Find out more about our latest publications

Spin-off and Treasury Stock Magic

Issue Papers 23-06 Feb. 23, 2023

- Research Topic Capital Markets

- Page 21

The so-called treasury stock magic refers to the phenomenon where a controlling shareholder gains stronger control over a new firm without additional investment. Assume that a parent firm pushing for a spin-off holds treasury stocks. In that case, the parent firm may regard itself as a shareholder and allocate new shares of the spin-off firm, which means the existing shareholder's control over the spin-off firm increases proportionally to the allocated stake. As the treasury stock magic increases the control of the controlling shareholder in the parent firm using its own treasury stocks, it has often been persistently condemned as an infringement of the interest of external shareholders.

This article shed light on the structure of spin-offs based on the treasury stock magic and carried out an empirical analysis on this issue in real-world practices. A model adopted for the treasury stock magic found that the combination of the treasury stock magic and investment in kind not only maximizes the control of controlling shareholders, but also effectively helps the controlling shareholder to meet the holding company requirements. Furthermore, controlling shareholders' control rises with a larger share of stake in treasury stocks, a higher spin-off ratio, and a spin-off firm's higher valuation relative to the parent firm. The data on a total of 144 spin-off cases in listed firms in Korea between 2000 and 2021 revealed that the firms transforming into holding companies extensively used the treasury stock magic in combination with capital increase via investment in kind. Also, those firms were found to have a higher stake in treasury stocks, a higher spin-off ratio, and a spin-off firm with higher valuation. As a result, spin-offs were found to lead to an evident increase in control of controlling shareholders, while cutting external shareholders' stake in market cap by 8.8 percentage points. On the other hand, no evident change was observed before and after spin-offs with regards to the ownership structure and shareholder composition of the firms that did not convert to holding companies.

The treasury stock magic is highly controversial due to its potential distortion of corporate control and wealth allocation. But this practice has persisted apparently under the current regulatory framework that lacks consistency in treating the actual economic value of treasury stocks. Although treasury stocks should not be viewed as holding economic value, quite a few laws and precedents recognize those stocks' asset-like features. This provides a rationale for new share allotment to treasury share holdings. What's needed at the current stage is a measure that could rein in the abuse of treasury stocks by controlling shareholders. More fundamentally, regulators must come up with a renewed regulatory scheme that better reflects the actual economic value of treasury stocks.

This article shed light on the structure of spin-offs based on the treasury stock magic and carried out an empirical analysis on this issue in real-world practices. A model adopted for the treasury stock magic found that the combination of the treasury stock magic and investment in kind not only maximizes the control of controlling shareholders, but also effectively helps the controlling shareholder to meet the holding company requirements. Furthermore, controlling shareholders' control rises with a larger share of stake in treasury stocks, a higher spin-off ratio, and a spin-off firm's higher valuation relative to the parent firm. The data on a total of 144 spin-off cases in listed firms in Korea between 2000 and 2021 revealed that the firms transforming into holding companies extensively used the treasury stock magic in combination with capital increase via investment in kind. Also, those firms were found to have a higher stake in treasury stocks, a higher spin-off ratio, and a spin-off firm with higher valuation. As a result, spin-offs were found to lead to an evident increase in control of controlling shareholders, while cutting external shareholders' stake in market cap by 8.8 percentage points. On the other hand, no evident change was observed before and after spin-offs with regards to the ownership structure and shareholder composition of the firms that did not convert to holding companies.

The treasury stock magic is highly controversial due to its potential distortion of corporate control and wealth allocation. But this practice has persisted apparently under the current regulatory framework that lacks consistency in treating the actual economic value of treasury stocks. Although treasury stocks should not be viewed as holding economic value, quite a few laws and precedents recognize those stocks' asset-like features. This provides a rationale for new share allotment to treasury share holdings. What's needed at the current stage is a measure that could rein in the abuse of treasury stocks by controlling shareholders. More fundamentally, regulators must come up with a renewed regulatory scheme that better reflects the actual economic value of treasury stocks.

Ⅰ. 서론

인적분할은 하나의 회사를 둘 이상의 회사로 분할하는 기업구조조정의 한 방법이다. 회사의 재산을 분할하여 새로운 회사를 설립하고 새로 설립된 회사가 발행한 신주를 기존회사의 주주에게 각 주주의 지분율에 따라 배정하는 형식이다. 기존회사 지분 10%를 보유하고 있었던 주주는 인적분할 후, 존속회사 지분 10%와 신설회사 지분 10%를 동시에 보유하게 된다. 한편 기존회사의 잔여재산과 법인격은 존속회사가 승계한다.

만약 기존회사가 자기주식을 보유하고 있었다면, 인적분할 과정에서 기존회사를 주주로 간주하여 신설회사의 신주를 배정하는 것이 가능하다. 인적분할 이후 존속회사는 신설회사의 지분을 보유하게 되고, 결과적으로 지배주주는 자신이 지배하는 존속회사가 보유한 신설회사 지분만큼 신설회사에 대해 강화된 지배력을 행사할 수 있게 된다. 이러한 지배력 강화가 지배주주의 추가적인 출연없이 달성되기 때문에 자사주 ‘마법’이라 부르며, 외부주주의 이익을 침해하는 행위라는 비판이 지속적으로 제기되어 왔다.

자사주 마법은 의도된 선택이라는 점에서 그 본질이 지배주주와 외부주주의 이해상충이라는 사실은 명백하다. 자사주 마법을 제한하기 위한 법안이 2015년부터 지금까지 9건 발의되었고, 공정거래위원회(2018.11.13)는 지주회사 전환과정에서 총수일가의 지배력이 크게 증가하는 배경으로 자사주 마법을 활용한 인적분할을 지적하면서 총수일가의 과도한 지배력 확대를 방지할 수 있도록 제도개선이 필요함을 인정하였다. 그럼에도 불구하고 자사주 마법은 여전히 지주회사 전환과정에서 빈번하게 활용되고 있다.

본고는 자사주 마법을 활용한 인적분할의 구조를 검토하고 자사주 마법이 활용되는 실태를 실증적으로 분석하는 것을 목적으로 한다. 그간 자사주 마법의 문제점에 대해 법규제적 관점의 논의는 다각적으로 이루어져 왔으나(노혁준, 2008; 노혁준, 2018; 황남석, 2015; 이은정, 2017; 이상훈, 2020a; 이상훈, 2020b), 자사주 마법의 경제적 유인구조를 조명하고 활용 실태를 실증적으로 분석한 연구는 많지 않았던 것으로 파악된다(유진수, 2014; 박진우·이민교, 2019).1) 본고의 분석은 자사주 마법의 본질과 폐해를 구체적으로 제시함으써 자사주 마법을 억제하기 위한 제도 개선의 필요성을 강조하고자 한다.

II. 인적분할과 자사주 마법의 구조

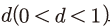

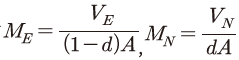

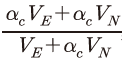

자사주 마법을 활용한 인적분할의 구조를 이해하기 위해 인적분할을 모형으로 구성하여 살펴보자. 순자산이 이고, 지배주주 지분율이

이고, 지배주주 지분율이  , 자기주식 지분율이

, 자기주식 지분율이  인 회사(‘기존회사’)가 인적분할을 진행하여 기존회사의 법인격을 승계하는 ‘존속회사’와 새로 설립되는 ‘신설회사’로 분할된다고 가정하자. 분할비율은

인 회사(‘기존회사’)가 인적분할을 진행하여 기존회사의 법인격을 승계하는 ‘존속회사’와 새로 설립되는 ‘신설회사’로 분할된다고 가정하자. 분할비율은  로, 회사 순자산의

로, 회사 순자산의  를 분할하여 신설회사에 배정하고,

를 분할하여 신설회사에 배정하고,  를 존속회사가 보유한다. 신설회사와 존속회사의 기업가치는 각각

를 존속회사가 보유한다. 신설회사와 존속회사의 기업가치는 각각  ,

,  , 주가는 각각

, 주가는 각각  ,

,  라 하자.

라 하자.

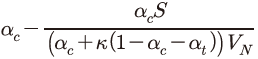

인적분할 후, 지배주주의 존속회사 지분율은 , 존속회사의 자기주식 지분율은

, 존속회사의 자기주식 지분율은  로 인적분할 이전과 동일하다. 신설회사의 경우, 발행한 신주를 기존회사 주주에게 지분율에 따라 배정하므로 지배주주의 신설회사 지분율 역시

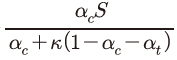

로 인적분할 이전과 동일하다. 신설회사의 경우, 발행한 신주를 기존회사 주주에게 지분율에 따라 배정하므로 지배주주의 신설회사 지분율 역시  로 동일하다. 기존회사가 자기주식을 보유한 경우 기존회사를 주주로 간주하여 신설회사의 신주를 배정할 수 있는데 이 경우 존속회사의 신설회사 지분율은

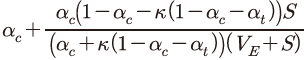

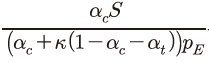

로 동일하다. 기존회사가 자기주식을 보유한 경우 기존회사를 주주로 간주하여 신설회사의 신주를 배정할 수 있는데 이 경우 존속회사의 신설회사 지분율은  가 된다.2) 지배주주가 존속회사를 지배하고 있으므로 결국 지배주주의 신설회사에 대한 지배권(controlling right)은

가 된다.2) 지배주주가 존속회사를 지배하고 있으므로 결국 지배주주의 신설회사에 대한 지배권(controlling right)은  가 된다. 지배주주의 추가적인 출연 없이 기존회사 자기주식에 대한 신주배정을 통해 신설회사에 대한 지배력이 강화되는 ‘자사주 마법’이 바로 이 부분이다.

가 된다. 지배주주의 추가적인 출연 없이 기존회사 자기주식에 대한 신주배정을 통해 신설회사에 대한 지배력이 강화되는 ‘자사주 마법’이 바로 이 부분이다.

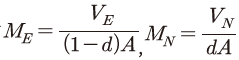

인적분할 이후, 특히 인적분할이 지주회사 전환과 관련된 경우, 존속회사의 현물출자 유상증자가 이어지는 경우가 대부분이다. 현물출자 유상증자는 통상 신설회사 주주를 대상으로 한 공개매수 형태로 이루어지는데 공개매수에 응하는 신설회사 주주는 신설회사 주식을 존속회사에 현물출자하고 존속회사가 발행한 신주를 받게 된다.3) 지배주주가 보유한 신설회사 지분을 존속회사 지분으로 교체함으로써, 지배주주가 존속회사를 소유하고 존속회사가 신설회사를 소유하는 지주회사 구조를 구축하는 것이 현물출자 유상증자의 목적이다.

존속회사가 규모가 인 현물출자 유상증자를 추진하고, 지배주주는 신설회사 보유지분 전체를, 지배주주 이외의 신설회사 주주는

인 현물출자 유상증자를 추진하고, 지배주주는 신설회사 보유지분 전체를, 지배주주 이외의 신설회사 주주는  의 비율로 유상증자에 참여한다고 가정하자. 신설회사 지분 를 보유한 존속회사는 자신의 현물출자 유상증자에 참여할 수 없다.

의 비율로 유상증자에 참여한다고 가정하자. 신설회사 지분 를 보유한 존속회사는 자신의 현물출자 유상증자에 참여할 수 없다.

지배주주는 신설회사 지분 를 존속회사에 출자하고 존속회사의 신주

를 존속회사에 출자하고 존속회사의 신주  주를 추가로 확보하게 된다. 지배주주가 보유한 존속회사 주식 수는

주를 추가로 확보하게 된다. 지배주주가 보유한 존속회사 주식 수는  주에서

주에서  주로 증가하고, 유상증자 후 존속회사 주식 수는

주로 증가하고, 유상증자 후 존속회사 주식 수는  주에서

주에서  주로 증가하므로, 지배주주의 존속회사 지분율은 당초

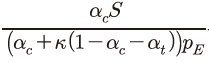

주로 증가하므로, 지배주주의 존속회사 지분율은 당초  에서

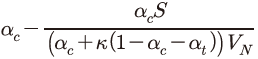

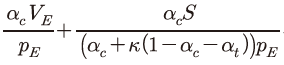

에서  로 증가한다. 여기서 주목되는 것은 지분율 증가폭이 존속회사의 신설회사 지분율

로 증가한다. 여기서 주목되는 것은 지분율 증가폭이 존속회사의 신설회사 지분율  에 비례한다는 점이다. 즉 자사주 마법을 통해 확보한 존속회사의 신설회사 지분은 현물출자 유상증자를 통한 지배주주의 존속회사 지분율 확대에도 기여한다. 한편 현물출자 유상증자 이후 지배주주의 신설회사 지분율은

에 비례한다는 점이다. 즉 자사주 마법을 통해 확보한 존속회사의 신설회사 지분은 현물출자 유상증자를 통한 지배주주의 존속회사 지분율 확대에도 기여한다. 한편 현물출자 유상증자 이후 지배주주의 신설회사 지분율은  로 감소한다.

로 감소한다.

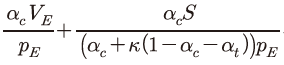

현물출자 유상증자의 목적이 지배주주의 존속회사 지분율을 최대화하는 것이라면 그 조건은 지배주주 이외의 신설회사 주주의 유상증자 참여가 최소화되고 , 유상증자 규모를 최대화

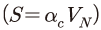

, 유상증자 규모를 최대화  하는 것이다.4) 이 조건을 적용하면 유상증자 이후 지배주주의 존속회사 지분율은

하는 것이다.4) 이 조건을 적용하면 유상증자 이후 지배주주의 존속회사 지분율은  , 신설회사 지분율은 0이 된다. 존속회사의 신설회사 지분율은, 지배주주가 보유한 신설회사 지분

, 신설회사 지분율은 0이 된다. 존속회사의 신설회사 지분율은, 지배주주가 보유한 신설회사 지분  를 존속회사로 이전했으므로

를 존속회사로 이전했으므로  에서

에서  로 증가한다.

로 증가한다.

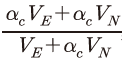

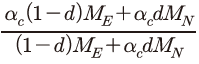

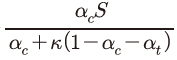

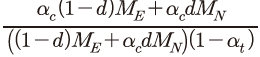

존속회사와 신설회사의 시장가-장부가 비율을 각각 , 라 하면, 지배주주의 존속회사에 대한 지분율은

, 라 하면, 지배주주의 존속회사에 대한 지분율은  로 정리할 수 있다.

로 정리할 수 있다.

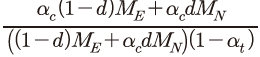

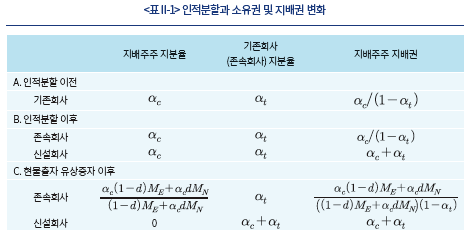

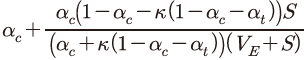

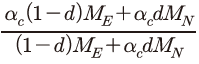

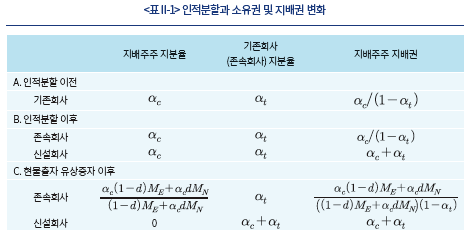

이상에서 논의한 내용을 정리하면 <표 II-1>과 같다. 1열과 2열은 각각 지배주주와 기존회사(존속회사)의 지분율을, 3열은 지배주주의 지배권을 제시하고 있다. 지배주주 지배권은 지배주주의 의결권 비중과 지배주주가 지배하는 존속회사의 의결권 비중을 합산한 값으로, 의결권이 없는 자기주식의 지분율을 배제하고 계산한다.

인적분할과 이어지는 현물출자 유상증자를 통해, 지배주주는 존속회사를 소유하고 존속회사는 신설회사를 소유하는 구조, 즉 지배주주가 존속회사를 직접 지배하고 존속회사를 통해 신설회사를 지배하는 구조가 구축된다. 지배주주의 신설회사에 대한 지배권은 , 존속회사에 대한 지배권은

, 존속회사에 대한 지배권은  로 조정되어, 두 회사에 대한 지배권은 모두 인적분할 이전 지배주주의 기존회사 지배권

로 조정되어, 두 회사에 대한 지배권은 모두 인적분할 이전 지배주주의 기존회사 지배권  보다 증가한다.

보다 증가한다.

공정거래법에 따르면 지주회사는 자회사가 상장기업인 경우 30% 이상의 지분을 보유하도록 되어 있다.5) 인적분할을 통해 기존회사가 지주회사로 전환되고 신설회사가 지주회사의 자회사가 된다고 할 때, <표 II-1>에 따르면 지주회사의 자회사 지분율은 현물출자 유상증자 후 이 된다. 자사주 마법을 활용하지 않는다면 현물출자 유상증자를 거치더라도 지주회사의 자회사 지분율은

이 된다. 자사주 마법을 활용하지 않는다면 현물출자 유상증자를 거치더라도 지주회사의 자회사 지분율은  를 넘지 못하며, 현물출자 유상증자를 시행하지 않는다면 자사주 마법을 활용하더라도 지주회사의 자회사 지분율은

를 넘지 못하며, 현물출자 유상증자를 시행하지 않는다면 자사주 마법을 활용하더라도 지주회사의 자회사 지분율은  를 넘지 못한다. 지주회사 전환을 위한 인적분할에서 자사주 마법과 현물출자 유상증자가 함께 활용될 수밖에 없는 이유가 여기에 있다. 지배주주의 지분율

를 넘지 못한다. 지주회사 전환을 위한 인적분할에서 자사주 마법과 현물출자 유상증자가 함께 활용될 수밖에 없는 이유가 여기에 있다. 지배주주의 지분율  이 낮을수록 그 필요성은 더욱 크다.

이 낮을수록 그 필요성은 더욱 크다.

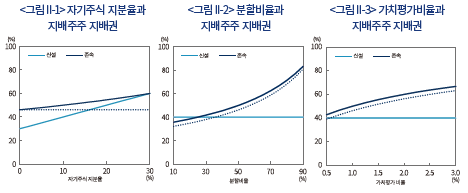

<표 II-1>에 따르면 인적분할 및 현물출자 유상증자 이후 지배주주의 지분율과 지배권의 변동에 영향을 미치는 요소는 자기주식 지분율 , 분할비율

, 분할비율 , 신설회사와 존속회사의 가치평가비율

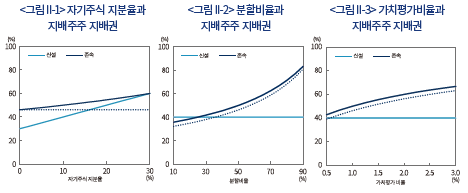

, 신설회사와 존속회사의 가치평가비율 등 세 가지이다. <그림 II-1>, <그림 II-2>, <그림 II-3>은 이들 세 가지 요인의 영향을 도식화하고 있다.

등 세 가지이다. <그림 II-1>, <그림 II-2>, <그림 II-3>은 이들 세 가지 요인의 영향을 도식화하고 있다.

세 그림에서, 붉은 실선은 신설회사에 대한 지배주주의 지배권(지배주주가 지배하는 존속회사의 신설회사 지분율)을, 파란 실선은 존속회사에 대한 지배주주의 지배권을, 파란 점선은 존속회사에 대한 지배주주의 지분율을 각각 의미한다. 인적분할 이전 지배주주 지분율 30%, 자기주식 지분율 10%, 신설회사와 존속회사의 가치평가비율 1, 분할비율 0.5를 기본값으로 둔다.

<그림 II-1>은 자기주식 지분율, 을 변동시켰을 때 지배주주 지배권과 지분율이 어떻게 변화하는지 보여준다. 자기주식 지분율이 0%일 때 지배주주의 신설회사 지배권은 30%, 존속회사 지배권은 46%이다. 여기서 자기주식 지분율이 20%로 증가하면 지배주주의 신설회사에 대한 지배권은 50%로, 존속회사에 대한 지배권은 55%로 증가한다. 자기주식 지분율이 높을수록 지배주주의 신설회사와 존속회사에 대한 지배권이 증가하는 것을 확인할 수 있다.

을 변동시켰을 때 지배주주 지배권과 지분율이 어떻게 변화하는지 보여준다. 자기주식 지분율이 0%일 때 지배주주의 신설회사 지배권은 30%, 존속회사 지배권은 46%이다. 여기서 자기주식 지분율이 20%로 증가하면 지배주주의 신설회사에 대한 지배권은 50%로, 존속회사에 대한 지배권은 55%로 증가한다. 자기주식 지분율이 높을수록 지배주주의 신설회사와 존속회사에 대한 지배권이 증가하는 것을 확인할 수 있다.

<그림 II-2>는 분할비율, 가 지배주주 지배권에 미치는 영향을 보여준다. 분할비율은 지배주주의 신설회사에 대한 지배권에는 영향을 주지 않으나, 분할비율이 커질수록 지배주주의 존속회사에 대한 지배권이 증가한다. 분할비율이 클수록 신설회사 지분으로 교환할 수 있는 존속회사 지분율이 커지기 때문에 나타나는 결과다.

가 지배주주 지배권에 미치는 영향을 보여준다. 분할비율은 지배주주의 신설회사에 대한 지배권에는 영향을 주지 않으나, 분할비율이 커질수록 지배주주의 존속회사에 대한 지배권이 증가한다. 분할비율이 클수록 신설회사 지분으로 교환할 수 있는 존속회사 지분율이 커지기 때문에 나타나는 결과다.

<그림 II-3>은 가치평가비율, 가 지배주주 지배권에 미치는 영향을 보여준다. 가치평가비율이 증가할수록, 즉 신설회사의 가치평가 수준이 존속회사에 비해 상대적으로 높을수록 지배주주의 존속회사에 대한 지배권이 상승한다. 신설회사의 기업가치평가 수준이 상대적으로 높을수록 신설회사 지분의 가치가 증가하고 더 많은 존속회사 주식과 교환할 수 있기 때문이다. 가치평가비율은 분할비율과 마찬가지로 지배주주의 신설회사에 대한 지배권에는 영향을 주지 않는다.

가 지배주주 지배권에 미치는 영향을 보여준다. 가치평가비율이 증가할수록, 즉 신설회사의 가치평가 수준이 존속회사에 비해 상대적으로 높을수록 지배주주의 존속회사에 대한 지배권이 상승한다. 신설회사의 기업가치평가 수준이 상대적으로 높을수록 신설회사 지분의 가치가 증가하고 더 많은 존속회사 주식과 교환할 수 있기 때문이다. 가치평가비율은 분할비율과 마찬가지로 지배주주의 신설회사에 대한 지배권에는 영향을 주지 않는다.

요약하면, 인적분할과 이어지는 현물출자 유상증자에서 기존회사의 자기주식 지분율은 신설회사에 대한 지배권에, 분할비율과 기업가치비율은 존속회사에 대한 지배권에 영향을 주는 요소라 할 수 있다.

III. 인적분할과 자사주 마법: 실증분석

자사주 마법을 활용한 인적분할과 이어지는 현물출자 유상증자가 신설회사와 존속회사의 소유구조에 어떠한 변화를 가져오는지, 지배주주와 외부주주 사이의 부(wealth)의 배분에 어떠한 영향을 미치는지 실증적으로 검토해 보자.

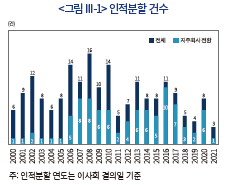

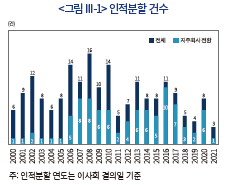

2000년부터 2021년 사이에 완료된 상장기업의 인적분할은 모두 193건으로 집계된다. <그림 III-1>에 따르면 인적분할은 2000년대 후반 이후 완만한 감소 추세를 보이고 있으나 매년 꾸준히 이루어지고 있는 것으로 나타난다. 193건 중 지주회사 전환과 관련된 인적분할은 92건이다. 이 기간 동안 공정거래법상 지주회사로 지정된 상장기업이 147개사라는 사실을 고려하면, 인적분할이 지주회사 전환 과정에서 널리 활용되는 기업구조조정 수단임을 알 수 있다.

한편 유가증권시장 상장기업의 인적분할이 136건, 코스닥시장 상장기업의 인적분할이 57건으로 유가증권시장 상장기업의 인적분할이 70%를 차지한다. 지주회사 전환과 관련된 인적분할은 유가증권시장이 136건 중 72건, 코스닥시장이 57건 중 20건으로 유가증권시장 상장기업에서 지주회사 전환을 위한 인적분할의 비중이 더 크다.

193건의 인적분할 중에서, 분할합병 과정에서 추진된 인적분할 15건, 기업구조조정 협약, 기업개선약정, 회사정리절차 등의 일환으로 추진된 비자발적 인적분할 7건, 인적분할로 신설된 회사가 비상장회사인 경우 17건, 분석에 필요한 자료가 확보되지 않는 10건을 제외한 144건을 대상으로 실증분석을 진행한다.

144건 중에서 지주회사 전환과 관련된 인적분할은 모두 82건, 지주회사 전환과 무관한 인적분할은 62건이다. 앞서 살펴본 바와 같이 지주회사 전환과 관련된 인적분할은 현물출자 유상증자가 동반되어 소유구조의 변동이 상대적으로 크다는 점을 고려하여, 이하의 실증분석에서는 지주회사 전환 관련 인적분할과 지주회사 비전환 인적분할로 표본을 구분하여 분석한다.

인적분할의 구체적인 내용과 일정에 대한 정보는 한국거래소 전자공시(KIND)로부터 확보하였으며, 상장기업 주가 관련 자료와 재무제표자료는 DataGuide, 소유구조 관련자료는 KOCOINFO의 TS2000을 통해 수집하였다.

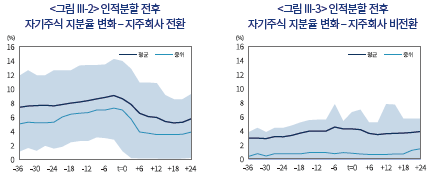

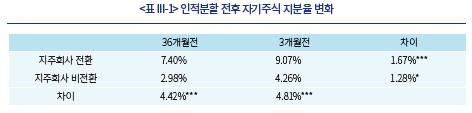

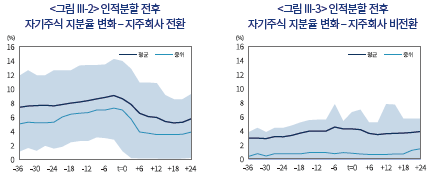

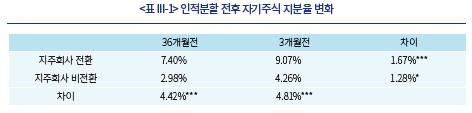

1. 인적분할 전후 자기주식 지분율 변화

인적분할 과정에서 나타나는 자사주 마법과 관련하여 인적분할 전후 자기주식 지분율의 추이를 살펴보자. <그림 III-2>와 <그림 III-3>은 각각 지주회사 전환 표본과 비전환 표본의 인적분할 기준일 전후 60개월 동안의 자기주식 지분율 변화를 보여준다.

지주회사 전환 인적분할 기업의 자기주식 지분율은 인적분할 36개월전 평균(중간값) 7.40% (5.02%)에서 인적분할 3개월 전 9.07%(7.26%)로 1.67%p(2.24%p) 상승하고(<그림 II-5>), 지주회사 비전환 인적분할 기업의 자기주식 지분율은 같은 기간 2.98%(0.37%)에서 4.26%(0.89%)로 1.28%p(0.52%p) 상승하는 것으로 나타난다(<그림 II-6>). 지주회사 전환 인적분할 기업의 자기주식 지분율이 두 배 이상 높고, 인적분할 시점까지 증가폭도 크다는 사실을 확인할 수 있다. 인적분할 36개월전과 3개월전의 자기주식 지분율 차이의 통계적 유의성을 검토한 <표 III-1>은 이러한 사실을 뒷받침한다. 지주회사 전환 표본과 비전환 표본의 자기주식 지분율 차이는 통계적으로 유의하며, 지주회사 전환 표본에서 자기주식 지분율 증가가 보다 명확하게 관찰된다. 지주회사 전환 인적분할 기업이 자사주 마법을 활용하기 유리한 조건을 갖추고 있을 뿐만 아니라 자사주 마법을 염두에 두고 인적분할 이전에 자기주식 지분율을 증가시키고 있는 것으로 판단된다.

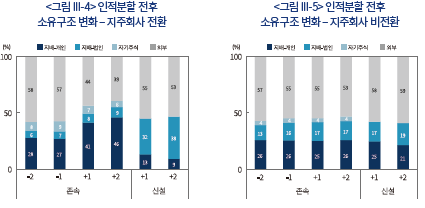

2. 인적분할 전후 소유구조 변화

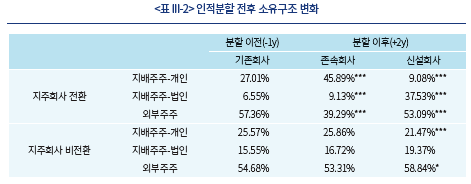

<표 II-1>을 통해 자사주 마법을 이용한 인적분할과 이어지는 현물출자 유상증자는 최종적으로 지배주주의 지배력을 강화하는 구조임을 확인하였다. 실제 인적분할 사례를 통해 인적분할 전후 소유구조의 변화를 구체적으로 살펴보자. 여기서 지배주주는 최대주주 및 특수관계인 전체를 의미하며, 지배주주-개인은 최대주주 개인 본인과 친족, 임원을, 지배주주-법인은 계열회사 및 비영리법인을 포함한다. 지주회사 전환 표본과 비전환 표본을 상호 비교하며, 지주회사 전환 표본은 존속회사가 지주회사인 경우로 한정한다.6)

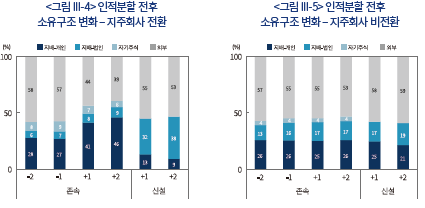

<그림 III-4>는 지주회사 전환 관련 인적분할 표본을 토대로 인적분할 전후 4년간 소유구조의 변화를 보여준다. 인적분할 직전 회계연도말(-1y) 기준으로 존속회사의 주주유형별 지분율은 지배주주-개인 27%, 지배주주-법인 7%, 자기주식 9%, 외부주주 57%로 나타난다. 지배주주 지분율은 34%로 같은 시점 상장기업의 평균 지배주주 지분율 41%보다 7% 가량 낮은데, 상대적으로 낮은 지배주주 지분율이 인적분할을 통한 지주회사 전환의 배경일 가능성을 생각해볼 수 있다. 인적분할 직후 회계연도말(+1y) 기준으로, 신설회사의 주주유형별 지분율은 지배주주-개인 13%, 지배주주-법인 32%, 외부주주 55%이며, 존속회사의 주주유형별 지분율은 지배주주-개인 41%, 지배주주-법인 8%, 자기주식 7%, 외부주주 44%로 나타난다.

인적분할 및 현물출자 유상증자 전후 소유구조의 변화는 다음과 같이 설명할 수 있다. 지배주주-개인의 인적분할 후 지분율은 신설회사와 존속회사 모두에서 27%로 동일하다. 이후 존속회사의 현물출자 유상증자에 참여하여 신설회사 지분을 존속회사에 출자하고 존속회사 지분을 확보함으로써 신설회사 지분율은 27%에서 13%로 감소하고 존속회사 지분율은 27%에서 41%로 증가하게 된다. 지배주주-법인은 인적분할 후 존속회사와 신설회사에 대해 각각 7%를 보유하게 되는데, 신설회사에 대해서는 자사주 마법으로 9%p가 추가되어 16%를 보유하게 된다. 존속회사의 현물출자 유상증자에서 존속회사는 지배주주-개인이 현물출자한 신설회사 지분을 확보하게 되고, 이에 따라 지배주주-법인의 신설회사에 대한 지배주주-법인의 지분율은 16%에서 32%로 증가한다.

인적분할 이후 두 번째 회계연도말(+2y)을 기준으로 보면, 지배주주-개인의 존속회사 지분율은 5%p 증가한 46%로, 신설회사 지분율은 4%p 감소한 9%로 나타난다. 동시에 지배주주-법인의 신설회사 지분율은 6%p 증가한 38%로 나타난다. 이는 일부 인적분할 표본에서 현물출자 유상증자가 첫 번째 회계연도말 이후에 마무리되었기 때문에 관찰되는 결과다.

<그림 III-5>는 지주회사 비전환 인적분할 표본의 소유구조 변화를 보여준다. 인적분할 직전 회계연도말(-1y) 기준으로 지배주주-개인, 지배주주-법인, 외부주주가 각각 26%, 16%, 55%를 보유하고 있다. 자기주식 지분율은 4%이다. 지배주주 지분율이 42%로 지주회사 전환 인적분할 표본에 비해 8%p 높아 지주회사 전환을 통한 지배주주의 지배력 강화 필요성이 상대적으로 낮다고 볼 수 있다. 지주회사 전환 인적분할 표본과 달리, 인적분할 이후 신설회사 및 존속회사의 지분율 구성은 인적분할 이전과 큰 차이가 없다. 신설회사의 경우 지배주주-개인, 지배주주-법인, 외부주주가 각각 25%, 17%, 58%를 보유하고 있으며, 존속회사의 경우 각각 25%, 17%, 57%를 보유하고 있다.

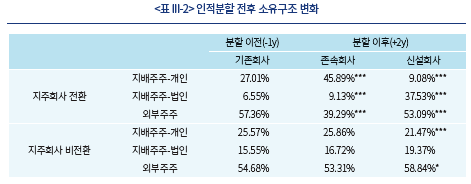

<표 III-2>는 인적분할 전후 주주유형별 지분율 변화의 통계적 유의성을 검토한 결과이다. 지주회사 전환 표본에서, 분할 이후 지배주주-개인의 지분은 존속회사로, 지배주주-법인의 지분은 신설회사로 집중되며 그 변화는 통계적으로 유의하다. 외부주주의 지분율은 분할 이전 57.36%였는데, 분할 이후 존속회사 지분율 39.29%, 신설회사 지분율 53.09%로 모두 유의하게 감소한다. 이러한 외부주주 지분율 감소는 지배주주의 추가적인 출자 없이 이루어진 결과다. 반면, 지주회사 비전환 표본에서 주주유형별 지분율 변화는 두드러지지 않는다. 외부주주의 신설회사 지분율은 인적분할 이후 오히려 유의하게 증가하는 것으로 나타나 지주회사 전환 표본과 대조적이다.

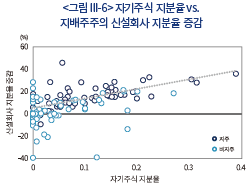

앞서 1절의 논의를 통해, 인적분할 및 현물출자 유상증자에 따른 지분율 변동은, 신설회사의 경우 자기주식 지분율에 의해 결정되고 존속회사의 경우 분할비율과 신설회사와 존속회사의 가치평가비율에 의해 결정됨을 확인한 바 있다. 이러한 관계를 실제 자료를 통해 확인해 보자.

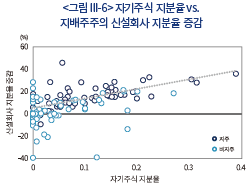

<그림 III-6>은 인적분할 직전 기존회사의 자기주식 지분율과 인적분할 전후(-1y부터 +2y까지) 지배주주의 신설회사 지분율 변화의 관계를 보여준다. <표 III-3>은 이 관계에 대한 회귀분석 결과이다. 자기주식 지분율이 높을수록 자사주 마법이 작동하면서 지배주주의 신설회사 지분율이 증가하는 모습이 명확하게 관찰된다. 회귀분석에서, 지주회사 전환 표본의 경우, 자기주식 지분율의 계수는 0.8569로 1% 수준에서 통계적으로 유의하며 결정계수(R2)는 0.4587이다. 지주회사 비전환 표본의 경우, 자기주식 지분율의 계수는 0.8239로 지주회사 전환 표본과 유사하고 5% 수준에서 통계적으로 유의하다. 그러나 결정계수는 0.0833으로 설명력이 지주회사 전환 표본에 비해 낮다. 예상된 바와 같이 자사주 마법의 효과는 지주회사 전환 표본에서 명확하게 관찰된다.

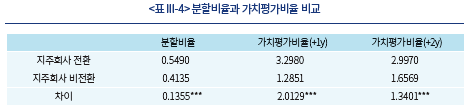

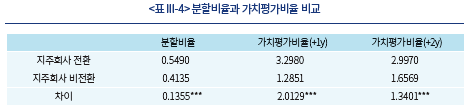

다음은 분할비율과 가치평가비율의 영향이다. <표 III-4>는 지주회사 전환 표본과 비전환 표본의 분할비율 과 가치평가비율

과 가치평가비율 을 비교하고 있다. 분할비율은 지주회사 전환 표본이 0.5490, 비전환 표본이 0.4135로 지주회사 전환 표본이 크고 그 차이는 통계적으로 유의하다. 가치평가비율도 마찬가지로 지주회사 전환 표본이 비전환 표본에 비해 유의하게 크다. 인적분할 직후 회계연도말 기준(+1y)으로 지주회사 전환 표본의 가치평가비율은 3.2980에 이르는 반면 비전환 표본의 가치평가비율은 1.2851에 불과하다. 지주회사 전환 표본의 경우 일반적으로 기존회사의 사업부문을 신설회사로 분할하고 존속회사는 자회사에 대한 지배를 주된 사업으로 하는 지주회사로 전환한다. 반면 지주회사 비전환 표본은 기존회사가 영위하는 사업의 일부를 신설회사로 분할하여 존속회사와 신설회사의 사업영역에 독립성을 부여하고자 하는 경우가 많다. 이런 측면에서 볼 때 <표 II-5>의 결과는 충분히 예상되는 결과다.

을 비교하고 있다. 분할비율은 지주회사 전환 표본이 0.5490, 비전환 표본이 0.4135로 지주회사 전환 표본이 크고 그 차이는 통계적으로 유의하다. 가치평가비율도 마찬가지로 지주회사 전환 표본이 비전환 표본에 비해 유의하게 크다. 인적분할 직후 회계연도말 기준(+1y)으로 지주회사 전환 표본의 가치평가비율은 3.2980에 이르는 반면 비전환 표본의 가치평가비율은 1.2851에 불과하다. 지주회사 전환 표본의 경우 일반적으로 기존회사의 사업부문을 신설회사로 분할하고 존속회사는 자회사에 대한 지배를 주된 사업으로 하는 지주회사로 전환한다. 반면 지주회사 비전환 표본은 기존회사가 영위하는 사업의 일부를 신설회사로 분할하여 존속회사와 신설회사의 사업영역에 독립성을 부여하고자 하는 경우가 많다. 이런 측면에서 볼 때 <표 II-5>의 결과는 충분히 예상되는 결과다.

소유구조 변동의 관점에서 <표 III-4>가 갖는 의미는, 지주회사 전환 표본이 갖는 특성이 지배주주의 존속회사에 대한 지배력을 극대화할 수 있는 조건이라는 것이다. <표 II-1>에서 검토한 바와 같이 분할비율이 클수록 또는 가치평가비율이 클수록 현물출자 유상증자를 통해 지배주주의 존속회사에 대한 지배력이 높아질 수 있기 때문이다.

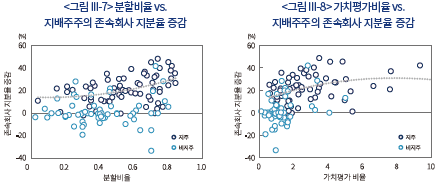

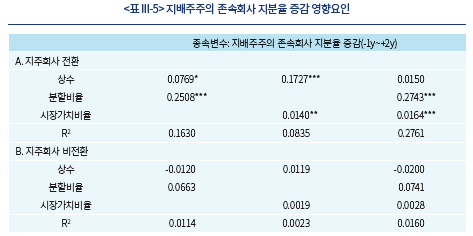

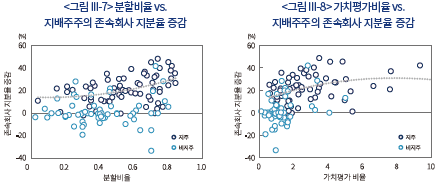

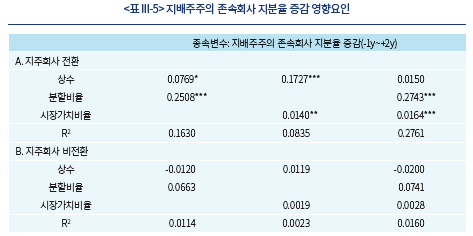

<그림 III-7>과 <그림 III-8>은 각각 분할비율과 지배주주의 존속회사 지분율 증감 사이의 관계, 신설회사와 존속회사의 기업가치비율과 지배주주의 존속회사 지분율 증감 사이의 관계를 보여주고 있다. 지주회사 전환 표본에서, 분할비율이 클수록, 또는 신설회사의 시장가-장부가 비율이 존속회사에 비해 클수록 인적분할 및 현물출자 유상증자 후 지배주주의 존속회사 지분율이 증가하는 것을 확인할 수 있다. 이러한 관계는 <그림 II-2>와 <그림 II-3>에서 도출한 결과와 일관된다. 반면 지주회사 비전환 표본에서는 유의한 관계가 관찰되지 않는다.

<표 III-5>는 <그림 III-7>과 <그림 III-8>의 관계에 대해 회귀분석을 시행한 결과다. 지주회사 전환 표본에 대한 결과(A)에 따르면, 분할비율이 클수록, 또는 신설회사의 가치평가 수준이 상대적으로 높을수록, 지배주주의 존속회사에 대한 지분율이 증가하고 그 관계는 통계적으로 유의함을 확인할 수 있다. 지주회사 비전환 표본에 대한 결과(B)에서는, 분할비율 또는 시장가치비율과 지배주주의 존속회사 지분율 변화 사이에 유의한 관계가 확인되지 않는다. 이 관계는 현물출자 유상증자를 통해 형성되는데 지주회사 비전환 표본에서는 현물출자 유상증자의 필요성이 낮고 실제 시행되지 않기 때문이다.

3. 인적분할 전후 부의 배분 변화

이상에서 인적분할 전후의 소유구조 변화와 그 결정요인에 대해 살펴보았다. 지주회사 전환 관련 인적분할의 경우, 지배주주의 존속회사와 신설회사 지분율이 모두 인적분할 이전에 비해 유의하게 증가한다는 사실이 확인된다. 이는 두 회사에서 외부주주의 지분율이 감소한다는 것을 의미하며 그 결과 외부주주에게 귀속되는 부의 비중도 줄어들었을 가능성이 높다는 것을 시사한다.

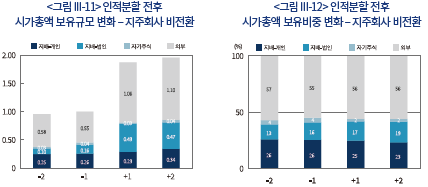

인적분할 전후 4년간 지배주주와 외부주주의 시가총액 보유비중 변화를 살펴보자. 각 시점의 시가총액은 인적분할 직전 회계연도말의 기존회사 시가총액으로 나누어 표준화한다. 즉 각 표본에서 인적분할 직전 회계연도말 시가총액은 1이다.

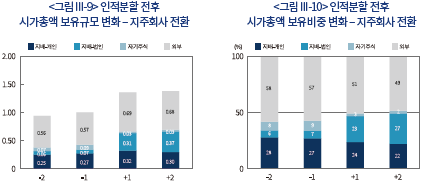

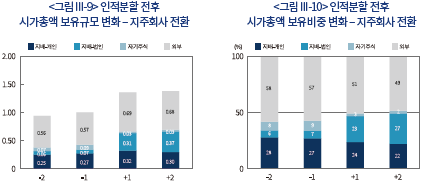

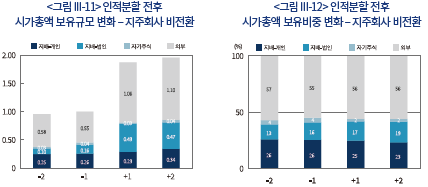

<그림 III-9>는 지주회사 전환 표본의 주주유형별 시가총액 보유금액 변화를 보여준다. 인적분할 이후의 값은 존속회사에 대해 보유한 시가총액과 신설회사에 대해 보유한 시가총액을 합산한 값이다. 지배주주-개인이 보유한 시가총액은 인적분할 직전(-1y) 0.27에서 인적분할 직후(+1y) 0.32로, 지배주주-법인은 같은 기간 0.07에서 0.31로 증가한다. 지배주주-개인과 지배주주-법인이 보유한 시가총액은 합산하여 0.34에서 0.63으로 88% 증가한 것으로 나타난다. 반면 외부주주는 0.57에서 0.69로 불과 21% 증가하는데 그친다.

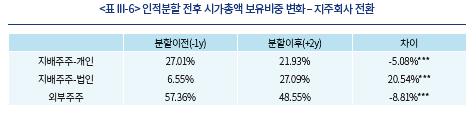

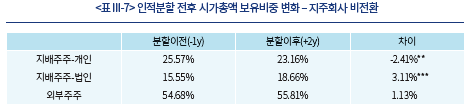

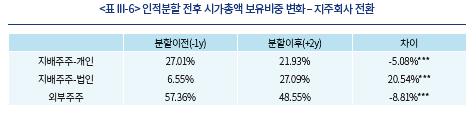

<그림 III-10>은 <그림 III-9>의 주주유형별 시가총액 보유규모를 보유비중으로 전환하여 나타낸 것이다. 지배주주-개인과 지배주주-법인의 시가총액 보유 비중은 인적분할 이전(-1) 34%에서 인적분할 이후(+1) 47%로 13%p 증가하는 반면, 외부주주의 시가총액 보유비중은 57%에서 51%로 6%p 감소한다. <표 III-6>은 분할이전(-1y)와 분할이후(+2y)의 시가총액 보유비중 변화를 통계적으로 검토한 결과이다. 외부주주의 보유비중 변화는 –8.81%p로 1% 수준에서 통계적으로 유의하다.

지배주주의 추가적인 출연 없이 인적분할과 현물출자 유상증자를 통해 이루어진 지배주주의 지배력 강화의 비용은 결국 외부주주가 지불하고 있는 것으로 평가할 수 있다. 아울러 인적분할을 통한 기업구조조정의 시너지가 존재한다 하더라도 그 과실은 지배주주와 외부주주 사이에 균등하게 배분되지 않는 것으로 볼 수 있다.

<그림 III-11>은 지주회사 비전환 표본의 주주유형별 시가총액 보유금액 변화를 보여준다. 지배주주-개인과 지배주주-법인이 보유한 시가총액은 인적분할 이전(-1y) 0.41에서 인적분할 이후(+1y) 0.78로 90% 증가한 것으로 나타난다. 외부주주가 보유한 시가총액은 인적분할 이전 0.55에서 인적분할 이후 1.06으로 94% 증가한 것으로 나타난다. 지배주주보다 외부주주의 부의 증가율이 소폭 높아 지주회사 전환 표본과 구분된다.

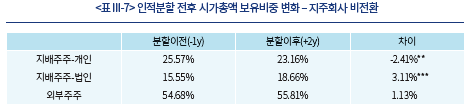

<그림 III-12>에서 지배주주와 외부주주의 시가총액 보유비중의 변화를 보면, 지배주주의 경우 인적분할 이전 41%, 인적분할 이후 42%로 큰 차이가 없고, 외부주주의 경우에도 인적분할 이전 55%, 인적분할 이후 56%로 큰 차이가 없다. 분할이전(-1y)와 분할이후(+2y)의 시가총액 보유비중 변화를 통계적으로 분석한 <표 III-7>에 따르면 외부주주의 보유비중 변화는 유의하지 않은 것으로 확인된다.

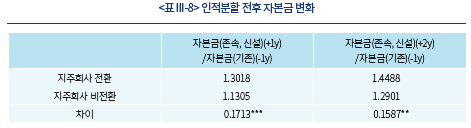

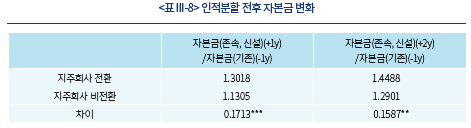

마지막으로 <표 III-8>은 인적분할 이전 기존회사의 자본금과 인적분할 이후 존속회사와 신설회사의 자본금의 비율을 계산하여 지주회사 전환 표본과 비전환 표본을 비교한 결과다. 자본금 증가율은 지주회사 전환 표본이 지주회사 비전환 표본에 비해 더 높고 그 차이는 통계적으로 유의하다. <그림 III-9>와 <그림 III-11>의 결과와 종합해 보면, 지주회사 비전환 표본은 인적분할 이후 유상증자를 시행한 지주회사 전환 표본만큼 자본을 확충하지 않았음에도 현저히 높은 시가총액 증가율을 나타내고 있다. 이는 지주회사 비전환 표본의 인적분할을 통한 기업구조조정이 시장의 긍정적인 평가를 얻고 있다고 해석할 수 있다.7) 반면 지주회사 전환 표본은 자본금 증가율과 시가총액 증가율에 큰 차이가 없어 지주회사 비전환 표본과는 다른 시장의 평가를 받고 있는 것으로 보인다. 평가의 차이는 인적분할 목적의 차이에서 비롯된 것이고 지배권과 부의 배분에서 나타나는 왜곡과 무관하지 않을 것으로 추정된다.

IV. 요약 및 정책적 시사점

본고의 분석을 통해, 자사주 마법은 지주회사 전환을 위한 인적분할 과정에서 현물출자 유상증자와 짝을 이루어 지배주주의 지배력을 강화하는 수단으로 활용되고 있음을 확인하였다. 아울러 지배주주의 추가적인 출연없이 이루어지는 지배주주의 지배력 강화는 결국 외부주주의 이익을 침해하는 결과를 초래하는 것으로 분석된다. 반면 지주회사 전환과 무관한 인적분할의 경우 지배주주와 외부주주의 지배권 분포와 부의 배분에 유의한 변화가 나타나지 않으며 기업구조조정 시너지에 대한 시장의 긍정적 평가가 관찰된다.

지배력과 부의 배분에 왜곡을 일으키는 자사주 마법이 많은 논란속에서도 지속되어 온 이유는 자기주식의 경제적 실질에 대해 일관성을 갖추지 못한 규제체계에 근본 원인이 있는 것으로 보인다.

경제적 관점에서 자기주식은 자산으로 볼 수 없다. 주식을 보유함으로써 확보하는 권리는 의결권, 배당권, 잔여재산 분배청구권 등을 들 수 있는데, 자기주식에 대해 이러한 권리는 인정되지 않는다. 상법상 의결권은 제한되며, 자기주식의 배당권과 잔여재산 분배청구권은 경제적으로 무의미하다. 그렇다면, 자기주식의 취득은 회사 재산을 주주에게 환원하는 행위로서 경제적 실질이 이익배당과 동일하다고 보는 것이 타당하다. 주주로부터 주식을 취득하는 형식을 취하고 있으나 그 주식은 더 이상 자산이 아니므로 취득한 금액 만큼 주주환원이 이루어졌다고 보면 된다. 회계적으로 자기주식의 취득을 자본의 차감 항목으로 반영하는 것이나, 자기주식 취득의 재원을 배당가능이익으로 제한하는 것은 자기주식 취득을 이익배당과 동일하게 인식한 결과라 할 수 있다. 자기주식 취득에 주주평등의 원칙을 적용하는 것도 마찬가지 이유다. 동일한 논리로, 자기주식 처분은 신주를 발행하는 것과 같다. 회계적으로 자기주식 처분은 자본을 증가시키는, 자기주식 취득과 대칭적인 행위로 인식한다. 자기주식이라는 자산이 처분대금으로 교체되는 것이 아니라 새로운 주주로부터 새로운 자금이 유입되는 것이다.

그럼에도 불구하고 인적분할 과정에서 기존회사의 자기주식에 신설회사의 신주를 배정하는 것이 가능한 것은 자기주식의 자산성을 인정하는 법령과 판례가 존재하기 때문인 것으로 보인다. 상법상 자기주식은 이사회의 결의에 따라 임의로 처분할 수 있으며 합병의 대가, 현물배당의 수단, 질권 등으로 활용하는 것이 가능하다.8) 주식의 자산가치가 존재하고 그것이 주주권에서 유래한다고 볼 때, 인적분할 과정에서 기존회사의 자기주식에 대해 신설회사의 신주를 배정하지 않는 것은 주주권을 포기하는 것, 즉 자기주식을 보유한 회사의 가치를 훼손하는 것이라는 논리가 가능해지는 것이다.

자기주식의 취득과 회계처리에 있어서는 자기주식의 자산성을 부인하면서, 자기주식의 처분 또는 활용에 있어서는 자산성을 인정하는 모순적인 규제를 기화로 지배주주는 자기주식을 사적인 이익을 위해 남용할 수 있게 된다. 본고에서 다루고 있는 자사주 마법은 가장 대표적인 사례라 할 수 있다. 지주회사는 기업소유지배구조의 투명성을 제고하고자 도입된 것인데, 지주회사 체제로 전환하는 과정에서 자사주 마법이 적극적으로 활용되어 외부주주의 부가 편취되는 결과를 낳고 있는 것은 아이러니한 상황이 아닐 수 없다. 자사주 마법은 주요국에서는 발생할 수 없는 문제이기 때문에 한국의 기업지배구조 취약성과 함께 자기주식 관련 제도의 비일관성을 드러낸다.9) 지배주주의 자기주식 남용을 억제할 수 있는 방안을 강구해야 하며, 근본적으로 자기주식의 경제적 실질에 부합하는 일관된 규제체계를 구성할 필요가 있다.

1) 유진수(2014)는 36개 사례를, 박진우·이민교(2019)는 51개 사례를 분석하여 지주회사 전환 과정에서 자사주 마법을 활용한 인적분할이 지배주주의 지분율 상승에 기여하고 있음을 보여주고 있다.

2) 인적분할 과정에서 기존회사 자기주식의 전부 혹은 일부를 존속회사가 아닌 신설회사로 배정하는 것도 가능하나 이러한 사례는 드문 것으로 파악된다. 만약 기존회사의 자기주식을 신설회사로 이전하고 신설회사가 발행한 신주를 이전된 자기주식에 배정하는 경우 신설회사의 자기주식이 발생한다.

3) 제3자 배정방식을 선택하는 경우도 있으나 공매매수방식을 선택하는 경우가 더 많다(박진우·이민교, 2019).

4) 이는 박진우‧이민교(2019)의 실증분석 결과에 대체로 부합한다. 이들에 따르면, 인적분할 이후 현물출자 유상증자 규모는 지배주주의 신설회사 보유주식수 대비 평균 106%이며, 유상증자에서 지배주주 이외의 신설회사 주주는 보유지분의 5.42%만을 존속회사 지분으로 교환하는 것으로 나타난다. 한편 지배주주 이외의 신설회사 주주가 유상증자에 참여하지 않는 것은 이해부족, 정보부족, 무관심, 또는 낮은 기대이익 때문으로 추정하고 있다.

5) 1999년 12월 지주회사 설립 및 전환을 허용할 당시 30%였으나 2007년 4월 20%로 완화되었고 2021년 12월 30%로 다시 상향 조정되었다.

6) 지주회사 전환 표본에서 존속회사가 지주회사인 경우가 대부분이나 신설회사가 지주회사인 경우가 일부 존재한다. 존속회사와 신설회사의 소유구조 변화를 비교할 때 혼동을 줄 우려가 있으므로 신설회사가 지주회사인 일부 표본을 제외한다.

7) 정무권(2018)도 유사한 결과를 보고하고 있다.

8) 정준우(2012), 안성포(2017)

9) 미국의 경우 자사주를 미발행주식으로 취급하는 주에서는 자사주 마법이 원천적으로 불가능하며, 금고주로 취급하더라도 자사주에 대한 현금, 현물배당이 불가하므로 자사주 마법은 발생할 수 없다. 일본은 인적분할이 허용되지 않으며, 독일은 자사주에 대해 분할신주를 배정하지 못하도록 규정되어 있다(박상인, 2019).

참고문헌

공정거래위원회, 2018. 11. 13, 공정거래법상 지주회사 현황 분석 결과 발표, 보도자료.

김우찬, 2020, 제21대 국회 개혁입법과제 제안-경제민주화 과제를 중심으로, 『경제개혁 이슈』 2020-4호, 1-206.

노혁준, 2008, 자기주식과 기업의 합병, 분할, 『증권법연구』 9(2), 117-153.

노혁준, 2018, 기업구조조정과 자기주식의 쟁점 및 입법적 개선방안, 『법학연구』 28(1), 111-142.

박상인, 2019, 한국 기업의 자사주 취득 및 보유에 관한 연구, 시장과 정부 연구센터.

박진우‧이민교, 2019, 중견기업의 인적분할을 통한 지주회사 전환, 『한국증권학회지』 48(1), 1-27.

안성포, 2017, 기업재편과 취득한 자기주식의 처분과 소각, 『법학연구』 20(4), 1-42.

유진수, 2014, 인적분할을 통한 지주회사 전환에 대한 연구, 『산업조직연구』 22(2), 73-95.

이상훈, 2020a, 인적 분할과 자사주마법, 『상사법연구』 39(2), 367-412.

이상훈, 2020b, 자사주 마법(魔法)과 해법(解法)-합병의 일방이 보유한 자기주식 또는 상대방 주식의 처리, 『상사법연구』 39(1), 265-308.

이은정, 2017, 지주회사 전환 동향과 전환 관련 규제 개선안, 『ERRI 이슈&분석』, 1-22.

정무권, 2018, 인적분할과 기업가치, 『재무관리연구』 35(3), 217-243.

정준우, 2012, 개정상법상 자기주식의 재무관리에 관한 쟁점사항 검토, 『법학연구』 15(3), 651-685.

황남석, 2015, 회사분할과 자기주식, 『조세법연구』 21(1), 117-138.

인적분할은 하나의 회사를 둘 이상의 회사로 분할하는 기업구조조정의 한 방법이다. 회사의 재산을 분할하여 새로운 회사를 설립하고 새로 설립된 회사가 발행한 신주를 기존회사의 주주에게 각 주주의 지분율에 따라 배정하는 형식이다. 기존회사 지분 10%를 보유하고 있었던 주주는 인적분할 후, 존속회사 지분 10%와 신설회사 지분 10%를 동시에 보유하게 된다. 한편 기존회사의 잔여재산과 법인격은 존속회사가 승계한다.

만약 기존회사가 자기주식을 보유하고 있었다면, 인적분할 과정에서 기존회사를 주주로 간주하여 신설회사의 신주를 배정하는 것이 가능하다. 인적분할 이후 존속회사는 신설회사의 지분을 보유하게 되고, 결과적으로 지배주주는 자신이 지배하는 존속회사가 보유한 신설회사 지분만큼 신설회사에 대해 강화된 지배력을 행사할 수 있게 된다. 이러한 지배력 강화가 지배주주의 추가적인 출연없이 달성되기 때문에 자사주 ‘마법’이라 부르며, 외부주주의 이익을 침해하는 행위라는 비판이 지속적으로 제기되어 왔다.

자사주 마법은 의도된 선택이라는 점에서 그 본질이 지배주주와 외부주주의 이해상충이라는 사실은 명백하다. 자사주 마법을 제한하기 위한 법안이 2015년부터 지금까지 9건 발의되었고, 공정거래위원회(2018.11.13)는 지주회사 전환과정에서 총수일가의 지배력이 크게 증가하는 배경으로 자사주 마법을 활용한 인적분할을 지적하면서 총수일가의 과도한 지배력 확대를 방지할 수 있도록 제도개선이 필요함을 인정하였다. 그럼에도 불구하고 자사주 마법은 여전히 지주회사 전환과정에서 빈번하게 활용되고 있다.

본고는 자사주 마법을 활용한 인적분할의 구조를 검토하고 자사주 마법이 활용되는 실태를 실증적으로 분석하는 것을 목적으로 한다. 그간 자사주 마법의 문제점에 대해 법규제적 관점의 논의는 다각적으로 이루어져 왔으나(노혁준, 2008; 노혁준, 2018; 황남석, 2015; 이은정, 2017; 이상훈, 2020a; 이상훈, 2020b), 자사주 마법의 경제적 유인구조를 조명하고 활용 실태를 실증적으로 분석한 연구는 많지 않았던 것으로 파악된다(유진수, 2014; 박진우·이민교, 2019).1) 본고의 분석은 자사주 마법의 본질과 폐해를 구체적으로 제시함으써 자사주 마법을 억제하기 위한 제도 개선의 필요성을 강조하고자 한다.

II. 인적분할과 자사주 마법의 구조

자사주 마법을 활용한 인적분할의 구조를 이해하기 위해 인적분할을 모형으로 구성하여 살펴보자. 순자산이

인적분할 후, 지배주주의 존속회사 지분율은

인적분할 이후, 특히 인적분할이 지주회사 전환과 관련된 경우, 존속회사의 현물출자 유상증자가 이어지는 경우가 대부분이다. 현물출자 유상증자는 통상 신설회사 주주를 대상으로 한 공개매수 형태로 이루어지는데 공개매수에 응하는 신설회사 주주는 신설회사 주식을 존속회사에 현물출자하고 존속회사가 발행한 신주를 받게 된다.3) 지배주주가 보유한 신설회사 지분을 존속회사 지분으로 교체함으로써, 지배주주가 존속회사를 소유하고 존속회사가 신설회사를 소유하는 지주회사 구조를 구축하는 것이 현물출자 유상증자의 목적이다.

존속회사가 규모가

지배주주는 신설회사 지분

를 존속회사에 출자하고 존속회사의 신주

를 존속회사에 출자하고 존속회사의 신주  주를 추가로 확보하게 된다. 지배주주가 보유한 존속회사 주식 수는

주를 추가로 확보하게 된다. 지배주주가 보유한 존속회사 주식 수는  주에서

주에서  주로 증가하고, 유상증자 후 존속회사 주식 수는

주로 증가하고, 유상증자 후 존속회사 주식 수는  주로 증가하므로, 지배주주의 존속회사 지분율은 당초

주로 증가하므로, 지배주주의 존속회사 지분율은 당초  로 증가한다. 여기서 주목되는 것은 지분율 증가폭이 존속회사의 신설회사 지분율

로 증가한다. 여기서 주목되는 것은 지분율 증가폭이 존속회사의 신설회사 지분율  로 감소한다.

로 감소한다.현물출자 유상증자의 목적이 지배주주의 존속회사 지분율을 최대화하는 것이라면 그 조건은 지배주주 이외의 신설회사 주주의 유상증자 참여가 최소화되고

, 신설회사 지분율은 0이 된다. 존속회사의 신설회사 지분율은, 지배주주가 보유한 신설회사 지분

, 신설회사 지분율은 0이 된다. 존속회사의 신설회사 지분율은, 지배주주가 보유한 신설회사 지분 존속회사와 신설회사의 시장가-장부가 비율을 각각

, 라 하면, 지배주주의 존속회사에 대한 지분율은

, 라 하면, 지배주주의 존속회사에 대한 지분율은  로 정리할 수 있다.

로 정리할 수 있다.이상에서 논의한 내용을 정리하면 <표 II-1>과 같다. 1열과 2열은 각각 지배주주와 기존회사(존속회사)의 지분율을, 3열은 지배주주의 지배권을 제시하고 있다. 지배주주 지배권은 지배주주의 의결권 비중과 지배주주가 지배하는 존속회사의 의결권 비중을 합산한 값으로, 의결권이 없는 자기주식의 지분율을 배제하고 계산한다.

인적분할과 이어지는 현물출자 유상증자를 통해, 지배주주는 존속회사를 소유하고 존속회사는 신설회사를 소유하는 구조, 즉 지배주주가 존속회사를 직접 지배하고 존속회사를 통해 신설회사를 지배하는 구조가 구축된다. 지배주주의 신설회사에 대한 지배권은

로 조정되어, 두 회사에 대한 지배권은 모두 인적분할 이전 지배주주의 기존회사 지배권

로 조정되어, 두 회사에 대한 지배권은 모두 인적분할 이전 지배주주의 기존회사 지배권 공정거래법에 따르면 지주회사는 자회사가 상장기업인 경우 30% 이상의 지분을 보유하도록 되어 있다.5) 인적분할을 통해 기존회사가 지주회사로 전환되고 신설회사가 지주회사의 자회사가 된다고 할 때, <표 II-1>에 따르면 지주회사의 자회사 지분율은 현물출자 유상증자 후

<표 II-1>에 따르면 인적분할 및 현물출자 유상증자 이후 지배주주의 지분율과 지배권의 변동에 영향을 미치는 요소는 자기주식 지분율

<그림 II-1>은 자기주식 지분율,

<그림 II-2>는 분할비율,

<그림 II-3>은 가치평가비율,

III. 인적분할과 자사주 마법: 실증분석

자사주 마법을 활용한 인적분할과 이어지는 현물출자 유상증자가 신설회사와 존속회사의 소유구조에 어떠한 변화를 가져오는지, 지배주주와 외부주주 사이의 부(wealth)의 배분에 어떠한 영향을 미치는지 실증적으로 검토해 보자.

2000년부터 2021년 사이에 완료된 상장기업의 인적분할은 모두 193건으로 집계된다. <그림 III-1>에 따르면 인적분할은 2000년대 후반 이후 완만한 감소 추세를 보이고 있으나 매년 꾸준히 이루어지고 있는 것으로 나타난다. 193건 중 지주회사 전환과 관련된 인적분할은 92건이다. 이 기간 동안 공정거래법상 지주회사로 지정된 상장기업이 147개사라는 사실을 고려하면, 인적분할이 지주회사 전환 과정에서 널리 활용되는 기업구조조정 수단임을 알 수 있다.

193건의 인적분할 중에서, 분할합병 과정에서 추진된 인적분할 15건, 기업구조조정 협약, 기업개선약정, 회사정리절차 등의 일환으로 추진된 비자발적 인적분할 7건, 인적분할로 신설된 회사가 비상장회사인 경우 17건, 분석에 필요한 자료가 확보되지 않는 10건을 제외한 144건을 대상으로 실증분석을 진행한다.

144건 중에서 지주회사 전환과 관련된 인적분할은 모두 82건, 지주회사 전환과 무관한 인적분할은 62건이다. 앞서 살펴본 바와 같이 지주회사 전환과 관련된 인적분할은 현물출자 유상증자가 동반되어 소유구조의 변동이 상대적으로 크다는 점을 고려하여, 이하의 실증분석에서는 지주회사 전환 관련 인적분할과 지주회사 비전환 인적분할로 표본을 구분하여 분석한다.

인적분할의 구체적인 내용과 일정에 대한 정보는 한국거래소 전자공시(KIND)로부터 확보하였으며, 상장기업 주가 관련 자료와 재무제표자료는 DataGuide, 소유구조 관련자료는 KOCOINFO의 TS2000을 통해 수집하였다.

1. 인적분할 전후 자기주식 지분율 변화

인적분할 과정에서 나타나는 자사주 마법과 관련하여 인적분할 전후 자기주식 지분율의 추이를 살펴보자. <그림 III-2>와 <그림 III-3>은 각각 지주회사 전환 표본과 비전환 표본의 인적분할 기준일 전후 60개월 동안의 자기주식 지분율 변화를 보여준다.

지주회사 전환 인적분할 기업의 자기주식 지분율은 인적분할 36개월전 평균(중간값) 7.40% (5.02%)에서 인적분할 3개월 전 9.07%(7.26%)로 1.67%p(2.24%p) 상승하고(<그림 II-5>), 지주회사 비전환 인적분할 기업의 자기주식 지분율은 같은 기간 2.98%(0.37%)에서 4.26%(0.89%)로 1.28%p(0.52%p) 상승하는 것으로 나타난다(<그림 II-6>). 지주회사 전환 인적분할 기업의 자기주식 지분율이 두 배 이상 높고, 인적분할 시점까지 증가폭도 크다는 사실을 확인할 수 있다. 인적분할 36개월전과 3개월전의 자기주식 지분율 차이의 통계적 유의성을 검토한 <표 III-1>은 이러한 사실을 뒷받침한다. 지주회사 전환 표본과 비전환 표본의 자기주식 지분율 차이는 통계적으로 유의하며, 지주회사 전환 표본에서 자기주식 지분율 증가가 보다 명확하게 관찰된다. 지주회사 전환 인적분할 기업이 자사주 마법을 활용하기 유리한 조건을 갖추고 있을 뿐만 아니라 자사주 마법을 염두에 두고 인적분할 이전에 자기주식 지분율을 증가시키고 있는 것으로 판단된다.

<표 II-1>을 통해 자사주 마법을 이용한 인적분할과 이어지는 현물출자 유상증자는 최종적으로 지배주주의 지배력을 강화하는 구조임을 확인하였다. 실제 인적분할 사례를 통해 인적분할 전후 소유구조의 변화를 구체적으로 살펴보자. 여기서 지배주주는 최대주주 및 특수관계인 전체를 의미하며, 지배주주-개인은 최대주주 개인 본인과 친족, 임원을, 지배주주-법인은 계열회사 및 비영리법인을 포함한다. 지주회사 전환 표본과 비전환 표본을 상호 비교하며, 지주회사 전환 표본은 존속회사가 지주회사인 경우로 한정한다.6)

<그림 III-4>는 지주회사 전환 관련 인적분할 표본을 토대로 인적분할 전후 4년간 소유구조의 변화를 보여준다. 인적분할 직전 회계연도말(-1y) 기준으로 존속회사의 주주유형별 지분율은 지배주주-개인 27%, 지배주주-법인 7%, 자기주식 9%, 외부주주 57%로 나타난다. 지배주주 지분율은 34%로 같은 시점 상장기업의 평균 지배주주 지분율 41%보다 7% 가량 낮은데, 상대적으로 낮은 지배주주 지분율이 인적분할을 통한 지주회사 전환의 배경일 가능성을 생각해볼 수 있다. 인적분할 직후 회계연도말(+1y) 기준으로, 신설회사의 주주유형별 지분율은 지배주주-개인 13%, 지배주주-법인 32%, 외부주주 55%이며, 존속회사의 주주유형별 지분율은 지배주주-개인 41%, 지배주주-법인 8%, 자기주식 7%, 외부주주 44%로 나타난다.

인적분할 및 현물출자 유상증자 전후 소유구조의 변화는 다음과 같이 설명할 수 있다. 지배주주-개인의 인적분할 후 지분율은 신설회사와 존속회사 모두에서 27%로 동일하다. 이후 존속회사의 현물출자 유상증자에 참여하여 신설회사 지분을 존속회사에 출자하고 존속회사 지분을 확보함으로써 신설회사 지분율은 27%에서 13%로 감소하고 존속회사 지분율은 27%에서 41%로 증가하게 된다. 지배주주-법인은 인적분할 후 존속회사와 신설회사에 대해 각각 7%를 보유하게 되는데, 신설회사에 대해서는 자사주 마법으로 9%p가 추가되어 16%를 보유하게 된다. 존속회사의 현물출자 유상증자에서 존속회사는 지배주주-개인이 현물출자한 신설회사 지분을 확보하게 되고, 이에 따라 지배주주-법인의 신설회사에 대한 지배주주-법인의 지분율은 16%에서 32%로 증가한다.

인적분할 이후 두 번째 회계연도말(+2y)을 기준으로 보면, 지배주주-개인의 존속회사 지분율은 5%p 증가한 46%로, 신설회사 지분율은 4%p 감소한 9%로 나타난다. 동시에 지배주주-법인의 신설회사 지분율은 6%p 증가한 38%로 나타난다. 이는 일부 인적분할 표본에서 현물출자 유상증자가 첫 번째 회계연도말 이후에 마무리되었기 때문에 관찰되는 결과다.

<그림 III-5>는 지주회사 비전환 인적분할 표본의 소유구조 변화를 보여준다. 인적분할 직전 회계연도말(-1y) 기준으로 지배주주-개인, 지배주주-법인, 외부주주가 각각 26%, 16%, 55%를 보유하고 있다. 자기주식 지분율은 4%이다. 지배주주 지분율이 42%로 지주회사 전환 인적분할 표본에 비해 8%p 높아 지주회사 전환을 통한 지배주주의 지배력 강화 필요성이 상대적으로 낮다고 볼 수 있다. 지주회사 전환 인적분할 표본과 달리, 인적분할 이후 신설회사 및 존속회사의 지분율 구성은 인적분할 이전과 큰 차이가 없다. 신설회사의 경우 지배주주-개인, 지배주주-법인, 외부주주가 각각 25%, 17%, 58%를 보유하고 있으며, 존속회사의 경우 각각 25%, 17%, 57%를 보유하고 있다.

앞서 1절의 논의를 통해, 인적분할 및 현물출자 유상증자에 따른 지분율 변동은, 신설회사의 경우 자기주식 지분율에 의해 결정되고 존속회사의 경우 분할비율과 신설회사와 존속회사의 가치평가비율에 의해 결정됨을 확인한 바 있다. 이러한 관계를 실제 자료를 통해 확인해 보자.

<그림 III-6>은 인적분할 직전 기존회사의 자기주식 지분율과 인적분할 전후(-1y부터 +2y까지) 지배주주의 신설회사 지분율 변화의 관계를 보여준다. <표 III-3>은 이 관계에 대한 회귀분석 결과이다. 자기주식 지분율이 높을수록 자사주 마법이 작동하면서 지배주주의 신설회사 지분율이 증가하는 모습이 명확하게 관찰된다. 회귀분석에서, 지주회사 전환 표본의 경우, 자기주식 지분율의 계수는 0.8569로 1% 수준에서 통계적으로 유의하며 결정계수(R2)는 0.4587이다. 지주회사 비전환 표본의 경우, 자기주식 지분율의 계수는 0.8239로 지주회사 전환 표본과 유사하고 5% 수준에서 통계적으로 유의하다. 그러나 결정계수는 0.0833으로 설명력이 지주회사 전환 표본에 비해 낮다. 예상된 바와 같이 자사주 마법의 효과는 지주회사 전환 표본에서 명확하게 관찰된다.

소유구조 변동의 관점에서 <표 III-4>가 갖는 의미는, 지주회사 전환 표본이 갖는 특성이 지배주주의 존속회사에 대한 지배력을 극대화할 수 있는 조건이라는 것이다. <표 II-1>에서 검토한 바와 같이 분할비율이 클수록 또는 가치평가비율이 클수록 현물출자 유상증자를 통해 지배주주의 존속회사에 대한 지배력이 높아질 수 있기 때문이다.

<표 III-5>는 <그림 III-7>과 <그림 III-8>의 관계에 대해 회귀분석을 시행한 결과다. 지주회사 전환 표본에 대한 결과(A)에 따르면, 분할비율이 클수록, 또는 신설회사의 가치평가 수준이 상대적으로 높을수록, 지배주주의 존속회사에 대한 지분율이 증가하고 그 관계는 통계적으로 유의함을 확인할 수 있다. 지주회사 비전환 표본에 대한 결과(B)에서는, 분할비율 또는 시장가치비율과 지배주주의 존속회사 지분율 변화 사이에 유의한 관계가 확인되지 않는다. 이 관계는 현물출자 유상증자를 통해 형성되는데 지주회사 비전환 표본에서는 현물출자 유상증자의 필요성이 낮고 실제 시행되지 않기 때문이다.

이상에서 인적분할 전후의 소유구조 변화와 그 결정요인에 대해 살펴보았다. 지주회사 전환 관련 인적분할의 경우, 지배주주의 존속회사와 신설회사 지분율이 모두 인적분할 이전에 비해 유의하게 증가한다는 사실이 확인된다. 이는 두 회사에서 외부주주의 지분율이 감소한다는 것을 의미하며 그 결과 외부주주에게 귀속되는 부의 비중도 줄어들었을 가능성이 높다는 것을 시사한다.

인적분할 전후 4년간 지배주주와 외부주주의 시가총액 보유비중 변화를 살펴보자. 각 시점의 시가총액은 인적분할 직전 회계연도말의 기존회사 시가총액으로 나누어 표준화한다. 즉 각 표본에서 인적분할 직전 회계연도말 시가총액은 1이다.

<그림 III-9>는 지주회사 전환 표본의 주주유형별 시가총액 보유금액 변화를 보여준다. 인적분할 이후의 값은 존속회사에 대해 보유한 시가총액과 신설회사에 대해 보유한 시가총액을 합산한 값이다. 지배주주-개인이 보유한 시가총액은 인적분할 직전(-1y) 0.27에서 인적분할 직후(+1y) 0.32로, 지배주주-법인은 같은 기간 0.07에서 0.31로 증가한다. 지배주주-개인과 지배주주-법인이 보유한 시가총액은 합산하여 0.34에서 0.63으로 88% 증가한 것으로 나타난다. 반면 외부주주는 0.57에서 0.69로 불과 21% 증가하는데 그친다.

<그림 III-10>은 <그림 III-9>의 주주유형별 시가총액 보유규모를 보유비중으로 전환하여 나타낸 것이다. 지배주주-개인과 지배주주-법인의 시가총액 보유 비중은 인적분할 이전(-1) 34%에서 인적분할 이후(+1) 47%로 13%p 증가하는 반면, 외부주주의 시가총액 보유비중은 57%에서 51%로 6%p 감소한다. <표 III-6>은 분할이전(-1y)와 분할이후(+2y)의 시가총액 보유비중 변화를 통계적으로 검토한 결과이다. 외부주주의 보유비중 변화는 –8.81%p로 1% 수준에서 통계적으로 유의하다.

지배주주의 추가적인 출연 없이 인적분할과 현물출자 유상증자를 통해 이루어진 지배주주의 지배력 강화의 비용은 결국 외부주주가 지불하고 있는 것으로 평가할 수 있다. 아울러 인적분할을 통한 기업구조조정의 시너지가 존재한다 하더라도 그 과실은 지배주주와 외부주주 사이에 균등하게 배분되지 않는 것으로 볼 수 있다.

<그림 III-12>에서 지배주주와 외부주주의 시가총액 보유비중의 변화를 보면, 지배주주의 경우 인적분할 이전 41%, 인적분할 이후 42%로 큰 차이가 없고, 외부주주의 경우에도 인적분할 이전 55%, 인적분할 이후 56%로 큰 차이가 없다. 분할이전(-1y)와 분할이후(+2y)의 시가총액 보유비중 변화를 통계적으로 분석한 <표 III-7>에 따르면 외부주주의 보유비중 변화는 유의하지 않은 것으로 확인된다.

본고의 분석을 통해, 자사주 마법은 지주회사 전환을 위한 인적분할 과정에서 현물출자 유상증자와 짝을 이루어 지배주주의 지배력을 강화하는 수단으로 활용되고 있음을 확인하였다. 아울러 지배주주의 추가적인 출연없이 이루어지는 지배주주의 지배력 강화는 결국 외부주주의 이익을 침해하는 결과를 초래하는 것으로 분석된다. 반면 지주회사 전환과 무관한 인적분할의 경우 지배주주와 외부주주의 지배권 분포와 부의 배분에 유의한 변화가 나타나지 않으며 기업구조조정 시너지에 대한 시장의 긍정적 평가가 관찰된다.

지배력과 부의 배분에 왜곡을 일으키는 자사주 마법이 많은 논란속에서도 지속되어 온 이유는 자기주식의 경제적 실질에 대해 일관성을 갖추지 못한 규제체계에 근본 원인이 있는 것으로 보인다.

경제적 관점에서 자기주식은 자산으로 볼 수 없다. 주식을 보유함으로써 확보하는 권리는 의결권, 배당권, 잔여재산 분배청구권 등을 들 수 있는데, 자기주식에 대해 이러한 권리는 인정되지 않는다. 상법상 의결권은 제한되며, 자기주식의 배당권과 잔여재산 분배청구권은 경제적으로 무의미하다. 그렇다면, 자기주식의 취득은 회사 재산을 주주에게 환원하는 행위로서 경제적 실질이 이익배당과 동일하다고 보는 것이 타당하다. 주주로부터 주식을 취득하는 형식을 취하고 있으나 그 주식은 더 이상 자산이 아니므로 취득한 금액 만큼 주주환원이 이루어졌다고 보면 된다. 회계적으로 자기주식의 취득을 자본의 차감 항목으로 반영하는 것이나, 자기주식 취득의 재원을 배당가능이익으로 제한하는 것은 자기주식 취득을 이익배당과 동일하게 인식한 결과라 할 수 있다. 자기주식 취득에 주주평등의 원칙을 적용하는 것도 마찬가지 이유다. 동일한 논리로, 자기주식 처분은 신주를 발행하는 것과 같다. 회계적으로 자기주식 처분은 자본을 증가시키는, 자기주식 취득과 대칭적인 행위로 인식한다. 자기주식이라는 자산이 처분대금으로 교체되는 것이 아니라 새로운 주주로부터 새로운 자금이 유입되는 것이다.

그럼에도 불구하고 인적분할 과정에서 기존회사의 자기주식에 신설회사의 신주를 배정하는 것이 가능한 것은 자기주식의 자산성을 인정하는 법령과 판례가 존재하기 때문인 것으로 보인다. 상법상 자기주식은 이사회의 결의에 따라 임의로 처분할 수 있으며 합병의 대가, 현물배당의 수단, 질권 등으로 활용하는 것이 가능하다.8) 주식의 자산가치가 존재하고 그것이 주주권에서 유래한다고 볼 때, 인적분할 과정에서 기존회사의 자기주식에 대해 신설회사의 신주를 배정하지 않는 것은 주주권을 포기하는 것, 즉 자기주식을 보유한 회사의 가치를 훼손하는 것이라는 논리가 가능해지는 것이다.

자기주식의 취득과 회계처리에 있어서는 자기주식의 자산성을 부인하면서, 자기주식의 처분 또는 활용에 있어서는 자산성을 인정하는 모순적인 규제를 기화로 지배주주는 자기주식을 사적인 이익을 위해 남용할 수 있게 된다. 본고에서 다루고 있는 자사주 마법은 가장 대표적인 사례라 할 수 있다. 지주회사는 기업소유지배구조의 투명성을 제고하고자 도입된 것인데, 지주회사 체제로 전환하는 과정에서 자사주 마법이 적극적으로 활용되어 외부주주의 부가 편취되는 결과를 낳고 있는 것은 아이러니한 상황이 아닐 수 없다. 자사주 마법은 주요국에서는 발생할 수 없는 문제이기 때문에 한국의 기업지배구조 취약성과 함께 자기주식 관련 제도의 비일관성을 드러낸다.9) 지배주주의 자기주식 남용을 억제할 수 있는 방안을 강구해야 하며, 근본적으로 자기주식의 경제적 실질에 부합하는 일관된 규제체계를 구성할 필요가 있다.

1) 유진수(2014)는 36개 사례를, 박진우·이민교(2019)는 51개 사례를 분석하여 지주회사 전환 과정에서 자사주 마법을 활용한 인적분할이 지배주주의 지분율 상승에 기여하고 있음을 보여주고 있다.

2) 인적분할 과정에서 기존회사 자기주식의 전부 혹은 일부를 존속회사가 아닌 신설회사로 배정하는 것도 가능하나 이러한 사례는 드문 것으로 파악된다. 만약 기존회사의 자기주식을 신설회사로 이전하고 신설회사가 발행한 신주를 이전된 자기주식에 배정하는 경우 신설회사의 자기주식이 발생한다.

3) 제3자 배정방식을 선택하는 경우도 있으나 공매매수방식을 선택하는 경우가 더 많다(박진우·이민교, 2019).

4) 이는 박진우‧이민교(2019)의 실증분석 결과에 대체로 부합한다. 이들에 따르면, 인적분할 이후 현물출자 유상증자 규모는 지배주주의 신설회사 보유주식수 대비 평균 106%이며, 유상증자에서 지배주주 이외의 신설회사 주주는 보유지분의 5.42%만을 존속회사 지분으로 교환하는 것으로 나타난다. 한편 지배주주 이외의 신설회사 주주가 유상증자에 참여하지 않는 것은 이해부족, 정보부족, 무관심, 또는 낮은 기대이익 때문으로 추정하고 있다.

5) 1999년 12월 지주회사 설립 및 전환을 허용할 당시 30%였으나 2007년 4월 20%로 완화되었고 2021년 12월 30%로 다시 상향 조정되었다.

6) 지주회사 전환 표본에서 존속회사가 지주회사인 경우가 대부분이나 신설회사가 지주회사인 경우가 일부 존재한다. 존속회사와 신설회사의 소유구조 변화를 비교할 때 혼동을 줄 우려가 있으므로 신설회사가 지주회사인 일부 표본을 제외한다.

7) 정무권(2018)도 유사한 결과를 보고하고 있다.

8) 정준우(2012), 안성포(2017)

9) 미국의 경우 자사주를 미발행주식으로 취급하는 주에서는 자사주 마법이 원천적으로 불가능하며, 금고주로 취급하더라도 자사주에 대한 현금, 현물배당이 불가하므로 자사주 마법은 발생할 수 없다. 일본은 인적분할이 허용되지 않으며, 독일은 자사주에 대해 분할신주를 배정하지 못하도록 규정되어 있다(박상인, 2019).

참고문헌

공정거래위원회, 2018. 11. 13, 공정거래법상 지주회사 현황 분석 결과 발표, 보도자료.

김우찬, 2020, 제21대 국회 개혁입법과제 제안-경제민주화 과제를 중심으로, 『경제개혁 이슈』 2020-4호, 1-206.

노혁준, 2008, 자기주식과 기업의 합병, 분할, 『증권법연구』 9(2), 117-153.

노혁준, 2018, 기업구조조정과 자기주식의 쟁점 및 입법적 개선방안, 『법학연구』 28(1), 111-142.

박상인, 2019, 한국 기업의 자사주 취득 및 보유에 관한 연구, 시장과 정부 연구센터.

박진우‧이민교, 2019, 중견기업의 인적분할을 통한 지주회사 전환, 『한국증권학회지』 48(1), 1-27.

안성포, 2017, 기업재편과 취득한 자기주식의 처분과 소각, 『법학연구』 20(4), 1-42.

유진수, 2014, 인적분할을 통한 지주회사 전환에 대한 연구, 『산업조직연구』 22(2), 73-95.

이상훈, 2020a, 인적 분할과 자사주마법, 『상사법연구』 39(2), 367-412.

이상훈, 2020b, 자사주 마법(魔法)과 해법(解法)-합병의 일방이 보유한 자기주식 또는 상대방 주식의 처리, 『상사법연구』 39(1), 265-308.

이은정, 2017, 지주회사 전환 동향과 전환 관련 규제 개선안, 『ERRI 이슈&분석』, 1-22.

정무권, 2018, 인적분할과 기업가치, 『재무관리연구』 35(3), 217-243.

정준우, 2012, 개정상법상 자기주식의 재무관리에 관한 쟁점사항 검토, 『법학연구』 15(3), 651-685.

황남석, 2015, 회사분할과 자기주식, 『조세법연구』 21(1), 117-138.