Find out more about our latest publications

Characteristics of Korean won FX markets and the effects of market opening to non-residents

Research Papers 23-07 Oct. 20, 2023

- Research Topic Macrofinance

- Page 72

- No other publications.

This paper studies the effect of Korea’s inter-bank FX market opening to non-residents and the extension of trading hours on the market volatility and trading volume, following the government plan announced in February 2023. It is worth analyzing the effect in a sense that the off-shore won/dollar NDF market has rapidly grown relative to the on-shore spot market while the amelioration of FX market infrastructure resulting from the market opening is the one of the key issues in widening the accessibility of foreign investors.

The growth of off-shore won/dollar NDF trading volume has been noticeable compared with other emerging market currencies. As a result, it affects the won/dollar exchange rate through not only the direct trading between domestic banks and non-residents but also indirect channels through off-shore NDF rates. According to the empirical analysis, the off-shore NDF rates seem to unilaterally affect the spot rate.

The simulation results using the agent-based market model (ABM) show that the market opening has little impact on the exchange rate volatility while the trading volume is expected to increase steadily. Meanwhile, these positive effects could be strengthened if the share of non-residents trading during the extended hours surpasses more than 20 percent of those trading during the regular hours. Also, it is found that the FX market turmoil arising from the market opening could be manageable as the resultant volatility would remain at a similar level to that of the recent global financial uncertainty.

These results imply that no discrimination between residents and non-residents and minimized procedural inconvenience for non-residents are required to induce more non-residents’ participation because sufficient non-residents‘ participation is a crucial element for successful market opening. In addition, the government needs to monitor closely whether any unexpected market turbulence occurs after the market opening. From a longer-term perspective, the market opening should serve as a stepping stone for the internationalization of the Korean won which is a prerequisite for further developing the financial and FX markets and maintaining financial stability of Korea.

The growth of off-shore won/dollar NDF trading volume has been noticeable compared with other emerging market currencies. As a result, it affects the won/dollar exchange rate through not only the direct trading between domestic banks and non-residents but also indirect channels through off-shore NDF rates. According to the empirical analysis, the off-shore NDF rates seem to unilaterally affect the spot rate.

The simulation results using the agent-based market model (ABM) show that the market opening has little impact on the exchange rate volatility while the trading volume is expected to increase steadily. Meanwhile, these positive effects could be strengthened if the share of non-residents trading during the extended hours surpasses more than 20 percent of those trading during the regular hours. Also, it is found that the FX market turmoil arising from the market opening could be manageable as the resultant volatility would remain at a similar level to that of the recent global financial uncertainty.

These results imply that no discrimination between residents and non-residents and minimized procedural inconvenience for non-residents are required to induce more non-residents’ participation because sufficient non-residents‘ participation is a crucial element for successful market opening. In addition, the government needs to monitor closely whether any unexpected market turbulence occurs after the market opening. From a longer-term perspective, the market opening should serve as a stepping stone for the internationalization of the Korean won which is a prerequisite for further developing the financial and FX markets and maintaining financial stability of Korea.

Ⅰ. 연구배경

우리나라가 1992년 외국인투자자에게 처음으로 국내 자본시장을 개방한 이래 두 차례 위기와 대외불확실성의 지속에도 불구하고 개방경제체제가 나름대로 양적·질적 발전을 거듭해 오고 있다. 우리나라의 무역 등 실물경제 규모가 꾸준히 확대되는 가운데 자본·금융거래에 있어서도 외국인의 국내 주식 및 채권에 대한 투자 잔액이 이미 1조달러를 상회하고 있고 국내 거주자의 해외증권투자도 이와 비슷한 규모까지 크게 확대되었다. 이에 따라 국경간 자본유출입 규모가 크게 확대되고 국내 외환시장에서의 외환거래 규모도 이에 동반하여 증가하는 등 성장을 거듭해 왔다.

그러나 아직까지 역내(on-shore) 외환시장은 실물경제나 주식시장 등 여타 자본시장의 발전 속도에 비해 상대적으로 완만한 양적 성장을 보이는 가운데 시장하부구조의 개선 등 질적인 발전 정도에 있어서도 미흡한 감이 없지 않다. 향후 대외부문의 안정을 유지하고 개방거시경제 체제를 더욱 공고히 확립하기 위해서는 우리나라 외환시장의 하부구조와 기능이 지금보다 더 고도화될 필요가 있다. 특히 외환시장의 중추적 기능을 담당하는 은행간(inter-bank) 외환시장의 참가자가 외환당국에서 인가받은 외국환은행으로 제한된 가운데 원화는 국제통화로서 자리매김하지 못하고 있는 상황이다. 반면 역외(off-shore) 글로벌 금융중심지에서는 원화외환시장이 차액결제선물환(Non-Deliverable Forward: NDF) 거래를 중심으로 빠르게 발전하면서 국내외 경제주체들의 다양한 외환거래 수요의 상당 부분을 담당하고 역내 외환시장의 성장을 더디게 하는 측면도 있는 것으로 보인다.

우리나라의 외환위기 직후인 1999년 4월 국내 은행과 역외 비거주자들 간의 NDF 거래가 허용된 이후 거래 규모가 꾸준히 증가하고 원화환율 결정에 직접적인 영향을 주고 있다. 비거주자들은 국내 증권투자에 따른 환헤지 등을 목적으로 원화와 같이 비국제화된 통화에 대해 거래편의가 있는 NDF거래에 치중하고 있어 환율 변동성을 확대시키고 역외 투기세력이라는 비판을 받고 있다. 이는 NDF 거래가 직접적인 외환의 유출입을 수반하지 않더라도 은행의 환포지션 변동을 통해 현물환율에 즉각적인 영향을 미치고 있는데 따른 것이다. 더욱이 최근에는 뉴욕이나 런던 등 글로벌 국제금융중심지에서 비거주자들 간에 이루어지는 원화 NDF 거래가 국내 현물환거래 규모를 훨씬 능가할 정도로 커지고 시장유동성이 확대되면서 원화 현물환율의 결정에 미치는 간접적인 영향도 확대되고 있다. 그 결과 역내·외 원화외환시장은 현물환 중심의 국내 외환시장과 비거주자들의 NDF 거래 중심의 역외 외환시장으로 구분되어 병존하고 있는 시장구조가 심화되고 있는 것으로 판단된다.

이런 점을 배경으로 우리 정부(기획재정부)는 2023년 2월 「외환시장 구조 개선방안」을 발표하였다. 이 방안은 국내 규제 및 감독체계에서 벗어난 역외 원화시장의 개설 대신, 국내 외환시장을 외국인에게 개방하여 경쟁적 시장구조로 전환하고자 하는 전략이라 할 수 있다. 이를 달성하기 위해 국내 외환시장 대외 개방, 개장시간 대폭 연장1), 선진수준 시장인프라 구축 등 세 가지 방안을 제시하였다. 구체적으로는 일정요건을 갖춘 해외소재 금융기관(Registered Financial Institution: RFI)에 대해 국내 은행간시장에서 국내 외국환중개사를 통한 현물환 및 외환스왑 거래에 대한 직접 참여를 허용하고 외환시장의 개장시간을 익일 오전 2시까지 연장하는 것이 그 골자이다. 이는 서울외환시장을 해외금융기관에 개방하여 외국인투자자의 거래편의와 접근성을 개선하는 동시에 역외 거래자의 NDF 거래 수요를 일정 부분 국내 현물환시장으로 흡수함으로써 시장하부구조를 개선하고 역외시장에 기인한 원화환율 변동성 확대를 최소화하여 우리나라 외환시장의 양적·질적 발전을 도모하고자 하는 계획이라 할 수 있다.

이에 대해 일부에서는 외국인의 국내 은행간 외환시장 참여 유인이 크지 않다는 점을 지적하는 가운데 설령 비거주자의 국내시장 참여가 확대되는 경우에도 시장참가자 확대를 통한 시장효율성 개선 등 긍정적 효과 외에 시장변동성 확대 등 부정적 측면을 가져올 수 있다는 우려를 제기하고 있다. 이러한 부정적인 견해는 역외 거래자들이 대체로 투기적 성향이 강하다는 일반적 인식을 반영하여 비거주자들의 국내 현물환시장 진입으로 원화환율의 변동성이 확대되고 시장의 교란요인이 될 수 있다는 우려에 따른 것이다. 따라서 역외 원화외환시장의 현황과 비거주자들의 거래 행태, 그리고 역내 외환시장이나 현물환율과의 관계 등에 대한 사전적인 연구 필요성이 크다고 판단되나 이에 관한 연구는 별로 없는 실정이다. 특히 내년 하반기 시행을 목표로 정부가 추진중인 외국인에 대한 국내 은행간 외환시장 개방이 원화환율의 변동성이나 외환거래량 등에 미칠 영향에 대해서는 아직까지 연구가 거의 이루어지지 못하고 있다.

이런 점을 배경으로 본 연구에서는 우선 역내·외 원화 외환시장 현황과 역내·외 시장간의 상호 관계 및 환율에 대한 영향을 살펴봄으로써 역외 비거주자의 국내 외환시장 참여에 따른 영향을 사전적으로 분석하고자 한다. 이어서 비거주자의 국내 외환시장 진입이 확대될 경우 국내 시장에서 원화환율 변동성 및 외환거래량 등에 미치는 영향을 심층적으로 분석하였다. 이를 위해 이론모형인 에이전트 모형을 우리나라 외환시장의 구조 및 특성을 반영하여 설정한 후 시뮬레이션을 통해 그 영향을 다각도로 분석해 보고자 한다. 보고서의 구성은 다음과 같다. 제II장에서는 역내·외 원화외환시장 현황 및 상호 관계를 살펴보고 제III장에서는 외환시장 개방에 따른 영향을 분석하였다. 제IV장에서는 요약 및 시사점을 제시하였다.

Ⅱ. 역내·외 원화외환시장 현황 및 관계

1. 우리나라의 외환시장 거래 구조

우리나라의 역내 은행간(interbank) 외환시장의 거래구조와 메커니즘을 간략히 설명하면 다음과 같다. 우선 시장참가자는 원칙적으로 외국환거래법상 외환당국에 등록된 국내은행과 외은지점 등 외국환은행으로 제한된다.2) 그 밖에 외국환은행은 아니지만 국내 증권사3)가 2003년 이후 은행간 외환시장에 참여하고 있는데 이는 2000년대 이후 국내외 증권투자자금의 유출입 규모가 크게 확대된 데 따른 것이다. 금번 정부의 외국인에 대한 은행간 외환시장 개방 계획은 현행 외국환거래법에서 명시한 외국환은행 이외의 참가범위 확대 조치라 할 수 있다.

은행간 시장에서의 현물환거래는 주로 외국환중개회사를 통한 중개거래가 대부분이다. 현재 현물환거래는 국내 계열의 2개 중개사4)만 중개업무가 허용되고 있다. 반면 다수의 외국계중개회사에 대해서는 현물환중개 업무가 허용되지 않고 있어 이들은 주로 엔/달러나 유로/달러 등 이종통화에 대한 중개업무나 역외 비거주자와의 NDF 거래 및 외환스왑 거래 등에 대한 중개업무에 치중하고 있다.

현재 은행간 시장에서 거래되고 있는 통화는 원/달러 및 원/위안5) 두 시장만 존재한다. 원/달러 현물환거래의 경우 최소 거래단위는 100만달러이며 100만달러씩 증액할 수 있다. 역내 시장의 중개거래 시간은 우리나라 주식시장 개장시간과 동일하게 오전 9:00 ~ 오후 3:30으로 되어 있다. 중개방식은 과거 전화나 메신저 등을 통한 방식보다는 대부분 전자중개시스템(Electronic Broking System: EBS)을 통해 체결되고 있다. 환율의 표기방식은 소수점 한자리(10전 단위)까지 표기하고 있다. 이와 같은 서울외환시장에서의 현물환 매매방식에 관한 세부적인 사항들은 은행간 외환시장 참가자들의 민간자율협의기구인 ‘서울외환시장운영협의회’에서 정하고 있다.

역내 시장에 비해 역외시장에서의 거래는 상대적으로 자유롭게 이루어진다. 다만, 원화 현물이 역외시장에서 자유롭게 거래되고 있지 못함에 따라 역외시장에서는 주로 원/달러 NDF 거래를 중심으로 거래가 이루어지고 있다. 역외시장에서의 원/달러 NDF 거래는 해외에서 원화의 실물 인수도가 이루어지지 않아도 될 뿐만 아니라 외환매매와 관련한 우리 외환당국의 규제체계의 적용을 받지 않아도 되므로 거래 참가자나 중개기관 및 거래방식 등에 대한 제약이 없다고 할 수 있다. 과거 싱가포르나 홍콩 등 아시아지역을 중심으로 형성되기 시작한 원/달러 NDF 시장은 최근에는 뉴욕은 물론 런던, 동경 등 주요 글로벌 금융중심지에서 더 큰 규모의 거래가 이루어지고 있다.

2. 역내·외 원화외환시장 현황

우리나라 외환시장은 크게 보아 현물환 중심의 역내 외환시장과 NDF 거래 중심의 역외 외환시장으로 구분된 모습을 보이고 있다. 여기서는 역내 외환시장의 현황을 외환거래 규모를 중심으로 살펴본 후 역외시장에서 비거주자들에 의해 주도되고 있는 원/달러 NDF 거래의 현황 및 특징을 살펴보았다.

가. 역내 외환거래 현황

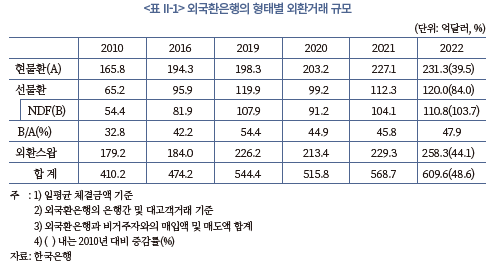

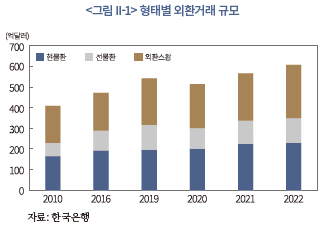

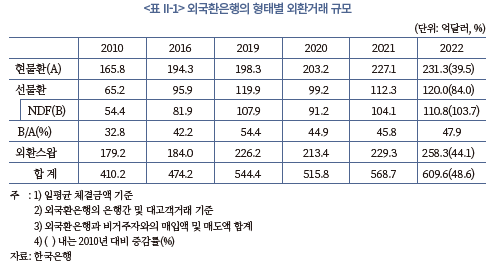

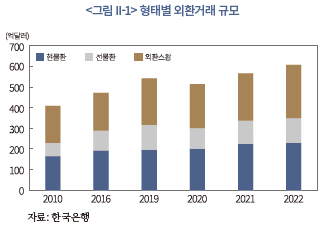

우리나라의 역내(서울) 외환시장에서 외국환은행이 은행간 또는 대고객과 체결한 총 외환거래 규모6)는 <표 II-1>에서 보는 바와 같이 2022년 기준 609.6억달러(일평균 기준)를 나타내고 있다. 이중 현물환(spot) 거래 규모는 일평균 231.3억달러로 외환스왑(258.3억달러) 다음으로 큰 비중을 차지한다. 현물환 거래를 기준으로 볼 때 최근의 일평균 거래규모는 2010년 대비 39.5% 증가에 그친 것으로 나타나 그간 우리나라의 자본유출입 등 자본〮금융거래의 증가나 주식시장 등 여타 자본시장의 양적 성장에 비해 상대적으로 더딘 성장세를 보여 왔다.

반면 선물환(forward) 및 외환스왑(FX swap) 거래는 현물환거래에 비해서는 비교적 빠른 증가세를 보였다. 은행들의 선물환거래는 수출입기업들의 환헤지를 위한 거래보다 역외 비거주자들과의 NDF 거래가 규모가 훨씬 커 선물환거래의 대부분을 차지하고 있는데 2022년 기준 역외 비거주자와의 NDF 거래 규모는 일평균 110.8억달러에 달하며 2010년 대비 2배 이상 증가하였다. 비거주자와의 NDF 거래가 빠르게 증가한 것은 1999년 4월 이후 국내 외국환은행과 역외 비거주자들 간의 NDF 거래가 허용된 이후 비거주자들이 환헤지(hedging)나 투기적 목적(speculation)을 위해 원/달러 NDF 거래 규모를 늘려온 데 기인한다. NDF 거래는 통상 국경간 자본유출입을 초래하지는 않으나 거래의 결과 국내 은행들의 외환포지션(FX position)의 즉각적인 변동을 수반하므로 현물환율의 결정에 직접적인 영향을 미치고 있다. 그 밖에 전통적 외환거래중 가장 큰 비중을 차지하고 있는 외환스왑 거래는 2022년 기준 일평균 258.3억달러의 거래규모를 나타내며 완만한 증가세를 보이고 있다.

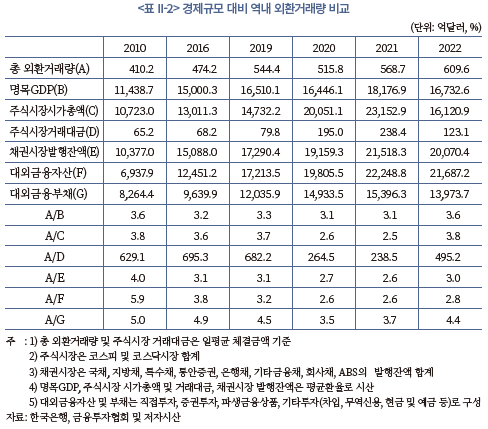

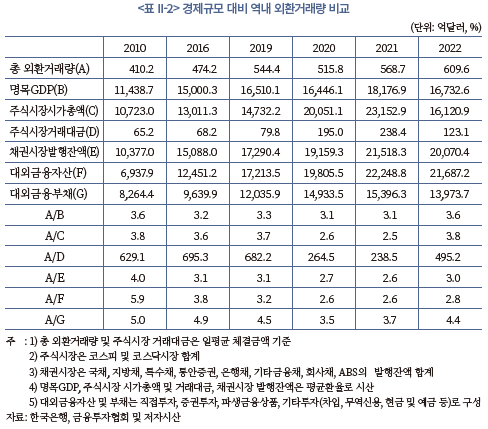

우리나라 역내 외환시장에서의 거래 규모는 실물경제 규모나 주식 및 채권시장의 시가총액, 그리고 대외금융자산 및 부채 등의 증가 속도에 비해 더딘 성장세를 보이고 있다. <표 II-2>에서 보는 바와 같이 명목GDP나 주식시장 시가총액 대비 총 외환거래량 규모는 2010년 이후 대체로 감소하다가 2022년에 이전 수준을 회복하였다. 그러나 채권시장발행잔액 대비로는 감소하였으며 특히 대외금융자산 및 대외금융부채 규모와 비교하여서는 외환거래규모의 증가 속도가 2010년 대비 크게 낮은 것으로 나타났다. 이는 그간 우리나라에서 비약적으로 늘어나고 있는 국경간 자본·금융 거래와 이에 수반되는 외환거래 수요에 비하여 역내 외환시장의 양적 성장세가 상대적으로 크지 않음을 의미하는 것으로 판단된다.

나. 역외 외환거래 현황

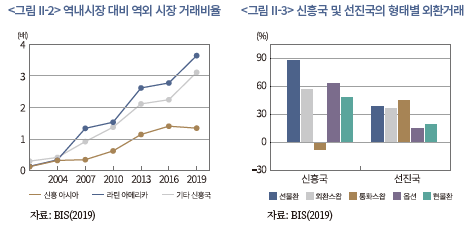

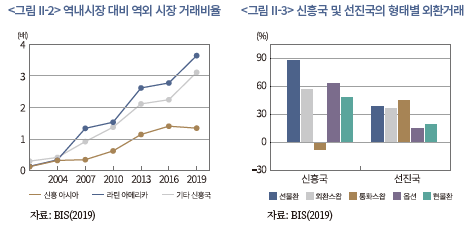

역내 외환시장이 상대적으로 완만한 성장세를 보이는 것과 달리 원화의 역외 외환시장은 빠른 성장세를 보이고 있다. 역내 시장보다 역외시장(off-shore)의 발전 속도가 빠른 것은 비단 우리나라 원화에 국한되지 않고 대부분의 신흥국 통화에서 공통적으로 관찰되는 국제적 현상과 무관하지 않은 것으로 보인다. <그림 II-2>와 <그림 II-3>에 제시된 국제결제은행의 조사결과에 따르면 아시아 신흥국의 경우 역외시장이 역내시장의 거래 규모를 상회하고 있는데 그 주된 이유는 역외시장 거래 형태중 차액결제선물환(NDF) 시장이 대부분의 통화에 대해 빠르게 성장하고 있는데 기인한다. 이는 우리나라 원화를 비롯한 대부분의 아시아 국가 통화들의 국제화 정도가 미흡하여 자국통화 대신 미달러화가 결제수단으로 주로 사용되는 NDF 거래가 외국인투자자들의 환헤지 및 투기적 목적 거래에 용이하기 때문이다.

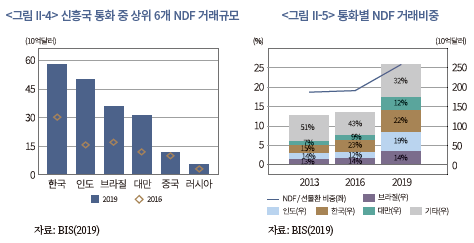

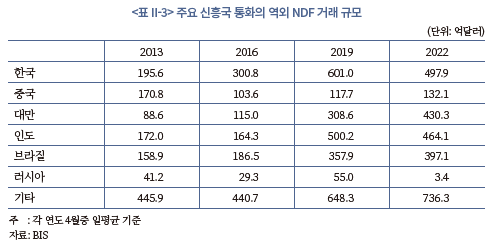

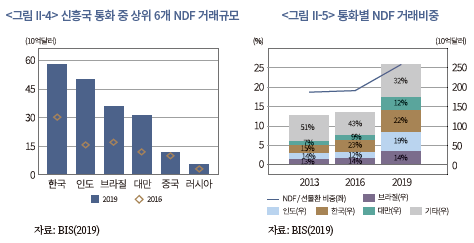

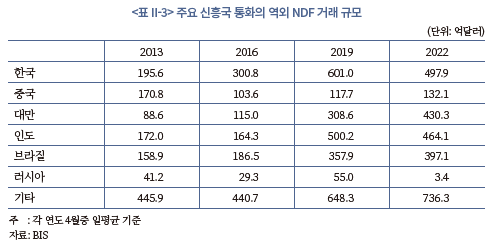

국제결제은행에서 발표한 역외 NDF 시장의 국별 및 통화별 거래규모를 살펴보면 신흥국 통화중 우리나라 원화 NDF 시장의 확대가 가장 두드러진 것으로 나타나고 있다. <그림 II-4>와 <그림 II-5> 및 <표 II-3>에서 보는 바와 같이 역외시장에서 원화의 일평균 NDF 거래 규모는 약 300억달러(2016년 기준) 수준에서 2019년에는 약 2배 수준으로 급증하여 신흥국 통화에서 차지하는 비중이 22%에 달하였다가 2022년에는 소폭 감소하였다. 이처럼 원화에 대한 역외 NDF 거래 규모가 가장 큰 폭으로 증가한 것은 우리나라의 실물 및 금융경제 규모가 꾸준히 확대되는 가운데 특히 거주자의 해외증권투자 규모와 외국인 증권투자자금 유출입이 다른 신흥국에 비해 가장 큰 폭으로 늘어나면서 원화에 대한 환헤지 목적 및 투기적 거래수요가 함께 증가해 온 데 따른 것으로 풀이된다.

<표 II-3>을 앞의 <표 II-1>과 연관하여 살펴보면 역외 비거주자가 국내 외국환은행과 체결한 원/달러 NDF 거래 규모(2022년중 110.8억달러)를 제외한 나머지 거래는 비거주자들간에 이루어진 것으로 추정할 수 있다. 이에 따르면 최근 비거주자들간의 일평균 NDF거래 규모가 2019년과 2022년의 경우 각각 약 500억달러 및 400억달러에 달하고 있다. 역외 비거주자는 국내 은행과 원/달러 NDF 거래를 하고 있을 뿐만 아니라 비거주자들 간에 훨씬 큰 규모로 동 거래가 이루어지고 있어 역외 원/달러 NDF 시장의 유동성이 역내시장 못지않게 풍부해짐으로써 매매호가의 매입-매도 스프레드(bid-ask spread)가 역내 현물환시장과 큰 차이가 없는 정도로 알려지고 있다.

이처럼 역외 NDF 시장에서 비거주자들의 원/달러 NDF 거래 규모 및 시장유동성이 크게 증가함에 따라 우리나라 원화 외환시장은 크게 보아 현물환거래 중심의 역내 시장과 NDF 거래 중심의 역외시장으로 구분되어 발전하는 모습을 띠고 있다. 또한 역외 NDF 시장의 유동성 및 효율성이 증가하면서 원화환율의 결정에 있어서도 국내 시장참가자의 외환매매 못지않게 역외 비거주자들의 원/달러 NDF 거래에 의해 큰 영향을 받고 있는 점을 시사한다.

3. 비거주자와 은행 간의 NDF 거래 및 환율 영향

역외 비거주자들은 국내 외국환은행과 NDF 거래를 하거나 비거주자들간의 거래를 통하여 원/달러 환율의 결정에 영향을 미치고 있다. 이 절에서는 우선 비거주자와 국내 외국환은행과의 NDF 거래가 은행의 외환포지션 변동을 통해 환율에 영향을 미치는 직접적인 경로에 대해 살펴보았다.

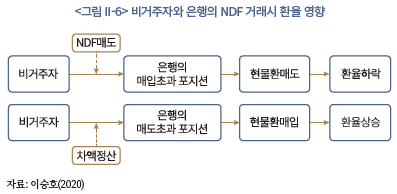

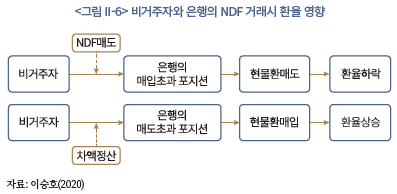

예를 들어 비거주자가 원화환율의 상승을 예상하여 국내 은행과 NDF 매입7)거래를 하는 경우 국내 외국환은행은 매도초과포지션(over-sold 또는 short position) 상태에 놓이게 되는데 이 때 은행들은 환포지션을 조정8)하기 위해 주로 현물환시장에서 외환을 매입하게 되므로 환율이 상승압력을 받는다. 반대로 비거주자의 NDF 매도(은행의 NDF 매입)시에는 은행은 매입초과포지션(over-bought 또는 long position) 상태의 환포지션 조정을 위해 현물환을 매도하므로 환율이 하락압력을 받는다. 이를 그림으로 정리하면 다음 <그림 II-6>과 같다.

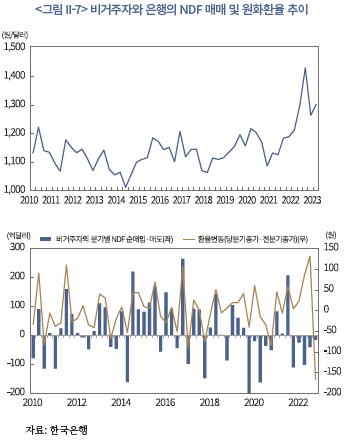

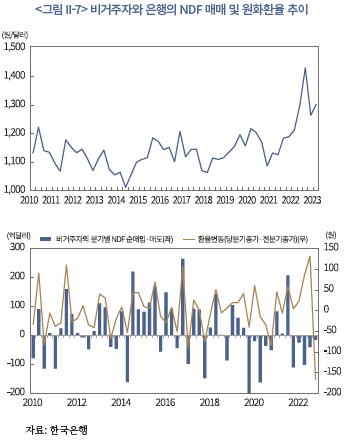

<그림 II-7>은 2010년 이후 국내 은행과 역외 비거주자 간의 분기별 NDF 거래 추이를 나타낸다. 이에 따르면 비거주자와 국내 은행 간의 NDF 거래는 원화환율 변동에 대체로 일관된 영향을 미치는 것으로 보인다.9) 즉, 비거주자의 NDF 순매입(은행의 순매도)시에는 원화환율 상승이, 반대로 비거주자의 NDF 순매도(은행의 순매입)시에는 환율하락 요인으로 작용하는 경우가 대부분이다. 실제 비거주자들의 NDF 순매입시에는 원화환율에 대한 상승 전망을 바탕으로 하는 경우가 일반적인데 동 거래의 결과 실제 원화환율에 상승압력이 나타남으로써 외화자금의 실제 유출입과 상관없이 환율 변동성을 심화시키는 요인이 되고 있다.

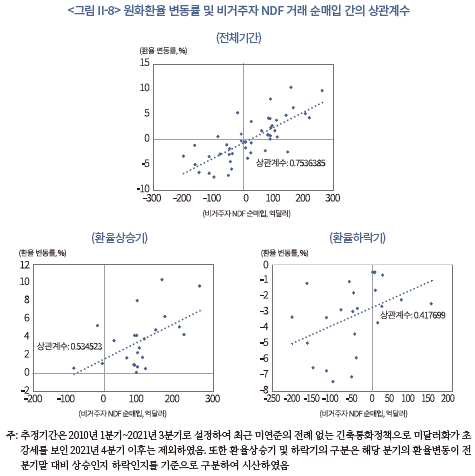

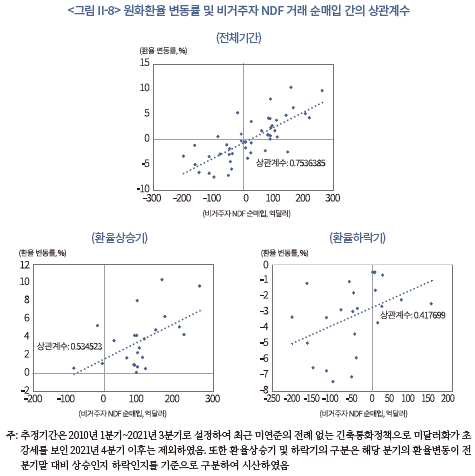

한편 원화환율 변동률과 비거주자의 NDF 거래간 상관계수(correlation coefficient)를 살펴보더라도 전체기간(2010년 1분기~2021년 3분기)의 경우 +0.75로 나타나 비거주자의 NDF 거래가 원화환율 변동과 밀접한 관계를 보였다. 이를 환율변동의 방향에 따라 원화환율의 상승기와 하락기로 구분하여 상관계수를 각각 구해보면 환율상승기의 상관계수(+0.53)가 환율하락기의 상관계수(+0.42)보다 다소 더 큰 것으로 나타났다. 이는 환율의 변동방향과 상관없이 비거주자의 국내은행과의 NDF 거래가 원화환율의 변동을 초래하는 요인으로 작용함을 의미한다. 또한 환율상승시 비거주자와 은행과의 NDF 거래가 환율에 미치는 영향력이 약간 더 큰 것으로 보이는데 이는 통상 거래통화의 약세가 예상되는 경우 비거주자가 더 집중적인 매매행태를 보이면서 결과적으로 환율 변동성을 증가시키는 비거주자의 투기적 매매성향이 일부 반영된 결과로 판단된다.

4. 현물환율과 NDF 환율 간의 관계 분석

역외 비거주자와 국내 은행과의 NDF 매매가 환율에 영향을 주는 직접 경로 못지않게 역외시장에서 비거주자들간의 원/달러 NDF 거래 증가로 NDF 환율이 형성됨으로써 국내 현물환율 결정에 미치는 간접적인 경로의 영향도 커지고 있다.

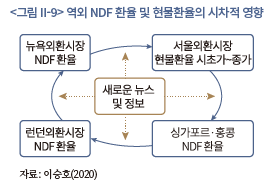

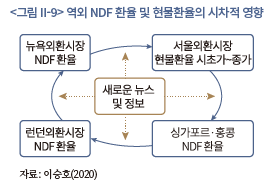

<그림 II-9>에 제시된 바와 같이 글로벌 24시간 외환시장의 특성을 반영하여 뉴욕외환시장의 원/달러 NDF 종가가 서울외환시장 개장 시초가 및 종가에 영향을 미치고 이는 다시 싱가포르, 런던 등 국제금융시장을 거치면서 다시 뉴욕외환시장의 NDF 환율에 그 영향이 연쇄적으로 나타나는 특징을 보이고 있다.10)

역외 원/달러 NDF 환율이 역내 현물환율에 미치는 영향에 관한 기존의 연구로는 빈기범·이상민·이원섭(2016)과 홍정효(2018) 등을 들 수 있다. 빈기범·이상민·이원섭(2016)은 역외 NDF 환율이 현물환율에 영향을 미치며 특히 글로벌 위기시 그 영향력이 증대되기는 하나 현물환율 결정을 주도하는 웩더독(wag the dog)을 촉발시키는 요인으로는 보기 어려운 것으로 주장하였다. 반면 홍정효(2018)는 뉴욕시장의 NDF 환율이 현물환율과 높은 상관관계를 가지며 두 환율이 안정적인 장기균형관계를 보이는 것으로 분석하였다. 또한 그랜져 인과관계 분석결과 두 환율간의 관계에 있어 역외 NDF 환율이 역내 현물환율에 더 강한 영향력을 나타내며 외부충격 시에는 변동성 전이효과가 있는 것으로 주장하였다.

본고에서는 역외 NDF 환율이 역내 환율결정에 미치는 간접적인 영향이 커지고 있는 점에 비추어 역내·외 환율간의 상호 관계 및 영향에 대하여 인과관계 검증 및 오차수정모형을 통한 분석을 실시하였다.

가. 인과관계 분석

역외 NDF 환율과 현물환율 시가 및 종가 간의 그랜져 인과관계(Granger causality)를 검증하기 위한 일별 역외 NDF 환율 데이터는 Bloomberg사에서 고시하는 뉴욕 외환시장의 오후 5:30 기준 가격(한국시각 익일 오전 6:30분)11)을 사용하였으며 다른 시간대나 여타 시장의 원/달러 NDF 환율은 획득이 어려워 시간대별 영향을 분석하기에는 한계가 있었다. 현물환율 시가 및 종가는 각각 오전 9시 및 3:30분 마감시의 역내 현물환시장 가격을 의미한다. 인과관계 검증을 위해 사용한 VAR모형은 일별 변수를 차분하여 사용하였으며 시차는 2를 적용하여 추정하였다.

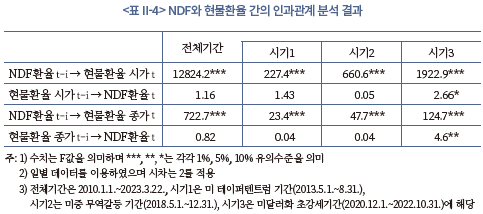

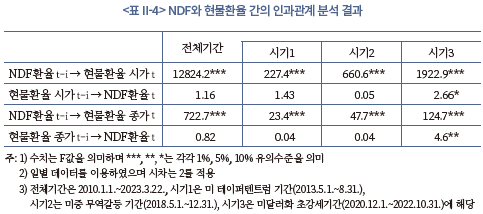

<표 II-4>에 나타난 인과관계 검증 결과에 따르면 역외 NDF 환율 변동은 역내 현물환율의 개장 시초가는 물론 종가에도 통계적으로 매우 유의한 영향을 주는 것으로 나타났다. 또한 추정기간을 전체기간과 별도로 미 테이퍼텐트럼 기간, 미중 무역갈등 기간, 미달러화 초강세기간 등 글로벌 불확실성이 컸던 기간에 대해 별도로 분석한 경우에서도 유사한 결과가 나타나 역외 NDF 환율이 역내 현물환율에 영향을 주는 점을 확인할 수 있다. 이는 원화환율의 결정에 있어 역내시장보다는 역외시장에서의 비거주자의 거래가 선행적인 영향을 주고 있는 점을 시사하는 결과라 할 수 있다.

반면 국내 현물환율이 역외 NDF 환율에 미치는 영향은 대체로 유의하지 않은 것으로 나타났다. 이는 국내 요인의 새로운 정보가 역외의 글로벌 금융시장에 미치는 파급효과는 그 반대의 경우보다 작을 수밖에 없고, 역내 서울외환시장 개장중 현물환율 가격이 싱가포르 NDF 환율에 이어 역내시장 마감후 런던 및 뉴욕 NDF 시장을 거치면서 유럽 및 미국 시간대의 다양하고 비중 있는 글로벌 경제 및 국제금융시장 뉴스에 희석되는 데 따른 결과로 보인다. 따라서 국제금융시장의 새로운 뉴스가 먼저 역외 NDF 환율에 반영되고 이어서 개장되는 역내 현물환율의 시초가에 영향을 주는 것이 가장 합리적인 가격전달 경로로 생각된다.

나. 오차수정모형 분석

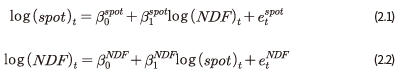

우리나라의 역내 현물환율과 역외 NDF 환율 간의 상호 연관성을 오차수정모형 분석을 통해 아울러 분석해 봄으로써 두 변수간의 정보흐름을 파악해 보았다. 추정을 위한 오차수정모형(vector error correction model)12)을 아래와 같이 설정하였다.

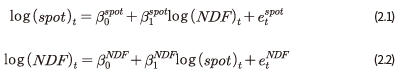

• 장기 추정식:

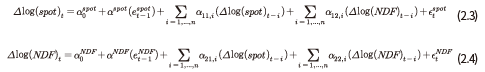

• 단기 추정식 :

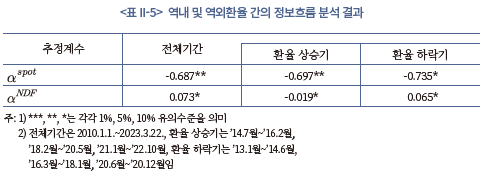

우선 장기추정식은 식 (2.1)과 식 (2.2)에 나타난 바와 같이 국내 현물환율은 역외 NDF 환율에 주로 영향을 받으며, 반대로 역외 NDF 환율은 국내 현물환율의 영향을 받는 것으로 모형을 설정하였다. 단기추정식(식 (2.3) 및 식 (2.4))은 장기추정식의 잔차항과 국내 현물환율 변동 및 역외 NDF 환율 변동의 전기 변수로 설정하였다. 위의 단기 추정식에서의 계수값 αspot이 -1~0 사이의 값을 가지며 통계적 유의성이 높은 경우 역외 NDF 환율이 역내 현물환율에 영향을 주는 것으로 해석할 수 있으며 반대로 αNDF의 경우 역내 현물환율이 역외 NDF 환율에 영향을 주는 것을 의미한다. 또한 두 계수가 모두 음(-)의 값을 갖고 통계적 유의성이 높은 경우 두 변수간 양방향 관계가 있음을 의미하며, 한 쪽만 유의성이 높은 경우에는 일방향(uni-directional)의 영향이 있는 것으로 해석할 수 있다.

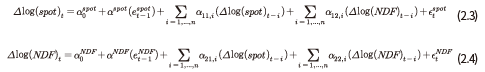

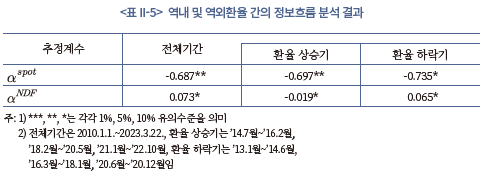

일별자료를 이용하여 추정한 결과 두 변수간에 공적분(cointegration) 관계가 존재하는 것으로 확인되었으며 오차수정모형의 추정 결과는 <표 II-5>에 제시되었다. 이에 따르면 역외 NDF 환율이 역내 현물환율에 영향을 미치는 일방향 관계가 있는 것으로 분석되었다. 즉, αspot이 -1~0 사이의 값을 가지며 유의성이 높은 것으로 나타난 반면 αNDF의 부호는 전체기간과 환율 하락기에서 양(+)의 값을 보였을 뿐만 아니라 환율 상승기의 경우에도 부호의 통계적 유의성이 그리 높지 않은 것으로 나타났다.

이러한 추정결과는 현물환율과 역외 NDF 환율이 장기균형관계를 가지고 있으며 단기적으로 역외 NDF 환율이 변동할 경우 현물환율이 이를 즉각 반영하여 조정되는 반면 그 반대의 조정경로는 잘 나타나지 않음을 의미한다. 따라서 단기적으로 역외 NDF 환율이 역내 현물환율에 대해 일방향 영향을 주는 것으로 볼 수 있다.

Ⅲ. 외환시장 개방 확대에 따른 영향 분석

정부의 국내 외환시장 대외 개방 및 개장시간 연장13) 계획이 이행될 경우 비거주자의 국내 외환시장 접근성이 높아지고 다양한 거래동기를 지닌 시장참가자가 늘어나면서 외환시장의 효율성이 증가하고 외환거래 규모가 증가하는 등의 시장발전에 대한 기대감도 높아지고 있다.

역외 비거주자들이 국내 은행간 외환시장에 직접 참여할 경우 우리나라 외환당국의 규제체계 내에서 현물환매매 내역에 대한 당국의 모니터링, 그리고 제반 간접비용의 발생이 예상된다는 점에서 신규 진입이 제한적일 것이라는 일부 우려가 있는 것이 사실이다. 그럼에도 불구하고 비거주자들은 국내시장 참여시 다음과 같은 이점을 향유할 수 있어 정부의 계획이 차질 없이 이행될 경우 점차 신규 진입이 늘어날 가능성이 있을 것으로 생각된다.

첫째, 역외 비거주자들은 국내시장 진입시 익일 새벽 2시까지 우리나라 은행간 시장의 참가자로서 거래가 가능하다. 따라서 역외시장의 업무시간 중에 원/달러 통화에 대한 환헤지나 투기적 목적을 위한 거래를 할 수 있으므로 거래의 편의성이 현재보다 크게 늘어날 것으로 예상된다.

둘째, 기존의 역외 NDF 시장을 통한 원/달러거래에 더하여 역내 은행간 시장에서 현물환 매매가 가능해짐에 따라 역외 NDF 환율과 현물환율 간의 단기적인 괴리가 발생하는 경우 재정차익거래 기회를 갖게 된다. 예를 들어 역내 현물환율이 역외 NDF 환율에 비해 일시적으로 유리한 호가를 보일 경우 역내외 시장을 통해 현물환 매입과 NDF 매도를 통한 재정차익거래가 가능하며 이 과정에서 역내 현물환거래 규모의 증가를 가져올 것으로 예상된다.

셋째, 비거주자의 역내 현물환시장 참여가 점차 늘어날 경우 현물환시장의 유동성이 현재보다 늘어나고 가격 효율성은 증대되면서 비거주자들의 역외 NDF 시장에서의 거래유인은 서서히 감소할 것으로 보인다. 이는 비록 역내시장이지만 비거주자의 원화에 대한 접근성이 높아짐에 따라 역외시장에서 해당 통화의 유통 제약을 우회하는 수단으로 사용되고 있는 NDF 거래의 유용성이 감소하기 때문이다. 이 경우 역외 NDF 거래의 일정 부분이 역내 현물환거래로 흡수되면서 역내 시장의 양적 성장으로 이어질 가능성이 있을 것으로 생각된다.

이런 점에 비추어 제Ⅲ장에서는 국내 외환시장이 해외기관에 개방되어 비거주자의 역내 외환시장 참여가 증가하고 거래시간이 연장될 경우 원화환율의 변동성과 외환거래량에 어떠한 영향을 미치는지를 심층적으로 분석해 보았다. 이를 위해 이론모형중 하나인 에이전트 기반 시장모형(Agent-Based market Model: ABM)을 사용하여 분석하였다. 이는 비거주자에 대한 외환시장 개방 및 거래시간 연장 조치가 우리나라는 물론 해외 사례도 찾아보기 어려운 제도개선 사항이므로 과거 데이터를 통한 실증분석의 한계를 극복하고 이론모형을 통한 다양한 시뮬레이션 분석을 실시하기 위함이다.

이를 위해 우선 한국 외환시장 특성을 반영한 ABM을 설정한 후, 이 모형을 사용하여 시장참가자가 증가하고 거래시간이 연장될 경우 원화환율의 변동성과 외환거래량에 미치는 효과를 시뮬레이션을 통해 다각도로 분석하고자 한다. 아울러 역외비거주자의 투기적 성향이 국내 거래자에 비해 상대적으로 크다는 대체적인 인식에 비추어, 비거주자의 국내 외환시장 참여확대로 국내 외환시장 참가자의 투자 성향이 전체적으로 변화하는 경우 환율 변동성과 외환거래량에 어떠한 영향을 미치는지에 대해서도 분석을 병행하였다.

제Ⅲ장은 다음과 같이 구성되어 있다. 1절에서는 ABM에 대해서 설명하고, 2절에서는 모수 추정과정을 보인 후 시뮬레이션에 사용된 모수값을 제시한다. 3절에서는 외환시장 개방 효과에 대한 시뮬레이션 결과를 제시하고, 마지막 4절에서는 Ⅲ장의 주요 연구내용을 요약하고 시사점을 도출한다.

1. 선행 연구

외환시장에서 시장참가자 확대와 거래시간 연장에 대한 동시적 영향을 분석한 기존 연구는 거의 존재하지 않는 실정이다. 따라서 본고에서는 외환시장과 자산시장으로서의 유사성이 크다고 생각되는 주식시장에 대한 선행연구를 원용하여 제2절에서 제시된 외환시장 모형설정에 참고하였다.

주식시장에서 거래시간 연장이 가격 변동성과 거래량에 미치는 효과와 관련한 기존 실증분석 연구로는 주로 대만과 일본 주식시장에 대한 연구를 들 수 있다. Fan & Lai(2006)는 대만 증권거래소에서 거래시간 연장이 장중 거래 패턴에 어떤 영향을 미치는지 분석했다. 이 연구에 따르면 거래시간 연장 전후인 2000년과 2001년에도 거래량과 수익률 변동성은 여전히 역J자 형태를 보였다. 그러나 거래 비용의 패턴은 거래시간 연장 후인 2001년에 더욱 완만해진 것으로 나타났다.

Lee et al.(2009)은 대만 선물시장에서 개장시장 연장이 주가 행태에 어떤 영향을 미치는지를 분석했다. 연구 결과에 따르면 개장시간 연장 이후 주식수익률의 변동성이 감소하고, 개장시점 주식 수익률의 자기 상관성이 완화된 것으로 나타났다. 또한 증시 개장시 발생하는 주가의 과도한 반응도 연장 이후에는 완화된 것으로 분석되었으며, 연장된 개장 기간 동안의 선물 수익률 변동으로 밤사이 주식 수익률 변화에 대한 예측력이 높아진 것으로 주장하였다.

일본의 주식시장 거래시간 연장에 대한 연구로는 Miwa(2019)가 있다. Miwa(2019)는 일본 주식선물시장 자료를 사용하여 거래시간 연장과 과도한 주가 변동 사이의 관련성에 대해 분석했다. 연구 결과에 따르면 거래시간이 연장될수록 주가의 과잉 반응이 증가하고, 주식 거래량도 증가하는 것으로 나타났다. 이는 거래시간 연장이 주가의 과도한 변동을 야기하고, 가격 효율성에도 부정적인 영향을 미칠 수 있음을 시사한다.

위에서 언급한 관련 문헌들에서는 대만과 일본의 실증분석 결과가 비교적 큰 차이를 보이고 있는데, 이러한 차이는 각 국가별 상이한 시장 특성에서 기인하였을 가능성이 높은 것으로 생각된다. 따라서 본고에서는 거래시간 연장뿐만 아니라 시장참가자의 증가를 포함하는 전반적인 외환시장 개방 확대의 효과를 분석하는데 주목적이 있으므로 우리나라 외환시장의 특성을 반영한 ABM을 설정한 후 시뮬레이션을 통해 그 영향을 분석하고자 한다.

ABM을 사용하여 거래시간 연장의 효과를 살펴본 기존의 연구로는 Miwa & Ueda(2017)가 있다. 이 연구에서는 거래시간 연장이 더 많은 거래 기회를 제공하고, 가격의 효율성을 높이는지에 대한 분석을 ABM을 사용하여 수행했다. 분석 결과에 따르면 거래시간 연장으로 일일 거래량이 증가한다는 것을 보였다. 또한 거래시간이 연장되었지만, 연장된 거래시간에 시장참가자의 수가 제한되는 경우에는 가격 형성 및 거래 활동에 왜곡이 발생할 수 있는 것으로 나타났다.

본고에서 사용하는 ABM은 복잡한 외환시장의 작동원리와 현상을 가급적 단순하게 모델링하고, 궁극적으로는 시장의 변화를 예측하기 위해 개별 에이전트의 상호작용을 중심으로 구성된 모형이라 할 수 있다.14) 에이전트 유형별로 상이한 특성, 행동 규칙, 목표 등을 부여받으며, 이에 근거하여 각 에이전트는 의사결정을 내린다고 가정한다. 이 과정에서 에이전트 간 상호작용은 시장의 균형 가격을 형성하게 되고, 거래량에 변동이 발생한다. ABM의 가장 큰 장점은 에이전트 유형별 특성, 행동 규칙 등을 조정하여 다양한 시나리오에 대해 시뮬레이션을 수행할 수 있으며 이를 통해 시장의 변동을 예측하거나 정책효과를 분석하는 데 유용하게 활용된다는 점이라 할 수 있다.

본 연구와 Miwa & Ueda(2017)의 연구는 ABM을 사용하여 거래시간 연장의 효과를 분석했다는 점에서 공통점이 있다. 두 연구 모두 Brock & Hommes(1998)와 Gaunersdorfer & Hommes(2007)를 토대로 일부를 변형하여 모형을 구축했다. 다만, Miwa & Ueda(2017)의 연구는 거래시간 연장이 가격에 미치는 효과를 분석했다는 점에서는 본고의 시도와 비슷하지만, 분석대상 시장이 본고에서와 같은 외환시장이 아니라 주식시장에 대한 거래시간 연장 효과를 분석하였다는 점에서 차이가 있다. 또한 Miwa & Ueda(2017)는 기존 연구의 모수를 사용하거나, 모수에 대한 임의의 범위를 설정하여 다양한 경우에 대해 시뮬레이션을 수행한 반면, 본고에서는 베이지안 추론(bayesian inference) 가운데 하나인 마코프체인 몬테카를로(Markov Chain Monte Carlo, 이하 MCMC)를 사용하여 한국 외환시장 특성을 반영한 모수를 추정하고, 추정된 모수를 사용하여 시뮬레이션 했다는 측면에서 차이가 있다.15)

2. 외환시장 모형 설정 및 분석방법

여기서는 시뮬레이션 분석을 위해 사용하는 ABM에 대해 설명하고 Brock & Hommes(1998)가 제안한 모형을 발전시킨 Miwa & Ueda(2017)의 모형을 기반으로 우리나라 외환시장의 구조적 특성을 최대한 반영하여 외환시장 모형을 설정한다.

가. 외환시장 모형

(1) 환율결정과정

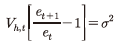

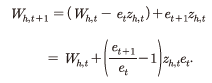

모형의 단순화를 위하여 외환시장 참가자가 한국 원화와 미국 달러화, 두 종류의 자산을 보유한다고 가정한다. 원화의 공급은 완전 탄력적인데 반해, 외화인 달러의 공급은 한정되어 있다. 외환시장에서 거래하는 투자자들은 근시안적으로 평균-분산을 최대화하는 목표를 가지고 거래를 한다고 가정한다. 투자자들의 선호는 다음과 같다.

단,

단,

와

와  는 각각

는 각각  유형 투자자의 조건부 기대와 조건부 분산을 의미한다.

유형 투자자의 조건부 기대와 조건부 분산을 의미한다.  는

는  유형 투자자의 자산을 의미하고,

유형 투자자의 자산을 의미하고,  는 자산 가운데 달러 자산을 의미한다. 하첨자 t 는 시간을 나타내며,

는 자산 가운데 달러 자산을 의미한다. 하첨자 t 는 시간을 나타내며,  는 위험회피 성향을 반영하는 모수이다. 식 (3.1)을 풀면 달러 자산에 대한 수요,

는 위험회피 성향을 반영하는 모수이다. 식 (3.1)을 풀면 달러 자산에 대한 수요,  는 다음과 같다.

는 다음과 같다.

단,

단,

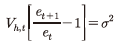

달러에 대한 수요는 t 기에서  기 동안 원/달러 환율 상승률에 대한 조건부 기대에 비례하여 증가하지만, 조건부 분산에 반비례한다. 조건부 분산은 모든 투자자에 대해 동일한 상수,

기 동안 원/달러 환율 상승률에 대한 조건부 기대에 비례하여 증가하지만, 조건부 분산에 반비례한다. 조건부 분산은 모든 투자자에 대해 동일한 상수,  로 가정한다. 이러한 단순한 달러 수요함수는 균형 환율을 쉽게 도출할 수 있다는 장점이 있지만, 달러 수요가 자산 수준과 무관하며, 동일한 투자자는 동일한 양의 달러를 보유하게 된다는 점에서 모형의 한계도 있다. 또한 달러 수요 결정이 근시적(myopic)이기 때문에 시간에 걸친 최적화가 필요한 동태적 환경에서 해석에 주의가 필요하다.16)

로 가정한다. 이러한 단순한 달러 수요함수는 균형 환율을 쉽게 도출할 수 있다는 장점이 있지만, 달러 수요가 자산 수준과 무관하며, 동일한 투자자는 동일한 양의 달러를 보유하게 된다는 점에서 모형의 한계도 있다. 또한 달러 수요 결정이 근시적(myopic)이기 때문에 시간에 걸친 최적화가 필요한 동태적 환경에서 해석에 주의가 필요하다.16)

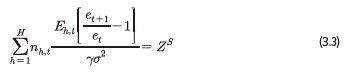

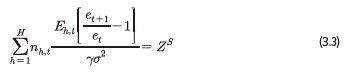

외환시장 균형 조건은 다음과 같다.

는 h 유형 투자자의 비중을 나타낸다. 식 (3.3)의 좌변은 모든 투자자 유형의 달러 수요 합계로서 달러 총수요를 의미한다. 식 (3.3) 우변의

는 h 유형 투자자의 비중을 나타낸다. 식 (3.3)의 좌변은 모든 투자자 유형의 달러 수요 합계로서 달러 총수요를 의미한다. 식 (3.3) 우변의  는 달러 공급을 의미하는데, 본고에서는 달러 공급이 없는 경우

는 달러 공급을 의미하는데, 본고에서는 달러 공급이 없는 경우 를 가정한다. 식 (3.3)를 정리하면

를 가정한다. 식 (3.3)를 정리하면

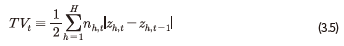

t 기 환율은 위 식 (3.4)와 같이 간단한 식으로 도출할 수 있다. 즉, t 기 환율은  기 환율에 대한 모든 시장참가자의 평균적인 기댓값이다. 실제 환율은 식 (3.4)의 환율에 잡음(noise)항이 더해져서 결정된다. 달러의 거래량, TV 는 다음 식 (3.5)와 같다.

기 환율에 대한 모든 시장참가자의 평균적인 기댓값이다. 실제 환율은 식 (3.4)의 환율에 잡음(noise)항이 더해져서 결정된다. 달러의 거래량, TV 는 다음 식 (3.5)와 같다.

(2) 투자자 유형별 환율기대와 투자자 비중

투자자 유형별로 환율에 대한 기대가 상이하며, 본고에서는 두 가지 유형의 투자자가 있다고 가정한다. 첫 번째 유형의 투자자는 달러의 가치가 펀더멘털(fundamental)로 회귀한다고 믿고, 이에 기반하여 미래 환율에 대한 기댓값을 정한다. 이 투자자의 미래 환율에 대한 기대를 하첨자 F 로 표시하고, 아래 식 (3.6)으로 표현할 수 있다.

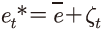

는 t 기 달러의 펀더멘털을 반영하는 환율로서 투자자가 관측하는 값이다. 진정한 펀더멘털 가치

는 t 기 달러의 펀더멘털을 반영하는 환율로서 투자자가 관측하는 값이다. 진정한 펀더멘털 가치 에 관측시 발생하는 잡음

에 관측시 발생하는 잡음 이 있다고 가정하여

이 있다고 가정하여  로 정의한다.

로 정의한다.  는 펀더멘털 환율로의 회귀속도와 관련된 모수이다.

는 펀더멘털 환율로의 회귀속도와 관련된 모수이다.

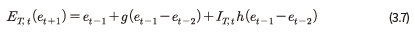

두 번째 유형의 에이전트는 추세를 추종하는 투자자로 과거 환율 변동 양상이 앞으로도 지속될 것이라 믿고, 이에 기반하여 미래 환율에 대한 기댓값을 형성한다. 이 투자자의 미래 환율에 대한 기대를 하첨자 T 로 표시하고, 아래 식 (3.7)로 표현할 수 있다.

는 추세 추종의 정도를 나타내는 모수이다.

는 추세 추종의 정도를 나타내는 모수이다.  는

는  기에서

기에서  기 동안 달러 투자로부터 이익이 발생했는지 여부를 나타내는 더미변수이며, h 는 환율상승기, 즉 달러 투자로부터 이익을 보는 기간 추가되는 추세 추종의 정도를 나타내는 모수이다. 이는 달러 상승기와 하락기 추세 추종자들이 환율에 대한 기대를 다르게 설정할 가능성을 모형에 반영한 것이다.

기 동안 달러 투자로부터 이익이 발생했는지 여부를 나타내는 더미변수이며, h 는 환율상승기, 즉 달러 투자로부터 이익을 보는 기간 추가되는 추세 추종의 정도를 나타내는 모수이다. 이는 달러 상승기와 하락기 추세 추종자들이 환율에 대한 기대를 다르게 설정할 가능성을 모형에 반영한 것이다.

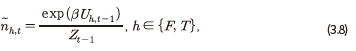

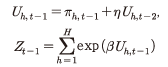

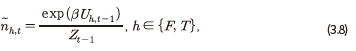

본 모형에서 투자자 유형별 비중은 내생적으로 결정된다. t 기 F 및 T 유형 투자자의 비중은

단,

는

는  기 투자자의 효용을 의미하는데, 이는

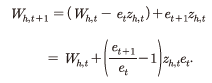

기 투자자의 효용을 의미하는데, 이는  기 달러 투자로부터의 이익

기 달러 투자로부터의 이익 17)과

17)과  기 투자자 효용

기 투자자 효용 의 일부로 구성된다. 지수함수(exp)로 변환한 효용이 상대적으로 큰 쪽의 투자자 비중이 늘어나도록 정규화하였다.

의 일부로 구성된다. 지수함수(exp)로 변환한 효용이 상대적으로 큰 쪽의 투자자 비중이 늘어나도록 정규화하였다.  는

는  기 효용이

기 효용이  기 효용에 반영되는 정도를 나타내는 모수이며,

기 효용에 반영되는 정도를 나타내는 모수이며,  는 유형의 업데이트에 영향을 미치는 모수이다.

는 유형의 업데이트에 영향을 미치는 모수이다.

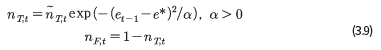

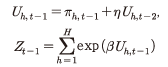

환율이 펀더멘털에서 멀리 떨어져 있을수록 추세 추종자의 비율이 감소하는 식 (3.9)를 추가함으로써 두 유형의 투자자 가운데 하나의 특정 유형으로 일방적으로 수렴되는 것을 방지한다.

이때 모수  가 커질수록 환율이 더욱 안정적으로 움직이며, 환율과 펀더멘털 환율 사이의 편차가 줄어든다. 이는 외환시장의 투자자들이 환율 변동에 더 신중하게 반응하고 펀더멘털 환율에 더 가깝게 환율이 형성되는 경향을 반영한다.

가 커질수록 환율이 더욱 안정적으로 움직이며, 환율과 펀더멘털 환율 사이의 편차가 줄어든다. 이는 외환시장의 투자자들이 환율 변동에 더 신중하게 반응하고 펀더멘털 환율에 더 가깝게 환율이 형성되는 경향을 반영한다.

(3) 외환시장 개방 확대

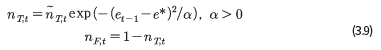

외환시장 개방 확대로 달러가 24시간 동안 거래될 수 있다고 가정한다. 따라서 달러 거래는 오전 9시부터 오후 3시 30분까지 기존 정규 거래시간에 가능할 뿐만 아니라 3시 30분 이후에도 가능하다. 다만 모든 투자자가 정규 시간 동안 자산을 거래하는 반면, 제한된 수의 투자자만 연장된 시간에 거래한다고 가정한다. 정규 시간 동안 달러에 대한 수요는 식 (3.2)와 같지만, 정규시간의 마감시간 달러에 대한 수요는 연장된 시간에 거래하는지 여부에 따라 달라지며 다음과 같다.

단,

는 정규 및 연장시간에 달러를 거래하는 투자자를 나타내고,

는 정규 및 연장시간에 달러를 거래하는 투자자를 나타내고,  는 정규시간 동안에만 자산을 거래하는 투자자를 나타낸다.

는 정규시간 동안에만 자산을 거래하는 투자자를 나타낸다.  는 정규시간 이후 거래에 참여하지 않게 되면서 발생하는 비유동성 위험(오버나잇 리스크)을 나타내는데, 이 값이

는 정규시간 이후 거래에 참여하지 않게 되면서 발생하는 비유동성 위험(오버나잇 리스크)을 나타내는데, 이 값이  와

와  간 상이하다.

간 상이하다.  의

의  는

는  로 설정되며, 지수 분포를 따른다고 가정한다

로 설정되며, 지수 분포를 따른다고 가정한다 .

.

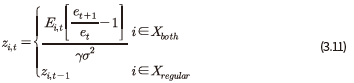

연장시간의 달러 수요는 다음과 같다.18)

는 연장시간에도 정규시간과 동일하게 거래를 하기 때문에 달러 수요는 식 (3.2)와 같다. 하지만

는 연장시간에도 정규시간과 동일하게 거래를 하기 때문에 달러 수요는 식 (3.2)와 같다. 하지만  는 연장시간에 거래에 참여하지 않기 때문에 연장시간 동안의 달러 수요는 정규시간의 달러 수요가 그대로 유지된다. 따라서 연장시간의 외환시장 균형조건은 다음과 같다.

는 연장시간에 거래에 참여하지 않기 때문에 연장시간 동안의 달러 수요는 정규시간의 달러 수요가 그대로 유지된다. 따라서 연장시간의 외환시장 균형조건은 다음과 같다.

연장시간의 균형 환율은 다음과 같다.

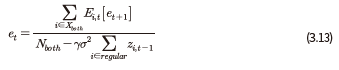

는 정규시간과 연장시간 모두 달러를 거래하는 투자자의 수를 반영하는 모수이다. 연장시간의 균형 환율도 앞서 정규시장의 균형 환율과 동일하게 식 (3.13)의 환율에 잡음(noise)항이 더해져서 결정된다.

는 정규시간과 연장시간 모두 달러를 거래하는 투자자의 수를 반영하는 모수이다. 연장시간의 균형 환율도 앞서 정규시장의 균형 환율과 동일하게 식 (3.13)의 환율에 잡음(noise)항이 더해져서 결정된다.

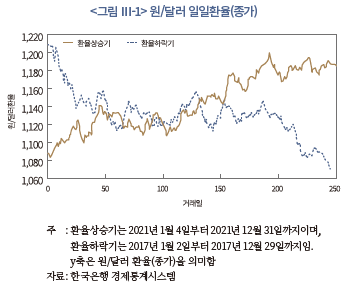

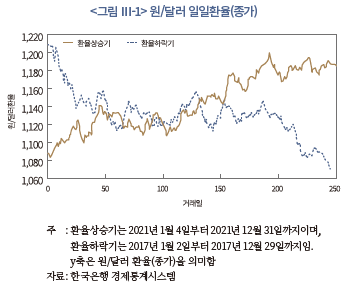

나. 모수 설정

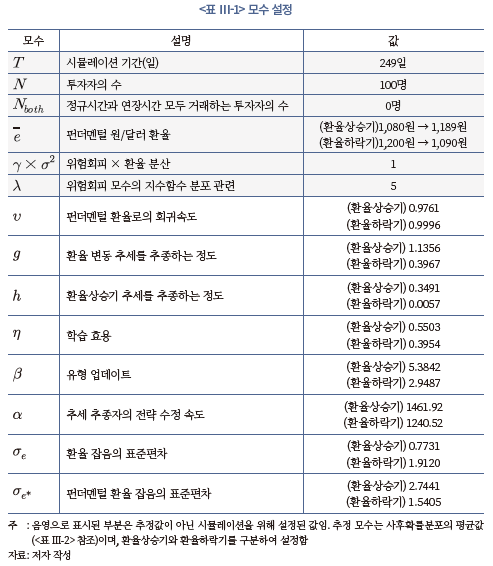

여기서는 MCMC를 사용하여 모수를 추정하고, 추정된 모수에 기반하여 도출한 시뮬레이션 결과가 실제 데이터를 얼마나 잘 모사할 수 있는지를 평가한다. 모수 추정을 위해 사용되는 자료는 일별 원/달러 환율(종가)이며, 모수 추정은 원/달러 환율이 상승하는 기간과 하락하는 기간을 구분하여 각각에 대해 추정한다. 모형을 통해 재현하고자 하는 환율상승기는 2021년 1월부터 2021년 12월(249영업일)이며, 환율하락기는 2017년 1월부터 2017년 12월(244영업일)이다(<그림 Ⅲ-1> 참조).

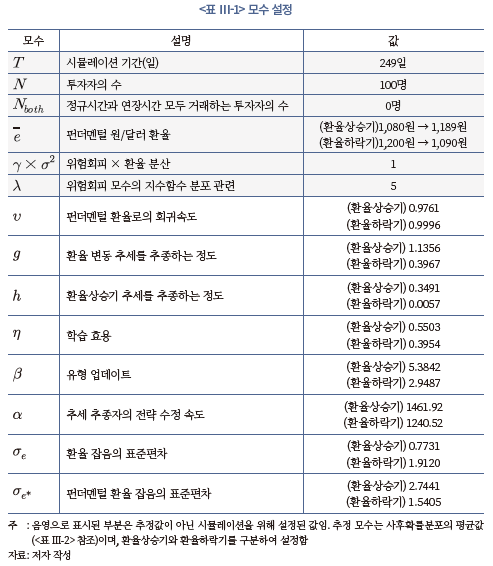

시뮬레이션을 위해 설정된 모수는 <표 Ⅲ-1>과 같다. 표에서 음영으로 표시한 부분은 추정 모수가 아닌 시뮬레이션을 위해 설정한 값이다. 시뮬레이션 기간(T )은 249일로서 환율상승기인 2021년 1월부터 2021년 12월의 영업일에 맞추어 설정하였다. 기본 모형에서 투자자의 수(N )를 100명으로 설정하였는데, 외환시장 개방 효과를 살펴보는 제3절의 시뮬레이션 분석에서는 이 상태에서 투자자의 수가 20%에서 100%로 점차 늘어나는 경우의 효과를 비교하여 보는 것이므로 절대적인 수 자체의 의미는 크지 않다.

현재 외환시장에서는 연장시간이 존재하지 않기 때문에 정규시간과 연장시간 모두 거래하는 투자자의 수 는 0명으로 설정하였다. 펀더멘털 원/달러 환율은 환율상승기와 환율하락기 각각 환율이 변화하는 추세를 반영하여 일평균 ±0.04%로 상승/하락하는 변화가 있다고 가정하였다. 위험회피와 환율 분산의 곱

는 0명으로 설정하였다. 펀더멘털 원/달러 환율은 환율상승기와 환율하락기 각각 환율이 변화하는 추세를 반영하여 일평균 ±0.04%로 상승/하락하는 변화가 있다고 가정하였다. 위험회피와 환율 분산의 곱 은 분석의 편의를 위하여 1로 설정하였다. 마지막으로 위험회피 모수의 지수함수 분포와 관련된

은 분석의 편의를 위하여 1로 설정하였다. 마지막으로 위험회피 모수의 지수함수 분포와 관련된  는 Miwa & Ueda(2017)에서 사용한 모수 범위의 중간값, 5로 설정한다.

는 Miwa & Ueda(2017)에서 사용한 모수 범위의 중간값, 5로 설정한다.

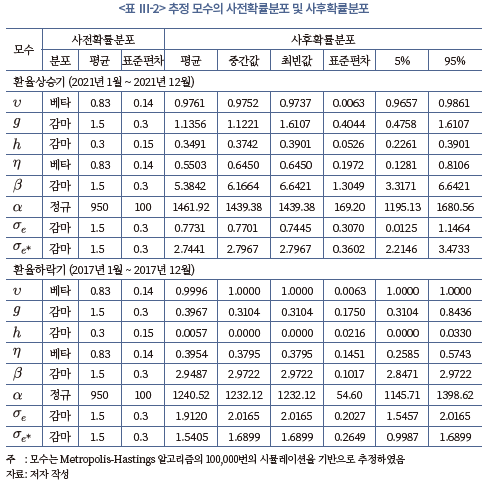

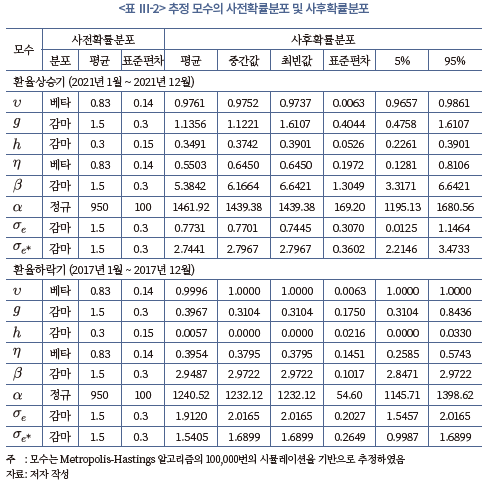

<표 Ⅲ-1>에서 음영으로 표시되지 않은 나머지 모수는 추정하였다. 추정된 모수 값은 모두 사후확률분포(posterior distribution)의 평균이며, 사후확률분포와 관련한 주요 통계치는 <표 Ⅲ-2>에서 확인할 수 있다. 사전확률분포(prior distribution)와 데이터에 기반한 우도 함수(likelihood function)를 사용하여 사후확률분포를 추정하는 과정을 반복적으로 수행한다. 이를 통해 모수의 값에 대한 사후확률분포를 추정할 수 있으며, 이 추정 결과를 사용하여 통계적 추론이나 예측 등에 활용할 수 있다. 사전확률분포는 관심 있는 모수의 값에 대한 사전 지식이나 연구자의 주관적 믿음을 확률분포로 표현한 것인데, 본 연구에서는 8개 모수 가운데 2개를 베타분포, 5개를 감마분포, 나머지 한 개를 정규분포로 설정했다. 이 분포는 관련 문헌에서 얻은 정보로서 모수에 대한 초기 추정치로 사용된다.

우도 함수는 주어진 모수값에 대해 실제 데이터로 관측될 확률을 나타내는 함수이다. 따라서 주어진 모수 값에 대한 일종의 데이터 적합도로 볼 수 있다. 본 연구에서는 우선 실제 데이터와 주어진 모수를 기반으로 도출한 시뮬레이션 데이터 사이의 평균, 표준편차, 최댓값, 최솟값, 왜도(skewness), 첨도(kurtosis)의 차이(제곱의 합)를 구하고, 이 차이를 통해 시뮬레이션 결과와 실제 데이터 간의 불일치 정도를 측정하는 것으로 우도 함수를 정의했다. 따라서 이 6개 통계량의 차이가 작을수록 우도는 높아진다.

본 연구에서는 Metropolis-Hastings 알고리즘을 사용하여 확률분포에 대한 샘플링을 수행한다. 주어진 사전확률분포로부터 초기값을 선택하고, 그 이후부터는 현재의 표본을 기반으로 다음 표본을 생성한다. 본고의 초기값은 모두 사전확률분포의 평균으로 설정했다. 표본을 생성하는 과정을 반복하여 MCMC 체인을 형성하는데, 체인이 충분히 수렴하면 생성된 표본들은 사후확률분포를 근사적으로 따르게 된다.

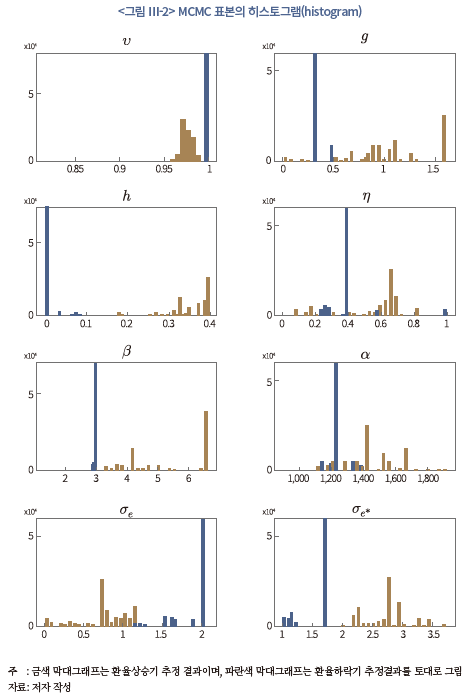

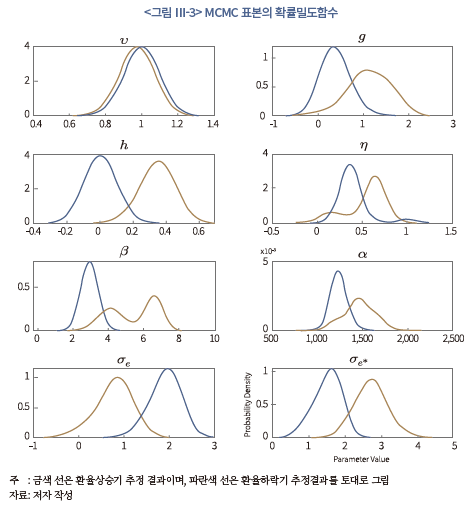

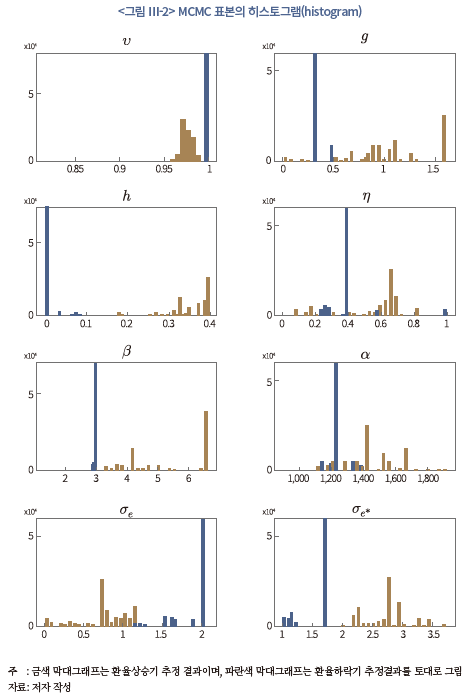

<그림 Ⅲ-2>는 각 모수별 표본의 분포를 보여준다. 금색과 파란색 막대그래프는 각각 환율상승기와 하락기의 추정 결과이다. 대체적으로 환율상승기보다는 하락기에 특정 값에 분포가 집중되는 경향이 있음을 볼 수 있다.

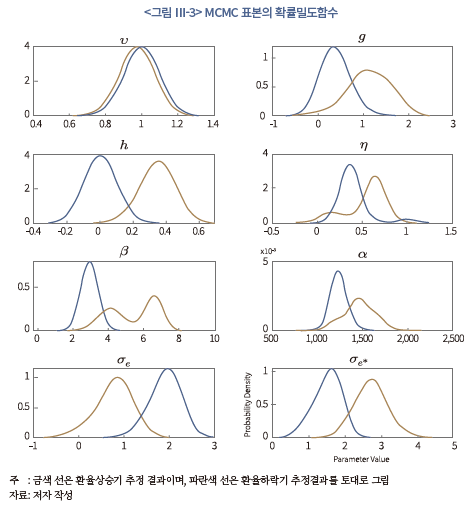

<그림 Ⅲ-3>은 각 모수별 표본의 확률밀도함수이다. 앞서 제시한 <그림 Ⅲ-2>의 MCMC 표본에 대한 히스토그램을 사용하여 표본의 확률밀도함수를 추정하였다. 이 그림에서도 금색과 파란색 선은 각각 환율상승기와 하락기의 추정 결과이다. 모수별로 다소 차이가 있으나 환율상승기와 하락기의 확률밀도함수가 상이한 것을 확인할 수 있다. 펀더멘털 환율로의 회귀 속도와 관련된 모수,  의 경우 평균과 표준편차가 다른 모수와 비교하여 상대적으로 유사한 반면, 나머지 모수에서는 평균에서 크고 작은 차이가 있음을 볼 수 있다.

의 경우 평균과 표준편차가 다른 모수와 비교하여 상대적으로 유사한 반면, 나머지 모수에서는 평균에서 크고 작은 차이가 있음을 볼 수 있다.  는 평균뿐만 아니라 표준편차에서도 차이를 보이고 있어, 환율상승기와 하락기로 구분하여 모수를 추정하는 작업에 대한 필요성을 확인할 수 있다.

는 평균뿐만 아니라 표준편차에서도 차이를 보이고 있어, 환율상승기와 하락기로 구분하여 모수를 추정하는 작업에 대한 필요성을 확인할 수 있다.

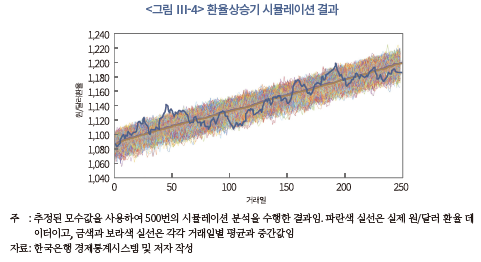

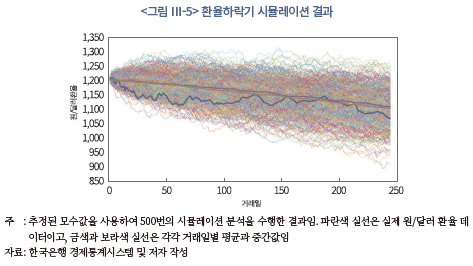

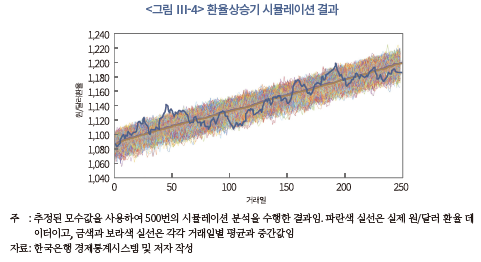

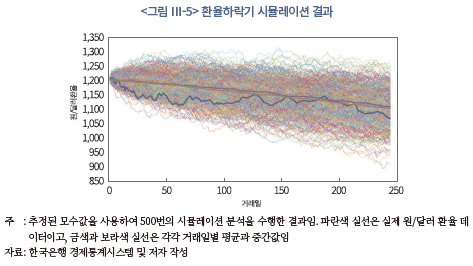

<그림 Ⅲ-4>와 <그림 Ⅲ-5>는 <표 Ⅲ-1>의 모수를 사용한 환율상승기와 하락기에 대한 시뮬레이션 결과이다. 각각 500번의 독립적인 시뮬레이션을 수행하였으며, 그림에 표시된 파란색 선은 실제 원/달러 환율이며, 금색 선은 해당 거래일의 (500번의 시뮬레이션 결과에 대한) 원/달러 환율 평균, 보라색 선은 해당 거래일의 원/달러 환율에 대한 중간값이다. 환율이 우상향하는 추세는 펀더멘털 환율 이 우상향한다는 가정을 반영하고 있다. 실제값은 500번의 시뮬레이션에서 예측하는 일정 구간을 거의 벗어나지 않고, 일정 밴드 안에서 변동하는 것을 확인할 수 있다. 환율하락기 시뮬레이션 결과는 환율상승기와 비교하여 시뮬레이션에서 예측하는 밴드가 상대적으로 넓다는 특징이 있으나, 여기에서도 마찬가지로 실제값은 밴드 안에서 변동하는 것을 볼 수 있어 지금까지의 ABM모형 설정과 모수추정이 대체로 적절하게 이루어진 것으로 생각된다.

이 우상향한다는 가정을 반영하고 있다. 실제값은 500번의 시뮬레이션에서 예측하는 일정 구간을 거의 벗어나지 않고, 일정 밴드 안에서 변동하는 것을 확인할 수 있다. 환율하락기 시뮬레이션 결과는 환율상승기와 비교하여 시뮬레이션에서 예측하는 밴드가 상대적으로 넓다는 특징이 있으나, 여기에서도 마찬가지로 실제값은 밴드 안에서 변동하는 것을 볼 수 있어 지금까지의 ABM모형 설정과 모수추정이 대체로 적절하게 이루어진 것으로 생각된다.

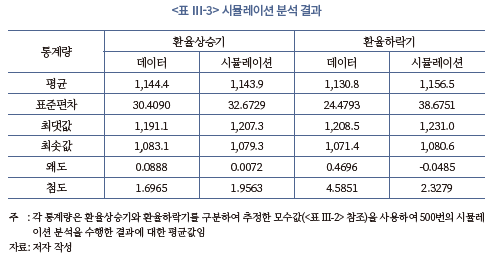

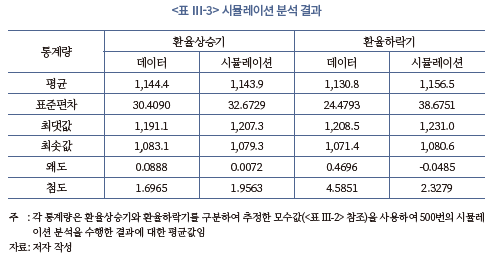

<표 Ⅲ-3>은 환율상승기와 하락기에 대한 시뮬레이션 결과를 주요 통계량으로 정리한 표이다. 전반적으로 우도 함수에서 반영하고 있는 6개의 통계치에서 실제 데이터와 시뮬레이션의 차이가 매우 작은 것을 확인할 수 있다. 따라서 전반적으로 본고에서 추정한 모수에 기반한 ABM이 실제 데이터를 잘 재현한다고 평가할 수 있는데, 그 중에서도 왜도와 첨도를 제외한 평균, 표준편차, 최댓값, 최솟값은 매우 유사하다. 환율상승기와 하락기 중에서는 환율상승기의 시뮬레이션 결과가 좀 더 실제 데이터와 비슷한 점이 많은 것으로 나타났다. 이상의 분석을 토대로 다음 3절에서는 외환시장 개방 확대로 인한 효과에 대해 시뮬레이션 분석을 수행한다.

3. 외환시장 개방 효과에 대한 시뮬레이션 분석

외환시장 개방 확대로 거래시간이 연장되고 비거주자의 역내 외환시장 참가자가 증가될 것으로 예상되는 바, 이러한 변화가 환율 변동성과 외환거래량에 어떠한 영향을 미치는지를 2절에서 설정한 ABM을 사용하여 분석한다. 우선 외환시장 참가자 증가가 환율 변동성과 거래량에 미치는 효과에 대해 시뮬레이션해 보고, 이어서 외환시장 개방 확대로 투기자의 성향이 변화할 경우에는 환율 변동성과 거래량에 어떤 영향을 미치는지에 대해 추가적으로 살펴본다. 시뮬레이션 분석은 환율상승기와 하락기를 구분하여 각각 분석함으로써 결과 해석의 강건성을 높이고자 하였다.

가. 외환시장 참가자 증가 효과

시장참가자 수와 관련된 ABM의 모수는 N 이다. 기본모형에서는 100명으로 설정되어 있으나, 만약 외환시장 개방 확대로 120명, 140명, 160명, 180명, 200명으로 증가하는 경우 환율 변동성 및 외환거래량에 어떤 변화가 있는지 비교한다. 이와 더불어 거래시간의 연장도 동시에 고려한다. 2절 ABM의 기본 모형에서는 3시 30분에 거래가 종료되나, 3절의 시뮬레이션 분석에서는 24시간 거래시간이 연장되는 경우를 가정한다. 이를 위해 연장된 시간에 시장에서 거래하는 참가자 비중이 정규시간 참가자의 0%, 20%, 40%, 60%, 80%, 100%로 변화하는 여러 경우로 가정하여 시뮬레이션을 수행한다.

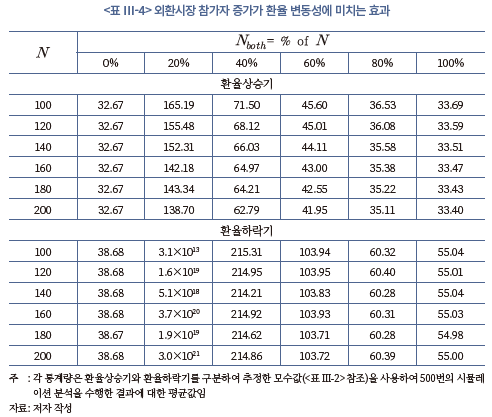

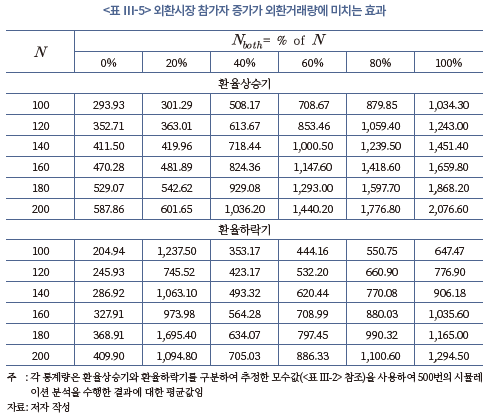

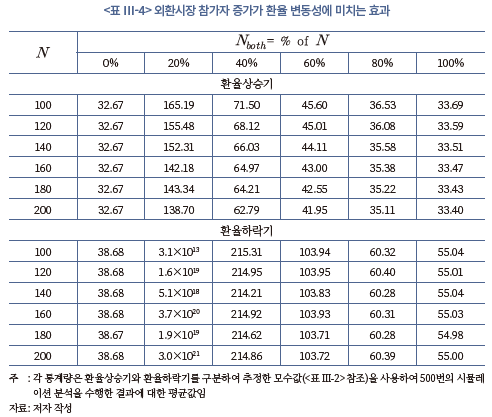

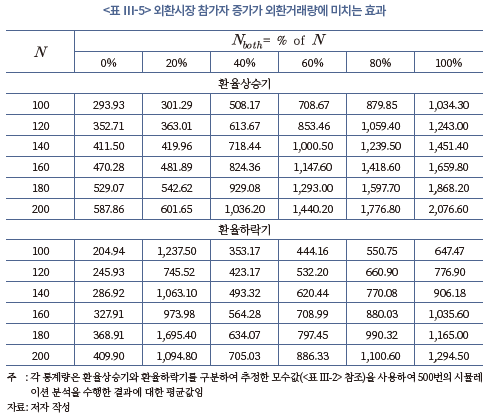

<표 Ⅲ-4>와 <표 Ⅲ-5>는 각각 외환시장 참가자 증가 및 거래시간 연장이 환율 변동성과 외환거래량에 미치는 효과에 대한 시뮬레이션 결과이다. 표에서 N 으로 표시된 첫 번째 열은 정규시간 시장참가자의 수를 의미하며, 0~100% 변하는 두 번째 행은 연장시간에 시장에 참여하는 투자자 비중을 의미한다. 연장시간 참가자 비중이 0%인 상황에서는 정규시간 참가자가 100명에서 순차적으로 늘어나더라도 환율 변동성에 미치는 영향은 거의 없는 것으로 나타났으나 이 경우에도 거래량은 증가하는 것을 확인할 수 있다. 이러한 특징은 환율상승기와 하락기에 큰 차이가 없었다.

한편 연장된 거래시간에 대한 시장참가자의 참여 정도를 고려할 경우에는 환율 변동성(249영업일 동안의 원/달러 환율에 대한 표준편차)이 크게 변화하는 것을 볼 수 있다. 정규시간에 100명의 시장참가자가 있는 상황에서 연장시간에 20%가 참여한다고 가정할 경우 환율의 표준편차가 32.6729에서 165.1903으로 늘어나 환율 변동성이 크게 높아지는 결과가 나타났다. 이러한 결과가 나타난 이유는 비유동성 위험(오버나잇 리스크)이 있는 80%의 참가자는 연장시간에 거래를 하지 못하는 상황에서 연장시간 동안 20%의 시장참가자의 거래에 의해 환율결정이 주도되기 때문이다. 특히 최초 20%의 참가자 성향이 투기적 성향이 강할 경우에는 환율 변동성이 더욱 커지게 되는데 위의 시뮬레이션 결과는 이러한 점이 반영된 결과로 생각된다.

이러한 변동성 증가는 환율상승기보다 환율하락기에 더 크게 나타나는 것으로 보인다. 이는 환율하락기와 달리 상승기의 경우에는 투기적 거래자들이 환율상승추세에 편승하여 외환매입 우위의 일관된 매매전략을 구사하는 경향이 있으므로 오히려 환율 변동성은 낮아지는 데 따른 결과로 해석할 수 있다. 또한 연장시간대 참가자 증가에 따른 거래량 변화의 경우에도 환율상승기와 하락기에 모두 증가하는 것으로 나타났다.

분석결과에서 보다 흥미로운 점은 연장시간에 시장에 참여하는 투자자의 비중이 20%를 초과하기 시작하는 경우에는 다시 환율 변동성이 낮아지기 시작한다는 점이다. 예를 들어 연장시간에 시장에 참여하는 투자자의 비중이 80%에 이르면 시장참가자의 수와 무관하게 환율 변동성은 35~36으로 낮아지고, 100%가 되면 33 정도로 더욱 낮아져 기본 모형의 환율 변동성(32)과 비슷한 수준으로 떨어지게 된다. 또한 이 경우 환율 변동성이 낮아지는 조정 과정에서도 외환 거래량은 꾸준히 증가하고 있음을 볼 수 있다. 다만, 환율상승기의 경우에는 거래량 증가가 점진적으로 일어나는데 반해 환율하락기에는 시장참가자가 20%에 이른 시점에서 급격히 증가한 후 반락하였다가 이후 점차적으로 증가하는 모습이 나타났다.

나. 투기적 거래자 증가에 따른 효과

외환시장 개방 확대로 환율추세를 추종하면서 거래하는 투기적 거래자의 비중이 커질 가능성을 배제하지 않을 수 없으며, 따라서 이러한 변화가 환율 변동성과 외환거래량에 미치는 효과를 추가적으로 분석하였다. 투기적 거래자는 ABM에서 추세 추종자에 해당하며 이와 밀접하게 관련되어 있는 모수는 (환율변동 추세를 추종하는 정도)와

(환율변동 추세를 추종하는 정도)와  (환율상승기 추세를 추종하는 정도)이다. 여기서는 모수

(환율상승기 추세를 추종하는 정도)이다. 여기서는 모수  와

와  가 2절에서 추정된 사후확률분포의 평균 수준으로부터 상승하거나 감소하는 경우 이것이 환율 변동성과 외환거래량에 어떤 영향을 미치는지 기본모형과 비교하여 평가한다. 해당 분석에 대한 시뮬레이션에서는

가 2절에서 추정된 사후확률분포의 평균 수준으로부터 상승하거나 감소하는 경우 이것이 환율 변동성과 외환거래량에 어떤 영향을 미치는지 기본모형과 비교하여 평가한다. 해당 분석에 대한 시뮬레이션에서는  과

과  으로 설정한다.

으로 설정한다.

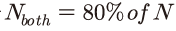

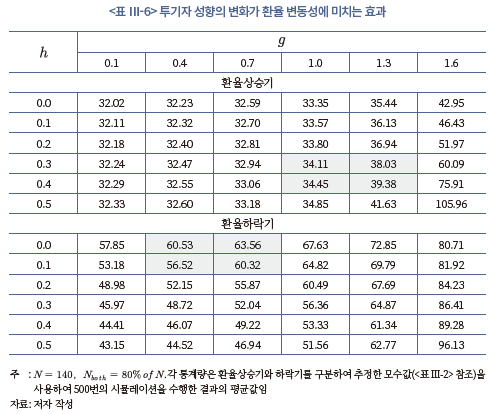

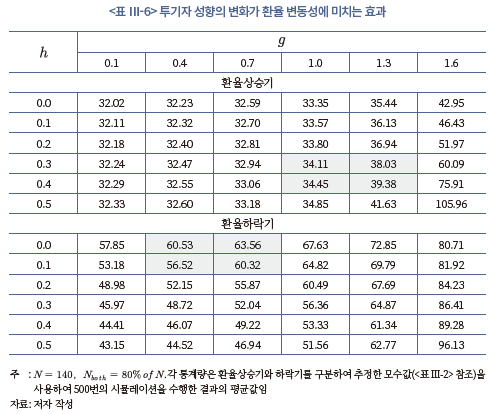

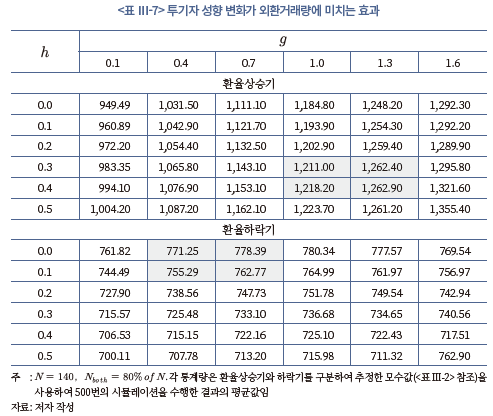

<표 Ⅲ-6>과 <표 Ⅲ-7>은 각각 투기자(추세 추종자) 성향의 변화가 환율 변동성과 외환거래량에 미치는 시뮬레이션 결과이다. 첫 번째 열은 모수 값을 나타내며, 두 번째 줄에 표시된 0.1에서부터 1.6까지 변화하는 것은 모수

값을 나타내며, 두 번째 줄에 표시된 0.1에서부터 1.6까지 변화하는 것은 모수  를 의미한다.

를 의미한다.  의 증가는

의 증가는  와 무관하게 환율상승기와 하락기 모두에서 환율 변동성을 높이는 것을 볼 수 있다. 이는 시장 내 환율추세를 추종하는 투기적 성향의 거래자 비중이 커질 경우 환율 변동성이 높아지면서 동시에 거래 유인이 높아져 외환거래량이 증가하는 당연한 결과로 풀이할 수 있다. 반면,

와 무관하게 환율상승기와 하락기 모두에서 환율 변동성을 높이는 것을 볼 수 있다. 이는 시장 내 환율추세를 추종하는 투기적 성향의 거래자 비중이 커질 경우 환율 변동성이 높아지면서 동시에 거래 유인이 높아져 외환거래량이 증가하는 당연한 결과로 풀이할 수 있다. 반면,  의 변화는 환율 변동성과 외환 거래량에 대체로 예상된 변화를 가져오지만 부분적으로 이 관계가 명확하지 않은 것으로 보인다.

의 변화는 환율 변동성과 외환 거래량에 대체로 예상된 변화를 가져오지만 부분적으로 이 관계가 명확하지 않은 것으로 보인다.

따라서 결과해석의 편의와 강건성을 위해 앞 2절의 베이스라인(baseline) 시나리오 분석을 토대로 투기적 성향 거래자의 한계적 확대가 미치는 영향을 설명할 필요가 있을 것으로 생각된다.19) <표 Ⅲ-6>과 <표 Ⅲ-7>에서 음영으로 표시된 부분은 이를 나타낸다. 이에 따르면 투기자 시장참가자의 비중 확대가 환율 변동성에 미치는 영향은 환율상승기와 하락기의 경우 최대 15%(34.11→39.38)와 5%(60.53→63.56) 정도의 증가를 가져와 그 영향이 그리 크지 않은 것으로 판단된다. 환율상승기의 환율 변동성 변화가 최대 15% 증가에 그친다는 점에서 시장에서 충분히 감내할 수준으로 보이는데 이는 환율 변동성의 절대적 수치가 과거 위기시와 비교하여 상대적으로 크지 않다는 점에 따른 것이다. 이에 관해서는 뒤에서 추가적으로 논의하였다.

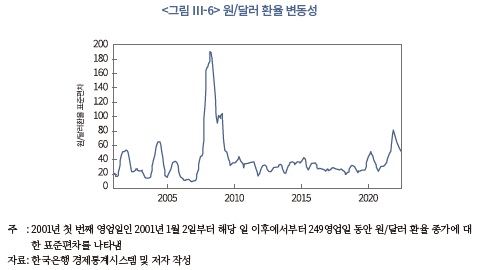

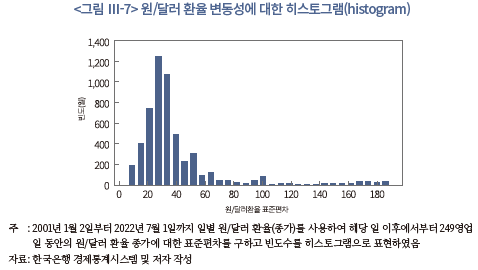

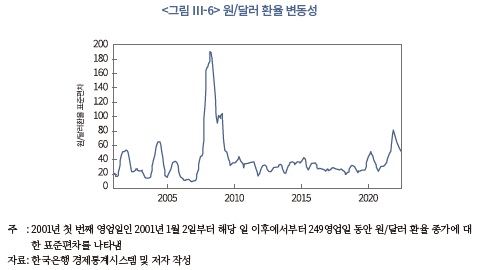

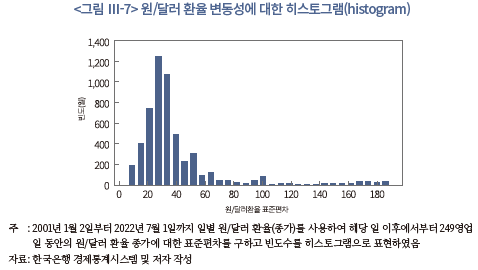

한편 환율 변동성과 관련하여 시뮬레이션 결과상의 수치 60(<표 III-4>의 환율하락기 연장시간에 참여하는 투자자비중 80% 가정 시)은 우려할 수준인가에 대한 평가가 필요하다. 이를 위해 본고에서는 <그림 Ⅲ-6>에 제시된 바와 같이 단순히 원/달러 환율의 변동성 그래프와 이를 히스토그램으로 표현한 <그림 Ⅲ-7>을 이용하였다.20)

전체 기간(2001년 1월 2일~2022년 7월 1일)중 환율의 변동성(표준편차 평균)은 38.78로 환율상승기 모수 추정을 위해 사용한 기간의 표준편차, 30.41보다 높다.21) 위기 기간(2008~2009년)을 포함하는 구간에서 향후 249일간의 일별 환율의 변동성은 60을 초과할 뿐만 아니라 전체 기간 중 100(60)을 초과하는 영업일도 255일(585일)이나 발생한 사실로 미루어 60이라는 수준이 외환위기를 초래할 수준의 변동성과는 큰 차이를 보이고 있다. 더욱이 외환위기는 환율하락기보다는 환율상승기와 밀접하게 관련되어 있다는 점, 그리고 미국을 비롯한 주요국의 금리 인상으로 국제금융시장의 불확실성이 높았던 최근 1년 동안(2021년 7월 1일~2022년 7월 1일)의 환율 변동성이 61.44 수준이었다는 것을 고려한다면 환율 변동성 60은 외환시장에서 충분히 감내할 수 있는 수준으로 판단된다.

이상에서는 외환시장 개방 확대의 효과를 ABM을 사용하여 분석하여 제시하였다. 다만, ABM은 시장의 다양한 현상을 설명하는데 활용할 수 있는 매우 유연한 이론모형이나 몇 가지 한계도 존재한다는 점에 유의할 필요가 있다. 첫째, ABM은 투자자 유형별 의사결정이나 투자자간 상호작용에 대해 비교적 많은 자유도를 제공하므로 때로는 높은 자유도로 인하여 모형이 복잡해지고, 따라서 시뮬레이션 결과의 해석이 어려워질 수 있다. 둘째, 각 투자자 유형별 의사결정에 대한 자료를 얻기 어렵기 때문에 실제 데이터와 모형의 결과를 일치시키는 캘리브레이션(calibration) 과정이 어렵다. 셋째, ABM은 시장에 대한 정확한 예측보다는 가능한 시나리오 하에서 결과를 예상하거나 특정 현상을 이해하는데 적합한 모형인 점을 고려할 필요가 있다. 따라서 위와 같은 모형의 한계를 염두하고 시뮬레이션 결과의 해석 및 일반화에 주의가 필요할 것으로 생각된다.

IV. 요약 및 시사점

본 연구에서는 최근 정부가 계획하고 있는 역내 외환시장의 개방 확대와 거래시간 연장이 우리나라 외환시장에 미치는 영향을 분석하였다. 이를 위해 우선 역내·외 원화외환시장 현황과 상호관계 분석 등을 통해 역외 비거주자의 외환매매 행태와 거래 특성을 사전적으로 분석하였다. 이어서 비거주자의 국내 외환시장 진입이 확대될 경우 환율 변동성 및 외환거래량에 미치는 영향을 이론모형 구축과 다양한 시뮬레이션을 통해 심층적으로 분석하였다.

우리나라 역내 외환시장은 그간 실물경제 규모나 자본시장의 발전 정도, 국경간 증권자금의 유출입 규모 등에 비해 외환거래 규모가 다소 미흡한 데 반해 역외시장에서는 비거주자들의 원/달러 NDF 거래 규모가 여타 통화에 비해 가장 빠르게 성장하고 있다. 비거주자들은 국내 은행과의 NDF 거래를 통해 현물환율에 직접적인 영향을 주고 있는데 환헤지 목적 이외에도 원화환율의 변동 방향을 추수하는 투기적 거래도 적극적으로 하면서 원화환율의 변동성을 증가시키고 있다. 이러한 매매패턴은 원화 약세 기대시에 더 강한 것으로 보이는데 이는 글로벌 금융시장의 외부충격 등으로 원화환율이 상승압력을 받는 경우 비거주자들의 원/달러 NDF 매매로 환율상승이 가속화될 수 있는 우리나라 외환시장의 구조적 특징을 반영한다.

최근에는 비거주자들 간에 이루어지는 원/달러 NDF 거래 규모가 역내시장의 현물환거래 규모 이상으로 확대되면서 현물환율 결정에 미치는 간접적인 경로도 강화되고 있다. 즉, 역외시장에서 비거주자들의 원/달러 NDF 시장의 유동성과 효율성이 증가하면서 현물환율과 NDF 환율 간의 상호 영향도 커지고 있는 데 본고의 분석 결과 주로 역외 NDF 환율이 국내 현물환율에 미치는 일방향 영향이 큰 것으로 확인되었다.

이와 같이 원화외환시장은 현물환 중심의 역내 외환시장과 비거주자들의 NDF 거래에 의해 주도되는 역외 외환시장으로 구분되어 병행 발전하는 모습이 나타나고 있다. 역외 비거주자의 투기적 성향이 상대적으로 더 크다는 점을 감안할 때 역외 비거주자에 대한 역내 외환시장 개방 확대는 환율 변동성이나 외환거래량에도 영향이 있을 수 있다는 점에서 본 연구에서는 이론모형인 에이전트 모형을 설정하고 시뮬레이션을 통해 외환시장 개방에 따른 외환시장 영향을 심층적으로 분석하였다.

우선 외환시장 참가자 증가에 따른 영향 분석에 있어서는 정규시간 참가자가 순차적으로 늘어나더라도 환율 변동성에는 별 영향이 없이 거래량이 증가하는 것으로 나타났다. 그러나 연장 거래시간에 대한 시장참가자의 참여 정도를 고려할 경우에는 환율 변동성이 크게 변화하는 것을 볼 수 있는데 이러한 영향은 환율상승기보다 환율하락기에 더 크게 나타났다. 이는 환율상승기의 경우에는 투기적 거래자들이 환율 상승추세에 편승하는 매매를 통해 수익을 추구하는 일관된 매매전략을 구사하는 경향이 있으므로 오히려 환율 변동성은 낮아지는 데 따른 결과로 생각된다. 분석결과에서 보다 흥미로운 점은 연장시간대에 참여하는 투자자의 비중이 20%를 초과하기 시작하는 경우에는 다시 환율 변동성이 낮아지기 시작한다는 점이다. 또한 환율 변동성이 낮아지는 조정 과정에서 외환거래량은 꾸준히 증가하는 것으로 나타났다.

한편 환율 추세를 추종하는 투기적 성향의 비거주자 참여가 커진다는 점을 고려하여 시장 내 투기자 성향의 변화가 환율 변동성과 외환거래량에 미치는 영향을 시뮬레이션을 통해 살펴보았다. 분석 결과 투기적 성향의 증가는 환율상승기와 하락기에서 모두 환율 변동성을 높이고 거래량도 증가시키는 것으로 나타났다. 이는 환율 변동성이 높아지면서 동시에 투기적 거래자의 거래 유인이 커진데 따른 당연한 결과로 풀이할 수 있다.

그러나 환율 변동성에 미치는 영향의 크기에 있어서는 환율상승기와 하락기의 경우 각각 최대 15%와 5% 정도의 증가에 그치는 것으로 나타났다. 이는 환율 변동성의 절대적 수치가 과거 위기시와 비교하여 상대적으로 크지 않을 뿐만 아니라 미국의 금리 인상으로 국제금융시장의 불확실성이 높았던 최근 1년 동안의 환율 변동성 수준과도 큰 차이가 없다는 점 등에서 외환시장 내에서 충분히 감내할 수 있는 수준으로 판단된다.

요약하자면 역외 비거주자에 대한 역내 외환시장 개방 확대가 이루어지더라도 원화환율 변동성 증가에 따른 부정적인 영향은 제한적인 데 반해 외환거래량 증가를 통한 시장발전에는 긍정적 효과를 나타낼 것으로 기대된다. 그러나 개장연장 시간대에 참여하는 비주거자가 20% 이상 충분히 증가하지 못할 경우에는 환율 변동성 확대가 크게 나타날 수 있다는 점에 유의할 필요가 있을 것으로 보인다.

역외 비거주자의 경우 시장 유동성과 가격 효율성이 확보된 역외 원/달러 NDF 시장을 통하여 이미 거래 목적을 달성하고 있는 상황이므로 역외 비거주자가 역내 시장에 진입하기 위한 충분한 유인책을 마련하는 것이 중요한 과제라 생각된다. 비거주자들은 역내 외환시장 진입 시 우리 외환당국의 규제체계 내로 들어오면서 거래내역에 대한 당국의 실시간 모니터링 부담이나 각종 보고의무 등에 대해 거부감을 가질 수 있기 때문이다. 따라서 역외 거래자의 NDF 거래 수요를 국내 현물환시장으로 흡수하고 시장하부구조를 개선하기 위해서는 무엇보다 은행간 외환시장에서 역외 비거주자와 국내 외국환은행과의 차별적인 대우가 없도록 하고 외국인의 등록 및 보고의무 등과 관련하여 번거로운 절차나 제반 비용의 발생을 최소화함으로써 이들의 참여가 원활히 이루어지도록 유도하는 것이 중요할 것으로 생각된다. 또한 비거주자 참여확대에 따른 외환시장의 변동성 증가나 예상치 못한 부작용이 나타나지 않는 지 등에 대한 당국의 지속적인 모니터링이 필요할 것으로 보인다.

보다 장기적인 관점에서 원화외환시장의 궁극적인 발전을 기하기 위해서는 외국인에 대한 시장개방에 따른 역내 외환시장의 한 단계 도약과 시장주도권의 강화를 발판삼아 원화의 역외 외환시장 개설을 추진하는 것도 중요한 과제라 생각된다. 현재 선진국은 물론 우리나라보다 경제 및 금융시장 발전 단계가 낮은 많은 신흥국들이 글로벌 외환시장 중심지에서 자국통화의 은행간 외환시장을 운영하고 있다는 점은 되새겨 볼 필요가 있다. 역외 원화외환시장 개설은 개방경제체제 하에서 우리나라 금융산업의 발전과 금융안정은 물론 원화의 국제화와 위상 제고를 위해 피할 수 없는 과제라 생각된다. 정부는 역내 외환시장 개방 계획을 차질 없이 이행하여 하부구조 개선과 외환시장의 발전을 기해 나가되 이를 원화의 역외 시장개설을 위한 과정으로 바라보는 것이 바람직할 것으로 생각된다.

1) 자세한 내용은 기재부(2023.2.7) 참조

2) 현재 외국인이 국내 은행과 거래하는 경우에는 은행간시장 참가자로서가 아니라 은행의 대고객거래로서 행하는 것이라 할 수 있다.

3) 국내 증권회사는 외국환거래법상 기타외국환업무취급기관으로 분류된다.

4) 서울외국환중개회사 및 한국자금중개주식회사를 말한다.

5) 원/위안 시장은 2015년 서울과 중국 상해에 각각 교차 설립되었으며 시장개설 초기 유동성 확보를 위해 대형은행들 위주로 시장조성자(market maker)를 지정하여 운영하고 있다.

6) 전통적 외환거래의 종류에는 통상 현물환, 선물환 및 외환스왑거래를 포함한다.

7) 여기서 NDF 매입이란 미달러화에 대한 매입을 의미한다.

8) 우리나라의 환포지션관리제도에는 종합포지션한도와 선물환포지션한도가 있다. 종합포지션한도의 경우 매입초과 또는 매도초과 외환포지션한도를 자기자본의 20% 이내로 규정하고 있다.

9) 다만, 2022년 이후에는 미연준의 급격한 통화정책 기조변화로 그 관계가 일관되지 않는 것으로 보인다.

10) NDF 환율은 선물환율의 일종이므로 현물환율과 구별되나 원화와 미달러화 두 통화의 내외금리차이 만큼을 NDF 환율에 이미 반영하고 있으므로 두 환율이 일관된 변동방향을 갖는다고 할 수 있다.

11) 예를 들어 특정일(t)의 경우 현물환율은 한국시각 오전 9시(시가) 또는 오후 3시(종가)를 의미하며 동일자(t)의 NDF 환율은 한국시각으로는 익일 오전 6:30분이 된다.

12) 오차수정모형은 두 변수간에 장기적인 상호관계를 가정하므로 두 변수간 공적분(cointegration)의 존재를 전제로 하며 이 경우 두 변수간의 단기적인 괴리가 조정과정을 거쳐 수렴하게 되는 점을 가정한다.

13) 기재부는 이번 개선방안에서 개장시간을 대폭 연장한다고 밝혔는데, 우선 한국시간으로 새벽 2시까지 거래시간을 연장하고, 추후 은행권 준비, 시장 여건 등을 고려하여 24시간까지 확대하는 것을 고려한다고 보도하였다. 자세한 내용은 기재부(2023.2.7) 참조

14) ABM과 관련하여 Bankes(2002)와 Macal & North(2009) 참조. Bankes(2002)는 기존 경제학을 포함한 사회과학 모형은 비현실적인 가정에 기반하고 있어 일부 사회과학 문제에 적합하지 않다고 지적하였다. 따라서 이에 대한 해결책으로 Bankes(2002)는 ABM이 대안이 될 수 있음을 주장하였다. ABM은 가정을 완화하고, 개별 에이전트의 행동, 동기, 관계를 표현하여 개별 사회과학 현상을 탐구하는 강력한 도구가 될 수 있다고 주장하였다. Macal & North(2009)는 컴퓨팅의 발전으로 경제학을 포함한 다양한 응용 분야에서 ABM이 생성되고 있으며, 앞으로 더 폭넓게 활용될 수 있는 잠재력이 있다고 평가했다. ABM은 일종의 연구자들의 실험실로서 전통적인 연역 및 귀납적 추론 방식을 보완할 수 있다고 주장하였다.

15) 에이전트 모형에 베이지안 추론 기법을 적용한 최근 연구로는 Shiono(2021)와 Grazzini, et al.(2021) 등이 있다. Shiono(2021)는 Radev et al.(2020)에 의해 제안된 새로운 비모수 베이지안 추론인 BayesFlow를 ABM의 추정에 적용할 수 있는지에 대해 분석했다. 분석 결과 BayesFlow는 기존 베이지안 추론 기법(Kernel Density Estimation-MCMC, Mixture Density Network-MCMC 등)보다 우수한 정확도를 달성하여 표준 New Keynesian ABM(NK-ABM)의 모의 데이터로부터 매개변수의 실제 값 복원 검증 테스트에서 뛰어난 결과를 보였다. Grazzini, et al.(2021)에서도 ABM에 대한 베이지안 추론 기법을 적용하였고, 이 방법론이 Simulated Minimum Distance(SMD)의 대안이 될 수 있음을 주장하였다.

16) 이에 관해서는 대외경제정책연구원(2022) 참조

17)

18) ABM에서는 정규시간에 거래하는 참가자의 일부 혹은 전부가 연장시간에 거래한다(베이스라인 모형에서는 연장시간 참가자의 수가 0임). 하지만 외환시장 개방 확대 이후 실제 예상되는 외국인 투자자의 역내 외환시장 참여는 국가 간 시차로 인해 주로 현재의 정규시간, 오후 3시 30분 이후가 될 가능성이 높다. 따라서 이 부분은 모형과 실제 간 차이라고 할 수 있으나, 기존 역내 참가자 역시도 외환시장 개방 확대 이후 연장시간에 모든 사람이 거래에 참여하지 않는다고 본다면 참가자의 수 측면에서 모형의 설정이 외환시장 개방 확대 이후 예상되는 역내 외환시장과 크게 괴리된다고 볼 수 없다.

19) 앞의 베이스라인 시뮬레이션에서 는 환율상승기와 하락기 각각 1.1356, 0.3967로, 는 환율상승기와 하락기 각각 0.3491, 0.0057로 모수가 추정되었다.

20) 해당 일에 대응하는 y 값은 해당 일 이후 249영업일간 일별 환율자료를 사용하여 계산한 표준편차이다.

21) 최댓값은 188.9645, 최솟값은 8.8013, 그리고 5%, 10%, 90%, 95% 값은 순서대로 14.3141, 17.1408, 62.8580, 99.1579이다.

참고문헌

기획재정부, 2023. 2. 7, 글로벌 수준의 시장접근성 제고를 위한 외환시장 구조 개선방안, 보도자료.

빈기범·이상민·이원섭, 2016, 역내외 현물환, 선물환 및 NDF 거래에 의한 원화 가치 가격발견에 관한 연구, 선물연구 24(2), 339-363.

이승호, 2020, 『환율의 이해와 예측』, 삶과지식.

홍정효, 2018, 뉴욕(New York) 원달러 역외선물환시장(NDF)의 가격발견기능 연구, 금융공학연구 17(4), 99-118.

Bank for International Settlements, 2019, Offshore markets drive trading of emerging market currencies, BIS Quarterly Review, December 2019.

Bankes, S.C., 2002, Agent-based modeling: A revolution? Proceedings of the National Academy of Sciences 99(3), 7199-7200.

Brock, W.A., Cars, H.H., 1998, Heterogeneous beliefs and routes to chaos in a simple asset pricing model., Journal of Economic dynamics and Control 22(8-9), 1235-1274.

Fan, Y.J, Lai, H.N., 2006, The intraday effect and the extension of trading hours for Taiwanese securities., International Review of Financial Analysis 15(4-5), 328-347.

Gaunersdorfer, A, Hommes, C., 2007, A Nonlinear Structural Model for Volatility Clustering. In: Teyssi re, G., Kirman, A.P. (eds) Long Memory in Economics. Springer, Berlin, Heidelberg.

Grazzini, J., Matteo G.R., Tsionas, M., 2017, Bayesian estimation of agent-based models., Journal of Economic Dynamics and Control 77, 26-47.

Lee, H.C., Chien, C.Y., Chen, H.L., Huang. Y.S., 2009, The extended opening session of the futures market and stock price behavior: Evidence from the Taiwan Stock Exchange., Review of Pacific Basin Financial Markets and Policies 12(3), 403-416.

Macal, C.M., North, M.J., 2009, Agent-based modeling and simulation., Proceedings of the 2009 winter simulation conference(WSC), 86-98, IEEE, 2009.

Michael, F., Eyup, K., 2023, Impact of trading hours extensions on foreign exchange volatility: intraday evidence from the Moscow exchange, Financial Innovation, Research, Open Access.

Miwa, K., 2019, Trading hours extension and intraday price behavior., International Review of Economics and Finance 64, 572-585.

Miwa, K., Ueda, K., 2017, Is the extension of trading hours always beneficial? An artificial agent-based analysis, Computational Economics 50, 595-627.

Radev, S.T., Mertens, U.K., Voss, A., Ardizzone, L., Köthe, U., 2020, BayesFlow: Learning complex stochastic models with invertible neural networks., IEEE transactions on neural networks and learning systems 33(4), 1452-1466.

Shiono, T., 2021, Estimation of agent-based models using Bayesian deep learning approach of BayesFlow., Journal of Economic Dynamics and Control 125, 104082.

우리나라가 1992년 외국인투자자에게 처음으로 국내 자본시장을 개방한 이래 두 차례 위기와 대외불확실성의 지속에도 불구하고 개방경제체제가 나름대로 양적·질적 발전을 거듭해 오고 있다. 우리나라의 무역 등 실물경제 규모가 꾸준히 확대되는 가운데 자본·금융거래에 있어서도 외국인의 국내 주식 및 채권에 대한 투자 잔액이 이미 1조달러를 상회하고 있고 국내 거주자의 해외증권투자도 이와 비슷한 규모까지 크게 확대되었다. 이에 따라 국경간 자본유출입 규모가 크게 확대되고 국내 외환시장에서의 외환거래 규모도 이에 동반하여 증가하는 등 성장을 거듭해 왔다.

그러나 아직까지 역내(on-shore) 외환시장은 실물경제나 주식시장 등 여타 자본시장의 발전 속도에 비해 상대적으로 완만한 양적 성장을 보이는 가운데 시장하부구조의 개선 등 질적인 발전 정도에 있어서도 미흡한 감이 없지 않다. 향후 대외부문의 안정을 유지하고 개방거시경제 체제를 더욱 공고히 확립하기 위해서는 우리나라 외환시장의 하부구조와 기능이 지금보다 더 고도화될 필요가 있다. 특히 외환시장의 중추적 기능을 담당하는 은행간(inter-bank) 외환시장의 참가자가 외환당국에서 인가받은 외국환은행으로 제한된 가운데 원화는 국제통화로서 자리매김하지 못하고 있는 상황이다. 반면 역외(off-shore) 글로벌 금융중심지에서는 원화외환시장이 차액결제선물환(Non-Deliverable Forward: NDF) 거래를 중심으로 빠르게 발전하면서 국내외 경제주체들의 다양한 외환거래 수요의 상당 부분을 담당하고 역내 외환시장의 성장을 더디게 하는 측면도 있는 것으로 보인다.

우리나라의 외환위기 직후인 1999년 4월 국내 은행과 역외 비거주자들 간의 NDF 거래가 허용된 이후 거래 규모가 꾸준히 증가하고 원화환율 결정에 직접적인 영향을 주고 있다. 비거주자들은 국내 증권투자에 따른 환헤지 등을 목적으로 원화와 같이 비국제화된 통화에 대해 거래편의가 있는 NDF거래에 치중하고 있어 환율 변동성을 확대시키고 역외 투기세력이라는 비판을 받고 있다. 이는 NDF 거래가 직접적인 외환의 유출입을 수반하지 않더라도 은행의 환포지션 변동을 통해 현물환율에 즉각적인 영향을 미치고 있는데 따른 것이다. 더욱이 최근에는 뉴욕이나 런던 등 글로벌 국제금융중심지에서 비거주자들 간에 이루어지는 원화 NDF 거래가 국내 현물환거래 규모를 훨씬 능가할 정도로 커지고 시장유동성이 확대되면서 원화 현물환율의 결정에 미치는 간접적인 영향도 확대되고 있다. 그 결과 역내·외 원화외환시장은 현물환 중심의 국내 외환시장과 비거주자들의 NDF 거래 중심의 역외 외환시장으로 구분되어 병존하고 있는 시장구조가 심화되고 있는 것으로 판단된다.

이런 점을 배경으로 우리 정부(기획재정부)는 2023년 2월 「외환시장 구조 개선방안」을 발표하였다. 이 방안은 국내 규제 및 감독체계에서 벗어난 역외 원화시장의 개설 대신, 국내 외환시장을 외국인에게 개방하여 경쟁적 시장구조로 전환하고자 하는 전략이라 할 수 있다. 이를 달성하기 위해 국내 외환시장 대외 개방, 개장시간 대폭 연장1), 선진수준 시장인프라 구축 등 세 가지 방안을 제시하였다. 구체적으로는 일정요건을 갖춘 해외소재 금융기관(Registered Financial Institution: RFI)에 대해 국내 은행간시장에서 국내 외국환중개사를 통한 현물환 및 외환스왑 거래에 대한 직접 참여를 허용하고 외환시장의 개장시간을 익일 오전 2시까지 연장하는 것이 그 골자이다. 이는 서울외환시장을 해외금융기관에 개방하여 외국인투자자의 거래편의와 접근성을 개선하는 동시에 역외 거래자의 NDF 거래 수요를 일정 부분 국내 현물환시장으로 흡수함으로써 시장하부구조를 개선하고 역외시장에 기인한 원화환율 변동성 확대를 최소화하여 우리나라 외환시장의 양적·질적 발전을 도모하고자 하는 계획이라 할 수 있다.

이에 대해 일부에서는 외국인의 국내 은행간 외환시장 참여 유인이 크지 않다는 점을 지적하는 가운데 설령 비거주자의 국내시장 참여가 확대되는 경우에도 시장참가자 확대를 통한 시장효율성 개선 등 긍정적 효과 외에 시장변동성 확대 등 부정적 측면을 가져올 수 있다는 우려를 제기하고 있다. 이러한 부정적인 견해는 역외 거래자들이 대체로 투기적 성향이 강하다는 일반적 인식을 반영하여 비거주자들의 국내 현물환시장 진입으로 원화환율의 변동성이 확대되고 시장의 교란요인이 될 수 있다는 우려에 따른 것이다. 따라서 역외 원화외환시장의 현황과 비거주자들의 거래 행태, 그리고 역내 외환시장이나 현물환율과의 관계 등에 대한 사전적인 연구 필요성이 크다고 판단되나 이에 관한 연구는 별로 없는 실정이다. 특히 내년 하반기 시행을 목표로 정부가 추진중인 외국인에 대한 국내 은행간 외환시장 개방이 원화환율의 변동성이나 외환거래량 등에 미칠 영향에 대해서는 아직까지 연구가 거의 이루어지지 못하고 있다.

이런 점을 배경으로 본 연구에서는 우선 역내·외 원화 외환시장 현황과 역내·외 시장간의 상호 관계 및 환율에 대한 영향을 살펴봄으로써 역외 비거주자의 국내 외환시장 참여에 따른 영향을 사전적으로 분석하고자 한다. 이어서 비거주자의 국내 외환시장 진입이 확대될 경우 국내 시장에서 원화환율 변동성 및 외환거래량 등에 미치는 영향을 심층적으로 분석하였다. 이를 위해 이론모형인 에이전트 모형을 우리나라 외환시장의 구조 및 특성을 반영하여 설정한 후 시뮬레이션을 통해 그 영향을 다각도로 분석해 보고자 한다. 보고서의 구성은 다음과 같다. 제II장에서는 역내·외 원화외환시장 현황 및 상호 관계를 살펴보고 제III장에서는 외환시장 개방에 따른 영향을 분석하였다. 제IV장에서는 요약 및 시사점을 제시하였다.

Ⅱ. 역내·외 원화외환시장 현황 및 관계

1. 우리나라의 외환시장 거래 구조

우리나라의 역내 은행간(interbank) 외환시장의 거래구조와 메커니즘을 간략히 설명하면 다음과 같다. 우선 시장참가자는 원칙적으로 외국환거래법상 외환당국에 등록된 국내은행과 외은지점 등 외국환은행으로 제한된다.2) 그 밖에 외국환은행은 아니지만 국내 증권사3)가 2003년 이후 은행간 외환시장에 참여하고 있는데 이는 2000년대 이후 국내외 증권투자자금의 유출입 규모가 크게 확대된 데 따른 것이다. 금번 정부의 외국인에 대한 은행간 외환시장 개방 계획은 현행 외국환거래법에서 명시한 외국환은행 이외의 참가범위 확대 조치라 할 수 있다.

은행간 시장에서의 현물환거래는 주로 외국환중개회사를 통한 중개거래가 대부분이다. 현재 현물환거래는 국내 계열의 2개 중개사4)만 중개업무가 허용되고 있다. 반면 다수의 외국계중개회사에 대해서는 현물환중개 업무가 허용되지 않고 있어 이들은 주로 엔/달러나 유로/달러 등 이종통화에 대한 중개업무나 역외 비거주자와의 NDF 거래 및 외환스왑 거래 등에 대한 중개업무에 치중하고 있다.

현재 은행간 시장에서 거래되고 있는 통화는 원/달러 및 원/위안5) 두 시장만 존재한다. 원/달러 현물환거래의 경우 최소 거래단위는 100만달러이며 100만달러씩 증액할 수 있다. 역내 시장의 중개거래 시간은 우리나라 주식시장 개장시간과 동일하게 오전 9:00 ~ 오후 3:30으로 되어 있다. 중개방식은 과거 전화나 메신저 등을 통한 방식보다는 대부분 전자중개시스템(Electronic Broking System: EBS)을 통해 체결되고 있다. 환율의 표기방식은 소수점 한자리(10전 단위)까지 표기하고 있다. 이와 같은 서울외환시장에서의 현물환 매매방식에 관한 세부적인 사항들은 은행간 외환시장 참가자들의 민간자율협의기구인 ‘서울외환시장운영협의회’에서 정하고 있다.

역내 시장에 비해 역외시장에서의 거래는 상대적으로 자유롭게 이루어진다. 다만, 원화 현물이 역외시장에서 자유롭게 거래되고 있지 못함에 따라 역외시장에서는 주로 원/달러 NDF 거래를 중심으로 거래가 이루어지고 있다. 역외시장에서의 원/달러 NDF 거래는 해외에서 원화의 실물 인수도가 이루어지지 않아도 될 뿐만 아니라 외환매매와 관련한 우리 외환당국의 규제체계의 적용을 받지 않아도 되므로 거래 참가자나 중개기관 및 거래방식 등에 대한 제약이 없다고 할 수 있다. 과거 싱가포르나 홍콩 등 아시아지역을 중심으로 형성되기 시작한 원/달러 NDF 시장은 최근에는 뉴욕은 물론 런던, 동경 등 주요 글로벌 금융중심지에서 더 큰 규모의 거래가 이루어지고 있다.

2. 역내·외 원화외환시장 현황

우리나라 외환시장은 크게 보아 현물환 중심의 역내 외환시장과 NDF 거래 중심의 역외 외환시장으로 구분된 모습을 보이고 있다. 여기서는 역내 외환시장의 현황을 외환거래 규모를 중심으로 살펴본 후 역외시장에서 비거주자들에 의해 주도되고 있는 원/달러 NDF 거래의 현황 및 특징을 살펴보았다.

가. 역내 외환거래 현황

우리나라의 역내(서울) 외환시장에서 외국환은행이 은행간 또는 대고객과 체결한 총 외환거래 규모6)는 <표 II-1>에서 보는 바와 같이 2022년 기준 609.6억달러(일평균 기준)를 나타내고 있다. 이중 현물환(spot) 거래 규모는 일평균 231.3억달러로 외환스왑(258.3억달러) 다음으로 큰 비중을 차지한다. 현물환 거래를 기준으로 볼 때 최근의 일평균 거래규모는 2010년 대비 39.5% 증가에 그친 것으로 나타나 그간 우리나라의 자본유출입 등 자본〮금융거래의 증가나 주식시장 등 여타 자본시장의 양적 성장에 비해 상대적으로 더딘 성장세를 보여 왔다.

반면 선물환(forward) 및 외환스왑(FX swap) 거래는 현물환거래에 비해서는 비교적 빠른 증가세를 보였다. 은행들의 선물환거래는 수출입기업들의 환헤지를 위한 거래보다 역외 비거주자들과의 NDF 거래가 규모가 훨씬 커 선물환거래의 대부분을 차지하고 있는데 2022년 기준 역외 비거주자와의 NDF 거래 규모는 일평균 110.8억달러에 달하며 2010년 대비 2배 이상 증가하였다. 비거주자와의 NDF 거래가 빠르게 증가한 것은 1999년 4월 이후 국내 외국환은행과 역외 비거주자들 간의 NDF 거래가 허용된 이후 비거주자들이 환헤지(hedging)나 투기적 목적(speculation)을 위해 원/달러 NDF 거래 규모를 늘려온 데 기인한다. NDF 거래는 통상 국경간 자본유출입을 초래하지는 않으나 거래의 결과 국내 은행들의 외환포지션(FX position)의 즉각적인 변동을 수반하므로 현물환율의 결정에 직접적인 영향을 미치고 있다. 그 밖에 전통적 외환거래중 가장 큰 비중을 차지하고 있는 외환스왑 거래는 2022년 기준 일평균 258.3억달러의 거래규모를 나타내며 완만한 증가세를 보이고 있다.

역내 외환시장이 상대적으로 완만한 성장세를 보이는 것과 달리 원화의 역외 외환시장은 빠른 성장세를 보이고 있다. 역내 시장보다 역외시장(off-shore)의 발전 속도가 빠른 것은 비단 우리나라 원화에 국한되지 않고 대부분의 신흥국 통화에서 공통적으로 관찰되는 국제적 현상과 무관하지 않은 것으로 보인다. <그림 II-2>와 <그림 II-3>에 제시된 국제결제은행의 조사결과에 따르면 아시아 신흥국의 경우 역외시장이 역내시장의 거래 규모를 상회하고 있는데 그 주된 이유는 역외시장 거래 형태중 차액결제선물환(NDF) 시장이 대부분의 통화에 대해 빠르게 성장하고 있는데 기인한다. 이는 우리나라 원화를 비롯한 대부분의 아시아 국가 통화들의 국제화 정도가 미흡하여 자국통화 대신 미달러화가 결제수단으로 주로 사용되는 NDF 거래가 외국인투자자들의 환헤지 및 투기적 목적 거래에 용이하기 때문이다.

이처럼 역외 NDF 시장에서 비거주자들의 원/달러 NDF 거래 규모 및 시장유동성이 크게 증가함에 따라 우리나라 원화 외환시장은 크게 보아 현물환거래 중심의 역내 시장과 NDF 거래 중심의 역외시장으로 구분되어 발전하는 모습을 띠고 있다. 또한 역외 NDF 시장의 유동성 및 효율성이 증가하면서 원화환율의 결정에 있어서도 국내 시장참가자의 외환매매 못지않게 역외 비거주자들의 원/달러 NDF 거래에 의해 큰 영향을 받고 있는 점을 시사한다.

3. 비거주자와 은행 간의 NDF 거래 및 환율 영향

역외 비거주자들은 국내 외국환은행과 NDF 거래를 하거나 비거주자들간의 거래를 통하여 원/달러 환율의 결정에 영향을 미치고 있다. 이 절에서는 우선 비거주자와 국내 외국환은행과의 NDF 거래가 은행의 외환포지션 변동을 통해 환율에 영향을 미치는 직접적인 경로에 대해 살펴보았다.

예를 들어 비거주자가 원화환율의 상승을 예상하여 국내 은행과 NDF 매입7)거래를 하는 경우 국내 외국환은행은 매도초과포지션(over-sold 또는 short position) 상태에 놓이게 되는데 이 때 은행들은 환포지션을 조정8)하기 위해 주로 현물환시장에서 외환을 매입하게 되므로 환율이 상승압력을 받는다. 반대로 비거주자의 NDF 매도(은행의 NDF 매입)시에는 은행은 매입초과포지션(over-bought 또는 long position) 상태의 환포지션 조정을 위해 현물환을 매도하므로 환율이 하락압력을 받는다. 이를 그림으로 정리하면 다음 <그림 II-6>과 같다.

역외 비거주자와 국내 은행과의 NDF 매매가 환율에 영향을 주는 직접 경로 못지않게 역외시장에서 비거주자들간의 원/달러 NDF 거래 증가로 NDF 환율이 형성됨으로써 국내 현물환율 결정에 미치는 간접적인 경로의 영향도 커지고 있다.

<그림 II-9>에 제시된 바와 같이 글로벌 24시간 외환시장의 특성을 반영하여 뉴욕외환시장의 원/달러 NDF 종가가 서울외환시장 개장 시초가 및 종가에 영향을 미치고 이는 다시 싱가포르, 런던 등 국제금융시장을 거치면서 다시 뉴욕외환시장의 NDF 환율에 그 영향이 연쇄적으로 나타나는 특징을 보이고 있다.10)

본고에서는 역외 NDF 환율이 역내 환율결정에 미치는 간접적인 영향이 커지고 있는 점에 비추어 역내·외 환율간의 상호 관계 및 영향에 대하여 인과관계 검증 및 오차수정모형을 통한 분석을 실시하였다.

가. 인과관계 분석

역외 NDF 환율과 현물환율 시가 및 종가 간의 그랜져 인과관계(Granger causality)를 검증하기 위한 일별 역외 NDF 환율 데이터는 Bloomberg사에서 고시하는 뉴욕 외환시장의 오후 5:30 기준 가격(한국시각 익일 오전 6:30분)11)을 사용하였으며 다른 시간대나 여타 시장의 원/달러 NDF 환율은 획득이 어려워 시간대별 영향을 분석하기에는 한계가 있었다. 현물환율 시가 및 종가는 각각 오전 9시 및 3:30분 마감시의 역내 현물환시장 가격을 의미한다. 인과관계 검증을 위해 사용한 VAR모형은 일별 변수를 차분하여 사용하였으며 시차는 2를 적용하여 추정하였다.

<표 II-4>에 나타난 인과관계 검증 결과에 따르면 역외 NDF 환율 변동은 역내 현물환율의 개장 시초가는 물론 종가에도 통계적으로 매우 유의한 영향을 주는 것으로 나타났다. 또한 추정기간을 전체기간과 별도로 미 테이퍼텐트럼 기간, 미중 무역갈등 기간, 미달러화 초강세기간 등 글로벌 불확실성이 컸던 기간에 대해 별도로 분석한 경우에서도 유사한 결과가 나타나 역외 NDF 환율이 역내 현물환율에 영향을 주는 점을 확인할 수 있다. 이는 원화환율의 결정에 있어 역내시장보다는 역외시장에서의 비거주자의 거래가 선행적인 영향을 주고 있는 점을 시사하는 결과라 할 수 있다.

나. 오차수정모형 분석

우리나라의 역내 현물환율과 역외 NDF 환율 간의 상호 연관성을 오차수정모형 분석을 통해 아울러 분석해 봄으로써 두 변수간의 정보흐름을 파악해 보았다. 추정을 위한 오차수정모형(vector error correction model)12)을 아래와 같이 설정하였다.

• 장기 추정식:

일별자료를 이용하여 추정한 결과 두 변수간에 공적분(cointegration) 관계가 존재하는 것으로 확인되었으며 오차수정모형의 추정 결과는 <표 II-5>에 제시되었다. 이에 따르면 역외 NDF 환율이 역내 현물환율에 영향을 미치는 일방향 관계가 있는 것으로 분석되었다. 즉, αspot이 -1~0 사이의 값을 가지며 유의성이 높은 것으로 나타난 반면 αNDF의 부호는 전체기간과 환율 하락기에서 양(+)의 값을 보였을 뿐만 아니라 환율 상승기의 경우에도 부호의 통계적 유의성이 그리 높지 않은 것으로 나타났다.

이러한 추정결과는 현물환율과 역외 NDF 환율이 장기균형관계를 가지고 있으며 단기적으로 역외 NDF 환율이 변동할 경우 현물환율이 이를 즉각 반영하여 조정되는 반면 그 반대의 조정경로는 잘 나타나지 않음을 의미한다. 따라서 단기적으로 역외 NDF 환율이 역내 현물환율에 대해 일방향 영향을 주는 것으로 볼 수 있다.

정부의 국내 외환시장 대외 개방 및 개장시간 연장13) 계획이 이행될 경우 비거주자의 국내 외환시장 접근성이 높아지고 다양한 거래동기를 지닌 시장참가자가 늘어나면서 외환시장의 효율성이 증가하고 외환거래 규모가 증가하는 등의 시장발전에 대한 기대감도 높아지고 있다.

역외 비거주자들이 국내 은행간 외환시장에 직접 참여할 경우 우리나라 외환당국의 규제체계 내에서 현물환매매 내역에 대한 당국의 모니터링, 그리고 제반 간접비용의 발생이 예상된다는 점에서 신규 진입이 제한적일 것이라는 일부 우려가 있는 것이 사실이다. 그럼에도 불구하고 비거주자들은 국내시장 참여시 다음과 같은 이점을 향유할 수 있어 정부의 계획이 차질 없이 이행될 경우 점차 신규 진입이 늘어날 가능성이 있을 것으로 생각된다.

첫째, 역외 비거주자들은 국내시장 진입시 익일 새벽 2시까지 우리나라 은행간 시장의 참가자로서 거래가 가능하다. 따라서 역외시장의 업무시간 중에 원/달러 통화에 대한 환헤지나 투기적 목적을 위한 거래를 할 수 있으므로 거래의 편의성이 현재보다 크게 늘어날 것으로 예상된다.

둘째, 기존의 역외 NDF 시장을 통한 원/달러거래에 더하여 역내 은행간 시장에서 현물환 매매가 가능해짐에 따라 역외 NDF 환율과 현물환율 간의 단기적인 괴리가 발생하는 경우 재정차익거래 기회를 갖게 된다. 예를 들어 역내 현물환율이 역외 NDF 환율에 비해 일시적으로 유리한 호가를 보일 경우 역내외 시장을 통해 현물환 매입과 NDF 매도를 통한 재정차익거래가 가능하며 이 과정에서 역내 현물환거래 규모의 증가를 가져올 것으로 예상된다.

셋째, 비거주자의 역내 현물환시장 참여가 점차 늘어날 경우 현물환시장의 유동성이 현재보다 늘어나고 가격 효율성은 증대되면서 비거주자들의 역외 NDF 시장에서의 거래유인은 서서히 감소할 것으로 보인다. 이는 비록 역내시장이지만 비거주자의 원화에 대한 접근성이 높아짐에 따라 역외시장에서 해당 통화의 유통 제약을 우회하는 수단으로 사용되고 있는 NDF 거래의 유용성이 감소하기 때문이다. 이 경우 역외 NDF 거래의 일정 부분이 역내 현물환거래로 흡수되면서 역내 시장의 양적 성장으로 이어질 가능성이 있을 것으로 생각된다.

이런 점에 비추어 제Ⅲ장에서는 국내 외환시장이 해외기관에 개방되어 비거주자의 역내 외환시장 참여가 증가하고 거래시간이 연장될 경우 원화환율의 변동성과 외환거래량에 어떠한 영향을 미치는지를 심층적으로 분석해 보았다. 이를 위해 이론모형중 하나인 에이전트 기반 시장모형(Agent-Based market Model: ABM)을 사용하여 분석하였다. 이는 비거주자에 대한 외환시장 개방 및 거래시간 연장 조치가 우리나라는 물론 해외 사례도 찾아보기 어려운 제도개선 사항이므로 과거 데이터를 통한 실증분석의 한계를 극복하고 이론모형을 통한 다양한 시뮬레이션 분석을 실시하기 위함이다.

이를 위해 우선 한국 외환시장 특성을 반영한 ABM을 설정한 후, 이 모형을 사용하여 시장참가자가 증가하고 거래시간이 연장될 경우 원화환율의 변동성과 외환거래량에 미치는 효과를 시뮬레이션을 통해 다각도로 분석하고자 한다. 아울러 역외비거주자의 투기적 성향이 국내 거래자에 비해 상대적으로 크다는 대체적인 인식에 비추어, 비거주자의 국내 외환시장 참여확대로 국내 외환시장 참가자의 투자 성향이 전체적으로 변화하는 경우 환율 변동성과 외환거래량에 어떠한 영향을 미치는지에 대해서도 분석을 병행하였다.

제Ⅲ장은 다음과 같이 구성되어 있다. 1절에서는 ABM에 대해서 설명하고, 2절에서는 모수 추정과정을 보인 후 시뮬레이션에 사용된 모수값을 제시한다. 3절에서는 외환시장 개방 효과에 대한 시뮬레이션 결과를 제시하고, 마지막 4절에서는 Ⅲ장의 주요 연구내용을 요약하고 시사점을 도출한다.

1. 선행 연구

외환시장에서 시장참가자 확대와 거래시간 연장에 대한 동시적 영향을 분석한 기존 연구는 거의 존재하지 않는 실정이다. 따라서 본고에서는 외환시장과 자산시장으로서의 유사성이 크다고 생각되는 주식시장에 대한 선행연구를 원용하여 제2절에서 제시된 외환시장 모형설정에 참고하였다.

주식시장에서 거래시간 연장이 가격 변동성과 거래량에 미치는 효과와 관련한 기존 실증분석 연구로는 주로 대만과 일본 주식시장에 대한 연구를 들 수 있다. Fan & Lai(2006)는 대만 증권거래소에서 거래시간 연장이 장중 거래 패턴에 어떤 영향을 미치는지 분석했다. 이 연구에 따르면 거래시간 연장 전후인 2000년과 2001년에도 거래량과 수익률 변동성은 여전히 역J자 형태를 보였다. 그러나 거래 비용의 패턴은 거래시간 연장 후인 2001년에 더욱 완만해진 것으로 나타났다.

Lee et al.(2009)은 대만 선물시장에서 개장시장 연장이 주가 행태에 어떤 영향을 미치는지를 분석했다. 연구 결과에 따르면 개장시간 연장 이후 주식수익률의 변동성이 감소하고, 개장시점 주식 수익률의 자기 상관성이 완화된 것으로 나타났다. 또한 증시 개장시 발생하는 주가의 과도한 반응도 연장 이후에는 완화된 것으로 분석되었으며, 연장된 개장 기간 동안의 선물 수익률 변동으로 밤사이 주식 수익률 변화에 대한 예측력이 높아진 것으로 주장하였다.

일본의 주식시장 거래시간 연장에 대한 연구로는 Miwa(2019)가 있다. Miwa(2019)는 일본 주식선물시장 자료를 사용하여 거래시간 연장과 과도한 주가 변동 사이의 관련성에 대해 분석했다. 연구 결과에 따르면 거래시간이 연장될수록 주가의 과잉 반응이 증가하고, 주식 거래량도 증가하는 것으로 나타났다. 이는 거래시간 연장이 주가의 과도한 변동을 야기하고, 가격 효율성에도 부정적인 영향을 미칠 수 있음을 시사한다.

위에서 언급한 관련 문헌들에서는 대만과 일본의 실증분석 결과가 비교적 큰 차이를 보이고 있는데, 이러한 차이는 각 국가별 상이한 시장 특성에서 기인하였을 가능성이 높은 것으로 생각된다. 따라서 본고에서는 거래시간 연장뿐만 아니라 시장참가자의 증가를 포함하는 전반적인 외환시장 개방 확대의 효과를 분석하는데 주목적이 있으므로 우리나라 외환시장의 특성을 반영한 ABM을 설정한 후 시뮬레이션을 통해 그 영향을 분석하고자 한다.

ABM을 사용하여 거래시간 연장의 효과를 살펴본 기존의 연구로는 Miwa & Ueda(2017)가 있다. 이 연구에서는 거래시간 연장이 더 많은 거래 기회를 제공하고, 가격의 효율성을 높이는지에 대한 분석을 ABM을 사용하여 수행했다. 분석 결과에 따르면 거래시간 연장으로 일일 거래량이 증가한다는 것을 보였다. 또한 거래시간이 연장되었지만, 연장된 거래시간에 시장참가자의 수가 제한되는 경우에는 가격 형성 및 거래 활동에 왜곡이 발생할 수 있는 것으로 나타났다.

본고에서 사용하는 ABM은 복잡한 외환시장의 작동원리와 현상을 가급적 단순하게 모델링하고, 궁극적으로는 시장의 변화를 예측하기 위해 개별 에이전트의 상호작용을 중심으로 구성된 모형이라 할 수 있다.14) 에이전트 유형별로 상이한 특성, 행동 규칙, 목표 등을 부여받으며, 이에 근거하여 각 에이전트는 의사결정을 내린다고 가정한다. 이 과정에서 에이전트 간 상호작용은 시장의 균형 가격을 형성하게 되고, 거래량에 변동이 발생한다. ABM의 가장 큰 장점은 에이전트 유형별 특성, 행동 규칙 등을 조정하여 다양한 시나리오에 대해 시뮬레이션을 수행할 수 있으며 이를 통해 시장의 변동을 예측하거나 정책효과를 분석하는 데 유용하게 활용된다는 점이라 할 수 있다.

본 연구와 Miwa & Ueda(2017)의 연구는 ABM을 사용하여 거래시간 연장의 효과를 분석했다는 점에서 공통점이 있다. 두 연구 모두 Brock & Hommes(1998)와 Gaunersdorfer & Hommes(2007)를 토대로 일부를 변형하여 모형을 구축했다. 다만, Miwa & Ueda(2017)의 연구는 거래시간 연장이 가격에 미치는 효과를 분석했다는 점에서는 본고의 시도와 비슷하지만, 분석대상 시장이 본고에서와 같은 외환시장이 아니라 주식시장에 대한 거래시간 연장 효과를 분석하였다는 점에서 차이가 있다. 또한 Miwa & Ueda(2017)는 기존 연구의 모수를 사용하거나, 모수에 대한 임의의 범위를 설정하여 다양한 경우에 대해 시뮬레이션을 수행한 반면, 본고에서는 베이지안 추론(bayesian inference) 가운데 하나인 마코프체인 몬테카를로(Markov Chain Monte Carlo, 이하 MCMC)를 사용하여 한국 외환시장 특성을 반영한 모수를 추정하고, 추정된 모수를 사용하여 시뮬레이션 했다는 측면에서 차이가 있다.15)

2. 외환시장 모형 설정 및 분석방법

여기서는 시뮬레이션 분석을 위해 사용하는 ABM에 대해 설명하고 Brock & Hommes(1998)가 제안한 모형을 발전시킨 Miwa & Ueda(2017)의 모형을 기반으로 우리나라 외환시장의 구조적 특성을 최대한 반영하여 외환시장 모형을 설정한다.

가. 외환시장 모형

(1) 환율결정과정

모형의 단순화를 위하여 외환시장 참가자가 한국 원화와 미국 달러화, 두 종류의 자산을 보유한다고 가정한다. 원화의 공급은 완전 탄력적인데 반해, 외화인 달러의 공급은 한정되어 있다. 외환시장에서 거래하는 투자자들은 근시안적으로 평균-분산을 최대화하는 목표를 가지고 거래를 한다고 가정한다. 투자자들의 선호는 다음과 같다.

외환시장 균형 조건은 다음과 같다.

투자자 유형별로 환율에 대한 기대가 상이하며, 본고에서는 두 가지 유형의 투자자가 있다고 가정한다. 첫 번째 유형의 투자자는 달러의 가치가 펀더멘털(fundamental)로 회귀한다고 믿고, 이에 기반하여 미래 환율에 대한 기댓값을 정한다. 이 투자자의 미래 환율에 대한 기대를 하첨자 F 로 표시하고, 아래 식 (3.6)으로 표현할 수 있다.

두 번째 유형의 에이전트는 추세를 추종하는 투자자로 과거 환율 변동 양상이 앞으로도 지속될 것이라 믿고, 이에 기반하여 미래 환율에 대한 기댓값을 형성한다. 이 투자자의 미래 환율에 대한 기대를 하첨자 T 로 표시하고, 아래 식 (3.7)로 표현할 수 있다.

본 모형에서 투자자 유형별 비중은 내생적으로 결정된다. t 기 F 및 T 유형 투자자의 비중은

환율이 펀더멘털에서 멀리 떨어져 있을수록 추세 추종자의 비율이 감소하는 식 (3.9)를 추가함으로써 두 유형의 투자자 가운데 하나의 특정 유형으로 일방적으로 수렴되는 것을 방지한다.

(3) 외환시장 개방 확대

외환시장 개방 확대로 달러가 24시간 동안 거래될 수 있다고 가정한다. 따라서 달러 거래는 오전 9시부터 오후 3시 30분까지 기존 정규 거래시간에 가능할 뿐만 아니라 3시 30분 이후에도 가능하다. 다만 모든 투자자가 정규 시간 동안 자산을 거래하는 반면, 제한된 수의 투자자만 연장된 시간에 거래한다고 가정한다. 정규 시간 동안 달러에 대한 수요는 식 (3.2)와 같지만, 정규시간의 마감시간 달러에 대한 수요는 연장된 시간에 거래하는지 여부에 따라 달라지며 다음과 같다.

연장시간의 달러 수요는 다음과 같다.18)

나. 모수 설정

여기서는 MCMC를 사용하여 모수를 추정하고, 추정된 모수에 기반하여 도출한 시뮬레이션 결과가 실제 데이터를 얼마나 잘 모사할 수 있는지를 평가한다. 모수 추정을 위해 사용되는 자료는 일별 원/달러 환율(종가)이며, 모수 추정은 원/달러 환율이 상승하는 기간과 하락하는 기간을 구분하여 각각에 대해 추정한다. 모형을 통해 재현하고자 하는 환율상승기는 2021년 1월부터 2021년 12월(249영업일)이며, 환율하락기는 2017년 1월부터 2017년 12월(244영업일)이다(<그림 Ⅲ-1> 참조).

<표 Ⅲ-1>에서 음영으로 표시되지 않은 나머지 모수는 추정하였다. 추정된 모수 값은 모두 사후확률분포(posterior distribution)의 평균이며, 사후확률분포와 관련한 주요 통계치는 <표 Ⅲ-2>에서 확인할 수 있다. 사전확률분포(prior distribution)와 데이터에 기반한 우도 함수(likelihood function)를 사용하여 사후확률분포를 추정하는 과정을 반복적으로 수행한다. 이를 통해 모수의 값에 대한 사후확률분포를 추정할 수 있으며, 이 추정 결과를 사용하여 통계적 추론이나 예측 등에 활용할 수 있다. 사전확률분포는 관심 있는 모수의 값에 대한 사전 지식이나 연구자의 주관적 믿음을 확률분포로 표현한 것인데, 본 연구에서는 8개 모수 가운데 2개를 베타분포, 5개를 감마분포, 나머지 한 개를 정규분포로 설정했다. 이 분포는 관련 문헌에서 얻은 정보로서 모수에 대한 초기 추정치로 사용된다.

우도 함수는 주어진 모수값에 대해 실제 데이터로 관측될 확률을 나타내는 함수이다. 따라서 주어진 모수 값에 대한 일종의 데이터 적합도로 볼 수 있다. 본 연구에서는 우선 실제 데이터와 주어진 모수를 기반으로 도출한 시뮬레이션 데이터 사이의 평균, 표준편차, 최댓값, 최솟값, 왜도(skewness), 첨도(kurtosis)의 차이(제곱의 합)를 구하고, 이 차이를 통해 시뮬레이션 결과와 실제 데이터 간의 불일치 정도를 측정하는 것으로 우도 함수를 정의했다. 따라서 이 6개 통계량의 차이가 작을수록 우도는 높아진다.

<그림 Ⅲ-2>는 각 모수별 표본의 분포를 보여준다. 금색과 파란색 막대그래프는 각각 환율상승기와 하락기의 추정 결과이다. 대체적으로 환율상승기보다는 하락기에 특정 값에 분포가 집중되는 경향이 있음을 볼 수 있다.

외환시장 개방 확대로 거래시간이 연장되고 비거주자의 역내 외환시장 참가자가 증가될 것으로 예상되는 바, 이러한 변화가 환율 변동성과 외환거래량에 어떠한 영향을 미치는지를 2절에서 설정한 ABM을 사용하여 분석한다. 우선 외환시장 참가자 증가가 환율 변동성과 거래량에 미치는 효과에 대해 시뮬레이션해 보고, 이어서 외환시장 개방 확대로 투기자의 성향이 변화할 경우에는 환율 변동성과 거래량에 어떤 영향을 미치는지에 대해 추가적으로 살펴본다. 시뮬레이션 분석은 환율상승기와 하락기를 구분하여 각각 분석함으로써 결과 해석의 강건성을 높이고자 하였다.

가. 외환시장 참가자 증가 효과

시장참가자 수와 관련된 ABM의 모수는 N 이다. 기본모형에서는 100명으로 설정되어 있으나, 만약 외환시장 개방 확대로 120명, 140명, 160명, 180명, 200명으로 증가하는 경우 환율 변동성 및 외환거래량에 어떤 변화가 있는지 비교한다. 이와 더불어 거래시간의 연장도 동시에 고려한다. 2절 ABM의 기본 모형에서는 3시 30분에 거래가 종료되나, 3절의 시뮬레이션 분석에서는 24시간 거래시간이 연장되는 경우를 가정한다. 이를 위해 연장된 시간에 시장에서 거래하는 참가자 비중이 정규시간 참가자의 0%, 20%, 40%, 60%, 80%, 100%로 변화하는 여러 경우로 가정하여 시뮬레이션을 수행한다.

<표 Ⅲ-4>와 <표 Ⅲ-5>는 각각 외환시장 참가자 증가 및 거래시간 연장이 환율 변동성과 외환거래량에 미치는 효과에 대한 시뮬레이션 결과이다. 표에서 N 으로 표시된 첫 번째 열은 정규시간 시장참가자의 수를 의미하며, 0~100% 변하는 두 번째 행은 연장시간에 시장에 참여하는 투자자 비중을 의미한다. 연장시간 참가자 비중이 0%인 상황에서는 정규시간 참가자가 100명에서 순차적으로 늘어나더라도 환율 변동성에 미치는 영향은 거의 없는 것으로 나타났으나 이 경우에도 거래량은 증가하는 것을 확인할 수 있다. 이러한 특징은 환율상승기와 하락기에 큰 차이가 없었다.

이러한 변동성 증가는 환율상승기보다 환율하락기에 더 크게 나타나는 것으로 보인다. 이는 환율하락기와 달리 상승기의 경우에는 투기적 거래자들이 환율상승추세에 편승하여 외환매입 우위의 일관된 매매전략을 구사하는 경향이 있으므로 오히려 환율 변동성은 낮아지는 데 따른 결과로 해석할 수 있다. 또한 연장시간대 참가자 증가에 따른 거래량 변화의 경우에도 환율상승기와 하락기에 모두 증가하는 것으로 나타났다.

분석결과에서 보다 흥미로운 점은 연장시간에 시장에 참여하는 투자자의 비중이 20%를 초과하기 시작하는 경우에는 다시 환율 변동성이 낮아지기 시작한다는 점이다. 예를 들어 연장시간에 시장에 참여하는 투자자의 비중이 80%에 이르면 시장참가자의 수와 무관하게 환율 변동성은 35~36으로 낮아지고, 100%가 되면 33 정도로 더욱 낮아져 기본 모형의 환율 변동성(32)과 비슷한 수준으로 떨어지게 된다. 또한 이 경우 환율 변동성이 낮아지는 조정 과정에서도 외환 거래량은 꾸준히 증가하고 있음을 볼 수 있다. 다만, 환율상승기의 경우에는 거래량 증가가 점진적으로 일어나는데 반해 환율하락기에는 시장참가자가 20%에 이른 시점에서 급격히 증가한 후 반락하였다가 이후 점차적으로 증가하는 모습이 나타났다.

나. 투기적 거래자 증가에 따른 효과

외환시장 개방 확대로 환율추세를 추종하면서 거래하는 투기적 거래자의 비중이 커질 가능성을 배제하지 않을 수 없으며, 따라서 이러한 변화가 환율 변동성과 외환거래량에 미치는 효과를 추가적으로 분석하였다. 투기적 거래자는 ABM에서 추세 추종자에 해당하며 이와 밀접하게 관련되어 있는 모수는

<표 Ⅲ-6>과 <표 Ⅲ-7>은 각각 투기자(추세 추종자) 성향의 변화가 환율 변동성과 외환거래량에 미치는 시뮬레이션 결과이다. 첫 번째 열은 모수

따라서 결과해석의 편의와 강건성을 위해 앞 2절의 베이스라인(baseline) 시나리오 분석을 토대로 투기적 성향 거래자의 한계적 확대가 미치는 영향을 설명할 필요가 있을 것으로 생각된다.19) <표 Ⅲ-6>과 <표 Ⅲ-7>에서 음영으로 표시된 부분은 이를 나타낸다. 이에 따르면 투기자 시장참가자의 비중 확대가 환율 변동성에 미치는 영향은 환율상승기와 하락기의 경우 최대 15%(34.11→39.38)와 5%(60.53→63.56) 정도의 증가를 가져와 그 영향이 그리 크지 않은 것으로 판단된다. 환율상승기의 환율 변동성 변화가 최대 15% 증가에 그친다는 점에서 시장에서 충분히 감내할 수준으로 보이는데 이는 환율 변동성의 절대적 수치가 과거 위기시와 비교하여 상대적으로 크지 않다는 점에 따른 것이다. 이에 관해서는 뒤에서 추가적으로 논의하였다.

전체 기간(2001년 1월 2일~2022년 7월 1일)중 환율의 변동성(표준편차 평균)은 38.78로 환율상승기 모수 추정을 위해 사용한 기간의 표준편차, 30.41보다 높다.21) 위기 기간(2008~2009년)을 포함하는 구간에서 향후 249일간의 일별 환율의 변동성은 60을 초과할 뿐만 아니라 전체 기간 중 100(60)을 초과하는 영업일도 255일(585일)이나 발생한 사실로 미루어 60이라는 수준이 외환위기를 초래할 수준의 변동성과는 큰 차이를 보이고 있다. 더욱이 외환위기는 환율하락기보다는 환율상승기와 밀접하게 관련되어 있다는 점, 그리고 미국을 비롯한 주요국의 금리 인상으로 국제금융시장의 불확실성이 높았던 최근 1년 동안(2021년 7월 1일~2022년 7월 1일)의 환율 변동성이 61.44 수준이었다는 것을 고려한다면 환율 변동성 60은 외환시장에서 충분히 감내할 수 있는 수준으로 판단된다.

IV. 요약 및 시사점

본 연구에서는 최근 정부가 계획하고 있는 역내 외환시장의 개방 확대와 거래시간 연장이 우리나라 외환시장에 미치는 영향을 분석하였다. 이를 위해 우선 역내·외 원화외환시장 현황과 상호관계 분석 등을 통해 역외 비거주자의 외환매매 행태와 거래 특성을 사전적으로 분석하였다. 이어서 비거주자의 국내 외환시장 진입이 확대될 경우 환율 변동성 및 외환거래량에 미치는 영향을 이론모형 구축과 다양한 시뮬레이션을 통해 심층적으로 분석하였다.

우리나라 역내 외환시장은 그간 실물경제 규모나 자본시장의 발전 정도, 국경간 증권자금의 유출입 규모 등에 비해 외환거래 규모가 다소 미흡한 데 반해 역외시장에서는 비거주자들의 원/달러 NDF 거래 규모가 여타 통화에 비해 가장 빠르게 성장하고 있다. 비거주자들은 국내 은행과의 NDF 거래를 통해 현물환율에 직접적인 영향을 주고 있는데 환헤지 목적 이외에도 원화환율의 변동 방향을 추수하는 투기적 거래도 적극적으로 하면서 원화환율의 변동성을 증가시키고 있다. 이러한 매매패턴은 원화 약세 기대시에 더 강한 것으로 보이는데 이는 글로벌 금융시장의 외부충격 등으로 원화환율이 상승압력을 받는 경우 비거주자들의 원/달러 NDF 매매로 환율상승이 가속화될 수 있는 우리나라 외환시장의 구조적 특징을 반영한다.

최근에는 비거주자들 간에 이루어지는 원/달러 NDF 거래 규모가 역내시장의 현물환거래 규모 이상으로 확대되면서 현물환율 결정에 미치는 간접적인 경로도 강화되고 있다. 즉, 역외시장에서 비거주자들의 원/달러 NDF 시장의 유동성과 효율성이 증가하면서 현물환율과 NDF 환율 간의 상호 영향도 커지고 있는 데 본고의 분석 결과 주로 역외 NDF 환율이 국내 현물환율에 미치는 일방향 영향이 큰 것으로 확인되었다.

이와 같이 원화외환시장은 현물환 중심의 역내 외환시장과 비거주자들의 NDF 거래에 의해 주도되는 역외 외환시장으로 구분되어 병행 발전하는 모습이 나타나고 있다. 역외 비거주자의 투기적 성향이 상대적으로 더 크다는 점을 감안할 때 역외 비거주자에 대한 역내 외환시장 개방 확대는 환율 변동성이나 외환거래량에도 영향이 있을 수 있다는 점에서 본 연구에서는 이론모형인 에이전트 모형을 설정하고 시뮬레이션을 통해 외환시장 개방에 따른 외환시장 영향을 심층적으로 분석하였다.

우선 외환시장 참가자 증가에 따른 영향 분석에 있어서는 정규시간 참가자가 순차적으로 늘어나더라도 환율 변동성에는 별 영향이 없이 거래량이 증가하는 것으로 나타났다. 그러나 연장 거래시간에 대한 시장참가자의 참여 정도를 고려할 경우에는 환율 변동성이 크게 변화하는 것을 볼 수 있는데 이러한 영향은 환율상승기보다 환율하락기에 더 크게 나타났다. 이는 환율상승기의 경우에는 투기적 거래자들이 환율 상승추세에 편승하는 매매를 통해 수익을 추구하는 일관된 매매전략을 구사하는 경향이 있으므로 오히려 환율 변동성은 낮아지는 데 따른 결과로 생각된다. 분석결과에서 보다 흥미로운 점은 연장시간대에 참여하는 투자자의 비중이 20%를 초과하기 시작하는 경우에는 다시 환율 변동성이 낮아지기 시작한다는 점이다. 또한 환율 변동성이 낮아지는 조정 과정에서 외환거래량은 꾸준히 증가하는 것으로 나타났다.

한편 환율 추세를 추종하는 투기적 성향의 비거주자 참여가 커진다는 점을 고려하여 시장 내 투기자 성향의 변화가 환율 변동성과 외환거래량에 미치는 영향을 시뮬레이션을 통해 살펴보았다. 분석 결과 투기적 성향의 증가는 환율상승기와 하락기에서 모두 환율 변동성을 높이고 거래량도 증가시키는 것으로 나타났다. 이는 환율 변동성이 높아지면서 동시에 투기적 거래자의 거래 유인이 커진데 따른 당연한 결과로 풀이할 수 있다.

그러나 환율 변동성에 미치는 영향의 크기에 있어서는 환율상승기와 하락기의 경우 각각 최대 15%와 5% 정도의 증가에 그치는 것으로 나타났다. 이는 환율 변동성의 절대적 수치가 과거 위기시와 비교하여 상대적으로 크지 않을 뿐만 아니라 미국의 금리 인상으로 국제금융시장의 불확실성이 높았던 최근 1년 동안의 환율 변동성 수준과도 큰 차이가 없다는 점 등에서 외환시장 내에서 충분히 감내할 수 있는 수준으로 판단된다.

요약하자면 역외 비거주자에 대한 역내 외환시장 개방 확대가 이루어지더라도 원화환율 변동성 증가에 따른 부정적인 영향은 제한적인 데 반해 외환거래량 증가를 통한 시장발전에는 긍정적 효과를 나타낼 것으로 기대된다. 그러나 개장연장 시간대에 참여하는 비주거자가 20% 이상 충분히 증가하지 못할 경우에는 환율 변동성 확대가 크게 나타날 수 있다는 점에 유의할 필요가 있을 것으로 보인다.

역외 비거주자의 경우 시장 유동성과 가격 효율성이 확보된 역외 원/달러 NDF 시장을 통하여 이미 거래 목적을 달성하고 있는 상황이므로 역외 비거주자가 역내 시장에 진입하기 위한 충분한 유인책을 마련하는 것이 중요한 과제라 생각된다. 비거주자들은 역내 외환시장 진입 시 우리 외환당국의 규제체계 내로 들어오면서 거래내역에 대한 당국의 실시간 모니터링 부담이나 각종 보고의무 등에 대해 거부감을 가질 수 있기 때문이다. 따라서 역외 거래자의 NDF 거래 수요를 국내 현물환시장으로 흡수하고 시장하부구조를 개선하기 위해서는 무엇보다 은행간 외환시장에서 역외 비거주자와 국내 외국환은행과의 차별적인 대우가 없도록 하고 외국인의 등록 및 보고의무 등과 관련하여 번거로운 절차나 제반 비용의 발생을 최소화함으로써 이들의 참여가 원활히 이루어지도록 유도하는 것이 중요할 것으로 생각된다. 또한 비거주자 참여확대에 따른 외환시장의 변동성 증가나 예상치 못한 부작용이 나타나지 않는 지 등에 대한 당국의 지속적인 모니터링이 필요할 것으로 보인다.

보다 장기적인 관점에서 원화외환시장의 궁극적인 발전을 기하기 위해서는 외국인에 대한 시장개방에 따른 역내 외환시장의 한 단계 도약과 시장주도권의 강화를 발판삼아 원화의 역외 외환시장 개설을 추진하는 것도 중요한 과제라 생각된다. 현재 선진국은 물론 우리나라보다 경제 및 금융시장 발전 단계가 낮은 많은 신흥국들이 글로벌 외환시장 중심지에서 자국통화의 은행간 외환시장을 운영하고 있다는 점은 되새겨 볼 필요가 있다. 역외 원화외환시장 개설은 개방경제체제 하에서 우리나라 금융산업의 발전과 금융안정은 물론 원화의 국제화와 위상 제고를 위해 피할 수 없는 과제라 생각된다. 정부는 역내 외환시장 개방 계획을 차질 없이 이행하여 하부구조 개선과 외환시장의 발전을 기해 나가되 이를 원화의 역외 시장개설을 위한 과정으로 바라보는 것이 바람직할 것으로 생각된다.

1) 자세한 내용은 기재부(2023.2.7) 참조

2) 현재 외국인이 국내 은행과 거래하는 경우에는 은행간시장 참가자로서가 아니라 은행의 대고객거래로서 행하는 것이라 할 수 있다.

3) 국내 증권회사는 외국환거래법상 기타외국환업무취급기관으로 분류된다.

4) 서울외국환중개회사 및 한국자금중개주식회사를 말한다.

5) 원/위안 시장은 2015년 서울과 중국 상해에 각각 교차 설립되었으며 시장개설 초기 유동성 확보를 위해 대형은행들 위주로 시장조성자(market maker)를 지정하여 운영하고 있다.

6) 전통적 외환거래의 종류에는 통상 현물환, 선물환 및 외환스왑거래를 포함한다.

7) 여기서 NDF 매입이란 미달러화에 대한 매입을 의미한다.

8) 우리나라의 환포지션관리제도에는 종합포지션한도와 선물환포지션한도가 있다. 종합포지션한도의 경우 매입초과 또는 매도초과 외환포지션한도를 자기자본의 20% 이내로 규정하고 있다.

9) 다만, 2022년 이후에는 미연준의 급격한 통화정책 기조변화로 그 관계가 일관되지 않는 것으로 보인다.

10) NDF 환율은 선물환율의 일종이므로 현물환율과 구별되나 원화와 미달러화 두 통화의 내외금리차이 만큼을 NDF 환율에 이미 반영하고 있으므로 두 환율이 일관된 변동방향을 갖는다고 할 수 있다.

11) 예를 들어 특정일(t)의 경우 현물환율은 한국시각 오전 9시(시가) 또는 오후 3시(종가)를 의미하며 동일자(t)의 NDF 환율은 한국시각으로는 익일 오전 6:30분이 된다.

12) 오차수정모형은 두 변수간에 장기적인 상호관계를 가정하므로 두 변수간 공적분(cointegration)의 존재를 전제로 하며 이 경우 두 변수간의 단기적인 괴리가 조정과정을 거쳐 수렴하게 되는 점을 가정한다.

13) 기재부는 이번 개선방안에서 개장시간을 대폭 연장한다고 밝혔는데, 우선 한국시간으로 새벽 2시까지 거래시간을 연장하고, 추후 은행권 준비, 시장 여건 등을 고려하여 24시간까지 확대하는 것을 고려한다고 보도하였다. 자세한 내용은 기재부(2023.2.7) 참조

14) ABM과 관련하여 Bankes(2002)와 Macal & North(2009) 참조. Bankes(2002)는 기존 경제학을 포함한 사회과학 모형은 비현실적인 가정에 기반하고 있어 일부 사회과학 문제에 적합하지 않다고 지적하였다. 따라서 이에 대한 해결책으로 Bankes(2002)는 ABM이 대안이 될 수 있음을 주장하였다. ABM은 가정을 완화하고, 개별 에이전트의 행동, 동기, 관계를 표현하여 개별 사회과학 현상을 탐구하는 강력한 도구가 될 수 있다고 주장하였다. Macal & North(2009)는 컴퓨팅의 발전으로 경제학을 포함한 다양한 응용 분야에서 ABM이 생성되고 있으며, 앞으로 더 폭넓게 활용될 수 있는 잠재력이 있다고 평가했다. ABM은 일종의 연구자들의 실험실로서 전통적인 연역 및 귀납적 추론 방식을 보완할 수 있다고 주장하였다.

15) 에이전트 모형에 베이지안 추론 기법을 적용한 최근 연구로는 Shiono(2021)와 Grazzini, et al.(2021) 등이 있다. Shiono(2021)는 Radev et al.(2020)에 의해 제안된 새로운 비모수 베이지안 추론인 BayesFlow를 ABM의 추정에 적용할 수 있는지에 대해 분석했다. 분석 결과 BayesFlow는 기존 베이지안 추론 기법(Kernel Density Estimation-MCMC, Mixture Density Network-MCMC 등)보다 우수한 정확도를 달성하여 표준 New Keynesian ABM(NK-ABM)의 모의 데이터로부터 매개변수의 실제 값 복원 검증 테스트에서 뛰어난 결과를 보였다. Grazzini, et al.(2021)에서도 ABM에 대한 베이지안 추론 기법을 적용하였고, 이 방법론이 Simulated Minimum Distance(SMD)의 대안이 될 수 있음을 주장하였다.

16) 이에 관해서는 대외경제정책연구원(2022) 참조

17)

18) ABM에서는 정규시간에 거래하는 참가자의 일부 혹은 전부가 연장시간에 거래한다(베이스라인 모형에서는 연장시간 참가자의 수가 0임). 하지만 외환시장 개방 확대 이후 실제 예상되는 외국인 투자자의 역내 외환시장 참여는 국가 간 시차로 인해 주로 현재의 정규시간, 오후 3시 30분 이후가 될 가능성이 높다. 따라서 이 부분은 모형과 실제 간 차이라고 할 수 있으나, 기존 역내 참가자 역시도 외환시장 개방 확대 이후 연장시간에 모든 사람이 거래에 참여하지 않는다고 본다면 참가자의 수 측면에서 모형의 설정이 외환시장 개방 확대 이후 예상되는 역내 외환시장과 크게 괴리된다고 볼 수 없다.

19) 앞의 베이스라인 시뮬레이션에서 는 환율상승기와 하락기 각각 1.1356, 0.3967로, 는 환율상승기와 하락기 각각 0.3491, 0.0057로 모수가 추정되었다.

20) 해당 일에 대응하는 y 값은 해당 일 이후 249영업일간 일별 환율자료를 사용하여 계산한 표준편차이다.

21) 최댓값은 188.9645, 최솟값은 8.8013, 그리고 5%, 10%, 90%, 95% 값은 순서대로 14.3141, 17.1408, 62.8580, 99.1579이다.

참고문헌

기획재정부, 2023. 2. 7, 글로벌 수준의 시장접근성 제고를 위한 외환시장 구조 개선방안, 보도자료.

빈기범·이상민·이원섭, 2016, 역내외 현물환, 선물환 및 NDF 거래에 의한 원화 가치 가격발견에 관한 연구, 선물연구 24(2), 339-363.

이승호, 2020, 『환율의 이해와 예측』, 삶과지식.

홍정효, 2018, 뉴욕(New York) 원달러 역외선물환시장(NDF)의 가격발견기능 연구, 금융공학연구 17(4), 99-118.

Bank for International Settlements, 2019, Offshore markets drive trading of emerging market currencies, BIS Quarterly Review, December 2019.

Bankes, S.C., 2002, Agent-based modeling: A revolution? Proceedings of the National Academy of Sciences 99(3), 7199-7200.

Brock, W.A., Cars, H.H., 1998, Heterogeneous beliefs and routes to chaos in a simple asset pricing model., Journal of Economic dynamics and Control 22(8-9), 1235-1274.

Fan, Y.J, Lai, H.N., 2006, The intraday effect and the extension of trading hours for Taiwanese securities., International Review of Financial Analysis 15(4-5), 328-347.

Gaunersdorfer, A, Hommes, C., 2007, A Nonlinear Structural Model for Volatility Clustering. In: Teyssi re, G., Kirman, A.P. (eds) Long Memory in Economics. Springer, Berlin, Heidelberg.

Grazzini, J., Matteo G.R., Tsionas, M., 2017, Bayesian estimation of agent-based models., Journal of Economic Dynamics and Control 77, 26-47.

Lee, H.C., Chien, C.Y., Chen, H.L., Huang. Y.S., 2009, The extended opening session of the futures market and stock price behavior: Evidence from the Taiwan Stock Exchange., Review of Pacific Basin Financial Markets and Policies 12(3), 403-416.

Macal, C.M., North, M.J., 2009, Agent-based modeling and simulation., Proceedings of the 2009 winter simulation conference(WSC), 86-98, IEEE, 2009.

Michael, F., Eyup, K., 2023, Impact of trading hours extensions on foreign exchange volatility: intraday evidence from the Moscow exchange, Financial Innovation, Research, Open Access.

Miwa, K., 2019, Trading hours extension and intraday price behavior., International Review of Economics and Finance 64, 572-585.

Miwa, K., Ueda, K., 2017, Is the extension of trading hours always beneficial? An artificial agent-based analysis, Computational Economics 50, 595-627.

Radev, S.T., Mertens, U.K., Voss, A., Ardizzone, L., Köthe, U., 2020, BayesFlow: Learning complex stochastic models with invertible neural networks., IEEE transactions on neural networks and learning systems 33(4), 1452-1466.

Shiono, T., 2021, Estimation of agent-based models using Bayesian deep learning approach of BayesFlow., Journal of Economic Dynamics and Control 125, 104082.