Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Policy Recommendations for Licensing Criteria of Korea's Fourth Internet-Only Bank

Publication date Oct. 22, 2024

Summary

The licensing approval criteria for Korea’s fourth internet-only bank are expected to be announced in November 2024. Accordingly, this round of licensing is anticipated to begin within this year. This new licensing focuses on micro and small businesses, and the key criteria for the licensing approval are expected to include the expansion of loan supply to micro and small businesses with low and medium credit scores, the provision of innovative financial services, and the capacity for stable capital raising. In addition, the financial authorities need to consider whether the consortia for the fourth internet-only bank have sufficiently secured or have the potential to secure a customer base of micro and small businesses, whether they can provide a variety of financial services that meet not only the needs of micro and small businesses but also the financial needs of workers, and whether they have not only the capacity for capital raising but also well-functioning risk management. Finally, as an alternative to the new licensing of internet-only banks, other measures that can achieve the same policy effects could be considered.

Since Korean financial authorities announced the plan to continuously assess internet-only bank licenses in July 2023, five consortia have formed as of October 2024 to apply for the license of the fourth internet-only bank (“4th Internet-Only Bank”).1) The authorities are expected to release the licensing approval criteria by November 2024 and begin accepting preliminary applications.2) Against this backdrop, this article examines the achievements and limitations of existing internet-only banks in Korea, and explores the current trends and issues surrounding the 4th Internet-Only Bank license application process. Additionally, it provides relevant policy recommendations.

Achievements and limitations of internet-only banks

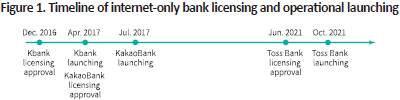

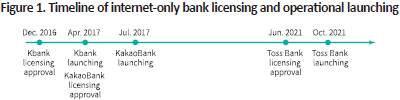

As of October 2024, Korea’s three licensed internet-only banks are Kbank, KakaoBank, and Toss Bank, as shown in Figure 1. Kbank received its license in December 2016 and launched in April 2017; KakaoBank was licensed in April 2017 and launched in July 2017; and Toss Bank, licensed in June 2021, began operations in October 2021.3) These banks entered the market, amid policy expectations of fostering competition within the banking industry and expanding lending to customers with low and medium credit scores by employing innovative tools, such as big data.4)

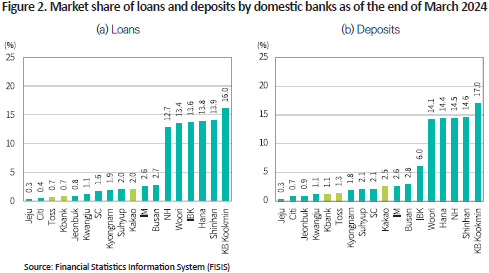

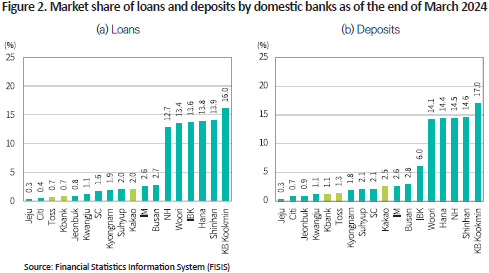

Despite their relatively short operational history, internet-only banks have experienced rapid growth. A comparison of market shares in lending and deposits by Korea’s banks, as of the end of March 2024, reveals that internet-only banks held a combined lending market share of 3.3%, and their share of deposits was just 5.0%, as depicted in Figure 2.5) Among Korea’s 18 domestic banks (excluding Korea Development Bank and Korea Eximbank), KakaoBank ranks ninth in lending, while Kbank and Toss Bank took 15th and 16th places, respectively. In terms of deposits, KakaoBank comes in ninth, with Toss Bank and Kbank ranking 13th and 14th, respectively.

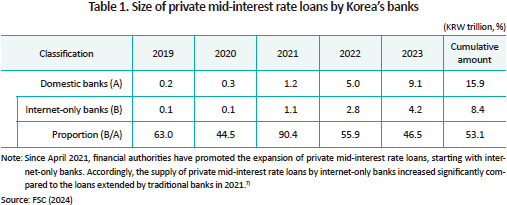

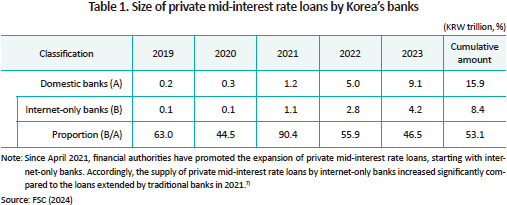

The assessment has been mixed as to whether internet-only banks have achieved the anticipated policy effects. They have significantly contributed to the expansion of mid-interest rate loans, in line with the goals set by financial authorities. According to data from the Korea Federation of Banks, as of June 2024, borrowers with low and medium credit scores took up 33.3% of Kbank’s household credit loans, 32.4% for KakaoBank, and 34.9% for Toss Bank. Moreover, as shown in Table 1, internet-only banks accounted for 53.1% of KRW 15.9 trillion in the cumulative mid-interest rate loans in the private sector from 2019 to 2023.6)

However, internet-only banks have not effectively served as catalysts for fostering competition in the banking industry and thus, have failed to drive the growth of private mid-interest rate loans. As illustrated in Figure 3, the household credit loan balance among traditional banks was 6.02 times higher than that of internet-only banks as of 2023. On the other hand, internet-only banks have a higher share of private mid-interest rate loans compared to traditional banks. Even if traditional banks hold a higher share, the difference remains within the 10% range, with traditional banks holding 1.15 times the share of internet-only banks as of 2023.

Meanwhile, as shown in Table 1, the recent growth in private mid-interest rate loans by traditional banks cannot be attributed to the “catfish effect” of internet-only banks. Rather, this growth primarily results from financial authorities easing the requirements for such loans in April 2021 and June 2022.8) Financial authorities have also indicated that the low supply of private mid-interest rate loans by traditional banks stems from a lack of incentives for offering these loans.9)

Another notable achievement of internet-only banks is the improved customer satisfaction across the banking industry.10) By optimizing customer expectations through mobile banking applications, internet-only banks have pushed traditional banks to emulate their service models, enhancing the convenience of banking services. For example, the customer authentication process and fund transfer services have become more streamlined than ever before.11)

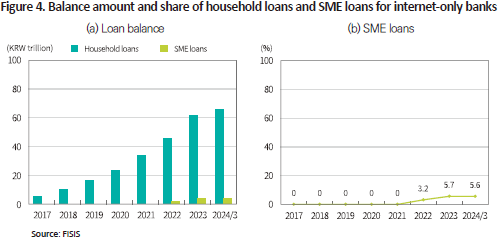

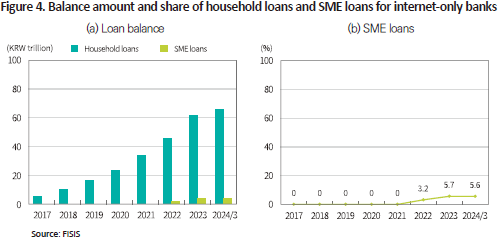

However, internet-only banks also face limitations. As illustrated in Figure 4, their loan portfolios are predominantly concentrated in household loans. Although internet-only banks are permitted to extend loans to SMEs under the Act on Special Cases Concerning Establishment and Operation of Internet-only Banks, their household loan balance amounted to KRW 66.0 trillion as of the end of March 2024, while their SME loans totaled just KRW 3.9 trillion, or 5.6% of total loan portfolios. Furthermore, 100% of these SME loans by internet-only banks have been extended to individual business owners (IBOs).12)

Current state and issues in preparation for the 4th Internet-Only Bank

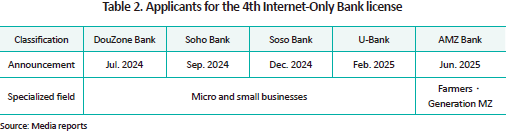

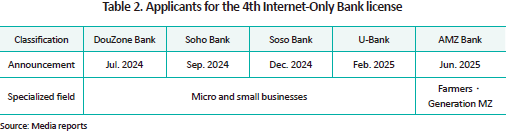

The possibility of the 4th Internet-Only Bank emerged in July 2023, when financial authorities unveiled its plan to approve a new internet-only bank license as part of the Measures to Improve Bank Management and Business Practices and Systems. As shown in Table 2, following this announcement, DouZone BizOn initiated the formation of a consortium for the launch of DouZone Bank in July; Korea Credit Data began preparing to establish KCD Bank (now Korea Soho Bank) in September; and the Soso Bank Preparation Committee announced its intention to create an internet-only bank focused on small and micro businesses in December. These are followed by U-Bank and AMZ Bank, which have announced plans to launch internet-only banks in February and June 2025, respectively.

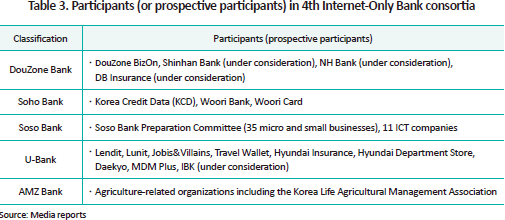

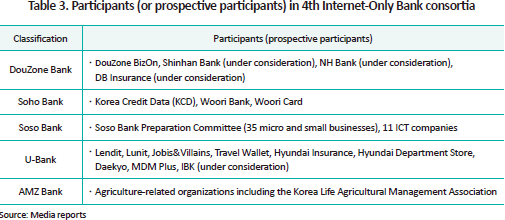

As seen in Table 3, companies from diverse sectors have participated in these five consortia. Notably, the U-Bank consortium stands out for having the most diverse participants. Existing financial institutions have confirmed, or are in negotiation to participate in the consortia for DouZone Bank, Korea Soho Bank, and U-Bank, while such participation by financial institutions has not been confirmed for Korea Soso Bank and AMZ Bank.

The active involvement of companies from various sectors in the 4th Internet-Only Bank consortia can be partially attributed to the policy proposal from the Presidential Committee of National Cohesion, which recommended establishing an internet-only bank dedicated to small businesses as part of its efforts to enhance their self-sufficiency.13) In the September 2024 press conference, the Chairman of the Financial Services Commission (FSC) stated that the FSC would finalize the licensing approval criteria and proceed with preliminary license application procedures no later than November of this year, which has also accelerated participation from various companies.14)

Currently, the primary concern for the 4th Internet-Only Bank consortia is how many licenses will be granted. The licensing decision is expected to influence whether companies considering participation in these consortia will confirm their involvement. As the four consortia are focused on supporting micro and small businesses, those who have yet to decide their participation, including commercial banks, are paying close attention to the licensing policy.

However, it should be noted that micro and small businesses are facing various challenges due to high interest rates, high inflation, and low-growth potential, while domestic banks have witnessed a sharp rise in delinquency rates for SME loans.15) In light of these conditions, issuing multiple new licenses to internet-only banks for the purpose of expanding lending to micro and small businesses presents a tough decision for financial authorities who are responsible for rigorously managing bank asset quality.

The current delinquency rate of SME loans extended by domestic banks is not high enough to pose a substantial threat to asset quality. Financial authorities also recognize that despite an upward trend in the delinquency rate among financially vulnerable borrowers including SMEs, it remains below pre-pandemic long-term averages.16) However, as shown in Figure 5, the delinquency rate for IBO loans from internet-only banks is rising more steeply compared to loans from traditional banks, suggesting that financial authorities need to exercise caution when considering whether to grant licenses to multiple consortia.

Policy direction for licensing the 4th Internet-Only Bank

Based on the current information, the key licensing approval criteria for the 4th Internet-Only Bank are expected to include the expansion of loans for micro and small businesses with low and medium credit scores, innovative financial service offerings, and the capacity for stable capital raising.17) Among them, the capacity for stable capital raising could be objectively assessed by investigating the participating companies in each consortium. However, it is challenging to demonstrate whether each consortium meets the other two requirements.

Expanding loans for micro and small businesses with low and medium credit scores may be a critical policy goal for the 4th Internet-Only Bank initiative. For financial authorities responsible for maintaining bank asset quality, however, it is equally important to ensure that the asset quality of the newly licensed bank remains stable. In this respect, financial authorities should prioritize assessing whether the 4th Internet-Only Bank has already secured, or has the potential to secure, a sufficient customer base consisting of micro and small businesses. Without this customer base, the bank may be incentivized to lower loan qualifications or reduce lending rates to increase the volume of loans to micro and small businesses with low and medium credit scores, which could ultimately undermine asset quality.18)

It would be undesirable for the 4th Internet-Only Bank to prioritize traditional deposit and loan services, as the existing internet-only banks have done. In order to achieve the goal of increasing loans to micro and small businesses, it may be more effective to encourage existing banks to extend more loans to these customer groups. In this context, it is equally important to evaluate the consortia’s ability to meet not only the financial needs of micro and small businesses but also the broader needs of workers by offering a range of innovative financial services.

To this end, the 4th Internet-Only Bank consortia should consider the best practices of overseas digital banks or fintech companies that specialize in small business services and propose measures to provide a variety of innovative financial services tailored to Korea’s regulatory environment. Financial authorities, in turn, should conduct relevant regulatory reforms to allow the 4th Internet-Only Bank to offer a variety of financial services.

The fundamental reason for assessing the 4th Internet-Only Bank’s capacity for stable capital expansion is to evaluate its capital adequacy or loss-absorbing capacity, both of which are key aspects of banking supervision. However, a bank’s capital adequacy is primarily determined by its risk-taking behavior. This suggests that the licensing process for the 4th Internet-Only Bank should place greater emphasis on risk management capabilities, rather than focusing solely on capital expansion.

Finally, it is not necessary to mandate issuing a license for an internet-only bank specifically to expand financial services targeting micro and small businesses.19) In the US, small business-focused fintech companies like Mercury and Novo have offered a wide range of financial services including banking services to small businesses through partnerships with existing banks, without holding their own banking licenses. It is worth considering taking alternative approaches in Korea, which would not involve concerns about bank asset quality while achieving the same policy effects.20)

1) Financial Services Commission (FSC), July 5, 2023, Measures to Improve Bank Management and Business Practices and Systems, attached press release.

2) FSC, September 13, 2024, Full transcript of the FSC Chairman’s press conference.

3) Financial Supervisory Service (FSS), March 23, 2023, Status of internet-only banks, attached FSC press release.

4) The purpose of the enactment of the Act on Special Cases Concerning Establishment and Operation of Internet-Only Banks in October 2018 explicitly states the promotion of mid-interest rate loans to resolve interest rate gaps.

5) Given the operational scope of internet-only banks, loans were limited to KRW household and corporate loans, while deposits were restricted to demand deposits and savings deposits.

6) FSC, 2024, Self-assessment report for 2023 (key policy measures).

7) FSC, April 26, 2021, Regulatory improvements for mid-interest rate loans, attached press release.

8) FSC, April 26, 2021, Regulatory improvements for mid-interest rate loans, attached press release; FSC, June 30, 2022, Plan for improving interest rate requirements for private mid-interest rate loans, press release.

9) FSC, April 26, 2021, Regulatory improvements for mid-interest rate loans, attached press release.

10) Korea Institute of Finance, 2023, Introduction of internet-only banks and evaluation of its achievement, attached FSC press release.

11) Before the introduction of internet-only banks, mobile banking applications of traditional banks required login using an authentication certificate, and users had to manually enter the recipient’s name, account number, and password for each transfer.

12) An individual business owner refers to a person registered as a business operator in their individual capacity under the Value-Added Tax Act. Individual business owners may include small business owners with fewer than five to ten full-time employees and actual sales between KRW 1 billion to 12 billion. It is notable that the requirements for full-time employees and sales revenue for small business owners vary by business type.

13) Presidential Committee of National Cohesion. March 28, 2024, Policy proposal from the Special Committee for enhancing self-sufficiency of small businesses, press release.

14) FSC, September 13, 2024, Full transcript of the FSC Chairman’s press conference.

15) Interagency Task Force, July 3, 2024, Comprehensive measures for small business owners and self-employed, attached press release; Bank of Korea, 2024, Recent trends in household and self-employed loans and characteristics of delinquency rate changes, Financial Stability Report (June 2024), appendix 1.

16) FSS, September 20, 2024, Status of Delinquency Rates on KRW loans of Korea’s banks (provisional), press release.

17) Korea Economic Daily, September 16, 2024, Competition begins for the fourth internet-only bank license, with a focus on customers with low and medium credit scores, innovation, and adequate capital.

18) Lee, S.B., 2016, An analysis of the performance of internet-only banks in the US and their implications for the Korean market, Korea Capital Market Institute research paper 16-01.

19) Based on legal principles, approval must be granted if the approval requirements are met, whereas a license may not be issued even after the licensing requirements are met on the ground of policy judgment.

20) FSC & FSS, June 7, 2023, Examination of regulatory improvements for outsourcing financial service operations and the introduction of bank agency, attached press release.

Achievements and limitations of internet-only banks

As of October 2024, Korea’s three licensed internet-only banks are Kbank, KakaoBank, and Toss Bank, as shown in Figure 1. Kbank received its license in December 2016 and launched in April 2017; KakaoBank was licensed in April 2017 and launched in July 2017; and Toss Bank, licensed in June 2021, began operations in October 2021.3) These banks entered the market, amid policy expectations of fostering competition within the banking industry and expanding lending to customers with low and medium credit scores by employing innovative tools, such as big data.4)

Despite their relatively short operational history, internet-only banks have experienced rapid growth. A comparison of market shares in lending and deposits by Korea’s banks, as of the end of March 2024, reveals that internet-only banks held a combined lending market share of 3.3%, and their share of deposits was just 5.0%, as depicted in Figure 2.5) Among Korea’s 18 domestic banks (excluding Korea Development Bank and Korea Eximbank), KakaoBank ranks ninth in lending, while Kbank and Toss Bank took 15th and 16th places, respectively. In terms of deposits, KakaoBank comes in ninth, with Toss Bank and Kbank ranking 13th and 14th, respectively.

The assessment has been mixed as to whether internet-only banks have achieved the anticipated policy effects. They have significantly contributed to the expansion of mid-interest rate loans, in line with the goals set by financial authorities. According to data from the Korea Federation of Banks, as of June 2024, borrowers with low and medium credit scores took up 33.3% of Kbank’s household credit loans, 32.4% for KakaoBank, and 34.9% for Toss Bank. Moreover, as shown in Table 1, internet-only banks accounted for 53.1% of KRW 15.9 trillion in the cumulative mid-interest rate loans in the private sector from 2019 to 2023.6)

However, internet-only banks have not effectively served as catalysts for fostering competition in the banking industry and thus, have failed to drive the growth of private mid-interest rate loans. As illustrated in Figure 3, the household credit loan balance among traditional banks was 6.02 times higher than that of internet-only banks as of 2023. On the other hand, internet-only banks have a higher share of private mid-interest rate loans compared to traditional banks. Even if traditional banks hold a higher share, the difference remains within the 10% range, with traditional banks holding 1.15 times the share of internet-only banks as of 2023.

Meanwhile, as shown in Table 1, the recent growth in private mid-interest rate loans by traditional banks cannot be attributed to the “catfish effect” of internet-only banks. Rather, this growth primarily results from financial authorities easing the requirements for such loans in April 2021 and June 2022.8) Financial authorities have also indicated that the low supply of private mid-interest rate loans by traditional banks stems from a lack of incentives for offering these loans.9)

Another notable achievement of internet-only banks is the improved customer satisfaction across the banking industry.10) By optimizing customer expectations through mobile banking applications, internet-only banks have pushed traditional banks to emulate their service models, enhancing the convenience of banking services. For example, the customer authentication process and fund transfer services have become more streamlined than ever before.11)

However, internet-only banks also face limitations. As illustrated in Figure 4, their loan portfolios are predominantly concentrated in household loans. Although internet-only banks are permitted to extend loans to SMEs under the Act on Special Cases Concerning Establishment and Operation of Internet-only Banks, their household loan balance amounted to KRW 66.0 trillion as of the end of March 2024, while their SME loans totaled just KRW 3.9 trillion, or 5.6% of total loan portfolios. Furthermore, 100% of these SME loans by internet-only banks have been extended to individual business owners (IBOs).12)

Current state and issues in preparation for the 4th Internet-Only Bank

The possibility of the 4th Internet-Only Bank emerged in July 2023, when financial authorities unveiled its plan to approve a new internet-only bank license as part of the Measures to Improve Bank Management and Business Practices and Systems. As shown in Table 2, following this announcement, DouZone BizOn initiated the formation of a consortium for the launch of DouZone Bank in July; Korea Credit Data began preparing to establish KCD Bank (now Korea Soho Bank) in September; and the Soso Bank Preparation Committee announced its intention to create an internet-only bank focused on small and micro businesses in December. These are followed by U-Bank and AMZ Bank, which have announced plans to launch internet-only banks in February and June 2025, respectively.

As seen in Table 3, companies from diverse sectors have participated in these five consortia. Notably, the U-Bank consortium stands out for having the most diverse participants. Existing financial institutions have confirmed, or are in negotiation to participate in the consortia for DouZone Bank, Korea Soho Bank, and U-Bank, while such participation by financial institutions has not been confirmed for Korea Soso Bank and AMZ Bank.

The active involvement of companies from various sectors in the 4th Internet-Only Bank consortia can be partially attributed to the policy proposal from the Presidential Committee of National Cohesion, which recommended establishing an internet-only bank dedicated to small businesses as part of its efforts to enhance their self-sufficiency.13) In the September 2024 press conference, the Chairman of the Financial Services Commission (FSC) stated that the FSC would finalize the licensing approval criteria and proceed with preliminary license application procedures no later than November of this year, which has also accelerated participation from various companies.14)

Currently, the primary concern for the 4th Internet-Only Bank consortia is how many licenses will be granted. The licensing decision is expected to influence whether companies considering participation in these consortia will confirm their involvement. As the four consortia are focused on supporting micro and small businesses, those who have yet to decide their participation, including commercial banks, are paying close attention to the licensing policy.

However, it should be noted that micro and small businesses are facing various challenges due to high interest rates, high inflation, and low-growth potential, while domestic banks have witnessed a sharp rise in delinquency rates for SME loans.15) In light of these conditions, issuing multiple new licenses to internet-only banks for the purpose of expanding lending to micro and small businesses presents a tough decision for financial authorities who are responsible for rigorously managing bank asset quality.

The current delinquency rate of SME loans extended by domestic banks is not high enough to pose a substantial threat to asset quality. Financial authorities also recognize that despite an upward trend in the delinquency rate among financially vulnerable borrowers including SMEs, it remains below pre-pandemic long-term averages.16) However, as shown in Figure 5, the delinquency rate for IBO loans from internet-only banks is rising more steeply compared to loans from traditional banks, suggesting that financial authorities need to exercise caution when considering whether to grant licenses to multiple consortia.

Policy direction for licensing the 4th Internet-Only Bank

Based on the current information, the key licensing approval criteria for the 4th Internet-Only Bank are expected to include the expansion of loans for micro and small businesses with low and medium credit scores, innovative financial service offerings, and the capacity for stable capital raising.17) Among them, the capacity for stable capital raising could be objectively assessed by investigating the participating companies in each consortium. However, it is challenging to demonstrate whether each consortium meets the other two requirements.

Expanding loans for micro and small businesses with low and medium credit scores may be a critical policy goal for the 4th Internet-Only Bank initiative. For financial authorities responsible for maintaining bank asset quality, however, it is equally important to ensure that the asset quality of the newly licensed bank remains stable. In this respect, financial authorities should prioritize assessing whether the 4th Internet-Only Bank has already secured, or has the potential to secure, a sufficient customer base consisting of micro and small businesses. Without this customer base, the bank may be incentivized to lower loan qualifications or reduce lending rates to increase the volume of loans to micro and small businesses with low and medium credit scores, which could ultimately undermine asset quality.18)

It would be undesirable for the 4th Internet-Only Bank to prioritize traditional deposit and loan services, as the existing internet-only banks have done. In order to achieve the goal of increasing loans to micro and small businesses, it may be more effective to encourage existing banks to extend more loans to these customer groups. In this context, it is equally important to evaluate the consortia’s ability to meet not only the financial needs of micro and small businesses but also the broader needs of workers by offering a range of innovative financial services.

To this end, the 4th Internet-Only Bank consortia should consider the best practices of overseas digital banks or fintech companies that specialize in small business services and propose measures to provide a variety of innovative financial services tailored to Korea’s regulatory environment. Financial authorities, in turn, should conduct relevant regulatory reforms to allow the 4th Internet-Only Bank to offer a variety of financial services.

The fundamental reason for assessing the 4th Internet-Only Bank’s capacity for stable capital expansion is to evaluate its capital adequacy or loss-absorbing capacity, both of which are key aspects of banking supervision. However, a bank’s capital adequacy is primarily determined by its risk-taking behavior. This suggests that the licensing process for the 4th Internet-Only Bank should place greater emphasis on risk management capabilities, rather than focusing solely on capital expansion.

Finally, it is not necessary to mandate issuing a license for an internet-only bank specifically to expand financial services targeting micro and small businesses.19) In the US, small business-focused fintech companies like Mercury and Novo have offered a wide range of financial services including banking services to small businesses through partnerships with existing banks, without holding their own banking licenses. It is worth considering taking alternative approaches in Korea, which would not involve concerns about bank asset quality while achieving the same policy effects.20)

1) Financial Services Commission (FSC), July 5, 2023, Measures to Improve Bank Management and Business Practices and Systems, attached press release.

2) FSC, September 13, 2024, Full transcript of the FSC Chairman’s press conference.

3) Financial Supervisory Service (FSS), March 23, 2023, Status of internet-only banks, attached FSC press release.

4) The purpose of the enactment of the Act on Special Cases Concerning Establishment and Operation of Internet-Only Banks in October 2018 explicitly states the promotion of mid-interest rate loans to resolve interest rate gaps.

5) Given the operational scope of internet-only banks, loans were limited to KRW household and corporate loans, while deposits were restricted to demand deposits and savings deposits.

6) FSC, 2024, Self-assessment report for 2023 (key policy measures).

7) FSC, April 26, 2021, Regulatory improvements for mid-interest rate loans, attached press release.

8) FSC, April 26, 2021, Regulatory improvements for mid-interest rate loans, attached press release; FSC, June 30, 2022, Plan for improving interest rate requirements for private mid-interest rate loans, press release.

9) FSC, April 26, 2021, Regulatory improvements for mid-interest rate loans, attached press release.

10) Korea Institute of Finance, 2023, Introduction of internet-only banks and evaluation of its achievement, attached FSC press release.

11) Before the introduction of internet-only banks, mobile banking applications of traditional banks required login using an authentication certificate, and users had to manually enter the recipient’s name, account number, and password for each transfer.

12) An individual business owner refers to a person registered as a business operator in their individual capacity under the Value-Added Tax Act. Individual business owners may include small business owners with fewer than five to ten full-time employees and actual sales between KRW 1 billion to 12 billion. It is notable that the requirements for full-time employees and sales revenue for small business owners vary by business type.

13) Presidential Committee of National Cohesion. March 28, 2024, Policy proposal from the Special Committee for enhancing self-sufficiency of small businesses, press release.

14) FSC, September 13, 2024, Full transcript of the FSC Chairman’s press conference.

15) Interagency Task Force, July 3, 2024, Comprehensive measures for small business owners and self-employed, attached press release; Bank of Korea, 2024, Recent trends in household and self-employed loans and characteristics of delinquency rate changes, Financial Stability Report (June 2024), appendix 1.

16) FSS, September 20, 2024, Status of Delinquency Rates on KRW loans of Korea’s banks (provisional), press release.

17) Korea Economic Daily, September 16, 2024, Competition begins for the fourth internet-only bank license, with a focus on customers with low and medium credit scores, innovation, and adequate capital.

18) Lee, S.B., 2016, An analysis of the performance of internet-only banks in the US and their implications for the Korean market, Korea Capital Market Institute research paper 16-01.

19) Based on legal principles, approval must be granted if the approval requirements are met, whereas a license may not be issued even after the licensing requirements are met on the ground of policy judgment.

20) FSC & FSS, June 7, 2023, Examination of regulatory improvements for outsourcing financial service operations and the introduction of bank agency, attached press release.