Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Factors Influencing Retail Customer Choice of a Securities Firm and Their Implications

Publication date May. 08, 2019

Summary

This article explores the factors that influence retail customers’ choice and retention of securities firms through a simple survey and provides recommendations for marketing and sales strategies that securities companies should focus on. For brokerage service, the highest percentage of survey respondents replied that low commissions are the main reason for their choice and retention of a securities firm. The second most important factor is the competitive edges of online trading system. These findings suggest that securities companies cannot avoid price competition for customer acquisition and should make persistent efforts to provide easily accessible and user friendly online trading platforms to their customers. For investing in financial products, the largest portion of respondents said they consider product competitiveness as an important lever for choosing and retaining a securities firm. This result is not irrelevant to the emergence of product features and competitiveness as the crucial competitive advantages of a securities company. To enhance product competitiveness, more important than anything else are developing products that reflect evolving customer preferences with market changes and employing sales strategies that are tailored to customers and help build customer trust. With these strategies being put in place, successful long-term growth would come to the retail segment of the securities industry.

The retail business segment of the securities industry becomes increasingly important to the wealth increase of Koreans in the era of population ageing as it serves as a channel for the supply of diverse investment products. The retail segment has been diversifying product and service offerings ranging from brokerage and fund sales to exchange-traded funds (ETF), equity-linked securities (ELS), derivative-linked securities (DLS), cash management accounts (CMA), retirement pensions, trusts, and investment advice. In this situation, understanding retail customer preferences is more important than anything else. This article explores the factors that influence retail customers’ choice and retention of securities firms through a simple survey and provides recommendations for marketing and sales strategies that securities firms should focus on.

Retail clients’ investment behavior towards financial products

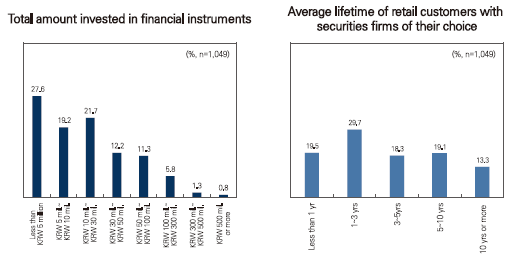

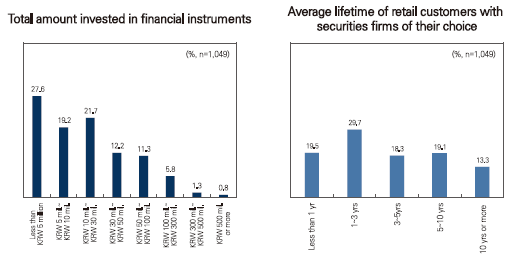

The survey1) in this article covered 1,049 adults aged 19 years or older who have had direct or indirect trading experience or have purchased financial products through a securities firm in the last six months. The survey found that a significant percentage of respondents who are securities firms’ retail customers have invested less than KRW 30 million in financial instruments. Stocks took up the largest proportion of their investment portfolios (45.5%), followed by investment funds (23.3%), CMA (14.1%), and ELS/DLS (8.7%). As for the average lifetime of retail customers with securities firms of their choice since the first transaction, the period from one to three years had the highest share (29.7%) of respondents. 31.1% of respondents said that they have changed their securities firm, suggesting that a significant portion of retail customers switched securities firms.

Factors influencing retail customers’ choice and retention of securities firms

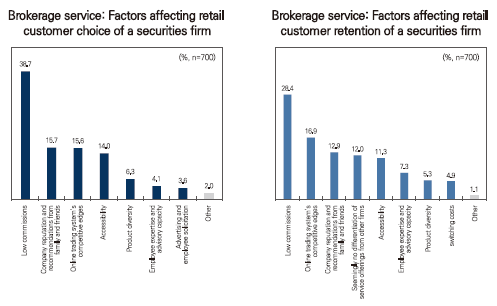

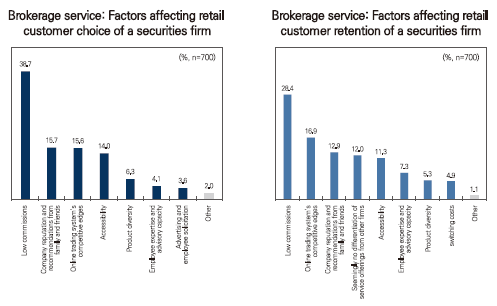

The survey results shown in figures below have implications that are worth considering with regard to marketing and sales strategies for retail brokerage business. First, a strikingly high proportion of respondents replied that low commissions are the main reason for their choice (38.7%) and retention (28.4%) of securities firms. These findings illustrate why securities companies are aggressively vying for customer acquisition by lowering their commission rates. In addition, the price competition among securities firms is expected to continue as long as there is no change in customer preference for low commissions.

On the other hand, a very small percentage of respondents said that they have continued to use the securities firm they chose due to the burden associated with switching to another securities firm, such as closing or opening a brokerage account. That is, service quality rather than switching costs would be the factor that makes customers stay loyal to the securities firms of their choice. Thus, securities firms should persistently strive for providing easily accessible and user friendly online trading platforms, although competitive pricing is essential, in order to acquire loyal customers.

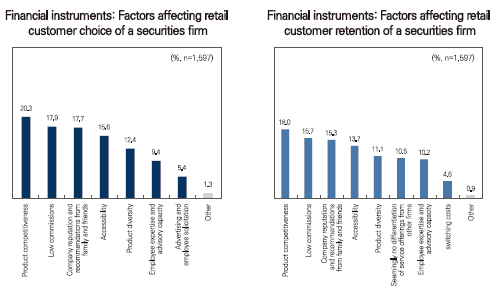

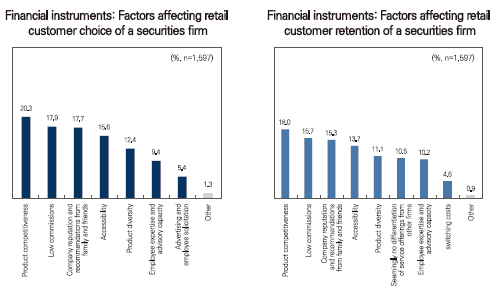

For investing in financial products, the largest share of respondents consider product competitiveness as an important lever for selecting and retaining their securities firm. This result is a far cry from the survey results showing that low commissions were cited as the biggest reason behind the selection and retention of a securities firm for brokerage service by the highest proportion of respondents.2) The aforementioned survey finding is not irrelevant to the emergence of a financial product’s features and competitive advantages as crucial factors affecting the competitiveness of a securities firm as a result of a decline in fund sales and the rise of differentiated products such as ETF and ELS over a decade.

To enhance product competitiveness, first of all, securities companies need to develop financial products in which customers may prefer to invest by taking into account market changes. The best example of this is the success of ELS products, which is consistent with the survey results revealing customers’ strong preference for product competitiveness. ELS is a medium risk/medium return product. These characteristics, which stand out in an uncertain stock market and in a low interest rate environment, have been viewed as an important growth driver of the ELS market. Given that, demand for ELS products will undoubtedly continue in periods of heightened market uncertainty and low interest rates. In the continuously changing stock market and interest rate environment, securities companies must keep looking for products whose demand can increase in line with market conditions as seen in the ELS case.

Second, securities companies should tailor their sales strategies to their customers, thereby building customer trust. As a case in point, let’s look at fund sales that have been declining these days. Touting past performance has been an important strategy employed by securities firms in selling investment funds because a fund’s performance data can be easily used to show product competitiveness. In practice, Kim Jongmin (2018)3) found that when money flows into equity funds, fund returns tend to be relatively high, but decline afterwards. However, if past performance is used as the kernel of fund sales strategy, individuals who buy funds would be disappointed when actual returns remain below previous return levels and would lose trust in the securities firm that sold the funds to them. Although the ongoing decline in fund sales is due in part to lackluster fund performance, it is also attributable partly to the fund sales strategy employed by securities firms laying stress on past performance. Hence, securities companies need to improve product competitiveness and differentiate their sales strategies by shifting from too much reliance on past performance towards development of fund styles tailored to customer characteristics such as age.

Conclusion

Korean securities companies have not yet reaped tangible results from the asset management market, but have generated revenues from the sale of various financial products. To sum up, the survey findings show that when customers choose their securities firm, important considerations are service quality, low commissions, company reputation and trust, not advertising or switching costs incurred as a result of closing or opening a trading account. These results are straightforward, but may provide important guidance for marketing and sales strategies of securities firms. As discussed earlier, if securities companies closely watch market movements, and identify and reflect customer needs in their products and services, successful long-term growth would come to the retail segment of the securities industry.

1) This article uses the results extracted from the customer satisfaction survey about investment products included in “Assessing the Degree of Competition in the Korean Securities Industry,” which is a report on KCMI research commissioned by the Financial Services Commission (FSS).

2) The survey results as to investment products above reflect the average of the numbers converted from survey responses concerning funds, individual retirement pensions (IRP), ELS/DLS, CMA, individual savings accounts (ISA), and wrap accounts.

3) See Kim Jongmin, 2018, Analysis on the Sales Pattern and Performance of the Korean Domestic Equity Funds, Research report 18-14.

Retail clients’ investment behavior towards financial products

The survey1) in this article covered 1,049 adults aged 19 years or older who have had direct or indirect trading experience or have purchased financial products through a securities firm in the last six months. The survey found that a significant percentage of respondents who are securities firms’ retail customers have invested less than KRW 30 million in financial instruments. Stocks took up the largest proportion of their investment portfolios (45.5%), followed by investment funds (23.3%), CMA (14.1%), and ELS/DLS (8.7%). As for the average lifetime of retail customers with securities firms of their choice since the first transaction, the period from one to three years had the highest share (29.7%) of respondents. 31.1% of respondents said that they have changed their securities firm, suggesting that a significant portion of retail customers switched securities firms.

Factors influencing retail customers’ choice and retention of securities firms

The survey results shown in figures below have implications that are worth considering with regard to marketing and sales strategies for retail brokerage business. First, a strikingly high proportion of respondents replied that low commissions are the main reason for their choice (38.7%) and retention (28.4%) of securities firms. These findings illustrate why securities companies are aggressively vying for customer acquisition by lowering their commission rates. In addition, the price competition among securities firms is expected to continue as long as there is no change in customer preference for low commissions.

For investing in financial products, the largest share of respondents consider product competitiveness as an important lever for selecting and retaining their securities firm. This result is a far cry from the survey results showing that low commissions were cited as the biggest reason behind the selection and retention of a securities firm for brokerage service by the highest proportion of respondents.2) The aforementioned survey finding is not irrelevant to the emergence of a financial product’s features and competitive advantages as crucial factors affecting the competitiveness of a securities firm as a result of a decline in fund sales and the rise of differentiated products such as ETF and ELS over a decade.

To enhance product competitiveness, first of all, securities companies need to develop financial products in which customers may prefer to invest by taking into account market changes. The best example of this is the success of ELS products, which is consistent with the survey results revealing customers’ strong preference for product competitiveness. ELS is a medium risk/medium return product. These characteristics, which stand out in an uncertain stock market and in a low interest rate environment, have been viewed as an important growth driver of the ELS market. Given that, demand for ELS products will undoubtedly continue in periods of heightened market uncertainty and low interest rates. In the continuously changing stock market and interest rate environment, securities companies must keep looking for products whose demand can increase in line with market conditions as seen in the ELS case.

Second, securities companies should tailor their sales strategies to their customers, thereby building customer trust. As a case in point, let’s look at fund sales that have been declining these days. Touting past performance has been an important strategy employed by securities firms in selling investment funds because a fund’s performance data can be easily used to show product competitiveness. In practice, Kim Jongmin (2018)3) found that when money flows into equity funds, fund returns tend to be relatively high, but decline afterwards. However, if past performance is used as the kernel of fund sales strategy, individuals who buy funds would be disappointed when actual returns remain below previous return levels and would lose trust in the securities firm that sold the funds to them. Although the ongoing decline in fund sales is due in part to lackluster fund performance, it is also attributable partly to the fund sales strategy employed by securities firms laying stress on past performance. Hence, securities companies need to improve product competitiveness and differentiate their sales strategies by shifting from too much reliance on past performance towards development of fund styles tailored to customer characteristics such as age.

Conclusion

Korean securities companies have not yet reaped tangible results from the asset management market, but have generated revenues from the sale of various financial products. To sum up, the survey findings show that when customers choose their securities firm, important considerations are service quality, low commissions, company reputation and trust, not advertising or switching costs incurred as a result of closing or opening a trading account. These results are straightforward, but may provide important guidance for marketing and sales strategies of securities firms. As discussed earlier, if securities companies closely watch market movements, and identify and reflect customer needs in their products and services, successful long-term growth would come to the retail segment of the securities industry.

1) This article uses the results extracted from the customer satisfaction survey about investment products included in “Assessing the Degree of Competition in the Korean Securities Industry,” which is a report on KCMI research commissioned by the Financial Services Commission (FSS).

2) The survey results as to investment products above reflect the average of the numbers converted from survey responses concerning funds, individual retirement pensions (IRP), ELS/DLS, CMA, individual savings accounts (ISA), and wrap accounts.

3) See Kim Jongmin, 2018, Analysis on the Sales Pattern and Performance of the Korean Domestic Equity Funds, Research report 18-14.