OPINION

2020 Mar/17

Special Listing Tracks and Investor Protection

Mar. 17, 2020

PDF

- Summary

- Recently, there has been a pronounced increase in innovative firms entering the exchange market via special listing tracks. A total of 72 firms newly listed between 2015 and 2019 fall into that category, showing the clear dominance of special listing tracks in this market. Despite the critical role in helping promising firms with technological power and growth potential to go public, special listing tracks have been also the subject of concerns, especially with regard to investor protection. Financial authorities and the Korea Exchange have made continuous strides in working on regulatory fixes-tougher disclosure rules, higher accounting transparency, to name a few-with the aim to improve market soundness of new growth industries and to protect investors. As more and more firms are expected to tap into special listing tracks to go public in the future, it’s highly important to adopt a differentiated approach to evaluating and monitoring firms with various industry- and firm-specific characteristics. Investors, financial services firms, the Korea Exchange, and the regulatory body should join hands together to come up with flexible plans and ardent effort for a balance between innovative firms’ growth and investors’ active market participation.

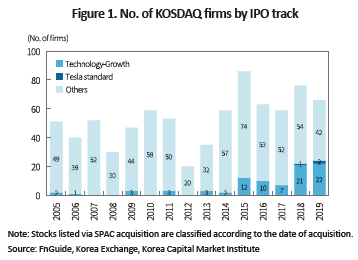

For the past few years, the Korea Exchange has strived for providing listing opportunities to a greater number of firms. Thanks to the efforts, the KOSDAQ saw a pronounced increase in initial public offerings of innovative firms that chose the market’s “technology-growth special listing tracks”, via which a total of 43 firms entered the market for 2018 and 2019 alone. During the same period, KOSDAQ IPOs excluding SPAC (Special Purpose Acquisition Company) listings reached 142 deals, meaning that one third of KOSDAQ IPOs are via special listing. This is viewed as a positive outcome as the policy allowed promising firms with technological power and growth potential to tap into the KOSDAQ market and thus helped liquidity flow into the stock market. However, most of the newly listed firms are pharmaceutical and bio firms in the high-risk, high-return industry, which is raising alarm about investor protection. At this juncture, this article explores the current state and characteristics of Korea’s special listing tracks, from which seeking to derive implications for development in this market segment and investor protection.

Expanded special listing tracks and listed firm characteristics

The technology-growth special listing is divided into the technology and growth tracks. A firm that wants to be eligible for the technology track should receive A and higher than BBB ratings from one of the two KRX-designated rating agencies. On the other hand, the growth track is available for a firm if the underwriter recognizes the firm’s growth potential and recommends it for listing without technology assessment. Instead, the underwriter must grant investors a “put-back option” for the sake of investor protection.

The technology special listing track was first introduced in March 2005, with the aim to list more bio venture firms with growth potential. To attract more firms, the technology track has been broadened to all industries in 2014. In 2017, the market also unveiled the growth track that offers access to firms recommended by underwriters. In that year, the KOSDAQ tried to diversify listing tracks by adding a viability criterion to the technology track, which aims to allow a firm with a unique business structure without technological power to be listed.

The technology-growth special listing tracks do not require firms to meet a certain business performance threshold. It’s open to any firm that meets a specified market capitalization or equity capita threshold, which is placed at a low level. Nevertheless, technology-growth tracks failed to attract IPOs as only 14 firms had chosen technology-growth tracks until 2014. It’s only after 2015 that the special listing tracks have begun making substantial outcomes. For five years from 2015 to 2019, a total of 72 firms carried out IPOs via the technology-growth tracks, and since then, they have taken hold as a leading path to IPO in the market.

One of the most evident characteristics found in firms listed via special listing tracks is a high bias towards few industries. Among a total of 88 listed firms in the technology-growth category as of end-2019, an absolute majority—64 firms—are in healthcare sector including the pharmaceutical, bio, medical equipment, and medical services.1) Despite a slight increase in non-bio firms such as nano new materials and voice recognition software providers on the special listing tracks, healthcare takes up an overwhelmingly large proportion (86%) of the technology-growth category in terms of market cap. This is a stark contrast to the low proportion of healthcare in the KOSPI market (6%) and in the KOSDAQ excluding the technology-growth category (18%).

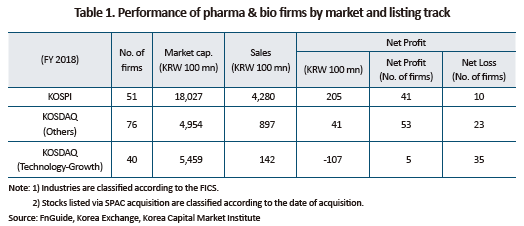

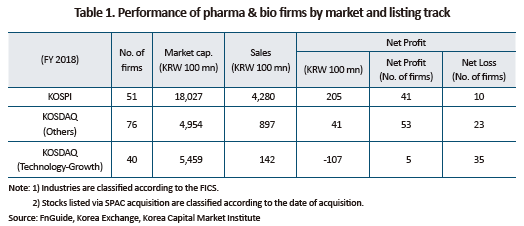

As concerned by some market participants, pharmaceutical and bio firms that entered the bourse via special listing show disappointing financial results. Table 1 shows key financial indicators of pharmaceutical and bio firms. As of 2018, pharmaceutical and bio firms in the technology-growth category had the average market cap of KRW 550 billion, and the average sales of KRW 14.2 billion. Those firms’ average net loss stood at KRW 10.7 trillion, with only five of 40 pharmaceutical and bio firms reported a net profit. The figure is far lower compared to other KOSDAQ firms in the same industry.

However, such poor earnings should not be considered a serious issue because what’s required by the nature of pharmaceutical and bio industries is a focus on research and development, rather than today’s sales. An increase in preference to growth potential over solid financial performance is a global trend, not limited to Korea. Among 544 firms newly listed on the NYSE and NASDAQ between 2015 and 2019, a total of 205 firms are biotech firms, with only three realizing net profits.2) Hong Kong has made aggressive strides in attracting more bio firms. As part of the strides in listing more unprofitable biotech companies that cannot overcome the high entry barrier to the main board, it established a separate listing track specialized for biotech firms.

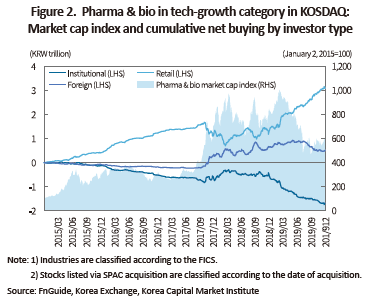

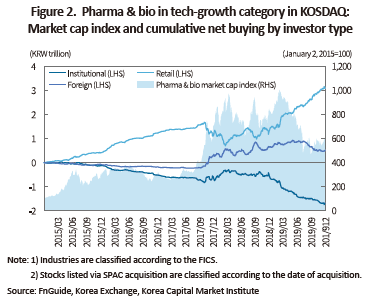

Growing interest among retail investors and risks

Although listing bio firms with growth potential takes hold as a global trend, caution is necessary because the KOSDAQ market is largely driven by retail investors and thus far different from global markets. Pharmaceutical and bio firms in the technology-growth category grew 6.4 times in terms of market cap between early 2015 and late 2019. At the end of 2017, stock prices once surged to abruptly push up market cap up to 10 times the early 2015 level, only to swing back to the current level in the middle of 2019. Retail investors maintained net buying for the period although they shed some shares to realize returns during abrupt price hikes. As a result, retail investors’ cumulative net buying of pharmaceutical and bio industries in the technology-growth category amounted to KRW 3 trillion between 2015 and 2019. Given the KRW 19 trillion net buying by retail investors in the entire KOSDAQ market, this clearly evidences a rapid rise in retail investors’ interest and investment in newly listed pharmaceutical and bio industries. By contrast, Korea’s institutional investors continuously net sold KRW 1.7 trillion worth of shares in this market from the beginning of 2015. As of late 2019, foreign investors’ net buying stood at only KRW 500 billion as they are shifting towards net selling from net buying.

Given the nature of pharmaceutical and bio industries, there exist many risk factors associated to each step of the drug development process from commercialization and technology transfer. A drug is developed via several different steps: Discovery of candidate compounds, preclinical studies, phase I trials, phase II trials, phase III trials, government approval, and commercialization. On average, developing a drug costs more than KRW 1 trillion and takes approximately 15 years, with the success rate as low as only 0.01%. The market for copy drugs such as biosimilars is hard to enter for latecomers. In addition, the fierce price competition among the increased number of new entrants makes chances of making profits very slim. Because a commercial success in pharmaceutical and bio industries takes high uncertainty and a long period of time, they are considered high-risk, high-return industries.

What’s at issue is whether retail investors in Korea are fully capable of recognizing and taking on risks inherent in pharmaceutical and bio industries and individual firms. Abrupt swings in stock prices were actually observed in some stocks (e.g., Sillajen, Helixmith, etc.) whenever a failed clinical trial was disclosed. In another case, Kolon TissueGene going public in 2017 has made their investors suffer as the firm’s head is being prosecuted for an alleged listing fraud where he had been accused of having solicited investors using a Ministry of Food and Drug Safety license the firm had acquired based on false reporting.

Conclusion and implications

Supervisory authorities and the KRX have strived for making the regulatory framework more complete, aiming to improve the soundness of new growth industries and to protect investors. As part of efforts, the Financial Supervisory Service (FSC) unveiled its business reporting guideline and toughened the screening process in 2018.3) More recently in February 2020, the KRX unveiled disclosure guidelines for pharmaceutical and bio industries in its way to seek to provide more substantial information under the disclosure framework on a negative-list basis.4) To enhance transparency in capitalizing research and development expenses, the FSC presented a set of detailed criteria under which those expenses are capitalized as an asset depending on the development stage and product type, and devised disclosure standards.5)

Going forward, more diversified firms are expected to enter the exchange via special listing tracks. IPOs of non-bio firms increased substantially to 14 firms for the past two years, and now a total of 20 non-bio firms are listed. Amid the growing interest in diversified areas such as materials, parts, and equipment, and fintech, more firms in those industries are likely to tap into the exchange. And as special listing tracks that had been limited to Korean firms only were expanded to foreign firms in 2019, Korea likely see more cases of foreign firms’ listing in the near future.

It’s important for investors, securities firms, the KRX, and supervisory authorities to deal with the issue more flexibly, and exert ardent efforts in shaping a win-win, mutually-reinforcing environment where innovative firms with financing needs could tap into the exchange market driven by active investors.

What’s necessary for supervisory authorities and the KRX is to make an active effort in tackling down any unfair trade activity, and monitoring any distress, in seeking to enhance market confidence and protect investors. As a greater number of early-stage innovative firms and more diversified industries emerge, information asymmetry could rise, making it even more difficult to accurately understand a firm’s conditions. This eventually will raise concerns over any corporate distress or unfair trade. To prevent investors from losing their confidence in the market, there should be a fast-paced, aggressive probe into any unfair trade activity, breach of disclosure mandates, or any unlawful elements arising from the process of maintaining listing status, any one of which should be dealt with stern measures.

Under relaxed listing criteria, underwriters should play an important role in discovering promising firms in early growth stage, and assessing their value. Indeed, it’s inevitable for a firm entering the exchange via special listing tracks to be distressed later due to any change in market conditions or any unexpected failure in technological development or commercialization. However, it doesn’t mean that listing is allowed for a weak firm with insufficient technological power or growth potential, or based on false reporting. Underwriters should be equipped with higher expertise in assessing a diverse range of tech firms.

Also necessary is a change in investor perception towards listed companies. Under the general listing standards, there should be no problem in regarding a firm’s listing as evidence of sustainability and financial soundness on a going concern basis. However, it’s more appropriate that special listing tracks are viewed as a proof of future potential, rather than as a proven qualification for maintaining the listing status. This requires investors to properly recognize the fact that a firm listed via special listing tracks could have higher risks compared to other stocks. In addition, investors should pay continuous attention to disclosure seeking to induce firms to voluntarily disclose sufficient information in a timely manner. It’s important for investors to call for more expert analyses on corporate value and growth potential, while showing greater interest in the innate value of their investments than short-term returns so as to increase their investment horizon. Last but not least, there will be more and more cases that require differentiated listing standards across industries. To deal with that properly, a more proactive approach is needed, such as raising public attention to bring relevant authorities, the KRX, and investors into the solution-seeking process.

1) Industries are classified according to the FnGuide Industry Classification Standard.

2) Ritter, J. (2019)

3) Financial Supervisory Service (August 14, 2018); Financial Supervisory Service (December 24, 2018)

4) Korea Exchange (February, 2020)

5) Financial Supervisory Service (September 19, 2018)

References

Ritter, J., 2019, Initial public offerings: Technology stock IPOs.

(Korean)

Financial Supervisory Service, August 14, 2018, Disclosure of pharma & bio firms and investor protection measures, Press Release.

Financial Supervisory Service, September 19, 2018, Supervisory guidelines on accounting treatment of R&D expenses of pharma & bio firms, Press Release.

Financial Supervisory Service, December 24, 2018, A quick assessment on how pharma & bio firms applied best practices to their disclosure, Press Release.

Korea Exchange, February, 2020, Guidelines on negative-list disclosure for pharmaceutical and bio firms.

Expanded special listing tracks and listed firm characteristics

The technology-growth special listing is divided into the technology and growth tracks. A firm that wants to be eligible for the technology track should receive A and higher than BBB ratings from one of the two KRX-designated rating agencies. On the other hand, the growth track is available for a firm if the underwriter recognizes the firm’s growth potential and recommends it for listing without technology assessment. Instead, the underwriter must grant investors a “put-back option” for the sake of investor protection.

The technology special listing track was first introduced in March 2005, with the aim to list more bio venture firms with growth potential. To attract more firms, the technology track has been broadened to all industries in 2014. In 2017, the market also unveiled the growth track that offers access to firms recommended by underwriters. In that year, the KOSDAQ tried to diversify listing tracks by adding a viability criterion to the technology track, which aims to allow a firm with a unique business structure without technological power to be listed.

The technology-growth special listing tracks do not require firms to meet a certain business performance threshold. It’s open to any firm that meets a specified market capitalization or equity capita threshold, which is placed at a low level. Nevertheless, technology-growth tracks failed to attract IPOs as only 14 firms had chosen technology-growth tracks until 2014. It’s only after 2015 that the special listing tracks have begun making substantial outcomes. For five years from 2015 to 2019, a total of 72 firms carried out IPOs via the technology-growth tracks, and since then, they have taken hold as a leading path to IPO in the market.

As concerned by some market participants, pharmaceutical and bio firms that entered the bourse via special listing show disappointing financial results. Table 1 shows key financial indicators of pharmaceutical and bio firms. As of 2018, pharmaceutical and bio firms in the technology-growth category had the average market cap of KRW 550 billion, and the average sales of KRW 14.2 billion. Those firms’ average net loss stood at KRW 10.7 trillion, with only five of 40 pharmaceutical and bio firms reported a net profit. The figure is far lower compared to other KOSDAQ firms in the same industry.

However, such poor earnings should not be considered a serious issue because what’s required by the nature of pharmaceutical and bio industries is a focus on research and development, rather than today’s sales. An increase in preference to growth potential over solid financial performance is a global trend, not limited to Korea. Among 544 firms newly listed on the NYSE and NASDAQ between 2015 and 2019, a total of 205 firms are biotech firms, with only three realizing net profits.2) Hong Kong has made aggressive strides in attracting more bio firms. As part of the strides in listing more unprofitable biotech companies that cannot overcome the high entry barrier to the main board, it established a separate listing track specialized for biotech firms.

Growing interest among retail investors and risks

Although listing bio firms with growth potential takes hold as a global trend, caution is necessary because the KOSDAQ market is largely driven by retail investors and thus far different from global markets. Pharmaceutical and bio firms in the technology-growth category grew 6.4 times in terms of market cap between early 2015 and late 2019. At the end of 2017, stock prices once surged to abruptly push up market cap up to 10 times the early 2015 level, only to swing back to the current level in the middle of 2019. Retail investors maintained net buying for the period although they shed some shares to realize returns during abrupt price hikes. As a result, retail investors’ cumulative net buying of pharmaceutical and bio industries in the technology-growth category amounted to KRW 3 trillion between 2015 and 2019. Given the KRW 19 trillion net buying by retail investors in the entire KOSDAQ market, this clearly evidences a rapid rise in retail investors’ interest and investment in newly listed pharmaceutical and bio industries. By contrast, Korea’s institutional investors continuously net sold KRW 1.7 trillion worth of shares in this market from the beginning of 2015. As of late 2019, foreign investors’ net buying stood at only KRW 500 billion as they are shifting towards net selling from net buying.

Given the nature of pharmaceutical and bio industries, there exist many risk factors associated to each step of the drug development process from commercialization and technology transfer. A drug is developed via several different steps: Discovery of candidate compounds, preclinical studies, phase I trials, phase II trials, phase III trials, government approval, and commercialization. On average, developing a drug costs more than KRW 1 trillion and takes approximately 15 years, with the success rate as low as only 0.01%. The market for copy drugs such as biosimilars is hard to enter for latecomers. In addition, the fierce price competition among the increased number of new entrants makes chances of making profits very slim. Because a commercial success in pharmaceutical and bio industries takes high uncertainty and a long period of time, they are considered high-risk, high-return industries.

What’s at issue is whether retail investors in Korea are fully capable of recognizing and taking on risks inherent in pharmaceutical and bio industries and individual firms. Abrupt swings in stock prices were actually observed in some stocks (e.g., Sillajen, Helixmith, etc.) whenever a failed clinical trial was disclosed. In another case, Kolon TissueGene going public in 2017 has made their investors suffer as the firm’s head is being prosecuted for an alleged listing fraud where he had been accused of having solicited investors using a Ministry of Food and Drug Safety license the firm had acquired based on false reporting.

Conclusion and implications

Supervisory authorities and the KRX have strived for making the regulatory framework more complete, aiming to improve the soundness of new growth industries and to protect investors. As part of efforts, the Financial Supervisory Service (FSC) unveiled its business reporting guideline and toughened the screening process in 2018.3) More recently in February 2020, the KRX unveiled disclosure guidelines for pharmaceutical and bio industries in its way to seek to provide more substantial information under the disclosure framework on a negative-list basis.4) To enhance transparency in capitalizing research and development expenses, the FSC presented a set of detailed criteria under which those expenses are capitalized as an asset depending on the development stage and product type, and devised disclosure standards.5)

Going forward, more diversified firms are expected to enter the exchange via special listing tracks. IPOs of non-bio firms increased substantially to 14 firms for the past two years, and now a total of 20 non-bio firms are listed. Amid the growing interest in diversified areas such as materials, parts, and equipment, and fintech, more firms in those industries are likely to tap into the exchange. And as special listing tracks that had been limited to Korean firms only were expanded to foreign firms in 2019, Korea likely see more cases of foreign firms’ listing in the near future.

It’s important for investors, securities firms, the KRX, and supervisory authorities to deal with the issue more flexibly, and exert ardent efforts in shaping a win-win, mutually-reinforcing environment where innovative firms with financing needs could tap into the exchange market driven by active investors.

What’s necessary for supervisory authorities and the KRX is to make an active effort in tackling down any unfair trade activity, and monitoring any distress, in seeking to enhance market confidence and protect investors. As a greater number of early-stage innovative firms and more diversified industries emerge, information asymmetry could rise, making it even more difficult to accurately understand a firm’s conditions. This eventually will raise concerns over any corporate distress or unfair trade. To prevent investors from losing their confidence in the market, there should be a fast-paced, aggressive probe into any unfair trade activity, breach of disclosure mandates, or any unlawful elements arising from the process of maintaining listing status, any one of which should be dealt with stern measures.

Under relaxed listing criteria, underwriters should play an important role in discovering promising firms in early growth stage, and assessing their value. Indeed, it’s inevitable for a firm entering the exchange via special listing tracks to be distressed later due to any change in market conditions or any unexpected failure in technological development or commercialization. However, it doesn’t mean that listing is allowed for a weak firm with insufficient technological power or growth potential, or based on false reporting. Underwriters should be equipped with higher expertise in assessing a diverse range of tech firms.

Also necessary is a change in investor perception towards listed companies. Under the general listing standards, there should be no problem in regarding a firm’s listing as evidence of sustainability and financial soundness on a going concern basis. However, it’s more appropriate that special listing tracks are viewed as a proof of future potential, rather than as a proven qualification for maintaining the listing status. This requires investors to properly recognize the fact that a firm listed via special listing tracks could have higher risks compared to other stocks. In addition, investors should pay continuous attention to disclosure seeking to induce firms to voluntarily disclose sufficient information in a timely manner. It’s important for investors to call for more expert analyses on corporate value and growth potential, while showing greater interest in the innate value of their investments than short-term returns so as to increase their investment horizon. Last but not least, there will be more and more cases that require differentiated listing standards across industries. To deal with that properly, a more proactive approach is needed, such as raising public attention to bring relevant authorities, the KRX, and investors into the solution-seeking process.

1) Industries are classified according to the FnGuide Industry Classification Standard.

2) Ritter, J. (2019)

3) Financial Supervisory Service (August 14, 2018); Financial Supervisory Service (December 24, 2018)

4) Korea Exchange (February, 2020)

5) Financial Supervisory Service (September 19, 2018)

References

Ritter, J., 2019, Initial public offerings: Technology stock IPOs.

(Korean)

Financial Supervisory Service, August 14, 2018, Disclosure of pharma & bio firms and investor protection measures, Press Release.

Financial Supervisory Service, September 19, 2018, Supervisory guidelines on accounting treatment of R&D expenses of pharma & bio firms, Press Release.

Financial Supervisory Service, December 24, 2018, A quick assessment on how pharma & bio firms applied best practices to their disclosure, Press Release.

Korea Exchange, February, 2020, Guidelines on negative-list disclosure for pharmaceutical and bio firms.