Find out more about our latest publications

Impact of carbon risk in the Korean economy and the importance of portfolio carbon neutrality

Research Papers 24-06 Feb. 26, 2024

- Research Topic Capital Markets

- Page 119

- No other publications.

In recent years, the international community has been demanding for more extensive and intensified greenhouse gas reduction efforts and actions to promote climate change response, which has become a major challenge and issue for companies and capital market participants. The Korean government has declared carbon neutrality by 2050, revised 2030 NDC upward and proposed detailed implementation plans. Also, the EU has announced a proposal to introduce a carbon border adjustment mechanism, which might accelerate internal and external efforts for climate change. In this regard, the carbon price is expected to increase gradually, and there is a global consensus that the carbon price must increase further than the current level to achieve the goal of carbon neutrality in 2050.

Based on this background, this study aims to estimate the impact of rising carbon prices on Korean companies and industries through a simple model, and this study is purposed to to highlight the importance of carbon risk and the need to proactively manage the carbon risk for domestic companies and capital market participants. In addition, by investigating and introducing various decarbonization investment methodologies that have been discussed and utilized overseas, we hope to help domestic financial investment companies and institutional investors effectively manage their portfolios’ carbon risk.

The results of our analysis of the impact of carbon price increases on domestic companies are as follows. First, the increase in carbon price, which is generally following the carbon neutrality pathway, leads to an increase in financial losses for companies in almost all industries. Second, this increase in financial losses leads to a worsening of credit risk, such as default. This trend is more pronounced in industries with high GHG emissions. Finally, we examine the impact of carbon risk in a model that takes into account the interaction among industries and find that the cost shock of carbon emissions is estimated to have significant spillover effects not only on high-carbon industries, but also on their associated low-carbon industries. The results of this empirical analysis suggest the importance of carbon risk for domestic companies and capital market participants and the need to prepare for it in the future.

Next, we investigate portfolio construction methodologies that investors can use to effectively manage carbon risk. Regarding this subject, our findings can be summarized as follows. First, internationally, there has been an ongoing discussion about how to reduce the carbon risk of a portfolio while still having similar risk-return characteristics to benchmark indices. Second, the key to these low-carbon investment methodology is to minimize the uncertainty of capital returns and the potential for greenwashing while maintaining the carbon neutrality of the portfolio. It is the most important to provide decarbonization incentives for companies in the portfolio by managing portfolios in such a way that investors could continue to invest and take engagement to the firms as a shareholder. Third, by applying the decarbonizing portfolio construction methodology used abroad and using GHG emission data of listed companies in the Korean stock market, the simple empirical results show that by setting appropriate parameters, an optimal portfolio can be constructed that achieves carbon neutrality of the portfolio while minimizing the opportunity cost for investors. Based on the contents of this paper, we expect that the Korean capital market will be able to utilize those decarbonizing investments methodologies in various ways in the future.

The impact of carbon risk on domestic companies and the implications of decarbonization methods and practices that have been consistently utilized overseas are quite clear. However, the Korean capital market still has not yet been able to vitalize decarbonizing investments for the most of domestic investors. Carbon risk is likely to materialize in the near future, and Korea economy will not be an exception. As we move toward carbon neutrality, the impact on invested companies and portfolios will be clear if the carbon price reaches the adequate level. Therefore, investors need to consider carbon risk as a material risk to their investment portfolios and promote efforts and actions to response the risk. Voluntary efforts by domestic companies and industries will be also important, but it is very critical that investors, as shareholders of companies, set carbon neutrality targets and promote sustainable investing for the future.

Based on this background, this study aims to estimate the impact of rising carbon prices on Korean companies and industries through a simple model, and this study is purposed to to highlight the importance of carbon risk and the need to proactively manage the carbon risk for domestic companies and capital market participants. In addition, by investigating and introducing various decarbonization investment methodologies that have been discussed and utilized overseas, we hope to help domestic financial investment companies and institutional investors effectively manage their portfolios’ carbon risk.

The results of our analysis of the impact of carbon price increases on domestic companies are as follows. First, the increase in carbon price, which is generally following the carbon neutrality pathway, leads to an increase in financial losses for companies in almost all industries. Second, this increase in financial losses leads to a worsening of credit risk, such as default. This trend is more pronounced in industries with high GHG emissions. Finally, we examine the impact of carbon risk in a model that takes into account the interaction among industries and find that the cost shock of carbon emissions is estimated to have significant spillover effects not only on high-carbon industries, but also on their associated low-carbon industries. The results of this empirical analysis suggest the importance of carbon risk for domestic companies and capital market participants and the need to prepare for it in the future.

Next, we investigate portfolio construction methodologies that investors can use to effectively manage carbon risk. Regarding this subject, our findings can be summarized as follows. First, internationally, there has been an ongoing discussion about how to reduce the carbon risk of a portfolio while still having similar risk-return characteristics to benchmark indices. Second, the key to these low-carbon investment methodology is to minimize the uncertainty of capital returns and the potential for greenwashing while maintaining the carbon neutrality of the portfolio. It is the most important to provide decarbonization incentives for companies in the portfolio by managing portfolios in such a way that investors could continue to invest and take engagement to the firms as a shareholder. Third, by applying the decarbonizing portfolio construction methodology used abroad and using GHG emission data of listed companies in the Korean stock market, the simple empirical results show that by setting appropriate parameters, an optimal portfolio can be constructed that achieves carbon neutrality of the portfolio while minimizing the opportunity cost for investors. Based on the contents of this paper, we expect that the Korean capital market will be able to utilize those decarbonizing investments methodologies in various ways in the future.

The impact of carbon risk on domestic companies and the implications of decarbonization methods and practices that have been consistently utilized overseas are quite clear. However, the Korean capital market still has not yet been able to vitalize decarbonizing investments for the most of domestic investors. Carbon risk is likely to materialize in the near future, and Korea economy will not be an exception. As we move toward carbon neutrality, the impact on invested companies and portfolios will be clear if the carbon price reaches the adequate level. Therefore, investors need to consider carbon risk as a material risk to their investment portfolios and promote efforts and actions to response the risk. Voluntary efforts by domestic companies and industries will be also important, but it is very critical that investors, as shareholders of companies, set carbon neutrality targets and promote sustainable investing for the future.

Ⅰ. 서론

최근 기후변화에 대한 국제적 관심의 증대와 글로벌 규제의 강화는 모든 국가에 기후변화 대응을 위한 더욱 광범위하고 강화된 감축 노력과 행동을 요구하고 있으며, 이는 기업에도 큰 도전과 변화를 불러오고 있다. 이처럼 기후변화 대응에 대한 글로벌 관심이 증대되는 가운데 우리나라도 2020년 12월 ‘2050 탄소중립’을 선언하고, 이와 함께 2030년 국가 온실가스 감축목표(National Determined Contribution: NDC)를 상향 조정하였다. 이어 2023년 4월에는 ‘탄소중립‧녹색성장 국가전략 및 제1차 국가 기본계획’을 수립하고 2030년까지 세부 부문별‧연도별 감축목표와 이행 방안을 제시하였다.

한편, 2021년 7월 EU 집행위원회는 EU 역내 외 기업 간의 공정한 경쟁환경 조성과 탄소 누출 방지라는 취지로 탄소국경조정제도(Carbon Border Adjustment Mechanism: CBAM)안을 발표하였다. 해당 규제에 따르면, EU로의 제품 수출 업체들은 해당 제품의 직간접 배출량을 의무적으로 보고해야 하며, 배출량 인증서를 구입하는 등 상당한 비용을 지출하게 된다. 특히, 철강, 석유화학 등 에너지 집약적, 다배출 중심의 산업에 크게 의존하고 있는 국내 기업들은 이러한 탄소 국경 조정제도 시행에 따른 부담이 더욱 클 것으로 예상된다.

이처럼 대내외적인 기후변화 대응 노력이 가속화되는 가운데 향후 탄소 가격은 점진적으로 증가할 것으로 보이며, 결과적으로 이러한 탄소 가격의 상승은 기업의 온실가스 배출 비용을 상승시켜 생산과 판매 비용의 증가로 이어질 수 있다. 2050년까지 탄소중립을 달성하기 위해서는 탄소 가격이 현재의 수준보다 더욱 인상되어야 한다는 점에 전 세계적으로 공감대가 형성되어 있는 가운데, 향후 어느 시점에서든 탄소 가격의 상향 조정은 불가피할 것으로 보인다. 그리고 이러한 탄소 가격 인상에 따른 기업의 비용 상승 충격이 일반적으로 예상하는 것보다 훨씬 빠르고, 더욱 급격하게 나타날 가능성도 배제하기 어렵다. 특히, 탄소 집약적이고 화석연료에 의존하는 산업 및 기술 특성을 가진 우리나라의 기업들은 탄소 가격 상승 위험에 더욱 취약할 수 있고, 이로 인한 재무적 손실도 더욱 가중될 수 있다. 이러한 문제의식 하에 본 연구는 탄소 가격 상승이 국내 기업에 어떠한 재무적 영향을 미칠지 분석하고, 이를 통해 국내 기업과 자본시장 참여자들에게 탄소 가격 위험의 중요성과 이에 대한 선제적 관리의 필요성을 환기하고자 하였다.

아울러 자본시장의 기후변화 대응을 촉진하고자 투자자 관점에서 탄소 리스크를 고려한 다양한 포트폴리오의 설계 방법론을 조사하고, 한국 주식시장에 이를 적용함으로써 우리나라 자본시장 참여자에 실무적인 시사점을 제공하고자 한다. 탄소 가격 상승과 같은 전환 위험은 향후 우리나라 기업과 산업 전반에 막대한 영향을 끼칠 수 있으며, 기업의 주주인 투자자가 고려해야 할 중대한 위험요인이 될 것으로 예상된다. 그리고 투자자의 위험 관리 측면 외에도, 탄소중립 목표에 부합하는 포트폴리오 조정은 장기적으로 투자기업에 탈탄소 유인을 제공하는 중요한 기제가 될 수 있으므로 자본시장의 기후변화 대응 측면에서도 중요한 연구 주제라 할 수 있다. 전 세계적으로 기후금융의 역할과 금융 부문을 통한 기후변화 대응 노력은 점차 강화되는 추세이고, 글로벌 기관투자자나 자산운용사, 지수사업자 등은 저탄소 포트폴리오 투자와 탈탄소 지수의 활용 및 채택을 늘리고 있다. 이러한 배경을 바탕으로 본 보고서는 탄소 리스크의 영향을 기업 관점에서 분석해보고 포트폴리오의 탄소 위험 관리를 위한 다양한 방법과 사례를 제시함으로써, 우리나라 금융투자회사와 기관투자자의 자산 포트폴리오 내 탄소 위험을 효과적으로 관리하는 데 도움을 주고자 하였으며, 더 나아가 자본시장의 기후변화 대응의 필요성을 강조하고자 하였다.

해외와 달리 우리나라의 경우, 탄소 리스크의 영향을 실증적으로 살펴보고, 포트폴리오 탄소 리스크의 관리 방안을 구체적으로 다뤘던 선행연구는 드물었던 것으로 판단된다. 기후금융의 역할과 중요성이 점차 강조되는 가운데, 본 보고서가 다루는 내용은 정책적, 실무적으로도 매우 중요한 주제라 판단된다. 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 탄소 가격의 상승이 우리나라 기업과 산업에 미치는 영향을 분석한다. 향후 탄소중립 목표를 달성하기 위한 적정 탄소 가격의 시나리오를 토대로, 기업의 현금흐름 관점에서 탄소 가격의 상승이 기업의 탄소 배출 비용을 얼마나 증가시키는지 추정한다. 또한 이를 바탕으로 기업의 신용위험이 얼마나 변화하는지 추정하고, 산업 연관 관계를 반영하여 산업 간 탄소 비용충격의 파급효과를 살펴본다. Ⅲ장에서는 탄소 리스크를 반영한 최적의 포트폴리오 설계 방법에 대해 논의한다. 구체적으로 포트폴리오의 탄소 리스크 측정 방법을 알아보고, 해외에서 실행 중인 저탄소 포트폴리오 및 탈탄소 지수 구성의 방법론과 사례를 조사하였다. 그리고 이러한 방법론과 우리나라 상장기업의 배출량 자료를 활용하여, 한국 주식시장의 저탄소 포트폴리오를 구성해보고 방법별 성과와 특징을 비교 분석한다. 마지막으로 Ⅳ장에서는 앞선 장의 분석 및 조사 결과를 바탕으로 시사점을 요약하면서 보고서를 마무리한다.

Ⅱ. 탄소 가격 상승에 따른 기업 및 산업 영향 분석

1. 탄소 가격 관련 제도 및 선행연구 검토

가. 국내 탄소 가격 관련 제도 개관

탄소 가격 제도의 대표적인 형태로는 배출권거래제(Emission Trading System: ETS)와 탄소세(Carbon Tax)가 있다. 먼저 배출권거래제는 국가의 온실가스 감축목표에 따라 배출권 총공급량이 정해지고, 이를 온실가스 배출업체에 할당하는 제도이다. 이후 업체들은 배출권이 남거나 부족한 경우 서로 거래를 통해 조절할 수 있으며, 시장의 수요와 공급에 따라 탄소 가격이 결정된다. 배출권거래제에 참여하는 기업들은 배출권 가격을 고려하여 배출권을 거래할 것인지 아니면 탄소 배출을 감소시킬 것인지를 결정한다. 배출 감축의 비용이 배출권 구매 비용보다 낮다면, 기업은 탄소 배출을 줄이고 그에 따른 잉여 배출권을 판매할 유인이 발생한다. 반면, 배출 감축에 드는 비용이 배출권 구매 비용보다 크다면, 기업은 배출을 감축하는 것보다 시장에서 추가 배출권을 구매하려고 할 것이다. 즉, 이러한 시장 메커니즘을 통해 기업들은 자신의 배출 효율성에 근거하여 배출량 감축과 배출권 거래 사이에서 자신에게 더 경제적인 옵션을 선택하게 된다. 또한 잉여배출권 매각을 통한 추가적인 수입은 기업의 감축 유인을 증가시키는 효과적인 기제가 될 수 있다.

그러나 이 방식은 탄소 가격이 시장에서의 거래에 따라 결정되므로 가격의 불확실성이 발생한다는 약점이 있다. 만일 배출권 가격이 시장에서 너무 낮게 형성될 경우, 이는 기업들의 탄소 감축 설비 및 기술에 대한 투자 유인을 저해하는 부정적인 영향을 가져올 수 있다. 예를 들어, 우리나라의 배출권 가격은 2019년 말에서 2020년 초반까지는 1톤당 약 4만 원 이상까지 상승하였으나 이후 하락세로 전환되어 현재는 톤당 2만 원 이하로 EU 및 캘리포니아 등 주요 배출권거래제 중 가장 낮은 수준을 나타내고 있다.

이와 달리 탄소세는 정부가 탄소 가격을 결정하고 이를 기반으로 탄소 배출 비용을 부과하는 방식이다. 탄소 가격제의 장점은 탄소 가격의 불확실성이 제거된다는 것이지만, 반면에 이러한 탄소 가격하에서 얼마나 많은 탄소가 감축될 것인지에 대한 확실성을 보장하지 못한다는 약점이 있다. 요약하면, 배출권거래제와 탄소세는 각각의 장단점을 가지고 있으며, 두 방식 모두 탄소 배출 관리의 중요한 정책 수단으로 활용될 수 있다. 2023년 기준 세계은행(World Bank)에 따르면 전 세계에서 시행 중인 탄소 가격 제도는 73개로, 이는 세계의 온실가스 배출량의 약 23%를 커버하고 있다. 이 중 전 세계 GDP의 40% 이상을 차지하는 지역에서 배출권 거래제를 실행하고 있으며, 유럽 연합(EU)의 EU-ETS은 세계에서 가장 큰 규모의 배출권 시장이다.1)

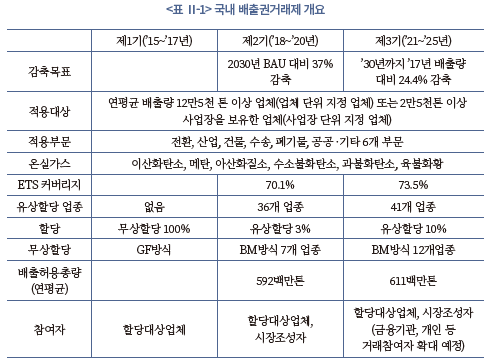

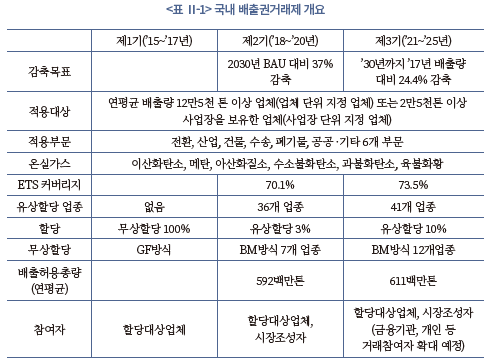

우리나라에서도 국가 온실가스 감축 목표를 달성하기 위한 수단으로 2015년 배출권거래제(K-ETS)를 도입하였다. 지금까지 제1차 계획기간(2015~2017), 제2차 계획기간(2018~2020)을 거쳐 현재 제3차 계획기간(2021~2025)이 진행 중이다. 배출권 참여업체는 크게 유상할당 업체와 무상할당 업체로 구분되는데, 철강, 반도체, 조선, 시멘트, 자동차 등 국제 무역, 생산비용에 미치는 영향이 큰 업종에 대해서는 배출권을 전량 무상으로 제공한다.2) 그 외의 업체들은 경매나 거래 시장을 통해 일정 비중의 배출권을 유상으로 구매해야 하며, 유상할당으로 인해 발생한 수입은 기업의 온실가스 감축설비 지원 등을 목적으로 기후대응기금의 재원으로 활용된다. 거래제가 처음 시행되었던 제1차 계획기간에는 100% 무상할당이었으나, 제2차 계획기간부터 36개 업종에 대해 3% 비중의 유상할당이 도입되었다. 현재 시행 중인 제3차 계획기간의 경우, 유상할당 대상이 41개 업종으로 확대되었고 유상할당 비중 또한 기존의 3%에서 10%로 상향되었다.3)

나. 탄소 가격과 기업 현금흐름 및 신용위험의 관계에 관한 선행연구

선행연구에 따르면 기후변화 전환 리스크(transition risk)4)는 현금흐름 경로와 재무상태표 경로를 통해 기업에 영향을 미칠 수 있는 것으로 이해되고 있다(Colas et al., 2018; Monnin, 2018; TCFD, 2017; Thomae & Ralite, 2019). 먼저, 현금흐름 경로를 살펴보면 전환 리스크는 탄소 집약적인 제품이나 서비스에 대한 수요를 감소시켜 기업의 매출액에 부정적인 영향을 미칠 수 있다. 또한, 고탄소 생산 시설을 저탄소 시설로 전환하거나 저탄소 기술 개발 R&D 비용을 증가시킴으로써 기업의 지출을 증가시킬 수 있으며, 탄소 배출 관련 규제 강화로 기업이 추가적인 비용을 부담하거나 벌금을 부과할 때도 기업의 현금흐름이 감소할 수 있다. 마찬가지로, 본 연구의 주요 분석 대상인 탄소 가격의 상승은 기업의 운영비용을 증가시킴으로써 기업의 현금흐름을 악화시킬 수 있다.

이와 함께 전환 리스크는 기업의 재무상태표에도 유의미한 영향을 미칠 수 있다. 대표적으로 저탄소 전환으로 인해 화석연료 사용이 감소하면서 기업이 기존에 보유하고 있던 화석연료 관련 자산의 가치가 급격히 하락하는 경우를 생각해 볼 수 있다. 혹은 저탄소 기술을 도입하면서 기존의 고탄소 생산 설비, 기계, 장비 등 생산 자본의 경쟁력이 상대적으로 저하되면서 자본 가치가 하락하는 경우가 있을 수 있다. 그리고 이와 같은 화석연료 연관 자산의 가치 하락을 우려한 금융기관들이 저탄소 부문으로 자본 흐름을 조정할 경우, 고탄소 기업의 자금조달 비용이 증가하고 주식, 채권 발행이 감소하게 되면서 기업의 재무상태표가 더욱 축소될 수 있다.

본 연구는 이러한 두 가지 채널 중에서 현금흐름 경로에 초점을 두고, 탄소 가격 상승이 기업의 운용비용을 증가시켜, 기업의 신용위험이 어떻게 변화하는지 살펴보고자 하였다. 앞서 언급한 바와 같이 탄소 배출 관련 정책의 강화로 인해 탄소 가격이 상승하게 되면, 기업은 더 많은 탄소 배출 비용을 부담해야 하므로 기업의 현금흐름이 줄어들게 되고, 이에 따라 부채 상환능력이 약화되어 신용위험이 증가할 수 있다. 그리고 탄소 가격은 일반적으로 배출 단위당 부과되므로, 탄소 배출량 수준이 높은 기업일수록 탄소 가격 상승에 따른 손실 민감도가 더 클 수 있다. 즉, 탄소 가격제가 도입될 경우, 기업의 탄소 배출량 수준과 신용위험 간에 양(+)의 상관관계가 강화될 것으로 예상할 수 있다.

탄소 배출량과 신용위험 간의 양의 상관관계는 최근의 여러 실증연구 결과에 의해서도 뒷받침되고 있다. 예를 들어, Capasso et al.(2020)은 유럽기업을 대상으로 한 분석에서 기업의 탄소 배출량 또는 탄소집약도가 높아질수록 부도 거리(distance to default)가 유의하게 감소(즉, 신용위험이 증가)하는 것을 발견하였다. 또한 이들은 이러한 관계가 파리협약 이후 더욱 강화되었음을 강조하면서, 기후 관련 정책이 강화될수록 전환리스크가 기업의 재무상태에 미치는 부정적 영향이 증가한다고 해석하였다. 이와 유사한 맥락에서 Seltzer et al.(2022)은 탄소 배출량이 많거나 환경성과점수가 낮은 기업일수록 신용등급이 낮고 신용 스프레드가 높아짐을 보였고, Ilhan et al.(2020)은 2015년 파리협약 이후 고탄소 배출 기업 주식의 하방 위험을 헤지하는 풋옵션 가격이 유의하게 상승함을 발견하였다. Bouchet & Guenedal(2020)은 MSCI World Index 구성종목 기업을 대상으로 IPCC(Intergovermental Panel on Climate Change)의 기후 시나리오 경로에 따라 탄소 가격이 점진적으로 상승할 때 개별 기업의 신용위험 변화를 추정하였다.5)

반면, 국내에서 탄소 가격 상승, 또는 전환리스크가 기업 및 산업에 미치는 영향을 장기간에 걸쳐 정량적으로 분석한 연구는 아직 많지 않은 편이다. 예외적으로 최근 김재윤‧전은경(2021)에서 NGFS 시나리오 경로를 바탕으로 이행 리스크(전환 리스크)가 중장기적으로 국내 산업의 부가가치와 은행의 자기자본비율에 미치는 영향을 추정한 스트레스 테스트 결과를 제시한 바 있다. 이들은 저탄소 정책이 강화될수록 고탄소산업 관련 금융자산의 가치가 빠르게 하락하면서 국내은행의 자기자본비율도 급격히 하락함을 보이며, 전환 리스크가 우리나라 경제와 금융시스템에 지대한 영향을 미칠 수 있다고 강조하였다. 그리고 온실가스 저감기술이 상용화되면 이러한 이행 리스크 충격이 상당 부분 완화될 수 있음을 보이며 저탄소 기술 투자가 확대되어야 한다고 주장하였다.

본 고는 이러한 국내외 선행연구를 확장하여 탄소 가격 상승에 따른 국내 주요 기업의 탄소 배출 비용 부담과 이로 인한 신용위험 변화를 추정하였다. Bouchet & Guenedal(2020)의 모형을 기본 모형으로 활용하여 탄소 가격 변동에 따른 기업의 신용위험 변화를 추정하였으며, 아울러 산업간 연관 관계를 추가로 고려함으로써 탄소 가격 상승이 고탄소 산업과 함께 저탄소 산업에도 어떠한 파급효과를 미칠 수 있는지를 분석하였다. 산업간 파급효과를 고려할 경우 김재윤‧전은경(2021)의 분석 결과와 달리 도소매업, 컴퓨터, 전자 및 광학기기 제조업, 금융 및 보험업 등 저탄소 산업도 탄소 가격 상승 시나리오에 따라 장기적으로 큰 폭의 손실이 발생할 수 있음을 보였다.

2. 탄소 가격 상승에 따른 기업 손실 추정

이 절에서는 탄소 가격의 상승에 따가 기업의 탄소 배출 비용 부담이 얼마나 증가하는지 추정하고 그로 인해 결과적으로 기업의 신용위험이 어떻게 변화하는지 분석하였다. 이를 위해 먼저 탄소 가격 변동이 기업의 신용위험에 미치는 영향에 대한 모형을 설명하고, 그다음으로 이러한 모형에 국내 상장기업의 탄소 배출량 데이터를 연계하여, 향후 예상되는 탄소 가격 변동 시나리오 하에서 기업의 신용위험을 추정한 결과를 제시한다.

앞 절에서 설명한 바와 같이 현실에서 탄소 가격 정책이 기업에 영향을 미칠 수 있는 경로는 매우 다양한 것으로 알려져 있다. 그중에서 본 연구는 탄소 배출권 가격 인상이 기업의 생산비용을 증가시키는 경로에 초점을 두어 모형을 설계하였다. 즉, 본 연구의 모형에서 배출권은 기업이 제품을 생산하기 위해 반드시 구매해야 하는 연료와 같이 일종의 재화(commodities)로 해석되며, 기업이 배출권 구입에 지불하는 비용은 손익계산서상의 매출원가(cost of goods sold)에 반영된다고 가정하였다. 이때, EBITDA(Earnings before interest, taxes, depreciation and amortization)는 매출액에서 이자비용, 세금 및 감가상각비를 제외한 운영비용을 차감하여 계산되므로, 결과적으로 탄소 가격이 상승하면 EBITDA는 감소하게 될 것으로 예상할 수 있다.6) 결과적으로 본 절에서는 모형과 실제 기업의 온실가스 배출량 데이터를 활용하여 탄소 가격 상승에 따른 EBITDA의 변화를 추정한다.

가. 분석모형

이하의 내용에서는 탄소 가격 상승이 기업의 신용위험에 어떻게 영향을 미치는지 설명하기 위해 본 연구에서 사용한 모형을 살펴볼 것이다. 이 모형은 탄소 가격이 EBITDA와 기업 가치에 어떠한 영향을 주는지를 분석하는 부분과, 이로 인한 기업 가치의 변동이 신용위험과 부도 확률에 어떻게 영향을 미치는지를 다루는 부분, 총 두 파트로 구성되어 있다.

[1단계] 탄소 가격 변동에 따른 기업의 현금흐름과 기업 가치 변화 추정

탄소 가격이 현금흐름과 기업 가치에 미치는 영향을 추정하기 위해서는 먼저 탄소 가격 도입으로 인해 기업이 지불하는 비용을 구체화할 필요가 있다. 본 고에서는 선행연구(Bouchet & Le Guenedal, 2020)를 참고하여 이 비용을 탄소 배출 비용(Carbon cost: CC)이라고 지칭하며, 이는 다음과 같이 계산된다.

여기서  는 기업

는 기업  가

가  시점에 배출하는 직접배출량(tons of CO2e),

시점에 배출하는 직접배출량(tons of CO2e),  는

는  시점의 탄소 가격을 나타낸다. 즉, 본 연구에서 각 기업의 탄소 배출 비용은 배출량과 탄소 가격을 곱한 값으로 정의된다.

시점의 탄소 가격을 나타낸다. 즉, 본 연구에서 각 기업의 탄소 배출 비용은 배출량과 탄소 가격을 곱한 값으로 정의된다.

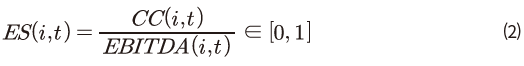

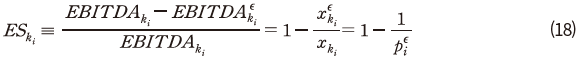

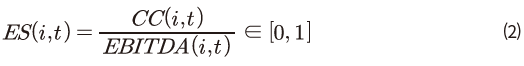

다음 단계에서는 이러한 탄소 배출 비용이 기업의 현금흐름에 미치는 영향을 추정한다. 앞서 언급한 바와 같이 탄소 가격의 상승은 기업의 생산비용을 증가시키고, 결과적으로 EBITDA를 감소시키는 것으로 예상된다. 이에 따라 탄소 가격 상승에 따른 기업의 이익 감소율(Earning shock: ES)은 EBITDA에서 탄소 배출 비용이 차지하는 비중으로 계산된다. 즉, 시점에 기업

시점에 기업 의 탄소 가격 상승에 따른 이익 감소율, 즉 손실률

의 탄소 가격 상승에 따른 이익 감소율, 즉 손실률 은 아래와 같이 나타낼 수 있다.

은 아래와 같이 나타낼 수 있다.

여기서 는 위의 식(1)에서 정의한 바와 같이

는 위의 식(1)에서 정의한 바와 같이  시점에 기업

시점에 기업 가 지불하는 탄소 배출 비용을 나타내며,

가 지불하는 탄소 배출 비용을 나타내며,  는

는  시점

시점  기업의 EBITDA를 나타낸다. 식(1)과 (2)에 따르면, EBITDA가 고정되어 있다는 가정하에, 탄소 가격의 인상 또는 직접배출량의 증가는 탄소 배출 비용(CC)을 증가시켜 해당 기업의 현금흐름을 악화(즉, 손실률

기업의 EBITDA를 나타낸다. 식(1)과 (2)에 따르면, EBITDA가 고정되어 있다는 가정하에, 탄소 가격의 인상 또는 직접배출량의 증가는 탄소 배출 비용(CC)을 증가시켜 해당 기업의 현금흐름을 악화(즉, 손실률  증가)시키는 것을 알 수 있다.

증가)시키는 것을 알 수 있다.

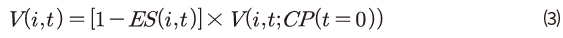

이처럼 탄소 가격 상승에 따른 미래 현금흐름 저하는 궁극적으로 기업 가치에 부정적인 영향을 미칠 것으로 예상할 수 있다. 여기서는 분석의 단순화를 위해 선행연구에서와 마찬가지로 추정 기간 기업 가치와 EBITDA의 비율이 크게 변하지 않는다고 가정한다.7) 이 경우, t시점에서 각 기업의 기업 가치는 탄소 가격 상승에 따른 기업의 손실률 이 커질수록 감소하는 함수로 다음과 같이 표현될 수 있다.

이 커질수록 감소하는 함수로 다음과 같이 표현될 수 있다.

여기서 은 탄소 가격이 상승하지 않았을 경우(즉, 탄소 가격이 현재(t=0)와 같은 수준에 머무는 경우)의 t시점에서 기업

은 탄소 가격이 상승하지 않았을 경우(즉, 탄소 가격이 현재(t=0)와 같은 수준에 머무는 경우)의 t시점에서 기업  의 기업 가치를 나타낸다. 분석 가정에 따라 기업 가치와 EBITDA의 비율이 일정한 경우, 기업 가치는 탄소 배출 비용과 EBITDA의 비율(즉, 탄소 가격 상승에 따른 이익 손실률,

의 기업 가치를 나타낸다. 분석 가정에 따라 기업 가치와 EBITDA의 비율이 일정한 경우, 기업 가치는 탄소 배출 비용과 EBITDA의 비율(즉, 탄소 가격 상승에 따른 이익 손실률,  )만큼 비례적으로 감소하게 됨을 알 수 있다.8)

)만큼 비례적으로 감소하게 됨을 알 수 있다.8)

이러한 모형의 단순화는 추정 과정의 용이성을 제고하기 위함이며, 현실적으로 탄소 위험의 영향을 정확히 측정하기 어렵기 때문이다. 본 장의 분석이 탄소 위험의 영향을 예비적으로 파악하고 이를 이해하는 것을 목적으로 하고 있음을 밝혀둔다.

[2단계] 탄소 가격 변동에 따른 기업의 신용위험 변화 추정

이전 단계에서는 탄소 가격의 상승이 기업 가치에 어떠한 영향을 미치는지에 대한 모형을 설명하였다. 이번 단계에서는 그 결과를 기반으로 탄소 가격의 변동이 기업의 신용위험에 어떠한 영향을 미치는지를 추정해보고자 한다. 이를 위해 본 연구는 선행연구를 따라 Merton(1974)의 부도 예측모형을 기본 모형으로 채택하였다. 이 모형에 대한 간략한 설명은 다음과 같다.

먼저, Merton 모형에서 t시점 총자산의 시장가치 는 자본의 시장가치

는 자본의 시장가치 와 부채의 시장가치

와 부채의 시장가치 를 합산한 값으로 표현되고, 총자산은 다음과 같은 기하 브라운 운동(Geometric Brownian Motion)을 따른다고 가정하고 있다.

를 합산한 값으로 표현되고, 총자산은 다음과 같은 기하 브라운 운동(Geometric Brownian Motion)을 따른다고 가정하고 있다.

여기서  는 t시점 총자산의 시장가치,

는 t시점 총자산의 시장가치,  는 총자산의 평균 수익률,

는 총자산의 평균 수익률,  는 총자산의 변동성이며,

는 총자산의 변동성이며,  는 Wiener process를 의미한다. 총자산이 단일 종류의 주식과 채권으로 구성되어 있다고 가정하면, 만기(T)에서의 자본의 시장가치는 채권을 상환하고 남은 자산의 가치인 콜 옵션과 동일한 성격을 가진다. 따라서 t시점의 자본의 시장가치

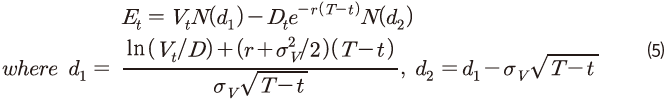

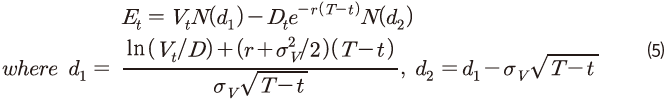

는 Wiener process를 의미한다. 총자산이 단일 종류의 주식과 채권으로 구성되어 있다고 가정하면, 만기(T)에서의 자본의 시장가치는 채권을 상환하고 남은 자산의 가치인 콜 옵션과 동일한 성격을 가진다. 따라서 t시점의 자본의 시장가치 는 Black-Scholes(1973)의 옵션 가격 결정 모형에 의해 다음과 같이 표현될 수 있다.

는 Black-Scholes(1973)의 옵션 가격 결정 모형에 의해 다음과 같이 표현될 수 있다.

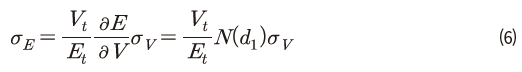

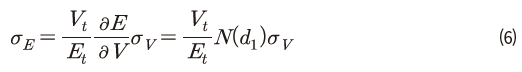

여기서 r은 무위험이자율, N(·)는 표준 정규 누적분포함수, 는 채권의 만기를 의미한다. 이때, 자본의 변동성

는 채권의 만기를 의미한다. 이때, 자본의 변동성 과 총자산의 변동성

과 총자산의 변동성 은 Ito’s lemma에 의해 다음과 같은 등식이 성립한다.

은 Ito’s lemma에 의해 다음과 같은 등식이 성립한다.

즉, 총자산의 시장가치 와 변동성

와 변동성 은 식(5)와 (6)으로 구성된 비선형 연립방정식을 만족시키는 해로 구할 수 있다. 최종적으로, 미래 t시점의 기업

은 식(5)와 (6)으로 구성된 비선형 연립방정식을 만족시키는 해로 구할 수 있다. 최종적으로, 미래 t시점의 기업  의 시장가치

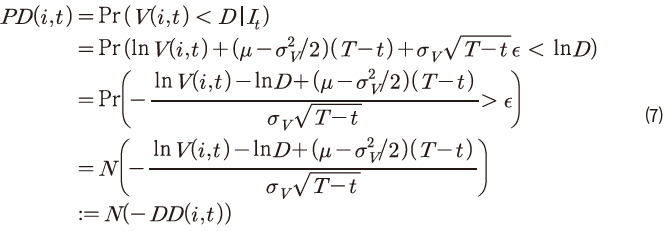

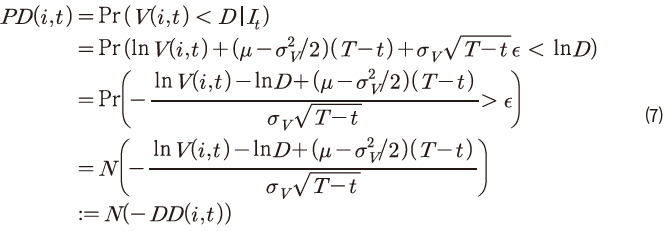

의 시장가치 를 계산한 후, 만기(T)에서의 부채가치(D)와 비교함으로써 t시점의 부도 확률(Probability of Default: PD)을 다음과 같이 산출할 수 있다.

를 계산한 후, 만기(T)에서의 부채가치(D)와 비교함으로써 t시점의 부도 확률(Probability of Default: PD)을 다음과 같이 산출할 수 있다.

여기서  는 t시점까지 이용할 수 있는 모든 정보,

는 t시점까지 이용할 수 있는 모든 정보,  은 표준 정규 확률변수

은 표준 정규 확률변수 ,

,  는 부도 거리(Distance to Default: DD)를 의미한다. 식(7)의 등호는 식(5)와 (6)에 따라 성립한다.

는 부도 거리(Distance to Default: DD)를 의미한다. 식(7)의 등호는 식(5)와 (6)에 따라 성립한다.

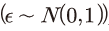

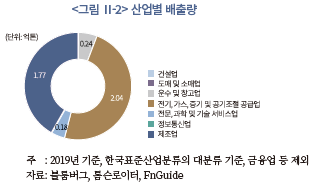

마지막 단계에서는, 이러한 Merton 모형에 탄소 가격의 영향을 추가로 반영하는 작업이 이뤄진다. 앞서 식(3)에서 기업 가치는 탄소 배출 비용과 EBITDA의 비율 만큼 비례적으로 감소함을 보였다. 따라서 직관적으로 탄소 가격 변동은 식(7)의 기업 가치

만큼 비례적으로 감소함을 보였다. 따라서 직관적으로 탄소 가격 변동은 식(7)의 기업 가치 를 변화시킬 것으로 예상할 수 있다. 즉, t시점의 탄소 가격이

를 변화시킬 것으로 예상할 수 있다. 즉, t시점의 탄소 가격이  로 증가하였다고 가정해 보자. 이 경우, 탄소 배출 비용이 증가하면서 식(2)와 (3)에 의해 기업의 현금흐름 및 총자산의 시장가치가 감소하게 되고, 이를 식(7)에 대입함으로써 기업의 부도 확률이 다음과 같이 증가하게 됨을 알 수 있다.

로 증가하였다고 가정해 보자. 이 경우, 탄소 배출 비용이 증가하면서 식(2)와 (3)에 의해 기업의 현금흐름 및 총자산의 시장가치가 감소하게 되고, 이를 식(7)에 대입함으로써 기업의 부도 확률이 다음과 같이 증가하게 됨을 알 수 있다.

모형의 투입변수 설정은 2019년 온실가스 배출량 데이터와 같은 해 말 시가총액 및 주식 수익률, 해당연도의 주가수익률 변동성을 기반으로 하였다. 부도 확률은 t 시점에서의 향후 1년간(t~t+1, 1-기간) 부도 확률로 계산하였다.9)

앞서 언급한 바와 같이 식(5)와 (6)의 비선형 연립방정식의 총자산 시장가치와 변동성을 추정하는 데는 Bharath & Shumway(2008)이 제안한 수치근사법(Newton’s method)을 사용하였다. 만기 부채 상환액(D)은 통상적인 가정에 따라 유동부채와 비유동부채의 50%를 합산한 수치로 계산하였다. 그리고 일반적인 접근법을 따라 부채의 시장가치는 장부가치와 동일하다고 가정하였고, 무위험이자율로는 1년 만기 통안증권 금리를 참조하였다.10)

나. 탄소 가격 경로의 설정

본 연구는 NGFS(Network for Greening Financial System)가 제시한 기후변화 시나리오를 참조하여 탄소 가격 변화 경로를 구성하였다. NGFS는 중앙은행과 금융기관의 기후 리스크 관련 분석과 이를 바탕으로 한 의사결정을 지원하기 위한 목적으로 설립된 이니셔티브이다. NGFS는 다양한 기후경제통합모형(Integrated Assessment Model: IAM)을 활용하여 기후변화 시나리오 경로를 도출하고, 이를 바탕으로 한 탄소 가격 변화 및 탄소 배출량 감축경로, 에너지 조합의 변화 경로 등을 제안하고 있다. 이러한 기후 시나리오는 정부와 금융기관이 기후 리스크를 평가하고 대응 전략을 수립하는 데 유용한 참고 자료로 활용될 수 있다.11)

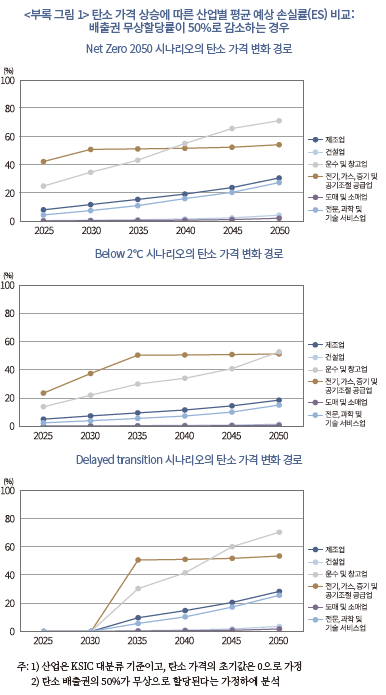

본 연구에서는 NGFS의 여러 기후 시나리오 중에서도 특히 한국에 대해 별도의 온실가스 감축경로가 제시된 GCAM 기반의 시나리오를 참조하여 분석을 수행하였다. NGFS는 지구 온난화 속도에 영향을 미치는 여러 중요한 요인들을 고려하여 기후 시나리오를 구성하고 있다. 특히, 기후변화 정책의 진행 정도, 탄소제거 기술의 발전 상황, 지역별 기후변화 대응 전략 등의 요인들을 기반으로 총 6개 유형의 기후변화 시나리오를 제공하고 있다.12) 본 연구에서는 이러한 6가지 시나리오 중에서 다음의 세 가지 주요 시나리오를 선택하여 분석하였다. 첫째, 2050년 넷제로에 도달하는 시나리오(Net Zero 2050), 둘째, 산업화 이전 대비 2℃ 미만으로 기온 상승을 제한하는 시나리오(Below 2℃), 그리고 마지막으로 뒤늦게 저탄소 전환 정책이 시행되는 지연된 전환 시나리오(Delayed transition)의 3가지 시나리오를 기반으로 분석을 수행하였다. 이러한 다양한 기후 시나리오를 기반으로 분석을 수행함으로써, 각기 다른 경로에서의 탄소 가격 상승에 따른 결과와 영향을 종합적으로 파악하고자 하였다.

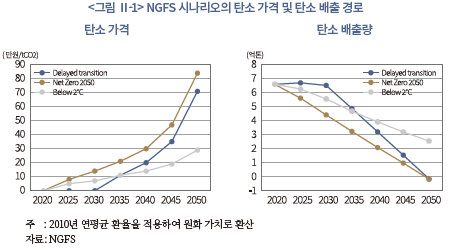

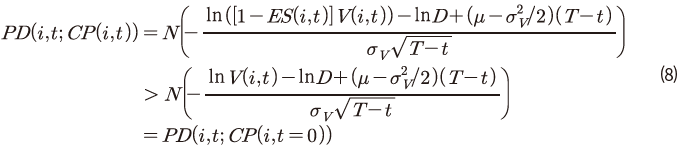

<그림 Ⅱ-1>은 각 시나리오에서의 탄소 배출량과 탄소 가격 변화 경로를 보여주고 있다. 먼저, Net Zero 2050 시나리오를 보면 탄소 배출량은 2020년 6.6억 톤에서 점차 감소하여 2045~2050년 사이에 제로(0)에 도달한다. 그리고 탄소 가격은 2025년 8만 4천원/tCO2에서 2050년 84만 1천원/tCO2까지 10배 이상 증가한다.13) 한편, Below 2℃ 시나리오에서는 2020년 6.6억 톤에서 2050년 2.6억 톤으로 Net Zero 2050 시나리오에 비해 탄소 배출량 감소율이 상대적으로 더 완만하다. 탄소 가격은 2025년 4만 7천원/tCO2에서 2050년 28만 7천원/tCO2까지 상승하며, 이 증가율 또한 Net Zero 2050 시나리오에 비해 상대적으로 완만한 것을 알 수 있다. 마지막으로, Delayed transition 시나리오는 저탄소 정책이 2030년 이후 뒤늦게 급격하게 추진되는 시나리오로 탄소 배출량은 2020년 6.6억 톤에서 2025년 6.7억 톤으로 상승한 이후 급격한 감소세로 전환되여 2050년 –0.14억 톤의 순배출(또는, 0.14억 톤의 순흡수) 상태에 이른다. 이 때 탄소 가격은 2035년에 10만원/tCO2로 상승하고 이후 계속해서 빠른 속도로 상승하여 2050년 71만원/tCO2에 도달한다.

본 장의 분석에서는 <그림 Ⅱ-1>의 탄소 가격 시나리오와 같이, 단위당 탄소 가격이 탄소중립으로 이행하는 과정에서 요구되는 적절한 수준으로 형성될 때, 현재 상태의 우리나라 기업에 미치는 영향을 추정하는 데 의의를 두고 있다. 국내 기업이 현재 수준의 기술력과 기후변화 대응 수준(=배출량), 재무 상태에 머물러 있는 것을 가정하고, 만약 탄소 가격이 시나리오와 같은 수준으로 인상되는 경우 기업의 현금흐름과 가치([1단계] 모형), 부도 위험([2단계] 모형)에 미치는 영향을 가늠해보는 것이다. 가정을 통한 추정이기 때문에, 향후 기업의 대응 변화와 혁신에 따라 탄소 리스크가 미치는 영향의 양상은 충분히 달라질 수 있다.

다. 분석 결과

1) 기초통계

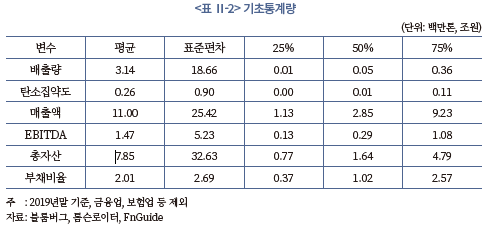

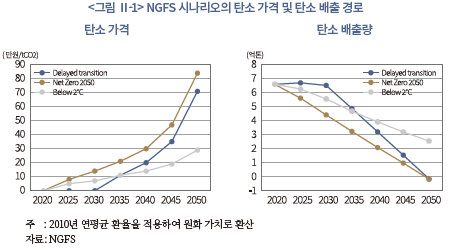

본 연구의 기업 탄소 배출 자료는 블룸버그 및 톰슨로이터에서 제공하는 2019년 말 직접 배출량(Scope 1) 데이터를 사용하였으며, 기업의 주가수익률 및 재무 정보는 FnGuide로부터 추출하였다.14) 이 중에서 탄소 배출량 정보와 재무 정보가 누락된 기업, 금융 및 보험업 업종의 기업은 대상에서 제외되었다. 결과적으로, 총 135개 기업이 분석 대상 기업으로 선정되었다.15) 분석에 사용된 주요 변수에 대한 기초통계량은 <표 Ⅱ-2>에 정리되어 있다.

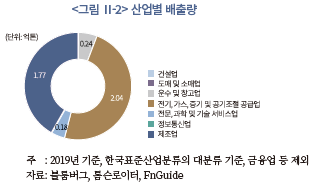

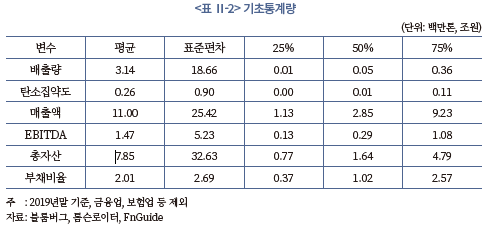

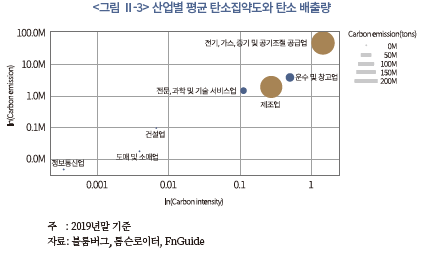

<그림 Ⅱ-2>는 한국표준산업분류의 대분류를 바탕으로 산업별 배출량 규모를 나타낸 것이다.16) 분석 대상인 136개 기업의 배출량을 합산한 수치는 약 4.24억 톤에 이르며 이는 2019년 국가 전체 온실가스 배출량 7억 137만톤의 약 60%에 해당한다. 이 중 대부분인 90% 이상의 배출량은 전기, 가스, 증기 및 공기조절 공급업(2.04억 톤)과 제조업(1.77억 톤)에서 발생하고 있다. 그 외 10%는 운수 및 창고업, 전문, 과학 및 기술 서비스업에서 주로 발생하였다. 그리고 정보통신업, 도매 및 소매업, 건설업 등의 합산 배출량은 약 80만 톤(0.01%)으로 타 산업 대비 그 규모가 작다.17)

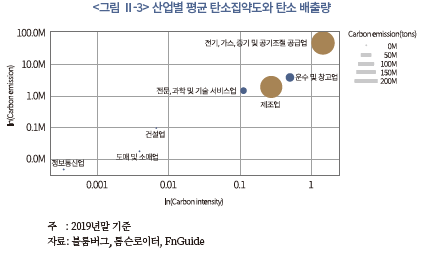

<그림 Ⅱ-3>은 산업별로 평균 탄소 배출량과 탄소집약도의 관계를 비교하여 나타낸 것이다. 세로축은 배출량의 자연로그 값, 가로축은 탄소집약도의 자연로그 값을 의미한다. 이를 통해 탄소 배출량이 많은 산업이 탄소집약도가 높은 경향을 보이는 것을 확인할 수 있다. 그러나 제조업과 전문, 과학 및 기술 서비스업의 사례에서 볼 수 있듯이, 유사한 수준의 산업 평균 배출량을 보이는 산업 간에도 탄소집약도에 있어서는 큰 차이가 나타날 수 있다.

제조업과 전문, 과학 및 기술 서비스업은 산업 평균 배출량 수준이 각각 190만톤, 150만톤으로 큰 차이를 보이지 않으나, 탄소집약도는 0.27, 0.11로 두 배 이상의 차이를 드러내고 있다. 이처럼 전문, 과학 및 기술 서비스업의 배출량이 제조업과 비슷하게 많지만, 탄소집약도가 상대적으로 낮은 이유는 이 산업에 속한 기업 대부분이 탄소 효율이 좋은 범위에 집중되어 있기 때문이다. 구체적으로 살펴보면, 전문, 과학 및 기술 서비스업의 경우 기업 대부분이 탄소집약도 0~0.44 범위에 분포하고 있다. 반면, 제조업은 다양한 하위 산업군으로 구성되어 있으므로 탄소집약도의 분포가 상대적으로 넓은 특징을 보인다. 예를 들어, 제조업에는 전자제품, 의약품, 식료품 제조업과 같이 탄소집약도 0.01~0.05 수준의 탄소 효율적 기업들부터 철강, 화학, 시멘트 등 탄소집약도 0.4~4.9 수준의 탄소 집약적 기업들까지 다양하게 포함되어 있다. 이런 다양한 하위 산업군의 탄소집약도 차이는 제조업의 평균 탄소집약도를 상승시키는 주요 요인 중 하나로 볼 수 있다.

2) 탄소 가격 상승이 기업의 현금흐름, 신용위험에 미치는 영향 분석

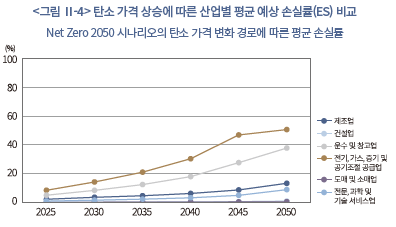

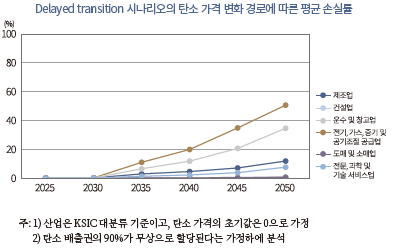

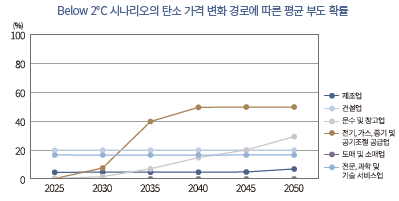

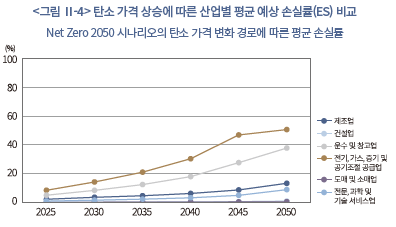

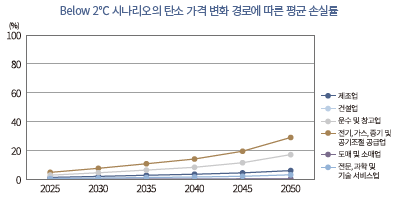

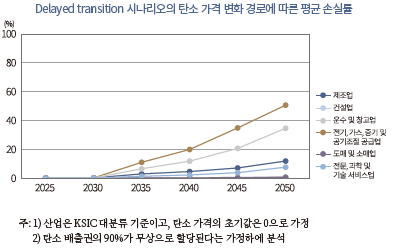

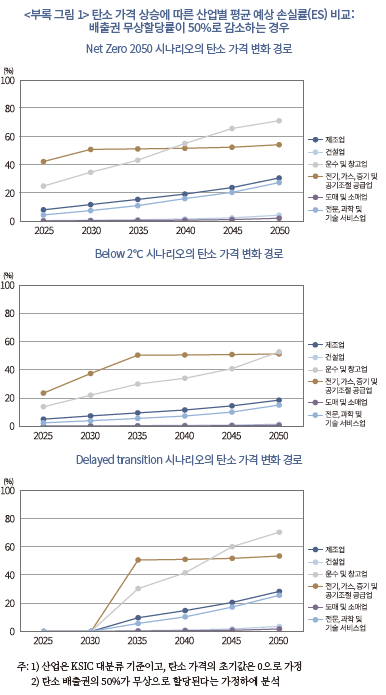

<그림 Ⅱ-4>는 NGFS 기후변화 시나리오 경로에 따른 탄소 가격 변동 시 산업별 평균 예상 손실률(=탄소 가격배출량/EBITDA)을 보여주고 있다. 본 고에서는 탄소 배출 비용의 과도한 추정을 방지하기 위해 현재 90%의 배출권이 무상할당되는 점을 고려하여 탄소 배출량의 10%에 대해서만 탄소 가격이 적용(즉, 배출권의 90%가 무상할당)되는 상황을 설정하였다.18) 탄소 가격 상승의 산업별 영향은 기후변화 시나리오 경로에 따라 약간의 차이는 있지만, 모든 시나리오에서 공통적으로 탄소집약도가 높은 산업들이 탄소 가격 상승에 대해 평균적으로 더 큰 부담을 경험하고 있는 것으로 나타나고 있다. 특히, 탄소집약도가 높은 운수 및 창고업, 전기, 가스, 증기 및 공기조절 공급업과 같은 산업은 탄소 가격이 상승할 때 타 산업에 비해 손실률이 더 급격하게 높아지는 경향을 보이고 있다. 이는 화석 연료에 크게 의존하고 있는 산업들이 탄소 가격의 변동에 매우 민감하게 반응하는 모습을 보일 것이라는 예상과 일치하는 결과이다.

시나리오별 세부 결과는 다음과 같다. 먼저, ‘Net Zero 2050’ 시나리오 경로에 따라 탄소 가격이 상승하는 경우를 보면, 전기, 가스, 증기 및 공기조절 공급업의 손실률이 가장 높은 가운데 대체로 모든 산업에서 탄소 가격 상승에 따라 손실률이 증가하는 모습을 보이고 있다. 특히, 전기, 가스, 증기 및 공기조절 공급업의 평균 예상 손실률은 2025년 8%에서 지속적으로 증가하며 2050년 50% 수준까지 오르는 것으로 나타난다. 다음으로 탄소 가격 상승의 영향을 가장 많이 받는 업종인 운수 및 창고업도 예상 손실률이 2025년 5%에서 2050년 38%까지 증가하는 모습을 보인다. 한편, 이와는 대조적으로 탄소집약도가 상대적으로 낮은 제조업과 전문, 과학 및 기술 서비스업은 2025년 예상 손실률이 1~2% 수준, 2050년 10% 내외의 수준을 보이며, 다른 탄소 집약적 산업 대비 상대적으로 그 값이 낮고 더 완만한 증가세를 보이고 있음을 확인할 수 있다.

한편, ‘Below 2℃’ 시나리오에서는 ‘Net Zero 2050’ 시나리오보다 탄소 가격이 낮게 설정되기 때문에 모든 산업의 탄소 배출 비용이 감소한다. 따라서 탄소 가격 상승에 따른 손실률도 더 낮게 나타난다. 전기, 가스, 증기 및 공기조절 공급업의 예상 손실률은 2025년에는 5%로 앞서 살펴본 “Net Zero 2050’ 시나리오와 크게 차이가 나지 않지만, 탄소 가격의 상승이 완만하게 이뤄지기 때문에 2050년의 손실률은 30% 미만 수준으로 상대적으로 낮게 추정된다. 마찬가지로 다른 산업도 2025년의 손실률은 ‘Net Zero 2050’ 시나리오와 크게 다르지 않지만, 이후 2050년까지의 손실률 증가는 상대적으로 매우 완만하게 나타난다.

마지막으로 ‘Delayed Transition’ 시나리오에서는 탄소 가격 상승이 뒤늦게 급격하게 나타난다. 이 시나리오에 따르면 저탄소 전환이 지연되면서 2030년 이후 짧은 기간 동안 탄소 가격이 급등하게 된다. 그 결과, 산업별 예상 손실도 급격하게 상승하는 모습을 보이는데, 예를 들면 전기, 가스, 증기 및 공기조절 공급업은 2030년 10% 수준에서 시작하여 2050년에는 ‘Net Zero 2050’ 시나리오와 유사한 수준인 50% 이상으로 손실률이 증가할 것으로 추정된다. 요약하면, 탄소 가격 상승 시나리오에 따라 산업별 손실률의 증가 폭과 속도가 다양하게 나타나는 것을 확인할 수 있다.

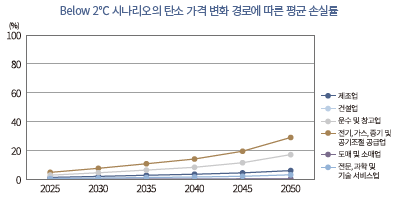

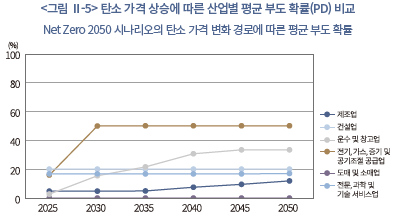

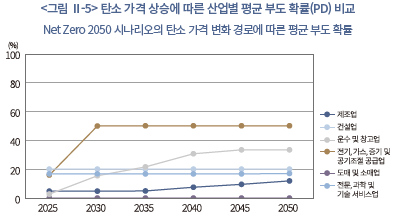

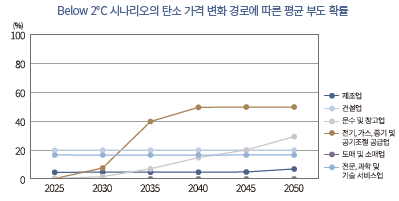

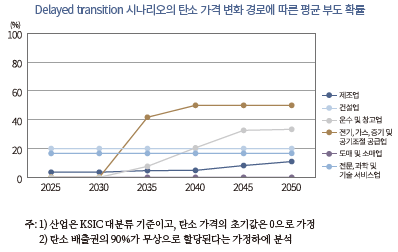

다음으로 <그림 Ⅱ-5>는 이러한 산업별 손실률 추정 결과를 바탕으로 추정한 산업별 예상 부도 확률을 나타낸 것이다. 부도 확률은 해당 연도를 기준으로 향후 1년 이내에 부도 위험에 놓일 확률을 의미한다. 여기에서도 앞서와 마찬가지로 배출권의 90%가 무상으로 할당되는 것을 가정하였다. 지금까지의 분석 결과와 유사하게, 고탄소 업종일수록 탄소 가격 상승에 따른 신용위험 민감도가 높은 것을 알 수 있다. ‘Net Zero 2050’ 시나리오를 보면, 전기, 가스, 증기 및 공기조절 공급업의 평균 부도 확률은 2025년 16%에서 출발하여, 2050년 50%까지 상승하는 모습을 보인다. 운수 및 창고업은 2025년 3%의 낮은 부도 확률을 보이지만, 이후 급격히 상승하여 2050년에는 30% 이상에 이르고 있다.19) 반면, 탄소집약도가 상대적으로 낮은 제조업, 전문, 과학 및 기술 서비스업에서는 2025년 10% 정도의 부도 확률을 보이고, 이후의 증가 폭도 크지 않다. 즉, 이러한 탄소 효율적인 산업은 탄소 가격 상승에 따른 영향이 상대적으로 미미한 것을 알 수 있다. 다만 앞서 서술하였듯이, 이러한 추정 결과는 기업의 재무구조, 기술, 정책 등 제반 환경이 현재와 같이 지속된다는 가정을 바탕으로 도출된 것이므로, 이러한 요소들이 변화하면 결과는 달라질 수 있음을 유의할 필요가 있다. 예를 들어, 다음 장에서 자세히 설명하겠지만, 산업 간의 파급효과를 반영한다면, 저탄소 업종도 탄소 가격 상승에 따라 큰 영향을 받을 수 있다.

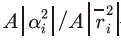

마지막으로, 이 모형을 기반으로 기업의 기후 리스크 노출도를 나타내는 새로운 지표를 개발할 수 있다. 현재 기업의 전환 리스크와 탄소 리스크를 평가하는 지표로는 탄소 배출량 총량 또는 탄소집약도(매출 또는 총수익 단위당 탄소 배출량)가 주로 사용되고 있다. 이러한 지표들은 직관적으로 이해하기가 쉽고 계산이 명확한 장점이 있지만, 해당 기업의 수익성이나 재무 상태를 반영하지 않는다. 따라서 기업의 재무 상황에 따라 탄소 가격의 상승이 기업마다 어떠한 차별적인 영향을 미치는지에 관한 정보를 제공하지 못한다.

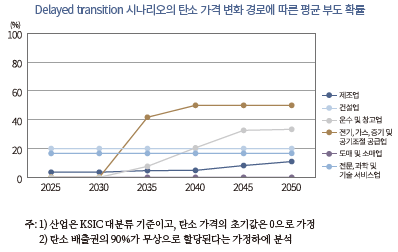

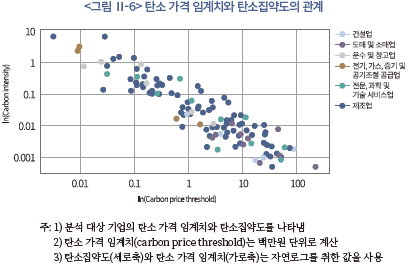

이러한 배경에서 Bouchet & Le Guenedal(2020)이 제시한 탄소 가격 임계치(carbon price threshold)는 기업의 탄소 리스크 측정에 있어서 새로운 지표로서 의미가 있다. 이 지표는 탄소 가격을 신용위험과 연계한 것으로, 기업의 부도 위험이 일정 수준 이상으로 증가하게 하는 탄소 가격 수준을 의미한다.20) 예를 들어, 부도 확률이 50% 수준을 넘도록 하는 탄소 가격 수준이 기업 A는 100달러, 기업 B는 200달러라면, 기업 A가 기업 B에 비해 상대적으로 탄소 가격 변동 리스크에 더 많이 노출되어 있다고 해석할 수 있다. 또한, 이러한 탄소 가격 임계치는 기업의 탄소 배출량 및 탄소집약도와 음(-)의 관계를 보일 가능성이 크다. 탄소 가격은 배출량 단위당 부과되기 때문에, 배출량이 많은 기업일수록 더 큰 배출 비용을 부담하게 되며, 그에 따른 현금흐름의 손실과 부도 확률의 상승 가능성도 클 것이기 때문이다.21)

<그림 Ⅱ-6>은 모든 분석 대상 기업에 대해 부도 확률이 50%가 되는 탄소 가격(=탄소 가격 임계치)를 계산하여 탄소집약도와의 관계를 좌표평면에 나타낸 것이다. 두 변수의 관계는 완벽하게 선형적이지는 않지만, 앞서 언급한 바와 같이 탄소집약도가 증가함에 따라 탄소 가격 임계치는 감소하는 경향을 보인다. 또한 유사한 수준의 탄소집약도를 가진 기업 간에도 탄소 가격 임계치는 상당히 다를 수 있다는 것을 확인할 수 있다. 이러한 현상은 탄소 가격 임계치가 탄소집약도 계산 시 고려되지 않는 기업의 다른 재무 상태 변수들을 반영한 결과로 볼 수 있다. 즉, 비슷한 수준의 탄소집약도를 가진 기업 사이에서도 재무 상태가 더 안정적인 기업은 탄소 가격 임계치가 더 낮게 산출될 수 있음을 의미한다.22)

물론, 탄소 가격 임계치를 계산하는 데 있어서 중요한 모수인 부도 확률이 연구자의 주관적인 판단에 따라 선택될 수 있다는 점에서 이 지표가 완전한 객관성을 갖추었다고 보기는 어려울 수 있다. 그렇지만, 이 지표는 기업의 탄소 리스크 노출도를 가격이라는 척도를 통해 표현하기 때문에, 투자자들이 탄소 가격 상승이 기업에 미치는 영향에 대해 직관적으로 이해하게 해주는 장점이 있다. 결과적으로 탄소 가격 임계치는 전통적인 지표인 탄소집약도나 배출량과 함께 보완적으로 활용하기에 좋은 지표가 될 수 있다.

3. 산업 연관 관계를 반영한 산업별 손실 분석

앞 장에서 분석한 결과에 따르면 탄소 가격의 상승은 기업의 현금흐름에 부정적인 영향을 주어 신용위험을 증가시킬 수 있다. 특히 에너지, 유틸리티, 운송업, 석유화학과 같은 고탄소 산업에 속한 기업들은 탄소 가격 상승 리스크에 더욱 취약하다. 그러나 이전 장에서는 탄소 가격의 상승이 개별 기업에 미치는 영향에만 초점을 두었으며, 기업 간의 상호작용을 고려하지 않았다. 만일 기업이 탄소 가격 상승에 따른 생산비용의 증가를 제품가격에 반영하여 소비자에게 전가할 수 있다면, 그러한 비용충격은 고탄소 산업뿐만 아니라 이와 연계된 저탄소 산업에도 큰 파급효과를 가져올 수 있다. 따라서 이 장에서는 Leontief(1936)의 투입-산출모형(Input-Output model)을 활용하여, 산업 간 파급효과를 고려한 탄소 가격 상승에 따른 산업별 손실률을 추정하고자 한다.

가. 산업연관표와 레온티에프 투입-산출 모형

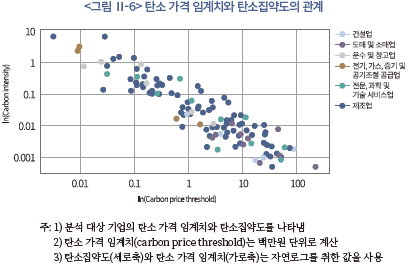

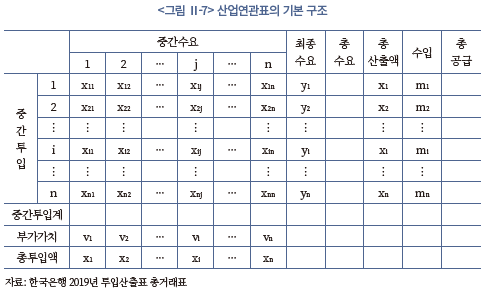

산업연관표는 일정 기간 발생하는 산업간 재화와 서비스 거래를 수량화하여 나타낸 표로, <그림 Ⅱ-7>에서와 같은 행렬 구조로 표현된다. 산업연관표의 세로 방향은 산업의 투입구조를 나타내며, 이는 중간투입과 부가가치로 구분된다. 중간투입은 각 산업에서 생산활동을 위해 사용한 중간재 투입액을 의미하며, 부가가치는 노동, 자본 등의 생산요소 투입액을 의미한다.

한편, 산업연관표의 가로 방향은 각 산업의 배분 구조를 나타내며, 중간수요와 최종수요로 구분된다. 중간수요는 타 산업의 생산활동에 필요한 중간재로 사용된 해당 산업의 산출물 금액을 의미하며. 최종수요는 소비, 투자, 수출 등으로 사용된 금액을 의미한다. 이러한 중간수요와 최종수요를 합산하면 총수요액이 되며, 여기서 수입액을 차감한 금액이 총산출액이 된다. 그리고 정의에 따라 각 산업의 총산출액은 해당 산업의 총투입액과 일치한다. 본 고에서는 국내 산업 간 비용 파급효과에 초점을 두므로, 총수요에서 수입액을 제외한 국내 거래만을 대상으로 분석을 수행하였다.

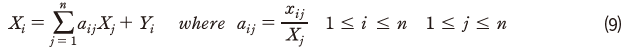

Leontief(1936)의 투입-산출모형(Input-Output model)은 산업연관표의 각 행을 다음과 같은 수식으로 표현할 수 있다.

여기서 는 섹터

는 섹터 의 총산출량을,

의 총산출량을,  는 섹터

는 섹터 의 생산물에 대한 최종수요를,

의 생산물에 대한 최종수요를,  는 섹터

는 섹터  에 판매된 섹터

에 판매된 섹터 의 생산물 수량을, 그리고

의 생산물 수량을, 그리고  는 섹터

는 섹터 의 생산물 한 단위를 생산하는데 필요한 섹터

의 생산물 한 단위를 생산하는데 필요한 섹터 의 생산물 수량(즉,

의 생산물 수량(즉,  )을 나타내는 투입계수(input coefficient)를 나타낸다.23) 여기서 분석의 단순화를 위해 투입계수

)을 나타내는 투입계수(input coefficient)를 나타낸다.23) 여기서 분석의 단순화를 위해 투입계수  는 고정된 상수로 간주하며, 최종수요

는 고정된 상수로 간주하며, 최종수요  는 외생적으로 주어진다고 가정한다. 이러한 가정하에서 식(9)는 다음과 같이

는 외생적으로 주어진다고 가정한다. 이러한 가정하에서 식(9)는 다음과 같이  를 내생변수로 하는 행렬방정식의 형태로 표현될 수 있다.24)

를 내생변수로 하는 행렬방정식의 형태로 표현될 수 있다.24)

그리고 식(10)을 X에 대해 정리하면 다음과 같다.

여기서  은 레온티에프 역행렬(Leontief inverse)을 의미한다. 이 행렬의

은 레온티에프 역행렬(Leontief inverse)을 의미한다. 이 행렬의  원소는 섹터

원소는 섹터 의 최종수요 변화로 인한 섹터의 총산출량의 변화를 나타낸다, 다시 말해, 섹터의 최종수요 변화가 산업 간 연관 관계를 통해 다른 산업부문에 미치는 파급효과를 표현한다.

의 최종수요 변화로 인한 섹터의 총산출량의 변화를 나타낸다, 다시 말해, 섹터의 최종수요 변화가 산업 간 연관 관계를 통해 다른 산업부문에 미치는 파급효과를 표현한다.

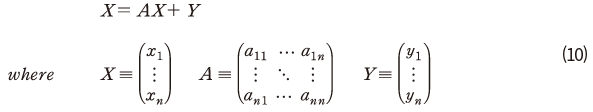

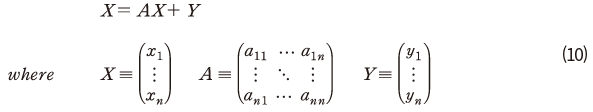

<그림 Ⅱ-8>은 한국은행 2019년 투입산출표를 기반으로 국내의 22개 산업 간의 거래 관계를 나타낸 그래프이다.25) 각 산업에 대한 총 투입액(또는 총 산출액)을 보면, 화학 부문이 181조원, 컴퓨터, 전자, 광학이 152조원, 운송장비가 159조원, 건설이 116조원, 도소매가 102조원, 운송서비스가 90조원 등으로 집계되었다. 이 6개 산업부문의 합계 투입액은 전체 분석 대상 22개 산업의 합계 투입액 1,440조원의 절반에 해당한다.

다음으로 산업 간 투입액 규모를 비교하여 보면, 컴퓨터, 전자, 광학에서 컴퓨터, 전자, 광학 부문으로 94조원, 화학에서 화학 부문으로 90조원, 운송장비에서 운송장비 부문으로 66조원, 1차 금속에서 1차 금속 부문으로 50조원 등으로 동종 산업 간 거래가 큰 비중을 차지하고 있다. 한편, 서로 다른 산업 간 투입액 규모를 보면, 석탄 및 석유 부문에서 화학 부문으로 33조원, 비금속광물 부문에서 건설 부문으로 24조원, 석탄 및 석유 부문에서 운송 서비스 부문으로 23조원, 화학 부문에서 컴퓨터, 전자, 광학 부문으로 19조원 등에서 거래 규모가 큰 것으로 나타났다. 이 중에서도 특히 석탄 및 석유, 화학, 비금속, 운송 등 고탄소 산업을 중심으로 거래 비중이 높은 것을 확인할 수 있다.

나. 레온티에프 가격모형을 이용한 탄소 가격 인상의 파급효과 분석

1) 레온티에프 가격모형의 기본 형태

앞서 살펴본 바와 같이 산업연관표는 각 산업이 제품의 생산을 위해 다른 산업의 생산품을 중간재로 얼마나 투입하였는지, 그리고 각 산업에서 생산된 제품이 다른 산업에서 얼마나 소비되었는지를 구조적으로 보여준다. 이러한 산업연관표의 특성을 이용하여 우리는 특정 산업에서 생산된 제품의 가격을 해당 제품의 생산에 투입된 요소의 비용으로 분해하여 볼 수 있다.

Leontief(1936) 모형에 따르면 투입 요소의 비중이 고정되어 있고 제품의 가격이 투입 요소 비용에 따라 결정될 경우, 제품의 가격은 투입 요소의 비용에 의해 결정된다. 예를 들어, 투입 요소의 가격이 상승하면, 이는 곧 기업의 생산비용을 증가시키게 되고, 결과적으로 기업은 이러한 생산비용 증가를 반영하여 제품가격을 높이게 된다. 더 나아가, 산업 간 연관 관계를 고려하면, 특정 산업의 제품가격 상승은 해당 제품을 중간재로 사용하는 다른 산업의 생산비용을 증가시켜, 경제 전체의 전반적인 물가 상승으로 이어질 수 있다.

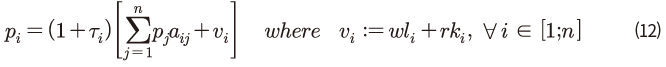

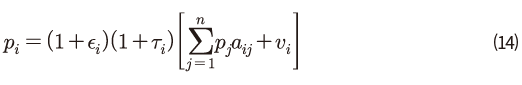

레온티에프 가격모형(Leontief price model)은 이러한 산업 간 물가 상승 파급효과를 투입-산출모형을 이용해 설명하는 모형으로, 이 모형에 따르면 개별 산업 에서 생산된 제품가격은 다음과 같이 결정된다.26)

여기서 는 섹터

는 섹터 에서 생산된 제품의 단위당 가격,

에서 생산된 제품의 단위당 가격,  는 섹터

는 섹터 에서 섹터

에서 섹터 로의 투입계수,

로의 투입계수,  는 섹터

는 섹터 의 제품을 구매할 때 내는 세금(ad valorem tax), 그리고

의 제품을 구매할 때 내는 세금(ad valorem tax), 그리고  는 섹터

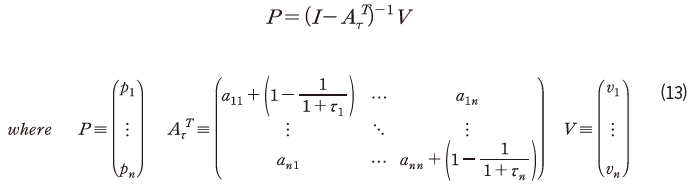

는 섹터 의 노동 및 자본비용으로 구성된 부가가치를 의미한다. 식(12)는 개별 산업의 최종 생산품의 가격이 중간재, 노동, 자본 등의 요소 투입 비용에 기반하여 결정된다는 것을 나타낸다. 위 식을 기반으로 산업별 제품 가격(P)을 행렬식으로 나타내면 다음과 같다.

의 노동 및 자본비용으로 구성된 부가가치를 의미한다. 식(12)는 개별 산업의 최종 생산품의 가격이 중간재, 노동, 자본 등의 요소 투입 비용에 기반하여 결정된다는 것을 나타낸다. 위 식을 기반으로 산업별 제품 가격(P)을 행렬식으로 나타내면 다음과 같다.

여기서 산업별 부가가치 는 고정되어 있다고 가정하고, 특정 산업의 생산 제품의 세금이 상승하는 경우를 생각하여 보자. 이는 식(13)에 따라 행렬

는 고정되어 있다고 가정하고, 특정 산업의 생산 제품의 세금이 상승하는 경우를 생각하여 보자. 이는 식(13)에 따라 행렬  를 변화시킨다. 결과적으로 어느 한 산업의 가격 상승 압력은 산업 간 투입-산출 관계를 통해 관련된 다른 산업의 생산품 가격에도 영향을 미치게 될 것으로 예상할 수 있다.

를 변화시킨다. 결과적으로 어느 한 산업의 가격 상승 압력은 산업 간 투입-산출 관계를 통해 관련된 다른 산업의 생산품 가격에도 영향을 미치게 될 것으로 예상할 수 있다.

2) 탄소 가격을 반영한 레온티에프 가격모형

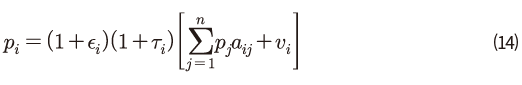

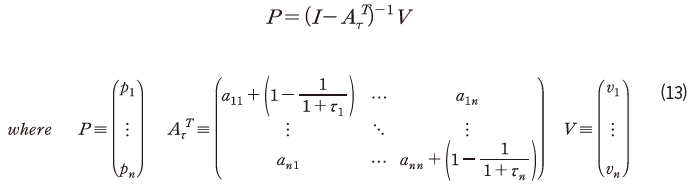

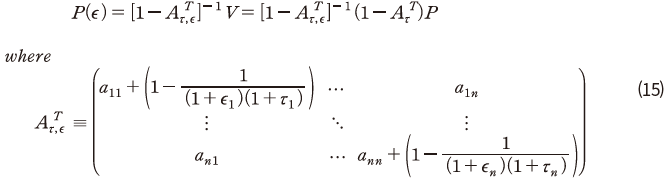

앞서 언급하였듯이, 탄소 가격의 상승은 기업의 생산비용을 증가시킨다. 그리고 탄소 가격의 인상은 기업의 제품가격 증가로 이어지며, 이는 다시 산업 간 연관 관계를 통해 다른 산업의 제품가격 상승으로까지 파급된다. 본 연구에서는 탄소 가격이 다음과 같이 레온티에프 가격모형에 탄소세 의 형태로 반영된다고 가정하였다.

의 형태로 반영된다고 가정하였다.

식(14)에서 모든 산업의 부가가치 와 투입계수

와 투입계수 는 고정된 상수로 가정하면, 탄소 가격의 상승은 세금의 인상과 유사한 결과를 가져온다. 앞서와 마찬가지로 이를 다시

는 고정된 상수로 가정하면, 탄소 가격의 상승은 세금의 인상과 유사한 결과를 가져온다. 앞서와 마찬가지로 이를 다시  에 대한 행렬식으로 표현하면 다음과 같다.

에 대한 행렬식으로 표현하면 다음과 같다.

따라서, 탄소 가격 인상 전의 가격  가 주어졌을 때, 식(15)를 이용하여 탄소 가격 상승 후의 가격

가 주어졌을 때, 식(15)를 이용하여 탄소 가격 상승 후의 가격  을 계산할 수 있다.

을 계산할 수 있다.

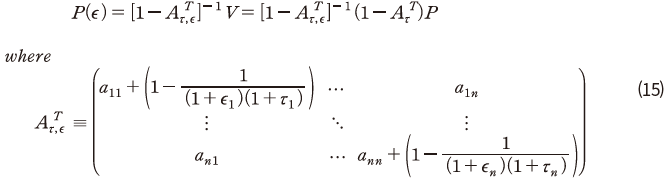

3) 산업별 탄소 가격의 측정

우리나라를 포함한 많은 국가에서 탄소 가격은 배출량 단위(tCO2-eq)당 부과되고 있다. 따라서, 우리의 모형을 적용하기 위해서는 이러한 배출량 단위당 탄소 가격을 탄소세로 변환하는 추가적인 작업이 필요하다. 본 연구에서는 산업별 탄소세의 대용 지표로 매출액 대비 탄소 비용 비율을 사용하였다.

여기서  는 배출량 단위당 탄소 가격(원/tCO2-eq),

는 배출량 단위당 탄소 가격(원/tCO2-eq),  는

는  산업의 직접배출량(Scope 1),

산업의 직접배출량(Scope 1),  는

는  산업의 매출액을 의미한다. 본 연구는 탄소 가격

산업의 매출액을 의미한다. 본 연구는 탄소 가격  는 NGFS의 시나리오에서 제안한 탄소 가격을, 산업별 탄소집약도

는 NGFS의 시나리오에서 제안한 탄소 가격을, 산업별 탄소집약도  는 해당 산업에 속한 전체 기업들의 2019년 기준 배출량과 매출액에 기반하여 계산하였다.

는 해당 산업에 속한 전체 기업들의 2019년 기준 배출량과 매출액에 기반하여 계산하였다.

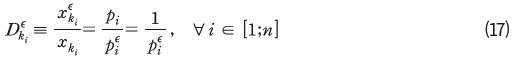

4) 탄소 가격 인상에 따른 기업 수익성 변화

지금까지 탄소 가격 인상이 산업 간 연관 관계를 통해 전 산업의 물가 상승으로 파급되는 경로에 대한 모형을 소개하였다. 이어서, 앞 장에서와 같이 이러한 탄소 가격 인상이 각 산업의 현금흐름(EBITDA)에 어떠한 영향을 미치는지를 추정하고자 한다. 이를 위해 본 연구에서는 먼저 물가 상승에 따라 개별 기업의 제품 수요 변동을 추정하고, 그리고 이러한 수요 변화가 EBITDA에 어떤 영향을 미치는지를 추정한다. 마지막으로, 이러한 결과를 기반으로 각 산업의 EBITDA 감소율, 즉 산업별 수익 충격을 추정한다.

본 연구는 분석을 단순화하기 위해 다음과 같은 가정을 도입한다. 동종 산업에 속한 모든 기업의 제품은 동질적이고, 수요함수의 가격탄력성은 1로 고정된다. 또한, 탄소 가격 변동 이전의 모든 산업의 가격은 1로 표준화되어 있다고 가정한다. 더불어, 레온티에프 가격모형과 마찬가지로 각 산업의 제품에 대한 수요는 다른 산업의 제품과의 상대가격에 영향을 받지 않으며 서로 독립적이라고 가정한다. 따라서 탄소 가격 인상으로 인해 산업의 생산품 가격이 에서

에서  로 상승하면,

로 상승하면,  산업에 속한 기업

산업에 속한 기업  가 생산한 제품의 수요 변화(

가 생산한 제품의 수요 변화( , 탄소 가격 변동에 따른 수요량 변화)는 다음과 같이 산업

, 탄소 가격 변동에 따른 수요량 변화)는 다음과 같이 산업  의 제품가격에 대한 음(-)의 함수로 나타낼 수 있다.

의 제품가격에 대한 음(-)의 함수로 나타낼 수 있다.

여기서  ,

,  는 탄소 가격 변동 이전 산업에 속한 기업 의 제품에 대한 수요량과 가격을 의미하여

는 탄소 가격 변동 이전 산업에 속한 기업 의 제품에 대한 수요량과 가격을 의미하여  ,

,  는 탄소 가격 변화 후 수요량과 가격을 의미한다.

는 탄소 가격 변화 후 수요량과 가격을 의미한다.

마지막으로, 기업의 EBITDA와 제품의 수요량이 선형관계에 있다고 가정하고 산업 에 속한 기업

에 속한 기업  의 EBITDA 손실률을 다음과 같이 산업

의 EBITDA 손실률을 다음과 같이 산업  의 제품가격의 증가함수로 나타낸다.

의 제품가격의 증가함수로 나타낸다.

그리고 앞서 동종 산업 내 기업의 제품은 모두 동질적이라고 가정하였으므로, 이는 다음과 같이 산업 의 평균적인 손실률 로 해석할 수 있다.

로 해석할 수 있다.

다. 분석 결과

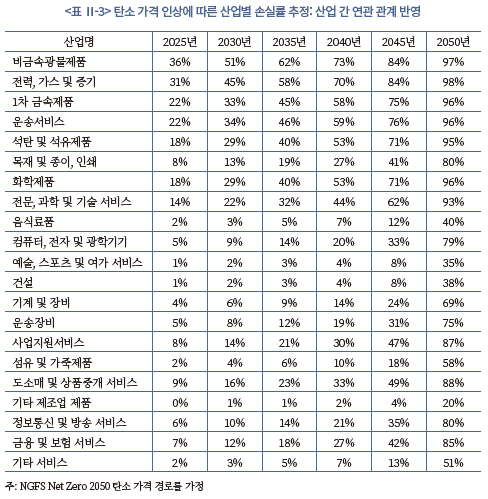

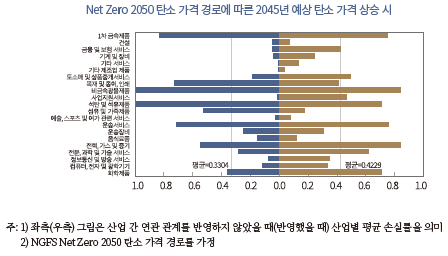

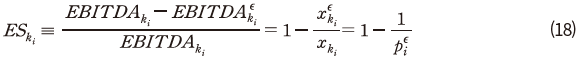

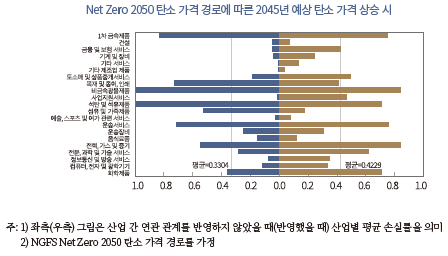

이처럼 탄소 가격을 추가로 반영한 레온티에프 가격모형을 사용하여 탄소 가격 인상에 따른 산업별 손실률을 계산한 결과를 <표 Ⅱ-3>에 제시하였다. 본 결과는 NGFS의 기후변화 시나리오 중 ‘Net Zero 2050’의 탄소 가격 경로를 기반으로 한 것이다.27) 일반적으로 예상할 수 있는 바와 같이 고탄소 산업, 예를 들어, 전력, 가스 및 증기, 금속, 운송, 석탄 및 석유, 화학 등의 산업들이 컴퓨터, 전자, 정보통신, 금융, 도소매 등의 저탄소 산업들에 비해 탄소 가격 인상에 따른 손실률이 전반적으로 더 높은 경향을 보인다. 예를 들어, 탄소 가격이 2025년 예상 탄소 가격 수준(약 8만원)으로 인상될 때 고탄소 산업은 18~36% 수준의 손실률을 기록하고 있으며(비금속광물제품 36%, 전력, 가스 및 증기 31%, 운송서비스 22%, 석탄 및 석유제품 18% 등), 저탄소 산업은 10% 미만의 상대적으로 낮은 손실률을 보인다(컴퓨터, 전자 및 광학기기 5%, 도소매 및 상품중개 서비스 9%, 정보통신 및 방송 6%, 금융 및 보험 7% 등).

이러한 추정 결과는 앞서 산업 간 연관 관계를 고려하지 않았을 때의 분석 결과와 비교해서 다음과 같은 주요한 차이점이 있다. 이전과 마찬가지로 탄소 가격 상승에 따른 손실률 증가 속도가 전력, 가스 및 증기, 화학, 금속 등 고탄소 산업에서 상대적으로 더 빠르지만, 이제는 앞서와 달리 탄소 가격이 상승함에 따라 저탄소 산업에서도 손실률이 증가하고 있다. 탄소 가격이 47만 원/tCO2-eq 수준에 이를 것으로 예상되는 2045년에는 음식료품, 예술, 스포츠 및 여가 서비스, 건설, 섬유 및 가죽제품 등 일부 산업을 제외한 전 산업부문에서 평균 손실률이 24~80%에 이르는 것으로 추정되고 있다.

특히, 저탄소 산업 중에서도 산업간 연관 관계가 높은 산업일수록 탄소 가격 인상에 따라 손실률 증가가 급격히 확대될 수 있음에 주목할 필요가 있다. 일례로 사업지원 서비스는 탄소집약도가 상대적으로 낮은 만큼 2025년 예상 탄소 가격 수준에서 8%의 비교적 낮은 손실률을 보이나, 이후 탄소 가격이 상승함에 따라 2035년 21%, 2040년 30%, 2045년 47%, 2050년 87%로 손실률이 점차 확대되고 있다.28) 반면, 음식료품, 예술, 스포츠 및 여가 서비스와 같이 상대적으로 산업 간 연관 관계가 낮은 저탄소 산업은 탄소 가격의 상승에도 불구하고 손실률의 증가가 크게 나타나지 않는다. 이는 저탄소 산업일지라도 산업 간의 연관 관계가 강한 경우에는 탄소 가격 인상에 따른 물가 파급효과에 더 큰 영향을 받게 되며, 따라서 탄소 가격 상승에 따른 손실 충격이 더욱 커질 수 있음을 나타낸다. 반대로, 고탄소 산업은 제품 가격 인상을 통해 탄소 가격 상승으로 인한 비용 부담을 다른 산업으로 전가할 수 있게 되면서, 앞서 산업 간 연관 관계를 고려하지 않았을 때보다 손실률의 증가가 더 완만하게 나타날 가능성이 있다.

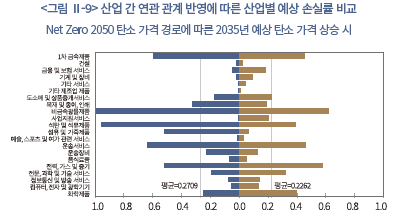

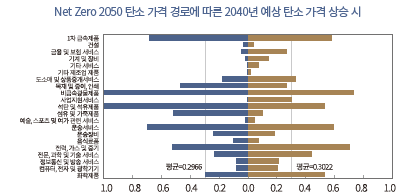

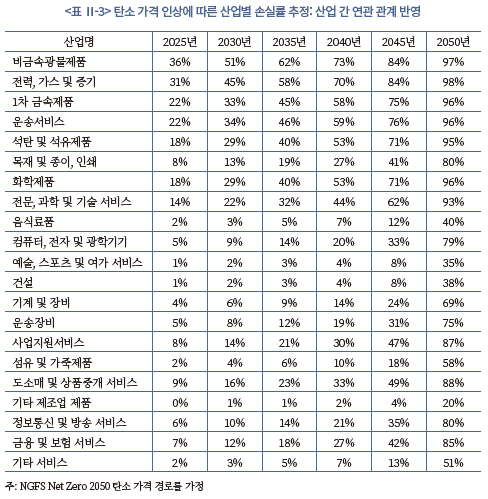

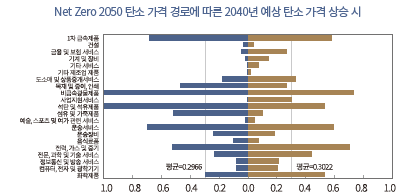

마지막으로, <그림 Ⅱ-9>는 산업 간 연관 관계를 이전 장의 분석과 같이 산업 간 연관 관계를 반영하지 않은 경우(파란색)와 산업 간 연관 관계를 고려한 경우(빨간색)에서의 산업별 평균 EBITDA 손실률을 비교한 결과를 보여준다. 여기서는 Net Zero 2050 시나리오 하에서의 탄소 가격 상승 경로를 기준으로 하였다. 그림에서 보는 바와 같이 산업 간 연관 관계를 반영했을 때의 산업별 손실률 분포가 좀 더 균일해지는 것을 확인할 수 있다. 이는 탄소 집약적인 산업에서 가격 인상을 통해 타 산업으로 탄소 배출 비용을 전가할 수 있어, 결과적으로 탄소 집약적인 산업의 손실률이 낮아지고 동시에 다른 산업군의 손실률이 높아지는 것을 의미한다. 일반적으로 비금속광물제품, 석탄 및 석유제품, 1차 금속제품, 전력, 가스 및 증기 등 고탄소 산업에서는 산업 간 연관 관계의 반영 여부와 관계없이 높은 손실률이 관찰되지만, 산업 간 연관 관계를 고려하였을 때 상대적으로 좀 더 감소하는 경향을 보인다. 반면, 전문, 과학 및 기술 서비스, 사업지원서비스, 도소매 및 상품중개서비스, 금융 및 보험 서비스, 컴퓨터, 전자 및 광학기기와 같은 탄소집약도가 상대적으로 낮은 산업들에서는 산업 간 연관 관계를 반영하였을 때 손실률이 확대되는 모습을 보인다.

산업 연관 관계와 레온티에프 가격모형을 토대로 탄소 리스크의 영향을 분석한 결과, 산업간 상호작용을 통해 탄소 가격 인상의 영향이 다른 산업으로도 파급될 수 있다. 만약 이러한 영향이 전 산업에 걸쳐 발생한다면, 결국 탄소 가격 상승에 따른 영향은 제품의 최종 소비자에게로 전가될 수 있을 것이다. 본 절의 분석모형은 이러한 영향에 관해 구체적으로 설계하지 않았지만, 탄소 리스크는 경제 전체 관점에서 소비자 후생(welfare)에 부정적인 요소로 작용할 것으로 판단된다.

Ⅲ. 탄소 리스크를 고려한 최적 포트폴리오 설계 방안

Ⅱ장의 분석 결과를 통해 알 수 있듯이, 탄소 가격 상승과 같은 전환 위험(transition risk)은 우리나라 기업과 산업 전반에 걸쳐 부정적인 영향을 끼칠 것으로 예상된다. 기업의 주주인 투자자도 이러한 영향을 인식하고 기후변화에 대응하기 위한 노력을 경주할 필요가 있다. 이와 관련하여 본 절에서는 투자자 관점에서 탄소 리스크(carbon risk)를 고려한 최적 포트폴리오의 설계 방안을 조사하고, 국내 주식시장 투자자에게 실무적으로 도움이 될 수 있는 저탄소 포트폴리오(low-carbon portfolio) 및 탈탄소 지수(decarbonized index)29) 구성 방법론의 활용 가능성을 분석한다. 이 절에서 수행한 조사와 분석은 향후 국내 금융회사 또는 투자자가 자산 포트폴리오의 탄소 위험을 효과적으로 관리하는 데 중요한 시사점을 제공할 것으로 판단된다.

1. 포트폴리오 탄소 위험 관리의 필요성

기후변화에 대응하는 과정에서 발생할 수 있는 전환 위험, 또는 이행 위험은 앞으로 투자자가 고려해야 할 중대한 위험요인이 될 것으로 예상된다. 기후변화에 대한 국제적 관심이 고조되고 글로벌 및 국가 단위의 온실가스 감축 규제가 본격적으로 시행되고 있으며, 향후 이러한 규제는 더욱 강화될 가능성이 크다. 현재 많은 국가가 선언한 2050년 탄소중립 목표를 달성하려면 탄소 가격의 상향 조정이 불가피할 것으로 예상되며, 이 과정에서 기업 및 산업부문에 막대한 영향을 미칠 수 있다. 이전 Ⅱ장에서 추정한 결과에 따르면, 탄소 가격 상승 시나리오에 따른 탄소 배출 비용은 기업의 현금흐름에 상당한 부담을 줄 것으로 나타났다. 또한 산업별로 추정된 손실률을 통해 유도한 평균 부도 확률을 살펴본 결과, 탄소 가격의 상승으로 인해 신용위험이 증가하며, 특히 이러한 영향은 고탄소 업종(예: 에너지, 운수 등)에서 두드러졌다. 그리고 산업 간 상호작용을 고려한 파급효과를 분석한 결과, 탄소 가격의 상승은 고탄소 업종뿐만 아니라 저탄소 산업에 미치는 영향도 더욱 악화시키는 것으로 확인되었다. 본질적으로 탄소 리스크와 같은 기후 위험(climate risk)은 장기적인 위험(long-run risk)의 속성을 내포하고 있으므로, 투자자 관점에서 탄소 리스크의 영향을 충분히 인식하고 중장기적인 대응 전략을 마련하는 것이 필요하다.

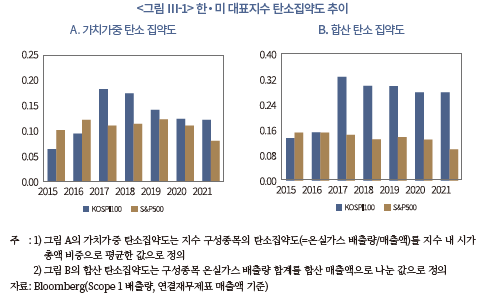

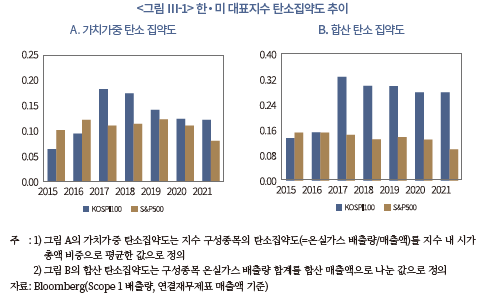

국내 투자자 관점에서 생각해보면, 향후 기후변화에 대한 대응은 선택이 아닌 필수일 것으로 보인다. 특히 우리나라의 많은 기업이 그간 수출 중심 및 탄소 집약적인 산업구조를 형성해왔기 때문에, 향후 국가 온실가스 감축목표의 이행 과정에서 온실가스 배출이 많은 산업과 기업 부문을 중심으로 탄소 위험과 관련 정책 위험(policy risk)에 크게 노출될 수 있다. <그림 Ⅲ-1>은 국내 주요 대형기업을 포함하고 있는 KOSPI100 지수30)와 미국 S&P500 지수의 포트폴리오 탄소집약도(carbon intensity)31) 추이를 비교하고 있다. 그림을 통해 알 수 있듯이, 우리나라 주식시장은 선진 시장 대비 높은 탄소 리스크에 노출된 것으로 확인된다.32) 특히 Ⅱ장의 분석 결과를 고려하면, 온실가스 감축을 강화하기 위한 노력이 고탄소 산업의 생산 및 판매 비용 증가, 신용 리스크 증대, 수익 감소로 연결될 수 있으며, 이러한 영향은 기업 가치의 하락으로 이어질 수 있다. 따라서 투자자는 포트폴리오의 장기적인 꼬리 위험(tail risk) 관리 측면에서 탄소 위험을 중요하게 고려해야 할 것이다.

한편 탄소 위험을 줄이기 위한 투자는 자본시장의 기후변화 대응 측면에서도 장기적인 탈탄소 유인을 제공하는 중요한 기제가 될 수 있다. 만약 충분한 수의 투자자들이 기후변화 대응을 위해 포트폴리오를 탄소중립 목표에 부합하도록 조정한다면, 이는 중장기적으로 기업과 산업부문의 온실가스 감축 유인으로 작동할 수 있다. 기후금융(climate finance)의 역할과 금융 부문을 통해 탄소중립을 유도하려는 노력은 강화되는 추세이고, 자본시장 내에서도 기후변화 대응을 위한 공감대가 형성되어 가고 있다. 글로벌 대형 투자자나 자산운용사, 은행 등 금융 부문별로 넷제로를 선언함과 동시에 이를 이행하기 위한 글로벌 네트워크를 결성하고 있다(송홍선, 2022).33) 금융회사가 선언한 탄소중립의 핵심은 회사가 보유한 자산 포트폴리오의 배출량에 대해 감축목표를 설정하는 것이다. 자본시장 내에서 이러한 움직임이 강화된다면 기업의 자본조달 비용 관점에서 투자 대상 기업에 온실가스 감축 유인을 제공할 수 있을 것이다. 즉, 저탄소 투자의 목적은 단순히 포트폴리오의 탄소 리스크를 줄이는 것 외에도, 배출량을 감축할 필요가 있는 기업에 탈탄소 유인을 제공함으로써 탄소중립이라는 공공의 목표를 달성하는 것이다.

2. 저탄소 포트폴리오 구성 방법과 사례

가. 포트폴리오 탄소 위험 측정 방법

포트폴리오의 탄소 위험(carbon risk)을 측정하기 위해, 먼저 탄소 위험을 어떻게 정의하는지 알아보자. 광범위한 관점에서 탄소 위험은 기후 위험(climate risk) 중 전환 또는 이행 위험의 한 유형으로 이해할 수 있다. 선행연구에 따르면 기후 위험은 기후변화 자체로 인한 물리적 위험(physical risk)과 저탄소‧친환경 경제로 전환하는 과정에서 탄소 가격 상승이나 규제 강화로 인한 전환 위험(transition risk)으로 분류할 수 있다(박혜진, 2023). 물리적 위험은 기후변화로 인한 자연재해와 해수면 상승, 산림 파괴 등 자연환경의 변화에서 발행하는 위험을 의미한다. 한편, 전환 위험은 온실가스 감축 정책과 규제의 시행, 저탄소 설비 투자와 탄소 가격 인상으로 인한 비용의 증가, 탈탄소 투자 확대에 따른 자본조달 비용의 상승 등, 저탄소 경제로 이행하는 과정에서 복합적으로 발생할 수 있는 위험을 말한다. 탄소 위험은 기본적으로 탄소 가격 상승에 따른 위험으로 정의되고, 광의의 개념으로 온실가스 배출이 많은 기업의 전환 위험으로 이해할 수 있다. 앞서 Ⅱ장에 살펴본 탄소 가격 상승에 따른 여러 파급효과(손실 증가, 신용위험 상승 등)는 기업의 현금흐름 경로 관점에서 발생할 수 있는 탄소 위험이다.

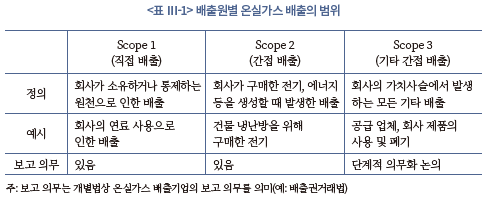

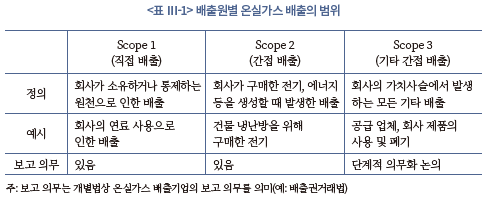

통상적으로 자주 쓰이는 탄소 위험의 대용치는 온실가스 배출량과 같은 탄소 발자국(carbon footprint)34) 지표이다. 규제 대상인 온실가스를 많이 배출할수록 해당 기업의 탄소 리스크가 클 것이다. 온실가스 프로토콜(GHG Protocol)에 따르면, 온실가스 배출량은 배출원에 따라 크게 세 가지 범주로 구분된다(<표 Ⅲ-1> 참고). 먼저 Scope 1 배출량은 기업이 소유하거나 관리하는 발생원으로부터 배출된 온실가스(직접 배출)를 의미한다. 예를 들어, 기업이 연료나 에너지원을 사용함으로써 온실가스를 배출한다면 이는 Scope 1 배출량에 해당된다. 한편, 회사가 구매하여 사용한 전기, 냉난방, 물, 스팀 등을 생산하는 과정에서 발생한 온실가스는 Scope 2로 정의된다(간접 배출). Scope 1과 2 배출량은 기업이 통제할 수 있는 배출량으로, 현재 우리나라에서 시행 중인 목표관리제 및 배출권거래제에 속해 있는 기업이 의무적으로 공시하고 있는 배출량 명세서에 포함된 항목이다. 이 외에도 회사가 소유하거나 통제하지 않는 곳에서 발생하는 온실가스를 포괄하는 Scope 3 배출량은 회사의 가치사슬(value chain)에서 배출되는 온실가스로 정의된다(기타 간접 배출). 예를 들어, 회사 제품의 공급 및 운송을 담당하는 업체의 배출, 회사 제품의 사용과 폐기로 인한 배출 등이 Scope 3에 포함된다. 현재 Scope 3 배출량은 공표할 의무는 없는 것으로 파악되나, 향후 논의에 따라 온실가스 배출량 보고 범위에 포함될 수 있다. 이러한 온실가스 배출량은 기업이 자발적으로 공시하기도 하며, 배출권거래제의 할당대상업체와 같이 일정 수준 이상의 온실가스를 배출하는 기업은 제도상 공시가 의무화되어 있다. 통상 저탄소 투자를 실행하는 투자자나 탈탄소 지수를 개발하는 지수사업자는 Trucost, Bloomberg 등 글로벌 데이터 제공업체로부터 기업 단위 배출량 자료를 확보하거나, 기업의 공시자료를 수집하여 관련 투자를 진행하는 것으로 파악된다.35)

일반적으로 포트폴리오의 탄소 리스크는 기업의 온실가스 배출량을 기반으로 측정된다. 이 중에서 가장 널리 쓰이는 포트폴리오의 탄소 리스크 측정 방법은 배출 총량 및 배수 지표가 있다(TCFD, 2017; State Street Global Advisors, 2020a). 보통 탄소 배출 총량(total carbon emission) 관점에서 포트폴리오의 탄소 리스크 지표로 가중평균 탄소 배출량(weighted average of carbon emissions)이 활용된다. 이는 식(20)과 같이 포트폴리오 내 투자비중 으로 투자기업의 배출량을 가중평균하는 것이다. 투자비중만큼 해당 기업의 배출량을 소유하는 것으로 이해할 수 있다(emission ownership). 가중평균 탄소 배출량은 포트폴리오 단위의 탄소 발자국으로 해석할 수 있다.

으로 투자기업의 배출량을 가중평균하는 것이다. 투자비중만큼 해당 기업의 배출량을 소유하는 것으로 이해할 수 있다(emission ownership). 가중평균 탄소 배출량은 포트폴리오 단위의 탄소 발자국으로 해석할 수 있다.

한편 배수(multiple) 지표는 탄소집약도(carbon intensity)로 정의되는데, 기업이 배출하는 온실가스 배출량을 매출액으로 나눠줌으로써 기업 간 비교가능성을 높인 지표이다.36) 이는 TCFD(2017) 권고안에서 제시된 이후 가장 활발히 활용되는 지표로, 탄소집약도를 포트폴리오 수준에서 정의해보면 크게 가중평균 탄소집약도(weighted average of carbon intensity)와 합산 탄소집약도(aggregate carbon intensity)로 나눠볼 수 있다. 식(21)은 포트폴리오 단위의 가중평균 탄소집약도를 보여주며, 이는 개별 기업의 탄소집약도를 포트폴리오 투자비중으로 가중평균한 값으로 정의된다. 가중평균 탄소집약도는 모든 자산군에 적용할 수 있고, 직관적으로 이해하기 쉬워 포트폴리오의 탄소 위험 지표로 가장 널리 활용되고 있다.

식(22)는 합산 탄소집약도를 산출하는 수식이며, 전체 포트폴리오를 하나의 자산으로 보고 계산하는 방식이다.37) 가중평균 탄소집약도와 같이 비교와 해석이 용이하다는 장점이 있다. 다만 포트폴리오 내 매출액 또는 배출량이 매우 비대칭적으로 분포해 있는 경우에는 해당 지표가 다소 왜곡될 수 있다. 이 중에서 어떤 지표가 가장 적절한지의 문제는 궁극적으로 이러한 지표를 사용하는 투자자들의 주된 관심 사항이 무엇인가에 달려있다. 만약 포트폴리오의 탄소 발자국을 확인하는 데 관심이 있는 투자자라면 총량 지표 방식이 적절할 것이며, 포트폴리오 기업의 탄소 배출 대비 산출이 얼마나 효율적인지를 알고 싶은 투자자에게는 탄소집약도가 더 적합할 것이다. 그리고 포트폴리오 내 탄소 집약적인 또는 고탄소 기업에 대한 전반적인 편중 정도를 파악하고 싶은 투자자의 경우, 가치가중 탄소집약도가 가장 유용한 지표가 될 것이다. 2절에서 소개할 탈탄소 지수 구성 방법에서도 이러한 배출량 기반의 포트폴리오 탄소 리스크 대용치가 다수 활용되고 있음을 알 수 있고, 3절의 실증분석 파트에서도 식(20)~(22)의 측정치를 토대로 분석을 진행할 것이다.

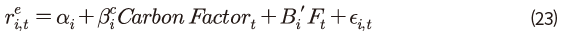

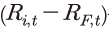

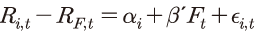

한편 최근에는 자본시장 기반의 모형을 통해 시장 전반의 탄소 위험요인을 추정하고(market-based measure), 추정된 탄소 위험요인에 대한 민감도(sensitivity)를 토대로 개별 기업의 탄소 리스크를 측정하는 방법이 제시되고 있다(Gorgen et al., 2020; 2021; Huij et al., 2022). 이는 앞서 설명한 온실가스 배출량 기반 지표의 단점을 극복하기 위함인데, 배출량을 토대로 탄소 위험을 측정하는 방식은 객관적일 수 있으나, 사용할 수 있는 배출량 자료의 제한, 측정 방법의 불일치, 공시의 지연 등 일반적인 주식 포트폴리오에 보편적으로 적용하기 어렵기 때문이다.38) 반면 시장 기반의 모형을 통해 민감도로 측정하는 방식은 시장에서 형성되는 주식 가격을 활용하기 때문에 투자 대상이나 분석 표본의 확장성이 높다. 가령, 시장 모형 기반의 방식은 아래 식(23)과 같이 시장 전반의 탄소 위험요인(carbon risk factor)을 주식 수익률을 통해 추정하고 , 해당 위험요인에 대한 베타

, 해당 위험요인에 대한 베타 를 개별 기업의 탄소 리스크 대용치로 사용한다. 선행연구에 따르면

를 개별 기업의 탄소 리스크 대용치로 사용한다. 선행연구에 따르면  를 배출량이 많은 집단과 배출량이 적은 집단 간 수익률의 차이(risk premium)로 정의한다.39) 아래 식(23)에서

를 배출량이 많은 집단과 배출량이 적은 집단 간 수익률의 차이(risk premium)로 정의한다.39) 아래 식(23)에서  와

와  는 각각 개별 기업의 초과수익률(excess returns)과 공통 위험요인(common risk factor)을 나타낸다.

는 각각 개별 기업의 초과수익률(excess returns)과 공통 위험요인(common risk factor)을 나타낸다.

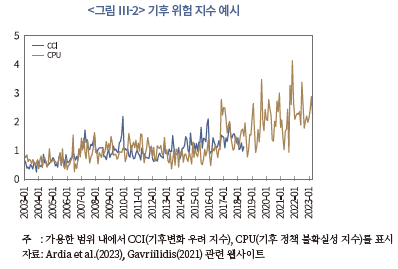

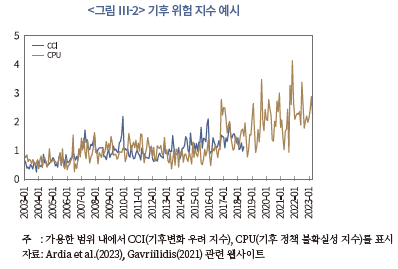

이 외에도 위와 같은 무비용 포트폴리오(zero-investment portfolio)의 수익률 기반의 추정치가 아닌 De Nard et al.(2023)의 연구와 같이, 기후 위험에 관한 뉴스 또는 불확실성을 지수화하여 해당 지표에 대한 민감도로 포트폴리오의 탄소 위험을 측정하는 방법도 제시되었다. De Nard et al.(2023)은 뉴욕 타임즈(New York Times) 기사에 등장하는 광범위한 텍스트 자료를 토대로 기후 위험 지수(climate risk index)를 구축하였고, 이를 바탕으로 개별 펀드의 기후 위험 민감도를 계산하여 기후 위험을 동적으로 헤지(hedge)하는 포트폴리오를 제시하였다. 이렇듯 최근 학계를 중심으로 기후 위험을 계량화하려는 시도가 활발히 진행되고 있으며, Ardia et al.(2023)은 미국 주요 신문 기사 자료를 토대로 기후변화 우려 지수(climate change concerns index)를 구축했고, Gavriilidis(2021)의 연구에서는 텍스트 기반의 기후 정책 불확실성 지수(climate policy uncertainty index)를 개발하였다(<그림 Ⅲ-2> 참고). 다만 주로 이러한 연구는 자료가 풍부한 선진 시장을 중심으로 진행되고 있으므로, 본 보고서에서는 시장 기반의 모형이 아닌 배출량 기반의 탄소 위험 측정치를 활용한다. 한국의 기후 위험 지수와 기후 정책 불확실성, 시장 기반의 탄소 리스크 팩터 등의 측정에 관한 연구는 향후 과제로 남긴다.

나. 저탄소 포트폴리오 구성 방법과 사례

탄소 위험을 측정하는 방법에 관한 논의가 꾸준히 진행됐듯이, 그간 학계와 업계는 이전부터 탄소 위험에 대한 인식과 포트폴리오 위험 관리의 필요성을 강조해왔고, 이 과정에서 다양한 투자 방법론과 전략이 제시되었다(Andersson et al., 2016; Bolton et al., 2022). 이러한 저탄소 투자의 방향은 기본적으로 탄소 위험을 어느 정도 분산하면서 동시에 온실가스 저감 유인을 제공할 수 있는 탈탄소(decarbonized) 포트폴리오를 구성하는 것이다. 이를 위해 투자자는 사전에 설정한 벤치마크 모지수를 구성하는 종목을 토대로 투자비중과 대상을 적절히 변경하는 방식을 활용한다. 이와 관련된 연구와 논의를 종합하면, 저탄소 포트폴리오 및 탈탄소 지수를 구성하는 데에 크게 세 가지 중요한 고려사항이 있다.

첫째, 벤치마크 모지수 대비 유의미한 탄소 발자국 수치가 수반되어야 한다. 포트폴리오를 구성하는 종목의 합산 온실가스 배출량, 또는 가중평균 탄소집약도와 같은 탄소 위험 지표가 벤치마크 대비 유의미하게 줄어들어야 한다. 이는 금융투자회사가 탄소중립을 선언하면서 자산 포트폴리오의 감축목표를 설정하는 것과 연계된다. 탈탄소 포트폴리오는 탄소중립을 목표로 하는 온실가스 감축 경로와 맞게 설정될 필요가 있다.

둘째, 저탄소 포트폴리오가 벤치마크 모지수를 일정 부분 이상 추종하고 모지수와 유사한 위험-수익률 특징을 가질 필요가 있다. 대개 포트폴리오의 탄소 리스크를 줄이는 방법으로 온실가스 규제로부터 비교적 자유로운 신재생에너지, 친환경 서비스 등과 연관된 자산을 중심으로 포트폴리오(또는 지수)에 구성하는 방법을 생각해볼 수 있다.40) 다만 이러한 방식은 투자 대상의 범위가 한정적이고 전략의 확장성(scalability)이 제한되기 때문에, 대형 기관투자자나 자산소유사(asset owner)의 벤치마크 포트폴리오로 적절하지 않다. 또한 다수의 연구에서 실증되었듯이, 기후 위험으로부터 자유로운 산업이나 기업에 집중적으로 투자하는(pure-play) 펀드나 지수가 시장 대비 저조한 성과를 시현한 경우도 잦으므로, 이러한 전략은 위험-수익률 관점에서도 불확실성이 크다고 할 수 있다(Andersson et al., 2016; Ibikunle & Steffen, 2017; Naqvi et al., 2021).41) 따라서 포트폴리오의 감축목표를 설정하고 탄소 위험 수준을 낮추되, 어느 정도는 시장 수익률을 추종하고 벤치마크 대비 추적 오차(tracking error)를 최소화하는 방식이 요구된다. 수익률을 높여야 할 투자자 관점에서 벤치마크 수익률과 비슷한 수준의 성과를 창출하면서, 포트폴리오의 탄소 위험을 낮추고 투자기업에 감축 유인을 제공할 수 있는 포트폴리오를 구성하는 것이 가장 합리적일 것이다.

셋째, 탈탄소 포트폴리오의 그린워싱(greenwashing) 위험을 최소화해야 한다. 단순히 배출량 및 탄소 위험이 적은 기업에만 투자하는 것이 아닌, 신뢰할 수 있는 전환 계획을 갖고 탈탄소화를 진행해야 하는 산업부문에 대한 투자도 함께 고려해야 한다. 가령 온실가스 배출량이 많은 기업을 단순히 투자 대상에서 철회(divestment)하는 네거티브 스크리닝(negative screening) 방식은 실효적인 탈탄소 유인을 제공하지 못할 수 있다(이인형, 2023). 이는 경제 내 탈탄소화를 진행해야 하는 산업부문의 비중이 작거나 탈탄소 유인을 제공하는 사회적 책임 자본이 부족할 경우, 자산 가격의 큰 변화 없이 고탄소 자산이 다른 포트폴리오에 편입되어 자본비용의 유의미한 변화가 발생하지 않기 때문이다(Berk & van Binsbergen, 2022). 2050년 탄소중립을 위해 실효적인 탈탄소 유인을 꾸준히 제공하려면, 기업에 대한 투자자의 지속적인 관여(engagement)가 무엇보다 중요하고, 저탄소 포트폴리오를 구성할 때 이러한 요소를 적절히 반영하여 포트폴리오를 설계할 필요가 있다.

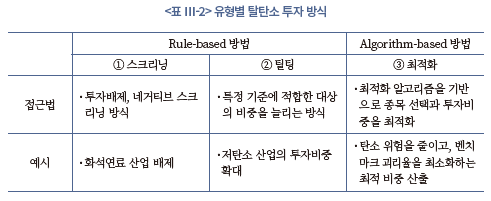

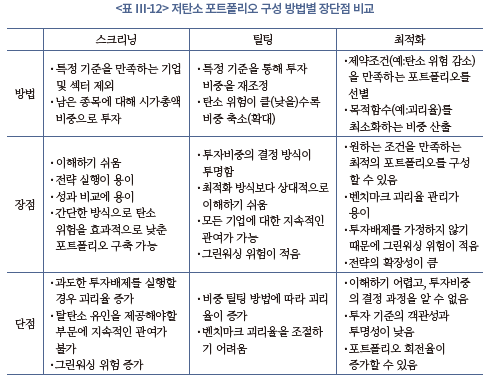

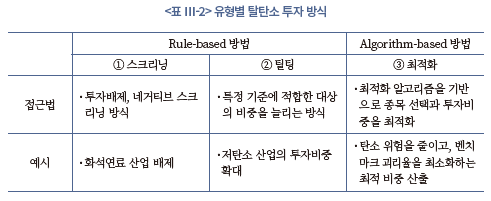

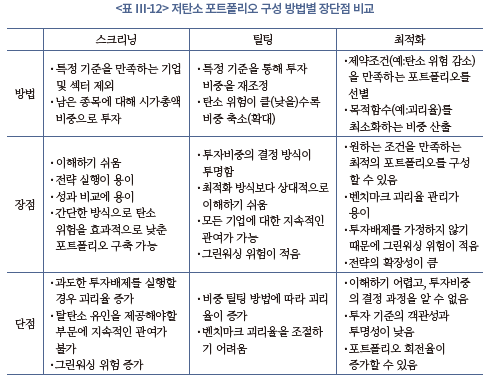

현재까지 여러 포트폴리오 전략이 제시되었으며, 기관투자자가 주로 채택하거나 지수사업자가 개발한 탈탄소 지수를 구성하기 위해 사용된 방법론을 일반화하면 다음과 같다. <표 Ⅲ-2>는 저탄소 포트폴리오 구성 방법론을 크게 세 가지로 정리하고 있으며, 대표적으로 ① 스크리닝(screening), ② 틸팅(tilting), ③ 최적화(optimization) 방식의 포트폴리오 구성 방법론이 알려져 있다(Bender et al., 2022). 전술한 고려사항을 토대로 각각의 접근 방식을 평가하고 방법별 특징과 사례를 살펴보자.

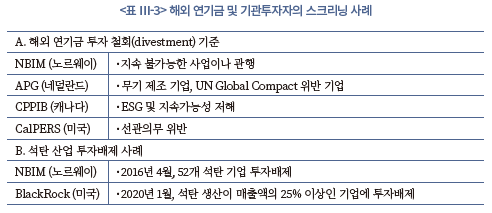

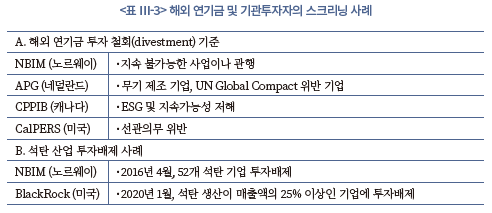

먼저 스크리닝(screening) 방법은 일종의 투자 철회 방식으로, 예를 들어 화석연료 매출의 비중이 큰 기업에 투자하지 않는 포트폴리오가 이에 해당한다. 대표적인 지수로 MSCI 등 글로벌 지수사업자가 산출하는 화석연료 배제 지수가 있다.42) <표 Ⅲ-3>은 해외 연기금 및 기관투자자의 몇 가지 스크리닝 사례를 보여주는데, 현재까지 주요 글로벌 기관투자자는 주로 고탄소 산업 또는 기업군(예: 석탄 산업)에 대해 네거티브 스크리닝 전략을 채택해왔다. 이러한 스크리닝 방식은 전략의 기준이 명확하고 이해하기 쉬우며, 성과 비교에 용이한 장점이 있다. 다만, 단순히 투자를 철회하는 방식은 저탄소 전환이 요구되는 기업에 더 이상 관여하기 어려워 그린워싱 위험이 크고, 특정 섹터를 과도하게 배제할 경우 벤치마크 괴리율이 높아질 수 있는 단점이 존재한다.

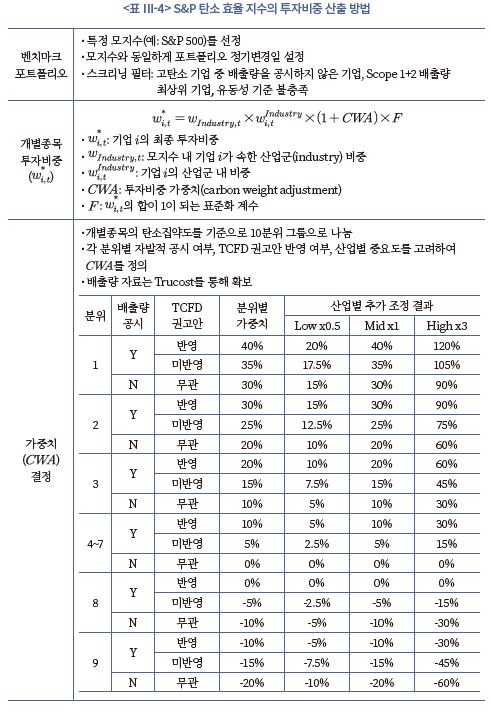

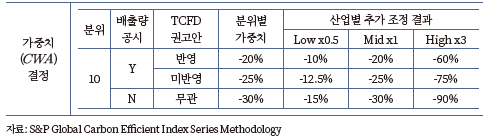

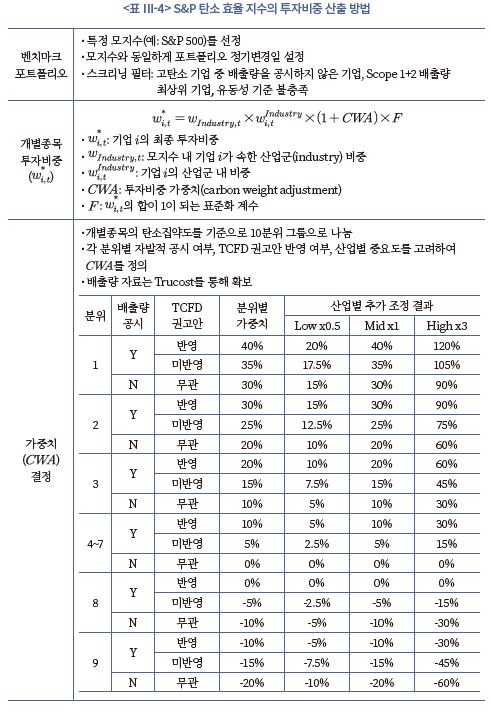

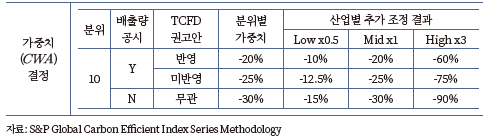

다음으로 틸팅(tilting) 방식은 기업이나 산업의 탄소 배출량, 또는 탄소 위험 지표를 토대로 투자비중을 조정하는 방법이다. 투자기업에 탈탄소 유인을 제공하기 위해, 탄소 리스크가 큰(작은) 기업의 가중치를 줄이는(늘리는) 방식으로 투자비중을 변경하는 것이 일반적이다. 대표적인 탈탄소 지수로 S&P Global의 탄소 효율 지수(Carbon Efficient Index)를 예로 들 수 있다.43) 이 지수는 개별 기업의 탄소집약도를 기준으로 탄소 효율이 높은 기업군에 양(+)의 가중치를 부여한다(자세한 방법은 <표 Ⅲ-4> 참고). 탄소 효율 지수는 개별 기업을 탄소집약도 기준 10분위 그룹으로 구분하고, 각 분위에 대해 자발적 공시 여부, TCFD 권고안 충족 여부, 산업별 중요도를 고려하여 투자비중의 가중치를 부여한다. 이 외에도 투자자별로 중요하게 고려할 부분을 추가하여 가중치를 변경하거나, 방법 자체를 단순화할 수 있을 것이다.44)

틸팅 방식은 저탄소로 전환할 필요가 있는 기업에 계속해서 투자하기 때문에 전술한 스크리닝 방법에 비해 지속가능성이 크고 그린워싱의 위험이 적다.45) 다만 투자비중이 공식에 의해 정해지므로 벤치마크 괴리율을 조절하기 어렵고, 비중을 어떻게 조정하느냐에 따라 괴리율이 높아질 수 있다.

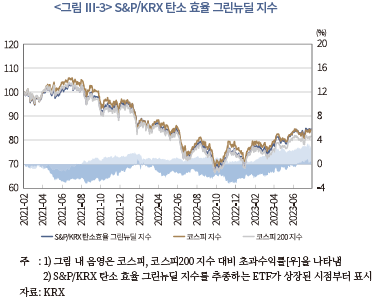

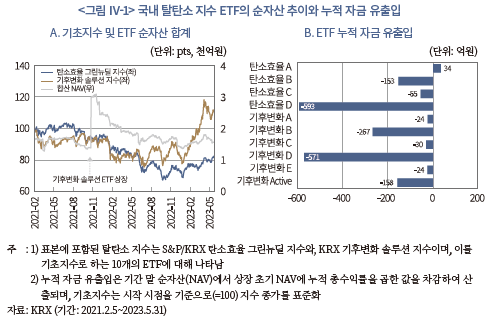

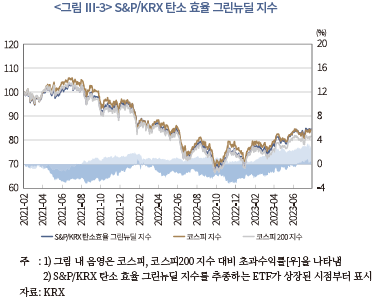

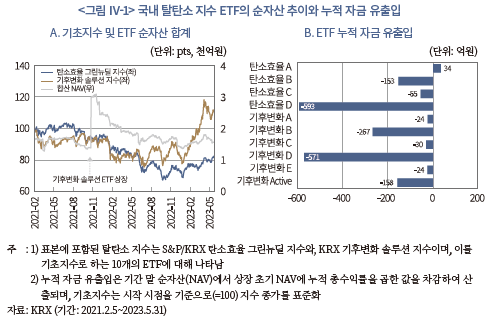

우리나라의 경우 S&P Korea 지수를 모지수로 하는 S&P/KRX 탄소 효율 그린뉴딜 지수가 이러한 방식으로 개발되었으며, 2021년 2월 이를 추종하는 4종의 ETF가 출시되었다.46) 아래 <그림 Ⅲ-3>에서 알 수 있듯이, 해당 틸팅 지수는 우리나라 시장 대표지수를 비교적 잘 추종하는 것으로 나타난다.

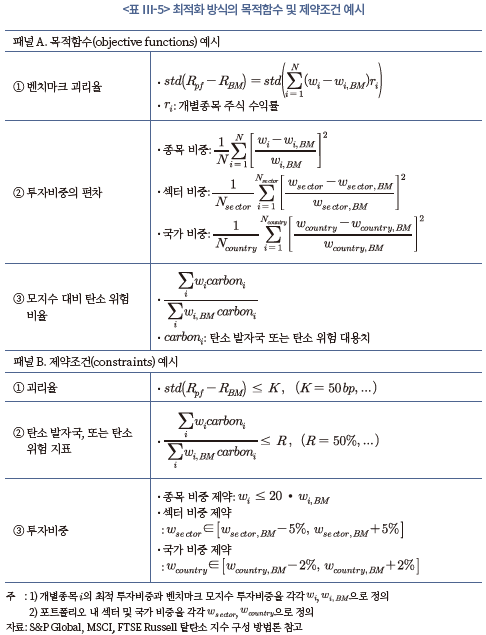

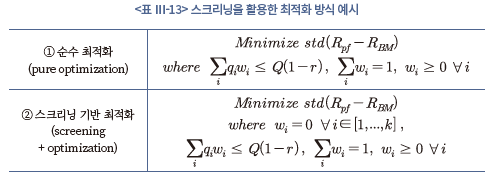

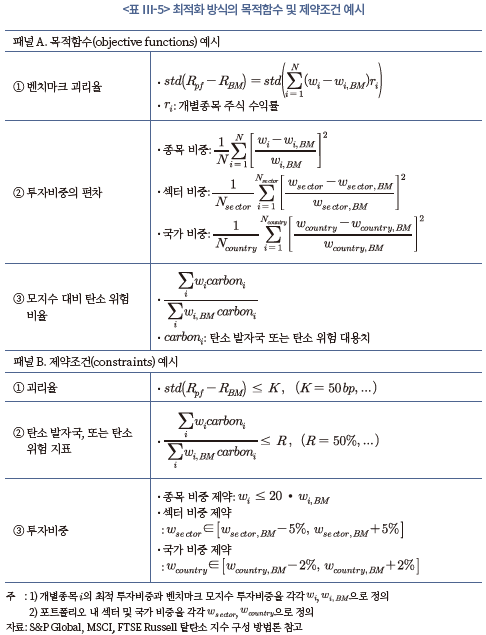

마지막으로 소개할 알고리즘을 바탕으로 투자비중을 최적화(optimization)하는 방식은 최근에 등장하는 탈탄소 지수에 가장 많이 활용되는 방식이다(Andersson et al., 2016; Bolton et al., 2022). 최적화 방식은 벤치마크 구성종목의 투자비중을 적절히 조절하여 전체 포트폴리오의 탄소 위험을 낮추는 측면에서 틸팅 방식과 유사하지만, 비중을 결정하는 공식이 사전에 정해져 있지 않으며 수치적인 방법을 통해 최적 투자비중을 찾아내는 점이 다르다. 가령 <표 Ⅲ-5>의 예시처럼, 포트폴리오의 탄소 발자국(패널B. 식②)을 일정 수준 이하(예: 50%)로 낮추는 투자비중 중에서, 벤치마크 대비 괴리율(패널A, 식①)을 최소화하는 포트폴리오를 찾는 방식이 있을 수 있다. 또한, 일정 수준 이하(예: 50bp)의 벤치마크 괴리율(패널B. 식①)을 갖는 포트폴리오 중 탄소 위험(패널A, 식③)을 최대로 감소시키는 최적 포트폴리오를 고려할 수 있을 것이다. 대표적으로 전자의 방식으로 설계된 탈탄소 지수 중에는 MSCI가 출시한 Low Carbon Leaders 지수 시리즈가 있고, 후자의 방식으로 Low Carbon Target 지수를 들 수 있다. 이렇듯 포트폴리오 또는 지수 구성의 목표에 맞게 목적함수와 제약조건을 잘 설정하며 최적의 비중을 찾아내는 것이 최적화 방법을 활용한 방식이다.

중에서, 벤치마크 대비 괴리율(패널A, 식①)을 최소화하는 포트폴리오를 찾는 방식이 있을 수 있다. 또한, 일정 수준 이하(예: 50bp)의 벤치마크 괴리율(패널B. 식①)을 갖는 포트폴리오 중 탄소 위험(패널A, 식③)을 최대로 감소시키는 최적 포트폴리오를 고려할 수 있을 것이다. 대표적으로 전자의 방식으로 설계된 탈탄소 지수 중에는 MSCI가 출시한 Low Carbon Leaders 지수 시리즈가 있고, 후자의 방식으로 Low Carbon Target 지수를 들 수 있다. 이렇듯 포트폴리오 또는 지수 구성의 목표에 맞게 목적함수와 제약조건을 잘 설정하며 최적의 비중을 찾아내는 것이 최적화 방법을 활용한 방식이다.

최적화 방식은 괴리율과 탄소 발자국 등을 투자자의 기호에 맞게 조절할 수 있기 때문에, 여러 다양한 위험요인에 대한 노출 정도를 벤치마크 모지수와 유사하게 가져갈 수 있을 뿐만 아니라 원하는 수준의 탄소 위험을 갖는 포트포리오를 구성할 수 있다. 또한 최적화 문제를 잘 설계하면(예를 들어, <표 Ⅲ-5>의 제약조건 식③), 특정 산업이나 기업군을 특별히 배제하지 않을 수 있어 투자자는 장기적으로 투자기업에 꾸준히 관여할 수 있다. 다만 스크리닝, 틸팅 방식에 비해 이해하기 어려운 단점이 있고, 최적 투자비중이 결정되는 논리를 알 수 없으므로(black box) 전략의 객관성이 다소 떨어진다고 할 수 있다. 이 외에도 최적화 파라미터가 보수적일수록 수치적인 근사해를 찾지 못할 가능성이 있고, 해당 결과가 다소 왜곡될 수 있는 단점도 있다.47)

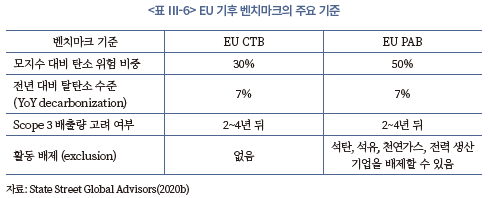

최근 유럽에서는 기관투자자 또는 지수사업자가 참고할 수 있는 탈탄소 지수의 구성요건에 대한 지침인 EU 기후 벤치마크(EU climate benchmark)를 제시하였다. 2019년 2월 EU 의회와 회원국은 기후변화에 대응하는 탄소중립 포트폴리오 대한 원칙을 제시하기 위한 벤치마크 기준을 개발하는 데 합의했고48), 유럽 위원회(European Commission)는 기후금융에 관한 기술 전문가 그룹(Technical Expert Group)49)을 선정하여, 2020년 7월 EU 기후 벤치마크 방법론에 대한 최소한의 기술적 요건을 명시하는 규칙을 채택하였다. EU 기후 벤치마크는 IPCC의 과학적 증거를 기반으로 저탄소, 친환경 경제로의 전환을 달성하기 위한 최소한의 감축경로로 정의된다. 기후 벤치마크는 EU 기후 전환 벤치마크(climate transition benchmark: CTB)와 EU 파리협정 연계 벤치마크(Paris-aligned benchmark: PAB)로 구성되는데, EU CTB는 TCFD가 전환 위험으로 분류한 여러 투자 위험으로부터 자산을 보호하는 것이 목적이며, EU PAB는 IPCC의 1.5°C 시나리오로 즉각적인 전환에 앞장서고자 하는 기관투자자를 위해 설계되었다.

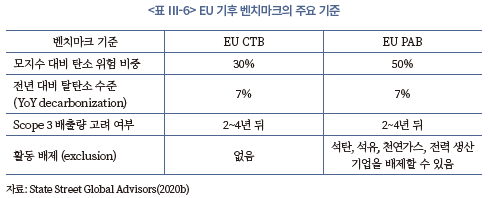

<표 Ⅲ-6>은 두 가지 EU 기후 벤치마크의 주요 기준을 비교한 것이다. 두 벤치마크 모두 전년 대비 7%의 탈탄소화 경로를 따른다는 점에서 동일하지만, EU PAB는 활동 배제(activity exclusion) 요건이 있고 초기 모지수 대비 탄소집약도 감소율이 50%로 EU CTB(30%)에 비해 엄격한 기준을 요구한다. 최근에는 MSCI, S&P Global, FTSE Russell 등 글로벌 지수사업자는 EU 기후 벤치마크 기준을 따르는 탈탄소 지수를 출시하고 있으며, 이러한 지수는 주로 EU 기후 벤치마크 요건에 맞는 탈탄소 경로를 따르면서 벤치마크 모지수와의 괴리율을 최소화하는 최적화 방식으로 설계된다(Bolton et al., 2022).50)

위와 같이 투자자의 기후변화 대응을 위한 노력과 논의가 꾸준히 있었던 해외에서는 연기금 등 주요 기관투자자를 중심으로 탈탄소 지수의 활용이 늘고 있는 것으로 파악된다. 대표적으로 스웨덴의 AP4(Swedish 4th Pension Fund)는 미국 주식 포트폴리오의 탄소 위험을 낮추고 벤치마크(S&P500)를 최대한 추종하기 위해 S&P Carbon Efficient Select 지수를 새로운 벤치마크로 채택했다.51) 또한 프랑스 준비 기금(Fonds de Réserve pour les Retraites: FRR)은 MSCI와 Amundi 자산운용과 협력하여 MSCI의 Low Carbon Leaders 지수 시리즈를 개발했고, 대륙별 패시브 운용자산에 대한 신규 운용자금을 저탄소 포트폴리오를 맞춰 배분하고 있다. 미국의 뉴욕주 일반퇴직연금(Common Retirement Fund: CRF)과 캘리포니아주 교직원 퇴직연금(California State Teachers Retirement System: CalSTRS)은 각각 FTSE Russell Climate Transition 지수와 MSCI ACWI Low Carbon Target 지수52)를 새로운 벤치마크로 설정하여 신규로 유입된 자본을 해당 탈탄소 지수에 맞게 투자하고 있다. 이 외에도 이러한 탈탄소 지수를 추종하는 ETF도 꾸준히 상장되면서, 일반 투자자에게 저렴한 비용으로 탄소 리스크를 줄일 수 있는 대안을 제공하고 있으며 탄소중립 포트폴리오 투자의 저변이 넓어지고 있다.

3. 한국 주식시장의 저탄소 포트폴리오 구성 결과

본 절에서는 앞서 소개한 저탄소 포트폴리오 및 탈탄소 지수의 구성 방법론을 한국 주식시장에 적용하여, 방법별 특징과 성과를 분석하고 각 방법론의 특성을 파악하고자 한다. 이 절의 분석은 한국 주식시장에서 포트폴리오의 위험 및 수익률 특성의 변화를 최소화하면서 동시에 탄소 위험을 낮춘 포트폴리오를 구축할 수 있는지 실증하는 것이 목적이다. 본 절의 분석 결과를 토대로 한국 주식시장 투자자 관점에서 저탄소 투자에 대한 실무적인 시사점을 제공할 것으로 기대된다.

가. 분석 자료 및 표본

분석을 진행하기 위해 개별 기업 단위 탄소 배출량 자료를 국가온실가스 종합관리시스템(National GHGs Management System: NGMS)53)으로부터 추출하였다. NGMS는 환경부가 온실가스 감축 정책으로 시행하고 있는 목표관리제와 배출권거래제의 기반이 되는 배출량 명세서, 이행 실적보고서, 할당 신청서 등, 기업체 또는 사업장 단위의 온실가스 배출활동과 연관된 데이터를 DB화하여 국내 온실가스 저감 정책 수립을 지원하는 시스템이다. 개별 기업 단위 온실가스 배출량 원자료는 NGMS에서 매년 공개하는 명세서 배출량 중 업체 배출량 통계 자료이다. 일반적으로 이행 연도 종료 후 다음 해 상반기 내로 목표관리업체 및 할당대상업체가 명세서를 제출하고, 같은 해 5월 중 인증 배출량을 통보하게 되는데, 이의 신청을 거쳐 통상 8월 말 전년도 이행시기의 온실가스 배출량 정보가 공개된다. 이후 마지막 수정 작업을 거쳐 12월 중 최종 자료가 공개된다. NGMS에서 공개하는 개별 업체 단위 온실가스 배출량은 직접 배출(Scope 1)과 공급받은 전기와 열을 생산하는데 배출되는 간접 배출(Scope 2)을 포함하는 개념이다.54) 원자료의 배출량 기본 단위는 이산화탄소상당량톤(tCO2-eq)이며, 편의상 본 절에서는 이산화탄소톤(tCO2) 또는 톤이라는 표현을 혼용한다. 분석을 위해 원자료의 기업체 또는 사업장 이름을 토대로 상장기업의 상호와 매칭하여 자료를 구축하였다. 이 외 상장기업의 섹터, 주식 가격, 매출액 등 자료는 DataGuide로부터 확보하였다.

본 절에서 사용한 NGMS 배출량 자료는 2011년부터 2021년까지이다. 기업별 온실가스 배출량을 종목별 자료와 합칠 때, NGMS에서 원자료가 최종적으로 공개되는 시기(다음 해 12월)를 고려하여 전년도 배출량을 당해 연도 12월 말일 기준으로 연결하였다.55) 배출량이 공개되는 기업은 온실가스 배출량이 5만tCO2 이상인 업체 및 1.5만tCO2 이상인 사업장을 운영하는 업체로 제한되므로, 분석에 포함된 상장기업은 주로 대형기업이다.56) 최종적으로, 분석에 포함된 상장기업은 NGMS 배출량 자료가 존재하면서, 분석에 필요한 주가 및 재무제표 자료가 있는 유가증권‧코스닥시장 상장기업이다. 외국상장기업과 SPAC은 분석에서 제외하였다.

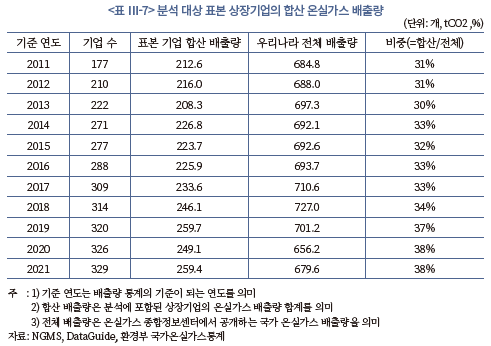

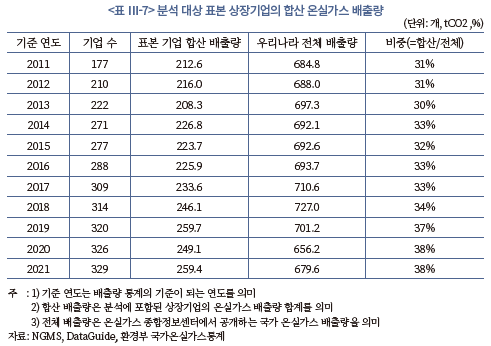

<표 Ⅲ-7>은 분석 대상 상장기업의 합산 온실가스 배출량 추이를 보여주고 있다. 배출량 통계의 기준 연도로 봤을 때, 표본 상장기업 수는 2011년 177개에서 2021년 329개로 매년 꾸준히 증가했다. 이는 목표관리업체의 기준이 2012년, 2014년 두 차례에 걸쳐 완화된 점도 영향을 끼쳤을 것으로 판단되며, 상장기업의 수가 매년 늘어난 요인도 작용한 것으로 보인다. 분석 대상 상장기업의 합산 배출량은 2011년 212.6tCO2에서 2021년 259.4tCO2로, 기업 수 증가와 함께 서서히 증가한 것으로 나타난다. 반면 온실가스 종합정보센터에서 공개하는 국가 전체 온실가스 배출량은 2011년 684.8tCO2에서 2018년까지 꾸준히 증가한 이후, 2021년 679.6tCO2로 다소 감소한 형태로 나타난다. 특히 2020년 코로나19로 인한 국가별 봉쇄 조치, 사회적 거리두기, 이동 제한 등으로 온실가스 배출량이 큰 폭으로 감소했다. 분석 기간 초기 국가 전체 배출량의 31%를 표본 상장기업의 배출량이 차지했으나, 이후 38%로 그 비중이 늘어났다(연평균 비중 34%). 전반적으로 분석 대상 상장기업의 온실가스 배출량은 우리나라 경제 내에서 유의미한 비중을 차지하고 있는 것으로 판단된다.

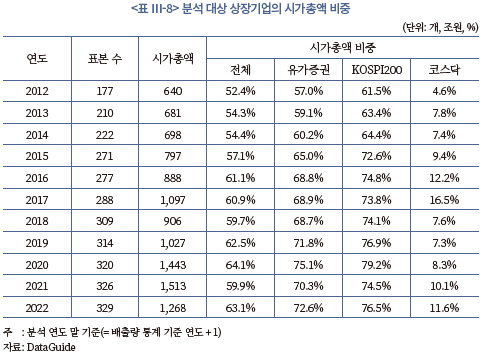

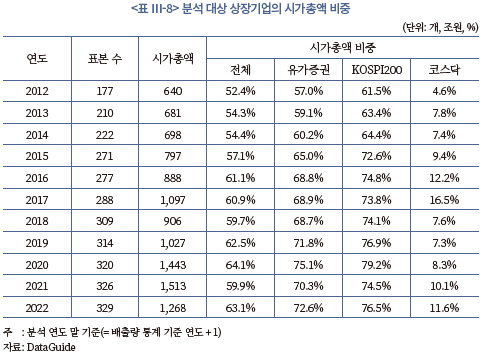

다음으로 분석 표본 기업의 시장 대표성을 살펴보기 위해 표본 상장기업의 주식시장 내 시가총액 비중을 살펴보았다. <표 Ⅲ-8>은 분석의 기준이 되는 연도별로 표본 기업의 합산 시가총액과 시장 내 비중을 요약한 것이다. 데이터 병합 시 주식 자료와 배출량 자료의 시차가 1년이기 때문에 <표 Ⅲ-8>의 기준 연도는 2012년부터 2022년까지이다. 분석의 시작 연도인 2012년 말에는 표본 상장기업의 합산 시가총액이 640조원으로 전체 시장의 52.4%를 차지했으나, 이후 그 비율이 점차 증가하여 분석 기간 말 2022년도에는 주식시장 내 표본 기업의 시가총액 비중이 63.1%로 증가했다. 표본을 상장 시장별로 나눠서 살펴보면, 유가증권시장 내 72.6%, 코스닥시장 내 11.6%를 차지한다. 배출량을 공개하는 목표관리제 및 배출권거래제에 포함된 기업이 주로 유가증권시장 대형 상장기업인 것을 알 수 있다. 한편, 우리나라 주식시장을 대표하는 인덱스인 KOSPI200 지수에 포함된 표본 기업의 시가총액 비중은 76.5%로 나타난다.57) 주로 대형기업이 분석에 포함된 것을 알 수 있으며, 전반적으로 시장 대표성을 갖는 표본이라고 볼 수 있다.

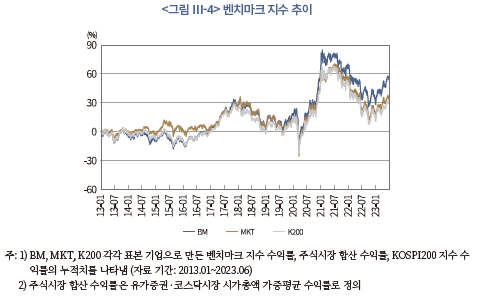

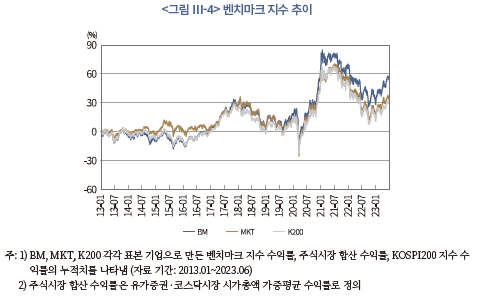

표본 기업의 시가총액 가중평균(cap-weighted) 수익률을 산출해보면, 우리나라 주식시장 합산 수익률 및 KOSPI200 지수의 수익률과 유사한 형태를 보인다(<그림 Ⅲ-4>). 표본 기업의 합산 수익률은 매년 12월 말 포트폴리오를 재조정하는 것으로 가정하여 시가총액 가중평균 수익률을 계산한 것이다. 이 수익률은 후술한 저탄소 포트폴리오의 벤치마크 수익률로 사용된다. <그림 Ⅲ-4>의 ‘BM’은 표본 기업의 합산 수익률인 저탄소 포트폴리오의 벤치마크 누적 수익률이고, ‘MKT’와 ‘K200’은 각각 유가증권‧코스닥시장 합산 수익률 및 KOSPI200 지수의 누적 수익률을 나타낸다. 그림에서 알 수 있듯이 표본 기업을 토대로 산출한 벤치마크 수익률은 우리나라 주식시장을 대표하는 수익률과 유사하게 움직이고 있다. 일별 수익률을 기준으로 표본 기업 합산 벤치마크 수익률과 우리나라 주식시장 합산 수익률의 상관계수는 0.95이며, KOSPI200 지수와의 상관계수는 0.98에 달한다.

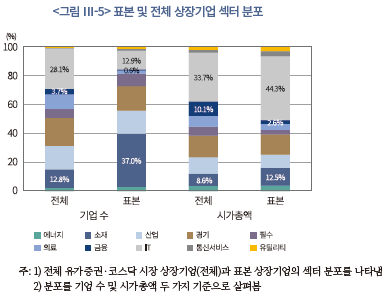

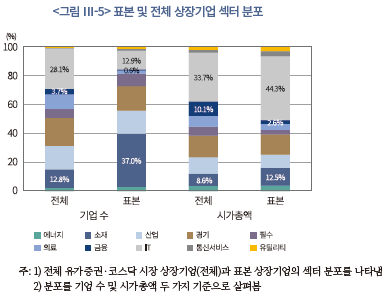

또한 <그림 Ⅲ-5>에서 보여주듯, 분석에 포함된 표본 상장기업은 여러 섹터에 골고루 분포해 있다. 시가총액 기준 섹터 분포의 경우에는(우측 그림) 표본 기업과 전체 상장기업의 분포가 유사한 것으로 판단되고, 기업 수(좌측 그림)는 일부 섹터에서 다소 차이가 난다. 특히 배출량이 공개되는 기업은 주로 소재 섹터에 포함되고, 상대적으로 의료, 금융 및 IT 섹터의 기업 수 비중이 시장 전체에 비해 작다. 이는 해당 섹터의 사업 구조 특성상 온실가스 배출량이 적은 점과 중소규모의 기업이 의료 및 IT 섹터에 다수 분포해 있기 때문이다. 시가총액 비중의 경우 IT 섹터 비중이 표본 기업에서 더 크게 나타나는데, 이는 삼성전자, SK하이닉스 등 일부 대형주의 시가총액 비중이 표본 내에서 매우 높기 때문이다. 이러한 전반적인 표본의 특징을 살펴보았을 때, 이 절의 분석에서 사용된 표본이 우리나라 주식시장을 어느 정도 대표하는 집단으로 판단해도 무리가 없을 것이다.

나. 분석 방법론

한국 주식시장의 저탄소 포트폴리오를 구성하기 위해 이 절에서는 분석에 사용된 스크리닝, 틸팅, 최적화 방법을 설명한다. 앞선 절에서 서술한 바와 같이 각각의 저탄소 포트폴리오 구성 방법에는 다양한 방식을 고려할 수 있다. 다만, 분석의 간결성과 해석의 용이성을 위해 이 절에서는 대표적인 방식으로 분석을 진행한다. 또한 포트폴리오는 앞선 가절에서 설명한 배출량 자료가 있는 표본 상장기업 집단을 벤치마크 유니버스로 한정하고, 매년 12월 말에 전년도 배출량 자료가 존재하는 기업을 대상으로 포트폴리오를 재조정한다.58) 분석에 사용된 NGMS 배출량 자료가 2011년부터 2021년까지이므로, 포트폴리오 투자 대상 및 비중 선정은 2012년 12월 말부터 2022년 12월 말까지 1년 단위로 진행한다. 1년 보유한다고 가정하여 수익률의 경우 2013년 1월부터 2023년 6월(자료 기간 말)까지의 일별 자료를 사용하였다.

개별 기업의 탄소 위험(carbon risk)59)은 다수의 문헌에서 자주 활용된 탄소집약도(carbon intensity)를 기반으로 측정한다(TCFD, 2017). 탄소집약도는 기업의 온실가스 배출량(단위: tCO2-eq)을 매출액(단위: 백만원)으로 나눈 비율로 정의하는데, 매출액 대비 온실가스 배출량이 많을수록 탄소 위험이 크다고 볼 수 있다. 포트폴리오의 탄소 위험 지표는 개별종목 단위 탄소 위험 지표와 일관성을 유지하기 위해, 앞선 2절의 식(21)와 같이 투자비중으로 가중평균한 탄소집약도(weighted average of carbon intensity)를 주된 지표로 사용하되, 식(22)의 합산 탄소집약도(aggregate carbon intensity)와 식(20)의 가중평균 탄소 배출량(weighted average of total carbon emissions)도 함께 살펴본다. 포트폴리오의 탄소 위험 지표도 마찬가지로 해당 지표가 클수록 위험 탄소 위험의 수준이 높음을 의미한다.

먼저 스크리닝 방식은 종목 스크리닝과 섹터 스크리닝을 진행하였다. 종목 스크리닝은 기업 단위 탄소집약도를 기준으로 상위 %의 고위험 종목을 투자 유니버스에서 제외하는 방식이다( 스크리닝 파라미터). 섹터 스크리닝의 경우, 표본 기업이 총 10개의 섹터로 분류되므로(<그림 Ⅲ-5> 참고) 상위 1개(

스크리닝 파라미터). 섹터 스크리닝의 경우, 표본 기업이 총 10개의 섹터로 분류되므로(<그림 Ⅲ-5> 참고) 상위 1개( 10%) 섹터를 제외한 포트폴리오만 살펴보았다. 스크리닝으로 제거된 종목 외에 남아있는 기업을 바탕으로 종목별 시가총액 비율만큼 투자하는 방식을 스크리닝 포트폴리오로 정의한다.

10%) 섹터를 제외한 포트폴리오만 살펴보았다. 스크리닝으로 제거된 종목 외에 남아있는 기업을 바탕으로 종목별 시가총액 비율만큼 투자하는 방식을 스크리닝 포트폴리오로 정의한다.

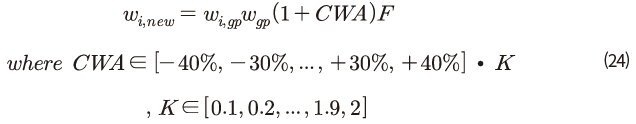

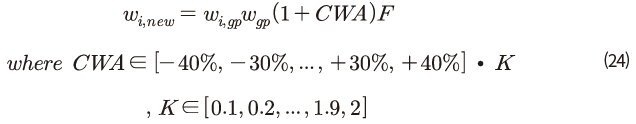

틸팅 방식은 S&P Global에서 사용하는 비중조정 방식을 일반화하였다. 이는 종목별 벤치마크 포트폴리오 비중에 탄소비중 조정계수 를 적절히 곱해서 비중을 재조정하는 방식이다. 매년 12월 말 벤치마크 유니버스 내 모든 종목을 탄소 위험 지표를 기준으로 10분위 그룹으로 나누고, 그룹별로 정한

를 적절히 곱해서 비중을 재조정하는 방식이다. 매년 12월 말 벤치마크 유니버스 내 모든 종목을 탄소 위험 지표를 기준으로 10분위 그룹으로 나누고, 그룹별로 정한  를 토대로 비중을 조정한다. 여기서

를 토대로 비중을 조정한다. 여기서  는 탄소 위험 지표가 클수록 투자비중을 낮추고, 반대로 위험 지표가 작을수록 투자비중을 늘리는 방식으로 정해진다. 아래 식(24)를 보면 종목

는 탄소 위험 지표가 클수록 투자비중을 낮추고, 반대로 위험 지표가 작을수록 투자비중을 늘리는 방식으로 정해진다. 아래 식(24)를 보면 종목  의 틸팅 포트폴리오 투자비중

의 틸팅 포트폴리오 투자비중 은 벤치마크 내 비중(

은 벤치마크 내 비중( =분위 내 비중분위 비중)에

=분위 내 비중분위 비중)에  항을 곱해서 산출되는데,

항을 곱해서 산출되는데,  는 모든 종목의 투자비중 합계가 1이 되는 표준화 계수를 의미한다.

는 모든 종목의 투자비중 합계가 1이 되는 표준화 계수를 의미한다.

는 탄소 위험 지표가 가장 큰 10분위의 경우에는 –40%로 설정하고, 다음 9분위는 –30%로 조정계수의 크기를 10%씩 변경하였다. 반대로 위험 지표가 가장 작은 1분위는

는 탄소 위험 지표가 가장 큰 10분위의 경우에는 –40%로 설정하고, 다음 9분위는 –30%로 조정계수의 크기를 10%씩 변경하였다. 반대로 위험 지표가 가장 작은 1분위는  값이 +40%이며, 중간 그룹인 5, 6분위는 조정계수 값 0%이다. 다음으로 식(24)의 틸팅 파라미터

값이 +40%이며, 중간 그룹인 5, 6분위는 조정계수 값 0%이다. 다음으로 식(24)의 틸팅 파라미터  는 틸팅의 정도(degree of tilting)를 나타내는 매개변수인데,

는 틸팅의 정도(degree of tilting)를 나타내는 매개변수인데,  가 커질수록 비중 재조정 정도를 강화하는 방식이다. 앞서 언급한 예시는

가 커질수록 비중 재조정 정도를 강화하는 방식이다. 앞서 언급한 예시는  가 1인 경우이고,

가 1인 경우이고,  값이 0.1이면 –4%부터 +4%까지 틸팅하는 것이고(약한 수준의 틸팅), 반면

값이 0.1이면 –4%부터 +4%까지 틸팅하는 것이고(약한 수준의 틸팅), 반면  값이 2인 경우에는

값이 2인 경우에는  를 –80%부터 +80%까지로 설정한다(강한 수준의 틸팅). 이는 다양한 틸팅 정도에 따른 다양한 시나리오를 살펴보기 위함이다.

를 –80%부터 +80%까지로 설정한다(강한 수준의 틸팅). 이는 다양한 틸팅 정도에 따른 다양한 시나리오를 살펴보기 위함이다.

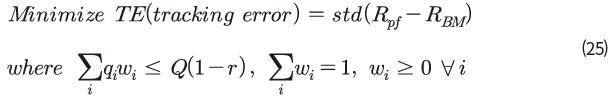

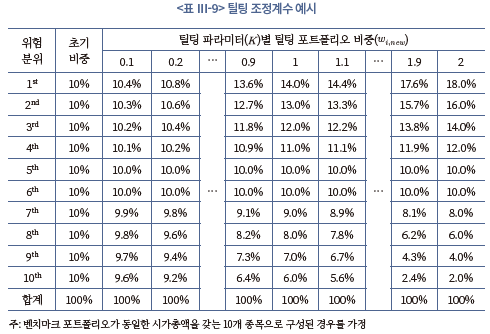

식(24)에 따른 비중 틸팅 정도를 요약하면 <표 Ⅲ-9>와 같다. 이해를 돕기 위해 벤치마크 유니버스 내 10개 종목만 존재하고 각 종목의 비중을 10%로 같다고 가정하였다. 표는 틸팅 파라미터 에 따라 분위별로 식(24)의 방식대로 조정된 투자비중을 보여주고 있다.

에 따라 분위별로 식(24)의 방식대로 조정된 투자비중을 보여주고 있다.  가 가장 작은 경우(

가 가장 작은 경우( =0.1)에는 탄소 위험이 가장 큰 종목은 초기비중의 4%(=40%0.1)만큼 줄어든 9.6%이고, 반대로 탄소 위험이 가장 작은 종목은 10.4%이다.

=0.1)에는 탄소 위험이 가장 큰 종목은 초기비중의 4%(=40%0.1)만큼 줄어든 9.6%이고, 반대로 탄소 위험이 가장 작은 종목은 10.4%이다.  가 1인 경우 최상위, 하위 분위의 틸팅 포트폴리오 비중이 초기비중에 비해 40%(=40%1)만큼 증감한 14%와 6%이다. 표에서 알 수 있듯이 식(24)에 따라 선형(linear)적으로 투자비중이 변경되고, 파라미터

가 1인 경우 최상위, 하위 분위의 틸팅 포트폴리오 비중이 초기비중에 비해 40%(=40%1)만큼 증감한 14%와 6%이다. 표에서 알 수 있듯이 식(24)에 따라 선형(linear)적으로 투자비중이 변경되고, 파라미터  가 증가할수록 그 정도가 강화된다. 이러한 방식은 글로벌 지수사업자인 S&P Global에서 탄소 효율 지수(carbon efficient indices) 시리즈를 만들 때 사용한 방식을 간단한 형태(pure tilting)로 변형한 것이다. 물론 이 외에도 조정계수의 수준을 변경할 수 있고 산업군에 따라 조정 정도를 조절하는 방식도 있을 수 있으며, 비선형적인 방식도 구상할 수 있을 것이다. 특정 종목이나 섹터의 비중을 고정할 수도 있다. 다만 본 절에서는 포트폴리오 구성 방법 간의 비교와 분석의 용이성을 위해 간단한 방식을 선택한 것이다.

가 증가할수록 그 정도가 강화된다. 이러한 방식은 글로벌 지수사업자인 S&P Global에서 탄소 효율 지수(carbon efficient indices) 시리즈를 만들 때 사용한 방식을 간단한 형태(pure tilting)로 변형한 것이다. 물론 이 외에도 조정계수의 수준을 변경할 수 있고 산업군에 따라 조정 정도를 조절하는 방식도 있을 수 있으며, 비선형적인 방식도 구상할 수 있을 것이다. 특정 종목이나 섹터의 비중을 고정할 수도 있다. 다만 본 절에서는 포트폴리오 구성 방법 간의 비교와 분석의 용이성을 위해 간단한 방식을 선택한 것이다.

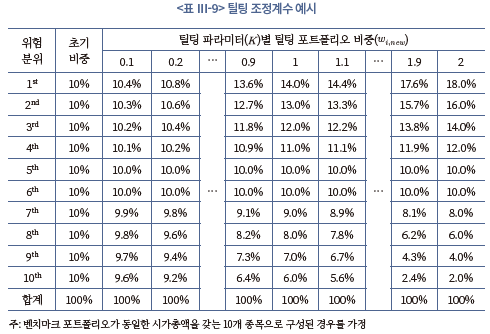

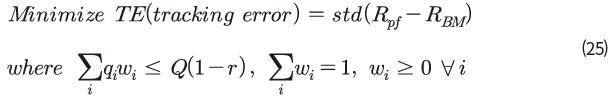

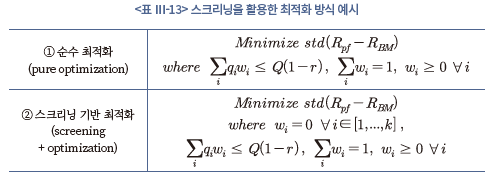

마지막으로 최적화 방식으로 저탄소 포트폴리오를 구성하기 위해 선행연구(Andersson et al., 2016; Bolton et al., 2022)에서 제시한 방법 중, MSCI 및 S&P Global 등 지수사업자가 가장 많이 활용하는 방식으로60) 최적화 문제(optimization problem)를 구성하였다. 최적화의 목적은 일정 수준 이상의 탄소 위험을 줄이며 동시에 벤치마크 지수와 유사한 위험-수익률 특징을 갖는 포트폴리오를 찾는 것이다. 다시 말해, 벤치마크 대비 탄소 위험을 줄이되 그 외 종합적인 공통 위험요인(common risk factor)에 대해 유사한 노출 정도를 갖는 포트폴리오를 구축하는 것이다. 이를 위해 최적화 문제의 목적함수를 벤치마크 모지수 대비 괴리율(tracking error)로 설정하고, 일정 수준 이상의 포트폴리오 탄소 위험 지표의 감소를 제약조건으로 하는 최소화 문제를 구성하였다.

이를 수식으로 표현하면 아래 식(25)와 같다. 과

과  은 각각 저탄소 포트폴리오와 벤치마크 유니버스의 일별 수익률을 나타낸다.61) 괴리율은 두 수익률 차이의 표준편차(standard deviation)로 정의한다. 괴리율이 낮을수록 저탄소 포트폴리오가 위험-수익률 관점에서 벤치마크와 유사한 특징을 가질 것이다. 한편, 아래 제약조건 식은 저탄소 포트폴리오의 탄소 위험(=가중평균 탄소집약도) 수준을 벤치마크 탄소 위험의 일정 비율

은 각각 저탄소 포트폴리오와 벤치마크 유니버스의 일별 수익률을 나타낸다.61) 괴리율은 두 수익률 차이의 표준편차(standard deviation)로 정의한다. 괴리율이 낮을수록 저탄소 포트폴리오가 위험-수익률 관점에서 벤치마크와 유사한 특징을 가질 것이다. 한편, 아래 제약조건 식은 저탄소 포트폴리오의 탄소 위험(=가중평균 탄소집약도) 수준을 벤치마크 탄소 위험의 일정 비율 이하로 맞출 것을 의미한다. 여기서

이하로 맞출 것을 의미한다. 여기서  는 벤치마크 포트폴리오의 가중평균 탄소집약도이며,

는 벤치마크 포트폴리오의 가중평균 탄소집약도이며,  은 개별종목 단위 탄소집약도이다. 제약조건에서 가장 중요한 변수는

은 개별종목 단위 탄소집약도이다. 제약조건에서 가장 중요한 변수는  인데,

인데,  은 포트폴리오의 탄소 위험 감축률(reduction rate)을 의미한다. 만약 벤치마크 대비 50% 정도의 탄소 위험을 줄인 포트폴리오를 구성하고자 한다면

은 포트폴리오의 탄소 위험 감축률(reduction rate)을 의미한다. 만약 벤치마크 대비 50% 정도의 탄소 위험을 줄인 포트폴리오를 구성하고자 한다면  을 0.5로 설정하면 된다. 본 절의 분석에서는 편의상

을 0.5로 설정하면 된다. 본 절의 분석에서는 편의상  을 20%(0.2)부터 80%(0.8)까지 5%(0.05) 단위로 변경하면서 최적화 문제를 푼다. 이 외 식(25)의 다른 제약조건 식은 포트폴리오 비중에 관한 일반적인 조건이다.62)

을 20%(0.2)부터 80%(0.8)까지 5%(0.05) 단위로 변경하면서 최적화 문제를 푼다. 이 외 식(25)의 다른 제약조건 식은 포트폴리오 비중에 관한 일반적인 조건이다.62)

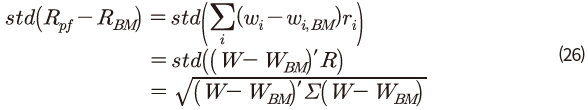

수치적인 방법을 이용하여 식(25)의 최적화 문제의 근사해를 찾으려면 목적함수와 제약조건을 매개변수인 투자비중 으로 나타낼 필요가 있다. 식(25)의 목적함수는 식(26)과 같이 투자비중의 함수로 표현할 수 있는데, 최종적으로 투자비중 벡터

으로 나타낼 필요가 있다. 식(25)의 목적함수는 식(26)과 같이 투자비중의 함수로 표현할 수 있는데, 최종적으로 투자비중 벡터 와 벤치마크 모지수의 비중

와 벤치마크 모지수의 비중 및 개별종목 간 수익률 분산-공분산 행렬(variance-covariance matrix)

및 개별종목 간 수익률 분산-공분산 행렬(variance-covariance matrix)  의 함수로 정의된다. 식(26)의

의 함수로 정의된다. 식(26)의  과

과  는 개별종목

는 개별종목  의 벤치마크 유니버스 내 비중 및 주식 수익률이며 이를 벡터(vector) 형태로 나타낸 것이

의 벤치마크 유니버스 내 비중 및 주식 수익률이며 이를 벡터(vector) 형태로 나타낸 것이  과

과  이다. 여기서 매개변수인 투자비중

이다. 여기서 매개변수인 투자비중  을 제외하면, 나머지 변수는 데이터를 통해 추정한 값을 사용하였다. 제약조건의 경우

을 제외하면, 나머지 변수는 데이터를 통해 추정한 값을 사용하였다. 제약조건의 경우  에 대해 간단한 1차 방정식 또는 부등식 형태로 정의되어 있으므로 추가적인 설명은 생략한다.

에 대해 간단한 1차 방정식 또는 부등식 형태로 정의되어 있으므로 추가적인 설명은 생략한다.

식(26)에서  은 12월 말 벤치마크 유니버스 내 종목별 시가총액 비중으로 정의하고,

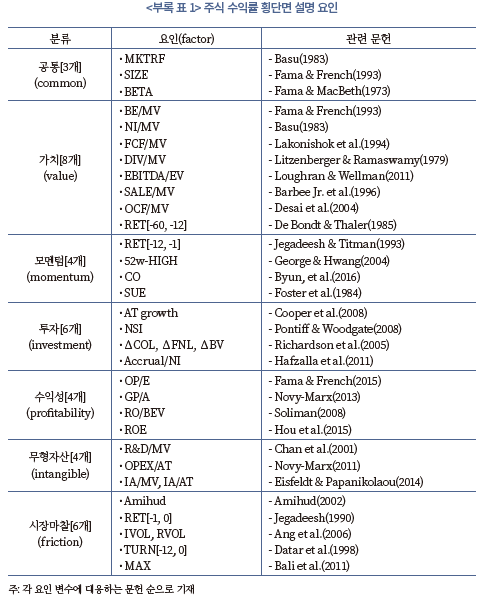

은 12월 말 벤치마크 유니버스 내 종목별 시가총액 비중으로 정의하고,  는 벤치마크에 포함된 모든 종목별 수익률 표준편차와 종목 간 수익률 상관계수로 산출할 수 있을 것이다. 다만 선행연구(예: Andersson et al., 2016)에서 지적했듯이, 종목별 상관계수의 경우 계산 부담과 더불어 추정하는 과정에서 오차(estimation error)가 발생할 수 있어 허위 상관관계(spurious correlation)가 나타날 가능성이 있다. 따라서 선행연구를 참조하여 식(26)의 종목별 분산-공분산 행렬을 공통 위험요인(risk factor, 팩터)의 분산-공분산 행렬과 위험요인에 대한 베타(beta, factor loading)로 치환하여 추정한다. 이는 개별종목 수익률에 비해 팩터 간 상관계수의 추정 오차가 작고, 무엇보다 최적화의 목적인 공통 위험요인에 대한 노출도를 벤치마크와 유사하게 가져가는 목적에 부합하기 때문이다. 팩터 모형의 활용 방법은 관련 연구의 방법론을 참고하였다(MSCI Barra, 2007; Andersson et al., 2016, Bolton et al., 2022).

는 벤치마크에 포함된 모든 종목별 수익률 표준편차와 종목 간 수익률 상관계수로 산출할 수 있을 것이다. 다만 선행연구(예: Andersson et al., 2016)에서 지적했듯이, 종목별 상관계수의 경우 계산 부담과 더불어 추정하는 과정에서 오차(estimation error)가 발생할 수 있어 허위 상관관계(spurious correlation)가 나타날 가능성이 있다. 따라서 선행연구를 참조하여 식(26)의 종목별 분산-공분산 행렬을 공통 위험요인(risk factor, 팩터)의 분산-공분산 행렬과 위험요인에 대한 베타(beta, factor loading)로 치환하여 추정한다. 이는 개별종목 수익률에 비해 팩터 간 상관계수의 추정 오차가 작고, 무엇보다 최적화의 목적인 공통 위험요인에 대한 노출도를 벤치마크와 유사하게 가져가는 목적에 부합하기 때문이다. 팩터 모형의 활용 방법은 관련 연구의 방법론을 참고하였다(MSCI Barra, 2007; Andersson et al., 2016, Bolton et al., 2022).

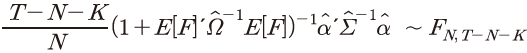

식(27)은 식(26)의 목적함수를 팩터의 분산-공분산 행렬 및 종목별 베타를 바탕으로 표현한 것이다. 개별종목의 수익률 벡터 를 팩터 모형으로 표현하면

를 팩터 모형으로 표현하면  와 같고(

와 같고( : 위험요인 벡터,

: 위험요인 벡터,  : 잔차), 이를 토대로 식(26)의

: 잔차), 이를 토대로 식(26)의  는 팩터의 분산-공분산 행렬인

는 팩터의 분산-공분산 행렬인  와 종목별 팩터에 대한 베타

와 종목별 팩터에 대한 베타 , 잔차항의 분산

, 잔차항의 분산 으로 표현된다.63) 따라서 종목별 분산-공분산 행렬을 계산하는 대신 팩터의 분산-공분산 행렬과 팩터에 대한 베타를 계산하여 최적화 문제를 해결하였다. 여기서 팩터의 분산-공분산 행렬과 베타는 최근 5년 팩터 수익률을 활용하여 계산하였다. 정리하면, 식(25)의 제약조건을 만족하면서 식(27)의 목적함수를 최소화하는 최적화 문제를 수치적인 방법을 이용한 근사해를 산출하였고(numerically approximate solution), 이를 최적화 방법을 활용한 저탄소 포트폴리오의 최적 비중으로 정의한다.

으로 표현된다.63) 따라서 종목별 분산-공분산 행렬을 계산하는 대신 팩터의 분산-공분산 행렬과 팩터에 대한 베타를 계산하여 최적화 문제를 해결하였다. 여기서 팩터의 분산-공분산 행렬과 베타는 최근 5년 팩터 수익률을 활용하여 계산하였다. 정리하면, 식(25)의 제약조건을 만족하면서 식(27)의 목적함수를 최소화하는 최적화 문제를 수치적인 방법을 이용한 근사해를 산출하였고(numerically approximate solution), 이를 최적화 방법을 활용한 저탄소 포트폴리오의 최적 비중으로 정의한다.

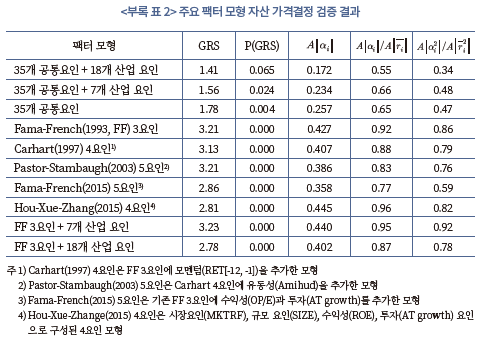

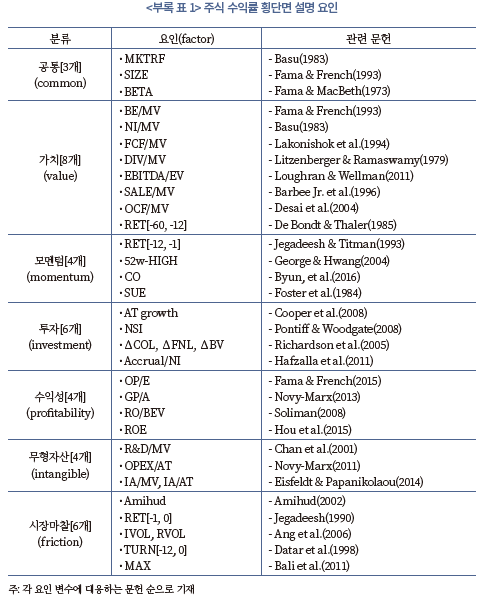

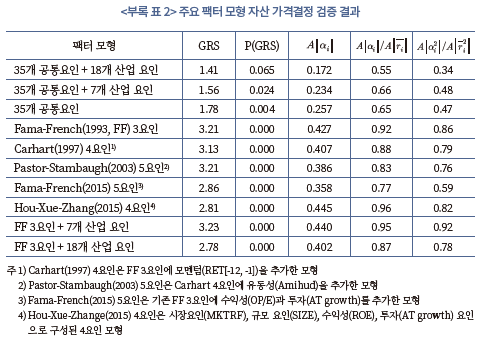

전술한 최적화 모형을 풀기 위해서는 적절한 팩터 모형을 설정해야 하는데, 본 연구에서는 주식 기대수익률의 횡단면과 관련된 많은 연구를 참고하여 한국 주식시장의 수익률 횡단면을 잘 설명하는 팩터 모형을 구축하였다. 수많은 요인 변수를 고려하였고 최종적으로 35개의 공통요인과 18개의 산업 요인을 포함한 모형을 선택하였다. 선행연구에서는 미국 주식시장 내 68개의 요인 모형을 사용한 바 있다(Andersson et al., 2016). 한국 주식시장의 팩터 모형에 대한 자세한 구축 과정에 대한 설명은 부록 2을 참조한다.

다. 분석 결과

앞서 설명한 방법론을 토대로 한국 주식시장의 저탄소 포트폴리오를 구축해보자. 크게 스크리닝, 틸팅, 최적화 방법에 관한 결과를 차례로 요약하고 각 방법의 특징을 비교해봄으로써, 우리나라 주식시장에서 저탄소 포트폴리오의 구축 및 실행 가능성(feasibility)을 검증한다. 이 절에서 사용한 포트폴리오 구성 방법은 해외의 주요 지수사업자와 기관투자자가 포트폴리오 탄소중립을 위한 탈탄소 지수를 구성할 때 활용하고 있는 방식으로, 분석 결과를 토대로 우리나라 주식시장 내 저탄소 투자의 활용 가능성을 확인할 수 있을 것이다.

1) 스크리닝 및 틸팅 방식의 저탄소 포트폴리오 구성 결과

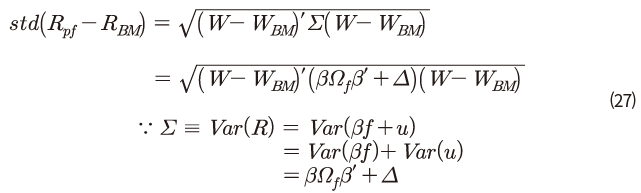

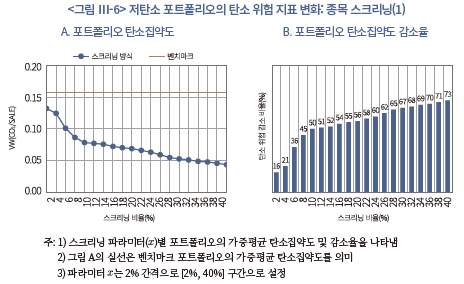

먼저 스크리닝 방식을 활용한 저탄소 포트폴리오의 효과를 살펴보자. <그림 Ⅲ-6>은 종목 스크리닝 결과를 나타내고 있다. 상위 %의 고위험 종목을 투자 유니버스에서 제외할 때마다 포트폴리오의 가중평균 탄소집약도(식(21))의 변화(그림 A)와 벤치마크 대비 감소율(그림 B)을 산출하였다.64) 스크리닝 파라미터

%의 고위험 종목을 투자 유니버스에서 제외할 때마다 포트폴리오의 가중평균 탄소집약도(식(21))의 변화(그림 A)와 벤치마크 대비 감소율(그림 B)을 산출하였다.64) 스크리닝 파라미터  는 2%부터 40%까지 2% 간격으로 변경한다. 분석 결과 탄소 위험 지표 상위 10%의 종목을 제거하면 포트폴리오의 탄소 위험이 벤치마크 대비 50% 감소하는 것으로 나타난다. 또한 포트폴리오 탄소 위험 수준이 파라미터가 작을 때 빠르게 감소하다가 이후 일정 수준을 넘어가면 감소율의 한계 변화가 줄어든다. 이는 벤치마크 기업의 온실가스 배출량 및 탄소집약도 등 탄소 위험 지표가 표본 내에서 비대칭적으로 분포해 있기 때문으로 추정된다(Koch & Bassen, 2013). 즉, 탄소 위험 지표가 연속적인 값을 가질 수 있지만, 일부 기업에서는 매우 큰 값을 보이는 것으로 해석된다. 이러한 결과는 단순 배출량을 기반으로 해도 질적으로 유사하다. 실무적인 관점에서 스크리닝 방식을 활용할 때 탄소 위험 지표의 분포에 따라 최적 파라미터를 설정해야 할 것으로 판단된다.

는 2%부터 40%까지 2% 간격으로 변경한다. 분석 결과 탄소 위험 지표 상위 10%의 종목을 제거하면 포트폴리오의 탄소 위험이 벤치마크 대비 50% 감소하는 것으로 나타난다. 또한 포트폴리오 탄소 위험 수준이 파라미터가 작을 때 빠르게 감소하다가 이후 일정 수준을 넘어가면 감소율의 한계 변화가 줄어든다. 이는 벤치마크 기업의 온실가스 배출량 및 탄소집약도 등 탄소 위험 지표가 표본 내에서 비대칭적으로 분포해 있기 때문으로 추정된다(Koch & Bassen, 2013). 즉, 탄소 위험 지표가 연속적인 값을 가질 수 있지만, 일부 기업에서는 매우 큰 값을 보이는 것으로 해석된다. 이러한 결과는 단순 배출량을 기반으로 해도 질적으로 유사하다. 실무적인 관점에서 스크리닝 방식을 활용할 때 탄소 위험 지표의 분포에 따라 최적 파라미터를 설정해야 할 것으로 판단된다.

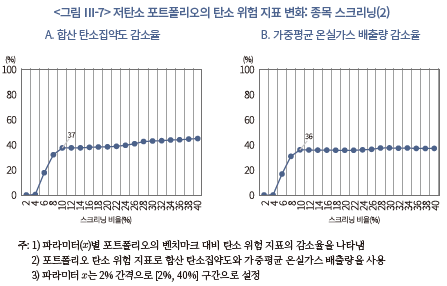

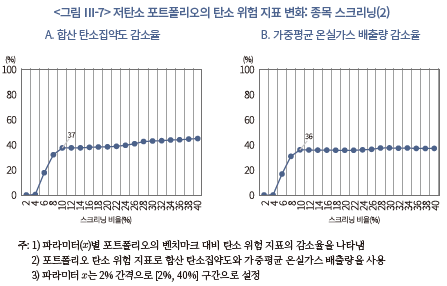

<그림 Ⅲ-7>은 탄소 위험 지표를 합산 탄소집약도(식(22))와 가중평균 탄소 배출량(식(20))으로 변경하여, 각 위험 지표의 감소율을 스크리닝 정도( )에 따라 그림으로 나타낸 것이다. 가중평균 탄소집약도와 달리 일정 비율(예:

)에 따라 그림으로 나타낸 것이다. 가중평균 탄소집약도와 달리 일정 비율(예:  =10%)을 넘어가면 탄소 위험의 감소가 크게 관찰되지 않는다. 이는 기업 단위 양적 지표(배출량)가 비율 지표(탄소집약도)보다 더욱 비대칭적으로 분포해 있는 것을 시사한다. 적정 수준의 스크리닝 비율을 선정하면 괴리율을 최대한 낮추면서 적절한 수준의 탄소 위험에 노출된 포트폴리오를 구축할 수 있을 것으로 판단된다.

=10%)을 넘어가면 탄소 위험의 감소가 크게 관찰되지 않는다. 이는 기업 단위 양적 지표(배출량)가 비율 지표(탄소집약도)보다 더욱 비대칭적으로 분포해 있는 것을 시사한다. 적정 수준의 스크리닝 비율을 선정하면 괴리율을 최대한 낮추면서 적절한 수준의 탄소 위험에 노출된 포트폴리오를 구축할 수 있을 것으로 판단된다.

탄소 위험의 감소도 중요하지만, 벤치마크 모지수 대비 괴리율도 투자 수익률 관점에서 중요한 지표라고 할 수 있다. 특히 대형 기관투자자 관점에서 탄소 위험을 줄이기 위해 투자 대상을 많이 배제할수록 모지수와의 격차가 커질 수 있어서, 저탄소 투자의 기회비용을 최소화할 수 있는 적절한 수준의 벤치마크 괴리율을 유지하는 것이 중요하다.

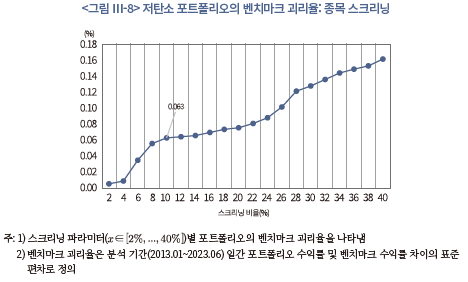

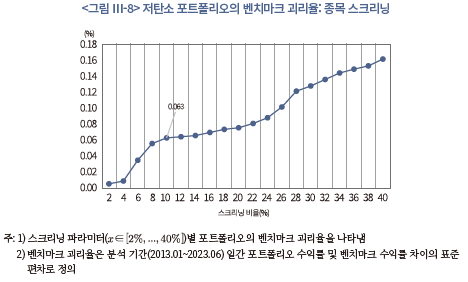

<그림 Ⅲ-8>은 스크리닝 비율 변경에 따른 벤치마크 괴리율을 나타낸 것이다. 괴리율은 포트폴리오 구성 후 스크리닝 포트폴리오의 수익률과 벤치마크 수익률 간 편차의 표준편차로 계산하였다(ex-post tracking error). 그림에서 알 수 있듯이 벤치마크 괴리율은 스크리닝 비율이 증가할수록 꾸준히 상승하는 형태를 보인다. 앞서 포트폴리오의 탄소 위험 수준의 감소가 일정 비율 이상에서 정체하는 점을 고려하면, 지나친 스크리닝은 투자의 편익보다는 비용이 클 것을 암시한다. <그림 Ⅲ-6, 7, 8>을 모두 고려했을 때, 적절한 수준의 괴리율을 유지하면서 탄소 위험을 줄일 수 있는 스크리닝 비율은 10%인 것으로 평가된다. 물론, 이러한 결과는 탄소 위험 대용치 및 투자 대상 유니버스의 변경에 따라 달라질 수 있다.

추가로 섹터 스크리닝의 특징과 성과를 간략히 살펴보기 위해, 연도별 포트폴리오 조정 시점에 상위 10% 고위험 섹터를 제거하는 전략을 살펴보았다. 원자료의 특성상 표본 상장기업이 10개의 섹터로 분류되므로65), 섹터 단위의 탄소 위험이 가장 큰 1개 섹터를 표본에서 제거하는 스크리닝 포트폴리오를 고려하였다.66) 섹터 단위 탄소 위험은 포트폴리오와 마찬가지로 시가총액 비중을 가중평균한 탄소집약도로 추정하였다.

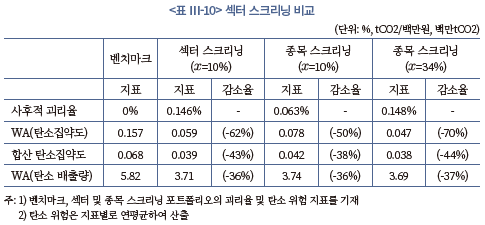

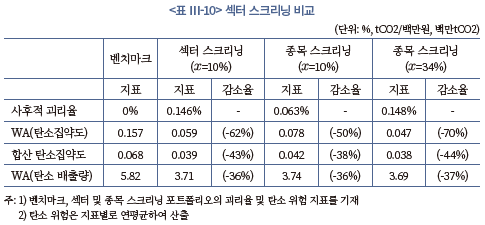

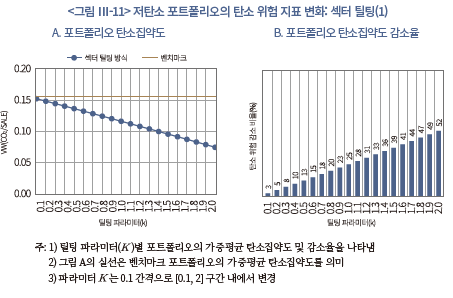

<표 Ⅲ-10>은 섹터 스크리닝 결과를 벤치마크 및 종목 스크리닝 결과와 비교하여 나타낸 표이다. 먼저 가중평균(weighted average: WA) 탄소집약도(식(21))의 경우, 섹터 스크리닝 포트폴리오의 탄소 위험이 벤치마크 대비 62% 감소하여, 같은 10% 비율의 종목 스크리닝(50% 감소)에 비해 탄소 위험을 더 낮추는 것으로 보인다. 합산 탄소집약도(식(22))의 감소율도 더 크게 나타난다. 반면 괴리율 측면에서 평가할 경우, 섹터 스크리닝이 종목 스크리닝에 비해 벤치마크 괴리가 더 큰 것으로 확인된다. 섹터 스크리닝의 일별 괴리율은 약 0.146%로 같은 비율의 종목 스크리닝 포트폴리오(0.063%)에 비해 2배 이상 크다. 이는 <표 Ⅲ-10>에서도 알 수 있듯이 위험 지표 상위 34%를 제거하는 종목 스크리닝의 괴리율과 유사한데, 섹터 스크리닝(=10%)과 유사한 수준의 괴리율을 갖는 종목 스크리닝(=34%) 포트폴리오의 탄소 위험 지표 감소율이 오히려 더 크게 관찰된다. 종목 대신 섹터를 스크리닝할 경우에는 괴리율 관점에서 편익 대비 비용이 큰 것을 알 수 있다. 이러한 요인을 데이터와 표본의 특성에서 찾을 수도 있겠지만, 섹터 스크리닝을 종목 스크리닝과 비교했을 때 산업 분산(industry diversification) 측면에서 효과적인 포트폴리오를 구성하기 어렵기 때문이다. 물론 특정 산업군을 잘 정의하여 해당 그룹을 제거하는 포트폴리오(예: 화석연료 배제)를 고려할 수 있지만, 이 경우 투자자의 지속적인 기업 관여(engagement)가 어렵고 꾸준한 탈탄소 유인을 제공하기 어려운 단점이 남게 된다. 전반적으로 스크리닝 방식의 저탄소 포트폴리오 구성은 실행이 간단하고, 적절한 파라미터를 설정하면 유의미한 탄소 위험과 적절한 수준의 괴리율을 만족하는 포트폴리오를 찾을 수 있는 장점이 있는 것으로 판단된다. 다만 지속적인 투자가 어려운 점과 과도한 섹터 스크리닝이 높은 괴리율로 이어질 수 있으므로 투자자 관점에서 적절한 기준을 선택할 필요가 있다.

다음으로 틸팅 방식의 저탄소 포트폴리오 구성 결과를 확인해보자. 앞서 스크리닝 방식과 비교하기 위해 포트폴리오의 탄소 위험을 모지수 대비 약 50%를 줄이는 포트폴리오를 기준으로 살펴보았다(EU PAB 기준 참고). 종목(섹터) 틸팅 방식은 리벨런싱 시점에 표본 기업(섹터)을 10개 그룹으로 나눈 뒤 분위별로 비중을 틸팅하는 방법을 적용하였다.

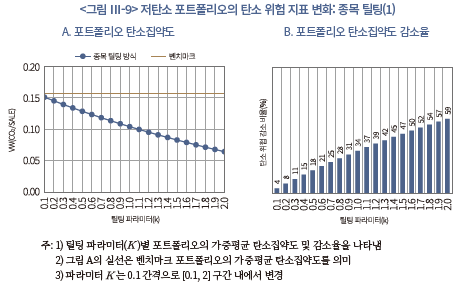

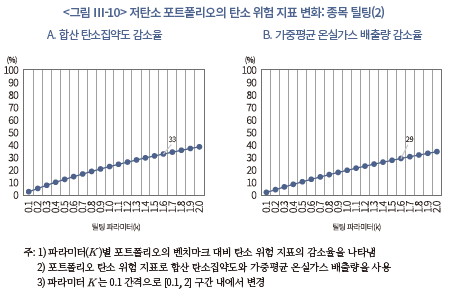

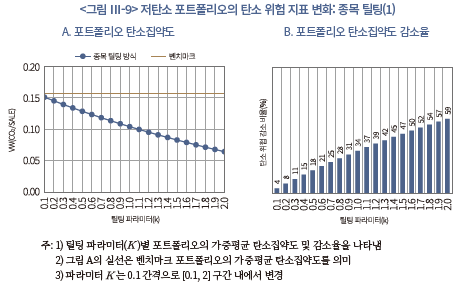

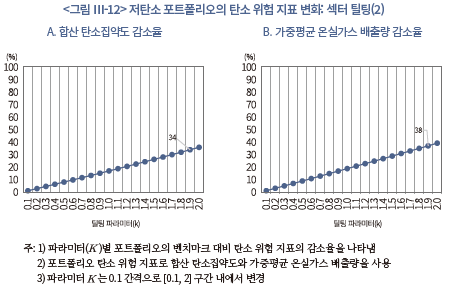

<그림 Ⅲ-9>와 <그림 Ⅲ-10>은 종목 틸팅(security tilting)을 실행한 저탄소 포트폴리오의 탄소 위험 감소 수준을 여러 지표를 기준으로 나타낸 결과이다. 앞서 스크리닝 결과와 마찬가지로 벤치마크 포트폴리오의 탄소 위험 대비 감소율로 저탄소 포트폴리오 성과를 측정하였다. <그림 Ⅲ-9>는 틸팅 포트폴리오의 가중평균 탄소집약도(그림 A, 식(21) 참고))와 벤치마크 대비 탄소 위험 감소율(그림 B)을 보여주는데, 틸팅 비중이 파라미터에 따라 선형적으로 결정되므로 감소율도 선형으로 증가하는 것을 알 수 있다. 특히 탄소 위험을 50% 정도 줄이기 위해서는 종목 틸팅 파라미터( )가 1.6이 되어야 하며, 이는 탄소 위험 최상‧하위 10분위 그룹의 비중을 벤치마크 대비 64% 조정한 포트폴리오를 의미한다.67) 틸팅 방식은 스크리닝과 달리 탄소 위험이 큰 종목에 대한 투자도 고려하므로, 투자비중을 크게 조정해야 유의미하게 포트폴리오 단위 탄소 위험을 낮출 수 있는 것으로 평가된다.

)가 1.6이 되어야 하며, 이는 탄소 위험 최상‧하위 10분위 그룹의 비중을 벤치마크 대비 64% 조정한 포트폴리오를 의미한다.67) 틸팅 방식은 스크리닝과 달리 탄소 위험이 큰 종목에 대한 투자도 고려하므로, 투자비중을 크게 조정해야 유의미하게 포트폴리오 단위 탄소 위험을 낮출 수 있는 것으로 평가된다.

한편 <그림 Ⅲ-10>에서 알 수 있듯이, 가중평균 탄소집약도를 50% 줄이는 틸팅 포트폴리오(=1.6)는 같은 수준의 스크리닝 포트폴리오( =10%)에 비해 다른 탄소 위험 지표가 다소 높게 측정된다. 예를 들어, 포트폴리오 가중평균 온실가스 배출량(식(20))의 경우 틸팅 포트폴리오(

=10%)에 비해 다른 탄소 위험 지표가 다소 높게 측정된다. 예를 들어, 포트폴리오 가중평균 온실가스 배출량(식(20))의 경우 틸팅 포트폴리오( =1.6)가 4.12백만tCO2(벤치마크 대비 29% 감소)이고 비교 대상 스크리닝 포트폴리오(

=1.6)가 4.12백만tCO2(벤치마크 대비 29% 감소)이고 비교 대상 스크리닝 포트폴리오( 10%)는 3.74백만tCO2(벤치마크 대비 36% 감소)로 계산된다. 개별종목 단위 온실가스 배출량이 일부 종목과 섹터에 집중되어 있으므로, 스크리닝과 같은 투자배제(divest) 기반의 비중 조절 방식이 틸팅 방식에 비해 효율적으로 포트폴리오 탄소 위험 관리가 가능할 것으로 판단된다.

10%)는 3.74백만tCO2(벤치마크 대비 36% 감소)로 계산된다. 개별종목 단위 온실가스 배출량이 일부 종목과 섹터에 집중되어 있으므로, 스크리닝과 같은 투자배제(divest) 기반의 비중 조절 방식이 틸팅 방식에 비해 효율적으로 포트폴리오 탄소 위험 관리가 가능할 것으로 판단된다.

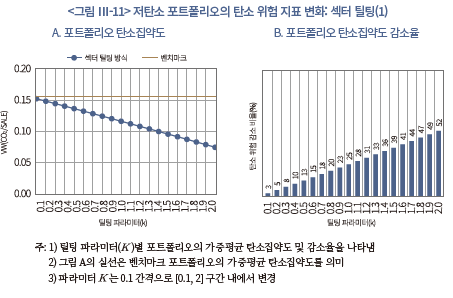

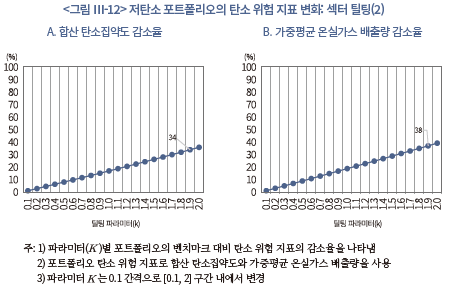

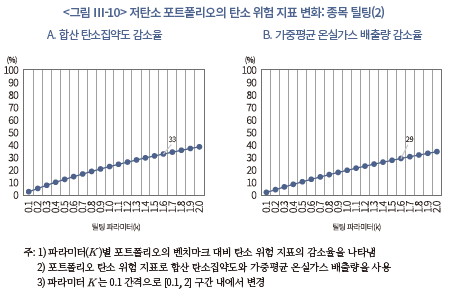

한편, <그림 Ⅲ-11>과 <그림 Ⅲ-12>는 각각 섹터 틸팅(sector tilting) 포트폴리오의 탄소 위험 감소 효과를 보여주고 있다. 가중평균 탄소집약도(식(21))를 기준으로 할 때 벤치마크 포트폴리오 대비 약 50% 수준으로 탄소 위험을 줄이기 위해서는 틸팅 파라미터( )가 최소 1.9 정도 되어야 함을 알 수 있다. 이는 같은 50% 수준의 탄소 위험 감소를 위한 종목 틸팅 파라미터(

)가 최소 1.9 정도 되어야 함을 알 수 있다. 이는 같은 50% 수준의 탄소 위험 감소를 위한 종목 틸팅 파라미터( =1.6)보다 높게 설정되는 것이다. 탄소 위험을 절반으로 줄이기 위한

=1.6)보다 높게 설정되는 것이다. 탄소 위험을 절반으로 줄이기 위한  가 1.9라는 점은 탄소집약도 10분위 포트폴리오 내 최대 76%의 벤치마크 비중 틸팅이 발생하는 것을 의미한다. 섹터 틸팅의 최소 파라미터 크기가 상대적으로 크기 때문에, 종목 틸팅에 비해 섹터 틸팅의 벤치마크 괴리율이 높을 것으로 예상된다.

가 1.9라는 점은 탄소집약도 10분위 포트폴리오 내 최대 76%의 벤치마크 비중 틸팅이 발생하는 것을 의미한다. 섹터 틸팅의 최소 파라미터 크기가 상대적으로 크기 때문에, 종목 틸팅에 비해 섹터 틸팅의 벤치마크 괴리율이 높을 것으로 예상된다.

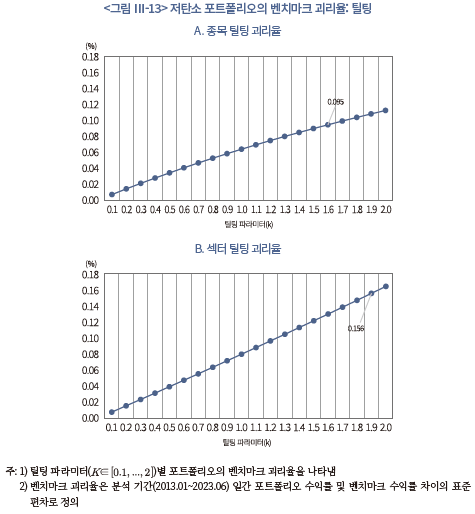

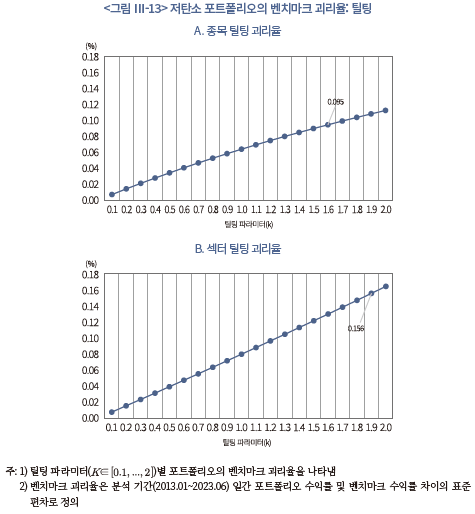

<그림 Ⅲ-13>은 앞서 구성한 종목 및 섹터 틸팅 포트폴리오의 파라미터별 벤치마크 괴리율을 나타내고 있다. 스크리닝과 달리 틸팅 방식은 개별종목의 탄소 위험 수준이 매우 높아도 최소한의 투자비중은 유지되기 때문에, 같은 수준의 탄소 위험 감소를 달성하려면 벤치마크와의 투자비중 괴리가 더욱 커질 필요가 있다. 따라서 벤치마크 포트폴리오 대비 약 50% 수준의 탄소 위험 감소를 유지하기 위한 괴리율은 종목 틸팅 포트폴리오가 0.095%( =1.6), 섹터 틸팅의 경우 0.156%(

=1.6), 섹터 틸팅의 경우 0.156%( =1.9)로 나타난다. 앞서 살펴보았던 종목 스크리닝(

=1.9)로 나타난다. 앞서 살펴보았던 종목 스크리닝( 10%)의 괴리율인 0.063%와 비교했을 때 틸팅 포트폴리오의 괴리율이 더 높게 나타난다. 다만 틸팅 방식의 경우, 탈탄소화를 진행해야 하는 기업 또는 섹터에 대한 지속적인 투자를 통해 최소한의 탈탄소 유인을 제공할 수 있다는 점에서, 스크리닝 방식에 비해 상대적으로 지속가능성이 크고 그린워싱의 위험이 적다고 볼 수 있다. 탄소 위험 지표를 변경해도 분석 결과상 관찰되는 틸팅 방식의 특징은 질적으로 유사하게 나타났다.

10%)의 괴리율인 0.063%와 비교했을 때 틸팅 포트폴리오의 괴리율이 더 높게 나타난다. 다만 틸팅 방식의 경우, 탈탄소화를 진행해야 하는 기업 또는 섹터에 대한 지속적인 투자를 통해 최소한의 탈탄소 유인을 제공할 수 있다는 점에서, 스크리닝 방식에 비해 상대적으로 지속가능성이 크고 그린워싱의 위험이 적다고 볼 수 있다. 탄소 위험 지표를 변경해도 분석 결과상 관찰되는 틸팅 방식의 특징은 질적으로 유사하게 나타났다.

2) 최적화 방식의 저탄소 포트폴리오 구성 결과

마지막으로 한국 주식시장 내 최적 저탄소 포트폴리오를 앞서 설명한 최적화 방법론을 바탕으로 구성해보자. 이를 수행하기 위해 일정 수준 이상 포트폴리오의 탄소 위험을 줄이면서 벤치마크 괴리율을 최소화하는 최적 투자비중을 찾아보았다. 최적화 방식은 틸팅, 스크리닝 방식과 달리 사전에 정의된 투자비중 결정식이 없으므로 수치적인 방법을 활용하여 근사해(numerical solution)를 찾는다. 이 절에서는 미래참조편향(look-ahead bias)을 사전에 차단하기 위해, 목적함수를 사후적 괴리율이 아닌 사전적 괴리율(ex-ante tracking error)로 표현한다. 포트폴리오를 1년마다 교체하므로 사전적 괴리율은 리벨런싱 시점으로부터 과거 1년 동안의 벤치마크 모지수 대비 괴리율로 정의된다.68) 또한, 제약조건으로 벤치마크 대비 탄소 감축 목표치를 20%에서 80% 사이로 두고 최적화 문제를 풀었다.

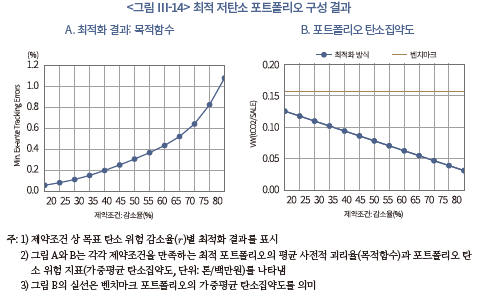

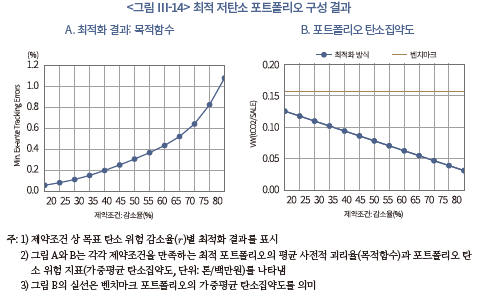

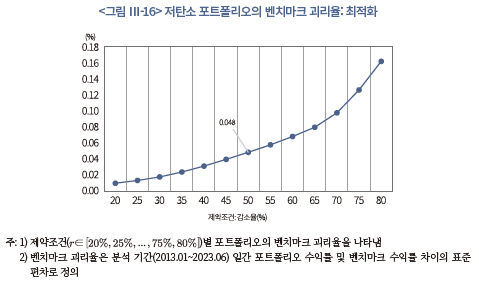

<그림 Ⅲ-14>는 목표 탄소 위험 감소율(식(25)의 ) 별로 산출된 최적 저탄소 포트폴리오의 최적화 결과를 요약한 것이다. 그림 A는 최적화 결과 계산된 사전적 괴리율(목적함수)을 보여주고 있고, 그림 B는 제약조건을 만족하는 최종 저탄소 포트폴리오의 탄소 위험 지표를 나타낸 것이다. 포트폴리오 탄소 위험으로 가중평균 탄소집약도(식(21))를 사용하였다. 먼저, 최적화 결과 최적 포트폴리오의 근사해를 찾을 수 있었다. 최적화 비중으로 계산한 포트폴리오 가중평균 탄소집약도는 제약조건을 정확히 만족한다(그림 B). 가령

) 별로 산출된 최적 저탄소 포트폴리오의 최적화 결과를 요약한 것이다. 그림 A는 최적화 결과 계산된 사전적 괴리율(목적함수)을 보여주고 있고, 그림 B는 제약조건을 만족하는 최종 저탄소 포트폴리오의 탄소 위험 지표를 나타낸 것이다. 포트폴리오 탄소 위험으로 가중평균 탄소집약도(식(21))를 사용하였다. 먼저, 최적화 결과 최적 포트폴리오의 근사해를 찾을 수 있었다. 최적화 비중으로 계산한 포트폴리오 가중평균 탄소집약도는 제약조건을 정확히 만족한다(그림 B). 가령  이 50%인 제약조건의 경우, 최적 포트폴리오의 탄소 위험 지표는 0.078(단위: 톤/백만원)로 벤치마크 포트폴리오의 탄소 위험 지표(0.157)와 비교했을 때 50% 이상 위험 수준이 감소하였다. 이 외에도 각각의

이 50%인 제약조건의 경우, 최적 포트폴리오의 탄소 위험 지표는 0.078(단위: 톤/백만원)로 벤치마크 포트폴리오의 탄소 위험 지표(0.157)와 비교했을 때 50% 이상 위험 수준이 감소하였다. 이 외에도 각각의  에 따른 제약조건을 만족하는 최적 투자비중이 산출되었다. 또한, 제약조건이 강화될수록 사전적 괴리율(목적함수 값)이 증가한다. 제약조건이 보수적일수록 이를 만족하는 최적 투자비중의 벤치마크 괴리도가 증가함을 알 수 있다. 따라서 적정 수준의 탄소 감축 목표치를 기준으로 최적 포트폴리오를 추정하는 접근이 요구된다.

에 따른 제약조건을 만족하는 최적 투자비중이 산출되었다. 또한, 제약조건이 강화될수록 사전적 괴리율(목적함수 값)이 증가한다. 제약조건이 보수적일수록 이를 만족하는 최적 투자비중의 벤치마크 괴리도가 증가함을 알 수 있다. 따라서 적정 수준의 탄소 감축 목표치를 기준으로 최적 포트폴리오를 추정하는 접근이 요구된다.

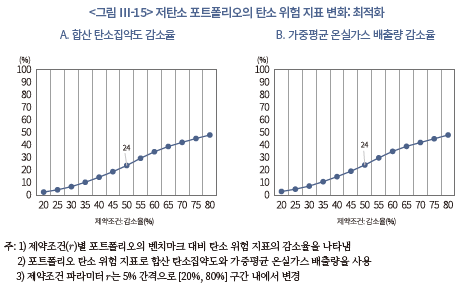

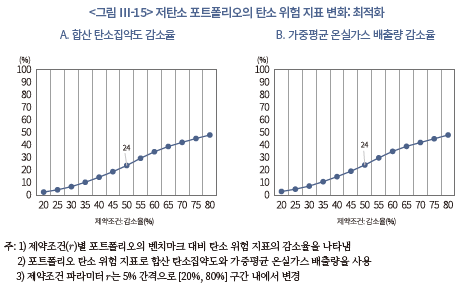

<그림 Ⅲ-15>는 탄소 위험 대용치를 변경하여, 최적화 방식으로 추정한 저탄소 포트폴리오의 벤치마크 대비 탄소 위험 감소 효과를 보여주고 있다. 그림 A와 B에서 알 수 있듯이, 벤치마크 포트폴리오 대비 약 50% 수준으로 탄소 위험(가중평균 탄소집약도 기준)을 줄이는 최적 포트폴리오의 합산 탄소집약도(식(22)) 및 가중평균 배출량(식(20)) 감소율은 24%로 동일하다. 이는 같은 수준의 탄소 위험을 낮추는 종목 스크리닝( 10%), 종목 틸팅(

10%), 종목 틸팅( =1.6), 섹터 틸팅(

=1.6), 섹터 틸팅( =1.9) 방식에 비해 합산 지표의 감소율이 낮다. 종목 스크리닝, 종목 틸팅, 섹터 틸팅의 합산 탄소집약도의 벤치마크 대비 감소율은 각각 37%, 33%, 34%이며, 가중평균 온실가스 배출량 감소율은 36%, 29%, 38%이다(<그림 Ⅲ-7, 10, 12> 참고). 이는 최적화 문제의 제약조건 식에 가중평균 탄소집약도만 포함되었기 때문으로 판단된다. 만약 제약조건에 사용된 포트폴리오 탄소 위험 대용치를 변경하면 해당 제약조건을 만족하는 최적 투자비중을 찾을 수 있을 것이다. 이처럼 최적화 방식은 제약조건과 목적함수 상에 사용된 지표에 대해서는 최적화된 결과를 제시하지만, 그 외 지표의 경우 성과가 다소 저조할 수 있다.

=1.9) 방식에 비해 합산 지표의 감소율이 낮다. 종목 스크리닝, 종목 틸팅, 섹터 틸팅의 합산 탄소집약도의 벤치마크 대비 감소율은 각각 37%, 33%, 34%이며, 가중평균 온실가스 배출량 감소율은 36%, 29%, 38%이다(<그림 Ⅲ-7, 10, 12> 참고). 이는 최적화 문제의 제약조건 식에 가중평균 탄소집약도만 포함되었기 때문으로 판단된다. 만약 제약조건에 사용된 포트폴리오 탄소 위험 대용치를 변경하면 해당 제약조건을 만족하는 최적 투자비중을 찾을 수 있을 것이다. 이처럼 최적화 방식은 제약조건과 목적함수 상에 사용된 지표에 대해서는 최적화된 결과를 제시하지만, 그 외 지표의 경우 성과가 다소 저조할 수 있다.

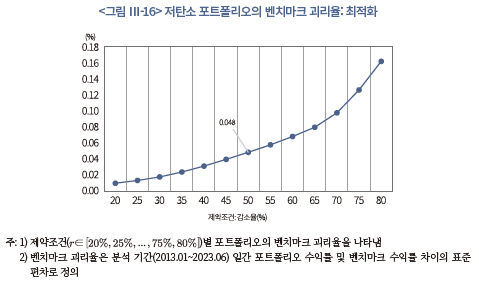

다음으로 목적함수로 사용된 괴리율 관점에서 최적 포트폴리오의 벤치마크 대비 사후적 괴리율(ex-post tracking error)을 살펴보자. 미래참조편향을 배제하기 위해 사전적 괴리율을 목적함수로 사용했기 때문에, 최적 비중으로 투자한 포트폴리오의 실제 사후적 괴리율은 달라질 수 있다. <그림 Ⅲ-16>은 제약조건 별 사후적 괴리율 보여주는데, 이는 앞서 스크리닝 및 틸팅 방식과 마찬가지로 분석 기간 수익률 편차(표트폴리오 – 벤치마크)의 표준편차로 정의하였다. 그림에서 표시한 것처럼 목표 탄소 위험 감축률(=50%)을 만족하는 최적 저탄소 포트폴리오의 괴리율은 0.048%이다. 이는 앞선 절에서 대조군으로 설정한 종목 스크리닝(

별 사후적 괴리율 보여주는데, 이는 앞서 스크리닝 및 틸팅 방식과 마찬가지로 분석 기간 수익률 편차(표트폴리오 – 벤치마크)의 표준편차로 정의하였다. 그림에서 표시한 것처럼 목표 탄소 위험 감축률(=50%)을 만족하는 최적 저탄소 포트폴리오의 괴리율은 0.048%이다. 이는 앞선 절에서 대조군으로 설정한 종목 스크리닝( 10%), 종목 틸팅(

10%), 종목 틸팅( =1.6), 섹터 틸팅(

=1.6), 섹터 틸팅( =1.9)의 괴리율인 0.063%, 0.095%, 0.156%에 비해 유의미하게 낮은 수치로 판단된다. 이는 두 가지를 시사하는데, 첫째 사전적 괴리율을 목적함수로 설정해도 제약조건이 까다롭지 않으면 포트폴리오의 사후적 괴리율도 유의미하게 낮출 수 있다. 둘째, 최적화 방식의 저탄소 포트폴리오는 다른 방식과 유사한 수준의 탄소 위험을 감소시키면서(제약조건) 벤치마크 대비 괴리율을 최소화할 수 있는 방법이다. 만약 모지수를 어느 정도 추종하면서 저탄소 투자를 병행하고자 한다면, 최적화 방식이 틸팅 및 스크리닝 방식에 비해 투자 수익률 관점에서 기회비용이 가장 작다고 볼 수 있다.

=1.9)의 괴리율인 0.063%, 0.095%, 0.156%에 비해 유의미하게 낮은 수치로 판단된다. 이는 두 가지를 시사하는데, 첫째 사전적 괴리율을 목적함수로 설정해도 제약조건이 까다롭지 않으면 포트폴리오의 사후적 괴리율도 유의미하게 낮출 수 있다. 둘째, 최적화 방식의 저탄소 포트폴리오는 다른 방식과 유사한 수준의 탄소 위험을 감소시키면서(제약조건) 벤치마크 대비 괴리율을 최소화할 수 있는 방법이다. 만약 모지수를 어느 정도 추종하면서 저탄소 투자를 병행하고자 한다면, 최적화 방식이 틸팅 및 스크리닝 방식에 비해 투자 수익률 관점에서 기회비용이 가장 작다고 볼 수 있다.

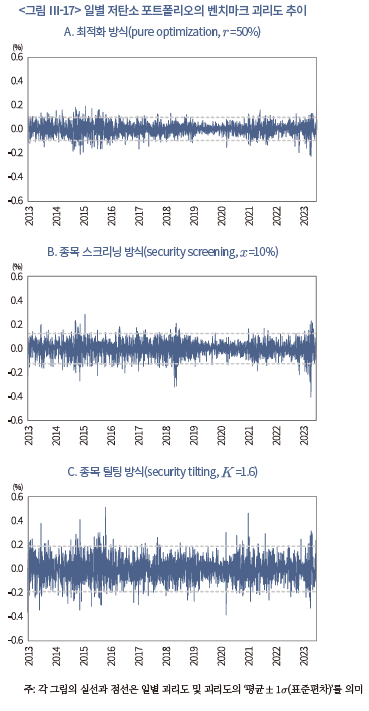

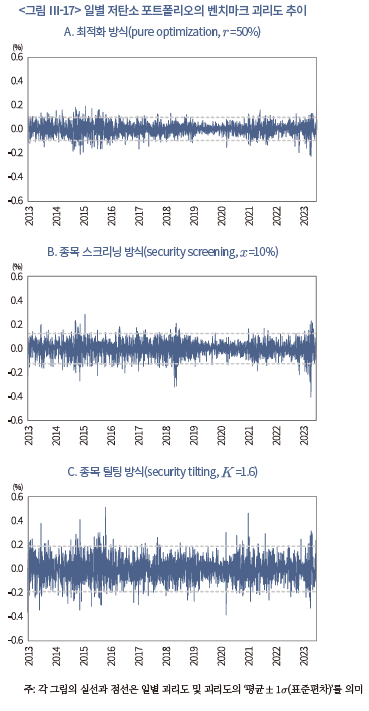

<그림 Ⅲ-17>은 비교 대상으로 선정한 세 가지 방식의 일별 벤치마크 괴리도(=포트폴리오 수익률 – 벤치마크 수익률)를 그린 것이다. 점선은 괴리도의 평균 표준편차(=괴리율)를 나타낸다. 그림에서도 알 수 있듯이 분석 기간 내 최적화 방식의 괴리도가 가장 낮게 관찰된다. 따라서 벤치마크를 최대한 추종하는 포트폴리오를 구성한다면 최적화 방식이 제일 적합하다.

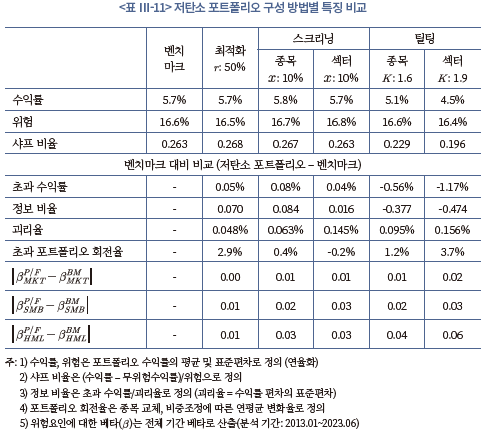

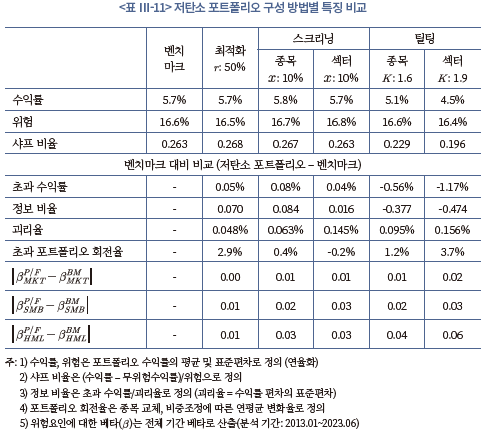

위험-수익률 측면에서 저탄소 포트폴리오의 다른 특징을 비교해보자(<표 Ⅲ-11>). 비교가능성을 제고하기 위해 포트폴리오의 가중평균 탄소집약도를 벤치마크 대비 50% 낮춘 포트폴리오를 비교하였다(최적화:  =50%, 스크리닝:

=50%, 스크리닝:  =10%, 틸팅(종목): =

=10%, 틸팅(종목): = 1.6, 틸팅(섹터):

1.6, 틸팅(섹터):  =1.9). 먼저 연간 수익률과 위험(수익률 표준편차), 샤프 비율(Sharpe ratio)의 경우, 최적화 및 종목 스크리닝 방식의 위험 대비 수익률이 상대적으로 높게 관찰된다. 초과 수익률과 정보 비율(information ratio) 관점에서도 유사한 결과가 도출되는데, 분석 기간 내 탄소집약도가 큰 종목의 위험 대비 수익률이 상대적으로 저조했던 것으로 추정된다.

=1.9). 먼저 연간 수익률과 위험(수익률 표준편차), 샤프 비율(Sharpe ratio)의 경우, 최적화 및 종목 스크리닝 방식의 위험 대비 수익률이 상대적으로 높게 관찰된다. 초과 수익률과 정보 비율(information ratio) 관점에서도 유사한 결과가 도출되는데, 분석 기간 내 탄소집약도가 큰 종목의 위험 대비 수익률이 상대적으로 저조했던 것으로 추정된다.

둘째, 앞서 언급한 바와 같이 벤치마크 대비 괴리율은 최적화 방식이 가장 낮게 관찰된다. 최적화 방식은 모지수를 가장 잘 추종하는 방식이며, 다른 공통 위험요인에 대한 노출도 벤치마크와 가장 유사하게 가져갈 수 있다. <표 Ⅲ-11>의 하단에 Fama & French(1993) 3-요인 모형의 시장요인 , 규모요인

, 규모요인 , 가치요인

, 가치요인 에 대한 베타(위험 노출 수준)를 벤치마크와 비교한 결과를 보여주고 있다. 최적화 방식의 베타는 벤치마크 베타와 차이가 0.01 미만으로 벤치마크와 거의 유사한 위험 노출 수준을 보여준다. 한편 이러한 베타의 차이는 최적화 방식에 비해 다른 방식에서 최소 2~3배 이상 발생하는 것을 알 수 있다. 즉, 최적화 방식은 모지수를 가장 효과적으로 추종하면서 다른 공통 위험요인에 대한 노출 수준을 유사하게 가져갈 수 있는 전략이다.

에 대한 베타(위험 노출 수준)를 벤치마크와 비교한 결과를 보여주고 있다. 최적화 방식의 베타는 벤치마크 베타와 차이가 0.01 미만으로 벤치마크와 거의 유사한 위험 노출 수준을 보여준다. 한편 이러한 베타의 차이는 최적화 방식에 비해 다른 방식에서 최소 2~3배 이상 발생하는 것을 알 수 있다. 즉, 최적화 방식은 모지수를 가장 효과적으로 추종하면서 다른 공통 위험요인에 대한 노출 수준을 유사하게 가져갈 수 있는 전략이다.

다만 이러한 최적화 방식의 강점을 다소 상쇄하는 단점이 있는데, <표 Ⅲ-11>에서 보여주듯 포트폴리오 회전율이 벤치마크 대비 높은 수준으로 나타난다(모지수 대비 +2.9%). 포트폴리오 회전율은 종목 투자비중 변화에 따른 평균 리벨런싱 수준을 의미하는데, 회전율이 높을수록 투자비중의 변화가 크고 결과적으로 전략을 유지하기 위한 리벨런싱 비용(rebalancing costs)이 커지게 된다.69) 리벨런싱 비용은 경제적으로 포트폴리오의 순자산에 부정적인 영향을 끼치기 때문에, 실무적인 관점에서 최적화 방식을 활용한다면 적정 수준의 비중 변경에 대한 요건이 필요할 것으로 판단된다.

3) 소결

이상의 분석 결과를 바탕으로 저탄소 포트폴리오를 구성하는 전략별 장단점을 비교하면 <표 Ⅲ-12>와 같다. 먼저 스크리닝 방식의 경우, 전략 방법의 이해가 쉽고 투자실행이 간단한 장점이 있고, 분석 결과 간단한 방식임에도 괴리율 및 탄소 위험 감소 측면에서 효과적인 포트폴리오를 구성할 수 있었다. 또한, 벤치마크 대비 차이점(특정 그룹 배제)이 명확하므로 성과를 비교하기 쉽다. 반면 스크리닝 비율이 높거나 특정 섹터를 아예 배제하는 등 과도하게 투자를 배제할 경우, 벤치마크 대비 괴리율이 증가할 수 있다. 무엇보다 탈탄소화를 진행해야 할 산업이나 기업에 꾸준히 투자를 진행하지 않을 수 있어 지속적인 관여가 어렵고, 결과적으로 투자자 관점에서 그린워싱 위험이 큰 전략이 될 가능성이 존재한다.

한편 틸팅 방식은 분석 결과 틸팅 조건과 내용을 사전에 적절하게 정의하면 포트폴리오의 탄소 위험을 충분히 낮출 수 있는 것으로 나타났다. 또한 최적화 방식에 비해 투자비중을 결정하는 방식이 투명하며, 상대적으로 전략 자체를 이해하고 실행하는 것이 어렵지 않다. 그리고 투자배제를 가정하지 않으므로 모든 투자 대상에 대한 지속적인 투자와 관여를 할 수 있어 그린워싱의 위험이 상대적으로 적다.

최적화 방식의 경우 목적함수와 제약조건을 만족하는 최적의 저탄소 포트폴리오(optimal low-carbon portfolio)를 추정할 수 있다는 점에서 다른 방법에 비해 벤치마크 괴리율 관리가 용이하다. 분석 결과 최적화 방식의 괴리율이 가장 낮고 안정적으로 나타났으며, 탄소 위험을 제외하면 다른 공통 위험요인에 대해 모지수와 가장 유사한 위험 노출 수준을 갖는 저탄소 포트폴리오를 구성할 수 있었다. 또한 스크리닝 방식처럼 투자배제를 가정하지 않아서 상대적으로 그린워싱의 위험을 낮춘 포트폴리오를 구성할 수 있고, 전략을 실행하는 주체의 기호에 맞게 제약조건과 목적함수를 수정할 수 있어 전략의 확장성이 크다. 다만 최적 투자비중이 어떠한 방식으로 결정되는지 알기 어려워(black box) 투자 기준이 객관적이지 않을 수 있다. 그리고 실증분석 결과 최적화 포트폴리오의 괴리율이 가장 낮게 나타났지만, 잦은 투자비중의 변경으로 인해 포트폴리오의 회전율(turnover)이 벤치마크 대비 크게 관찰되었다.70) 비록 본 절에서는 최적 투자비중이 추정되었지만, 표본의 구성이나 주어진 파라미터가 변경됨에 따라 수치적인 근사해(numerical solution)가 추정되지 않을 수도 있을 것이다.