OPINION

- Summary

- Global investment banks have been increasing fintech investments to find long-term growth drivers and achieve greater operational efficiency. Their fintech investments are focused on three main strategies, that is, expanding principal investment in fintech firms, providing them with incubation services through fintech innovation labs, and leveraging fintech technologies for operational efficiency gains. Lessons learnt from global peers’ fintech investment strategies highlight the need to create incentive-compatible environment for encouraging active fintech investment by Korean financial investment services firms. To that end, legal and regulatory improvements are necessary to allow financial investment services firms to provide acceleration services with relaxed limits on equity ownership in fintech firms and less stringent calculation formula applied to risk exposure calculation. In addition, it is worth considering the creation of a stock exchange or investment bank for fintech companies. Meantime, financia l investment services firms should proactively expand their investment in fintech technologies by setting up fintech innovation labs and hiring more IT professionals.

Global investment banks have been increasing fintech investments to proactively respond to changes in the financial industry driven by the Fourth Industrial Revolution.1) Goldman Sachs has been at the forefront of fintech investments. It already declared itself as a technology firm, not a financial one in 2015, pressing ahead with digital innovation across all lines of business. As a result, it has been able to constantly increase operational efficiency, reducing its cost to income ratio to the lowest level among global peers. Major global investment banks, including JP Morgan, Morgan Stanley, UBS, BNP Paribas, and Credit Suisse as well as Goldman Sachs, search for fintech companies with high growth potential and make principal investments in them or provide growth-stage fintech companies with investment banking services such as M&A advice, acquisition financing, and financial advisory services. Furthermore, they have been focusing their efforts on achieving greater operational efficiency across the entire business lines through direct acquisitions of fintech firms or strategic alliances with them.

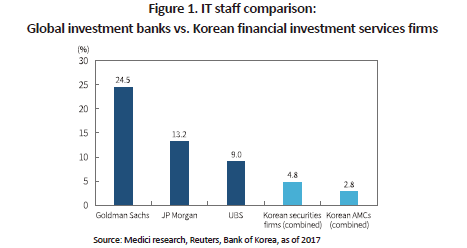

Unfortunately, fintech investments made by financial investment services firms in Korea have been lackluster. For instance, while IT professionals account for 10% to 25% of total headcount at global investment banks, including Goldman Sachs, JP Morgan, and UBS, IT professionals take up around 3% to 5% of total headcount at Korean securities companies and asset management companies (AMCs). Even the IT staff, which represent only the small portion of total employees in domestic firms, are primarily tasked with such non-core business functions as cyber security and IT equipment management. On the other hand, a large number of IT specialists at global peers reportedly take charge of core functions in key business departments. This trend is supported by a recent announcement of JP Morgan’s plan to hire a high volume of tech experts for the implementation of artificial intelligence (AI), machine learning and cloud technologies in all areas of the bank.

Why don’t Korean financial investment services firms pay much attention to fintech investment? That may be because, in their view, the growth potential for fintech in capital markets is weaker than that for fintech in banking that provides payments and money transfer services. Further, domestic financial investment services firms face legal restrictions concerning large principal investments in high-potential fintech firms that they identify. This is the other reason for their lackluster interest in fintech investments. This article takes a close look at global investment banks’ fintech investment strategies, and presents policy implications on legal and regulatory improvements and capital markets infrastructure in order for Korean financial investment services firms to proactively make fintech investments.

Global investment banks’ fintech investment strategies

One of main fintech investment strategies embraced by global investment banks is to actively look for promising fintech firms and make principal investments in those firms at the early stages. Goldman Sachs set up its Principal Strategic Investments (PSI) group in 2012, investing USD 1.5 billion in more than 70 high-potential fintech firms. In early 2019, the PSI group posted seven-year annual average return of 25%. The 2013 investment in AI-based data analytics firm, Kensho Technologies, is the most well-known among the PSI group’s fintech startup investments. Kensho, which had been named as one of the most promising fintech firms in 2016 by Fortune was acquired by S&P Global for USD 550 million in 2018. Subsequently, Goldman Sachs took hefty profits from its fintech investment. Following suit of the Goldman Sachs PSI group’s success, Morgan Stanley, JP Morgan and other US investment banks are increasing their principal investments in promising fintech companies. As part of fintech investment strategies, they set up a fintech strategic investments team or broadened the scope of the Private Equity Group to include fintech investments.

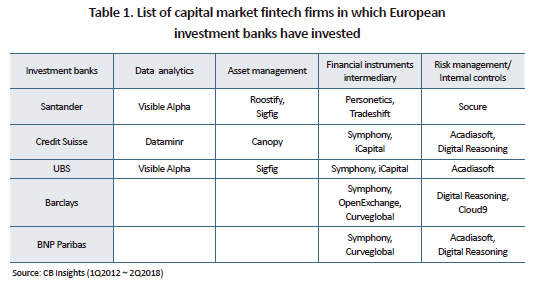

Likewise, European investment banks have been expanding principal investments in fintech companies. Spain’s Santander Bank2) is the most aggressive investor in fintech firms. Based in London, Santander InnoVentures has invested considerably in fintech startups in a wide range of areas such as money transfer, payments (banking services), AI-based data analytics, corporate value chain analysis, digital identity verification, and asset management (capital market services). Major European investment banks including Credit Suisse, UBS, and Barclays have also made equity investments in capital market fintech companies that provide AI-based data analytics, asset management, over-the-counter financial instruments intermediary, deposit/margin management, or internal control solution services (Table 1).

Another fintech investment strategy of global investment banks is to support the growth of fintech firms by acting as a startup accelerator or incubator.3) Global investment banks created fintech innovation labs to support selected companies throughout all stages of growth. Those innovation labs select fintech startups, offer them equity investment, office space or IT infrastructure, assist them in developing a business model, and help them with public relations, M&A or financial advice. Prime examples are Goldman Sachs' Internal Brain Trust, JP Morgan's Financial Solutions Labs, Barclays Accelerator, and Deutsche Bank Innovation Labs. In addition, there are UBS Wealth Management Innovation Lab designed to support fintech startups in wealth management, and Morgan Stanley’s Multicultural Innovation Lab aimed at helping multicultural or women entrepreneurs, both of which are slightly different from the aforementioned innovation labs. As Fintech companies have timely access to funding and receive incubation services through fintech innovation labs run by global investment banks, they can significantly increase the likelihood of success. In the meantime, global investment banks can have opportunities to provide one-stop financial services to fintech firms throughout their life cycle. Given that, fintech innovation labs are a win-win strategy for fintech firms and global investment banks.

Lastly, global investment banks have been achieving greater operational efficiency by leveraging cutting-edge fintech technologies. The cost to income ratio is usually high for divisions responsible for research analysis, wealth management, investment solicitation, customer service, risk management at an investment bank. To lower the cost to income ratio for the division in charge of managing client assets, global investment banks have adopted AI-based research & analystics solutions and robo advisors. This is one of their notable efficiency improvement strategies. On top of that, global investment banks have attempted to cut customer service costs by embracing AI-based chatbot. Online direct sales solutions based on big data analytics are also expected to enable global investment banks to considerably reduce the costs of running face-to-face sales channels. Also, they are striving to increase operational efficiency in trade execution and risk management units. For example, Marquee, Goldman Sachs’ integrated cloud-based trading platform, provides internal divisions and institutional clients with access to Goldman Sachs’ material data and application programming interfaces (APIs) for research analysis, trade execution and risk management. This strategy enables Marquee users to make most of the data and APIs when executing transactions and managing risks, leading to marked efficiency gains in the operations of not only Goldman Sachs but also its institutional clients.

Stimulating financial investment services firms’ fintech investments

First, the legal and regulatory framework should be improved in an incentive compatible manner in order to induce domestic financial investment services firms to make active principal investments in fintech companies. Unlike global investment banks, it is impossible for domestic financial investment services firms to act as a startup accelerator because of legal restrictions on the addition of acceleration to their business scope. Further, it is difficult for them to make large equity investments in fintech firms because they are permitted to do so only with prior approval provided by the authentic interpretation of the Act on the Structural Improvement of the Financial Industry.4) Accordingly, financial investment services firms find it hard to make big equity investments in fintech startups unless they demonstrate that prospective investees with cutting-edge IT technologies, such as AI, machine learning-based data analytics, cloud and database solutions, identity verification or cyber security, have direct relevance to their business activities or are needed for the conduct of their business.5) Furthermore, the Act on the Structural Improvement of the Financial Industry imposes no restrictions on financial investment services firms looking to aquire equity stakes in foreign fintech firms, implying adverse discrimination regarding the acquisition of equity stakes in local fintech firms. What is more, a domestic company owns more than 5% stake in a fintech company, 50% to 200% risk weight will be added to exposures in calculating the company’s net capital ratio according to risk-weights applied for concentrated positions in equity securities. This decreases the capacity of a financial investment services firm to make principal investments. In addition, if domestic financial investment services firms indirectly invest in fintech firms by way of taking part in a private equity fund or serving as a general partner of a new technology cooperative, they are required to prepare consolidated financial statements although they have no legal payment obligation in relation to equity investments of limited partners who are investors other than financial institutions. This would result in an increase in risk exposure or a decrease in net operating capital, which would erode the firm’s principal investment capacity.

Second, it is necessary to consider how to improve capital markets infrastructure to ensure fintech firms’ easy and better access to entrepreneurial capital. More specifically, it is worth considering the creation of a stock exchange for fintech firms or startups, modeling after a new Silicon Valley stock exchange, the Long-Term Stock Exchange (LTSE) to which the US Securities and Exchange Commission gave the green light recently.6) The LTSE will not require quarterly earnings reports by startups for their easy access to entrepreneurial capital and focus on long-term results, adopting a regime to give shareholders a vote in proportion to how long they hold the stock for startups’ access to patient capital. It is also worth considering the establishment of an investment bank specialized in providing fintech firms with a portfolio of equity investments and loans, learning from the success story of Silicon Valley Bank (SVB).7) Fintech equity investments would be made by accelerators or venture capital firms while working capital loans to those firms would be provided by investment banks catering only to fintech companies. In this case, fintech-specialized investment banks can share capital returns from fintech firms through equity investments in accelerators or venture capitalists. Fintech firms can raise working capital funds from those investment banks in a stable manner.

Third, domestic financial investment services firms desperately need to make efforts to invest in fintech companies. By referring to the set-up of fintech innovation labs by global peers, they ought to proactively look for promising fintech firms, providing office space and IT infrastructure, and acting as a strategic advisor offering financial advice and so on. Also, they could set up a fintech support center that provides differentiated services related to wealth management, MyData, and overseas expansion, like the innovation labs of UBS and Morgan Stanley. Moreover, domestic financial investment services firms need to hire more IT experts in AI, machine learning, and cloud technologies in a bid to increase operational efficiency. By providing a low-cost online direct sales platform, they could improve their high-cost face-to-face sales channels, which would ultimately lead to a rise in the welfare of financial consumers in the long run. On top of that, the use of AI-based chatbot in investment solicitation and customer service would reduce the costs of back-end operations, producing operational efficiency gains.

1) Lee Hyo Seob, 2017, Finance in the Fourth Industrial Revolution: Expected Changes and Future Responses, KCMI Capital Market Focus.

2) Established in 1857, Santander Bank is primarily engaged in commercial banking. Since the mid-2000s, it has continued to expand its investment banking business, with a focus on Europe.

3) Accelerator and incubator companies perform similar functions in the sense that they provide startup support services such as access to finance or facilities. However, a difference between the two lies in the focus of their business. While incubators focus on provision of incubation services to help budding entrepreneurs or startups develop new business models, accelerators aim to help early-stage companies to grow.

4) See Article 24.1 and 24.5 of the Act on the Structural Improvement of the Financial Industry.

5) According to the Financial Services Commission (FSC)’s press release titled “Facilitating financial firms’ investment in fintech firms,” on November 27, 2018, the FSC plans to remove uncertainty over the authentic interpretation by defining fintech firms in a broader sense so as to encourage financial investment services firms to actively invest in fintech firms.

6) The SEC unveiled on May 10, 2019 that it approved the creation of the Long-Term Stock Exchange, so-called Silicon Valley-based securities exchange.

7) Silicon Valley Bank (SVB) is specialized in funding support for venture businesses. It is regarded as an innovative investment bank model in that that it functions as an equity investor like a venture capitalist and as a capital provider for venture firms at the same time. SVB reported a very high ROE of 19.8% at the end of 2018, showing a continued increase in profitability since its creation in 1983.