Find out more about our latest publications

Introduction of Sustainability-Linked Bonds into Korea: Expectations and Challenges

Issue Papers 23-03 Jan. 12, 2023

- Research Topic Capital Markets

- Page 22

Recently, sustainable linked bonds (SLBs) have been newly adopted in Korea’s ESG bond market. The market has achieved highly quantitative growth but is faced with problems such as a leaning toward social bonds and a lack of private company engagement, which requires qualitative improvements. Under the circumstances, it is unfortunate that domestic companies rarely make full use of ESG bonds to meet environmental and social goals such as the net-zero transition that require enormous funds. Among various factors that contribute to underused ESG bonds, the most notable is that the use of funds from ESG bonds is limited to specific projects. On the other hand, SLBs are not constrained by the scope of fund use and thus, a growing number of companies are expected to tap into SLBs to improve environmental and social issues.

SLB issuers can use the funds raised from SLBs for achieving specific environmental or social goals to finance any corporate activities. For this reason, SLBs can provide an opportunity for companies, which are unable to find a huge green or social project or fall into the brown industry category, to have access to the ESG bond market. In addition, an SLB is an incentive-based borrowing instrument under which financial conditions such as interest rates are tied to whether the issuer achieves a commitment. This is beneficial for investors as the risk of greenwashing that comes with conventional ESG bonds can be mitigated. However, SLBs may give rise to other types of greenwashing, depending on goal setting or incentive structure, which requires both SLB issuers and investors to exercise caution.

The introduction of SLBs is expected to expand Korea’s ESG bond market base and boost the engagement of private companies. As any SLB has yet to be issued in Korea, however, Korea needs to make thorough preparation to ensure that SLBs take hold and thrive. First of all, a database across industries and sectors should be created based on corporate ESG disclosure to set a goal and evaluate whether an SLB accomplishes the goal. What is also needed is a sophisticated methodology to assess an SLB design structure, based on which Korean companies should establish ESG strategies. Most importantly, trust in the early SLB market should be built to ensure that they live up to the expectations of market participants.

SLB issuers can use the funds raised from SLBs for achieving specific environmental or social goals to finance any corporate activities. For this reason, SLBs can provide an opportunity for companies, which are unable to find a huge green or social project or fall into the brown industry category, to have access to the ESG bond market. In addition, an SLB is an incentive-based borrowing instrument under which financial conditions such as interest rates are tied to whether the issuer achieves a commitment. This is beneficial for investors as the risk of greenwashing that comes with conventional ESG bonds can be mitigated. However, SLBs may give rise to other types of greenwashing, depending on goal setting or incentive structure, which requires both SLB issuers and investors to exercise caution.

The introduction of SLBs is expected to expand Korea’s ESG bond market base and boost the engagement of private companies. As any SLB has yet to be issued in Korea, however, Korea needs to make thorough preparation to ensure that SLBs take hold and thrive. First of all, a database across industries and sectors should be created based on corporate ESG disclosure to set a goal and evaluate whether an SLB accomplishes the goal. What is also needed is a sophisticated methodology to assess an SLB design structure, based on which Korean companies should establish ESG strategies. Most importantly, trust in the early SLB market should be built to ensure that they live up to the expectations of market participants.

Ⅰ. 서론

최근 국내에도 지속가능연계채권(Sustainability-Linked Bonds: SLB)이 도입되었다. 한국거래소는 국내 ESG채권 시장의 접근성 제고를 위해 2020년 개설한 사회적책임투자(Socially Responsible Investment: SRI)1) 전용 세그먼트에 2022년 9월 SLB를 새롭게 추가하였다. 그간 한국거래소 SRI 전용 세그먼트에는 녹색채권(green bonds), 사회적채권(social bonds), 지속가능채권(sustainability bonds)의 3가지 전통적 ESG채권만 포함되었으나, SLB가 추가되면서 글로벌 시장과 동일한 ESG채권 포트폴리오를 갖추게 되었다.

글로벌 시장에서는 SLB가 이미 사회적채권에 버금가는 규모로 성장했으며, 국내에서도 SLB의 도입은 발행자 및 투자자 모두에게 국내 ESG채권 시장의 저변을 확대해 주는 수단이 될 수 있다. SLB는 전통적 ESG채권이 지니는 자금활용 범위의 제한을 풀어줌으로써 민간기업 및 비친환경적 기업에게도 SLB를 발행할 유인을 제공하기 때문이다. 다수의 국내 기업들이 넷제로(net-zero) 달성을 위한 막대한 자금 동원에 ESG채권을 충분하게 활용하지 못하고 있는 상황에서 SLB는 새로운 활로를 열어줄 것으로 기대된다.

그러나 SLB가 국내 시장에 안착하기 위해서는 극복해야 할 과제도 상당하다. 글로벌 시장에서도 SLB는 2019년 처음 발행되어 아직 발전 초기 단계에 있으며 전통적 ESG채권에 비해 SLB에 대한 인지도도 낮은 편이다. 또한, 현재 대부분의 발행된 SLB는 만기가 도래하지 않은 상황으로 SLB의 실효성에 대한 평가는 진행형이며, SLB의 장단점에 대한 의견들도 분분하다. 국내외로 SLB 관련 문헌이 제한적인 점도 이러한 상황을 반영한다.

본고는 2019년에서 2022년 9월 사이 블룸버그(Bloomberg)에서 제공하는 ESG채권 자료를 통해 SLB의 구조와 주요 특징을 소개하고자 한다. 우선 국내 ESG채권 시장의 현황에 비추어 SLB 도입의 필요성과 기대를 조명한다. 다음으로는 SLB의 주요 구성 요소와 세부적 구조를 설명하고, 글로벌 SLB 시장의 현황과 특징을 정리해본다. 이와 함께 일각에서 제기하는 잠재적 SLB 워싱 문제의 주요 논점도 짚어본다. 마지막으로 앞선 내용을 토대로 SLB의 국내 시장 안착을 위해 갖추어야 할 기반 여건과 앞으로 풀어나가야 할 과제를 제시한다.

II. 국내 지속가능연계채권(SLB) 도입의 기대

1. ESG채권 개요

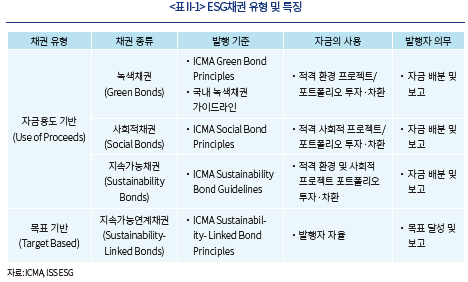

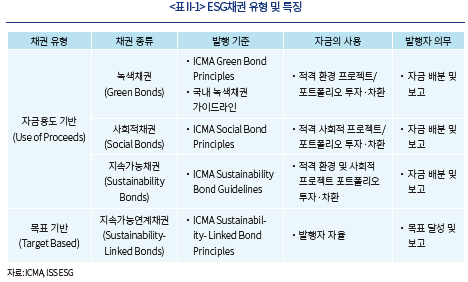

ESG채권은 자금의 활용 범위에 따라 크게 두 가지 유형으로 나누어진다(<표 II-1>). 하나는 자금의 사용이 특정 환경ㆍ사회적 프로젝트에만 국한되는 ‘자금용도 기반(use-of-proceeds)’ 채권이며 녹색채권, 사회적채권 및 지속가능채권을 포함한 일명 GSS채권(Green, Social, Sustainabilty Bonds)이 여기에 속한다. 다른 하나는 자금 활용이 자유로운 ‘목표 기반(target based)’ 채권이며 지속가능연계채권(Sustainability-Linked Bonds: SLB)이 여기에 속한다.2)

현재 국내외로 ESG채권의 발행 기준은 국제자본시장연맹(International Capital Markets Association: ICMA)의 ‘채권원칙(Bond Principles)’이 제공하고 있다. ICMA의 채권원칙에는 녹색채권 원칙(Green Bond Principles: GBP), 사회적채권 원칙(Social Bond Principles: SBP), 지속가능채권 가이드라인(Sustainability Bond Guidelines: SBG) 및 지속가능연계채권 원칙(Sustainability-Linked Bond Principles: SLBP)의 4개가 있다. ICMA는 각 ESG채권 유형에 대해 조달자금의 사용ㆍ관리, 사전ㆍ사후 보고, 검증 등에 대한 주요 원칙과 기준을 제시한다. 국내에서는 2020년에는 환경부, 금융위원회, 한국환경산업기술 및 한국거래소가 ICMA의 GBP를 기반으로 국내 녹색채권 가이드라인을 마련하였다.

2. 국내 ESG채권 시장 현황

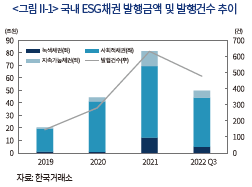

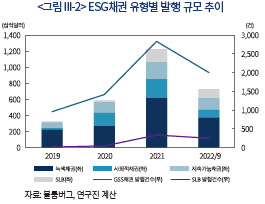

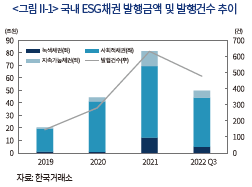

국내 ESG채권 시장은 외형적으로는 단기간에 괄목할만한 성장을 이루고 있다. <그림 II-1>은 한국거래소에 등록된 국내 ESG채권 유형별 발행 규모 추이를 보여준다. 국내 ESG채권 발행금액은 2019년 20.5조원에서 2021년 81.5조원으로 4배 증가했으며, 2022년에는 9월까지 49.8조원을 기록하고 있다. ESG채권 발행 건수도 2019년 145건에서 2021년 632건으로 4.4배 증가했으며, 2022년에는 9월까지 478건이 발행되었다.

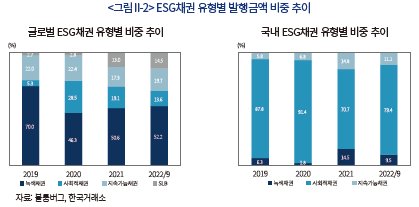

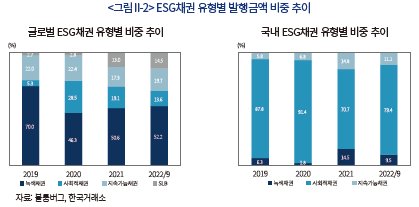

국내 ESG채권 시장의 특징 중 하나는 녹색채권 중심의 해외 시장과 달리 사회적채권 중심으로 형성되어 있는 점이다(<그림 II-2>). 국내 ESG채권 시장에서 발행금액 기준 사회적채권 비중은 2019년 87.8%에서 2021년에는 70.7%로 감소하였지만 여전히 높은 비중을 차지하고 있다. 반면, 글로벌 ESG채권 시장에서는 발행금액 기준 녹색채권이 2019년 70.0%에서 2021년 50.6%로 감소했으나 가장 높은 비중을 차지하고 있다.3) 국내에서 사회적채권 비중이 높은 것은 공사가 발행한 특수채에 ESG 인증을 받는 경우가 늘어난 데 주로 기인하며, 이로 인해 국내 ESG채권 시장이 다소 왜곡된 측면이 있다(김필규, 2021). 국내 사회적채권의 주요 발행자로는 주택금융공사, 예금보험공사, 보증기관 등 공사가 차지하는 비중이 높으며, 2021년 기준 국내 ESG채권 발행금액 중 공사 비중은 51.6%에 달한다. 특히, 이와 같은 사회적채권 자금의 투입은 대부분은 기존에 수행하던 사업(business as usual)에 주로 사용되고 있으며, ESG채권의 취지인 ‘의미 있는 기여(substantial contribution)’와는 다소 거리가 멀다.

사회적채권과 대조적으로 국내 녹색채권 발행은 미흡한 상황이다. 발행금액 기준 국내 ESG채권 중 녹색채권이 차지하는 비중은 2019년 6.3%에서 2021년 14.5%로 증가했으나, 여전히 낮은 수준이다. 특히 국내 민간기업의 녹색채권 발행이 부족하다. 2019년에서 2022년 사이 국내 민간기업 중 녹색채권을 발행한 회사는 65개사, 이중 비금융회사는 49개사만 있다. 나아가 녹색채권 발행 비금융회사는 주로 정유회사, 발전ㆍ전력회사 등 제한된 산업군에 속하며, 이중 시가총액 기준 국내 100대 기업에 속하는 경우는 15개사에 불과하다. 이는 현재 파리기후협약(Paris Agreement)의 이행, 넷제로 달성 등 국내 기업들이 계획하고 있는 환경 개선 목표 달성에 녹색채권이 충분히 사용되지 못하고 있음을 보여주기도 한다. 환경부가 2020년 12월 발표한 ‘2030 국가온실가스감축목표’는 2017년 대비 2030에 24.4%를 감축하는 것이며, 여기에는 국내 기업의 적극적인 참여가 전제되어 있다.

3. GSS채권의 한계

국내에서 녹색채권이 충분하게 활용되지 못하고 있는 데에는 녹색채권을 비롯한 GSS채권의 3가지 구조적인 한계가 주요 원인을 제공한다. 첫째, GSS채권은 조달된 자금이 특정 환경ㆍ사회적 프로젝트로 국한되며, 그 이유는 ESG 워싱(washing) 방지를 위해 채권의 조달자금이 무분별하게 사용되지 않도록 하기 위해서다. 그러나 이러한 보호 장치는 발행자, 특히 민간기업 입장에서 GSS채권의 활용도와 발행 유인을 저해하는 요인으로 작용한다. 대다수 민간기업의 경우 GSS채권을 발행할 만큼 대규모의 적격 프로젝트를 찾는 데 어려움이 있다.

둘째, 환경ㆍ사회적 개선 효과(impact)의 불확실성도 GSS채권이 지니는 한계에 속한다. ICMA는 GSS채권 발행에 있어서 대상 프로젝트의 환경ㆍ사회적 기대 효과를 발행설명서에 공시하고, 이를 외부 기관으로부터 사전ㆍ사후적으로 검증받을 것을 권고하고 있다. 그러나 이와 같은 발행 절차에도 불구하고 실제로 GSS채권 프로젝트가 기대한 수준의 개선 효과를 발휘하게 보장할 방법은 없다. 또한, Ehlers et al.(2020)은 GSS채권이 프로젝트 단위(project level)로 설정되어 있기 때문에 발행 기업 단위(firm level) 차원에서는 의미 있는 수준의 환경ㆍ사회적 개선이 나타나지 않을 수 있다는 점을 지적한다.4)

셋째, 투자자의 관점에서 GSS채권 프로젝트의 기대 효과가 실질적으로 나타나지 않거나 예상 수준을 하회하더라도 발행자에게 책임을 묻거나 보상받을 방안이 없다. ICMA의 ESG 채권원칙은 이와 같은 워싱 문제를 방지하기 위해 세밀한 발행 절차와 더불어, 프로젝트 기대 효과 산출에 대한 기준도 제시하고 있다. 그럼에도 불구하고 ICMA의 ESG 채권원칙은 강제성이 없는 자발적 기준이며, GSS 채권 프로젝트의 기대 효과가 나타나지 않을 경우 발행자에 대한 불이익은 평판위험(reputation risk) 외에는 딱히 없다(ESMA, 2021).

4. SLB에 대한 기대

SLB는 GSS채권이 지니는 3가지 단점을 보완할 수 있게 설계되었다. 첫째, SLB는 발행 자금이 프로젝트에 국한되지 않고 기업 운영 전반에 사용할 수 있도록 범위의 넓혀줌으로써 대규모 환경ㆍ사회적 프로젝트를 찾기 어려운 기업도 SLB를 발행할 유인을 마련해준다. 또한, SLB는 회사법 관점에서 신의성실의무(fiduciary duty)로 인해 ESG 투자에 나서기 어려운 기업도 ESG채권 시장으로 끌어 들여올 수 있다. SLB는 ESG 활동에 대한 재무적 이득이 명확하기 때문에 경영진 입장에서 주주에 대한 신의성실의무 위반 문제를 완화해줄 수 있기 때문이다(Povolonis, 2022).

둘째, SLB는 환경ㆍ사회적 개선 효과가 명확한 장점을 지닌다. SLB 발행자는 사전에 정량적 환경ㆍ사회적 측정치를 정하고 이에 기반한 검증 가능한 목표를 설정해야 한다. 해당 목표는 SLB 만기 이전에 달성해야 하기 때문에 GSS채권이 지니는 기대 개선 효과의 불확실성 문제를 완화해준다(Berrada et al., 2022). 나아가 SLB의 환경ㆍ사회적 개선 효과는 프로젝트 단위가 아니라 발행 기업 단위로 설정되기 때문에 Ehlers et al.(2020)이 지적하는 문제도 일부 해소해준다.

셋째, SLB 발행자가 약속한 환경ㆍ사회적 개선 목표를 달성하지 못할 경우 투자자는 이에 대한 보상을 받을 수 있다. SLB는 발행자의 목표 달성을 채권 만기 이전에 확인하고 목표 달성 여부에 따라 재무적 보상 또는 페널티가 부과되는 인센티브(incentive)를 포함한다. SLB에서 가장 널리 사용되는 인센티브는 목표 달성 확인 이후 만기까지 남은 기간동안 이자율이 조정되는 구조다. SLB 발행자는 목표를 달성하지 않을 경우 평판위험과 더불어 명확한 재무적 비용을 지불해야 하기 때문에 약속을 지키도록 노력할 유인이 생긴다.

III. SLB의 구조 및 시장 현황

1. SLB의 구조

ICMA(2020)는 SLB를 ‘발행자가 사전에 정한 특정 지속가능성/ESG 목표의 달성 여부에 따라 금융 또는 구조가 변하는 채권’으로 정의한다. 이와 같은 성과 연계 조건부 채권ㆍ대출은 마이크로파이낸스(micro-finance), 변동 이자율 구조는 신종자본증권 및 후순위채권에서도 널리 사용되는 방식이기도 하다(Chan, 2022; Mielnik & Erlandsson, 2022).

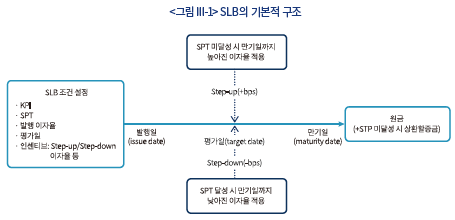

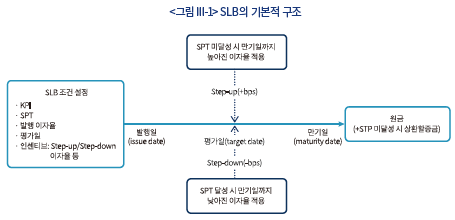

SLB는 크게 4개의 주요 요소로 구성되어 있다(<그림 III-1>): (1) 환경ㆍ사회적 개선 효과를 측정하는 ‘핵심 성과지표(Key Performance Indicators: KPI)’; (2) 발행자가 달성을 약속하는 ‘지속가능성 성과목표(Sustainability Performance Target: SPT)’; (3) SPT의 달성 여부를 평가하는 ‘평가일(target date)’; (4) SPT의 달성 여부에 따라 결정되는 인센티브(incentive).

가. 핵심성과지표(KPI)

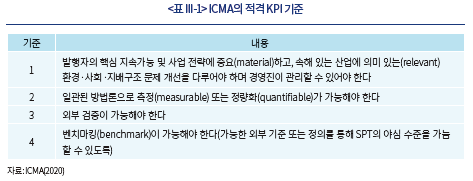

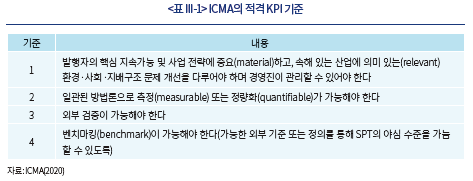

SLB의 목표, 즉 SPT를 정하기에 앞서 무엇으로 SPT를 측정(measure)할지를 결정해야 할 필요가 있으며, KPI가 그 역할을 한다. 예를 들어 KPI는 ‘탄소배출량’이고, SPT는 ‘2030년까지 2022년 대비 탄소배출량을 30% 감축’하는 것이다. <표 III-1>은 ICMA의 적격 KPI 기준을 보여준다. ICMA는 적격 KPI가 사업과 연계성(relevance)이 높고, 구체적(specific)이며, 측정가능(measurable)한 성격을 갖출 것을 권고한다.

ICMA가 제시하는 적격 KPI는 측정 및 비교가능성을 강조하고 있으며, 이에 따라 사회보다는 환경 분야에 적합한 측면이 있다. 기후변화 등 환경 문제의 경우 탄소배출 감소 등 그 원인과 해결책이 과학적 근거에 기반하고 측정할 수 있는 방법이 상대적으로 명확하다. 반면 양극화 같은 사회적 문제의 경우 원인과 해결책이 복잡하고 사회적채권을 살펴볼 경우에도 기대 효과 등에 대한 측정이 주로 정성적으로 이루어진다. 실제로 그간 발행된 SLB를 보면 KPI는 환경 분야가 압도적 비중을 차지하고 있다. SLB의 KPI는 단일 또는 복수가 사용될 수 있으며, KPI를 SPT와 일대일로 연결하거나 복수의 KPI를 하나의 SPT에 사용하는 등 여러 조합이 가능하다. 이와 더불어 환경 및 사회 분야의 KPI를 하나의 SLB에 포함하는 혼합형(mixed) 사례도 일부 있다.

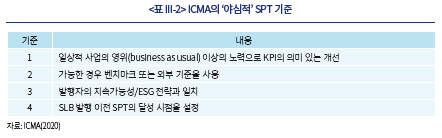

나. 지속가능성 성과목표(SPT)

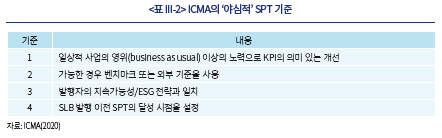

SPT 수준의 설정은 SLB가 실제로 의미 있는 환경ㆍ사회적 개선 효과를 발휘하는지를 결정하는 주요 요인이다. ICMA는 SPT 수준은 충분히 ‘야심적(ambitious)’이어야 하며 이에 대한 기준을 제시하고 있다(<표 III-2>). SPT의 달성을 위해서는 ‘일상적 사업의 영위(business-as-usual)’ 이상의 노력이 필요하며, 발행자의 지속가능성/ESG 전략과 일치하여야 한다. 또한 SPT의 평가일은 발행 이전에 설정되고 SPT의 평가는 만기 이전에 이루어져야 한다.

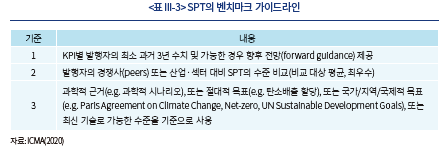

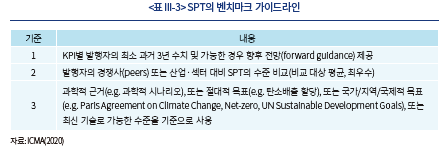

ICMA는 SPT의 추가적 가이드라인을 제시하고 있다(<표 III-3>). SPT를 구성하는 KPI는 발행자의 과거 및 향후 예상되는 수준에 대한 3년치 이상의 정보를 제공할 것을 권고한다. 또한 발행자의 산업ㆍ섹터ㆍ경쟁사의 평균 및 최우수(best-in-class) 수준과의 비교도 포함할 것을 권고한다. 추가적으로 과학ㆍ기술적 근거, 파리 기후 협약, 넷제로 등 국가ㆍ지역ㆍ국제적 목표 등을 SPT 설정 기준으로 사용할 수 있다.

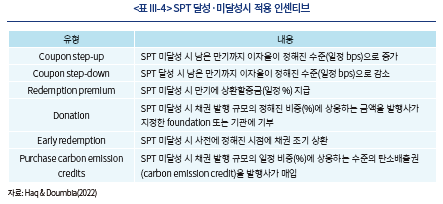

다. 인센티브

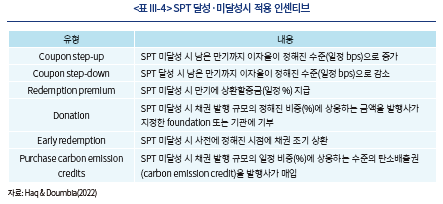

SLB는 평가일에 SPT의 달성 여부를 확인하고, 그 결과에 따라 사전에 정해진 재무적 인센티브가 적용된다. <표 III-4>는 SLB에 주로 사용되는 인센티브 유형을 보여준다. SLB에 가장 많이 사용되는 인센티브는 이자율의 상향(step-up) 또는 하향(step-down) 조정이다. Step-up은 평가일에 SPT를 달성할 경우 SLB 발행시 이자율이 유지되고, SPT를 달성하지 못할 경우 만기까지 이자율이 사전에 정해진 수준만큼 추가되어 상승하는 페널티다. 반대로 step-down은 평가일에 SPT를 달성하지 못할 경우 SLB 발행시 이자율이 유지되고, SPT의 달성시 사전에 정해진 수준에 따라 이자율이 만기까지 낮아지는 구조다. 기존 발행된 SLB의 경우 step-up 및 step-down의 이자율 조정 수준으로는 25bps가 가장 많이 사용되고 있다. 복수의 SPT를 가진 SLB의 경우 복수의 step-up 또는 step-down이 적용되는 누적(cumulative) 인센티브 구조를 지닐 수 있으며, step-up과 step-down을 함께 적용하는 경우도 가능하다. 이자율 조정 외에 SPT 미달성시 만기에 상환할증금(redemption premium) 부여, 액면가의 일정 비율을 기부(donation) 또는 탄소배출권(carbon emission credit) 매입, 투자자의 조기상환(early redemption) 행사 등의 인센티브도 있다.

2. SLB 시장 현황 및 특징

가. SLB 시장 규모

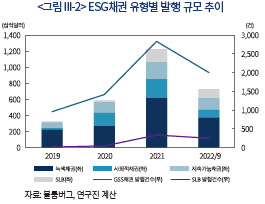

<그림 III-2>는 2019년에서 2022년 9월 사이 글로벌 ESG채권 발행 금액 및 건수 추이를 보여준다. SLB는 ESG채권 중에서 가장 빠르게 성장하는 유형에 속하며 SLB 발행금액은 2019년 90억달러에서 2021년 1,603억달러로 증가했고, 2022년에는 9월까지 1,053억달러가 발행되었다. SLB 발행건수도 2019년 18건에서 2022년 337건으로 증가했으며, 2022년에는 9월까지 252건의 SLB가 발행되었다. SLB가 ESG채권 시장에서 차지하는 비중도 빠르게 늘어나고 있으며, 발행금액 기준 SLB의 비중은 2019년 2.7%에서 2021년에는 13.0%로 증가했으며, 2022년 9월 기준 14.5%로 사회적채권 비중인 13.6%를 상회한다.

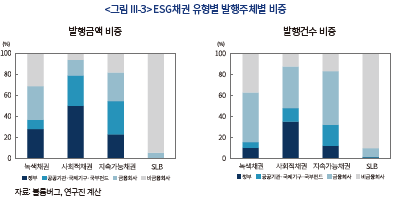

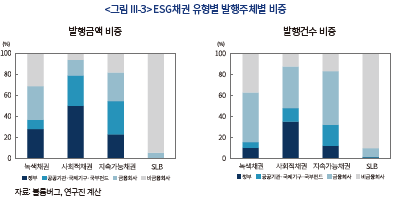

글로벌 SLB 시장의 빠른 성장에는 민간기업의 참여가 주요 역할을 하고 있다. <그림 III-3>은 ESG채권의 발행주체별 비중을 보여준다. 주목할 점은 GSS채권에 비해 SLB의 경우 민간기업 비중이 압도적이며, 특히 비금융기업이 시장을 주도하고 있다는 것이다. SLB 발행금액의 경우 99.9%를 민간기업이 차지하고 있으며, 이중 비금융회사 비중은 94.3%를 차지한다. SLB 발행건수로 볼 경우에도 90.5%가 비금융회사에 속한다.

나. KPI 및 SPT

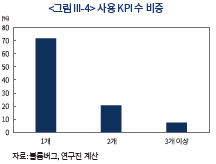

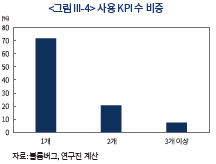

대부분 SLB의 경우 단일 KPI를 사용하고 있는 것으로 나타난다. <그림 III-4>는 2019년에서 2022년 9월 사이 발행된 SLB 중 1개, 2개 및 3개 이상의 KPI를 사용하는 비중을 보여준다. 사용 KPI 수의 비중을 보면 1개의 단일 KPI를 사용하는 경우가 71.8%로 가장 많으며, 2개 이상의 복수 KPI를 사용하는 경우는 28.2%를 차지한다. 이중 3개 이상의 KPI를 사용하는 경우는 7.5%에 불과하다.

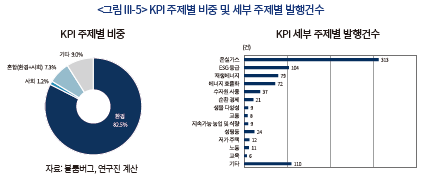

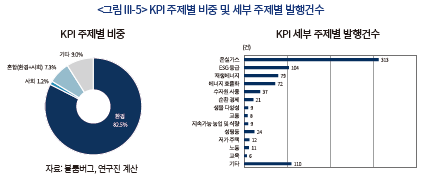

SLB의 KPI는 통상 환경, 사회, 혼합(환경-사회)의 3개 주제로 구분된다. <그림 III-5>는 KPI 주제별 비중과 세부 주제별 발행건수를 보여준다. KPI 주제로는 환경이 82.5%로 가장 높은 비중을 차지하며, 혼합은 7.3%, 사회는 1.2%, 기타는 9.0% 수준이다. 기타 항목에 포함되는 KPI 중에서는 발행자의 ESG 등급이 가장 널리 사용된다. 환경 관련 KPI가 가장 높은 비중을 차지하는 점은 앞서 설명한 바와 같이 사회 및 지배구조 관련 문제에 있어서 KPI 및 SPT의 정량화가 환경 문제에 비해 매우 어려운 측면을 반영하고 있다.

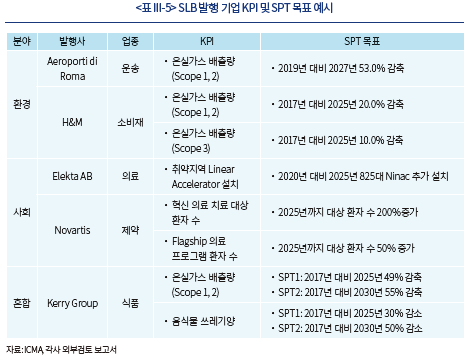

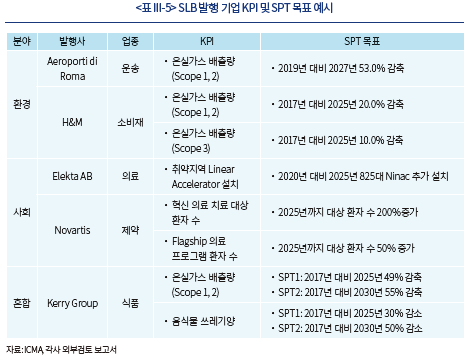

<표 III-5>는 일부 SLB의 KPI 및 SPT 사례를 보여준다. 환경 주제 KPI의 경우 온실가스ㆍ탄소배출량 감축을 널리 사용하고 있으며, 발행사에 따라 Scope 1~3을 포함하고 있다. KPI와 SPT에 있어서도 여러 조합이 가능하다. H&M과 Novartis의 경우 2개의 KPI와 각 KPI에 따라 SPT를 설정하고 있다. Kerry Group의 경우 2개의 KPI와 각 KPI별로 2개의 SPT를 설정하고 있다.

다. 인센티브

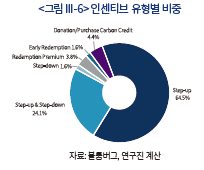

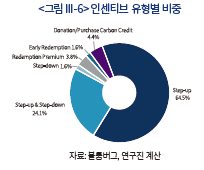

<그림 III-6>은 SLB에서 사용되는 인센티브 유형별 비중을 보여준다. 분석 대상 SLB에서는 SPT 미달성시 이자율이 상승하는 step-up 페널티가 64.5%로 가장 많이 사용되고 있다. Step-up과 step-down을 같이 사용하는 경우는 24.1%이며, step-down만을 사용하는 경우는 1.6%로 매우 드물게 사용되고 있다. 이자율 외의 인센티브로는 기부ㆍ탄소배출권 구매가 4.4%, 상환프리미엄이 3.8%, 조기상환 옵션이 1.6%를 차지하고 있다.

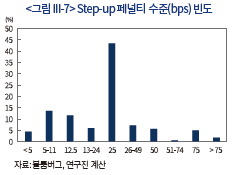

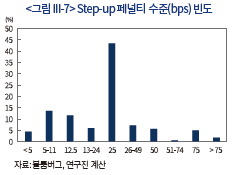

<그림 III-7>은 step-up 페널티 수준의 빈도를 보여준다. Step-up 페널티 수준은 43.8%가 25bps에 집중되어 있으며 이는 현재 step-up을 사용하는 SLB의 경우 25bps가 일종의 관행(rule-of-thumb)으로 사용되고 있는 현상을 반영한다(Berrada et al., 2022; Haq & Doumbia, 2022). 분석 대상 SLB의 평균 만기는 8.2년이며, step-up을 사용하는 경우 평가일은 발행일로부터 평균 4.8년 이후로 SPT에 대한 평가는 만기까지 41%의 기간이 남은 시점에 평균적으로 이루어지고 있다.

3. SLB 발행 사례

가. Enel

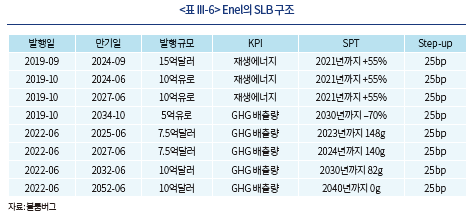

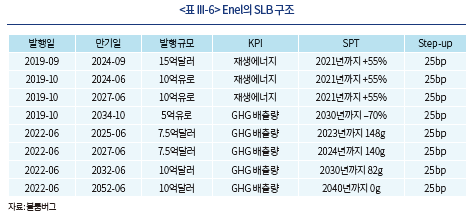

Enel은 31개국, 7,000만 고객에게 전기와 가스를 공급하는 이탈리아 에너지 회사로 2040년까지 발전시설을 재생에너지로 전환하고, 가스 소매사업을 종료하겠다는 탈탄소 ESG 전략을 추진하고 있다. Enel은 자사 ESG 전략의 일환으로 2019년 9월 세계 최초로 SLB를 발행했으며, 2022년 현재 가장 많은 금액의 SLB를 발행하였다. <표 III-6>은 Enel의 주요 SLB 발행 구조를 보여준다. Enel은 다수의 SLB를 Multi Tranche 구조로 발행하여 자금을 조달하였고 2022년 9월까지 발행된 SLB은 20여개, 규모는 250억달러에 달한다.

Enel이 발행한 SLB는 KPI로 재생에너지 설치용량(Renewable Installed Capacity Percentage)5)과 GHG 배출량(Scope 1)을 선정하였다. 2019년에 발행된 SLB를 살펴볼 경우 재생에너지 설치로는 풍력, 태양열, 수력 및 지열 및 천연자원에서 파생된 다른 비화석 연료원의 기술을 독점적으로 사용하는 전기 발전 설비만을 포함하며(원자력은 제외) 2021년 55%, 2022년 60%, 2030년 30%에 도달하는 것으로 설정하였다. 직접 배출량 감축 SPT로는 2017년 GHG 배출량 수준인 414g/kWh를 2030년까지 70% 감축하여 125g/kWh를 목표로 한다.

2019년 발행 SLB는 SPT를 달성하지 못하는 경우 25bp의 금리가 가산되는 step-up 조정을 포함하는 채권 구조로 당시 3배 이상의 청약이 모집되었다. Enel은 SLB를 통해 자금을 조달하면 약 15bp 더 낮은 금액으로 채권을 발행할 수 있다고 밝혔다. 2019년 발행된 SLB는 재생에너지 발전 설치용량 추정치가 2021년 12월 31일 기준 58%로 목표(55%)에 도달하여 SPT가 달성되었다. 2022년 Enel은 프레임워크를 다시 업데이트하여 기업의 최종목표인 100% 달성을 2050년에서 2040년으로 앞당기어 SPT를 재설정하였다.

나. Tesco

Tesco Plc.는 1919년 영국에 창립한 다국적 유통업체로 전세계 유통업체 매출 2위, 점포수 3위이며 14개국에 진출해 영업하고 있다. Tesco는 자사의 지속가능성 전략으로 2050년까지의 넷제로 달성과 더불어 3가지 목표를 설정하고 있다. 첫째, Scope 1, 2 GHG 배출량의 감축, 둘째, 재생에너지 활용의 확대, 셋째, 음식물 쓰레기의 감소다.

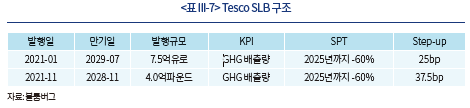

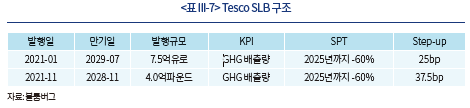

Tesco는 지속가능성 전략의 일환으로 2021년 회사 최초로 2건의 SLB를 발행했다. SLB의 KPI는 GHG 배출량 감축으로 선정하였으며 Scope 1과 2를 포함한다. Scope 1과 2의 배출량은 그룹 운영에서 발생하는 총 배출량의 약 3분의 2를 차지하고 있으며 Tesco 그룹은 2020년까지 GHG배출량을 35%, 2025년까지 60%, 2030년까지 85%, 2050년까지 100% 감축할 것임을 밝혔다. 2021년 1월 0.375%의 이자율, 8.5년의 만기(2029년 7월 만기)를 구조로 하는 7억 5천만유로의 SLB를 발행하였고 2025년 SPT(배출량 60% 감축)를 달성하지 못할 경우 이자율이 2027년(6.5년) 7월에 25bp 상향 조정되는 형태를 취한다. 2021년 11월 발행한 SLB는 SPT를 달성하지 못하는 경우, 2027년 2월부터 이자율이 37.5bp 상향된다.

Tesco는 해당 SPT를 달성하기 위한 방안 중 하나로 5,500대의 배달 차량을 전부 전기차로 교체할 계획이며 이를 통해 연간 총 66,000톤의 탄소배출량을 줄일 수 있을 것으로 예상한다. 또한 KPI에 포함되지는 않았지만, 그룹의 전력 수요를 재생 가능한 자원에서 100% 조달하고 대체 연료 사용, 경로 최적화, 전기차 충전소 설치 및 주요 공급업체와의 협력을 통해 식품 제조 및 농업으로부터의 배출에 대한 Scope 3 배출량을 2015년 기준 대비 2030년까지 17% 줄이기로 약속하였다.

IV. SLB 워싱의 잠재성

1. SLB 발행 및 투자 유인

SLB는 올바르게 설계될 경우 발행자 및 투자자 모두가 만족하는 수준의 환경ㆍ사회적 개선 결과를 가져다줄 수 있다. 발행자의 관점에서는 약속하는 환경ㆍ사회적 활동에 수반되는 비용 이상으로 자금조달 비용이 절감될 경우 SLB를 발행할 유인이 생긴다. 이와 더불어 일부 발행자는 당사의 ESG 의지를 시장에 전달(signal)하기 위한 목적으로 SLB를 사용하기도 한다(Kolbel & Lambillon, 2022). SLB의 주요 투자자층은 환경ㆍ사회적 이슈에 가치를 부여하는 ‘임팩트 ESG 투자자(impact ESG investor)’다. 임팩트 ESG 투자자는 일반 투자자와 동일한 수익률을 추구할 수 있지만, 그 수익률을 계산하는 데 있어서 환경ㆍ사회적 개선 효과에 재무적 가치를 부여한다. 따라서 임팩트 ESG 투자자의 관점에서는 발행자가 약속하는 환경ㆍ사회적 개선 효과에 대한 가치가 SLB에서 제공하는 비용 절감 이상일 경우 SLB에 투자할 유인이 생긴다(Povolonis, 2022).

그러나 SLB는 어떻게 설계되는가에 따라 GSS채권과는 또 다른 형태의 워싱 문제를 야기할 수 있다. SLB 워싱에 대해서는 크게 2가지 이슈가 제기된다. 첫째는 SPT 수준의 적정성이고 둘째는 SPT 달성과 인센티브의 불일치 가능성이다(Mielnik & Erlandsson, 2022).

2. SPT 설정의 적정성

SLB를 둘러싼 주요 이슈 중 하나는 SPT 수준의 적정성이다. 앞서 설명한 바로 ICMA는 적격 SPT에 대한 기준으로 발행자 관점에서 야심적(ambitious)이어야 한다고 설명한다. 그러나 실제로 이러한 기준을 두고 어느 정도 수준이 바람직한지에 대해서는 보다 구체적인 기준이 없다. 이 때문에 일각에서는 SLB 발행자가 SPT를 쉽게 달성할 수 있거나 환경ㆍ사회적 개선 효과가 높지 않은 수준으로 설정하고 SLB의 이자율 혜택을 누리는 일종의 무임승차(free rider) 문제가 발생할 수 있다고 지적한다. 반대로 SLB 투자자가 너무 높은 수준의 SPT를 요구할 경우 발행자 입장에서는 비용이 과도해져서 SPT 달성을 위해 노력하지 않을 유인이 생긴다.6) 현재 SPT의 적정성에 대한 평가 방법론은 이러한 문제를 방지하기 위해 다소 불충분한 측면이 있다.

3. SLB 인센티브의 설계

SLB 인센티브는 SPT를 달성하지 않는 게 발행자의 재무적 이익을 극대화하는 구조로 잘못 또는 의도적으로 설계될 수 있다. 이와 같은 SLB 인센티브 구조에 따른 워싱 문제에 대해서는 2가지 측면이 지적된다. 첫째, SPT 달성 여부에 따른 보상이나 페널티가 너무 낮게 설정되는 경우이다. 둘째, STP 평가일이 너무 일찍 또는 늦게 설정되어 SPT 달성을 위한 유인이 충분하지 못한 경우이다.

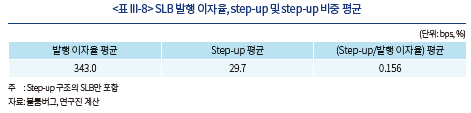

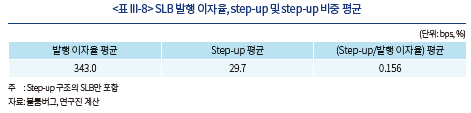

SLB 인센티브의 문제점에 관해서는 step-up 수준의 적정성이 가장 많이 언급된다. <표 III-8>은 분석 대상 SLB의 평균 발행금리, step-up 수준 및 발행금리 대비 step-up의 비중을 보여준다. Step-up 페널티를 두고 있는 SLB의 평균 발행금리는 343bps이며, step-up 이자율 평균은 29.7bps다. 평균적으로 SLB 발행자가 SPT를 달성하지 못할 경우 추가적으로 지불해야 하는 이자율은 발행 이자율의 15.6% 수준이다. Kolbel & Lambillon(2022)은 그간 발행되어온 SLB의 step-up 수준은 발행자의 SPT 이행을 보장하기에는 부족하다고 평가한다. 여기에는 step-up 수준에 있어서 25bps가 관행적으로 사용되는 점이 주요 문제점으로 주목된다.

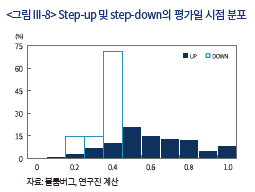

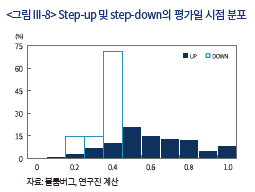

평가일의 설정 또한 발행자 관점에서 SPT 달성 노력에 영향을 미칠 수 있는 요인이다(Haq & Doumbia, 2022). <그림 III-8>은 step-up 또는 step-down을 사용하는 SLB의 평가일 분포를 보여준다.7) Step-down 구조 SLB의 경우 발행자 입장에서 SPT 달성 시 이자율 감소의 혜택을 극대화하기 위해서는 평가일을 발행일에 가깝게 설정할 유인이 있다. 반대로 step-up 구조 SLB는 평가일을 만기일에 가깝게 설정할수록 SPT 미달성시 이자율 상승으로 인한 비용을 최소화할 수 있다. 실제 분석 대상 SLB를 살펴볼 경우 step-down SLB는 평가일이 채권 발행 기간의 50% 미만에 모두 설정되어 있으며, step-up SLB는 76.9%가 발행 기간의 50% 이상으로 설정되어 있다. Step-down 및 step-up 구조의 SLB 모두 평가일이 만기에 가깝게 설정될수록 발행자가 SPT를 달성할 유인이 떨어지는 특성을 SLB 투자자가 유의해야 할 점이다.

또 하나의 잠재적 워싱은 평가일 이후 발행자의 행태다. SPT의 달성 여부와 상관없이 평가일 이후에는 발행자에 대한 재무적 인센티브가 더 이상 없기 때문에, SPT와 반대되는 활동을 추진할 가능성이 존재한다. 이러한 SLB 워싱의 가능성으로 인해 일각에서는 SPT의 평가가 연간 단위 등 보다 촘촘하게 이루어져야 한다고 제안한다. 대부분의 SLB는 2021년 이후 발행되어 아직 평가일이나 만기가 도래한 경우가 제한적이다. 따라서 SLB 워싱 문제가 실제로 얼마나 발생하는지에 대해서는 아직 확인이 어려운 측면이 있다. 향후 만기를 채운 SLB 사례가 축적됨에 따라 SLB의 구조가 개선되고 다양한 유형의 SLB 구조가 출현할 것으로 예상된다.

V. 국내 SLB 안착을 위한 과제

SLB의 국내 도입은 녹색채권 발행과 민간기업 참여가 부족한 국내 ESG채권 시장에 새로운 활력을 제공해 줄 것으로 기대된다. 그러나 SLB가 국내 시장에 안착하기 위해서는 갖추어야 할 기반 여건과 극복해야 할 과제도 만만치 않다.

첫째, SLB의 KPI 및 SPT 설정을 위한 데이터베이스가 마련되어야 한다. GSS채권의 경우 서로 상이한 프로젝트 단위로 기대효과가 측정되기 때문에 데이터의 비교가능성은 상대적으로 덜 중요한 측면이 있다. 그러나 SLB의 경우 KPI 및 SPT의 적정성과 더불어 올바른 인센티브를 설계하기 위해서는 벤치마크 데이터의 구축이 필수적이다. ICMA는 KPI에 있어서 발행자의 과거 및 전망치와 더불어 경쟁사ㆍ산업ㆍ섹터의 수치를 사용할 것을 권고하고 있다. 그러나 현재 국내 상장기업의 지속가능성 관련 정보 공시는 2025년부터 단계적으로 의무화가 계획되어 있는 상황으로 온실가스 배출 등 ESG 정보가 부분적으로만 제공되고 있다(이인형ㆍ이상호, 2021). 여기에 국내의 경우 온실가스 배출 등에 관해 가치사슬, 즉 Scope 3 관련 정보가 미흡한 점도 풀어야 할 숙제다. 따라서 초기 국내 SLB는 현재 신용평가사 등이 제공하는 기업의 ESG 등급과 연계된 구조로 발행하고, ESG 공시 자료가 체계적으로 구축됨에 따라 보다 다양한 유형으로 확대되는 방향을 생각해볼 수 있다.

둘째, 워싱을 방지하기 위한 SLB의 올바른 설계에도 신경을 써야 한다. 특히 이와 관련해서는 앞서 살펴본 SLB의 여러 워싱 가능성 요인 중에서도 step-up 수준의 설정이 관건이다. 아직 국내 SLB 발행 사례가 없는 상황에서 초기에는 해외 관행을 참조하여 step-up 수준으로 25bps가 사용될 가능성이 점쳐진다. 그러나 최근 국내외적으로 금리가 가파르게 상승하고 있는 상황에서 과거의 step-up 수준을 사용하는 것이 적합한가에 대해서는 검토가 필요하다. 이와 더불어 SLB 워싱 방지에는 외부검증 기관의 역할이 매우 중요하다. 국내 주요 신용평가사는 SLB 도입에 앞서 SLB에 대한 평가 방법론을 마련해둔 상황이다. 그러나 해당 평가 방법론은 KPI 선정, SPT 설정 등 ICMA에서 제시하는 SLB 발행 기준을 중심으로 설계되었으며 step-up 수준, 평가일 설정 등 SLB의 세부적 사항에 대한 기준은 명확하지 않은 측면이 있다. 향후 국내 SLB 발행 사례가 축적됨에 따라 평가 방법론의 고도화도 함께 이루어져야 할 것이다.

셋째, SLB 발행을 계획하는 국내 기업은 명확한 ESG 전략을 수립할 필요가 있다. SLB의 자유로운 조달자금의 활용과 이자율 혜택은 무료가 아니다. SLB 발행자는 의미 있는 수준의 환경ㆍ사회적 개선 목표를 투자자에게 약속함으로써 자금조달 비용 절감의 혜택을 얻는 것이다. 나아가 이와 같은 목표는 단순히 기존 사업의 연속이 아니고 ESG 전략에 부합한 추가적인 노력을 통해 달성할 수 있는 수준이어야 한다. 그간 국내 GSS채권을 살펴보면 대상 프로젝트가 사실상 새로운 사업보다는 기존 사업의 차환 용도로 사용되는 경우가 상당히 많다. SLB가 국내 시장에서 신뢰를 얻고 활성화되기 위해서는 발행자가 의미 있는 수준의 환경‧사회적 개선 효과를 제공해야 할 것이며, 이는 상당한 노력을 수반하는 국내 기업의 ESG 전략에 기반해야 할 것이다.

1) SRI채권은 명칭은 다르지만 ESG채권과 동일하다.

2) 최초 녹색채권은 2007년 유럽투자은행(European Investment Bank: EIB)이 발행했으며, 최초 SLB는 2019년 이탈리아 전력회사 Enel이 발행했다.

3) 글로벌 ESG채권 시장에서는 코로나-19 대응 관련 사회적채권 및 지속가능채권의 발행이 2020년에서 2021년 사이 급증하면서 녹색채권 비중이 감소하였다.

4) Ehlers et al.(2020)은 2015년에서 2018년 사이 녹색채권 발행 기업의 탄소집약도(carbon intensity)를 분석한 결과 발행 후 2년까지는 기업단위 탄소집약도가 감소하지만, 2년에서 3년 사이에는 탄소집약도가 증가하여 전체 기간(3년)에는 유의한 탄소집약도 변화가 없다는 결과를 제시한다.

5) Renewable Installed Capacity Percentage(%) = Renewable installed capacity(MW) / Total installed capacity(MW)

6) 물론 이 경우 발행자는 SPT의 미달성으로 인해 평판위험(reputation risk)에 노출되기는 한다(Chan, 2022).

7) SLB 간 비교분석을 위해 발행일을 0, 만기일을 1로 표준화하였다.

참고문헌

김필규, 2021, ESG채권의 특성 분석과 활성화 방안, 자본시장연구원 『자본시장포커스』 2021-11.

이인형ㆍ이상호, 2021, 『지속가능보고 의무공시 이행을 위한 논의 방향』, 자본시장연구원 조사보고서 21-01.

Berrada, T., Engelhardt, L., Gibson, R., Krueger, P., 2022, The economics of sustainability linked bonds, Finance Working Paper No.820/2022, ECGI.

Chan, R., 2022, Ensuring impactful performance in green bonds and sustainability-linked loans.

Ehlers, T., Mojon, B., Packer, F., 2020, Green bonds and carbon emissions: exploring the case for a rating system at the firm level, BIS Quarterly Review, September 2020.

ESMA, 2021, Investor protection: Environmental impact and liquidity of green bonds, ESMA Report on Trends, Risks and Vulnerabilities No.2.

Haq, I., Doumbia, D., 2022, Structural loopholes in sustainability-linked bonds.

ICMA, 2020, Sustainability-Linked Bond Principles.

ICMA, 2021, Handbook: Harmonized framework for impact reporting.

Kolbel, J., Lambillon, A., 2022, Who pays for sustainability? An analysis of sustainability-linked bonds, Department of Banking and Finance, working paper, University of Zurich.

Mielnik, S., Erlandsson, U., 2022, An option pricing approach for sustainability-linked bonds.

Povilonis, J., 2022, Contracting for ESG: Sustainability-linked bonds and a new investor paradigm, The Business Lawyer 77.

SME Climate Hub, 2022, New data reveals two-thirds of surveyed small busineses concerned over navigating climate change.

최근 국내에도 지속가능연계채권(Sustainability-Linked Bonds: SLB)이 도입되었다. 한국거래소는 국내 ESG채권 시장의 접근성 제고를 위해 2020년 개설한 사회적책임투자(Socially Responsible Investment: SRI)1) 전용 세그먼트에 2022년 9월 SLB를 새롭게 추가하였다. 그간 한국거래소 SRI 전용 세그먼트에는 녹색채권(green bonds), 사회적채권(social bonds), 지속가능채권(sustainability bonds)의 3가지 전통적 ESG채권만 포함되었으나, SLB가 추가되면서 글로벌 시장과 동일한 ESG채권 포트폴리오를 갖추게 되었다.

글로벌 시장에서는 SLB가 이미 사회적채권에 버금가는 규모로 성장했으며, 국내에서도 SLB의 도입은 발행자 및 투자자 모두에게 국내 ESG채권 시장의 저변을 확대해 주는 수단이 될 수 있다. SLB는 전통적 ESG채권이 지니는 자금활용 범위의 제한을 풀어줌으로써 민간기업 및 비친환경적 기업에게도 SLB를 발행할 유인을 제공하기 때문이다. 다수의 국내 기업들이 넷제로(net-zero) 달성을 위한 막대한 자금 동원에 ESG채권을 충분하게 활용하지 못하고 있는 상황에서 SLB는 새로운 활로를 열어줄 것으로 기대된다.

그러나 SLB가 국내 시장에 안착하기 위해서는 극복해야 할 과제도 상당하다. 글로벌 시장에서도 SLB는 2019년 처음 발행되어 아직 발전 초기 단계에 있으며 전통적 ESG채권에 비해 SLB에 대한 인지도도 낮은 편이다. 또한, 현재 대부분의 발행된 SLB는 만기가 도래하지 않은 상황으로 SLB의 실효성에 대한 평가는 진행형이며, SLB의 장단점에 대한 의견들도 분분하다. 국내외로 SLB 관련 문헌이 제한적인 점도 이러한 상황을 반영한다.

본고는 2019년에서 2022년 9월 사이 블룸버그(Bloomberg)에서 제공하는 ESG채권 자료를 통해 SLB의 구조와 주요 특징을 소개하고자 한다. 우선 국내 ESG채권 시장의 현황에 비추어 SLB 도입의 필요성과 기대를 조명한다. 다음으로는 SLB의 주요 구성 요소와 세부적 구조를 설명하고, 글로벌 SLB 시장의 현황과 특징을 정리해본다. 이와 함께 일각에서 제기하는 잠재적 SLB 워싱 문제의 주요 논점도 짚어본다. 마지막으로 앞선 내용을 토대로 SLB의 국내 시장 안착을 위해 갖추어야 할 기반 여건과 앞으로 풀어나가야 할 과제를 제시한다.

II. 국내 지속가능연계채권(SLB) 도입의 기대

1. ESG채권 개요

ESG채권은 자금의 활용 범위에 따라 크게 두 가지 유형으로 나누어진다(<표 II-1>). 하나는 자금의 사용이 특정 환경ㆍ사회적 프로젝트에만 국한되는 ‘자금용도 기반(use-of-proceeds)’ 채권이며 녹색채권, 사회적채권 및 지속가능채권을 포함한 일명 GSS채권(Green, Social, Sustainabilty Bonds)이 여기에 속한다. 다른 하나는 자금 활용이 자유로운 ‘목표 기반(target based)’ 채권이며 지속가능연계채권(Sustainability-Linked Bonds: SLB)이 여기에 속한다.2)

2. 국내 ESG채권 시장 현황

국내 ESG채권 시장은 외형적으로는 단기간에 괄목할만한 성장을 이루고 있다. <그림 II-1>은 한국거래소에 등록된 국내 ESG채권 유형별 발행 규모 추이를 보여준다. 국내 ESG채권 발행금액은 2019년 20.5조원에서 2021년 81.5조원으로 4배 증가했으며, 2022년에는 9월까지 49.8조원을 기록하고 있다. ESG채권 발행 건수도 2019년 145건에서 2021년 632건으로 4.4배 증가했으며, 2022년에는 9월까지 478건이 발행되었다.

3. GSS채권의 한계

국내에서 녹색채권이 충분하게 활용되지 못하고 있는 데에는 녹색채권을 비롯한 GSS채권의 3가지 구조적인 한계가 주요 원인을 제공한다. 첫째, GSS채권은 조달된 자금이 특정 환경ㆍ사회적 프로젝트로 국한되며, 그 이유는 ESG 워싱(washing) 방지를 위해 채권의 조달자금이 무분별하게 사용되지 않도록 하기 위해서다. 그러나 이러한 보호 장치는 발행자, 특히 민간기업 입장에서 GSS채권의 활용도와 발행 유인을 저해하는 요인으로 작용한다. 대다수 민간기업의 경우 GSS채권을 발행할 만큼 대규모의 적격 프로젝트를 찾는 데 어려움이 있다.

둘째, 환경ㆍ사회적 개선 효과(impact)의 불확실성도 GSS채권이 지니는 한계에 속한다. ICMA는 GSS채권 발행에 있어서 대상 프로젝트의 환경ㆍ사회적 기대 효과를 발행설명서에 공시하고, 이를 외부 기관으로부터 사전ㆍ사후적으로 검증받을 것을 권고하고 있다. 그러나 이와 같은 발행 절차에도 불구하고 실제로 GSS채권 프로젝트가 기대한 수준의 개선 효과를 발휘하게 보장할 방법은 없다. 또한, Ehlers et al.(2020)은 GSS채권이 프로젝트 단위(project level)로 설정되어 있기 때문에 발행 기업 단위(firm level) 차원에서는 의미 있는 수준의 환경ㆍ사회적 개선이 나타나지 않을 수 있다는 점을 지적한다.4)

셋째, 투자자의 관점에서 GSS채권 프로젝트의 기대 효과가 실질적으로 나타나지 않거나 예상 수준을 하회하더라도 발행자에게 책임을 묻거나 보상받을 방안이 없다. ICMA의 ESG 채권원칙은 이와 같은 워싱 문제를 방지하기 위해 세밀한 발행 절차와 더불어, 프로젝트 기대 효과 산출에 대한 기준도 제시하고 있다. 그럼에도 불구하고 ICMA의 ESG 채권원칙은 강제성이 없는 자발적 기준이며, GSS 채권 프로젝트의 기대 효과가 나타나지 않을 경우 발행자에 대한 불이익은 평판위험(reputation risk) 외에는 딱히 없다(ESMA, 2021).

4. SLB에 대한 기대

SLB는 GSS채권이 지니는 3가지 단점을 보완할 수 있게 설계되었다. 첫째, SLB는 발행 자금이 프로젝트에 국한되지 않고 기업 운영 전반에 사용할 수 있도록 범위의 넓혀줌으로써 대규모 환경ㆍ사회적 프로젝트를 찾기 어려운 기업도 SLB를 발행할 유인을 마련해준다. 또한, SLB는 회사법 관점에서 신의성실의무(fiduciary duty)로 인해 ESG 투자에 나서기 어려운 기업도 ESG채권 시장으로 끌어 들여올 수 있다. SLB는 ESG 활동에 대한 재무적 이득이 명확하기 때문에 경영진 입장에서 주주에 대한 신의성실의무 위반 문제를 완화해줄 수 있기 때문이다(Povolonis, 2022).

둘째, SLB는 환경ㆍ사회적 개선 효과가 명확한 장점을 지닌다. SLB 발행자는 사전에 정량적 환경ㆍ사회적 측정치를 정하고 이에 기반한 검증 가능한 목표를 설정해야 한다. 해당 목표는 SLB 만기 이전에 달성해야 하기 때문에 GSS채권이 지니는 기대 개선 효과의 불확실성 문제를 완화해준다(Berrada et al., 2022). 나아가 SLB의 환경ㆍ사회적 개선 효과는 프로젝트 단위가 아니라 발행 기업 단위로 설정되기 때문에 Ehlers et al.(2020)이 지적하는 문제도 일부 해소해준다.

셋째, SLB 발행자가 약속한 환경ㆍ사회적 개선 목표를 달성하지 못할 경우 투자자는 이에 대한 보상을 받을 수 있다. SLB는 발행자의 목표 달성을 채권 만기 이전에 확인하고 목표 달성 여부에 따라 재무적 보상 또는 페널티가 부과되는 인센티브(incentive)를 포함한다. SLB에서 가장 널리 사용되는 인센티브는 목표 달성 확인 이후 만기까지 남은 기간동안 이자율이 조정되는 구조다. SLB 발행자는 목표를 달성하지 않을 경우 평판위험과 더불어 명확한 재무적 비용을 지불해야 하기 때문에 약속을 지키도록 노력할 유인이 생긴다.

III. SLB의 구조 및 시장 현황

1. SLB의 구조

ICMA(2020)는 SLB를 ‘발행자가 사전에 정한 특정 지속가능성/ESG 목표의 달성 여부에 따라 금융 또는 구조가 변하는 채권’으로 정의한다. 이와 같은 성과 연계 조건부 채권ㆍ대출은 마이크로파이낸스(micro-finance), 변동 이자율 구조는 신종자본증권 및 후순위채권에서도 널리 사용되는 방식이기도 하다(Chan, 2022; Mielnik & Erlandsson, 2022).

SLB는 크게 4개의 주요 요소로 구성되어 있다(<그림 III-1>): (1) 환경ㆍ사회적 개선 효과를 측정하는 ‘핵심 성과지표(Key Performance Indicators: KPI)’; (2) 발행자가 달성을 약속하는 ‘지속가능성 성과목표(Sustainability Performance Target: SPT)’; (3) SPT의 달성 여부를 평가하는 ‘평가일(target date)’; (4) SPT의 달성 여부에 따라 결정되는 인센티브(incentive).

SLB의 목표, 즉 SPT를 정하기에 앞서 무엇으로 SPT를 측정(measure)할지를 결정해야 할 필요가 있으며, KPI가 그 역할을 한다. 예를 들어 KPI는 ‘탄소배출량’이고, SPT는 ‘2030년까지 2022년 대비 탄소배출량을 30% 감축’하는 것이다. <표 III-1>은 ICMA의 적격 KPI 기준을 보여준다. ICMA는 적격 KPI가 사업과 연계성(relevance)이 높고, 구체적(specific)이며, 측정가능(measurable)한 성격을 갖출 것을 권고한다.

ICMA가 제시하는 적격 KPI는 측정 및 비교가능성을 강조하고 있으며, 이에 따라 사회보다는 환경 분야에 적합한 측면이 있다. 기후변화 등 환경 문제의 경우 탄소배출 감소 등 그 원인과 해결책이 과학적 근거에 기반하고 측정할 수 있는 방법이 상대적으로 명확하다. 반면 양극화 같은 사회적 문제의 경우 원인과 해결책이 복잡하고 사회적채권을 살펴볼 경우에도 기대 효과 등에 대한 측정이 주로 정성적으로 이루어진다. 실제로 그간 발행된 SLB를 보면 KPI는 환경 분야가 압도적 비중을 차지하고 있다. SLB의 KPI는 단일 또는 복수가 사용될 수 있으며, KPI를 SPT와 일대일로 연결하거나 복수의 KPI를 하나의 SPT에 사용하는 등 여러 조합이 가능하다. 이와 더불어 환경 및 사회 분야의 KPI를 하나의 SLB에 포함하는 혼합형(mixed) 사례도 일부 있다.

SPT 수준의 설정은 SLB가 실제로 의미 있는 환경ㆍ사회적 개선 효과를 발휘하는지를 결정하는 주요 요인이다. ICMA는 SPT 수준은 충분히 ‘야심적(ambitious)’이어야 하며 이에 대한 기준을 제시하고 있다(<표 III-2>). SPT의 달성을 위해서는 ‘일상적 사업의 영위(business-as-usual)’ 이상의 노력이 필요하며, 발행자의 지속가능성/ESG 전략과 일치하여야 한다. 또한 SPT의 평가일은 발행 이전에 설정되고 SPT의 평가는 만기 이전에 이루어져야 한다.

SLB는 평가일에 SPT의 달성 여부를 확인하고, 그 결과에 따라 사전에 정해진 재무적 인센티브가 적용된다. <표 III-4>는 SLB에 주로 사용되는 인센티브 유형을 보여준다. SLB에 가장 많이 사용되는 인센티브는 이자율의 상향(step-up) 또는 하향(step-down) 조정이다. Step-up은 평가일에 SPT를 달성할 경우 SLB 발행시 이자율이 유지되고, SPT를 달성하지 못할 경우 만기까지 이자율이 사전에 정해진 수준만큼 추가되어 상승하는 페널티다. 반대로 step-down은 평가일에 SPT를 달성하지 못할 경우 SLB 발행시 이자율이 유지되고, SPT의 달성시 사전에 정해진 수준에 따라 이자율이 만기까지 낮아지는 구조다. 기존 발행된 SLB의 경우 step-up 및 step-down의 이자율 조정 수준으로는 25bps가 가장 많이 사용되고 있다. 복수의 SPT를 가진 SLB의 경우 복수의 step-up 또는 step-down이 적용되는 누적(cumulative) 인센티브 구조를 지닐 수 있으며, step-up과 step-down을 함께 적용하는 경우도 가능하다. 이자율 조정 외에 SPT 미달성시 만기에 상환할증금(redemption premium) 부여, 액면가의 일정 비율을 기부(donation) 또는 탄소배출권(carbon emission credit) 매입, 투자자의 조기상환(early redemption) 행사 등의 인센티브도 있다.

가. SLB 시장 규모

<그림 III-2>는 2019년에서 2022년 9월 사이 글로벌 ESG채권 발행 금액 및 건수 추이를 보여준다. SLB는 ESG채권 중에서 가장 빠르게 성장하는 유형에 속하며 SLB 발행금액은 2019년 90억달러에서 2021년 1,603억달러로 증가했고, 2022년에는 9월까지 1,053억달러가 발행되었다. SLB 발행건수도 2019년 18건에서 2022년 337건으로 증가했으며, 2022년에는 9월까지 252건의 SLB가 발행되었다. SLB가 ESG채권 시장에서 차지하는 비중도 빠르게 늘어나고 있으며, 발행금액 기준 SLB의 비중은 2019년 2.7%에서 2021년에는 13.0%로 증가했으며, 2022년 9월 기준 14.5%로 사회적채권 비중인 13.6%를 상회한다.

대부분 SLB의 경우 단일 KPI를 사용하고 있는 것으로 나타난다. <그림 III-4>는 2019년에서 2022년 9월 사이 발행된 SLB 중 1개, 2개 및 3개 이상의 KPI를 사용하는 비중을 보여준다. 사용 KPI 수의 비중을 보면 1개의 단일 KPI를 사용하는 경우가 71.8%로 가장 많으며, 2개 이상의 복수 KPI를 사용하는 경우는 28.2%를 차지한다. 이중 3개 이상의 KPI를 사용하는 경우는 7.5%에 불과하다.

<그림 III-6>은 SLB에서 사용되는 인센티브 유형별 비중을 보여준다. 분석 대상 SLB에서는 SPT 미달성시 이자율이 상승하는 step-up 페널티가 64.5%로 가장 많이 사용되고 있다. Step-up과 step-down을 같이 사용하는 경우는 24.1%이며, step-down만을 사용하는 경우는 1.6%로 매우 드물게 사용되고 있다. 이자율 외의 인센티브로는 기부ㆍ탄소배출권 구매가 4.4%, 상환프리미엄이 3.8%, 조기상환 옵션이 1.6%를 차지하고 있다.

가. Enel

Enel은 31개국, 7,000만 고객에게 전기와 가스를 공급하는 이탈리아 에너지 회사로 2040년까지 발전시설을 재생에너지로 전환하고, 가스 소매사업을 종료하겠다는 탈탄소 ESG 전략을 추진하고 있다. Enel은 자사 ESG 전략의 일환으로 2019년 9월 세계 최초로 SLB를 발행했으며, 2022년 현재 가장 많은 금액의 SLB를 발행하였다. <표 III-6>은 Enel의 주요 SLB 발행 구조를 보여준다. Enel은 다수의 SLB를 Multi Tranche 구조로 발행하여 자금을 조달하였고 2022년 9월까지 발행된 SLB은 20여개, 규모는 250억달러에 달한다.

2019년 발행 SLB는 SPT를 달성하지 못하는 경우 25bp의 금리가 가산되는 step-up 조정을 포함하는 채권 구조로 당시 3배 이상의 청약이 모집되었다. Enel은 SLB를 통해 자금을 조달하면 약 15bp 더 낮은 금액으로 채권을 발행할 수 있다고 밝혔다. 2019년 발행된 SLB는 재생에너지 발전 설치용량 추정치가 2021년 12월 31일 기준 58%로 목표(55%)에 도달하여 SPT가 달성되었다. 2022년 Enel은 프레임워크를 다시 업데이트하여 기업의 최종목표인 100% 달성을 2050년에서 2040년으로 앞당기어 SPT를 재설정하였다.

나. Tesco

Tesco Plc.는 1919년 영국에 창립한 다국적 유통업체로 전세계 유통업체 매출 2위, 점포수 3위이며 14개국에 진출해 영업하고 있다. Tesco는 자사의 지속가능성 전략으로 2050년까지의 넷제로 달성과 더불어 3가지 목표를 설정하고 있다. 첫째, Scope 1, 2 GHG 배출량의 감축, 둘째, 재생에너지 활용의 확대, 셋째, 음식물 쓰레기의 감소다.

Tesco는 지속가능성 전략의 일환으로 2021년 회사 최초로 2건의 SLB를 발행했다. SLB의 KPI는 GHG 배출량 감축으로 선정하였으며 Scope 1과 2를 포함한다. Scope 1과 2의 배출량은 그룹 운영에서 발생하는 총 배출량의 약 3분의 2를 차지하고 있으며 Tesco 그룹은 2020년까지 GHG배출량을 35%, 2025년까지 60%, 2030년까지 85%, 2050년까지 100% 감축할 것임을 밝혔다. 2021년 1월 0.375%의 이자율, 8.5년의 만기(2029년 7월 만기)를 구조로 하는 7억 5천만유로의 SLB를 발행하였고 2025년 SPT(배출량 60% 감축)를 달성하지 못할 경우 이자율이 2027년(6.5년) 7월에 25bp 상향 조정되는 형태를 취한다. 2021년 11월 발행한 SLB는 SPT를 달성하지 못하는 경우, 2027년 2월부터 이자율이 37.5bp 상향된다.

IV. SLB 워싱의 잠재성

1. SLB 발행 및 투자 유인

SLB는 올바르게 설계될 경우 발행자 및 투자자 모두가 만족하는 수준의 환경ㆍ사회적 개선 결과를 가져다줄 수 있다. 발행자의 관점에서는 약속하는 환경ㆍ사회적 활동에 수반되는 비용 이상으로 자금조달 비용이 절감될 경우 SLB를 발행할 유인이 생긴다. 이와 더불어 일부 발행자는 당사의 ESG 의지를 시장에 전달(signal)하기 위한 목적으로 SLB를 사용하기도 한다(Kolbel & Lambillon, 2022). SLB의 주요 투자자층은 환경ㆍ사회적 이슈에 가치를 부여하는 ‘임팩트 ESG 투자자(impact ESG investor)’다. 임팩트 ESG 투자자는 일반 투자자와 동일한 수익률을 추구할 수 있지만, 그 수익률을 계산하는 데 있어서 환경ㆍ사회적 개선 효과에 재무적 가치를 부여한다. 따라서 임팩트 ESG 투자자의 관점에서는 발행자가 약속하는 환경ㆍ사회적 개선 효과에 대한 가치가 SLB에서 제공하는 비용 절감 이상일 경우 SLB에 투자할 유인이 생긴다(Povolonis, 2022).

그러나 SLB는 어떻게 설계되는가에 따라 GSS채권과는 또 다른 형태의 워싱 문제를 야기할 수 있다. SLB 워싱에 대해서는 크게 2가지 이슈가 제기된다. 첫째는 SPT 수준의 적정성이고 둘째는 SPT 달성과 인센티브의 불일치 가능성이다(Mielnik & Erlandsson, 2022).

2. SPT 설정의 적정성

SLB를 둘러싼 주요 이슈 중 하나는 SPT 수준의 적정성이다. 앞서 설명한 바로 ICMA는 적격 SPT에 대한 기준으로 발행자 관점에서 야심적(ambitious)이어야 한다고 설명한다. 그러나 실제로 이러한 기준을 두고 어느 정도 수준이 바람직한지에 대해서는 보다 구체적인 기준이 없다. 이 때문에 일각에서는 SLB 발행자가 SPT를 쉽게 달성할 수 있거나 환경ㆍ사회적 개선 효과가 높지 않은 수준으로 설정하고 SLB의 이자율 혜택을 누리는 일종의 무임승차(free rider) 문제가 발생할 수 있다고 지적한다. 반대로 SLB 투자자가 너무 높은 수준의 SPT를 요구할 경우 발행자 입장에서는 비용이 과도해져서 SPT 달성을 위해 노력하지 않을 유인이 생긴다.6) 현재 SPT의 적정성에 대한 평가 방법론은 이러한 문제를 방지하기 위해 다소 불충분한 측면이 있다.

3. SLB 인센티브의 설계

SLB 인센티브는 SPT를 달성하지 않는 게 발행자의 재무적 이익을 극대화하는 구조로 잘못 또는 의도적으로 설계될 수 있다. 이와 같은 SLB 인센티브 구조에 따른 워싱 문제에 대해서는 2가지 측면이 지적된다. 첫째, SPT 달성 여부에 따른 보상이나 페널티가 너무 낮게 설정되는 경우이다. 둘째, STP 평가일이 너무 일찍 또는 늦게 설정되어 SPT 달성을 위한 유인이 충분하지 못한 경우이다.

SLB 인센티브의 문제점에 관해서는 step-up 수준의 적정성이 가장 많이 언급된다. <표 III-8>은 분석 대상 SLB의 평균 발행금리, step-up 수준 및 발행금리 대비 step-up의 비중을 보여준다. Step-up 페널티를 두고 있는 SLB의 평균 발행금리는 343bps이며, step-up 이자율 평균은 29.7bps다. 평균적으로 SLB 발행자가 SPT를 달성하지 못할 경우 추가적으로 지불해야 하는 이자율은 발행 이자율의 15.6% 수준이다. Kolbel & Lambillon(2022)은 그간 발행되어온 SLB의 step-up 수준은 발행자의 SPT 이행을 보장하기에는 부족하다고 평가한다. 여기에는 step-up 수준에 있어서 25bps가 관행적으로 사용되는 점이 주요 문제점으로 주목된다.

V. 국내 SLB 안착을 위한 과제

SLB의 국내 도입은 녹색채권 발행과 민간기업 참여가 부족한 국내 ESG채권 시장에 새로운 활력을 제공해 줄 것으로 기대된다. 그러나 SLB가 국내 시장에 안착하기 위해서는 갖추어야 할 기반 여건과 극복해야 할 과제도 만만치 않다.

첫째, SLB의 KPI 및 SPT 설정을 위한 데이터베이스가 마련되어야 한다. GSS채권의 경우 서로 상이한 프로젝트 단위로 기대효과가 측정되기 때문에 데이터의 비교가능성은 상대적으로 덜 중요한 측면이 있다. 그러나 SLB의 경우 KPI 및 SPT의 적정성과 더불어 올바른 인센티브를 설계하기 위해서는 벤치마크 데이터의 구축이 필수적이다. ICMA는 KPI에 있어서 발행자의 과거 및 전망치와 더불어 경쟁사ㆍ산업ㆍ섹터의 수치를 사용할 것을 권고하고 있다. 그러나 현재 국내 상장기업의 지속가능성 관련 정보 공시는 2025년부터 단계적으로 의무화가 계획되어 있는 상황으로 온실가스 배출 등 ESG 정보가 부분적으로만 제공되고 있다(이인형ㆍ이상호, 2021). 여기에 국내의 경우 온실가스 배출 등에 관해 가치사슬, 즉 Scope 3 관련 정보가 미흡한 점도 풀어야 할 숙제다. 따라서 초기 국내 SLB는 현재 신용평가사 등이 제공하는 기업의 ESG 등급과 연계된 구조로 발행하고, ESG 공시 자료가 체계적으로 구축됨에 따라 보다 다양한 유형으로 확대되는 방향을 생각해볼 수 있다.

둘째, 워싱을 방지하기 위한 SLB의 올바른 설계에도 신경을 써야 한다. 특히 이와 관련해서는 앞서 살펴본 SLB의 여러 워싱 가능성 요인 중에서도 step-up 수준의 설정이 관건이다. 아직 국내 SLB 발행 사례가 없는 상황에서 초기에는 해외 관행을 참조하여 step-up 수준으로 25bps가 사용될 가능성이 점쳐진다. 그러나 최근 국내외적으로 금리가 가파르게 상승하고 있는 상황에서 과거의 step-up 수준을 사용하는 것이 적합한가에 대해서는 검토가 필요하다. 이와 더불어 SLB 워싱 방지에는 외부검증 기관의 역할이 매우 중요하다. 국내 주요 신용평가사는 SLB 도입에 앞서 SLB에 대한 평가 방법론을 마련해둔 상황이다. 그러나 해당 평가 방법론은 KPI 선정, SPT 설정 등 ICMA에서 제시하는 SLB 발행 기준을 중심으로 설계되었으며 step-up 수준, 평가일 설정 등 SLB의 세부적 사항에 대한 기준은 명확하지 않은 측면이 있다. 향후 국내 SLB 발행 사례가 축적됨에 따라 평가 방법론의 고도화도 함께 이루어져야 할 것이다.

셋째, SLB 발행을 계획하는 국내 기업은 명확한 ESG 전략을 수립할 필요가 있다. SLB의 자유로운 조달자금의 활용과 이자율 혜택은 무료가 아니다. SLB 발행자는 의미 있는 수준의 환경ㆍ사회적 개선 목표를 투자자에게 약속함으로써 자금조달 비용 절감의 혜택을 얻는 것이다. 나아가 이와 같은 목표는 단순히 기존 사업의 연속이 아니고 ESG 전략에 부합한 추가적인 노력을 통해 달성할 수 있는 수준이어야 한다. 그간 국내 GSS채권을 살펴보면 대상 프로젝트가 사실상 새로운 사업보다는 기존 사업의 차환 용도로 사용되는 경우가 상당히 많다. SLB가 국내 시장에서 신뢰를 얻고 활성화되기 위해서는 발행자가 의미 있는 수준의 환경‧사회적 개선 효과를 제공해야 할 것이며, 이는 상당한 노력을 수반하는 국내 기업의 ESG 전략에 기반해야 할 것이다.

1) SRI채권은 명칭은 다르지만 ESG채권과 동일하다.

2) 최초 녹색채권은 2007년 유럽투자은행(European Investment Bank: EIB)이 발행했으며, 최초 SLB는 2019년 이탈리아 전력회사 Enel이 발행했다.

3) 글로벌 ESG채권 시장에서는 코로나-19 대응 관련 사회적채권 및 지속가능채권의 발행이 2020년에서 2021년 사이 급증하면서 녹색채권 비중이 감소하였다.

4) Ehlers et al.(2020)은 2015년에서 2018년 사이 녹색채권 발행 기업의 탄소집약도(carbon intensity)를 분석한 결과 발행 후 2년까지는 기업단위 탄소집약도가 감소하지만, 2년에서 3년 사이에는 탄소집약도가 증가하여 전체 기간(3년)에는 유의한 탄소집약도 변화가 없다는 결과를 제시한다.

5) Renewable Installed Capacity Percentage(%) = Renewable installed capacity(MW) / Total installed capacity(MW)

6) 물론 이 경우 발행자는 SPT의 미달성으로 인해 평판위험(reputation risk)에 노출되기는 한다(Chan, 2022).

7) SLB 간 비교분석을 위해 발행일을 0, 만기일을 1로 표준화하였다.

참고문헌

김필규, 2021, ESG채권의 특성 분석과 활성화 방안, 자본시장연구원 『자본시장포커스』 2021-11.

이인형ㆍ이상호, 2021, 『지속가능보고 의무공시 이행을 위한 논의 방향』, 자본시장연구원 조사보고서 21-01.

Berrada, T., Engelhardt, L., Gibson, R., Krueger, P., 2022, The economics of sustainability linked bonds, Finance Working Paper No.820/2022, ECGI.

Chan, R., 2022, Ensuring impactful performance in green bonds and sustainability-linked loans.

Ehlers, T., Mojon, B., Packer, F., 2020, Green bonds and carbon emissions: exploring the case for a rating system at the firm level, BIS Quarterly Review, September 2020.

ESMA, 2021, Investor protection: Environmental impact and liquidity of green bonds, ESMA Report on Trends, Risks and Vulnerabilities No.2.

Haq, I., Doumbia, D., 2022, Structural loopholes in sustainability-linked bonds.

ICMA, 2020, Sustainability-Linked Bond Principles.

ICMA, 2021, Handbook: Harmonized framework for impact reporting.

Kolbel, J., Lambillon, A., 2022, Who pays for sustainability? An analysis of sustainability-linked bonds, Department of Banking and Finance, working paper, University of Zurich.

Mielnik, S., Erlandsson, U., 2022, An option pricing approach for sustainability-linked bonds.

Povilonis, J., 2022, Contracting for ESG: Sustainability-linked bonds and a new investor paradigm, The Business Lawyer 77.

SME Climate Hub, 2022, New data reveals two-thirds of surveyed small busineses concerned over navigating climate change.