Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

The Role of Artificial Intelligence in Finance and Relevant Challenges

Publication date Mar. 21, 2023

Summary

Amid growing interest in ChatGPT, the development and utilization of conversational AI services for financial consumers are expected to further accelerate in the financial sector. Particularly noteworthy is the emergence of the AI-powered virtual financial assistant (VFA) such as Erica launched by Bank of America. VFAs can support a wide range of financial services including account inquiry, remittance, budget tracking, bill management, credit card management, abnormal transaction warning, financial planning, investment advice, order processing, and transaction reporting. As a response to the rise of AI-powered services, Korea’s financial authorities established the AI Guideline for Finance in July 2021. They also unveiled the Plan to Promote the Use of AI in Finance and Build Trust in AI Services in August 2022 and have been carrying out relevant projects. Nevertheless, financial authorities and the financial industry need to do everything possible to ensure that the project to build a financial corpus, which began in the second half of 2022, can be carried out without a hitch. This is because the performance and risks of AI-powered financial services will be largely determined by the quality and quantity of the financial corpus.

ChatGPT, a conversational artificial intelligence (AI) based on a language model, was launched by the US-based startup OpenAI on November 30, 2022, throwing a spotlight on AI software more than ever.1) Currently, there are many attempts in various areas to assess what ChatGPT is capable of while prospects for the role and ripple effects of AI have flooded in. Against this backdrop, this article explores ChatGPT to take a brief look at the role and challenges of AI in the financial sector. For this analysis, more than 12 questions are repeatedly asked to ChatGPT and then, its answers are weighed against relevant literature.2)

Types of AI and capabilities of ChatGPT

AI can be defined as a virtual or physical machine that can emulate the human mind in its thinking and behaving process. It is even expected to be able to think and act in a more rational way than humans do (Russel and Norvig, 1995). But at this moment, not all types of AI are capable of thinking and behaving like a human being. Different AI technologies have been developed and used for each intended purpose and their capabilities and functions widely vary. Such divergence can be well explained only by types of AI that have been introduced up until now.

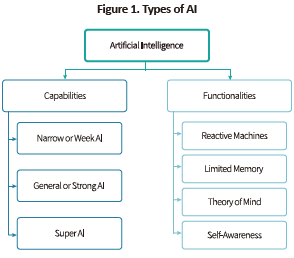

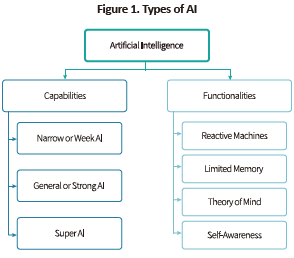

As illustrated in Figure 1, AI can be classified into different types, depending on capabilities to think and act like human beings and functionalities. On the capability front, less human-like AI is described as narrow or weak AI, more human-like AI as general or strong AI, and the one that transcends human intelligence as super AI. On the functionality front, AI can be segmented into reactive machines, limited memory, theory of mind and self-awareness types (Hintze, November 14, 2016).3)

ChatGPT classifies types of AI in a similar manner to the aforementioned AI categorization. But its answer is found to be flawed in two aspects. First, it does not distinguish AI technology from types of AI. For instance, machine learning and natural language processing are more similar to AI technology. When asked repeatedly about types of AI, ChatGPT often gives AI technology as an answer. Second, when it comes to types of AI, it hardly tells the difference between capabilities and functionalities. Super AI is typically expected to have self-awareness. However, ChatGPT depicts super AI as a concept in parallel with self-awareness.

As such, answers provided by ChatGPT are neither perfect nor complete because it is designed to generate the most probabilistically appropriate answer to random questions raised by users by tapping into pre-learned data and defined rules. As for a question as to which type of AI ChatGPT falls into, it says narrow AI or reactive machines. Accordingly, it should be noted that ChatGPT neither gives an accurate answer by learning all available data in real time nor draws an original inference from past experience and new knowledge. For now, it is up to humans to judge the quality of ChatGPT’s answers. Still, as shown in use cases from various areas, it is no exaggeration to say that ChatGPT has opened a new world of AI applications, going beyond the realm of useful AI systems (Mollick, December 14, 2022).

The role of AI in the financial sector

There are not many areas, other than the financial sector, where digitalization can be easily implemented, given that financial services are intangible ones provided by the medium of electronically transferable money. This explains why the financial sector (excluding insurance) earns the second highest score in digital maturity after information and communications technology (ICT) (Boston Consulting Group, 2021). But having the potential for digitalization is in stark contrast to achieving successful digitalization. According to the 2021 survey conducted by Boston Consulting Group, only 28% of the financial service firms surveyed are seen to have accomplished digital transformation.

To succeed in digital transformation or financial service digitalization, a financial service firm needs to be equipped with not only digital leadership, strategies and corporate culture but also technical prowess (McKinsey & Company, October 29, 2018; Okwechime, 2020; Forth and de Laubier, June 3, 2021). ChatGPT presents customer experience, data management, cybersecurity, agility, collaboration and talent as chief factors contributing to the successful digital transformation of financial service firms. When asked about factors behind digital transformation, ChatGPT mentions leadership commitment, specific strategies, customer-centered approach, agile methodology and data-based decision making.

This indicates that AI may play a very specific role in digitalizing financial services. There is an expectation that AI performs tasks that human beings cannot carry out in a digital environment, makes consistent decisions more efficiently compared to humans, and processes tasks that can be done by humans more effectively in a shorter time. ChatGPT suggests several roles that AI can play to help digitalize financial services, which include services and support for customers via chatbots and virtual assistant programs, investment and portfolio management, data analysis and insight offering for credit evaluation and loan appraisal, risk management, support for internal control and compliance monitoring, detection of the risk of fraud, and creation and management of digital content. These are only part of the entire tasks that can be carried out by AI. It is widely accepted that there is no limitation in what AI can perform regarding the tasks required by financial service firms.

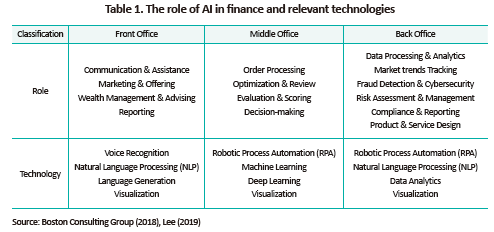

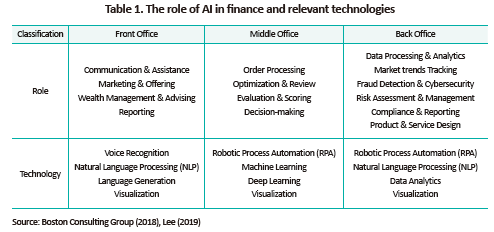

Meanwhile, each role played by AI necessitates a different set of AI technologies. As shown in Table 1, AI technologies required by financial service firms may vary, depending on front-, middle- and back-office tasks. This suggests that no one-size-fits-all AI approach works in the financial sector and a customized AI system should be developed to accommodate the features of each task.

Examples of AI-powered financial services

As mentioned above, AI has already been integrated into a wide range of financial services. With respect to the use of AI, Nvidia surveyed more than 500 global financial service firms in 2022. It has been found that more than 75% of the surveyed use high-performance computing, machine learning, or deep learning technologies (Nvidia, 2022). Among the respondents, 31% invest in AI technologies for detecting fraudulent dealings, 28% for conversational AI, 27% for algorithmic trading, 23% for money laundering and Know Your Customer (KYC), 23% for investment management, 22% for optimizing portfolios, 19% for predicting the risk of insolvency, and 19% for optimizing marketing activities.4) Compared to the 2021 survey result, investments in conversational AI technology such as ChatGPT have grown remarkably.

There is a clear explanation for rapidly expanding investments in ChatGPT-like conversational AIs (Deloitte, 2021). In the aftermath of the Covid-19 pandemic, financial consumers have become highly dependent on digital channels, which has required firms to overcome a limitation of digital channels or the lack of communication. Furthermore, the adoption of conversational AI has been viewed as one of the most effective solutions to deliver a better digital experience to financial consumers and make digital channels more useful. In addition, conversational AI applicable to front-office work is likely to make direct contributions to the profit growth of financial service firms, whereas AI technology adopted for middle- and back-office tasks can help reduce costs.

Among conversational AIs provided by financial service firms, the most successful one is the AI-powered virtual financial assistant (VFA).5) In the past, chatbots were primarily used to give simple responses to customer questions. But the VFA is able to provide various support services for customers. ChatGPT cites budget tracking, investment advice, bill management, abnormal transaction warning, and financial planning as the main functions of the VFA.

The most well-known VFA is Erica launched by Bank of America in 2018 (Romera, June 12, 2021). Erica has garnered 32 million users as of October 2022 and provides 1.5 million users on a daily average a wide range of financial services via voice or text messages, including account inquiry, credit card management, remittance, transaction reporting, and investment advice (Bank of America, October 12, 2022). With Erica, Bank of America intends to promote the sale of financial products and accumulate AI learning materials related to sales activities. To this end, it is scheduled to add another function to Erica by the first half of 2023, which will refer Erica users to a financial expert who can give answers to questions regarding residential mortgage loans, credit cards and deposit products.

The risk of AI and policy challenges

ChatGPT has been sweeping the globe, partly because anyone can readily use the service first hand and it has been highly praised for outstanding performance, compared to previously introduced conversational AI services. Around the world, how to use ChatGPT is actively discussed and projects for developing ChatGPT-like conversational AI services are in full force. In particular, the financial sector is expected to see the emergence of several VFAs that go beyond the realm of chatbots.

In the meantime, the growth of AI services for financial consumers may raise various issues regarding AI. The International Monetary Fund (IMF) presents embedded bias, outcome explainability and complexity, cybersecurity, privacy, robustness and financial stability as primary risks posed by AI (IMF, 2021). ChatGPT gives a similar answer by defining bias and discrimination, lack of responsibility, security risk, job displacement, trust and regulations as issues arising from AI-powered financial services.

A prime example is that if the data used to train AI algorithms is biased, it could make a decision that discriminates against a specific group of financial consumers. As AI works as a kind of black box and is operated by an automated algorithm, its decision could result in unfair consequences to financial consumers. Furthermore, errors inherent in AI or external hacking attacks may incapacitate the financial system. What is worse, it is hard to clarify who is responsible for such problems.

In this respect, Korea’s financial authorities recognized the importance of AI risk management early on and prepared the AI Guideline for Finance in July 2021 (Financial Services Commission (FSC, July 8, 2021). A closer look at the guideline reveals that tight regulation has been established to thoroughly manage not only the aforementioned risks but also potential risks arising from any category. The financial authorities also unveiled the Plan to Promote the Use of AI in Finance and Build Trust in AI Services in August 2022 and have been carrying out relevant projects (FSC, August 3, 2022). In this sense, Korea seems to have put in place an effective control system for potential AI risks arising from the financial sector.

However, an AI risk management system is not sufficient. What is most urgently needed for AI to meet explainable or responsible requirements is the high-quality corpus in massive amounts in the financial domain.6)7) Notably, the quality and quantity of the corpus determine the performance and risk of AI-powered financial services. For this reason, the financial authorities and the financial industry ought to make thorough preparation for the seamless implementation of the financial corpus project jointly initiated by all financial sector associations in the second half of 2022 (FSC, August 3, 2022).

To this end, financial service firms should step up efforts to actively share their own corpus with other firms. Without the high-quality financial corpus in large amounts, it would be difficult to develop a sophisticated VFA like Bank of America’s Erica.8) Also necessary is attention and support from the financial authorities. Considering how AI services designed for financial consumers are currently developed and utilized in Korea, a regulatory framework is needed to encourage financial service firms to be more active in financial corpus sharing and develop and test AIs.

1) For instance, it took three and a half years for Netflix to hit the mark of one million subscribers, two years for Twitter, ten months for Facebook and two and a half months for Instagram. But ChatGPT has gathered one million users in just five days, demonstrating its huge popularity. It has exceeded ten billion in monthly active users (MAU), representing 10% of Google’s MAU.

2) If the same question is asked repeatedly to ChatGPT, its answer varies from time to time. In addition, ChatGPT may give answers in a limited sense as its processing is based on pre-learned data. Furthermore, it hardly reflects up-to-date AI trends in that ChatGPT software has learned text data compiled until 2021.

3) For reference, prime examples of reactive machines and limited memory are Google’s AlphaGo and autonomous driving AI installed on vehicles, respectively. Theory of mind and self-awareness AI systems exist only as a concept.

4) According to the 2022 survey on banks by the Economist, 57.6% of respondents are practically using AIs for fraud detection, 53.7% for IT management optimization, 50.2% for digital marketing, 48.3% for risk assessment, 43.9% for tailored customer experience, 42.4% for credit evaluation, 42.0% for product design optimization, 40.0% for sales and marketing optimization, 39.5% individualized investment services, and 36.6% for portfolio optimization (The Economist, 2022).

5) Not all VFAs provide conversational AI services. These AIs even present pre- or post-processed result values. A case in point is Robo-advisor Wealthfront that was established in 2008 in the US. Since 2016, Wealthfront has integrated AI technology to evaluate individual risk tolerance ranges and investment goals of customers and analyze market trends to offer personalized investment advice and portfolio management services.

6) See Meske et al. (2022) for more details about explainable or responsible AI.

7) A corpus refers to a collection of text or voice data having a linguistic structure, which has been accumulated by AI in a form that can be processed, treated and analyzed.

8) Many US financial service firms have attempted to develop VFAs like Bank of America’s Erica. But development projects have often been delayed by the lack of funding or the financial corpus.

References

Bank of America, 2022. 10. 12., Bank f America’s Erica tops 1 billion client interactions, now nearly 1.5 million per day, Press Release.

Boston Consulting Group, 2018, The Impact of Artificial Intelligence (AI) on the Financial Job Market.

Boston Consulting Group, 2021, Which Industries are Best Positioned for Digital Transformation Success?.

Deloitte, 2021, Unlocking the Value of Digital Assistants.

Forth, P., de Laubier, R., 2021. 6. 3, Which sectors perform best in digital transformation, Boston Consulting Group.

Hintze, A., 2016. 11. 14, Understanding the four types of artificial intelligence, Government Technology(www.govtech.com).

IMF, 2021, Powering the Digital Economy.

McKinsey & Company, 2018. 10. 29., Unlocking success in digital transformations.

Meske, C., Abedin, B., Klier, M., Rabhi, F., 2022, Explainable and responsible artificial intelligence, Electronic Markets 31, 2103-2106.

Mollick, E., 2022. 12. 14, ChatGPT is a tipping point for AI, Harvard Business Review.

Nvidia, 2022, State of AI in Financial Services: 2022 Trends.

Okwechime, J., 2020, How Artificial Intelligence is Transforming the Financial Services Industry, Risk Advisory Insights, Deloitte.

Romera, J., 2021. 6. 12, Virtual financial assistants: What’s taking so long?, VentureBeat.

Russel, S. J., P. Norvig, 1995, Artificial Intelligence: A Modern Approach. Prentice Hall.

The Economist, 2022, Banking on a Game-changer: AI in Financial Services.

Toosi, A., Bottino, A., Babak S., Siegel Eliot, 2021, A brief history of AI: How to prevent another winter (A critical review), PET clinics 16(4), 449-469.

[Korean]

Financial Services Commission, July 8, 2021, The AI Guideline for Finance will be put in place, press release.

Financial Services Commission, August 3, 2022, The Plan to Promote the Use of AI in Finance and Build Trust in AI Services, attached press release.

Lee, S.B., 2019, The role of big data and AI in the financial industry and relevant responses, presentation materials for the Bank of Korea Daegu Kyeongbuk Branch Seminar.

Lee, S.B., 2021, Cases and implications of digital innovation by global IBs: With a focus on the latest AI technology trends, presentation materials for Seoul IB Forum held in November 2021.

Types of AI and capabilities of ChatGPT

AI can be defined as a virtual or physical machine that can emulate the human mind in its thinking and behaving process. It is even expected to be able to think and act in a more rational way than humans do (Russel and Norvig, 1995). But at this moment, not all types of AI are capable of thinking and behaving like a human being. Different AI technologies have been developed and used for each intended purpose and their capabilities and functions widely vary. Such divergence can be well explained only by types of AI that have been introduced up until now.

As illustrated in Figure 1, AI can be classified into different types, depending on capabilities to think and act like human beings and functionalities. On the capability front, less human-like AI is described as narrow or weak AI, more human-like AI as general or strong AI, and the one that transcends human intelligence as super AI. On the functionality front, AI can be segmented into reactive machines, limited memory, theory of mind and self-awareness types (Hintze, November 14, 2016).3)

As such, answers provided by ChatGPT are neither perfect nor complete because it is designed to generate the most probabilistically appropriate answer to random questions raised by users by tapping into pre-learned data and defined rules. As for a question as to which type of AI ChatGPT falls into, it says narrow AI or reactive machines. Accordingly, it should be noted that ChatGPT neither gives an accurate answer by learning all available data in real time nor draws an original inference from past experience and new knowledge. For now, it is up to humans to judge the quality of ChatGPT’s answers. Still, as shown in use cases from various areas, it is no exaggeration to say that ChatGPT has opened a new world of AI applications, going beyond the realm of useful AI systems (Mollick, December 14, 2022).

The role of AI in the financial sector

There are not many areas, other than the financial sector, where digitalization can be easily implemented, given that financial services are intangible ones provided by the medium of electronically transferable money. This explains why the financial sector (excluding insurance) earns the second highest score in digital maturity after information and communications technology (ICT) (Boston Consulting Group, 2021). But having the potential for digitalization is in stark contrast to achieving successful digitalization. According to the 2021 survey conducted by Boston Consulting Group, only 28% of the financial service firms surveyed are seen to have accomplished digital transformation.

To succeed in digital transformation or financial service digitalization, a financial service firm needs to be equipped with not only digital leadership, strategies and corporate culture but also technical prowess (McKinsey & Company, October 29, 2018; Okwechime, 2020; Forth and de Laubier, June 3, 2021). ChatGPT presents customer experience, data management, cybersecurity, agility, collaboration and talent as chief factors contributing to the successful digital transformation of financial service firms. When asked about factors behind digital transformation, ChatGPT mentions leadership commitment, specific strategies, customer-centered approach, agile methodology and data-based decision making.

This indicates that AI may play a very specific role in digitalizing financial services. There is an expectation that AI performs tasks that human beings cannot carry out in a digital environment, makes consistent decisions more efficiently compared to humans, and processes tasks that can be done by humans more effectively in a shorter time. ChatGPT suggests several roles that AI can play to help digitalize financial services, which include services and support for customers via chatbots and virtual assistant programs, investment and portfolio management, data analysis and insight offering for credit evaluation and loan appraisal, risk management, support for internal control and compliance monitoring, detection of the risk of fraud, and creation and management of digital content. These are only part of the entire tasks that can be carried out by AI. It is widely accepted that there is no limitation in what AI can perform regarding the tasks required by financial service firms.

Meanwhile, each role played by AI necessitates a different set of AI technologies. As shown in Table 1, AI technologies required by financial service firms may vary, depending on front-, middle- and back-office tasks. This suggests that no one-size-fits-all AI approach works in the financial sector and a customized AI system should be developed to accommodate the features of each task.

As mentioned above, AI has already been integrated into a wide range of financial services. With respect to the use of AI, Nvidia surveyed more than 500 global financial service firms in 2022. It has been found that more than 75% of the surveyed use high-performance computing, machine learning, or deep learning technologies (Nvidia, 2022). Among the respondents, 31% invest in AI technologies for detecting fraudulent dealings, 28% for conversational AI, 27% for algorithmic trading, 23% for money laundering and Know Your Customer (KYC), 23% for investment management, 22% for optimizing portfolios, 19% for predicting the risk of insolvency, and 19% for optimizing marketing activities.4) Compared to the 2021 survey result, investments in conversational AI technology such as ChatGPT have grown remarkably.

There is a clear explanation for rapidly expanding investments in ChatGPT-like conversational AIs (Deloitte, 2021). In the aftermath of the Covid-19 pandemic, financial consumers have become highly dependent on digital channels, which has required firms to overcome a limitation of digital channels or the lack of communication. Furthermore, the adoption of conversational AI has been viewed as one of the most effective solutions to deliver a better digital experience to financial consumers and make digital channels more useful. In addition, conversational AI applicable to front-office work is likely to make direct contributions to the profit growth of financial service firms, whereas AI technology adopted for middle- and back-office tasks can help reduce costs.

Among conversational AIs provided by financial service firms, the most successful one is the AI-powered virtual financial assistant (VFA).5) In the past, chatbots were primarily used to give simple responses to customer questions. But the VFA is able to provide various support services for customers. ChatGPT cites budget tracking, investment advice, bill management, abnormal transaction warning, and financial planning as the main functions of the VFA.

The most well-known VFA is Erica launched by Bank of America in 2018 (Romera, June 12, 2021). Erica has garnered 32 million users as of October 2022 and provides 1.5 million users on a daily average a wide range of financial services via voice or text messages, including account inquiry, credit card management, remittance, transaction reporting, and investment advice (Bank of America, October 12, 2022). With Erica, Bank of America intends to promote the sale of financial products and accumulate AI learning materials related to sales activities. To this end, it is scheduled to add another function to Erica by the first half of 2023, which will refer Erica users to a financial expert who can give answers to questions regarding residential mortgage loans, credit cards and deposit products.

The risk of AI and policy challenges

ChatGPT has been sweeping the globe, partly because anyone can readily use the service first hand and it has been highly praised for outstanding performance, compared to previously introduced conversational AI services. Around the world, how to use ChatGPT is actively discussed and projects for developing ChatGPT-like conversational AI services are in full force. In particular, the financial sector is expected to see the emergence of several VFAs that go beyond the realm of chatbots.

In the meantime, the growth of AI services for financial consumers may raise various issues regarding AI. The International Monetary Fund (IMF) presents embedded bias, outcome explainability and complexity, cybersecurity, privacy, robustness and financial stability as primary risks posed by AI (IMF, 2021). ChatGPT gives a similar answer by defining bias and discrimination, lack of responsibility, security risk, job displacement, trust and regulations as issues arising from AI-powered financial services.

A prime example is that if the data used to train AI algorithms is biased, it could make a decision that discriminates against a specific group of financial consumers. As AI works as a kind of black box and is operated by an automated algorithm, its decision could result in unfair consequences to financial consumers. Furthermore, errors inherent in AI or external hacking attacks may incapacitate the financial system. What is worse, it is hard to clarify who is responsible for such problems.

In this respect, Korea’s financial authorities recognized the importance of AI risk management early on and prepared the AI Guideline for Finance in July 2021 (Financial Services Commission (FSC, July 8, 2021). A closer look at the guideline reveals that tight regulation has been established to thoroughly manage not only the aforementioned risks but also potential risks arising from any category. The financial authorities also unveiled the Plan to Promote the Use of AI in Finance and Build Trust in AI Services in August 2022 and have been carrying out relevant projects (FSC, August 3, 2022). In this sense, Korea seems to have put in place an effective control system for potential AI risks arising from the financial sector.

However, an AI risk management system is not sufficient. What is most urgently needed for AI to meet explainable or responsible requirements is the high-quality corpus in massive amounts in the financial domain.6)7) Notably, the quality and quantity of the corpus determine the performance and risk of AI-powered financial services. For this reason, the financial authorities and the financial industry ought to make thorough preparation for the seamless implementation of the financial corpus project jointly initiated by all financial sector associations in the second half of 2022 (FSC, August 3, 2022).

To this end, financial service firms should step up efforts to actively share their own corpus with other firms. Without the high-quality financial corpus in large amounts, it would be difficult to develop a sophisticated VFA like Bank of America’s Erica.8) Also necessary is attention and support from the financial authorities. Considering how AI services designed for financial consumers are currently developed and utilized in Korea, a regulatory framework is needed to encourage financial service firms to be more active in financial corpus sharing and develop and test AIs.

1) For instance, it took three and a half years for Netflix to hit the mark of one million subscribers, two years for Twitter, ten months for Facebook and two and a half months for Instagram. But ChatGPT has gathered one million users in just five days, demonstrating its huge popularity. It has exceeded ten billion in monthly active users (MAU), representing 10% of Google’s MAU.

2) If the same question is asked repeatedly to ChatGPT, its answer varies from time to time. In addition, ChatGPT may give answers in a limited sense as its processing is based on pre-learned data. Furthermore, it hardly reflects up-to-date AI trends in that ChatGPT software has learned text data compiled until 2021.

3) For reference, prime examples of reactive machines and limited memory are Google’s AlphaGo and autonomous driving AI installed on vehicles, respectively. Theory of mind and self-awareness AI systems exist only as a concept.

4) According to the 2022 survey on banks by the Economist, 57.6% of respondents are practically using AIs for fraud detection, 53.7% for IT management optimization, 50.2% for digital marketing, 48.3% for risk assessment, 43.9% for tailored customer experience, 42.4% for credit evaluation, 42.0% for product design optimization, 40.0% for sales and marketing optimization, 39.5% individualized investment services, and 36.6% for portfolio optimization (The Economist, 2022).

5) Not all VFAs provide conversational AI services. These AIs even present pre- or post-processed result values. A case in point is Robo-advisor Wealthfront that was established in 2008 in the US. Since 2016, Wealthfront has integrated AI technology to evaluate individual risk tolerance ranges and investment goals of customers and analyze market trends to offer personalized investment advice and portfolio management services.

6) See Meske et al. (2022) for more details about explainable or responsible AI.

7) A corpus refers to a collection of text or voice data having a linguistic structure, which has been accumulated by AI in a form that can be processed, treated and analyzed.

8) Many US financial service firms have attempted to develop VFAs like Bank of America’s Erica. But development projects have often been delayed by the lack of funding or the financial corpus.

References

Bank of America, 2022. 10. 12., Bank f America’s Erica tops 1 billion client interactions, now nearly 1.5 million per day, Press Release.

Boston Consulting Group, 2018, The Impact of Artificial Intelligence (AI) on the Financial Job Market.

Boston Consulting Group, 2021, Which Industries are Best Positioned for Digital Transformation Success?.

Deloitte, 2021, Unlocking the Value of Digital Assistants.

Forth, P., de Laubier, R., 2021. 6. 3, Which sectors perform best in digital transformation, Boston Consulting Group.

Hintze, A., 2016. 11. 14, Understanding the four types of artificial intelligence, Government Technology(www.govtech.com).

IMF, 2021, Powering the Digital Economy.

McKinsey & Company, 2018. 10. 29., Unlocking success in digital transformations.

Meske, C., Abedin, B., Klier, M., Rabhi, F., 2022, Explainable and responsible artificial intelligence, Electronic Markets 31, 2103-2106.

Mollick, E., 2022. 12. 14, ChatGPT is a tipping point for AI, Harvard Business Review.

Nvidia, 2022, State of AI in Financial Services: 2022 Trends.

Okwechime, J., 2020, How Artificial Intelligence is Transforming the Financial Services Industry, Risk Advisory Insights, Deloitte.

Romera, J., 2021. 6. 12, Virtual financial assistants: What’s taking so long?, VentureBeat.

Russel, S. J., P. Norvig, 1995, Artificial Intelligence: A Modern Approach. Prentice Hall.

The Economist, 2022, Banking on a Game-changer: AI in Financial Services.

Toosi, A., Bottino, A., Babak S., Siegel Eliot, 2021, A brief history of AI: How to prevent another winter (A critical review), PET clinics 16(4), 449-469.

[Korean]

Financial Services Commission, July 8, 2021, The AI Guideline for Finance will be put in place, press release.

Financial Services Commission, August 3, 2022, The Plan to Promote the Use of AI in Finance and Build Trust in AI Services, attached press release.

Lee, S.B., 2019, The role of big data and AI in the financial industry and relevant responses, presentation materials for the Bank of Korea Daegu Kyeongbuk Branch Seminar.

Lee, S.B., 2021, Cases and implications of digital innovation by global IBs: With a focus on the latest AI technology trends, presentation materials for Seoul IB Forum held in November 2021.