Find out more about our latest publications

Foreign Investor Dynamics in the Korean Government Bond Market: A Comprehensive Analysis and Policy Implications

Research Papers 23-09 Dec. 18, 2023

- Research Topic Macrofinance

- Page 73

The share of foreign investors in the spot market for Korean government bonds has expanded significantly from just 1.6% in 2006 to nearly 20% in the second quarter of 2023. In particular, the share of foreign investors' trading in 3-year and 10-year government bond futures accounted for 44% and 53% as of 2022, making them major players in the government bond market. The influence of foreign investors in the government bond market is expected to expand further as the fiscal deficit is expected to continue for a significant period of time, and major domestic institutional investors such as national pension funds have announced plans to increase the proportion of overseas investments. Accordingly, analyzing the behavior of foreign investors in government bonds will become increasingly important for stable fiscal management and financial stability.

With this in mind, this paper examines whether the steep increase in the share of foreign investors in sovereign debt markets can be explained using empirical panel models for emerging economies. In addition, to understand the investment behavior of foreign investors in terms of financial stability, we analyze the impact of foreign trading on government bond yields and yield volatility by separating government bond spot and futures markets.

Using an econometric model that explains the share of foreign investment in local currency government bond markets in emerging economies, we find that the increase in the share of foreign investors in the spot market of Korea is consistent with the model, given the expansion of global liquidity and Korea's high sovereign credit rating. We also find that the trading behavior of foreigners in the spot market has not affected government bond yields or volatility so far.

On the other hand, in the futures market, where the share of foreigners is much larger than in the spot market, we find that foreigners' net purchases of government bond futures have a significant impact on the decline of government bond yields. In particular, the impact of foreigners' net purchases in the 10-year Treasury futures market is significant, and estimation by splitting the sample period confirms that the impact of foreigners in Treasury futures is even larger in the recent sample. On the other hand, despite the increase in foreign participation, we do not observe a significant wag-the-dog effect, where the price and volume of government bonds fluctuate rapidly on the expiration date, which may be due to the fact that the final settlement price in the government bond futures market, unlike the final settlement price of stock index futures and options, uses the average price calculation method on the expiration date.

Given the influence of foreigners in the government bond futures market, it is necessary to have a system that can detect and respond to abnormal trading behavior of foreign investors in the government bond futures market. It is necessary to expand the investor base by encouraging the participation of domestic institutional investors such as pension funds, insurance companies, and market makers in the government bond futures market to prepare for the possibility of clustering behavior by foreign investors in the event of an emergency. On the other hand, it is necessary to be cautious about increasing the share of retail investors in the government bond futures market, as a significant number of retail investors, unlike foreigners, have been analyzed to lose money in the market. With the listing of 30-year government bond futures on the horizon, it is necessary to strengthen retail investor education on the risks of investing in ultra-long-term government bond futures and consider improving the system to protect retail investors.

With this in mind, this paper examines whether the steep increase in the share of foreign investors in sovereign debt markets can be explained using empirical panel models for emerging economies. In addition, to understand the investment behavior of foreign investors in terms of financial stability, we analyze the impact of foreign trading on government bond yields and yield volatility by separating government bond spot and futures markets.

Using an econometric model that explains the share of foreign investment in local currency government bond markets in emerging economies, we find that the increase in the share of foreign investors in the spot market of Korea is consistent with the model, given the expansion of global liquidity and Korea's high sovereign credit rating. We also find that the trading behavior of foreigners in the spot market has not affected government bond yields or volatility so far.

On the other hand, in the futures market, where the share of foreigners is much larger than in the spot market, we find that foreigners' net purchases of government bond futures have a significant impact on the decline of government bond yields. In particular, the impact of foreigners' net purchases in the 10-year Treasury futures market is significant, and estimation by splitting the sample period confirms that the impact of foreigners in Treasury futures is even larger in the recent sample. On the other hand, despite the increase in foreign participation, we do not observe a significant wag-the-dog effect, where the price and volume of government bonds fluctuate rapidly on the expiration date, which may be due to the fact that the final settlement price in the government bond futures market, unlike the final settlement price of stock index futures and options, uses the average price calculation method on the expiration date.

Given the influence of foreigners in the government bond futures market, it is necessary to have a system that can detect and respond to abnormal trading behavior of foreign investors in the government bond futures market. It is necessary to expand the investor base by encouraging the participation of domestic institutional investors such as pension funds, insurance companies, and market makers in the government bond futures market to prepare for the possibility of clustering behavior by foreign investors in the event of an emergency. On the other hand, it is necessary to be cautious about increasing the share of retail investors in the government bond futures market, as a significant number of retail investors, unlike foreigners, have been analyzed to lose money in the market. With the listing of 30-year government bond futures on the horizon, it is necessary to strengthen retail investor education on the risks of investing in ultra-long-term government bond futures and consider improving the system to protect retail investors.

Ⅰ. 연구의 배경

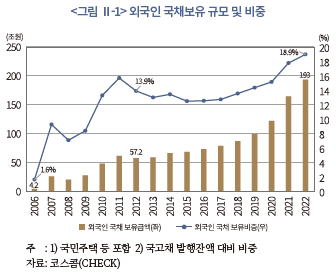

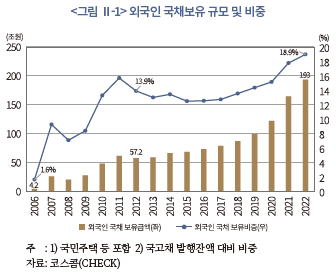

한국의 양호한 재정건전성, 신용등급 상승 및 글로벌 유동성 증가의 영향으로 외국인의 국채투자 비중이 코로나19 감염확산 기간을 거치면서 크게 늘어났다. 2006년 외국인의 한국 국채보유 금액은 4.2조원으로 전체 국채 상장 잔액의 1.6%에 불과했으나 2022년말 193조원(18.9%)을 기록하는 등 비약적으로 상승하였다. 한편 국회예산정책처(2022)에 따르면 2% 중반 수준의 재정적자가 상당 기간 지속될 것으로 예측됨에 따라 국채 공급이 늘어날 것으로 예상되는 한편 국민연금 등 국내 연기금들의 해외투자가 확대되면서 기관투자자들의 국채수요가 공급에 걸맞게 늘어나는 데 일정 부분 한계가 존재한다. 이에 따라 국채시장에서 외국인 투자자가 갖는 영향력이 더욱 확대될 것으로 보이는 만큼 외국인의 국채투자에 대한 행태분석은 안정적인 재정운영과 금융안정 차원에서 중요성이 더욱 커질 것으로 판단된다. 다양한 국적 및 투자행태를 갖는 외국인을 단일한 유형으로 파악하기는 곤란하나 대외 경제의 불확실성이 확대되거나 예상치 못한 금융위기 또는 지정학적 위험의 발생으로 외국인 투자자들이 대규모로 국채를 매도하고, 타 외국인들이 이를 추종하여 연쇄적으로 국채를 매도하는 경우 국채금리가 급등하고 원화가치가 하락하는 등 금융시장의 변동성이 크게 확대될 수 있다. 또한, 2020년 코로나19 감염확산 이후 국채발행 잔액이 크게 늘어나는 가운데 외국인의 보유 비중 또한 최근 들어 빠르게 늘고 있으나 향후 재정수요에 비례하여 외국인의 국채투자가 늘기 어려울 경우 국채금리가 구조적으로 상승하면서 재정부담이 추가적으로 커지는 악순환이 발생할 수 있다.

이러한 점을 감안하여 본 고에서는 국채시장에서 외국인 비중 결정요인과 함께 외국인의 투자행태가 국내 시장에 미치는 영향력을 분석한다. 한국을 포함한 신흥국의 자본흐름에 대한 선행연구들은 널리 존재하나 신흥국들이 자국통화로 외채를 조달하기 어려웠던 만큼 신흥국의 현지통화(local currency) 국채투자에 국한한 연구들은 상대적으로 매우 부족한 상황이다. 또한, 외국인의 국채투자에 대한 국내 연구들은 한국은행을 비롯한 국내 연구기관들을 중심으로 여러 차례 분석되었으나, 국내 데이터에 국한하여 분석하다 보니 글로벌 포트폴리오 관점에서 신흥국 투자와 정합된 분석이 불가능할 뿐만 아니라 외국인의 국내 국채투자가 확대된 것이 대체로 글로벌 금융위기 이후인만큼 제한된 표본기간으로부터 발생하는 관측치의 제약 문제도 존재한다. 이러한 가운데 본 고에서는 신흥국의 현지통화 국채 패널분석을 통해 외국인의 국내 채권투자 비중이 기존 문헌에서 중시되는 결정요인들에 비추어 적정한 수준인지를 판단해 본다.

마지막으로, 외국인의 투자행태를 금융안정 측면에서 파악하기 위해 국채현물시장과 선물시장으로 구분하여 외국인 매매가 국채 수익률 및 수익률의 변동성에 미치는 영향을 분석한다. 특히, 앞서 언급한 국채현물시장내 보유비중에 대한 분석과 별도로 최근 선물시장을 중심으로 외국인의 매매 비중이 가파르게 증가함에 따라 외국인의 선물시장에서의 매매 행태가 국채선물의 가격 발견기능에 미치는 영향을 살펴본다. 또한, 파생상품시장에서 만기일에 가격 및 거래량이 급등하는 이른바 만기일 효과가 국채선물 시장에서도 발생하는지 여부에 대해 검증해 본다.

본 연구의 구성은 다음과 같다. 먼저 제Ⅱ장에서 국내 국채시장의 외국인 투자 현황을 제시하고 제Ⅲ장에서는 외국인의 현지통화 국채투자 동인을 분석한다. 제Ⅳ장에서 외국인의 투자행태가 국채시장에 미치는 영향을 살펴보고 제Ⅴ장에서는 분석내용을 기반으로 안정적 국채시장 운영 및 금융안정을 위한 정책적 시사점을 간략하게 제시한다.

Ⅱ. 국내 채권시장의 외국인 투자현황

1. 외국인 국채보유 현황

외국인 투자자의 국채보유 규모는 양호한 대외 건전성 및 글로벌 유동성 확대 등에 힘입어 꾸준한 증가세를 보이고 있다. 2006년말 4.2조원에 불과했던 외국인 투자자의 국채보유 규모는 2022년말 193조원을 기록하는 등 비약적으로 증가하였고, 외국인 투자자의 국채보유 비중(국고채 발행잔액 대비) 또한 2022년말 18.9%로 2006년말(1.6%) 대비 약 11.8배 증가했다. 글로벌 금융위기 이후 글로벌 유동성이 풍부해진 가운데, 외환보유액 증가, 건전한 재정 운용 등 양호한 대외 건전성이 외국인 투자자의 국채투자에 긍정적인 영향을 미친 것으로 판단되며 자세한 분석은 Ⅲ장에서 다루기로 한다.

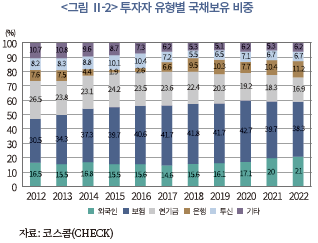

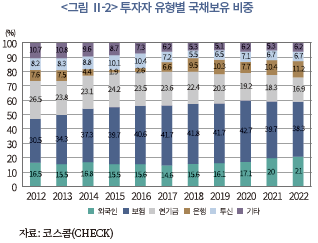

2. 투자자 유형별 국채보유 비중 및 듀레이션

국채보유 비중을 투자자별로 살펴보면, 2022년말 기준 보험회사의 국채보유 비중이 38.3%로 주요 투자자 중 가장 높은 비중을 차지하였으며, 다음으로 외국인(21.0%), 연기금(16.9%), 은행(11.2%), 금융투자회사(6.7%)의 순서이다. 2012년 대비 외국인(16.5%→21%), 은행(7.6%→11.2%)의 국채보유 비중이 빠르게 증가하였으며, 연기금의 국채보유 비중은 다소 감소(26.5%→16.9%)한 것으로 나타났다. 국민연금기금의 기금운용계획에 따르면 국내 채권투자 비중1)이 감소될 것으로 예정되어 있어, 향후 외국인 투자자의 국채보유 비중은 더욱 증가할 것으로 전망된다.

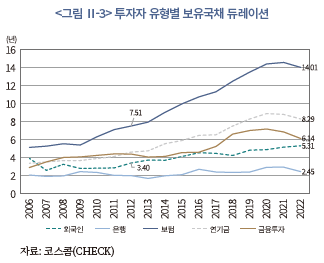

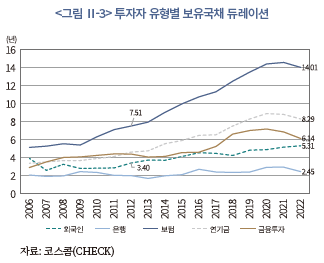

한편, 장기물 국고채 발행이 증가하고, 보험회사 및 연기금을 중심으로 부채 듀레이션이 증가함에 따라 주요 투자자들이 보유한 국채의 평균 잔존만기는 대체로 증가하는 추세이다. 은행을 제외한 대부분 투자자의 평균 잔존만기가 증가 추세를 나타내는 가운데, 외국인 투자자는 평균 잔존만기가 3~5년 내외의 국채를 선호하며, 보험회사 및 연기금은 만기가 긴 국채를 선호하는 것으로 분석된다. 다만, 최근 들어 보험회사, 연기금 등 타 투자자의 듀레이션이 축소된 반면 외국인이 보유한 국채의 듀레이션은 오히려 증가하였다. 2022년 기준 보험회사, 연기금 및 금융투자의 평균 잔존만기는 각각 14.0년, 8.3년, 6.1년으로 2020년 이후 다소 축소되는 모습을 나타내는 데 반해 외국인 투자자가 보유한 국채의 평균 잔존만기는 5.3년으로 2000년대 후반 3년 미만에서 꾸준히 증가하고 있는 것으로 나타났다. 한편, 국내 은행이 보유한 국채의 평균 잔존만기는 2.5년으로 주요 투자자 중에서 평균 잔존만기가 가장 짧으며 2000년대 중반 이후 주로 만기가 짧은 국채에 투자하고 있는 것으로 분석된다.

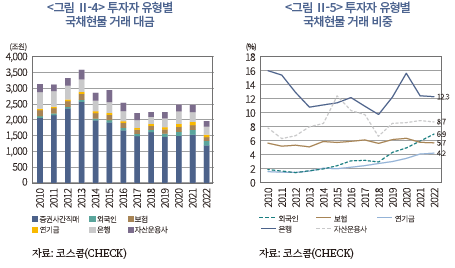

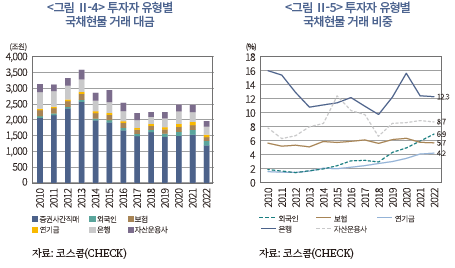

3. 투자자 유형별 국채 거래

국채현물 시장에서 투자자별 거래를 살펴보면 국고채전문딜러(Primary Dealer: PD) 제도의 영향으로 증권회사가 시장 조성자 기능을 수행하기 때문에 증권사 간 직매 거래 비중이 대부분(약 70%)을 차지한다. 증권사 간 직매를 제외하면 은행, 자산운용사 순으로 거래 비중이 높으며, 외국인 투자자의 국채 거래 비중이 꾸준히 증가해 2022년 기준 세 번째로 높은 비중을 차지하고 있다. 2022년 국채현물시장에서 외국인 투자자의 거래 규모는 140조원으로 전체 거래대금의 약 7%에 불과하나 2012년(49조원, 1.4%)과 비교하면 거래 비중은 약 5배 증가하였다.

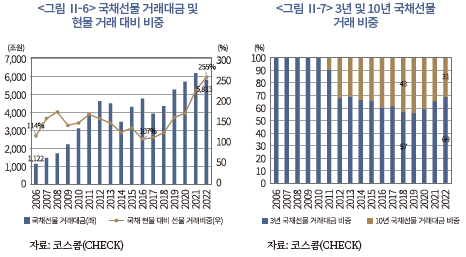

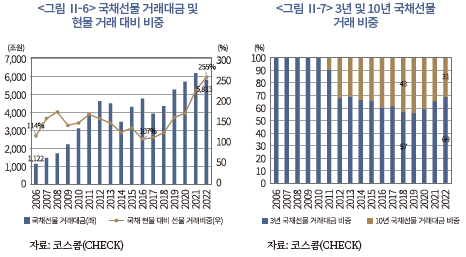

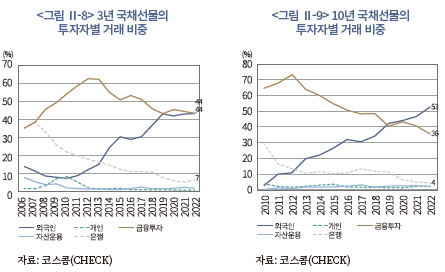

한편, 국채선물 시장의 거래 규모는 현물 거래의 2배를 넘어 빠르게 증가하는 추세이다. 2022년 국채선물 거래 규모는 5,813조원으로 동기간 현물 거래 규모의 255%를 차지했다. 만기별로 살펴보면, 3년물 국채선물 거래 비중이 10년물 국채선물 거래 비중의 약 2~2.5배를 차지하는 것으로 나타났다.

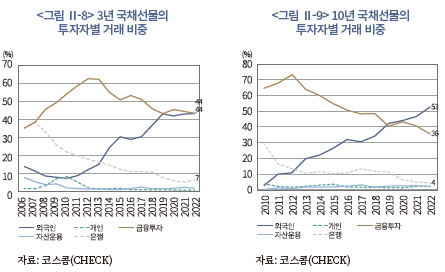

국채선물 시장의 풍부한 유동성, 편리한 접근성, 낮은 거래 비용, 외국인 통합계좌 도입 등의 영향으로 외국인 투자자의 참여가 큰 폭으로 증가했다. 3년 및 10년 국채선물의 외국인 투자자 거래 비중은 2022년 기준 각각 44% 및 53%로 2010년(9% 및 3%) 대비 각각 35%p 및 50%p 증가한 반면, 은행의 거래 비중은 큰 폭(3년 선물: 22%(2010) → 7%(2022), 10년 선물: 29%(2010) → 4%(2022))으로 감소하였다. 10년 국채선물 시장에서 외국인은 주요 투자자 유형 중에서 가장 높은 거래 비중을 차지하는 등 국채선물 시장에서 외국인 투자자의 영향력이 크게 확대되고 있으며, 국채가격 및 변동성에 미치는 영향이 확대되었을 것으로 예상되는 만큼 이를 분석할 필요가 있다고 판단된다.

Ⅲ. 외국인 투자자의 현지통화 국채투자 동인 분석

본 장에서는 외국인 투자자의 신흥국 현지통화 국채투자 동인을 분석한다. 글로벌 유동성 및 위험선호 등 글로벌 공통요인과 함께 개별국의 거시경제적 요인 및 채권시장 관련 변수들을 포함한 고정효과 패널분석을 실시한다. 한국 국채시장에서 외국인이 차지하는 비중과 실증모형을 통한 추정치와의 비교를 통해 외국인의 과유입 여부를 판단한다.

1. 선행연구 및 본 연구의 기여점

본 장의 연구는 크게 두 가지 연구결과와 연결된다. 첫째는 글로벌 포트폴리오 투자유인에 관한 연구들이다. 이와 관련하여 대내외 금리차 등 개별국의 거시경제적 요인을 강조하는 연구들이 존재한다. Ahmed & Zlate(2014)은 대내외 금리차가 외국인 채권 포트폴리오 유입에 유의한 변수임을 보였다. 또한, Beirne et al.(2021)은 외국인의 국채시장 비중 확대가 자본유출입의 변동성을 확대하는 요인이라고 보고하였다.

한편, VIX(Volatility Index) 등 글로벌 위험요인이나 글로벌 유동성의 변화가 자본유출입의 주요 요인임을 지적하는 연구들도 존재한다. Fratzscher(2012)는 주간 단위의 펀드자료를 분석한 결과 VIX가 높을 때 유의하게 자본유출이 관찰되며, 특히 주요 금융위기 상황에서는 VIX가 급격히 증가할 때 선진국에서는 주식 순유입이 관찰되는 반면 신흥국에서는 채권 순유출이 관찰됨을 보인다. Ghosh et al.(2014)은 55개국 신흥국을 대상으로 자본의 급격한 순유입 요인을 분석한 결과 미국의 실질금리가 올라갈수록, S&P 500의 주가 변동성이 증가할수록 신흥국에서 자본유출이 늘어난다는 결과를 제시하고 있다. 한편 Bruno & Shin(2013)은 국가간 은행차입자금의 결정요인에 대한 실증분석에서 VIX가 유의한 결정요인임을 보고하고 있다. Forbes & Warnock(2012) 및 Alberola et al.(2015)은 글로벌 외환보유액 및 주요국 통화량을 글로벌 유동성의 대용변수로 사용하여 글로벌 요인이 중요하며 성장률을 제외한 개별국 요인은 대체로 유의하지 않음을 밝히고 있다. 국내 연구로는 윤경수·김지현(2012)이 글로벌 유동성을 BIS의 ‘선진국 국내신용 및 국가간 대출’로 설정하고 유동성 과잉상태 여부가 신흥국 자본유입에 유의미하다는 점을 밝히고 있으며 강현주·이승호(2012)는 글로벌 유동성을 통화량과 같은 양적 지표와 금리나 주가 등 가격 지표로 구분하였을 때 포트폴리오 자금은 가격 지표에, 은행대출은 양적 지표에 유의하게 반응한다는 점을 실증적으로 제시하였다.

둘째로는 직접적으로 외국인의 한국 채권투자 동인과 관련된 문헌들이다. 우선 글로벌 자본이동에서와 마찬가지로 대내외 금리차 및 차익거래 유인이 외국인의 국내채권 투자에 유의하게 영향을 미친다는 연구가 존재한다. 김수현(2018)은 외국인 채권의 투자주체를 민간자본과 공공자본으로 구분하여 대내외 금리차가 미치는 영향을 분석하였다. 분석 결과 공공자본은 대내외 금리차에 영향을 받지 않는 반면 민간 자본은 대내외 금리차에 유의하게 영향을 받는 것으로 나타났다. 윤영진‧박종욱(2019)은 기간을 구분하여 2010년 이전에는 대내외 금리차가 외국인 채권 순투자에 유의한 영향을 주지 못했으나 2010년 이후에는 유의한 것으로 나타났다고 보고하였다. 한편, 내외 금리차에 스왑 스프레드를 고려한 차익거래 유인이 확대될수록 외국인 채권 순매수가 증가한다는 연구도 존재한다. 양양현‧이혜림(2008) 및 유복근(2018) 등은 글로벌 금융위기 전후 시기에 차익거래 유인과 외국인 채권 순매수의 관계를 분석하였다. 박종연‧김동순(2011)은 차익거래 유인이 외국인 채권매매에 미치는 영향이 만기별로 상이할 수 있음을 보여준다. 즉, 단기채권은 차익거래 유인이 확대될수록 외국인 채권 순매수가 유의하게 증가한 반면 장기채권에는 차익거래 유인의 영향이 제한적인 것으로 나타났다.

대내외 금리차 및 차익거래 유인 외에도 국내외 위험요인이 외국인의 국내 채권 순매수에 영향을 미친다는 연구들도 존재한다. 원승연‧주상영(2009)은 글로벌 금융위기 직전 시기를 중심으로 분석한 결과 차익거래 유인뿐만 아니라 한국 국채의 CDS 프리미엄이 외국인 채권 순매수에 유의한 영향을 미쳤음을 제시한다. 김소영‧이윤석(2017)은 실효환율 변화율이 증가할 경우 외국인 채권 순매도가 증가할 수 있음을 제시하였다. 앞서 언급한 박종연‧김동순(2011)에서도 장기채권의 경우 CDS 프리미엄, 환율변동성 등 대내외 위험요인들이 차익거래 유인보다 영향을 미친 것으로 나타났다. Jang & Atukeren(2019)은 외국인 국내채권 투자 동인에 관한 연구에서 투자자의 기대수익, 한국의 국가신용등급 및 글로벌 위험선호 등이 주요 요인인 반면 한국의 지정학적 위험의 영향력은 단기적이라는 점을 보고하였다. 배영수‧한재준(2022)은 과거의 논의를 종합하여 차익거래 유인의 영향이 국제금융시장의 위험회피 수준에 따라 달라질 수 있으며 위험 프리미엄을 감안한 차익거래 유인의 채권투자자금 유출입에 설명력이 매우 높다는 점을 보고한다. 특히 양양현‧이혜림(2008) 및 유복근(2018) 등의 연구에서 지적된 글로벌 금융위기 이후 차익거래 유인의 설명력 약화가 국제금융시장의 위험선호 약화와 관련이 있음을 지적한다.

이와 같이 신흥국의 자본흐름을 분석한 선행연구들은 전통적인 신흥국 원죄론(original sin)2), 즉 해외통화 표시 외채 문제의 관점에서 채권투자에 대한 결정요인에 초점을 두거나 외국인 비중이 신흥국 자본흐름의 변동성에 미치는 영향에 주로 관심을 두었던 만큼 신흥국의 현지통화(local currency) 국채투자의 결정요인에 국한한 연구들은 상대적으로 매우 부족한 상황이다. Sienaert(2012), Fonay(2022), Onen et al.(2023) 등은 외국인 신흥국 자국통화표시 국채투자를 다루고 있으나 투자 결정요인 등에 관한 학술적 연구가 아닌 현황 조사에 머물러 있는 실정이다. 한편, 외국인의 국채투자에 대한 국내 연구들은 국내 데이터에 국한하여 분석하다 보니 글로벌 포트폴리오 관점에서 신흥국 투자와 정합된 분석이 불가능할 뿐만 아니라 외국인의 국내 국채투자가 확대된 것이 대체로 글로벌 금융위기 이후인만큼 제한된 표본기간으로부터 발생하는 관측치의 제약 문제도 존재한다. 이러한 가운데 본 장의 연구 목적은 신흥국의 자국통화표시 채권에 대한 투자 결정요인을 밝히는 한편 신흥국 패널분석을 통해 외국인의 국내채권 투자 비중이 기존 문헌에서 중시되는 결정요인들에 비추어 적정한 수준인지를 판단해 본다. 이를 통해 향후 외국인들의 채권투자 비중이 조정될 수 있는지 여부를 파악해 볼 수 있다.

2. 분석 모형 및 데이터

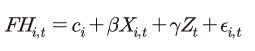

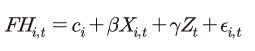

본 고에서는 외국인의 신흥국 현지통화 표시 국채시장의 비중에 대한 결정요인을 판단하기 위해 외국인 국채보유 비중 을 종속변수로 하고 국가간 자본이동의 주요 동인들을 설명변수로 하는 다음과 같은 고정효과 패널 모형을 추정한다.

을 종속변수로 하고 국가간 자본이동의 주요 동인들을 설명변수로 하는 다음과 같은 고정효과 패널 모형을 추정한다.

국가간 자금 이동에 대한 투자자들의 군집 행동(herd behavior)과 주요 신흥국들이 지리적으로 근접하여 국별 외국인 투자 비중에 대해 상호 의존성이 발생할 수 있는 만큼 Hoechle(2007)에 따라 일반적인 형태의 시공간적 의존성(spatial and temporal dependence)에 강건한 Driscoll–Kraay 표준오차를 사용하여 모델을 추정한다.

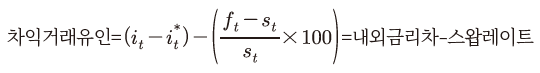

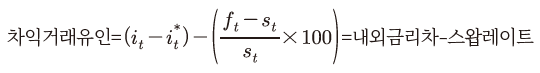

한편, 모형에 사용된 주요 설명변수들은 기존 문헌연구에서 사용된 변수를 중심으로 다음과 같은 변수들을 고려하였다. 즉, 개별국 고유의 요인(pull factor)에 해당하는 는 차익거래 유인, 명목실효환율, 채권시장 발전도 및 국가신용등급을 포함한다. 구체적으로 차익거래 유인은 무위험 이자율평형정리(covered interest parity)에 근거하여 국별 데이터 가용 여부에 따라 1년물 국채금리 또는 기준금리 간 금리차에 1년물 스왑레이트(swap rate)를 차감하여 다음과 같이 산출하였다.

는 차익거래 유인, 명목실효환율, 채권시장 발전도 및 국가신용등급을 포함한다. 구체적으로 차익거래 유인은 무위험 이자율평형정리(covered interest parity)에 근거하여 국별 데이터 가용 여부에 따라 1년물 국채금리 또는 기준금리 간 금리차에 1년물 스왑레이트(swap rate)를 차감하여 다음과 같이 산출하였다.

여기서  및

및  는 각각 국내 및 해외 이자율을,

는 각각 국내 및 해외 이자율을,  및

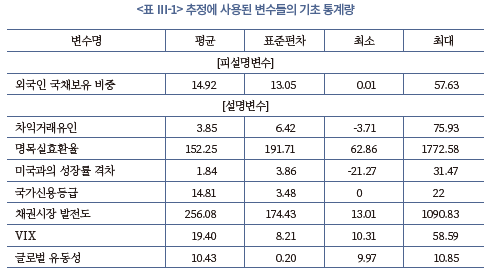

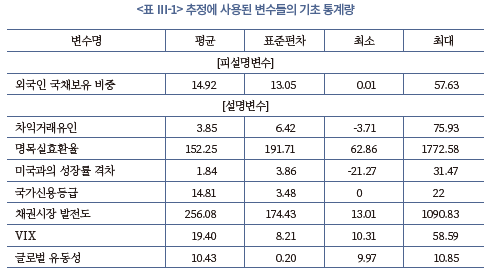

및  는 대미달러 선도환율 및 현물환율을 의미한다. 명목실효환율은 교역량을 가중치로 하여 해당국 통화의 가치를 지수화한 것으로 클수록 강세를 의미하며 BIS가 집계한 데이터를 사용하였다. 채권시장 발전도는 명목GDP 대비 채권시장 규모를 의미한다. 국가신용등급은 S&P가 발표한 국가신용등급을 지수화한 것으로 최고 등급인 AAA는 22점, AA+는 21점, AA는 20점,…, CC는 1점의 순으로 구성된다. 글로벌 공통요인(push factor)인 는 글로벌 유동성 및 위험선호를 반영한다. 우선, 글로벌 유동성은 G4 국가(미국, 유로지역, 일본 및 영국)의 (로그) 통화량을, 글로벌 위험선호는 VIX 지수를 사용하였다. 한편, 모든 설명변수 데이터들은 Refinitiv Datastream 및 FRED를 통해 입수하였으며 패널의 표본기간은 2005년 4분기부터 2021년 4분기까지이다. <표 Ⅲ-1>은 추정에 사용된 주요 변수들의 기초 통계량을 제시하고 있다.

는 대미달러 선도환율 및 현물환율을 의미한다. 명목실효환율은 교역량을 가중치로 하여 해당국 통화의 가치를 지수화한 것으로 클수록 강세를 의미하며 BIS가 집계한 데이터를 사용하였다. 채권시장 발전도는 명목GDP 대비 채권시장 규모를 의미한다. 국가신용등급은 S&P가 발표한 국가신용등급을 지수화한 것으로 최고 등급인 AAA는 22점, AA+는 21점, AA는 20점,…, CC는 1점의 순으로 구성된다. 글로벌 공통요인(push factor)인 는 글로벌 유동성 및 위험선호를 반영한다. 우선, 글로벌 유동성은 G4 국가(미국, 유로지역, 일본 및 영국)의 (로그) 통화량을, 글로벌 위험선호는 VIX 지수를 사용하였다. 한편, 모든 설명변수 데이터들은 Refinitiv Datastream 및 FRED를 통해 입수하였으며 패널의 표본기간은 2005년 4분기부터 2021년 4분기까지이다. <표 Ⅲ-1>은 추정에 사용된 주요 변수들의 기초 통계량을 제시하고 있다.

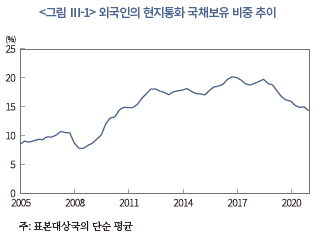

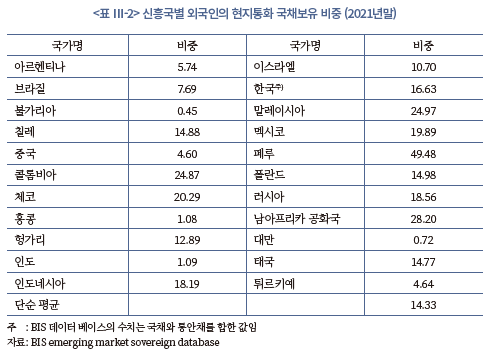

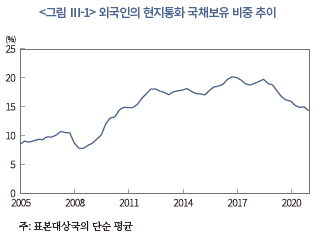

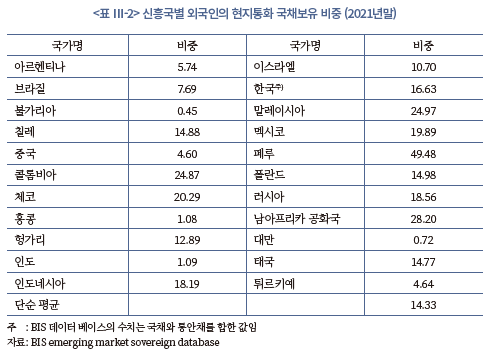

종속변수인 외국인 국채보유 비중 은 BIS가 구축한 신흥국의 국채투자 데이터(emerging market sovereign database)를 바탕으로 하여 전체 국채시장 대비 외국인 보유 비중을 사용하였다. 본 고에서 사용된 국가는 한국, 대만, 브라질, 체코 등 총 22개국으로 구성되어 있다.3) <그림 Ⅲ-1>은 표본기간중 외국인 국채보유 비중의 단순 평균 추세를 제시하고 있다. 글로벌 금융위기 이전에는 전통적 원죄론에서 강조한 바와 같이 외국인의 신흥국 현지통화 표시 국채보유 비중은 전체 국채시장 대비 10% 미만에 불과하였다. 그러나, 금융위기 이후 주요국 중앙은행들의 대규모 양적완화에 따른 유동성 확대 등에 힘입어 신흥국으로의 자본유입이 크게 확대됨에 따라 외국인의 국채보유 비중 또한 빠르게 확대되었다. 다만, 미 연준이 양적완화를 중단하고 금리인상을 고려하던 2013년부터 외국인 비중이 대체로 20% 수준에서 정체되었다. 2020년 코로나19 감염확산에 대한 대응으로 재정적자가 늘어나면서 국채시장 규모가 확대됨에 따라 점차 하락하였다. 한편, <표 Ⅲ-2>는 입수 가능한 가장 최근 시기인 2021년 4분기 기준 국별 외국인 국채보유 비중을 제시하고 있는데 우리나라는 대체로 표본대상국 중 평균에 근접한 수준인 것으로 나타났다.

은 BIS가 구축한 신흥국의 국채투자 데이터(emerging market sovereign database)를 바탕으로 하여 전체 국채시장 대비 외국인 보유 비중을 사용하였다. 본 고에서 사용된 국가는 한국, 대만, 브라질, 체코 등 총 22개국으로 구성되어 있다.3) <그림 Ⅲ-1>은 표본기간중 외국인 국채보유 비중의 단순 평균 추세를 제시하고 있다. 글로벌 금융위기 이전에는 전통적 원죄론에서 강조한 바와 같이 외국인의 신흥국 현지통화 표시 국채보유 비중은 전체 국채시장 대비 10% 미만에 불과하였다. 그러나, 금융위기 이후 주요국 중앙은행들의 대규모 양적완화에 따른 유동성 확대 등에 힘입어 신흥국으로의 자본유입이 크게 확대됨에 따라 외국인의 국채보유 비중 또한 빠르게 확대되었다. 다만, 미 연준이 양적완화를 중단하고 금리인상을 고려하던 2013년부터 외국인 비중이 대체로 20% 수준에서 정체되었다. 2020년 코로나19 감염확산에 대한 대응으로 재정적자가 늘어나면서 국채시장 규모가 확대됨에 따라 점차 하락하였다. 한편, <표 Ⅲ-2>는 입수 가능한 가장 최근 시기인 2021년 4분기 기준 국별 외국인 국채보유 비중을 제시하고 있는데 우리나라는 대체로 표본대상국 중 평균에 근접한 수준인 것으로 나타났다.

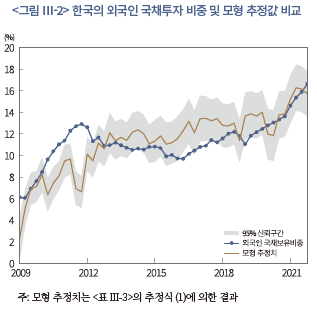

3. 추정결과

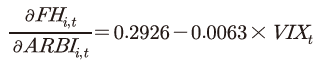

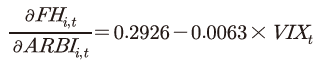

분석결과는 <표 Ⅲ-3>에 정리되어 있다. 우선, 글로벌 공통요인인 글로벌 유동성과 VIX 지수는 부호가 예상과 부합하며 통계적으로도 유의한 것으로 나타났다. 개별국 고유요인 중에서는 차익거래 유인, 채권시장 발전도 및 국가신용등급이 외국인 비중을 통계적으로 유의하게 높이는 것으로 나타났다. 한편, 차익거래 유인과 VIX간 교차항을 포함한 경우 통계적 유의성은 부족하나 부호는 음(-)으로 추정되었다. 추정된 결과에 따르면 차익거래유인의 외국인 국채보유 비중에 대한 영향은

이 되므로 배영수·한재준(2022)에서 지적한 바와 같이 글로벌 위험회피도가 커질수록 차익거래 유인의 영향이 약화됨을 시사한다. 한편, 실효환율이나 성장률과 같이 신흥국 자본유입과 관련된 거시경제 통제 변수들은 통계적 유의성이 없는 것으로 나타났다. 종합해 보면 외국인 국채보유 비중은 글로벌 유동성 및 위험선호와 같은 국제금융시장 상황에 크게 의존하는 동시에 개별국의 수익성(차익거래 유인) 및 안전성(국가신용등급)과 함께 시장규모와 밀접한 연관이 있는 유동성 상황에도 크게 의존하는 것으로 나타났다.

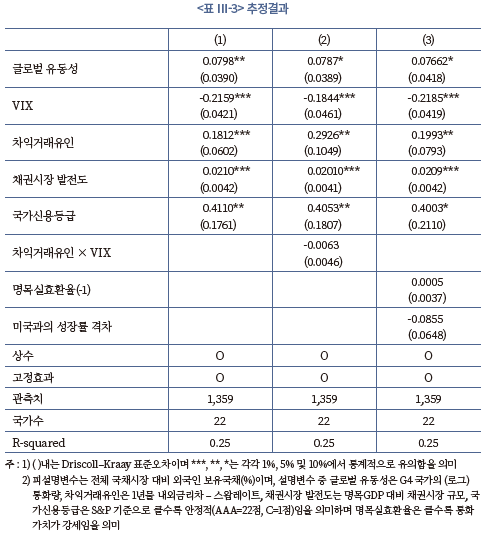

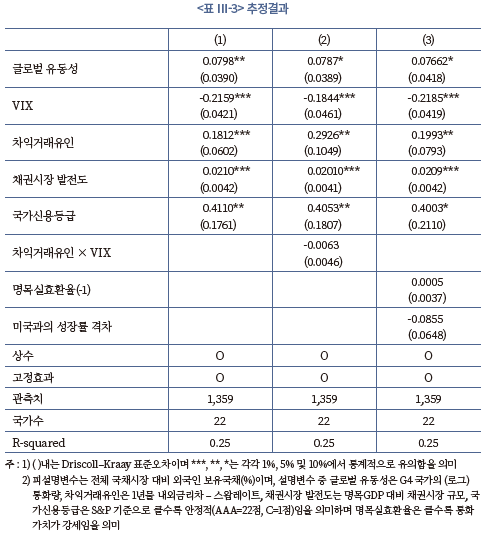

한편, 이러한 모형의 추정결과를 한국의 외국인 국채보유 비중 추이와 비교해 본 결과는 <그림 Ⅲ-2>와 같다. 대체로 실제 데이터는 <표 Ⅲ-3>의 추정식(1)에 의한 추정치의 95% 신뢰구간 이내에 존재하는 것으로 나타났다. 과거 2010~2011년과 같이 신흥국으로의 자본유입이 확대되면서 국내의 외국인 국채보유 비중이 가파르게 상승함에 따라 모형 추정치와 괴리가 컸던 기간이 존재했었으나, 이후의 상황을 살펴보면 외국인 국채보유 비중이 하향 조정되면서 모형 추정치에 대체로 수렴하는 것으로 나타났다.

Ⅱ장에서 제시된 바와 같이 2020년 이후 한국 국채시장에서 외국인 비중이 가파르게 늘어난 가운데 이러한 변화가 동 모형을 통해서 설명가능한 수준인지를 살펴보면, 최근 시점의 수치는 모형의 추정치를 다소 상회하고 있으나 여전히 95% 신뢰구간 이내에 있는 것으로 판단된다. 2023년 2분기 기준 외국인 비중은 BIS 통계와 동일하게 통안채를 포함한 경우 19% 수준이다. 한편 <표 Ⅲ-3>의 추정식 (1)의 추정계수를 바탕으로 설명변수의 최근 수치를 사용한 값은 17.4%로 국내 요인보다는 글로벌 요인의 개선에 힘입어 상승한 것으로 나타났다. 이에 따라 실제 데이터가 모형 추정치를 다소 상회하나 2021년 4분기 기준의 표준오차를 그대로 적용하면 여전히 신뢰구간 이내에 존재하는 것으로 판단된다. 다만 최근의 외국인 비중 증가세가 매우 가파른 만큼 향후 증가 추이에 대한 면밀한 모니터링이 필요하다.

Ⅳ. 외국인 투자행태가 국채시장에 미치는 영향 분석

본 장에서는 국채현물시장과 선물시장에서 외국인의 매매 행태가 국채 수익률, 국채 수익률의 변동성에 미치는 영향을 살펴보고자 한다. 더불어 국채선물시장에서 외국인의 매매 비중이 빠르게 증가함에 따라 외국인의 선물시장 매매 행태가 국채선물의 가격 발견기능에 미치는 영향을 분석하고 국채선물 만기일에 가격 및 거래량 급변동 현상 등 주요 웩더독(wag-the-dog) 현상의 여부를 진단하고자 한다.

1. 국채현물시장에서 외국인 투자행태의 영향력 분석

가. 문헌연구

국채현물시장에서 투자자 유형별 매매 행태가 국채 수익률, 국채 수익률의 변동성, 주가지수, 환율 등에 미치는 영향을 살펴본 연구는 많지 않다. Arslanalp & Poghosyan(2016)은 선진국 국채시장을 대상으로 외국인의 채권 순매수 행태를 분석한 결과, 외국인 투자자가 해당 국가 국채발행 잔액 중 보유 비중을 1%p 증가시키면 해당 국가의 장기 국채 수익률이 0.06~0.1% 하락함을 보였다. Burger & Warnock(2007)은 40개 국가의 채권시장을 분석한 결과, 비거주자인 외국인 투자 비중이 낮을수록 해당 국가의 채권시장 변동성이 유의하게 높고 외부 충격에 의한 채권시장 영향력이 큰 것을 보였다. 채권 매매에 대한 연구는 아니지만 Richard(2005)는 한국, 대만, 필리핀, 인도네시아, 태국 등 아시아 주식시장을 대상으로 외국인의 매매 행태를 분석하였는데, 외국인 투자자는 미국 등 선진시장에서 주가가 상승했을 때 순매수하는 경향이 크며, 외국인 투자자의 순매수로 인해 해당 아시아 국가의 주가수익률도 양(+)의 영향을 받는 것을 보였다.

한국 국채현물시장에서 외국인의 순매매 행태가 국채 수익률, 국채 수익률의 변동성, 원달러 환율 등에 미치는 영향을 살펴본 연구는 많지 않다. 원승연‧주상영(2009)은 국채현물시장에서 외국인들의 투자 결정요인을 살펴보고 외국인의 국채 순매매 행태가 시장금리 변화에 미치는 영향을 분석하였다. 분석 결과에 따르면 차익거래 기회가 증가할수록 외국인의 순매매가 유의하게 증가하며 외국인의 순매매 증가에도 불구하고 차익거래 기회는 쉽게 사라지지 않는 것으로 나타났다. 또한 국채현물시장에서 외국인 순매수가 증가할수록 시장금리가 일정 부문 하락하였다. 김동순‧박종연(2011)은 한국 국채현물시장에서 만기별로 외국인 매매행태의 원인을 살펴보았으며, 외국인이 중장기 국채 순매수를 확대할수록 시장금리는 유의하게 하락 압력을 받는다고 보고하였다. 우준명(2017)은 한국 국채현물시장에서 외국인의 채권 순매수가 많을수록 채권시장 변동성에 유의한 영향을 미침을 보였으며 특히 고(高) 변동성 국면에서는 외국인의 국채 순매수가 채권시장 변동성을 더욱 확대시킨다는 결과를 제시하였다.

이상의 선행연구를 요약하면, 국채현물시장에서 외국인이 순매수를 증가시키면 장기 국채를 중심으로 채권 수익률이 유의하게 하락할 개연성이 크다고 예상할 수 있다. 반면 외국인의 국채 순매수 증가는 국채현물시장의 변동성을 다소 줄여주는 긍정적 기능을 수행할 수 있고, 경우에 따라 국채현물시장의 변동성을 확대시킬 개연성도 예상할 수 있다.

나. 연구방법론

국채현물시장에서 외국인 매매행태가 국채 수익률 및 국채 수익률의 변동성에 유의미한 영향을 주는지 살펴보기 위해 Richard(2005)의 식별전략을 바탕으로 하여 구조 VAR 모형을 설정하였다. 구체적으로, 미국 10년 국채금리의 하락(상승)으로 외국인 투자가가 한국 국채현물시장에서 순매수(순매도)를 수행하며, 외국인의 국채현물시장 순매수는 국채 수익률의 하락(상승)과 변동성 하락(하락)을 가져오고 원달러 환율 및 스왑레이트 등에 유의미한 영향을 미칠 수 있다는 모형을 설정하였다. 다만 한국이 소규모 개방경제임을 감안하여 외국인 채권 순매매 및 국내 시장변수가 미국 국채금리에 영향을 주지 못한다는 추가적인 제약을 부가하였다. VAR 모형에 사용된 시차는 BIC(Bayesian Information Criteria) 및 AIC(Akaike Information Criteria) 등에 근거하여 국내 시장변수에 따라 2~4를 사용하였다.

시계열 모형 추정을 위해 2011년 7월 1일부터 2023년 6월 30일까지 주간 데이터를 이용하였으며, 최근 외국인 투자자의 순매매 증가 현상에 따른 영향력을 살펴보기 위해 전체 샘플기간을 2011년 7월 1일부터 2017년 6월 30일까지 기간과 2017년 7월 1일부터 2023년 6월 30일 기간으로 구분하여 별도의 실증분석을 수행하였다. 외국인의 국채 순매매 정도는 100억원을 기준으로 로그 변환을 수행한 뒤 전주 대비 변화를 사용했다. 미국 및 한국 국채 수익률은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률의 변동성은 국채 수익률의 표준편차를 계산한 뒤 연단위로 환산하여 계산하였으며, 해당 역사적 변동성은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률 및 수익률의 변동성의 경우 3년물과 10년물로 구분하여 별도의 실증분석을 수행했다. 원달러 환율은 주간 단위 원달러 환율의 변화율을 사용했으며, 스왑레이트는 서울외환시장에서 고시되는 3개월물 bid-offer의 중간값을 기준으로 원달러 환율 기준 스왑레이트의 변화율을 사용했다. 이때 미국과 한국의 국고채 수익률, 원달러 환율은 한국은행 경제통계시스템에서 제공하는 자료를 사용했으며, 외국인 국채 순매수 규모 및 스왑레이트 등의 자료는 코스콤 체크단말기에서 제공하는 자료를 사용했다.

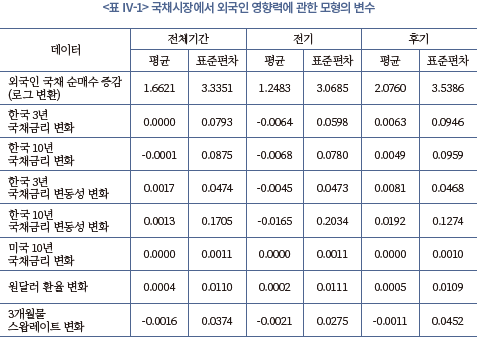

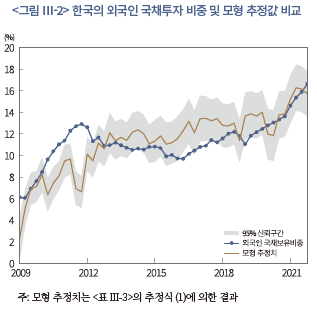

본 시계열 분석 모형에서 사용한 데이터를 살펴보면, 국채현물시장에서 외국인은 평균적으로 주간 500억원 이상 국채를 순매수한 것으로 관찰되었으며 2017년 7월 이후에는 주간 약 800억원 이상 순매수를 수행하는 등 외국인의 국채 순매수 강도가 커진 것을 확인할 수 있다. 한국 3년물 및 10년물 국채금리 변화는 0과 큰 차이가 나지 않았으나, 2017년 7월 이후에는 국채금리가 평균적으로 상승한 것으로 확인되었다. 또한 2017년 7월 이후 3년물 및 10년물 국채금리 변동성은 다소 증가한 것으로 관찰되었다.

다. 실증분석

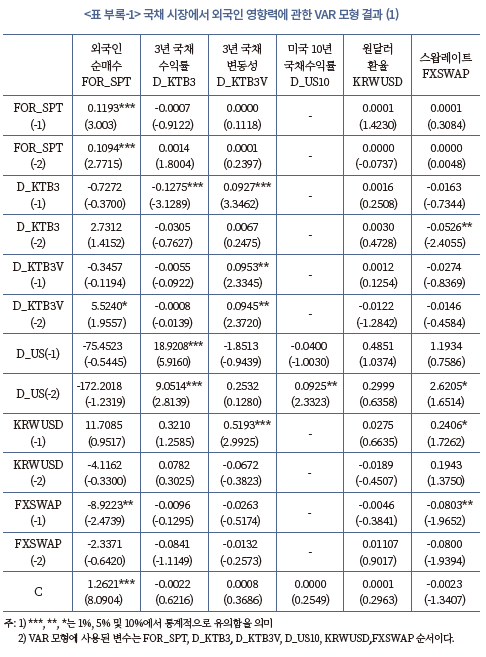

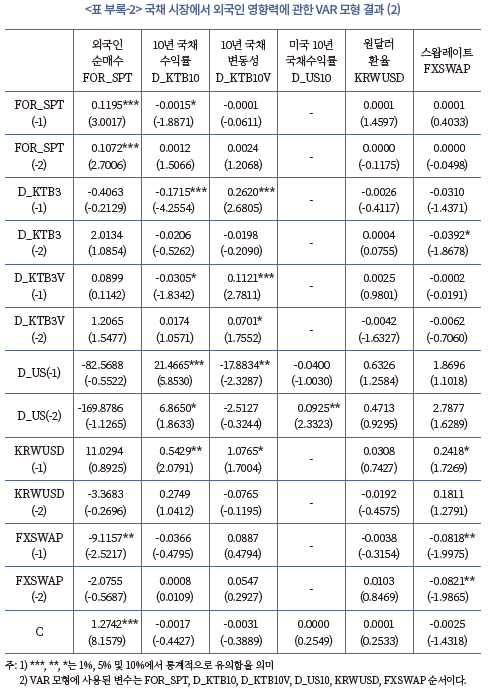

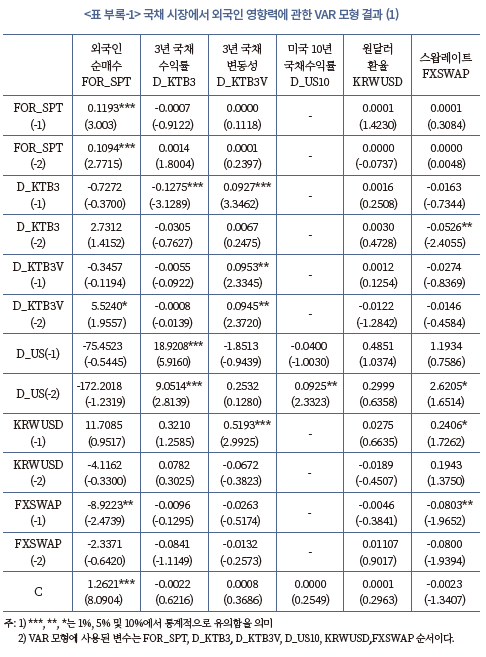

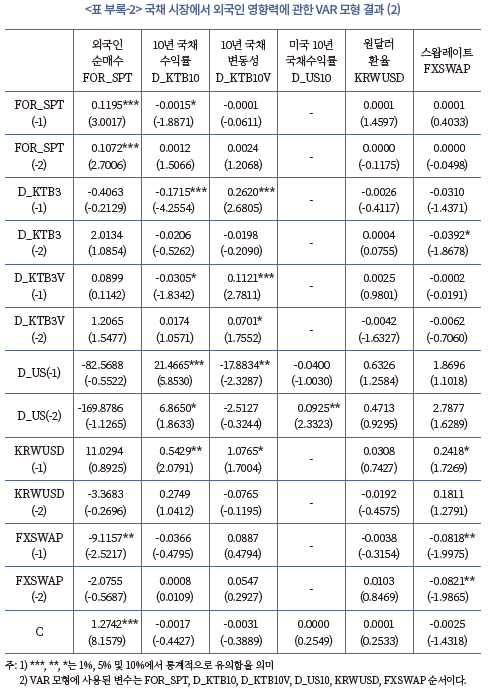

전체 샘플기간에서 VAR 모형을 추정한 결과, 스왑레이트가 하락했을 때 국채현물시장에서 외국인 순매수가 유의하게 증가하며, 직전 시점의 외국인 순매수 증가는 현재 외국인 순매수 증가에 유의한 양(+)의 영향을 미치는 것으로 관찰되었다(<표 부록-1> 및 <표 부록-2> 참조). 즉 원화 가치의 상승을 기대하여 미래 원달러 환율이 하락할 것으로 예상하면, 국채현물시장에서 외국인 순매수가 증가하며 이러한 현상은 단기 추세를 가지는 것으로 말할 수 있다.

국채현물시장에서 외국인 투자행태가 국채금리 변화 및 국채 가격 변동성에 미치는 영향을 살펴본 결과, 국채현물시장에서 외국인의 매매 행태는 3년물 국채금리 및 3년물 국채 가격 변동성에 유의미한 영향을 미치지 못하는 것으로 확인되었다. 미국 10년물 국채금리의 변화가 한국 3년물 국채금리 변화에 유의미한 양(+)의 영향을 미쳤으며, 원달러 환율이 상승하면 3년물 국채금리 변동성이 상승하는 것으로 관찰되었다. 한편 국채현물시장에서 외국인 순매수의 증가는 10년물 국채금리의 하락에 10% 수준에서 유의미한 영향을 미쳤다.4) 국채현물시장에서 외국인 매매 행태는 원달러 환율 및 스왑레이트에는 유의미한 영향을 미치지 못했다.

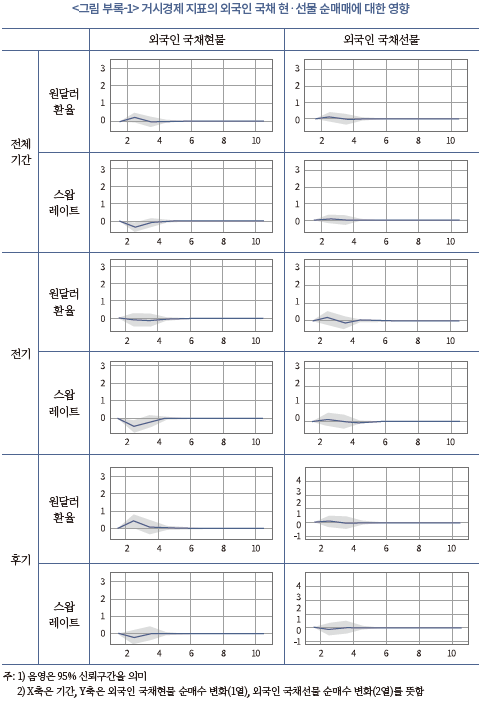

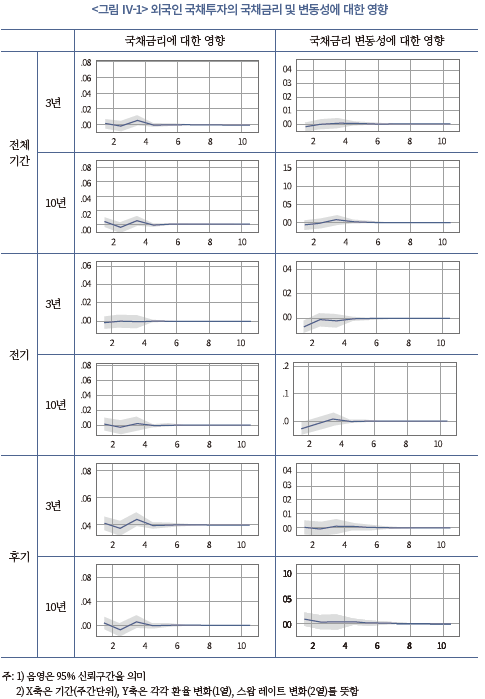

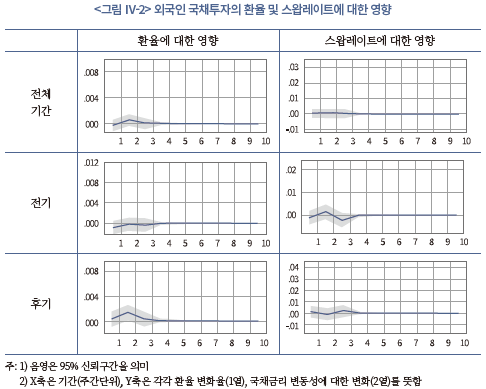

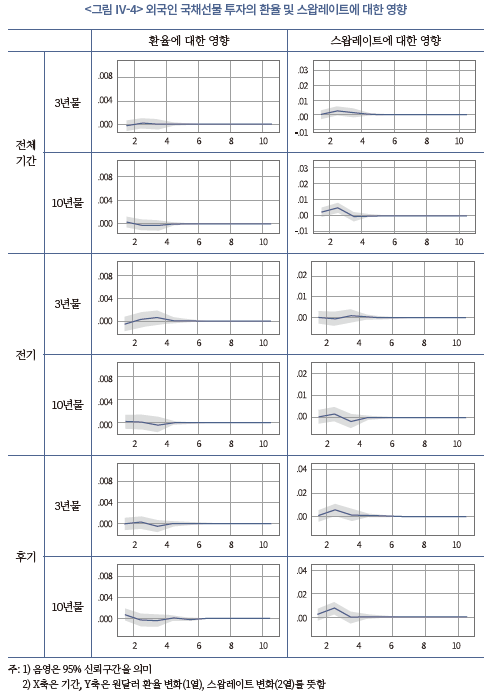

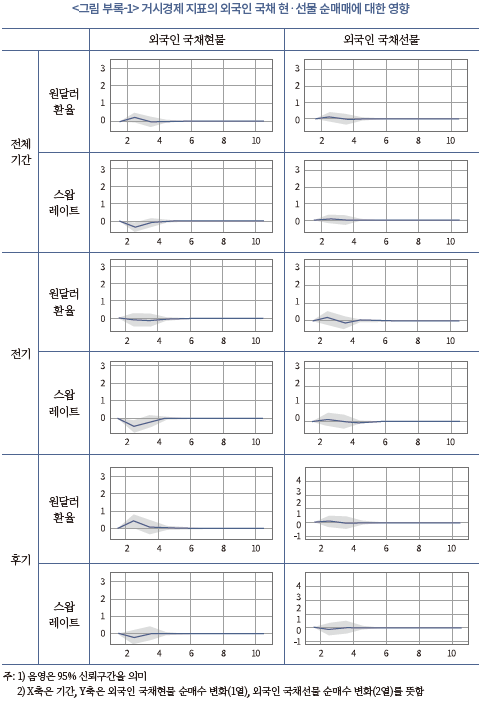

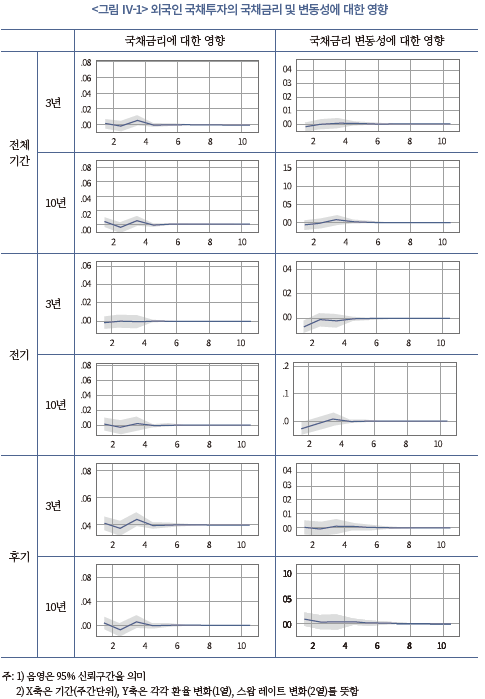

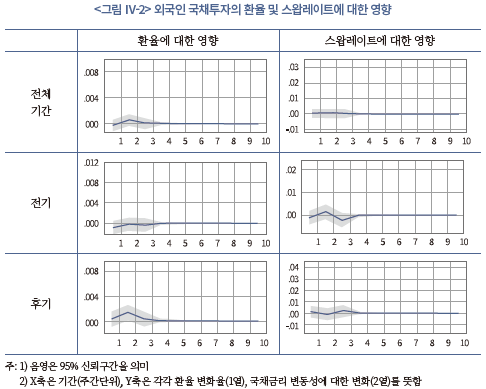

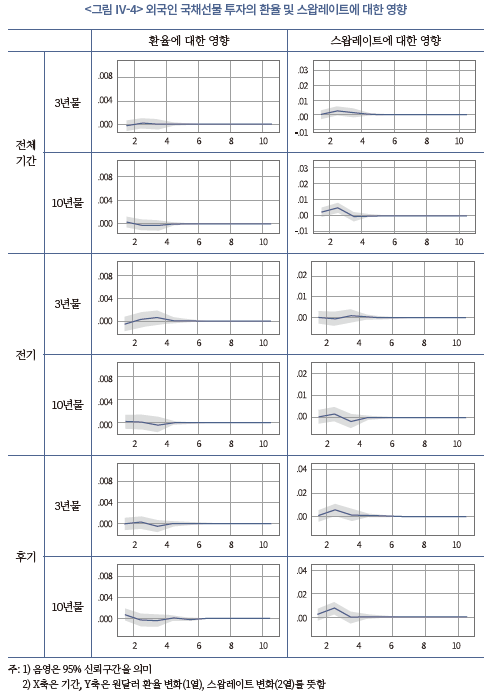

한편, <그림 Ⅳ-1> 및 <그림 Ⅳ-2>에 제시된 바와 같이 충격 반응 함수를 통해 외국인 순매수 행태가 국채금리 및 국채 가격 변동성, 원달러 환율, 스왑레이트에 미치는 영향력을 살펴본 결과, 외국인 순매수 행태는 국내 채권시장 및 외환시장에 유의미한 영향력을 미치지 못하였다. 전체 샘플기간을 2017년 7월 1일 이전과 이후로 나누어 외국인 순매수의 영향력을 살펴본 결과, 최근 시점에서 외국인 순매수가 국채금리 하락에 미치는 영향력이 소폭 큰 것으로 예상할 수 있으나 통계적 유의성은 관찰되지 않았다. 또한 전기와 후기 모두에서 외국인의 국채 순매수는 원달러 환율 및 스왑레이트 등에 유의미한 영향을 미치지 못한 것으로 관찰되었다.

2. 국채선물시장에서 외국인 투자행태의 영향력 분석

가. 문헌연구

한국 국채선물시장에서 외국인 투자자의 비중이 빠르게 증가했음에도 불구하고 외국인 투자자의 영향력에 관한 연구는 많지 않다. 강규호‧서영경(2022)은 2011년 1월부터 2022년 6월까지 일별 자료를 분석하여, 외국인의 국채선물 순매도가 3년 국채금리 인상에 통계적으로 유의한 양(+)의 영향을 미치는 것을 보여주었다. 특히 강규호‧서영경(2022)은 기준금리 인상 시기에 국채선물시장에서 외국인의 영향력이 크게 나타났음을 보였으며, 외국인의 국채선물 영향력을 줄이기 위해 국채선물에 대한 증거금률을 인상하고 최종결제가격 제도 등을 변경할 필요를 제시했다. Choi et al.(2017)은 2004년 1월부터 2013년 12월까지 일간 자료를 기반으로 구조적 VAR 모형을 설계하고, 이를 기초로 외국인의 국채선물 순매도가 국채금리 상승에 유의한 양(+)의 영향을 미치는 것을 보였으며, 국채선물시장과 달리 국채현물시장에서 외국인의 순매매는 국채금리 변화에 유의미한 영향을 미치지 못하는 점을 제시했다.

국채선물시장에서 현물시장의 가격발견 기능 및 선물시장의 웩더독(wag-the-dog) 현상에 관한 연구는 많지 않다. 대신, 주가지수 선물시장을 대상으로 현물시장에 대한 가격 발견기능 및 웩더독 현상에 관한 연구는 꾸준히 수행되어왔다. 오승현‧한상범(2008)은 2000년 1월부터 2005년 12월까지 주가지수 선물시장을 대상으로 일별 분석을 통해 개인, 기관, 외국인 등으로 구분하여 투자자 유형별 거래행태를 분석하고 이들 투자자별로 주가 예측력을 살펴보았는데, 한국 주가지수 선물시장에서 외국인은 평균적으로 높은 투자성과를 실현했으며 주가 예측력도 높은 것을 보였다. 반면 상당수 기관투자자의 주가 예측력은 크지 않음을 보였으며, 개인의 주가 예측력은 다소 낮은 것을 보여주었다. 홍정효(2019)는 2013년 1월부터 2018년 3월까지 일간 데이터 기반의 VECM 모형을 통해, 국채선물과 국채현물 간 상호 연계성이 존재하며 특히 3년물 국채선물의 가격발견 기능이 우수함을 보였다. 한덕희‧문규현(2017)은 국채선물과 국채현물 간 장기간에 걸친 인과관계는 관찰되지 않지만, 단기적인 인과관계는 존재함을 보임으로써 국채선물시장에서 가격발견 기능이 작동하고 있음을 제시하였다. 홍정효(2019), 한덕희‧문규현(2017)은 국채선물시장에서 투자자 유형별로 구분하여 투자자의 정보 예측력 및 가격발견 기능을 제시하지 못한 점에서 한계를 가진다.

이상의 선행연구를 요약하면, 국채선물시장에서 외국인의 순매수(순매도)는 국채금리 하락(상승)에 유의한 영향을 미칠 수 있는 것으로 예상할 수 있다. 특히 투자자 유형별로 국채선물시장의 영향력을 살펴보면, 외국인의 가격 예측력이 국내 기관투자자나 개인보다 상대적으로 우수한 것으로 추론할 수 있다. 더불어 국채선물시장에서 정보 우위에 있는 외국인 참여가 증가했다면 국채선물시장과 현물시장 간 상호 연계성 및 가격 발견기능이 향상할 것으로 예상할 수 있다.

나. 연구방법론

국채선물 시장에서 외국인 매매행태가 국채 수익률 및 국채 수익률의 변동성에 유의미한 영향을 주는지 살펴보기 위해 Richards(2005) 및 Choi et al. (2017)을 바탕으로 구조 VAR 모형을 설정하였다. 국채선물 시장에서 외국인투자자의 영향력을 분석하기 위해 국채현물 시장에서 외국인 순매매의 영향력을 살펴본 앞절의 VAR 모형과 유사한 모형을 사용했다. 다만 국채선물 시장의 경우 3년물과 10년물 시장으로 구분되어 외국인의 참여가 활발하기 때문에 3년물과 10년물 국채선물 시장으로 구분하여 별도의 VAR 모형을 적용하였다. 더불어 국채선물 시장에서 외국인, 기관, 개인의 순매매가 국채현물의 가격 및 가격 변동성에 유의미한 영향을 미치는지, 그리고 국채선물과 국채현물 간 차익거래 감소에 유의미한 영향을 미치는지 살펴보기 위해 일별 자료에 기반한 회귀분석 모형을 활용하여 국채선물 시장에서 외국인의 영향력을 살펴보았다.

시계열 모형 추정을 위해 2011년 7월 1일부터 2023년 6월 30일까지 주간 및 일간 데이터를 이용하였으며, 최근 외국인 투자자의 순매매 증가 현상에 따른 영향력을 살펴보기 위해 전체 샘플기간을 2011년 7월 1일부터 2017년 6월 30일까지 기간과 2017년 7월 1일부터 2023년 6월 30일 기간으로 구분하여 별도의 실증분석을 수행하였다. 국채선물 시장은 3년물과 10년물로 각각 구분하여 외국인의 국채선물 순매매 정도를 계산하였으며, 현물시장과 유사하게 100억원을 기준으로 로그 변환을 수행한 뒤 전주 대비 변화를 사용했다. 미국 및 한국 국채 수익률은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률의 변동성은 국채 수익률의 표준편차를 계산한 뒤 연단위로 환산하여 계산하였으며, 해당 역사적 변동성은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률 및 수익률의 변동성의 경우 3년물과 10년물과 구분하여 별도의 실증분석을 수행했다. 원달러 환율은 주간 및 일간 단위 원달러 환율의 변화율을 사용했으며, 스왑레이트는 서울외환시장에서 고시되는 3개월물 bid-offer의 중간값을 기준으로 원달러 환율 기준 스왑레이트의 변화율을 사용했다. 차익거래 기회를 뜻하는 베이시스는 국채선물의 이론가격에서 국채현물의 가격을 뺀 값을 사용하였다. 이때 미국과 한국의 국고채 수익률, 원달러 환율은 한국은행 경제통계시스템에서 제공하는 자료를 사용했으며, 외국인 국채 순매수 규모 및 스왑레이트 등의 자료는 코스콤 체크단말기에서 제공하는 자료를 사용했다.

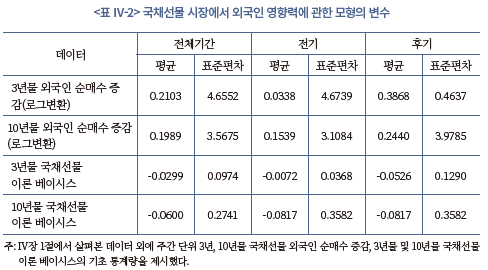

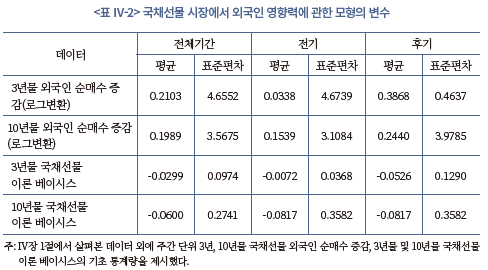

본 시계열 분석 모형에서 사용한 데이터를 살펴보면, 국채 3년물과 10년물 선물시장에서 외국인은 평균적으로 주간 124억원과 122억원을 각각 순매수한 것으로 관찰되었는데 이는 국채현물시장에서 외국인의 순매수 금액대비 다소 낮다. 즉 국채선물 시장에 참여하는 외국인 중 상당수는 헤지목적으로 선물시장에 참여하는 것으로 예상할 수 있다. 전체 샘플기간을 전기와 후기로 구분해보면 후기에서 외국인의 국채선물 순매수가 큰 폭으로 증가한 것을 확인할 수 있다. 또한 3년물과 10년물 국채선물의 이론 베이시스는 각각 –0.0299, -0.0736으로 국채선물이 국채현물 대비 저평가되는 현상이 관찰된다. 특히 10년물 국채선물의 저평가 현상이 다소 큰 것으로 관찰된다.

다. 실증분석

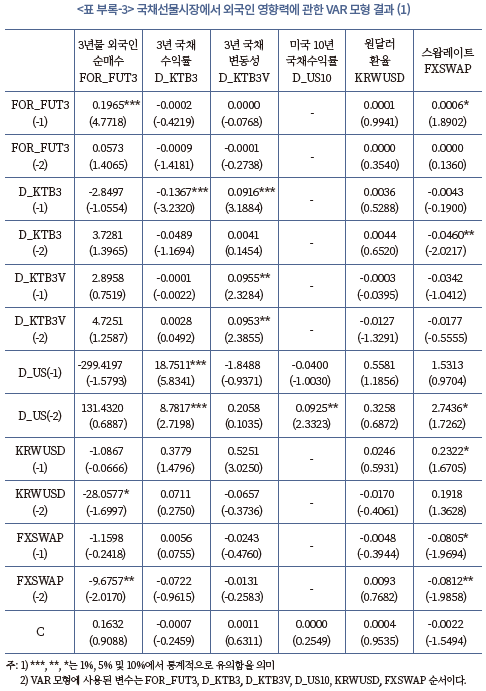

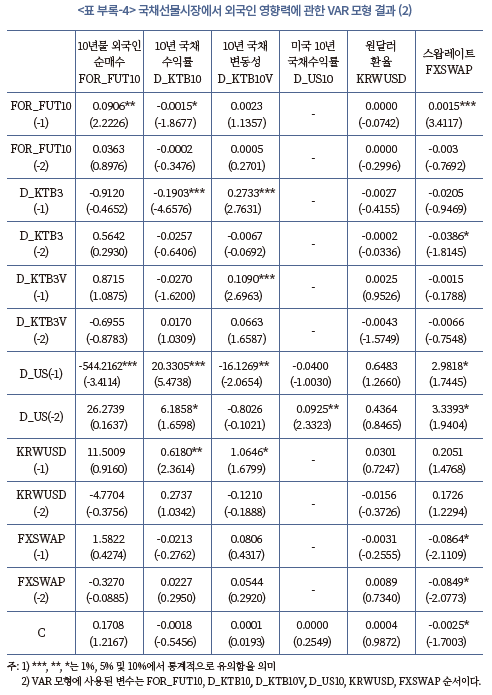

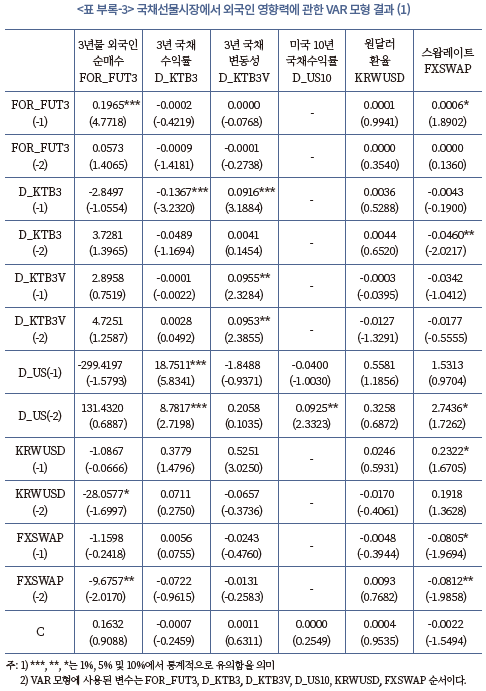

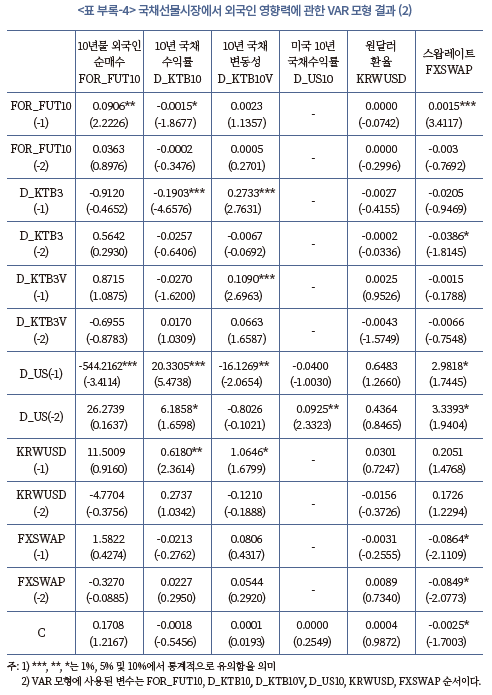

전체 샘플기간에서 VAR 모형을 통해 외국인의 국채선물 순매수의 동인을 살펴본 결과, 3년물 국채선물 시장과 10년물 국채선물 시장에서 외국인 국채선물 순매수의 동인이 다르게 나타났다(<표 부록-3> 및 <표 부록-4> 참조). 3년물 국채선물 시장에서 두 직전 시기의 원달러 환율이 하락할수록 그리고 스왑레이트가 하락할수록 3년물 국채선물 시장에서 외국인 순매수가 유의하게 증가하는 것으로 관찰되었으며, 외국인 순매수는 양(+)의 추세를 가지는 것으로 확인되었다. 반면 10년물 국채선물 시장에서는 직전 시기에 미국 10년 국채금리가 하락할수록 외국인 순매수가 유의하게 증가하며, 국채현물 및 3년물 국채선물 시장과 유사하게 양(+)의 추세를 가지는 것으로 관찰되었다. 이는 3년물 국채선물 시장에 참여하는 외국인은 차익거래 유인들에 보다 민감하게 반응하며, 10년물 국채선물 시장에 참여하는 외국인은 미국 장기채권 시장 변화에 민감하게 반응하는 것으로 추론할 수 있다.

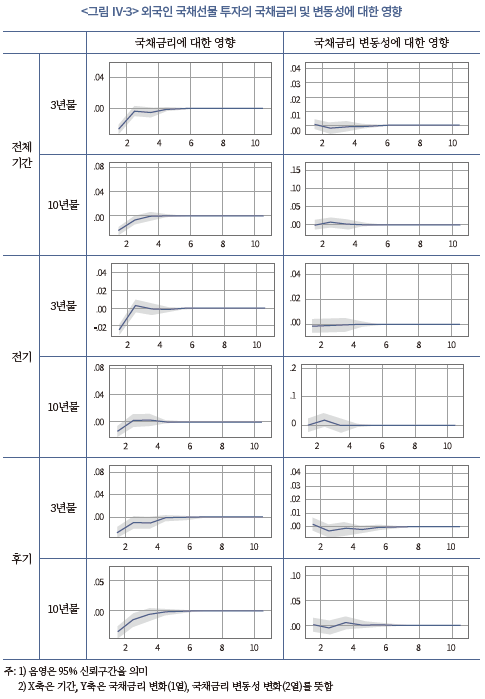

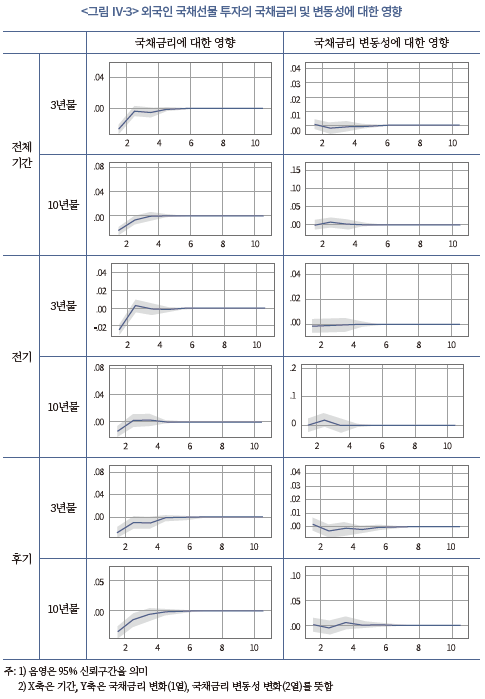

한편, <그림 Ⅳ-3>에 제시된 바와 같이 충격반응함수를 통해 3년물과 10년물 국채선물 시장에서 외국인의 영향력을 살펴본 결과, 외국인의 국채선물 매입이 통계적으로 유의하게 국채금리를 하락시키는 것으로 나타났다. 다만, 3년물의 경우 외국인의 매매 행태에 따른 충격반응함수의 반응 크기가 작고, 반응의 듀레이션이 10년물에 비해 짧은 것을 관찰할 수 있다. 이러한 결과는 최근 10년물 국채선물 시장에서 외국인 매매 비중이 큰 폭으로 증가한 가운데, 미국 장기금리의 하락(상승) 예상시 외국인은 유동성이 풍부한 한국 10년물 국채선물 시장에서 추세적으로 순매수(순매도)를 수행한 것으로 볼 수 있다. 또한, <그림 Ⅳ-3> 및 <그림 Ⅳ-4>를 살펴보면 3년물 및 10년물 국채선물 시장 모두에서 외국인 순매수는 국채금리 변동성, 원달러 환율, 스왑레이트 등에는 유의미한 영향을 미치지 못하였다. 한편 충격반응함수를 통해 미국 국채금리 변화, 원달러 환율 변화, 3개월물 스왑레이트 변화가 외국인 현‧선물 순매수에 미치는 영향을 살펴본 결과, 미국 국채금리 및 원달러 환율 변화는 외국인의 국채 현‧선물 매매에 유의하게 영향을 미치지 못하는 것으로 나타났다. 반면 3개월물 스왑레이트가 하락하는 경우 외국인 국채현물 순매수가 유의하게 증가하는 것으로 확인되었다(<그림 부록-1> 참조). 이러한 결과는 원화 가치의 상승을 기대하여 미래 원달러 환율이 하락할 것으로 전망하는 경우, 외국인이 추세적으로 국채현물을 매수한 것으로 추론할 수 있다.

전체 샘플기간을 2017년 7월 이전과 이후로 나누어 외국인 순매수의 영향력을 살펴본 결과, 최근 시점에서 국채선물 시장에서의 외국인 순매수가 국채금리 하락에 보다 유의하게 영향을 미치는 것으로 관찰되었다. 특히 10년물 국채선물 시장에서 외국인의 영향력은 1% 수준에서 유의한 것으로 관찰되는 등 외국인의 순매수 영향력이 큰 것으로 확인되었다. 한편, 전기와 후기 모두에서 외국인의 국채 순매수는 원달러 환율 및 스왑레이트 등에 유의미한 영향을 미치지 못한 것으로 관찰되었다.

다음으로 국채선물 시장에서 일별 투자자별 매매행태 자료를 기초로, 투자자별 국채금리 예측력과 국채금리 변동성에 대한 예측력을 살펴보았다. 종속변수는 3년과 10년 국채 수익률 변화로 두고, 주요 독립변수는 3년물과 10년물 국채선물 시장에서 외국인 순매수 증감, 기관 순매수 증감, 개인 순매수 증감, 국채현물 시장에서 외국인 순매수 증감 데이터를 사용하여 회귀분석을 수행하였다. 그 외 독립변수로는 미국 10년 국채금리 변화, 원달러 환율 변화, VKOSPI 변화 등을 사용했다.5)

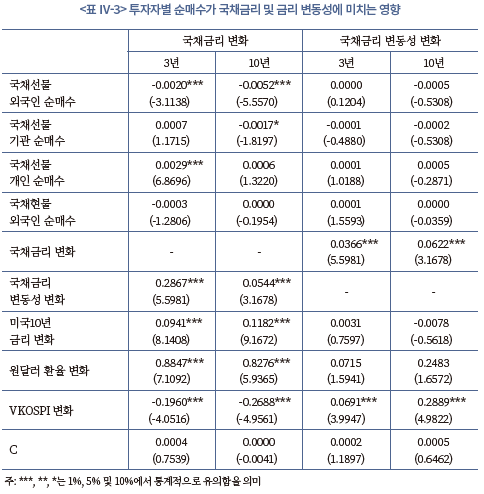

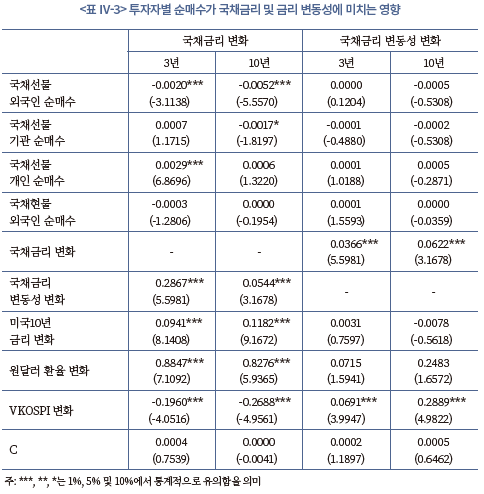

일별 데이터를 활용하여 국채선물 시장에서 투자자별 영향력을 살펴본 결과는 <표 Ⅳ-3>에 정리되어 있다. 분석 결과 국채선물 시장에서 외국인 순매수가 증가할수록 국채금리가 통계적으로 유의하게 하락하는 것으로 관찰되었다. 국채선물 시장에서 기관투자자와 개인의 매매 행태는 국채금리 하락에 유의한 영향을 미치지 못하였으며, 3년물 국채선물의 경우 개인의 순매수가 증가할수록 오히려 국채금리는 유의하게 상승하는 것으로 관찰되었다. 한편 국채현물 시장에서 외국인 매매 행태는 국채금리 변화에 유의한 영향을 미치지 못하였다. 국내 투자자별 매매 행태 외에도 미국 10년 국채금리가 하락할수록, 원달러 환율이 하락할수록, 국내 VKOSPI가 상승할수록 한국 국채금리는 통계적으로 유의하게 하락하는 것으로 확인되었다. 국채선물과 국채현물 시장에서 투자자별 매매 행태는 국채금리 변동성에 유의미한 영향을 미치지 못하였다. 대신, 국채금리가 상승할수록 국채금리 변동성이 유의하게 상승했으며, VKOSPI가 상승할수록 국채금리 변동성이 커지는 것으로 나타났다. 즉 주가지수 시장에서 변동성이 확대되는 시기에는 국채시장의 변동성 역시 확대되는 경향이 높다.

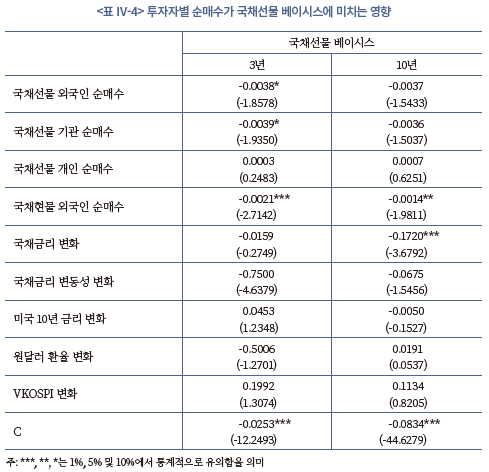

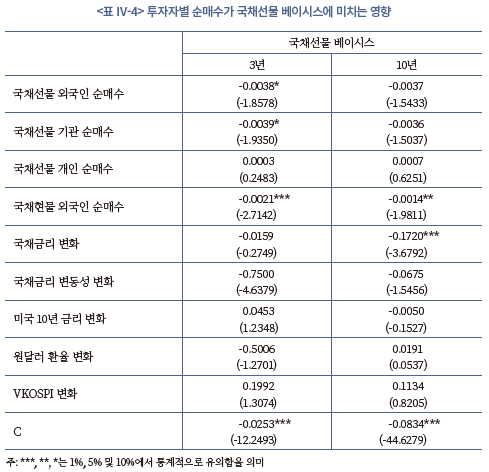

한편, <표 Ⅳ-4>에 나타난 바와 같이 한국 국채선물 시장에서는 선물 가격이 현물 가격대비 저평가되는 현상이 관찰되었다. 국채선물 저평가의 원인을 살펴본 결과, 국채선물 시장에서 투자자별 매매행태는 이론 베이시스에 유의미한 영향을 미치지 못하였다. 대신, 국채현물 시장에서 외국인이 순매수할수록 이론 베이시스가 하락하는 것으로 관찰되었다. 즉, 국채현물 시장에 참여하는 외국인 중에서 상당수는 차익거래를 수행하는 것으로 추론할 수 있다. 한편 국내외 시장금리, 원달러 환율, VKOSPI 등 주요 독립변수들이 국채선물 시장에서 이론 베이시스의 저평가 현상을 설명하지 못하는 것으로 확인됨에 따라 한국 국채선물 시장의 저평가 현상은 다소 이례적인 것으로 말할 수 있다.

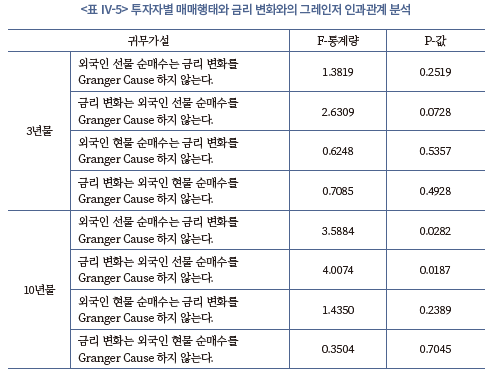

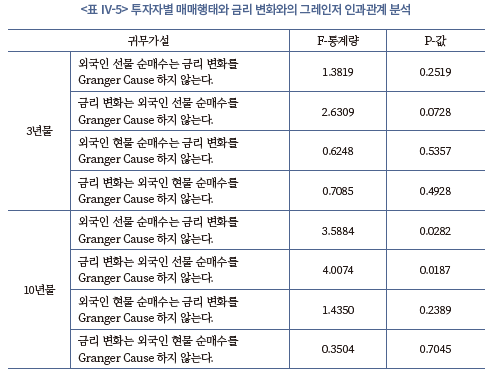

그레인저 인과관계 분석을 통해 국채 현‧선물 시장에서의 투자자별 매매 행태와 국채금리 변화와의 인과관계를 분석한 결과는 <표 Ⅳ-5>에 정리되어 있다. 분석 결과 3년물 국채선물 시장에서 외국인 순매매는 국채금리 변화와 상호 인과관계가 있는 것으로 관찰되었다. 10년물 국채선물 시장에서 외국인 순매매가 국채금리 변화를 설명하는 원인 변수로 말하기 어렵지만, 국채금리 변화는 외국인 순매매를 설명하는 유의미한 원인 변수로 말할 수 있다. 한편, 국채현물 시장에서 외국인 순매매는 국채금리 변화와 상호 인과관계가 존재하지 않는 것으로 확인되었다. 즉, 국채현물 시장과 달리, 국채선물 시장에서의 외국인 매매 행태는 국채금리 변화를 설명하는데 보다 유의미한 정보를 가지고 있는 것으로 말할 수 있다.

3. 국채선물시장의 만기일 효과 분석

가. 문헌연구

국채선물 시장에서 웩더독(wag-the-dog)으로 불리는 만기일 현상에 관한 연구는 많지 않다. Edwards(1988), Bhattachara(1987)는 미국 국채선물 및 옵션 시장을 대상으로 만기일 현상을 분석한 결과, 만기일에 거래량이 증가하고 가격 변동성이 커지는 현상이 관찰됨을 제시했다. Stoll & Whaley(1987)는 미국 S&P500 선물 시장을 대상으로 만기일 효과를 분석한 결과, 주가지수 선물 만기일에 현‧선물 가격 변동성이 크고, 거래량이 유의하게 증가하며 만기일 다음날에 가격회귀 현상이 유의하게 관찰됨을 제시하였다.

국내에서는 국채선물 시장으로 만기일 효과를 분석한 연구는 많지 않으며, 주로 주가지수 선물‧옵션 시장을 대상으로 만기일 효과에 대한 연구가 수행되었다. 최종범‧류혁선(2006)은 1997년 7월부터 2004년 7월까지 KOSPI200 선물‧옵션을 대상으로 만기일 효과를 분석하였는데, 선물‧옵션 동시 만기일에 파생상품 거래량이 유의하게 증가하며, 가격 변동성 또한 유의하게 증가함을 보였다. 남길남‧이효섭(2012)은 한국 주가지수 선물‧옵션 시장을 대상으로 만기일 효과를 분석하였는데 한국 옵션시장 만기일에는 거래량이 증가하고, 가격 변동성이 커지며, 만기일 전후 가격회귀 현상이 유의하게 관찰되는 것을 확인하였다. 또한 남길남‧이효섭(2012)은 주요국 주가지수 선물‧옵션 시장에서도 시장 개설 초기에는 만기일 효과가 관찰되었으나 이후 점차 완화된 반면, KOSPI200 옵션 시장에서는 만기일 효과가 시장 개설 초기 이후부터 지속적으로 관찰되는 문제를 지적하였다. 이에, 주요국 파생상품시장에서 최종결제가격 제도 등의 변경을 통해 만기일 효과를 완화했음을 근거로 한국 주가지수 파생상품시장에서도 최종결제가격 제도를 변경하는 방안을 제안하였다.

이상을 종합하면 국내외 주가지수 파생상품 시장에서 만기일에 거래량 및 가격 변동성 증가, 만기일 직후의 가격회귀 현상 등이 관찰되는 등 파생상품시장에서 만기일 효과가 관찰되었다. 이에, 상당수 국가에서는 주가지수 파생상품의 최종결제가격 제도를 개선함으로써 만기일 효과를 줄이고자 하였다. 한편, 국채선물 시장을 대상으로 만기일 효과에 대한 심도 있는 분석은 거의 수행되지 않았다.

나. 연구방법론

본 절에서는 Stoll & Whaley(1987) 및 남길남‧이효섭(2012)에서 사용한 방법론을 기초로 하여 한국 국채선물 시장에서 만기일 효과가 존재하는지 여부를 살펴보고자 한다. 우선 국채선물 만기일인 매 분기 결제월(3월, 6월, 9월, 12월)의 세 번째 화요일에 국채선물 시장의 수익률 및 가격 변동폭이 유의하게 증가하는지 여부를 진단하였다. 2011년 7월 1일부터 2023년 6월 30일까지 일간 국채선물 가격 데이터를 기초로, 만기일과 비만기일에 일별 국채 수익률 및 국채 수익률의 변동성이 유의하게 차이나는지 여부를 t-검정을 통해 살펴보았다. 이때 국채 수익률의 가격 변동성은 국채선물 만기일에 선물의 고가와 저가의 변동폭을 계산한 뒤, 비만기일의 고가와 저가의 변동폭을 비교하는 방법으로 가격 변동폭의 증가 여부를 진단하였다. 다음으로 국채선물 만기일의 국채선물 거래량이 비만기일의 거래량 대비 유의하게 증가하는지 여부를 분석하였다. 국채선물 만기일에는 연결선물 상품이 오전 9시에서 11시 30분까지 거래가 수행되기 때문에, 만기일에 발표되는 연결선물 상품의 거래량에 보정계수6)를 곱하여 비만기일의 선물 거래량과 비교하였다.

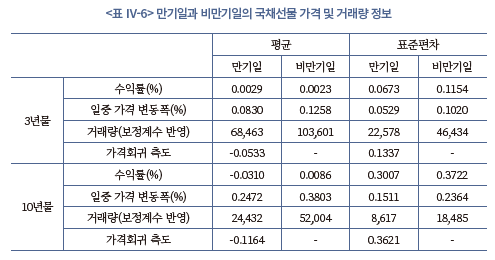

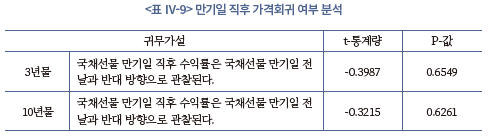

마지막으로 국채선물 만기일 직후 국채가격 변화율이 만기일의 국채가격 변화율과 유의한 수준에서 가격회귀 현상이 관찰되는지를 살펴보았다. Stoll & Whaley(1987) 및 남길남‧이효섭(2012)에서 사용한 만기일 가격회귀 측도(REV)를 아래처럼 정의하고, 국채선물 만기일과 만기일 직후의 가격회귀 정도를 측정하였다. 만약 국채선물 만기일에 국채가격이 1% 하락했다가(RET1), 국채선물 만기일 직후 국채가격이 1% 상승했으면(RET2) 가격회귀 측도(REV)는 2% 값을 가진다. 또한 국채선물 만기일에 국채가격이 1% 하락했다가, 국채선물 만기일 직후 국채가격이 0.5% 하락했으면 가격 반전이 일어나지 않았기 때문에, 가격회귀 측도(REV)는 –0.5% 값을 가진다. 전체 분석기간에서 가격회귀 측도의 평균값이 0과 유의하게 차이가 나고 양(+)의 값을 가지면, 만기일에 가격회귀 현상이 존재하는 것으로 말할 수 있다. 이와 같은 분석 방법론에서 사용한 만기일과 비만기일의 국채선물 가격 및 거래량에 관한 정보는 아래 표와 같다.

다. 실증분석

1) 수익률 및 가격 변동성 증가 여부

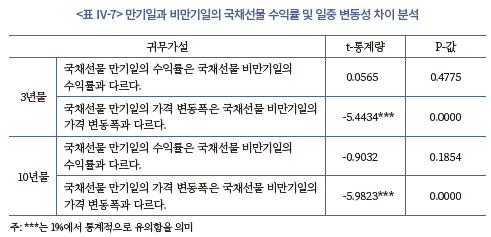

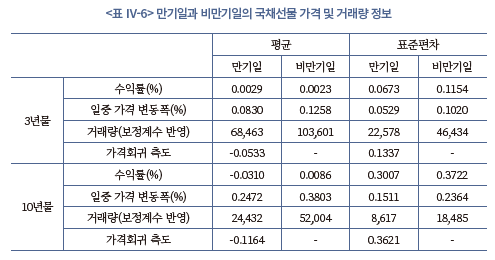

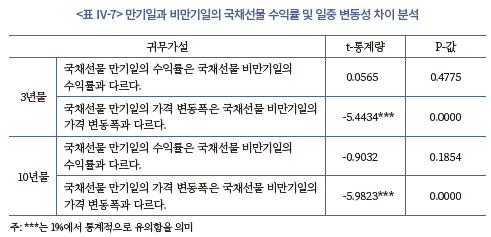

2011년 7월 1일부터 2023년 6월 30일까지 국채선물 만기일은 총 48거래일이 존재하며, 국채선물 비만기일은 2,910 거래일이 존재한다. <표 Ⅳ-6>에서 볼 수 있듯이, 만기일에 3년물, 10년물 국채선물 수익률은 각각 0.0029%, -0.0310%로 통계적으로 유의한 수준에서 0과 다르다고 말할 수 없다. 마찬가지로 비만기일에도 3년물과 10년물의 국채선물 수익률은 0과 다르지 않다. 이분산을 가정한 두 집단간 평균값의 차이 여부를 t-검정 방법을 통해 분석한 결과, 만기일과 비만기일의 국채선물 수익률은 다르지 않았다. 즉 3년물과 10년물 국채선물 모두 만기일에 유의미한 가격 상승 또는 하락이 있다고 말하기 어렵다.

동일한 기간 동안 만기일과 비만기일에 국채선물의 일중 가격 변동폭이 유의하게 차이가 나는지를 살펴보았다. 3년물 국채선물의 경우 만기일의 일중 가격 변동폭은 0.0830%로 비만기일의 가격 변동폭(0.1258%)에 비교하여 통계적으로 유의하게 낮은 것으로 관찰되었다. 마찬가지로 10년물 국채선물에 있어서도 만기일에 일중 가격 변동폭(0.2472%)은 비만기일의 일중 가격 변동폭(0.3803%)과 비교하여 통계적으로 유의하게 낮았다. 즉, KOSPI200 선물‧옵션 시장과 달리 국채선물 시장에서는 만기일에 수익률이 급등하거나 급락하는 현상이 관찰되지 않으며, 만기일에 가격 변동폭이 비만기일에 비하여 유의하게 낮은 것으로 확인되었다. 국채선물 만기일의 일중 가격 변동폭이 오히려 낮은 것으로 관찰된 데에는 국채선물의 최종결제가격은 최종거래일의 평균가격 방식을 사용하기 때문인 것으로 추론할 수 있다.7)

2) 거래량 증가 여부

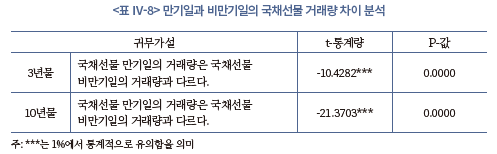

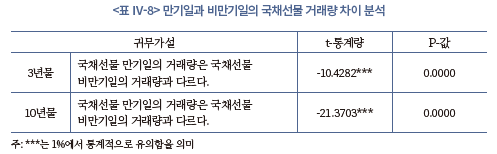

2011년 7월 1일부터 2023년 6월 30일까지 국채선물 만기일과 국채선물 비만기일에 거래량이 유의하게 차이가 나는지를 분석하였다. 만기일 거래시간을 비만기일 거래시간과 같도록 보정하고 이분산을 가정한 두 집단간 평균값의 차이 여부를 t-검정 방법을 통해 분석한 결과, 만기일의 국채선물 거래량은 1% 유의수준에서 비만기일의 국채선물 거래량보다 작은 것으로 관찰되었다. <표 Ⅳ-6>에서 볼 수 있듯이, 3년물과 10년물 국채선물 만기일의 보정 거래량은 각각 68,463 계약과 24,432 계약으로 비만기일의 거래량 대비 각각 66.1%와 46.9%에 불과하다. 이분산을 가정한 t-검정을 통해 두 집단간 차이 여부를 분석한 결과, 1% 유의수준에서 만기일의 국채선물 거래량이 비만기일의 국채선물 거래량보다 작은 것으로 관찰되었다. 이는 KOSPI200 선물‧옵션 만기일에 거래량이 유의하게 증가하는 현상과 정반대의 현상이 관찰된 것으로, 한국 국채선물 시장에서는 거래량 급증과 관련한 만기일 효과가 존재하지 않는 것으로 말할 수 있다. 앞선 수익률 및 일중 변동폭 분석과 유사하게, 국채선물 시장에서 최종결제가격 제도가 평균가격 방식을 사용하기 때문에 만기일에 거래량이 급증하는 현상이 관찰되지 않은 것으로 생각할 수 있다.

3) 만기일 직후 가격회귀 여부

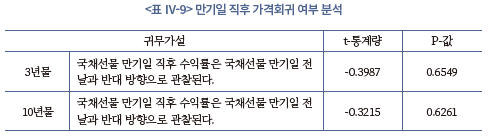

2011년 7월 1일부터 2023년 6월 30일까지 48번의 국채선물 만기일에 대해서 만기일 직후 거래일에 수익률 반전 효과가 관찰되는지 여부를 분석하였다. Stoll & Whaley(1987), 남길남‧이효섭(2012)에 따르면 식(1)에서 정의한 가격회귀 측도(REV)가 0보다 유의하게 큰 양(+)의 값을 가지면, 국채선물 만기일에 수익률 왜곡 현상이 큰 것으로 보아 만기일 효과가 존재하는 것으로 말할 수 있다. 48번의 국채선물 만기일에 가격회귀 측도를 분석한 결과, 3년물 국채선물과 10년물 국채선물 모두 가격회귀 측도가 각각 –0.0533, -0.1164로 관찰되는 등 음(-)의 값을 가졌다. 또한 해당 가격회귀 측도가 0과 유의하게 차이가 나는지를 분석한 결과 10% 유의수준에서도 0과 다르다고 말할 수 없었다. 즉, KOSPI200 선물‧옵션 시장과 달리, 국채선물 시장에서는 만기일 직후 가격회귀 현상은 관찰되지 않았다. 이는 앞선 분석에서 국채선물 만기일에 수익률의 급변동 현상이 관찰되지 않았고, 일중 가격 변동폭 및 거래량의 경우 만기일에 오히려 감소하는 것으로 관찰되는 등 국채선물 최종결제 시점에 근접하여 이례적 현상이 관찰되지 않았기 때문으로 추론할 수 있다. 이상의 결과를 종합하면 한국 3년물과 10년물 국채선물 시장에서는 수익률 급변동 현상, 일중 변동폭 확대 현상, 거래량 급증 현상, 만기일 직후 가격회귀 현상 등 주요 만기일 효과가 관찰되지 않는 것으로 요약할 수 있다.

Ⅴ. 정책적 시사점

외국인이 우리나라 국채현물시장에서 차지하는 비중은 2006년 1.6%에 불과했으나 2023년 2분기에는 20% 수준까지 크게 확대되었으며 3년물 및 10년물 국채선물의 외국인 투자자 거래 비중은 2022년 기준 각각 44% 및 53%를 차지하고 있어 외국인 투자자들이 국채시장에 주요한 행위자로 자리매김하게 되었다. 특히 이러한 비중 확대는 글로벌 금융위기 이후 한동안 정체되었다가 코로나19 감염확산 이후 가파르게 상승하는 모습을 나타내고 있다. 이러한 상승세가 WGBI(World Government Bond Index) 등 선진국 채권지수 편입 기대감과 더불어 Ⅲ장의 분석을 감안하면 글로벌 유동성 확대 및 한국의 높은 국가신용등급을 고려할 때 신흥국 패널 모형에도 부합하는 것으로 나타났다. 또한 Ⅳ장의 분석에 따르면 현물시장에서 외국인의 매매 행태가 지금까지는 국채 수익률이나 변동성에는 영향을 주지 않는 것으로 판단된다. 다만, 최근의 외국인 비중의 가파른 증가세를 감안할때 현물시장에서 외국인의 영향력이 점차 확대되고 있을 것으로 추정가능한 만큼 외국인 매매동향에 대한 면밀한 모니터링이 필요할 것으로 보인다. 특히, 코로나19 감염확산 이후 외국인 비중 확대가 상당 부분 글로벌 요인의 개선에 기인한다는 Ⅱ장의 분석결과를 감안하면 미국의 양적긴축(quantitative tightening) 및 주요국 중앙은행의 고금리 장기화 등 국내 정책으로 통제할 수 없는 요인들로 인해 글로벌 유동성이 축소되고 위험선호가 약화되어 외국인 채권자금의 변동성이 급등락할 위험에 유의할 필요가 있다.

또한, 최근 들어 외국인 비중이 크게 확대된 선물시장에서는 외국인의 영향력이 통계적으로 유의한 것으로 나타난 만큼 향후 외국인 매매 동향을 유의하게 살펴볼 필요가 있다. 특히 외국인의 국채선물 순매도가 금리상승에 유의한 영향을 미치는 것으로 나타난 만큼 국채선물 시장에서 외국인 순매도가 지속되거나 외국인의 순매도가 일정 임계수준을 넘어서는 경우 채권시장 전반의 수익률 및 매매심리에 부정적 영향을 미치는 지를 관찰할 필요가 있다. 이와 관련해서 예상치 못한 주요국 중앙은행의 기준금리 인상이나 경기지표 호조의 영향으로 시장금리가 단기간 급격히 상승하는 경우 외국인은 국채선물 시장에서 대규모로 매도하고, 외국인의 국채선물 매도는 다시 시장금리의 상승을 초래하는 현상이 발생할 수 있다. 최근 개인투자자가 장기물 국채선물 참여를 늘리고 있고, 기관투자자의 경우 미결제약정 한도 규제 등을 받지 않기 때문에 시장금리 급등 시기에서 상당수 국채선물 투자자가 마진콜 요청을 받을 개연성이 존재한다. 따라서, 고금리 환경이 지속되며 국채선물 시장의 변동성이 확대되는 시기에는 위탁증거금률을 인상하거나 위탁증거금 현금예탁비율을 상향하는 등의 정책을 고려할 필요가 있다.8)

한편, 한국 국채선물시장이 양적으로 큰 폭의 성장세를 가져온 가운데, 외국인의 참여 증가로 만기일 효과에 대한 우려가 제기되었으나 실증분석 결과 유의미한 만기일 효과가 관찰되지는 않았다. 그럼에도 불구하고 국채선물시장에서의 외국인 순매매가 시장금리 변화에 유의한 영향을 주고 있는 만큼 국채선물 시장에서 외국인의 이상거래 행위 여부에 대한 체계적인 모니터링이 필요할 것이다. 특히 외국인이 국채현물 포지션을 구축한 이후 국채선물시장에서의 매매를 통해 이득을 수취하려는 행위가 일어나지 않도록 현‧선물 통합 이상거래 탐지시스템을 개선할 필요가 있으며, 미국, 독일, 호주 등 주요국 국채선물 시장에서 미결제약정 한도를 설정하는 것을 참고하여 외국인 국채선물의 미결제약정 포지션 한도의 적정성 여부 등도 중장기적으로 검토할 필요가 있다. 이와 함께 한국 국채선물 시장에서 외국인의 순매매 포지션이 분단위로 공개되는 가운데, 일부 고빈도 매매 투자자들은 외국인 매매 행태를 기초로 추종매매를 수행할 개연성이 있다. 국채선물 시장에서 외국인은 정보우위를 가진 것으로 알려져 있어 외국인 선물 포지션과 관련한 군집행위와 추종매매 개연성이 존재한다. 따라서 외국인 선물매매에 따른 쏠림현상을 완화하기 위해 분단위로 공개되는 투자자별 순매매 정보의 발표 주기를 늦추는 방안을 고려할 필요가 있다.

외국인의 국채시장 비중이 확대되는 가운데 유사시 투자자들의 군집행위 및 추종매매 가능성 등을 고려한다면 국채시장 안정을 위해 국내 기관투자자의 참여 유인을 제고시킬 필요가 있다. 특히 10년물 국채선물 시장에서 외국인 순매매가 국채 수익률 및 수익률의 변동성에 미치는 영향이 확대되고 있는 만큼 연기금, 공제회, 보험회사 등 장기 성향의 기관투자자 및 국채선물 시장조성자의 참여를 늘릴 수 있도록 인센티브 체계 개선을 검토할 필요가 있다. 반면 최근 개인투자용 국채 도입 등으로 국채시장에 대한 개인투자자의 접근성이 제도적으로 확대되고 있으나 국채선물시장에서 개인투자자의 참여 증가에 대해서는 주의가 필요할 것으로 판단된다. 분석 결과 개인의 국채선물 순매수는 국채가격의 하락(국채금리의 상승)을 설명하는 데 유용한 변수로 나타났으며 상당수 개인이 국채선물 포지션에서 손실을 기록하는 것은 다소 우려가 된다. 이에 따라 개인에 대한 투자자 교육을 강화하는 한편 초장기 국채선물시장에서 개인투자자 진입 규제의 적정성을 검토할 필요가 있다.

1) 2023년 6월말 기준 국내채권은 전체 국민연금자산의 32.3%를 차지하고 있으나 ‘2024~2028년 기금운용 중기자산배분(안)’에 따르면 해외채권(7.1%) 포함 전체 채권 비중을 30% 내외로 결정했다.

2) Eichengreen & Hausmann(1999) 및 Eichengreen et al.(2003)은 신흥국 경제가 자국통화로는 해외로부터 돈을 차입할 수가 없음을 강조한다. 결국 달러화와 같은 국제적으로 통용력 있는 외화로 빌려야 하는 구조적 한계

(‘원죄’)로 인해 자산과 부채간의 통화 불일치가 발생하는 만큼 대외 충격에 따른 거시경제 및 금융시장 불안이 불가피하다는 점을 지적하고 있다.

3) BIS 데이터에 포함된 국가 중 페루의 외국인 비중은 2021년 4분기 기준 49.5%로 주요국에 비해 매우 높은 수준인데 표본이 시작되는 2005년 4분기에도 이미 26.2%로 표본평균의 3배를 상회하였다.

4) 국채현물시장에서 외국인 순매수 정보는 만기별로 구별되지 않기 때문에, 국채현물시장에서 외국인이 장기물 국채를 순매수하는 것이 10년물 국채금리 하락에 영향을 미친 것으로 해석하기는 어렵다.

5) 본 회귀분석 식에서 종속변수와 독립변수 모두 단위근(unit root)을 제거하였다.

6) 보정계수는 만기일과 비만기일의 거래시간 배율 차이인 2.7을 사용했다.

7) 한국거래소에 상장된 3년물과 10년물 국채선물의 최종결제가격 산출시, 국채선물 최종거래일의 11시 30분 수익률과 최종거래일의 10시, 10시 30분, 11시의 수익률 중 최고치와 최저치를 제외한 수익률을 평균하여 산출한다.

8) 강규호‧서영경(2022) 참조

참고문헌

강규호‧서영경, 2022, 외국인 국채선물투자의 영향과 시사점, 『한국경제포럼』15(3), 27-52.

강현주‧이승호, 2012, 『글로벌 유동성과 국제자본이동과의 관계에 관한 연구』, 자본시장연구원 연구보고서 13-02.

김동순‧박종연, 2011, 외국인의 만기별 국내 채권투자 결정요인과 채권시장 영향, 『국제지역연구』15(1), 291-314.

김소영‧이윤석, 2017,『금융실효환율과 대외포지션 및 자본유출입의 관계 분석』, 금융연구원 연구보고서.

김수현, 2018,『한국 채권시장의 해외자본 유출입 결정요인』, 한국은행 경제연구 2018-44호.

국회예산정책처, 2022, 『2022~2031년 NABO 중기재정전망』.

남길남‧이효섭, 2012, 『주가지수파생상품 만기일 효과에 관한 연구』, 자본시장연구원 연구보고서 12-01.

박종연‧김동순, 2011,외국인의 만기별 국내 채권투자 결정요인과 채권시장 영향, 『국제지역연구』 15권(1), 291-314.

배영수‧한재준, 2022, 내외금리차가 외국인 투자자의 국내 채권 투자 결정에 미치는 영향, 한국경제의 분석 28(3), 171-216.

양양현‧이혜림, 2008,『차익거래 유인과 외은지점 및 외국인의 국내 채권투자에 관한 분석』, 한국은행 조사통계월보.

오승현‧한상범, 2008, 한국 유가증권시장의 투자자 유형별 거래행태 분석,『산업경제연구』21(1), 269-287.

우준명, 2017, 외국인 채권매매가 국내 채권시장 변동성에 미치는 영향, 『금융연구』31(4), 51-75.

원승연‧주상영, 2009,외국인의 채권 투자 결정요인과 영향에 대한 연구, 『경제학연구』 57(3), 31-65.

유복근, 2018, 글로벌 금융위기 전·후 외국인의 채권투자 결정요인 변화 분석: 한국의 사례, 『금융연구』, 32(3), 101-128.

윤경수‧김지현, 2012,『글로벌 유동성이 신흥국으로의 자본이동에 미치는 영향 및 시사점』, BOK 경제리뷰 No.2012-7.

윤영진‧박종욱, 2019, 내외금리차와 자본유출입: 이론 및 실증분석, 『경제학연구』 67(2), 71-111.

최종범‧류혁선, 2006, KOSPI200 선물 및 옵션의 만기일 효과, 『한국증권학회지』35, 69-101.

한덕희‧문규현, 2017, 국채 현‧선물시장에서의 장‧단기 가격발견 효율성 분석,『기업경영연구』24(2), 179-194.

홍정효, 2019, 3년 국채선물의 일중 시간별 헤지성과 및 가격발견 연구, 『기업경영연구』26(1), 47-59.

Ahmed, S., Zlate, A., 2014, Capital flows to emerging market economies: A brave new world? Journal of International Money and Finance 48, 221-245.

Alberola, E., Aitor, E., José, M.S., 2015, International reserves and gross capital flow dynamics, BIS working papers No.152.

Arslanalp S., Poghosyan T., 2016, Foreign investor flows and sovereign bond yields in advanced economies, Journal of Banking and Financial Economics 2, 45-67.

Beirne, J., Renzhi, N., Volz, U., 2021, Local currency bond markets, foreign investor participation, and capital flow volatility in emerging Asia, ADBI working paper No.1252.

Bhattachara, R.K., 1987, Option expirations and treasury bond futures prices, Journal of Futures Market 7(1), 49-64.

Bruno, V., Shin, H.S., 2013, Capital flows, cross-border banking and global liquidity, Review of Economic Studies 82(2), 535-564.

Burger, J.D., Warnock, F.E., Warnock, V.C., 2022, A natural level of capital flows, Journal of Monetary Economics 130, 1-16.

Burger J.D., Warnock F.E., 2007, Foreign participation in local currency bond markets, Review of Financial Economics 16(3), 291-304.

Choi J.H., Lim, H.S., Mercado, R.J., Park, C.Y., 2017, Price discovery and foreign participation in Korea’s government bond cash and futures market, Working paper.

Edwards, F.R., 1988, Futures trading and cash market volatility: Stock index and interest rate futures, Journal of Futures Market 8(4), 421-439.

Eichengreen, B., Ricardo, H., 1999, Exchange Rates and Financial Stability, Federal Reserve Bank of Kansas City, 319-367.

Eichengreen, B., Ricardo H., Ugo P., 2003, Currency mismatches, debt intolerance and original sin: Why they are not the same and why it matters, NBER working paper No.10036.

Fonay, B.I., 2022, The Effects of Foreign Investors' Holdings on the Local Currency Sovereign Bond Markets in Latin America, IDB Technical Note IDB-TN-2451.

Forbes, K., Warnock, F.E., 2012, Debt-and equity-led capital flow episodes, NBER working paper 18329.

Fratzscher, M., 2012, Capital flows, push versus pull factors the global financial crisis, Journal of International Economics 88, 341-356.

Ghosh, A.R., Qureshi, M.S., Kim, J.I., Zalduendo, J., 2014, Surges, Journal of International Economics 92, No.2.

Hoechle, D., 2007, Robust standard errors for panel regressions with cross-sectional dependence, Stata Journal 7 (3), 281-312.

Jang, J.Y., Atukeren, E., 2019, Sustainable Local Currency Debt: An Analysis of Foreigners’ Korea Treasury Bonds Investments Using a LA-VARX Model, Sustainability 11, 3603.

Onen, M., Shin, H.S., Peter, G., 2023, Overcoming original sin: Insights from a new dataset, BIS working papers No.1075.

Richards, A., 2005, Big fish in small ponds: The trading behavior and price impact of foreign investors in asian emerging equity markets, Journal of Financial and Quantitative Analysis 40(1), 1-27.

Sienaert, A., 2012, Foreign investment in local currency bonds considerations for emerging market public debt managers, World Bank Policy Research working paper 6284.

Stoll, H.R., Whaley, R.E., 1987, Program trading and expiration-day effects, Financial Analysts Journal 47, 55-72.

<부록>

한국의 양호한 재정건전성, 신용등급 상승 및 글로벌 유동성 증가의 영향으로 외국인의 국채투자 비중이 코로나19 감염확산 기간을 거치면서 크게 늘어났다. 2006년 외국인의 한국 국채보유 금액은 4.2조원으로 전체 국채 상장 잔액의 1.6%에 불과했으나 2022년말 193조원(18.9%)을 기록하는 등 비약적으로 상승하였다. 한편 국회예산정책처(2022)에 따르면 2% 중반 수준의 재정적자가 상당 기간 지속될 것으로 예측됨에 따라 국채 공급이 늘어날 것으로 예상되는 한편 국민연금 등 국내 연기금들의 해외투자가 확대되면서 기관투자자들의 국채수요가 공급에 걸맞게 늘어나는 데 일정 부분 한계가 존재한다. 이에 따라 국채시장에서 외국인 투자자가 갖는 영향력이 더욱 확대될 것으로 보이는 만큼 외국인의 국채투자에 대한 행태분석은 안정적인 재정운영과 금융안정 차원에서 중요성이 더욱 커질 것으로 판단된다. 다양한 국적 및 투자행태를 갖는 외국인을 단일한 유형으로 파악하기는 곤란하나 대외 경제의 불확실성이 확대되거나 예상치 못한 금융위기 또는 지정학적 위험의 발생으로 외국인 투자자들이 대규모로 국채를 매도하고, 타 외국인들이 이를 추종하여 연쇄적으로 국채를 매도하는 경우 국채금리가 급등하고 원화가치가 하락하는 등 금융시장의 변동성이 크게 확대될 수 있다. 또한, 2020년 코로나19 감염확산 이후 국채발행 잔액이 크게 늘어나는 가운데 외국인의 보유 비중 또한 최근 들어 빠르게 늘고 있으나 향후 재정수요에 비례하여 외국인의 국채투자가 늘기 어려울 경우 국채금리가 구조적으로 상승하면서 재정부담이 추가적으로 커지는 악순환이 발생할 수 있다.

이러한 점을 감안하여 본 고에서는 국채시장에서 외국인 비중 결정요인과 함께 외국인의 투자행태가 국내 시장에 미치는 영향력을 분석한다. 한국을 포함한 신흥국의 자본흐름에 대한 선행연구들은 널리 존재하나 신흥국들이 자국통화로 외채를 조달하기 어려웠던 만큼 신흥국의 현지통화(local currency) 국채투자에 국한한 연구들은 상대적으로 매우 부족한 상황이다. 또한, 외국인의 국채투자에 대한 국내 연구들은 한국은행을 비롯한 국내 연구기관들을 중심으로 여러 차례 분석되었으나, 국내 데이터에 국한하여 분석하다 보니 글로벌 포트폴리오 관점에서 신흥국 투자와 정합된 분석이 불가능할 뿐만 아니라 외국인의 국내 국채투자가 확대된 것이 대체로 글로벌 금융위기 이후인만큼 제한된 표본기간으로부터 발생하는 관측치의 제약 문제도 존재한다. 이러한 가운데 본 고에서는 신흥국의 현지통화 국채 패널분석을 통해 외국인의 국내 채권투자 비중이 기존 문헌에서 중시되는 결정요인들에 비추어 적정한 수준인지를 판단해 본다.

마지막으로, 외국인의 투자행태를 금융안정 측면에서 파악하기 위해 국채현물시장과 선물시장으로 구분하여 외국인 매매가 국채 수익률 및 수익률의 변동성에 미치는 영향을 분석한다. 특히, 앞서 언급한 국채현물시장내 보유비중에 대한 분석과 별도로 최근 선물시장을 중심으로 외국인의 매매 비중이 가파르게 증가함에 따라 외국인의 선물시장에서의 매매 행태가 국채선물의 가격 발견기능에 미치는 영향을 살펴본다. 또한, 파생상품시장에서 만기일에 가격 및 거래량이 급등하는 이른바 만기일 효과가 국채선물 시장에서도 발생하는지 여부에 대해 검증해 본다.

본 연구의 구성은 다음과 같다. 먼저 제Ⅱ장에서 국내 국채시장의 외국인 투자 현황을 제시하고 제Ⅲ장에서는 외국인의 현지통화 국채투자 동인을 분석한다. 제Ⅳ장에서 외국인의 투자행태가 국채시장에 미치는 영향을 살펴보고 제Ⅴ장에서는 분석내용을 기반으로 안정적 국채시장 운영 및 금융안정을 위한 정책적 시사점을 간략하게 제시한다.

Ⅱ. 국내 채권시장의 외국인 투자현황

1. 외국인 국채보유 현황

외국인 투자자의 국채보유 규모는 양호한 대외 건전성 및 글로벌 유동성 확대 등에 힘입어 꾸준한 증가세를 보이고 있다. 2006년말 4.2조원에 불과했던 외국인 투자자의 국채보유 규모는 2022년말 193조원을 기록하는 등 비약적으로 증가하였고, 외국인 투자자의 국채보유 비중(국고채 발행잔액 대비) 또한 2022년말 18.9%로 2006년말(1.6%) 대비 약 11.8배 증가했다. 글로벌 금융위기 이후 글로벌 유동성이 풍부해진 가운데, 외환보유액 증가, 건전한 재정 운용 등 양호한 대외 건전성이 외국인 투자자의 국채투자에 긍정적인 영향을 미친 것으로 판단되며 자세한 분석은 Ⅲ장에서 다루기로 한다.

국채보유 비중을 투자자별로 살펴보면, 2022년말 기준 보험회사의 국채보유 비중이 38.3%로 주요 투자자 중 가장 높은 비중을 차지하였으며, 다음으로 외국인(21.0%), 연기금(16.9%), 은행(11.2%), 금융투자회사(6.7%)의 순서이다. 2012년 대비 외국인(16.5%→21%), 은행(7.6%→11.2%)의 국채보유 비중이 빠르게 증가하였으며, 연기금의 국채보유 비중은 다소 감소(26.5%→16.9%)한 것으로 나타났다. 국민연금기금의 기금운용계획에 따르면 국내 채권투자 비중1)이 감소될 것으로 예정되어 있어, 향후 외국인 투자자의 국채보유 비중은 더욱 증가할 것으로 전망된다.

국채현물 시장에서 투자자별 거래를 살펴보면 국고채전문딜러(Primary Dealer: PD) 제도의 영향으로 증권회사가 시장 조성자 기능을 수행하기 때문에 증권사 간 직매 거래 비중이 대부분(약 70%)을 차지한다. 증권사 간 직매를 제외하면 은행, 자산운용사 순으로 거래 비중이 높으며, 외국인 투자자의 국채 거래 비중이 꾸준히 증가해 2022년 기준 세 번째로 높은 비중을 차지하고 있다. 2022년 국채현물시장에서 외국인 투자자의 거래 규모는 140조원으로 전체 거래대금의 약 7%에 불과하나 2012년(49조원, 1.4%)과 비교하면 거래 비중은 약 5배 증가하였다.

본 장에서는 외국인 투자자의 신흥국 현지통화 국채투자 동인을 분석한다. 글로벌 유동성 및 위험선호 등 글로벌 공통요인과 함께 개별국의 거시경제적 요인 및 채권시장 관련 변수들을 포함한 고정효과 패널분석을 실시한다. 한국 국채시장에서 외국인이 차지하는 비중과 실증모형을 통한 추정치와의 비교를 통해 외국인의 과유입 여부를 판단한다.

1. 선행연구 및 본 연구의 기여점

본 장의 연구는 크게 두 가지 연구결과와 연결된다. 첫째는 글로벌 포트폴리오 투자유인에 관한 연구들이다. 이와 관련하여 대내외 금리차 등 개별국의 거시경제적 요인을 강조하는 연구들이 존재한다. Ahmed & Zlate(2014)은 대내외 금리차가 외국인 채권 포트폴리오 유입에 유의한 변수임을 보였다. 또한, Beirne et al.(2021)은 외국인의 국채시장 비중 확대가 자본유출입의 변동성을 확대하는 요인이라고 보고하였다.

한편, VIX(Volatility Index) 등 글로벌 위험요인이나 글로벌 유동성의 변화가 자본유출입의 주요 요인임을 지적하는 연구들도 존재한다. Fratzscher(2012)는 주간 단위의 펀드자료를 분석한 결과 VIX가 높을 때 유의하게 자본유출이 관찰되며, 특히 주요 금융위기 상황에서는 VIX가 급격히 증가할 때 선진국에서는 주식 순유입이 관찰되는 반면 신흥국에서는 채권 순유출이 관찰됨을 보인다. Ghosh et al.(2014)은 55개국 신흥국을 대상으로 자본의 급격한 순유입 요인을 분석한 결과 미국의 실질금리가 올라갈수록, S&P 500의 주가 변동성이 증가할수록 신흥국에서 자본유출이 늘어난다는 결과를 제시하고 있다. 한편 Bruno & Shin(2013)은 국가간 은행차입자금의 결정요인에 대한 실증분석에서 VIX가 유의한 결정요인임을 보고하고 있다. Forbes & Warnock(2012) 및 Alberola et al.(2015)은 글로벌 외환보유액 및 주요국 통화량을 글로벌 유동성의 대용변수로 사용하여 글로벌 요인이 중요하며 성장률을 제외한 개별국 요인은 대체로 유의하지 않음을 밝히고 있다. 국내 연구로는 윤경수·김지현(2012)이 글로벌 유동성을 BIS의 ‘선진국 국내신용 및 국가간 대출’로 설정하고 유동성 과잉상태 여부가 신흥국 자본유입에 유의미하다는 점을 밝히고 있으며 강현주·이승호(2012)는 글로벌 유동성을 통화량과 같은 양적 지표와 금리나 주가 등 가격 지표로 구분하였을 때 포트폴리오 자금은 가격 지표에, 은행대출은 양적 지표에 유의하게 반응한다는 점을 실증적으로 제시하였다.

둘째로는 직접적으로 외국인의 한국 채권투자 동인과 관련된 문헌들이다. 우선 글로벌 자본이동에서와 마찬가지로 대내외 금리차 및 차익거래 유인이 외국인의 국내채권 투자에 유의하게 영향을 미친다는 연구가 존재한다. 김수현(2018)은 외국인 채권의 투자주체를 민간자본과 공공자본으로 구분하여 대내외 금리차가 미치는 영향을 분석하였다. 분석 결과 공공자본은 대내외 금리차에 영향을 받지 않는 반면 민간 자본은 대내외 금리차에 유의하게 영향을 받는 것으로 나타났다. 윤영진‧박종욱(2019)은 기간을 구분하여 2010년 이전에는 대내외 금리차가 외국인 채권 순투자에 유의한 영향을 주지 못했으나 2010년 이후에는 유의한 것으로 나타났다고 보고하였다. 한편, 내외 금리차에 스왑 스프레드를 고려한 차익거래 유인이 확대될수록 외국인 채권 순매수가 증가한다는 연구도 존재한다. 양양현‧이혜림(2008) 및 유복근(2018) 등은 글로벌 금융위기 전후 시기에 차익거래 유인과 외국인 채권 순매수의 관계를 분석하였다. 박종연‧김동순(2011)은 차익거래 유인이 외국인 채권매매에 미치는 영향이 만기별로 상이할 수 있음을 보여준다. 즉, 단기채권은 차익거래 유인이 확대될수록 외국인 채권 순매수가 유의하게 증가한 반면 장기채권에는 차익거래 유인의 영향이 제한적인 것으로 나타났다.

대내외 금리차 및 차익거래 유인 외에도 국내외 위험요인이 외국인의 국내 채권 순매수에 영향을 미친다는 연구들도 존재한다. 원승연‧주상영(2009)은 글로벌 금융위기 직전 시기를 중심으로 분석한 결과 차익거래 유인뿐만 아니라 한국 국채의 CDS 프리미엄이 외국인 채권 순매수에 유의한 영향을 미쳤음을 제시한다. 김소영‧이윤석(2017)은 실효환율 변화율이 증가할 경우 외국인 채권 순매도가 증가할 수 있음을 제시하였다. 앞서 언급한 박종연‧김동순(2011)에서도 장기채권의 경우 CDS 프리미엄, 환율변동성 등 대내외 위험요인들이 차익거래 유인보다 영향을 미친 것으로 나타났다. Jang & Atukeren(2019)은 외국인 국내채권 투자 동인에 관한 연구에서 투자자의 기대수익, 한국의 국가신용등급 및 글로벌 위험선호 등이 주요 요인인 반면 한국의 지정학적 위험의 영향력은 단기적이라는 점을 보고하였다. 배영수‧한재준(2022)은 과거의 논의를 종합하여 차익거래 유인의 영향이 국제금융시장의 위험회피 수준에 따라 달라질 수 있으며 위험 프리미엄을 감안한 차익거래 유인의 채권투자자금 유출입에 설명력이 매우 높다는 점을 보고한다. 특히 양양현‧이혜림(2008) 및 유복근(2018) 등의 연구에서 지적된 글로벌 금융위기 이후 차익거래 유인의 설명력 약화가 국제금융시장의 위험선호 약화와 관련이 있음을 지적한다.

이와 같이 신흥국의 자본흐름을 분석한 선행연구들은 전통적인 신흥국 원죄론(original sin)2), 즉 해외통화 표시 외채 문제의 관점에서 채권투자에 대한 결정요인에 초점을 두거나 외국인 비중이 신흥국 자본흐름의 변동성에 미치는 영향에 주로 관심을 두었던 만큼 신흥국의 현지통화(local currency) 국채투자의 결정요인에 국한한 연구들은 상대적으로 매우 부족한 상황이다. Sienaert(2012), Fonay(2022), Onen et al.(2023) 등은 외국인 신흥국 자국통화표시 국채투자를 다루고 있으나 투자 결정요인 등에 관한 학술적 연구가 아닌 현황 조사에 머물러 있는 실정이다. 한편, 외국인의 국채투자에 대한 국내 연구들은 국내 데이터에 국한하여 분석하다 보니 글로벌 포트폴리오 관점에서 신흥국 투자와 정합된 분석이 불가능할 뿐만 아니라 외국인의 국내 국채투자가 확대된 것이 대체로 글로벌 금융위기 이후인만큼 제한된 표본기간으로부터 발생하는 관측치의 제약 문제도 존재한다. 이러한 가운데 본 장의 연구 목적은 신흥국의 자국통화표시 채권에 대한 투자 결정요인을 밝히는 한편 신흥국 패널분석을 통해 외국인의 국내채권 투자 비중이 기존 문헌에서 중시되는 결정요인들에 비추어 적정한 수준인지를 판단해 본다. 이를 통해 향후 외국인들의 채권투자 비중이 조정될 수 있는지 여부를 파악해 볼 수 있다.

2. 분석 모형 및 데이터

본 고에서는 외국인의 신흥국 현지통화 표시 국채시장의 비중에 대한 결정요인을 판단하기 위해 외국인 국채보유 비중

한편, 모형에 사용된 주요 설명변수들은 기존 문헌연구에서 사용된 변수를 중심으로 다음과 같은 변수들을 고려하였다. 즉, 개별국 고유의 요인(pull factor)에 해당하는

는 차익거래 유인, 명목실효환율, 채권시장 발전도 및 국가신용등급을 포함한다. 구체적으로 차익거래 유인은 무위험 이자율평형정리(covered interest parity)에 근거하여 국별 데이터 가용 여부에 따라 1년물 국채금리 또는 기준금리 간 금리차에 1년물 스왑레이트(swap rate)를 차감하여 다음과 같이 산출하였다.

는 차익거래 유인, 명목실효환율, 채권시장 발전도 및 국가신용등급을 포함한다. 구체적으로 차익거래 유인은 무위험 이자율평형정리(covered interest parity)에 근거하여 국별 데이터 가용 여부에 따라 1년물 국채금리 또는 기준금리 간 금리차에 1년물 스왑레이트(swap rate)를 차감하여 다음과 같이 산출하였다.

분석결과는 <표 Ⅲ-3>에 정리되어 있다. 우선, 글로벌 공통요인인 글로벌 유동성과 VIX 지수는 부호가 예상과 부합하며 통계적으로도 유의한 것으로 나타났다. 개별국 고유요인 중에서는 차익거래 유인, 채권시장 발전도 및 국가신용등급이 외국인 비중을 통계적으로 유의하게 높이는 것으로 나타났다. 한편, 차익거래 유인과 VIX간 교차항을 포함한 경우 통계적 유의성은 부족하나 부호는 음(-)으로 추정되었다. 추정된 결과에 따르면 차익거래유인의 외국인 국채보유 비중에 대한 영향은

한편, 이러한 모형의 추정결과를 한국의 외국인 국채보유 비중 추이와 비교해 본 결과는 <그림 Ⅲ-2>와 같다. 대체로 실제 데이터는 <표 Ⅲ-3>의 추정식(1)에 의한 추정치의 95% 신뢰구간 이내에 존재하는 것으로 나타났다. 과거 2010~2011년과 같이 신흥국으로의 자본유입이 확대되면서 국내의 외국인 국채보유 비중이 가파르게 상승함에 따라 모형 추정치와 괴리가 컸던 기간이 존재했었으나, 이후의 상황을 살펴보면 외국인 국채보유 비중이 하향 조정되면서 모형 추정치에 대체로 수렴하는 것으로 나타났다.

Ⅳ. 외국인 투자행태가 국채시장에 미치는 영향 분석

본 장에서는 국채현물시장과 선물시장에서 외국인의 매매 행태가 국채 수익률, 국채 수익률의 변동성에 미치는 영향을 살펴보고자 한다. 더불어 국채선물시장에서 외국인의 매매 비중이 빠르게 증가함에 따라 외국인의 선물시장 매매 행태가 국채선물의 가격 발견기능에 미치는 영향을 분석하고 국채선물 만기일에 가격 및 거래량 급변동 현상 등 주요 웩더독(wag-the-dog) 현상의 여부를 진단하고자 한다.

1. 국채현물시장에서 외국인 투자행태의 영향력 분석

가. 문헌연구

국채현물시장에서 투자자 유형별 매매 행태가 국채 수익률, 국채 수익률의 변동성, 주가지수, 환율 등에 미치는 영향을 살펴본 연구는 많지 않다. Arslanalp & Poghosyan(2016)은 선진국 국채시장을 대상으로 외국인의 채권 순매수 행태를 분석한 결과, 외국인 투자자가 해당 국가 국채발행 잔액 중 보유 비중을 1%p 증가시키면 해당 국가의 장기 국채 수익률이 0.06~0.1% 하락함을 보였다. Burger & Warnock(2007)은 40개 국가의 채권시장을 분석한 결과, 비거주자인 외국인 투자 비중이 낮을수록 해당 국가의 채권시장 변동성이 유의하게 높고 외부 충격에 의한 채권시장 영향력이 큰 것을 보였다. 채권 매매에 대한 연구는 아니지만 Richard(2005)는 한국, 대만, 필리핀, 인도네시아, 태국 등 아시아 주식시장을 대상으로 외국인의 매매 행태를 분석하였는데, 외국인 투자자는 미국 등 선진시장에서 주가가 상승했을 때 순매수하는 경향이 크며, 외국인 투자자의 순매수로 인해 해당 아시아 국가의 주가수익률도 양(+)의 영향을 받는 것을 보였다.

한국 국채현물시장에서 외국인의 순매매 행태가 국채 수익률, 국채 수익률의 변동성, 원달러 환율 등에 미치는 영향을 살펴본 연구는 많지 않다. 원승연‧주상영(2009)은 국채현물시장에서 외국인들의 투자 결정요인을 살펴보고 외국인의 국채 순매매 행태가 시장금리 변화에 미치는 영향을 분석하였다. 분석 결과에 따르면 차익거래 기회가 증가할수록 외국인의 순매매가 유의하게 증가하며 외국인의 순매매 증가에도 불구하고 차익거래 기회는 쉽게 사라지지 않는 것으로 나타났다. 또한 국채현물시장에서 외국인 순매수가 증가할수록 시장금리가 일정 부문 하락하였다. 김동순‧박종연(2011)은 한국 국채현물시장에서 만기별로 외국인 매매행태의 원인을 살펴보았으며, 외국인이 중장기 국채 순매수를 확대할수록 시장금리는 유의하게 하락 압력을 받는다고 보고하였다. 우준명(2017)은 한국 국채현물시장에서 외국인의 채권 순매수가 많을수록 채권시장 변동성에 유의한 영향을 미침을 보였으며 특히 고(高) 변동성 국면에서는 외국인의 국채 순매수가 채권시장 변동성을 더욱 확대시킨다는 결과를 제시하였다.

이상의 선행연구를 요약하면, 국채현물시장에서 외국인이 순매수를 증가시키면 장기 국채를 중심으로 채권 수익률이 유의하게 하락할 개연성이 크다고 예상할 수 있다. 반면 외국인의 국채 순매수 증가는 국채현물시장의 변동성을 다소 줄여주는 긍정적 기능을 수행할 수 있고, 경우에 따라 국채현물시장의 변동성을 확대시킬 개연성도 예상할 수 있다.

나. 연구방법론

국채현물시장에서 외국인 매매행태가 국채 수익률 및 국채 수익률의 변동성에 유의미한 영향을 주는지 살펴보기 위해 Richard(2005)의 식별전략을 바탕으로 하여 구조 VAR 모형을 설정하였다. 구체적으로, 미국 10년 국채금리의 하락(상승)으로 외국인 투자가가 한국 국채현물시장에서 순매수(순매도)를 수행하며, 외국인의 국채현물시장 순매수는 국채 수익률의 하락(상승)과 변동성 하락(하락)을 가져오고 원달러 환율 및 스왑레이트 등에 유의미한 영향을 미칠 수 있다는 모형을 설정하였다. 다만 한국이 소규모 개방경제임을 감안하여 외국인 채권 순매매 및 국내 시장변수가 미국 국채금리에 영향을 주지 못한다는 추가적인 제약을 부가하였다. VAR 모형에 사용된 시차는 BIC(Bayesian Information Criteria) 및 AIC(Akaike Information Criteria) 등에 근거하여 국내 시장변수에 따라 2~4를 사용하였다.

시계열 모형 추정을 위해 2011년 7월 1일부터 2023년 6월 30일까지 주간 데이터를 이용하였으며, 최근 외국인 투자자의 순매매 증가 현상에 따른 영향력을 살펴보기 위해 전체 샘플기간을 2011년 7월 1일부터 2017년 6월 30일까지 기간과 2017년 7월 1일부터 2023년 6월 30일 기간으로 구분하여 별도의 실증분석을 수행하였다. 외국인의 국채 순매매 정도는 100억원을 기준으로 로그 변환을 수행한 뒤 전주 대비 변화를 사용했다. 미국 및 한국 국채 수익률은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률의 변동성은 국채 수익률의 표준편차를 계산한 뒤 연단위로 환산하여 계산하였으며, 해당 역사적 변동성은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률 및 수익률의 변동성의 경우 3년물과 10년물로 구분하여 별도의 실증분석을 수행했다. 원달러 환율은 주간 단위 원달러 환율의 변화율을 사용했으며, 스왑레이트는 서울외환시장에서 고시되는 3개월물 bid-offer의 중간값을 기준으로 원달러 환율 기준 스왑레이트의 변화율을 사용했다. 이때 미국과 한국의 국고채 수익률, 원달러 환율은 한국은행 경제통계시스템에서 제공하는 자료를 사용했으며, 외국인 국채 순매수 규모 및 스왑레이트 등의 자료는 코스콤 체크단말기에서 제공하는 자료를 사용했다.

본 시계열 분석 모형에서 사용한 데이터를 살펴보면, 국채현물시장에서 외국인은 평균적으로 주간 500억원 이상 국채를 순매수한 것으로 관찰되었으며 2017년 7월 이후에는 주간 약 800억원 이상 순매수를 수행하는 등 외국인의 국채 순매수 강도가 커진 것을 확인할 수 있다. 한국 3년물 및 10년물 국채금리 변화는 0과 큰 차이가 나지 않았으나, 2017년 7월 이후에는 국채금리가 평균적으로 상승한 것으로 확인되었다. 또한 2017년 7월 이후 3년물 및 10년물 국채금리 변동성은 다소 증가한 것으로 관찰되었다.

전체 샘플기간에서 VAR 모형을 추정한 결과, 스왑레이트가 하락했을 때 국채현물시장에서 외국인 순매수가 유의하게 증가하며, 직전 시점의 외국인 순매수 증가는 현재 외국인 순매수 증가에 유의한 양(+)의 영향을 미치는 것으로 관찰되었다(<표 부록-1> 및 <표 부록-2> 참조). 즉 원화 가치의 상승을 기대하여 미래 원달러 환율이 하락할 것으로 예상하면, 국채현물시장에서 외국인 순매수가 증가하며 이러한 현상은 단기 추세를 가지는 것으로 말할 수 있다.

국채현물시장에서 외국인 투자행태가 국채금리 변화 및 국채 가격 변동성에 미치는 영향을 살펴본 결과, 국채현물시장에서 외국인의 매매 행태는 3년물 국채금리 및 3년물 국채 가격 변동성에 유의미한 영향을 미치지 못하는 것으로 확인되었다. 미국 10년물 국채금리의 변화가 한국 3년물 국채금리 변화에 유의미한 양(+)의 영향을 미쳤으며, 원달러 환율이 상승하면 3년물 국채금리 변동성이 상승하는 것으로 관찰되었다. 한편 국채현물시장에서 외국인 순매수의 증가는 10년물 국채금리의 하락에 10% 수준에서 유의미한 영향을 미쳤다.4) 국채현물시장에서 외국인 매매 행태는 원달러 환율 및 스왑레이트에는 유의미한 영향을 미치지 못했다.

한편, <그림 Ⅳ-1> 및 <그림 Ⅳ-2>에 제시된 바와 같이 충격 반응 함수를 통해 외국인 순매수 행태가 국채금리 및 국채 가격 변동성, 원달러 환율, 스왑레이트에 미치는 영향력을 살펴본 결과, 외국인 순매수 행태는 국내 채권시장 및 외환시장에 유의미한 영향력을 미치지 못하였다. 전체 샘플기간을 2017년 7월 1일 이전과 이후로 나누어 외국인 순매수의 영향력을 살펴본 결과, 최근 시점에서 외국인 순매수가 국채금리 하락에 미치는 영향력이 소폭 큰 것으로 예상할 수 있으나 통계적 유의성은 관찰되지 않았다. 또한 전기와 후기 모두에서 외국인의 국채 순매수는 원달러 환율 및 스왑레이트 등에 유의미한 영향을 미치지 못한 것으로 관찰되었다.

가. 문헌연구

한국 국채선물시장에서 외국인 투자자의 비중이 빠르게 증가했음에도 불구하고 외국인 투자자의 영향력에 관한 연구는 많지 않다. 강규호‧서영경(2022)은 2011년 1월부터 2022년 6월까지 일별 자료를 분석하여, 외국인의 국채선물 순매도가 3년 국채금리 인상에 통계적으로 유의한 양(+)의 영향을 미치는 것을 보여주었다. 특히 강규호‧서영경(2022)은 기준금리 인상 시기에 국채선물시장에서 외국인의 영향력이 크게 나타났음을 보였으며, 외국인의 국채선물 영향력을 줄이기 위해 국채선물에 대한 증거금률을 인상하고 최종결제가격 제도 등을 변경할 필요를 제시했다. Choi et al.(2017)은 2004년 1월부터 2013년 12월까지 일간 자료를 기반으로 구조적 VAR 모형을 설계하고, 이를 기초로 외국인의 국채선물 순매도가 국채금리 상승에 유의한 양(+)의 영향을 미치는 것을 보였으며, 국채선물시장과 달리 국채현물시장에서 외국인의 순매매는 국채금리 변화에 유의미한 영향을 미치지 못하는 점을 제시했다.

국채선물시장에서 현물시장의 가격발견 기능 및 선물시장의 웩더독(wag-the-dog) 현상에 관한 연구는 많지 않다. 대신, 주가지수 선물시장을 대상으로 현물시장에 대한 가격 발견기능 및 웩더독 현상에 관한 연구는 꾸준히 수행되어왔다. 오승현‧한상범(2008)은 2000년 1월부터 2005년 12월까지 주가지수 선물시장을 대상으로 일별 분석을 통해 개인, 기관, 외국인 등으로 구분하여 투자자 유형별 거래행태를 분석하고 이들 투자자별로 주가 예측력을 살펴보았는데, 한국 주가지수 선물시장에서 외국인은 평균적으로 높은 투자성과를 실현했으며 주가 예측력도 높은 것을 보였다. 반면 상당수 기관투자자의 주가 예측력은 크지 않음을 보였으며, 개인의 주가 예측력은 다소 낮은 것을 보여주었다. 홍정효(2019)는 2013년 1월부터 2018년 3월까지 일간 데이터 기반의 VECM 모형을 통해, 국채선물과 국채현물 간 상호 연계성이 존재하며 특히 3년물 국채선물의 가격발견 기능이 우수함을 보였다. 한덕희‧문규현(2017)은 국채선물과 국채현물 간 장기간에 걸친 인과관계는 관찰되지 않지만, 단기적인 인과관계는 존재함을 보임으로써 국채선물시장에서 가격발견 기능이 작동하고 있음을 제시하였다. 홍정효(2019), 한덕희‧문규현(2017)은 국채선물시장에서 투자자 유형별로 구분하여 투자자의 정보 예측력 및 가격발견 기능을 제시하지 못한 점에서 한계를 가진다.

이상의 선행연구를 요약하면, 국채선물시장에서 외국인의 순매수(순매도)는 국채금리 하락(상승)에 유의한 영향을 미칠 수 있는 것으로 예상할 수 있다. 특히 투자자 유형별로 국채선물시장의 영향력을 살펴보면, 외국인의 가격 예측력이 국내 기관투자자나 개인보다 상대적으로 우수한 것으로 추론할 수 있다. 더불어 국채선물시장에서 정보 우위에 있는 외국인 참여가 증가했다면 국채선물시장과 현물시장 간 상호 연계성 및 가격 발견기능이 향상할 것으로 예상할 수 있다.

나. 연구방법론

국채선물 시장에서 외국인 매매행태가 국채 수익률 및 국채 수익률의 변동성에 유의미한 영향을 주는지 살펴보기 위해 Richards(2005) 및 Choi et al. (2017)을 바탕으로 구조 VAR 모형을 설정하였다. 국채선물 시장에서 외국인투자자의 영향력을 분석하기 위해 국채현물 시장에서 외국인 순매매의 영향력을 살펴본 앞절의 VAR 모형과 유사한 모형을 사용했다. 다만 국채선물 시장의 경우 3년물과 10년물 시장으로 구분되어 외국인의 참여가 활발하기 때문에 3년물과 10년물 국채선물 시장으로 구분하여 별도의 VAR 모형을 적용하였다. 더불어 국채선물 시장에서 외국인, 기관, 개인의 순매매가 국채현물의 가격 및 가격 변동성에 유의미한 영향을 미치는지, 그리고 국채선물과 국채현물 간 차익거래 감소에 유의미한 영향을 미치는지 살펴보기 위해 일별 자료에 기반한 회귀분석 모형을 활용하여 국채선물 시장에서 외국인의 영향력을 살펴보았다.

시계열 모형 추정을 위해 2011년 7월 1일부터 2023년 6월 30일까지 주간 및 일간 데이터를 이용하였으며, 최근 외국인 투자자의 순매매 증가 현상에 따른 영향력을 살펴보기 위해 전체 샘플기간을 2011년 7월 1일부터 2017년 6월 30일까지 기간과 2017년 7월 1일부터 2023년 6월 30일 기간으로 구분하여 별도의 실증분석을 수행하였다. 국채선물 시장은 3년물과 10년물로 각각 구분하여 외국인의 국채선물 순매매 정도를 계산하였으며, 현물시장과 유사하게 100억원을 기준으로 로그 변환을 수행한 뒤 전주 대비 변화를 사용했다. 미국 및 한국 국채 수익률은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률의 변동성은 국채 수익률의 표준편차를 계산한 뒤 연단위로 환산하여 계산하였으며, 해당 역사적 변동성은 추세를 가지는 것으로 확인되어 1차 차분한 데이터를 사용했다. 한국 국채 수익률 및 수익률의 변동성의 경우 3년물과 10년물과 구분하여 별도의 실증분석을 수행했다. 원달러 환율은 주간 및 일간 단위 원달러 환율의 변화율을 사용했으며, 스왑레이트는 서울외환시장에서 고시되는 3개월물 bid-offer의 중간값을 기준으로 원달러 환율 기준 스왑레이트의 변화율을 사용했다. 차익거래 기회를 뜻하는 베이시스는 국채선물의 이론가격에서 국채현물의 가격을 뺀 값을 사용하였다. 이때 미국과 한국의 국고채 수익률, 원달러 환율은 한국은행 경제통계시스템에서 제공하는 자료를 사용했으며, 외국인 국채 순매수 규모 및 스왑레이트 등의 자료는 코스콤 체크단말기에서 제공하는 자료를 사용했다.

본 시계열 분석 모형에서 사용한 데이터를 살펴보면, 국채 3년물과 10년물 선물시장에서 외국인은 평균적으로 주간 124억원과 122억원을 각각 순매수한 것으로 관찰되었는데 이는 국채현물시장에서 외국인의 순매수 금액대비 다소 낮다. 즉 국채선물 시장에 참여하는 외국인 중 상당수는 헤지목적으로 선물시장에 참여하는 것으로 예상할 수 있다. 전체 샘플기간을 전기와 후기로 구분해보면 후기에서 외국인의 국채선물 순매수가 큰 폭으로 증가한 것을 확인할 수 있다. 또한 3년물과 10년물 국채선물의 이론 베이시스는 각각 –0.0299, -0.0736으로 국채선물이 국채현물 대비 저평가되는 현상이 관찰된다. 특히 10년물 국채선물의 저평가 현상이 다소 큰 것으로 관찰된다.

전체 샘플기간에서 VAR 모형을 통해 외국인의 국채선물 순매수의 동인을 살펴본 결과, 3년물 국채선물 시장과 10년물 국채선물 시장에서 외국인 국채선물 순매수의 동인이 다르게 나타났다(<표 부록-3> 및 <표 부록-4> 참조). 3년물 국채선물 시장에서 두 직전 시기의 원달러 환율이 하락할수록 그리고 스왑레이트가 하락할수록 3년물 국채선물 시장에서 외국인 순매수가 유의하게 증가하는 것으로 관찰되었으며, 외국인 순매수는 양(+)의 추세를 가지는 것으로 확인되었다. 반면 10년물 국채선물 시장에서는 직전 시기에 미국 10년 국채금리가 하락할수록 외국인 순매수가 유의하게 증가하며, 국채현물 및 3년물 국채선물 시장과 유사하게 양(+)의 추세를 가지는 것으로 관찰되었다. 이는 3년물 국채선물 시장에 참여하는 외국인은 차익거래 유인들에 보다 민감하게 반응하며, 10년물 국채선물 시장에 참여하는 외국인은 미국 장기채권 시장 변화에 민감하게 반응하는 것으로 추론할 수 있다.

한편, <그림 Ⅳ-3>에 제시된 바와 같이 충격반응함수를 통해 3년물과 10년물 국채선물 시장에서 외국인의 영향력을 살펴본 결과, 외국인의 국채선물 매입이 통계적으로 유의하게 국채금리를 하락시키는 것으로 나타났다. 다만, 3년물의 경우 외국인의 매매 행태에 따른 충격반응함수의 반응 크기가 작고, 반응의 듀레이션이 10년물에 비해 짧은 것을 관찰할 수 있다. 이러한 결과는 최근 10년물 국채선물 시장에서 외국인 매매 비중이 큰 폭으로 증가한 가운데, 미국 장기금리의 하락(상승) 예상시 외국인은 유동성이 풍부한 한국 10년물 국채선물 시장에서 추세적으로 순매수(순매도)를 수행한 것으로 볼 수 있다. 또한, <그림 Ⅳ-3> 및 <그림 Ⅳ-4>를 살펴보면 3년물 및 10년물 국채선물 시장 모두에서 외국인 순매수는 국채금리 변동성, 원달러 환율, 스왑레이트 등에는 유의미한 영향을 미치지 못하였다. 한편 충격반응함수를 통해 미국 국채금리 변화, 원달러 환율 변화, 3개월물 스왑레이트 변화가 외국인 현‧선물 순매수에 미치는 영향을 살펴본 결과, 미국 국채금리 및 원달러 환율 변화는 외국인의 국채 현‧선물 매매에 유의하게 영향을 미치지 못하는 것으로 나타났다. 반면 3개월물 스왑레이트가 하락하는 경우 외국인 국채현물 순매수가 유의하게 증가하는 것으로 확인되었다(<그림 부록-1> 참조). 이러한 결과는 원화 가치의 상승을 기대하여 미래 원달러 환율이 하락할 것으로 전망하는 경우, 외국인이 추세적으로 국채현물을 매수한 것으로 추론할 수 있다.

전체 샘플기간을 2017년 7월 이전과 이후로 나누어 외국인 순매수의 영향력을 살펴본 결과, 최근 시점에서 국채선물 시장에서의 외국인 순매수가 국채금리 하락에 보다 유의하게 영향을 미치는 것으로 관찰되었다. 특히 10년물 국채선물 시장에서 외국인의 영향력은 1% 수준에서 유의한 것으로 관찰되는 등 외국인의 순매수 영향력이 큰 것으로 확인되었다. 한편, 전기와 후기 모두에서 외국인의 국채 순매수는 원달러 환율 및 스왑레이트 등에 유의미한 영향을 미치지 못한 것으로 관찰되었다.

일별 데이터를 활용하여 국채선물 시장에서 투자자별 영향력을 살펴본 결과는 <표 Ⅳ-3>에 정리되어 있다. 분석 결과 국채선물 시장에서 외국인 순매수가 증가할수록 국채금리가 통계적으로 유의하게 하락하는 것으로 관찰되었다. 국채선물 시장에서 기관투자자와 개인의 매매 행태는 국채금리 하락에 유의한 영향을 미치지 못하였으며, 3년물 국채선물의 경우 개인의 순매수가 증가할수록 오히려 국채금리는 유의하게 상승하는 것으로 관찰되었다. 한편 국채현물 시장에서 외국인 매매 행태는 국채금리 변화에 유의한 영향을 미치지 못하였다. 국내 투자자별 매매 행태 외에도 미국 10년 국채금리가 하락할수록, 원달러 환율이 하락할수록, 국내 VKOSPI가 상승할수록 한국 국채금리는 통계적으로 유의하게 하락하는 것으로 확인되었다. 국채선물과 국채현물 시장에서 투자자별 매매 행태는 국채금리 변동성에 유의미한 영향을 미치지 못하였다. 대신, 국채금리가 상승할수록 국채금리 변동성이 유의하게 상승했으며, VKOSPI가 상승할수록 국채금리 변동성이 커지는 것으로 나타났다. 즉 주가지수 시장에서 변동성이 확대되는 시기에는 국채시장의 변동성 역시 확대되는 경향이 높다.

한편, <표 Ⅳ-4>에 나타난 바와 같이 한국 국채선물 시장에서는 선물 가격이 현물 가격대비 저평가되는 현상이 관찰되었다. 국채선물 저평가의 원인을 살펴본 결과, 국채선물 시장에서 투자자별 매매행태는 이론 베이시스에 유의미한 영향을 미치지 못하였다. 대신, 국채현물 시장에서 외국인이 순매수할수록 이론 베이시스가 하락하는 것으로 관찰되었다. 즉, 국채현물 시장에 참여하는 외국인 중에서 상당수는 차익거래를 수행하는 것으로 추론할 수 있다. 한편 국내외 시장금리, 원달러 환율, VKOSPI 등 주요 독립변수들이 국채선물 시장에서 이론 베이시스의 저평가 현상을 설명하지 못하는 것으로 확인됨에 따라 한국 국채선물 시장의 저평가 현상은 다소 이례적인 것으로 말할 수 있다.

가. 문헌연구

국채선물 시장에서 웩더독(wag-the-dog)으로 불리는 만기일 현상에 관한 연구는 많지 않다. Edwards(1988), Bhattachara(1987)는 미국 국채선물 및 옵션 시장을 대상으로 만기일 현상을 분석한 결과, 만기일에 거래량이 증가하고 가격 변동성이 커지는 현상이 관찰됨을 제시했다. Stoll & Whaley(1987)는 미국 S&P500 선물 시장을 대상으로 만기일 효과를 분석한 결과, 주가지수 선물 만기일에 현‧선물 가격 변동성이 크고, 거래량이 유의하게 증가하며 만기일 다음날에 가격회귀 현상이 유의하게 관찰됨을 제시하였다.

국내에서는 국채선물 시장으로 만기일 효과를 분석한 연구는 많지 않으며, 주로 주가지수 선물‧옵션 시장을 대상으로 만기일 효과에 대한 연구가 수행되었다. 최종범‧류혁선(2006)은 1997년 7월부터 2004년 7월까지 KOSPI200 선물‧옵션을 대상으로 만기일 효과를 분석하였는데, 선물‧옵션 동시 만기일에 파생상품 거래량이 유의하게 증가하며, 가격 변동성 또한 유의하게 증가함을 보였다. 남길남‧이효섭(2012)은 한국 주가지수 선물‧옵션 시장을 대상으로 만기일 효과를 분석하였는데 한국 옵션시장 만기일에는 거래량이 증가하고, 가격 변동성이 커지며, 만기일 전후 가격회귀 현상이 유의하게 관찰되는 것을 확인하였다. 또한 남길남‧이효섭(2012)은 주요국 주가지수 선물‧옵션 시장에서도 시장 개설 초기에는 만기일 효과가 관찰되었으나 이후 점차 완화된 반면, KOSPI200 옵션 시장에서는 만기일 효과가 시장 개설 초기 이후부터 지속적으로 관찰되는 문제를 지적하였다. 이에, 주요국 파생상품시장에서 최종결제가격 제도 등의 변경을 통해 만기일 효과를 완화했음을 근거로 한국 주가지수 파생상품시장에서도 최종결제가격 제도를 변경하는 방안을 제안하였다.

이상을 종합하면 국내외 주가지수 파생상품 시장에서 만기일에 거래량 및 가격 변동성 증가, 만기일 직후의 가격회귀 현상 등이 관찰되는 등 파생상품시장에서 만기일 효과가 관찰되었다. 이에, 상당수 국가에서는 주가지수 파생상품의 최종결제가격 제도를 개선함으로써 만기일 효과를 줄이고자 하였다. 한편, 국채선물 시장을 대상으로 만기일 효과에 대한 심도 있는 분석은 거의 수행되지 않았다.

나. 연구방법론

본 절에서는 Stoll & Whaley(1987) 및 남길남‧이효섭(2012)에서 사용한 방법론을 기초로 하여 한국 국채선물 시장에서 만기일 효과가 존재하는지 여부를 살펴보고자 한다. 우선 국채선물 만기일인 매 분기 결제월(3월, 6월, 9월, 12월)의 세 번째 화요일에 국채선물 시장의 수익률 및 가격 변동폭이 유의하게 증가하는지 여부를 진단하였다. 2011년 7월 1일부터 2023년 6월 30일까지 일간 국채선물 가격 데이터를 기초로, 만기일과 비만기일에 일별 국채 수익률 및 국채 수익률의 변동성이 유의하게 차이나는지 여부를 t-검정을 통해 살펴보았다. 이때 국채 수익률의 가격 변동성은 국채선물 만기일에 선물의 고가와 저가의 변동폭을 계산한 뒤, 비만기일의 고가와 저가의 변동폭을 비교하는 방법으로 가격 변동폭의 증가 여부를 진단하였다. 다음으로 국채선물 만기일의 국채선물 거래량이 비만기일의 거래량 대비 유의하게 증가하는지 여부를 분석하였다. 국채선물 만기일에는 연결선물 상품이 오전 9시에서 11시 30분까지 거래가 수행되기 때문에, 만기일에 발표되는 연결선물 상품의 거래량에 보정계수6)를 곱하여 비만기일의 선물 거래량과 비교하였다.

마지막으로 국채선물 만기일 직후 국채가격 변화율이 만기일의 국채가격 변화율과 유의한 수준에서 가격회귀 현상이 관찰되는지를 살펴보았다. Stoll & Whaley(1987) 및 남길남‧이효섭(2012)에서 사용한 만기일 가격회귀 측도(REV)를 아래처럼 정의하고, 국채선물 만기일과 만기일 직후의 가격회귀 정도를 측정하였다. 만약 국채선물 만기일에 국채가격이 1% 하락했다가(RET1), 국채선물 만기일 직후 국채가격이 1% 상승했으면(RET2) 가격회귀 측도(REV)는 2% 값을 가진다. 또한 국채선물 만기일에 국채가격이 1% 하락했다가, 국채선물 만기일 직후 국채가격이 0.5% 하락했으면 가격 반전이 일어나지 않았기 때문에, 가격회귀 측도(REV)는 –0.5% 값을 가진다. 전체 분석기간에서 가격회귀 측도의 평균값이 0과 유의하게 차이가 나고 양(+)의 값을 가지면, 만기일에 가격회귀 현상이 존재하는 것으로 말할 수 있다. 이와 같은 분석 방법론에서 사용한 만기일과 비만기일의 국채선물 가격 및 거래량에 관한 정보는 아래 표와 같다.

REV = -sign(RET1·RET2)×|RET1 – RET2| 식(1)

1) 수익률 및 가격 변동성 증가 여부

2011년 7월 1일부터 2023년 6월 30일까지 국채선물 만기일은 총 48거래일이 존재하며, 국채선물 비만기일은 2,910 거래일이 존재한다. <표 Ⅳ-6>에서 볼 수 있듯이, 만기일에 3년물, 10년물 국채선물 수익률은 각각 0.0029%, -0.0310%로 통계적으로 유의한 수준에서 0과 다르다고 말할 수 없다. 마찬가지로 비만기일에도 3년물과 10년물의 국채선물 수익률은 0과 다르지 않다. 이분산을 가정한 두 집단간 평균값의 차이 여부를 t-검정 방법을 통해 분석한 결과, 만기일과 비만기일의 국채선물 수익률은 다르지 않았다. 즉 3년물과 10년물 국채선물 모두 만기일에 유의미한 가격 상승 또는 하락이 있다고 말하기 어렵다.

2) 거래량 증가 여부

2011년 7월 1일부터 2023년 6월 30일까지 국채선물 만기일과 국채선물 비만기일에 거래량이 유의하게 차이가 나는지를 분석하였다. 만기일 거래시간을 비만기일 거래시간과 같도록 보정하고 이분산을 가정한 두 집단간 평균값의 차이 여부를 t-검정 방법을 통해 분석한 결과, 만기일의 국채선물 거래량은 1% 유의수준에서 비만기일의 국채선물 거래량보다 작은 것으로 관찰되었다. <표 Ⅳ-6>에서 볼 수 있듯이, 3년물과 10년물 국채선물 만기일의 보정 거래량은 각각 68,463 계약과 24,432 계약으로 비만기일의 거래량 대비 각각 66.1%와 46.9%에 불과하다. 이분산을 가정한 t-검정을 통해 두 집단간 차이 여부를 분석한 결과, 1% 유의수준에서 만기일의 국채선물 거래량이 비만기일의 국채선물 거래량보다 작은 것으로 관찰되었다. 이는 KOSPI200 선물‧옵션 만기일에 거래량이 유의하게 증가하는 현상과 정반대의 현상이 관찰된 것으로, 한국 국채선물 시장에서는 거래량 급증과 관련한 만기일 효과가 존재하지 않는 것으로 말할 수 있다. 앞선 수익률 및 일중 변동폭 분석과 유사하게, 국채선물 시장에서 최종결제가격 제도가 평균가격 방식을 사용하기 때문에 만기일에 거래량이 급증하는 현상이 관찰되지 않은 것으로 생각할 수 있다.

2011년 7월 1일부터 2023년 6월 30일까지 48번의 국채선물 만기일에 대해서 만기일 직후 거래일에 수익률 반전 효과가 관찰되는지 여부를 분석하였다. Stoll & Whaley(1987), 남길남‧이효섭(2012)에 따르면 식(1)에서 정의한 가격회귀 측도(REV)가 0보다 유의하게 큰 양(+)의 값을 가지면, 국채선물 만기일에 수익률 왜곡 현상이 큰 것으로 보아 만기일 효과가 존재하는 것으로 말할 수 있다. 48번의 국채선물 만기일에 가격회귀 측도를 분석한 결과, 3년물 국채선물과 10년물 국채선물 모두 가격회귀 측도가 각각 –0.0533, -0.1164로 관찰되는 등 음(-)의 값을 가졌다. 또한 해당 가격회귀 측도가 0과 유의하게 차이가 나는지를 분석한 결과 10% 유의수준에서도 0과 다르다고 말할 수 없었다. 즉, KOSPI200 선물‧옵션 시장과 달리, 국채선물 시장에서는 만기일 직후 가격회귀 현상은 관찰되지 않았다. 이는 앞선 분석에서 국채선물 만기일에 수익률의 급변동 현상이 관찰되지 않았고, 일중 가격 변동폭 및 거래량의 경우 만기일에 오히려 감소하는 것으로 관찰되는 등 국채선물 최종결제 시점에 근접하여 이례적 현상이 관찰되지 않았기 때문으로 추론할 수 있다. 이상의 결과를 종합하면 한국 3년물과 10년물 국채선물 시장에서는 수익률 급변동 현상, 일중 변동폭 확대 현상, 거래량 급증 현상, 만기일 직후 가격회귀 현상 등 주요 만기일 효과가 관찰되지 않는 것으로 요약할 수 있다.

외국인이 우리나라 국채현물시장에서 차지하는 비중은 2006년 1.6%에 불과했으나 2023년 2분기에는 20% 수준까지 크게 확대되었으며 3년물 및 10년물 국채선물의 외국인 투자자 거래 비중은 2022년 기준 각각 44% 및 53%를 차지하고 있어 외국인 투자자들이 국채시장에 주요한 행위자로 자리매김하게 되었다. 특히 이러한 비중 확대는 글로벌 금융위기 이후 한동안 정체되었다가 코로나19 감염확산 이후 가파르게 상승하는 모습을 나타내고 있다. 이러한 상승세가 WGBI(World Government Bond Index) 등 선진국 채권지수 편입 기대감과 더불어 Ⅲ장의 분석을 감안하면 글로벌 유동성 확대 및 한국의 높은 국가신용등급을 고려할 때 신흥국 패널 모형에도 부합하는 것으로 나타났다. 또한 Ⅳ장의 분석에 따르면 현물시장에서 외국인의 매매 행태가 지금까지는 국채 수익률이나 변동성에는 영향을 주지 않는 것으로 판단된다. 다만, 최근의 외국인 비중의 가파른 증가세를 감안할때 현물시장에서 외국인의 영향력이 점차 확대되고 있을 것으로 추정가능한 만큼 외국인 매매동향에 대한 면밀한 모니터링이 필요할 것으로 보인다. 특히, 코로나19 감염확산 이후 외국인 비중 확대가 상당 부분 글로벌 요인의 개선에 기인한다는 Ⅱ장의 분석결과를 감안하면 미국의 양적긴축(quantitative tightening) 및 주요국 중앙은행의 고금리 장기화 등 국내 정책으로 통제할 수 없는 요인들로 인해 글로벌 유동성이 축소되고 위험선호가 약화되어 외국인 채권자금의 변동성이 급등락할 위험에 유의할 필요가 있다.

또한, 최근 들어 외국인 비중이 크게 확대된 선물시장에서는 외국인의 영향력이 통계적으로 유의한 것으로 나타난 만큼 향후 외국인 매매 동향을 유의하게 살펴볼 필요가 있다. 특히 외국인의 국채선물 순매도가 금리상승에 유의한 영향을 미치는 것으로 나타난 만큼 국채선물 시장에서 외국인 순매도가 지속되거나 외국인의 순매도가 일정 임계수준을 넘어서는 경우 채권시장 전반의 수익률 및 매매심리에 부정적 영향을 미치는 지를 관찰할 필요가 있다. 이와 관련해서 예상치 못한 주요국 중앙은행의 기준금리 인상이나 경기지표 호조의 영향으로 시장금리가 단기간 급격히 상승하는 경우 외국인은 국채선물 시장에서 대규모로 매도하고, 외국인의 국채선물 매도는 다시 시장금리의 상승을 초래하는 현상이 발생할 수 있다. 최근 개인투자자가 장기물 국채선물 참여를 늘리고 있고, 기관투자자의 경우 미결제약정 한도 규제 등을 받지 않기 때문에 시장금리 급등 시기에서 상당수 국채선물 투자자가 마진콜 요청을 받을 개연성이 존재한다. 따라서, 고금리 환경이 지속되며 국채선물 시장의 변동성이 확대되는 시기에는 위탁증거금률을 인상하거나 위탁증거금 현금예탁비율을 상향하는 등의 정책을 고려할 필요가 있다.8)

한편, 한국 국채선물시장이 양적으로 큰 폭의 성장세를 가져온 가운데, 외국인의 참여 증가로 만기일 효과에 대한 우려가 제기되었으나 실증분석 결과 유의미한 만기일 효과가 관찰되지는 않았다. 그럼에도 불구하고 국채선물시장에서의 외국인 순매매가 시장금리 변화에 유의한 영향을 주고 있는 만큼 국채선물 시장에서 외국인의 이상거래 행위 여부에 대한 체계적인 모니터링이 필요할 것이다. 특히 외국인이 국채현물 포지션을 구축한 이후 국채선물시장에서의 매매를 통해 이득을 수취하려는 행위가 일어나지 않도록 현‧선물 통합 이상거래 탐지시스템을 개선할 필요가 있으며, 미국, 독일, 호주 등 주요국 국채선물 시장에서 미결제약정 한도를 설정하는 것을 참고하여 외국인 국채선물의 미결제약정 포지션 한도의 적정성 여부 등도 중장기적으로 검토할 필요가 있다. 이와 함께 한국 국채선물 시장에서 외국인의 순매매 포지션이 분단위로 공개되는 가운데, 일부 고빈도 매매 투자자들은 외국인 매매 행태를 기초로 추종매매를 수행할 개연성이 있다. 국채선물 시장에서 외국인은 정보우위를 가진 것으로 알려져 있어 외국인 선물 포지션과 관련한 군집행위와 추종매매 개연성이 존재한다. 따라서 외국인 선물매매에 따른 쏠림현상을 완화하기 위해 분단위로 공개되는 투자자별 순매매 정보의 발표 주기를 늦추는 방안을 고려할 필요가 있다.

외국인의 국채시장 비중이 확대되는 가운데 유사시 투자자들의 군집행위 및 추종매매 가능성 등을 고려한다면 국채시장 안정을 위해 국내 기관투자자의 참여 유인을 제고시킬 필요가 있다. 특히 10년물 국채선물 시장에서 외국인 순매매가 국채 수익률 및 수익률의 변동성에 미치는 영향이 확대되고 있는 만큼 연기금, 공제회, 보험회사 등 장기 성향의 기관투자자 및 국채선물 시장조성자의 참여를 늘릴 수 있도록 인센티브 체계 개선을 검토할 필요가 있다. 반면 최근 개인투자용 국채 도입 등으로 국채시장에 대한 개인투자자의 접근성이 제도적으로 확대되고 있으나 국채선물시장에서 개인투자자의 참여 증가에 대해서는 주의가 필요할 것으로 판단된다. 분석 결과 개인의 국채선물 순매수는 국채가격의 하락(국채금리의 상승)을 설명하는 데 유용한 변수로 나타났으며 상당수 개인이 국채선물 포지션에서 손실을 기록하는 것은 다소 우려가 된다. 이에 따라 개인에 대한 투자자 교육을 강화하는 한편 초장기 국채선물시장에서 개인투자자 진입 규제의 적정성을 검토할 필요가 있다.

1) 2023년 6월말 기준 국내채권은 전체 국민연금자산의 32.3%를 차지하고 있으나 ‘2024~2028년 기금운용 중기자산배분(안)’에 따르면 해외채권(7.1%) 포함 전체 채권 비중을 30% 내외로 결정했다.

2) Eichengreen & Hausmann(1999) 및 Eichengreen et al.(2003)은 신흥국 경제가 자국통화로는 해외로부터 돈을 차입할 수가 없음을 강조한다. 결국 달러화와 같은 국제적으로 통용력 있는 외화로 빌려야 하는 구조적 한계

(‘원죄’)로 인해 자산과 부채간의 통화 불일치가 발생하는 만큼 대외 충격에 따른 거시경제 및 금융시장 불안이 불가피하다는 점을 지적하고 있다.

3) BIS 데이터에 포함된 국가 중 페루의 외국인 비중은 2021년 4분기 기준 49.5%로 주요국에 비해 매우 높은 수준인데 표본이 시작되는 2005년 4분기에도 이미 26.2%로 표본평균의 3배를 상회하였다.

4) 국채현물시장에서 외국인 순매수 정보는 만기별로 구별되지 않기 때문에, 국채현물시장에서 외국인이 장기물 국채를 순매수하는 것이 10년물 국채금리 하락에 영향을 미친 것으로 해석하기는 어렵다.

5) 본 회귀분석 식에서 종속변수와 독립변수 모두 단위근(unit root)을 제거하였다.

6) 보정계수는 만기일과 비만기일의 거래시간 배율 차이인 2.7을 사용했다.

7) 한국거래소에 상장된 3년물과 10년물 국채선물의 최종결제가격 산출시, 국채선물 최종거래일의 11시 30분 수익률과 최종거래일의 10시, 10시 30분, 11시의 수익률 중 최고치와 최저치를 제외한 수익률을 평균하여 산출한다.

8) 강규호‧서영경(2022) 참조

참고문헌

강규호‧서영경, 2022, 외국인 국채선물투자의 영향과 시사점, 『한국경제포럼』15(3), 27-52.

강현주‧이승호, 2012, 『글로벌 유동성과 국제자본이동과의 관계에 관한 연구』, 자본시장연구원 연구보고서 13-02.

김동순‧박종연, 2011, 외국인의 만기별 국내 채권투자 결정요인과 채권시장 영향, 『국제지역연구』15(1), 291-314.

김소영‧이윤석, 2017,『금융실효환율과 대외포지션 및 자본유출입의 관계 분석』, 금융연구원 연구보고서.

김수현, 2018,『한국 채권시장의 해외자본 유출입 결정요인』, 한국은행 경제연구 2018-44호.

국회예산정책처, 2022, 『2022~2031년 NABO 중기재정전망』.

남길남‧이효섭, 2012, 『주가지수파생상품 만기일 효과에 관한 연구』, 자본시장연구원 연구보고서 12-01.

박종연‧김동순, 2011,외국인의 만기별 국내 채권투자 결정요인과 채권시장 영향, 『국제지역연구』 15권(1), 291-314.

배영수‧한재준, 2022, 내외금리차가 외국인 투자자의 국내 채권 투자 결정에 미치는 영향, 한국경제의 분석 28(3), 171-216.

양양현‧이혜림, 2008,『차익거래 유인과 외은지점 및 외국인의 국내 채권투자에 관한 분석』, 한국은행 조사통계월보.

오승현‧한상범, 2008, 한국 유가증권시장의 투자자 유형별 거래행태 분석,『산업경제연구』21(1), 269-287.

우준명, 2017, 외국인 채권매매가 국내 채권시장 변동성에 미치는 영향, 『금융연구』31(4), 51-75.

원승연‧주상영, 2009,외국인의 채권 투자 결정요인과 영향에 대한 연구, 『경제학연구』 57(3), 31-65.

유복근, 2018, 글로벌 금융위기 전·후 외국인의 채권투자 결정요인 변화 분석: 한국의 사례, 『금융연구』, 32(3), 101-128.

윤경수‧김지현, 2012,『글로벌 유동성이 신흥국으로의 자본이동에 미치는 영향 및 시사점』, BOK 경제리뷰 No.2012-7.

윤영진‧박종욱, 2019, 내외금리차와 자본유출입: 이론 및 실증분석, 『경제학연구』 67(2), 71-111.

최종범‧류혁선, 2006, KOSPI200 선물 및 옵션의 만기일 효과, 『한국증권학회지』35, 69-101.

한덕희‧문규현, 2017, 국채 현‧선물시장에서의 장‧단기 가격발견 효율성 분석,『기업경영연구』24(2), 179-194.

홍정효, 2019, 3년 국채선물의 일중 시간별 헤지성과 및 가격발견 연구, 『기업경영연구』26(1), 47-59.

Ahmed, S., Zlate, A., 2014, Capital flows to emerging market economies: A brave new world? Journal of International Money and Finance 48, 221-245.

Alberola, E., Aitor, E., José, M.S., 2015, International reserves and gross capital flow dynamics, BIS working papers No.152.

Arslanalp S., Poghosyan T., 2016, Foreign investor flows and sovereign bond yields in advanced economies, Journal of Banking and Financial Economics 2, 45-67.

Beirne, J., Renzhi, N., Volz, U., 2021, Local currency bond markets, foreign investor participation, and capital flow volatility in emerging Asia, ADBI working paper No.1252.

Bhattachara, R.K., 1987, Option expirations and treasury bond futures prices, Journal of Futures Market 7(1), 49-64.

Bruno, V., Shin, H.S., 2013, Capital flows, cross-border banking and global liquidity, Review of Economic Studies 82(2), 535-564.

Burger, J.D., Warnock, F.E., Warnock, V.C., 2022, A natural level of capital flows, Journal of Monetary Economics 130, 1-16.

Burger J.D., Warnock F.E., 2007, Foreign participation in local currency bond markets, Review of Financial Economics 16(3), 291-304.

Choi J.H., Lim, H.S., Mercado, R.J., Park, C.Y., 2017, Price discovery and foreign participation in Korea’s government bond cash and futures market, Working paper.

Edwards, F.R., 1988, Futures trading and cash market volatility: Stock index and interest rate futures, Journal of Futures Market 8(4), 421-439.

Eichengreen, B., Ricardo, H., 1999, Exchange Rates and Financial Stability, Federal Reserve Bank of Kansas City, 319-367.

Eichengreen, B., Ricardo H., Ugo P., 2003, Currency mismatches, debt intolerance and original sin: Why they are not the same and why it matters, NBER working paper No.10036.

Fonay, B.I., 2022, The Effects of Foreign Investors' Holdings on the Local Currency Sovereign Bond Markets in Latin America, IDB Technical Note IDB-TN-2451.

Forbes, K., Warnock, F.E., 2012, Debt-and equity-led capital flow episodes, NBER working paper 18329.

Fratzscher, M., 2012, Capital flows, push versus pull factors the global financial crisis, Journal of International Economics 88, 341-356.

Ghosh, A.R., Qureshi, M.S., Kim, J.I., Zalduendo, J., 2014, Surges, Journal of International Economics 92, No.2.

Hoechle, D., 2007, Robust standard errors for panel regressions with cross-sectional dependence, Stata Journal 7 (3), 281-312.

Jang, J.Y., Atukeren, E., 2019, Sustainable Local Currency Debt: An Analysis of Foreigners’ Korea Treasury Bonds Investments Using a LA-VARX Model, Sustainability 11, 3603.

Onen, M., Shin, H.S., Peter, G., 2023, Overcoming original sin: Insights from a new dataset, BIS working papers No.1075.

Richards, A., 2005, Big fish in small ponds: The trading behavior and price impact of foreign investors in asian emerging equity markets, Journal of Financial and Quantitative Analysis 40(1), 1-27.

Sienaert, A., 2012, Foreign investment in local currency bonds considerations for emerging market public debt managers, World Bank Policy Research working paper 6284.

Stoll, H.R., Whaley, R.E., 1987, Program trading and expiration-day effects, Financial Analysts Journal 47, 55-72.

<부록>