Find out more about our latest publications

Relationship between Inflation and Asset Returns: From the Perspective of Hedging against Inflation Risk

Issue Papers 22-25 Dec. 19, 2022

- Research Topic Macrofinance

- Page 28

As prices in major economies including Korea have hit record highs in several decades, inflation risk management has grown in importance. In this regard, this article analyzes the relationship between inflation and returns on major assets both in Korea and the US, and presents implications for hedging against the latest inflation risk. The analysis results can be summarized as follows.

First, the relationship between stock or bond prices and inflation could vary depending on whether the current inflation characteristic is counter-cyclical or pro-cyclical. In the counter-cyclical inflation period when rising prices exacerbate the real economy, higher inflation is likely to trigger the simultaneous decline in stock and bond prices. Second, it is hard to predict any change in commodity prices that are deemed a typical inflation hedge, owing to their unstable relation with inflation. Third, the sensitivity to inflation of real estate varies by nation. The correlation between real estate and inflation is positive in the US, while no significant correlation has been identified in Korea. Fourth, as for the Inflation Linked Korea Treasury Bond (KTBi) adopted for hedging against inflation risk, the short- or medium-term KTBi issued in the US and Korea, not a longer-term one, is more useful for inflation risk hedge over the short- and medium-term horizon.

Based on the analysis, this article offers the following implications. First of all, the recent inflation can be characterized by counter-cyclical factors. Therefore, even though stock and bond prices plunge, the response to inflation through diversified investments of stocks and bonds would entail risks. Given the recent trend in commodity prices, commodities are expected to serve as an effective tool to hedge against domestic inflation. However, it should be noted that commodities are useful for inflation hedge only to the extent that they act as determinants of domestic inflation. In addition, considering higher volatility in commodity prices, it is desirable to take into account the correlation between commodities and other assets for risk diversification before making investment decisions. What is also needed is a wide range of maturities for KTBi to hedge against inflation risk over the medium-term horizon. But various considerations except for inflation should be factored in to issue government bonds including KTBi. Hence, financial institutions need to provide support for investors’ inflation risk management through inflation derivatives.

First, the relationship between stock or bond prices and inflation could vary depending on whether the current inflation characteristic is counter-cyclical or pro-cyclical. In the counter-cyclical inflation period when rising prices exacerbate the real economy, higher inflation is likely to trigger the simultaneous decline in stock and bond prices. Second, it is hard to predict any change in commodity prices that are deemed a typical inflation hedge, owing to their unstable relation with inflation. Third, the sensitivity to inflation of real estate varies by nation. The correlation between real estate and inflation is positive in the US, while no significant correlation has been identified in Korea. Fourth, as for the Inflation Linked Korea Treasury Bond (KTBi) adopted for hedging against inflation risk, the short- or medium-term KTBi issued in the US and Korea, not a longer-term one, is more useful for inflation risk hedge over the short- and medium-term horizon.

Based on the analysis, this article offers the following implications. First of all, the recent inflation can be characterized by counter-cyclical factors. Therefore, even though stock and bond prices plunge, the response to inflation through diversified investments of stocks and bonds would entail risks. Given the recent trend in commodity prices, commodities are expected to serve as an effective tool to hedge against domestic inflation. However, it should be noted that commodities are useful for inflation hedge only to the extent that they act as determinants of domestic inflation. In addition, considering higher volatility in commodity prices, it is desirable to take into account the correlation between commodities and other assets for risk diversification before making investment decisions. What is also needed is a wide range of maturities for KTBi to hedge against inflation risk over the medium-term horizon. But various considerations except for inflation should be factored in to issue government bonds including KTBi. Hence, financial institutions need to provide support for investors’ inflation risk management through inflation derivatives.

Ⅰ. 논의 배경

금번 인플레이션은 일시적인 현상에 그칠 것이라는 당초 예상을 크게 벗어나며, 주요국 물가가 수십 년래 최고 수준을 기록하는 상황을 초래하였다. 각국 중앙은행의 긴축으로 인플레이션이 다소 완화될 수 있겠으나, 주요국간 지정학적 갈등 및 기후변화 대응 가속화 등의 영향으로 인플레이션 위험이 상당 기간 지속될 가능성이 제기되고 있다(Lagarde, 2022; Schnabel, 2022). 이런 가운데, 높은 인플레이션으로 경제주체의 어려움이 커지고, 금융시장에서는 주식과 채권을 포함하여 주요 자산 가격이 동반하여 크게 하락하는 등 금융불안이 확대되고 있다.

이와 같은 배경에서 인플레이션 위험관리의 중요성이 크게 부각되고 있다. 하지만, 최근의 높은 인플레이션은 수십 년간 경험되지 않은 현상인 만큼, 정책당국뿐만 아니라 금융시장참여자의 대응에 어려움이 많은 실정이다(ESMA, 2022; Neville et al., 2022). 이에, 본 연구에서는 인플레이션 위험 헤지 관점에서 인플레이션과 주요 자산가격 변화의 관계를 살펴보고자 한다.

본 연구의 구성은 다음과 같다. 우선, 인플레이션 위험의 개념 및 헤지의 경제적 의미를 살펴본다. 인플레이션 위험을 관리하기 위해서는 헤지해야 할 인플레이션 위험에 대한 이해가 선행될 필요가 있다. 다음으로, 기존연구의 논의에 기초하여 인플레이션의 경제적 특성이 인플레이션과 자산수익률간 관계에 미치는 영향을 알아본다. 실증분석에서는 국내 주요 자산수익률과 인플레이션간 관계를 살펴보고, 미국 사례와 비교해본다.

Ⅱ. 인플레이션과 자산수익률간 관계: 이론적 배경

인플레이션과 자산수익률간 관계는 다양한 관점에서 살펴볼 수 있겠으나, 본 고에서는 자산의 인플레이션 위험 헤지 특성에 초점을 맞춘다. 아래에서는 우선 인플레이션 위험 헤지의 개념을 알아본다. 다음으로 인플레이션의 경제적 특성이 주요 자산별 인플레이션 위험 헤지 성과에 미치는 영향을 살펴본다.

1. 인플레이션 위험 및 헤지의 개념

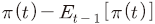

자산의 가격이 인플레이션만큼 변동하면 해당 자산은 인플레이션 변화를 헤지할 수 있는 것으로 볼 수 있다. 그런데, 최근 상황을 보면, 인플레이션은 절대 수준보다는 금융시장의 기대치와 다를 때 자산가격 변화에 미치는 영향이 크다는 점을 알 수 있다. 이는 자산가격이 예상 인플레이션 수준을 이미 반영하였기 때문으로 볼 수 있다. 따라서 현재( ) 시점의 실제 인플레이션(

) 시점의 실제 인플레이션( )을 과거 정보(

)을 과거 정보( )에 기초해 형성된 기대인플레이션(

)에 기초해 형성된 기대인플레이션( ) 및 실제 인플레이션과 기대인플레이션의 차이, 즉 인플레이션 충격(

) 및 실제 인플레이션과 기대인플레이션의 차이, 즉 인플레이션 충격( )으로 구분할 필요가 있다. 본 연구에서는 Fama & Schwert(1977), Bekaert & Wang(2010), Connolly et al.(2021), Neville et al.(2021), Fang et al.(2022) 등 다수 기존연구와 마찬가지로, 인플레이션 충격을 인플레이션 위험으로 정의하고, 아래 식(1)과 같이 자산별 명목수익률(

)으로 구분할 필요가 있다. 본 연구에서는 Fama & Schwert(1977), Bekaert & Wang(2010), Connolly et al.(2021), Neville et al.(2021), Fang et al.(2022) 등 다수 기존연구와 마찬가지로, 인플레이션 충격을 인플레이션 위험으로 정의하고, 아래 식(1)과 같이 자산별 명목수익률( )과 인플레이션 충격간 관계를 살펴본다.

)과 인플레이션 충격간 관계를 살펴본다.

식(1)에서 자산수익률의 인플레이션 충격에 대한 민감도인 계수를 인플레이션 베타로 지칭한다. 자산의 인플레이션 베타가 1이면, 해당 자산은 인플레이션 충격만큼 수익률이 변동하므로, 예상치 못한 인플레이션 변화를 완전하게 헤지하게 된다. 인플레이션 베타가 1보다 작지만 안정적으로 양의 값을 가질 때에도 헤지 비율(hedge ratio)의 조정을 통해 인플레이션 위험을 헤지할 수 있다. 이처럼, 본 연구에서는 자산의 인플레이션 충격에 대한 민감도 측면에서 인플레이션과 자산수익률간 관계를 알아본다. 자산의 인플레이션 헤지 특성을 살펴보는 대부분의 기존연구에서 인플레이션 충격에 초점을 맞추는 이유는 기대인플레이션의 경우, 단기 명목국채의 만기 보유를 통해 헤지가 용이하기 때문이다.

계수를 인플레이션 베타로 지칭한다. 자산의 인플레이션 베타가 1이면, 해당 자산은 인플레이션 충격만큼 수익률이 변동하므로, 예상치 못한 인플레이션 변화를 완전하게 헤지하게 된다. 인플레이션 베타가 1보다 작지만 안정적으로 양의 값을 가질 때에도 헤지 비율(hedge ratio)의 조정을 통해 인플레이션 위험을 헤지할 수 있다. 이처럼, 본 연구에서는 자산의 인플레이션 충격에 대한 민감도 측면에서 인플레이션과 자산수익률간 관계를 알아본다. 자산의 인플레이션 헤지 특성을 살펴보는 대부분의 기존연구에서 인플레이션 충격에 초점을 맞추는 이유는 기대인플레이션의 경우, 단기 명목국채의 만기 보유를 통해 헤지가 용이하기 때문이다.

미국을 중심으로 선진국을 분석한 기존연구1)에서 보고된 주요 자산수익률과 인플레이션(소비자물가 상승률) 충격간 관계를 간략히 정리하면 다음과 같다. 우선, 명목국채는 대부분의 연구에서 일관되게 음의 인플레이션 베타를 가지는 것으로 나타났다. 이는 명목국채의 현금흐름(이자 및 원금)이 미래 물가 수준과 관계없이 현재 시점에서 고정되기 때문이다. 명목자산인 채권과 달리, 기업의 실물자산에서 발생하는 현금흐름의 현재가치인 주식의 경우, 대체로 1970년대부터 1990년대까지는 인플레이션 충격과 음의 상관관계를 가지는 것으로 나타났다. 반면, 2000년대 들어서는 양의 인플레이션 베타를 가지는 것으로 분석되었다. 이 점에 대해서는 다음 절에서 살펴보기로 한다. 대표적인 인플레이션 헤지 자산으로 고려되는 원자재는 대체로 인플레이션과 양의 상관관계를 갖는 것으로 나타났다. 부동산은 자산 형태(실물 부동산 또는 리츠)에 따라 차이가 관찰되는 가운데, 실물 부동산은 대체로 인플레이션과 양의 상관관계를 갖는 것으로 조사되었다.

2. 인플레이션의 특성이 자산수익률과 인플레이션간 관계에 미치는 영향

본 절에서는 인플레이션의 특성에 따라 자산수익률과 인플레이션간 관계가 달라질 수 있음을 살펴본다. 이를 살펴보기 위해, 먼저 식(1)에 정리된 인플레이션 헤지의 경제적 의미를 알아본다.

가. 피셔(Fisher)가설과 인플레이션의 실질경제 중립성(neutrality)

Fama & Schwert(1977)가 제시한 일반 피셔가설에 따르면, 자산의 명목수익률( )은 실질수익률(real return,

)은 실질수익률(real return,  )과 인플레이션(

)과 인플레이션( )의 합으로 구성된다.2) 자산의 실질가치로부터 발생하는 실질수익률은 실질성장률, 생산성 및 경제주체의 위험선호 등과 같은 실질경제요인에 의해 결정된다. 피셔가설은 경제의 실질요인과 명목요인(인플레이션)이 서로 무관함을 의미하며, 이를 인플레이션 중립성(inflation neutrality)이라 한다. 예를 들어, 주식의 경우, 기업이 인플레이션 상승분을 제품가격에 반영해 소비자에게 전가할 수 있다면, 기업의 실질가치는 인플레이션과 무관해진다(Mishkin, 1992; Attie & Roache, 2009). 주식, 원자재 및 부동산 등과 같은 실물자산이 인플레이션 위험을 헤지할 수 있다는 인식은 이와 같은 인플레이션 중립성에 기초하고 있다.3) 따라서, 자산의 실질수익률(실질경제요인)과 인플레이션간 관계가 자산의 인플레이션 헤지 특성, 즉 인플레이션과 자산수익률간 관계에 중요한 영향을 미칠 가능성이 있는 것으로 예상해볼 수 있다.

)의 합으로 구성된다.2) 자산의 실질가치로부터 발생하는 실질수익률은 실질성장률, 생산성 및 경제주체의 위험선호 등과 같은 실질경제요인에 의해 결정된다. 피셔가설은 경제의 실질요인과 명목요인(인플레이션)이 서로 무관함을 의미하며, 이를 인플레이션 중립성(inflation neutrality)이라 한다. 예를 들어, 주식의 경우, 기업이 인플레이션 상승분을 제품가격에 반영해 소비자에게 전가할 수 있다면, 기업의 실질가치는 인플레이션과 무관해진다(Mishkin, 1992; Attie & Roache, 2009). 주식, 원자재 및 부동산 등과 같은 실물자산이 인플레이션 위험을 헤지할 수 있다는 인식은 이와 같은 인플레이션 중립성에 기초하고 있다.3) 따라서, 자산의 실질수익률(실질경제요인)과 인플레이션간 관계가 자산의 인플레이션 헤지 특성, 즉 인플레이션과 자산수익률간 관계에 중요한 영향을 미칠 가능성이 있는 것으로 예상해볼 수 있다.

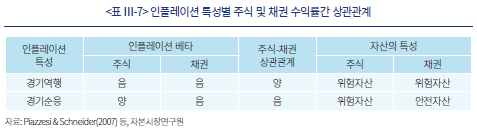

나. 인플레이션의 실질경제 비중립성(non-neutrality)과 자산수익률

Piazzesi & Schneider(2007) 등4)은 인플레이션이 실질경제와 무관하지 않으며, 특히 미국의 경우, 2000년 무렵을 기준으로 인플레이션의 특성이 경기역행(countercyclical)에서 경기순응(procyclical)으로 전환되었다는 견해를 제시하였다. 인플레이션의 경기역행적 특성은 인플레이션이 증가하면 실질경제여건이 악화되는 경향을 의미한다. 반면, 2000년대 들어서는 경기확장기에 인플레이션이 높아지는 경향이 관찰되는데, 이를 경기순응적 인플레이션으로 지칭하였다. 자산가격 측면에서 투자자들은 경기역행적 인플레이션에서 양의 인플레이션 충격이 발생하면 스태그플레이션 위험이 증가하는 것으로 평가하게 된다. 반면, 경기순응 인플레이션에서는 양의 인플레이션 충격이 발생하면, 실질경제여건이 개선되는 신호로 해석할 수 있다.5)

인플레이션이 경기역행 또는 경기순응적 특성을 갖는 데에는 다양한 원인이 있겠으나, 인플레이션의 원천(수요충격 및 공급충격) 측면에서 살펴볼 수 있다. Goodfriend & King(1997), Blinder & Rudd(2008), Ermolov(2022) 등에 따르면, 인플레이션은 발생 원인이 (음의) 공급충격에 있을 때, 경기역행적 특성을 갖는 것으로 평가된다. 반면, 공급충격보다 초과수요(경제 내 적정 공급규모를 초과하는 수요)로 인한 인플레이션은 경기순응성을 보이는 것으로 지적된다. 다만, 인플레이션은 수요충격과 공급충격이 혼재하여 발생할 수 있는데, 경기역행적 인플레이션은 인플레이션의 원인 중 수요충격보다 공급충격이 큰 경우에 발생할 수 있다. 반대로 공급충격보다 수요충격의 비중이 높은 경우에는 인플레이션이 경기순응적 특성을 가질 가능성이 큰 것으로 볼 수 있다. 아래에서는 Piazzesi & Schneider(2007) 등에서 제시된 인플레이션의 특성(경기역행, 경기순응)별로 인플레이션 충격이 자산수익률에 미치는 영향을 살펴본다. 다만, 아래 논의에서는 가독성을 고려하여 동 연구들의 이론적 분석을 직관적으로 설명하므로, 엄밀성이 떨어질 수 있음을 미리 밝힌다.

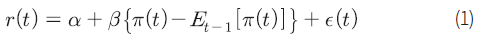

1) 주식 및 채권

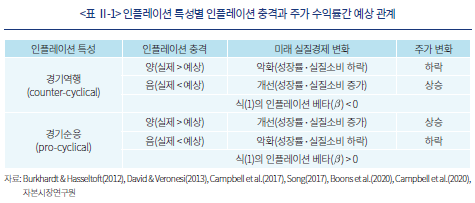

주식(종합주가지수)의 경우, 경기역행적 인플레이션에서는 양의 인플레이션 충격(실제 인플레이션>기대인플레이션)이 발생하면 실질경제여건의 악화가 예상되므로, 가격이 하락한다. 반대로 경기순응적 인플레이션에서는 인플레이션이 높을수록 경제여건이 개선될 가능성이 커지므로, 양의 인플레이션 충격이 발생하면 주식 가격이 상승한다. 인플레이션 특성별로 인플레이션 충격과 주식 수익률간에 예상되는 관계를 정리하면 <표 Ⅱ-1>과 같다.

결과적으로 인플레이션과 주가의 관계는 인플레이션의 특성에 따라 달라지며, 관계의 강도 또한 인플레이션의 경기순응성 및 경기역행성의 강도에 의존하는 것으로 예상해볼 수 있다. 앞 절에서 언급된 바와 같이, 미국의 경우, 2000년 무렵을 기준으로 주식의 인플레이션 베타가 음에서 양으로 전환되었다는 실증분석 결과가 보고되고 있다(Connolly et al., 2021; Neville et al., 2021; Fang et al., 2022). 여기에는 다양한 원인이 있을 수 있으나, 인플레이션의 특성 변화(경기역행 → 경기순응)를 주요 원인으로 볼 수 있다.

인플레이션 특성별로 채권과 인플레이션 충격간 관계를 알아보기 전에, 명목채권의 일반적 특성을 정리한다. 채권(국채)금리는 실질금리와 인플레이션의 합으로 분해할 수 있다. 다른 조건이 동일할 때, 명목채권은 인플레이션이 높아질수록 금리가 상승하여 채권가격이 하락한다(‘인플레이션 효과’). 반면, 실질경제가 저조할수록 실질금리가 낮아져 채권가격이 상승하게 된다(‘실질금리 효과’). 이처럼 채권은 인플레이션과 실질경제여건이 금리 및 가격에 반대 방향으로 영향을 미친다. 따라서 경기역행적 인플레이션에서는 양의 인플레이션 충격이 발생하면, 인플레이션 효과로 금리가 상승하여 채권가격이 하락하지만, 실질경제여건이 악화되므로 실질금리 효과 측면에서는 금리가 하락하여 채권가격이 상승할 수 있다. 다만, Piazzesi & Schneider(2007) 등의 논의를 종합하면, 1970년대 및 1980년대 초와 같이 강한 경기역행적 인플레이션에서는 인플레이션 효과가 실질금리 효과를 상회하여, 금리가 상승하고 채권가격이 하락하는 것으로 파악된다. 반면, 경기순응적 인플레이션에서는 양의 인플레이션 충격이 발생하면 실질경제여건이 개선되므로, 인플레이션 효과와 실질금리 효과가 동일한 방향으로 작용하여, 금리가 상승하고 채권가격은 하락한다. 따라서 명목채권의 경우, <표 Ⅱ-2>에 정리된 것처럼, 인플레이션 특성과 관계없이 대체로 음의 인플레이션 베타를 가질 것으로 예상할 수 있다.

2) 기타 실물자산: 원자재 및 부동산

실물자산인 원자재와 부동산은 통상 인플레이션 위험을 헤지할 수 있는 것으로 간주되어 있다. 원자재는 인플레이션의 주요 결정요인이라는 점에서 인플레이션 위험을 헤지할 가능성이 있다. 다만, 다음과 같은 이유에서 원자재가 안정적으로 인플레이션 위험을 헤지할 수 있을 것으로 예단하기 어려운 측면이 있다(Bekaert & Wang, 2010). 우선, 원자재 가격과 인플레이션간 관계가 일정하지 않을 수 있다. 다음으로, 원자재 가격은 미 달러화로 표시되기 때문에, 우리나라의 경우에는 원자재 가격 자체와 함께, 환율의 영향이 클 수 있다. 앞 절의 논의에 기초할 때, 실질경제여건에 따른 원자재 가격 변동이 원자재의 인플레이션 헤지 성과에 영향을 미칠 것으로 기대할 수 있다. 하지만 핵심 원자재인 에너지를 보면, 글로벌 수요와 함께 공급 충격이 중요 가격결정 요인이다(Killian, 2009; WB, 2022). 따라서 원자재 가격과 실질경제여건간 관계는 주식이나 채권보다 일관성이 낮을 가능성이 있다. 이상으로부터, 특히 우리나라의 인플레이션 위험 헤지 측면에서는 원자재의 유용성을 사전적으로 판단하기 힘든 측면이 있는 것으로 볼 수 있다.

부동산은 가계 자산 중 가장 높은 비중을 차지한다는 점에서 인플레이션 위험 헤지 여부에 관심도가 높다. 우선, 부동산은 자산 형태(실물 부동산 또는 리츠)에 따라 차이가 보고된다. 최근 국내에서 인플레이션 헤지 수단으로 주목받고 있는 리츠의 경우, 주식과 유사한 형태의 인플레이션 민감도를 갖는 것으로 나타났다(Gyourko & Linneman, 1988; Fang et al., 2022). 따라서 리츠에 대해서는 앞에서 논의된 인플레이션 특성별 주식의 인플레이션 헤지 특성을 참고할 수 있다. 다음으로, 실물부동산 가격을 미래 임대료의 현재가치로 파악하는 관점(Attie & Roache, 2009)을 따를 경우, 부동산이 경기역행적(경기순응적) 인플레이션에서 양의 인플레이션 충격에 음(양)의 인플레이션 베타를 가질 것으로 기대할 수 있다. 다만, 부동산 가격은 실물경제여건 외에 정책 및 주택공급 등의 영향을 받기 때문에(자본시장연구원, 2018; 성병묵 외, 2022), 부동산의 인플레이션 위험 헤지 여부는 사전적으로 단정하기 어려운 측면이 있는 것으로 판단된다.

Ⅲ. 인플레이션과 자산수익률간 관계: 실증분석

아래에서는 인플레이션과 국내 자산수익률간 관계를 분석한다. 본 장에서는 미국의 인플레이션 및 자산수익률간 관계를 함께 알아본다. 다음으로 최근 상황을 평가해본다.

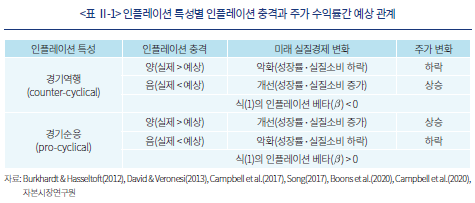

1. 자료 및 실증분석 방법

본 고에서는 한국 및 미국 자산(주식, 명목국채, 원자재, 부동산, 물가채)의 분기별 명목수익률과 인플레이션 충격간 관계를 살펴본다. 다만, 분석에서는 국가별 자산수익률과 자국 인플레이션과의 관계를 살펴본다. 따라서 미국 자산을 한국 인플레이션 위험 헤지 관점에서 고려하지 않는다. 본 연구에서 사용된 변수의 정의 및 분석기간은 <부록 1>에 정리하였다. 한미 모두 자산별로 자료의 가용시점이 다르기 때문에 분석가능 기간에 차이가 있다. 이에 모든 자산수익률이 동시에 이용 가능한 기간으로 분석을 한정하지 않고, 자산별로 다른 분석 기간을 사용하였다.

본 고의 분석에는 II 장의 식(1)을 적용하여, 아래 식(2)와 같이 자산의 (전분기대비) 분기별 명목수익률( )을 동 분기 인플레이션(소비자물가지수 상승률) 충격(

)을 동 분기 인플레이션(소비자물가지수 상승률) 충격( )에 회귀분석하여 인플레이션 베타를 추정한다.

)에 회귀분석하여 인플레이션 베타를 추정한다.

식(2)에서 는 더미변수로 특정 시기(예: 경기순응적 인플레이션 시기,

는 더미변수로 특정 시기(예: 경기순응적 인플레이션 시기,  기간)에 1의 값을 가지며, 나머지 시기(예: 경기역행적 인플레이션 시기,

기간)에 1의 값을 가지며, 나머지 시기(예: 경기역행적 인플레이션 시기,  기간)에는 0의 값을 갖는다.

기간)에는 0의 값을 갖는다.  및

및  는 각각

는 각각  기간 및

기간 및  기간의 인플레이션 베타를 의미한다.6) 또한,

기간의 인플레이션 베타를 의미한다.6) 또한,  를 통해

를 통해  기간 및

기간 및  기간 사이에 인플레이션 베타에 변화가 발생하였는지를 살펴볼 수 있다.

기간 사이에 인플레이션 베타에 변화가 발생하였는지를 살펴볼 수 있다.

인플레이션 충격을 산출하기 위해서는 먼저 기대인플레이션을 추정해야 한다. 본 고에서는 기존연구에 따라, 랜덤워크(Gultekim 1983; Bekaert & Wang, 2010; Neville et al., 2021 등, 이하 RW로 표기) 및 거시변수 모형(Fang et al., 2022, 이하 Macro VAR로 표기7))에 기초하여 기대물가를 산출하였다.

2. 인플레이션과 자산수익률간 관계 분석결과

앞 장에서 살펴본 바와 같이, 인플레이션과 자산가격간 관계에는 인플레이션의 특성(경기역행, 경기순응)이 영향을 미칠 수 있다. 따라서 국내 인플레이션의 특성을 살펴볼 필요가 있다. <부록 2>에 정리된 것처럼, 1970년 1분기부터 2022년 1분기를 분석한 결과, 국내 인플레이션은 대체로 1970년~1981년까지는 경기역행, 1982년 이후에는 경기순응 인플레이션의 특성을 가지는 것으로 확인되었다. 본 연구에서 미국은 Piazzesi & Schneider(2007) 등을 준용하여, 1970년~2000년까지를 경기역행적 인플레이션, 2001년 이후를 경기순응적 인플레이션으로 구분한다. 그런데 <부록 1>에 정리된 것처럼, 국내 자산가격은 대부분 1982년 이후부터 이용할 수 있다. 결과적으로 국내의 경우에는 경기역행적 인플레이션 시기의 분석이 가능하지 않다. 경기역행적 인플레이션 시기의 자산수익률과 인플레이션 충격간 관계는 미국의 분석결과를 참고하고자 한다.8)

가. 주식

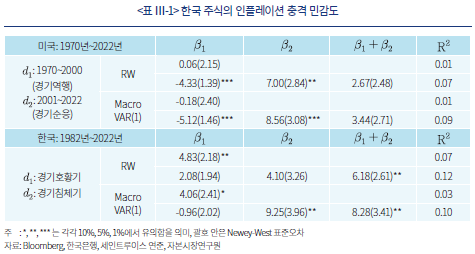

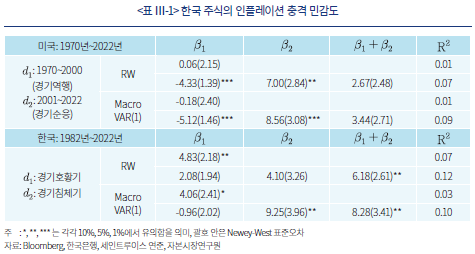

<표 Ⅲ-1>은 한미 주식의 인플레이션 충격 베타 추정치를 보여준다. 제시된 결과는 식(2)에서, 주식 수익률( )을 각 기대물가 모형에서 도출된 인플레이션 충격(

)을 각 기대물가 모형에서 도출된 인플레이션 충격( )에 회귀분석하여 산출하였다. 미국은 전체기간(1970년~2022년) 및 인플레이션 특성별(경기역행, 경기순응) 차이를 분석하였으며, 한국은 전체기간(1982년~2022년, 경기순응) 및 실질경제 상태별(경기 호황기 및 불황기) 차이9)를 살펴보았다.

)에 회귀분석하여 산출하였다. 미국은 전체기간(1970년~2022년) 및 인플레이션 특성별(경기역행, 경기순응) 차이를 분석하였으며, 한국은 전체기간(1982년~2022년, 경기순응) 및 실질경제 상태별(경기 호황기 및 불황기) 차이9)를 살펴보았다.

우선, <표 Ⅲ-1>에서 미국 주식은 인플레이션 특성을 고려하지 않은 전체기간을 대상으로 할 경우(기대물가 모형별 결과의 첫째 행), 인플레이션 충격과 무관한 것으로 확인되었다. 반면, 인플레이션 특성을 고려할 경우(기대물가 모형별 둘째 행), 경기역행 인플레이션에서는 음의 인플레이션 베타( < 0)를 가지며, 경기순응 인플레이션에서는 유의성은 낮지만, 양의 베타(

< 0)를 가지며, 경기순응 인플레이션에서는 유의성은 낮지만, 양의 베타( > 0)를 나타냈다. 또한 양 인플레이션 특성 시기별로 인플레이션 베타의 차이(

> 0)를 나타냈다. 또한 양 인플레이션 특성 시기별로 인플레이션 베타의 차이( )가 유의하였다.

)가 유의하였다.

국내 주식은 전체기간(기대물가 모형별 결과 첫째 행의  , 경기순응) 동안 유의한 양의 베타를 가진다. 국내는 분석기간(1982년 이후) 전체가 경기순응 인플레이션이므로, 동일한 인플레이션 특성에서 추정된 미국 결과와 비교해보면, 대체로 국내 주식의 인플레이션 베타가 미국보다 유의성이 높은 것으로 나타났다. 특히, 국내 주식은 경기침체기에 인플레이션 베타의 유의성이 높은 것으로 확인되었다(기대물가 모형별 둘째 행의

, 경기순응) 동안 유의한 양의 베타를 가진다. 국내는 분석기간(1982년 이후) 전체가 경기순응 인플레이션이므로, 동일한 인플레이션 특성에서 추정된 미국 결과와 비교해보면, 대체로 국내 주식의 인플레이션 베타가 미국보다 유의성이 높은 것으로 나타났다. 특히, 국내 주식은 경기침체기에 인플레이션 베타의 유의성이 높은 것으로 확인되었다(기대물가 모형별 둘째 행의  > 0 및

> 0 및  > 0). 이는 앞 장에서 살펴본 것처럼, 경기순응 인플레이션에서는 경기침체기에 양의 인플레이션 충격이 발생하면 경기침체 탈피 신호로 해석될 수 있음을 시사한다. 이상으로부터 한미 주식의 인플레이션 베타는 대체로 <표 Ⅱ-1>에 정리된 이론적 관계에 부합함을 알 수 있다.

> 0). 이는 앞 장에서 살펴본 것처럼, 경기순응 인플레이션에서는 경기침체기에 양의 인플레이션 충격이 발생하면 경기침체 탈피 신호로 해석될 수 있음을 시사한다. 이상으로부터 한미 주식의 인플레이션 베타는 대체로 <표 Ⅱ-1>에 정리된 이론적 관계에 부합함을 알 수 있다.

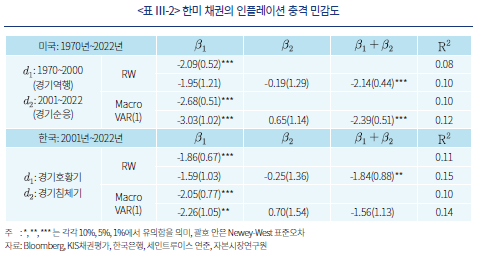

나. 채권(10년 만기 명목국채)

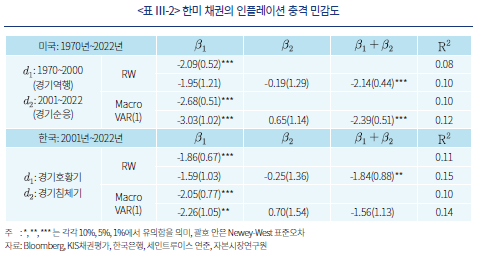

<표 Ⅲ-2>는 한미 채권의 인플레이션 베타 추정치를 보여준다. 분석방법은 주식과 동일하다. 미국 채권은 대체로 전체기간 및 경기역행ㆍ경기순응에서 음의 인플레이션 베타를 나타낸다. 아울러, 인플레이션 특성별로 차이(기대물가 모형별 )가 유의하지 않았다. 국내 채권도 미국과 같게 양의 인플레이션 충격 발생시 가격이 하락함을 알 수 있으며, 이러한 관계는 경제 상태(호황 또는 침체)에 의존하지 않는 것으로 나타났다. 결과적으로 채권 수익률과 인플레이션간 관계는 <표 Ⅱ-2>에 정리된 이론적 예상에 부합하는 것으로 판단할 수 있다.10)

)가 유의하지 않았다. 국내 채권도 미국과 같게 양의 인플레이션 충격 발생시 가격이 하락함을 알 수 있으며, 이러한 관계는 경제 상태(호황 또는 침체)에 의존하지 않는 것으로 나타났다. 결과적으로 채권 수익률과 인플레이션간 관계는 <표 Ⅱ-2>에 정리된 이론적 예상에 부합하는 것으로 판단할 수 있다.10)

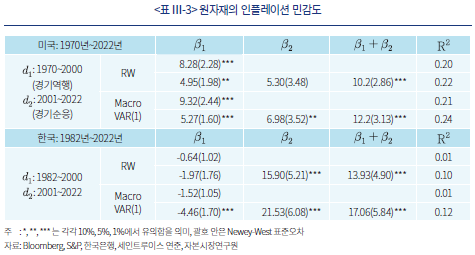

다. 원자재

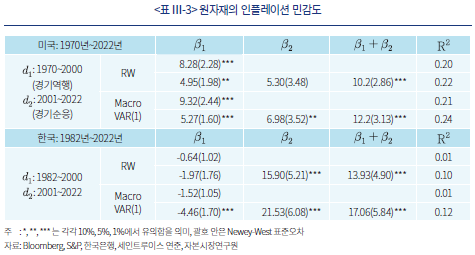

본 고에서는 다양한 원자재선물로 구성되는 GSCI(Goldman Sachs Commodity Index) 수익률과 인플레이션 충격간 관계를 살펴보았다.11) <표 Ⅲ-3>은 원자재 가격의 한미 인플레이션 충격에 대한 민감도를 나타낸다. 미국 결과를 보면, 원자재가 전체기간 및 인플레이션 특성별 모두 유의한 양의 인플레이션 베타를 가진다. 흥미롭게 2001년 이후에 원자재의 인플레이션 베타가 유의하게 증가한 것을 알 수 있는데, 이는 인플레이션 특성의 변화보다는 동 시기에 원자재의 미국 물가에 대한 영향이 증가한 데 기인하는 것으로 판단된다. 이러한 점은 같은 시기 원자재 가격의 국내 인플레이션 충격에 대한 반응에서 확인할 수 있다. <표 Ⅲ-3>에서 원자재의 국내 인플레이션 베타는 2000년까지는 대체로 음의 값을 보였으나, 2001년 이후에는 양으로 전환하였다(기대물가 모형별 둘째 행의 > 0 및

> 0 및  > 0). 그런데, 국내의 경우, 2001년을 전후하여 인플레이션 특성에 변화가 발생하지 않았으므로, 동 결과는 원자재 가격이 국내 물가에 미치는 영향이 증가한 데 원인이 있는 것으로 해석할 수 있다. 이상으로부터, 2001년 이후에 원자재 가격이 양국 인플레이션에 미치는 영향이 증가하였으며, 그 결과, 인플레이션 민감도가 유의하게 증가한 것으로 생각해볼 수 있다.

> 0). 그런데, 국내의 경우, 2001년을 전후하여 인플레이션 특성에 변화가 발생하지 않았으므로, 동 결과는 원자재 가격이 국내 물가에 미치는 영향이 증가한 데 원인이 있는 것으로 해석할 수 있다. 이상으로부터, 2001년 이후에 원자재 가격이 양국 인플레이션에 미치는 영향이 증가하였으며, 그 결과, 인플레이션 민감도가 유의하게 증가한 것으로 생각해볼 수 있다.

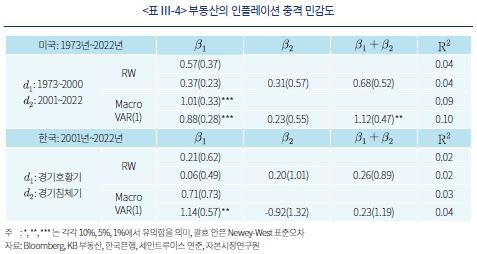

라. 부동산

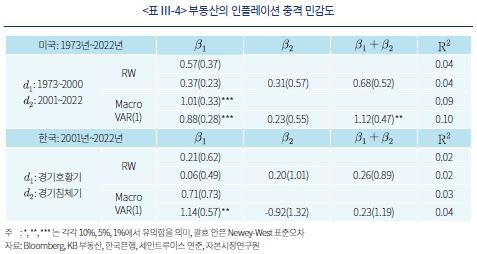

<표 Ⅲ-4>는 한미 부동산 수익률과 인플레이션 충격간 관계를 보여준다. 본 고에서는 실물 부동산을 분석한다. 한미 분석결과를 비교해보면, 미국 부동산의 인플레이션 베타가 한국보다 유의성이 높은 것을 알 수 있다. 미국의 경우, 부동산과 인플레이션간 관계가 인플레이션의 특성과 무관한 것으로 확인되었다. 국내 부동산은 미국보다 낮은 인플레이션 베타를 갖는 것으로 나타났다. 인플레이션 베타의 부호는 양이지만, 유의성이 낮다.12) 다만, 통계적으로 유의한 음의 베타 또한 관찰되지 않았으므로, 인플레이션 충격 발생시 국내 부동산 가격이 유의하게 상승 또는 하락하지는 않았던 것으로 볼 수 있다. 이상의 양국간 차이는 인플레이션 산출시 부동산이 차지하는 비중이 다르다는 점이 원인일 가능성이 있다. 부동산이 인플레이션 구성에서 차지하는 비중은 미국이 한국보다 월등히 높다.13)

3. 최근 상황에 대한 평가 및 시사점

금번 인플레이션은 1980년대 초반 이후 사례를 찾아볼 수 없는 만큼, 경제적 특성 파악이 용이하지 않은 측면이 있다. 본 고에서 살펴본 바와 같이, 특히 주식과 채권의 경우, 인플레이션의 특성에 따라 인플레이션 베타의 부호가 달라질 수 있다. 아래에서는 금번 인플레이션의 특성을 평가해 보고 시사점을 모색한다.

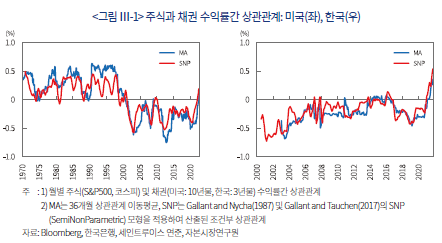

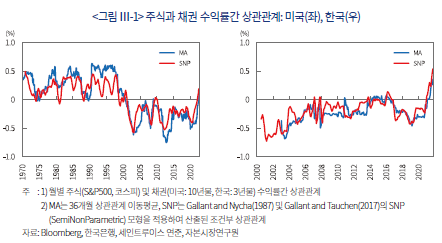

최근의 스태그플레이션 가능성에 대한 논란에서 알 수 있듯이, 한미 모두 금번 인플레이션과 실질경제여건간 관계에는 다소 불확실한 측면이 있다. 이런 가운데, 금융시장은 금번 인플레이션을 경기역행적 인플레이션으로 평가 중인 것으로 보인다. 이는 <그림 Ⅲ-1>을 통해 확인할 수 있다. 그림에는 최근 주목받고 있는 주식 및 채권 수익률(가격변화)간 상관관계15)가 나타나 있다. 미국의 주식과 채권가격은 1990년대까지는 양의 상관관계를 보였으나, 2000년경부터는 일관되게 음의 상관관계를 나타냈다.16) 한국 주식과 채권 수익률 또한 2001년부터 일부시기를 제외하고 음의 상관관계를 보여 왔다. 그런데, 한미 모두 2022년 들어서 양 자산간 상관관계가 양으로 전환되었다.

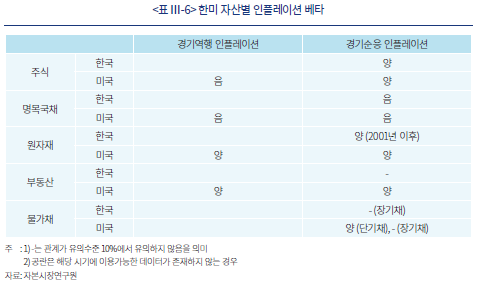

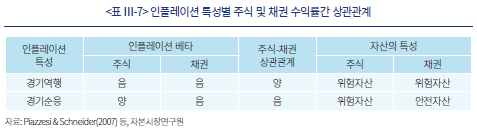

Ⅱ장에서 언급된 Piazzesi & Schneider(2007) 등은 공통으로 2000년경을 전후해 미국 주식-채권간 상관관계 부호에 변화(sign-switching)가 발생한 주요 원인이 인플레이션의 특성 변화(경기역행→경기순응)에 있음을 규명하였다. 이는 <표 Ⅲ-7>에 정리된 바를 통해 확인할 수 있다. <표 Ⅲ-7>에서 주목할 부분은 경기역행 인플레이션에서는 채권이 안전자산이 아닐 수 있다는 점이다. 위험자산은 투자자의 한계효용이 높을 때(예: 경기침체기) 가격이 하락하고, 한계효용이 낮을 때(예: 호황기) 가격이 상승하는 자산으로 정의할 수 있다(Song, 2017; Boons et al., 2020; Campbell et al., 2020). 반면, 안전자산은 한계효용이 높을 때 가격이 상승하고, 한계효용이 낮을 때 가격이 하락하는 자산으로 정의할 수 있다. 주식은 양 인플레이션 특성에서 실질경제가 저조할 때 가격이 하락하므로, 위험자산의 전형으로 볼 수 있다. 반면, 채권의 경우, 경기순응적 인플레이션에서는 경제가 저조할 때(인플레이션이 낮을 때) 가격이 상승하므로 안전자산이 된다. 하지만, 경기역행적 인플레이션에서는 경제가 저조할 때(인플레이션이 높을 때) 가격이 하락하므로, 채권 또한 주식과 같은 위험자산으로 볼 수 있다.

따라서, Piazzesi & Schneider(2007) 등을 준용하여, 주식-채권간 상관관계를 통해 인플레이션의 특성을 파악할 경우, 2022년부터 나타난 주식-채권간 양의 상관관계는 금번 인플레이션이 경기역행적 성격이 강할 수 있음을 시사한다. 이런 관점에 기초할 때, 금번 인플레이션 상승기에는 주식-채권 분산투자를 통한 인플레이션 위험 헤지 전략의 위험성이 높은 것으로 판단할 수 있다. 특히, 경기역행적 인플레이션에서는 명목국채가 주식과 마찬가지로 위험자산이 될 수 있다는 점에 유의할 필요가 있다. 결과적으로 금년들어 주식과 채권가격이 크게 하락하였으나, 향후에도 헤지 기간이 중기(분기) 시계인 경우에는, 동 자산을 통한 인플레이션 위험 헤지가 적절하지 않을 가능성이 있는 것으로 예상해 볼 수 있다.

Ⅳ. 결론 및 시사점

본 연구에서는 인플레이션 충격 헤지 관점에서, 국내 주요 자산수익률과 인플레이션간 관계를 살펴보았다. 주요 결과를 정리하면 다음과 같다. 첫째, 인플레이션 위험관리는 기대인플레이션보다 예상치 못한 인플레이션 변화인 인플레이션 충격에 초점을 맞출 필요가 있다. 기대인플레이션은 단기 명목국채를 통해 헤지가 용이하다. 둘째, 주식과 명목채권을 중심으로, 인플레이션과 자산수익률간 관계에는 인플레이션의 경제적 특성(경기역행 또는 경기순응)이 중요한 역할을 할 수 있다. 최근과 같이 양의 인플레이션 충격(기대치를 상회하는 인플레이션)에 대한 헤지가 중요한 경기역행적 인플레이션의 경우, 주식과 채권은 양의 인플레이션 충격이 발생할 때 가격이 하락하는 경향이 있으므로, 인플레이션 위험 헤지에 적합하지 않을 가능성이 있다. 셋째, 원자재 및 부동산 등과 같은 실물자산의 인플레이션 헤지 유용성은 실질경제여건보다는 각 자산의 특성에 영향을 받는 것으로 확인되었다. 원자재의 경우, 인플레이션과의 관계에 불안정성이 있어, 주식 및 채권과 달리, 헤지 성과 예측이 용이하지 않은 측면이 있다. 실물 부동산은 국가별로 인플레이션과의 관계에 차이가 관찰되었다. 미국 부동산은 인플레이션 헤지 효과가 높은 반면, 국내 부동산은 인플레이션과 유의한 관계가 확인되지 않았다. 넷째, 인플레이션 위험 헤지를 목표로 발행되는 물가채의 경우, 단기 또는 중기 시계의 인플레이션 위험 헤지에는 만기가 길지 않은 물가채가 적합한 것으로 확인되었다. 만기 7년 이상 장기 물가채는 헤지 기간을 분기로 고려할 경우, 예상과 달리 인플레이션 위험 헤지 유용성이 유의하지 않은 것으로 나타났다.17)

본 고의 결과를 바탕으로 국내 투자자의 인플레이션 위험관리를 위한 시사점을 살펴보면 다음과 같다. 첫째, 최근의 상황을 고려할 때, 원자재의 인플레이션 헤지 유용성이 높을 것으로 예상되나, 기본적으로 원자재는 국내 인플레이션의 결정요인으로 작용하는 만큼만 유용성이 있다는 점에 유의할 필요가 있다.18) 아울러, 원자재 가격은 변동성이 높기 때문에, 위험분산을 위해 여타 자산과의 상관관계를 고려한 자산배분 관점의 투자가 적절한 것으로 판단된다. 둘째, 금번 인플레이션이 경기역행적 특성을 가질 가능성이 큰 만큼, 헤지 목표 기간이 중기인 경우, 주식과 채권간 분산투자를 통한 인플레이션 위험 대응이 예기치 않은 결과를 가져올 수 있다는 점에 유의할 필요가 있다. 셋째, 단기 및 중기시계의 인플레이션 위험관리 측면에서 보면, 국내 물가채의 만기를 다양화하고, 발행을 늘려 유동성을 보완할 필요성이 있다.19) 하지만, 국채발행은 경제주체의 인플레이션 위험 헤지 외의 다양한 요인을 종합적으로 고려해야 하는 만큼, 금융기관이 인플레이션 스왑20) 등 파생상품을 활용하여 투자자의 인플레이션 위험관리를 지원할 필요가 있는 것으로 판단된다. 넷째, 이상의 시사점을 고려할 때, 인플레이션 위험관리에는 전문적인 지식이 요구된다고 볼 수 있다. 따라서 금융기관의 적극적 역할이 중요한 것으로 판단된다. 다섯째, 금융기관은 인플레이션 위험 헤지를 위한 금융상품을 도입할 때, 헤지 대상 인플레이션을 명확히 정의할 필요가 있다. 국내 인플레이션이 아닌 글로벌 인플레이션을 헤지 대상으로 할 경우, 국내 투자자 입장에서는 위험 헤지가 아닌 위험 추구가 될 가능성이 있다는 점에 유의해야 할 것이다. 마지막으로, 본 고의 분석에 기초할 때, 금번 국내 인플레이션은 1980년대 초반 이후 처음으로 발생한 경기역행적 인플레이션으로 볼 수 있다. 금융기관 및 투자자 모두 금번 인플레이션 대응에 어려움이 많을 것으로 예상되는 만큼, 보다 면밀한 접근이 요구된다.

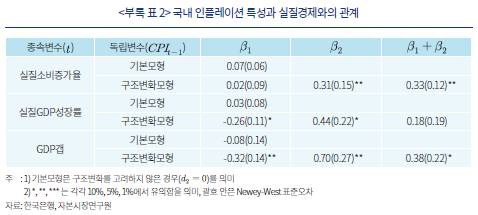

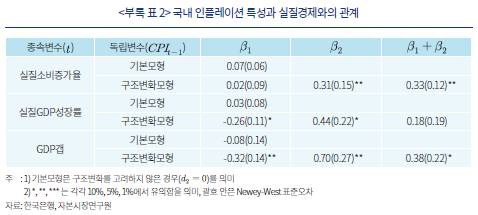

<부록 2> 국내 인플레이션 특성 분석

본 고에서는 다음 두 단계 분석을 통해 국내 인플레이션의 특성을 분석하였다. 첫째, Piazzesi & Schneider(2007) 등 Ⅱ장에서 언급된 기존연구에 기초하여, 전분기 CPI 상승률과 이번 분기 실질소비증가율(내구재 제외)간 관계에 대해 다중구조변화(multiple structural breaks)를 검정하였다. 구조변화 검증은 Bai & Perron(1998)21) 및 Campbell et al.(2020)의 방법을 적용하였다. 둘째, 식별된 구조변화 시점을 전후하여 인플레이션과 실질경제여건(실질소비증가율ㆍ실질GDP증가율ㆍGDP갭)간 관계에 발생한 구조변화의 성격을 분석하였다. 분석에는 1970년 1분기부터 2022년 2분기까지의 분기별 (전분기대비) CPI 상승률, 실질소비증가율(내구재 제외) 및 GDP갭을 사용하였다.

우선, Bai & Perron(1998) 및 Campbell et al.(2020)의 방법 모두에서 인플레이션과 실질소비증가율간 관계에 1981년 4분기에 1회의 구조변화가 식별되었다. 다음으로 <부록 표 2>에는 식(2)에 제시된 회귀분석 모형을 적용해 추정한 결과가 나타나 있다. 제시된 결과는 식(2)에 전분기의 CPI 상승률을 독립변수로, 이번 분기의 실질경제여건(실질소비증가율ㆍ실질GDP증가율ㆍGDP갭)을 종속변수로 적용하여 추정한 결과이다. 더미변수( )는 1981년 4분기부터 2022년 2분기까지는 1이며, 1970년 1분기부터 1981년 3분기까지는 0의 값을 가진다.

)는 1981년 4분기부터 2022년 2분기까지는 1이며, 1970년 1분기부터 1981년 3분기까지는 0의 값을 가진다.

추정 결과를 살펴보면, 구조변화를 고려하지 않을 경우(기본모형), 국내에서는 분석 기간 동안 CPI와 미래 실질경제여건간 관계가 유의하지 않음을 알 수 있다. 구조변화를 고려할 경우(구조변화모형), 실질경제변수간에 결과가 완전히 일치하지는 않으나, 대체로 1981년 3분기까지는 CPI가 상승할수록 실질경제 여건이 악화(실질성장률 및 GDP갭의 추정치가 음의 값)된 것으로 볼 수 있다. 반면, 1981년 4분기부터는 개선되는 경향(실질소비증가율 및 GDP갭의

추정치가 음의 값)된 것으로 볼 수 있다. 반면, 1981년 4분기부터는 개선되는 경향(실질소비증가율 및 GDP갭의  추정치가 양의 값)을 확인할 수 있다. 따라서, 국내 인플레이션은 대체적으로 1970년부터 1981년 3분기 동안에는 경기역행성을 보이는 것으로 볼 수 있으며, 1981년 4분기 이후에는 경기순응성을 가지는 것으로 판단해볼 수 있다.22)

추정치가 양의 값)을 확인할 수 있다. 따라서, 국내 인플레이션은 대체적으로 1970년부터 1981년 3분기 동안에는 경기역행성을 보이는 것으로 볼 수 있으며, 1981년 4분기 이후에는 경기순응성을 가지는 것으로 판단해볼 수 있다.22)

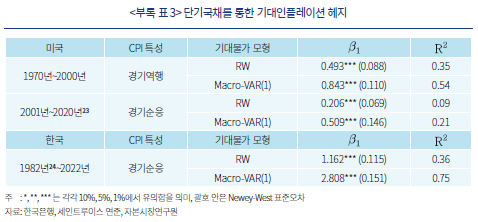

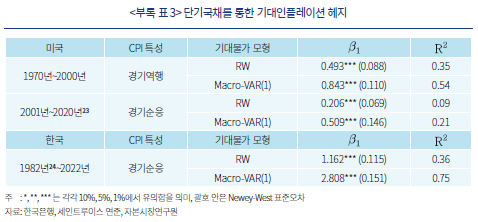

본 고 Ⅱ장에서 통상 자산의 인플레이션 헤지 성과를 살펴봄에 있어, 인플레이션 충격에 초점을 맞추는 이유가 기대인플레이션은 단기 명목국채를 통해 헤지가 용이하기 때문이라는 점을 언급한 바 있다. <부록 표 3>은 전분기 말에 3개월 만기 명목국채를 매입하여 이번 분기까지 보유할 때 발생하는 보유수익률을, 전분기말에 형성된 이번 분기에 대한 기대인플레이션에 회귀분석한 결과를 보여준다. 분석 결과, 한미 모두 3개월 만기 국채 수익률이 기대인플레이션과 매우 밀접한 양의 관계를 가진다. 특히, 우리나라의 경우, 국채가 기대인플레이션보다 높은 수익률( >1)을 나타냈다. 미국의 결과에서 알 수 있듯이, 단기국채의 기대인플레이션 헤지 유용성은 인플레이션 특성(경기역행 또는 경기순응)에 무관함을 알 수 있다. 이상의 결과는 기대인플레이션이 단기 명목국채 금리 결정의 핵심 요인이라는 점에 기인하는 것으로 볼 수 있다.

>1)을 나타냈다. 미국의 결과에서 알 수 있듯이, 단기국채의 기대인플레이션 헤지 유용성은 인플레이션 특성(경기역행 또는 경기순응)에 무관함을 알 수 있다. 이상의 결과는 기대인플레이션이 단기 명목국채 금리 결정의 핵심 요인이라는 점에 기인하는 것으로 볼 수 있다.

1) 인플레이션과 자산가격에 대한 연구는 1970년대부터 광범위하게 진행되어왔다. 본문에 정리된 내용은 Fama & Schwert(1977), Fama(1981), Kaul(1987), Erb & Harvey(2006), Kat & Oomen(2007), Bekaert & Wang(2010), Connolly et al.(2021), Neville et al.(2021), Fang et al.(2022) 등의 분석결과를 중심으로 작성하였다. 기존연구의 결과는 분석 대상 표본기간 및 수익률 산출기간(월, 분기, 년)에 따라 차이가 있다. 본문에서는 기존연구 결과 중, 월 및 분기 대상 결과를 정리하였다.

2) 피셔가설(Fisher, 1930)은 명목(채권)금리가 실질금리와 기대인플레이션으로 분해됨을 의미한다. 본문에서는 편의상 Fama & Schwert(1977)가 언급한 일반 피셔공식(generalized Fisher equation)을 사후적 관점(ex-post)에서 기술하였다.

3) 자산의 실질수익률이 인플레이션과 무관하면, 자산의 명목수익률은 인플레이션과 일대일 대응관계를 갖게 되며, 이 경우 앞의 식(1)에서 인플레이션 베타가 1이 된다.

4) Piazzesi & Schneider(2007), Bansal & Shaliastovich(2012), Burkhardt & Hasseltoft(2012), David & Veronesi(2013), Campbell et al.(2017), Song(2017), Boons et al.(2020), Campbell et al.(2020) 등은 인플레이션 충격이 주식과 채권의 가격 결정에 반영되는 이론적 메커니즘을 분석하였다.

5) Piazzesi & Schneider(2007) 등이 제시한 이론적 관점에 기초할 경우, 투자자 입장에서는 실질경제여건이 악화되어 한계효용이 높은 상황에 대한 헤지가 중요하다. 경기역행적 인플레이션에서는 양의 인플레이션 충격이 발생할 때 실질경제가 악화되어 한계효용이 높아지므로, 이에 대한 헤지가 중요하다. 따라서 이 경우에는 인플레이션이 높을 때 가격이 올라가는 자산이 투자자에게 가치가 있다. 하지만 인플레이션이 경기순응성을 보일 때는 음의 인플레이션 충격이 발생할 때 실질경제가 악화되어 한계효용이 증가한다. 따라서 이런 상황에서는 음의 인플레이션 충격을 헤지할 수 있는 자산이 가치가 있는 것으로 볼 수 있다. 결과적으로 이론적 관점에서만 보면, 경기순응적 인플레이션에서 양의 인플레이션 충격이 헤지 대상인지에는 논란이 있을 수 있다.

6) 회귀식 추정 결과 해석시 다음 사항에 유의할 필요가 있다. 인플레이션 베타가 유의하더라도 모형의 설명력이 지나치게 낮을 때에는 자산의 수익률 결정에 인플레이션 외 여타 요인의 영향이 클 가능성이 있다. 따라서 해당 자산으로 인플레이션 위험을 헤지할 경우에는 인플레이션 외의 위험요인을 고려할 필요가 있다.

7) 분기별 인플레이션, GDP갭, 무위험 금리(미국: 연방기금금리, 한국: 콜금리)로 구성된 VAR(1)에서 산출된 인플레이션을 기대인플레이션으로 사용한다.

8) 아울러, 앞 장에서 기대인플레이션의 경우 단기 명목국채의 만기 보유를 통해 헤지가 용이하다는 점을 언급한 바 있다. <부록 3>에 한미 단기 명목국채의 기대인플레이션 헤지 성과 분석결과를 정리하였다. 부록에 제시된 것처럼, 한미 모두 단기국채를 통한 기대인플레이션 헤지가 어렵지 않음을 알 수 있다.

9) Connolly and Stivers(2019) 및 Connolly et al.(2021)은 동일한 인플레이션 특성에서도 경기 침체기와 비침체기에 인플레이션과 자산수익률간 관계에 차이가 있을 수 있다는 분석 결과를 제시하였다. 이에, 본 고에서는 국내의 경우, 경기역행 인플레이션 시기를 분석할 수 없음을 감안하여, 경기 침체기와 호황기간의 차이를 살펴보고자 한다.

10) 본 고에서 제시하지는 않으나, 채권은 만기가 길수록 강한 음의 인플레이션 베타를 갖는 것으로 확인되었다. 이는 채권의 듀레이션 효과 때문으로 볼 수 있다.

11) Erb & Harvey(2019)가 지적한 바와 같이, GSCI는 현물이 아닌 선물지수이므로, 본 고의 분석결과가 실제 원자재 가격의 행태와 차이가 있을 수 있다. 또한 GSCI와 같은 선물지수의 경우, 지수 구성요소에 대한 가중치에 따라 인플레이션간 관계에 차이가 있을 수 있다는 점에도 유의할 필요가 있다. 참고로, 본 고에서 사용한 GSCI는 에너지, 금속, 농산물 등 24개 품목으로 구성되어 있다. 2022년 8월 기준, 각 품목별 가중치는 에너지(원유 및 천연가스 등) 53.48%, 농산물 20.48%, 산업용 금속 12.71%, 금ㆍ은 5.97% 등이다.

12) 부동산을 주택 및 아파트, 지역을 전국, 서울, 강남 등으로 세분화하여 분석한 결과에서도 유의한 양의 베타를 확인할 수 없었다.

13) 2022년 6월 기준, 소비자물가지수에서 부동산 가격과 밀접히 연관된 주거비 비중이 한국은 9.8%이나, 미국은 32% 수준이다.

14) 물가채는 채권의 현금흐름(원금 및 이자)에서 인플레이션 위험을 제거하므로, 만기까지 보유할 때의 실질수익률을 매입 당시의 만기수익률(yield-to-maturity)로 고정할 수 있다.

15) Economist(2022.8.11), FT(2022.9.22) 및 WSJ(2022.10.9) 등을 참고하기 바란다.

16) 미국 주식-채권간 상관관계의 특성은 Piazzesi & Schneider(2007) 등을 비롯해, 다수 연구에서 검증된 결과이다.

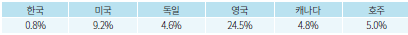

17) 인플레이션과 자산수익률간 관계는 투자 시계에 따라 달라질 수 있다. 본 고에서는 분기별 인플레이션과 자산수익률간 관계를 살펴보았다. 따라서 연기금 등에 적합한 장기 시계에 대해서는 별도로 살펴볼 필요가 있는 것으로 판단된다.

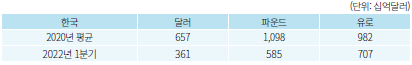

18) 본고의 실증분석에는 제시되지 않았으나, 미 달러로 거래되는 원자재 가격이 국내 인플레이션 결정요인으로 작용하는 데에는 원달러 환율의 영향도 중요한 것으로 확인되었다. 원자재 가격이 동일해도 원달러 환율이 변동할 경우, 수입물가 경로를 통해 원자재 가격이 국내 인플레이션에 미치는 영향이 증폭되거나 완화될 수 있다.

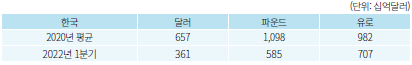

19) 우리나라는 주요국 대비 국채 중 물가채 비중이 현저히 낮은 수준이다. 기획재정부 및 BIS(우리나라를 제외한 국가)에 따르면 2021년말 기준, 주요국의 국채잔액 중 물가채 비중은 아래 표와 같다.

20) 인플레이션 스왑은 고정금리 쿠폰과 실현된 인플레이션 인덱스(CPI 상승률)로 결정되는 변동금리 쿠폰을 교환하는 장외파생거래이다(Hinnerich, 2008). 인플레이션 스왑은 물가채권을 매수하고 명목채권을 매도한 합성포지션이며 물가채권보다 인덱스를 헤지하는 효과가 더 크다고 볼 수 있다. 2000년대 초반에 도입되었으며, 미국ㆍ영국ㆍ유로지역의 인플레이션을 기초로 하는 거래가 활성화되어 있다(Barnes, 2021). LCH에 따르면, 2022년 1분기에 동 사가 청산한 달러ㆍ파운드ㆍ유로화에 대한 인플레이션 스왑의 거래량(명목금액)은 2.7조달러로, 2020년 평균치인 1.7조달러에서 66% 급증하였다. 아래 표는 LCH가 청산한 달러ㆍ파운드ㆍ유로화 인플레이션 스왑의 명목잔액(2020년 평균치와 2022년 1분기, 금액은 달러로 환산)을 나타낸다.

21) 본 고에서는 Ditzen et al.(2021)이 Bai & Perron(1998)의 방법을 적용하여 고안한 알고리즘을 활용하였다. 간략히 살펴보면, 동 방법에서는 우선 구조변화가 없다는 가설을 기각할 수 있는 최대 숫자의 구조변화를 식별한다. 다음으로, s개 대비 s+1개의 구조변화의 유의성을 검정하는 절차를 통해 최종 구조변화 숫자 및 시점을 식별한다. 분석 결과, 유의수준 5%에서 분석 기간 중 1회의 구조변화가 발생한 것으로 추정되었다. 다만, 분석에서 IMF 외환위기 당시인 1998년 1분기는 제외하였다. 동 분기에는 실질성장률 및 실질소비증가율이 연율로 27%가량 급락하였는데, 분석 기간 중 특이치로 볼 수 있다. 다각도로 살펴본 결과, 동 분기를 포함하면 전반적인 변수간 관계가 왜곡되는 것으로 확인되었다.

22) 추정치를 살펴보면, CPI가 실질소비증가율, 실질성장률 및 GDP갭에 미치는 영향이 1981년 4분기를 기점으로 유의하게 증가한 것으로 나타났다.

추정치를 살펴보면, CPI가 실질소비증가율, 실질성장률 및 GDP갭에 미치는 영향이 1981년 4분기를 기점으로 유의하게 증가한 것으로 나타났다.

23) 미국 3개월 국채(T-bill)의 기대인플레이션 민감도는 2021년부터 크게 낮아진 것으로 확인되었다. 2022년까지의 자료를 사용할 경우, 의 추정치(표준오차)는 0.231(0.135)로 유의수준 10%에서 유의하였으나, 계수의 크기가 크게 작아졌다. 이는 연준의 양적완화 효과로 판단된다. 2021년부터 인플레이션이 상승하기 시작하였고, 본 고에서 추정된 기대인플레이션도 증가하였다. 하지만 3개월 국채금리는 연준의 양적완화로 낮은 수준에서 형성되었다. 동 이슈는 국내와 연관성이 낮으므로 상세히 살펴보지 않는다.

의 추정치(표준오차)는 0.231(0.135)로 유의수준 10%에서 유의하였으나, 계수의 크기가 크게 작아졌다. 이는 연준의 양적완화 효과로 판단된다. 2021년부터 인플레이션이 상승하기 시작하였고, 본 고에서 추정된 기대인플레이션도 증가하였다. 하지만 3개월 국채금리는 연준의 양적완화로 낮은 수준에서 형성되었다. 동 이슈는 국내와 연관성이 낮으므로 상세히 살펴보지 않는다.

24) <부록 1>에 정리된 것처럼, 국내 3개월 만기 국채 수익률 자료는 2001년부터 이용가능하다. <부록 표 3>에서, 1980년~2000년에 대해서는, 콜금리를 3개월 재투자한 수익률로 국채 3개월 금리를 대체하였다.

참고문헌

성병묵ㆍ김찬우ㆍ황나윤, 2022, 자산으로서 우리나라 주택의 특징 및 시사점, 한국은행 BOK 이슈노트 제2022-19호.

자본시장연구원, KCMI 2018년 하반기 경제 및 자본시장전망.

Arnold, S., Auer, B.R., 2015, What do scientists know about inflation hedging? North American Journal of Economics and Finance 34, 187-214.

Attie, A.P., Roache, S.K., 2009, Inflation hedging for long-term investors, IMF working paper.

Baele, L., Bekaert, G., Inghelbrecht, K., 2010, The determinants of stocks and bond return comovements, Review of Financial Studies 23(6), 2374-2429.

Bai, B.Y.J., Perron, P., 1998, Estimating and testing linear models with multiple structural changes, Econometrica 66(1), 47–78.

Bansal, R., Shaliastovich, I., 2012, A long-run risks explanation of predictability puzzles in bond and currency markets, Review of Financial Studies 26(1), 1-33.

Barnes, C., 2021, G3 inflation swap volumes are on the up, Clarus.

Bekaert, G., Engstrom., E., 2010, Inflation and the stock market: Understanding the “Fed model”, Journal of Monetary Economics 57(3), 278-294.

Bekaert, G., Wang, X., 2010, Inflation risk and the inflation risk premium, Economic Policy October 2010, 755-806.

Blanchard, O.J., 1989, A traditional interpretation of macroeconomic fluctuations, American Economic Review 79(5), 1146-1164.

Blinder, A.S., Rudd, J.B., 2008, The supply-shock explanation of the great stagflation revisited, NBER working paper 14563.

Boons, M., Duarte, F.M., de Roon, F., Szymanowsak, M., 2020, Time-varying inflation risks and stock returns, Journal of Financial Economics 136(2), 444-470.

Burkhardt, D., Hasseltoft, H., 2012, Understanding asset correlations, Swiss Finance Institute Research Paper Series No.12-38.

Campbell, J.Y., Pflueger, C., Viceira, L.M., 2020, Macroeconomic drivers of bond and equity risks, Journal of Political Economy 128(8), 3148-3185.

Campbell, J.Y., Sunderam, A., Viceira, L.M., 2017, Inflation bets or deflation hedges? The changing risks of nominal bonds, Critical Finance Review 6, 263–301.

Connolly, R.A., Stivers, C., 2019, Changes in inflation expectations, stock returns and the economic state: A signaling role for inflation?, working paper.

Connolly, R.A., Stivers, C., Sun, L., 2021, Stock returns and inflation shocks in weaker economic times, Financial Management 51(3), 827-867.

David, A., Veronesi, P., 2013, What ties return volatilities to price valuations and fundamentals? Journal of Political Economy 121(4), 682-746.

Ditzen, J., Karavias, Y., Westerlund, J., 2021, Testing and estimating structural breaks in time series and panel data in Stata.

Economist, 2022.8.11, How should investors prepare for repeat inflation shocks?

Ermolov, A., 2022, Time-varying risk of nominal bonds: How important are macroeconomic shocks, Journal of Financial Economics 145(1), 1-28.

European Securities and Markets Authority(ESMA), 2022, Recommendations in regard of the impact of inflation on investor protection, ESMA Securities and Markets Stakeholder Group.

Fama, E.F., 1981, Stock returns, real activity, inflation and money, American Economic Review 71(4), 545-565.

Fama, E.F., Schwert, G.W., 1977, Asset returns and inflation, Journal of Finance 47(4), 1315-1342.

Fang, X., Liu, X., 2022, Getting to the core: Inflation risks within and across asset classes, NBER working paper 30169.

Financial Times, 2022.9.22, Investors wonder if the 60/40 portfolio has a future.

Fisher, I., 1930, The theory of interest, New York: Macmillan.

Gallant, R.A., Nychka, D.W., 1987, Semi-nonparametric maximum likelihood estimation, Econometrica, 55(2) 363-390.

Gallant, R.A., Tauchen, G., 2017, SNP: A program for nonparametric time series analysis, Penn State University.

Goodfriend, M., King, R., 1997, The new neoclassical synthesis and the role of monetary policy, In B. S. Bernanke, & J. Rotemberg, NBER Macroeconomics Annual, MIT Press.

Gyourko, J., Linneman, P., 1988, Owner-occupied homes, income-producing real estate and REIT as inflation hedges, Journal of Real Estate Finance and Economics 1(4), 347–372.

Hinnerich, M., 2008, Inflation-indexed swaps and swaptions, Journal of Banking and Finance 32, 2293-2306.

Jaffe, J.F., Mandelker, 1976, The “Fisher effect” for risky assets: An empirical investigation, Journal of Finance 31(2), 447-458.

Kat, Harry M. and Roel C. A. Oomen, 2007, What every investor should know about commodities, Part II: Multivariate return analysis, Journal of Investment Management 5(3), 16–40.

Kaul, G., 1987, Stock returns and inflation: The role of the monetary sector, Journal of Financial Economics 18(2), 253-276.

Killian, L., 2009, Not oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market, American Economic Review 99(3), 1053-1069.

Lagarde, C., 2022, A new global map: European resilience in a changing world, ECB.

Neville, H., Draaisma, T., Funnell, B., Harvey, C.R., Van Hemert, O., 2021, The Best Strategies for Inflationary Times, Journal of Portfolio Management 47(8), 8-37.

Piazzesi, M., Schneider, M., 2007, Equilibrium yield curves, In NBER Macroeconomics Annual 2006, Volume 21, 389-472.

Schnabel, I., 2022, A new age of energy inflation: Climateflation, fossilflation and greenflation, ECB.

Schotman, P., Schweitzer, 2000, Horizon sensitivity of the inflation hedge of stocks, Journal of Semitropical Finance 7, 301-315.

Song, D.H., 2017, Bond market exposures to macroeconomic and monetary policy risks, Review of Financial Studies 30(8), 2761–2817.

Wall Street Journal, 2022.10.9, Markets are topsy-turvy, and there’s worse: It’s hard to cushion your portfolio.

World Bank, 2022, Commodity markets outlook, April, 2022.

Zhang, Z., 2021, Stock returns and inflation redux: An explanation from monetary policy in advanced and emerging markets, IMF working paper.

금번 인플레이션은 일시적인 현상에 그칠 것이라는 당초 예상을 크게 벗어나며, 주요국 물가가 수십 년래 최고 수준을 기록하는 상황을 초래하였다. 각국 중앙은행의 긴축으로 인플레이션이 다소 완화될 수 있겠으나, 주요국간 지정학적 갈등 및 기후변화 대응 가속화 등의 영향으로 인플레이션 위험이 상당 기간 지속될 가능성이 제기되고 있다(Lagarde, 2022; Schnabel, 2022). 이런 가운데, 높은 인플레이션으로 경제주체의 어려움이 커지고, 금융시장에서는 주식과 채권을 포함하여 주요 자산 가격이 동반하여 크게 하락하는 등 금융불안이 확대되고 있다.

이와 같은 배경에서 인플레이션 위험관리의 중요성이 크게 부각되고 있다. 하지만, 최근의 높은 인플레이션은 수십 년간 경험되지 않은 현상인 만큼, 정책당국뿐만 아니라 금융시장참여자의 대응에 어려움이 많은 실정이다(ESMA, 2022; Neville et al., 2022). 이에, 본 연구에서는 인플레이션 위험 헤지 관점에서 인플레이션과 주요 자산가격 변화의 관계를 살펴보고자 한다.

본 연구의 구성은 다음과 같다. 우선, 인플레이션 위험의 개념 및 헤지의 경제적 의미를 살펴본다. 인플레이션 위험을 관리하기 위해서는 헤지해야 할 인플레이션 위험에 대한 이해가 선행될 필요가 있다. 다음으로, 기존연구의 논의에 기초하여 인플레이션의 경제적 특성이 인플레이션과 자산수익률간 관계에 미치는 영향을 알아본다. 실증분석에서는 국내 주요 자산수익률과 인플레이션간 관계를 살펴보고, 미국 사례와 비교해본다.

Ⅱ. 인플레이션과 자산수익률간 관계: 이론적 배경

인플레이션과 자산수익률간 관계는 다양한 관점에서 살펴볼 수 있겠으나, 본 고에서는 자산의 인플레이션 위험 헤지 특성에 초점을 맞춘다. 아래에서는 우선 인플레이션 위험 헤지의 개념을 알아본다. 다음으로 인플레이션의 경제적 특성이 주요 자산별 인플레이션 위험 헤지 성과에 미치는 영향을 살펴본다.

1. 인플레이션 위험 및 헤지의 개념

자산의 가격이 인플레이션만큼 변동하면 해당 자산은 인플레이션 변화를 헤지할 수 있는 것으로 볼 수 있다. 그런데, 최근 상황을 보면, 인플레이션은 절대 수준보다는 금융시장의 기대치와 다를 때 자산가격 변화에 미치는 영향이 크다는 점을 알 수 있다. 이는 자산가격이 예상 인플레이션 수준을 이미 반영하였기 때문으로 볼 수 있다. 따라서 현재(

식(1)에서 자산수익률의 인플레이션 충격에 대한 민감도인

미국을 중심으로 선진국을 분석한 기존연구1)에서 보고된 주요 자산수익률과 인플레이션(소비자물가 상승률) 충격간 관계를 간략히 정리하면 다음과 같다. 우선, 명목국채는 대부분의 연구에서 일관되게 음의 인플레이션 베타를 가지는 것으로 나타났다. 이는 명목국채의 현금흐름(이자 및 원금)이 미래 물가 수준과 관계없이 현재 시점에서 고정되기 때문이다. 명목자산인 채권과 달리, 기업의 실물자산에서 발생하는 현금흐름의 현재가치인 주식의 경우, 대체로 1970년대부터 1990년대까지는 인플레이션 충격과 음의 상관관계를 가지는 것으로 나타났다. 반면, 2000년대 들어서는 양의 인플레이션 베타를 가지는 것으로 분석되었다. 이 점에 대해서는 다음 절에서 살펴보기로 한다. 대표적인 인플레이션 헤지 자산으로 고려되는 원자재는 대체로 인플레이션과 양의 상관관계를 갖는 것으로 나타났다. 부동산은 자산 형태(실물 부동산 또는 리츠)에 따라 차이가 관찰되는 가운데, 실물 부동산은 대체로 인플레이션과 양의 상관관계를 갖는 것으로 조사되었다.

2. 인플레이션의 특성이 자산수익률과 인플레이션간 관계에 미치는 영향

본 절에서는 인플레이션의 특성에 따라 자산수익률과 인플레이션간 관계가 달라질 수 있음을 살펴본다. 이를 살펴보기 위해, 먼저 식(1)에 정리된 인플레이션 헤지의 경제적 의미를 알아본다.

가. 피셔(Fisher)가설과 인플레이션의 실질경제 중립성(neutrality)

Fama & Schwert(1977)가 제시한 일반 피셔가설에 따르면, 자산의 명목수익률(

나. 인플레이션의 실질경제 비중립성(non-neutrality)과 자산수익률

Piazzesi & Schneider(2007) 등4)은 인플레이션이 실질경제와 무관하지 않으며, 특히 미국의 경우, 2000년 무렵을 기준으로 인플레이션의 특성이 경기역행(countercyclical)에서 경기순응(procyclical)으로 전환되었다는 견해를 제시하였다. 인플레이션의 경기역행적 특성은 인플레이션이 증가하면 실질경제여건이 악화되는 경향을 의미한다. 반면, 2000년대 들어서는 경기확장기에 인플레이션이 높아지는 경향이 관찰되는데, 이를 경기순응적 인플레이션으로 지칭하였다. 자산가격 측면에서 투자자들은 경기역행적 인플레이션에서 양의 인플레이션 충격이 발생하면 스태그플레이션 위험이 증가하는 것으로 평가하게 된다. 반면, 경기순응 인플레이션에서는 양의 인플레이션 충격이 발생하면, 실질경제여건이 개선되는 신호로 해석할 수 있다.5)

인플레이션이 경기역행 또는 경기순응적 특성을 갖는 데에는 다양한 원인이 있겠으나, 인플레이션의 원천(수요충격 및 공급충격) 측면에서 살펴볼 수 있다. Goodfriend & King(1997), Blinder & Rudd(2008), Ermolov(2022) 등에 따르면, 인플레이션은 발생 원인이 (음의) 공급충격에 있을 때, 경기역행적 특성을 갖는 것으로 평가된다. 반면, 공급충격보다 초과수요(경제 내 적정 공급규모를 초과하는 수요)로 인한 인플레이션은 경기순응성을 보이는 것으로 지적된다. 다만, 인플레이션은 수요충격과 공급충격이 혼재하여 발생할 수 있는데, 경기역행적 인플레이션은 인플레이션의 원인 중 수요충격보다 공급충격이 큰 경우에 발생할 수 있다. 반대로 공급충격보다 수요충격의 비중이 높은 경우에는 인플레이션이 경기순응적 특성을 가질 가능성이 큰 것으로 볼 수 있다. 아래에서는 Piazzesi & Schneider(2007) 등에서 제시된 인플레이션의 특성(경기역행, 경기순응)별로 인플레이션 충격이 자산수익률에 미치는 영향을 살펴본다. 다만, 아래 논의에서는 가독성을 고려하여 동 연구들의 이론적 분석을 직관적으로 설명하므로, 엄밀성이 떨어질 수 있음을 미리 밝힌다.

1) 주식 및 채권

주식(종합주가지수)의 경우, 경기역행적 인플레이션에서는 양의 인플레이션 충격(실제 인플레이션>기대인플레이션)이 발생하면 실질경제여건의 악화가 예상되므로, 가격이 하락한다. 반대로 경기순응적 인플레이션에서는 인플레이션이 높을수록 경제여건이 개선될 가능성이 커지므로, 양의 인플레이션 충격이 발생하면 주식 가격이 상승한다. 인플레이션 특성별로 인플레이션 충격과 주식 수익률간에 예상되는 관계를 정리하면 <표 Ⅱ-1>과 같다.

인플레이션 특성별로 채권과 인플레이션 충격간 관계를 알아보기 전에, 명목채권의 일반적 특성을 정리한다. 채권(국채)금리는 실질금리와 인플레이션의 합으로 분해할 수 있다. 다른 조건이 동일할 때, 명목채권은 인플레이션이 높아질수록 금리가 상승하여 채권가격이 하락한다(‘인플레이션 효과’). 반면, 실질경제가 저조할수록 실질금리가 낮아져 채권가격이 상승하게 된다(‘실질금리 효과’). 이처럼 채권은 인플레이션과 실질경제여건이 금리 및 가격에 반대 방향으로 영향을 미친다. 따라서 경기역행적 인플레이션에서는 양의 인플레이션 충격이 발생하면, 인플레이션 효과로 금리가 상승하여 채권가격이 하락하지만, 실질경제여건이 악화되므로 실질금리 효과 측면에서는 금리가 하락하여 채권가격이 상승할 수 있다. 다만, Piazzesi & Schneider(2007) 등의 논의를 종합하면, 1970년대 및 1980년대 초와 같이 강한 경기역행적 인플레이션에서는 인플레이션 효과가 실질금리 효과를 상회하여, 금리가 상승하고 채권가격이 하락하는 것으로 파악된다. 반면, 경기순응적 인플레이션에서는 양의 인플레이션 충격이 발생하면 실질경제여건이 개선되므로, 인플레이션 효과와 실질금리 효과가 동일한 방향으로 작용하여, 금리가 상승하고 채권가격은 하락한다. 따라서 명목채권의 경우, <표 Ⅱ-2>에 정리된 것처럼, 인플레이션 특성과 관계없이 대체로 음의 인플레이션 베타를 가질 것으로 예상할 수 있다.

실물자산인 원자재와 부동산은 통상 인플레이션 위험을 헤지할 수 있는 것으로 간주되어 있다. 원자재는 인플레이션의 주요 결정요인이라는 점에서 인플레이션 위험을 헤지할 가능성이 있다. 다만, 다음과 같은 이유에서 원자재가 안정적으로 인플레이션 위험을 헤지할 수 있을 것으로 예단하기 어려운 측면이 있다(Bekaert & Wang, 2010). 우선, 원자재 가격과 인플레이션간 관계가 일정하지 않을 수 있다. 다음으로, 원자재 가격은 미 달러화로 표시되기 때문에, 우리나라의 경우에는 원자재 가격 자체와 함께, 환율의 영향이 클 수 있다. 앞 절의 논의에 기초할 때, 실질경제여건에 따른 원자재 가격 변동이 원자재의 인플레이션 헤지 성과에 영향을 미칠 것으로 기대할 수 있다. 하지만 핵심 원자재인 에너지를 보면, 글로벌 수요와 함께 공급 충격이 중요 가격결정 요인이다(Killian, 2009; WB, 2022). 따라서 원자재 가격과 실질경제여건간 관계는 주식이나 채권보다 일관성이 낮을 가능성이 있다. 이상으로부터, 특히 우리나라의 인플레이션 위험 헤지 측면에서는 원자재의 유용성을 사전적으로 판단하기 힘든 측면이 있는 것으로 볼 수 있다.

부동산은 가계 자산 중 가장 높은 비중을 차지한다는 점에서 인플레이션 위험 헤지 여부에 관심도가 높다. 우선, 부동산은 자산 형태(실물 부동산 또는 리츠)에 따라 차이가 보고된다. 최근 국내에서 인플레이션 헤지 수단으로 주목받고 있는 리츠의 경우, 주식과 유사한 형태의 인플레이션 민감도를 갖는 것으로 나타났다(Gyourko & Linneman, 1988; Fang et al., 2022). 따라서 리츠에 대해서는 앞에서 논의된 인플레이션 특성별 주식의 인플레이션 헤지 특성을 참고할 수 있다. 다음으로, 실물부동산 가격을 미래 임대료의 현재가치로 파악하는 관점(Attie & Roache, 2009)을 따를 경우, 부동산이 경기역행적(경기순응적) 인플레이션에서 양의 인플레이션 충격에 음(양)의 인플레이션 베타를 가질 것으로 기대할 수 있다. 다만, 부동산 가격은 실물경제여건 외에 정책 및 주택공급 등의 영향을 받기 때문에(자본시장연구원, 2018; 성병묵 외, 2022), 부동산의 인플레이션 위험 헤지 여부는 사전적으로 단정하기 어려운 측면이 있는 것으로 판단된다.

Ⅲ. 인플레이션과 자산수익률간 관계: 실증분석

아래에서는 인플레이션과 국내 자산수익률간 관계를 분석한다. 본 장에서는 미국의 인플레이션 및 자산수익률간 관계를 함께 알아본다. 다음으로 최근 상황을 평가해본다.

1. 자료 및 실증분석 방법

본 고에서는 한국 및 미국 자산(주식, 명목국채, 원자재, 부동산, 물가채)의 분기별 명목수익률과 인플레이션 충격간 관계를 살펴본다. 다만, 분석에서는 국가별 자산수익률과 자국 인플레이션과의 관계를 살펴본다. 따라서 미국 자산을 한국 인플레이션 위험 헤지 관점에서 고려하지 않는다. 본 연구에서 사용된 변수의 정의 및 분석기간은 <부록 1>에 정리하였다. 한미 모두 자산별로 자료의 가용시점이 다르기 때문에 분석가능 기간에 차이가 있다. 이에 모든 자산수익률이 동시에 이용 가능한 기간으로 분석을 한정하지 않고, 자산별로 다른 분석 기간을 사용하였다.

본 고의 분석에는 II 장의 식(1)을 적용하여, 아래 식(2)와 같이 자산의 (전분기대비) 분기별 명목수익률(

식(2)에서

인플레이션 충격을 산출하기 위해서는 먼저 기대인플레이션을 추정해야 한다. 본 고에서는 기존연구에 따라, 랜덤워크(Gultekim 1983; Bekaert & Wang, 2010; Neville et al., 2021 등, 이하 RW로 표기) 및 거시변수 모형(Fang et al., 2022, 이하 Macro VAR로 표기7))에 기초하여 기대물가를 산출하였다.

2. 인플레이션과 자산수익률간 관계 분석결과

앞 장에서 살펴본 바와 같이, 인플레이션과 자산가격간 관계에는 인플레이션의 특성(경기역행, 경기순응)이 영향을 미칠 수 있다. 따라서 국내 인플레이션의 특성을 살펴볼 필요가 있다. <부록 2>에 정리된 것처럼, 1970년 1분기부터 2022년 1분기를 분석한 결과, 국내 인플레이션은 대체로 1970년~1981년까지는 경기역행, 1982년 이후에는 경기순응 인플레이션의 특성을 가지는 것으로 확인되었다. 본 연구에서 미국은 Piazzesi & Schneider(2007) 등을 준용하여, 1970년~2000년까지를 경기역행적 인플레이션, 2001년 이후를 경기순응적 인플레이션으로 구분한다. 그런데 <부록 1>에 정리된 것처럼, 국내 자산가격은 대부분 1982년 이후부터 이용할 수 있다. 결과적으로 국내의 경우에는 경기역행적 인플레이션 시기의 분석이 가능하지 않다. 경기역행적 인플레이션 시기의 자산수익률과 인플레이션 충격간 관계는 미국의 분석결과를 참고하고자 한다.8)

가. 주식

<표 Ⅲ-1>은 한미 주식의 인플레이션 충격 베타 추정치를 보여준다. 제시된 결과는 식(2)에서, 주식 수익률(

우선, <표 Ⅲ-1>에서 미국 주식은 인플레이션 특성을 고려하지 않은 전체기간을 대상으로 할 경우(기대물가 모형별 결과의 첫째 행), 인플레이션 충격과 무관한 것으로 확인되었다. 반면, 인플레이션 특성을 고려할 경우(기대물가 모형별 둘째 행), 경기역행 인플레이션에서는 음의 인플레이션 베타(

나. 채권(10년 만기 명목국채)

<표 Ⅲ-2>는 한미 채권의 인플레이션 베타 추정치를 보여준다. 분석방법은 주식과 동일하다. 미국 채권은 대체로 전체기간 및 경기역행ㆍ경기순응에서 음의 인플레이션 베타를 나타낸다. 아울러, 인플레이션 특성별로 차이(기대물가 모형별

본 고에서는 다양한 원자재선물로 구성되는 GSCI(Goldman Sachs Commodity Index) 수익률과 인플레이션 충격간 관계를 살펴보았다.11) <표 Ⅲ-3>은 원자재 가격의 한미 인플레이션 충격에 대한 민감도를 나타낸다. 미국 결과를 보면, 원자재가 전체기간 및 인플레이션 특성별 모두 유의한 양의 인플레이션 베타를 가진다. 흥미롭게 2001년 이후에 원자재의 인플레이션 베타가 유의하게 증가한 것을 알 수 있는데, 이는 인플레이션 특성의 변화보다는 동 시기에 원자재의 미국 물가에 대한 영향이 증가한 데 기인하는 것으로 판단된다. 이러한 점은 같은 시기 원자재 가격의 국내 인플레이션 충격에 대한 반응에서 확인할 수 있다. <표 Ⅲ-3>에서 원자재의 국내 인플레이션 베타는 2000년까지는 대체로 음의 값을 보였으나, 2001년 이후에는 양으로 전환하였다(기대물가 모형별 둘째 행의

<표 Ⅲ-4>는 한미 부동산 수익률과 인플레이션 충격간 관계를 보여준다. 본 고에서는 실물 부동산을 분석한다. 한미 분석결과를 비교해보면, 미국 부동산의 인플레이션 베타가 한국보다 유의성이 높은 것을 알 수 있다. 미국의 경우, 부동산과 인플레이션간 관계가 인플레이션의 특성과 무관한 것으로 확인되었다. 국내 부동산은 미국보다 낮은 인플레이션 베타를 갖는 것으로 나타났다. 인플레이션 베타의 부호는 양이지만, 유의성이 낮다.12) 다만, 통계적으로 유의한 음의 베타 또한 관찰되지 않았으므로, 인플레이션 충격 발생시 국내 부동산 가격이 유의하게 상승 또는 하락하지는 않았던 것으로 볼 수 있다. 이상의 양국간 차이는 인플레이션 산출시 부동산이 차지하는 비중이 다르다는 점이 원인일 가능성이 있다. 부동산이 인플레이션 구성에서 차지하는 비중은 미국이 한국보다 월등히 높다.13)

마. 물가채

물가채(물가연동국채)는 원금과 이자가 만기까지의 실제 인플레이션에 연동되어 변화하므로, 인플레이션 위험에 대한 효과적 헤지 수단으로 고려할 수 있다.14) 한국과 미국의 물가채는 장기(한국: 10년, 미국: 5년, 10년, 30년)로 발행된다. 물가채는 만기까지의 기대인플레이션(평균 인플레이션)이 증가하면 가격이 상승한다. 따라서, 장기 물가채가 단기 및 중기 시계의 인플레이션 충격을 헤지하는 데에도 유용할 것인지는 단정 짓기 어려운 측면이 있다.

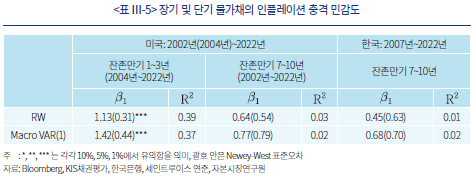

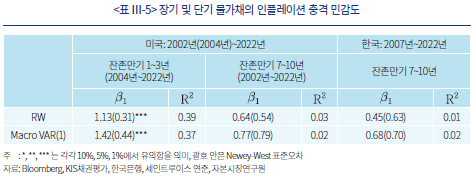

본 연구와 같이 분기 시계를 기준으로 물가채를 이용해 인플레이션 위험을 헤지하는 경우를 살펴보자. 양의 인플레이션 충격이 발생할 때 만기가 10년인 물가채 가격이 상승(양의 인플레이션 충격 베타)하기 위해서는 인플레이션 충격이 영구적인 특성을 가질 필요가 있다. 즉, 인플레이션 충격이 물가채 잔존만기 동안의 평균적 기대인플레이션 수준에 영향을 미치지 않는다면, 물가채 가격이 인플레이션 충격만큼 상승하지 않을 가능성이 크다. 반면, 물가채의 잔존만기가 짧을수록 인플레이션 충격에 대한 가격 민감도가 커질 가능성이 있다. <표 Ⅲ-5>에는 잔존만기가 1~3년 및 7~10년인 미국 물가채와 잔존만기 7~10년인 한국 물가채 분기 수익률(가격변화)의 인플레이션 충격 베타 추정치가 나타나 있다. <표 Ⅲ-5>를 보면, 한미 모두 장기 물가채의 경우 분기 인플레이션 충격에 대한 베타계수가 부호는 양이지만 유의하지 않음을 알 수 있다. 반면, 잔존만기가 1~3년인 미국 물가채는 베타계수가 1과 유의하게 다르지 않은 것으로 확인되었다. 이는 동 물가채가 인플레이션 충격을 효과적으로 헤지할 수 있음을 의미한다.

물가채(물가연동국채)는 원금과 이자가 만기까지의 실제 인플레이션에 연동되어 변화하므로, 인플레이션 위험에 대한 효과적 헤지 수단으로 고려할 수 있다.14) 한국과 미국의 물가채는 장기(한국: 10년, 미국: 5년, 10년, 30년)로 발행된다. 물가채는 만기까지의 기대인플레이션(평균 인플레이션)이 증가하면 가격이 상승한다. 따라서, 장기 물가채가 단기 및 중기 시계의 인플레이션 충격을 헤지하는 데에도 유용할 것인지는 단정 짓기 어려운 측면이 있다.

본 연구와 같이 분기 시계를 기준으로 물가채를 이용해 인플레이션 위험을 헤지하는 경우를 살펴보자. 양의 인플레이션 충격이 발생할 때 만기가 10년인 물가채 가격이 상승(양의 인플레이션 충격 베타)하기 위해서는 인플레이션 충격이 영구적인 특성을 가질 필요가 있다. 즉, 인플레이션 충격이 물가채 잔존만기 동안의 평균적 기대인플레이션 수준에 영향을 미치지 않는다면, 물가채 가격이 인플레이션 충격만큼 상승하지 않을 가능성이 크다. 반면, 물가채의 잔존만기가 짧을수록 인플레이션 충격에 대한 가격 민감도가 커질 가능성이 있다. <표 Ⅲ-5>에는 잔존만기가 1~3년 및 7~10년인 미국 물가채와 잔존만기 7~10년인 한국 물가채 분기 수익률(가격변화)의 인플레이션 충격 베타 추정치가 나타나 있다. <표 Ⅲ-5>를 보면, 한미 모두 장기 물가채의 경우 분기 인플레이션 충격에 대한 베타계수가 부호는 양이지만 유의하지 않음을 알 수 있다. 반면, 잔존만기가 1~3년인 미국 물가채는 베타계수가 1과 유의하게 다르지 않은 것으로 확인되었다. 이는 동 물가채가 인플레이션 충격을 효과적으로 헤지할 수 있음을 의미한다.

결과적으로, 단기 및 중기 시계의 인플레이션 충격 헤지에는 장기 물가채보다 만기 1~3년의 물가채가 적합한 것으로 판단해 볼 수 있다. 하지만, 물가채를 통해 인플레이션 충격을 헤지하는 데에는 낮은 유동성이 저해 요인이 될 가능성이 있다. 물가채는 전반적으로 유동성이 저조한데, 특히 잔존만기 1~3년의 물가채는 경과물이므로 잠재적으로 높은 유동성 리스크가 있는 것으로 볼 수 있다. 물가채의 유동성이 급격히 하락할 경우, 물가채 가격이 유동성 프리미엄 때문에 하락할 가능성이 있다. 결과적으로 물가채의 인플레이션 충격 헤지 유용성이 크게 낮아질 수 있다. 더욱이, Bekaert & Wang(2010)이 지적한 바와 같이, 물가채는 경기침체기 또는 금융불안시 유동성이 더 낮아질 수 있다는 점에도 유의할 필요가 있다.

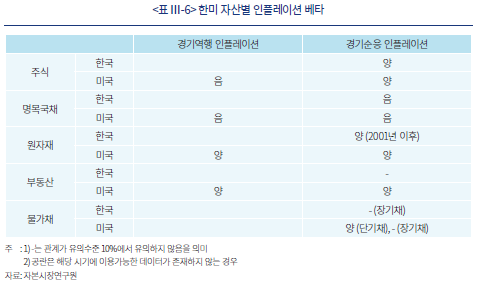

이상에서 살펴본 자산별 인플레이션 베타 추정결과를 정성적으로 정리하면 <표 Ⅲ-6>과 같다.

금번 인플레이션은 1980년대 초반 이후 사례를 찾아볼 수 없는 만큼, 경제적 특성 파악이 용이하지 않은 측면이 있다. 본 고에서 살펴본 바와 같이, 특히 주식과 채권의 경우, 인플레이션의 특성에 따라 인플레이션 베타의 부호가 달라질 수 있다. 아래에서는 금번 인플레이션의 특성을 평가해 보고 시사점을 모색한다.

최근의 스태그플레이션 가능성에 대한 논란에서 알 수 있듯이, 한미 모두 금번 인플레이션과 실질경제여건간 관계에는 다소 불확실한 측면이 있다. 이런 가운데, 금융시장은 금번 인플레이션을 경기역행적 인플레이션으로 평가 중인 것으로 보인다. 이는 <그림 Ⅲ-1>을 통해 확인할 수 있다. 그림에는 최근 주목받고 있는 주식 및 채권 수익률(가격변화)간 상관관계15)가 나타나 있다. 미국의 주식과 채권가격은 1990년대까지는 양의 상관관계를 보였으나, 2000년경부터는 일관되게 음의 상관관계를 나타냈다.16) 한국 주식과 채권 수익률 또한 2001년부터 일부시기를 제외하고 음의 상관관계를 보여 왔다. 그런데, 한미 모두 2022년 들어서 양 자산간 상관관계가 양으로 전환되었다.

Ⅳ. 결론 및 시사점

본 연구에서는 인플레이션 충격 헤지 관점에서, 국내 주요 자산수익률과 인플레이션간 관계를 살펴보았다. 주요 결과를 정리하면 다음과 같다. 첫째, 인플레이션 위험관리는 기대인플레이션보다 예상치 못한 인플레이션 변화인 인플레이션 충격에 초점을 맞출 필요가 있다. 기대인플레이션은 단기 명목국채를 통해 헤지가 용이하다. 둘째, 주식과 명목채권을 중심으로, 인플레이션과 자산수익률간 관계에는 인플레이션의 경제적 특성(경기역행 또는 경기순응)이 중요한 역할을 할 수 있다. 최근과 같이 양의 인플레이션 충격(기대치를 상회하는 인플레이션)에 대한 헤지가 중요한 경기역행적 인플레이션의 경우, 주식과 채권은 양의 인플레이션 충격이 발생할 때 가격이 하락하는 경향이 있으므로, 인플레이션 위험 헤지에 적합하지 않을 가능성이 있다. 셋째, 원자재 및 부동산 등과 같은 실물자산의 인플레이션 헤지 유용성은 실질경제여건보다는 각 자산의 특성에 영향을 받는 것으로 확인되었다. 원자재의 경우, 인플레이션과의 관계에 불안정성이 있어, 주식 및 채권과 달리, 헤지 성과 예측이 용이하지 않은 측면이 있다. 실물 부동산은 국가별로 인플레이션과의 관계에 차이가 관찰되었다. 미국 부동산은 인플레이션 헤지 효과가 높은 반면, 국내 부동산은 인플레이션과 유의한 관계가 확인되지 않았다. 넷째, 인플레이션 위험 헤지를 목표로 발행되는 물가채의 경우, 단기 또는 중기 시계의 인플레이션 위험 헤지에는 만기가 길지 않은 물가채가 적합한 것으로 확인되었다. 만기 7년 이상 장기 물가채는 헤지 기간을 분기로 고려할 경우, 예상과 달리 인플레이션 위험 헤지 유용성이 유의하지 않은 것으로 나타났다.17)

본 고의 결과를 바탕으로 국내 투자자의 인플레이션 위험관리를 위한 시사점을 살펴보면 다음과 같다. 첫째, 최근의 상황을 고려할 때, 원자재의 인플레이션 헤지 유용성이 높을 것으로 예상되나, 기본적으로 원자재는 국내 인플레이션의 결정요인으로 작용하는 만큼만 유용성이 있다는 점에 유의할 필요가 있다.18) 아울러, 원자재 가격은 변동성이 높기 때문에, 위험분산을 위해 여타 자산과의 상관관계를 고려한 자산배분 관점의 투자가 적절한 것으로 판단된다. 둘째, 금번 인플레이션이 경기역행적 특성을 가질 가능성이 큰 만큼, 헤지 목표 기간이 중기인 경우, 주식과 채권간 분산투자를 통한 인플레이션 위험 대응이 예기치 않은 결과를 가져올 수 있다는 점에 유의할 필요가 있다. 셋째, 단기 및 중기시계의 인플레이션 위험관리 측면에서 보면, 국내 물가채의 만기를 다양화하고, 발행을 늘려 유동성을 보완할 필요성이 있다.19) 하지만, 국채발행은 경제주체의 인플레이션 위험 헤지 외의 다양한 요인을 종합적으로 고려해야 하는 만큼, 금융기관이 인플레이션 스왑20) 등 파생상품을 활용하여 투자자의 인플레이션 위험관리를 지원할 필요가 있는 것으로 판단된다. 넷째, 이상의 시사점을 고려할 때, 인플레이션 위험관리에는 전문적인 지식이 요구된다고 볼 수 있다. 따라서 금융기관의 적극적 역할이 중요한 것으로 판단된다. 다섯째, 금융기관은 인플레이션 위험 헤지를 위한 금융상품을 도입할 때, 헤지 대상 인플레이션을 명확히 정의할 필요가 있다. 국내 인플레이션이 아닌 글로벌 인플레이션을 헤지 대상으로 할 경우, 국내 투자자 입장에서는 위험 헤지가 아닌 위험 추구가 될 가능성이 있다는 점에 유의해야 할 것이다. 마지막으로, 본 고의 분석에 기초할 때, 금번 국내 인플레이션은 1980년대 초반 이후 처음으로 발생한 경기역행적 인플레이션으로 볼 수 있다. 금융기관 및 투자자 모두 금번 인플레이션 대응에 어려움이 많을 것으로 예상되는 만큼, 보다 면밀한 접근이 요구된다.

<부록 1> 변수 선정 및 정의

<부록 2> 국내 인플레이션 특성 분석

본 고에서는 다음 두 단계 분석을 통해 국내 인플레이션의 특성을 분석하였다. 첫째, Piazzesi & Schneider(2007) 등 Ⅱ장에서 언급된 기존연구에 기초하여, 전분기 CPI 상승률과 이번 분기 실질소비증가율(내구재 제외)간 관계에 대해 다중구조변화(multiple structural breaks)를 검정하였다. 구조변화 검증은 Bai & Perron(1998)21) 및 Campbell et al.(2020)의 방법을 적용하였다. 둘째, 식별된 구조변화 시점을 전후하여 인플레이션과 실질경제여건(실질소비증가율ㆍ실질GDP증가율ㆍGDP갭)간 관계에 발생한 구조변화의 성격을 분석하였다. 분석에는 1970년 1분기부터 2022년 2분기까지의 분기별 (전분기대비) CPI 상승률, 실질소비증가율(내구재 제외) 및 GDP갭을 사용하였다.

우선, Bai & Perron(1998) 및 Campbell et al.(2020)의 방법 모두에서 인플레이션과 실질소비증가율간 관계에 1981년 4분기에 1회의 구조변화가 식별되었다. 다음으로 <부록 표 2>에는 식(2)에 제시된 회귀분석 모형을 적용해 추정한 결과가 나타나 있다. 제시된 결과는 식(2)에 전분기의 CPI 상승률을 독립변수로, 이번 분기의 실질경제여건(실질소비증가율ㆍ실질GDP증가율ㆍGDP갭)을 종속변수로 적용하여 추정한 결과이다. 더미변수(

추정 결과를 살펴보면, 구조변화를 고려하지 않을 경우(기본모형), 국내에서는 분석 기간 동안 CPI와 미래 실질경제여건간 관계가 유의하지 않음을 알 수 있다. 구조변화를 고려할 경우(구조변화모형), 실질경제변수간에 결과가 완전히 일치하지는 않으나, 대체로 1981년 3분기까지는 CPI가 상승할수록 실질경제 여건이 악화(실질성장률 및 GDP갭의

<부록 3> 단기 명목국채를 통한 기대인플레이션 헤지

본 고 Ⅱ장에서 통상 자산의 인플레이션 헤지 성과를 살펴봄에 있어, 인플레이션 충격에 초점을 맞추는 이유가 기대인플레이션은 단기 명목국채를 통해 헤지가 용이하기 때문이라는 점을 언급한 바 있다. <부록 표 3>은 전분기 말에 3개월 만기 명목국채를 매입하여 이번 분기까지 보유할 때 발생하는 보유수익률을, 전분기말에 형성된 이번 분기에 대한 기대인플레이션에 회귀분석한 결과를 보여준다. 분석 결과, 한미 모두 3개월 만기 국채 수익률이 기대인플레이션과 매우 밀접한 양의 관계를 가진다. 특히, 우리나라의 경우, 국채가 기대인플레이션보다 높은 수익률(

1) 인플레이션과 자산가격에 대한 연구는 1970년대부터 광범위하게 진행되어왔다. 본문에 정리된 내용은 Fama & Schwert(1977), Fama(1981), Kaul(1987), Erb & Harvey(2006), Kat & Oomen(2007), Bekaert & Wang(2010), Connolly et al.(2021), Neville et al.(2021), Fang et al.(2022) 등의 분석결과를 중심으로 작성하였다. 기존연구의 결과는 분석 대상 표본기간 및 수익률 산출기간(월, 분기, 년)에 따라 차이가 있다. 본문에서는 기존연구 결과 중, 월 및 분기 대상 결과를 정리하였다.

2) 피셔가설(Fisher, 1930)은 명목(채권)금리가 실질금리와 기대인플레이션으로 분해됨을 의미한다. 본문에서는 편의상 Fama & Schwert(1977)가 언급한 일반 피셔공식(generalized Fisher equation)을 사후적 관점(ex-post)에서 기술하였다.

3) 자산의 실질수익률이 인플레이션과 무관하면, 자산의 명목수익률은 인플레이션과 일대일 대응관계를 갖게 되며, 이 경우 앞의 식(1)에서 인플레이션 베타가 1이 된다.

4) Piazzesi & Schneider(2007), Bansal & Shaliastovich(2012), Burkhardt & Hasseltoft(2012), David & Veronesi(2013), Campbell et al.(2017), Song(2017), Boons et al.(2020), Campbell et al.(2020) 등은 인플레이션 충격이 주식과 채권의 가격 결정에 반영되는 이론적 메커니즘을 분석하였다.

5) Piazzesi & Schneider(2007) 등이 제시한 이론적 관점에 기초할 경우, 투자자 입장에서는 실질경제여건이 악화되어 한계효용이 높은 상황에 대한 헤지가 중요하다. 경기역행적 인플레이션에서는 양의 인플레이션 충격이 발생할 때 실질경제가 악화되어 한계효용이 높아지므로, 이에 대한 헤지가 중요하다. 따라서 이 경우에는 인플레이션이 높을 때 가격이 올라가는 자산이 투자자에게 가치가 있다. 하지만 인플레이션이 경기순응성을 보일 때는 음의 인플레이션 충격이 발생할 때 실질경제가 악화되어 한계효용이 증가한다. 따라서 이런 상황에서는 음의 인플레이션 충격을 헤지할 수 있는 자산이 가치가 있는 것으로 볼 수 있다. 결과적으로 이론적 관점에서만 보면, 경기순응적 인플레이션에서 양의 인플레이션 충격이 헤지 대상인지에는 논란이 있을 수 있다.

6) 회귀식 추정 결과 해석시 다음 사항에 유의할 필요가 있다. 인플레이션 베타가 유의하더라도 모형의 설명력이 지나치게 낮을 때에는 자산의 수익률 결정에 인플레이션 외 여타 요인의 영향이 클 가능성이 있다. 따라서 해당 자산으로 인플레이션 위험을 헤지할 경우에는 인플레이션 외의 위험요인을 고려할 필요가 있다.

7) 분기별 인플레이션, GDP갭, 무위험 금리(미국: 연방기금금리, 한국: 콜금리)로 구성된 VAR(1)에서 산출된 인플레이션을 기대인플레이션으로 사용한다.

8) 아울러, 앞 장에서 기대인플레이션의 경우 단기 명목국채의 만기 보유를 통해 헤지가 용이하다는 점을 언급한 바 있다. <부록 3>에 한미 단기 명목국채의 기대인플레이션 헤지 성과 분석결과를 정리하였다. 부록에 제시된 것처럼, 한미 모두 단기국채를 통한 기대인플레이션 헤지가 어렵지 않음을 알 수 있다.

9) Connolly and Stivers(2019) 및 Connolly et al.(2021)은 동일한 인플레이션 특성에서도 경기 침체기와 비침체기에 인플레이션과 자산수익률간 관계에 차이가 있을 수 있다는 분석 결과를 제시하였다. 이에, 본 고에서는 국내의 경우, 경기역행 인플레이션 시기를 분석할 수 없음을 감안하여, 경기 침체기와 호황기간의 차이를 살펴보고자 한다.

10) 본 고에서 제시하지는 않으나, 채권은 만기가 길수록 강한 음의 인플레이션 베타를 갖는 것으로 확인되었다. 이는 채권의 듀레이션 효과 때문으로 볼 수 있다.

11) Erb & Harvey(2019)가 지적한 바와 같이, GSCI는 현물이 아닌 선물지수이므로, 본 고의 분석결과가 실제 원자재 가격의 행태와 차이가 있을 수 있다. 또한 GSCI와 같은 선물지수의 경우, 지수 구성요소에 대한 가중치에 따라 인플레이션간 관계에 차이가 있을 수 있다는 점에도 유의할 필요가 있다. 참고로, 본 고에서 사용한 GSCI는 에너지, 금속, 농산물 등 24개 품목으로 구성되어 있다. 2022년 8월 기준, 각 품목별 가중치는 에너지(원유 및 천연가스 등) 53.48%, 농산물 20.48%, 산업용 금속 12.71%, 금ㆍ은 5.97% 등이다.

12) 부동산을 주택 및 아파트, 지역을 전국, 서울, 강남 등으로 세분화하여 분석한 결과에서도 유의한 양의 베타를 확인할 수 없었다.

13) 2022년 6월 기준, 소비자물가지수에서 부동산 가격과 밀접히 연관된 주거비 비중이 한국은 9.8%이나, 미국은 32% 수준이다.

14) 물가채는 채권의 현금흐름(원금 및 이자)에서 인플레이션 위험을 제거하므로, 만기까지 보유할 때의 실질수익률을 매입 당시의 만기수익률(yield-to-maturity)로 고정할 수 있다.

15) Economist(2022.8.11), FT(2022.9.22) 및 WSJ(2022.10.9) 등을 참고하기 바란다.

16) 미국 주식-채권간 상관관계의 특성은 Piazzesi & Schneider(2007) 등을 비롯해, 다수 연구에서 검증된 결과이다.

17) 인플레이션과 자산수익률간 관계는 투자 시계에 따라 달라질 수 있다. 본 고에서는 분기별 인플레이션과 자산수익률간 관계를 살펴보았다. 따라서 연기금 등에 적합한 장기 시계에 대해서는 별도로 살펴볼 필요가 있는 것으로 판단된다.

18) 본고의 실증분석에는 제시되지 않았으나, 미 달러로 거래되는 원자재 가격이 국내 인플레이션 결정요인으로 작용하는 데에는 원달러 환율의 영향도 중요한 것으로 확인되었다. 원자재 가격이 동일해도 원달러 환율이 변동할 경우, 수입물가 경로를 통해 원자재 가격이 국내 인플레이션에 미치는 영향이 증폭되거나 완화될 수 있다.

19) 우리나라는 주요국 대비 국채 중 물가채 비중이 현저히 낮은 수준이다. 기획재정부 및 BIS(우리나라를 제외한 국가)에 따르면 2021년말 기준, 주요국의 국채잔액 중 물가채 비중은 아래 표와 같다.

20) 인플레이션 스왑은 고정금리 쿠폰과 실현된 인플레이션 인덱스(CPI 상승률)로 결정되는 변동금리 쿠폰을 교환하는 장외파생거래이다(Hinnerich, 2008). 인플레이션 스왑은 물가채권을 매수하고 명목채권을 매도한 합성포지션이며 물가채권보다 인덱스를 헤지하는 효과가 더 크다고 볼 수 있다. 2000년대 초반에 도입되었으며, 미국ㆍ영국ㆍ유로지역의 인플레이션을 기초로 하는 거래가 활성화되어 있다(Barnes, 2021). LCH에 따르면, 2022년 1분기에 동 사가 청산한 달러ㆍ파운드ㆍ유로화에 대한 인플레이션 스왑의 거래량(명목금액)은 2.7조달러로, 2020년 평균치인 1.7조달러에서 66% 급증하였다. 아래 표는 LCH가 청산한 달러ㆍ파운드ㆍ유로화 인플레이션 스왑의 명목잔액(2020년 평균치와 2022년 1분기, 금액은 달러로 환산)을 나타낸다.

21) 본 고에서는 Ditzen et al.(2021)이 Bai & Perron(1998)의 방법을 적용하여 고안한 알고리즘을 활용하였다. 간략히 살펴보면, 동 방법에서는 우선 구조변화가 없다는 가설을 기각할 수 있는 최대 숫자의 구조변화를 식별한다. 다음으로, s개 대비 s+1개의 구조변화의 유의성을 검정하는 절차를 통해 최종 구조변화 숫자 및 시점을 식별한다. 분석 결과, 유의수준 5%에서 분석 기간 중 1회의 구조변화가 발생한 것으로 추정되었다. 다만, 분석에서 IMF 외환위기 당시인 1998년 1분기는 제외하였다. 동 분기에는 실질성장률 및 실질소비증가율이 연율로 27%가량 급락하였는데, 분석 기간 중 특이치로 볼 수 있다. 다각도로 살펴본 결과, 동 분기를 포함하면 전반적인 변수간 관계가 왜곡되는 것으로 확인되었다.

22)

23) 미국 3개월 국채(T-bill)의 기대인플레이션 민감도는 2021년부터 크게 낮아진 것으로 확인되었다. 2022년까지의 자료를 사용할 경우,

24) <부록 1>에 정리된 것처럼, 국내 3개월 만기 국채 수익률 자료는 2001년부터 이용가능하다. <부록 표 3>에서, 1980년~2000년에 대해서는, 콜금리를 3개월 재투자한 수익률로 국채 3개월 금리를 대체하였다.

참고문헌

성병묵ㆍ김찬우ㆍ황나윤, 2022, 자산으로서 우리나라 주택의 특징 및 시사점, 한국은행 BOK 이슈노트 제2022-19호.

자본시장연구원, KCMI 2018년 하반기 경제 및 자본시장전망.

Arnold, S., Auer, B.R., 2015, What do scientists know about inflation hedging? North American Journal of Economics and Finance 34, 187-214.

Attie, A.P., Roache, S.K., 2009, Inflation hedging for long-term investors, IMF working paper.

Baele, L., Bekaert, G., Inghelbrecht, K., 2010, The determinants of stocks and bond return comovements, Review of Financial Studies 23(6), 2374-2429.

Bai, B.Y.J., Perron, P., 1998, Estimating and testing linear models with multiple structural changes, Econometrica 66(1), 47–78.

Bansal, R., Shaliastovich, I., 2012, A long-run risks explanation of predictability puzzles in bond and currency markets, Review of Financial Studies 26(1), 1-33.

Barnes, C., 2021, G3 inflation swap volumes are on the up, Clarus.

Bekaert, G., Engstrom., E., 2010, Inflation and the stock market: Understanding the “Fed model”, Journal of Monetary Economics 57(3), 278-294.

Bekaert, G., Wang, X., 2010, Inflation risk and the inflation risk premium, Economic Policy October 2010, 755-806.

Blanchard, O.J., 1989, A traditional interpretation of macroeconomic fluctuations, American Economic Review 79(5), 1146-1164.

Blinder, A.S., Rudd, J.B., 2008, The supply-shock explanation of the great stagflation revisited, NBER working paper 14563.

Boons, M., Duarte, F.M., de Roon, F., Szymanowsak, M., 2020, Time-varying inflation risks and stock returns, Journal of Financial Economics 136(2), 444-470.

Burkhardt, D., Hasseltoft, H., 2012, Understanding asset correlations, Swiss Finance Institute Research Paper Series No.12-38.

Campbell, J.Y., Pflueger, C., Viceira, L.M., 2020, Macroeconomic drivers of bond and equity risks, Journal of Political Economy 128(8), 3148-3185.

Campbell, J.Y., Sunderam, A., Viceira, L.M., 2017, Inflation bets or deflation hedges? The changing risks of nominal bonds, Critical Finance Review 6, 263–301.

Connolly, R.A., Stivers, C., 2019, Changes in inflation expectations, stock returns and the economic state: A signaling role for inflation?, working paper.

Connolly, R.A., Stivers, C., Sun, L., 2021, Stock returns and inflation shocks in weaker economic times, Financial Management 51(3), 827-867.

David, A., Veronesi, P., 2013, What ties return volatilities to price valuations and fundamentals? Journal of Political Economy 121(4), 682-746.

Ditzen, J., Karavias, Y., Westerlund, J., 2021, Testing and estimating structural breaks in time series and panel data in Stata.

Economist, 2022.8.11, How should investors prepare for repeat inflation shocks?

Ermolov, A., 2022, Time-varying risk of nominal bonds: How important are macroeconomic shocks, Journal of Financial Economics 145(1), 1-28.

European Securities and Markets Authority(ESMA), 2022, Recommendations in regard of the impact of inflation on investor protection, ESMA Securities and Markets Stakeholder Group.

Fama, E.F., 1981, Stock returns, real activity, inflation and money, American Economic Review 71(4), 545-565.

Fama, E.F., Schwert, G.W., 1977, Asset returns and inflation, Journal of Finance 47(4), 1315-1342.

Fang, X., Liu, X., 2022, Getting to the core: Inflation risks within and across asset classes, NBER working paper 30169.

Financial Times, 2022.9.22, Investors wonder if the 60/40 portfolio has a future.

Fisher, I., 1930, The theory of interest, New York: Macmillan.

Gallant, R.A., Nychka, D.W., 1987, Semi-nonparametric maximum likelihood estimation, Econometrica, 55(2) 363-390.

Gallant, R.A., Tauchen, G., 2017, SNP: A program for nonparametric time series analysis, Penn State University.

Goodfriend, M., King, R., 1997, The new neoclassical synthesis and the role of monetary policy, In B. S. Bernanke, & J. Rotemberg, NBER Macroeconomics Annual, MIT Press.

Gyourko, J., Linneman, P., 1988, Owner-occupied homes, income-producing real estate and REIT as inflation hedges, Journal of Real Estate Finance and Economics 1(4), 347–372.

Hinnerich, M., 2008, Inflation-indexed swaps and swaptions, Journal of Banking and Finance 32, 2293-2306.

Jaffe, J.F., Mandelker, 1976, The “Fisher effect” for risky assets: An empirical investigation, Journal of Finance 31(2), 447-458.

Kat, Harry M. and Roel C. A. Oomen, 2007, What every investor should know about commodities, Part II: Multivariate return analysis, Journal of Investment Management 5(3), 16–40.

Kaul, G., 1987, Stock returns and inflation: The role of the monetary sector, Journal of Financial Economics 18(2), 253-276.

Killian, L., 2009, Not oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market, American Economic Review 99(3), 1053-1069.

Lagarde, C., 2022, A new global map: European resilience in a changing world, ECB.

Neville, H., Draaisma, T., Funnell, B., Harvey, C.R., Van Hemert, O., 2021, The Best Strategies for Inflationary Times, Journal of Portfolio Management 47(8), 8-37.

Piazzesi, M., Schneider, M., 2007, Equilibrium yield curves, In NBER Macroeconomics Annual 2006, Volume 21, 389-472.

Schnabel, I., 2022, A new age of energy inflation: Climateflation, fossilflation and greenflation, ECB.

Schotman, P., Schweitzer, 2000, Horizon sensitivity of the inflation hedge of stocks, Journal of Semitropical Finance 7, 301-315.

Song, D.H., 2017, Bond market exposures to macroeconomic and monetary policy risks, Review of Financial Studies 30(8), 2761–2817.

Wall Street Journal, 2022.10.9, Markets are topsy-turvy, and there’s worse: It’s hard to cushion your portfolio.

World Bank, 2022, Commodity markets outlook, April, 2022.

Zhang, Z., 2021, Stock returns and inflation redux: An explanation from monetary policy in advanced and emerging markets, IMF working paper.