OPINION

2024 Apr/16

Challenges for Cloud Transformation in the Capital Market of Korea

Apr. 16, 2024

PDF

- Summary

- As the digital economy advances and non-face-to-face financial transactions become the new normal, cloud transformation has shifted from being an option to a necessity. Overseas capital markets have actively embraced this shift towards cloud infrastructure. Despite this global trend, the Korean capital market has been relatively slow in adopting the cloud environment than other financial sectors, primarily due to its reliance on internally developed IT infrastructure and services to support non-face-to-face financial transactions since the early 2000s. In this regard, it is now critical for the Korean capital market to spur its transition to cloud systems. To facilitate this transformation and ensure transaction stability, it is vital to nurture managed service providers (MSPs) capable of navigating the structural complexity and systemic sensitivity inherent in the market’s IT infrastructure and services.

With the rapid advancement of financial digitization, the transition to cloud systems is gaining momentum within the financial services industry and financial markets. However, the rate of cloud adoption in the Korean capital market and financial investment sector remains relatively low, despite their significantly higher dependence on IT and data compared to other financial sectors. Against this backdrop, this article explores the imperative need for cloud transformation in the Korean capital market and financial investment firms. Additionally, it presents strategies and challenges for successful cloud transformation, drawing on insights from overseas cases.

Fundamental concept of cloud

Cloud stands as one of the core technologies driving the Fourth Industrial Revolution, often referred to as ABCD (AI, Blockchain, Cloud and Data). While cloud computing is commonly understood as a means of data storage and backup, its professional significance lies in its ability to enhance the usefulness of data and AI.

In technical terms, the cloud can be succinctly described as a technology that delivers computing services over the Internet.1) Before the introduction of cloud systems, individuals conducted data processing on personal computers, while enterprises relied on their on-premise IT infrastructure.2) In contrast, cloud computing empowers individuals or enterprises to perform data processing using the IT infrastructure accessed through the Internet, thereby eliminating the need for reliance on personal computers or on-premise infrastructure.

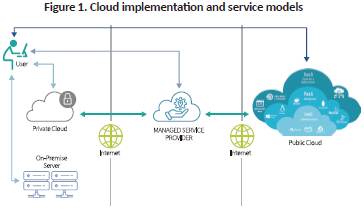

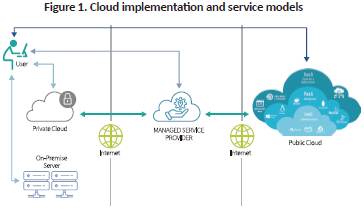

The provision of computing services by cloud systems can be categorized into three types, as illustrated in Figure 1. The first type is Infrastructure as a Service (IaaS). It logically allocates and provides various IT infrastructure components accessible via the Internet, such as servers, data storage, and networks.

The second type is Platform as a Service (PaaS). This service offers a platform or environment where programs or applications can be developed and run on the IT infrastructure supplied by IaaS.

The third type is Software as a Service (SaaS), which allows direct access to programs or applications on the IT infrastructure and platform provided by IaaS and PaaS.

Cloud can also be divided into public and private cloud systems depending on the entity responsible for implementation. Public cloud refers to the cloud where a Cloud Service Provider (CSP) directly owns and manages IT resources, platforms, and software. On the other hand, private cloud is built and utilized directly by individual enterprises within their on-premise IT infrastructure.

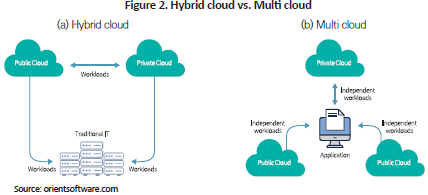

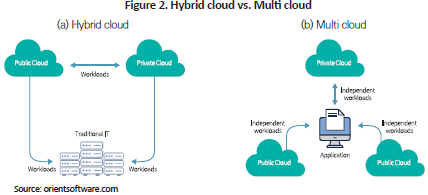

There are various ways to construct cloud infrastructure. As shown in Figure 2, it is possible to establish hybrid cloud by combining public and private cloud systems, or multi cloud comprised of three or more public or private cloud systems. Notably, enterprises often choose to implement hybrid cloud or multi cloud to mitigate their heavy reliance on CSPs and secure control over cloud systems.

In addition, a Managed Service Provider (MSP) can be employed to ensure efficient cloud maintenance and management. MSPs provide a range of services, including cloud adoption consulting, shifting from existing IT infrastructure to cloud, and cloud operation and management. Specifically, when building hybrid or multi-cloud systems, enterprises often depend on MSPs.

Need for cloud transformation

The transition to cloud services entrails advantages in terms of efficiency, agility, and scalability. First, in the era of big data and AI, it is not economically feasible for individual enterprises to purchase large-scale computing resources and build and maintain IT infrastructure. Particularly, SMEs or startups with limited capital face challenges in establishing and managing competitive IT infrastructure independently. Conversely, cloud systems are characterized by high economic efficiency (Kang, 2019; Cho, 2021). They enable enterprises to access IT infrastructure equipped with powerful computing resources at affordable prices while reducing maintenance costs for IT infrastructure.

Second, the traditional approach to adapting to technological changes typically involves expanding or replacing IT infrastructure, which requires a considerable investment of time and resources. In many cases, enterprises encounter challenges in developing various IT services in a timely manner or are forced to abandon such development efforts. In contrast, cloud infrastructure facilitates agile responses to a technological shift and the demand for diverse IT service development (Deloitte, 2019). This is because the cloud not only provides all available IT infrastructure and services but also allows enterprises to select infrastructure and services tailored to their specific needs.

Third, interoperability plays a pivotal role in integrating an enterprise’s on-premise IT infrastructure and services with new IT services, necessitating significant investments of time and resources. Unlike conventional systems, cloud solutions offer flexible scalability to accommodate unique characteristics and needs of an enterprise’s IT operations, thanks to the excellent interoperability of IT infrastructure and services provided by the cloud. In addition, enterprises have the option to purchase and utilize various scalability packages as needed.

There are downsides of cloud transformation as well, including network reliance, the risk of a single point of failure, dependency on cloud providers and lack of control, cybersecurity threats and irrecoverability, limited integration with existing IT infrastructure, and unexpected costs.3) Nevertheless, the expected benefits from cloud transformation far outweigh these costs. This is why cloud transformation is perceived as a necessity rather than an option in the digital economy era (Deloitte, 2019).

Cloud transformation in overseas capital markets

According to a survey conducted by CSA in 2023, 98% of the financial institutions surveyed report using cloud services, indicating widespread adoption of cloud technology worldwide in the financial sector. Additionally, a 2023 survey by PwC finds that 66% of the surveyed are actively pursuing a transition to cloud systems to drive growth and innovation.

An analysis of the cloud transformation trend in overseas capital markets reveals three key aspects. First, the purpose of cloud transformation varies among different capital market participants (Accenture, 2020). Depending on participant profiles, cloud transformation can serve various objectives. Amid the growing need for data management and analysis, some prioritize cost savings, while others seek to meet customer demand for digital experience or leverage cloud computing to create a new revenue stream.

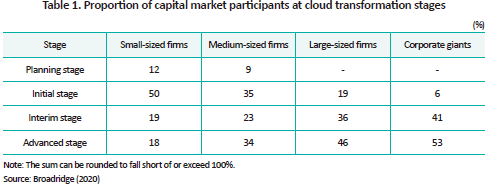

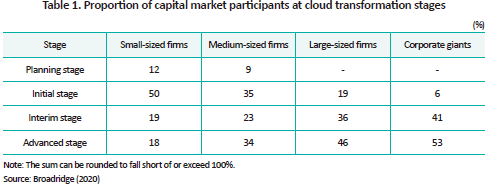

Second, larger firms are more inclined to implement cloud transformation compared to their smaller counterparts (Broadridge, 2020). Table 1 compares the proportion of capital market participants at each stage of cloud transformation based on the size of firms. It is evident that larger firms tend to represent a bigger proportion in advanced or interim stages of cloud transformation.

Third, overseas stock exchanges are formulating cloud transformation strategies and spearheading the transition to the cloud environment in capital markets. For instance, Nasdaq in the US has been planning a company-wide cloud transition since 2008. Following the launch of Nasdaq Cloud Data Service through Amazon Web Services (AWS) in April 2020, it has fully engaged in cloud service provision since 2021.

The Toronto Stock Exchange (TSX) in Canada has also established and provided the AWS-based data lake since December 2019. The London Stock Exchange (LSE) Group in the UK acquired the big data firm Refinitive in 2021 and has provided the cloud-based Refinitive Data Platform to capital market participants. Deutsche Börse, the stock exchange in Germany, is recognized as the most active player in pursuing cloud transition, having devised a basic plan for cloud transformation in 2017.

The Japan Exchange Group (JPX) developed JPX Data Cloud in 2015 and entered into a partnership with AWS in 2020 to provide the cloud-based access service Arrownet. The Australian Securities Exchange (ASX) acts as an MSP to deliver ASX CloudConnect to capital market participants.

Cloud transformation environment in the Korean financial sector

South Korea has imposed relatively strict regulations on cloud systems within the financial sector, compared to other countries. Financial institutions and fintech firms in Korea have identified the regulatory framework as an obstacle to the adoption and utilization of new digital technologies. Recognizing the need to support digital transition in the financial sector, Korean financial authorities are pushing for a gradual relaxation of cloud regulations (Financial Services Commission, April 15, 2023).

In the financial sector, cloud regulations primarily pertain to financial security regulations. Financial institutions believe that even a single minor or major financial security incident could result in huge losses for financial consumers and erode trust in the financial system, despite the significant benefits from cloud transformation.

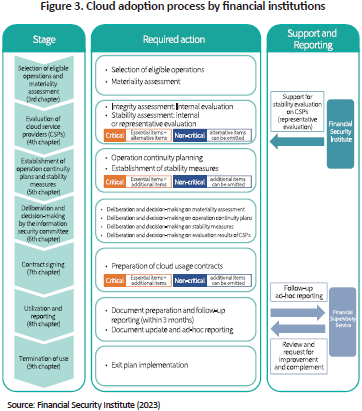

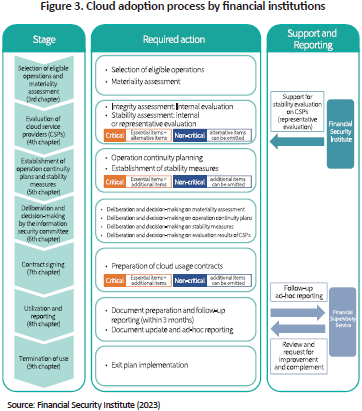

As illustrated in Figure 3, non-critical operations, which are less susceptible to financial security incidents, can be readily migrated to the cloud environment, while critical operations are subject to rigorous requirements for cloud transformation.4) In principle, there are no operations prohibited from transitioning to cloud systems. In other words, more stringent procedures and methods are required for critical operations, due to their material impact on financial security.

Similar requirements are applied to the capital market where any operations can be transferred to cloud systems. Compared to other financial sectors, the capital market exhibits unparalleled dependency on IT infrastructure and services, as well as a substantial volume of data production. A close examination of IT infrastructure and services supplied by the Korea Exchange, Korea Securities Depository, and Koscom reveals that a significant portion of these services fall into the non-critical category. For instance, various capital market data services are categorized into non-critical operations. In this regard, the capital market could experience an easier and smoother transition to cloud compared to other financial sectors.

Strategies and challenges for cloud transformation in the capital market

As the digital economy advances further, propelled by the Fourth Industrial Revolution, the significance of data and AI continues to grow, leading to a surge in demand for cloud services in the financial services industry. Despite this global trend, the capital market in Korea has lagged behind other financial sectors in adopting cloud technologies, which can be attributed to the establishment of its own IT infrastructure and services to support non-face-to-face financial transactions since the early 2000s (Financial Supervisory Service (FSS), March 21, 2023).

However, the capital market needs to actively embrace cloud transformation, mirroring the progress in other financial sectors. To align with the advancement in data and AI technologies, or enhance the price discovery function, it is necessary to improve the accessibility and usefulness of capital market data through cloud adoption. Additionally, in light of the recent trend of IT incidents in the financial sector, cloud transformation is indispensable in mitigating the risk of computer failures caused by simultaneous access-induced overload (FSS, April 25, 2022, September 6, 2023).

To this end, the capital market and financial investment industry should develop a systematic strategy for an effective and stable shift toward the cloud environment and identify and tackle potential challenges for cloud transformation. To facilitate the capital market’s transition to cloud systems and ensure transaction stability, it is imperative to foster MSPs specialized in navigating the structural complexity and systemic sensitivity inherent in the market’s IT infrastructure and services.

1) Under Article 2 of the Act on the Development of Cloud Computing and Protection of its Users, cloud computing refers to a data processing system that contains information and communications resources, such as integrated and shared information and communication devices, information and communication systems, and software, allowing the flexible utilization that aligns with user requirements or changes in demand through information and communication networks.

2) The IT infrastructure built and operated by an enterprise itself is referred to as on-premise.

3) The risk of a single point of failure refers to the possibility that the failure of one system within IT infrastructure leads to the failure of the entire IT infrastructure, causing disruptions in normal data processing operations and digital services.

4) According to Article 14-2 of the Supervisory Regulation on Electronic Financial Services, the materiality assessment of critical operations takes into account various factors, including the nature of operations processed through cloud computing services such as scale and complexity, the impact of service disruptions from cloud service providers (CSPs), the impact of electronic security breaches on customers, the dependency on CSPs in case of entrusting multiple tasks to a single CSP, and the internal control and regulatory compliance capabilities of financial institutions or electronic financial service providers regarding the use of cloud computing services.

References

Accenture, 2020, The New Cloud Imperative in Capital Markets.

Broadridge, 2020, The Broadridge Next-Gen Technology Pulse Survey.

Cloud Security Alliance (CSA), 2023, State of Financial Services in Cloud.

Deloitte, 2019, The Wisdom of Clouds: Four Compelling Reasons to Adopt the Cloud.

PwC, 2023, Cloud is the Engine Required to Drive the Next Wave of Innovation within Financial Services.

[Korean]

Kang, M.S., 2019, Trend and outlook of the cloud computing market, KDB Future Strategy Research Institute, KDB Monthly Report No. 758.

Financial Supervisory Service (FSS), April 25, 2022, Status and countermeasures of electronic financial incidents in 2021, press release.

FSS, September 6, 2023, Status and countermeasures of electronic financial incidents in the first half of 2023, press release.

FSS, March 21, 2023, Supervisory directions for digital finance in 2023, materials of financial supervision tasks reporting.

Financial Security Institute, 2023, Guidelines for using cloud computing services in the financial sector.

Financial Services Commission, April 15, 2022, Improvement for cloud and network separation regulations in the financial sector, press release.

Cho, Y.J., 2021, Trend in the cloud industry ecosystem that serves as the core infrastructure of the Digital New Deal, KDB Future Strategy Research Institute, KDB Monthly Report No. 782.

Fundamental concept of cloud

Cloud stands as one of the core technologies driving the Fourth Industrial Revolution, often referred to as ABCD (AI, Blockchain, Cloud and Data). While cloud computing is commonly understood as a means of data storage and backup, its professional significance lies in its ability to enhance the usefulness of data and AI.

In technical terms, the cloud can be succinctly described as a technology that delivers computing services over the Internet.1) Before the introduction of cloud systems, individuals conducted data processing on personal computers, while enterprises relied on their on-premise IT infrastructure.2) In contrast, cloud computing empowers individuals or enterprises to perform data processing using the IT infrastructure accessed through the Internet, thereby eliminating the need for reliance on personal computers or on-premise infrastructure.

The provision of computing services by cloud systems can be categorized into three types, as illustrated in Figure 1. The first type is Infrastructure as a Service (IaaS). It logically allocates and provides various IT infrastructure components accessible via the Internet, such as servers, data storage, and networks.

The second type is Platform as a Service (PaaS). This service offers a platform or environment where programs or applications can be developed and run on the IT infrastructure supplied by IaaS.

The third type is Software as a Service (SaaS), which allows direct access to programs or applications on the IT infrastructure and platform provided by IaaS and PaaS.

Cloud can also be divided into public and private cloud systems depending on the entity responsible for implementation. Public cloud refers to the cloud where a Cloud Service Provider (CSP) directly owns and manages IT resources, platforms, and software. On the other hand, private cloud is built and utilized directly by individual enterprises within their on-premise IT infrastructure.

There are various ways to construct cloud infrastructure. As shown in Figure 2, it is possible to establish hybrid cloud by combining public and private cloud systems, or multi cloud comprised of three or more public or private cloud systems. Notably, enterprises often choose to implement hybrid cloud or multi cloud to mitigate their heavy reliance on CSPs and secure control over cloud systems.

In addition, a Managed Service Provider (MSP) can be employed to ensure efficient cloud maintenance and management. MSPs provide a range of services, including cloud adoption consulting, shifting from existing IT infrastructure to cloud, and cloud operation and management. Specifically, when building hybrid or multi-cloud systems, enterprises often depend on MSPs.

Need for cloud transformation

The transition to cloud services entrails advantages in terms of efficiency, agility, and scalability. First, in the era of big data and AI, it is not economically feasible for individual enterprises to purchase large-scale computing resources and build and maintain IT infrastructure. Particularly, SMEs or startups with limited capital face challenges in establishing and managing competitive IT infrastructure independently. Conversely, cloud systems are characterized by high economic efficiency (Kang, 2019; Cho, 2021). They enable enterprises to access IT infrastructure equipped with powerful computing resources at affordable prices while reducing maintenance costs for IT infrastructure.

Second, the traditional approach to adapting to technological changes typically involves expanding or replacing IT infrastructure, which requires a considerable investment of time and resources. In many cases, enterprises encounter challenges in developing various IT services in a timely manner or are forced to abandon such development efforts. In contrast, cloud infrastructure facilitates agile responses to a technological shift and the demand for diverse IT service development (Deloitte, 2019). This is because the cloud not only provides all available IT infrastructure and services but also allows enterprises to select infrastructure and services tailored to their specific needs.

Third, interoperability plays a pivotal role in integrating an enterprise’s on-premise IT infrastructure and services with new IT services, necessitating significant investments of time and resources. Unlike conventional systems, cloud solutions offer flexible scalability to accommodate unique characteristics and needs of an enterprise’s IT operations, thanks to the excellent interoperability of IT infrastructure and services provided by the cloud. In addition, enterprises have the option to purchase and utilize various scalability packages as needed.

There are downsides of cloud transformation as well, including network reliance, the risk of a single point of failure, dependency on cloud providers and lack of control, cybersecurity threats and irrecoverability, limited integration with existing IT infrastructure, and unexpected costs.3) Nevertheless, the expected benefits from cloud transformation far outweigh these costs. This is why cloud transformation is perceived as a necessity rather than an option in the digital economy era (Deloitte, 2019).

Cloud transformation in overseas capital markets

According to a survey conducted by CSA in 2023, 98% of the financial institutions surveyed report using cloud services, indicating widespread adoption of cloud technology worldwide in the financial sector. Additionally, a 2023 survey by PwC finds that 66% of the surveyed are actively pursuing a transition to cloud systems to drive growth and innovation.

An analysis of the cloud transformation trend in overseas capital markets reveals three key aspects. First, the purpose of cloud transformation varies among different capital market participants (Accenture, 2020). Depending on participant profiles, cloud transformation can serve various objectives. Amid the growing need for data management and analysis, some prioritize cost savings, while others seek to meet customer demand for digital experience or leverage cloud computing to create a new revenue stream.

Second, larger firms are more inclined to implement cloud transformation compared to their smaller counterparts (Broadridge, 2020). Table 1 compares the proportion of capital market participants at each stage of cloud transformation based on the size of firms. It is evident that larger firms tend to represent a bigger proportion in advanced or interim stages of cloud transformation.

Third, overseas stock exchanges are formulating cloud transformation strategies and spearheading the transition to the cloud environment in capital markets. For instance, Nasdaq in the US has been planning a company-wide cloud transition since 2008. Following the launch of Nasdaq Cloud Data Service through Amazon Web Services (AWS) in April 2020, it has fully engaged in cloud service provision since 2021.

The Toronto Stock Exchange (TSX) in Canada has also established and provided the AWS-based data lake since December 2019. The London Stock Exchange (LSE) Group in the UK acquired the big data firm Refinitive in 2021 and has provided the cloud-based Refinitive Data Platform to capital market participants. Deutsche Börse, the stock exchange in Germany, is recognized as the most active player in pursuing cloud transition, having devised a basic plan for cloud transformation in 2017.

The Japan Exchange Group (JPX) developed JPX Data Cloud in 2015 and entered into a partnership with AWS in 2020 to provide the cloud-based access service Arrownet. The Australian Securities Exchange (ASX) acts as an MSP to deliver ASX CloudConnect to capital market participants.

Cloud transformation environment in the Korean financial sector

South Korea has imposed relatively strict regulations on cloud systems within the financial sector, compared to other countries. Financial institutions and fintech firms in Korea have identified the regulatory framework as an obstacle to the adoption and utilization of new digital technologies. Recognizing the need to support digital transition in the financial sector, Korean financial authorities are pushing for a gradual relaxation of cloud regulations (Financial Services Commission, April 15, 2023).

In the financial sector, cloud regulations primarily pertain to financial security regulations. Financial institutions believe that even a single minor or major financial security incident could result in huge losses for financial consumers and erode trust in the financial system, despite the significant benefits from cloud transformation.

As illustrated in Figure 3, non-critical operations, which are less susceptible to financial security incidents, can be readily migrated to the cloud environment, while critical operations are subject to rigorous requirements for cloud transformation.4) In principle, there are no operations prohibited from transitioning to cloud systems. In other words, more stringent procedures and methods are required for critical operations, due to their material impact on financial security.

Similar requirements are applied to the capital market where any operations can be transferred to cloud systems. Compared to other financial sectors, the capital market exhibits unparalleled dependency on IT infrastructure and services, as well as a substantial volume of data production. A close examination of IT infrastructure and services supplied by the Korea Exchange, Korea Securities Depository, and Koscom reveals that a significant portion of these services fall into the non-critical category. For instance, various capital market data services are categorized into non-critical operations. In this regard, the capital market could experience an easier and smoother transition to cloud compared to other financial sectors.

Strategies and challenges for cloud transformation in the capital market

As the digital economy advances further, propelled by the Fourth Industrial Revolution, the significance of data and AI continues to grow, leading to a surge in demand for cloud services in the financial services industry. Despite this global trend, the capital market in Korea has lagged behind other financial sectors in adopting cloud technologies, which can be attributed to the establishment of its own IT infrastructure and services to support non-face-to-face financial transactions since the early 2000s (Financial Supervisory Service (FSS), March 21, 2023).

However, the capital market needs to actively embrace cloud transformation, mirroring the progress in other financial sectors. To align with the advancement in data and AI technologies, or enhance the price discovery function, it is necessary to improve the accessibility and usefulness of capital market data through cloud adoption. Additionally, in light of the recent trend of IT incidents in the financial sector, cloud transformation is indispensable in mitigating the risk of computer failures caused by simultaneous access-induced overload (FSS, April 25, 2022, September 6, 2023).

To this end, the capital market and financial investment industry should develop a systematic strategy for an effective and stable shift toward the cloud environment and identify and tackle potential challenges for cloud transformation. To facilitate the capital market’s transition to cloud systems and ensure transaction stability, it is imperative to foster MSPs specialized in navigating the structural complexity and systemic sensitivity inherent in the market’s IT infrastructure and services.

1) Under Article 2 of the Act on the Development of Cloud Computing and Protection of its Users, cloud computing refers to a data processing system that contains information and communications resources, such as integrated and shared information and communication devices, information and communication systems, and software, allowing the flexible utilization that aligns with user requirements or changes in demand through information and communication networks.

2) The IT infrastructure built and operated by an enterprise itself is referred to as on-premise.

3) The risk of a single point of failure refers to the possibility that the failure of one system within IT infrastructure leads to the failure of the entire IT infrastructure, causing disruptions in normal data processing operations and digital services.

4) According to Article 14-2 of the Supervisory Regulation on Electronic Financial Services, the materiality assessment of critical operations takes into account various factors, including the nature of operations processed through cloud computing services such as scale and complexity, the impact of service disruptions from cloud service providers (CSPs), the impact of electronic security breaches on customers, the dependency on CSPs in case of entrusting multiple tasks to a single CSP, and the internal control and regulatory compliance capabilities of financial institutions or electronic financial service providers regarding the use of cloud computing services.

References

Accenture, 2020, The New Cloud Imperative in Capital Markets.

Broadridge, 2020, The Broadridge Next-Gen Technology Pulse Survey.

Cloud Security Alliance (CSA), 2023, State of Financial Services in Cloud.

Deloitte, 2019, The Wisdom of Clouds: Four Compelling Reasons to Adopt the Cloud.

PwC, 2023, Cloud is the Engine Required to Drive the Next Wave of Innovation within Financial Services.

[Korean]

Kang, M.S., 2019, Trend and outlook of the cloud computing market, KDB Future Strategy Research Institute, KDB Monthly Report No. 758.

Financial Supervisory Service (FSS), April 25, 2022, Status and countermeasures of electronic financial incidents in 2021, press release.

FSS, September 6, 2023, Status and countermeasures of electronic financial incidents in the first half of 2023, press release.

FSS, March 21, 2023, Supervisory directions for digital finance in 2023, materials of financial supervision tasks reporting.

Financial Security Institute, 2023, Guidelines for using cloud computing services in the financial sector.

Financial Services Commission, April 15, 2022, Improvement for cloud and network separation regulations in the financial sector, press release.

Cho, Y.J., 2021, Trend in the cloud industry ecosystem that serves as the core infrastructure of the Digital New Deal, KDB Future Strategy Research Institute, KDB Monthly Report No. 782.