Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Needs for Thematic Reviews of Investor Suitability and Regulatory Improvements

Publication date Jul. 07, 2020

Summary

A suitability test serves to enhance investors’ capabilities of self-protection and self-responsibility, while making retail banks and investment brokers remain vigilant of any potential mis-selling. However, according to the criteria, method, and procedure of evaluating an investor’s suitability, errors can occur in the evaluation and the results can be manipulated in any cases. This was what actually happened in Korea’s recent derivative-linked funds (DLF) and Lime fund mis-selling scandals: Many of the sellers of those funds were found to have improperly evaluated investor suitability and manipulated the results. This necessitates a thorough review of how retail banks and investment brokers comply with the regulatory requirements for investor suitability. Also necessary is to supplement the framework of investor suitability to meet the non-face-to-face environment in the preparation for the coming era of contactless financial services amid the lingering Covid-19 pandemic. Alongside, it should be better to allow financial firms to have access to clients’ own financial information (MyData) for testing investor suitability more completely.

The lingering Covid-19 pandemic will accelerate the rise of contactless financial services and dramatically increase non-face-to-face sales of financial investment products as the low rate trend will keep lowering deposit interest rates. However, the recent mis-selling scandals involving DLF and Lime funds have raised a question mark on whether retail banks and investment brokers are properly assess investor suitability when they recommend or sell financial investment products to their clients. As the rise of sales via non-face-to-face channels could possibly increase chances of mis-selling, this article tries to review how retail banks and investment brokers assess investor suitability, and proposes some ideas supplement the current system, which will help prevent mis-selling in the era of growing contactless services.

What a suitability test means

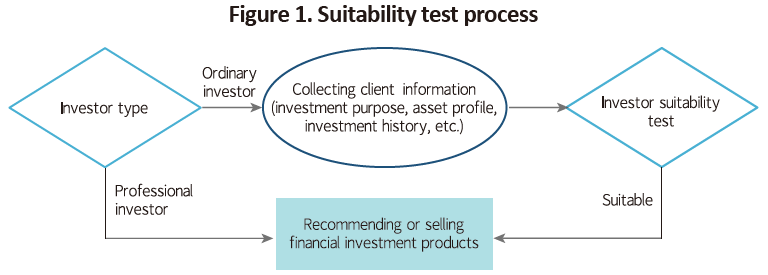

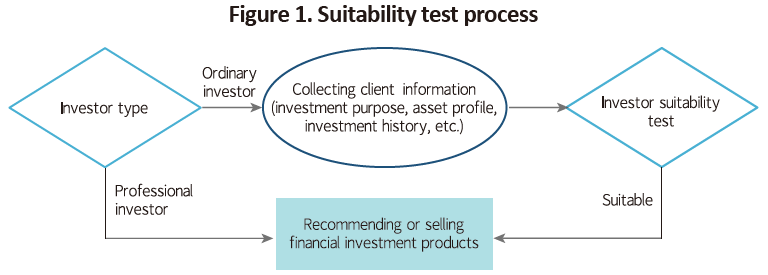

Under Article 46 of the Financial Investment Services and Capital Markets Act, any financial firm shall comply with the suitability principle as illustrated in Figure 1.1) A suitability test begins when a financial services firm asks its client whether he or she is an ordinary or professional investor. An ordinary investor is then asked about details such as the investment purpose, asset profile, and investment history before being recommended specific financial investment products. A financial investment product can be recommended or sold to an investor only if it is proved suitable for his/her investment purpose, asset profile, and investment experience. A product sales or recommendation is not allowed without the suitability test.

The suitability test system has three important implications. First, it helps investors to properly ponder upon their investment appetite and to make an informed decision to invest in financial investment products. Second, it ensures investors to better identify whether a financial services firm recommends or distributes a product that is not suitable for their investment appetite. Third, it keeps reminding financial institutions of the fact that any mis-selling could lead to a legal sanction. In short, the system helps investors to bolster their self-responsibility and self-protection while holding retail banks and investment brokers more accountable for product sales and recommendations.

Problems in suitability test

Despite the meaningful policy objectives, the suitability test is often deployed by means of avoiding accountability for mis-selling, rather than effectively preventing mis-selling in advance. This is because the standards, methods, and procedures of a suitability test are prone to errors and manipulation, and also because the results based on client information can be hardly verified by a third party. Citing that aspect, Japan’s Financial Services Agency concluded that the suitability test turned to a mere formality and was not properly functioning.2)

The possibility of errors in the suitability test stems from three reasons. First, it is never easy for a financial services firm to accurately collect every piece of suitability-related information via interviews or questionnaires. This becomes particularly tricky in non-face-to-face, online contacts. Under the Standard Working Rules on Investment Recommendations by Korea Financial Investment Association (KOFIA), a financial services firm should collect client information via at least 27 questions, but quite a few of them are difficult for investors to answer immediately.3) For example, it requires more than oral accounts to accurately gauge an investor’s financial conditions including the composition of financial assets.

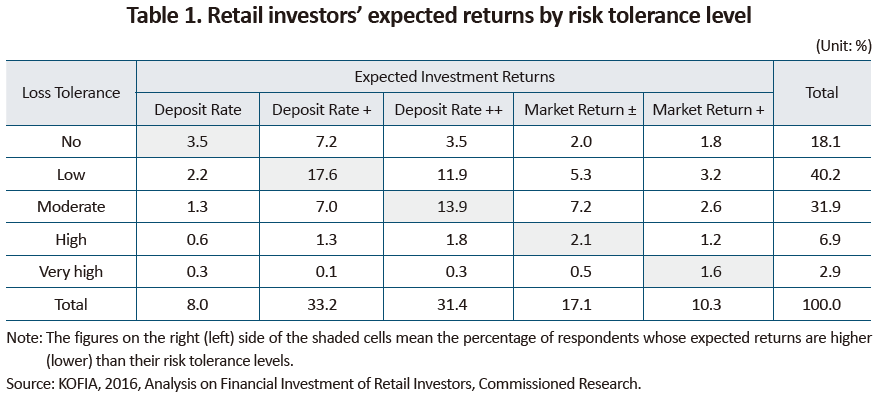

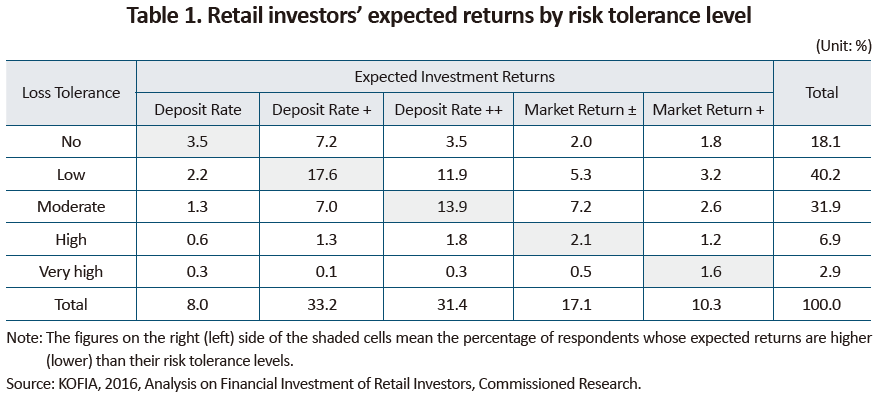

Second, the result of the test may vary depending on the criteria for sorting out the answers that are often contradicting and inconsistent. For example, it seems only natural for an investor to expect an investment return that is proportional to his own risk tolerance level under the high-risk, high-return principle. However, a KOFIA survey carried out in 2016 said otherwise: Among a total of 2,375 respondents, about 45.8% (1,089 respondents) gave expected investment returns that were higher than their risk tolerance levels, while the returns expected by 15.5% (368 respondents) of the respondents were lower than their risk tolerance levels.4) In this case, the result of the suitability test depends on how the suitability criteria are adjusted—either to the expected investment return or the risk tolerance level.

Third, the result also depends on the method by which investor suitability is tested. KOFIA’s Standard Working Rules on Investment Recommendations present some examples such as scoring, factor-out, and mixed methods.5) However, each method may produce different test results depending on the criteria for scoring or factoring out unsuitable products. For example, it’s possible that age is given a low score, or is regarded as less-important factor-out criteria, which may result in a high-risk financial investment product being sold or recommended to an aged investor.

What’s more serious is a possibility of result manipulation. This not only makes it difficult for financial firm staff to properly evaluate suitability during product sales, but also hinders a third party from verifying the appropriateness of the result after the sales. That’s exactly what happened in four out of six cases of DLF mis-selling: The Financial Dispute Settlement Committee of the Financial Supervisory Service ordered two commercial banks to be partially liable to compensate losses to their investors in December 2019. In those four cases, bank staff was found to have manipulated the suitability test results, arbitrarily upgrading client investment appetite to a riskier grade of “active” or “aggressive”.6) Other than that, there have been reports about several other cases of result manipulation by financial firm staff.

Needs for thematic reviews of investor suitability and regulatory improvements

What’s needed to properly assess the appropriateness of the suitability test is a thorough review on the current practice. This is what the Securities and Exchange Commission (SEC) in the US and the Financial Conduct Authority (FCA) do on a regular or irregular basis. Every year or so, they implement focused or thematic evaluations on how retail banks and investment brokers run the suitability test, based on which to provide proper guidance if needed.7) 8) By contrast, Korea’s dealing of the issue is limited to ex-post investigation into mis-selling cases. The focus of the investigation is primarily on the appropriateness of the suitability test, not on how to improve the system. Regulators should channel more effort into thoroughly reviewing how retail banks and investment brokers test investor suitability in practice and deriving ideas for possible regulatory improvements.

Also worth considering is designing a better suitability test system that could be better poised for the rapid rise in contactless financial services. KOFIA’s Standard Working Rules on Investment Recommendations guide retail banks and investment brokers to collect client information for evaluating suitability based on face-to-face contacts. As non-face-to-face financial transactions are expected to increase exponentially, retail banks and investment brokers need to come up with their own guidelines on how to properly evaluate suitability via non-face-to-face contacts. Non-face-to-face contacts usually lack interaction and often lead to a situation requiring exceptional guidelines. For example, there might be cases where investors in certain age groups need additional information, or investors may provide contradicting or inconsistent responses. Also necessary is a system where those financial firms use regtech or similar tools to monitor how their staff is running suitability tests. Desirably, such a system should be able to prevent mis-selling triggered by unsuitable product recommendations when more financial investment products are expected to be sold via non-face-to-face channels going forward.

Financial authorities also have a role to play. For example, Korea unveiled MyData services with the revision in the Credit Information Use and Protection Act in January 2020. MyData services enable investors, upon their agreement and request, to be provided with their own transaction history and all financial information held by financial institutions. If a financial firm have access to that financial information, it will easily find out the accurate status of client assets and properly evaluate investor suitability. However, the revised Credit Information Use and Protection Act explicitly prescribes that the financial information shall be provided only to MyData businesses or financial firms specified under the Presidential Decree. For the ongoing legislative revision on the Decree, a desirable direction would be to allow more retail banks and investment brokers to access their clients’ financial information for the purpose of the suitability test.

1) On March 25, 2021, the suitability regulation currently stipulated under the Financial Investment Services and Capital Markets Act will be transferred to the Financial Consumer Protection Act that was enacted in March 2020.

2) 金融庁, December 17, 2018,「高齢社会における金融サービスのあり方」等の議論に関連して これまでいただいた意見等の整理, 事務局説明資料.

3) Based on contacts with clients, retail banks and investment brokers need to collect information on their clients's asset profile, investment experience, their current and overall investment purpose and attitude towards investment returns, financial literacy and knowledge, risk tolerance level, family relations, taxation, age, vulnerable investor status, investment horizon, investment products in which they are interested, and investment size.

4) The survey was conducted in July 2016 by Gallup Korea and five securities firms among a total of 2,399 retail investors aged 30 or older who reside in seven regions in Korea.

5) Scoring is a method that evaluates a client’s investment appetite with the total score that is the sum of the scores from each question. On the other hand, the factor-out method uses questions and answers for opting out financial investment products that are unsuitable for sales or recommendation. The mixed method uses both scoring and factor-out methods.

6) Financial Supervisory Service, December 5, 2019, FDSC ordered DLF sellers to compensate 40% to 80% of losses, Press Release.

7) SEC, 2019, How the SEC works to protect senior investors, Office of the Investor Advocate.

8) The FCA collected and assessed a total of 150 suitability test files from 15 wealth management firms and private banks in December 2015. Slightly later in February 2016, it implemented a thematic review on whether investment advisers provide suitable advice. More recently in May 2017, it reviewed the suitability of 1,142 investment advice and the appropriateness of disclosure of a total of 656 financial firms.

What a suitability test means

Under Article 46 of the Financial Investment Services and Capital Markets Act, any financial firm shall comply with the suitability principle as illustrated in Figure 1.1) A suitability test begins when a financial services firm asks its client whether he or she is an ordinary or professional investor. An ordinary investor is then asked about details such as the investment purpose, asset profile, and investment history before being recommended specific financial investment products. A financial investment product can be recommended or sold to an investor only if it is proved suitable for his/her investment purpose, asset profile, and investment experience. A product sales or recommendation is not allowed without the suitability test.

Problems in suitability test

Despite the meaningful policy objectives, the suitability test is often deployed by means of avoiding accountability for mis-selling, rather than effectively preventing mis-selling in advance. This is because the standards, methods, and procedures of a suitability test are prone to errors and manipulation, and also because the results based on client information can be hardly verified by a third party. Citing that aspect, Japan’s Financial Services Agency concluded that the suitability test turned to a mere formality and was not properly functioning.2)

The possibility of errors in the suitability test stems from three reasons. First, it is never easy for a financial services firm to accurately collect every piece of suitability-related information via interviews or questionnaires. This becomes particularly tricky in non-face-to-face, online contacts. Under the Standard Working Rules on Investment Recommendations by Korea Financial Investment Association (KOFIA), a financial services firm should collect client information via at least 27 questions, but quite a few of them are difficult for investors to answer immediately.3) For example, it requires more than oral accounts to accurately gauge an investor’s financial conditions including the composition of financial assets.

Second, the result of the test may vary depending on the criteria for sorting out the answers that are often contradicting and inconsistent. For example, it seems only natural for an investor to expect an investment return that is proportional to his own risk tolerance level under the high-risk, high-return principle. However, a KOFIA survey carried out in 2016 said otherwise: Among a total of 2,375 respondents, about 45.8% (1,089 respondents) gave expected investment returns that were higher than their risk tolerance levels, while the returns expected by 15.5% (368 respondents) of the respondents were lower than their risk tolerance levels.4) In this case, the result of the suitability test depends on how the suitability criteria are adjusted—either to the expected investment return or the risk tolerance level.

What’s more serious is a possibility of result manipulation. This not only makes it difficult for financial firm staff to properly evaluate suitability during product sales, but also hinders a third party from verifying the appropriateness of the result after the sales. That’s exactly what happened in four out of six cases of DLF mis-selling: The Financial Dispute Settlement Committee of the Financial Supervisory Service ordered two commercial banks to be partially liable to compensate losses to their investors in December 2019. In those four cases, bank staff was found to have manipulated the suitability test results, arbitrarily upgrading client investment appetite to a riskier grade of “active” or “aggressive”.6) Other than that, there have been reports about several other cases of result manipulation by financial firm staff.

Needs for thematic reviews of investor suitability and regulatory improvements

What’s needed to properly assess the appropriateness of the suitability test is a thorough review on the current practice. This is what the Securities and Exchange Commission (SEC) in the US and the Financial Conduct Authority (FCA) do on a regular or irregular basis. Every year or so, they implement focused or thematic evaluations on how retail banks and investment brokers run the suitability test, based on which to provide proper guidance if needed.7) 8) By contrast, Korea’s dealing of the issue is limited to ex-post investigation into mis-selling cases. The focus of the investigation is primarily on the appropriateness of the suitability test, not on how to improve the system. Regulators should channel more effort into thoroughly reviewing how retail banks and investment brokers test investor suitability in practice and deriving ideas for possible regulatory improvements.

Also worth considering is designing a better suitability test system that could be better poised for the rapid rise in contactless financial services. KOFIA’s Standard Working Rules on Investment Recommendations guide retail banks and investment brokers to collect client information for evaluating suitability based on face-to-face contacts. As non-face-to-face financial transactions are expected to increase exponentially, retail banks and investment brokers need to come up with their own guidelines on how to properly evaluate suitability via non-face-to-face contacts. Non-face-to-face contacts usually lack interaction and often lead to a situation requiring exceptional guidelines. For example, there might be cases where investors in certain age groups need additional information, or investors may provide contradicting or inconsistent responses. Also necessary is a system where those financial firms use regtech or similar tools to monitor how their staff is running suitability tests. Desirably, such a system should be able to prevent mis-selling triggered by unsuitable product recommendations when more financial investment products are expected to be sold via non-face-to-face channels going forward.

Financial authorities also have a role to play. For example, Korea unveiled MyData services with the revision in the Credit Information Use and Protection Act in January 2020. MyData services enable investors, upon their agreement and request, to be provided with their own transaction history and all financial information held by financial institutions. If a financial firm have access to that financial information, it will easily find out the accurate status of client assets and properly evaluate investor suitability. However, the revised Credit Information Use and Protection Act explicitly prescribes that the financial information shall be provided only to MyData businesses or financial firms specified under the Presidential Decree. For the ongoing legislative revision on the Decree, a desirable direction would be to allow more retail banks and investment brokers to access their clients’ financial information for the purpose of the suitability test.

1) On March 25, 2021, the suitability regulation currently stipulated under the Financial Investment Services and Capital Markets Act will be transferred to the Financial Consumer Protection Act that was enacted in March 2020.

2) 金融庁, December 17, 2018,「高齢社会における金融サービスのあり方」等の議論に関連して これまでいただいた意見等の整理, 事務局説明資料.

3) Based on contacts with clients, retail banks and investment brokers need to collect information on their clients's asset profile, investment experience, their current and overall investment purpose and attitude towards investment returns, financial literacy and knowledge, risk tolerance level, family relations, taxation, age, vulnerable investor status, investment horizon, investment products in which they are interested, and investment size.

4) The survey was conducted in July 2016 by Gallup Korea and five securities firms among a total of 2,399 retail investors aged 30 or older who reside in seven regions in Korea.

5) Scoring is a method that evaluates a client’s investment appetite with the total score that is the sum of the scores from each question. On the other hand, the factor-out method uses questions and answers for opting out financial investment products that are unsuitable for sales or recommendation. The mixed method uses both scoring and factor-out methods.

6) Financial Supervisory Service, December 5, 2019, FDSC ordered DLF sellers to compensate 40% to 80% of losses, Press Release.

7) SEC, 2019, How the SEC works to protect senior investors, Office of the Investor Advocate.

8) The FCA collected and assessed a total of 150 suitability test files from 15 wealth management firms and private banks in December 2015. Slightly later in February 2016, it implemented a thematic review on whether investment advisers provide suitable advice. More recently in May 2017, it reviewed the suitability of 1,142 investment advice and the appropriateness of disclosure of a total of 656 financial firms.