Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Directions of Risk Assessment and Presentation for Financial Investment Products

Publication date Oct. 13, 2020

Summary

Korea recently introduced a regulatory duty to provide a financial investment product’s risk level as one of the key information, which aims to help financial consumers to have an intuitive understanding of the risk of principal losses inherent in the financial investment product. Under the duty, a regulated financial firm which sells investment products or provides investment advice to its clients should assess a product’s risk level in advance. However, the conduct of calculating risk level has become a mere formality: In practice, most firms have set out neither objective, reasonable computation methodology nor evaluation procedure, so they have simply classified risk levels based on the examples presented in the SRO regulation which was abolished about 10 years ago. Therefore, rather than admitting the current practices as it is, it is necessary to set out a clear and objective methodology suitable for the domestic situation by referring to the EU case for PRIIPs.

Under the Financial Consumer Protection Act established in March 2020, a financial product distributor and others shall be obligated, starting from March 2021, to provide consumers a financial product’s risk level that is part of key product information, whereas a financial product direct seller shall assess a product’s risk level pursuant to the standards established in the Enforcement Decree.1) Thus far since February 4, 2009, a regulated financial firm has assessed the risk associated with a financial investment product in accordance with the standard working rules on investment recommendations set forth by Korea Financial Investment Association (KOFIA). However, Korea’s current practice of product risk assessment is not without potential issues that may need revisiting. Against the backdrop, this article begins by exploring some issues behind the current system, and then looks into the EU product risk assessment system, based on which to present some opinions on how to assess a financial investment product’s risk.

Korea’s product risk assessment: Methodology and current practice

Currently, a financial investment product’s risk is assessed based on Article 16 of the standard working rules on investment recommendations. Accordingly, a financial firm should consider assessment criteria presented by the rules for formulating its own product risk assessment criteria, based on which to classify financial investment products into different ratings.2) The assessment criteria consist of quantitative and qualitative elements. The quantitative elements include the volatility of underlying assets, the possibility of principal losses, the type and composition of underlying assets, credit ratings, remaining maturities, the percentage of derivatives, risk-adjusted performance measures, leverage levels, investment periods, and others. The qualitative criteria refer to the product structure, clarity in calculating returns, difficulty in understanding, counterparty risk, risk associated with structured products, early redemption possibility, liquidity, and others.

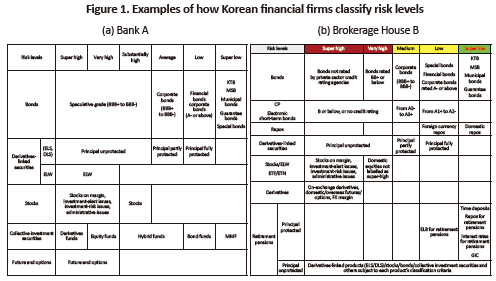

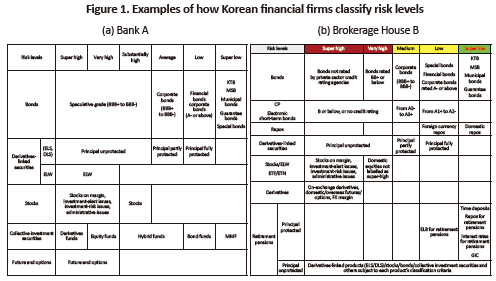

However, a closer look at risk classification schemes of seven securities firms and four banks as of June 2020 reveals that they barely customized the standard working rules and have yet to formulate their own, concrete methodology for computing product risk. Furthermore, Figure 1 shows that risk classification becomes a mere formality in those financial firms who—without any thorough method of assessing product risk levels—try to label product risk based solely on the examples presented in the SRO regulation. This appears to have stemmed from one reason: As the standard working rules have not elaborated a concrete risk assessment method, financial firms have adopted the risk classification example presented in the previous regulation that was abolished when the aforementioned standard working rules were amended on August 27, 2010.

Hence, it appears hard to use the current classification scheme above for assessing a risk level of a financial investment product and providing it as key product information. A more desirable approach is to provide financial firms a clear method of calculating a product’s risk level. Also necessary is a more objective risk assessment method to help financial consumers to have an intuitive understanding about the possibility of principal losses, which seems perfectly in line with the regulatory objective of the Financial Consumer Protection Act that stipulates the inclusion of risk levels in key product information.

EU risk calculation methodology and the characteristics

When establishing the regulation on the key information document (KID) of packaged retail and insurance-based investment products (PRIIPs), the European Union set out a detailed method that provides concrete guidance for financial firms to calculate the summary risk indicator (SRI) in the KID based on an objective and reasonable method.3) The method first considers market and credit risk for a product’s SRI. The market risk herein is computed based on the VaR-equivalent volatility that is an annualized Value-at-Risk figure in the 97.5% confidence interval assuming that a financial investment product is held for a recommended period. Depending on the volatility of the product, a market risk indicator is designated as shown in Table 1. Also, the regulation categorizes PRIIPs into four types given the product-specific nature, and each type is subject to a different volatility evaluation method. For example, derivatives are always rated seventh in market risk indicators without volatility evaluation.

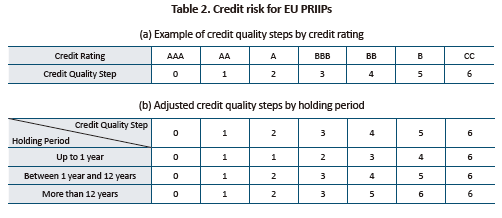

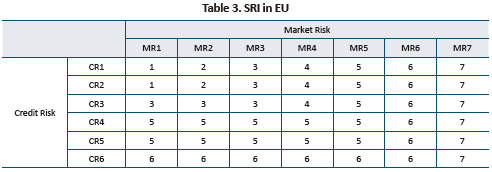

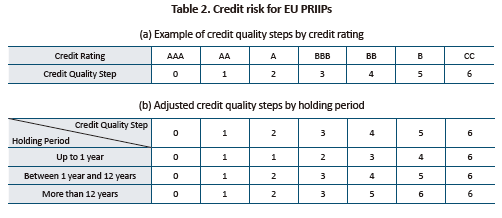

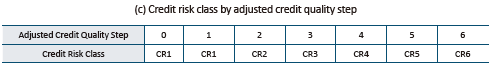

Under the regulation, a product’s credit risk should be evaluated by an external credit assessment institution (ECAI) registered in the European Securities and Markets Authority (ESMA). Otherwise, the evaluation should follow the basic method set forth in the regulation. After credit risk evaluation, a product is first given a credit quality step as illustrated in (a) in Table 2, which is subsequently adjusted depending on the product’s maturity or recommended holding period as shown in (b) in Table 2. For example, a financial product whose credit rating is A with the holding period of less than one year, the credit quality step is adjusted to 1 from 2. Based on the adjusted credit quality step, the product is finally mapped to a credit risk indicator in (c) in Table 2. A financial product whose market risk is rated 7, its credit risk goes unevaluated.

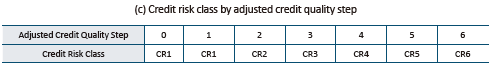

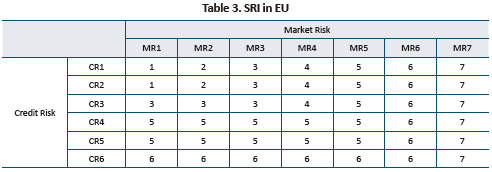

Based on a product’s market risk class and credit risk class, the product is finally designated an SRI as shown in Table 3.

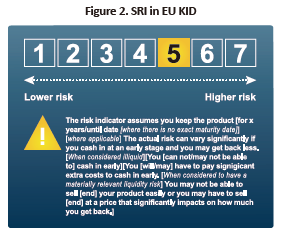

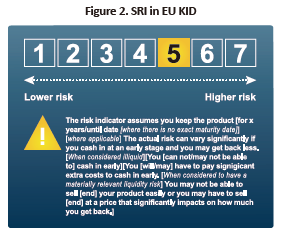

Unlike Korea, the EU obligates a financial investment product manufacturer to compute risk levels. The level of risk should be classified into class 1 to 7 in proportional to the risk of principal losses, and be presented in the KID as shown in the layout example in Figure 2. The regulation also includes some documenting directions for narrative explanation and other important contents to be included in the KID. In particular, the narrative explanation must include details on a financial product’s liquidity risk.

Further improvements proposed for Korea’s risk assessment methodology

Currently, Korea’s financial authorities have been working on how to compute risk levels of financial investment products as part of drafting the Enforcement Decree of the Financial Consumer Protection Act. Given the current practice where Korea’s financial firms compute a product’s risk level mentioned above, a desirable approach would be to formulate a detailed risk assessment method in the Enforcement Decree and relevant rules, rather than allowing financial firms to devise their own method. Although the EU system can be a useful benchmark, it’d better for Korea to fully consider domestic situations for devising its own methodology. Towards that end, it’s necessary to have a phase-in period for expert opinions and consultation before the Financial Consumer Protection Act takes into effect on March 25, 2021.

Furthermore, the current Financial Consumer Protection Act stipulates that the distributor of financial investment products should evaluate product risk levels, which requires a regulatory improvement. A better approach is using the data provided by the manufacturer of financial products. This not only prevents the product distributor from failing to evaluating the risk of a financial product with a complex risk and return structure, but also helps enhance accountability of the product manufacturer. Last but not least, a product’s risk level should be provided to financial consumers as part of key information. For financial consumers to have an intuitive understanding about the danger of principal losses, it is necessary to set out a clear and objective methodology suitable for the domestic situation by referring to the EU case for PRIIPs that presents and provides a financial investment product’s risk level in a way proportional to the risk of principal losses.

1) Under the Financial Consumer Protection Act, “a financial product distributor and others” are defined as “a financial product distributor or a financial product advisor”, whereas “a financial product distributor” is broken down into “a financial product direct seller” and “a financial product agent/intermediary”.

2) A financial firm herein refers to an entity that recommends investors to buy financial products, which is “a financial product direct seller” under the Financial Consumer Protection Act.

3) For details, refer to the PRIIP Regulation (Key Information Documents for Packaged Retail and Insurance-based Investment Products (PRIIPs) - Regulation (EU) No. 1286/2014), and the supplementing regulation (Delegated Regulation (EU) 2017/653).

Korea’s product risk assessment: Methodology and current practice

Currently, a financial investment product’s risk is assessed based on Article 16 of the standard working rules on investment recommendations. Accordingly, a financial firm should consider assessment criteria presented by the rules for formulating its own product risk assessment criteria, based on which to classify financial investment products into different ratings.2) The assessment criteria consist of quantitative and qualitative elements. The quantitative elements include the volatility of underlying assets, the possibility of principal losses, the type and composition of underlying assets, credit ratings, remaining maturities, the percentage of derivatives, risk-adjusted performance measures, leverage levels, investment periods, and others. The qualitative criteria refer to the product structure, clarity in calculating returns, difficulty in understanding, counterparty risk, risk associated with structured products, early redemption possibility, liquidity, and others.

However, a closer look at risk classification schemes of seven securities firms and four banks as of June 2020 reveals that they barely customized the standard working rules and have yet to formulate their own, concrete methodology for computing product risk. Furthermore, Figure 1 shows that risk classification becomes a mere formality in those financial firms who—without any thorough method of assessing product risk levels—try to label product risk based solely on the examples presented in the SRO regulation. This appears to have stemmed from one reason: As the standard working rules have not elaborated a concrete risk assessment method, financial firms have adopted the risk classification example presented in the previous regulation that was abolished when the aforementioned standard working rules were amended on August 27, 2010.

Hence, it appears hard to use the current classification scheme above for assessing a risk level of a financial investment product and providing it as key product information. A more desirable approach is to provide financial firms a clear method of calculating a product’s risk level. Also necessary is a more objective risk assessment method to help financial consumers to have an intuitive understanding about the possibility of principal losses, which seems perfectly in line with the regulatory objective of the Financial Consumer Protection Act that stipulates the inclusion of risk levels in key product information.

EU risk calculation methodology and the characteristics

When establishing the regulation on the key information document (KID) of packaged retail and insurance-based investment products (PRIIPs), the European Union set out a detailed method that provides concrete guidance for financial firms to calculate the summary risk indicator (SRI) in the KID based on an objective and reasonable method.3) The method first considers market and credit risk for a product’s SRI. The market risk herein is computed based on the VaR-equivalent volatility that is an annualized Value-at-Risk figure in the 97.5% confidence interval assuming that a financial investment product is held for a recommended period. Depending on the volatility of the product, a market risk indicator is designated as shown in Table 1. Also, the regulation categorizes PRIIPs into four types given the product-specific nature, and each type is subject to a different volatility evaluation method. For example, derivatives are always rated seventh in market risk indicators without volatility evaluation.

Under the regulation, a product’s credit risk should be evaluated by an external credit assessment institution (ECAI) registered in the European Securities and Markets Authority (ESMA). Otherwise, the evaluation should follow the basic method set forth in the regulation. After credit risk evaluation, a product is first given a credit quality step as illustrated in (a) in Table 2, which is subsequently adjusted depending on the product’s maturity or recommended holding period as shown in (b) in Table 2. For example, a financial product whose credit rating is A with the holding period of less than one year, the credit quality step is adjusted to 1 from 2. Based on the adjusted credit quality step, the product is finally mapped to a credit risk indicator in (c) in Table 2. A financial product whose market risk is rated 7, its credit risk goes unevaluated.

Based on a product’s market risk class and credit risk class, the product is finally designated an SRI as shown in Table 3.

Unlike Korea, the EU obligates a financial investment product manufacturer to compute risk levels. The level of risk should be classified into class 1 to 7 in proportional to the risk of principal losses, and be presented in the KID as shown in the layout example in Figure 2. The regulation also includes some documenting directions for narrative explanation and other important contents to be included in the KID. In particular, the narrative explanation must include details on a financial product’s liquidity risk.

Further improvements proposed for Korea’s risk assessment methodology

Currently, Korea’s financial authorities have been working on how to compute risk levels of financial investment products as part of drafting the Enforcement Decree of the Financial Consumer Protection Act. Given the current practice where Korea’s financial firms compute a product’s risk level mentioned above, a desirable approach would be to formulate a detailed risk assessment method in the Enforcement Decree and relevant rules, rather than allowing financial firms to devise their own method. Although the EU system can be a useful benchmark, it’d better for Korea to fully consider domestic situations for devising its own methodology. Towards that end, it’s necessary to have a phase-in period for expert opinions and consultation before the Financial Consumer Protection Act takes into effect on March 25, 2021.

Furthermore, the current Financial Consumer Protection Act stipulates that the distributor of financial investment products should evaluate product risk levels, which requires a regulatory improvement. A better approach is using the data provided by the manufacturer of financial products. This not only prevents the product distributor from failing to evaluating the risk of a financial product with a complex risk and return structure, but also helps enhance accountability of the product manufacturer. Last but not least, a product’s risk level should be provided to financial consumers as part of key information. For financial consumers to have an intuitive understanding about the danger of principal losses, it is necessary to set out a clear and objective methodology suitable for the domestic situation by referring to the EU case for PRIIPs that presents and provides a financial investment product’s risk level in a way proportional to the risk of principal losses.

1) Under the Financial Consumer Protection Act, “a financial product distributor and others” are defined as “a financial product distributor or a financial product advisor”, whereas “a financial product distributor” is broken down into “a financial product direct seller” and “a financial product agent/intermediary”.

2) A financial firm herein refers to an entity that recommends investors to buy financial products, which is “a financial product direct seller” under the Financial Consumer Protection Act.

3) For details, refer to the PRIIP Regulation (Key Information Documents for Packaged Retail and Insurance-based Investment Products (PRIIPs) - Regulation (EU) No. 1286/2014), and the supplementing regulation (Delegated Regulation (EU) 2017/653).