Find out more about our latest publications

The effect of ETFs on underlying stock markets: Evidence from Korea

Research Papers 23-03 Jan. 30, 2023

- Research Topic Capital Markets

- Page 91

The Korean ETF market has shown remarkable growth. ETFs, which are low-cost, diversified, and highly convenient investment products, have recorded a high average annual growth of 33% since their introduction in Korea. The growth rates surpass those of global ETF markets in terms of both market size and the number of products. On the other hand, there are concerns about ETFs such as the adverse effects of rising indexation and the impact of frequent trading and money flows of ETFs. Following the literature, this report is aimed to discuss and study the potential impact of ETFs on underlying markets.

This report analyzes the impact of ETFs on Korean stock markets. Based on recent market data on ETFs, this report concentrates on empirical analyses of information efficiency, return characteristics, and volatility.

The empirical results are summarized as follows. First, ETFs promote the reflection of fundamental information on the stock price. The larger the weight of ETF holdings, the stronger the relationship between the stock return and changes in earnings. Also, the post-earnings-announcement drift decreases as ETF ownership increases. These results are clear in the market- or industry-level systematic earnings information.

Second, ETFs cause the co-movement of stock returns in their basket portfolios. In the ETF-level analysis, The more asset held by ETFs, the stronger the synchronization of stock returns within the ETFs. In the stock-level analysis, the return co-movement between stock and market returns is strong for stocks with high ETF ownership. Furthermore, these results are conspicuous for stocks with high ETF trading activity, and both informed and uninformed trading, such as arbitrage activity, contributes to the return co-movement. Overall results imply that ETFs could have negative effects on price efficiency and investors’ diversification.

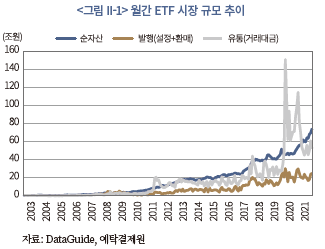

Third, an increase in stock holdings by ETFs also affects the return characteristics of individual stocks. Empirical results show that high ETF ownership is associated with negative return serial correlation and high systematic return volatility. These results are also strongly observed in stocks with high ETF trading activity similar to the prior results.

The overall results of this report show that the effects of ETFs, which have been empirically confirmed in overseas markets, are also exhibited in the Korean stock markets. The effects of ETFs on information efficiency, changes in return characteristics, and return volatility are related. Those effects could be either positive or negative on underlying stock markets.

Korean ETF markets are still small compared to the global markets. However, considering the remarkable growth of ETFs, the impacts of ETFs examined in this study would be shown constantly and in new aspects. Multifaceted research is needed on the effect of ETFs on capital markets and ways to minimize it.

This report analyzes the impact of ETFs on Korean stock markets. Based on recent market data on ETFs, this report concentrates on empirical analyses of information efficiency, return characteristics, and volatility.

The empirical results are summarized as follows. First, ETFs promote the reflection of fundamental information on the stock price. The larger the weight of ETF holdings, the stronger the relationship between the stock return and changes in earnings. Also, the post-earnings-announcement drift decreases as ETF ownership increases. These results are clear in the market- or industry-level systematic earnings information.

Second, ETFs cause the co-movement of stock returns in their basket portfolios. In the ETF-level analysis, The more asset held by ETFs, the stronger the synchronization of stock returns within the ETFs. In the stock-level analysis, the return co-movement between stock and market returns is strong for stocks with high ETF ownership. Furthermore, these results are conspicuous for stocks with high ETF trading activity, and both informed and uninformed trading, such as arbitrage activity, contributes to the return co-movement. Overall results imply that ETFs could have negative effects on price efficiency and investors’ diversification.

Third, an increase in stock holdings by ETFs also affects the return characteristics of individual stocks. Empirical results show that high ETF ownership is associated with negative return serial correlation and high systematic return volatility. These results are also strongly observed in stocks with high ETF trading activity similar to the prior results.

The overall results of this report show that the effects of ETFs, which have been empirically confirmed in overseas markets, are also exhibited in the Korean stock markets. The effects of ETFs on information efficiency, changes in return characteristics, and return volatility are related. Those effects could be either positive or negative on underlying stock markets.

Korean ETF markets are still small compared to the global markets. However, considering the remarkable growth of ETFs, the impacts of ETFs examined in this study would be shown constantly and in new aspects. Multifaceted research is needed on the effect of ETFs on capital markets and ways to minimize it.

The Korean ETF market has shown remarkable growth. ETFs, which are low-cost, diversified, and highly convenient investment products, have recorded a high average annual growth of 33% since their introduction in Korea. The growth rates surpass those of global ETF markets in terms of both market size and the number of products. On the other hand, there are concerns about ETFs such as the adverse effects of rising indexation and the impact of frequent trading and money flows of ETFs. Following the literature, this report is aimed to discuss and study the potential impact of ETFs on underlying markets.

This report analyzes the impact of ETFs on Korean stock markets. Based on recent market data on ETFs, this report concentrates on empirical analyses of information efficiency, return characteristics, and volatility.

The empirical results are summarized as follows. First, ETFs promote the reflection of fundamental information on the stock price. The larger the weight of ETF holdings, the stronger the relationship between the stock return and changes in earnings. Also, the post-earnings-announcement drift decreases as ETF ownership increases. These results are clear in the market- or industry-level systematic earnings information.

Second, ETFs cause the co-movement of stock returns in their basket portfolios. In the ETF-level analysis, The more asset held by ETFs, the stronger the synchronization of stock returns within the ETFs. In the stock-level analysis, the return co-movement between stock and market returns is strong for stocks with high ETF ownership. Furthermore, these results are conspicuous for stocks with high ETF trading activity, and both informed and uninformed trading, such as arbitrage activity, contributes to the return co-movement. Overall results imply that ETFs could have negative effects on price efficiency and investors’ diversification.

Third, an increase in stock holdings by ETFs also affects the return characteristics of individual stocks. Empirical results show that high ETF ownership is associated with negative return serial correlation and high systematic return volatility. These results are also strongly observed in stocks with high ETF trading activity similar to the prior results.

The overall results of this report show that the effects of ETFs, which have been empirically confirmed in overseas markets, are also exhibited in the Korean stock markets. The effects of ETFs on information efficiency, changes in return characteristics, and return volatility are related. Those effects could be either positive or negative on underlying stock markets.

Korean ETF markets are still small compared to the global markets. However, considering the remarkable growth of ETFs, the impacts of ETFs examined in this study would be shown constantly and in new aspects. Multifaceted research is needed on the effect of ETFs on capital markets and ways to minimize it.

This report analyzes the impact of ETFs on Korean stock markets. Based on recent market data on ETFs, this report concentrates on empirical analyses of information efficiency, return characteristics, and volatility.

The empirical results are summarized as follows. First, ETFs promote the reflection of fundamental information on the stock price. The larger the weight of ETF holdings, the stronger the relationship between the stock return and changes in earnings. Also, the post-earnings-announcement drift decreases as ETF ownership increases. These results are clear in the market- or industry-level systematic earnings information.

Second, ETFs cause the co-movement of stock returns in their basket portfolios. In the ETF-level analysis, The more asset held by ETFs, the stronger the synchronization of stock returns within the ETFs. In the stock-level analysis, the return co-movement between stock and market returns is strong for stocks with high ETF ownership. Furthermore, these results are conspicuous for stocks with high ETF trading activity, and both informed and uninformed trading, such as arbitrage activity, contributes to the return co-movement. Overall results imply that ETFs could have negative effects on price efficiency and investors’ diversification.

Third, an increase in stock holdings by ETFs also affects the return characteristics of individual stocks. Empirical results show that high ETF ownership is associated with negative return serial correlation and high systematic return volatility. These results are also strongly observed in stocks with high ETF trading activity similar to the prior results.

The overall results of this report show that the effects of ETFs, which have been empirically confirmed in overseas markets, are also exhibited in the Korean stock markets. The effects of ETFs on information efficiency, changes in return characteristics, and return volatility are related. Those effects could be either positive or negative on underlying stock markets.

Korean ETF markets are still small compared to the global markets. However, considering the remarkable growth of ETFs, the impacts of ETFs examined in this study would be shown constantly and in new aspects. Multifaceted research is needed on the effect of ETFs on capital markets and ways to minimize it.

Ⅰ. 서론

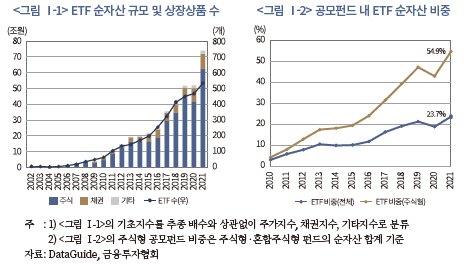

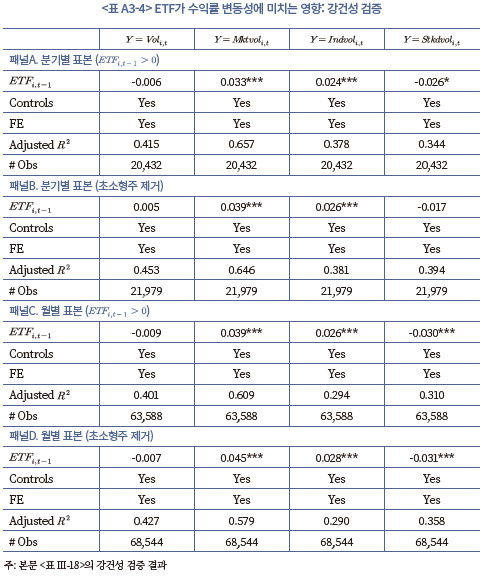

21세기 성공적인 금융혁신으로 회자되는 상장지수펀드(Exchange Traded Fund: ETF, 이하 ETF)는 2000년대 우리나라 공모펀드 시장의 성장을 주도했다고 해도 과언이 아니다. 2002년 10월 국내 ETF가 처음 상장된 이후 2021년 말 순자산 규모는 약 74조원으로, 도입 후 연평균 33%라는 매우 높은 성장률을 기록했다. 상장상품 수도 연평균 30%씩 증가했는데(<그림 Ⅰ-1> 참고), 이는 글로벌 ETF 시장의 성장 속도를 상회하는 수치이다.1) <그림 Ⅰ-2>에 따르면 우리나라 공모펀드 내 ETF의 순자산 비중은 23.7%로 매년 꾸준히 증가하고 있다. 특히 주식형 공모펀드로 한정하면 ETF가 차지하는 비중은 54.9%로 ETF 외 일반 공모펀드의 규모보다 크다.

글로벌 금융위기 이후 지속된 국내 공모펀드 시장의 침체 속에서 ETF의 괄목할만한 성장은 긍정적으로 평가되나, 기초지수를 추종하고 시장에서 활발히 거래되는 ETF의 특성상 잠재적인 시장 영향에 대한 우려가 제기되고 있다. 일반적인 ETF가 패시브(passive) 펀드라는 점에서 지나친 지수화(indexing)에 따른 자본시장 내 가격 왜곡 및 기초자산 수익률 특성의 변화가 발생할 수 있고, 높은 ETF 유동성을 바탕으로 한 다양한 거래 수요로 인해 기초자산의 가격 변동이 심화될 수 있다(Wurgler, 2010; Ben-David et al., 2018; Baltussen et al., 2019). 관련하여 학계에서는 정보 효율성, 변동성, 수익률 특성, 유동성 등 다양한 관점에서 ETF가 기초자산 시장에 미치는 영향에 관한 연구가 진행되었고, 2017년 미국 SEC는 ETF의 영향에 대해 주목하여 관련된 논의를 공론화한 바 있다.2)

선행연구에 따르면 ETF 시장 내 정보거래자가 늘어날 경우 포트폴리오 단위의 정보 반영이 촉진될 수 있으나(Glosten et al., 2021), 다른 한편으로 개별종목 단위의 정보거래가 위축될 수 있다. 이는 결과적으로 ETF에 편입된 기초자산 간 수익률의 동조화, 고유변동성의 감소를 초래할 수 있다(Da & Shive, 2018). 또한 높은 유동성을 지닌 ETF를 활용한 차익거래 및 단기투자 수요가 증가하면 유통시장 내 ETF 가격 충격이 기초자산으로 전이될 수 있고, 나아가 시장 전체의 가격 반전(reversal) 현상이 심화될 수 있다(Ben-David et al., 2018; Baltussen et al., 2019). 한편 기초자산의 유형에 따라 ETF에 편입됨으로써 기초자산의 유동성 및 가격 발견이 제고될 수 있다는 긍정적인 영향도 보고되고 있다(Madhaven & Sobczyk, 2016; Dannhauser, 2017). 요약하면 ETF가 기초자산에 미치는 영향은 긍정적, 부정적 영향이 혼재되어 나타나는 것으로 확인된다.

이러한 ETF의 영향에 관한 논의는 과거 파생상품시장의 영향에 대한 논쟁과 유사한 측면이 있다. 파생상품이 기초자산에 미치는 영향에 관한 다양한 의견과 분석이 꾸준히 제시되어 온 점을 상기하면, 현재 ETF 시장이 빠르게 성장 중인 점을 고려했을 때 ETF가 기초자산에 미칠 수 있는 긍‧부정적 영향에 대한 논의와 분석은 앞으로도 꾸준하게 이뤄질 것으로 예상된다. 특히 해외에서는 공모펀드 시장 전체가 성장하는 추세 속에서 ETF가 빠르게 성장했지만, 우리나라의 경우 ETF 외 공모펀드 시장은 다소 정체된 가운데 ETF에 대한 유독 높은 선호도가 지속되어 왔기 때문에 ETF의 잠재적 영향을 파악하고 이해하는 것은 우리나라 자본시장의 특성상 학술적, 정책적 관점에서 중요한 과제라 할 수 있다.

이에 본 고에서는 ETF의 대표적인 기초자산인 상장주식을 중심으로 ETF가 미치는 영향에 대해 다각도로 분석한다. 먼저 정보 효율성 관점에서 ETF가 상장기업의 기초여건(fundamental) 변화와 주식 수익률 관계를 강화하는지 분석하고, ETF가 편입자산의 수익률 동조화에 미치는 영향을 분석한다. 또한 ETF를 활용한 단기 거래의 증가가 기초자산 수익률의 시차 종속성(serial dependency) 및 변동성에 미치는 영향을 살펴본다.

이와 관련해서 국내에서도 관련된 연구가 시도되었으나 ETF가 미치는 영향에 대해 종합적으로 이해하기에는 분석의 영역과 표본이 다소 제한적이었던 것으로 판단된다. 대부분의 분석 기간은 ETF의 주식 편입비중이 작았던 시기를 포함하고 있고 실증분석 결과도 해외의 주요 연구와 상반된 경우가 존재한다. 그리하여 본 고는 국내 ETF가 일정 수준의 양적 성장을 이룬 시기에 초점을 맞춰 ETF의 영향을 종합적으로 분석함으로써 ETF가 기초자산에 미칠 수 있는 영향에 대한 이해를 돕고자 한다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 국내 ETF 시장 현황을 파악하고 본 연구와 관련된 선행연구를 검토한다. Ⅲ장에서는 보고서의 분석 방향을 설정하고 앞서 제시한 관점에서 ETF가 주식시장에 미치는 영향에 대한 분석 방법론과 실증분석 결과를 서술한다. 마지막 Ⅳ장에서는 분석 결과에 대한 요약과 시사점을 끝으로 보고서가 마무리된다.

Ⅱ. ETF 시장 현황 및 선행연구

1. 국내 ETF 시장 현황

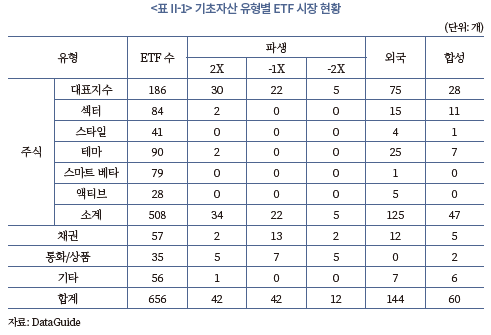

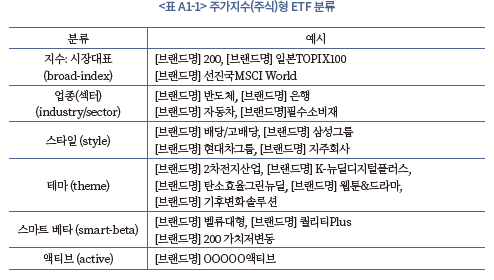

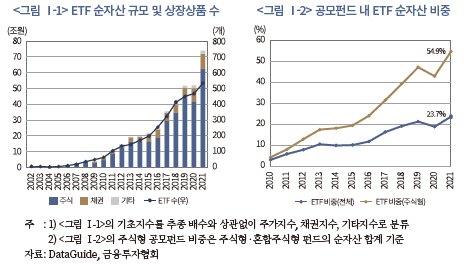

ETF가 처음 도입된 2002년부터 2021년까지 한국 주식시장에 상장된 ETF는 모두 656개로 집계된다(<표 II-1> 참고). ETF를 유형별로 분류하여 살펴보면3), 주식형 ETF가 508개로 약 77%를 차지하며, 채권형 ETF 57개, 통화 및 상품(commodity) 관련 ETF 35개, 기타 ETF 56개이다. 기타 ETF에는 부동산(REITs), 인프라, 혼합자산, 커버드콜, 롱숏 ETF 등이 포함된다. 주식형 ETF는 다시 대표지수, 섹터, 스타일, 테마, 스마트 베타, 액티브 등 6개 유형으로 구분할 수 있다. 대표지수형 ETF가 186개로 가장 많고 테마 90개, 섹터 84개, 스마트 베타 79개 순이다.

레버리지(2X), 인버스(-1X), 2배 인버스(-2X)와 같은 파생형 ETF는 모두 96개로, 벤치마크에 대한 파생상품이 활성화되어 있는 주가지수(주식-대표지수), 채권, 통화/상품형 ETF에서 비중이 높다. 파생형 ETF는 대표지수형의 31%, 채권형의 30%, 통화/상품형의 49%를 차지한다. 주가지수를 추종하는 상품의 경우 레버리지(2X) ETF의 비중이 크고, 채권지수를 추종하는 ETF 중에는 인버스(-1X) 상품의 비중이 큰 것이 특징적이다. 외국 지수 또는 자산을 투자 대상으로 하는 ETF는 125개, 파생상품계약을 통해 벤치마크를 복제하는 합성(synthetic) ETF는 47개이며, 이 중에는 주식-대표지수형 ETF인 경우가 많다. 해외 주가지수 중 실물자산으로 지수 추종이 어려운 경우 합성 방식을 활용하는 것으로 생각된다.

ETF의 유형 분류를 통해 국내 시장에서 투자자가 선택할 수 있는 ETF의 기초자산과 운용전략은 상당히 다양화되어 있음을 확인할 수 있다. 한편 <표 II-1>에 포함된 ETF 중 123개는 표본 기간 내에 상장폐지된 것으로 확인된다.

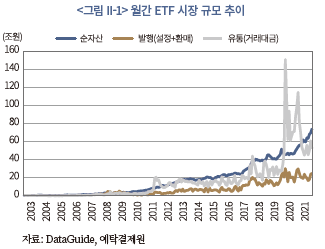

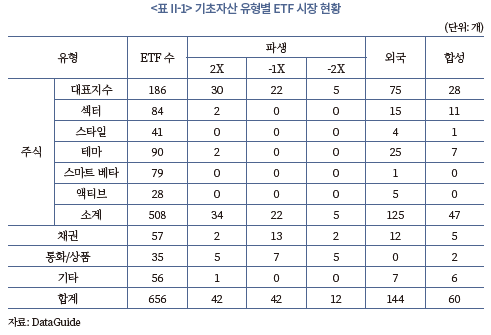

<그림 II-1>은 ETF의 순자산, 발행시장, 유통시장의 규모를 보여준다. 순자산 규모는 2011년 말 10조원에서 2021년 말 74조원으로 증가하여 최근 10년간 연평균 22%의 가파른 성장세를 보였다. ETF 순자산 규모의 성장과 함께 거래대금도 빠르게 증가하였다. 코로나19 팬데믹이 한창이던 2020년 3월에는 월간 거래대금이 151조원을 기록하기도 하였으며, 2021년 월평균 거래대금은 61조원 수준이다. 월간 거래회전율로 보면 평균 100%로 주식시장의 4~5배에 이르고, 2021년 기준 ETF를 포함한 전체 주식시장 거래대금에서 ETF 거래대금의 비중은 약 10%에 달한다. ETF 순자산 규모가 주식시장 시가총액 대비 2~3%에 불과하다는 점을 고려하면 ETF가 거래소시장에서 매우 활발히 거래되고 있음을 알 수 있다. 발행시장의 설정과 환매도 활발하여 2021년 월평균 설정금액은 12조원, 환매금액은 10조원 수준이다.4) 이를 통해 국내 ETF 시장은 빠르게 성장하고 있으며 유동성이 매우 풍부한 것으로 평가할 수 있다.

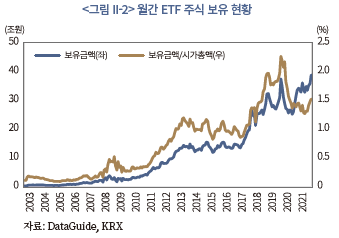

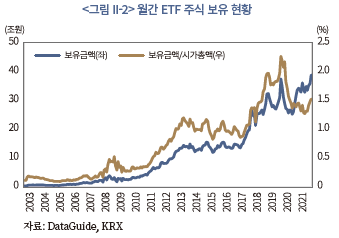

주식형 ETF 중에서 국내 상장주식을 보유하고 있는 356개 ETF를 대상으로, ETF의 상장주식 보유현황에 대해서 살펴보자. <그림 II-2>는 주식형 ETF의 주식 보유금액과 시가총액 대비 보유금액 비중의 추이를 보여준다. ETF의 주식 보유금액은 ETF 시장의 성장과 함께 증가하는 추세가 나타난다. 2012년 11월 10조원, 2017년 12월 20조원, 2019년 1월 30조원을 넘어섰으며 2021년 12월 기준 약 39조원을 기록하고 있다. 이는 국내 ETF 전체 순자산의 53%를 차지하는데, 전체 주식시장 시가총액에서 차지하는 비중은 최대 2.3%, 2021년 12월 기준 1.5% 수준이다.

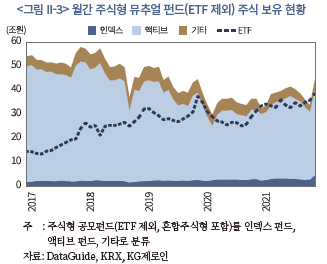

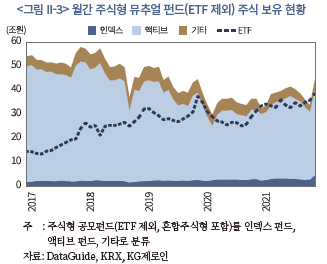

ETF의 주식 보유금액은 주식형 펀드(ETF 제외, 혼합주식형 포함)와 큰 차이가 나지 않는다. <그림 II-3>에 따르면 2017년 초만 하더라도 ETF의 주식 보유금액은 주식형 펀드의 약 1/4 수준에 불과하였으나 ETF 시장이 확대되는 동안 일반 주식형 공모펀드가 위축되면서 2021년에는 비슷한 수준을 형성하고 있다. 거래 편의성, 상품 다양성, 비용 효율성 등 ETF의 장점이 부각되면서 ETF가 주식형 공모펀드를 잠식하고 있는 것으로 추정된다.

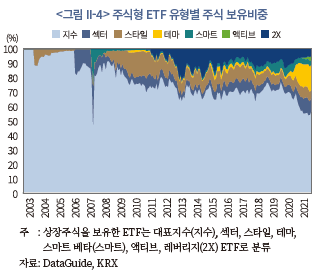

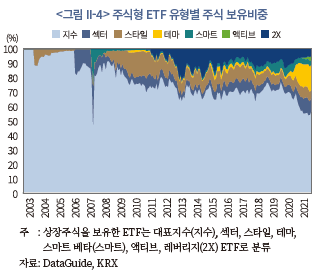

<그림 II-4>는 <그림 II-2>에서 제시한 ETF 국내 주식 보유금액을 ETF 유형별 비중으로 나타낸 것이다. 주식형 ETF의 유형이 다양화되면서 대표지수형 이외 유형의 ETF가 보유한 주식의 비중이 증가하는 모습을 볼 수 있다. 2021년 12월 기준 전체 주식형 ETF의 주식 보유금액 39조원 중에서, 대표지수형이 57%, 테마형이 17%, 섹터형이 9%를 각각 보유하고 있다. 테마형 ETF의 보유비중이 최근 2년간 급증한 것이 특징적이다.

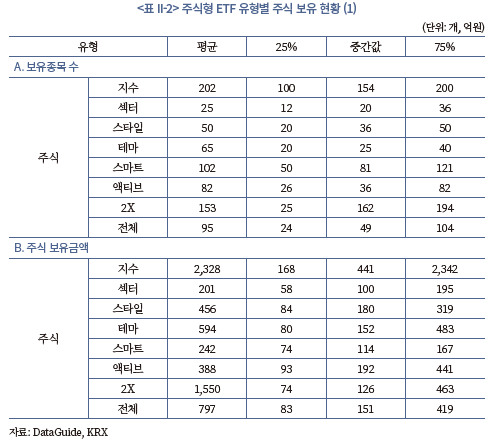

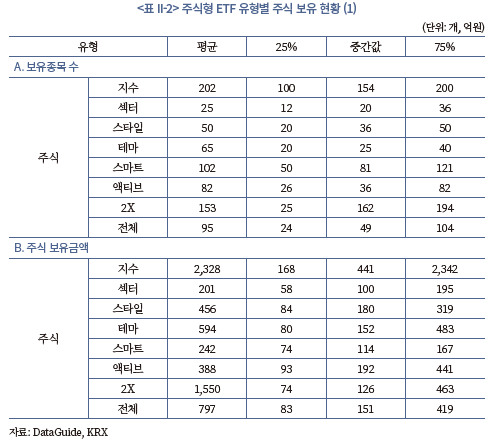

<표 II-2>는 개별 ETF의 보유종목 수와 주식 보유금액의 분포를 ETF 유형별로 정리한 것이다. 주식형 ETF는 평균적으로 95개 종목을 보유하고 있는 것으로 나타난다. 대표지수형과 레버리지(2X)형이 각각 202종목, 153종목으로 가장 많은 종목을 보유하고 있다. 이들 ETF가 주식시장 내 대표지수를 벤치마크로 삼고 있어서 나타나는 특성이다. 반면 섹터형, 테마형, 스타일형과 같이 투자 대상을 유형화 혹은 선별하는 방식으로 접근하는 ETF는 상대적으로 보유종목 수가 적다.

개별 주식형 ETF의 주식 보유금액은 평균 797억원으로 나타난다. 356개 ETF 중 62%(221개)가 200억원 미만, 80%(284개)가 500억원 미만으로 소규모 ETF가 대부분인 가운데, 주식 보유금액이 5,000억원을 넘는 ETF가 15개로 ETF간 편차가 큰 것으로 확인된다. 유형별로는 대표지수형과 레버리지(2X)형의 보유금액이 상대적으로 크고, 섹터형과 스마트 베타 ETF의 보유금액이 작다.

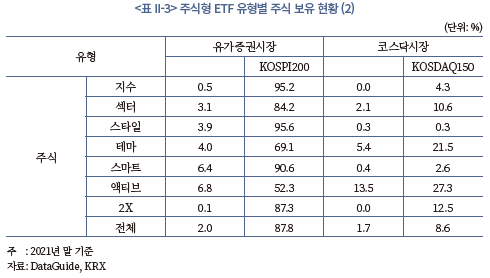

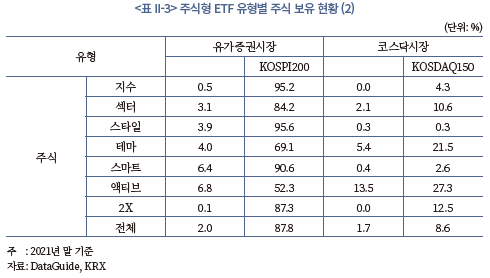

<표 II-3>은 2021년 말 기준으로, 유형별 ETF의 주식 보유금액을 유가증권시장과 코스닥시장 내 주요지수(KOSPI200, KOSDAQ150) 편입 여부에 따라 분류한 것이다. 보유주식의 90%는 유가증권시장에, 10%는 코스닥시장에 투자되어 있고, 96%는 KOSPI200과 KOSDAQ150 지수 편입종목에 투자되어 있는 것으로 나타난다. ETF 유형별로 차이가 관찰되는데, 지수형과 레버리지(2X)형은 대부분 지수 편입종목으로, 스타일형과 스마트 베타형은 대부분 유가증권시장 종목으로 보유하고 있는 반면, 테마형과 액티브형은 지수 비편입종목과 코스닥시장 보유비중이 비교적 높다.

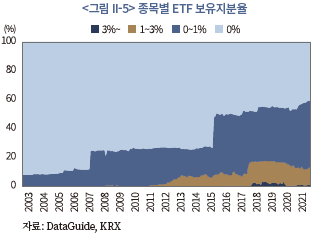

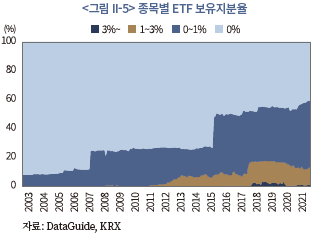

<그림 II-5>와 <그림 II-6>은 상장주식 종목별 ETF 보유비중(지분율)의 분포와 해당 종목을 보유한 ETF 수의 분포를 시계열적으로 나타내고 있다. 먼저 <그림 II-5>에 따르면 ETF의 투자대상에 포함되는 주식은 점차 증가하고 있는 것을 볼 수 있다. 2003년 초 전체 상장종목의 8%(1,531종목 중 121종목) 수준이었던 것이 2021년 말에는 58%(2,275종목 중 1,324종목)로 증가하였다. 주식형 ETF의 운용전략 다양화와 함께 투자대상이 확대된 결과로 추정된다. 보유비중으로 보면 1% 미만인 경우가 많으나, 2018년 이후로 보유비중이 1%를 넘는 종목이 320여 종목, 약 15%를 차지한다. ETF 보유비중이 3%를 넘는 경우도 일부 관찰된다.

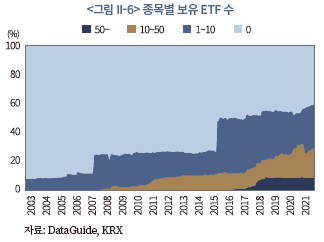

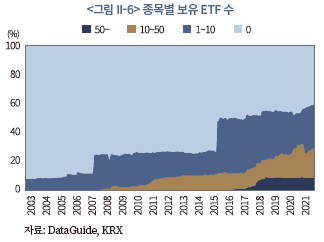

<그림 II-6>에 따르면 2021년 말 기준으로, 전체 상장종목의 9%인 196개 종목은 51개 이상의 ETF가 해당 종목을 보유하고 있는 것으로 나타난다. 이 외 상장종목의 19%는 11~50개의 ETF가, 나머지 30%는 10개 이하의 ETF가 보유하고 있다.

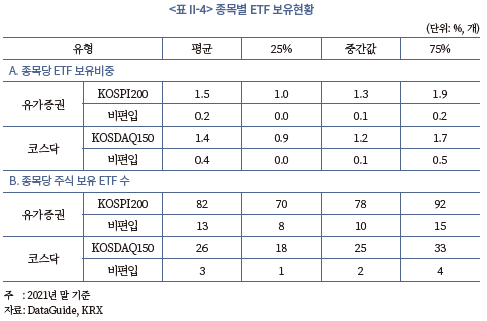

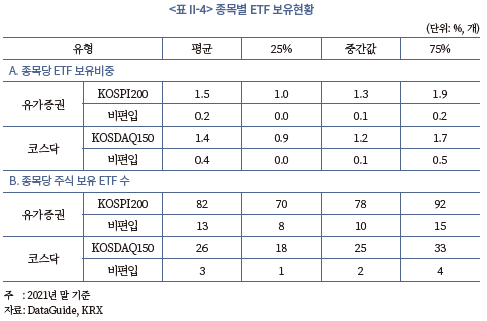

<표 II-4>는 개별종목에 대한 ETF의 보유비중(지분율)과 해당 종목을 보유한 ETF 수를 각 종목의 상장시장과 지수편입 여부에 따라 제시하고 있다. 자료의 시점은 2021년 말 기준이며, ETF가 보유하지 않은 종목은 통계에서 제외한다. 종목당 ETF의 보유비중은 주요 주가지수의 편입종목에서 크게 나타난다. KOSPI200 편입종목은 평균 1.5%, KOSDAQ150 편입종목은 평균 1.4%를 ETF가 보유하고 있다. 반면 지수 비편입종목은 유가증권시장 0.2%, 코스닥시장 0.4%에 불과하다. 종목당 주식 보유 ETF 수 역시 주요지수 편입종목이 많다. KOSPI200에 포함된 종목은 평균 82개 ETF가, KOSDAQ150에 포함된 종목은 평균 26개 ETF가 해당 종목을 보유하고 있다. 지수 비편입종목은 유가증권시장의 경우 평균 13개, 코스닥시장의 경우 평균 3개 ETF가 해당 종목을 보유하고 있는 것으로 나타난다.

2. 선행연구 검토

일반적인 ETF는 특정 지수를 추종하는 패시브 펀드이다. 최근 액티브 ETF 상품이 상장되고 있으나 아직 그 비중이 작으므로, 모든 선행연구에서 ETF는 기초지수의 수익률을 추종하는 패시브 펀드로 전제된다.

ETF를 포함한 패시브 투자가 확대된다고 할 때, 기초자산 시장에서 잡음거래자(noise trader)가 ETF 시장으로 이동하면서 전반적인 시장 효율성 제고에 기여할 수 있다는 평가가 있다(Stambaugh, 2014). 반면 지나친 지수화에 따라 시장 가격(valuation) 및 위험-수익률 관계의 왜곡이 나타날 수 있다는 주장도 존재한다(Wurgler, 2010).5) ETF의 규모가 급격히 증가함에 따라 펀드자금 유출입에 따른 가격 비효율성 및 위험6)이 증가할 수 있는데, 펀드 내 편입종목을 거래할 때 펀드매니저의 역량으로 수급에 따른 영향을 통제할 수 있는 액티브 펀드와 달리 패시브 펀드의 거래는 기계적으로 발생한다는 측면에서 펀더멘탈(fundamental)과 무관한 거래의 영향이 확대될 수 있다.

ETF는 투자자의 자유로운 환매와 설정이 가능하고 기준가격과의 괴리를 최소화한다는 점에서 개방형펀드의 속성을 보유하고 있고, 동시에 거래소에 상장되어 유통되는 폐쇄형펀드의 특징을 모두 가진 집합투자기구이다. 이를 구현하기 위해 ETF 발행사(집합투자업자)는 지정참가회사(Authorized Participant: AP)를 지정하여 AP의 차익거래를 통해 ETF의 가격 실패를 막는다. 또한 ETF의 높은 환금성과 유동성을 유지하기 위해 AP 중 유동성공급 계약을 맺은 유동성공급자(Liquidity Provider: LP)는 거래소가 규정한 방식에 따라 ETF 호가를 제출하고 있다. 그 결과 ETF를 통한 손쉽고 저렴한 포트폴리오 투자가 가능해지나, ETF의 높은 유동성은 단기차익을 추구하는 거래의 수요를 확대하는 요소로 작용한다(Broman & Shum, 2018).7) 이러한 거래가 무정보거래(uninformed trading)에 가깝다면 ETF는 기초자산 시장에 대한 가격충격의 전달 경로가 될 가능성이 있다.

이러한 특징을 바탕으로 ETF가 주식시장에 미치는 영향에 관한 연구를 살펴보면 다음과 같다. 먼저 기초지수를 추종하는 상품이라는 점에서 ETF 투자자 저변이 확대되면 지수 수준(index-level)의 정보 반영이 촉진될 수 있다. Glosten et al.(2021)의 연구에 따르면 ETF 보유비중이 클수록 포트폴리오 단위의 체계적 정보 반영이 촉진되는 것으로 나타난다. 다만 이는 개별종목의 고유정보가 효율적으로 가격에 반영되는 것과는 별개며 분석 주기에 따라서 결과가 약해지기도 한다(Israeli et al., 2017). 한편 포트폴리오 단위의 거래활동이 늘어나고 단기 투자수요가 증가함에 따라 개별종목의 가격 효율성이 저하되기도 한다. 대표적으로 ETF 편입종목의 수익률 동조화를 들 수 있는데, Da & Shive(2018)에 따르면 ETF 보유비중과 거래활동 증가는 개별종목의 수익률 동조화와 연관된 것으로 확인된다. 이는 과거 지수 편입종목의 수익률 동조화에 대한 분석과 유사한 측면이 있고(Barberis et al., 2005; Greendwood, 2008), 이러한 현상이 현저해진다면 ETF 투자자가 기대하는 분산투자 효과가 낮아질 수도 있다.

한편 ETF와 연계된 차익거래 등 단기 거래의 영향이 증가한다면 주식시장 내 단기 가격 반전(short-run price reversal)이 심화될 수 있고, 펀더멘탈과 무관한 ETF의 가격 충격이 주식가격에 전이될 수 있다. Baltussen et al.(2019)은 주요 15개국의 20개 주가지수 시계열의 시차 종속성(serial dependency)이 감소한 주요 요인으로 ETF와 같은 지수 추종 상품의 증가를 지목한다. 이들 분석에 따르면 2000년대 이후 주식시장 시차 종속성이 음(-)의 값으로 전환되었으며 시차 종속성의 감소는 ETF 자산편입 규모와 관련되어 있다.8) 이러한 결과는 크게 두 가지를 시사하는데, 주가지수 수준에서 가격 반전이 증가했다는 점에서 펀더멘탈과 무관한 거래의 영향이 커졌다는 것, 그리고 이러한 수익률 특성의 변화는 ETF와 같은 패시브 투자자의 거래비용 증가와 효익 감소로 이어질 수 있다는 것이다. 한편 Ben-David et al.(2018)의 연구에서는 개별종목 단위의 ETF 보유비중과 주가 변동성 간의 정(+)의 관계가 확인되어 ETF 시장 내 단기 수급 및 비정보거래가 주식가격의 변동성을 확대할 수 있음을 보여주었다.

국내에서도 ETF가 주식시장에 미치는 영향에 관한 연구가 진행되었는데 해외 문헌에 비하면 연구의 다양성은 다소 제한적이다. 김상현‧손판도(2019)는 KOSPI200 지수를 추종하는 ETF를 대상으로 ETF의 KOSPI200 보유비중과 KOSPI200 지수의 변동성 간의 음(-)의 관계를 도출하였다. 최병호 외(2021)는 개별주식 단위에서 KOSPI200 편입종목의 ETF 보유비중과 변동성과의 관계를 검증하였는데 통계적으로 일관된 결과가 도출되지 않았다.9) 송준혁‧이창일(2020)의 연구에서는 개별종목 단위의 분석을 통해 ETF 보유비중이 클수록 호가 스프레드, 수익률 동조화 지표 및 고평가 정도가 증가하는 것을 확인하였다.

이들 연구는 국내 ETF의 주식 보유 수준이 낮은 시기를 분석 기간으로 설정했다는 점, 일부 ETF를 분석대상으로 한정했다는 점에서 한계가 있는 것으로 생각된다. ETF 도입 초기와 달리 다양한 지수를 추종하는 ETF가 증가했고 ETF 발행 및 유통시장의 규모가 급격히 성장했기 때문에, 최근의 ETF 시장을 대상으로 한 종합적인 분석의 필요성이 높다고 할 수 있다.

Ⅲ. ETF가 주식시장에 미치는 영향

본 장에서는 선행연구를 바탕으로 ETF가 주식시장에 미치는 영향에 대해 실증적으로 검토한다. 1절에서는 본 고에서 활용한 ETF 주식 보유 데이터 및 ETF 보유비중 산출 방식을 설명하고, 2절에서는 정보 효율성 관점에서 ETF의 영향을 검증한다. 3절 및 4절에서는 각각 ETF가 주식 수익률의 동조화, 시차 종속성 및 변동성에 미치는 영향에 대해 분석한다.

1. 분석 자료

ETF 활동(ETF activity) 변수의 주된 대용치로 선행연구에서 제시한 개별종목 단위 ETF 보유비중을 사용하며(Israeli et al., 2017; Ben-David et al., 2018; Glosten et al., 2021), 본 장의 분석에 포함된 ETF는 파생형, 액티브 상품을 제외한 패시브 형태의 단순 추종(plain-vanilla) 상품이다. ETF 보유비중 산출을 위해 한국거래소에서 제공하는 ETF PDF(Portfolio Deposit File) 자료를 활용한다. PDF 자료는 ETF의 설정 및 환매를 위한 기본 단위인 설정단위(Creation Unit: CU) 한 개의 구성 종목 내역으로 ETF가 추종하는 지수의 구성과 거의 동일하며 매일(daily) 시장에 공개되는 자료이다. ETF마다 1 CU에 해당하는 수량은 상이하며 ETF별 일별 상장주식수를 바탕으로 ETF의 주식 보유현황을 산출한다.10)

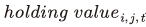

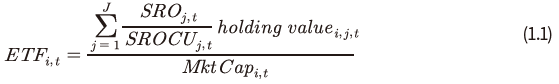

본 연구에서는 ETF 보유비중 을 ETF 시장 참여자의 거래활동과 ETF의 역할에 관한 대용치로 사용하는데, 선행연구에 따라 ETF 보유비중이 클수록 ETF 관련 거래활동이 많고 기초자산에 미치는 영향도 클 것으로 가정한다. ETF 보유비중은 시가총액 대비 ETF 보유금액으로 정의하며, 개별 ETF의 PDF 자료와 일간 CU 정보를 바탕으로 아래 식(1.1)과 같이 계산한다. 이 식에서,

을 ETF 시장 참여자의 거래활동과 ETF의 역할에 관한 대용치로 사용하는데, 선행연구에 따라 ETF 보유비중이 클수록 ETF 관련 거래활동이 많고 기초자산에 미치는 영향도 클 것으로 가정한다. ETF 보유비중은 시가총액 대비 ETF 보유금액으로 정의하며, 개별 ETF의 PDF 자료와 일간 CU 정보를 바탕으로 아래 식(1.1)과 같이 계산한다. 이 식에서, 는 개별 ETF j의 상장주식수,

는 개별 ETF j의 상장주식수,  는 ETF j의 설정단위당 주식수,

는 ETF j의 설정단위당 주식수,  는 ETF j의 1설정단위에서 주식 i에 대한 보유금액,

는 ETF j의 1설정단위에서 주식 i에 대한 보유금액,  은 주식 i의 시가총액을 각각 의미한다. ETF 보유비중

은 주식 i의 시가총액을 각각 의미한다. ETF 보유비중 은 후술할 2절부터 4절의 실증분석에서 사용할 주된 독립변수가 된다. ETF 보유비중을 산출할 때 월별 표본의 경우 월간 15거래일 이상, 분기별 표본은 경우 분기내 45거래일 이상 주식 수익률 및 거래량 관측치가 존재하는 종목으로 제한한다.

은 후술할 2절부터 4절의 실증분석에서 사용할 주된 독립변수가 된다. ETF 보유비중을 산출할 때 월별 표본의 경우 월간 15거래일 이상, 분기별 표본은 경우 분기내 45거래일 이상 주식 수익률 및 거래량 관측치가 존재하는 종목으로 제한한다.

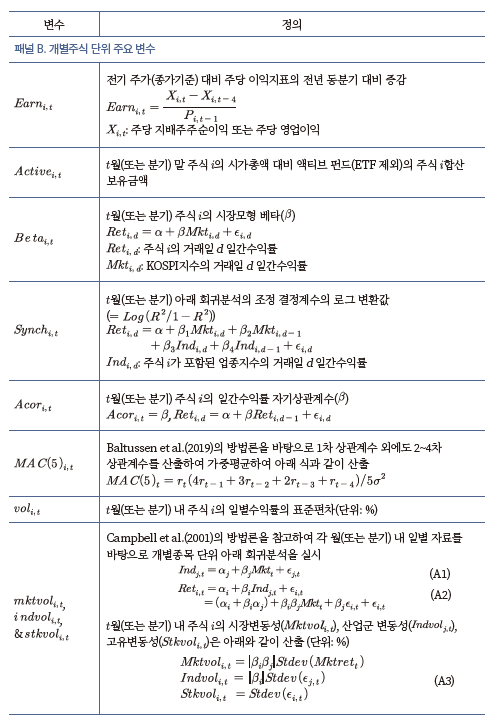

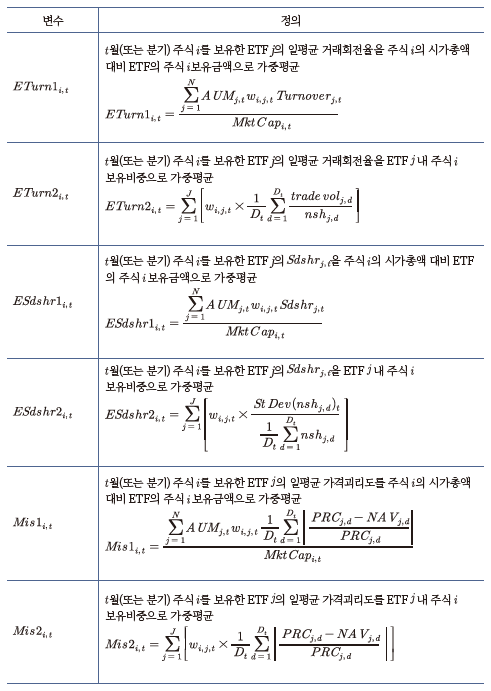

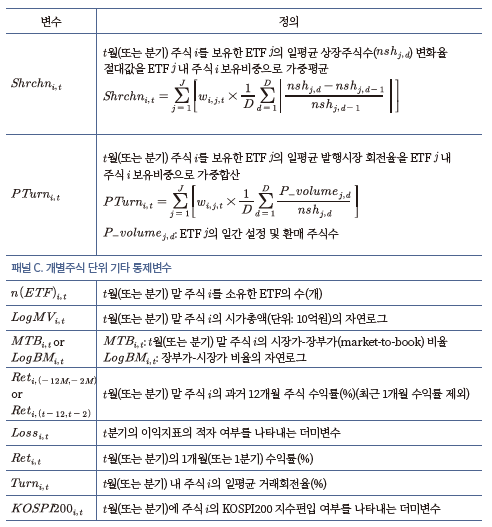

이 외에 개별주식 및 ETF의 가격, 거래량 등 시장 정보와 기업 재무제표 자료는 DataGuide를 통해 확보하고, ETF를 제외한 일반 뮤추얼 펀드의 주식 보유현황은 KG제로인의 월별 뮤추얼 펀드 보유 자료를 사용한다. 본 연구의 분석 기간은 일반 뮤추얼 펀드 보유 자료의 시작 시점인 2017년 1월부터 2021년 12월까지로, 앞서 Ⅱ장의 ETF 시장 현황에서 살펴보았듯이 주식시장 전체 또는 개별종목 단위의 ETF 보유비중이 유의미하게 나타나는 시기이다.

2. ETF와 정보 효율성

가. 분석 개요

본 절에서는 Glosten et al.(2021)의 방법론을 바탕으로 ETF가 주식시장의 정보 효율성에 미치는 영향을 분석한다. 이를 위해 ETF가 기업의 기초여건(fundamental) 변화와 개별종목 수익률의 관계를 강화시키는 역할을 수행하는지 검증한다. 만약 기초여건 변화가 개별종목 수익률에 영향을 주지 않는다면 기초여건에 대한 정보가 무가치하거나 기초여건에 대한 정보가 반영되는 경로가 취약하다는 것을 의미한다. 만약 ETF가 기초여건 변화와 수익률의 관계를 강화시킨다면 ETF가 정보 반영 경로로 기능하고 있다는 것을 의미하며 주식시장의 정보 효율성 강화에 기여하고 있다고 평가할 수 있다.

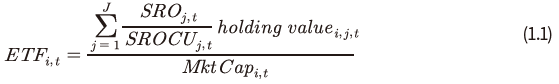

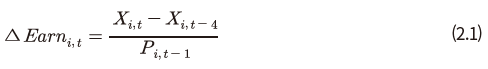

기업의 기초여건 변화는 식(2.1)처럼 분기별 이익지표의 변화 로 측정하며, 기업실적의 계절성을 고려하여 전년 동기 대비 변화값을 이용한다. 이익지표

로 측정하며, 기업실적의 계절성을 고려하여 전년 동기 대비 변화값을 이용한다. 이익지표 는 연결재무제표의 주당 지배주주순이익 및 주당 영업이익을 사용하며, 전분기말 주가

는 연결재무제표의 주당 지배주주순이익 및 주당 영업이익을 사용하며, 전분기말 주가 를 이용하여 표준화한다.

를 이용하여 표준화한다.

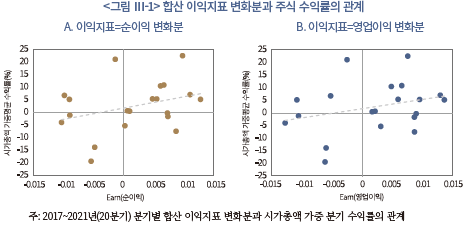

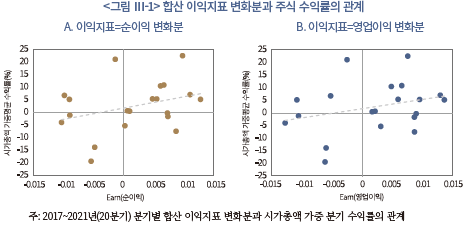

분석 기간(2017~2021년) 동안 분기별 상장기업의 합산 이익지표 변화분(전년 동기 대비)과 시가총액 가중 분기 수익률의 관계를 살펴보면 <그림 Ⅲ-1>과 같다. 이익지표의 변화와 주식 수익률은 약한 정(+)의 관계가 있음을 알 수 있다. 이익지표의 변화가 기업의 미래성과에 대한 정보를 포함하고 있다는 것을 의미한다.

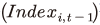

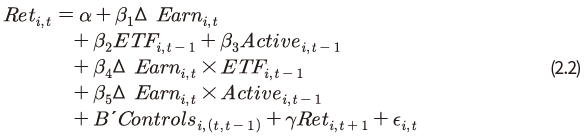

분석을 위한 회귀식은 아래 식(2.2)와 같다. 종속변수는 주식 i의 t분기의 수익률 이고, 핵심 독립변수는 이익지표 변화

이고, 핵심 독립변수는 이익지표 변화 및 이익지표 변화와 ETF 보유비중의 교차항

및 이익지표 변화와 ETF 보유비중의 교차항 이다. 만약 이익지표 변화의 추정계수가 양(+)이고 교차항의 추정계수도 양(+)이라면, ETF 보유비중이 클수록 이익지표 변화에 대한 수익률의 민감도가 커지며 ETF가 정보 효율성을 높이는 역할을 수행한다고 해석할 수 있다.

이다. 만약 이익지표 변화의 추정계수가 양(+)이고 교차항의 추정계수도 양(+)이라면, ETF 보유비중이 클수록 이익지표 변화에 대한 수익률의 민감도가 커지며 ETF가 정보 효율성을 높이는 역할을 수행한다고 해석할 수 있다.

ETF뿐만 아니라 ETF 이외의 주식형 펀드도 정보 효율성에 영향을 미칠 수 있다. 이를 고려하여 액티브 펀드의 보유비중 11), 이익지표 변화와의 교차항을 독립변수로 포함한다. 액티브 펀드의 보유비중 역시 해당 유형 내 모든 펀드의 합산 보유금액을 시가총액으로 나누어 산출한다. 기타 통제변수로 기업 규모, 시장가-장부가 비율, 변동성, 과거 수익률, 베타, 손실 여부 등 종속변수가 수익률인 경우 통상적으로 활용되는 변수들을 포함한다.12) 아울러 이익지표 반응계수

11), 이익지표 변화와의 교차항을 독립변수로 포함한다. 액티브 펀드의 보유비중 역시 해당 유형 내 모든 펀드의 합산 보유금액을 시가총액으로 나누어 산출한다. 기타 통제변수로 기업 규모, 시장가-장부가 비율, 변동성, 과거 수익률, 베타, 손실 여부 등 종속변수가 수익률인 경우 통상적으로 활용되는 변수들을 포함한다.12) 아울러 이익지표 반응계수 의 측정 오차를 줄이기 위해 미래 수익률

의 측정 오차를 줄이기 위해 미래 수익률 을 독립변수로 포함한다.13)

을 독립변수로 포함한다.13)

ETF 및 액티브 펀드의 보유비중은 전분기 값을 이용하여 내생성(endogeneity) 문제의 가능성을 줄이고, 모든 독립변수는 상하위 1% 표본을 윈저화(winsorization)하여 극단치의 영향을 최소화한다.14)

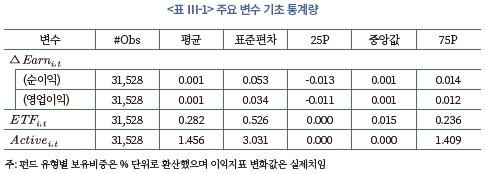

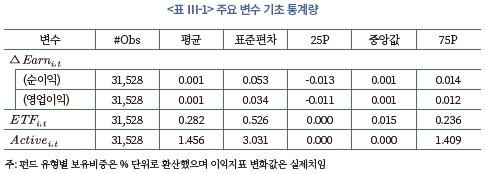

<표 Ⅲ-1>은 31,528개 기업-분기 관측치에 대한 주요 변수의 기초 통계량이다. ETF의 평균 보유비중은 0.282%이며, 액티브 펀드의 평균 보유비중은 1.456%이다. 분석에 포함하지 않았으나 인덱스 펀드의 평균 보유비중은 0.016%에 불과하다. 각 분위값을 비교해 볼 때 액티브 펀드는 미보유한 종목의 수가 많으며, ETF가 뮤추얼 펀드에 비해 투자 대상이 넓은 특징을 보인다.

나. 분석 결과

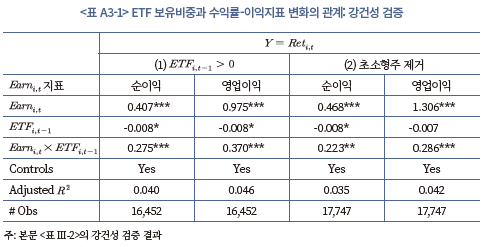

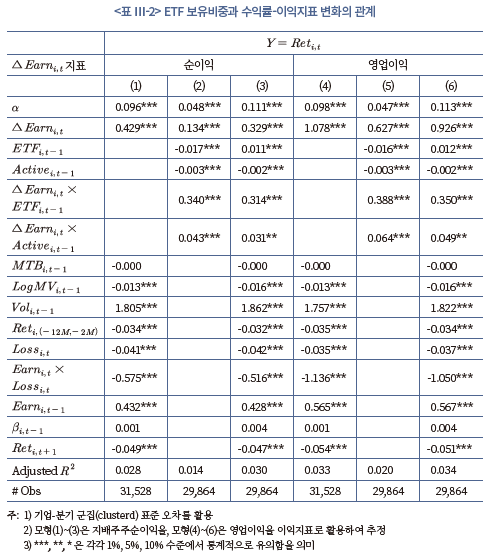

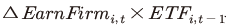

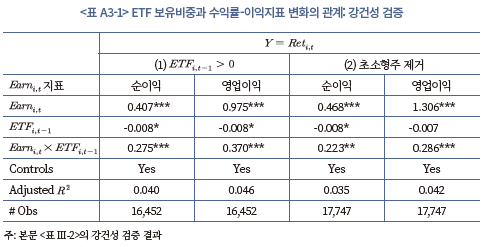

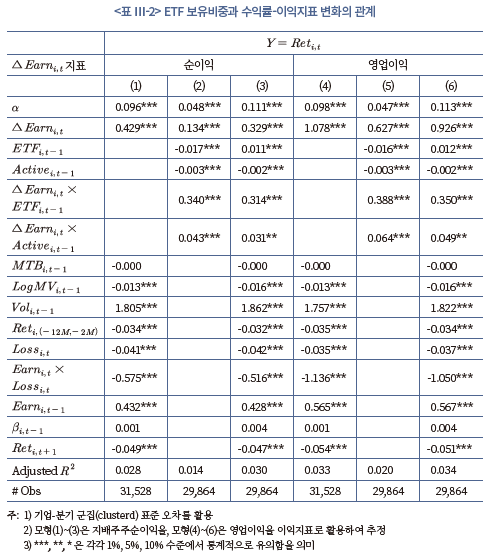

<표 Ⅲ-2>는 회귀분석 식(2.2)의 패널 회귀분석 결과를 제시하고 있다. 모형(1)~(3)은 지배주주순이익을, 모형(4)~(6)은 영업이익을 이익지표로 사용하여 분석한 결과이다.

모든 분석에서 이익지표의 변화는 주식 수익률과 통계적으로 유의한 양(+)의 관계가 있는 것으로 나타난다. 이익지표가 증가(감소)할수록 주식 수익률이 높다는(낮다는) 것으로, 이익지표의 변화는 수익률에 영향을 미치는 정보를 담고 있다는 의미이다. ETF 보유비중과 이익지표 변화의 교차항의 계수를 보면, 모형(2), (3), (5), (6) 모두에서 1% 수준에서 통계적으로 유의한 양(+)의 값이 관찰된다. 즉 ETF 보유비중이 클수록 이익지표 변화에 대한 수익률의 반응이 커지며, ETF 거래활동은 이익지표 정보가 주가에 반영되는 경로로 기능한다고 평가할 수 있다. 정보거래를 통한 가격 발견 기능을 수행할 것으로 기대되는 액티브 펀드의 경우에도 ETF와 유사한 결과가 확인된다. 이상의 결과는 기존 문헌의 분석 결과와 일치한다(Glosten et al., 2021).

ETF가 패시브 펀드임에도 불구하고 정보 효율성의 개선에 기여하는 것은 ETF가 유동성이 높은 지수상품이라는 특징 때문으로 평가할 수 있다. 기초자산 시장의 경우 시장 마찰(market friction) 등의 이유로 정보 반영이 지체될 수 있는 반면, ETF는 상장상품으로서 활발히 거래되기 때문에 지수 단위의 정보거래에 용이하게 활용될 수 있기 때문이다.

이익지표의 변화가 담고 있는 정보는, 상장기업 전체의 이익변화에 대한 정보와 개별기업의 이익변화에 대한 정보 등 두 가지 정보로 구분해 볼 수 있다. ETF가 주가에 반영되도록 돕는 정보는 어떤 유형의 정보인지 추가적인 분석을 통해 검토해보도록 한다.

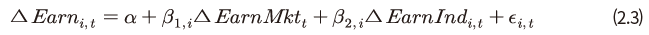

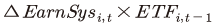

개별기업의 이익지표 변화 는 아래 식(2.3)의 회귀분석을 통해 체계적 요소와 고유 요소로 분해할 수 있다. 여기서

는 아래 식(2.3)의 회귀분석을 통해 체계적 요소와 고유 요소로 분해할 수 있다. 여기서  는 표본 상장기업 전체의 이익지표 변화이며,

는 표본 상장기업 전체의 이익지표 변화이며,  는 분석대상 기업이 포함된 산업15) 내 상장기업 전체의 이익지표 변화이다. 개별기업별로 회귀분석을 시행한 후, 적합된 값(fitted value)을 이익지표 변화의 체계적 요소

는 분석대상 기업이 포함된 산업15) 내 상장기업 전체의 이익지표 변화이다. 개별기업별로 회귀분석을 시행한 후, 적합된 값(fitted value)을 이익지표 변화의 체계적 요소 로, 잔차(residual)를 고유 요소

로, 잔차(residual)를 고유 요소 로 정의한다.

로 정의한다.

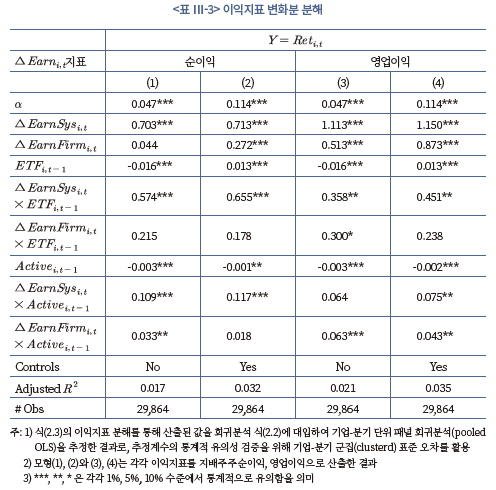

회귀분석 식(2.2)의 패널 회귀분석에서 이익지표 변화 변수를 체계적 요소 변수와 고유 요소 변수로 교체하여 회귀분석을 시행한 결과를 살펴보자. 분석 결과는 <표 Ⅲ-3>에 제시되어 있다. 모형(1)과 (2)는 순이익을 이익지표로, 모형(3)과 (4)는 영업이익을 이익지표로 활용한 결과이며, 모형(1)과 (3)은 기타 통제변수를 포함하지 않은 결과, 모형(2)와 (4)는 기타 통제변수를 포함한 결과이다.

ETF가 이익지표 변화에 대한 수익률 반응에 미치는 영향은 개별기업 고유 요소보다는 체계적 요소와 연관된 이익지표 변화에서 나타난다. 의 계수는 모형(1)~(4) 모두에서 통계적으로 유의한 양(+)의 값을 갖는 반면,

의 계수는 모형(1)~(4) 모두에서 통계적으로 유의한 양(+)의 값을 갖는 반면,  의 계수는 모형(3)에서만 유의하다. 액티브 펀드의 경우, 교차항의 계수는 체계적 요소와 고유 요소 모두에서 유의한 결과가 관찰된다. 이러한 결과는 운용전략의 차이와 밀접한 연관이 있을 것으로 추정된다. 패시브 전략을 주로 활용하는 ETF는 체계적 정보의 효율적 반영에 기여하고 액티브 펀드는 상대적으로 고유정보의 효율적 반영에 기여한다고 평가할 수 있다.

의 계수는 모형(3)에서만 유의하다. 액티브 펀드의 경우, 교차항의 계수는 체계적 요소와 고유 요소 모두에서 유의한 결과가 관찰된다. 이러한 결과는 운용전략의 차이와 밀접한 연관이 있을 것으로 추정된다. 패시브 전략을 주로 활용하는 ETF는 체계적 정보의 효율적 반영에 기여하고 액티브 펀드는 상대적으로 고유정보의 효율적 반영에 기여한다고 평가할 수 있다.

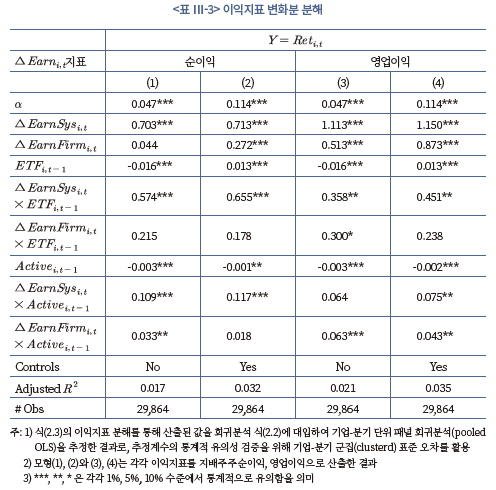

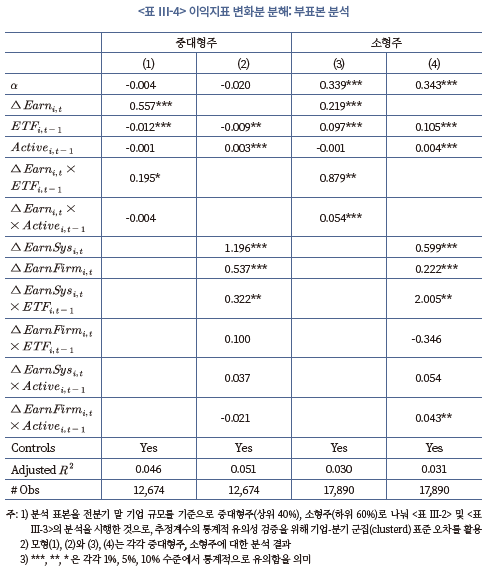

<표 Ⅲ-4>는 분석 표본을 중대형주와 소형주 두 집단으로 나누어 <표 III-2>와 <표 III-3>의 분석을 시행한 결과를 요약한 것이다. 전분기 말 시가총액 상위 40%를 중대형주로, 하위 60%를 소형주로 설정하며, 이익지표로 순이익을 이용한다. 모형(1)과 (3)은 <표 III-2>의 분석과 동일하며, 모형(2)와 (4)는 <표 III-3>의 분석과 동일하다.

분석 결과, ETF 보유비중이 이익지표 변화에 대한 수익률 반응에 미치는 영향은 중대형주 표본과 소형주 표본 모두에서 유의한 결과가 관찰된다. 다만 소형주 표본에서 유의성이 다소 높은 것으로 나타난다. 기관투자자 및 외국인투자자의 비중이 크고, 정보공개의 수준이나 재무분석의 빈도가 높은 대형주에서는 ETF가 차별적인 정보채널로 기능할 가능성이 상대적으로 작은 반면 정보 효율성이 낮은 소형주에서는 ETF의 역할이 부각되는 것으로 이해할 수 있다. 분석 결과에서 이익지표 변화 또는

또는 의 계수가 중대형주에서 더 크게 추정되고 있다는 점 또한 이러한 분석을 뒷받침한다.

의 계수가 중대형주에서 더 크게 추정되고 있다는 점 또한 이러한 분석을 뒷받침한다.

이익지표의 변화에 대한 정보가 시장에 공개되었을 때 주가 수익률에 즉각적으로 반영된다면 정보 효율성이 높다고 평가할 수 있다. 정보 효율성이 낮다면, 기대치를 상회하는 이익공시 이후 주가가 서서히 오르고, 기대치를 하회하는 이익공시 이후 주가가 서서히 하락하는 패턴, 즉 주가지연반응(Post-Earnings-Announcement Drift: PEAD)이 나타난다. ETF가 정보 효율성을 제고하는 역할을 수행한다면, ETF 보유비중이 높은 주식일수록 이익공시 후 주가지연반응이 작게 나타날 것으로 예상할 수 있다.

이를 실증적으로 분석하기 위해, 매월 가장 최근에 발표된 분기16)의 이익지표 변화 의 크기에 따라 5분위 포트폴리오를 구축하고, 다음 월의 동일 가중 평균 수익률을 산출한다. 전기 이익지표를 당기 이익지표의 기대치로 간주하고 이익지표의 전기 대비 차이를 이익충격으로 가정하는 것이다. 이익충격이 가장 큰(주로 양(+)의 충격) 포트폴리오의 수익률과 가장 작은(주로 음(-)의 충격) 포트폴리오 수익률의 격차를 통해 이익공시 후 주가지연반응의 존재 여부를 확인하고, 주가지연반응과 ETF 보유비중의 관계를 통해 ETF가 정보 효율성에 미치는 영향을 파악한다.

의 크기에 따라 5분위 포트폴리오를 구축하고, 다음 월의 동일 가중 평균 수익률을 산출한다. 전기 이익지표를 당기 이익지표의 기대치로 간주하고 이익지표의 전기 대비 차이를 이익충격으로 가정하는 것이다. 이익충격이 가장 큰(주로 양(+)의 충격) 포트폴리오의 수익률과 가장 작은(주로 음(-)의 충격) 포트폴리오 수익률의 격차를 통해 이익공시 후 주가지연반응의 존재 여부를 확인하고, 주가지연반응과 ETF 보유비중의 관계를 통해 ETF가 정보 효율성에 미치는 영향을 파악한다.

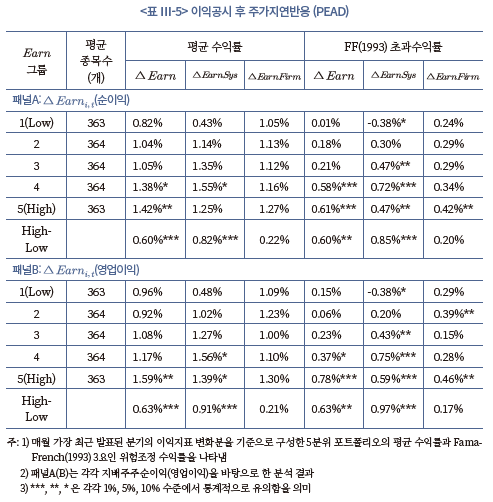

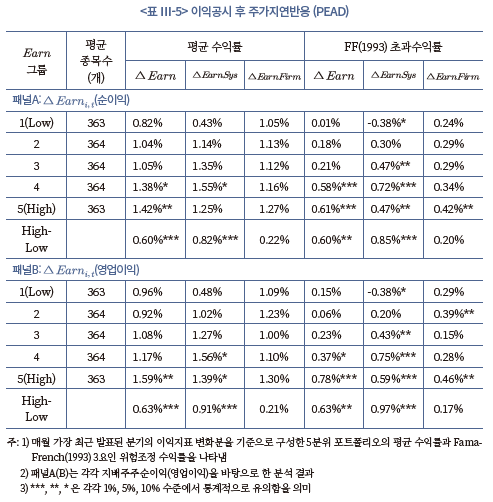

<표 Ⅲ-5>는 5분위 포트폴리오의 평균 수익률과 평균 초과수익률을 제시하고 있다. 이익지표로 순이익을 활용한 패널A에 따르면, 5(High) 포트폴리오의 수익률은 1.42%, 1(Low) 포트폴리오의 수익률은 0.82%로 그 차이는 통계적으로 유의하다. Fama-French의 3요인 모형을 토대로 산출한 초과수익률을 기준으로 보면, 5(High) 포트폴리오의 수익률은 0.61%, 1(Low) 포트폴리오의 수익률은 0.01%로 역시 통계적으로 유의한 차이를 보인다. 즉 이익공시 후 주가지연반응이 관찰된다. 순이익을 체계적 요소와 고유 요소로 분해하여 이익충격을 별도로 정의하고 분석하면 체계적 요소에서만 주가지연반응이 관찰된다. 이익지표로 영업이익을 활용한 패널B의 결과는 패널A의 결과와 대체로 유사하다.

ETF가 주가지연반응에 미치는 영향을 살펴보면 다음과 같다. 전월 말 ETF 보유비중 이 0인 그룹, 횡단면 중간값 이하인 그룹, 횡단면 중간값 초과인 그룹 등 세 그룹으로 분류17)하고, 이익지표 변화

이 0인 그룹, 횡단면 중간값 이하인 그룹, 횡단면 중간값 초과인 그룹 등 세 그룹으로 분류17)하고, 이익지표 변화 를 기준으로 독립적으로 5분위 그룹을 구성한다(총 15개 그룹).

를 기준으로 독립적으로 5분위 그룹을 구성한다(총 15개 그룹).

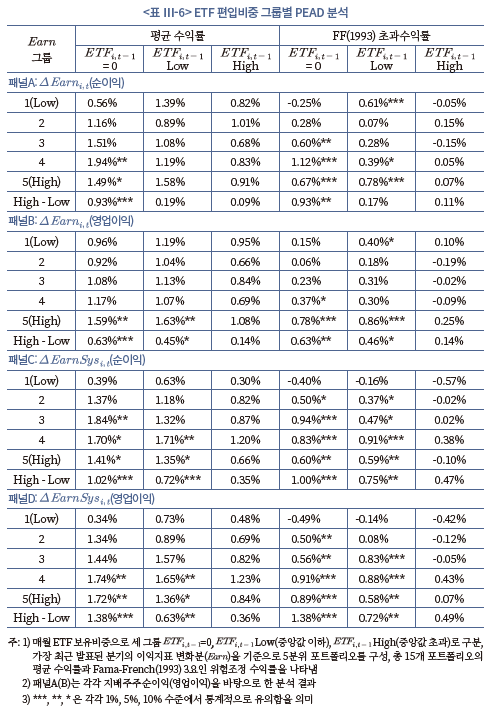

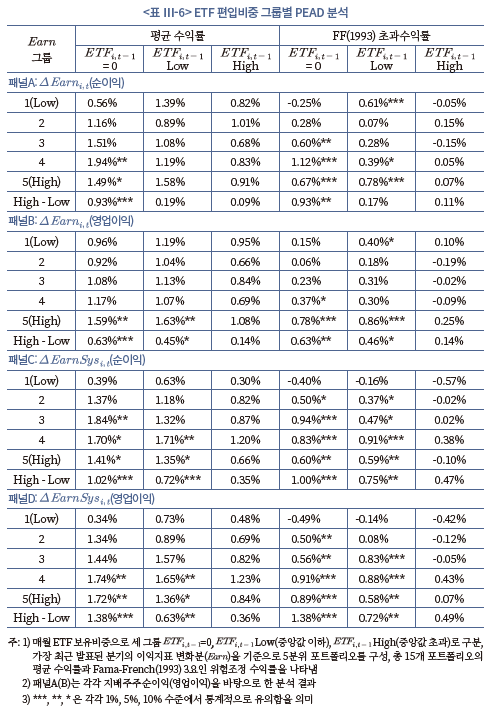

ETF 보유비중에 따른 주가지연반응 분석 결과는 <표 Ⅲ-6>에 제시되어 있다. 패널A와 B는 이익지표 변화를 기준으로, 패널C와 D는 이익지표의 체계적 요소의 변화를 기준으로 분석한 결과이며, 패널A와 C는 이익지표로 지배주주순이익을, 패널B와 D는 이익지표로 영업이익을 사용한 결과이다.

모든 경우 ETF 보유비중이 중간값 초과(High)인 그룹에서는 주가지연반응이 관찰되지 않는 반면 ETF 보유비중이 0인 그룹에서는 주가지연반응이 유의하게 관찰된다. 이익지표로 영업이익을 이용하거나 이익지표의 체계적 요소를 이용하는 경우(패널B, C, D), ETF 보유비중이 낮은 그룹(Low)에서도 주가지연반응이 나타난다. 이는 ETF의 보유비중이 높을수록 주가지연반응은 감소한다는 것으로 ETF가 정보 효율성 제고에 기여함을 시사한다.

ETF 보유비중은 기본적으로 기업의 규모(size)와 연관되어 있어 이러한 분석 결과가 규모 요인에 의해 나타나는 현상일 수 있다. 그러나 패널 회귀분석을 통해 확인한 결과, 기업의 규모 요인을 통제하더라도 주가지연반응은 ETF 보유비중이 클수록 작게 나타난다.

3. ETF와 주식 수익률 동조화

가. 분석 개요

2절의 분석을 통해 ETF가 주식시장의 정보 효율성 제고에 긍정적인 영향을 미친다는 점을 확인하였다. 특히 시장 전체 또는 해당 기업이 속한 섹터 정보의 반영에 ETF가 긍정적으로 기여하는 것으로 나타난다. 본 절에서는 ETF가 개별주식의 수익률 동조화(comovement)에 미치는 영향을 살펴본다. ETF가 시장 전체 혹은 섹터 정보의 반영을 촉진한다면 이러한 공통 정보로 인해 개별종목의 주가 수익률이 동조화될 가능성이 있다. 이 외에도 정보거래 외 ETF 단위 거래활동의 증가로 포트폴리오 단위의 거래가 늘어나 ETF 편입종목 내 수익률이 동조화될 수 있다.

만약 ETF의 보유비중이 클수록 수익률 동조화 정도가 강하다면, 크게 두 가지 분석을 통해 이를 검증할 수 있을 것이다. 첫째, 특정 ETF가 보유한 기초자산의 규모가 클수록 해당 ETF가 보유한 종목 간 수익률 동조화가 강해질 것이다. 둘째, ETF 보유비중이 큰 종목일수록 ETF의 벤치마크 포트폴리오(통상 시장 포트폴리오)와의 동조화 정도가 강해질 것이다. 본 절에서는 관련 선행연구(Da & Shive, 2018)를 바탕으로 이러한 가능성을 검토하고자 한다.

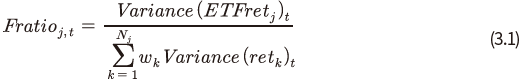

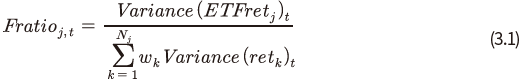

먼저 개별 ETF 단위의 분석을 위해 아래 식(3.1)과 같이 ETF 포트폴리오의 수익률 동조화 측정치 를 산출한다.

를 산출한다.

는 ETF 수익률의 분산,

는 ETF 수익률의 분산,  와 ETF 구성 종목의 수익률 분산 가중평균,

와 ETF 구성 종목의 수익률 분산 가중평균,  의 비율이다. 분자는 분모에 구성 종목간 공분산(covariance)의 가중평균을 더한 값이므로, 구성 종목간 상관계수가 작을수록

의 비율이다. 분자는 분모에 구성 종목간 공분산(covariance)의 가중평균을 더한 값이므로, 구성 종목간 상관계수가 작을수록  가 작아진다.

가 작아진다.  는 포트폴리오의 분산 효과(diversification effect)를 측정하는 변수로 많이 활용되는데 본 절에서는 구성 종목 간 동조화 정도를 측정하는 지표로 사용한다.18) 즉, 동조화 정도가 클수록

는 포트폴리오의 분산 효과(diversification effect)를 측정하는 변수로 많이 활용되는데 본 절에서는 구성 종목 간 동조화 정도를 측정하는 지표로 사용한다.18) 즉, 동조화 정도가 클수록  값은 커진다.

값은 커진다.

ETF 단위의 분석을 위해, 를 종속변수로 하는 아래 회귀분석 식(3.2)의 ETF 단위 패널 회귀분석을 실시한다. 또한 극단치의 영향을 최소화하기 위해 분석에 사용한 모든 변수는 상하위 1% 표본을 윈저화한다.

를 종속변수로 하는 아래 회귀분석 식(3.2)의 ETF 단위 패널 회귀분석을 실시한다. 또한 극단치의 영향을 최소화하기 위해 분석에 사용한 모든 변수는 상하위 1% 표본을 윈저화한다.

주요 독립변수는  로, ETF가 추종하는 포트폴리오의 합산 시가총액 대비 ETF의 합산 주식 보유금액으로 정의한다.

로, ETF가 추종하는 포트폴리오의 합산 시가총액 대비 ETF의 합산 주식 보유금액으로 정의한다.  가 클수록 동조화 수준이 커질 것으로 예상한다. ETF의 보유 이외에 ETF 거래활동의 영향을 파악하기 위해 ETF 유통시장 및 발행시장의 유동성 변수를 포함한다. 유통시장 유동성의 대용치로 ETF의 일평균 거래회전율

가 클수록 동조화 수준이 커질 것으로 예상한다. ETF의 보유 이외에 ETF 거래활동의 영향을 파악하기 위해 ETF 유통시장 및 발행시장의 유동성 변수를 포함한다. 유통시장 유동성의 대용치로 ETF의 일평균 거래회전율 , 발행시장 유동성의 대용치로 ETF 발행주식 수의 표준편차를 평균 발행주식 수로 나눈 값

, 발행시장 유동성의 대용치로 ETF 발행주식 수의 표준편차를 평균 발행주식 수로 나눈 값 을 사용한다(Da & Shive 2018; Agarwal et al., 2018). 추가적으로 ETF 가격괴리의 영향을 살펴보기 위해 일평균 가격괴리도

을 사용한다(Da & Shive 2018; Agarwal et al., 2018). 추가적으로 ETF 가격괴리의 영향을 살펴보기 위해 일평균 가격괴리도 를 설명변수에 추가한다. 주가 동조화를 유발하는 중요한 경로는 차익거래인데 가격괴리도가 큰 경우 차익거래가 활발하지 않다는 것을 의미하기 때문이다.

를 설명변수에 추가한다. 주가 동조화를 유발하는 중요한 경로는 차익거래인데 가격괴리도가 큰 경우 차익거래가 활발하지 않다는 것을 의미하기 때문이다.

기타 통제변수로 순자산(NAV) 규모 , 구성 종목 수

, 구성 종목 수 , KOSPI200 여부, 운용보수(%)

, KOSPI200 여부, 운용보수(%) 를 포함하고, 펀드 및 시점 고정 효과를 통제한다.19)

를 포함하고, 펀드 및 시점 고정 효과를 통제한다.19)

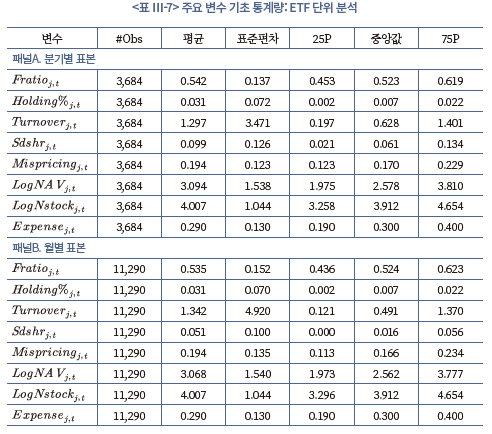

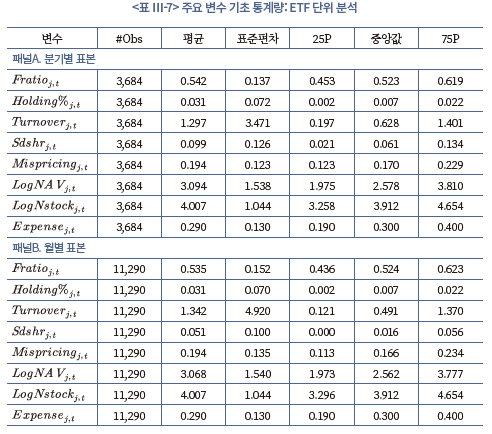

아래 <표 Ⅲ-7>은 ETF 단위의 분석에 사용되는 변수의 기초 통계량이다. 는 평균 0.542, 시가총액 보유비중은 평균 0.031%로 나타난다. 미국시장 ETF의

는 평균 0.542, 시가총액 보유비중은 평균 0.031%로 나타난다. 미국시장 ETF의  평균 0.42, 시가총액 보유비중 0.113%과 비교할 때, 우리나라 ETF의 분산 수준과 시가총액 보유비중이 상대적으로 낮다.

평균 0.42, 시가총액 보유비중 0.113%과 비교할 때, 우리나라 ETF의 분산 수준과 시가총액 보유비중이 상대적으로 낮다.

개별종목 단위의 분석을 위해 아래 식(3.3)의 패널 회귀분석을 시행한다.

종속변수인 개별주식의 수익률 동조화 정도는 시장모형(market model)을 통해 분기 또는 월별 단위로 추정한 베타 를 사용한다. 주요 독립변수는 전분기 또는 전월의 종목별 ETF 보유비중

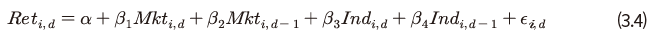

를 사용한다. 주요 독립변수는 전분기 또는 전월의 종목별 ETF 보유비중 이다. 아울러 분석 결과의 강건성을 확보하기 위해 추가적인 수익률 동조화 측정치를 종속변수로 활용한다. 아래 식(3.4)에 따라, 개별종목의 일간수익률을 종속변수로, 당일 및 전일의 시장 수익률

이다. 아울러 분석 결과의 강건성을 확보하기 위해 추가적인 수익률 동조화 측정치를 종속변수로 활용한다. 아래 식(3.4)에 따라, 개별종목의 일간수익률을 종속변수로, 당일 및 전일의 시장 수익률 과 해당 종목이 속한 업종의 수익률

과 해당 종목이 속한 업종의 수익률 을 독립변수로 설정하여 회귀분석을 시행한다. 여기서 산출된 조정 결정계수

을 독립변수로 설정하여 회귀분석을 시행한다. 여기서 산출된 조정 결정계수 를 로그변환한 값을 주가 동조성

를 로그변환한 값을 주가 동조성 으로 정의한다.20) 이는 Durnev et al.(2003)이 제안한 주가 동조성 측정 지표로, ETF와 주가 동조화에 관한 국내외 선행연구에서 사용된 바 있다(Israeli et al., 2017; 송준혁‧이창일, 2020). ETF 보유비중이 높을수록 수익률 동조화 정도가 강해질 것으로 예상한다.

으로 정의한다.20) 이는 Durnev et al.(2003)이 제안한 주가 동조성 측정 지표로, ETF와 주가 동조화에 관한 국내외 선행연구에서 사용된 바 있다(Israeli et al., 2017; 송준혁‧이창일, 2020). ETF 보유비중이 높을수록 수익률 동조화 정도가 강해질 것으로 예상한다.

기타 통제변수로 ETF를 제외한 주식형 펀드의 보유비중, 기업 규모, 거래회전율, 과거 수익률, KOSPI200 편입 여부, 수익률 변동성을 포함하며, 종목 및 시점 고정 효과를 통제한다. 개별종목 단위 분석은 월별 및 분기별 표본을 모두 활용하는데 이는 분석 주기별 효과의 지속성을 검증하기 위한 것이다. 월별 표본의 경우 월간 15거래일 이상, 분기별 표본의 경우 분기 내 45거래일 이상 주식 수익률 및 거래량 관측치가 존재하는 종목으로 표본을 제한한다. 또한 본 절에서도 모든 독립변수와 종속변수는 상, 하위 1% 표본을 윈저화하여 극단치의 영향을 최소화한다.

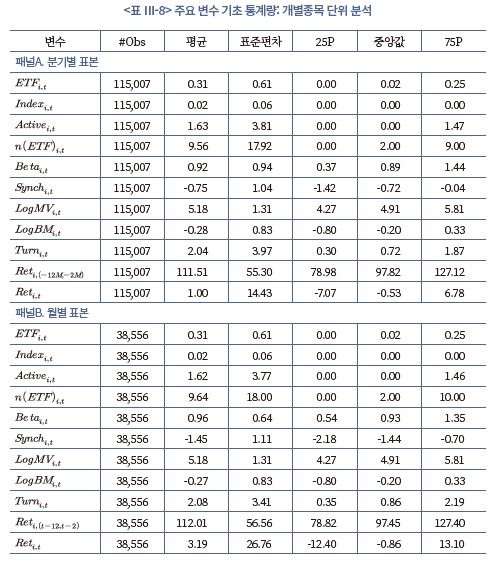

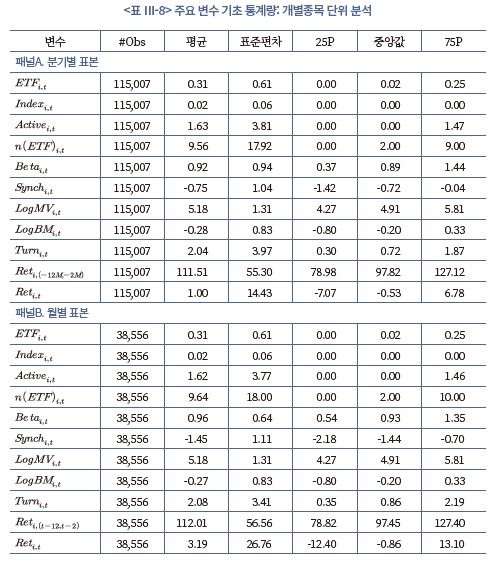

<표 Ⅲ-8>은 개별종목 단위 분석에 사용된 변수의 기초 통계량이다. 상장주식의 ETF 보유비중은 평균 0.31%이며, ETF 보유비중이 0%인 종목을 제외하면 평균 0.55%이다. ETF 시장이 발달한 미국의 약 2.6%21)에 비해서는 낮은 수치이다.  의 평균은 분기자료 기준 0.92, 월간자료 기준 0.96이며

의 평균은 분기자료 기준 0.92, 월간자료 기준 0.96이며  의 평균은 분기자료 기준 –0.75, 월간자료 기준 –1.45이다.22)

의 평균은 분기자료 기준 –0.75, 월간자료 기준 –1.45이다.22)

나. 분석 결과

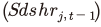

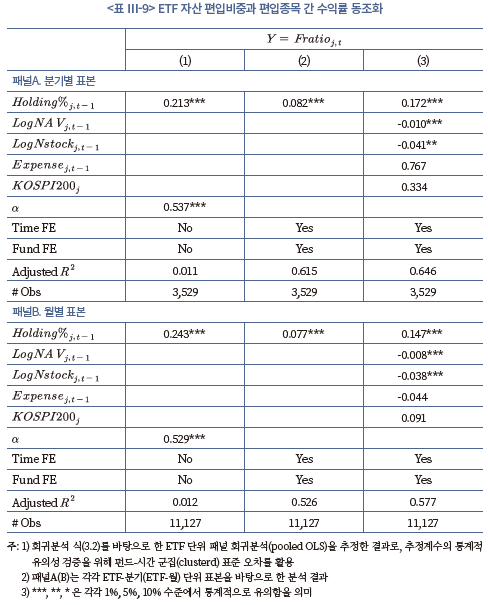

회귀분석 식(3.2)를 바탕으로 한 ETF 단위의 분석 결과는 <표 Ⅲ-9>에 제시되어 있다. 기타 통제변수와 시점 및 ETF 고정효과를 통제한 모형(3)의 결과를 보면, 의 추정계수는 분기자료 기준 0.172, 월간자료 기준 0.147로 모두 1% 수준에서 통계적으로 유의하다. ETF의 보유규모가 클수록 해당 ETF가 보유한 종목간 수익률 상관계수가 증가, 즉 동조화되는 것으로 해석할 수 있다. 이러한 결과는 기존 연구결과(Da & Shive, 2018)와 일치한다.

의 추정계수는 분기자료 기준 0.172, 월간자료 기준 0.147로 모두 1% 수준에서 통계적으로 유의하다. ETF의 보유규모가 클수록 해당 ETF가 보유한 종목간 수익률 상관계수가 증가, 즉 동조화되는 것으로 해석할 수 있다. 이러한 결과는 기존 연구결과(Da & Shive, 2018)와 일치한다.

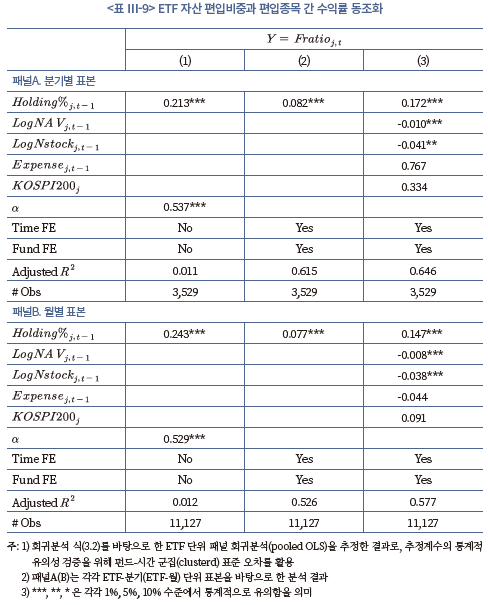

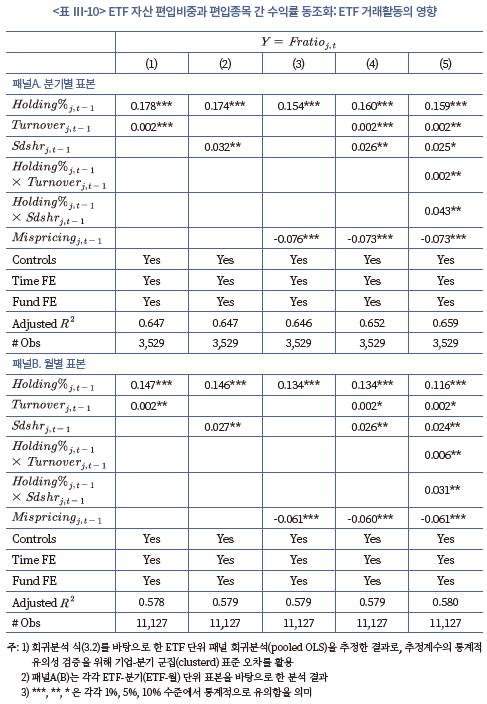

<표 Ⅲ-10>은 ETF 거래활동의 영향을 추가적으로 분석하고 있다. 분기 표본과 월간 표본 모두에서, ETF의 거래가 많을수록 , 설정과 환매가 많을수록

, 설정과 환매가 많을수록 수익률 동조화 수준이 높은 것으로 분석된다. ETF 거래가 유발하는 포트폴리오 단위의 차익거래가 보유종목간 수익률 동조화를 유발하는 것으로 해석할 수 있다. 발행시장 유동성이 유통시장 유동성에 비해 계수의 유의성이 상대적으로 낮은 것은 ETF 차익거래 등 보유종목의 거래를 유발하는 빈도가 작기 때문으로 보인다. 한편 ETF 거래활동이 수익률 동조화에 미치는 영향은 ETF의 규모에 따라 다른 것으로 나타난다. ETF 보유비중과 유통시장 및 발행시장 유동성의 교차변수의 계수는 통계적으로 유의한 양(+)의 값으로, ETF의 거래활동이 수익률 동조화에 미치는 영향은 ETF 규모가 클수록 커지는 것으로 확인된다.

수익률 동조화 수준이 높은 것으로 분석된다. ETF 거래가 유발하는 포트폴리오 단위의 차익거래가 보유종목간 수익률 동조화를 유발하는 것으로 해석할 수 있다. 발행시장 유동성이 유통시장 유동성에 비해 계수의 유의성이 상대적으로 낮은 것은 ETF 차익거래 등 보유종목의 거래를 유발하는 빈도가 작기 때문으로 보인다. 한편 ETF 거래활동이 수익률 동조화에 미치는 영향은 ETF의 규모에 따라 다른 것으로 나타난다. ETF 보유비중과 유통시장 및 발행시장 유동성의 교차변수의 계수는 통계적으로 유의한 양(+)의 값으로, ETF의 거래활동이 수익률 동조화에 미치는 영향은 ETF 규모가 클수록 커지는 것으로 확인된다.

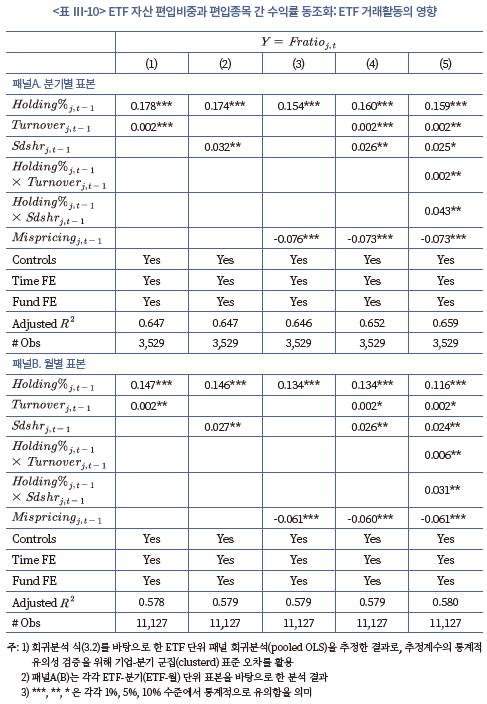

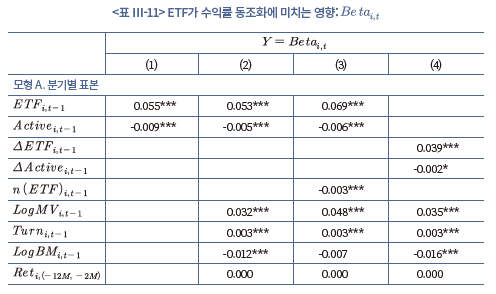

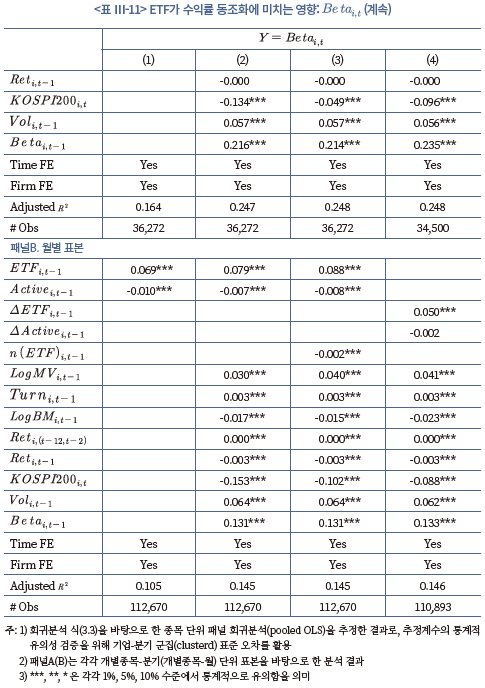

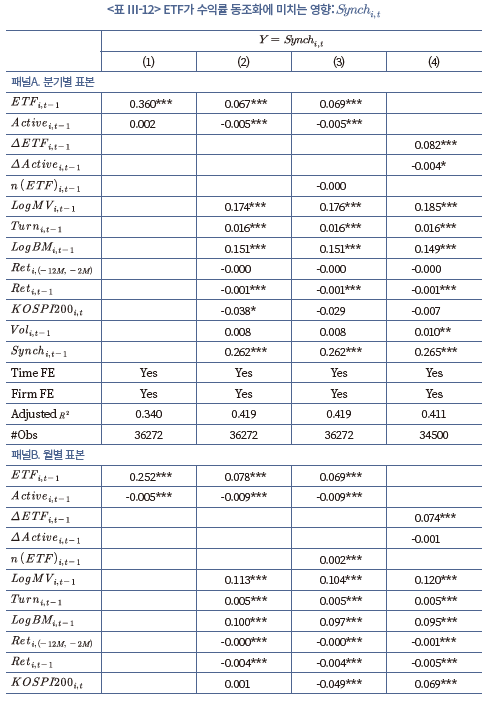

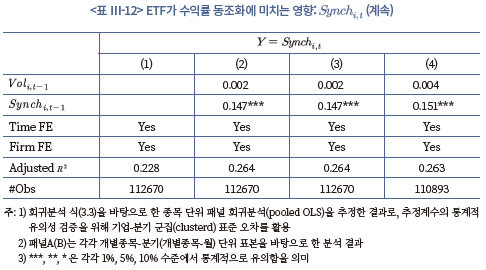

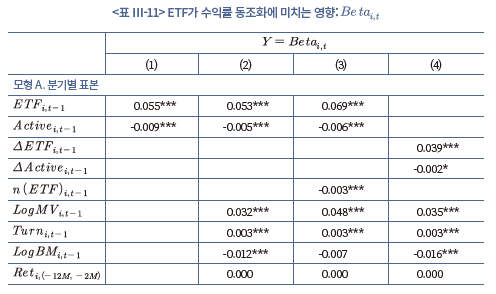

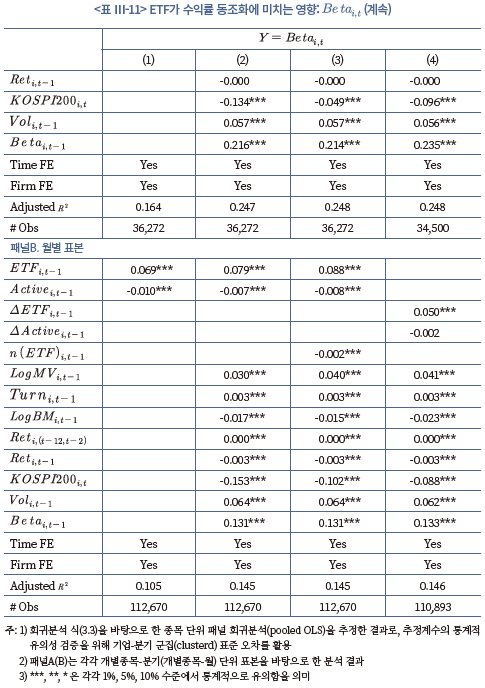

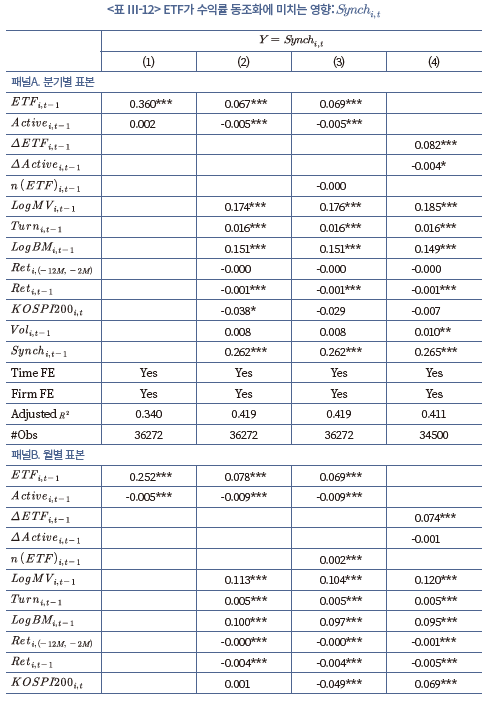

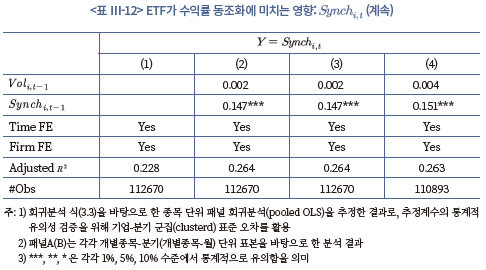

회귀분석 식(3.3)을 바탕으로 한 개별종목 단위의 분석 결과는 <표 Ⅲ-11>과 <표 III-12>에 제시되어 있다.  를 종속변수로 이용한 <표 III-11>의 결과에 따르면, 통제변수의 포함여부와 무관하게 분기자료와 월간자료 모두에서, ETF 보유비중

를 종속변수로 이용한 <표 III-11>의 결과에 따르면, 통제변수의 포함여부와 무관하게 분기자료와 월간자료 모두에서, ETF 보유비중 은

은  와 양(+)의 관계가 있으며 1% 수준에서 통계적으로 유의하다. ETF 보유비중 대신 보유비중의 변화

와 양(+)의 관계가 있으며 1% 수준에서 통계적으로 유의하다. ETF 보유비중 대신 보유비중의 변화 를 설명변수로 이용하는 경우(모형(4))에도 1% 수준에서 유의한 양(+)의 관계가 확인된다.

를 설명변수로 이용하는 경우(모형(4))에도 1% 수준에서 유의한 양(+)의 관계가 확인된다.  를 종속변수로 이용한 <표 Ⅲ-12>의 결과 역시 <표 III-11>의 결과와 유사하다. ETF 보유비중 또는 ETF 보유비중 변화의 계수는 양(+)의 값이며 1% 수준에서 통계적으로 유의하다. ETF 보유가 해당 종목의 수익률 동조성을 강화시키는 요인임을 확인할 수 있다.23)

를 종속변수로 이용한 <표 Ⅲ-12>의 결과 역시 <표 III-11>의 결과와 유사하다. ETF 보유비중 또는 ETF 보유비중 변화의 계수는 양(+)의 값이며 1% 수준에서 통계적으로 유의하다. ETF 보유가 해당 종목의 수익률 동조성을 강화시키는 요인임을 확인할 수 있다.23)

<표 Ⅲ-11>의 패널B를 모든 통제변수를 추가하였을 때(모형(3)) 에 대한 ETF 보유비중의 회귀계수는 0.088이다. 이는 ETF 보유비중이 1% 증가할 때 베타가 0.088 증가하는 것으로 베타의 표준편차가 0.64임을 고려하면 표준편차의 약 0.13배가 증가하는 것으로 해석할 수 있다. 한편, <표 III-11>과 <표 III-12>에서 액티브 펀드의 보유비중은 일부 분석에서 수익률 동조성과 유의한 음(-)의 관계가 나타난다. 보유종목의 비중을 조정하는 액티브 펀드의 운용방식이 수익률 동조성 약화와 연관이 있는 것으로 추정된다.

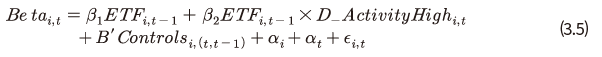

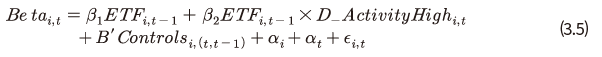

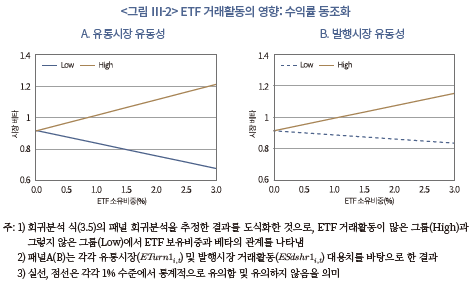

<표 III-10>의 ETF 단위 분석과 유사하게, 아래 회귀분석 식(3.5)를 토대로 개별종목 단위에서 ETF 거래활동이 수익률 동조성에 미치는 영향을 살펴보자. 식(3.5)는 회귀분석 식(3.3)에 ETF 보유비중과 ETF 거래활동 더미변수 의 교차항을 추가한 것이다.

의 교차항을 추가한 것이다.  은 해당종목을 보유한 ETF의 거래활동이 관찰되는 종목 중에서 ETF 거래활동이 상위 50%인 종목의 경우 1의 값을, 나머지 종목의 경우 0의 값을 갖는 변수이다.24)

은 해당종목을 보유한 ETF의 거래활동이 관찰되는 종목 중에서 ETF 거래활동이 상위 50%인 종목의 경우 1의 값을, 나머지 종목의 경우 0의 값을 갖는 변수이다.24)

앞선 분석과 동일하게 ETF 거래활동은 유통시장 유동성 , 발행시장 유동성

, 발행시장 유동성 , 가격괴리도

, 가격괴리도 등 세 가지 지표를 이용한다. 기존 연구의 방법론을 따라, ETF 단위로 측정한 거래활동 지표를 아래 식(3.6)을 통해 개별종목 단위 지표로 변환한다(Agarwal et al., 2018; Ben-David et al., 2018; Da & Shive, 2018).

등 세 가지 지표를 이용한다. 기존 연구의 방법론을 따라, ETF 단위로 측정한 거래활동 지표를 아래 식(3.6)을 통해 개별종목 단위 지표로 변환한다(Agarwal et al., 2018; Ben-David et al., 2018; Da & Shive, 2018).

여기서  는 ETF j의 거래활동 지표,

는 ETF j의 거래활동 지표, 은 주식 i의 시가총액,

은 주식 i의 시가총액,  은 주식 i를 보유한 ETF j의 순자산규모(NAV), 는 ETF 의 주식 에 대한 포트폴리오 내 보유비중이다.

은 주식 i를 보유한 ETF j의 순자산규모(NAV), 는 ETF 의 주식 에 대한 포트폴리오 내 보유비중이다.

분석의 강건성을 확보하기 위해, 표준화 방식을 변경한 거래활동 지표

, ETF의 일평균 상장주식수 변화율을 이용한 발행시장 유동성 지표

, ETF의 일평균 상장주식수 변화율을 이용한 발행시장 유동성 지표 (Agarwal et al., 2018), 예탁결제원의 ETF 설정, 환매 자료25)를 바탕으로 구축한 발행시장 유동성 지표

(Agarwal et al., 2018), 예탁결제원의 ETF 설정, 환매 자료25)를 바탕으로 구축한 발행시장 유동성 지표 등을 추가로 활용한다.26)

등을 추가로 활용한다.26)

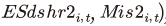

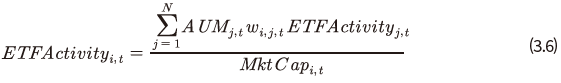

<그림 III-2>은 회귀분석 식(3.5)의 패널 회귀분석 결과를 도식화한 것으로, 패널A와 패널B는 각각 유통시장 유동성 , 발행시장 유동성

, 발행시장 유동성 을 기준으로 분석한 결과이다. 주황색 실선은 ETF 거래활동이 많은 종목(High)에서, 파란색 실선은 ETF 거래활동이 적은 종목(Low)에서 ETF 보유비중과 베타의 관계를 나타낸다. 회귀분석 식(3.5)의 계수로 표현하면, 실선의 기울기는 (High)그룹에서

을 기준으로 분석한 결과이다. 주황색 실선은 ETF 거래활동이 많은 종목(High)에서, 파란색 실선은 ETF 거래활동이 적은 종목(Low)에서 ETF 보유비중과 베타의 관계를 나타낸다. 회귀분석 식(3.5)의 계수로 표현하면, 실선의 기울기는 (High)그룹에서  , (Low)그룹에서 이다.

, (Low)그룹에서 이다.

ETF 거래활동이 많은 종목에서 ETF 보유비중은 베타와 양(+)의 관계가 있는 반면 ETF 거래활동이 적은 종목에서 ETF 보유비중은 베타와 음(-)의 관계가 있거나 통계적으로 유의한 관계가 나타나지 않는다. 수익률 동조화는 ETF 거래활동과 밀접한 관련이 있음을 확인할 수 있다.

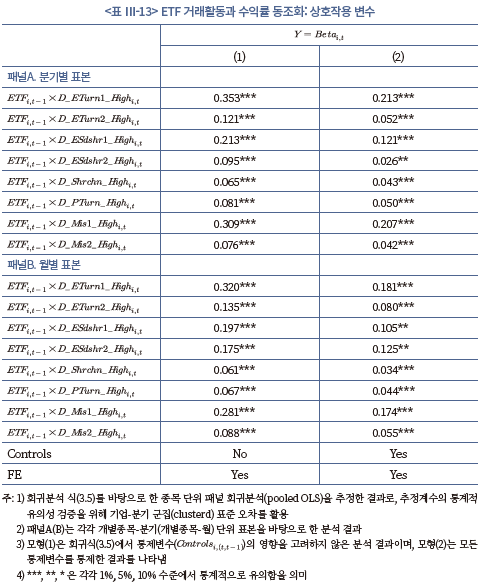

<표 Ⅲ-13>은 다양한 ETF 거래활동 지표를 이용하여 패널 회귀분석 식(3.5)를 추정한 결과이다. 결과 보고의 간결성을 위해 ETF 보유비중과 ETF 거래활동 더미변수의 교차항의 추정계수와 통계적 유의성만 보고한다. 예외 없이 모든 ETF 거래활동 지표에서 교차항의 계수 값은 통계적으로 유의한 양(+)의 값으로 추정된다. 이는 ETF 보유비중과 수익률 동조화의 관계에 있어 ETF 거래활동이 주요한 영향요인임을 보여준다. 활발한 ETF 거래는 차익거래와 같은 포트폴리오 단위의 현물거래를 유발하고 ETF가 보유한 종목간 수익률 동조화를 일으킨다고 평가할 수 있다.

마지막으로 ETF 거래의 어떠한 요소가 수익률 동조화에 영향을 미치는지 확인해 본다. 일반적으로 거래는 정보거래(informed trades)와 무정보거래(non-fundamental trades)로 구분해 볼 수 있는데, ETF 거래활동의 변수를 앞서 Ⅱ절의 결과를 바탕으로 정보와 관련된 부분과 아닌 부분으로 분해한다.

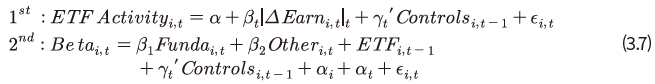

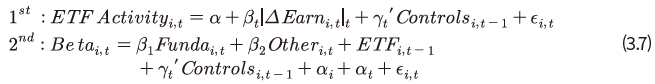

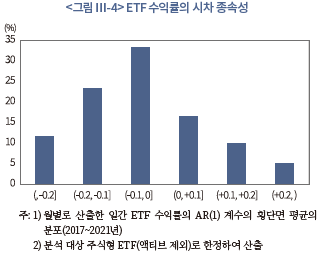

이를 검증하기 위해 2단계 회귀분석(2-stage regressions)을 실시한다. 아래 식(3.7)처럼 먼저 ETF 거래활동 지표를 종속변수로, 이익지표 변화의 절대값과 기타 통제변수를 독립변수로 하여 분기별 횡단면 회귀분석을 시행한다(1단계). 그 결과 적합된 값(fitted value)을 정보거래 요소 로, 잔차(residual)를 무정보거래 요소

로, 잔차(residual)를 무정보거래 요소 로 정의한다. 이렇게 분해한 두 개의 거래활동 지표를 회귀분석 식(3.3)에 설명변수로 추가하여 회귀분석을 시행한다(2단계). 종속변수는 베타를 이용한다.

로 정의한다. 이렇게 분해한 두 개의 거래활동 지표를 회귀분석 식(3.3)에 설명변수로 추가하여 회귀분석을 시행한다(2단계). 종속변수는 베타를 이용한다.

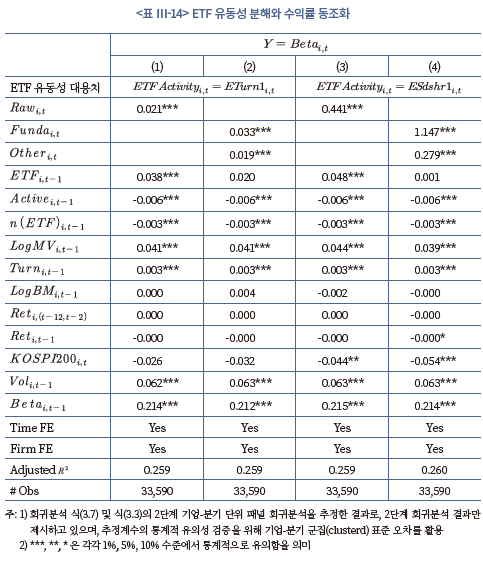

<표 Ⅲ-14>는 2단계 회귀분석 결과를 제시하고 있다.27) 먼저 ETF 유통시장 유동성을 기준으로 분석할 경우, 원지표 , 정보거래 요소

, 정보거래 요소 , 무정보거래 요소

, 무정보거래 요소 모두 수익률 동조성과 통계적으로 유의한 양(+)의 관계가 확인된다. 물론 원지표를 사용하면 동시성(simultaneity)에 따른 내생성 이슈가 있기에 추정계수 값에 큰 의미를 두지 않는다. ETF 발행시장 유동성을 기준으로 분석하는 경우에도 결과는 유사하다. 가장 중요한 부분은 내생성을 어느 정도 통제한 모형(2)와 (4)에 대한 결과에서 알 수 있듯이 ETF 거래활동을 분해한 경우에는 ETF 보유비중에 대한 추정계수의 유의성이 사라진다는 점이다. 이는 수익률 동조화 측면에서 ETF 거래활동의 영향이 유의미한 영향을 미친다는 것을 의미한다. 또한 정보거래 및 무정보거래 요소의 계수가 모두 양(+)의 값으로 통계적으로 유의하기 때문에, ETF로 인한 주식 수익률 동조화에는 앞선 2절에 따른 포트폴리오 단위 정보 효율성과도 연관되어 있고 선행연구에서 제기하는 ETF와 연계된 단기 차익거래 등의 영향도 공존하는 것으로 볼 수 있다.

모두 수익률 동조성과 통계적으로 유의한 양(+)의 관계가 확인된다. 물론 원지표를 사용하면 동시성(simultaneity)에 따른 내생성 이슈가 있기에 추정계수 값에 큰 의미를 두지 않는다. ETF 발행시장 유동성을 기준으로 분석하는 경우에도 결과는 유사하다. 가장 중요한 부분은 내생성을 어느 정도 통제한 모형(2)와 (4)에 대한 결과에서 알 수 있듯이 ETF 거래활동을 분해한 경우에는 ETF 보유비중에 대한 추정계수의 유의성이 사라진다는 점이다. 이는 수익률 동조화 측면에서 ETF 거래활동의 영향이 유의미한 영향을 미친다는 것을 의미한다. 또한 정보거래 및 무정보거래 요소의 계수가 모두 양(+)의 값으로 통계적으로 유의하기 때문에, ETF로 인한 주식 수익률 동조화에는 앞선 2절에 따른 포트폴리오 단위 정보 효율성과도 연관되어 있고 선행연구에서 제기하는 ETF와 연계된 단기 차익거래 등의 영향도 공존하는 것으로 볼 수 있다.

4. ETF와 주식 수익률의 시차 종속성 및 변동성

가. 분석 개요

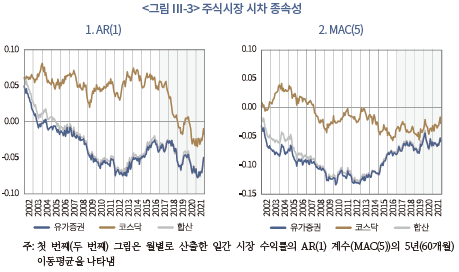

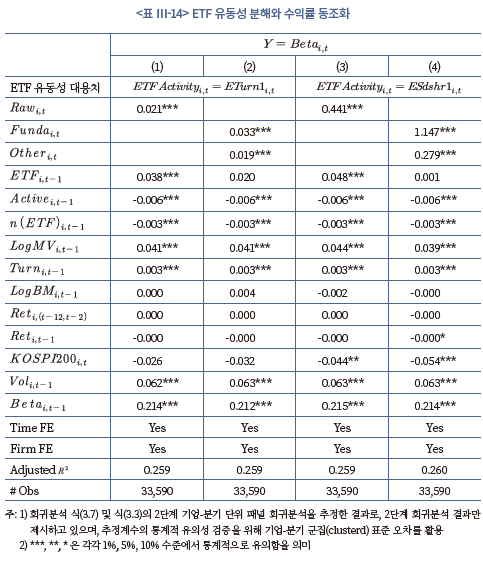

ETF, 지수선물 등 지수 추종 상품의 증가와 이와 관련된 차익거래 등 단기 거래의 증가는 시장 수익률의 시차 종속성(serial dependency)을 감소시키는 것으로 알려져 있다(Baltussen et al., 2019). 우리나라의 경우에도 <그림 Ⅲ-3>에 나타나는 바와 같이, KOSPI지수와 KOSDAQ지수 수익률의 시차 종속성(1차 자기상관계수(AR(1))의 5년 이동평균)이 분석 기간인 2017년 이후 감소하는 추세가 나타난다. 또한 추가적인 분석 결과 개별종목 단위의 시차 종속성 역시 금융위기 이후 꾸준히 감소하였다.

<그림 Ⅲ-3>의 두 번째 그림은 Baltussen et al.(2019)에서 사용한 MAC(5) 변수로 다기간 상관계수(Multi-period Autocorrelation: MAC)의 5년 이동평균 추이를 나타낸다. MAC(5)는 1차 상관계수 외에도 4거래일 시차까지 고려한 가중평균 상관계수(총 5거래일)로, t거래일의 주식 수익률 과 과거 수익률 간 상관계수의 합으로 산출하되 최근 수익률에 더 높은 비중을 주는 방식으로 아래 식(4.1)의 기댓값(expectation)으로 이해할 수 있다. <그림 Ⅲ-3>에서 보여주듯 MAC(5)는 AR(1)에 비해 전반적으로 수준(level)이 낮으며, AR(1) 계수는 2017년 이후 지속 감소했지만 MAC(5)는 일정 수준을 유지하고 있다. 이는 지수 수준에서 수익률의 1차 상관계수는 감소했으나 그 외 2~4차 상관계수는 다소 증가한 것으로 풀이된다. 본 절에서는 AR(1) 계수 외에도 MAC(5)도 분석에 포함하여 ETF가 개별주식 수익률의 시차 종속성에 미치는 영향에 대해 살펴본다.

과 과거 수익률 간 상관계수의 합으로 산출하되 최근 수익률에 더 높은 비중을 주는 방식으로 아래 식(4.1)의 기댓값(expectation)으로 이해할 수 있다. <그림 Ⅲ-3>에서 보여주듯 MAC(5)는 AR(1)에 비해 전반적으로 수준(level)이 낮으며, AR(1) 계수는 2017년 이후 지속 감소했지만 MAC(5)는 일정 수준을 유지하고 있다. 이는 지수 수준에서 수익률의 1차 상관계수는 감소했으나 그 외 2~4차 상관계수는 다소 증가한 것으로 풀이된다. 본 절에서는 AR(1) 계수 외에도 MAC(5)도 분석에 포함하여 ETF가 개별주식 수익률의 시차 종속성에 미치는 영향에 대해 살펴본다.

ETF가 주식 수익률 시차 종속성에 영향을 미치는 요인은 다음과 같다. 일반적으로 ETF의 설정과 환매가 장 종료(closing) 후 이루어지는 점을 고려할 때, 장 종료 전 차익거래 수요가 주가에 비체계적인 충격을 일으키고, 이는 다음날 수익률의 반전(reversal)을 일으키면서 결과적으로 시차 종속성이 감소하는 효과로 나타날 수 있다. 이와 관련하여 Jiang et al.(2022)은 미국 주식시장의 일중(intraday) 거래 자료를 분석한 결과 주식시장의 개장 시간 내 U-형태의 유동성이 장 종료에 가까운 시간에 집중되는 형태로 변화하였으며 주요 요인으로 ETF와 같은 지수 추종 상품의 증가를 제시한다. 또한 Bogousslavsky & Muravyev(2021)의 분석에 따르면 ETF와 같은 패시브 펀드 비중의 증가는 장 마감 동시호가(closing auction trade) 거래의 증가와 연관되어 있으며, 마감 동시호가 거래의 증가는 종가(closinig price)의 가격괴리(price deviation)를 야기하고 다음 거래일 오전에 괴리가 해소되는 것으로 분석된다. 이처럼 ETF의 규모 및 거래활동이 늘어나면 기초자산인 주식의 일간 가격 반전이 심화될 가능성이 존재한다.

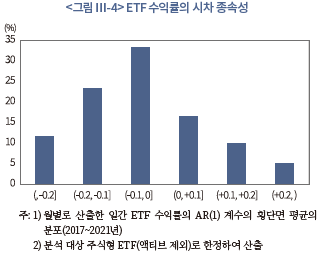

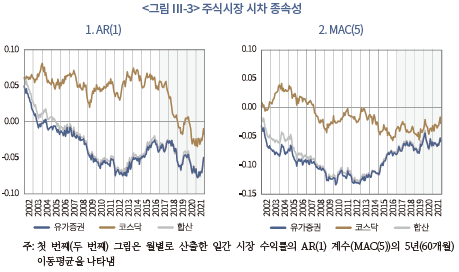

<그림 Ⅲ-4>는 2017년부터 2021년까지 분석 대상 주식형 ETF의 시차 종속성 분포를 보여준다. ETF의 시차 종속성(AR(1) 계수)의 횡단면 평균은 –0.049로 동기간 KOSPI지수의 시차 종속성 –0.050과 유사한 값이다. 주식시장뿐만 아니라 ETF의 일간 가격 반전도 존재하는 것으로 알 수 있다.

가격 효율성 관점에서 시차 종속성이 0에서 벗어날수록 효율성이 약화되는 것을 의미한다. 효율적 시장이라면 전기의 수익률은 미래 수익률에 영향을 줄 수 없기 때문이다. 정보의 지연 반응으로 인해 시차 종속성이 양(+)인 경우도 비효율적이지만 과도한 반응으로 인해 음(-)인 경우에는 투자자에게도 부정적인 영향을 줄 수 있다. 수익률 반전이 체계적으로 발생하면 유동성공급자(price maker)는 수익을 낼 수 있지만 반대로 유동성수요자(price taker) 입장에서는 거래비용으로 작용할 수 있다. 만약 투자자가 유동성을 수요하는 행태를 취한다면 시차 종속성이 음(-)인 경우에 투자자의 효익 감소로 이어질 수 있다. 본 절에서는 ETF가 주가 수익률의 시차 종속성에 미치는 영향을 실증적으로 살펴본다.

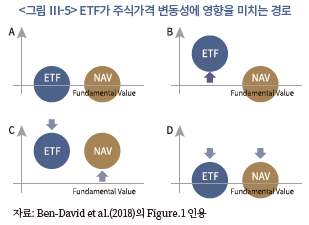

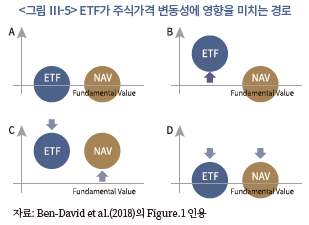

또한 본 절에서는 ETF가 개별주식의 수익률 변동성에 미치는 영향을 검토한다. 잦은 가격 반전은 불필요한 변동성을 야기할 수 있을 뿐만 아니라 ETF가 수익률 동조화를 심화시킴으로써 체계적 위험(systematic risk)에 대한 과도한 노출을 유발할 수 있기 때문이다. 관련하여 Ben-David et al.(2018)은 미국 주식시장을 대상으로 ETF 보유비중과 월간 수익률 변동성 간의 양(+)의 관계를 실증했고 주된 요인으로 ETF에 수반된 차익거래와 같은 단기 거래를 제시한다. Ben-David et al.(2018)에 따르면 <그림 Ⅲ-5>와 같이 정상(A)인 상황에서 ETF 가격에 펀더멘탈과 무관한 충격(non-fundamental shock)이 올 경우(B), ETF 시장 참여자의 차익거래(주식 매수, ETF 매도)로 인해 기초자산(주식)에 충격이 전이(C)되고 다시 펀더멘탈로 회귀(D)함으로써 주식가격의 불필요한 변동이 발생한다. 물론 이는 ETF 시장에 충분한 시장 참여자가 있고 이들의 거래가 유의미한 비중을 차지하는 것을 전제로 한다. 반면 Box et al.(2021)은 분간(minute-by-minute) 수익률 및 거래 자료를 분석하여 ETF 거래와 주식 수익률 간에 유의미한 상관관계가 없다고 보고하고 있다. 벡터자기회귀 모형을 사용한 분석 결과 ETF 수익률이 기초자산 수익률에 미치는 영향은 미미한 것으로 나타난다.

이처럼 ETF가 수익률 변동성에 미치는 영향에 대한 실증적인 근거는 아직은 명확하지 않다고 생각되나, 본 절에서는 가용한 자료를 바탕으로 ETF 보유비중과 수익률 변동성과의 관계에 대한 분석을 시도한다. 다만 고빈도 자료가 가용하지 않으므로 본 절의 분석 결과를 일반화하지 않도록 유의할 필요가 있다.

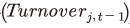

본 절에서 사용할 주요 종속변수 중 하나인 개별종목 수익률의 시차 종속성은 Baltussen et al.(2019)을 참고하여 월별 또는 분기별 일간 수익률의 1차 자기상관계수 및 다기간 상관계수

및 다기간 상관계수 로 측정한다. 개별종목 수익률 변동성은 Ben-David et al.(2018)의 연구와 같이 월별 또는 분기별로 일간 수익률의 표준편차로 계산하나, 앞선 절의 분석 결과를 고려하여 Campbell et al.(2001)의 방법론을 이용하여 시장변동성

로 측정한다. 개별종목 수익률 변동성은 Ben-David et al.(2018)의 연구와 같이 월별 또는 분기별로 일간 수익률의 표준편차로 계산하나, 앞선 절의 분석 결과를 고려하여 Campbell et al.(2001)의 방법론을 이용하여 시장변동성 , 업종변동성

, 업종변동성 , 고유변동성

, 고유변동성 으로 분해한다.28) 이는 주식 수익률의 변동을 체계적 요인과 비체계적 요인으로 분해하여 살펴보는 것으로, ETF가 체계적 정보 반영을 촉진하고 시장 수익률과의 동조화를 심화시키기 때문이다.

으로 분해한다.28) 이는 주식 수익률의 변동을 체계적 요인과 비체계적 요인으로 분해하여 살펴보는 것으로, ETF가 체계적 정보 반영을 촉진하고 시장 수익률과의 동조화를 심화시키기 때문이다.

본 절에서 사용할 패널회귀 분석모형은 아래 식(4.2)와 같은데, 종속변수는 시차 종속성 대용치 또는 수익률 변동성

또는 수익률 변동성 및 분해값

및 분해값

을 사용한다. 그 외 통제변수 및 고정효과는 앞선 절의 분석과 동일하다. 또한 모든 독립변수와 종속변수는 상하위 1v% 표본을 윈저화한다.

을 사용한다. 그 외 통제변수 및 고정효과는 앞선 절의 분석과 동일하다. 또한 모든 독립변수와 종속변수는 상하위 1v% 표본을 윈저화한다.

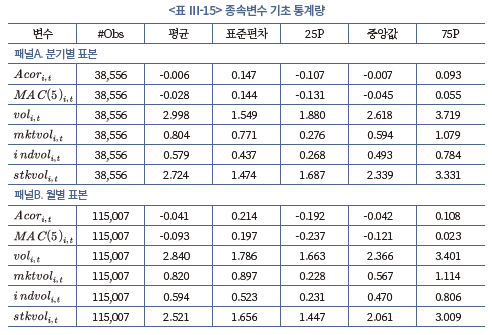

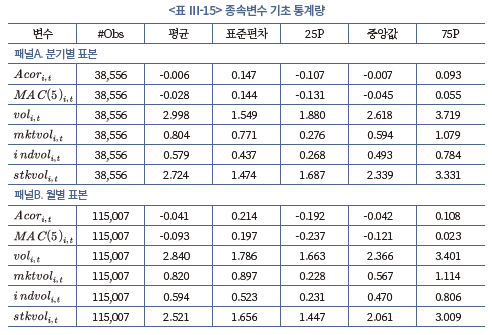

<표 III-15>는 주요 변수의 기초통계량이다. 개별종목의 평균 1차 시차 종속성은 월간자료 기준으로 –0.041, 분기자료 기준으로 –0.006으로 산출되고, MAC(5)의 평균은 월간자료의 경우 –0.093, 분기자료의 경우 –0.028로 다기간 상관계수가 더 크게 나타난다. AR(1) 및 MAC(5) 방식의 상관계수 간의 평균 횡단면 상관계수는 약 0.7 이상으로 높게 나타난다. 변동성의 경우 월간자료 기준 2.84%, 분기자료 기준 3.00%이다. 변동성을 시장변동성, 업종변동성, 고유변동성으로 분해하면 고유변동성의 비중이 가장 크고, 수익률 변동성()은 각각의 변동성과 약 0.40 , 0.35

, 0.35 , 0.98

, 0.98 의 상관계수를 가지므로 고유변동성과 가장 연관되어 있다.

의 상관계수를 가지므로 고유변동성과 가장 연관되어 있다.

나. 분석 결과

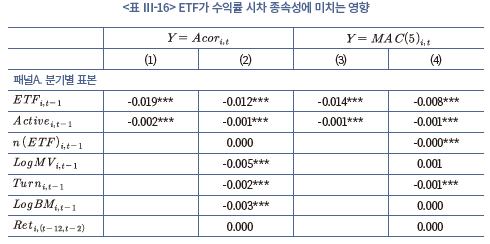

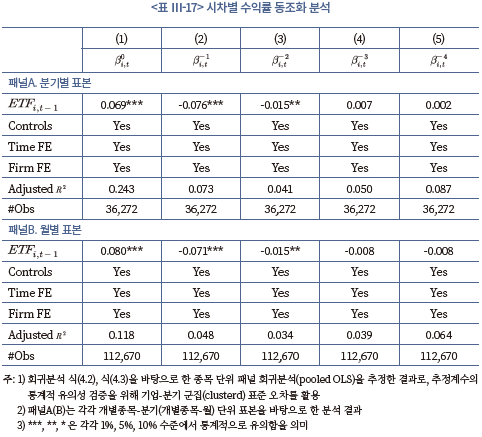

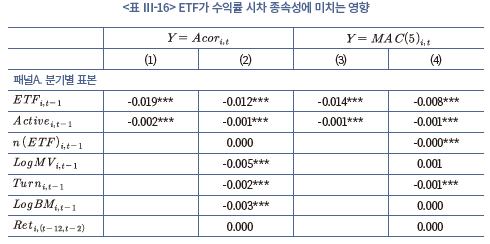

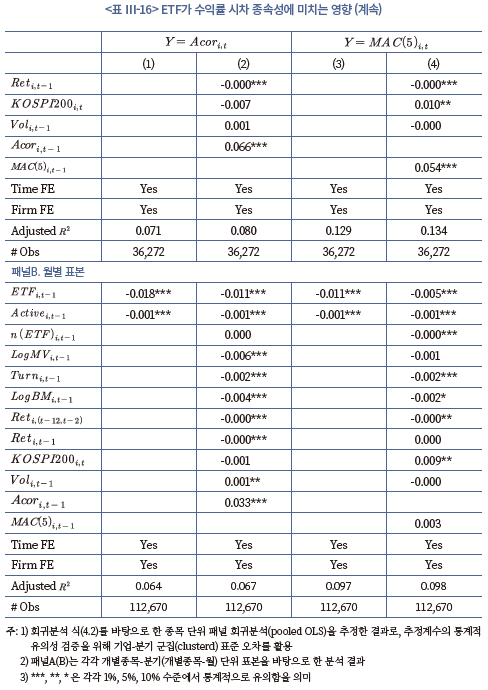

<표 III-16>은 ETF가 시차 종속성에 미치는 영향을 분석하기 위해 식(4.2)의 패널 회귀분석을 시행한 결과이다. 종속변수가 개별종목의 1차 시차 종속성 인 경우(모형(1)과 (2)), ETF 보유비중이 클수록 시차 종속성이 감소하는 것으로 나타난다. 통제변수 포함여부와 무관하게, 월간 자료와 분기자료 모두에서 1% 수준에서 통계적으로 유의하다. ETF는 가격반전을 일으키는 거래활동을 유발함으로써 개별주식 수익률의 시차 종속성을 감소시키는 것으로 추정된다.29) 종속변수가 개별종목의 다기간 시차 종속성

인 경우(모형(1)과 (2)), ETF 보유비중이 클수록 시차 종속성이 감소하는 것으로 나타난다. 통제변수 포함여부와 무관하게, 월간 자료와 분기자료 모두에서 1% 수준에서 통계적으로 유의하다. ETF는 가격반전을 일으키는 거래활동을 유발함으로써 개별주식 수익률의 시차 종속성을 감소시키는 것으로 추정된다.29) 종속변수가 개별종목의 다기간 시차 종속성 인 경우(모형(3)과 (4)) 역시 ETF 보유비중의 계수는 유의한 음(-)의 값으로 추정된다. ETF 보유비중이 증가할수록 가격 효율성이 하락한다고 해석할 수 있다.

인 경우(모형(3)과 (4)) 역시 ETF 보유비중의 계수는 유의한 음(-)의 값으로 추정된다. ETF 보유비중이 증가할수록 가격 효율성이 하락한다고 해석할 수 있다.

Baltussen et al.(2019)의 연구에서 주요 지수 단위의 패널자료를 토대로 ETF 보유비중과 시차 종속성 간의 관계를 살펴보았다면 본 연구에서는 개별종목 단위의 관계를 살펴보는 시도를 했다는 점에서 차별성이 있다. 특히 1차 시차 종속성에 대한 ETF 보유비중의 추정계수가 –0.019로, ETF 보유비중이 1% 증가할 경우(패널A) 일간 수익률의 AR(1) 계수가 –0.019만큼 감소한다는 것으로 해석할 수 있다. 이는 월별 표본의 기초 통계상의 평균(-0.041)과 중앙값(-0.042)을 고려했을 때 의미 있는 수치라 평가된다.

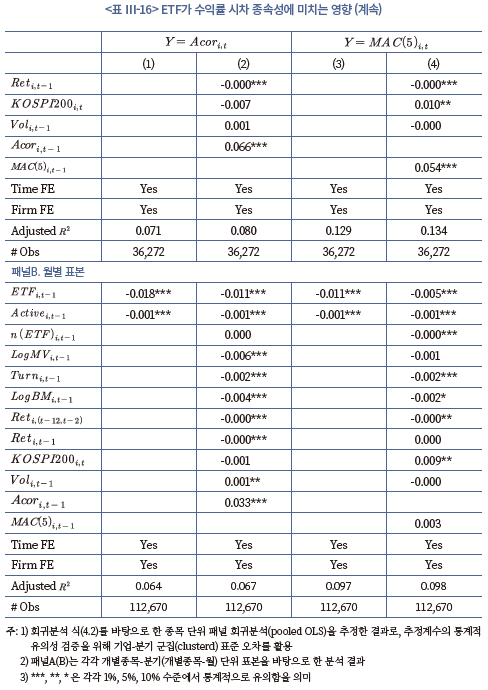

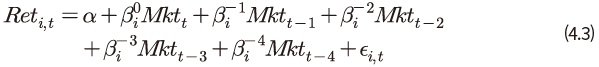

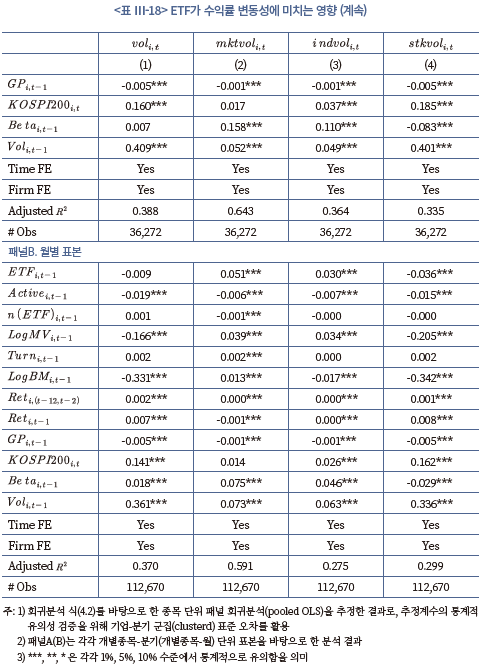

분석 개요에서 제시한 주요 패널 회귀분석 외에도, 앞선 2절의 수익률 동조화 현상과의 연관성을 확보하고, 시차 종속성 감소에 따른 시장 충격의 정도를 살펴보기 위해 아래 식(4.3)을 바탕으로 시차별 베타를 측정한다. 2절의 주된 결과 중 하나는 ETF 보유비중이 클수록 베타가 증가하는 것이었으며, 분석에 사용했던 베타는 동시점(contemporaneous) 베타이다. 본 절에서는 식(4.3)을 통해 시장모형에서 독립변수인 시장 수익률의 시차를 확장하여, 추정계수  를 산출해 t일 전 시장 수익률에 대한 개별종목 수익률의 민감도를 측정한다. 만약 ETF로 인해 개별주식의 시장 수익률과의 동조화가 강화되고 수익률 간 시차 종속성을 감소시킨다면 시차를 적용한 베타에는 차별적인 영향을 줄 것으로 예상되며, 이는 기초자산에 미치는 시장 단위의 충격이 동시점 외에도 시차를 두고 나타날 수 있음을 의미한다(Da & Shive, 2018).

를 산출해 t일 전 시장 수익률에 대한 개별종목 수익률의 민감도를 측정한다. 만약 ETF로 인해 개별주식의 시장 수익률과의 동조화가 강화되고 수익률 간 시차 종속성을 감소시킨다면 시차를 적용한 베타에는 차별적인 영향을 줄 것으로 예상되며, 이는 기초자산에 미치는 시장 단위의 충격이 동시점 외에도 시차를 두고 나타날 수 있음을 의미한다(Da & Shive, 2018).

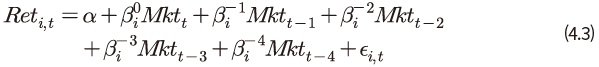

<표 Ⅲ-17>은 식(4.3)을 토대로 추정한 시차별 베타,  을 종속변수로, ETF 보유비중

을 종속변수로, ETF 보유비중 과 기타 통제변수를 설명변수로 회귀분석(식 4.2)을 시행한 결과이다. 기타 통제변수는 3절의 <표 III-11>과 동일하다.

과 기타 통제변수를 설명변수로 회귀분석(식 4.2)을 시행한 결과이다. 기타 통제변수는 3절의 <표 III-11>과 동일하다.

종속변수가 동일 거래일 시장 수익률에 대한 베타 인 모형(1)의 경우, ETF 보유비중의 계수는 통계적으로 유의한 양(+)의 값을 가진다. 이는 ETF가 수익률 동조성에 영향을 준다는 것으로 <표 III-11>의 결과와 일관된다. 반면, 종속변수가 직전 거래일 시장 수익률에 대한 베타

인 모형(1)의 경우, ETF 보유비중의 계수는 통계적으로 유의한 양(+)의 값을 가진다. 이는 ETF가 수익률 동조성에 영향을 준다는 것으로 <표 III-11>의 결과와 일관된다. 반면, 종속변수가 직전 거래일 시장 수익률에 대한 베타 인 경우 또는 2거래일 전 시장 수익률에 대한 베타

인 경우 또는 2거래일 전 시장 수익률에 대한 베타 인 경우 ETF 보유비중의 계수는 통계적으로 유의한 음(-)의 값으로 추정된다. ETF의 보유비중이 클수록 과거 시장 수익률과 개별종목 수익률 간 상관관계(cross autocorrelation)가 감소한다는 것으로 ETF 거래가 시차 종속성 감소와 연관되어 있음을 보여준다. 또한 이러한 결과는 기초자산 간 상호 연관된(correlated) 속성을 가진 ETF 거래활동이 기초자산 내 가격 회귀를 심화시키며, ETF로 인한 시장 충격 전이 및 수익률 변동성 확대 가능성을 시사한다.

인 경우 ETF 보유비중의 계수는 통계적으로 유의한 음(-)의 값으로 추정된다. ETF의 보유비중이 클수록 과거 시장 수익률과 개별종목 수익률 간 상관관계(cross autocorrelation)가 감소한다는 것으로 ETF 거래가 시차 종속성 감소와 연관되어 있음을 보여준다. 또한 이러한 결과는 기초자산 간 상호 연관된(correlated) 속성을 가진 ETF 거래활동이 기초자산 내 가격 회귀를 심화시키며, ETF로 인한 시장 충격 전이 및 수익률 변동성 확대 가능성을 시사한다.

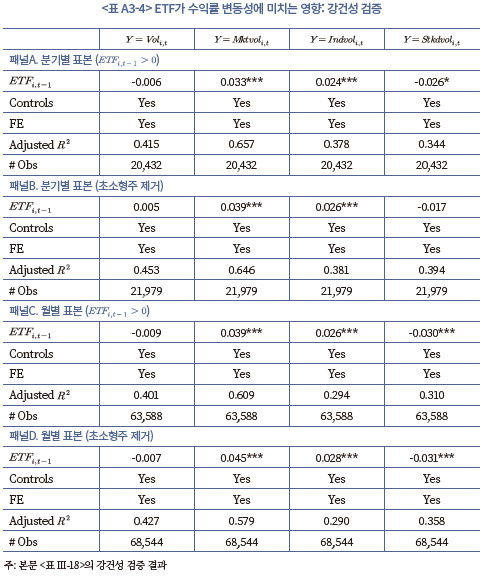

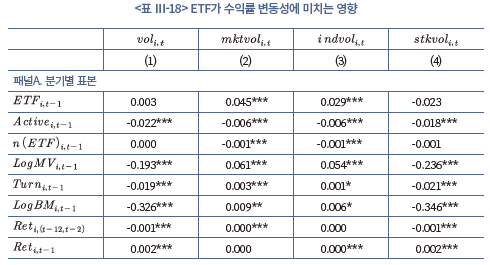

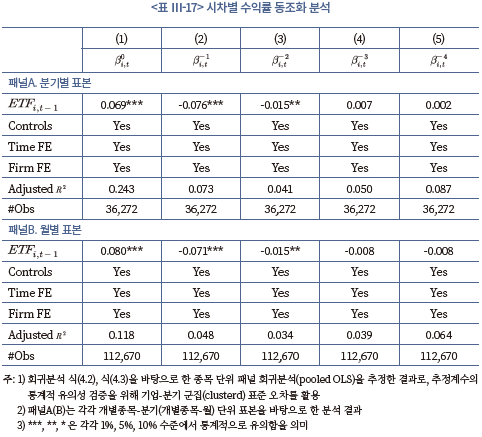

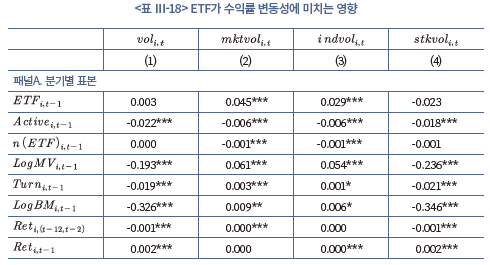

다음으로 ETF가 변동성에 미치는 영향을 분석한다. <표 Ⅲ-18>의 결과는 변동성 대용치를 종속변수로 회귀분석 식(4.2)의 패널 회귀분석을 시행한 결과이다. 개별주식의 수익률 변동성과 ETF 보유비중 사이에 통계적으로 유의한 관계가 관찰되지 않는데, 이는 기존 국내연구에서도 유사한 결과를 보고한 바 있다(최병호 외, 2021).30)

반면, 수익률 변동성을 시장변동성 , 업종변동성

, 업종변동성 , 고유변동성

, 고유변동성 으로 분해하여 분석할 경우, ETF 보유비중이 증가할수록 시장변동성과 업종변동성이 증가하는 것으로 나타난다. ETF와 연관된 거래활동으로 인해 개별종목의 주식가격이 체계적 위험에 더 민감해지기 때문이다. ETF가 체계적 요인과 연관이 있다는 이러한 결과는 2절과 3절의 분석 결과와 일관된 것이다. <표 Ⅲ-18>의 패널B의 시장변동성 및 업종변동성의 회귀계수는 각각 0.051, 0.030으로 ETF 보유비중이 1% 증가할 경우 다른 요인이 동일하다면 각각의 변동성이 0.051%, 0.03% 증가하는 것으로 해석할 수 있다. 월별 표본에서의 각 변수의 표준편차가 0.897%, 0.523%인 점을 고려했을 때 표준편차의 약 0.057배로 영향의 경제적인 크기는 크지 않은 것으로 평가된다.

으로 분해하여 분석할 경우, ETF 보유비중이 증가할수록 시장변동성과 업종변동성이 증가하는 것으로 나타난다. ETF와 연관된 거래활동으로 인해 개별종목의 주식가격이 체계적 위험에 더 민감해지기 때문이다. ETF가 체계적 요인과 연관이 있다는 이러한 결과는 2절과 3절의 분석 결과와 일관된 것이다. <표 Ⅲ-18>의 패널B의 시장변동성 및 업종변동성의 회귀계수는 각각 0.051, 0.030으로 ETF 보유비중이 1% 증가할 경우 다른 요인이 동일하다면 각각의 변동성이 0.051%, 0.03% 증가하는 것으로 해석할 수 있다. 월별 표본에서의 각 변수의 표준편차가 0.897%, 0.523%인 점을 고려했을 때 표준편차의 약 0.057배로 영향의 경제적인 크기는 크지 않은 것으로 평가된다.

한편 단순 수익률 표준편차 를 종속변수로 사용할 경우 통계적으로도 유의한 결과가 도출되지 않는다. 이러한 분석 결과는 ETF 보유비중과 수익률 변동성 간의 양(+)의 관계를 도출한 선행연구(Ben-David et al., 2018)의 결과와 다소 차이가 있는데, 시차의 영향보다는 변동성 대용치의 측정 방법에 따른 결과로 추정된다.31) 국내 개별주식의 일간 수익률 변동성

를 종속변수로 사용할 경우 통계적으로도 유의한 결과가 도출되지 않는다. 이러한 분석 결과는 ETF 보유비중과 수익률 변동성 간의 양(+)의 관계를 도출한 선행연구(Ben-David et al., 2018)의 결과와 다소 차이가 있는데, 시차의 영향보다는 변동성 대용치의 측정 방법에 따른 결과로 추정된다.31) 국내 개별주식의 일간 수익률 변동성 은 시장변동성 및 업종변동성보다 고유변동성

은 시장변동성 및 업종변동성보다 고유변동성 과 더욱 밀접하게 관련되어 있다. 변동성과 고유변동성의 횡단면 상관계수의 평균은 0.98로 매우 높기 때문이다. 기본적으로 포트폴리오 단위의 거래 및 정보 반영을 촉진하는 ETF의 특성상 개별종목의 고유변동성에 미치는 영향은 유의미하지 않을 것으로 생각된다.

과 더욱 밀접하게 관련되어 있다. 변동성과 고유변동성의 횡단면 상관계수의 평균은 0.98로 매우 높기 때문이다. 기본적으로 포트폴리오 단위의 거래 및 정보 반영을 촉진하는 ETF의 특성상 개별종목의 고유변동성에 미치는 영향은 유의미하지 않을 것으로 생각된다.

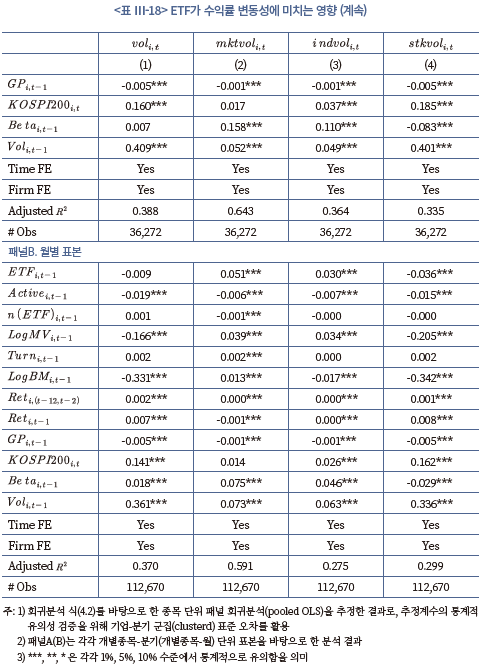

마지막으로, ETF 거래활동이 수익률 변동성에 미치는 영향을 검토한다. 앞선 3절의 회귀분석 식(3.5)의 패널 회귀분석에서 종속변수를 본 절에서 분해한 수익률 변동성으로 교체하여 분석한다. ETF 거래활동은 식(3.6)을 이용하여 동일하게 계산하며(<부록 2> 참고),  는 t시점 ETF 거래활동이 상위 50%에 포함되는 종목의 경우 1의 값을, 그렇지 않을 경우 0의 값을 갖는 더미변수이다. 거래활동의 지표는 유통시장 유동성, 발행시장 유동성, 가격괴리도 등 <표 III-13>과 동일하다.

는 t시점 ETF 거래활동이 상위 50%에 포함되는 종목의 경우 1의 값을, 그렇지 않을 경우 0의 값을 갖는 더미변수이다. 거래활동의 지표는 유통시장 유동성, 발행시장 유동성, 가격괴리도 등 <표 III-13>과 동일하다.

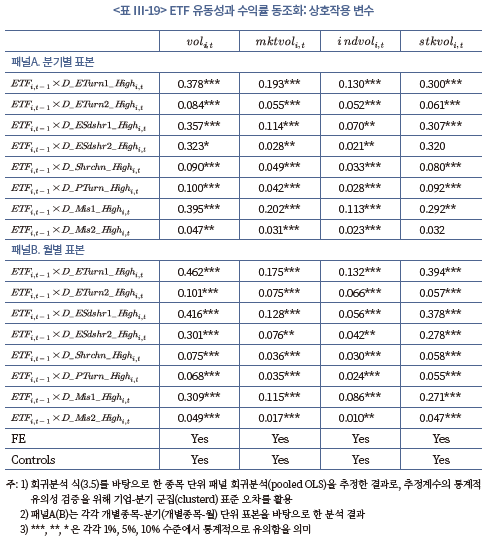

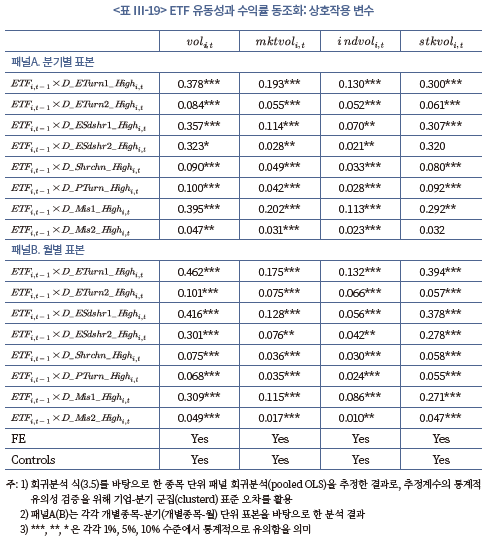

분석 결과는 <표 Ⅲ-19>에 요약되어 있다. 보고의 편의를 위해 분석의 핵심을 보여주는 ETF 보유비중과 ETF 거래활동의 교차변수의 계수값과 통계적 유의성만 제시한다. 교차변수의 계수는, 거래활동 지표나 변동성의 유형과 무관하게 거의 모든 경우 통계적으로 유의한 양(+)의 값으로 추정된다. ETF와 연관된 거래활동은 개별종목의 수익률 변동성을 증가시키는 요인인 것으로 나타난다.

4절의 실증분석 결과를 요약하면 다음과 같다. 첫째, ETF는 개별종목 단위의 시차 종속성 감소에 유의미한 영향을 미친다. 1차 및 다기간 상관계수를 분석한 결과 모두 통계적으로 유의하다. 둘째, ETF는 개별주식 수익률과 시차 시장 수익률(lagged market returns)과의 상관계수의 감소에도 영향을 미친다. 셋째, ETF는 체계적 변동성을 증가시키나 고유변동성에는 유의미한 영향을 미치지 않는다. 다만 ETF 거래활동이 활발할 경우 수익률 변동성 증가에 영향을 미치는 것으로 나타나나, 변동성에 미치는 영향의 크기는 유의미한 수준은 아닌 것으로 판단된다.

Ⅳ. 요약 및 시사점

본 연구의 분석 결과, ETF가 주식시장에 미치는 영향은 다음과 같다. 첫째, ETF는 정보 효율성 측면에서 포트폴리오 단위의 펀더멘탈 정보 반영을 촉진하는 매개체가 될 수 있다. ETF 보유비중이 클수록 수익률과 이익지표 변화의 관계가 강화되고 이익공시 후 주가지연반응(PEAD)이 감소한다. 특히 이는 주로 체계적 이익지표 변화에 대해 뚜렷하게 나타난다. 둘째, 포트폴리오 단위의 정보 효율성은 증가하지만, 편입종목 간 수익률 동조화가 현저해진다. 수익률 동조화는 ETF 보유비중과 연관되어 있으며 ETF의 거래활동이 그 경로로 작용한다. 셋째, ETF의 보유비중 증가는 개별주식의 수익률 시차 종속성 및 체계적 위험과 관련이 있다. ETF 보유비중이 클수록 개별종목 단위의 시차 종속성이 감소하고 시장과 연계된 수익률 변동성이 증가한다.

ETF 시장의 확대는 포트폴리오 단위의 정보 효율성 관점에서는 긍정적이나, 개별종목 단위의 가격 효율성 및 변동성 관점에서는 부정적인 영향이 존재할 가능성이 존재한다. 이는 ETF와 연관된 거래가 비단 정보거래뿐만 아니라 잦은 차익거래 및 단기 수급 등 펀더멘탈과 무관한 거래도 많기 때문으로 추정된다. 특히 기초자산에서 이러한 현상이 심화될 경우 투자자의 효용에도 부정적인 영향을 미칠 수 있다.

본 연구결과는 기존 선행연구에서 실증했던 여러 ETF의 효과가 국내 기초자산 시장에도 나타날 수 있음을 보여준다. 무엇보다 정보 효율성 및 수익률 특성의 변화, 변동성 측면에서 ETF의 영향에 관한 분석 결과는 서로 무관하지 않으며 ETF라는 상품의 특성과 시장 구조적인 요인이 이러한 결과를 동시에 유발하는 것으로 생각된다.

본 고의 실증분석 결과에서도 알 수 있듯이 ETF는 기초자산 시장에 영향을 줄 수 있으며 그 양상은 긍정적‧부정적인 면을 동시에 내포하고 있다. 과거 파생상품시장의 효과에 관한 다양한 연구 결과물과 논의가 축적되어 온 것처럼 ETF에 대한 이슈도 꾸준히 제기될 것으로 전망된다. 다만 본 연구에서 제시한 ETF의 영향에 대한 평가 외에도, 저렴한 비용의 분산투자, 높은 환금성 등 투자자 관점에서 ETF가 보유한 여러 장점과 이로 인한 긍정적인 효과도 충분히 있으므로 ETF와 기초자산 시장의 안정적인 공존을 위한 시각을 갖출 필요가 있다.

국내 ETF 시장은 아직 해외 시장과 비교했을 때 절대적, 상대적 규모 면에서 크다고 볼 수 없다. 하지만 국내 ETF 시장이 전 세계 ETF 시장보다 빠른 성장 속도를 보였고 무엇보다 ETF 외의 일반 공모펀드 시장은 정체되고 있다는 점은 다소 우려되는 부분이다. ETF의 괄목할 만한 성장 자체는 긍정적일 수 있으나 다양한 공모펀드 시장과 동반 성장하는 것이 장기적으로 펀드 생태계구축과 기초자산 시장과의 공존을 달성할 수 있는 방법일 것으로 생각된다. 액티브 ETF가 대안이 될 수도 있으며 ETF를 기초자산으로 하는 선물시장의 확대 방안도 고려해볼 수 있다. 향후 ETF가 기초자산 시장, 나아가 국내 자본시장에 미치는 영향에 대한 심도 있는 고민과 연구가 축적되어야 할 것이다.

1) ETFGI에 따르면 같은 기간 글로벌 ETF 시장의 순자산 규모와 상품 수의 성장률은 각각 연평균 25%, 20%를 보여 국내 ETF 시장이 더욱 빠르게 성장한 것을 볼 수 있다.

2) SEC(2017. 9. 8)

3) 본 고에서는 기초지수의 종류에 따라 ETF를 분류하였으며 파생형 상품(레버리지‧인버스)이라도 기초지수가 주가(채권)지수인 경우에도 주식(채권)형 ETF로 분류하였다. 주가지수를 추종하는 ETF는 지수(대표지수), 섹터(업종), 스타일, 테마, 스마트 베타, 액티브로 분류하였으며 상세한 분류 기준에 대한 설명은 부록 1을 참조한다.

4) 예탁결제원에서 제공하는 발행시장 유동성 정보는 현재 상장상품에 대해서만 제공하기 때문에 상장폐지된 ETF의 설정‧환매금액은 빠져있어 실제보다 작게 산출될 여지가 있다. 다만 상장폐지된 상품의 유동성이 작은 점을 고려하면 실제치와 큰 차이는 없을 것으로 판단된다.

5) 지나친 지수화에 따른 시장 비효율성의 대표적인 예시로 주요 지수편입‧퇴출 효과를 들 수 있다. 과거 연구에 따르면 지수편입 및 퇴출로 인해 가격 반전을 수반하지 않은 비정상적 초과수익률이 관찰되고(Shleifer, 1986; Lynch & Mendenhall, 1997), 편입비중의 산정방식 변경도 비정상적 수익률을 발생시키는 것으로 확인된다(Kaul et al., 2000).

6) 이와 관련하여 뮤추얼 펀드의 자금 유출입과 주식시장 모멘텀(momentum) 이상 현상의 연관성에 관한 연구(Lou, 2012), 펀드 수급을 기반으로 한 모멘텀 및 가격 반전(reversal)에 대한 접근(Vayanos & Woolley, 2013)이 있으며, Coval & Stafford(2007)의 연구에서는 뮤추얼 펀드의 과도한 자금 유출입에 따른 단기적인 주식가격 충격에 대해 실증한다.

7) 특히 우리나라의 경우 ETF 거래에 따른 증권거래세가 없어 현‧선물과 연계된 고빈도매매(High Frequency Trading: HFT), 알고리즘 거래 등이 더욱 활발하게 발생할 수 있다.

8) 이 외에도 주가지수 파생상품(선물)의 영향도 존재한다.

9) 선행연구 결과와 상반되거나 일관된 결과가 도출되지 않는 요인은 분명하지 않다. 해당 연구의 분석 기간이 국내 ETF 주식 편입 규모가 크지 않은 시기를 다수 포함하고 있기 때문일 수도 있으며, 수익률 변동성 측정 방식의 오류(measurement error) 및 설명변수의 내생성이 작용할 가능성도 있다.

10) ETF 운용자산 내 실제 보유(holding)와 다를 수 있지만 ETF 발행시장에서의 AP 거래의 기본 구성 내역이라는 점에서 ETF 주식 보유의 추정치로 적합하다고 판단된다.

11) 본 고에서는 ETF를 제외한 뮤추얼 펀드 중 액티브 펀드의 보유비중만을 분석에 포함한다. 이는 국내 주식에 대한 인덱스 펀드의 보유비중이 절대적으로 작은 점(개별종목 단위 평균 0.016%) 및 주요 변수인 ETF 보유비중과의 다중공선성(multicollinearity)이 발생할 수 있다는 점을 고려한 것이다. 인덱스 펀드의 보유비중을 분석에 포함하여도 결과의 질적인 차이는 없다.

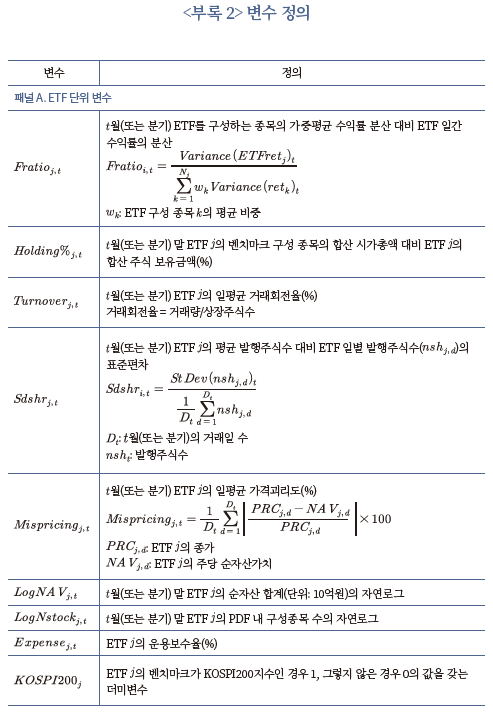

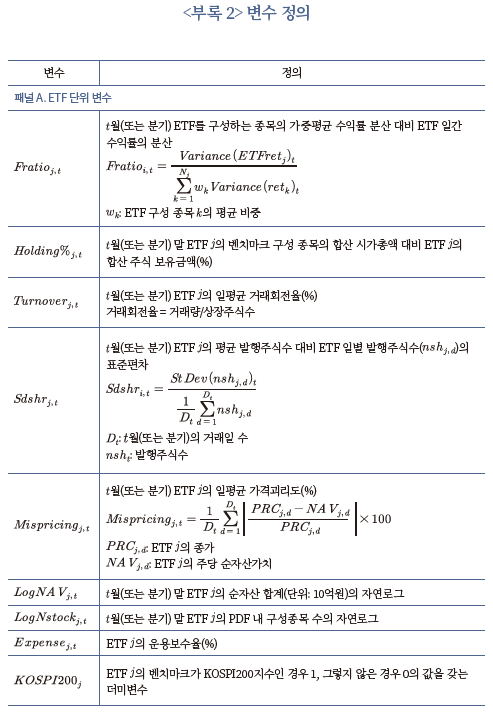

12) 분석에 사용한 개별 변수에 대한 자세한 산출 방식은 부록 2를 참조한다.

13) 이익과 주식 수익률의 관계(returns-earnings relation)를 분석한 회계학 연구에서는 현시점의 수익률에 영향을 미칠 수 있는 중요한 요소 중 하나로 미래 이익지표 변화에 대한 기대(expected future earnings)를 제시한다. 과거 관련 연구에서는 이를 통제하기 위해 미래 이익지표의 실제 변화치를 사용했으나 예상치 못한 변화(unexpected component)에 대해서는 완벽히 통제하지 못하므로 그 대안으로 미래 주식 수익률을 사용하는 것이다(Collins et al., 1994).

14) 이 외에도 보고서 상의 모든 패널 회귀분석에 사용된 연속(continuous) 변수는 마찬가지로 상하위 1% 회귀분석을 적용한다.

15) 산업군은 FnGuide Sector를 기준으로 분류한다.

16) 이익공시 이후 효과를 살펴보기 위해 매월 말 포트폴리오 구축 시 가장 최근에 발표된 분기의 이익지표 변화분을 기준으로 포트폴리오를 구성한다.

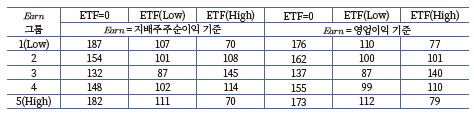

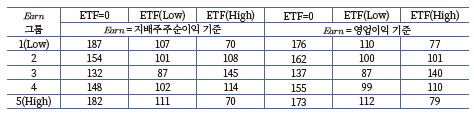

17) 독립적으로 분류한 15개의 각 그룹별 평균 기업 수(단위: 개)는 아래 표와 같다. 기준을 에서

에서  으로 변경해도 기업 수의 분포는 유사하다.

으로 변경해도 기업 수의 분포는 유사하다.

18) 예를 들어 동일 가중 포트폴리오의 경우, 식(3.1)의 분모는 와 같고, 분자는

와 같고, 분자는 와 같은데, 만약 모든 구성 종목의 분산

와 같은데, 만약 모든 구성 종목의 분산 이 같다면 식(3.1)의

이 같다면 식(3.1)의 는

는  으로, 구성 종목간 상관계수의 평균과 같다.

으로, 구성 종목간 상관계수의 평균과 같다.

19) 자세한 개별 변수의 산출 방식은 부록 2를 참조한다.

20) 조정 결정계수 을

을  로 변환한다.

로 변환한다.  는 기본적으로 0에서 1사이의 값을 가지므로, 범위 제한이 없는 연속 변수로 전환할 목적이다.

는 기본적으로 0에서 1사이의 값을 가지므로, 범위 제한이 없는 연속 변수로 전환할 목적이다.

21) Ben-David et al.(2018), Da & Shive(2018) 참고

22) 조정 결정계수로 역산하면 각각 0.322, 0.190이다.

23) ETF 보유비중이 0인 표본을 제거하거나 초소형주를 제거한 분석에도 결과의 질적인 차이는 없다. 이 분석의 강건성을 검토한 결과는 부록 3을 참조한다.

24) 더미변수의 기준을 상위 30%, 40% 등으로 변경해도 결과의 질적인 차이는 없다.

25) 예탁결제원에서 제공하는 개별 ETF 단위 설정, 환매 자료는 자료 추출 시점에 상장되어 거래되는 ETF의 경우에만 확보가 가능한 측면이 있어, 개별종목 단위 변수를 산출할 때 과거 상장폐지되었던 ETF는 고려가 불가능하다. 이로 인해 생존편향(survivorship bias)이 있을 수 있으나 대다수의 상장폐지된 ETF가 거래 부족으로 인한 점을 고려하면 결과에 큰 영향은 없을 것으로 판단된다.

26) 자세한 개별 변수의 산출 방식은 부록 2를 참조한다.

27) 1단계 회귀분석에서 의 평균 횡단면 회귀계수는 유통시장 유동성 지표

의 평균 횡단면 회귀계수는 유통시장 유동성 지표 가 종속변수인 경우 0.275, 발행시장 유동성 지표

가 종속변수인 경우 0.275, 발행시장 유동성 지표 가 종속변수인 경우 0.031이며, 모두 1% 수준에서 통계적으로 유의하다.

가 종속변수인 경우 0.031이며, 모두 1% 수준에서 통계적으로 유의하다.

28) 각 변수에 대한 자세한 산출 방식은 부록 2를 참조한다.

29) 추가적인 분석 결과 1차 상관계수의 절대값 을 종속변수로 사용할 경우, ETF 보유비중의 회귀계수는 유의한 양(+)의 값으로 측정된다. 전반적으로 ETF 보유비중이 증가할수록 상관계수가 감소하고 그 크기(절대값)도 커지므로 가격 효율성이 하락한다고 볼 수 있다.

을 종속변수로 사용할 경우, ETF 보유비중의 회귀계수는 유의한 양(+)의 값으로 측정된다. 전반적으로 ETF 보유비중이 증가할수록 상관계수가 감소하고 그 크기(절대값)도 커지므로 가격 효율성이 하락한다고 볼 수 있다.

30) 최병호 외(2021)와 Ben-David et al.(2018)은 동시점(contemporaneous) ETF 보유비중을 독립변수로 사용하는데, 내생성을 통제하기 위해 지수편입 효과를 도구 변수로 사용하여 강건성 검증을 실시했다. 본 보고서에서는 내생성 이슈를 최소화하기 위해 전 시점 보유비중을 사용했으나, 동시점 보유비중을 사용하여도 결과는 대체로 유사하다.

31) Box et al.(2021)의 분석에서 알 수 있듯이 ETF 거래와 수익률과의 관계는 명확하지 않은 것으로 생각된다. 본 절의 분석 결과도 대용치의 측정 방법의 차이에 기인할 수도 있으나 분석의 주기(frequency)를 달리하면 다른 양상이 나타날 가능성도 존재한다.

32) 주식시장 내 대표종목에 투자하는 상품도 포함

참고문헌

김상현‧손판도, 2019, 상장지수펀드(ETF)의 소유지분이 주식시장의 변동성에 미치는 영향, 『산업경제연구』 32(3), 1091-1110.

송준혁‧이창일, 2020, ETF 시장 확대가 개별 구성 주식의 행태에 미치는 효과 분석, 『선물연구』 28(1), 63-101.

최병호‧김시청‧한재훈, 2021, 상장지수펀드의 주식소유비중과 변동성에 관한 검정, 『한국경영학회』 융합학술대회 2659-2702.

Agarwal, V., Hanouna, P., Moussawi, R., Stahel, C.W., 2018, Do ETFs increase the commonality in liquidity of underlying stock? 28th Annual Conference on Financial Economics and Accounting working paper.

Baltussen, G., van Bekkum, S., Da, Z., 2019, Indexing and stock market serial dependence around the world, Journal of Financial Economics 132(1), 26-48.

Barberis, N., Shleifer, A., Wurgler, J., 2005, Comovement, Journal of Financial Economics 75(2), 283-317.

Ben-David, I., Franzoni, F., Moussawi, R., 2018, Do ETFs increase volatility? Journal of Finance 73(6), 2471-2535.

Bogousslavsky, V., Muravyev, D., 2021, Who trades at the close? Implications for price discovery, liquidity, and disagreement, American Economic Association working paper.

Box, T., Davis, R., Evans, R., Lynch, A., 2021, Intraday arbitrage between ETFs and their underlying portfolios, Journal of Financial Economics 141(3), 1078-1095.

Broman, M.S., Shum, P., 2018, Relative liquidity, fund flows, and short-term demand: Evidence from exchange-traded funds, Financial Review 53(1), 87-115.

Campbell, J.T., Lettau, M., Malkiel, B.G., Xu, Y., 2001, Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk, Journal of Finance 56(1), 1-43.

Collins, D.W., Kothari, S.P., Shanken, J., Sloan, R.G., 1994, Lack of timeliness and noise as explanations for the low contemporaneous return-earnings association, Journal of Accounting and Economics 18(3), 289-324.

Coval, J., Stafford, E., 2007, Asset fire sales (and purchases) in equity markets, Journal of Financial Economics 86(2), 479-512.

Da, Z., Shive, S., 2018, Exchange traded funds and asset return correlations, European Financial Management 24(1), 136-168.

Dannhauser, C.D., 2017, The impact of innovation: Evidence from corporate bond exchange-traded funds(ETFs), Journal of Financial Economics 125(3), 537-560.

Durnev, A., Morck, R., Yeung, B., Zarowin, P., 2003, Does greater firm-specific return variation mean more of less informed stock pricing? Journal of Accounting Research 41(5), 797-836.

Fama, E.F., French, K.R., 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33(1), 3-56.

Glosten, L., Nallareddy, S., Zou, Y., 2021, ETF activity and information efficiency of underlying securities, Management Science 67(1), 22-47.

Greenwood, R., 2008, Excess comovement of stock returns: Evidence from cross-sectional variation in Nikkei 225 weights, Review of Financial Studies 21(3), 1153-1186.

Israeli, D., Lee, C.M.C., Sridharan, S.A., 2017, Is there a dark side to exchange traded funds? An information perspective, Review of Accounting Studies 22(3), 1048-1083.

Jiang, W., Wu, S., Yao, C., 2022, How index funds reshape intraday market dynamics, SSRN working paper.

Kaul, A., Mehrotra, V., Morck, R., 2000, Demand curves for stocks do slope down: New evidence from an index weights adjustment, Journal of Finance 55(2), 893-912.

Lou, D., 2012, A low-based explanation of return predictability, Review of Financial Studies 25(12), 3457-3489.

Lynch, A.W., Mendenhall, R.R., 1997, New evidence on stock price effects associated with changes in the S&P500 Index, Journal of Business 70(3), 351-383.

Madhavan, A., Sobczyk, A., 2016, Price dynamics and liquidity of exchange-traded funds, Journal of Investment Management 14(2), 1-17.

SEC, 2017. 9. 8, SEC-NYU dialogue on securities markets-ETPs, Speech and Statements.

Shleifer, A., 1986, Do demand curves for stocks slope down? Journal of Finance 41(3), 579-790.

Stambaugh, R.F., 2014, Presidential address: Investment noise and trends, Journal of Finance 69(4), 1415-1453.

Vayanos, D., Woolley, P., 2013, An institutional theory of momentum and reversal, Review of Financial Studies 26(5), 1087-1145.

Wurgler, J., 2010, On the economic consequences of index-linked investing, NBER working paper.

<부록 1> ETF 유형 분류

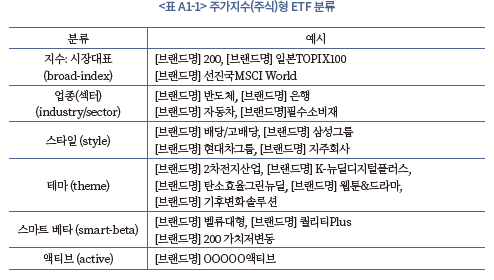

Ⅱ장에서는 ETF를 기초지수의 종류에 따라 분류하는데 파생형 상품(레버리지‧인버스)이라도 기초지수가 주가(채권)지수인 경우에는 주식(채권)형 ETF로 정의한다. 주가지수를 추종하는 ETF는 아래 <표 A1-1>과 같이 지수(대표지수), 업종, 스타일, 테마, 스마트베타, 액티브로 분류한다. 지수(대표지수)형 ETF는 주식시장을 대표하는 지수를 추종하는 상품으로 주로 시가총액 가중(value-weighted)지수를 추종한다. 업종(섹터) ETF는 사전에 정의된 산업 기준에 따라 분류된 주가지수를 추종하는 상품이며, 테마 ETF는 특정 주제나 추세와 연관된 지수를 추종하는 상품으로 업종 ETF와 유사한 측면이 있다. 스마트 베타 ETF는 소위 팩터(factor) 전략으로 분류되는 상품으로 시가총액 가중 외 지수를 구성하는 방식이 다양하다. 스타일 ETF는 스마트 베타 ETF와 달리 일반적으로 알려진 팩터 외 종목의 특성을 바탕으로 구성한 지수를 추종하는 상품이며, 액티브 ETF는 전술한 다섯 가지 패시브(passive) ETF와 달리 벤치마크 대비 초과 성과를 목표로 운용되는 상품이다.

21세기 성공적인 금융혁신으로 회자되는 상장지수펀드(Exchange Traded Fund: ETF, 이하 ETF)는 2000년대 우리나라 공모펀드 시장의 성장을 주도했다고 해도 과언이 아니다. 2002년 10월 국내 ETF가 처음 상장된 이후 2021년 말 순자산 규모는 약 74조원으로, 도입 후 연평균 33%라는 매우 높은 성장률을 기록했다. 상장상품 수도 연평균 30%씩 증가했는데(<그림 Ⅰ-1> 참고), 이는 글로벌 ETF 시장의 성장 속도를 상회하는 수치이다.1) <그림 Ⅰ-2>에 따르면 우리나라 공모펀드 내 ETF의 순자산 비중은 23.7%로 매년 꾸준히 증가하고 있다. 특히 주식형 공모펀드로 한정하면 ETF가 차지하는 비중은 54.9%로 ETF 외 일반 공모펀드의 규모보다 크다.

선행연구에 따르면 ETF 시장 내 정보거래자가 늘어날 경우 포트폴리오 단위의 정보 반영이 촉진될 수 있으나(Glosten et al., 2021), 다른 한편으로 개별종목 단위의 정보거래가 위축될 수 있다. 이는 결과적으로 ETF에 편입된 기초자산 간 수익률의 동조화, 고유변동성의 감소를 초래할 수 있다(Da & Shive, 2018). 또한 높은 유동성을 지닌 ETF를 활용한 차익거래 및 단기투자 수요가 증가하면 유통시장 내 ETF 가격 충격이 기초자산으로 전이될 수 있고, 나아가 시장 전체의 가격 반전(reversal) 현상이 심화될 수 있다(Ben-David et al., 2018; Baltussen et al., 2019). 한편 기초자산의 유형에 따라 ETF에 편입됨으로써 기초자산의 유동성 및 가격 발견이 제고될 수 있다는 긍정적인 영향도 보고되고 있다(Madhaven & Sobczyk, 2016; Dannhauser, 2017). 요약하면 ETF가 기초자산에 미치는 영향은 긍정적, 부정적 영향이 혼재되어 나타나는 것으로 확인된다.

이러한 ETF의 영향에 관한 논의는 과거 파생상품시장의 영향에 대한 논쟁과 유사한 측면이 있다. 파생상품이 기초자산에 미치는 영향에 관한 다양한 의견과 분석이 꾸준히 제시되어 온 점을 상기하면, 현재 ETF 시장이 빠르게 성장 중인 점을 고려했을 때 ETF가 기초자산에 미칠 수 있는 긍‧부정적 영향에 대한 논의와 분석은 앞으로도 꾸준하게 이뤄질 것으로 예상된다. 특히 해외에서는 공모펀드 시장 전체가 성장하는 추세 속에서 ETF가 빠르게 성장했지만, 우리나라의 경우 ETF 외 공모펀드 시장은 다소 정체된 가운데 ETF에 대한 유독 높은 선호도가 지속되어 왔기 때문에 ETF의 잠재적 영향을 파악하고 이해하는 것은 우리나라 자본시장의 특성상 학술적, 정책적 관점에서 중요한 과제라 할 수 있다.

이에 본 고에서는 ETF의 대표적인 기초자산인 상장주식을 중심으로 ETF가 미치는 영향에 대해 다각도로 분석한다. 먼저 정보 효율성 관점에서 ETF가 상장기업의 기초여건(fundamental) 변화와 주식 수익률 관계를 강화하는지 분석하고, ETF가 편입자산의 수익률 동조화에 미치는 영향을 분석한다. 또한 ETF를 활용한 단기 거래의 증가가 기초자산 수익률의 시차 종속성(serial dependency) 및 변동성에 미치는 영향을 살펴본다.

이와 관련해서 국내에서도 관련된 연구가 시도되었으나 ETF가 미치는 영향에 대해 종합적으로 이해하기에는 분석의 영역과 표본이 다소 제한적이었던 것으로 판단된다. 대부분의 분석 기간은 ETF의 주식 편입비중이 작았던 시기를 포함하고 있고 실증분석 결과도 해외의 주요 연구와 상반된 경우가 존재한다. 그리하여 본 고는 국내 ETF가 일정 수준의 양적 성장을 이룬 시기에 초점을 맞춰 ETF의 영향을 종합적으로 분석함으로써 ETF가 기초자산에 미칠 수 있는 영향에 대한 이해를 돕고자 한다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 국내 ETF 시장 현황을 파악하고 본 연구와 관련된 선행연구를 검토한다. Ⅲ장에서는 보고서의 분석 방향을 설정하고 앞서 제시한 관점에서 ETF가 주식시장에 미치는 영향에 대한 분석 방법론과 실증분석 결과를 서술한다. 마지막 Ⅳ장에서는 분석 결과에 대한 요약과 시사점을 끝으로 보고서가 마무리된다.

Ⅱ. ETF 시장 현황 및 선행연구

1. 국내 ETF 시장 현황

ETF가 처음 도입된 2002년부터 2021년까지 한국 주식시장에 상장된 ETF는 모두 656개로 집계된다(<표 II-1> 참고). ETF를 유형별로 분류하여 살펴보면3), 주식형 ETF가 508개로 약 77%를 차지하며, 채권형 ETF 57개, 통화 및 상품(commodity) 관련 ETF 35개, 기타 ETF 56개이다. 기타 ETF에는 부동산(REITs), 인프라, 혼합자산, 커버드콜, 롱숏 ETF 등이 포함된다. 주식형 ETF는 다시 대표지수, 섹터, 스타일, 테마, 스마트 베타, 액티브 등 6개 유형으로 구분할 수 있다. 대표지수형 ETF가 186개로 가장 많고 테마 90개, 섹터 84개, 스마트 베타 79개 순이다.

레버리지(2X), 인버스(-1X), 2배 인버스(-2X)와 같은 파생형 ETF는 모두 96개로, 벤치마크에 대한 파생상품이 활성화되어 있는 주가지수(주식-대표지수), 채권, 통화/상품형 ETF에서 비중이 높다. 파생형 ETF는 대표지수형의 31%, 채권형의 30%, 통화/상품형의 49%를 차지한다. 주가지수를 추종하는 상품의 경우 레버리지(2X) ETF의 비중이 크고, 채권지수를 추종하는 ETF 중에는 인버스(-1X) 상품의 비중이 큰 것이 특징적이다. 외국 지수 또는 자산을 투자 대상으로 하는 ETF는 125개, 파생상품계약을 통해 벤치마크를 복제하는 합성(synthetic) ETF는 47개이며, 이 중에는 주식-대표지수형 ETF인 경우가 많다. 해외 주가지수 중 실물자산으로 지수 추종이 어려운 경우 합성 방식을 활용하는 것으로 생각된다.

ETF의 유형 분류를 통해 국내 시장에서 투자자가 선택할 수 있는 ETF의 기초자산과 운용전략은 상당히 다양화되어 있음을 확인할 수 있다. 한편 <표 II-1>에 포함된 ETF 중 123개는 표본 기간 내에 상장폐지된 것으로 확인된다.

개별 주식형 ETF의 주식 보유금액은 평균 797억원으로 나타난다. 356개 ETF 중 62%(221개)가 200억원 미만, 80%(284개)가 500억원 미만으로 소규모 ETF가 대부분인 가운데, 주식 보유금액이 5,000억원을 넘는 ETF가 15개로 ETF간 편차가 큰 것으로 확인된다. 유형별로는 대표지수형과 레버리지(2X)형의 보유금액이 상대적으로 크고, 섹터형과 스마트 베타 ETF의 보유금액이 작다.

<그림 II-6>에 따르면 2021년 말 기준으로, 전체 상장종목의 9%인 196개 종목은 51개 이상의 ETF가 해당 종목을 보유하고 있는 것으로 나타난다. 이 외 상장종목의 19%는 11~50개의 ETF가, 나머지 30%는 10개 이하의 ETF가 보유하고 있다.

일반적인 ETF는 특정 지수를 추종하는 패시브 펀드이다. 최근 액티브 ETF 상품이 상장되고 있으나 아직 그 비중이 작으므로, 모든 선행연구에서 ETF는 기초지수의 수익률을 추종하는 패시브 펀드로 전제된다.

ETF를 포함한 패시브 투자가 확대된다고 할 때, 기초자산 시장에서 잡음거래자(noise trader)가 ETF 시장으로 이동하면서 전반적인 시장 효율성 제고에 기여할 수 있다는 평가가 있다(Stambaugh, 2014). 반면 지나친 지수화에 따라 시장 가격(valuation) 및 위험-수익률 관계의 왜곡이 나타날 수 있다는 주장도 존재한다(Wurgler, 2010).5) ETF의 규모가 급격히 증가함에 따라 펀드자금 유출입에 따른 가격 비효율성 및 위험6)이 증가할 수 있는데, 펀드 내 편입종목을 거래할 때 펀드매니저의 역량으로 수급에 따른 영향을 통제할 수 있는 액티브 펀드와 달리 패시브 펀드의 거래는 기계적으로 발생한다는 측면에서 펀더멘탈(fundamental)과 무관한 거래의 영향이 확대될 수 있다.

ETF는 투자자의 자유로운 환매와 설정이 가능하고 기준가격과의 괴리를 최소화한다는 점에서 개방형펀드의 속성을 보유하고 있고, 동시에 거래소에 상장되어 유통되는 폐쇄형펀드의 특징을 모두 가진 집합투자기구이다. 이를 구현하기 위해 ETF 발행사(집합투자업자)는 지정참가회사(Authorized Participant: AP)를 지정하여 AP의 차익거래를 통해 ETF의 가격 실패를 막는다. 또한 ETF의 높은 환금성과 유동성을 유지하기 위해 AP 중 유동성공급 계약을 맺은 유동성공급자(Liquidity Provider: LP)는 거래소가 규정한 방식에 따라 ETF 호가를 제출하고 있다. 그 결과 ETF를 통한 손쉽고 저렴한 포트폴리오 투자가 가능해지나, ETF의 높은 유동성은 단기차익을 추구하는 거래의 수요를 확대하는 요소로 작용한다(Broman & Shum, 2018).7) 이러한 거래가 무정보거래(uninformed trading)에 가깝다면 ETF는 기초자산 시장에 대한 가격충격의 전달 경로가 될 가능성이 있다.

이러한 특징을 바탕으로 ETF가 주식시장에 미치는 영향에 관한 연구를 살펴보면 다음과 같다. 먼저 기초지수를 추종하는 상품이라는 점에서 ETF 투자자 저변이 확대되면 지수 수준(index-level)의 정보 반영이 촉진될 수 있다. Glosten et al.(2021)의 연구에 따르면 ETF 보유비중이 클수록 포트폴리오 단위의 체계적 정보 반영이 촉진되는 것으로 나타난다. 다만 이는 개별종목의 고유정보가 효율적으로 가격에 반영되는 것과는 별개며 분석 주기에 따라서 결과가 약해지기도 한다(Israeli et al., 2017). 한편 포트폴리오 단위의 거래활동이 늘어나고 단기 투자수요가 증가함에 따라 개별종목의 가격 효율성이 저하되기도 한다. 대표적으로 ETF 편입종목의 수익률 동조화를 들 수 있는데, Da & Shive(2018)에 따르면 ETF 보유비중과 거래활동 증가는 개별종목의 수익률 동조화와 연관된 것으로 확인된다. 이는 과거 지수 편입종목의 수익률 동조화에 대한 분석과 유사한 측면이 있고(Barberis et al., 2005; Greendwood, 2008), 이러한 현상이 현저해진다면 ETF 투자자가 기대하는 분산투자 효과가 낮아질 수도 있다.

한편 ETF와 연계된 차익거래 등 단기 거래의 영향이 증가한다면 주식시장 내 단기 가격 반전(short-run price reversal)이 심화될 수 있고, 펀더멘탈과 무관한 ETF의 가격 충격이 주식가격에 전이될 수 있다. Baltussen et al.(2019)은 주요 15개국의 20개 주가지수 시계열의 시차 종속성(serial dependency)이 감소한 주요 요인으로 ETF와 같은 지수 추종 상품의 증가를 지목한다. 이들 분석에 따르면 2000년대 이후 주식시장 시차 종속성이 음(-)의 값으로 전환되었으며 시차 종속성의 감소는 ETF 자산편입 규모와 관련되어 있다.8) 이러한 결과는 크게 두 가지를 시사하는데, 주가지수 수준에서 가격 반전이 증가했다는 점에서 펀더멘탈과 무관한 거래의 영향이 커졌다는 것, 그리고 이러한 수익률 특성의 변화는 ETF와 같은 패시브 투자자의 거래비용 증가와 효익 감소로 이어질 수 있다는 것이다. 한편 Ben-David et al.(2018)의 연구에서는 개별종목 단위의 ETF 보유비중과 주가 변동성 간의 정(+)의 관계가 확인되어 ETF 시장 내 단기 수급 및 비정보거래가 주식가격의 변동성을 확대할 수 있음을 보여주었다.

국내에서도 ETF가 주식시장에 미치는 영향에 관한 연구가 진행되었는데 해외 문헌에 비하면 연구의 다양성은 다소 제한적이다. 김상현‧손판도(2019)는 KOSPI200 지수를 추종하는 ETF를 대상으로 ETF의 KOSPI200 보유비중과 KOSPI200 지수의 변동성 간의 음(-)의 관계를 도출하였다. 최병호 외(2021)는 개별주식 단위에서 KOSPI200 편입종목의 ETF 보유비중과 변동성과의 관계를 검증하였는데 통계적으로 일관된 결과가 도출되지 않았다.9) 송준혁‧이창일(2020)의 연구에서는 개별종목 단위의 분석을 통해 ETF 보유비중이 클수록 호가 스프레드, 수익률 동조화 지표 및 고평가 정도가 증가하는 것을 확인하였다.

이들 연구는 국내 ETF의 주식 보유 수준이 낮은 시기를 분석 기간으로 설정했다는 점, 일부 ETF를 분석대상으로 한정했다는 점에서 한계가 있는 것으로 생각된다. ETF 도입 초기와 달리 다양한 지수를 추종하는 ETF가 증가했고 ETF 발행 및 유통시장의 규모가 급격히 성장했기 때문에, 최근의 ETF 시장을 대상으로 한 종합적인 분석의 필요성이 높다고 할 수 있다.

Ⅲ. ETF가 주식시장에 미치는 영향

본 장에서는 선행연구를 바탕으로 ETF가 주식시장에 미치는 영향에 대해 실증적으로 검토한다. 1절에서는 본 고에서 활용한 ETF 주식 보유 데이터 및 ETF 보유비중 산출 방식을 설명하고, 2절에서는 정보 효율성 관점에서 ETF의 영향을 검증한다. 3절 및 4절에서는 각각 ETF가 주식 수익률의 동조화, 시차 종속성 및 변동성에 미치는 영향에 대해 분석한다.

1. 분석 자료

ETF 활동(ETF activity) 변수의 주된 대용치로 선행연구에서 제시한 개별종목 단위 ETF 보유비중을 사용하며(Israeli et al., 2017; Ben-David et al., 2018; Glosten et al., 2021), 본 장의 분석에 포함된 ETF는 파생형, 액티브 상품을 제외한 패시브 형태의 단순 추종(plain-vanilla) 상품이다. ETF 보유비중 산출을 위해 한국거래소에서 제공하는 ETF PDF(Portfolio Deposit File) 자료를 활용한다. PDF 자료는 ETF의 설정 및 환매를 위한 기본 단위인 설정단위(Creation Unit: CU) 한 개의 구성 종목 내역으로 ETF가 추종하는 지수의 구성과 거의 동일하며 매일(daily) 시장에 공개되는 자료이다. ETF마다 1 CU에 해당하는 수량은 상이하며 ETF별 일별 상장주식수를 바탕으로 ETF의 주식 보유현황을 산출한다.10)

본 연구에서는 ETF 보유비중

2. ETF와 정보 효율성

가. 분석 개요

본 절에서는 Glosten et al.(2021)의 방법론을 바탕으로 ETF가 주식시장의 정보 효율성에 미치는 영향을 분석한다. 이를 위해 ETF가 기업의 기초여건(fundamental) 변화와 개별종목 수익률의 관계를 강화시키는 역할을 수행하는지 검증한다. 만약 기초여건 변화가 개별종목 수익률에 영향을 주지 않는다면 기초여건에 대한 정보가 무가치하거나 기초여건에 대한 정보가 반영되는 경로가 취약하다는 것을 의미한다. 만약 ETF가 기초여건 변화와 수익률의 관계를 강화시킨다면 ETF가 정보 반영 경로로 기능하고 있다는 것을 의미하며 주식시장의 정보 효율성 강화에 기여하고 있다고 평가할 수 있다.

기업의 기초여건 변화는 식(2.1)처럼 분기별 이익지표의 변화

ETF뿐만 아니라 ETF 이외의 주식형 펀드도 정보 효율성에 영향을 미칠 수 있다. 이를 고려하여 액티브 펀드의 보유비중

ETF 및 액티브 펀드의 보유비중은 전분기 값을 이용하여 내생성(endogeneity) 문제의 가능성을 줄이고, 모든 독립변수는 상하위 1% 표본을 윈저화(winsorization)하여 극단치의 영향을 최소화한다.14)

<표 Ⅲ-2>는 회귀분석 식(2.2)의 패널 회귀분석 결과를 제시하고 있다. 모형(1)~(3)은 지배주주순이익을, 모형(4)~(6)은 영업이익을 이익지표로 사용하여 분석한 결과이다.

모든 분석에서 이익지표의 변화는 주식 수익률과 통계적으로 유의한 양(+)의 관계가 있는 것으로 나타난다. 이익지표가 증가(감소)할수록 주식 수익률이 높다는(낮다는) 것으로, 이익지표의 변화는 수익률에 영향을 미치는 정보를 담고 있다는 의미이다. ETF 보유비중과 이익지표 변화의 교차항의 계수를 보면, 모형(2), (3), (5), (6) 모두에서 1% 수준에서 통계적으로 유의한 양(+)의 값이 관찰된다. 즉 ETF 보유비중이 클수록 이익지표 변화에 대한 수익률의 반응이 커지며, ETF 거래활동은 이익지표 정보가 주가에 반영되는 경로로 기능한다고 평가할 수 있다. 정보거래를 통한 가격 발견 기능을 수행할 것으로 기대되는 액티브 펀드의 경우에도 ETF와 유사한 결과가 확인된다. 이상의 결과는 기존 문헌의 분석 결과와 일치한다(Glosten et al., 2021).

이익지표의 변화가 담고 있는 정보는, 상장기업 전체의 이익변화에 대한 정보와 개별기업의 이익변화에 대한 정보 등 두 가지 정보로 구분해 볼 수 있다. ETF가 주가에 반영되도록 돕는 정보는 어떤 유형의 정보인지 추가적인 분석을 통해 검토해보도록 한다.

개별기업의 이익지표 변화

ETF가 이익지표 변화에 대한 수익률 반응에 미치는 영향은 개별기업 고유 요소보다는 체계적 요소와 연관된 이익지표 변화에서 나타난다.

분석 결과, ETF 보유비중이 이익지표 변화에 대한 수익률 반응에 미치는 영향은 중대형주 표본과 소형주 표본 모두에서 유의한 결과가 관찰된다. 다만 소형주 표본에서 유의성이 다소 높은 것으로 나타난다. 기관투자자 및 외국인투자자의 비중이 크고, 정보공개의 수준이나 재무분석의 빈도가 높은 대형주에서는 ETF가 차별적인 정보채널로 기능할 가능성이 상대적으로 작은 반면 정보 효율성이 낮은 소형주에서는 ETF의 역할이 부각되는 것으로 이해할 수 있다. 분석 결과에서 이익지표 변화

이를 실증적으로 분석하기 위해, 매월 가장 최근에 발표된 분기16)의 이익지표 변화

<표 Ⅲ-5>는 5분위 포트폴리오의 평균 수익률과 평균 초과수익률을 제시하고 있다. 이익지표로 순이익을 활용한 패널A에 따르면, 5(High) 포트폴리오의 수익률은 1.42%, 1(Low) 포트폴리오의 수익률은 0.82%로 그 차이는 통계적으로 유의하다. Fama-French의 3요인 모형을 토대로 산출한 초과수익률을 기준으로 보면, 5(High) 포트폴리오의 수익률은 0.61%, 1(Low) 포트폴리오의 수익률은 0.01%로 역시 통계적으로 유의한 차이를 보인다. 즉 이익공시 후 주가지연반응이 관찰된다. 순이익을 체계적 요소와 고유 요소로 분해하여 이익충격을 별도로 정의하고 분석하면 체계적 요소에서만 주가지연반응이 관찰된다. 이익지표로 영업이익을 활용한 패널B의 결과는 패널A의 결과와 대체로 유사하다.

ETF 보유비중에 따른 주가지연반응 분석 결과는 <표 Ⅲ-6>에 제시되어 있다. 패널A와 B는 이익지표 변화를 기준으로, 패널C와 D는 이익지표의 체계적 요소의 변화를 기준으로 분석한 결과이며, 패널A와 C는 이익지표로 지배주주순이익을, 패널B와 D는 이익지표로 영업이익을 사용한 결과이다.

모든 경우 ETF 보유비중이 중간값 초과(High)인 그룹에서는 주가지연반응이 관찰되지 않는 반면 ETF 보유비중이 0인 그룹에서는 주가지연반응이 유의하게 관찰된다. 이익지표로 영업이익을 이용하거나 이익지표의 체계적 요소를 이용하는 경우(패널B, C, D), ETF 보유비중이 낮은 그룹(Low)에서도 주가지연반응이 나타난다. 이는 ETF의 보유비중이 높을수록 주가지연반응은 감소한다는 것으로 ETF가 정보 효율성 제고에 기여함을 시사한다.

ETF 보유비중은 기본적으로 기업의 규모(size)와 연관되어 있어 이러한 분석 결과가 규모 요인에 의해 나타나는 현상일 수 있다. 그러나 패널 회귀분석을 통해 확인한 결과, 기업의 규모 요인을 통제하더라도 주가지연반응은 ETF 보유비중이 클수록 작게 나타난다.

가. 분석 개요

2절의 분석을 통해 ETF가 주식시장의 정보 효율성 제고에 긍정적인 영향을 미친다는 점을 확인하였다. 특히 시장 전체 또는 해당 기업이 속한 섹터 정보의 반영에 ETF가 긍정적으로 기여하는 것으로 나타난다. 본 절에서는 ETF가 개별주식의 수익률 동조화(comovement)에 미치는 영향을 살펴본다. ETF가 시장 전체 혹은 섹터 정보의 반영을 촉진한다면 이러한 공통 정보로 인해 개별종목의 주가 수익률이 동조화될 가능성이 있다. 이 외에도 정보거래 외 ETF 단위 거래활동의 증가로 포트폴리오 단위의 거래가 늘어나 ETF 편입종목 내 수익률이 동조화될 수 있다.

만약 ETF의 보유비중이 클수록 수익률 동조화 정도가 강하다면, 크게 두 가지 분석을 통해 이를 검증할 수 있을 것이다. 첫째, 특정 ETF가 보유한 기초자산의 규모가 클수록 해당 ETF가 보유한 종목 간 수익률 동조화가 강해질 것이다. 둘째, ETF 보유비중이 큰 종목일수록 ETF의 벤치마크 포트폴리오(통상 시장 포트폴리오)와의 동조화 정도가 강해질 것이다. 본 절에서는 관련 선행연구(Da & Shive, 2018)를 바탕으로 이러한 가능성을 검토하고자 한다.

먼저 개별 ETF 단위의 분석을 위해 아래 식(3.1)과 같이 ETF 포트폴리오의 수익률 동조화 측정치

의 비율이다. 분자는 분모에 구성 종목간 공분산(covariance)의 가중평균을 더한 값이므로, 구성 종목간 상관계수가 작을수록

의 비율이다. 분자는 분모에 구성 종목간 공분산(covariance)의 가중평균을 더한 값이므로, 구성 종목간 상관계수가 작을수록 ETF 단위의 분석을 위해,

기타 통제변수로 순자산(NAV) 규모

아래 <표 Ⅲ-7>은 ETF 단위의 분석에 사용되는 변수의 기초 통계량이다.

나. 분석 결과

회귀분석 식(3.2)를 바탕으로 한 ETF 단위의 분석 결과는 <표 Ⅲ-9>에 제시되어 있다. 기타 통제변수와 시점 및 ETF 고정효과를 통제한 모형(3)의 결과를 보면,

<표 Ⅲ-10>은 ETF 거래활동의 영향을 추가적으로 분석하고 있다. 분기 표본과 월간 표본 모두에서, ETF의 거래가 많을수록

<표 Ⅲ-11>의 패널B를 모든 통제변수를 추가하였을 때(모형(3)) 에 대한 ETF 보유비중의 회귀계수는 0.088이다. 이는 ETF 보유비중이 1% 증가할 때 베타가 0.088 증가하는 것으로 베타의 표준편차가 0.64임을 고려하면 표준편차의 약 0.13배가 증가하는 것으로 해석할 수 있다. 한편, <표 III-11>과 <표 III-12>에서 액티브 펀드의 보유비중은 일부 분석에서 수익률 동조성과 유의한 음(-)의 관계가 나타난다. 보유종목의 비중을 조정하는 액티브 펀드의 운용방식이 수익률 동조성 약화와 연관이 있는 것으로 추정된다.

분석의 강건성을 확보하기 위해, 표준화 방식을 변경한 거래활동 지표

<그림 III-2>은 회귀분석 식(3.5)의 패널 회귀분석 결과를 도식화한 것으로, 패널A와 패널B는 각각 유통시장 유동성

ETF 거래활동이 많은 종목에서 ETF 보유비중은 베타와 양(+)의 관계가 있는 반면 ETF 거래활동이 적은 종목에서 ETF 보유비중은 베타와 음(-)의 관계가 있거나 통계적으로 유의한 관계가 나타나지 않는다. 수익률 동조화는 ETF 거래활동과 밀접한 관련이 있음을 확인할 수 있다.

이를 검증하기 위해 2단계 회귀분석(2-stage regressions)을 실시한다. 아래 식(3.7)처럼 먼저 ETF 거래활동 지표를 종속변수로, 이익지표 변화의 절대값과 기타 통제변수를 독립변수로 하여 분기별 횡단면 회귀분석을 시행한다(1단계). 그 결과 적합된 값(fitted value)을 정보거래 요소

가. 분석 개요

ETF, 지수선물 등 지수 추종 상품의 증가와 이와 관련된 차익거래 등 단기 거래의 증가는 시장 수익률의 시차 종속성(serial dependency)을 감소시키는 것으로 알려져 있다(Baltussen et al., 2019). 우리나라의 경우에도 <그림 Ⅲ-3>에 나타나는 바와 같이, KOSPI지수와 KOSDAQ지수 수익률의 시차 종속성(1차 자기상관계수(AR(1))의 5년 이동평균)이 분석 기간인 2017년 이후 감소하는 추세가 나타난다. 또한 추가적인 분석 결과 개별종목 단위의 시차 종속성 역시 금융위기 이후 꾸준히 감소하였다.

ETF가 주식 수익률 시차 종속성에 영향을 미치는 요인은 다음과 같다. 일반적으로 ETF의 설정과 환매가 장 종료(closing) 후 이루어지는 점을 고려할 때, 장 종료 전 차익거래 수요가 주가에 비체계적인 충격을 일으키고, 이는 다음날 수익률의 반전(reversal)을 일으키면서 결과적으로 시차 종속성이 감소하는 효과로 나타날 수 있다. 이와 관련하여 Jiang et al.(2022)은 미국 주식시장의 일중(intraday) 거래 자료를 분석한 결과 주식시장의 개장 시간 내 U-형태의 유동성이 장 종료에 가까운 시간에 집중되는 형태로 변화하였으며 주요 요인으로 ETF와 같은 지수 추종 상품의 증가를 제시한다. 또한 Bogousslavsky & Muravyev(2021)의 분석에 따르면 ETF와 같은 패시브 펀드 비중의 증가는 장 마감 동시호가(closing auction trade) 거래의 증가와 연관되어 있으며, 마감 동시호가 거래의 증가는 종가(closinig price)의 가격괴리(price deviation)를 야기하고 다음 거래일 오전에 괴리가 해소되는 것으로 분석된다. 이처럼 ETF의 규모 및 거래활동이 늘어나면 기초자산인 주식의 일간 가격 반전이 심화될 가능성이 존재한다.

<그림 Ⅲ-4>는 2017년부터 2021년까지 분석 대상 주식형 ETF의 시차 종속성 분포를 보여준다. ETF의 시차 종속성(AR(1) 계수)의 횡단면 평균은 –0.049로 동기간 KOSPI지수의 시차 종속성 –0.050과 유사한 값이다. 주식시장뿐만 아니라 ETF의 일간 가격 반전도 존재하는 것으로 알 수 있다.

또한 본 절에서는 ETF가 개별주식의 수익률 변동성에 미치는 영향을 검토한다. 잦은 가격 반전은 불필요한 변동성을 야기할 수 있을 뿐만 아니라 ETF가 수익률 동조화를 심화시킴으로써 체계적 위험(systematic risk)에 대한 과도한 노출을 유발할 수 있기 때문이다. 관련하여 Ben-David et al.(2018)은 미국 주식시장을 대상으로 ETF 보유비중과 월간 수익률 변동성 간의 양(+)의 관계를 실증했고 주된 요인으로 ETF에 수반된 차익거래와 같은 단기 거래를 제시한다. Ben-David et al.(2018)에 따르면 <그림 Ⅲ-5>와 같이 정상(A)인 상황에서 ETF 가격에 펀더멘탈과 무관한 충격(non-fundamental shock)이 올 경우(B), ETF 시장 참여자의 차익거래(주식 매수, ETF 매도)로 인해 기초자산(주식)에 충격이 전이(C)되고 다시 펀더멘탈로 회귀(D)함으로써 주식가격의 불필요한 변동이 발생한다. 물론 이는 ETF 시장에 충분한 시장 참여자가 있고 이들의 거래가 유의미한 비중을 차지하는 것을 전제로 한다. 반면 Box et al.(2021)은 분간(minute-by-minute) 수익률 및 거래 자료를 분석하여 ETF 거래와 주식 수익률 간에 유의미한 상관관계가 없다고 보고하고 있다. 벡터자기회귀 모형을 사용한 분석 결과 ETF 수익률이 기초자산 수익률에 미치는 영향은 미미한 것으로 나타난다.

이처럼 ETF가 수익률 변동성에 미치는 영향에 대한 실증적인 근거는 아직은 명확하지 않다고 생각되나, 본 절에서는 가용한 자료를 바탕으로 ETF 보유비중과 수익률 변동성과의 관계에 대한 분석을 시도한다. 다만 고빈도 자료가 가용하지 않으므로 본 절의 분석 결과를 일반화하지 않도록 유의할 필요가 있다.

본 절에서 사용할 패널회귀 분석모형은 아래 식(4.2)와 같은데, 종속변수는 시차 종속성 대용치

<표 III-16>은 ETF가 시차 종속성에 미치는 영향을 분석하기 위해 식(4.2)의 패널 회귀분석을 시행한 결과이다. 종속변수가 개별종목의 1차 시차 종속성

Baltussen et al.(2019)의 연구에서 주요 지수 단위의 패널자료를 토대로 ETF 보유비중과 시차 종속성 간의 관계를 살펴보았다면 본 연구에서는 개별종목 단위의 관계를 살펴보는 시도를 했다는 점에서 차별성이 있다. 특히 1차 시차 종속성에 대한 ETF 보유비중의 추정계수가 –0.019로, ETF 보유비중이 1% 증가할 경우(패널A) 일간 수익률의 AR(1) 계수가 –0.019만큼 감소한다는 것으로 해석할 수 있다. 이는 월별 표본의 기초 통계상의 평균(-0.041)과 중앙값(-0.042)을 고려했을 때 의미 있는 수치라 평가된다.

종속변수가 동일 거래일 시장 수익률에 대한 베타

반면, 수익률 변동성을 시장변동성

한편 단순 수익률 표준편차

분석 결과는 <표 Ⅲ-19>에 요약되어 있다. 보고의 편의를 위해 분석의 핵심을 보여주는 ETF 보유비중과 ETF 거래활동의 교차변수의 계수값과 통계적 유의성만 제시한다. 교차변수의 계수는, 거래활동 지표나 변동성의 유형과 무관하게 거의 모든 경우 통계적으로 유의한 양(+)의 값으로 추정된다. ETF와 연관된 거래활동은 개별종목의 수익률 변동성을 증가시키는 요인인 것으로 나타난다.

4절의 실증분석 결과를 요약하면 다음과 같다. 첫째, ETF는 개별종목 단위의 시차 종속성 감소에 유의미한 영향을 미친다. 1차 및 다기간 상관계수를 분석한 결과 모두 통계적으로 유의하다. 둘째, ETF는 개별주식 수익률과 시차 시장 수익률(lagged market returns)과의 상관계수의 감소에도 영향을 미친다. 셋째, ETF는 체계적 변동성을 증가시키나 고유변동성에는 유의미한 영향을 미치지 않는다. 다만 ETF 거래활동이 활발할 경우 수익률 변동성 증가에 영향을 미치는 것으로 나타나나, 변동성에 미치는 영향의 크기는 유의미한 수준은 아닌 것으로 판단된다.

본 연구의 분석 결과, ETF가 주식시장에 미치는 영향은 다음과 같다. 첫째, ETF는 정보 효율성 측면에서 포트폴리오 단위의 펀더멘탈 정보 반영을 촉진하는 매개체가 될 수 있다. ETF 보유비중이 클수록 수익률과 이익지표 변화의 관계가 강화되고 이익공시 후 주가지연반응(PEAD)이 감소한다. 특히 이는 주로 체계적 이익지표 변화에 대해 뚜렷하게 나타난다. 둘째, 포트폴리오 단위의 정보 효율성은 증가하지만, 편입종목 간 수익률 동조화가 현저해진다. 수익률 동조화는 ETF 보유비중과 연관되어 있으며 ETF의 거래활동이 그 경로로 작용한다. 셋째, ETF의 보유비중 증가는 개별주식의 수익률 시차 종속성 및 체계적 위험과 관련이 있다. ETF 보유비중이 클수록 개별종목 단위의 시차 종속성이 감소하고 시장과 연계된 수익률 변동성이 증가한다.

ETF 시장의 확대는 포트폴리오 단위의 정보 효율성 관점에서는 긍정적이나, 개별종목 단위의 가격 효율성 및 변동성 관점에서는 부정적인 영향이 존재할 가능성이 존재한다. 이는 ETF와 연관된 거래가 비단 정보거래뿐만 아니라 잦은 차익거래 및 단기 수급 등 펀더멘탈과 무관한 거래도 많기 때문으로 추정된다. 특히 기초자산에서 이러한 현상이 심화될 경우 투자자의 효용에도 부정적인 영향을 미칠 수 있다.

본 연구결과는 기존 선행연구에서 실증했던 여러 ETF의 효과가 국내 기초자산 시장에도 나타날 수 있음을 보여준다. 무엇보다 정보 효율성 및 수익률 특성의 변화, 변동성 측면에서 ETF의 영향에 관한 분석 결과는 서로 무관하지 않으며 ETF라는 상품의 특성과 시장 구조적인 요인이 이러한 결과를 동시에 유발하는 것으로 생각된다.

본 고의 실증분석 결과에서도 알 수 있듯이 ETF는 기초자산 시장에 영향을 줄 수 있으며 그 양상은 긍정적‧부정적인 면을 동시에 내포하고 있다. 과거 파생상품시장의 효과에 관한 다양한 연구 결과물과 논의가 축적되어 온 것처럼 ETF에 대한 이슈도 꾸준히 제기될 것으로 전망된다. 다만 본 연구에서 제시한 ETF의 영향에 대한 평가 외에도, 저렴한 비용의 분산투자, 높은 환금성 등 투자자 관점에서 ETF가 보유한 여러 장점과 이로 인한 긍정적인 효과도 충분히 있으므로 ETF와 기초자산 시장의 안정적인 공존을 위한 시각을 갖출 필요가 있다.

국내 ETF 시장은 아직 해외 시장과 비교했을 때 절대적, 상대적 규모 면에서 크다고 볼 수 없다. 하지만 국내 ETF 시장이 전 세계 ETF 시장보다 빠른 성장 속도를 보였고 무엇보다 ETF 외의 일반 공모펀드 시장은 정체되고 있다는 점은 다소 우려되는 부분이다. ETF의 괄목할 만한 성장 자체는 긍정적일 수 있으나 다양한 공모펀드 시장과 동반 성장하는 것이 장기적으로 펀드 생태계구축과 기초자산 시장과의 공존을 달성할 수 있는 방법일 것으로 생각된다. 액티브 ETF가 대안이 될 수도 있으며 ETF를 기초자산으로 하는 선물시장의 확대 방안도 고려해볼 수 있다. 향후 ETF가 기초자산 시장, 나아가 국내 자본시장에 미치는 영향에 대한 심도 있는 고민과 연구가 축적되어야 할 것이다.

1) ETFGI에 따르면 같은 기간 글로벌 ETF 시장의 순자산 규모와 상품 수의 성장률은 각각 연평균 25%, 20%를 보여 국내 ETF 시장이 더욱 빠르게 성장한 것을 볼 수 있다.

2) SEC(2017. 9. 8)

3) 본 고에서는 기초지수의 종류에 따라 ETF를 분류하였으며 파생형 상품(레버리지‧인버스)이라도 기초지수가 주가(채권)지수인 경우에도 주식(채권)형 ETF로 분류하였다. 주가지수를 추종하는 ETF는 지수(대표지수), 섹터(업종), 스타일, 테마, 스마트 베타, 액티브로 분류하였으며 상세한 분류 기준에 대한 설명은 부록 1을 참조한다.

4) 예탁결제원에서 제공하는 발행시장 유동성 정보는 현재 상장상품에 대해서만 제공하기 때문에 상장폐지된 ETF의 설정‧환매금액은 빠져있어 실제보다 작게 산출될 여지가 있다. 다만 상장폐지된 상품의 유동성이 작은 점을 고려하면 실제치와 큰 차이는 없을 것으로 판단된다.

5) 지나친 지수화에 따른 시장 비효율성의 대표적인 예시로 주요 지수편입‧퇴출 효과를 들 수 있다. 과거 연구에 따르면 지수편입 및 퇴출로 인해 가격 반전을 수반하지 않은 비정상적 초과수익률이 관찰되고(Shleifer, 1986; Lynch & Mendenhall, 1997), 편입비중의 산정방식 변경도 비정상적 수익률을 발생시키는 것으로 확인된다(Kaul et al., 2000).

6) 이와 관련하여 뮤추얼 펀드의 자금 유출입과 주식시장 모멘텀(momentum) 이상 현상의 연관성에 관한 연구(Lou, 2012), 펀드 수급을 기반으로 한 모멘텀 및 가격 반전(reversal)에 대한 접근(Vayanos & Woolley, 2013)이 있으며, Coval & Stafford(2007)의 연구에서는 뮤추얼 펀드의 과도한 자금 유출입에 따른 단기적인 주식가격 충격에 대해 실증한다.

7) 특히 우리나라의 경우 ETF 거래에 따른 증권거래세가 없어 현‧선물과 연계된 고빈도매매(High Frequency Trading: HFT), 알고리즘 거래 등이 더욱 활발하게 발생할 수 있다.

8) 이 외에도 주가지수 파생상품(선물)의 영향도 존재한다.

9) 선행연구 결과와 상반되거나 일관된 결과가 도출되지 않는 요인은 분명하지 않다. 해당 연구의 분석 기간이 국내 ETF 주식 편입 규모가 크지 않은 시기를 다수 포함하고 있기 때문일 수도 있으며, 수익률 변동성 측정 방식의 오류(measurement error) 및 설명변수의 내생성이 작용할 가능성도 있다.

10) ETF 운용자산 내 실제 보유(holding)와 다를 수 있지만 ETF 발행시장에서의 AP 거래의 기본 구성 내역이라는 점에서 ETF 주식 보유의 추정치로 적합하다고 판단된다.

11) 본 고에서는 ETF를 제외한 뮤추얼 펀드 중 액티브 펀드의 보유비중만을 분석에 포함한다. 이는 국내 주식에 대한 인덱스 펀드의 보유비중이 절대적으로 작은 점(개별종목 단위 평균 0.016%) 및 주요 변수인 ETF 보유비중과의 다중공선성(multicollinearity)이 발생할 수 있다는 점을 고려한 것이다. 인덱스 펀드의 보유비중을 분석에 포함하여도 결과의 질적인 차이는 없다.

12) 분석에 사용한 개별 변수에 대한 자세한 산출 방식은 부록 2를 참조한다.

13) 이익과 주식 수익률의 관계(returns-earnings relation)를 분석한 회계학 연구에서는 현시점의 수익률에 영향을 미칠 수 있는 중요한 요소 중 하나로 미래 이익지표 변화에 대한 기대(expected future earnings)를 제시한다. 과거 관련 연구에서는 이를 통제하기 위해 미래 이익지표의 실제 변화치를 사용했으나 예상치 못한 변화(unexpected component)에 대해서는 완벽히 통제하지 못하므로 그 대안으로 미래 주식 수익률을 사용하는 것이다(Collins et al., 1994).

14) 이 외에도 보고서 상의 모든 패널 회귀분석에 사용된 연속(continuous) 변수는 마찬가지로 상하위 1% 회귀분석을 적용한다.

15) 산업군은 FnGuide Sector를 기준으로 분류한다.

16) 이익공시 이후 효과를 살펴보기 위해 매월 말 포트폴리오 구축 시 가장 최근에 발표된 분기의 이익지표 변화분을 기준으로 포트폴리오를 구성한다.

17) 독립적으로 분류한 15개의 각 그룹별 평균 기업 수(단위: 개)는 아래 표와 같다. 기준을

18) 예를 들어 동일 가중 포트폴리오의 경우, 식(3.1)의 분모는

19) 자세한 개별 변수의 산출 방식은 부록 2를 참조한다.

20) 조정 결정계수

21) Ben-David et al.(2018), Da & Shive(2018) 참고

22) 조정 결정계수로 역산하면 각각 0.322, 0.190이다.

23) ETF 보유비중이 0인 표본을 제거하거나 초소형주를 제거한 분석에도 결과의 질적인 차이는 없다. 이 분석의 강건성을 검토한 결과는 부록 3을 참조한다.