후에는 증권사 등 비은행금융기관에 대해서도 소액해외송금이 허용되었다.

2. 법의 주요 특징

외국환거래법은 제정 당시 우리나라의 외환부족에서 비롯된 외환위기라는 특수한 경험을 시대적 배경으로 하고 있어 다음과 같은 제도적 특징을 아직까지 유지하고 있다. 이에는 자본거래 사전신고제, 지급 및 수령시 절차적 규제, 외국환업무취급기관주의, 유사시 안전장치 및 모니터링 등이라 할 수 있는데 아래에서는 이에 대해 간략히 살펴보았다.

가. 자본거래 사전신고제

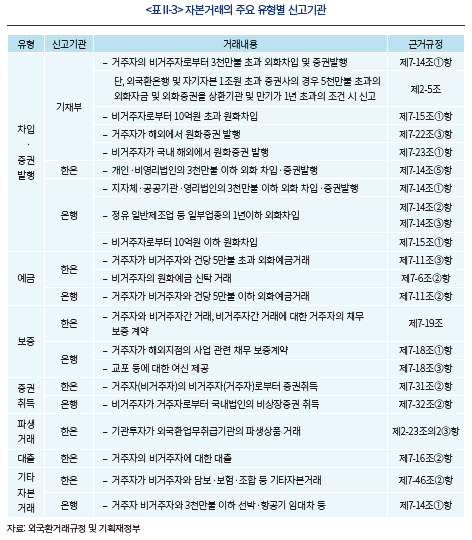

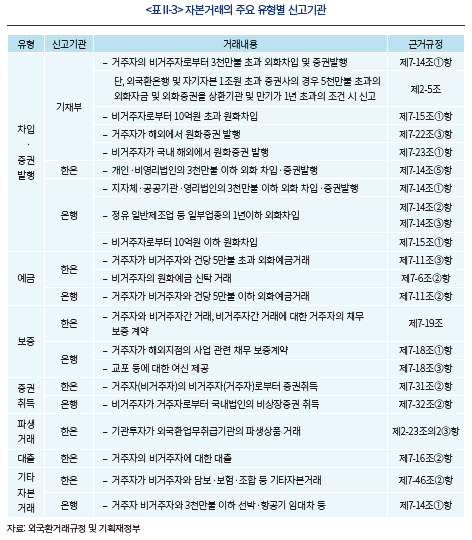

1990년대를 거치면서 수출입 등 경상거래가 완전 자유화된 것과 달리 대부분의 자본거래에 대해서는 사전에 기획재정부나 한국은행 또는 외국환은행에 신고토록 하고 있다. 다만, 외국환업무취급기관이 외국환업무1)로서 수행하는 거래는 신고가 면제되나 이 경우에도 외환거래질서를 해칠 우려가 있거나 급격한 외자유출입을 야기할 위험이 있는 경우에는 신고토록 하고 있다. 이는 자본거래의 경우 경상거래와 달리 거래의 진위여부를 파악하기 곤란하고 자본유출입에 따른 금융시장의 변동성 확대 등 부정적 측면이 상대적으로 큰 특징이 있는 점을 고려한 것이다.

신고대상에 있어서는 외국환업무를 본연의 업무로 인정받는 외국환은행에 대해서는 대부분 사전신고 의무가 면제되나 증권사나 보험사 등 기타외국환업무취급기관이나 기업, 개인 등 여타 경제주체들은 신고의무를 갖는다고 할 수 있다. 현행 외국환거래규정에서 신고대상 자본거래의 종류는 <표 II-3>과 같이 구분하고 규정하고 있다.

2006년 1월 제2차 외환자유화 시행과 더불어 자본거래는 허가제에서 신고제로 변경되었으나 신고제가 시행된 이후에도 단순신고가 아닌 신고수리제의 성격을 띠고 있다. 따라서 외환당국이 신고수리를 신속히 처리하지 않는 경우 거래가 지연되거나 위축되고 거래당사자가 시장상황 변화에 탄력적으로 대응하기 어려운 경우가 빈번히 발생하였다.

뿐만 아니라 증권회사와 같은 비은행금융기관의 경우 해당 자본거래가 사전신고 대상 거래인지의 여부를 판단하기 위해 당국의 유권해석을 받아야 하는 경우도 빈번한데 이는 해당 자본거래가 자본시장법에서 허용하는 금융회사의 본질적 업무와 직접 관련된 외국환업무인지가 불분명한 경우가 존재하기 때문이다. 이런 점에서 그동안 수차례 자본거래 사전신고제에 대한 폐지 또는 완화 논의가 있었으나 대외건전성 관리 및 모니터링 목적을 위해 현재까지 유지되고 있다.

나. 지급 및 수령시 절차적 규제

외국환거래법은 대외거래에 따른 자금의 대외지급시 원칙적으로 외국환은행을 통한 송금방식으로 하도록 하고 있다. 이때 외국환은행은 지급의 사유와 금액을 입증하는 서류를 제출받아 당해 지급이 법령에 의한 신고 등의 대상인지 여부를 확인한다. 경상거래의 경우 허가나 사전신고가 불필요하나 자본거래에 대해서는 사전신고를 거친 경우에만 자금의 결제가 가능하도록 하고 있으며 은행은 이를 확인할 의무를 지니고 있다. 비거주자의 경우에는 자금취득 경위에 대한 입증서류를 제출하여 외국환은행의 확인을 받은 후 해외송금 등 지급이 가능하도록 하고 있다.

최근에는 핀테크 활성화를 배경으로 소액송금업자에 대해 연간 5만불, 건당 5천불 범위내의 소액송금을 허용함으로써 외국환은행을 통하지 않는 거래가 가능해졌다. 아울러 증권회사에 대해서도 동일한 소액송금업무를 허용한 바 있다. 그러나 소액해외송금은 규모 면에서 은행에 비해 미미한 수준으로 우리나라의 경우 아직까지 외환의 대외지급이나 해외로부터의 수령은 외국환은행을 통하는 방식을 엄격히 유지하고 있다고 할 수 있다. 대외지급과 관련한 이러한 절차적 규제에 따라 증권사 등이 해외투자와 관련하여 해외송금을 할 필요가 있는 경우 다시 은행을 경유하여 자금을 송금하여야 한다.

외국환은행을 통한 지급 및 수령의 경우라 하더라도 비정형적인 거래의 경우에는 불법적인 외화유출입 수단으로 악용될 소지가 있다는 점에서 사전신고 또는 확인절차를 거치게 하도록 하고 있다. 그 예로는 상계에 의한 지급, 기간초과 지급, 제3자지급 등을 들 수 있다. 상계지급의 경우 거래의 존재여부나 거래규모를 파악하기 곤란하고, 기획재정부 장관이 정한 기간을 초과하여 지급하는 경우 사실상 금전대차의 성격을 가지는 것으로 보며, 제3자지급의 경우에는 거래의 진위여부의 확인이 어렵기 때문이다.

다. 외국환업무취급기관주의

우리나라에서 금융기관이 외국환업무를 영위하기 위해서는 충분한 자본ㆍ시설 및 전문인력을 갖추어 우선 기획재정부장관에게 외국환업무취급기관으로 등록하여야 한다. 일정요건에는 금융기관의 자본규모나 재무구조 등 자본요건, 외환정보집중기관인 한국은행과 전산망이 연결되어 있는 시설요건, 그리고 적정한 인력요건을 말한다.

외국환거래법상 외국환업무취급기관은 외국환은행과 기타외국환업무취급기관으로 구분된다. 외국환은행의 경우에는 모든 외국환업무를 취급할 수 있으며 대부분의 경우 거래를 위한 사전신고 의무가 면제된다. 반면 기타외국환업무취급기관은 각 기관의 모법에서 정한 당해 기관의 업무와 직접적으로 관련된 경우에 한하여 외국환업무의 취급이 가능하나2) 많은 경우 사전신고를 통해 업무와의 직접 관련성 여부를 확인받아야 한다.

예를 들어 증권사의 경우 법에 명시된 외국환업무 중 우리나라와 외국간의 지급ㆍ추심(推尋) 및 수령, 외국통화로 표시되거나 지급되는 거주자와의 예금, 금전의 대차 또는 보증, 비거주자와의 예금, 금전의 대차 또는 보증 등은 직접 연관성을 인정받지 못하고 있어 거래가 원칙적으로 허용되지 않는다. 다시 말하여 은행법에서 정한 은행의 고유업무라 할 수 있는 예금 및 계좌개설, 외국환은행으로부터의 외화차입, 개인을 대상으로 한 투자목적 이외의 외국환 매매(일반환전) 등은 원칙적으로 허용되지 않고 있으며 투자목적 자금의 경우에도 소액 이외의 해외송금은 허용되지 않는다.

라. 유사시 안전장치 및 모니터링

우리나라의 외국환거래법은 외화유동성 위기 등 비상사태에 대비하여 안전장치를 두고 있으며 사전적인 모니터링을 명시하고 있다. 즉, 천재지변, 전시∙사변, 국내외 경제사정의 중대하고도 급격한 변동, 기타 이에 준하는 사태발생시 비상조치권(safeguard)을 취할 수 있도록 하고 있으나(법 제6조) 아직까지 발동된 예는 없다. 이러한 안전장치에는 대외거래의 일시 정지, 외환집중제, 대외채권회수, 자본거래허가제, 가변예치의무제 등이 포함된다.

또한 평상시에도 외환정보에 대한 모니터링을 강화하는 방향으로 운영되고 있다. 이를 위해 외환전산망을 운영하고 있으며 한국은행을 외환정보집중기관으로 지정하고 외환전산망을 통해 입수한 정보를 국세청, 금융감독원, 정보분석원(FIU) 등 관련 기관에 제공하고 있다. 이러한 모니터링 체계의 강화는 거래의 자율성을 보장하되 대외부문의 안정성에 영향을 줄 수 있는 제반거래를 사전에 파악하여 대외건전성을 유지하기 위한 목적에 따른 것이라 할 수 있다.

Ⅲ. 거시경제환경 변화와 법 운영 평가

이 장에서는 외국환거래법의 제정 이후 최근까지 우리나라의 거시경제환경 변화를 살펴본 후 현행 외국환거래법의 실제 운영을 도입당시 취지에 비추어 평가해보았다. 아울러 일본의 신외환법 도입(1998년) 배경 및 주요 내용을 간략히 살펴보았다.

1. 거시경제환경 변화

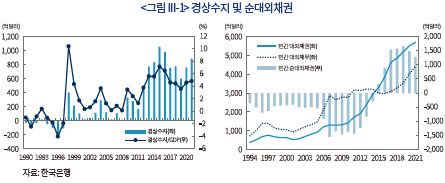

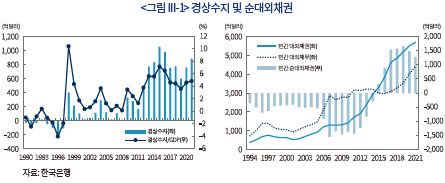

가. 외환부족국에서 순대외채권국으로 이행

우리나라는 1997년 외환위기 직후인 외국환거래법의 제정 당시 외환의 절대적인 부족국가에서 벗어나 이미 풍부한 외환을 보유한 자본수출국으로 이행하였다. 이는 무엇보다 2000년대 이후 대규모 경상수지 흑자 기조가 정착된 데 기인한다. 2010~2021년중 우리나라의 경상수지 흑자 규모는 기간중 총 8,333억달러로 GDP대비 4.6%(기간중 연평균)에 달한다. 이러한 대규모 경상수지 흑자는 거주자들의 해외금융저축 증가로 나타나고 있는데 그 결과 2015년 이후에는 민간부문의 대외채권이 대외부채를 상회하는 순대외채권국으로 전환되었다. 2021년말 기준 민간부문의 순대외채권 잔액은 4,479억달러에 달한다.

이는 우리나라가 과거 경험한 외화유동성 부족에 따른 위기시와 뚜렷한 차이를 보이는 것으로서 향후에도 대외불확실성이나 외국인의 급격한 외자유출이 발생하더라도 외화유동성 위기로 발전할 가능성은 크지 않은 상황임을 의미한다. 따라서 암묵적으로 외자유출의 억제를 도모하고 있는 지급이나 수령시 절차적 규제, 외국환업무취급기관주의 등 현행 외국환거래법의 운영체계 전반에 변화가 필요함을 시사하는 것으로 생각된다.

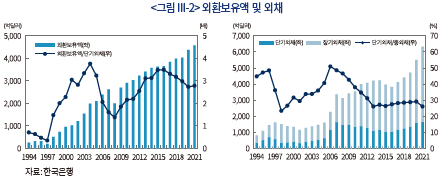

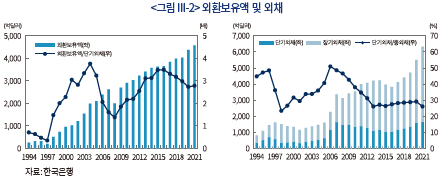

나. 위기대응역량 큰 폭 확충

과거에 비해 우리나라의 위기대응역량 또한 큰 폭으로 확충되었다. 이는 국가 전체적으로 외화유동성의 확충과 더불어 외채구조가 건실해졌을 뿐만 아니라 외국환거래법 하에서 다양한 거시건전성정책의 도입으로 대외충격에 대한 사전적, 사후적 대응체계가 정비된 데 기인한다.

그 예로 우리나라 외환당국이 보유하고 있는 외환보유액은 단기외채의 3배 수준에 달하여 비상시 최종대부자(lender of last resort)로서의 유동성 공급기능에 어려움이 없는 수준이다. 총외채중 단기외채가 차지하는 비중도 30% 이하 수준을 유지하며 외채구조가 안정적으로 개선되었다. 뿐만 아니라 글로벌 금융위기 이후 선물환포지션한도, 은행세 등이 도입되며 급격한 외자유입과 외채증가를 억제하고 경기순응성(pro-cyclicality)에 기인한 대외부문의 복원력(resilience)이 크게 향상된 것으로 평가받는다.

최근 글로벌 인플레이션의 심화에 따른 미 연준의 초긴축적 통화정책으로 미달러화가 가파른 강세를 보임에 따라 명목원화환율이 가파른 상승세를 나타내었으나 일본이나 유로 등 주요 수출경쟁상대국에 비하여 상대적인 원화의 약세정도는 크지 않은 것으로 보이며 여타 외환부문의 안정성에도 큰 문제가 없는 것으로 판단된다. 즉, 명목원화환율의 상승에도 불구하고 양호한 대외차입여건, 건전한 외채구조, 건실한 국가신용등급 유지 등은 우리나라의 위기대응능력과 대외신인도가 크게 확충되었음을 보여주는 예이다. 이러한 점에서 환율변동성에 대한 지나친 우려를 갖기보다 외국환거래법의 전면적인 개편을 통해 거래의 자유화와 시장기능 활성화를 도모해 나가는 것이 바람직한 시점으로 판단된다.

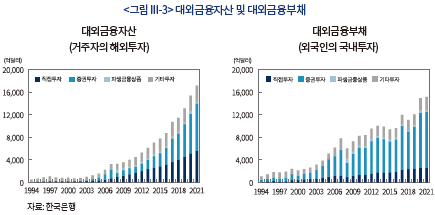

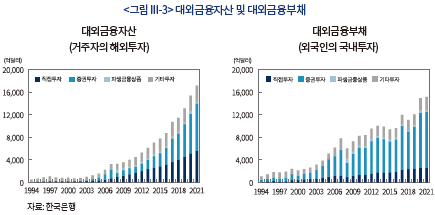

다. 해외투자 및 비은행금융기관의 중요성 증가

2000년대 이후 전 세계적으로 국제자본이동이 확대되고 자본거래의 상대적 중요성이 과거보다 훨씬 커지고 있는 가운데 우리나라의 해외금융투자가 급증하고 있는 점은 주요한 특징이라 할 수 있다. 즉, 2000년 이후 최근까지 우리나라에 대한 외국인들의 국내투자 증가로 대외금융부채는 약 6배 증가하는 데 그친 반면 거주자의 해외투자에 따른 대외금융자산은 무려 21배나 증가하였다. 여기에는 해외 주식 및 채권 등 증권투자가 가장 큰 비중을 차지하고 있다.

이는 경상수지 흑자에 따른 잉여 외환의 투자수익률 제고를 위해 글로벌 금융시장으로 투자처를 확대해 나가고 있는 데 따른 것으로 우리나라의 잠재성장률 저하, 인구고령화에 따른 투자수익률 제고 필요성 등 거시경제환경 변화를 반영한 것으로 볼 수 있으며 이러한 추세는 상당기간 지속될 것으로 보인다.

한편 이러한 해외금융투자의 증가로 은행보다 상대적으로 비은행금융기관의 중요성이 커지고 있다. 과거 수출입기업과 은행 중심의 외환거래보다 비은행금융기관을 중심으로 한 해외투자 등 자본거래가 전체 외환거래에서 차지하는 비중이 상대적으로 커지고 있는 것은 전 세계적인 추세라 할 수 있다. 국제결제은행의 조사에 따르면 국제외환거래에서 은행-비은행기관간(연기금 포함) 거래가 은행-은행, 은행-기업간 거래보다 커 가장 큰 비중을 차지하는 것으로 조사되었다.3) 우리나라에서도 향후 해외금융투자 규모가 꾸준히 증가하면서 비은행금융기관의 역할이 계속 확대될 것으로 예상되므로 지금과 같은 외국환은행 중심의 법 관리체계(외국환은행중심주의)에 대해서는 보완이 필요할 것으로 생각된다.

라. 새로운 대외지급 수단 및 방법의 출현

최근 디지털금융의 확산으로 전통적인 대외지급수단 외에 가상자산이나 간편결제서비스 등 새로운 지급수단과 방법이 등장하며 외국환거래법 체계에 새로운 과제를 제시하고 있다. 현행 외국환거래법에서 정의하는 외국환의 종류는 대외지급수단(외국통화), 외화증권, 외화파생상품, 외화채권 등으로 한정하고 있어 이러한 새로운 지급수단에 대한 규율체계가 부재한 상황이다.

현재 외국환거래법상 가상자산의 성격에 대해 정해진 바는 없으며 가상자산 매매목적의 송‧수금은 제한하고 있다. 일부 외국계회사는 온라인 간편결제서비스를 제공하며 사실상의 선불전자지급, PG업, 소액송금업 등을 영위하고 있으나 현재 미등록상태로 외국환거래법의 적용에서 배제되어 있다. 뿐만 아니라 향후 중앙은행의 디지털화폐(CBDC)가 국가간 결제에 활용될 경우 외국환거래법과의 정합성 문제가 제기될 가능성도 있을 것으로 보인다.

따라서 금융의 디지털화 가속화로 새로운 대외지급 수단 및 방법이 등장하고 있는 만큼 외국환거래법이 이에 대한 새로운 규율방법을 모색해 나갈 필요가 커지고 있다.

2. 법 운영에 대한 평가

위에서 살펴본 바와 같이 우리나라는 지난 20여년간 거시경제환경의 변화에도 불구하고 1997년과 2008년 두 차례 위기의 경험과 이후에도 지속된 대외불확실성 등으로 외국환거래법의 도입 당시 취지와 달리 대외안정의 유지를 최우선적으로 중시하면서 운영되어 왔다. 특히 외화 부족에 따른 유동성위기의 트라우마가 많은 경제주체들에게 잠재하고 있어 국가간 원활한 자본이동보다는 외자유출 억제의 철학이 법의 운영 전반에 자리 잡고 있고 대외불확실성에 따른 환율변동성에 대해서도 과도한 우려를 갖는 결과를 초래하였다.

우리나라에서 대외부문의 안정을 위한 보수적인 법 운영은 불가피한 측면이 있고 대외건전성 유지에 기여한 바도 적지 않은 것으로 판단되나 한편으로는 이러한 정책운영의 결과 거래자유화 및 시장기능 활성화의 달성에는 다소 소극적으로 대응해 온 것으로 생각된다. 법의 제정 당시 암묵적으로 외자유출 억제와 변동성 완화를 위해 도입되었던 자본거래 사전신고제나 대외지급시 절차적 규제, 금융기관별 외국환업무 제한 등이 여전히 상존하면서 새로운 거시경제환경에 효과적으로 대응하지 못하고 법의 도입취지와 달리 실제에 있어서는 대외거래 및 외환부문에 대한 조정 및 관리 방식으로 운영되어 왔다고 할 수 있다.

그러나 최근 우리나라의 거시경제환경의 긍정적 변화를 감안할 때 이러한 조치들이 경제주체들에게 주는 불편과 비효율성에 비해 대외건전성 유지에 큰 실익이 있는 것인지는 명확하지 않은 것으로 판단된다. 자본거래 사전신고제의 경우 거래의 자율성과 편의성을 저해하고 거래를 위축시키는 결과를 초래하고 있는 데 반해 대외건전성을 유지하는 효과적인 수단으로 보기 어렵다. 또한 비은행금융기관에 대한 외국환업무의 제한과 은행을 통한 대외지급 체계의 유지는 외환부족 시절에서 비롯된 외자유출 억제의 철학과 외환부문의 변동성 완화를 기저에 깔고 있어 최근의 거시경제환경 변화를 반영하지 못하고 오히려 금융산업의 균형적인 발전을 통한 외환부문의 대외건전성 제고에 역행하는 측면이 있는 것으로 판단된다.

따라서 법의 목적인 거래의 자유와 시장기능 활성화라는 측면과 대외부문의 안정 등 두 정책목표를 균형있게 달성해 나가기 위해서는 시장상황에 대한 모니터링이나 거시건전성정책 등을 통해 대외건전성의 유지 노력은 지속해 나가되, 외환부족 시기에 형성되었던 관리 및 조정을 위한 제반 조치와 규율체계에 대한 대폭적이고 획기적인 개편을 통해 국민불편 해소와 시장기능 활성화 그리고 금융산업의 균형적인 발전을 도모해 나가는 것이 필요한 시점으로 생각된다.

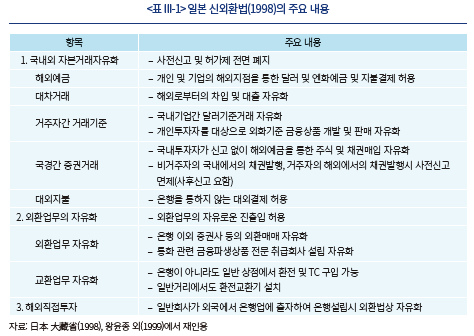

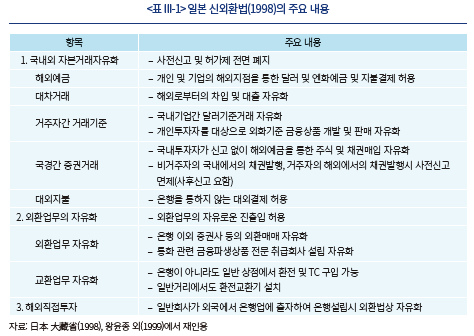

한편 1990년대 중반 대규모 경상수지 흑자, 경제성장률 저하, 인구노령화에 따른 투자수익률 제고 필요 등에 직면하였던 일본이 1998년 신외환법의 제정을 통해 금융빅뱅과 경제활력 제고에 나섰던 점은 최근 우리나라의 거시경제환경과 당시 일본의 여건이 매우 유사하고 우리나라의 외국환거래법 체계가 전통적으로 일본의 법체계를 상당부분 참고해 왔던 점에서 금번 외국환거래법 개편 과정에 시사하는 바가 클 것으로 생각된다.

당시 일본은 신외환법(1998)을 제정하면서 외환거래 완전자유화를 통해 해외로부터의 국민가처분소득 확대를 도모하였다. 이를 위해 일본의 신외환법에서는 현재 우리나라 외국환거래법의 근간을 이루고 있는 자본거래 사전신고제, 은행을 통한 대외지급 및 지불방법에 대한 규제, 은행중심의 외국환업무취급기관주의 등 대부분의 장치들이 전면적으로 폐지되었다. 개인이나 기업 등 모든 시장참가자의 외환업무 허용으로 자유로운 진입과 퇴출이 보장되었을 뿐만 아니라 이들의 해외 예금계좌의 개설 및 대금결제, 외화자금의 대차도 자유로이 허용되었다. 또한 경제안전 유지를 위한 일부 업종을 제외하고 자본거래의 사전신고제 또는 허가제를 완전히 폐지하였으며, 우리나라의 외국환업무취급기관제도와 유사한 외국환공인은행제도가 폐지되어 은행을 통한 대외 지급 및 영수 원칙이나 구체적인 대외지불방법에 대한 규제도 사라졌으며 은행의 대외거래 적법성 확인 등 위임사무도 모두 철폐되었다.

이러한 노력의 결과 일본의 대외투자가 크게 늘어나고 최근에는 경상수지 흑자의 대부분이 해외금융자산으로 부터의 안정적인 이자 및 배당 수입에서 발생함으로써 국민가처분 소득의 증가와 경제 활성화에 긍정적인 작용을 한 것으로 평가받고 있다. 이는 경상수지의 대부분을 무역수지에 의존하고 있어 글로벌 경기상황이나 무역갈등 등으로 경제의 변동성이 큰 우리나라와 차이를 보이는 것이다.4) 또한 일본 기업 등의 국제금융업무와 환헤지 거래가 국내외에서 보다 다양하고 편리하게 보장됨으로써 기업경쟁력 강화에 기여한 것으로 분석된다.5) 뿐만 아니라 금융기관의 국제금융역량도 강화되면서 일부 일본계 금융기관들이 글로벌투자은행으로 부상하는 계기가 된 것으로 보인다.

Ⅳ. 외국환거래법의 개편 필요성 및 방향

1. 국민불편 해소 및 거래자유 보장

외국환거래법은 그간 거시경제환경 변화에도 법의 근간을 유지한 채 부분 개편을 거듭한 결과 법령 체계가 이해하기 어렵고 다른 금융관련법과의 정합성이 결여되어 있다. 법령 체계상으로도 예외사항의 열거주의, 복잡성, 타법과의 이중규제 등의 문제점이 노정됨에 따라 일반 국민들이 부지에 의한 법령위반 사례가 빈번히 발생하고 금융기관의 경우에도 법조문의 이해와 이행에 많은 시간과 비용이 발생하고 있다.

특히 외국환은행을 제외한 다른 경제주체들이 각종 자본거래나 대외지급시 사전신고제나 사후보고 의무 등으로 거래의 편의성과 자율성이 크게 저해되고 있다. 자본거래의 경우 동일한 거래유형에 대해서도 거래규모, 거래상대방, 외환유출 여부 등에 따라 신고대상 여부 및 신고주체, 접수기관이 상이하다. 또한 신고예외 사항을 일일이 열거하는 방식을 취하고 있어 해당기관이 신고가 필요한 것인지 여부를 판단하기 어렵고 사전신고를 거치는 과정에서 금융환경 변화에 신속히 대응하기도 어렵다. 뿐만 아니라 대외건전성이나 모니터링 목적 이외의 실효성이 낮은 신고사항도 상존하고 있는데 대표적으로 해외직접투자의 경우 사전신고는 물론 사업실적에 대한 사후보고까지 정례적으로 요구받고 있다.

따라서 외국환거래법의 법령체계를 정비하고 각종 자본거래에 대한 사전신고제 재검토 등을 통해 국민불편을 해소하고 거래의 자율성 및 편의성을 제고하는 방향으로 개편될 필요가 있다. 법령체계에 있어서는 예외의 예외 등 법령해석을 어렵게 하는 조문을 정비하여 원칙-예외로 단순화하고 법-시행령-규정 체계를 일관성 있게 정비할 필요가 있다. 자본거래에 대한 사전신고 의무는 현재와 같이 외국환은행과 기타외국환업무취급기관 등 대상에 따라 차이를 두기보다는 경제주체들의 일상적 거래나 외화자금의 대외유출이 없는 거주자간 자본거래에 대해서는 사전신고제를 원칙적으로 폐지하고 사후보고 체계로 전환할 필요가 있다. 다만, 대외건전성에 영향을 미치거나 외환거래질서에 중대한 영향을 줄 수 있어 당국이 사전에 이를 파악할 필요가 있는 거래는 신고대상임을 명시적으로 규정하여 거래편의를 제고하고 규제합리화를 도모할 필요가 있다.

2. 금융산업 외환경쟁력의 균형적 발전

현행 외국환거래법은 외국환업무취급기관제도를 운영함에 따라 업권간 허용업무 범위에 있어 은행과 비은행금융기관에 대해 차이를 두고 있다. 은행의 경우 외국환업무를 은행의 본질적인 업무로 인정하여 법에서 규정한 모든 업무를 자유롭게 취급할 수 있는 데 반해 증권사 등 비은행금융기관의 경우 업무범위에 제약이 있다. 이러한 은행과 비은행금융기관간의 업무허용범위의 차이는 업권간 불평등 문제를 넘어서서 금융산업의 전체적인 외환경쟁력과 위기대응력을 약화시키는 요인으로 작용하고 있다.

대표적인 예로 코로나19 발생 직후 글로벌 주가하락시 국내 증권사의 ELS 마진콜 발생과 외화유동성 부족으로 원화환율이 급등한 경험은 비은행금융기관의 외환부문 취약성이 전체 외환시스템의 안정을 저해한 사례라 할 수 있다. 당시 외화유동성 위기에 대응한 증권사의 은행으로부터의 긴급한 외화차입은 외화대출 용도제한에 따라 제약을 받았으며 주된 외자조달 수단인 외환스왑(FX swap) 시장을 통한 외자조달의 경우에도 금융시장 불안 증폭을 우려한 은행들의 소극적 협조로 인해 결과적으로 현물환 외환시장에서 원화환율의 급등을 초래한 바 있다. 이는 외자의 조달과 운용에 있어 은행과 비은행금융기관의 업무취급범위 차이를 두고 있는 외국환업무취급기관제도에 근본 원인이 있다고 할 수 있다. 금융의 연계성이 더욱 강화되고 있는 최근의 시장상황에 비추어 볼 때 향후에도 비은행금융기관에서 발생한 대외건전성 위기는 은행은 물론 외환시스템 전체의 안정성을 위협할 가능성이 더욱 커지고 있다.

뿐만 아니라 최근 비은행금융기관을 통한 대내외 금융투자의 증가로 국경간 자본이동이 비약적으로 확대되고 있어 대외지급시 원칙적으로 은행만을 통하도록 하는 제도는 규제실익이 크지 않은 것으로 보인다. 이는 과거 외환부족 시절 은행에 대한 관리를 통해 외자유출을 억제하고자 하였던 과거의 관행으로서 대외채권국의 지위가 지속될 것으로 보이는 우리나라의 경우 제고해 볼 필요가 크다고 생각된다. 만약 거주자의 대외증권투자시 투자를 위한 외국환의 매매와 더불어 대외지급이 증권사를 통해 이루어질 경우 투자자의 편의가 향상될 뿐만 아니라 비은행금융기관의 종합적인 외환서비스 업무가 확충됨으로써 결과적으로 우리나라 금융산업의 외환 및 국제금융업무 역량이 커지고 대외건전성이 개선되는 효과가 나타날 수 있을 것으로 기대된다.

따라서 새로운 외국환거래법은 기관별 외국환업무의 허용범위 및 규율체계의 합리성과 일관성을 제고하고 금융산업의 균형적인 발전을 통해 외환경쟁력을 강화하는 방향으로 제정될 필요가 있다. 외국환업무 취급기관별로 모법에서 정한 본연의 업무 내에서 허용범위가 규정되어 있는 외국환업무를 업권별 구별 없이 동일하게 적용하거나 적어도 국가간 자금이동이 발생하지 않는 외국환거래와 구별함으로써 비은행금융기관에 대한 외국환업무 허용범위에 대한 제한을 과감히 철폐할 필요가 있다. 아울러 비은행금융기관의 업무범위 확대에 발맞추어 이들 기관에 대해서도 은행과 마찬가지의 동일업무-동일규제 체계를 적용하고 모니터링 체계를 강화함으로써 금융산업 전체의 위기대응력 및 균형적인 발전을 통해 대외건전성을 강화해 나갈 필요가 있을 것으로 보인다.

3. 개방경제하의 경제 활력 제고

‘신외환법’은 우리나라의 잠재성장률 저하, 인구 고령화에 대비한 노후소득 확보 등 시대적 요구에 부응하고 경제활력 제고에 기여하는 방향으로 개편될 필요가 있다. 이를 위해서는 해외로부터의 투자자금의 유입과 해외로의 투자자금 유출이 양방향에서 모두 원활히 일어나도록 함으로써 외국환거래법의 출범 당시 계획했던 개방경제하의 이점을 극대화할 필요가 있다. 즉 외국인투자자의 안정적인 투자자금(in-bound)의 확보와 더불어 빠르게 늘어나고 있는 거주자의 해외금융투자(out-bound)가 국민가처분 소득을 효과적으로 증가시키는 데 기여토록 하는 것이 중요하다.

국내로의 외국인 투자자금을 안정적으로 확보하기 위해서는 외국인투자자의 외환거래 관련 제반 불편사항을 해소하고 대외신인도를 유지하는 것이 우선이다. 이를 위해서는 우리나라 자본시장 및 외환시장의 하부구조 선진화를 통해 외국인투자자의 국내시장 매력도를 높여나갈 필요가 있다. 이러한 노력을 통해 우리 주식시장의 MSCI 선진국지수 편입과 금융선진화를 자연스럽게 촉진하는 것이 중요한 과제로 인식되고 있다.

또한 우리나라 거주자의 해외투자가 국민가처분 소득을 증가시켜 경제 활력을 제고하고 노후소득 증가로 이어지도록 법체계를 정비해 나갈 필요가 있다. 이를 위해서는 거주자의 해외투자 편의성 제고는 물론 투자수익률 향상과 리스크 관리를 지원할 수 있는 방안을 강구해 나가는 것이 필요하다. 보다 장기적인 관점에서는 원화가 해외에서 자유로이 거래되는 국제통화로 자리매김해 나가도록 하는 것도 우리 경제주체들의 해외투자 편의증진과 소득 창출에 기여할 것으로 생각된다. 원화의 국제화를 위해서는 무엇보다 현재 법령에서 규정하고 있는 비거주자의 원화조달에 대한 제약을 완화하고 원화계정에 대한 예치 및 처분사유를 확대하여 비거주자의 원화에 대한 접근성을 높여나가는 것이 선행과제라 할 것이다.

다만, 개방경제하의 경제활력 제고를 위한 국경간 자본유출입의 확대는 금융시장의 변동성 증가요인이 될 수 있는 만큼 법의 목적에 대외거래의 조정 및 관리 대신에 대외건전성의 유지를 명시하고 비상시에 대비한 안전장치도 정비할 필요가 있다. 현재 유사시 안전장치의 내실을 기하기 위해서는 평상시와 위기시를 구분하여 대응조치를 명확히 함으로써 국내외 투자자들의 예측가능성을 제고하고 비상대응조치의 실효성을 높이는 방안을 마련할 필요가 있을 것으로 보인다.

최근 대내외 금융시장의 불확실성이 지속되고 원화환율이 가파르게 상승하면서 일부에서 외국환거래법 개편을 통한 거래자유화 및 시장기능 활성화 노력에 대해 우려를 제기할 수 있겠으나 금번 외국환거래법 체계의 개편은 새로운 거시경제환경하에서 우리나라의 대외건전성을 구조적으로 강화시켜 외부충격에 대한 위기대응력을 궁극적으로 높이는 데 기여한다는 점에서 시장상황과 무관하게 차분하고 면밀히 추진되어야 할 과제로 생각된다.

1) 여기서 외국환업무란 법 제3조에 명시된 바와 같이 외국환의 발행 또는 매매, 대한민국과 외국간의 지급ㆍ추심(推尋) 및 수령, 외국통화로 표시되거나 지급되는 거주자와의 예금, 금전의 대차 또는 보증, 비거주자와의 예금, 금전의 대차 또는 보증, 그 밖에 이와 유사한 업무로서 대통령령으로 정하는 업무(비거주자와의 원화 증권 또는 원화 채권의 매매, 거주자간의 신탁 보험 및 파생상품거래 또는 거주자와 비거주자간의 신탁 보험 및 파생상품거래 등)를 말한다.

2) 이에 관해서는 시행령 제14조 참조

3) BIS(2019) 자료에 따르면 전세계 외환시장에서 은행-은행, 은행-비은행금융기관, 은행-기업의 외환거래 비중은 각각 38.3%, 54.5%, 7.2%인 것으로 나타났다.

4) 두 나라의 경상수지 흑자 구성을 보면 한국의 경우 2020~2021년 기간중 경상수지 흑자(1,642억달러)중 본원소득수지는 328억달러 흑자를 보여 19.9%를 차지하였으나 일본의 경우에는 같은 기간중 본원소득수지(3,660억달러)가 경상수지흑자 총액(2,894억달러)의 126.4%에 달하였다.

5) 이에 관해서는 왕윤종 등(1999) 참조

참고문헌

김성욱, 2022. 7, 新외환법 제정 필요성 및 기본방향, 신외환법 제정방향 세미나 발표자료.

서문식, 2021, 『우리나라 외환관리』, 박영사.

왕윤종‧정재완‧김종근‧이홍배, 1999, 주요 아시아 경쟁국 기업의 환위험 관리실태와 시사점, 『대외경제정책연구원 KIEP정책연구』 99-04.

이승호, 2022, 거시경제환경 변화에 따른 외국환거래법의 개편 필요성과 방향, 자본시장연구원 『자본시장포커스』 2022-5호.

이승호, 2022. 7, 외국환거래법 현황과 개편 필요성, 신외환법 제정방향 세미나 발표자료.

이지평, 1998, 일본 신외환법 이후 저팬머니의 향방, LG경제연구원 LG주간경제.

조지은, 2021. 11, 우리나라 외환거래제도의 이해, 한국은행 금요강좌 제867회 발표자료.

한국은행, 2016, 『한국의 외환제도와 외환시장』.

BIS, 2019, Triennial Central Bank Survey of Foreign Exchange and Over-the-counter (OTC) Derivatives Markets in 2019.

日本 大藏省, 1998, 外國換 及 外國貿易法 拔本 改正.

외국환거래법(Foreign Exchange Transaction Act)은 우리나라의 모든 대외거래 및 외환거래를 총괄하는 법으로서 외환위기 직후인 1990년대말 제정된 이후 지금까지 법체계를 유지해 오고 있다. 제정 당시 우리나라는 외화유동성의 절대적 부족으로 인한 원화환율의 급등과 대외건전성의 약화로 경제가 큰 어려움에 처해 있었던 상황을 반영하여 외국환거래법은 대외거래의 자유화와 시장기능의 활성화를 추진하는 동시에 한편으로는 대외안정을 유지하기 위한 조치들을 법에 반영하여 제정되었다. 또한 2008년 발생한 글로벌 금융위기를 비롯하여 이후에도 유럽재정위기, 미국 등 선진국의 통화정책 급변 등 지속적으로 발생하는 대외불확실성으로 말미암아 외국환거래법은 암묵적으로 외자의 유출을 억제하고 환율의 급변동을 완화하는 방향으로 운영되어 왔다.

그 결과 법의 도입취지인 대외거래의 자유화나 시장기능의 활성화보다는 상대적으로 거시건전성정책 등을 통한 대외건전성의 유지에 치중해 온 측면이 있다. 특히 법 제정 당시의 주요 특징이라 할 수 있는 자본거래 사전신고제, 대외지급 및 수령시 절차적 규제, 외국환업무취급기관에 대한 차별적 업무범위 등이 법의 근간을 이루고 있어 대외안정에 기여하는 실익에 비해 많은 정책비용과 국민 불편, 금융산업의 균형적인 발전 저해 등 부정적 측면도 상존하고 있는 것으로 판단된다.

최근 우리나라의 대외여건 및 거시금융환경의 변화로 외국환거래법의 전면적인 개편 필요성이 커지고 있다. 우리나라는 과거의 외환부족 국가에서 벗어나 이미 자본수출국으로 이행하였으며 대외부문의 위기대응력도 과거에 비해 훨씬 높아졌다. 특히 대규모 경상수지 흑자로 풍부해진 외화유동성은 경제주체들의 해외금융저축의 형태로 변모하고 있으며 이 과정에서 비은행금융기관의 중요성이 크게 높아지고 있다. 이러한 거시경제환경 변화는 현재의 외국환거래법에 상존하고 있는 외자유출 억제의 철학과 외국환은행 중심의 법 운영체계에도 한계가 커지고 있음을 의미한다.

지난해 이후 우리 정부도 이런 거시경제환경 변화를 반영하여 외국환거래법에 대한 개편논의와 준비를 적극적으로 진행중이다. 이번 개편은 과거 어느 때보다 전면 개편에 대한 필요성이 큰 것으로 인식되는 가운데 지금까지의 부분적인 수정을 넘어서 ‘신외환법’의 탄생을 목표로 내년중 법의 제정과 하위규정의 개정을 계획중이다. 이런 점에서 본 보고서는 거시경제환경 변화를 감안한 외국환거래법의 개편 필요성에 대해 분석하고 바람직한 개편방향을 모색해 보고자 한다. 보고서의 구성은 제II장에서 외국환거래법의 의의 및 변천과정과 주요 특징을 설명하였다. 제III장에서는 그간 우리나라의 거시경제환경 변화와 현재 법 운영의 현주소를 진단해 보았다. 제IV장에서는 외국환거래법의 개편 필요성과 바람직한 개편 방향을 제시하였다.

Ⅱ. 외국환거래법의 의의 및 특징

1. 의의 및 변천과정

외국환거래법(Foreign Exchange Transaction Act)은 우리나라의 모든 대외거래 및 외환거래를 총괄하는 법으로서 법의 목적은 “외국환거래와 그 밖의 대외거래의 자유를 보장하고 시장기능을 활성화하여 대외거래의 원활화 및 국제수지의 균형과 통화가치의 안정을 도모함으로써 국민경제의 건전한 발전에 이바지함을 목적으로 한다”로 명시(법 제1조)되어 있다. 이를 크게 나누어 보면 거래의 자유와 시장기능 활성화라는 측면과 국제수지의 균형 및 안정이라는 측면을 동시에 도모하여 외환위기를 벗어나 명실상부한 개방경제 체제로의 전환을 모색한 것으로 볼 수 있다.

외국환거래법의 적용범위는 거주자와 비거주자간에 발생하는 모든 대외거래는 물론 거주자간에 발생하는 외환거래, 그리고 비거주자간에 발생하는 원화거래도 모두 포함하고 있다. 국제수지 통계에 포착되는 모든 대외거래의 경우에는 원화와 외화에 대해 모두 적용된다. 국가간 자본유출입이 발생하는 대외거래는 금융 및 외환시장에 직접적인 영향을 주는 데 반해 국내에서 거주자간에 발생하는 외환거래의 경우에는 대외건전성에 미치는 직접적인 영향이 크지 않다는 점에서 법의 적용범위에 관한 조정 필요성이 제기되고 있다. 또한 아직까지 원화가 국제화되지 않아 비거주자간의 원화거래가 실제 미미한 수준임에도 현행 외국환거래법은 이를 법의 적용범위에 포함하고 있다.

우선 글로벌 금융위기 이전까지는 외국환거래법의 목표를 달성하기 위해 부분적인 자유화가 꾸준히 진행되었다. 2002년 7월부터 시행된 제1차 외환자유화 조치에서는 개인의 증여성송금 자유화, 증권사 및 보험사의 은행간외환시장 참여 허용, 원화수출 자유화 및 비거주자 원화차입한도 확대 등의 조치가 이루어졌다. 2006년 1월부터 시행된 제2차 외환자유화 조치에서는 자본거래 허가제가 신고제로 전환되었으며 자본거래의 지급증빙서류 제출의무 폐지, 대외채권 회수의무 면제허가의 신고제 전환, 지정거래외국환은행제도 폐지 등도 시행되었다. 2009년 7월부터 시행 예정이었던 제3단계 자유화 조치 계획에는 외환자유화의 마지막 단계라 할 수 있는 원화의 국제화 추진과 외국환거래법을 폐지한 후 신외환법의 시행 계획까지 포함하였으나 2008년 발생한 글로벌 금융위기로 계획이 전면 중단된 채 현재에 이르고 있다.

한편 글로벌 금융위기 이후에는 대외불확실성의 지속에 따라 외환부문의 자유화를 위한 조치들이 큰 진전을 보이지 못하였다. 즉, 제1차 및 제2차 유럽재정위기, 미국의 테이퍼텐트럼(taper tantrum) 등 대외불확실성의 지속으로 법의 도입당시 표방하였던 거래자유화를 위한 조치들은 보류된 채 주로 대외부문의 안정달성을 위한 각종 거시건전성정책(macro-prudential policy)들이 도입되었다. 선물환포지션한도, 은행세, 외화LCR 도입 등이 대표적인데 이러한 조치들은 우리나라 대외부문의 취약성 극복과 안정에 기여한 것으로 평가받고 있다. 2015년에는 비은행금융기관의 외국환업무와 관련하여 외국환거래규정에서 허용가능업무를 일일이 열거하던 방식에서 자본시장법 등 해당기관의 모법에서 허용된 업무와 직접 관련이 있는 경우 원칙적으로 외국환업무를 영위할 수 있도록 변경하였으나 거래유형에 따라 사전신고제를 유지하고 있다.

한편 최근에는 금융산업의 새로운 환경변화를 반영하여 PG업자의 송·수금 허용(2015년), 소액 해외송금업 및 온라인환전업(2018년) 신설 등 핀테크를 외환법령의 영역에 포함하였다. 그러나 핀테크(FinTech) 산업 육성을 위한 이러한 조치들은 오히려 비은행금융기관과의 업무허용 범위에 대한 형평성 문제가 제기되는 결과를 초래하기도 하였다. 그 결과 2018년 이후에는 증권사 등 비은행금융기관에 대해서도 소액해외송금이 허용되었다.

외국환거래법은 제정 당시 우리나라의 외환부족에서 비롯된 외환위기라는 특수한 경험을 시대적 배경으로 하고 있어 다음과 같은 제도적 특징을 아직까지 유지하고 있다. 이에는 자본거래 사전신고제, 지급 및 수령시 절차적 규제, 외국환업무취급기관주의, 유사시 안전장치 및 모니터링 등이라 할 수 있는데 아래에서는 이에 대해 간략히 살펴보았다.

가. 자본거래 사전신고제

1990년대를 거치면서 수출입 등 경상거래가 완전 자유화된 것과 달리 대부분의 자본거래에 대해서는 사전에 기획재정부나 한국은행 또는 외국환은행에 신고토록 하고 있다. 다만, 외국환업무취급기관이 외국환업무1)로서 수행하는 거래는 신고가 면제되나 이 경우에도 외환거래질서를 해칠 우려가 있거나 급격한 외자유출입을 야기할 위험이 있는 경우에는 신고토록 하고 있다. 이는 자본거래의 경우 경상거래와 달리 거래의 진위여부를 파악하기 곤란하고 자본유출입에 따른 금융시장의 변동성 확대 등 부정적 측면이 상대적으로 큰 특징이 있는 점을 고려한 것이다.

신고대상에 있어서는 외국환업무를 본연의 업무로 인정받는 외국환은행에 대해서는 대부분 사전신고 의무가 면제되나 증권사나 보험사 등 기타외국환업무취급기관이나 기업, 개인 등 여타 경제주체들은 신고의무를 갖는다고 할 수 있다. 현행 외국환거래규정에서 신고대상 자본거래의 종류는 <표 II-3>과 같이 구분하고 규정하고 있다.

뿐만 아니라 증권회사와 같은 비은행금융기관의 경우 해당 자본거래가 사전신고 대상 거래인지의 여부를 판단하기 위해 당국의 유권해석을 받아야 하는 경우도 빈번한데 이는 해당 자본거래가 자본시장법에서 허용하는 금융회사의 본질적 업무와 직접 관련된 외국환업무인지가 불분명한 경우가 존재하기 때문이다. 이런 점에서 그동안 수차례 자본거래 사전신고제에 대한 폐지 또는 완화 논의가 있었으나 대외건전성 관리 및 모니터링 목적을 위해 현재까지 유지되고 있다.

나. 지급 및 수령시 절차적 규제

외국환거래법은 대외거래에 따른 자금의 대외지급시 원칙적으로 외국환은행을 통한 송금방식으로 하도록 하고 있다. 이때 외국환은행은 지급의 사유와 금액을 입증하는 서류를 제출받아 당해 지급이 법령에 의한 신고 등의 대상인지 여부를 확인한다. 경상거래의 경우 허가나 사전신고가 불필요하나 자본거래에 대해서는 사전신고를 거친 경우에만 자금의 결제가 가능하도록 하고 있으며 은행은 이를 확인할 의무를 지니고 있다. 비거주자의 경우에는 자금취득 경위에 대한 입증서류를 제출하여 외국환은행의 확인을 받은 후 해외송금 등 지급이 가능하도록 하고 있다.

최근에는 핀테크 활성화를 배경으로 소액송금업자에 대해 연간 5만불, 건당 5천불 범위내의 소액송금을 허용함으로써 외국환은행을 통하지 않는 거래가 가능해졌다. 아울러 증권회사에 대해서도 동일한 소액송금업무를 허용한 바 있다. 그러나 소액해외송금은 규모 면에서 은행에 비해 미미한 수준으로 우리나라의 경우 아직까지 외환의 대외지급이나 해외로부터의 수령은 외국환은행을 통하는 방식을 엄격히 유지하고 있다고 할 수 있다. 대외지급과 관련한 이러한 절차적 규제에 따라 증권사 등이 해외투자와 관련하여 해외송금을 할 필요가 있는 경우 다시 은행을 경유하여 자금을 송금하여야 한다.

외국환은행을 통한 지급 및 수령의 경우라 하더라도 비정형적인 거래의 경우에는 불법적인 외화유출입 수단으로 악용될 소지가 있다는 점에서 사전신고 또는 확인절차를 거치게 하도록 하고 있다. 그 예로는 상계에 의한 지급, 기간초과 지급, 제3자지급 등을 들 수 있다. 상계지급의 경우 거래의 존재여부나 거래규모를 파악하기 곤란하고, 기획재정부 장관이 정한 기간을 초과하여 지급하는 경우 사실상 금전대차의 성격을 가지는 것으로 보며, 제3자지급의 경우에는 거래의 진위여부의 확인이 어렵기 때문이다.

다. 외국환업무취급기관주의

우리나라에서 금융기관이 외국환업무를 영위하기 위해서는 충분한 자본ㆍ시설 및 전문인력을 갖추어 우선 기획재정부장관에게 외국환업무취급기관으로 등록하여야 한다. 일정요건에는 금융기관의 자본규모나 재무구조 등 자본요건, 외환정보집중기관인 한국은행과 전산망이 연결되어 있는 시설요건, 그리고 적정한 인력요건을 말한다.

외국환거래법상 외국환업무취급기관은 외국환은행과 기타외국환업무취급기관으로 구분된다. 외국환은행의 경우에는 모든 외국환업무를 취급할 수 있으며 대부분의 경우 거래를 위한 사전신고 의무가 면제된다. 반면 기타외국환업무취급기관은 각 기관의 모법에서 정한 당해 기관의 업무와 직접적으로 관련된 경우에 한하여 외국환업무의 취급이 가능하나2) 많은 경우 사전신고를 통해 업무와의 직접 관련성 여부를 확인받아야 한다.

예를 들어 증권사의 경우 법에 명시된 외국환업무 중 우리나라와 외국간의 지급ㆍ추심(推尋) 및 수령, 외국통화로 표시되거나 지급되는 거주자와의 예금, 금전의 대차 또는 보증, 비거주자와의 예금, 금전의 대차 또는 보증 등은 직접 연관성을 인정받지 못하고 있어 거래가 원칙적으로 허용되지 않는다. 다시 말하여 은행법에서 정한 은행의 고유업무라 할 수 있는 예금 및 계좌개설, 외국환은행으로부터의 외화차입, 개인을 대상으로 한 투자목적 이외의 외국환 매매(일반환전) 등은 원칙적으로 허용되지 않고 있으며 투자목적 자금의 경우에도 소액 이외의 해외송금은 허용되지 않는다.

라. 유사시 안전장치 및 모니터링

우리나라의 외국환거래법은 외화유동성 위기 등 비상사태에 대비하여 안전장치를 두고 있으며 사전적인 모니터링을 명시하고 있다. 즉, 천재지변, 전시∙사변, 국내외 경제사정의 중대하고도 급격한 변동, 기타 이에 준하는 사태발생시 비상조치권(safeguard)을 취할 수 있도록 하고 있으나(법 제6조) 아직까지 발동된 예는 없다. 이러한 안전장치에는 대외거래의 일시 정지, 외환집중제, 대외채권회수, 자본거래허가제, 가변예치의무제 등이 포함된다.

또한 평상시에도 외환정보에 대한 모니터링을 강화하는 방향으로 운영되고 있다. 이를 위해 외환전산망을 운영하고 있으며 한국은행을 외환정보집중기관으로 지정하고 외환전산망을 통해 입수한 정보를 국세청, 금융감독원, 정보분석원(FIU) 등 관련 기관에 제공하고 있다. 이러한 모니터링 체계의 강화는 거래의 자율성을 보장하되 대외부문의 안정성에 영향을 줄 수 있는 제반거래를 사전에 파악하여 대외건전성을 유지하기 위한 목적에 따른 것이라 할 수 있다.

Ⅲ. 거시경제환경 변화와 법 운영 평가

이 장에서는 외국환거래법의 제정 이후 최근까지 우리나라의 거시경제환경 변화를 살펴본 후 현행 외국환거래법의 실제 운영을 도입당시 취지에 비추어 평가해보았다. 아울러 일본의 신외환법 도입(1998년) 배경 및 주요 내용을 간략히 살펴보았다.

1. 거시경제환경 변화

가. 외환부족국에서 순대외채권국으로 이행

우리나라는 1997년 외환위기 직후인 외국환거래법의 제정 당시 외환의 절대적인 부족국가에서 벗어나 이미 풍부한 외환을 보유한 자본수출국으로 이행하였다. 이는 무엇보다 2000년대 이후 대규모 경상수지 흑자 기조가 정착된 데 기인한다. 2010~2021년중 우리나라의 경상수지 흑자 규모는 기간중 총 8,333억달러로 GDP대비 4.6%(기간중 연평균)에 달한다. 이러한 대규모 경상수지 흑자는 거주자들의 해외금융저축 증가로 나타나고 있는데 그 결과 2015년 이후에는 민간부문의 대외채권이 대외부채를 상회하는 순대외채권국으로 전환되었다. 2021년말 기준 민간부문의 순대외채권 잔액은 4,479억달러에 달한다.

이는 우리나라가 과거 경험한 외화유동성 부족에 따른 위기시와 뚜렷한 차이를 보이는 것으로서 향후에도 대외불확실성이나 외국인의 급격한 외자유출이 발생하더라도 외화유동성 위기로 발전할 가능성은 크지 않은 상황임을 의미한다. 따라서 암묵적으로 외자유출의 억제를 도모하고 있는 지급이나 수령시 절차적 규제, 외국환업무취급기관주의 등 현행 외국환거래법의 운영체계 전반에 변화가 필요함을 시사하는 것으로 생각된다.

과거에 비해 우리나라의 위기대응역량 또한 큰 폭으로 확충되었다. 이는 국가 전체적으로 외화유동성의 확충과 더불어 외채구조가 건실해졌을 뿐만 아니라 외국환거래법 하에서 다양한 거시건전성정책의 도입으로 대외충격에 대한 사전적, 사후적 대응체계가 정비된 데 기인한다.

그 예로 우리나라 외환당국이 보유하고 있는 외환보유액은 단기외채의 3배 수준에 달하여 비상시 최종대부자(lender of last resort)로서의 유동성 공급기능에 어려움이 없는 수준이다. 총외채중 단기외채가 차지하는 비중도 30% 이하 수준을 유지하며 외채구조가 안정적으로 개선되었다. 뿐만 아니라 글로벌 금융위기 이후 선물환포지션한도, 은행세 등이 도입되며 급격한 외자유입과 외채증가를 억제하고 경기순응성(pro-cyclicality)에 기인한 대외부문의 복원력(resilience)이 크게 향상된 것으로 평가받는다.

다. 해외투자 및 비은행금융기관의 중요성 증가

2000년대 이후 전 세계적으로 국제자본이동이 확대되고 자본거래의 상대적 중요성이 과거보다 훨씬 커지고 있는 가운데 우리나라의 해외금융투자가 급증하고 있는 점은 주요한 특징이라 할 수 있다. 즉, 2000년 이후 최근까지 우리나라에 대한 외국인들의 국내투자 증가로 대외금융부채는 약 6배 증가하는 데 그친 반면 거주자의 해외투자에 따른 대외금융자산은 무려 21배나 증가하였다. 여기에는 해외 주식 및 채권 등 증권투자가 가장 큰 비중을 차지하고 있다.

이는 경상수지 흑자에 따른 잉여 외환의 투자수익률 제고를 위해 글로벌 금융시장으로 투자처를 확대해 나가고 있는 데 따른 것으로 우리나라의 잠재성장률 저하, 인구고령화에 따른 투자수익률 제고 필요성 등 거시경제환경 변화를 반영한 것으로 볼 수 있으며 이러한 추세는 상당기간 지속될 것으로 보인다.

라. 새로운 대외지급 수단 및 방법의 출현

최근 디지털금융의 확산으로 전통적인 대외지급수단 외에 가상자산이나 간편결제서비스 등 새로운 지급수단과 방법이 등장하며 외국환거래법 체계에 새로운 과제를 제시하고 있다. 현행 외국환거래법에서 정의하는 외국환의 종류는 대외지급수단(외국통화), 외화증권, 외화파생상품, 외화채권 등으로 한정하고 있어 이러한 새로운 지급수단에 대한 규율체계가 부재한 상황이다.

현재 외국환거래법상 가상자산의 성격에 대해 정해진 바는 없으며 가상자산 매매목적의 송‧수금은 제한하고 있다. 일부 외국계회사는 온라인 간편결제서비스를 제공하며 사실상의 선불전자지급, PG업, 소액송금업 등을 영위하고 있으나 현재 미등록상태로 외국환거래법의 적용에서 배제되어 있다. 뿐만 아니라 향후 중앙은행의 디지털화폐(CBDC)가 국가간 결제에 활용될 경우 외국환거래법과의 정합성 문제가 제기될 가능성도 있을 것으로 보인다.

따라서 금융의 디지털화 가속화로 새로운 대외지급 수단 및 방법이 등장하고 있는 만큼 외국환거래법이 이에 대한 새로운 규율방법을 모색해 나갈 필요가 커지고 있다.

2. 법 운영에 대한 평가

위에서 살펴본 바와 같이 우리나라는 지난 20여년간 거시경제환경의 변화에도 불구하고 1997년과 2008년 두 차례 위기의 경험과 이후에도 지속된 대외불확실성 등으로 외국환거래법의 도입 당시 취지와 달리 대외안정의 유지를 최우선적으로 중시하면서 운영되어 왔다. 특히 외화 부족에 따른 유동성위기의 트라우마가 많은 경제주체들에게 잠재하고 있어 국가간 원활한 자본이동보다는 외자유출 억제의 철학이 법의 운영 전반에 자리 잡고 있고 대외불확실성에 따른 환율변동성에 대해서도 과도한 우려를 갖는 결과를 초래하였다.

우리나라에서 대외부문의 안정을 위한 보수적인 법 운영은 불가피한 측면이 있고 대외건전성 유지에 기여한 바도 적지 않은 것으로 판단되나 한편으로는 이러한 정책운영의 결과 거래자유화 및 시장기능 활성화의 달성에는 다소 소극적으로 대응해 온 것으로 생각된다. 법의 제정 당시 암묵적으로 외자유출 억제와 변동성 완화를 위해 도입되었던 자본거래 사전신고제나 대외지급시 절차적 규제, 금융기관별 외국환업무 제한 등이 여전히 상존하면서 새로운 거시경제환경에 효과적으로 대응하지 못하고 법의 도입취지와 달리 실제에 있어서는 대외거래 및 외환부문에 대한 조정 및 관리 방식으로 운영되어 왔다고 할 수 있다.

그러나 최근 우리나라의 거시경제환경의 긍정적 변화를 감안할 때 이러한 조치들이 경제주체들에게 주는 불편과 비효율성에 비해 대외건전성 유지에 큰 실익이 있는 것인지는 명확하지 않은 것으로 판단된다. 자본거래 사전신고제의 경우 거래의 자율성과 편의성을 저해하고 거래를 위축시키는 결과를 초래하고 있는 데 반해 대외건전성을 유지하는 효과적인 수단으로 보기 어렵다. 또한 비은행금융기관에 대한 외국환업무의 제한과 은행을 통한 대외지급 체계의 유지는 외환부족 시절에서 비롯된 외자유출 억제의 철학과 외환부문의 변동성 완화를 기저에 깔고 있어 최근의 거시경제환경 변화를 반영하지 못하고 오히려 금융산업의 균형적인 발전을 통한 외환부문의 대외건전성 제고에 역행하는 측면이 있는 것으로 판단된다.

따라서 법의 목적인 거래의 자유와 시장기능 활성화라는 측면과 대외부문의 안정 등 두 정책목표를 균형있게 달성해 나가기 위해서는 시장상황에 대한 모니터링이나 거시건전성정책 등을 통해 대외건전성의 유지 노력은 지속해 나가되, 외환부족 시기에 형성되었던 관리 및 조정을 위한 제반 조치와 규율체계에 대한 대폭적이고 획기적인 개편을 통해 국민불편 해소와 시장기능 활성화 그리고 금융산업의 균형적인 발전을 도모해 나가는 것이 필요한 시점으로 생각된다.

한편 1990년대 중반 대규모 경상수지 흑자, 경제성장률 저하, 인구노령화에 따른 투자수익률 제고 필요 등에 직면하였던 일본이 1998년 신외환법의 제정을 통해 금융빅뱅과 경제활력 제고에 나섰던 점은 최근 우리나라의 거시경제환경과 당시 일본의 여건이 매우 유사하고 우리나라의 외국환거래법 체계가 전통적으로 일본의 법체계를 상당부분 참고해 왔던 점에서 금번 외국환거래법 개편 과정에 시사하는 바가 클 것으로 생각된다.

당시 일본은 신외환법(1998)을 제정하면서 외환거래 완전자유화를 통해 해외로부터의 국민가처분소득 확대를 도모하였다. 이를 위해 일본의 신외환법에서는 현재 우리나라 외국환거래법의 근간을 이루고 있는 자본거래 사전신고제, 은행을 통한 대외지급 및 지불방법에 대한 규제, 은행중심의 외국환업무취급기관주의 등 대부분의 장치들이 전면적으로 폐지되었다. 개인이나 기업 등 모든 시장참가자의 외환업무 허용으로 자유로운 진입과 퇴출이 보장되었을 뿐만 아니라 이들의 해외 예금계좌의 개설 및 대금결제, 외화자금의 대차도 자유로이 허용되었다. 또한 경제안전 유지를 위한 일부 업종을 제외하고 자본거래의 사전신고제 또는 허가제를 완전히 폐지하였으며, 우리나라의 외국환업무취급기관제도와 유사한 외국환공인은행제도가 폐지되어 은행을 통한 대외 지급 및 영수 원칙이나 구체적인 대외지불방법에 대한 규제도 사라졌으며 은행의 대외거래 적법성 확인 등 위임사무도 모두 철폐되었다.

Ⅳ. 외국환거래법의 개편 필요성 및 방향

1. 국민불편 해소 및 거래자유 보장

외국환거래법은 그간 거시경제환경 변화에도 법의 근간을 유지한 채 부분 개편을 거듭한 결과 법령 체계가 이해하기 어렵고 다른 금융관련법과의 정합성이 결여되어 있다. 법령 체계상으로도 예외사항의 열거주의, 복잡성, 타법과의 이중규제 등의 문제점이 노정됨에 따라 일반 국민들이 부지에 의한 법령위반 사례가 빈번히 발생하고 금융기관의 경우에도 법조문의 이해와 이행에 많은 시간과 비용이 발생하고 있다.

특히 외국환은행을 제외한 다른 경제주체들이 각종 자본거래나 대외지급시 사전신고제나 사후보고 의무 등으로 거래의 편의성과 자율성이 크게 저해되고 있다. 자본거래의 경우 동일한 거래유형에 대해서도 거래규모, 거래상대방, 외환유출 여부 등에 따라 신고대상 여부 및 신고주체, 접수기관이 상이하다. 또한 신고예외 사항을 일일이 열거하는 방식을 취하고 있어 해당기관이 신고가 필요한 것인지 여부를 판단하기 어렵고 사전신고를 거치는 과정에서 금융환경 변화에 신속히 대응하기도 어렵다. 뿐만 아니라 대외건전성이나 모니터링 목적 이외의 실효성이 낮은 신고사항도 상존하고 있는데 대표적으로 해외직접투자의 경우 사전신고는 물론 사업실적에 대한 사후보고까지 정례적으로 요구받고 있다.

따라서 외국환거래법의 법령체계를 정비하고 각종 자본거래에 대한 사전신고제 재검토 등을 통해 국민불편을 해소하고 거래의 자율성 및 편의성을 제고하는 방향으로 개편될 필요가 있다. 법령체계에 있어서는 예외의 예외 등 법령해석을 어렵게 하는 조문을 정비하여 원칙-예외로 단순화하고 법-시행령-규정 체계를 일관성 있게 정비할 필요가 있다. 자본거래에 대한 사전신고 의무는 현재와 같이 외국환은행과 기타외국환업무취급기관 등 대상에 따라 차이를 두기보다는 경제주체들의 일상적 거래나 외화자금의 대외유출이 없는 거주자간 자본거래에 대해서는 사전신고제를 원칙적으로 폐지하고 사후보고 체계로 전환할 필요가 있다. 다만, 대외건전성에 영향을 미치거나 외환거래질서에 중대한 영향을 줄 수 있어 당국이 사전에 이를 파악할 필요가 있는 거래는 신고대상임을 명시적으로 규정하여 거래편의를 제고하고 규제합리화를 도모할 필요가 있다.

2. 금융산업 외환경쟁력의 균형적 발전

현행 외국환거래법은 외국환업무취급기관제도를 운영함에 따라 업권간 허용업무 범위에 있어 은행과 비은행금융기관에 대해 차이를 두고 있다. 은행의 경우 외국환업무를 은행의 본질적인 업무로 인정하여 법에서 규정한 모든 업무를 자유롭게 취급할 수 있는 데 반해 증권사 등 비은행금융기관의 경우 업무범위에 제약이 있다. 이러한 은행과 비은행금융기관간의 업무허용범위의 차이는 업권간 불평등 문제를 넘어서서 금융산업의 전체적인 외환경쟁력과 위기대응력을 약화시키는 요인으로 작용하고 있다.

대표적인 예로 코로나19 발생 직후 글로벌 주가하락시 국내 증권사의 ELS 마진콜 발생과 외화유동성 부족으로 원화환율이 급등한 경험은 비은행금융기관의 외환부문 취약성이 전체 외환시스템의 안정을 저해한 사례라 할 수 있다. 당시 외화유동성 위기에 대응한 증권사의 은행으로부터의 긴급한 외화차입은 외화대출 용도제한에 따라 제약을 받았으며 주된 외자조달 수단인 외환스왑(FX swap) 시장을 통한 외자조달의 경우에도 금융시장 불안 증폭을 우려한 은행들의 소극적 협조로 인해 결과적으로 현물환 외환시장에서 원화환율의 급등을 초래한 바 있다. 이는 외자의 조달과 운용에 있어 은행과 비은행금융기관의 업무취급범위 차이를 두고 있는 외국환업무취급기관제도에 근본 원인이 있다고 할 수 있다. 금융의 연계성이 더욱 강화되고 있는 최근의 시장상황에 비추어 볼 때 향후에도 비은행금융기관에서 발생한 대외건전성 위기는 은행은 물론 외환시스템 전체의 안정성을 위협할 가능성이 더욱 커지고 있다.

뿐만 아니라 최근 비은행금융기관을 통한 대내외 금융투자의 증가로 국경간 자본이동이 비약적으로 확대되고 있어 대외지급시 원칙적으로 은행만을 통하도록 하는 제도는 규제실익이 크지 않은 것으로 보인다. 이는 과거 외환부족 시절 은행에 대한 관리를 통해 외자유출을 억제하고자 하였던 과거의 관행으로서 대외채권국의 지위가 지속될 것으로 보이는 우리나라의 경우 제고해 볼 필요가 크다고 생각된다. 만약 거주자의 대외증권투자시 투자를 위한 외국환의 매매와 더불어 대외지급이 증권사를 통해 이루어질 경우 투자자의 편의가 향상될 뿐만 아니라 비은행금융기관의 종합적인 외환서비스 업무가 확충됨으로써 결과적으로 우리나라 금융산업의 외환 및 국제금융업무 역량이 커지고 대외건전성이 개선되는 효과가 나타날 수 있을 것으로 기대된다.

따라서 새로운 외국환거래법은 기관별 외국환업무의 허용범위 및 규율체계의 합리성과 일관성을 제고하고 금융산업의 균형적인 발전을 통해 외환경쟁력을 강화하는 방향으로 제정될 필요가 있다. 외국환업무 취급기관별로 모법에서 정한 본연의 업무 내에서 허용범위가 규정되어 있는 외국환업무를 업권별 구별 없이 동일하게 적용하거나 적어도 국가간 자금이동이 발생하지 않는 외국환거래와 구별함으로써 비은행금융기관에 대한 외국환업무 허용범위에 대한 제한을 과감히 철폐할 필요가 있다. 아울러 비은행금융기관의 업무범위 확대에 발맞추어 이들 기관에 대해서도 은행과 마찬가지의 동일업무-동일규제 체계를 적용하고 모니터링 체계를 강화함으로써 금융산업 전체의 위기대응력 및 균형적인 발전을 통해 대외건전성을 강화해 나갈 필요가 있을 것으로 보인다.

3. 개방경제하의 경제 활력 제고

‘신외환법’은 우리나라의 잠재성장률 저하, 인구 고령화에 대비한 노후소득 확보 등 시대적 요구에 부응하고 경제활력 제고에 기여하는 방향으로 개편될 필요가 있다. 이를 위해서는 해외로부터의 투자자금의 유입과 해외로의 투자자금 유출이 양방향에서 모두 원활히 일어나도록 함으로써 외국환거래법의 출범 당시 계획했던 개방경제하의 이점을 극대화할 필요가 있다. 즉 외국인투자자의 안정적인 투자자금(in-bound)의 확보와 더불어 빠르게 늘어나고 있는 거주자의 해외금융투자(out-bound)가 국민가처분 소득을 효과적으로 증가시키는 데 기여토록 하는 것이 중요하다.

국내로의 외국인 투자자금을 안정적으로 확보하기 위해서는 외국인투자자의 외환거래 관련 제반 불편사항을 해소하고 대외신인도를 유지하는 것이 우선이다. 이를 위해서는 우리나라 자본시장 및 외환시장의 하부구조 선진화를 통해 외국인투자자의 국내시장 매력도를 높여나갈 필요가 있다. 이러한 노력을 통해 우리 주식시장의 MSCI 선진국지수 편입과 금융선진화를 자연스럽게 촉진하는 것이 중요한 과제로 인식되고 있다.

또한 우리나라 거주자의 해외투자가 국민가처분 소득을 증가시켜 경제 활력을 제고하고 노후소득 증가로 이어지도록 법체계를 정비해 나갈 필요가 있다. 이를 위해서는 거주자의 해외투자 편의성 제고는 물론 투자수익률 향상과 리스크 관리를 지원할 수 있는 방안을 강구해 나가는 것이 필요하다. 보다 장기적인 관점에서는 원화가 해외에서 자유로이 거래되는 국제통화로 자리매김해 나가도록 하는 것도 우리 경제주체들의 해외투자 편의증진과 소득 창출에 기여할 것으로 생각된다. 원화의 국제화를 위해서는 무엇보다 현재 법령에서 규정하고 있는 비거주자의 원화조달에 대한 제약을 완화하고 원화계정에 대한 예치 및 처분사유를 확대하여 비거주자의 원화에 대한 접근성을 높여나가는 것이 선행과제라 할 것이다.

다만, 개방경제하의 경제활력 제고를 위한 국경간 자본유출입의 확대는 금융시장의 변동성 증가요인이 될 수 있는 만큼 법의 목적에 대외거래의 조정 및 관리 대신에 대외건전성의 유지를 명시하고 비상시에 대비한 안전장치도 정비할 필요가 있다. 현재 유사시 안전장치의 내실을 기하기 위해서는 평상시와 위기시를 구분하여 대응조치를 명확히 함으로써 국내외 투자자들의 예측가능성을 제고하고 비상대응조치의 실효성을 높이는 방안을 마련할 필요가 있을 것으로 보인다.

최근 대내외 금융시장의 불확실성이 지속되고 원화환율이 가파르게 상승하면서 일부에서 외국환거래법 개편을 통한 거래자유화 및 시장기능 활성화 노력에 대해 우려를 제기할 수 있겠으나 금번 외국환거래법 체계의 개편은 새로운 거시경제환경하에서 우리나라의 대외건전성을 구조적으로 강화시켜 외부충격에 대한 위기대응력을 궁극적으로 높이는 데 기여한다는 점에서 시장상황과 무관하게 차분하고 면밀히 추진되어야 할 과제로 생각된다.

1) 여기서 외국환업무란 법 제3조에 명시된 바와 같이 외국환의 발행 또는 매매, 대한민국과 외국간의 지급ㆍ추심(推尋) 및 수령, 외국통화로 표시되거나 지급되는 거주자와의 예금, 금전의 대차 또는 보증, 비거주자와의 예금, 금전의 대차 또는 보증, 그 밖에 이와 유사한 업무로서 대통령령으로 정하는 업무(비거주자와의 원화 증권 또는 원화 채권의 매매, 거주자간의 신탁 보험 및 파생상품거래 또는 거주자와 비거주자간의 신탁 보험 및 파생상품거래 등)를 말한다.

2) 이에 관해서는 시행령 제14조 참조

3) BIS(2019) 자료에 따르면 전세계 외환시장에서 은행-은행, 은행-비은행금융기관, 은행-기업의 외환거래 비중은 각각 38.3%, 54.5%, 7.2%인 것으로 나타났다.

4) 두 나라의 경상수지 흑자 구성을 보면 한국의 경우 2020~2021년 기간중 경상수지 흑자(1,642억달러)중 본원소득수지는 328억달러 흑자를 보여 19.9%를 차지하였으나 일본의 경우에는 같은 기간중 본원소득수지(3,660억달러)가 경상수지흑자 총액(2,894억달러)의 126.4%에 달하였다.

5) 이에 관해서는 왕윤종 등(1999) 참조

참고문헌

김성욱, 2022. 7, 新외환법 제정 필요성 및 기본방향, 신외환법 제정방향 세미나 발표자료.

서문식, 2021, 『우리나라 외환관리』, 박영사.

왕윤종‧정재완‧김종근‧이홍배, 1999, 주요 아시아 경쟁국 기업의 환위험 관리실태와 시사점, 『대외경제정책연구원 KIEP정책연구』 99-04.

이승호, 2022, 거시경제환경 변화에 따른 외국환거래법의 개편 필요성과 방향, 자본시장연구원 『자본시장포커스』 2022-5호.

이승호, 2022. 7, 외국환거래법 현황과 개편 필요성, 신외환법 제정방향 세미나 발표자료.

이지평, 1998, 일본 신외환법 이후 저팬머니의 향방, LG경제연구원 LG주간경제.

조지은, 2021. 11, 우리나라 외환거래제도의 이해, 한국은행 금요강좌 제867회 발표자료.

한국은행, 2016, 『한국의 외환제도와 외환시장』.

BIS, 2019, Triennial Central Bank Survey of Foreign Exchange and Over-the-counter (OTC) Derivatives Markets in 2019.

日本 大藏省, 1998, 外國換 及 外國貿易法 拔本 改正.