Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

The Catfish Effect of US Fintech Firms

Publication date Dec. 03, 2019

Summary

Recently, Charles Schwab, the largest retail brokerage firm in the US, announced the elimination of commissions for online trades of stocks, ETFs, and options. Its competitors such as E*Trade and TD Ameritrade also followed suit. What’s notable is that Robinhood, a small fintech firm, is behind the significant shift. Founded in Silicon Valley in 2013, Robinhood has been gaining sizable market share by offering zero commissions on stocks and ETF trading. It is actually becoming more common place in the financial services industry where a fintech firm disrupts the traditional competitive structure. The global financial industry is now in the mist of a shift from human capital towards technological capability. For existing players, fintech firms present a challenge as well as an opportunity at the same time. Technology is enabling the pioneering of new markets and changing the traditional competitive landscape. To stay ahead with the fintech trend and maintain a competitive advantage, Korean financial firms need to build a technological edge. Towards that end, they must develop a clear technology strategy and build a dedicated team with knowledge and expertise in the fintech industry. Going forward, Korean financial firms must be engaged in deepening Korea’s fintech ecosystem.

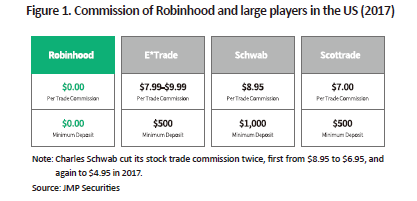

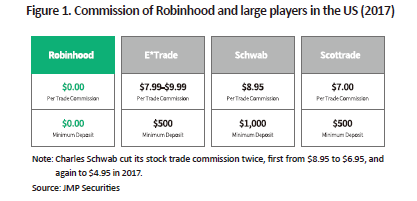

Fintech firms are shaking up the US financial industry as it sees the realization of the so-called catfish effect, a small firm triggering large-scale players to move forward. Charles Schwab, a US leading retail brokerage firm, slashed its online trading commission for equity, ETF, and options from the previous $4.95 per trade to zero starting from October 7, 2019. Various factors are behind Charles Schwab’s move, but a crucial one has been the popularity of free stock trading offered by Silicon Valley startup Robinhood. Charles Schwab CFO Peter Crawford stated, “We’re not feeling competitive pressure from these firms … yet, but we don’t want to fall into the trap that a myriad of other firms in a variety of industries have fallen into and wait too long to respond to new entrants. It has seemed inevitable that commissions would head towards zero, so why wait?”1) Other large-scale retail brokerage firms such as E*Trade and TD Ameritrade followed suit, announcing to offer commission-free trades.

Fintech firms’ impact goes beyond the securities industry to affect the overall financial sector, disrupting the existing competitive landscape and leading to the reshaping of existing business models. As Korean financial firms are also trying to develop their technological capabilities, they should pay attention to the recent development in the US market to glance a view on the developing trends in the financial services industry.

Entry of fintech firms and the new industry landscape

It was Charles Schwab, at one time, that led the innovation and reshaping of the competitive landscape in the US securities industry. Charles Schwab was founded in 1971 as a small brokerage and stock market newsletter publisher in San Francisco. On May 1, 1975, commonly referred to as May Day, the US Securities and Exchange Commission (SEC) recommended abolishing the fixed-rate securities trading commission that had been maintained for over a century, stirring up confusion in the US securities industry. When large brokerage firms such as Merrill Lynch were busy charging higher commissions, Charles Schwab introduced the discount brokerage model, offering the lowest commission and an online based business. In the 1980s, Charles Schwab rose to become the largest retail brokerage firm in the US, and has maintained that status for a long time.

Recently, the threat to Charles Schwab isn’t coming from its large-scale competitors, such as TD Ameritrade and E*Trade, but from small fintech players such as Robinhood. Robinhood, a mobile-based, branchless brokerage was founded in Silicon Valley by former high frequency trading platform developers Vladimir Tenev and Baiju Bhatt in 2013. The company put forward a business model offering commission-free trades of equity and ETFs, primarily targeting the millennial generation,2) who are mostly small investors and sensitive to transaction costs.3) On top of the low price, Robinhood’s simple, intuitive mobile trading system has appealed to the millennial generation, helping the company gain more than 6 million customers as of 2019. Moreover, its customer composition, with over 80% under the age of 35, is another reason that Robinhood is a firm to keep an eye on for large players that are eager to secure a future revenue base by turning the young adults into the customer base.

Pioneering new markets and forming new competition

Fintech firms are penetrating a broad range of segments in financial services, including areas once considered hard-to-access, by using tools such as big data and algorithms. For example, the key to M&A advising, that took hold as a core investment banking service in the 1980s, was considered to be the capability of bankers, their analytical, networking and client management skills. However, technology is beginning to replace human capability and fintech firms are penetrating the area of M&A advising.

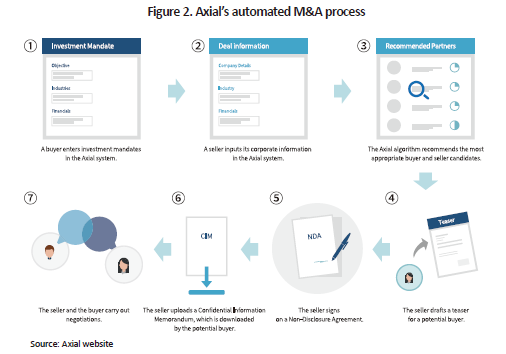

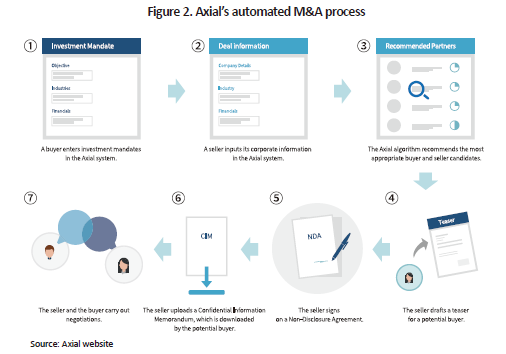

Established in 2010, Axial is a fintech firm providing an online platform that intermediates M&A deals by matching buyers and sellers of middle market firms, who are mostly unlisted small- to medium-sized firms. Axial’s service uses an algorithm that matches potential buyer firms with seller firms without human bankers’ intervention. For example, an investor interested in acquiring a firm can register for membership with Axial, fill in standardized forms including investment goals, target firm features. Axial’s algorithm then recommends potential transaction partners within four hours on average. Eight years since its establishment, Axial has aided its members close more than 2,000 deals and intermediate over $25 billion worth of investments, helping Axial become the world’s largest online investment network for unlisted firms.

Going forward, the collision between fintech firms such as Axial and large investment banks such as Goldman Sachs seems inevitable. Goldman Sachs, a traditional player once mainly targeting Fortune 500 firms, has recently been expanding into the middle market. David Solomon, who has been the CEO of Goldman Sachs since 2018 said, “There are lots and lots of companies … worth $500 million to $3 billion that have never been served by Goldman.” Stressing that the firm should expand its customer base, Solomon expected $5 billion in additional revenue from the middle market segment.4) Aiming to enhance the efficiency of IPO, M&A, and other investment banking deals, Goldman Sachs has mapped out every process into more than 100 steps to automate a substantial part of them.5) Simply put, technology is now turning once unprofitable markets into penetrable ones.

Effort to secure a technological edge

From the perspective of existing players, the newly emerging fintech firms are a potential competitor and a collaborator at the same time. Given the speed and diversity of technological development, it is inefficient for every single financial firm to develop its own technology. Thus, leveraging alliances with fintech firms is not an optional but a necessity. And any enhancement in the technological edge requires a clear digitalization strategy and a specialized team that is capable of realizing the strategy.

Toward that end, the way global players are developing technologies offers useful insights. For example, Goldman Sachs has a Principal Strategic Investment (PSI) unit that is in charge of enhancing business efficiency and carrying out fintech investments. The PSI unit is composed of experts with understanding and knowledge of the fintech industry, and is given independence and autonomy toward strategic decision making. As of 2019, the unit employs 28 persons 50% of whom are female. The unit has played a pivotal role in Goldman Sachs’ technology development and investment, such as the AI trading system Kensho, retail financial platform Marcus and the messenger service Symphony. The financial industry’s shift from human capital towards technological capability is an inevitable reality. To remain competitive, and not to lag behind competitors, Korean financial firms need to develop a long-term plan to build up their technological capabilities. Because realizing that plan takes more than an individual firm’s effort, they need to cooperate closely with Korean and foreign fintech firms. Also, Korean financial firms must double their commitment and engagement in expanding and deepening Korea’s fintech ecosystem.

1) Forbes, October 5, 2019, Fortunes of Charles Schwab and Two other Brokerage Billionaires Fall Nearly $3 Billion Combined After Cutting Trading Fees.

2) This refers to the generation born between the 1980s to the 2000s, aged between 18 and 35 as of 2018.

3) Robinhood has further expanded to option and crypto currency trades, and since 2019, cash management accounts (CMA).

4) Bloomberg, February 14, 2019, Goldman Considers Buying a Boutique in Mid-Market Push.

5) Bloomberg, June 13, 2017, Goldman Set Out to Automate IPOs and It Has Come Far, Really Fast.

Fintech firms’ impact goes beyond the securities industry to affect the overall financial sector, disrupting the existing competitive landscape and leading to the reshaping of existing business models. As Korean financial firms are also trying to develop their technological capabilities, they should pay attention to the recent development in the US market to glance a view on the developing trends in the financial services industry.

Entry of fintech firms and the new industry landscape

It was Charles Schwab, at one time, that led the innovation and reshaping of the competitive landscape in the US securities industry. Charles Schwab was founded in 1971 as a small brokerage and stock market newsletter publisher in San Francisco. On May 1, 1975, commonly referred to as May Day, the US Securities and Exchange Commission (SEC) recommended abolishing the fixed-rate securities trading commission that had been maintained for over a century, stirring up confusion in the US securities industry. When large brokerage firms such as Merrill Lynch were busy charging higher commissions, Charles Schwab introduced the discount brokerage model, offering the lowest commission and an online based business. In the 1980s, Charles Schwab rose to become the largest retail brokerage firm in the US, and has maintained that status for a long time.

Recently, the threat to Charles Schwab isn’t coming from its large-scale competitors, such as TD Ameritrade and E*Trade, but from small fintech players such as Robinhood. Robinhood, a mobile-based, branchless brokerage was founded in Silicon Valley by former high frequency trading platform developers Vladimir Tenev and Baiju Bhatt in 2013. The company put forward a business model offering commission-free trades of equity and ETFs, primarily targeting the millennial generation,2) who are mostly small investors and sensitive to transaction costs.3) On top of the low price, Robinhood’s simple, intuitive mobile trading system has appealed to the millennial generation, helping the company gain more than 6 million customers as of 2019. Moreover, its customer composition, with over 80% under the age of 35, is another reason that Robinhood is a firm to keep an eye on for large players that are eager to secure a future revenue base by turning the young adults into the customer base.

Pioneering new markets and forming new competition

Fintech firms are penetrating a broad range of segments in financial services, including areas once considered hard-to-access, by using tools such as big data and algorithms. For example, the key to M&A advising, that took hold as a core investment banking service in the 1980s, was considered to be the capability of bankers, their analytical, networking and client management skills. However, technology is beginning to replace human capability and fintech firms are penetrating the area of M&A advising.

Established in 2010, Axial is a fintech firm providing an online platform that intermediates M&A deals by matching buyers and sellers of middle market firms, who are mostly unlisted small- to medium-sized firms. Axial’s service uses an algorithm that matches potential buyer firms with seller firms without human bankers’ intervention. For example, an investor interested in acquiring a firm can register for membership with Axial, fill in standardized forms including investment goals, target firm features. Axial’s algorithm then recommends potential transaction partners within four hours on average. Eight years since its establishment, Axial has aided its members close more than 2,000 deals and intermediate over $25 billion worth of investments, helping Axial become the world’s largest online investment network for unlisted firms.

Going forward, the collision between fintech firms such as Axial and large investment banks such as Goldman Sachs seems inevitable. Goldman Sachs, a traditional player once mainly targeting Fortune 500 firms, has recently been expanding into the middle market. David Solomon, who has been the CEO of Goldman Sachs since 2018 said, “There are lots and lots of companies … worth $500 million to $3 billion that have never been served by Goldman.” Stressing that the firm should expand its customer base, Solomon expected $5 billion in additional revenue from the middle market segment.4) Aiming to enhance the efficiency of IPO, M&A, and other investment banking deals, Goldman Sachs has mapped out every process into more than 100 steps to automate a substantial part of them.5) Simply put, technology is now turning once unprofitable markets into penetrable ones.

Effort to secure a technological edge

From the perspective of existing players, the newly emerging fintech firms are a potential competitor and a collaborator at the same time. Given the speed and diversity of technological development, it is inefficient for every single financial firm to develop its own technology. Thus, leveraging alliances with fintech firms is not an optional but a necessity. And any enhancement in the technological edge requires a clear digitalization strategy and a specialized team that is capable of realizing the strategy.

Toward that end, the way global players are developing technologies offers useful insights. For example, Goldman Sachs has a Principal Strategic Investment (PSI) unit that is in charge of enhancing business efficiency and carrying out fintech investments. The PSI unit is composed of experts with understanding and knowledge of the fintech industry, and is given independence and autonomy toward strategic decision making. As of 2019, the unit employs 28 persons 50% of whom are female. The unit has played a pivotal role in Goldman Sachs’ technology development and investment, such as the AI trading system Kensho, retail financial platform Marcus and the messenger service Symphony. The financial industry’s shift from human capital towards technological capability is an inevitable reality. To remain competitive, and not to lag behind competitors, Korean financial firms need to develop a long-term plan to build up their technological capabilities. Because realizing that plan takes more than an individual firm’s effort, they need to cooperate closely with Korean and foreign fintech firms. Also, Korean financial firms must double their commitment and engagement in expanding and deepening Korea’s fintech ecosystem.

1) Forbes, October 5, 2019, Fortunes of Charles Schwab and Two other Brokerage Billionaires Fall Nearly $3 Billion Combined After Cutting Trading Fees.

2) This refers to the generation born between the 1980s to the 2000s, aged between 18 and 35 as of 2018.

3) Robinhood has further expanded to option and crypto currency trades, and since 2019, cash management accounts (CMA).

4) Bloomberg, February 14, 2019, Goldman Considers Buying a Boutique in Mid-Market Push.

5) Bloomberg, June 13, 2017, Goldman Set Out to Automate IPOs and It Has Come Far, Really Fast.