Find out more about our latest publications

Eligible Pre-Designated Products for Retirement Pension Management: Characteristics and Implications

Issue Papers 23-18 Oct. 11, 2023

- Research Topic Asset Management/Pension

- Page 22

The Korean-style default option (K-default option) has been introduced as a pre-designated retirement pension system, prompting the need for a comprehensive discussion on various policy options crucial for its establishment. The focal point of the discussion is a clear understanding of the new system’s characteristics. Notably, the pre-designation of retirement pension plans, operating under an opt-in scheme with explicit investment instructions, diverges from traditional default options as it lacks the nudging element. Instead, the pre-designation scheme aims to encourage defined contribution (DC) plan participants to build a reasonable investment portfolio, positioning itself as a mechanism to utilize representative products rather than default options for portfolio construction.

This pre-designation retirement pension scheme mirrors the representative product system that includes principal-protected products. Concerns voiced in the scheme design stage have become a reality six months into full-scale operation. Employees who display limited interest in pension asset investment face difficulties in selecting investment-linked eligible products (low, medium, high risk) based on risk appetite, leading to over 88% of eligible employees to opt for the principal-protected type (ultra-low risk). In terms of pension asset management, it is crucial to adopt a management strategy with an appropriate level of risk and reasonable risk premiums. Hence, improvements in the scheme are essential to ensure that products eligible for pre-designation align with the implementation of this management strategy.

An analysis of risk-return profiles of eligible products reveals that the majority have secured an appropriate level of risk and risk premiums in terms of medium-term returns of three years or more. The analysis further indicates that as risk increases, the risk-adjusted return (Sharpe index) tends to rise. This suggests that it could be effective to adopt a strategy of selecting products based on expected returns required by individual retirement planning. However, it is worth noting that inefficiencies in the composition of portfolio products, predominantly comprising most eligible products, can pose challenges. This is because portfolio products, presented as a combination of Target Date Funds (TDFs), rarely comply with the current scheme’s requirement to maintain a specific risk level. To build an effective portfolio, it is recommended to utilize funds that target specific risk levels, such as Balanced Funds (BFs) or Target Risk Funds (TRFs). Alternatively, using a single retirement date TDF, rather than a portfolio-based TDF, is desirable for optimal results.

This pre-designation retirement pension scheme mirrors the representative product system that includes principal-protected products. Concerns voiced in the scheme design stage have become a reality six months into full-scale operation. Employees who display limited interest in pension asset investment face difficulties in selecting investment-linked eligible products (low, medium, high risk) based on risk appetite, leading to over 88% of eligible employees to opt for the principal-protected type (ultra-low risk). In terms of pension asset management, it is crucial to adopt a management strategy with an appropriate level of risk and reasonable risk premiums. Hence, improvements in the scheme are essential to ensure that products eligible for pre-designation align with the implementation of this management strategy.

An analysis of risk-return profiles of eligible products reveals that the majority have secured an appropriate level of risk and risk premiums in terms of medium-term returns of three years or more. The analysis further indicates that as risk increases, the risk-adjusted return (Sharpe index) tends to rise. This suggests that it could be effective to adopt a strategy of selecting products based on expected returns required by individual retirement planning. However, it is worth noting that inefficiencies in the composition of portfolio products, predominantly comprising most eligible products, can pose challenges. This is because portfolio products, presented as a combination of Target Date Funds (TDFs), rarely comply with the current scheme’s requirement to maintain a specific risk level. To build an effective portfolio, it is recommended to utilize funds that target specific risk levels, such as Balanced Funds (BFs) or Target Risk Funds (TRFs). Alternatively, using a single retirement date TDF, rather than a portfolio-based TDF, is desirable for optimal results.

Ⅰ. 사전지정운용제도와 디폴트옵션제도

확정급여형(Defined Contribution: DC) 및 개인형(Individual Retirement Pension: IRP) 퇴직연금에 사전지정운용제도가 도입되었다.1) 지속적이고 합리적인 장기투자를 전제로 하는 연금자산 운용의 어려움을 보완하기 위한 제도적 장치이다. 특히 DC형 퇴직연금에서는 이렇게 난이도 높은 연금자산 운용에 대한 책임이 오롯이 근로자 개인에게 부과되며 그에 따른 저조한 운용성과 역시 개인에게 그대로 귀속된다. 원리금보장상품에 방치되어 연금의 실질가치도 유지하지 못하는 우리 퇴직연금 적립금 운용의 현실은 개인이 아닌 제도의 문제이다. 행태재무학(behavioral finance)에서 강조하는 개인의 제한된 합리성을 근거로 강제되는 법정 연금제도인 퇴직연금제도에서 최고의 합리성이 요구되는 적립금의 운용 과정은 개인의 판단에만 맡겨두는 불합리한 구조이기 때문이다. 이러한 제도적 단점을 보완하기 위하여 DC형 퇴직연금이 발달한 서구에서는 디폴트옵션(default option) 제도나 집합운용DC(Collective DC: CDC) 같은 제도적 보완 장치를 강구하였다. 우리 퇴직연금도 이러한 해외사례를 벤치마킹하고 관련 전문가의 오랜 논의를 거쳐 사전지정운용이라는 이름으로 디폴트옵션제도를 도입하였다.2)

하지만 사전지정운용제도가 디폴트옵션으로 기능하기를 기대하기는 어렵다. DC 근로자가 ‘분산된 위험의 장기투자 포트폴리오’를 구축한다는 제도 목적은 동일하나 이를 달성하기 위한 운용 기제가 완전히 상이하기 때문이다. 다수의 연금 선진국에서 디폴트옵션제도를 통해 합리적인 투자 포트폴리오를 구축할 수 있었던 이유는 디폴트옵션이 강제나 규제가 아닌 넛지(nudge)로 작동하기 때문이다.3) 퇴직연금 적립금 운용에서 디폴트옵션이 성공적인 넛지가 될수 있는 핵심 요소는 선택적 탈퇴(opt out)이다. 근로자가 구체적인 운용지시를 통해 선택적 탈퇴를 하지 않았을 때 주어지는 상태(default status)가 ‘합리적 투자 포트폴리오’인 것이다. 그에 비하여 사전지정운용제도는 선택적 진입(opt in) 방식이다. 근로자가 운용지시에 준하는 수준의 명시적인 선택을 실행하여야만 제도에 편입되는 구조이다. 개인이 아무런 행동을 취하지 않았을 때의 상태가 제도 안이냐 밖이냐 하는 작은 차이가 완전히 다른 결과를 가져온다는 것이 디폴트옵션의 핵심이다. 이러한 구조적 차이를 감안하면, 향후 사전지정운용제도가 어떤 식으로 개선되더라도 정상적인 디폴트옵션제도로 전환되기는 어려울 것으로 사료된다. 온전한 의미의 디폴트옵션제도 도입은 기금형 지배구조와 함께 논의되어야 할 사안이다.4)

2021년 근퇴법 개정을 통해 도입된 제도는 디폴트옵션제도가 아닌 사전지정운용제도이다. 새롭게 도입된 제도를 정착 또는 활성화하기 위해서는 제도의 도입 목적과 특성을 명확하게 이해하려는 노력이 무엇보다 중요하다. 그로부터 제도 활성화의 구체적인 방향이 설정될 수 있기 때문이다. 사전지정운용제도가 완전히 정착되더라도 DC 근로자의 적립금 운용에 있어 해외에서 확인된 디폴트옵션의 일반적인 편익을 기대하기는 어렵다. DC 근로자가 사전지정운용제도로부터 기대할 수 있는 편익은 과거 금융감독원이 퇴직연금사업자의 자율적 참여를 전제로 추진하였던 ‘대표상품제도’의 취지에 가깝다. 대표상품제도는 금융기관인 퇴직연금사업자가 기관의 이름을 걸고 저보수·고효율의 양질의 상품을 제시하고, 감독기관은 이를 별도 공시 및 관리함으로써 상품 선택에 대한 근로자의 부담을 경감시키기 위한 목적이었다.5) 이는 사전지정운용제도의 구조 및 도입 취지와 동일하다.

사전지정운용제도의 역할과 의의를 이렇게 규정하고, 이를 기반으로 제도 활성화를 위한 개선방안과 정책적 시사점을 도출하는 것이 본 연구의 목적이다. 이를 위해 사전지정운용제도의 현황 및 문제점을 살펴보고, 일 년의 준비기간 동안 고용노동부의 사전 승인을 얻은 279개 사전지정운용 적격상품의 위험수익특성(risk return profile)을 분석하였다. 적합성 원칙에 따라 4개의 위험군별로 제시된 적격상품은 적정 위험량을 유지하면서 보수 인하 등을 통한 수익률 극대화를 목적으로 한다. 적격상품의 특성에 대한 분석을 바탕으로 사전지정운용제도의 정착 및 활성화라는 관점에서 상품을 설계하고 제시하는 퇴직연금사업자와 이를 선택하고 활용하는 DC 및 IRP 근로자, 그리고 적격상품을 사전 승인하고 운용성과를 사후 공시하는 감독 당국에 참조되는 정책적 시사점을 제시하고자 한다.

Ⅱ. 제도 현황 및 문제점

1. 사전지정운용제도

근퇴법 상에 명시된 공식적인 제도 명칭은 디폴트옵션이 아닌 사전지정운용제도이다. 이름이 의미하듯이 DC 및 IRP 근로자는 일정 기간6) 내 구체적인 운용지시를 내리지 못하는 경우 자동으로 운용되는 상품을 근로자 스스로 미리 지정해 놓아야 한다. 이를 위하여 퇴직연금사업자는 특정 요건에 부합하는 사전지정운용 적격상품을 고용노동부로부터 사전 승인받아 기업에 제시하고, 기업은 노사 합의를 거쳐 이를 퇴직연금 규약에 반영하여야 한다.

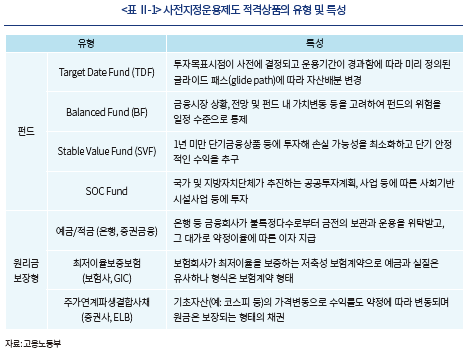

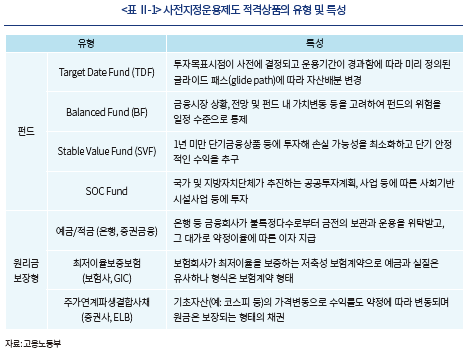

사전지정운용 적격상품의 특징은 다음과 같다. 먼저 사전지정운용제도에서는 미국 기업연금(401k)과 동일하게 설정가능한 적격상품의 유형을 열거식으로 정의하고 있다. 하지만 미국 기업연금 디폴트옵션의 적격상품(Qualified Default Investment Alternative: QDIA)은 디폴트 투자로 인한 손실에 대한 기업 면책의 전제조건으로서 장기투자자산의 위험분산이 목적임을 분명히 하고 있다. 이에 따라 적격상품에 원리금보장상품이 포함되지 않으며, 안정형 펀드(Stable Value Fund: SVF)는 3개월 미만의 임시 보관 용도로만 사용토록 규제하고 있다. 그에 비하여 우리 사전지정운용제도에서는 안정형 펀드에 대한 별도의 운용 규제가 없으며, 원리금보장상품도 적격상품 유형에 포함되어 있다. 그 외에, 제도적 제약으로 인하여 적격상품으로 일임운용(managed account)이 허용되지 않으며, 정책적 목적에 따라 사회간접자본(Social Overhean Capital: SOC) 펀드가 별도 유형으로 추가된 부분이 특징적이다.

퇴직연금에서 사전지정운용은 법적 의무사항으로, 모든 DC 및 IRP 가입자는 본격적인 운용지시에 앞서 퇴직연금사업자로부터 본인의 사전지정운용 상품을 미리 선정할 것을 요구받게 된다. 이러한 의사결정체계에서는 이전에 원리금보장상품으로 과도한 쏠림을 초래했던 가입자의 무관심이 그대로 재현되거나 오히려 강화될 수밖에 없다. 원리금보장상품이 포함된 사전지정운용제도로 인하여 제도 실행 이후 원리금보장상품 비중이 오히려 확대된 일본의 사례를 그대로 따라갈 수밖에 없는 구조이기 때문이다.7)

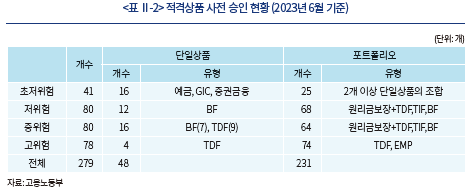

2. 사전지정운용 적격상품의 승인

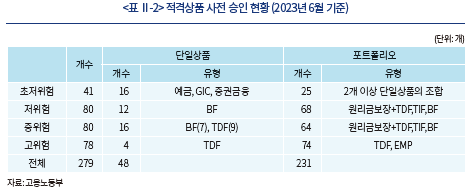

2023년 6월 말 현재, 전체 41개 퇴직연금사업자가 총 279개 상품을 사전지정운용 적격상품으로 승인받았다. 개별 사업자별로 원리금보장상품인 초저위험 상품은 반드시 포함토록 하고 실적배당상품에서는 위험군별로 최대 3개까지 설정할 수 있도록 한 결과, 6개월 동안 총 세 차례의 심사를 통해 최종 승인된 적격상품은 초저위험 41개, 저위험 80개, 중위험 80개, 고위험 78개로 집계되었다. 가장 많은 상품이 승인 신청되었던 1차 심사에서는 총 220개의 상품 중 55개가 탈락하여 25%의 높은 탈락률을 보였다. 제도 초기 단계에서 사전지정운용 상품이 요구하는 승인요건에 대한 분명한 신호를 퇴직연금사업자에게 전달하기 위한 목적이다.

승인 거절의 주요 사유는 보수율 과다와 부적절한 계열사 상품 편입이다. 퇴직연금 운용에서 보수율 인하를 통한 수익률 제고 노력은 다수의 해외사례에서 공통적으로 나타나는 양상이다. 보수율의 상한을 설정하는 방식이 일반적이나, 우리의 경우 위험군별로 포트폴리오 구축 비용이 상이하다는 점을 고려하여 과거 수익률로 설명되지 않는 높은 운용보수나, 특정 허들 이상의 높은 판매보수가 불승인 기준으로 적용되었다. 퇴직연금 보수율의 적정성에 대해선 여러 이견이 있을 수 있으나, 운용관리기관 및 자산관리기관에게 별도의 퇴직연금 운용보수가 지급되는 상황에서 동일한 퇴직연금사업자가 수취하게 되는 판매보수에 대해선 부정적인 시각이 일반적이다. 사전지정운용 상품에 있어서는 이러한 판매보수의 적정성 판단이 보다 엄격하다고 볼 수 있다. 이러한 1차 심사 결과가 퇴직연금사업자에게 피드백됨에 따라 최종 선정된 적격상품의 평균 보수율은 기존보다 30% 이상 인하된 것으로 보고된다. 장기투자를 전제로 하는 연금자산의 운용에서 보수율 인하는 장기수익률 제고의 중요한 요인 중 하나이다.

계열사 펀드의 부적절한 편입 사유는 고객의 이익을 최우선으로 한다는 수탁자책임(fiduciary duty)의 관점으로 해석된다. 과거 운용성과(track record)가 좋지 않은 계열사 펀드를 적격상품에 무리하게 편입시키는 경우 수탁자책임에 반하는 이해관계 상충의 우려가 제기될 수 있기 때문이다. 계열사 펀드 편입이 반드시 수탁자책임에 반하는 이해상충을 의미하는 것은 아니므로, 해당 펀드의 과거 운용성과와 함께 고려된다. 즉, 저조한 과거 운용성과 펀드를 불승인하는 기준이 계열사 펀드의 경우 보다 엄격하게 적용되는 것으로 이해할 수 있다. 이러한 불승인 사유 역시 퇴직연금사업자에게 구체적으로 피드백되어, 이후의 심사에서는 계열사 상품 편입 비중이 크게 축소된 것으로 나타났다.

적격상품 사전 승인 결과의 가장 큰 특징은 전체 상품의 83%가 단일상품이 아닌 포트폴리오 형식으로 설계되었다는 점이다. 이러한 현상은 위험자산의 편입을 전제로 하는 실적배당형뿐만 아니라 무위험자산이라 할 수 있는 원리금보장상품에서도 동일하게 나타났다. 예금자 보호가 적용되는 금액이라면 거래상대방위험조차 없는 단기 예금상품에서 고객 최선의 이익에 부합하는 선택 기준은 금융기관의 제시이율 뿐이다. 그럼에도 불구하고 제시이율이 차이가 나는 2개 이상의 예금상품을 조합하여 포트폴리오를 구성하는 사례가 61%에 달하였다.

비합리적인 포트폴리오 구성의 문제는 실적배당형에서 보다 심각하다. 위험수준을 막론하고 실적배당상품 대부분은 TDF의 조합으로 제시되었다. 우선 단일 TDF가 아닌 다른 은퇴 시점 TDF의 조합으로 구성된 포트폴리오의 특성은 직관적으로 가늠하기 어렵다. TDF는 특정 은퇴 시점을 목표로 사전 설정된 글라이드 패스(glide path)에 따라 위험자산 비중을 줄여가는 구조다. 이러한 특성이 지속적인 포트폴리오 조정(rebalancing)을 필요로 하는 연금자산의 관리에 있어 차별적인 장점이 되며, 여러 해외사례에서 디폴트옵션의 대부분이 TDF로 운용되는 직접적인 이유이다. 하지만 서로 다른 은퇴 시점 TDF의 조합은 이러한 특장점을 모두 희석시키게 된다. 현행 적격상품에서는 긴 은퇴 시점 TDF를 고위험 상품의 대용으로, 짧은 은퇴 시점 TDF를 저위험 상품의 대용으로 편입하고 있어 개별 근로자의 은퇴 계획과는 무관하게 선택된다.

사전지정운용제도에서와 같이 위험군별로 일정 위험량을 유지해야 하는 경우라면 처음부터 특정 위험량을 목표로 설계된 TRF(Target Risk Fund) 또는 혼합형 펀드(Balanced Fund: BF)를 활용하는 것이 바람직하다. TDF는 시간이 경과함에 따라 위험량이 줄어들며, 그 경우 새로운 적격상품으로 재승인 받아야 하는 번거로움까지 있다. 현재 국내에는 퇴직연금사업자가 활용할 수 있는 검증된 TRF 상품이 많지 않다는 점이 이러한 문제의 원인으로 파악된다. 자산운용회사를 포함한 국내 자산운용업계의 적극적인 대응이 요구되는 부분이다.

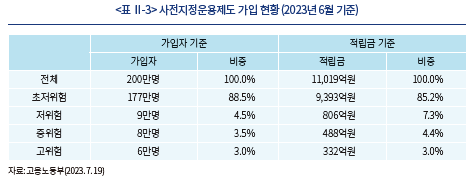

3. 가입 현황 및 수익성과

2022년 7월 법 개정에 의한 제도 도입 이후 일 년의 준비기간 동안 적격상품의 승인과 퇴직연금 규약 반영, 그리고 근로자의 상품 지정이 진행되었다. 고용노동부가 2023년 6월 말 기준으로 발표한 제도 도입 현황을 살펴보면, 사전 승인을 받은 296개의 상품 중 31개 사업자의 223개 상품이 판매 및 운용 중인 것으로 파악된다. 사전지정운용 상품을 사전 지정한 가입자 수는 DC형이 97만명, IRP가 103만명으로, 두 제도 간에는 중복 가입자가 많아서 정확한 제도 가입률은 추산하기 어렵다.

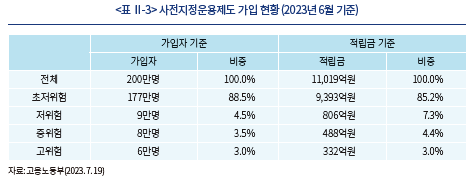

전체 가입자 중 177만명이 초저위험 상품을 선택하여, 사전지정운용에서 원리금보장상품 비중은 가입자 수 기준으로 88.5%에 이르고 있다. 저위험이 9만명(4.5%), 중위험이 8만명(4.0%), 고위험이 6만명(3.0%) 수준이다. 적립금 기준으로는 1조 1,019억원이며 이 중에서 IRP가 8,013억원으로 전체의 73%를 차지한다. 초저위험 상품의 적립금 규모는 9,393억원으로, 금액 기준으로 원리금보장상품 비중은 85.2% 수준이다. 가입자 수 기준보다 약간 낮은 비중임을 감안할 때, 원리금보장상품을 사전지정운용으로 지정하는 근로자의 평균 적립금 규모가 실적배당상품보다 작음을 알 수 있다. 실적배당형 상품의 적립금 규모는 저위험이 806억원(7.3%), 중위험이 488억원(4.4%), 고위험이 332억원(3.0%) 수준으로, 가입자 수 기준과는 다소 차이를 보인다.

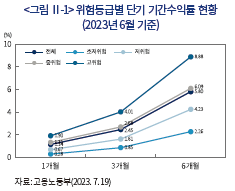

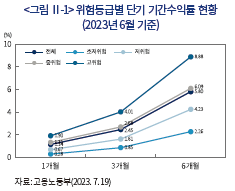

사전지정운용제도의 안착을 위해 가장 중요한 부분은 성과의 공시다. 특히 근로자의 선택을 전제로 하는 사전지정운용제도에서는 합리적인 상품 선택이라는 측면에서 상품 간 객관적인 비교가 가능한 공시 체계가 마련되어야 한다. 비록 6개월의 짧은 운용기간이지만 고용노동부는 분기별로 사전지정운용의 수익성과를 공시하고 있다. 운용이 개시된 2023년 상반기는 글로벌 주식시장의 회복에 힘입어 6개월 기간수익률이 5.80%라는 비교적 높은 수익성과를 시현하였다. <그림 Ⅱ-1>의 위험군별 단기 실현수익률 현황을 살펴보면 큰 위험을 취하는 고위험군으로 갈수록 그에 상응하는 높은 수익성과를 기록하고 있어, 지난 상반기는 흔히 말하는 위험프리미엄(risk premium)을 확보할 수 있었던 기간으로 평가된다. 하지만 이는 변동성 높은 시장 상황에서의 단기적 운용성과이므로 이를 일반화하여 홍보하는 것은 적절치 않다.

제도 도입 이후 누적수익률이라 할 수 있는 6개월 수익률을 보면 2.26%의 원리금보장상품에 비해 고위험 상품은 8.88%의 높은 수익성과를 기록하고 있다. 하지만 근로자의 상품 선택을 위한 정보 제공이라는 측면에서 이러한 단기 기간수익률의 의미는 극히 제한적이다. 이는 단순히 해당 기간 양호했던 시장 상황을 반영하는 것일 뿐, 단순히 이를 연율화하여 고위험 상품군의 수익률이 17%에 이른다고 해석하는 것 역시 앞서 언급한 바와 같이 적절치 않은 일반화이다. 시가평가 자산의 단기수익률을 장기로 연율화하지 않는다는 것이 성과공시의 표준이다. 의미 있는 성과공시는 보다 장기수익률에 기반하여야 하나, 장기 실현수익률이 확인되지 않는 제도 초기라는 한계가 있다.

하지만 적격상품 대부분은 사전지정운용을 위해 신규 조성된 펀드가 아니라 과거에 설정되어 지금까지 운용 중인 펀드를 재구성한 것이다. 따라서 포트폴리오를 구성하는 하위 펀드의 과거 수익성과를 바탕으로 상품 단위의 장기 위험수익특성을 파악해 볼 수 있다. 포트폴리오로 제시되는 상품 단위의 위험수익특성은 하위 펀드의 단순 합과 동일하지 않다는 것이 포트폴리오 이론이다. 이어지는 장에서 자세히 언급하겠으나, 최소한 3년 이상의 장기 실적을 바탕으로 위험군별로 제시되는 상품 단위의 기대수익률과 위험량을 가늠하는 것이 중요하다.

Ⅲ. 적격상품의 위험수익특성 분석

1. 분석 자료

위험수익특성 분석을 위한 자료는 279개 적격상품 중에서 신규 설정 펀드를 제외하고 해당 기간 퇴직연금 공모펀드로 운용되었던 상품을 대상으로 하였다. 금융투자협회 및 FnGuide의 펀드평가 자료를 활용하였다. 최근 1년 기간수익률은 2022년 6월 1일부터 2023년 5월 31일까지 운용되었던 240개 상품을 대상으로 측정하였으며, 최근 3년 연평균수익률은 2020년 6월 1일부터 2023년 5월 31일까지 펀드 운용기간 3년 미만 펀드를 제외하고 총 212개 상품을 대상으로 분석하였다.

포트폴리오 상품의 수익률은 하위 펀드 수익률을 상품설명서에 제시된 펀드별 비중으로 가중평균하여 산출하였다. 기간수익률 산출 방식은 기준가를 이용한 주간 수익률의 기하연결(geometric link)이다. 따라서 위험은 1년 기간수익률은 52주, 3년 연평균수익률은 156주 주간수익률의 표준편차를 연율화하는 방식으로 산출하였다. 복수의 상품군으로 구성된 위험군은 일종의 자산군과 유사한 개념이므로, 위험군별 분석은 개별 상품의 설정 규모를 감안하지 않은 동일가중방식으로 산출하였다.

2. 원리금보장형(초저위험)

1년 만기 단기예금 형식인 초저위험 상품은 사실상 무위험자산이라 할 수 있으므로 위험의 측정은 큰 의미가 없다. 기대수익률 역시 금융기관이 제시하는 평균 이율로 확정적이다. 원리금보장상품의 위험량은 단기 상품에 대한 재약정 위험 정도로 해석될 수 있다. 시중 금리 변동에 따라 재약정 이율이 달라지기 때문이다. 일부 금융기관의 원리금보장상품은 현재 우대 금리 형식의 높은 제시이율이 향후에도 지속적으로 제공될 수 있을 것인가 하는 의문이 제기되기도 하였다.

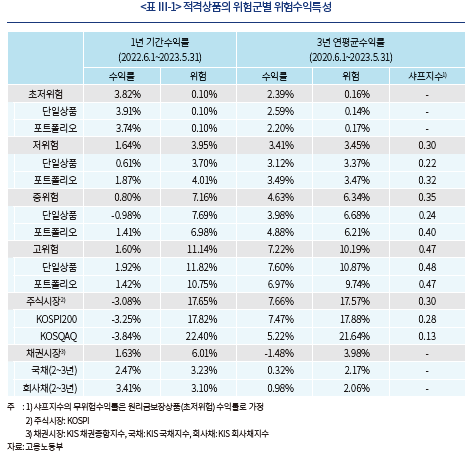

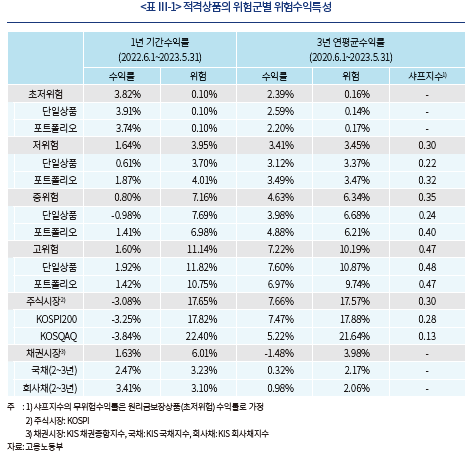

<표 Ⅲ-1>을 보면, 비교적 높은 금리 상황을 반영하여 초저위험 상품의 최근 1년 기간수익률은 3.82%를 기록하였다. 기존 퇴직연금 상품을 사전지정운용 적격상품으로 재설계할 때 평균 30% 정도의 보수율 하락이 있었음을 감안하면, 해당 적격상품의 기간수익률은 4%에 가까운 성과로 해석될 수 있다. 앞 절에서 언급한 반기(6개월) 실현수익률보다 약간 낮은 수준이다.

사전지정운용에서도 원리금보장상품 비중이 여전히 높은 이유는 역시 근로자의 무관심이겠으나, 그중 일부는 이러한 고금리 상황이 반영된 근로자의 적극적인 선택적 진입(opt in)의 결과로 사료된다. 넛지 개념의 일반적 디폴트옵션은 선택적 탈퇴(opt out)를 전제로 하나, 우리 사전지정운용제도는 선택적 진입이 허용되기 때문이다. 이 부분 역시 우리 사전지정운용제도가 디폴트옵션보다는 대표상품제도로 이해함이 바람직하다는 주장의 근거 중 하나다. 위험회피 성향이 극단적으로 강하거나 은퇴를 앞두고 있어 투자 시계(investment horizon)가 짧은 근로자의 경우 자신의 연금자산 운용 방식으로 원리금보장상품을 적극적으로 선택할 수 있다. 이 경우 보수율 및 제시이율 측면에서 절대적으로 유리한 사전지정운용제도의 원리금보장상품으로 선택적 진입하는 것이 보다 합리적일 것이다. 하지만 그럼에도 불구하고 해당 기간의 높은 물가상승률을 감안하면 원리금보장상품의 실질가치 유지는 역시나 어려움을 명심하여야 한다.

3. 실적배당형

근로자들이 사전지정운용 상품을 사전 지정할 때 실질적인 선택과 고민은 실적배당형을 중심으로 이루어진다. 본인의 정확한 위험성향을 알지 못하는 상태에서 운용관리기관이 제시하는 위험군별 적격상품에 대한 상품안내만 보고 자신의 사전지정운용 상품을 지정하여야 한다. 상품안내서에는 적격상품을 구성하는 하위펀드의 위험수익특성과 펀드 간 비중에 대한 정보만 담겨있으며, 이러한 정보를 바탕으로 얼마나 많은 위험을 감수하는 것이 최적인지를 결정해야 하는 어려움이 있다. 바로 위험프리미엄의 추정이다. 하지만 실적배당상품의 위험군별 위험수익특성에서는 일관된 위험프리미엄이 관측되지 않는 경우가 빈번하다. 특히 시장 상황에 따른 변동성이 큰 단기수익률에서는 분석 기간의 영향이 클 수밖에 없다.

<표 Ⅲ-1>을 보면, 적격상품의 1년 기간수익률에 대한 본 연구의 실증분석에서도 고위험군으로 갈수록 위험량의 증가는 비교적 일관되게 나타나지만 위험의 확대에 따른 수익률의 증가는 일관적이지 않다. 저위험 상품 수익률이 1.64%로 가장 높은 반면 중위험 상품은 0.80%로 가장 낮았다. 고위험 상품의 수익률은 다시 높아져 저위험과 비슷한 수준인 1.60%를 기록하였다. 해당 기간은 고비용 인플레이션(cost push inflation)으로 주식과 채권이 동반 하락하던 시기와 금리 인상에 따른 채권 수익률 하락 시기를 모두 포함하고 있다. 따라서 채권 위주의 저위험 실적배당상품의 수익률이 원리금보장상품에 미치지 못함으로 인하여 주로 예금과 저위험 TDF8)로 구성된 저위험군과 중위험군의 수익률이 원리금보장상품보다 낮은 것으로 파악된다.

중위험군은 저위험군에 비해 상대적으로 원리금보장상품 비중이 작으므로 가장 낮은 수익률을 시현하였으나, 원리금보장상품을 포함하지 않으면서 고위험 TDF 위주로 구성된 고위험군은 글로벌 주식시장의 회복세에 힘입어 중·저위험군에 비해 상대적으로 높은 수익성과를 보일 수 있었던 것으로 해석된다. 이상의 분석 및 그에 대한 해석을 종합하면, 위험군별로 일정 수준의 위험프리미엄이 확보됨을 확인하기 위해서는 최소한 자본시장의 활황과 불황이라는 한 주기를 온전히 포함할 수 있는, 가능한 장기의 분석 기간이 필요하다는 뜻이다. 본 연구에서는 자료의 한계를 감안하여 3년 중기수익률을 사용하였다.

<표 Ⅲ-1>에서 확인할 수 있듯이, 2020년 하반기부터 측정된 3년 연평균수익률은 위험량의 증가에 따른 적정 수준의 기대수익률 제고를 시현하고 있다. 해외 주식 및 채권과 대체투자 등으로 포트폴리오를 구성하는 TDF는 그 자체로 비교적 분산된 글로벌 포트폴리오를 구축하고 있어 글로벌 자본시장 전망(Capital Market Assumption: CMA)을 충실히 반영하고 있는 것으로 평가된다. 원리금보장상품의 수익률을 무위험수익률로 가정하여 개별 위험군의 위험조정성과(샤프지수)를 측정해보면, 저위험 0.30에서 고위험 0.47까지 점차 상승하는 것으로 관측된다. 위험성향 별로 제시되는 사전지정운용 적격상품이 중장기적으로는 충분한 위험프리미엄을 확보하고 있음을 의미한다.

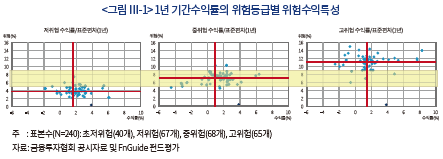

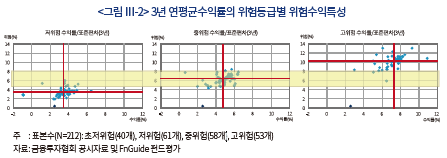

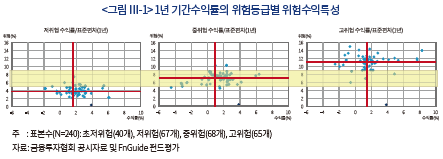

개인이 선택해야 할 부분은 적정위험 수준과 함께 운용관리기관이 제시하는 적격상품이다. 대부분의 적격상품은 2~3개 하위펀드의 포트폴리오 형태로 제시되고 있다. 앞서 언급한 바와 같이, 포트폴리오의 위험수익특성은 이를 구성하는 하위펀드의 단순 합이 아니며, 펀드 간의 상관관계가 고려되어야 한다. 따라서 운용관리기관이 제공하는 상품설명서에 나와 있는 하위펀드에 대한 소개만으로 근로자가 선택할 적격상품의 특성을 온전히 파악하기는 어렵다. 이러한 배경에서, 상품설명서의 배분 비중으로 하위펀드의 과거 수익성과를 재조합하여 개별 적격상품의 1년 기간수익률을 측정하였다. 이를 바탕으로 238개 적격상품의 위험수익특성을 위험군별로 도시하면 <그림 Ⅲ-1>과 같다. 먼저 위험군별 적정 위험량의 유지 관점에서 보면, 노란색 음영으로 표시된 중위험 상품을 95% 이상 포함하는 위험 밴드에 위치한 저위험 및 고위험 상품이 적지 않음을 알 수 있다. 저위험 상품 중 10개, 고위험 상품 중 5개가 중위험 수준의 위험량을 보이고 있다. 1년 기간수익률로 상품의 위험량을 측정할 때 위험군별 적정 위험수준이 유지되지 않는 경우가 많음을 의미한다. 그에 비하여 <그림 Ⅲ-2>에서 보듯이, 3년 연평균수익률의 위험량 분석에서는 저위험 상품 중 4개, 고위험 상품 중 2개만이 중위험 밴드에 포함됨을 확인할 수 있다.

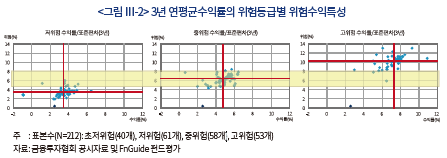

최근 3년 동안 중기 연평균수익률을 활용한 위험군별 위험수익특성 분석 결과는 <그림 Ⅲ-2>와 같다. 우선 1년 단기수익률에 비하여 위험도 증가에 따른 위험프리미엄 확보가 보다 명확히 확인된다. 동일 위험군에 포함된 적격상품의 산포도가 단기수익률에 비해 많이 축소되어 장기투자에 따른 위험 감소 효과를 확인할 수 있다. 해당 그림에서 무위험자산인 원리금보장상품과 산포도의 중심을 연결한 직선의 기울기가 샤프지수의 역수가 된다. 고위험군으로 갈수록 위험조정수익이 개선됨을 시각적으로 확인할 수 있다.

적합성 원칙 준수를 위하여 가입자 위험성향에 맞추어 위험군별로 상품을 제시하는 현행 사전지정운용제도에서 은퇴 시점별 TDF의 조합으로 적정 위험량을 조절하는 방식 자체가 부정확하고 비효율적이다. 개별 적격상품의 위험수익특성에 대한 분석 결과를 보면, 위험군별 전체 위험량은 적정 위험수준을 유지하고 있으나 근로자가 선택하게 되는 개별 상품에서는 그 편차가 크게 나타난다. 하위펀드를 구성하는 개별 TDF의 포트폴리오 구성을 알 수 없는 상황에서 은퇴 시기를 기준으로 TDF의 위험량을 근사(proxy)하는 방식이기 때문이다. TDF는 가능한 단일 상품으로 제시되는 것이 바람직하다. <표 Ⅲ-1>에 의하면 단일상품이 포트폴리오 상품에 비해 변동성이 약간 높은 것으로 확인되나 이는 포트폴리오 이론에 따른 기계적인 결과이며, 위험에 따른 수익성과는 일관적이지 않다. 사전지정운용 적격상품으로 단일 TDF를 권고하는 이유는 위험수익특성에서의 우월성보다는 적합성 원칙하에서 위험량의 유지 및 상품 관리의 어려움이라 할 수 있다.

앞서 언급한 바와 같이 이러한 위험군별 상품 제시에 적합한 펀드는 BF 또는 TRF이다. 하지만 전체 238개 실적배당형상품 중에서 TRF를 사용하는 비중은 10% 미만이다. 이는 적격상품이 별도의 펀드로 신규 설정되지 않고 기존의 퇴직연금 펀드를 재구성하는 관행에 따라 현재 국내 퇴직연금 시장에서 운용실적(track record)이 확인된 TRF 상품이 많지 않기 때문으로 사료된다. 즉, 사전지정운용의 적격성 심사를 통과하고 근로자의 선택을 받기에 가장 유리한 상품이 TDF이기 때문이다. 효율성 높은 하위펀드의 시장 공급은 자산운용회사의 역할이다. 은행 및 보험, 증권 같은 퇴직연금사업자는 아니지만 퇴직연금 시장에서 중요한 역할을 하는 금융기관이 자산운용회사다. 현재는 퇴직연금 시장에서 단순히 상품 공급자의 역할로 한정되어 있지만, 기금형 퇴직연금 및 일임투자 등이 허용되면 자산운용회사도 퇴직연금시장에 제도적으로 편입되고 관리될 필요가 있다.

Ⅳ. 제도 활성화를 위한 정책제언

앞서 논의한 바와 같이 사전지정운용제도에서 일반적인 디폴트옵션의 효과를 기대하기는 어렵다. 하지만 사전지정운용제도는 DC 근로자의 선택 편의성을 제고하고 이로부터 원리금보장상품의 치중에서 합리적인 투자 포트폴리오 구축으로 발전하기 위한 제도적 보완장치로 기능할 수 있다. 새롭게 도입된 제도가 시장에 안착하고 그 역할을 강화할 수 있도록, 제도의 운영 주체라 할 수 있는 퇴직연금사업자와 DC 근로자, 그리고 감독 당국이 참조할 수 있는 정책적 시사점을 제시하고자 한다.

1. 퇴직연금사업자: 상품 설계 및 제시

사전지정운용제도의 활성화를 위해 가장 중요한 주체는 적격상품을 설계하고 이를 근로자에게 제시하는 퇴직연금사업자이다. 특히 적합성 원칙에 따라 위험성향에 부합하는 적격상품을 설계하고 근로자로부터 이를 선택받아야 하는 퇴직연금사업자의 역할과 중요성이 강조된다. 3장의 실증분석 결과를 보면 위험군별 장기 위험수익특성은 비교적 일관되고 유의미한 것으로 평가된다. 하지만 이는 제도적 관점에서 의미가 있는 위험군별 특성이며, 개인은 해당 위험군 내에서 넓은 산포를 보이는 여러 상품 중에서 하나를 본인의 사전지정운용으로 지정하여야 한다. 실제 근로자가 선택할 수 있는 범위는 279개 전체 적격상품이 아니라 사용자가 계약한 퇴직연금 운용관리기관이 제시하는 7~10개의 적격상품이 된다. 따라서 사용자는 퇴직연금사업자가 제시하는 적격상품이 동일 위험군의 전체 적격상품 내에서 어디에 위치하는지 상시적으로 모니터링해야 한다. 그에 따라 필요하면 적격상품의 교체 또는 운용관리기관의 교체를 모색하여야 한다.

이는 우리 사전지정운용제도가 선택의 책임을 근로자에게 두는 운용구조임에도 불구하고 적격상품의 경쟁력은 퇴직연금사업자의 경쟁우위로 연결될 수 있다는 의미이다. 호주 퇴직연금(Superannuation)의 성공요인은 기금 간 운용 경쟁이며9), 이는 기금이 제시하는 디폴트옵션의 경쟁력으로 나타난다. 이 부분이 호주 퇴직연금이 난립하던 디폴트옵션을 MySuper라는 단일체계로 통합 관리하게 된 직접적인 이유다. 우리 사전지정운용제도의 적격상품도 MySuper와 유사한 수준으로 규제되고 공시된다. 이에 따라 운용관리기관이 제시하는 적격상품의 성과가 시장 및 비교집단(peer group)과 비교 평가된다. 장기적으로 사전지정운용 적격상품의 성과(performance)가 운용관리기관의 역량을 평가하는 가장 중요한 지표가 될 수 있음을 의미한다. 지금까지는 DC형 퇴직연금의 저조한 성과에 대해 퇴직연금사업자에게 그 책임을 물을 수는 없었다. 왜냐하면 수익률을 결정짓는 모든 투자의사결정이 근로자 개인에 의해 이루어지고, 퇴직연금사업자는 단순히 이를 실행하는 역할에 불과하기 때문이다. 하지만 퇴직연금사업자가 설계하고 제시하는 적격상품의 성과는 그 의미가 다르다. 그 자체로 퇴직연금사업자의 역량이자 책임이며 기관의 경쟁우위가 될 수 있다.

양질의 적격상품을 설계하고 제시하는 것은 운용관리기관이 준수해야 할 기본적인 수탁자책임이기도 하다. 금융기관인 퇴직연금사업자에는 가입자 최선의 이익에 부합하여야 한다는, 이른바 수탁자책임(fiduciary duty)이 부여되어 있다. 예를 들면, 무위험자산이라 할 수 있는 확정금리형 상품에서 보다 높은 제시이율을 확보할 수 있음에도 불구하고 금융기관의 다른 이해관계로 인해 낮은 이율의 적격상품이 구성된다면 이는 수탁자책임의 위배로 해석될 여지가 있다. 우리나라에서는 이러한 수탁자책임이 선언적 의미로만 인식되나, 신탁의 역사가 오래된 서구에서는 퇴직연금사업자가 과연 수탁자책임을 다하였느냐는 법적 소송이 야기될 수 있을 정도의 엄중한 책무이다. 퇴직연금사업자가 적격상품을 설계하는 과정에서 반드시 염두에 둬야 할 부분이다.

2. DC 및 IRP 근로자: 상품 선택

사전지정운용의 90% 이상이 원리금보장상품에 집중된 결과는 대단히 우려스러운 상황이나, 사실 제도 설계 단계부터 어느 정도 예견된 결과이기도 하다. 원리금보장상품이 포함된 지정운용제도라는 일본의 유사 사례에서 이미 확인되고 있기 때문이다. 하지만 사전지정운용 방법이 원리금보장상품으로 지정되는 것은 보다 심각한 상황을 초래할 수 있다. 무관심에 의한 방치가 사전지정운용제도로 인해 오히려 구조적으로 지속되는 계기가 될 수도 있기 때문이다. 운용지시를 내리지 못했을 때 실행되는 상품에 대한 선택을 본격적인 운용지시보다 더 심사숙고해서 결정할 것을 요구받는, 다소 모순적인 상황이 되었다. 하지만 현행 사전지정운용 방식을 대표상품제도의 일환으로 이해한다면 퇴직연금 운용의 효율화에 있어 사전지정제도의 역할과 의의를 충분히 살릴 수 있다.

실적배당형은 저·중·고위험의 3개 위험군으로 제시된다. 해외사례를 보면 대부분의 디폴트옵션은 대상 근로자의 평균적인 위험성향보다 약간 보수적인 위험의 실적배당형으로 제시되는 것이 일반적이다. 따라서 우리는 근로자 개인의 위험성향 내지는 그보다 한 단계 아래의 위험군에서 상품을 선택하면 되겠으나, 불행히도 사전지정운용의 대상이 되는 근로자 중에서 자신의 위험성향을 정확히 인지하는 경우는 거의 없을 것이다. 사전지정운용이 실행되는 것은 정해진 기한 내에 정상적인 운용지시를 내리지 못한 근로자를 대상으로 하는데, 자신의 위험성향을 정확히 파악하고 있을 정도로 투자에 관심 있는 근로자라면 구체적인 운용지시를 내리고 더 이상 사전지정운용의 대상이 되지 않을 것이기 때문이다.

위험이란 투자에 있어 가장 중요한 개념이지만 일반인이 제대로 이해하기에 어려운 부분이기도 하다. 따라서 위험군 별로 제시되는 기대수익률을 참조하여 상품을 선택할 것을 제안한다. 이렇게 수익률 기반의 선택이 가능한 이유는, 적격상품의 위험량은 일정 수준 이하로 통제되어 있으며 위험에 대한 보상, 즉 위험을 많이 취할수록 그에 합당하는 기대수익도 증가하는 상품으로 사전 승인되어 있기 때문이다. 적격상품에 대한 사전 승인의 의미는 우수한 투자상품이라는 인증은 아니지만, 투자 대상이 될 수 없는 나쁜 상품의 배제는 될 수 있다. 이때 중요한 것은 여기에서 수익률은 기대수익이지 미래의 실현수익이 아니라는 점이다. 장기투자를 전제로 할 때 기대할 수 있는 평균수익률 정도로 이해할 수 있다. 따라서 이를 가늠하기 위해서는 개별 상품의 단기가 아닌 가능한 장기 위험수익특성을 참조하는 것이 중요하다.

3. 감독 당국: 사전 승인 및 사후 공시

앞서 지적한 바와 같이, 현재 퇴직연금사업자가 설계하여 제시하는 적격상품의 구성에는 TDF의 조합과 같은 구조적인 문제가 있다. 하지만 이러한 문제를 적격상품의 사전 승인 과정에서 해소하기는 어렵다. 금융상품에 대한 전문가적 판단을 바탕으로 만들어지는 적격상품의 구조와 구성에 대해 감독 당국이 구체적인 가이드라인을 제시하는 것은 적절치 않기 때문이다. 사전 승인 과정은 적격성 심사이지 효율성 평가가 아니다. 투자상품으로서의 적격성에 대한 최소한의 인증이라는 감독 당국의 기존 입장은 그대로 유지될 필요가 있다.

합리적인 투자 포트폴리오 확대를 목적으로 하는 사전지정운용제도에 원리금보장상품이 선택가능한 대안으로 포함된 것은 일종의 제도적 결함이라 할 수 있다. 이는 가입자 교육이나 홍보 강화 등을 통해 완화해야 할 과제이나, DC 근로자의 적립금 운용에 있어 이러한 금융교육 및 홍보의 효과가 크지 않다는 점이 문제이다.10) 향후 제도 개편을 통해 원리금보장상품은 적격상품의 유형에서 제외되는 것이 바람직하겠으나, 이러한 제도 개편이 어렵다면 적어도 미국의 QDIA에서와 같이 사전지정운용 상품으로 원리금보장상품을 지정하는 경우 그 기간을 짧게 한정할 필요가 있다.

사전지정운용 적격상품의 효율성 제고는 금융기관인 퇴직연금사업자 간의 경쟁 구도를 강화하는 방향으로 추진되어야 한다. 이러한 경쟁 구도는 사후 공시를 통해 사전지정운용의 성과를 근로자 또는 사용자가 직접 판단하고 그 결과를 퇴직연금사업자에게 피드백 하는 과정을 통해 강화될 수 있다. 지금까지 퇴직연금사업자의 경쟁은 가입자 유치 경쟁이었다. 이를 적격상품의 효율성에 대한 운용 경쟁으로 유도할 수 있는 공시 체계가 중요하다는 뜻이다. 제도 초기 단계에서 감독 당국이 가장 집중해야 할 부분이 제도 도입 목적에 부합하는 효과적인 공시 체계의 설계 및 관리이다. 공시의 주기는 분기 단위 등 가능한 짧은 주기로 빈번하게 공시되는 것이 바람직하나, 수익률 산출 기간(평가기간)은 가능한 장기로 설정되어야 한다. 적어도 3년 이상의 장기수익률 관점에서 자신의 투자상품을 평가하고 다른 상품과 비교되도록 공시 항목의 구성 및 우선순위 등이 배치되어야 한다. 특히 운용성과의 공시는 비교집단(peer group) 간의 객관적(apple to apple) 비교가 중요함을 강조한다.

디폴트옵션으로서 사전지정운용제도가 갖는 제도적 한계는 분명하다. 따라서 향후 온전한 의미의 디폴트옵션에 대한 고민도 필요하다. 사전지정운용제도를 도입하는 과정에서 경험한 바와 같이, 이는 퇴직연금의 지배구조와 연결된 문제이다. 많은 전문가들이 디폴트옵션제도가 도입되기 위해서는 기금형 지배구조의 도입이 전제되어야 한다고 주장하였다.11) 고용노동부는 중소기업퇴직연금기금 도입 이후 중단된 기금형 퇴직연금제도에 대한 논의를 다시 재개할 필요가 있다. 이와 더불어, 디폴트옵션의 필요성은 결국 DC형 퇴직연금제도에서 적립금의 운용은 개인이 아닌 전문가에 위임되는 구조가 바람직하다는 인식에서부터 출발한다는 관점에서 중소기업퇴직연금기금과 같이 DC 적립금을 모아서 집단적으로 운용하는 집합DC(Collective DC: CDC) 형태의 퇴직연금제도도 활성화 될 필요가 있다. 최근 국회 공적연금개혁특별위원회를 중심으로 논의되는 국민연금기금의 퇴직연금사업자 참여 등도 기금형 또는 CDC형 퇴직연금제도를 전제로 할 때만 의미가 있다. 지배구조 개선에 대한 감독 당국의 적극적인 의지와 노력이 요구된다.

Ⅴ. 결론 및 시사점

2025년이면 퇴직연금 제도 도입 20주년이 된다. 외형적으로는 300조원을 상회하는 거대 연금으로 성장하였다. 짧지 않은 이력이며 비약적인 성장세다. 정부 당국을 포함한 시장 참여자의 적극적인 노력으로 그동안 많은 제도 개편과 운용 개선이 추진된 결과라 하겠다. 그럼에도 불구하고 여전히 많은 문제들이 지적되고 있다. 외형적 성장에 이은 제도 내실화가 요구되는 상황에서, 그 중심에는 퇴직연금의 운용수익률 제고가 있다. 제도 일원화 및 중도인출 제한, 연금화 강제 등 퇴직연금제도의 산적한 과제들에 있어 가장 바람직한 해법은 법에 의한 강제가 아니라 개인의 자발적 선택이다. 이를 유인할 수 있는 가장 효율적인 기제가 높은 운용수익률이다. 호주의 기업연금(Superannuation) 사례가 이를 방증한다. 연금제도에서 운용수익률이 문제가 되는 것은 특히 DC형 퇴직연금이다. 이를 위하여 많은 전문가들의 지난한 논의과정을 거쳐 어렵게 도입된 것이 사전지정운용제도이다. 사전지정운용제도의 도입 목적이 운용수익률 제고이며, 이는 실적배당상품 확대를 통해서만 구현될 수 있음을 분명히 할 필요가 있다.

비록 디폴트옵션으로서의 역할을 기대하기는 어려우나, 사전지정운용제도는 법으로 강제되는 대표상품제도로 도입 목적을 달성할 수 있다. DC 적립금의 합리적 운용이 자동으로 주어지지는 않지만 적어도 그 가능성을 높일 수 있는 제도적 보완장치는 될 수 있다는 의미다. 이러한 제도 목적이 온전히 달성되기 위해서는 적격상품을 제시하는 퇴직연금사업자와 이를 선택하는 근로자, 그리고 감독 당국의 적극적인 노력이 배가되어야 한다. 퇴직연금제도의 다음 20년의 화두는 운용수익률이 될 것이다. 그 시발점에서 사전지정운용제도가 도입되었다. 사전지정운용제도의 성과(performance)가 향후 우리 퇴직연금제도의 성공과 실패를 나눌 수 있다.

1)「근로자퇴직급여보장법(이하 근퇴법)」 개정을 통해 2022년 7월 12일에 사전지정운용제도가 도입되었으며, 일 년의 준비기간을 거쳐 2023년 7월 12일부터 본격 시행되었다.

2) 국내 퇴직연금제도에 디폴트옵션을 도입하기 위한 자세한 논의 과정은 남재우(2017)를 참조할 수 있다.

3) 넛지의 사전적 의미는 팔꿈치로 슬쩍 찌르는 행위이다. 강제하지 않고 부드러운 개입으로 더 좋은 선택을 할 수 있도록 유도하는 방법을 의미한다.

4) 오랜 기간 많은 전문가의 논의를 통해 도입된 제도임에도 불구하고 온전한 의미의 디폴트옵션으로 설계되지 못한 이유는 원리금보장상품에 대한 퇴직연금사업자의 업권별 이해관계와 계약형 지배구조하에서 실적배당상품의 원금손실에 대한 면책의 어려움 때문이다. 자세한 논의는 남재우(2017)를 참조한다.

5) 이는 호주 퇴직연금(Superannuation)의 MySuper를 참조하였다. 근로자 스스로 기금(Superannuation Fund)을 선택할 수 있는 호주에서는 기금의 선택이 곧 디폴트옵션의 선택을 의미하게 된다. 근로자의 합리적인 상품 선택을 돕기 위하여 기금별로 오직 하나의 디폴트옵션만 설정할 수 있도록 하고, 상품 간 비교가능성을 높이기 위하여 감독 당국(APRA)이 디폴트옵션의 성과를 표준화된 방법으로 공시토록 한 것이 MySuper의 핵심이다. 자세한 사항은 이경희(2018)를 참조한다.

6) 최초 가입 또는 기존 운용기간 만료 후 4주 동안 근로자의 운용지시가 없을 경우 퇴직연금사업자는 해당 근로자에게 사전지정운용 방법으로 운용될 수 있음을 통지하고, 이후 2주 동안 운용지시가 없을 경우 추가적인 승인 절차 없이 사전 지정된 방법으로 운용을 개시한다.

7) 일본은 2018년 ‘지정운용방법’이라는 이름으로 원리금보장상품이 포함된 사전지정운용제도를 도입하였으며, 원리금보장상품 편중 문제를 완화하기 위하여 상품설명서에 ‘원리금보장형 선택 시 실질적 구매력 확보가 어렵다’는 정보를 반드시 제공하도록 하였다(이경희 외, 2021).

8) TDF2025와 같이 은퇴 시점이 가까워 채권 위주의 자산 구성으로 추정되는 TDF를 저위험 TDF로 분류하고 TDF2045 같이 주식 위주의 자산 구성으로 추정되는 은퇴 시점이 많이 남은 TDF를 고위험 TDF로 분류한다.

9) 기금형 지배구조인 호주 퇴직연금에서는 근로자가 기금(Superannuation Fund)을 선택할 수 있으며, 이때 선택의 기준으로 기금이 Mysuper라는 이름의 단일상품으로 제시하는 디폴트옵션의 경쟁력이 가장 중요하게 고려된다. 이러한 경쟁구도가 호주의 디폴트옵션이 수익률과 안정성 모두에서 높은 수준의 운용 효율성을 달성할 수 있었던 배경이다.

10) Atkinson & Messy(2012)에 의하면 영국 노동청의 근로자 금융역량 강화 프로그램의 장기적 효과를 추적한 결과 이수 그룹과 미이수 그룹 간 유의미한 차이가 나타나지 않았다.

11) 보다 자세한 내용은 김재현(2023)을 참조할 수 있다.

참고문헌

김재현, 2023, 도입 20주년을 앞둔 퇴직연금제도 과제: 지배구조 다양화, 보험연합학술대회.

고용노동부, 2023. 5. 31, 2023년 1분기 사전지정운용방법(디폴트옵션) 주요 현황 공시.

고용노동부, 2023. 7. 19, 2023년 2분기 사전지정운용방법(디폴트옵션) 주요 현황 공시.

남재우, 2017, 퇴직연금 적립금 운용 효율화를 위한 한국형 디폴트옵션 도입 방안, 『금융감독연구』 4(2), 61-83.

남재우, 2021, 확정기여형(DC) 퇴직연금제도와 디폴트옵션, 자본시장연구원『자본시장포커스』2021-05호.

이경희, 2018, 호주 퇴직연금제도 현황과 시사점, 보험연구원 연구보고서 14권.

이경희‧박희진‧손성동, 2021, 일본의 퇴직연금 디폴트옵션제도 도입 사례 분석 및 시사점, 『한일경상논집』 90, 73-83.

Atkinson, A. and F. Messy, 2012, Measuring Financial Literacy: Results of the OECD / International Network on Financial Education (INFE) Pilot Study, OECD Working Papers on Finance, Insurance and Private Pensions No. 15, OECD Publishing.

고용노동부 www.moel.go.kr

금융투자협회 www.kofia.or.kr

FnGuide www.fnguide.com

확정급여형(Defined Contribution: DC) 및 개인형(Individual Retirement Pension: IRP) 퇴직연금에 사전지정운용제도가 도입되었다.1) 지속적이고 합리적인 장기투자를 전제로 하는 연금자산 운용의 어려움을 보완하기 위한 제도적 장치이다. 특히 DC형 퇴직연금에서는 이렇게 난이도 높은 연금자산 운용에 대한 책임이 오롯이 근로자 개인에게 부과되며 그에 따른 저조한 운용성과 역시 개인에게 그대로 귀속된다. 원리금보장상품에 방치되어 연금의 실질가치도 유지하지 못하는 우리 퇴직연금 적립금 운용의 현실은 개인이 아닌 제도의 문제이다. 행태재무학(behavioral finance)에서 강조하는 개인의 제한된 합리성을 근거로 강제되는 법정 연금제도인 퇴직연금제도에서 최고의 합리성이 요구되는 적립금의 운용 과정은 개인의 판단에만 맡겨두는 불합리한 구조이기 때문이다. 이러한 제도적 단점을 보완하기 위하여 DC형 퇴직연금이 발달한 서구에서는 디폴트옵션(default option) 제도나 집합운용DC(Collective DC: CDC) 같은 제도적 보완 장치를 강구하였다. 우리 퇴직연금도 이러한 해외사례를 벤치마킹하고 관련 전문가의 오랜 논의를 거쳐 사전지정운용이라는 이름으로 디폴트옵션제도를 도입하였다.2)

하지만 사전지정운용제도가 디폴트옵션으로 기능하기를 기대하기는 어렵다. DC 근로자가 ‘분산된 위험의 장기투자 포트폴리오’를 구축한다는 제도 목적은 동일하나 이를 달성하기 위한 운용 기제가 완전히 상이하기 때문이다. 다수의 연금 선진국에서 디폴트옵션제도를 통해 합리적인 투자 포트폴리오를 구축할 수 있었던 이유는 디폴트옵션이 강제나 규제가 아닌 넛지(nudge)로 작동하기 때문이다.3) 퇴직연금 적립금 운용에서 디폴트옵션이 성공적인 넛지가 될수 있는 핵심 요소는 선택적 탈퇴(opt out)이다. 근로자가 구체적인 운용지시를 통해 선택적 탈퇴를 하지 않았을 때 주어지는 상태(default status)가 ‘합리적 투자 포트폴리오’인 것이다. 그에 비하여 사전지정운용제도는 선택적 진입(opt in) 방식이다. 근로자가 운용지시에 준하는 수준의 명시적인 선택을 실행하여야만 제도에 편입되는 구조이다. 개인이 아무런 행동을 취하지 않았을 때의 상태가 제도 안이냐 밖이냐 하는 작은 차이가 완전히 다른 결과를 가져온다는 것이 디폴트옵션의 핵심이다. 이러한 구조적 차이를 감안하면, 향후 사전지정운용제도가 어떤 식으로 개선되더라도 정상적인 디폴트옵션제도로 전환되기는 어려울 것으로 사료된다. 온전한 의미의 디폴트옵션제도 도입은 기금형 지배구조와 함께 논의되어야 할 사안이다.4)

2021년 근퇴법 개정을 통해 도입된 제도는 디폴트옵션제도가 아닌 사전지정운용제도이다. 새롭게 도입된 제도를 정착 또는 활성화하기 위해서는 제도의 도입 목적과 특성을 명확하게 이해하려는 노력이 무엇보다 중요하다. 그로부터 제도 활성화의 구체적인 방향이 설정될 수 있기 때문이다. 사전지정운용제도가 완전히 정착되더라도 DC 근로자의 적립금 운용에 있어 해외에서 확인된 디폴트옵션의 일반적인 편익을 기대하기는 어렵다. DC 근로자가 사전지정운용제도로부터 기대할 수 있는 편익은 과거 금융감독원이 퇴직연금사업자의 자율적 참여를 전제로 추진하였던 ‘대표상품제도’의 취지에 가깝다. 대표상품제도는 금융기관인 퇴직연금사업자가 기관의 이름을 걸고 저보수·고효율의 양질의 상품을 제시하고, 감독기관은 이를 별도 공시 및 관리함으로써 상품 선택에 대한 근로자의 부담을 경감시키기 위한 목적이었다.5) 이는 사전지정운용제도의 구조 및 도입 취지와 동일하다.

사전지정운용제도의 역할과 의의를 이렇게 규정하고, 이를 기반으로 제도 활성화를 위한 개선방안과 정책적 시사점을 도출하는 것이 본 연구의 목적이다. 이를 위해 사전지정운용제도의 현황 및 문제점을 살펴보고, 일 년의 준비기간 동안 고용노동부의 사전 승인을 얻은 279개 사전지정운용 적격상품의 위험수익특성(risk return profile)을 분석하였다. 적합성 원칙에 따라 4개의 위험군별로 제시된 적격상품은 적정 위험량을 유지하면서 보수 인하 등을 통한 수익률 극대화를 목적으로 한다. 적격상품의 특성에 대한 분석을 바탕으로 사전지정운용제도의 정착 및 활성화라는 관점에서 상품을 설계하고 제시하는 퇴직연금사업자와 이를 선택하고 활용하는 DC 및 IRP 근로자, 그리고 적격상품을 사전 승인하고 운용성과를 사후 공시하는 감독 당국에 참조되는 정책적 시사점을 제시하고자 한다.

Ⅱ. 제도 현황 및 문제점

1. 사전지정운용제도

근퇴법 상에 명시된 공식적인 제도 명칭은 디폴트옵션이 아닌 사전지정운용제도이다. 이름이 의미하듯이 DC 및 IRP 근로자는 일정 기간6) 내 구체적인 운용지시를 내리지 못하는 경우 자동으로 운용되는 상품을 근로자 스스로 미리 지정해 놓아야 한다. 이를 위하여 퇴직연금사업자는 특정 요건에 부합하는 사전지정운용 적격상품을 고용노동부로부터 사전 승인받아 기업에 제시하고, 기업은 노사 합의를 거쳐 이를 퇴직연금 규약에 반영하여야 한다.

사전지정운용 적격상품의 특징은 다음과 같다. 먼저 사전지정운용제도에서는 미국 기업연금(401k)과 동일하게 설정가능한 적격상품의 유형을 열거식으로 정의하고 있다. 하지만 미국 기업연금 디폴트옵션의 적격상품(Qualified Default Investment Alternative: QDIA)은 디폴트 투자로 인한 손실에 대한 기업 면책의 전제조건으로서 장기투자자산의 위험분산이 목적임을 분명히 하고 있다. 이에 따라 적격상품에 원리금보장상품이 포함되지 않으며, 안정형 펀드(Stable Value Fund: SVF)는 3개월 미만의 임시 보관 용도로만 사용토록 규제하고 있다. 그에 비하여 우리 사전지정운용제도에서는 안정형 펀드에 대한 별도의 운용 규제가 없으며, 원리금보장상품도 적격상품 유형에 포함되어 있다. 그 외에, 제도적 제약으로 인하여 적격상품으로 일임운용(managed account)이 허용되지 않으며, 정책적 목적에 따라 사회간접자본(Social Overhean Capital: SOC) 펀드가 별도 유형으로 추가된 부분이 특징적이다.

2. 사전지정운용 적격상품의 승인

2023년 6월 말 현재, 전체 41개 퇴직연금사업자가 총 279개 상품을 사전지정운용 적격상품으로 승인받았다. 개별 사업자별로 원리금보장상품인 초저위험 상품은 반드시 포함토록 하고 실적배당상품에서는 위험군별로 최대 3개까지 설정할 수 있도록 한 결과, 6개월 동안 총 세 차례의 심사를 통해 최종 승인된 적격상품은 초저위험 41개, 저위험 80개, 중위험 80개, 고위험 78개로 집계되었다. 가장 많은 상품이 승인 신청되었던 1차 심사에서는 총 220개의 상품 중 55개가 탈락하여 25%의 높은 탈락률을 보였다. 제도 초기 단계에서 사전지정운용 상품이 요구하는 승인요건에 대한 분명한 신호를 퇴직연금사업자에게 전달하기 위한 목적이다.

승인 거절의 주요 사유는 보수율 과다와 부적절한 계열사 상품 편입이다. 퇴직연금 운용에서 보수율 인하를 통한 수익률 제고 노력은 다수의 해외사례에서 공통적으로 나타나는 양상이다. 보수율의 상한을 설정하는 방식이 일반적이나, 우리의 경우 위험군별로 포트폴리오 구축 비용이 상이하다는 점을 고려하여 과거 수익률로 설명되지 않는 높은 운용보수나, 특정 허들 이상의 높은 판매보수가 불승인 기준으로 적용되었다. 퇴직연금 보수율의 적정성에 대해선 여러 이견이 있을 수 있으나, 운용관리기관 및 자산관리기관에게 별도의 퇴직연금 운용보수가 지급되는 상황에서 동일한 퇴직연금사업자가 수취하게 되는 판매보수에 대해선 부정적인 시각이 일반적이다. 사전지정운용 상품에 있어서는 이러한 판매보수의 적정성 판단이 보다 엄격하다고 볼 수 있다. 이러한 1차 심사 결과가 퇴직연금사업자에게 피드백됨에 따라 최종 선정된 적격상품의 평균 보수율은 기존보다 30% 이상 인하된 것으로 보고된다. 장기투자를 전제로 하는 연금자산의 운용에서 보수율 인하는 장기수익률 제고의 중요한 요인 중 하나이다.

계열사 펀드의 부적절한 편입 사유는 고객의 이익을 최우선으로 한다는 수탁자책임(fiduciary duty)의 관점으로 해석된다. 과거 운용성과(track record)가 좋지 않은 계열사 펀드를 적격상품에 무리하게 편입시키는 경우 수탁자책임에 반하는 이해관계 상충의 우려가 제기될 수 있기 때문이다. 계열사 펀드 편입이 반드시 수탁자책임에 반하는 이해상충을 의미하는 것은 아니므로, 해당 펀드의 과거 운용성과와 함께 고려된다. 즉, 저조한 과거 운용성과 펀드를 불승인하는 기준이 계열사 펀드의 경우 보다 엄격하게 적용되는 것으로 이해할 수 있다. 이러한 불승인 사유 역시 퇴직연금사업자에게 구체적으로 피드백되어, 이후의 심사에서는 계열사 상품 편입 비중이 크게 축소된 것으로 나타났다.

비합리적인 포트폴리오 구성의 문제는 실적배당형에서 보다 심각하다. 위험수준을 막론하고 실적배당상품 대부분은 TDF의 조합으로 제시되었다. 우선 단일 TDF가 아닌 다른 은퇴 시점 TDF의 조합으로 구성된 포트폴리오의 특성은 직관적으로 가늠하기 어렵다. TDF는 특정 은퇴 시점을 목표로 사전 설정된 글라이드 패스(glide path)에 따라 위험자산 비중을 줄여가는 구조다. 이러한 특성이 지속적인 포트폴리오 조정(rebalancing)을 필요로 하는 연금자산의 관리에 있어 차별적인 장점이 되며, 여러 해외사례에서 디폴트옵션의 대부분이 TDF로 운용되는 직접적인 이유이다. 하지만 서로 다른 은퇴 시점 TDF의 조합은 이러한 특장점을 모두 희석시키게 된다. 현행 적격상품에서는 긴 은퇴 시점 TDF를 고위험 상품의 대용으로, 짧은 은퇴 시점 TDF를 저위험 상품의 대용으로 편입하고 있어 개별 근로자의 은퇴 계획과는 무관하게 선택된다.

사전지정운용제도에서와 같이 위험군별로 일정 위험량을 유지해야 하는 경우라면 처음부터 특정 위험량을 목표로 설계된 TRF(Target Risk Fund) 또는 혼합형 펀드(Balanced Fund: BF)를 활용하는 것이 바람직하다. TDF는 시간이 경과함에 따라 위험량이 줄어들며, 그 경우 새로운 적격상품으로 재승인 받아야 하는 번거로움까지 있다. 현재 국내에는 퇴직연금사업자가 활용할 수 있는 검증된 TRF 상품이 많지 않다는 점이 이러한 문제의 원인으로 파악된다. 자산운용회사를 포함한 국내 자산운용업계의 적극적인 대응이 요구되는 부분이다.

3. 가입 현황 및 수익성과

2022년 7월 법 개정에 의한 제도 도입 이후 일 년의 준비기간 동안 적격상품의 승인과 퇴직연금 규약 반영, 그리고 근로자의 상품 지정이 진행되었다. 고용노동부가 2023년 6월 말 기준으로 발표한 제도 도입 현황을 살펴보면, 사전 승인을 받은 296개의 상품 중 31개 사업자의 223개 상품이 판매 및 운용 중인 것으로 파악된다. 사전지정운용 상품을 사전 지정한 가입자 수는 DC형이 97만명, IRP가 103만명으로, 두 제도 간에는 중복 가입자가 많아서 정확한 제도 가입률은 추산하기 어렵다.

전체 가입자 중 177만명이 초저위험 상품을 선택하여, 사전지정운용에서 원리금보장상품 비중은 가입자 수 기준으로 88.5%에 이르고 있다. 저위험이 9만명(4.5%), 중위험이 8만명(4.0%), 고위험이 6만명(3.0%) 수준이다. 적립금 기준으로는 1조 1,019억원이며 이 중에서 IRP가 8,013억원으로 전체의 73%를 차지한다. 초저위험 상품의 적립금 규모는 9,393억원으로, 금액 기준으로 원리금보장상품 비중은 85.2% 수준이다. 가입자 수 기준보다 약간 낮은 비중임을 감안할 때, 원리금보장상품을 사전지정운용으로 지정하는 근로자의 평균 적립금 규모가 실적배당상품보다 작음을 알 수 있다. 실적배당형 상품의 적립금 규모는 저위험이 806억원(7.3%), 중위험이 488억원(4.4%), 고위험이 332억원(3.0%) 수준으로, 가입자 수 기준과는 다소 차이를 보인다.

하지만 적격상품 대부분은 사전지정운용을 위해 신규 조성된 펀드가 아니라 과거에 설정되어 지금까지 운용 중인 펀드를 재구성한 것이다. 따라서 포트폴리오를 구성하는 하위 펀드의 과거 수익성과를 바탕으로 상품 단위의 장기 위험수익특성을 파악해 볼 수 있다. 포트폴리오로 제시되는 상품 단위의 위험수익특성은 하위 펀드의 단순 합과 동일하지 않다는 것이 포트폴리오 이론이다. 이어지는 장에서 자세히 언급하겠으나, 최소한 3년 이상의 장기 실적을 바탕으로 위험군별로 제시되는 상품 단위의 기대수익률과 위험량을 가늠하는 것이 중요하다.

Ⅲ. 적격상품의 위험수익특성 분석

1. 분석 자료

위험수익특성 분석을 위한 자료는 279개 적격상품 중에서 신규 설정 펀드를 제외하고 해당 기간 퇴직연금 공모펀드로 운용되었던 상품을 대상으로 하였다. 금융투자협회 및 FnGuide의 펀드평가 자료를 활용하였다. 최근 1년 기간수익률은 2022년 6월 1일부터 2023년 5월 31일까지 운용되었던 240개 상품을 대상으로 측정하였으며, 최근 3년 연평균수익률은 2020년 6월 1일부터 2023년 5월 31일까지 펀드 운용기간 3년 미만 펀드를 제외하고 총 212개 상품을 대상으로 분석하였다.

포트폴리오 상품의 수익률은 하위 펀드 수익률을 상품설명서에 제시된 펀드별 비중으로 가중평균하여 산출하였다. 기간수익률 산출 방식은 기준가를 이용한 주간 수익률의 기하연결(geometric link)이다. 따라서 위험은 1년 기간수익률은 52주, 3년 연평균수익률은 156주 주간수익률의 표준편차를 연율화하는 방식으로 산출하였다. 복수의 상품군으로 구성된 위험군은 일종의 자산군과 유사한 개념이므로, 위험군별 분석은 개별 상품의 설정 규모를 감안하지 않은 동일가중방식으로 산출하였다.

2. 원리금보장형(초저위험)

1년 만기 단기예금 형식인 초저위험 상품은 사실상 무위험자산이라 할 수 있으므로 위험의 측정은 큰 의미가 없다. 기대수익률 역시 금융기관이 제시하는 평균 이율로 확정적이다. 원리금보장상품의 위험량은 단기 상품에 대한 재약정 위험 정도로 해석될 수 있다. 시중 금리 변동에 따라 재약정 이율이 달라지기 때문이다. 일부 금융기관의 원리금보장상품은 현재 우대 금리 형식의 높은 제시이율이 향후에도 지속적으로 제공될 수 있을 것인가 하는 의문이 제기되기도 하였다.

<표 Ⅲ-1>을 보면, 비교적 높은 금리 상황을 반영하여 초저위험 상품의 최근 1년 기간수익률은 3.82%를 기록하였다. 기존 퇴직연금 상품을 사전지정운용 적격상품으로 재설계할 때 평균 30% 정도의 보수율 하락이 있었음을 감안하면, 해당 적격상품의 기간수익률은 4%에 가까운 성과로 해석될 수 있다. 앞 절에서 언급한 반기(6개월) 실현수익률보다 약간 낮은 수준이다.

사전지정운용에서도 원리금보장상품 비중이 여전히 높은 이유는 역시 근로자의 무관심이겠으나, 그중 일부는 이러한 고금리 상황이 반영된 근로자의 적극적인 선택적 진입(opt in)의 결과로 사료된다. 넛지 개념의 일반적 디폴트옵션은 선택적 탈퇴(opt out)를 전제로 하나, 우리 사전지정운용제도는 선택적 진입이 허용되기 때문이다. 이 부분 역시 우리 사전지정운용제도가 디폴트옵션보다는 대표상품제도로 이해함이 바람직하다는 주장의 근거 중 하나다. 위험회피 성향이 극단적으로 강하거나 은퇴를 앞두고 있어 투자 시계(investment horizon)가 짧은 근로자의 경우 자신의 연금자산 운용 방식으로 원리금보장상품을 적극적으로 선택할 수 있다. 이 경우 보수율 및 제시이율 측면에서 절대적으로 유리한 사전지정운용제도의 원리금보장상품으로 선택적 진입하는 것이 보다 합리적일 것이다. 하지만 그럼에도 불구하고 해당 기간의 높은 물가상승률을 감안하면 원리금보장상품의 실질가치 유지는 역시나 어려움을 명심하여야 한다.

3. 실적배당형

근로자들이 사전지정운용 상품을 사전 지정할 때 실질적인 선택과 고민은 실적배당형을 중심으로 이루어진다. 본인의 정확한 위험성향을 알지 못하는 상태에서 운용관리기관이 제시하는 위험군별 적격상품에 대한 상품안내만 보고 자신의 사전지정운용 상품을 지정하여야 한다. 상품안내서에는 적격상품을 구성하는 하위펀드의 위험수익특성과 펀드 간 비중에 대한 정보만 담겨있으며, 이러한 정보를 바탕으로 얼마나 많은 위험을 감수하는 것이 최적인지를 결정해야 하는 어려움이 있다. 바로 위험프리미엄의 추정이다. 하지만 실적배당상품의 위험군별 위험수익특성에서는 일관된 위험프리미엄이 관측되지 않는 경우가 빈번하다. 특히 시장 상황에 따른 변동성이 큰 단기수익률에서는 분석 기간의 영향이 클 수밖에 없다.

<표 Ⅲ-1>을 보면, 적격상품의 1년 기간수익률에 대한 본 연구의 실증분석에서도 고위험군으로 갈수록 위험량의 증가는 비교적 일관되게 나타나지만 위험의 확대에 따른 수익률의 증가는 일관적이지 않다. 저위험 상품 수익률이 1.64%로 가장 높은 반면 중위험 상품은 0.80%로 가장 낮았다. 고위험 상품의 수익률은 다시 높아져 저위험과 비슷한 수준인 1.60%를 기록하였다. 해당 기간은 고비용 인플레이션(cost push inflation)으로 주식과 채권이 동반 하락하던 시기와 금리 인상에 따른 채권 수익률 하락 시기를 모두 포함하고 있다. 따라서 채권 위주의 저위험 실적배당상품의 수익률이 원리금보장상품에 미치지 못함으로 인하여 주로 예금과 저위험 TDF8)로 구성된 저위험군과 중위험군의 수익률이 원리금보장상품보다 낮은 것으로 파악된다.

<표 Ⅲ-1>에서 확인할 수 있듯이, 2020년 하반기부터 측정된 3년 연평균수익률은 위험량의 증가에 따른 적정 수준의 기대수익률 제고를 시현하고 있다. 해외 주식 및 채권과 대체투자 등으로 포트폴리오를 구성하는 TDF는 그 자체로 비교적 분산된 글로벌 포트폴리오를 구축하고 있어 글로벌 자본시장 전망(Capital Market Assumption: CMA)을 충실히 반영하고 있는 것으로 평가된다. 원리금보장상품의 수익률을 무위험수익률로 가정하여 개별 위험군의 위험조정성과(샤프지수)를 측정해보면, 저위험 0.30에서 고위험 0.47까지 점차 상승하는 것으로 관측된다. 위험성향 별로 제시되는 사전지정운용 적격상품이 중장기적으로는 충분한 위험프리미엄을 확보하고 있음을 의미한다.

개인이 선택해야 할 부분은 적정위험 수준과 함께 운용관리기관이 제시하는 적격상품이다. 대부분의 적격상품은 2~3개 하위펀드의 포트폴리오 형태로 제시되고 있다. 앞서 언급한 바와 같이, 포트폴리오의 위험수익특성은 이를 구성하는 하위펀드의 단순 합이 아니며, 펀드 간의 상관관계가 고려되어야 한다. 따라서 운용관리기관이 제공하는 상품설명서에 나와 있는 하위펀드에 대한 소개만으로 근로자가 선택할 적격상품의 특성을 온전히 파악하기는 어렵다. 이러한 배경에서, 상품설명서의 배분 비중으로 하위펀드의 과거 수익성과를 재조합하여 개별 적격상품의 1년 기간수익률을 측정하였다. 이를 바탕으로 238개 적격상품의 위험수익특성을 위험군별로 도시하면 <그림 Ⅲ-1>과 같다. 먼저 위험군별 적정 위험량의 유지 관점에서 보면, 노란색 음영으로 표시된 중위험 상품을 95% 이상 포함하는 위험 밴드에 위치한 저위험 및 고위험 상품이 적지 않음을 알 수 있다. 저위험 상품 중 10개, 고위험 상품 중 5개가 중위험 수준의 위험량을 보이고 있다. 1년 기간수익률로 상품의 위험량을 측정할 때 위험군별 적정 위험수준이 유지되지 않는 경우가 많음을 의미한다. 그에 비하여 <그림 Ⅲ-2>에서 보듯이, 3년 연평균수익률의 위험량 분석에서는 저위험 상품 중 4개, 고위험 상품 중 2개만이 중위험 밴드에 포함됨을 확인할 수 있다.

앞서 언급한 바와 같이 이러한 위험군별 상품 제시에 적합한 펀드는 BF 또는 TRF이다. 하지만 전체 238개 실적배당형상품 중에서 TRF를 사용하는 비중은 10% 미만이다. 이는 적격상품이 별도의 펀드로 신규 설정되지 않고 기존의 퇴직연금 펀드를 재구성하는 관행에 따라 현재 국내 퇴직연금 시장에서 운용실적(track record)이 확인된 TRF 상품이 많지 않기 때문으로 사료된다. 즉, 사전지정운용의 적격성 심사를 통과하고 근로자의 선택을 받기에 가장 유리한 상품이 TDF이기 때문이다. 효율성 높은 하위펀드의 시장 공급은 자산운용회사의 역할이다. 은행 및 보험, 증권 같은 퇴직연금사업자는 아니지만 퇴직연금 시장에서 중요한 역할을 하는 금융기관이 자산운용회사다. 현재는 퇴직연금 시장에서 단순히 상품 공급자의 역할로 한정되어 있지만, 기금형 퇴직연금 및 일임투자 등이 허용되면 자산운용회사도 퇴직연금시장에 제도적으로 편입되고 관리될 필요가 있다.

Ⅳ. 제도 활성화를 위한 정책제언

앞서 논의한 바와 같이 사전지정운용제도에서 일반적인 디폴트옵션의 효과를 기대하기는 어렵다. 하지만 사전지정운용제도는 DC 근로자의 선택 편의성을 제고하고 이로부터 원리금보장상품의 치중에서 합리적인 투자 포트폴리오 구축으로 발전하기 위한 제도적 보완장치로 기능할 수 있다. 새롭게 도입된 제도가 시장에 안착하고 그 역할을 강화할 수 있도록, 제도의 운영 주체라 할 수 있는 퇴직연금사업자와 DC 근로자, 그리고 감독 당국이 참조할 수 있는 정책적 시사점을 제시하고자 한다.

1. 퇴직연금사업자: 상품 설계 및 제시

사전지정운용제도의 활성화를 위해 가장 중요한 주체는 적격상품을 설계하고 이를 근로자에게 제시하는 퇴직연금사업자이다. 특히 적합성 원칙에 따라 위험성향에 부합하는 적격상품을 설계하고 근로자로부터 이를 선택받아야 하는 퇴직연금사업자의 역할과 중요성이 강조된다. 3장의 실증분석 결과를 보면 위험군별 장기 위험수익특성은 비교적 일관되고 유의미한 것으로 평가된다. 하지만 이는 제도적 관점에서 의미가 있는 위험군별 특성이며, 개인은 해당 위험군 내에서 넓은 산포를 보이는 여러 상품 중에서 하나를 본인의 사전지정운용으로 지정하여야 한다. 실제 근로자가 선택할 수 있는 범위는 279개 전체 적격상품이 아니라 사용자가 계약한 퇴직연금 운용관리기관이 제시하는 7~10개의 적격상품이 된다. 따라서 사용자는 퇴직연금사업자가 제시하는 적격상품이 동일 위험군의 전체 적격상품 내에서 어디에 위치하는지 상시적으로 모니터링해야 한다. 그에 따라 필요하면 적격상품의 교체 또는 운용관리기관의 교체를 모색하여야 한다.

이는 우리 사전지정운용제도가 선택의 책임을 근로자에게 두는 운용구조임에도 불구하고 적격상품의 경쟁력은 퇴직연금사업자의 경쟁우위로 연결될 수 있다는 의미이다. 호주 퇴직연금(Superannuation)의 성공요인은 기금 간 운용 경쟁이며9), 이는 기금이 제시하는 디폴트옵션의 경쟁력으로 나타난다. 이 부분이 호주 퇴직연금이 난립하던 디폴트옵션을 MySuper라는 단일체계로 통합 관리하게 된 직접적인 이유다. 우리 사전지정운용제도의 적격상품도 MySuper와 유사한 수준으로 규제되고 공시된다. 이에 따라 운용관리기관이 제시하는 적격상품의 성과가 시장 및 비교집단(peer group)과 비교 평가된다. 장기적으로 사전지정운용 적격상품의 성과(performance)가 운용관리기관의 역량을 평가하는 가장 중요한 지표가 될 수 있음을 의미한다. 지금까지는 DC형 퇴직연금의 저조한 성과에 대해 퇴직연금사업자에게 그 책임을 물을 수는 없었다. 왜냐하면 수익률을 결정짓는 모든 투자의사결정이 근로자 개인에 의해 이루어지고, 퇴직연금사업자는 단순히 이를 실행하는 역할에 불과하기 때문이다. 하지만 퇴직연금사업자가 설계하고 제시하는 적격상품의 성과는 그 의미가 다르다. 그 자체로 퇴직연금사업자의 역량이자 책임이며 기관의 경쟁우위가 될 수 있다.

양질의 적격상품을 설계하고 제시하는 것은 운용관리기관이 준수해야 할 기본적인 수탁자책임이기도 하다. 금융기관인 퇴직연금사업자에는 가입자 최선의 이익에 부합하여야 한다는, 이른바 수탁자책임(fiduciary duty)이 부여되어 있다. 예를 들면, 무위험자산이라 할 수 있는 확정금리형 상품에서 보다 높은 제시이율을 확보할 수 있음에도 불구하고 금융기관의 다른 이해관계로 인해 낮은 이율의 적격상품이 구성된다면 이는 수탁자책임의 위배로 해석될 여지가 있다. 우리나라에서는 이러한 수탁자책임이 선언적 의미로만 인식되나, 신탁의 역사가 오래된 서구에서는 퇴직연금사업자가 과연 수탁자책임을 다하였느냐는 법적 소송이 야기될 수 있을 정도의 엄중한 책무이다. 퇴직연금사업자가 적격상품을 설계하는 과정에서 반드시 염두에 둬야 할 부분이다.

2. DC 및 IRP 근로자: 상품 선택

사전지정운용의 90% 이상이 원리금보장상품에 집중된 결과는 대단히 우려스러운 상황이나, 사실 제도 설계 단계부터 어느 정도 예견된 결과이기도 하다. 원리금보장상품이 포함된 지정운용제도라는 일본의 유사 사례에서 이미 확인되고 있기 때문이다. 하지만 사전지정운용 방법이 원리금보장상품으로 지정되는 것은 보다 심각한 상황을 초래할 수 있다. 무관심에 의한 방치가 사전지정운용제도로 인해 오히려 구조적으로 지속되는 계기가 될 수도 있기 때문이다. 운용지시를 내리지 못했을 때 실행되는 상품에 대한 선택을 본격적인 운용지시보다 더 심사숙고해서 결정할 것을 요구받는, 다소 모순적인 상황이 되었다. 하지만 현행 사전지정운용 방식을 대표상품제도의 일환으로 이해한다면 퇴직연금 운용의 효율화에 있어 사전지정제도의 역할과 의의를 충분히 살릴 수 있다.

실적배당형은 저·중·고위험의 3개 위험군으로 제시된다. 해외사례를 보면 대부분의 디폴트옵션은 대상 근로자의 평균적인 위험성향보다 약간 보수적인 위험의 실적배당형으로 제시되는 것이 일반적이다. 따라서 우리는 근로자 개인의 위험성향 내지는 그보다 한 단계 아래의 위험군에서 상품을 선택하면 되겠으나, 불행히도 사전지정운용의 대상이 되는 근로자 중에서 자신의 위험성향을 정확히 인지하는 경우는 거의 없을 것이다. 사전지정운용이 실행되는 것은 정해진 기한 내에 정상적인 운용지시를 내리지 못한 근로자를 대상으로 하는데, 자신의 위험성향을 정확히 파악하고 있을 정도로 투자에 관심 있는 근로자라면 구체적인 운용지시를 내리고 더 이상 사전지정운용의 대상이 되지 않을 것이기 때문이다.

위험이란 투자에 있어 가장 중요한 개념이지만 일반인이 제대로 이해하기에 어려운 부분이기도 하다. 따라서 위험군 별로 제시되는 기대수익률을 참조하여 상품을 선택할 것을 제안한다. 이렇게 수익률 기반의 선택이 가능한 이유는, 적격상품의 위험량은 일정 수준 이하로 통제되어 있으며 위험에 대한 보상, 즉 위험을 많이 취할수록 그에 합당하는 기대수익도 증가하는 상품으로 사전 승인되어 있기 때문이다. 적격상품에 대한 사전 승인의 의미는 우수한 투자상품이라는 인증은 아니지만, 투자 대상이 될 수 없는 나쁜 상품의 배제는 될 수 있다. 이때 중요한 것은 여기에서 수익률은 기대수익이지 미래의 실현수익이 아니라는 점이다. 장기투자를 전제로 할 때 기대할 수 있는 평균수익률 정도로 이해할 수 있다. 따라서 이를 가늠하기 위해서는 개별 상품의 단기가 아닌 가능한 장기 위험수익특성을 참조하는 것이 중요하다.

3. 감독 당국: 사전 승인 및 사후 공시

앞서 지적한 바와 같이, 현재 퇴직연금사업자가 설계하여 제시하는 적격상품의 구성에는 TDF의 조합과 같은 구조적인 문제가 있다. 하지만 이러한 문제를 적격상품의 사전 승인 과정에서 해소하기는 어렵다. 금융상품에 대한 전문가적 판단을 바탕으로 만들어지는 적격상품의 구조와 구성에 대해 감독 당국이 구체적인 가이드라인을 제시하는 것은 적절치 않기 때문이다. 사전 승인 과정은 적격성 심사이지 효율성 평가가 아니다. 투자상품으로서의 적격성에 대한 최소한의 인증이라는 감독 당국의 기존 입장은 그대로 유지될 필요가 있다.

합리적인 투자 포트폴리오 확대를 목적으로 하는 사전지정운용제도에 원리금보장상품이 선택가능한 대안으로 포함된 것은 일종의 제도적 결함이라 할 수 있다. 이는 가입자 교육이나 홍보 강화 등을 통해 완화해야 할 과제이나, DC 근로자의 적립금 운용에 있어 이러한 금융교육 및 홍보의 효과가 크지 않다는 점이 문제이다.10) 향후 제도 개편을 통해 원리금보장상품은 적격상품의 유형에서 제외되는 것이 바람직하겠으나, 이러한 제도 개편이 어렵다면 적어도 미국의 QDIA에서와 같이 사전지정운용 상품으로 원리금보장상품을 지정하는 경우 그 기간을 짧게 한정할 필요가 있다.

사전지정운용 적격상품의 효율성 제고는 금융기관인 퇴직연금사업자 간의 경쟁 구도를 강화하는 방향으로 추진되어야 한다. 이러한 경쟁 구도는 사후 공시를 통해 사전지정운용의 성과를 근로자 또는 사용자가 직접 판단하고 그 결과를 퇴직연금사업자에게 피드백 하는 과정을 통해 강화될 수 있다. 지금까지 퇴직연금사업자의 경쟁은 가입자 유치 경쟁이었다. 이를 적격상품의 효율성에 대한 운용 경쟁으로 유도할 수 있는 공시 체계가 중요하다는 뜻이다. 제도 초기 단계에서 감독 당국이 가장 집중해야 할 부분이 제도 도입 목적에 부합하는 효과적인 공시 체계의 설계 및 관리이다. 공시의 주기는 분기 단위 등 가능한 짧은 주기로 빈번하게 공시되는 것이 바람직하나, 수익률 산출 기간(평가기간)은 가능한 장기로 설정되어야 한다. 적어도 3년 이상의 장기수익률 관점에서 자신의 투자상품을 평가하고 다른 상품과 비교되도록 공시 항목의 구성 및 우선순위 등이 배치되어야 한다. 특히 운용성과의 공시는 비교집단(peer group) 간의 객관적(apple to apple) 비교가 중요함을 강조한다.

디폴트옵션으로서 사전지정운용제도가 갖는 제도적 한계는 분명하다. 따라서 향후 온전한 의미의 디폴트옵션에 대한 고민도 필요하다. 사전지정운용제도를 도입하는 과정에서 경험한 바와 같이, 이는 퇴직연금의 지배구조와 연결된 문제이다. 많은 전문가들이 디폴트옵션제도가 도입되기 위해서는 기금형 지배구조의 도입이 전제되어야 한다고 주장하였다.11) 고용노동부는 중소기업퇴직연금기금 도입 이후 중단된 기금형 퇴직연금제도에 대한 논의를 다시 재개할 필요가 있다. 이와 더불어, 디폴트옵션의 필요성은 결국 DC형 퇴직연금제도에서 적립금의 운용은 개인이 아닌 전문가에 위임되는 구조가 바람직하다는 인식에서부터 출발한다는 관점에서 중소기업퇴직연금기금과 같이 DC 적립금을 모아서 집단적으로 운용하는 집합DC(Collective DC: CDC) 형태의 퇴직연금제도도 활성화 될 필요가 있다. 최근 국회 공적연금개혁특별위원회를 중심으로 논의되는 국민연금기금의 퇴직연금사업자 참여 등도 기금형 또는 CDC형 퇴직연금제도를 전제로 할 때만 의미가 있다. 지배구조 개선에 대한 감독 당국의 적극적인 의지와 노력이 요구된다.

Ⅴ. 결론 및 시사점

2025년이면 퇴직연금 제도 도입 20주년이 된다. 외형적으로는 300조원을 상회하는 거대 연금으로 성장하였다. 짧지 않은 이력이며 비약적인 성장세다. 정부 당국을 포함한 시장 참여자의 적극적인 노력으로 그동안 많은 제도 개편과 운용 개선이 추진된 결과라 하겠다. 그럼에도 불구하고 여전히 많은 문제들이 지적되고 있다. 외형적 성장에 이은 제도 내실화가 요구되는 상황에서, 그 중심에는 퇴직연금의 운용수익률 제고가 있다. 제도 일원화 및 중도인출 제한, 연금화 강제 등 퇴직연금제도의 산적한 과제들에 있어 가장 바람직한 해법은 법에 의한 강제가 아니라 개인의 자발적 선택이다. 이를 유인할 수 있는 가장 효율적인 기제가 높은 운용수익률이다. 호주의 기업연금(Superannuation) 사례가 이를 방증한다. 연금제도에서 운용수익률이 문제가 되는 것은 특히 DC형 퇴직연금이다. 이를 위하여 많은 전문가들의 지난한 논의과정을 거쳐 어렵게 도입된 것이 사전지정운용제도이다. 사전지정운용제도의 도입 목적이 운용수익률 제고이며, 이는 실적배당상품 확대를 통해서만 구현될 수 있음을 분명히 할 필요가 있다.

비록 디폴트옵션으로서의 역할을 기대하기는 어려우나, 사전지정운용제도는 법으로 강제되는 대표상품제도로 도입 목적을 달성할 수 있다. DC 적립금의 합리적 운용이 자동으로 주어지지는 않지만 적어도 그 가능성을 높일 수 있는 제도적 보완장치는 될 수 있다는 의미다. 이러한 제도 목적이 온전히 달성되기 위해서는 적격상품을 제시하는 퇴직연금사업자와 이를 선택하는 근로자, 그리고 감독 당국의 적극적인 노력이 배가되어야 한다. 퇴직연금제도의 다음 20년의 화두는 운용수익률이 될 것이다. 그 시발점에서 사전지정운용제도가 도입되었다. 사전지정운용제도의 성과(performance)가 향후 우리 퇴직연금제도의 성공과 실패를 나눌 수 있다.

1)「근로자퇴직급여보장법(이하 근퇴법)」 개정을 통해 2022년 7월 12일에 사전지정운용제도가 도입되었으며, 일 년의 준비기간을 거쳐 2023년 7월 12일부터 본격 시행되었다.

2) 국내 퇴직연금제도에 디폴트옵션을 도입하기 위한 자세한 논의 과정은 남재우(2017)를 참조할 수 있다.

3) 넛지의 사전적 의미는 팔꿈치로 슬쩍 찌르는 행위이다. 강제하지 않고 부드러운 개입으로 더 좋은 선택을 할 수 있도록 유도하는 방법을 의미한다.

4) 오랜 기간 많은 전문가의 논의를 통해 도입된 제도임에도 불구하고 온전한 의미의 디폴트옵션으로 설계되지 못한 이유는 원리금보장상품에 대한 퇴직연금사업자의 업권별 이해관계와 계약형 지배구조하에서 실적배당상품의 원금손실에 대한 면책의 어려움 때문이다. 자세한 논의는 남재우(2017)를 참조한다.

5) 이는 호주 퇴직연금(Superannuation)의 MySuper를 참조하였다. 근로자 스스로 기금(Superannuation Fund)을 선택할 수 있는 호주에서는 기금의 선택이 곧 디폴트옵션의 선택을 의미하게 된다. 근로자의 합리적인 상품 선택을 돕기 위하여 기금별로 오직 하나의 디폴트옵션만 설정할 수 있도록 하고, 상품 간 비교가능성을 높이기 위하여 감독 당국(APRA)이 디폴트옵션의 성과를 표준화된 방법으로 공시토록 한 것이 MySuper의 핵심이다. 자세한 사항은 이경희(2018)를 참조한다.

6) 최초 가입 또는 기존 운용기간 만료 후 4주 동안 근로자의 운용지시가 없을 경우 퇴직연금사업자는 해당 근로자에게 사전지정운용 방법으로 운용될 수 있음을 통지하고, 이후 2주 동안 운용지시가 없을 경우 추가적인 승인 절차 없이 사전 지정된 방법으로 운용을 개시한다.

7) 일본은 2018년 ‘지정운용방법’이라는 이름으로 원리금보장상품이 포함된 사전지정운용제도를 도입하였으며, 원리금보장상품 편중 문제를 완화하기 위하여 상품설명서에 ‘원리금보장형 선택 시 실질적 구매력 확보가 어렵다’는 정보를 반드시 제공하도록 하였다(이경희 외, 2021).

8) TDF2025와 같이 은퇴 시점이 가까워 채권 위주의 자산 구성으로 추정되는 TDF를 저위험 TDF로 분류하고 TDF2045 같이 주식 위주의 자산 구성으로 추정되는 은퇴 시점이 많이 남은 TDF를 고위험 TDF로 분류한다.

9) 기금형 지배구조인 호주 퇴직연금에서는 근로자가 기금(Superannuation Fund)을 선택할 수 있으며, 이때 선택의 기준으로 기금이 Mysuper라는 이름의 단일상품으로 제시하는 디폴트옵션의 경쟁력이 가장 중요하게 고려된다. 이러한 경쟁구도가 호주의 디폴트옵션이 수익률과 안정성 모두에서 높은 수준의 운용 효율성을 달성할 수 있었던 배경이다.

10) Atkinson & Messy(2012)에 의하면 영국 노동청의 근로자 금융역량 강화 프로그램의 장기적 효과를 추적한 결과 이수 그룹과 미이수 그룹 간 유의미한 차이가 나타나지 않았다.

11) 보다 자세한 내용은 김재현(2023)을 참조할 수 있다.

참고문헌

김재현, 2023, 도입 20주년을 앞둔 퇴직연금제도 과제: 지배구조 다양화, 보험연합학술대회.

고용노동부, 2023. 5. 31, 2023년 1분기 사전지정운용방법(디폴트옵션) 주요 현황 공시.

고용노동부, 2023. 7. 19, 2023년 2분기 사전지정운용방법(디폴트옵션) 주요 현황 공시.

남재우, 2017, 퇴직연금 적립금 운용 효율화를 위한 한국형 디폴트옵션 도입 방안, 『금융감독연구』 4(2), 61-83.

남재우, 2021, 확정기여형(DC) 퇴직연금제도와 디폴트옵션, 자본시장연구원『자본시장포커스』2021-05호.

이경희, 2018, 호주 퇴직연금제도 현황과 시사점, 보험연구원 연구보고서 14권.

이경희‧박희진‧손성동, 2021, 일본의 퇴직연금 디폴트옵션제도 도입 사례 분석 및 시사점, 『한일경상논집』 90, 73-83.

Atkinson, A. and F. Messy, 2012, Measuring Financial Literacy: Results of the OECD / International Network on Financial Education (INFE) Pilot Study, OECD Working Papers on Finance, Insurance and Private Pensions No. 15, OECD Publishing.

고용노동부 www.moel.go.kr

금융투자협회 www.kofia.or.kr

FnGuide www.fnguide.com