Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Implications of Japan’s “New Form of Capitalism Realization” Policy for the Korean Landscape

Publication date Jan. 16, 2024

Summary

With the inauguration of Japan’s Kishida Cabinet, the “New Form of Capitalism Realization” policy was introduced to address structural issues, including wage stagnation, low fertility rates, and widening income inequality. The financial industry-related initiatives of the policy include improving corporate governance, increasing household income, fostering startups, and advancing both green transformation (GX) and digital transformation (DX). Despite its relatively short implementation period, the Kishida administration’s policy has yielded positive results, well demonstrated by the recent surge in Japanese stock indices, the escape from the deflationary trend, and the upward revision of economic growth prospects. Given Korea’s challenges of low growth, declining fertility rates, and population aging, it is crucial for the Korean government to actively examine the “New Form of Capitalism Realization” policy and incorporate some policy measures into the Korean system. First, Korea should draw reference from Japan Exchange Group (JPX)’s improvement in corporate governance and urge listed companies to make efforts toward profitability and growth. Second, it is essential to substantially expand tax benefits for individual savings accounts (ISAs) and personal pension plans and facilitate the utilization of trust instruments designed for addressing low fertility rates, thereby increasing household income. Third, Korea needs to foster top talent to bolster competitiveness in transition finance and digital finance, while providing active support for the launch of startups, particularly in key areas such as carbon footprint reduction and artificial intelligence (AI).

Japanese Prime Minister Kishida’s New Capitalism Policy

With the establishment of the Kishida Cabinet in October 2021, the Japanese government introduced the concept of the “New Form of Capitalism Realization” as its economic slogan to tackle structural challenges such as stagnant wages, declining fertility, and widening income inequality. To advance this initiative, the Kishida administration set up the “Council of New Form of Capitalism Realization”. The council has convened more than 20 times since its inception. In June 2022, it unveiled a comprehensive plan titled “Grand Design and Action Plan for a New Form of Capitalism”, focusing on five key areas: 1) human resources, 2) science, technology and innovation industries, 3) startups, 4) Green Transformation (GX), and 5) Digital Transformation (DX). The plan aims to outline substantial investments and create a virtuous cycle of growth and distribution through initiatives like doubling household asset income and expanding tax deductions. In June 2023, the Kishida administration officially announced the “Grand Design and Action Plan for a New Form of Capitalism 2023 Revised Version”, outlining specific execution plans including the “startup development five-year plan”, “doubling asset-based income plan”, and “three-pronged labor market reforms”.

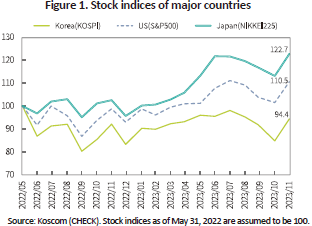

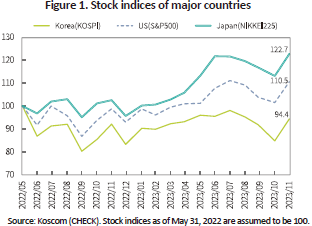

The New Form of Capitalism Realization policy pursued by the Kishida Cabinet (hereinafter referred to as the “New Capitalism Policy”) is assessed to have yielded positive results, despite its relatively short implementation period. Since the detailed execution plans were unveiled in June 2022, Japan’s NIKKEI225 index has soared by 22.7% till quite recently. During the same period, the increase in Japanese stock indices has far outpaced that of major indices in other countries, including the US S&P500 (10.5%), Germany’s DAX30 (12.7%), and Korea’s KOSPI (5.6%) as shown in Figure 1. Deflation and low growth, which persistently plagued the Japanese economy for an extended period, are now improving. The Japanese core consumer price index (CPI), released monthly from October 2022 to September 2023, consistently hovered over 3%, showing signs of improvement in private consumption. With the recovery in private consumption and corporate investment, economic growth prospects have been revised upward. In October 2023, the International Monetary Fund (IMF) raised its projection for Japan’s 2023 GDP growth rate from the initial 1.4% to 2.0%, representing a 0.6 percentage point increase and surpassing that of Korea (1.4%). The IMF also mentioned that the Japanese economy would likely depart from its long-term low-growth trend.

On the other hand, Korea is expected to witness a sustained slowdown in potential growth, driven by low fertility, population aging as well as burgeoning household debt and a downturn in corporate investment. In this respect, initiatives of the New Capitalism Policy pursued by the Kishida administration, aimed at addressing issues like low growth, low fertility and population aging, are likely to provide significant implications for Korea grappling with similar challenges. Against this backdrop, this article delves into specific details of the Kishida administration’s “New Capitalism Policy”, with a focus on the financial sector and presents its potential implications for the Korean landscape.

New Capitalism Policy’s specific details focusing on the financial industry

The financial industry-related initiatives in the Kishida administration’s New Capitalism Policy can be categorized into improving corporate governance, increasing household income, fostering startups, and promoting GX and DX. First, a noteworthy policy measure for corporate governance improvement is the “demand for aggressively enhancing corporate value in Japan’s listed companies”. The Tokyo Stock Exchange announced a plan in March 2023 to require listed companies with a price book value ratio (PBR) of 1 or less1) to disclose improvement measures and specific targets for enhancing capital profitability and growth potential. Additionally, it plans to release a monthly list of companies that include specific efforts to enhance corporate value in corporate governance reports, starting from January 15, 2024.2) This indicates that the Japanese government intends to demand listed companies’ active efforts to improve shareholder value through monitoring to prevent their activities from turning out to be empty commitments. Japan Exchange Group (JPX) streamlined its existing five trading markets into three (prime, standard and growth markets) in April 2022. Among them, the prime market of JPX requires its listed companies to comprise a minimum of one third of board members with outside directors and ensure that these outside directors perform advisory and supervisory duties. Furthermore, one of the outside directors should be appointed as the chairperson of the board. Since 2014, Japan’s public pension funds and central bank have used NIKKEI400, which gives weight to corporate government improvements, as a benchmark index for purchasing Japanese stocks. In June 2023, they introduced a new index called JPX Prime 150 that places weight on companies of which ROE is higher than capital costs and PBR exceeds 1. Since then, institutional investors have been encouraged to use JPX Prime 150 as a benchmark, prompting Japan’s listed companies to enhance corporate value.

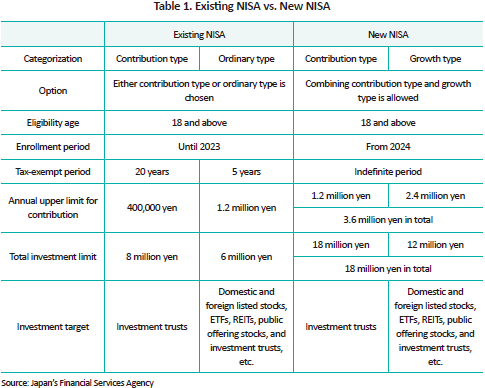

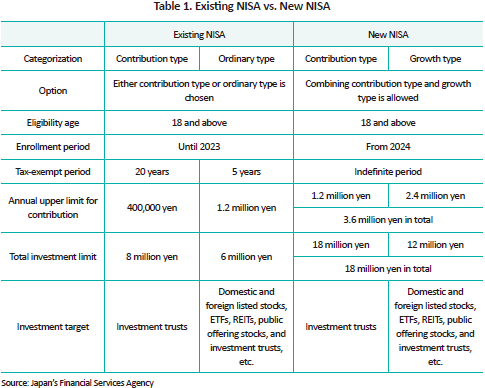

Second, the Kishida administration has unveiled a plan to induce households to transfer their financial assets from bank deposits to financial investment products, aiming to boost household income. This plan stems from its analysis of the status of household financial assets. The administration has concluded that more than half of the financial assets held by Japanese households are tied up in bank deposits,3) hindering the flow of funds into productive sectors and leading to a slump in corporate investment. Additionally, limited holdings of financial investment products make it difficult for households to enjoy corporate profits. As part of this plan, the administration has expanded the tax exemption of NISA (Nippon Individual Savings Account) as a key policy task for increasing household income (Table 1). The (new) NISA system scheduled to take effect in 2024 has tripled the upper limit for tax-free investment from the existing 1.2 million yen to 3.6 million yen. The tax-exempt investment duration has also been extended to an indefinite period from a maximum of 5 years for ordinary NISA accounts. As for NISA accounts, the contribution type and growth type have been consolidated into a single investment system. In addition to NISA improvements, the Japanese government has decided to raise the iDeCo (individual-type defined contribution pension plan) contribution limit and relax eligibility requirements for iDeCo. More specifically, the monthly contribution limit for DC-type corporate pension members has been raised from 12,000 yen to 20,000 yen. Participation in iDeCo has been allowed regardless of corporate pension enrollment and the age for iDeCo eligibility has been extended from under 65 to under 70. Moreover, the Financial Services Agency (FSA) unveiled specific policy goals to diversify sales channels from a bank-centric approach to financial advisory services and financial product/service intermediary services and to improve transparency and objectivity in sales fees of financial investment products, such as mutual funds and trusts, aiming for adopting a sophisticated asset management system. On top of that, the FSA will provide more support for employee stock ownership associations to boost workers’ financial income and establish the Organization for the Promotion of Financial and Economic Education to improve financial education for schools and the general public.

Third, the Kishida administration has set forth the Startup Development Five-year Plan to discover and nurture new growth industries in June 2023. It has decided to invest more than 10 trillion yen by 2027, ten times larger than the current investment value, with the goal of establishing 100 unicorn companies and 100,000 startups within five years. To increase venture capital supply for startups, it has also reinforced the venture capital investment function of the Small and Medium Enterprise Agency, the Industrial Innovation Investment Institution, and joint public-private funds. As a means of cultivating talent for startups, matters regarding stock option issue prices and the stock option exercise period will be authorized by the board of directors rather than by the general shareholders’ meeting. It has also proposed extending the exercise period for stock option tax benefits from 10 to 15 years and significantly raising or abolishing the ceiling amount for tax-qualified stock options. Additionally, the government announced initiatives to increase the participation of professional investors in unlisted stock transactions and ease approval criteria and disclosure obligations for Proprietary Trading Systems (PTS), aiming to facilitate the funding activities of startups.

Lastly, the Kishida administration has unveiled the policy to promote GX and DX to achieve sustainable growth. The Ministry of Economy, Trade and Industry (METI) set forth the “GX Strategy” in July 2023, encompassing GX policies for stable energy supply, the introduction of a growth-driven carbon pricing system, implementing GX across society, and efficient utilization of resources. Among them, the initiatives focusing on the financial sector include the 10-year issuance of green transition bonds (government bonds) worth 20 trillion yen, the introduction of an incentive-based carbon pricing system, and policies to activate the emission rights trading market, private transition finance and impact investments. As for a DX policy, the METI has presented measures to foster Web 3.0, aiming for sound innovation technologies such as NFTs (Non-Fungible Tokens) and DAOs (Decentralized Autonomous Organizations), which are based on blockchain technology. Specifically, it has proposed lowering the capital gains tax rate on crypto assets, establishing business models related to crypto assets and NFTs, and making a substantial investment for the digital ecosystem development. Innovative services based on a convergence of GX and DX are being pursued. An illustrative example is a platform that issues and distributes green bonds and voluntary emission credits in the form of Security Token Offerings (STOs). This platform, utilizing blockchain technology, offers advantages such as measuring, reporting and verifying emissions reduction channels in an objective and transparent manner and providing investors with fractional investment opportunities.

Implications for the Korean landscape

The goal of the “New Capitalism Policy” presented by the Kishida administration is to move capital flows of Japanese economic agents from safe assets to venture capital and to boost household and corporate wealth by improving corporate governance and nurturing innovative growth industries. This policy has been assessed to deliver positive results including rising stock indices, an escape from deflation and upward revision of economic growth prospects, despite its relatively short implementation period. As a decline in fertility and population aging are accelerating, Korea has experienced burgeoning household debt and a slump in corporate investment and thus, is expected to struggle with a long-term slowdown in potential growth. Hence, it is essential for the Korean government to closely examine the Kishida administration’s New Capitalism Policy and embrace relevant measures.

First, a policy is needed to move surplus funds held by Korean households and companies from bank deposits to venture capital. Building upon JPX’s corporate governance improvement, the Korean government should urge companies with a PBR of 1 or less or low capital efficiency to exert efforts to improve profitability and growth potential. Second, active policy support is required to boost household income. As is the case with Japan’s NISA system and iDeCo, Korea’s ISA and personal pension products should substantially expand tax benefits. In addition, Korea also needs to facilitate the utilization of trust instruments designed for addressing low fertility such as marriage and childcare support trusts and education fund donation trusts, thereby increasing household income, particularly among the younger generation. Third, it is crucial to foster top talent to enhance the competitiveness of transition finance and digital finance, while active support should be provided for the launch of startups in key areas such as carbon footprint reduction and artificial intelligence (AI).

1) The prime and standard markets among the Tokyo Stock Exchange markets cover approximately 3,300 listed companies.

2) Tokyo Stock Exchange (October 26, 2023).

3) According to the Japanese Financial Services Agency, 54% of the financial assets of Japanese households are held in bank deposits, with only 19% allocated to financial investment products as of the end of March of 2023. Conversely, bank deposits account for only 13% of total financial assets held by US households, while 56% of their assets are invested in financial instruments.

References

Cabinet Office of the Government of Japan, 2023, Grand Design and Action Plan for a New Form of Capitalism 2023 Revised Version.

Cabinet Office of the Government of Japan, 2022, Doubling Asset-based Income Plan.

Tokyo Stock Exchange, October 26, 2023, TSE to publish a list of companies that have disclosed information regarding 「Action to Implement Management that is Conscious of Cost of Capital and Stock Price」

With the establishment of the Kishida Cabinet in October 2021, the Japanese government introduced the concept of the “New Form of Capitalism Realization” as its economic slogan to tackle structural challenges such as stagnant wages, declining fertility, and widening income inequality. To advance this initiative, the Kishida administration set up the “Council of New Form of Capitalism Realization”. The council has convened more than 20 times since its inception. In June 2022, it unveiled a comprehensive plan titled “Grand Design and Action Plan for a New Form of Capitalism”, focusing on five key areas: 1) human resources, 2) science, technology and innovation industries, 3) startups, 4) Green Transformation (GX), and 5) Digital Transformation (DX). The plan aims to outline substantial investments and create a virtuous cycle of growth and distribution through initiatives like doubling household asset income and expanding tax deductions. In June 2023, the Kishida administration officially announced the “Grand Design and Action Plan for a New Form of Capitalism 2023 Revised Version”, outlining specific execution plans including the “startup development five-year plan”, “doubling asset-based income plan”, and “three-pronged labor market reforms”.

The New Form of Capitalism Realization policy pursued by the Kishida Cabinet (hereinafter referred to as the “New Capitalism Policy”) is assessed to have yielded positive results, despite its relatively short implementation period. Since the detailed execution plans were unveiled in June 2022, Japan’s NIKKEI225 index has soared by 22.7% till quite recently. During the same period, the increase in Japanese stock indices has far outpaced that of major indices in other countries, including the US S&P500 (10.5%), Germany’s DAX30 (12.7%), and Korea’s KOSPI (5.6%) as shown in Figure 1. Deflation and low growth, which persistently plagued the Japanese economy for an extended period, are now improving. The Japanese core consumer price index (CPI), released monthly from October 2022 to September 2023, consistently hovered over 3%, showing signs of improvement in private consumption. With the recovery in private consumption and corporate investment, economic growth prospects have been revised upward. In October 2023, the International Monetary Fund (IMF) raised its projection for Japan’s 2023 GDP growth rate from the initial 1.4% to 2.0%, representing a 0.6 percentage point increase and surpassing that of Korea (1.4%). The IMF also mentioned that the Japanese economy would likely depart from its long-term low-growth trend.

On the other hand, Korea is expected to witness a sustained slowdown in potential growth, driven by low fertility, population aging as well as burgeoning household debt and a downturn in corporate investment. In this respect, initiatives of the New Capitalism Policy pursued by the Kishida administration, aimed at addressing issues like low growth, low fertility and population aging, are likely to provide significant implications for Korea grappling with similar challenges. Against this backdrop, this article delves into specific details of the Kishida administration’s “New Capitalism Policy”, with a focus on the financial sector and presents its potential implications for the Korean landscape.

New Capitalism Policy’s specific details focusing on the financial industry

The financial industry-related initiatives in the Kishida administration’s New Capitalism Policy can be categorized into improving corporate governance, increasing household income, fostering startups, and promoting GX and DX. First, a noteworthy policy measure for corporate governance improvement is the “demand for aggressively enhancing corporate value in Japan’s listed companies”. The Tokyo Stock Exchange announced a plan in March 2023 to require listed companies with a price book value ratio (PBR) of 1 or less1) to disclose improvement measures and specific targets for enhancing capital profitability and growth potential. Additionally, it plans to release a monthly list of companies that include specific efforts to enhance corporate value in corporate governance reports, starting from January 15, 2024.2) This indicates that the Japanese government intends to demand listed companies’ active efforts to improve shareholder value through monitoring to prevent their activities from turning out to be empty commitments. Japan Exchange Group (JPX) streamlined its existing five trading markets into three (prime, standard and growth markets) in April 2022. Among them, the prime market of JPX requires its listed companies to comprise a minimum of one third of board members with outside directors and ensure that these outside directors perform advisory and supervisory duties. Furthermore, one of the outside directors should be appointed as the chairperson of the board. Since 2014, Japan’s public pension funds and central bank have used NIKKEI400, which gives weight to corporate government improvements, as a benchmark index for purchasing Japanese stocks. In June 2023, they introduced a new index called JPX Prime 150 that places weight on companies of which ROE is higher than capital costs and PBR exceeds 1. Since then, institutional investors have been encouraged to use JPX Prime 150 as a benchmark, prompting Japan’s listed companies to enhance corporate value.

Second, the Kishida administration has unveiled a plan to induce households to transfer their financial assets from bank deposits to financial investment products, aiming to boost household income. This plan stems from its analysis of the status of household financial assets. The administration has concluded that more than half of the financial assets held by Japanese households are tied up in bank deposits,3) hindering the flow of funds into productive sectors and leading to a slump in corporate investment. Additionally, limited holdings of financial investment products make it difficult for households to enjoy corporate profits. As part of this plan, the administration has expanded the tax exemption of NISA (Nippon Individual Savings Account) as a key policy task for increasing household income (Table 1). The (new) NISA system scheduled to take effect in 2024 has tripled the upper limit for tax-free investment from the existing 1.2 million yen to 3.6 million yen. The tax-exempt investment duration has also been extended to an indefinite period from a maximum of 5 years for ordinary NISA accounts. As for NISA accounts, the contribution type and growth type have been consolidated into a single investment system. In addition to NISA improvements, the Japanese government has decided to raise the iDeCo (individual-type defined contribution pension plan) contribution limit and relax eligibility requirements for iDeCo. More specifically, the monthly contribution limit for DC-type corporate pension members has been raised from 12,000 yen to 20,000 yen. Participation in iDeCo has been allowed regardless of corporate pension enrollment and the age for iDeCo eligibility has been extended from under 65 to under 70. Moreover, the Financial Services Agency (FSA) unveiled specific policy goals to diversify sales channels from a bank-centric approach to financial advisory services and financial product/service intermediary services and to improve transparency and objectivity in sales fees of financial investment products, such as mutual funds and trusts, aiming for adopting a sophisticated asset management system. On top of that, the FSA will provide more support for employee stock ownership associations to boost workers’ financial income and establish the Organization for the Promotion of Financial and Economic Education to improve financial education for schools and the general public.

Third, the Kishida administration has set forth the Startup Development Five-year Plan to discover and nurture new growth industries in June 2023. It has decided to invest more than 10 trillion yen by 2027, ten times larger than the current investment value, with the goal of establishing 100 unicorn companies and 100,000 startups within five years. To increase venture capital supply for startups, it has also reinforced the venture capital investment function of the Small and Medium Enterprise Agency, the Industrial Innovation Investment Institution, and joint public-private funds. As a means of cultivating talent for startups, matters regarding stock option issue prices and the stock option exercise period will be authorized by the board of directors rather than by the general shareholders’ meeting. It has also proposed extending the exercise period for stock option tax benefits from 10 to 15 years and significantly raising or abolishing the ceiling amount for tax-qualified stock options. Additionally, the government announced initiatives to increase the participation of professional investors in unlisted stock transactions and ease approval criteria and disclosure obligations for Proprietary Trading Systems (PTS), aiming to facilitate the funding activities of startups.

Lastly, the Kishida administration has unveiled the policy to promote GX and DX to achieve sustainable growth. The Ministry of Economy, Trade and Industry (METI) set forth the “GX Strategy” in July 2023, encompassing GX policies for stable energy supply, the introduction of a growth-driven carbon pricing system, implementing GX across society, and efficient utilization of resources. Among them, the initiatives focusing on the financial sector include the 10-year issuance of green transition bonds (government bonds) worth 20 trillion yen, the introduction of an incentive-based carbon pricing system, and policies to activate the emission rights trading market, private transition finance and impact investments. As for a DX policy, the METI has presented measures to foster Web 3.0, aiming for sound innovation technologies such as NFTs (Non-Fungible Tokens) and DAOs (Decentralized Autonomous Organizations), which are based on blockchain technology. Specifically, it has proposed lowering the capital gains tax rate on crypto assets, establishing business models related to crypto assets and NFTs, and making a substantial investment for the digital ecosystem development. Innovative services based on a convergence of GX and DX are being pursued. An illustrative example is a platform that issues and distributes green bonds and voluntary emission credits in the form of Security Token Offerings (STOs). This platform, utilizing blockchain technology, offers advantages such as measuring, reporting and verifying emissions reduction channels in an objective and transparent manner and providing investors with fractional investment opportunities.

Implications for the Korean landscape

The goal of the “New Capitalism Policy” presented by the Kishida administration is to move capital flows of Japanese economic agents from safe assets to venture capital and to boost household and corporate wealth by improving corporate governance and nurturing innovative growth industries. This policy has been assessed to deliver positive results including rising stock indices, an escape from deflation and upward revision of economic growth prospects, despite its relatively short implementation period. As a decline in fertility and population aging are accelerating, Korea has experienced burgeoning household debt and a slump in corporate investment and thus, is expected to struggle with a long-term slowdown in potential growth. Hence, it is essential for the Korean government to closely examine the Kishida administration’s New Capitalism Policy and embrace relevant measures.

First, a policy is needed to move surplus funds held by Korean households and companies from bank deposits to venture capital. Building upon JPX’s corporate governance improvement, the Korean government should urge companies with a PBR of 1 or less or low capital efficiency to exert efforts to improve profitability and growth potential. Second, active policy support is required to boost household income. As is the case with Japan’s NISA system and iDeCo, Korea’s ISA and personal pension products should substantially expand tax benefits. In addition, Korea also needs to facilitate the utilization of trust instruments designed for addressing low fertility such as marriage and childcare support trusts and education fund donation trusts, thereby increasing household income, particularly among the younger generation. Third, it is crucial to foster top talent to enhance the competitiveness of transition finance and digital finance, while active support should be provided for the launch of startups in key areas such as carbon footprint reduction and artificial intelligence (AI).

1) The prime and standard markets among the Tokyo Stock Exchange markets cover approximately 3,300 listed companies.

2) Tokyo Stock Exchange (October 26, 2023).

3) According to the Japanese Financial Services Agency, 54% of the financial assets of Japanese households are held in bank deposits, with only 19% allocated to financial investment products as of the end of March of 2023. Conversely, bank deposits account for only 13% of total financial assets held by US households, while 56% of their assets are invested in financial instruments.

References

Cabinet Office of the Government of Japan, 2023, Grand Design and Action Plan for a New Form of Capitalism 2023 Revised Version.

Cabinet Office of the Government of Japan, 2022, Doubling Asset-based Income Plan.

Tokyo Stock Exchange, October 26, 2023, TSE to publish a list of companies that have disclosed information regarding 「Action to Implement Management that is Conscious of Cost of Capital and Stock Price」