OPINION

2023 Oct/10

Permitting Broker-Dealers to Provide Money Transfer for Corporates: Issues and Challenges

Oct. 10, 2023

PDF

- Summary

- The recent discussion on whether to permit broker-dealers to conduct corporate money transfers has hardly stemmed from the argument that they should engage in payment services in the same way as commercial banks do. The discussion has been prompted from an economic perspective that broker-dealers should be able to provide companies with money transfer services permitted under the Financial Investment Services and Capital Markets Act in a more convenient and less expensive manner. Under the context, concerns over rapid money movements, rising corporate lending rates and stability of the payment and settlement system have been raised. However, such concerns are somewhat exaggerated and can be adequately resolved through policy measures. In this respect, broker-dealers should strengthen competitiveness in terms of payment and settlement functions and financial investment services to achieve policy effects expected from the permission of corporate money transfer.

Since early 2023, Korean financial authorities and the financial services industry have discussed whether to allow broker-dealers to engage in corporate payment services. Despite initial concerns about rapid money movements, rising corporate lending rates and a threat to payment and settlement stability, stakeholders have narrowed their differences in opinions and stance concerning this issue. Even if broker-dealers are permitted to provide payment services to companies, they should resolve relevant challenges to dispel concerns and achieve expected policy effects. Against this backdrop, this article examines major issues related to permitting Korean broker-dealers to provide corporate payment services, and discusses future challenges to be resolved by them.1)

Backgrounds

In Korea, broker-dealers can conduct a money transfer for an investor using his or her deposits under Article 40 Paragraph 1-4 of the Financial Investment Services and Capital Markets Act (FSCMA). Notably, when the FSCMA was enacted in August 2007, relevant authorities agreed to permit broker-dealers to provide money transfer services to non-institutional customers through the payment and settlement system (PSS) as an initial step (Bank of Korea, 2011).2) Accordingly, broker-dealers have provided limited money transfer services to companies through firm banking, a more inconvenient and expensive transfer method.3)

The ongoing discussion on whether to permit broker-dealers to conduct corporate money transfers hardly stems from the argument that broker-dealers should engage in payment services in the same way as commercial banks do. The discussion has been prompted from an economic perspective that broker-dealers should be able to provide money transfer services specified by the FSCMA to companies in a more convenient and less expensive manner. More specifically, the need for enhancing convenience in corporate financial investment services, improving efficiency in corporate funds management and expanding corporate financing opportunities has become greater than ever before.

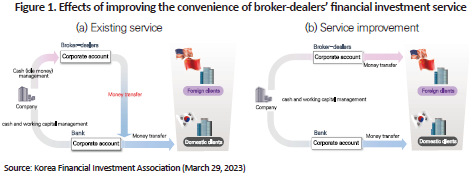

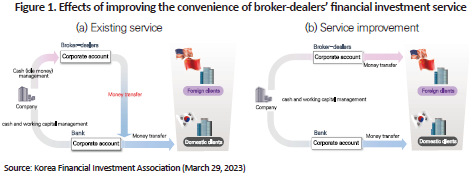

Even if a company manages surplus funds through a broker-dealer's financial investment service, it cannot directly transfer funds from its securities account to domestic or foreign clients, as shown in Figure 1(a). Broker-dealers are prohibited from engaging in corporate money transfer via the payment and settlement system. This causes inconvenience to companies because they have no choice but to transfer funds to their bank account before using them. For this reason, even companies that want to manage surplus funds using broker-dealers’ financial investment service may be reluctant to deal with broker-dealers.4)

If broker-dealers are permitted to conduct corporate money transfer through the payment and settlement system as presented in Figure 1(b), companies could conveniently deposit or withdraw funds using their securities accounts, which would make broker-dealers’ financial investment services significantly convenient. On top of that, companies could benefit from a wider range of choices, thereby facilitating competition in corporate financial services between broker-dealers and banks and resulting in quality improvement in corporate financial services.

If corporate financial services provided by banks are sufficiently competitive and can meet the needs of companies in terms of quality, the benefits to be newly generated may not be significant even after corporate money transfer through the payment and settlement system is permitted for broker-dealers. However, it should be noted that banks recognize a company’s surplus funds as a low-cost means of financing rather than actively managing the funds. This is well demonstrated by the fact that although almost all SMEs use banks as their primary financial institutions, around 90.0% of SMEs hardly have their funds managed separately.5)

Furthermore, banks emphasize the importance of relationship financing, but provide selective and limited credit facilities only to companies that have significant sales figures or offer collateral or guarantees. For this reason, nascent companies choose a bank as the primary financial institution to use payment services essentially needed for their business activities. However, some of them do not even have the opportunity to take out loans from banks and struggle to raise funds through venture capital, and become eligible for bank loans only after entering the growth stage.

In contrast, broker-dealers could manage corporate funds more actively than banks if allowed to engage in corporate money transfer through the payment and settlement system.6) In particular, if Korean broker-dealers can provide cash management services aimed at overseeing both liquidity and profitability of surplus funds as is the case with their foreign counterparts, they could manage surplus funds more efficiently to meet the needs of companies.

Additionally, if the corporate money transfer is conducted by broker-dealers via the payment and settlement system, this could expand their contact points with companies. Utilizing such contact points, they could accumulate information related to a company’s business and management activities since the inception of the company’s business, based on which a variety of financing channels suitable for each growth stage could be provided to the company. Simply put, broker-dealers would be able to realize relationship financing in the true sense, while banks pursue selective and limited relationship financing.

Issues

Corporate money transfer via the payment and settlement system has not been permitted for broker-dealers until the present day due to concerns over rapid money movements, rising corporate lending rates and stability of payment services. In this respect, this article thoroughly examines how broker-dealers have provided money transfer services to non-institutional customers through the payment and settlement system since 2009. The examination leads to the finding that such concerns are somewhat exaggerated and can be adequately resolved through policy measures.

Banks argue that if broker-dealers are authorized to conduct corporate money transfer via the payment and settlement system, individual customers as well as companies may move a great deal of extra funds deposited in banks to broker-dealers, thereby triggering rapid money movements. Such an argument may be convincing, given that surplus funds worth KRW 634.6 trillion are placed in bank accounts as of the end of 2022.7)

Just because deposit and withdrawal services via broker-dealers become more convenient, however, companies using a bank as their primary financial institution will hardly turn to a broker-dealer without regard to other factors. Companies may consider using both a bank and a broker-dealer as their primary financial institution due to existing financial transactions. This suggests that even if a significant number of companies switch financial institutions, money movements are supposed to occur at a gradual pace. For instance, if a company frequently uses a line of credit from its current account or raises funds by taking out secured loans, it may be difficult to change its primary financial institution to a broker-dealer.

Although such money movements may reduce banks’ profits, they are not a matter of concern to society as a whole. Money movements from banks to broker-dealers mean that benefits obtained by companies are greater than costs. In response to this change, banks can improve their corporate financial services in an effort to provide more benefits to companies. Consequently, this can boost social welfare.

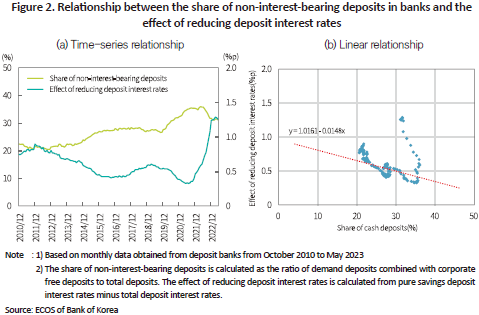

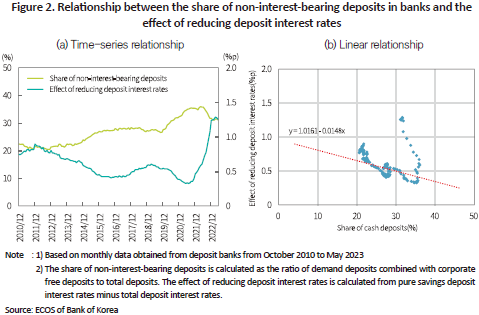

On the part of banks, another concern is that as a growing amount of funds moves from banks to broker-dealers, banks’ financing costs and corporate lending rates will increase. However, Figure 2 demonstrates that when a bank’s total deposits are divided into cash deposits and savings deposits, the lower share of cash deposits does not necessarily mean a rise in deposit interest rates.8) Hence, even if corporate money transfer via the payment and settlement system is conducted by broker-dealers, the resultant money movements would not raise banks’ financing costs and corporate lending rates.9)

A more likely scenario is that lending rates will increase only for companies whose bank deposits or use of payment services declined due to a switch to broker-dealers. When calculating corporate lending rates, banks tend to apply widely different lending rates, depending on a company’s deposits and use of payment services.10) Not all companies will be affected by rising lending rates.

Lastly, some raise concerns about increasing payment default risk and a potential threat to payment and settlement stability, arguing that unlike non-institutional money transfer, corporate money transfer involves a relatively large amount of funds and thus, may have an immense impact on individual money transfer. Strictly speaking, however, broker-dealers are not the cause of the payment default risk. The same risk also occurs when a bank deals with corporate money transfers.

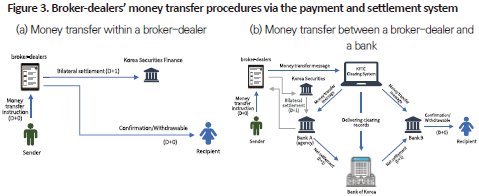

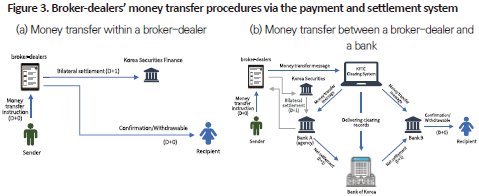

Korea has implemented an uncommon payment and settlement system under which real-time money transfer (D+0) is processed on the following date (D+1) through deferred net settlement (DNS).11) Accordingly, a financial company waiting for funds collection has to bear the risk of payment default for less than one day until the settlement of transferred funds is completed on the following date, as shown in Figure 1(b). To minimize payment default risk under the existing system, a financial company responsible for remitting funds is required to manage liquidity strictly. If a money transfer occurs within a single financial company as shown in Figure 3(a), the transfer is completed through self-clearing in real time (D+0), causing no risk of a payment default.12)

Meanwhile, as banks usually hold sufficient demand deposits, a payment default event is unlikely to occur unless there is a mass withdrawal. The same is true for broker-dealers. Without a mass withdrawal, it is almost impossible for the size of the money transfer to exceed the amount of investor deposits.13) A broker-dealer withdraws 5% of investor deposits from Korea Securities Finance on a daily basis for net settlement. If the withdrawal amount falls short of the difference to be settled, it makes an additional withdrawal of investor deposits from Korean Securities Finance or takes out an intraday loan from a bank to prevent a payment default event from occurring.14)

Challenges

As stated above, even if broker-dealers are permitted to conduct corporate money transfer through the payment and settlement system, companies will hardly change the primary financial institution from a bank to a broker-dealer without regard to other factors. In the event where the benefits obtained from a company’s switch to a broker-dealer outweigh costs, significant money movements can occur and expected policy effects including providing convenient financial investment services to companies, enhancing efficiency in corporate funds management, and expanding corporate financing opportunities can be achieved.

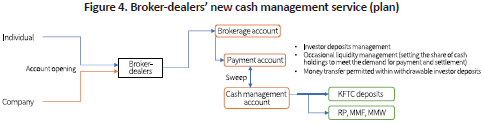

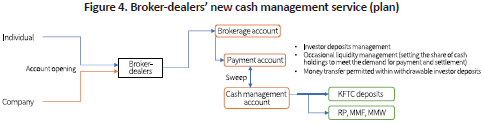

To this end, broker-dealers need to strengthen their competitiveness in payment services. It is worth considering reforming the existing CMA service that neglects liquidity management with a focus on maximizing profitability. As illustrated in Figure 4, Korean broker-dealers should establish a new type of cash management service that organically manages liquidity and profitability of cash assets by referring to cash management services adopted by their foreign counterparts. The introduction of the service should be actively considered in that it can contribute to improving the stability of payment services.

In addition, broker-dealers need to provide customized corporate financial services suitable for a company’s growth stage or life cycle. They should assume a greater role as a financial intermediary to ensure that promising early-stage enterprises and SMEs do not face difficulties in raising funds from private or public capital markets. This can pave the ground for realizing relationship finance in the true sense.

On a final note, if broker-dealers carry out corporate money transfers via the payment and settlement system, it may lead to soaring demand from individuals and companies for asset management services. In response to such growing demand, broker-dealers should strengthen the competitiveness of their asset management services. In this respect, more efforts should be put into efficiently managing financial assets to meet the needs of individual customers and companies, rather than focusing on the sale of financial instruments.

1) Strictly speaking, “corporate money transfer” is a more precise term than “corporate payment and settlement”. In subsequent discussions, the term corporate money transfer instead of corporate payment and settlement is uniformly used in this article.

2) broker-dealers are banned from engaging in corporate money transfer via the payment and settlement system under the regulations of the Korea Financial Telecommunications & Clearings Institute (KFTC) (Bank of Korea, 2011).

3) In the case of money transfer via the payment and settlement system, a customer may give direct instruction of withdrawal or deposit transfers to financial institutions such as banks participating in the payment and settlement system. In the case of money transfer through firm banking, however, the customer can ask the relevant broker-dealer for withdrawal or deposit transfers to banks associated with the broker-dealer. In the latter case, the customer must have an account at a bank associated with the relevant broker-dealer in order to access the broker-dealer’s money transfer service. When money transfer is conducted through firm banking, the broker-dealer must pay the bank the money transfer fee of KRW 400 to 400 per transfer, which is more than 10 times higher than the amount payable in the case of money transfer through the payment and settlement system.

4) According to the 2022 Financial Status Survey of SMEs, 58.0% of the SMES surveyed (4,683) are managing surplus funds as financial assets, and 63.7% put priority on deposit and withdrawal convenience when managing surplus funds. Among the SMEs that manage surplus funds by using financial investment products such as funds, trusts and bonds, 95.4% access such products through banks (Industrial Bank of Korea, 2022).

5) According to the 2022 Financial Status Survey of SMEs, 42.0% of the SMEs surveyed (4,683) do not manage surplus funds separately, and among the remaining 58.0%, 82.9% manage extra funds in the form of money market accounts (Industrial Bank of Korea, 2022). It should be noted that the SMEs that replied that their surplus funds are managed in the form of money market accounts are hardly considered to have managed their surplus in practical terms. Accordingly, it can be interpreted that around 90.0% of SMEs do not manage surplus funds separately.

6) Foreign broker-dealers can indirectly engage in the payment and settlement system through agency contracts with banks and thus, can freely provide money transfer services via the payment and settlement system. Based on the system, they provide companies with cash management and treasury management services.

7) According to statistics released by Bank of Korea, combined cash assets held by households and companies are estimated at KRW 634.6 trillion as of the end of 2022, with household demand deposits of KRW 138.7 trillion, corporate demand deposits of KRW 11.63 trillion and corporate free deposits of KRW 299.2 trillion.

8) The estimates of the constant term and the estimated coefficients of the explanatory viable were found to be statistically significant at the 1% significance level. But the regression analysis shown above has a limitation in that it failed to control the characteristics of time series data and other explanatory variables.

9) If sudden money movements occur on a considerable scale, it could push up banks’ financing costs and corporate lending rates in the medium to long term.

10) According to corporate collateral loan interest rates of banks disclosed by the Korea Federation of Banks based on new loans extended between March and May 2023, the base rate is 69.3% and the additional rate is 57.5% on average. A preferential interest rate of 26.8% is deducted depending on a company’s deposit or use of payment services.

11) In the case of DNS-based money transfer in foreign countries, transferred funds can be withdrawn or used once the settlement is completed. For this reason, money transfer on a DNS basis takes two to three days.

12) Money transfer within a single financial company is processed through self-clearing, requiring no separate settlement procedures.

13) When the FSCMA was enacted in August 2007, there were concerns that if personal money transfer were permitted for broker-dealers through the payment and settlement system, it could threaten payment stability. However, any payment default event by broker-dealers has not occurred to date.

14) To prevent broker-dealers from lacking the net settlement amount in the first place, the current investor deposit withdrawal system should be reformed to allocate 5% of investor deposits as the net settlement amount.

References

Korea Financial Investment Association, March 29, 2023, Corporate payment services permitted for broker-dealers: Effects on promoting competition in the financial sector and improving social benefits, presentation material.

Bank of Korea, 2011, Explanation on money transfer of financial investment companies, reference data 2011-2.

IBK (Industrial Bank of Korea), 2022, Survey on Financial Status of SMEs for 2022.

Backgrounds

In Korea, broker-dealers can conduct a money transfer for an investor using his or her deposits under Article 40 Paragraph 1-4 of the Financial Investment Services and Capital Markets Act (FSCMA). Notably, when the FSCMA was enacted in August 2007, relevant authorities agreed to permit broker-dealers to provide money transfer services to non-institutional customers through the payment and settlement system (PSS) as an initial step (Bank of Korea, 2011).2) Accordingly, broker-dealers have provided limited money transfer services to companies through firm banking, a more inconvenient and expensive transfer method.3)

The ongoing discussion on whether to permit broker-dealers to conduct corporate money transfers hardly stems from the argument that broker-dealers should engage in payment services in the same way as commercial banks do. The discussion has been prompted from an economic perspective that broker-dealers should be able to provide money transfer services specified by the FSCMA to companies in a more convenient and less expensive manner. More specifically, the need for enhancing convenience in corporate financial investment services, improving efficiency in corporate funds management and expanding corporate financing opportunities has become greater than ever before.

Even if a company manages surplus funds through a broker-dealer's financial investment service, it cannot directly transfer funds from its securities account to domestic or foreign clients, as shown in Figure 1(a). Broker-dealers are prohibited from engaging in corporate money transfer via the payment and settlement system. This causes inconvenience to companies because they have no choice but to transfer funds to their bank account before using them. For this reason, even companies that want to manage surplus funds using broker-dealers’ financial investment service may be reluctant to deal with broker-dealers.4)

If broker-dealers are permitted to conduct corporate money transfer through the payment and settlement system as presented in Figure 1(b), companies could conveniently deposit or withdraw funds using their securities accounts, which would make broker-dealers’ financial investment services significantly convenient. On top of that, companies could benefit from a wider range of choices, thereby facilitating competition in corporate financial services between broker-dealers and banks and resulting in quality improvement in corporate financial services.

If corporate financial services provided by banks are sufficiently competitive and can meet the needs of companies in terms of quality, the benefits to be newly generated may not be significant even after corporate money transfer through the payment and settlement system is permitted for broker-dealers. However, it should be noted that banks recognize a company’s surplus funds as a low-cost means of financing rather than actively managing the funds. This is well demonstrated by the fact that although almost all SMEs use banks as their primary financial institutions, around 90.0% of SMEs hardly have their funds managed separately.5)

Furthermore, banks emphasize the importance of relationship financing, but provide selective and limited credit facilities only to companies that have significant sales figures or offer collateral or guarantees. For this reason, nascent companies choose a bank as the primary financial institution to use payment services essentially needed for their business activities. However, some of them do not even have the opportunity to take out loans from banks and struggle to raise funds through venture capital, and become eligible for bank loans only after entering the growth stage.

In contrast, broker-dealers could manage corporate funds more actively than banks if allowed to engage in corporate money transfer through the payment and settlement system.6) In particular, if Korean broker-dealers can provide cash management services aimed at overseeing both liquidity and profitability of surplus funds as is the case with their foreign counterparts, they could manage surplus funds more efficiently to meet the needs of companies.

Additionally, if the corporate money transfer is conducted by broker-dealers via the payment and settlement system, this could expand their contact points with companies. Utilizing such contact points, they could accumulate information related to a company’s business and management activities since the inception of the company’s business, based on which a variety of financing channels suitable for each growth stage could be provided to the company. Simply put, broker-dealers would be able to realize relationship financing in the true sense, while banks pursue selective and limited relationship financing.

Issues

Corporate money transfer via the payment and settlement system has not been permitted for broker-dealers until the present day due to concerns over rapid money movements, rising corporate lending rates and stability of payment services. In this respect, this article thoroughly examines how broker-dealers have provided money transfer services to non-institutional customers through the payment and settlement system since 2009. The examination leads to the finding that such concerns are somewhat exaggerated and can be adequately resolved through policy measures.

Banks argue that if broker-dealers are authorized to conduct corporate money transfer via the payment and settlement system, individual customers as well as companies may move a great deal of extra funds deposited in banks to broker-dealers, thereby triggering rapid money movements. Such an argument may be convincing, given that surplus funds worth KRW 634.6 trillion are placed in bank accounts as of the end of 2022.7)

Just because deposit and withdrawal services via broker-dealers become more convenient, however, companies using a bank as their primary financial institution will hardly turn to a broker-dealer without regard to other factors. Companies may consider using both a bank and a broker-dealer as their primary financial institution due to existing financial transactions. This suggests that even if a significant number of companies switch financial institutions, money movements are supposed to occur at a gradual pace. For instance, if a company frequently uses a line of credit from its current account or raises funds by taking out secured loans, it may be difficult to change its primary financial institution to a broker-dealer.

Although such money movements may reduce banks’ profits, they are not a matter of concern to society as a whole. Money movements from banks to broker-dealers mean that benefits obtained by companies are greater than costs. In response to this change, banks can improve their corporate financial services in an effort to provide more benefits to companies. Consequently, this can boost social welfare.

On the part of banks, another concern is that as a growing amount of funds moves from banks to broker-dealers, banks’ financing costs and corporate lending rates will increase. However, Figure 2 demonstrates that when a bank’s total deposits are divided into cash deposits and savings deposits, the lower share of cash deposits does not necessarily mean a rise in deposit interest rates.8) Hence, even if corporate money transfer via the payment and settlement system is conducted by broker-dealers, the resultant money movements would not raise banks’ financing costs and corporate lending rates.9)

A more likely scenario is that lending rates will increase only for companies whose bank deposits or use of payment services declined due to a switch to broker-dealers. When calculating corporate lending rates, banks tend to apply widely different lending rates, depending on a company’s deposits and use of payment services.10) Not all companies will be affected by rising lending rates.

Lastly, some raise concerns about increasing payment default risk and a potential threat to payment and settlement stability, arguing that unlike non-institutional money transfer, corporate money transfer involves a relatively large amount of funds and thus, may have an immense impact on individual money transfer. Strictly speaking, however, broker-dealers are not the cause of the payment default risk. The same risk also occurs when a bank deals with corporate money transfers.

Korea has implemented an uncommon payment and settlement system under which real-time money transfer (D+0) is processed on the following date (D+1) through deferred net settlement (DNS).11) Accordingly, a financial company waiting for funds collection has to bear the risk of payment default for less than one day until the settlement of transferred funds is completed on the following date, as shown in Figure 1(b). To minimize payment default risk under the existing system, a financial company responsible for remitting funds is required to manage liquidity strictly. If a money transfer occurs within a single financial company as shown in Figure 3(a), the transfer is completed through self-clearing in real time (D+0), causing no risk of a payment default.12)

Meanwhile, as banks usually hold sufficient demand deposits, a payment default event is unlikely to occur unless there is a mass withdrawal. The same is true for broker-dealers. Without a mass withdrawal, it is almost impossible for the size of the money transfer to exceed the amount of investor deposits.13) A broker-dealer withdraws 5% of investor deposits from Korea Securities Finance on a daily basis for net settlement. If the withdrawal amount falls short of the difference to be settled, it makes an additional withdrawal of investor deposits from Korean Securities Finance or takes out an intraday loan from a bank to prevent a payment default event from occurring.14)

Challenges

As stated above, even if broker-dealers are permitted to conduct corporate money transfer through the payment and settlement system, companies will hardly change the primary financial institution from a bank to a broker-dealer without regard to other factors. In the event where the benefits obtained from a company’s switch to a broker-dealer outweigh costs, significant money movements can occur and expected policy effects including providing convenient financial investment services to companies, enhancing efficiency in corporate funds management, and expanding corporate financing opportunities can be achieved.

To this end, broker-dealers need to strengthen their competitiveness in payment services. It is worth considering reforming the existing CMA service that neglects liquidity management with a focus on maximizing profitability. As illustrated in Figure 4, Korean broker-dealers should establish a new type of cash management service that organically manages liquidity and profitability of cash assets by referring to cash management services adopted by their foreign counterparts. The introduction of the service should be actively considered in that it can contribute to improving the stability of payment services.

In addition, broker-dealers need to provide customized corporate financial services suitable for a company’s growth stage or life cycle. They should assume a greater role as a financial intermediary to ensure that promising early-stage enterprises and SMEs do not face difficulties in raising funds from private or public capital markets. This can pave the ground for realizing relationship finance in the true sense.

On a final note, if broker-dealers carry out corporate money transfers via the payment and settlement system, it may lead to soaring demand from individuals and companies for asset management services. In response to such growing demand, broker-dealers should strengthen the competitiveness of their asset management services. In this respect, more efforts should be put into efficiently managing financial assets to meet the needs of individual customers and companies, rather than focusing on the sale of financial instruments.

1) Strictly speaking, “corporate money transfer” is a more precise term than “corporate payment and settlement”. In subsequent discussions, the term corporate money transfer instead of corporate payment and settlement is uniformly used in this article.

2) broker-dealers are banned from engaging in corporate money transfer via the payment and settlement system under the regulations of the Korea Financial Telecommunications & Clearings Institute (KFTC) (Bank of Korea, 2011).

3) In the case of money transfer via the payment and settlement system, a customer may give direct instruction of withdrawal or deposit transfers to financial institutions such as banks participating in the payment and settlement system. In the case of money transfer through firm banking, however, the customer can ask the relevant broker-dealer for withdrawal or deposit transfers to banks associated with the broker-dealer. In the latter case, the customer must have an account at a bank associated with the relevant broker-dealer in order to access the broker-dealer’s money transfer service. When money transfer is conducted through firm banking, the broker-dealer must pay the bank the money transfer fee of KRW 400 to 400 per transfer, which is more than 10 times higher than the amount payable in the case of money transfer through the payment and settlement system.

4) According to the 2022 Financial Status Survey of SMEs, 58.0% of the SMES surveyed (4,683) are managing surplus funds as financial assets, and 63.7% put priority on deposit and withdrawal convenience when managing surplus funds. Among the SMEs that manage surplus funds by using financial investment products such as funds, trusts and bonds, 95.4% access such products through banks (Industrial Bank of Korea, 2022).

5) According to the 2022 Financial Status Survey of SMEs, 42.0% of the SMEs surveyed (4,683) do not manage surplus funds separately, and among the remaining 58.0%, 82.9% manage extra funds in the form of money market accounts (Industrial Bank of Korea, 2022). It should be noted that the SMEs that replied that their surplus funds are managed in the form of money market accounts are hardly considered to have managed their surplus in practical terms. Accordingly, it can be interpreted that around 90.0% of SMEs do not manage surplus funds separately.

6) Foreign broker-dealers can indirectly engage in the payment and settlement system through agency contracts with banks and thus, can freely provide money transfer services via the payment and settlement system. Based on the system, they provide companies with cash management and treasury management services.

7) According to statistics released by Bank of Korea, combined cash assets held by households and companies are estimated at KRW 634.6 trillion as of the end of 2022, with household demand deposits of KRW 138.7 trillion, corporate demand deposits of KRW 11.63 trillion and corporate free deposits of KRW 299.2 trillion.

8) The estimates of the constant term and the estimated coefficients of the explanatory viable were found to be statistically significant at the 1% significance level. But the regression analysis shown above has a limitation in that it failed to control the characteristics of time series data and other explanatory variables.

9) If sudden money movements occur on a considerable scale, it could push up banks’ financing costs and corporate lending rates in the medium to long term.

10) According to corporate collateral loan interest rates of banks disclosed by the Korea Federation of Banks based on new loans extended between March and May 2023, the base rate is 69.3% and the additional rate is 57.5% on average. A preferential interest rate of 26.8% is deducted depending on a company’s deposit or use of payment services.

11) In the case of DNS-based money transfer in foreign countries, transferred funds can be withdrawn or used once the settlement is completed. For this reason, money transfer on a DNS basis takes two to three days.

12) Money transfer within a single financial company is processed through self-clearing, requiring no separate settlement procedures.

13) When the FSCMA was enacted in August 2007, there were concerns that if personal money transfer were permitted for broker-dealers through the payment and settlement system, it could threaten payment stability. However, any payment default event by broker-dealers has not occurred to date.

14) To prevent broker-dealers from lacking the net settlement amount in the first place, the current investor deposit withdrawal system should be reformed to allocate 5% of investor deposits as the net settlement amount.

References

Korea Financial Investment Association, March 29, 2023, Corporate payment services permitted for broker-dealers: Effects on promoting competition in the financial sector and improving social benefits, presentation material.

Bank of Korea, 2011, Explanation on money transfer of financial investment companies, reference data 2011-2.

IBK (Industrial Bank of Korea), 2022, Survey on Financial Status of SMEs for 2022.