Find out more about our latest publications

Major Reforms in Unfair Trade Regulation and Future Challenges -Comparing the Korean, U.S., and Japanese systems-

Research Papers 24-01 Jan. 15, 2024

- Research Topic Capital Markets

- Page 112

- No other publications.

- No other publications.

Unfair trading is a financial crime that causes financial damage to many investors and undermines confidence in our capital markets. In South Korea, the Financial Investment Services and Capital Markets Act regulates unfair trade, and efforts have been made to improve the system in response to increasingly sophisticated unfair trade practices. However, despite the steady efforts of supervisory authorities, unfair trade schemes continue to evolve, becoming increasingly organized and sophisticated. The number of illegal activities that are difficult to detect using existing methods is growing, and the difficulty of proving unfair trade has made it difficult to effectively prevent, detect, investigate, and enforce it.

To address these issues, a number of legal changes were made in 2023. First, the Financial Investment Services and Capital Markets Act was amended to create penalty surcharges for three types of unfair transactions, codify the method of calculating unjust enrichment, and introduce a system to reduce sanctions for self-reporters. In addition, on September 21, 2023, the Financial Services Commission, the Ministry of Justice, the Seoul Southern District Prosecutors' Office, the Financial Supervisory Service, and the Korea Exchange jointly announced a plan to improve overall market monitoring and investigation and the sanction system for unfair transactions in the capital market.

As various regulations on unfair trade are being introduced and newly discussed, it is necessary to exam how the system improvement plan can play a role in preventing unfair trade and protecting investors, as well as what needs to be improved. This report compares the cases in the United States, which has a well-developed capital market, and Japan, which has a similar legal system to Korea, to examine whether it is an appropriate way to quickly detect and punish unfair traders and protect investors who have been harmed by them.

First, the investigation system for unfair trading needs to be streamlined. Beyond collaboration and information sharing, it is important to resolve the issue of overlapping investigative and decision-making bodies by establishing a clear division of roles between agencies. In addition, investigative powers such as the right to inspect communications and the right to compulsory investigation should be strengthened to ensure prompt and efficient investigations. Second, with the introduction of the penalty surcharge system, it is necessary to design a system for rational operation. By establishing objective criteria to distinguish between criminal penalties and fines, taking into account the legal nature of the fines and their compatibility with other laws, it is necessary to achieve the purpose of introducing a fine system with prompt monetary sanctions.

Third, it is necessary to improve the efficiency of detecting unfair traders by encouraging the whistleblower program and the cooperation program. The whistleblower awards funded by penalty surcharges, a limit on rewards based on contributions, sanctions for false reports, and measures to protect public interest reporters should be specifically designed. In the case of the cooperation program, it is necessary to list the factors to be considered in determining the reduction in sanctions but to refine them by referring to the SEC rules, or to quantify the criteria for judging the cooperator based on the timing of the report, the specificity of the report, the degree of cooperation with the investigation, the statements of accomplices, the unfair gain of the cooperator, the preemptive provision of data, timeliness, and the status of the reporter. Finally, measures should be put in place to provide redress for ordinary investors. To this end, the Securities-related Class Action Act should be improved, and information, such as judgments should be provided to victims so that they can receive appropriate damages. Furthermore, in the case of unfair trade, as in the case of fraud, it is appropriate to make the recovery of victims’ damages (settlement) a special extenuating circumstances in sentencing to provide an incentive for perpetrators to compensate victims as a matter of criminal policy.

These comprehensive efforts to improve the system are expected to increase the credibility of our capital markets and contribute to the protection of investors.

To address these issues, a number of legal changes were made in 2023. First, the Financial Investment Services and Capital Markets Act was amended to create penalty surcharges for three types of unfair transactions, codify the method of calculating unjust enrichment, and introduce a system to reduce sanctions for self-reporters. In addition, on September 21, 2023, the Financial Services Commission, the Ministry of Justice, the Seoul Southern District Prosecutors' Office, the Financial Supervisory Service, and the Korea Exchange jointly announced a plan to improve overall market monitoring and investigation and the sanction system for unfair transactions in the capital market.

As various regulations on unfair trade are being introduced and newly discussed, it is necessary to exam how the system improvement plan can play a role in preventing unfair trade and protecting investors, as well as what needs to be improved. This report compares the cases in the United States, which has a well-developed capital market, and Japan, which has a similar legal system to Korea, to examine whether it is an appropriate way to quickly detect and punish unfair traders and protect investors who have been harmed by them.

First, the investigation system for unfair trading needs to be streamlined. Beyond collaboration and information sharing, it is important to resolve the issue of overlapping investigative and decision-making bodies by establishing a clear division of roles between agencies. In addition, investigative powers such as the right to inspect communications and the right to compulsory investigation should be strengthened to ensure prompt and efficient investigations. Second, with the introduction of the penalty surcharge system, it is necessary to design a system for rational operation. By establishing objective criteria to distinguish between criminal penalties and fines, taking into account the legal nature of the fines and their compatibility with other laws, it is necessary to achieve the purpose of introducing a fine system with prompt monetary sanctions.

Third, it is necessary to improve the efficiency of detecting unfair traders by encouraging the whistleblower program and the cooperation program. The whistleblower awards funded by penalty surcharges, a limit on rewards based on contributions, sanctions for false reports, and measures to protect public interest reporters should be specifically designed. In the case of the cooperation program, it is necessary to list the factors to be considered in determining the reduction in sanctions but to refine them by referring to the SEC rules, or to quantify the criteria for judging the cooperator based on the timing of the report, the specificity of the report, the degree of cooperation with the investigation, the statements of accomplices, the unfair gain of the cooperator, the preemptive provision of data, timeliness, and the status of the reporter. Finally, measures should be put in place to provide redress for ordinary investors. To this end, the Securities-related Class Action Act should be improved, and information, such as judgments should be provided to victims so that they can receive appropriate damages. Furthermore, in the case of unfair trade, as in the case of fraud, it is appropriate to make the recovery of victims’ damages (settlement) a special extenuating circumstances in sentencing to provide an incentive for perpetrators to compensate victims as a matter of criminal policy.

These comprehensive efforts to improve the system are expected to increase the credibility of our capital markets and contribute to the protection of investors.

Ⅰ. 서론

불공정거래 행위는 시장의 가격형성기능을 왜곡하거나 정보비대칭을 남용‧악용하여 다른 시장 참가자에게 손해를 입히는 사기적 위법행위를 말한다. 이러한 불공정거래는 다수의 투자자에게 금전적 피해를 입히고, 우리 자본시장에 대한 신뢰도를 훼손하는 금융범죄이다. 이에 자본시장법에서는 불공정거래를 규제하기 위한 규정을 두고 있고, 고도화되는 불공정거래 행위에 대응하여 제도 개선 노력을 기울여 왔다.

1962년 제정된 구 증권거래법에서 시세조종행위 금지 규정을 처음 도입하였고, 미공개정보이용, 시세조종, 부정거래 등 3대 불공정행위에 대해서는 형사처벌(징역, 벌금, 몰수‧추징) 규정을 마련하였다. 2002년에는 증권거래법 개정으로 현장조사권‧영치권이 도입되고, 압수수색‧심문이 가능한 조사공무원 제도가 도입되었으며, 2013년 불공정거래 근절 종합대책에 따라 현재 조사체계가 정립되었다. 조사공무원 활성화 및 조사 전담부서 신설 등 금융위의 조사기능이 강화되었고, 조사‧심리기관협의회(이하 조심협)를 통해 사건을 분류하여 중요사건은 금융위로 일반사건은 금감원에서 조사를 하도록 하는 체계를 확립하였다. 또한 긴급사건의 신속한 수사전환을 위한 ‘긴급조치(패스트트랙)’ 제도가 신설되었다. 불공정거래 행위자에 대한 제재를 강화하기 위해 제재수준 향상을 위한 제도 개선도 이루어졌다. 시세조종 등 3대 불공정거래에 대한 처벌을 대폭 강화하여, 2014년에는 몰수‧추징을 필수적으로 병과하도록 하였고, 2018년에는 징역 10년 이하의 형사처벌을 유기징역 1년 이상으로 상향하였다. 형사처벌 외에도 과징금제도를 도입하여, 2015년부터는 시장질서교란행위자에 대해 과징금을 부과할 수 있도록 하였고, 2021년에는 불법공매도에도 과징금이 적용되도록 하였다. 뿐만 아니라 불법공매도 조치를 한 대상자를 공개하여 불법행위를 억지하기 위한 노력을 기울여 왔다.

그러나 감독당국의 꾸준한 노력에도 불구하고 불공정거래 수법은 갈수록 조직화‧지능화 되는 등 지속적으로 진화하고 있다. 기존 방식으로는 혐의 포착이 어려운 불법행위가 증가하고 있고 불공정거래에 대한 입증의 어려움으로 인해 이에 대한 처벌, 차단, 예방이 효과적으로 이루어지지 못하고 있는 현실이다. 2021년 불공정거래 사범의 21.2%가 재범이고, 부당이득액 규모가 2020년 3,793억 원에서 2021년 6.327억 원으로 확대되었다.

이러한 상황에서 2023년 4월에 발생한 대규모 주가조작 사태를 계기로 오랜 기간 논의되어 왔던 제도 개선 방안이 빠르게 추진되어 2023년 7월 18일 자본시장법이 개정되었고, 2024년 1월 19일 시행 예정이다. 개정안은 크게 과징금 신설, 부당이득 산정방식 법제화, 자진신고자 제재 감면 등 3가지 내용을 담고 있다. 주가조작 적발‧예방, 행정제재, 형사처벌 등 자본시장 불공정거래 제도 전반을 대폭 개선하는 취지이다.

또한 2023년 9월 21일 금융위‧법무부‧서울남부지검‧금감원‧거래소 등 유관기관은 합동으로 시장감시‧조사‧제재 체계 전반을 개선하는 「자본시장 불공정거래 대응체계 개선방안」을 발표하였다. 불공정거래 대응은 심리‧조사‧수사 기관간 ‘Team Play’가 중요하므로 기관간 상시 협업체계 가동 및 정보공유를 대폭 강화하는 내용을 담고 있다. 뿐만 아니라 포상금 제도를 개편하여 최고한도를 상향하고(20억 원 → 30억 원), 정부재원으로 포상이 가능하도록 추진할 계획임을 밝혔다. 과징금 제재 시행 준비, 금융당국의 자산동결제도 도입 추진, 불공정거래 전력자 10년간 거래제한 및 상장사 임원 제한 도입 등 조치‧제재를 다양화하는 방안도 담고 있다.

불공정거래에 대한 다양한 규제가 도입되고 새로운 방안이 발표되고 있는 상황에서, 제도 개선방안이 불공정거래를 근절하고 투자자를 보호하기 위해 어떤 역할을 할 수 있는지에 대한 검토와 보완해야 할 부분에 대하여 연구해보고자 한다. 개선방안을 설계하는 원칙은 불공정거래 근절을 위한 효율적인 방안 마련이다. 이에 현행 제도 및 올해 발표된 주요 대책들1)이 불공정거래 행위자를 신속하게 적발하여 합당한 처벌을 하고 그로 인해 피해를 입은 투자자들을 보호하기 위한 적절한 방안인지를 검토하기 위해 자본시장이 발달한 미국과 우리나라와 유사한 법체계를 가진 일본의 사례를 비교 연구하고자 한다. 이를 위해 구체적으로 불공정거래 조사체계의 신속성과 효율성 문제, 형사처벌과 과징금의 합리적 운용, 공익신고 및 자진신고의 활성화, 투자자에 대한 피해구제의 관점에서 현행 제도 및 정부가 추진 중인 방안을 살펴보고 향후 과제를 제안하고자 한다.

Ⅱ. 불공정거래 조사체계의 효율화 방안

1. 현행 제도의 문제점 및 개선방안 검토

가. 현행 제도의 문제점

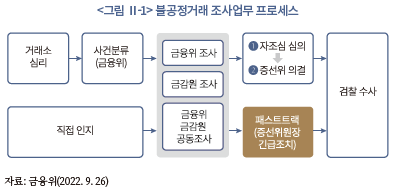

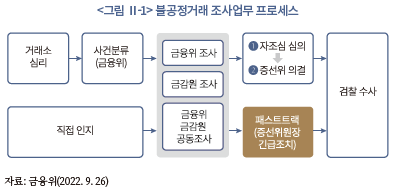

불공정거래 조사체계와 권한에 대한 문제점은 오래전부터 제기되어 왔다. 분산된 조사체계, 조사‧제재 권한 미비 등이 불공정거래에 대한 신속‧효과적 대응에 장애요소로 작용하고 있다. <그림 Ⅱ-1>에서 보는 것처럼 현재 기관별로 조사 업무가 분산된 반면, 총괄 관리, 협업 및 정보 공유 체계는 미흡한 현실이다.

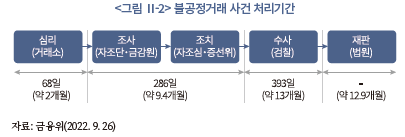

먼저, 불공정거래에 대한 제재는 증권선물위원회(이하 증선위)의 자문기구인 자본시장조사심의위원회(이하 자조심)에 상정하여 심의를 거치고 증선위의 의결을 거쳐 최종적으로 조치가 이루어진다. 이는 결과적으로 동일한 내용에 대해 2번의 심의를 받게 만들어서 처리기간을 더 길게 하는 원인이 된다. 또한 여러 절차를 거치며 조치 내용 및 근거 등에 대해 사전 통지가 이루어지고, 그 과정에서 주요 혐의자가 도주하거나 혐의를 누설할 위험도 있어 적시에 효과적인 수사를 하기 어렵다는 문제가 있다.2)

처리 기간의 장기화 및 중복 절차로 인해 조사의 효율성이 저하될 뿐 아니라 증거인멸의 우려도 존재한다. 장기간에 걸친 조사 과정에서 증거인멸 등으로 인해 불공정거래 행위자들이 가벼운 처벌을 받게 되고, 이는 재범으로 이어지는 원인 중 하나이다.

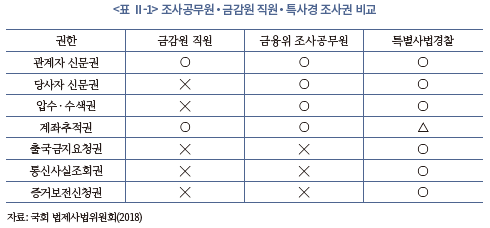

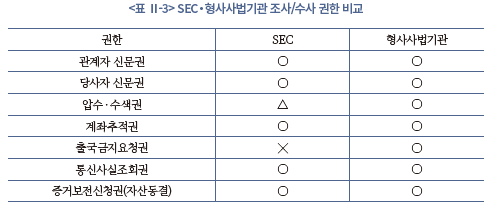

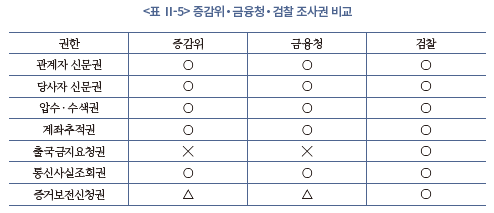

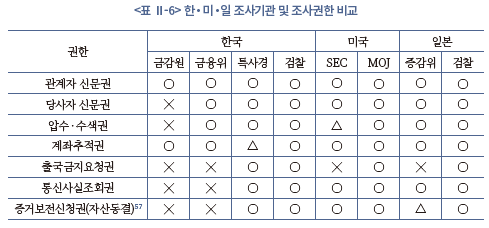

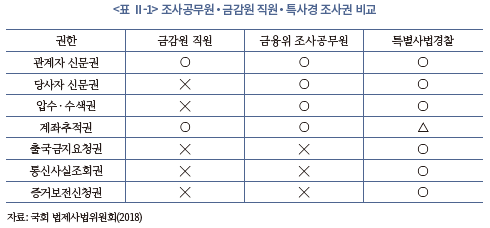

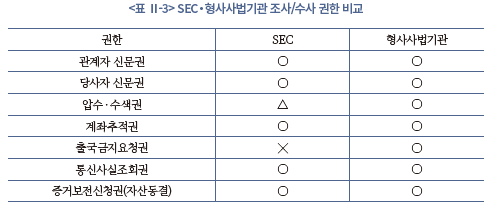

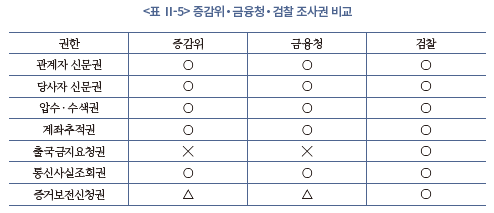

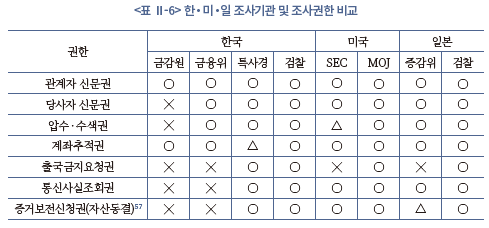

금융위와 금감원의 조사기구별 권한도 상이해서, <표 Ⅱ-1>을 보면 동일한 사건이라 할지라도 누가 조사하는지에 따라 초기 조사단계에서부터 확보할 수 있는 증거가 다르다는 문제가 있다. 금감원의 경우 강제적 성격이 있는 영치권, 현장조사권 및 압수‧수색권은 없어 적시에 적법한 증거를 모두 획득하기 어렵다. 금감원은 거래정보요구권, 출석요구, 진술서 제출요구 및 장부‧서류 기타 물건의 제출 요구권만 있을 뿐이다. 뿐만 아니라 금감원 직원이 피고인과의 문답과정에서 작성한 문답서에 대해 위법하게 수집한 증거로 증거능력을 부정한 판결이 있어3), 검찰은 금감원의 문답서와 동일한 내용에 대해 처음부터 다시 피의자 신문을 하고 있다. 그 과정에서 금감원 조사직원이 질문한 핵심 혐의에 대해 피의자는 증거인멸이나 공범자들과 혐의 부인을 위한 증거 및 증언 조작이 가능해진다.

이러한 문제를 해결하기 위해 금융위에 조사공무원 제도가 도입되었으나, 검찰이 가진 권한에 비해 축소되어 있어 조사에 한계가 있다. 또한 검찰과 거의 동일한 권한을 가진 특별사법경찰은 증선위 위원장이 패스트트랙 사건으로 선정하여 검찰청에 이첩한 자본시장의 불공정거래 사건 중 서울남부지방검찰청이 지휘하는 사건만 수사하는 것으로 담당 업무를 제한하고 있어 한계가 있다.

나. 정부 발표 개선방안

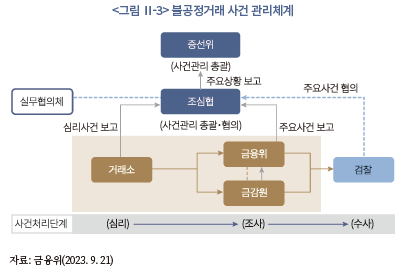

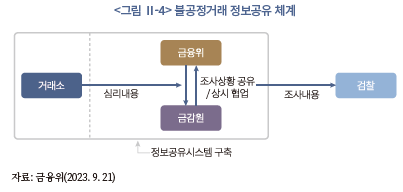

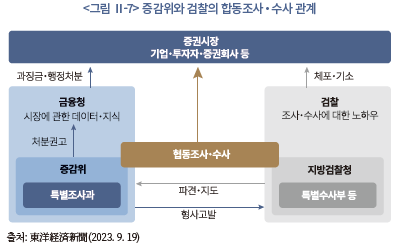

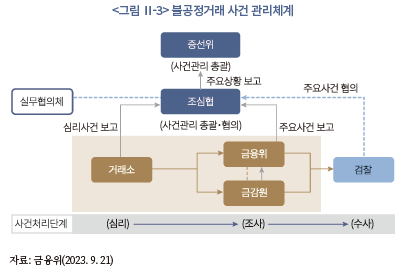

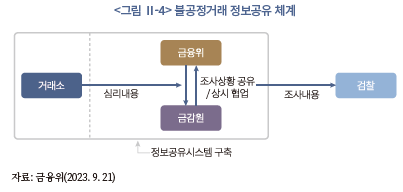

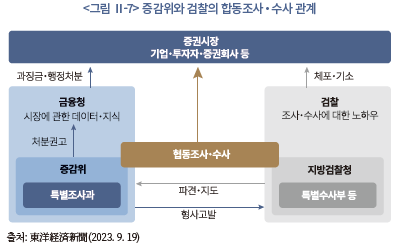

분산된 조사체계, 조사‧제재 권한 미비 등이 불공정거래에 대한 신속‧효과적 대응에 장애요소로 작용한다는 문제의식을 가지고, 2023년 9월 21일 정부는 불공정거래 대응 협업체계 개편을 발표하였다. 먼저 기관간 상시 사건 관리체계를 구축하겠다는 방침을 밝혔다. 증선위를 중심으로 기관간(금융위‧금감원‧거래소+검찰) 상시 협업체계를 구축하여 사건 전반을 관리‧협의하겠다는 것이다. 기관별 시장감시‧심리‧조사 등 주요상황을 수시 공유하면서, 협조 필요사항 및 사건 처리방향 등을 긴밀히 협의할 것이라고 한다. 이러한 내용을 도식화하면 <그림 Ⅱ-3>과 같다.

두 번째로 기관간 정보공유를 확대하겠다고 밝혔다. 조사정보 공유시스템을 가동하여 사건 상황에 맞게 기관별 필요한 기능이 신속히 활용될 수 있도록 조사상황을 적극 공유하고, 심리분석 자료, 조사결과보고서와 같은 주요정보는 체계적으로 축적‧관리하겠다는 것이다.

세 번째로 거래소‧금감원‧금융위 협업을 강화하겠다고 발표하였다. 거래소의 이상거래 적출‧심리(정밀분석) 업무를 통합하여 효율화하고, 금융위‧금감원 협업체계를 개편하여 중요(금융위)/일반(금감원)의 단편적 분류 방식을 폐지하고 사건성격‧범죄유형 및 각 기관 권한‧장점 등을 고려하여 금융위‧금감원 협의 하에 배정하도록 한다. 또한 조심협 또는 실무협의체 논의를 통해 강제조사 등이 필요하다고 판단되면 반드시 활용되도록 개선하겠다고 밝혔다. 그리고 거래소 심리 후 통보한 사건에 대해 금융위‧금감원 조사결과 및 최종 조치내용 등을 거래소와 공유하여 매 분기 금융위‧금감원‧거래소가 심리통보 내용과 조사결과를 비교‧분석한 후 심리‧분석 등 거래소 업무개선에 활용하겠다는 것이다.

마지막으로 긴급‧중대사건 대응체계를 강화하겠다는 방침이다. 거래소 심리중 또는 금융위‧금감원 조사진행 사건 중 사건규모 및 범죄유형, 혐의자의 수, 사회적 파장 가능성 등을 고려하여 판단한 긴급‧중대사건은 주요상황을 사건초기부터 기관 간 적극 공유하겠다는 것이다.

2. 미국의 불공정거래 조사체계

가. 조사체계의 개관

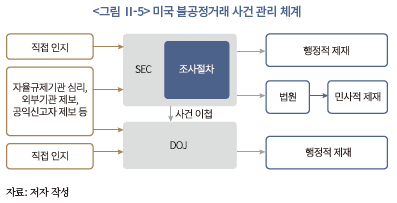

미국 연방증권법상 불공정거래 조사는 연방증권거래위원회(Securities and Exchange Commission: SEC)를 중심으로 이루어진다.4) SEC는 New York Stock Exchange, NASDAQ Stock Market, Chicago Board of Options, Financial Induatry Regulatory Authority(이하 FINRA) 등 자율규제기관의 도움을 받아 불공정거래를 조사하고 제재를 부과한다.5)

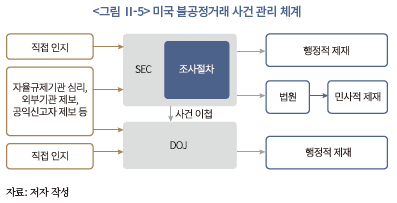

연방증권법상 불공정거래에 대해 취할 수 있는 제재조치에는 민사적 제재, 행정적 제재, 형사적 제재가 있는데, 이중 SEC가 부과할 수 있는 조치는 민사적 제재와 행정적 제재이고, 형사적 제재는 법무부(Department of Justice: DOJ) 등 형사사법기관에서 담당한다. 따라서 형사적 제재가 필요하다고 판단되는 사건은 SEC에서 형사사법기관으로 이첩한다.6)

나. 조사기관

1) SEC

SEC는 1934년에 ① 투자자 보호, ② 공정하고 질서 있는 효율적 시장의 유지, ③ 자본형성의 촉진을 달성하기 위해 1934년 연방증권거래법(Securities Exchange Act of 1934)에 근거하여 설립되었다.7) SEC는 증권시장을 규제하고, 관련 규칙을 제정할 수 있다. 또한 불공정거래에 대한 조사권한을 가지고 있고, 이를 바탕으로 제재를 부과할 수 있다. SEC의 조사권한은 1933년 연방증권법(Securities Act of 1933), 1934년 연방증권거래법, 1940년 투자자문업자법(Investment Advisers Act of 1940), 1940년 투자회사법(Investment Company Act of 1940)에 법률상 근거를 두고 있고8), 조사에 관한 세부 사항은 SEC Rule에서 규정하고 있으며(17 C.F.R. §§ 201-203)9), 실무적인 업무처리 방식은 집행매뉴얼(Enforcement Manual)에 규정하고 있다.10)

SEC의 위원회(Commission)는 4명의 위원과 1명의 위원장으로 구성되며 하부 지원 조직을 갖추고 있다. SEC가 불공정거래 조사 권한을 갖지만, 실질적으로 조사 권한을 행사하여 조사 업무를 수행하는 곳은 SEC 내 집행국(Division of Enforcement)이다.11) 종래에는 법 집행 기능을 워싱턴 D.C.에 위치한 SEC 본부의 여러 부서에서 나누어 처리해 왔는데, 1972년 8월부터 집행국을 설치하여 법 집행 업무를 한 곳에서 통합하여 처리하기 시작했다.12)

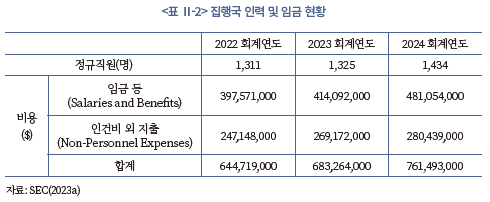

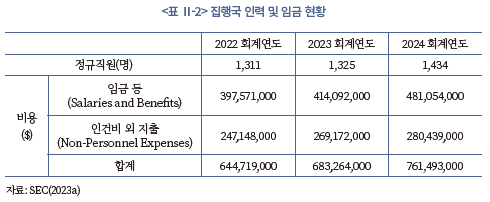

집행국 소속 정규직원의 수는 2022 회계연도에 1,311명이었고, 2023 회계연도 예산에서는 1,325명을 배정받았다. 2024 회계연도 예산안에서는 집행국 인력 규모를 확대하기 위해 1,434명으로 증원을 요청한 상태이다. 이와 같이 집행국 인력 증원을 요청한 이유는 그동안 집행국 업무량에 비해 인력이 지나치게 부족하다는 문제 제기가 있었기 때문이다.13)

집행국 인력 및 임금 현황과 집행국 업무량에 관한 데이터는 아래와 같다.

2) 형사사법기관

연방증권법상 불공정거래에 대한 형사적 제재 권한은 DOJ와 그 산하 검찰청 등 형사사법기관에 있다.14) 형사사법기관은 불공정거래 행위를 독자적으로 수사하여 기소하는 경우도 있고 SEC로부터 이첩된 사건을 기소하는 경우도 있다. DOJ 내부적으로 연방증권법상 불공정거래 행위는 Criminal Division의 Fraud Section 내 하위 부서인 Market Integrity and Major Frauds(이하 MIMF)와 관련이 높다. 45명의 검사로 구성된 MIMF 부서는 증권, 상품, 가상자산 및 기타 금융 사기 및 시세조종 사건의 기소를 중점적으로 처리하고 있다. 특히, MIMF는 SEC, 연방선물거래위원회(Commodity Futures Trading Commission: CFTC) 및 기타 연방기관과 협력하여 불공정거래 사건을 포함한 각종 금융 사기 사건을 단속하는데, 이 부서에서 주로 다루는 사건은 시세조종 사기, 기업회계 사기, 내부자거래, 가상자산 사기, 대규모 투자 사기, 연방 프로그램 및 조달 관련 사기, 소비자 및 투자자 사기 등이다.15)

다. SEC 조사절차

SEC는 연방증권법상 불공정거래 조사 권한을 가지고 있고, 이러한 권한을 행사하는 데 있어 광범위한 재량이 인정된다.16) SEC의 조사절차는 대략 ① 단서 확보, ② 예비조사(Matters Under Inquiry: MUI), ③ 정식조사, ④ 처분권고 결정 및 Wells 고지 절차, ⑤ Action Memo 절차, ⑥ 위원회 결의 및 제재조치 순으로 진행된다.17)

1) 단서 확보

집행국은 SEC 자체 인지 조사, 발행기업의 감시인, 내부고발자, 경쟁자, 투자자 등의 제보, FINRA 등 유관기관 또는 다른 정부기관으로부터의 제보, 언론, 소송자료 또는 다른 사건의 증인의 증언, 시장감시 거래정보 등 다양한 경로를 통해 증권법 위반 가능성에 관한 단서를 확보한다.18) 특히, SEC는 제보 및 불만사항을 접수하는 TCR(Tips, Complaints, and Referrals) 시스템을 운영하고 있으며, 집행매뉴얼에서는 집행국 직원이 정기적으로 TCR 시스템을 검색하여 단서를 확보하고, 예비조사나 정식조사 개시 여부 또는 조사대상자 추가 여부 등을 결정하기 전에 TCR 시스템을 검색할 것이 권장된다.19)

2) 예비조사

예비조사는 정식조사 전에 이루어지는 조사이다.20) 예비조사를 개시하기 위해서는 집행국 조사담당자(부국장급 이하)가 사건을 미리 검토해보고 ① 해당 사건이 연방증권법 위반행위에 관한 것인지, ② 해당 사건을 어느 부서에 배당하는 것이 효율적인지를 판단해야 한다. 사전 검토 결과, 예비조사가 필요하다고 판단되면 조사담당직원은 내부시스템상에서 예비조사 개시 조치를 취하고, 부국장(Associate Director) 또는 지역사무소 책임자(Regional Director)의 승인을 받아 예비조사를 개시한다. 조사담당직원은 TCR 시스템에서 해당 사안과 관련되는 단서(tips, complaints, and referrals)를 검색해보고, 만약 해당 사안과 관련되는 조사나 단서가 발견되면 해당 조사나 단서에 배정된 직원과 협의해야 한다. 예비조사는 원칙적으로 비공개로 진행되며, 조사담당직원은 60일 이내에 예비조사를 종결하거나 정식조사로 전환한다.21)

3) 정식조사

예비조사만으로는 사건 조사가 충분히 이루어지기 어려운 경우 조사담당직원은 예비조사를 정식조사로 전환하는 요청을 하고, 위원회(현재 집행국 국장에 해당 권한 위임)에서 이를 승인하면 정식조사가 개시된다. 정식조사 절차에서는 소환장(subpoena) 발부를 통해 문서의 제출, 증인의 출석, 증인의 선서를 요구하는 등 강제조사가 가능하다.22) 다만, 조사대상자가 소환장에 불응할 경우 SEC가 단독으로 소환을 강제할 수는 없고 법원의 명령을 통해 간접적으로 강제하는 것은 가능하다.23) 정식조사도 원칙적으로 비공개로 진행된다.24)

4) Wells 절차

조사담당자가 사안을 조사한 결과 제재조치가 필요하다고 판단되어 위원회에 제재 권고를 하고자 하는 경우, 조사담당자는 이 사실을 조사대상자에게 알리고 의견제출의 기회를 제공한다.25) Wells 절차라고 불리는 이 절차는 크게 Wells 고지(notice)와 Wells 답변(submisson)으로 이루어진다. Wells 고지는 조사대상자에게 집행국이 위원회에 제출할 집행조치권고안을 사전에 알려주는 것으로서 ① 조사담당직원이 위원회에 소제기 또는 제재절차 개시를 권고한다는 사실, ② 조사담당직원이 제재 권고안에 포함하기로 미리 결정한 증권법 위반행위, ③ 제재 권고안과 관련하여 집행국 및 위원회에 답변서를 제출할 수 있다는 사실 등을 기재하여 조사대상자에게 고지한다.26) Wells 고지는 반드시 이행해야 하는 의무사항은 아니지만, SEC는 일반적으로 Wells 고지를 이행하고 있다.27) Wells 고지에 대해 의견을 제출하고자 하는 조사대상자는 Wells 답변을 통해 자신의 의견을 제출할 수 있다.28)

5) Action Memo 절차

집행국은 Wells 절차를 거친 제재 위원회에 제재조치 권고안을 제출한다. 집행국에서 위원회에 제출하는 제재조치 권고안을 Action Memo라 하며, 이 Action Memo에는 집행국의 제재조치 권고 내용과 그에 대한 사실적, 법률적 근거를 기재한다.29)

6) 위원회 결의 및 제재조치

위원회는 Action Memo를 검토한 후 투표로 그 제재조치 권고안에 대한 승인 여부를 결정한다. 위원회의 검토는 비공개 위원회 회의를 통해 이루어지는데30), 연방법원에 민사소송을 제기할 것인지 아니면 행정법 판사(Administrative Law Judges: ALJ)에게 맡길지는 다양한 요인에 따라 결정된다. 필요성이 인정되는 경우 위원회는 두 절차를 병행하여 진행하기도 한다.31) 민사소송에서 SEC는 향후 위반행위를 금지하는 명령인 금지명령을 청구하며, 금지명령을 위반한 자는 법원모욕죄로 벌금형 또는 징역형에 처해질 수 있다. 또한, 종종 민사제재금(civil penalty)과 부당이득환수(disgorgement of ill-gotten gains)를 요구하기도 하며, 특정 상황에서는 회사 임원이나 이사로 활동하는 것을 금지하거나 정지하는 법원 명령도 요청한다. SEC는 민사소송 외에도 다양한 행정적 제재를 부과할 수 있으며, 이러한 행정적 제재는 행정법판사와 위원회가 심리한다. 행정적 제재 중 중지명령(cease and desist order)은 연방증권법을 위반한 모든 사람을 상대로 제기할 수 있으며, 브로커, 딜러, 투자자문업자 등과 같은 규제대상기관 및 그 직원에 대해서는 등록을 취소 또는 정지하거나 취업을 금지 또는 정지하는 조치를 부과할 수 있다. SEC는 중지명령이나 민사제재금을 부과하면서 이와 함께 부당이득환수를 명할 수 있다. 또한, 특정 업계, 협회 및 행위 관련 금지명령도 부과할 수 있다.32)

라. SEC 조사권한

1) 임의조사

1934년 연방증권거래법 Section 21(a)(1)은 SEC에 불공정거래를 조사할 권한과 재량을 부여하였다(15 U.S.C. § 78u(a)(1)). 이에 따라 SEC는 조사를 수행하는 과정에서 임의적인 증거제출 및 증언을 요청할 수 있다. 즉, SEC는 소환장을 발부하지 아니하고 자발적으로 문서 또는 정보 제출을 요청할 수 있고, 증인에게 자발적 증언(testimony)이나 전화, 대면 등 비공식 인터뷰(informal interview)를 요청할 수 있다.33) 다만, 이러한 비공식 조사는 소환장에 의한 강제조사가 아니므로 전적으로 조사대상자의 협조에 의존하는 임의조사이다.34)

2) 강제조사

SEC가 조사 수행 과정에서 강제적 사실 수집이 필요하다고 판단되면 SEC는 1934년 연방증권거래법 Section 21(b)에 따라 소환장을 발부하여 강제조사를 실시할 수 있다(15 U.S.C. §78u(b)). 즉, SEC 집행국은 소환장을 발부받아 ① 증인 소환과 출석 강제, ② 증거 수집, ③ 장부, 문서, 서신, 회의록 또는 기타 기록의 제출을 요구할 수 있다(15 U.S.C. §78u(b)). 이와 같이 소환장에 근거하여 문서 제출을 강제하거나 선서증언을 강제할 수 있고, 이 경우 집행국 직원은 조사대상자에게 SEC Form 1662를 제공한다. 그런데 조사대상자가 소환장에 불응하거나 이를 준수하지 않을 경우, SEC는 이에 대한 강제를 법원에 요청할 수 있고, 해당 법원은 조사대상자에게 SEC 또는 SEC에서 지정한 위원이나 임원에게 문서 제출 또는 증언을 하도록 명할 수 있다. 만약 조사대상자가 이러한 법원의 명령에 따르지 않는다면 당해 법원은 이를 법원모욕죄로 처벌할 수 있다(15 U.S.C. §78u(c)). 정당한 이유없이 SEC의 증인 소환, 문서 제출 요구에 응하지 아니한 경우에는 1년 이내의 금고형이나 1,000달러 이하의 벌금 또는 양자가 병과될 수 있다(15 U.S.C. §78u(c)).

문서 제출을 요구하는 소환장을 발부하기 위해서는 정식조사명령서에 조사담당직원을 지정해야 한다. 여기서 ‘문서’라 함은 소환 대상 법인 또는 개인이 소유, 보관 또는 통제하는 모든 서면, 인쇄물 또는 타이핑된 자료를 포함하되 이에 국한되지 않는다. 서신 및 통신, 사무실 간 통신, 전표, 티켓, 기록, 워크시트, 재무 기록, 회계 문서, 부기 문서, 각서, 보고서, 매뉴얼, 전화 기록, 전보, 팩시밀리, 모든 유형의 메시지, 전화 메시지, 음성 메일, 테이프 녹음, 공지, 지침, 회의록, 요약, 파일 폴더 표시, 기타 조직 표시, 구매 주문서, 마이크로 필름 및 마이크로 피시 등 사진 프로세스로 기록된 정보, 컴퓨터 출력물, 스프레드시트, 기타 전자적으로 저장된 정보 등이 모두 포함될 수 있다. 위원회가 정식조사명령을 발령하면 해당 조사담당직원이 소환장을 발부할 수 있으며, 통신서비스 회사의 통신사실기록이나 은행의 금융거래기록은 소환장을 사용해야 입수할 수 있다.35)

마. 형사절차

연방증권법의 형사적 제재는 DOJ 및 그 산하 검찰청 등 형사사법기관에서 담당한다.36) SEC에서 형사적 제재 가치가 있다고 판단되는 사건을 형사사법기관에 이첩하여 수사가 개시되는 경우도 있고, 형사사법기관 자체 조사를 통해 기소하는 경우도 있다. 형사사법기관은 증권 관련 사기행위를 기소할 때 이용할 수 있는 범죄가 다양하다. 실제로 형사적 제재 절차에서는 연방증권법 및 연방증권거래법에 규정된 범죄뿐만 아니라 우편 사기, 보이스 피싱, 부패 조직에 대한 공갈 및 부패 방지법(RICO)상의 범죄로 기소되는 경우도 많다. 형사적 제재 절차에서는 형사사법기관이 이러한 모든 범죄에 대해 합리적 의심의 여지가 없을 정도의 입증을 부담한다.37)

1933년 연방증권법 및 1934년 연방증권거래법은 민사적 제재 규정과 형사적 제재 규정을 모두 포함하고 있다. 따라서 같은 법률에 있다고 하더라도 형사적 제재 규정과 민사적 제재 규정을 적용할 때에는 주관적 요건과 입증책임 등에서 차이를 보인다. 우선 1933년 연방증권법과 1934년 연방증권거래법에 따라 민사적 제재를 부과하려면 주관적 요건으로 scienter38)를 요하지만, 이에 대해 형사적 제재를 부과하려면 피고인에게 고의(willfully)가 존재하여야 한다. 또한, 민사적 제재를 위해서는 보통 우월한 증거(preponderance of the evidence)의 수준으로 입증하면 충분한 경우가 많은데39), 형사적 제재를 위해서는 유죄에 대하여 합리적 의심이 없는(beyond reasonable doubt) 수준의 고도의 입증책임을 요한다.40)

바. SEC와 형사사법기관 간 협력

SEC는 행정제재 조치를 취할 권한 또는 민사적 제재조치를 위해 연방법원에 소를 제기할 권한을 갖지만 형사적 제재조치를 위한 공소권은 없다. 형사적 제재와 관련한 권한은 전적으로 형사사법기관에 있다. 따라서 형사적 제재를 위한 절차는 DOJ 등 형사사법기관에서 주도하고 SEC는 이에 협력하는 역할만 수행한다. SEC의 협력 권한은 SEC가 조사절차를 진행하고 있거나 민사소송을 제기한 상태에서 형사사법기관이 수사를 개시하거나 기소결정을 한 경우에도 행사할 수 있다.41) 즉, 민사적 제재 절차와 형사적 제재 절차가 병행하게 된 상황에서도 SEC는 형사사법기관에 협력할 수 있다.

이처럼 SEC의 조사와 형사사법기관의 수사 절차는 병행할 수 있으며, 실제로 두 절차가 동시에 진행되는 경우가 종종 있다. 연방대법원은 민사소송과 형사소송을 병행할 수 있다고 판시한 바 있고42),연방항소법원도 SEC 조사와 형사사법기관 수사가 동시에 진행될 수 있다고 보았다.43) 이 경우 SEC는 형사사법기관에 정보를 공유하는 등의 방법으로 협력할 수 있다. 1933년 연방증권법 Section 20(b), 1934년 연방증권거래법 Section 21(d), SEC Rule 24c-1에 의하면, SEC는 조사 결과 수집한 정보를 다른 기관과 공유할 수 있고, SEC의 재량으로 형사사법기관에 해당 정보를 전달할 수 있다(15 U.S.C. § 77t(b); 15 U.S.C. § 78u(d); 17 C.F.R. § 240.24c-1). 나아가 SEC 기관 차원에서도 조사담당직원에게 형사사법기관의 수사에 적극적으로 협력하고 정보를 공유하도록 권장하고 있다. 이 경우 SEC 집행국 조사 파일에 접근할 수 있도록 형사사법기관에 접근 권한을 부여하거나 SEC 직원을 Special Assistant U.S. Attorneys로 배정하는 방법44) 등을 통해 검찰의 형사적 제재 절차에 협력할 수 있다.45)

다만, 형사사법기관의 수사와 병행하여 SEC 조사절차를 진행하고자 하는 경우 또는 형사사법기관의 수사가 이미 진행되고 있는 사안에 대하여 SEC가 민사소송을 제기하고자 하는 경우, 이를 위한 승인을 요청할 것인지를 결정할 때 SEC 조사담당직원은 다음 사항을 고려해야 한다.46)

① SEC의 조사는 그 자체로 독립적인 조사 목적이 있어야 하고, 단순히 형사사법기관의 수사 절차를 돕기 위한 목적으로만 SEC 조사를 진행할 수는 없다는 점이다. 따라서 SEC 조사를 단순히 형사 기소 목적 증거확보만을 위해서 개시해서는 안된다. 다만, SEC 조사가 SEC의 제재와 형사사법기관의 제재에 모두 도움이 되는 경우에는 조사를 실시할 수 있다. ② SEC 조사담당직원은 요청 대상 문서, 증언, 질문사항, 증언장소 등을 독립적으로 결정해야 한다. ③ 조사대상자나 변호사가 형사절차가 병행되고 있는지를 묻는 경우 SEC 조사담당직원은 조사대상자나 변호사에게 Form 1662의 일상적인 정보 사용에 관한 내용을 안내하고 형사사법기관의 조사에 대해서는 언급하지 않는다. 이러한 질문을 하는 자가 형사절차 진행 여부를 확인하고자 하는 경우 형사사법기관에 문의할 것을 권유해야 하나, 만약 어느 형사사법기관에 연락을 취해야 하는지를 물을 경우 SEC 조사담당직원은 해당 형사사법기관의 허가를 받지 아니하는 한 답변을 거부해야 한다. ④ SEC 조사담당직원을 감독하는 자는 형사사법기관과의 모든 중요한 논의 및 서면 의사소통에 참여해야 한다. ⑤ 일반적으로 형사사법기관과의 정보 공유는 허용된다. 설령 그러한 정보 공유가 검사에게 도움을 주기 위한 것이고, 실제로 검사에게 도움이 된다고 하더라도 허용된다. ⑥ 특정한 상황에서 형사사법기관이 SEC 조사담당직원에게 형사상 수사 절차에 해를 끼칠 수 있는 행위를 자제할 것을 요청할 수 있으며, 역으로 SEC 조사담당직원이 형사사법기관에 SEC 조사에 해를 끼칠 수 있는 행위를 자제할 것을 요청할 수 있다. 다만, 개별 사안마다 상황이 고유하므로 조사담당직원은 위에서 언급한 고려사항에 관하여 상급자와 상의해야 한다.

3. 일본의 불공정거래 조사체계

가. 불공정거래 조사‧감시기관

일본에서 불공정거래에 대한 조사‧감독의 역할을 하는 기관으로는 증권거래 등 감시위원회(이하 증감위)가 있다. 버블 붕괴 후 증권 관련 사건이 다발적으로 일어남에 따라 증권 행정의 방향성에 대하여 많은 논의가 이루어졌다. 이전에는 일본 대장성이 증권회사 등의 시장참가자가 지켜야 할 규범을 정하는 역할과 이를 감독하는 역할을 모두 담당하고 있었지만, 이는 공정성의 측면에서 바람직하지 않다는 비판적 여론이 거세짐에 따라, 증감위가 대장성 산하(현재는 조직재편에 따라 금융청 산하)에 설치되었다.

조사‧감독 시스템에 대한 조직‧권한 관계를 살펴보면, 금융상품거래법(이하 금상법)상의 각종 규제 권한은 원칙적으로 내각총리대신에 속한다. 그러나 대부분의 권한은 금융청 장관에게 위임하고 있다(금상법 제194조의7 제1항). 그리고 금융청 장관은 위임받은 권한 중 일부를 금융청 산하에 설치된 증감위에 위임하여 1차적으로 증권, 파생상품 등의 금융상품거래에 대한 시장규제를 담당하게 하고 있다(금상법 제194조의7 제2항).

이에 따라 증감위는 불공정거래에 관한 대부분의 조사‧감시역할을 수행하고 있다. 구체적으로는 공시 및 시장거래의 조사‧감시, 행정처분이나 과징금 납부 명령의 권고, 범칙사건의 조사, 고발 등, 긴급정지명령의 재판소에의 청구, 금융상품거래업자‧기관의 조사‧검사, 금융청 장관 등에 대한 건의 등 다양한 업무를 수행하고 있다.

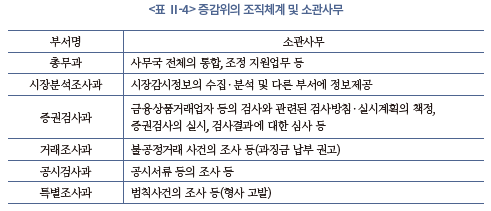

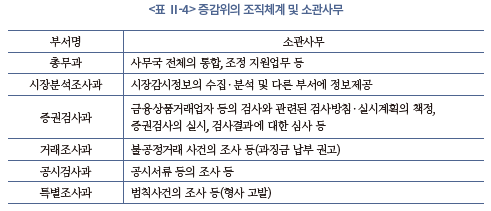

나. 증감위의 조직체계 및 현황

증감위는 위원장 및 2명의 위원으로 구성되는 합의제 기관으로서 산하에 사무국을 두고 있다. 증감위의 사무국은 총무과, 시장분석조사과, 증권검사과, 거래조사과, 공시검사과, 특별조사과로 나뉘어 있고, 증감위의 직원은 총 389명에 이른다.47)

시장분석조사과는 증감위의 정보의 입구로서 투자자 등으로부터 정보를 제공받고, 금융‧자본시장 전체에 대해 폭넓게 정보를 수집‧분석하여 다른 특별조사과나 거래조사과 등 각 조사과의 검사‧조사에 활용할 수 있도록 정보를 제공하는 역할을 한다. 또한 발행‧유통시장 전체에 대한 시장감시 업무를 수행하고, 불공정거래의 의심이 있는 거래를 심사하는 업무를 수행한다. 증감위의 정보수집은 대부분 시장분석조사과에서 이루어진다. 시장분석조사과는 우선 정보제공창구를 마련하여 투자자나 시장관계자 등으로부터 정보를 수집하고 있다. 정보제공창구를 통하여 연간 약 6,000~7,000건의 정보가 증감위에 접수되고 있고, 이 중 불공정거래와 관련된 정보만 하더라도 연간 약 4,000~5,000건이 접수되고 있다.48)

증권검사과는 금융상품거래업자 등의 업무나 재산의 상황 등에 대한 검사 업무를 수행한다. 검사 결과 문제가 있는 금융상품거래업자 등에 대해서는 문제점을 지적하고 개선을 요구하는 한편, 중대한 법령 위반행위 등이 인정되는 경우에는 금융청 장관에 대하여 행정처분을 요구하는 권고를 한다. 거래조사과는 내부자거래나 시세조종, 풍문의 유포‧위계 등의 불공정거래에 대한 과징금 사건을 조사하는 부서이다. 거래조사 결과 위반행위가 인정되는 경우에는 금융청 장관에 대해 과징금 납부명령을 발령하도록 권고하는 업무를 수행한다.

공시검사과는 유가증권보고서 등의 공시서류 제출자에 대해서, 보고의 청취 및 검사를 실시한다. 공시검사 결과, 공시서류의 중요한 사항에 대한 허위기재 등이 인정되는 경우에는 금융청 장관에 대해 과징금 납부명령을 발령하도록 권고하는 업무를 수행한다. 마지막으로 특별조사과는 범칙사건을 담당하여 금융상품거래의 공정을 해치는 악질적인 행위의 실태를 파악하고, 이를 검찰에 고발하기 위한 조사업무를 수행한다.

다. 증감위의 주요 조사 권한

1) 범칙사건의 조사를 위한 권한

증감위는 금상법 제9장(제210조~제227조)의 규정에 따라 금융청 장관의 위임을 받지 않고 독자적으로 범칙사건49)의 조사를 위한 임의조사권과 강제조사권을 가진다. 증감위의 임의조사권한으로, 증감위 직원은 범칙사건을 조사하기 위하여 필요한 경우에는 범칙 피의자‧참고인에 대하여 출석을 요구하거나, 질문‧검사‧영치 등의 처분을 할 수 있다(법 제210조 1항). 그러나 이것들은 어디까지나 임의조사이기 때문에 피의자‧참고인의 동의가 필요하고, 강제력을 행사하여서는 안 된다. 또한, 증감위는 관공서 또는 공사 단체에 조회를 실시하고 필요한 보고를 요구할 수 있다(동조 제2항).

또한 증감위의 강제조사권한으로는 증감위 직원에게 법원의 허가장을 얻어 현장조사‧수색‧압수(법 제211조 1항), 우편물, 전신관련 통신기록 압류권한(법 제211조의2 제1항), 경찰관에 대한 지원요청(법 제218조) 등의 권한이 인정되고 있다. 이와 같은 권한은 강제력을 수반하기 때문에 피의자 등의 인권 보호의 관점에서 형사사건에서의 강제수사와 동일하게 법원의 허가장을 얻을 필요가 있다.

나아가, 증감위의 직원은 범칙사건의 조사결과를 위원회에 보고(법 제223조)하여야 하며, 증감위 위원은 범칙의 심증이 있는 경우에는 고발하여야 하고, 영치‧압수한 물건 등이 있는 경우에는 검찰관에게 이를 인도하여야 한다(법 제226조).

2) 행정권한의 행사를 위한 조사‧검사 권한

원칙적으로 금융청 장관은 금융상품거래업자, 금융상품중개업자, 등록금융기관, 금융상품거래업협회, 금융상품거래소, 증권금융회사 등에 대해 보고청취‧검사권을 가지고 있는데, 이러한 권한 중 유가증권의 매매 기타 거래 또는 파생상품 등의 거래에 대한 공정성 확보와 관련된 일정한 사항에 대한 보고청취‧검사권을 증감위에 위임하고 있다

(법 제194조의7 2항).

또한, 불공정거래규제의 실효성을 확보하기 위하여 과징금제도가 도입됨에 따라 증감위는 과징금 사건을 조사하기 위하여 사건관계인, 참고인 등에 대한 질문‧보고 등의 청취 및 검사 권한을 가진다(법 제194조의7 제2항 제8호). 이외에도, 증감위는 금상법 제187조의 심문 등에 관한 조사를 위한 처분이나, 금상법 제192조의 재판소에의 금지‧정지명령의 신청 권한(법 제194조의7 제4항)이나 공시서류의 제출자에 대한 조사 권한(법 제194조의7 제3항) 등의 권한도 가지고 있다.

이와 같은 조사권한을 행사하여 증감위가 과징금 납부명령 등의 행정처분이 필요하다고 인정하는 경우에는 금융청 장관에게 권고할 수 있고, 이에 따라 과징금 심판절차가 개시되게 된다(금융청 설치법 제20조 제1항).

한편, 후술하듯 실무상으로는 이중처벌 금지원칙 위배에 대한 우려를 불식시키기 위해서 위반행위의 '악질성'을 기준으로 하여, 형사처벌의 대상이 되어야 한다고 증감위가 판단하는 경우에는 범칙사건으로 분류하여 형사 고발 조치를 취하고, 이외의 경우에는 과징금 사건으로 분류하여 과징금 부과 처분을 하고 있다.

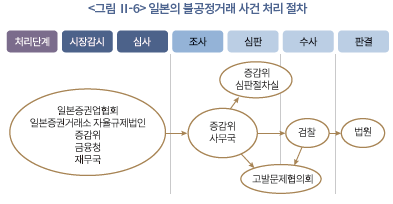

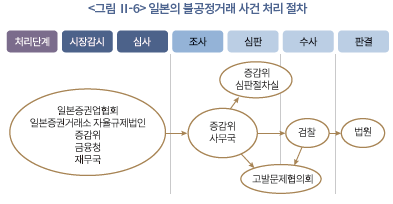

과거에는 범칙사건을 조사할 때, 검찰에서 파견된 검사가 우선 증감위에 들어오는 정보를 분석하고, 형사고발 가능성이 있는 사건을 우선 선정하였다. 그리고 이렇게 선정된 사건을 검사들이 주로 파견되어 있는 특별조사과에서 담당하는 방식으로 조사가 이루어졌다. 이와 같은 체제 하에서 검찰에서 파견된 검사는 불공정거래 사건과 관련된 조사정보를 증감위의 행정조사과에 대해서도 철저하게 비밀로 지키며 정보를 독점하고 있었다. 증감위의 행정직원들은 평소 업계 사람들과 연결고리가 있어 조사사실에 관한 비밀정보 등을 업계 사람들에게 누설할 염려가 있다는 이유에서였다.

그러나 이와 같은 파견검사에 의한 검찰의 실질적인 정보 독점 시스템은 2006년의 라이브도어 사건과, 무라카미 펀드 사건을 조사할 당시를 기점으로 큰 변화를 맞이하게 되었다. 당시 파견검사가 증감위의 임원들에게도 당해 사건에 대한 조사정보를 자세히 보고 하지 않고, 바로 검찰의 특수부와 극비리에 사건을 절충해 버리는 사건이 발생하였기 때문이다. 이에 따라 항상 정보가 부족하여 조사 업무 수행에 많은 비판을 받아왔던 증감위 측의 불만이 커지게 되었다.

한편 이 무렵 취임한 사도(佐渡) 증감위 위원장에 의해 증감위의 조사체계에 큰 변화가 찾아왔다. 기존에는 파견검사가 주로 속해 있던 특별조사과에 우선 정보가 집중되었지만, 이후에는 조사의 초동단계에 증감위 중심인 시장분석심사과가 모든 정보를 수집‧분석하여, 거래조사과와 특별조사과 등의 조사 부서에 할당하게 되며, 검찰 중심의 조사체계에서 증감위(행정) 중심의 조사체계로 변화하게 된 것이다.50) 이에 따라 모든 정보는 시장분석심사과에 집중되어, 증감위 직원이 중심이 된 거래조사과가 이러한 정보를 바탕으로 과징금 사건을 조사하며, 주로 검찰 출신으로 구성되어 있는 특별조사과는 형사고발 사건을 조사하도록 하며 공평하게 정보가 배분되게 되었다.

한편, 형사사건을 조사하는 특별조사과가 고발조치를 취할 때에는 통상적으로 사전에 증감위와 검찰의 협의체인 고발문제협의회를 개최하고 있다. 고발문제협의회에서 고발조치를 취하는 것으로 결정이 되면, 위원장과 2명의 위원이 합의로 판단하는 증감위에 안건이 상정되지만, 이러한 안건에 대해서는 위원장과 위원들도 특별한 간섭을 하지 않는다고 한다.51) 다만, 후술하듯이 증감위에서 조사가 이루어지는 사건의 대부분은 과징금 부과사건이고, 예외적으로 형사고발 조치가 취해지고 있는 점을 보면, 과거에 비하여 검찰이 증감위에 행사하는 영향력은 많이 줄어든 것으로 보인다.

4. 향후 과제

미국과 일본의 사례를 살펴본 결과, 나라마다 규범 제정과 감독권한의 부여는 다르나 불공정거래 조사를 각기 다른 기구에서 각기 다른 권한을 가지고 수행하지 않는 것으로 나타났다. 미국은 SEC에서 규범 제정과 감독권한을 모두 가지고 있고, 집행국에서 불공정거래 조사를 수행한다. 일본은 금융청에서 규범을 제정하고 증감위에서 감독 권한을 행사하나, 불공정거래 조사는 증감위에서만 수행하고 금융청은 과징금 부과에 대하여 추가적인 조사만 수행할 뿐이다. 물론 동일한 사건에 대해서 미국은 SEC의 조사절차와 검찰의 수사가 동시에 이루어지기도 하고 일본의 경우 증감위와 검찰이 합동으로 수사를 하기도 하고 관련 문제를 논의하기 위해 ‘고발문제협의회’를 운영한다는 특징이 있지만, 행정기구로는 SEC와 증감위에서 전담하여 조사를 한다는 점이 우리나라와 다르다.

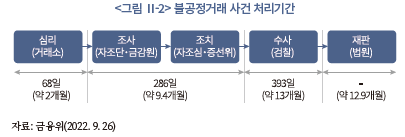

우리나라의 경우 불공정거래 사건의 조사체계가 복잡하고, 각 기관마다 주어진 법적 권한도 달라서 효율적 조사가 이루어지지 못하고 있는 것으로 보인다. 예를 들어, 거래소의 심리, 금감원(금융위)의 조사, 자조심의 심의, 증선위의 의결을 거쳐 고발‧통보 되기까지 1년의 장기간이 소요되고 그 과정에서 주요 혐의자가 도주하거나 증거인멸의 우려도 있다는 지적이 오래전부터 있어 왔다.52)

이를 해결하기 위해 정부가 발표한 방안은 기관간 협력 및 정보 공유 강화를 통해 조사의 효율성과 신속성을 높이겠다는 것이다. 정부는 증선위를 중심으로 기관간(금융위‧금감원‧거래소 + 필요시 검찰) 상시 협업체계를 구축하여 월 1회 조심협을 개최하여 사건 전반을 관리‧협의하는 등 상시 협업체계를 구축하겠다고 발표하였다. 또한 기관별 시장감시‧심리, 조사 등 주요상황을 수시 공유하면서 협조가 필요한 사항이나 사건 처리 방향 등을 긴밀히 협의하겠다는 방침이다. 또한 조사정보 공유시스템을 가동하여 심리분석자료, 조사결과보고서, 자조심‧증선위 안건, 법원 판결 내용 등의 주요 정보를 체계적으로 축적하여 관리하고 조사상황을 적극 공유하는 방향으로 제도를 개선하였다고 밝혔다. 이러한 정부의 개선방안은 과거의 조사‧수사 정보가 공유되어 새로운 불공정거래 행위에 대한 조사‧수사에 도움을 얻을 수 있을 뿐 아니라, 올해 발생했던 CFD와 사건과 같은 대형 불공정거래 사건이 발생할 경우 기관간 협력을 통해 빠른 절차 진행이 가능하게 되는 긍정적 효과가 있을 것으로 기대된다.

이러한 정부의 개선방안은 현재 우리나라의 금융규제 환경에서는 각각의 기관들의 협업체계 구축과 정보 공유라는 단기적 처방으로 의의가 있지만, 기관의 다양성과 절차의 복잡성 그리고 조사기관별 권한의 차이로 인한 문제는 해결하지 못한다는 한계는 여전히 존재한다. 또한 협의과정에서 도리어 비효율이 발생할 가능성도 배제할 수 없다. 해당 사건을 어느 기관에서 조사할 것인지에 대하여 기관간 의견이 일치하지 않을 경우 마찰이 빚어질 수 있고53), 특히 기관간의 협의과정에서 의견 대립이 있을 때 이를 중재할 수 있는 상위기관이 없어 오히려 효율성이 떨어질 수 있다.54)

우리나라도 미국‧일본의 입법례를 참고하여 기관별로 역할을 분배하고, 효율적으로 운영하는 방안을 검토해야 한다. 현재 정부가 발표한 개선방안에 따르면 서로 정보는 공유하고 상의하겠으나, 여전히 불공정거래 조사를 금융위, 금감원, 금융위와 금감원의 공동조사라는 각기 다른 기관에서 진행하겠다는 점은 변함이 없다. 미국의 경우 SEC가 담당하여 사건을 처리하고 사건의 중대성에 따라 부여되는 권한의 차이가 있으나 동일한 기관 내에서 배분이므로 보다 효율적일 수 있다. 일본은 증감위라는 동일한 기구안에서 업무부서별로 불공정거래 관련 조사 내용을 담당하여 동일한 조사효과를 가져오고 있다. 우리나라의 경우 금감원과 금융위에서 각각 불공정거래의 조사를 담당할 필요는 없어 보인다.55) 특히 여러 개의 불공정거래 혐의가 있는 사건의 경우 금융위와 금감원에서 혐의의 중요도에 따라 각각 조사하게 될 경우 중복조사로 시간만 지연되는 비효율이 발생하게 된다. 금융회사에 대한 검사 업무를 수행한 경험을 통해 정확한 증거수집이 가능하고, 불공정거래 조사를 오랜 기간 담당하며 쌓은 노하우를 통해 사건 초기에 전문적이고 신속한 조사가 가능한 금감원에서 불공정거래 조사를 담당하는 것이 효율적일 수 있다. 이러한 이유로 미국에서도 SEC 집행부에서 그리고 일본에서도 증감위에서 불공정거래 조사를 전담하고 있는 것으로 보인다.

금감원에서 조사를 집중하도록 하는 한편, 금융위는 불공정거래의 컨트럴 타워 역할을 수행하여 금감원이 조사한 사건을 검찰로 이첩할 것인지 과징금을 부과할 것인지 등을 결정하고 과징금을 부과하는 일을 전담하는 방안을 생각해 볼 수 있다. 또한 동일한 안건에 대해 자조심 심의와 증선위 의결의 절차를 중복해서 거치도록 하고 있는 현행 제도도 재검토가 필요하다. 안건에 대한 심의와 의결의 결과가 달라지는 경우가 거의 없음에도 불구하고 한달에 한번 개최되는 자조심과 한달에 두 번 개최되는 증선위를 거치는 동안 시간도 지연되고 회의 자료 준비 담당자의 중복성도 있으므로 이를 하나로 통일하는 방안도 고민해야 한다.56)

조사기관을 정비한 다음에 해야 할 일은 조사권한을 강화하는 일이다. 정부 발표에 자산동결권한이 신설되기는 하였으나, 여전히 미국과 일본의 조사기구에 비해서는 조사권한이 제한적이다. 물론 형사사법기구인 검찰에 비해 행정기구의 조사권한이 적은 것은 당연하나, 우리나라의 금감원, 금융위의 조사권한을 미국의 SEC나 일본의 금융청에 비교할 때도 제한적임을 알 수 있다.

특히 혐의의 입증을 위해 필수적인 통신조회권이 인정되지 않는 것도 제도 개선이 필요하다. 현행법상 통신기록조회는 1년 이내만 가능하여 조사를 거쳐 검찰에 이첩될 경우 1년이 지나 통신기록 조회를 할 수 없어 증거확보에 어려움이 있는 현실이다. 특히 가장 효율적인 조사는 초동단계에서부터 확실한 증거를 확보해야 하는데, 불공정거래 조사에 있어 중요한 금감원 직원에게 허용되는 권한이 적어서 이 또한 문제가 된다. 공무원이 아닌 민간인 신분의 금감원 직원에게 어느 정도의 강제조사 권한을 허용할 수 있는지 여부가 문제될 수 있으나, 강제조사권이 부여된 특사경의 조사 대상 및 인원을 확대할 경우 현행법제 안에서도 해결할 수 있으므로 적극 검토할 필요가 있다.58) 한편 자본시장법상 강제조사권이 부여되는 조사공무원의 지명을 금감원 직원을 대상으로 하는 것과59) 금융위와 금감원의 역할 분담과 관련한 금융감독기구 체제의 개편에 대한 논의60)도 장기적으로는 검토해 볼 만하다.61)

Ⅲ. 형사처벌과 과징금의 합리적 운용방안

1. 현행 제도의 문제점 및 개선방안 검토

가. 현행 제도의 문제점

우리나라의 불공정거래에 대한 제재수단은 형사처벌에 의존하고 있어, 불공정거래 행위자의 가장 강한 동기인 경제적 이득에 대해 박탈이 제대로 이루어지지 않는다는 취약점이 있어 왔다. 더욱이 조사 및 수사가 장기화되면서 증거인멸이 이루어지고 결과적으로 형사처벌 수위가 낮다는 문제가 발생하면서 재범의 우려 또한 높아지고 있다. 자본시장법 위반 사건의 경우 재판에서 집행유예비율과 상고기각률이 형사사건 평균에 비해 높게 나오는데, 이는 3대 불공정거래 사건에 대한 처벌 수준이 높지 않다는 주장을 일부 뒷받침 한다는 실증 연구도 있다.62)

이러한 문제를 해결하기 위해 2015년 과징금제도가 도입되었으나 시장질서교란행위자에 한정되고 2021년에는 불법공매도에 확대 적용되었을 뿐 시세조종 등 3대 불공정행위에 대해서는 과징금제도가 도입되지 않고 있었다.

나. 개정 자본시장법 검토

그런데 2023년 7월 자본시장법을 개정하여 3대 불공정거래 행위에 과징금제도가 도입되었고, 2024년 1월 19일 시행을 앞두고 있다. 불공정거래 행위자에 대하여 불공정거래 행위로 얻은 이익 또는 회피한 손실액의 2배 이하의 과징금을 부과할 수 있도록 하고, 같은 행위에 대하여 형사처벌을 받은 경우 과징금 부과를 취소하거나 벌금 등에 상당하는 금액을 과징금에서 제외할 수 있으며, 검찰총장은 금융위가 과징금을 부과하기 위하여 수사 관련 자료를 요구하는 경우 필요하다고 인정되는 범위에서 이를 제공할 수 있도록 하였다(제429조의2).

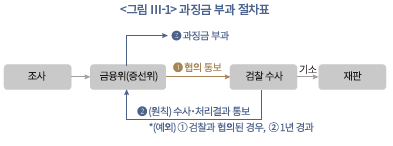

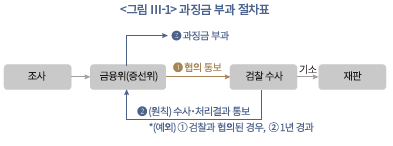

이러한 법 개정에 따라 2023년 9월 25일에 입법예고된 자본시장법 시행령에 따르면, 과징금 부과의 원칙은 검찰의 수사결과를 통보받은 이후에 하되, 예외적으로 금융위가 검찰에 혐의를 통보한 후 검찰과 협의되거나 1년 경과시 검찰 수사결과 통보 전 과징금 부과가 가능하도록 하였다. 다만 1년 경과시에도 수사‧처분 지연에 합리적 사유가 있거나, 과징금 先부과시 최종 수사‧처분과 배치될 합리적 우려가 있는 경우 검찰 요청시 부과 대상에서 제외하도록 하였다. 이를 도식화하면 다음과 같다.

2. 미국의 민사제재금 부과 절차

가. 민사제재금의 개요

미국에서의 법령위반행위에 대한 제재수단으로서 우리나라의 과징금과 유사한 것으로는 민사제재금(civil penalty)이 있다. 행정상 의무이행의 확보를 위한 제재적 수단이 행정상 수단이 아닌 민사적 수단이라는 점에서 우리의 법제와는 차이가 있으나, 경제적 이익 박탈이라는 측면에서 과징금과 유사한 측면이 있다.63)

SEC가 금전적 제재(monetary sanctions)인 민사제재금을 부과할 권한은 1934년 연방증권거래법 Section 21(d)(3), 1933년 연방증권법 Section 20(d), 1940년 투자자문업자법 Section 209(e), 1940년 투자회사법 Section 42(e)에 명시되어 있다(15 U.S.C. § 78u(d)(3); 15 U.S.C. § 77t(d); 15 U.S.C. § 80b–9(e); 15 U.S.C. § 80a–41(e)). 각 규정에 의하면 SEC는 ① SEC 중지명령(cease and desist order)에 위반한 경우나 ② 증권법상의 어떠한 규정이라도 위반한 자에 대해서는 누구에게나 민사제재금을 부과할 수 있다.

민사제재금의 한도액은 SEC의 입증 정도에 따라 3단계로 구분한다. ① 단순 위반의 경우는 1단계, ② 사기(fraud), 기망(deceit), 시세조종(manipulation), 고의(deliberate) 또는 중과실(reckless)에 의한 위반의 경우는 2단계, ③ 사기에 의한 위반이며, 그로 인해 직간접적으로 타인에게 상당한 손실을 초래했거나 초래할 수 있는 심각한 위험이 있는 경우는 3단계에 해당한다. 단계별 구체적 상한액은 매년 물가상승률을 반영하여 조정되고 있는데, 2023년 1월 기준 1단계 한도액은 자연인 11,162달러, 법인 111,614달러, 2단계 한도액은 자연인 111,614달러, 법인 558,071달러, 3단계 한도액은 자연인 223,229달러, 법인 1,116,140달러이다.64)

나. 민사제재금의 종류

민사제재금은 ① SEC가 직접 부과하는 행정적 제재로서의 민사제재금이 있고(1934년 연방증권거래법 Section 21B(b); 15 U.S.C. § 78u–2(b)), ② SEC가 연방법원에 청구하여 법원이 부과하는 민사적 제재로서의 민사제재금이 있다(Section 21(d)(3); 15 U.S.C. § 78u(d)(3)).

민사적 제재로서의 민사제재금과 행정적 제재로서의 민사제재금은 다음과 같은 차이가 있다. ① 첫째, 민사적 제재는 모든 국민을 대상으로 하므로 투자자에 대해서도 부과할 수 있으나, 행정적 제재는 SEC의 감독 대상에 대해서만 부과할 수 있다. 따라서 행정적 제재로서의 민사제재금은 브로커딜러 등과 같은 피감기관에 대해서만 부과할 수 있다. ② 둘째, 민사제재금이 민사적 제재인지, 행정적 제재인지를 불문하고 3단계 한도액 기준은 동일하게 적용된다. 그러나 민사적 제재로서의 민사제재금에는 3단계 법정한도액과 위반자가 취득한 이익 중에서 고액인 것이 한도로서 적용되는 반면, 행정적 제재로서의 민사제재금에는 3단계 법정한도액만 적용된다. ③ 셋째, 민사적 제재로서의 민사제재금은 법원이 재량에 따라 부과할 수 있으나, 행정적 제재로서의 민사제재금은 민사제재금의 부과가 공익(public interest)에 부합해야 하고, 법 위반행위가 고의에 의해 이루어졌을 것을 요한다.

다. 민사제재금과 형사처벌의 관계

1933년 연방증권법 Section 24에 의하면 고의로(willfully) 동법 규정을 위반한 경우에 형사처벌을 부과할 수 있고(15 U.S.C. § 77x), 1934년 연방증권거래법 Section 32에 의하면 고의 및 악의로(willfully and knowingly) 동법 규정을 위반한 경우에 형사처벌을 부과할 수 있다(15 U.S.C. § 78ff).

연방증권법상 형사적 제재는 형사사법기관에서 담당한다. 일반 행정기관인 SEC는 형사적 제재를 부과할 권한이 없기 때문이다.65) 따라서 SEC가 특정 사건을 조사하는 과정에서 형사적 제재가 적합한 사건이라고 판단할 경우에는 보통 사건을 DOJ에 이첩한다.66)

이 경우 조사담당직원은 이첩에 관하여 상급관리자와 상의한 후, 국장보 또는 지역사무소 소장급 상관의 승인을 받아야 해당 사건을 형사사법기관에 비공식적으로 회부할 수 있다. SEC가 형사사법기관에 비공식적 회부 여부를 결정할 때에는 위반행위의 죄질, 상습성, 투자자 보호에 형사사법기관의 관여가 의미를 갖는지 여부 등을 고려한다. 구체적인 처리절차는 우선 상급관리자가 이첩을 승인하면 조사담당직원은 해당 사건을 형사사법기관에 통보하고, 이때 조사담당직원은 형사사법기관에 접근요청(access request)을 할 수 있다. 접근요청 승인이 완료되면 조사담당직원은 형사사법기관과 조사파일의 기록을 공유할 수 있다. 그러나 승인이 완료되기 전까지는 문서를 형사사법기관에 전달해서는 안된다.

형사사법기관은 SEC로부터 받은 사건을 검토한 후 기소 여부를 결정하는 데 기소 여부는 형사사법기관의 재량에 따라 결정한다. 형사사법기관은 증권법 위반행위에 대하여 스스로 조사하여 기소를 하는 경우도 있지만, SEC로부터 사건을 송부받아 기소하는 경우가 많다.

3. 일본의 과징금 부과 절차

가. 과징금제도의 도입 배경 및 개관

일본에서는 종래부터 형사책임은 고도의 입증을 요구하기 때문에 적용이 쉽지 않고, 벌금의 금액도 많지 않기 때문에 충분한 억제 효과를 발휘하지 못할 뿐만 아니라, 재판절차도 많은 시간이 소요된다는 비판이 제기됨에 따라, 신속한 법 집행을 위하여 2004년 법 개정을 통하여 과징금제도가 처음으로 도입되었다.

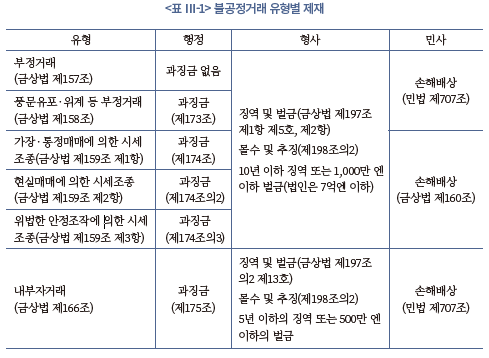

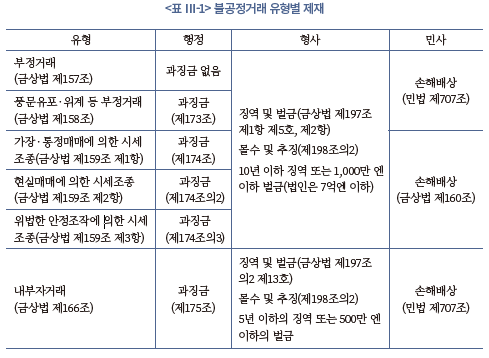

과징금 부과 대상이 되는 주요 불공정거래 행위는 부정거래(금상법 제157조)를 제외하고, 풍문의 유포‧위계 등(법 제158조), 가장‧통정매매에 의한 시세조종(법 제159조 1항), 현실매매에 의한 시세조종(법 제159조 제2항), 위법한 안정조작에 의한 시세조종(법 제159조 3항), 내부자거래(법 제166조)가 있다.

나아가, 금상법상의 과징금제도는 무과실책임67)으로 규정되어 있으므로, 행위자가 보다 많은 주의를 기울여 법을 위반하지 않도록 행동해야 한다는 점에서 과징금은 형사책임이나 민사책임보다도 위법행위 억제 효과가 높다고 평가되고 있다.68)

일본 금상법상의 과징금은 미국의 민사제재금(civil penalty)과 같이 행정 제재의 관점이 아닌 법령 위반자의 경제적인 이득 박탈(disgorgement)의 관점에 따라 설계되어, 과징금의 금액은 경제적 이득액을 기준으로 산정하고 있다.

이에 대해서 과징금의 금액을 경제적 이득액으로 한정하게 된다면 충분한 억제효과를 발휘할 수 없다는 비판이 도입 당시에도 존재하였다. 그럼에도 불구하고 경제적 이득액으로 과징금 금액을 한정하게 된 것은 형사처벌에 더하여 과징금을 부과하는 것은 일본 헌법 제39조의 이중처벌의 금지에 위반할 수 있다는 우려를 불식시키기 위함이었다.69)

한편, 과징금제도의 도입 이후 일본에서는 내부자거래를 중심으로 활발하게 과징금 부과 처분이 이루어지게 되었지만, 금액 자체가 많지 않았기 때문에, 내부자거래를 하는 것이 오히려 법 위반 행위자에게 이득인 상황이 되었고, 충분한 억제 효과를 발휘하지 못한다는 비판이 계속 이어지게 되었다. 2008년에는 과징금의 부과 대상을 보다 넓히고, 과징금의 산정기준도 위반자가 실제로 얻은 이익 상당액이 아닌 위반자가 얻을 수 있었던 이익 상당액을 기준으로 산정하도록 미세하게 개정이 이루어졌지만, 현재까지도 대부분의 경우에 경제적인 이득액을 기준으로 과징금을 산정하고 있다. 이에 따라 경제적인 이득만이 아니라 법 위반행위의 규모도 함께 고려하여 과징금을 산정해야 한다는 비판이 여전히 제기되고 있다.70)

또한, 금상법에 선행하여 과징금제도를 규정하고 있던 독점금지법은 2005년 개정에 따라 경제적 이득 박탈의 관점에서 졸업하여, 행정상 제재금으로 기능하고 있는 점71), 최고재판소도 과징금의 금액은 반드시 경제적 이득액과 일치하여야 하는 것은 아니라고 판결하였다는 점72), 대량보유보고규제 위반의 과징금의 경우에는 경제적 이득액을 기준으로 산정하고 있지 않다는 점, 과징금의 가산 및 감면제도의 존재 등을 이유로 금상법상의 과징금도 행정규제의 실효성 확보를 위하여 제재금으로 기능해야 한다는 비판도 유력하게 제기되고 있다.73)

나. 과징금의 부과 절차

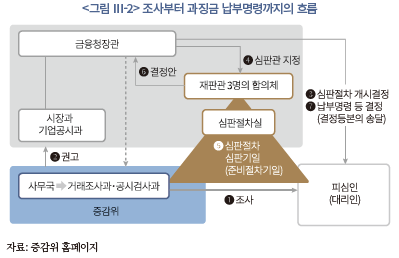

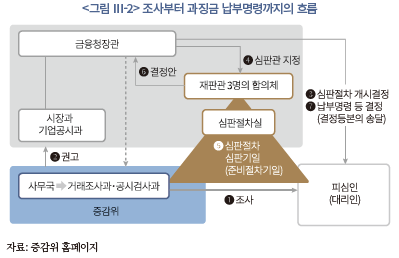

과징금 부과절차에 대해서 살펴보면, 우선 앞서 설명한 바와 같이 증감위가 조사권한을 행사하여 조사한 결과, 과징금 납부명령 등의 행정처분이 필요하다고 인정하는 경우에는 금융청 장관에게 과징금 처분 명령을 할 것을 권고할 수 있고, 이에 따라 과징금 심판절차가 개시되게 된다(금융청 설치법 20조 1항).

구체적으로 과징금 처분의 절차는 다음과 같이 이루어진다. 우선 앞서 설명한 ① 증감위의 과징금 조사 및 권고가 행해지면 ② 금융청장관에 의한 심판개시결정이 이루어진다(금상법 제178조, 제179조). 이후에는 ③ 심판관에 의한 심판 절차 개시(법 제180조), ④ 피심인에 의한 답변서 제출(법 제183조 제1항), ⑤ 심판기일의 불개최, 개최(동조 제2항, 제184조~제185조의5), ⑥ 심판관에 의한 결정안의 작성과 금융청장관에의 제출(법 제185조의6), ⑦ 금융청장관의 당해 결정안에 기한 결정(법 제184조의7 제17항~제19항), ⑧ 피심인에의 당해 결정서 등본의 송부(동조 제20항) 순으로 진행된다.

이와 같은 심판절차는 대부분 증감위의 권고에 기초하여 동일한 내용으로 이루어지지만, 법률상의 요건은 아니고, 실제로 증감위의 권고를 거치지 않고 금융청이 주도하여 심판절차를 개시한 사안도 존재한다.74) 심판절차는 과징금 납부명령 결정의 사전 절차로서 중립성과 공정성을 확보할 뿐만 아니라 행정 운영의 신속성과 효율성을 도모하기 위한 제도설계가 이루어졌다고 평가된다. 심판절차는 재판과 같은 대심구조가 아닌, 재판관과 심판절차의 당사자인 피심인이 과징금을 납부해야 하는 기초사실이 있는지를 주체적으로 심리하는 절차로서, 본질적으로 심판관과 피심인만으로 구성되어 있다. 민사소송과 같은 변론주의가 적용되는 것이 아니고 직권주의에 따라 증거인정이 폭 넓게 인정된다.

한편, 심판절차는 중립성 및 공정성 확보의 관점에서 다음과 같은 특징도 가진다. 우선, ① 심판관은 금융청장관에 의하여 임명되지만, 실제로는 재판관 출신이 포함되는 등 공정성을 확보하기 위한 조치가 취해지고 있다(법 제185조의17, 과징금부령 제6조 제2항). 또한, ② 금융청장관이 지정하는 직원(이하 지정직원)이 심판 절차에 참가하여 주장 및 입증행위를 할 수 있다(법 제181조2항, 제3항). 지정직원은 심판 절차의 당사자가 아니지만, 심판절차 참가를 통하여 심판관이 제3자적인 입장에서 심판을 행할 수 있도록 하기 위함이다. ③ 피심인의 방어 준비를 위하여 재판관은 제1회 심판기일 전에 피심인 및 대리인의 신청에 의하여 자료의 전부 또는 일부의 열람‧등사를 지정직원에게 요청할 수 있도록 할 수 있다(법 제185조의17, 과징금 부령 제30조 제4항). 나아가, ④ 공정성 확보의 관점에서 피심인이 당사자로서 각종 권리(의견진술권, 각종 증거조사 참여 및 질문권 등)가 보장되어 있다(법 제184조 제1항, 제185조 제1항, 제185조의2, 제185조의3 제1항, 제185조의4 제1항 및 제2항, 제185조의5, 제185조의17, 과징금부령 제22조 제3항 등). 또한 지정직원에 의한 주장의 변경은 피심인의 이익을 해하지 않는 범위 내에서만 허용된다(법 제181조 제4항).

이와 같은 심판 절차가 행해진 이후에 금융청장관이 과징금 납부명령을 행할 때 금융청장관은 심판관이 제출한 결정안에 기초하여 과징금 납부명령을 행해야 한다(법 제185조의7 제17항). 이와 같은 과징금 납부명령에 대해서는 피심인이 행정사건소송법상의 취소소송을 제기할 수 있지만, 제소기간은 결정 효력발생일로부터 30일 이내로(행정사건소송법 제185조의18) 그 기간을 단축하고 있다.75)

다. 과징금과 형사처벌의 관계

1) 과징금 사건과 형사 사건의 분류기준

불공정거래 유형 중 부정거래(금상법 제157조)를 제외하고는 과징금 규정과 형사처벌 규정이 동시에 적용된다. 반면에 부정거래의 경우에는 과징금 규정이 없어 바로 형사사건으로서 증감위가 사건을 조사하고 고발 조치를 취할 수 있지만, 포괄규정의 특성상 구성요건 행위가 지나치게 추상적으로 규정되어 있어 죄형법정주의에 위반될 수 있다는 비판이 지속적으로 제기되어 왔다. 이와 같은 이유로 증감위가 부정거래에 관한 금상법 제157조 규정의 적용에 적극적이지 않아, 1993년 이후 동 규정을 적용하여 고발 조치를 취한 사례는 찾아보기 어렵다.76)

이론적으로는 이상과 같이 부정거래의 경우를 제외하고는 과징금 규정과 형사처벌 규정이 동시에 적용되지만, 실무상으로는 이중처벌 금지원칙 위배에 대한 우려를 불식시키기 위해서 위반행위의 '악질성'을 기준으로 분류하고 있다. 즉, 특히 악질적이어서 형사처벌의 대상이 되어야 한다고 증감위가 판단하는 경우에는 형사 고발 조치를 취하고, 이외의 경우에는 과징금 부과 처분을 하고 있다. 그런데 이와 같은 '악질성' 기준은 증감위의 재량적인 판단에 달려있는 것으로 명확한 기준이 정해져 있는 것은 아니어서 사건의 금전적인 규모 뿐만 아니라, 불공정거래 행위에 이용된 수법, 고의성 및 계획성, 당해 사건이 사회에 미치는 영향력, 사건에 대한 여론 등에 큰 영향을 받는 것으로 보인다. 구체적으로는 뒤에서 과징금과 고발사건의 최근 주요 사례와 특징을 분석하면서 함께 설명하도록 한다.

한편 형사 고발을 하게 되는 사안 중 과징금 부과처분이 이루어진 후에도, 추후에 위반행위의 악질성이 증거를 통해 밝혀지면 다시 형사 고발을 하는 경우도 있다고 한다.

2) 과징금 처분과 형사처벌의 조정

불공정거래 행위 유형별로 부정거래, 풍문의 유포‧위계 등, 시세조종의 경우에는 10년 이하 징역 또는 1,000만 엔 이하 벌금이 부과된다. 내부자거래의 경우에는 5년 이하의 징역 또는 500만 엔 이하의 벌금이 부과되고, 모든 유형의 불공정거래에 대해서 몰수‧추징 규정이 존재한다.

일본의 과징금제도는 민‧형사와 달리 무과실 책임으로 규정되어 있고, 과징금의 금액도 위반자의 경제적 이득 상당액을 기준으로 산정하기 때문에, 형사처벌과 병과하더라도 이는 이중처벌 금지(일헌법 제39조)에는 위반되지 않는다고 해석된다. 따라서 원칙적으로 과징금 처분과 벌금이 동시에 이루어지더라도 양자 간의 금액을 조정하지 않아도 된다.

반면에, 형사처벌과 함께 부과되는 몰수‧추징과 과징금의 관계에서는 상호간에 조정이 이루어진다. 형사처벌이 먼저 확정된 경우에는 몰수‧추징 금액을 공제하여 과징금의 금액을 결정한다(금상법 제185조의7 제17항). 형사처벌이 과징금보다 나중에 확정된 경우에는 몰수‧추징 금액을 공제한 금액으로 과징금 납부명령을 변경한다(법 제185조의8 제7항). 이와 같은 조정 규정을 두는 이유는 위반자의 경제적 이득을 박탈한다는 점에서 과징금과 몰수‧추징이 공통적인 기능을 하기 때문이다.

나아가, 계속공시서류의 허위기재의 경우에 한하여 벌금과 과징금의 금액을 조정하도록 하며, 예외적으로 조정을 위한 규정을 두고 있다(법 제185조의7 제16항 및 제185조의8 제6항). 계속공시서류의 허위기재에 대한 과징금 금액을 위반자의 경제적 이득 상당액을 기준으로 산정해야 하는지에 대해 견해의 대립이 있기 때문에, 이와 같은 예외적인 규정을 두게 된 것이다.77)

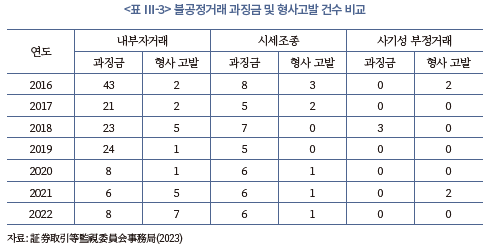

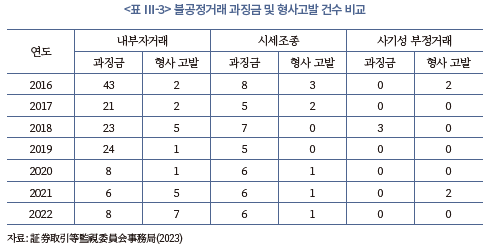

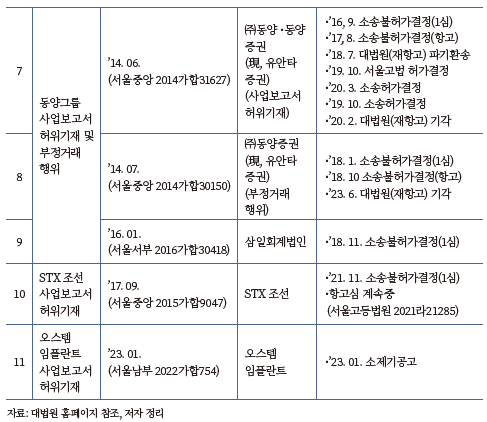

3) 과징금과 형사고발 사건 수

일본의 과징금 부과 건수와 형사고발 사건 수를 살펴보면 다음 <표 Ⅲ-2>, <표 Ⅲ-3>과 같다. 주로 일본에서는 내부자거래가 불공정거래 유형 중 가장 발생빈도가 높고 과징금 권고 건수도 가장 많은 것으로 나타나고 있다.

나아가, 아래 표와 같은 2005년부터 2022년까지의 과징금 권고 사안을 이용된 미공개 정보에 따라 다시 분류해 보면, 전체 358건 중 공개매수 등의 사실이 95건(24.8%)으로 가장 많고, 업무제휴 사실이 65건(17%), 업적 예상 등의 수정 사실 58건(15.1%), 신주발행 사실 56건(14.6%) 순으로 나타났다. 또한 금상법 제166조 제2항 제1호부터 제3호까지의 중요사실에는 해당하지 않지만, 동조 제4호 내지 제8호의 상장회사 등(상장회사 등의 자회사)의 운영, 업무 또는 재산에 관한 중요사실로서 투자자의 투자 판단에 현저한 영향을 미치는 사실(이른바, 포괄조항 또는 바스켓 조항)에 해당하는 사안은 2023년 3월 말까지 20건(5.2%)으로 집계되고 있다.78)

4) 과징금제도 운영의 성과

과징금이 도입되기 이전에는 특히 불공정거래 행위에 대한 억제는 대부분 형사처벌을 통해서 이루어지고 있었지만, 형사책임은 고도의 입증을 요구하기 때문에 적용이 쉽지 않고, 벌금의 금액도 많지 않기 때문에 충분한 억제 효과를 발휘하지 못할 뿐만 아니라, 재판절차도 많은 시간이 소요된다는 비판이 많이 제기되고 있었다. 뿐만 아니라 불공정거래를 적발하기 위한 검찰청의 인력이나 수사체계에도 한계가 있기 때문에 현실적으로는 사회적으로 영향력이 큰 중대한 사안에 대해서만 검찰이 선별적으로 수사를 행하기도 하였다. 또한 일본 사회적으로도 형벌은 보충적으로만 운영해야 한다는 인식이 지배적이었기 때문에 빈번하게 검찰이 수사를 하지 않는 측면도 있었다.79)

이와 같은 문제점에 따라 신속한 처벌과 충분한 억제효과를 위하여 과징금제도가 도입되었지만, 증감위 자체에 조사체계가 제대로 구축되지 않았던 탓도 있어서 도입 당시 9개월간은 한 건도 과징금이 부과된 사례가 없었다. 그러나 2006년에 처음으로 내부자거래 사건에서 과징금 부과 처분을 한 이후로, 과징금 부과 건수가 점차 증가하기 시작하고, 과징금 금액이 1억 엔대에 달하는 사안들도 나타나기 시작하였다.80) 이후에는 앞선 <표 Ⅲ-2>에서 나타난 바와 같이 최근에 이르기까지 다수의 과징금 부과가 이루어지고 있고, 특히 악질성이 높은 사안에 대해서는 과징금이 도입되기 이전과 같이 형사고발 조치도 취해지고 있다.

이와 같이 금상법상 과징금제도가 도입되기 이전 일본에서는 특히 사회적으로 중대한 사안에 대해서만 형사처벌이 이루어져 불공정거래 행위에 대해서 충분한 억제가 이루어지지 않고 있었지만, 도입 이후에는 상대적으로 경미한 사안에는 과징금이, 중대한 사안에는 형사처벌이 이루어지며 이전보다 불공정거래 행위에 대한 억제가 철저하게 이루어지고 있다고 평가되고 있다.81)

라. 과징금 사건 주요 사례와 특징

1) 내부자거래

최근 주목할 만한 주요 사례로서는 다른 사안들과 비교하여 상대적으로 많은 금액의 과징금 부과 처분을 한 주식회사 레오팔레스21 사건이 있다. 동 사건은 주식회사 레오팔레스21의 사원 A가, 동사의 업무집행기관이 신주를 발행하고 이를 인수할 자를 모집할 것이라는 결정을 한 사실을 알게 되어, 이와 같은 중요사실이 발표된 2020년 9월 30일 이전에, 열흘에 걸쳐 자기계산으로 동사의 주식 18만 주를 3,009만 7,430 엔에 매수한 사안이다. 이와 같은 위반행위에 대하여 증감위는 법 위반자의 경제적 이득액이 많은 편임에도 불구하고, 형사 고발을 하지 않고 1,850만엔의 과징금 부과 처분을 하였다는 점이 특징적이다.82)

2) 시세조종

시세조종과 관련하여, 최근 5년간의 권고 사안 30건을 이용된 시세조종 수법에 따라 분류해보면, 가장매매가 11건, 상‧하한가 매수주문이 20건, 종가 관여가 4건, 허수 주문이 16건을 차지하고 있다. 또한 1개의 사안당 사용된 수법의 수를 보면 1개 수법이 10건, 2개 수법이 16건, 3개 수법이 3건이며 전체의 약 60%의 사안에서 복수의 수법을 조합하여 시세조종이 이루어지고 있는 것으로 나타났다. 이처럼 최근의 시세조종 수법은 교묘하고 복잡하게 변화하고 있고, 2022년에는 발각을 회피하기 위하여 복수의 증권회사 계좌나 차명계좌를 이용하는 사안이 계속 적발되고 있으며, 시세 받치기를 하여 하한가를 지지하면서 주가 인상을 수반하는 가장매매를 반복함으로써 제3자의 거래를 유인하는 수법도 있었다. 또한 국채선물옵션거래를 하면서, 옵션의 원자산인 장기국채선물거래의 허수주문을 통하여 시세를 조종하는 수법도 있었다.83)

시세조종과 관련하여 최근의 주요 사례로는 Atlantic Trading London Limited 사건을 들 수 있다. 동 회사는 고속거래행위를 하는 것에 대해 관동재무국의 등록을 받은 영국법인인데, 동 회사에서 금융상품거래 등의 업무를 담당하고 있던 트레이더의 수동거래에 의하여 시세조종행위가 이루어졌다. 구체적으로는 오사카거래소에 상장되어 있던 장기국채선물의 매매를 유인할 목적으로 2022년 1월 9일 오전 8시 57분 8초경부터 같은 달 10일 오후 1시 52분 15초경까지의 기간 동안 약정시킬 의도가 없는 가격으로 허수주문을 반복적으로 행함으로써 거래가 성황리에 있는 것으로 오인시키는 수법을 사용하여 시세조종 행위를 하였다. 동 사건은 크로스 보더 사안으로서 일본증권거래소 자율규제법인과의 적극적인 협력‧연계를 통하여 제재가 이루어졌다는 특징을 가진다.84)

3) 풍문의 유포‧위계 등

최근 풍문의 유포‧위계 등과 관련하여 특징적인 사건으로는, 2018년도에 진실한 수급균형에 기초한 제3자의 거래를 배제하기 위하여 특수한 허수주문85)을 발주함으로써 허위의 수급균형 상황을 만들어 내고, 장 종료 직전에 약정이 체결되는 것을 회피하여 높은 가격으로 팔거나 낮은 가격으로 사는 사건이 다수 발생한 것을 들 수 있다.86) 이와 같은 행위는 일반적인 허수주문과는 달리 특수한 허수주문이 이용되었기 때문에 금상법상 시세조종행위금지에 대한 규정이 아닌, 금상법 제158조의 위계의 금지 규정을 적용하여 과징금 권고가 행해졌다.

마. 고발 사건 주요 사례와 특징87)

1) 내부자거래

내부자거래와 관련하여 고발이 이루어진 최근 주요 사안으로는 주식회사 Aiming 내부자거래 사건이 있다. 동 사안은 주식회사 스퀘어 에닉스에 근무하고 있는 A가 2019년 11월 하순에 주식회사 Aming과 스퀘어 에닉스가 공동으로 개발하고 있는 휴대전화기용 신작 게임에 대한 서비스 개시를 앞두고 있는 단계에 있다는 사실을 알고, 이와 같은 사실이 공표되기 전인 같은 해 12월 상순부터 2020년 2월 상순까지 Aming의 주식 합계 7만 2,000주를 약 2,080만엔에 매수한 사안이다. 그리고 동 사안에서는 A로부터 이와 같은 사실의 정보를 전달받은 지인 B와 C도 해당 사실 공표 전에 각각 9만주(2,640만엔), 1만주(280만엔)를 매수하기도 하였다. 증감위는 이에 대하여 법 위반자의 합계 주식 매수대금도 상대적으로 크고, 정보전달이 다수에게 이루어졌다는 점에서 악질성이 크다고 판단하여 A, B, C를 모두 2022년 12월 6일에 형사 고발하였다.

이외에도 가장 최근인 2023년의 종합 메디컬 홀딩스 주식회사(이하 종합 메디컬) 및 주식회사 스페이스 밸류 홀딩스(이하 스페이스 밸류) 내부자거래 사건도 주목할 만하다. 동 사안은 2019년 12월 상순, 사모펀드 운영회사인 폴라리스 캐피털 그룹(이하 폴라리스)의 업무집행기관이 종합 메디컬과 스페이스 밸류의 주식에 대한 공개매수를 실시할 것이라는 결정을 하였는데, 이와 같은 사실을 알게 된 폴라리스의 직원 A가 종합 메디컬과 스페이스 밸류의 주식을 공개매수 사실의 공표 전에 각각 2,000주(420만엔), 2만 7,000주(2,390만엔)를 매수한 사안이다. 투자를 전문으로 하는 사모펀드 운영회사의 직원이라는 점에서 비난 가능성이 더욱 높아 악질성이 크다고 판단하여 증감위는 2023년 3월 고발조치를 취하였다.

2) 시세조종

시세조종과 관련하여서는 SMBC 닛코증권 주식회사 사건이 있다. 동 사안은 동사의 임직원인 범칙 혐의자들이 공모하여 당해 회사가 취급하고 있는 블록 딜(ブロックオファー, block deal) 거래에서 도쿄증권거래소가 개설한 유가증권시장에 상장하고 있는 5개 종목에 대하여, 매매가격 기준이 되는 거래당일 종가가 전날의 종가에 비하여 대폭으로 하락하는 것을 회피하기 위하여, 2020년 10월부터 2021년 4월까지 각 거래일에 시세조종의 일종인 위법한 안정조작 매매 등을 수차례에 걸쳐 행한 사안이다. 증감위는 전문투자자라는 당해 회사와 범칙 혐의자들의 지위나 시장의 공정성에 주는 영향 등의 제반 사정을 고려하였을 때, 사안이 중대하고 악질적이라고 판단하여 2022년 4월 12일 형사 고발하였다.

3) 풍문의 유포‧위계 등

최근 주요 사건으로 테라 주식회사(이하 테라) 사건이 있다. 동 사안은 도쿄증권거래소에 상장하고 있는 테라가 실시하는 제3자 배정 유상증자의 배정예정회사인 CENEGENICS JAPAN(이하 CENEGENICS)의 이사의 지위에 있던 A가 상기 제3자 배정 유상증자에 관하여 CENEGENICS가 납입자금을 확보하고 있다는 취지의 허위사실을 테라의 직원에게 전달하여 이를 믿게 하고, 테라가 이를 공표하게 하는 등의 방법으로 테라의 주가를 상승을 유도함과 동시에, 공표로부터 납입기일까지의 기간 중 당해 배정 예정인 테라의 주식의 일부양도, 또는 담보에 제공할 것을 약속하는 등의 방법으로 조달한 자금을 납입에 충당하여 테라의 주식을 취득하려 한 사안이다. 이에 대하여 증감위는 A를 유가증권의 거래를 위하여 유가증권의 시세를 조종하기 위한 목적을 가지고 위계를 사용한 혐의로 검찰에 2022년 3월 16일 고발하였다. 동 사안에서는 CENEGENICS의 A뿐만 아니라, 테라의 일부 임직원들도 제3자 배정 유상증자에 대한 중요사실 공표 전에 자사의 주식을 매수하는 등의 내부자거래를 행한 사실이 적발되기도 하여 사회적으로 큰 파장을 일으킨 사건이다.

4. 향후 과제

자본시장법상의 불공정거래에 대한 미국의 민사제재금이나 일본의 과징금의 경우에도 SEC와 금융청에서 부과하고 있고, 이를 검찰과 협의하는 경우는 해외 주요 입법례 어디에서도 찾기 어렵다.88) 그런데 입법예고된 시행령에 따르면 검찰의 수사 결과 통보 후에 과징금을 부과하도록 하고 있는데, 과징금의 법적 성격이나 타 법률에서 과징금을 부과하는 체계를 고려할 때 검찰과 협의하도록 하고 있는 자본시장법상의 과징금 부과는 법적 정합성과 효율성 측면에서 재검토가 필요하다.

먼저 법적 성격을 보면 과징금은 행정법상 의무를 불이행하였거나 위반한 자에 대한 금전상의 제재로, 위반행위로 얻은 경제적 이익을 박탈하기 위한 목적 또는 행정명령의 이행을 강제하기 위한 목적으로 부과된다.89) 대법원은 불법적인 경제적 이익을 박탈하고 이에 더하여 위법한 행위의 억지라는 행정목적을 실현하기 위하여 과징금을 부과한다고 판단하였다.90) 헌법재판소도 ‘과징금제도는 대체로 행정법상의 의무위반행위에 대하여 행정청이 의무위반행위로 인한 불법적인 이익을 박탈하거나, 혹은 당해 법규상의 일정한 행정명령의 이행을 강제하기 위하여 의무자에게 부과‧징수하는 금전’이라고 보고 있다.91) 즉 과징금은 형사벌인 벌금과 행정벌인 과태료와는 다른 경제적 이득의 환수와 행정제재적 성격을 모두 가진 금전제재이다.92) 과징금의 부과는 제재적 성격과 부당이득의 환수라는 측면을 모두 가지고 있으므로, 일괄적인 기준이 아닌 개별 행위의 성격에 따라 행정청의 재량권이 인정된다. 다시 말해 행정청의 재량에 의해 과징금의 부과 여부와 금액이 결정되며 부과액이 상당히 고액이면서도 감독기관 내부 규정에 따라 운영된다.93) 이러한 과징금의 법적 성격으로 인해 현행법상 과징금 부과를 허용한 218개의 법률94) 중 검찰과 협의하여 과징금을 부과하도록 한 것은 자본시장법상 불공정거래에 대한 과징금과 해당 법률을 참고하여 만든 가상자산이용자보호법의 불공정거래에 대한 과징금에 한정된다. 가장 최근에 과징금이 도입되었고 형사처벌이 병과되는 개인정보보호법(2023. 9. 15 시행)의 경우에도 과징금과 형사처벌은 별개로 부과되도록 하고 있다. 이러한 과징금의 법적 성격과 타 법령과의 정합성에 비추어 볼 때 과징금과 형사처벌은 별개로 부과하는 것이 적절하다.

다음으로 효율성 측면에서 살펴보면, 과징금 도입을 발의한 법안95)과 이에 대한 검토보고서96)에서도 과징금 도입의 필요성에 대해 기존 형사제재의 공백을 보완하고 보다 신속하고 효과적으로 불공정거래 행위를 제재하기 위함이라고 밝히고 있다. 그런데 자본시장법 개정안과 같이 원칙적으로 수사나 처리결과 통보 이후, 예외적으로 검찰에 혐의통보한 후 협의되거나 1년 경과시에 과징금을 부과할 수 있다면, 신속한 과징금 부과가 어렵게 된다. 더욱이 개정 자본시장법 시행령안에서는 단서 조항으로 1년 경과시에도 ① 수사‧처분 지연에 합리적 사유가 있거나, ② 과징금 先부과시 최종 수사‧처분과 배치될 합리적 우려가 있는 경우 검찰 요청시 부과대상에서 제외하도록 하고 있다. 형사절차와 과징금 부과는 별개로 진행되는 것인데, 혐의 통보와 별개로 과징금 부과 여부에 대해 검찰과 협의해야 한다면 비효율적이다. 행정기관에서 조사 결과에 따라 과징금을 부과할 수 있어야, 과징금의 도입 목적인 신속한 금전제재라는 입법취지에도 부합하게 될 것이다.

이러한 문제를 해결하기 위해서는 검찰의 수사결과 통보 후 과징금을 부과하도록 한 자본시장법시행령 입법예고안만 수정할 것이 아니라 근본적으로 형사처벌 금액에 대해 과징금을 감면해 주도록 한 자본시장법 개정안에 대한 재검토가 필요하다. 미국‧일본의 경우 과징금 부과와 형사처벌 대상이 중첩적으로 적용가능하도록 하고 있다. 일본의 경우 실무상 과징금 부과 사안에 대해 형사고발을 하지 않으나, 법적으로는 중첩 적용가능하도록 제도가 설계되어 과징금 처분과 벌금이 동시에 이루어지더라도 양자 간의 금액을 조정하지 않아도 된다. 미국‧일본의 경우 부당이득과 형량이 연계가 되지 않아서 과징금은 부당이득에 연계하여 부과하고 형사처벌은 별개로 이루어질 수 있다는 점에서 우리 법체계와 차이가 있다. 따라서 과징금제도가 도입된 이상, 부당이득액은 과징금과 연동하고 형사처벌은 부당이득액과 무관하게 행위에 대한 처벌로 이루어지도록 하는 것이 바람직하다.

과징금과 형사처벌을 별개로 하도록 할 경우, 사건별 규제 대상을 구분할 수 있는 체계의 마련이 필요하다. 금융기관과 수사기관 간 합의된 형사처벌‧과징금 부과 대상을 구분하는 객관적 기준의 마련이다.97) 일본의 경우 형사처벌 수준에 이르지 않는 정도의 불공정거래 행위에 대하여 과징금을 부과하며, 행위의 악성, 중대성 및 사회적 영향도에 따라 형사사건과 과징금 사건을 분류한다. 미국 SEC의 경우 형사사건 이첩여부 결정시 위반행위의 죄질, 상습성, 형사당국의 관여가 중요한 판단기준이다. 이러한 기준을 통해 과징금으로 종결할 사건은 금융당국에서 과징금을 부과하고 형사처벌이 필요한 중대 사건은 검찰로 이첩하도록 하는 체계를 정립할 경우 신속한 금전제재라는 과징금의 도입취지를 달성할 수 있을 것으로 본다.

Ⅳ. 공익신고 및 자진신고 활성화 방안

1. 현행 제도의 문제점 및 개선방안 검토

가. 현행 제도의 문제점

불공정거래는 다수의 범죄혐의자가 관련되어 은밀하고 조직적으로 이루어지는 경우가 많아, 내부자의 진술‧증거 확보가 중요하다. 이를 위해 공익신고에 대한 포상금 제도가 도입되어 있지만 포상건수도 적고 금액도 적어 활용이 미비한 상태이다.

자진신고시 처벌을 감면해 주는 제도 역시 도입되지 않아서, 불공정거래 공범자들로부터 의미 있는 협조를 받기 어려운 상황이었다.

나. 자본시장법 개정안

2023년 7월 개정된 자본시장법에서는 불공정거래 행위자가 위반행위를 자진신고하거나 타인의 죄에 대해 진술‧증언하는 경우 형벌이나 과징금을 감면할 수 있도록 하는 내용도 포함되어 있다. 형벌도 감면해 주도록 한 점은 기존의 형사법체계에서 독특하나 불공정거래의 사안의 중요성을 감안하여 도입되었다.

2023년 9월 25일에 입법예고된 자본시장법 시행령에서는 과징금의 감면에 대해서만 규정하고 있다. 불공정거래 행위자가 해당 불공정거래 행위에 대하여 수사기관에 자수한 경우, 증선위에 자진신고한 경우, 수사‧재판절차에서 해당 불공정거래 행위에 관한 다른 사람의 범죄를 규명하는 진술 또는 증언이나, 그 밖의 자료제출 행위 또는 범인검거를 위한 제보를 한 경우에 과징금이나 형사처벌을 감면하도록 하고 있다. 뿐만 아니라 자신이 조사‧수사받고 있는 불공정거래 행위 이외에 다른 불공정거래 행위에 대해서 자진신고 하는 경우에도 과징금을 감면할 수 있도록 하고 있다. 다만 ‘면제 또는 감면을 할 수 있다’고 규정하여 행정청의 재량으로 감면할 수 있도록 정하고 있다. 한편 다른 자에게 그 의사에 반하여 해당 불공정거래 행위에 참여하도록 강요하거나 이를 중단하지 못하도록 강요한 사실이 있거나 일정 기간 동안 반복적으로 불공정거래 행위를 한 경우에는 과징금을 감면할 수 없도록 하였다.

자진신고감면제도의 경우 개정 자본시장법 시행령안에서는 구체적인 감면기준을 자본시장조사 업무규정에서 정하도록 하고 있다. 현재 입법예고 중인 개정 규정안에 의하면, 감면 요건의 판단기준으로 다음의 사항을 열거하고 있다.

(1) 자진신고자 등이 알고 있는 당해 불공정거래 행위와 관련된 사실을 지체 없이 모두 진술하였는지 여부

(2) 당해 불공정거래 행위와 관련하여 자진신고자 등이 보유하고 있거나 수집할 수 있는 모든 자료를 신속하게 제출하였는지 여부

(3) 사실 확인에 필요한 수사기관 또는 증선위 등의 요구에 신속하게 답변하고 협조하였는지 여부

(4) 자진신고자 등이 법인인 경우 임직원(가능하다면 전직 임직원 포함)이 조사 등 및 이에 준하는 절차에서 지속적이고 진실하게 협조할 수 있도록 최선을 다하였는지 여부

(5) 불공정거래 행위와 관련된 증거와 정보를 파기, 조작, 훼손, 은폐하였는지 여부

또한 입증에 기여하는 새로운 증거에 해당하는지 여부를 판단하는 기준으로 다음의 사항을 열거하고 있다.

(1) 해당 불공정거래 행위에 참여한 자가 복수인 경우, 참여자 간에 불공정거래 행위를 모의한 합의서 등 서면, 통신기록 및 그 내용을 알 수 있는 자료, 금융거래내역, 그 밖에 성립과정 또는 실행사실을 입증할 수 있는 자료

(2) 자진신고자 등 또는 당해 불공정거래 행위에 참여한 다른 자에 의해 작성된 확인서, 진술서 등 불공정거래 행위를 할 것을 논의하거나 실행한 사실을 육하원칙에 따라 구체적으로 기술한 자료 및 관련 사실을 입증할 수 있는 구체적 자료

(3) 관련 사실을 입증할 수 있는 구체적 자료가 없는 경우라도 진술서 등 신청사실을 충분히 인정할 수 있는 자료

마지막으로 자진신고제도의 남용을 막기 위해 다음의 요건을 고려하여 감면여부를 결정하고, 형 또는 과징금 납부명령을 받은 날로부터 5년 이내에 다시 불공정거래 행위를 할 경우 감면할 수 없도록 하고 있다.

(1) 다른 자에게 그 의사에 반하여 당해 불공정거래 행위에 참여하도록 하기 위하여 또는 이를 중단하지 못하도록 하기 위하여 폭행 또는 협박 등을 가하였는지 여부

(2) 다른 자에게 그 의사에 반하여 당해 불공정거래 행위에 참여하도록 하기 위하여 또는 이를 중단하지 못하도록 하기 위하여 당해 시장에서 정상적인 거래활동이 곤란할 정도의 압력 또는 제재 등을 가하였는지 여부

다. 정부발표 개선방안

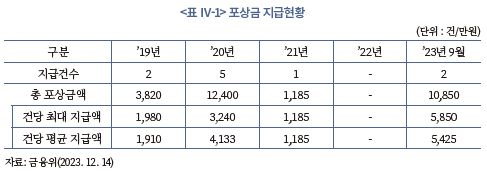

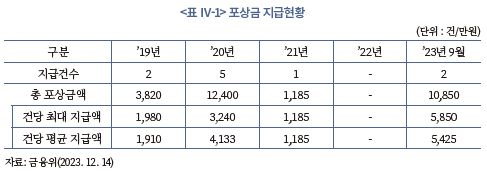

2023년 9월 21일 정부는 불공정거래 대응 협업체계 개편을 발표하면서 포상금 제도 개편도 발표하였고, 이에 따라 12월 14일에 자본시장법 시행령 및 관련 규정에 대한 입법예고를 실시하였다. 주요 내용으로는 포상금의 최고한도를 현행 20억원에서 30억원으로 상향하고, 신고한 사건 조사 결과 혐의자에 부당이득이 있을 경우, 범죄수익 규모에 따라 포상금이 더 지급되도록 ‘부당이득’ 규모를 포상금 산정기준에 반영하도록 하고 있다. 또한 적극적인 신고를 유도하기 위해 익명신고가 가능하도록 하고, 익명신고 후 포상금을 지급받기 위해서는 신고일로부터 1년 이내에 자신의 신원과 신고인임을 증명할 수 있는 자료를 제출하도록 할 예정이다. 또한 금감원의 예산으로 지급되는 포상금의 재원을 확대하기 위해 2024년부터는 정부재원으로 포상할 수 있도록 추진하겠다는 방침이다.

2. 미국의 공익신고 및 자진신고 제도

가. 미국의 공익신고자 프로그램

1) 공익신고자 프로그램 의의

증권법상 불공정거래 행위는 은밀하게 이루어지므로 감독기관에서 적발하여 단속하기가 어렵다. 감독기관이 불공정거래 행위를 인지하게 되더라도 법 위반에 대한 책임을 묻기 위해서는 증거를 확보해야 하는데, 행위자들이 증거를 잘 남기지 않기 때문에 증거확보도 상당히 어려운 게 현실이다. 이러한 상황 때문에 내부자가 위법행위를 고발하는 공익신고가 증권법상 불공정거래 행위를 단속하는 데 있어 중요한 기능을 수행한다.98)

미국 연방증권법상 현재와 같은 공익신고자 프로그램은 2011년 8월 도드-프랭크법(Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010) Section 922를 통해 완성되었다. 도드-프랭크법 제정 이전 내부자거래 및 증권사기방지법(Insider Trading and Securities Fraud Enforcement Act of 1988: ITSFEA)에서도 SEC에 포상금 지급 권한을 부여하였는데, 이때 도입된 포상금 제도는 적용범위가 모든 증권법 위반이 아니라 내부자거래에 한정되어 있었다. 그 후 의회는 도드-프랭크법 Section 922를 통해 내부자거래 및 증권사기방지법의 해당 규정을 폐지하고 그 대신 모든 유형의 증권법 위반에 광범위하게 적용되는 연방증권거래법 Section 21F를 신설했다.99) 1934년 연방증권거래법 Section 21F(g)는 모든 포상금 재원은 SEC의 제재로 인해 직접 발생한 민사제재금과 부당이득환수금이고, SEC는 이를 재원으로 하여 기금을 조성하여 포상금을 지급한다(15 U.S.C. § 78u–6(g)).100)

2) 공익신고자 프로그램 운영 현황

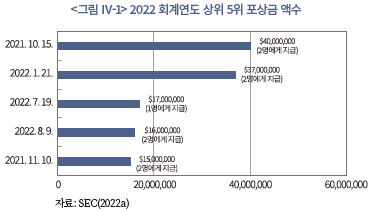

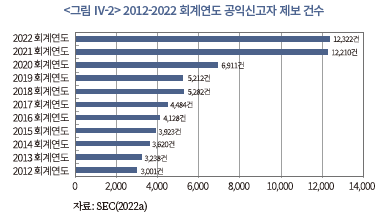

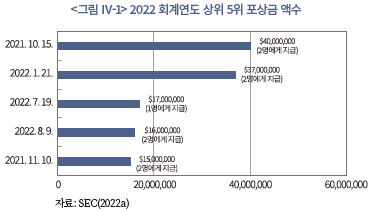

미국에서 SEC 공익신고자 프로그램은 활발하게 이용되고 있다. SEC 공익신고자 프로그램 운영 현황을 살펴보면 2022 회계연도에 12,300건 이상의 공익신고를 접수받았고, 이 중에서 103건에 대해 약 2억 2,900만 달러의 포상금을 지급했다.101) 이는 프로그램 역사상 두 번째로 높은 사건 수와 금액이다.102) 2022 회계연도에 공익신고자에게 지급된 포상금 액수 상위 5위까지를 보면 다음과 같다.

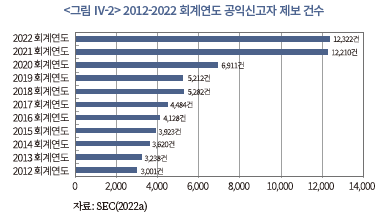

2022 회계연도에 SEC는 12,300건 이상의 공익신고자 제보를 접수했으며, 이는 2021 회계연도에 비해 소폭 증가한 수치이다.103) 아래 표는 공익신고자 프로그램이 시작된 이후 매년 SEC에 접수된 공익신고자 제보 건수를 나타낸다.

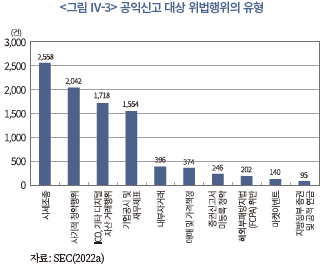

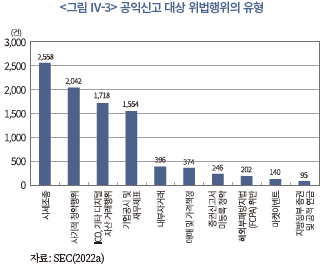

2022 회계연도에 SEC에 접수된 공익신고 건수는 매우 높은 수준이었으며, 여기에는 다양한 법 위반 혐의가 포함되어 있다. 공익신고자가 가장 많이 신고한 위법행위 유형은 시세조종(Manipulation) 21%, 청약사기(Offering Fraud) 17%, ICO 및 암호화폐(Initial Coin Offerings and Cryptocurrencies) 14%, 회사 공시 및 재무(Corporate Disclosures and Financials) 13%이다.104) 다음 그래프는 2022 회계연도에 접수된 공익신고 건수를 혐의 유형별로 나타낸 것이다.

3) 공익신고자 프로그램 세부 내용

공익신고자 프로그램에서 ‘공익신고자’란 이미 발생했거나 진행 중인 연방증권법 위반 가능성에 대한 1차 정보를 자발적으로 서면으로 SEC에 제공하는 자를 말한다. 1934년 연방증권거래법 Section 21F는 적격 공익신고자가 증권법 위반에 대한 최초 정보를 SEC에 제공하여 100만 달러 이상의 금전적 제재(민사제재금 및 부당이득환수 포함)를 성공적으로 부과하는 경우, SEC가 해당 공익신고자에게 징수된 제재금의 10%에서 30%에 해당하는 포상금을 지급하도록 규정하고 있다(15 U.S.C. § 78u-6(a), (b)). 또한 공익신고자의 제보로 인해 법무부, 다른 연방기관, 자율규제기관 또는 주 법무장관이 제재 조치를 취하는 경우에도 SEC는 포상금을 지급해야 한다. 만약 공익신고자가 SEC의 포상금 결정에 불만이 있다면 SEC의 결정 이후 30일 이내에 미국의 적절한 항소법원에 항소할 수 있다(15 U.S.C. § 78u-6(f)).105)

공익신고를 위해서는 ‘TCR 양식(Form TCR)’을 작성‧제출해야 하는데, 이 TCR 양식에는 허위정보를 기재해서는 안 된다. 만약 이 양식에 허위정보를 기재한다면 위증죄(perjury)가 성립하여 형사처벌을 받을 수 있다. 또한, 공익신고자는 신상정보를 밝히지 아니하고 익명으로도 신고할 수 있으며 이 경우 변호사를 통해 대리 신고할 수 있다.106)

한편, SEC는 잘못된 신고로 인해 SEC 조사가 방해되는 것을 방지하기 위해 3건 이상 경솔한 신고 또는 사기적이거나 공익신고자 프로그램의 효율을 저해할 수 있는 신고를 한 자에 대해서는 영구히 공익신고 포상 대상에서 제외할 수 있다. 실제로 2021년 9월 28일에 SEC가 경솔하게 수백 건의 공익신고를 한 자를 공익신고 포상 대상에서 영구적으로 제외한 바 있다.

도드-프랭크법은 공익신고자 프로그램의 관할기관을 SEC로 규정하고 있으므로 동법에 따른 포상금을 지급받으려면 원칙적으로 SEC에 제보해야 한다.107) 그러나 SEC에 공익신고를 한 사건에 대해 다른 연방정부기관에서 제재조치를 하게 된 경우라도 그 연방정부기관이 운영하고 있는 공익신고 프로그램이 SEC의 공익신고자 프로그램과 유사하지 아니하거나 SEC가 지급할 최대금액이 500만 달러를 초과하지 않는다면 SEC는 공익신고자 프로그램에 의한 포상금을 지급할 수 있다(SEC Rule 21F-3; 17 C.F.R. § 240.21F-3).108) 또한, SEC는 포상금의 상향 조정에 관해서만 재량권을 가지고, 하향 조정에 대해서는 재량권이 인정되지 않으므로 SEC의 재량에 의한 포상금 감액은 불가능하다(SEC Rule 21F-6; 17 C.F.R. § 240.21F-6).109)

도드-프랭크법 제정 후 분과위원회에서 공익신고자 프로그램에 관한 규칙을 발표했다.110) 이 규칙 제정 과정에서 공익신고자가 SEC에 제보하기 전에 먼저 회사의 내부통제시스템을 통해 고용주에게 보고하도록 할 것인지 여부가 문제되었는데, 최종 규칙에는 회사의 내부통제시스템을 활용할 것을 권장하되 내부통제시스템을 거칠 것을 의무화하지는 않았다. 따라서 공익신고자가 내부통제시스템을 거치지 않고 바로 SEC에 신고하는 경우에도 포상금을 지급받을 수 있다.111)

한편, 위 규칙이 최종적으로 채택되기 전에는 Section 21F 포상금 수령자의 자격을 제한할 수 있는지, 특히 공익신고자가 변호사인 경우 그에게 포상금을 지급할 수 있는지가 문제되었는데, 최종적으로는 SEC Rule 21F-4(b)(4)에서 의뢰인의 비밀에 접근할 수 있거나 비밀정보를 알게 된 변호사는 주 변호사책임규칙(state professional responsibility rules) 또는 SEC Rule에서 공개가 허용되는 경우가 아니라면 공익신고자 포상금을 받을 수 없도록 규정하였다(17 C.F.R. § 240.21F-4(b)(4)).112)

한편, 도드-프랭크법의 공익신고자 프로그램에서 공익신고자가 SEC에 제공하는 정보는 1차(original) 정보일 것을 요한다.113) 따라서 공익신고를 통해 제공하는 정보는 ① 신고자의 독립적 지식이나 분석으로부터 도출된 것이어야 하고, ② SEC가 다른 정보원을 통해 입수하지 아니한 것이어야 하며, ③ 사법부 또는 행정부의 심리(a judicial or administrative hearing), 정부 보고서(governmental report), 청문(hearing), 감사(audit), 조사 또는 뉴스 미디어(공익신고자 자신이 정보의 출처가 아닌 경우)에서 얻은 정보가 아니어야 하고, ④ 도드-프랭크법 제정일인 2010년 7월 21일 이후 위원회에 최초로 제공된 정보이어야 한다(SEC Rule 21F-4(b)(4); 17 C.F.R. § 240.21F-4(b)(4)).

4) 공익신고자에 대한 보복행위 금지

1934년 연방증권거래법 Section 21F(h)는 공익신고자에 대한 보복행위를 금지한다. 보복행위 금지의 대상은 고용주에 국한되지 않는다. 누구든지 공익신고자에게 보복행위를 하는 것이 금지되며 이에 반하는 행위는 1934년 연방증권거래법 Section 21F(h) 위반이 성립할 수 있다.114)

도드-프랭크법에서는 사뷔엔스옥슬리법(Sarbanes–Oxley Act of 2002)을 통해 제정된 기존의 공익신고자 보호 규정115)을 강화했는데, 특히 주목할 만한 사항은 공익신고 후 보복을 당한 금융서비스업계 직원을 위한 사적소권을 신설한 것이다. 그 외에도 18 U.S.C. § 1514A(a)(1)의 사적소권을 개정하여 소멸시효를 연장하고, 분쟁 전 중재 조항 또는 분쟁 전 보복행위에 대한 권리 및 구제수단 포기 조항의 집행을 금지하며, 상장회사의 연결재무제표에 재무정보가 포함된 자회사의 직원에게도 동 규정이 적용된다는 점을 명시하였다.116)

또한 도드-프랭크법은 1934년 연방증권거래법에 다음과 같은 내용의 Section 21F(h)(1)을 추가하였다.117) 즉, 공익신고자가 ① 본 조항에 따라 SEC에 정보를 제공하는 경우, ② 그러한 정보에 근거하거나 그와 관련된 SEC의 조사 또는 민사적 또는 행정적 제재 조치를 개시, 증언 또는 지원하는 경우, 또는 ③ 사뷔엔스옥슬리법, 1934년 연방증권거래법 및 SEC의 관할에 속하는 기타 법률, 규칙 또는 규정에 따라 요구되거나 보호되는 공시를 하는 경우, 고용주는 공익신고자의 합법적 행위를 이유로 고용 조건에서 공익신고자를 해고, 강등, 정직, 위협, 괴롭힘, 직간접적으로 또는 기타 방식으로 차별해서는 안 된다(15 U.S.C. § 78u–6(h)(1)).

1934년 연방증권거래법 Section 21F(h)(1)(A)를 위반하여 보복을 당했다고 주장하는 개인은 ① 차별이 없었다면 개인이 가졌을 동일한 직급 지위로 복직, ② 개인에게 지급해야 할 미지급 임금의 2배와 이자, ③ 소송 비용, 전문가 증인 비용 및 합리적인 변호사 수임료에 대한 보상을 구하기 위해 연방지방법원에 소를 제기할 수 있다(15 U.S.C. § 78u–6(h)(1)(A)).

공익신고자 보복 관련 소송은 SEC에서 별도의 독립적 제재조치로 개시될 수도 있는데, In the Matter of International Game Technology, Exchange Act Release No. 78991(2016. 9. 29) 사건에서 SEC는 처음으로 이와 같은 소송을 제기한 바 있다. 또한 SEC는 증권법 위반에 대한 SEC 직원과 개인 간의 의사소통을 방해하는 어떠한 조치도 취할 수 없다는 Rule 21F-17을 제정하였다(17 C.F.R. § 240.21F-17).118)

나. 자진신고 감면제도

1) 자진신고 감면제도의 의의

SEC의 조사는 비공식 조사에 해당하는 예비조사와 공식적인 조사 명령을 받아서 진행하는 정식조사가 있다.119) 예비조사에서는 대부분의 조사를 조사대상자의 자발적 협조에 의존하고120), 정식조사에서는 소환장을 발부하여 강제조사가 가능하다.121) 따라서 강제조사 등 법적 의무가 부과되어 그 의무를 이행하는 것은 의무의 이행일뿐 조사대상자의 적극적인 협조라고 보기 어렵다.122) 그러나 법적 의무 이행을 넘어 그 이상의 자료나 정보를 제공하는 것은 조사대상자의 협조에 해당할 수 있다. 조사대상자의 적극적인 협조가 이루어지는 경우 SEC는 이에 대하여 공로를 인정하여 제재 감면 등의 혜택을 줄 수 있다.123)

2) 개인 협조자

SEC가 조사에 협조한 개인의 공로를 인정하여 혜택을 부여하고자 할 때에는 ① 조사대상자가 제공한 협조, ② 협조가 제공된 해당 사건의 중요성, ③ 협조 제공자에게 책임을 지움으로써 얻는 사회적 이익, ④ 협조 제공자의 지위 등을 고려해야 한다.124) 이하에서는 각 항목의 세부 내용을 살펴보기로 한다.125)

① 조사대상자가 제공한 협조와 관련하여 SEC는 개인이 제공한 협조의 가치와 성격을 고려해야 한다. 우선, 협조의 가치와 관련해서는 (i) 개인의 협조가 조사에 실질적인 도움을 주었는지, (ii) 개인이 SEC에 위법행위를 최초로 신고했는지 또는 조사에 대한 협조를 제공했는지, 계류 중인 조사 또는 관련 조치를 인지하기 전에 협조를 제공했는지 등 개인 협조의 적시성, (iii) 조사가 개인이 제공한 정보 또는 기타 협조를 바탕으로 개시되었는지, (iv) 협조가 진실하고 완전하며 신뢰할 수 있는지 등 개인이 제공한 협조의 품질, (v) 개인의 조사 협조로 인해 절약된 시간 및 자원 등을 고려해야 한다. 다음, 협조의 성격과 관련해서는 (i) 개인의 협조가 자발적이었는지 또는 다른 법 집행기관 또는 규제기관과의 계약 조건에 의해 요구되었는지, (ii) 개인이 SEC에 제공한 지원의 유형, (iii) 직원이 요청하지 않았거나 다른 방법으로는 발견되지 않았을 수 있는 비닉특권126) 없는 정보를 제공했는지, (iv) 개인이 다른 사람이 조사에 참여하지 않았을 수도 있는 직원을 지원하도록 장려하거나 권한을 부여했는지, (v) 개인이 협조를 제공한 특수한 상황 등을 고려해야 한다.

② 협조가 제공된 해당 사건의 중요성과 관련하여 SEC는 조사의 성격과 조사 대상 위반행위로 인해 투자자나 타인에게 초래되는 위험을 고려해야 한다. 우선, 조사의 성격과 관련해서는 (i) 조사 대상 사건이 위원회의 우선 처리 대상 사건인지, (ii) 증권법 위반의 유형, (iii) 위법행위의 시기 및 기간, (iv) 위반 횟수, (v) 위반행위의 고립적 또는 반복적 성격 등을 고려해야 한다. 다음, 조사 대상 위반행위로 인해 투자자나 타인에게 초래되는 위험과 관련해서는 (i) 조사 대상 위반으로 인한 피해 또는 잠재적 피해의 규모, (ii) 조사 대상 위반으로 인해 발생하거나 위협받는 피해의 유형, (iii) 피해를 입은 개인 또는 단체의 수 등을 고려해야 한다.

③ 협조 제공자에게 책임을 지움으로써 얻는 사회적 이익을 평가할 때 SEC는 (i) 위반행위의 성격과 위반행위 발생 당시 개인의 지식, 교육, 훈련, 경험 및 책임 직책의 맥락에서 평가된 개인의 위법행위의 심각성, (ii) 개인의 과실 여부, (iii) 개인이 불법행위를 용인한 정도, (iv) 위반행위로 인한 피해를 구제하기 위해 개인이 취한 노력, (v) 조사 대상 위반으로 인해 다른 연방 또는 주 정부 기관 및 업계 단체에서 해당 개인에게 부과한 제재 등을 고려해야 한다.

④ 협조 제공자의 지위와 관련하여 SEC는 (i) 증권법 또는 규정 준수를 포함한 개인의 적법성 이력, (ii) 해당 개인이 과거 위법행위에 대한 책임 인정을 입증한 정도, (iii) 해당 개인의 직업을 고려할 때 향후 연방 증권법 위반을 범할 가능성이 있는 정도 등을 고려하여 평가한다.

3) 기업 협조자

기업의 조사 협조에 대해서는 크게 ① 위법행위 발견 전 자체 정책 수립, ② 위법행위 발견 시 자체 보고, ③ 구제, ④ 법 집행기관과의 협력 등 네 가지 기준을 고려해야 한다. 예컨대, ①과 관련해서는 효과적인 컴플라이언스 절차를 수립하고 적절한 분위기를 조성하는 경우가 있고, ②와 관련해서는 위법행위의 성격, 범위, 기원 및 결과에 대한 철저한 검토를 수행하고 위법행위를 일반대중, 규제기관 및 자율규제기관에 신속하고 완전하며 효과적으로 공개하는 경우가 있다. ③과 관련해서는 위법행위자를 해고하거나 적절하게 징계하고, 위법행위의 재발방지를 위해 내부통제 및 절차를 수정 및 개선하며, 피해를 받은 자에게 적절하게 보상하는 경우가 포함되며, ④와 관련해서는 SEC 직원에게 조사 대상 위반행위 및 회사의 시정 노력과 관련된 모든 정보를 제공하는 경우가 포함된다.127)

SEC는 제재 조치를 취하지 않는 것부터 혐의 감경, 가벼운 제재 조치, SEC의 제재 조치 문서에 완화 문구 포함 등 자체 정책, 자체 보고, 시정 및 협력을 인정할지와 그 정도를 결정할 때 고려할 기준을 아래와 같이 제시하였다.128)

첫째, 관련된 위법행위의 성격은 무엇인가? 부주의, 단순 실수, 단순 태만, 위법행위의 징후에 대한 무모하거나 의도적인 무관심, 고의적인 위법 등에서 기인한 것인가? 회사 감사인이 잘못된 판단을 내렸는가?

둘째, 위법행위는 어떻게 발생했는가? 특정 성과를 달성하기 위해 직원들에게 가해진 압력의 결과인가, 아니면 회사를 지배하는 자들이 정한 불법적인 분위기 때문인가? 현재 밝혀진 위법행위를 방지하기 위해 어떤 규정 준수 절차가 마련되어 있는가? 이러한 절차가 위법행위를 중단하거나 억제하지 못한 이유는 무엇인가?

셋째, 위법행위가 조직 내 어디에서 발생했는가? 지휘 체계에서 얼마나 높은 직급이 해당 위법행위를 알고 있었거나 가담했는가? 고위 직원이 명백한 위법행위의 징후에 가담했거나 이를 외면했는가? 해당 행위가 얼마나 조직적으로 이루어졌는가? 해당 행위가 해당 법인의 업무수행 방식에서 나타나는 증상인가, 아니면 고립된 문제인가?

넷째, 위법행위가 얼마나 오래 지속되었는가? 1/4분기 또는 일회성 사건이었는가, 아니면 몇 년 동안 지속되었는가? 상장회사의 경우, 위법행위가 상장 전에 발생했는가? 위법행위가 회사의 상장 추진에 도움이 되었는가?

다섯째, 위법행위로 인해 투자자 및 기타 기업 구성원이 입은 피해는 어느 정도인가? 위법행위가 발견되고 공개되었을 때 회사 주식의 주가가 크게 하락했는가?

여섯째, 위법행위는 어떻게 발견되었으며 누가 이를 발견했는가?

일곱 번째, 위법행위 발견 후 효과적인 대응을 실행하는 데 얼마나 걸렸는가?

여덟 번째, 위법행위를 알게 된 후 회사는 어떤 조치를 취했는가? 회사는 위법행위를 즉시 중단했는가? 위법행위에 책임이 있는 자가 여전히 회사에 재직 중인가? 그렇다면 여전히 같은 직책에 있는가? 회사는 위법행위의 존재를 일반대중, 규제기관 및 자율규제기관에 신속하고 완전하며 효과적으로 공개했는가? 회사는 적절한 규제 및 법 집행기관에 전적으로 협조했는가? 회사는 추가로 발생했을 가능성이 있는 관련 위법행위를 파악했는가? 회사는 투자자 및 기타 기업 구성원에 대한 피해 정도를 파악하기 위한 조치를 취했는가? 회사는 해당 행위로 인해 부정적인 영향을 받은 사람들에게 적절하게 보상했는가?

아홉 번째, 회사는 이러한 많은 문제를 해결하고 필요한 정보를 파악하기 위해 어떤 절차를 따랐는가? 감사위원회와 이사회에 충분한 정보를 제공했는가? 그랬다면 시기는 언제였는가?

열 번째, 회사는 진실을 완전하고 신속하게 파악하기 위해 노력했는가? 회사는 행위 및 관련 행동의 성격, 범위, 기원 및 결과에 대한 철저한 검토를 수행했는가? 경영진, 이사회 또는 사외이사로만 구성된 위원회가 검토를 감독했는가? 회사 직원 또는 외부 인사가 검토를 수행했는가? 외부인인 경우, 회사를 위해 다른 업무를 수행했는가? 외부 변호사가 검토를 수행한 경우, 경영진이 이전에 해당 변호사를 고용한 적이 있는가? 검토에 범위 제한이 있었는가? 그렇다면 어떤 제한이 있었는가?

열한 번째, 회사는 검토 결과를 직원에게 즉시 제공하고 상황에 대한 대응을 반영하는 충분한 문서를 제공했는가? 회사는 법 위반행위자에 대한 신속한 제재 조치가 용이하게 하기 위해 가능한 위반행위와 증거를 충분히 정확하게 식별했는가? 검토 결과를 자세히 설명하는 면밀한 서면 보고서를 작성했는가? 직원이 직접 요청하지 않았거나 다른 방법으로는 발견하지 못했을 수 있는 정보를 회사가 자발적으로 공개했는가? 회사는 회사 직원들에게 SEC 직원들에게 협조할 것을 요청하고 그러한 협조를 구하기 위해 모든 합리적인 노력을 기울였는가?

열두 번째, 해당 행위가 재발하지 않을 것이라는 어떤 보장이 있는가? 회사는 위법행위의 재발을 방지하기 위해 설계된 새롭고 보다 효과적인 내부 통제 및 절차를 채택하고 그 시행을 보장했는가? 회사는 상황을 시정하고 해당 행위가 재발하지 않도록 하기 위한 회사의 조치를 평가할 수 있도록 SEC 직원에게 충분한 정보를 제공했는가?

열세 번째, 해당 회사가 위법행위가 발생한 회사와 동일한 회사인가, 아니면 합병 또는 파산 구조조정을 통해 변경된 회사인가?

4) 협조 계약

2010년 1월 SEC는 DOJ가 형사절차에서 사용해 오던 도구인 ① 협력 계약(cooperation agreement), ② 기소유예합의(Deferred Prosecution Agreements: DPA), ③ 불기소합의(Non Prosecution Agreements: NPA)을 SEC의 증권규제에 도입하였다.129) 여기서 기소유예합의는 조사대상자가 유예 기간 동안 SEC 조사에 협조하고 일정 조건을 이행하면 SEC의 제재가 실효되는 것을 말하고, 불기소합의는 이러한 경우에 제재를 부과하지 않는 것을 말한다.130)

3. 일본의 공익신고 및 자진신고 제도

가. 일본의 공익신고자 보호제도

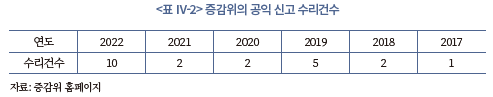

일본은 공익신고자보호법에 근거한 공익신고 창구를 설치하여 회사 내부자로부터의 신고도 접수하고 있다. 다만, 공익신고 창구를 통한 신고는 아래 <표 Ⅳ-2>에서 볼 수 있듯이 그리 많지는 않다. 공익신고자보호법의 요건을 갖추기 위해 당해 회사에 ‘1년 이내’에 고용되어 있어야 하고, 거래처 관계 회사에 고용되어 있었어야 하며, 사실이라고 믿을 만한 ‘증거나 이유’ 등을 갖추어 ‘실명’으로 신고해야 해서 신고 건수가 낮은 것으로 파악된다.131)

다만 이와 같은 수치는 공익신고, 즉 내부자 고발로서 공익신고자보호법에 의해 보호되는 신고의 건수만을 의미하고, 그러한 요건을 갖추지 못한 신고도 일반적인 정보제공이나 제3자에 의한 신고와 마찬가지로 취급하여 유효하게 활용하고 있다고 한다. 전술한 바와 같이, 내부자 고발이 아닌 증감위 내의 시장분석 조사과의 정보제공 창구에서 투자자나 시장관계자로부터 제공받고 있는 정보제공 및 신고는 연간 약 6,000~7,000건에 이르고 있고, 이 중 불공정거래와 관련된 정보만 하더라도 연간 약 4,000~5,000건의 정보가 접수되고 있다.132)

또한 자율규제기관인 일본증권업협회나 일본증권거래소 자율규제법인과 연계하여 정보를 수집하기도 한다. 특히 증감위는 일본증권거래소 자율규제법인으로부터 불공정거래로 의심되는 거래에 대한 정보를 주기적으로 제공받고 있다. 동 법인은 주가나 매매가격의 동향을 추적하며 부자연스러운 거래를 내부 시스템이나 시장 내외부의 정보제공을 통하여 추출한 다음, 불공정거래에 대한 조사‧심사 업무를 수행하고 있으며, 연간 약 3,000건 정도의 조사‧심사를 하고 있다.133) 그리고 조사‧심사 결과 불공정거래의 의심이 있는 것으로 판단되는 사안을 증감위에 통보하고, 증감위는 이러한 사안에 대해 조사 권한을 행사하여 당해 거래에 대해 구체적인 조사‧심사를 하고 있다.

한편 정보제공 창구나 공익신고 창구를 운영하는 등 여러 곳으로부터 정보를 제공받고 있기는 하지만 정보제공자에 대해 보상이 이루어지는 것은 아니다. 즉 우리나라나 미국의 경우와는 달리 일본에서는 내부고발이나 신고에 대한 포상금제도는 존재하지 않는다. 포상금제도에 대해서는 2004년과 2020년 공익신고자보호법 개정 당시에도 도입에 대한 논의가 이루어지긴 하였으나 사회적 정의를 위한 신고는 당연한 것이며, 포상금을 노리고 신고를 하는 경우와 같은 부작용이 더 클 수 있다는 생각에 따라 결국 포상금 제도는 도입되지 않았다.134)135)

나. 자진신고 감면제도

자진신고에 대한 감면제도로는 일정한 위반행위에 대해서 증감위의 조사가 시작되기 전에 법 위반 사실을 신고한 경우에는 과징금의 금액을 반액으로 감액해주는 과징금 감액제도가 존재한다(법 제185조의7 제14항).

공시서류 등의 허위기재, 대량보유보고서의 부제출과 같이 공시와 관련된 부분에 대해서 주로 과징금 감액제도가 적용되고, 불공정거래 행위 유형과 관련하여서는, 법인에 의한 자기주식 취득과 관련하여 내부자거래를 행한 자가 증감위의 조사절차가 개시되기 전에 위반사실을 신고한 경우에, 가장 최근의 위반사실과 관련된 과징금 금액을 반액으로 감액하고 있다.

이에 대하여 재발 방지 차원에서 법인의 자기주식취득 관련 내부자거래에 대해서만 과징금 규정을 두었지만, 다른 불공정거래 행위에 비하여 특별히 위와 같은 행위가 반복적으로 일어난다고 하기는 어렵기 때문에, 재발방지를 위하여 감액제도를 두었다기보다는, 회사의 컴플라이언스 체제의 구축을 촉진시키기 위한 규정으로 보아야 한다고 해석되고 있다.136)

이와 같은 해석에 따르면 법인의 자기주식취득의 경우에 적용되는 과징금 감액제도는 재발방지나 조사의 편의를 위한 제도가 아니고, 다른 불공정거래 유형에 대해서는 과징금 감액제도를 두고 있지 않고 있기 때문에, 실질적으로 일본에서는 불공정거래 행위에 대하여 재발방지나 조사의 편의를 위하여 자진신고를 통한 감면제도를 두고 있지 않다고도 평가할 수 있을 것이다.137)

4. 향후 과제

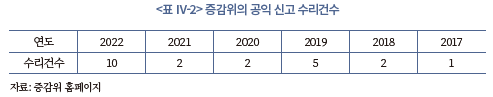

공익신고를 활성화하기 위해서는 포상금 지급이 핵심이다. 포상금을 지급하는 미국의 경우 연간 제보 건수가 증가하고 있어, 2022년의 경우에만 12,300건 이상의 공익신고를 접수 받았다. 이 중에서 103건에 대해 약 2억 2,900만 달러의 포상금을 지급하였고 이러한 시장 학습 효과를 통해 공익신고를 통한 제보는 앞으로도 늘어갈 것이다. 반면에 일본의 경우 공익을 위한 신고는 당연한 것으로 포상금을 지급하지 않겠다는 정책을 펼친 결과 불공정거래에 대한 신고가 연간 10건 이하에 불과하다.

나라마다 정책 방향은 다를 수 있으나, 불공정거래 근절이라는 정책 목표와 효율적인 문제 해결이라는 관점에서 볼 때 포상금제도를 활용하는 것이 중요하다고 본다. 비용을 지급하더라도 그보다 불공정거래 적발을 통해 몰수‧추징하는 금액과 벌금 그리고 향후 도입될 과징금까지 생각하면 더 많은 비용을 회수할 수 있게 된다. 그런데 공익신고를 활성화하기 위해서는 단순히 포상금액의 상한을 높이고, 정부예산으로 지급하겠다는 계획만으로는 부족하다. 정해진 예산의 범위에서 지급하다 보니 충분한 지급이 이루어지지 않을 수가 있기 때문이다. 공익신고자에 대한 포상금을 지급하지 않는 일본의 경우 공익신고가 활성화되지 않는 점에 비추어 볼 때 미국과 같은 포상금제도의 도입이 필요하다.

먼저 포상금액의 한도를 기여도에 근거하여 지급하도록 한 점을 참고할 수 있다. SEC가 성공적으로 집행 조치를 취하여 100만 달러 이상의 금전적 제재(민사제재금 및 부당이득환수 포함)를 부과하는 경우, SEC가 해당 공익신고자에게 징수된 제재금의 10%에서 30%에 해당하는 포상금을 지급하도록 규정하고 있다. 또한 SEC는 포상금의 상향 조정에 관해서만 재량권을 가지고, 하향 조정에 대해서는 재량권이 인정되지 않으므로 SEC의 재량에 의한 포상금 감액은 불가능하다는 점도 참고할 수 있다. 우리나라의 경우 기여도를 고려하겠다고 하나 미국과 같이 제재금에 비례해서 포상금을 지급하는 것이 아니라 가중치 점수에 반영될 뿐이다. 2023년 12월 14일에 입법예고된 포상금 지급기준을 보면 중요도에 따른 기준금액과 기여율을 곱하여 산정하도록 하고 있고, 중요도는 ① 자산총액, ② 일평균 거래금액, ③ 적발된 위반행위의 수, ④ 조사결과 조치, ⑤ 부당이득 각각에 가중치를 곱하여 산출하도록 정하고 있다. 기여율은 신고내용의 구체성과 조사 및 적발 기여도를 평가점수로 환산하는 등 복잡한 산식으로 인해 신고자 입장에서 포상금 예측이 어려울 수 있다. 향후 정책적으로 미국과 같이 불공정거래 행위자로부터 징수한 금전 대비 퍼센트(미국은 10~30%)를 규정하는 방식으로 하여 공익신고를 활성화하도록 하는 방안을 검토해 볼 것을 제안한다.

이러한 포상금을 받기 위해 허위신고를 하는 것을 방지하기 위한 조치도 필요하다. SEC는 잘못된 신고로 인해 SEC 조사가 방해되는 것을 방지하기 위해 3건 이상 경솔한 신고 또는 사기적이거나 공익신고자 프로그램의 효율을 저해할 수 있는 신고를 한 자에 대해서는 영구히 공익신고 포상 대상에서 제외할 수 있다. 실제로 2021년 9월 28일 수백 건의 경솔한 공익신고를 한 자에 대해서 영구적 공익신고 포상 대상에서 제외한 바 있다.

또한 공익신고자와 관련하여 보복에 대한 보호조치가 추가적으로 필요하다. 현재는 공익신고자가 보복을 받은 경우 국민권익위원회만 공익신고자 보호법에 의한 보호조치 및 이의 실효성 확보를 위해 위반시 이행강제금 부과가 가능하다. 자본시장법의 공익신고자의 경우 국민권익위원회에 의한 보호조치보다는 직접적인 영향력이 있는 금융당국의 보복방지조치가 필요하다. 현재 금융위는 공익신고자에 대하여 원상회복 등 조치를 요구할 권한이나 권고할 권한만 가지고 있는 현실이다. 공익신고자의 소속기관에 대해 금융위가 직접 보복방지조치 및 이행강제금 부과의 권한을 가질 수 있어야 공익신고제도를 실효성 있게 운영할 수 있다.

무엇보다 중요한 것은 포상금의 재원이다. 3대 불공정거래에 과징금이 징수되어도 현행법상 일반회계에 귀속되어 불공정거래 근절을 위한 용도로 사용되지 못한다는 한계가 있으므로, 이 부분에 대한 재검토가 필요하다. 우리나라 현행법상 법률을 통하여 과징금을 국가의 특별회계나 기금에 귀속시키거나 용도를 특정 사업으로 한정하는 것이 가능하다.

대기환경보전법의 과징금은 환경정책기본법에 따른 환경개선 특별회계의 세입으로 편입되고(제76조의6 제4항), 국민건강보험법상 과징금은 요양급여 비용‧응급의료기금 지원‧재난적 의료비 지원 사업에 사용되며(제99조 제8항), 신문 등의 진흥에 관한 법률에 따른 과징금은 언론진흥기금으로 출연된다(제27조 제4항). 이러한 점을 감안하여 우리도 미국처럼 과징금으로 기금을 조성하고 해당 기금에서 포상금이 지급되도록 하는 방안을 검토하는 것이 필요하다.

다음으로 자진신고 감면제도의 경우, 개정 자본시장조사 업무규정안의 경우 ‘성실한 협조’를 중요 판단 기준으로 삼고 있다. ① 관련된 사실을 지체없이 모두 진술하였는지, ② 모든 자료를 신속하게 제출하였는지, ③ 신속하게 답변하고 협조하였는지, ④ 지속적이고 진실하게 협조하였는지, ⑤ 증거와 정보를 파기, 조작, 훼손, 은폐하였는지 여부가 판단 기준이다. 그런데 ‘지체없이’와 ‘신속하게’, ‘진실하게’ 등 모호한 기준이 자진신고감면제도의 운영에 어려움을 가져올 수 있다. 향후 제도의 운영 과정을 통해 보완해야 할 부분이기는 하나, SEC의 기준을 참고할 필요가 있다.

앞서 살펴본 바와 같이 SEC는 ① 조사대상자가 제공한 협조, ② 협조가 제공된 해당 사건의 중요성, ③ 협조 제공자에게 책임을 지움으로써 얻는 사회적 이익, ④ 협조 제공자의 지위 등을 고려한다. 이미 각각의 내용에 대해 자세히 설명하였으므로, 참고해야 할 주요한 내용만 간단히 열거하도록 한다. 특히 조사대상자가 제공한 협조와 관련하여 ‘지체없이’와 같은 모호한 기준이 아니라 조사대상자의 협조가 조사에 실질적인 도움을 주었는지, 제공된 정보나 협조를 바탕으로 조사가 개시되었는지, 그로 인해 절약된 시간이나 자원 등도 고려하도록 하고 있다. 또한 협조가 제공된 사건과 관련하여 증권법 위반의 유형, 위법행위의 시기 및 기간, 위반 횟수, 그로 인한 피해규모까지도 고려하도록 하고 있다. 우리나라 규정 안에서는 5년 이내에 다시 불공정거래 행위를 한 경우 감면할 수 없다고 획일적으로 규정한 반면, SEC는 개인의 위법 이력, 과거 협조 정도까지도 고려하도록 하고 있어서 훨씬 구체적이다. 또한 앞서 살펴본 바와 같이 SEC는 개인 협조자와 기업 협조자에 대해서 각기 다른 기준을 수립하고 있다는 점도 참고할 필요가 있다. 기업의 조사협조에 대해 효과적인 내부통제시스템을 구축하였는지 여부, 위법행위에 대해 적절히 대응하였는지 여부를 감면의 요소로 고려하도록 한 점이 특징적이다.

현행 규정안과 같이 자진신고 감면 결정을 위해 고려해야 할 사항을 열거하되 SEC의 규정을 참고하여 구체화하는 방안도 생각해 볼 수 있고, 신고시점, 신고 내용의 구체성, 조사 협조 정도, 공범 진술 여부, 조사 협조자의 부당이득, 선제적 자료 제공, 적시성, 신고자의 지위 등을 기준으로 일정한 점수를 부여하는 방안을 고려할 수 있다.138)

Ⅴ. 투자자 피해구제 방안

1. 현행 제도의 문제점 및 개선방안 검토

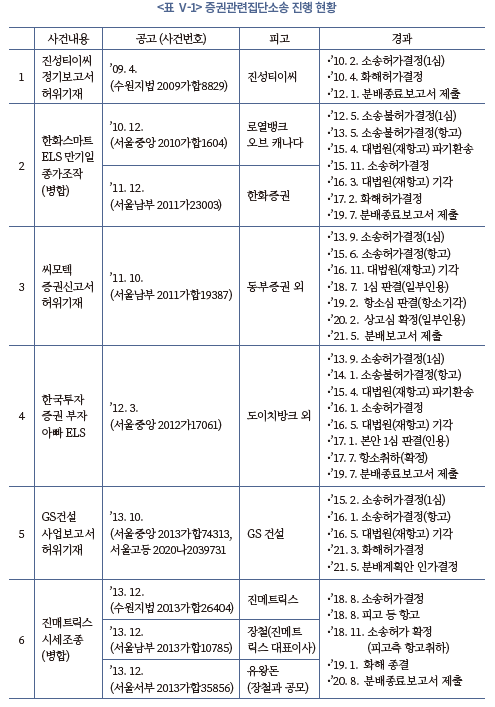

불공정거래의 경우 가해자는 단일하고 거액의 이익을 얻는데 반하여 피해자는 불명확한 다수이고 소액의 손해로 분산된다. 소액의 투자자로서는 민사소송을 통해 청구할 수 있는 금액은 자신의 실제 손해액에 한정되지만 소송비용은 상대적으로 높아 실제로 소송을 제기하는 경우가 드물다. 이를 위해 증권관련 집단소송법이 제정되어 있으나 실제 운영 사건을 보면 이를 통해 보상받는 경우가 매우 드물다.139)

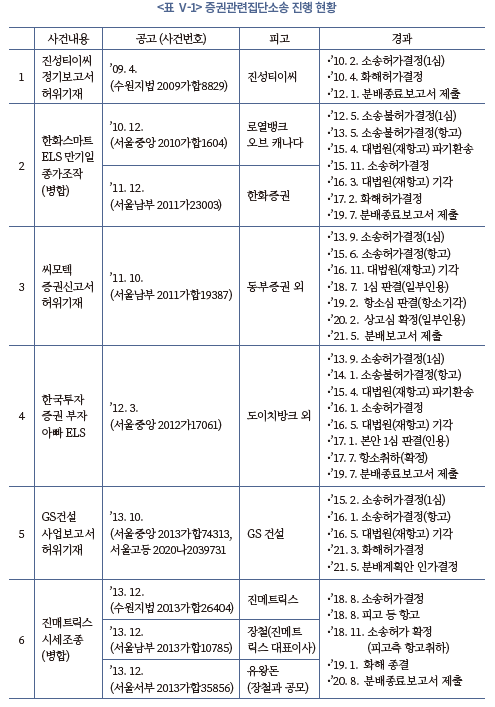

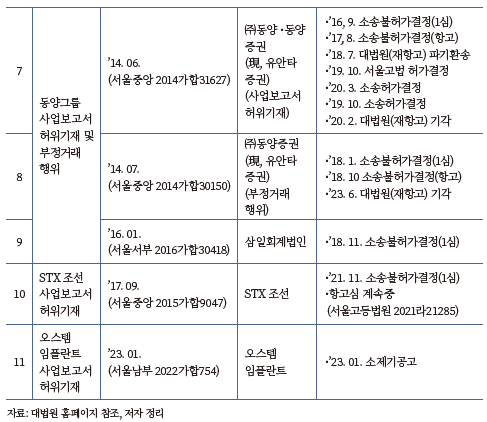

증권관련 집단소송법은 증권 거래 과정에서 발생한 집단적인 피해를 효율적으로 구제하고 이를 통하여 기업의 경영 투명성을 높이기 위하여, 민사소송법에 대한 특례로 2004년 1월 20일 집단소송법이 제정되어 2005년 1월 1일 시행되면서 도입되었다. 제정 당시 남소를 방지하기 위한 엄격한 제소요건, 소송허가제, 원고 및 원고 대리인에 대한 규제 등의 장치를 마련하였으나, 우려와 달리 2009년 4월에 가서야 첫 집단소송이 제기되었다. 뿐만 아니라 도입된지 18년이 경과하였음에도, 증권관련집단소송 제기 건수는 2023년 9월 현재 약 11건 정도에 불과한 상황이다. 그 중 본안판결이 나온 사안은 도이치뱅크 사건과 씨모텍 사건 2건이다. 도이치뱅크 사건은 항소 포기로 확정되었으나 씨모텍 사건은 아직 상고심에 계속되어 있다. 재판상화해로 종결된 사안은 RBC 사건을 포함하여 3건이다.140) 소송요건도 엄격하여 소송제기도 어렵지만, 소송허가 받기까지도 장기간 걸리고 판결까지 더 오래 걸리는 현실이기 때문이다. 특히 2017년 10번째 소제기 이후 2023년에 이르러서야 11번째 소제기가 있다는 것은 그만큼 증권관련집단소송이 피해자의 구제에 기여하는 바가 적다는 것을 보여준다.

집단소송이 제기된다고 하여도, 증권 관련 분쟁에서는 불공정거래 행위 입증에 필요한 정보나 자료의 대부분을 피해자가 보유하고 있지 않아서 소송 수행에 어려움이 있다. 집단소송의 경우에도 입증책임은 원고에게 있고, 원고가 적절한 입증을 하지 못하면 패소하기 때문이다. 민사소송법 제344조의 문서제출명령 등이 도입되어 있으나, 이러한 법원의 명령에 피고가 응하지 않아도 특별한 제재 수단이 없다는 문제가 있다. 집단소송에서는 문서제출명령에 응하지 않을 경우 제63조에 따라 제재할 수 있으나 과태료가 3천만 원에 불과하다.

피해자의 소송이 어렵다는 것을 감안하여 2013년 정부가 발표한 종합대책에 의해 거래소에 불공정거래 피해자 소송지원센터가 설립되어 소송에 필요한 자료를 제공하나 자료의 내용에 한계가 있다.141) 제공 자료는 종목별 매매정보142), 1분 단위 주가지수143)인데 이는 투자자들도 인터넷 검색을 통해 찾을 수 있는 자료이고 소송에 필요한 법률상담도 직접적인 소송수행에 도움을 주지 않는 자문에 불과하다. 여전히 피해자들은 자신들의 비용으로 직접 불공정거래 자료를 찾아야 하는 상황이다.

또한 3대 불공정거래 행위에 대해서는 증권관련 집단소송 제기가 가능하지만, 제178조의2의 시장질서 교란행위의 피해자는 증권관련 집단소송을 제기할 수 없다. 시장질서 교란행위가 최근에 도입된 제도임을 감안하면 이를 배제하기 위한 입법취지라기 보다는 집단소송 관련 제도가 개선되지 않은 문제로 보인다.

2023년에 불공정거래와 관련하여 많은 제도 변화가 있었지만 안타깝게도 피해자 구제에 대한 대안은 한 건도 발표되지 않았다. 증권관련집단소송제도를 개선하기 위한 입법안도 과거에 많이 발의되었으나, 본격적인 논의는 없는 상황이다.

2. 미국의 투자자 피해구제 방안

가. Fair fund 제도

1) 의의

SEC나 법원은 위반행위자가 부당하게 얻은 이익을 환수하기 위한 명령을 내릴 수 있다. 또한 법원이나 SEC는 유죄 당사자를 처벌하고 다른 사람들이 유사한 위법 행위를 저지르지 못하도록 민사제재금을 부과할 수 있다.144) 그런데 부당이득환수금은 위법행위로 피해를 입은 피해자에게 분배가 가능한 경우에는 분배하는 것이 일반적이나, 민사제재금은 전통적으로 모두 국고(U.S. Treasury)에 귀속되었다. 그러나 미국 의회는 사뷔엔스옥슬리법 Section 308과 연방증권법에 따라 SEC가 제기한 소송 또는 행정 조치에서 환수된 금액과 부과된 민사제재금은 위원회의 신청 또는 지시에 따라 해당 위반행위 피해자의 이익을 위해 환수 기금에 추가되어 그 일부가 된다는 규정을 마련하였다(15 U.S.C. § 7246(a)). 또한, 의회는 도드-프랭크법을 통해 이 Fair Fund 조항을 다시 개정하여 SEC가 금전적 제재 조치의 일부로 부당이득을 환수했는지 여부와 관계없이 제재 조치로 부과한 민사제재금을 피해자에게 분배하기 위한 기금에 추가할 수 있도록 허용했다. 나아가 동법은 이 금원을 증권사기를 신고한 공익신고자에게 포상금으로 지급하고 감사실(Inspector General) 활동 자금으로 사용할 수 있도록 규정하였다.145)

2) 분배 절차

SEC는 부당이득환수금 및 민사제재금의 금액과 15 U.S.C. 7246(b)에 따라 위원회가 수령한 모든 기금을 위반으로 피해를 입은 투자자의 이익을 위한 기금을 조성하는 데 사용하도록 명령할 수 있다(SEC Rule 1100; 17 C.F.R. § 201.1100).

이 규정에 근거하여 SEC는 언제든지 당사자에게 Fair Fund 또는 부당이득환수금의 자금 관리 및 분배에 대한 계획서를 제출하도록 명령할 수 있다(SEC Rule 1101(a); 17 C.F.R. § 201.1101(a)). 특별히 다른 명령이 없는 한, Fair Fund 또는 부당이득환수금 집행 계획에는 ① 추가 기금 수령 절차(기금이 보관될 계좌 지정, 기금을 투자할 수 있는 상품, Fair Fund의 경우 해당되는 경우 15 U.S.C. 7246(b)에 따른 자금 수령을 포함), ② 기금을 수령할 수 있는 자격이 있는 자의 범주 명시, ③ 기금의 존재와 기금을 수령할 수 있는 자격이 있음을 대상자에게 통지하는 절차, ④ 청구 및 승인 절차, 분쟁이 있는 청구 처리 절차, 청구 마감일, ⑤ 분배되지 않은 기금의 처분에 관한 조항, 기금의 만기 예정일, ⑥ 기금을 감독하고, 클레임을 처리하고, 회계를 준비하고, 세금 신고서를 제출하고, SEC의 승인에 따라 위반으로 피해를 입은 투자자에게 기금으로부터 분배금을 지급하는 기금 관리자의 선정, 보수 및 필요한 경우 보상을 포함한 기금 관리 절차, ⑦ SEC 또는 청문담당관이 요구하는 기타 규정이 포함되어야 한다(SEC Rule 1101(b); 17 C.F.R. § 201.1101(b)).

제안된 민사제재금 계획 또는 제안된 Fair Fund 계획에 대한 통지는 SEC 사건명부(Docket), SEC 웹사이트 및 SEC 또는 청문담당관이 요구하는 기타 간행물에 게시되어야 한다. 통지서에는 제안된 계획의 사본을 입수할 수 있는 방법이 명시되어야 하며, 제안된 계획에 대해 의견을 제시하고자 하는 자는 서면으로 SEC에 의견을 제출할 수 있음을 명시해야 한다(SEC Rule 1103; 17 C.F.R. § 201.1103).

SEC는 제안된 부당이득환수 계획 또는 Fair Fund 계획의 공지가 게시된 후 30일이 경과하면 언제든지 명령에 따라 제안된 계획을 승인, 수정 승인 또는 비승인할 수 있다. SEC의 재량에 따라 채택 전에 대폭 수정된 계획안은 17 C.F.R. § 201.1103에 따라 추가 의견 제출 기간을 위해 다시 게시될 수 있다. SEC 또는 청문담당관이 서면 명령으로 정당한 사유를 제시하여 기간을 연장하지 않는 한, 계획안에 대한 최종 의견제출 기간이 종료된 날로부터 30일 이내에 계획을 승인 또는 비승인하는 명령을 내려야 한다(SEC Rule 1104; 17 C.F.R. § 201.1104).

위원회 또는 청문담당관은 SEC 직원을 포함하여 누구든지 부당이득환수 계획 또는 Fair Fund 계획의 관리자로 임명하고 해당 관리자에게 계획 관리에 대한 책임을 위임할 수 있는 재량권을 갖는다. 관리자는 위원회 또는 청문담당관의 명령에 따라 언제든지 해임될 수 있다(SEC Rule 1105(a); 17 C.F.R. § 201.1105(a)). 위원회 또는 청문담당관이 자금의 적절한 분배를 보장하기 위해 적절하다고 판단하는 조건에 따라 피청구인에게 부당이득환수 계획을 관리하거나 관리하는 데 도움을 주도록 요구하거나 허용할 수 있다(SEC Rule 1105(b); 17 C.F.R. § 201.1105(b)).

관리자가 SEC 직원인 경우, 관리자의 서비스에 대한 보수는 관리자에게 지급되지 않는다. 관리자가 SEC 직원이 아닌 경우, 관리자는 완료된 서비스에 대한 보수 신청서를 제출할 수 있으며, SEC 또는 청문담당관이 승인하면 해당 서비스에 대한 합당한 보수를 지급받을 수 있다. 이에 대한 이의는 신청서가 당사자에게 송달된 날로부터 21일 이내에 제기되어야 한다(SEC Rule 1105(d); 17 C.F.R. § 201.1105(d)).

매 분기 첫 10일 동안 또는 위원회 또는 청문담당관이 달리 지시하는 경우, 관리자는 부당이득환수 계획의 관리와 관련하여 벌어들이거나 받은 모든 돈과 지출한 모든 돈에 대한 회계 보고서를 제출해야 한다. 최종 회계는 관리자를 해임하고 관리자의 채권을 취소하기 전에 위원회 또는 청문담당관의 승인을 위해 제출되어야 한다(SEC Rule 1105(f); 17 C.F.R. § 201.1105(f)). 계획은 당사자 또는 계획 관리자의 신청에 따라 또는 SEC 또는 청문담당관의 직권으로 수정할 수 있다(SEC Rule 1105(g); 17 C.F.R. § 201.1105(g)).

3) Fair Fund 운영 현황

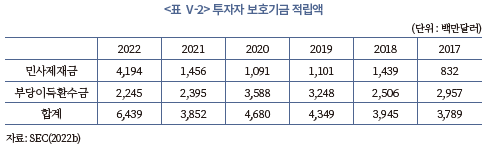

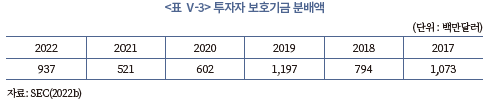

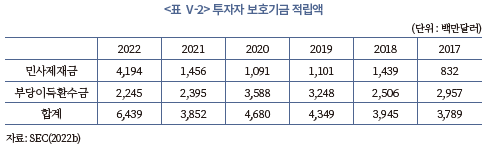

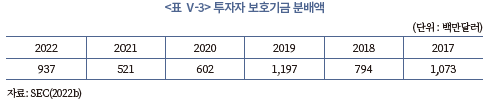

민사제재금, 부당이득환수금, 판결 전 이자(pre-judgment interest)를 포함하여 2022 회계연도에 SEC의 금전적 제재조치로 부과된 금액은 총 64억 3,900만 달러로, 2021 회계연도 38억 5,200만 달러보다 증가한 수치에 해당하며, 이 금액은 SEC 역사상 최고 수치이다. 총 금전적 제재 중 민사제재금은 41억 9,400만 달러로 이 역시 사상 최고치를 기록했다. 한편, 2022 회계연도 부당이득환수금(disgorgement)은 22억 4,500만 달러로 2021 회계연도보다 6% 감소했다.146) 회계연도별 투자자 보호기금 적립액과 분배액은 아래 표와 같다.

나. 증권집단소송 등 사적 소송

1) 증권집단소송

미국 증권법상 불공정거래가 발생하였을 때, 개인 당사자는 경우에 따라 사적 소송을 제기할 수 있다. 특히, 미국 불공정거래 행위 규제에서 가장 빈번하게 사용되는 1934년 연방증권거래법 Section 10(b)를 근거로 개인 당사자가 사적 소송을 제기할 수 있다는 명문의 규정은 없지만, 연방대법원은 묵시적 사적 소권을 인정해오고 있다. 따라서 매수 또는 매도와의 관련성, 중요성, 사기적 행위, Scienter, 신뢰 또는 거래인과관계, 손해인과관계, 손해의 발생을 입증하면 1934년 연방증권거래법 Section 10(b)에 기하여 소를 제기할 수 있다.147)

또한, 이러한 사적 소송에서 다수성, 공통성, 전형성, 대표의 적절성, 우월성, 우수성 요건을 충족하면 집단소송의 형태로 제기할 수도 있다.148) 집단소송으로 제기할 경우에는 피해를 입은 모든 투자자를 대신하여 소송을 제기할 수 있고, 이는 SEC가 제기한 강제 집행 소송과는 별개의 소송이다. 집단소송을 통해 얻은 모든 피해 회복에 참여할 자격이 있을 수 있고, 증권 집단소송 정보센터 웹사이트를 방문하여 자신의 투자와 관련된 집단소송이 제기되었는지 여부를 확인할 수 있다.

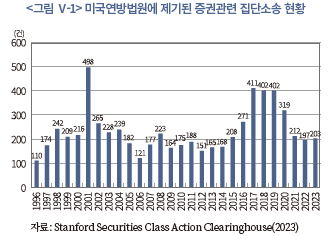

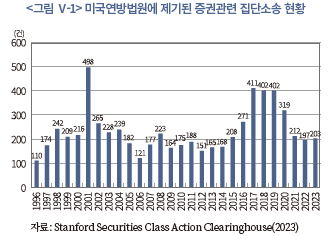

미국 연방법원에 제기된 증권관련 집단소송 현황을 보면, 연도별 차이는 있으나 최소 100건 이상 꾸준히 제기되고 있다.

미국에서 제기된 증권관련 집단소송의 소제기부터 종결까지 소요된 시일을 분석한 연구결과에 따르면, 83%의 증권집단소송이 제기된 지 4년 안에 종결되는 것으로 나타났다. 1년 미만 15%, 1년 이상 2년 미만 29%, 2년 이상 3년 미만 23%, 3년 이상 4년 미만이 16%, 4년 이상 소요된 소송이 17%이다.149)

2) 집단소송과 증거개시절차

미국의 연방민사소송절차는 크게 소답(pleading), 증거개시(discovery), 공판(trial) 순으로 진행된다. 원고가 소장을 제출하고 피고가 이에 대해 답변서를 제출하는 과정인 소답 절차가 마무리되면, 곧이어 증거개시절차가 시작된다. 증거개시절차는 공판 이전에 소송을 준비하기 위하여 일방 당사자가 상대방 당사자나 제3자로부터 관련 정보를 얻기 위해 진행되는 절차이다. 증거개시절차에서는 기본적으로 당사자들 스스로 이행하고, 법원이 적극적으로 개입하지 않는다. 법원은 전체적인 감독만 하고 당사자 간에 의견 충돌이 있는 경우에만 개입한다.150)

연방민사소송규칙(Federal Rules of Civil Procedure)에서 인정하고 있는 증거개시 방법으로는 증언녹취(depositions), 질문서(interrogatories to parties), 문서, 전자정보, 유형물 등의 제출 요구(request for production), 신체 및 정신 감정(physical and mental examinations), 사실 및 문서의 진정성에 대한 자백 요구(requests for admission)가 있다. 이중에서 ‘증언녹취’와 ‘문서, 전자정보, 유형물 등의 제출 요구’ 방법은 상대방 당사자 외에 제3자에 대해서도 이용할 수 있다.

① 진술녹취 방법은 제3자인 증인이나 소송당사자인 증인에 대하여 구두로 질문하여 이를 녹취하거나 서면질의를 하고 이에 대하여 구두로 답변하는 것을 녹취하는 것이고(Rule 30), ② 질문서 방법은 소송당사자에게 서면질의서를 보내고 이에 대한 답변을 서면으로 받는 것이다(Rule 33). ③ 문서, 전자정보, 유형물 등의 제출 요구는 증거조사를 위해 문서, 전자적으로 저장된 정보, 유체물의 제출을 요청하거나 상대방 당사자가 소유, 지배하고 있는 부동산에 출입을 허용하는 것이며(Rule 34), ④ 신체 및 정신 감정 방법은 소송당사자의 신체 및 정신 상태가 문제되는 경우에 법원의 명령을 통해 소송당사자의 신체 및 정신에 대한 감정을 받도록 하는 것이다(Rule 35). 끝으로 ⑤ 사실 및 문서의 진정성에 대한 자백 요구 방법은 사실과 문서의 진정성에 대하여 이를 자백하는지 부인하는지를 요구하는 것으로(Rule 36), 이는 공판에서 다투어질 쟁점이 무엇인지를 밝혀 쟁점을 좁히는 기능을 한다.

연방민사소송규칙은 이러한 증거개시절차를 위반한 경우에 대비하여 제재수단을 마련해두고 있다. 증거개시절차에서 일방 당사자의 제출 요구를 받은 상대방 당사자가 이를 이행하지 않거나 불완전하게 이행한 경우 그 일방 당사자는 법원에 강제개시명령을 신청할 수 있다(Rule 37). 상대방 당사자가 법원으로부터 이러한 명령을 받았음에도 불구하고 이행하지 아니하면 ① 증거개시명령에 포함된 사실에 대해 증거개시를 신청한 당사자가 주장하는 대로 간주하거나 해당 청구나 항변을 제기하거나 이에 반대하는 것을 금지할 수 있고, ② 청구의 전부 또는 일부를 기각할 수 있으며, ③ 개시명령이 이행될 때까지 추가 절차의 진행을 중단할 수 있다. 또한, ④ 당해 소송 절차의 전부나 일부를 각하할 수 있고, ⑤ 궐석재판으로 진행할 수도 있다. 나아가 ⑥ 신체 및 정신 감정 명령을 제외한 다른 증거개시명령을 불이행한 경우 법원모욕죄(contempt of court)로 처벌할 수도 있다(Rule 37(b)(2)).

증거개시절차의 기능은 공판 과정에서 이용하기 어려운 증거를 미리 확보할 수 있다는 점, 미리 취득한 자료를 바탕으로 공판에서 심리할 쟁점을 분명하게 할 수 있다는 점, 예상하지 못한 증거를 제출함으로써 상대방에게 예기치 못한 충격을 주는 것을 방지할 수 있다는 점, 미리 제공된 자료를 바탕으로 당사자가 이를 이용하여 가치 있는 자료를 확보할 수 있다는 점이다.151)

3. 일본의 투자자 피해구제 방안

일본의 경우 불공정거래 행위로 인한 투자자인 피해자를 보호하기 위한 제도는 별도로 존재하지 않는다. 일반적으로 투자자를 보호하기 위한 제도로는 투자자보호기금 제도가 있기는 하지만, 금융투자업자가 파산 등의 사유로 인해 투자재산 반환 등 투자자의 요구에 적절히 대응하지 못할 경우, 금융투자업자를 대신하여 투자자에 대한 채무를 이행하는 역할을 하고 있고, 투자자보호기금의 보호범위에 증권거래로 인하여 발생한 피해는 포함되지 않는다.152)

한편, 투자자는 금상법 또는 민법의 규정에 따라 손해배상을 청구할 수 있다. 다만 불공정거래 행위에 대한 민사책임에 대해서는 우리나라와는 달리 시세조종행위에 대해서만 금상법상 민사책임 규정이 존재한다. 부정거래, 풍문의 유포‧위계 등, 내부자거래에 대해서는 금상법상 별도의 민사책임 규정이 없이 민법상의 불법행위책임의 요건을 갖춘 경우에 한해, 민법상 불법행위책임 규정(일민법 제709조)만이 적용될 뿐이다.

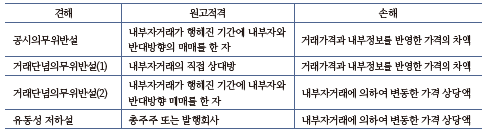

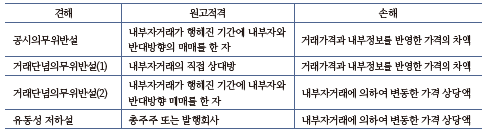

부정거래와 풍문의 유포‧위계 등의 경우에는 위법행위의 유형이 다양하기 때문에 구체적인 행위를 지정하여 별도의 손해배상 규정을 두는 것이 법 기술상 쉽지 않기 때문으로 해석된다. 그리고 내부자거래의 경우에도 내부자거래행위로 인하여 누구에게 어떠한 손해를 가하였는지에 대해서도 견해가 갈리고 있어, 일본에서는 금상법상 별도의 규정을 두지 않고, 민법상의 불법행위책임 규정을 통하여 대응하고 있는 것으로 파악된다.153)

한편, 시세조종행위에 대하여 별도의 불법행위책임 규정을 두고 있는 목적이 시세조종행위로 인한 피해자의 구제가 아니라는 점도 특징적이다. 즉 일본의 경우 시세조종행위에 대한 민사책임을 별도로 규정한 목적은 침해된 시장의 자원배분 기능을 정상화하는 것이고, 투자자는 시장의 기능이 침해됨으로 인하여 부수적으로 손해를 입은 것이라는 사고방식이 그 전제에 깔려 있다.154)

나아가, 일본에서는 모든 불공정거래 유형에 있어 민사책임이 인정된 사례를 찾아보기 힘들다. 내부자거래와 관련하여 손해의 인과관계 입증이 문제가 된 사례155), 시세조종과 관련하여 청구기각으로 종결된 사례156)정도가 존재할 뿐이다. 이와 같이 불공정거래에 대한 민사책임이 제대로 이루어지지 않는 원인으로는 ① 손해의 산정 및 입증이 어려울 뿐만 아니라, ② 소송비용 대비 피해액이 적은 경우가 많다는 점이 주로 지적되고 있다.157)

①과 관련하여 구체적으로 살펴보면, 우선 민법상의 불법행위책임을 통하여 손해배상청구를 해야 하는 부정거래나, 풍문 유포‧위계, 내부자거래의 경우에는 원고가 상대방의 불법행위 및 손해 발생에 관하여 입증하여야 하는데 이러한 입증이 쉽지 않다는 문제가 있다. 또한 내부자거래가 문제되는 사안의 경우, 전술한 바와 같이 견해에 따라서 원고적격과 손해액이 달라질 수 있기 때문에, 피해를 주장하는 자의 입장에서는 어떠한 기준에 따라 주장‧입증을 해야하는지 명확하지 않을 수 있다. 뿐만 아니라 거래행위가 시장 내에서 이루어진 경우에는 수많은 매수주문과 매도주문이 집약적으로 이루어진다. 이 때 내부자의 불법행위와 투자자의 손해 사이에 인과관계를 입증하기 위해서는 내부자의 매수(매도)주문과 투자자의 매도(매수)주문이 서로 연결되어 매매가 성립되었다는 사실을 입증해야 하는데 이는 현실적으로 매우 어렵다는 문제도 있다.158)

한편, 시세조종행위에 대한 손해배상책임을 규정한 금상법 제160조는 민법상 손해배상규정에 대한 특칙으로서 투자자 보호를 위하여 규정한 것으로 피해자가 시세조종행위와 손해 사이의 인과관계를 입증할 필요가 없다고 해석하는 재판례가 존재한다.159) 그러나 이와 같이 해석한다고 하더라도 피해자는 규정의 구조상 시세조종행위으로 인하여 형성된 가격으로 거래를 하였다는 점을 입증해야 하는데, 이는 결국 시세조종행위와 자신이 거래한 가격 사이의 인과관계를 입증하는 것이 되므로 양자 간에 큰 차이는 없다고 해석되고 있다.160) 그런데 주식의 가격은 여러 가지 내‧외부요인으로 인하여 시시각각 변하는 것이기 때문에, 피해를 주장하는 자가 거래한 가격이 시세조종행위와 인과관계가 있다는 점을 입증하기란 현실적으로 매우 어렵다.

②의 문제와 관련하여서는, 피해를 주장하는 자가 이상과 같은 방법에 따라 손해를 모두 입증한다고 하더라도 실제로 자신이 입은 손해에 비하여 변호사를 선임하고 소송을 제기하는 비용이 더 많이 들기 때문에 손해배상을 청구하는 경우도 실제 그리 많지 않은 것으로 파악되고 있다. 나아가, 변호사가 피해자들을 모집하여, 선정당사자 지정을 통한 집단소송을 제기하는 것도 생각해볼 수 있지만, 사안에 따라 위법행위자가 손해를 배상할 자력이 없는 경우도 있을 수 있고, 사안의 난이도에 비해 실제 손해배상액이 크지 않을 가능성도 충분히 있기 때문에 변호사 입장에서는 이와 같은 소송을 제기할 유인도 크지 않을 것이다.161)

이와 같은 문제점에 따라 일본에서 역시 불공정거래 행위 등의 피해자를 보호하기 위하여 우리나라나 미국과 같은 증권거래 관련 집단소송 제도(혹은 클래스 액션)나 미국의 공정기금 제도(fair fund)과 같은 제도의 설계의 필요성에 대해서는 일반적으로 공감하고 있다.

그러나 집단소송제도에 대한 도입 논의는 일본의 독점금지법 차원에서 많이 논의가 되어 소비자단체소송이 도입되기는 하였지만, ‘소비자’와 ‘투자자’의 개념적인 차이로 인하여 투자자가 소비자단체소송 제도를 이용할 수는 없다고 해석되고 있다.162) 나아가, 앞서 설명한 바와 같이 불공정거래 행위에 있어 민사책임이 가지는 한계로 인하여 집단소송을 통한 문제의 해결에 대해서는 회의적인 견해가 대부분이다.

한편, 미국의 공정기금 제도와 유사하게, 과징금을 피해자인 투자자에게 분배하는 제도의 도입과 관련하여서는 구체적인 도입을 위한 논의가 이루어진 적은 없지만, 도입이 필요하다는 견해들은 유력하게 제기되고 있다.163) 그러나 과징금제도가 경제적 이득액을 기준으로 과징금을 산정하고 있어, 보통 투자자들의 손해보다 법 위반자의 경제적 이득액이 더 적은 경우가 대부분이기 때문에 분배할 과징금이 더 적을 가능성이 있다는 문제점이 있고, 이에 따라 과징금의 산정기준의 변화 역시 필요하다고 지적되고 있다.

4. 향후 과제

미국의 경우 자본시장이 발달한 국가답게 투자자 보호를 위한 실효성 있는 제도가 운영되고 있다. 투자자 보호를 위해 직접적으로 사용되는 Fair fund 뿐 아니라 증권관련 집단소송과 디스커버리제도를 이용해 사적 소송을 통한 구제도 활발하게 이루어지고 있다. 반면 일본의 경우 논의는 있으나 우리나라에 도입된 증권관련 집단소송조차 일본에서는 허용되지 않고 있다. 다만 앞서 언급한 것처럼 일본에서도 피해자 구제에 대한 고민과 미국식 제도 도입에 대한 논의가 이루어지고 있다는 점은 참고할 만하다.

불공정거래 행위는 자본시장 전체의 신뢰도를 저하시키는 범죄이기도 하지만 실제로 피해자들의 재산상의 손실을 가져오는 범죄이기도 하다. 불공정거래 행위자의 부당이득을 국가가 회수하는 것도 중요하지만, 불법행위로 인해 피해를 입은 투자자들의 피해구제와 원상회복에 대해 고려하지 않는 것은 공평의 관점에서 재고할 필요가 있다.164)

우리나라의 경우 투자자의 피해구제에 대한 적절한 대응책이 제시되지 않고 있는 상황에서, 과징금제도의 도입 이후 도리어 투자자들이 피해를 보상받을 수 있는 재원을 더욱 축소시킬 우려도 있다. 현행 자본시장법에서는 불공정거래에 대해 몰수‧추징과 벌금을 병과하고 있어 이로 인해 국고 수입은 증가하지만, 불공정거래 행위자의 책임재산이 감축되어 피해를 입은 투자자들은 보상받을 재원을 확보하기 어려운 상황이다. 그런데 과징금제도까지 도입되고 이를 위해 자산동결까지 할 경우 신속하게 불공정거래 행위자의 재산이 국고로 귀속되어 피해자를 위한 재원은 더욱 축소될 수 있다. 이러한 과징금의 재원을 미국의 Fair fund와 같은 방식으로 운영하여 투자자에게 직접 분배하는 것도 검토해 볼 수 있으나 이는 장기 과제165)로 두고 현행 제도상 개선 가능한 방법에 한정하여 검토하도록 한다.

먼저 증권관련 집단소송제도가 투자자의 피해구제에 기여할 수 있도록 개선해야 한다. 소송요건과 관련하여 현행법은 ‘구성원이 50인 이상이고, 청구의 원인이 된 행위 당시를 기준으로 그 구성원이 보유하고 있는 증권의 합계가 피고 회사의 발행증권총수의 1만분의 1 이상일 것’의 요건이 있다. 그런데 법원에서 이를 심리하는 과정에서 ‘발행증권총수의 1만분의 1이상’이라는 요건의 소명이 문제되어 소송불허가 결정이 이루어지는 문제가 있다.166) 집단소송의 ‘공통성’의 성격은 ‘50인 이상’이면 충분하고 피해자 입장에서 소명이 어려운 ‘발행증권총수의 1만분의 1이상’ 요건은 삭제하는 것이 바람직하다.

또한 남소 우려로 인해 대표당사자 및 원고측 소송대리인은 ‘3년간 3건 미만’으로 제한하고 있는데, 이는 피고측 소송대리인과 형평에 어긋나고 집단소송에 전문적인 경험을 쌓은 변호인들이 활동하지 못하게 만드는 문제가 된다. 이러한 원고소송대리인의 자격제한은 폐지하는 것이 타당하다.167)

증권집단소송은 법원의 소송허가재판 이후 손해배상청구를 위한 본안재판으로 이루어져 사실상 6심제로 진행되어 절차가 지연되고, 그 과정에서 증거 인멸이나 재산 은닉이 이루어져 피해자 구제에 어려움이 있다. 이를 위해 소송의 허가 단계에서 증거보전 및 증거조사가 가능하도록 할 필요가 있다. 또한 거래소에 설치된 소송지원센터를 통해 법원의 1심 판결문과 필요한 자료를 제공하는 것이 필요하다.168) 자본시장 불공정거래 행위에 대한 투자자들의 인지시점은 손해배상청구권 소멸시효의 기산점이 되는데, 자본시장법상 손해배상청구권은 단기소멸시효가 적용되어 피해자들이 뒤늦게 인지할 경우 구제받지 못할 우려가 크다. 불공정거래 행위가 언론에 보도된 날이 아니라 민형사 재판 판결이 선고된 때로 보는 것이 필요하다.169)

더 나아가 미국의 증거개시제도를 참고해 한국식 디스커버리제도가 도입될 경우, 증권관련집단소송의 피해자 구제에도 도움이 될 수 있다. 투자자나 소비자가 회사를 상대로 소를 제기하려면 회사 내부 자료에 접근할 수 있어야 하는데, 이들이 회사 내부 자료에 접근하는 것은 불가능하다. 미국의 집단소송에서는 증거개시제도를 통하여 투자자나 소비자 등이 회사 내부 증거자료를 용이하게 수집함으로써 사실관계를 명확하게 규명할 수 있어, 소송의 유불리를 사전에 예측하여 화해로 사건이 조기에 종결되는 경우가 많다.170)

또한 일반적 형사범죄는 피해자의 피해회복(합의)이 양형인자로, 형사정책적으로 피해자에게 배상할 유인을 가해자에게 제공하는 것이 타당하다. 그러나 불공정거래 범죄에 대해서는 피해자의 피해 회복이 양형인자로 포함되어 있지 않다는 문제가 있다. 따라서 불공정거래의 경우에도 일반 형사범죄와 마찬가지로 피해자의 피해회복(합의)을 양형인자로 두는 것이 필요하다.171) 동일한 재산범죄인 일반 사기죄의 경우 처벌불원이나 실질적 피해회복(공탁 포함)이 특별양형인자로 되어 있고, 상당한 피해회복이 일반 양형인자로 되어 있다.172) 그런데 자본시장에서의 사기에 해당하는 3대 불공정거래에서는 피해자의 피해회복이 특별 양형인자나 일반 양형인자에 모두 포함되어 있지 않다.173) 만약 증권범죄의 특성상 피해 투자자를 직접 알 수 없다면, 공탁의 형식으로 하도록 하고 추후 법원이 피해 투자자에게 통보하여 반환하도록 하는 것이 필요하다.174)

Ⅵ. 결론

최근 몇 년간 자본시장의 투자자 수가 크게 늘어나고 있는 가운데, 다양한 형태의 불공정행위가 지속적으로 증가하고 지능적‧조직적인 범죄행위도 꾸준히 발생하고 있다. 2019년에는 614만명이었던 개인 투자자 수가 코로나를 거치며 폭발적으로 증가하여 2022년 기준으로 1,441만명에 달하고 있다. 자본시장 참가자가 증가하면서 불법행위 가능성도 확대될 뿐 아니라 그로 인해 피해를 입게 되는 투자자들의 수도 증가할 수 있는 상황이다. 그런데 불공정거래 수법은 지속적으로 진화하여 기존 방식으로는 혐의 포착이 어려운 불법행위가 발생하고 대규모 불법행위로 장기간 조사‧수사가 필요한 사건이 증가하고 있다.