Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

How the Proliferation of Generative AI is Reshaping the Financial Services Industry and Future Challenges

Publication date Jul. 09, 2024

Summary

As the financial services industry increasingly integrates generative AI, it is expected to enhance the allocation of resources and risk diversification among economic agents. This integration will likely foster the convergence of financial and non-financial sectors and drive the emergence of innovative industries. Global financial services companies are aggressively adopting generative AI to boost internal operational efficiency, enhance customer consultation capabilities, and expand their innovative financial services. In contrast, their Korean counterparts encounter challenges such as limited digital capabilities and stringent regulatory constraints, resulting in a slower adoption of generative AI. Meanwhile, the widespread use of generative AI raises concerns about information leakage and data illusion and misuse. Notably, the utilization of generative AI by financial services companies may disrupt financial stability, harm consumer protection, and expose them to legal risks, including intellectual property infringement.

In Korea, the regulatory framework should be overhauled to enable financial services companies to expand generative AI-driven innovative services and mitigate financial risks associated with generative AI. First, financial services companies in Korea should be encouraged to increase investments in generative AI-related talent and infrastructure. Second, it is necessary to revise the network separation regulations, which currently hinder the utilization of generative AI, facilitate the integration of heterogeneous data, alleviate restrictions on subsidiaries’ ownership, and expand the scope of ancillary business activities. Lastly, the Financial Regulatory Sandbox and the AI Guidelines for the Financial Sector should be enhanced to systematically manage financial risks stemming from the use of generative AI.

In Korea, the regulatory framework should be overhauled to enable financial services companies to expand generative AI-driven innovative services and mitigate financial risks associated with generative AI. First, financial services companies in Korea should be encouraged to increase investments in generative AI-related talent and infrastructure. Second, it is necessary to revise the network separation regulations, which currently hinder the utilization of generative AI, facilitate the integration of heterogeneous data, alleviate restrictions on subsidiaries’ ownership, and expand the scope of ancillary business activities. Lastly, the Financial Regulatory Sandbox and the AI Guidelines for the Financial Sector should be enhanced to systematically manage financial risks stemming from the use of generative AI.

The rise of generative AI and the resultant productivity improvement

Since the launch of Chat GPT at the end of 2022, generative AI has revolutionized nearly every industry, significantly enhancing productivity. Economic agents can leverage generative AI to generate creative text, images, music, videos, and program source codes. By employing deep learning on vast datasets, generative AI can perform tasks swiftly and accurately for users, such as searching, translating, and summarizing existing data. Moreover, by considering specific user preferences, it can produce personalized news and videos and recommend healthcare and financial services more conveniently and affordably. According to major academic research,1) technological innovation contributes to economic development by increasing potential growth rates through the enhancement of the total factor productivity (TFP). Goldman Sachs2) recently predicted that generative AI could increase global GDP by 7% (approximately USD 7 trillion) over the next decade and improve the productivity of economic agents by 1.5%. According to McKinsey’s estimates,3) generative AI technologies will boost labor productivity in nearly every industry, potentially resulting in operating income gains of 1.3% to 1.9% in major industries, while driving global economic growth by an annual average of 0.2% to 0.6% until 2040.

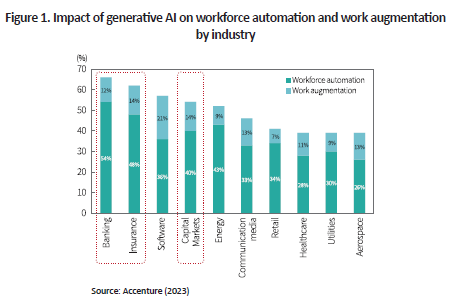

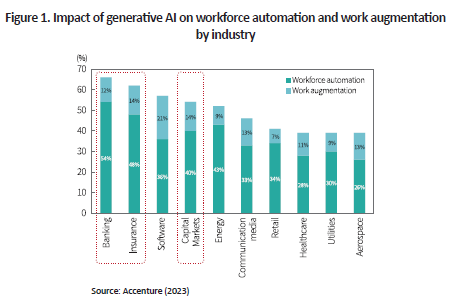

The proliferation of generative AI is expected to revolutionize the entire manufacturing and service industries, and its impact on the financial services industry is likely to stand out. The financial services industry primarily aims to enhance the utility of economic agents by efficiently allocating resources among them and providing risk diversification. By leveraging generative AI, it can quickly learn from a vast amount of financial and non-financial data and offer personalized financial services to economic agents more conveniently, affordably, and swiftly than ever before. This advancement is anticipated to increase the utility of economic agents and contribute to higher potential growth rates in the long run. Accenture (2023) found that among 20 types of industries, banking and insurance would benefit the most from generative AI in terms of workforce automation and work augmentation, with financial investment having the fourth highest potential for workforce automation and work augmentation (see Figure 1). McKinsey also suggested that the banking industry would see significant profitability gains from the widespread use of generative AI, second only to the high-tech industry. Specifically, the high-tech industry is expected to see a revenue increase of USD 240 billion to 460 billion, while the banking industry is projected to report a revenue increase of USD 200 billion to 340 billion.

As such, the widespread use of generative AI is poised to accelerate the digital innovation of the financial services industry at home and abroad. Notably, as major international financial institutions, including commercial banks, insurance companies, and investment banks (IBs), have expanded innovative services using generative AI, expectations for its potential application are rising in the Korean financial sector. However, the rapid adoption of generative AI also raises concerns about financial risks, such as customer information leakage, financial system disruptions arising from algorithm errors, and potential harm to consumers. In this context, this article examines how generative AI is reshaping the financial services industry and explores the desirable pathways for the advancement of generative AI.

Transformation in the financial services industry driven by generative AI

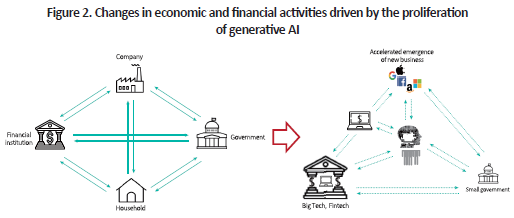

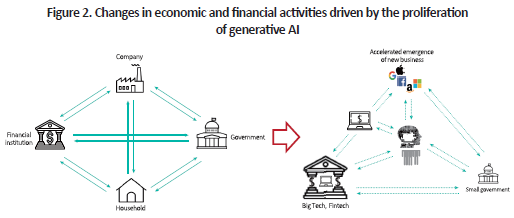

With the widespread adoption of generative AI, future economic and financial activities are expected to divulge significantly from historical trends (see Figure 2). First, the rise of personalized services facilitated by advances in generative AI is anticipated to empower households as influential economic actors. Equipped with hyper-intelligent systems for managing housing, clothing, and leisure, households will drive demand for personalized financial services, prompting financial institutions to expand their offerings accordingly. Second, the proliferation of generative AI is set to mitigate information asymmetries among economic agents, thereby enhancing the efficiency of resource allocation. In other words, generative AI will enhance the resource allocation function traditionally carried out by financial institutions, potentially reducing the government’s role in this area and fostering a shift towards a smaller government model. Third, the use of generative AI will spur cross-industry convergence and the emergence of innovative industries, increasing the importance of venture capital provision. Fourth, the growing reliance on data will boost the value of intangible assets capable of generating added value, such as high-quality information. Consequently, financial services companies are expected to shift their focus from tangible assets to intangible assets in terms of brokerage and investment services.

Global financial services companies are increasingly harnessing generative AI to boost internal operational efficiency, enhance customer consultation capabilities, and introduce innovative financial services. For instance, Bank of America launched its AI-powered chatbot, Erica, in 2016. Recently, Erica has integrated generative AI algorithms, which enable it to analyze extensive customer data to offer personalized responses and financial solutions tailored to individual preferences. If the customer doesn't respond positively, Erica comes up with a new answer based on customer preferences and gets feedback. In April 2024, JPMorgan Chase Bank announced that it has developed over 400 business applications, which are actively utilized across various domains including customer consultations, asset management, financial forecasting, and anomaly detection in financial transactions. Citibank in the US has established the GitHub Copilot platform to expand its generative AI services, facilitating the development and utilization of generative AI algorithms. This platform enables Citibank to enhance its generative AI capabilities across various functions including customer consultations, asset management services, anomaly detection in financial transactions, and compliance tasks. As such, most major commercial banks are actively integrating generative AI to increase internal operational efficiency and enhance customer consultation capabilities.

Global investment banks (IBs) and asset management firms are actively utilizing generative AI to increase internal operational efficiency and expand their analytical coverage. For example, Goldman Sachs’ trading division employs generative AI to learn and analyze large amounts of financial and non-financial data, optimizing systematic trading algorithms. In addition, Goldman Sachs’ research division utilizes proprietary large language models (LLMs) and generative AI algorithms to provide performance forecasts for companies worldwide. Morgan Stanley has collaborated with OpenAI to develop a specialized AI service capable of learning and analyzing both internal and external data. This generative AI service enables Morgan Stanley to identify customer preferences and deliver optimal portfolios in real-time, tailored to individual investment profiles. It also provides up-to-the-minute news on the companies, in which customers hold investments, and offers investment advisory services, such as buy or sell recommendations. Leading global asset management firms such as BlackRock and Vanguard employ generative AI to create optimized investment portfolios tailored to individual needs and to predict financial market conditions, facilitating dynamic portfolio rebalancing. These firms also leverage generative AI algorithms to attract new customers or offer new financial products.

Global insurance companies are utilizing or planning to integrate generative AI in nearly all business areas. Insurance companies are highly optimistic about the potential of generative AI, as it allows them to harness vast amounts of financial and non-financial data across all areas of the insurance ecosystem, including identifying customer product needs, calculating loss ratios, underwriting, marketing insurance products, paying out claims, and offering customer consultations. In particular, as the aging population drives up demand for integrated healthcare services, major global insurance companies are using individual medical data to design and market customized insurance products and provide personalized healthcare services, such as diet and exercise regimens. Lemonade, a digital insurance company in the US, offers personalized home and auto insurance products by analyzing customers’ financial and non-financial data. Additionally, it employs its own generative AI algorithms for insurance fraud detection. Swiss insurance company Zurich and Japan’s SBI Life Insurance utilize generative AI-driven chatbots to develop new products and streamline the claims payout process.

Financial risks posed by the proliferation of generative AI

The widespread adoption of generative AI has significantly increased efficiency within financial services companies, leading to the delivery of innovative financial services to customers. However, this advancement also introduces potential financial risks. Since generative AI relies on the ability to learn and analyze large amounts of financial and non-financial data, its usage can result in the leakage of material information belonging to financial institutions and individuals. There is also a risk of generating false information or producing excessive irrelevant data in the process of creating new documents, images, and videos. Furthermore, if generative AI learns and analyzes critical data to present new creative works without the consent of the data provider, it could infringe on intellectual property rights.

Excessive reliance on generative AI by financial services companies poses significant risks. A malfunction in generative AI algorithms could disrupt the financial system, resulting in systemic risk. Once a trading algorithm powered by generative AI is made public and widely adopted by a large number of investors, it may lead to an excessive concentration of financial activities in specific sectors. Moreover, if robo-advisors based on generative AI become prevalent, there is a possibility that programmers intentionally or accidentally recommend financial products that favor specific financial institutions or customers, potentially causing harm to financial consumers.

If a malfunction of generative AI algorithms causes significant harm to financial consumers, it may be challenging to hold anyone legally accountable. In Korea, major financial business laws, including the Banking Act, the Insurance Business Act, and the Financial Investment Services and Capital Markets Act, primarily impose penalties for regulatory violations in the form of personal sanctions against the violator or monetary penalties against the financial services company. Therefore, under the current regulatory framework, it is difficult to hold the financial services company legally accountable for malfunctions of generative AI. There is also the issue of polarization within the financial services industry. Small and medium-sized financial services companies may struggle to adopt generative AI due to limitations in manpower and budget, leading to decreased competitiveness and potentially resulting in long-term polarization within the financial services industry. On top of that, the widespread use of generative AI could lead to the loss of quality jobs in the industry, as generative AI can easily replace skilled personnel currently engaged in customer consultation, product development, credit evaluation, and risk management.

Implications for Korea

The proliferation of generative AI is expected to accelerate digital innovation in the financial services industry. By leveraging generative AI, financial services companies can offer more convenient, affordable, and faster services to a broader range of economic agents, while new industries will emerge through the convergence and innovation of financial and non-financial services. In practice, global financial market players, including commercial banks, insurance companies, and investment firms, are actively using generative AI to boost internal operational efficiency, enhance customer consultation capabilities, and expand innovative services. In contrast, their Korean counterparts have been slower to adopt generative AI due to limited digital adoption capabilities and regulatory constraints.

To facilitate financial innovation through generative AI, financial services companies should implement the following measures. First, their management should actively adopt and utilize generative AI. This requires improving the incentive system for executives and expanding immunity provision under liability structures to support long-term investment in AI-related personnel and IT infrastructure. Second, financial regulations should be relaxed to enable the use of generative AI by financial services companies. Regulatory reforms should focus on easing network separation regulations and promoting the integration of heterogeneous data, on the condition of imposing stricter sanctions on security incidents. To foster digital transformation in financial services companies, it is necessary to alleviate subsidiary ownership restrictions and broaden the scope of concurrent operation and incidental business activities. Third, a regulatory framework specifically for generative AI should be established to mitigate the financial risk associated with its employment. It is essential to overhaul the Financial Regulatory Sandbox to allow financial services companies and fintech companies greater flexibility in developing and testing innovative digital services. Additionally, the AI Guidelines for the Financial Sector should be improved to prevent generative AI-based financial services from undermining financial stability and consumer protection.

1) See Schumpeter (1911) and Garleanu et al. (2012).

2) See Goldman Sachs (2023).

3) See McKinsey & Company (2023).

References

Accenture, 2023, A New Era of Generative AI for Everyone.

Garleanu, N., Panageas, S., Yu, J., 2012, Technological growth and asset pricing, Journal of Finance 67(4), 1265-1292.

Goldman Sachs, 2023, Generative AI Could Raise Global GDP by 7%, Goldman Sachs Research (2023.5).

McKinsey & Company, 2023, What’s the Future of Generative AI? An Early View in 15 Charts (2023. 8).

Schumpeter, J.A., 1911, The Theory of Economic Development, Harvard University Press, Cambridge.

Since the launch of Chat GPT at the end of 2022, generative AI has revolutionized nearly every industry, significantly enhancing productivity. Economic agents can leverage generative AI to generate creative text, images, music, videos, and program source codes. By employing deep learning on vast datasets, generative AI can perform tasks swiftly and accurately for users, such as searching, translating, and summarizing existing data. Moreover, by considering specific user preferences, it can produce personalized news and videos and recommend healthcare and financial services more conveniently and affordably. According to major academic research,1) technological innovation contributes to economic development by increasing potential growth rates through the enhancement of the total factor productivity (TFP). Goldman Sachs2) recently predicted that generative AI could increase global GDP by 7% (approximately USD 7 trillion) over the next decade and improve the productivity of economic agents by 1.5%. According to McKinsey’s estimates,3) generative AI technologies will boost labor productivity in nearly every industry, potentially resulting in operating income gains of 1.3% to 1.9% in major industries, while driving global economic growth by an annual average of 0.2% to 0.6% until 2040.

The proliferation of generative AI is expected to revolutionize the entire manufacturing and service industries, and its impact on the financial services industry is likely to stand out. The financial services industry primarily aims to enhance the utility of economic agents by efficiently allocating resources among them and providing risk diversification. By leveraging generative AI, it can quickly learn from a vast amount of financial and non-financial data and offer personalized financial services to economic agents more conveniently, affordably, and swiftly than ever before. This advancement is anticipated to increase the utility of economic agents and contribute to higher potential growth rates in the long run. Accenture (2023) found that among 20 types of industries, banking and insurance would benefit the most from generative AI in terms of workforce automation and work augmentation, with financial investment having the fourth highest potential for workforce automation and work augmentation (see Figure 1). McKinsey also suggested that the banking industry would see significant profitability gains from the widespread use of generative AI, second only to the high-tech industry. Specifically, the high-tech industry is expected to see a revenue increase of USD 240 billion to 460 billion, while the banking industry is projected to report a revenue increase of USD 200 billion to 340 billion.

Transformation in the financial services industry driven by generative AI

With the widespread adoption of generative AI, future economic and financial activities are expected to divulge significantly from historical trends (see Figure 2). First, the rise of personalized services facilitated by advances in generative AI is anticipated to empower households as influential economic actors. Equipped with hyper-intelligent systems for managing housing, clothing, and leisure, households will drive demand for personalized financial services, prompting financial institutions to expand their offerings accordingly. Second, the proliferation of generative AI is set to mitigate information asymmetries among economic agents, thereby enhancing the efficiency of resource allocation. In other words, generative AI will enhance the resource allocation function traditionally carried out by financial institutions, potentially reducing the government’s role in this area and fostering a shift towards a smaller government model. Third, the use of generative AI will spur cross-industry convergence and the emergence of innovative industries, increasing the importance of venture capital provision. Fourth, the growing reliance on data will boost the value of intangible assets capable of generating added value, such as high-quality information. Consequently, financial services companies are expected to shift their focus from tangible assets to intangible assets in terms of brokerage and investment services.

Global investment banks (IBs) and asset management firms are actively utilizing generative AI to increase internal operational efficiency and expand their analytical coverage. For example, Goldman Sachs’ trading division employs generative AI to learn and analyze large amounts of financial and non-financial data, optimizing systematic trading algorithms. In addition, Goldman Sachs’ research division utilizes proprietary large language models (LLMs) and generative AI algorithms to provide performance forecasts for companies worldwide. Morgan Stanley has collaborated with OpenAI to develop a specialized AI service capable of learning and analyzing both internal and external data. This generative AI service enables Morgan Stanley to identify customer preferences and deliver optimal portfolios in real-time, tailored to individual investment profiles. It also provides up-to-the-minute news on the companies, in which customers hold investments, and offers investment advisory services, such as buy or sell recommendations. Leading global asset management firms such as BlackRock and Vanguard employ generative AI to create optimized investment portfolios tailored to individual needs and to predict financial market conditions, facilitating dynamic portfolio rebalancing. These firms also leverage generative AI algorithms to attract new customers or offer new financial products.

Global insurance companies are utilizing or planning to integrate generative AI in nearly all business areas. Insurance companies are highly optimistic about the potential of generative AI, as it allows them to harness vast amounts of financial and non-financial data across all areas of the insurance ecosystem, including identifying customer product needs, calculating loss ratios, underwriting, marketing insurance products, paying out claims, and offering customer consultations. In particular, as the aging population drives up demand for integrated healthcare services, major global insurance companies are using individual medical data to design and market customized insurance products and provide personalized healthcare services, such as diet and exercise regimens. Lemonade, a digital insurance company in the US, offers personalized home and auto insurance products by analyzing customers’ financial and non-financial data. Additionally, it employs its own generative AI algorithms for insurance fraud detection. Swiss insurance company Zurich and Japan’s SBI Life Insurance utilize generative AI-driven chatbots to develop new products and streamline the claims payout process.

Financial risks posed by the proliferation of generative AI

The widespread adoption of generative AI has significantly increased efficiency within financial services companies, leading to the delivery of innovative financial services to customers. However, this advancement also introduces potential financial risks. Since generative AI relies on the ability to learn and analyze large amounts of financial and non-financial data, its usage can result in the leakage of material information belonging to financial institutions and individuals. There is also a risk of generating false information or producing excessive irrelevant data in the process of creating new documents, images, and videos. Furthermore, if generative AI learns and analyzes critical data to present new creative works without the consent of the data provider, it could infringe on intellectual property rights.

Excessive reliance on generative AI by financial services companies poses significant risks. A malfunction in generative AI algorithms could disrupt the financial system, resulting in systemic risk. Once a trading algorithm powered by generative AI is made public and widely adopted by a large number of investors, it may lead to an excessive concentration of financial activities in specific sectors. Moreover, if robo-advisors based on generative AI become prevalent, there is a possibility that programmers intentionally or accidentally recommend financial products that favor specific financial institutions or customers, potentially causing harm to financial consumers.

If a malfunction of generative AI algorithms causes significant harm to financial consumers, it may be challenging to hold anyone legally accountable. In Korea, major financial business laws, including the Banking Act, the Insurance Business Act, and the Financial Investment Services and Capital Markets Act, primarily impose penalties for regulatory violations in the form of personal sanctions against the violator or monetary penalties against the financial services company. Therefore, under the current regulatory framework, it is difficult to hold the financial services company legally accountable for malfunctions of generative AI. There is also the issue of polarization within the financial services industry. Small and medium-sized financial services companies may struggle to adopt generative AI due to limitations in manpower and budget, leading to decreased competitiveness and potentially resulting in long-term polarization within the financial services industry. On top of that, the widespread use of generative AI could lead to the loss of quality jobs in the industry, as generative AI can easily replace skilled personnel currently engaged in customer consultation, product development, credit evaluation, and risk management.

Implications for Korea

The proliferation of generative AI is expected to accelerate digital innovation in the financial services industry. By leveraging generative AI, financial services companies can offer more convenient, affordable, and faster services to a broader range of economic agents, while new industries will emerge through the convergence and innovation of financial and non-financial services. In practice, global financial market players, including commercial banks, insurance companies, and investment firms, are actively using generative AI to boost internal operational efficiency, enhance customer consultation capabilities, and expand innovative services. In contrast, their Korean counterparts have been slower to adopt generative AI due to limited digital adoption capabilities and regulatory constraints.

To facilitate financial innovation through generative AI, financial services companies should implement the following measures. First, their management should actively adopt and utilize generative AI. This requires improving the incentive system for executives and expanding immunity provision under liability structures to support long-term investment in AI-related personnel and IT infrastructure. Second, financial regulations should be relaxed to enable the use of generative AI by financial services companies. Regulatory reforms should focus on easing network separation regulations and promoting the integration of heterogeneous data, on the condition of imposing stricter sanctions on security incidents. To foster digital transformation in financial services companies, it is necessary to alleviate subsidiary ownership restrictions and broaden the scope of concurrent operation and incidental business activities. Third, a regulatory framework specifically for generative AI should be established to mitigate the financial risk associated with its employment. It is essential to overhaul the Financial Regulatory Sandbox to allow financial services companies and fintech companies greater flexibility in developing and testing innovative digital services. Additionally, the AI Guidelines for the Financial Sector should be improved to prevent generative AI-based financial services from undermining financial stability and consumer protection.

1) See Schumpeter (1911) and Garleanu et al. (2012).

2) See Goldman Sachs (2023).

3) See McKinsey & Company (2023).

References

Accenture, 2023, A New Era of Generative AI for Everyone.

Garleanu, N., Panageas, S., Yu, J., 2012, Technological growth and asset pricing, Journal of Finance 67(4), 1265-1292.

Goldman Sachs, 2023, Generative AI Could Raise Global GDP by 7%, Goldman Sachs Research (2023.5).

McKinsey & Company, 2023, What’s the Future of Generative AI? An Early View in 15 Charts (2023. 8).

Schumpeter, J.A., 1911, The Theory of Economic Development, Harvard University Press, Cambridge.